QTC has funding facilities that allow for borrowing in foreign currencies. At times, QTC’s Cash Fund invests in foreign currency assets. QTC enters into both forward exchange contracts and cross currency swaps to hedge the exposure of foreign currency borrowings and offshore investments from fluctuations in exchange rates. The following table summarises the hedging effect, in Australian dollars, that cross currency swaps and forward exchange contracts have had on the face value of offshore borrowings and investments.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | BORROWINGS | | | OFFSHORE INVESTMENTS | | | DERIVATIVE CONTRACTS | | | NET EXPOSURE | |

| | | | | | | | |

| | | 2022 $000 | | | 2021 $000 | | | 2022 $000 | | | 2021 $000 | | | 2022 $000 | | | 2021 $000 | | | 2022

$000 | | | 2021

$000 | |

| | | | | | | | |

USD | | | (1 481 325) | | | | (2 311 346) | | | | - | | | | - | | | | 1 481 325 | | | | 2 311 346 | | | | - | | | | - | |

| | | | | | | | |

CHF | | | (167 333) | | | | (158 715) | | | | - | | | | - | | | | 167 333 | | | | 158 715 | | | | - | | | | - | |

| | | | | | | | |

JPY | | | (159 877) | | | | (180 376) | | | | - | | | | - | | | | 159 877 | | | | 180 376 | | | | - | | | | - | |

| | | | | | | | |

EUR | | | (693 031) | | | | (721 451) | | | | 75 990 | | | | 79 106 | | | | 617 041 | | | | 642 345 | | | | - | | | | - | |

QTC lends to clients based on a duration profile specified in the client mandates. QTC then manages any mismatch between the duration profile of client loans and QTC’s funding within an Asset and Liability Management Portfolio. Duration is a direct measure of the interest rate sensitivity of a financial instrument or a portfolio of financial instruments and quantifies the change in value of a financial instrument or portfolio due to interest rate movements. All costs or benefits of managing any mismatch between client loans and QTC’s funding are passed on to the State, ensuring that QTC is effectively immunised from interest rate risk with respect to these portfolios.

QTC’s interest rate risk, which results from borrowing in advance and investing surplus funds in high credit quality, highly liquid assets, is managed with consideration given to duration risk, yield curve risk, basis risk and Value-at-Risk (VaR).

QTC uses a Board-approved VaR framework to manage QTC’s exposure to market risk complemented by other measures such as defined stress tests. The VaR measure estimates the potential mark-to-market loss over a given holding period at a 99% confidence level. QTC uses the historical simulation approach to calculate VaR with a holding period of ten business days.

To manage the risk of non-parallel yield curve movements, QTC manages portfolio cash flows in a series of time periods so that the net interest rate risk in each time period can be measured. QTC enters into interest rate swaps and futures contracts to assist in the management of interest rate risk.

In QTC’s Funding and Liquidity portfolios, interest rate swaps may be utilised to change the interest rate exposure of medium to long-term fixed rate borrowings into that of a floating rate borrowing. Also, at times, floating to fixed swaps may be undertaken to generate a fixed rate term funding profile. QTC is exposed to basis risk when interest rate swaps are used in the Funding and Liquidity portfolios. Basis risk represents a mark-to-market exposure due to movements between the swap curve, as well as cash, bank bill and bond futures contracts and QTC’s yield curve.

Client deposits in the QTC Cash Fund are invested on behalf of clients and returns received from these investments are passed onto QTC’s clients except for mark-to-market gains or losses from credit spread movements. QTC generally holds these investments to maturity and therefore any mark-to-market impacts from credit spread changes are typically reversed over the life of the assets.

| (iii) | Commodity price risk |

QTC is not directly exposed to commodity price changes.

| (b) | Funding and liquidity risks |

QTC has a robust internal framework whereby extensive liquidity scenario analysis and forecasting is undertaken to understand assumption sensitivities to ensure there is appropriate forward looking visibility of the State’s liquidity position.

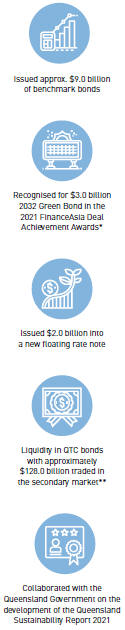

QTC debt is a Level 1 (prudentially required) asset for Australian banks under Basel III reforms with a zero per cent capital risk weighting. Even in difficult market circumstances, this generally ensures QTC debt is in high demand. Demand is further supported by the fact that QTC borrowings are guaranteed by the Queensland Government, (QTC has been rated AA+/Aa1/AA+ by ratings agencies Standard & Poors, Moody’s and Fitch respectively) and that QTC benchmark bonds are Reserve Bank of Australia (RBA) repurchase agreement eligible (repo eligible). The ability to readily issue debt is considered a potential source of liquidity.

QTC maintains appropriate liquidity to meet minimum requirements as defined by the Board. Limits are set by the Board and reviewed annually for the following liquidity metrics:

| ∎ | | QTC Liquidity Coverage Ratio – QTC must maintain a minimum liquidity balance sufficient to cover a stressed liquidity requirement over a set horizon. |

| ∎ | | Standard & Poor’s Liquidity Ratio – QTC must maintain a minimum ratio of liquid assets to debt servicing requirements at all times over a rolling 12 month horizon. |

| ∎ | | Cash Flow Waterfall – QTC must maintain positive cash equivalents net of all inflows and outflows over a set horizon. |

In addition to adhering to Board-approved liquidity metrics, QTC holds contingent liquid assets in the form of public sector entity deposits and investments owned by SIO.

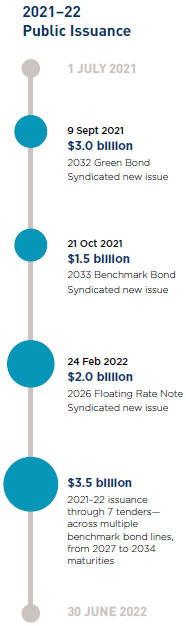

QTC maintains its AUD benchmark bond facility as its core medium to long-term funding facility and its domestic treasury note facility as its core short-term funding facility. In addition, QTC has in place a Green Bond Program, Euro and US medium-term note facilities and Euro and US commercial paper facilities to take advantage of alternative funding opportunities in global markets. These facilities ensure that QTC is readily able to access both the domestic and international financial markets.

Deposits on account of the Cash Fund and Working Capital Facility are repayable at call while deposits held as security for stock lending and repurchase agreements are repayable when the security is lodged with QTC.

Except for deposits and payables, the maturity analysis for liabilities has been calculated based on the contractual cash flows relating to the repayment of the principal (face value) and interest amounts over the contractual terms.

Except for cash and receivables, the maturity analysis for assets has been calculated based on the contractual cash flows relating to repayment of the principal (face value) and interest amounts over the contractual terms.

In relation to client onlendings, certain loans are interest only with no fixed repayment date for the principal component (i.e. loans are made based on the quality of the client’s business and its financial strength). For the purposes of completing the maturity analysis, the principal component of these loans has been included in the greater than five-year time band with no interest payment assumed in this time band.