UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-05876

LORD ABBETT SERIES FUND, INC.

(Exact name of Registrant as specified in charter)

90 Hudson Street, Jersey City, NJ 07302

(Address of principal executive offices) (Zip code)

Brooke A. Fapohunda, Esq., Vice President & Assistant Secretary

90 Hudson Street, Jersey City, NJ 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 201-6984

Date of fiscal year end: 12/31

Date of reporting period: 12/31/2016

| Item 1: | Report(s) to Shareholders. |

2016 LORD ABBETT

ANNUAL REPORT

Lord Abbett

Series Fund—Bond Debenture Portfolio

For the fiscal year ended December 31, 2016

Table of Contents

Lord Abbett Series Fund — Bond Debenture Portfolio

Annual Report

For the fiscal year ended December 31, 2016

From left to right: James L.L. Tullis, Chairman of the Lord Abbett Funds and Daria L. Foster Director, President, and Chief Executive Officer of the Lord Abbett Funds. | | Dear Shareholders: We are pleased to provide you with this overview of the performance of Lord Abbett Series Fund — Bond Debenture Portfolio for the fiscal year ended December 31, 2016. On this page, and the following pages, we discuss the major factors that influenced fiscal year performance. For additional information about the Fund, please visit our website at www.lordabbett.com, where you also can access the quarterly commentaries that provide updates on the Fund’s performance and other portfolio related updates. Thank you for investing in Lord Abbett mutual funds. We value the trust that you place in us and look forward to serving your investment needs in the years to come. Best regards,

Daria L. Foster Director, President and Chief Executive Officer |

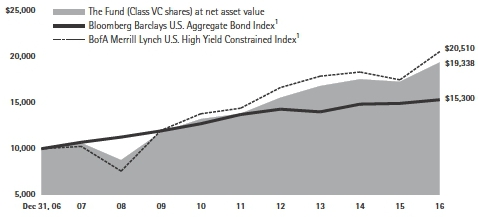

For the fiscal year ended December 31, 2016, the Fund returned 12.13%, reflecting performance at the net asset value (NAV) of Class VC shares, with all distributions reinvested, compared to its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index1 which returned 2.65% over the same period.

The high yield sector of the U.S. fixed income market experienced strong returns during the 12-month period, outperforming traditional government-related and investment grade securities

within the fixed income market as well as the U.S. equity market. Leveraged loans also experienced strong returns, although not to the same extent as high yield bonds.

As it has in the past, the Fund maintained a significant allocation to high yield bonds, as we remained positive on the high yield market from a fundamental perspective. The Fund’s exposure to high yield bonds likely contributed to relative performance, as the high yield market significantly outperformed the Fund’s benchmark.

1

The Fund maintained a sizable allocation to equities throughout the period, as equities provided portfolio diversification, a high degree of liquidity, and a more diverse opportunity set to express certain investment themes than did certain fixed income securities. The Fund’s allocation to equities likely contributed to relative performance, as the asset class outperformed the Bloomberg Barclays U.S. Aggregate Bond Index.

Within the Fund’s investment grade bond allocation, the Fund’s exposure to ‘AAA’ rated bonds likely detracted from performance, as ‘AAA’ rated bonds underperformed the benchmark during the period.

The Fund’s portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

1 The Bloomberg Barclays U.S. Aggregate Bond Index represents securities that are SEC-registered, taxable, and dollar-denominated. The index covers the U.S. investment-grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Total return comprises price appreciation/depreciation and income as a percentage of the original investment.

Unless otherwise specified, indexes reflect total return, with all dividends reinvested. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

Important Performance and Other Information

Performance data quoted in the following pages reflect past performance and are no guarantee of future results. Current performance may be higher or lower than the performance quoted. The investment return and principal value of an investment in the Funds will fluctuate so that shares, on any given day or when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling Lord Abbett at 888-522-2388 or referring to www.lordabbett.com.

During certain periods shown, expense waivers and reimbursements were in place. Without such expense

waivers and reimbursements, the Funds’ returns would have been lower.

The annual commentary above discusses the views of the Fund’s management and various portfolio holdings of the Funds as of December 31, 2016. These views and portfolio holdings may have changed after this date. Information provided in the commentary is not a recommendation to buy or sell securities. Because the Fund’s portfolio is actively managed and may change significantly, the Fund may no longer own the securities described above or may have otherwise changed their positions in the securities. For more recent information about the Fund’s portfolio holdings, please visit www.lordabbett.com.

A Note about Risk: See Notes to Financial Statements for a discussion of investment risks. For a more detailed discussion of the risks associated with each Fund, please see the Fund’s prospectus.

Mutual funds are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by, banks, and are subject to investment risks including possible loss of principal amount invested.

The Fund serves as an underlying investment vehicle for variable annuity contracts and variable life insurance policies.

2

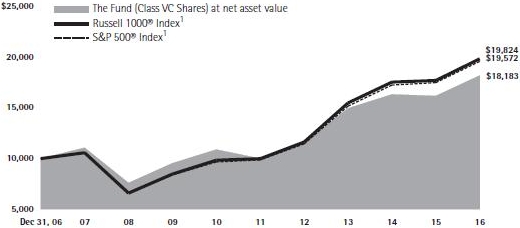

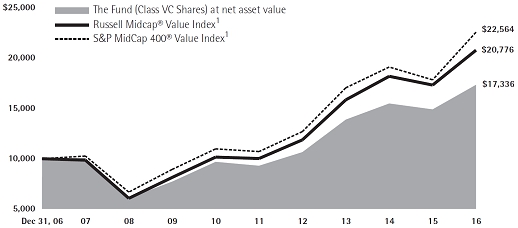

Investment Comparison

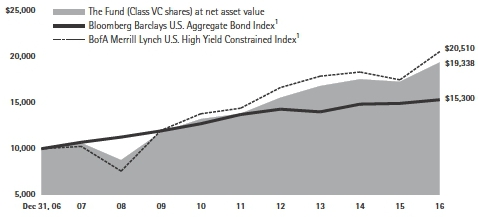

Below is a comparison of a $10,000 investment in Class VC shares with the same investment in the Bloomberg Barclays U.S. Aggregate Bond Index and the BofA Merrill Lynch U.S. High Yield Constrained Index, assuming reinvestment of all dividends and distributions. The Fund’s shares are sold only to insurance company separate accounts that fund certain variable annuity and variable life contracts. This line graph comparison does not reflect the sales charges or other expenses of these contracts. If those sales charges and expenses were reflected, returns would be lower. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

| | | Average Annual Total Returns for the

Periods Ended December 31, 2016 |

| | | | 1 Year | | | 5 Years | | | 10 Years |

| Class VC | | | 12.13 | % | | | 7.00 | % | | | 6.82 | % |

1 Performance for each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance.

3

Expense Example

As a shareholder of the Fund, you incur ongoing costs, including management fees; expenses related to the Fund’s services arrangements with certain insurance companies; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2016 through December 31, 2016).

The Example reflects only expenses that are deducted from the assets of the Fund. Fees and expenses, including sales charges applicable to the various insurance products that invest in the Fund, are not reflected in this Example. If such fees and expenses were reflected in the Example, the total expenses shown would be higher. Fees and expenses regarding such variable insurance products are separately described in the prospectus related to those products.

Actual Expenses

The first line of the table on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled “Expenses Paid During Period 7/1/16 – 12/31/16” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

4

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning | | Ending | | Expenses |

| | | Account | | Account | | Paid During |

| | | Value | | Value | | Period† |

| | | | | | | 7/1/16 - |

| | | 7/1/16 | | 12/31/16 | | 12/31/16 |

| Class VC | | | | | | |

| Actual | | $1,000.00 | | $1,058.60 | | $4.66 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,020.61 | | $4.57 |

| † | Net expenses are equal to the Fund’s annualized expense ratio of 0.90%, multiplied by the average account value over the period, multiplied by 184/366 (to reflect one-half year period). |

Portfolio Holdings Presented by Sector

December 31, 2016

| Sector* | %** | |

| Asset Backed | 2.48 | % |

| Automotive | 1.54 | % |

| Banking | 8.15 | % |

| Basic Industry | 13.53 | % |

| Capital Goods | 4.50 | % |

| Consumer Goods | 4.82 | % |

| Energy | 15.57 | % |

| Financial Services | 2.04 | % |

| Foreign Government | 4.23 | % |

| Healthcare | 5.07 | % |

| Insurance | 1.49 | % |

| Leisure | 4.32 | % |

| Media | 6.31 | % |

| Municipal | 0.33 | % |

| Real Estate | 1.28 | % |

| Retail | 4.42 | % |

| Services | 2.52 | % |

| Technology & Electronics | 5.41 | % |

| Telecommunications | 5.14 | % |

| Transportation | 2.81 | % |

| Utility | 2.85 | % |

| Repurchase Agreement | 1.19 | % |

| Total | 100.00 | % |

| * | A sector may comprise several industries. |

| ** | Represents percent of total investments. |

5

Schedule of Investments

December 31, 2016

| Investments | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000) | | | Fair

Value | |

| LONG-TERM INVESTMENTS 97.53% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| ASSET-BACKED SECURITIES 2.04% | | | | | | | | | | | | |

| | | | | | | | ’ | | | | | |

| Automobiles 0.37% | | | | | | | | | | | | |

| Drive Auto Receivables Trust 2016-BA D† | | 4.53% | | 8/15/2023 | | $ | 1,028 | | | $ | 1,034,569 | |

| Ford Credit Auto Owner Trust 2016-C C | | 1.93% | | 4/15/2023 | | | 532 | | | | 523,311 | |

| Hyundai Auto Receivables Trust 2016-B C | | 2.19% | | 11/15/2022 | | | 1,175 | | | | 1,157,601 | |

| TCF Auto Receivables Owner Trust 2016-1A B† | | 2.32% | | 6/15/2022 | | | 979 | | | | 966,737 | |

| Westlake Automobile Receivables Trust 2016-3A B† | | 2.07% | | 12/15/2021 | | | 277 | | | | 275,914 | |

| Total | | | | | | | | | | | 3,958,132 | |

| | | | | | | | | | | | | |

| Other 1.67% | | | | | | | | | | | | |

| ALM XIX Ltd. 2016-19A C† | | 4.984% | # | 7/15/2028 | | | 462 | | | | 468,856 | |

| ALM XVIII Ltd. 2016-18A C† | | 5.007% | # | 7/15/2027 | | | 500 | | | | 504,587 | |

| Anchorage Capital CLO 7 Ltd. 2015-7A D† | | 4.53% | # | 10/15/2027 | | | 400 | | | | 391,335 | |

| Anchorage Capital CLO 8 Ltd. 2016-8A D† | | 4.921% | # | 7/28/2028 | | | 250 | | | | 253,066 | |

| Anchorage Capital CLO 9 Ltd. 2016-9A D† | | 4.951% | # | 1/15/2029 | | | 900 | | | | 894,126 | |

| Anchorage Capital CLO Ltd. 2013-1A C† | | 4.378% | # | 7/13/2025 | | | 250 | | | | 247,463 | |

| Ascentium Equipment Receivables Trust 2016-2A B† | | 2.50% | | 9/12/2022 | | | 417 | | | | 410,958 | |

| BlueMountain CLO Ltd. 2016-1A D† | | 5.681% | # | 4/20/2027 | | | 500 | | | | 506,060 | |

| Engs Commercial Finance Trust 2016-1A A2† | | 2.63% | | 2/22/2022 | | | 1,063 | | | | 1,057,410 | |

| Guggenheim 5180-2 CLO LP 2015-1A A2B† | | 3.48% | # | 11/25/2027 | | | 2,500 | | | | 2,522,893 | |

| JFIN CLO II Ltd. 2015-2A B1† | | 3.28% | # | 10/19/2026 | | | 1,500 | | | | 1,505,893 | |

| KKR Financial CLO Ltd. 2013-2A C† | | 4.632% | # | 1/23/2026 | | | 500 | | | | 486,630 | |

| Leaf Receivables Funding 11 LLC 2016-1 A3† | | 2.05% | | 6/15/2019 | | | 492 | | | | 491,105 | |

| Leaf Receivables Funding 11 LLC 2016-1 A4† | | 2.49% | | 4/15/2022 | | | 634 | | | | 630,604 | |

| OHA Loan Funding Ltd. 2013-1A D† | | 4.482% | # | 7/23/2025 | | | 450 | | | | 446,691 | |

| OZLM VIII Ltd. 2014-8A A2A† | | 3.03% | # | 10/17/2026 | | | 1,250 | | | | 1,252,151 | |

| PFS Financing Corp. 2016-BA A† | | 1.87% | | 10/15/2021 | | | 562 | | | | 557,082 | |

| Sonic Capital LLC 2016-1A A2† | | 4.472% | | 5/20/2046 | | | 537 | | | | 531,458 | |

| Sound Point CLO XI Ltd. 2016-1A D† | | 5.531% | # | 7/20/2028 | | | 2,000 | | | | 2,009,060 | |

| Taco Bell Funding LLC 2016-1A A23† | | 4.97% | | 5/25/2046 | | | 1,025 | | | | 1,020,387 | |

| Voya CLO Ltd. 2016-2A C† | | 4.932% | # | 7/19/2028 | | | 750 | | | | 737,942 | |

| Westcott Park CLO Ltd. 2016-1A D† | | 5.231% | # | 7/20/2028 | | | 850 | | | | 849,986 | |

| Total | | | | | | | | | | | 17,775,743 | |

| Total Asset-Backed Securities (cost $21,441,083) | | | | | | | | | | | 21,733,875 | |

| 6 | See Notes to Financial Statements. | |

Schedule of Investments (continued)

December 31, 2016

| Investments | | Shares

(000) | | Fair

Value | |

| COMMON STOCKS 13.29% | | | | | | |

| | | | | | | |

| Aerospace/Defense 0.21% | | | | | | |

| Huntington Ingalls Industries, Inc. | | 6 | | $ | 1,101,088 | |

| Northrop Grumman Corp. | | 5 | | | 1,170,342 | |

| Total | | | | | 2,271,430 | |

| | | | | | | |

| Air Transportation 0.24% | | | | | | |

| Hawaiian Holdings, Inc.* | | 26 | | | 1,457,832 | |

| Spirit Airlines, Inc.* | | 18 | | | 1,051,027 | |

| Total | | | | | 2,508,859 | |

| | | | | | | |

| Auto Parts & Equipment 0.36% | | | | | | |

| BorgWarner, Inc. | | 26 | | | 1,039,126 | |

| Chassix Holdings, Inc. | | 59 | | | 1,754,512 | |

| LCI Industries | | 10 | | | 1,060,152 | |

| Total | | | | | 3,853,790 | |

| | | | | | | |

| Automakers 0.24% | | | | | | |

| Oshkosh Corp. | | 16 | | | 1,017,284 | |

| Thor Industries, Inc. | | 15 | | | 1,509,755 | |

| Total | | | | | 2,527,039 | |

| | | | | | | |

| Banking 1.40% | | | | | | |

| Comerica, Inc. | | 27 | | | 1,809,274 | |

| Cullen/Frost Bankers, Inc. | | 15 | | | 1,311,892 | |

| Great Western Bancorp, Inc. | | 30 | | | 1,287,736 | |

| Hilltop Holdings, Inc. | | 37 | | | 1,096,849 | |

| LegacyTexas Financial Group, Inc. | | 29 | | | 1,239,697 | |

| PacWest Bancorp | | 20 | | | 1,088,800 | |

| Regions Financial Corp. | | 75 | | | 1,077,000 | |

| Sberbank of Russia PJSC ADR | | 96 | | | 1,111,200 | |

| SVB Financial Group* | | 12 | | | 2,111,761 | |

| Texas Capital Bancshares, Inc.* | | 19 | | | 1,520,960 | |

| Zions Bancorporation | | 31 | | | 1,313,150 | |

| Total | | | | | 14,968,319 | |

| | | | | | | |

| Beverages 0.10% | | | | | | |

| Boston Beer Co., Inc. (The) Class A* | | 6 | | | 1,082,794 | |

| | | | | | | |

| Brokerage 0.12% | | | | | | |

| E*TRADE Financial Corp.* | | 37 | | | 1,267,462 | |

| | See Notes to Financial Statements. | 7 |

Schedule of Investments (continued)

December 31, 2016

| Investments | | Shares

(000) | | Fair

Value | |

| Building & Construction 0.27% | | | | | | |

| Granite Construction, Inc. | | 34 | | $ | 1,849,595 | |

| LGI Homes, Inc.* | | 34 | | | 969,379 | |

| Total | | | | | 2,818,974 | |

| | | | | | | |

| Building Materials 0.51% | | | | | | |

| Beacon Roofing Supply, Inc.* | | 23 | | | 1,052,331 | |

| Gibraltar Industries, Inc.* | | 23 | | | 974,610 | |

| Martin Marietta Materials, Inc. | | 6 | | | 1,332,503 | |

| Simpson Manufacturing Co., Inc. | | 23 | | | 1,015,000 | |

| Vulcan Materials Co. | | 8 | | | 1,040,747 | |

| Total | | | | | 5,415,191 | |

| | | | | | | |

| Chemicals 0.54% | | | | | | |

| Celanese Corp. Series A | | 13 | | | 1,012,754 | |

| CF Industries Holdings, Inc. | | 36 | | | 1,142,724 | |

| Scotts Miracle-Gro Co. (The) Class A | | 12 | | | 1,147,078 | |

| Trinseo SA | | 20 | | | 1,206,280 | |

| Versum Materials, Inc.* | | 45 | | | 1,249,115 | |

| Total | | | | | 5,757,951 | |

| | | | | | | |

| Diversified Capital Goods 0.50% | | | | | | |

| A.O. Smith Corp. | | 23 | | | 1,072,383 | |

| AMETEK, Inc. | | 22 | | | 1,058,751 | |

| Belden, Inc. | | 14 | | | 1,070,332 | |

| MSC Industrial Direct Co., Inc. Class A | | 12 | | | 1,112,653 | |

| Rockwell Automation, Inc. | | 8 | | | 1,050,202 | |

| Total | | | | | 5,364,321 | |

| | | | | | | |

| Electric: Integrated 0.21% | | | | | | |

| IDACORP, Inc. | | 13 | | | 1,071,315 | |

| Portland General Electric Co. | | 26 | | | 1,108,555 | |

| Total | | | | | 2,179,870 | |

| | | | | | | |

| Electronics 0.42% | | | | | | |

| Cognex Corp. | | 17 | | | 1,059,337 | |

| Littelfuse, Inc. | | 8 | | | 1,177,280 | |

| MKS Instruments, Inc. | | 18 | | | 1,086,782 | |

| Trimble, Inc.* | | 37 | | | 1,114,465 | |

| Total | | | | | 4,437,864 | |

| 8 | See Notes to Financial Statements. | |

Schedule of Investments (continued)

December 31, 2016

| Investments | | Shares

(000) | | Fair

Value | |

| Energy: Exploration & Production 0.53% | | | | | | |

| Callon Petroleum Co.* | | 78 | | $ | 1,202,826 | |

| Concho Resources, Inc.* | | 8 | | | 996,091 | |

| Diamondback Energy, Inc.* | | 10 | | | 1,024,951 | |

| Parsley Energy, Inc. Class A* | | 29 | | | 1,036,267 | |

| Sanchez Energy Corp.* | | 2 | | | 16,380 | |

| Templar Energy LLC Class A | | 46 | | | 346,644 | |

| WPX Energy, Inc.* | | 72 | | | 1,049,521 | |

| Total | | | | | 5,672,680 | |

| | | | | | | |

| Environmental 0.10% | | | | | | |

| Tetra Tech, Inc. | | 25 | | | 1,063,648 | |

| | | | | | | |

| Food: Wholesale 0.19% | | | | | | |

| Hershey Co. (The) | | 10 | | | 1,069,570 | |

| Mead Johnson Nutrition Co. | | 14 | | | 997,716 | |

| Total | | | | | 2,067,286 | |

| | | | | | | |

| Forestry/Paper 0.31% | | | | | | |

| KapStone Paper and Packaging Corp. | | 50 | | | 1,100,295 | |

| Louisiana-Pacific Corp.* | | 60 | | | 1,128,342 | |

| Potlatch Corp. | | 27 | | | 1,116,803 | |

| Total | | | | | 3,345,440 | |

| | | | | | | |

| Gaming 0.10% | | | | | | |

| Wynn Resorts Ltd. | | 12 | | | 1,045,992 | |

| | | | | | | |

| Hotels 0.16% | | | | | | |

| La Quinta Holdings, Inc.* | | 39 | | | 559,874 | |

| Marriott International, Inc. Class A | | 13 | | | 1,107,912 | |

| Total | | | | | 1,667,786 | |

| | | | | | | |

| Integrated Energy 0.09% | | | | | | |

| NOW, Inc.* | | 48 | | | 986,408 | |

| | | | | | | |

| Machinery 0.44% | | | | | | |

| Middleby Corp. (The)* | | 13 | | | 1,669,893 | |

| Nordson Corp. | | 16 | | | 1,786,974 | |

| Toro Co. (The) | | 23 | | | 1,263,015 | |

| Total | | | | | 4,719,882 | |

| | | | | | | |

| Managed Care 0.10% | | | | | | |

| WellCare Health Plans, Inc.* | | 8 | | | 1,076,352 | |

| | See Notes to Financial Statements. | 9 |

Schedule of Investments (continued)

December 31, 2016

| Investments | | Shares

(000) | | Fair

Value | |

| Media: Content 0.41% | | | | | | | |

| AMC Networks, Inc. Class* | | | 20 | | $ | 1,041,357 | |

| Netflix, Inc.* | | | 18 | | | 2,203,269 | |

| Scripps Networks Interactive, Inc. Class A | | | 16 | | | 1,148,343 | |

| Total | | | | | | 4,392,969 | |

| | | | | | | | |

| Medical Products 0.15% | | | | | | | |

| ABIOMED, Inc.* | | | 5 | | | 531,286 | |

| ICU Medical, Inc.* | | | 8 | | | 1,105,125 | |

| Total | | | | | | 1,636,411 | |

| | | | | | | | |

| Metals/Mining (Excluding Steel) 0.63% | | | | | | | |

| Anglo American plc*(a) | | GBP | 112 | | | 1,597,517 | |

| First Majestic Silver Corp. (Canada)*(b) | | | 110 | | | 837,507 | |

| Fresnillo plc(a) | | GBP | 71 | | | 1,075,106 | |

| Mirabela Nickel Ltd.*(a) | | AUD | 2,560 | | | 18,476 | |

| MMC Norilsk Nickel PJSC ADR | | | 70 | | | 1,177,130 | |

| Silver Wheaton Corp. (Canada)(b) | | | 53 | | | 1,023,999 | |

| Vale SA ADR | | | 130 | | | 994,044 | |

| Total | | | | | | 6,723,779 | |

| | | | | | | | |

| Non-Electric Utilities 0.20% | | | | | | | |

| American Water Works Co., Inc. | | | 14 | | | 1,039,668 | |

| Aqua America, Inc. | | | 35 | | | 1,059,271 | |

| Total | | | | | | 2,098,939 | |

| | | | | | | | |

| Oil Field Equipment & Services 0.61% | | | | | | | |

| Halliburton Co. | | | 24 | | | 1,284,638 | |

| MRC Global, Inc.* | | | 70 | | | 1,427,580 | |

| National Oilwell Varco, Inc. | | | 29 | | | 1,093,885 | |

| Patterson-UTI Energy, Inc. | | | 53 | | | 1,431,740 | |

| U.S. Silica Holdings, Inc. | | | 23 | | | 1,295,081 | |

| Total | | | | | | 6,532,924 | |

| | | | | | | | |

| Packaging 0.10% | | | | | | | |

| Packaging Corp. of America | | | 12 | | | 1,048,375 | |

| | | | | | | | |

| Personal & Household Products 0.41% | | | | | | | |

| Brunswick Corp. | | | 20 | | | 1,068,984 | |

| Central Garden & Pet Co.* | | | 22 | | | 737,907 | |

| Hasbro, Inc. | | | 13 | | | 1,018,427 | |

| 10 | See Notes to Financial Statements. | |

Schedule of Investments (continued)

December 31, 2016

| Investments | | Shares

(000) | | Fair

Value | |

| Personal & Household Products (continued) | | | | | | | |

| LVMH Moet Hennessy Louis Vuitton SE(a) | | EUR | 3 | | $ | 534,662 | |

| Pool Corp. | | | 10 | | | 1,044,443 | |

| Total | | | | | | 4,404,423 | |

| | | | | | | | |

| Pharmaceuticals 0.54% | | | | | | | |

| Blueprint Medicines Corp.* | | | 21 | | | 589,050 | |

| Cantel Medical Corp. | | | 14 | | | 1,102,500 | |

| Exelixis, Inc.* | | | 73 | | | 1,083,331 | |

| Patheon NV (Netherlands)*(b) | | | 39 | | | 1,116,819 | |

| Seattle Genetics, Inc.* | | | 16 | | | 827,803 | |

| TESARO, Inc.* | | | 8 | | | 1,075,436 | |

| Total | | | | | | 5,794,939 | |

| | | | | | | | |

| Rail 0.10% | | | | | | | |

| CSX Corp. | | | 29 | | | 1,040,174 | |

| | | | | | | | |

| Real Estate Investment Trusts 0.20% | | | | | | | |

| DCT Industrial Trust, Inc. | | | 23 | | | 1,089,605 | |

| EastGroup Properties, Inc. | | | 7 | | | 535,340 | |

| Pebblebrook Hotel Trust | | | 17 | | | 514,675 | |

| Total | | | | | | 2,139,620 | |

| | | | | | | | |

| Recreation & Travel 0.31% | | | | | | | |

| Camping World Holdings, Inc. Class A | | | 35 | | | 1,142,638 | |

| Royal Caribbean Cruises Ltd. | | | 13 | | | 1,058,316 | |

| Vail Resorts, Inc. | | | 7 | | | 1,069,485 | |

| Total | | | | | | 3,270,439 | |

| | | | | | | | |

| Restaurants 0.31% | | | | | | | |

| Cheesecake Factory, Inc. (The) | | | 17 | | | 1,031,433 | |

| Shake Shack, Inc. Class A* | | | 33 | | | 1,186,975 | |

| Texas Roadhouse, Inc. | | | 23 | | | 1,107,205 | |

| Total | | | | | | 3,325,613 | |

| | | | | | | | |

| Software/Services 0.31% | | | | | | | |

| Arista Networks, Inc.* | | | 11 | | | 1,074,341 | |

| Proofpoint, Inc.* | | | 14 | | | 1,024,213 | |

| Veeva Systems, Inc. Class A* | | | 29 | | | 1,198,615 | |

| Total | | | | | | 3,297,169 | |

| | See Notes to Financial Statements. | 11 |

Schedule of Investments (continued)

December 31, 2016

| Investments | | Shares

(000) | | Fair

Value | |

| Specialty Retail 0.55% | | | | | | | |

| Kering(a) | | EUR | 5 | | $ | 1,134,103 | |

| Lithia Motors, Inc. Class A | | | 11 | | | 1,040,922 | |

| Moncler SpA(a) | | EUR | 66 | | | 1,152,562 | |

| Ritchie Bros Auctioneers, Inc. (Canada)(b) | | | 27 | | | 928,200 | |

| Tiffany & Co. | | | 6 | | | 495,552 | |

| Ulta Salon, Cosmetics & Fragrance, Inc.* | | | 4 | | | 1,049,333 | |

| Total | | | | | | 5,800,672 | |

| | | | | | | | |

| Steel Producers/Products 0.12% | | | | | | | |

| Worthington Industries, Inc. | | | 27 | | | 1,261,572 | |

| | | | | | | | |

| Support: Services 0.35% | | | | | | | |

| Ashtead Group plc(a) | | GBP | 59 | | | 1,143,002 | |

| Neff Corp. Class A* | | | 36 | | | 500,550 | |

| Science Applications International Corp. | | | 13 | | | 1,111,643 | |

| Total System Services, Inc. | | | 21 | | | 1,015,558 | |

| Total | | | | | | 3,770,753 | |

| | | | | | | | |

| Technology Hardware & Equipment 0.16% | | | | | | | |

| NVIDIA Corp. | | | 16 | | | 1,731,216 | |

| | | | | | | | |

| Telecommunications: Wireless 0.12% | | | | | | | |

| T-Mobile US, Inc.* | | | 23 | | | 1,308,237 | |

| | | | | | | | |

| Telecommunications: Wireline Integrated & Services 0.10% | | | | | | | |

| Zayo Group Holdings, Inc.* | | | 33 | | | 1,067,950 | |

| | | | | | | | |

| Theaters & Entertainment 0.10% | | | | | | | |

| Live Nation Entertainment, Inc.* | | | 39 | | | 1,043,252 | |

| | | | | | | | |

| Transportation: Infrastructure/Services 0.10% | | | | | | | |

| Landstar System, Inc. | | | 13 | | | 1,076,913 | |

| | | | | | | | |

| Trucking & Delivery 0.27% | | | | | | | |

| Old Dominion Freight Line, Inc.* | | | 20 | | | 1,743,682 | |

| Ryder System, Inc. | | | 15 | | | 1,104,615 | |

| Total | | | | | | 2,848,297 | |

| Total Common Stocks (cost $125,817,510) | | | | | | 141,713,974 | |

| 12 | See Notes to Financial Statements. | |

Schedule of Investments (continued)

December 31, 2016

| Investments | | Interest

Rate | | | Maturity

Date | | Principal

Amount

(000) | | | Fair

Value | |

| CONVERTIBLE BONDS 0.30% | | | | | | | | | | | |

| | | | | | | | | | | | |

| Oil Field Equipment & Services 0.20% | | | | | | | | | | | | | | |

| Ensco Jersey Finance Ltd. (Jersey)†(b) | | | 3.00% | | | 1/31/2024 | | $ | 2,037 | | | $ | 2,082,833 | |

| | | | | | | | | | | | | | | |

| Support: Services 0.10% | | | | | | | | | | | | | | |

| Priceline Group, Inc. (The) | | | 1.00% | | | 3/15/2018 | | | 675 | | | | 1,066,078 | |

| Total Convertible Bonds (cost $3,153,171) | | | | | | | | | | | | | 3,148,911 | |

| | | | | | | | | | | | | | | |

| | | Dividend

Rate | | | | | Shares

(000) | | | | | |

| CONVERTIBLE PREFERRED STOCKS 0.13% | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Building & Construction 0.08% | | | | | | | | | | | | | | |

| William Lyon Homes Unit | | | Zero Coupon | | | | | | 9 | | | | 828,414 | |

| | | | | | | | | | | | | | | |

| Energy: Exploration & Production 0.05% | | | | | | | | | | | | | | |

| Sanchez Energy Corp. | | | 4.875% | | | | | | 10 | | | | 267,691 | |

| Sanchez Energy Corp. | | | 6.50% | | | | | | 11 | | | | 342,435 | |

| Total | | | | | | | | | | | | | 610,126 | |

| Total Convertible Preferred Stocks (cost $1,365,338) | | | | | | | | | | | | | 1,438,540 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | Principal | | | | | |

| | | Interest | | | | | Amount | | | | | |

| | | Rate | | | | | (000) | | | | | |

| FLOATING RATE LOANS(c) 4.29% | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Auto Parts & Equipment 0.07% | | | | | | | | | | | | | | |

| Chassix, Inc. Initial Term Loan | | | 12.00% | | | 7/29/2019 | | $ | 762 | | | | 765,335 | |

| | | | | | | | | | | | | | | |

| Department Stores 0.10% | | | | | | | | | | | | | | |

| Belk, Inc. 1st Lien Closing Date Term Loan | | | 5.75% | | | 12/12/2022 | | | 1,230 | | | | 1,064,977 | |

| | | | | | | | | | | | | | | |

| Diversified Capital Goods 0.10% | | | | | | | | | | | | | | |

| Harsco Corp. Initial Term Loan | | | 6.00% | | | 11/2/2023 | | | 1,067 | | | | 1,091,674 | |

| | | | | | | | | | | | | | | |

| Electric: Generation 0.39% | | | | | | | | | | | | | | |

| Dayton Power & Light Co. (The) Term Loan | | | 4.01% | | | 8/24/2022 | | | 1,060 | | | | 1,076,568 | |

| Lightstone Generation LLC Term Loan B | | | 6.54% | | | 1/30/2024 | | | 1,512 | | | | 1,533,417 | |

| Lightstone Generation LLC Term Loan C | | | 6.54% | | | 1/30/2024 | | | 144 | | | | 146,040 | |

| Longview Power LLC Advance Term Loan B | | | 7.00% | | | 4/13/2021 | | | 1,026 | | | | 909,642 | |

| Moxie Liberty LLC Advance Construction Term Loan B1 | | | 7.50% | | | 8/21/2020 | | | 525 | | | | 518,682 | |

| Total | | | | | | | | | | | | | 4,184,349 | |

| | See Notes to Financial Statements. | 13 |

Schedule of Investments (continued)

December 31, 2016

| | | Interest | | | Maturity | | Principal

Amount | | | Fair | |

| Investments | | Rate | | | Date | | (000) | | | Value | |

| Energy: Exploration & Production 0.58% | | | | | | | | | | | | | | |

| California Resources Corp. Term Loan | | | –(d) | | | 9/24/2019 | | $ | 1,079 | | | $ | 1,050,555 | |

| California Resources Corp. Term Loan | | | 11.375% | | | 12/31/2021 | | | 1,480 | | | | 1,647,114 | |

| Chesapeake Energy Corp. Class A Term Loan | | | 8.50% | | | 8/23/2021 | | | 741 | | | | 808,616 | |

| Chief Exploration & Development LLC 2nd Lien Term Loan | | | 7.753% | | | 5/16/2021 | | | 1,600 | | | | 1,572,000 | |

| Jonah Energy LLC 2nd Lien Initial Term Loan | | | 7.50% | | | 5/12/2021 | | | 1,190 | | | | 1,130,500 | |

| Total | | | | | | | | | | | | | 6,208,785 | |

| | | | |

| Food: Wholesale 0.24% | | | | | | | | | | | | | | |

| Amplify Snack Brands, Inc. Term Loan | | | 6.50% | | | 8/24/2023 | | | 2,673 | | | | 2,607,577 | |

| | | | | | | | | | | | | | | |

| Gaming 0.44% | | | | | | | | | | | | | | |

| Amaya Holdings B.V. 1st Lien Initial Term Loan B (Netherlands)(b) | | | 5.00% | | | 8/1/2021 | | | 1,042 | | | | 1,048,073 | |

| Caesar’s Entertainment Resort Properties LLC Term Loan B | | | 7.00% | | | 10/11/2020 | | | 1,235 | | | | 1,248,619 | |

| Cowlitz Tribal Gaming Authority Term Loan B | | | 11.50% | | | 12/6/2021 | | | 2,210 | | | | 2,392,325 | |

| Total | | | | | | | | | | | | | 4,689,017 | |

| | | | |

| Health Services 0.10% | | | | | | | | | | | | | | |

| Genoa, a QoL Healthcare Co., LLC 1st Lien initial Term Loan | | | 4.75% | | | 10/30/2023 | | | 1,059 | | | | 1,072,587 | |

| | | | |

| Media: Diversified 0.11% | | | | | | | | | | | | | | |

| UFC Holdings, LLC 2nd Lien Term Loan | | | 8.50% | | | 8/18/2024 | | | 1,107 | | | | 1,140,902 | |

| | | | |

| Metals/Mining (Excluding Steel) 0.30% | | | | | | | | | | | | | | |

| Murray Energy Corp. Term Loan B2 | | | 8.25% | | | 4/16/2020 | | | 1,415 | | | | 1,358,219 | |

| Oxbow Carbon LLC 2nd Lien Initial Term Loan | | | 8.00% | | | 1/17/2020 | | | 650 | | | | 638,625 | |

| Peabody Energy Corp. Term Loan | | | –(d) | | | 9/24/2020 | | | 1,200 | | | | 1,174,800 | |

| Total | | | | | | | | | | | | | 3,171,644 | |

| | | | |

| Oil Field Equipment & Services 0.24% | | | | | | | | | | | | | | |

| Fairmount Santrol, Inc. Tranche B2 Term Loan | | | 4.50% | | | 9/5/2019 | | | 1,705 | | | | 1,661,965 | |

| FTS International, Inc. Initial Term Loan | | | 5.75% | | | 4/16/2021 | | | 1,030 | | | | 848,030 | |

| Total | | | | | | | | | | | | | 2,509,995 | |

| | | | |

| Personal & Household Products 0.25% | | | | | | | | | | | | | | |

| Britax US Holdings, Inc. Initial Dollar Term Loan | | | 4.50% | | | 10/15/2020 | | | 2,421 | | | | 2,072,165 | |

| FGI Operating Co. LLC Term Loan B | | | 5.50% | | | 4/19/2019 | | | 586 | | | | 559,089 | |

| Total | | | | | | | | | | | | | 2,631,254 | |

| 14 | See Notes to Financial Statements. | |

Schedule of Investments (continued)

December 31, 2016

| | | | | | | | Principal | | | | |

| | | Interest | | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | | Date | | (000) | | | Value | |

| Recreation & Travel 0.10% | | | | | | | | | | | | | | |

| Delta 2 (Lux) S.A.R.L. 2nd Lien Facility Term Loan (Luxembourg)(b) | | | 8.068% | | | 7/29/2022 | | $ | 1,045 | | | $ | 1,055,450 | |

| | | | | | | | | | | | | | | |

| Specialty Retail 0.37% | | | | | | | | | | | | | | |

| Bass Pro Group, LLC Term Loan B | | | 5.97% | | | 12/15/2023 | | | 2,134 | | | | 2,116,853 | |

| Container Store, Inc. (The) Facility Term Loan | | | 4.25% | | | 4/6/2019 | | | 1,193 | | | | 1,095,755 | |

| Gymboree Corp. (The) Term Loan | | | 5.00% | | | 2/23/2018 | | | 1,342 | | | | 717,299 | |

| Total | | | | | | | | | | | | | 3,929,907 | |

| | | | | | | | | | | | | | | |

| Support: Services 0.71% | | | | | | | | | | |

| BakerCorp International, Inc. Refinanced Term Loan | | | 4.25% | | | 2/7/2020 | | | 780 | | | | 748,008 | |

| Monitronics International Inc. Term Loan B2 | | | 6.50% | | | 9/30/2022 | | | 1,211 | | | | 1,224,970 | |

| Safway Group Holding LLC Initial Term Loan | | | 5.75% | | | 8/21/2023 | | | 1,858 | | | | 1,888,150 | |

| University Support Services LLC Term Loan | | | 6.25% | | | 7/6/2022 | | | 2,163 | | | | 2,195,962 | |

| Zodiac Pool Solutions LLC 1st Lien Term Loan (France)(b) | | | 5.50% | | | 12/20/2023 | | | 1,529 | | | | 1,543,342 | |

| Total | | | | | | | | | | | | | 7,600,432 | |

| | | | | | | | | | | | | | | |

| Telecommunications: Wireline Integrated & Services 0.09% | | | | | | | | | | | |

| Fairpoint Communications, Inc. Term Loan | | | 7.50% | | | 2/14/2019 | | | 931 | | | | 942,444 | |

| | | | | | | | | | | | | | | |

| Trucking & Delivery 0.10% | | | | | | | | | | | | | | |

| YRC Worldwide, Inc. Initial Term Loan | | | 8.00% | | | 2/13/2019 | | | 1,058 | | | | 1,051,134 | |

| Total Floating Rate Loans (cost $43,766,162) | | | | | | | | | | | | | 45,717,463 | |

| | | | | | | | | | | | | | | |

| FOREIGN BONDS(a) 0.45% | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Mexico 0.09% | | | | | | | | | | | | | | |

| Red de Carreteras de Occidente S.A.P.I.B. de CV† | | | 9.00% | | | 6/10/2028 | | MXN | 22,100 | | | | 987,408 | |

| | | | | | | | | | | | | | | |

| Netherlands 0.12% | | | | | | | | | | | | | | |

| Hema Bondco I BV† | | | 6.25% | | | 6/15/2019 | | EUR | 1,300 | | | | 1,272,826 | |

| | | | | | | | | | | | | | | |

| Spain 0.14% | | | | | | | | | | | | | | |

| Banco Popular Espanol SA | | | 11.50% | # | | 1/1/2099 | | EUR | 1,400 | | | | 1,489,980 | |

| | | | | | | | | | | | | | | |

| United Kingdom 0.10% | | | | | | | | | | | | | | |

| Premier Foods Finance plc† | | | 6.50% | | | 3/15/2021 | | GBP | 816 | | | | 1,038,824 | |

| Total Foreign Bonds (cost $5,495,390) | | | | | | | | | | | | | 4,789,038 | |

| | | | | | | | | | | | | | | |

| FOREIGN GOVERNMENT OBLIGATIONS 4.31% | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Angola 0.11% | | | | | | | | | | | | | | |

| Republic of Angola†(b) | | | 9.50% | | | 11/12/2025 | | $ | 1,200 | | | | 1,165,170 | |

| | See Notes to Financial Statements. | 15 |

Schedule of Investments (continued)

December 31, 2016

| | | | | | | | Principal | | | | |

| | | Interest | | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | | Date | | (000) | | | Value | |

| Argentina 0.85% | | | | | | | | | | | |

| City of Buenos Aires†(b) | | | 7.50% | | | 6/1/2027 | | $ | 725 | | | $ | 743,125 | |

| City of Buenos Aires†(b) | | | 8.95% | | | 2/19/2021 | | | 925 | | | | 1,036,000 | |

| Province of Santa Fe†(b) | | | 6.90% | | | 11/1/2027 | | | 1,094 | | | | 1,031,095 | |

| Provincia de Mendoza†(b) | | | 8.375% | | | 5/19/2024 | | | 1,346 | | | | 1,389,745 | |

| Provincia of Neuquen†(b) | | | 8.625% | | | 5/12/2028 | | | 992 | | | | 1,029,200 | |

| Republic of Argentina†(b) | | | 7.50% | | | 4/22/2026 | | | 1,618 | | | | 1,702,945 | |

| Republic of Argentina(b) | | | 8.75% | | | 5/7/2024 | | | 1,800 | | | | 2,139,975 | |

| Total | | | | | | | | | | | | | 9,072,085 | |

| | | | | | | | | | | | | | | |

| Australia 0.41% | | | | | | | | | | | | | | |

| Australian Government(a) | | | 4.25% | | | 4/21/2026 | | AUD | 3,084 | | | | 2,506,623 | |

| Queensland Treasury Corp.†(a) | | | 4.00% | | | 6/21/2019 | | AUD | 2,500 | | | | 1,885,087 | |

| Total | | | | | | | | | | | | | 4,391,710 | |

| | | | | | | | | | | | | | | |

| Bahamas 0.09% | | | | | | | | | | | | | | |

| Commonwealth of Bahamas†(b) | | | 5.75% | | | 1/16/2024 | | $ | 900 | | | | 918,477 | |

| | | | | | | | | | | | | | | |

| Bermuda 0.23% | | | | | | | | | | | | | | |

| Government of Bermuda† | | | 4.138% | | | 1/3/2023 | | | 1,350 | | | | 1,391,040 | |

| Government of Bermuda† | | | 4.854% | | | 2/6/2024 | | | 975 | | | | 1,018,066 | |

| Total | | | | | | | | | | | | | 2,409,106 | |

| | | | | | | | | | | | | | | |

| Brazil 0.14% | | | | | | | | | | | | | | |

| Federal Republic of Brazil†(b) | | | 5.333% | | | 2/15/2028 | | | 1,550 | | | | 1,453,125 | |

| | | | | | | | | | | | | | | |

| Canada 0.37% | | | | | | | | | | | | | | |

| Province of British Columbia Canada(a) | | | 2.85% | | | 6/18/2025 | | CAD | 5,000 | | | | 3,895,654 | |

| | | | | | | | | | | | | | | |

| Cayman Islands 0.04% | | | | | | | | | | | | | | |

| Cayman Islands Government† | | | 5.95% | | | 11/24/2019 | | $ | 425 | | | | 469,094 | |

| | | | | | | | | | | | | | | |

| Dominican Republic 0.28% | | | | | | | | | | | | | | |

| Dominican Republic†(b) | | | 6.85% | | | 1/27/2045 | | | 3,173 | | | | 3,013,462 | |

| | | | | | | | | | | | | | | |

| Ethiopia 0.10% | | | | | | | | | | | | | | |

| Republic of Ethiopia†(b) | | | 6.625% | | | 12/11/2024 | | | 1,115 | | | | 1,031,330 | |

| | | | | | | | | | | | | | | |

| Gabon 0.11% | | | | | | | | | | | | | | |

| Republic of Gabon†(b) | | | 6.375% | | | 12/12/2024 | | | 1,300 | | | | 1,216,735 | |

| | | | | | | | | | | | | | | |

| Ghana 0.12% | | | | | | | | | | | | | | |

| Republic of Ghana†(b) | | | 9.25% | | | 9/15/2022 | | | 1,200 | | | | 1,287,018 | |

| 16 | See Notes to Financial Statements. |

Schedule of Investments (continued)

December 31, 2016

| | | | | | | Principal | | | |

| | | Interest | | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | | Date | | (000) | | | Value | |

| Greece 0.09% | | | | | | | | | | | | | | |

| Hellenic Republic†(a) | | | 4.75% | | | 4/17/2019 | | EUR | 1,000 | | | $ | 996,197 | |

| | | | | | | | | | | | | | | |

| Honduras 0.15% | | | | | | | | | | | | | | |

| Honduras Government†(b) | | | 7.50% | | | 3/15/2024 | | $ | 1,500 | | | | 1,610,100 | |

| | | | | | | | | | | | | | | |

| Jamaica 0.50% | | | | | | | | | | | | | | |

| Government of Jamaica(b) | | | 6.75% | | | 4/28/2028 | | | 1,500 | | | | 1,646,250 | |

| Government of Jamaica(b) | | | 7.625% | | | 7/9/2025 | | | 1,150 | | | | 1,317,566 | |

| Government of Jamaica(b) | | | 8.00% | | | 3/15/2039 | | | 2,110 | | | | 2,353,431 | |

| Total | | | | | | | | | | | | | 5,317,247 | |

| | | | | | | | | | | | | | | |

| Jordan 0.10% | | | | | | | | | | | | | | |

| Kingdom of Jordan†(b) | | | 5.75% | | | 1/31/2027 | | | 1,135 | | | | 1,078,012 | |

| | | | | | | | | | | | | | | |

| Qatar 0.14% | | | | | | | | | | | | | | |

| State of Qatar†(b) | | | 4.625% | | | 6/2/2046 | | | 1,500 | | | | 1,503,891 | |

| | | | | | | | | | | | | | | |

| Russia 0.21% | | | | | | | | | | | | | | |

| Russian Federal Bond—OFZ(a) | | | 7.60% | | | 4/14/2021 | | RUB | 141,915 | | | | 2,272,167 | |

| | | | | | | | | | | | | | | |

| United Arab Emirates 0.12% | | | | | | | | | | | | | | |

| Abu Dhabi Government International†(b) | | | 3.125% | | | 5/3/2026 | | $ | 1,255 | | | | 1,233,937 | |

| | | | | | | | | | | | | | | |

| Zambia 0.15% | | | | | | | | | | | | | | |

| Republic of Zambia†(b) | | | 8.97% | | | 7/30/2027 | | | 1,666 | | | | 1,649,340 | |

| Total Foreign Government Obligations (cost $44,951,255) | | | | | | | | | | | | | 45,983,857 | |

| | | | | | | | | | | | | | | |

| HIGH YIELD CORPORATE BONDS 71.93% | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Advertising 0.32% | | | | | | | | | | | | | | |

| Clear Channel Worldwide Holdings, Inc. | | | 6.50% | | | 11/15/2022 | | | 1,579 | | | | 1,622,422 | |

| Lamar Media Corp. | | | 5.75% | | | 2/1/2026 | | | 566 | | | | 597,838 | |

| Southern Graphics, Inc.† | | | 8.375% | | | 10/15/2020 | | | 1,200 | | | | 1,224,000 | |

| Total | | | | | | | | | | | | | 3,444,260 | |

| | | | | | | | | | | | | | | |

| Aerospace/Defense 0.51% | | | | | | | | | | | | | | |

| Huntington Ingalls Industries, Inc.† | | | 5.00% | | | 12/15/2021 | | | 2,050 | | | | 2,139,687 | |

| Huntington Ingalls Industries, Inc.† | | | 5.00% | | | 11/15/2025 | | | 498 | | | | 518,542 | |

| L-3 Communications Corp. | | | 3.85% | | | 12/15/2026 | | | 703 | | | | 700,224 | |

| Lockheed Martin Corp. | | | 4.70% | | | 5/15/2046 | | | 877 | | | | 957,830 | |

| TransDigm, Inc. | | | 6.50% | | | 7/15/2024 | | | 1,111 | | | | 1,167,939 | |

| Total | | | | | | | | | | | | | 5,484,222 | |

| | See Notes to Financial Statements. | 17 |

Schedule of Investments (continued)

December 31, 2016

| | | | | | | | Principal | | | | |

| | | Interest | | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | | Date | | (000) | | | Value | |

| Air Transportation 0.48% | | | | | | | | | | | | | | |

| Air Canada (Canada)†(b) | | | 7.75% | | | 4/15/2021 | | $ | 1,140 | | | $ | 1,279,650 | |

| Air Canada 2015-2 Class A Pass-Through Trust (Canada)†(b) | | | 4.125% | | | 6/15/2029 | | | 861 | | | | 883,326 | |

| Air Canada 2015-2 Class B Pass-Through Trust (Canada)†(b) | | | 5.00% | | | 6/15/2025 | | | 1,859 | | | | 1,861,319 | |

| Avianca Holdings SA/Avianca Leasing LLC/Grupo Taca Holdings Ltd. (Panama)†(b) | | | 8.375% | | | 5/10/2020 | | | 1,090 | | | | 1,111,800 | |

| Total | | | | | | | | | | | | | 5,136,095 | |

| | | | | | | | | | | | | | | |

| Auto Parts & Equipment 0.68% | | | | | | | | | | | | | | |

| Allison Transmission, Inc.† | | | 5.00% | | | 10/1/2024 | | | 1,250 | | | | 1,265,625 | |

| Gates Global LLC/Gates Global Co.† | | | 6.00% | | | 7/15/2022 | | | 1,617 | | | | 1,589,511 | |

| International Automotive Components Group SA (Luxembourg)†(b) | | | 9.125% | | | 6/1/2018 | | | 1,186 | | | | 1,162,280 | |

| MPG Holdco I, Inc. | | | 7.375% | | | 10/15/2022 | | | 1,036 | | | | 1,087,800 | |

| Nemak SA de CV (Mexico)†(b) | | | 5.50% | | | 2/28/2023 | | | 826 | | | | 823,935 | |

| TI Group Automotive Systems LLC† | | | 8.75% | | | 7/15/2023 | | | 1,250 | | | | 1,312,500 | |

| Total | | | | | | | | | | | | | 7,241,651 | |

| | | | | | | | | | | | | | | |

| Automakers 0.27% | | | | | | | | | | | | | | |

| BMW US Capital LLC† | | | 2.80% | | | 4/11/2026 | | | 1,024 | | | | 987,311 | |

| General Motors Co. | | | 6.25% | | | 10/2/2043 | | | 1,714 | | | | 1,901,239 | |

| Total | | | | | | | | | | | | | 2,888,550 | |

| | | | | | | | | | | | | | | |

| Banking 6.51% | | | | | | | | | | | | | | |

| ABN AMRO Bank NV (Netherlands)†(b) | | | 4.75% | | | 7/28/2025 | | | 1,976 | | | | 2,006,745 | |

| ANZ New Zealand Int’l Ltd. (United Kingdom)†(b) | | | 2.125% | | | 7/28/2021 | | | 1,510 | | | | 1,470,092 | |

| Associated Banc-Corp. | | | 4.25% | | | 1/15/2025 | | | 1,000 | | | | 992,684 | |

| Australia & New Zealand Banking Group Ltd. (United Kingdom)†(b) | | | 6.75% | # | | – | (e) | | 1,415 | | | | 1,497,745 | |

| Banco Bilbao Vizcaya Argentaria SA (Spain)(b) | | | 9.00% | # | | – | (e) | | 800 | | | | 836,198 | |

| Banco de Bogota SA (Colombia)†(b) | | | 6.25% | | | 5/12/2026 | | | 700 | | | | 715,750 | |

| Banco de Galicia y Buenos Aires SA (Argentina)†(b) | | | 8.25% | # | | 7/19/2026 | | | 1,000 | | | | 1,047,500 | |

| Bank of America Corp. | | | 4.25% | | | 10/22/2026 | | | 1,468 | | | | 1,488,734 | |

| Bank of America Corp. | | | 4.45% | | | 3/3/2026 | | | 2,501 | | | | 2,582,213 | |

| BankUnited, Inc. | | | 4.875% | | | 11/17/2025 | | | 2,525 | | | | 2,504,709 | |

| BNP Paribas SA (France)†(b) | | | 6.75% | # | | – | (e) | | 1,617 | | | | 1,598,809 | |

| Citigroup, Inc. | | | 4.45% | | | 9/29/2027 | | | 1,473 | | | | 1,499,520 | |

| Citizens Financial Group, Inc. | | | 4.35% | | | 8/1/2025 | | | 831 | | | | 836,348 | |

| Citizens Financial Group, Inc. | | | 5.50% | # | | – | (e) | | 1,495 | | | | 1,487,525 | |

| Comerica, Inc. | | | 3.80% | | | 7/22/2026 | | | 1,258 | | | | 1,241,121 | |

| 18 | See Notes to Financial Statements. | |

Schedule of Investments (continued)

December 31, 2016

| | | | | | | | Principal | | | | |

| | | Interest | | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | | Date | | (000) | | | Value | |

| Banking (continued) | | | | | | | | | | | | | | |

| Commonwealth Bank of Australia (Australia)†(b) | | | 4.50% | | | 12/9/2025 | | $ | 973 | | | $ | 998,075 | |

| Compass Bank | | | 3.875% | | | 4/10/2025 | | | 1,100 | | | | 1,048,628 | |

| Credit Suisse Group AG (Switzerland)†(b) | | | 7.50% | # | | – | (e) | | 1,075 | | | | 1,128,669 | |

| Fifth Third Bancorp | | | 8.25% | | | 3/1/2038 | | | 1,708 | | | | 2,388,044 | |

| First Republic Bank | | | 4.375% | | | 8/1/2046 | | | 80 | | | | 72,993 | |

| Global Bank Corp. (Panama)†(b) | | | 4.50% | | | 10/20/2021 | | | 1,500 | | | | 1,464,300 | |

| Goldman Sachs Group, Inc. (The) | | | 3.50% | | | 1/23/2025 | | | 1,545 | | | | 1,527,101 | |

| Goldman Sachs Group, Inc. (The) | | | 5.15% | | | 5/22/2045 | | | 1,911 | | | | 2,017,370 | |

| HSBC Holdings plc (United Kingdom)(b) | | | 4.25% | | | 8/18/2025 | | | 4,671 | | | | 4,722,185 | |

| Industrial & Commercial Bank of China Ltd. | | | 3.231% | | | 11/13/2019 | | | 1,550 | | | | 1,590,057 | |

| Intesa Sanpaolo SpA (Italy)†(b) | | | 5.71% | | | 1/15/2026 | | | 1,269 | | | | 1,213,074 | |

| Intesa Sanpaolo SpA (Italy)†(b) | | | 7.70% | # | | – | (e) | | 1,851 | | | | 1,746,881 | |

| JPMorgan Chase & Co. | | | 3.90% | | | 7/15/2025 | | | 1,900 | | | | 1,955,797 | |

| JPMorgan Chase & Co. | | | 6.75% | # | | – | (e) | | 888 | | | | 957,930 | |

| KeyBank NA | | | 2.50% | | | 11/22/2021 | | | 1,508 | | | | 1,499,403 | |

| Lloyds Banking Group plc (United Kingdom)(b) | | | 4.582% | | | 12/10/2025 | | | 975 | | | | 981,495 | |

| Lloyds Banking Group plc (United Kingdom)(b) | | | 7.50% | # | | – | (e) | | 1,019 | | | | 1,052,118 | |

| M&T Bank Corp. | | | 5.125% | # | | – | (e) | | 1,147 | | | | 1,111,156 | |

| Macquarie Group Ltd. (Australia)†(b) | | | 6.00% | | | 1/14/2020 | | | 725 | | | | 786,022 | |

| Morgan Stanley | | | 3.125% | | | 7/27/2026 | | | 2,144 | | | | 2,052,507 | |

| Morgan Stanley | | | 4.00% | | | 7/23/2025 | | | 937 | | | | 962,174 | |

| National Savings Bank (Sri Lanka)†(b) | | | 5.15% | | | 9/10/2019 | | | 950 | | | | 937,859 | |

| People’s United Bank NA | | | 4.00% | | | 7/15/2024 | | | 1,100 | | | | 1,085,301 | |

| Popular, Inc. | | | 7.00% | | | 7/1/2019 | | | 2,125 | | | | 2,202,031 | |

| Royal Bank of Scotland Group plc (United Kingdom)(b) | | | 5.125% | | | 5/28/2024 | | | 584 | | | | 583,183 | |

| Royal Bank of Scotland Group plc (United Kingdom)(b) | | | 6.10% | | | 6/10/2023 | | | 506 | | | | 530,338 | |

| Royal Bank of Scotland Group plc (United Kingdom)(b) | | | 6.125% | | | 12/15/2022 | | | 506 | | | | 538,717 | |

| Royal Bank of Scotland Group plc (United Kingdom)(b) | | | 7.50% | # | | – | (e) | | 2,235 | | | | 2,123,250 | |

| Royal Bank of Scotland Group plc (United Kingdom)(b) | | | 8.625% | # | | – | (e) | | 870 | | | | 889,575 | |

| Sberbank of Russia Via SB Capital SA (Luxembourg)†(b) | | | 5.50% | # | | 2/26/2024 | | | 1,095 | | | | 1,115,531 | |

| Standard Chartered plc (United Kingdom)†(b) | | | 7.50% | # | | – | (e) | | 1,025 | | | | 1,025,000 | |

| SVB Financial Group | | | 3.50% | | | 1/29/2025 | | | 999 | | | | 964,241 | |

| Toronto-Dominion Bank (The) (Canada)(b) | | | 3.625% | # | | 9/15/2031 | | | 750 | | | | 733,862 | |

| | See Notes to Financial Statements. | 19 |

Schedule of Investments (continued)

December 31, 2016

| | | | | | | | Principal | | | | |

| | | Interest | | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | | Date | | (000) | | | Value | |

| Banking (continued) | | | | | | | | | | | | | | |

| UBS AG/Stamford CT | | | 7.625% | | | 8/17/2022 | | $ | 606 | | | $ | 688,568 | |

| UBS Group AG (Switzerland)(b) | | | 7.00% | # | | – | (e) | | 1,000 | | | | 1,051,750 | |

| Washington Mutual Bank(f) | | | 6.875% | | | 6/15/2011 | | | 1,250 | | | | 125 | |

| Wells Fargo & Co. | | | 4.90% | | | 11/17/2045 | | | 1,759 | | | | 1,810,927 | |

| Wells Fargo Capital X | | | 5.95% | | | 12/1/2086 | | | 101 | | | | 105,545 | |

| Total | | | | | | | | | | | | | 69,467,475 | |

| | | | | | | | | | | | | | | |

| Beverages 1.37% | | | | | | | | | | | | | | |

| Anheuser-Busch InBev Finance, Inc. | | | 3.65% | | | 2/1/2026 | | | 4,153 | | | | 4,224,000 | |

| Bacardi Ltd.† | | | 2.75% | | | 7/15/2026 | | | 999 | | | | 934,187 | |

| Brown-Forman Corp. | | | 4.50% | | | 7/15/2045 | | | 1,572 | | | | 1,647,288 | |

| Coca-Cola Bottling Co. Consolidated | | | 3.80% | | | 11/25/2025 | | | 877 | | | | 882,298 | |

| Constellation Brands, Inc. | | | 4.25% | | | 5/1/2023 | | | 1,300 | | | | 1,354,457 | |

| Constellation Brands, Inc. | | | 6.00% | | | 5/1/2022 | | | 1,343 | | | | 1,521,404 | |

| Dr. Pepper Snapple Group, Inc. | | | 4.50% | | | 11/15/2045 | | | 879 | | | | 895,373 | |

| PepsiCo, Inc. | | | 3.60% | | | 3/1/2024 | | | 1,653 | | | | 1,725,621 | |

| PepsiCo, Inc. | | | 4.25% | | | 10/22/2044 | | | 419 | | | | 433,772 | |

| PepsiCo, Inc. | | | 4.45% | | | 4/14/2046 | | | 927 | | | | 989,784 | |

| Total | | | | | | | | | | | | | 14,608,184 | |

| | | | | | | | | | | | | | | |

| Brokerage 0.08% | | | | | | | | | | | | | | |

| TD Ameritrade Holding Corp. | | | 2.95% | | | 4/1/2022 | | | 800 | | | | 810,529 | |

| | | | | | | | | | | | | | | |

| Building & Construction 1.41% | | | | | | | | | | | | | | |

| Ashton Woods USA LLC/Ashton Woods Finance Co.† | | | 6.875% | | | 2/15/2021 | | | 1,220 | | | | 1,180,350 | |

| Brookfield Residential Properties, Inc. (Canada)†(b) | | | 6.50% | | | 12/15/2020 | | | 632 | | | | 649,380 | |

| Brookfield Residential Properties, Inc./Brookfield Residential U.S. Corp. (Canada)†(b) | | | 6.125% | | | 7/1/2022 | | | 947 | | | | 956,470 | |

| DR Horton, Inc. | | | 4.75% | | | 2/15/2023 | | | 580 | | | | 595,950 | |

| K. Hovnanian Enterprises, Inc.† | | | 7.25% | | | 10/15/2020 | | | 1,564 | | | | 1,482,359 | |

| Lennar Corp. | | | 4.75% | | | 11/15/2022 | | | 1,754 | | | | 1,806,620 | |

| Lennar Corp. | | | 4.75% | | | 5/30/2025 | | | 830 | | | | 813,400 | |

| PulteGroup, Inc. | | | 5.00% | | | 1/15/2027 | | | 1,759 | | | | 1,677,646 | |

| PulteGroup, Inc. | | | 6.375% | | | 5/15/2033 | | | 2,250 | | | | 2,255,625 | |

| Toll Brothers Finance Corp. | | | 5.625% | | | 1/15/2024 | | | 1,000 | | | | 1,042,500 | |

| William Lyon Homes, Inc. | | | 7.00% | | | 8/15/2022 | | | 2,514 | | | | 2,614,560 | |

| Total | | | | | | | | | | | | | 15,074,860 | |

| 20 | See Notes to Financial Statements. | |

Schedule of Investments (continued)

December 31, 2016

| | | | | | | | Principal | | | | |

| | | Interest | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | Date | | (000) | | | Value | |

| Building Materials 1.78% | | | | | | | | | | | | | | |

| Allegion plc (Ireland)(b) | | | 5.875 | % | | 9/15/2023 | | $ | 409 | | | $ | 435,585 | |

| Builders FirstSource, Inc.† | | | 5.625 | % | | 9/1/2024 | | | 752 | | | | 758,580 | |

| Builders FirstSource, Inc.† | | | 10.75 | % | | 8/15/2023 | | | 1,075 | | | | 1,238,938 | |

| Cemex SAB de CV (Mexico)†(b) | | | 7.75 | % | | 4/16/2026 | | | 1,996 | | | | 2,215,560 | |

| Eagle Materials, Inc. | | | 4.50 | % | | 8/1/2026 | | | 768 | | | | 769,920 | |

| FBM Finance, Inc.† | | | 8.25 | % | | 8/15/2021 | | | 1,003 | | | | 1,063,180 | |

| HD Supply, Inc.† | | | 5.75 | % | | 4/15/2024 | | | 458 | | | | 484,656 | |

| Hillman Group, Inc. (The)† | | | 6.375 | % | | 7/15/2022 | | | 1,311 | | | | 1,238,895 | |

| Lennox International, Inc. | | | 3.00 | % | | 11/15/2023 | | | 1,001 | | | | 973,360 | |

| Martin Marietta Materials, Inc. | | | 4.25 | % | | 7/2/2024 | | | 1,146 | | | | 1,166,152 | |

| Masco Corp. | | | 4.375 | % | | 4/1/2026 | | | 635 | | | | 644,525 | |

| Masonite International Corp.† | | | 5.625 | % | | 3/15/2023 | | | 838 | | | | 869,425 | |

| Ply Gem Industries, Inc. | | | 6.50 | % | | 2/1/2022 | | | 1,025 | | | | 1,057,031 | |

| Standard Industries, Inc.† | | | 5.375 | % | | 11/15/2024 | | | 1,949 | | | | 2,012,343 | |

| Standard Industries, Inc.† | | | 5.50 | % | | 2/15/2023 | | | 950 | | | | 988,095 | |

| Voto-Votorantim Overseas Trading Operations IV Ltd.† | | | 7.75 | % | | 6/24/2020 | | | 1,900 | | | | 2,061,500 | |

| Vulcan Materials Co. | | | 4.50 | % | | 4/1/2025 | | | 1,005 | | | | 1,055,250 | |

| Total | | | | | | | | | | | | | 19,032,995 | |

| | | | | | | | | | | | | | | |

| Cable & Satellite Television 4.09% | | | | | | | | | | | | | | |

| Altice Financing SA (Luxembourg)†(b) | | | 6.625 | % | | 2/15/2023 | | | 1,600 | | | | 1,648,000 | |

| Altice Financing SA (Luxembourg)†(b) | | | 7.50 | % | | 5/15/2026 | | | 515 | | | | 536,888 | |

| Cablevision SA (Argentina)†(b) | | | 6.50 | % | | 6/15/2021 | | | 1,020 | | | | 1,039,125 | |

| Cablevision Systems Corp. | | | 5.875 | % | | 9/15/2022 | | | 3,000 | | | | 2,932,500 | |

| CCO Holdings LLC/CCO Holdings Capital Corp.† | | | 5.125 | % | | 5/1/2023 | | | 702 | | | | 724,815 | |

| CCO Holdings LLC/CCO Holdings Capital Corp.† | | | 5.875 | % | | 4/1/2024 | | | 1,785 | | | | 1,909,950 | |

| Charter Communications Operating LLC/Charter Communications Operating Capital | | | 6.384 | % | | 10/23/2035 | | | 2,701 | | | | 3,092,777 | |

| Charter Communications Operating LLC/Charter Communications Operating Capital | | | 6.484 | % | | 10/23/2045 | | | 772 | | | | 895,606 | |

| CSC Holdings LLC† | | | 10.125 | % | | 1/15/2023 | | | 925 | | | | 1,070,688 | |

| CSC Holdings LLC† | | | 10.875 | % | | 10/15/2025 | | | 5,316 | | | | 6,339,330 | |

| DISH DBS Corp. | | | 7.75 | % | | 7/1/2026 | | | 5,313 | | | | 6,003,690 | |

| Mediacom Broadband LLC/Mediacom Broadband Corp. | | | 6.375 | % | | 4/1/2023 | | | 2,269 | | | | 2,393,795 | |

| Mediacom LLC/Mediacom Capital Corp. | | | 7.25 | % | | 2/15/2022 | | | 325 | | | | 335,969 | |

| SFR Group SA (France)†(b) | | | 6.00 | % | | 5/15/2022 | | | 4,132 | | | | 4,255,960 | |

| Time Warner Cable, Inc. | | | 5.875 | % | | 11/15/2040 | | | 1,537 | | | | 1,644,456 | |

| Unitymedia GmbH (Germany)†(b) | | | 6.125 | % | | 1/15/2025 | | | 449 | | | | 463,593 | |

| | See Notes to Financial Statements. | 21 |

Schedule of Investments (continued)

December 31, 2016

| | | | | | | | Principal | | | | |

| | | Interest | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | Date | | (000) | | | Value | |

| Cable & Satellite Television (continued) | | | | | | | | | | | | | | |

| Unitymedia Hessen GmbH & Co. KG/Unitymedia NRW GmbH (Germany)†(b) | | | 5.00 | % | | 1/15/2025 | | $ | 1,111 | | | $ | 1,111,000 | |

| Unitymedia Hessen GmbH & Co. KG/Unitymedia NRW GmbH (Germany)†(b) | | | 5.50 | % | | 1/15/2023 | | | 2,068 | | | | 2,161,060 | |

| UPCB Finance IV Ltd.† | | | 5.375 | % | | 1/15/2025 | | | 1,929 | | | | 1,953,112 | |

| Virgin Media Finance plc (United Kingdom)†(b) | | | 6.00 | % | | 10/15/2024 | | | 997 | | | | 1,030,649 | |

| VTR Finance BV (Netherlands)†(b) | | | 6.875 | % | | 1/15/2024 | | | 1,275 | | | | 1,319,625 | |

| Wave Holdco LLC/Wave Holdco Corp. PIK† | | | 8.25 | % | | 7/15/2019 | | | 737 | | | | 723,817 | |

| Total | | | | | | | | | | | | | 43,586,405 | |

| | | | | | | | | | | | | | | |

| Chemicals 1.65% | | | | | | | | | | | | | | |

| Albemarle Corp. | | | 5.45 | % | | 12/1/2044 | | | 1,524 | | | | 1,642,995 | |

| Braskem Finance Ltd. | | | 6.45 | % | | 2/3/2024 | | | 1,002 | | | | 1,059,615 | |

| Celanese US Holdings LLC | | | 5.875 | % | | 6/15/2021 | | | 571 | | | | 634,727 | |

| CF Industries, Inc.† | | | 4.50 | % | | 12/1/2026 | | | 1,090 | | | | 1,073,471 | |

| Chemours Co. (The) | | | 7.00 | % | | 5/15/2025 | | | 1,640 | | | | 1,623,600 | |

| Equate Petrochemical BV (Netherlands)†(b) | | | 4.25 | % | | 11/3/2026 | | | 1,350 | | | | 1,292,679 | |

| GCP Applied Technologies, Inc.† | | | 9.50 | % | | 2/1/2023 | | | 459 | | | | 527,850 | |

| Grupo Idesa SA de CV (Mexico)†(b) | | | 7.875 | % | | 12/18/2020 | | | 1,450 | | | | 1,319,500 | |

| Hexion, Inc. | | | 6.625 | % | | 4/15/2020 | | | 1,191 | | | | 1,059,990 | |

| Kraton Polymers LLC/Kraton Polymers Capital Corp.† | | | 10.50 | % | | 4/15/2023 | | | 1,025 | | | | 1,160,812 | |

| Momentive Performance Materials, Inc. | | | 3.88 | % | | 10/24/2021 | | | 1,278 | | | | 1,207,710 | |

| NOVA Chemicals Corp. (Canada)†(b) | | | 5.25 | % | | 8/1/2023 | | | 1,129 | | | | 1,144,524 | |

| TPC Group, Inc.† | | | 8.75 | % | | 12/15/2020 | | | 410 | | | | 348,500 | |

| Trinseo Materials Operating SCA/Trinseo Materials Finance, Inc. (Luxembourg)†(b) | | | 6.75 | % | | 5/1/2022 | | | 505 | | | | 531,513 | |

| Tronox Finance LLC | | | 6.375 | % | | 8/15/2020 | | | 206 | | | | 193,640 | |

| Tronox Finance LLC† | | | 7.50 | % | | 3/15/2022 | | | 1,838 | | | | 1,723,125 | |

| Westlake Chemical Corp.† | | | 5.00 | % | | 8/15/2046 | | | 1,108 | | | | 1,098,623 | |

| Total | | | | | | | | | | | | | 17,642,874 | |

| | | | | | | | | | | | | | | |

| Consumer/Commercial/Lease Financing 0.99% | | | | | | | | | | | | | | |

| Discover Bank/Greenwood DE | | | 3.45 | % | | 7/27/2026 | | | 1,823 | | | | 1,763,851 | |

| Nationstar Mortgage LLC/Nationstar Capital Corp. | | | 6.50 | % | | 7/1/2021 | | | 1,788 | | | | 1,819,290 | |

| Navient Corp. | | | 5.00 | % | | 10/26/2020 | | | 964 | | | | 985,690 | |

| Navient Corp. | | | 5.875 | % | | 10/25/2024 | | | 419 | | | | 400,145 | |

| Navient Corp. | | | 6.125 | % | | 3/25/2024 | | | 771 | | | | 752,689 | |

| Navient Corp. | | | 6.625 | % | | 7/26/2021 | | | 3,011 | | | | 3,191,660 | |

| NFP Corp.† | | | 9.00 | % | | 7/15/2021 | | | 1,553 | | | | 1,644,238 | |

| Total | | | | | | | | | | | | | 10,557,563 | |

| 22 | See Notes to Financial Statements. | |

Schedule of Investments (continued)

December 31, 2016

| | | | | | | | Principal | | | | |

| | | Interest | | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | | Date | | (000) | | | Value | |

| Discount Stores 0.65% | | | | | | | | | | | | | | |

| Amazon.com, Inc. | | | 4.80% | | | 12/5/2034 | | $ | 6,312 | | | $ | 6,968,315 | |

| | | | | | | | | | | | | | | |

| Diversified Capital Goods 1.59% | | | | | | | | | | | | | | |

| Accudyne Industries Borrower/Accudyne Industries LLC (Luxembourg)†(b) | | | 7.75% | | | 12/15/2020 | | | 1,225 | | | | 1,025,937 | |

| Apex Tool Group LLC† | | | 7.00% | | | 2/1/2021 | | | 614 | | | | 552,600 | |

| BCD Acquisition, Inc.† | | | 9.625% | | | 9/15/2023 | | | 1,020 | | | | 1,096,500 | |

| Fortive Corp.† | | | 3.15% | | | 6/15/2026 | | | 1,019 | | | | 1,006,223 | |

| Fortive Corp.† | | | 4.30% | | | 6/15/2046 | | | 509 | | | | 506,076 | |

| General Cable Corp. | | | 5.75% | | | 10/1/2022 | | | 1,152 | | | | 1,123,200 | |

| General Electric Co. | | | 5.00% | # | | – | (e) | | 2,356 | | | | 2,447,766 | |

| Griffon Corp. | | | 5.25% | | | 3/1/2022 | | | 1,163 | | | | 1,182,771 | |

| Siemens Financieringsmaatschappij NV (Netherlands)†(b) | | | 3.25% | | | 5/27/2025 | | | 1,235 | | | | 1,239,650 | |

| SPX FLOW, Inc.† | | | 5.625% | | | 8/15/2024 | | | 523 | | | | 528,230 | |

| SPX FLOW, Inc.† | | | 5.875% | | | 8/15/2026 | | | 753 | | | | 754,882 | |

| Unifrax I LLC/Unifrax Holding Co.† | | | 7.50% | | | 2/15/2019 | | | 1,199 | | | | 1,199,000 | |

| Valmont Industries, Inc. | | | 5.25% | | | 10/1/2054 | | | 2,656 | | | | 2,335,442 | |

| Wabtec Corp.† | | | 3.45% | | | 11/15/2026 | | | 1,998 | | | | 1,924,566 | |

| Total | | | | | | | | | | | | | 16,922,843 | |

| | | | | | | | | | | | | | | |

| Electric: Generation 0.51% | | | | | | | | | | | | | | |

| Energy Future Intermediate Holding Co. LLC/EFIH Finance, Inc.†(f) | | | 10.00% | | | 12/1/2020 | | | 2,300 | | | | 523,250 | |

| Illinois Power Generating Co.(f) | | | 7.00% | | | 4/15/2018 | | | 1,757 | | | | 632,520 | |

| Listrindo Capital BV (Netherlands)†(b) | | | 4.95% | | | 9/14/2026 | | | 1,243 | | | | 1,214,318 | |

| NSG Holdings LLC/NSG Holdings, Inc.† | | | 7.75% | | | 12/15/2025 | | | 1,845 | | | | 2,000,043 | |

| Talen Energy Supply LLC | | | 6.50% | | | 6/1/2025 | | | 1,371 | | | | 1,065,952 | |

| Total | | | | | | | | | | | | | 5,436,083 | |

| | | | | | | | | | | | | | | |

| Electric: Integrated 1.38% | | | | | | | | | | | | | | |

| AES Panama SRL (Panama)†(b) | | | 6.00% | | | 6/25/2022 | | | 577 | | | | 600,080 | |

| Black Hills Corp. | | | 4.20% | | | 9/15/2046 | | | 803 | | | | 768,667 | |

| Cleco Corporate Holdings LLC† | | | 4.973% | | | 5/1/2046 | | | 1,221 | | | | 1,240,793 | |

| El Paso Electric Co. | | | 5.00% | | | 12/1/2044 | | | 1,953 | | | | 2,044,135 | |

| Emera, Inc. (Canada)(b) | | | 6.75% | # | | 6/15/2076 | | | 1,916 | | | | 2,059,700 | |

| Entergy Arkansas, Inc. | | | 4.95% | | | 12/15/2044 | | | 1,909 | | | | 1,952,172 | |

| Entergy Mississippi, Inc. | | | 2.85% | | | 6/1/2028 | | | 1,525 | | | | 1,450,168 | |

| Indianapolis Power & Light Co.† | | | 4.05% | | | 5/1/2046 | | | 2,043 | | | | 1,936,272 | |

| IPALCO Enterprises, Inc. | | | 3.45% | | | 7/15/2020 | | | 168 | | | | 171,780 | |

| | See Notes to Financial Statements. | 23 |

Schedule of Investments (continued)

December 31, 2016

| | | | | | | | Principal | | | | |

| | | Interest | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | Date | | (000) | | | Value | |

| Electric: Integrated (continued) | | | | | | | | | | | | | | |

| Louisville Gas & Electric Co. | | | 4.375 | % | | 10/1/2045 | | $ | 598 | | | $ | 630,010 | |

| Puget Energy, Inc. | | | 3.65 | % | | 5/15/2025 | | | 909 | | | | 897,434 | |

| Southern California Edison Co. | | | 3.90 | % | | 3/15/2043 | | | 1,000 | | | | 985,837 | |

| Total | | | | | | | | | | | | | 14,737,048 | |

| | | | | | | | | | | | | | | |

| Electronics 1.61% | | | | | | | | | | | | | | |

| Micron Technology, Inc.† | | | 7.50 | % | | 9/15/2023 | | | 1,435 | | | | 1,592,850 | |

| NVIDIA Corp. | | | 3.20 | % | | 9/16/2026 | | | 3,622 | | | | 3,489,576 | |

| NXP BV/NXP Funding LLC (Netherlands)†(b) | | | 3.875 | % | | 9/1/2022 | | | 3,511 | | | | 3,563,665 | |

| NXP BV/NXP Funding LLC (Netherlands)†(b) | | | 4.625 | % | | 6/1/2023 | | | 984 | | | | 1,035,660 | |

| Qorvo, Inc. | | | 7.00 | % | | 12/1/2025 | | | 2,879 | | | | 3,202,887 | |

| QUALCOMM, Inc. | | | 4.65 | % | | 5/20/2035 | | | 500 | | | | 529,533 | |

| QUALCOMM, Inc. | | | 4.80 | % | | 5/20/2045 | | | 500 | | | | 535,577 | |

| Trimble, Inc. | | | 4.75 | % | | 12/1/2024 | | | 3,132 | | | | 3,176,753 | |

| Total | | | | | | | | | | | | | 17,126,501 | |

| | | | | | | | | | | | | | | |

| Energy: Exploration & Production 6.11% | | | | | | | | | | | | | | |

| Bill Barrett Corp. | | | 7.00 | % | | 10/15/2022 | | | 1,261 | | | | 1,210,560 | |

| Bonanza Creek Energy, Inc. | | | 6.75 | % | | 4/15/2021 | | | 1,270 | | | | 952,500 | |

| Carrizo Oil & Gas, Inc. | | | 6.25 | % | | 4/15/2023 | | | 1,916 | | | | 1,973,480 | |

| Chaparral Energy, Inc.(f) | | | 7.625 | % | | 11/15/2022 | | | 859 | | | | 773,100 | |

| Chaparral Energy, Inc.(f) | | | 8.25 | % | | 9/1/2021 | | | 1,036 | | | | 934,990 | |

| Chesapeake Energy Corp. | | | 4.875 | % | | 4/15/2022 | | | 636 | | | | 583,530 | |

| Chesapeake Energy Corp. | | | 6.625 | % | | 8/15/2020 | | | 2,669 | | | | 2,709,035 | |

| Clayton Williams Energy, Inc. | | | 7.75 | % | | 4/1/2019 | | | 1,035 | | | | 1,045,350 | |

| Concho Resources, Inc. | | | 5.50 | % | | 4/1/2023 | | | 3,820 | | | | 3,977,766 | |

| CONSOL Energy, Inc. | | | 5.875 | % | | 4/15/2022 | | | 1,065 | | | | 1,049,025 | |

| CONSOL Energy, Inc. | | | 8.00 | % | | 4/1/2023 | | | 1,091 | | | | 1,125,094 | |

| Continental Resources, Inc. | | | 4.50 | % | | 4/15/2023 | | | 1,099 | | | | 1,082,515 | |

| Continental Resources,Inc. | | | 3.80 | % | | 6/1/2024 | | | 3,075 | | | | 2,852,062 | |

| CrownRock LP/CrownRock Finance, Inc.† | | | 7.125 | % | | 4/15/2021 | | | 2,840 | | | | 2,967,800 | |

| Denbury Resources, Inc. | | | 4.625 | % | | 7/15/2023 | | | 617 | | | | 498,228 | |

| Denbury Resources, Inc. | | | 5.50 | % | | 5/1/2022 | | | 2,783 | | | | 2,442,082 | |

| Eclipse Resources Corp. | | | 8.875 | % | | 7/15/2023 | | | 1,229 | | | | 1,288,914 | |

| EP Energy LLC/Everest Acquisition Finance, Inc. | | | 9.375 | % | | 5/1/2020 | | | 1,082 | | | | 1,002,873 | |

| Gulfport Energy Corp. | | | 6.625 | % | | 5/1/2023 | | | 197 | | | | 206,850 | |

| Hilcorp Energy I LP/Hilcorp Finance Co.† | | | 5.00 | % | | 12/1/2024 | | | 2,703 | | | | 2,696,242 | |

| Kosmos Energy Ltd. † | | | 7.875 | % | | 8/1/2021 | | | 2,175 | | | | 2,175,000 | |

| Marathon Oil Corp. | | | 3.85 | % | | 6/1/2025 | | | 562 | | | | 545,955 | |

| 24 | See Notes to Financial Statements. | |

Schedule of Investments (continued)

December 31, 2016

| | | | | | | | Principal | | | | |

| | | Interest | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | Date | | (000) | | | Value | |

| Energy: Exploration & Production (continued) | | | | | | | | | | | | | | |

| MEG Energy Corp. (Canada)†(b) | | | 6.375 | % | | 1/30/2023 | | $ | 1,661 | | | $ | 1,486,595 | |

| MEG Energy Corp. (Canada)†(b) | | | 7.00 | % | | 3/31/2024 | | | 4,023 | | | | 3,660,930 | |

| Murphy Oil Corp. | | | 6.875 | % | | 8/15/2024 | | | 517 | | | | 551,898 | |

| Newfield Exploration Co. | | | 5.625 | % | | 7/1/2024 | | | 2,399 | | | | 2,512,952 | |

| Oasis Petroleum, Inc. | | | 6.875 | % | | 3/15/2022 | | | 1,168 | | | | 1,203,040 | |

| Occidental Petroleum Corp. | | | 4.40 | % | | 4/15/2046 | | | 805 | | | | 821,209 | |

| PDC Energy, Inc.† | | | 6.125 | % | | 9/15/2024 | | | 449 | | | | 461,348 | |

| PDC Energy, Inc. | | | 7.75 | % | | 10/15/2022 | | | 2,550 | | | | 2,728,500 | |

| Petrobras Argentina SA (Argentina)†(b) | | | 7.375 | % | | 7/21/2023 | | | 1,019 | | | | 996,073 | |

| Range Resources Corp. | | | 4.875 | % | | 5/15/2025 | | | 2,435 | | | | 2,371,081 | |

| Range Resources Corp.† | | | 5.875 | % | | 7/1/2022 | | | 2,071 | | | | 2,164,195 | |

| Rice Energy, Inc. | | | 6.25 | % | | 5/1/2022 | | | 1,587 | | | | 1,638,578 | |

| RSP Permian, Inc. | | | 6.625 | % | | 10/1/2022 | | | 1,517 | | | | 1,611,813 | |

| Sanchez Energy Corp. | | | 6.125 | % | | 1/15/2023 | | | 1,379 | | | | 1,316,945 | |

| Sanchez Energy Corp. | | | 7.75 | % | | 6/15/2021 | | | 906 | | | | 926,385 | |

| Seven Generations Energy Ltd. (Canada)†(b) | | | 6.875 | % | | 6/30/2023 | | | 1,779 | | | | 1,894,635 | |

| SM Energy Co. | | | 5.625 | % | | 6/1/2025 | | | 655 | | | | 635,350 | |

| SM Energy Co. | | | 6.75 | % | | 9/15/2026 | | | 887 | | | | 918,045 | |

| Southwestern Energy Co. | | | 6.70 | % | | 1/23/2025 | | | 1,100 | | | | 1,130,250 | |

| Tullow Oil plc (United Kingdom)†(b) | | | 6.25 | % | | 4/15/2022 | | | 1,106 | | | | 1,034,110 | |

| WPX Energy, Inc. | | | 6.00 | % | | 1/15/2022 | | | 1,000 | | | | 1,030,000 | |

| Total | | | | | | | | | | | | | 65,186,883 | |

| | | | | | | | | | | | | | | |

| Food & Drug Retailers 0.87% | | | | | | | | | | | | | | |

| BI-LO LLC/BI-LO Finance Corp.† | | | 9.25 | % | | 2/15/2019 | | | 804 | | | | 685,410 | |

| Ingles Markets, Inc. | | | 5.75 | % | | 6/15/2023 | | | 961 | | | | 992,233 | |

| New Albertson’s, Inc. | | | 7.45 | % | | 8/1/2029 | | | 950 | | | | 902,500 | |

| New Albertson’s, Inc. | | | 7.75 | % | | 6/15/2026 | | | 1,700 | | | | 1,691,500 | |

| Rite Aid Corp. | | | 7.70 | % | | 2/15/2027 | | | 2,175 | | | | 2,729,625 | |

| SMU SA (Chile)†(b) | | | 7.75 | % | | 2/8/2020 | | | 900 | | | | 877,500 | |

| Tops Holding LLC/Top Markets II Corp.† | | | 8.00 | % | | 6/15/2022 | | | 1,662 | | | | 1,437,630 | |

| Total | | | | | | | | | | | | | 9,316,398 | |

| | | | | | | | | | | | | | | |

| Food: Wholesale 1.18% | | | | | | | | | | | | | | |

| Arcor SAIC (Argentina)†(b) | | | 6.00 | % | | 7/6/2023 | | | 1,018 | | | | 1,063,810 | |

| Bunge Ltd. Finance Corp. | | | 3.25 | % | | 8/15/2026 | | | 1,204 | | | | 1,158,530 | |

| Cosan Luxembourg SA (Luxembourg)†(b) | | | 7.00 | % | | 1/20/2027 | | | 1,200 | | | | 1,203,000 | |

| Kellogg Co. | | | 4.50 | % | | 4/1/2046 | | | 2,033 | | | | 1,994,674 | |

| Lamb Weston Holdings, Inc.† | | | 4.625 | % | | 11/1/2024 | | | 1,248 | | | | 1,254,240 | |

| | See Notes to Financial Statements. | 25 |

Schedule of Investments (continued)

December 31, 2016

| | | | | | | | Principal | | | | |

| | | Interest | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | Date | | (000) | | | Value | |

| Food: Wholesale (continued) | | | | | | | | | | | | | | |

| Land O’Lakes, Inc.† | | | 6.00 | % | | 11/15/2022 | | $ | 1,274 | | | $ | 1,395,030 | |

| Mead Johnson Nutrition Co. | | | 4.125 | % | | 11/15/2025 | | | 1,319 | | | | 1,350,967 | |

| Pinnacle Foods Finance LLC/Pinnacle Foods Finance Corp. | | | 4.875 | % | | 5/1/2021 | | | 1,050 | | | | 1,086,750 | |

| Post Holdings, Inc.† | | | 7.75 | % | | 3/15/2024 | | | 1,397 | | | | 1,557,655 | |

| Post Holdings, Inc.† | | | 8.00 | % | | 7/15/2025 | | | 418 | | | | 470,250 | |

| Total | | | | | | | | | | | | | 12,534,906 | |

| | | | | | | | | | | | | | | |

| Forestry/Paper 0.41% | | | | | | | | | | | | | | |

| International Paper Co. | | | 4.40 | % | | 8/15/2047 | | | 1,211 | | | | 1,149,094 | |

| Millar Western Forest Products Ltd. (Canada)(b) | | | 8.50 | % | | 4/1/2021 | | | 1,010 | | | | 560,550 | |

| Norbord, Inc. (Canada)†(b) | | | 6.25 | % | | 4/15/2023 | | | 1,475 | | | | 1,534,000 | |

| Rayonier AM Products, Inc.† | | | 5.50 | % | | 6/1/2024 | | | 1,145 | | | | 1,076,300 | |

| Total | | | | | | | | | | | | | 4,319,944 | |

| | | | | | | | | | | | | | | |

| Gaming 2.22% | | | | | | | | | | | | | | |

| Boyd Gaming Corp. | | | 6.875 | % | | 5/15/2023 | | | 1,495 | | | | 1,612,731 | |

| Caesar’s Entertainment Resort Properties LLC/Caesar’s Entertainment Resort Properties Finance, Inc. | | | 11.00 | % | | 10/1/2021 | | | 1,050 | | | | 1,152,375 | |

| Caesar’s Growth Properties Holdings LLC/Caesar’s Growth Properties Finance, Inc. | | | 9.375 | % | | 5/1/2022 | | | 1,496 | | | | 1,620,318 | |

| Carlson Travel, Inc.† | | | 6.75 | % | | 12/15/2023 | | | 942 | | | | 982,035 | |

| GLP Capital LP/GLP Financing II, Inc. | | | 5.375 | % | | 4/15/2026 | | | 704 | | | | 735,962 | |

| International Game Technology plc† | | | 6.50 | % | | 2/15/2025 | | | 1,343 | | | | 1,447,082 | |

| MCE Finance Ltd. (Hong Kong)†(b) | | | 5.00 | % | | 2/15/2021 | | | 1,750 | | | | 1,747,601 | |

| MGM Growth Properties Operating Partnership LP/MGP Finance Co-Issuer, Inc.† | | | 5.625 | % | | 5/1/2024 | | | 544 | | | | 571,200 | |

| MGM Resorts International | | | 6.00 | % | | 3/15/2023 | | | 3,985 | | | | 4,313,762 | |

| MGM Resorts International | | | 7.75 | % | | 3/15/2022 | | | 762 | | | | 878,205 | |

| Mohegan Tribal Gaming Authority† | | | 7.875 | % | | 10/15/2024 | | | 2,065 | | | | 2,114,044 | |

| River Rock Entertainment Authority(f) | | | 9.00 | % | | 11/1/2018 | | | 431 | | | | 89,432 | |

| Scientific Games International, Inc. | | | 10.00 | % | | 12/1/2022 | | | 1,120 | | | | 1,120,000 | |

| Sugarhouse HSP Gaming Prop. Mezz. LP/Sugarhouse HSP Gaming Finance Corp.† | | | 6.375 | % | | 6/1/2021 | | | 2,490 | | | | 2,496,225 | |

| Wynn Macau Ltd. (Macau)†(b) | | | 5.25 | % | | 10/15/2021 | | | 2,780 | | | | 2,814,750 | |

| Total | | | | | | | | | | | | | 23,695,722 | |

| | | | | | | | | | | | | | | |

| Gas Distribution 3.73% | | | | | | | | | | | | | | |

| American Midstream Partners LP/American Midstream Finance Corp.† | | | 8.50 | % | | 12/15/2021 | | | 672 | | | | 668,640 | |

| 26 | See Notes to Financial Statements. |

Schedule of Investments (continued)

December 31, 2016

| | | | | | | | Principal | | | | |

| | | Interest | | | Maturity | | Amount | | | Fair | |

| Investments | | Rate | | | Date | | (000) | | | Value | |

| Gas Distribution (continued) | | | | | | | | | | | | | | |

| Boardwalk Pipelines LP | | | 5.95% | | | 6/1/2026 | | $ | 1,570 | | | $ | 1,708,425 | |

| Cheniere Corpus Christi Holdings LLC† | | | 5.875% | | | 3/31/2025 | | | 1,059 | | | | 1,084,480 | |

| Cheniere Corpus Christi Holdings LLC† | | | 7.00% | | | 6/30/2024 | | | 1,017 | | | | 1,105,988 | |

| Columbia Pipeline Group, Inc. | | | 4.50% | | | 6/1/2025 | | | 1,024 | | | | 1,077,620 | |

| Dominion Gas Holdings LLC | | | 3.60% | | | 12/15/2024 | | | 1,175 | | | | 1,193,411 | |

| Enbridge, Inc. (Canada)(b) | | | 6.00% | # | | 1/15/2077 | | | 1,146 | | | | 1,146,000 | |

| Energy Transfer Equity LP | | | 5.50% | | | 6/1/2027 | | | 1,097 | | | | 1,075,060 | |

| Energy Transfer Equity LP | | | 5.875% | | | 1/15/2024 | | | 1,263 | | | | 1,310,362 | |

| Florida Gas Transmission Co. LLC† | | | 4.35% | | | 7/15/2025 | | | 2,895 | | | | 2,922,885 | |

| Genesis Energy LP/Genesis Energy Finance Corp. | | | 6.75% | | | 8/1/2022 | | | 1,240 | | | | 1,294,560 | |

| IFM US Colonial Pipeline 2 LLC† | | | 6.45% | | | 5/1/2021 | | | 1,400 | | | | 1,525,752 | |

| LBC Tank Terminals Holding Netherlands BV (Belgium)†(b) | | | 6.875% | | | 5/15/2023 | | | 1,419 | | | | 1,458,022 | |