UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number_811-05878

__Franklin Value Investors Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: _650 312-2000

Date of fiscal year end: 10/31

Date of reporting period: _10/31/15

Item 1. Reports to Stockholders.

Annual Report

and Shareholder Letter

October 31, 2015

Franklin Value Investors Trust

Franklin All Cap Value Fund

Franklin Balance Sheet Investment Fund

Franklin Large Cap Value Fund

Franklin MicroCap Value Fund

Franklin MidCap Value Fund

Franklin Small Cap Value Fund

Sign up for electronic delivery at franklintempleton.com/edelivery

| |

| Contents | |

| Annual Report | |

| Economic and Market Overview | 3 |

| Franklin All Cap Value Fund | 4 |

| Franklin Balance Sheet Investment Fund | 14 |

| Franklin Large Cap Value Fund | 24 |

| Franklin MicroCap Value Fund | 34 |

| Franklin MidCap Value Fund | 42 |

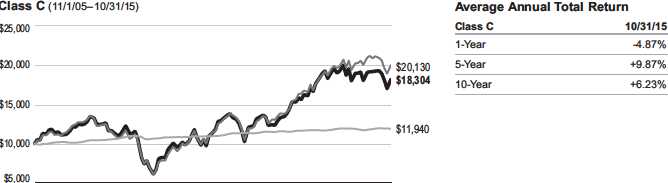

| Franklin Small Cap Value Fund | 52 |

| Financial Highlights and Statements of Investments | 62 |

| Financial Statements | 109 |

| Notes to Financial Statements | 118 |

| Report of Independent Registered | |

| Public Accounting Firm | 135 |

| Tax Information | 136 |

| Board Members and Officers | 137 |

| Meeting of Shareholders | 142 |

| Shareholder Information | 145 |

Visit franklintempleton.com for fund updates,

to access your account, or to find helpful

financial planning tools.

|

2 Annual Report franklintempleton.com

Annual Report

Economic and Market Overview

The U.S. economy grew moderately during the 12 months under review. After recording a small gain in 2015’s first quarter, the economy strengthened in the second quarter but moderated in the third quarter despite healthy consumer spending. Businesses cut back on inventories, exports slowed, and state and local governments reduced their spending. In contrast, non-manufacturing activities strengthened. The unemployment rate declined to 5.0% at period-end, the lowest level in more than seven years.1 Housing market data were generally encouraging as existing home sales and prices rose amid low mortgage rates. Retail sales grew modestly, driven by automobile and auto component sales. Inflation remained subdued, but after two consecutive declines, monthly inflation, as measured by the Consumer Price Index, rose in October as prices for energy and other goods increased.

During the period, the Federal Reserve (Fed) kept its target interest rate at 0%–0.25% while considering when an increase might be appropriate. Although global financial markets anticipated an increase, in September and October the Fed kept interest rates unchanged and said it expected moderate economic expansion, but it would continue to monitor developments domestically and abroad.

Although U.S. stock markets experienced sell-offs at times during the period, investor confidence generally grew as corporate profits remained healthy, the Fed kept its target interest rate low, the eurozone economy improved, China implemented more stimulus measures and Greece reached an agreement with its creditors. Toward period-end, U.S. stocks rallied amid easing concerns about China and increased optimism that certain central banks might introduce additional stimulus measures. Despite periods of volatility, the broad U.S. stock market, as measured by the Standard & Poor’s® 500 Index, had a moderate gain. However, large capitalization value stocks, as measured by the Russell 1000® Value Index, were relatively flat, while small capitalization value stocks, as measured by the Russell 2000® Value Index, registered a loss.

1. Source: Bureau of Labor Statistics.

franklintempleton.com

Annual Report

|

3

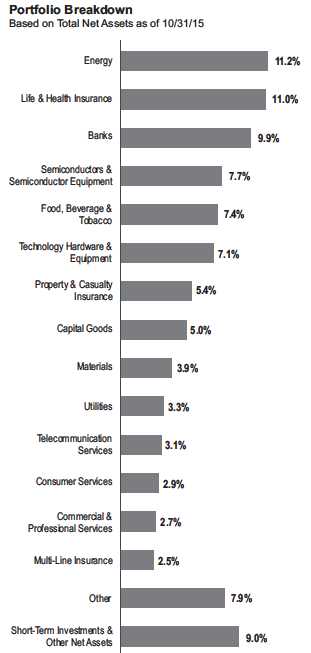

Franklin All Cap Value Fund

This annual report for Franklin All Cap Value Fund covers the fiscal year ended October 31, 2015. Effective December 10, 2015, the Fund will close to all new investments (with limited exceptions), in preparation for a proposed Fund reorganization subject to shareholder approval.

Your Fund’s Goal and Main Investments

The Fund seeks long-term total return by primarily investing in stocks of companies of any size that we believe are undervalued at the time of purchase and have the potential for capital appreciation.

Performance Overview

For the 12 months under review, the Fund’s Class A shares had a -5.45% cumulative total return. In comparison, the Russell 3000® Value Index, which measures performance of those Russell 3000® Index companies with lower price-to-book ratios and lower forecasted growth values, generated a +0.24% total return.1 Although this report covers a 12-month period, our investment strategy aims for long-term results. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 7.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Investment Strategy

Our goal is to invest in stocks of companies of any size that we determine are currently undervalued and have the potential for capital appreciation. The Fund purchases securities that are out of favor in the market for reasons we believe will prove to be temporary in nature, or that appear to be inexpensive measured by factors such as price relative to earnings, book value or cash flow. In addition, the Fund may invest in companies with valuable intangibles we believe are not reflected in the stock price. This strategy is not aimed at short-term trading gains, nor do we consider the composition of any index. Rather, we try to identify attractively priced, financially sound companies that meet our investment criteria, and we assume at purchase that we will hold the positions for several years.

1. Source: Morningstar.

The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio. See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 66.

|

4 Annual Report

franklintempleton.com

FRANKLIN ALL CAP VALUE FUND

Manager’s Discussion

During the 12 months under review, holdings that helped absolute Fund performance included Gibraltar Industries, Universal Forest Products and The Pep Boys – Manny, Moe & Jack. Gibraltar Industries, a construction infrastructure products manufacturer, benefited from increased investor confidence in management’s long-term plans to improve profitability and a positive response to a recently announced strategic acquisition. We sold shares of Gibraltar as it reached our target price, but we still had a meaningful position believing the company had an attractive long-term outlook. Universal Forest Products, a wood-based constructions materials provider, reported better-than-expected earnings due to strong overall demand and penetration into new markets. The Pep Boys, an automobile sales and services provider, received a cash takeover offer from Bridgestone at nearly a 24% premium to the prior day’s closing price.

Detractors from absolute Fund performance included PHI, Axiall and Unit Corp. PHI provides helicopter transportation to the offshore energy industry and air medical services. Lower energy prices led PHI’s customers to cancel or delay capital projects, which reduced flight hours and revenue for PHI. Axiall, a chemical and building products manufacturer, was negatively affected by weaker-than-expected end-market pricing due to industry-wide chlor-alkali capacity expansions and still relatively weak demand. The company replaced its chief executive officer and is implementing cost-cutting measures to offset weakness while simultaneously exploring alternatives for its building products business. Given the recent changes, we believe Axiall has the potential for share price appreciation as global growth worries abate and energy prices stabilize over time. Shares of Unit Corp., an onshore provider of drilling rigs, experienced a negative impact from a sharp drop in oil prices that began in mid-2014. The company’s subsequent reduction in its rig count was also expected to hinder earnings.

| | |

| Top 10 Holdings | | |

| 10/31/15 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| AAR Corp. | 4.4 | % |

| Aerospace & Defense | | |

| The Kraft Heinz Co. | 3.8 | % |

| Food, Beverage & Tobacco | | |

| Universal Forest Products Inc. | 3.0 | % |

| Building Products | | |

| Axiall Corp. | 2.9 | % |

| Materials | | |

| Maple Leaf Foods Inc. (Canada) | 2.9 | % |

| Food, Beverage & Tobacco | | |

| Orbcomm Inc. | 2.8 | % |

| Telecommunication Services | | |

| The Pep Boys – Manny, Moe & Jack | 2.8 | % |

| Retailing | | |

| Gibraltar Industries Inc. | 2.8 | % |

| Building Products | | |

| Sanofi, ADR (France) | 2.7 | % |

| Pharmaceuticals, Biotechnology & Life Sciences | | |

| Insteel Industries Inc. | 2.5 | % |

| Building Products | | |

During the reporting period, some of our large new purchases were Orbcomm, a wireless communications provider; Sanofi, a pharmaceutical producer; Prudential Financial, an insurance provider and investment manager; The Kraft Heinz Co. a food and beverage producer; Mattel, a toy manufacturer; The Men’s Wearhouse, a men’s clothing retailer; and LTC Properties, a health care facility real estate investment trust. We also added to several existing positions including AAR, an aviation and government defense services and products provider; Everbank Financial, a commercial bank; and the aforementioned Axiall, among others. Conversely, we liquidated positions in Royal Caribbean Cruises, L.B. Foster and QUALCOMM, among others. We also reduced several positions including Corning, Omega Protein, Target and Gibraltar Industries.

franklintempleton.com

Annual Report

|

5

FRANKLIN ALL CAP VALUE FUND

As fellow shareholders, we found recent Fund performance disappointing. Although the market has not favored our value investing style in recent years, we have maintained our disciplined process and continue to believe it can reward investors over the long term. Thank you for your continued participation in Franklin All Cap Value Fund. We look forward to continuing to serve your investment needs.

Donald G. Taylor, CPA

Bruce C. Baughman, CPA

Portfolio Management Team

The foregoing information reflects our analysis, opinions and portfolio holdings as of October 31, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

|

6 Annual Report

franklintempleton.com

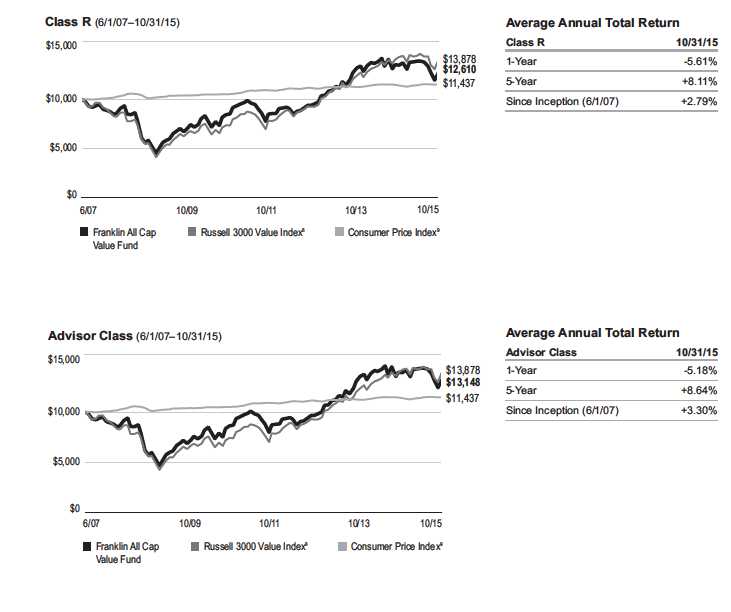

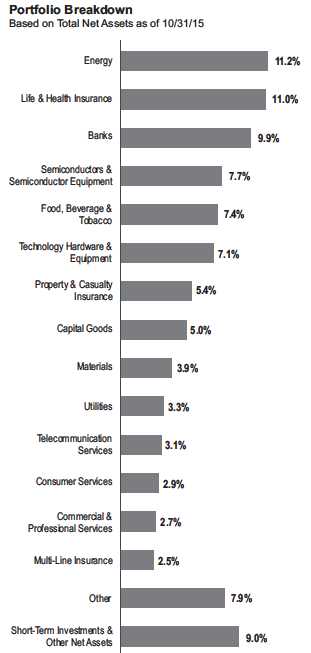

FRANKLIN ALL CAP VALUE FUND

Performance Summary as of October 31, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | |

| Net Asset Value | | | | | | |

| Share Class (Symbol) | | 10/31/15 | | 10/31/14 | | Change |

| A (FRAVX) | $ | 11.87 | $ | 13.01 | -$ | 1.14 |

| C (N/A) | $ | 11.55 | $ | 12.74 | -$ | 1.19 |

| R (N/A) | $ | 11.86 | $ | 13.00 | -$ | 1.14 |

| Advisor (N/A) | $ | 11.94 | $ | 13.09 | -$ | 1.15 |

| |

| |

| Distributions1 (11/1/14–10/31/15) | | | | | | |

| | | Dividend | | Long-Term | | |

| Share Class | | Income | | Capital Gain | | Total |

| A | $ | 0.0094 | $ | 0.4254 | $ | 0.4348 |

| C | | — | $ | 0.4254 | $ | 0.4254 |

| R | $ | 0.0008 | $ | 0.4254 | $ | 0.4262 |

| Advisor | $ | 0.0499 | $ | 0.4254 | $ | 0.4753 |

franklintempleton.com

Annual Report

|

7

FRANKLIN ALL CAP VALUE FUND

PERFORMANCE SUMMARY

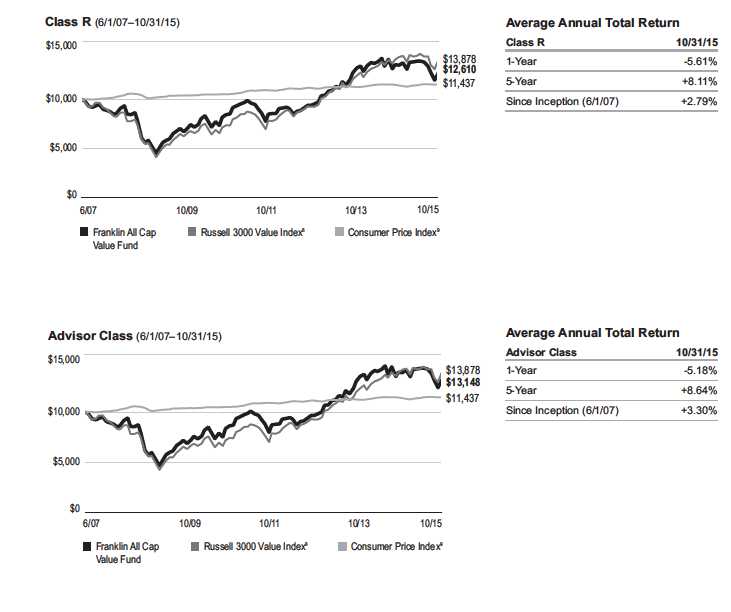

Performance as of 10/31/152

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R/Advisor Class: no sales charges.

| | | | | | | | | | | | |

| | | | | | | | | | Total Annual Operating Expenses7 | |

| | Cumulative | | Average Annual | | | Value of | Average Annual | | | | | |

| Share Class | Total Return3 | | Total Return4 $10,000 Investment5 | Total Return (9/30/15)6 | | (with waiver) | | (without waiver) | |

| A | | | | | | | | | 1.25 | % | 1.42 | % |

| 1-Year | -5.45 | % | -10.86 | % | $ | 8,914 | -13.56 | % | | | | |

| 5-Year | +49.13 | % | +7.05 | % | $ | 14,060 | +6.39 | % | | | | |

| Since Inception (6/1/07) +28.12% | | +2.27 | % | $ | 12,075 | +1.53 | % | | | | |

| C | | | | | | | | | 1.95 | % | 2.12 | % |

| 1-Year | -6.05 | % | -6.96 | % | $ | 9,304 | -9.83 | % | | | | |

| 5-Year | +43.97 | % | +7.56 | % | $ | 14,397 | +6.89 | % | | | | |

| Since Inception (6/1/07) +20.91% | | +2.28 | % | $ | 12,091 | +1.55 | % | | | | |

| R | | | | | | | | | 1.45 | % | 1.62 | % |

| 1-Year | -5.61 | % | -5.61 | % | $ | 9,439 | -8.44 | % | | | | |

| 5-Year | +47.66 | % | +8.11 | % | $ | 14,766 | +7.45 | % | | | | |

| Since Inception (6/1/07) +26.10% | | +2.79 | % | $ | 12,610 | +2.07 | % | | | | |

| Advisor | | | | | | | | | 0.95 | % | 1.12 | % |

| 1-Year | -5.18 | % | -5.18 | % | $ | 9,482 | -8.01 | % | | | | |

| 5-Year | +51.32 | % | +8.64 | % | $ | 15,132 | +7.99 | % | | | | |

| Since Inception (6/1/07) +31.48% | | +3.30 | % | $ | 13,148 | +2.58 | % | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

|

8 Annual Report

franklintempleton.com

FRANKLIN ALL CAP VALUE FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment2

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

|

franklintempleton.com Annual Report 9

FRANKLIN ALL CAP VALUE FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment2 (continued)

|

10 Annual Report franklintempleton.com

FRANKLIN ALL CAP VALUE FUND

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. Value securities may not increase in price as anticipated or may decline further in value. While smaller and midsize companies may offer substantial opportunities for capital growth, they also involve heightened risks and should be considered speculative. Historically, smaller and midsize company securities have been more volatile in price than larger company securities, especially over the short term. The Fund may invest up to 25% of its total assets in foreign securities, which may involve special risks, including currency fluctuations and economic and political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

| Class C: | These shares have higher annual fees and expenses than Class A shares. |

| Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

| Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income and

capital gain.

2. The Fund has an expense reduction contractually guaranteed through at least 2/29/16 and a fee waiver associated with any investment in a Franklin Templeton money

fund, contractually guaranteed through at least its current fiscal year-end. Fund investment results reflect the expense reduction and fee waiver, to the extent applicable;

without these reductions, the results would have been lower.

3. Cumulative total return represents the change in value of an investment over the periods indicated.

4. Average annual total return represents the average annual change in value of an investment over the periods indicated.

5. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

6. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

7. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

8. Source: Morningstar. The Russell 3000 Value Index is market capitalization weighted and measures performance of those Russell 3000 Index companies with lower

price-to-book ratios and lower forecasted growth values.

9. Source: Bureau of Labor Statistics, bls.gov/cpi. The Consumer Price Index is a commonly used measure of the inflation rate.

See www.franklintempletondatasources.com for additional data provider information.

|

franklintempleton.com Annual Report 11

FRANKLIN ALL CAP VALUE FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribu- tion and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

|

12 Annual Report

franklintempleton.com

FRANKLIN ALL CAP VALUE FUND

YOUR FUND’S EXPENSES

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 5/1/15 | | Value 10/31/15 | | Period* 5/1/15–10/31/15 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 921.60 | $ | 5.91 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.06 | $ | 6.21 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 918.10 | $ | 9.38 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,015.43 | $ | 9.86 |

| R | | | | | | |

| Actual | $ | 1,000 | $ | 920.00 | $ | 7.02 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,017.90 | $ | 7.37 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 922.70 | $ | 4.60 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.42 | $ | 4.84 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.22%;

C: 1.94%; R: 1.45%; and Advisor: 0.95%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the

one-half year period.

franklintempleton.com

Annual Report

|

13

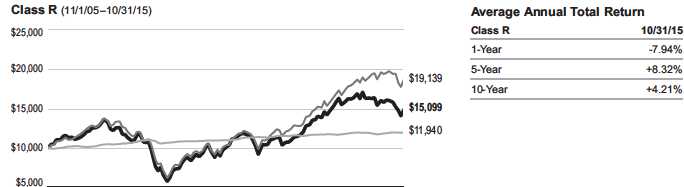

Franklin Balance Sheet Investment Fund

This annual report for Franklin Balance Sheet Investment Fund covers the fiscal year ended October 31, 2015.

Your Fund’s Goal and Main Investments

The Fund seeks high total return, of which capital appreciation and income are components, by investing most of its assets in equity securities of companies of any size that we believe are undervalued in the marketplace at the time of purchase but have the potential for capital appreciation.

Performance Overview

For the 12 months under review, the Fund’s Class A shares had a -7.73% cumulative total return. In comparison, the Russell 3000® Value Index, which measures performance of those Russell 3000® Index companies with lower price-to-book ratios and lower forecasted growth values, generated a +0.24% total return.1 Although this report covers a 12-month period, our investment strategy aims for long-term results. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 17.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Investment Strategy

Our strategy uses low price-to-book value as its primary reference valuation measure. Book value per share is a company’s net worth or shareholders’ equity on an accounting or “book” basis, divided by shares outstanding. The equity securities bought by the Fund will typically be purchased at a low price relative to book value. This strategy is not aimed at short-term trading gains, and we do not adhere to the composition of the benchmark. Rather, we try to identify individual companies that meet our investment criteria, with a 3-5 year investment horizon.

1. Source: Morningstar.

The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio. See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 74.

|

14 Annual Report

franklintempleton.com

FRANKLIN BALANCE SHEET INVESTMENT FUND

Manager’s Discussion

During the 12 months under review, holdings that helped absolute Fund performance included StanCorp Financial Group, HCC Insurance Holdings and Fresh Del Monte Produce. StanCorp Financial Group, an insurance provider and asset manager, received a cash takeover offer from Meiji Yasuda Life Insurance at nearly a 50% premium to the prior day’s closing price. HCC Insurance Holdings, a specialty insurance provider, received an offer from Tokio Marine Holding at a 38% premium to its prior day’s closing price. Fresh Del Monte Produce, a fruit producer and marketer, reported three consecutive quarters of significant earnings growth as the global banana market experienced increased demand and price stabilization. The company was successful in its efforts to focus on higher value products and geographic expansion by leveraging its existing infrastructure and relationships.

Detractors from absolute Fund performance included Intrepid Potash, Cloud Peak Energy and PHI. Shares of Intrepid Potash, a potash producer and mine operator, declined as low crop prices, a strong U.S. dollar and an influx of new supply led to weaker potash prices. These conditions threatened the viability of a high-production-cost mine. Cloud Peak Energy, a coal mine owner and operator, experienced a difficult pricing environment for its Powder River Basin coal as the decline of natural gas prices encouraged utility customers to switch from coal to gas. Moreover, a price decline in the seaborne thermal coal market also negatively impacted the company’s export tonnage. PHI provides helicopter transportation to the offshore energy industry and air medical services. Lower energy prices led PHI’s customers to cancel or delay capital projects, which reduced flight hours and revenue for PHI.

During the reporting period, some of our large new purchases were Ruby Tuesday, a restaurant chain; Bio-Rad Laboratories, a specialty chemicals producer; Occidental Petroleum, an oil and gas producer; News Corp., a media and information services provider; M.D.C. Holdings, a lender and housing

| | |

| Top 10 Holdings | | |

| 10/31/15 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| Corning Inc. | 3.9 | % |

| Technology Hardware & Equipment | | |

| E-L Financial Corp. Ltd. | 2.7 | % |

| Life & Health Insurance | | |

| First Solar Inc. | 2.6 | % |

| Semiconductors & Semiconductor Equipment | | |

| Citigroup Inc. | 2.5 | % |

| Banks | | |

| National Western Life Group Inc., A | 2.5 | % |

| Life & Health Insurance | | |

| The Chubb Corp. | 2.4 | % |

| Property & Casualty Insurance | | |

| Photronics Inc. | 2.3 | % |

| Semiconductors & Semiconductor Equipment | | |

| MetLife Inc. | 2.3 | % |

| Life & Health Insurance | | |

| KeyCorp | 2.3 | % |

| Banks | | |

| Prudential Financial Inc. | 2.3 | % |

| Life & Health Insurance | | |

developer; Fabrinet, an electronic manufacturing services provider; and QEP Resources, an oil and gas producer. We also added to existing positions including Cloud Peak Energy, mentioned earlier; First Solar, a solar power provider; Ingram Micro, a technology distribution provider; Photronics, a pho-tomask (microscopic electronic circuit images) retailer; and Apache, an oil and gas producer; among others. In contrast, some of the largest liquidations included Ashland, Reliance Steel & Aluminum, Old Republic International, Tidewater and the aforementioned HCC Insurance Holdings, among others. We reduced several positions including Archer Daniels Midland, Selective Insurance Group, Bunge, Citigroup, Assurant, Vail Resorts, Allegheny Technologies and KeyCorp.

franklintempleton.com

Annual Report

|

15

FRANKLIN BALANCE SHEET INVESTMENT FUND

As fellow shareholders, we found recent Fund performance disappointing. Although the market has not favored our value investing style in recent years, we have maintained our disciplined process and continue to believe it can reward investors over the long term. Thank you for your continued participation in Franklin Balance Sheet Investment Fund. We look forward to continuing to serve your investment needs.

Bruce C. Baughman, CPA

Donald G. Taylor, CPA

Portfolio Management Team

The foregoing information reflects our analysis, opinions and portfolio holdings as of October 31, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

|

16 Annual Report

franklintempleton.com

FRANKLIN BALANCE SHEET INVESTMENT FUND

Performance Summary as of October 31, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | | | |

| Net Asset Value | | | | | | | | |

| Share Class (Symbol) | | 10/31/15 | | 10/31/14 | | Change | | |

| A (FRBSX) | $ | 40.06 | $ | 51.55 | -$ | 11.49 | | |

| C (FCBSX) | $ | 38.70 | $ | 50.22 | -$ | 11.52 | | |

| R (FBSRX) | $ | 40.06 | $ | 51.48 | -$ | 11.42 | | |

| R6 (FBSIX) | $ | 41.10 | $ | 52.70 | -$ | 11.60 | | |

| Advisor (FBSAX) | $ | 41.08 | $ | 52.68 | -$ | 11.60 | | |

| |

| |

| Distributions1 (11/1/14–10/31/15) | | | | | | | | |

| | | Dividend | | Short-Term | | Long-Term | | |

| Share Class | | Income | | Capital Gain | | Capital Gain | | Total |

| A | $ | 0.1685 | $ | 0.7874 | $ | 6.7992 | $ | 7.7551 |

| C | | — | $ | 0.7874 | $ | 6.7992 | $ | 7.5866 |

| R | $ | 0.0067 | $ | 0.7874 | $ | 6.7992 | $ | 7.5933 |

| R6 | $ | 0.3856 | $ | 0.7874 | $ | 6.7992 | $ | 7.9722 |

| Advisor | $ | 0.3057 | $ | 0.7874 | $ | 6.7992 | $ | 7.8923 |

franklintempleton.com

Annual Report

|

17

FRANKLIN BALANCE SHEET INVESTMENT FUND

PERFORMANCE SUMMARY

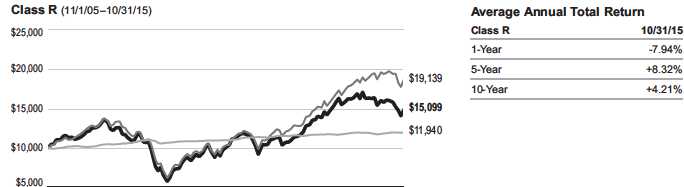

Performance as of 10/31/152

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R/R6/Advisor Class: no sales charges.

| | | | | | | | | | | | |

| | | | | | | | | | Total Annual Operating Expenses7 | |

| | Cumulative | | Average Annual | | | Value of | Average Annual | | | | | |

| Share Class | Total Return3 | | Total Return4 | | $ | 10,000 Investment5 | Total Return (9/30/15)6 | | (with waiver) | | (without waiver) | |

| A | | | | | | | | | 0.90 | % | 0.91 | % |

| 1-Year | -7.73 | % | -13.02 | % | $ | 8,698 | -18.48 | % | | | | |

| 5-Year | +50.94 | % | +7.31 | % | $ | 14,227 | +6.77 | % | | | | |

| 10-Year | +54.32 | % | +3.82 | % | $ | 14,545 | +2.94 | % | | | | |

| C | | | | | | | | | 1.65 | % | 1.66 | % |

| 1-Year | -8.41 | % | -9.18 | % | $ | 9,082 | -14.88 | % | | | | |

| 5-Year | +45.40 | % | +7.77 | % | $ | 14,540 | +7.24 | % | | | | |

| 10-Year | +43.04 | % | +3.64 | % | $ | 14,304 | +2.77 | % | | | | |

| R | | | | | | | | | 1.15 | % | 1.16 | % |

| 1-Year | -7.94 | % | -7.94 | % | $ | 9,206 | -13.73 | % | | | | |

| 5-Year | +49.10 | % | +8.32 | % | $ | 14,910 | +7.77 | % | | | | |

| 10-Year | +50.99 | % | +4.21 | % | $ | 15,099 | +3.32 | % | | | | |

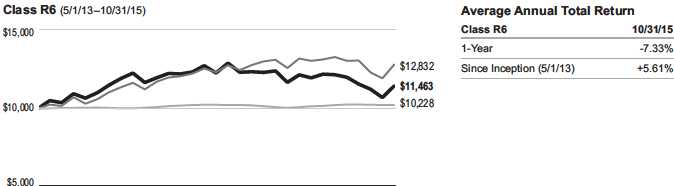

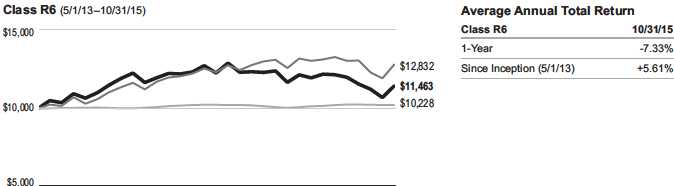

| R6 | | | | | | | | | 0.50 | % | 0.51 | % |

| 1-Year | -7.33 | % | -7.33 | % | $ | 9,267 | -13.15 | % | | | | |

| Since Inception (5/1/13) +14.63% | | +5.61 | % | $ | 11,463 | +2.89 | % | | | | |

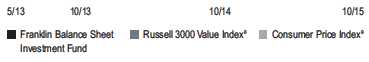

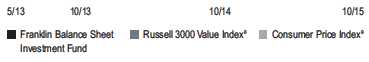

| Advisor | | | | | | | | | 0.65 | % | 0.66 | % |

| 1-Year | -7.51 | % | -7.51 | % | $ | 9,249 | -13.30 | % | | | | |

| 5-Year | +52.81 | % | +8.85 | % | $ | 15,281 | +8.30 | % | | | | |

| 10-Year | +60.41 | % | +4.84 | % | $ | 16,041 | +3.95 | % | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

|

18 Annual Report

franklintempleton.com

FRANKLIN BALANCE SHEET INVESTMENT FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment2

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

|

franklintempleton.com Annual Report 19

FRANKLIN BALANCE SHEET INVESTMENT FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment2 (continued)

|

20 Annual Report

franklintempleton.com

FRANKLIN BALANCE SHEET INVESTMENT FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment2 (continued)

All investments involve risks, including possible loss of principal. Value securities may not increase in price as anticipated or may decline further in value. While smaller and midsize companies may offer substantial opportunities for capital growth, they also involve heightened risks and should be considered speculative. Historically, smaller and midsize company securities have been more volatile in price than larger company securities, especially over the short term. The Fund may invest up to 25% of its total assets in foreign securities, which may involve special risks, including currency fluctuations and economic and political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: These shares have higher annual fees and expenses than Class A shares.

Class R: Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares.

Class R6: Shares are available to certain eligible investors as described in the prospectus.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income and

capital gain.

2. The Fund has a fee waiver associated with any investment in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end.

Fund investment results reflect the fee waiver; without this reduction, the results would have been lower.

3. Cumulative total return represents the change in value of an investment over the periods indicated.

4. Average annual total return represents the average annual change in value of an investment over the periods indicated.

5. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

6. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

7. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

8. Source: Morningstar. The Russell 3000 Value Index is market capitalization weighted and measures performance of those Russell 3000 Index companies with lower

price-to-book ratios and lower forecasted growth values.

9. Source: Bureau of Labor Statistics, bls.gov/cpi. The Consumer Price Index is a commonly used measure of the inflation rate.

See www.franklintempletondatasources.com for additional data provider information.

franklintempleton.com

Annual Report

|

21

FRANKLIN BALANCE SHEET INVESTMENT FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribu- tion and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

|

22 Annual Report

franklintempleton.com

FRANKLIN BALANCE SHEET INVESTMENT FUND

YOUR FUND’S EXPENSES

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 5/1/15 | | Value 10/31/15 | | Period* 5/1/15–10/31/15 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 936.40 | $ | 4.78 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.27 | $ | 4.99 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 933.00 | $ | 8.43 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,016.48 | $ | 8.79 |

| R | | | | | | |

| Actual | $ | 1,000 | $ | 935.30 | $ | 6.00 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.00 | $ | 6.26 |

| R6 | | | | | | |

| Actual | $ | 1,000 | $ | 938.40 | $ | 2.54 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,022.58 | $ | 2.65 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 937.50 | $ | 3.57 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.53 | $ | 3.72 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 0.98%;

C: 1.73%; R: 1.23%; R6: 0.52%; and Advisor: 0.73%), multiplied by the average account value over the period, multiplied by 184/365 to reflect

the one-half year period.

franklintempleton.com

Annual Report

|

23

Franklin Large Cap Value Fund

This annual report for Franklin Large Cap Value Fund covers the fiscal year ended October 31, 2015.

Your Fund’s Goal and Main Investments

The Fund seeks long-term capital appreciation by investing at least 80% of its net assets in large capitalization companies that we believe are undervalued. We define large capitalization companies as those with market capitalizations that are similar in size at the time of purchase to those in the Russell 1000® Index.1

Performance Overview

For the 12 months under review, the Fund’s Class A shares had a -3.75% cumulative total return. In comparison, the Russell 1000® Value Index, which measures performance of those Russell 1000® Index companies with lower price-to-book ratios and lower forecasted growth values, generated a +0.53% total return.2 Although this report covers a 12-month period, our investment strategy aims for long-term results. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 27.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Investment Strategy

We seek to invest in securities of large capitalization companies that we believe are selling below their underlying worth and hold them until they reach what we consider their fair value. Our aim is to construct a diversified portfolio of fundamentally sound companies purchased at attractive prices, often when they are out of favor with other investors for reasons we believe are temporary. Portfolio securities are selected without regard to benchmark comparisons and are based on fundamental, bottom-up research focusing on several criteria, such as low price relative to earnings, cash flow or book value. We also consider stocks with recent sharp price declines that we believe still have significant growth potential or that possess valuable intangibles not reflected in the stock price.

1. The Russell 1000 Index is market capitalization weighted and measures performance of the largest companies in the Russell 3000 Index, which represents the majority

of the U.S. market’s total market capitalization.

2. Source: Morningstar.

The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 82.

FRANKLIN LARGE CAP VALUE FUND

Manager’s Discussion

During the 12 months under review, holdings that helped absolute Fund performance included NIKE, Walgreens Boots Alliance and Home Depot. Shares of NIKE, an apparel manufacturer and retailer, rose due to continued strong performance as the company reported solid growth over the past two quarters in gross revenues (on a currency-neutral basis) and in its estimates of future sales. We expect NIKE to experience continued revenue growth based on the company’s innovation and progressive market segmentation. NIKE also increased the automation of its supplier factory base, which we believe should drive margin expansion. Shares of Walgreens, the largest U.S. drug store operator, rose amid the final stages of its integration with Alliance Boots, a multi-national health and beauty group. The stock benefited from positive sentiment around management’s strategic plans to create a global health care company with a consumer-centric beauty focus. Home Depot, a home improvement retailer, experienced better-than-expected earnings due to a housing recovery cycle along with company improvements in its merchandising and distribution network.

Detractors from absolute Fund performance included Alcoa, Ensco and Xerox. Alcoa, a manufacturer and developer of lightweight metals, exceeded revenue expectations, but fears of disruption to aluminum market demand from increased Chinese supply affected its valuation. Shares of Ensco, an operator of offshore drilling rigs, declined due to weaker demand for drilling services associated with depressed oil prices. Nevertheless, in our view Ensco remained one of the better positioned offshore drillers trading at a significant discount to its book value. Shares of Xerox, a business outsourcing services provider, fell due to lower-than-expected earnings attributed to higher costs in implementing health care services contracts.

During the reporting period, we initiated positions including Sanofi, a pharmaceutical provider; Discover Financial Services, a banking and credit services provider; Western Digital, a data storage solutions provider; Albemarle, a commercial chemical producer; BB&T, an insurance, lending and financial services provider; Ralph Lauren, an apparel retailer; Roche Holding, a

| | |

| Top 10 Holdings | | |

| 10/31/15 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| NIKE Inc., B | 2.1 | % |

| Consumer Durables & Apparel | | |

| General Dynamics Corp. | 1.9 | % |

| Capital Goods | | |

| Target Corp. | 1.8 | % |

| Retailing | | |

| CVS Health Corp. | 1.8 | % |

| Food & Staples Retailing | | |

| Aflac Inc. | 1.8 | % |

| Insurance | | |

| Corning Inc. | 1.8 | % |

| Technology Hardware & Equipment | | |

| Citigroup Inc. | 1.8 | % |

| Banks | | |

| Johnson Controls Inc. | 1.7 | % |

| Automobiles & Components | | |

| The Allstate Corp. | 1.7 | % |

| Insurance | | |

| Merck & Co. Inc. | 1.7 | % |

| Pharmaceuticals, Biotechnology & Life Sciences | | |

pharmaceutical and diagnostics research and services provider; Mosaic, an agricultural nutrient provider; SanDisk, a flash storage developer and provider; American Airlines Group, an airline operator; Medtronic, a medical technology provider; and KKR & Co., an asset manager. We also added to some existing positions, including FMC, a chemical solutions and marketing provider; EMC, an information technology provider; First Solar, a solar power provider; and Regions Financial, a lending and financial services provider, among others. In contrast, some of the largest liquidations included 3M Co., a worldwide, diversified industrial and consumer company; Gilead Sciences, a biophar-maceutical company; Chubb, an insurance provider; Progressive, an automotive and residential insurance provider; and the aforementioned Walgreens. We also reduced our holdings in Teva Pharmaceutical Industries, Home Depot, Norfolk Southern and Allstate, among others.

franklintempleton.com

Annual Report

|

25

FRANKLIN LARGE CAP VALUE FUND

As fellow shareholders, we found recent Fund performance disappointing. Although the market has not favored our value investing style in recent years, we have maintained our disciplined process and continue to believe it can reward investors over the long term. Thank you for your continued participation in Franklin Large Cap Value Fund. We look forward to continuing to serve your investment needs.

CFA® is a trademark owned by CFA Institute.

The foregoing information reflects our analysis, opinions and portfolio holdings as of October 31, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

|

26 Annual Report

franklintempleton.com

FRANKLIN LARGE CAP VALUE FUND

Performance Summary as of October 31, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | |

| Net Asset Value | | | | | | |

| Share Class (Symbol) | | 10/31/15 | | 10/31/14 | | Change |

| A (FLVAX) | $ | 17.86 | $ | 18.91 | -$ | 1.05 |

| C (FLCVX) | $ | 17.61 | $ | 18.67 | -$ | 1.06 |

| R (FLCRX) | $ | 17.71 | $ | 18.76 | -$ | 1.05 |

| R6 (FRLGX) | $ | 17.82 | $ | 18.87 | -$ | 1.05 |

| Advisor (N/A) | $ | 17.81 | $ | 18.86 | -$ | 1.05 |

| |

| |

| Distributions1 (11/1/14–10/31/15) | | | | | | |

| | | Dividend | | Long-Term | | |

| Share Class | | Income | | Capital Gain | | Total |

| A | $ | 0.1052 | $ | 0.2390 | $ | 0.3442 |

| C | | — | $ | 0.2390 | $ | 0.2390 |

| R | $ | 0.0621 | $ | 0.2390 | $ | 0.3011 |

| R6 | $ | 0.1895 | $ | 0.2390 | $ | 0.4285 |

| Advisor | $ | 0.1615 | $ | 0.2390 | $ | 0.4005 |

franklintempleton.com

Annual Report

|

27

FRANKLIN LARGE CAP VALUE FUND

PERFORMANCE SUMMARY

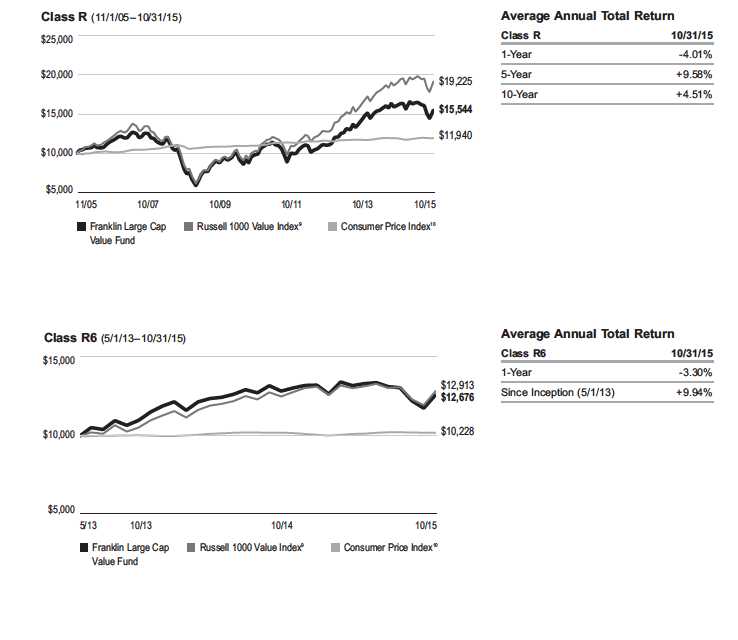

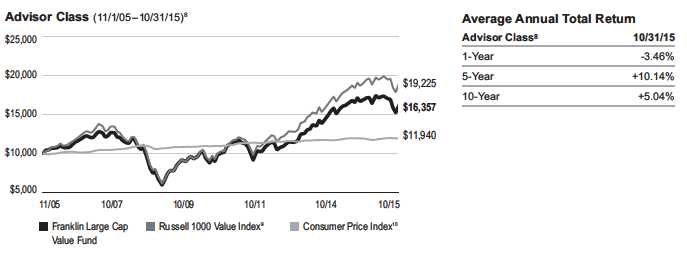

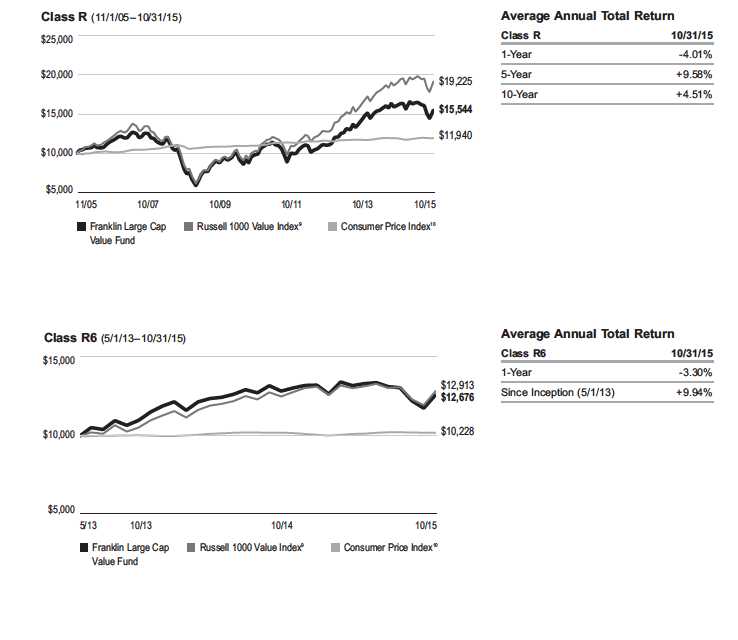

Performance as of 10/31/152

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R/R6/Advisor Class: no sales charges.

| | | | | | | | | | |

| | Cumulative | | Average Annual | | | Value of | Average Annual | | Total Annual | |

| Share Class | Total Return3 | | Total Return4 | | $ | 10,000 Investment5 | Total Return (9/30/15)6 | | Operating Expenses7 | |

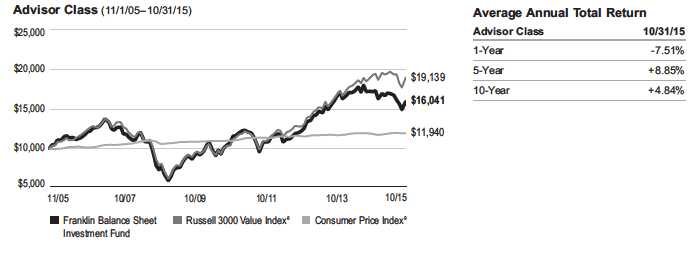

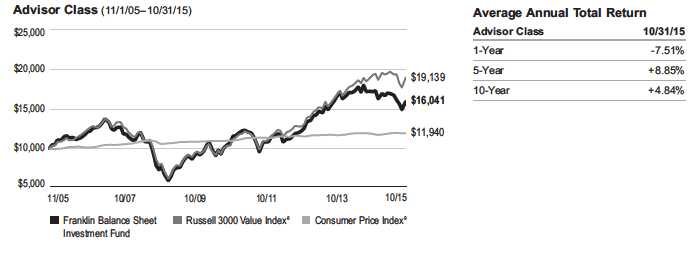

| A | | | | | | | | | 1.30 | % |

| 1-Year | -3.75 | % | -9.27 | % | $ | 9,073 | -14.22 | % | | |

| 5-Year | +59.68 | % | +8.52 | % | $ | 15,048 | +7.64 | % | | |

| 10-Year | +58.65 | % | +4.11 | % | $ | 14,957 | +3.29 | % | | |

| C | | | | | | | | | 2.00 | % |

| 1-Year | -4.42 | % | -5.36 | % | $ | 9,464 | -10.46 | % | | |

| 5-Year | +54.15 | % | +9.04 | % | $ | 15,415 | +8.16 | % | | |

| 10-Year | +47.99 | % | +4.00 | % | $ | 14,799 | +3.19 | % | | |

| R | | | | | | | | | 1.50 | % |

| 1-Year | -4.01 | % | -4.01 | % | $ | 9,599 | -9.16 | % | | |

| 5-Year | +58.01 | % | +9.58 | % | $ | 15,801 | +8.69 | % | | |

| 10-Year | +55.44 | % | +4.51 | % | $ | 15,544 | +3.69 | % | | |

| R6 | | | | | | | | | 0.83 | % |

| 1-Year | -3.30 | % | -3.30 | % | $ | 9,670 | -8.52 | % | | |

| Since Inception (5/1/13) +26.76% | | +9.94 | % | $ | 12,676 | +7.12 | % | | |

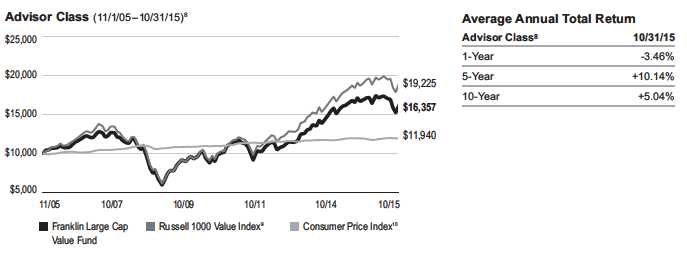

| Advisor8 | | | | | | | | | 1.00 | % |

| 1-Year | -3.46 | % | -3.46 | % | $ | 9,654 | -8.66 | % | | |

| 5-Year | +62.07 | % | +10.14 | % | $ | 16,207 | +9.24 | % | | |

| 10-Year | +63.57 | % | +5.04 | % | $ | 16,357 | +4.23 | % | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

|

28 Annual Report

franklintempleton.com

FRANKLIN LARGE CAP VALUE FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment2

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index

franklintempleton.com

Annual Report

|

29

FRANKLIN LARGE CAP VALUE FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment2 (continued)

|

30 Annual Report

franklintempleton.com

FRANKLIN LARGE CAP VALUE FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment2 (continued)

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. These price movements may result from factors affecting individual companies, industries or the securities market as a whole. The Fund may invest up to 25% of its total assets in foreign securities, which may involve special risks, including currency fluctuations and economic and political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: These shares have higher annual fees and expenses than Class A shares.

Class R: Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares.

Class R6: Shares are available to certain eligible investors as described in the prospectus.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income and

capital gain.

2. The Fund has a fee waiver associated with any investment in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end.

Fund investment results reflect the fee waiver, to the extent applicable; without these reductions, the results would have been lower.

3. Cumulative total return represents the change in value of an investment over the periods indicated.

4. Average annual total return represents the average annual change in value of an investment over the periods indicated.

5. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

6. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

7. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

8. Effective 11/1/05, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the

following methods of calculation: (a) For periods prior to 11/1/05, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s

maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 11/1/05, actual Advisor Class performance is used reflecting

all charges and fees applicable to that class. Since 11/1/05 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were

+63.91% and +5.07%.

9. Source: Morningstar. The Russell 1000 Value Index is market capitalization weighted and measures performance of those Russell 1000 Index companies with lower

price-to-book ratios and lower forecasted growth values.

10. Source: Bureau of Labor Statistics, bls.gov/cpi. The Consumer Price Index is a commonly used measure of the inflation rate.

See www.franklintempletondatasources.com for additional data provider information.

franklintempleton.com

Annual Report

|

31

FRANKLIN LARGE CAP VALUE FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribu- tion and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

|

32 Annual Report

franklintempleton.com

FRANKLIN LARGE CAP VALUE FUND

YOUR FUND’S EXPENSES

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 5/1/15 | | Value 10/31/15 | | Period* 5/1/15–10/31/15 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 944.50 | $ | 6.62 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.40 | $ | 6.87 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 940.70 | $ | 10.17 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,014.72 | $ | 10.56 |

| R | | | | | | |

| Actual | $ | 1,000 | $ | 943.00 | $ | 7.74 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,017.24 | $ | 8.03 |

| R6 | | | | | | |

| Actual | $ | 1,000 | $ | 946.90 | $ | 4.22 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.87 | $ | 4.38 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 945.80 | $ | 5.30 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.76 | $ | 5.50 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.35%;

C: 2.08%; R: 1.58%; R6: 0.86%; and Advisor: 1.08%), multiplied by the average account value over the period, multiplied by 184/365 to reflect

the one-half year period.

franklintempleton.com

Annual Report

|

33

Franklin MicroCap Value Fund

This annual report for the Franklin MicroCap Value Fund covers the fiscal year ended October 31, 2015. The Fund closed to new investors (with the exception of certain retirement accounts) in January 2004 and has remained closed except for two days in mid-February 2013, when we opened the Fund on a limited basis. Existing shareholders may add to or reduce their investments in the Fund; however, once an account is reduced to zero, it may not be reopened unless the Fund reopens.

Your Fund’s Goal and Main Investments

The Fund seeks high total return, of which capital appreciation and income are components, by investing at least 80% of its net assets in securities of companies with market capitalizations under $500 million at the time of purchase that we believe are undervalued in the marketplace.1

Performance Overview

For the 12 months under review, the Fund’s Class A shares had a -8.58% cumulative total return. In comparison, the Russell 2000® Value Index, which measures performance of those Russell 2000® Index companies with lower price-to-book ratios and lower forecasted growth values, had a -2.88% total return.2 Although this report covers a 12-month period, our investment strategy aims for long-term results. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 37.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Investment Strategy

Our strategy is to buy shares of financially sound, well-established companies at a low price-to-book value, where we have reasonable confidence that book value will increase over several years. We limit purchases to companies with market capitalizations of less than $500 million, which we define as “microcap.”1 Book value per share is a company’s

1. Effective 12/10/12, the maximum market capitalization for each investment that the Fund can invest in increased from $400 million at time of purchase to $500 million.

2. Source: Morningstar.

The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 88.

FRANKLIN MICROCAP VALUE FUND

| | |

| Top 10 Holdings | | |

| 10/31/15 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| Seneca Foods Corp., A & B | 4.6 | % |

| Food, Beverage & Tobacco | | |

| Omega Protein Corp. | 3.8 | % |

| Food, Beverage & Tobacco | | |

| Gibraltar Industries Inc. | 3.6 | % |

| Building Products | | |

| Healthcare Services Group Inc. | 3.3 | % |

| Commercial & Professional Services | | |

| Delta Apparel Inc. | 3.1 | % |

| Consumer Durables & Apparel | | |

| Hurco Cos. Inc | 2.9 | % |

| Machinery | | |

| Hardinge Inc. | 2.6 | % |

| Machinery | | |

| Miller Industries Inc. | 2.3 | % |

| Machinery | | |

| Bar Harbor Bankshares | 2.3 | % |

| Banks | | |

| PHI Inc. | 2.3 | % |

| Energy | | |

net worth or shareholders’ equity on an accounting or “book” basis, divided by shares outstanding. This strategy is not aimed at short-term trading gains, nor do we consider the composition of any index. Rather, we try to identify individual companies that meet our investment criteria, and we assume at purchase that we will hold the positions for several years.

Manager’s Discussion

During the 12 months under review, holdings that helped absolute Fund performance included Gibraltar Industries, Delta Apparel and John B. Sanfilippo & Sons. Gibraltar Industries, a manufacturer of building and infrastructure products, reported earnings gains from a recent acquisition and from programs to improve plant-level operations. The company’s new management’s efforts led to sharply better operating results. Delta

Apparel, an apparel designer and retailer, divested a non-core segment, reported recovering margins after several quarters of poor results and announced a share repurchase authorization. John B. Sanfilippo & Sons, a nut and snack items producer, reported better-than-expected earnings despite experiencing higher costs for certain ingredients.

Detractors from absolute Fund performance included PHI, International Shipholding and Global Power Equipment. PHI provides helicopter transportation to the offshore energy industry and air medical services. Lower energy prices led PHI’s customers to cancel or delay capital projects, which reduced flight hours and revenue for PHI. International Shipholding specializes in “niche” marine transportation services, such as the Jones Act, rail ferry and trans-ocean auto cargos. Depressed freight rates and equipment outages in 2015 impaired the company’s cash flows enough to raise credit concerns. Global Power Equipment Group makes equipment and offers engineering services for the power generation industry. In May, the company had to delay filing quarterly results and said it will restate prior results because of accounting errors and in August disclosed the loss of a long-term contract with a large customer.

During the reporting period, we initiated positions in Alaska Communications Systems Group, a telecommunications provider; Renewable Energy Group, a biodiesel producer; Golden Entertainment, a casino operator; County Bancorp, a community bank; and Friedman Industries, a steel service center and pipe manufacturer. We added to existing positions in Sterling Construction, a heavy civil construction contractor; Leapfrog Enterprises, a child-focused educational technology developer; and the aforementioned Global Power Equipment Group; among others. We exited positions in P.A.M. Transportation, RTI International Metals, Frisch’s Restaurants, Saia, Griffon, Kimball International, and Callaway Golf. We reduced positions in Omega Protein, Healthcare Services Group, Lydall, Seneca Foods, Origen Financial, Dixie Group and the aforementioned Delta Apparel and John B. Sanfilippo & Sons.

franklintempleton.com

Annual Report

|

35

FRANKLIN MICROCAP VALUE FUND

As fellow shareholders, we found recent Fund performance disappointing. Although the market has not favored our value investing style in recent years, we have maintained our disciplined process and continue to believe it can reward investors over the long term. Thank you for your continued participation in Franklin MicroCap Value Fund. We look forward to continuing to serve your investment needs.

Bruce C. Baughman, CPA

Lead Portfolio Manager

Donald G. Taylor, CPA

Portfolio Management Team

The foregoing information reflects our analysis, opinions and portfolio holdings as of October 31, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

|

36 Annual Report

franklintempleton.com

FRANKLIN MICROCAP VALUE FUND

Performance Summary as of October 31, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | |

| Net Asset Value | | | | | | |

| Share Class (Symbol) | | 10/31/15 | | 10/31/14 | | Change |

| A (FRMCX) | $ | 32.90 | $ | 39.88 | -$ | 6.98 |

| R6 (FMCVX) | $ | 33.09 | $ | 39.94 | -$ | 6.85 |

| Advisor (FVRMX) | $ | 33.00 | $ | 39.90 | -$ | 6.90 |

| |

| |

| Distributions1 (11/1/14–10/31/15) | | | | | | |

| | | Short-Term | | Long-Term | | |

| Share Class | | Capital Gain | | Capital Gain | | Total |

| A | $ | 0.0742 | $ | 3.5793 | $ | 3.6535 |

| R6 | $ | 0.0742 | $ | 3.5793 | $ | 3.6535 |

| Advisor | $ | 0.0742 | $ | 3.5793 | $ | 3.6535 |

franklintempleton.com

Annual Report

|

37

FRANKLIN MICROCAP VALUE FUND

PERFORMANCE SUMMARY

Performance as of 10/31/152

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class R6/Advisor Class: no sales charges.

| | | | | | | | | | | | |

| | | | | | | | | | Total Annual Operating Expenses7 | |

| | Cumulative | | Average Annual | | | Value of | Average Annual | | | | | |

| Share Class | Total Return3 | | Total Return4 | | $ | 10,000 Investment5 | Total Return (9/30/15)6 | | (with waiver) | | (without waiver) | |

| A | | | | | | | | | 1.16 | % | 1.18 | % |

| 1-Year | -8.58 | % | -13.83 | % | $ | 8,617 | -14.50 | % | | | | |

| 5-Year | +65.40 | % | +9.29 | % | $ | 15,589 | +8.71 | % | | | | |

| 10-Year | +92.88 | % | +6.16 | % | $ | 18,178 | +5.46 | % | | | | |

| R6 | | | | | | | | | 0.79 | % | 0.81 | % |

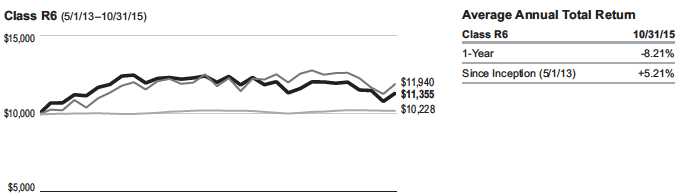

| 1-Year | -8.21 | % | -8.21 | % | $ | 9,179 | -8.93 | % | | | | |

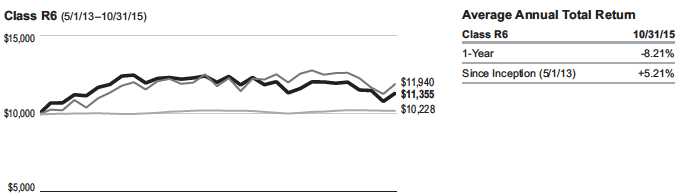

| Since Inception (5/1/13) +13.55% | | +5.21 | % | $ | 11,355 | +3.34 | % | | | | |

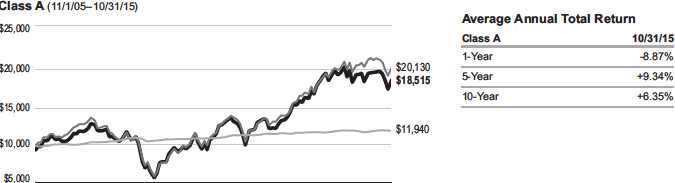

| Advisor8 | | | | | | | | | 0.92 | % | 0.94 | % |

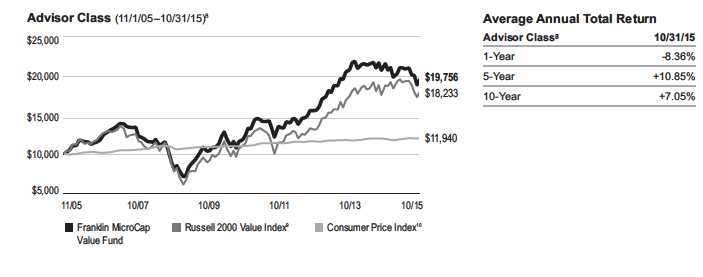

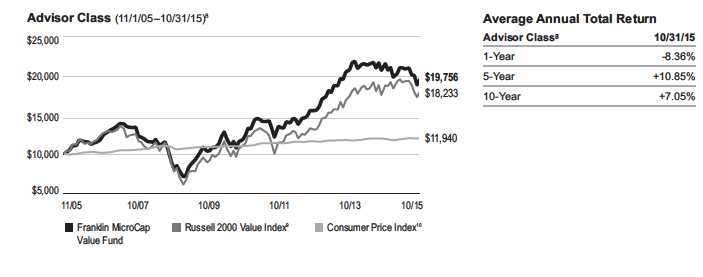

| 1-Year | -8.36 | % | -8.36 | % | $ | 9,164 | -9.05 | % | | | | |

| 5-Year | +67.36 | % | +10.85 | % | $ | 16,736 | +10.28 | % | | | | |

| 10-Year | +97.56 | % | +7.05 | % | $ | 19,756 | +6.35 | % | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

|

38 Annual Report

franklintempleton.com

FRANKLIN MICROCAP VALUE FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment2

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

franklintempleton.com

Annual Report

|

39

FRANKLIN MICROCAP VALUE FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment2 (continued)

All investments involve risks, including possible loss of principal. The Fund’s ability to invest in smaller company securities that may have limited liquidity involves additional risks, such as relatively small revenues, limited product lines and small market share. Historically, these stocks have exhibited greater price volatility than larger company stocks, especially over the short term. In addition, the Fund may invest up to 25% of its total assets in foreign securities, which involve special risks, including currency fluctuations and economic and political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class R6: Shares are available to certain eligible investors as described in the prospectus.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income and

capital gain.

2. The Fund has a fee waiver associated with any investment in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end.

Fund investment results reflect the fee waiver, to the extent applicable; without this reduction, the results would have been lower.

3. Cumulative total return represents the change in value of an investment over the periods indicated.

4. Average annual total return represents the average annual change in value of an investment over the periods indicated.

5. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

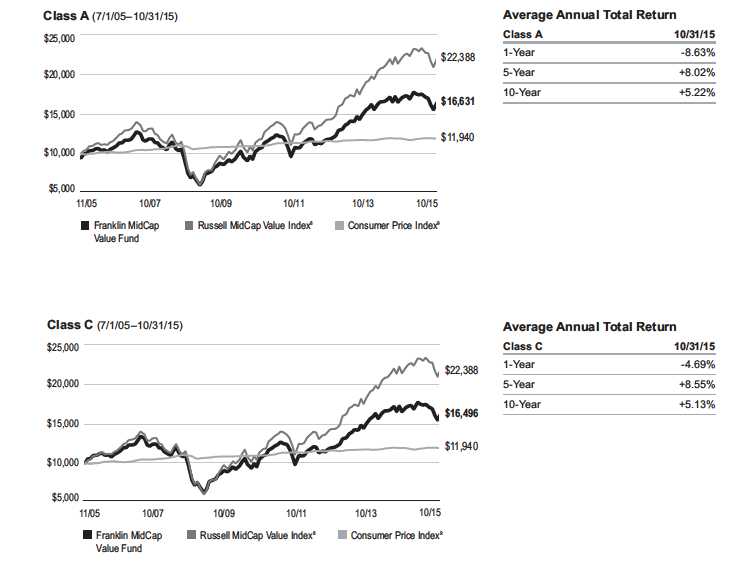

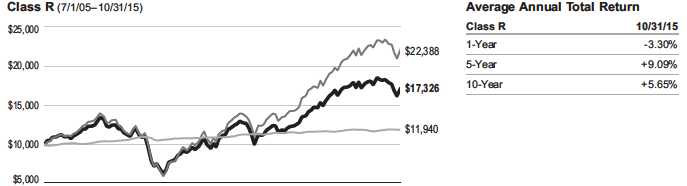

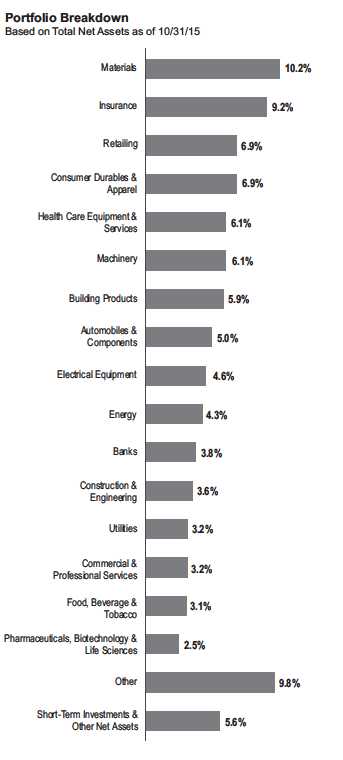

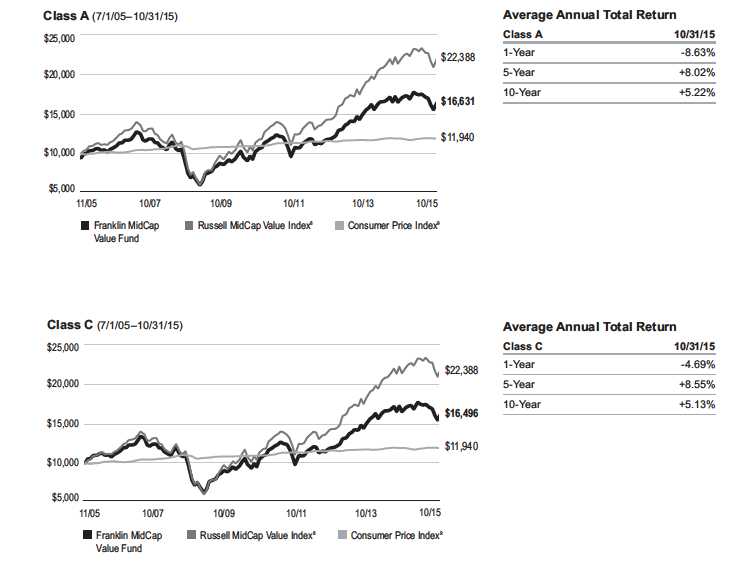

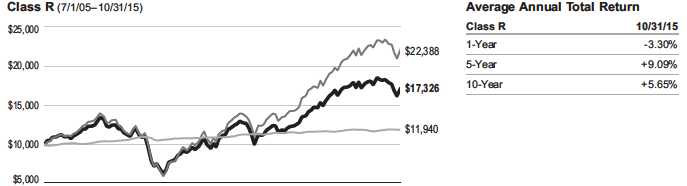

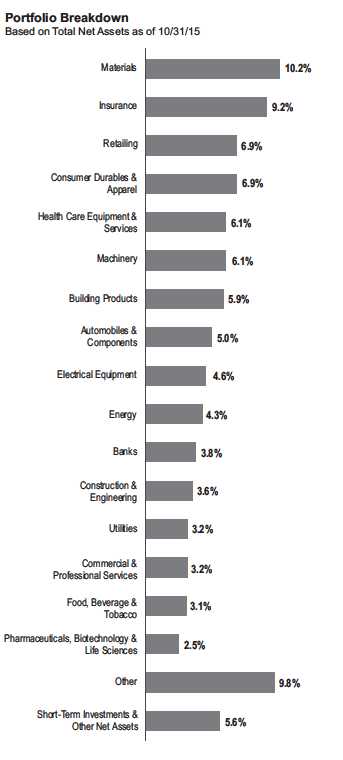

6. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.