UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number811-05823

DOMINI INVESTMENT TRUST

(Exact Name of Registrant as Specified in Charter)

180 Maiden Lane, Suite 1302, New York, New York 10038

(Address of Principal Executive Offices)

Carole M. Laible

Domini Impact Investments LLC

180 Maiden Lane, Suite 1302

New York, New York 10038

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code:212-217-1100

Date of Fiscal Year End: July 31

Date of Reporting Period: July 31, 2019

| Item 1. | Reports to Stockholders. |

A copy of the report transmitted to stockholders pursuant to Rule30e-1 under the Investment Company Act of 1940 follows.

ANNUAL REPORT 2019 July 31, 2019DOMINI IMPACT INTERNATIONAL EQUITY FUNDSM DOMINI IMPACT EQUITY FUNDSM DOMINI IMPACT BOND FUNDSM

INVESTING FOR IMPACT We are honored to work on your behalf to create a better future. In addition to our annual Impact Report, we provide quarterly updates to keep you informed on our most recent engagement work, exciting new initiatives, and highlights of interesting investments. Visit domini.com/impact sign up for e-delivery If you invest directly with Domini, you can avoid an annual fee of $15 by signing up for paperless E-Delivery of your statements, reports and tax forms- just log into your account, go to :Account options,” and select “e-delivery Option.” If you invest through a financial advisor, brokerage firm, or employer-sponsored retirement plan, why not ask your advisor or plan sponsor how to receive your documents electronically? It can reduce your carbon footprint, save trees, and unclutter your life, all with just a few strokes of your keyboard!

TABLE OF CONTENTS

INVESTINGFOR GOOD®

LETTER TO SHAREHOLDERS

Dear Fellow Shareholders,

Responsible investors know that the way you invest can make a difference that goes well beyond investing only in industries we feel supportive of; we make a difference by looking at the total impact of how we manage our overall portfolios. An important and often overlooked impact is the ability to support the fabric of a local society. Population wellness and happiness are strongly tied to the communities in which we live.

At Domini, we support institutions that are important to the health, safety, and support of its neighbors. Businesses that operate with amplified positive impact on their communities are often thought of as “anchor institutions.” At the core of their business, they serve people with the understanding that this will improve their business and its results. These entities not only provide jobs but often add value through health services, financial literacy, educational resources, counseling services, small business development, and economic development.

At Domini Impact Investments we have been reviewing theeco-system of communities and evaluating the components to keeping a location healthy. The benefits of many components are clear and plentiful. Public transit systems, libraries, hospitals, public schools, green spaces for recreation, and banks (as opposed to ATMs) represent some of the most obvious components.

Realtor.com and Redfin found, in separate studies, that real estate prices command up to a whopping 32% more than equivalent opportunities not convenient to public transit. Some of this is driven by millennial preferences — studies show 63% of millennials prefer to live in acar-free orcar-infrequent location, but much is driven simply by traditional commuter preference. What these figures argue is that public transit is not just a nice gift to people who cannot afford cars; it is valued highly by the affluent as well.

Hospitals matter and are disappearing from rural areas. We now have a phrase for it, “hospital deserts.” About 30 million Americans do not live within an hour’s travel of a trauma center, which means that accidental deaths are 50% higher in rural areas than urban ones. This is not only a failure of a civilized nation; it is the ripping away of an important anchor to a community. Hospitals employ roughly seven million Americans, and in many places, they are the single largest employer in the region (our largest private corporate employer, Walmart, has approximately 1.5 million employees in the United States). Thirteen states, including rural ones like Alaska and North Dakota along with densely populated ones like Massachusetts and Connecticut, depend on hospitals as the number one source of jobs for their citizens.

2

INVESTINGFOR GOOD®

Public schools are perhaps our most beloved anchor institutions. Academic work indicates that a high-quality public-school system is the most influential aspect of housing costs. People want good schools, and good schools enrich a community. Public schools are also important sources of employment, currently employing approximately three and a half million teachers alone.

Green space also enhances value. One 2018 study shows that being within 100 meters of an urban green space increased real estate prices by roughly eight percent. America’s various parks and recreational properties generated $154 billion in economic activity in 2015 and generated over a million jobs. But no amount of economic value can adequately quantify the benefits to the quality of life that these facilities create.

While public transportation, many hospitals, public schools and parks are not in shareholders’ hands, most banks are. We at Domini recognize this is a different dynamic but also recognize the important role that financial institutions can play in keeping the other anchor institutions healthy. Further, as roughly two million Americans work for commercial banks, we recognize the role they play in keeping jobs local and in funding local institutions.

These comments have focused on the economic benefits of only the very largest community anchors, but many smaller ones, such as our public libraries and little leagues in various sports also play a key role. The focus on financial or economic benefit is not to suggest that only money matters, but rather, we argue that the figures demonstrate that our nation is willing to pay highly for these institutions. Our lives are enriched by them and we spend dearly to protect them.

In this annual report we review for you some of the findings from our study of the key role of anchor institutions. We thank you for your interest in our work and for your continued support of the concept that one can invest for good.

| | |

Carole Laible CEO | |

Amy Domini Founder and Chair |

3

INVESTINGFOR GOOD®

HOW ANCHOR INSTITUTIONS BUILD COMMUNITY WEALTH

As a long-term impact investor, we believe that a sustainable world is a prerequisite for sustainable returns. Domini seeks to understand the root causes of the most intractable challenges facing people and our planet and identify system-level solutions that enable a healthy planet and society to thrive. Our goal is to invest in companies and institutions that support the health of our environmental, societal and financial systems through our equity and fixed income portfolios.

Companies acting as anchor institutions can play a big role when it comes to building sustainable communities and disrupting the trend of growing inequality.We define anchor institutions as enterprises that have a large and rooted presence in a local area and are motivated to support their communities’ economic growth and well-being through programs, products and services, as well as their roles as employer and purchaser.

Safe, healthy and affordable products and services let consumers succeed with business. Targeted programs offered can complement products and services in a way that both supports communities and grows market share. While traditional functions like providing a living wage, health care, retirement savings and decent working conditions remain essential and core features of a responsible company, anchor institutions may go further, adding value in areas such as education, housing or green space to the communities in which they operate. Requiring these practices of their suppliers as well helps anchor institutions deepen their impact. Finally, these institutions can serve as magnets that attract like-minded institutions and can add to the intangible value of the community. These actions demonstrate how forward-thinking companies can become a pillar of building healthy, thriving communities within which to operate.When successful, anchor institutions create a virtuous cycle, accruing benefits to communities, the company, its investors and society at large.

Domini works to identify these companies and institutions through our proprietary research and standard setting processes, in which we weigh measures of successful anchor institutions in the context of robust, industry-specific key performance indicators. In addition to a quantitative assessment, this process paints a qualitative picture that is more than the sum of its parts: companies that handle specific and discrete issues in a responsible manner demonstrate a forward-looking culture of intentionality and responsibility which we consider reflective of quality management teams.

To help bring the concept of anchor institutions to life, the following are two examples: one is a publicly traded company we invest in our Domini Impact Equity Fund while the other is a nonprofit hospital that we provide capital to through our bond portfolio.

4

INVESTINGFOR GOOD®

Banks as Anchor Institutions (Domini Impact Equity Fund)

Banks play a unique and essential role in our society. As demonstrated by the financial crisis of 2008, the risks banks can pose to communities and investors are all too clear; however, institutions also have the opportunity to create significant positive impacts in their communities in which they operate. Providing safe, affordable and high-quality products and services to underserved populations and small businesses is just one example of how this may be the case. Banks that fulfill the vital role of community economic development, we believe, will prosper in the long run as a stable financial system is built on a foundation of fairness and justice for all.

We considerScotiabank, amid-sized, Canadian publicly traded bank, to be a strong example. The bank diversified its consumer base into regions of Latin America where 50% of the population and 30% of the purchasing power is concentrated in the lower-income segment of the population, which was underserved by traditional banks.By understanding its community and recognizing gaps in the market’s service of the community’s needs, the bank generated a positive impact while increasing its market share and effectively managing its business.

The bank recognized that account fees act as a major barrier to serving lower-income customers.By eliminating those fees, the bank increased account openings and market share substantially. It also offers micro-lending products to clients that typically have variable and unstable incomes and therefore fall outside the traditional retail banking target market. It has enabled those individuals to start micro businesses while establishing a profitable new business segment within the company. A mobile banking service also supports access for populations without access to bank branches.

In addition to specific products, Scotiabank has invested considerably in financial literacy. In its home country, the bank provides immigrants withpre- and post-arrival support through free and cost-reduced financial services and financial literacy programs. It has also developed financial education workshops for families living in poverty abroad. Each of these efforts indicate thatScotiabank operates with intentionality and a deep cultural commitment to being a catalyst in the communities it serves and strengthens its business as a result.

Healthcare Systems as Anchor Institutions (Domini Impact Bond Fund)

Nonprofit healthcare systems can also fill the role of anchor institutions by providing affordable, broadly accessible, and quality health care as well as addressing a wider variety of unmet needs in underserved communities. The recent trend of consolidation in the healthcare space has led to a decline in local institutions and the loss of the associated local knowledge. However, some institutions continue to stand as an example of what is possible.

5

INVESTINGFOR GOOD®

Boston Medical Center (“BMC”) is a “safety net hospital.” It has a mission to provide care to individuals regardless of their ability to pay, with a significant portion of its patients beinglow-income, uninsured, and elderly.The hospital has demonstrated an ability and willingness to look beyond the traditional bounds of healthcare in a way that will deliver better health outcomes and support the community in a holistic way.

BMC, for example, has identified housing and nutrition as major drivers of the success of its mission. A survey revealed that malnutrition is one of the biggest causes of chronic disease in its community. To address this, the hospital established a preventive food kitchen & pantry program. Physicians and nutritionists provide “prescriptions” for supplemental food that promotes physical health, prevents future illness, and facilitates recovery. The pantry provides food prescriptions to thousands of households each month, while the kitchen offers cooking demonstrations and other educational resources to support patients in their long-term health.

BMC is also one of the first hospitals in the country to recognize the social determinants of health1 and, in its particular case, the role that living conditions play in the health of its community. Given that knowledge, the hospital decided to direct its mandatory community investment of $6.5 million to affordable housing projects in its city, in partnership with local shelters and community development corporations. The initiative includes $1 million each for initiatives to help families fight evictions, create a housing stabilization program for people with complex medical issues, and to support a grocery store within one of its housing developments.

As a final note, the hospital has a best in class program to provide help navigating the health-system in a culturally competent manner, addressing the fact that one third of their patients arenon-English speakers. BMC provideson-site medical interpreters for more than a dozen languages and outreach programs to guide the most vulnerable patients through doctor visits and treatment programs. Counselors come from the communities they serve and receive special training to address patients’ specific needs. As in the example of Scotiabank,the collection of efforts made by BMC to understand, serve and support its community evinces a culture of intentionality that in turn provides efficiently delivered health care and enables healthy, sustainable communities.

1 The social determinants of health are the economic and social conditions that influence individual and group differences in health status. https://www.who.int/social_determinants/sdh_definition/en/

6

INVESTINGFOR GOOD®

Both Scotiabank and the Boston Medical Center operate as multi-faceted parts of a community system rather than as a singular, isolated entity. They worked to understand their communities and the challenges they face. They intentionally filled gaps in the market to address those challenges. In doing so, they recognized and addressed the complexity and importance of the creation of community wealth. Companies depend on communities for multiple resources required for their business, such as an educated work force, financially-sound consumers, or roads and infrastructure. Companies that act as anchor institutions, building and supporting community development, allow the company, its investors, its communities and society at large to prosper together.

The holdings discussed above can be found in the portfolio of the Domini Impact Equity Fund and Domini Impact Bond Fund, included herein. The composition of each portfolio is subject to change.

The Domini Funds are not bank deposits and are not insured. You may lose money. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost.

An investment in the Domini Impact Equity Fund is subject to market, market sector, impact investing, and foreign investing risks. Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing security regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity.

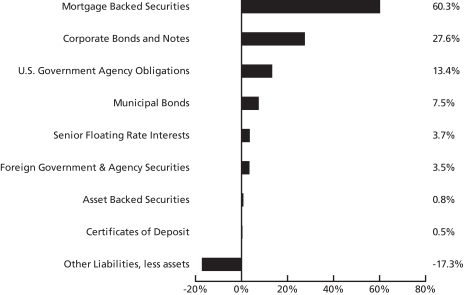

An investment in the Domini Impact Bond Fund is subject to credit, interest rate, liquidity, impact investing and market risks.

This report is not authorized for distribution to prospective investors of the Domini Funds referenced herein unless preceded or accompanied by a current prospectus for the relevant Fund.Nothing contained herein is to be considered a recommendation concerning the merits of any noted company or security, or an offer of sale or a solicitation of an offer to buy shares of any Fund or issuer referenced in this report. Such offering is only made by prospectus, which includes details as to the offering price and other material information. Carefully consider the Funds’ investment objectives, risk factors and charges and expenses before investing. This and other information can be found in the Funds’ prospectus, which may be obtained by calling1-800-762-6814 or at www.domini.com. DSIL Investment Services LLC, distributor, member FINRA. Domini Impact Investments LLC is each Fund’s investment manager. The Funds are subadvised by unaffiliated entities. 9/19

7

DOMINI IMPACT INTERNATIONAL EQUITY FUND

Performance Commentary (Unaudited)

The Fund invests primarily inmid- tolarge-cap equities across Europe, theAsia-Pacific region, and throughout the rest of the world. It is managed through atwo-step process designed to capitalize on the strengths of Domini Impact Investments and Wellington Management Company, the Fund’s subadviser. Domini creates an approved list of companies based on its social, environmental and governance analysis, and Wellington seeks to add value and manage risk through a systematic and disciplined portfolio construction process.

Market Overview:

International equities, as measured by the MSCI EAFE Index (net)*, declined 2.60% over the trailing twelve-month period ended July 31, 2019. Throughout the period, global trade disputes, slowing global economic growth, and political uncertainties weighed on equity markets.

Intensifying trade war rhetoric between the U.S. and China contributed to growing market uncertainty during the summer of 2018. This disruption had an outsized impact on developing economies, particularly in China. Global equities experienced steep declines during the final months of 2018, as fears around slowing global growth led to a sharp correction and a large spike in volatility.

Nevertheless, stocks rebounded during the first quarter of 2019 and recovered a significant portion of their losses. Markets were buoyed by constructive dialogue on trade negotiations between the U.S. and China and a shift by many of the world’s major central banks toward loosening monetary policy. Still, sluggish economic indicators and growing geopolitical risks provided causes for concern. In April, the United Kingdom managed to avoid a hardno-deal Brexit after the European Union granted a flexible extension until October 31. After failing to secure a deal for the third time, Prime Minister Theresa May announced that she would resign as leader of Britain’s Conservative Party and was subsequently succeeded by the Boris Johnson, a key figure in thepro-Brexit movement.

An escalation in trade tensions between the U.S. and China temporarily disrupted the market’s recovery in May but eased by the end of the second quarter after the two countries agreed to resume negotiations at the Group of 20 (G20) summit. The U.S. announced that existing tariffs would remain in place but temporarily suspended tariffs on an additional $300 billion of Chinese goods.

Near the end of the period, monetary policy took center stage, as markets looked to the world’s central banks to help stimulate the slowing economy. In July, the U.S. Federal Reserve Bank lowered interest rates for the first time in 11 years. Meanwhile the European Central Bank gave strong hints that a new

8

round of quantitative easing could begin in September, and the Bank of Japan committed to keeping rates lower for longer.

Portfolio Performance:

The Domini Impact International Equity Fund Investor shares declined 6.81% for the12-month period ended July 31, 2019 versus MSCI EAFE Index (net) which declined 2.60%.

Security selection was the primary driver of underperformance relative to the MSCI EAFE Index. Weak selection within the consumer staples, industrials and information technology sectors hindered results. Within consumer staples, relative returns were most hurt by not owning Swiss food and beverage company Nestlé†, as well as overweight positions to British supermarkets Sainsbury’s and Morrisons. Strong security selection within the financials and real estate sectors partially offset these negative results.

From an allocation perspective, sector positioning relative to the MSCI EAFE Index slightly benefitted relative results during the period, driven by the Fund’s exclusion of the energy sector, which was the worst performing sector in the benchmark during the period.

From a regional perspective, poor security selection within the United Kingdom, Japan, and other developed markets in Europe detracted from relative results. Anout-of-benchmark allocation to emerging markets also detracted from relative performance, driven primarily by exposure to Taiwan and South Korea. This negative impact was partially offset by positive selection within developed Asia-Pacific markets outside Japan.

From a market capitalization standpoint, the Fund’s weak security selection withinmid-cap (between $2 billion and $10 billion) andlarge-cap (between $10 billion and $50 billion) stocks were the primary detractors from relative performance. The Fund’s underweight allocation tomega-cap stocks (greater than $50 billion) also detracted from relative results.

Over the period, the Fund benefitted overall from its exposure to the submanager’s quality (management behavior) theme and both its long-term and short-term momentum themes, most notably in Europe. Additional contributions to Fund performance resulted from an underweight position relative to the MSCI EAFE Index in European bank stocks (specifically not owning UBS†, HSBC and Danske Bank†) and an overweight position in European insurance stocks. Detractors from performance over the period included an underweight to Asian equities relative to the MSCI EAFE Index. Positive exposure to the submanager’s pure value themes in Japan and Europe was the largest detractor to performance.

9

At a security level, the Fund’s relative results were most hurt by not owning Nestlé†. Other top detractors included Japanese automotive manufacturer Nissan and Sainsbury’s. Top contributors to relative performance included Australian iron ore company Fortescue Metals Group, German athletic apparel manufacturer Adidas, and bottling company Coca-Cola European Partners.

* MSCI EAFE Index (net) returns reflect reinvested dividends net of withholding taxes but reflect no deduction for fees, expenses or other taxes.

† Not approved for investment by Domini as of July 31, 2019.

10

TEN LARGEST HOLDINGS (Unaudited)

| | | | | | | | | | |

| | | | |

| SECURITY DESCRIPTION | | % NET

ASSETS | | | SECURITY DESCRIPTION | | % NET

ASSETS | |

| | | | |

| Allianz SE | | | 2.5% | | | Sanofi | | | 2.0% | |

| | | | |

| adidas AG | | | 2.4% | | | Coca Cola European Partners PLC | | | 2.0% | |

| | | | |

| Novartis AG | | | 2.2% | | | Ferguson PLC | | | 1.9% | |

| | | | |

| Kering SA | | | 2.1% | | | Telefonica SA | | | 1.8% | |

| | | | |

| Nissan Motor Co Ltd | | | 2.1% | | | Unilever PLC | | | 1.8% | |

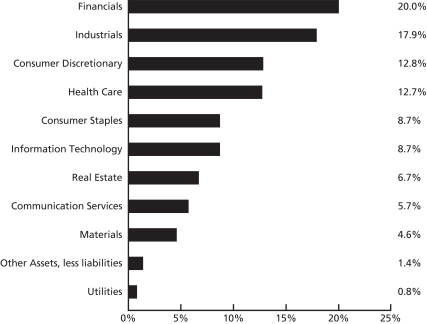

PORTFOLIO HOLDINGS BY INDUSTRY SECTOR (% OF NET ASSETS) (Unaudited)

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by Domini Impact Investments. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification nor shall any such party have any liability therefrom.

11

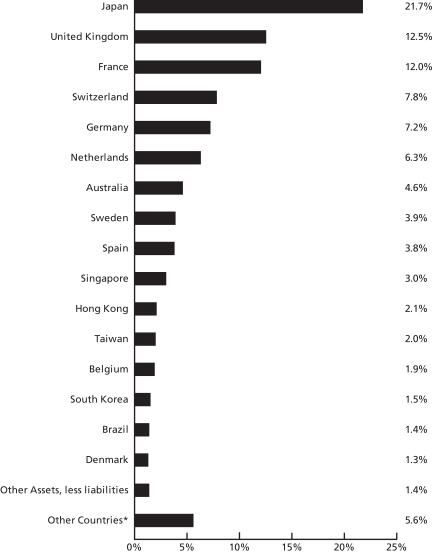

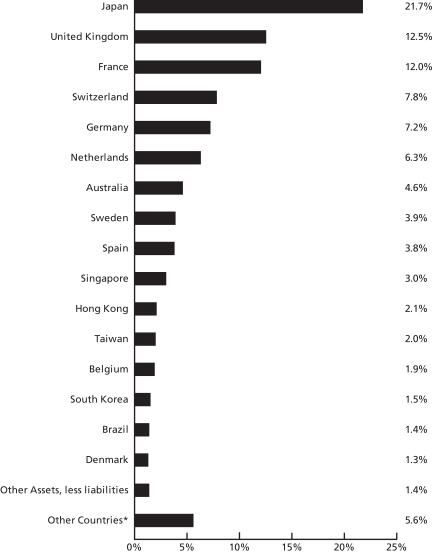

PORTFOLIO HOLDINGS BY COUNTRY (% OF NET ASSETS) (Unaudited)

The holdings mentioned above are described in the Fund’s Portfolio of Investments as of 7/31/2019 included herein. The composition of the Fund’s portfolio is subject to change.

*Other countries include Italy 0.9%, China 0.8%, Finland 0.8%, Austria 0.7%, Turkey 0.6%, United States 0.5%, Thailand 0.4%, Hungary 0.2%, India 0.2%, Israel 0.2%, Malaysia 0.2%, Norway 0.1%, and Ireland 0.0%.

12

| | | | | | |

| |

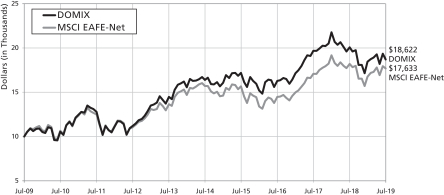

| AVERAGE ANNUAL TOTAL RETURNS (Unaudited) |

| | |

| | | Investor shares | | MSCI EAFE

(NET) |

| | | |

| As of 7/31/19 | | 1 Year | | -6.81% | | -2.60% |

| | | |

| | 5 Year | | 2.64% | | 2.39% |

| | | |

| | | 10 Year | | 6.41% | | 5.84% |

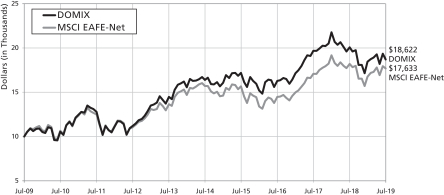

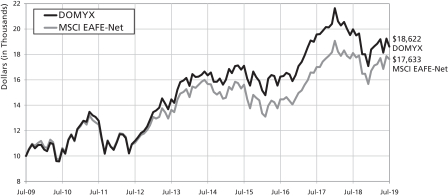

Comparison of $10,000 Investment in the Domini Impact International Equity Fund Investor Shares (DOMIX) and MSCI EAFE (NET) (Unaudited)

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. The returns reflect any applicable expense waivers in effect during the periods shown. Without such waivers, Fund performance would be lower. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost. Call1-800-582-6757 or visit www.domini.com for performance information current to the most recentmonth-end, which may be lower or higher than the performance data quoted. A 2.00% redemption fee applies on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Quoted performance data does not reflect the deduction of this fee, which would reduce the performance quoted. See the prospectus for further information.

Per the prospectus dated December 1, 2018, the Fund’s annual operating expenses totaled: 1.41% (gross/net).

The table and the graph do not reflect the deduction of fees and taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return is based on the Fund’s net asset values and assumes all dividends and capital gains were reinvested.

An investment in the Fund is not a bank deposit and is not insured. You may lose money. The Fund is subject to market, market sector, style and foreign investing risks. Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing security regulations and accounting standards limited public information possible changes in taxation, and periods of illiquidity.

The Morgan Stanley Capital International Europe Australasia Far East (MSCI EAFE) index (net) is an unmanaged index of common stocks. MSCI EAFE (net) includes the reinvestment of dividends net of withholding tax, but does not reflect other fees, expenses or taxes. It is not available for direct investment.

13

| | | | | | | | |

| |

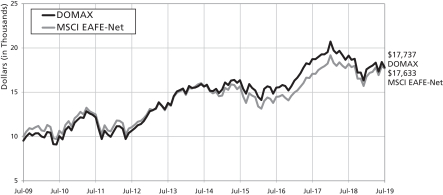

| AVERAGE ANNUAL TOTAL RETURNS (Unaudited) |

| | | |

| | | Class A shares

(with 4.75%

maximum

Sales Charge) | | Class A shares

(without Sales

Charge) | | MSCI EAFE (NET) |

| | | | |

| As of 7/31/19 | | 1 Year | | -11.26% | | -6.83% | | -2.60% |

| | | | |

| | 5 Year | | 1.61% | | 2.61% | | 2.39% |

| | | | |

| | | 10 Year | | 5.90% | | 6.41% | | 5.84% |

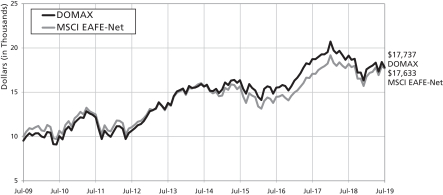

Comparison of $10,000 Investment in the Domini Impact International Equity Fund Class A Shares (DOMAX) and MSCI EAFE (NET) (with 4.75% maximum sales charge) (Unaudited)

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. The returns reflect any applicable expense waivers in effect during the periods shown. Without such waivers, Fund performance would be lower. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost. Call1-800-762-6814 or visit www.domini.com for performance information current to the most recentmonth-end, which may be lower or higher than the performance data quoted. A 2.00% redemption fee applies on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Quoted performance data does not reflect the deduction of this fee, which would reduce the performance quoted. See the prospectus for further information.

Per the prospectus dated December 1, 2018, the Fund’s annual operating expenses totaled: 1.47%/1.43% (gross/net). The Fund’s adviser has contractually agreed to waive certain fees and/or reimburse certain ordinary operating expenses in order to limit Class A share expenses to 1.43% through November 30, 2019, absent an earlier modification approved by the Funds’ Board of Trustees.

The table and graph do not reflect the deduction of fees and taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return is based on the Fund’s net asset values and assumes all dividends and capital gains were reinvested.

An investment in the Fund is not a bank deposit and is not insured. You may lose money. The Fund is subject to market, market sector, style and foreign investing risks. Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing security regulations and accounting standards limited public information possible changes in taxation, and periods of illiquidity.

The Morgan Stanley Capital International Europe Australasia Far East (MSCI EAFE) index (net) is an unmanaged index of common stocks. MSCI EAFE (net) includes the reinvestment of dividends net of withholding tax, but does not reflect other fees, expenses or taxes. It is not available for direct investment.

14

| | | | | | |

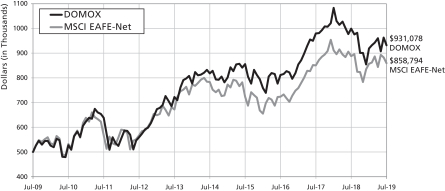

| |

| AVERAGE ANNUAL TOTAL RETURNS (Unaudited) |

| | |

| | | Institutional shares | | MSCI EAFE (NET) |

| | | |

| As of 7/31/19 | | 1 Year | | -6.49% | | -2.60% |

| | | |

| | 5 Year | | 3.04% | | 2.39% |

| | | |

| | | 10 Year* | | 6.41% | | 5.84% |

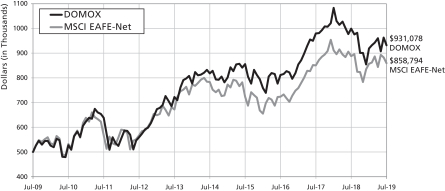

Comparison of $500,000 Investment in the Domini Impact International Equity Fund Institutional Shares (DOMOX) and MSCI EAFE (NET)* (Unaudited)

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. The returns reflect any applicable expense waivers in effect during the periods shown. Without such waivers, Fund performance would be lower. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost. Call1-800-762-6814 or visit www.domini.com for performance information current to the most recentmonth-end, which may be lower or higher than the performance data quoted. A 2.00% redemption fee applies on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Quoted performance data does not reflect the deduction of this fee, which would reduce the performance quoted. See the prospectus for further information.

Per the prospectus dated December 1, 2018, the Fund’s annual operating expenses totaled: 1.02% (gross/net).

The table and graph do not reflect the deduction of fees and taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return is based on the Fund’s net asset values and assumes all dividends and capital gains were reinvested.

An investment in the Fund is not a bank deposit and is not insured. You may lose money. The Fund is subject to market, market sector, style and foreign investing risks. Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing security regulations and accounting standards limited public information possible changes in taxation, and periods of illiquidity.

The Morgan Stanley Capital International Europe Australasia Far East (MSCI EAFE) index (net) is an unmanaged index of common stocks. MSCI EAFE (net) includes the reinvestment of dividends net of withholding tax, but does not reflect other fees, expenses or taxes. It is not available for direct investment.

*Institutional shares were not offered prior to November 30, 2012. All performance information for time periods beginning prior to November 28, 2012 is the performance of the Investor shares. Unless otherwise noted, this performance has not been adjusted to reflect the lower expenses of the Institutional shares.

15

| | | | | | |

| |

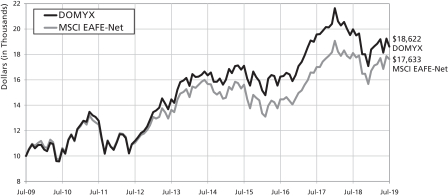

| AVERAGE ANNUAL TOTAL RETURNS (Unaudited) |

| | |

| | | Class Y shares | | MSCI EAFE (NET) |

| | | |

| As of 7/31/19 | | 1 Year | | -6.50% | | -2.60% |

| | | |

| | 5 Year* | | 2.64% | | 2.39% |

| | | |

| | | 10 Year* | | 6.41% | | 5.84% |

Comparison of $10,000 Investment in the Domini Impact International Equity Fund Class Y Shares (DOMYX) and MSCI EAFE (NET)* (Unaudited)

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. The returns reflect any applicable expense waivers in effect during the periods shown. Without such waivers, Fund performance would be lower. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost. Call1-800-762-6814 or visit www.domini.com for performance information current to the most recentmonth-end, which may be lower or higher than the performance data quoted. A 2.00% redemption fee applies on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Quoted performance data does not reflect the deduction of this fee, which would reduce the performance quoted. See the prospectus for further information.

Per the prospectus dated December 1, 2018, the Fund’s annual operating expenses totaled: 1.13% (gross/net). The Fund’s adviser has contractually agreed to waive certain fees and/or reimburse certain ordinary operating expenses in order to limit Class Y share expenses to 1.15%, through November 30, 2019, absent an earlier modification approved by the Funds’ Board of Trustees.

The table and graph do not reflect the deduction of fees and taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return is based on the Fund’s net asset values and assumes all dividends and capital gains were reinvested.

An investment in the Fund is not a bank deposit and is not insured. You may lose money. The Fund is subject to market, market sector, style and foreign investing risks. Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing security regulations and accounting standards limited public information possible changes in taxation, and periods of illiquidity.

The Morgan Stanley Capital International Europe Australasia Far East (MSCI EAFE) index (net) is an unmanaged index of common stocks. MSCI EAFE (net) includes the reinvestment of dividends net of withholding tax, but does not reflect other fees, expenses or taxes. It is not available for direct investment.

*Y Shares did not commence operations until July 23, 2018. All performance information for time periods beginning prior to July 23, 2018 is the performance of the Investor Shares. Unless otherwise noted, this performance has not been adjusted to reflect the lower expenses of the Institutional shares.

16

DOMINI IMPACT INTERNATIONAL EQUITY FUND

PORTFOLIOOF INVESTMENTS

July 31, 2019

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

| Common Stock – 98.6% | | | | | | | | |

Australia – 4.6% | | | | | | | | | | |

Dexus | | Real Estate | | | 1,304,145 | | | $ | 11,756,326 | |

Fortescue Metals Group Ltd | | Materials | | | 3,209,959 | | | | 18,215,455 | |

Goodman Group | | Real Estate | | | 606,459 | | | | 6,181,874 | |

Harvey Norman Holdings Ltd | | Retailing | | | 1,254,240 | | | | 3,785,757 | |

Mirvac Group | | Real Estate | | | 7,232,452 | | | | 16,017,358 | |

| | | | | | | | | | |

| | | | | | | | | 55,956,770 | |

| | | | | | | | | | |

| | | | | | | | | | |

Austria – 0.7% | |

Raiffeisen Bank International AG | | Banks | | | 188,678 | | | | 4,450,380 | |

Verbund AG | | Utilities | | | 64,694 | | | | 3,631,207 | |

| | | | | | | | | | |

| | | | | | | | | 8,081,587 | |

| | | | | | | | | | |

| | | | | | | | | | |

Belgium – 1.9% | |

Ageas | | Insurance | | | 186,584 | | | | 10,074,938 | |

Colruyt SA | | Food & Staples Retailing | | | 134,210 | | | | 7,033,599 | |

UCB SA | | Pharma, Biotech & Life Sciences | | | 74,101 | | | | 5,811,536 | |

| | | | | | | | | | |

| | | | | | | | | 22,920,073 | |

| | | | | | | | | | |

| | | | | | | | | | |

Brazil – 1.4% | |

Banco do Brasil SA | | Banks | | | 413,813 | | | | 5,413,246 | |

Cia Brasileira de Distribuicao | | Food & Staples Retailing | | | 86,100 | | | | 2,140,716 | |

Cia de Transmissao de Energia Eletrica Paulista | | Utilities | | | 394,100 | | | | 2,534,743 | |

Cyrela Brazil Realty SA Empreendimentos e Participacoes | | Consumer Durables & Apparel | | | 388,777 | | | | 2,521,172 | |

IRB Brasil Resseguros S/A | | Insurance | | | 170,671 | | | | 4,309,186 | |

| | | | | | | | | | |

| | | | | | | | | 16,919,063 | |

| | | | | | | | | | |

| | | | | | | | | | |

China – 0.8% | |

Li Ning Co Ltd | | Consumer Durables & Apparel | | | 1,041,093 | | | | 2,566,797 | |

Ping An Insurance Group Co of China Ltd Cl H | | Insurance | | | 481,590 | | | | 5,676,109 | |

Tingyi Cayman Islands Holding Corp | | Food & Beverage | | | 1,140,917 | | | | 1,702,776 | |

| | | | | | | | | | |

| | | | | | | | | 9,945,682 | |

| | | | | | | | | | |

| | | | | | | | | | |

Denmark – 1.3% | |

DSV A/S | | Transportation | | | 53,720 | | | | 5,157,171 | |

GN Store Nord A/S | | Health Care Equipment & Services | | | 83,416 | | | | 3,979,964 | |

Novo Nordisk A/S Cl B | | Pharma, Biotech & Life Sciences | | | 28,377 | | | | 1,370,599 | |

Vestas Wind Systems A/S | | Capital Goods | | | 60,586 | | | | 5,000,802 | |

| | | | | | | | | | |

| | | | | | | | | 15,508,536 | |

| | | | | | | | | | |

| | | | | | | | | | |

17

DOMINI IMPACT INTERNATIONAL EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

July 31, 2019

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

Finland – 0.8% | |

Metso Oyj | | Capital Goods | | | 128,782 | | | $ | 4,977,093 | |

Valmet Oyj | | Capital Goods | | | 227,077 | | | | 4,434,768 | |

| | | | | | | | | | |

| | | | | | | | | 9,411,861 | |

| | | | | | | | | | |

| | | | | | | | | | |

France – 12.0% | |

Alstom SA | | Capital Goods | | | 128,431 | | | | 5,563,339 | |

AXA SA | | Insurance | | | 321,342 | | | | 8,140,831 | |

BNP Paribas SA | | Banks | | | 129,351 | | | | 6,088,624 | |

Capgemini SE | | Software & Services | | | 88,695 | | | | 11,326,197 | |

Carrefour SA | | Food & Staples Retailing | | | 375 | | | | 7,267 | |

CNP Assurances | | Insurance | | | 202,651 | | | | 4,212,640 | |

Credit Agricole SA | | Banks | | | 458,322 | | | | 5,487,388 | |

Edenred | | Commercial & Professional Services | | | 183,571 | | | | 9,265,134 | |

Eiffage SA | | Capital Goods | | | 136,709 | | | | 13,586,627 | |

Eutelsat Communications SA | | Media & Entertainment | | | 101,119 | | | | 1,944,231 | |

Kering SA | | Consumer Durables & Apparel | | | 49,391 | | | | 25,658,479 | |

Peugeot SA | | Automobiles & Components | | | 734,906 | | | | 17,446,253 | |

Publicis Groupe SA | | Media & Entertainment | | | 125,284 | | | | 6,217,978 | |

Sanofi | | Pharma, Biotech & Life Sciences | | | 293,489 | | | | 24,598,362 | |

Schneider Electric SE | | Capital Goods | | | 74,929 | | | | 6,501,950 | |

| | | | | | | | | | |

| | | | | | | | | 146,045,300 | |

| | | | | | | | | | |

| | | | | | | | | | |

Germany – 7.2% | |

adidas AG | | Consumer Durables & Apparel | | | 91,820 | | | | 29,436,176 | |

Allianz SE | | Insurance | | | 129,804 | | | | 30,289,783 | |

HeidelbergCement AG | | Materials | | | 181,913 | | | | 13,213,234 | |

Merck KGaA | | Pharma, Biotech & Life Sciences | | | 152,184 | | | | 15,611,558 | |

| | | | | | | | | | |

| | | | | | | | | 88,550,751 | |

| | | | | | | | | | |

| | | | | | | | | | |

Hong Kong – 2.1% | |

AIA Group Ltd | | Insurance | | | 343,928 | | | | 3,527,005 | |

CK Asset Holdings Ltd | | Real Estate | | | 351,814 | | | | 2,645,421 | |

Hongkong Land Holdings Ltd | | Real Estate | | | 697,620 | | | | 4,254,431 | |

Kerry Properties Ltd | | Real Estate | | | 533,679 | | | | 2,004,032 | |

Swire Pacific Ltd Cl A | | Real Estate | | | 424,317 | | | | 4,836,552 | |

Swire Properties Ltd | | Real Estate | | | 905,378 | | | | 3,269,331 | |

Wharf Holdings Ltd/The | | Real Estate | | | 1,372,526 | | | | 3,337,378 | |

Wheelock & Co Ltd | | Real Estate | | | 297,708 | | | | 1,873,484 | |

| | | | | | | | | | |

| | | | | | | | | 25,747,634 | |

| | | | | | | | | | |

| | | | | | | | | | |

Hungary – 0.2% | |

OTP Bank Nyrt | | Banks | | | 71,196 | | | | 2,986,012 | |

| | | | | | | | | | |

| | | | | | | | | 2,986,012 | |

| | | | | | | | | | |

| | | | | | | | | | |

18

DOMINI IMPACT INTERNATIONAL EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

July 31, 2019

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

India – 0.2% | |

Dr Reddy’s Laboratories Ltd | | Pharma, Biotech & Life Sciences | | | 81,629 | | | $ | 3,030,888 | |

| | | | | | | | | | |

| | | | | | | | | 3,030,888 | |

| | | | | | | | | | |

| | | | | | | | | | |

Ireland – 0.0% | |

Irish Bank Resolution Corp Ltd/Old (a) (c) | | Banks | | | 138,674 | | | | 0 | |

| | | | | | | | | | |

| | | | | | | | | 0 | |

| | | | | | | | | | |

| | | | | | | | | | |

Israel – 0.2% | |

Check Point Software Technologies Ltd (a) | | Software & Services | | | 20,093 | | | | 2,249,411 | |

| | | | | | | | | | |

| | | | | | | | | 2,249,411 | |

| | | | | | | | | | |

| | | | | | | | | | |

Italy – 0.9% | |

Buzzi Unicem SpA | | aterials | | | 338,751 | | | | 6,924,205 | |

CNH Industrial NV | | Capital Goods | | | 442,496 | | | | 4,506,394 | |

| | | | | | | | | | |

| | | | | | | | | 11,430,599 | |

| | | | | | | | | | |

| | | | | | | | | | |

Japan – 21.7% | |

Alfresa Holdings Corp | | Health Care Equipment & Services | | | 66,994 | | | | 1,618,421 | |

Brother Industries Ltd | | Technology Hardware & Equipment | | | 247,656 | | | | 4,393,545 | |

Central Japan Railway Co | | Transportation | | | 99,282 | | | | 19,996,450 | |

Dai Nippon Printing Co Ltd | | Commercial & Professional Services | | | 383,241 | | | | 8,054,224 | |

Fancl Corp | | Household & Personal Products | | | 304,386 | | | | 7,664,735 | |

FUJIFILM Holdings Corp | | Technology Hardware & Equipment | | | 225,704 | | | | 10,719,195 | |

GungHo Online Entertainment Inc | | Media & Entertainment | | | 125,931 | | | | 3,329,268 | |

Hachijuni Bank Ltd/The | | Banks | | | 1,028,321 | | | | 3,882,733 | |

Hoya Corp | | Health Care Equipment & Services | | | 66,769 | | | | 5,130,112 | |

K’s Holdings Corp | | Retailing | | | 540,872 | | | | 4,941,477 | |

Kose Corp | | Household & Personal Products | | | 73,323 | | | | 12,523,577 | |

KYORIN Holdings Inc | | Pharma, Biotech & Life Sciences | | | 69,497 | | | | 1,171,316 | |

Matsumotokiyoshi Holdings Co Ltd | | Food & Staples Retailing | | | 95,279 | | | | 3,177,822 | |

Medipal Holdings Corp | | Health Care Equipment & Services | | | 299,857 | | | | 6,382,082 | |

Mitsubishi Estate Co Ltd | | Real Estate | | | 213,505 | | | | 3,937,756 | |

Mitsubishi Gas Chemical Co Inc | | Materials | | | 532,252 | | | | 7,096,953 | |

Mitsui Fudosan Co Ltd | | Real Estate | | | 535,964 | | | | 12,122,908 | |

Mixi Inc | | Media & Entertainment | | | 99,201 | | | | 1,878,005 | |

MS&AD Insurance Group Holdings Inc | | Insurance | | | 351,341 | | | | 11,539,263 | |

Nikon Corp | | Consumer Durables & Apparel | | | 669,604 | | | | 9,058,693 | |

Nintendo Co Ltd | | Media & Entertainment | | | 39,377 | | | | 14,515,197 | |

19

DOMINI IMPACT INTERNATIONAL EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

July 31, 2019

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

Japan(Continued) | |

Nippon Electric Glass Co Ltd | | Technology Hardware & Equipment | | | 163,629 | | | $ | 3,666,537 | |

Nippon Telegraph & Telephone Corp | | Telecommunication Services | | | 76,436 | | | | 3,456,469 | |

Nissan Motor Co Ltd | | Automobiles & Components | | | 3,845,805 | | | | 25,046,935 | |

Nomura Real Estate Holdings Inc | | Real Estate | | | 63,243 | | | | 1,283,205 | |

NTN Corp | | Capital Goods | | | 5,300 | | | | 14,737 | |

Obic Co Ltd | | Software & Services | | | 34,124 | | | | 3,643,124 | |

ORIX Corp | | Diversified Financials | | | 1,334,040 | | | | 19,077,026 | |

Seino Holdings Co Ltd | | Transportation | | | 416,167 | | | | 5,193,891 | |

Shionogi & Co Ltd | | Pharma, Biotech & Life Sciences | | | 283,657 | | | | 15,735,771 | |

Sumitomo Dainippon Pharma Co Ltd | | Pharma, Biotech & Life Sciences | | | 337,864 | | | | 6,217,034 | |

Suzuken Co Ltd/Aichi Japan | | Health Care Equipment & Services | | | 75,672 | | | | 4,178,316 | |

Taiyo Yuden Co Ltd | | Technology Hardware & Equipment | | | 163,896 | | | | 3,248,292 | |

TIS Inc | | Software & Services | | | 112,540 | | | | 5,853,050 | |

Toppan Printing Co Ltd | | Commercial & Professional Services | | | 541,358 | | | | 8,816,586 | |

Toyo Seikan Group Holdings Ltd | | Materials | | | 348,727 | | | | 6,099,606 | |

| | | | | | | | | | |

| | | | | | | | | 264,664,311 | |

| | | | | | | | | | |

| | | | | | | | | | |

Malaysia – 0.2% | |

RHB Bank Bhd | | Banks | | | 1,763,548 | | | | 2,350,543 | |

| | | | | | | | | | |

| | | | | | | | | 2,350,543 | |

| | | | | | | | | | |

| | | | | | | | | | |

Netherlands – 6.3% | |

Aegon NV | | Insurance | | | 944,885 | | | | 4,683,239 | |

Coca-Cola European Partners PLC | | Food & Beverage | | | 435,560 | | | | 24,077,757 | |

Koninklijke Ahold Delhaize NV | | Food & Staples Retailing | | | 522,419 | | | | 11,934,251 | |

Koninklijke Philips NV | | Health Care Equipment & Services | | | 63,823 | | | | 3,011,286 | |

NN Group NV | | Insurance | | | 335,786 | | | | 12,688,764 | |

NXP Semiconductors NV | | Semiconductors,Semiconductor Eqpmt | | | 77,046 | | | | 7,965,786 | |

Wolters Kluwer NV | | Commercial & Professional Services | | | 170,776 | | | | 12,450,312 | |

| | | | | | | | | | |

| | | | | | | | | 76,811,395 | |

| | | | | | | | | | |

| | | | | | | | | | |

Norway – 0.1% | |

Orkla ASA | | Food & Beverage | | | 158,044 | | | | 1,355,666 | |

| | | | | | | | | | |

| | | | | | | | | 1,355,666 | |

| | | | | | | | | | |

| | | | | | | | | | |

20

DOMINI IMPACT INTERNATIONAL EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

July 31, 2019

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

Singapore – 3.0% | |

Ascendas Real Estate Investment Trust | | Real Estate | | | 1,948,053 | | | $ | 4,342,580 | |

CapitaLand Commercial Trust | | Real Estate | | | 1,065,755 | | | | 1,598,333 | |

CapitaLand Ltd | | Real Estate | | | 813,430 | | | | 2,139,678 | |

ComfortDelGro Corp Ltd | | Transportation | | | 3,132,723 | | | | 6,164,992 | |

United Overseas Bank Ltd | | Banks | | | 423,479 | | | | 8,101,158 | |

Yangzijiang Shipbuilding Holdings Ltd | | Capital Goods | | | 13,456,058 | | | | 13,931,658 | |

| | | | | | | | | | |

| | | | | | | | | 36,278,399 | |

| | | | | | | | | | |

| | | | | | | | | | |

South Korea – 1.5% | |

BNK Financial Group Inc | | Banks | | | 445,386 | | | | 2,627,252 | |

Industrial Bank of Korea | | Banks | | | 436,178 | | | | 4,831,350 | |

LG Electronics Inc | | Consumer Durables & Apparel | | | 27,377 | | | | 1,499,142 | |

LG Uplus Corp | | Telecommunication Services | | | 460,791 | | | | 5,046,086 | |

Woori Financial Group Inc | | Banks | | | 412,218 | | | | 4,553,829 | |

| | | | | | | | | | |

| | | | | | | | | 18,557,659 | |

| | | | | | | | | | |

| | | | | | | | | | |

Spain – 3.8% | |

Acciona SA | | Utilities | | | 38,496 | | | | 4,122,711 | |

Aena SME SA | | Transportation | | | 28,494 | | | | 5,195,315 | |

Banco Bilbao Vizcaya Argentaria SA | | Banks | | | 2,825,511 | | | | 14,469,847 | |

Banco Santander SA | | Banks | | | 2,078 | | | | 8,921 | |

Telefonica SA | | Telecommunication Services | | | 2,911,270 | | | | 22,322,710 | |

| | | | | | | | | | |

| | | | | | | | | 46,119,504 | |

| | | | | | | | | | |

| | | | | | | | | | |

Sweden – 3.9% | |

Essity AB Cl B | | Household & Personal Products | | | 207,065 | | | | 6,194,131 | |

Getinge AB Cl B | | Health Care Equipment & Services | | | 254,836 | | | | 3,765,666 | |

ICA Gruppen AB | | Food & Staples Retailing | | | 48,790 | | | | 2,182,877 | |

Industrivarden AB Cl C | | Diversified Financials | | | 284,690 | | | | 6,228,751 | |

Sandvik AB | | Capital Goods | | | 861,163 | | | | 13,308,870 | |

Telefonaktiebolaget LM Ericsson Cl B | | Technology Hardware & Equipment | | | 1,778,589 | | | | 15,671,824 | |

| | | | | | | | | | |

| | | | | | | | | 47,352,119 | |

| | | | | | | | | | |

| | | | | | | | | | |

Switzerland – 7.8% | |

Adecco Group AG | | Commercial & Professional Services | | | 142,280 | | | | 7,798,340 | |

Geberit AG | | Capital Goods | | | 9,471 | | | | 4,392,305 | |

Novartis AG | | Pharma, Biotech & Life Sciences | | | 292,554 | | | | 26,950,152 | |

Sonova Holding AG | | Health Care Equipment & Services | | | 54,979 | | | | 12,700,881 | |

Swiss Life Holding AG | | Insurance | | | 33,956 | | | | 16,484,279 | |

Swiss Re AG | | Insurance | | | 152,132 | | | | 14,799,684 | |

Swisscom AG | | Telecommunication Services | | | 25,039 | | | | 12,190,721 | |

| | | | | | | | | | |

| | | | | | | | | 95,316,362 | |

| | | | | | | | | | |

| | | | | | | | | | |

21

DOMINI IMPACT INTERNATIONAL EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

July 31, 2019

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

Taiwan – 2.0% | |

Asia Cement Corp | | Materials | | | 1,892,232 | | | $ | 2,530,841 | |

AU Optronics Corp | | Technology Hardware & Equipment | | | 13,639,926 | | | | 3,601,192 | |

Feng TAY Enterprise Co Ltd | | Consumer Durables & Apparel | | | 205,675 | | | | 1,367,751 | |

Lite-On Technology Corp | | Technology Hardware & Equipment | | | 3,811,152 | | | | 5,395,023 | |

Novatek Microelectronics Corp | | Semiconductors,Semiconductor Eqpmt | | | 1,050,862 | | | | 5,549,669 | |

Realtek Semiconductor Corp | | Semiconductors,Semiconductor Eqpmt | | | 232,089 | | | | 1,541,378 | |

United Microelectronics Corp | | Semiconductors,Semiconductor Eqpmt | | | 9,056,259 | | | | 4,020,947 | |

| | | | | | | | | | |

| | | | | | | | | 24,006,801 | |

| | | | | | | | | | |

| | | | | | | | | | |

Thailand – 0.4% | |

CP ALL PCL | | Food & Staples Retailing | | | 1,814,368 | | | | 5,037,941 | |

| | | | | | | | | | |

| | | | | | | | | 5,037,941 | |

| | | | | | | | | | |

| | | | | | | | | | |

Turkey – 0.6% | |

Turkiye Garanti Bankasi AS (a) | | Banks | | | 2,424,803 | | | | 4,279,585 | |

Turkiye Is Bankasi AS Cl C (a) | | Banks | | | 3,138,113 | | | | 3,506,082 | |

| | | | | | | | | | |

| | | | | | | | | 7,785,667 | |

| | | | | | | | | | |

| | | | | | | | | | |

United Kingdom – 12.5% | |

3i Group PLC | | Diversified Financials | | | 1,126,535 | | | | 15,284,318 | |

Antofagasta PLC | | Materials | | | 142,082 | | | | 1,614,094 | |

Auto Trader Group PLC | | Media & Entertainment | | | 1,918,226 | | | | 12,678,817 | |

Barratt Developments PLC | | Consumer Durables & Apparel | | | 898,508 | | | | 7,063,022 | |

Berkeley Group Holdings PLC | | Consumer Durables & Apparel | | | 260,024 | | | | 12,313,641 | |

Burberry Group PLC | | Consumer Durables & Apparel | | | 214,070 | | | | 5,943,251 | |

Ferguson PLC | | Capital Goods | | | 309,775 | | | | 23,209,488 | |

Halma PLC | | Technology Hardware & Equipment | | | 47,622 | | | | 1,157,943 | |

Hikma Pharmaceuticals PLC | | Pharma, Biotech & Life Sciences | | | 346,115 | | | | 7,774,622 | |

Micro Focus International PLC | | Software & Services | | | 596,038 | | | | 12,641,209 | |

Next PLC | | Retailing | | | 106,533 | | | | 7,895,694 | |

Rentokil Initial PLC | | Commercial & Professional Services | | | 603,233 | | | | 3,209,009 | |

Royal Mail PLC | | Transportation | | | 2,140,619 | | | | 5,496,408 | |

Sage Group PLC/The | | Software & Services | | | 370,567 | | | | 3,253,680 | |

Spirax-Sarco Engineering PLC | | Capital Goods | | | 21,548 | | | | 2,365,799 | |

22

DOMINI IMPACT INTERNATIONAL EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

July 31, 2019

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

United Kingdom(Continued) | |

Standard Chartered PLC | | Banks | | | 420,974 | | | $ | 3,488,279 | |

Travis Perkins PLC | | Capital Goods | | | 357,850 | | | | 5,964,938 | |

Unilever PLC | | Household & Personal Products | | | 357,294 | | | | 21,643,181 | |

| | | | | | | | | | |

| | | | | | | | | 152,997,393 | |

| | | | | | | | | | |

| | | | | | | | | | |

United States – 0.5% | |

Jazz Pharmaceuticals PLC (a) | | Pharma, Biotech & Life Sciences | | | 45,301 | | | | 6,314,053 | |

| | | | | | | | | | |

| | | | | | | | | 6,314,053 | |

| | | | | | | | | | |

| | |

| Total Investments – 98.6%(Cost $1,147,086,326) (b) | | | | | 1,203,731,980 | |

| | |

| Other Assets, less liabilities – 1.4% | | | | | 17,165,289 | |

| | | | | | | | | | |

| | |

| Net Assets – 100.0% | | | | | $1,220,897,269 | |

| | | | | | | | | | |

(a)Non-income producing security.

(b) The aggregate cost for federal income tax purposes is $1,169,778,833. The aggregate gross unrealized appreciation is $95,905,599 and the aggregate gross unrealized depreciation is $61,952,452, resulting in net unrealized appreciation of $33,953,147.

(c) Securities for which there are no such quotations or valuations are valued at fair value as determined in good faith by or at the direction of the Fund’s Board of Trustees.

As of the date of this report, certain foreign securities were fair valued by an independent pricing service under the direction of the Board of Trustees or its delegates in accordance with the Trust’s Valuation and Pricing Policies and Procedures.

SEE NOTES TO FINANCIAL STATEMENTS

23

DOMINI IMPACT EQUITY FUND

Performance Commentary (Unaudited)

The Fund invests in a diversified portfolio of primarilymid- tolarge-cap U.S. equities. Domini selects securities combining two unique strategies: “U.S. Core” and “Thematic Solutions.” U.S. Core seeks to provide core stock market exposure through a diversified selection of companies that Domini has determined have strong social and environmental profiles. Thematic Solutions seeks to provide opportunistic exposure to companies that provide sustainability solutions in thematic-focused areas, as determined by Domini’s social, environmental and financial research and analysis. SSGA Funds Management, Inc. purchases and sells securities to implement Domini’s investment selections and manage the amount of assets to be held in short-term investments.

Prior to December 1, 2018, the Fund was subadvised by Wellington Management Company and managed through atwo-step process. Domini created an approved list of companies based on its social and environmental analysis, and Wellington sought to add value and manage risk through a systematic portfolio construction process.

Market Overview:

Despite heightened market volatility, U.S. equities remained generally upbeat throughout most of the twelve-month period ended July 31, 2019, and the S&P 500 Index ended the period with a 7.99% gain. Although the global outlook grew more uncertain amid prevailing trade tensions and signs of slowing growth, domestic equities were supported by resilient U.S. economic data, generally strong corporate earnings, and a reversal in monetary policy by the Federal Reserve Bank (Fed).

The market’s bullish sentiment had greatly faded by the time 2018 drew to a close. After rising by double-digit levels through the end of September, the S&P 500 saw its 2018 gains wiped out during the final three months of the year, falling about 20% from peak to trough. Growing fears over a prolonged trade war with China and the looming threat of Brexit combined with rising interest rates and lackluster third-quarter earnings to create a perfect storm that triggered a sharp selloff in October. False hopes of a trade truce between the U.S. and China and the Fed’s softening tone on further interest-rate increases briefly helped to steady the market in November before the selloff resumed in earnest in December, as the U.S. government entered its longest shutdown in history.

Nevertheless, the new year brought with it a renewed sense of optimism, and stocks rebounded as generally strong economic data and corporate earnings suggested that the U.S. economy remained on firm footing. As of July 31, the S&P 500 had gained over 20%year-to-date, more than recovering 2018 losses.

24

Fueled by last year’s tax cuts, corporations continued to repurchase stock in record quantities, and their forward guidance for 2019 was encouraging relative to the market’s subdued expectations coming into the year.

Throughout the period, the labor market remained a particularly bright spot in the economic landscape, with wages rising and unemployment dropping to a50-year low of 3.6% in April. Signs of weakness emerged by the end of the period, however. The housing market faced significant headwinds, and expansion in both the manufacturing and services sectors slowed. Political tensions at home and abroad continued to weigh on business and consumer confidence, and the U.S. and China failed to make meaningful progress on trade negotiations before the end of the period.

Amidst low inflation, ongoing trade uncertainty, and slowing global growth, the Fed officially reversed policy course in July, cutting benchmark rates for the first time since 2008. While the rate reduction should provide some near-term support for equity markets, many investors felt the25-basis-point reduction did not go far enough and continue to seek assurances of more accommodative policy to help sustain the economy amid the growing apprehension.

Portfolio Performance — Full Fiscal Year 2019:

The Domini Impact Equity Fund Investor shares returned 6.31% for the twelve-month period ended July 31, 2019, underperforming relative to the S&P 500 Index, which returned 7.99%. The strategy of this Fund was changed as of December 1, 2018 (see further performance commentary below).

Security selection was the primary driver of underperformance relative to the benchmark, with especially weak selection in the consumer discretionary and industrials sectors. Sector allocation, on the other hand, contributed positively to relative results for the period. This was driven primarily by the Fund’s exclusion of the energy sector, which was the worst performing sector for the benchmark over the period, and its overweight to information technology, which conversely was the best performing sector for the benchmark over the period.

From a market capitalization standpoint, the Fund’s overweight to small- andmid-cap stocks detracted from relative results for the period, as these stocks generally underperformed theirlarge-cap peers for the period.

At a company level, the top contributors to relative results for the period were pharmacy retailerWalgreens Boots Alliance,out-of-benchmark OLED manufacturerUniversal Display Corporation, pharmaceutical companyMerck, computer software companyMicrosoft, and graphics processing unit developerNvidia.

25

The top detractors from relative results were consulting firmRobert Half, luxury clothing companyRalph Lauren, electronic trading platformE-Trade, business IT services providerDXC Technology, and educational technology company2U.

Portfolio Performance — Since December 1, 2018:

Since the inception of its new investment strategy on December 1, 2018, the Fund’s Investor shares returned 10.10% as of July 31, 2019, outperforming relative to the S&P 500 Index, which returned 9.38% for the eight-month period.

Sector allocation was the primary driver of outperformance, primarily attributed to the Fund’s overweight to information technology and underweight to energy, which were the benchmark’s best and worst performing sectors for the period, respectively. Security selection contributed positively to relative results, with strong selection in health care offsetting weaker selection in consumer discretionary.

From a market capitalization standpoint, the Fund’s overweight to small- andmid-cap stocks detracted from relative results for the period, as these stocks generally underperformed theirlarge-cap peers for the period.

At a company level, the top contributors to relative results for the period were pharmacy retailerout-of-benchmark OLED manufacturerUniversal Display Corporation, computer software companyMicrosoft, consumer electronics companyApple,out-of-benchmark Australian software companyAtlassian, andout-of-benchmark Swiss pharmaceutical companyNovartis.

The top detractor from relative results was social media companyFacebook, which was not approved for investment by Domini as of July 31, 2019. Not holding the benchmark company hurt relative results. Other top detractors wereout-of-benchmark educational technology company2U; electronic trading platformE-Trade,out-of-benchmark electric vehicle manufacturerTesla, and insurance services providerPrudential Financial.

26

TEN LARGEST HOLDING (Unaudited)

| | | | | | | | | | |

| | | | |

| SECURITY DESCRIPTION | | % NET

ASSETS | | | SECURITY DESCRIPTION | | % NET

ASSETS | |

| | | | |

| Microsoft Corp | | | 5.9% | | | Procter & Gamble Co/The | | | 1.7% | |

| | | | |

| Apple Inc | | | 5.0% | | | Bank of America Corp | | | 1.5% | |

| | | | |

| Amazon.com Inc | | | 4.4% | | | Walt Disney Co/The | | | 1.5% | |

| | | | |

| Alphabet Inc Cl A | | | 4.2% | | | AT&T Inc | | | 1.4% | |

| | | | |

| Visa Inc Cl A | | | 1.8% | | | Mastercard Inc Cl A | | | 1.4% | |

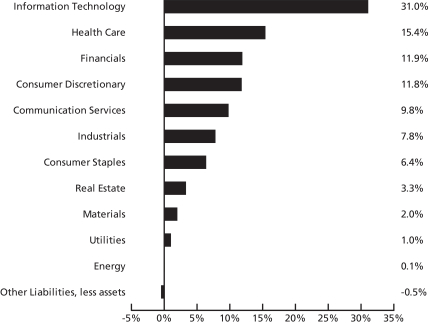

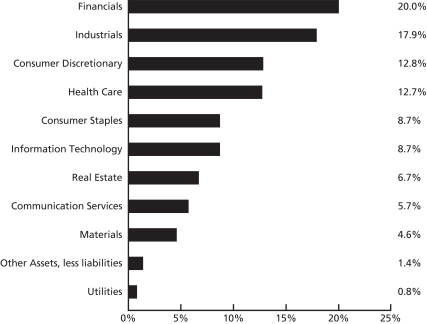

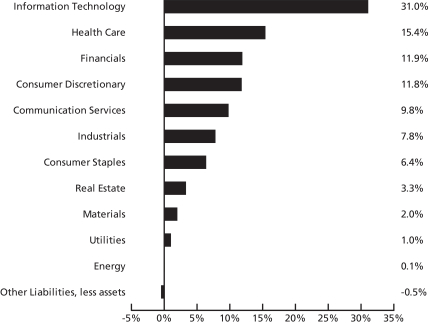

PORTFOLIO HOLDINGS BY INDUSTRY SECTOR (% OF NET ASSETS) (Unaudited)

The holdings mentioned above are described in the Domini Impact Equity Fund’s Portfolio of Investments as of 7/31/19, included herein. The composition of the Fund’s portfolio is subject to change.

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by Domini Impact Investments. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification nor shall any such party have any liability therefrom.

27

| | | | | | |

| |

| AVERAGE ANNUAL TOTAL RETURNS (Unaudited) |

| | |

| | | Investor shares | | S&P 500 |

| | | |

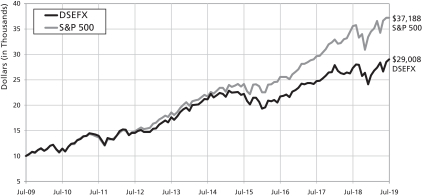

| As of 7/31/19 | | 1 Year | | 6.31% | | 7.99% |

| | | |

| | 5 Year | | 6.55% | | 11.34% |

| | | |

| | | 10 Year | | 11.24% | | 14.03% |

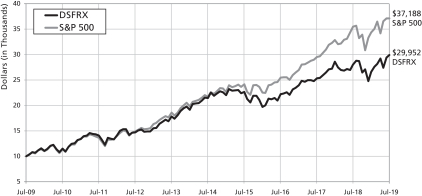

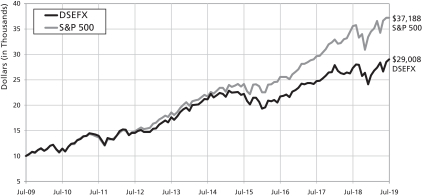

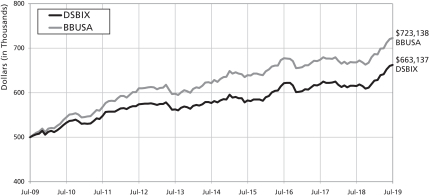

Comparison of $10,000 Investment in the Domini Impact Equity Fund Investor Shares (DSEFX) and S&P 500 (Unaudited)

NOTE: The Fund’s current investment strategy commenced on December 1, 2018 with SSGA Funds Management, Inc. as its subadviser. Performance information for periods prior to December 1, 2018 reflects the investment strategies employed during those periods.

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. The returns reflect any applicable expense waivers in effect during the periods shown. Without such waivers, Fund performance would be lower. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost. Call1-800-582-6757 or visit www.domini.com for performance information current to the most recentmonth-end, which may be lower or higher than the performance data quoted. A 2.00% redemption fee applies on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Quoted performance data does not reflect the deduction of this fee, which would reduce the performance quoted. See the prospectus for further information.

Per the prospectus dated December 1, 2018, the Fund’s annual operating expenses totaled 1.06% (gross/net). The Fund’s adviser has contractually agreed to waive certain fees and/or reimburse certain ordinary expenses in order to limit Investor share expenses to 1.09% through November 30, 2019, absent an earlier modification approved by the Funds’ Board of Trustees.

The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Fund is based on the Fund’s net asset values and assumes all dividend and capital gains were reinvested.

An investment in the Fund is not a bank deposit and is not insured. You may lose money. The Fund is subject to market, market sector, impact investing and foreign investing risks. Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing security regulations and accounting standards limited public information possible changes in taxation, and periods of illiquidity.

The Standard & Poor’s 500 Index (S&P 500) is an unmanaged index of common stocks. Investors cannot invest directly in the S&P 500.

28

| | | | | | | | |

| |

| AVERAGE ANNUAL TOTAL RETURNS (Unaudited) |

| | | |

| | | Class A shares (with

4.75% maximum

Sales Charge) | | Class A shares

(without

Sales Charge) | | S&P 500 |

| | | | |

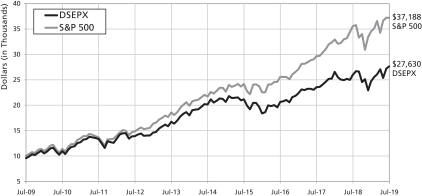

| As of 7/31/19 | | 1 Year | | 1.23% | | 6.28% | | 7.99% |

| | | | |

| | 5 Year | | 5.49% | | 6.52% | | 11.34% |

| | | | |

| | | 10 Year | | 10.70% | | 11.24% | | 14.03% |

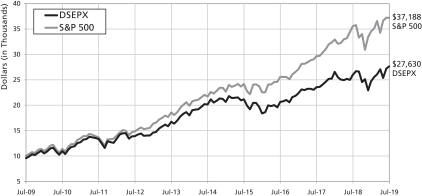

Comparison of $10,000 Investment in the Domini Impact Equity Fund Class A Shares (DSEPX) and S&P 500 (with 4.75% maximum sales charge) (Unaudited)

NOTE: The Fund’s current investment strategy commenced on December 1, 2018 with SSGA Funds Management, Inc. as its subadviser. Performance information for periods prior to December 1, 2018 reflects the investment strategies employed during those periods.

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. The returns reflect any applicable expense waivers in effect during the periods shown. Without such waivers, Fund performance would be lower. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost. Call1-800-762-6814 or visit www.domini.com for performance information current to the most recentmonth-end, which may be lower or higher than the performance data quoted. A 2.00% redemption fee applies on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Quoted performance data does not reflect the deduction of this fee, which would reduce the performance quoted. See the prospectus for further information.

Per the prospectus dated December 1, 2018, the Fund’s annual operating expenses totaled 1.34% (gross)/1.09% (net). The Fund’s adviser has contractually agreed to waive certain fees and/or reimburse certain ordinary operating expenses in order to limit Class A share expenses to 1.09% through November 30, 2019, absent an earlier modification approved by the Funds’ Board of Trustees.

The table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Fund is based on the Fund’s net asset values and assumes all dividend and capital gains were reinvested.

An investment in the Fund is not a bank deposit and is not insured. You may lose money. The Fund is subject to market, market sector, impact investing and foreign investing risks. Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing security regulations and accounting standards limited public information possible changes in taxation, and periods of illiquidity.

The Standard & Poor’s 500 Index (S&P 500) is an unmanaged index of common stocks. Investors cannot invest directly in the S&P 500.

29

| | | | | | |

| |

| AVERAGE ANNUAL TOTAL RETURNS (Unaudited) |

| | |

| | | Institutional shares | | S&P 500 |

| | | |

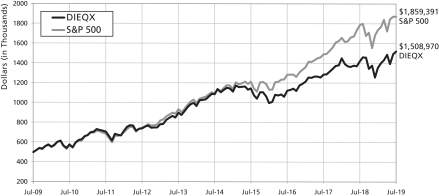

| As of 7/31/19 | | 1 Year | | 6.69% | | 7.99% |

| | | |

| | 5 Year | | 6.92% | | 11.34% |

| | | |

| | | 10 Year | | 11.68% | | 14.03% |

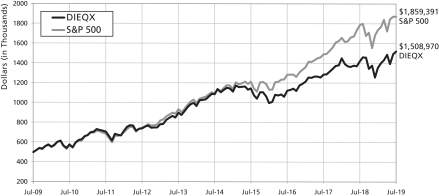

Comparison of $500,000 Investment in the Domini Impact Equity Fund Institutional (DIEQX) Shares and S&P 500 (Unaudited)

NOTE: The Fund’s current investment strategy commenced on December 1, 2018 with SSGA Funds Management, Inc. as its subadviser. Performance information for periods prior to December 1, 2018 reflects the investment strategies employed during those periods.

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. The returns reflect any applicable expense waivers in effect during the periods shown. Without such waivers, Fund performance would be lower. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost. Call1-800-762-6814 or visit www.domini.com for performance information current to the most recentmonth-end, which may be lower or higher than the performance data quoted. A 2.00% redemption fee applies on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Quoted performance data does not reflect the deduction of this fee, which would reduce the performance quoted. See the prospectus for further information.

Per the prospectus dated December 1, 2018, the Fund’s annual operating expenses totaled 0.72% (gross/net). The Fund’s adviser has contractually agreed to waive certain fees and/or reimburse certain ordinary operating expenses in order to limit Institutional share expenses to 0.74% through November 30, 2019, absent an earlier modification approved by the Funds’ Board of Trustees.

The table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Fund is based on the Fund’s net asset values and assumes all dividend and capital gains were reinvested.

An investment in the Fund is not a bank deposit and is not insured. You may lose money. The Fund is subject to market, market sector, impact investing and foreign investing risks. Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing security regulations and accounting standards limited public information possible changes in taxation, and periods of illiquidity.

The Standard & Poor’s 500 Index (S&P 500) is an unmanaged index of common stocks. Investors cannot invest directly in the S&P 500.

30

| | | | | | |

| |

| AVERAGE ANNUAL TOTAL RETURNS (Unaudited) |

| | |

| | | Class R shares | | S&P 500 |

| | | |

| As of 7/31/19 | | 1 Year | | 6.62% | | 7.99% |

| | | |

| | 5 Year | | 6.86% | | 11.34% |

| | | |

| | | 10 Year | | 11.59% | | 14.03% |

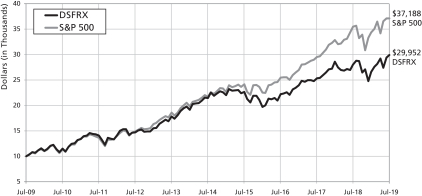

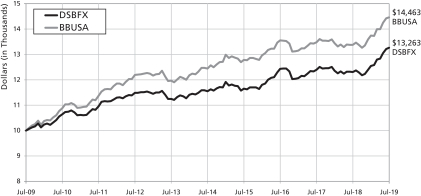

Comparison of $10,000 Investment in the Domini Impact Equity Fund Class R Shares (DSFRX) and S&P 500 (Unaudited)

NOTE: The Fund’s current investment strategy commenced on December 1, 2018 with SSGA Funds Management, Inc. as its subadviser. Performance information for periods prior to December 1, 2018 reflects the investment strategies employed during those periods.

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. The returns reflect any applicable expense waivers in effect during the periods shown. Without such waivers, Fund performance would be lower. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost. Call1-800-762-6814 or visit www.domini.com for performance information current to the most recentmonth-end, which may be lower or higher than the performance data quoted. A 2.00% redemption fee applies on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Quoted performance data does not reflect the deduction of this fee, which would reduce the performance quoted. See the prospectus for further information.

Per the prospectus dated December 1, 2018, the Fund’s annual operating expenses totaled 0.80% (gross/net). The Fund’s adviser has contractually agreed to waive certain fees and/or reimburse certain ordinary operating expenses in order to limit Class R share expenses to 0.80% through November 30, 2019, absent an earlier modification approved by the Funds’ Board of Trustees.

The table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Fund is based on the Fund’s net asset values and assumes all dividend and capital gains were reinvested.

An investment in the Fund is not a bank deposit and is not insured. You may lose money. The Fund is subject to market, market sector, impact investing and foreign investing risks. Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing security regulations and accounting standards limited public information possible changes in taxation, and periods of illiquidity.

The Standard & Poor’s 500 Index (S&P 500) is an unmanaged index of common stocks. Investors cannot invest directly in the S&P 500.

31

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS

July 31, 2019

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| Common Stocks – 100.5% | | | | | | |

| Communication Services – 9.8% | | | | | | |

AT&T Inc | | | 317,485 | | | $ | 10,810,364 | |

Alphabet Inc Cl A (a) | | | 26,650 | | | | 32,465,030 | |

CenturyLink Inc | | | 45,400 | | | | 548,886 | |

Charter Communications Inc Cl A (a) | | | 7,158 | | | | 2,758,550 | |

Comcast Corp Cl A | | | 199,908 | | | | 8,630,028 | |

Electronic Arts Inc (a) | | | 12,818 | | | | 1,185,665 | |

Netflix Inc (a) | | | 18,945 | | | | 6,119,046 | |

New York Times Co/The Cl A | | | 6,000 | | | | 214,080 | |

Omnicom Group Inc | | | 9,500 | | | | 762,090 | |

Take-Two Interactive Software Inc (a) | | | 4,681 | | | | 573,516 | |

TELUS Corp | | | 27,697 | | | | 994,599 | |

Verizon Communications Inc | | | 183,096 | | | | 10,119,716 | |

| | | | | | | | |

| | | | | | | 75,181,570 | |

| | | | | | | | |

| | |

| Consumer Discretionary – 11.8% | | | | | | |

Advance Auto Parts Inc | | | 2,957 | | | | 445,442 | |

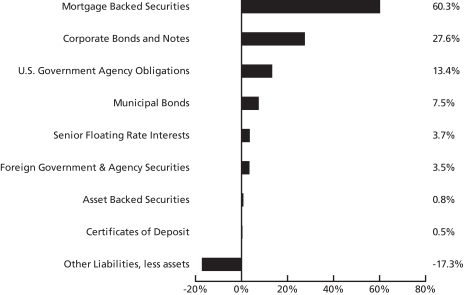

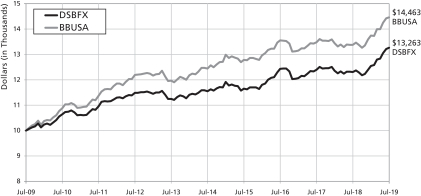

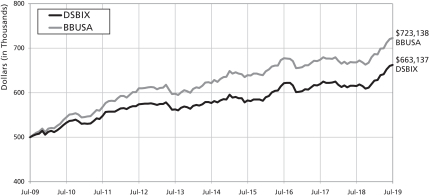

Amazon.com Inc (a) | | | 18,289 | | | | 34,141,539 | |