Agricultural

The volume of agriculture exports rose by around 15 per cent in 2021–22, driven by a sharp increase in cotton and other crops exports, as high global prices and improved growing conditions boosted Queensland production. High prices continue to support the value of agriculture exports, which totalled an estimated $13.2 billion in the 12 months to September 2022, a 30 per cent increase on the previous year.

Looking ahead, beef production and exports are expected to return to growth in 2022–23, cotton exports are expected to grow strongly, and sugar production and exports are expected to return to a more normal level.

Services

The reopening of the international borders has started to flow through into increased arrivals of international students and visitors. However, both currently remain below pre-COVID levels.

Visa applications for overseas students, which are a leading indicator of commencements, have already returned to pre-COVID levels. This points to a strong pipeline of future student inflows and commencements.

The recovery in short-term international arrivals, which drives international tourism exports, has been more gradual and has only recently reached half of pre-COVID levels. With continuing improvements in confidence and capacity, this recovery is expected to continue over the remainder of 2022–23 to see overseas services exports return to around their pre-pandemic level by 2023–24.

Labour market

Queensland’s labour market remains exceptionally strong and historically tight, reflecting the state’s strong recovery from COVID-19 and the impacts of international border closures restricting labour flows.

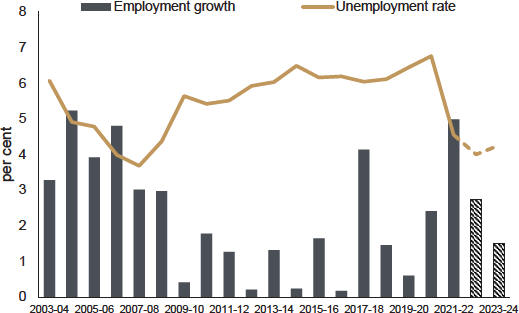

In September quarter 2022, Queensland’s unemployment rate fell to 3.6 per cent, its lowest rate since 2007–2008, while the employment-to-population ratio was 64.3 per cent, its highest rate in more than a decade. Further, the job vacancy rate (a key indicator of labour demand, which is the number of vacancies as a proportion of total labour force) reached 3.0 per cent, its highest rate on record.

In year-average terms, Queensland’s employment rose 5.0 per cent in 2021–22, Queensland’s strongest annual employment growth since 2004–05.

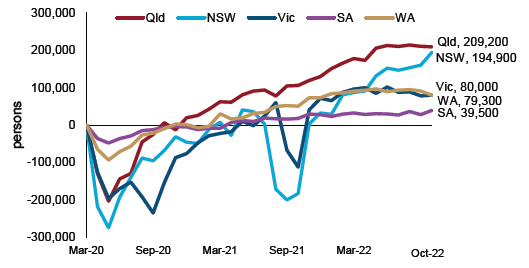

On a monthly basis, employment in Queensland in October 2022 was 209,200 persons (or 8.2 per cent) above its pre-COVID level of March 2020. This was the strongest growth of any state or territory, in both absolute and percentage terms.

Queensland’s labour market is expected to remain strong in the coming years and population growth is forecast to strengthen to 13⁄4 per cent in both 2022–23 and 2023–24 as overseas migration rebounds.

However, rising interest rates and a weaker global economic outlook compared with Budget are expected to weigh on Queensland’s domestic economic growth, and therefore employment growth.

In year-average terms, employment is now forecast to grow 23⁄4 per cent in 2022–23, before moderating to 11⁄2 per cent growth in 2023–24, broadly in line with population growth.

The year-average unemployment rate is forecast to remain low, falling from 4.6 per cent in 2021–22 to 4 per cent on average across 2022–23 (unchanged from Budget), before rising marginally to 41⁄4 per cent in 2023–24 (Chart 2). The unemployment rate over the past 2 decades has averaged 5.8 per cent.

The drivers of employment growth in Queensland are expected to continue to be broad based and, therefore, the benefit should be felt across most regions. Key growth industries for employment are likely to include health care, construction, retail trade, transport and warehousing, accommodation and food services, and professional services.