UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06096

The Torray Fund

(Exact name of registrant as specified in charter)

7501 Wisconsin Avenue, Suite 1100

Bethesda, MD 20814-6523

(Address of principal executive offices) (Zip code)

William M Lane

Torray LLC

7501 Wisconsin Avenue, Suite 1100

Bethesda, MD 20814-6523

(Name and address of agent for service)

registrant’s telephone number, including area code: 301-493-4600

Date of fiscal year end: December 31

Date of reporting period: June 30, 2007

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

The Torray Fund

Letter to Shareholders

July 31, 2007

Dear Fellow Shareholders,

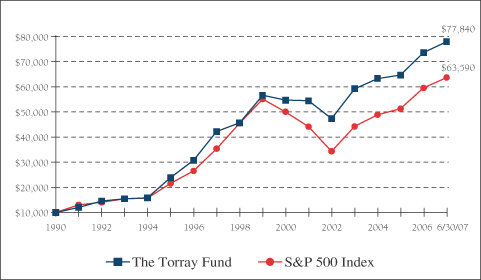

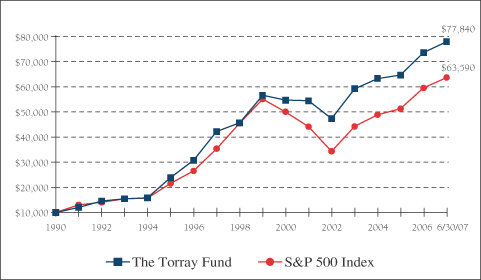

The Torray Fund gained 5.9% during the six-month period ending June 30, compared to 7% for the Standard & Poor’s 500 Index. The difference reflects continued strength in energy, cyclical, commodity-based and low quality stocks — areas we have avoided. This has been the case going on four years now and, though frustrating, we are not tempted to change course. The Fund returned 20% over the last 12 months, about the same as the market, an indication that investors are beginning to recognize the superior economics of companies in our portfolio. Since inception 16½ years ago, it has earned 13.2% compounded annually, turning $10,000 into $77,840, while the Index returned 11.9% and $63,590.

In last year’s Annual Report we drew attention to the enormous outflow of capital from poorly performing U.S. equities into foreign markets over a span now approaching seven years. Record low interest rates and the stock market’s dismal record since the peak reached in March 2000 are responsible for the shift in investor focus. (Adjusted for inflation, the S&P 500, with dividends reinvested, lost 8% of its value during this period while overseas markets were generally trending up.) Ironically, this reversed an earlier flood of money in the opposite direction as large numbers of investors were lured by the late 1990’s speculative mania here at home.

Now it appears the global theme has cooled, and institutions, once again eyeing the world through a rearview mirror, are plunging head-on into so-called “alternatives” — private equity and hedge funds, real estate, commodities, timber and so on. Surveys indicate another sharp reduction in U.S. equity holdings is funding these ventures, keeping pressure on blue chip stocks and driving up the prices of the alternatives. These asset allocation decisions once again reflect investors’ bad habit of assuming what has happened will keep happening; the higher markets go, the more bullish they become, and vice-versa.

In a telling example we have underscored before, institutions held 77% of their assets in U.S. stocks at the height of the tech/telecom.dot.com bubble when P/E ratios averaged 37-to-1 (an earnings return of just 2.7%). From that point, as nearly everyone knows, the S&P 500 dropped 50% and NASDAQ 80% — over seven years later the latter is still down about 50%. Yet, today, with P/E’s at around 16-to-1 (an earnings return of 6.25% and heading higher as corporate profits continue to rise), published studies indicate institutions’ domestic equity allotment has fallen into the mid-40% range. An old friend from Dallas, Frederick E. “Shad” Rowe, writes in the May issue of the highly regarded Grant’s Interest Rate Observer that a large state teachers’

1

The Torray Fund

Letter to Shareholders

July 31, 2007

retirement fund, currently “in a $12 billion actuarial hole,” plans to increase its alternative investments from $4.5 billion to $38 billion and reduce its U.S. stock portfolio from 52% to 25%. While perhaps an extreme case, there is no doubt about the direction institutions are heading, and also no doubt in our minds they will be wrong again. Sooner or later it seems inevitable some of the alternatives will prove disappointing, and those that are highly leveraged, complex and illiquid will inflict punishing losses just as the market did a few years ago. Some already have. We think investors would be wise to reverse course and start buying what they’ve been selling — blue chip domestic stocks.

Meanwhile, disquieting news has surfaced in the fixed income markets where yield-starved investors have piled into highly speculative collateralized mortgage and debt obligations (CMOs and CDOs), significant numbers backed by sub-prime home loans, leveraged corporate loans, junk bonds and a potpourri of other esoteric concoctions. In a puzzling twist, even though no one so far claims to know exactly what’s in these opaque securities, Standard & Poor’s, Moody’s and Fitch have pronounced many of them investment grade — Aaa down to Baa. In what would seem a conflict of interest, they have also been paid twice, once for the ratings and again, far more, for providing guidelines on how the various pools of assets should be structured to achieve them. At this point evidence suggests their risk assessments have been faulty. Under pressure from investors that contend the credit ratings do not reflect current default rates, the highest in a decade, large numbers of sub-prime mortgage pools and collateralized debt obligations are being downgraded or put on credit watch. Many of these securities contain loans originated by companies now in bankruptcy.

Following the just-announced total failure of two large super-leveraged hedge funds heavily invested in these assets, the blocking of redemptions on four others and the announced liquidation of at least one more, Moody’s et al maintain — as they have quietly before — that their ratings are only opinions and investors should not rely on them. (In past lawsuits courts have agreed, ruling that ratings, like newspaper editorials, are protected under the First Amendment.) Either way, the reported default rate on easily analyzed Baa corporate bonds (the lowest investment grade) from 1983 to 2005 has been only 2.2% measured over five-year periods. By comparison, from 1993 to 2005, the murky Baa CMOs and CDOs suffered default rates of 24%. How can two instruments identically rated by the same agencies produce such bizarrely disparate results? One also ponders why anyone would buy securities backed by, among other assets, mortgages on houses owned by people that certifiably can’t service them. Yet, supposedly sophis-

2

The Torray Fund

Letter to Shareholders

July 31, 2007

ticated institutions employing elaborate risk controls bought a lot, in some cases on nine or ten-to-one leverage.

This weird business is both a sign of the times and an echo from the past, like many of today’s other popular but warped financial constructs, symptomatic of a world awash in cash, much of it seemingly in the wrong hands. Lost in it all is the fact that successful free enterprise systems are built on production, employment, advances in technology, scientific research and the reinvestment of capital, not shuffling money from one pocket to another and overlaying the process with piles of paper sliced and diced for trading on Wall Street. Federal Reserve Board Chief Ben S. Bernanke disagrees. Testifying before Congress on July 18, he said that hedge funds, private equity and other private pools of investment capital provide “important benefits for the economy by spreading financial risks and increasing liquidity in the markets.” With all due respect to the chairman, recent revelations suggest some, at least, have had the opposite effect.

In reflecting on all of this, we are reminded of the following lines from an article in Barrons 18 years ago by Dr. Abraham J. Briloff, the Emanuel Saxe distinguished professor emeritus of accountancy, Bernard Baruch College of the City University of New York. He had this to say about the 1989 leveraged buyout of RJR Nabisco, the subject of Bryan Burrough’s best-selling Barbarians at the Gate: “The new RJR’s debt exceeds equity by a ratio of 21-to-1, and tangible net worth is a staggering negative $23 billion. What has been created here is, in essence, an enormous glacier of junk bonds floating on a sea of intangibles.” It would be interesting to hear his views today. Sharp as ever, the eminent professor, now 90 and living in Great Neck, New York, has been called “the most famous accountant in the world” and “the philosopher king of his profession.” He was honored at the August 2006 American Accounting Association meeting in Washington where Floyd Norris of The New York Times delivered the plenary address, “Where is the next Abe Briloff?”

Long-time loyal colleague Paul Williams, looking for something else, recently came across a talk Bob gave in the spring of 1989 that incorporated Dr. Briloff’s quote. In many ways it was a period like this one. Here is an excerpt from what Paul found: “Today we are witness to vast excesses of senseless stock and futures trading, index arbitrage programs, mergers, acquisitions and leveraged buyouts.” Seven months later, on October 13, in the midst of ever-bigger and riskier deals, financing for the $6.8 billion United Airlines buyout collapsed. The stock, then trading around $120, became worthless three years later in a bankruptcy filed December 9, 2002. It was

3

The Torray Fund

Letter to Shareholders

July 31, 2007

the end of the ‘80s buyout boom. Investors retrenched, deal making evaporated and the market lost 7% in a day. While government bonds in ‘89 yielded 9½%, and IBM bonds 10½%, investors were too busy gambling on stocks, futures and mergers to notice. By contrast, until a few months ago when trouble first surfaced in the sub-prime market, they couldn’t seem to get enough poor quality debt at lower yields. This recap is not intended to suggest we expect something bad to happen. Rather, it’s meant to highlight the heavy toll market manias like today’s take on speculators. Fortunately, the intelligent, long-term investor in high quality stocks and funds need not be concerned. Regardless of what the market does, we are confident about our prospects.

Time Magazine columnist Michael Kinsley in The New York Times (“We Try Harder, But What’s the Point,” May 16, 2007) put today’s scene in perspective. Tongue-in-cheek, Kinsley traces the convoluted history of what is now known as Avis Budget Group, founded in 1946 by Warren E. Avis on the idea of putting rental cars at airports. (Mr. Avis died last month at the age of 92.) He named it Avis Airlines Rent-a-Car, which he sold eight years later to another businessman. In all, Kinsley reports, Avis has been bought, sold or reorganized 17 or 18 times, depending on how one keeps score. He recounts that “each time Avis changed hands or structure there were fees for bankers and fees for lawyers, bonuses for the top executives and theories why this was exactly what the company needed.” The article goes on to inform that the acquirers included ITT, Norton Simon and Esmark (formerly Swift and Company) through its purchase of Norton Simon. Later Esmark was acquired by Beatrice Foods and then Beatrice itself fell into the hands of a leverage buyout company, which then sold Avis to an investment group, Wesray, (whew!) which, in turn, offloaded the fleet leasing business to PHH Group, and took the foreign operations public under the name Avis Europe PLC. Finally, Wesray unloaded what was left of Avis on its employees, tripling its money in 14 months. Subsequent deals involved General Motors, HFS (which sold the company in a public offering), PHH again, and so on and on.

There’s more, but you get the idea. As Kinsley insightfully observed, “Modern capitalism has two parts: there’s business and there’s finance. More and more the news business these days is actually about finance, and much of it is mystifying. Even if you can understand — just barely —how it works, you still wonder what the point is and why people who do it need to get paid so much. And you strongly suspect that this swirl of activity around Avis for the past six decades has had little or nothing to do with the business of renting cars.” In closing, he draws our attention to a report in last September’s Wall Street Journal a week after Avis Budget Group once again began trading on the New York Stock Exchange. “The Company,” said the Journal,

4

The Torray Fund

Letter to Shareholders

July 31, 2007

was “ripe for the picking,” adding that financier Carl Icahn had acquired a $100 million stake but wouldn’t comment on his intentions. It then warned, “If a buyout or acquisition deal doesn’t materialize for Avis, its stock and bond investors will have to focus on the fundamentals of the car rental business.” “Goodness!” exclaims Kinsley. “Anything but that!”

The stock market has been very volatile in recent weeks and investors seem extremely nervous. We hope you are not. Over time, the economic performance of companies in our portfolio should produce a reasonable, low-risk return. While we’re waiting, the best approach — as always — is to forget about the market and avoid listening to the experts about where it’s headed.

We thank you for your investment and continued confidence in our judgment.

| | | | |

| Sincerely, | | | | |

| | |

| | | |  |

| Robert E. Torray | | | | Douglas C. Eby |

5

The Torray Fund

PERFORMANCE DATA

As of June 30, 2007 (unaudited)

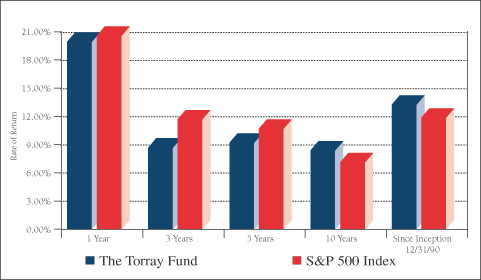

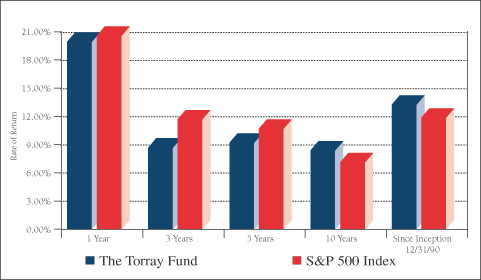

Average Annual Returns on an Investment in The Torray Fund vs. the S&P 500 Index

For the periods ended June 30, 2007:

| | | | | | | | | | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Since

Inception

12/31/90 |

The Torray Fund | | 19.91% | | 8.66% | | 9.18% | | 8.37% | | 13.24% |

S&P 500 Index | | 20.57% | | 11.67% | | 10.70% | | 7.13% | | 11.85% |

Cumulative Returns for the 16 1/2 years ended June 30, 2007

| | | |

The Torray Fund | | 678.40 | % |

S&P 500 Index | | 535.90 | % |

6

The Torray Fund

PERFORMANCE DATA (continued)

As of June 30, 2007 (unaudited)

Change in Value of $10,000 Invested on December 31, 1990 (commencement of operations) to:

| | | | | | | | | | | | | | | | | | |

| | | 12/31/92 | | 12/31/95 | | 12/31/98 | | 12/31/01 | | 12/31/04 | | 06/30/07 |

The Torray Fund | | $ | 14,523 | | $ | 23,796 | | $ | 45,576 | | $ | 54,325 | | $ | 63,227 | | $ | 77,840 |

S&P 500 Index | | $ | 14,047 | | $ | 21,547 | | $ | 45,438 | | $ | 44,054 | | $ | 48,811 | | $ | 63,590 |

The returns quoted represent past performance and do not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher. Returns current to the most recent month-end are available at www.torray.com. The returns shown do not reflect the deduction of taxes a shareholder would pay on the redemption of fund shares and distributions. The Fund’s gross annual operating expense ratio, as stated in the current prospectus, is 1.10%. Returns on both The Torray Fund and the S&P 500 Index assume reinvestment of all dividends and distributions. The S&P 500 Index is an unmanaged index consisting of 500 U.S. large-cap stocks.

7

The Torray Fund

FUND PROFILE

As of June 30, 2007 (unaudited)

| | |

DIVERSIFICATION (% of net assets) | | |

| |

Financials | | 29.81% |

Health Care | | 22.10 |

Information Technology | | 15.77 |

Industrials | | 14.00 |

Consumer Discretionary | | 6.36 |

Telecommunications | | 5.16 |

Materials | | 3.40 |

Consumer Staples | | 2.87 |

Short-Term Investments | | 0.55 |

Other Liabilities Less Assets | | (0.02) |

| | |

| | 100.00% |

| | |

| TOP TEN EQUITY HOLDINGS |

| 1. | | Markel Corp. |

| 2. | | EMC Corp. |

| 3. | | Medtronic, Inc. |

| 4. | | Cardinal Health, Inc. |

| 5. | | Fairfax Financial Holdings, Ltd. |

| 6. | | Applied Materials, Inc. |

| 7. | | AMBAC Financial Group, Inc. |

| 8. | | Abbott Laboratories |

| 9. | | W.R. Grace & Co. |

| 10. | | Haemonetics Corp. |

| | | | | |

TOP FIXED INCOME HOLDINGS | | | |

|

Level 3 Communications, Inc., 10.00%, due 2011 | |

| |

PORTFOLIO CHARACTERISTICS | | | |

| | |

Net Assets (million) | | | | $1,181 | |

Number of Holdings | | | | 42 | |

Portfolio Turnover | | | | 10.02% | * |

P/E Multiple (forward) | | | | 15.4x | |

Portfolio Yield | | | | 1.10% | ** |

Market Capitalization | | Average | | 53.4 B | |

| | Median | | 30.3 B | |

| * | | For the six-month period ended June 30, 2007 |

See notes to the financial statements.

8

The Torray Fund

SCHEDULE OF INVESTMENTS

As of June 30, 2007 (unaudited)

| | | | | | | |

| | | Shares | | | | Market Value |

| COMMON STOCK 94.31% | | | |

| |

| 29.81% FINANCIALS | | | |

| | 131,705 | | Markel Corp. * | | $ | 63,818,975 |

| | 265,535 | | Fairfax Financial Holdings, Ltd. | | | 50,895,093 |

| | 574,150 | | AMBAC Financial Group, Inc. | | | 50,060,139 |

| | 708,362 | | JPMorgan Chase & Co. | | | 34,320,139 |

| | 1,093,600 | | Marsh & McLennan Cos., Inc. | | | 33,770,368 |

| | 116,850 | | Goldman Sachs Group, Inc. (The) | | | 25,327,237 |

| | 445,909 | | Aflac, Inc. | | | 22,919,723 |

| | 151,800 | | Franklin Resources, Inc. | | | 20,108,946 |

| | 320,600 | | American Express Co. | | | 19,614,308 |

| | 2,240,200 | | LaBranche & Co., Inc. * | | | 16,532,676 |

| | 577,200 | | Calamos Asset Management, Inc., Class A | | | 14,747,460 |

| | | | | | | |

| | | | | | | 352,115,064 |

| |

| 22.10% HEALTH CARE | | | |

| | 1,039,700 | | Medtronic, Inc. | | | 53,918,842 |

| | 753,300 | | Cardinal Health, Inc. | | | 53,213,112 |

| | 751,700 | | Abbott Laboratories | | | 40,253,535 |

| | 711,500 | | Haemonetics Corp. * | | | 37,432,015 |

| | 486,500 | | Amgen, Inc. * | | | 26,898,585 |

| | 467,500 | | Eli Lilly & Co. | | | 26,123,900 |

| | 375,900 | | Johnson & Johnson | | | 23,162,958 |

| | | | | | | |

| | | | | | | 261,002,947 |

| |

| 15.77% INFORMATION TECHNOLOGY | | | |

| | 3,245,200 | | EMC Corp. * | | | 58,738,120 |

| | 2,519,600 | | Applied Materials, Inc. | | | 50,064,452 |

| | 1,526,800 | | Intel Corp. | | | 36,276,768 |

| | 506,200 | | Automatic Data Processing, Inc. | | | 24,535,514 |

| | 801,800 | | Western Union Co. (The) | | | 16,701,494 |

| | | | | | | |

| | | | | | | 186,316,348 |

9

The Torray Fund

SCHEDULE OF INVESTMENTS (continued)

As of June 30, 2007 (unaudited)

| | | | | | | |

| | | Shares | | | | Market Value |

| |

| 14.00% INDUSTRIALS | | | |

| | 611,300 | | Illinois Tool Works, Inc. | | $ | 33,126,347 |

| | 747,200 | | Owens Corning, Inc. * | | | 25,128,336 |

| | 329,000 | | Danaher Corp. | | | 24,839,500 |

| | 317,400 | | General Dynamics Corp. | | | 24,827,028 |

| | 483,400 | | USG Corp. * | | | 23,705,936 |

| | 253,850 | | United Technologies Corp. | | | 18,005,581 |

| | 205,600 | | Emerson Electric Co. | | | 9,622,080 |

| | 58,300 | | Honeywell International, Inc. | | | 3,281,124 |

| | 73,600 | | General Electric Co. | | | 2,817,408 |

| | | | | | | |

| | | | | | | 165,353,340 |

| |

| 6.36% CONSUMER DISCRETIONARY | | | |

| | 840,400 | | O’Reilly Automotive, Inc. * | | | 30,716,620 |

| | 328,700 | | Gannett Co., Inc. | | | 18,062,065 |

| | 466,900 | | Walt Disney Co. (The) | | | 15,939,966 |

| | 325,000 | | Time Warner, Inc. | | | 6,838,000 |

| | 129,024 | | McClatchy Co. (The), Class A | | | 3,265,597 |

| | 35,856 | | Citadel Broadcasting Corp. | | | 231,271 |

| | | | | | | |

| | | | | | | 75,053,519 |

| |

| 3.40% MATERIALS | | | |

| | 1,639,900 | | W.R. Grace & Co. * | | | 40,161,151 |

| |

| 2.87% CONSUMER STAPLES | | | |

| | 386,500 | | Proctor & Gamble Co. (The) | | | 23,649,935 |

| | 197,400 | | Anheuser-Busch Cos., Inc. | | | 10,296,384 |

| | | | | | | |

| | | | | | | 33,946,319 |

| | | | | | | |

| TOTAL COMMON STOCK 94.31% | | | 1,113,948,688 |

| (cost $825,327,121) | | | | | |

10

The Torray Fund

SCHEDULE OF INVESTMENTS (continued)

As of June 30, 2007 (unaudited)

| | | | | | | | |

| | | Principal

Amount ($) | | | | Market Value | |

| CONVERTIBLE BOND 5.16% | | | | |

| | 31,980,000 | | Level 3 Communications, Inc., 10.00%, due 2011(1) | | $ | 61,025,899 | |

| (cost $33,199,134) | | | | | | |

| |

| SHORT-TERM INVESTMENTS 0.55% | | | | |

| | 6,469,312 | | PNC Bank Money Market Account, 4.76%, due 07/02/07 | | | 6,469,312 | |

| (cost $6,469,312) | | | | | | |

| | | | | | | | |

| TOTAL INVESTMENTS 100.02% | | | 1,181,443,899 | |

| (cost $864,995,567) | | | | | | |

| |

| OTHER LIABILITIES LESS ASSETS (0.02%) | | | (277,070 | ) |

| | | | | | | | |

| NET ASSETS 100.00% | | $ | 1,181,166,829 | |

| | | | | | | | |

| * | | Non-income producing securities |

(1) | | This security is valued at fair value, as determined in good faith by the Advisor under the supervision of the Board of Trustees in accordance with the Fund’s Valuation Procedures. The total fair value of this security at June 30, 2007 is $61,025,899, which represents 5.16% of net assets. |

See notes to the financial statements.

11

The Torray Fund

STATEMENT OF ASSETS AND LIABILITIES

As of June 30, 2007 (unaudited)

| | | | |

ASSETS | | | | |

Investments in securities at value

(cost $864,995,567) | | $ | 1,181,443,899 | |

Interest and dividends receivable | | | 1,050,459 | |

Receivable for fund shares sold | | | 793,455 | |

Prepaid expenses | | | 15,865 | |

| | | | |

TOTAL ASSETS | | | 1,183,303,678 | |

| | | | |

| |

LIABILITIES | | | | |

Payable to advisor | | | 949,440 | |

Payable for fund shares redeemed | | | 887,947 | |

Accrued expenses | | | 296,949 | |

Payable to trustees | | | 2,513 | |

| | | | |

TOTAL LIABILITIES | | | 2,136,849 | |

| | | | |

| |

NET ASSETS | | $ | 1,181,166,829 | |

| | | | |

Shares of beneficial interest ($1 par value,

26,912,489 shares outstanding, unlimited

shares authorized) | | $ | 26,912,489 | |

Paid-in-capital in excess of par | | | 807,508,477 | |

Distributions in excess of net investment income | | | (786,977 | ) |

Accumulated net realized gain on investments | | | 31,084,508 | |

Net unrealized appreciation of investments | | | 316,448,332 | |

| | | | |

| |

TOTAL NET ASSETS | | $ | 1,181,166,829 | |

| | | | |

Net Asset Value, Offering and Redemption Price Per Share | | $ | 43.89 | |

| | | �� | |

See notes to the financial statements.

12

The Torray Fund

STATEMENT OF OPERATIONS

For the six months ended June 30, 2007 (unaudited)

| | | |

INVESTMENT INCOME | | | |

Dividend income (net of foreign taxes withheld of $138,618) | | $ | 6,295,316 |

Interest income | | | 1,328,280 |

| | | |

Total income | | | 7,623,596 |

| | | |

| |

EXPENSES | | | |

Management fees | | | 5,926,971 |

Transfer agent fees & expenses | | | 375,350 |

Printing, postage & mailing | | | 47,259 |

Custodian fees | | | 44,156 |

Interest expense | | | 36,321 |

Trustees’ fees | | | 34,264 |

Legal fees | | | 34,246 |

Registration & filing fees | | | 27,045 |

Audit fees | | | 17,650 |

Insurance | | | 10,289 |

| | | |

Total expenses | | | 6,553,551 |

| | | |

NET INVESTMENT INCOME | | | 1,070,045 |

| | | |

REALIZED AND UNREALIZED GAIN

ON INVESTMENTS | | | |

Net realized gain on investments | | | 31,136,621 |

Net change in unrealized appreciation on investments | | | 37,277,779 |

| | | |

Net realized and unrealized gain on investments | | | 68,414,400 |

| | | |

NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 69,484,445 |

| | | |

See notes to the financial statements.

13

The Torray Fund

STATEMENTS OF CHANGES IN NET ASSETS

For the periods indicated:

| | | | | | | | |

| | | Six months ended

06/30/07

(unaudited) | | | Year ended

12/31/06 | |

Increase in Net Assets from Operations: | | | | | | | | |

Net investment income | | $ | 1,070,045 | | | $ | 2,233,733 | |

Net realized gain on investments | | | 31,136,621 | | | | 77,850,871 | |

Capital gain distributions from investment companies | | | — | | | | 537,718 | |

Net change in unrealized appreciation

on investments | | | 37,277,779 | | | | 75,047,861 | |

| | | | | | | | |

Net increase in net assets from operations | | | 69,484,445 | | | | 155,670,183 | |

| | | | | | | | |

| | |

Distributions to Shareholders from: | | | | | | | | |

Net investment income ($0.053 and

$0.087 per share, respectively) | | | (1,457,495 | ) | | | (2,633,260 | ) |

Net realized gains ($0.082 and $2.612 per

share, respectively) | | | (2,195,897 | ) | | | (73,114,435 | ) |

| | | | | | | | |

Total distributions | | | (3,653,392 | ) | | | (75,747,695 | ) |

| | | | | | | | |

| | |

Shares of Beneficial Interest | | | | | | | | |

Decrease from share transactions | | | (83,583,542 | ) | | | (210,953,920 | ) |

| | | | | | | | |

Total decrease | | | (17,752,489 | ) | | | (131,031,432 | ) |

| | |

Net Assets — Beginning of Period | | | 1,198,919,318 | | | | 1,329,950,750 | |

| | | | | | | | |

Net Assets — End of Period | | $ | 1,181,166,829 | | | $ | 1,198,919,318 | |

| | | | | | | | |

Distributions in Excess of Net Investment Income | | $ | (786,977 | ) | | $ | (399,527 | ) |

| | | | | | | | |

See notes to the financial statements.

14

The Torray Fund

FINANCIAL HIGHLIGHTS

For a share outstanding throughout each period:

PER SHARE DATA

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

06/30/07

(unaudited) | | | Years ended December 31: | |

| | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

Net Asset Value,

Beginning of Period | | $ | 41.570 | | | $ | 39.020 | | | $ | 41.080 | | | $ | 39.980 | | | $ | 32.240 | | | $ | 37.530 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income from investment operations | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.038 | | | | 0.073 | | | | 0.133 | | | | 0.165 | | | | 0.220 | | | | 0.205 | |

Net gains (losses) on securities (both realized and unrealized) | | | 2.417 | | | | 5.176 | | | | 0.653 | | | | 2.523 | | | | 7.864 | | | | (5.083 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.455 | | | | 5.249 | | | | 0.786 | | | | 2.688 | | | | 8.084 | | | | (4.878 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Less: distributions | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends (from net investment income) | | | (0.053 | ) | | | (0.087 | ) | | | (0.133 | ) | | | (0.165 | ) | | | (0.220 | ) | | | (0.205 | ) |

Distributions (from capital gains) | | | (0.082 | ) | | | (2.612 | ) | | | (2.713 | ) | | | (1.423 | ) | | | (0.124 | ) | | | (0.207 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.135 | ) | | | (2.699 | ) | | | (2.846 | ) | | | (1.588 | ) | | | (0.344 | ) | | | (0.412 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value,

End of Period | | $ | 43.890 | | | $ | 41.570 | | | $ | 39.020 | | | $ | 41.080 | | | $ | 39.980 | | | $ | 32.240 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN(1) | | | 5.91 | %** | | | 13.74 | % | | | 2.08 | % | | | 6.90 | % | | | 25.19 | % | | | (13.05 | %) |

RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period

(000’s omitted) | | $ | 1,181,167 | | | $ | 1,198,919 | | | $ | 1,329,951 | | | $ | 1,734,500 | | | $ | 1,655,279 | | | $ | 1,367,536 | |

Ratios of expenses to average net assets | | | 1.11 | %* | | | 1.10 | % | | | 1.07 | % | | | 1.08 | % | | | 1.11 | % | | | 1.07 | % |

Ratios of net income to average net assets | | | 0.18 | %* | | | 0.18 | % | | | 0.34 | % | | | 0.41 | % | | | 0.62 | % | | | 0.58 | % |

Portfolio turnover rate | | | 10.02 | %** | | | 21.92 | % | | | 33.16 | % | | | 27.12 | % | | | 37.11 | % | | | 22.52 | % |

(1) | | Past performance is not predictive of future performance. |

See notes to the financial statements.

15

The Torray Fund

NOTES TO FINANCIAL STATEMENTS

As of June 30, 2007 (unaudited)

NOTE 1 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Torray Fund (“Fund”) is a separate series of The Torray Fund (“Trust”). The Trust is registered under the Investment Company Act of 1940 as a no-load, diversified, open-end management investment company. The Trust was organized as a business trust under Massachusetts law. The Fund’s primary investment objective is to provide long-term total return. The Fund seeks to meet its objective by investing its assets in a diversified portfolio of common stocks. In order to accomplish these goals, the Fund intends to hold stocks for the long term, as opposed to actively buying and selling. There can be no assurances that the Fund’s investment objectives will be achieved.

The following is a summary of accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America.

Securities Valuation Portfolio securities for which market quotations are readily available are valued at market value, which is determined by using the last reported sale price, or, if no sales are reported, the last reported bid price. For NASDAQ traded securities, market value is determined on the basis of the NASDAQ official closing price instead of the last reported sales price. Other assets and securities for which no quotations are readily available or for which Torray LLC (the “Advisor”) believes do not reflect market value are valued at fair value as determined in good faith by the Advisor under the supervision of the Board of Trustees in accordance with the Fund’s Valuation Procedures. Short-term obligations having remaining maturities of 60 days or less are valued at amortized cost, which approximates market value.

Securities Transactions and Investment Income Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the specific identification basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income, including amortization of discount on short-term investments, and expenses are recorded on the accrual basis. Premium and discount amortization is amortized using the effective yield to maturity method.

Federal Income Taxes The Fund intends to continue to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income, including any net realized gain on investments to its shareholders. Therefore, no Federal income tax provision is required.

Net Asset Value The net asset value per share of the Fund is determined daily as of the close of trading on the New York Stock Exchange by dividing the value of the Fund’s net assets by the number of shares outstanding.

Interest Expense When cash balances are overdrawn in the Fund’s custody account, the Fund is charged an overdraft fee equal to 1.25% above the Federal Funds Rate. This amount of $32,507 is included in “interest expense” in the Statement of Operations. For the six months ended June 30, 2007, the average amount of overdrafts were $1,677,801 and the average rate charged was 6.49%. In addition, in December 2006, the Trust entered into a line of

16

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of June 30, 2007 (unaudited)

credit facility with PNC Bank. Under the terms of the line of credit, the separate series of the Trust (including the Fund) may borrow up to $20,000,000 on a short-term basis with interest accruing at the Federal Funds Rate plus 0.75%. This amount of $3,814 is also included in “interest expense” in the Statement of Operations. For the six months ended June 30, 2007, the average amount of credit utilized was $1,181,600 at an average rate of 6.07%. As of June 30, 2007, the Fund had no outstanding borrowings under this line of credit facility.

Use of Estimates In preparing financial statements in accordance with accounting principles generally accepted in the United States of America, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Recent Accounting Pronouncements On July 13, 2006, the Financial Accounting Standards Board (“FASB”) released FASB Interpretation No.48 “Accounting for Uncertainty in Income Taxes” (“FIN 48”). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax return to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the year of determination. Adoption of FIN 48 is required for fiscal years beginning after December 15, 2006 and is to be applied to all open tax years as of the effective date. Management has completed their analysis and has determined that the adoption of FIN 48 will not have an impact on the financial statements.

In September 2006, the FASB issued Statement on Financial Accounting Standards No. 157, Fair Value Measurements (“SFAS No. 157”). This standard establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements. SFAS No. 157 applies to fair value measurements already required or permitted by existing standards. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. The changes to current generally accepted accounting principles from the application of this SFAS No. 157 relate to the definition of fair value, the methods used to measure fair value, and the expanded disclosures about fair value measurements. As of June 30, 2007, the Fund does not believe the adoption of SFAS No. 157 will impact the financial statement amounts, however, additional disclosures may be required about the inputs used to develop the measurements and the effect of certain of the measurements on changes in net assets for the period.

17

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of June 30, 2007 (unaudited)

NOTE 2 — SHARES OF BENEFICIAL INTEREST TRANSACTIONS

Transactions in shares of beneficial interest were as follows:

| | | | | | | | | | | | | | |

| | | Six months ended

06/30/07 | | | Year ended

12/31/06 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

Shares issued | | 1,108,949 | | | $ | 47,963,572 | | | 1,876,465 | | | $ | 75,722,613 | |

Reinvestments of dividends and distributions | | 80,233 | | | | 3,505,855 | | | 1,806,759 | | | | 72,571,132 | |

Shares redeemed | | (3,121,025 | ) | | | (135,052,969 | ) | | (8,920,428 | ) | | | (359,247,665 | ) |

| | | | | | | | | | | | | | |

| | (1,931,843 | ) | | $ | (83,583,542 | ) | | (5,237,204 | ) | | $ | (210,953,920 | ) |

| | | | | | | | | | | | | | |

Officers, Trustees and affiliated persons of The Torray Fund and their families directly or indirectly control 2,238,322 shares or 8.32% of the Fund.

NOTE 3 — INVESTMENT TRANSACTIONS

Purchases and sales of investment securities, other than short-term investments, for the six months ended June 30, 2007, aggregated $119,430,350 and $209,420,207, respectively.

NOTE 4 — MANAGEMENT FEES

Pursuant to the Management Contract, Torray LLC provides investment advisory and administrative services to the Fund. The Fund pays Torray LLC a management fee, computed daily and payable monthly at the annual rate of one percent of the Fund’s average daily net assets. For the six months ended June 30, 2007, The Torray Fund paid management fees of $5,926,971.

Excluding the management fee, other expenses incurred by the Fund during the six months ended June 30, 2007, totaled $626,580. These expenses include all costs associated with the Fund’s operations including transfer agent fees, Independent Trustees’ fees ($14,000 per annum and $2,000 for each Board meeting attended), interest expense, taxes, dues, fees and expenses of registering and qualifying the Fund and its shares for distribution, charges of custodian, auditing and legal expenses, insurance premiums, supplies, postage, expenses of issue or redemption of shares, reports to shareholders and Trustees, expenses of printing and mailing prospectuses, proxy statements and proxies to existing shareholders, and other miscellaneous expenses.

Certain officers and Trustees of the Fund are also officers and/or shareholders of Torray LLC.

18

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of June 30, 2007 (unaudited)

NOTE 5 — TAX MATTERS

Distributions to shareholders are determined in accordance with Federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America.

The tax character of distributions paid during the year ended December 31, 2006 were as follows:

| | | |

| | | 2006 |

| | |

Distributions paid from: | | | |

Ordinary income | | $ | 2,633,260 |

Long-term capital gain | | | 73,114,435 |

| | | |

| | $ | 75,747,695 |

| | | |

The following information is based upon the federal income tax basis of investment securities as of June 30, 2007:

| | | | | | |

Gross unrealized appreciation | | $ | 328,108,985 | | | |

Gross unrealized depreciation | | | (11,660,653 | ) | | |

| | | | | | |

Net unrealized appreciation | | $ | 316,448,332 | | | |

| | | | | | |

Federal income tax basis | | $ | 864,995,567 | | | |

| | | | | | |

The primary difference between book basis and tax basis distributions and distributable earnings is different book and tax treatment of amortization of bond premiums and the tax deferral of losses on wash sales.

NOTE 6 — COMMITMENTS AND CONTINGENCIES

The Fund indemnifies its officers and trustees for certain liabilities that may arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

19

The Torray Fund

PORTFOLIO HOLDINGS, PROXY VOTING AND PROCEDURES

As of June 30, 2007 (unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at http://www.sec.gov. The Fund’s Form N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Commission’s Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-800-443-3036; and on the Commission’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities is available without charge, upon request, by calling 1-800-443-3036; and on the Commission’s website at http://www.sec.gov.

20

The Torray Fund

ABOUT YOUR FUND’S EXPENSES

As of June 30, 2007 (unaudited)

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of the Fund, you incur ongoing costs, including management fees, and other fund expenses. Operating expenses, which are deducted directly from the Fund’s gross income, directly reduce the investment return of the Fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples below are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The table on the next page illustrates the Fund’s cost in two ways:

Actual Fund Return This section helps you estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the third column shows the operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period”on the next page.

Hypothetical 5% Return This section is intended to help you compare your Fund’s costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses, and that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge transactions fees, such as purchase or redemption fees, nor does it carry a “sales load.”

The calculation assumes no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

21

The Torray Fund

ABOUT YOUR FUND’S EXPENSES (continued)

As of June 30, 2007 (unaudited)

More information about the Fund’s expenses, including recent annual expense ratios, can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

| | | | | | | | | |

| | | Beginning

Account Value

January 1, 2007 | | Ending

Account Value

June 30, 2007 | | Expenses Paid

During Period * |

Based on Actual Fund Return | | $ | 1,000.00 | | $ | 1,059.10 | | $ | 5.64 |

Based on Hypothetical 5% Return

(before expenses) | | $ | 1,000.00 | | $ | 1,019.18 | | $ | 5.53 |

| * | | Expenses are equal to The Torray Fund’s annualized expense ratio of 1.11% for the period, multiplied by the average account value over the period, multiplied by 180/365 (to reflect the one-half year period). |

22

TRUSTEES

Carol T. Crawford

Bruce C. Ellis

William M Lane

Robert P. Moltz

Wayne H. Shaner

INVESTMENT ADVISOR

Torray LLC

OFFICERS

Robert E. Torray, Chairman

Douglas C. Eby, President

William M Lane, Executive Vice President

Fred M. Fialco, Vice President

Siva Natarajan, Vice President

A. Scott Lamond IV, Vice President

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Briggs, Bunting & Dougherty, LLP

Two Penn Center Plaza, Suite 820

Philadelphia, PA 19102-1732

TRANSFER AGENT

PFPC Inc.

101 Sabin Street

Pawtucket, RI 02860-1427

LEGAL COUNSEL

Dechert LLP

1775 I Street, N.W.

Washington, DC 20006

Distributed by PFPC Distributors, Inc.

760 Moore Road, King of Prussia, PA 19406-1212

Date of first use, August 2007

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus. All indices are unmanaged groupings of stocks that are not available for investment.

The

TORRAY

FUND

SEMI-ANNUAL REPORT

June 30, 2007

The Torray Fund

Suite 1100

7501 Wisconsin Avenue

Bethesda, Maryland 20814-6523

(301) 493-4600

(800) 443-3036

The Torray Institutional Fund

Letter to Shareholders

July 31, 2007

Dear Fellow Shareholders,

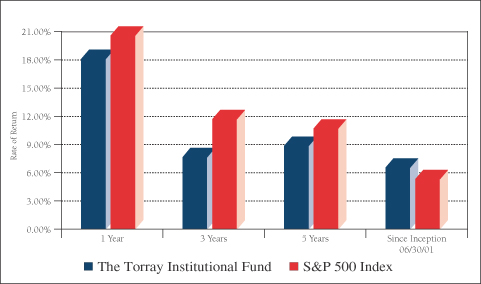

The Torray Institutional Fund gained 5.9% during the six-month period ending June 30, compared to an advance of 7% for the Standard & Poor’s 500 Index. The difference reflects continued strength in energy, cyclical, commodity-based and low quality stocks — areas we have avoided. This has been the case going on four years now and, though frustrating, we are not tempted to change course. The Fund returned 18% over the last 12 months, an indication that investors are beginning to recognize the superior economics of companies in our portfolio. Since inception six years ago, it has earned 6.5% compounded annually, compared to 5.3% for the Index. While both results are modest by historic standards, they come as no surprise given the market’s gross overvaluation at the close of the last decade.

In last year’s Annual Report we drew attention to the enormous outflow of capital from poorly performing U.S. equities into foreign markets over a span now approaching seven years. Record low interest rates and the stock market’s dismal record since the peak reached in March 2000 are responsible for the shift in investor focus. (Adjusted for inflation, the S&P 500, with dividends reinvested, lost 8% of its value during this period while overseas markets were generally trending up.) Ironically, this reversed an earlier flood of money in the opposite direction as large numbers of investors were lured by the late 1990’s speculative mania here at home.

Now it appears the global theme has cooled, and institutions, once again eyeing the world through a rearview mirror, are plunging head-on into so-called “alternatives” — private equity and hedge funds, real estate, commodities, timber and so on. Surveys indicate another sharp reduction in U.S. equity holdings is funding these ventures, keeping pressure on blue chip stocks and driving up the prices of the alternatives. These asset allocation decisions once again reflect investors’ bad habit of assuming what has happened will keep happening; the higher markets go, the more bullish they become, and vice-versa.

In a telling example we have underscored before, institutions held 77% of their assets in U.S. stocks at the height of the tech/telecom.dot.com bubble when P/E ratios averaged 37-to-1 (an earnings return of just 2.7%). From that point, as nearly everyone knows, the S&P 500 dropped 50% and NASDAQ 80% — over seven years later the latter is still down about 50%. Yet, today, with P/E’s at around 16-to-1 (an earnings return of 6.25% and heading higher as corporate profits continue to rise), published studies indicate institutions’ domestic equity allotment has fallen into the mid-40% range. An old friend from Dallas, Frederick E. “Shad” Rowe, writes

1

The Torray Institutional Fund

Letter to Shareholders

July 31, 2007

in the May issue of the highly regarded Grant’s Interest Rate Observer that a large state teachers’ retirement fund, currently “in a $12 billion actuarial hole,” plans to increase its alternative investments from $4.5 billion to $38 billion and reduce its U.S. stock portfolio from 52% to 25%. While perhaps an extreme case, there is no doubt about the direction institutions are heading, and also no doubt in our minds they will be wrong again. Sooner or later it seems inevitable some of the alternatives will prove disappointing, and those that are highly leveraged, complex and illiquid will inflict punishing losses just as the market did a few years ago. Some already have. We think investors would be wise to reverse course and start buying what they’ve been selling — blue chip domestic stocks.

Meanwhile, disquieting news has surfaced in the fixed income markets where yield-starved investors have piled into highly speculative collateralized mortgage and debt obligations (CMOs and CDOs), significant numbers backed by sub-prime home loans, leveraged corporate loans, junk bonds and a potpourri of other esoteric concoctions. In a puzzling twist, even though no one so far claims to know exactly what’s in these opaque securities, Standard & Poor’s, Moody’s and Fitch have pronounced many of them investment grade — Aaa down to Baa. In what would seem a conflict of interest, they have also been paid twice, once for the ratings and again, far more, for providing guidelines on how the various pools of assets should be structured to achieve them. At this point evidence suggests their risk assessments have been faulty. Under pressure from investors that contend the credit ratings do not reflect current default rates, the highest in a decade, large numbers of sub-prime mortgage pools and collateralized debt obligations are being downgraded or put on credit watch. Many of these securities contain loans originated by companies now in bankruptcy.

Following the just-announced total failure of two large super-leveraged hedge funds heavily invested in these assets, the blocking of redemptions on four others and the announced liquidation of at least one more, Moody’s et al maintain — as they have quietly before — that their ratings are only opinions and investors should not rely on them. (In past lawsuits courts have agreed, ruling that ratings, like newspaper editorials, are protected under the First Amendment.) Either way, the reported default rate on easily analyzed Baa corporate bonds (the lowest investment grade) from 1983 to 2005 has been only 2.2% measured over five-year periods. By comparison, from 1993 to 2005, the murky Baa CMOs and CDOs suffered default rates of 24%. How can two instruments identically rated by the same agencies produce such bizarrely disparate results? One also ponders why anyone would buy securities backed by, among other assets,

2

The Torray Institutional Fund

Letter to Shareholders

July 31, 2007

mortgages on houses owned by people that certifiably can’t service them. Yet, supposedly sophisticated institutions employing elaborate risk controls bought a lot, in some cases on nine or ten-to-one leverage.

This weird business is both a sign of the times and an echo from the past, like many of today’s other popular but warped financial constructs, symptomatic of a world awash in cash, much of it seemingly in the wrong hands. Lost in it all is the fact that successful free enterprise systems are built on production, employment, advances in technology, scientific research and the reinvestment of capital, not shuffling money from one pocket to another and overlaying the process with piles of paper sliced and diced for trading on Wall Street. Federal Reserve Board Chief Ben S. Bernanke disagrees. Testifying before Congress on July 18, he said that hedge funds, private equity and other private pools of investment capital provide “important benefits for the economy by spreading financial risks and increasing liquidity in the markets.” With all due respect to the chairman, recent revelations suggest some, at least, have had the opposite effect.

In reflecting on all of this, we are reminded of the following lines from an article in Barrons 18 years ago by Dr. Abraham J. Briloff, the Emanuel Saxe distinguished professor emeritus of accountancy, Bernard Baruch College of the City University of New York. He had this to say about the 1989 leveraged buyout of RJR Nabisco, the subject of Bryan Burrough’s best-selling Barbarians at the Gate: “The new RJR’s debt exceeds equity by a ratio of 21-to-1, and tangible net worth is a staggering negative $23 billion. What has been created here is, in essence, an enormous glacier of junk bonds floating on a sea of intangibles.” It would be interesting to hear his views today. Sharp as ever, the eminent professor, now 90 and living in Great Neck, New York, has been called “the most famous accountant in the world” and “the philosopher king of his profession.” He was honored at the August 2006 American Accounting Association meeting in Washington where Floyd Norris of The New York Times delivered the plenary address, “Where is the next Abe Briloff?”

Long-time loyal colleague Paul Williams, looking for something else, recently came across a talk Bob gave in the spring of 1989 that incorporated Dr. Briloff’s quote. In many ways it was a period like this one. Here is an excerpt from what Paul found: “Today we are witness to vast excesses of senseless stock and futures trading, index arbitrage programs, mergers, acquisitions and leveraged buyouts.” Seven months later, on October 13, in the midst of ever-bigger and riskier deals, financing for the $6.8 billion United Airlines buyout collapsed. The stock, then trading

3

The Torray Institutional Fund

Letter to Shareholders

July 31, 2007

around $120, became worthless three years later in a bankruptcy filed December 9, 2002. It was the end of the ‘80s buyout boom. Investors retrenched, deal making evaporated and the market lost 7% in a day. While government bonds in ‘89 yielded 9½%, and IBM bonds 10½%, investors were too busy gambling on stocks, futures and mergers to notice. By contrast, until a few months ago when trouble first surfaced in the sub-prime market, they couldn’t seem to get enough poor quality debt at lower yields. This recap is not intended to suggest we expect something bad to happen. Rather, it’s meant to highlight the heavy toll market manias like today’s take on speculators. Fortunately, the intelligent, long-term investor in high quality stocks and funds need not be concerned. Regardless of what the market does, we are confident about our prospects.

Time Magazine columnist Michael Kinsley in The New York Times (“We Try Harder, But What’s the Point,” May 16, 2007) put today’s scene in perspective. Tongue-in-cheek, Kinsley traces the convoluted history of what is now known as Avis Budget Group, founded in 1946 by Warren E. Avis on the idea of putting rental cars at airports. (Mr. Avis died last month at the age of 92.) He named it Avis Airlines Rent-a-Car, which he sold eight years later to another businessman. In all, Kinsley reports, Avis has been bought, sold or reorganized 17 or 18 times, depending on how one keeps score. He recounts that “each time Avis changed hands or structure there were fees for bankers and fees for lawyers, bonuses for the top executives and theories why this was exactly what the company needed.” The article goes on to inform that the acquirers included ITT, Norton Simon and Esmark (formerly Swift and Company) through its purchase of Norton Simon. Later Esmark was acquired by Beatrice Foods and then Beatrice itself fell into the hands of a leverage buyout company, which then sold Avis to an investment group, Wesray, (whew!) which, in turn, offloaded the fleet leasing business to PHH Group, and took the foreign operations public under the name Avis Europe PLC. Finally, Wesray unloaded what was left of Avis on its employees, tripling its money in 14 months. Subsequent deals involved General Motors, HFS (which sold the company in a public offering), PHH again, and so on and on.

There’s more, but you get the idea. As Kinsley insightfully observed, “Modern capitalism has two parts: there’s business and there’s finance. More and more the news business these days is actually about finance, and much of it is mystifying. Even if you can understand — just barely —how it works, you still wonder what the point is and why people who do it need to get paid so much. And you strongly suspect that this swirl of activity around Avis for the past six decades has had little or nothing to do with the business of renting cars.” In closing, he draws our attention to a report in last September’s Wall Street Journal a week after Avis Budget Group once again

4

The Torray Institutional Fund

Letter to Shareholders

July 31, 2007

began trading on the New York Stock Exchange. “The Company,” said the Journal, was “ripe for the picking,” adding that financier Carl Icahn had acquired a $100 million stake but wouldn’t comment on his intentions. It then warned, “If a buyout or acquisition deal doesn’t materialize for Avis, its stock and bond investors will have to focus on the fundamentals of the car rental business.” “Goodness!” exclaims Kinsley. “Anything but that!”

The stock market has been very volatile in recent weeks and investors seem extremely nervous. We hope you are not. Over time, the economic performance of companies in our portfolio should produce a reasonable, low-risk return. While we’re waiting, the best approach — as always — is to forget about the market and avoid listening to the experts about where it’s headed.

We thank you for your investment and continued confidence in our judgment.

| | | | |

| Sincerely, | | | | |

| | |

| | | |  |

| Robert E. Torray | | | | Douglas C. Eby |

5

The Torray Institutional Fund

PERFORMANCE DATA

As of June 30, 2007 (unaudited)

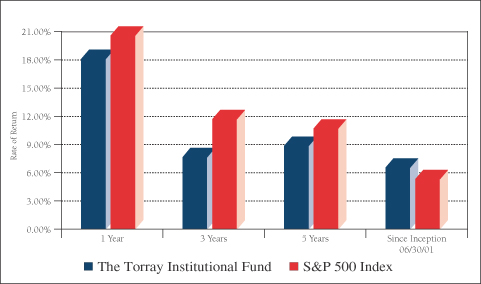

Average Annual Returns on an Investment in The Torray Institutional Fund vs. the S&P 500 Index

For the periods ended June 30, 2007:

| | | | | | | | |

| | | 1 Year | | 3 Years | | 5 Years | | Since

Inception

06/30/01 |

The Torray Institutional Fund | | 18.07% | | 7.63% | | 8.85% | | 6.54% |

S&P 500 Index | | 20.57% | | 11.67% | | 10.70% | | 5.31% |

Cumulative Returns for the 6 years ended June 30, 2007

| | | |

TheTorray Institutional Fund | | 46.26 | % |

S&P 500 Index | | 36.36 | % |

6

The Torray Institutional Fund

PERFORMANCE DATA (continued)

As of June 30, 2007 (unaudited)

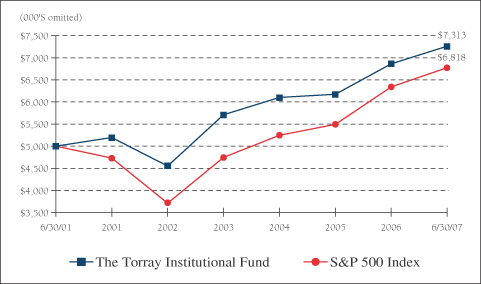

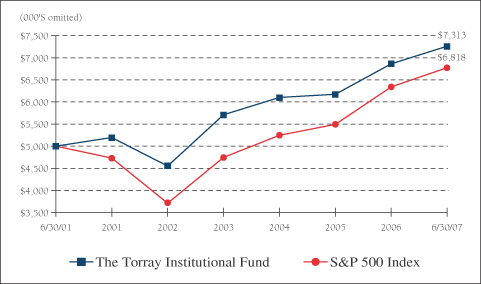

Change in Value of $5,000,000 Invested on June 30, 2001 (commencement of operations) to:

| | | | | | | | | | | | | | | |

| | | 06/30/01 | | 12/31/02 | | 12/31/04 | | 12/31/06 | | 06/30/07 |

The Torray Institutional Fund | | $ | 5,000,000 | | $ | 4,537,500 | | $ | 6,123,000 | | $ | 6,908,000 | | $ | 7,313,000 |

S&P 500 Index | | $ | 5,000,000 | | $ | 3,682,500 | | $ | 5,255,500 | | $ | 6,373,000 | | $ | 6,818,000 |

The returns quoted represent past performance and do not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher. Returns current to the most recent month-end are available at www.torray.com. The returns shown do not reflect the deduction of taxes a shareholder would pay on the redemption of fund shares and distributions. The Fund’s gross annual operating expense ratio, as stated in the current prospectus, is 0.85%. Returns on both The Torray Institutional Fund and the S&P 500 Index assume reinvestment of all dividends and distributions. The S&P 500 Index is an unmanaged index consisting of 500 U.S. large-cap stocks.

7

The Torray Institutional Fund

FUND PROFILE

As of June 30, 2007 (unaudited)

| | |

DIVERSIFICATION (% of net assets) |

| |

Financials | | 26.78% |

Health Care | | 20.83 |

Industrials | | 15.68 |

Information Technology | | 14.14 |

Consumer Discretionary | | 8.83 |

Telecommunications | | 6.04 |

Consumer Staples | | 3.64 |

Materials | | 3.59 |

Short-Term Investments | | 0.77 |

Other Liabilities Less Assets | | (0.30) |

| | |

| | 100.00% |

| | |

| TOP TEN EQUITY HOLDINGS |

| 1. | | Medtronic, Inc. |

| 2. | | EMC Corp. |

| 3. | | AMBAC Financial Group, Inc. |

| 4. | | O’Reilly Automotive, Inc. |

| 5. | | Cardinal Health, Inc. |

| 6. | | Haemonetics Corp. |

| 7. | | W.R. Grace & Co. |

| 8. | | Fairfax Financial Holdings, Ltd. |

| 9. | | Marsh & McLennan Cos., Inc. |

| 10. | | Abbott Laboratories |

| | | | | |

TOP FIXED INCOME HOLDINGS | | | |

|

Level 3 Communications, Inc., 10.00%, due 2011 | |

| |

PORTFOLIO CHARACTERISTICS | | | |

| | |

Net Assets (million) | | | | $177 | |

Number of Holdings | | | | 41 | |

Portfolio Turnover | | | | 9.75% | * |

P/E Multiple (forward) | | | | 15.9x | |

Portfolio Yield | | | | 1.20% | ** |

Market Capitalization | | Average | | 54.6 B | |

| | Median | | 30.9 B | |

| * | | For the six-month period ended June 30, 2007 |

See notes to the financial statements.

8

The Torray Institutional Fund

SCHEDULE OF INVESTMENTS

As of June 30, 2007 (unaudited)

| | | | | | | |

| | | Shares | | | | Market Value |

| COMMON STOCK 93.49% | | | |

| |

| 26.78% FINANCIALS | | | |

| | 84,835 | | AMBAC Financial Group, Inc. | | $ | 7,396,764 |

| | 32,029 | | Fairfax Financial Holdings, Ltd. | | | 6,138,998 |

| | 198,438 | | Marsh & McLennan Cos., Inc. | | | 6,127,765 |

| | 753,000 | | LaBranche & Co., Inc. * | | | 5,557,140 |

| | 112,442 | | JPMorgan Chase & Co. | | | 5,447,815 |

| | 70,100 | | Aflac, Inc. | | | 3,603,140 |

| | 26,200 | | Franklin Resources, Inc. | | | 3,470,714 |

| | 56,123 | | American Express Co. | | | 3,433,605 |

| | 14,657 | | Goldman Sachs Group, Inc. (The) | | | 3,176,905 |

| | 123,304 | | Calamos Asset Management, Inc., Class A | | | 3,150,417 |

| | | | | | | |

| | | | | | | 47,503,263 |

| |

| 20.83% HEALTH CARE | | | |

| | 148,000 | | Medtronic, Inc. | | | 7,675,280 |

| | 95,000 | | Cardinal Health, Inc. | | | 6,710,800 |

| | 122,800 | | Haemonetics Corp. * | | | 6,460,508 |

| | 105,800 | | Abbott Laboratories | | | 5,665,590 |

| | 63,400 | | Johnson & Johnson | | | 3,906,708 |

| | 59,600 | | Amgen, Inc. * | | | 3,295,284 |

| | 58,000 | | Eli Lilly & Co. | | | 3,241,040 |

| | | | | | | |

| | | | | | | 36,955,210 |

| |

| 15.68% INDUSTRIALS | | | |

| | 101,100 | | Illinois Tool Works, Inc. | | | 5,478,609 |

| | 126,300 | | Owens Corning, Inc. * | | | 4,247,469 |

| | 51,957 | | Danaher Corp. | | | 3,922,754 |

| | 76,400 | | USG Corp. * | | | 3,746,656 |

| | 45,711 | | General Dynamics Corp. | | | 3,575,514 |

| | 46,441 | | United Technologies Corp. | | | 3,294,060 |

| | 33,946 | | Emerson Electric Co. | | | 1,588,673 |

| | 26,800 | | Honeywell International, Inc. | | | 1,508,304 |

| | 11,700 | | General Electric Co. | | | 447,876 |

| | | | | | | |

| | | | | | | 27,809,915 |

9

The Torray Institutional Fund

SCHEDULE OF INVESTMENTS (continued)

As of June 30, 2007 (unaudited)

| | | | | | | |

| | | Shares | | | | Market Value |

| |

| 14.14% INFORMATION TECHNOLOGY | | | |

| | 412,300 | | EMC Corp. * | | $ | 7,462,630 |

| | 284,007 | | Applied Materials, Inc. | | | 5,643,219 |

| | 220,956 | | Intel Corp. | | | 5,249,915 |

| | 83,716 | | Automatic Data Processing, Inc. | | | 4,057,715 |

| | 128,739 | | Western Union Co. (The) | | | 2,681,633 |

| | | | | | | |

| | | | | | | 25,095,112 |

| |

| 8.83% CONSUMER DISCRETIONARY | | | |

| | 183,700 | | O’Reilly Automotive, Inc. * | | | 6,714,235 |

| | 80,002 | | Gannett Co., Inc. | | | 4,396,110 |

| | 65,310 | | Walt Disney Co. (The) | | | 2,229,683 |

| | 65,000 | | Time Warner, Inc. | | | 1,367,600 |

| | 36,491 | | McClatchy Co. (The), Class A | | | 923,587 |

| | 5,015 | | Citadel Broadcasting Corp. | | | 32,347 |

| | | | | | | |

| | | | | | | 15,663,562 |

| |

| 3.64% CONSUMER STAPLES | | | |

| | 61,500 | | Proctor & Gamble Co. (The) | | | 3,763,185 |

| | 51,790 | | Anheuser-Busch Cos., Inc. | | | 2,701,366 |

| | | | | | | |

| | | | | | | 6,464,551 |

| |

| 3.59% MATERIALS | | | |

| | 260,195 | | W.R. Grace & Co. * | | | 6,372,176 |

| | | | | | | |

| TOTAL COMMON STOCK 93.49% | | | 165,863,789 |

| (cost $133,113,962) | | | | | |

10

The Torray Institutional Fund

SCHEDULE OF INVESTMENTS (continued)

As of June 30, 2007 (unaudited)

| | | | | | | | |

| | | Principal

Amount ($) | | | | Market Value | |

| CONVERTIBLE BOND 6.04% | | | | |

| | 5,620,000 | | Level 3 Communications, Inc., 10.00%, due 2011(1) | | $ | 10,724,376 | |

| (cost $5,620,000) | | | | | | |

| |

| SHORT-TERM INVESTMENTS 0.77% | | | | |

| | 1,360,612 | | PNC Bank Money Market Account, 4.76%, due 07/02/07 | | | 1,360,612 | |

| (cost $1,360,612) | | | | | | |

| | | | | | | | |

| TOTAL INVESTMENTS 100.30% | | | 177,948,777 | |

| (cost $140,094,574) | | | | | | |

| |

| OTHER LIABILITES LESS ASSETS (0.30%) | | | (533,744 | ) |

| | | | | | | | |

| NET ASSETS 100.00% | | $ | 177,415,033 | |

| | | | | | | | |

| * | | Non-income producing securities |

(1) | | This security is valued at fair value, as determined in good faith by the Advisor under the supervision of the Board of Trustees in accordance with the Fund’s Valuation Procedures. The total fair value of this security at June 30, 2007 is $10,724,376, which represents 6.04% of net assets. |

See notes to the financial statements.

11

The Torray Institutional Fund

STATEMENT OF ASSETS AND LIABILITIES

As of June 30, 2007 (unaudited)

| | | |

ASSETS | | | |

Investments in securities at value

(cost $140,094,574) | | $ | 177,948,777 |

Interest and dividends receivable | | | 187,413 |

Receivable for fund shares sold | | | 38,186 |

| | | |

TOTAL ASSETS | | | 178,174,376 |

| | | |

| |

LIABILITIES | | | |

Payable for fund shares redeemed | | | 651,620 |

Payable to advisor | | | 107,723 |

| | | |

TOTAL LIABILITIES | | | 759,343 |

| | | |

| |

NET ASSETS | | $ | 177,415,033 |

| | | |

Shares of beneficial interest ($1 par value,

1,547,284 shares outstanding, unlimited

shares authorized) | | $ | 1,547,284 |

Paid-in-capital in excess of par | | | 130,463,616 |

Accumulated undistributed net investment income | | | 6,567 |

Accumulated net realized gain on investments | | | 7,543,363 |

Net unrealized appreciation of investments | | | 37,854,203 |

| | | |

| |

TOTAL NET ASSETS | | $ | 177,415,033 |

| | | |

Net Asset Value, Offering and Redemption Price Per Share | | $ | 114.66 |

| | | |

See notes to the financial statements.

12

The Torray Institutional Fund

STATEMENT OF OPERATIONS

For the six months ended June 30, 2007 (unaudited)

| | | |

INVESTMENT INCOME | | | |

Dividend income (net of foreign taxes withheld of $19,347) | | $ | 1,076,780 |

Interest income | | | 300,984 |

| | | |

Total income | | | 1,377,764 |

| | | |

| |

EXPENSES | | | |

Management fees | | | 824,889 |

| | | |

Total expenses | | | 824,889 |

| | | |

NET INVESTMENT INCOME | | | 552,875 |

| | | |

REALIZED AND UNREALIZED GAIN

ON INVESTMENTS | | | |

Net realized gain on investments | | | 8,685,281 |

Net change in unrealized appreciation on investments | | | 1,879,878 |

| | | |

Net realized and unrealized gain on investments | | | 10,565,159 |

| | | |

NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 11,118,034 |

| | | |

See notes to the financial statements.

13

The Torray Institutional Fund

STATEMENTS OF CHANGES IN NET ASSETS

For the periods indicated:

| | | | | | | | |

| | | Six months ended

06/30/07

(unaudited) | | | Year ended

12/31/06 | |

Increase in Net Assets from Operations: | | | | | | | | |

Net investment income | | $ | 552,875 | | | $ | 1,572,577 | |

Net realized gain on investments | | | 8,685,281 | | | | 34,297,242 | |

Capital gain distributions from investment companies | | | — | | | | 190,765 | |

Net change in unrealized appreciation

(depreciation) on investments | | | 1,879,878 | | | | (6,888,801 | ) |

| | | | | | | | |

Net increase in net assets from operations | | | 11,118,034 | | | | 29,171,783 | |

| | | | | | | | |

| | |

Distributions to Shareholders from: | | | | | | | | |

Net investment income ($0.332 and

$0.790 per share, respectively) | | | (546,308 | ) | | | (1,705,784 | ) |

Net realized gains ($0.000 and $14.797 per

share, respectively) | | | — | | | | (25,771,863 | ) |

| | | | | | | | |

Total distributions | | | (546,308 | ) | | | (27,477,647 | ) |

| | | | | | | | |

| | |

Shares of Beneficial Interest | | | | | | | | |

Decrease from share transactions | | | (39,007,948 | ) | | | (196,507,859 | ) |

| | | | | | | | |

Total decrease | | | (28,436,222 | ) | | | (194,813,723 | ) |

| | |

Net Assets — Beginning of Period | | | 205,851,255 | | | | 400,664,978 | |

| | | | | | | | |

Net Assets — End of Period | | $ | 177,415,033 | | | $ | 205,851,255 | |

| | | | | | | | |

Accumulated Undistributed Net Investment Income | | $ | 6,567 | | | $ | — | |

| | | | | | | | |

See notes to the financial statements.

14

The Torray Institutional Fund

FINANCIAL HIGHLIGHTS

For a share outstanding throughout each period:

PER SHARE DATA

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

06/30/07

(unaudited) | | | Years ended December 31: | |

| | | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

Net Asset Value,

Beginning of Period | | $ | 108.640 | | | $ | 111.920 | | | $ | 116.290 | | | $ | 110.520 | | | $ | 89.490 | | | $ | 103.300 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.939 | | | | 0.720 | | | | 0.616 | | | | 0.588 | | | | 0.671 | | | | 0.679 | |

Net gains (losses) on investments (both realized and unrealized) | | | 5.413 | | | | 11.587 | | | | 0.748 | (2) | | | 7.025 | | | | 22.586 | | | | (13.810 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 6.352 | | | | 12.307 | | | | 1.364 | | | | 7.613 | | | | 23.257 | | | | (13.131 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Less: distributions | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends (from net investment

income) | | | (0.332 | ) | | | (0.790 | ) | | | (0.616 | ) | | | (0.588 | ) | | | (0.671 | ) | | | (0.679 | ) |

Distributions (from capital gains) | | | — | | | | (14.797 | ) | | | (5.118 | ) | | | (1.255 | ) | | | (1.556 | ) | | | 0.000 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.332 | ) | | | (15.587 | ) | | | (5.734 | ) | | | (1.843 | ) | | | (2.227 | ) | | | (0.679 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value,

End of Period | | $ | 114.660 | | | $ | 108.640 | | | $ | 111.920 | | | $ | 116.290 | | | $ | 110.520 | | | $ | 89.490 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN(1) | | | 5.89 | %** | | | 11.40 | % | | | 1.28 | % | | | 6.96 | % | | | 26.16 | % | | | (12.73 | %) |

RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period

(000’s omitted) | | $ | 177,415 | | | $ | 205,851 | | | $ | 400,665 | | | $ | 1,012,566 | | | $ | 598,183 | | | $ | 137,715 | |

Ratios of expenses to average net

assets | | | 0.85 | %* | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % |

Ratios of net income to average net

assets | | | 0.57 | %* | | | 0.60 | % | | | 0.59 | % | | | 0.56 | % | | | 0.80 | % | | | 0.85 | % |

Portfolio turnover rate | | | 9.75 | %** | | | 24.26 | % | | | 53.66 | % | | | 16.12 | % | | | 22.20 | % | | | 6.87 | % |

(1) | | Past performance is not predictive of future performance. |

(2) | | The amount shown for the year ended December 31, 2005 for a share outstanding throughout the year does not accord with the aggregate net losses on investments reported in the statement of operations for the year because of the timing of sales and repurchases of Fund shares in relation to fluctuating market value of the investments of the Fund. |

See notes to the financial statements.

15

The Torray Institutional Fund

NOTES TO FINANCIAL STATEMENTS

As of June 30, 2007 (unaudited)

NOTE 1 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Torray Institutional Fund (“Fund”) is a separate series of The Torray Fund (“Trust”). The Trust is registered under the Investment Company Act of 1940 as a no-load, diversified, open-end management investment company. The Trust was organized as a business trust under Massachusetts law and the Fund commenced operations on June 30, 2001. The Fund’s primary investment objective is to provide long-term total return. The Fund seeks to meet its objective by investing its assets in a diversified portfolio of common stocks. In order to accomplish these goals, the Fund intends to hold stocks for the long term, as opposed to actively buying and selling. There can be no assurances that the Fund’s investment objectives will be achieved.

The following is a summary of accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America.

Securities Valuation Portfolio securities for which market quotations are readily available are valued at market value, which is determined by using the last reported sale price, or, if no sales are reported, the last reported bid price. For NASDAQ traded securities, market value is determined on the basis of the NASDAQ official closing price instead of the last reported sales price. Other assets and securities for which no quotations are readily available or for which Torray LLC (the “Advisor”) believes do not reflect market value are valued at fair value as determined in good faith by the Advisor under the supervision of the Board of Trustees in accordance with the Fund’s Valuation Procedures. Short-term obligations having remaining maturities of 60 days or less are valued at amortized cost, which approximates market value.

Securities Transactions and Investment Income Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the specific identification basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income, including amortization of discount on short-term investments, and expenses are recorded on the accrual basis. Premium and discount amortization is amortized using the effective yield to maturity method.

Federal Income Taxes The Fund intends to continue to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income, including any net realized gain on investments to its shareholders. Therefore, no Federal income tax provision is required.

Net Asset Value The net asset value per share of the Fund is determined daily as of the close of trading on the New York Stock Exchange by dividing the value of the Fund’s net assets by the number of shares outstanding.

Interest Expense When cash balances are overdrawn in the Fund’s custody account, the Fund is charged an overdraft fee equal to 1.25% above the Federal Funds Rate. Such overdraft fees are paid by the Advisor under the comprehensive management fee arrangement described in Note 4. In addition, in December 2006, the Trust entered

16

The Torray Institutional Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of June 30, 2007 (unaudited)