UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-05888

SMALLCAP World Fund, Inc.

(Exact Name of Registrant as Specified in Charter)

6455 Irvine Center Drive

Irvine, California 92618

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (949) 975-5000

Date of fiscal year end: September 30

Date of reporting period: September 30, 2019

Brian D. Bullard

SMALLCAP World Fund, Inc.

6455 Irvine Center Drive

Los Angeles, California 90071

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

SMALLCAP World Fund® Annual report

for the year ended

September 30, 2019 |  |

We believe small

companies around

the world can provide

opportunities for

investors

Beginning January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, we intend to no longer mail paper copies of the fund’s shareholder reports, unless specifically requested from American Funds or your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Capital Group website (capitalgroup.com); you will be notified by mail and provided with a website link to access the report each time a report is posted. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. If you prefer to receive shareholder reports and other communications electronically, you may update your mailing preferences with your financial intermediary, or enroll in e-delivery at capitalgroup.com (for accounts held directly with the fund).

You may elect to receive paper copies of all future reports free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the fund, you may inform American Funds that you wish to continue receiving paper copies of your shareholder reports by contacting us at (800) 421-4225. Your election to receive paper reports will apply to all funds held with American Funds or through your financial intermediary.

SMALLCAP World Fund seeks to provide you with long-term growth of capital.

This fund is one of more than 40 offered by Capital Group, home of American Funds, one of the nation’s largest mutual fund families. For more than 85 years, Capital Group has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report, unless otherwise indicated, are for Class A shares at net asset value. If a sales charge (maximum 5.75%) had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, visit capitalgroup.com.

See page 4 for Class A share results with relevant sales charges deducted. For other share class results, visit capitalgroup.com and americanfundsretirement.com

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit capitalgroup.com for more information.

Investing outside the United States may be subject to risks, such as currency fluctuations and political instability. These risks may be heightened in connection with investments in developing countries. Investing in small-capitalization stocks can involve greater risk than is customarily associated with investing in stocks of larger, more established companies. Refer to the fund prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the fund.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Contents

| 1 | Letter to investors |

| | |

| 4 | The value of a long-term perspective |

| | |

| 6 | Summary investment portfolio |

| | |

| 15 | Financial statements |

| | |

| 42 | Board of directors and other officers |

Fellow investors:

SMALLCAP World Fund saw a small negative return for the fiscal year ended September 30, 2019, a difficult period for investment in global and small-capitalization equities due to a variety of economic and geopolitical concerns.

For the full 12-month period, the fund declined 1.37%. The fund’s results reflect a capital gains distribution of just over $3.31 a share.

By way of comparison, the MSCI All Country World Small Cap Index, an unmanaged index of global small-cap equities that does not include fees or expenses, declined 5.45%. The fund’s peer group, as measured by the Lipper Global Small-/Mid-Cap Funds Average, lost 4.62%. As you can see in the table below, the fund has maintained a track record of surpassing both benchmark measures over longer periods.

The year in review

The fiscal period began with a sharp decline in equity markets around the world, with the U.S. nearly falling into what’s traditionally considered a bear market (a loss of 20% or more on a major market index from its peak). Markets then recovered steadily through the first several months of calendar 2019 before seeing increased volatility through the summer and early autumn.

U.S. gross domestic product grew 3.1% in the first quarter of calendar 2019, with growth slipping to 2.0% in the second quarter. The nation’s unemployment rate dipped to 3.5% in September, marking a new low for the current economic cycle.

Overseas, the European nations in the eurozone saw GDP growth of just 0.4% in the first quarter and 0.2% in the second quarter, with slower growth in Germany

Results at a glance

For periods ended September 30, 2019, with all distributions reinvested

| | | Cumulative

total returns | | Average annual total returns |

| | | 1 year | | 5 years | | 10 years | | Lifetime

(since 4/30/90) |

| | | | | | | | | |

| SMALLCAP World Fund (Class A shares) | | | –1.37 | % | | | 8.52 | % | | | 10.18 | % | | | 9.51 | % |

| MSCI All Country World Small Cap Index* | | | –5.45 | | | | 6.24 | | | | 9.12 | | | | 7.89 | |

| Lipper Global Small-/Mid-Cap Funds Average† | | | –4.62 | | | | 6.31 | | | | 9.20 | | | | 8.73 | |

| * | The MSCI All Country World Small Cap Index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Results reflect dividends net of withholding taxes. Because the index was not in existence when the fund’s Class A shares were first sold, cumulative returns through May 31, 1994, reflect the returns of the S&P Developed <$1.2 Billion Index. MSCI source: MSCI. S&P source: S&P Dow Jones Indices LLC. |

| † | Source: Thomson Reuters Lipper. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper categories are dynamic and averages may have few funds, especially over longer periods. To see the number of funds included in the Lipper category for each fund’s lifetime, please see the Quarterly Statistical Update available on our website. |

and the United Kingdom’s pending exit from the European Union potential factors there. Japan’s GDP grew at an 0.3% rate in the second quarter, while China’s economic growth, according to official government measures, was 6.2% for the second quarter, marking a slow but steady decline from its peak of 6.8% in the first quarter of 2018.

Thus, the overall picture of the global economy is still generally a positive one, though it’s evident that growth rates around the world have slowed. Given that the last global recession started a decade ago, this isn’t unreasonable. However, we saw over the past year that the equity markets remain susceptible to shifts in sentiment and geopolitical events, and this may be the case going forward as well.

How the fund responded

SMALLCAP World Fund is committed to Capital Group’s long-term approach to investing, fueled by deep fundamental research into companies around the world. Over the past year, we’ve committed even more resources toward the kind of research that has brought the fund it’s record of strong long-term returns, and we believe the results were reflected this year.

Top holding Insulet, one of the companies at the forefront of diabetes management, is a strong example of our research efforts, as it’s been in SMALLCAP’s portfolio for several years. It returned 55.7% for the fund’s fiscal year. Nine of the fund’s top ten holdings saw positive returns for the year, led by Notre Dame Intermedica Participacoes, which gained just under 100%. Detractors included seventh-largest holding Molina Healthcare, which declined 26.2%.

Overall, holdings in information technology and industrials equities aided the fund’s absolute returns, as well as relative to the fund’s benchmark index. Holdings in utilities, materials and real estate weighed against relative returns.

Geographically, U.S. holdings were additive to the fund’s returns, relative to the index. Emerging markets equities likewise helped the fund’s returns for the period, as did a wide variety of European holdings.

The fund held roughly 8% of the portfolio in cash and other short-term assets, less liabilities at the end of the 12-month period, down from 10.3% the year prior. Holding cash remains an important part of many portfolio managers’ strategies, allowing them to mitigate the effects of market volatility while allowing them to make investments in a timely manner when opportunities arise.

The road ahead

We are more than a decade removed from the last significant and sustained down market in equities, with global markets generally continuing to produce positive returns for investors. The nature of market cycles likely has not changed, however, and it’s reasonable to expect that a market downturn, and an economic recession, will occur in the future.

The fund’s portfolio managers have a diversity of opinion as to the timing, duration and severity of any potential downturn. That said, there are reasons to remain positive about global growth opportunities, and it’s possible that economic growth, albeit slower, may

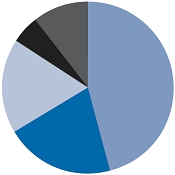

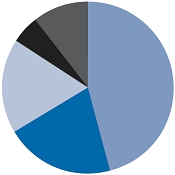

Where the fund’s assets are invested (by country of domicile)

| | As of September 30, 2019 | | Percent of net assets |

| n | United States | | | 45.2 | % |

| n | Europe | | | 22.4 | |

| n | Asia & Pacific Basin | | | 18.3 | |

| n | Other (including Canada & Latin America) | | | 6.0 | |

| n | Short-term securities & other assets less liabilities | | | 8.1 | |

| | As of September 30, 2018 | | Percent of net assets |

| n | United States | | | 46.1 | % |

| n | Europe | | | 20.5 | |

| n | Asia & Pacific Basin | | | 17.7 | |

| n | Other (including Canada & Latin America) | | | 5.4 | |

| n | Short-term securities & other assets less liabilities | | | 10.3 | |

Largest equity holdings

| | | Percent of net assets |

| Insulet | | | 1.7 | % |

| RingCentral | | | 1.4 | |

| Kotak Mahindra Bank | | | 1.0 | |

| MongoDB | | | .9 | |

| WiseTech Global | | | .7 | |

| Notre Dame Intermedica Participacoes | | | .7 | |

| Molina Healthcare | | | .7 | |

| Allakos | | | .7 | |

| Paycom Software | | | .7 | |

| Alteryx | | | .7 | |

continue through the coming fiscal year. However, there is always the potential for disruptions, whether they are economic or a shift in sentiment due to political or social change.

The fund’s managers continue to seek out companies with the potential to disrupt industries and make an outsized impact, thus creating the potential for long-term results on behalf of our shareholders. We will continue to invest heavily in our research capabilities. While we will certainly monitor current events and market conditions, we believe our long-term focus has fueled the results reviewed here.

We thank you for your continued support of SMALLCAP World Fund, and look forward to reporting to you again in six months.

Cordially,

Julian N. Abdey

Co-President

Jonathan Knowles

Co-President

Gregory W. Wendt

Co-President

November 7, 2019

For current information about the fund, visit capitalgroup.com.

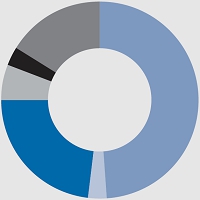

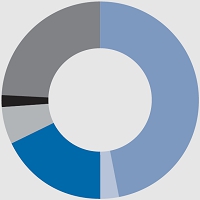

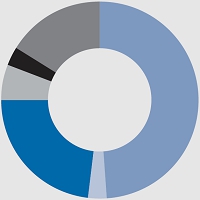

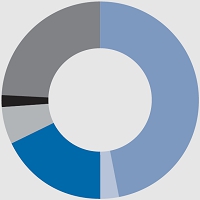

The New Geography of Investing®

Where a company does business can be more important than where it’s located. Here’s a look at SMALLCAP World Fund’s portfolio in terms of where its equity holdings earn their revenue. The charts below show the countries and regions in which the fund’s equity investments are located, and where the revenue comes from.

Equity portion breakdown by domicile (%)

| | Region | | Fund | | Index |

| n | United States | | | 49 | % | | | 52 | % |

| n | Canada | | | 3 | | | | 3 | |

| n | Europe | | | 23 | | | | 20 | |

| n | Japan | | | 6 | | | | 11 | |

| n | Asia-Pacific ex. Japan | | | 3 | | | | 4 | |

| n | Emerging markets | | | 16 | | | | 10 | |

| | Total | | | 100 | % | | | 100 | % |

Equity portion breakdown by revenue (%)

| | Region | | Fund | | Index |

| n | United States | | | 47 | % | | | 45 | % |

| n | Canada | | | 3 | | | | 3 | |

| n | Europe | | | 18 | | | | 18 | |

| n | Japan | | | 6 | | | | 10 | |

| n | Asia-Pacific ex. Japan | | | 2 | | | | 4 | |

| n | Emerging markets | | | 24 | | | | 20 | |

| | Total | | | 100 | % | | | 100 | % |

Compared with the MSCI ACWI Small Cap Index as a percent of net assets. Source: MSCI.

All figures include convertible securities.

SMALLCAP World Fund source: Capital Group (as of September 30, 2019).

The value of a long-term perspective

Fund results shown are for Class A shares and reflect deduction of the maximum sales charge of 5.75% on the $10,000 investment.1Thus, the net amount invested was $9,425. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit capitalgroup.com.

The results shown are before taxes on fund distributions and sale of fund shares.

| 1 | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $25,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| 2 | Includes reinvested dividends and reinvested capital gain distributions. |

| 3 | The MSCI All Country World Small Cap Index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Results reflect dividends net of withholding taxes. Because the index was not in existence when the fund’s Class A shares were first sold, cumulative returns through May 31, 1994, reflect the returns of the S&P Developed <$1.2 Billion Index. MSCI source: MSCI. S&P source: S&P Dow Jones Indices LLC. |

| 4 | For the period April 30, 1990, commencement of operations, through September 30, 1990. |

| | |

How a $10,000 investment has grown

This chart shows how a $10,000 investment in SMALLCAP World Fund’s Class A shares grew from April 30, 1990 — the fund’s inception — through September 30, 2019, the end of the fund’s latest fiscal year. As you can see, the $10,000 would have grown to $136,420 even after deducting the maximum 5.75% sales charge.

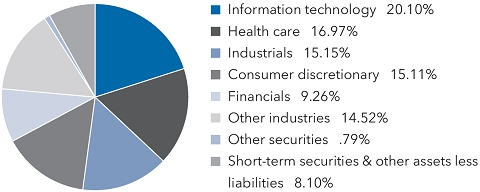

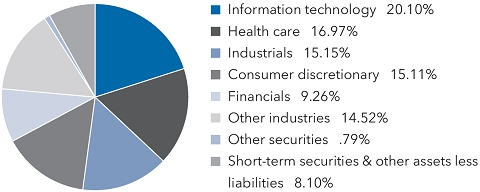

Summary investment portfolioSeptember 30, 2019

| Industry sector diversification | Percent of net assets |

| Country diversification by domicile | | Percent of

net assets |

| United States | | | 45.24 | % |

| Eurozone* | | | 9.07 | |

| United Kingdom | | | 6.56 | |

| Japan | | | 5.19 | |

| India | | | 4.70 | |

| Sweden | | | 2.67 | |

| China | | | 2.66 | |

| Brazil | | | 2.34 | |

| Canada | | | 2.32 | |

| Other countries | | | 11.15 | |

| Short-term securities & other assets less liabilities | | | 8.10 | |

| * | Countries using the euro as a common currency; those represented in the fund’s portfolio are Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, the Netherlands, Slovenia and Spain. |

| Common stocks 91.11% | | Shares | | | Value

(000) | |

| Information technology 20.10% | | | | | | | | |

| RingCentral, Inc., Class A1 | | | 4,741,200 | | | $ | 595,778 | |

| MongoDB, Inc., Class A1,2 | | | 3,110,992 | | | | 374,812 | |

| WiseTech Global Ltd. | | | 13,804,451 | | | | 323,590 | |

| Paycom Software, Inc.1 | | | 1,433,494 | | | | 300,303 | |

| Alteryx, Inc., Class A1 | | | 2,747,200 | | | | 295,132 | |

| Network International Holdings PLC1,3 | | | 34,351,542 | | | | 225,968 | |

| DocuSign, Inc.1 | | | 3,621,737 | | | | 224,258 | |

| Cree, Inc.1 | | | 4,484,130 | | | | 219,722 | |

| SimCorp AS3 | | | 2,199,151 | | | | 193,109 | |

| EPAM Systems, Inc.1 | | | 881,200 | | | | 160,660 | |

| Square, Inc., Class A1 | | | 2,274,730 | | | | 140,920 | |

| Ceridian HCM Holding Inc.1 | | | 2,851,343 | | | | 140,771 | |

| Smartsheet Inc., Class A1 | | | 3,905,000 | | | | 140,697 | |

| Net One Systems Co., Ltd.3 | | | 5,194,958 | | | | 139,958 | |

| Other securities | | | | | | | 5,357,764 | |

| | | | | | | | 8,833,442 | |

| | | | | | | | | |

| Health care 16.97% | | | | | | | | |

| Insulet Corp.1,3 | | | 4,456,019 | | | | 734,931 | |

| Notre Dame Intermédica Participações SA | | | 24,624,949 | | | | 321,521 | |

| Molina Healthcare, Inc.1 | | | 2,841,997 | | | | 311,824 | |

| Allakos Inc.1,2,3 | | | 3,859,959 | | | | 303,509 | |

| NovoCure Ltd.1 | | | 3,580,597 | | | | 267,757 | |

| Haemonetics Corp.1 | | | 1,974,000 | | | | 249,000 | |

| GW Pharmaceuticals PLC (ADR)1,3 | | | 1,915,345 | | | | 220,322 | |

| CONMED Corp.3 | | | 2,258,462 | | | | 217,151 | |

| Bluebird Bio, Inc.1 | | | 2,061,720 | | | | 189,307 | |

| Natera, Inc.1,3 | | | 4,770,580 | | | | 156,475 | |

| Integra LifeSciences Holdings Corp.1 | | | 2,589,805 | | | | 155,570 | |

| Allogene Therapeutics, Inc.1,2 | | | 5,440,264 | | | | 148,274 | |

| Other securities | | | | | | | 4,184,723 | |

| | | | | | | | 7,460,364 | |

| | | | | | | | | |

| Industrials 15.15% | | | | | | | | |

| IMCD NV3 | | | 3,332,269 | | | | 246,432 | |

| VARTA AG, non-registered shares1,3 | | | 2,493,496 | | | | 245,960 | |

| MonotaRO Co., Ltd. | | | 8,596,900 | | | | 224,692 | |

| Nihon M&A Center Inc. | | | 7,044,180 | | | | 198,051 | |

| Spirax-Sarco Engineering PLC | | | 2,028,028 | | | | 195,620 | |

| BELIMO Holding AG3 | | | 33,323 | | | | 183,301 | |

| Rheinmetall AG | | | 1,443,999 | | | | 182,650 | |

| Aalberts NV, non-registered shares | | | 4,109,100 | | | | 162,846 | |

| NIBE Industrier AB, Class B | | | 12,762,000 | | | | 161,858 | |

| | | Shares | | | Value

(000) | |

| BWX Technologies, Inc. | | | 2,723,350 | | | $ | 155,803 | |

| Rexnord Corp.1,3 | | | 5,708,000 | | | | 154,401 | |

| Aerojet Rocketdyne Holdings, Inc.1 | | | 2,958,046 | | | | 149,411 | |

| IDEX Corp. | | | 875,000 | | | | 143,395 | |

| Marel hf., non-registered shares (ISK denominated) | | | 30,060,697 | | | | 137,383 | |

| Marel hf., non-registered shares (EUR denominated)1 | | | 1,166,667 | | | | 5,341 | |

| Bravida Holding AB3 | | | 16,173,198 | | | | 141,868 | |

| Harmonic Drive Systems Inc.2 | | | 3,215,500 | | | | 139,772 | |

| Other securities | | | | | | | 3,829,359 | |

| | | | | | | | 6,658,143 | |

| | | | | | | | | |

| Consumer discretionary 15.11% | | | | | | | | |

| Takeaway.com NV1 | | | 3,038,700 | | | | 242,441 | |

| Floor & Decor Holdings, Inc., Class A1 | | | 4,297,800 | | | | 219,832 | |

| Dollarama Inc. | | | 6,015,000 | | | | 215,339 | |

| Ocado Group PLC1 | | | 13,103,000 | | | | 213,065 | |

| frontdoor, inc.1,3 | | | 4,379,000 | | | | 212,688 | |

| ServiceMaster Global Holdings, Inc.1 | | | 3,459,000 | | | | 193,358 | |

| Evolution Gaming Group AB | | | 8,937,960 | | | | 175,780 | |

| TopBuild Corp.1,3 | | | 1,783,600 | | | | 171,993 | |

| Trainline PLC1,3 | | | 33,352,068 | | | | 171,824 | |

| Helen of Troy Ltd.1 | | | 983,400 | | | | 155,043 | |

| Five Below, Inc.1 | | | 1,124,402 | | | | 141,787 | |

| Mattel, Inc.1,2 | | | 12,260,000 | | | | 139,641 | |

| Wyndham Hotels & Resorts, Inc. | | | 2,690,300 | | | | 139,196 | |

| Other securities | | | | | | | 4,247,041 | |

| | | | | | | | 6,639,028 | |

| | | | | | | | | |

| Financials 9.26% | | | | | | | | |

| Kotak Mahindra Bank Ltd. | | | 18,292,040 | | | | 424,451 | |

| RenaissanceRe Holdings Ltd. | | | 1,058,600 | | | | 204,786 | |

| Bajaj Finance Ltd. | | | 3,257,000 | | | | 185,949 | |

| Essent Group Ltd. | | | 3,797,535 | | | | 181,029 | |

| MarketAxess Holdings Inc. | | | 431,800 | | | | 141,415 | |

| Cannae Holdings, Inc.1,3 | | | 5,137,578 | | | | 141,129 | |

| Other securities | | | | | | | 2,793,016 | |

| | | | | | | | 4,071,775 | |

| | | | | | | | | |

| Consumer staples 4.01% | | | | | | | | |

| Emmi AG3 | | | 317,072 | | | | 258,601 | |

| Raia Drogasil SA, ordinary nominative | | | 7,661,392 | | | | 176,666 | |

| Other securities | | | | | | | 1,327,616 | |

| | | | | | | | 1,762,883 | |

| | | | | | | | | |

| Communication services 3.36% | | | | | | | | |

| Iridium Communications Inc.1,3 | | | 6,801,932 | | | | 144,745 | |

| Iridium Communications Inc.1,3,4 | | | 636,132 | | | | 13,537 | |

| Other securities | | | | | | | 1,319,123 | |

| | | | | | | | 1,477,405 | |

| | | | | | | | | |

| Materials 3.36% | | | | | | | | |

| Allegheny Technologies Inc.1,3 | | | 10,087,124 | | | | 204,264 | |

| Other securities | | | | | | | 1,272,729 | |

| | | | | | | | 1,476,993 | |

| | | | | | | | | |

| Other 3.79% | | | | | | | | |

| Other securities | | | | | | | 1,665,434 | |

| | | | | | | | | |

| Total common stocks (cost: $28,780,508,000) | | | | | | | 40,045,467 | |

| | | | | | | | | |

| Preferred securities 0.56% | | | | | | | | |

| Other 0.56% | | | | | | | | |

| Other securities | | | | | | | 246,184 | |

| | | | | | | | | |

| Total preferred securities (cost: $147,103,000) | | | | | | | 246,184 | |

| Rights & warrants 0.00% | | Shares | | | Value

(000) | |

| Other 0.00% | | | | | | |

| Other securities | | | | | | $ | 1,668 | |

| | | | | | | | | |

| Total rights & warrants (cost: $0) | | | | | | | 1,668 | |

| | | | | | | | | |

| Convertible stocks 0.18% | | | | | | | | |

| Other 0.18% | | | | | | | | |

| Other securities | | | | | | | 79,199 | |

| | | | | | | | | |

| Total convertible stocks (cost: $89,833,000) | | | | | | | 79,199 | |

| | | | | | | | | |

| Convertible bonds 0.02% | | Principal amount

(000) | | | | | |

| Energy 0.02% | | | | | | | | |

| Other securities | | | | | | | 10,575 | |

| | | | | | | | | |

| Total convertible bonds (cost: $16,126,000) | | | | | | | 10,575 | |

| | | | | | | | | |

| Bonds, notes & other debt instruments 0.03% | | | | | | | | |

| Other 0.03% | | | | | | | | |

| Other securities | | | | | | | 12,300 | |

| | | | | | | | | |

| Total bonds, notes & other debt instruments (cost: $17,846,000) | | | | | | | 12,300 | |

| | | | | | | | | |

| Short-term securities 9.34% | | Shares | | | | | |

| Money market investments 7.30% | | | | | | | | |

| Blackrock FedFund 1.86%5,6 | | | 200,000,000 | | | | 200,000 | |

| Capital Group Central Cash Fund 2.07%5 | | | 27,158,505 | | | | 2,715,579 | |

| Fidelity Institutional Money Market Funds - Government Portfolio 1.86%5,6 | | | 15,000,000 | | | | 15,000 | |

| Goldman Sachs Financial Square Government Fund 1.84%5,6 | | | 250,000,000 | | | | 250,000 | |

| Invesco - Short-term Investments Trust - Government & Agency Portfolio 1.83%5,6 | | | 13,087,608 | | | | 13,088 | |

| Morgan Stanley Institutional Liquidity Funds - Government Portfolio 1.85%5,6 | | | 15,000,000 | | | | 15,000 | |

| | | | | | | | 3,208,667 | |

| | | | | | | | | |

| | | Principal amount

(000) | | | | | |

| Other short-term securities 2.04% | | | | | | | | |

| Oversea-Chinese Banking Corp. Ltd. 2.06%–2.06% due 10/10/2019–10/11/20194 | | $ | 200,000 | | | | 199,884 | |

| Québec (Province of) 2.00% due 12/11/20194 | | | 200,000 | | | | 199,219 | |

| Toronto-Dominion Bank 1.99% due 10/16/20194 | | | 200,000 | | | | 199,824 | |

| United Overseas Bank Ltd. 2.09%–2.09% due 11/12/2019–11/13/20194 | | | 200,000 | | | | 199,510 | |

| Other securities | | | | | | | 99,944 | |

| | | | | | | | 898,381 | |

| | | | | | | | | |

| Total short-term securities (cost: $4,107,056,000) | | | | | | | 4,107,048 | |

| Total investment securities 101.24% (cost: $33,158,472,000) | | | | | | | 44,502,441 | |

| Other assets less liabilities (1.24)% | | | | | | | (547,042 | ) |

| | | | | | | | | |

| Net assets 100.00% | | | | | | $ | 43,955,399 | |

This summary investment portfolio is designed to streamline the report and help investors better focus on the fund’s principal holdings. See the inside back cover for details on how to obtain a complete schedule of portfolio holdings.

“Other securities” includes all issues that are not disclosed separately in the summary investment portfolio.

Investments in affiliates

A company is an affiliate of the fund under the Investment Company Act of 1940 if the fund’s holdings represent 5% or more of the outstanding voting shares of that company. The value of the fund’s affiliated-company holdings is either shown in the summary investment portfolio or included in the value of “Other securities” under the respective industry sectors. Further details on these holdings and related transactions during the year ended September 30, 2019, appear below.

| | | Beginning

shares | | Additions | | Reductions | | Ending

shares | | Net

realized

gain (loss)

(000) | | | Net

unrealized

appreciation

(depreciation)

(000) | | | Dividend

income

(000) | | | Value of

affiliates at

9/30/2019

(000) | |

| Common stocks 19.54% | | | | | | | | | | | | | | | | | | | |

| Information technology 4.52% | | | | | | | | | | | | | | | | | | | |

| Network International Holdings PLC1 | | — | | 34,351,542 | | — | | 34,351,542 | | $ | — | | | $ | 15,282 | | | $ | — | | | $ | 225,968 | |

| SimCorp AS | | 1,401,470 | | 797,681 | | — | | 2,199,151 | | | — | | | | 1,756 | | | | 1,843 | | | | 193,109 | |

| Net One Systems Co., Ltd. | | — | | 5,194,958 | | — | | 5,194,958 | | | — | | | | 24,822 | | | | 1,757 | | | | 139,958 | |

| Yext, Inc.1 | | 7,625,428 | | 1,970,846 | | 935,000 | | 8,661,274 | | | 5,813 | | | | (69,194 | ) | | | — | | | | 137,628 | |

| Netcompany Group AS, non-registered shares1 | | 2,631,826 | | 943,087 | | 375,000 | | 3,199,913 | | | 1,981 | | | | 12,247 | | | | — | | | | 127,624 | |

| Alarm.Com Holdings, Inc.1 | | 3,249,000 | | — | | 728,300 | | 2,520,700 | | | 16,219 | | | | (38,122 | ) | | | — | | | | 117,565 | |

| Carel Industries SpA | | 7,370,849 | | 450,000 | | — | | 7,820,849 | | | — | | | | 26,352 | | | | 889 | | | | 115,760 | |

| Jenoptik AG | | 1,295,000 | | 3,266,200 | | — | | 4,561,200 | | | — | | | | (43,256 | ) | | | 1,766 | | | | 113,051 | |

| Douzone Bizon Co., Ltd. | | 1,636,408 | | 378,650 | | — | | 2,015,058 | | | — | | | | 1,371 | | | | 657 | | | | 110,174 | |

| CANCOM SE, non-registered shares | | 850,000 | | 1,139,634 | | — | | 1,989,634 | | | — | | | | 15,551 | | | | 1,096 | | | | 107,346 | |

| Bottomline Technologies, Inc.1 | | 2,808,000 | | 40,000 | | 200,000 | | 2,648,000 | | | (1,332 | ) | | | (91,604 | ) | | | — | | | | 104,199 | |

| SUNeVision Holdings Ltd. | | 101,554,000 | | 26,660,000 | | — | | 128,214,000 | | | — | | | | 5,794 | | | | 1,955 | | | | 95,862 | |

| Fortnox AB | | — | | 4,550,903 | | — | | 4,550,903 | | | — | | | | 6,467 | | | | — | | | | 76,372 | |

| Megaport Ltd.1 | | 7,476,000 | | 3,297,000 | | — | | 10,773,000 | | | — | | | | 36,190 | | | | — | | | | 66,096 | |

| Sansan, Inc.1,2 | | — | | 1,596,800 | | — | | 1,596,800 | | | — | | | | (10,616 | ) | | | — | | | | 60,328 | |

| Bravura Solutions Ltd. | | 17,125,000 | | 2,000,000 | | — | | 19,125,000 | | | — | | | | (9,197 | ) | | | 1,259 | | | | 53,441 | |

| eMemory Technology Inc.7 | | 5,992,000 | | — | | 1,967,666 | | 4,024,334 | | | (6,357 | ) | | | 8,656 | | | | 1,040 | | | | 42,488 | |

| Endurance International Group Holdings, Inc.1 | | 6,992,277 | | 2,715,122 | | — | | 9,707,399 | | | — | | | | (47,248 | ) | | | — | | | | 36,403 | |

| Faraday Technology Corp.7,8 | | 9,733,000 | | 5,637,000 | | — | | 15,370,000 | | | — | | | | 4,099 | | | | 395 | | | | 28,513 | |

| Accesso Technology Group PLC1,2 | | — | | 2,185,500 | | — | | 2,185,500 | | | — | | | | (519 | ) | | | — | | | | 23,271 | |

| Humanica PCL | | 34,600,000 | | 16,240,900 | | 6,840,500 | | 44,000,400 | | | (96 | ) | | | (3,122 | ) | | | 195 | | | | 11,797 | |

| Acacia Communications, Inc.1,9 | | 2,585,240 | | — | | 1,696,240 | | 889,000 | | | 30,134 | | | | 25,424 | | | | — | | | | — | |

| Datalex PLC1,9 | | 6,106,000 | | — | | 6,106,000 | | — | | | (23,529 | ) | | | 10,562 | | | | — | | | | — | |

| Inphi Corp.1,9 | | 2,532,699 | | 428,000 | | 1,693,667 | | 1,267,032 | | | 42,651 | | | | 2,383 | | | | — | | | | — | |

| MACOM Technology Solutions Holdings, Inc.1,9 | | 925,000 | | 4,623,525 | | 2,693,000 | | 2,855,525 | | | (4,080 | ) | | | 19,605 | | | | — | | | | — | |

| SPS Commerce, Inc.1,9 | | 1,159,000 | | — | | 1,159,000 | | — | | | 35,919 | | | | (47,452 | ) | | | — | | | | — | |

| Talend SA (ADR)1,9 | | 2,216,455 | | 216,800 | | 2,351,755 | | 81,500 | | | 12,842 | | | | (91,953 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 1,986,953 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Health care 5.34% | | | | | | | | | | | | | | | | | | | | |

| Insulet Corp.1 | | 3,633,423 | | 1,108,896 | | 286,300 | | 4,456,019 | | | 14,528 | | | | 279,163 | | | | — | | | | 734,931 | |

| Allakos Inc.1,2 | | 3,142,848 | | 717,111 | | — | | 3,859,959 | | | — | | | | 124,463 | | | | — | | | | 303,509 | |

| GW Pharmaceuticals PLC (ADR)1 | | 2,250,346 | | 162,634 | | 497,635 | | 1,915,345 | | | 39,888 | | | | (163,918 | ) | | | — | | | | 220,322 | |

| CONMED Corp. | | 1,920,000 | | 469,300 | | 130,838 | | 2,258,462 | | | (938 | ) | | | 37,526 | | | | 1,671 | | | | 217,151 | |

| Natera, Inc.1 | | 3,215,580 | | 2,055,000 | | 500,000 | | 4,770,580 | | | 198 | | | | 32,243 | | | | — | | | | 156,475 | |

| iRhythm Technologies, Inc.1 | | 1,571,200 | | 34,000 | | 148,750 | | 1,456,450 | | | 6,510 | | | | (38,652 | ) | | | — | | | | 107,937 | |

| Nakanishi Inc. | | 4,312,700 | | 1,020,000 | | — | | 5,332,700 | | | — | | | | (25,857 | ) | | | 1,400 | | | | 83,992 | |

| Cortexyme, Inc.1,4,7 | | — | | 1,560,515 | | — | | 1,560,515 | | | — | | | | 23,126 | | | | — | | | | 38,126 | |

| Cortexyme, Inc.1,2 | | — | | 512,157 | | — | | 512,157 | | | — | | | | 3,374 | | | | — | | | | 12,768 | |

| Metropolis Healthcare Ltd.1 | | — | | 2,809,350 | | — | | 2,809,350 | | | — | | | | 13,870 | | | | — | | | | 50,456 | |

| CellaVision AB, non-registered shares | | 1,908,123 | | — | | 687,123 | | 1,221,000 | | | 9,686 | | | | 1,291 | | | | 233 | | | | 47,319 | |

| Corindus Vascular Robotics, Inc.1 | | — | | 21,745,432 | | 10,872,716 | | 10,872,716 | | | — | | | | 31,535 | | | | — | | | | 46,535 | |

| Cansino Biologics Inc., Class H1,2 | | — | | 10,370,800 | | — | | 10,370,800 | | | — | | | | 9,129 | | | | — | | | | 44,195 | |

Investments in affiliates(continued)

| | | Beginning

shares | | Additions | | Reductions | | Ending

shares | | Net

realized

gain (loss)

(000) | | | Net

unrealized

appreciation

(depreciation)

(000) | | | Dividend

income

(000) | | | Value of

affiliates at

9/30/2019

(000) | |

| Osstem Implant Co., Ltd.1 | | 1,142,821 | | — | | 8,547 | | 1,134,274 | | $ | (220 | ) | | $ | (9,944 | ) | | $ | — | | | $ | 39,543 | |

| Revenio Group Oyj, non-registered shares8 | | 803,464 | | 910,356 | | — | | 1,713,820 | | | — | | | | 4,916 | | | | 417 | | | | 36,239 | |

| Flexion Therapeutics, Inc.1,2 | | 3,002,700 | | 158,000 | | 650,000 | | 2,510,700 | | | (5,092 | ) | | | (8,369 | ) | | | — | | | | 34,409 | |

| Autolus Therapeutics PLC (ADR)1,2 | | 1,100,000 | | 1,277,718 | | — | | 2,377,718 | | | — | | | | (32,242 | ) | | | — | | | | 29,531 | |

| Cellectis SA (ADR)1,8 | | 875,000 | | 654,736 | | — | | 1,529,736 | | | — | | | | (21,605 | ) | | | — | | | | 15,909 | |

| Cellectis SA, non-registered shares1,2,8 | | 784,492 | | 396,748 | | — | | 1,181,240 | | | — | | | | (17,643 | ) | | | — | | | | 12,154 | |

| Diplomat Pharmacy, Inc.1 | | 5,930,624 | | 397,836 | | 1,994,019 | | 4,334,441 | | | (38,202 | ) | | | (45,530 | ) | | | — | | | | 21,239 | |

| WIN-Partners Co., Ltd. | | — | | 1,817,600 | | — | | 1,817,600 | | | — | | | | (783 | ) | | | — | | | | 19,029 | |

| NuCana PLC (ADR)1,2 | | 2,542,628 | | 32,188 | | — | | 2,574,816 | | | — | | | | (44,911 | ) | | | — | | | | 18,642 | |

| Xenon Pharmaceuticals Inc.1 | | 1,900,900 | | 118,326 | | — | | 2,019,226 | | | — | | | | (7,874 | ) | | | — | | | | 18,193 | |

| Clovis Oncology, Inc.1,2 | | 652,000 | | 2,910,000 | | — | | 3,562,000 | | | — | | | | (47,186 | ) | | | — | | | | 13,999 | |

| Neuronetics, Inc.1,8 | | 474,644 | | 989,656 | | — | | 1,464,300 | | | — | | | | (23,145 | ) | | | — | | | | 12,168 | |

| Adaptimmune Therapeutics PLC (ADR)1,2 | 7,186,700 | | 233,000 | | — | | 7,419,700 | | | — | | | | (87,119 | ) | | | — | | | | 11,204 | |

| Neovasc Inc.1 | | 1,346,592 | | 3,757,798 | | 4,526,533 | | 577,857 | | | (26,124 | ) | | | 765 | | | | — | | | | 2,219 | |

| Neovasc Inc. (CAD denominated)1 | | 62,946 | | — | | 62,946 | | — | | | — | | | | 21,860 | | | | — | | | | — | |

| CryoLife, Inc.1,9 | | 2,157,251 | | 679,600 | | 1,710,947 | | 1,125,904 | | | 12,480 | | | | (26,606 | ) | | | — | | | | — | |

| Evolent Health, Inc., Class A1,9 | | 4,505,000 | | — | | 4,505,000 | | — | | | (8,464 | ) | | | (65,873 | ) | | | — | | | | — | |

| Fleury SA, ordinary nominative9 | | 16,147,000 | | 1,171,000 | | 3,625,000 | | 13,693,000 | | | (6,702 | ) | | | 22,032 | | | | 3,756 | | | | — | |

| Glaukos Corp.1,9 | | 2,820,000 | | — | | 1,669,678 | | 1,150,322 | | | 60,192 | | | | (55,554 | ) | | | — | | | | — | |

| Molina Healthcare, Inc.1,9 | | 4,022,587 | | — | | 1,180,590 | | 2,841,997 | | | 97,929 | | | | (224,066 | ) | | | — | | | | — | |

| Pacific Biosciences of California, Inc.1,9 | | 8,843,303 | | — | | 8,843,303 | | — | | | 39,261 | | | | (21,939 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 2,348,194 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Industrials 3.78% | | | | | | | | | | | | | | | | | | | | | | | | |

| IMCD NV | | 1,507,000 | | 1,825,269 | | — | | 3,332,269 | | | — | | | | (15,413 | ) | | | 1,860 | | | | 246,432 | |

| VARTA AG, non-registered shares1 | | 2,157,755 | | 1,169,013 | | 833,272 | | 2,493,496 | | | 31,856 | | | | 157,451 | | | | — | | | | 245,960 | |

| BELIMO Holding AG | | 23,830 | | 9,493 | | — | | 33,323 | | | — | | | | 17,240 | | | | 2,616 | | | | 183,301 | |

| Rexnord Corp.1 | | 5,005,000 | | 703,000 | | — | | 5,708,000 | | | — | | | | (17,572 | ) | | | — | | | | 154,401 | |

| Bravida Holding AB | | 16,173,198 | | — | | — | | 16,173,198 | | | — | | | | 9,205 | | | | 3,398 | | | | 141,868 | |

| Diploma PLC8 | | 3,179,994 | | 2,496,006 | | — | | 5,676,000 | | | — | | | | 12,584 | | | | 1,335 | | | | 116,060 | |

| TechnoPro Holdings, Inc. | | 1,523,500 | | 350,100 | | — | | 1,873,600 | | | — | | | | (2,973 | ) | | | 2,135 | | | | 110,900 | |

| Continental Building Products, Inc.1 | | 3,080,700 | | — | | 300,000 | | 2,780,700 | | | 3,893 | | | | (33,898 | ) | | | — | | | | 75,885 | |

| Bingo Industries Ltd.2 | | — | | 37,574,800 | | — | | 37,574,800 | | | — | | | | 4,119 | | | | 465 | | | | 56,048 | |

| Barrett Business Services, Inc. | | 580,000 | | 300,000 | | 290,000 | | 590,000 | | | 421 | | | | 8,113 | | | | 604 | | | | 52,404 | |

| Coor Service Management Holding AB | | 4,502,788 | | 1,375,842 | | — | | 5,878,630 | | | — | | | | 4,899 | | | | 2,455 | | | | 50,879 | |

| Avon Rubber PLC | | 2,248,000 | | 233,863 | | — | | 2,481,863 | | | — | | | | 9,042 | | | | 530 | | | | 50,717 | |

| Tsubaki Nakashima Co., Ltd. | | 2,821,800 | | 892,500 | | 794,200 | | 2,920,100 | | | (3,689 | ) | | | (15,068 | ) | | | 2,118 | | | | 43,670 | |

| Instalco AB | | 2,934,000 | | 897,789 | | — | | 3,831,789 | | | — | | | | 8,569 | | | | 598 | | | | 39,314 | |

| Trust Tech Inc. | | 622,000 | | 2,254,200 | | — | | 2,876,200 | | | — | | | | (14,096 | ) | | | 837 | | | | 34,421 | |

| Greaves Cotton Ltd. | | 15,200,000 | | 1,000,000 | | — | | 16,200,000 | | | — | | | | 3,847 | | | | 916 | | | | 33,386 | |

| Alfen NV1,2 | | 1,275,000 | | — | | — | | 1,275,000 | | | — | | | | (1,416 | ) | | | — | | | | 17,844 | |

| J. Kumar Infraprojects Ltd. | | 4,450,500 | | — | | — | | 4,450,500 | | | — | | | | (4,333 | ) | | | 141 | | | | 8,142 | |

| Advanced Disposal Services, Inc.1,9 | | 4,710,502 | | 75,000 | | 4,590,502 | | 195,000 | | | 40,263 | | | | (16,350 | ) | | | — | | | | — | |

| Fluence Corp. Ltd.1,9 | | 14,826,347 | | 14,290,437 | | 29,116,784 | | — | | | (6,545 | ) | | | 5,440 | | | | — | | | | — | |

| KeyW Holding Corp.1,9 | | 2,536,400 | | — | | 2,536,400 | | — | | | (3,120 | ) | | | 7,757 | | | | — | | | | — | |

| King Slide Works Co., Ltd.7,9 | | 7,190,765 | | — | | 5,700,765 | | 1,490,000 | | | (7,034 | ) | | | (7,774 | ) | | | 450 | | | | — | |

| Kratos Defense & Security Solutions, Inc.1,9 | | 8,262,000 | | — | | 5,812,200 | | 2,449,800 | | | 23,837 | | | | (13,299 | ) | | | — | | | | — | |

| R.R. Donnelley & Sons Co.9 | | 5,631,489 | | — | | 5,631,489 | | — | | | (27,190 | ) | | | 19,168 | | | | 365 | | | | — | |

| | | Beginning

shares | | Additions | | Reductions | | Ending

shares | | Net

realized

gain (loss)

(000) | | | Net

unrealized

appreciation

(depreciation)

(000) | | | Dividend

income

(000) | | | Value of

affiliates at

9/30/2019

(000) | |

| va-Q-tec AG1,7,9 | | 781,221 | | — | | 781,221 | | — | | $ | (6,779 | ) | | $ | 5,709 | | | $ | — | | | $ | — | |

| XP Power Ltd.9 | | 1,295,000 | | — | | 780,000 | | 515,000 | | | 302 | | | | (13,349 | ) | | | 729 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 1,661,632 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Consumer discretionary 2.37% | | | | | | | | | | | | | | | | | | | | |

| frontdoor, inc.1,8 | | 112,000 | | 5,192,000 | | 925,000 | | 4,379,000 | | | (15,727 | ) | | | 65,089 | | | | — | | | | 212,688 | |

| TopBuild Corp.1 | | 1,682,000 | | 101,600 | | — | | 1,783,600 | | | — | | | | 70,073 | | | | — | | | | 171,993 | |

| Trainline PLC1 | | — | | 33,352,068 | | — | | 33,352,068 | | | — | | | | 7,304 | | | | — | | | | 171,824 | |

| Luckin Coffee Inc., Class A (ADR)1,2 | | — | | 4,835,924 | | — | | 4,835,924 | | | — | | | | (3,930 | ) | | | — | | | | 91,883 | |

| Domino’s Pizza Group PLC | | 22,017,815 | | 5,290,000 | | — | | 27,307,815 | | | — | | | | (12,105 | ) | | | 3,367 | | | | 85,586 | |

| zooplus AG, non-registered shares1,2 | | 560,634 | | 238,212 | | 293,158 | | 505,688 | | | 4,732 | | | | (36,777 | ) | | | — | | | | 60,188 | |

| Party City Holdco Inc.1,2 | | — | | 7,489,459 | | — | | 7,489,459 | | | — | | | | (32,601 | ) | | | — | | | | 42,765 | |

| Delta Corp. Ltd. | | 21,407,238 | | — | | 7,385,000 | | 14,022,238 | | | (20,929 | ) | | | 10,135 | | | | 349 | | | | 33,419 | |

| Shop Apotheke Europe NV, non-registered shares1 | | 572,857 | | 232,000 | | — | | 804,857 | | | — | | | | (7,000 | ) | | | — | | | | 31,274 | |

| Del Taco Restaurants, Inc.1 | | — | | 2,939,200 | | — | | 2,939,200 | | | — | | | | (3,646 | ) | | | — | | | | 30,053 | |

| Lands’ End, Inc.1 | | 2,061,232 | | 138,768 | | — | | 2,200,000 | | | — | | | | (13,131 | ) | | | — | | | | 24,959 | |

| Beazer Homes USA, Inc.1,8 | | 1,659,813 | | — | | — | | 1,659,813 | | | — | | | | 7,303 | | | | — | | | | 24,731 | |

| MIPS AB | | 1,396,751 | | — | | — | | 1,396,751 | | | — | | | | 6,565 | | | | 362 | | | | 23,695 | |

| Hoteles City Express, SAB de CV1 | | — | | 24,121,157 | | 2,084,009 | | 22,037,148 | | | (372 | ) | | | (6,071 | ) | | | — | | | | 19,018 | |

| Tile Shop Holdings, Inc. | | 3,158,000 | | — | | — | | 3,158,000 | | | — | | | | (12,506 | ) | | | 632 | | | | 10,074 | |

| Hostelworld Group PLC | | 7,645,662 | | — | | 1,126,899 | | 6,518,763 | | | (1,675 | ) | | | (9,673 | ) | | | 1,126 | | | | 9,105 | |

| BNN Technology PLC1,7,10 | | 19,007,000 | | — | | — | | 19,007,000 | | | — | | | | (7,751 | ) | | | — | | | | 1,019 | |

| At Home Group Inc.1,9 | | 3,878,873 | | 715,000 | | 4,593,873 | | — | | | (70,019 | ) | | | (30,920 | ) | | | — | | | | — | |

| Evolution Gaming Group AB9 | | 2,652,021 | | 10,835,349 | | 4,549,410 | | 8,937,960 | | | 58,951 | | | | 18,942 | | | | 3,786 | | | | — | |

| Garrett Motion Inc.1,9 | | — | | 5,615,000 | | 5,615,000 | | — | | | (19,626 | ) | | | — | | | | — | | | | — | |

| Maisons du Monde SA9 | | 2,374,914 | | — | | 2,374,914 | | — | | | (35,684 | ) | | | 16,486 | | | | — | | | | — | |

| Nien Made Enterprise Co., Ltd.7,9 | | 13,493,000 | | 1,722,000 | | 8,460,000 | | 6,755,000 | | | (27,448 | ) | | | 26,177 | | | | 2,170 | | | | — | |

| Quotient Technology Inc.1,9 | | 5,311,667 | | — | | 5,311,667 | | — | | | (11,083 | ) | | | (20,346 | ) | | | — | | | | — | |

| Seria Co., Ltd.9 | | 4,138,791 | | 88,100 | | 4,226,891 | | — | | | (15,914 | ) | | | (8,235 | ) | | | 842 | | | | — | |

| Sleep Country Canada Holdings Inc.9 | | 3,011,968 | | — | | 3,011,968 | | — | | | 6,809 | | | | (23,564 | ) | | | 289 | | | | — | |

| Strategic Education, Inc.9 | | 1,068,970 | | 222,750 | | 427,720 | | 864,000 | | | 37,586 | | | | (16,356 | ) | | | 2,258 | | | | — | |

| MakeMyTrip Ltd., non-registered shares1,9 | | 3,684,051 | | 143,601 | | 3,190,052 | | 637,600 | | | (16,537 | ) | | | 7,744 | | | | — | | | | — | |

| Tailored Brands, Inc.9 | | 3,981,850 | | — | | 3,981,850 | | — | | | (33,057 | ) | | | (24,803 | ) | | | 976 | | | | — | |

| Taiwan Paiho Ltd.9 | | 20,561,000 | | — | | 20,561,000 | | — | | | (16,803 | ) | | | 13,111 | | | | — | | | | — | |

| Takeaway.com NV1,9 | | 1,622,100 | | 1,717,500 | | 300,900 | | 3,038,700 | | | 3,088 | | | | 47,318 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 1,044,274 | |

| Financials 0.77% | | | | | | | | | | | | | | | | | | | | | | | | |

| Cannae Holdings, Inc.1 | | 4,895,000 | | 242,578 | | — | | 5,137,578 | | | — | | | | 33,671 | | | | — | | | | 141,129 | |

| Seacoast Banking Corp. of Florida1 | | — | | 3,031,901 | | — | | 3,031,901 | | | — | | | | (4,218 | ) | | | — | | | | 76,737 | |

| Trupanion, Inc.1,2 | | 2,640,200 | | 48,894 | | — | | 2,689,094 | | | — | | | | (27,408 | ) | | | — | | | | 68,357 | |

| HUB24 Ltd.2 | | 4,298,000 | | 79,158 | | — | | 4,377,158 | | | — | | | | (3,027 | ) | | | 140 | | | | 37,195 | |

| Greenhill & Co., Inc. | | 1,169,700 | | — | | — | | 1,169,700 | | | — | | | | (15,475 | ) | | | 234 | | | | 15,346 | |

| Bharat Financial Inclusion Ltd.1,9 | | 2,410,000 | | 5,914,779 | | 8,324,779 | | — | | | — | 11 | | | (3,758 | ) | | | — | | | | — | |

| CenterState Bank Corp.9 | | 6,069,250 | | 323,800 | | 3,160,317 | | 3,232,733 | | | (14,788 | ) | | | (14,362 | ) | | | 1,512 | | | | — | |

| GoldMoney Inc.1,9 | | 4,931,100 | | — | | 4,931,100 | | — | | | (8,762 | ) | | | 5,361 | | | | — | | | | — | |

| M&A Capital Partners Co., Ltd.1,9 | | 1,133,400 | | — | | 1,133,400 | | — | | | (11,967 | ) | | | (13,439 | ) | | | — | | | | — | |

| NMI Holdings, Inc.1,9 | | 5,036,127 | | — | | 3,523,127 | | 1,513,000 | | | 49,314 | | | | (27,874 | ) | | | — | | | | — | |

| Third Point Reinsurance Ltd.1,9 | | 6,147,821 | | — | | 6,147,821 | | — | | | (12,376 | ) | | | (2,179 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 338,764 | |

Investments in affiliates(continued)

| | | Beginning

shares | | Additions | | Reductions | | Ending

shares | | Net

realized

gain (loss)

(000) | | | Net

unrealized

appreciation

(depreciation)

(000) | | | Dividend

income

(000) | | | Value of

affiliates at

9/30/2019

(000) | |

| Consumer staples 0.92% | | | | | | | | | | | | | | | | | | | | |

| Emmi AG | | 311,300 | | 5,772 | | — | | 317,072 | | $ | — | | | $ | 21,548 | | | $ | 2,794 | | | $ | 258,601 | |

| TCI Co., Ltd.7 | | — | | 6,635,058 | | — | | 6,635,058 | | | — | | | | (7,799 | ) | | | 772 | | | | 66,608 | |

| Primo Water Corp.1 | | — | | 3,123,557 | | — | | 3,123,557 | | | — | | | | (6,846 | ) | | | — | | | | 38,357 | |

| CCL Products (India) Ltd. | | 10,642,173 | | — | | — | | 10,642,173 | | | — | | | | (980 | ) | | | 540 | | | | 35,935 | |

| R.E.A. Holdings PLC1 | | 2,162,000 | | — | | — | | 2,162,000 | | | — | | | | (3,909 | ) | | | — | | | | 4,094 | |

| Ariake Japan Co., Ltd.9 | | 1,754,000 | | 74,200 | | 1,828,200 | | — | | | 12,831 | | | | (79,136 | ) | | | — | | | | — | |

| Simply Good Foods Co., Class A1,9 | | 4,420,000 | | — | | 1,632,000 | | 2,788,000 | | | 17,720 | | | | 13,938 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 403,595 | |

| Communication services 0.43% | | | | | | | | | | | | | | | | | | | | |

| Iridium Communications Inc.1 | | 7,666,388 | | 161,544 | | 1,026,000 | | 6,801,932 | | | 16,718 | | | | (20,177 | ) | | | — | | | | 144,745 | |

| Iridium Communications Inc.1,4 | | 636,132 | | — | | — | | 636,132 | | | — | | | | (776 | ) | | | — | | | | 13,537 | |

| Kamakura Shinsho, Ltd.2 | | — | | 2,135,000 | | — | | 2,135,000 | | | — | | | | 587 | | | | — | | | | 29,224 | |

| Care.com, Inc.1,9 | | 1,642,963 | | 900,037 | | 2,543,000 | | — | | | (16,666 | ) | | | (4,336 | ) | | | — | | | | — | |

| Entertainment One Ltd.9 | | 21,220,339 | | 2,982,661 | | 8,621,500 | | 15,581,500 | | | 21,177 | | | | 8,961 | | | | 360 | | | | — | |

| Zegona Communications PLC9 | | 7,911,786 | | 980,781 | | 5,592,263 | | 3,300,304 | | | (4,765 | ) | | | 3,933 | | | | 257 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 187,506 | |

| Materials 0.77% | | | | | | | | | | | | | | | | | | | | |

| Allegheny Technologies Inc.1 | | 6,615,300 | | 5,082,524 | | 1,610,700 | | 10,087,124 | | | (5,176 | ) | | | (71,880 | ) | | | — | | | | 204,264 | |

| Loma Negra Compania Industrial Argentina SA (ADR)1,8 | | 577,695 | | 7,856,003 | | 1,323,198 | | 7,110,500 | | | (10,438 | ) | | | (38,689 | ) | | | — | | | | 40,885 | |

| JCU Corp. | | — | | 1,687,000 | | — | | 1,687,000 | | | — | | | | 3,166 | | | | 368 | | | | 33,951 | |

| Navin Fluorine International Ltd. | | 3,202,000 | | — | | — | | 3,202,000 | | | — | | | | 2,661 | | | | 352 | | | | 33,148 | |

| Excelsior Mining Corp.1,2 | | 12,868,000 | | — | | — | | 12,868,000 | | | — | | | | 933 | | | | — | | | | 10,198 | |

| Nevada Copper Corp.1 | | 48,480,000 | | 20,890,000 | | 22,280,000 | | 47,090,000 | | | (3,803 | ) | | | (7,748 | ) | | | — | | | | 8,175 | |

| Mayur Uniquoters Ltd. | | 3,660,000 | | — | | 1,257,066 | | 2,402,934 | | | (5,827 | ) | | | (1,004 | ) | | | 161 | | | | 7,192 | |

| Bacanora Lithium PLC1,9 | | 8,573,925 | | — | | 8,573,925 | | — | | | (6,963 | ) | | | 5,687 | | | | — | | | | — | |

| BlueJay Mining PLC1,9 | | 45,009,091 | | — | | 45,009,091 | | — | | | (3,172 | ) | | | 1,294 | | | | — | | | | — | |

| Danakali Ltd.1,9 | | 16,700,000 | | — | | 16,700,000 | | — | | | (496 | ) | | | (2,688 | ) | | | — | | | | — | |

| Hummingbird Resources PLC1,9 | | 27,459,300 | | — | | 27,459,300 | | — | | | (2,676 | ) | | | (97 | ) | | | — | | | | — | |

| Kenmare Resources PLC1,9 | | 7,124,863 | | — | | 7,124,863 | | — | | | (31,730 | ) | | | 26,914 | | | | — | | | | — | |

| Scapa Group PLC9 | | 12,183,326 | | 170,000 | | 12,353,326 | | — | | | (20,503 | ) | | | (22,825 | ) | | | 123 | | | | — | |

| Sirius Minerals PLC1,2,9 | | 247,367,560 | | 212,205,000 | | 263,290,365 | | 196,282,195 | | | (15,477 | ) | | | (65,219 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 337,813 | |

| Real estate 0.50% | | | | | | | | | | | | | | | | | | | | | | | | |

| WHA Corp. PCL | | 1,106,071,920 | | — | | 354,751,720 | | 751,320,200 | | | 14,263 | | | | 971 | | | | 2,045 | | | | 116,929 | |

| Altus Group Ltd. | | — | | 3,014,100 | | — | | 3,014,100 | | | — | | | | 16,954 | | | | 505 | | | | 90,888 | |

| Foxtons Group PLC1 | | 17,881,785 | | — | | — | | 17,881,785 | | | — | | | | (1,406 | ) | | | — | | | | 10,993 | |

| MGM Growth Properties LLC REIT, Class A9 | | 4,017,887 | | — | | 1,677,887 | | 2,340,000 | | | 4,887 | | | | (3,743 | ) | | | 3,052 | | | | — | |

| Purplebricks Group PLC1,9 | | 17,905,676 | | — | | 17,905,676 | | — | | | (9,102 | ) | | | 2,927 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 218,810 | |

| Energy 0.14% | | | | | | | | | | | | | | | | | | | | | | | | |

| NuVista Energy Ltd.1 | | — | | 15,965,000 | | — | | 15,965,000 | | | — | | | | (24,744 | ) | | | — | | | | 29,885 | |

| Nine Energy Service, Inc.1 | | 1,504,000 | | 949,000 | | — | | 2,453,000 | | | — | | | | (52,909 | ) | | | — | | | | 15,135 | |

| Savannah Petroleum PLC1 | | 65,357,000 | | 8,100,000 | | 21,296,821 | | 52,160,179 | | | (6,873 | ) | | | (855 | ) | | | — | | | | 14,751 | |

| BNK Petroleum Inc.1,9 | | 12,804,914 | | — | | 12,804,914 | | — | | | (15,654 | ) | | | 13,635 | | | | — | | | | — | |

| Independence Contract Drilling, Inc.1,9 | | 2,908,057 | | — | | 2,908,057 | | — | | | (1,250 | ) | | | (4,134 | ) | | | — | | | | — | |

| Lekoil Ltd. (CDI)1,9 | | 42,922,391 | | — | | 42,922,391 | | — | | | (19,750 | ) | | | 13,228 | | | | — | | | | — | |

| PetroTal Corp.1,9 | | 34,775,000 | | — | | 34,775,000 | | — | | | 10 | | | | (1,577 | ) | | | — | | | | — | |

| | | Beginning

shares | | Additions | | Reductions | | Ending

shares | | Net

realized

gain (loss)

(000) | | | Net

unrealized

appreciation

(depreciation)

(000) | | | Dividend

income

(000) | | | Value of

affiliates at

9/30/2019

(000) | |

| Providence Resources PLC1,9 | | 35,235,000 | | — | | 35,235,000 | | — | | $ | 102 | | | $ | (2,183 | ) | | $ | — | | | $ | — | |

| San Leon Energy PLC1,9 | | 32,348,000 | | — | | 32,348,000 | | — | | | (17,713 | ) | | | 21,025 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 59,771 | |

| Utilities 0.00% | | | | | | | | | | | | | | | | | | | | | | | | |

| Mytrah Energy Ltd.1,7,10 | | 10,418,000 | | — | | — | | 10,418,000 | | | — | | | | (5,097 | ) | | | — | | | | 128 | |

| Total common stocks | | | | | | | | | | | | | | | | | | | 8,587,440 | |

| Preferred securities 0.09% | | | | | | | | | | | | | | | | | | | | |

| Consumer discretionary 0.09% | | | | | | | | | | | | | | | | | | | | |

| Made.com Design Ltd., Series C-4, preferred shares1,7,10,12 | | 2,067,967 | | — | | — | | 2,067,967 | | | — | | | | (2,040 | ) | | | — | | | | 39,793 | |

| Consumer staples 0.00% | | | | | | | | | | | | | | | | | | | | |

| R.E.A. Holdings PLC 9.00%, preferred shares | | 96,000 | | — | | — | | 96,000 | | | — | | | | (47 | ) | | | 6 | | | | 85 | |

| Total preferred securities | | | | | | | | | | | | | | | | | | | 39,878 | |

| Rights & warrants 0.00% | | | | | | | | | | | | | | | | | | | | |

| Health care 0.00% | | | | | | | | | | | | | | | | | | | | | | | | |

| Neovasc Inc., Class A, warrants, expire 20221 | | 28,290 | | — | | 28,290 | | — | | | — | | | | — | | | | — | | | | — | |

| Energy 0.00% | | | | | | | | | | | | | | | | | | | | | | | | |

| Savannah Petroleum PLC, warrants, expire 20191 | | 21,698,000 | | — | | 21,698,000 | | — | | | — | | | | (523 | ) | | | — | | | | — | |

| Total rights & warrants | | | | | | | | | | | | | | | | | | | — | |

| Convertible stocks 0.05% | | | | | | | | | | | | | | | | | | | | |

| Information technology 0.05% | | | | | | | | | | | | | | | | | | | | |

| RealSelf, Inc., Series C, convertible preferred1,7,10,12 | | 3,468,862 | | — | | — | | 3,468,862 | | | — | | | | 4,856 | | | | — | | | | 24,317 | |

| Health care 0.00% | | | | | | | | | | | | | | | | | | | | |

| Cortexyme, Inc., Series B, 8.00% noncumulative convertible preferred1,7 | | 4,244,602 | | — | | 4,244,602 | | — | | | — | | | | — | | | | — | | | | — | |

| Total convertible stocks | | | | | | | | | | | | | | | | | | | 24,317 | |

| Total 19.68% | | | | | | | | | | $ | 68,697 | | | $ | (797,668 | ) | | $ | 71,259 | | | $ | 8,651,635 | |

The following footnotes apply to either the individual securities noted or one or more of the securities aggregated and listed as a single line item.

| 1 | Security did not produce income during the last 12 months. |

| 2 | All or a portion of this security was on loan. The total value of all such securities, including those in “Other securities,” was $902,919,000, which represented 2.05% of the net assets of the fund. Refer to Note 5 for more information on securities lending. |

| 3 | Represents an affiliated company as defined under the Investment Company Act of 1940. |

| 4 | Acquired in a transaction exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities, including those in “Other securities,” was $1,026,191,000, which represented 2.33% of the net assets of the fund. |

| 5 | Rate represents the seven-day yield at 9/30/2019. |

| 6 | Security purchased with cash collateral from securities on loan. Refer to Note 5 for more information on securities lending. |

| 7 | Valued under fair value procedures adopted by authority of the board of directors. The total value of all such securities, including those in “Other securities,” was $838,998,000, which represented 1.91% of the net assets of the fund. |

| 8 | This security was an unaffiliated issuer in its initial period of acquisition at 9/30/2018; it was not publicly disclosed. |

| 9 | Unaffiliated issuer at 9/30/2019. |

| 10 | Value determined using significant unobservable inputs. |

| 11 | Amount less than one thousand. |

| 12 | Acquired through a private placement transaction exempt from registration under the Securities Act of 1933. May be subject to legal or contractual restrictions on resale. Further details on these holdings appear on the following page. |

| Private placement securities | | Acquisition

date(s) | | Cost

(000) | | | Value

(000) | | | Percent

of net

assets | |

| Made.com Design Ltd., Series C-4, preferred shares | | 3/2/2018 | | $ | 41,328 | | | $ | 39,793 | | | | .09 | % |

| RealSelf, Inc., Series C, convertible preferred | | 4/18/2018 | | | 19,000 | | | | 24,317 | | | | .06 | |

| Other private placement securities | | 12/3/2013-9/11/2019 | | | 204,070 | | | | 200,904 | | | | .45 | |

| Total private placement securities | | | | $ | 264,398 | | | $ | 265,014 | | | | .60 | % |

Key to abbreviations

ADR = American Depositary Receipts

CAD = Canadian dollars

CDI = CREST Depository Interest

EUR = Euros

ISK = Icelandic kronor

See notes to financial statements.

Financial statements

Statement of assets and liabilities

at September 30, 2019 | |

| | (dollars in thousands) |

| Assets: | | | | | | | | |

| Investment securities, at value: | | | | | | | | |

| Unaffiliated issuers (cost: $26,238,716) | | $ | 35,850,806 | | | | | |

| Affiliated issuers (cost: $6,919,756) | | | 8,651,635 | | | $ | 44,502,441 | |

| Cash | | | | | | | 6,267 | |

| Cash denominated in currencies other than U.S. dollars (cost: $45,648) | | | | | | | 45,642 | |

| Receivables for: | | | | | | | | |

| Sales of investments | | | 19,372 | | | | | |

| Sales of fund’s shares | | | 50,607 | | | | | |

| Dividends and interest | | | 34,460 | | | | | |

| Securities lending income | | | 4,634 | | | | | |

| Other | | | 1,875 | | | | 110,948 | |

| | | | | | | | 44,665,298 | |

| Liabilities: | | | | | | | | |

| Collateral for securities on loan | | | | | | | 493,088 | |

| Payables for: | | | | | | | | |

| Purchases of investments | | | 107,593 | | | | | |

| Repurchases of fund’s shares | | | 32,879 | | | | | |

| Investment advisory services | | | 22,492 | | | | | |

| Services provided by related parties | | | 9,359 | | | | | |

| Directors’ deferred compensation | | | 4,558 | | | | | |

| Non-U.S. taxes | | | 38,852 | | | | | |

| Other | | | 1,078 | | | | 216,811 | |

| Net assets at September 30, 2019 | | | | | | $ | 43,955,399 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

| Capital paid in on shares of capital stock | | | | | | $ | 31,056,591 | |

| Total distributable earnings | | | | | | | 12,898,808 | |

| Net assets at September 30, 2019 | | | | | | $ | 43,955,399 | |

(dollars and shares in thousands, except per-share amounts)

Total authorized capital stock — 2,000,000 shares,

$.01 par value (795,202 total shares outstanding)

| | | Net assets | | | Shares

outstanding | | | Net asset value

per share | |

| | | | | | | | | | | | | |

| Class A | | $ | 23,203,080 | | | | 420,025 | | | $ | 55.24 | |

| Class C | | | 673,335 | | | | 14,199 | | | | 47.42 | |

| Class T | | | 11 | | | | — | * | | | 55.54 | |

| Class F-1 | | | 703,021 | | | | 12,896 | | | | 54.51 | |

| Class F-2 | | | 4,908,565 | | | | 87,247 | | | | 56.26 | |

| Class F-3 | | | 2,152,571 | | | | 38,579 | | | | 55.80 | |

| Class 529-A | | | 1,337,447 | | | | 24,536 | | | | 54.51 | |

| Class 529-C | | | 184,614 | | | | 3,818 | | | | 48.35 | |

| Class 529-E | | | 57,955 | | | | 1,100 | | | | 52.68 | |

| Class 529-T | | | 13 | | | | — | * | | | 55.49 | |

| Class 529-F-1 | | | 146,449 | | | | 2,643 | | | | 55.41 | |

| Class R-1 | | | 24,162 | | | | 492 | | | | 49.08 | |

| Class R-2 | | | 542,564 | | | | 11,044 | | | | 49.12 | |

| Class R-2E | | | 28,505 | | | | 525 | | | | 54.34 | |

| Class R-3 | | | 756,791 | | | | 14,404 | | | | 52.54 | |

| Class R-4 | | | 790,721 | | | | 14,434 | | | | 54.78 | |

| Class R-5E | | | 38,938 | | | | 702 | | | | 55.44 | |

| Class R-5 | | | 376,015 | | | | 6,579 | | | | 57.16 | |

| Class R-6 | | | 8,030,642 | | | | 141,979 | | | | 56.56 | |

| * | Amount less than one thousand. |

See notes to financial statements.

Statement of operations

for the year ended September 30, 2019 | |

| | (dollars in thousands) |

| Investment income: | | | | | | |

| Income: | | | | | | | | |

| Dividends (net of non-U.S. taxes of $23,383; also includes $71,259 from affiliates) | | $ | 404,699 | | | | | |

| Interest (net of non-U.S. taxes of $34) | | | 48,516 | | | | | |

| Securities lending income (net of fees) | | | 31,866 | | | $ | 485,081 | |

| Fees and expenses*: | | | | | | | | |

| Investment advisory services | | | 259,375 | | | | | |

| Distribution services | | | 82,306 | | | | | |

| Transfer agent services | | | 46,980 | | | | | |

| Administrative services | | | 12,152 | | | | | |

| Reports to shareholders | | | 1,981 | | | | | |

| Registration statement and prospectus | | | 2,905 | | | | | |

| Directors’ compensation | | | 496 | | | | | |

| Auditing and legal | | | 161 | | | | | |

| Custodian | | | 4,864 | | | | | |

| State and local taxes | | | 1 | | | | | |

| Other | | | 2,268 | | | | | |

| Total fees and expenses before reimbursements | | | 413,489 | | | | | |

| Less transfer agent services reimbursements | | | 50 | | | | | |

| Total fees and expenses after reimbursements | | | | | | | 413,439 | |

| Net investment income | | | | | | | 71,642 | |

| | | | | | | | | |

| Net realized gain and unrealized depreciation: | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments (net of non-U.S. taxes of $4,139): | | | | | | | | |

| Unaffiliated issuers | | | 1,608,557 | | | | | |

| Affiliated issuers | | | 68,697 | | | | | |

| Forward currency contracts | | | (544 | ) | | | | |

| Currency transactions | | | (3,028 | ) | | | 1,673,682 | |

| Net unrealized (depreciation) appreciation on: | | | | | | | | |

| Investments (net of non-U.S. taxes of $37,805): | | | | | | | | |

| Unaffiliated issuers | | | (1,531,666 | ) | | | | |

| Affiliated issuers | | | (797,668 | ) | | | | |

| Forward currency contracts | | | 923 | | | | | |

| Currency translations | | | (791 | ) | | | (2,329,202 | ) |

| Net realized gain and unrealized depreciation | | | | | | | (655,520 | ) |

| | | | | | | | | |

| Net decrease in net assets resulting from operations | | | | | | $ | (583,878 | ) |

| * | Additional information related to class-specific fees and expenses is included in the notes to financial statements. |

See notes to financial statements.

| Statements of changes in net assets | |

| | (dollars in thousands) |

| | | Year ended September 30, | |

| | | 2019 | | | 2018 | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 71,642 | | | $ | 46,991 | |

| Net realized gain | | | 1,673,682 | | | | 2,346,244 | |

| Net unrealized (depreciation) appreciation | | | (2,329,202 | ) | | | 2,561,220 | |

| Net (decrease) increase in net assets resulting from operations | | | (583,878 | ) | | | 4,954,455 | |

| | | | | | | | | |

| Distributions paid to shareholders | | | (2,434,865 | ) | | | (1,678,270 | ) |

| | | | | | | | | |

| Net capital share transactions | | | 3,097,094 | | | | 3,711,671 | |

| | | | | | | | | |

| Total increase in net assets | | | 78,351 | | | | 6,987,856 | |

| | | | | | | | | |

| Net assets: | | | | | | | | |

| Beginning of year | | | 43,877,048 | | | | 36,889,192 | |

| End of year | | $ | 43,955,399 | | | $ | 43,877,048 | |

See notes to financial statements.

Notes to financial statements

1. Organization

SMALLCAP World Fund, Inc. (the “fund”) is registered under the Investment Company Act of 1940 as an open-end, diversified management investment company. The fund seeks to provide long-term growth of capital. Shareholders approved a proposal to reorganize the fund from a Maryland corporation to a Delaware statutory trust. The reorganization may be completed in the next year; however, the fund reserves the right to delay the implementation.

The fund has 19 share classes consisting of six retail share classes (Classes A, C, T, F-1, F-2 and F-3), five 529 college savings plan share classes (Classes 529-A, 529-C, 529-E, 529-T and 529-F-1) and eight retirement plan share classes (Classes R-1, R-2, R-2E, R-3, R-4, R-5E, R-5 and R-6). The 529 college savings plan share classes can be used to save for college education. The retirement plan share classes are generally offered only through eligible employer-sponsored retirement plans. The fund’s share classes are described further in the following table:

| Share class | | Initial sales

charge | | Contingent deferred sales

charge upon redemption | | Conversion feature |

| Classes A and 529-A | | Up to 5.75% | | None (except 1% for certain redemptions within 18 months of purchase without an initial sales charge) | | None |

| Class C | | None | | 1% for redemptions within one year of purchase | | Class C converts to Class F-1 after 10 years |

| Class 529-C | | None | | 1% for redemptions within one year of purchase | | Class 529-C converts to Class 529-A after 10 years |

| Class 529-E | | None | | None | | None |

| Classes T and 529-T* | | Up to 2.50% | | None | | None |

| Classes F-1, F-2, F-3 and 529-F-1 | | None | | None | | None |

| Classes R-1, R-2, R-2E, R-3, R-4, R-5E, R-5 and R-6 | | None | | None | | None |

| * | Class T and 529-T shares are not available for purchase. |

Holders of all share classes have equal pro rata rights to the assets, dividends and liquidation proceeds of the fund. Each share class has identical voting rights, except for the exclusive right to vote on matters affecting only its class. Share classes have different fees and expenses (“class-specific fees and expenses”), primarily due to different arrangements for distribution, transfer agent and administrative services. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different per-share dividends by each share class.

2. Significant accounting policies

The fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board. The fund’s financial statements have been prepared to comply with U.S. generally accepted accounting principles (“U.S. GAAP”). These principles require the fund’s investment adviser to make estimates and assumptions that affect reported amounts and disclosures. Actual results could differ from those estimates. Subsequent events, if any, have been evaluated through the date of issuance in the preparation of the financial statements. The fund follows the significant accounting policies described in this section, as well as the valuation policies described in the next section on valuation.

Security transactions and related investment income — Security transactions are recorded by the fund as of the date the trades are executed with brokers. Realized gains and losses from security transactions are determined based on the specific identified cost of the securities. In the event a security is purchased with a delayed payment date, the fund will segregate liquid assets sufficient to meet its payment obligations. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. Market discounts, premiums and original issue discounts on fixed-income securities are amortized daily over the expected life of the security.

Class allocations — Income, fees and expenses (other than class-specific fees and expenses) and realized and unrealized gains and losses are allocated daily among the various share classes based on their relative net assets. Class-specific fees and expenses, such as distribution, transfer agent and administrative services, are charged directly to the respective share class.

Distributions paid to shareholders — Income dividends and capital gain distributions are recorded on the ex-dividend date.

Currency translation — Assets and liabilities, including investment securities, denominated in currencies other than U.S. dollars are translated into U.S. dollars at the exchange rates supplied by one or more pricing vendors on the valuation date. Purchases and sales of investment securities and income and expenses are translated into U.S. dollars at the exchange rates on the dates of such transactions. The effects of changes in exchange rates on investment securities are included with the net realized gain or loss and net unrealized appreciation or depreciation on investments in the fund’s statement of operations. The realized gain or loss and unrealized appreciation or depreciation resulting from all other transactions denominated in currencies other than U.S. dollars are disclosed separately.

3. Valuation

Capital Research and Management Company (“CRMC”), the fund’s investment adviser, values the fund’s investments at fair value as defined by U.S. GAAP. The net asset value of each share class of the fund is generally determined as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open.

Methods and inputs — The fund’s investment adviser uses the following methods and inputs to establish the fair value of the fund’s assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Equity securities are generally valued at the official closing price of, or the last reported sale price on, the exchange or market on which such securities are traded, as of the close of business on the day the securities are being valued or, lacking any sales, at the last available bid price. Prices for each security are taken from the principal exchange or market on which the security trades.

Fixed-income securities, including short-term securities, are generally valued at prices obtained from one or more pricing vendors. Vendors value such securities based on one or more of the inputs described in the following table. The table provides examples of inputs that are commonly relevant for valuing particular classes of fixed-income securities in which the fund is authorized to invest. However, these classifications are not exclusive, and any of the inputs may be used to value any other class of fixed-income security.

| Fixed-income class | | Examples of standard inputs |

| All | | Benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data (collectively referred to as “standard inputs”) |

| Corporate bonds & notes; convertible securities | | Standard inputs and underlying equity of the issuer |

| Bonds & notes of governments & government agencies | | Standard inputs and interest rate volatilities |

When the fund’s investment adviser deems it appropriate to do so (such as when vendor prices are unavailable or deemed to be not representative), fixed-income securities will be valued in good faith at the mean quoted bid and ask prices that are reasonably and timely available (or bid prices, if ask prices are not available) or at prices for securities of comparable maturity, quality and type.

Securities with both fixed-income and equity characteristics, or equity securities traded principally among fixed-income dealers, are generally valued in the manner described for either equity or fixed-income securities, depending on which method is deemed most appropriate by the fund’s investment adviser. The Capital Group Central Cash Fund (“CCF”), a fund within the Capital Group Central Fund Series (“Central Funds”), is valued based upon a floating net asset value, which fluctuates with changes in the value of CCF’s portfolio securities. The underlying securities are valued based on the policies and procedures in CCF’s statement of additional information. Forward currency contracts are valued at the mean of representative quoted bid and ask prices, generally based on prices supplied by one or more pricing vendors.

Securities and other assets for which representative market quotations are not readily available or are considered unreliable by the fund’s investment adviser are fair valued as determined in good faith under fair valuation guidelines adopted by authority of the fund’s board of directors as further described. The investment adviser follows fair valuation guidelines, consistent with U.S. Securities and Exchange Commission rules and guidance, to consider relevant principles and factors when making fair value determinations. The investment adviser considers relevant indications of value that are reasonably and timely available to it in determining the fair value to be assigned to a particular security, such as the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. In addition, the closing prices of equity securities that trade in markets outside U.S. time zones may be adjusted to reflect significant events

that occur after the close of local trading but before the net asset value of each share class of the fund is determined. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations that would have been used had greater market activity occurred.

Processes and structure — The fund’s board of directors has delegated authority to the fund’s investment adviser to make fair value determinations, subject to board oversight. The investment adviser has established a Joint Fair Valuation Committee (the “Fair Valuation Committee”) to administer, implement and oversee the fair valuation process, and to make fair value decisions. The Fair Valuation Committee regularly reviews its own fair value decisions, as well as decisions made under its standing instructions to the investment adviser’s valuation teams. The Fair Valuation Committee reviews changes in fair value measurements from period to period and may, as deemed appropriate, update the fair valuation guidelines to better reflect the results of back testing and address new or evolving issues. The Fair Valuation Committee reports any changes to the fair valuation guidelines to the board of directors. The fund’s board and audit committee also regularly review reports that describe fair value determinations and methods.

The fund’s investment adviser has also established a Fixed-Income Pricing Review Group to administer and oversee the fixed-income valuation process, including the use of fixed-income pricing vendors. This group regularly reviews pricing vendor information and market data. Pricing decisions, processes and controls over security valuation are also subject to additional internal reviews, including an annual control self-evaluation program facilitated by the investment adviser’s compliance group.

Classifications — The fund’s investment adviser classifies the fund’s assets and liabilities into three levels based on the inputs used to value the assets or liabilities. Level 1 values are based on quoted prices in active markets for identical securities. Level 2 values are based on significant observable market inputs, such as quoted prices for similar securities and quoted prices in inactive markets. Certain securities trading outside the U.S. may transfer between Level 1 and Level 2 due to valuation adjustments resulting from significant market movements following the close of local trading. Level 3 values are based on significant unobservable inputs that reflect the investment adviser’s determination of assumptions that market participants might reasonably use in valuing the securities. The valuation levels are not necessarily an indication of the risk or liquidity associated with the underlying investment. For example, U.S. government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market. The following table presents the fund’s valuation levels as of September 30, 2019 (dollars in thousands):

| | | Investment securities | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets: | | | | | | | | | | | | | | | | |

| Common stocks: | | | | | | | | | | | | | | | | |

| Information technology | | $ | 8,641,136 | | | $ | 186,415 | | | $ | 5,891 | | | $ | 8,833,442 | |

| Health care | | | 7,347,962 | | | | 38,126 | | | | 74,276 | | | | 7,460,364 | |

| Industrials | | | 6,622,731 | | | | 35,412 | | | | — | | | | 6,658,143 | |

| Consumer discretionary | | | 6,461,222 | | | | 176,787 | | | | 1,019 | | | | 6,639,028 | |

| Financials | | | 4,002,910 | | | | 68,865 | | | | — | | | | 4,071,775 | |

| Consumer staples | | | 1,696,275 | | | | 66,608 | | | | — | | | | 1,762,883 | |

| Communication services | | | 1,477,405 | | | | — | | | | — | | | | 1,477,405 | |

| Materials | | | 1,476,369 | | | | — | | | | 624 | | | | 1,476,993 | |

| Other | | | 1,643,258 | | | | — | | | | 22,176 | | | | 1,665,434 | |