Budget Strategy and Outlook 2022-23

In addition to agriculture, other key sectors impacted in the regions include construction, tourism (including accommodation and hospitality) and a wide range of other services industries, such as wholesale trade, retail trade, transport and sectors related to recreational and entertainment activities. In some cases, this lost economic activity will likely be partly recouped over time as people defer their expenditure. In other key sectors, such as agriculture and tourism, this is likely to be more of a permanent loss of economic output.

In comparison, the 2010–11 floods and Severe Tropical Cyclone Yasi resulted in flooded coal mines, extensive damage to rail transport and port operations, reduction in sugar, horticulture, and other crop harvests, as well as severely impacting tourism across the state. That event significantly reduced economic output, estimated at the time to be equal to around 21⁄4 percentage points of GSP.

Similarly, the impact of Severe Tropical Cyclone Debbie, which saw coal rail lines shut for an extended period and major damage to tourism infrastructure in the Whitsundays, was estimated to be around 3⁄4 percentage point of GSP, spread across 2016–17 and 2017–18.

Financial impacts of the 2022 floods on the 2022–23 Queensland Budget, including the costs to rebuild damaged roads and local government infrastructure, as well as assisting individuals, families and businesses impacted by the disasters, are addressed in Chapter 3.

| 2.4.1 | Household consumption |

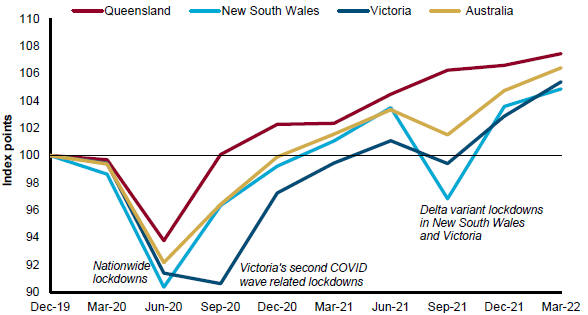

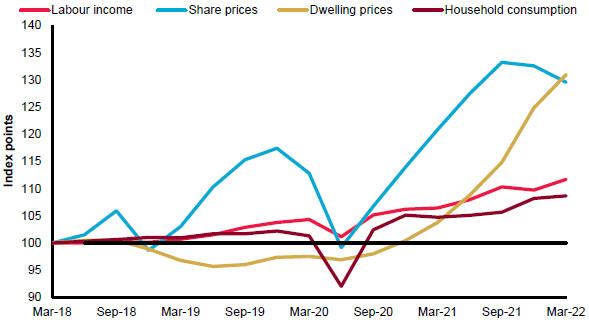

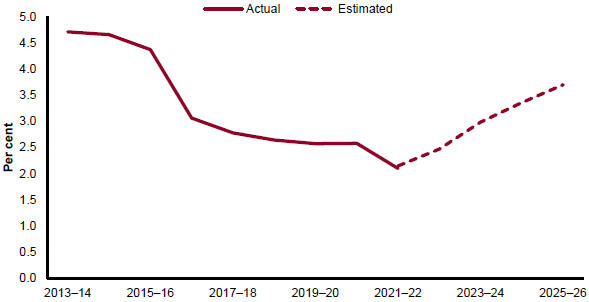

Following the nationwide lockdowns in 2020, a combination of factors, such as strong labour market conditions, substantial government stimulus and acceleration in asset prices, placed household balance sheets in a strong position and elevated savings. As shown by Chart 2.3, these improvements in household income and wealth led real household consumption in Queensland to generally strengthen over this period, and by the end of 2021 was 6.8 per cent above pre-pandemic levels.

The Omicron variant outbreaks in early 2022 and related supply chain disruptions, as well as rising inflationary pressures and temporary impacts from the severe flooding events in South East Queensland, weighed on household spending intentions and constrained consumption growth in March quarter 2022. However, strong outcomes in the first half of 2021–22 are still expected to lead to year-average growth of around 31⁄4 per cent in that year.

Since the start of the pandemic, there has been a shift towards increased spending on some discretionary items such as recreation, clothing and footwear, and household furnishings and equipment, while border closures and virus restrictions had severely reduced Queenslander’s spending on transport services. The recent reopening of the international borders, which will allow Queenslanders to again travel and spend overseas, is expected to result in a re-adjustment of the composition of expenditure seen during the COVID-19 crisis over the rest of 2022 and into 2023.

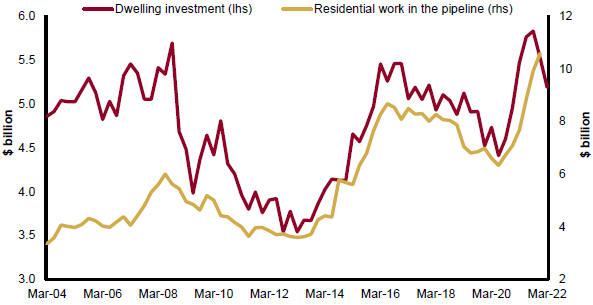

Driven by sustained growth in labour income, a lagged impact of the terms of trade boom, a pick-up in population growth and further strong growth in dwelling construction, real consumption growth in Queensland is expected to remain solid at around 23⁄4 per cent in 2022–23.

As monetary policy tightens and the dwelling construction cycle matures, consumption growth is expected ease to around 21⁄4 per cent in 2023–24.

40

Translating and interpreting assistance

Translating and interpreting assistance