UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Investment Company Act file number: 811-06113

The Caldwell & Orkin Funds, Inc.

(Exact name of registrant as specified in charter)

5185 Peachtree Parkway, Suite 370, Norcross, GA 30092-6541

(Address of principal executive offices) (Zip code)

Michael B. Orkin

5185 Peachtree Parkway, Suite 370, Norcross, GA 30092-6541

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code: 678-533-7850

Date of fiscal year end: April 30

Date of reporting period: May 1, 2010 - October 31, 2010

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

| Item 1. | Report to Stockholders. |

| | |

| | Caldwell & Orkin |

Table of Contents | | Market Opportunity Fund |

October 31, 2010 | | |

| | |

| | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Shareholder Letter |

| | October 31, 2010 |

| | | | |

| Investment Adviser | |  | | Shareholder Accounts |

| C&O Funds Advisor, Inc. | | | c/o ALPS Fund Services, Inc. |

| 5185 Peachtree Parkway, | | | P.O. Box 46256 |

| Suite 370 | | | Denver, Colorado 80201 |

| Norcross, Georgia | | | (800) 467-7903 |

| 30092-6541 | | | |

| (800) 237-7073 | | | |

| | |

| Dear Fellow Shareholder: | | | | December 22, 2010 |

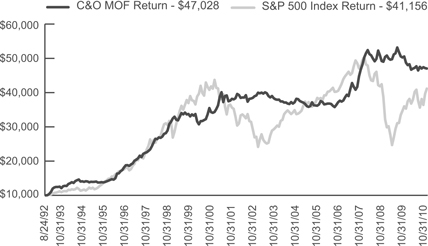

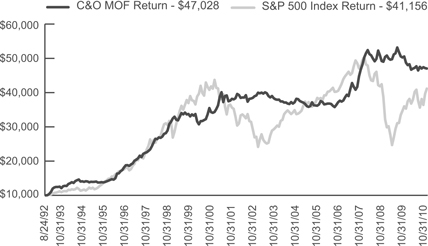

The Caldwell & Orkin Market Opportunity Fund (the “Fund”) dipped -1.33% in the 6-month period ended October 31, 2010. The S&P 500 Total Return Index (“S&P 500”) inched up 0.74% during the same period. For the 12 months ended October 31, 2010, the Fund slipped -3.49%, compared to a gain of 16.52% for the S&P 500. Since commencement of active management on August 24, 1992 through October 31, 2010, the Fund has generated an 8.88% compounded annual return, bettering the S&P 500’s 8.08% compounded annual return. The Fund’s total return from August 24, 1992 through October 31, 2010 has been 370.28%, compared to the S&P 500’s total return of 311.56%. Please see standardized performance figures on page 7.

The performance data quoted represents past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Please call 800-237-7073 or visit www.CaldwellOrkinFunds.com for current month-end performance. The Fund’s performance assumes the reinvestment of dividends and capital gains, if any.

Total annualized Fund operating expenses for the Fund’s fiscal year ended April 30, 2010 were 1.72%. Excluding interest and dividend expenses from securities sold short, the Fund’s operating expenses for the same period were 1.12%. Additional information about the Fund’s fees and expenses is available in the Fund’s prospectus.

The Fund has achieved these results while maintaining a low market risk profile and with little reliance on the movement of the stock market (see pages 7, 9, 10 and 11). Since we began actively managing the Fund on August 24, 1992, the Fund’s price movements have had virtually no correlation (0.39%) with the price movements of the S&P 500 as measured by R, the correlation coefficient. An S&P 500 index fund has nearly a 100% correlation to the market in any given period. The Fund’s lack of correlation to the index indicates that its performance is not attributable to that of the market. Additionally, given the Fund’s low correlation to the S&P 500, deviations in Fund performance relative to the S&P 500’s performance are to be expected. (Statistical computations by Ned Davis Research, Inc. (“NDR”)).

Management Discussion and Analysis

The Market Opportunity Fund opened the semi-annual period on May 1, 2010 68% invested and 36% net long. Technology companies represented our largest long sector focus (15%) - and within that sector, semiconductor firms were the largest industry concentration (8%) - followed by the communications (8%) and energy sectors (7%). The lion’s share of energy sector stocks (6%) were

| | |

Semi-Annual Report (Unaudited) | October 31, 2010 | | 1 |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Shareholder Letter |

| | October 31, 2010 |

in the exploration and production industries, and our major focus there was natural gas. On the short side of the portfolio, Alliance Data Systems Corp. (ADS), a private-label credit card company that caters to the sub-prime market was our largest single position (-1%). Emerging country exchange-traded funds (“ETFs”) and U.S. Treasury Bond ETFs were also relatively large short sector investments with each at -2%. We had 66 positions on the long side, and 22 on the short side. We also held 6% of the portfolio in high-grade corporate bonds.

A macro theme we’ve followed for many years has been the growth of government, corporate and personal debt, and its effect on the economy and the markets. Our nervousness about debt has taken on even more urgency given the issues facing the Eurozone, the U.S. government, and states and municipalities in the U.S. (many of which have resorted to selling off public buildings, slashing programs and releasing prisoners early to save money and raise cash to meet current obligations). We continue to worry about debt and remain vigilant about the U.S.’s ability to handle its financial obligations.

The first half of the Fund’s fiscal year was a rather lackluster time in the equity markets. As mentioned, the S&P 500 was up 0.74% for the six months, and the broader Wilshire 5000 Total Market Index was up just 0.48%. The Russell 2000 index fell -1.85%. The initial bullish overtones of the Federal Reserve’s (the “Fed”) historic easing campaign were somewhat overshadowed by a significant slowing of U.S. money supply growth, European debt crises, the BP oil disaster in the Gulf of Mexico, the housing crisis, a lackluster economic recovery and persistently high unemployment.

On April 6, market concerns about Greece grew significantly, reflected by investors selling Greek bonds and sending bond yields to 7.1%. Confidence was further shaken when on April 22 the European Union revealed that the Greek budget deficit in 2009 was 13.6% of gross domestic product (GDP), more than the Greek government’s estimate of 12.7%. Moody’s then lowered Greece’s government bond rating and said further downgrades were possible. The following day Greek Prime Minister George Papandreou said “the time has come” for Greece to request aid from the Eurozone and International Monetary Fund (“IMF”). On May 2, 2010 Greece reached a bailout deal with other Eurozone countries and the IMF.

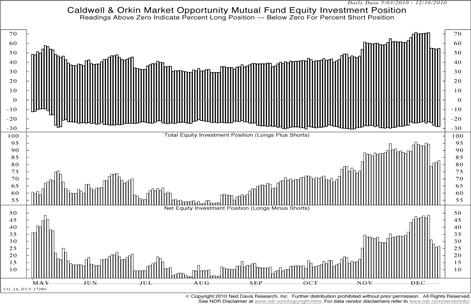

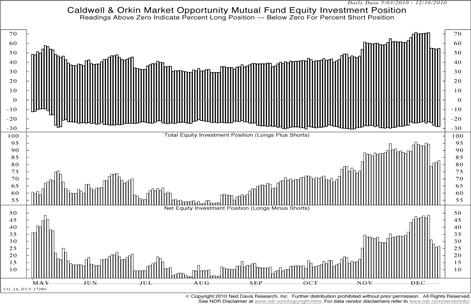

Greece may have become the poster-child of what could well happen throughout western civilization as European and the U.S. governments are forced to reduce debt levels and reign-in services while trying to stimulate economic growth. By late May the risk climate turned more negative as European debt crisis concerns mounted and economic liquidity fell. We reduced the Fund’s total and net exposure, and from mid-May through the end of the review period the Fund averaged 13% net long and 72% invested. While we did keep our net invested position relatively low during that timeframe, our total invested position did fluctuate quite a bit from a low of about 60% in the late-July / early-August timeframe, increasing to a high of 86% in late October (see the Equity Investment Position chart on page 11). Note that the net position reference represents long and short stock positions, and excludes options and corporate bonds.

The market suffered a setback during this period, with the S&P 500 falling -14.60% between April 26, 2010 and June 30, 2010. The Fund dipped -1.08% as the shorts kicked in, returning 20.52%.

On the long side, our best equity performer was Sybase, Inc. (SY), a software services company. That position, which was liquidated in mid-May when it was acquired by German business

| | |

2 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Shareholder Letter |

| | October 31, 2010 |

software company SAP AG, contributed 0.55% to overall Fund performance. Our worst-performing longs included Popular, Inc. (BPOP) and Helix Energy Solutions Group, Inc. (HLX). Collectively, the top five long contributors added 2.32% to performance, and our five worst-performing longs cost the Fund -1.79% in overall performance.

On the short side of the portfolio, our thematic play against the for-profit education industry paid off. Corinthian Colleges, Inc., (COCO) returned 1.12%, followed by ITT Educational Services, Inc. (ESI), Career Education Corp. (CECO) and Apollo Group, Inc. (APOL). Four of our best five short picks were education stocks, and collectively they contributed 2.37% to Fund performance.

The short positions that detracted most from Fund performance during the review period included Rackspace Hosting, Inc. (RAX), a web hosting and design concern, Veeco Instruments, Inc. (VECO), American Eagle Outfitters, Inc. (AEO), big-box retailer Best Buy, Inc. (BBY) and apparel manufacturer Under Armour, Inc. (UA). Collectively, our five worst-performing shorts cost the Fund -1.60% in overall performance.

During the six months ended October 31, 2010 the greatest portfolio positioning change in the long portfolio was in the technology sector. We opened May 1, 2010 with a 15% long tech sector allocation (8% of which was semiconductor industry related), and closed October 31 with a 4% tech position (2% in semis.) Additionally, our tech exposure on the short side went from -1% to -6% (semis went from 0% to -4%). Our semi focus on the long side was primarily smartphone-related, and on the short side mostly PC-related.

Another long sector we pulled back on was energy. The Fund’s long allocation went from a 7% position to a 3% position by October 31. The sector ran into some turbulence for a number of reasons including the BP oil spill, the resulting prospect for enhanced government regulation and oversight and falling natural gas prices. We used it as an opportunity to lock in gains. We are still bullish on natural gas, and since October 31 we’ve added to our long energy position. The day after the November elections President Obama twice mentioned natural gas as an energy source he would support. Other tailwinds for natural gas include the heavy switchover activity (particularly among utilities) away from coal and oil towards natural gas, a relatively low carbon emitting energy source, and a collective movement towards shifting to using energy sources produced in our own country.

The largest sector movement among the shorts was in the consumer non-cyclical sector. Non-cyclical stocks are generally defensive issues that do well in economic downturns since demand for their products and services continues regardless of the economy. This sector includes the for-profit education industry (listed as “Schools” in the Schedule of Investments). Our opening allocation to the sector May 1, 2010 was -2% (which included one very small education position), and we closed October 31, 2010 with a -10% sector allocation, of which -6% was to schools. Again, our shorts and put options in this area did well during the review period. Of note, The Washington Post Co. (WPO) appears in the Schedule of Investments under “Schools.” While WPO does indeed run a newspaper of the same name, we consider the company to be more of a for-profit education concern than a media conglomerate as the majority of their profits are derived from an education subsidiary (Kaplan). The newspaper side of the business is bleeding red ink.

| | |

Semi-Annual Report (Unaudited) | October 31, 2010 | | 3 |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Shareholder Letter |

| | October 31, 2010 |

We also increased exposure to the consumer cyclical sector, which includes retailers, in both the long and short portfolios. The long consumer cyclical allocation went from 4% to 10%, and the short allocation dropped from -1% to -5%. Similar to the technology holdings, each purchase and short was for stock-specific reasons.

In the communications sector, we added to the long side (going from 8% to 10%), particularly in the telecommunications industry (4% to 7%). Our major focus in this sector are companies revolving around the smartphone industry - cell phone manufacturers, cell phone tower operators, the components that go into cell phones, etc. The asset re-allocations on the long side during the period were beneficial for the Fund as the communications sector did well during the review period.

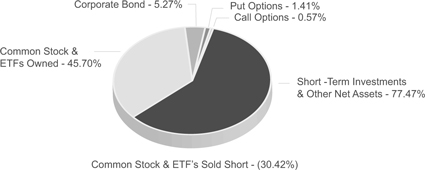

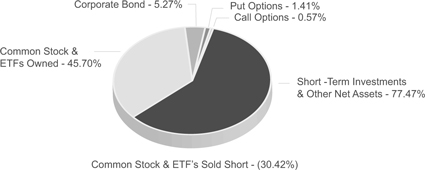

The Market Opportunity Fund closed the semi-annual period on October 31, 2010 positioned 46% long, -30% short (16% net long), 1% in put options, 1% in call options, 5% in corporate bonds and 17% in cash & equivalents. As detailed on pages 14 and 15, wireless equipment operators represented our largest long industry (4%), and schools were the greatest short industry exposure at -6%. Over the course of the six months ended October 31, 2010, the longs declined -3.44%, and the shorts returned 4.46%.

Outlook

Despite many headwinds, the U.S. economy is showing some signs of life. Ed Hyman’s ISI Group, Inc. has increased its forecast for real GDP growth in 2011 from below-trend 2.0% to above-trend 3.0%. After slogging through four quarters of negative real GDP growth between Q2 2008 and Q2 2009, the U.S. economy posted a positive quarterly growth rate of 1.60% in Q3 2009, and has remained in positive territory since. The economy grew a revised 2.52% in Q3 2010. Hyman cites several catalysts behind the forecast change: policy initiatives such as the Fed’s QE2, probable tax cut extensions, continued stock market gains and the easing of Eurozone financial strains with the European Central Bank buying sovereign bonds. But there are significant risks. A big risk is more tightening by the People’s Bank of China in response to inflation accelerating, putting a damper on stock prices around the world. Additional risks: housing prices in the U.S. remain depressed and unstable, the U.S. unemployment rate ticked up to 9.8% in November, the recurring Eurozone sovereign debt crises and the aforementioned state and local government budget woes.

Given QE2’s positive impact on money supply growth, a marginally improving economy and a more business-friendly policy outlook, we remain cyclically (shorter-term) bullish. However, behind this cyclical backdrop the secularly (longer-term) bearish reality of an over-leveraged economy remains.

On behalf of all of us at Caldwell & Orkin, I thank you for your continued support and wish you a happy and healthy New Year.

Sincerely,

Michael B. Orkin, CFA

Portfolio Manager and Chief Investment Officer

| | |

4 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Shareholder Letter |

| | October 31, 2010 |

Postscript

In managing the Fund for risk as well as return our goal is to make money over a full market cycle, which includes both bull market (rising) and bear market (falling) cycles, but with less stomach churn. NDR computed what they consider to be bull and bear market cycles for the S&P 500 going back to the Fund’s commencement of active management. NDR’s analysis shows that during the four full market cycles going back to 1992, the Fund has lagged the market during the bull phases, and outperformed during the bear phases, though not necessarily with positive returns. Importantly, the Fund has outperformed the S&P 500 during each of the four full market cycles. Notably, the Fund’s performance has had virtually no correlation (0.39%) to the performance of the S&P 500 as measured by R, the correlation coefficient. An S&P 500 index fund would have a correlation coefficient of nearly 100%. NDR’s analysis is available on the Fund’s website, www.CaldwellOrkinFunds.com under the “Risk Profile Data” tab.

The Fund’s investment objective is to provide long-term capital growth with a short-term focus on capital preservation. Our philosophy in managing the Fund is to focus on risk as well as return. We use active asset allocation - the opportunistic shifting of assets between long stock positions, short stock positions (selling borrowed stock and attempting to replace the borrowed securities in the future at a lower price), options, bonds and cash equivalents - to manage exposure to market risk (the risk that the broad market declines, taking good companies down with it). The Fund may hold up to 60% of its net assets in short positions at any time and also invest in options. Short positions and put options are employed with the intent of making money when those stocks we judge to be mispriced fall. When we use short positions or put options, the Fund’s portfolio is considered to be “hedged,” so that it is not fully exposed to the price movements and volatility of the broader market. Our asset allocation determinations are primarily based on our perception of risk in the marketplace. In summary, our goal is to make money over a full market cycle, but with less stomach churn.

The Fund’s disciplined investment philosophy and active management style typically leads to higher-than-average portfolio turnover. High turnover may have an unfavorable impact on the amount of taxable distributions paid to shareholders. Higher turnover may also result in higher brokerage costs for the Fund. The Fund’s turnover rate will typically exceed 100% per year, and will not be a limiting factor when we deem change appropriate. Fund holdings, industry and asset allocations are subject to change without notice. The Fund may or may not have a position in any of the companies mentioned in this commentary as of the date of this report.

An investment in the Fund involves risk, including the loss of principal. Additionally, there are certain risks inherent in investing in the Fund, including market risk, short sale risk, interest rate risk, business risk, small company risk, market valuation risk, political risk, and portfolio turnover risk. For a complete discussion of these risks, you may request a copy of the Fund’s prospectus by calling 800-237-7073. The Fund uses aggressive investment strategies (including short positions and options) that have the potential for yielding high returns; however, these strategies may also result in losses. Stocks sold short have unlimited risk. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Options are not suitable for all investors.

Investors should expect that the Fund’s performance may fluctuate independently of stock market indices, such as the S&P 500 Total Return Index.

Distributed by ALPS Distributors, Inc., Member FINRA/SIPC

1290 Broadway, Suite 1100, Denver, CO 80203

| | |

Semi-Annual Report (Unaudited) | October 31, 2010 | | 5 |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Shareholder Letter |

| | October 31, 2010 |

Statistical Risk Definitions:

Correlation Coefficient (R): R is a statistical measure of correlation. In this report, R is a measurement of investment risk that indicates how closely performance is linked to the broad market – it quantifies the degree to which a fund’s performance correlates with the performance of a benchmark. R can vary between 100% (perfect positive correlation) and –100% (perfect negative correlation). 0% represents no correlation. An R of 100% means that all movements of a fund are fully explained by movements in its benchmark index. Conversely, a low R indicates that very few of the fund’s movements are explained by movements in its benchmark index, and a negative R indicates a fund’s movements are inversely correlated with its benchmark index.

Coefficient of Determination (R-Square): R-Square, also represented as R2, is another measurement of investment risk that quantifies the degree to which a fund’s performance correlates with the performance of its benchmark index. R-Square is calculated by multiplying the Correlation Coefficient (R) by itself, and is therefore always positive. R-Square can vary between 0% (no correlation) and 100% (perfect correlation). The higher the value of R-Square, the greater the degree of correlation between the fund and its benchmark index. R-squared does not take into account the direction of the correlation (positive or negative), therefore R-Squared is not able to reflect inverse correlation between a fund and its benchmark index.

Beta: A measure of a fund’s sensitivity to market movements. Usually the higher betas represent riskier investments. When correlation is low, beta has minimal, if any, significance.

Standard deviation: A statistical measure of dispersion about an average, indicating the volatility of a fund’s total returns.

Sharpe Ratio: The Sharpe Ratio is calculated by subtracting the risk-free (T-bill) rate of return from a portfolio’s total return and then dividing this by its standard deviation. The resulting fraction can be thought of as return per unit of risk. The higher a portfolio’s Sharpe Ratio, the better the risk-adjusted performance.

Semi-variance: A measure of a fund’s downside (negative return) volatility relative to a benchmark. Lower numbers are associated with less risk.

Index Definitions:

Russell 2000 Index: The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000 provides a comprehensive and unbiased small-cap barometer and is completely reconstituted annually.

S&P 500 Total Return Index: The S&P 500 Total Return Index is a capitalization-weighted, unmanaged index of 500 large U.S. companies chosen for market size, liquidity and industry group representation and includes reinvested dividends. You cannot invest directly in an index.

Wilshire 5000 Total Market Index: The Wilshire 5000 Total Market Index represents the broadest index for the U.S. equity market, measuring the performance of all U.S. equity securities with readily available price data.

You may not invest directly in an index.

Other Definition:

QE2: QE2 is the name Wall Street has given to the Federal Reserve’s second round of quantitative easing, a monetary policy whereby the Fed buys securities in the open market (in this case Treasury bonds) in an effort to stimulate the economy.

| | |

6 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Performance Summary |

| | October 31, 2010 (Unaudited) |

| | | | |

Fiscal Year Ended April 30, 2010 | | C&O Market Opportunity Fund(1) | | S&P 500 Total

Return Index(2) |

1991 | | 1.25% | | 0.42% |

1992 | | 11.96% | | 14.03% |

1993* | | 15.09% | | 9.24% |

1993** | | 21.09% | | 9.18% |

1994 | | 16.48% | | 5.32% |

1995 | | -2.28% | | 17.47% |

1996 | | 31.80% | | 30.21% |

1997 | | 23.24% | | 25.13% |

1998 | | 25.77% | | 41.07% |

1999 | | 19.43% | | 21.82% |

2000 | | -0.02% | | 10.13% |

| | | | |

Fiscal Year Ended April 30, 2010 | | C&O Market Opportunity Fund(1) | | S&P 500 Total Return Index(2) |

2001 | | 11.43% | | -12.97% |

2002 | | 1.88% | | -12.63% |

2003 | | 1.12% | | -13.31% |

2004 | | -3.55% | | 22.88% |

2005 | | -0.17% | | 6.34% |

2006 | | -2.74% | | 15.42% |

2007 | | 15.31% | | 15.24% |

2008 | | 17.92% | | -4.68% |

2009 | | 4.73% | | -35.31% |

2010 | | -7.40% | | 38.84% |

| | | | |

Total Return Through October 31, 2010 | | | | |

6 months ended | | -1.33% | | 0.74% |

12 months ended | | -3.49% | | 16.52% |

Since 8/24/92 (3) | | 370.28% | | 311.56% |

| | | | |

Average Annual Returns Through October 31, 2010 | | | | |

One Year | | -3.49% | | 16.52% |

Three Years | | -2.20% | | -6.49% |

Five Years | | 4.76% | | 1.73% |

Ten Years | | 2.64% | | -0.02% |

Since 8/24/92(3) | | 8.88% | | 8.08% |

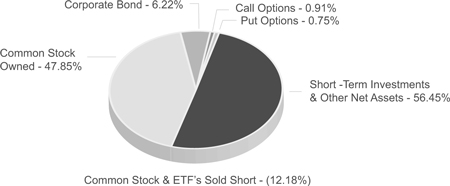

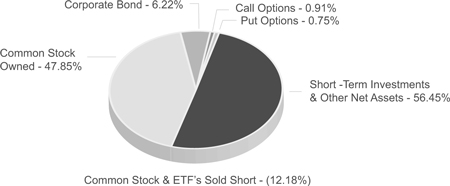

Net Asset Allocation

April 30, 2010

| | |

Semi-Annual Report (Unaudited) | October 31, 2010 | | 7 |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Performance Summary |

| | October 31, 2010 (Unaudited) |

Net Asset Allocation

October 31, 2010

| 1 | The performance data quoted represents past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Please call 800-377-7073 or visit www.CaldwellOrkinFunds.com for current month-end performance. The Fund’s performance assumes the reinvestment of dividends and capital gains, if any. Fund holdings, industry and asset allocations are subject to change without notice. See additional important disclosures on page 5 and 6. |

Total annualized Fund operating expenses for the Fund’s fiscal year ended April 30, 2010 were 1.72%. Additional information about the Fund’s fees and expenses is available in the Fund’s prospectus.

Fund holdings, industry and asset allocations are subject to change without notice. The Fund may or may not have a position in any of the companies mentioned in this report as of the date of this report.

| 2 | Investors should expect that the Fund’s performance may fluctuate independently of stock market indices, such as the S&P 500 Total Return index. The S&P 500 Total Return index is a widely recognized unmanaged index of 500 common stock prices adjusted to reflect the reinvestment of dividends and distributions. You may not invest directly in an index. |

| 3 | Effective August 24, 1992, the Fund changed its investment objective to provide long-term capital growth with a short-term focus on capital preservation through investment selection and asset allocation. Prior to that time, the Fund was passively managed and indexed to the largest 100 over-the-counter (OTC) stocks. |

| * | For the full fiscal year ended April 30, 1993. |

| ** | From August 24, 1992 through April 30, 1993 - the portion of the year using the active investment management style of C&O Funds Advisor, Inc., the manager of the Fund. |

| | |

8 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Statistical Risk Profile |

| | October 31, 2010 |

| | | | | | | | | | |

| Ten Worst S&P 500 Total Return Days |

| Date | | C&O MOF | | S&P 500 | | Variance | | | | The Caldwell & Orkin Market Opportunity Fund outperformed the S&P 500 Total Return index

on all ten of the ten worst days, and was positive on three of the ten days. |

10/15/08 | | -1.47% | | -9.02% | | 7.55% | | |

12/1/08 | | -1.58% | | -8.92% | | 7.34% | | |

9/29/08 | | -0.37% | | -8.78% | | 8.41% | | |

10/9/08 | | -2.12% | | -7.61% | | 5.49% | | |

10/27/97 | | -1.60% | | -6.89% | | 5.29% | | |

8/31/98 | | 0.42% | | -6.79% | | 7.21% | | |

11/20/08 | | 0.23% | | -6.70% | | 6.93% | | |

11/19/08 | | -0.28% | | -6.10% | | 5.82% | | |

10/22/08 | | -1.11% | | -6.09% | | 4.98% | | |

4/14/00 | | 1.81% | | -5.82% | | 7.63% | | |

|

| Ten Worst S&P 500 Total Return Weeks |

| Week Ending | | C&O MOF | | S&P 500 | | Variance | | | | The Caldwell & Orkin Market Opportunity Fund outperformed the S&P 500 Total Return index

in all ten of the ten worst weeks, and was positive in seven of those weeks. |

10/10/08 | | -2.71% | | -18.14% | | 15.43% | | |

9/21/01 | | 1.63% | | -11.57% | | 13.20% | | |

4/14/00 | | 4.51% | | -10.52% | | 15.03% | | |

10/3/08 | | 1.83% | | -9.33% | | 11.16% | | |

11/21/08 | | 0.56% | | -8.33% | | 8.89% | | |

7/19/02 | | 0.65% | | -7.96% | | 8.61% | | |

3/6/09 | | -0.88% | | -6.96% | | 6.08% | | |

7/12/02 | | 1.01% | | -6.81% | | 7.82% | | |

2/20/09 | | 0.20% | | -6.80% | | 7.00% | | |

10/24/08 | | -0.28% | | -6.72% | | 6.44% | | |

|

| Ten Worst S&P 500 Total Return Months |

| Month | | C&O MOF | | S&P 500 | | Variance | | | | The Caldwell & Orkin Market Opportunity Fund outperformed the S&P 500 Total Return index

in all ten of the ten worst months, and was positive in seven of those months. |

10/31/08 | | 3.42% | | -16.74% | | 20.16% | | |

8/31/98 | | 3.12% | | -14.46% | | 17.58% | | |

9/30/02 | | 2.10% | | -10.86% | | 12.96% | | |

2/28/09 | | 0.30% | | -10.71% | | 11.01% | | |

2/28/01 | | 4.78% | | -9.13% | | 13.91% | | |

9/30/08 | | -0.42% | | -8.89% | | 8.47% | | |

6/30/08 | | 4.84% | | -8.43% | | 13.27% | | |

1/31/09 | | -0.73% | | -8.30% | | 7.57% | | |

9/30/01 | | 3.29% | | -8.06% | | 11.35% | | |

5/31/10 | | -2.55% | | -8.04% | | 5.49% | | |

Short selling began May 2, 1994. Past performance is no guarantee of future results. See additional important disclosures on page 5. Computations by Ned Davis Research, Inc.

| | |

Semi-Annual Report (Unaudited) | October 31, 2010 | | 9 |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Statistical Risk Profile |

| | October 31, 2010 |

| | | | |

| Caldwell & Orkin Market Opportunity Fund |

| | |

Date Range | | C&O MOF | | S&P 500 |

01/17/2008 - 05/07/2010 | | -15.71% | | -11.68% |

04/12/1999 - 11/23/1999 | | -13.24% | | 4.23% |

10/09/2002 - 05/25/2006 | | -13.12% | | 74.17% |

05/26/2000 - 06/07/2000 | | -8.15% | | 6.81% |

12/29/2000 - 01/19/2001 | | -8.06% | | 1.75% |

04/04/2001 - 03/11/2002 | | -7.98% | | 7.22% |

03/15/1993 - 04/26/1993 | | -7.83% | | -3.65% |

03/18/1994 - 02/03/1995 | | -7.68% | | 4.21% |

04/10/2007 - 05/24/2007 | | -7.14% | | 4.31% |

10/07/1998 - 11/05/1998 | | -6.41% | | 16.95% |

| | | | |

| S&P 500 Total Return Index |

| | |

Date Range | | C&O MOF | | S&P 500 |

10/09/2007 - 03/09/2009 | | -0.61% | | -55.26% |

03/24/2000 - 10/09/2002 | | 28.57% | | -47.41% |

07/17/1998 - 08/31/1998 | | 4.02% | | -19.19% |

04/23/2010 - 07/02/2010 | | -1.52% | | -15.67% |

11/27/2002 - 03/11/2003 | | 2.19% | | -14.28% |

07/16/1999 - 10/15/1999 | | -0.45% | | -11.78% |

10/07/1997 - 10/27/1997 | | 0.18% | | -10.74% |

09/23/1998 - 10/08/1998 | | 2.02% | | -9.94% |

02/18/1997 - 04/11/1997 | | 2.72% | | -9.39% |

07/19/2007 - 08/15/2007 | | 7.66% | | -9.30% |

| | | | |

| Statistical Risk Measurements |

| | | C&O MOF | | S&P 500 |

Coefficient of Determination (R-Square) | | 0.00% | | 100.00% |

Correlation Coefficient (R) | | 0.39% | | 100.00% |

Beta | | 0.002 | | 1.000 |

Standard Deviation | | 0.517 | | 1.209 |

Sharpe Ratio | | 0.65 | | 0.32 |

Semi-Variance(downside volatility) | | 0.13 | | 0.72 |

| | | | |

| Performance During the Last Three Market Downturns of 20% or More |

| | | C&O MOF | | S&P 500 |

| 01/06/2009 - 03/09/2009 | | -3.42% | | -27.19% |

| 10/09/2007 - 11/20/2008 | | 1.80% | | -50.73% |

| 01/04/2002 - 10/09/2002 | | 7.25% | | -32.95% |

Short selling began May 2, 1994. Past performance is no guarantee of future results. See additional important disclosures on pages 5 and 6. Computations by Ned Davis Research, Inc.

| | |

10 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin | | Growth of $10,000 | |

Market Opportunity Fund | | Equity Investment Position Chart |

| | October 31, 2010 |

Caldwell & Orkin Market Opportunity Fund Versus S&P 500 Total Return Index

Since Commencement of Active Style of Investment Management Results of a Hypothetical $10,000 Investment August 24, 1992 through October 31, 2010

Past performance does not predict future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. See additional disclosure on page 5.

| | |

Semi-Annual Report (Unaudited) | October 31, 2010 | | 11 |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Disclosure of Fund Expenses |

| | October 31, 2010 (Unaudited) |

We believe it is important for you to understand the impact of fees and expenses on your investment in the Fund. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs related to the purchase and redemption of Fund shares, including redemption fees and brokerage commissions (if applicable); and (2) ongoing costs, including management fees, administrative expenses, portfolio transaction costs and other Fund expenses. A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The below example is based on an investment of $1,000.00 invested at the beginning of the period and held for the entire period indicated, May 1, 2010 through October 31, 2010. The table below illustrates the Fund’s expenses in two ways:

Based on Actual Fund Returns

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Based on a Hypothetical 5% Return for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or brokerage commissions. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | |

| | | Beginning

Account Value 05/01/2010 | | Ending

Account Value 10/31/2010 | | | Expense Ratio1 | | Expenses

Paid During Period2 |

Actual3 | | $1,000.00 | | $ | 986.70 | | | 1.91% | | $9.56 |

Hypothetical (5% return before expenses)4 | | $1,000.00 | | $ | 1,015.58 | | | 1.91% | | $9.70 |

| 1 | The annualized expense ratio reflects actual expenses from the Fund from 5/1/2010- 10/31/2010, as a percentage of average net assets for that period. |

| 2 | Expenses are equal to the Caldwell & Orkin Market Opportunity Fund’s annualized expense ratio of 1.91% multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), divided by 365 (to reflect the half-year period.) |

| 3 | Excluding interest expense and dividend expense from short positions, your actual cost of investment in the Fund would be $5.91 |

| 4 | Excluding interest expense and dividend expense from short positions, your hypothetical cost of investment in the Fund would be $6.01 |

| | |

12 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Sector Diversification |

| | October 31, 2010 |

The following table presents the Fund’s 10/31/2010 portfolio holdings by sector based on total net assets, sorted by net exposure (net long to net short).

| | | | | | | | |

| | | Long | | Short | | Totala | | Netb |

Wireless Equipment | | 4.24% | | | | 4.24% | | 4.24% |

Electric - Integrated | | 2.81% | | | | 2.81% | | 2.81% |

Hotels & Motels | | 1.72% | | | | 1.72% | | 1.72% |

Broadcast Services/Program | | 1.55% | | | | 1.55% | | 1.55% |

Retail - Auto Parts | | 1.46% | | | | 1.46% | | 1.46% |

Retail - Apparel/Shoe | | 2.29% | | -0.84% | | 3.13% | | 1.45% |

Auto-Cars/Light Trucks | | 1.44% | | | | 1.44% | | 1.44% |

Diversified Manufacturing Operations | | 1.27% | | | | 1.27% | | 1.27% |

Tools - Hand Held | | 1.18% | | | | 1.18% | | 1.18% |

Computers | | 1.98% | | -0.87% | | 2.85% | | 1.11% |

Telecom Services | | 1.11% | | | | 1.11% | | 1.11% |

Oil Field Machinery & Equipment | | 1.11% | | | | 1.11% | | 1.11% |

Industrial Audio & Video Products | | 1.05% | | | | 1.05% | | 1.05% |

Finance - Investment Banker/Broker | | 0.98% | | | | 0.98% | | 0.98% |

Building - Heavy Construction | | 0.98% | | | | 0.98% | | 0.98% |

Retail - Building Products | | 0.96% | | | | 0.96% | | 0.96% |

Auto/Truck Parts & Equipment | | 0.95% | | | | 0.95% | | 0.95% |

Gold Mining | | 0.93% | | | | 0.93% | | 0.93% |

Beverages - Non-alcoholic | | 0.84% | | | | 0.84% | | 0.84% |

Telephone - Integrated | | 0.81% | | | | 0.81% | | 0.81% |

Oil-Field Services | | 0.73% | | | | 0.73% | | 0.73% |

Brewery | | 0.73% | | | | 0.73% | | 0.73% |

Multi-Media | | 0.68% | | | | 0.68% | | 0.68% |

Engines - Internal Combustion | | 0.61% | | | | 0.61% | | 0.61% |

Oil & Gas Drilling | | 0.60% | | | | 0.60% | | 0.60% |

Diversified Financial Services | | 0.58% | | | | 0.58% | | 0.58% |

Oil Refining & Marketing | | 0.56% | | | | 0.56% | | 0.56% |

Medical - Drugs | | 0.56% | | | | 0.56% | | 0.56% |

Human Resources | | 0.55% | | | | 0.55% | | 0.55% |

Hazardous Waste Disposal | | 0.53% | | | | 0.53% | | 0.53% |

Semiconductor Components/Integrated Circuits | | 0.51% | | | | 0.51% | | 0.51% |

Cellular Telecommunications | | 0.51% | | | | 0.51% | | 0.51% |

Reinsurance | | 0.48% | | | | 0.48% | | 0.48% |

E-Commerce/Services | | 0.41% | | | | 0.41% | | 0.41% |

Retail - Home Furnishings | | 0.38% | | | | 0.38% | | 0.38% |

Apparel Manufacturers | | 0.33% | | | | 0.33% | | 0.33% |

Internet Infrastructure Software | | 0.23% | | | | 0.23% | | 0.23% |

Athletic Footwear | | 0.22% | | | | 0.22% | | 0.22% |

Electric - Transmission | | 0.21% | | | | 0.21% | | 0.21% |

Diversified Banking Institution | | 0.15% | | | | 0.15% | | 0.15% |

Coatings/Paint | | 0.11% | | | | 0.11% | | 0.11% |

Footwear (Non-Athletic) & Related Apparel | | 0.91% | | -0.81% | | 1.72% | | 0.10% |

Agricultural Chemicals | | 0.01% | | | | 0.01% | | 0.01% |

| | |

Semi-Annual Report (Unaudited) | October 31, 2010 | | 13 |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Sector Diversification |

| | October 31, 2010 (Unaudited) |

| | | | | | | | |

| | | Long | | Short | | Totala | | Netb |

Building - Residential/Commercial | | 0.60% | | -0.60% | | 1.20% | | 0.00% |

Airlines | | | | -0.09% | | 0.09% | | -0.09% |

Retail - Sporting Goods | | | | -0.17% | | 0.17% | | -0.17% |

Applications Software | | | | -0.18% | | 0.18% | | -0.18% |

Real Estate Operation/Development | | | | -0.22% | | 0.22% | | -0.22% |

Educational Software | | | | -0.31% | | 0.31% | | -0.31% |

Electronics - Military | | | | -0.42% | | 0.42% | | -0.42% |

Real Estate Management/Services | | | | -0.45% | | 0.45% | | -0.45% |

Retail - Appliances | | | | -0.47% | | 0.47% | | -0.47% |

Retail - Consumer Electronics | | | | -0.48% | | 0.48% | | -0.48% |

Commercial Services - Finance | | | | -0.48% | | 0.48% | | -0.48% |

Telecom Equipment Fiber Optics | | 0.32% | | -0.80% | | 1.12% | | -0.48% |

Commercial Banks - Non-U.S. | | | | -0.53% | | 0.53% | | -0.53% |

Commercial Banks - Central U.S. | | 0.47% | | -1.11% | | 1.58% | | -0.64% |

Building - Mobile Home/Manufactured Housing & RV | | | | -0.79% | | 0.78% | | -0.78% |

Retail - Computer Equipment | | | | -0.97% | | 0.97% | | -0.97% |

Web Hosting/Design | | 0.03% | | -1.05% | | 1.08% | | -1.02% |

Electronic Components - Semiconductors | | 1.47% | | -2.58% | | 4.05% | | -1.11% |

Semiconductor Equipment | | | | -1.55% | | 1.55% | | -1.55% |

Commercial Services | | | | -1.62% | | 1.62% | | -1.62% |

Super-Regional Banks - U.S. | | | | -1.76% | | 1.76% | | -1.76% |

Medical - Outpatient/Home Medical Care | | | | -1.98% | | 1.98% | | -1.98% |

Schools | | 0.33% | | -6.10% | | 6.44% | | -5.78% |

Subtotal Common Stocks (long & short positions) | | 43.47% | | -27.23% | | 70.70% | | 16.24% |

| | | | | | | | | |

Exchange Traded Fund - iShares MSCI Japan Index Fund | | 1.72% | | | | 1.72% | | 1.72% |

Exchange Traded Fund - SPDR Gold Shares | | 0.51% | | | | 0.51% | | 0.51% |

Exchange Traded Fund - Country Fund - India | | | | -0.00%* | | -0.00%* | | -0.00%* |

Exchange Traded Fund - Country Fund - Spain | | | | -1.02% | | 1.02% | | -1.02% |

Exchange Traded Fund - U.S. Treasury Bond Fund | | | | -1.03% | | 1.03% | | -1.03% |

Exchange Traded Fund - Country Fund - China | | | | -1.14% | | 1.14% | | -1.14% |

Subtotal Exchange-Traded Funds (long & short positions) | | 2.23% | | -3.19% | | 5.42% | | -0.96% |

| | | | | | | | | |

Subtotal Equities (long & short positions) | | 45.70% | | -30.42% | | 76.12% | | 15.28% |

| | | | | | | | |

Call Options | | 0.57% | | | | 0.57% | | |

Put Options | | 1.41% | | | | 1.41% | | |

Corporate Bonds | | 5.27% | | | | 5.27% | | |

Other Assets less Liabilities | | 16.63% | | | | 16.63% | | |

Total Portfolio Holdings | | 69.58% | | -30.42% | | 100.00% | | |

| | | | | | | | |

* Less than 0.005% of net assets.

(a) Total exposure is Long exposure plus the absolute value of the Short exposure.

(b) Net exposure is Long exposure less Short exposure.

| | |

14 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Schedule of Investments |

| | October 31, 2010 (Unaudited) |

| | | | | | | | |

| | | Shares | | | Value (Note 1) | |

LONG INVESTMENTS (52.95%) | | | | | | | | |

COMMON STOCKS (43.47%) | | | | | | | | |

Agricultural Chemicals (0.01%) | | | | | | | | |

Agrium, Inc. | | | 100 | | | $ | 8,851 | |

CF Industries Holdings, Inc. | | | 100 | | | | 12,253 | |

| | | | | | | | |

| | | | | | | 21,104 | |

| | | | | | | | |

| | |

Apparel Manufacturers (0.33%) | | | | | | | | |

Coach, Inc. | | | 25,500 | | | | 1,275,000 | |

| | | | | | | | |

| | |

Applications Software (0.00%)† | | | | | | | | |

Red Hat, Inc.1 | | | 100 | | | | 4,226 | |

Salesforce.com, Inc.1 | | | 100 | | | | 11,607 | |

| | | | | | | | |

| | | | | | | 15,833 | |

| | | | | | | | |

| | |

Athletic Footwear (0.22%) | | | | | | | | |

NIKE, Inc. - Class B | | | 10,400 | | | | 846,976 | |

| | | | | | | | |

| | |

Automotive - CarsLight Trucks (1.44%) | | | | | | | | |

Ford Motor Co.1 | | | 388,300 | | | | 5,486,679 | |

| | | | | | | | |

| | |

Automotive/Truck Parts & Equipment (0.95%) | | | | | | | | |

ArvinMeritor, Inc.1 | | | 30,300 | | | | 502,374 | |

Tenneco, Inc.1 | | | 57,100 | | | | 1,862,602 | |

WABCO Holdings, Inc.1 | | | 26,700 | | | | 1,239,414 | |

| | | | | | | | |

| | | | | | | 3,604,390 | |

| | | | | | | | |

| | |

Beverages - Non-Alcoholic (0.84%) | | | | | | | | |

PepsiCo, Inc. | | | 48,800 | | | | 3,186,640 | |

| | | | | | | | |

| | |

Brewery (0.73%) | | | | | | | | |

Anheuser-Busch InBev NV ADR | | | 44,500 | | | | 2,799,050 | |

| | | | | | | | |

| | |

Broadcast Services/Programming (1.55%) | | | | | | | | |

Discovery Communications, Inc. - Class A1 | | | 132,700 | | | | 5,919,747 | |

| | | | | | | | |

| | |

Building - Heavy Construction (0.98%) | | | | | | | | |

Chicago Bridge & Iron Co. NV1 | | | 148,400 | | | | 3,741,164 | |

| | | | | | | | |

| | |

Building - Residential/Commercial (0.60%) | | | | | | | | |

KB Home | | | 218,500 | | | | 2,296,435 | |

| | | | | | | | |

| | |

Semi-Annual Report (Unaudited) | October 31, 2010 | | 15 |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Schedule of Investments |

| | October 31, 2010 (Unaudited) |

| | | | | | | | |

| | | Shares | | | Value (Note 1) | |

| | |

Cellular Telecommunication (0.51%) | | | | | | | | |

Vodafone Group PLC ADR | | | 70,800 | | | $ | 1,947,708 | |

| | | | | | | | |

| | |

Coatings/Paint (0.11%) | | | | | | | | |

The Sherwin-Williams Co. | | | 5,500 | | | | 401,335 | |

| | | | | | | | |

| | |

Commercial Banks - Central U.S. (0.47%) | | | | | | | | |

Old National Bancorp | | | 188,400 | | | | 1,782,264 | |

| | | | | | | | |

| | |

Computers (1.98%) | | | | | | | | |

Apple, Inc.1 | | | 25,100 | | | | 7,551,837 | |

| | | | | | | | |

| | |

Diversified Banking Institution (0.15%) | | | | | | | | |

The Goldman Sachs Group, Inc. | | | 100 | | | | 16,095 | |

JPMorgan Chase & Co. | | | 14,900 | | | | 560,687 | |

| | | | | | | | |

| | | | | | | 576,782 | |

| | | | | | | | |

| | |

Diversified Financial Services (0.58%) | | | | | | | | |

CIT Group, Inc.1 | | | 51,000 | | | | 2,209,830 | |

| | | | | | | | |

| | |

Diversified Manufacturing Operations (1.27%) | | | | | | | | |

Eaton Corp. | | | 54,600 | | | | 4,850,118 | |

| | | | | | | | |

| | |

E-Commerce/Services (0.41%) | | | | | | | | |

Expedia, Inc. | | | 53,900 | | | | 1,560,405 | |

| | | | | | | | |

| | |

Electric - Integrated (2.81%) | | | | | | | | |

CMS Energy Corp. | | | 413,300 | | | | 7,596,454 | |

OGE Energy Corp. | | | 70,900 | | | | 3,130,944 | |

| | | | | | | | |

| | | | | | | 10,727,398 | |

| | | | | | | | |

| | |

Electric - Transmission (0.21%) | | | | | | | | |

National Grid PLC ADR | | | 16,600 | | | | 788,168 | |

| | | | | | | | |

| | |

Electronic Components - Semiconductors (1.47%) | | | | | | | | |

ARM Holdings PLC ADR | | | 169,000 | | | | 2,987,920 | |

Broadcom Corp. - Class A | | | 100 | | | | 4,074 | |

Skyworks Solutions, Inc.1 | | | 114,900 | | | | 2,632,359 | |

| | | | | | | | |

| | | | | | | 5,624,353 | |

| | | | | | | | |

| | |

16 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Schedule of Investments |

| | October 31, 2010 (Unaudited) |

| | | | | | | | |

| | | Shares | | | Value (Note 1) | |

Engines - Internal Combustion (0.61%) | | | | | | | | |

Cummins, Inc. | | | 26,200 | | | $ | 2,308,220 | |

| | | | | | | | |

| | |

Finance - Investment Banker/Broker (0.98%) | | | | | | | | |

MF Global Holdings, Ltd.1 | | | 478,500 | | | | 3,746,655 | |

| | | | | | | | |

| | |

Footwear (Non-Athletic) & Related Apparel (0.91%) | | | | | | | | |

Deckers Outdoor Corp.1 | | | 37,300 | | | | 2,167,130 | |

Skechers U.S.A., Inc.- Class A1 | | | 67,700 | | | | 1,316,088 | |

| | | | | | | | |

| | | | | | | 3,483,218 | |

| | | | | | | | |

| | |

Gold Mining (0.93%) | | | | | | | | |

Agnico-Eagle Mines, Ltd. | | | 20,800 | | | | 1,613,872 | |

Newmont Mining Corp. | | | 31,600 | | | | 1,923,492 | |

| | | | | | | | |

| | | | | | | 3,537,364 | |

| | | | | | | | |

| | |

Hazardous Waste Disposal (0.53%) | | | | | | | | |

Clean Harbors, Inc.1 | | | 28,900 | | | | 2,037,450 | |

| | | | | | | | |

| | |

Hotels & Motels (1.72%) | | | | | | | | |

Marriott International, Inc. - Class A | | | 115,100 | | | | 4,264,455 | |

Starwood Hotels & Resorts Worldwide, Inc. | | | 42,300 | | | | 2,290,122 | |

| | | | | | | | |

| | | | | | | 6,554,577 | |

| | | | | | | | |

| | |

Human Resources (0.55%) | | | | | | | | |

Manpower, Inc. | | | 38,200 | | | | 2,090,686 | |

| | | | | | | | |

| | |

Industrial Audio & Video Products (1.05%) | | | | | | | | |

Dolby Laboratories, Inc. - Class A1 | | | 65,200 | | | | 4,021,536 | |

| | | | | | | | |

| | |

Internet Infrastructure Software (0.23%) | | | | | | | | |

Akamai Technologies, Inc.1 | | | 17,100 | | | | 883,557 | |

| | | | | | | | |

| | |

Medical - Drugs (0.56%) | | | | | | | | |

Allergan, Inc. | | | 29,600 | | | | 2,143,336 | |

| | | | | | | | |

| | |

Multi-Media (0.68%) | | | | | | | | |

News Corp. - Class B | | | 111,600 | | | | 1,794,528 | |

The Walt Disney Co. | | | 22,100 | | | | 798,031 | |

| | | | | | | | |

| | | | | | | 2,592,559 | |

| | | | | | | | |

| | |

Semi-Annual Report (Unaudited) | October 31, 2010 | | 17 |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Schedule of Investments |

| | October 31, 2010 (Unaudited) |

| | | | | | | | |

| | | Shares | | | Value (Note 1) | |

Oil - Field Services (0.73%) | | | | | | | | |

Helix Energy Solutions Group, Inc.1 | | | 220,400 | | | $ | 2,796,876 | |

| | | | | | | | |

| | |

Oil & Gas Drilling (0.60%) | | | | | | | | |

Ensco PLC, ADR | | | 49,100 | | | | 2,275,294 | |

| | | | | | | | |

| | |

Oil Field Machinery & Equipment (1.11%) | | | | | | | | |

Cameron International Corp.1 | | | 96,900 | | | | 4,239,375 | |

| | | | | | | | |

| | |

Oil Refining & Marketing (0.56%) | | | | | | | | |

Frontier Oil Corp. | | | 161,400 | | | | 2,138,550 | |

| | | | | | | | |

| | |

Reinsurance (0.48%) | | | | | | | | |

Greenlight Capital Re, Ltd. - Class A1 | | | 64,000 | | | | 1,827,840 | |

| | | | | | | | |

| | |

Retail - Apparel/Shoe (2.29%) | | | | | | | | |

AnnTaylor Stores Corp.1 | | | 174,400 | | | | 4,063,520 | |

Limited Brands, Inc. | | | 104,800 | | | | 3,080,072 | |

Phillips-Van Heusen Corp. | | | 26,200 | | | | 1,607,108 | |

| | | | | | | | |

| | | | | | | 8,750,700 | |

| | | | | | | | |

| | |

Retail - Auto Parts (1.46%) | | | | | | | | |

Advance Auto Parts, Inc. | | | 65,700 | | | | 4,269,186 | |

PEP Boys-Manny Moe & Jack | | | 112,400 | | | | 1,313,956 | |

| | | | | | | | |

| | | | | | | 5,583,142 | |

| | | | | | | | |

| | |

Retail - Building Products (0.96%) | | | | | | | | |

Home Depot, Inc. | | | 118,900 | | | | 3,671,632 | |

| | | | | | | | |

| | |

Retail - Home Furnishings (0.38%) | | | | | | | | |

Pier 1 Imports, Inc.1 | | | 167,600 | | | | 1,454,768 | |

| | | | | | | | |

| | |

Schools (0.33%) | | | | | | | | |

Career Education Corp.1 | | | 71,500 | | | | 1,254,110 | |

| | | | | | | | |

| | |

Semiconductor Components/Integrated Circuits (0.51%) | | | | | | | | |

Atmel Corp.1 | | | 130,600 | | | | 1,157,116 | |

Cypress Semiconductor Corp.1 | | | 56,300 | | | | 793,830 | |

| | | | | | | | |

| | | | | | | 1,950,946 | |

| | | | | | | | |

| | |

18 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Schedule of Investments |

| | October 31, 2010 (Unaudited) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | Shares | | | Value (Note 1) | |

| | |

Telecom Equipment Fiber Optics (0.32%) | | | | | | | | | |

Finisar Corp.1 | | | | | | | | | | | 71,400 | | | $ | 1,214,514 | |

| | | | | | | | | | | | | | | | |

| | |

Telecom Services (1.11%) | | | | | | | | | |

BCE, Inc. | | | | | | | | | | | 126,300 | | | | 4,232,313 | |

| | | | | | | | | | | | | | | | |

| | |

Telephone - Integrated (0.81%) | | | | | | | | | |

Verizon Communications, Inc. | | | | | | | | | | | 95,300 | | | | 3,094,391 | |

| | | | | | | | | | | | | | | | |

| | | | |

Tools - Hand Held (1.18%) | | | | | | | | | | | | | | | | |

Stanley Black & Decker, Inc. | | | | | | | | | | | 72,800 | | | | 4,511,416 | |

| | | | | | | | | | | | | | | | |

| | | | |

Web Hosting/Design (0.03%) | | | | | | | | | | | | | | | | |

Rackspace Hosting, Inc.1 | | | | | | | | | | | 4,000 | | | | 99,840 | |

| | | | | | | | | | | | | | | | |

| | | | |

Wireless Equipment (4.24%) | | | | | | | | | | | | | | | | |

American Tower Corp. - Class A1 | | | | | | | | | | | 90,100 | | | | 4,650,061 | |

Crown Castle International Corp.1 | | | | | | | | | | | 130,400 | | | | 5,622,848 | |

Motorola, Inc.1 | | | | | | | | | | | 145,600 | | | | 1,186,640 | |

SBA Communications Corp. - Class A1 | | | | | | | | | | | 120,500 | | | | 4,730,830 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 16,190,379 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL COMMON STOCKS | | | | | | | | | | | | | | | | |

(Cost $152,055,186) | | | | | | | | | | | | | | | 165,898,460 | |

| | |

| | | | |

EXCHANGE TRADED FUNDS (2.23%) | | | | | | | | | | | | | | | | |

iShares MSCI Japan Index Fund | | | | | | | | | | | 656,800 | | | | 6,568,000 | |

SPDR Gold Shares1 | | | | | | | | | | | 14,700 | | | | 1,949,808 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 8,517,808 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL EXCHANGE TRADED FUNDS | | | | | | | | | | | | | | | | |

(Cost $8,293,039) | | | | | | | | | | | | | | | 8,517,808 | |

| | |

| | | | |

| | | Expiration

Date | | | Exercise Price | | | Number of

Contracts | | | Value

(Note 1) | |

PURCHASED OPTIONS (1.98%) | | | | | | | | | | | | | | | | |

PURCHASED CALL OPTIONS (0.57%) | | | | | | | | | | | | | | | | |

ARM Holdings PLC ADR | | | April, 2011 | | | | $17.00 | | | | 1,361 | | | | 306,225 | |

Expedia, Inc. | | | November, 2010 | | | | 30.00 | | | | 4,530 | | | | 285,390 | |

Home Depot, Inc. | | | January, 2011 | | | | 30.00 | | | | 3,680 | | | | 688,160 | |

iShares MSCI Japan Index Fund | | | January, 2011 | | | | 10.00 | | | | 10,229 | | | | 358,015 | |

| | |

Semi-Annual Report (Unaudited) | October 31, 2010 | | 19 |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Schedule of Investments |

| | October 31, 2010 (Unaudited) |

| | | | | | | | | | | | | | | | |

| | | Expiration

Date | | | Exercise

Price | | | Number of

Contracts | | | Value (Note 1) | |

| | |

PURCHASED CALL OPTIONS (continued) | | | | | | | | | | | | | |

Verizon Communications, Inc. | | | January, 2011 | | | | $30.00 | | | | 1,188 | | | $ | 552,420 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL PURCHASED CALL OPTIONS | | | | | | | | | | | | | | | | |

(Cost $2,248,498) | | | | | | | | | | | | | | | 2,190,210 | |

| | | | | | | | | | | | | | | | |

| | | | |

PURCHASED PUT OPTIONS (1.41%) | | | | | | | | | | | | | | | | |

Alliance Data Systems Corp. | | | January, 2011 | | | | 65.00 | | | | 684 | | | | 471,960 | |

Alliance Data Systems Corp. | | | March, 2011 | | | | 65.00 | | | | 426 | | | | 353,580 | |

Amedisys, Inc. | | | October, 2010 | | | | 27.00 | | | | 4,040 | | | | 945,360 | |

Apollo Group, Inc. | | | January, 2011 | | | | 40.00 | | | | 897 | | | | 444,015 | |

Corinthian Colleges, Inc. | | | January, 2011 | | | | 6.00 | | | | 5,020 | | | | 652,600 | |

PowerShares QQQ Trust, Series I | | | November, 2010 | | | | 48.00 | | | | 2,475 | | | | 39,600 | |

Rackspace Hosting, Inc. | | | December, 2010 | | | | 25.00 | | | | 2,236 | | | | 469,560 | |

Research In Motion, Ltd. | | | December, 2010 | | | | 50.00 | | | | 875 | | | | 122,500 | |

SPDR S&P 500 ETF Trust | | | November, 2010 | | | | 118.00 | | | | 2,820 | | | | 555,540 | |

SPDR S&P 500 ETF Trust | | | November, 2010 | | | | 113.00 | | | | 2,255 | | | | 157,850 | |

Strayer Education, Inc. | | | January, 2011 | | | | 165.00 | | | | 241 | | | | 867,600 | |

Suntrust Banks, Inc. | | | January, 2011 | | | | 24.00 | | | | 2,130 | | | | 291,810 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL PURCHASED PUT OPTIONS | | | | | | | | | | | | | | | | |

(Cost $7,661,300) | | | | | | | | | | | | | | | 5,371,975 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL PURCHASED OPTIONS | | | | | | | | | | | | | | | | |

(Cost $9,909,798) | | | | | | | | | | | | | | | 7,562,185 | |

| | | | |

Description and Maturity Date | | | | | Coupon

Rate | | | Principal

Amount | | | Value

(Note 1) | |

CORPORATE BONDS (5.27%) | | | | | | | | | | | | | | | | |

Bank One Corp.

11/15/2011 | | | | | | | 5.900% | | | $ | 4,400,000 | | | | 4,619,899 | |

CBS Corp.

05/15/2011 | | | | | | | 6.625% | | | | 4,085,000 | | | | 4,209,682 | |

ConAgra Foods, Inc.

09/15/2011 | | | | | | | 6.750% | | | | 1,475,000 | | | | 1,548,809 | |

The Estee Lauder Cos., Inc.

11/01/2013 | | | | | | | 7.750% | | | | 2,000,000 | | | | 2,377,424 | |

| | |

20 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Schedule of Investments |

| | October 31, 2010 (Unaudited) |

| | | | | | | | | | | | |

Description and Maturity Date | | Coupon

Rate | | | Principal

Amount | | | Value (Note 1) | |

| | |

CORPORATE BONDS (continued) | | | | | | | | | | | | |

Hewlett-Packard Co.

03/01/2014 | | | 6.125% | | | $ | 4,400,000 | | | $ | 5,096,164 | |

Safeway, Inc.

08/15/2014 | | | 5.625% | | | | 2,000,000 | | | | 2,277,308 | |

| | | | | | | | | | | | |

| | | |

TOTAL CORPORATE BONDS (Cost $18,537,525) | | | | | | | | | | | 20,129,286 | |

| | |

| | | |

TOTAL LONG INVESTMENTS (Cost $188,795,548) | | | | | | | | | | | 202,107,739 | |

| | |

| | | |

| | | 7-Day Yield | | | Shares | | | Value (Note 1) | |

| | |

SHORT TERM INVESTMENTS (42.53%) | | | | | | | | | | | | |

MONEY MARKET FUNDS2 | | | | | | | | | | | | |

JPMorgan U.S. Treasury Plus

Money Market Fund | | | 0.03% | | | | 162,301,110 | | | | 162,301,110 | |

| | | |

TOTAL SHORT TERM INVESTMENTS (Cost $162,301,110) | | | | | | | | | | | 162,301,110 | |

| | |

| | | |

TOTAL INVESTMENTS - (95.48%) (Cost $351,096,658) | | | | | | | | | | $ | 364,408,849 | |

| | |

Assets in Excess of Other Liabilities (4.52%) | | | | | | | | 17,236,210 | |

| | |

| | | |

NET ASSETS (100.00%) | | | | | | | | | | $ | 381,645,059 | |

| | |

| | | |

| SCHEDULE OF SECURITIES SOLD SHORT | | | | | Shares | | | Value (Note 1) | |

| | |

COMMON STOCKS (-27.23%) | | | | | | | | | | | | |

Airlines (-0.09%) | | | | | | | | | | | | |

Delta Air Lines, Inc. | | | | | | | (25,100) | | | $ | (348,639) | |

| | | | | | | | | | | | |

| | | |

Applications Software (-0.18%) | | | | | | | | | | | | |

Nuance Communications, Inc. | | | | | | | (43,300) | | | | (680,243) | |

| | | | | | | | | | | | |

| |

Building - Mobile Home/Manufactured Housing & RV (-0.79%) | | | | | |

Thor Industries, Inc. | | | | | | | (95,100) | | | | (2,994,699) | |

| | | | | | | | | | | | |

| | |

Semi-Annual Report (Unaudited) | October 31, 2010 | | 21 |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Schedule of Investments |

| | October 31, 2010 (Unaudited) |

| | | | | | | | |

| SCHEDULE OF SECURITIES SOLD SHORT (continued) | | Shares | | | Value (Note 1) | |

| | |

Building - Residential/Commercial (-0.60%) | | | | | | | | |

Beazer Homes USA, Inc. | | | (372,000) | | | $ | (1,510,320) | |

Hovnanian Enterprises, Inc. - Class A | | | (218,100) | | | | (776,436) | |

| | | | | | | | |

| | | | | | | (2,286,756) | |

| | | | | | | | |

| | |

Commercial Banks - Central U.S. (-1.11%) | | | | | | | | |

Associated Banc-Corp. | | | (76,800) | | | | (973,056) | |

TCF Financial Corp. | | | (247,400) | | | | (3,255,784) | |

| | | | | | | | |

| | | | | | | (4,228,840) | |

| | | | | | | | |

| | |

Commercial Banks Non - U.S. (-0.53%) | | | | | | | | |

Banco Bilbao Vizcaya Argentaria SA ADR | | | (153,100) | | | | (2,013,265) | |

| | | | | | | | |

| | |

Commercial Services (-1.62%) | | | | | | | | |

Alliance Data Systems Corp. | | | (101,800) | | | | (6,181,296) | |

| | | | | | | | |

| | |

Commercial Services - Finance (-0.48%) | | | | | | | | |

Moody’s Corp. | | | (68,200) | | | | (1,845,492) | |

| | | | | | | | |

| | |

Computers (-0.87%) | | | | | | | | |

Research In Motion, Ltd. | | | (58,500) | | | | (3,331,575) | |

| | | | | | | | |

| | |

Educational Software (-0.31%) | | | | | | | | |

Blackboard, Inc. | | | (28,500) | | | | (1,189,590) | |

| | | | | | | | |

| | |

Electronic Components - Semiconductors (-2.58%) | | | | | | | | |

Altera Corp. | | | (59,600) | | | | (1,860,116) | |

Micron Technology, Inc. | | | (206,600) | | | | (1,708,582) | |

National Semiconductor Corp. | | | (306,600) | | | | (4,200,420) | |

Xilinx, Inc. | | | (77,300) | | | | (2,072,413) | |

| | | | | | | | |

| | | | | | | (9,841,531) | |

| | | | | | | | |

| | |

Electronics - Military (-0.42%) | | | | | | | | |

L-3 Communications Holdings, Inc. | | | (22,300) | | | | (1,609,837) | |

| | | | | | | | |

| | |

Footwear (Non-Athletic) & Related Apparel (-0.81%) | | | | | | | | |

Skechers U.S.A., Inc. - Class A | | | (158,600) | | | | (3,083,184) | |

| | | | | | | | |

| | |

Medical - Outpatient/Home Medical Care (-1.98%) | | | | | | | | |

Amedisys, Inc. | | | (297,500) | | | | (7,574,350) | |

| | | | | | | | |

| | |

22 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Schedule of Investments |

| | October 31, 2010 (Unaudited) |

| | | | | | | | |

| SCHEDULE OF SECURITIES SOLD SHORT (continued) | | Shares | | | Value (Note 1) | |

| | |

Real Estate Management/Services (-0.45%) | | | | | | | | |

E-House China Holdings, Ltd., ADR | | | (101,800) | | | $ | (1,701,078) | |

| | | | | | | | |

| | |

Real Estate Operation/Development (-0.22%) | | | | | | | | |

The St. Joe Co. | | | (42,300) | | | | (854,037) | |

| | | | | | | | |

| | |

Retail - Apparel/Shoe (-0.84%) | | | | | | | | |

The Buckle, Inc. | | | (42,700) | | | | (1,242,143) | |

J. Crew Group, Inc. | | | (60,900) | | | | (1,948,191) | |

| | | | | | | | |

| | | | | | | (3,190,334) | |

| | | | | | | | |

| | |

Retail - Appliances (-0.47%) | | | | | | | | |

hhgregg, Inc. | | | (78,200) | | | | (1,801,728) | |

| | | | | | | | |

| | |

Retail - Computer Equipment (-0.97%) | | | | | | | | |

GameStop Corp. - Class A | | | (189,100) | | | | (3,717,706) | |

| | | | | | | | |

| | |

Retail - Consumer Electronics (-0.48%) | | | | | | | | |

Best Buy Co., Inc. | | | (42,400) | | | | (1,822,352) | |

| | | | | | | | |

| | |

Retail - Sporting Goods (-0.17%) | | | | | | | | |

Cabela’s, Inc. | | | (35,000) | | | | (648,900) | |

| | | | | | | | |

| | |

Schools (-6.10%) | | | | | | | | |

Apollo Group, Inc. - Class A | | | (103,800) | | | | (3,890,424) | |

Career Education Corp. | | | (144,900) | | | | (2,541,546) | |

Corinthian Colleges, Inc. | | | (430,000) | | | | (2,244,600) | |

ITT Educational Services, Inc. | | | (63,900) | | | | (4,123,467) | |

Strayer Education, Inc. | | | (45,400) | | | | (6,348,282) | |

The Washington Post Co. - Class B | | | (10,300) | | | | (4,142,145) | |

| | | | | | | | |

| | | | | | | (23,290,464) | |

| | | | | | | | |

| | |

Semiconductor Equipment (-1.55%) | | | | | | | | |

Teradyne, Inc. | | | (130,400) | | | | (1,465,696) | |

Veeco Instruments, Inc. | | | (106,700) | | | | (4,465,395) | |

| | | | | | | | |

| | | | | | | (5,931,091) | |

| | | | | | | | |

| | |

Super - Regional Banks - U.S. (-1.76%) | | | | | | | | |

Capital One Financial Corp. | | | (73,700) | | | | (2,746,799) | |

SunTrust Banks, Inc. | | | (158,000) | | | | (3,953,160) | |

| | | | | | | | |

| | | | | | | (6,699,959) | |

| | | | | | | | |

| | |

Semi-Annual Report (Unaudited) | October 31, 2010 | | 23 |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Schedule of Investments |

| | October 31, 2010 (Unaudited) |

| | | | | | | | |

| SCHEDULE OF SECURITIES SOLD SHORT (continued) | | Shares | | | Value (Note 1) | |

| | |

Telecom Equipment Fiber Optics (-0.80%) | | | | | | | | |

Corning, Inc. | | | (166,500) | | | | $ (3,043,620) | |

| | | | | | | | |

| | |

Web Hosting/Design (-1.05%) | | | | | | | | |

Rackspace Hosting, Inc. | | | (160,200) | | | | (3,998,592) | |

| | | | | | | | |

| | |

EXCHANGE TRADED FUNDS (-3.19%) | | | | | | | | |

Country Fund - China (-1.14%) | | | | | | | | |

iShares FTSE/Xinhua China 25 Index Fund | | | (97,000) | | | | (4,363,060) | |

| | | | | | | | |

| | |

Country Fund - India (-0.00%)† | | | | | | | | |

WisdomTree India Earnings Fund | | | (100) | | | | (2,719) | |

| | | | | | | | |

| | |

Country Fund - Spain (-1.02%) | | | | | | | | |

iShares MSCI Spain Index Fund | | | (90,700) | | | | (3,894,658) | |

| | | | | | | | |

| | |

U.S. Treasury Bond Fund (-1.03%) | | | | | | | | |

iShares Barclays 1-3 Year Treasury Bond Fund | | | (23,100) | | | | (1,951,719) | |

iShares Barclays 7-10 Year Treasury Bond Fund | | | (19,900) | | | | (1,965,523) | |

| | | | | | | | |

| | | | | | | (3,917,242) | |

| | | | | | | | |

| | |

TOTAL SECURITIES SOLD SHORT (Proceeds $124,327,811) | | | | | | | $ (116,086,837) | |

| | |

| † | Less than 0.005% of net assets. |

| 1 | Non-Income Producing Security. |

| 2 | A portion of the Money Market Fund assets are held as collateral for short sales activity. |

Common Abbreviations:

ADR - American Depositary Receipts

ETF - Exchange Traded Fund

Ltd. - Limited

NV - Naamloze Vennootschap is the Dutch term for a public limited liability corporation.

PLC - Public Limited Company

SA - Generally designates corporations in various countries, mostly those employing civil law.

SPDR - Standard & Poor’s Depositary Receipt

See accompanying notes to financial statements.

| | |

24 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Statement of Assets & Liabilities |

| | October 31, 2010 |

| | | | |

ASSETS | | | | |

Investments at value (cost $351,096,658) | | | $364,408,849 | |

Deposits with brokers for securities sold short | | | 121,874,410 | |

Receivables: | | | | |

Investment securities sold | | | 32,206,127 | |

Interest and dividends | | | 418,384 | |

Capital shares sold | | | 342,686 | |

Other assets | | | 54,465 | |

| | | | |

Total Assets | | | 519,304,921 | |

| | | | |

| |

LIABILITIES | | | | |

Securities sold short, not yet purchased (proceeds $124,327,811) | | | 116,086,837 | |

Payables: | | | | |

Investment securities purchased | | | 21,005,402 | |

Capital shares redeemed | | | 123,858 | |

Dividends payable - short sales | | | 35,545 | |

Investment advisory fee | | | 313,536 | |

Accrued expenses and other liabilities | | | 94,684 | |

| | | | |

Total Liabilities | | | 137,659,862 | |

| | | | |

| |

Total Net Assets | | | $381,645,059 | |

| | | | |

| |

NET ASSETS | | | | |

Paid-in capital applicable to 19,822,573 shares outstanding; par value $0.10 per share; 30,000,000 shares authorized | | | $413,171,298 | |

Undistributed net investment loss | | | (2,520,036 | ) |

Accumulated net realized loss on investments | | | (50,559,368 | ) |

Net unrealized appreciation of investments | | | 21,553,165 | |

| | | | |

| | | $381,645,059 | |

| | | | |

| |

NET ASSET VALUE AND OFFERING/REDEMPTION PRICE PER SHARE | | | $19.25 | |

| | | | |

See accompanying notes to financial statements.

| | |

Semi-Annual Report (Unaudited) | October 31, 2010 | | 25 |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Statement of Operations |

| | For the Six Months Ended October 31, 2010 |

| | | | |

INVESTMENT INCOME | | | | |

Dividends (net of foreign withholding taxes of $15,997) | | | $569,812 | |

Interest | | | 623,379 | |

| | | | |

Total Investment Income | | | 1,193,191 | |

| | | | |

| |

EXPENSES | | | | |

Investment advisory fees (Note 2) | | | 1,875,375 | |

Dividend expense on securities sold short | | | 426,586 | |

Interest expense | | | 983,507 | |

Administration and accounting fees (Note 2) | | | 120,148 | |

Professional fees | | | 74,361 | |

Directors’ fees and expenses | | | 32,626 | |

Insurance expense | | | 7,532 | |

Transfer agent fees | | | 128,073 | |

Custodian fees | | | 17,195 | |

Blue sky servicing fees | | | 13,456 | |

Shareholder report printing | | | 15,943 | |

Chief compliance officer expense | | | 22,740 | |

Other expenses | | | 10,808 | |

| | | | |

Total Expenses before waiver | | | 3,728,350 | |

| | | | |

Less fees waived by Administrator (Note 2) | | | (15,123) | |

| | | | |

Total net expenses | | | 3,713,227 | |

| | | | |

Net Investment Loss | | | (2,520,036) | |

| | | | |

| |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | |

Net realized loss on investments | | | (7,920,281) | |

Net realized loss on securities sold short | | | (5,646,527) | |

Change in unrealized appreciation/(depreciation) on investments | | | 2,195,593 | |

Change in unrealized appreciation/(depreciation) on securities sold short | | | 8,422,767 | |

| | | | |

NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | (2,948,448) | |

| | | | |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | $(5,468,484) | |

| | | | |

See accompanying notes to financial statements.

| | |

26 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Statement of Changes in Net Assets |

| | | | | | | | |

| | | For the Six Months

Ended October 31, 2010

(Unaudited) | | | For the Year Ended

April 30, 2010 | |

| | |

INCREASE/(DECREASE) IN NET ASSETS FROM OPERATIONS: | | | | | | | | |

Net investment loss | | | $(2,520,036) | | | | $(3,278,286) | |

Net realized loss on investments and securities sold short | | | (13,566,808) | | | | (31,936,266) | |

Change in net unrealized appreciation or (depreciation) of investments and securities sold short | | | 10,618,360 | | | | 1,624,891 | |

| | | | |

| | | (5,468,484) | | | | (33,589,661) | |

| | | | |

| | |

DECREASE IN NET ASSETS FROM DISTRIBUTIONS TO STOCKHOLDERS FROM: | | | | | | | | |

Net realized gain on investments | | | – | | | | (3,262,646) | |

| | | | |

| | | – | | | | (3,262,646) | |

| | | | |

| | |

INCREASE/(DECREASE) IN NET ASSETS FROM COMMON STOCK TRANSACTIONS: | | | | | | | | |

Net proceeds from sale of shares | | | 62,368,805 | | | | 300,001,846 | |

Reinvested distributions | | | – | | | | 2,802,527 | |

Cost of shares redeemed | | | (70,438,739) | | | | (174,156,466) | |

Redemption fee proceeds (Note 1) | | | 109,480 | | | | 348,670 | |

| | | | |

Net increase/(decrease) in net assets resulting from capital share transactions | | | (7,960,454) | | | | 128,996,577 | |

| | | | |

| | |

INCREASE/(DECREASE) IN NET ASSETS | | | (13,428,938) | | | | 92,144,270 | |

| | |

NET ASSETS | | | | | | | | |

Beginning of period | | | 395,073,997 | | | | 302,929,727 | |

| | | | |

End of period (including undistributed net investment income/(loss) of $(2,520,036) and $0, respectively) | | | $381,645,059 | | | | $395,073,997 | |

| | | | |

See accompanying notes to financial statements.

| | |

Semi-Annual Report (Unaudited) | October 31, 2010 | | 27 |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Financial Highlights |

| | |

For a capital share outstanding throughout each period.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Six

Months

Ended

October 31,

2010

(Unaudited) | | | For the

Year Ended

April 30,

2010 | | | For the

Year Ended

April 30,

2009 | | | For the

Year Ended

April 30,

2008 | | | For the Year Ended

April 30,

2007 | | | For the

Year Ended April 30, 2006 | |

| | |

PER SHARE DATA: | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $19.51 | | | | $21.24 | | | | $21.40 | | | | $18.68 | | | | $16.69 | | | | $17.35 | |

Income/(loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net Investment income/(loss) | | | (0.13) | | | | (0.16) | | | | 0.01 | | | | 0.20 | | | | 0.53 | | | | 0.28 | |

Net realized and unrealized gain/(loss) on investments | | | (0.14) | | | | (1.43) | | | | 0.94 | | | | 3.15 | | | | 1.99 | | | | (0.76) | |

| | | | |

Total from Investment Operations | | | (0.27) | | | | (1.59) | | | | 0.95 | | | | 3.35 | | | | 2.52 | | | | (0.48) | |

| | | | |

| | | | | | |

LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | – | | | | – | | | | (0.12) | | | | (0.37) | | | | (0.53) | | | | (0.19) | |

From net realized gain on investments | | | – | | | | (0.16) | | | | (1.02) | | | | (0.30) | | | | – | | | | – | |

| | | | |

Total Distributions | | | – | | | | (0.16) | | | | (1.14) | | | | (0.67) | | | | (0.53) | | | | (0.19) | |

| | | | |

Redemption fee proceeds | | | 0.01 | | | | 0.02 | | | | 0.03 | | | | 0.04 | | | | 0.00 | 1 | | | 0.01 | |

| | | | |

Net asset value, end of Period | | | $19.25 | | | | $19.51 | | | | $21.24 | | | | $21.40 | | | | $18.68 | | | | $16.69 | |

| | | | |

| | | | | | |

Total Return | | | (1.33%) | 2 | | | (7.40%) | | | | 4.73% | | | | 17.92% | | | | 15.31% | | | | (2.74%) | |

| | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |