UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-06113

The Caldwell & Orkin Funds, Inc.

(Exact name of registrant as specified in charter)

5185 Peachtree Parkway, Suite 370, Norcross, GA 30092-6542

(Address of principal executive offices) (Zip code)

Michael B. Orkin

5185 Peachtree Parkway, Suite 370, Norcross, GA 30092-6541

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code: 678-533-7850

Date of fiscal year end: April 30

Date of reporting period: May 1, 2011 – April 30, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

| Item 1. | Reports to Stockholders. |

| | |

| | Caldwell & Orkin |

| Table of Contents | | Market Opportunity Fund |

April 30, 2012 | | |

| | |

| | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Shareholder Letter |

| | April 30, 2012 (Unaudited) |

| | | | | | |

Investment Adviser | | |  | | | Shareholder Accounts |

C&O Funds Advisor, Inc. | | | c/o ALPS Fund Services, Inc. |

5185 Peachtree Parkway, | | | P.O. Box 46256 |

Suite 370 | | | Denver, Colorado 80201 |

Norcross, Georgia | | | (800) 467-7903 |

30092-6541 | | | |

(800) 237-7073 | | | |

| | | | |

Dear Fellow Shareholder: | | | | June 19, 2012 |

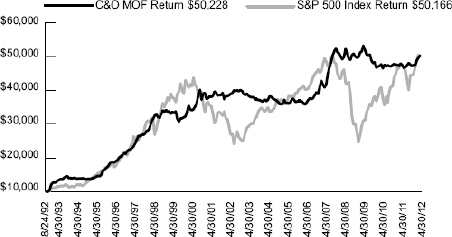

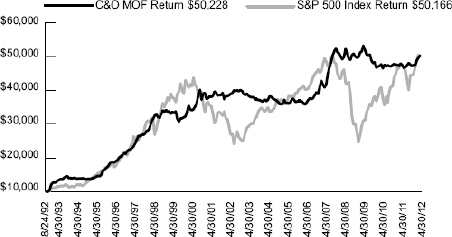

The Caldwell & Orkin Market Opportunity Fund (the “Fund” or “MOF”) rose 5.54% in the 6-month period ended April 30, 2012. The S&P 500 Total Return Index (“S&P 500”) gained 12.77% during the same period. For the 12 months ended April 30, 2012, the Fund gained 4.95%, while the S&P 500 increased 4.76%. And, since commencement of active management on August 24, 1992 through April 30, 2012, the Fund has generated an 8.54% compound annual return, bettering the S&P 500’s 8.53% compound annual return during the same period by a nose. The Fund’s total return from August 24, 1992 through April 30, 2012 has been 402.28%, compared to the S&P 500’s total return of 401.66%. Of course, past performance is no guarantee of future results. Please see standardized performance on page 6.

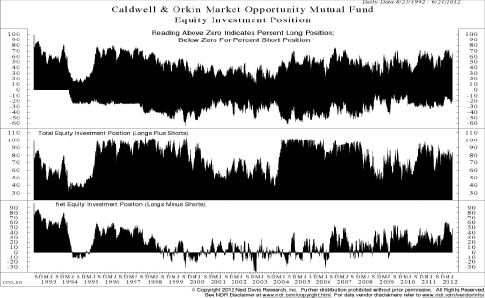

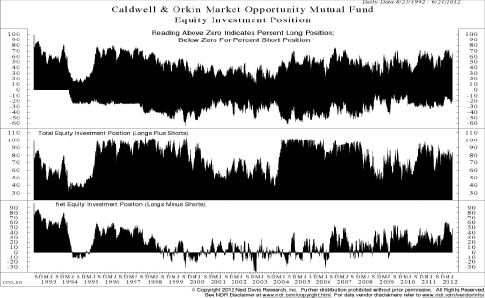

Importantly, the Fund has achieved these results while maintaining a low market risk profile and with little reliance on the movement of the stock market (see pages 6, 8, 9 and 10). Since we began actively managing the Fund on August 24, 1992, the Fund’s price movements have had virtually no correlation (3.23%) with the price movements of the S&P 500 as measured by R, the correlation coefficient. An S&P 500 Index fund has nearly a 100% correlation to the market in any given period. The Fund’s lack of correlation to the market indicates that its performance is not attributable to that of the index. Additionally, given the Fund’s low correlation to the S&P 500, deviations in Fund performance relative to the S&P 500’s performance are to be expected. (Statistical computations by Ned Davis Research, Inc.)

Management Discussion and Analysis

For the year-ended April 30, 2012 the Fund continued to generate return characteristics emblematic of a true long / short mutual fund with low correlation to the S&P 500. During the months experiencing negative market performance (May – September 2011, November 2011 and April 2012) the Fund significantly outperformed relative to the S&P 500, gaining .71% vs. -16.97% for the S&P 500. During the months experiencing positive market performance (October and December 2011 and January – March 2012) the Fund underperformed relative to the S&P 500, gaining 4.21% versus 26.16% for the index.

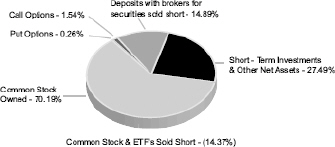

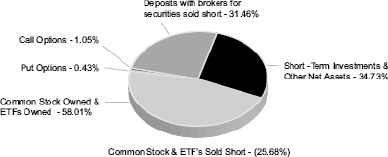

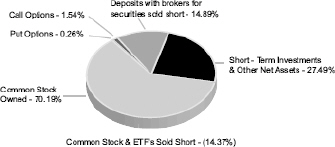

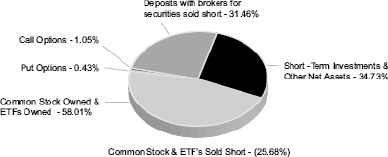

From April 30, 2011 through April 30, 2012 the Fund maintained a net-long invested position (see the Equity Investment Position chart on page 10). The Fund’s gross long exposure at period-end was 70.19%, and it fluctuated throughout the year from a low of 32.37% to a high of 72.87%, averaging 55.33%. During this time period the long portfolio underperformed the S&P 500, returning -1.61%. The Fund’s gross short exposure ended the period at -14.37%, fluctuating throughout the year from a low of -9.81% to a high of -34.14%, averaging -23.49%. The short

| | |

Annual Report | April 30, 2012 | | 1 |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Shareholder Letter |

| | April 30, 2012 (Unaudited) |

portfolio outperformed the S&P 500, returning of 9.65%. The Fund’s net invested position (longs minus shorts) ended the period at 55.82% net long, fluctuating from 4.03% to 61.20%, and averaging 31.84%. The Fund’s total invested position (longs plus absolute value of the shorts plus puts plus calls) ended the period at 84.74%, fluctuating from 56.08% to 95.16%.

The Fund’s asset allocation fluctuations throughout the year are generally the result of risk control measures. Specifically looking at asset allocation shifts last year, we reduced our long positions between August – November 2011, and reduced the shorts from January – April 2012.

On the long we side we added exposure to homebuilding and building products companies, oil & gas pipeline companies and we increased our exposure to technology. We purchased shares of homebuilder stocks as data emerged that indicated housing fundamentals were improving. After years of oversupply, the inventory of homes for sale was coming into balance, mortgage interest rates were at all-time lows, the cost of renting was rising and four years worth of pent-up demand was starting to come off the sidelines. At 11.79% homebuilders are currently our largest long industry exposure. We also established a 9.10% position in building products companies that we thought would be direct beneficiaries of improved housing market fundamentals. Our oil & gas pipeline purchases (7.07% of the portfolio) give us exposure to increasing domestic energy production and usage while minimizing exploration and pricing risk, with the added benefit of producing income. We increased our technology exposure to 12.26%. While multiple themes underlie this allocation, the predominate driver is mobile connectivity and increased use of cloud-based storage. We reduced our exposures to electric-integrated utilities and to medical HMO providers during the review period.

On the short side of the portfolio we significantly reduced our exposures to European banks and emerging market exchange-traded funds (“ETF-s”). We also reduced our exposure to for-profit education, though it remains our largest short industry exposure at -2.50%.

During the period six of our 10 biggest winners were longs. Gains in our largest single position, Apple Inc. (AAPL), led the way as the company’s innovation continued to drive sales of its mobile devices. The Fund also had gains in homebuilder stocks Lennar Corp. (LEN) and Pulte Group (PHM), two homebuilders benefitting from improving order growth. Building products company Fortune Brands Home & Security (FBHS) benefitted from these trends as well. Investments in Starbucks Corp. (SBUX), Kinder Morgan, Inc. (KMI) and a call position in Petrohawk (HK), which was acquired by BHP Billiton (BHP), also helped the Fund’s performance. The three shorts in our top 10 performers were a solar panel manufacturer, an e-commerce service provider and a European bank.

Three out of five of our biggest losers were longs. Gold miner shares Goldcorp (GG) and the Market Vectors Gold Miners ETF (GDX) fell as the price of gold weakened while the cost to mine gold increased. Vertex Pharmaceuticals Inc. (our largest gainer in fiscal year 2011) hurt performance as well, due to increased competition in the Hepatitis C drug market. Our two worst performing shorts were a retailer and a hospital operator. While the retailer is still fundamentally a potential short candidate, it is no longer in the portfolio. We still maintain exposure to the hospital operator.

| | |

2 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin Market Opportunity Fund | | Shareholder Letter |

| | April 30, 2012 (Unaudited) |

Outlook

This fiscal year begins on a similar yet diverging path from the two preceding years. The victory of anti-austerity candidates in Greece and France has placed the issue of European Union fragility back on center stage. The U.S. economic recovery remains less than robust with employment growth stagnating at levels insufficient to keep up with the growth in the population. As we near the expiration of the Federal Reserve’s Operation Twist policy intervention (a Fed initiative to drive down interest rates on 10-year bonds), the rate of growth in the money supply has slowed, providing a headwind to U.S. equity markets.

The divergence from the path of years before comes in the form of an improving U.S. housing market, an expansion in credit availability and a reduction in global interest rates. There are direct and indirect economic benefits from the improvement in housing fundamentals. Perhaps most importantly a housing recovery lifts consumer net worth, helping repair household balance sheets and lift consumer confidence. Reflective of this, the Federal Reserve’s recent Senior Loan Officer Survey (SLOS) indicated that, not only are banks loosening lending standards, but household and business loan demand is surprisingly robust. At the same time, the economic slowdown in Europe and in emerging markets has greatly reduced inflationary pressures, leading to a drastic reduction in global interest rates. All these factors point to potentially accelerating U.S. domestic growth.

The Fund is bullishly positioned with a total invested position at May 31, 2012 of 84.15% and a net long position of 40.13% (which we recently reduced). Should the European Union conflagration accelerate or U.S. employment growth further stagnate, the Fund will likely be repositioned in a more defensive posture.

Markets move in cycles. Our goal in managing the Fund is to outperform over the course of a full market cycle, which includes both bull and bear market phases. Ned Davis Research, Inc. (“NDR”) has computed what they consider to be bull and bear market cycles for the S&P 500. Most of their definition focuses on a 20% market move in either direction. The Fund has outperformed in four out of the last five full market cycles. The NDR data is shown below:

| | | | | | | | |

| Bull Market Phase | |

| Start Date | | MOF | | | S&P | |

8/24/1992* | | | 210.84 | % | | | 230.03 | % |

8/31/1998 | | | 6.14 | % | | | 62.88 | % |

9/21/2001 | | | -5.72 | % | | | 22.00 | % |

10/9/2002 | | | 16.86 | % | | | 119.38 | % |

3/9/2009 | | | -1.63 | % | | | 111.33 | % |

| | | | | | | | |

| Bear Market Phase | |

| Start Date** | | MOF | | | S&P | |

7/17/1998 | | | 4.02 | % | | | -19.19 | % |

9/1/2000 | | | 15.10 | % | | | -35.71 | % |

3/19/2002 | | | 10.02 | % | | | -33.01 | % |

10/9/2007 | | | -0.61 | % | | | -55.26 | % |

4/29/2011 | | | 0.47 | % | | | -18.72 | % |

| | | | | | | | |

| Full Market Cycle | |

| End Date*** | | MOF | | | S&P | |

8/31/1998 | | | 223.35 | % | | | 166.69 | % |

9/21/2001 | | | 22.17 | % | | | 4.72 | % |

10/9/2002 | | | 3.73 | % | | | -18.27 | % |

3/9/2009 | | | 16.14 | % | | | -1.85 | % |

10/3/2011 | | | -1.17 | % | | | 71.76 | % |

| * | The first bull market phase began 10/11/1990, but the table begins with 8/24/1992, which coincides with commencement of active management of the Caldwell & Orkin Market Opportunity Fund. |

| ** | The bear market start date is the bull market’s end date. |

| *** | A full market cycle runs from the bull market start date to the full market cycle end date. |

Source: Ned Davis Research, Inc.

Sincerely,

Michael B. Orkin, CFA

Portfolio Manager and Chief Investment Officer

| | |

Annual Report | April 30, 2012 | | 3 |

| | |

Caldwell & Orkin Market Opportunity Fund | | Shareholder Letter |

| | April 30, 2012 (Unaudited) |

Disclosure

The Fund’s investment objective is to provide long-term capital growth with a short-term focus on capital preservation. Our philosophy in managing the Fund is to focus on risk as well as return. We use active asset allocation - the opportunistic shifting of assets between long stock positions, short stock positions (selling borrowed stock and attempting to replace the borrowed securities in the future at a lower price), options, bonds and cash equivalents - to manage exposure to market risk (the risk that the broad market declines, taking good companies down with it). The Fund may hold up to 60% of its net assets in short positions at any time and also invest in options. Short positions and put options are employed with the intent of making money when those stocks we judge to be mispriced fall. When we use short positions or put options, the Fund’s portfolio is considered to be “hedged,” so that it is not fully exposed to the price movements and volatility of the broader market. Our asset allocation determinations are primarily based on our perception of risk in the marketplace. In summary, our goal is to make money over a full market cycle, but with less stomach churn.

The Fund’s disciplined investment philosophy and active management style typically leads to higher-than-average portfolio turnover. High turnover may have an unfavorable impact on the amount of taxable distributions paid to shareholders. Higher turnover may also result in higher brokerage costs for the Fund. The Fund’s turnover rate will typically exceed 100% per year, and will not be a limiting factor when we deem change appropriate. Fund holdings, industry and asset allocations are subject to change without notice. The Fund may or may not have a position in any of the companies mentioned in this commentary as of the date of this report.

An investment in the Fund involves risk, including the loss of principal. Additionally, there are certain risks inherent in investing in the Fund, including market risk, short sale risk, interest rate risk, business risk, small company risk, market valuation risk, political risk, and portfolio turnover risk. For a complete discussion of these risks, you may request a copy of the Fund’s prospectus by calling 800-237-7073. The Fund uses aggressive investment strategies (including short positions and options) that have the potential for yielding high returns; however, these strategies may also result in losses. Stocks sold short have unlimited risk. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Options are not suitable for all investors.

Investors should expect that the Fund’s performance may fluctuate independently of stock market indices, such as the S&P 500 Total Return Index.

Distributed by ALPS Distributors, Inc., Member FINRA/SIPC

1290 Broadway, Suite 1100, Denver, CO 80203

| | |

4 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin Market Opportunity Fund | | Shareholder Letter |

| | April 30, 2012 (Unaudited) |

Statistical Risk Definitions:

Correlation Coefficient (R): R is a statistical measure of correlation. In this report, R is a measurement of investment risk that indicates how closely performance is linked to the broad market – it quantifies the degree to which a fund’s performance correlates with the performance of a benchmark. R can vary between 100% (perfect positive correlation) and –100% (perfect negative correlation). 0% represents no correlation. An R of 100% means that all movements of a fund are fully explained by movements in its benchmark index. Conversely, a low R indicates that very few of the fund’s movements are explained by movements in its benchmark index, and a negative R indicates a fund’s movements are inversely correlated with its benchmark index.

Coefficient of Determination (R-Square): R-Square, also represented as R2, is another measurement of investment risk that quantifies the degree to which a fund’s performance correlates with the performance of its benchmark index. R-Square is calculated by multiplying the Correlation Coefficient (R) by itself, and is therefore always positive. R-Square can vary between 0% (no correlation) and 100% (perfect correlation). The higher the value of R-Square, the greater the degree of correlation between the fund and its benchmark index. R-squared does not take into account the direction of the correlation (positive or negative), therefore R-Squared is not able to reflect inverse correlation between a fund and its benchmark index.

Beta: A measure of a fund’s sensitivity to market movements. Usually the higher betas represent riskier investments. When correlation is low, beta has minimal, if any, significance.

Standard deviation: A statistical measure of dispersion about an average, indicating the volatility of a fund’s total returns.

Sharpe Ratio: The Sharpe Ratio is calculated by subtracting the risk-free (T-bill) rate of return from a portfolio’s total return and then dividing this by its standard deviation. The resulting fraction can be thought of as return per unit of risk. The higher a portfolio’s Sharpe Ratio, the better the risk-adjusted performance.

Semi-variance: A measure of a fund’s downside (negative return) volatility relative to a benchmark. Lower numbers are associated with less risk.

Index Definition:

S&P 500 Total Return Index: The S&P 500 Total Return Index is a capitalization-weighted, unmanaged index of 500 large U.S. companies chosen for market size, liquidity and industry group representation and includes reinvested dividends. You cannot invest directly in an index.

| | |

Annual Report | April 30, 2012 | | 5 |

| | |

Caldwell & Orkin Market Opportunity Fund | | Performance Summary |

| | April 30, 2012 |

| | | | | | | | |

Fiscal Year Ended April 30, | | C&O Market

Opportunity

Fund(1) | | | S&P 500 Total

Return Index(2) | |

1992 | | | 11.96 | % | | | 14.03 | % |

1993* | | | 15.09 | % | | | 9.24 | % |

1993** | | | 21.09 | % | | | 9.18 | % |

1994 | | | 16.48 | % | | | 5.32 | % |

1995 | | | -2.28 | % | | | 17.47 | % |

1996 | | | 31.80 | % | | | 30.21 | % |

1997 | | | 23.24 | % | | | 25.13 | % |

1998 | | | 25.77 | % | | | 41.07 | % |

1999 | | | 19.43 | % | | | 21.82 | % |

2000 | | | -0.02 | % | | | 10.13 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Total Return Through April 30, 2012 | | | | | | |

6 months ended | | | 5.54 | % | | | 12.77 | % |

12 months ended | | | 4.95 | % | | | 4.76 | % |

Since 8/24/92(3) | | | 402.28 | % | | | 401.66 | % |

| | | | | | | | |

Fiscal Year Ended April 30, | | C&O Market

Opportunity

Fund(1) | | | S&P 500 Total

Return Index(2) | |

2001 | | | 11.43 | % | | | -12.97 | % |

2002 | | | 1.88 | % | | | -12.63 | % |

2003 | | | 1.12 | % | | | -13.31 | % |

2004 | | | -3.55 | % | | | 22.88 | % |

2005 | | | -0.17 | % | | | 6.34 | % |

2006 | | | -2.74 | % | | | 15.42 | % |

2007 | | | 15.31 | % | | | 15.24 | % |

2008 | | | 17.92 | % | | | -4.68 | % |

2009 | | | 4.73 | % | | | -35.31 | % |

2010 | | | -7.40 | % | | | 38.84 | % |

2011 | | | 0.41 | % | | | 17.22 | % |

2012 | | | 4.95 | % | | | 4.76 | % |

| | | | | | | | |

Average Annual Returns Through April 30, 2012 | | | | | | |

OneYear | | | 4.95 | % | | | 4.76 | % |

ThreeYears | | | -0.81 | % | | | 19.46 | % |

FiveYears | | | 3.80 | % | | | 1.01 | % |

TenYears | | | 2.78 | % | | | 4.71 | % |

FifteenYears | | | 5.53 | % | | | 5.65 | % |

Since 8/24/92(3) | | | 8.54 | % | | | 8.53 | % |

Total annualized Fund operating expenses for the Fund’s fiscal year ended April 30, 2012 were 2.12%, or 1.26% before interest expenses and dividend expenses related to short sales. These figures exclude Acquired Fund Fees and Expenses of 0.09%. Additional information about the Fund’s fees and expenses is available in the Fund’s prospectus.

| | |

6 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin Market Opportunity Fund | | Performance Summary |

| | April 30, 2012 |

Net Asset Allocation

October 31, 2011

| 1 | The performance data quoted represents past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Please call 800-377-7073 or visit www.caldwellorkinfunds.com for current month-end performance. The Fund’s performance assumes the reinvestment of dividends and capital gains, if any. Fund holdings, industry and asset allocations are subject to change without notice. The Fund may or may not have a position in any of the companies mentioned in this report as of the date of this report. See additional important disclosures on pages 4 and 5. |

| 2 | Investors should expect that the Fund’s performance may fluctuate independently of stock market indices, such as the S&P 500 Total Return index. The S&P 500 Total Return index is a widely recognized unmanaged index of 500 common stock prices adjusted to reflect the reinvestment of dividends and distributions. You may not invest directly in an index. |

| 3 | Effective August 24, 1992, the Fund changed its investment objective to provide long-term capital growth with a short-term focus on capital preservation through investment selection and asset allocation. Prior to that time, the Fund was passively managed and indexed to the largest 100 over-the-counter (OTC) stocks. |

| * | For the full fiscal year ended April 30, 1993. |

| ** | From August 24, 1992 through April 30, 1993 - the portion of the year using the active investment management style of C&O Funds Advisor, Inc., the manager of the Fund. |

| | |

Annual Report | April 30, 2012 | | 7 |

| | |

Caldwell & Orkin Market Opportunity Fund | | Statistical Risk Profile |

| | April 30, 2012 |

Ten Worst S&P 500 Total Return Days

| | | | | | | | | | | | | | |

| Date | | C&O MOF | | | S&P 500 | | | Variance | | | |

10/15/2008 | | | -1.47% | | | | -9.02% | | | | 7.55% | | | |

12/1/2008 | | | -1.58% | | | | -8.92% | | | | 7.34% | | | |

9/29/2008 | | | -0.37% | | | | -8.78% | | | | 8.41% | | | |

10/9/2008 | | | -2.12% | | | | -7.61% | | | | 5.49% | | | |

10/27/1997 | | | -1.60% | | | | -6.89% | | | | 5.29% | | | |

8/31/1998 | | | 0.42% | | | | -6.79% | | | | 7.21% | | | |

11/20/2008 | | | 0.23% | | | | -6.70% | | | | 6.93% | | | |

8/8/2011 | | | -0.63% | | | | -6.66% | | | | 6.03% | | | |

11/19/2008 | | | -0.28% | | | | -6.10% | | | | 5.82% | | | |

10/22/2008 | | | -1.11% | | | | -6.09% | | | | 4.98% | | | |

The Caldwell & Orkin Market Opportunity Fund outperformed the S&P 500 Total Return index on all ten of the ten worst days, and was positive on two of the ten days.

Ten Worst S&P 500 Total Return Weeks

| | | | | | | | | | | | | | |

| Week Ending | | C&O MOF | | | S&P 500 | | | Variance | | | |

10/10/2008 | | | -2.71% | | | | -18.14% | | | | 15.43% | | | |

9/21/2001 | | | 1.63% | | | | -11.57% | | | | 13.20% | | | |

4/14/2000 | | | 4.51% | | | | -10.52% | | | | 15.03% | | | |

10/3/2008 | | | 1.83% | | | | -9.33% | | | | 11.16% | | | |

11/21/2008 | | | 0.56% | | | | -8.33% | | | | 8.89% | | | |

7/19/2002 | | | 0.65% | | | | -7.96% | | | | 8.61% | | | |

8/5/2011 | | | -0.77% | | | | -7.15% | | | | 6.38% | | | |

3/6/2009 | | | -0.88% | | | | -6.96% | | | | 6.08% | | | |

7/12/2002 | | | 1.01% | | | | -6.81% | | | | 7.82% | | | |

2/20/2009 | | | 0.20% | | | | -6.80% | | | | 7.00% | | | |

The Caldwell & Orkin Market Opportunity Fund outperformed the S&P 500 Total Return index in all ten of the ten worst weeks, and was positive in seven of those weeks.

Ten Worst S&P 500 Total Return Months

| | | | | | | | | | | | | | |

| Month | | C&O MOF | | | S&P 500 | | | Variance | | | |

10/31/2008 | | | 3.42% | | | | -16.74% | | | | 20.16% | | | |

8/31/1998 | | | 3.12% | | | | -14.46% | | | | 17.58% | | | |

9/30/2002 | | | 2.10% | | | | -10.86% | | | | 12.96% | | | |

2/28/2009 | | | 0.30% | | | | -10.71% | | | | 11.01% | | | |

2/28/2001 | | | 4.78% | | | | -9.13% | | | | 13.91% | | | |

9/30/2008 | | | -0.42% | | | | -8.89% | | | | 8.47% | | | |

6/30/2008 | | | 4.84% | | | | -8.43% | | | | 13.27% | | | |

1/31/2009 | | | -0.73% | | | | -8.30% | | | | 7.57% | | | |

9/30/2001 | | | 3.29% | | | | -8.06% | | | | 11.35% | | | |

5/31/2010 | | | -2.55% | | | | -8.04% | | | | 5.49% | | | |

The Caldwell & Orkin Market Opportunity Fund outperformed the S&P 500 Total Return index in all ten of the ten worst months, and was positive in seven of those months.

Short selling began May 2, 1994. Past performance is no guarantee of future results. See additional important disclosures on pages 4 and 5. Computations by Ned Davis Research, Inc.

| | |

8 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin Market Opportunity Fund | | Statistical Risk Profile |

| | April 30, 2012 |

Ten Worst Drawdowns

| | | | | | | | |

| Caldwell & Orkin Market Opportunity Fund | |

| Date Range | | C&O MOF | | | S&P 500 | |

01/17/2008 - 05/07/2010 | | | -15.71 | % | | | -11.68 | % |

04/12/1999 - 11/23/1999 | | | -13.24 | % | | | 4.23 | % |

10/09/2002 - 05/25/2006 | | | -13.12 | % | | | 74.17 | % |

05/26/2000 - 06/07/2000 | | | -8.15 | % | | | 6.81 | % |

12/29/2000 - 01/19/2001 | | | -8.06 | % | | | 1.75 | % |

04/04/2001 - 03/11/2002 | | | -7.98 | % | | | 7.22 | % |

03/15/1993 - 04/26/1993 | | | -7.83 | % | | | -3.65 | % |

03/18/1994 - 02/03/1995 | | | -7.68 | % | | | 4.21 | % |

04/10/2007 - 05/24/2007 | | | -7.14 | % | | | 4.31 | % |

10/07/1998 - 11/05/1998 | | | -6.41 | % | | | 16.95 | % |

| | | | | | | | |

| S&P 500 Total Return Index | |

| Date Range | | C&O MOF | | | S&P 500 | |

10/09/2007 - 03/09/2009 | | | -0.61 | % | | | -55.26 | % |

03/24/2000 - 10/09/2002 | | | 28.57 | % | | | -47.41 | % |

07/17/1998 - 08/31/1998 | | | 4.02 | % | | | -19.19 | % |

04/29/2011 - 10/03/2011 | | | -1.12 | % | | | -18.72 | % |

04/23/2010 - 07/02/2010 | | | -1.52 | % | | | -15.67 | % |

11/27/2002 - 03/11/2003 | | | 2.19 | % | | | -14.28 | % |

07/16/1999 - 10/15/1999 | | | -0.45 | % | | | -11.78 | % |

10/07/1997 - 10/27/1997 | | | 0.18 | % | | | -10.74 | % |

09/23/1998 - 10/08/1998 | | | 2.02 | % | | | -9.94 | % |

10/28/2011 - 11/25/2011 | | | -0.64 | % | | | -9.70 | % |

| | | | |

Statistical Risk Measurements 8/24/1992 through 4/30/2012 (daily data) |

| | | C&O MOF | | S&P 500 |

Coefficient of Determination (R-Square) | | 0.10% | | 100.00% |

Correlation Coefficient “R” | | 3.23% | | 100.00% |

Beta | | 0.014 | | 1.000 |

Standard Deviation | | 0.51 | | 1.214 |

Sharpe Ratio | | 0.66 | | 0.36 |

Semi-Variance | | 0.13 | | 0.73 |

Performance During the Last Three Market Downturns of 20% or More |

| | | C&O MOF | | S&P 500 |

01/06/2009 -03/09/2009 | | -3.42% | | -27.19% |

10/09/2007 -11/20/2008 | | 1.80% | | -50.73% |

01/04/2002 -10/09/2002 | | 7.25% | | -32.95% |

Short selling began May 2, 1994. Past performance is no guarantee of future results. See additional important disclosures on pages 4 and 5. Computations by Ned Davis Research, Inc.

| | |

Annual Report | April 30, 2012 | | 9 |

| | |

Caldwell & Orkin Market Opportunity Fund | | Growth of $10,000 |

| | April 30, 2012 |

Caldwell & Orkin Market Opportunity Fund Versus S&P 500 Total Return Index

Since Commencement of Active Style of Investment Management Results of a Hypothetical $10,000 Investment August 24, 1992 through April 30, 2012.

Past performance does not predict future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. See additional disclosure on pages 4 and 5.

| | |

10 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin Market Opportunity Fund | | Disclosure of Fund Expenses |

| | April 30, 2012 (Unadited) |

We believe it is important for you to understand the impact of fees and expenses on your investment in the Fund. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs related to the purchase and redemption of Fund shares, including redemption fees and brokerage commissions (if applicable); and (2) ongoing costs, including management fees, administrative expenses, portfolio transaction costs and other Fund expenses. A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The below example is based on an investment of $1,000.00 invested at the beginning of the period and held for the entire period indicated, November 1, 2011 through April 30, 2012. The table below illustrates the Fund’s expenses in two ways:

Based on Actual Fund Returns

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Based on a Hypothetical 5% Return for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or brokerage commissions. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

| | | Beginning

Account Value

11/01/2011 | | | Ending

Account Value

04/30/2012 | | | Expense

Ratio1 | | Expenses

Paid During

Period2 | |

Actual3 | | $ | 1,000.00 | | | $ | 1,055.40 | | | 2.07% | | $ | 10.58 | |

Hypothetical (5% return before expenses)4 | | $ | 1,000.00 | | | $ | 1,014.57 | | | 2.07% | | $ | 10.37 | |

| | |

Annual Report | April 30, 2012 | | 11 |

| | |

Caldwell & Orkin | | |

Market Opportunity Fund | | Disclosure of Fund Expenses |

| | April 30, 2012 (Unaudited) |

| 1 | The annualized expense ratio used in this example reflects actual expenses from the Fund for the six month period 11/1/2011- 4/30/2012, as a percentage of average net assets for that period. It differs from the Ratio of total expenses figure of 2.12% on page 27 of this report, as that figure represents expenses for the twelve month period 5/1/2011 – 4/30/2012. |

| 2 | Expenses are equal to the Caldwell & Orkin Market Opportunity Fund’s annualized expense ratio of 2.07% multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (182), divided by 366 (to reflect the half-year period.) |

| 3 | Excluding interest expense and dividend expense from short positions, your actual cost of investment in the Fund would be $6.44. |

| 4 | Excluding interest expense and dividend expense from short positions, your hypothetical cost of investment in the Fund would be $6.32. |

| | |

12 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin Market Opportunity Fund | | Sector Diversification |

| | April 30, 2012 (Unaudited) |

The following table presents the Fund’s 4/30/2012 portfolio holdings by sector based on total net assets, sorted by net exposure (net long to net short).

| | | | | | | | | | | | | | | | |

| | | Long | | | Short | | | Total (1) | | | Net (2) | |

Building - Residential /Commercial | | | 11.79 | % | | | | | | | 11.79 | % | | | 11.79 | % |

Pipelines | | | 7.07 | % | | | | | | | 7.07 | % | | | 7.07 | % |

Retail - Building Products | | | 4.15 | % | | | | | | | 4.15 | % | | | 4.15 | % |

Electric - Transmission | | | 3.65 | % | | | | | | | 3.65 | % | | | 3.65 | % |

Building & Construction Production - Miscellaneous | | | 3.17 | % | | | | | | | 3.17 | % | | | 3.17 | % |

Computers | | | 2.94 | % | | | | | | | 2.94 | % | | | 2.94 | % |

Reinsurance | | | 2.48 | % | | | | | | | 2.48 | % | | | 2.48 | % |

Computers-Memory Devices | | | 2.34 | % | | | | | | | 2.34 | % | | | 2.34 | % |

Applications Software | | | 2.16 | % | | | | | | | 2.16 | % | | | 2.16 | % |

Medical - HMO | | | 1.93 | % | | | | | | | 1.93 | % | | | 1.93 | % |

Transactional Software | | | 1.92 | % | | | | | | | 1.92 | % | | | 1.92 | % |

Retail - Restaurants | | | 1.61 | % | | | | | | | 1.61 | % | | | 1.61 | % |

Semiconductor Components/Integrated Circuits | | | 1.59 | % | | | | | | | 1.59 | % | | | 1.59 | % |

Food - Retail | | | 1.38 | % | | | | | | | 1.38 | % | | | 1.38 | % |

Coatings/Paint | | | 1.37 | % | | | | | | | 1.37 | % | | | 1.37 | % |

Aerospace/Defense - Equipment | | | 1.66 | % | | | -0.30 | % | | | 1.96 | % | | | 1.36 | % |

Retail - Auto Parts | | | 1.33 | % | | | | | | | 1.33 | % | | | 1.33 | % |

Medical - Drugs | | | 1.26 | % | | | | | | | 1.26 | % | | | 1.26 | % |

Oil & Gas Drilling | | | 1.24 | % | | | | | | | 1.24 | % | | | 1.24 | % |

Electric - Integrated | | | 1.23 | % | | | | | | | 1.23 | % | | | 1.23 | % |

Internet - Infrastructure Software | | | 1.06 | % | | | | | | | 1.06 | % | | | 1.06 | % |

Computers-Integrated Systems | | | 1.04 | % | | | | | | | 1.04 | % | | | 1.04 | % |

Broadcast Services/Programming | | | 1.03 | % | | | | | | | 1.03 | % | | | 1.03 | % |

Retail - Bedding | | | 1.03 | % | | | | | | | 1.03 | % | | | 1.03 | % |

Diversified Banking Institution | | | 0.98 | % | | | | | | | 0.98 | % | | | 0.98 | % |

Electronic Components - Semiconductors | | | 0.97 | % | | | | | | | 0.97 | % | | | 0.97 | % |

Aerospace/Defense | | | 1.05 | % | | | -0.37 | % | | | 1.42 | % | | | 0.68 | % |

Athletic Footwear | | | 0.61 | % | | | | | | | 0.61 | % | | | 0.61 | % |

Chemicals - Diversified | | | 0.60 | % | | | | | | | 0.60 | % | | | 0.60 | % |

Distribution/Wholesale | | | 0.51 | % | | | | | | | 0.51 | % | | | 0.51 | % |

Retail - Home Furnishings | | | 0.41 | % | | | | | | | 0.41 | % | | | 0.41 | % |

Retail - Automobile | | | 0.40 | % | | | | | | | 0.40 | % | | | 0.40 | % |

Transportation - Rail | | | 0.84 | % | | | -0.44 | % | | | 1.28 | % | | | 0.40 | % |

Beverages - Non-Alcoholic | | | 0.35 | % | | | | | | | 0.35 | % | | | 0.35 | % |

Telecom Services | | | 0.30 | % | | | | | | | 0.30 | % | | | 0.30 | % |

Diversified Operations | | | 0.29 | % | | | | | | | 0.29 | % | | | 0.29 | % |

Multi-line Insurance | | | 0.21 | % | | | | | | | 0.21 | % | | | 0.21 | % |

Advanced Materials/Production | | | 0.19 | % | | | | | | | 0.19 | % | | | 0.19 | % |

Networking Products | | | 0.16 | % | | | | | | | 0.16 | % | | | 0.16 | % |

Energy - Alternate Sources | | | 0.07 | % | | | | | | | 0.07 | % | | | 0.07 | % |

Retail - Major Department Store | | | 0.07 | % | | | | | | | 0.07 | % | | | 0.07 | % |

| | |

Annual Report | April 30, 2012 | | 13 |

| | |

Caldwell & Orkin Market Opportunity Fund | | Sector Diversification |

| | April 30, 2012 (Unaudited) |

| | | | | | | | | | | | | | | | |

| | | Long | | | Short | | | Total (1) | | | Net (2) | |

Diversified Manufacturing Operations | | | | | | | -0.00%* | | | | -0.00%* | | | | -0.00%* | |

Electronic Measuring Instruments | | | | | | | -0.00%* | | | | -0.00%* | | | | -0.00%* | |

Real Estate Management/Services | | | | | | | -0.00%* | | | | -0.00%* | | | | -0.00%* | |

Footwear (Non-Athletic) & Related Apparel | | | | | | | -0.20% | | | | 0.20% | | | | -0.20% | |

Metal - Copper | | | | | | | -0.30% | | | | 0.30% | | | | -0.30% | |

Retail - Apparel/Shoe | | | 1.12% | | | | -1.50% | | | | 2.62% | | | | -0.38% | |

Electronic Devices | | | | | | | -0.40% | | | | 0.40% | | | | -0.40% | |

Retail – Video Games | | | | | | | -0.45% | | | | 0.45% | | | | -0.45% | |

Food - Miscellaneous/Diversified | | | | | | | -0.46% | | | | 0.46% | | | | -0.46% | |

Machinery - Construction/Mining | | | | | | | -0.46% | | | | 0.46% | | | | -0.46% | |

Commercial Banks - Non-U.S. | | | 0.63% | | | | -1.11% | | | | 1.74% | | | | -0.48% | |

Apparel Manufacturers | | | | | | | -0.58% | | | | 0.58% | | | | -0.58% | |

E-Commerce/Services | | | | | | | -0.80% | | | | 0.80% | | | | -0.80% | |

Beverages -Wine/Spirits | | | | | | | -1.08% | | | | 1.08% | | | | -1.08% | |

E-Commerce/Products | | | | | | | -1.08% | | | | 1.08% | | | | -1.08% | |

Medical - Hospitals | | | 0.00%* | | | | -1.14% | | | | 1.14% | | | | -1.14% | |

Schools | | | | | | | -2.50% | | | | 2.50% | | | | -2.50% | |

| | | | | | | | | | | | | | | | | |

Subtotal Common Stocks (long & short positions) | | | 70.19% | | | | -13.17% | | | | 83.36% | | | | 57.02% | |

| | | | | | | | | | | | | | | | |

Exchange Traded Fund – Country Fund -Australia | | | | | | | -0.20% | | | | 0.20% | | | | -0.20% | |

Exchange Traded Fund – Emerging Country Fund | | | | | | | -0.40% | | | | 0.40% | | | | -0.40% | |

Exchange Traded Fund - Country Fund -Russia | | | | | | | -0.60% | | | | 0.60% | | | | -0.60% | |

| | | | | | | | | | | | | | | | | |

Subtotal Exchange-Traded Funds (long & short positions) | | | 0.00% | | | | -1.20% | | | | 1.20% | | | | -1.20% | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Subtotal Equities (long & short positions) | | | 70.19% | | | | -14.37% | | | | 84.56% | | | | 55.82% | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Call Options | | | 1.54% | | | | | | | | 1.54% | | | | | |

Put Options | | | 0.26% | | | | | | | | 0.26% | | | | | |

Other Assets less Liabilities | | | 13.64% | | | | | | | | 13.64% | | | | | |

| | | | | | | | | | | | | | | | | |

Total Portfolio Holdings | | | 85.63% | | | | -14.37% | | | | 100.00% | | | | | |

| | | | | | | | | | | | | | | | | |

* Less than 0.005% of net assets.

(1) Total exposure is Long exposure plus the absolute value of the Short exposure.

(2) Net exposure is Long exposure less Short exposure.

| | |

14 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin Market Opportunity Fund | | Schedule of Investments |

| | April 30, 2012 |

| | | | | | | | |

| | Shares | | | Value

(Note 1) | |

LONG INVESTMENTS (71.99%) | | | | | | | | |

COMMON STOCKS (70.19%) | | | | | | | | |

Advanced Materials/Production (0.19%) | | | | | | | | |

Hexcel Corp.1 | | | 17,900 | | | $ | 490,102 | |

| | | | | | | | |

| | |

Aerospace/Defense (1.05%) | | | | | | | | |

Spirit Aerosystems Holdings, Inc. -Class A1 | | | 78,300 | | | | 1,957,500 | |

TransDigm Group, Inc.1 | | | 5,400 | | | | 681,048 | |

| | | | | | | | |

| | | | | | | 2,638,548 | |

| | | | | | | | |

| | |

Aerospace/Defense - Equipment (1.66%) | | | | | | | | |

BE Aerospace, Inc.1 | | | 73,100 | | | | 3,437,893 | |

Triumph Group, Inc. | | | 12,000 | | | | 753,840 | |

| | | | | | | | |

| | | | | | | 4,191,733 | |

| | | | | | | | |

| | |

Applications Software (2.16%) | | | | | | | | |

Check Point Software Technologies, Ltd.1 | | | 47,500 | | | | 2,761,175 | |

Microsoft Corp. | | | 68,400 | | | | 2,190,168 | |

Red Hat, Inc.1 | | | 8,200 | | | | 488,802 | |

| | | | | | | | |

| | | | | | | 5,440,145 | |

| | | | | | | | |

| | |

Athletic Footwear (0.61%) | | | | | | | | |

NIKE, Inc. - Class B | | | 13,700 | | | | 1,532,619 | |

| | | | | | | | |

| | |

Beverages - Non - Alcoholic (0.35%) | | | | | | | | |

The Coca-Cola Co. | | | 11,500 | | | | 877,680 | |

| | | | | | | | |

| | |

Broadcast Services/Programming (1.03%) | | | | | | | | |

Discovery Communications, Inc. -Class A1 | | | 47,900 | | | | 2,606,718 | |

| | | | | | | | |

| | |

Building -Residential/Commercial (11.79%) | | | | | | | | |

DR Horton, Inc. | | | 193,500 | | | | 3,163,725 | |

Lennar Corp. - Class A | | | 293,900 | | | | 8,152,786 | |

M/I Homes, Inc.1 | | | 147,200 | | | | 1,957,760 | |

Meritage Homes Corp.1 | | | 61,500 | | | | 1,745,985 | |

PulteGroup, Inc.1 | | | 342,400 | | | | 3,369,216 | |

The Ryland Group, Inc. | | | 197,300 | | | | 4,441,223 | |

Standard Pacific Corp.1 | | | 383,200 | | | | 1,938,992 | |

Toll Brothers, Inc.1 | | | 194,000 | | | | 4,927,600 | |

| | | | | | | | |

| | | | | | | 29,697,287 | |

| | | | | | | | |

| | |

Building & Construction Production - Miscellaneous (3.17%) | | | | | | | | |

Armstrong World Industries, Inc. | | | 11,400 | | | | 502,056 | |

| | |

Annual Report | April 30, 2012 | | 15 |

| | |

Caldwell & Orkin Market Opportunity Fund | | Schedule of Investments |

| | April 30, 2012 |

| | | | | | | | |

| | | Shares | | | Value (Note 1) | |

Building & Construction Production - Miscellaneous (continued) | | | | | | | | |

Fortune Brands Home & Security, Inc.1 | | | 220,200 | | | $ | 5,007,348 | |

Owens Corning1 | | | 71,900 | | | | 2,469,765 | |

| | | | | | | | |

| | | | | | | 7,979,169 | |

| | | | | | | | |

| | |

Chemicals - Diversified (0.60%) | | | | | | | | |

E.I. du Pont de Nemours & Co. | | | 28,100 | | | | 1,502,226 | |

| | | | | | | | |

| | |

Coatings/Paint (1.37%) | | | | | | | | |

The Sherwin-Williams Co. | | | 21,200 | | | | 2,549,936 | |

Valspar Corp. | | | 17,500 | | | | 895,125 | |

| | | | | | | | |

| | | | | | | 3,445,061 | |

| | | | | | | | |

| | |

Commercial Banks Non - U.S. (0.63%) | | | | | | | | |

Banco Bilbao Vizcaya Argentaria SA, Sponsored ADR | | | 161,600 | | | | 1,090,800 | |

Banco Santander SA, Sponsored ADR | | | 80,300 | | | | 508,299 | |

| | | | | | | | |

| | | | | | | 1,599,099 | |

| | | | | | | | |

| | |

Computers (2.94%) | | | | | | | | |

Apple, Inc.1 | | | 12,700 | | | | 7,419,848 | |

| | | | | | | | |

| | |

Computers - Integrated Systems (1.04%) | | | | | | | | |

NCR Corp.1 | | | 111,100 | | | | 2,610,850 | |

| | | | | | | | |

| | |

Computers - Memory Devices (2.34%) | | | | | | | | |

EMC Corp.1 | | | 120,600 | | | | 3,402,126 | |

OCZ Technology Group, Inc.1 | | | 422,400 | | | | 2,492,160 | |

| | | | | | | | |

| | | | | | | 5,894,286 | |

| | | | | | | | |

| | |

Distribution/Wholesale (0.51%) | | | | | | | | |

Pool Corp. | | | 34,500 | | | | 1,273,395 | |

| | | | | | | | |

| | |

Diversified Banking Institution (0.98%) | | | | | | | | |

Bank of America Corp. | | | 304,000 | | | | 2,465,440 | |

| | | | | | | | |

| | |

Diversified Operations (0.29%) | | | | | | | | |

Primoris Services Corp. | | | 51,100 | | | | 736,862 | |

| | | | | | | | |

| | |

Electric - Integrated (1.23%) | | | | | | | | |

CMS Energy Corp. | | | 134,800 | | | | 3,099,052 | |

| | | | | | | | |

| | |

16 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin Market Opportunity Fund | | Schedule of Investments |

| | April 30, 2012 |

| | | | | | | | |

| | | Shares | | | Value (Note 1) | |

Electric - Transmission (3.65%) | | | | | | | | |

National Grid PLC, Sponsored ADR | | | 169,900 | | | $ | 9,189,891 | |

| | | | | | | | |

| | |

Electronic Components - Semiconductors (0.97%) | | | | | | | | |

Broadcom Corp. - Class A1 | | | 67,000 | | | | 2,452,200 | |

| | | | | | | | |

| | |

Energy - Alternate Sources (0.07%) | | | | | | | | |

Clean Energy Fuels Corp.1 | | | 8,700 | | | | 167,388 | |

| | | | | | | | |

| | |

Food -Retail (1.38%) | | | | | | | | |

Whole Foods Market, Inc. | | | 41,800 | | | | 3,472,326 | |

| | | | | | | | |

| | |

Internet - Infrastructure Software (1.06%) | | | | | | | | |

TIBCO Software, Inc.1 | | | 81,500 | | | | 2,681,350 | |

| | | | | | | | |

| | |

Medical - Drugs (1.26%) | | | | | | | | |

Johnson & Johnson | | | 48,800 | | | | 3,176,392 | |

| | | | | | | | |

| | |

Medical - HMO (1.93%) | | | | | | | | |

UnitedHealth Group, Inc. | | | 86,600 | | | | 4,862,590 | |

| | | | | | | | |

| | |

Medical - Hospitals (0.00%)† | | | | | | | | |

Tenet Healthcare Corp.1 | | | 100 | | | | 519 | |

| | | | | | | | |

| | |

Multi-line Insurance (0.21%) | | | | | | | | |

American International Group, Inc.1 | | | 15,500 | | | | 527,465 | |

| | | | | | | | |

| | |

Networking Products (0.16%) | | | | | | | | |

Cisco Systems, Inc. | | | 19,500 | | | | 392,925 | |

| | | | | | | | |

| | |

Oil & Gas Drilling (1.24%) | | | | | | | | |

Ensco PLC, Sponsored ADR | | | 41,000 | | | | 2,240,650 | |

Hercules Offshore, Inc.1 | | | 173,900 | | | | 883,412 | |

| | | | | | | | |

| | | | | | | 3,124,062 | |

| | | | | | | | |

| | |

Pipelines (7.07%) | | | | | | | | |

Enbridge, Inc. | | | 201,900 | | | | 8,457,591 | |

Kinder Morgan, Inc. | | | 116,400 | | | | 4,178,760 | |

Plains All American Pipeline LP | | | 63,200 | | | | 5,177,976 | |

| | | | | | | | |

| | | | | | | 17,814,327 | |

| | | | | | | | |

| | |

Annual Report | April 30, 2012 | | 17 |

| | |

Caldwell & Orkin Market Opportunity Fund | | Schedule of Investments |

| | April 30, 2012 |

| | | | | | | | |

| | | Shares | | | Value (Note 1) | |

Reinsurance (2.48%) | | | | | | | | |

Greenlight Capital Re, Ltd. - Class A1 | | | 251,300 | | | $ | 6,257,370 | |

| | | | | | | | |

| | |

Retail - Apparel/Shoe (1.12%) | | | | | | | | |

Urban Outfitters, Inc.1 | | | 97,200 | | | | 2,814,912 | |

| | | | | | | | |

| | |

Retail - Auto Parts (1.33%) | | | | | | | | |

O’Reilly Automotive, Inc.1 | | | 31,900 | | | | 3,364,174 | |

| | | | | | | | |

| | |

Retail - Automobile (0.40%) | | | | | | | | |

Group 1 Automotive, Inc. | | | 17,400 | | | | 1,007,112 | |

| | | | | | | | |

| | |

Retail - Bedding (1.03%) | | | | | | | | |

Bed Bath & Beyond, Inc.1 | | | 36,700 | | | | 2,583,313 | |

| | | | | | | | |

| | |

Retail - Building Products (4.15%) | | | | | | | | |

Home Depot, Inc. | | | 100,100 | | | | 5,184,179 | |

Lowe’s Cos., Inc. | | | 125,200 | | | | 3,940,044 | |

Lumber Liquidators Holdings, Inc.1 | | | 46,400 | | | | 1,342,352 | |

| | | | | | | | |

| | | | | | | 10,466,575 | |

| | | | | | | | |

| | |

Retail - Home Furnishings (0.41%) | | | | | | | | |

Pier 1 Imports, Inc. | | | 59,700 | | | | 1,025,646 | |

| | | | | | | | |

| | |

Retail - Major Department Store (0.07%) | | | | | | | | |

TJX Cos., Inc. | | | 4,000 | | | | 166,840 | |

| | | | | | | | |

| | |

Retail - Restaurants (1.61%) | | | | | | | | |

Panera Bread Co. -Class A1 | | | 4,700 | | | | 742,224 | |

Starbucks Corp. | | | 57,900 | | | | 3,322,302 | |

| | | | | | | | |

| | | | | | | 4,064,526 | |

| | | | | | | | |

| | |

Semiconductor Components/Integrated Circuits (1.59%) | | | | | | | | |

QUALCOMM, Inc. | | | 62,600 | | | | 3,996,384 | |

| | | | | | | | |

| | |

Telecom Services (0.30%) | | | | | | | | |

Allot Communications, Ltd.1 | | | 31,100 | | | | 763,194 | |

| | | | | | | | |

| | |

Transactional Software (1.92%) | | | | | | | | |

VeriFone Systems, Inc.1 | | | 101,700 | | | | 4,844,988 | |

| | | | | | | | |

| | |

18 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin Market Opportunity Fund | | Schedule of Investments |

| | April 30, 2012 |

| | | | | | | | |

| | | Shares | | | Value (Note 1) | |

Transportation - Rail (0.84%) | | | | | | | | |

Kansas City Southern | | | 27,500 | | | $ | 2,118,050 | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS (Cost $158,136,894) | | | | | | | 176,834,639 | |

| |

| | | | | | | | | | | | | | |

| | | Expiration Date | | Exercise

Price | | | Number of

Contracts | | | Value (Note 1) | |

PURCHASED OPTIONS (1.80%) | | | | | | | | | | | | | | |

PURCHASED CALL OPTIONS (1.54%) | | | | | | | | | | | | | | |

Apple Computer, Inc. | | June, 2012 | | | $600.00 | | | | 70 | | | | 134,400 | |

Apple, Inc. | | June, 2012 | | | 590.00 | | | | 70 | | | | 165,200 | |

DR Horton, Inc. | | August, 2012 | | | 15.00 | | | | 1,734 | | | | 364,140 | |

Fortune Brands Home & Security, Inc. | | June, 2012 | | | 20.00 | | | | 512 | | | | 138,240 | |

Fortune Brands Home & Security, Inc. | | September, 2012 | | | 22.50 | | | | 4,458 | | | | 802,440 | |

Greenlight Capital Re, Ltd. | | August, 2012 | | | 25.00 | | | | 53 | | | | 4,770 | |

Lennar Corp. | | May, 2012 | | | 23.00 | | | | 1,121 | | | | 538,080 | |

Lennar Corp. | | August, 2012 | | | 27.00 | | | | 2,916 | | | | 839,808 | |

OCZ Technology Group, Inc. | | May, 2012 | | | 6.00 | | | | 4,619 | | | | 277,140 | |

Toll Brothers, Inc. | | September, 2012 | | | 24.00 | | | | 1,795 | | | | 556,450 | |

Vertex Pharmaceuticals, Inc. | | October, 2012 | | | 45.00 | | | | 220 | | | | 64,900 | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL PURCHASED CALL OPTIONS (Cost $2,815,867) | | | | | | | | | | | | | 3,885,568 | |

| | | | | | | | | | | | | | |

| | | | |

PURCHASED PUT OPTIONS (0.26%) | | | | | | | | | | | | | | |

Community Health Systems, Inc. | | June, 2012 | | | 25.00 | | | | 1,721 | | | | 318,385 | |

Community Health Systems, Inc. | | September, 2012 | | | 22.00 | | | | 995 | | | | 164,175 | |

Research In Motion, Ltd. | | May, 2012 | | | 14.00 | | | | 1,210 | | | | 62,920 | |

Shutterfly, Inc. | | September, 2012 | | | 30.00 | | | | 250 | | | | 100,250 | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL PURCHASED PUT OPTIONS (Cost $1,118,512) | | | | | | | | | | | | | 645,730 | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL PURCHASED OPTIONS (Cost $3,934,379) | | | | | | | | | | | | | 4,531,298 | |

| |

| | |

Annual Report | April 30, 2012 | | 19 |

| | |

Caldwell & Orkin Market Opportunity Fund | | Schedule of Investments |

| | April 30, 2012 |

| | | | | | | | | | | | |

| | | Expiration

Date | | Exercise

Price | | Number of

Contracts | | | Value (Note 1) | |

TOTAL LONG INVESTMENTS (Cost $162,071,273) | | | | | | | | | | $ | 181,365,937 | |

| | | |

| | | 7-Day Yield | | | Shares | | | | | |

SHORT TERM INVESTMENTS (29.04%) | | | | | | | | | | | | |

MONEY MARKET FUNDS2 | | | | | | | | | | | | |

JPMorgan 100% U.S. Treasury Securities Money Market Fund | | 0.00% 3 | | | 73,144,918 | | | | 73,144,918 | |

| | | | | | | | | | | | |

| | | | |

TOTAL SHORT TERM INVESTMENTS (Cost $73,144,918) | | | | | | | | | | | 73,144,918 | |

| | | | |

TOTAL INVESTMENTS - (101.03%) (Cost $235,216,191) | | | | | | | | | | $ | 254,510,855 | |

| | | | |

Liabilities in Excess of Other Assets (-1.03%) | | | | | | | | | | | (2,603,809) | |

| | | | |

NET ASSETS (100.00%) | | | | | | | | | | $ | 251,907,046 | |

| | | | | | | | | | | | | |

| | | | |

| SCHEDULE OF SECURITIES SOLD SHORT | | | | | | Shares | | | Value (Note 1) | |

COMMON STOCKS (-13.17%) | | | | | | | | | | | | |

Aerospace/Defense (-0.37%) | | | | | | | | | | | | |

Aerovironment, Inc. | | | | | | | (38,000) | | | $ | (924,160) | |

| | | | | | | | | | | | |

| | | | |

Aerospace/Defense - Equipment (-0.30%) | | | | | | | | | | | | |

Alliant Techsystems, Inc. | | | | | | | (14,300) | | | | (762,190) | |

| | | | | | | | | | | | |

| | | | |

Apparel Manufacturers (-0.58%) | | | | | | | | | | | | |

Columbia Sportswear Co. | | | | | | | (14,500) | | | | (682,950) | |

Hanesbrands, Inc. | | | | | | | (27,500) | | | | (776,050) | |

| | | | | | | | | | | | |

| | | | | | | | | | | (1,459,000) | |

| | | | | | | | | | | | |

| | | | |

Beverages - Wine/Spirits (-1.08%) | | | | | | | | | | | | |

Green Mountain Coffee Roasters, Inc. | | | | | | | (55,800) | | | | (2,720,250) | |

| | | | | | | | | | | | |

| | | | |

Commercial Banks Non - U.S. (-1.11%) | | | | | | | | | | | | |

Banco Bilbao Vizcaya Argentaria SA, Sponsored ADR | | | | | | | (263,300) | | | | (1,777,275) | |

| | |

20 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin Market Opportunity Fund | | Schedule of Investments |

| | April 30, 2012 |

| | | | | | | | |

| SCHEDULE OF SECURITIES SOLD SHORT (continued) | | Shares | | | Value (Note 1) | |

Commercial Banks Non - U.S. (continued) | | | | | | | | |

Banco Santander SA, Sponsored ADR | | | (160,900) | | | $ | (1,018,497) | |

| | | | | | | | |

| | | | | | | (2,795,772) | |

| | | | | | | | |

| | |

Diversified Manufacturing Operations (-0.00%)† | | | | | | | | |

AO Smith Corp. | | | (100) | | | | (4,760) | |

| | | | | | | | |

| | |

E - Commerce/Products (-1.08%) | | | | | | | | |

Nutrisystem, Inc. | | | (22,800) | | | | (264,024) | |

Shutterfly, Inc. | | | (78,700) | | | | (2,449,144) | |

| | | | | | | | |

| | | | | | | (2,713,168) | |

| | | | | | | | |

| | |

E - Commerce/Services (-0.80%) | | | | | | | | |

Netflix, Inc. | | | (25,000) | | | | (2,003,500) | |

OpenTable, Inc. | | | (100) | | | | (4,473) | |

| | | | | | | | |

| | | | | | | (2,007,973) | |

| | | | | | | | |

| | |

Electronic Devices (-0.40%) | | | | | | | | |

Research In Motion, Ltd. | | | (70,000) | | | | (1,001,000) | |

| | | | | | | | |

| | |

Electronic Measuring Instruments (-0.00%)† | | | | | | | | |

Trimble Navigation, Ltd. | | | (100) | | | | (5,414) | |

| | | | | | | | |

| | |

Food - Miscellaneous/Diversified (-0.46%) | | | | | | | | |

Diamond Foods, Inc. | | | (55,400) | | | | (1,157,860) | |

| | | | | | | | |

| | |

Footwear (Non-Athletic) & Related Apparel (-0.20%) | | | | | | | | |

Deckers Outdoor Corp. | | | (9,800) | | | | (499,898) | |

| | | | | | | | |

| | |

Machinery - Construction & Mining (-0.46%) | | | | | | | | |

Joy Global, Inc. | | | (16,500) | | | | (1,167,705) | |

| | | | | | | | |

| | |

Medical - Hospitals (-1.14%) | | | | | | | | |

Community Health Systems, Inc. | | | (104,200) | | | | (2,536,228) | |

Health Management Associates, Inc. -Class A | | | (48,300) | | | | (347,760) | |

| | | | | | | | |

| | | | | | | (2,883,988) | |

| | | | | | | | |

| | |

Metal - Copper (-0.30%) | | | | | | | | |

Freeport-McMoRan Copper & Gold, Inc. | | | (20,000) | | | | (766,000) | |

| | | | | | | | |

| | |

Annual Report | April 30, 2012 | | 21 |

| | |

Caldwell & Orkin Market Opportunity Fund | | Schedule of Investments |

| | April 30, 2012 |

| | | | | | | | |

| SCHEDULE OF SECURITIES SOLD SHORT (continued) | | Shares | | | Value (Note 1) | |

Real Estate Management/Services (-0.00%)† E-House China Holdings, Ltd., ADR | | | (100 | ) | | $ | (742 | ) |

| | | | | | | | |

| | |

Retail - Apparel/Shoe (-1.50%) | | | | | | | | |

The Buckle, Inc. | | | (32,400 | ) | | | (1,496,232 | ) |

Guess?, Inc. | | | (78,200 | ) | | | (2,289,696 | ) |

| | | | | | | | |

| | | | | | | (3,785,928 | ) |

| | | | | | | | |

Retail - Video Games (-0.45%) GameStop Corp. -Class A | | | (49,300 | ) | | | (1,122,068 | ) |

| | | | | | | | |

| | |

Schools (-2.50%) | | | | | | | | |

Apollo Group, Inc. -Class A | | | (11,900 | ) | | | (419,118 | ) |

Career Education Corp. | | | (179,400 | ) | | | (1,279,122 | ) |

Corinthian Colleges, Inc. | | | (158,100 | ) | | | (607,104 | ) |

ITT Educational Services, Inc. | | | (19,500 | ) | | | (1,287,390 | ) |

K12, Inc. | | | (42,500 | ) | | | (1,083,750 | ) |

Strayer Education, Inc. | | | (16,300 | ) | | | (1,608,484 | ) |

| | | | | | | | |

| | | | | | | (6,284,968 | ) |

| | | | | | | | |

| | |

Transportation - Rail (-0.44%) Genesee & Wyoming, Inc. | | | (20,700 | ) | | | (1,115,937 | ) |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS (Proceeds $40,188,516) | | | | | | | (33,178,781 | ) |

| | | | | | | | |

| | |

EXCHANGE TRADED FUNDS (-1.20%) | | | | | | | | |

Country Fund - Australia (-0.20%) iShares® MSCI Australia Index Fund | | | (21,300 | ) | | | (507,792 | ) |

| | | | | | | | |

| | |

Country Fund - Russia (-0.60%) Market Vectors Russia ETF | | | (50,500 | ) | | | (1,512,475 | ) |

| | | | | | | | |

| | |

Emerging Country Exchange-Traded Funds (-0.40%) iShares® FTSE China 25 Index Fund | | | (26,500 | ) | | | (1,005,145 | ) |

| | | | | | | | |

| | |

TOTAL EXCHANGE TRADED FUNDS (Proceeds $2,964,953) | | | | | | | (3,025,412 | ) |

| | | | | | | | |

| | |

TOTAL SECURITIES SOLD SHORT (Proceeds $43,153,469) | | | | | | $ | (36,204,193 | ) |

| |

| | |

22 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin Market Opportunity Fund | | Schedule of Investments |

| | April 30, 2012 |

| † | Less than 0.005% of net assets. |

| 1 | Non-Income Producing Security. |

| 2 | A portion of the Money Market Fund assets are held as collateral for short sales activity. |

| 3 | Amount represents less than 0.005%. |

Common Abbreviations:

ADR - American Depositary Receipts

ETF - Exchange Traded Fund

FTSE - Financial Times Stock Exchange

LP - Limited Partnership

Ltd. - Limited

MSCI - Morgan Stanley Capital International

PLC - Public Limited Company

SA - Generally designates corporations in various countries, mostly those employing civil law

See accompanying notes to financial statements.

| | |

Annual Report | April 30, 2012 | | 23 |

| | |

Caldwell & Orkin Market Opportunity Fund | | Statement of Assets & Liabilities |

| | April 30, 2012 |

| | | | |

ASSETS | | | | |

Investments at value (cost $235,216,191) | | $ | 254,510,855 | |

Deposits with brokers for securities sold short | | | 37,500,091 | |

Receivables: | | | | |

Investment securities sold | | | 5,003,556 | |

Interest and dividends | | | 73,030 | |

Capital shares sold | | | 96,983 | |

Other assets | | | 16,889 | |

| | | | |

Total Assets | | | 297,201,404 | |

| | | | |

| |

LIABILITIES | | | | |

Securities sold short, not yet purchased (proceeds $43,153,469) | | | 36,204,193 | |

Payables: | | | | |

Investment securities purchased | | | 8,145,377 | |

Capital shares redeemed | | | 525,954 | |

Dividends payable - short sales | | | 94,522 | |

Investment advisory fee | | | 203,865 | |

Accrued expenses and other liabilities | | | 120,447 | |

| | | | |

Total Liabilities | | | 45,294,358 | |

| | | | |

| |

Net Assets | | $ | 251,907,046 | |

| | | | |

| |

COMPOSITION OF NET ASSETS | | | | |

Paid-in capital applicable to 12,253,222 shares outstanding; par value

$0.10 per share; 30,000,000 shares authorized | | $ | 259,062,880 | |

Undistributed net investment loss | | | (1,009,949 | ) |

Accumulated net realized loss on investments | | | (32,389,825 | ) |

Net unrealized appreciation of investments | | | 26,243,940 | |

| | | | |

| | $ | 251,907,046 | |

| | | | |

| |

NET ASSET VALUE AND OFFERING/REDEMPTION PRICE PER SHARE | | | $20.56 | |

| | | | |

See accompanying notes to financial statements.

| | |

24 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin Market Opportunity Fund | | Statement of Operations |

| | For the Year Ended April 30, 2012 |

| | | | |

INVESTMENT INCOME | | | | |

Dividends (net of foreign withholding taxes of $40,492) | | | $2,326,656 | |

Interest | | | 7,910 | |

| | | | |

Total Investment Income | | | 2,334,566 | |

| | | | |

| |

EXPENSES | | | | |

Investment advisory fees (Note 2) | | | 2,722,939 | |

Dividend expense on securities sold short | | | 1,189,620 | |

Interest expense | | | 1,179,535 | |

Transfer agent fees | | | 179,481 | |

Administration and accounting fees (Note 2) | | | 175,240 | |

Professional fees | | | 88,331 | |

Directors’ fees and expenses | | | 64,004 | |

Insurance expense | | | 58,754 | |

Blue sky servicing fees | | | 58,659 | |

Chief compliance officer expense | | | 45,000 | |

Custodian fees | | | 39,404 | |

Shareholder report printing | | | 35,005 | |

Other expenses | | | 19,981 | |

| | | | |

Total Expenses before waiver | | | 5,855,953 | |

Less fees waived by Administrator (Note 2) | | | (30,082 | ) |

| | | | |

Total net expenses | | | 5,825,871 | |

| | | | |

Net Investment Loss | | | (3,491,305 | ) |

| | | | |

| |

REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | | | | |

Net realized gain on investments | | | 8,738,345 | |

Net realized gain on securities sold short | | | 6,586,228 | |

Net realized gain on written options | | | 3,689 | |

Change in unrealized depreciation on investments | | | (1,809,665 | ) |

Change in unrealized appreciation on securities sold short | | | 1,067,815 | |

| | | | |

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 14,586,412 | |

| | | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | $11,095,107 | |

| | | | |

See accompanying notes to financial statements.

| | |

Annual Report | April 30, 2012 | | 25 |

| | |

Caldwell & Orkin Market Opportunity Fund | | Statements of Changes in Net Assets |

| | |

| | | | | | | | |

| | | For the Year Ended

April 30, 2012 | | | For the Year Ended

April 30, 2011 | |

| | | | |

INCREASE/(DECREASE) IN NET ASSETS FROM OPERATIONS: | | | | | | | | |

Net investment loss | | | $(3,491,305) | | | | $(5,064,477) | |

Net realized gain/(loss) on investments, securities sold short and written options | | | 15,328,262 | | | | (10,477,045) | |

Change in net unrealized appreciation/(depreciation) of investments and securities sold short | | | (741,850) | | | | 16,050,985 | |

| | | | |

| | | 11,095,107 | | | | 509,463 | |

| | | | |

| | |

DECREASE IN NET ASSETS FROM COMMON STOCK TRANSACTIONS: | | | | | | | | |

Net proceeds from sale of shares | | | 45,960,719 | | | | 118,936,001 | |

Cost of shares redeemed | | | (137,975,481) | | | | (182,072,337) | |

Redemption fee proceeds (Note 1) | | | 102,634 | | | | 276,943 | |

| | | | |

Net decrease in net assets resulting from capital share transactions | | | (91,912,128) | | | | (62,859,393) | |

| | | | |

| | |

DECREASE IN NET ASSETS | | | (80,817,021) | | | | (62,349,930) | |

| | |

NET ASSETS | | | | | | | | |

Beginning of year | | | 332,724,067 | | | | 395,073,997 | |

| | | | |

End of year (including undistributed net investment income/(loss) of $(1,009,949) and $0, respectively) | | | $251,907,046 | | | | $332,724,067 | |

| | | | |

See accompanying notes to financial statements.

| | |

26 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin Market Opportunity Fund | | Financial Highlights |

| | |

| | | | | | | | | | | | | | | | | | | | |

For a capital share outstanding throughout each year. | | | | | | | | | | | | | | | | | | | | |

| | | For the

Year Ended

April 30,

2012 | | | For the

Year Ended

April 30,

2011 | | | For the

Year Ended

April 30,

2010 | | | For the

Year Ended

April 30,

2009 | | | For the

Year Ended

April 30,

2008 | |

PER SHARE DATA: | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | | $19.59 | | | | $19.51 | | | | $21.24 | | | | $21.40 | | | | $18.68 | |

Income/(loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net Investment income/(loss) | | | (0.28) | | | | (0.30) | | | | (0.16) | | | | 0.01 | | | | 0.20 | |

Net realized and unrealized gain/(loss) on investments | | | 1.24 | | | | 0.36 | | | | (1.43) | | | | 0.94 | | | | 3.15 | |

| | | | |

Total from Investment Operations | | | 0.96 | | | | 0.06 | | | | (1.59) | | | | 0.95 | | | | 3.35 | |

| | | | |

| | | | | |

LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | – | | | | – | | | | – | | | | (0.12) | | | | (0.37) | |

From net realized gain on investments | | | – | | | | – | | | | (0.16) | | | | (1.02) | | | | (0.30) | |

| | | | |

Total Distributions | | | – | | | | – | | | | (0.16) | | | | (1.14) | | | | (0.67) | |

| | | | |

Redemption fee proceeds | | | 0.01 | | | | 0.02 | | | | 0.02 | | | | 0.03 | | | | 0.04 | |

| | | | |

Net asset value, end of year | | | $20.56 | | | | $19.59 | | | | $19.51 | | | | $21.24 | | | | $21.40 | |

| | | | |

| | | | | |

Total Return | | | 4.95% | | | | 0.41% | | | | (7.40%) | | | | 4.73% | | | | 17.92% | |

| | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | | $251,907 | | | | $332,724 | | | | $395,074 | | | | $302,930 | | | | $228,454 | |

Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

Management fees | | | 0.99% | | | | 0.97% | | | | 0.83% | | | | 0.83% | | | | 0.84% | |

Administrative Fees | | | 0.27% | | | | 0.22% | | | | 0.20% | | | | 0.27% | | | | 0.24% | |

| | | | |

Expenses before dividends on securities sold short and interest expense | | | 1.26% | | | | 1.19% | | | | 1.03% | | | | 1.10% | | | | 1.08% | |

Interest expense | | | 0.43% | | | | 0.51% | | | | 0.31% | | | | 0.24% | | | | 0.18% | |

Expenses from dividends on securities sold short | | | 0.43% | | | | 0.34% | | | | 0.29% | | | | 0.55% | | | | 1.02% | |

| | | | |

Ratio of total expenses1 | | | 2.12% | 2 | | | 2.04% | 2 | | | 1.63% | 2 | | | 1.89% | | | | 2.28% | |

| | | | |

Ratio of net investment income/(loss)1 | | | (1.27%) | 2 | | | (1.36%) | 2 | | | (0.82%) | 2 | | | (0.11%) | | | | 1.23% | |

Portfolio turnover rate | | | 517% | | | | 493% | | | | 662% | | | | 879% | | | | 712% | |

| 1 | The ratio of expenses to average net assets and net investment income to average net assets do not reflect the expenses of other investment companies (Acquired Fund Fees and Expenses). |

| 2 | The ratio of total expenses to average net assets and ratio of net investment income/(loss) include fees waived by Fund’s Administrator in the amount of 0.01%, 0.01% and less than 0.005%, respectively, for the years ended April 30, 2012, 2011 and 2010, respectively. |

|

| See accompanying notes to financial statements. |

| | |

Annual Report | April 30, 2012 | | 27 |

| | |

Caldwell & Orkin Market Opportunity Fund | | Notes to Financial Statements |

| | April 30, 2012 |

The Caldwell & Orkin Market Opportunity Fund (the “Fund”) is the only active investment portfolio of The Caldwell & Orkin Funds, Inc. (“Caldwell & Orkin”), an open-end, diversified management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and incorporated under the laws of the State of Maryland on August 15, 1989. Prior to June, 1992, Caldwell & Orkin’s name was The OTC Select- 100 Fund, Inc. and consisted of only one portfolio, The OTC Select-100 Fund. The shareholders of The OTC Select-100 Fund subsequently approved changing the corporate name from The OTC Select-100 Fund, Inc. to The Caldwell& Orkin Funds, Inc. and to amend the investment objective and policies of The OTC Select-100 Fund. As a result of such amendment, The OTC Select-100 Fund was renamed and its assets and objectives were those of the Caldwell & Orkin Aggressive Growth Fund. In August, 1996, the Board of Directors of Caldwell & Orkin approved changing the name of the Caldwell & Orkin Aggressive Growth Fund to the Caldwell & Orkin Market Opportunity Fund. The Fund’s objectives are to provide long-term capital growth with a short-term focus on capital preservation through investment selection and asset allocation. The Fund seeks to outperform the stock market (as measured by indices such as the S&P 500 Total Return Index) over the course of a full market cycle, which includes both bull market (a period of rising security prices) and bear market (a period of falling security prices) phases, but with less stomach churn.

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Securities Valuation

Securities are stated at the closing price on the date at which the net asset value (“NAV”) is being determined. If the date of determination is not a trading date, or the closing price is not otherwise available, the last bid price is used for a value instead. Debt securities, other than short- term investments, are valued at the price provided by an independent pricing service. Short- term investments having a maturity of 60 days or less at the time of the purchase are stated at amortized cost, which approximates market value. Any assets or securities for which market quotations are not readily available are valued at fair value as determined in good faith by or under the direction of the Fund’s Board of Directors in accordance with the Fund’s Fair Value Pricing Policy.

Fair Value Measurements

A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the reporting period end. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| | |

28 | | 1-800-467-7903 | www.CaldwellOrkinFunds.com |

| | |

Caldwell & Orkin Market Opportunity Fund | | Notes to Financial Statements |

| | April 30, 2012 |

| | |

Level 1 – | | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| |

Level 2 – | | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| |

Level 3 – | | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The following is a summary of the inputs used as of April 30, 2012 in valuing the Fund’s investments carried at value:

| | | | | | | | | | | | | | | | |

Investments in Securities at Value* | | Level 1 - Quoted

Prices | | | Level 2 - Other

Significant

Observable

Inputs | | | Level 3 -

Significant

Unobservable

Inputs | | | Total | |

Common Stocks | | $ | 176,834,639 | | | $ | – | | | $ | – | | | $ | 176,834,639 | |

Purchased Call Options | | | 3,378,418 | | | | 507,150 | | | | – | | | | 3,885,568 | |

Purchased Put Options | | | 163,170 | | | | 482,560 | | | | – | | | | 645,730 | |

Short Term Investments | | | 73,144,918 | | | | – | | | | – | | | | 73,144,918 | |

TOTAL | | $ | 253,521,145 | | | $ | 989,710 | | | $ | – | | | $ | 254,510,855 | |

| | | | | | | | | | | | | | | | | |

| | | | |

Other Financial Instruments* | | | | | | | | | | | | | | | | |

Common Stocks Sold Short | | $ | (33,178,781) | | | $ | – | | | $ | – | | | $ | (33,178,781) | |

Exchange Traded Funds Sold Short | | | (3,025,412) | | | | – | | | | – | | | | (3,025,412) | |

TOTAL | | $ | (36,204,193) | | | $ | – | | | $ | – | | | $ | (36,204,193) | |

| | | | | | | | | | | | | | | | | |

During the fiscal year ended April 30, 2012, there were no significant transfers between Level 1 and 2 securities. The Fund evaluates transfers into or out of all levels as of the end of the reporting period. All securities of the Fund were valued using either Level 1 or Level 2 inputs during the year ended April 30, 2012. Thus, a reconciliation of assets in which significant unobservable inputs (Level 3)were used is not applicable.

*For detailed industry descriptions, see the accompanying Schedule of Investments.

Recent Accounting Pronouncements

In May 2011, the FASB issued ASU No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements” in GAAP and the International Financial Reporting Standards (“IFRSs”). ASU No. 2011-04 amends FASB ASC Topic 820, Fair Value Measurements and Disclosures, to establish common requirements for measuring fair value and for disclosing information about fair value measurements in accordance with GAAP and IFRSs. ASU No. 2011-04 is effective for fiscal years beginning after December 15, 2011 and for interim periods within those fiscal years. Management is currently evaluating the impact these amendments may have on the Fund’s financial statements.

| | |

Annual Report | April 30, 2012 | | 29 |

| | |

Caldwell & Orkin Market Opportunity Fund | | Notes to Financial Statements |

| | April 30, 2012 |

Use of Derivatives