Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Investment Company Act file number: 811-06113

The Caldwell & Orkin Funds, Inc.

(Exact name of registrant as specified in charter)

5185 Peachtree Parkway, Suite 370, Norcross, GA 30092-6541

(Address of principal executive offices) (Zip code)

Michael B. Orkin

5185 Peachtree Parkway, Suite 370, Norcross, GA 30092-6541

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code: 678-533-7850

Date of fiscal year end: April 30

Date of reporting period: May 1, 2012 - October 31, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §. 3507.

Table of Contents

Item 1. Report to Stockholders.

[Insert Semi-Annual Report]

Table of Contents

Table of Contents

| October 31, 2012 |

| 1 | ||||||

| 6 | ||||||

| 8 | ||||||

| 10 | ||||||

| 11 | ||||||

| 13 | ||||||

| 15 | ||||||

| 24 | ||||||

| 25 | ||||||

| 26 | ||||||

| 27 | ||||||

| 29 | ||||||

| 39 | ||||||

Table of Contents

October 31, 2012 (Unaudited)

| Investment Adviser |  | Shareholder Accounts | ||

| C&O Funds Advisor, Inc. | c/o ALPS Fund Services, Inc. | |||

| 5185 PeachtreeParkway, | P.O. Box 46256 | |||

| Suite 370 | Denver, Colorado 80201 | |||

| Norcross, Georgia | (800) 467-7903 | |||

| 30092-6541 | ||||

| (800) 237-7073 |

Dear Fellow Shareholder:

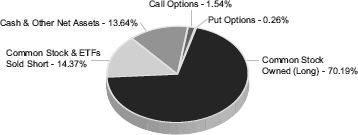

The Caldwell & Orkin Market Opportunity Fund (the “Fund”) rose 5.40% in the 6-month period ended October 31, 2012. The S&P 500 Total Return Index (the Index) rose 2.16% during the same period. For the 12 months ended October 31, 2012, the Fund gained 11.29%, while the S&P 500 increased 15.21%. And, since commencement of active management on August 24, 1992 through October 31, 2012, the Fund has generated an 8.61% compound annual return, bettering the S&P 500’s 8.43% compound annual return during the same period. The Fund’s total return from August 24, 1992 through April 30, 2012 has been 402.28% compared to the S&P 500’s total return of 401.66% Of course, past performance is no guarantee of future results.

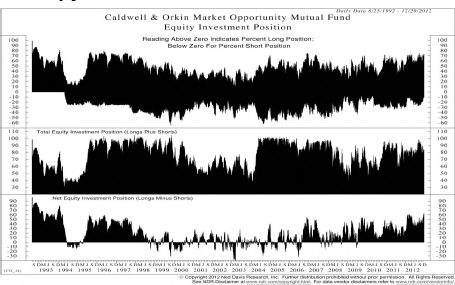

Importantly, the Fund has achieved these long-term results while maintaining a low market risk profile and with little reliance on the movement of the stock market (see pages 6, 8, 9 and 10). Since we began actively managing the Fund on August 24, 1992, the Fund’s price movements have had virtually no correlation (2.00%) with the price movements of the S&P 500 as measured by R, the correlation coefficient. An S&P 500 Index fund has nearly a 100% correlation to the market in any given period. The Fund’s lack of correlation to the market indicates that its performance is not attributable to that of the index. Additionally, given the Fund’s low correlation to the S&P 500, deviations in Fund performance relative to the S&P 500’s performance are to be expected. (Statistical computations by Ned Davis Research, Inc.)

Management Discussion and Analysis

For the six-months ended October 31, 2012 the Fund generated return characteristics emblematic of a true long/short mutual fund with low correlation to the Index. During the months experiencing negative market performance (May and October 2012) the Fund significantly outperformed relative to the Index and experienced positive performance in both months. During the months experiencing positive market performance (June, July, August and September 2012) the Fund underperformed relative to the Index. The Fund experienced positive performance in every month except June 2012.

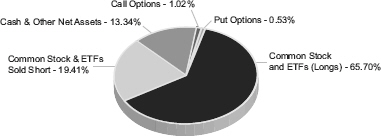

From May 1, 2012 through October 31, 2012 the Fund maintained a net long invested position. The gross long exposure ranged from 49.63% to 75.39%, averaged 62.53% and ended at 65.65%. During this time period the long portfolio outperformed the Index, generating a total return of 5.99%. The Fund’s short position ranged from 15.30% to 27.29%, averaged 21.85% and ended at 19.40%. The short portfolio outperformed the inverse return of the Index, generating a total return of 5.65%. Overall, the Fund’s total invested position ranged from 69.63% to 98.48%, averaged 84.38% and ended at 85.05%. The Fund’s net invested position ranged from 24.87% net long to 56.60% net long, averaged 40.68% net long and ended 46.25% net long.

Semi-Annual Report | October 31, 2012 | 1 |

Table of Contents

Caldwell & Orkin | ||

| Market Opportunity Fund | Shareholder Letter |

October 31, 2012 (Unaudited)

The decrease in the total invested position during the time period was the result of a reduction of positions in our long portfolio, partly offset by an increase of positions in our short portfolio. The small reduction in our long portfolio was due to the elimination of a few positions and was not the result of a change in portfolio sector allocation. On the long side we remained bullish on homebuilders and housing related companies. At 12.01%, building-residential/commercial remained our largest long exposure. This industry is benefitting from the most bullish fundamental housing backdrop in six years: household formations are again accelerating, housing supply is critically low, mortgage rates are near record lows, rental equivalents are high, employment is growing slow, but steady, and home prices are rising (adding a wealth effect multiplier to the economy). We also slightly increased our exposure to energy pipelines (from 7.06% to 9.58%) as increased domestic energy production is driving demand for the efficient gas and liquids transportation that these pipelines provide. We have maintained significant exposure (4.89%) to electric-integrated utilities. In addition to attractive dividend yields, these stocks offer potential earnings growth through regulator-approved rate increases.

On the short side of the portfolio we decreased our exposure to emerging market exchange-traded funds (ETFs) as inflation pressures in these regions have subsided. We maintained short exposure to for-profit education companies (2.63%) as the fundamental issues facing the industry (poor business models, regulatory supervision, enrollment growth, etc.) remain. We added exposure to computer manufacturers (1.36%) whose revenue is largely derived from the traditional desktop and laptop computer market that is losing the competitive battle against the mobile connectivity of tablets and smartphones.

During the period eight of our 10 biggest winners were longs. Gains in homebuilder PulteGroup Inc. (PHM), led the way as the company benefitted from increased demand for housing. The Fund also had gains in gold mining company Agnico-Eagle Mines, Ltd. (AEM), fueled by a continued increase in gold prices coupled with a decline in mining costs. The two shorts in our top 10 performers were consumer discretionary companies.

Three out of five of our biggest losers were shorts. The single equity long investment in this group was Aeropostale, Inc. (ARO), a specialty retailing company. In early-August, the company pre-announced negative second-quarter earnings due to a highly promotional retail environment. We purchased ARO with the expectations that new management and better product assortments would drive a turnaround. We sold our ARO position. The other holding in our worst five performers was a call position in SPDR Gold Trust (GLD). This option was a very small but leveraged gold position. For the period, eight of our biggest gains were greater than our single largest loss.

Outlook

As we enter the second-half of the Fund’s fiscal year, the “fiscal cliff” is dominating the conversation in the equity markets. What is less discussed is the underlying strength of the economy, strength that could be fortified by good policy. As the website Politico reported on Tuesday, December 11th, “What is striking is that if you put everyone from President Barack Obama and Senate Majority Whip Dick Durbin to House Speaker John Boehner and Senator Rob Portman on truth serum, they basically agree: Washington could set the economy on a very safe course, if not on fire, through a half-dozen policies that are not partisan.”

2 | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

Table of Contents

Caldwell & Orkin | ||

| Market Opportunity Fund | Shareholder Letter |

October 31, 2012 (Unaudited)

While we believe going over the “fiscal cliff” would likely be a significant negative for the markets, we place better-than-even odds that policy makers will reach an agreement on taxes and spending measures. If our expectations are not met we will adjust the portfolio accordingly.

Markets move in cycles. In managing the Fund, we strive to outperform over the course of a full market cycle, which includes both bull and bear market phases. Ned Davis Research, Inc. (“NDR”) has computed what they consider to be bull and bear market cycles for the S&P 500. Most of their definition focuses on a 20% market move in either direction. We present the NDR data for your review:

| Bull Market Phase | Bear Market Phase | Full Market Cycle | ||||||||||||||||||||||||||||||||||

| Start Date | MOF | S&P | Start Date** | MOF | S&P | End Date*** | MOF | S&P | ||||||||||||||||||||||||||||

8/24/1992* | 210.84% | 230.03% | 7/17/1998 | 4.02% | -19.19% | 8/31/1998 | 223.35% | 166.69% | ||||||||||||||||||||||||||||

8/31/1998 | 6.14% | 62.88% | 9/1/2000 | 15.10% | -35.71% | 9/21/2001 | 22.17% | 4.72% | ||||||||||||||||||||||||||||

9/21/2001 | -5.72% | 22.00% | 3/19/2002 | 10.02% | -33.01% | 10/9/2002 | 3.73% | -18.27% | ||||||||||||||||||||||||||||

10/9/2002 | 16.86% | 119.38% | 10/9/2007 | -0.61% | -55.26% | 3/9/2009 | 16.14% | -1.85% | ||||||||||||||||||||||||||||

3/9/2009 | -1.63% | 111.33% | 4/9/2011 | 0.47% | -18.72% | 10/3/2011 | -1.17% | 71.76% | ||||||||||||||||||||||||||||

| * | The first bull market phase began 10/11/1990, but the table begins with 8/24/1992, which coincides with commencement of active management of the Caldwell & Orkin Market Opportunity Fund. |

| ** | The bear market start date is the bull market’s end date. |

| *** | A full market cycle runs from the bull market start date to the full market cycle end date. |

Sincerely,

Michael B. Orkin, CFA

Portfolio Manager and Chief Investment Officer

Semi-Annual Report | October 31, 2012 | 3 |

Table of Contents

Caldwell & Orkin | ||

| Market Opportunity Fund | Shareholder Letter |

October 31, 2012 (Unaudited)

Disclosure

The Fund’s investment objective is to provide long-term capital growth with a short-term focus on capital preservation. Our philosophy in managing the Fund is to focus on risk as well as return. We use active asset allocation - the opportunistic shifting of assets between long stock positions, short stock positions (selling borrowed stock and attempting to replace the borrowed securities in the future at a lower price), options, bonds and cash equivalents - to manage exposure to market risk (the risk that the broad market declines, taking good companies down with it). The Fund may hold up to 60% of its net assets in short positions at any time and also invest in options. Short positions and put options are employed with the intent of making money when those stocks we judge to be mispriced fall. When we use short positions or put options, the Fund’s portfolio is considered to be “hedged,” so that it is not fully exposed to the price movements and volatility of the broader market. Our asset allocation determinations are primarily based on our perception of risk in the marketplace. In summary, our goal is to make money over a full market cycle, but with less stomach churn.

The Fund’s disciplined investment philosophy and active management style typically leads to higher-than-average portfolio turnover. High turnover may have an unfavorable impact on the amount of taxable distributions paid to shareholders. Higher turnover may also result in higher brokerage costs for the Fund. The Fund’s turnover rate will typically exceed 100% per year, and will not be a limiting factor when we deem change appropriate. Fund holdings, industry and asset allocations are subject to change without notice. The Fund may or may not have a position in any of the companies mentioned in this commentary as of the date of this report.

An investment in the Fund involves risk, including the loss of principal. Additionally, there are certain risks inherent in investing in the Fund, including market risk, short sale risk, interest rate risk, business risk, small company risk, market valuation risk, political risk, and portfolio turnover risk. For a complete discussion of these risks, you may request a copy of the Fund’s prospectus by calling 800-237-7073. The Fund uses aggressive investment strategies (including short positions and options) that have the potential for yielding high returns; however, these strategies may also result in losses. Stocks sold short have unlimited risk. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Options are not suitable for all investors.

Investors should expect that the Fund’s performance may fluctuate independently of stock market indices, such as the S&P 500 Total Return Index.

Distributed by ALPS Distributors, Inc., Member FINRA/SIPC

1290 Broadway, Suite 1100, Denver, CO 80203

4 | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

Table of Contents

Caldwell & Orkin | ||

| Market Opportunity Fund | Shareholder Letter |

October 31, 2012 (Unaudited)

Statistical Risk Definitions:

Correlation Coefficient (R): R is a statistical measure of correlation. In this report, R is a measurement of investment risk that indicates how closely performance is linked to the broad market – it quantifies the degree to which a fund’s performance correlates with the performance of a benchmark. R can vary between 100% (perfect positive correlation) and –100% (perfect negative correlation). 0% represents no correlation. An R of 100% means that all movements of a fund are fully explained by movements in its benchmark index. Conversely, a low R indicates that very few of the fund’s movements are explained by movements in its benchmark index, and a negative R indicates a fund’s movements are inversely correlated with its benchmark index.

Coefficient of Determination (R-Square): R-Square, also represented as R2, is another measurement of investment risk that quantifies the degree to which a fund’s performance correlates with the performance of its benchmark index. R-Square is calculated by multiplying the Correlation Coefficient (R) by itself, and is therefore always positive. R-Square can vary between 0% (no correlation) and 100% (perfect correlation). The higher the value of R-Square, the greater the degree of correlation between the fund and its benchmark index. R-squared does not take into account the direction of the correlation (positive or negative), therefore R-Squared is not able to reflect inverse correlation between a fund and its benchmark index.

Beta: A measure of a fund’s sensitivity to market movements. Usually the higher betas represent riskier investments. When correlation is low, beta has minimal, if any, significance.

Standard deviation: A statistical measure of dispersion about an average, indicating the volatility of a fund’s total returns.

Sharpe Ratio: The Sharpe Ratio is calculated by subtracting the risk-free (T-bill) rate of return from a portfolio’s total return and then dividing this by its standard deviation. The resulting fraction can be thought of as return per unit of risk. The higher a portfolio’s Sharpe Ratio, the better the risk-adjusted performance.

Semi-variance: A measure of a fund’s downside (negative return) volatility relative to a benchmark. Lower numbers are associated with less risk.

Index Definition:

S&P 500 Total Return Index: The S&P 500 Total Return Index is a capitalization-weighted, unmanaged index of 500 large U.S. companies chosen for market size, liquidity and industry group representation and includes reinvested dividends. You cannot invest directly in an index.

Semi-Annual Report | October 31, 2012 | 5 |

Table of Contents

October 31, 2012 (Unaudited)

Fiscal Year Ended April 30, | C&O Market Opportunity Fund(1) | S&P 500 Total Return Index(2) | ||

1993* | 15.09% | 9.24% | ||

1993** | 21.09% | 9.18% | ||

1994 | 16.48% | 5.32% | ||

1995 | -2.28% | 17.47% | ||

1996 | 31.80% | 30.21% | ||

1997 | 23.24% | 25.13% | ||

1998 | 25.77% | 41.07% | ||

1999 | 19.43% | 21.82% | ||

2000 | -0.02% | 10.13% | ||

2001 | 11.43% | -12.97% | ||

| ||||

Total Return Through October 31, 2012 | ||||

6 months ended | 5.45% | 2.16% | ||

12 months ended | 11.29% | 15.21% | ||

Since 8/24/92(3) | 429.64% | 412.47% | ||

| Fiscal Year Ended April 30, | C&O Market Opportunity Fund(1) | S&P 500 Total Return Index(2) | ||

2002 | 1.88% | -12.63% | ||

2003 | 1.12% | -13.31% | ||

2004 | -3.55% | 22.88% | ||

2005 | -0.17% | 6.34% | ||

2006 | -2.74% | 15.42% | ||

2007 | 15.31% | 15.24% | ||

2008 | 17.92% | -4.68% | ||

2009 | 4.73% | -35.31% | ||

2010 | -7.40% | 38.84% | ||

2011 | 0.41% | 17.22% | ||

2012 | 4.95% | 4.76% | ||

| Average Annual Returns Through October 31, 2012 | ||||

One Year | 11.29% | 15.21% | ||

Three Years | 2.82% | 13.21% | ||

Five Years | 1.05% | 0.36% | ||

Ten Years | 2.90% | 6.91% | ||

Fifteen Years | 4.72% | 4.81% | ||

Twenty Years | 8.18% | 8.38% | ||

Since 8/24/92(3) | 8.61% | 8.43% | ||

Total annualized Fund operating expenses for the Fund’s fiscal year ended April 30, 2012 were 2.12%, or 1.26% before interest expenses and dividend expenses related to short sales. These figures exclude Acquired Fund Fees and Expenses of 0.03%. Additional information about the Fund’s fees and expenses is available in the Fund’s prospectus.

Net Asset Allocation

October 31, 2012

6 | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

Table of Contents

Caldwell & Orkin | ||

| Market Opportunity Fund | Performance Summary |

October 31, 2012 (Unaudited)

Net Asset Allocation

April 30, 2012

| 1 | The performance data quoted represents past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Please call 800-377-7073 or visit www.caldwellorkinfunds.com for current month-end performance. The Fund’s performance assumes the reinvestment of dividends and capital gains, if any. Fund holdings, industry and asset allocations are subject to change without notice. The Fund may or may not have a position in any of the companies mentioned in this report as of the date of this report. See additional important disclosures on pages 4 and 5. |

| 2 | Investors should expect that the Fund’s performance may fluctuate independently of stock market indices, such as the S&P 500 Total Return index. The S&P 500 Total Return index is a widely recognized unmanaged index of 500 common stock prices adjusted to reflect the reinvestment of dividends and distributions. You may not invest directly in an index. |

| 3 | Effective August 24, 1992, the Fund changed its investment objective to provide long-term capital growth with a short-term focus on capital preservation through investment selection and asset allocation. Prior to that time, the Fund was passively managed and indexed to the largest 100 over-the-counter (OTC) stocks. |

| * | For the full fiscal year ended April 30, 1993. |

| ** | From August 24, 1992 through April 30, 1993 - the portion of the year using the active investment management style of C&O Funds Advisor, Inc., the manager of the Fund. |

Semi-Annual Report | October 31, 2012 | 7 |

Table of Contents

October 31, 2012 (Unaudited)

| Ten Worst S&P 500 Total Return Days | ||||||||

| Date | C&O MOF | S&P 500 | Variance | The Caldwell & Orkin Market Opportunity Fund outperformed the S&P 500 Total Return index on all ten of the ten worst days, and was positive on two of the ten days. | ||||

| 10/15/2008 | -1.47% | -9.02% | 7.55% | |||||

| 12/1/2008 | -1.58% | -8.92% | 7.34% | |||||

| 9/29/2008 | -0.37% | -8.78% | 8.41% | |||||

| 10/9/2008 | -2.12% | -7.61% | 5.49% | |||||

| 10/27/1997 | -1.60% | -6.89% | 5.29% | |||||

| 8/31/1998 | 0.42% | -6.79% | 7.21% | |||||

| 11/20/2008 | 0.23% | -6.70% | 6.93% | |||||

| 8/8/2011 | -0.63% | -6.66% | 6.03% | |||||

| 11/19/2008 | -0.28% | -6.10% | 5.82% | |||||

| 10/22/2008 | -1.11% | -6.09% | 4.98% | |||||

| Ten Worst S&P 500 Total Return Weeks | ||||||||

| Week Ending | C&O MOF | S&P 500 | Variance | The Caldwell & Orkin Market Opportunity Fund outperformed the S&P 500 Total Return index in all ten of the ten worst weeks, and was positive in seven of those weeks. | ||||

| 10/10/2008 | -2.71% | -18.14% | 15.43% | |||||

| 9/21/2001 | 1.63% | -11.57% | 13.20% | |||||

| 4/14/2000 | 4.51% | -10.52% | 15.03% | |||||

| 10/3/2008 | 1.83% | -9.33% | 11.16% | |||||

| 11/21/2008 | 0.56% | -8.33% | 8.89% | |||||

| 7/19/2002 | 0.65% | -7.96% | 8.61% | |||||

| 8/5/2011 | -0.77% | -7.15% | 6.38% | |||||

| 3/6/2009 | -0.88% | -6.96% | 6.08% | |||||

| 7/12/2002 | 1.01% | -6.81% | 7.82% | |||||

| 2/20/2009 | 0.20% | -6.80% | 7.00% | |||||

| Ten Worst S&P 500 Total Return Months | ||||||||

| Month | C&O MOF | S&P 500 | Variance | The Caldwell & Orkin Market Opportunity Fund outperformed the S&P 500 Total Return index in all ten of the ten worst months, and was positive in seven of those months. | ||||

| 10/31/2008 | 3.42% | -16.74% | 20.16% | |||||

| 8/31/1998 | 3.12% | -14.46% | 17.58% | |||||

| 9/30/2002 | 2.10% | -10.86% | 12.96% | |||||

| 2/28/2009 | 0.30% | -10.71% | 11.01% | |||||

| 2/28/2001 | 4.78% | -9.13% | 13.91% | |||||

| 9/30/2008 | -0.42% | -8.89% | 8.47% | |||||

| 6/30/2008 | 4.84% | -8.43% | 13.27% | |||||

| 1/31/2009 | -0.73% | -8.30% | 7.57% | |||||

| 9/30/2001 | 3.29% | -8.06% | 11.35% | |||||

| 5/31/2010 | -2.55% | -8.04% | 5.49% | |||||

Short selling began May 2, 1994. Past performance is no guarantee of future results. See additional important disclosures on pages 4 and 5. Computations by Ned Davis Research, Inc.

8 | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

Table of Contents

Caldwell & Orkin | ||

| Market Opportunity Fund | Statistical Risk Profile |

October 31, 2012 (Unaudited)

| Ten Worst Drawdowns | ||||||||||||||||||||

| Caldwell & Orkin Market Opportunity Fund | S&P 500 Total Return Index | |||||||||||||||||||

| Date Range | C&O MOF | S&P 500 | Date Range | C&O MOF | S&P 500 | |||||||||||||||

01/17/2008 - 05/07/2010 | -15.71 | % | -11.68 | % | 10/09/2007 - 03/09/2009 | -0.61 | % | -55.26 | % | |||||||||||

04/12/1999 - 11/23/1999 | -13.24 | % | 4.23 | % | 03/24/2000 - 10/09/2002 | 28.57 | % | -47.41 | % | |||||||||||

10/09/2002 - 05/25/2006 | -13.12 | % | 74.17 | % | 07/17/1998 - 08/31/1998 | 4.02 | % | -19.19 | % | |||||||||||

05/26/2000 - 06/07/2000 | -8.15 | % | 6.81 | % | 04/29/2011 - 10/03/2011 | 0.47 | % | -18.72 | % | |||||||||||

12/29/2000 - 01/19/2001 | -8.06 | % | 1.75 | % | 04/23/2010 - 07/02/2010 | -1.52 | % | -15.67 | % | |||||||||||

04/04/2001 - 03/11/2002 | -7.98 | % | 7.22 | % | 11/27/2002 - 03/11/2003 | 2.19 | % | -14.28 | % | |||||||||||

03/15/1993 - 04/26/1993 | -7.83 | % | -3.65 | % | 07/16/1999 - 10/15/1999 | -0.45 | % | -11.78 | % | |||||||||||

03/18/1994 - 02/03/1995 | -7.68 | % | 4.21 | % | 10/07/1997 - 10/27/1997 | 0.18 | % | -10.74 | % | |||||||||||

04/10/2007 - 05/24/2007 | -7.14 | % | 4.31 | % | 09/23/1998 - 10/08/1998 | 2.02 | % | -9.94 | % | |||||||||||

10/07/1998 - 11/05/1998 | -6.41 | % | 16.95 | % | 04/02/2012 - 06/01/2012 | -1.27 | % | -9.63 | % | |||||||||||

Statistical Risk Measurements 8/24/1992 through 10/31/2012 (daily data) | ||||||||

| C&O MOF | S&P 500 | |||||||

Coefficient of Determination (R-Square) | 0.04% | 100.00% | ||||||

Correlation Coefficient “R” | 2.00% | 100.00% | ||||||

Beta | 0.019 | 1.000 | ||||||

Standard Deviation | 0.511 | 1.206 | ||||||

Sharpe Ratio | 0.68 | 0.36 | ||||||

Semi-Variance | 0.13 | 0.72 | ||||||

| Performance During the Last Three Market Downturns of 20% or More | ||||||||

| C&O MOF | S&P 500 | |||||||

01/06/2009 - 03/09/2009 | -3.42 | % | -27.19 | % | ||||

10/09/2007 - 11/20/2008 | 1.80 | % | -50.73 | % | ||||

01/04/2002 - 10/09/2002 | 7.25 | % | -32.95 | % | ||||

Short selling began May 2, 1994. Past performance is no guarantee of future results. See additional important disclosures on pages 4 and 5. Computations by Ned Davis Research, Inc.

Semi-Annual Report | October 31, 2012 | 9 |

Table of Contents

October 31, 2012 (Unaudited)

Caldwell & Orkin Market Opportunity Fund Versus S&P 500 Total Return Index

Since Commencement of Active Style of Investment Management Results of a Hypothetical $10,000 Investment August 24, 1992 through October 31, 2012.

Past performance does not predict future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. See additional disclosure on pages 4 and 5.

10 | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

Table of Contents

October 31, 2012 (Unaudited)

We believe it is important for you to understand the impact of fees and expenses on your investment in the Fund. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs related to the purchase and redemption of Fund shares, including redemption fees and brokerage commissions (if applicable); and (2) ongoing costs, including management fees, administrative expenses, portfolio transaction costs and other Fund expenses. A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The below example is based on an investment of $1,000.00 invested at the beginning of the period and held for the entire period indicated, May 1, 2012 through October 31, 2012. The table below illustrates the Fund’s expenses in two ways:

Based on Actual Fund Returns

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Based on a Hypothetical 5% Return for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or brokerage commissions. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Semi-Annual Report | October 31, 2012 | 11 |

Table of Contents

Caldwell & Orkin | ||

| Market Opportunity Fund | Disclosure of Fund Expenses |

October 31, 2012 (Unaudited)

Beginning Account Value | Ending Account Value 10/31/2012 | Expense Ratio1 | Expenses Paid During Period2 | |||||||||||||||||

Actual3 | $ | 1,000.00 | $ | 1,054.00 | 2.11% | $ | 10.92 | |||||||||||||

Hypothetical (5% return before expenses)4 | $ | 1,000.00 | $ | 1,014.57 | 2.11% | $ | 10.71 | |||||||||||||

| 1 | The annualized expense ratio reflects actual expenses from the Fund from May 1, 2012 through October 31, 2012, as a percentage of average net assets for that period. |

| 2 | Expenses are equal to the Caldwell & Orkin Market Opportunity Fund’s annualized expense ratio of 2.11% multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), divided by 365 (to reflect the half-year period.) |

| 3 | Excluding interest expense and dividend expense from short positions, your actual cost of investment in the Fund would be $6.58. |

| 4 | Excluding interest expense and dividend expense from short positions, your hypothetical cost of investment in the Fund would be $6.46. |

12 | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

Table of Contents

October 31, 2012 (Unaudited)

The following table presents the Caldwell & Orkin Market Opportunity Fund’s 10/31/2012 portfolio holdings by sector based on total net assets, sorted by net exposure (net long to net short).

| Long | Short | Total (1) | Net (2) | |||||||||||||

Building - Residential /Commercial | 12.02 | % | 12.02 | % | 12.02 | % | ||||||||||

Pipelines | 9.59 | % | 9.59 | % | 9.59 | % | ||||||||||

Retail - Apparel/Shoe | 5.77 | % | -0.98 | % | 6.75 | % | 4.79 | % | ||||||||

Electric - Integrated | 4.89 | % | 4.89 | % | 4.89 | % | ||||||||||

Retail - Building Products | 3.29 | % | 3.29 | % | 3.29 | % | ||||||||||

Building & Construction Production - Miscellaneous | 2.65 | % | 2.65 | % | 2.65 | % | ||||||||||

Reinsurance | 2.51 | % | 2.51 | % | 2.51 | % | ||||||||||

Coatings/Paint | 2.29 | % | 2.29 | % | 2.29 | % | ||||||||||

Gold Mining | 2.27 | % | 2.27 | % | 2.27 | % | ||||||||||

Medical - HMO | 1.90 | % | 1.90 | % | 1.90 | % | ||||||||||

Real Estate Investment Trust - Mortgage | 1.09 | % | 1.09 | % | 1.09 | % | ||||||||||

Textile - Home Furnishing | 1.07 | % | 1.07 | % | 1.07 | % | ||||||||||

Diversified Banking Institution | 1.02 | % | 1.02 | % | 1.02 | % | ||||||||||

Semiconductor Components/Integrated Circuits | 1.01 | % | 1.01 | % | 1.01 | % | ||||||||||

Food - Retail | 0.95 | % | 0.95 | % | 0.95 | % | ||||||||||

Retail - Restaurants | 0.76 | % | -0.09 | % | 0.85 | % | 0.67 | % | ||||||||

Oil & Gas Companies - Exploration & Production | 0.71 | % | 0.71 | % | 0.71 | % | ||||||||||

Motion Pictures & Services | 0.66 | % | 0.66 | % | 0.66 | % | ||||||||||

Motorcycle/Motor Scooter | 0.61 | % | 0.61 | % | 0.61 | % | ||||||||||

Private Equity | 0.50 | % | 0.50 | % | 0.50 | % | ||||||||||

Automotive - Truck Parts & Equipment | 0.49 | % | 0.49 | % | 0.49 | % | ||||||||||

Commercial Services | 0.49 | % | -0.22 | % | 0.71 | % | 0.27 | % | ||||||||

Multi-Media | 0.49 | % | 0.49 | % | 0.49 | % | ||||||||||

Distribution/Wholesale | 0.45 | % | 0.45 | % | 0.45 | % | ||||||||||

Networking Products | 0.34 | % | 0.34 | % | 0.34 | % | ||||||||||

Medical - Drugs | 0.31 | % | 0.31 | % | 0.31 | % | ||||||||||

Oil & Gas Drilling | 0.30 | % | 0.30 | % | 0.30 | % | ||||||||||

Broadcast Services/Programming | 0.23 | % | 0.23 | % | 0.23 | % | ||||||||||

Diversified Manufacturing Operations | 0.21 | % | 0.21 | % | 0.21 | % | ||||||||||

Building - Heavy Construction | 0.20 | % | 0.20 | % | 0.20 | % | ||||||||||

Cellular Telecom | 0.20 | % | 0.20 | % | 0.20 | % | ||||||||||

Coal | 0.20 | % | 0.20 | % | 0.20 | % | ||||||||||

Footwear (Non-Athletic) & Related Apparel | 0.19 | % | 0.19 | % | 0.19 | % | ||||||||||

Beverages - Non-Alcoholic | 0.10 | % | 0.10 | % | 0.10 | % | ||||||||||

Retail - Discount | 0.10 | % | 0.10 | % | 0.10 | % | ||||||||||

Finance - Mortgage Loan/Banker | 0.00 | %* | 0.00 | %* | 0.00 | %* | ||||||||||

Investment Management/Advisory Services | 0.00 | %* | 0.00 | %* | 0.00 | %* | ||||||||||

Telecommunication Services | 0.00 | %* | 0.00 | %* | 0.00 | %* | ||||||||||

Vitamins & Nutrition Products | -0.00 | %* | -0.00 | %* | -0.00 | %* | ||||||||||

Medical Products | -0.06 | % | 0.06 | % | -0.06 | % | ||||||||||

Retail - Computer Equipment | -0.10 | % | 0.10 | % | -0.10 | % | ||||||||||

Semi-Annual Report | October 31, 2012 | 13 |

Table of Contents

Caldwell & Orkin | ||

| Market Opportunity Fund | Sector Diversification |

October 31, 2012 (Unaudited)

| Long | Short | Total (1) | Net (2) | |||||||||||||

Building Products - Air & Heating | -0.11 | % | 0.11 | % | -0.11 | % | ||||||||||

Metal - Copper | -0.14 | % | 0.14 | % | -0.14 | % | ||||||||||

Food - Miscellaneous/Diversified | -0.18 | % | 0.18 | % | -0.18 | % | ||||||||||

Electronic Measuring Instruments | -0.20 | % | 0.20 | % | -0.20 | % | ||||||||||

Apparel Manufacturers | -0.26 | % | 0.26 | % | -0.26 | % | ||||||||||

Aerospace/Defense | -0.31 | % | 0.31 | % | -0.31 | % | ||||||||||

E-Marketing/Information | -0.36 | % | 0.36 | % | -0.36 | % | ||||||||||

Dental Supplies & Equipment | -0.38 | % | 0.38 | % | -0.38 | % | ||||||||||

Toys | -0.48 | % | 0.48 | % | -0.48 | % | ||||||||||

Building - Mobile Home/Manufactured Housing & RV | -0.49 | % | 0.49 | % | -0.49 | % | ||||||||||

Machinery - Tools & Related Products | -0.49 | % | 0.49 | % | -0.49 | % | ||||||||||

Diversified Minerals | -0.51 | % | 0.51 | % | -0.51 | % | ||||||||||

Applications Software | -0.52 | % | 0.52 | % | -0.52 | % | ||||||||||

Commerical Banks - Non-U.S. | -0.56 | % | 0.56 | % | -0.56 | % | ||||||||||

E-Commerce/Products | 0.52 | % | -0.59 | % | 1.11 | % | -0.07 | % | ||||||||

Steel - Producers | -0.61 | % | 0.61 | % | -0.61 | % | ||||||||||

Transport - Services | -0.70 | % | 0.70 | % | -0.70 | % | ||||||||||

Home Furnishings | -0.79 | % | 0.79 | % | -0.79 | % | ||||||||||

Medical - Hospitals | -0.98 | % | -0.98 | % | -0.98 | % | ||||||||||

Medical - Outpatient/Home Medical Care | -0.98 | % | -0.98 | % | -0.98 | % | ||||||||||

E-Commerce/Services | -1.17 | % | 1.17 | % | -1.17 | % | ||||||||||

Beverages - Wine/Spirits | -1.20 | % | 1.20 | % | -1.20 | % | ||||||||||

Computers | 0.49 | % | -1.36 | % | 1.85 | % | -0.87 | % | ||||||||

Electronic Devices | -1.47 | % | 1.47 | % | -1.47 | % | ||||||||||

Schools | -2.63 | % | 2.63 | % | -2.63 | % | ||||||||||

Subtotal Common Stocks (long & short positions) | 60.87 | % | -18.92 | % | 75.87 | % | 41.95 | % | ||||||||

| ||||||||||||||||

Exchange Traded Fund - Country Fund - United States | 1.10 | % | 1.10 | % | 1.10 | % | ||||||||||

Exchange Traded Fund - Gold | 3.73 | % | 3.73 | % | 3.73 | % | ||||||||||

Exchange Traded Funds - Emerging Countries | -0.49 | % | 0.49 | % | -0.49 | % | ||||||||||

Subtotal Exchange-Traded Funds (long & short positions) | 4.83 | % | -0.49 | % | 5.32 | % | 4.34 | % | ||||||||

| ||||||||||||||||

Subtotal Equities (long & short positions) | 65.70 | % | -19.41 | % | 81.19 | % | 46.29 | % | ||||||||

Call Options | 1.02 | % | 1.02 | % | ||||||||||||

Put Options | 0.53 | % | 0.53 | % | ||||||||||||

Other Assets less Liabilities | 13.34 | % | 13.34 | % | ||||||||||||

Total Portfolio Holdings | 80.59 | % | -19.41 | % | 100.00 | % | ||||||||||

| * | Less than 0.005% of net assets. |

| (1) | Total exposure is Long exposure plus the absolute value of the Short exposure. |

| (2) | Net exposure is Long exposure less Short exposure. |

14 | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

Table of Contents

October 31, 2012 (Unaudited)

| Shares | Value (Note 1) | |||||||

LONG INVESTMENTS (67.25%) | ||||||||

COMMON STOCKS (60.87%) | ||||||||

Automotive - Truck Parts & Equipment (0.49%) | ||||||||

Delphi Automotive PLC1 | 39,800 | $ | 1,251,312 | |||||

|

| |||||||

Beverages - Non - Alcoholic (0.10%) | ||||||||

The Coca-Cola Co. | 6,600 | 245,388 | ||||||

|

| |||||||

Broadcast Services/Programming (0.23%) | ||||||||

Discovery Communications, Inc. - Class A1 | 9,800 | 578,396 | ||||||

|

| |||||||

Building - Heavy Construction (0.20%) | ||||||||

Chicago Bridge & Iron Co. N.V. | 13,600 | 510,680 | ||||||

|

| |||||||

Building - Residential/Commercial (12.02%) | ||||||||

Beazer Homes USA, Inc.1 | 150,100 | 2,475,149 | ||||||

Lennar Corp. - Class A | 142,400 | 5,335,728 | ||||||

M/I Homes, Inc.1 | 137,100 | 3,050,475 | ||||||

Meritage Homes Corp.1 | 77,100 | 2,851,158 | ||||||

Pulte Group, Inc.1 | 281,000 | 4,872,540 | ||||||

The Ryland Group, Inc. | 38,500 | 1,303,995 | ||||||

Standard Pacific Corp.1 | 975,700 | 6,732,330 | ||||||

Toll Brothers, Inc.1 | 124,900 | 4,122,949 | ||||||

|

| |||||||

| 30,744,324 | ||||||||

|

| |||||||

Building & Construction Production - Miscellaneous (2.65%) | ||||||||

Fortune Brands Home & Security, Inc.1 | 238,800 | 6,791,472 | ||||||

|

| |||||||

Cellular Telecom (0.20%) | ||||||||

Sprint Nextel Corp.1 | 93,300 | 516,882 | ||||||

|

| |||||||

Coal (0.20%) | ||||||||

CONSOL Energy, Inc. | 14,300 | 502,788 | ||||||

|

| |||||||

Coatings/Paint (2.29%) | ||||||||

The Sherwin-Williams Co. | 41,000 | 5,845,780 | ||||||

|

| |||||||

Commercial Services (0.49%) | ||||||||

PHH Corp.1 | 59,700 | 1,242,357 | ||||||

|

| |||||||

Computers (0.49%) | ||||||||

Apple, Inc. | 2,100 | 1,249,710 | ||||||

|

| |||||||

Semi-Annual Report | October 31, 2012 | 15 |

Table of Contents

Caldwell & Orkin | ||

| Market Opportunity Fund | Schedule of Investments |

October 31, 2012 (Unaudited)

| Shares | Value (Note 1) | |||||||

Distribution/Wholesale (0.45%) | ||||||||

Beacon Roofing Supply, Inc.1 | 27,900 | $ | 902,286 | |||||

Pool Corp. | 6,000 | 252,720 | ||||||

|

| |||||||

| 1,155,006 | ||||||||

|

| |||||||

Diversified Banking Institution (1.02%) | ||||||||

Citigroup, Inc. | 69,800 | 2,609,822 | ||||||

|

| |||||||

Diversified Manufacturing Operations (0.21%) | ||||||||

Eaton Corp. | 11,400 | 538,308 | ||||||

|

| |||||||

E - Commerce/Products (0.52%) | ||||||||

eBay, Inc.1 | 27,600 | 1,332,804 | ||||||

|

| |||||||

Electric - Integrated (4.89%) | ||||||||

American Electric Power Co., Inc. | 112,100 | 4,981,724 | ||||||

CMS Energy Corp. | 309,600 | 7,529,472 | ||||||

|

| |||||||

| 12,511,196 | ||||||||

|

| |||||||

Finance - Mortgage Loan/Banker (0.00%)† | ||||||||

Walter Investment Management Corp.1 | 100 | 4,833 | ||||||

|

| |||||||

Food - Retail (0.95%) | ||||||||

Whole Foods Market, Inc. | 25,600 | 2,425,088 | ||||||

|

| |||||||

Footwear (Non-Athletic) & Related Apparel (0.19%) | ||||||||

Skechers U.S.A., Inc. - Class A1 | 29,600 | 491,360 | ||||||

|

| |||||||

Gold Mining (2.27%) | ||||||||

Agnico-Eagle Mines, Ltd. | 102,600 | 5,795,874 | ||||||

|

| |||||||

Investment Management/Advisory Services (0.00%)† | ||||||||

Altisource Portfolio Solutions SA1 | 100 | 11,350 | ||||||

|

| |||||||

Medical - Drugs (0.31%) | ||||||||

Johnson & Johnson | 11,300 | 800,266 | ||||||

|

| |||||||

Medical - HMO (1.90%) | ||||||||

UnitedHealth Group, Inc. | 86,600 | 4,849,600 | ||||||

|

| |||||||

16 | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

Table of Contents

Caldwell & Orkin | ||

| Market Opportunity Fund | Schedule of Investments |

October 31, 2012 (Unaudited)

| Shares | Value (Note 1) | |||||||

Motion Pictures & Services (0.66%) | ||||||||

Lions Gate Entertainment Corp.1 | 101,700 | $ | 1,696,356 | |||||

|

| |||||||

Motorcycle/Motor Scooter (0.61%) | ||||||||

Harley-Davidson, Inc. | 33,200 | 1,552,432 | ||||||

|

| |||||||

Multi-Media (0.49%) | ||||||||

The Walt Disney Co. | 25,300 | 1,241,471 | ||||||

|

| |||||||

Networking Products (0.34%) | ||||||||

Cisco Systems, Inc. | 50,700 | 868,998 | ||||||

|

| |||||||

Oil & Gas Companies - Exploration & Production (0.71%) | ||||||||

Southwestern Energy Co.1 | 52,500 | 1,821,750 | ||||||

|

| |||||||

Oil & Gas Drilling (0.30%) | ||||||||

Ensco PLC - Class A | 13,300 | 769,006 | ||||||

|

| |||||||

Pipelines (9.59%) | ||||||||

Enbridge, Inc. | 201,900 | 8,029,563 | ||||||

Kinder Morgan, Inc. | 227,200 | 7,886,112 | ||||||

Plains All American Pipeline LP | 189,800 | 8,613,124 | ||||||

|

| |||||||

| 24,528,799 | ||||||||

|

| |||||||

Private Equity (0.50%) | ||||||||

Blackstone Group LP | 83,800 | 1,287,168 | ||||||

|

| |||||||

Real Estate Investment Trust - Mortgage (1.09%) | ||||||||

PennyMac Mortgage Investment Trust | 109,800 | 2,793,312 | ||||||

|

| |||||||

Reinsurance (2.51%) | ||||||||

Greenlight Capital Re, Ltd. - Class A1 | 251,300 | 6,420,715 | ||||||

|

| |||||||

Retail - Apparel/Shoe (5.77%) | ||||||||

ANN, Inc.1 | 28,700 | 1,009,092 | ||||||

Chico’s FAS, Inc. | 278,600 | 5,181,960 | ||||||

The Gap, Inc. | 82,000 | 2,929,040 | ||||||

Limited Brands, Inc. | 60,800 | 2,911,712 | ||||||

Urban Outfitters, Inc.1 | 76,500 | 2,735,640 | ||||||

|

| |||||||

| 14,767,444 | ||||||||

|

| |||||||

Retail - Building Products (3.29%) | ||||||||

Home Depot, Inc. | 137,000 | 8,409,060 | ||||||

Semi-Annual Report | October 31, 2012 | 17 |

Table of Contents

Caldwell & Orkin | ||

| Market Opportunity Fund | Schedule of Investments |

October 31, 2012 (Unaudited)

| Shares | Value (Note 1) | |||||||

Retail - Building Products (continued) | ||||||||

Lumber Liquidators Holdings, Inc.1 | 100 | $ | 5,582 | |||||

|

| |||||||

| 8,414,642 | ||||||||

|

| |||||||

Retail - Discount (0.10%) | ||||||||

Costco Wholesale Corp. | 2,600 | 255,918 | ||||||

|

| |||||||

Retail - Restaurants (0.76%) | ||||||||

Panera Bread Co. - Class A1 | 11,500 | 1,939,360 | ||||||

|

| |||||||

Semiconductor Components/Integrated Circuits (1.01%) | ||||||||

QUALCOMM, Inc. | 44,300 | 2,594,873 | ||||||

|

| |||||||

Telecommunication Services (0.00%)† | ||||||||

Allot Communications, Ltd.1 | 100 | 2,336 | ||||||

|

| |||||||

Textile - Home Furnishings (1.07%) | ||||||||

Mohawk Industries, Inc.1 | 32,800 | 2,737,816 | ||||||

|

| |||||||

TOTAL COMMON STOCKS (Cost $134,165,712) | 155,696,992 | |||||||

EXCHANGE TRADED FUNDS (4.83%) | ||||||||

Country Fund - United States (1.10%) | ||||||||

Market Vectors Gold Miners ETF | 53,400 | 2,822,190 | ||||||

|

| |||||||

Gold (3.73%) | ||||||||

SPDR® Gold Shares1 | 49,400 | 8,242,884 | ||||||

Sprott Physical Gold Trust1 | 88,200 | 1,299,186 | ||||||

|

| |||||||

| 9,542,070 | ||||||||

|

| |||||||

TOTAL EXCHANGE TRADED FUNDS | ||||||||

(Cost $11,187,613) | 12,364,260 | |||||||

Expiration Date | Exercise Price | Number of Contracts | Value (Note 1) | |||||||||||

PURCHASED OPTIONS (1.55%) | ||||||||||||||

PURCHASED CALL OPTIONS (1.02%) | ||||||||||||||

Citigroup, Inc. | January, 2013 | $ | 37.00 | 465 | 120,900 | |||||||||

Fortune Brands Home & Security, Inc. | December, 2012 | 22.50 | 380 | 224,200 | ||||||||||

Lennar Corp. | February, 2013 | 35.00 | 1,035 | 512,325 | ||||||||||

18 | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

Table of Contents

Caldwell & Orkin | ||

| Market Opportunity Fund | Schedule of Investments |

October 31, 2012 (Unaudited)

| Expiration Date | Exercise Price | Number of Contracts | Value (Note 1) | |||||||||||

PURCHASED CALL OPTIONS (continued) | ||||||||||||||

Meritage Homes Corp. | December, 2012 | $35.00 | 501 | $150,300 | ||||||||||

Pulte Group, Inc. | January, 2013 | 16.00 | 2,015 | 481,585 | ||||||||||

Sherwin-Williams Co. | January, 2013 | 145.00 | 626 | 313,000 | ||||||||||

Southwestern Energy Co. | December, 2012 | 32.00 | 872 | 300,840 | ||||||||||

Standard Pacific Corp. | December, 2012 | 5.00 | 1,718 | 317,830 | ||||||||||

UnitedHealth Group, Inc. | December, 2012 | 55.00 | 705 | 183,300 | ||||||||||

|

| |||||||||||||

TOTAL PURCHASED CALL OPTIONS | ||||||||||||||

(Cost $2,164,303) | 2,604,280 | |||||||||||||

|

| |||||||||||||

PURCHASED PUT OPTIONS (0.53%) | ||||||||||||||

Cerner Corp. | January, 2013 | 75.00 | 292 | 90,520 | ||||||||||

Community Health Systems, Inc. | December, 2012 | 26.00 | 508 | 50,800 | ||||||||||

Gamestop Corp. | January, 2013 | 19.00 | 489 | 32,763 | ||||||||||

Garmin, Ltd. | January, 2013 | 42.00 | 526 | 289,300 | ||||||||||

Green Mountain Coffee Roasters, Inc. | December, 2012 | 30.00 | 420 | 304,080 | ||||||||||

Monster Beverage Co. | December, 2012 | 60.00 | 215 | 335,400 | ||||||||||

NetFlix, Inc. | January, 2012 | 80.00 | 275 | 258,500 | ||||||||||

|

| |||||||||||||

TOTAL PURCHASED PUT OPTIONS | ||||||||||||||

(Cost $1,268,170) | 1,361,363 | |||||||||||||

|

| |||||||||||||

TOTAL PURCHASED OPTIONS | ||||||||||||||

(Cost $3,432,473) | 3,965,643 | |||||||||||||

TOTAL LONG INVESTMENTS | ||||||||||||||

(Cost $148,785,798) | 172,026,895 | |||||||||||||

| 7-Day Yield | Shares | Value (Note 1) | ||||||||

SHORT TERM INVESTMENTS (30.36%) | ||||||||||

MONEY MARKET FUNDS2 | ||||||||||

JPMorgan 100% U.S. Treasury Securities Money Market Fund | 0.00%3 | 77,645,044 | 77,645,044 | |||||||

|

| |||||||||

Semi-Annual Report | October 31, 2012 | 19 |

Table of Contents

Caldwell & Orkin | ||

| Market Opportunity Fund | Schedule of Investments |

October 31, 2012 (Unaudited)

Value (Note 1) | ||||||||

TOTAL SHORT TERM INVESTMENTS (Cost $77,645,044) | $ | 77,645,044 | ||||||

TOTAL INVESTMENTS - (97.61%) (Cost $226,430,842) | $ | 249,671,939 | ||||||

Assets in Excess of Other Liabilities (2.39%) | 6,101,056 | |||||||

NET ASSETS (100.00%) | $ | 255,772,995 | ||||||

| SCHEDULE OF SECURITIES SOLD SHORT | Shares | Value (Note 1) | ||||||

COMMON STOCKS (-18.92%) | ||||||||

Aerospace/Defense (-0.31%) | ||||||||

Aerovironment, Inc. | (100) | $ | (2,199) | |||||

Rockwell Collins, Inc. | (15,000) | (803,700) | ||||||

|

| |||||||

| (805,899) | ||||||||

|

| |||||||

Apparel Manufacturers (-0.26%) | ||||||||

Hanesbrands, Inc. | (19,500) | (652,665) | ||||||

|

| |||||||

Applications Software (-0.52%) | ||||||||

Microsoft Corp. | (46,400) | (1,324,024) | ||||||

|

| |||||||

Beverages - Wine/Spirits (-1.20%) | ||||||||

Green Mountain Coffee Roasters, Inc. | (127,100) | (3,070,736) | ||||||

|

| |||||||

Building - Mobile Home/Manufactured Housing & RV (-0.49%) | ||||||||

Thor Industries, Inc. | (33,100) | (1,258,793) | ||||||

|

| |||||||

Building Products - Air & Heating (-0.11%) | ||||||||

Lennox International, Inc. | (5,500) | (275,275) | ||||||

|

| |||||||

Commercial Banks Non - U.S. (-0.56%) | ||||||||

Sberbank of Russia, Sponsored ADR | (124,000) | (1,444,600) | ||||||

|

| |||||||

Commercial Services (-0.22%) | ||||||||

HMS Holdings Corp. | (24,200) | (558,778) | ||||||

|

| |||||||

20 | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

Table of Contents

Caldwell & Orkin | ||

| Market Opportunity Fund | Schedule of Investments |

October 31, 2012 (Unaudited)

| SCHEDULE OF SECURITIES SOLD SHORT (continued) | Shares | Value (Note 1) | ||||||

Computers (-1.36%) | ||||||||

Dell, Inc. | (209,200) | $ | (1,930,916) | |||||

Hewlett-Packard Co. | (111,400) | (1,542,890) | ||||||

|

| |||||||

| (3,473,806) | ||||||||

|

| |||||||

Dental Supplies & Equipment (-0.38%) | ||||||||

Align Technology, Inc. | (36,700) | (975,486) | ||||||

|

| |||||||

Diversified Minerals (-0.51%) | ||||||||

BHP Billiton, Ltd., Sponsored ADR | (18,500) | (1,308,690) | ||||||

|

| |||||||

E - Commerce/Products (-0.59%) | ||||||||

MercadoLibre, Inc. | (15,200) | (1,276,344) | ||||||

Nutrisystem, Inc. | (22,800) | (219,564) | ||||||

Shutterfly, Inc. | (100) | (3,026) | ||||||

|

| |||||||

| (1,498,934) | ||||||||

|

| |||||||

E - Commerce/Services (-1.17%) | ||||||||

NetFlix, Inc. | (38,000) | (3,005,420) | ||||||

|

| |||||||

E - Marketing/Information (-0.36%) | ||||||||

Liquidity Services, Inc. | (22,300) | (919,429) | ||||||

|

| |||||||

Electronic Devices (-1.47%) | ||||||||

Garmin, Ltd. | (65,200) | (2,476,948) | ||||||

Research In Motion, Ltd. | (161,700) | (1,282,281) | ||||||

|

| |||||||

| (3,759,229) | ||||||||

|

| |||||||

Electronic Measuring Instruments (-0.20%) | ||||||||

Trimble Navigation, Ltd. | (10,600) | (500,108) | ||||||

|

| |||||||

Food - Miscellaneous/Diversified (-0.18%) | ||||||||

Diamond Foods, Inc. | (25,500) | (472,260) | ||||||

|

| |||||||

Home Furnishings (-0.79%) | ||||||||

Tempur-Pedic International, Inc. | (76,600) | (2,025,304) | ||||||

|

| |||||||

Machinery - Tools & Related Products (-0.49%) | ||||||||

Kennametal, Inc. | (35,100) | (1,243,242) | ||||||

|

| |||||||

Semi-Annual Report | October 31, 2012 | 21 |

Table of Contents

Caldwell & Orkin | ||

| Market Opportunity Fund | Schedule of Investments |

October 31, 2012 (Unaudited)

| SCHEDULE OF SECURITIES SOLD SHORT (continued) | Shares | Value (Note 1) | ||||||

Medical - Hospitals (-0.98%) | ||||||||

Community Health Systems, Inc. | (91,100) | $ | (2,497,962) | |||||

|

| |||||||

Medical - Outpatient/Home Medical Care (-0.98%) | ||||||||

Amedisys, Inc. | (227,000) | (2,506,080) | ||||||

|

| |||||||

Medical Products (-0.06%) | ||||||||

Luminex Corp. | (10,200) | (164,016) | ||||||

|

| |||||||

Metal - Copper (-0.14%) | ||||||||

Freeport-McMoRan Copper & Gold, Inc. | (9,500) | (369,360) | ||||||

|

| |||||||

Retail - Apparel/Shoe (-0.98%) | ||||||||

Guess?, Inc. | (101,100) | (2,505,258) | ||||||

|

| |||||||

Retail - Computer Equipment (-0.10%) | ||||||||

GameStop Corp. - Class A | (10,800) | (246,564) | ||||||

|

| |||||||

Retail - Restaurants (-0.09%) | ||||||||

Buffalo Wild Wings, Inc. | (2,900) | (220,255) | ||||||

|

| |||||||

Schools (-2.63%) | ||||||||

American Public Education, Inc. | (17,400) | (633,882) | ||||||

Apollo Group, Inc. - Class A | (89,300) | (1,793,144) | ||||||

Career Education Corp. | (168,500) | (572,900) | ||||||

Corinthian Colleges, Inc. | (293,100) | (800,163) | ||||||

ITT Educational Services, Inc. | (21,100) | (453,439) | ||||||

K12, Inc. | (42,500) | (869,975) | ||||||

Strayer Education, Inc. | (28,000) | (1,608,880) | ||||||

|

| |||||||

| (6,732,383) | ||||||||

|

| |||||||

Steel - Producers (-0.61%) | ||||||||

ArcelorMittal - Registered Shares | (105,700) | (1,561,189) | ||||||

|

| |||||||

Toys (-0.48%) | ||||||||

LeapFrog Enterprises, Inc. | (139,000) | (1,228,760) | ||||||

|

| |||||||

Transport - Services (-0.70%) | ||||||||

United Parcel Service, Inc. - Class B | (24,300) | (1,779,975) | ||||||

|

| |||||||

22 | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

Table of Contents

Caldwell & Orkin | ||

| Market Opportunity Fund | Schedule of Investments |

October 31, 2012 (Unaudited)

| SCHEDULE OF SECURITIES SOLD SHORT (continued) | Shares | Value (Note 1) | ||||||

Vitamins & Nutrition Products (-0.00%)† | ||||||||

Herbalife, Ltd. | (100) | $ | (5,135) | |||||

|

| |||||||

TOTAL COMMON STOCKS (Proceeds $57,782,301) | (48,389,615) | |||||||

|

| |||||||

EXCHANGE TRADED FUNDS (-0.49%) | ||||||||

Country Fund - Emerging Countries (-0.49%) | ||||||||

WisdomTree India Earnings Fund | (69,200) | (1,252,520) | ||||||

iShares® MSCI Turkey Index Fund | (100) | (6,057) | ||||||

|

| |||||||

TOTAL EXCHANGE TRADED FUNDS (Proceeds $1,257,191) | (1,258,577) | |||||||

|

| |||||||

TOTAL SECURITIES SOLD SHORT (Proceeds $59,039,492) | $ | (49,648,192) | ||||||

| † | Less than 0.005% of net assets. |

| 1 | Non-Income Producing Security. |

| 2 | A portion of the Money Market Fund assets are held as collateral for short sales activity. |

| 3 | Amount represents less than 0.005%. |

Common Abbreviations:

ADR - American Depositary Receipts

ETF - Exchange Traded Fund

LP - Limited Partnership

Ltd. - Limited

MSCI - Morgan Stanley Capital International

N.V. - Naamloze Vennootschap is the Dutch term for a public limited liability corporation

PLC - Public Limited Company

SA - Generally designates corporations in various countries, mostly those employing civil law

SPDR - Standard & Poor’s Depositary Receipt

See accompanying notes to financial statements.

Semi-Annual Report | October 31, 2012 | 23 |

Table of Contents

October 31, 2012 (Unaudited)

ASSETS | ||||

Investments at value (cost $226,430,842) | $249,671,939 | |||

Deposits with brokers for securities sold short | 56,697,087 | |||

Receivables: | ||||

Investment securities sold | 505,884 | |||

Interest and dividends | 259,063 | |||

Capital shares sold | 218,374 | |||

Other assets | 63,822 | |||

|

| |||

Total Assets | 307,416,169 | |||

|

| |||

LIABILITIES | ||||

Securities sold short, not yet purchased (proceeds $59,039,492) | 49,648,192 | |||

Payable due to broker on securities sold short | 114,221 | |||

Payables: | ||||

Investment securities purchased | 1,157,227 | |||

Capital shares redeemed | 402,542 | |||

Dividends payable - short sales | 5,938 | |||

Investment advisory fee | 216,506 | |||

Accrued expenses and other liabilities | 98,548 | |||

|

| |||

Total Liabilities | 51,643,174 | |||

|

| |||

Net Assets | $255,772,995 | |||

|

| |||

COMPOSITION OF NET ASSETS | ||||

Paid-in capital applicable to 11,801,630 shares outstanding; par value $0.10 per share; 30,000,000 shares authorized | $249,786,587 | |||

Undistributed net investment loss | (2,299,959 | ) | ||

Accumulated net realized loss on investments and securities sold short | (24,346,030 | ) | ||

Net unrealized appreciation of investments and securities sold short | 32,632,397 | |||

|

| |||

| $255,772,995 | ||||

|

| |||

NET ASSET VALUE AND OFFERING/REDEMPTION PRICE PER SHARE | $21.67 | |||

|

| |||

See accompanying notes to financial statements.

24 | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

Table of Contents

For the Six Months Ended October 31, 2012 (Unaudited)

INVESTMENT INCOME | ||||

Dividends (net of foreign withholding taxes of $33,007) | $ | 1,344,446 | ||

Interest | 1,004 | |||

|

| |||

Total Investment Income | 1,345,450 | |||

|

| |||

EXPENSES | ||||

Investment advisory fees (Note 2) | 1,249,968 | |||

Interest expense | 717,893 | |||

Dividend expense on securities sold short | 324,733 | |||

Transfer agent fees | 86,145 | |||

Administration and accounting fees (Note 2) | 84,340 | |||

Professional fees | 44,663 | |||

Directors’ fees and expenses | 32,588 | |||

Insurance expense | 31,201 | |||

Chief compliance officer expense | 21,261 | |||

Blue sky servicing fees | 19,894 | |||

Custodian fees | 17,474 | |||

Shareholder report printing | 12,046 | |||

Other expenses | 8,377 | |||

|

| |||

Total Expenses before waiver | 2,650,583 | |||

Less fees waived by Administrator (Note 2) | (15,123) | |||

|

| |||

Total net expenses | 2,635,460 | |||

|

| |||

Net Investment Loss | (1,290,010) | |||

|

| |||

REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | ||||

Net realized gain on investments | 8,837,230 | |||

Net realized loss on securities sold short | (793,435) | |||

Change in unrealized appreciation on investments | 3,946,433 | |||

Change in unrealized depreciation on securities sold short | 2,442,024 | |||

|

| |||

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS AND SECURITIES SOLD SHORT | 14,432,252 | |||

|

| |||

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 13,142,242 | ||

|

| |||

See accompanying notes to financial statements.

Semi-Annual Report | October 31, 2012 | 25 |

Table of Contents

| For the Six Months Ended October 31, 2012 (Unaudited) | For the Year Ended April 30, 2012 | |||||||

INCREASE/(DECREASE) IN NET ASSETS FROM OPERATIONS: | ||||||||

Net investment loss | $ | (1,290,010) | $ | (3,491,305) | ||||

Net realized gain on investments and securities sold short | 8,043,795 | 15,328,262 | ||||||

Change in net unrealized appreciation/(depreciation) of investments and securities sold short | 6,388,457 | (741,850) | ||||||

|

| |||||||

| 13,142,242 | 11,095,107 | |||||||

|

| |||||||

DECREASE IN NET ASSETS FROM COMMON STOCK TRANSACTIONS: | ||||||||

Net proceeds from sale of shares | 25,124,497 | 45,960,719 | ||||||

Cost of shares redeemed | (34,459,713) | (137,975,481) | ||||||

Redemption fee proceeds (Note 1) | 58,923 | 102,634 | ||||||

|

| |||||||

Net decrease in net assets resulting from capital share transactions | (9,276,293) | (91,912,128) | ||||||

|

| |||||||

INCREASE/(DECREASE) IN NET ASSETS | 3,865,949 | (80,817,021) | ||||||

NET ASSETS | ||||||||

Beginning of period | 251,907,046 | 332,724,067 | ||||||

|

| |||||||

End of period (including undistributed net investment income/(loss) of $(2,299,959) and $(1,009,949), respectively) | $ | 255,772,995 | $ | 251,907,046 | ||||

|

| |||||||

See accompanying notes to financial statements.

26 | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

Table of Contents

For a capital share outstanding throughout each period.

| For the Six Months Ended October 31, 2012 (Unaudited) | For the Year Ended April 30, 2012 | For the Year Ended April 30, 2011 | For the Year Ended April 30, 2010 | For the Year Ended April 30, 2009 | For the Year Ended April 30, 2008 | |||||||||||||||||||

| ||||||||||||||||||||||||

PER SHARE DATA: | ||||||||||||||||||||||||

Net asset value, beginning of period | $ | 20.56 | $ | 19.59 | $ | 19.51 | $ | 21.24 | $ | 21.40 | $ | 18.68 | ||||||||||||

Income/(loss) from investment operations: | ||||||||||||||||||||||||

Net Investment income/(loss) | (0.11) | (0.28) | (0.30) | (0.16) | 0.01 | 0.20 | ||||||||||||||||||

Net realized and unrealized gain/(loss) on investments | 1.22 | 1.24 | 0.36 | (1.43) | 0.94 | 3.15 | ||||||||||||||||||

|

| |||||||||||||||||||||||

Total from Investment Operations | 1.11 | 0.96 | 0.06 | (1.59) | 0.95 | 3.35 | ||||||||||||||||||

|

| |||||||||||||||||||||||

LESS DISTRIBUTIONS: | ||||||||||||||||||||||||

From net investment income | – | – | – | – | (0.12) | (0.37) | ||||||||||||||||||

From net realized gain on investments | – | – | – | (0.16) | (1.02) | (0.30) | ||||||||||||||||||

|

| |||||||||||||||||||||||

Total Distributions | – | – | – | (0.16) | (1.14) | (0.67) | ||||||||||||||||||

|

| |||||||||||||||||||||||

Redemption fee proceeds | 0.00 | (1) | 0.01 | 0.02 | 0.02 | 0.03 | 0.04 | |||||||||||||||||

|

| |||||||||||||||||||||||

Net asset value, end of period | $ | 21.67 | $ | 20.56 | $ | 19.59 | $ | 19.51 | $ | 21.24 | $ | 21.40 | ||||||||||||

|

| |||||||||||||||||||||||

Total Return | 5.40% | (2) | 4.95% | 0.41% | (7.40%) | 4.73% | 17.92% | |||||||||||||||||

Semi-Annual Report | October 31, 2012 | 27 |

Table of Contents

Caldwell & Orkin | ||

| Market Opportunity Fund | Financial Highlights |

For a capital share outstanding throughout each period.

| For the Six Months Ended October 31, 2012 (Unaudited) | For the Year Ended April 30, 2012 | For the Year Ended April 30, 2011 | For the Year Ended April 30, 2010 | For the Year Ended April 30, 2009 | For the Year Ended April 30, 2008 | |||||||||||||||||||

| ||||||||||||||||||||||||

Ratios and Supplemental Data: | ||||||||||||||||||||||||

Net assets, end of period (000’s) | $ | 255,773 | $ | 251,907 | $ | 332,724 | $ | 395,074 | $ | 302,930 | $ | 228,454 | ||||||||||||

Ratios to Average Net Assets: | ||||||||||||||||||||||||

Management fees | 1.00% | (3) | 0.99% | 0.97% | 0.83% | 0.83% | 0.84% | |||||||||||||||||

Administrative Fees | 0.27% | (3) | 0.27% | 0.22% | 0.20% | 0.27% | 0.24% | |||||||||||||||||

|

| |||||||||||||||||||||||

Expenses before dividends on securities sold short and interest expense | 1.28% | (3) | 1.26% | 1.19% | 1.03% | 1.10% | 1.08% | |||||||||||||||||

Interest expense | 0.58% | (3) | 0.43% | 0.51% | 0.31% | 0.24% | 0.18% | |||||||||||||||||

Expenses from dividends on securities sold short | 0.26% | (3) | 0.43% | 0.34% | 0.29% | 0.55% | 1.02% | |||||||||||||||||

|

| |||||||||||||||||||||||

Ratio of total expenses(4) | 2.11% | (3)(5) | 2.12% | (5) | 2.04% | (5) | 1.63% | (5) | 1.89% | 2.28% | ||||||||||||||

|

| |||||||||||||||||||||||

Ratio of net investment income/(loss) | (1.03%) | (3)(5) | (1.27%) | (5) | (1.36%) | (5) | (0.82%) | (5) | (0.11%) | 1.23% | ||||||||||||||

Portfolio turnover rate | 165% | (2) | 517% | 493% | 662% | 879% | 712% | |||||||||||||||||

| (1) | Amount is less than $0.01. |

| (2) | Not Annualized. |

| (3) | Annualized. |

| (4) | The ratio of expenses to average net assets and net investment income/(loss) to average net assets do not reflect the expenses of other investment companies. |

| (5) | The ratio of total expenses to average net assets and ratio of net investment income/(loss) include fees waived by Fund’s Administrator in the amount of less than 0.005%, 0.01%, 0.01% and less than 0.005%, respectively, for the period/years ended October 31, 2012, April 30, 2012, 2011 and 2010, respectively. |

See accompanying notes to financial statements.

28 | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

Table of Contents

October 31, 2012 (Unaudited)

The Caldwell & Orkin Market Opportunity Fund (the “Fund”) is the only active investment portfolio of The Caldwell & Orkin Funds, Inc. (“Caldwell & Orkin”), an open-end, diversified management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and is incorporated under the laws of the State of Maryland. Prior to June, 1992, Caldwell & Orkin’s name was The OTC Select-100 Fund, Inc. and consisted of only one portfolio, The OTC Select-100 Fund. The shareholders of The OTC Select-100 Fund subsequently approved changing the corporate name from The OTC Select-100 Fund, Inc. to The Caldwell& Orkin Funds, Inc. and to amend the investment objective and policies of The OTC Select-100 Fund. As a result of such amendment, The OTC Select-100 Fund was renamed and its assets and objectives were those of the Caldwell & Orkin Aggressive Growth Fund. In August, 1996, the Board of Directors of Caldwell & Orkin approved changing the name of the Caldwell & Orkin Aggressive Growth Fund to the Caldwell& Orkin Market Opportunity Fund. The Fund’s investment objective is to provide long-term capital growth with a short-term focus on capital preservation. C&O Funds Advisor, Inc. (the “Adviser”), uses catalyst-driven, multi-dimensional, disciplined investment process focusing on active asset allocation, security selection and surveillance to achieve the Fund’s investment objective. The Adviser’s philosophy in managing the Fund is to focus on risk as well as return.

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities Valuation

Securities are stated at the closing price on the date at which the net asset value (“NAV”) is being determined. If the date of determination is not a trading date, or the closing price is not otherwise available, the last bid price is used for a value instead. Debt securities, other than short-term investments, are valued at the price provided by an independent pricing service. Short-term investments having a maturity of 60 days or less at the time of the purchase are stated at amortized cost, which approximates market value. Any assets or securities for which market quotations are not readily available are valued at fair value as determined in good faith by or under the direction of the Fund’s Board of Directors in accordance with the Fund’s Fair Value Pricing Policy.

Fair Value Measurements

A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent

Semi-Annual Report | October 31, 2012 | 29 |

Table of Contents

| Caldwell & Orkin | ||

| Market Opportunity Fund | Notes to Financial Statements |

October 31, 2012 (Unaudited)

of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the reporting period end. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

Level 1 | – | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; | ||

Level 2 | – | Quoted prices which are not active quoted prices for similar assets or liabilities in active markets or inputs other than quoted process that are observable (either directly or indirectly) for substantially the full term of the asset of liability; and | ||

Level 3 | – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market for the asset or liability at the measurement date. | ||

The following is a summary of the inputs used as of October 31, 2012 in valuing the Fund’s investments carried at value:

| Investments in Securities at Value* | Level 1 - Quoted Prices | Level 2 - Other Significant Observable Inputs | Level 3 - Significant Unobservable Inputs | Total | ||||||||||||

Common Stocks | $ | 155,696,992 | $ | – | $ | – | $ | 155,696,992 | ||||||||

Exchange Traded Funds | 12,364,260 | – | – | 12,364,260 | ||||||||||||

Purchased Options | 3,071,973 | 893,670 | – | 3,965,643 | ||||||||||||

Short Term Investments | 77,645,044 | – | – | 77,645,044 | ||||||||||||

| ||||||||||||||||

TOTAL | $ | 248,778,269 | $ | 893,670 | $ | – | $ | 249,671,939 | ||||||||

| ||||||||||||||||

| Other Financial Instruments* | ||||||||||||||||

Liabilities | ||||||||||||||||

Securities Sold Short | ||||||||||||||||

Common Stocks | $ | (48,389,615 | ) | $ | – | $ | – | $ | (48,389,615 | ) | ||||||

Exchange Traded Funds | (1,258,577 | ) | – | – | (1,258,577 | ) | ||||||||||

| ||||||||||||||||

TOTAL | $ | (49,648,192 | ) | $ | – | $ | – | $ | (49,648,192 | ) | ||||||

| ||||||||||||||||

During the six months ended October 31, 2012, there were no significant transfers between Level 1 and 2 securities. The Fund evaluates transfers into or out of all levels as of the end of the reporting period. All securities of the Fund were valued using either Level 1 or Level 2 inputs during the six months ended October 31, 2012. Thus, a reconciliation of assets in which significant unobservable inputs (Level 3) were used is not applicable.

* For detailed industry descriptions, see the accompanying Schedule of Investments.

30 | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

Table of Contents

| Caldwell & Orkin | ||

| Market Opportunity Fund | Notes to Financial Statements |

October 31, 2012 (Unaudited)

Use of Derivatives

Derivative Instruments and Hedging Activities: The following discloses the Fund’s use of derivative instruments and hedging activities.

The Fund’s investment objective not only permits the Fund to purchase investment securities, they also allow the Fund to enter into various types of derivative contracts, purchased and written options. In doing so, the Fund will employ strategies in differing combinations to permit them to increase, decrease, or change the level or types of exposure to market factors. Central to those strategies are features inherent to derivatives that make them more attractive for this purpose than equity or debt securities; they require little or no initial cash investment, they can focus exposure on only certain selected risk factors, and they may not require the ultimate receipt or delivery of the underlying security (or securities) to the contract. This may allow the Fund to pursue its objective more quickly and efficiently than if they were to make direct purchases or sales of securities capable of affecting a similar response to market factors.

Market Risk Factors: In pursuit of their investment objectives, certain Funds may seek to use derivatives to increase or decrease their exposure to the following market risk factors:

Equity Risk: Equity risk relates to the change in value of equity securities as they relate to increases or decreases in the general market.

Purchasing Put and Call Options: The Fund may invest in options on securities and indices, and use such securities either to hedge risk or enhance the long positions in the Fund’s portfolio.

By purchasing a put option, the purchaser obtains the right (but not the obligation) to sell the option’s underlying instrument at a fixed strike price. In return for this right, the purchaser pays the current market price for the option (known as the option premium). Options have various types of underlying instruments, including specific securities, indices of securities prices, and futures contracts. The purchaser may terminate its position in a put option by allowing it to expire or by exercising the option. If the option is allowed to expire, the purchaser will lose the entire premium. If the option is exercised, the purchaser completes the sale of the underlying instrument at the strike price. A purchaser may also terminate a put option position by closing it out in the secondary market at its current price, if a liquid secondary market exists. The buyer of a typical put option can expect to realize a gain if security prices fall substantially. However, if the underlying instrument’s price does not fall enough to offset the cost of purchasing the option, a put buyer can expect to suffer a loss (limited to the amount of the premium, plus related transaction costs).

The features of call options are essentially the same as those of put options, except that the purchaser of a call option obtains the right to purchase, rather than sell, the underlying instrument at the option’s strike price. A call buyer typically attempts to participate in potential price increases of the underlying instrument with risk limited to the cost of the option if security prices fall. At the same time, the buyer can expect to suffer a loss if security prices do not rise sufficiently to offset the cost of the option.

Writing Put and Call Options: The writer of a put or call option takes the opposite side of the transaction from the option’s purchaser. In return for receipt of the premium, the writer assumes the obligation to pay the strike price for the option’s underlying instrument if the other party to the option chooses to exercise it. The writer may seek to terminate a position in a put option

Semi-Annual Report | October 31, 2012 | 31 |

Table of Contents

| Caldwell & Orkin | ||

| Market Opportunity Fund | Notes to Financial Statements |

October 31, 2012 (Unaudited)

before exercise by closing out the option in the secondary market at its current price. If the secondary market is not liquid for a put option, however, the writer must continue to be prepared to pay the strike price while the option is outstanding, regardless of price changes. When writing an option on a futures contract, the Fund will be required to make margin payments to an FCM as described above for futures contracts.

If security prices rise, a put writer would generally expect to profit, although its gain would be limited to the amount of the premium it received. If security prices remain the same over time, it is likely that the writer will also profit, because it should be able to close out the option at a lower price. If security prices fall, the put writer would expect to suffer a loss. This loss should be less than the loss from purchasing the underlying instrument directly, however, because the premium received for writing the option should mitigate the effects of the decline.

Writing a call option obligates the writer to sell or deliver the option’s underlying instrument, in return for the strike price, upon exercise of the option. The characteristics of writing call options are similar to those of writing put options, except that writing calls generally is a profitable strategy if prices remain the same or fall. Through receipt of the option premium, a call writer mitigates the effects of a price decline. At the same time, because a call writer must be prepared to deliver the underlying instrument in return for the strike price, even if its current value is greater, a call writer gives up some ability to participate in security price increases.

The Fund did not transact in any written options during the six months ended October 31, 2012.