UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06096

The Torray Fund

(Exact name of registrant as specified in charter)

7501 Wisconsin Avenue, Suite 750 West

Bethesda, MD 20814-6519

(Address of principal executive offices) (Zip code)

William M. Lane

Torray LLC

7501 Wisconsin Avenue, Suite 750 West

Bethesda, MD 20814-6519

(Name and address of agent for service)

(301) 493-4600

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2015

Date of reporting period: December 31, 2015

Item 1. Report to Stockholders.

The

TORRAY

FUND

ANNUAL REPORT

December 31, 2015

The Torray Fund

Suite 750 W

7501 Wisconsin Avenue

Bethesda, Maryland 20814-6519

(301) 493-4600

(855) 753-8174

The Torray Fund

Letter to Shareholders

January 15, 2016

Dear Fellow Shareholders,

When we wrote to you last year at this time, we ventured that the market’s 17.5% compound annual return over the preceding six years was unlikely to repeat anytime soon. Judging by its poor showing in 2015 and weakness so far this year, it appears we may have guessed right. The Torray Fund lost 1.36% last year. While the S&P 500 was slightly positive, its gain was misleading. As a group, ninety-eight percent – 490 of the 500 stocks – produced a negative result. Outsized gains in the other 10 boosted the Index 3.3%, wiping out the losses and leaving a net return of 1.38%. A wide disparity in performance also marked the spread between growth and value stocks (our Fund falls into the latter category). The Russell 1000 Value Index lost 3.8%, but the 1000 Growth Index gained 5.7%.

Given the market’s sharp downturn this month, we are pleased to report that we have a 15% cash balance on hand. This has nothing to do with trying to time the market. The money gradually accumulated last year as we pared back on a number of long-term holdings that had appreciated to levels we were not comfortable with. In addition, corporate transactions beyond our control resulted in cash inflows as well. We have been waiting a long time for valuations to realign with underlying fundamentals and it now appears to be happening. On the other hand, the most popular momentum-driven shares that have dominated the market in recent years still have a long way to go. We’re not interested in any of them.

Despite the seemingly endless bad news, we remain positive about the future of our country, its economic prospects and the rewards that come from investing in high quality stocks for the long term. We realize this is hard to do in times like these. But, the good news is that it seems like a broad range of U.S. stocks has largely discounted the bulk of the risk. We are particularly confident about the valuations of companies held by our Fund, as well as many others we have under consideration. The forward estimated price/earnings (P/E) ratio on the S&P 500 was recently 15.1, about in line with its average dating back to 1926. The Torray Fund’s average P/E ratio was a conservative 12.3. Due to the market’s decline, both ratios are now even lower.

Wall Street prognosticators don’t share our optimism. While the start of every new year brings fresh forecasts of what’s in store, countless academic studies have shown these guesses are almost always wrong. The latest analysis reveals that annual market predictions since 2000 have been way off-base. In each of the 15 years, forecasters called for the market to go up, with annual returns averaging 9.5%. The actual number came in under 4%, one of the lowest on record. In five of the years, stocks went down. In 2001, the consensus called for a gain of 20.7%, but the market fell 13%. In 2008, the start of one of the worst downturns in history, the projections called for an 11.1% advance. Stocks collapsed 38.5%.

The Torray Fund

Letter to Shareholders (continued)

January 15, 2016

As we’ve often said, no one knows what the market is going to do, and investors are wise to not even think about it. While the economic and political backdrop today is certainly scary, in our opinion it’s not worse than the wars, depressions, recessions and collapsing stock prices of the past. Recovery from some of these setbacks took many years, but in the end, important, well-financed businesses always rebounded to new highs and bigger dividend payouts, rewarding their long-term shareholders. We believe today’s challenges will eventually be resolved and the outcome will be the same. This is by far the most important thing for investors to keep in mind. Sadly, though, it is the one truth they invariably ignore. The financial industry, increasingly crowded with supposed experts battling it out for the public’s money, deserves much of the blame. The only way they can win is by beating each other and the market for short-term returns. This concentration on tomorrow and the next day ruins any long-term chance of preserving capital and compounding money over a lifetime.

Please believe us when we say this is not going to happen at our company. We, our partners and employees have a meaningful investment alongside yours, and every one of us is committed to the principles set forth in these letters. Independent ownership of the business ensures everlasting freedom from outside influence.

Sincere appreciation is extended, as always, for your loyalty and confidence in our advice and management.

| | Sincerely, |

| | |

| |  |

| | Robert E. Torray |

| | |

| | |

| | |

| |  |

| | Fred M. Fialco |

The Torray Fund

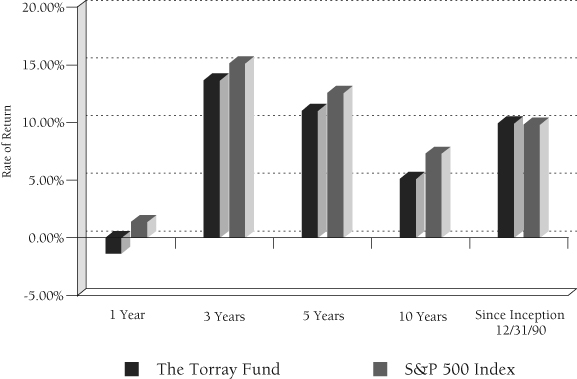

PERFORMANCE DATA

As of December 31, 2015 (unaudited)

Average Annual Returns on an Investment in

The Torray Fund vs. the S&P 500 Index

For the periods ended December 31, 2015:

| | | | | | Since |

| | | | | | Inception |

| | 1 Year | 3 Years | 5 Years | 10 Years | 12/31/90 |

| The Torray Fund | -1.36% | 13.66% | 11.02% | 5.13% | 9.92% |

| S&P 500 Index | 1.38% | 15.13% | 12.57% | 7.31% | 9.82% |

Cumulative Returns for the 25 years ended December 31, 2015

| | The Torray Fund | | 963.42% | |

| | S&P 500 Index | | 939.52% | |

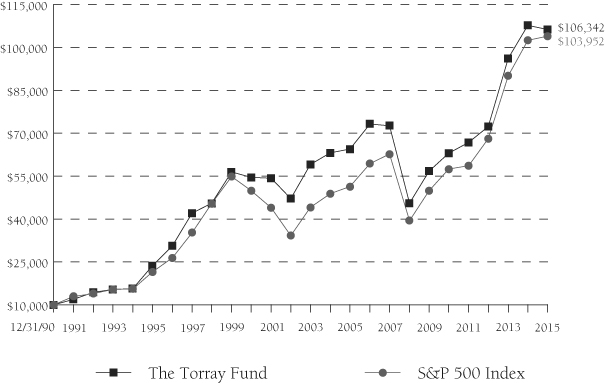

The Torray Fund

PERFORMANCE DATA (continued)

As of December 31, 2015 (unaudited)

Change in Value of $10,000 Invested

on December 31, 1990 (commencement of operations) to:

| | 12/31/90 | 12/31/95 | 12/31/00 | 12/31/05 | 12/31/10 | 12/31/15 |

| The Torray Fund | $10,000 | $23,774 | $54,563 | $64,476 | $63,039 | $106,342 |

| S&P 500 Index | $10,000 | $21,544 | $49,978 | $51,354 | $57,511 | $103,952 |

The returns quoted represent past performance and do not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher. For performance current to the most recent month end, please call (800) 626-9769. The returns shown do not reflect the deduction of taxes a shareholder would pay on the redemption of fund shares and distributions. The Fund’s annual operating expense ratio, as stated in the current prospectus, is 1.15%. Returns on both The Torray Fund and the S&P 500 Index assume reinvestment of all dividends and distributions. The S&P 500 Index is an unmanaged index consisting of 500 U.S. large-cap stocks. It is not possible to invest directly in an index. Current and future portfolio holdings are subject to change and risk.

The Torray Fund

FUND PROFILE

As of December 31, 2015 (unaudited)

DIVERSIFICATION (% of net assets)

| Information Technology | | | 19.5 | % |

| Financials | | | 18.2 | % |

| Industrials | | | 17.3 | % |

| Health Care | | | 8.7 | % |

| Consumer Discretionary | | | 7.5 | % |

| Energy | | | 4.5 | % |

| Telecommunications | | | 3.6 | % |

| Consumer Staples | | | 3.1 | % |

| Materials | | | 2.3 | % |

| Short-Term Investment | | | 15.2 | % |

| Other Assets and Liabilities, Net | | | 0.1 | % |

| | | | 100.0 | % |

| TOP TEN EQUITY HOLDINGS (% of net assets) | |

| | |

| 1. | | General Electric Co. | | | 4.2 | % |

| 2. | | Chubb Corp. | | | 4.1 | % |

| 3. | | AT&T Inc. | | | 3.6 | % |

| 4. | | Wells Fargo & Co. | | | 3.5 | % |

| 5. | | Stanley Black & Decker, Inc. | | | 3.3 | % |

| 6. | | EMC Corp. | | | 3.3 | % |

| 7. | | Cisco Systems, Inc. | | | 3.2 | % |

| 8. | | Intel Corp. | | | 3.2 | % |

| 9. | | Sysco Corp. | | | 3.1 | % |

| 10. | | Loews Corp. | | | 3.1 | % |

| | | | | | 34.6 | % |

PORTFOLIO CHARACTERISTICS

| Net Assets (millions) | | $394 |

| Number of Holdings | | 32 |

| Portfolio Turnover | | 10.77% |

| P/E Multiple (forward) | | 12.3x |

| Trailing Weighted Average Dividend Yield | | 2.79% |

| Market Capitalization (billions) | Average | $87.9 |

| | Median | $30.1 |

The Torray Fund

SCHEDULE OF INVESTMENTS

As of December 31, 2015

| | | Shares | | | | Market Value | |

| COMMON STOCKS 84.7% | |

| | | | | | | | |

| 19.5% INFORMATION TECHNOLOGY | |

| | | | 508,000 | | EMC Corp. | | $ | 13,045,440 | |

| | | | 465,300 | | Cisco Systems, Inc. | | | 12,635,222 | |

| | | | 366,400 | | Intel Corp. | | | 12,622,480 | |

| | | | 87,650 | | International Business Machines Corp. | �� | | 12,062,393 | |

| | | | 475,900 | | Western Union Co. | | | 8,523,369 | |

| | | | 124,200 | | VMware, Inc. – Class A* | | | 7,025,994 | |

| | | | 393,400 | | Hewlett Packard Enterprise Co. | | | 5,979,680 | |

| | | | 393,400 | | HP Inc. | | | 4,657,856 | |

| | | | | | | | | 76,552,434 | |

| | | | | | | | | | |

| 18.2% FINANCIALS | |

| | | | 121,200 | | Chubb Corp. | | | 16,075,968 | |

| | | | 253,400 | | Wells Fargo & Co. | | | 13,774,824 | |

| | | | 314,300 | | Loews Corp. | | | 12,069,120 | |

| | | | 679,000 | | Bank of America Corp. | | | 11,427,570 | |

| | | | 183,618 | | Marsh & McLennan Cos., Inc. | | | 10,181,618 | |

| | | | 118,550 | | American Express Co. | | | 8,245,153 | |

| | | | | | | | | 71,774,253 | |

| | | | | | | | | | |

| 17.3% INDUSTRIALS | |

| | | | 527,097 | | General Electric Co. | | | 16,419,072 | |

| | | | 123,400 | | Stanley Black & Decker, Inc. | | | 13,170,482 | |

| | | | 268,900 | | Republic Services, Inc. | | | 11,828,911 | |

| | | | 82,100 | | General Dynamics Corp. | | | 11,277,256 | |

| | | | 166,350 | | Eaton Corp. plc | | | 8,656,854 | |

| | | | 177,000 | | Chicago Bridge & Iron Co. NV | | | 6,901,230 | |

| | | | | | | | | 68,253,805 | |

| | | | | | | | | | |

| 8.7% HEALTH CARE | | | | |

| | | | 108,924 | | Johnson & Johnson | | | 11,188,673 | |

| | | | 71,750 | | Becton Dickinson & Co. | | | 11,055,957 | |

| | | | 53,500 | | UnitedHealth Group Inc. | | | 6,293,740 | |

| | | | 41,100 | | Anthem, Inc. | | | 5,730,984 | |

| | | | | | | | | 34,269,354 | |

See notes to the financial statements.

The Torray Fund

SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2015

| | | | | | | | |

| | | Shares | | | | Market Value | |

| 7.5% CONSUMER DISCRETIONARY | |

| | | | 716,550 | | Gannett Co., Inc. | | $ | 11,672,599 | |

| | | | 161,300 | | Tupperware Brands Corp. | | | 8,976,345 | |

| | | | 343,900 | | TEGNA Inc. | | | 8,776,328 | |

| | | | | | | | | 29,425,272 | |

| 4.5% ENERGY | |

| | | | 776,700 | | Boardwalk Pipeline Partners, LP | | | 10,081,566 | |

| | | | 245,120 | | BP plc – ADR | | | 7,662,451 | |

| | | | | | | | | 17,744,017 | |

| 3.6% TELECOMMUNICATIONS | |

| | | | 407,372 | | AT&T Inc. | | | 14,017,671 | |

| | | | | | | | | | |

| 3.1% CONSUMER STAPLES | |

| | | | 299,900 | | Sysco Corp. | | | 12,295,900 | |

| | | | | | | | | | |

| 2.3% MATERIALS | |

| | | | 176,200 | | Dow Chemical Co. | | | 9,070,776 | |

| | | | | | | | | | |

| TOTAL COMMON STOCK | |

| (cost $243,295,093) | | | 333,403,482 | |

| | | | | | | | | | |

| SHORT-TERM INVESTMENT 15.2% | |

| | | | 60,079,331 | | Fidelity Institutional Government Portfolio, | | | | |

| | | | | | Institutional Class, 0.14%^ | | | 60,079,331 | |

| (cost $60,079,331) | | | | |

| TOTAL INVESTMENTS 99.9% | | | 393,482,813 | |

| (cost $303,374,424) | | | | |

| OTHER ASSETS AND LIABILITIES, NET 0.1% | | | 295,040 | |

| TOTAL NET ASSETS 100.0% | | $ | 393,777,853 | |

| * | Non-income producing security |

| ^ | The rate shown is the annualized seven day effective yield as of December 31, 2015. |

ADR – American Depositary Receipt

See notes to the financial statements.

The Torray Fund

STATEMENT OF ASSETS AND LIABILITIES

As of December 31, 2015

| ASSETS | |

| Investments in securities at value | | | |

| (cost $303,374,424) | | $ | 393,482,813 | |

| Dividends & interest receivable | | | 773,142 | |

| Receivable for fund shares sold | | | 3,000 | |

| Prepaid expenses | | | 46,570 | |

| TOTAL ASSETS | | | 394,305,525 | |

| | | | | |

| LIABILITIES | |

| Payable to investment manager | | | 335,534 | |

| Payable for fund shares redeemed | | | 148,117 | |

| Accrued expenses | | | 44,021 | |

| TOTAL LIABILITIES | | | 527,672 | |

| | | | | |

| NET ASSETS | | $ | 393,777,853 | |

| | | | | |

| NET ASSETS CONSIST OF | |

| Shares of beneficial interest ($1 stated value, | | | | |

| 8,653,351 shares outstanding, unlimited shares authorized) | | $ | 8,653,351 | |

| Paid-in capital in excess of par | | | 293,419,828 | |

| Undistributed net investment income | | | 2,583 | |

| Accumulated net realized gain on investments | | | 1,593,702 | |

| Net unrealized appreciation on investments | | | 90,108,389 | |

| | | | | |

| TOTAL NET ASSETS | | $ | 393,777,853 | |

| Net Asset Value, Offering and Redemption Price per Share | | $ | 45.51 | |

See notes to the financial statements.

The Torray Fund

STATEMENT OF OPERATIONS

For the year ended December 31, 2015

| INVESTMENT INCOME | |

| Dividend income (net of withholding of $9,075) | | $ | 8,561,145 | |

| Interest income | | | 6,040 | |

| Total investment income | | | 8,567,185 | |

| | | | | |

| EXPENSES | |

| Management fees (See Note 4) | | | 4,079,032 | |

| Transfer agent fees & expenses (See Note 4) | | | 275,004 | |

| Insurance expense | | | 107,202 | |

| Trustees’ fees | | | 97,999 | |

| Legal fees | | | 49,378 | |

| Printing, postage & mailing | | | 37,306 | |

| Federal & state registration fees | | | 29,733 | |

| Audit fees | | | 24,008 | |

| Custodian fees (See Note 4) | | | 17,842 | |

| Total expenses | | | 4,717,504 | |

| | | | | |

| NET INVESTMENT INCOME | | | 3,849,681 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | |

| Net realized gain on investments | | | 19,563,467 | |

| Net change in unrealized appreciation (depreciation) on investments | | | (29,225,604 | ) |

| Net realized and unrealized loss on investments | | | (9,662,137 | ) |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (5,812,456 | ) |

See notes to the financial statements.

The Torray Fund

STATEMENTS OF CHANGES IN NET ASSETS

For the years indicated:

| | | Year ended | | | Year ended | |

| | | 12/31/15 | | | 12/31/14 | |

| Increase (Decrease) in Net Assets | |

| Resulting from Operations: | |

| Net investment income | | $ | 3,849,681 | | | $ | 4,125,606 | |

| Net realized gain on investments | | | 19,563,467 | | | | 28,873,105 | |

| Net change in unrealized appreciation | | | | | | | | |

| (depreciation) on investments | | | (29,225,604 | ) | | | 13,615,010 | |

| Net increase (decrease) in net assets | | | | | | | | |

| resulting from operations | | | (5,812,456 | ) | | | 46,613,721 | |

| | | | | | | | | |

| Distributions to Shareholders from: | |

| Net investment income | | | | | | | | |

| ($0.479 and $0.491 per share, respectively) | | | (4,131,205 | ) | | | (4,406,226 | ) |

| Net realized gains | | | | | | | | |

| ($1.478 and $0.000 per share, respectively) | | | (12,472,780 | ) | | | — | |

| Total distributions to shareholders | | | (16,603,985 | ) | | | (4,406,226 | ) |

| | | | | | | | | |

| Shares of Beneficial Interest: | |

| Net decrease from share transactions (Note 5) | | | (7,660,069 | ) | | | (19,648,204 | ) |

| Total increase (decrease) in net assets | | | (30,076,510 | ) | | | 22,559,291 | |

| Net Assets — Beginning of year | | | 423,854,363 | | | | 401,295,072 | |

| Net Assets — End of year | | $ | 393,777,853 | | | $ | 423,854,363 | |

| Undistributed Net Investment Income | | $ | 2,583 | | | $ | 280,549 | |

| | | | | | | | | |

See notes to the financial statements.

The Torray Fund

FINANCIAL HIGHLIGHTS

For a share outstanding throughout each year presented:

PER SHARE DATA

| | | Years ended December 31: | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| Net Asset Value, Beginning of Year | | $ | 48.110 | | | $ | 43.400 | | | $ | 33.000 | | | $ | 30.870 | | | $ | 29.430 | |

| Investment operations: | | | | | | | | | | | | | �� | | | | | | | |

Net investment income(1) | | | 0.445 | | | | 0.458 | | | | 0.444 | | | | 0.440 | | | | 0.328 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on securities | | | (1.088 | ) | | | 4.743 | | | | 10.351 | | | | 2.139 | | | | 1.438 | |

| Total from investment operations | | | (0.643 | ) | | | 5.201 | | | | 10.795 | | | | 2.579 | | | | 1.766 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.479 | ) | | | (0.491 | ) | | | (0.395 | ) | | | (0.449 | ) | | | (0.326 | ) |

| Net capital gains | | | (1.478 | ) | | | — | | | | — | | | | — | | | | — | |

| Total distributions | | | (1.957 | ) | | | (0.491 | ) | | | (0.395 | ) | | | (0.449 | ) | | | (0.326 | ) |

| Net Asset Value, End of Year | | $ | 45.510 | | | $ | 48.110 | | | $ | 43.400 | | | $ | 33.000 | | | $ | 30.870 | |

| | | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN(2) | | | (1.36 | )% | | | 12.04 | % | | | 32.84 | % | | | 8.38 | % | | | 6.01 | % |

| SUPPLEMENTAL DATA AND RATIOS | |

| Net assets, end of year (000’s omitted) | | $ | 393,778 | | | $ | 423,854 | | | $ | 401,295 | | | $ | 331,508 | | | $ | 344,468 | |

| Ratios of expenses to average net assets | | | 1.16 | % | | | 1.15 | % | | | 1.15 | % | | | 1.17 | % | | | 1.17 | % |

| Ratios of net investment income | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 0.95 | % | | | 1.01 | % | | | 1.15 | % | | | 1.35 | % | | | 1.07 | % |

| Portfolio turnover rate | | | 10.77 | % | | | 15.68 | % | | | 13.63 | % | | | 16.55 | % | | | 12.85 | % |

(1) | Calculated based on average amount of shares outstanding during the year. |

(2) | Past performance is not predictive of future performance. Returns assume reinvestment of all dividends and distributions. |

See notes to the financial statements.

The Torray Fund

NOTES TO FINANCIAL STATEMENTS

As of December 31, 2015

The Torray Fund (“Fund”) is a separate diversified series of The Torray Fund (“Trust”). The Trust is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Trust is organized as a business trust under Massachusetts law. The Fund’s investment objectives are to build investor wealth over extended periods and to minimize shareholder capital gains tax liability by limiting the realization of long- and short-term gains. The Fund seeks to meet its objectives by investing in the common stocks of high quality businesses that are fairly priced and run by sound management. These companies must have solid finances and a long-term record of rising sales, earnings and free cash flow. Investments are held as long as the issuers’ fundamentals remain intact. The Fund invests principally in the common stocks of large capitalization companies (e.g. companies with market capitalization of $8 billion or more). There can be no assurance that the Fund’s investment objectives will be achieved.

| NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America.

Security Valuation All investments in securities are recorded at their estimated fair value, as described in Note 3.

Federal Income Taxes The Fund complies with the requirements of subchapter M of the Internal Revenue Code of 1986, as amended, necessary to qualify as a regulated investment company and distributes substantially all net taxable investment income and net realized gains to shareholders in a manner which results in no tax cost to the Fund. Therefore, no federal income tax provision is required. As of and during the year ended December 31, 2015, the Fund did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority. As of and during the year ended December 31, 2015, the Fund did not have liabilities for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits on uncertain tax positions as income tax expense in the Statement of Operations. During the year ended December 31, 2015, the Fund did not incur any interest or penalties.

Security Transactions and Investment Income The Fund follows industry practice and records security transactions on the trade date. Realized gains and losses on sales of securities are calculated on the basis of identified cost. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations. Discounts and premiums on securities purchased are amortized over the expected life of the respective securities.

The Fund distributes all net investment income, if any, quarterly and net realized capital gains, if any, annually.

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2015

Distributions to shareholders are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, GAAP requires that they be reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund. For the year ended December 31, 2015, the Fund increased undistributed net investment income by $3,558, decreased accumulated net realized gains on investments by $864 and decreased paid-in capital by $2,694.

Use of Estimates The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

| NOTE 3 — SECURITIES VALUATION |

The Fund has adopted authoritative fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion of changes in valuation techniques and related inputs during the period and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

| | • Level 1 — | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| | • Level 2 — | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | • Level 3 — | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis. The Fund’s investments are carried at fair value.

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2015

Equity Securities Securities that are primarily traded on a national securities exchange are valued at the last sale price on the exchange on which they are primarily traded on the day of valuation or, if there has been no sale on such day, at the mean between the bid and ask prices. Securities traded primarily in the Nasdaq Global Market System for which market quotations are readily available are valued using the Nasdaq Official Closing Price (“NOCP”). If the NOCP is not available, such securities are valued at the last sale price on the day of valuation, or if there has been no sale on such day, at the mean between the bid and ask prices. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy. If the market for a particular security is not active, and the mean between bid and ask prices is used, these securities are categorized in Level 2 of the fair value hierarchy.

Short-Term Investments Investments in money market funds are valued at their net asset value per share. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Securities for which market quotations are not readily available, or if the closing price does not represent fair value, are valued following procedures approved by the Board of Trustees. As of December 31, 2015, no Fund portfolio securities were priced using the Trust’s fair value guidelines.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s securities as of December 31, 2015:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 333,403,482 | | | $ | — | | | $ | — | | | $ | 333,403,482 | |

| Short-Term Investment | | | 60,079,331 | | | | — | | | | — | | | | 60,079,331 | |

| Total Investments in Securities | | $ | 393,482,813 | | | $ | — | | | $ | — | | | $ | 393,482,813 | |

Transfers between levels are recognized at the end of the reporting period. During the year ended December 31, 2015, the Fund recognized no transfers between levels. The Fund did not invest in any Level 3 investments during the year. Refer to the Schedule of Investments for further information on the classification of investments.

| NOTE 4 — MANAGEMENT FEES AND OTHER TRANSACTIONS WITH AFFILIATES |

The Trust has an agreement (“Management Contract”) with Torray LLC (“Manager”) to furnish investment advisory services and to pay for certain operating expenses of the Fund. Pursuant to the Management Contract between the Trust and the Manager, the Manager is entitled to receive, on a monthly basis, an annual advisory fee equal to 1.00% of the Fund’s average daily net assets. For the year ended December 31, 2015, the Fund incurred management fees of $4,079,032.

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2015

Effective November 7, 2015, the Manager and the Fund have entered into a new Operating Expenses Limitation Agreement (the “Agreement”) whereby the Manager has contractually agreed prospectively for the term of Agreement to waive its management fee and reimburse the Fund for its current Operating Expenses so as to limit the Fund’s current Operating Expenses to an annual rate, expressed as a percentage of the Fund’s average annual net assets, to 1.00%. For purposes of the Agreement, the term “Operating Expenses” includes the Manager’s management fee and all other expenses necessary or appropriate for the operation of the Fund, excluding any front-end or contingent deferred loads, taxes, leverage, interest, brokerage commissions, acquired fund fees and expenses, trustee fees and expenses, auditor fees and expenses, legal fees and expenses, insurance costs, registration and filing fees, printing postage and mailing expenses, expenses incurred in connection with any merger or reorganization, or extraordinary expenses such as litigation. The Agreement will remain in effect until December 31, 2016. For the year ended December 31, 2015, there were no fee waivers.

Effective November 7, 2015, U.S. Bancorp Fund Services, LLC (“USBFS” or the “Administrator”) acts as the Fund’s Administrator, Transfer Agent, and Fund Accountant. U.S. Bank, N.A. (the “Custodian”) serves as the custodian to the Fund. The Custodian is an affiliate of the Administrator. The Administrator performs various administrative and accounting services for the Fund. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Fund’s custodian; coordinates the payment of the Fund’s expenses and reviews the Fund’s expense accruals. As compensation for its services, the Administrator is entitled to a monthly fee at an annual rate based upon the average daily net assets of the Fund, subject to annual minimums.

Certain officers and Trustees of the Fund are also officers and/or shareholders of the Advisor, and are not paid by the Fund for serving in such capacities.

| NOTE 5 — SHARES OF BENEFICIAL INTEREST TRANSACTIONS |

Transactions in shares of beneficial interest were as follows:

| | | Year ended | | | Year ended | |

| | | 12/31/15 | | | 12/31/14 | |

| | | Amount | | | Shares | | | Amount | | | Shares | |

| Shares sold | | | 134,371 | | | $ | 6,398,638 | | | | 75,580 | | | $ | 3,423,260 | |

| Reinvestments of dividends and distributions | | | 341,153 | | | | 15,738,776 | | | | 90,348 | | | | 4,137,023 | |

| Shares redeemed | | | (633,060 | ) | | | (29,797,483 | ) | | | (600,805 | ) | | | (27,208,487 | ) |

| | | | (157,536 | ) | | $ | (7,660,069 | ) | | | (434,877 | ) | | $ | (19,648,204 | ) |

As of December 31, 2015, the Trust’s officers, Trustees and affiliated persons and their families directly or indirectly controlled 1,580,466 shares or 18.26% of the Fund.

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2015

| NOTE 6 — INVESTMENT TRANSACTIONS |

Purchases and sales of investment securities, other than short-term investments, for the year ended December 31, 2015, aggregated $38,590,968 and $66,154,161, respectively.

Distributions to shareholders are determined in accordance with United States federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America.

The tax character of distributions paid during the years ended December 31, 2015 and 2014 were as follows:

| | | 2015 | | | 2014 | |

| Distributions paid from: | | | | | | |

| Ordinary income | | $ | 4,130,341 | | | $ | 4,406,226 | |

| Capital gains | | | 12,473,644 | | | | — | |

| | | $ | 16,603,985 | | | $ | 4,406,226 | |

As of December 31, 2015, the components of distributable earnings on a tax basis were as follows:

| Undistributed ordinary income | | $ | — | |

| Undistributed long-term capital gains | | | 1,594,650 | |

| Unrealized appreciation | | | 90,110,024 | |

| Total accumulated earnings | | $ | 91,704,674 | |

As of December 31, 2015, the Fund did not have any capital loss carryovers. A regulated investment company may elect for any taxable year to treat any portion of any qualified late year loss as arising on the first day of the next taxable year. Qualified late year losses are certain capital and ordinary losses which occur during the portion of the Fund’s taxable year subsequent to October 31. For the taxable year ended December 31, 2015, the Fund does not plan to defer any late year losses.

The following information is based upon the federal tax basis of investment securities as of December 31, 2015:

| Gross unrealized appreciation | | $ | 99,103,274 | |

| Gross unrealized depreciation | | | (8,993,250 | ) |

| Net unrealized appreciation | | | 90,110,024 | |

| Cost | | $ | 303,372,789 | |

The difference between book-basis and tax-basis unrealized appreciation is attributable to differences in the treatment of partnerships.

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2015

| NOTE 8 — COMMITMENTS AND CONTINGENCIES |

The Fund indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

| NOTE 9 — SUBSEQUENT EVENTS |

Management has evaluated the impact of all subsequent events on the Fund through the date these financial statements were issued and has determined that there were no subsequent events requiring recognition or disclosure in the financial statements.

The Torray Fund

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of The Torray Fund

and the Shareholders of The Torray Fund

We have audited the accompanying statement of assets and liabilities of The Torray Fund (the “Fund”), including the schedule of investments, as of December 31, 2015, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2015 by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of The Torray Fund as of December 31, 2015, and the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and its financial highlights for each of the years in the five-year period then ended, in conformity with accounting principles generally accepted in the United States of America.

| |  |

| | |

| | BBD, LLP |

Philadelphia, Pennsylvania

February 25, 2016

The Torray Fund

FUND MANAGEMENT

As of December 31, 2015 (unaudited)

The Trust is overseen by a Board of Trustees (the “Board”), who has delegated the day-to-day management to the officers of the Trust. The Board meets regularly to review the Fund’s activities, contractual arrangements, and performance. The Trustees and officers serve until their successors are elected and qualified, or until the Trustee or officer dies, resigns or is removed, or becomes disqualified.

Information pertaining to the Trustees and officers of the Trust is set forth below. The Statement of Additional Information (SAI) includes additional information about the Trustees and is available without charge, upon request, by calling (855) 753-8174.

| | | | No. of | |

| | | | Portfolios in | |

| Name, Age, | Term of Office | | Fund Complex | Other |

| Address* and | and Length of | Principal Occupation(s) | Overseen by | Directorships |

| Position(s) with the Trust | Time Served | During Past Five Years | Trustee | Held |

| |

| INDEPENDENT TRUSTEES |

| | | | | |

| Carol T. Crawford (72) | Indefinite Term | Attorney and International | 1 | None |

| Trustee | Since 2006 | Trade Consultant, | | |

| | | McLean, VA | | |

| | | | | |

| Bruce C. Ellis (71) | Indefinite Term | Private Investor, | 1 | None |

| Trustee | Since 1993 | Bethesda, MD | | |

| | | | | |

| Robert P. Moltz (68) | Indefinite Term | Chairman and CEO, Weaver Bros. | 1 | None |

| Trustee | Since 1990 | Insurance Associates, Inc., | | |

| | | Bethesda, MD | | |

| | | | | |

| Wayne H. Shaner (68)** | Indefinite Term | Managing Partner, | 1 | Director, |

| Trustee and Chairman of | Since 1993 | Rockledge Partners, LLC, | | Van Eck Funds |

| the Board | | Investment Advisory Firm, | | New York, NY |

| | | Easton, MD (Jan. 2004-present); | | |

| | | Vice President, Torray LLC, | | |

| | | Bethesda, MD (Jan. 2008-June 2008) | | |

The Torray Fund

FUND MANAGEMENT (continued)

As of December 31, 2015 (unaudited)

| | | | No. of | |

| | | | Portfolios in | |

| Name, Age, | Term of Office | | Fund Complex | Other |

| Address* and | and Length of | Principal Occupation(s) | Overseen by | Directorships |

| Position(s) with the Trust | Time Served | During Past Five Years | Trustee | Held |

| |

| INTERESTED TRUSTEES AND OFFICERS OF THE TRUST |

| | | | | |

| William M Lane (65)*** | Indefinite Term | Executive Vice President and | 1 | None |

| Trustee, Treasurer and | Since 1990 | Secretary, Torray LLC, | | |

| Secretary | | Bethesda, MD (Oct. 2005-present); | | |

| | | Chief Compliance Officer, | | |

| | | Torray LLC, Bethesda, MD | | |

| | | (Oct. 2005-Mar. 2011); | | |

| | | Vice President, Secretary, | | |

| | | Treasurer and Chief | | |

| | | Compliance Officer, | | |

| | | Robert E. Torray & Co. Inc., | | |

| | | Bethesda, MD | | |

| | | (Jul. 1984-Oct. 2005) | | |

| | | | | |

| Robert E. Torray (78) | Indefinite Term | Chairman, Torray LLC, | N/A | None |

| President | Since 2007 | Bethesda, MD (2005-present); | | |

| | | President, Torray LLC, | | |

| | | Bethesda, MD (2007-present); | | |

| | | President, Robert E. Torray & | | |

| | | Co. Inc., Bethesda, MD | | |

| | | (May 1972-Oct. 2005) | | |

| | | | | |

| Barbara C. Warder (58) | Indefinite Term | Chief Compliance Officer and | N/A | None |

| Chief Compliance Officer | Since 2011 | Anti-Money Laundering Officer, | | |

| and Anti-Money | | Torray LLC, Bethesda, MD | | |

| Laundering Officer | | (Mar. 2011-present); | | |

| | | Chief Operating Officer | | |

| | | and Chief Compliance Officer, | | |

| | | Resolute Capital Management, | | |

| | | Washington, DC | | |

| | | (Mar. 1998-June 2010) | | |

| * | All addresses are c/o The Torray Fund, 7501 Wisconsin Avenue, Suite 750W, Bethesda, MD 20814-6519. |

| ** | Mr. Shaner is deemed to be an independent Trustee effective as of January 1, 2011. |

| *** | Mr. Lane, by virtue of his employment with Torray LLC, the Trust’s investment manager, is considered an “interested person” of the Trust, as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended. |

The Torray Fund

FACTORS CONSIDERED BY THE BOARD OF TRUSTEES IN CONNECTION WITH THEIR

APPROVAL OF THE TRUST’S MANAGEMENT AGREEMENT WITH THE ADVISOR (unaudited)

The Torray Fund (“Trust”) has entered into a Management Contract (the “Agreement”) with Torray LLC (“Advisor”) pursuant to which the Advisor provides investment management services to The Torray Fund, a series of the Trust (“Fund”). In accordance with the Investment Company Act of 1940, the Trust’s Board of Trustees (“Board”), including a majority of the Trustees who are not “interested persons” of the Trust as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (“Independent Trustees”) is required, on an annual basis, to consider the continuation of the Agreement with the Advisor, and this must take place at an in-person meeting of the Board. The relevant provisions of the Investment Company Act of 1940, as amended (“1940 Act”) specifically provide that it is the duty of the Board to request and evaluate such information as the Board determines is necessary to allow them to properly consider the continuation of the Agreement, and it is the duty of the Advisor to furnish the Trustees with such information that is responsive to their request.

At the regular meeting of the Board on September 29, 2015, the Board, including all of the Trustees who are not “interested persons” of the Trust as that term is defined in Section 2(a)(19) of the 1940 Act (“Independent Trustees”), considered and approved the continuation of the Agreement. Prior to the meeting, the Trustees received and considered information from the Advisor designed to provide the Trustees with the information necessary to evaluate the terms of the Agreement (“Support Materials”). Before voting to approve the continuation of the Agreement, the Trustees reviewed the Support Materials with counsel to the Independent Trustees and a memorandum from such counsel discussing the legal standards applicable to their consideration of the continuation of the Agreement. The Advisor also met with the Trustees and provided further information regarding the management services it provides to the Fund under the Agreement (“Management Services”), including but not limited to information regarding its overall investment philosophy with respect to the Fund.

In determining whether to approve the continuation of the Agreement, the Trustees considered all factors they believed relevant to such determination, including the following: (1) the nature, extent, and quality of the services of the Management Services; (2) the investment performance of the Fund; (3) the cost of the Management Services and the profits that the Advisor and its affiliate realize from the Advisor’s relationship with the Fund; (4) the extent to which the Advisor realizes economies of scale as the Fund grows and whether fees for the Management Services reflect these economies for the benefit of the Fund’s investors; (5) management fees paid by the Fund and the net and total expense ratios of the Fund and other similar mutual funds; and (6) any other benefits that the Advisor derives from its relationship with the Fund.

Based upon the Advisor’s presentation and Support Materials, the Board concluded that the overall arrangements between the Fund and the Advisor as set forth in the Agreement are fair and reasonable in light of the services performed, fees paid and such other matters as the Trustees considered relevant in the exercise of their reasonable judgment. In their deliberations, the Trustees did not identify any particular information that was all-important or controlling. The material factors and conclusions that formed the basis of the Trustees’ determination to approve the continuation of the Agreement are summarized below.

The Torray Fund

FACTORS CONSIDERED BY THE BOARD OF TRUSTEES IN CONNECTION WITH THEIR

APPROVAL OF THE TRUST’S MANAGEMENT AGREEMENT WITH THE ADVISOR (unaudited) (continued)

Nature, Extent and Quality of Services. With respect to the nature, extent and quality of services that Manager renders, the Trustees considered the scope of services provided under the Agreement, which includes, but are not limited to, the following: (1) investing the Fund’s assets consistent with the Fund’s investment objective, policies and restrictions; (2) making investment decisions and placing all orders for the purchase and sale of portfolio securities and cash instruments; (3) paying for the administration and fund accounting services that BNY Mellon provides and the distribution services Foreside provides to the Fund; (4) monitoring the compliance of the Fund’s investment portfolio with applicable Federal securities laws and regulations and Internal Revenue standards; and (5) providing the interested Trustee, Chief Financial Officer and Chief Compliance Officer of the Fund and paying the salaries, fees and expenses of such persons. The Trustees also considered the Advisor’s long-term investment philosophy with respect to the Fund and the significant industry experience of the Advisor’s personnel involved in servicing the Fund, noting their high quality. In addition, the Trustees reviewed the Advisor’s brokerage and best-execution procedures and observed that they were reasonable and consistent with standard industry practice. The Trustees also noted that while the Advisor is permitted to use soft dollars to acquire proprietary and third-party research, it receives only proprietary research and that such research is provided on an unsolicited basis and is not the motivation for the selection of broker-dealers. Finally, the Trustees discussed the state of the Advisor’s compliance program and acknowledged that a recent independent risk assessment of the program did not identify any material concerns. The Trustees concluded that they were satisfied with the nature, extent and quality of services provided by the Advisor pursuant to the Agreement.

Performance of the Fund. The Board reviewed the Fund’s performance as reported in the Support Materials for various periods ending as of June 30, 2015, July 31, 2015 and August 31, 2015. The Trustees discussed the Advisor’s focus on long-term investing and risk management, the fact that the Fund tends to underperform in strong markets and outperform during periods of negative market activity, and the fact that the Advisor does not provide management services to any other fee paying accounts with similar investment objectives, policies and restrictions. The Trustees also noted the Fund’s positive performance for all reported time periods as of June 30, 2015, as well as its overall three star Morningstar rating as of August 2015, its three-star Morningstar rankings for one year, three year, and 10 year performance as of the same date, and its “average” Morningstar rating with respect risk and return. The Trustees considered that while the Fund has recently underperformed the S&P 500, particularly in the last year when a small number of stocks have dominated the S&P’s positive performance, its annualized since inception performance of nearly 24½ years exceeds that of the S&P 500. The Trustees finally noted that the Fund’s performance has generally been consistent with the Morningstar Large Cap Value category. After further discussion, the Trustees concluded that they were satisfied with the Fund’s performance.

Cost of Advisory Services and Profitability. The Trustees next considered and discussed with the Advisor the income and expenses of the Advisor as of September 30, 2015 and the Advisor’s balance sheet as of the same date, noting in particular both the revenues and associated costs of managing the Fund. The Trustees also discussed with the Advisor its business succession planning, insurance coverage, potential new business opportunities, and the recent distribution success and significant asset and revenue growth of two Transamerica mutual funds subadvised by one of the Advisor’s portfolio managers, as well as the recent launch of a new mutual fund advised by a newly formed entity of which the

The Torray Fund

FACTORS CONSIDERED BY THE BOARD OF TRUSTEES IN CONNECTION WITH THEIR

APPROVAL OF THE TRUST’S MANAGEMENT AGREEMENT WITH THE ADVISOR (unaudited) (continued)

Advisor is a minority owner, with the same portfolio manager responsible for that fund’s management. The Trustees concluded that the Advisor’s profitability with respect to the Fund was reasonable, that its assets were sufficient to provide the services called for by the Agreement, and that the Advisor’s assets, coupled with its insurance coverage, were sufficient to cover potential liabilities incurred under the Agreement.

Comparative Fee and Expense Data; Economies of Scale. The Trustees discussed the Fund’s management fee of 1.00% and its current expense ratio of 1.15%. The Trustees noted that the management fee payable to the Advisor is a in the form of a “unified fee,” a relatively uncommon arrangement wherein the Advisor is required to pay certain expenses of the Fund from its management fee (“Specified Expenses”), and that comparative fee data for such arrangements is not readily available from data sources such as Morningstar and Lipper. The Trustees first noted that the Fund’s overall expense ratio of 1.15% is very close to that of the Morningstar Large Cap Value category in the current year, as it had been in the three preceding years. The Trustees then discussed that the Advisor receives a gross management fee of 1.00 % and a net management fee of approximately 93 basis points after payment of Specified Expenses, and compared those fee levels to the median advisory fees for funds in the Morningstar Large Cap Value category, noting that they were generally comparable. The Trustees also noted that because the Fund has no rule 12b-1 or shareholder servicing fees, the Advisor pays certain distribution and platform expenses exclusively from its own legitimate profits. The Trustees discussed economies of scale with the Advisor and considered the Advisor’s representation that the Fund’s asset level is not high enough to warrant breakpoints in the management fee. The Trustees also noted that the Advisor does not service any other fee paying accounts with similar investment objectives, policies and restrictions as the Fund. After further discussion, the Trustees concluded that the fees paid to the Advisor under the Agreement and the Fund’s overall expenses were reasonable.

Other Benefits. The Trustees considered the Advisor’s representation that it does not derive any other benefits from its relationship with the Fund and concluded that Advisor does not receive any additional financial or other benefits from its relationship with the Fund.

The Torray Fund

PORTFOLIO HOLDINGS, PROXY VOTING AND PROCEDURES

As of December 31, 2015 (unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at http://www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Commission’s Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-855-753-8174.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge, upon request, by calling 1-855-753-8174; and on the Commission’s website at http://www.sec.gov.

The Torray Fund

ABOUT YOUR FUND’S EXPENSES

As of December 31, 2015 (unaudited)

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of the Fund, you incur ongoing costs, including management fees, and other fund expenses. Operating expenses, which are deducted directly from the Fund’s gross income, directly reduce the investment return of the Fund.

A mutual fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples below are based on an investment of $1,000 made at the beginning of the period and held for the entire period from July 1, 2015 to December 31, 2015.

The table below illustrates the Fund’s cost in two ways:

Actual Fund Return This section helps you estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the third column shows the operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period” on the next page.

Hypothetical 5% Return This section is intended to help you compare your Fund’s costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses, and that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge transactions fees, such as purchase or redemption fees, nor does it carry a “sales load.”

The calculation assumes no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

More information about the Fund’s expenses, including recent annual expense ratios, can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

| | Beginning | Ending | |

| | Account Value | Account Value | Expenses Paid |

| | July 1, 2015 | December 31, 2015 | During Period(1) |

Based on Actual Fund Return(2) | $1,000.00 | $ 992.90 | $5.93 |

| Based on Hypothetical 5% Return (before expenses) | $1,000.00 | $1,019.26 | $6.01 |

(1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 1.18%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half-year period). |

(2) | Based on the actual returns for the six-month period ended December 31, 2015 of -0.71%. |

The Torray Fund

TAX INFORMATION

As of December 31, 2015 (unaudited)

We are required to advise you within 60 days of the Fund’s fiscal year end regarding the Federal tax status of certain distributions received by shareholders during such fiscal year. The information below is provided for the Fund’s fiscal year ending December 31, 2015. All designations are based on financial information available as of the date of this annual report and, accordingly are subject to change. For each item it is the intention of the Fund to designate the maximum amount permitted under the Internal Revenue Code and the regulations thereunder.

Qualified Dividend Income/Dividends Received Deduction

For the fiscal year ended December 31, 2015, certain dividends paid by the Fund may be subject to a maximum tax rate of 23.8%, as provided for by the American Taxpayer Relief Act of 2012. The percentage of dividends declared from ordinary income designated as qualified dividend income was 100.00% for the Fund.

For corporate shareholders, the percent of ordinary income distributions qualifying for the corporate dividends received deduction for the fiscal year ended December 31, 2015, was 100.00% for the Fund.

The percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions under Internal Revenue Section 871(k)(2)(C) for the Fund was 0.00%.

Dividends and distributions received by retirement plans such as IRA’s, Keogh-type plans and 403(b) plans need not be reported as taxable income. However, many retirement plan trusts may need this information for their annual information reporting.

The Torray Fund

PRIVACY NOTICE

The Fund collects only relevant information about you that the law allows or requires it to have in order to conduct its business and properly service you. The Fund collects financial and personal information about you (“Personal Information”) directly (e.g., information on account applications and other forms, such as your name, address, and social security number, and information provided to access account information or conduct account transactions online, such as password, account number, e-mail address, and alternate telephone number), and indirectly (e.g., information about your transactions with us, such as transaction amounts, account balance and account holdings).

The Fund does not disclose any non-public personal information about its shareholders or former shareholders other than for everyday business purposes such as to process a transaction, service an account, respond to court orders and legal investigations or as otherwise permitted by law. Third parties that may receive this information include companies that provide transfer agency, technology and administrative services to the Fund, as well as the Fund’s investment manager who is an affiliate of the Fund. If you maintain a retirement/educational custodial account directly with the Fund, we may also disclose your Personal Information to the custodian for that account for shareholder servicing purposes. The Fund limits access to your Personal Information provided to unaffiliated third parties to information necessary to carry out their assigned responsibilities to the Fund. All shareholder records will be disposed of in accordance with applicable law. The Fund maintains physical, electronic and procedural safeguards to protect your Personal Information and requires its third party service providers with access to such information to treat your Personal Information with the same high degree of confidentiality.

In the event that you hold shares of the Fund through a financial intermediary, including, but not limited to, a broker-dealer, credit union, bank or trust company, the privacy policy of your financial intermediary governs how your non-public personal information is shared with unaffiliated third parties.

TRUSTEES

Carol T. Crawford

Bruce C. Ellis

William M Lane

Robert P. Moltz

Wayne H. Shaner

INVESTMENT ADVISOR

Torray LLC

OFFICERS

Robert E. Torray

William M Lane

Fred M. Fialco

Nicholas C. Haffenreffer

Barbara C. Warder

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

BBD, LLP

1835 Market Street, 26th Floor

Philadelphia, PA 19103

ADMINISTRATOR AND TRANSFER AGENT

U.S. Bancorp Fund Services, LLC

615 E. Michigan Street

Milwaukee, WI 53202

LEGAL COUNSEL

Bernstein Shur

100 Middle Street, 6th Floor

Portland, ME 04104

Distributed by Foreside Funds Distributors LLC

400 Berwyn Park, 899 Cassatt Road,

Berwyn, PA 19132

Date of first use, February 2016

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus. All indices are unmanaged groupings of stocks that are not available for investment.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this period.

The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the registrant’s code of ethics that applies to the registrant’s principal executive officer and principal financial officer is filed herewith.

Item 3. Audit Committee Financial Expert.

The Registrant’s Board of Trustees has not designated an audit committee financial expert. The Registrant has determined that it will retain the services of an independent third party to assist it if circumstances arise that require specific investment company auditing expertise.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal periods. “Audit services” refer to performing an audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for the past fiscal year. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning, including reviewing the Fund’s tax returns and distribution calculations. There were no “other services” provided by the principal accountant. For the fiscal year ended December 31, 2015 the Fund’s principal accountant was BBD, LLP. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal periods for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | | FYE 12/31/2015 | FYE 12/31/2014 | |

| | Audit Fees | $22,000 | $22,000 | |

| | Audit-Related Fees | $0 | $0 | |

| | Tax Fees | $2,000 | $2,000 | |

| | All Other Fees | $0 | $0 | |

| | | | | |

The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre‑approve all audit and non‑audit services of the registrant, including services provided to any entity affiliated with the registrant.

The percentage of fees billed by BBD, LLP applicable to non-audit services pursuant to waiver of pre-approval requirement was as follows:

| | | FYE 12/31/2015 | FYE 12/31/2014 | |

| | Audit-Related Fees | 0% | 0% | |

| | Tax Fees | 0% | 0% | |

| | All Other Fees | 0% | 0% | |

All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full‑time permanent employees of the principal accountant.

The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the past year. The audit committee of the board of trustees/directors has considered whether the provision of non-audit services that were rendered to the registrant's investment adviser is compatible with maintaining the principal accountant's independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

| | Non-Audit Related Fees | FYE 12/31/2015 | FYE 12/31/2014 | |

| | Registrant | $0 | $0 | |

| | Registrant’s Investment Adviser | $0 | $0 | |

Item 5. Audit Committee of Listed Registrants.

Not applicable to open-end investment companies.

Item 6. Schedule of Investments.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed‑End Management Investment Company and Affiliated Purchases.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

Not Applicable.

Item 11. Controls and Procedures.

| (a) | The Registrant’s President and Treasurer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d‑15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no significant changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 12. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Filed herewith |

(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(3) Any written solicitation to purchase securities under Rule 23c‑1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

| (b) | Certification pursuant to Section 906 of the Sarbanes‑Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) The Torray Fund

By (Signature and Title)* /s/Robert E. Torray

Robert E. Torray, President

(Principal Executive Officer)

Date March 7, 2016

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)* /s/Robert E. Torray

Robert E. Torray, President

(Principal Executive Officer)

Date March 7, 2016

By (Signature and Title)* /s/William M. Lane

William M. Lane, Treasurer

(Principal Financial Officer)

Date March 7, 2016

* Print the name and title of each signing officer under his or her signature.