UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06110

Western Asset Funds, Inc.

Name of Fund:

385 East Colorado Boulevard

Pasadena, CA 91101

Address of Principal Executive Offices:

Richard M. Wachterman, Esq.

Legg Mason Wood Walker, Incorporated

100 Light Street

Baltimore, MD 21202

Name and address of agent for service:

Registrant’s telephone number, including area code: (410) 539-0000

Date of fiscal year end: March 31, 2005

Date of reporting period: September 30, 2004

Item 1 – Report to Shareholders

Western Asset Funds, Inc.

Western Asset Limited Duration Bond Portfolio

Western Asset Intermediate Bond Portfolio

Western Asset Intermediate Plus Bond Portfolio

Western Asset Core Bond Portfolio

Western Asset Core Plus Bond Portfolio

Western Asset Inflation Indexed Plus Bond Portfolio

Western Asset High Yield Portfolio

Western Asset Non-U.S. Opportunity Bond Portfolio

Semi-Annual Report to Shareholders

September 30, 2004

Semi-Annual Report to Shareholders

EXPENSE EXAMPLES

As a shareholder of any of the Funds, you incur ongoing costs, including management fees, service (12b-1) fees on Financial Intermediary Class shares, and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on April 1, 2004, and held through September 30, 2004.

Actual Expenses

The first line for each Fund in the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each Fund in the accompanying table provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the actual return of any of the Funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| | | | | | | | | | | |

| | | Beginning

Account Value

4/1/04 | | Ending

Account Value

9/30/04 | | Expenses PaidA

During the Period

4/1/04 to 9/30/04 | | Annualized

Expense Ratio |

Limited Duration Bond Portfolio Institutional Class: | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,002.60 | | $ | 2.01 | | 0.40% |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,023.06 | | | 2.03 | | |

Intermediate Bond Portfolio

Institutional Class: | | | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,011.20 | | | 2.27 | | 0.45% |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,022.81 | | | 2.28 | | |

Intermediate Plus Bond Portfolio Institutional Class: | | | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,012.40 | | | 2.22 | | 0.45% |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,022.31 | | | 2.23 | | |

Core Bond Portfolio

Institutional Class: | | | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,012.80 | | | 2.32 | | 0.46% |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,022.76 | | | 2.33 | | |

Financial Intermediary Class: | | | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,012.40 | | | 3.68 | | 0.73% |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,021.41 | | | 3.70 | | |

| A | These calculations are based on expenses incurred in the most recent fiscal half-year. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average value over the period, multiplied by the number of days in the most recent fiscal half-year (183), and divided by 365. |

1

Semi-Annual Report to Shareholders

EXPENSE EXAMPLE—Continued

| | | | | | | | | | | |

| | | Beginning

Account Value

4/1/04 | | Ending

Account Value

9/30/04 | | Expenses PaidA

During the Period

4/1/04 to 9/30/04 | | Annualized

Expense Ratio |

Core Plus Bond Portfolio

Institutional Class: | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,021.50 | | $ | 2.28 | | 0.45% |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,022.81 | | | 2.28 | | |

Financial Intermediary Class: | | | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,020.30 | | | 3.55 | | 0.70% |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,021.56 | | | 3.55 | | |

Inflation Indexed Plus Bond Portfolio Institutional Class: | | | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,007.20 | | | 1.26 | | 0.25% |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,023.82 | | | 1.27 | | |

High Yield Portfolio

Institutional Class: | | | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,047.00 | | | 3.28 | | 0.64% |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,021.86 | | | 3.24 | | |

Non-U.S. Opportunity Bond Portfolio Institutional Class: | | | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,016.20 | | | 2.78 | | 0.55% |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,022.31 | | | 2.79 | | |

| A | These calculations are based on expenses incurred in the most recent fiscal half-year. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average value over the period, multiplied by the number of days in the most recent fiscal half-year (183), and divided by 365. |

2

Semi-Annual Report to Shareholders

PORTFOLIO COMPOSITION

The following tables show the portfolio composition (as a percentage of the portfolio) for each of the Funds:

| | | | | | | | | | | | | | | | | | | | | | | | |

| Debt RatingsA | | Limited

Duration | | | Intermediate | | | Intermediate

Plus | | | Core | | | Core

Plus | | | Inflation

Indexed Plus | | | High

Yield | | | Non-U.S. | |

AAA | | 73.55 | % | | 55.51 | % | | 55.45 | % | | 78.22 | % | | 77.60 | % | | 96.49 | % | | — | | | 74.15 | % |

AA | | 2.04 | % | | 3.23 | % | | 2.47 | % | | 0.53 | % | | 0.42 | % | | — | | | — | | | 13.59 | % |

A | | 8.68 | % | | 14.81 | % | | 14.49 | % | | 3.91 | % | | 3.17 | % | | 0.73 | % | | 0.25 | % | | 0.82 | % |

BBB | | 15.19 | % | | 22.92 | % | | 22.82 | % | | 12.74 | % | | 9.45 | % | | — | | | 2.81 | % | | — | |

BB | | 0.47 | % | | 1.87 | % | | 2.67 | % | | 1.74 | % | | 3.52 | % | | — | | | 26.85 | % | | — | |

B | | — | | | 0.37 | % | | 1.55 | % | | 0.90 | % | | 3.55 | % | | — | | | 53.77 | % | | — | |

Below B | | — | | | — | | | 0.27 | % | | 0.38 | % | | 0.26 | % | | — | | | 15.02 | % | | — | |

Not Rated | | 0.07 | % | | 1.29 | % | | 0.28 | % | | 1.58 | % | | 2.03 | % | | 2.78 | % | | 1.30 | % | | 11.44 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| | | 100.00 | % | | 100.00 | % | | 100.00 | % | | 100.00 | % | | 100.00 | % | | 100.00 | % | | 100.00 | % | | 100.00 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| | | | | | | | |

Maturity

Schedule | | Limited

Duration | | | Intermediate | | | Intermediate

Plus | | | Core | | | Core

Plus | | | Inflation

Indexed Plus | | | High

Yield | | | Non-U.S. | |

Less Than 1 Year | | 25.30 | % | | 9.06 | % | | 14.63 | % | | 32.53 | % | | 35.20 | % | | 0.41 | % | | 0.57 | % | | 13.22 | % |

1 to 3 Years | | 20.05 | % | | 17.49 | % | | 25.08 | % | | 10.48 | % | | 8.17 | % | | 6.49 | % | | 4.25 | % | | 22.31 | % |

3 to 5 Years | | 20.82 | % | | 29.97 | % | | 25.30 | % | | 13.64 | % | | 15.05 | % | | 12.77 | % | | 10.69 | % | | 6.69 | % |

5 to 10 Years | | 8.66 | % | | 25.45 | % | | 28.61 | % | | 9.74 | % | | 11.85 | % | | 47.76 | % | | 77.16 | % | | 36.02 | % |

10 to 20 Years | | 2.78 | % | | 3.99 | % | | 0.81 | % | | 6.10 | % | | 2.73 | % | | — | | | 5.01 | % | | 4.32 | % |

20 to 30 Years | | 15.97 | % | | 13.47 | % | | 5.57 | % | | 17.77 | % | | 15.00 | % | | 31.02 | % | | 2.05 | % | | 16.95 | % |

More Than 30 Years | | 6.42 | % | | 0.57 | % | | — | | | 9.74 | % | | 12.00 | % | | 1.55 | % | | 0.27 | % | | 0.49 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| | | 100.00 | % | | 100.00 | % | | 100.00 | % | | 100.00 | % | | 100.00 | % | | 100.00 | % | | 100.00 | % | | 100.00 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| A | Source: Standard & Poor's. |

3

Semi-Annual Report to Shareholders

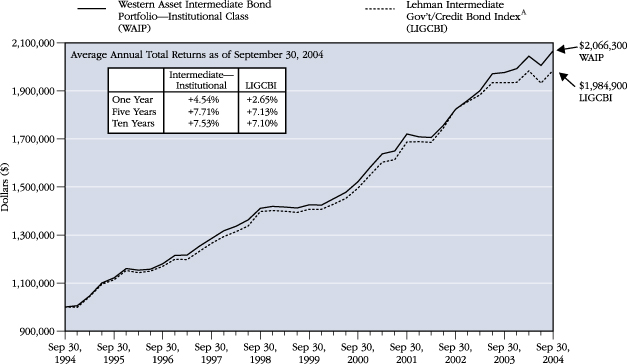

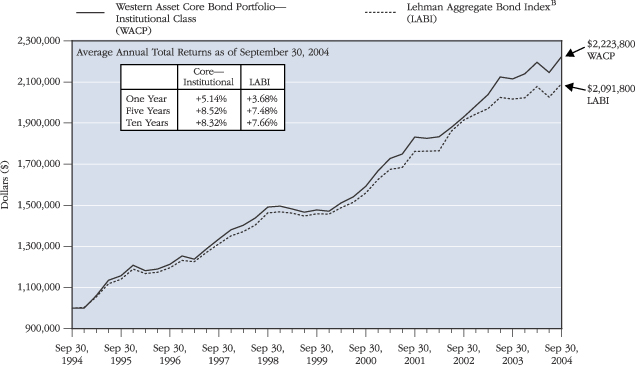

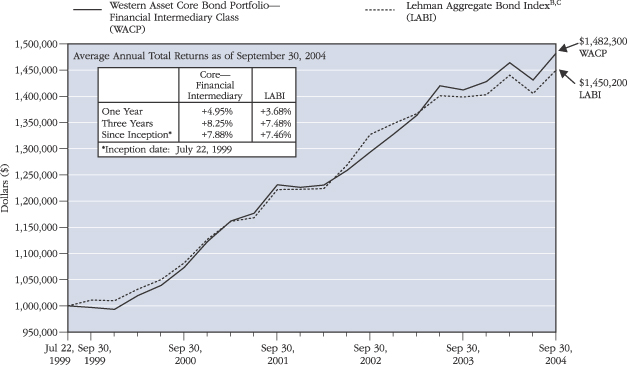

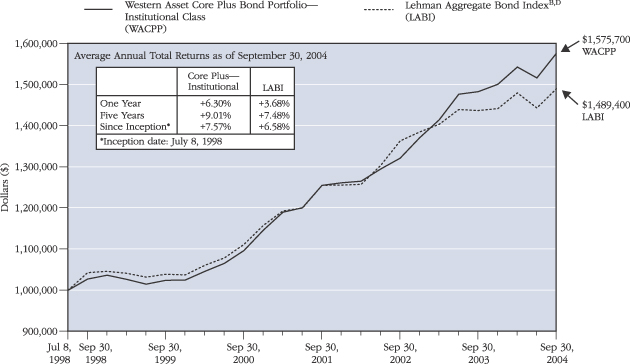

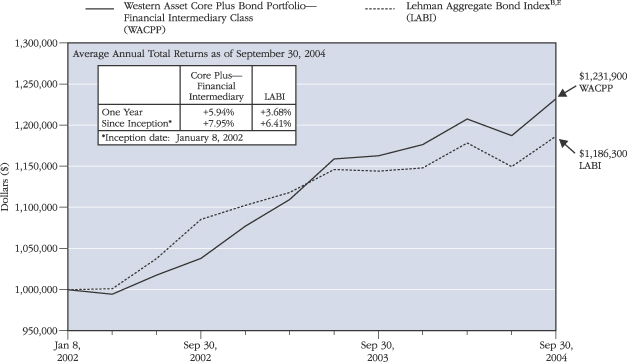

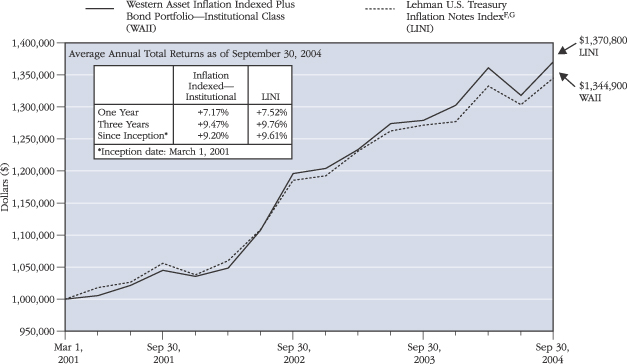

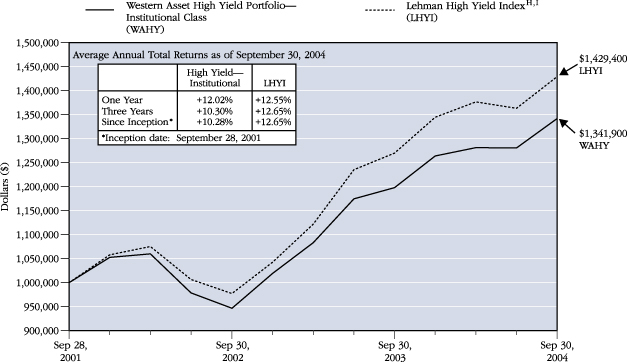

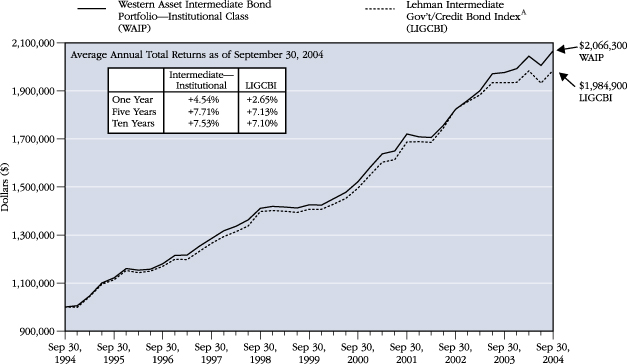

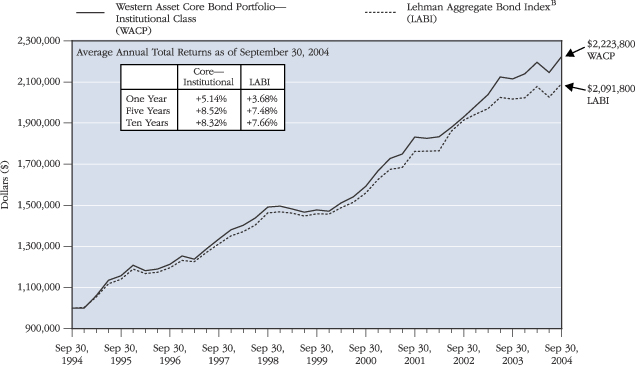

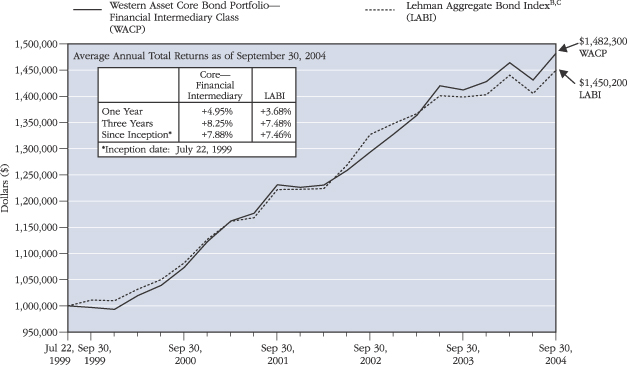

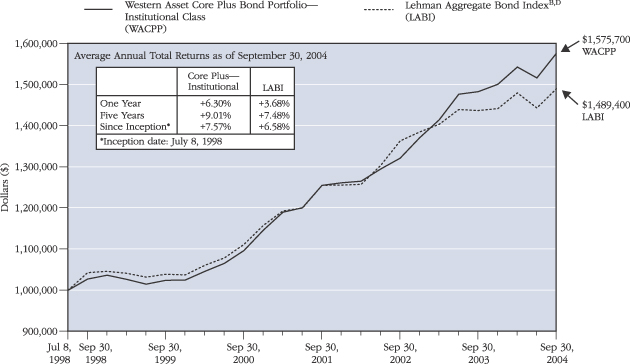

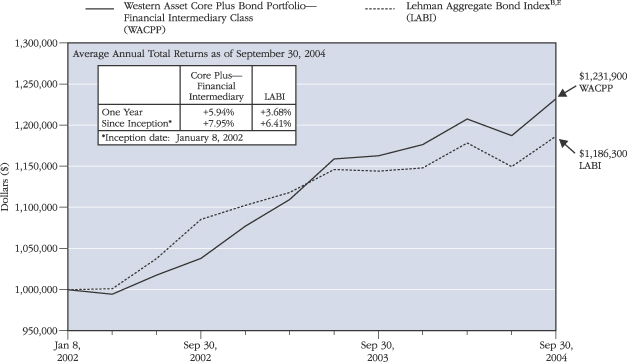

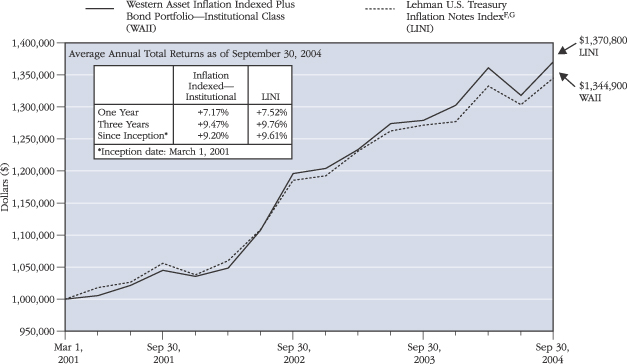

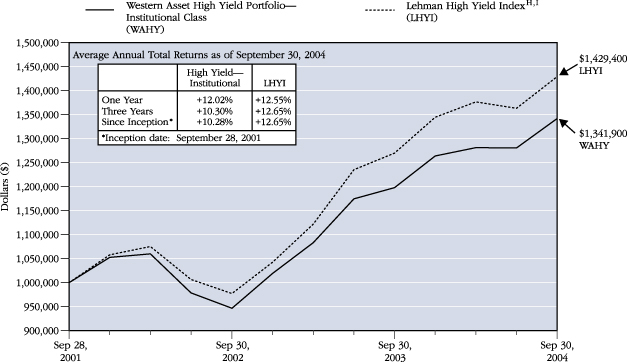

PERFORMANCE INFORMATION

The following graphs and tables compare each Fund’s total returns against that of an appropriate broad-based securities market index. The lines illustrate the cumulative total return of an initial $1,000,000 investment for the periods indicated. The line for each Fund represents the total return after deducting all Fund investment management and other administrative expenses and the transaction costs of buying and selling securities. The line representing the securities market index does not include any transaction costs associated with buying and selling securities in the index or other investment management or administrative expenses.

Due to the limited operating history of the Western Asset Limited Duration Bond Portfolio and the Western Asset Intermediate Plus Bond Portfolio, performance graphs are not presented. The Funds, which began operations on October 1, 2003, and April 1, 2004, respectively, had total returns of 1.97% and 1.24%, respectively, for the period ended September 30, 2004.

Total return measures investment performance in terms of appreciation or depreciation in net asset value per share, plus dividends and any capital gain distributions. It assumes that dividends and distributions were reinvested at the time they were paid. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual returns tend to smooth out variations in a fund’s return, so that they differ from actual year-to-year results.

The performance data quoted represents past performance and does not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information, please visit www.westernassetfunds.com. The investment return and principal value of the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods.

4

Semi-Annual Report to Shareholders

Western Asset Intermediate Bond Portfolio

The graph and table do not reflect the deduction of taxes that a shareholder

would pay on Fund distributions or the redemption of Fund shares.

Past performance does not predict future performance.

| A | A total return index consisting of investment grade corporate debt issues as well as debt issues of U.S. government agencies and the U.S. Treasury. The debt issues all maintain maturities within a range of 1 to 10 years. It is not possible to invest in an index. |

5

Semi-Annual Report to Shareholders

| B | A market value-weighted index that tracks the daily price, coupon, pay-downs, and total return performance of fixed rate, publicly placed, dollar-denominated, and nonconvertible investment grade debt issues with at least $100 million par amount outstanding and with at least one year to final maturity. It is not possible to invest in an index. |

PERFORMANCE INFORMATION—Continued

Western Asset Core Bond Portfolio

The graph and table do not reflect the deduction of taxes that a shareholder

would pay on Fund distributions or the redemption of Fund shares.

Past performance does not predict future performance.

6

Semi-Annual Report to Shareholders

Western Asset Core Bond Portfolio—Continued

The graph and table do not reflect the deduction of taxes that a shareholder

would pay on Fund distributions or the redemption of Fund shares.

Past performance does not predict future performance.

| C | The Fund’s Financial Intermediary Class inception date is July 22, 1999. Index returns are for periods beginning July 31, 1999. |

7

Semi-Annual Report to Shareholders

PERFORMANCE INFORMATION—Continued

Western Asset Core Plus Bond Portfolio

The graph and table do not reflect the deduction of taxes that a shareholder

would pay on Fund distributions or the redemption of Fund shares.

Past performance does not predict future performance.

| D | The Fund’s Institutional Class inception date is July 8, 1998. Index returns are for periods beginning June 30, 1998. |

8

Semi-Annual Report to Shareholders

Western Asset Core Plus Bond Portfolio—Continued

The graph and table do not reflect the deduction of taxes that a shareholder

would pay on Fund distributions or the redemption of Fund shares.

Past performance does not predict future performance.

| E | The Fund’s Financial Intermediary Class inception date is January 8, 2002. Index returns are for periods beginning December 31, 2001. |

9

Semi-Annual Report to Shareholders

| F | An unmanaged index that measures the performance of intermediate (1 to 10 year) U.S. Treasury inflation-protected securities. It is not possible to invest in an index. |

| G | The Fund’s Institutional Class inception date is March 1, 2001. Index returns are for periods beginning February 28, 2001. |

PERFORMANCE INFORMATION—Continued

Western Asset Inflation Indexed Plus Bond Portfolio

The graph and table do not reflect the deduction of taxes that a shareholder

would pay on Fund distributions or the redemption of Fund shares.

Past performance does not predict future performance.

10

Semi-Annual Report to Shareholders

Western Asset High Yield Portfolio

The graph and table do not reflect the deduction of taxes that a shareholder

would pay on Fund distributions or the redemption of Fund shares.

Past performance does not predict future performance.

| H | A market value-weighted index that tracks the daily price-only, coupon, and total return performance of non-investment grade, fixed rate, publicly placed, dollar-denominated, and non-convertible debt registered with the U.S. Securities and Exchange Commission. It is not possible to invest in an index. |

| I | The Fund’s Institutional Class inception date is September 28, 2001. Index returns are for periods beginning September 30, 2001. |

11

Semi-Annual Report to Shareholders

| J | An index encompassing an all-inclusive universe of institutionally traded bonds, including all fixed rate bonds with remaining maturities of one year or longer and with amounts outstanding of at least the equivalent of $25 million USD. This Index excludes the U.S. and is currency-hedged as a means of achieving low-risk interest rate diversification. It is not possible to invest in an index. |

| K | The Fund’s Institutional Class inception date is July 15, 1998. Index returns are for periods beginning July 31, 1998. |

PERFORMANCE INFORMATION—Continued

Western Asset Non-U.S. Opportunity Bond Portfolio

The graph and table do not reflect the deduction of taxes that a shareholder

would pay on Fund distributions or the redemption of Fund shares.

Past performance does not predict future performance.

12

Semi-Annual Report to Shareholders

PORTFOLIO OF INVESTMENTS

September 30, 2004 (Unaudited)

(Amounts in Thousands)

Western Asset Limited Duration Bond Portfolio

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

Long-Term Securities | | 87.1% | | | | | | | | | | | |

| | | | | |

Corporate Bonds and Notes | | 21.2% | | | | | | | | | | | |

| | | | | |

Aerospace/Defense | | 0.2% | | | | | | | | | | | |

Northrop Grumman Corporation | | | | 4.079% | | 11/16/06 | | $ | 70 | | $ | 71 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Banking and Finance | | 2.0% | | | | | | | | | | | |

Ford Motor Credit Company | | | | 2.790% | | 9/28/07 | | | 390 | | | 389 | A |

General Motors Acceptance Corporation | | | | 4.150% | | 2/7/05 | | | 60 | | | 61 | |

General Motors Acceptance Corporation | | | | 5.250% | | 5/16/05 | | | 70 | | | 71 | |

General Motors Acceptance Corporation | | | | 7.500% | | 7/15/05 | | | 110 | | | 114 | |

Household Finance Corporation | | | | 6.500% | | 1/24/06 | | | 120 | | | 126 | |

John Deere Capital Corporation | | | | 3.900% | | 1/15/08 | | | 120 | | | 122 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 883 | |

| | | | | | | | | | | |

|

|

|

Banks | | 0.8% | | | | | | | | | | | |

Bank of America Corporation | | | | 1.913% | | 10/22/04 | | | 70 | | | 70 | A |

FleetBoston Financial Corporation | | | | 4.875% | | 12/1/06 | | | 140 | | | 145 | |

Wachovia Corporation | | | | 6.800% | | 6/1/05 | | | 120 | | | 124 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 339 | |

| | | | | | | | | | | |

|

|

|

Cable | | 0.5% | | | | | | | | | | | |

Tele-Communications, Inc. | | | | 7.250% | | 8/1/05 | | | 200 | | | 210 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Chemicals | | 0.3% | | | | | | | | | | | |

The Dow Chemical Company | | | | 7.000% | | 8/15/05 | | | 140 | | | 145 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Computer Services and Systems | | 0.2% | | | | | | | | | | | |

Electronic Data Systems Corporation | | | | 7.125% | | 10/15/09 | | | 90 | | | 97 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Consumer Products | | 0.3% | | | | | | | | | | | |

The Procter & Gamble Company | | | | 4.750% | | 6/15/07 | | | 120 | | | 125 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Diversified Financial Services | | 0.8% | | | | | | | | | | | |

Citigroup Inc. | | | | 3.625% | | 2/9/09 | | | 115 | | | 115 | |

U.S. Bancorp | | | | 3.125% | | 3/15/08 | | | 130 | | | 128 | |

Wells Fargo & Company | | | | 1.900% | | 3/3/06 | | | 100 | | | 100 | A |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 343 | |

| | | | | | | | | | | |

|

|

|

Drug and Grocery Store Chains | | 0.1% | | | | | | | | | | | |

Safeway Inc. | | | | 2.164% | | 11/1/05 | | | 30 | | | 30 | A |

| | | | | | | | | | | |

|

|

|

13

Semi-Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | | |

| | | | | |

Electric | | 2.4% | | | | | | | | | | | |

American Electric Power Company, Inc. | | | | 6.125% | | 5/15/06 | | $ | 160 | | $ | 168 | |

DTE Energy Company | | | | 2.740% | | 6/1/07 | | | 215 | | | 215 | A |

FirstEnergy Corp. | | | | 5.500% | | 11/15/06 | | | 400 | | | 416 | |

Southern California Edison Company | | | | 1.890% | | 1/13/06 | | | 60 | | | 60 | A |

Virginia Electric and Power Company | | | | 5.750% | | 3/31/06 | | | 150 | | | 156 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 1,015 | |

| | | | | | | | | | | |

|

|

|

Energy | | 1.0% | | | | | | | | | | | |

Pacific Gas and Electric Company | | | | 3.600% | | 3/1/09 | | | 90 | | | 89 | |

Progress Energy, Inc. | | | | 6.750% | | 3/1/06 | | | 150 | | | 158 | |

Sempra Energy | | | | 2.210% | | 5/21/08 | | | 90 | | | 90 | A |

TXU Energy Co. | | | | 2.380% | | 1/17/06 | | | 100 | | | 100 | A,B |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 437 | |

| | | | | | | | | | | |

|

|

|

Environmental Services | | 0.4% | | | | | | | | | | | |

Waste Management, Inc. | | | | 7.000% | | 10/15/06 | | | 175 | | | 188 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Food, Beverage and Tobacco | | 1.3% | | | | | | | | | | | |

Altria Group, Inc. | | | | 7.000% | | 7/15/05 | | | 140 | | | 143 | |

Altria Group, Inc. | | | | 5.625% | | 11/4/08 | | | 95 | | | 97 | |

Kellogg Company | | | | 6.000% | | 4/1/06 | | | 130 | | | 136 | |

Kraft Foods Inc. | | | | 5.625% | | 11/1/11 | | | 40 | | | 42 | |

Sara Lee Corporation | | | | 1.950% | | 6/15/06 | | | 160 | | | 158 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 576 | |

| | | | | | | | | | | |

|

|

|

Investment Banking/Brokerage | | 2.3% | | | | | | | | | | | |

J.P. Morgan Chase & Co. | | | | 2.000% | | 5/20/05 | | | 100 | | | 100 | A |

J.P. Morgan Chase & Co. | | | | 2.160% | | 10/2/09 | | | 160 | | | 160 | A |

Lehman Brothers Holdings Inc. | | | | 1.750% | | 4/20/07 | | | 180 | | | 180 | A |

Merrill Lynch & Co., Inc. | | | | 7.375% | | 5/15/06 | | | 140 | | | 151 | |

The Bear Stearns Companies Inc. | | | | 2.130% | | 9/9/09 | | | 200 | | | 200 | A |

The Goldman Sachs Group, Inc. | | | | 2.100% | | 2/25/05 | | | 110 | | | 110 | A |

The Goldman Sachs Group, Inc. | | | | 1.980% | | 7/23/09 | | | 100 | | | 100 | A |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 1,001 | |

| | | | | | | | | | | |

|

|

|

Media | | 1.9% | | | | | | | | | | | |

America Online Inc. | | | | 0.000% | | 12/6/19 | | | 295 | | | 188 | C,D |

Clear Channel Communications, Inc. | | | | 3.125% | | 2/1/07 | | | 80 | | | 79 | |

Liberty Media Corporation | | | | 3.380% | | 9/17/06 | | | 160 | | | 162 | A |

News America Incorporated | | | | 6.625% | | 1/9/08 | | | 140 | | | 152 | |

Viacom Inc. | | | | 5.625% | | 5/1/07 | | | 220 | | | 233 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 814 | |

| | | | | | | | | | | |

|

|

|

14

PORTFOLIO OF INVESTMENTS—Continued

Western Asset Limited Duration Bond Portfolio—Continued

Semi-Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | | |

| | | | | |

Medical Care Facilities | | 0.1% | | | | | | | | | | | |

HCA Inc. | | | | 6.910% | | 6/15/05 | | $ | 30 | | $ | 31 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Oil and Gas | | 2.0% | | | | | | | | | | | |

Amerada Hess Corporation | | | | 7.375% | | 10/1/09 | | | 120 | | | 135 | |

Apache Corporation | | | | 6.250% | | 4/15/12 | | | 90 | | | 101 | |

Devon Energy Corporation | | | | 2.750% | | 8/1/06 | | | 150 | | | 149 | |

Occidental Petroleum Corporation | | | | 7.650% | | 2/15/06 | | | 110 | | | 117 | |

Pemex Project Funding Master Trust | | | | 8.500% | | 2/15/08 | | �� | 50 | | | 56 | |

Pemex Project Funding Master Trust | | | | 3.180% | | 6/15/10 | | | 190 | | | 192 | A,B |

Tosco Corporation | | | | 7.625% | | 5/15/06 | | | 115 | | | 123 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 873 | |

| | | | | | | | | | | |

|

|

|

Paper and Forest Products | | 0.4% | | | | | | | | | | | |

MeadWestvaco Corporation | | | | 8.400% | | 6/1/07 | | | 130 | | | 145 | |

Weyerhaeuser Company | | | | 5.500% | | 3/15/05 | | | 45 | | | 45 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 190 | |

| | | | | | | | | | | |

|

|

|

Pharmaceuticals | | 0.3% | | | | | | | | | | | |

Bristol-Myers Squibb Company | | | | 4.750% | | 10/1/06 | | | 120 | | | 124 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Retail | | 0.4% | | | | | | | | | | | |

Target Corporation | | | | 5.400% | | 10/1/08 | | | 150 | | | 159 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Special Purpose | | 2.2% | | | | | | | | | | | |

American Honda Finance Corporation | | | | 3.850% | | 11/6/08 | | | 34 | | | 34 | B |

ChevronTexaco Capital Company | | | | 3.500% | | 9/17/07 | | | 120 | | | 121 | |

DaimlerChrysler NA Holding Corporation | | | | 2.343% | | 9/10/07 | | | 340 | | | 341 | A |

Sprint Capital Corporation | | | | 7.900% | | 3/15/05 | | | 240 | | | 246 | |

Sprint Capital Corporation | | | | 4.780% | | 8/17/06 | | | 40 | | | 41 | |

Toyota Motor Credit Corporation | | | | 1.751% | | 2/15/05 | | | 125 | | | 125 | A |

Verizon Wireless Capital LLC | | | | 1.810% | | 5/23/05 | | | 50 | | | 50 | A,B |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 958 | |

| | | | | | | | | | | |

|

|

|

Telecommunications | | 0.3% | | | | | | | | | | | |

BellSouth Corporation | | | | 4.200% | | 9/15/09 | | | 110 | | | 110 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Telecommunications (Cellular/Wireless) | | 0.6% | | | | | | | | | | | |

AT&T Wireless Services Inc. | | | | 7.350% | | 3/1/06 | | | 160 | | | 170 | |

Motorola, Inc. | | | | 4.608% | | 11/16/07 | | | 80 | | | 82 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 252 | |

| | | | | | | | | | | |

|

|

|

15

Semi-Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | | |

| | | | | |

Telecommunications Equipment | | 0.4% | | | | | | | | | | | |

New York Telephone | | | | 6.000% | | 4/15/08 | | $ | 160 | | $ | 170 | |

| | | | | | | | | | | |

|

|

|

Total Corporate Bonds and Notes

(Identified Cost—$9,137) | | | | | | | | | | | | 9,141 | |

Asset-Backed Securities | | 24.2% | | | | | | | | | | | |

| | | | | |

Fixed Rate Securities | | 5.0% | | | | | | | | | | | |

ACE Security Corp. 2003-MH1 | | | | 2.200% | | 8/15/30 | | | 183 | | | 181 | B |

Aesop Funding II LLC 1998-1 | | | | 6.140% | | 5/20/06 | | | 250 | | | 254 | B |

Capital One Auto Finance Trust 2001-B A4 | | | | 4.880% | | 9/15/08 | | | 250 | | | 256 | |

Capital One Auto Finance Trust 2002-B | | | | 2.710% | | 10/16/06 | | | 159 | | | 160 | |

Hyundai Auto Receivables Trust 2002-A | | | | 2.800% | | 2/15/07 | | | 175 | | | 175 | B |

Onyx Acceptance Owner Trust 2002-D | | | | 3.100% | | 7/15/09 | | | 138 | | | 139 | |

Structured Asset Securities Corporation 2004-SC1 A | | | | 8.809% | | 12/25/29 | | | 284 | | | 302 | B |

UCFC Home Equity Loan 1998-D | | | | 6.905% | | 4/15/30 | | | 140 | | | 145 | |

UPFC Auto Receivables Trust 2004-A | | | | 3.270% | | 9/15/10 | | | 500 | | | 500 | |

Vanderbilt Mortgage Finance 2001-C | | | | 4.235% | | 8/7/14 | | | 42 | | | 42 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 2,154 | |

| | | | | | | | | | | |

|

|

|

Indexed SecuritiesA | | 19.2% | | | | | | | | | | | |

AmeriCredit Automobile Loan Trust 2003-BX | | | | 1.920% | | 1/6/10 | | | 30 | | | 30 | |

AmeriCredit Automobile Receivables Trust 2003-AM | | | | 1.956% | | 10/6/06 | | | 44 | | | 44 | |

AQ Finance Nim Trust 2003-N13 | | | | 2.070% | | 12/25/08 | | | 126 | | | 126 | B |

Bayview Financial Acquisition Trust 2004-C A1 | | | | 2.035% | | 5/28/44 | | | 414 | | | 415 | |

Capital Auto Receivables Asset Trust 2003-1 | | | | 1.810% | | 6/15/05 | | | 67 | | | 67 | |

Centex Home Equity 2002-D | | | | 2.280% | | 12/25/32 | | | 112 | | | 112 | |

Chase Credit Card Master Trust 2002-2 | | | | 2.660% | | 7/16/07 | | | 100 | | | 100 | |

Chase Funding Mortgage Loan Asset-Backed Certificates 2002-4 | | | | 2.210% | | 10/25/32 | | | 118 | | | 118 | |

Chase USA Master Trust 2000-1 | | | | 2.320% | | 8/17/09 | | | 200 | | | 199 | |

Chesapeake Funding LLC 2003-1 | | | | 1.946% | | 8/7/08 | | | 300 | | | 300 | |

Citibank Credit Card Issuance Trust 2000-C2 | | | | 2.250% | | 10/15/07 | | | 90 | | | 90 | |

Citibank Credit Card Issuance Trust 2002-C3 | | | | 3.020% | | 12/15/09 | | | 160 | | | 164 | |

Countrywide Asset-Backed Certificates 2000-4 | | | | 2.080% | | 12/25/31 | | | 125 | | | 125 | |

Countrywide Asset-Backed Certificates 2001-4 | | | | 2.180% | | 4/25/32 | | | 59 | | | 60 | |

Countrywide Asset-Backed Certificates 2002-3 | | | | 2.210% | | 5/25/32 | | | 79 | | | 79 | |

Countrywide Asset-Backed Certificates 2002-C | | | | 2.000% | | 5/15/28 | | | 94 | | | 94 | |

Countrywide Home Equity Loan Trust 2002-G | | | | 2.130% | | 12/15/28 | | | 957 | | | 959 | |

Countrywide Home Equity Loan Trust 2004-J | | | | 2.160% | | 3/25/32 | | | 800 | | | 800 | |

Countrywide Home Equity Loan Trust 2004-O | | | | 2.160% | | 2/15/34 | | | 390 | | | 390 | |

DSLA Mortgage Loan Trust 2004-ARI | | | | 2.070% | | 9/19/44 | | | 560 | | | 560 | |

16

PORTFOLIO OF INVESTMENTS—Continued

Western Asset Limited Duration Bond Portfolio—Continued

Semi-Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

Asset-Backed Securities—Continued | | | | | | | | | | | | | |

| | | | | |

Indexed Securities—Continued | | | | | | | | | | | | | |

EQCC Trust 2002-1 | | | | 2.140% | | 11/25/31 | | $ | 111 | | $ | 111 | |

First North American National Bank 2003-A | | | | 2.240% | | 5/16/11 | | | 220 | | | 221 | |

Irwin Home Equity Trust 2003-A | | | | 2.340% | | 10/25/27 | | | 90 | | | 90 | |

Metris Master Trust 2002-3A | | | | 2.111% | | 5/20/09 | | | 490 | | | 489 | |

Navistar Financial 2003-B Owner Trust | | | | 1.960% | | 4/15/08 | | | 200 | | | 200 | |

New Century Home Equity Loan Trust 2001-NC1 | | | | 2.101% | | 6/20/31 | | | 71 | | | 71 | |

Providian Gateway Master Trust 2002-B | | | | 2.460% | | 6/15/09 | | | 500 | | | 501 | B |

Rental Car Finance Corporation 2003-1A | | | | 2.240% | | 5/25/08 | | | 500 | | | 503 | B |

Rental Car Finance Corporation 2004-1A | | | | 2.040% | | 6/25/09 | | | 500 | | | 501 | B |

Residential Asset Securities Corporation 1999-KS1 | | | | 2.115% | | 3/25/29 | | | 148 | | | 148 | |

Structured Asset Securities Corporation 2002-BC1 A1 | | | | 2.340% | | 8/25/32 | | | 83 | | | 83 | |

Superior Wholesale Inventory Financing

Trust 2004-A10 | | | | 1.879% | | 9/15/11 | | | 500 | | | 499 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 8,249 | |

| | | | | | | | | | | |

|

|

|

Total Asset-Backed Securities

(Identified Cost—$10,417) | | | | | | | | | | | | 10,403 | |

Mortgage-Backed Securities | | 12.6% | | | | | | | | | | | |

| | | | | |

Fixed Rate Securities | | 1.6% | | | | | | | | | | | |

Asset Securitization Corporation 1996-D2 | | | | 6.920% | | 2/14/29 | | | 135 | | | 141 | |

Bank of America Mortgage Securities 2003-D | | | | 4.569% | | 5/25/33 | | | 314 | | | 314 | E |

Countrywide Alternative Loan Trust 2004-J1 | | | | 6.000% | | 2/25/34 | | | 126 | | | 128 | |

Residential Asset Mortgage Products, Inc. 2004-SL2 | | | | 8.500% | | 10/25/31 | | | 87 | | | 92 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 675 | |

| | | | | | | | | | | |

|

|

|

Indexed SecuritiesA | | 11.0% | | | | | | | | | | | |

Bear Stearns Commercial Mortgage Securities Incorporated 2004-ESA A1 | | | | 1.978% | | 5/14/16 | | | 250 | | | 250 | B |

Crusade Global Trust 2003-2 | | | | 2.100% | | 9/18/34 | | | 159 | | | 159 | |

Granite Mortgages PLC 2003-1 | | | | 1.820% | | 1/20/20 | | | 339 | | | 339 | |

Holmes Financing plc Series 6 | | | | 1.770% | | 4/15/08 | | | 300 | | | 300 | |

Impac CMB Trust 2002-8 | | | | 2.300% | | 3/25/33 | | | 121 | | | 121 | |

Impac CMB Trust 2003-12 | | | | 2.220% | | 12/25/33 | | | 416 | | | 416 | |

Impac Secured Assets Corp. 2004-3 | | | | 2.040% | | 11/25/34 | | | 496 | | | 495 | |

J.P. Morgan Chase Commercial Mortgage Securities Corp. 2003-FL2A | | | | 2.010% | | 11/15/16 | | | 177 | | | 177 | B |

Mall America Capital Company LLC 2000-1 | | | | 2.050% | | 3/12/10 | | | 250 | | | 250 | B |

Medallion Trust 2000-2G | | | | 2.110% | | 12/18/31 | | | 163 | | | 163 | |

Medallion Trust 2003-1G | | | | 2.100% | | 12/21/33 | | | 146 | | | 146 | |

Merrill Lynch Mortgage Investor, Inc. 2004-SL1 | | | | 2.100% | | 4/25/35 | | | 205 | | | 205 | |

17

Semi-Annual Report to Shareholders

PORTFOLIO OF INVESTMENTS—Continued

Western Asset Limited Duration Bond Portfolio—Continued

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

Mortgage-Backed Securities—Continued | | | | | | | | | | | | | |

| | | | | |

Indexed Securities—Continued | | | | | | | | | | | | | |

MLCC Mortgage Investors, Inc. 2003-H | | | | 2.865% | | 1/25/29 | | $ | 145 | | $ | 153 | |

Morgan Stanley Dean Witter Capital I Trust 2001-XLF | | | | 2.236% | | 10/7/13 | | | 103 | | | 103 | B |

Residential Asset Mortgage Products, Inc. 2002-RS6 | | | | 2.290% | | 11/25/32 | | | 163 | | | 164 | |

Sequoia Mortgage Trust 2003-2 A2 | | | | 1.620% | | 6/20/33 | | | 184 | | | 184 | |

Sequoia Mortgage Trust 2003-8 A1 | | | | 2.131% | | 1/20/34 | | | 446 | | | 446 | |

Torrens Trust 2000-1GA | | | | 2.020% | | 7/15/31 | | | 75 | | | 75 | B |

Washington Mutual 2004-AR8 | | | | 2.260% | | 6/25/44 | | | 590 | | | 590 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 4,736 | |

| | | | | | | | | | | |

|

|

|

Total Mortgage-Backed Securities

(Identified Cost—$5,419) | | | | | | | | | | | | 5,411 | |

U.S. Government and Agency Obligations | | 22.9% | | | | | | | | | | | |

| | | | | |

Fixed Rate Securities | | 17.2% | | | | | | | | | | | |

Fannie Mae | | | | 3.125% | | 7/15/06 | | | 860 | | | 866 | |

Fannie Mae | | | | 3.250% | | 2/15/09 | | | 440 | | | 434 | |

Fannie Mae | | | | 2.800% | | 3/1/19 | | | 260 | | | 259 | |

Federal Home Loan Bank | | | | 2.500% | | 3/30/06 | | | 870 | | | 869 | |

Federal Home Loan Bank | | | | 2.625% | | 10/16/06 | | | 450 | | | 448 | |

Freddie Mac | | | | 3.625% | | 11/14/08 | | | 430 | | | 432 | |

Freddie Mac | | | | 5.750% | | 3/15/09 | | | 400 | | | 434 | |

United States Treasury Notes | | | | 1.625% | | 9/30/05 | | | 2,600 | | | 2,586 | |

United States Treasury Notes | | | | 3.375% | | 9/15/09 | | | 1,060 | | | 1,060 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 7,388 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Indexed SecuritiesF | | 5.7% | | | | | | | | | | | |

United States Treasury Inflation-Protected Security | | | | 3.625% | | 1/15/08 | | | 1,114 | | | 1,221 | |

United States Treasury Inflation-Protected Security | | | | 3.000% | | 7/15/12 | | | 748 | | | 828 | |

United States Treasury Inflation-Protected Security | | | | 3.875% | | 4/15/29 | | | 311 | | | 413 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 2,462 | |

| | | | | | | | | | | |

|

|

|

Total U.S. Government and Agency Obligations

(Identified Cost—$9,818) | | | | | | | | | | | | 9,850 | |

U.S. Government Agency Mortgage-Backed Securities | | 2.0% | | | | | | | | | | | |

| | | | | |

Fixed Rate Securities | | 2.0% | | | | | | | | | | | |

Fannie Mae | | | | 5.500% | | 10/1/34 | | | 700 | | | 709 | G |

Government National Mortgage Association | | | | 5.000% | | 10/1/34 | | | 130 | | | 129 | G |

| | | | | | | | | | | |

|

|

|

Total U.S. Government Agency Mortgage-Backed

Securities (Identified Cost—$838) | | | | | | | | | | | | 838 | |

18

Semi-Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

Yankee BondsH | | 4.2% | | | | | | | | | | | |

| | | | | |

Banks | | 0.2% | | | | | | | | | | | |

The Korea Development Bank | | | | 4.750% | | 7/20/09 | | $ | 70 | | $ | 72 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Foreign Governments | | 0.6% | | | | | | | | | | | |

Republic of Chile | | | | 2.062% | | 1/28/08 | | | 40 | | | 40 | A |

Russian Federation | | | | 8.250% | | 3/31/10 | | | 60 | | | 65 | |

Russian Federation | | | | 8.250% | | 3/31/10 | | | 130 | | | 142 | B |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 247 | |

| | | | | | | | | | | |

|

|

|

Manufacturing (Diversified) | | 0.7% | | | | | | | | | | | |

Tyco International Group SA | | | | 4.436% | | 6/15/07 | | | 300 | | | 306 | B |

| | | | | | | | | | | |

|

|

|

| | | | | |

Retail | | 0.3% | | | | | | | | | | | |

Wal-Mart Stores Canada, Inc. | | | | 5.580% | | 5/1/06 | | | 140 | | | 146 | B |

| | | | | | | | | | | |

|

|

|

| | | | | |

Special Purpose | | 1.0% | | | | | | | | | | | |

BP Capital Markets Plc | | | | 2.750% | | 12/29/06 | | | 140 | | | 139 | |

Deutsche Telekom International Finance BV | | | | 8.250% | | 6/15/05 | | | 200 | | | 208 | |

Diageo Capital Plc | | | | 3.375% | | 3/20/08 | | | 100 | | | 100 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 447 | |

| | | | | | | | | | | |

|

|

|

Telecommunications | | 1.4% | | | | | | | | | | | |

British Telecommunications plc | | | | 7.875% | | 12/15/05 | | | 110 | | | 116 | |

Telecom Italia Capital | | | | 4.000% | | 1/15/10 | | | 220 | | | 218 | B |

Telefonos de Mexico SA de CV (Telmex) | | | | 8.250% | | 1/26/06 | | | 250 | | | 267 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 601 | |

| | | | | | | | | | | |

|

|

|

Total Yankee Bonds (Identified Cost—$1,815) | | | | | | | | | | | | 1,819 | |

| | | | | | | | | | | |

|

|

|

Total Long-Term Securities (Identified Cost—$37,444) | | | | | | | | | | | | 37,462 | |

19

Semi-Annual Report to Shareholders

PORTFOLIO OF INVESTMENTS—Continued

Western Asset Limited Duration Bond Portfolio—Continued

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR/

SHARES | | VALUE | |

Short-Term Securities | | 15.2% | | | | | | | | | | | |

| | | | | |

U.S. Government and Agency Obligations | | 0.1% | | | | | | | | | | | |

Fannie Mae | | | | 0.000% | | 4/1/05 | | $ | 30 | | $ | 30 | C,I |

| | | | | | | | | | | |

|

|

|

| | | | | |

Repurchase Agreements | | 15.1% | | | | | | | | | | | |

Goldman, Sachs & Company

1.85%, dated 9/30/04, to be repurchased at $6,525 on 10/1/04 (Collateral: $6,185 Fannie Mae notes, 5.5%, due 3/15/11, value $6,671) | | | | | | | | | 6,525 | | | 6,525 | |

| | | | | | | | | | | |

|

|

|

Total Short-Term Securities (Identified Cost—$6,555) | | | | | | | | | | | | 6,555 | |

Total Investments (Identified Cost—$43,999) | | 102.3% | | | | | | | | | | 44,017 | |

Other Assets Less Liabilities | | (2.3)% | | | | | | | | | | (971 | ) |

| | | | | | | | | | | |

|

|

|

| | | | | |

Net Assets | | 100.0% | | | | | | | | | $ | 43,046 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | |

| | | EXPIRATION | | ACTUAL

CONTRACTS | | APPRECIATION/

(DEPRECIATION) | |

Futures Contracts PurchasedJ | | | | | | | | |

U.S. Treasury Note Futures | | December 2004 | | 45 | | $ | (4 | ) |

| | | | | | |

|

|

|

Futures Contracts WrittenI | | | | | | | | |

U.S. Treasury Note Futures | | December 2004 | | 17 | | $ | 4 | |

| | | | | | |

|

|

|

| | | | | | | | | |

| A | Indexed security – The rates of interest earned on these securities are tied to the London Interbank Offered Rate (“LIBOR”), the Consumer Price Index (“CPI”), or the one-year Treasury Bill rate. The coupon rates are the rates as of September 30, 2004. |

| B | Rule 144a Security – A security purchased pursuant to Rule 144a under the Securities Act of 1933 which may not be resold subject to that rule except to qualified institutional buyers. These securities represent 10.65% of net assets. |

| C | Zero coupon bond – A bond with no periodic interest payments which is sold at such a discount as to produce a current yield to maturity. |

| D | Convertible security – Security may be converted into the issuer’s common stock. |

| E | Stepped coupon security – A security with a predetermined schedule of interest or dividend rate changes, at which time it begins to accrue interest or pay dividends. |

| F | Treasury Inflation-Protected Security – Treasury security whose principal value is adjusted daily in accordance with changes to the Consumer Price Index for All Urban Consumers. Interest is calculated on the basis of the current adjusted principal value. |

| G | When-issued security – Security purchased on a delayed delivery basis. Final settlement amount and maturity date have not yet been announced. |

| H | Yankee Bond – A dollar-denominated bond issued in the U.S. by foreign entities. |

| I | All or a portion of this security is collateral to cover futures contracts. |

| J | Futures are described in more detail in the notes to financial statements. |

See notes to financial statements.

20

Semi-Annual Report to Shareholders

PORTFOLIO OF INVESTMENTS

September 30, 2004 (Unaudited)

(Amounts in Thousands)

Western Asset Intermediate Bond Portfolio

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE | |

Long-Term Securities | | 91.4% | | | | | | | | | | | |

| | | | | |

Corporate Bonds and Notes | | 37.9% | | | | | | | | | | | |

| | | | | |

Aerospace/Defense | | 1.0% | | | | | | | | | | | |

Northrop Grumman Corporation | | | | 4.079% | | 11/16/06 | | $ | 1,270 | | $ | 1,290 | |

Raytheon Company | | | | 6.750% | | 8/15/07 | | | 1,510 | | | 1,652 | |

Systems 2001 Asset Trust | | | | 6.664% | | 9/15/13 | | | 1,709 | | | 1,898 | A |

United Technologies Corporation | | | | 6.350% | | 3/1/11 | | | 1,280 | | | 1,421 | B |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 6,261 | |

| | | | | | | | | | | |

|

|

|

Banking and Finance | | 3.9% | | | | | | | | | | | |

Boeing Capital Corporation | | | | 6.350% | | 11/15/07 | | | 1,530 | | | 1,656 | B |

Countrywide Home Loans, Inc. | | | | 2.875% | | 2/15/07 | | | 1,250 | | | 1,236 | |

Ford Motor Credit Company | | | | 2.790% | | 9/28/07 | | | 11,730 | | | 11,716 | C |

General Motors Acceptance Corporation | | | | 2.595% | | 5/18/06 | | | 1,500 | | | 1,504 | B,C |

General Motors Acceptance Corporation | | | | 2.510% | | 1/16/07 | | | 1,950 | | | 1,953 | C |

General Motors Acceptance Corporation | | | | 6.125% | | 8/28/07 | | | 805 | | | 848 | B |

General Motors Acceptance Corporation | | | | 3.080% | | 9/23/08 | | | 4,270 | | | 4,268 | C |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 23,181 | |

| | | | | | | | | | | |

|

|

|

Banks | | 1.3% | | | | | | | | | | | |

Bank of America Corporation | | | | 5.250% | | 2/1/07 | | | 1,100 | | | 1,153 | |

Bank of America Corporation | | | | 2.260% | | 9/15/14 | | | 2,170 | | | 2,166 | C |

BankBoston NA | | | | 6.375% | | 3/25/08 | | | 1,270 | | | 1,384 | |

U.S. Bank NA | | | | 2.870% | | 2/1/07 | | | 1,410 | | | 1,401 | |

Wachovia Corporation | | | | 3.625% | | 2/17/09 | | | 1,900 | | | 1,885 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 7,989 | |

| | | | | | | | | | | |

|

|

|

Cable | | 0.9% | | | | | | | | | | | |

Comcast Corporation | | | | 6.500% | | 1/15/15 | | | 530 | | | 572 | |

Continental Cablevision, Inc. | | | | 8.875% | | 9/15/05 | | | 3,096 | | | 3,267 | |

Cox Communications, Inc. | | | | 3.875% | | 10/1/08 | | | 1,110 | | | 1,070 | B |

Cox Communications, Inc. | | | | 4.625% | | 6/1/13 | | | 210 | | | 194 | |

TCI Communications, Inc. | | | | 8.000% | | 8/1/05 | | | 220 | | | 232 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 5,335 | |

| | | | | | | | | | | |

|

|

|

Chemicals | | 0.2% | | | | | | | | | | | |

E.I. du Pont de Nemours and Company | | | | 4.125% | | 4/30/10 | | | 1,270 | | | 1,281 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Computer Services and Systems | | 0.4% | | | | | | | | | | | |

Electronic Data Systems Corporation | | | | 7.125% | | 10/15/09 | | | 2,360 | | | 2,535 | B |

| | | | | | | | | | | |

|

|

|

21

Semi-Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | | |

| | | | | |

Diversified Financial Services | | 2.2% | | | | | | | | | | | |

CIT Group Inc. | | | | 1.940% | | 5/18/07 | | $ | 150 | | $ | 150 | C |

CIT Group Inc. | | | | 4.000% | | 5/8/08 | | | 1,410 | | | 1,424 | |

CIT Group Inc. | | | | 3.375% | | 4/1/09 | | | 150 | | | 146 | |

Citigroup Inc. | | | | 1.880% | | 6/4/07 | | | 1,220 | | | 1,219 | C |

Citigroup Inc. | | | | 5.625% | | 8/27/12 | | | 2,470 | | | 2,640 | |

General Electric Capital Corporation | | | | 1.762% | | 7/28/08 | | | 2,650 | | | 2,646 | C |

General Electric Capital Corporation | | | | 2.148% | | 9/15/14 | | | 1,530 | | | 1,527 | |

U.S. Bancorp | | | | 3.125% | | 3/15/08 | | | 1,500 | | | 1,477 | |

Wells Fargo & Company | | | | 1.980% | | 9/15/09 | | | 1,570 | | | 1,568 | C |

Wells Fargo & Company | | | | 5.000% | | 11/15/14 | | | 350 | | | 355 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 13,152 | |

| | | | | | | | | | | |

|

|

|

Drug and Grocery Store Chains | | 0.3% | | | | | | | | | | | |

Safeway Inc. | | | | 2.164% | | 11/1/05 | | | 740 | | | 741C | |

The Kroger Co. | | | | 6.200% | | 6/15/12 | | | 1,090 | | | 1,184 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 1,925 | |

| | | | | | | | | | | |

|

|

|

Electric | | 3.0% | | | | | | | | | | | |

American Electric Power Company, Inc. | | | | 6.125% | | 5/15/06 | | | 1,830 | | | 1,918 | B |

Carolina Power & Light Company | | | | 5.950% | | 3/1/09 | | | 1,175 | | | 1,258 | |

Commonwealth Edison Company | | | | 6.150% | | 3/15/12 | | | 325 | | | 362 | |

Dominion Resources, Inc. | | | | 5.700% | | 9/17/12 | | | 2,220 | | | 2,334 | |

DTE Energy Company | | | | 2.740% | | 6/1/07 | | | 1,480 | | | 1,480 | C |

FirstEnergy Corp. | | | | 6.450% | | 11/15/11 | | | 2,420 | | | 2,640 | |

General Electric Company | | | | 5.000% | | 2/1/13 | | | 3,110 | | | 3,198 | |

Niagara Mohawk Power Corporation | | | | 7.750% | | 10/1/08 | | | 2,150 | | | 2,447 | |

The Cleveland Electric Illuminating Company | | | | 5.650% | | 12/15/13 | | | 2,115 | | | 2,189 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 17,826 | |

| | | | | | | | | | | |

|

|

|

Energy | | 2.5% | | | | | | | | | | | |

Duke Energy Corporation | | | | 6.250% | | 1/15/12 | | | 1,330 | | | 1,448 | |

Exelon Corporation | | | | 6.750% | | 5/1/11 | | | 2,200 | | | 2,456 | |

MidAmerican Energy Holdings Company | | | | 5.875% | | 10/1/12 | | | 1,020 | | | 1,077 | |

Pacific Gas and Electric Company | | | | 3.600% | | 3/1/09 | | | 2,850 | | | 2,817 | B |

Progress Energy, Inc. | | | | 5.850% | | 10/30/08 | | | 1,250 | | | 1,330 | B |

Progress Energy, Inc. | | | | 7.100% | | 3/1/11 | | | 1,650 | | | 1,863 | B |

Sempra Energy | | | | 2.210% | | 5/21/08 | | | 1,930 | | | 1,928 | C |

TXU Energy Co. | | | | 2.380% | | 1/17/06 | | | 1,900 | | | 1,905 | A,C |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 14,824 | |

| | | | | | | | | | | |

|

|

|

22

PORTFOLIO OF INVESTMENTS—Continued

Western Asset Intermediate Bond Portfolio—Continued

Semi-Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | | |

| | | | | |

Environmental Services | | 0.6% | | | | | | | | | | | |

Waste Management, Inc. | | | | 7.000% | | 10/15/06 | | $ | 2,900 | | $ | 3,110 | |

Waste Management, Inc. | | | | 7.375% | | 8/1/10 | | | 200 | | | 231 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 3,341 | |

| | | | | | | | | | | |

|

|

|

Food, Beverage and Tobacco | | 2.7% | | | | | | | | | | | |

Altria Group, Inc. | | | | 7.000% | | 7/15/05 | | | 2,000 | | | 2,049 | |

Altria Group, Inc. | | | | 6.375% | | 2/1/06 | | | 460 | | | 475 | |

Altria Group, Inc. | | | | 5.625% | | 11/4/08 | | | 1,970 | | | 2,012 | B |

Kraft Foods Inc. | | | | 4.000% | | 10/1/08 | | | 3,740 | | | 3,763 | B |

Kraft Foods Inc. | | | | 5.625% | | 11/1/11 | | | 900 | | | 951 | |

Pepsi Bottling Holdings Inc. | | | | 5.625% | | 2/17/09 | | | 2,441 | | | 2,628 | A |

Philip Morris Companies, Inc. | | | | 7.125% | | 10/1/04 | | | 730 | | | 730 | |

Philip Morris Companies, Inc. | | | | 6.950% | | 6/1/06 | | | 1,390 | | | 1,458 | B |

Sara Lee Corporation | | | | 2.750% | | 6/15/08 | | | 2,050 | | | 2,006 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 16,072 | |

| | | | | | | | | | | |

|

|

|

Gas and Pipeline Utilities | | 0.4% | | | | | | | | | | | |

The Williams Companies, Inc. | | | | 8.125% | | 3/15/12 | | | 1,900 | | | 2,190 | B |

| | | | | | | | | | | |

|

|

|

| | | | | |

Insurance | | 0.5% | | | | | | | | | | | |

ACE INA Holdings Inc. | | | | 8.300% | | 8/15/06 | | | 1,610 | | | 1,757 | |

Loews Corporation | | | | 3.125% | | 9/15/07 | | | 1,240 | | | 1,214 | D |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 2,971 | |

| | | | | | | | | | | |

|

|

|

Investment Banking/Brokerage | | 4.6% | | | | | | | | | | | |

Credit Suisse First Boston USA | | | | 6.125% | | 11/15/11 | | | 2,220 | | | 2,419 | |

J.P. Morgan & Co. Incorporated | | | | 4.560% | | 2/15/12 | | | 2,190 | | | 2,365 | C |

J.P. Morgan Chase & Co. | | | | 2.160% | | 10/2/09 | | | 6,080 | | | 6,079 | C |

J.P. Morgan Chase Capital XIII | | | | 2.880% | | 9/30/34 | | | 1,500 | | | 1,485 | C |

Lehman Brothers Holdings Inc. | | | | 7.000% | | 2/1/08 | | | 495 | | | 546 | |

Lehman Brothers Holdings Inc. | | | | 3.500% | | 8/7/08 | | | 1,550 | | | 1,538 | B |

Merrill Lynch & Co., Inc. | | | | 4.125% | | 1/15/09 | | | 3,130 | | | 3,155 | |

Morgan Stanley | | | | 3.625% | | 4/1/08 | | | 250 | | | 251 | |

Salomon Smith Barney Holdings Inc. | | | | 6.250% | | 1/15/05 | | | 2,150 | | | 2,176 | |

The Bear Stearns Companies Inc. | | | | 2.875% | | 7/2/08 | | | 1,380 | | | 1,340 | |

The Bear Stearns Companies Inc. | | | | 5.700% | | 11/15/14 | | | 500 | | | 526 | |

The Goldman Sachs Group, Inc. | | | | 1.980% | | 7/23/09 | | | 1,880 | | | 1,882 | C |

The Goldman Sachs Group, Inc. | | | | 2.570% | | 9/29/14 | | | 3,980 | | | 3,980 | B,C |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 27,742 | |

| | | | | | | | | | | |

|

|

|

23

Semi-Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | | |

| | | | | |

Investment Management | | 0.5% | | | | | | | | | | | |

Dryden Investor Trust | | | | 7.157% | | 7/23/08 | | $ | 2,584 | | $ | 2,766 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Media | | 1.5% | | | | | | | | | | | |

America Online Inc. | | | | 0.000% | | 12/6/19 | | | 2,240 | | | 1,428 | D,E |

AOL Time Warner Inc. | | | | 6.875% | | 5/1/12 | | | 1,740 | | | 1,941 | |

Cox Enterprises, Inc. | | | | 8.000% | | 2/15/07 | | | 1,150 | | | 1,234A | |

Liberty Media Corporation | | | | 3.380% | | 9/17/06 | | | 1,365 | | | 1,380 | C |

Turner Broadcasting System, Inc. | | | | 8.375% | | 7/1/13 | | | 1,830 | | | 2,207 | |

Viacom Inc. | | | | 5.625% | | 8/15/12 | | | 730 | | | 765 | B |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 8,955 | |

| | | | | | | | | | | |

|

|

|

Medical Care Facilities | | 0.6% | | | | | | | | | | | |

HCA Inc. | | | | 8.750% | | 9/1/10 | | | 3,075 | | | 3,604 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Oil and Gas | | 3.4% | | | | | | | | | | | |

Amerada Hess Corporation | | | | 7.375% | | 10/1/09 | | | 2,440 | | | 2,742 | B |

Anadarko Petroleum Corporation | | | | 3.250% | | 5/1/08 | | | 1,720 | | | 1,700 | |

Apache Corporation | | | | 6.250% | | 4/15/12 | | | 2,280 | | | 2,555 | B |

ConocoPhillips | | | | 4.750% | | 10/15/12 | | | 1,620 | | | 1,643 | |

Panhandle Eastern Pipe Line Company | | | | 4.800% | | 8/15/08 | | | 315 | | | 323 | |

Pemex Project Funding Master Trust | | | | 8.500% | | 2/15/08 | | | 1,000 | | | 1,124 | |

Pemex Project Funding Master Trust | | | | 3.180% | | 6/15/10 | | | 5,080 | | | 5,133 | A,C |

Sonat Inc. | | | | 7.625% | | 7/15/11 | | | 4,880 | | | 4,807 | |

XTO Energy, Inc. | | | | 7.500% | | 4/15/12 | | | 560 | | | 658 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 20,685 | |

| | | | | | | | | | | |

|

|

|

Paper and Forest Products | | 0.8% | | | | | | | | | | | |

MeadWestvaco Corporation | | | | 6.850% | | 4/1/12 | | | 2,063 | | | 2,298 | |

Willamette Industries, Inc. | | | | 7.125% | | 7/22/13 | | | 2,270 | | | 2,569 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 4,867 | |

| | | | | | | | | | | |

|

|

|

Pharmaceuticals | | 0.2% | | | | | | | | | | | |

Bristol-Myers Squibb Company | | | | 5.750% | | 10/1/11 | | | 1,200 | | | 1,287 | B |

| | | | | | | | | | | |

|

|

|

| | | | | |

Retail | | 0.5% | | | | | | | | | | | |

Target Corporation | | | | 5.875% | | 3/1/12 | | | 1,320 | | | 1,437 | |

Wal-Mart Stores, Inc. | | | | 3.375% | | 10/1/08 | | | 600 | | | 596 | B |

Wal-Mart Stores, Inc. | | | | 4.125% | | 2/15/11 | | | 850 | | | 851 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 2,884 | |

| | | | | | | | | | | |

|

|

|

24

PORTFOLIO OF INVESTMENTS—Continued

Western Asset Intermediate Bond Portfolio—Continued

Semi-Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | | |

| | | | | |

Special Purpose | | 3.4% | | | | | | | | | | | |

DaimlerChrysler NA Holding Corporation | | | | 2.343% | | 9/10/07 | | $ | 4,710 | | $ | 4,715 | C |

DaimlerChrysler NA Holding Corporation | | | | 7.300% | | 1/15/12 | | | 2,170 | | | 2,465 | |

Devon Financing Corporation ULC | | | | 6.875% | | 9/30/11 | | | 2,500 | | | 2,821 | |

Sprint Capital Corporation | | | | 4.780% | | 8/17/06 | | | 1,970 | | | 2,025 | |

Sprint Capital Corporation | | | | 8.375% | | 3/15/12 | | | 4,540 | | | 5,499 | B |

Verizon Global Funding Corp. | | | | 7.250% | | 12/1/10 | | | 2,500 | | | 2,882 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 20,407 | |

| | | | | | | | | | | |

|

|

|

Telecommunications | | 0.7% | | | | | | | | | | | |

BellSouth Corporation | | | | 4.200% | | 9/15/09 | | | 2,300 | | | 2,313 | |

Pacific Bell | | | | 6.125% | | 2/15/08 | | | 1,800 | | | 1,939 | B |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 4,252 | |

| | | | | | | | | | | |

|

|

|

Telecommunications (Cellular/Wireless) | | 0.8% | | | | | | | | | | | |

AT&T Wireless Services Inc. | | | | 7.350% | | 3/1/06 | | | 500 | | | 531 | |

AT&T Wireless Services Inc. | | | | 8.125% | | 5/1/12 | | | 2,304 | | | 2,784 | |

Motorola, Inc. | | | | 4.608% | | 11/16/07 | | | 1,570 | | | 1,613 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 4,928 | |

| | | | | | | | | | | |

|

|

|

Transportation | | 1.0% | | | | | | | | | | | |

Continental Airlines, Inc. | | | | 6.545% | | 2/2/19 | | | 1,349 | | | 1,302 | |

Delta Air Lines, Inc. | | | | 6.619% | | 3/18/11 | | | 561 | | | 510 | |

Delta Air Lines, Inc. | | | | 6.718% | | 7/2/24 | | | 2,556 | | | 2,627 | |

U.S. Airways | | | | 6.850% | | 7/30/19 | | | 1,371 | | | 1,253 | |

Union Pacific Corporation | | | | 7.250% | | 11/1/08 | | | 250 | | | 280 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 5,972 | |

| | | | | | | | | | | |

|

|

|

Total Corporate Bonds and Notes

(Identified Cost—$222,977) | | | | | | | | | | | | 227,232 | |

Asset-Backed Securities | | 9.2% | | | | | | | | | | | |

| | | | | |

Fixed Rate Securities | | 2.0% | | | | | | | | | | | |

ABFS Mortgage Loan Trust 2002-3 | | | | 4.263% | | 9/15/33 | | | 3,189 | | | 3,226 | F |

Conseco Finance Securitizations Corp. 2000-4 | | | | 8.310% | | 5/1/32 | | | 800 | | | 689 | |

Ford Credit Auto Owner Trust 2002-B | | | | 4.140% | | 12/15/05 | | | 1,135 | | | 1,139 | |

Green Tree Financial Corporation 1994-6 | | | | 8.900% | | 1/15/20 | | | 3,800 | | | 4,113 | |

Mego Mortgage Home Loan Trust 1996-2 | | | | 7.275% | | 8/25/17 | | | 59 | | | 59 | |

UCFC Home Equity Loan 1998-D | | | | 6.905% | | 4/15/30 | | | 790 | | | 817 | |

WFS Financial Owner Trust 2002-2 | | | | 3.810% | | 2/20/07 | | | 1,982 | | | 1,990 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 12,033 | |

| | | | | | | | | | | |

|

|

|

25

Semi-Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE | |

Asset-Backed Securities—Continued | | | | | | | | | | | | | |

| | | | | |

Indexed SecuritiesC | | 6.9% | | | | | | | | | | | |

AFC Home Equity Loan Trust 2003-3 | | | | 2.190% | | 10/25/30 | | $ | 2,957 | | $ | 2,945 | A |

AmeriCredit Automobile Receivables Trust 2003-BX | | | | 1.876% | | 11/6/06 | | | 1,273 | | | 1,273 | |

Amresco Residential Securities Mortgage Loan Trust 1998-2 | | | | 2.390% | | 6/25/28 | | | 522 | | | 521 | |

Asset Backed Securities Corp. Home Equity Loan Trust 2002-HE2 | | | | 2.060% | | 8/15/32 | | | 909 | | | 909 | |

Capital One Auto Finance Trust 2003-A | | | | 1.920% | | 10/15/07 | | | 5,500 | | | 5,505 | |

CNH Equipment Trust 2003-A | | | | 1.940% | | 7/16/07 | | | 5,500 | | | 5,501 | |

Countrywide Asset-Backed Certificates 2002-BC1 | | | | 2.170% | | 4/25/32 | | | 2,376 | | | 2,379 | |

Household Home Equity Loan Trust 2002-3 | | | | 2.261% | | 7/20/32 | | | 2,370 | | | 2,373 | |

IndyMac Home Equity Loan Asset-Backed Trust 2001-A | | | | 2.100% | | 3/25/31 | | | 1,695 | | | 1,693 | |

MMCA Automobile Trust 2002-1 | | | | 2.040% | | 1/15/10 | | | 942 | | | 941 | |

Morgan Stanley ABS Capital I 2003-NC8 A2 | | | | 2.200% | | 9/25/33 | | | 3,341 | | | 3,350 | |

MSDWCC HELOC Trust 2003-1 | | | | 2.110% | | 11/25/15 | | | 3,879 | | | 3,880 | |

Paragon Hotel Finance Company 2003-CTF | | | | 3.260% | | 11/15/13 | | | 100 | | | 101 | A |

Residential Asset Securities Corporation 2003-KS1 | | | | 2.210% | | 1/25/33 | | | 3,888 | | | 3,896 | |

Saxon Asset Securities Trust 2003-3 | | | | 1.980% | | 12/25/33 | | | 553 | | | 553 | |

Sovereign Dealer Floor Plan Master LLC 2000-1A | | | | 2.010% | | 10/15/07 | | | 5,500 | | | 5,508 | A |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 41,328 | |

| | | | | | | | | | | |

|

|

|

Stripped Securities | | 0.3% | | | | | | | | | | | |

ACA CDS 2002-1, Ltd. | | | | 5.484% | | 7/15/08 | | | 7,600 | | | 646 | G1 |

Oakwood Mortgage Investors Inc. 2001-C | | | | 6.000% | | 5/15/08 | | | 5,320 | | | 800 | G1 |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 1,446 | |

| | | | | | | | | | | |

|

|

|

Total Asset-Backed Securities

(Identified Cost—$54,972) | | | | | | | | | | | | 54,807 | |

Mortgage-Backed Securities | | 5.9% | | | | | | | | | | | |

| | | | | |

Fixed Rate Securities | | 1.6% | | | | | | | | | | | |

Asset Securitization Corporation 1996-D2 | | | | 6.920% | | 2/14/29 | | | 842 | | | 879 | |

GMAC Commercial Mortgage Securities Inc. 1998-C1 | | | | 6.700% | | 5/15/30 | | | 1,000 | | | 1,091 | |

GMAC Commercial Mortgage Securities Inc. 1998-C2 | | | | 6.150% | | 5/15/35 | | | 1,079 | | | 1,096 | |

Merrill Lynch Mortgage Investors, Inc. 1998-C1 | | | | 6.310% | | 11/15/26 | | | 590 | | | 607 | |

Morgan Stanley Capital I 1995-GAL1 | | | | 7.950% | | 8/15/27 | | | 2,650 | | | 2,738 | A |

Nomura Asset Securities Corporation 1996-MD5 | | | | 7.120% | | 4/13/39 | | | 1,500 | | | 1,589 | |

Ocwen Residential MBS Corporation 1998-R1 | | | | 7.000% | | 10/25/40 | | | 649 | | | 662 | A,F |

Wells Fargo Mortgage Backed Securities Trust 2002-18 | | | | 5.500% | | 12/25/32 | | | 648 | | | 655 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 9,317 | |

| | | | | | | | | | | |

|

|

|

26

PORTFOLIO OF INVESTMENTS—Continued

Western Asset Intermediate Bond Portfolio—Continued

Semi-Annual Report to Shareholders

| | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE |

Mortgage-Backed Securities—Continued | | | | | | | | | | | | |

| | | | | |

Indexed SecuritiesC | | 4.3% | | | | | | | | | | |

Commerce 2002-Fl7 | | | | 2.110% | | 11/15/14 | | $ | 3,093 | | $ | 3,093A |

Countrywide Home Loans 2004-20 | | | | 3.626% | | 9/25/34 | | | 3,558 | | | 3,664 |

Countrywide Home Loans 2003-49 | | | | 3.697% | | 12/19/33 | | | 1,000 | | | 988 |

Credit Suisse First Boston Mortgage Securities Corp.

2003-TFLA1 | | | | 2.030% | | 4/15/13 | | | 5,420 | | | 5,421A |

Impac CMB Trust 2001-3 | | | | 2.210% | | 10/25/31 | | | 1,700 | | | 1,701 |

Impac CMB Trust 2002-5 | | | | 2.210% | | 7/25/32 | | | 1,995 | | | 1,999 |

Impac CMB Trust 2003-12 | | | | 2.220% | | 12/25/33 | | | 4,828 | | | 4,826 |

Wells Fargo Mortgage Backed Securities Trust 2004-S | | | | 3.542% | | 9/25/34 | | | 4,350 | | | 4,258 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 25,950 |

| | | | | | | | | | | |

|

|

Stripped Securities | | N.M. | | | | | | | | | | |

FFCA Secured Lending Corporation 1997-1 | | | | 0.434% | | 2/18/22 | | | 1,449 | | | 17A,G1 |

| | | | | | | | | | | |

|

|

Total Mortgage-Backed Securities

(Identified Cost—$35,698) | | | | | | | | | | | | 35,284 |

U.S. Government and Agency Obligations | | 31.2% | | | | | | | | | | |

| | | | | |

Fixed Rate Securities | | 29.2% | | | | | | | | | | |

Fannie Mae | | | | 5.500% | | 5/2/06 | | | 3,900 | | | 4,072 |

Fannie Mae | | | | 6.250% | | 2/1/11 | | | 2,900 | | | 3,202B |

Fannie Mae | | | | 6.125% | | 3/15/12 | | | 3,160 | | | 3,521 |

Fannie Mae | | | | 4.375% | | 3/15/13 | | | 3,540 | | | 3,520B |

Federal Home Loan Bank | | | | 2.625% | | 10/16/06 | | | 6,000 | | | 5,973B |

Freddie Mac | | | | 3.625% | | 11/14/08 | | | 6,320 | | | 6,347B |

Freddie Mac | | | | 5.800% | | 3/30/09 | | | 600 | | | 655 |

Freddie Mac | | | | 3.000% | | 4/15/09 | | | 4,410 | | | 4,295B |

Freddie Mac | | | | 4.500% | | 1/15/13 | | | 2,450 | | | 2,461B |

Overseas Private Investment Corporation | | | | 7.740% | | 8/15/07 | | | 3,000 | | | 3,253 |

Tennessee Valley Authority | | | | 5.625% | | 1/18/11 | | | 460 | | | 499 |

United States Treasury Bonds | | | | 2.375% | | 1/15/25 | | | 18,881 | | | 19,670 |

United States Treasury Notes | | | | 1.500% | | 3/31/06 | | | 9,410 | | | 9,287B |

United States Treasury Notes | | | | 2.750% | | 6/30/06 | | | 8,820 | | | 8,856B |

United States Treasury Notes | | | | 2.375% | | 8/15/06 | | | 30 | | | 30B |

United States Treasury Notes | | | | 2.250% | | 2/15/07 | | | 2,370 | | | 2,345B |

United States Treasury Notes | | | | 3.125% | | 5/15/07 | | | 3,860 | | | 3,893B |

United States Treasury Notes | | | | 4.375% | | 5/15/07 | | | 980 | | | 1,019B |

United States Treasury Notes | | | | 6.625% | | 5/15/07 | | | 2,290 | | | 2,511B |

United States Treasury Notes | | | | 2.750% | | 8/15/07 | | | 520 | | | 519B |

United States Treasury Notes | | | | 3.000% | | 2/15/08 | | | 680 | | | 680B |

United States Treasury Notes | | | | 2.625% | | 5/15/08 | | | 26,610 | | | 26,220B |

27

Semi-Annual Report to Shareholders

PORTFOLIO OF INVESTMENTS—Continued

Western Asset Intermediate Bond Portfolio—Continued

| | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE |

U.S. Government and Agency

Obligations—Continued | | | | | | | | | | | | |

| | | | | |

Fixed Rate Securities—Continued | | | | | | | | | | | | |

United States Treasury Notes | | | | 4.000% | | 6/15/09 | | $ | 47,210 | | $ | 48,586B |

United States Treasury Notes | | | | 3.500% | | 8/15/09 | | | 7,990 | | | 8,038B |

United States Treasury Notes | | | | 3.375% | | 9/15/09 | | | 60 | | | 60 |

United States Treasury Notes | | | | 4.000% | | 11/15/12 | | | 1,205 | | | 1,211B |

United States Treasury Notes | | | | 4.250% | | 8/15/14 | | | 4,305 | | | 4,350B |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 175,073 |

| | | | | | | | | | | |

|

|

Indexed SecuritiesH | | 1.3% | | | | | | | | | | |

United States Treasury Inflation-Protected Security | | | | 3.000% | | 7/15/12 | | | 1,485 | | | 1,645B |

United States Treasury Inflation-Protected Security | | | | 1.875% | | 7/15/13 | | | 722 | | | 734B |

United States Treasury Inflation-Protected Security | | | | 2.000% | | 7/15/14 | | | 322 | | | 329B |

United States Treasury Inflation-Protected Security | | | | 3.625% | | 4/15/28 | | | 3,783 | | | 4,799 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 7,507 |

| | | | | | | | | | | |

|

|

Stripped Securities | | 0.7% | | | | | | | | | | |

United States Treasury Bonds | | | | 0.000% | | 2/15/23 | | | 7,080 | | | 2,752B,G2 |

United States Treasury Notes | | | | 0.000% | | 5/15/30 | | | 6,490 | | | 1,729B,G2 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 4,481 |

| | | | | | | | | | | |

|

|

Total U.S. Government and Agency Obligations (Identified Cost—$184,047) | | | | | | | | | | | | 187,061 |

U.S. Government Agency Mortgage-

Backed Securities | | 0.5% | | | | | | | | | | |

| | | | | |

Fixed Rate Securities | | 0.5% | | | | | | | | | | |

Fannie Mae | | | | 7.250% | | 1/15/10 | | | 200 | | | 232 |

Fannie Mae | | | | 5.125% | | 1/2/14 | | | 1,300 | | | 1,324B |

Fannie Mae | | | | 6.500% | | 6/1/14 | | | 508 | | | 538 |

Fannie Mae | | | | 8.000% | | 9/1/15 | | | 136 | | | 145 |

Fannie Mae | | | | 9.500% | | 4/1/21 | | | 88 | | | 100 |

Freddie Mac | | | | 8.500% | | 7/1/06 | | | 1 | | | 1 |

Freddie Mac | | | | 6.500% | | 6/1/13 to 11/1/15 | | | 135 | | | 143 |

Freddie Mac | | | | 7.500% | | 4/1/17 | | | 7 | | | 8 |

Freddie Mac | | | | 9.300% | | 4/15/19 | | | 132 | | | 132 |

Freddie Mac | | | | 6.000% | | 12/15/28 | | | 504 | | | 506 |

28

Semi-Annual Report to Shareholders

| | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE |

U.S. Government Agency Mortgage-Backed Securities—Continued | | | | | | | | | | | | |

| | | | | |

Fixed Rate Securities—Continued | | | | | | | | | | | | |

Government National Mortgage Association | | | | 9.500% | | 9/15/05 | | $ | 13 | | $ | 14 |

Government National Mortgage Association | | | | 9.000% | | 6/15/06 | | | 37 | | | 38 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 3,181 |

| | | | | | | | | | | |

|

|

Stripped Securities | | N.M. | | | | | | | | | | |

Fannie Mae | | | | 0.000% | | 5/25/22 | | | 22 | | | 19G2 |

Freddie Mac | | | | 10.000% | | 3/1/21 | | | 18 | | | 4G1 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 23 |

| | | | | | | | | | | |

|

|

Variable Rate SecuritiesI | | N.M. | | | | | | | | | | |

Fannie Mae | | | | 3.191% | | 3/1/18 | | | 50 | | | 51 |

Freddie Mac | | | | 3.612% | | 1/1/19 | | | 19 | | | 19 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 70 |

| | | | | | | | | | | |

|

|

Total U.S. Government Agency Mortgage-

Backed Securities (Identified Cost—$3,252) | | | | | | | | | | | | 3,274 |

Yankee BondsJ | | 6.5% | | | | | | | | | | |

| | | | | |

Banking and Finance | | 0.3% | | | | | | | | | | |

HBOS Treasury Services plc | | | | 4.000% | | 9/15/09 | | | 1,530 | | | 1,534A |

| | | | | | | | | | | |

|

|

| | | | | |

Banks | | 1.6% | | | | | | | | | | |

HSBC Holdings plc | | | | 7.500% | | 7/15/09 | | | 5,700 | | | 6,564 |

The Korea Development Bank | | | | 4.250% | | 11/13/07 | | | 60 | | | 61 |

The Korea Development Bank | | | | 5.750% | | 9/10/13 | | | 2,770 | | | 2,920 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 9,545 |

| | | | | | | | | | | |

|

|

Diversified Financial Services | | 0.5% | | | | | | | | | | |

Pemex Finance LTD. | | | | 7.800% | | 2/15/13 | | | 2,400 | | | 2,830 |

| | | | | | | | | | | |

|

|

| | | | | |

Electric | | 0.3% | | | | | | | | | | |

SP PowerAssets Limited | | | | 5.000% | | 10/22/13 | | | 1,965 | | | 1,991A |

| | | | | | | | | | | |

|

|

| | | | | |

Foreign Governments | | 0.9% | | | | | | | | | | |

Russian Federation | | | | 5.000% | | 3/31/30 | | | 4,640 | | | 4,463 |

United Mexican States | | | | 8.375% | | 1/14/11 | | | 850 | | | 997 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 5,460 |

| | | | | | | | | | | |

|

|

Insurance | | 0.1% | | | | | | | | | | |

XL Capital plc | | | | 6.500% | | 1/15/12 | | | 700 | | | 768 |

| | | | | | | | | | | |

|

|

29

Semi-Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | | VALUE |

Yankee Bonds—Continued | | | | | | | | | | | | | |

| | | | | |

Manufacturing (Diversified) | | 1.1% | | | | | | | | | | | |

Tyco International Group SA | | | | 5.875% | | 11/1/04 | | $ | 1,000 | | | $ | 1,003 |

Tyco International Group SA | | | | 6.375% | | 6/15/05 | | | 1,000 | | | | 1,026 |

Tyco International Group SA | | | | 4.436% | | 6/15/07 | | | 3,350 | | | | 3,423A |

Tyco International Group SA | | | | 6.375% | | 10/15/11 | | | 180 | | | | 199 |

Tyco International Group SA | | | | 6.000% | | 11/15/13 | | | 1,020 | | | | 1,101 |

| | | | | | | | | | | | |

|

|

| | | | | | | | | | | | | | 6,752 |

| | | | | | | | | | | | |

|

|

Special Purpose | | 0.8% | | | | | | | | | | | |

Deutsche Telekom International Finance BV | | | | 8.500% | | 6/15/10 | | | 1,300 | | | | 1,558 |

Diageo Capital Plc | | | | 3.375% | | 3/20/08 | | | 2,090 | | | | 2,082 |

Petrozuata Finance, Inc. | | | | 8.220% | | 4/1/17 | | | 1,090 | | | | 1,074A |

| | | | | | | | | | | | |

|

|

| | | | | | | | | | | | | | 4,714 |

| | | | | | | | | | | | |

|

|

Telecommunications | | 0.9% | | | | | | | | | | | |

Koninklijke KPN NV | | | | 8.000% | | 10/1/10 | | | 1,600 | | | | 1,903 |

Telecom Italia Capital | | | | 4.000% | | 1/15/10 | | | 3,550 | | | | 3,523A |

| | | | | | | | | | | | |

|

|

| | | | | | | | | | | | | | 5,426 |

| | | | | | | | | | | | |

|

|

Total Yankee Bonds (Identified Cost—$37,816) | | | | | | | | | | | | | 39,020 |

Preferred Stocks | | 0.2% | | | | | | | | | | | |

Home Ownership Funding Corporation | | | | 13.331% | | | | | 6 | shs | | | 247A,F |

Home Ownership Funding Corporation II | | | | 13.338% | | | | | 18 | | | | 740A,F |

| | | | | | | | | | | | |

|

|

Total Preferred Stocks (Identified Cost—$1,942) | | | | | | | | | | | | | 987 |

| | | | | | | | | | | | |

|

|

Total Long-Term Securities (Identified Cost—$540,704) | | | | | | | | | | | 547,665 |

Investment of Proceeds From Securities Lending | | 25.1% | | | | | | | | | | | |

State Street Navigator Securities Lending Prime Portfolio | | | | | | | | | 150,568 | | | | 150,568 |

| | | | | | | | | | | | |

|

|

Total Investment of Proceeds From Securities Lending (Identified Cost—$150,568) | | | | | | | | | | | | | 150,568 |

Short-Term Securities | | 7.2% | | | | | | | | | | | |

| | | | | |

U.S. Government and Agency Obligations | | 0.1% | | | | | | | | | | | |

Fannie Mae | | | | 0.000% | | 4/1/05 | | $ | 470 | | | | 465E,K |

| | | | | | | | | | | | |

|

|

| | | | | |