UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-05986

T. Rowe Price Index Trust, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about Small-Cap Index Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Small-Cap Index Fund - Investor Class | $31 | 0.29% |

|---|

What drove fund performance during the past 12 months?

Small-cap U.S. stocks produced strong gains in 2024, as equity investors generally welcomed not only looser monetary policy starting in September, but also reduced political uncertainty following U.S. election results.

Information technology names produced robust results during the period as the sector benefited from strong investor interest in companies expected to benefit from artificial intelligence developments. Hardware and software companies performed very well during the year, as Super Micro Computer and MicroStrategy were two of the top-performing companies in the portfolio. Industrials and business services also contributed to returns, as construction and engineering companies performed particularly well.

Energy was the only sector that detracted from absolute returns during the reporting period, albeit very modestly. Energy equipment and services names hurt the most, with Noble performing worst.

The fund, which is not available for direct purchase by members of the public, employs a full replication strategy, which involves investing substantially all of its assets in all of the stocks in the index and seeking to maintain holdings of each stock in proportion to its weight in the Russell 2000 Index. By replicating the structure of the index, our intention is to closely track its performance.

How has the fund performed?

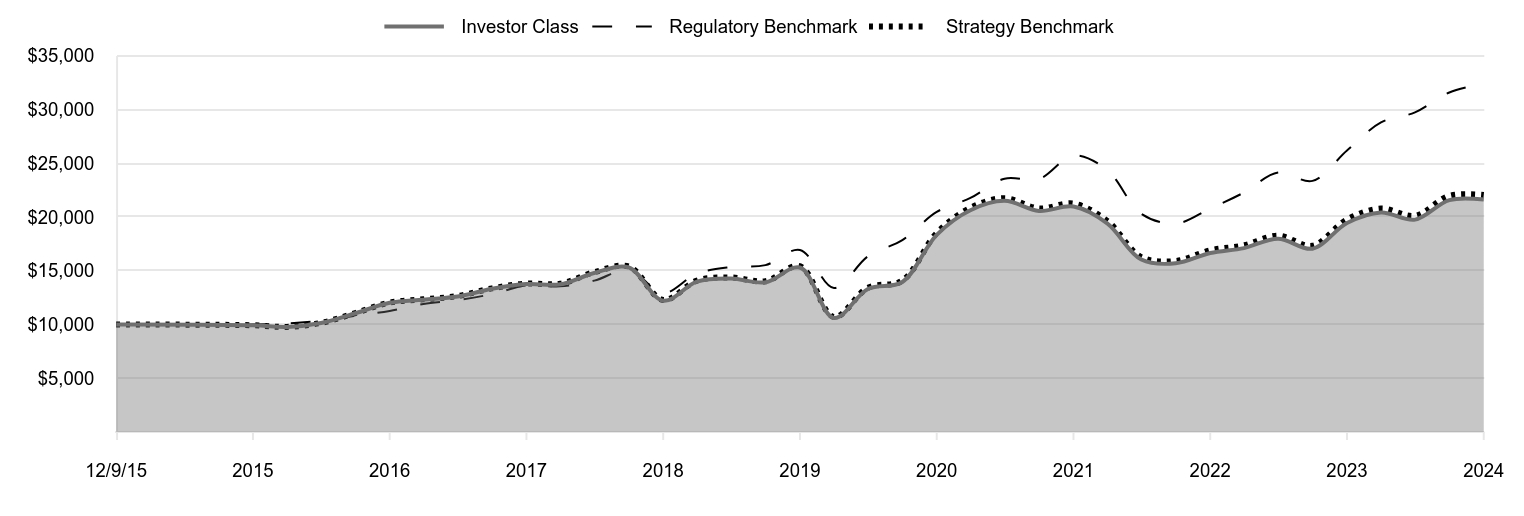

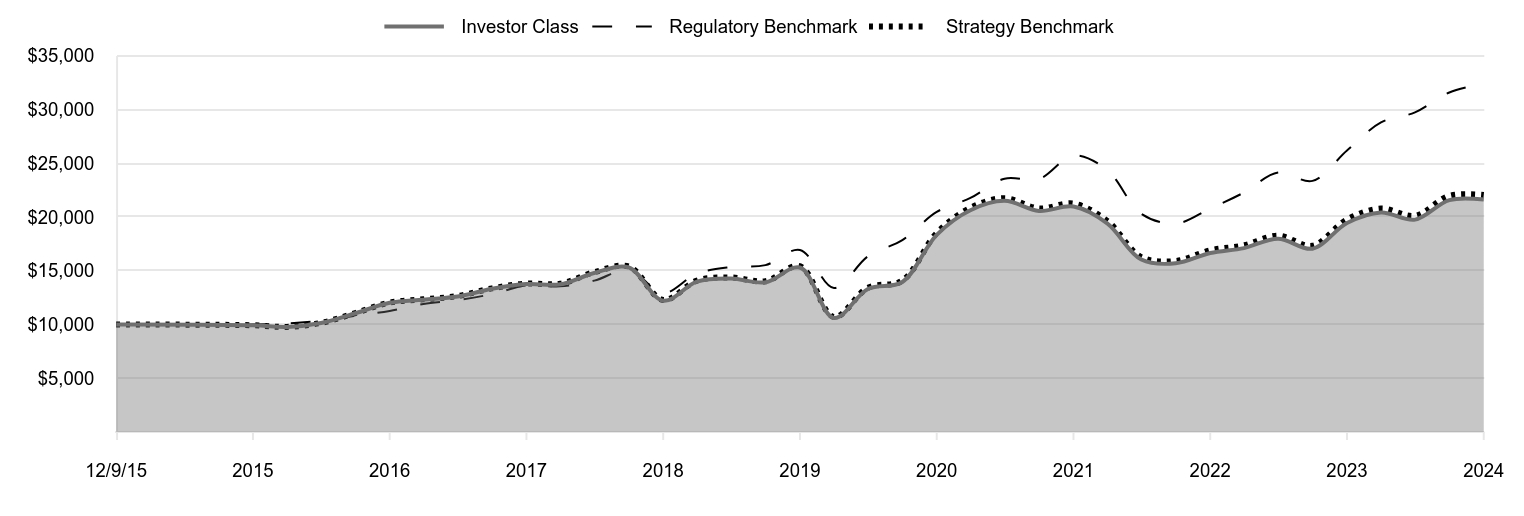

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Investor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 12/9/15 | 10,000 | 10,000 | 10,000 |

|---|

| 12/31/15 | 9,925 | 9,989 | 9,927 |

|---|

| 3/31/16 | 9,765 | 10,085 | 9,777 |

|---|

| 6/30/16 | 10,135 | 10,351 | 10,147 |

|---|

| 9/30/16 | 11,047 | 10,806 | 11,065 |

|---|

| 12/31/16 | 12,015 | 11,261 | 12,043 |

|---|

| 3/31/17 | 12,312 | 11,907 | 12,340 |

|---|

| 6/30/17 | 12,600 | 12,267 | 12,644 |

|---|

| 9/30/17 | 13,319 | 12,827 | 13,361 |

|---|

| 12/31/17 | 13,758 | 13,640 | 13,807 |

|---|

| 3/31/18 | 13,736 | 13,552 | 13,795 |

|---|

| 6/30/18 | 14,794 | 14,079 | 14,865 |

|---|

| 9/30/18 | 15,312 | 15,082 | 15,396 |

|---|

| 12/31/18 | 12,209 | 12,925 | 12,286 |

|---|

| 3/31/19 | 13,983 | 14,740 | 14,078 |

|---|

| 6/30/19 | 14,270 | 15,344 | 14,373 |

|---|

| 9/30/19 | 13,923 | 15,522 | 14,028 |

|---|

| 12/31/19 | 15,299 | 16,934 | 15,422 |

|---|

| 3/31/20 | 10,609 | 13,395 | 10,701 |

|---|

| 6/30/20 | 13,305 | 16,346 | 13,421 |

|---|

| 9/30/20 | 13,957 | 17,851 | 14,083 |

|---|

| 12/31/20 | 18,341 | 20,472 | 18,501 |

|---|

| 3/31/21 | 20,633 | 21,771 | 20,850 |

|---|

| 6/30/21 | 21,501 | 23,565 | 21,745 |

|---|

| 9/30/21 | 20,556 | 23,541 | 20,797 |

|---|

| 12/31/21 | 20,967 | 25,725 | 21,242 |

|---|

| 3/31/22 | 19,401 | 24,367 | 19,643 |

|---|

| 6/30/22 | 16,044 | 20,298 | 16,266 |

|---|

| 9/30/22 | 15,689 | 19,391 | 15,910 |

|---|

| 12/31/22 | 16,652 | 20,784 | 16,901 |

|---|

| 3/31/23 | 17,106 | 22,276 | 17,364 |

|---|

| 6/30/23 | 17,986 | 24,145 | 18,268 |

|---|

| 9/30/23 | 17,052 | 23,359 | 17,331 |

|---|

| 12/31/23 | 19,442 | 26,179 | 19,762 |

|---|

| 3/31/24 | 20,428 | 28,802 | 20,786 |

|---|

| 6/30/24 | 19,753 | 29,728 | 20,105 |

|---|

| 9/30/24 | 21,575 | 31,580 | 21,969 |

|---|

| 12/31/24 | 21,627 | 32,411 | 22,042 |

|---|

202501-4140694, 202502-4108875

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 12/9/15 |

|---|

| Small-Cap Index Fund (Investor Class) | 11.24% | 7.17% | 8.89% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 13.86 | 13.86 |

|---|

| Russell 2000 Index (Strategy Benchmark) | 11.54 | 7.40 | 9.12 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$206,379

- Number of Portfolio Holdings1,983

- Investment Advisory Fees Paid (000s)$(189)

- Portfolio Turnover Rate24.7%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Financials | 18.4% |

| Industrials & Business Services | 17.6 |

| Health Care | 16.4 |

| Information Technology | 13.8 |

| Consumer Discretionary | 9.7 |

| Real Estate | 6.0 |

| Energy | 5.1 |

| Materials | 4.2 |

| Consumer Staples | 2.9 |

| Other | 5.9 |

Top Ten Holdings (as a % of Net Assets)

| FTAI Aviation | 0.5% |

| Sprouts Farmers Market | 0.5 |

| Insmed | 0.4 |

| Vaxcyte | 0.4 |

| Credo Technology Group Holding | 0.4 |

| Applied Industrial Technologies | 0.3 |

| Mueller Industries | 0.3 |

| Rocket Lab USA | 0.3 |

| Fluor | 0.3 |

| IonQ | 0.3 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Small-Cap Index Fund

Investor Class (TRSYX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about Small-Cap Index Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Small-Cap Index Fund - I Class | $15 | 0.14% |

|---|

What drove fund performance during the past 12 months?

Small-cap U.S. stocks produced strong gains in 2024, as equity investors generally welcomed not only looser monetary policy starting in September, but also reduced political uncertainty following U.S. election results.

Information technology names produced robust results during the period as the sector benefited from strong investor interest in companies expected to benefit from artificial intelligence developments. Hardware and software companies performed very well during the year, as Super Micro Computer and MicroStrategy were two of the top-performing companies in the portfolio. Industrials and business services also contributed to returns, as construction and engineering companies performed particularly well.

Energy was the only sector that detracted from absolute returns during the reporting period, albeit very modestly. Energy equipment and services names hurt the most, with Noble performing worst.

The fund, which is not available for direct purchase by members of the public, employs a full replication strategy, which involves investing substantially all of its assets in all of the stocks in the index and seeking to maintain holdings of each stock in proportion to its weight in the Russell 2000 Index. By replicating the structure of the index, our intention is to closely track its performance.

How has the fund performed?

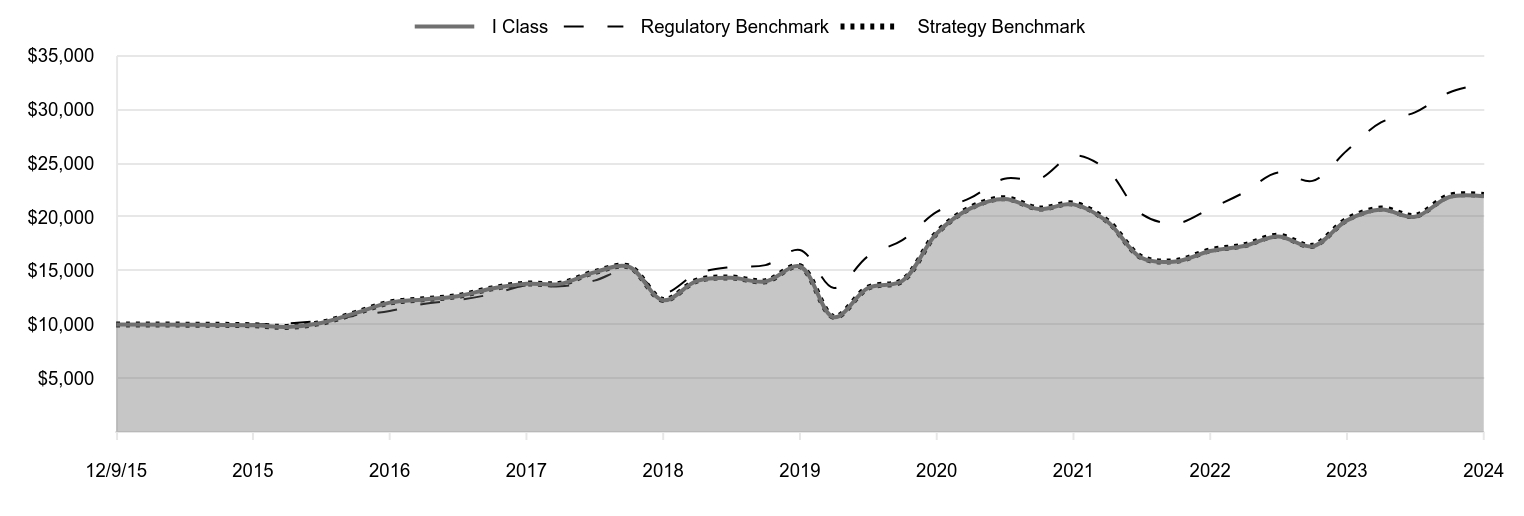

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| I Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 12/9/15 | 10,000 | 10,000 | 10,000 |

|---|

| 12/31/15 | 9,925 | 9,989 | 9,927 |

|---|

| 3/31/16 | 9,775 | 10,085 | 9,777 |

|---|

| 6/30/16 | 10,145 | 10,351 | 10,147 |

|---|

| 9/30/16 | 11,057 | 10,806 | 11,065 |

|---|

| 12/31/16 | 12,035 | 11,261 | 12,043 |

|---|

| 3/31/17 | 12,333 | 11,907 | 12,340 |

|---|

| 6/30/17 | 12,631 | 12,267 | 12,644 |

|---|

| 9/30/17 | 13,350 | 12,827 | 13,361 |

|---|

| 12/31/17 | 13,789 | 13,640 | 13,807 |

|---|

| 3/31/18 | 13,778 | 13,552 | 13,795 |

|---|

| 6/30/18 | 14,850 | 14,079 | 14,865 |

|---|

| 9/30/18 | 15,380 | 15,082 | 15,396 |

|---|

| 12/31/18 | 12,258 | 12,925 | 12,286 |

|---|

| 3/31/19 | 14,050 | 14,740 | 14,078 |

|---|

| 6/30/19 | 14,339 | 15,344 | 14,373 |

|---|

| 9/30/19 | 14,002 | 15,522 | 14,028 |

|---|

| 12/31/19 | 15,396 | 16,934 | 15,422 |

|---|

| 3/31/20 | 10,675 | 13,395 | 10,701 |

|---|

| 6/30/20 | 13,394 | 16,346 | 13,421 |

|---|

| 9/30/20 | 14,061 | 17,851 | 14,083 |

|---|

| 12/31/20 | 18,474 | 20,472 | 18,501 |

|---|

| 3/31/21 | 20,801 | 21,771 | 20,850 |

|---|

| 6/30/21 | 21,685 | 23,565 | 21,745 |

|---|

| 9/30/21 | 20,736 | 23,541 | 20,797 |

|---|

| 12/31/21 | 21,176 | 25,725 | 21,242 |

|---|

| 3/31/22 | 19,589 | 24,367 | 19,643 |

|---|

| 6/30/22 | 16,203 | 20,298 | 16,266 |

|---|

| 9/30/22 | 15,859 | 19,391 | 15,910 |

|---|

| 12/31/22 | 16,839 | 20,784 | 16,901 |

|---|

| 3/31/23 | 17,295 | 22,276 | 17,364 |

|---|

| 6/30/23 | 18,195 | 24,145 | 18,268 |

|---|

| 9/30/23 | 17,268 | 23,359 | 17,331 |

|---|

| 12/31/23 | 19,687 | 26,179 | 19,762 |

|---|

| 3/31/24 | 20,694 | 28,802 | 20,786 |

|---|

| 6/30/24 | 20,014 | 29,728 | 20,105 |

|---|

| 9/30/24 | 21,864 | 31,580 | 21,969 |

|---|

| 12/31/24 | 21,932 | 32,411 | 22,042 |

|---|

202501-4140694, 202502-4108875

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 12/9/15 |

|---|

| Small-Cap Index Fund (I Class) | 11.40% | 7.33% | 9.05% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 13.86 | 13.86 |

|---|

| Russell 2000 Index (Strategy Benchmark) | 11.54 | 7.40 | 9.12 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$206,379

- Number of Portfolio Holdings1,983

- Investment Advisory Fees Paid (000s)$(189)

- Portfolio Turnover Rate24.7%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Financials | 18.4% |

| Industrials & Business Services | 17.6 |

| Health Care | 16.4 |

| Information Technology | 13.8 |

| Consumer Discretionary | 9.7 |

| Real Estate | 6.0 |

| Energy | 5.1 |

| Materials | 4.2 |

| Consumer Staples | 2.9 |

| Other | 5.9 |

Top Ten Holdings (as a % of Net Assets)

| FTAI Aviation | 0.5% |

| Sprouts Farmers Market | 0.5 |

| Insmed | 0.4 |

| Vaxcyte | 0.4 |

| Credo Technology Group Holding | 0.4 |

| Applied Industrial Technologies | 0.3 |

| Mueller Industries | 0.3 |

| Rocket Lab USA | 0.3 |

| Fluor | 0.3 |

| IonQ | 0.3 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Small-Cap Index Fund

I Class (TRCSX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about Small-Cap Index Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Small-Cap Index Fund - Z Class | $0 | 0.00% |

|---|

What drove fund performance during the past 12 months?

Small-cap U.S. stocks produced strong gains in 2024, as equity investors generally welcomed not only looser monetary policy starting in September, but also reduced political uncertainty following U.S. election results.

Information technology names produced robust results during the period as the sector benefited from strong investor interest in companies expected to benefit from artificial intelligence developments. Hardware and software companies performed very well during the year, as Super Micro Computer and MicroStrategy were two of the top-performing companies in the portfolio. Industrials and business services also contributed to returns, as construction and engineering companies performed particularly well.

Energy was the only sector that detracted from absolute returns during the reporting period, albeit very modestly. Energy equipment and services names hurt the most, with Noble performing worst.

The fund, which is not available for direct purchase by members of the public, employs a full replication strategy, which involves investing substantially all of its assets in all of the stocks in the index and seeking to maintain holdings of each stock in proportion to its weight in the Russell 2000 Index. By replicating the structure of the index, our intention is to closely track its performance.

How has the fund performed?

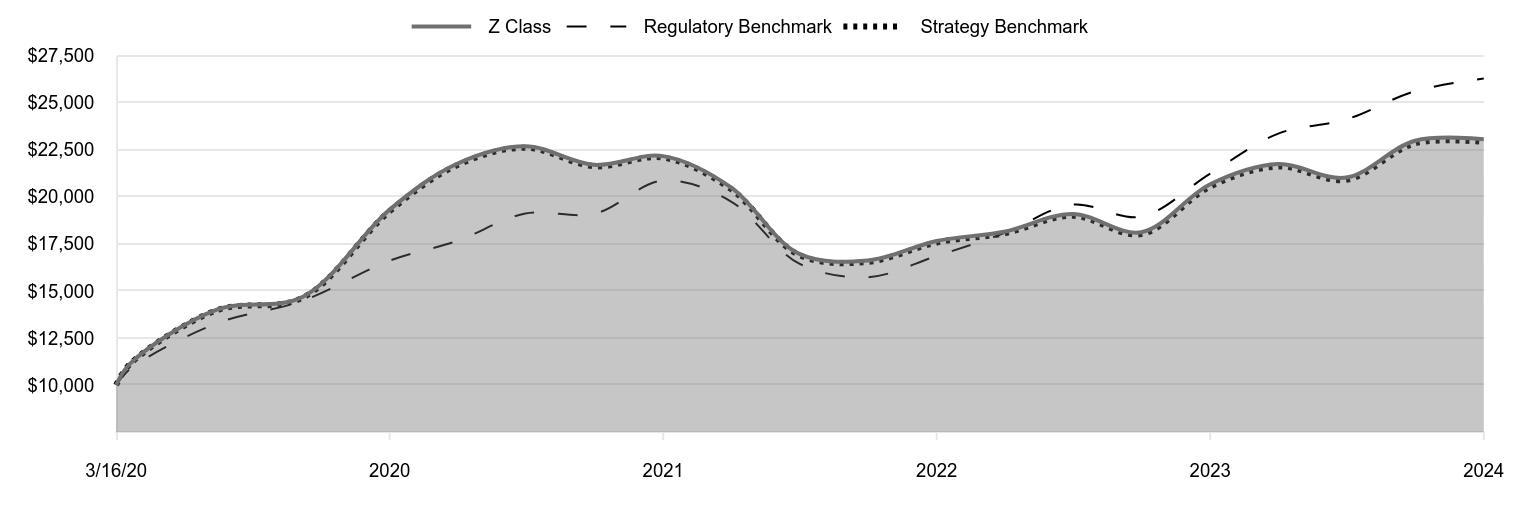

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Z Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 3/16/20 | 10,000 | 10,000 | 10,000 |

|---|

| 3/31/20 | 11,146 | 10,865 | 11,127 |

|---|

| 6/30/20 | 13,992 | 13,259 | 13,955 |

|---|

| 9/30/20 | 14,690 | 14,480 | 14,643 |

|---|

| 12/31/20 | 19,322 | 16,606 | 19,237 |

|---|

| 3/31/21 | 21,758 | 17,659 | 21,680 |

|---|

| 6/30/21 | 22,683 | 19,115 | 22,610 |

|---|

| 9/30/21 | 21,703 | 19,095 | 21,624 |

|---|

| 12/31/21 | 22,164 | 20,867 | 22,088 |

|---|

| 3/31/22 | 20,515 | 19,765 | 20,425 |

|---|

| 6/30/22 | 16,980 | 16,464 | 16,913 |

|---|

| 9/30/22 | 16,620 | 15,729 | 16,543 |

|---|

| 12/31/22 | 17,655 | 16,859 | 17,574 |

|---|

| 3/31/23 | 18,148 | 18,069 | 18,055 |

|---|

| 6/30/23 | 19,092 | 19,585 | 18,995 |

|---|

| 9/30/23 | 18,120 | 18,948 | 18,020 |

|---|

| 12/31/23 | 20,668 | 21,235 | 20,549 |

|---|

| 3/31/24 | 21,740 | 23,362 | 21,613 |

|---|

| 6/30/24 | 21,025 | 24,114 | 20,905 |

|---|

| 9/30/24 | 22,983 | 25,616 | 22,843 |

|---|

| 12/31/24 | 23,067 | 26,290 | 22,919 |

|---|

202501-4140694, 202502-4108875

Average Annual Total Returns

| | 1 Year | Since Inception 3/16/20 |

|---|

| Small-Cap Index Fund (Z Class) | 11.61% | 19.04% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 22.33 |

|---|

| Russell 2000 Index (Strategy Benchmark) | 11.54 | 18.88 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$206,379

- Number of Portfolio Holdings1,983

- Investment Advisory Fees Paid (000s)$(189)

- Portfolio Turnover Rate24.7%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Financials | 18.4% |

| Industrials & Business Services | 17.6 |

| Health Care | 16.4 |

| Information Technology | 13.8 |

| Consumer Discretionary | 9.7 |

| Real Estate | 6.0 |

| Energy | 5.1 |

| Materials | 4.2 |

| Consumer Staples | 2.9 |

| Other | 5.9 |

Top Ten Holdings (as a % of Net Assets)

| FTAI Aviation | 0.5% |

| Sprouts Farmers Market | 0.5 |

| Insmed | 0.4 |

| Vaxcyte | 0.4 |

| Credo Technology Group Holding | 0.4 |

| Applied Industrial Technologies | 0.3 |

| Mueller Industries | 0.3 |

| Rocket Lab USA | 0.3 |

| Fluor | 0.3 |

| IonQ | 0.3 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Small-Cap Index Fund

Z Class (TRZIX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| | | | | | | | | | |

| | | 2024 | | | | 2023 | | | |

Audit Fees | | $ | 23,525 | | | $ | 24,714 | | | |

Audit-Related Fees | | | - | | | | - | | | |

Tax Fees | | | - | | | | - | | | |

All Other Fees | | | - | | | | - | | | |

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,262,000 and $1,524,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

Financial

Highlights

Portfolio

of

Investments

Financial

Statements

and

Notes

Additional

Fund

Information

Financial

Statements

and

Other

Information

For

more

insights

from

T.

Rowe

Price

investment

professionals,

go

to

troweprice.com

.

T.

ROWE

PRICE

TRSYX

Small-Cap

Index

Fund

TRCSX

Small-Cap

Index

Fund–

.

I Class

TRZIX

Small-Cap

Index

Fund–

.

Z Class

T.

ROWE

PRICE

Small-Cap

Index

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Investor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

14.40

$

12.48

$

15.93

$

14.16

$

12.20

Investment

activities

Net

investment

income

(1)(2)

0.18

0

.18

0.17

0.11

0.11

Net

realized

and

unrealized

gain/loss

1.46

1.90

(3.44)

1.91

2.30

Total

from

investment

activities

1.64

2.08

(3.27)

2.02

2.41

Distributions

Net

investment

income

(0.18)

(0.16)

(0.16)

(0.11)

(0.12)

Net

realized

gain

(0.26)

—

(0.02)

(0.14)

(0.33)

Total

distributions

(0.44)

(0.16)

(0.18)

(0.25)

(0.45)

NET

ASSET

VALUE

End

of

period

$

15.60

$

14.40

$

12.48

$

15.93

$

14.16

Ratios/Supplemental

Data

Total

return

(2)(3)

11.24%

16.75%

(20.58)%

14.32%

19.88%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.34%

0.35%

4.93%

1.87%

4.10%

Net

expenses

after

waivers/

payments

by

Price

Associates

0.29%

0.29%

0.29%

0.34%

0.35%

Net

investment

income

1.22%

1.39%

1.26%

0.70%

1.00%

Portfolio

turnover

rate

24.7%

27.2%

22.0%

29.0%

21.1%

Net

assets,

end

of

period

(in

thousands)

$98

$177

$154

$197

$6,726

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Small-Cap

Index

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

I

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

14.47

$

12.54

$

16.01

$

14.21

$

12.23

Investment

activities

Net

investment

income

(1)(2)

0.21

0.20

0.19

0.18

0.13

Net

realized

and

unrealized

gain/loss

1.47

1.91

(3.46)

1.89

2.30

Total

from

investment

activities

1.68

2.11

(3.27)

2.07

2.43

Distributions

Net

investment

income

(0.24)

(0.18)

(0.18)

(0.13)

(0.12)

Net

realized

gain

(0.26)

—

(0.02)

(0.14)

(0.33)

Total

distributions

(0.50)

(0.18)

(0.20)

(0.27)

(0.45)

NET

ASSET

VALUE

End

of

period

$

15.65

$

14.47

$

12.54

$

16.01

$

14.21

Ratios/Supplemental

Data

Total

return

(2)(3)

11.40%

16.92%

(20.48)%

14.63%

20.00%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.31%

0.40%

0.42%

0.65%

3.93%

Net

expenses

after

waivers/payments

by

Price

Associates

0.14%

0.14%

0.14%

0.17%

0.20%

Net

investment

income

1.38%

1.55%

1.43%

1.12%

1.15%

Portfolio

turnover

rate

24.7%

27.2%

22.0%

29.0%

21.1%

Net

assets,

end

of

period

(in

thousands)

$132,082

$112,086

$85,393

$90,212

$355

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Small-Cap

Index

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Z

Class

(1)

..

Year

..

..

Ended

.

3/16/20

(1)

Through

12/31/20

12/31/24

12/31/23

12/31/22

12/31/21

NET

ASSET

VALUE

Beginning

of

period

$

14.46

$

12.53

$

15.99

$

14.20

$

7.59

Investment

activities

Net

investment

income

(2)(3)

0.24

0.23

0.22

0.23

0.11

Net

realized

and

unrealized

gain/loss

1.46

1.90

(3.47)

1.85

6.95

Total

from

investment

activities

1.70

2.13

(3.25)

2.08

7.06

Distributions

Net

investment

income

(0.25)

(0.20)

(0.19)

(0.15)

(0.12)

Net

realized

gain

(0.26)

—

(0.02)

(0.14)

(0.33)

Total

distributions

(0.51)

(0.20)

(0.21)

(0.29)

(0.45)

NET

ASSET

VALUE

End

of

period

$

15.65

$

14.46

$

12.53

$

15.99

$

14.20

Ratios/Supplemental

Data

Total

return

(3)(4)

11.61%

17.07%

(20.35)%

14.71%

93.22%

Ratios

to

average

net

assets:

(3)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.26%

0.32%

0.38%

0.72%

3.86%

(5)

Net

expenses

after

waivers/

payments

by

Price

Associates

0.00%

0.00%

0.00%

0.01%

0.01%

(5)

Net

investment

income

1.55%

1.75%

1.67%

1.40%

1.30%

(5)

Portfolio

turnover

rate

24.7%

27.2%

22.0%

29.0%

21.1%

Net

assets,

end

of

period

(in

thousands)

$74,199

$36,196

$11,833

$1,104

$187

0%

0%

0%

0%

0%

(1)

Inception

date

(2)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(3)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(4)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

Total

return

is

not

annualized

for

periods

less

than

one

year.

(5)

Annualized

T.

ROWE

PRICE

Small-Cap

Index

Fund

December

31,

2024

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

COMMON

STOCKS

99.6%

COMMUNICATION

SERVICES

2.7%

Diversified

Telecommunication

Services

0.6%

Anterix (1)

763

24

AST

SpaceMobile (1)(2)

10,291

217

ATN

International

760

13

Bandwidth,

Class

A (1)

1,838

31

Cogent

Communications

Holdings

3,368

260

Globalstar (1)

56,417

117

IDT,

Class

B

1,202

57

Liberty

Latin

America,

Class

A (1)

2,357

15

Liberty

Latin

America,

Class

C (1)

10,155

64

Lumen

Technologies (1)

77,424

411

Shenandoah

Telecommunications

3,828

48

1,257

Entertainment

0.5%

AMC

Entertainment

Holdings,

Class

A (1)

27,091

108

Atlanta

Braves

Holdings,

Class

A (1)

766

31

Atlanta

Braves

Holdings,

Class

C (1)

3,883

149

Cinemark

Holdings (1)

8,440

261

Eventbrite,

Class

A (1)

5,793

19

Golden

Matrix

Group (1)(2)

1,587

3

IMAX (1)

3,326

85

Lions

Gate

Entertainment,

Class

A (1)(2)

4,430

38

Lions

Gate

Entertainment,

Class

B (1)

9,475

72

LiveOne (1)

5,016

7

Madison

Square

Garden

Entertainment (1)

3,064

109

Marcus

1,846

40

Playstudios (1)

7,880

15

Reservoir

Media (1)

1,458

13

Sphere

Entertainment (1)(2)

2,111

85

Vivid

Seats,

Class

A (1)(2)

6,265

29

1,064

Interactive

Media

&

Services

0.6%

Bumble,

Class

A (1)

7,507

61

Cargurus (1)

6,664

243

Cars.com (1)

5,127

89

EverQuote,

Class

A (1)

1,869

37

fuboTV (1)(2)

24,153

30

Getty

Images

Holdings (1)

7,476

16

Grindr (1)

1,837

33

T.

ROWE

PRICE

Small-Cap

Index

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

MediaAlpha,

Class

A (1)

2,409

27

Nextdoor

Holdings (1)

12,991

31

Outbrain (1)

3,077

22

QuinStreet (1)

4,087

94

Shutterstock

1,863

57

System1 (1)

2,295

2

TrueCar (1)

6,696

25

Vimeo (1)

11,086

71

Webtoon

Entertainment (1)(2)

1,074

15

Yelp (1)

4,975

193

Ziff

Davis (1)

3,417

186

ZipRecruiter,

Class

A (1)

5,407

39

1,271

Media

0.8%

Advantage

Solutions (1)

8,005

23

AMC

Networks,

Class

A (1)(2)

2,439

24

Boston

Omaha,

Class

A (1)(2)

1,983

28

Cable

One (2)

435

158

Cardlytics (1)(2)

2,821

10

Clear

Channel

Outdoor

Holdings (1)

26,208

36

EchoStar,

Class

A (1)(2)

9,359

214

Emerald

Holding (2)

1,038

5

Entravision

Communications,

Class

A

4,222

10

EW

Scripps,

Class

A (1)

4,845

11

Gambling.com

Group (1)

1,326

19

Gannett (1)

10,593

54

Gray

Television

6,638

21

Ibotta,

Class

A (1)(2)

1,195

78

iHeartMedia,

Class

A (1)

8,836

17

Innovid (1)

8,750

27

Integral

Ad

Science

Holding (1)

5,526

58

John

Wiley

&

Sons,

Class

A

3,038

133

Magnite (1)

9,729

155

National

CineMedia (1)

5,266

35

PubMatic,

Class

A (1)

3,295

48

Scholastic

1,735

37

Sinclair

2,397

39

Stagwell (1)

6,594

43

TechTarget (1)

2,097

42

TEGNA

12,719

233

Thryv

Holdings (1)

2,869

42

Townsquare

Media,

Class

A (2)

1,224

11

T.

ROWE

PRICE

Small-Cap

Index

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

WideOpenWest (1)

3,828

19

1,630

Wireless

Telecommunication

Services

0.2%

Gogo (1)(2)

4,810

39

Spok

Holdings

1,331

22

Telephone

&

Data

Systems

7,574

258

319

Total

Communication

Services

5,541

CONSUMER

DISCRETIONARY

9.7%

Automobile

Components

1.1%

Adient (1)

6,735

116

American

Axle

&

Manufacturing

Holdings (1)

8,620

50

Cooper-Standard

Holdings (1)

1,333

18

Dana

10,122

117

Dorman

Products (1)

1,984

257

Fox

Factory

Holding (1)

3,284

99

Gentherm (1)

2,388

95

Goodyear

Tire

&

Rubber (1)

21,920

197

Holley (1)(2)

3,650

11

LCI

Industries

1,907

197

Luminar

Technologies (1)

1,794

10

Modine

Manufacturing (1)

3,973

461

Patrick

Industries

2,491

207

Phinia

3,234

156

Solid

Power (1)(2)

12,488

24

Standard

Motor

Products

1,588

49

Stoneridge (1)

1,949

12

Visteon (1)

2,114

188

XPEL (1)

1,902

76

2,340

Automobiles

0.1%

Canoo (1)

217

—

Livewire

Group (1)

1,171

6

Winnebago

Industries

2,186

104

110

Broadline

Retail

0.0%

1stdibs.com (1)

1,865

7

Groupon (1)(2)

1,852

22

Qurate

Retail,

Class

B (1)

65

—

Savers

Value

Village (1)

1,733

18

47

T.

ROWE

PRICE

Small-Cap

Index

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Distributors

0.0%

A-Mark

Precious

Metals

1,455

40

GigaCloud

Technology,

Class

A (1)(2)

1,740

32

Weyco

Group

432

16

88

Diversified

Consumer

Services

1.2%

Adtalem

Global

Education (1)

2,867

260

American

Public

Education (1)

1,228

26

Carriage

Services

1,021

41

Chegg (1)

8,619

14

Clear

Secure,

Class

A

6,803

181

Coursera (1)

10,685

91

European

Wax

Center,

Class

A (1)(2)

2,383

16

Frontdoor (1)

5,900

323

Graham

Holdings,

Class

B

246

214

KinderCare

Learning (1)

2,112

38

Laureate

Education (1)

10,093

185

Lincoln

Educational

Services (1)

2,115

33

Mister

Car

Wash (1)(2)

7,449

54

Nerdy (1)(2)

6,995

11

OneSpaWorld

Holdings

7,771

155

Perdoceo

Education

5,057

134

Strategic

Education

1,717

160

Stride (1)

3,260

339

Udemy (1)

6,894

57

Universal

Technical

Institute (1)

3,072

79

2,411

Hotels,

Restaurants

&

Leisure

2.0%

Accel

Entertainment (1)

3,967

42

Bally's (1)

1,790

32

Biglari

Holdings,

Class

B (1)

59

15

BJ's

Restaurants (1)

1,518

53

Bloomin'

Brands

6,018

73

Brinker

International (1)

3,372

446

Cheesecake

Factory (2)

3,743

178

Cracker

Barrel

Old

Country

Store (2)

1,717

91

Dave

&

Buster's

Entertainment (1)(2)

2,460

72

Denny's (1)

3,769

23

Despegar.com (1)

4,765

92

Dine

Brands

Global (2)

1,133

34

El

Pollo

Loco

Holdings (1)

1,885

22

Empire

Resorts,

EC (1)(3)

9

—

T.

ROWE

PRICE

Small-Cap

Index

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Everi

Holdings (1)

6,146

83

First

Watch

Restaurant

Group (1)(2)

2,291

43

Full

House

Resorts (1)(2)

2,270

9

Global

Business

Travel

Group

I (1)

9,741

90

Golden

Entertainment

1,536

49

Hilton

Grand

Vacations (1)

5,496

214

Inspired

Entertainment (1)

1,761

16

International

Game

Technology

8,711

154

Jack

in

the

Box (2)

1,492

62

Krispy

Kreme

6,498

64

Kura

Sushi

USA,

Class

A (1)

442

40

Life

Time

Group

Holdings (1)

4,790

106

Lindblad

Expeditions

Holdings (1)

2,862

34

Monarch

Casino

&

Resort

996

79

Nathan's

Famous

222

17

ONE

Group

Hospitality (1)

1,360

4

Papa

John's

International

2,570

106

PlayAGS (1)

3,130

36

Portillo's,

Class

A (1)(2)

3,991

37

Potbelly (1)

1,951

18

RCI

Hospitality

Holdings

659

38

Red

Rock

Resorts,

Class

A

3,800

176

Rush

Street

Interactive (1)

5,803

80

Sabre (1)

29,548

108

Shake

Shack,

Class

A (1)

2,910

378

Six

Flags

Entertainment

7,106

342

Super

Group

SGHC

11,664

73

Sweetgreen,

Class

A (1)

7,683

246

Target

Hospitality (1)

2,395

23

United

Parks

&

Resorts (1)

2,529

142

Vacasa,

Class

A (1)(2)

762

4

Xponential

Fitness,

Class

A (1)(2)

1,972

26

4,070

Household

Durables

1.9%

Beazer

Homes

USA (1)

2,260

62

Cavco

Industries (1)

635

283

Century

Communities

2,139

157

Champion

Homes (1)

4,107

362

Cricut,

Class

A

3,522

20

Dream

Finders

Homes,

Class

A (1)(2)

2,090

49

Ethan

Allen

Interiors

1,800

51

Flexsteel

Industries

334

18

GoPro,

Class

A (1)

10,250

11

T.

ROWE

PRICE

Small-Cap

Index

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Green

Brick

Partners (1)

2,381

134

Hamilton

Beach

Brands

Holding,

Class

A

617

10

Helen

of

Troy (1)

1,761

105

Hooker

Furnishings

806

11

Hovnanian

Enterprises,

Class

A (1)

388

52

Installed

Building

Products

1,835

322

iRobot (1)

2,490

19

KB

Home

4,980

327

Landsea

Homes (1)

1,362

12

La-Z-Boy

3,263

142

Legacy

Housing (1)

877

22

LGI

Homes (1)

1,608

144

Lifetime

Brands

916

5

Lovesac (1)(2)

1,092

26

M/I

Homes (1)

2,037

271

Meritage

Homes

2,748

423

Purple

Innovation (1)

3,083

2

Sonos (1)

9,323

140

Taylor

Morrison

Home (1)

7,870

482

Traeger (1)

2,404

6

Tri

Pointe

Homes (1)

7,051

256

United

Homes

Group (1)

302

1

Worthington

Enterprises

2,392

96

4,021

Leisure

Products

0.4%

Acushnet

Holdings (2)

2,190

156

AMMO (1)

5,813

6

Clarus

2,343

11

Escalade

722

10

Funko,

Class

A (1)

2,349

31

JAKKS

Pacific (1)

608

17

Johnson

Outdoors,

Class

A (2)

343

11

Latham

Group (1)

2,945

21

Malibu

Boats,

Class

A (1)

1,547

58

Marine

Products

561

5

MasterCraft

Boat

Holdings (1)

1,218

23

Peloton

Interactive,

Class

A (1)

27,020

235

Revelyst (1)

4,412

85

Smith

&

Wesson

Brands

3,429

35

Solo

Brands,

Class

A (1)(2)

2,408

3

Sturm

Ruger

1,297

46

Topgolf

Callaway

Brands (1)

11,050

87

840

T.

ROWE

PRICE

Small-Cap

Index

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Specialty

Retail

2.4%

1-800-Flowers.com,

Class

A (1)(2)

2,043

17

Abercrombie

&

Fitch,

Class

A (1)

3,866

578

Academy

Sports

&

Outdoors

5,279

304

aka

Brands

Holding (1)

83

2

American

Eagle

Outfitters

13,653

228

America's

Car-Mart (1)

555

28

Arhaus (2)

3,892

37

Arko

6,408

42

Asbury

Automotive

Group (1)

1,506

366

BARK (1)(2)

10,061

18

Beyond (1)

3,229

16

Boot

Barn

Holdings (1)

2,267

344

Buckle

2,387

121

Build-A-Bear

Workshop

967

44

Caleres (2)

2,656

61

Camping

World

Holdings,

Class

A

4,266

90

Citi

Trends (1)(2)

443

12

Designer

Brands,

Class

A (2)

3,447

18

Destination

XL

Group (1)(2)

4,340

12

EVgo (1)(2)

7,557

31

Foot

Locker (1)

6,459

140

Genesco (1)

818

35

Group

1

Automotive

1,014

427

GrowGeneration (1)

4,431

7

Haverty

Furniture

1,080

24

J

Jill

520

14

Lands'

End (1)

984

13

Leslie's (1)

13,343

30

MarineMax (1)

1,705

49

Monro

2,340

58

National

Vision

Holdings (1)

6,102

64

ODP (1)

2,475

56

OneWater

Marine,

Class

A (1)(2)

842

15

Petco

Health

&

Wellness (1)

6,290

24

RealReal (1)(2)

7,791

85

Revolve

Group (1)

2,969

99

RumbleON,

Class

B (1)(2)

1,227

7

Sally

Beauty

Holdings (1)

7,827

82

Shoe

Carnival

1,343

44

Signet

Jewelers

3,246

262

Sleep

Number (1)

1,571

24

Sonic

Automotive,

Class

A

1,130

72

T.

ROWE

PRICE

Small-Cap

Index

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Stitch

Fix,

Class

A (1)

8,128

35

ThredUp,

Class

A (1)

7,307

10

Tile

Shop

Holdings (1)

2,171

15

Tilly's,

Class

A (1)(2)

1,310

6

Torrid

Holdings (1)(2)

1,869

10

Upbound

Group

4,119

120

Urban

Outfitters (1)

4,864

267

Victoria's

Secret (1)

6,002

249

Warby

Parker,

Class

A (1)

6,846

166

Winmark

221

87

Zumiez (1)

1,188

23

4,988

Textiles,

Apparel

&

Luxury

Goods

0.6%

Figs,

Class

A (1)

10,177

63

G-III

Apparel

Group (1)

2,959

97

Hanesbrands (1)

27,154

221

Kontoor

Brands

4,214

360

Movado

Group

1,181

23

Oxford

Industries

1,125

89

Rocky

Brands

493

11

Steven

Madden

5,569

237

Superior

Group

918

15

Vera

Bradley (1)

1,839

7

Wolverine

World

Wide

6,095

135

1,258

Total

Consumer

Discretionary

20,173

CONSUMER

STAPLES

2.9%

Beverages

0.3%

MGP

Ingredients

1,057

42

National

Beverage

1,824

78

Primo

Brands

12,086

372

Vita

Coco (1)(2)

3,046

112

604

Consumer

Staples

Distribution

&

Retail

0.9%

Andersons

2,537

103

Chefs'

Warehouse (1)

2,712

134

Guardian

Pharmacy

Services,

Class

A (1)

652

13

HF

Foods

Group (1)

2,819

9

Ingles

Markets,

Class

A

1,093

70

Natural

Grocers

by

Vitamin

Cottage

748

30

PriceSmart

1,937

179

SpartanNash

2,588

47

T.

ROWE

PRICE

Small-Cap

Index

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Sprouts

Farmers

Market (1)

7,736

983

United

Natural

Foods (1)

4,554

124

Village

Super

Market,

Class

A

651

21

Weis

Markets

1,252

85

1,798

Food

Products

1.0%

Alico (2)

541

14

B&G

Foods (2)

5,758

40

Beyond

Meat (1)(2)

4,460

17

BRC,

Class

A (1)(2)

3,656

12

Calavo

Growers

1,267

32

Cal-Maine

Foods

3,142

323

Dole

5,712

77

Forafric

Global (1)

365

4

Fresh

Del

Monte

Produce

2,625

87

Hain

Celestial

Group (1)

7,074

44

J

&

J

Snack

Foods

1,179

183

John

B.

Sanfilippo

&

Son

685

60

Lancaster

Colony

1,502

260

Lifeway

Foods (1)(2)

353

9

Limoneira

1,259

31

Mama's

Creations (1)

2,726

22

Mission

Produce (1)

3,424

49

Seneca

Foods,

Class

A (1)(2)

375

30

Simply

Good

Foods (1)

6,981

272

SunOpta (1)

7,411

57

TreeHouse

Foods (1)

3,654

128

Utz

Brands

5,052

79

Vital

Farms (1)

2,531

95

Westrock

Coffee (1)

2,711

17

WK

Kellogg (2)

4,993

90

2,032

Household

Products

0.3%

Central

Garden

&

Pet (1)(2)

763

30

Central

Garden

&

Pet,

Class

A (1)

4,042

134

Energizer

Holdings

5,491

191

Oil-Dri

365

32

WD-40

1,046

254

641

Personal

Care

Products

0.3%

Beauty

Health (1)(2)

5,365

9

Edgewell

Personal

Care

3,766

127

T.

ROWE

PRICE

Small-Cap

Index

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Herbalife (1)

7,916

53

Honest (1)

6,528

45

Interparfums

1,393

183

Medifast (1)

748

13

Nature's

Sunshine

Products (1)

982

14

Nu

Skin

Enterprises,

Class

A

3,715

26

Olaplex

Holdings (1)(2)

9,831

17

USANA

Health

Sciences (1)

848

30

Veru (1)

9,733

6

Waldencast,

Class

A (1)

1,756

7

530

Tobacco

0.1%

Ispire

Technology (1)(2)

1,380

7

Turning

Point

Brands

1,299

78

Universal

1,826

100

185

Total

Consumer

Staples

5,790

ENERGY

5.1%

Energy

Equipment

&

Services

2.1%

Archrock

12,786

318

Atlas

Energy

Solutions (2)

5,250

116

Borr

Drilling (2)

18,426

72

Bristow

Group (1)

1,924

66

Cactus,

Class

A

5,109

298

ChampionX

14,605

397

Core

Laboratories (2)

3,581

62

DMC

Global (1)(2)

1,386

10

Drilling

Tools

International (1)

911

3

Expro

Group

Holdings (1)

7,371

92

Forum

Energy

Technologies (1)

841

13

Geospace

Technologies (1)

922

9

Helix

Energy

Solutions

Group (1)

10,941

102

Helmerich

&

Payne

7,394

237

Innovex

International (1)

2,544

36

Kodiak

Gas

Services

2,484

101

Liberty

Energy

12,166

242

Mammoth

Energy

Services (1)

1,558

5

Nabors

Industries (1)

676

39

Natural

Gas

Services

Group (1)

871

23

Noble

10,579

332

NPK

International (1)

6,623

51

Oceaneering

International (1)

7,775

203

T.

ROWE

PRICE

Small-Cap

Index

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Oil

States

International (1)

4,590

23

Patterson-UTI

Energy

29,904

247

ProFrac

Holding,

Class

A (1)(2)

1,652

13

ProPetro

Holding (1)

6,753

63

Ranger

Energy

Services,

Class

A

1,326

21

RPC (2)

6,305

37

SEACOR

Marine

Holdings (1)(2)

1,760

12

Seadrill (1)

5,362

209

Select

Water

Solutions

6,915

92

Solaris

Energy

Infrastructure

1,882

54

TETRA

Technologies (1)

9,349

33

Tidewater (1)

3,778

207

Transocean (1)(2)

56,096

210

Valaris (1)

4,741

210

4,258

Oil,

Gas

&

Consumable

Fuels

3.0%

Aemetis (1)

2,664

7

Amplify

Energy (1)(2)

2,772

17

Ardmore

Shipping

3,078

37

Berry

5,712

24

BKV (1)

1,090

26

California

Resources

5,275

274

Centrus

Energy,

Class

A (1)

1,097

73

Clean

Energy

Fuels (1)

12,762

32

CNX

Resources (1)

11,168

409

Comstock

Resources (1)(2)

7,023

128

CONSOL

Energy

2,238

239

Crescent

Energy,

Class

A

12,557

183

CVR

Energy

2,692

50

Delek

U.S.

Holdings

4,920

91

DHT

Holdings

10,453

97

Diversified

Energy

3,561

60

Dorian

LPG

2,830

69

Empire

Petroleum (1)(2)

1,272

10

Encore

Energy (1)

13,569

46

Energy

Fuels (1)(2)

14,620

75

Evolution

Petroleum

2,342

12

Excelerate

Energy,

Class

A

1,280

39

FLEX

LNG (2)

2,334

53

FutureFuel

1,804

10

Golar

LNG

7,583

321

Granite

Ridge

Resources (2)

3,938

25

Green

Plains (1)

4,768

45

T.

ROWE

PRICE

Small-Cap

Index

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Gulfport

Energy (1)

1,004

185

Hallador

Energy (1)(2)

1,849

21

HighPeak

Energy (2)

1,040

15

International

Seaways (2)

3,166

114

Kinetik

Holdings

2,958

168

Kosmos

Energy (1)

36,247

124

Magnolia

Oil

&

Gas,

Class

A

13,270

310

Murphy

Oil

10,990

333

NACCO

Industries,

Class

A

275

8

NextDecade (1)

9,036

70

Nordic

American

Tankers (2)

15,282

38

Northern

Oil

&

Gas (2)

7,586

282

Par

Pacific

Holdings (1)

4,244

70

PBF

Energy,

Class

A

7,717

205

Peabody

Energy

9,728

204

PrimeEnergy

Resources (1)

49

11

REX

American

Resources (1)

1,213

51

Riley

Exploration

Permian

925

29

Ring

Energy (1)

10,512

14

Sable

Offshore (1)

3,841

88

SandRidge

Energy

2,495

29

Scorpio

Tankers

3,445

171

SFL

9,962

102

Sitio

Royalties,

Class

A

6,229

119

SM

Energy

8,764

340

Talos

Energy (1)

10,982

107

Teekay

4,258

29

Teekay

Tankers,

Class

A

1,867

74

Uranium

Energy (1)

30,658

205

Ur-Energy (1)(2)

26,192

30

VAALCO

Energy

8,025

35

Verde

Clean

Fuels (1)

210

1

Vital

Energy (1)(2)

2,228

69

Vitesse

Energy (2)

1,879

47

W&T

Offshore (2)

7,003

12

World

Kinect

4,326

119

6,281

Total

Energy

10,539

FINANCIALS

18.4%

Banks

10.2%

1st

Source

1,399

82

ACNB

601

24

Amalgamated

Financial

1,413

47

T.

ROWE

PRICE

Small-Cap

Index

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Amerant

Bancorp

2,834

64

Ameris

Bancorp

5,044

316

Ames

National

629

10

Arrow

Financial

1,222

35

Associated

Banc-Corp

12,390

296

Atlantic

Union

Bankshares

6,839

259

Axos

Financial (1)

4,188

293

Banc

of

California

10,744

166

BancFirst

1,545

181

Bancorp (1)

3,605

190

Bank

First

734

73

Bank

of

Hawaii

3,005

214

Bank

of

Marin

Bancorp

1,249

30

Bank

of

NT

Butterfield

&

Son

3,441

126

Bank7

350

16

BankUnited

5,732

219

Bankwell

Financial

Group

463

14

Banner

2,627

175

Bar

Harbor

Bankshares

1,117

34

BayCom

756

20

BCB

Bancorp

1,137

13

Berkshire

Hills

Bancorp

3,264

93

Blue

Foundry

Bancorp (1)

1,455

14

Bridgewater

Bancshares (1)

1,556

21

Brookline

Bancorp

6,839

81

Burke

&

Herbert

Financial

Services

1,034

64

Business

First

Bancshares

1,811

47

Byline

Bancorp

2,424

70

Cadence

Bank

14,013

483

California

Bancorp (1)

1,883

31

Camden

National

1,146

49

Capital

Bancorp

694

20

Capital

City

Bank

Group

1,025

38

Capitol

Federal

Financial

9,474

56

Carter

Bankshares (1)

1,722

30

Cathay

General

Bancorp

5,324

253

Central

Pacific

Financial

2,038

59

Chemung

Financial

245

12

ChoiceOne

Financial

Services

634

23

Citizens

&

Northern

1,145

21

Citizens

Financial

Services

335

21

City

Holding

1,107

131

Civista

Bancshares

1,189

25

T.

ROWE

PRICE

Small-Cap

Index

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

CNB

Financial

1,586

39

Coastal

Financial (1)

877

74

Colony

Bankcorp

1,343

22

Columbia

Financial (1)

2,033

32

Community

Financial

System

4,001

247

Community

Trust

Bancorp

1,172

62

Community

West

Bancshares

1,226

24

ConnectOne

Bancorp

2,816

65

CrossFirst

Bankshares (1)

3,540

54

Customers

Bancorp (1)

2,247

109

CVB

Financial

10,183

218

Dime

Community

Bancshares

2,743

84

Eagle

Bancorp

2,306

60

Eastern

Bankshares

14,758

255

Enterprise

Bancorp

785

31

Enterprise

Financial

Services

2,863

161

Equity

Bancshares,

Class

A

1,072

45

Esquire

Financial

Holdings

529

42

ESSA

Bancorp

641

13

Farmers

&

Merchants

Bancorp

970

29

Farmers

National

Banc

2,722

39

FB

Financial

2,740

141

Fidelity

D&D

Bancorp

371

18

Financial

Institutions

1,207

33

First

Bancorp

782

21

First

Bancorp

North

Carolina

3,090

136

First

BanCorp

Puerto

Rico

12,381

230

First

Bancshares

2,357

83

First

Bank

New

Jersey

1,532

22

First

Busey

4,143

98

First

Business

Financial

Services

641

30

First

Commonwealth

Financial

7,804

132

First

Community

Bankshares

1,330

55

First

Financial

881

41

First

Financial

Bancorp

7,263

195

First

Financial

Bankshares

9,963

359

First

Financial

Northwest

506

11

First

Foundation

4,846

30

First

Internet

Bancorp

633

23

First

Interstate

BancSystem,

Class

A

6,103

198

First

Merchants

4,456

178

First

Mid

Bancshares

1,782

66

First

of

Long

Island

1,563

18

T.

ROWE

PRICE

Small-Cap

Index

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

First

Western

Financial (1)

552

11

Five

Star

Bancorp

1,244

37

Flagstar

Financial

19,495

182

Flushing

Financial

2,053

29

FS

Bancorp

512

21

Fulton

Financial

13,886

268

FVCBankcorp (1)

1,175

15

German

American

Bancorp

2,167

87

Glacier

Bancorp

8,716

438

Great

Southern

Bancorp

641

38

Greene

County

Bancorp

498

14

Guaranty

Bancshares

621

22

Hancock

Whitney

6,644

364

Hanmi

Financial

2,345

55

HarborOne

Bancorp

2,787

33

HBT

Financial

963

21

Heartland

Financial

USA

3,261

200

Heritage

Commerce

4,423

42

Heritage

Financial

2,616

64

Hilltop

Holdings

3,605

103

Hingham

Institution

For

Savings (2)

126

32

Home

Bancorp

545

25

Home

BancShares

14,261

404

HomeStreet (1)

1,331

15

HomeTrust

Bancshares

1,136

38

Hope

Bancorp

8,964

110

Horizon

Bancorp

3,246

52

Independent

Bank,

(MA)

3,263

209

Independent

Bank,

(MI)

1,560

54

Independent

Bank

Group

2,802

170

International

Bancshares

4,135

261

Investar

Holding

669

15

John

Marshall

Bancorp

946

19

Kearny

Financial

3,357

24

Lakeland

Financial

1,920

132

LCNB

970

15

LINKBANCORP (2)

1,607

12

Live

Oak

Bancshares

2,692

106

Mercantile

Bank

1,229

55

Metrocity

Bankshares

1,369

44

Metropolitan

Bank

Holding (1)

831

49

Mid

Penn

Bancorp

1,153

33

Middlefield

Banc

509

14

T.

ROWE

PRICE

Small-Cap

Index

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Midland

States

Bancorp

1,581

39

MidWestOne

Financial

Group

1,429

42

MVB

Financial

904

19

National

Bank

Holdings,

Class

A

2,849

123

National

Bankshares

411

12

NB

Bancorp (1)

2,930

53

NBT

Bancorp

3,557

170

Nicolet

Bankshares

1,043

109

Northeast

Bank

527

48

Northeast

Community

Bancorp

957

23

Northfield

Bancorp

2,934

34

Northrim

BanCorp

420

33

Northwest

Bancshares

9,833

130

Norwood