Notes to the Financial Statements

| 1. | Basis of financial statements preparation |

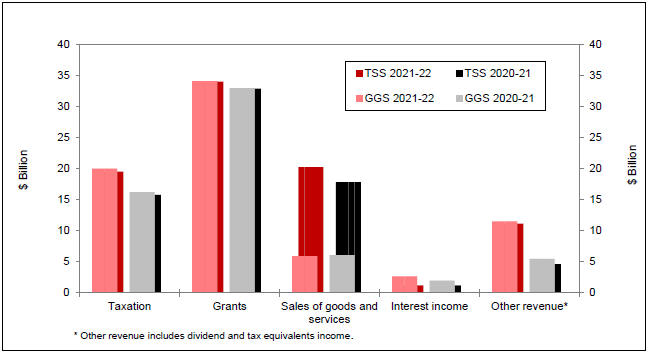

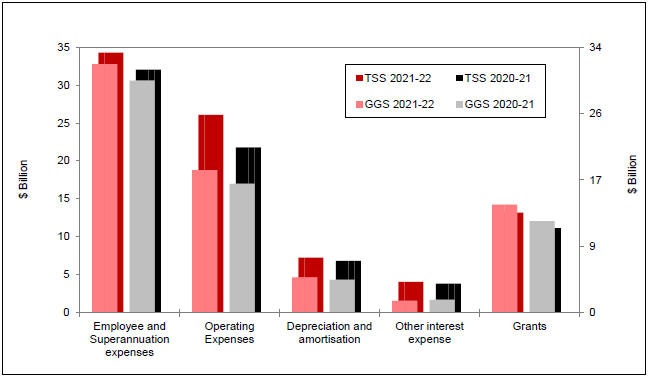

This financial report is prepared for the Queensland General Government Sector (GGS) and the consolidated Total State Sector (TSS).

The GGS is a component of the TSS. The GGS is determined in accordance with the principles and rules contained in the Australian Bureau of Statistics’ (ABS) Australian System of Government Finance Statistics: Concepts, Sources and Methods 2015 (ABS GFS Manual). According to the ABS GFS Manual, the GGS consists of all government units and non-profit institutions controlled and mainly financed by government. Government units are legal entities established by political processes that have legislative, judicial or executive authority over other units and which provide goods and services to the community or to individuals on a non-market basis and make transfer payments to redistribute income and wealth. Non-profit institutions are created for the purpose of producing or distributing goods and services but are not a source of income, profit or other financial gain for the Government. Refer Note 1(c) for further information on sectors.

Unless otherwise stated, references in this report to “the State” include both the GGS and TSS.

| (b) | The Government reporting entity |

The Queensland Government economic entity (Total State Sector) includes all State Government departments, other General Government entities, Public Non-financial Corporations (PNFC), Public Financial Corporations (PFC) and their controlled entities. Refer Note 50 for a full list of controlled entities included in each sector.

Under AASB 1049 Whole of Government and General Government Sector Financial Reporting, the preparation of the GGS financial report does not require full application of AASB 10 Consolidated Financial Statements and AASB 9 Financial Instruments. The GGS includes the value of all material assets, liabilities, equity, revenue and expenses of entities controlled by the GGS of Queensland. Assets, liabilities, revenue, expenses and cash flows of Government controlled entities that are in the PNFC and the PFC are not separately recognised in the GGS.

Instead, the GGS recognises an asset, being the controlling equity investment in those entities and recognises an increment or decrement relating to changes in the carrying amount of that asset, measured in accordance with AASB 1049.

Where control of an entity is obtained during the financial year, its results are included in the Operating Statement from the date control commences. Where control of an entity ceases during a financial year, its results are included for that part of the year during which control existed.

Generally, only those agencies considered material by virtue of the size of their financial transactions and/or resources managed are consolidated for the purposes of this report (refer Note 50 for further details).

In the process of reporting the Queensland Government as a single economic entity, all material inter-entity and intra-entity transactions and balances have been eliminated to the extent practicable.

The ABS GFS Manual provides the basis upon which GFS information contained in the financial report is prepared. In particular, Note 51 discloses how key fiscal aggregates of net worth, net operating balance, fiscal balance and cash surplus/(deficit), determined using the principles and rules in the ABS GFS Manual, differ from the aggregates included in this financial report.

Assets, liabilities, revenue and expenses that are attributed reliably to each sector of the Queensland Government economic entity are disclosed in Note 2. For disclosure purposes, transactions and balances between entities within each sector have been eliminated in the sector. The financial impact of inter-sector transactions and balances is also disclosed under the heading of Consolidation Adjustments.

A brief description of each broad sector of the Government’s activities, determined in accordance with the ABS GFS Manual follows:

General Government Sector (GGS)

The primary function of GGS agencies is to provide public services that:

– are non-trading in nature and that are for the collective benefit of the community;

– are largely financed by way of taxes, fees and other compulsory charges; and

– involve the transfer or redistribution of income.

Public Non-financial Corporations Sector (PNFC Sector)

The primary function of enterprises in the PNFC Sector is to provide goods and services that:

– are trading, non-regulatory or non-financial in nature; and

– are financed by way of sales of goods and services to consumers.

| | |

| 5-10 | | Audited Consolidated Financial Statements 2021–22 – Queensland Government |