Annual Report

Economic and Market Overview

The U.S. economy grew moderately during the 12-month period ended October 31, 2013. Despite a large decline in federal government spending during the fourth quarter of 2012, economic growth improved in 2013, supported by business investment, consumer spending, inventory gains, exports, and state and local government spending. Solid new and existing home sales accompanied historically low mortgage rates, rising but affordable housing prices, low inventories and multi-year lows in new foreclosures. Manufacturing, a mainstay of economic productivity, expanded for most of the period, and the unemployment rate fell to 7.3% in October 2013 from 7.9% a year earlier.1

In the fourth quarter of 2012, financial markets reflected uncertainty surrounding the outcome of the national election and whether Congress would avert automatic federal budget cuts and income tax increases scheduled for the beginning of 2013. Congress passed a budget bill on January 1, 2013, that preserved lower income tax rates for most U.S. households, but Washington’s lack of consensus on proposed expenditure reductions resulted in further across-the-board federal spending cuts starting in March. Federal Reserve Board (Fed) Chairman Ben Bernanke indicated in May that the Fed might reduce monthly purchases of mortgage-backed securities and Treasuries, assuming ongoing U.S. recovery. However, in September, he announced that any tapering of Fed purchases would be postponed until U.S. economic growth strengthened. Because of partisan disagreement about a new health care law, Congress did not authorize some routine federal funding, resulting in a temporary shutdown of non-essential U.S. government services beginning on October 1. On October 17, the partial shutdown ended after Congress agreed to fund the government until January 15, 2014, and raise the debt limit through February 7. Near period-end, the Fed left its monetary policy unchanged as it awaited more evidence of a sustainable economic expansion. The Fed noted that although the government’s fiscal policy may have restrained growth, the economy maintained its underlying strength.

1. Source: Bureau of Labor Statistics.

Annual Report | 3

Rising corporate profits and generally favorable economic data bolstered investor confidence, helping markets overcome brief periods of sell-offs in reaction to Fed statements and to Washington’s fiscal negotiations. U.S. stocks generated strong 12-month returns as the Standard & Poor’s 500 Index (S&P 500®) and Dow Jones Industrial Average (DJIA) reached all-time highs during the period. Additionally, small- and mid-capitalization stocks, as measured by the Russell 2000® Index and the Russell Midcap® Index, reached record highs during the 12-month period and outperformed the S&P 500 and DJIA.2

The foregoing information reflects our analysis and opinions as of October 31, 2013. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

2. RUSSELL® is a trademark of the Frank Russell Company.

4 | Annual Report

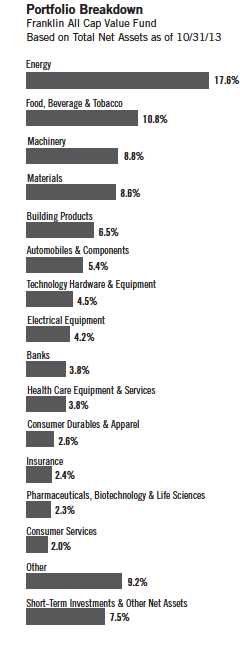

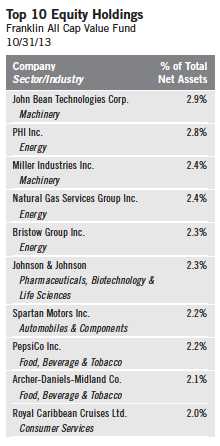

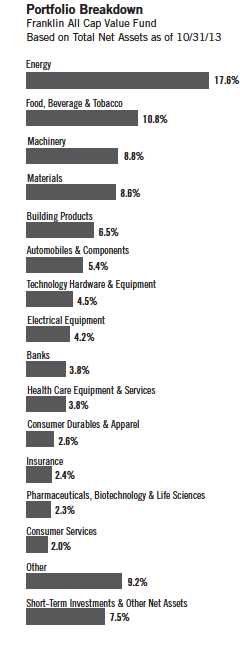

Franklin All Cap Value Fund

Your Fund’s Goal and Main Investments: Franklin All Cap Value Fund seeks long-term total return by primarily investing in stocks of companies of any size that we believe are undervalued at the time of purchase and have the potential for capital appreciation.

We are pleased to bring you Franklin All Cap Value Fund’s annual report for the fiscal year ended October 31, 2013.

Performance Overview

Franklin All Cap Value Fund – Class A delivered a +33.69% cumulative total return for the 12 months under review. In comparison, the Russell 3000® Value Index, which measures performance of those Russell 3000® Index companies with lower price-to-book ratios and lower forecasted growth values, generated a +28.64% total return.1 Although this report covers a 12-month period, our investment strategy aims for long-term results. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 9.

Investment Strategy

Our goal is to invest in stocks of companies of any size that we determine are currently undervalued and have the potential for capital appreciation. The Fund purchases securities that are out of favor in the market for reasons we believe will prove to be temporary, or that appear to be inexpensive measured by factors such as price relative to earnings, book value or cash flow. In addition, the Fund may invest in companies with valuable intangibles we believe are not reflected in the stock price. This strategy is not aimed at short-term trading gains, nor do we consider the composition of any index. Rather, we try to identify attractively priced, financially sound companies that meet our investment criteria, and we assume at purchase that we will hold the positions for several years.

1. Source: © 2013 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

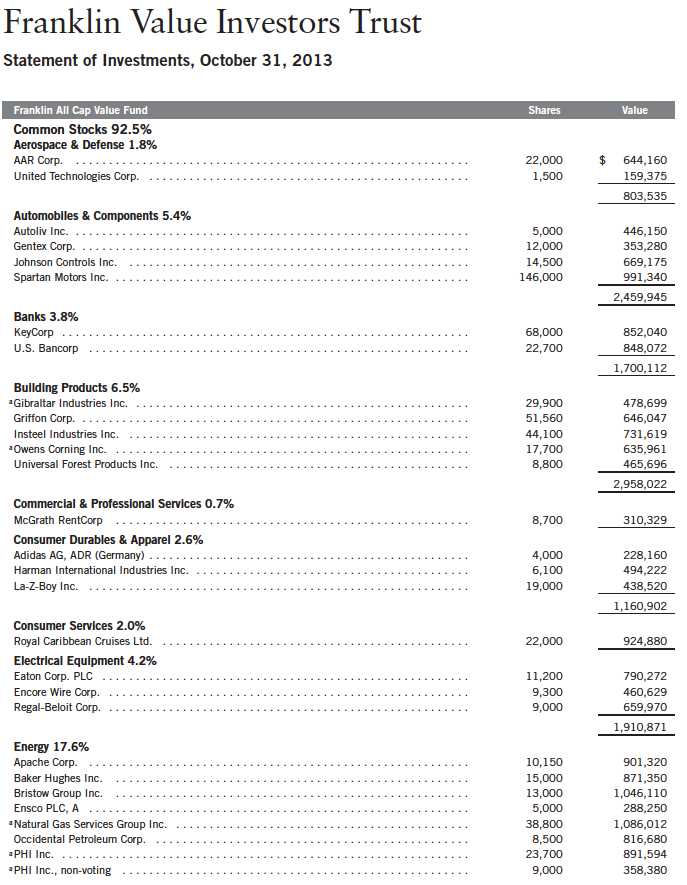

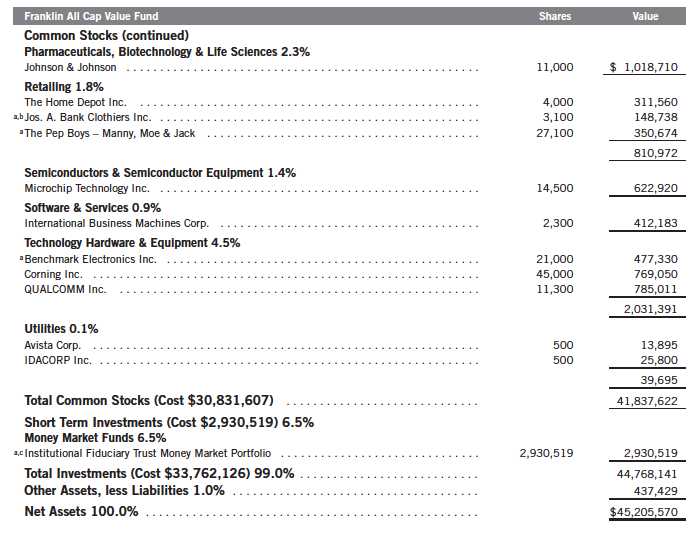

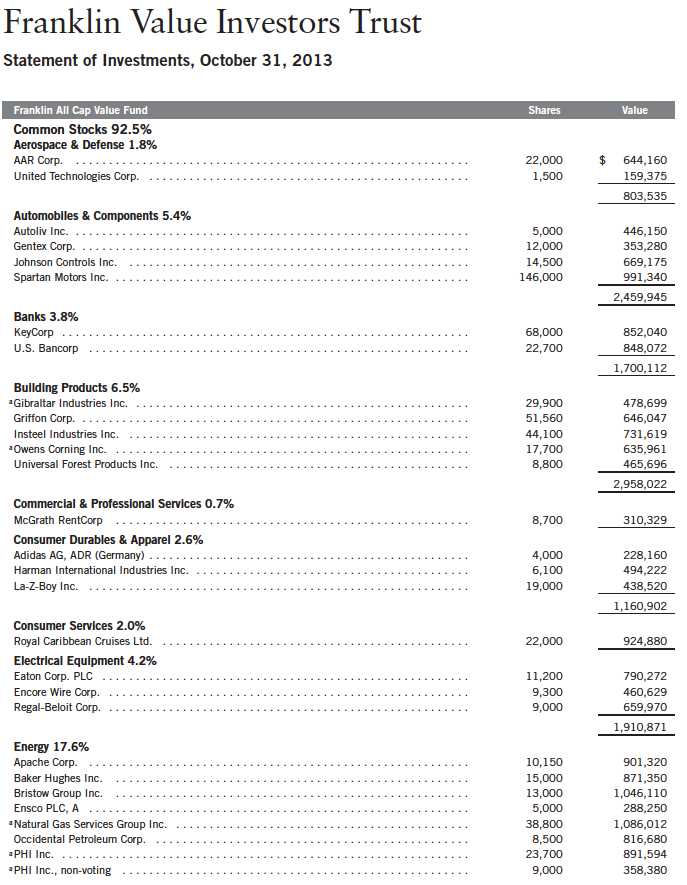

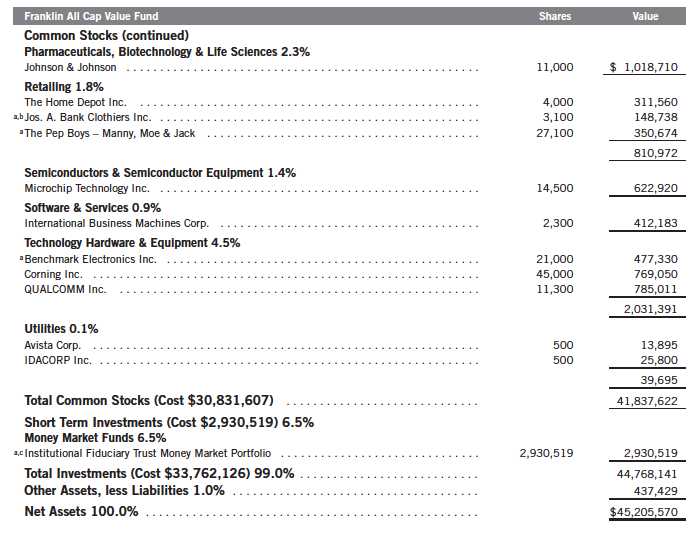

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 69.

Annual Report | 5

Manager’s Discussion

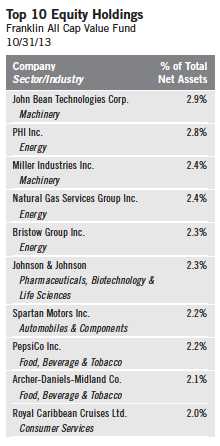

During the 12 months under review, contributors to absolute performance encompassed several of the Fund’s largest holdings. These included food processing equipment manufacturer John Bean Technologies, energy equipment manufacturer Natural Gas Services Group, offshore energy helicopter transportation provider Bristow Group and agribusiness services provider Archer-Daniels-Midland. Automotive systems and building efficiency products manufacturer Johnson Controls also helped performance. John Bean Technologies hired a new chief executive officer, and Natural Gas Services Group reported multiple quarters of double-digit earnings-per-share growth as well as increased utilization and gross margins. Bristow Group experienced strong earnings-per-share growth driven by increased demand for aircraft to support deep water drilling and the award of a major search and rescue contract for the U.K. government. Archer-Daniels-Midland benefited from increased focus on capital allocation, improved asset utilization and a favorable outlook for major crop supplies in 2014. Johnson Controls reported higher third-quarter earnings resulting from its stabilizing automotive business in Europe as well as increased auto sales in Asia and the U.S. Although demand for the company’s building products softened, the company benefited from its strong service business as well as pricing and cost reduction efforts. Johnson Controls also announced an agreement to divest its automotive electronics business.

Most positions contributed to absolute performance, but detractors included fish meal and oil products producer Omega Protein, global software and services provider Microsoft, global information technology software and services provider International Business Machines (IBM) and outdoor power equipment manufacturer Briggs & Stratton. Shares of Omega Protein declined, resulting from news of a subpar start to the commercial fishing season. Microsoft faced a challenging outlook given increased competition for personal computers from alternative devices such as smartphones and tablets.

IBM’s shares underperformed as the company, as well as some of its competitors, reported poor sales growth. In particular, revenue from IBM’s services and hardware segments declined. Briggs & Stratton suffered from an extremely slow start to the spring lawn and garden season and retailers’ cautious approach to managing inventories.

During the Fund’s fiscal year, we initiated positions in 19 new holdings. Some of the largest new purchases were Miller Industries, a manufacturer of vehicle towing and recovery equipment; Baker Hughes, a diversified oil services company; QUALCOMM, a digital communications products and services manufacturer; KeyCorp, a bank holding company; Xylem, a fluid technology and equipment provider; Alcoa, an aluminum producer; Regal-Beloit, an electric motor manufacturer; Universal Stainless & Alloy Products, a specialty steel products manufacturer and marketer; and Omega Protein. We also added to several existing positions including Spartan Motors, a vehicle chassis manufacturer; Bunge, a global agribusiness and food company; U.S. Bancorp, a bank holding company; and Royal Caribbean Cruises, a cruise ship operator, among others. We liquidated our positions in 13 companies including Microsoft, Xerox, Rocky Brands, Nexans and Time Warner Cable. We also reduced several positions, including IDACORP, Kaiser Aluminum, IBM, Natural Gas Services Group and Avista.

There were three all cash takeover announcements during the period: Gardner Denver was acquired by KKR, Maidenform Brands was acquired by HanesBrands, and NV Energy, which was sold during the period, agreed to be acquired by Berkshire Hathaway, with the closing expected in early 2014.

Annual Report | 7

8 | Annual Report

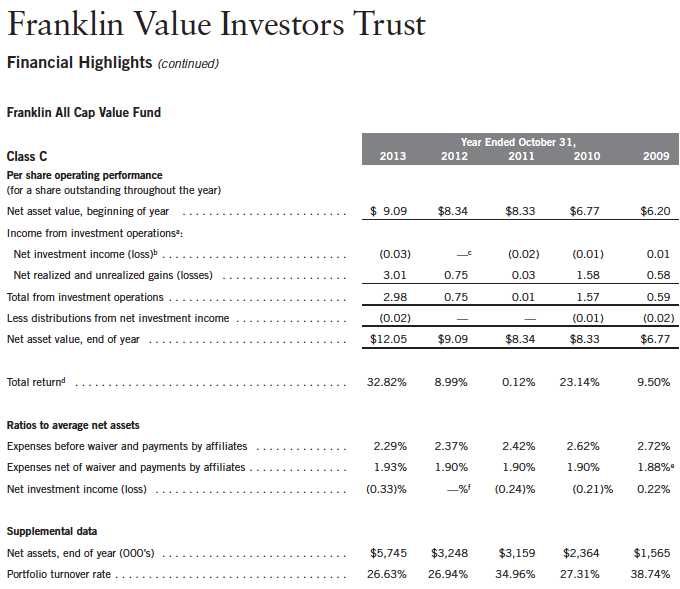

Performance Summary as of 10/31/13

Franklin All Cap Value Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Annual Report | 9

Performance Summary (continued)

Performance1

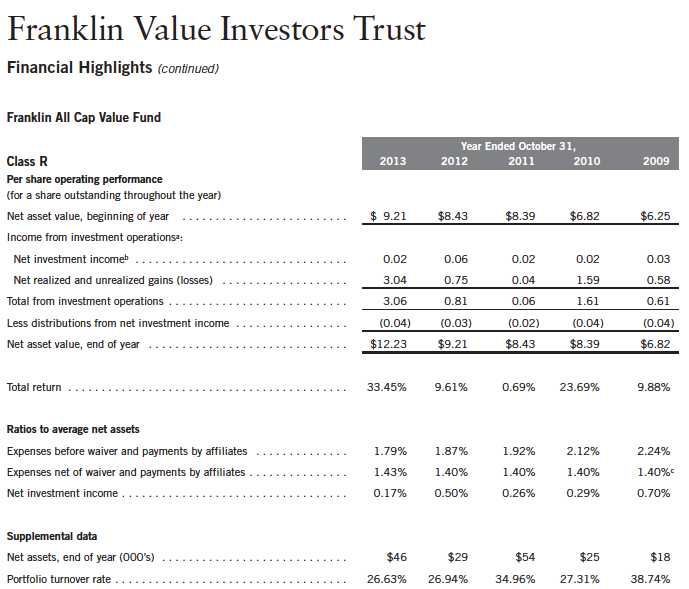

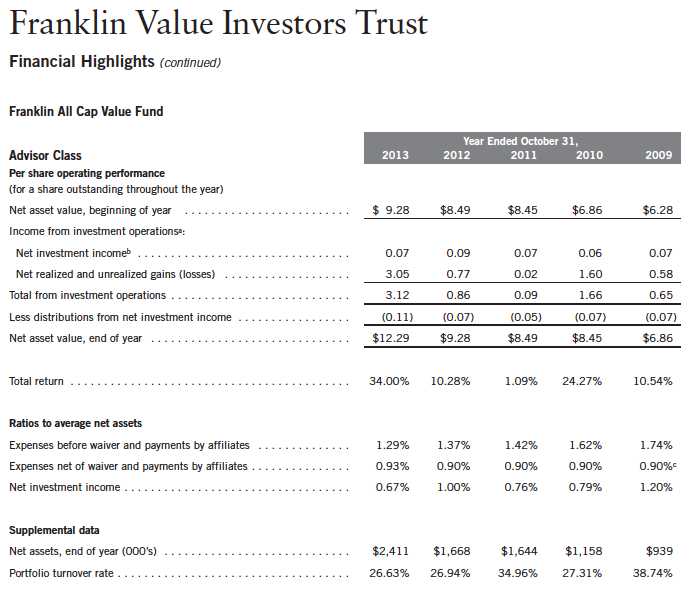

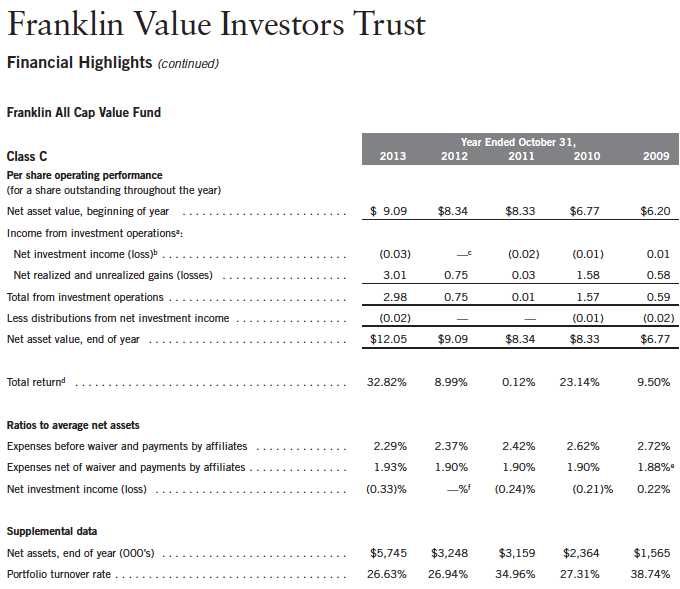

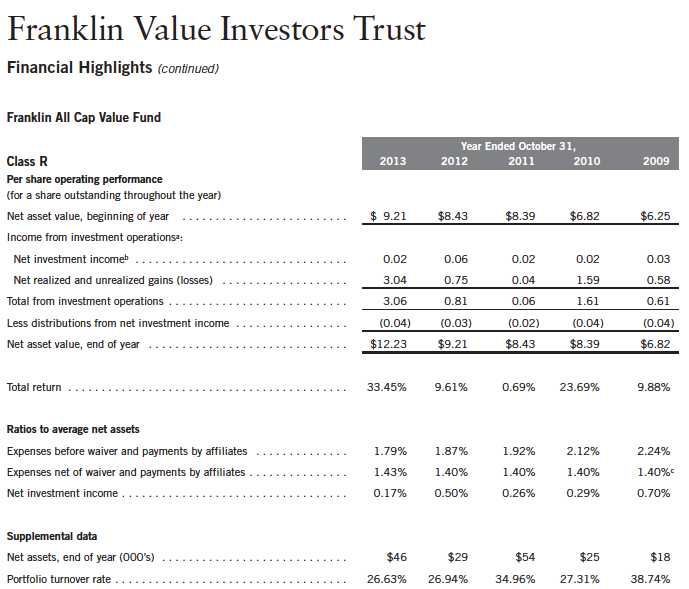

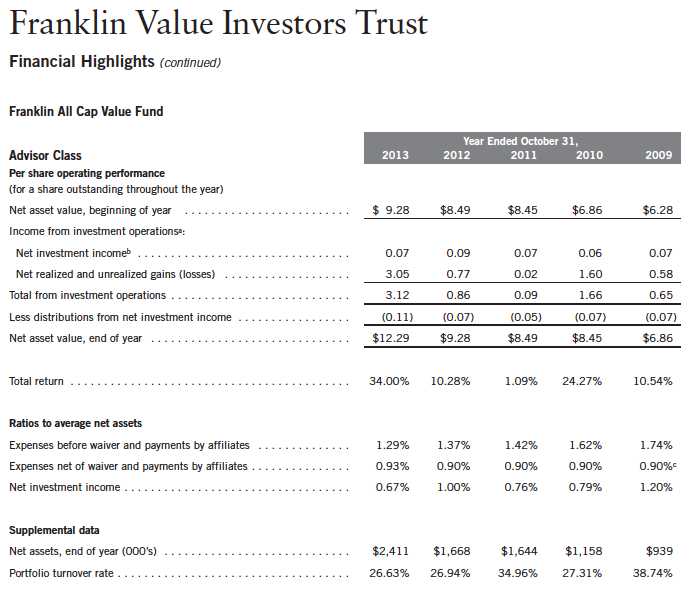

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Class R/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

10 | Annual Report

Annual Report | 11

12 | Annual Report

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. Value securities may not increase in price as anticipated or may decline further in value. While smaller and midsize companies may offer substantial opportunities for capital growth, they also involve heightened risks and should be considered speculative. Historically, smaller and midsize company securities have been more volatile in price than larger company securities, especially over the short term. The Fund may invest up to 25% of its total assets in foreign securities, which may involve special risks, including currency fluctuations and economic and political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class C: Class R: | These shares have higher annual fees and expenses than Class A shares. Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. The Fund has an expense reduction contractually guaranteed through at least 2/28/14 and a fee waiver associated with its investments in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year end. Fund investment results reflect the expense reduction and fee waiver, to the extent applicable; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. 4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

7. Source: © 2013 Morningstar. The Russell 3000® Value Index is market capitalization weighted and measures performance of those Russell 3000® Index companies with lower price-to-book ratios and lower forecasted growth values. The Consumer Price Index (CPI), calculated by the Bureau of Labor Statistics, is a commonly used measure of the inflation rate.

Annual Report | 13

Your Fund’s Expenses

Franklin All Cap Value Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

14 | Annual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.23%; C: 1.93%;

R: 1.43%; and Advisor: 0.93%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

Annual Report | 15

Franklin Balance Sheet Investment Fund

Your Fund’s Goal and Main Investments: Franklin Balance Sheet Investment Fund seeks high total return, of which capital appreciation and income are components, by investing most of its assets in equity securities of companies of any size that we believe are undervalued in the marketplace at the time of purchase but have the potential for capital appreciation.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

We are pleased to bring you Franklin Balance Sheet Investment Fund’s annual report for the fiscal year ended October 31, 2013.

Performance Overview

Franklin Balance Sheet Investment Fund – Class A delivered a +33.90% cumulative total return for the 12 months under review. In comparison, the Russell 3000® Value Index, which measures performance of those Russell 3000® Index companies with lower price-to-book ratios and lower forecasted growth values, generated a +28.64% total return.1 Although this report covers a 12-month period, our investment strategy aims for long-term results. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 19.

Investment Strategy

Our strategy is to buy shares of financially sound, well-established companies at a low price-to-book value when we have reasonable confidence that book value will increase over several years. Book value per share is a company’s net worth or shareholders’ equity on an accounting or “book” basis, divided by shares outstanding. We generally define “low price-to-book value” as the lower two deciles (20%) of our investable universe, which we derive from a proprietary database for screening purposes. This strategy is not aimed at short-term trading gains, nor do we consider the composition of any index. Rather, we try to identify individual companies that meet our investment criteria, and we assume at purchase that we will hold the positions for several years.

1. Source: © 2013 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

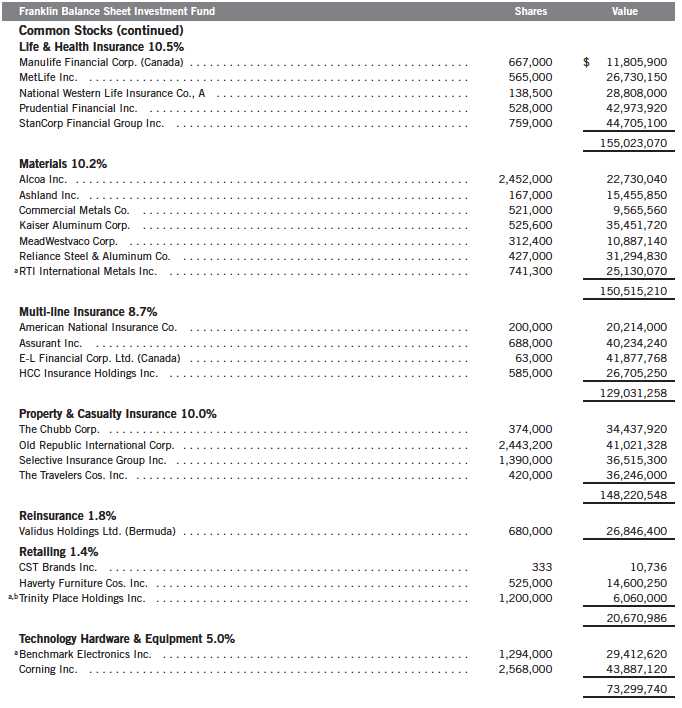

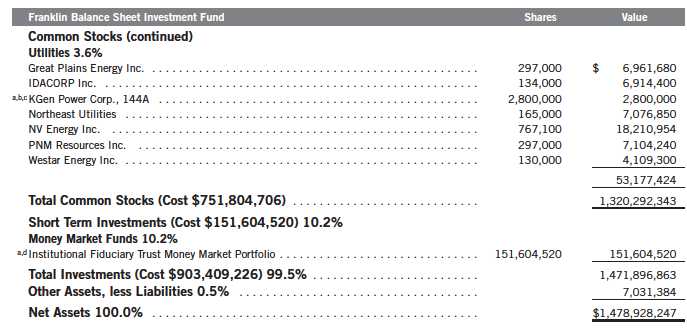

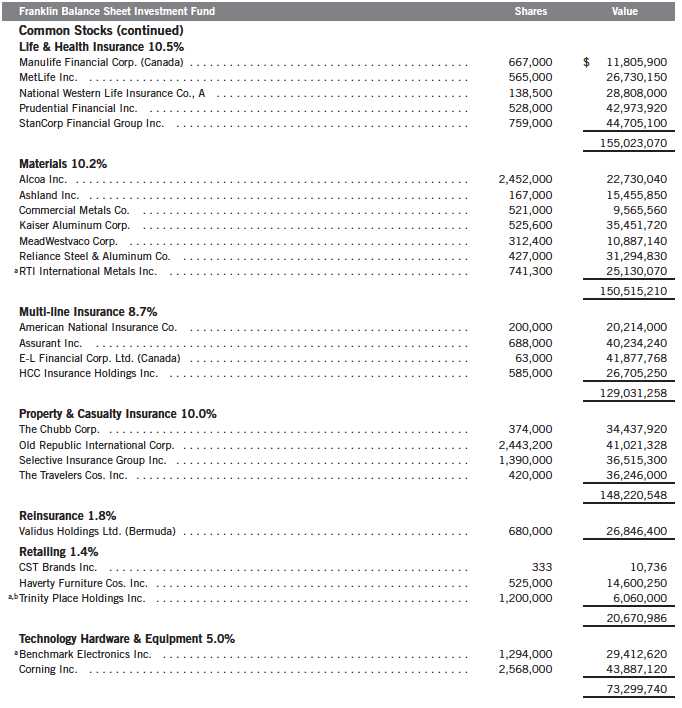

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 77.

16 | Annual Report

Manager’s Discussion

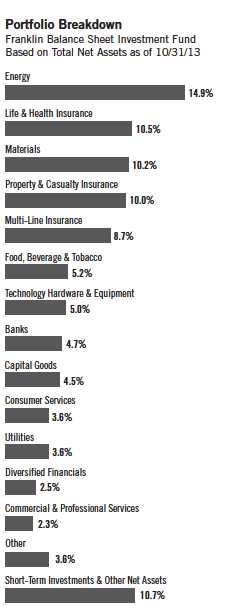

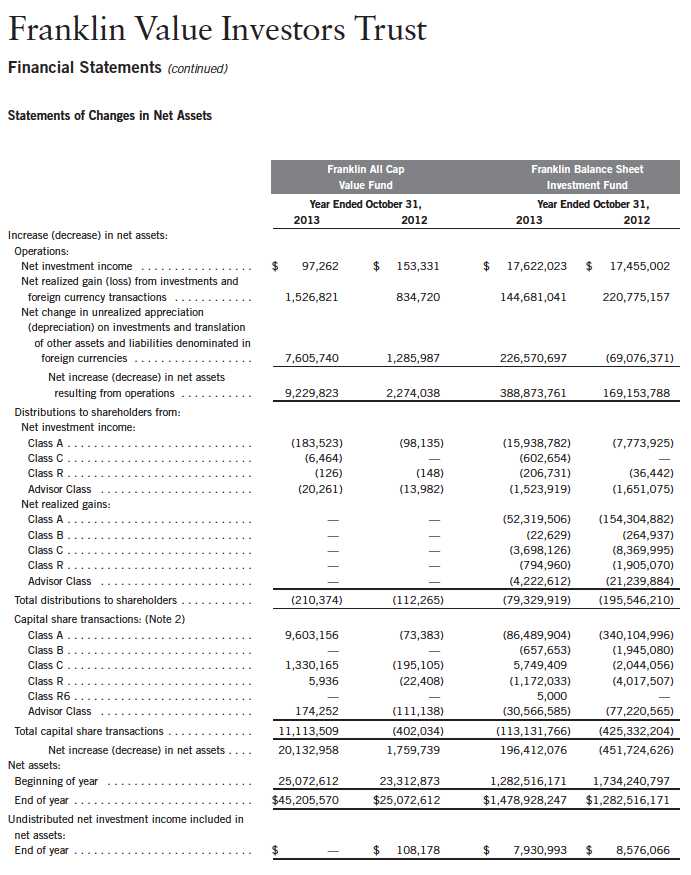

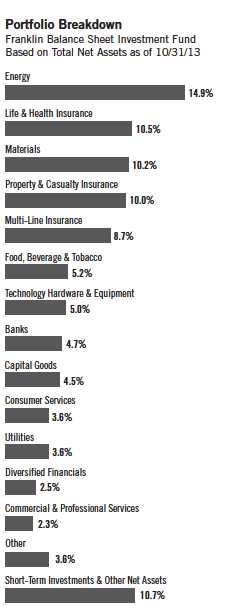

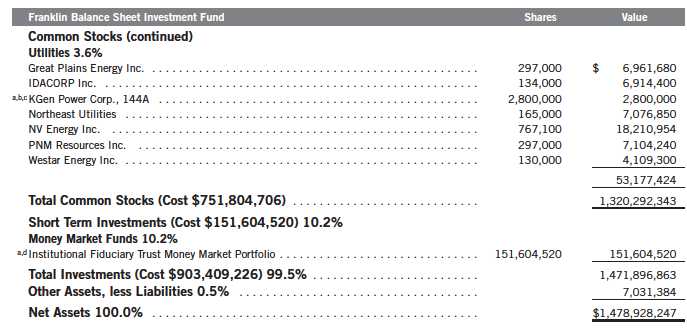

On October 31, 2013, the Fund’s total net assets were $1.48 billion, with short-term investments and other net assets making up 10.7%, compared with total net assets of $1.3 billion and short-term investments and other net assets of 2.4% on October 31, 2012.

During the Fund’s fiscal year, contributors to absolute Fund performance included several financials sector holdings, notably insurers StanCorp Financial Group, Old Republic International, E-L Financial, Assurant and Prudential Financial.2 StanCorp Financial Group benefited as fundamentals in group underwriting continued to improve, reversing a negative outlook for the stock. Old Republic International saw positive trends in its key insurance lines, and announced a plan to recapitalize and spin off its mortgage insurance business. Assurant negotiated with regulators to achieve favorable policy changes in its property business, while Prudential Financial and E-L Financial were expected, along with other life insurers, to benefit from an eventual increase in interest rates. E-L Financial also sold its property casualty business to Travelers.

Detractors from Fund performance included Ruby Tuesday (casual dining restaurant operator), McDermott International (oil and gas subsea construction), Sherritt International (oils, metals, coal) and ESCO Technologies (engineered products and systems). Ruby Tuesday reported poor first-quarter operating results and lowered its guidance for the remainder of its fiscal year 2014. McDermott International, a recent addition to the portfolio, sought to improve execution on several large construction contracts. Sherritt International’s poorly timed investment in new nickel production left it with a weak balance sheet in a depressed environment for nickel prices. ESCO Technologies put its troubled water metering business up for sale, leaving the company’s near-term earnings power in doubt.

During the reporting period, we identified five new investment opportunities: Devon Energy and Apache, oil and natural gas exploration and production companies; Alcoa, an aluminum producer; and the aforementioned Ruby Tuesday and McDermott International. We also added to existing positions in Bunge, a global agribusiness and food company; Royal Caribbean Cruises, a cruise ship operator; Corning, a specialty glass and ceramics manufacturer; Comerica, a bank holding company; and Valero Energy, an independent petroleum refining and marketing company, among others. Cash deployed into new or existing positions totaled $145 million.

2. The financials sector comprises banks, diversified financials, life and health insurance, multi-line insurance, property and casualty insurance, and reinsurance in the SOI.

Annual Report | 17

18 | Annual Report

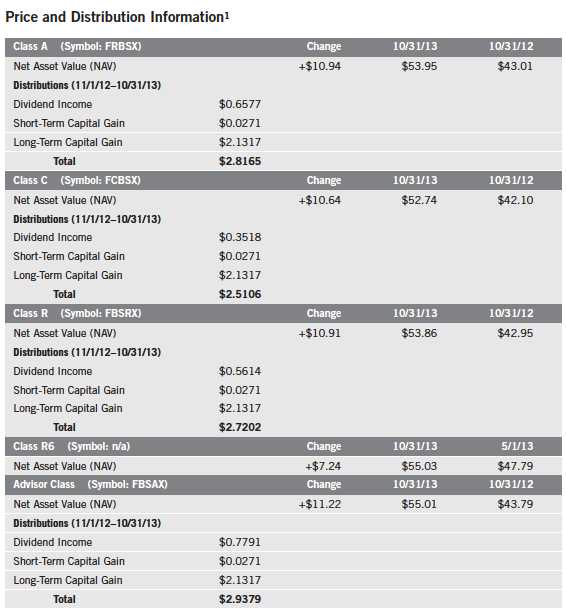

Performance Summary as of 10/31/13

Franklin Balance Sheet Investment Fund

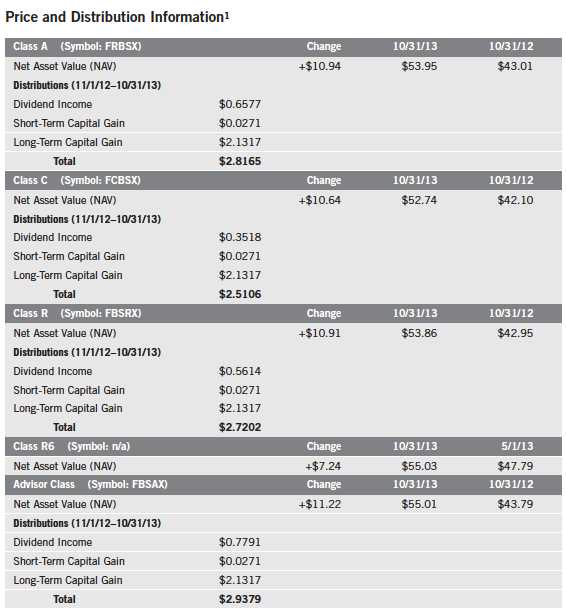

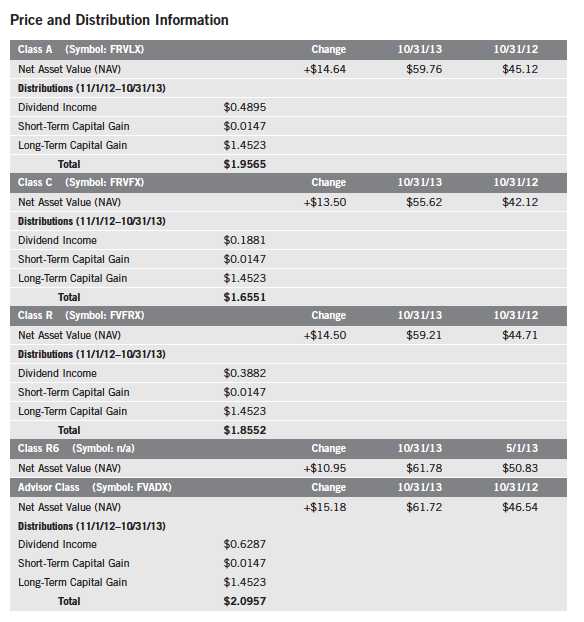

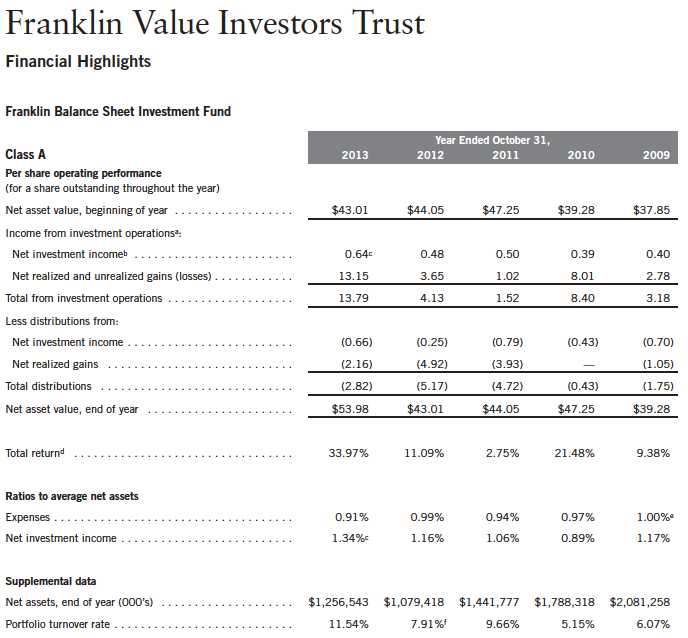

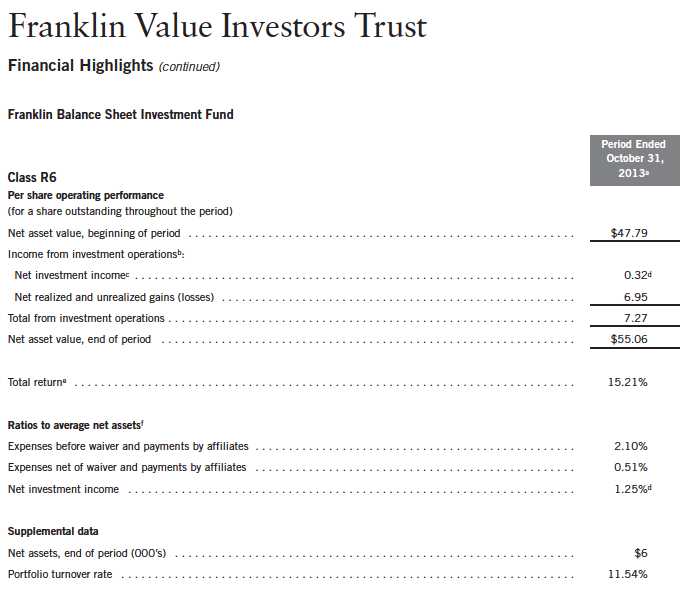

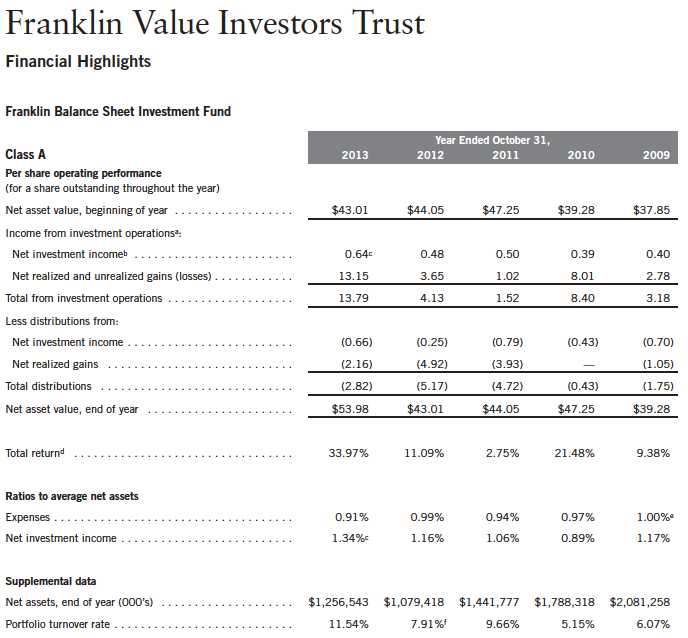

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Annual Report | 19

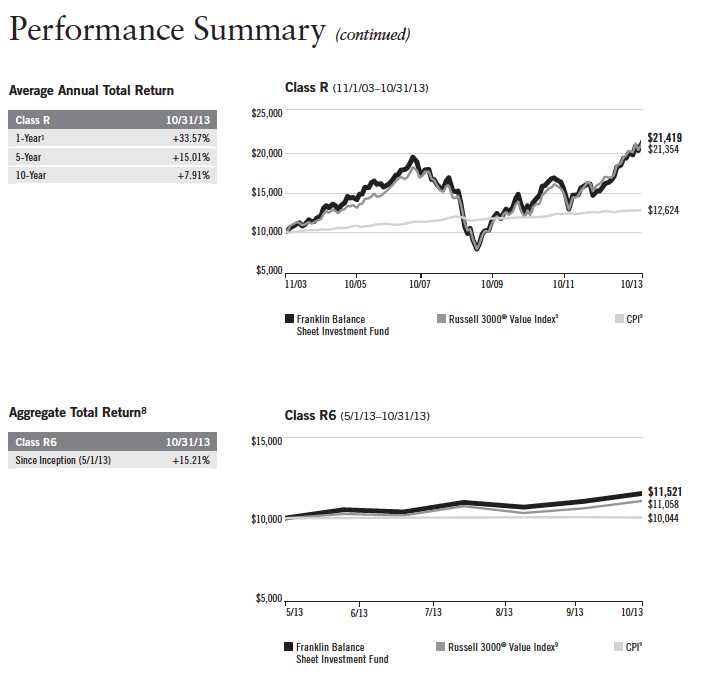

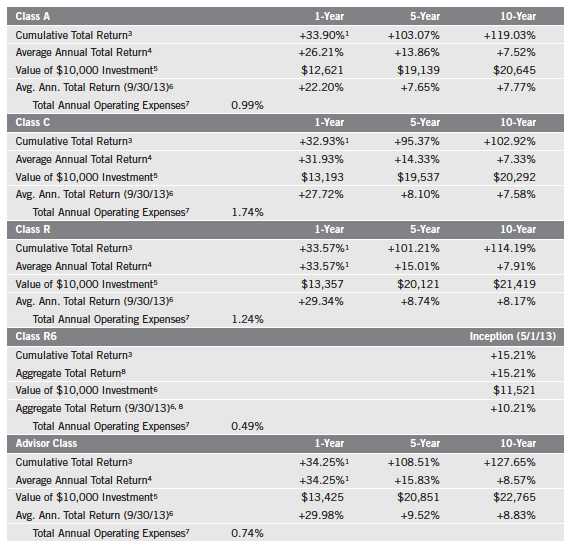

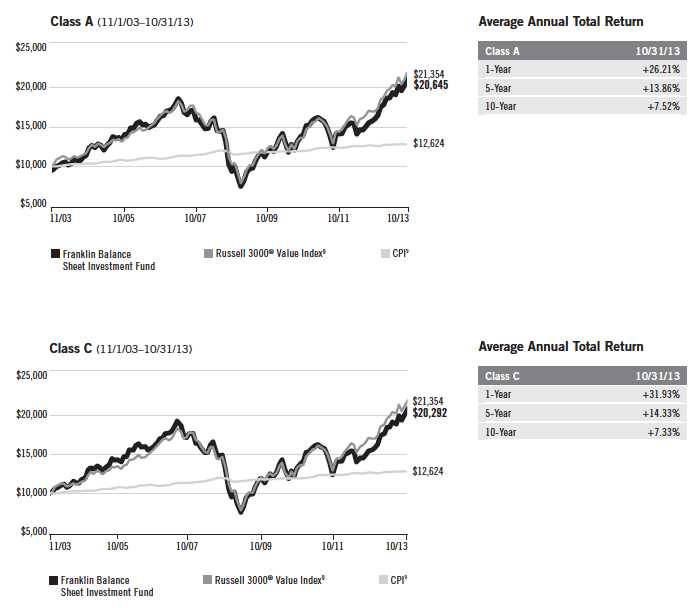

Performance Summary (continued)

Performance2

Cumulative total return excludes sales charges. Aggregate and average annual total returns and value of $10,000 invest-ment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Class R/R6/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

20 | Annual Report

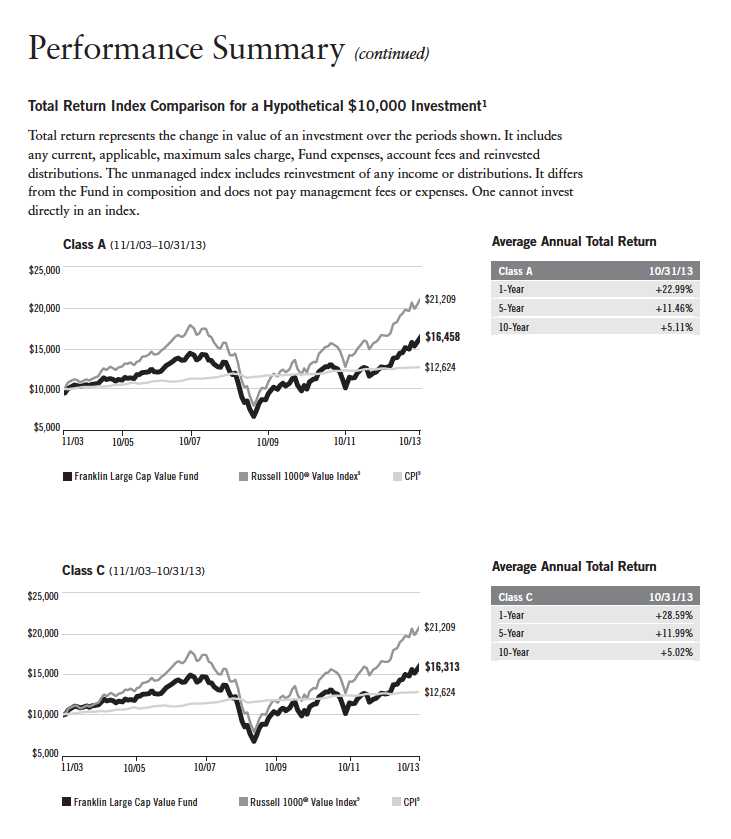

Performance Summary (continued)

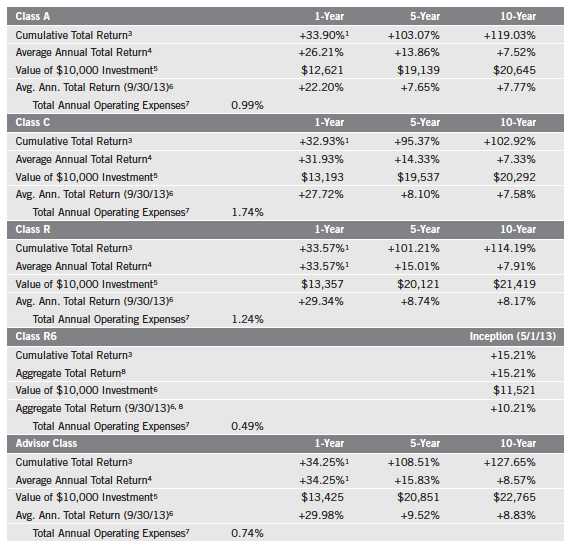

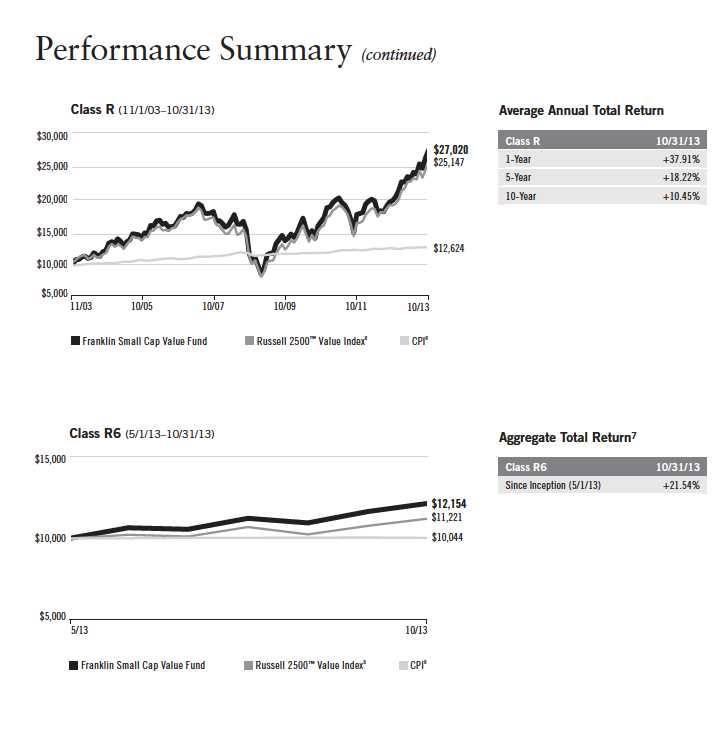

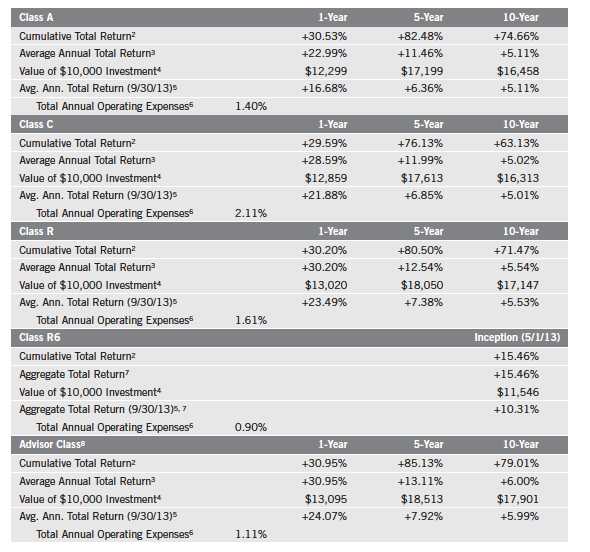

Total Return Index Comparison for a Hypothetical $10,000 Investment2

Total return represents the change in value of an investment over the periods shown. It includes any current, applicable, maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

Annual Report | 21

22 | Annual Report

Endnotes

All investments involve risks, including possible loss of principal. Value securities may not increase in price as anticipated or may decline further in value. While smaller and midsize companies may offer substantial opportunities for capital growth, they also involve heightened risks and should be considered speculative. Historically, smaller and midsize company securities have been more volatile in price than larger company securities, especially over the short term. The Fund may invest up to 25% of its total assets in foreign securities, which may involve special risks, including currency fluctuations and economic and political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class C: | Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

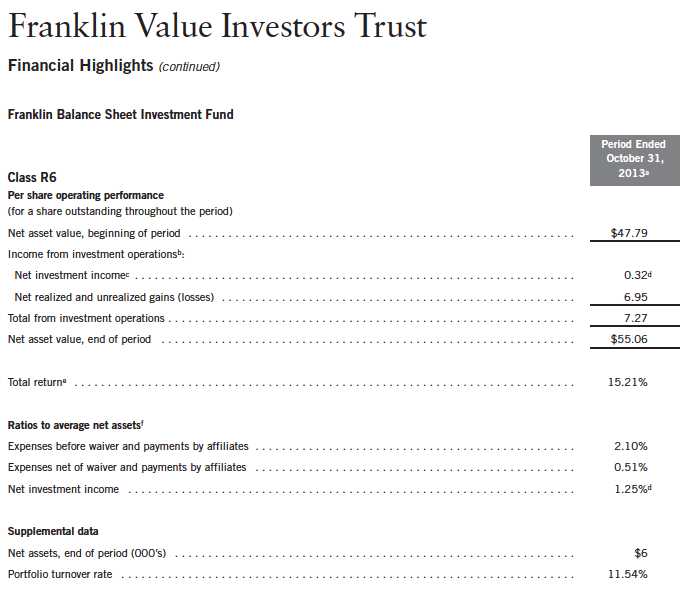

Class R6: Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. Shares are available to certain eligible investors as described in the prospectus. |

1. Price and total return information is based on net asset values calculated for shareholder transactions. Certain adjustments were made to the net assets of the Fund at 10/31/13 for financial reporting purposes, and as a result, the net asset values for shareholder transactions and the total returns based on those net asset values differ from the adjusted net asset values and total returns reported in the Financial Highlights.

2. The Fund has a fee waiver associated with its investments in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year end. Fund investment results reflect the fee waiver, to the extent applicable; without this reduction, the results would have been lower.

3. Cumulative total return represents the change in value of an investment over the periods indicated.

4. Average annual total return represents the average annual change in value of an investment over the periods indicated. 5. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

6. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

7. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

8. Aggregate total return represents the change in value of an investment for the period indicated. Since Class R6 shares have existed for less than one year, average annual total return is not available.

9. Source: © 2013 Morningstar. The Russell 3000® Value Index is market capitalization weighted and measures performance of those Russell 3000® Index companies with lower price-to-book ratios and lower forecasted growth values. The Consumer Price Index (CPI), calculated by the Bureau of Labor Statistics, is a commonly used measure of the inflation rate.

Annual Report | 23

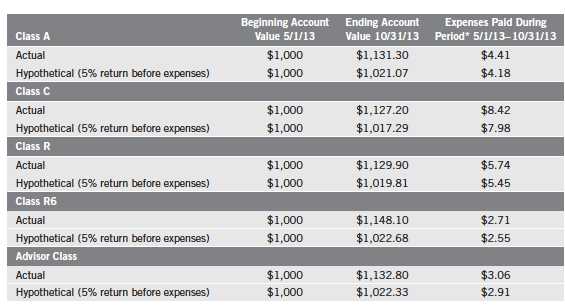

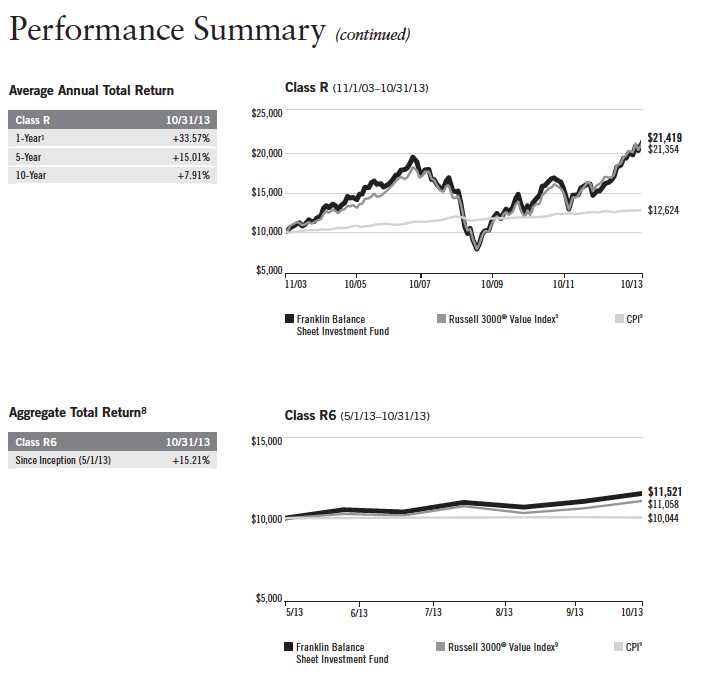

Your Fund’s Expenses

Franklin Balance Sheet Investment Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

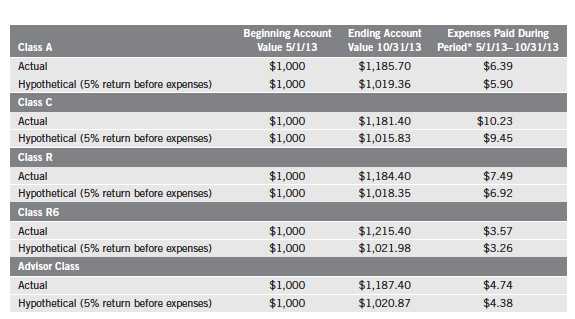

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

24 | Annual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.82%; C: 1.57%; R: 1.07%; R6: 0.51% (net of expense waivers); and Advisor: 0.57%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

Annual Report | 25

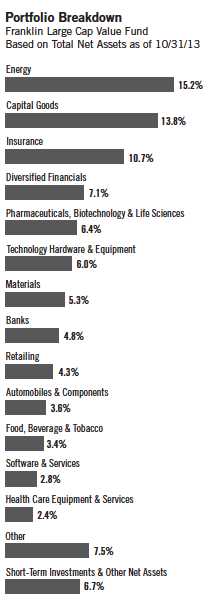

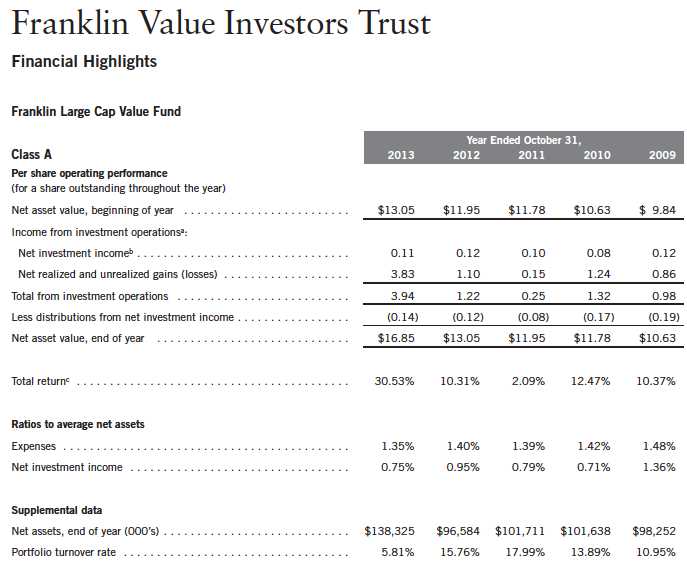

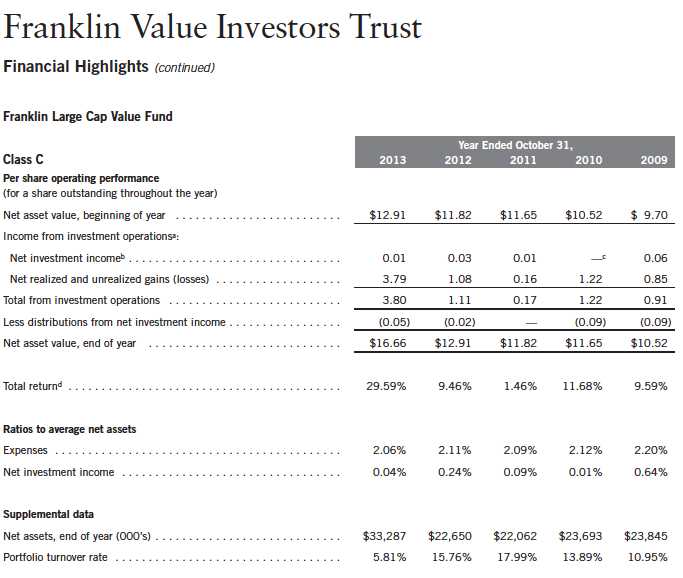

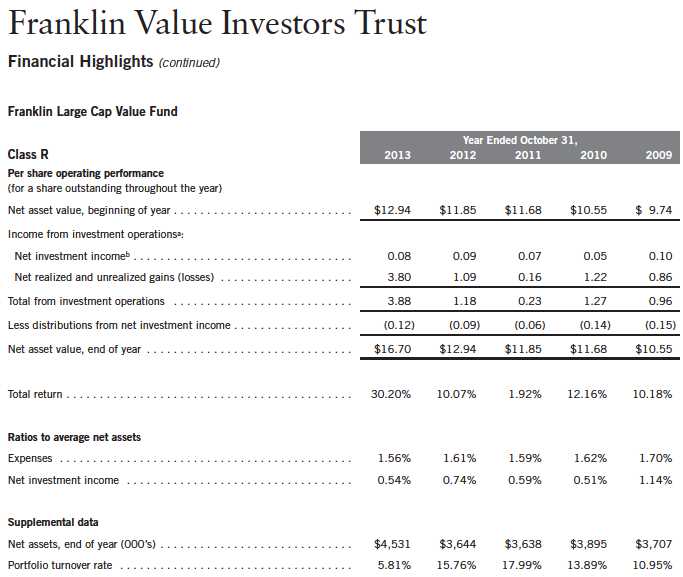

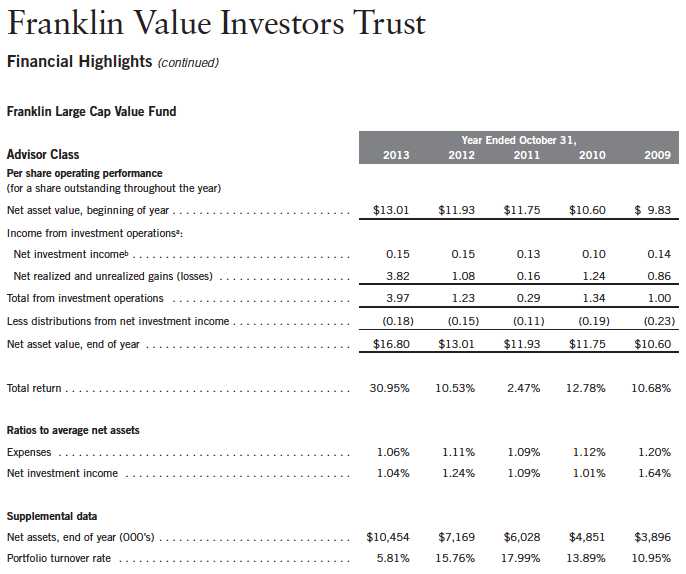

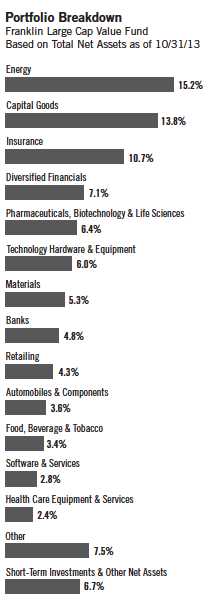

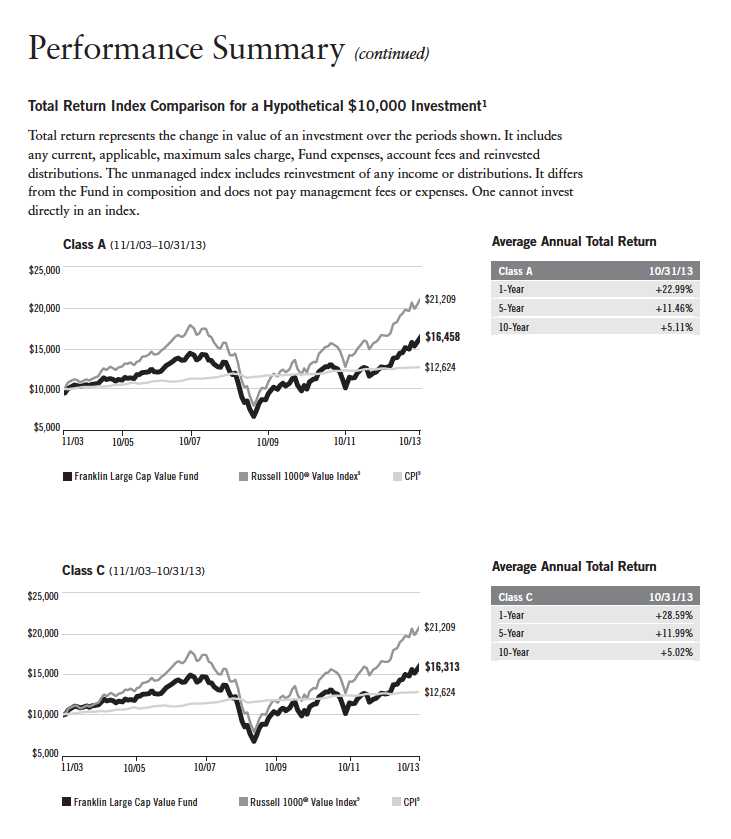

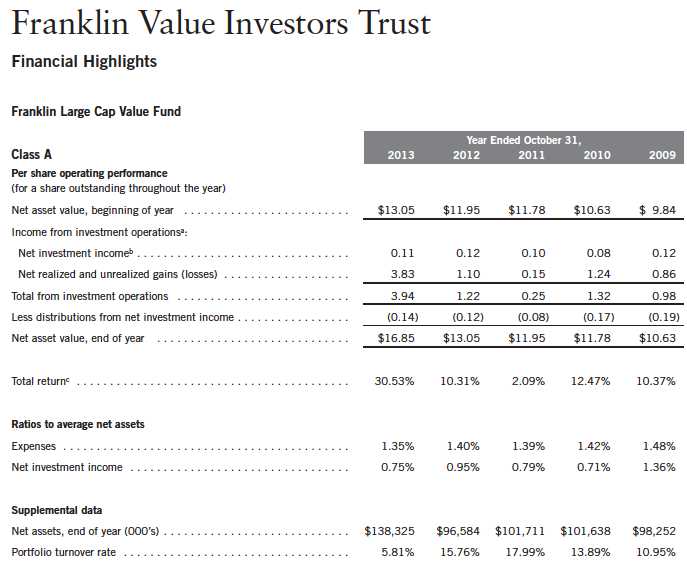

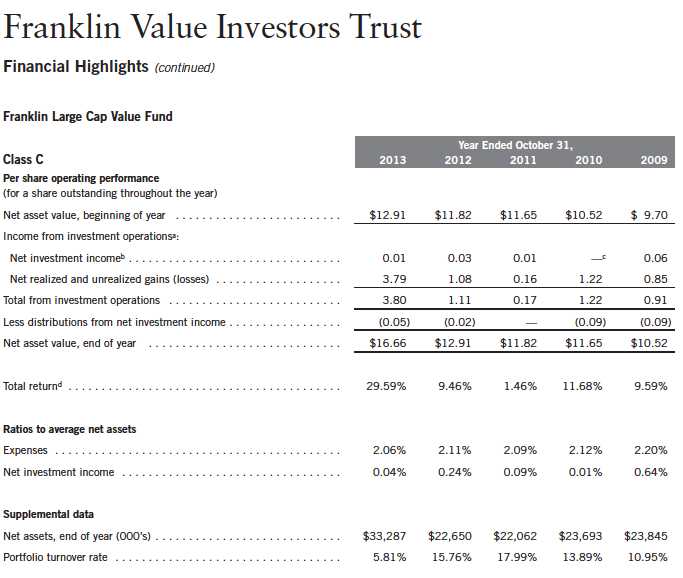

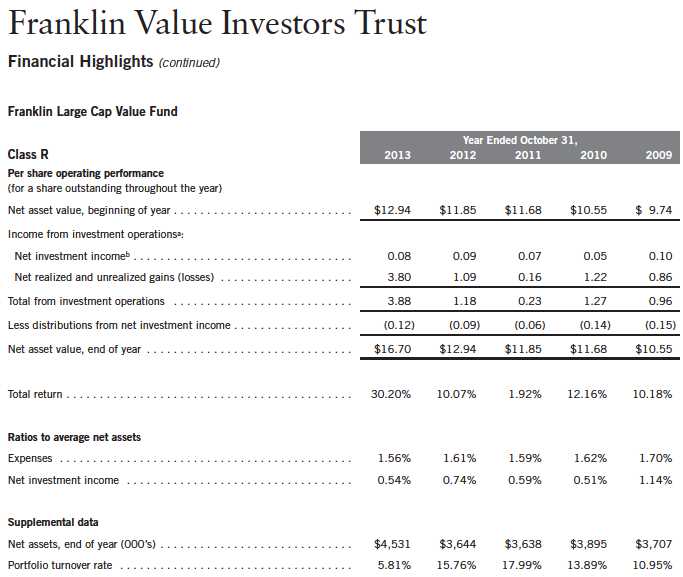

Franklin Large Cap Value Fund

Your Fund’s Goal and Main Investments: Franklin Large Cap Value Fund seeks long-term capital appreciation by investing at least 80% of its net assets in large capitalization companies that we believe are undervalued. We define large capitalization companies as those with market capitalizations that are similar in size at the time of purchase to those in the Russell 1000® Index.1

We are pleased to bring you Franklin Large Cap Value Fund’s annual report for the fiscal year ended October 31, 2013.

Performance Overview

Franklin Large Cap Value Fund – Class A delivered a +30.53% cumulative total return for the 12 months under review. In comparison, the Russell 1000® Value Index, which measures performance of those Russell 1000® Index companies with lower price-to-book ratios and lower forecasted growth values, generated a +28.29% total return.2 Although this report covers a 12-month period, our investment strategy aims for long-term results. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 29.

Investment Strategy

We seek to invest in securities of large capitalization companies that we believe are selling below their underlying worth and hold them until they reach what we consider their fair market value. Our aim is to construct a diversified portfolio of fundamentally sound companies purchased at attractive prices, often when they are out of favor with other investors for reasons we believe are temporary. Portfolio securities are selected without regard to benchmark comparisons and are based on fundamental, bottom-up research focusing on several criteria, such as low price relative to earnings, cash flow or book value. We also consider stocks with recent sharp price declines that we believe still have significant growth potential or that possess valuable intangibles not reflected in the stock price.

1. The Russell 1000® Index is market capitalization weighted and measures performance of the largest companies in the Russell 3000® Index, which represents the majority of the U.S. market’s total market capitalization.

2. Source: © 2013 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

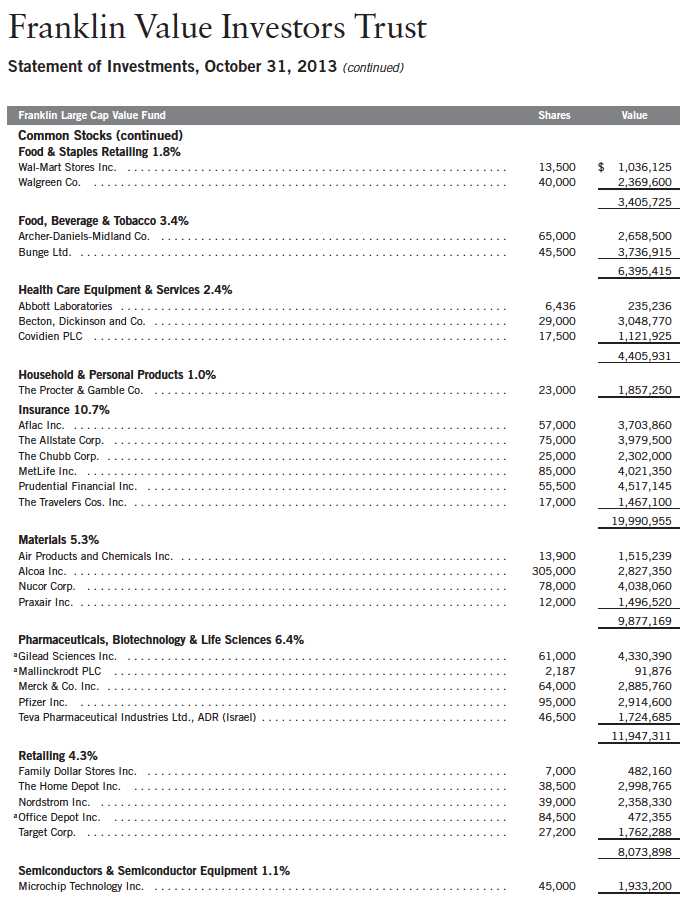

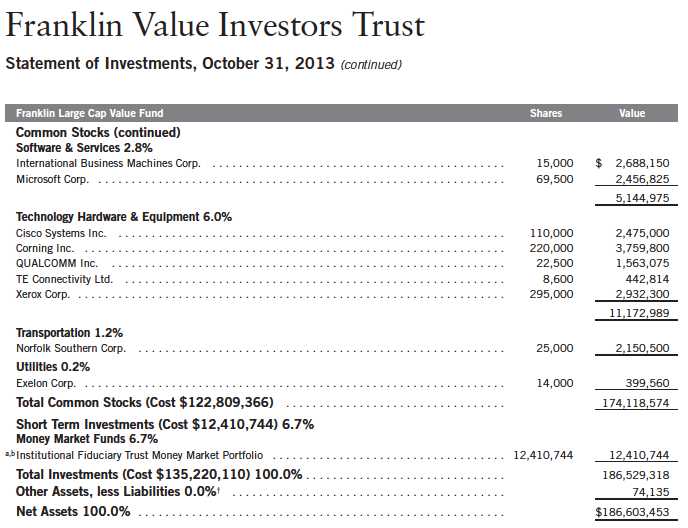

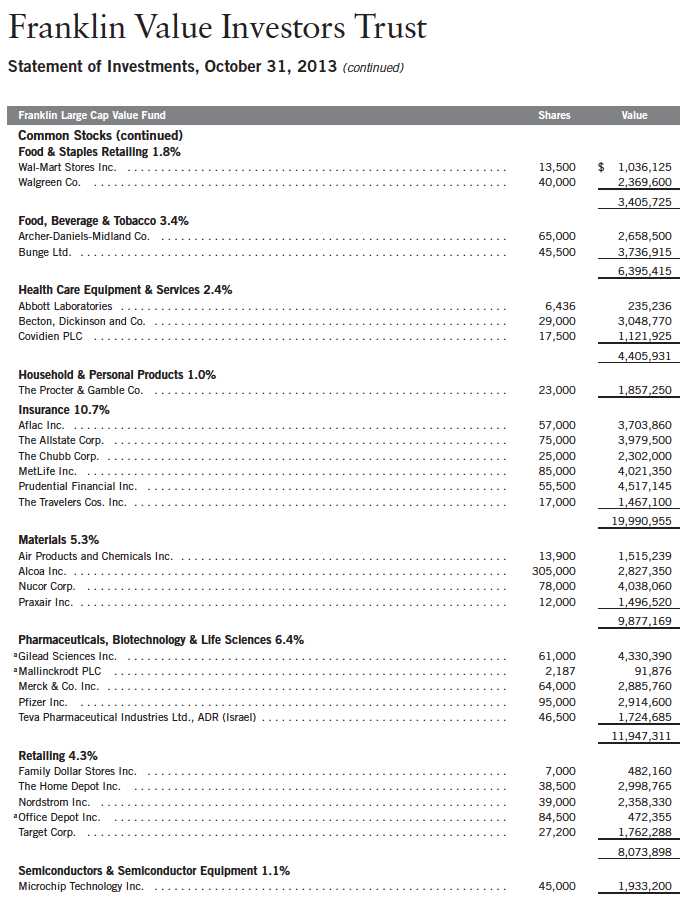

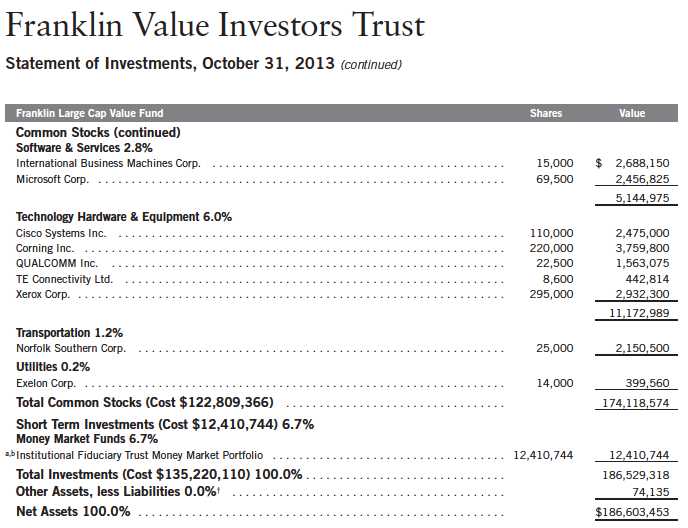

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 85.

26 | Annual Report

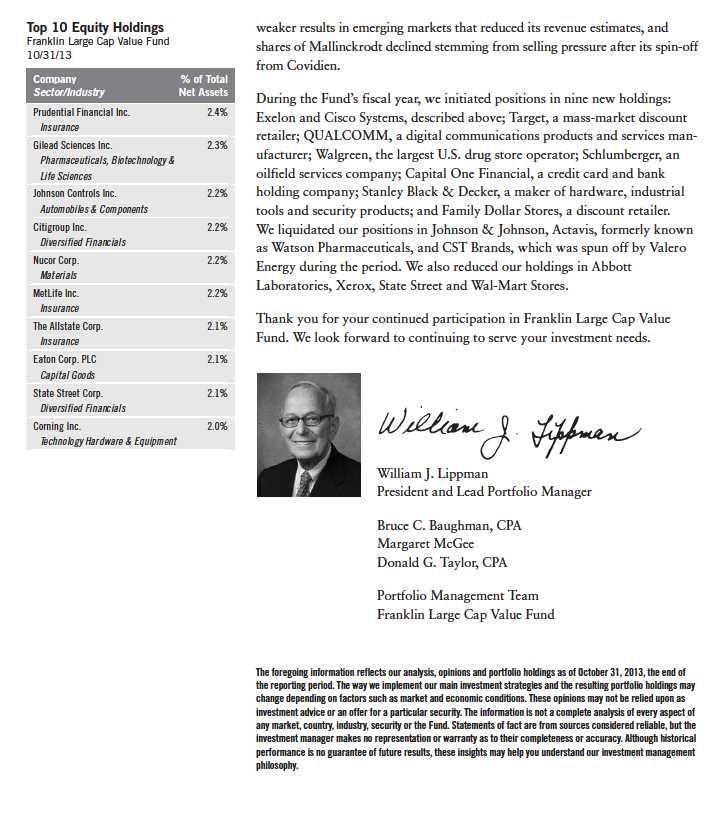

Manager’s Discussion

During the 12 months under review, financials sector holdings contributed to absolute Fund performance, most notably financial services providers Prudential Financial and State Street.3 Industrials and consumer discretionary sector holdings also contributed to results, especially automotive systems and building efficiency products manufacturer Johnson Controls and industrial products and equipment manufacturer Dover.4 The Fund’s health care sector holdings also aided performance, led by biopharmaceutical firm Gilead Sciences.5 Prudential Financial and State Street were expected to benefit from an eventual increase in interest rates. Johnson Controls reported higher third-quarter earnings resulting from its stabilizing automotive business in Europe as well as increased auto sales in Asia and the U.S. Although demand for the company’s building products softened, the company benefited from its strong service business as well as pricing and cost reduction efforts. Johnson Controls also announced an agreement to divest its struggling automotive electronics business. Dover experienced strength in its businesses serving the consumer electronics and refrigeration markets that led to stronger-than-expected sales and earnings growth. The company also announced its intention to spin off several businesses in its communication technologies segment. Gilead Sciences announced favorable trial results for a potential hepatitis C drug, and optimism continued to surround its new HIV drug, Stribild.

Most investment sectors and positions held by the Fund contributed to absolute performance, but some detractors included electric utility Exelon, drug maker Teva Pharmaceutical Industries, global information technology software and services provider International Business Machines (IBM), data networking equipment and software supplier Cisco Systems and specialty drug and diagnostic imaging equipment manufacturer Mallinckrodt. Lower energy prices and weak electricity demand contributed to falling quarterly profits for electric utility Exelon, the largest owner of U.S. nuclear power plants. Teva Pharmaceutical Industries suffered from management transition, weakness in its core generics business in the U.S. and Europe, and concerns about a major drug coming off patent in 2015. IBM reported increased net income and earnings in the fourth quarter of 2012. In subsequent quarters, however, IBM’s shares underperformed as the company, as well as some of its competitors, reported poor sales growth. In particular, revenue from IBM’s services and hardware segments declined. Shares of Cisco Systems faltered because of

3. The financials sector comprises banks, diversified financials and insurance in the SOI.

4. The industrials sector comprises capital goods and transportation in the SOI. The consumer discretionary sector comprises consumer durables and apparel, consumer services and retailing in the SOI.

5. The health care sector comprises health care equipment and services; and pharmaceuticals, biotechnology and life sciences in the SOI.

Annual Report | 27

28 | Annual Report

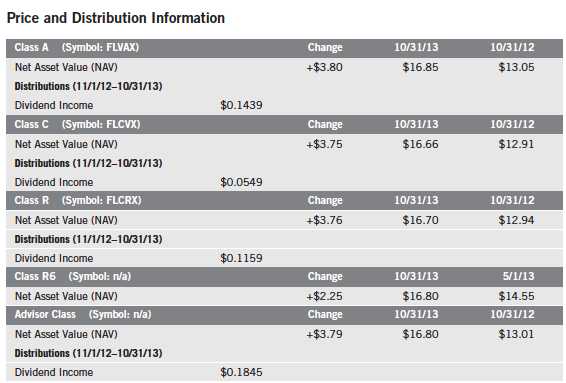

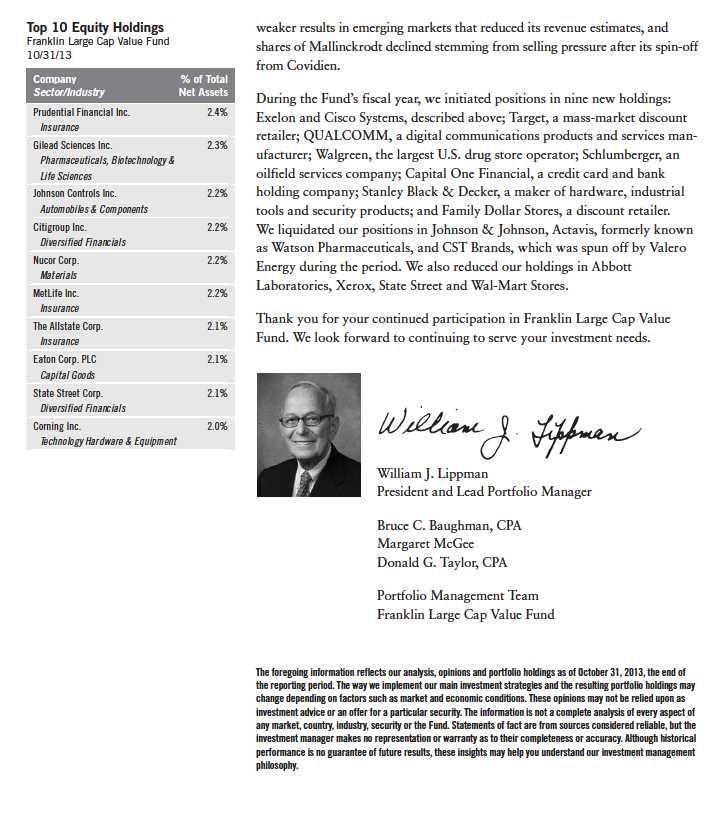

Performance Summary as of 10/31/13

Franklin Large Cap Value Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Annual Report | 29

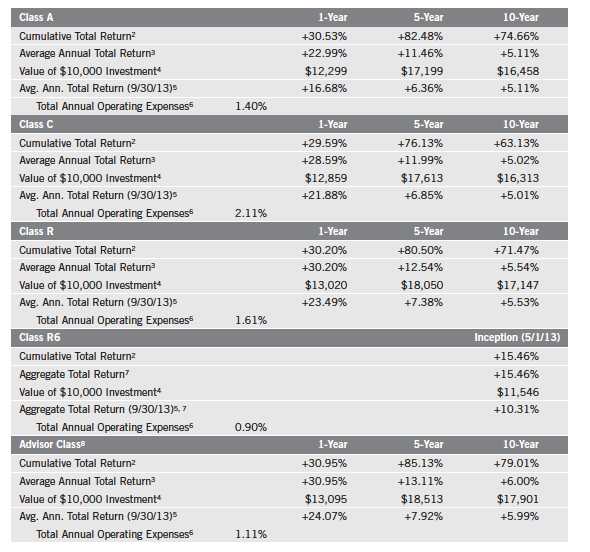

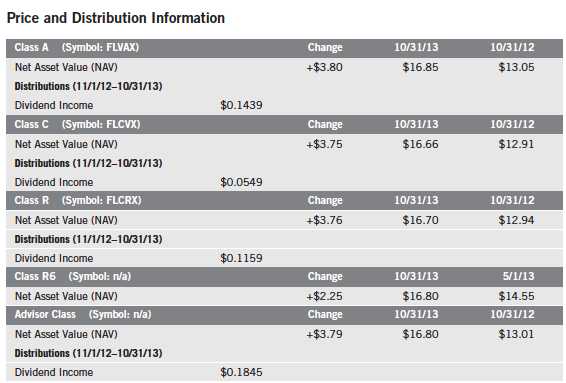

Performance Summary (continued)

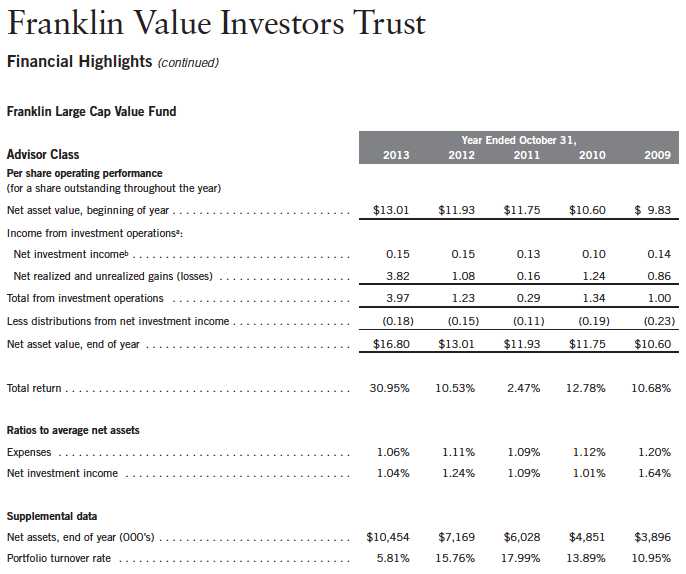

Performance1

Cumulative total return excludes sales charges. Aggregate and average annual total returns and value of $10,000 invest-ment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Class R/R6/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

30 | Annual Report

Annual Report | 31

32 | Annual Report

Endnotes

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. These price movements may result from factors affecting individual companies, industries or the securities market as a whole. The Fund may invest up to 25% of its total assets in foreign securities, which may involve special risks, including currency fluctuations and economic and political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class C: | Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

Class R6: Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. Shares are available to certain eligible investors as described in the prospectus. |

1. The Fund has a fee waiver associated with its investments in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year end. Fund investment results reflect the fee waiver, to the extent applicable; without this reduction, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. 4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

7. Aggregate total return represents the change in value of an investment for the period indicated. Since Class R6 shares have existed for less than one year, average annual total return is not available.

8. Effective 11/1/05, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 11/1/05, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 11/1/05, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 11/1/05 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +49.99% and +5.20%.

9. Source: © 2013 Morningstar. The Russell 1000® Value Index is market capitalization weighted and measures performance of those Russell 1000® Index companies with lower price-to-book ratios and lower forecasted growth values. The Consumer Price Index (CPI), calculated by the Bureau of Labor Statistics, is a commonly used measure of the inflation rate.

Annual Report | 33

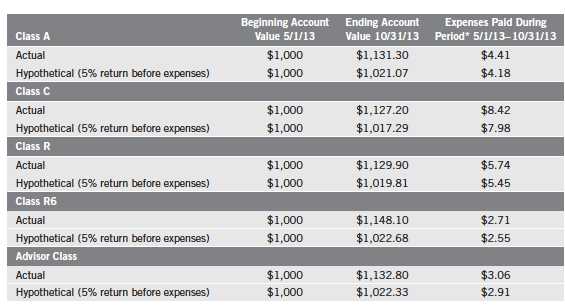

Your Fund’s Expenses

Franklin Large Cap Value Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

34 | Annual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 1.33%; C: 2.05%; R: 1.55%; R6: 0.87% (net of expense waivers); and Advisor: 1.05%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

Annual Report | 35

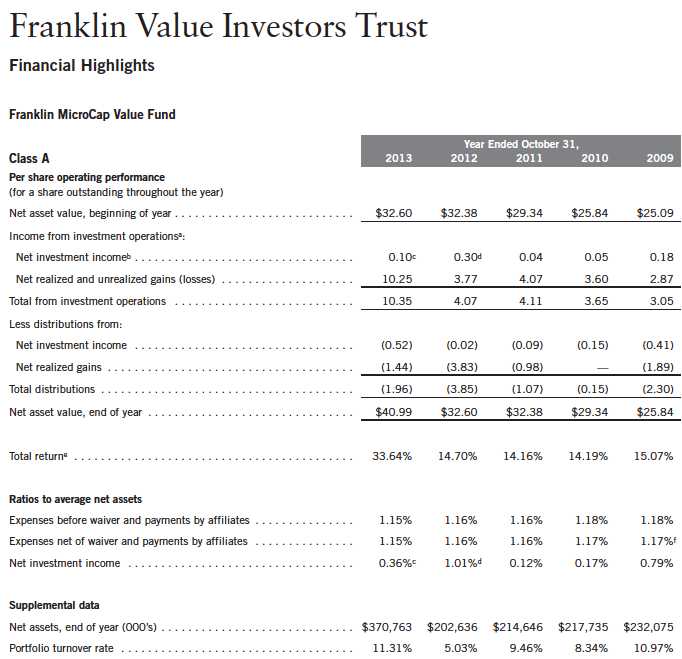

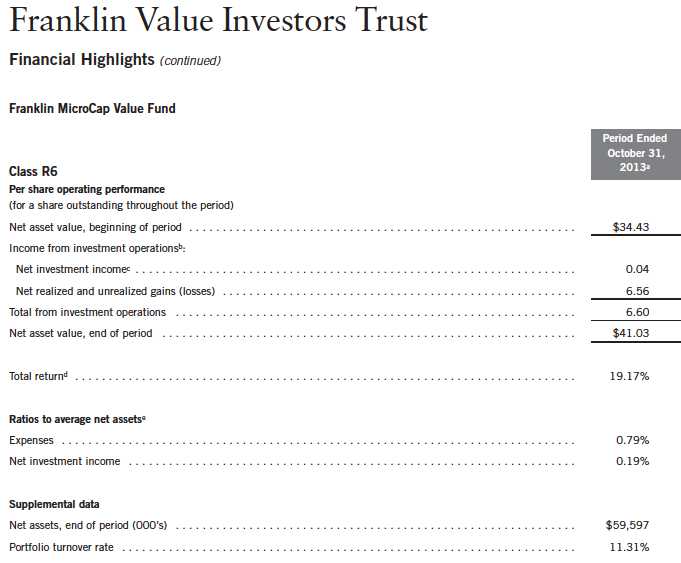

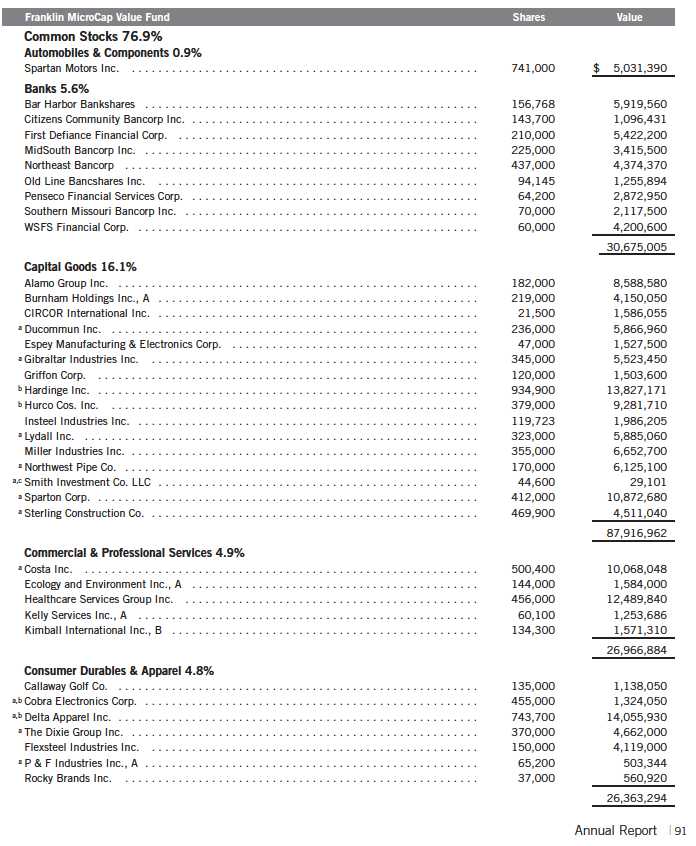

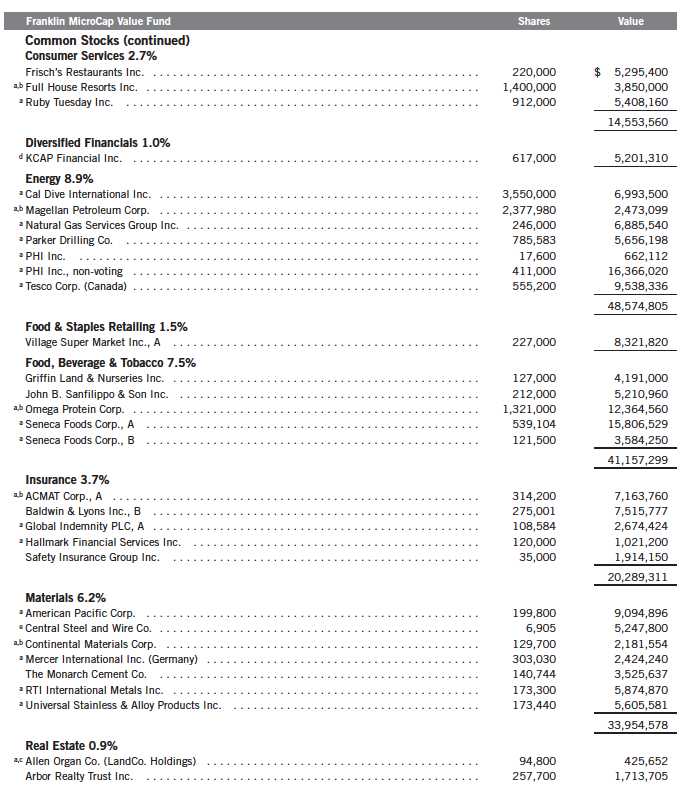

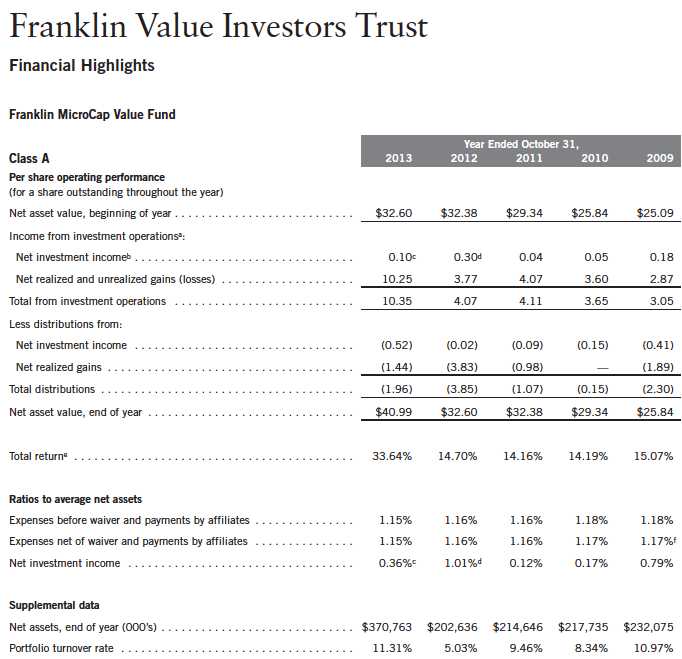

Franklin MicroCap Value Fund

Your Fund’s Goal and Main Investments: Franklin MicroCap Value Fund seeks high total return, of which capital appreciation and income are components, by investing at least 80% of its net assets in securities of companies with market capitalizations under $500 million at the time of purchase that we believe are undervalued in the marketplace.1

We are pleased to bring you Franklin MicroCap Value Fund’s annual report for the fiscal year ended October 31, 2013.

Performance Overview

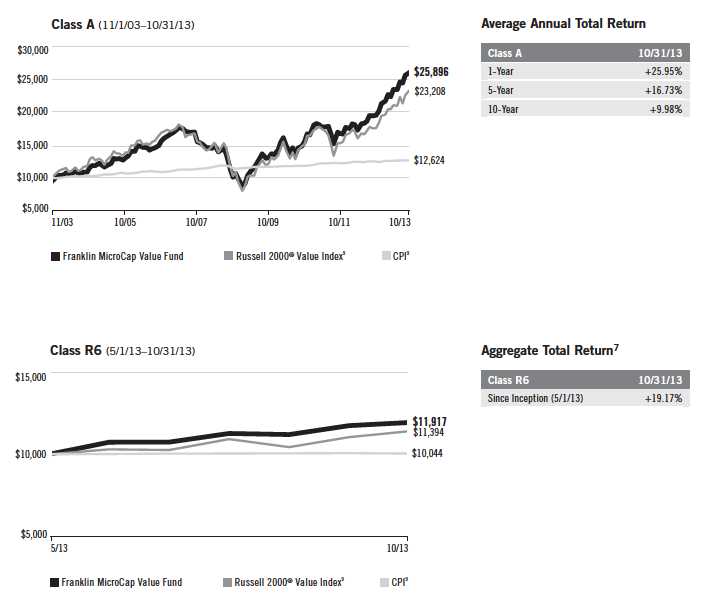

Franklin MicroCap Value Fund – Class A delivered a +33.64% cumulative total return for the 12 months under review. In comparison, the Russell 2000® Value Index, which measures performance of those Russell 2000® Index companies with lower price-to-book ratios and lower forecasted growth values, generated a +32.83% total return.2 Although this report covers a 12-month period, our investment strategy aims for long-term results. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 39.

Investment Strategy

Our strategy is to buy shares of financially sound, well-established companies at a low price-to-book value, where we have reasonable confidence that book value will increase over several years. We limit purchases to companies with market capitalizations of less than $500 million, which we define as “microcap.”1 Book value per share is a company’s net worth or shareholders’ equity on an accounting or “book” basis, divided by shares outstanding. This strategy is not aimed at short-term trading gains, nor do we consider the composition of any index. Rather, we try to identify individual companies that meet our investment criteria, and we assume at purchase that we will hold the positions for several years.

1. Effective 12/10/12, the maximum market capitalization for each investment that the Fund can invest in increased from $400 million at time of purchase to $500 million.

2. Source: © 2013 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

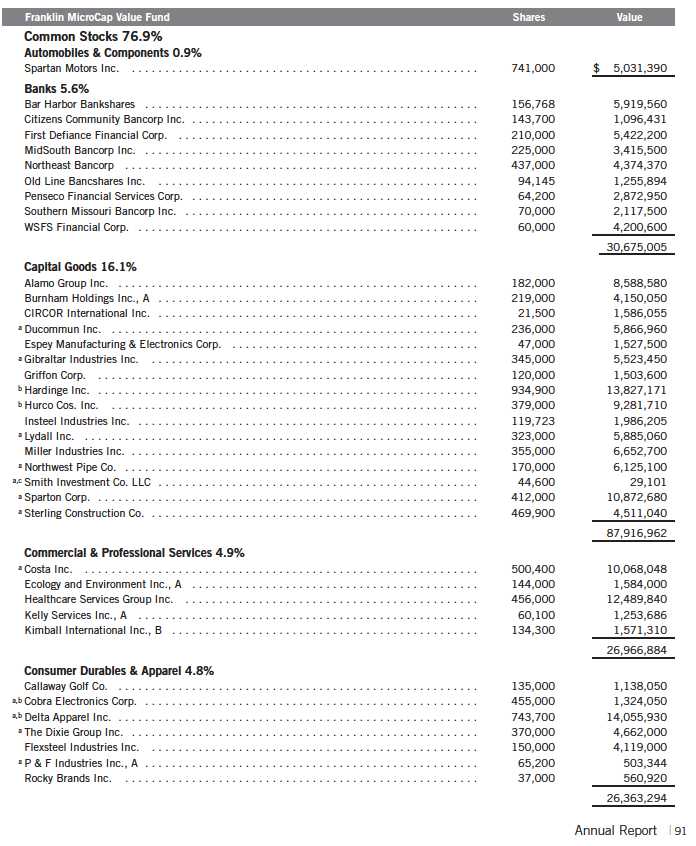

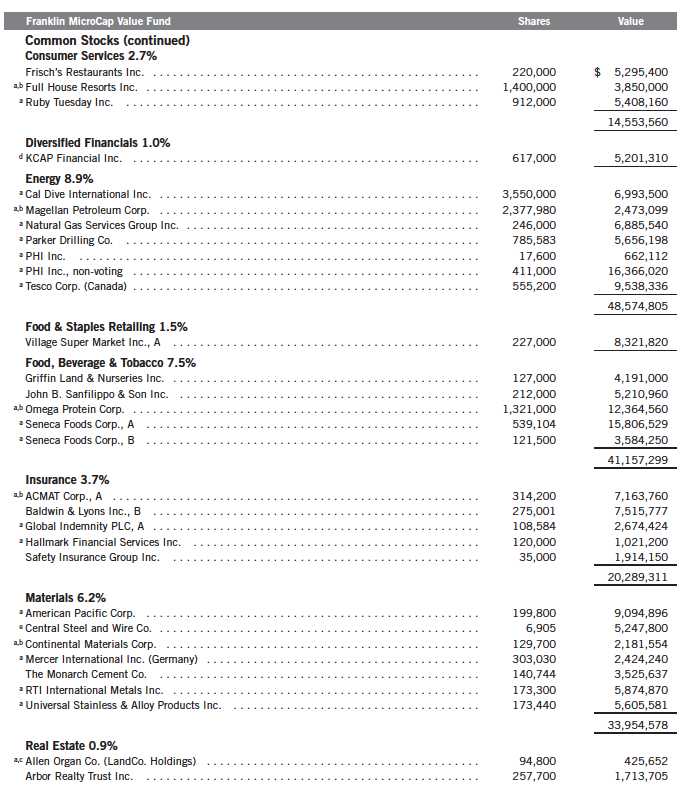

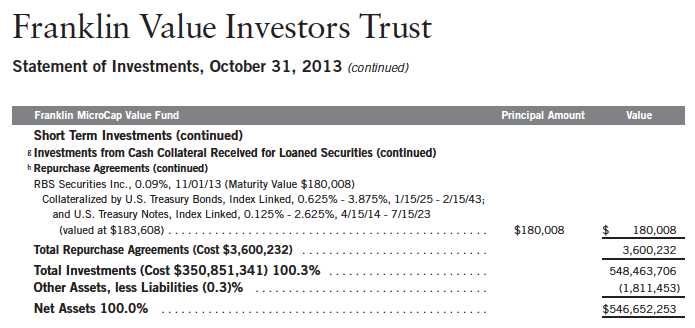

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 91.

36 | Annual Report

Manager’s Discussion

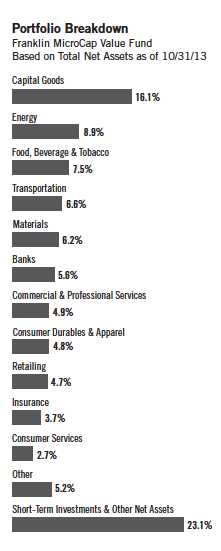

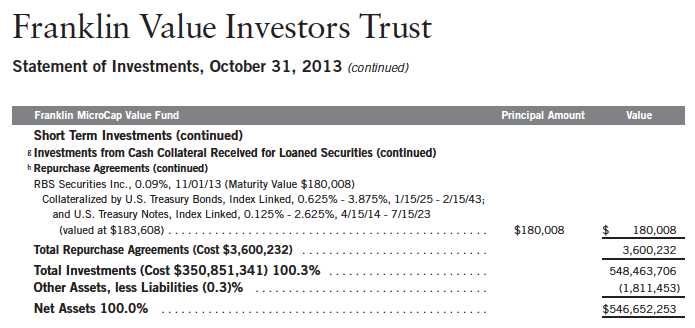

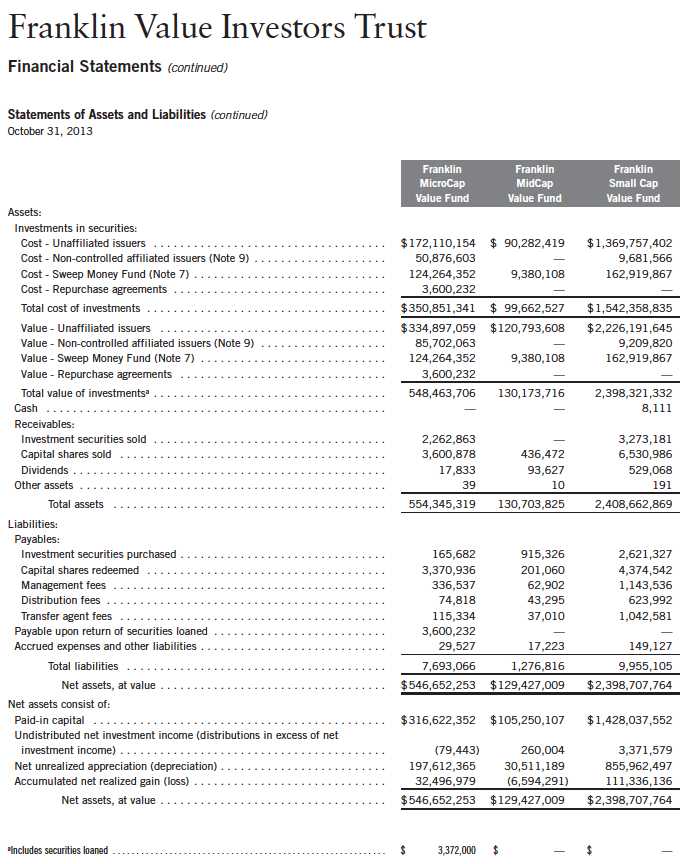

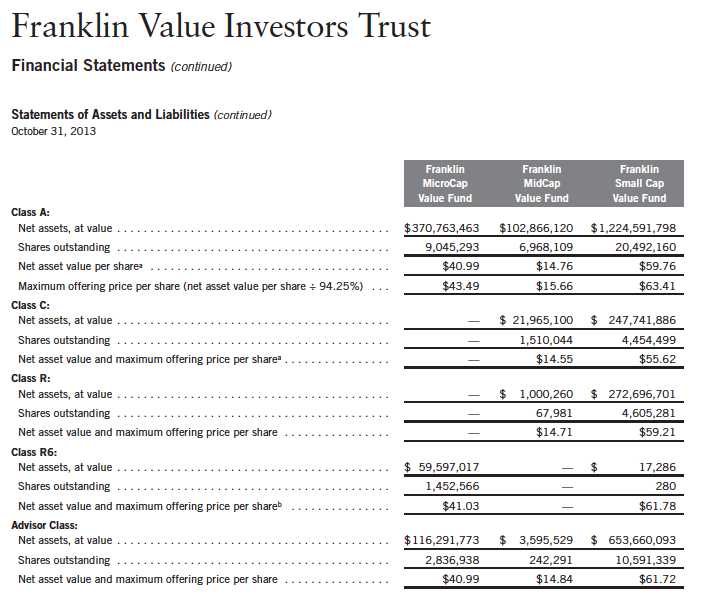

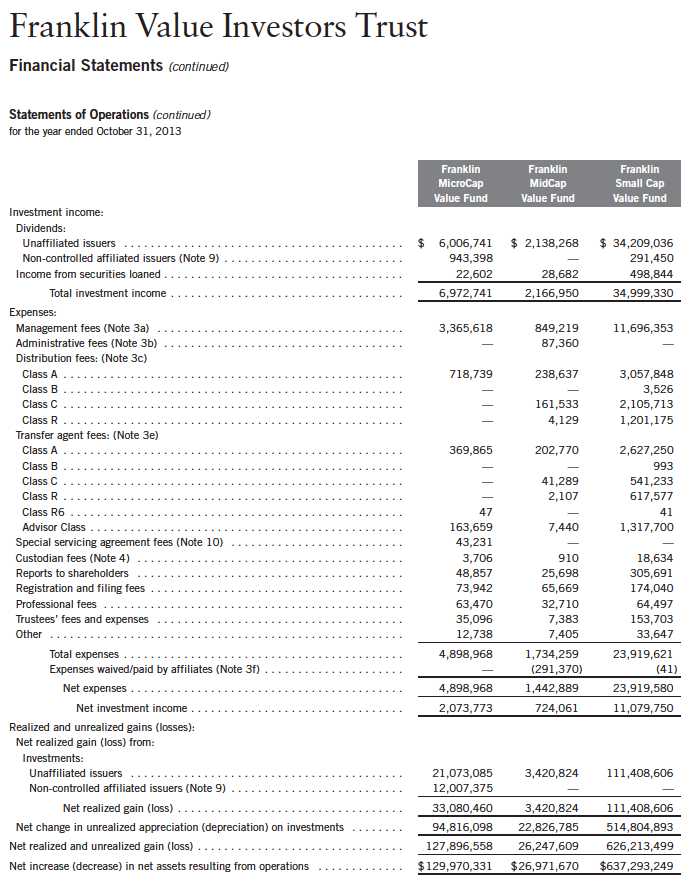

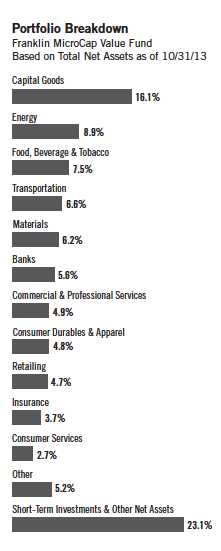

On October 31, 2013, the Fund’s total net assets were $546.7 million, with short-term investments and other net assets making up 23.1%, compared with total net assets of $367.9 million and short-term investments and other net assets of 9.3% on October 31, 2012. The Fund closed to new investors (with the exception of certain retirement accounts) in January 2004 and has remained closed except for two days in mid-February 2013. We opened the Fund on a limited basis so that we might increase the number of shareholders and broaden our investor base. The Fund’s being closed does not restrict existing shareholders from adding to or reducing their investments in the Fund, except that once an account is reduced to zero, it may not be reopened unless the Fund reopens.

During the 12 months under review, contributors to absolute Fund performance included a number of industrials sector holdings, such as USA Truck and SAIA (trucking), Costa, formerly known as A.T. Cross (sunglasses) and Sparton (electromechanical devices).3 American Pacific (specialty chemicals) was also a notable contributor. USA Truck, which made belated progress in turning around its operations, also became the object of a hostile takeover bid from Knight Transportation. Costa divested its legacy A.T. Cross accessories business for $60 million to focus on its rapidly growing Costa and Native sunglass brands. Sparton reported better-than-expected earnings, helped by recent acquisitions. American Pacific, whose financial results were stellar during the period, was also rumored to be in takeover talks.

All investment sectors and most positions held by the Fund benefited performance, but detractors included Ruby Tuesday (casual dining restaurant chain), Cobra Electronics (mobile communication products), Full House Resorts (gaming), Tandy Brands Accessories (leather belts and gift accessories) and Universal Stainless & Alloy Products (specialty steel products manufacturer and marketer). Cobra Electronics is a small player in the hyper-competitive consumer electronics realm. It struggled to gain traction with new products, and contended with expensive “patent troll” litigation. Tandy Brands Accessories, which was sold, was unable to turn around its operations. Ruby Tuesday and Full House Resorts were relatively new positions. Ruby Tuesday has been trying to rebrand its ailing casual dining offering. Full House Resorts’ Rising Star Casino in Indiana faced new competition from Ohio. Universal Stainless & Alloy Products encountered cyclical headwinds in the form of supply chain reductions in the aerospace industry.

We identified eight new investment opportunities during the period under review: Ruby Tuesday and Full House Resorts, described above; Cal Dive International, an offshore oil and gas construction contractor; Tesco, an oil and gas drilling equipment provider; Sterling Construction, a heavy civil

3. The industrials sector comprises capital goods and commercial and professional services in the SOI.

Annual Report | 37

38 | Annual Report

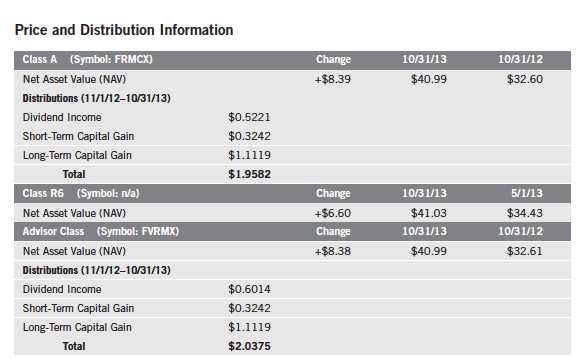

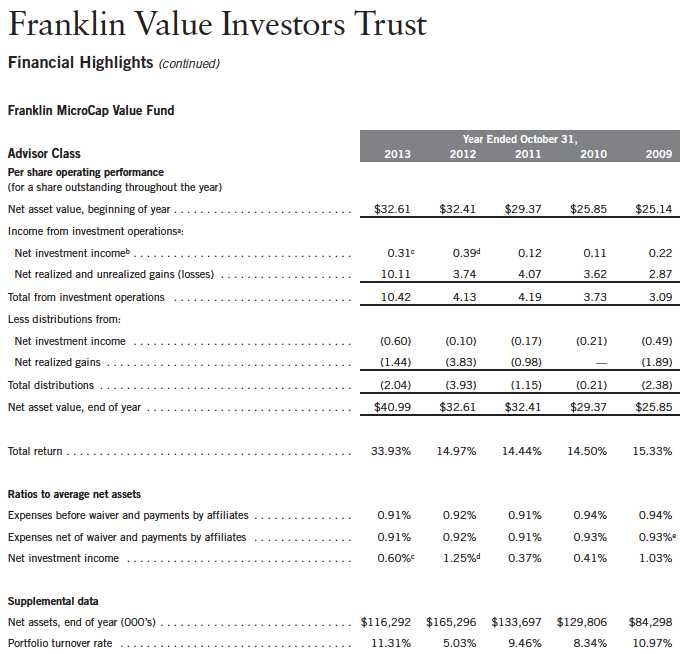

Performance Summary as of 10/31/13

Franklin MicroCap Value Fund

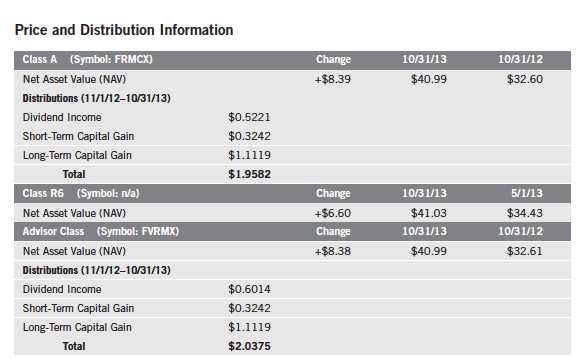

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Annual Report | 39

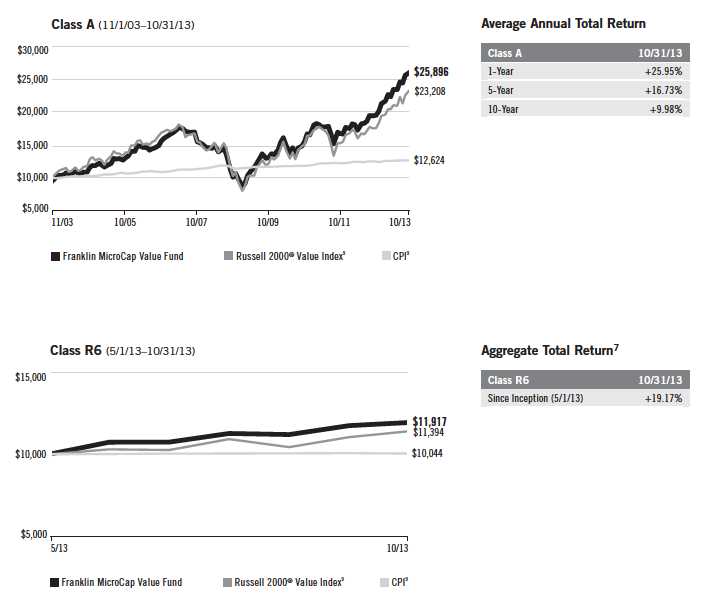

Performance Summary (continued)

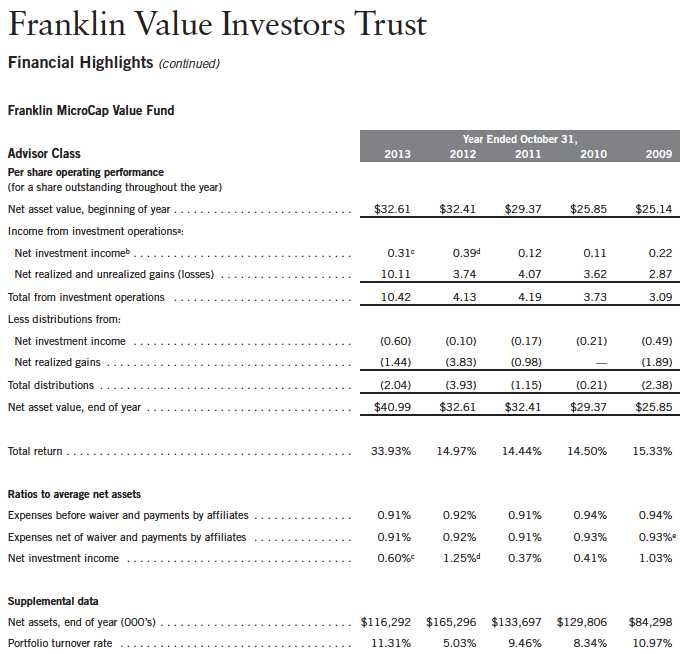

Performance1

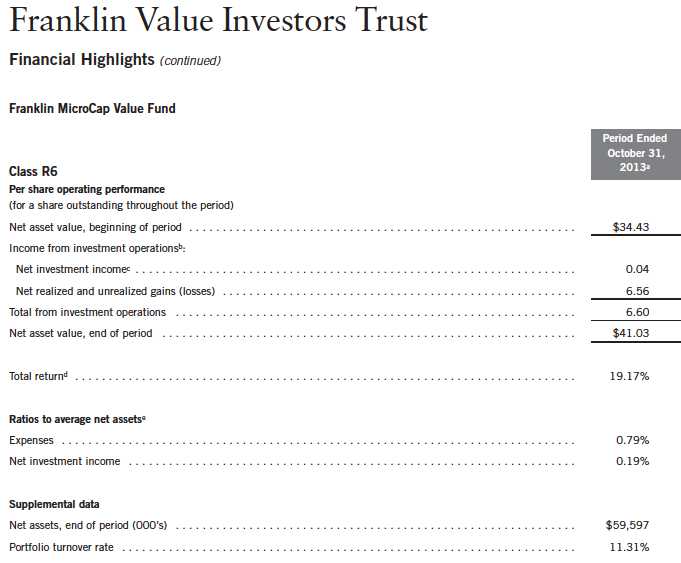

Cumulative total return excludes sales charges. Aggregate and average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class R6/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

40 | Annual Report

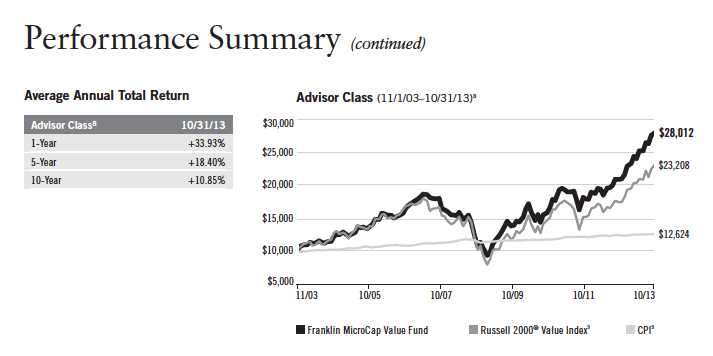

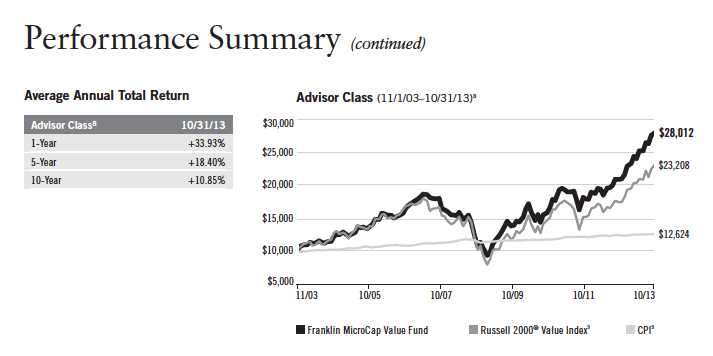

Performance Summary (continued)

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

Annual Report | 41

Endnotes

All investments involve risks, including possible loss of principal. The Fund’s ability to invest in smaller company securities that may have limited liquidity involves additional risks, such as relatively small revenues, limited product lines and small market share. Historically, these stocks have exhibited greater price volatility than larger company stocks, especially over the short term. In addition, the Fund may invest up to 25% of its total assets in foreign securities, which involve special risks, including currency fluctuations and economic and political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| | |

| | Class R6: | Shares are available to certain eligible investors as described in the prospectus. |

| | Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. The Fund has a fee waiver associated with its investments in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year end. Fund investment results reflect the fee waiver, to the extent applicable; without this reduction, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. 4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

7. Aggregate total return represents the change in value of an investment for the period indicated. Since Class R6 shares have existed for less than one year, average annual total return is not available.

8. Effective 11/1/05, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 11/1/05, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 11/1/05, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 11/1/05 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +107.30% and +9.54%.

9. Source: © 2013 Morningstar. The Russell 2000® Value Index is market capitalization weighted and measures performance of those Russell 2000® Index companies with lower price-to-book ratios and lower forecasted growth values. The Consumer Price Index (CPI), calculated by the Bureau of Labor Statistics, is a commonly used measure of the inflation rate.

42 | Annual Report

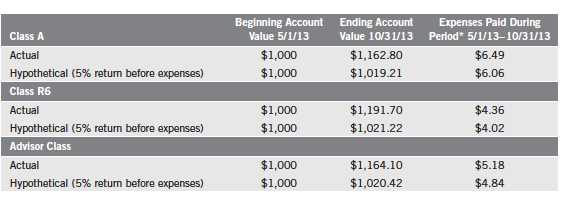

Your Fund’s Expenses

Franklin MicroCap Value Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Annual Report | 43

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 1.19%; R6: 0.79%; and Advisor: 0.95%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

44 | Annual Report

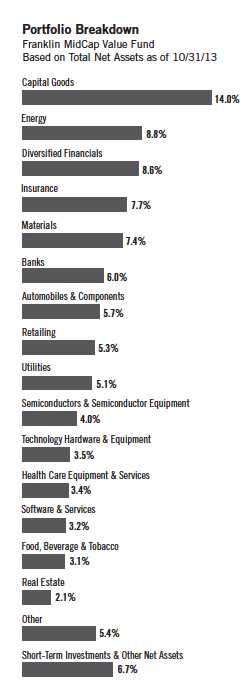

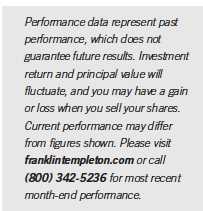

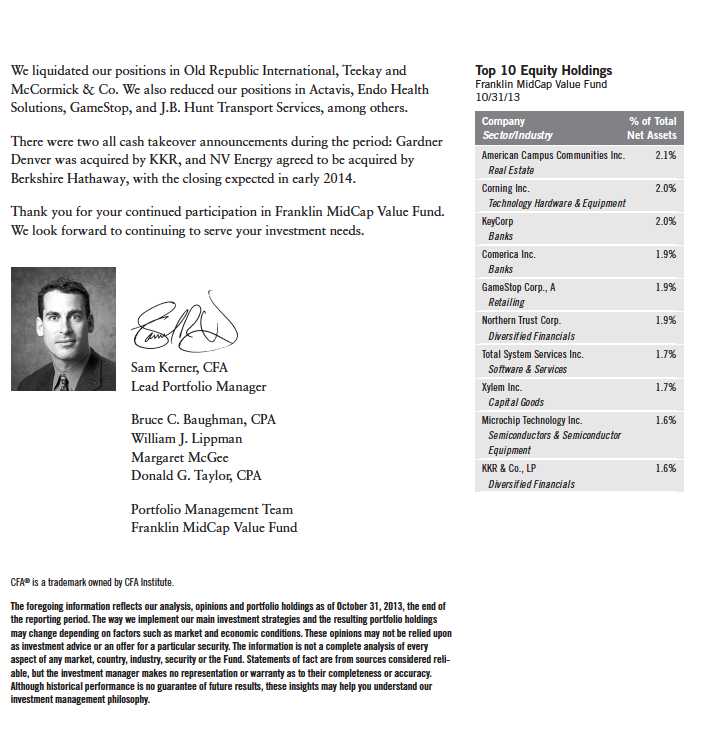

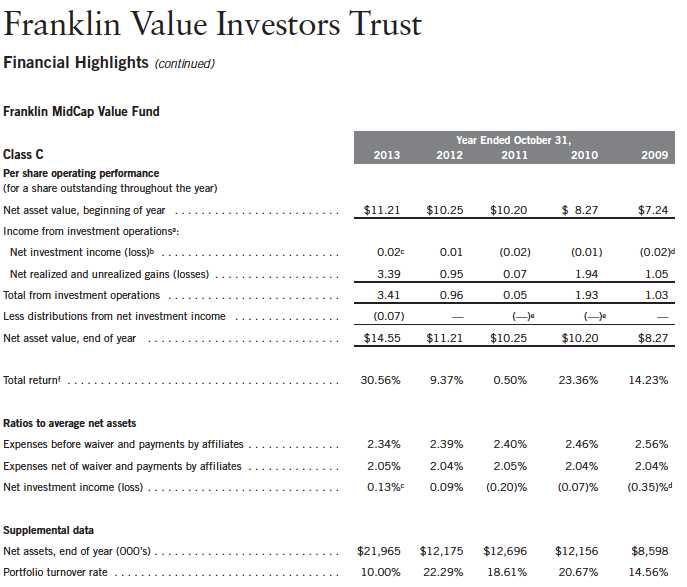

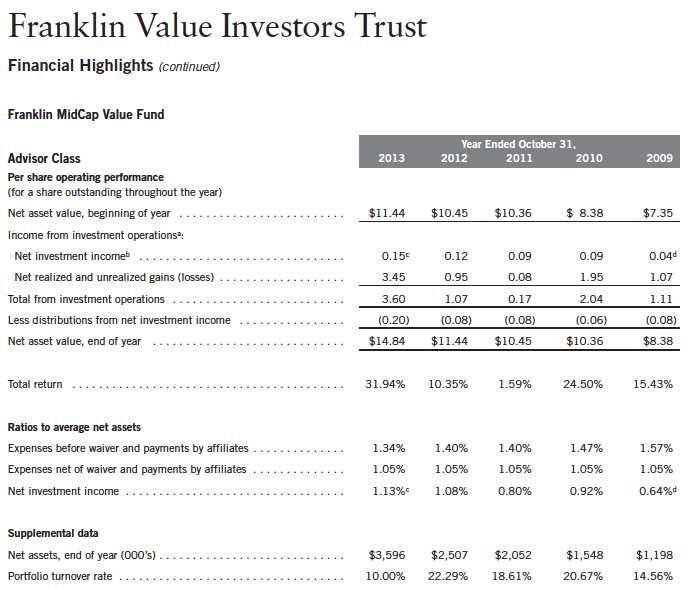

Franklin MidCap Value Fund

Your Fund’s Goal and Main Investments: Franklin MidCap Value Fund seeks long-term total return by investing at least 80% of net assets in securities of mid-capitalization companies that we believe are undervalued. We define mid-capitalization companies as those with market capitalizations that are similar in size at the time of purchase to those in the Russell Midcap® Index.1

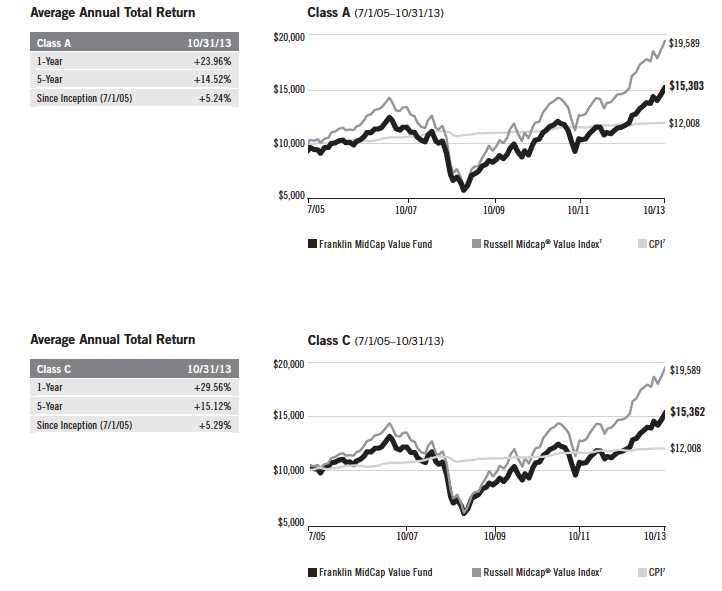

This annual report for Franklin MidCap Value Fund covers the fiscal year ended October 31, 2013.

Performance Overview

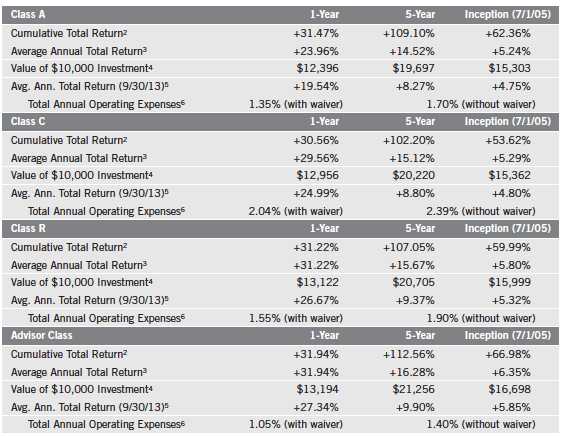

Franklin MidCap Value Fund – Class A delivered a +31.47% cumulative total return for the 12 months under review. In comparison, the Russell Midcap® Value Index, which measures performance of those Russell Midcap® Index companies with lower price-to-book ratios and lower forecasted growth values, generated a +33.45% total return.2 Although this report covers a 12-month period, our investment strategy aims for long-term results. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 48.

Investment Strategy

Our goal is to invest in mid-capitalization companies that we determine are currently undervalued and have the potential for capital appreciation. The Fund purchases stocks that are out of favor in the market for reasons we believe will prove to be temporary. In addition, the Fund may invest in companies with valuable intangibles we believe are not reflected in the stock price. This strategy is not aimed at short-term trading gains, nor do we consider the composition of any index. Rather, we try to identify attractively priced, financially sound companies that meet our investment criteria, and we assume at purchase that we will hold the positions for several years.

1. The Russell Midcap® Index is market capitalization weighted and measures performance of the smallest companies in the Russell 1000® Index, which represent a modest amount of the Russell 1000® Index’s total market capitalization.

2. Source: © 2013 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

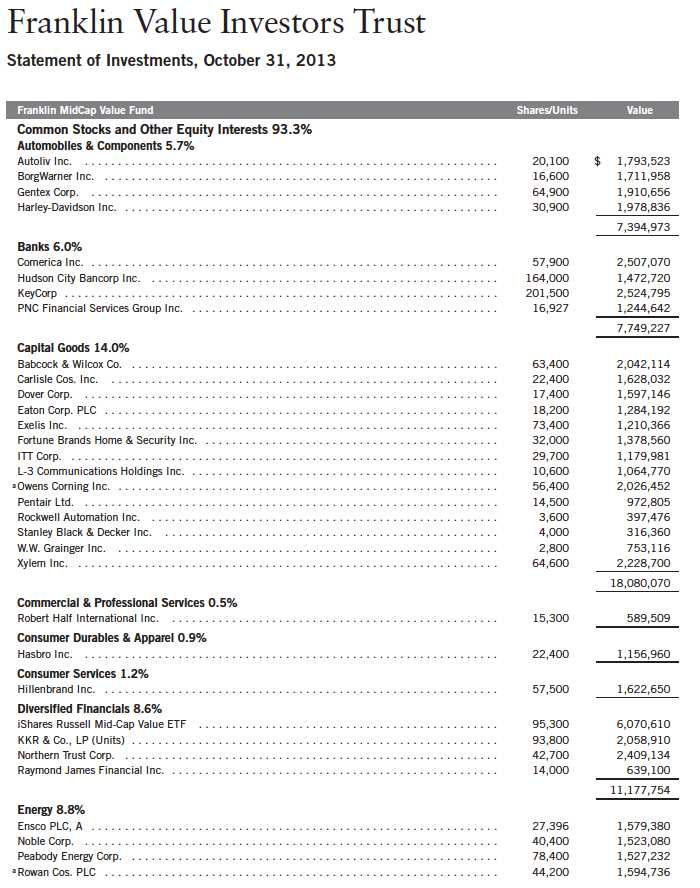

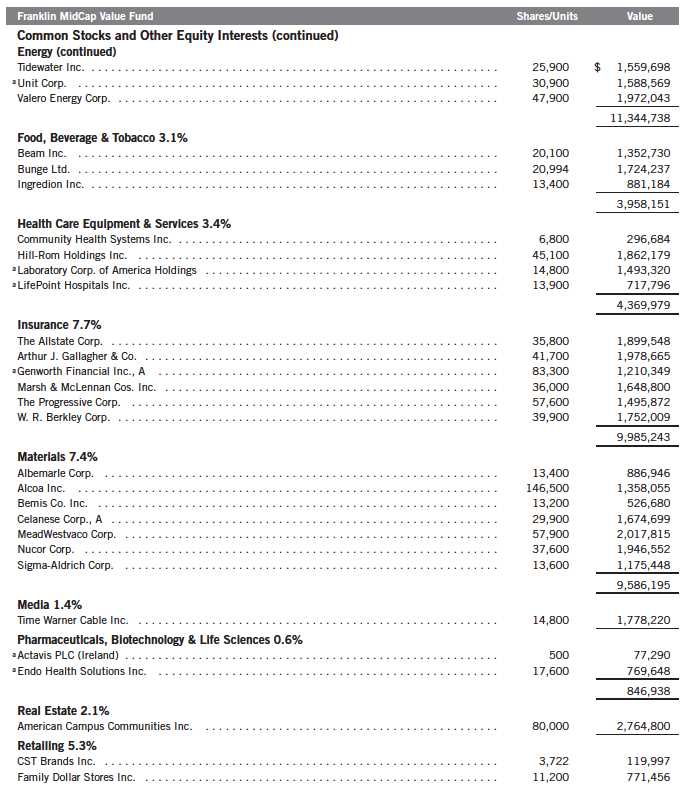

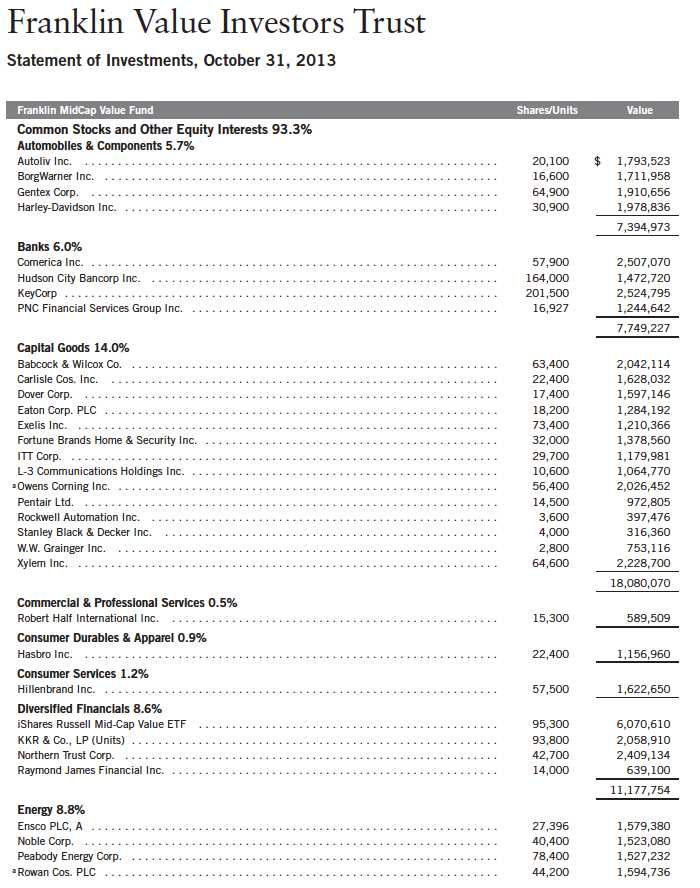

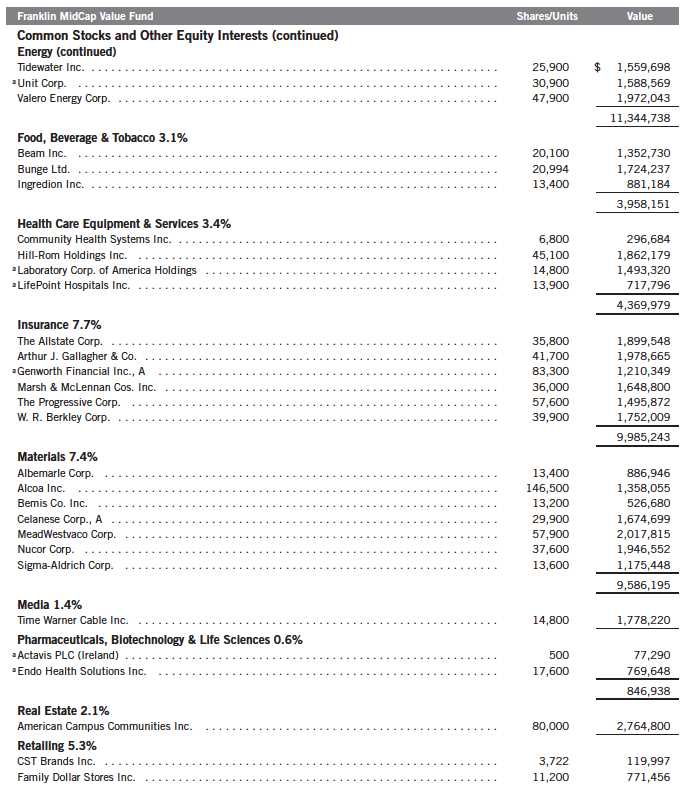

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 99.

Annual Report | 45

Manager’s Discussion

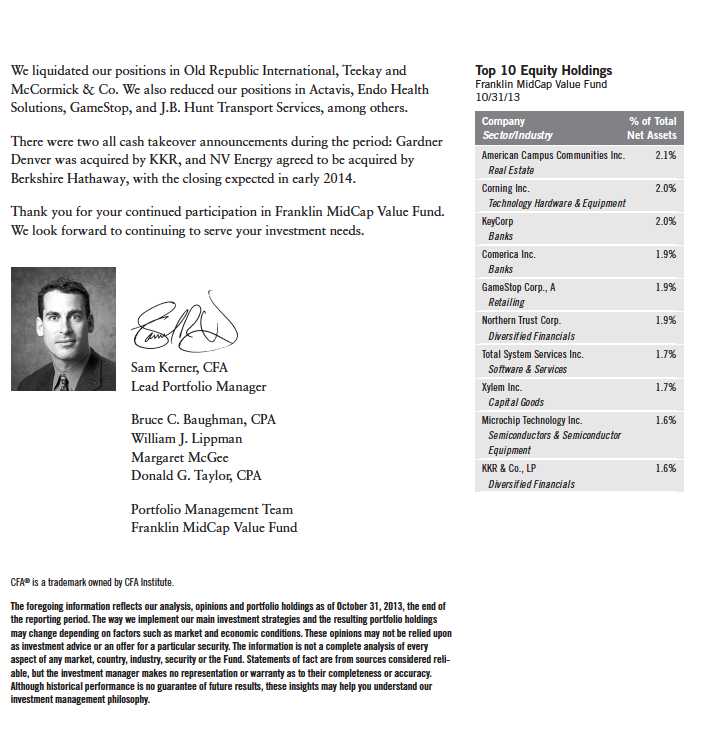

During the 12 months under review, contributors to absolute Fund performance included video game retailer GameStop, private equity investment group KKR, auto components supplier Gentex, business outsourcing provider Xerox and securities services provider Leidos Holdings, which was a spin-off of Science Applications International Corp. (formerly SAIC). Shares of GameStop rallied based on management’s optimistic guidance regarding robust same-store sales for the upcoming holiday season and was anticipated to profit from the introduction of new video game consoles from Microsoft and Sony. KKR benefited from a steady flow of private equity deals and capitalized on strong market conditions aiding capital formation and portfolio harvesting. Shares of Gentex rose resulting from a consistent trend of higher-than-expected profit margins as the company continued to dramatically grow sales of auto-dimming exterior car mirrors. Results from Xerox improved based on better execution in its services segment. Leidos Holdings, formerly a division of Science Applications International, was spun out to existing shareholders. Doing so allowed both entities to compete for government contracts previously unavailable.

Most of the Fund’s positions benefited performance, but detractors included coal producer Peabody Energy and student housing operator American Campus Communities. Peabody Energy encountered falling prices for high margin metallurgical coal used to fire steel furnaces, and American Campus Communities suffered amid investor concerns regarding slower preleasing and student housing oversupply.

During the reporting period, the Fund initiated nine new positions, including the aforementioned American Campus Communities; Corning, a specialty glass and ceramics manufacturer; PetSmart, a pet products and services provider; KLA-Tencor, a semiconductor manufacturing services provider; Maxim Integrated Products, an integrated circuit manufacturer; Raymond James Financial, a diversified financial services holding company; Stanley Black & Decker, a maker of hardware, industrial tools and security products; Community Health Systems, a hospital and clinic operator; and iShares Russell Mid-Cap Value ETF, an exchange-traded fund. By investing in the ETF, we sought to put some of the Fund’s cash to work more efficiently, while retaining liquidity as we searched for new investment opportunities. We viewed the ETF investment as an interim solution for cash that resulted from strong inflows to the Fund. The ETF was designed to be similar to the benchmark index in composition and performance.

Consistent with our value strategy, we added to existing positions in Nucor, a steel manufacturer; Peabody Energy, described above, Valero Energy, a petroleum refiner and marketer; and Bunge, a global agribusiness and food company, among others.

46 | Annual Report

Annual Report | 47

Performance Summary as of 10/31/13

Franklin MidCap Value Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

48 | Annual Report

Performance Summary (continued)

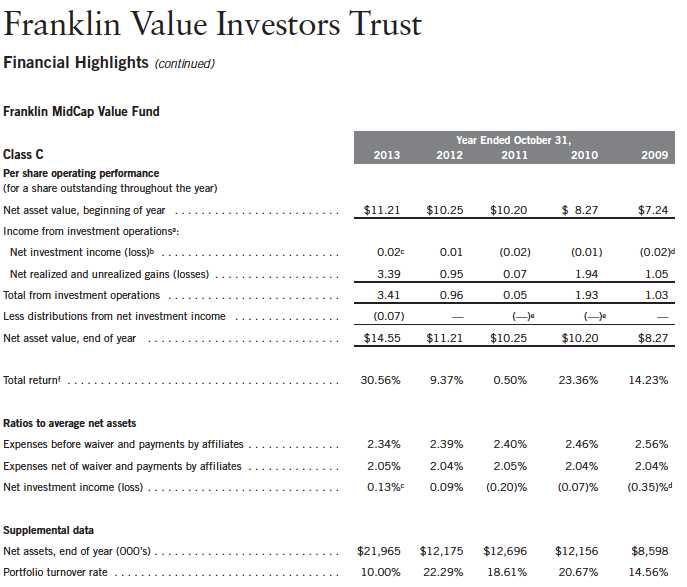

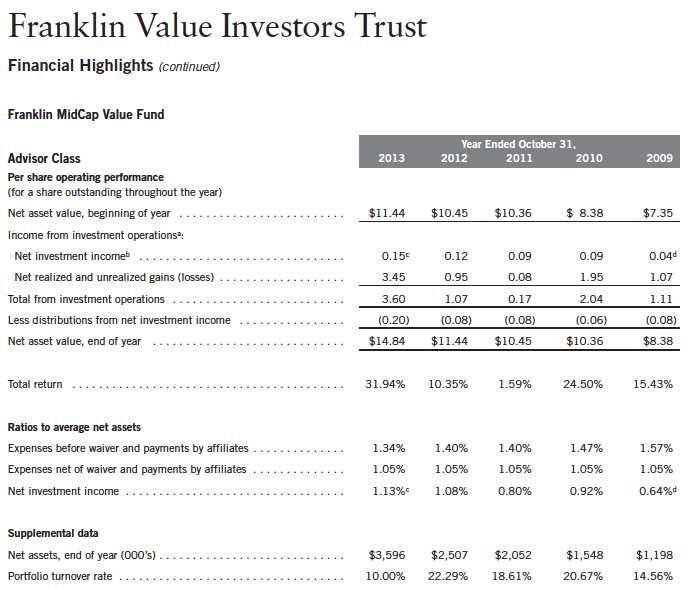

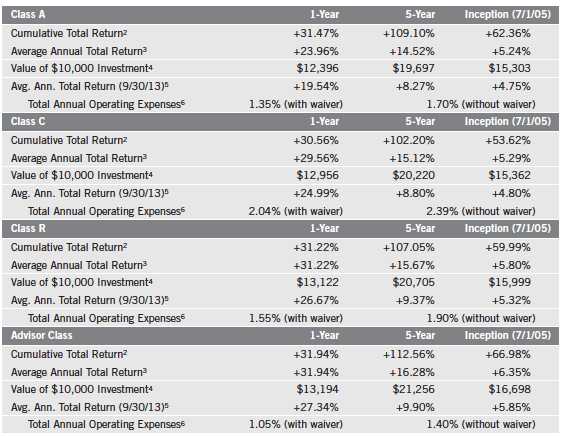

Performance1

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Class R/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Annual Report | 49

Performance Summary (continued)

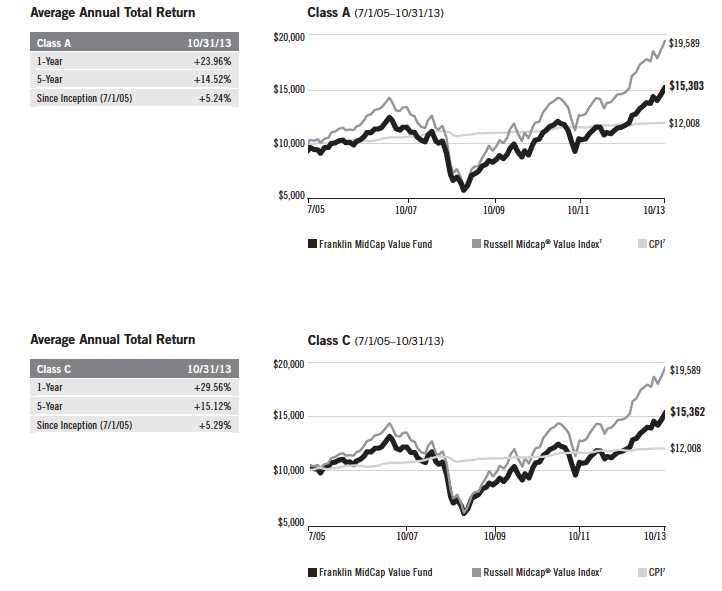

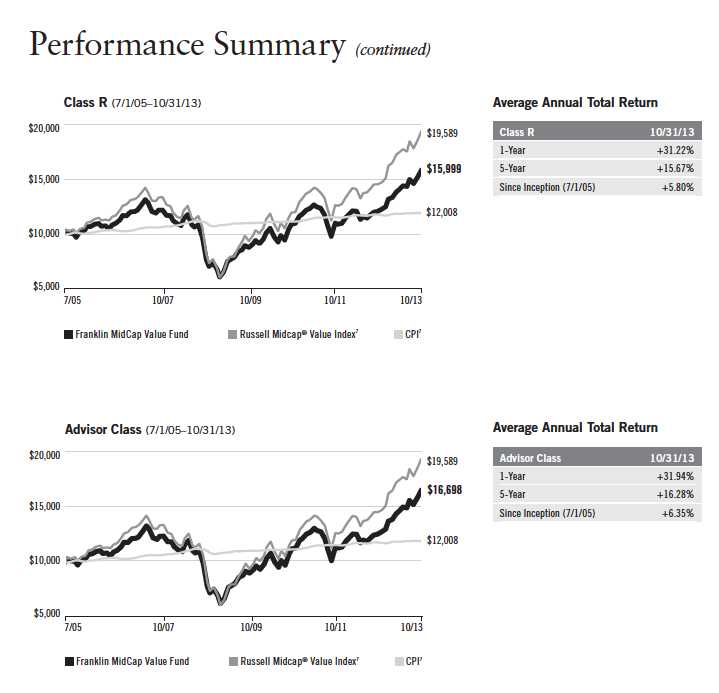

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

50 | Annual Report

Annual Report | 51

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Historically, midsize company securities have been more volatile in price than larger company securities, especially over the short term. Midsize companies may be more susceptible to particular economic events or competitive factors than are larger, more broadly diversified companies. In addition, the Fund may invest up to 25% of its total assets in foreign securities, which involve special risks, including currency fluctuations and economic and political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class C: Class R: | These shares have higher annual fees and expenses than Class A shares. Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. The Fund has an expense reduction contractually guaranteed through at least 2/28/14 and a fee waiver associated with its investments in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year end. Fund investment results reflect the expense reduction and fee waiver, to the extent applicable; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. 4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

7. Source: © 2013 Morningstar. The Russell Midcap® Value Index is market capitalization weighted and measures performance of those Russell Midcap® Index companies with lower price-to-book ratios and lower forecasted growth values. The Consumer Price Index (CPI), calculated by the Bureau of Labor Statistics, is a commonly used measure of the inflation rate.

52 | Annual Report

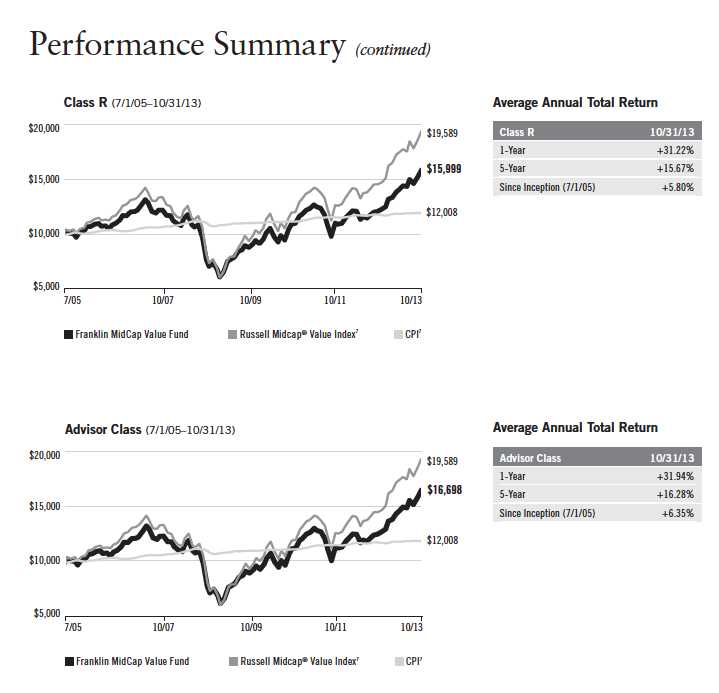

Your Fund’s Expenses

Franklin MidCap Value Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

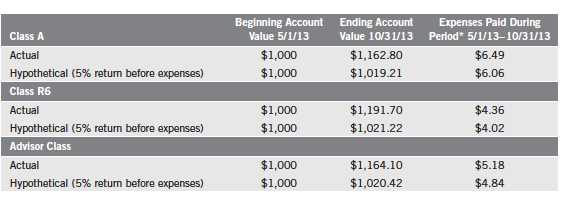

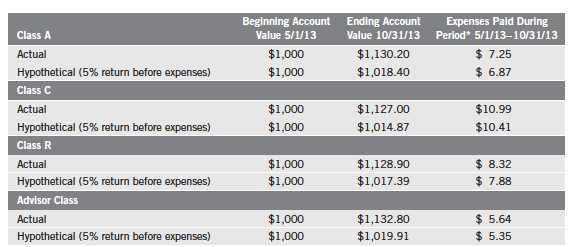

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Annual Report | 53

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.35%; C: 2.05%; R: 1.55%; and Advisor: 1.05%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

54 | Annual Report

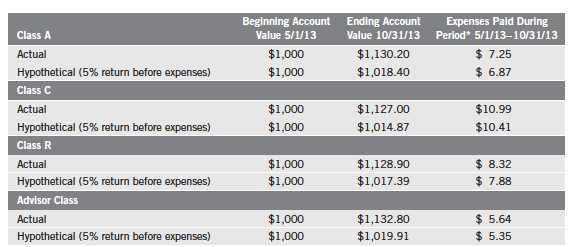

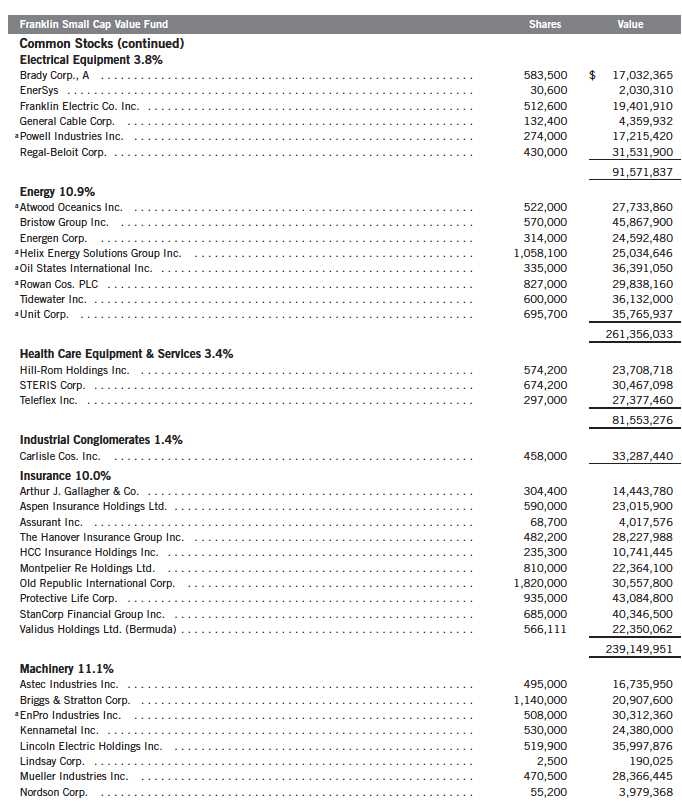

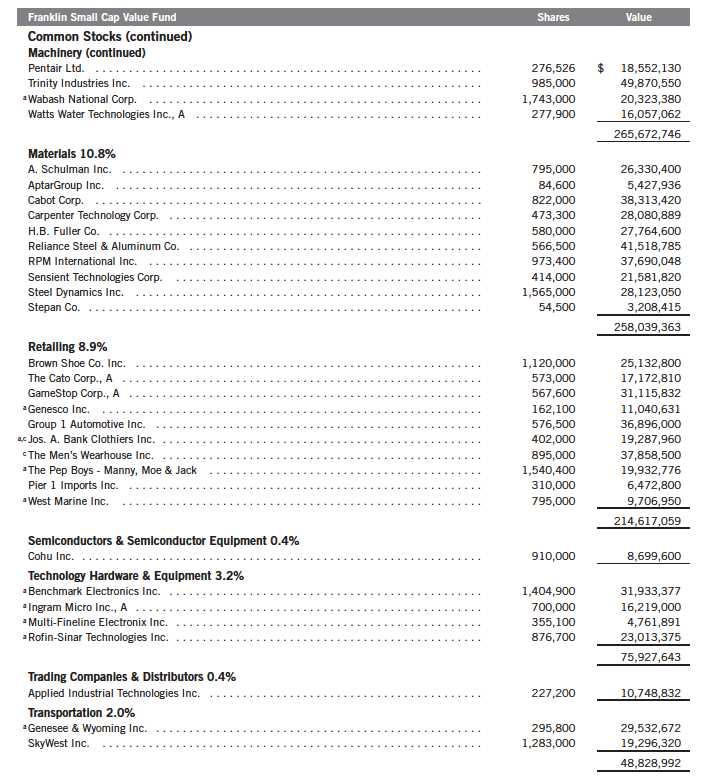

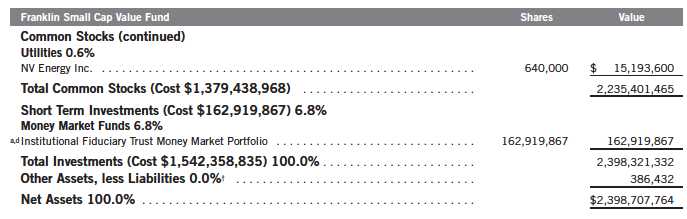

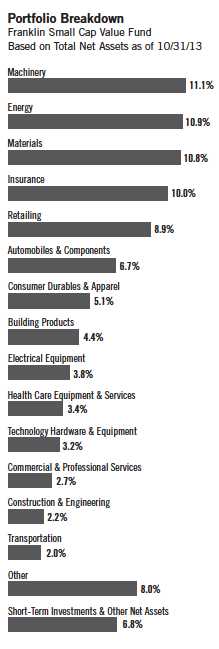

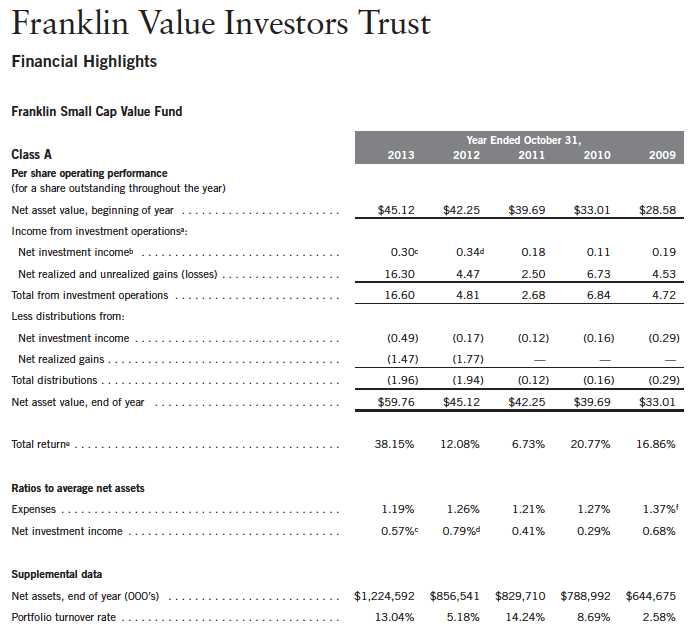

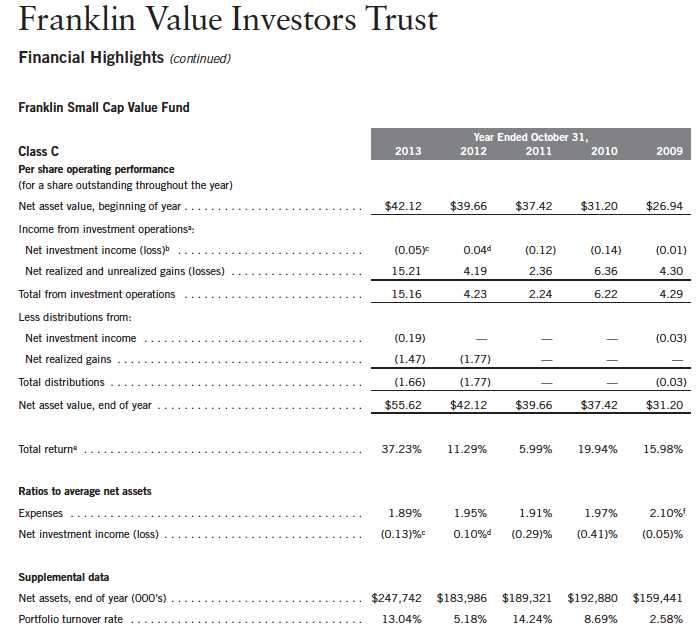

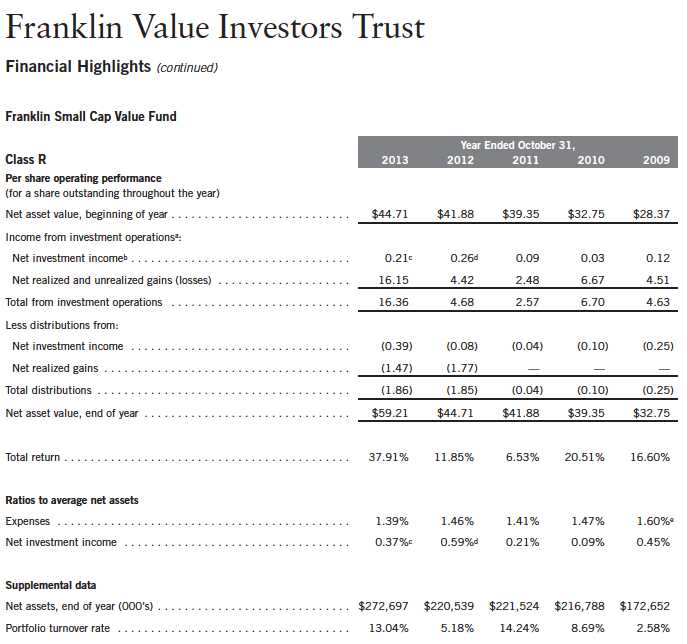

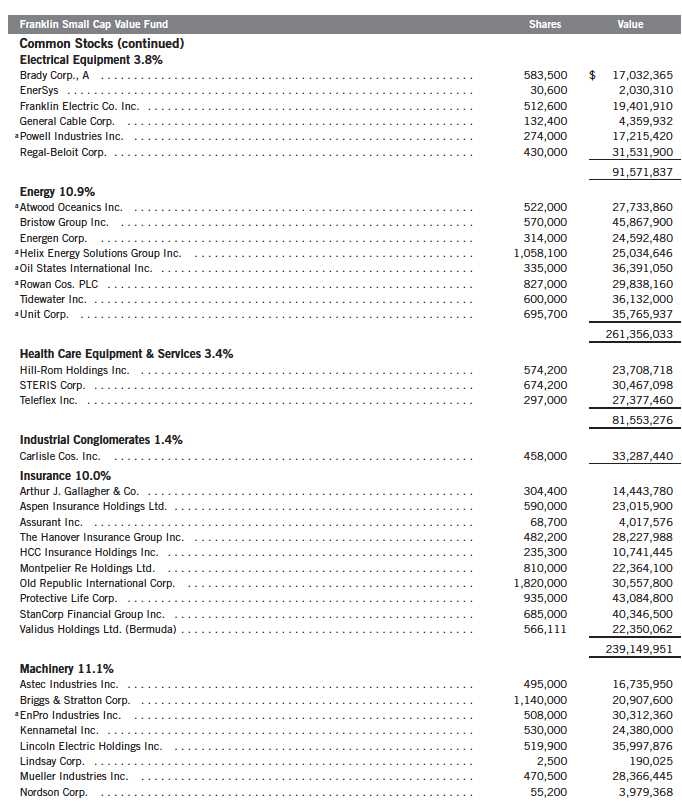

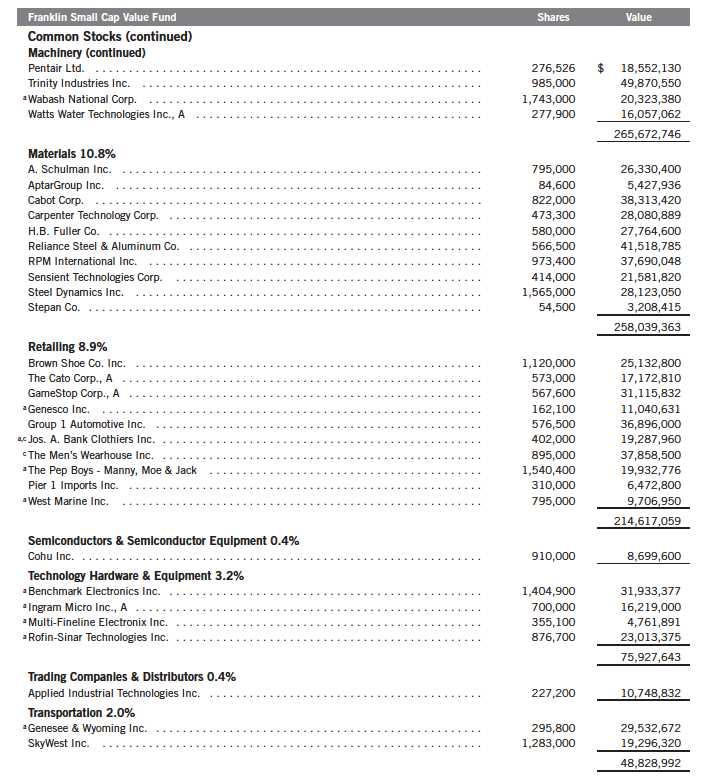

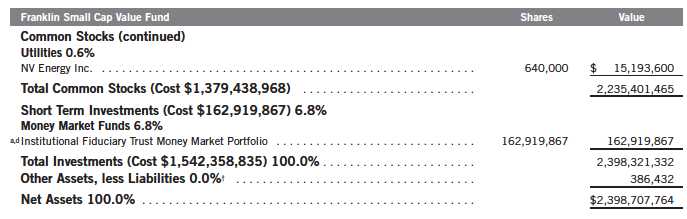

Franklin Small Cap Value Fund

Your Fund’s Goal and Main Investments: Franklin Small Cap Value Fund seeks long-term total return by investing at least 80% of net assets in securities of small-capitalization companies that we believe are undervalued. We define small-capitalization companies as those with market capitalizations less than $3.5 billion at the time of purchase.

We are pleased to bring you Franklin Small Cap Value Fund’s annual report for the fiscal year ended October 31, 2013.

Performance Overview

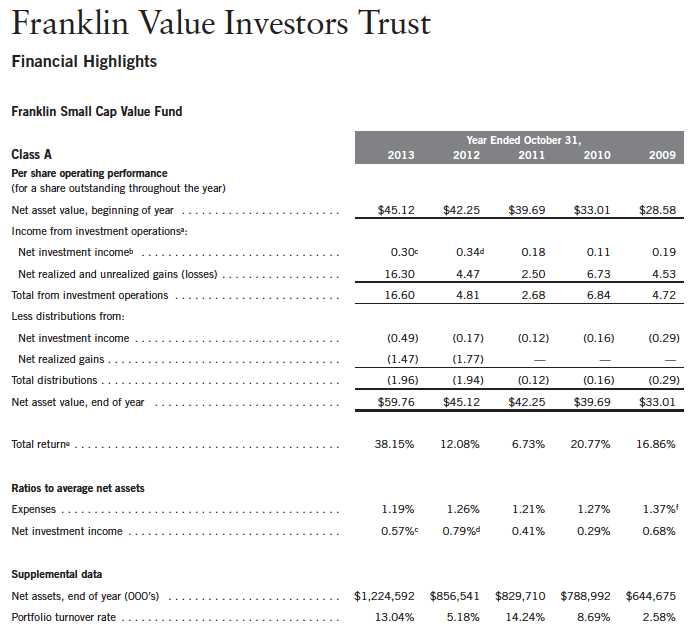

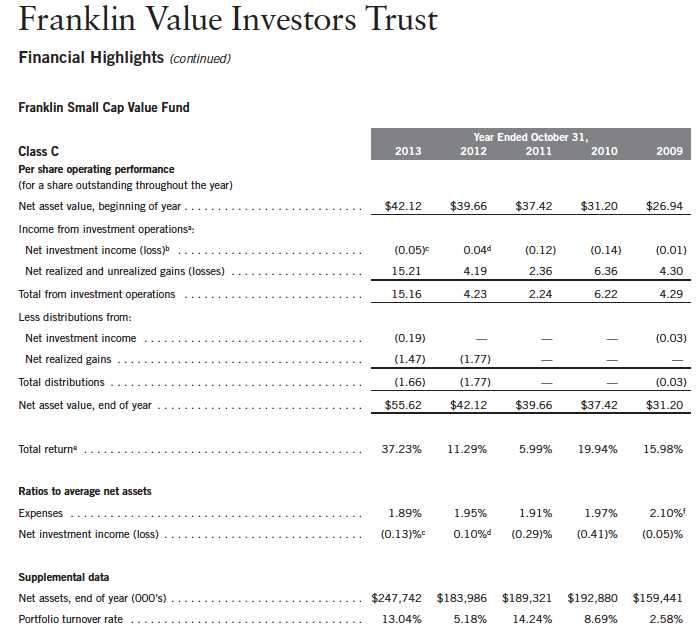

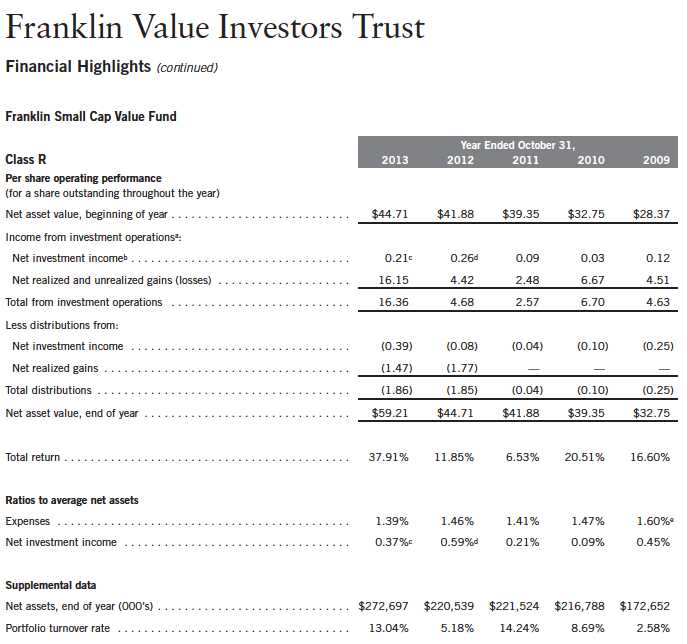

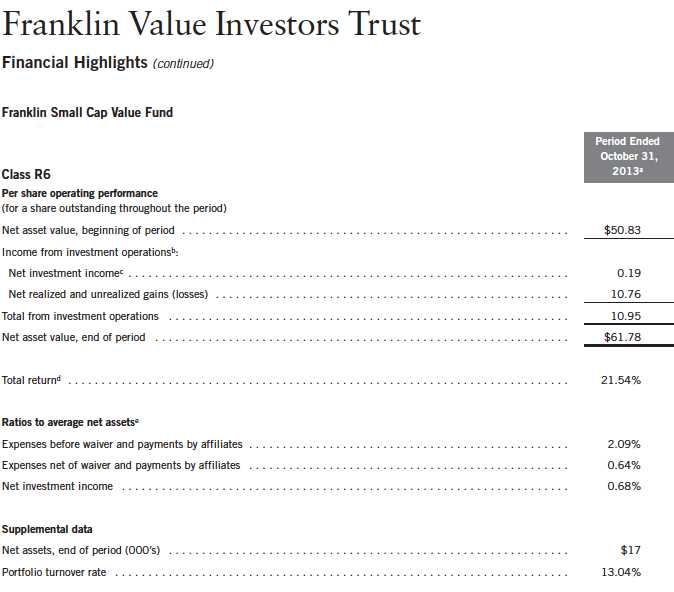

Franklin Small Cap Value Fund – Class A delivered a +38.15% cumulative total return for the 12 months under review. In comparison, the Russell 2500™ Value Index, which measures performance of those Russell 2500™ Index companies with lower price-to-book ratios and lower forecasted growth values, generated a +33.35% total return.1 Although this report covers a 12-month period, our investment strategy aims for long-term results. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 58.

Investment Strategy

We seek to invest in small-capitalization companies that we believe are selling below their underlying worth and hold them until they reach what we consider their fair market value. We seek a diversified portfolio of fundamentally sound companies purchased at attractive prices, often when they are out of favor with other investors. Portfolio securities are selected without regard to benchmark comparisons and are based on fundamental, bottom-up research focusing on several criteria, such as low price relative to earnings, book value or cash flow. We also consider stocks with recent sharp price declines that we believe still have significant growth potential or that possess valuable intangibles not reflected in the stock price.

1. Source: © 2013 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 107.

Annual Report | 55

Manager’s Discussion

During the 12 months under review, contributors to absolute Fund performance included video game retailer GameStop, insurer Protective Life, recreational vehicle manufacturer Thor Industries, aircraft-related aftermarket services provider AAR and railcar manufacturer Trinity Industries. GameStop benefited from management’s optimistic guidance regarding robust same-store sales for the upcoming holiday season and was anticipated to profit from the introduction of new video game consoles from Microsoft and Sony. Shares of Protective Life rallied based on solid earnings growth driven by its annuities business, a potential benefit from acquisitions and the prospect for higher interest rates. Thor Industries appreciated owing to strong demand for towable recreational vehicles and growing sales of motorized vehicles. AAR’s share price rose because of increased demand for spare parts and maintenance services to the improving commercial aviation sector along with the company’s solid free cash flow generation. Trinity Industries posted record earnings and backlog resulting from increased demand for rail cars to support the domestic energy boom.

Most positions in the Fund benefited performance, but detractors included flexible circuit materials manufacturer Multi-Fineline Electronix, single-family home builders M.D.C. Holdings and M/I Homes, hair care salon operator Regis and outdoor power equipment manufacturer Briggs & Stratton. Weaker-than-expected demand led to disappointing earnings for Multi-Fineline Electronix. M.D.C. Holdings and M/I Homes suffered from an uncertain outlook for new housing demand as a result of higher interest rates. Regis posted lower-than-expected revenue and earnings as its effort to implement a major restructuring had not yet gained traction. Briggs & Stratton struggled with an extremely slow start to the spring lawn and garden season and retailers’ cautious approach to managing inventories.

During the reporting period, the Fund initiated positions in nine new holdings, including Regal-Beloit, an electric motor manufacturer; Carpenter Technology, a high performance metals manufacturer; Pep Boys – Manny, Moe & Jack, an auto service and retail chain; Jos. A. Bank Clothiers, a men’s clothing designer and retailer; Harman International Industries, an audio and infotainment manufacturer; and Genesco, a specialty retailer, among others. We also added to our positions in Cabot, a specialty chemicals and materials company; Unit Corp., a diversified energy company; and STERIS, a health care sterilization technology provider, among others. We liquidated positions in 17 companies including Graco, American Woodmark, Lancaster Colony, CIRCOR International and West Pharmaceutical Services. We reduced our positions in several securities including Protective Life, GameStop, Pier 1 Imports, Nordson and Benchmark Electronics, among others.

56 | Annual Report

Annual Report | 57

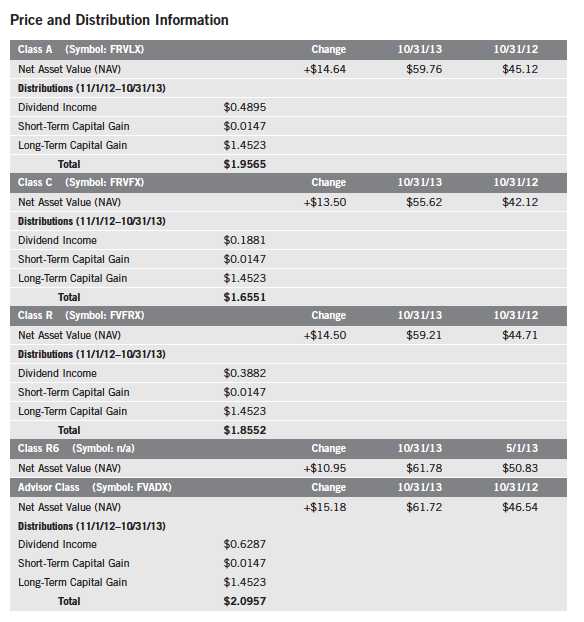

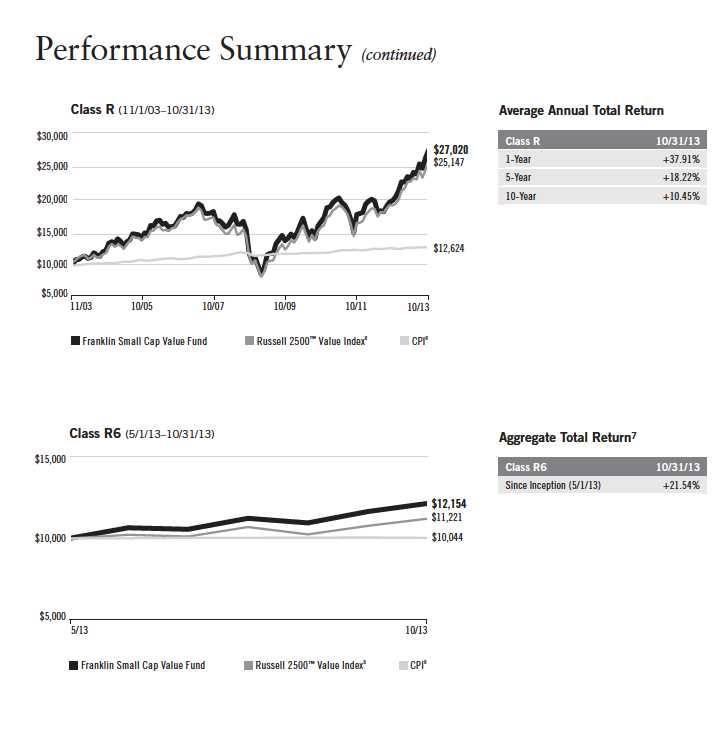

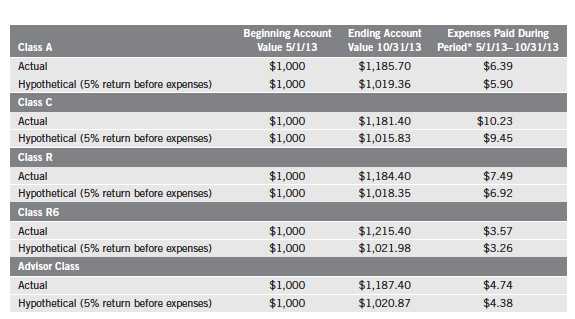

Performance Summary as of 10/31/13

Franklin Small Cap Value Fund