| |

|

|

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811- 5979 |

|

| John Hancock California Tax-Free Income Fund |

| (Exact name of registrant as specified in charter) |

| |

| 601 Congress Street, Boston, Massachusetts 02210 |

| (Address of principal executive offices) (Zip code) |

|

| Alfred P. Ouellette |

| Senior Counsel and Assistant Secretary |

| |

| 601 Congress Street |

| |

| Boston, Massachusetts 02210 |

| |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: 617-663-4324 |

| |

| |

| Date of fiscal year end: | August 31 |

| |

| |

| Date of reporting period: | August 31, 2008 |

ITEM 1. REPORT TO SHAREHOLDERS.

Discussion of Fund performance

By MFC Global Investment Management (U.S.), LLC

Municipal bonds weathered a difficult environment to post positive results for the year ended August 31, 2008. Mortgage-related losses led to credit rating downgrades for municipal bond insurers. The ensuing credit concerns, along with an exodus of non-traditional municipal investors such as hedge funds, led to a sell-off in the municipal market in early 2008. However, municipal bonds enjoyed a recovery during the last six months of the period. California has been hit particularly hard by the U.S. economic slowdown, leading to a sizable budget deficit. The state is currently operating without a budget as the governor and legislature struggle to resolve the deficit problem.

Fund performance

For the year ended August 31, 2008, John Hancock California Tax-Free Income Fund’s Class A, Class B and Class C shares posted total returns of 2.18%, 1.31% and 1.31%, respectively, at net asset value. By comparison, Morningstar’s muni California long fund category produced an average return of 1.33%, while the Lehman Brothers Municipal Bond Index returned 4.48%.

“Municipal bonds weathered a

difficult environment to post

positive results for the year ended

August 31, 2008.”

The key behind the Fund’s outperformance of its Morningstar peer group average was its higher credit quality. With credit spreads — the difference between the yields of higher-and lower-quality bonds — widening significantly during the period, the portfolio’s emphasis on higher-quality securities enhanced results relative to its peer group. Another favorable factor was individual security selection, particularly among lower-quality bonds. Our focus on fundamental credit research and comprehensive analysis was rewarded as our lower-quality holdings held up well in a difficult environment for lower-rated investments.

Bonds that finance essential services, such as water and sewer, were among the better performers in the portfolio for the 12-month period, along with education and general obligation bonds. The weakest performers were tobacco bonds, which suffered the most from the hedge-fund selling.

This commentary reflects the views of the portfolio managers through the end of the Fund’s period discussed in this report. The managers’ statements reflect their own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Past performance is no guarantee of future results.

Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| |

| 6 | California Tax-Free Income Fund | Annual report |

A look at performance

For the periods ended August 31, 2008

| | | | | | | | | | | | | |

| | | | Average annual returns (%) | | | Cumulative total returns (%) | | | |

| | | | with maximum sales charge (POP) | | with maximum sales charge (POP) | | | SEC 30- |

| | |

| |

| | day yield |

| | Inception | | | | | Since | | | | | Since | | (%) as of |

| Class | date | | 1-year | 5-year | 10-year | inception | | 1-year | 5-year | 10-year | inception | | 8-31-08 |

|

| A | 12-29-89 | | –2.42 | 3.17 | 3.59 | — | | –2.42 | 16.91 | 42.25 | — | | 4.66 |

|

| B | 12-31-91 | | –3.57 | 2.90 | 3.40 | — | | –3.57 | 15.39 | 39.68 | — | | 4.13 |

|

| C | 4-1-99 | | 0.33 | 3.25 | — | 3.16 | | 0.33 | 17.34 | — | 34.06 | | 4.12 |

|

Performance figures assume all distributions are reinvested. Public offering price (POP) figures reflect maximum sales charges on Class A shares of 4.5% and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The returns for Class C shares have been adjusted to reflect the elimination of the front-end sales charge effective July 15, 2004. The Class B shares’ CDSC declines annually between years 1 to 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC.

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The net expenses equal the gross expenses and are as follows: Class A — 0.81%, Class B — 1.66%, Class C — 1.66%.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For current to the most recent month end performance data, please call 1-800-225-5291 or visit the Fund’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Please note that a portion of the Fund’s income may be subject to taxes, and some investors may be subject to the Alternative Minimum Tax (AMT). Also note that capital gains are taxable.

The Fund’s performance results reflect any applicable expense reductions, without which the expenses would increase and results would have been less favorable.

| |

| Annual report | California Tax-Free Income Fund | 7 |

A look at performance

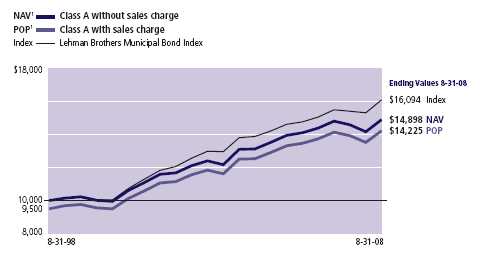

Growth of $10,000

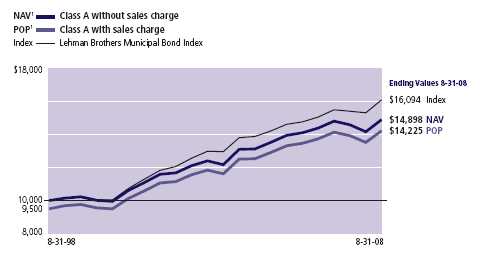

This chart shows what happened to a hypothetical $10,000 investment in California Tax-Free Income Fund Class A shares for the period indicated. For comparison, we’ve shown the same investment in the Lehman Brothers Municipal Bond Index.

| | | | |

| | | | With maximum | |

| Class | Period beginning | Without sales charge | sales charge | Index |

|

| B2 | 8-31-98 | $13,968 | $13,968 | $16,094 |

|

| C2 | 4-1-99 | 13,406 | 13,406 | 15,662 |

|

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Fund’s Class B and Class C shares, respectively, as of August 31, 2008. The Class C shares investment with maximum sales charge has been adjusted to reflect the elimination of the front-end sales charge effective July 15, 2004. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

Lehman Brothers Municipal Bond Index is an unmanaged index that includes municipal bonds and is commonly used as a measure of bond performance.

It is not possible to invest directly in an index. Index figures do not reflect sales charges, which would have resulted in lower values if they did.

1 NAV represents net asset value and POP represents public offering price.

2 No contingent deferred sales charge applicable.

| |

| 8 | California Tax-Free Income Fund | Annual report |

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

■ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■ Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on March 1, 2008 with the same investment held until August 31, 2008.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 3-1-08 | on 8-31-08 | period ended 8-31-081 |

|

| Class A | $1,000.00 | $1,052.20 | $4.23 |

|

| Class B | 1,000.00 | $1,047.70 | 8.60 |

|

| Class C | 1,000.00 | $1,047.70 | 8.60 |

|

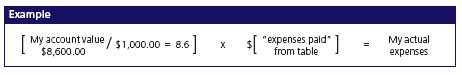

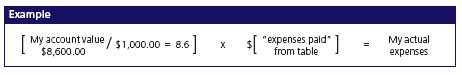

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at August 31, 2008, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

| |

| Annual report | California Tax-Free Income Fund | 9 |

Your expenses

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on March 1, 2008, with the same investment held until August 31, 2008. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 3-1-08 | on 8-31-08 | period ended 8-31-081 |

|

| Class A | $1,000.00 | $1,021.00 | $4.17 |

|

| Class B | 1,000.00 | 1,016.70 | 8.47 |

|

| Class C | 1,000.00 | 1,016.70 | 8.47 |

|

Remember, these examples do not include any transaction costs, such as sales charges; therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 0.82%, 1.67% and 1.67% for Class A, Class B and Class C, respectively, multiplied by the average account value over the period, multiplied by number of days in most recent fiscal half-year/366 (to reflect the one-half year period).

| |

| 10 | California Tax-Free Income Fund | Annual report |

Portfolio summary

| |

| Top 10 holdings1 | |

|

| Santa Ana Financing Auth., 7-1-24, 6.250% | 3.6% |

|

| San Bernardino, County of, 8-1-17, 5.500% | 3.0% |

|

| Golden State Tobacco Securitization Corp., 6-1-35, 5.000% | 2.9% |

|

| Puerto Rico Aqueduct & Sewer Auth., 7-1-11, 7.470% | 2.8% |

|

| California, State of, 3-1-16, 6.615% | 2.2% |

|

| New Haven Unified School District, 8-1-22, Zero | 2.1% |

|

| Puerto Rico, Commonwealth of, 7-1-15, 6.500% | 2.1% |

|

| Santa Clara County Financing Auth., 5-15-17, 5.500% | 2.0% |

|

| California, State of, 4-1-29, 4.750% | 1.9% |

|

| Puerto Rico Ind’l., Tourist, Ed’l. Med. & | |

| Environmental Control Facilities Financing Auth., 7-1-18, 7.920% | 1.8% |

|

| | | | |

| Sector distribution1,2 | | | | |

|

| General Obligation Bonds | 16% | | Leasing Contracts | 3% |

| |

|

| Revenue Bonds | | | Education | 2% |

| |

|

| Transportation | 8% | | Electric | 2% |

| |

|

| Correctional Facilities | 8% | | Economic Development | 2% |

| |

|

| Health | 8% | | Pollution | 1% |

| |

|

| Special Tax | 7% | | Other Revenue bonds | 27% |

| |

|

| Water and Sewer | 6% | | Short-term investments | |

| | & other | 1% |

| Tobacco | 5% | |

|

| | | |

| Tax Allocation | 4% | | | |

| | |

1 As a percentage of net assets on August 31, 2008.

2 Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| |

| Annual report | California Tax-Free Income Fund | 11 |

F I N A N C I A L S T A T E M E N T S

Fund’s investments

Securities owned by the Fund on 8-31-08

This schedule is divided into two main categories: tax-exempt long-term bonds and short-term investments. Tax-exempt long-term bonds are broken down by state or territory. Under each state or territory is a list of securities owned by the Fund. Short-term investments, which represent the Fund’s cash position, are listed last.

| | | | | | |

| | Interest | | Maturity | Credit | Par value | |

| State, issuer, description | rate | | date | rating (A) | (000) | Value |

| |

| Tax-exempt long-term bonds 99.00% | | | | | $314,317,122 |

|

| (Cost $306,901,838) | | | | | | |

| | | | | | | |

| California 89.60% | | | | | | 284,475,627 |

|

| ABAG Finance Auth. for Nonprofit Corps | | | | | | |

| Health Fac Rev Inst. on Aging | 5.650% | | 08-15-38 | A+ | $1,000 | 997,110 |

| Rev San Diego Hosp Assn Ser 2001A | 6.125 | | 08-15-20 | A– | 2,000 | 2,055,320 |

|

| Anaheim, City of, | | | | | | |

| Rev Ref Cert of Part Reg | | | | | | |

| Convention Ctr (D)(P) | 6.133 | | 07-16-23 | AA | 2,000 | 2,050,160 |

|

| Anaheim Public Financing Auth., | | | | | | |

| Rev Lease Cap Apprec Sub Pub Imp | | | | | | |

| Proj Ser 1997C (D) | Zero | | 09-01-18 | AAA | 3,000 | 1,915,020 |

|

| Antioch Pub. Financing Auth. | | | | | | |

| Reassmt. Rev., Sub. Ser. B (G) | 5.850 | | 09-02-15 | BB+ | 1,375 | 1,406,487 |

|

| Antioch Public Financing Auth., | | | | | | |

| Rev Ref Reassessment Sub | | | | | | |

| Ser 1998B (G) | 5.500 | | 04-01-43 | AA | 5,000 | 5,218,550 |

|

| Bay Area Toll Auth., | | | | | | |

| Rev Ref Toll Bridge Ser 2007F | 5.000 | | 04-01-31 | AA | 5,000 | 5,062,450 |

|

| Belmont Community Facilities District, | | | | | | |

| Rev Special Tax Dist No. 2000-1 | | | | | | |

| Library Proj Ser 2004A (D) | 5.750 | | 08-01-24 | Aa3 | 1,000 | 1,126,350 |

|

| California Statewide Communities | | | | | | |

| Develop Auth., | | | | | | |

| CHF Irvine LLC UCI East Campus | 5.750 | | 05-15-32 | BAA2 | 1,230 | 1,212,657 |

| Rev Ref Sr Living Presbyterian | | | | | | |

| Homes Ser 2006A | 4.875 | | 11-15-36 | BBB+ | 2,000 | 1,648,740 |

|

| California County Tobacco Securitization | | | | | | |

| Agency, Rev Asset Backed Bond Fresno | | | | | | |

| County Fdg Corp | 6.000 | | 06-01-35 | BBB | 1,765 | 1,588,835 |

| Rev Asset Backed Bond Kern County | | | | | | |

| Corp Ser 2002A | 6.125 | | 06-01-43 | BBB | 5,000 | 4,542,400 |

| Rev Asset Backed Bond Stanislaus | | | | | | |

| Fdg Ser 2002A | 5.500 | | 06-01-33 | Baa3 | 1,000 | 890,530 |

| Rev Asset Backed Bond Los Angeles | | | | | | |

| County (Zero to 12-1-10 | | | | | | |

| then 5.250%) | Zero | | 06-01-21 | Baa3 | 5,000 | 3,816,900 |

See notes to financial statements

| |

| 12 | California Tax-Free Income Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

| | | | | | |

| | Interest | | Maturity | Credit | Par value | |

| State, issuer, description | rate | | date | rating (A) | (000) | Value |

| | | | | | | |

| California (continued) | | | | | | |

|

| California Department of Water Resources, | | | | | | |

| Rev Pwr Supply Ser 2002A | 5.375% | | 05-01-21 | A | $4,000 | $4,447,920 |

| Rev Pwr Supply Ser 2008H (D) | 5.000 | | 05-01-22 | AAA | 5,000 | 5,250,050 |

|

| California Educational Facilities Auth., | | | | | | |

| Rev College & Univ Proj | 5.000 | | 02-01-26 | Baa3 | 4,525 | 4,076,075 |

| Rev Ref Pooled College & Univ | | | | | | |

| Financing Ser 1993B | 6.125 | | 06-01-09 | Baa2 | 5 | 5,018 |

| Rev Univ of San Diego Ser 2002A | 5.500 | | 10-01-32 | A2 | 1,435 | 1,475,582 |

| Rev Ref Woodbury Univ | 5.000 | | 01-01-25 | BBB– | 1,800 | 1,638,504 |

| Rev Ref Woodbury Univ | 5.000 | | 01-01-30 | BBB– | 2,000 | 1,732,800 |

|

| California Statewide Financing Auth., | | | | | | |

| Rev Tobacco Settlement Asset | | | | | | |

| Backed Bond 2002A | 6.000 | | 05-01-37 | Baa3 | 2,500 | 2,244,500 |

| Rev Tobacco Settlement Asset | | | | | | |

| Backed Bond 2002B | 6.000 | | 05-01-37 | Baa3 | 4,000 | 3,591,200 |

|

| California, State of, | | | | | | |

| GO Ref Daily Kindergarten | | | | | | |

| Univ. Ser A–4 (V) | 2.240 | | 05-01-34 | AA | 810 | 810,000 |

| GO Unltd (D) | 4.750 | | 04-01-29 | AAA | 6,000 | 5,999,760 |

| GO Unltd (D)(G) | 6.615 | | 03-01-16 | AA | 6,255 | 7,061,269 |

| GO Unltd | 5.125 | | 04-01-23 | A+ | 2,000 | 2,044,220 |

| GO Unltd | 5.125 | | 11-01-24 | A+ | 3,500 | 3,560,935 |

|

| California Health Facilities Financing Auth., | | | | | | |

| Rev Catholic Health Care West | | | | | | |

| Ser 2004G | 5.250 | | 07-01-23 | A | 1,000 | 996,360 |

| Rev Kaiser Permanente Ser. A | 5.250 | | 04-01-39 | A+ | 2,500 | 2,444,025 |

|

| California Infrastructure & | | | | | | |

| Economic Development | | | | | | |

| Rev J David Gladstone Inst Proj | 5.250 | | 10-01-34 | A– | 1,000 | 1,000,310 |

| Rev Kaiser Hosp Asst I LLC | | | | | | |

| Ser 2001A | 5.550 | | 08-01-31 | A+ | 3,000 | 3,016,260 |

| Rev Performing Arts Center | 5.000 | | 12-01-27 | A | 500 | 508,115 |

|

| California Municipal Finance Auth., | | | | | | |

| Rev Ref American Heritage Education | | | | | | |

| Foundation Proj 2006A | 5.250 | | 06-01-26 | BBB– | 1,000 | 912,550 |

|

| California Pollution Control Financing | | | | | | |

| Auth., | | | | | | |

| Rev Poll Control Pacific Gas & Electric | | | | | | |

| Ser 1996A (D) | 5.350 | | 12-01-16 | AA | 1,000 | 1,010,350 |

| Rev Solid Waste Disposal Keller | | | | | | |

| Canyon Landfill Co Proj | 6.875 | | 11-01-27 | BB– | 2,000 | 1,973,360 |

| Rev Solid Waste Disp Mgmt Inc | | | | | | |

| Proj Ser 2005C | 5.125 | | 11-01-23 | BBB | 2,000 | 1,720,580 |

|

| California State Public Works Board, | | | | | | |

| Rev Lease Dept of Corrections | | | | | | |

| Ser 2003C | 5.500 | | 06-01-18 | A | 5,000 | 5,346,850 |

| Rev Ref Lease Dept of Corrections | | | | | | |

| State Prisons Ser 1993A (D) | 5.000 | | 12-01-19 | AA | 5,000 | 5,208,450 |

|

| California Statewide Cmmtys. Dev. | | | | | | |

| Auth. Rev., | | | | | | |

| Thomas Jefferson Sch. Law Ser. A | 7.250 | | 10-01-38 | BB+ | 2,000 | 1,938,100 |

See notes to financial statements

| |

| Annual report | California Tax-Free Income Fund | 13 |

F I N A N C I A L S T A T E M E N T S

| | | | | | |

| | Interest | | Maturity | Credit | Par value | |

| State, issuer, description | rate | | date | rating (A) | (000) | Value |

| | | | | | | |

| California (continued) | | | | | | |

|

| California State University, | | | | | | |

| Rev Ref Systemwide Ser 2005C (D) | 5.000% | | 11-01-38 | AA | $5,000 | $4,961,150 |

|

| Capistrano Unified School District, | | | | | | |

| Rev Spec Tax Cmty Facil Dist No. | | | | | | |

| 90 2 (G) | 6.000 | | 09-01-33 | BB | 750 | 752,888 |

| Rev Spec Tax Cmty Facil Dist No. | | | | | | |

| 90 2 (G) | 5.875 | | 09-01-23 | BB | 500 | 502,900 |

| Rev Spec Tax Cmty Facil Dist No. | | | | | | |

| 98 2 (G) | 5.750 | | 09-01-29 | AA | 2,470 | 2,616,397 |

|

| Center Unified School District, | | | | | | |

| GO Unltd Ref Cap Apprec | | | | | | |

| Ser 1997C (D) | Zero | | 09-01-16 | AA | 2,145 | 1,519,883 |

|

| Chula Vista Industrial Development Auth., | | | | | | |

| Rev Ref Tax Alloc Bayfront | | | | | | |

| Ser 2006B (G) | 5.250 | | 10-01-27 | BB+ | 1,250 | 1,142,900 |

|

| Cloverdale Community | | | | | | |

| Development Agency, | | | | | | |

| Rev Tax Allocation Redev Proj (G) | 5.500 | | 09-01-38 | BB+ | 3,000 | 2,641,830 |

|

| Contra Costa County Public | | | | | | |

| Financing Auth., | | | | | | |

| Rev Ref Lease Various Cap Facil | | | | | | |

| Ser 1999 A (D) | 5.000 | | 06-01-28 | AA | 1,770 | 1,831,649 |

| Rev Ref Lease Various Cap Facil | | | | | | |

| Ser 1999 A (D) | 5.000 | | 06-01-28 | AA | 1,230 | 1,231,156 |

|

| Corona Community Facilities District, | | | | | | |

| Rev Special Tax Escrow 97-2 (G) | 5.875 | | 09-01-23 | BB+ | 1,255 | 1,256,983 |

|

| East Side Unified High School District, | | | | | | |

| Santa Clara County, | | | | | | |

| GO Ultd Ref 2012 (D) | 5.250 | | 09-01-24 | AAA | 2,500 | 2,769,700 |

|

| Folsom Public Financing Auth., | | | | | | |

| Rev Ref Sub Bond Ser 2007B (G) | 5.125 | | 09-01-26 | BB | 1,000 | 870,640 |

|

| Foothill/Eastern Transportation Corridor | | | | | | |

| Agency, | | | | | | |

| Rev Ref Toll Rd Cap Apprec | Zero | | 01-15-25 | BBB– | 6,615 | 2,316,639 |

| Rev Ref Toll Rd Cap Apprec | Zero | | 01-15-36 | BBB– | 30,000 | 4,885,800 |

|

| Fresno Joint Powers Financing Auth., | | | | | | |

| Rev Ref Ser 1994A (G) | 6.550 | | 09-02-12 | A+ | 200 | 200,396 |

|

| Fresno, City of, | | | | | | |

| Rev Swr Ser A 1 (D) | 5.250 | | 09-01-19 | AA | 1,000 | 1,066,970 |

|

| Fullerton Community Facilities District, | | | | | | |

| Rev Spec Tax Amerige Heights Dist | | | | | | |

| No. 1 (G) | 6.200 | | 09-01-32 | BB | 1,000 | 1,011,980 |

|

| Golden State Tobacco Securitization Corp, | | | | | | |

| Rev Asset Backed Bond Ser 2003A | 6.250 | | 06-01-33 | AAA | 2,760 | 3,007,627 |

| Rev Asset Backed Bond Ser 2005A (D) | 5.000 | | 06-01-35 | A | 10,000 | 9,133,500 |

|

| Imperial Irrigation Dist, | | | | | | |

| Elec Rev Ref Sys | 5.000 | | 11-01-33 | A+ | 2,500 | 2,468,100 |

|

| Inglewood Unified School District Facilities | | | | | | |

| Financing Auth., | | | | | | |

| Rev Ref Bond (D) | 5.250 | | 10-15-26 | AAA | 5,000 | 5,383,050 |

See notes to financial statements

| |

| 14 | California Tax-Free Income Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

| | | | | | |

| | Interest | | Maturity | Credit | Par value | |

| State, issuer, description | rate | | date | rating (A) | (000) | Value |

| | | | | | | |

| California (continued) | | | | | | |

|

| Irvine, City of, | | | | | | |

| Rev Meadows Mobile Home Park | | | | | | |

| Ser 1998A (G) | 5.700% | | 03-01-28 | BBB– | $3,975 | $3,976,113 |

|

| Laguna Salada Union School District, | | | | | | |

| GO Unltd Ser 2000C (D) | Zero | | 08-01-26 | A | 1,000 | 394,350 |

|

| Lancaster School District, | | | | | | |

| Rev Ref Cert of Part Cap Apprec (D) | Zero | | 04-01-19 | AAA | 1,730 | 1,073,032 |

| Rev Ref Cert of Part Cap Apprec (D) | Zero | | 04-01-22 | AAA | 1,380 | 709,141 |

|

| Lee Lake Water District, | | | | | | |

| Rev Spec Tax Cmty Facil Dist No. | | | | | | |

| 2 Montecito Ranch (G) | 6.125 | | 09-01-27 | BB | 1,200 | 1,146,888 |

|

| Long Beach, City of, | | | | | | |

| Rev Ref Harbor Ser 1998A (D) | 6.000 | | 05-15-18 | AA | 2,660 | 2,888,654 |

| Rev Spec Tax Cmty Facil Dist No. | | | | | | |

| 6 Pike (G) | 6.250 | | 10-01-26 | BB– | 2,500 | 2,519,500 |

|

| Los Angeles Community | | | | | | |

| Facilities District, | | | | | | |

| Rev Spec Tax No. 3 Cascades | | | | | | |

| Business Park Proj (G) | 6.400 | | 09-01-22 | BB+ | 655 | 658,223 |

|

| Los Angeles Unified School District, | | | | | | |

| GO Unltd Elecfion of 1997 | | | | | | |

| Ser 2002E (D) | 5.500 | | 07-01-17 | AA | 1,500 | 1,666,590 |

|

| Millbrae, City of, | | | | | | |

| Rev Magnolia of Millbrae Proj | | | | | | |

| Ser 1997A (G) | 7.375 | | 09-01-27 | BB | 2,500 | 2,522,800 |

|

| Modesto, City of, | | | | | | |

| Rev Spec Tax Cmnty Facs Dist No. | | | | | | |

| 04-1 2 (G) | 5.100 | | 09-01-26 | BB | 3,000 | 2,603,940 |

|

| New Haven Unified School District, | | | | | | |

| GO Unltd Cap Apprec | | | | | | |

| Ser 1998B (D) | Zero | | 08-01-22 | A+ | 14,200 | 6,744,290 |

|

| Northern California Transmission Agency, | | | | | | |

| Rev Ref Calif-Oregon Transm Proj | | | | | | |

| Ser 1990A (D) | 7.000 | | 05-01-13 | AA | 100 | 111,038 |

|

| Orange, County of, | | | | | | |

| Rev Spec Assessment Imp Bond Act | | | | | | |

| 1915 Ltd Oblig (G) | 5.750 | | 09-02-33 | BB | 1,570 | 1,537,391 |

|

| Orange Cove Irrigation District, | | | | | | |

| Rev Ref Cert of Part Rehab Proj (D) | 5.000 | | 02-01-17 | AA | 2,045 | 2,048,620 |

|

| Oxnard, City of, | | | | | | |

| Rev Special Tax District No. 3- | | | | | | |

| Seabridge (G) | 5.000 | | 09-01-35 | BB | 1,500 | 1,309,665 |

|

| Paramount Unified School District, | | | | | | |

| GO Unltd Cap Apprec Bonds | | | | | | |

| Ser 2001B (D) | Zero | | 09-01-25 | AAA | 4,735 | 2,017,536 |

|

| Pasadena, City of, | | | | | | |

| Cert of Part Ref Old Pasadena | | | | | | |

| Parking Facil Proj | 6.250 | | 01-01-18 | AA+ | 920 | 1,047,402 |

|

| Poway, City of, | | | | | | |

| Rev Ref Cmty Facil Dist No. 88 1 | | | | | | |

| Pkwy Business Ctr (G) | 6.750 | | 08-15-15 | BB | 1,000 | 1,021,280 |

See notes to financial statements

| |

| Annual report | California Tax-Free Income Fund | 15 |

F I N A N C I A L S T A T E M E N T S

| | | | | | |

| | Interest | | Maturity | Credit | Par value | |

| State, issuer, description | rate | | date | rating (A) | (000) | Value |

| | | | | | | |

| California (continued) | | | | | | |

|

| Rancho Santa Fe Community | | | | | | |

| Services District, | | | | | | |

| Rev Spec Tax Cmty Facil | | | | | | |

| Dist No. 1 (G) | 6.700% | | 09-01-30 | BB | $1,000 | $1,014,020 |

|

| Ripon Redevelopment Agency, | | | | | | |

| Rev Ref Community Redevelopment | | | | | | |

| Proj (D) | 4.750 | | 11-01-36 | A2 | 1,700 | 1,568,539 |

|

| Riverside County Asset Leasing Corp, | | | | | | |

| Rev Leasehold Linked Ctfs | | | | | | |

| Riverside County Ser 1993A | 6.500 | | 06-01-12 | AA– | 1,000 | 1,086,200 |

|

| Sacramento City Financing Auth, | | | | | | |

| Rev Convention Ctr Hotel Sr | | | | | | |

| Ser 1999A (G) | 6.250 | | 01-01-30 | AA | 4,975 | 5,220,566 |

|

| San Bernardino, County of, | | | | | | |

| Rev Cert of Part Cap Facil Proj | | | | | | |

| Ser 1992B | 6.875 | | 08-01-24 | AAA | 350 | 440,300 |

| Rev Ref Cert of Part Med Ctr Fin Proj (D) | 5.500 | | 08-01-17 | AA | 8,750 | 9,543,712 |

|

| San Bruno Park School District, | | | | | | |

| GO Unltd Cap Apprec | | | | | | |

| Ser 2000B (D) | Zero | | 08-01-21 | A+ | 1,015 | 526,805 |

| GO Unltd Cap Apprec | | | | | | |

| Ser 2000B (D) | Zero | | 08-01-23 | A+ | 1,080 | 494,791 |

|

| San Diego County Water Auth., | | | | | | |

| Rev Ref Cert (D)(M)(P) | 9.006 | | 04-22-09 | AAA | 400 | 419,080 |

|

| San Diego Redevelopment Agency, | | | | | | |

| Rev Ref Tax Alloc Cap Apprec | | | | | | |

| Ser 1999B (G) | Zero | | 09-01-17 | BB | 1,600 | 952,768 |

| Rev Ref Tax Alloc Cap Apprec | | | | | | |

| Ser 1999B (G) | Zero | | 09-01-18 | BB | 1,700 | 933,742 |

| Rev Ref Tax Alloc City Heights | | | | | | |

| Proj Ser 1999A (G) | 5.800 | | 09-01-28 | BB | 1,395 | 1,310,268 |

| Rev Ref Tax Alloc City Heights | | | | | | |

| Proj Ser 1999A (G) | 5.750 | | 09-01-23 | BB | 1,000 | 976,450 |

|

| San Diego Unified School District, | | | | | | |

| GO Unltd Cap Apprec | | | | | | |

| Ser 1999A (D) | Zero | | 07-01-21 | AA | 2,500 | 1,322,775 |

| GO Unltd Election of 1998 | | | | | | |

| Ser 2000B (D) | 5.000 | | 07-01-25 | AA | 2,450 | 2,563,851 |

|

| San Francisco State Building Auth., | | | | | | |

| Rev Ref Lease Dept of Gen Serv | | | | | | |

| Ser 1993A | 5.000 | | 10-01-13 | A | 2,145 | 2,282,452 |

|

| San Francisco City & County | | | | | | |

| Redevelopment Agency, | | | | | | |

| Rev Spec Tax Cmnty Facil Dist No. | | | | | | |

| 6 Ser 2005A (G) | 5.150 | | 08-01-35 | BB | 1,250 | 1,064,713 |

| Rev Cmty Facil Dist No. 6 Mission | | | | | | |

| Ser 2001A (G) | 6.000 | | 08-01-25 | BB | 2,500 | 2,453,025 |

|

| San Joaquin, County of, | | | | | | |

| Cert of Part Ref County Admin | | | | | | |

| Building (D) | 5.000 | | 11-15-29 | AA | 2,965 | 2,971,286 |

See notes to financial statements

| |

| 16 | California Tax-Free Income Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

| | | | | | |

| | Interest | | Maturity | Credit | Par value | |

| State, issuer, description | rate | | date | rating (A) | (000) | Value |

| | | | | | | |

| California (continued) | | | | | | |

|

| San Joaquin Hills Transportation | | | | | | |

| Corridor Agency, | | | | | | |

| Rev Ref Toll Rd Conv Cap Apprec | | | | | | |

| Ser 1997A | 5.750% | | 01-15-21 | BB– | $5,000 | $4,715,650 |

| Rev Toll Rd Sr Lien | Zero | | 01-01-22 | AAA | 6,500 | 3,506,880 |

| Rev Toll Rd Sr Lien | Zero | | 01-01-14 | AAA | 5,000 | 4,174,150 |

|

| San Marcos Public Facilities Auth., | | | | | | |

| Rev Sub Tax Increment Proj Area 3 | | | | | | |

| Ser 1999A (G) | 6.000 | | 08-01-31 | AA | 1,305 | 1,377,884 |

|

| San Mateo County Joint Power Auth., | | | | | | |

| Rev Ref Lease Cap Proj Prog (D) | 5.000 | | 07-01-21 | AA | 1,815 | 1,924,517 |

|

| Santa Ana Financing Auth., | | | | | | |

| Rev Lease Police Admin & Hldg | | | | | | |

| Facil Ser 1994A (D) | 6.250 | | 07-01-19 | AA | 1,790 | 2,107,618 |

| Rev Lease Police Admin & Hldg | | | | | | |

| Facil Ser 1994A (D) | 6.250 | | 07-01-24 | AA | 10,000 | 11,529,000 |

| Rev Ref Mainplace Proj Ser 1998D (G) | 5.600 | | 09-01-19 | BBB– | 1,000 | 1,012,950 |

|

| Santa Clara County Financing Auth., | | | | | | |

| Rev Ref Lease Multiple Facil | | | | | | |

| Proj Ser 2000B (D) | 5.500 | | 05-15-17 | AA | 6,000 | 6,329,520 |

|

| Santa Fe Springs Community | | | | | | |

| Development Commission, | | | | | | |

| Rev Tax Alloc Cap Apprec Cons | | | | | | |

| Redev Proj Ser 2006A (D) | Zero | | 09-01-20 | AA | 1,275 | 704,144 |

|

| Santa Margarita Water District, | | | | | | |

| Rev Spec Tax Cmty Facil Dist | | | | | | |

| No. 99 1 (G) | 6.000 | | 09-01-30 | AA | 500 | 574,070 |

|

| Santaluz Community Facilities District, | | | | | | |

| Rev Spec Tax Dist No. 2 Imp Area | | | | | | |

| No. 1 (G) | 6.375 | | 09-01-30 | BB | 1,495 | 1,497,960 |

|

| Southern California Public Power Auth., | | | | | | |

| Rev Natural Gas Proj No. 1 Ser 2007A | 5.250 | | 11-01-26 | AA– | 1,000 | 989,540 |

| Rev Ref Southern Transm Proj (D) | Zero | | 07-01-13 | Aa3 | 4,400 | 3,753,728 |

|

| Tobacco Securitization Auth. of | | | | | | |

| Northern California, | | | | | | |

| Rev Asset Backed Bond Ser 2001A | 5.375 | | 06-01-41 | AAA | 1,000 | 1,082,170 |

|

| Torrance, City of, | | | | | | |

| Rev Ref Hosp Torrance Mem Med Ctr | | | | | | |

| Ser 2001A | 5.500 | | 06-01-31 | A+ | 2,000 | 2,001,560 |

|

| Turlock Health Facilities, | | | | | | |

| Rev Emanuel Med Ctr Ser 2007B | 5.125 | | 10-15-37 | BBB+ | 2,500 | 2,113,025 |

|

| Tustin Unified School District, | | | | | | |

| Rev Spec Tax Cmty Facil Dis | | | | | | |

| No. 97 1 | 6.375 | | 09-01-35 | AAA | 1,000 | 1,020,250 |

|

| Vallejo Sanitation and Flood | | | | | | |

| Control District, | | | | | | |

| Rev Ref Cert of Part (D)(G) | 5.000 | | 07-01-19 | A | 2,500 | 2,474,075 |

|

| West Covina Redevelopment Agency, | | | | | | |

| Rev Ref Cmty Facil Dist Fashion | | | | | | |

| Plaza Proj | 6.000 | | 09-01-22 | AA | 3,000 | 3,328,350 |

See notes to financial statements

| |

| Annual report | California Tax-Free Income Fund | 17 |

F I N A N C I A L S T A T E M E N T S

| | | | | | |

| | Interest | | Maturity | Credit | Par value | |

| State, issuer, description | rate | | date | rating (A) | (000) | Value |

| | | | | | | |

| Puerto Rico 9.40% | | | | | | $29,841,495 |

|

| Puerto Rico, Commonwealth of, | | | | | | |

| GO Unltd (P) | 6.500% | | 07-01-15 | BBB– | $6,000 | 6,632,340 |

|

| Puerto Rico Highway & | | | | | | |

| Transportation Auth., | | | | | | |

| Rev Ref Ser 1996Z (D) | 6.250 | | 07-01-14 | AA | 3,250 | 3,590,730 |

| Rev Ref Ser 1998A (D) | 5.000 | | 07-01-38 | AA | 190 | 182,865 |

|

| Puerto Rico Ind’l, Tourist, Ed’l, Med & | | | | | | |

| Environmental Control Facilities | | | | | | |

| Financing Auth., | | | | | | |

| GO Unltd Ser 975 (D) | 7.920 | | 07-01-18 | Aaa | 5,000 | 5,716,900 |

|

| Puerto Rico Aqueduct & Sewer Auth., | | | | | | |

| Rev Inverse Floater (Gtd) (D)(M)(P) | 7.470 | | 07-01-11 | AAA | 7,500 | 9,016,200 |

| Rev Sr Lien Ser 2008A (Zero to | | | | | | |

| 7-1-11 then 6.125%) | Zero | | 07-01-24 | BBB– | 1,750 | 1,547,770 |

| Rev Hosp de la Concepcion | | | | | | |

| Ser 2000A | 6.500 | | 11-15-20 | AA | 500 | 531,840 |

|

| Puerto Rico Public Financing Corp, | | | | | | |

| Rev Commonwealth Appropriation | | | | | | |

| Ser 2002E | 5.700 | | 08-01-25 | Aaa | 2,500 | 2,622,850 |

| |

| |

| State, issuer, description | | | | | | Value |

|

| |

| Short-term investments 0.03% | | | | | | $103,000 |

|

| (Cost $103,000) | | | | | | |

| | | | | | | |

| Joint Repurchase Agreement 0.03% | | | | | | 103,000 |

|

| Joint Repurchase Agreement with Barclays PLC dated 8-29-08 | | | |

| at 2.02% to be repurchased at $103,023 on 9-02-08, | | | | | |

| collateralized by $90,070 U.S. Treasury Inflation Indexed | | | |

| Note, 2.50%, due 7-15-16 (valued at $105,060, including interest). | | | |

| | | | | | $103 | 103,000 |

|

| |

| Total investments (Cost $307,004,838)† 99.03% | | | | | $314,420,122 |

|

| |

| Other assets and liabilities, net 0.97% | | | | | $3,092,788 |

|

| |

| Total net assets 100.00% | | | | | | $317,512,910 |

|

The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the Fund.

See notes to financial statements

| |

| 18 | California Tax-Free Income Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

Notes to Schedule of Investments

(A) Credit ratings are unaudited and are rated by Moody’s Investors Service where Standard & Poor’s ratings are not available unless indicated otherwise.

(D) Bond is insured by one of these companies:

| | |

| Insurance coverage | As a % of total investments | |

| |

| Ambac Financial Group, Inc. | 5.02 | |

| Financial Guaranty Insurance Company | 8.95 | |

| Financial Security Assurance, Inc. | 9.81 | |

| Municipal Bond Insurance Association | 21.35 | |

(G) Security rated internally by John Hancock Advisers, LLC. Unaudited.

(M) Inverse floater bond purchased on secondary market.

(P) Variable rate obligation. The coupon rate shown represents the rate at period end.

(V) Variable rate demand notes are securities whose interest rates are reset periodically at market levels. These securities are often payable on demand and are shown at their current rates as of August 31, 2008.

† At August 31, 2008, the aggregate cost of investment securities for federal income tax purposes was $305,646,171. Net unrealized appreciation aggregated $8,773,951, of which $16,260,700 related to appreciated investment securities and $7,486,749 related to depreciated investment securities.

See notes to financial statements

| |

| Annual report | California Tax-Free Income Fund | 19 |

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 8-31-08

This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum offering price per share.

| |

| Assets | |

|

| Investments at value (Cost $307,004,838) | $314,420,122 |

| Receivable for shares sold | 201,060 |

| Interest receivable | 4,184,958 |

| Receivable from affiliates | 28,922 |

| Other assets | 36,901 |

| | |

| Total assets | 318,871,963 |

| |

| Liabilities | |

|

| Due to custodian | 555,983 |

| Payable for shares repurchased | 414,666 |

| Dividends payable | 227 |

| Payable to affiliates | |

| Management fees | 143,088 |

| Distribution and service fees | 55,754 |

| Other | 67,983 |

| Other payables and accrued expenses | 121,352 |

| | |

| Total liabilities | 1,359,053 |

| |

| Net assets | |

|

| Capital paid-in | 308,631,449 |

| Accumulated net realized gain on investments | 1,427,298 |

| Net unrealized appreciation of investments | 7,415,284 |

| Accumulated net investment income | 38,879 |

| | |

| Net assets | $317,512,910 |

| |

| Net asset value per share | |

|

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($293,560,255 ÷ 28,332,591 shares) | $10.36 |

| Class B ($10,381,415 ÷ 1,001,909 shares)1 | $10.36 |

| Class C ($13,571,240 ÷ 1,309,848 shares)1 | $10.36 |

| |

| Maximum offering price per share | |

|

| Class A ($10.36 ÷ 95.5%)2 | $10.85 |

1 Redemption price is equal to net asset value less any applicable contingent deferred sales charge.

2 On single retail sales of less than $100,000. On sales of $100,000 or more and on group sales the offering price is reduced.

See notes to financial statements

| |

| 20 | California Tax-Free Income Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

Statement of operations For the year ended 8-31-08

This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| |

| Investment income | |

|

| Interest | $17,119,477 |

| | |

| Total investment income | 17,119,477 |

| |

| Expenses | |

|

| Investment management fees (Note 4) | 1,790,496 |

| Distribution and service fees (Note 4) | 699,727 |

| Transfer agent fees (Note 4) | 129,294 |

| Accounting and legal services fees (Note 4) | 37,228 |

| Custodian fees | 83,930 |

| Professional fees | 40,637 |

| Printing fees | 29,186 |

| Trustees’ fees | 19,336 |

| Blue sky fees | 16,835 |

| Miscellaneous | 9,870 |

| | |

| Total expenses | 2,856,539 |

| Less expense reductions (Note 4) | (1,988) |

| | |

| Net expenses | 2,854,551 |

| | |

| Net investment income | 14,264,926 |

| |

| Realized and unrealized gain (loss) | |

|

| Net realized gain (loss) on investments | 219,561 |

| Change in net unrealized appreciation (depreciation) of investments | (7,654,523) |

| | |

| Net realized and unrealized loss | (7,434,962) |

| | |

| Increase in net assets from operations | $6,829,964 |

See notes to financial statements

| |

| Annual report | California Tax-Free Income Fund | 21 |

F I N A N C I A L S T A T E M E N T S

Statements of changes in net assets

These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| | |

| | Year | Year |

| | ended | ended |

| | 8-31-07 | 8-31-08 |

|

| Increase (decrease) in net assets | | |

|

| From operations | | |

| Net investment income | $14,124,386 | $14,264,926 |

| Net realized gain | 1,521,490 | 219,561 |

| Change in net unrealized appreciation (depreciation) | (11,454,555) | (7,654,523) |

| | | |

| Increase in net assets resulting from operations | 4,191,321 | 6,829,964 |

| | | |

| Distributions to shareholders | | |

| From net investment income | | |

| Class A | (13,058,903) | (13,221,127) |

| Class B | (664,098) | (437,796) |

| Class C | (323,845) | (443,676) |

| From net realized gain | | |

| Class A | — | (374,572) |

| Class B | — | (16,486) |

| Class C | — | (14,767) |

| | | |

| | (14,046,846) | (14,508,424) |

| | | |

| From Fund share transactions (Note 5) | 10,655,928 | (3,483,468) |

| | | |

| Total increase (decrease) | 800,403 | (11,161,928) |

| |

| Net assets | | |

|

| Beginning of year | 327,874,435 | 328,674,838 |

| | | |

| End of year1 | $328,674,838 | $317,512,910 |

1 Includes accumulated net investment income of $38,879 and $38,879, respectively.

See notes to financial statements

| |

| 22 | California Tax-Free Income Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

Financial highlights

The Financial Highlights show how the Fund’s net asset value for a share has changed since the end of the previous period.

| | | | | |

| CLASS A SHARES | | | | | |

| |

| Period ended | 8-31-041 | 8-31-051 | 8-31-06 | 8-31-07 | 8-31-08 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of year | $10.60 | $10.91 | $11.08 | $10.93 | $10.61 |

| Net investment income2 | 0.52 | 0.51 | 0.49 | 0.47 | 0.47 |

| Net realized and unrealized gain | | | | | |

| (loss) on investments | 0.30 | 0.16 | (0.15) | (0.32) | (0.25) |

| Total from investment operations | 0.82 | 0.67 | 0.34 | 0.15 | 0.22 |

| Less distributions | | | | | |

| From net investment income | (0.51) | (0.50) | (0.49) | (0.47) | (0.46) |

| From net realized gain | — | — | — | — | (0.01) |

| Total distributions | (0.51) | (0.50) | (0.49) | (0.47) | (0.47) |

| Net asset value, end of year | $10.91 | $11.08 | $10.93 | $10.61 | $10.36 |

| Total return (%)3 | 7.84 | 6.24 | 3.194 | 1.344 | 2.184 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of year (in millions) | $308 | $306 | $296 | $304 | $294 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 0.83 | 0.86 | 0.82 | 0.81 | 0.81 |

| Expenses net of all fee waivers | 0.83 | 0.86 | 0.82 | 0.81 | 0.81 |

| Expenses net of all fee waivers | | | | | |

| and credits | 0.83 | 0.86 | 0.82 | 0.81 | 0.81 |

| Net investment income | 4.72 | 4.59 | 4.53 | 4.33 | 4.45 |

| Portfolio turnover (%) | 21 | 13 | 33 | 41 | 22 |

1 Audited by previous Independent Registered Public Accounting Firm.

2 Based on the average of the shares outstanding.

3 Assumes dividend reinvestment and does not reflect the effect of sales charges.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

See notes to financial statements

| |

| Annual report | California Tax-Free Income Fund | 23 |

F I N A N C I A L S T A T E M E N T S

Financial highlights

| | | | | |

| CLASS B SHARES | | | | | |

| |

| Period ended | 8-31-041 | 8-31-051 | 8-31-06 | 8-31-07 | 8-31-08 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of year | $10.60 | $10.91 | $11.08 | $10.93 | $10.61 |

| Net investment income2 | 0.42 | 0.41 | 0.40 | 0.38 | 0.38 |

| Net realized and unrealized gain | | | | | |

| (loss) on investments | 0.31 | 0.16 | (0.15) | (0.32) | (0.25) |

| Total from investment operations | 0.73 | 0.57 | 0.25 | 0.06 | 0.13 |

| Less distributions | | | | | |

| From net investment income | (0.42) | (0.40) | (0.40) | (0.38) | (0.37) |

| From net realized gain | — | — | — | — | (0.01) |

| Total distributions | (0.42) | (0.40) | (0.40) | (0.38) | (0.38) |

| Net asset value, end of year | $10.91 | $11.08 | $10.93 | $10.61 | $10.36 |

| Total return (%)3 | 6.93 | 5.35 | 2.324 | 0.484 | 1.314 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of year (in millions) | $43 | $32 | $24 | $15 | $10 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 1.69 | 1.71 | 1.67 | 1.66 | 1.66 |

| Expenses net of all fee waivers | 1.69 | 1.71 | 1.67 | 1.66 | 1.66 |

| Expenses net of all fee waivers | | | | | |

| and credits | 1.69 | 1.71 | 1.67 | 1.66 | 1.66 |

| Net investment income | 3.87 | 3.75 | 3.68 | 3.47 | 3.59 |

| Portfolio turnover (%) | 21 | 13 | 33 | 41 | 22 |

1 Audited by previous Independent Registered Public Accounting Firm.

2 Based on the average of the shares outstanding.

3 Assumes dividend reinvestment and does not reflect the effect of sales charges.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

See notes to financial statements

| |

| 24 | California Tax-Free Income Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

Financial highlights

| | | | | |

| CLASS C SHARES | | | | | |

| |

| Period ended | 8-31-041 | 8-31-051 | 8-31-06 | 8-31-07 | 8-31-08 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of year | $10.60 | $10.91 | $11.08 | $10.93 | $10.61 |

| Net investment income2 | 0.42 | 0.41 | 0.40 | 0.37 | 0.38 |

| Net realized and unrealized gain | | | | | |

| (loss) on investments | 0.31 | 0.16 | (0.15) | (0.31) | (0.25) |

| Total from investment operations | 0.73 | 0.57 | 0.25 | 0.06 | 0.13 |

| Less distributions | | | | | |

| From net investment income | (0.42) | (0.40) | (0.40) | (0.38) | (0.37) |

| From net realized gain | — | — | — | — | (0.01) |

| Total distributions | (0.42) | (0.40) | (0.40) | (0.38) | (0.38) |

| Net asset value, end of year | $10.91 | $11.08 | $10.93 | $10.61 | $10.36 |

| Total return (%)3 | 6.93 | 5.35 | 2.324 | 0.484 | 1.314 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of year (in millions) | $7 | $7 | $8 | $10 | $14 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 1.69 | 1.71 | 1.67 | 1.66 | 1.66 |

| Expenses net of all fee waivers | 1.69 | 1.71 | 1.67 | 1.66 | 1.66 |

| Expenses net of all fee waivers | | | | | |

| and credits | 1.69 | 1.71 | 1.67 | 1.66 | 1.66 |

| Net investment income | 3.87 | 3.74 | 3.68 | 3.47 | 3.60 |

| Portfolio turnover (%) | 21 | 13 | 33 | 41 | 22 |

1 Audited by previous Independent Registered Public Accounting Firm.

2 Based on the average of the shares outstanding.

3 Assumes dividend reinvestment and does not reflect the effect of sales charges.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

See notes to financial statements

| |

| Annual report | California Tax-Free Income Fund | 25 |

Notes to financial statements

Note 1

Organization

John Hancock California Tax-Free Income Fund (the Fund) is a non-diversified open-end management investment company registered under the Investment Company Act of 1940, as amended (the 1940 Act). The Fund seeks a high level of current income, consistent with the preservation of capital, that is exempt from federal and California personal income taxes. Since the Fund invests primarily in California issuers, the Fund may be affected by political, economic or regulatory developments in the state of California.

The Trustees have authorized the issuance of multiple classes of shares of the Fund, designated as Class A, Class B and Class C shares. The shares of each class represent an interest in the same portfolio of investments of the Fund and have equal rights as to voting, redemptions, dividends and liquidation, except that certain expenses, subject to the approval of the Trustees, may be applied differently to each class of shares in accordance with current regulations of the Securities and Exchange Commission (SEC) and the Internal Revenue Service. Shareholders of a class that bears distribution and service expenses under the terms of a distribution plan have exclusive voting rights to that distribution plan. Class B shares will convert to Class A shares eight years after purchase.

Note 2

Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security valuation

The net asset value of Class A, Class B and Class C shares of the Fund is determined daily as of the close of the New York Stock Exchange (NYSE), normally at 4:00 p.m., Eastern Time. Short-term debt investments that have a remaining maturity of 60 days or less are valued at amortized cost, and thereafter assume a constant amortization to maturity of any discount or premium, which approximates market value. All other securities held by the Fund are valued at the last sale price or official closing price (closing bid price or last evaluated quote if no sale has occurred) as of the close of business on the principal securities exchange (domestic or foreign) on which they trade or, lacking any sales, at the closing bid price. Securities traded only in the over-the-counter market are valued at the last bid price quoted by b rokers making markets in the securities at the close of trading. Securities for which there are no such quotations, principally debt securities, are valued based on the evaluated prices provided by an independent pricing service, which utilizes both dealer-supplied and electronic data processing techniques, which take into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data. Fixed income securities are subject to credit and interest rate risk and involve some risk of default in connection with principal and interest payments.

Other assets and securities for which no such quotations are readily available are valued at fair value as determined in good faith under consistently applied procedures established by and under the general supervision of the Board of Trustees.

| |

| 26 | California Tax-Free Income Fund | Annual report |

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general economic conditions, interest rates, investor perceptions and market liquidity.

Joint repurchase agreement

Pursuant to an exemptive order issued by the SEC, the Fund, along with other registered investment companies having a management contract with John Hancock Advisers, LLC (the Adviser), a wholly owned subsidiary of John Hancock Financial Services, Inc., a subsidiary of Manulife Financial Corporation (MFC), may participate in a joint repurchase agreement transaction. Aggregate cash balances are invested in one or more large repurchase agreements, whose underlying securities are obligations of the U.S. government and/or its agencies. The Fund’s custodian bank receives delivery of the underlying securities for the joint account on the Fund’s behalf. When a Fund enters into a repurchase agreement, it receives delivery of collateral, the amount of which at the time of purchase and each subsequent business day is required to be maintained at such a level that the value is generally 102% of the repurchase amount.

Investment transactions

Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment security transactions are reported on trade date. Interest income is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date net of foreign withholding taxes. Discounts/premiums are accreted/amortized for financial reporting purposes. Realized gains and losses from investment transactions are recorded on an identified cost basis.

Class allocations

Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the appropriate net asset value of the respective classes. Distribution and service fees, if any, and transer agent fees for Class A, Class B and Class C shares are calculated daily at the class level based on the appropriate net asset value of each class and the specific expense rate(s) applicable to each class.

Guarantees and indemnifications

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

Expenses

The majority of expenses are directly identifiable to an individual fund. Trust expenses that are not readily identifiable to a specific fund are allocated in such a manner as deemed equitable, taking into consideration, among other things, the nature and type of expense and the relative size of the funds.

Bank borrowings

The Fund is permitted to have bank borrowings for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The Fund has entered into a line of credit agreement with The Bank of New York Mellon (BNYM), the Swing Line Lender and Administrative Agent. This agreement enables the Fund to participate, with other funds managed by the Adviser, in an unsecured line of credit with BNYM, which permits borrowings of up to $150 million, collectively. Interest is charged to each fund based on its borrowing. In addition, a commitment fee is charged to each fund based on the average daily unused portion of the line of credit and is allocated among the participating funds. The Fund had no borrowing activity under the line of credit during the year ended August 31, 2008.

Pursuant to the custodian agreement, the Custodian may, in its discretion, advance funds to the Fund to make properly authorized payments. When such payments result in an overdraft, the Fund is obligated to repay the Custodian for any overdraft together with interest due thereon. The Custodian has a lien, security interest or security

| |

| Annual report | California Tax-Free Income Fund | 27 |

entitlement in any Fund property, to the maximum extent permitted by law to the extent of any overdraft.

Federal income taxes

The Fund qualifies as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

The Fund has adopted the provisions of Financial Accounting Standards Board (FASB) Interpretation No. 48, Accounting for Uncertainty in Income Taxes, an interpretation of FASB Statement 109 (FIN 48), at the beginning of the Fund’s fiscal year. FIN 48 prescribes a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. The implementation of FIN 48 did not have a material impact on the Fund’s financial statements. Each of the Fund’s federal tax returns for the prior three years remain subject to examination by the Internal Revenue Service.

New accounting pronouncements

In September 2006, FASB Standard No. 157, Fair Value Measurements (FAS 157), was issued and is effective for fiscal years beginning after November 15, 2007. FAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosure about fair value measurements. As of July 31, 2008, management does not believe the adoption of FAS 157 will have a material impact on the amounts reported in the financial statements.

In March 2008, FASB No. 161 (FAS 161), Disclosures about Derivative Instruments and Hedging Activities, an amendment of FASB Statement No. 133 (FAS 133), was issued and is effective for fiscal years and interim reporting periods beginning after November 15, 2008. FAS 161 amends and expands the disclosure requirements of FAS 133 in order to provide financial statement users an understanding of a company’s use of derivative instruments, how derivative instruments are accounted for under FAS 133 and related interpretations and how these instruments affect a company’s financial position, performance, and cash flows. FAS 161 requires companies to disclose information detailing the objectives and strategies for using derivative instruments, the level of derivative activity entered into by the company, and any credit risk-related contingent features of the agreements. M anagement is currently evaluating the adoption of FAS 161 on the Fund’s financial statement disclosures.

Distribution of income and gains

The Fund records distributions to shareholders from net investment income and net realized gains, if any, on the ex-dividend date. The Fund generally declares dividends daily and pays them monthly. Capital gains, if any, are distributed annually. During the year ended August 31, 2007, the tax character of distributions paid was as follows: ordinary income $48,591 and exempt income $13,998,255. During the year ended August 31, 2008, the tax character of distributions paid was as follows: ordinary income $20,361, exempt income $14,082,238, and long-term capital gains $405,825. Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class.

As of August 31, 2008, the components of distributable earnings on a tax basis included $60,375 of undistributed exempt income and $183,171 of undistributed long-term gain.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

Capital accounts within financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period. Permanent book-tax differences are primarily

| |

| 28 | California Tax-Free Income Fund | Annual report |

attributable to amortization and accretion on debt securities.

Note 3

Risks and uncertainties

State concentration risk

The Fund invests mainly in bonds from a single state and its performance is affected by local, state and regional factors. The risks may include economic or policy changes, erosion of the tax base, and state legislative changes (especially those regarding budgeting and taxes). Although the Fund invests mainly in investment-grade bonds, which generally have a relatively low level of credit risk, any factors that might lead to a credit decline statewide would be likely to cause widespread decline in the credit quality of the Fund’s holdings.

Insurance concentration risk

The Fund may hold insured municipal obligations which are insured as to their scheduled payment of principal and interest under an insurance policy obtained by the issuer or underwriter of the obligation at the time of its original issuance. Since there are a limited number of municipal obligation insurers, a Fund may have a concentration of investments covered by one insurer. Accordingly, the concentration may make the Fund’s value more volatile and investment values may rise and fall more rapidly. In addition, the credit quality of companies which provide the insurance may affect the value of those securities and insurance does not guarantee the market value of the insured obligation.

Municipal bond risk

The Fund generally invests in general obligation or revenue municipal bonds. The bonds are backed by the municipal issuer and have the risk that the issuer’s credit quality will decline. General obligation bonds are backed by the municipal issuer’s ability to levy taxes. In extreme cases, a municipal issuer could declare bankruptcy or otherwise become unable to honor its commitments to bondholders which may be caused by many reasons, including fiscal mismanagement and erosion of the tax base. Revenue bonds are backed only by income associated with a specific facility. Any circumstance that reduces or threatens the economic viability of that particular facility can affect the bond’s credit quality.

Note 4

Management fee and transactions with

affiliates and others

The Fund has an investment management contract with the Adviser. Under the investment management contract, the Fund pays a monthly management fee to the Adviser equivalent, on an annual basis, to the sum of: (a) 0.55% of the first $500,000,000 of the Fund’s average daily net asset value and (b) 0.50% of the Fund’s average daily net asset value in excess of $500,000,000. The effective rate for the year ended August 31, 2008 is 0.55% of the Fund’s average daily net asset value. The Fund has a subadvisory agreement with MFC Global Investment Management (U.S.), LLC, a subsidiary of John Hancock Financial Services, Inc. The Fund is not responsible for payment of subadvisory fees.

The Fund has a Distribution Agreement with John Hancock Funds, LLC (JH Funds), a wholly owned subsidiary of the Adviser. The Fund has adopted Distribution Plans with respect to Class A, Class B and Class C, pursuant to Rule 12b-1 under the 1940 Act, to pay JH Funds for the services it provides as distributor of shares of the Fund. Accordingly, the Fund makes monthly payments to JH Funds at an annual rate not to exceed 0.15%, 1.00% and 1.00% of average daily net asset value of Class A, Class B and Class C, respectively. A maximum of 0.25% of such payments may be service fees, as defined by the Conduct Rules of the Financial Industry Regulatory Authority (formerly the National Association of Securities Dealers). Under the Conduct Rules, curtailment of a portion of the Fund’s 12b-1 payments could occur under certain circumstances.

The Fund has an agreement with its custodian bank, under which custody fees are reduced by balance credits applied during the period. Accordingly, the expense reductions related to custody fee offsets amounted to $116.

Class A shares are assessed up-front sales charges. During the year ended August 31, 2008, JH Funds received net up-front sales charges

| |

| Annual report | California Tax-Free Income Fund | 29 |

of $258,776 with regard to sales of Class A shares. Of this amount, $30,701 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $219,826 was paid as sales commissions to unrelated broker-dealers and $5,249 was paid as sales commissions to sales personnel of Signator Investors, Inc. (Signator Investors), a related broker-dealer. The Adviser’s indirect parent, John Hancock Life Insurance Company (JHLICO), is the indirect sole shareholder of Signator Investors.

Class B shares that are redeemed within six years of purchase are subject to a contingent deferred sales charge (CDSC) at declining rates, beginning at 5.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Class C shares that are redeemed within one year of purchase are subject to a CDSC at a rate of 1.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from the CDSCs are paid to JH Funds and are used in whole or in part to defray its expenses for providing distribution-related services to the Fund in connection with the sale of Class B and Class C shares. During the year ended August 31, 2008, CDSCs received by JH Funds amounted to $7,584 for Class B shares and $1,327 for Class C shares.

The Fund has a transfer agent agreement with John Hancock Signature Services, Inc. (Signature Services), an indirect subsidiary of JHLICO. For Class A, Class B and Class C shares, the Fund pays a monthly transfer agent fee at an annual rate of 0.01% of each class’s average daily net asset value, plus a fee based on the number of shareholder accounts and reimbursement for certain out-of-pocket expenses, aggregated and allocated to each class on the basis of its relative net asset value. For the period from September 1, 2007 to May 31, 2008, the Fund paid a monthly fee which is based on an annual rate of $16 for each Class A shareholder account, $18.50 for each Class B shareholder account and $17.50 for each Class C shareholder account. Effective June 1, 2008, the Fund pays a monthly fee which is based on an annual rate of $17.50 for each Class A, Class B and Class C shareholder account.

The Fund receives earnings credits from its transfer agent as a result of uninvested cash balances. These credits are used to reduce a portion of the Fund’s transfer agent fees and out-of-pocket expenses. During the year ended August 31, 2008, the Fund’s transfer agent fees and out-of-pocket expenses were reduced by $1,872 for transfer agent credits earned.

Class level expenses for the year ended August 31, 2008 were as follows:

| | |

| | Distribution and | |

| Share class | service fees | |

| |

| Class A | $451,009 | |

| Class B | 123,691 | |

| Class C | 125,027 | |

| Total | $699,727 | |

The Fund has an agreement with the Adviser and affiliates to perform necessary tax, accounting, compliance, legal and other administrative services for the Fund. The compensation for the year amounted to $37,228 with an effective rate of 0.01% of the Fund’s average daily net asset value.

Mr. James R. Boyle is Chairman of the Adviser, as well as affiliated Trustee of the Fund, and is compensated by the Adviser and/or its affiliates. The compensation of unaffiliated Trustees is borne by the Fund. The unaffiliated Trustees may elect to defer, for tax purposes, their receipt of this compensation under the John Hancock Group of Funds Deferred Compensation Plan. The Fund makes investments into other John Hancock funds, as applicable, to cover its liability for the deferred compensation. Investments to cover the Fund’s deferred compensation liability are recorded on the Fund’s books as an other asset. The deferred compensation liability and the related other asset are always equal and are marked to market on a periodic basis to reflect any income earned by the investments, as well as any unrealized gains or losses. The Deferred Compensation Plan investments had no impact on the operations of the Fund.

| |

| 30 | California Tax-Free Income Fund | Annual report |

Note 5

Fund share transactions

This listing illustrates the number of Fund shares sold, reinvested and repurchased during the years ended August 31, 2007, and August 31, 2008, along with the corresponding dollar value.

| | | | |

| | | Year ended 8-31-07 | Year ended 8-31-08 |

| | Shares | Amount | Shares | Amount |

| Class A shares | | | | |

|

| Sold | 3,792,506 | $41,272,167 | 4,992,318 | $52,426,707 |

| Distributions reinvested | 657,865 | 7,156,422 | 734,057 | 7,695,093 |

| Repurchased | (2,952,305) | (32,110,845) | (6,016,558) | (63,195,548) |

| Net increase (decrease) | 1,498,066 | $16,317,744 | (290,183) | ($3,073,748) |

| |

| Class B shares | | | | |

|

| Sold | 71,439 | $777,087 | 51,446 | $549,219 |

| Distributions reinvested | 32,893 | 358,311 | 24,616 | 258,404 |

| Repurchased | (895,152) | (9,748,798) | (459,249) | (4,853,916) |

| Net decrease | (790,820) | ($8,613,400) | (383,187) | ($4,046,293) |

| |

| Class C shares | | | | |

|

| Sold | 444,131 | $4,844,342 | 546,964 | $5,771,432 |

| Distributions reinvested | 14,852 | 161,580 | 23,635 | 247,277 |

| Repurchased | (188,913) | (2,054,338) | (227,092) | (2,382,136) |

| Net increase | 270,070 | $2,951,584 | 343,507 | $3,636,573 |

| |

| Net increase (decrease) | 977,316 | $10,655,928 | (329,863) | ($3,483,468) |

|

Note 6

Purchase and sale of securities

Purchases and proceeds from sales or maturities of securities, including purchase and sales of variable rate demand notes of $43,535,000 and $47,725,000, respectively, during the year ended August 31, 2008, aggregated $69,022,465 and $77,966,760 respectively. Short-term securities are excluded from these amounts.

| |

| Annual report | California Tax-Free Income Fund | 31 |

Auditors’ report

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of John Hancock California Tax-Free Income Fund,

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of John Hancock California Tax-Free Income Fund (the Fund) at August 31, 2008, and the results of its operations, the changes in its net assets and the financial highlights for the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at August 31, 2008 by correspondence with the custodian and brokers, and the application of alternative auditing procedures where securities purchased had not been received, provide a reasonable basis for our opinion. The financial highlights for each of the periods ended on or before August 31, 2005 were audited by other auditors whose report expressed an unqualified opinion thereon.

PricewaterhouseCoopers LLP

Boston, Massachusetts

October 23, 2008

| |

| 32 | California Tax-Free Income Fund | Annual report |

Tax information

Unaudited

For federal income tax purposes, the following information is furnished with respect to the distributions of the Fund, if any, paid during its taxable year ended August 31, 2008.

The Fund has designated distributions to shareholders of $405,825 as a long-term capital gain dividend.

None of the 2008 income dividends qualify for the corporate dividends-received deduction. Shareholders who are not subject to the alternative minimum tax received income dividends that are 99.86% tax-exempt. The percentage of income dividends from the Fund subject to the alternative minimum tax is 3.16%. None of the income dividends were derived from U.S. Treasury Bills.

For specific information on exception provisions in your state, consult your local state tax officer or your tax adviser. Shareholders will be mailed a 2008 U.S. Treasury Department Form 1099-DIV in January 2009. This will reflect the total of all distributions that are taxable for calendar year 2008.

| |

| Annual report | California Tax-Free Income Fund | 33 |

Board Consideration of and

Continuation of Investment Advisory

Agreement and Subadvisory

Agreement: John Hancock California

Tax-Free Income Fund

The Investment Company Act of 1940 (the 1940 Act) requires the Board of Trustees (the Board) of John Hancock Tax-Exempt Series Fund (the Trust), including a majority of the Trustees who have no direct or indirect interest in the investment advisory agreement and are not “interested persons” of the Trust, as defined in the 1940 Act (the Independent Trustees), annually to meet in person to review and consider the continuation of: (i) the investment advisory agreement (the Advisory Agreement) with John Hancock Advisers, LLC (the Adviser) and (ii) the investment subadvisory agreement (the Subadvisory Agreement) with MFC Global Investment Management (U.S.), LLC (the Subadviser) for the John Hancock California Tax-Free Income Fund (the Fund). The Advisory Agreement and the Subadvisory Agreement are collectively referred to as the Advisory Agreements.

At meetings held on May 5–6 and June 9–10, 2008, the Board considered the factors and reached the conclusions described below relating to the selection of the Adviser and Subadviser and the continuation of the Advisory Agreements. During such meetings, the Board’s Contracts/Operations Committee and the Independent Trustees also met in executive sessions with their independent legal counsel.