UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-05986

T. Rowe Price Index Trust, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about Mid-Cap Index Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Mid-Cap Index Fund - Investor Class | $30 | 0.27% |

|---|

What drove fund performance during the past 12 months?

Mid-cap U.S. stocks produced strong gains in 2024, as equity investors generally welcomed not only looser monetary policy starting in September, but also reduced political uncertainty following U.S. election results.

Financials names produced robust results during the period, thanks in part to lower short-term interest rates and strong equity market gains. Capital markets companies performed very well during the year, as KKR and Robinhood Markets advanced strongly. The information technology sector also generated strong gains during the period, as the software segment performed particularly well.

No sectors detracted from absolute returns during the reporting period.

The fund, which is not available for direct purchase by members of the public, employs a full replication strategy, which involves investing substantially all of its assets in all of the stocks in the index and seeking to maintain holdings of each stock in proportion to its weight in the index. By replicating the structure of the Russell Select Mid Cap Index, our intention is to closely track its performance.

How has the fund performed?

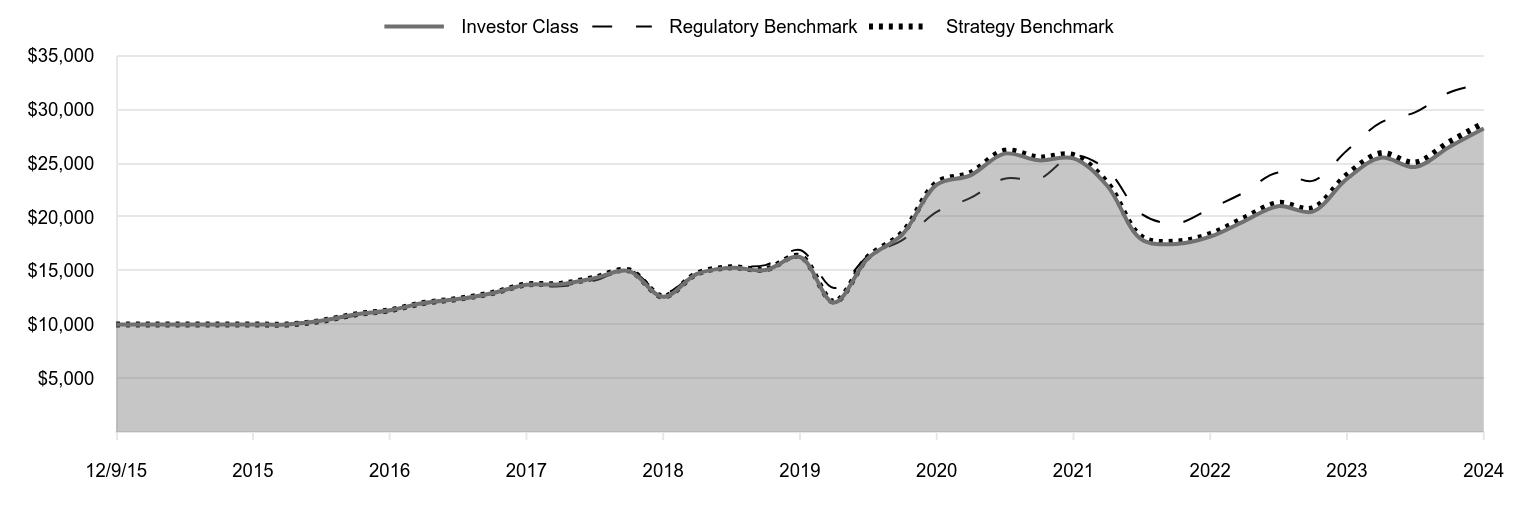

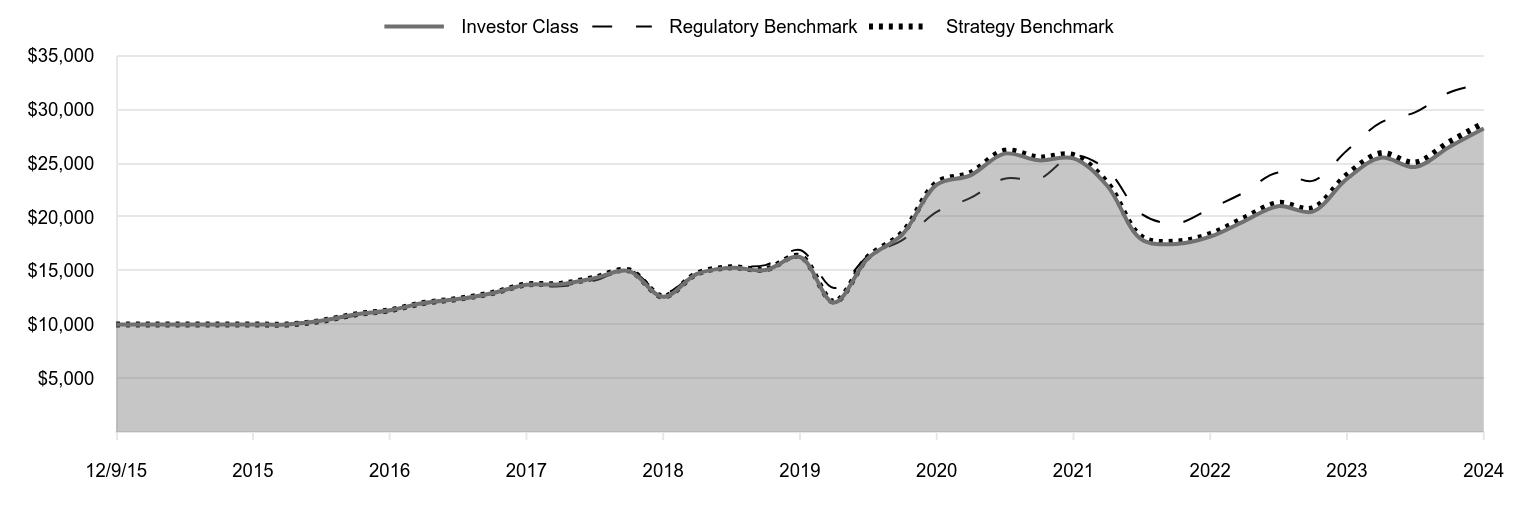

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Investor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 12/9/15 | 10,000 | 10,000 | 10,000 |

|---|

| 12/31/15 | 10,000 | 9,989 | 10,006 |

|---|

| 3/31/16 | 10,010 | 10,085 | 9,995 |

|---|

| 6/30/16 | 10,341 | 10,351 | 10,323 |

|---|

| 9/30/16 | 10,942 | 10,806 | 10,937 |

|---|

| 12/31/16 | 11,333 | 11,261 | 11,322 |

|---|

| 3/31/17 | 11,993 | 11,907 | 11,995 |

|---|

| 6/30/17 | 12,364 | 12,267 | 12,377 |

|---|

| 9/30/17 | 12,910 | 12,827 | 12,921 |

|---|

| 12/31/17 | 13,700 | 13,640 | 13,718 |

|---|

| 3/31/18 | 13,743 | 13,552 | 13,775 |

|---|

| 6/30/18 | 14,311 | 14,079 | 14,345 |

|---|

| 9/30/18 | 14,987 | 15,082 | 15,042 |

|---|

| 12/31/18 | 12,570 | 12,925 | 12,598 |

|---|

| 3/31/19 | 14,707 | 14,740 | 14,736 |

|---|

| 6/30/19 | 15,267 | 15,344 | 15,318 |

|---|

| 9/30/19 | 15,061 | 15,522 | 15,117 |

|---|

| 12/31/19 | 16,279 | 16,934 | 16,364 |

|---|

| 3/31/20 | 12,049 | 13,395 | 12,111 |

|---|

| 6/30/20 | 16,158 | 16,346 | 16,261 |

|---|

| 9/30/20 | 18,382 | 17,851 | 18,522 |

|---|

| 12/31/20 | 23,000 | 20,472 | 23,180 |

|---|

| 3/31/21 | 23,877 | 21,771 | 24,098 |

|---|

| 6/30/21 | 25,893 | 23,565 | 26,160 |

|---|

| 9/30/21 | 25,267 | 23,541 | 25,537 |

|---|

| 12/31/21 | 25,459 | 25,725 | 25,748 |

|---|

| 3/31/22 | 22,906 | 24,367 | 23,173 |

|---|

| 6/30/22 | 17,932 | 20,298 | 18,157 |

|---|

| 9/30/22 | 17,489 | 19,391 | 17,707 |

|---|

| 12/31/22 | 18,169 | 20,784 | 18,410 |

|---|

| 3/31/23 | 19,599 | 22,276 | 19,878 |

|---|

| 6/30/23 | 21,003 | 24,145 | 21,301 |

|---|

| 9/30/23 | 20,499 | 23,359 | 20,801 |

|---|

| 12/31/23 | 23,555 | 26,179 | 23,923 |

|---|

| 3/31/24 | 25,517 | 28,802 | 25,927 |

|---|

| 6/30/24 | 24,649 | 29,728 | 25,053 |

|---|

| 9/30/24 | 26,518 | 31,580 | 26,976 |

|---|

| 12/31/24 | 28,228 | 32,411 | 28,744 |

|---|

202501-4140694, 202502-4108663

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 12/9/15 |

|---|

| Mid-Cap Index Fund (Investor Class) | 19.84% | 11.64% | 12.14% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 13.86 | 13.86 |

|---|

| Russell Select Mid Cap Index (Strategy Benchmark) | 20.15 | 11.93 | 12.36 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$234,941

- Number of Portfolio Holdings509

- Investment Advisory Fees Paid (000s)$(190)

- Portfolio Turnover Rate31.7%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Information Technology | 19.9% |

| Financials | 18.2 |

| Industrials & Business Services | 16.9 |

| Consumer Discretionary | 12.7 |

| Health Care | 8.2 |

| Communication Services | 5.9 |

| Materials | 5.2 |

| Real Estate | 4.9 |

| Energy | 3.8 |

| Other | 4.3 |

Top Ten Holdings (as a % of Net Assets)

| Marvell Technology | 2.0% |

| AppLovin | 1.8 |

| Spotify Technology | 1.4 |

| CRH | 1.4 |

| DoorDash | 1.3 |

| Trade Desk | 1.1 |

| Coinbase Global | 1.1 |

| Snowflake | 1.1 |

| Cheniere Energy | 1.0 |

| MicroStrategy | 1.0 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Mid-Cap Index Fund

Investor Class (TRMNX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about Mid-Cap Index Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Mid-Cap Index Fund - I Class | $15 | 0.14% |

|---|

What drove fund performance during the past 12 months?

Mid-cap U.S. stocks produced strong gains in 2024, as equity investors generally welcomed not only looser monetary policy starting in September, but also reduced political uncertainty following U.S. election results.

Financials names produced robust results during the period, thanks in part to lower short-term interest rates and strong equity market gains. Capital markets companies performed very well during the year, as KKR and Robinhood Markets advanced strongly. The information technology sector also generated strong gains during the period, as the software segment performed particularly well.

No sectors detracted from absolute returns during the reporting period.

The fund, which is not available for direct purchase by members of the public, employs a full replication strategy, which involves investing substantially all of its assets in all of the stocks in the index and seeking to maintain holdings of each stock in proportion to its weight in the index. By replicating the structure of the Russell Select Mid Cap Index, our intention is to closely track its performance.

How has the fund performed?

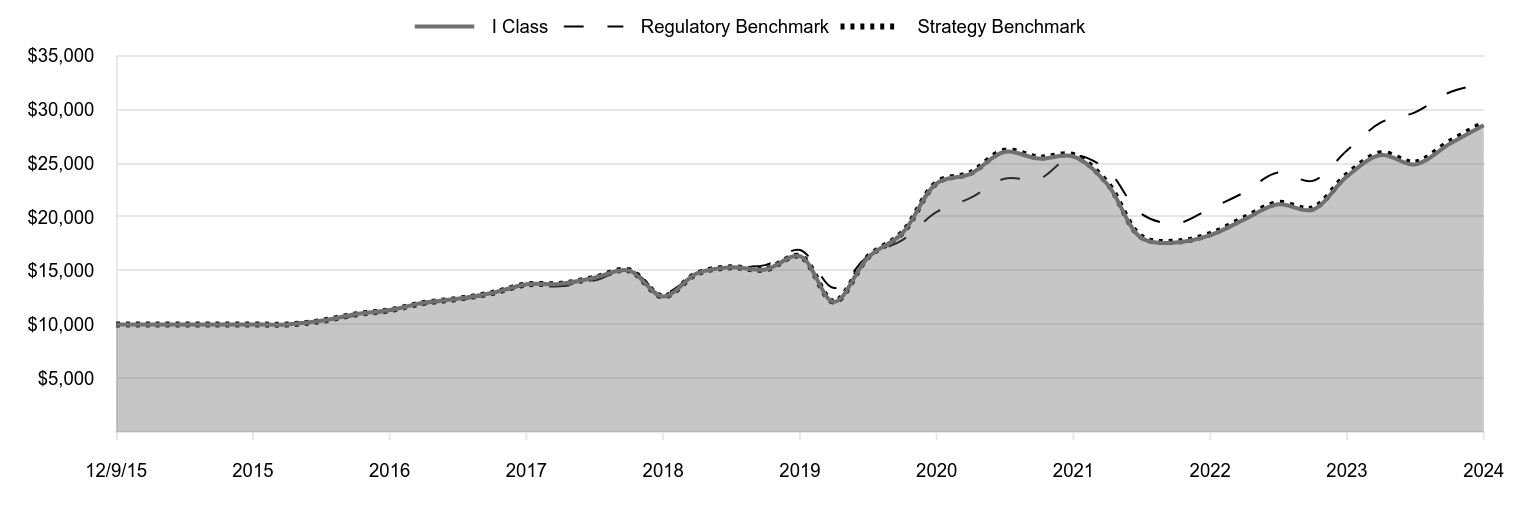

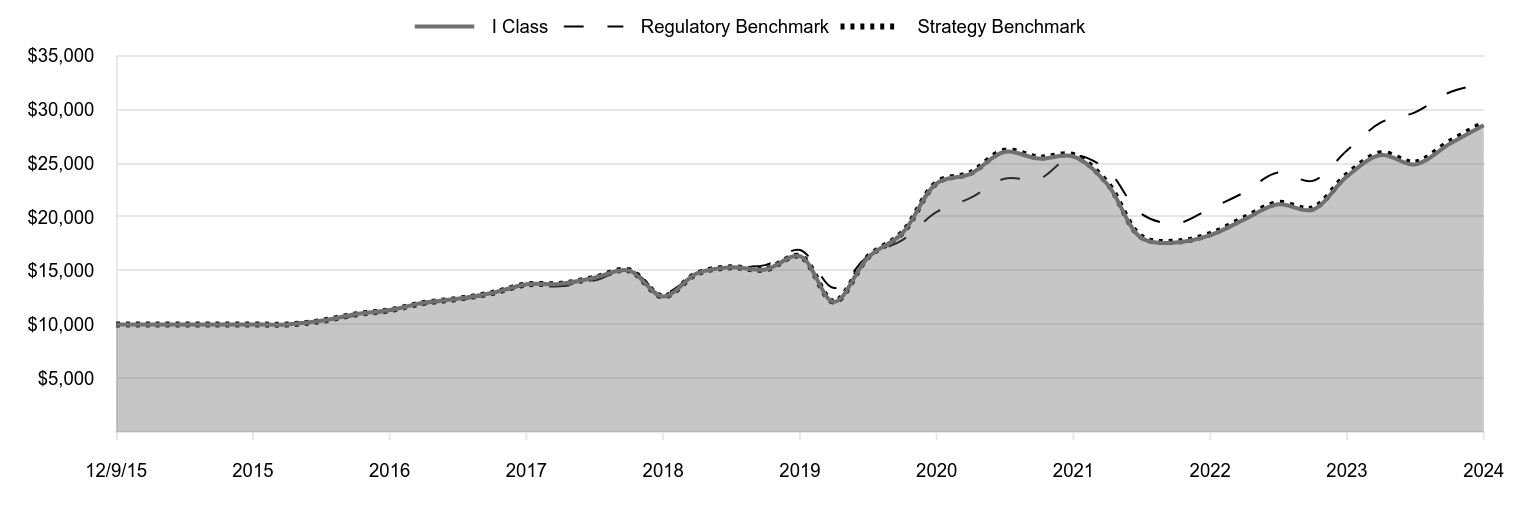

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| I Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 12/9/15 | 10,000 | 10,000 | 10,000 |

|---|

| 12/31/15 | 10,000 | 9,989 | 10,006 |

|---|

| 3/31/16 | 10,010 | 10,085 | 9,995 |

|---|

| 6/30/16 | 10,341 | 10,351 | 10,323 |

|---|

| 9/30/16 | 10,952 | 10,806 | 10,937 |

|---|

| 12/31/16 | 11,343 | 11,261 | 11,322 |

|---|

| 3/31/17 | 12,014 | 11,907 | 11,995 |

|---|

| 6/30/17 | 12,396 | 12,267 | 12,377 |

|---|

| 9/30/17 | 12,932 | 12,827 | 12,921 |

|---|

| 12/31/17 | 13,735 | 13,640 | 13,718 |

|---|

| 3/31/18 | 13,778 | 13,552 | 13,775 |

|---|

| 6/30/18 | 14,348 | 14,079 | 14,345 |

|---|

| 9/30/18 | 15,036 | 15,082 | 15,042 |

|---|

| 12/31/18 | 12,612 | 12,925 | 12,598 |

|---|

| 3/31/19 | 14,756 | 14,740 | 14,736 |

|---|

| 6/30/19 | 15,329 | 15,344 | 15,318 |

|---|

| 9/30/19 | 15,123 | 15,522 | 15,117 |

|---|

| 12/31/19 | 16,356 | 16,934 | 16,364 |

|---|

| 3/31/20 | 12,100 | 13,395 | 12,111 |

|---|

| 6/30/20 | 16,235 | 16,346 | 16,261 |

|---|

| 9/30/20 | 18,490 | 17,851 | 18,522 |

|---|

| 12/31/20 | 23,136 | 20,472 | 23,180 |

|---|

| 3/31/21 | 24,015 | 21,771 | 24,098 |

|---|

| 6/30/21 | 26,062 | 23,565 | 26,160 |

|---|

| 9/30/21 | 25,434 | 23,541 | 25,537 |

|---|

| 12/31/21 | 25,628 | 25,725 | 25,748 |

|---|

| 3/31/22 | 23,065 | 24,367 | 23,173 |

|---|

| 6/30/22 | 18,070 | 20,298 | 18,157 |

|---|

| 9/30/22 | 17,626 | 19,391 | 17,707 |

|---|

| 12/31/22 | 18,306 | 20,784 | 18,410 |

|---|

| 3/31/23 | 19,758 | 22,276 | 19,878 |

|---|

| 6/30/23 | 21,182 | 24,145 | 21,301 |

|---|

| 9/30/23 | 20,676 | 23,359 | 20,801 |

|---|

| 12/31/23 | 23,775 | 26,179 | 23,923 |

|---|

| 3/31/24 | 25,763 | 28,802 | 25,927 |

|---|

| 6/30/24 | 24,889 | 29,728 | 25,053 |

|---|

| 9/30/24 | 26,783 | 31,580 | 26,976 |

|---|

| 12/31/24 | 28,528 | 32,411 | 28,744 |

|---|

202501-4140694, 202502-4108663

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 12/9/15 |

|---|

| Mid-Cap Index Fund (I Class) | 19.99% | 11.77% | 12.27% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 13.86 | 13.86 |

|---|

| Russell Select Mid Cap Index (Strategy Benchmark) | 20.15 | 11.93 | 12.36 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$234,941

- Number of Portfolio Holdings509

- Investment Advisory Fees Paid (000s)$(190)

- Portfolio Turnover Rate31.7%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Information Technology | 19.9% |

| Financials | 18.2 |

| Industrials & Business Services | 16.9 |

| Consumer Discretionary | 12.7 |

| Health Care | 8.2 |

| Communication Services | 5.9 |

| Materials | 5.2 |

| Real Estate | 4.9 |

| Energy | 3.8 |

| Other | 4.3 |

Top Ten Holdings (as a % of Net Assets)

| Marvell Technology | 2.0% |

| AppLovin | 1.8 |

| Spotify Technology | 1.4 |

| CRH | 1.4 |

| DoorDash | 1.3 |

| Trade Desk | 1.1 |

| Coinbase Global | 1.1 |

| Snowflake | 1.1 |

| Cheniere Energy | 1.0 |

| MicroStrategy | 1.0 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Mid-Cap Index Fund

I Class (TRMSX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about Mid-Cap Index Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Mid-Cap Index Fund - Z Class | $0 | 0.00% |

|---|

What drove fund performance during the past 12 months?

Mid-cap U.S. stocks produced strong gains in 2024, as equity investors generally welcomed not only looser monetary policy starting in September, but also reduced political uncertainty following U.S. election results.

Financials names produced robust results during the period, thanks in part to lower short-term interest rates and strong equity market gains. Capital markets companies performed very well during the year, as KKR and Robinhood Markets advanced strongly. The information technology sector also generated strong gains during the period, as the software segment performed particularly well.

No sectors detracted from absolute returns during the reporting period.

The fund, which is not available for direct purchase by members of the public, employs a full replication strategy, which involves investing substantially all of its assets in all of the stocks in the index and seeking to maintain holdings of each stock in proportion to its weight in the index. By replicating the structure of the Russell Select Mid Cap Index, our intention is to closely track its performance.

How has the fund performed?

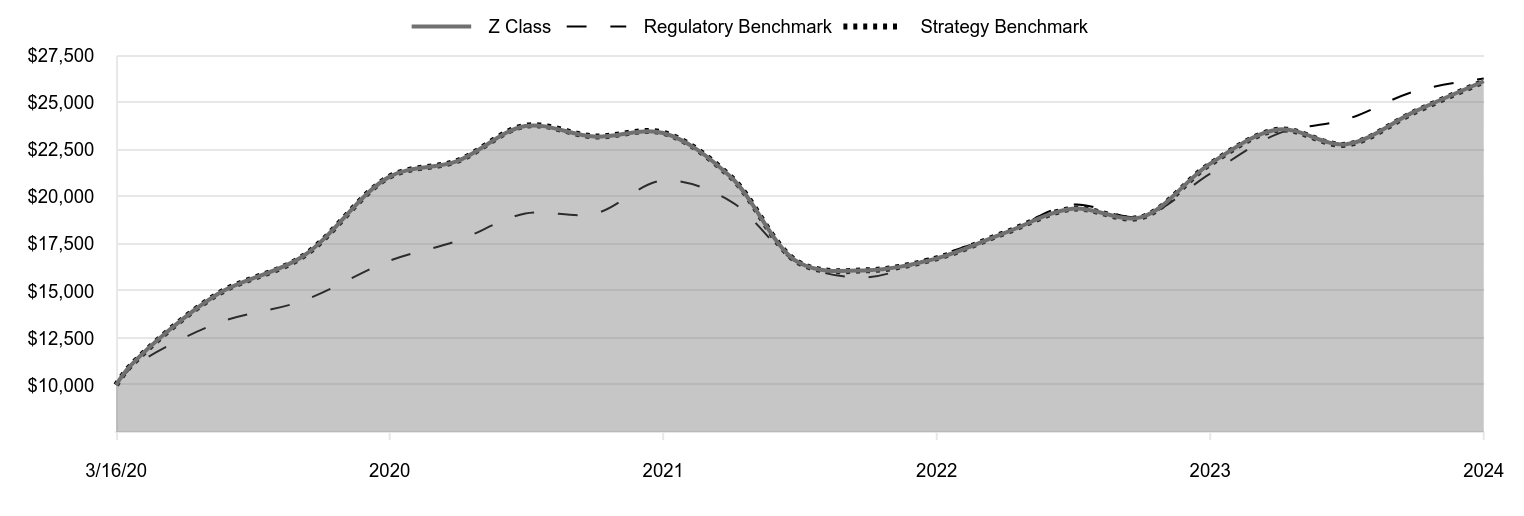

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Z Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 3/16/20 | 10,000 | 10,000 | 10,000 |

|---|

| 3/31/20 | 11,017 | 10,865 | 11,008 |

|---|

| 6/30/20 | 14,785 | 13,259 | 14,781 |

|---|

| 9/30/20 | 16,840 | 14,480 | 16,836 |

|---|

| 12/31/20 | 21,074 | 16,606 | 21,071 |

|---|

| 3/31/21 | 21,898 | 17,659 | 21,905 |

|---|

| 6/30/21 | 23,764 | 19,115 | 23,779 |

|---|

| 9/30/21 | 23,203 | 19,095 | 23,212 |

|---|

| 12/31/21 | 23,391 | 20,867 | 23,404 |

|---|

| 3/31/22 | 21,064 | 19,765 | 21,064 |

|---|

| 6/30/22 | 16,505 | 16,464 | 16,505 |

|---|

| 9/30/22 | 16,099 | 15,729 | 16,095 |

|---|

| 12/31/22 | 16,731 | 16,859 | 16,734 |

|---|

| 3/31/23 | 18,069 | 18,069 | 18,069 |

|---|

| 6/30/23 | 19,371 | 19,585 | 19,362 |

|---|

| 9/30/23 | 18,921 | 18,948 | 18,908 |

|---|

| 12/31/23 | 21,765 | 21,235 | 21,746 |

|---|

| 3/31/24 | 23,584 | 23,362 | 23,567 |

|---|

| 6/30/24 | 22,798 | 24,114 | 22,773 |

|---|

| 9/30/24 | 24,543 | 25,616 | 24,521 |

|---|

| 12/31/24 | 26,144 | 26,290 | 26,128 |

|---|

202501-4140694, 202502-4108663

Average Annual Total Returns

| | 1 Year | Since Inception 3/16/20 |

|---|

| Mid-Cap Index Fund (Z Class) | 20.12% | 22.19% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 22.33 |

|---|

| Russell Select Mid Cap Index (Strategy Benchmark) | 20.15 | 22.18 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$234,941

- Number of Portfolio Holdings509

- Investment Advisory Fees Paid (000s)$(190)

- Portfolio Turnover Rate31.7%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Information Technology | 19.9% |

| Financials | 18.2 |

| Industrials & Business Services | 16.9 |

| Consumer Discretionary | 12.7 |

| Health Care | 8.2 |

| Communication Services | 5.9 |

| Materials | 5.2 |

| Real Estate | 4.9 |

| Energy | 3.8 |

| Other | 4.3 |

Top Ten Holdings (as a % of Net Assets)

| Marvell Technology | 2.0% |

| AppLovin | 1.8 |

| Spotify Technology | 1.4 |

| CRH | 1.4 |

| DoorDash | 1.3 |

| Trade Desk | 1.1 |

| Coinbase Global | 1.1 |

| Snowflake | 1.1 |

| Cheniere Energy | 1.0 |

| MicroStrategy | 1.0 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Mid-Cap Index Fund

Z Class (TRSZX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| | | | | | |

| | | | 2024 | | 2023 |

| | Audit Fees | | $23,525 | | $23,064 |

| | Audit-Related Fees | | - | | - |

| | Tax Fees | | - | | - |

| | All Other Fees | | - | | - |

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,262,000 and $1,524,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

Financial

Highlights

Portfolio

of

Investments

Financial

Statements

and

Notes

Additional

Fund

Information

Financial

Statements

and

Other

Information

For

more

insights

from

T.

Rowe

Price

investment

professionals,

go

to

troweprice.com

.

T.

ROWE

PRICE

TRMNX

Mid-Cap

Index

Fund

TRMSX

Mid-Cap

Index

Fund–

.

I Class

TRSZX

Mid-Cap

Index

Fund–

.

Z Class

T.

ROWE

PRICE

Mid-Cap

Index

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Investor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

17.65

$

13.72

$

19.55

$

18.37

$

13.47

Investment

activities

Net

investment

income

(1)(2)

0.15

0.15

0.16

0.13

0.11

Net

realized

and

unrealized

gain/loss

3.37

3.91

(5.74)

1.82

5.43

Total

from

investment

activities

3.52

4.06

(5.58)

1.95

5.54

Distributions

Net

investment

income

(0.10)

(0.13)

(0.14)

(0.11)

(0.11)

Net

realized

gain

(0.23)

—

(0.11)

(0.66)

(0.53)

Total

distributions

(0.33)

(0.13)

(0.25)

(0.77)

(0.64)

NET

ASSET

VALUE

End

of

period

$

20.84

$

17.65

$

13.72

$

19.55

$

18.37

Ratios/Supplemental

Data

Total

return

(2)(3)

19.84%

29.65%

(28.63)%

10.69%

41.29%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.30%

0.35%

2.54%

1.46%

3.14%

Net

expenses

after

waivers/

payments

by

Price

Associates

0.27%

0.27%

0.27%

0.30%

0.31%

Net

investment

income

0.82%

0.99%

1.00%

0.69%

0.75%

Portfolio

turnover

rate

31.7%

29.5%

23.4%

34.7%

38.3%

Net

assets,

end

of

period

(in

thousands)

$103

$214

$166

$237

$8,724

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Mid-Cap

Index

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

I

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

17.70

$

13.75

$

19.60

$

18.42

$

13.49

Investment

activities

Net

investment

income

(1)(2)

0.19

0.17

0.18

0.18

0.12

Net

realized

and

unrealized

gain/loss

3.37

3.93

(5.76)

1.79

5.45

Total

from

investment

activities

3.56

4.10

(5.58)

1.97

5.57

Distributions

Net

investment

income

(0.18)

(0.15)

(0.16)

(0.13)

(0.11)

Net

realized

gain

(0.23)

—

(0.11)

(0.66)

(0.53)

Total

distributions

(0.41)

(0.15)

(0.27)

(0.79)

(0.64)

NET

ASSET

VALUE

End

of

period

$

20.85

$

17.70

$

13.75

$

19.60

$

18.42

Ratios/Supplemental

Data

Total

return

(2)(3)

19.99%

29.87%

(28.57)%

10.77%

41.45%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.30%

0.40%

0.44%

0.56%

3.06%

Net

expenses

after

waivers/payments

by

Price

Associates

0.14%

0.14%

0.14%

0.16%

0.18%

Net

investment

income

0.98%

1.12%

1.15%

0.86%

0.88%

Portfolio

turnover

rate

31.7%

29.5%

23.4%

34.7%

38.3%

Net

assets,

end

of

period

(in

thousands)

$138,433

$114,837

$80,256

$90,604

$460

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Mid-Cap

Index

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Z

Class

(1)

..

Year

..

..

Ended

.

3/16/20

(1)

Through

12/31/20

12/31/24

12/31/23

12/31/22

12/31/21

NET

ASSET

VALUE

Beginning

of

period

$

17.71

$

13.75

$

19.60

$

18.41

$

9.05

Investment

activities

Net

investment

income

(2)(3)

0.22

0.20

0.21

0.22

0.11

Net

realized

and

unrealized

gain/loss

3.37

3.93

(5.77)

1.79

9.89

Total

from

investment

activities

3.59

4.13

(5.56)

2.01

10.00

Distributions

Net

investment

income

(0.21)

(0.17)

(0.18)

(0.16)

(0.11)

Net

realized

gain

(0.23)

—

(0.11)

(0.66)

(0.53)

Total

distributions

(0.44)

(0.17)

(0.29)

(0.82)

(0.64)

NET

ASSET

VALUE

End

of

period

$

20.86

$

17.71

$

13.75

$

19.60

$

18.41

Ratios/Supplemental

Data

Total

return

(3)(4)

20.12%

30.09%

(28.47)%

11.00%

110.74%

Ratios

to

average

net

assets:

(3)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.25%

0.32%

0.40%

0.60%

3.07%

(5)

Net

expenses

after

waivers/

payments

by

Price

Associates

0.00%

0.00%

0.00%

0.01%

0.00%

(5)

Net

investment

income

1.15%

1.31%

1.37%

1.09%

1.00%

(5)

Portfolio

turnover

rate

31.7%

29.5%

23.4%

34.7%

38.3%

Net

assets,

end

of

period

(in

thousands)

$96,405

$37,136

$11,404

$1,132

$204

0%

0%

0%

0%

0%

(1)

Inception

date

(2)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(3)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(4)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

Total

return

is

not

annualized

for

periods

less

than

one

year.

(5)

Annualized

T.

ROWE

PRICE

Mid-Cap

Index

Fund

December

31,

2024

Shares

$

Value

(Cost

and

value

in

$000s)

‡

COMMON

STOCKS

99.7%

COMMUNICATION

SERVICES

5.9%

Diversified

Telecommunication

Services

0.4%

Frontier

Communications

Parent (1)

12,458

432

GCI

Liberty,

Class

A,

EC (1)(2)

203

—

Iridium

Communications

5,699

166

Liberty

Global,

Class

A (1)

8,488

108

Liberty

Global,

Class

C (1)

7,823

103

809

Entertainment

3.2%

Liberty

Media

Corp-Liberty

Formula

One,

Class

A (1)

1,187

100

Liberty

Media

Corp-Liberty

Formula

One,

Class

C (1)

10,608

983

Liberty

Media

Corp-Liberty

Live,

Class

A (1)

1,013

67

Liberty

Media

Corp-Liberty

Live,

Class

C (1)

2,328

158

Madison

Square

Garden

Sports (1)

932

210

Playtika

Holding

3,816

27

ROBLOX,

Class

A (1)

26,545

1,536

Roku (1)

6,356

473

Spotify

Technology (1)

7,423

3,321

TKO

Group

Holdings (1)

3,968

564

7,439

Interactive

Media

&

Services

0.6%

IAC (1)

3,726

161

Pinterest,

Class

A (1)

30,405

882

TripAdvisor (1)

5,405

80

Trump

Media

&

Technology

Group (1)

3,737

127

ZoomInfo

Technologies (1)

15,222

160

1,410

Media

1.7%

Liberty

Broadband,

Class

A (1)

855

64

Liberty

Broadband,

Class

C (1)

5,550

415

New

York

Times,

Class

A

8,086

421

Nexstar

Media

Group

1,544

244

Sirius

XM

Holdings

10,791

246

Trade

Desk,

Class

A (1)

22,551

2,650

4,040

Total

Communication

Services

13,698

CONSUMER

DISCRETIONARY

12.7%

Automobile

Components

0.3%

Gentex

11,725

337

T.

ROWE

PRICE

Mid-Cap

Index

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

Lear

2,743

259

QuantumScape (1)(3)

18,069

94

690

Automobiles

0.5%

Harley-Davidson

6,011

181

Lucid

Group (1)

49,528

150

Rivian

Automotive,

Class

A (1)(3)

41,936

558

Thor

Industries (3)

2,551

244

1,133

Broadline

Retail

1.0%

Coupang (1)

58,558

1,287

Dillard's,

Class

A (3)

159

69

Etsy (1)

5,643

298

Kohl's (3)

5,533

78

Macy's

13,736

233

Nordstrom

5,104

123

Ollie's

Bargain

Outlet

Holdings (1)

3,098

340

2,428

Diversified

Consumer

Services

1.0%

ADT

16,568

115

Bright

Horizons

Family

Solutions (1)

2,891

320

Duolingo (1)

1,875

608

Grand

Canyon

Education (1)

1,448

237

H&R

Block

7,050

373

Service

Corp.

International

7,071

564

2,217

Hotels,

Restaurants

&

Leisure

4.0%

Aramark

13,172

491

Boyd

Gaming

3,179

231

Cava

Group (1)

3,829

432

Choice

Hotels

International

1,388

197

Churchill

Downs

3,505

468

DoorDash,

Class

A (1)

17,855

2,995

DraftKings,

Class

A (1)

22,894

852

Dutch

Bros,

Class

A (1)

5,481

287

Hyatt

Hotels,

Class

A

2,085

327

Light

&

Wonder (1)

4,455

385

Marriott

Vacations

Worldwide

1,743

156

Penn

Entertainment (1)

7,547

150

Planet

Fitness,

Class

A (1)

4,288

424

Texas

Roadhouse

3,377

609

Travel

+

Leisure

3,339

168

T.

ROWE

PRICE

Mid-Cap

Index

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

Vail

Resorts

1,903

357

Wendy's

8,642

141

Wingstop

1,488

423

Wyndham

Hotels

&

Resorts

3,809

384

9,477

Household

Durables

1.1%

Leggett

&

Platt

6,876

66

Newell

Brands

20,808

207

SharkNinja (1)

3,319

323

Tempur

Sealy

International

8,439

479

Toll

Brothers

5,092

641

TopBuild (1)

1,514

471

Whirlpool (3)

2,653

304

2,491

Leisure

Products

0.4%

Brunswick

3,282

212

Mattel (1)

16,974

301

Polaris

2,580

149

YETI

Holdings (1)

4,267

164

826

Specialty

Retail

3.5%

Advance

Auto

Parts

3,035

144

AutoNation (1)

1,275

217

Bath

&

Body

Works

11,064

429

Burlington

Stores (1)

3,206

914

Carvana (1)

5,472

1,113

Dick's

Sporting

Goods

2,832

648

Five

Below (1)

2,727

286

Floor

&

Decor

Holdings,

Class

A (1)

5,281

527

GameStop,

Class

A (1)

19,854

622

Gap

10,178

240

Lithia

Motors

1,320

472

Murphy

USA

921

462

Penske

Automotive

Group

924

141

RH (1)

757

298

Valvoline (1)

6,478

234

Wayfair,

Class

A (1)(3)

4,778

212

Williams-Sonoma

6,326

1,171

8,130

Textiles,

Apparel

&

Luxury

Goods

0.9%

Amer

Sports (1)

2,915

81

Birkenstock

Holding (1)

2,005

114

T.

ROWE

PRICE

Mid-Cap

Index

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

Capri

Holdings (1)

5,743

121

Carter's (3)

1,819

99

Columbia

Sportswear (3)

1,667

140

Crocs (1)

2,899

318

PVH

2,782

294

Skechers

USA,

Class

A (1)

6,628

446

Under

Armour,

Class

A (1)

9,705

80

Under

Armour,

Class

C (1)

9,829

73

VF

17,769

381

2,147

Total

Consumer

Discretionary

29,539

CONSUMER

STAPLES

3.0%

Beverages

0.3%

Boston

Beer,

Class

A (1)

442

132

Celsius

Holdings (1)

8,834

233

Coca-Cola

Consolidated

307

387

752

Consumer

Staples

Distribution

&

Retail

1.5%

Albertsons,

Class

A

21,212

417

BJ's

Wholesale

Club

Holdings (1)

6,636

593

Casey's

General

Stores

1,866

739

Grocery

Outlet

Holding (1)

4,737

74

Maplebear (1)

8,385

347

Performance

Food

Group (1)

7,705

651

U.S.

Foods

Holding (1)

11,544

779

3,600

Food

Products

0.7%

Darling

Ingredients (1)

7,953

268

Flowers

Foods

9,401

194

Freshpet (1)

2,365

350

Ingredion

3,296

454

Pilgrim's

Pride (1)

2,113

96

Post

Holdings (1)

2,397

274

Seaboard

12

29

1,665

Household

Products

0.1%

Reynolds

Consumer

Products

2,801

75

Spectrum

Brands

Holdings

1,359

115

190

Personal

Care

Products

0.4%

BellRing

Brands (1)

6,468

487

T.

ROWE

PRICE

Mid-Cap

Index

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

Coty,

Class

A (1)

19,108

133

elf

Beauty (1)

2,697

339

959

Total

Consumer

Staples

7,166

ENERGY

3.8%

Energy

Equipment

&

Services

0.5%

NOV

19,715

288

TechnipFMC

21,417

620

Weatherford

International

3,619

259

1,167

Oil,

Gas

&

Consumable

Fuels

3.3%

Antero

Midstream

17,003

257

Antero

Resources (1)

14,592

512

Cheniere

Energy

11,285

2,425

Chord

Energy

3,123

365

Civitas

Resources

4,978

228

DT

Midstream

4,885

486

Expand

Energy

11,666

1,161

HF

Sinclair

7,824

274

Matador

Resources

5,975

336

New

Fortress

Energy

4,006

61

Ovintiv

13,245

536

Permian

Resources

32,916

473

Range

Resources

12,030

433

Viper

Energy

5,158

253

7,800

Total

Energy

8,967

FINANCIALS

18.2%

Banks

4.1%

Bank

OZK

5,331

237

BOK

Financial

1,158

123

Columbia

Banking

System

10,459

282

Comerica

6,730

416

Commerce

Bancshares

6,263

390

Cullen/Frost

Bankers

2,986

401

East

West

Bancorp

6,957

666

First

Citizens

BancShares,

Class

A

606

1,280

First

Hawaiian

6,381

166

First

Horizon

26,864

541

FNB

17,842

264

NU

Holdings,

Class

A (1)

160,822

1,666

T.

ROWE

PRICE

Mid-Cap

Index

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

Pinnacle

Financial

Partners

3,845

440

Popular

3,624

341

Prosperity

Bancshares

4,559

344

Synovus

Financial

7,297

374

TFS

Financial

2,540

32

Webster

Financial

8,584

474

Western

Alliance

Bancorp

5,446

455

Wintrust

Financial

3,293

411

Zions

Bancorp

7,341

398

9,701

Capital

Markets

6.0%

Affiliated

Managers

Group

1,489

275

Ares

Management,

Class

A

9,351

1,655

Blue

Owl

Capital

26,180

609

Carlyle

Group

11,013

556

Coinbase

Global,

Class

A (1)

10,235

2,541

Evercore,

Class

A

1,819

504

Houlihan

Lokey

2,637

458

Interactive

Brokers

Group,

Class

A

5,339

943

Janus

Henderson

Group

6,465

275

Jefferies

Financial

Group

8,801

690

Lazard

5,490

283

LPL

Financial

Holdings

3,763

1,229

Morningstar

1,342

452

Robinhood

Markets,

Class

A (1)

33,970

1,266

SEI

Investments

5,071

418

Stifel

Financial

4,993

530

TPG

4,214

265

Tradeweb

Markets,

Class

A

5,850

766

Virtu

Financial,

Class

A

4,074

145

XP,

Class

A

20,465

243

14,103

Consumer

Finance

0.9%

Ally

Financial

13,807

497

Credit

Acceptance (1)(3)

311

146

OneMain

Holdings

5,661

295

SLM

10,661

294

SoFi

Technologies (1)

53,279

821

2,053

Financial

Services

3.0%

Affirm

Holdings (1)

13,063

795

Block (1)

28,062

2,385

T.

ROWE

PRICE

Mid-Cap

Index

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

Corebridge

Financial

14,870

445

Equitable

Holdings

16,000

755

Euronet

Worldwide (1)

2,145

221

MGIC

Investment

12,903

306

Rocket,

Class

A (1)(3)

7,121

80

Shift4

Payments,

Class

A (1)

3,115

323

Toast,

Class

A (1)

22,907

835

UWM

Holdings (3)

4,551

27

Voya

Financial

4,943

340

Western

Union

16,939

180

WEX (1)

2,014

353

7,045

Insurance

3.6%

American

Financial

Group

3,611

494

Assured

Guaranty

2,527

228

Axis

Capital

Holdings

3,898

345

Brighthouse

Financial (1)

3,006

144

CNA

Financial

1,143

55

Fidelity

National

Financial

13,082

734

First

American

Financial

5,012

313

Hanover

Insurance

Group

1,791

277

Kemper

3,038

202

Kinsale

Capital

Group

1,110

516

Lincoln

National

8,533

271

Markel

Group (1)

640

1,105

Old

Republic

International

11,888

430

Primerica

1,699

461

Reinsurance

Group

of

America

3,311

707

RenaissanceRe

Holdings

2,587

644

RLI

2,104

347

Ryan

Specialty

Holdings

5,186

333

Unum

Group

9,155

669

White

Mountains

Insurance

Group

125

243

8,518

Mortgage

Real

Estate

Investment

Trusts

0.6%

AGNC

Investment,

REIT (3)

41,317

381

Annaly

Capital

Management,

REIT

28,195

516

Rithm

Capital,

REIT

26,009

282

Starwood

Property

Trust,

REIT (3)

15,694

297

1,476

Total

Financials

42,896

T.

ROWE

PRICE

Mid-Cap

Index

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

HEALTH

CARE

8.2%

Biotechnology

3.1%

Alnylam

Pharmaceuticals (1)

6,511

1,532

Apellis

Pharmaceuticals (1)(3)

5,232

167

BioMarin

Pharmaceutical (1)

9,554

628

Exact

Sciences (1)

9,177

516

Exelixis (1)

14,156

471

GRAIL (1)(3)

1,437

26

Ionis

Pharmaceuticals (1)

7,848

274

Natera (1)

5,793

917

Neurocrine

Biosciences (1)

5,029

686

Roivant

Sciences (1)

21,338

252

Sarepta

Therapeutics (1)

4,555

554

Ultragenyx

Pharmaceutical (1)

4,504

189

United

Therapeutics (1)

2,201

777

Viking

Therapeutics (1)(3)

5,331

215

7,204

Health

Care

Equipment

&

Supplies

0.9%

DENTSPLY

SIRONA

10,137

192

Enovis (1)

2,774

122

Envista

Holdings (1)

8,609

166

Globus

Medical,

Class

A (1)

5,632

466

Inspire

Medical

Systems (1)

1,469

272

Masimo (1)

2,182

361

Penumbra (1)

1,854

440

QuidelOrtho (1)

3,115

139

2,158

Health

Care

Providers

&

Services

0.8%

Acadia

Healthcare (1)

4,558

181

Amedisys (1)

1,605

146

Chemed

754

399

Encompass

Health

4,978

460

Premier,

Class

A

5,085

108

Tenet

Healthcare (1)

4,811

607

1,901

Health

Care

Technology

0.8%

Certara (1)

6,221

66

Doximity,

Class

A (1)

6,218

332

Veeva

Systems,

Class

A (1)

7,454

1,567

1,965

T.

ROWE

PRICE

Mid-Cap

Index

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

Life

Sciences

Tools

&

Services

1.8%

10X

Genomics,

Class

A (1)

5,280

76

Avantor (1)

34,195

720

Azenta (1)

2,411

121

Bio-Rad

Laboratories,

Class

A (1)

956

314

Bruker

5,477

321

Fortrea

Holdings (1)

4,596

86

Illumina (1)

8,057

1,077

Medpace

Holdings (1)

1,278

425

QIAGEN

11,239

500

Repligen (1)

2,828

407

Sotera

Health (1)

7,711

105

4,152

Pharmaceuticals

0.8%

Elanco

Animal

Health (1)

24,694

299

Intra-Cellular

Therapies (1)

5,178

432

Jazz

Pharmaceuticals (1)

3,043

375

Organon

12,904

192

Perrigo

6,789

175

Royalty

Pharma,

Class

A

19,686

502

1,975

Total

Health

Care

19,355

INDUSTRIALS

&

BUSINESS

SERVICES

16.9%

Aerospace

&

Defense

1.6%

BWX

Technologies

4,586

511

Curtiss-Wright

1,932

686

HEICO

2,218

527

HEICO,

Class

A

4,095

762

Hexcel

4,082

256

Loar

Holdings (1)

1,510

111

Spirit

AeroSystems

Holdings,

Class

A (1)(3)

5,809

198

Standardaero (1)

3,467

86

Woodward

2,968

494

3,631

Air

Freight

&

Logistics

0.1%

GXO

Logistics (1)

5,888

256

256

Building

Products

1.8%

AAON

3,422

403

Advanced

Drainage

Systems

3,559

411

Armstrong

World

Industries

2,180

308

T.

ROWE

PRICE

Mid-Cap

Index

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

AZEK (1)

7,295

346

Carlisle

2,274

839

Fortune

Brands

Innovations

6,249

427

Hayward

Holdings (1)

7,286

111

Owens

Corning

4,348

741

Simpson

Manufacturing

2,153

357

Trex (1)

5,374

371

4,314

Commercial

Services

&

Supplies

1.0%

Clean

Harbors (1)

2,562

590

MSA

Safety

1,856

308

RB

Global

9,227

832

Tetra

Tech

13,403

534

Vestis

6,725

102

2,366

Construction

&

Engineering

1.8%

AECOM

6,744

720

API

Group (1)

11,544

415

Comfort

Systems

USA

1,771

751

EMCOR

Group

2,302

1,045

Everus

Construction

Group (1)

2,579

170

MasTec (1)

3,151

429

Valmont

Industries

998

306

WillScot

Holdings (1)

9,059

303

4,139

Electrical

Equipment

1.6%

Acuity

Brands

1,562

456

nVent

Electric

8,309

566

Regal

Rexnord

3,338

518

Sensata

Technologies

Holding

7,495

206

Vertiv

Holdings,

Class

A

18,087

2,055

3,801

Ground

Transportation

1.3%

Avis

Budget

Group (1)(3)

888

72

Knight-Swift

Transportation

Holdings

7,871

417

Landstar

System

1,762

303

Lyft,

Class

A (1)

18,431

238

Ryder

System

2,100

329

Saia (1)

1,332

607

Schneider

National,

Class

B

2,395

70

U-Haul

Holding (1)(3)

414

29

U-Haul

Holding,

Non-Voting

5,030

322

T.

ROWE

PRICE

Mid-Cap

Index

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

XPO (1)

5,761

755

3,142

Machinery

2.8%

AGCO

3,122

292

Allison

Transmission

Holdings

4,347

470

CNH

Industrial

43,913

498

Crane

2,484

377

Donaldson

6,095

411

Esab

2,837

340

Flowserve

6,669

384

Gates

Industrial (1)

11,870

244

Graco

8,433

711

ITT

4,156

594

Lincoln

Electric

Holdings

2,776

520

Middleby (1)

2,704

366

Oshkosh

3,271

311

RBC

Bearings (1)

1,442

431

Timken

3,241

231

Toro

5,184

415

6,595

Marine

Transportation

0.1%

Kirby (1)

2,909

308

308

Passenger

Airlines

0.4%

Alaska

Air

Group (1)

6,369

413

American

Airlines

Group (1)

33,121

577

990

Professional

Services

2.6%

Amentum

Holdings (1)

6,512

137

Booz

Allen

Hamilton

Holding

6,351

817

CACI

International,

Class

A (1)

1,120

453

Clarivate (1)

20,891

106

Concentrix

2,408

104

Dun

&

Bradstreet

Holdings (3)

15,171

189

FTI

Consulting (1)

1,788

342

Genpact

8,815

379

KBR

6,758

392

ManpowerGroup

2,361

136

Parsons (1)

2,294

212

Paycor

HCM (1)

4,103

76

Paylocity

Holding (1)

2,182

435

Robert

Half

5,139

362

T.

ROWE

PRICE

Mid-Cap

Index

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

Science

Applications

International

2,482

277

SS&C

Technologies

Holdings

10,830

821

TransUnion

9,818

910

6,148

Trading

Companies

&

Distributors

1.8%

Air

Lease

5,232

252

Core

&

Main,

Class

A (1)

9,651

491

Ferguson

Enterprises

10,224

1,775

MSC

Industrial

Direct,

Class

A

2,298

172

SiteOne

Landscape

Supply (1)

2,236

295

Watsco

1,741

825

WESCO

International

2,125

384

4,194

Total

Industrials

&

Business

Services

39,884

INFORMATION

TECHNOLOGY

19.9%

Communications

Equipment

0.4%

Ciena (1)

7,282

618

Lumentum

Holdings (1)

3,408

286

Ubiquiti

208

69

973

Electronic

Equipment,

Instruments

&

Components

1.2%

Arrow

Electronics (1)

2,632

298

Avnet

4,365

228

Cognex

8,622

309

Coherent (1)

6,289

596

Crane

NXT

2,455

143

Ingram

Micro

Holding (1)

888

17

IPG

Photonics (1)

1,349

98

Littelfuse

1,224

289

TD

SYNNEX

3,823

448

Vontier

7,586

277

2,703

IT

Services

3.4%

Amdocs

5,663

482

Cloudflare,

Class

A (1)

15,156

1,632

DXC

Technology (1)

8,972

179

Globant (1)

2,116

454

Kyndryl

Holdings (1)

11,542

399

MongoDB (1)

3,620

843

Okta (1)

8,162

643

Snowflake,

Class

A (1)

15,971

2,466

T.

ROWE

PRICE

Mid-Cap

Index

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

Twilio,

Class

A (1)

7,703

833

7,931

Semiconductors

&

Semiconductor

Equipment

3.9%

Allegro

MicroSystems (1)

6,153

134

Amkor

Technology

5,648

145

Astera

Labs (1)

5,451

722

Cirrus

Logic (1)

2,697

269

Entegris

7,590

752

GLOBALFOUNDRIES (1)(3)

4,933

212

Lattice

Semiconductor (1)

6,914

392

MACOM

Technology

Solutions

Holdings (1)

2,833

368

Marvell

Technology

43,273

4,779

MKS

Instruments

3,396

355

Onto

Innovation (1)

2,463

410

Qorvo (1)

4,810

336

Universal

Display

2,370

346

Wolfspeed (1)(3)

6,259

42

9,262

Software

10.6%

Appfolio,

Class

A (1)

1,137

281

AppLovin,

Class

A (1)

13,243

4,289

Aspen

Technology (1)

1,364

341

Atlassian,

Class

A (1)

8,044

1,958

Bentley

Systems,

Class

B

7,123

333

BILL

Holdings (1)

5,091

431

CCC

Intelligent

Solutions

Holdings (1)

22,680

266

Confluent,

Class

A (1)

12,580

352

Datadog,

Class

A (1)

15,102

2,158

DocuSign (1)

10,279

925

Dolby

Laboratories,

Class

A

2,932

229

DoubleVerify

Holdings (1)

7,260

139

Dropbox,

Class

A (1)

12,021

361

Dynatrace (1)

14,861

808

Elastic (1)

4,380

434

Five9 (1)

3,721

151

Gitlab,

Class

A (1)

6,201

349

Guidewire

Software (1)

4,127

696

HashiCorp,

Class

A (1)

7,285

249

HubSpot (1)

2,470

1,721

Informatica,

Class

A (1)

4,128

107

Manhattan

Associates (1)

3,084

833

MicroStrategy,

Class

A (1)

8,316

2,408

nCino (1)

4,183

140

T.

ROWE

PRICE

Mid-Cap

Index

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

Nutanix,

Class

A (1)

12,613

772

Pegasystems

2,236

208

Procore

Technologies (1)

5,430

407

RingCentral,

Class

A (1)

4,121

144

SentinelOne,

Class

A (1)

13,994

311

Smartsheet,

Class

A (1)

6,882

386

Teradata (1)

4,855

151

UiPath,

Class

A (1)

21,743

276

Unity

Software (1)

15,351

345

Zoom

Communications (1)

13,335

1,088

Zscaler (1)

4,710

850

24,897

Technology

Hardware,

Storage

&

Peripherals

0.4%

Pure

Storage,

Class

A (1)

15,527

954

954

Total

Information

Technology

46,720

MATERIALS

5.2%

Chemicals

1.1%

Ashland

2,449

175

Axalta

Coating

Systems (1)

11,056

378

Chemours

7,469

126

Element

Solutions

11,226

286

Huntsman

8,196

148

NewMarket

338

179

Olin

5,882

199

RPM

International

6,406

788

Scotts

Miracle-Gro

2,130

141

Westlake

1,681

193

2,613

Construction

Materials

1.6%

CRH

34,703

3,210

Eagle

Materials

1,689

417

3,627

Containers

&

Packaging

1.1%

AptarGroup

3,321

522

Berry

Global

Group

5,817

376

Crown

Holdings

5,882

486

Graphic

Packaging

Holding

15,076

410

Sealed

Air

7,296

247

Silgan

Holdings

4,157

216

T.

ROWE

PRICE

Mid-Cap

Index

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

Sonoco

Products

4,912

240

2,497

Metals

&

Mining

1.3%

Alcoa

12,456

471

ATI (1)

6,254

344

Cleveland-Cliffs (1)

24,171

227

MP

Materials (1)(3)

6,697

104

Reliance

2,712

730

Royal

Gold

3,303

436

Southern

Copper

4,427

403

United

States

Steel

11,320

385

3,100

Paper

&

Forest

Products

0.1%

Louisiana-Pacific

3,182

329

329

Total

Materials

12,166

REAL

ESTATE

4.9%

Diversified

Real

Estate

Investment

Trusts

0.3%

WP

Carey,

REIT

10,963

597

597

Health

Care

Real

Estate

Investment

Trusts

0.4%

Healthcare

Realty

Trust,

REIT

17,712

300

Medical

Properties

Trust,

REIT

30,320

120

Omega

Healthcare

Investors,

REIT

13,566

513

933

Hotel

&

Resort

Real

Estate

Investment

Trusts

0.1%

Park

Hotels

&

Resorts,

REIT

10,356

146

146

Industrial

Real

Estate

Investment

Trusts

0.8%

Americold

Realty

Trust,

REIT

14,253

305

EastGroup

Properties,

REIT

2,494

400

First

Industrial

Realty

Trust,

REIT

6,694

336

Lineage,

REIT

3,087

181

Rexford

Industrial

Realty,

REIT

11,074

428

STAG

Industrial,

REIT

9,076

307

1,957

Office

Real

Estate

Investment

Trusts

0.4%

Cousins

Properties,

REIT

8,073

248

Highwoods

Properties,

REIT

5,232

160

Kilroy

Realty,

REIT

5,862

237

T.

ROWE

PRICE

Mid-Cap

Index

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

Vornado

Realty

Trust,

REIT

8,901

374

1,019

Real

Estate

Management

&

Development

0.6%

Howard

Hughes

Holdings (1)

1,581

122

Jones

Lang

LaSalle (1)

2,377

602

Seaport

Entertainment

Group (1)(3)

400

11

Zillow

Group,

Class

A (1)

2,348

166

Zillow

Group,

Class

C (1)

7,819

579

1,480

Residential

Real

Estate

Investment

Trusts

0.9%

American

Homes

4

Rent,

Class

A,

REIT

17,082

639

Equity

LifeStyle

Properties,

REIT

9,550

636

Sun

Communities,

REIT

6,216

765

2,040

Retail

Real

Estate

Investment

Trusts

0.5%

Agree

Realty,

REIT (3)

5,428

382

Brixmor

Property

Group,

REIT

15,209

424

NNN

REIT,

REIT

9,473

387

1,193

Specialized

Real

Estate

Investment

Trusts

0.9%

CubeSmart,

REIT

11,255

482

EPR

Properties,

REIT

3,743

166

Gaming

&

Leisure

Properties,

REIT

13,177

635

Lamar

Advertising,

Class

A,

REIT

4,381

533

National

Storage

Affiliates

Trust,

REIT

3,506

133

Rayonier,

REIT

7,732

202

2,151

Total

Real

Estate

11,516

UTILITIES

1.0%

Electric

Utilities

0.3%

IDACORP

2,665

291

OGE

Energy

10,145

419

710

Gas

Utilities

0.3%

MDU

Resources

10,187

184

National

Fuel

Gas

4,569

277

UGI

10,782

304

765

T.

ROWE

PRICE

Mid-Cap

Index

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

Independent

Power

&

Renewable

Electricity

Producers

0.2%

Brookfield

Renewable (3)

6,778

188

Clearway

Energy,

Class

A

1,818

44

Clearway

Energy,

Class

C

4,190

109

341

Water

Utilities

0.2%

Essential

Utilities

12,666

460

460

Total

Utilities

2,276

Total

Common

Stocks

(Cost

$198,669)

234,183

EQUITY

MUTUAL

FUNDS

0.2%

SPDR

S&P

MidCap

400

ETF

Trust (3)

923

526

Total

Equity

Mutual

Funds

(Cost

$528)

526

SHORT-TERM

INVESTMENTS

0.3%

Money

Market

Funds

0.3%

T.

Rowe

Price

Government

Reserve

Fund,

4.53% (4)(5)

683,217

683

Total

Short-Term

Investments

(Cost

$683)

683

SECURITIES

LENDING

COLLATERAL

1.6%

INVESTMENTS

IN

A

POOLED

ACCOUNT

THROUGH

SECURITIES

LENDING

PROGRAM

WITH

STATE

STREET

BANK

AND

TRUST

COMPANY 1.6%

Money

Market

Funds 1.6%

T.

Rowe

Price

Government

Reserve

Fund,

4.53% (4)(5)

3,831,216

3,831

Total

Investments

in

a

Pooled

Account

through

Securities

Lending

Program

with

State

Street

Bank

and

Trust

Company

3,831

Total

Securities

Lending

Collateral

(Cost

$3,831)

3,831

Total

Investments

in

Securities

101.8%

of

Net

Assets

(Cost

$203,711)

$

239,223

T.

ROWE

PRICE

Mid-Cap

Index

Fund

‡

Shares

are

denominated

in

U.S.

dollars

unless

otherwise

noted.

(1)

Non-income

producing

(2)

See

Note

2.

Level

3

in

fair

value

hierarchy.

(3)

See

Note

3.

All

or

a

portion

of

this

security

is

on

loan

at

December

31,

2024.

(4)

Seven-day

yield

(5)

Affiliated

Companies

EC

Escrow

CUSIP;

represents

a

beneficial

interest

in

a