UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-06135

Templeton Institutional Funds

(Exact name of registrant as specified in charter)

300 S.E. 2nd Street,

Fort Lauderdale, FL 33301-1923

(Address of principal executive offices) (Zip code)

Craig S. Tyle,

One Franklin Parkway,

San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: (954)527-7500

Date of fiscal year end: 12/31

Date of reporting period: 12/31/19

Item 1. Reports to Stockholders.

Internet Delivery of Fund Reports Unless You Request Paper Copies:Effective January 1, 2021, as permitted by the SEC, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request them from the Fund or your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you have not signed up for electronic delivery, we would encourage you to join fellow shareholders who have. You may elect to receive shareholder reports and other communications electronically from the Fund by calling (800)321-8563 or by contacting your financial intermediary.

You may elect to continue to receive paper copies of all your future shareholder reports free of charge by contacting your financial intermediary or, if you invest directly with a Fund, calling (800)321-8563 to let the Fund know of your request. Your election to receive reports in paper will apply to all funds held in your account.

FRANKLIN TEMPLETON

Successful investing begins with ambition. And achievement only comes when you reach for it. That’s why we continually strive to deliver better outcomes for investors. No matter what your goals are, our deep, global investment expertise allows us to offer solutions that can help.

During our more than 70 years of experience, we’ve managed through all kinds of markets—up, down and those in between. We’re always preparing for what may come next. It’s because of this, combined with our strength as one of the world’s largest asset managers that we’ve earned the trust of millions of investors around the world.

Contents

|

| Visitftinstitutional.comfor fund updates, to access your account, or to find investment insights. |

| | | | | | | | |

| | | | | |

| Not FDIC Insured | | | | | May Lose Value | | | | | No Bank Guarantee |

| | | | | | |

| | | |

| ftinstitutional.com | | Not part of the annual report | | | 1 | |

ANNUAL REPORT

Economic and Market Overview

Global developed and emerging market stocks, as measured by the MSCI All Country World Index, posted strong returns during the reporting period. Although global economic growth slowed from 2018, interest-rate cuts from many central banks and the easing of trade tensions nearperiod-end contributed to the generally positive environment for equities worldwide. Reflecting investor optimism and slowing but resilient economic growth, stocks advanced in every major region of the globe.

In the U.S., solid economic growth also supported equities, as healthy consumer spending and a strong labor market kept the economy afloat. The unemployment rate fell during the year, reaching 3.5% in September, November and December 2019, the lowest recorded unemployment rate in 50 years.1 Wages also grew, albeit at a moderate pace, and inflation remained persistently low. In addition, deficit spending by the U.S. government boosted current growth at the expense of long-term debt. Despite the strength in the consumer sector, some parts of the economy struggled, particularly heavy industry. Annual industrial production contracted late in the reporting period, manufacturing output stalled and capital spending declined.

The U.S. Federal Reserve (Fed) provided a substantial boost to equity markets early in the reporting period as it shifted to a more accommodative monetary policy. In January 2019, the Fed signaled the end of its tightening cycle and cut the federal funds rate three times thereafter, lowering it to a range of 1.50%–1.75%. Stocks responded positively to the interest-rate cuts and gained further in December 2019 after the Fed indicated it would likely leave interest rates unchanged in 2020.

Growth slowed overall in the eurozone, particularly in Germany and Italy. Germany, which is heavily reliant on exports, was adversely affected by the trade conflict between the U.S. and China and the resulting slowdown in global trade. In Italy, political uncertainty and budget concerns caused the country’s annual gross domestic product (GDP) growth to stall in 2019’s first quarter before accelerating in the second quarter. Despite sluggish economic conditions, European developed market equities, as measured by the MSCI Europe Index, posted strong returns overall, as easing trade tensions buoyed investor optimism and an electoral victory by the Conservative Party in the U.K. alleviated uncertainty

surrounding Brexit. Although the European Central Bank left its headline refinancing rate unchanged, it lowered the deposit rate and restarted its bond-buying stimulus program, further supporting stocks.

Economic growth in Asia was relatively solid overall, despite slowdowns in several large emerging market countries, such as China and India. Japan’s economy grew amid the Bank of Japan’s sizable stimulus program. The trade war between the U.S. and China provided the backdrop for Asian stocks, which rose and fell in sync with investor sentiment regarding a trade deal. A phase one trade agreement between the two countries reached in December 2019 propelled Asian developed and emerging market stocks, which ultimately ended with strong returns over the12-month period, as measured by the MSCI All Country Asia Index.

Emerging market stocks overall experienced several sharp selloffs and subsequent rebounds throughout the reporting period before ending with gains. In aggregate, economic growth slowed somewhat from 2018 but remained solid, although there was some variation among individual countries. Many central banks in emerging markets cut interest rates throughout the reporting period which, along with resilient GDP growth, provided a supportive environment for equities. Russian stocks posted the highest returns among emerging markets as the threat of further sanctions receded and a solid fiscal environment reassured investors. Overall, global emerging markets, as measured by the MSCI Emerging Markets Index, posted robust returns for the period.

The foregoing information reflects our analysis and opinions as of December 31, 2019. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

1. Source: U.S. Bureau of Labor Statistics.

See www.franklintempletondatasources.com for additional data provider information

| | | | |

| | | |

| 2 | | Annual Report | | ftinstitutional.com |

Foreign Smaller Companies Series

This annual report for Foreign Smaller Companies Series (Fund) covers the fiscal year ended December 31, 2019.

Your Fund’s Goal and Main Investments

The Fund seeks long-term capital growth. Under normal market conditions, the Fund invests at least 80% of its net assets in investments of smaller companies located outside the U.S., including emerging markets.

Performance Overview

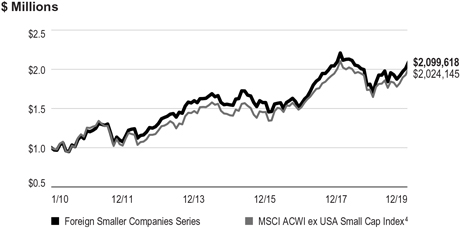

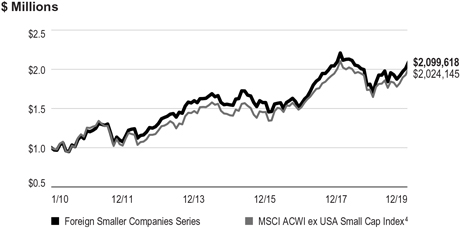

The Fund posted a +22.86% cumulative total return for the 12 months under review. In comparison, the MSCI All Country World Index (ACWI) ex USA Small Cap Index, which measures performance of global developed and emerging marketsmall-cap equities, excluding the U.S., posted a +22.93% total return.1 Please note, index performance information is provided for reference and we do not attempt to track the index but rather undertake investments on the basis of fundamental research. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 6.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recentmonth-end performance, go toftinstitutional.comor call a Franklin Templeton Institutional Services representative at (800)321-8563.

Investment Strategy

When choosing equity investments, we apply abottom-up, value-oriented, long-term approach, focusing on the market price of a company’s securities relative to our evaluation of the company’s long-term earnings, asset value and cash flow potential. This includes an assessment of the potential impacts of material environmental, social and governance factors (ESG) on the long-term risk and return profile of a company. We also consider a company’s price/earnings ratio, profit margins and liquidation value.

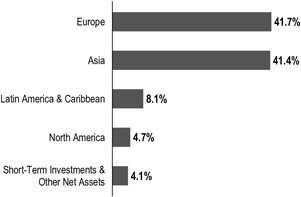

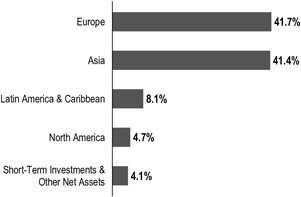

Geographic Composition

Based on Total Net Assets as of 12/31/19

Manager’s Discussion

Several holdings performed well during the period under review. Belgium-based Barco is a market leader in cinema projection, wireless meeting-room technology and displays for health care. We believe its upcoming wave of projector upgrades should drive a return to growth in the cinema business, as laser technology offers totalcost-of-ownership and image-quality benefits over the old, existing xenon lamp-based projectors. Its ClickShare product is a runaway success, and we believe it has a clear potential for further growth.

Shares of U.K. sandwich retailer Greggs rose amid surprisingly strong sales results as shorter queues and enhanced marketing efforts drove improvements. Looking at the longer term, Greggs is a leading player in the U.K. take-away sandwich and savories market, with growth opportunities from new products and organic store expansion.

The stock of Hong Kong-based Techtronic Industries, a global-leading power tools company, rose after the announcement of strong financial results. We expect Techtronic to continue to gain market share by penetrating entirely new markets and making the business less reliant on growth in the power tools market.

1. Source: Morningstar.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 25.

| | | | | | |

| | | |

| ftinstitutional.com | | Annual Report | | | 3 | |

FOREIGN SMALLER COMPANIES SERIES

Portfolio Composition

12/31/19

| | | | |

| Sector/Industry | |

| % of Total

Net Assets |

|

Machinery | | | 12.7 | % |

Leisure Products | | | 7.2 | % |

Textiles, Apparel & Luxury Goods | | | 6.7 | % |

Electronic Equipment, Instruments & Components | | | 6.7 | % |

Professional Services | | | 5.7 | % |

Food Products | | | 4.4 | % |

Banks | | | 3.5 | % |

Capital Markets | | | 3.5 | % |

Specialty Retail | | | 3.4 | % |

Diversified Consumer Services | | | 2.4 | % |

Household Durables | | | 2.3 | % |

Metals & Mining | | | 2.3 | % |

Containers & Packaging | | | 2.3 | % |

Electrical Equipment | | | 2.2 | % |

Life Sciences Tools & Services | | | 2.2 | % |

Technology Hardware, Storage & Peripherals | | | 2.1 | % |

Other | | | 26.3 | % |

Short-Term Investments & Other Net Assets | | | 4.1 | % |

In contrast, the Fund had some underperformers during the period under review. China-based Goodbaby International is a leading juvenile-durables manufacturer. We believe Goodbaby International’s shares could potentially appreciate and its valuation multiples increase due to the company’s greater focus on self-owned brands, a structural uptrend in profit margins and better profitability. Earnings growth, in our view, should be driven by cross-selling of self-owned brands in different regions,product-mix upgrades, cost-saving synergies and new business lines.

China ZhengTong Auto Services Holdings, a car dealer in China focusing on premium brands, was impacted by U.S.-China trade war concerns. The company has achieved a competitive advantage by carefully nurturing strong relationships with key luxury automobile suppliers. The continued expansion of the China’s middle and upper classes, in our view, provides a long-term growth driver for ZhengTong.

Japan-based Fuji Oil Holdings, a confectionery and baking ingredient manufacturer and a global player in the oligopolistic cocoa butter alternative industry, was impacted by concerns over a recent acquisition in Brazil. Looking at the longer term, we expect high demand for new products and strong revenue growth aided by international sales. As

Top 10 Holdings

12/31/19

| | | | |

Company

Sector/Industry, Country | |

| % of Total

Net Assets |

|

OneSpaWorld Holdings Ltd. Diversified Consumer Services, Bahamas | | | 2.4 | % |

Technogym SpA Leisure Products, Italy | | | 2.0 | % |

Barco NV Electronic Equipment, Instruments & Components, Belgium | | | 1.9 | % |

Techtronic Industries Co. Ltd. Machinery, Hong Kong | | | 1.9 | % |

Huhtamaki OYJ Containers & Packaging, Finland | | | 1.9 | % |

Rational AG Machinery, Germany | | | 1.9 | % |

Tsumura & Co. Pharmaceuticals, Japan | | | 1.8 | % |

MEITEC Corp. Professional Services, Japan | | | 1.8 | % |

The Thule Group AB Leisure Products, Sweden | | | 1.7 | % |

Stabilus SA Machinery, Germany | | | 1.7 | % |

investments to expand capacity and product lines unfold, we believe profit margins will normalize as well.

Thank you for your continued participation in Foreign Smaller Companies Series. We look forward to serving your future investment needs.

| | |

| |

Harlan B. Hodes, CPA Portfolio Manager |

| | | | |

| | | |

| 4 | | Annual Report | | ftinstitutional.com |

FOREIGN SMALLER COMPANIES SERIES

The foregoing information reflects our analysis, opinions and portfolio holdings as of December 31, 2019, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | | | | | |

| | | |

| ftinstitutional.com | | Annual Report | | | 5 | |

FOREIGN SMALLER COMPANIES SERIES

Performance Summary as of December 31, 2019

The performance table and graph do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 12/31/191

| | | | |

| | | Cumulative Total Return2 | | Average Annual Total Return3 |

| 1-Year | | +22.86% | | +22.86% |

| 5-Year | | +35.75% | | +6.30% |

| 10-Year | | +109.96% | | +7.70% |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recentmonth-end performance, go toftinstitutional.comor call a Franklin Templeton Institutional Services representative at (800) 321-8563.

See page 8 for Performance Summary footnotes.

| | | | |

| | | |

| 6 | | Annual Report | | ftinstitutional.com |

FOREIGN SMALLER COMPANIES SERIES

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $1,000,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

1/1/10–12/31/19

See page 8 for Performance Summary footnotes.

| | | | | | |

| | | |

| ftinstitutional.com | | Annual Report | | | 7 | |

FOREIGN SMALLER COMPANIES SERIES

PERFORMANCE SUMMARY

Distributions(1/1/19–12/31/19)

| | | | | | |

Net Investment

Income | | Long-Term

Capital Gain | | | Total |

| $0.3747 | | | $0.2807 | | | $0.6554 |

Total Annual Operating Expenses5

| | | | |

| | With Fee Waiver | | Without Fee

Waiver |

| | | 1.01% | | 1.02% |

All investments involve risks, including possible loss of principal. Smaller, midsized and relatively new or unseasoned companies can be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies. Historically, these securities have exhibited greater price volatility than large-company stocks, particularly over the short term. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size and lesser liquidity. Because the Fund may invest its assets in companies in a specific region, including Europe, it is subject to greater risks of adverse developments in that region and/or the surrounding regions than a fund that is more broadly diversified geographically. Political, social or economic disruptions in the region, even in countries in which the Fund is not invested, may adversely affect the value of securities held by the Fund. Current political and financial uncertainty surrounding the European Union may increase market volatility and the economic risk of investing in companies in Europe. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has a fee waiver associated with any investment it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 4/30/20. Fund investment results reflect the fee waiver; without this waiver, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Source: Morningstar. The MSCI ACWI ex USA Small Cap Index is a free float-adjusted, market capitalization-weighted index designed to measure performance ofsmall-cap equity securities of global developed and emerging markets, excluding the U.S.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

| | | |

| 8 | | Annual Report | | ftinstitutional.com |

FOREIGN SMALLER COMPANIES SERIES

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions, if applicable; and (2) ongoing Fund costs, including management fees, distribution and service(12b-1) fees, if applicable, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value.” You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50= $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | | | Actual | | | | Hypothetical |

| | | | | (actual return after expenses) | | | | (5% annual return before expenses) |

Beginning Account Value 7/1/19 | | | | Ending Account

Value 12/31/19 | | Paid During Period

7/1/19–12/31/191, 2 | | | | Ending Account

Value 12/31/19 | | Paid During Period

7/1/19–12/31/191, 2 | | | | Net

Annualized

Expense

Ratio2 |

| $1,000 | | | | $1,073.30 | | $5.38 | | | | $1,020.01 | | $5.24 | | | | 1.03% |

1. Expenses are equal to the annualized expense ratio for thesix-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 184/365 to reflect theone-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| | | | | | |

| | | |

| ftinstitutional.com | | Annual Report | | | 9 | |

Global Equity Series

This annual report for Global Equity Series (Fund) covers the fiscal year ended December 31, 2019.

Your Fund’s Goal and Main Investments

The Fund seeks long-term capital growth. Under normal market conditions, the Fund invests at least 80% of its net assets in equity securities of companies located anywhere in the world, including developing markets.

Performance Overview

The Fund posted a +12.20% cumulative total return for the 12 months under review. For comparison, the Fund’s benchmark, the MSCI All Country World Index (ACWI), which measures stock market performance in global developed and emerging markets, posted a +27.30% total return.1 Please note, index performance information is provided for reference and we do not attempt to track an index but rather undertake investments on the basis of fundamental research. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 13.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recentmonth-end performance, go toftinstitutional.comor call a Franklin Templeton Institutional Services representative at (800)321-8563.

Investment Strategy

We employ abottom-up, value-oriented, long-term investment strategy. We focus on the market price of a company’s securities relative to our evaluation of the company’s long-term earnings, asset value and cash flow potential. This includes an assessment of the potential impacts of material environmental, social and governance (ESG) factors on the long-term risk and return profile of a company. We also consider a company’s price/earnings ratio, profit margins and liquidation value. We attempt to identify those companies that offer above-average opportunities for capital appreciation in various countries and industries

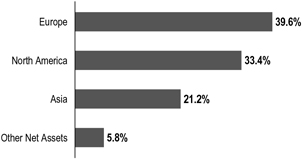

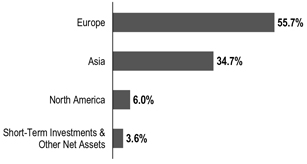

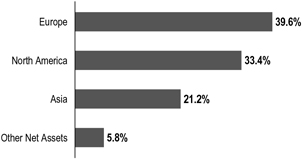

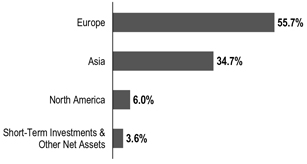

Geographic Composition

Based on Total Net Assets as of 12/31/19

where economic and political factors, including currency movements, are favorable to capital growth.

Manager’s Discussion

The Fund posted double-digit percentage absolute gains but underperformed its benchmark, the MSCI ACWI, in 2019, a year when value stocks posted their worst annual performance relative to growth stocks since the peak of the technology, media and telecommunication bubble two decades ago.

An underweighting and stock selection in the information technology (IT) sector detracted significantly from relative performance.2 Although our IT holdings overall posted strong absolute gains during the year, an underweight allocation to the market-leading sector pressured performance relative to the benchmark. There were no IT holdings among the Fund’s 10 biggest relative detractors, though the sector included one of the Fund’s top relative contributors during the year, Netherlands-based semiconductor solutions company NXP Semiconductors. Tellingly, broad sector outperformance during the year was driven almost entirely by multiples expansion, not by fundamentals, which actually deteriorated in 2019. Within the IT sector, we have avoided what we considered to be expensive, momentum-driven stocks, finding opportunities instead among hardware companies with restructuring potential, semiconductor manufacturers excessively pressured by supply concerns

1. Source: Morningstar.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

2. The IT sector comprises communications equipment; electronic equipment, instruments and components; semiconductors and semiconductor equipment; software; and technology hardware, storage and peripherals in the SOI.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 31.

| | | | |

| | | |

10 | | Annual Report | | ftinstitutional.com |

GLOBAL EQUITY SERIES

and, occasionally, mature software firms with healthy cash flows and new growth opportunities.

Stock selection in the communication services sector also detracted from relative performance.3 Chinese telecommunication firms China Telecom and China Mobile both fell to their lowest stock price levels in more than a decade amid concerns about elevated 5G capital expenditures. We continue to believe these stocks offer undemanding valuations, attractive dividend yields and solid competitive positions in a secular growth market. Within the telecommunication services industry more generally, we look for what we view as lowly valued firms with strong balance sheets, declining capital intensity and attractive dividends operating in markets with stable competitive dynamics and regulatory structures.

Stock selection and an overweighting in the energy sector also detracted from relative performance amid oil price volatility during the period.4 U.K.-based integrated energy producer BP was among the sector’s biggest relative detractors; the firm reported higher oil and gas production in 2019 and solid results from its energy trading business, but investors hoping for a dividend increase during the year were disappointed when the firm’s chief financial officer indicated that raising the dividend payout would be premature with leverage at current levels. BP has made solid progress selling assets to shore up its balance sheet, and we believe its financial position has the potential to be further strengthened by firmer oil prices and rising production following years of investment.

Turning to contributors, stock selection and an overweighting in the financials sector benefited relative performance.5 U.S. bank Citigroup and French lender BNP Paribas both finished the period among the Fund’s top three relative contributors. Citigroup’s share price reached a post-financial crisis high atyear-end as the steeper yield curve—with yields on long-term U.S. Treasuries higher than short-term U.S. Treasuries—aided profitability and improving conditions abroad buoyed sentiment at the global bank. We believe Citigroup remains one of the cheapest major U.S. banks and one of the few with material scope to benefit from ongoing self-help measures. BNP Paribas benefited from solid results at its fixed income unit and more benign European economic conditions. In our view, BNP Paribas is a diverse, high-quality European bank with an excellent track record of managing

Portfolio Composition

12/31/19

| | | | |

| |

| Sector/Industry | | % of Total

Net Assets | |

| Banks | | | 13.4% | |

| Pharmaceuticals | | | 11.3% | |

| Oil, Gas & Consumable Fuels | | | 10.3% | |

| Diversified Telecommunication Services | | | 8.0% | |

| Food & Staples Retailing | | | 4.9% | |

| Metals & Mining | | | 4.6% | |

| Multi-Utilities | | | 4.1% | |

| Wireless Telecommunication Services | | | 3.2% | |

| Semiconductors & Semiconductor Equipment | | | 3.2% | |

| Health Care Providers & Services | | | 3.1% | |

| Industrial Conglomerates | | | 2.8% | |

| Real Estate Management & Development | | | 2.7% | |

| Media | | | 2.4% | |

| Technology Hardware, Storage & Peripherals | | | 2.3% | |

| Aerospace & Defense | | | 2.2% | |

| Other | | | 15.7% | |

| Other Net Assets | | | 5.8% | |

credit risk and maintaining profitability in various economic conditions.

From a regional standpoint, key detractors from performance compared to the benchmark index included stock selection and an overweighting in Asia, pressured by relative weakness in Japan and China. In Europe, relative weakness in Germany, the U.K. and Italy more than offset relative strength in France and the Netherlands, while in North America, stock selection and an underweighting in the U.S. dampened relative performance.

As investors, we can neither predict the future nor time the markets. However, we can observe the market direction and take prudent steps to prepare our portfolios for probable outcomes. Trends that appear extended, expensive and unsustainable are ones we will always seek to avoid, despite the challenges avoiding these trends has caused during this unusually prolonged market cycle. In today’s environment, this means acknowledging the inconsistencies and problems facing the global financial system and constructing

3. The communication services sector comprises diversified telecommunication services, interactive media and services, media and wireless telecommunication services in the SOI.

4. The energy sector comprises oil, gas and consumable fuels in the SOI.

5. The financials sector comprises banks and diversified financial services in the SOI.

See www.franklintempletondatasources.com for additional data provider information.

| | | | | | |

| | | |

| ftinstitutional.com | | Annual Report | | | 11 | |

GLOBAL EQUITY SERIES

Top 10 Holdings

12/31/19

| | | | |

Company Sector/Industry, Country | | % of Total

Net Assets | |

Deutsche Telekom AG

Diversified Telecommunica

tion Services, Germany | | | 3.2% | |

Verizon Communications Inc.

Diversified Telecommunication Services, U.S. | | | 2.9% | |

Wells Fargo & Co.

Banks, U.S. | | | 2.6% | |

The Kroger Co.

Food & Staples Retailing, U.S. | | | 2.4% | |

Allergan PLC

Pharmaceuticals, U.S. | | | 2.3% | |

Samsung Electronics Co. Ltd.

Technology Hardware, Storage & Peripherals,

South Korea | | | 2.3% | |

Citigroup Inc.

Banks, U.S. | | | 2.3% | |

Standard Chartered PLC

Banks, U.K. | | | 2.3% | |

Vodafone Group PLC

Wireless Telecommunication Services, U.K. | | | 2.2% | |

BAE Systems PLC

Aerospace & Defense, U.K. | | | 2.2% | |

high-quality, high-conviction portfolios to manage growing risks and capitalize on evolving opportunities.

Thank you for your continued participation in Global Equity Series. We look forward to serving your future investment needs.

| | |

| |

Antonio T. Docal, CFA Lead Portfolio Manager |

| |

| | Peter A. Nori, CFA Portfolio Manager |

| |

| | Matthew R. Nagle, CFA Portfolio Manager |

The foregoing information reflects our analysis, opinions and portfolio holdings as of December 31, 2019, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

CFA® is a trademark owned by CFA Institute.

| | | | |

| | | |

12 | | Annual Report | | ftinstitutional.com |

GLOBAL EQUITY SERIES

Performance Summary as of December 31, 2019

The performance table and graph do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 12/31/191

| | | | |

| | |

| | | Cumulative Total Return2 | | Average Annual Total Return3 |

1-Year | | +12.20% | | +12.20% |

5-Year | | +17.23% | | +3.23% |

10-Year | | +88.15% | | +6.52% |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recentmonth-end performance, go toftinstitutional.comor call a Franklin Templeton Institutional Services representative at

(800)321-8563.

See page 15 for Performance Summary footnotes.

| | | | | | |

| | | |

| ftinstitutional.com | | Annual Report | | | 13 | |

GLOBAL EQUITY SERIES

PERFORMANCE SUMMARY

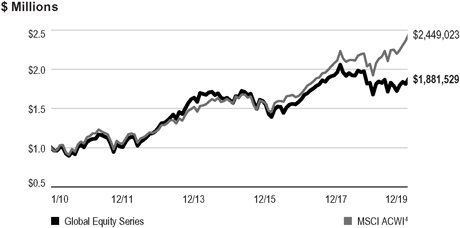

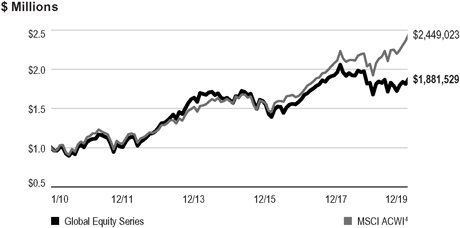

Total Return Index Comparison for a Hypothetical $1,000,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

1/1/10–12/31/19

See page 15 for Performance Summary footnotes.

| | | | |

| | | |

14 | | Annual Report | | ftinstitutional.com |

GLOBAL EQUITY SERIES

PERFORMANCE SUMMARY

Distributions(1/1/19–12/31/19)

| | | | | | | | | | | | |

Net Investment

Income | | Short-Term

Capital Gain | | | Long-Term

Capital Gain | | | Total | |

| $0.0279 | | | $0.0071 | | | | $0.2865 | | | $ | 0.3215 | |

Total Annual Operating Expenses5

| | | | |

| | | With Fee Waiver | | Without Fee Waiver |

| | | 0.85% | | 0.85% |

All investments involve risks, including possible loss of principal. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments; investments in emerging markets involve heightened risks related to the same factors. Because the Fund may invest its assets in companies in a specific region, including Europe, it is subject to greater risks of adverse developments in that region and/or the surrounding regions than a fund that is more broadly diversified geographically. Political, social or economic disruptions in the region, even in countries in which the Fund is not invested, may adversely affect the value of securities held by the Fund. Current political and financial uncertainty surrounding the European Union may increase market volatility and the economic risk of investing in companies in Europe. In addition, smaller-company stocks have historically experienced more price volatility than larger-company stocks, especially over the short term. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has a fee waiver associated with any investment it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 4/30/20. Fund investment results reflect the fee waiver; without this waiver, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Source: Morningstar. The MSCI ACWI is a free float-adjusted, market capitalization-weighted index designed to measure equity market performance of global developed and emerging markets.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| | | | | | |

| | | |

| ftinstitutional.com | | Annual Report | | | 15 | |

GLOBAL EQUITY SERIES

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions, if applicable; and (2) ongoing Fund costs, including management fees, distribution and service(12b-1) fees, if applicable, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value.” You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50= $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | Actual (actual return after expenses) | | | | Hypothetical (5% annual return before expenses) | | | | |

| | | | | | | | | | | | |

| | | Beginning

Account

Value 7/1/19 | | | | Ending

Account

Value 12/31/19 | | | | Paid During

Period 7/1/19–12/31/191, 2 | | | | Ending

Account

Value 12/31/19 | | | | Paid During

Period 7/1/19–12/31/191, 2 | | | | | | Net

Annualized

Expense

Ratio2 |

| | $1,000 | | | | $1,028.20 | | | | $4.75 | | | | $1,020.52 | | | | $4.74 | | | | | | 0.93% |

1. Expenses are equal to the annualized expense ratio for thesix-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 184/365 to reflect theone-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| | | | |

| | | |

| 16 | | Annual Report | | ftinstitutional.com |

International Equity Series

This annual report for International Equity Series (Fund) covers the fiscal year ended December 31, 2019.

Your Fund’s Goal and Main Investments

The Fund seeks long-term capital growth. Under normal market conditions, the Fund invests at least 80% of its net assets in foreign(non-U.S.) equity securities. The Fund invests predominantly in companies located outside the U.S. including companies located in developing market countries.

Performance Overview

The Fund’s Primary shares posted a +11.57% cumulative total return for the 12 months under review. For comparison, the Fund’s benchmark, the MSCI All Country World Index (ACWI) ex USA Index, which measures stock market performance in global developed and emerging markets excluding the U.S., posted a +22.13% total return for the period under review.1 The Fund’s other benchmark, the MSCI Europe, Australasia, Far East Index (EAFE), which measures stock market performance in global developed markets excluding the U.S. and Canada, posted a +22.66% total return.1 Please note, index performance information is provided for reference and we do not attempt to track an index but rather undertake investments on the basis of fundamental research. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 20.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recentmonth-end performance, go toftinstitutional.comor call a Franklin Templeton Institutional Services representative at (800)321-8563.

Investment Strategy

We employ abottom-up, value-oriented, long-term investment strategy. We focus on the market price of a company’s securities relative to our evaluation of the company’s long-term earnings, asset value and cash flow potential. This includes an assessment of the potential

Geographic Composition

Based on Total Net Assets as of 12/31/19

impacts of material environmental, social and governance (ESG) factors on the long-term risk and return profile of a company. We also consider a company’s price/earnings ratio, profit margins and liquidation value. We attempt to identify those companies that offer above-average opportunities for capital appreciation in various countries and industries where economic and political factors, including currency movements, are favorable to capital growth.

Manager’s Discussion

The Fund posted double-digit percentage absolute gains but underperformed its benchmark, the MSCI ACWI ex USA Index, in 2019, a year when value stocks delivered their worst annual performance relative to growth stocks since the peak of the technology, media and telecommunication bubble two decades ago.

Stock selection and an overweighting resulted in communication services being the most significant sector detractor from relative performance during the year.2 Luxembourg-based satellite operator SES was among the sector’s biggest relative detractors, as its shares declined due to a regulatory ruling that many investors believe will impact an upcoming spectrum auction. We remain constructive on the stock given its strong balance sheet, healthy dividend yield and our expectation of renewed growth in SES’s core business. Elsewhere in the sector, Chinese telecommunication firms China Telecom and China Mobile both fell to their lowest stock price levels in more than

1. Source: Morningstar.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

2. The communication services sector comprises diversified telecommunication services, interactive media and services, media and wireless telecommunication services in the SOI.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 36.

| | | | | | |

| | | |

ftinstitutional.com | | Annual Report | | | 17 | |

INTERNATIONAL EQUITY SERIES

a decade amid concerns about elevated 5G capital expenditures. We continue to believe these stocks offer undemanding valuations, attractive dividend yields and solid competitive positions in a secular growth market.

Stock selection in the health care sector, as well as stock selection and an overweighting in the energy sector, also detracted from relative performance.3 In the health care sector, shares of Israeli generic drugmaker Teva Pharmaceutical Industries (not held atperiod-end) declined amid a series of legal and regulatory setbacks that, in our assessment, impaired the balance of risks, leading us to sell the stock. Global pharmaceuticals stocks more broadly have experienced solid earnings revisions and improving pipeline prospects, but concerns about U.S. health care reform are overshadowing fundamentals. History suggests that companies capable of innovating to provide products that address unmet medical needs will continue to thrive and profit. In the energy sector, Italian integrated energy firm ENI declined amid volatile oil prices as investors overlooked strong production growth and focused instead on tepid earnings results andone-off issues. In our view, ENI stands out among major oil companies given its successful exploration and organic growth efforts, underleveraged balance sheet, commitment to shareholder return and strong track record of strategic execution.

Turning to contributors, stock selection in the materials sector benefited relative performance.4 Shares of Canadian mining firm Wheaton Precious Metals rallied as the price of gold broke out of asix-year trading range. We continue to like Wheaton Precious Metals’ attractive, capital-light streaming model, which provides financing for (primarily) base metals miners in return for a claim on their precious metals byproduct. More generally, we have maintained a modest precious metals allocation as a portfolio hedge and diversifier, in anticipation of an eventual move higher in gold prices given record-high debt levels, historically low interest rates, escalating geopolitical turmoil and renewed central bank buying.

Stock selection in the utilities sector also contributed to relative performance.5 French water, waste and energy utility Veolia Environnement was the sector’s top relative contributor, as its shares rose during the year as cost savings came in ahead of schedule and underlying businesses showed good organic growth trends. Restructuring progress

Portfolio Composition

12/31/19

| | | | |

| Sector/Industry | | % of Total

Net Assets | |

Banks | | | 14.8% | |

Oil, Gas & Consumable Fuels | | | 10.9% | |

Pharmaceuticals | | | 10.7% | |

Metals & Mining | | | 6.8% | |

Diversified Telecommunication Services | | | 6.1% | |

Multi-Utilities | | | 5.2% | |

Real Estate Management & Development | | | 4.9% | |

Wireless Telecommunication Services | | | 4.4% | |

Semiconductors & Semiconductor Equipment | | | 3.8% | |

Food & Staples Retailing | | | 3.2% | |

Industrial Conglomerates | | | 3.2% | |

Technology Hardware, Storage & Peripherals | | | 3.1% | |

Beverages | | | 2.8% | |

Chemicals | | | 2.8% | |

Health Care Providers & Services | | | 2.6% | |

Aerospace & Defense | | | 2.5% | |

Other | | | 8.6% | |

Short-Term Investments & Other Net Assets | | | 3.6% | |

has been obscured in recent years by macro- and industry-related challenges, and we were encouraged in 2019 to see those headwinds fade and investors begin to recognize Veolia’s solid progress and prospects for long-term value creation.

From a regional standpoint, key detractors from performance compared to the index included stock selection in Asia, pressured by relative weakness in China and Japan. In Europe, relative weakness in Germany and the U.K. more than offset relative strength in France and the Netherlands.

As investors, we can neither predict the future nor time the markets. However, we can observe the market direction and take prudent steps to prepare our portfolios for probable outcomes. Trends that appear extended, expensive and unsustainable are ones we will always seek to avoid, despite the challenges avoiding these trends has caused during this unusually prolonged market cycle. In today’s environment, this means acknowledging the inconsistencies and problems facing the global financial system and constructing

3. The health care sector comprises health care providers and services and pharmaceuticals in the SOI. The energy sector comprises energy equipment and services and oil, gas and consumable fuels in the SOI.

4. The materials sector comprises chemicals and metals and mining in the SOI.

5. The utilities sector comprises multi-utilities in the SOI.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

| | | |

18 | | Annual Report | | ftinstitutional.com |

INTERNATIONAL EQUITY SERIES

high-quality, high-conviction portfolios to manage growing risks and capitalize on evolving opportunities.

Top 10 Holdings

12/31/19

| | | | |

Company

Sector/Industry, Country | | % of Total

Net Assets | |

| |

Deutsche Telekom AG

Diversified Telecommunication Services, Germany | | | 3.3% | |

| |

Samsung Electronics Co. Ltd.

Technology Hardware, Storage & Peripherals,

South Korea | | | 3.0% | |

| |

Standard Chartered PLC

Banks, U.K. | | | 3.0% | |

| |

Vodafone Group PLC

Wireless Telecommunication Services, U.K. | | | 2.9% | |

| |

BNP Paribas SA

Banks, France | | | 2.9% | |

| |

E.ON SE

Multi-Utilities, Germany | | | 2.7% | |

| |

Takeda Pharmaceutical Co. Ltd.

Pharmaceuticals, Japan | | | 2.7% | |

| |

Barrick Gold Corp.

Metals & Mining, Canada | | | 2.6% | |

| |

Wheaton Precious Metals Corp.

Metals & Mining, Canada | | | 2.6% | |

| |

Sanofi

Pharmaceuticals, France | | | 2.5% | |

Thank you for your continued participation in International Equity Series. We look forward to serving your future investment needs.

| | |

| |

Antonio T. Docal, CFA Lead Portfolio Manager |

| | |

| | Peter A. Nori, CFA Matthew R. Nagle, CFA |

| |

| | Portfolio Management Team |

The foregoing information reflects our analysis, opinions and portfolio holdings as of December 31, 2019, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | | | | | |

| | | |

| ftinstitutional.com | | Annual Report | | | 19 | |

INTERNATIONAL EQUITY SERIES

Performance Summary as of December 31, 2019

The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 12/31/191

| | | | |

| Share Class | | Cumulative

Total Return2 | | Average Annual

Total Return3 |

Primary

1-Year | | +11.57% | | +11.57% |

| 5-Year | | +15.10% | | +2.85% |

| 10-Year | | +44.52% | | +3.75% |

| | |

Service

1-Year | | +11.34% | | +11.34% |

| 5-Year | | +14.17% | | +2.69% |

| 10-Year | | +42.33% | | +3.59% |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recentmonth-end performance, go toftinstitutional.comor call a Franklin Templeton Institutional Services representative at (800)321-8563.

See page 22 for Performance Summary footnotes.

| | | | |

| | | |

20 | | Annual Report | | ftinstitutional.com |

INTERNATIONAL EQUITY SERIES

PERFORMANCE SUMMARY

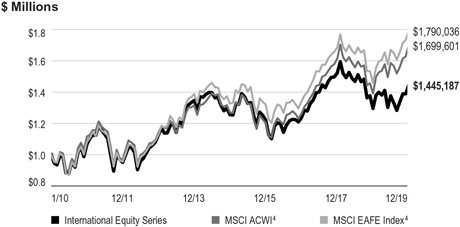

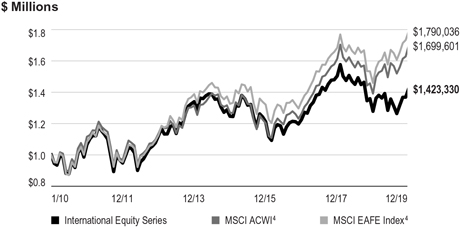

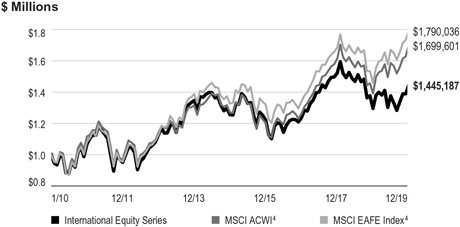

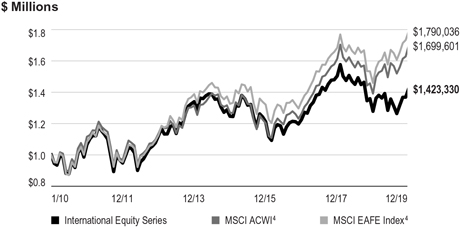

Total Return Index Comparison for a Hypothetical $1,000,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

Primary Shares(1/1/10–12/31/19)

Service Shares(1/1/10–12/31/19)

See page 22 for Performance Summary footnotes.

| | | | | | |

| | | |

| ftinstitutional.com | | Annual Report | | | 21 | |

INTERNATIONAL EQUITY SERIES

PERFORMANCE SUMMARY

Distributions(1/1/19–12/31/19)

| | | | | | | | | | | | |

| Share Class | | Net Investment

Income | | | Long-Term

Capital Gain | | | Total | |

Primary | | | $1.0222 | | | | $0.0118 | | | | $1.0340 | |

Service | | | $0.8506 | | | | $0.0118 | | | | $0.8624 | |

Total Annual Operating Expenses5

| | | | | | | | |

| Share Class | | With Fee Waiver | | | | Without Fee

Waiver | | |

Primary | | 0.81% | | | | 0.81% | | |

Service | | 0.96% | | | | 0.96% | | |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Foreign investing involves special risks, including currency fluctuations, economic instability and political developments. Investments in developing markets involve heightened risks related to the same factors, in addition to those associated with these markets’ small or midcap size and lesser liquidity. Because the Fund may invest in companies in a specific region, including Europe, it is subject to greater risks of adverse developments in that region and/or the surrounding regions than a fund that is more broadly diversified geographically. Political, social or economic disruptions in the region, even in countries in which the Fund is not invested, may adversely affect the value of securities held by the Fund. Current political uncertainty surrounding the European Union (EU) and the financial instability of some countries in the EU may increase market volatility and the economic risk of investing in companies in Europe. Value securities may not increase in price as anticipated or may decline further in value. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has a fee waiver associated with any investment it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 4/30/20. Fund investment results reflect the fee waiver; without this waiver, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Source: Morningstar. The MSCI ACWI ex USA Index is a free float-adjusted, market capitalization-weighted index designed to measure equity market performance of global developed and emerging markets, excluding the U.S. The MSCI EAFE Index is a free float-adjusted, market capitalization-weighted index designed to measure equity market performance of global developed markets excluding the U.S. and Canada.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

| | | |

| 22 | | Annual Report | | ftinstitutional.com |

INTERNATIONAL EQUITY SERIES

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions, if applicable; and (2) ongoing Fund costs, including management fees, distribution and service(12b-1) fees, if applicable, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | Actual (actual return after expenses) | | | | Hypothetical (5% annual return before expenses) | | | | |

| | | | | | | | | | | | |

Share Class | | Beginning

Account

Value 7/1/19 | | | | Ending

Account

Value 12/31/19 | | | | Expenses

Paid During

Period

7/1/19–12/31/191, 2 | | | | Ending

Account

Value 12/31/19 | | | | Expenses

Paid During

Period

7/1/19–12/31/191, 2 | | | | | | Net

Annualized

Expense

Ratio2 |

Primary Shares | | $1,000 | | | | $1,050.00 | | | | $4.19 | | | | $1,021.12 | | | | $4.13 | | | | | | 0.81% |

Service Shares | | $1,000 | | | | $1,048.90 | | | | $4.96 | | | | $1,020.37 | | | | $4.89 | | | | | | 0.96% |

1. Expenses are equal to the annualized expense ratio for thesix-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 184/365 to reflect theone-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| | | | | | |

| | | |

| ftinstitutional.com | | Annual Report | | | 23 | |

TEMPLETON INSTITUTIONAL FUNDS

Financial Highlights

Foreign Smaller Companies Series

| | | | | | | | | | | | | | | | | | | | |

| |

| | | Year Ended December 31, |

| | | | | |

| | | 2019 | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | |

Per share operating performance (for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | | $17.96 | | | | $25.08 | | | | $19.93 | | | | $20.90 | | | | $20.80 | |

| | | | |

| | | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment incomeb | | | 0.30 | | | | 0.37 | | | | 0.30 | | | | 0.29 | | | | 0.28 | |

| | | | | |

Net realized and unrealized gains (losses) | | | 3.79 | | | | (4.97 | ) | | | 6.49 | | | | (0.48 | ) | | | 0.12 | |

| | | | |

| | | | | |

Total from investment operations | | | 4.09 | | | | (4.60 | ) | | | 6.79 | | | | (0.19 | ) | | | 0.40 | |

| | | | |

| | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (0.37 | ) | | | (0.21 | ) | | | (0.68 | ) | | | (0.41 | ) | | | (0.28 | ) |

| | | | | |

Net realized gains | | | (0.28 | ) | | | (2.31 | ) | | | (0.96 | ) | | | (0.37 | ) | | | (0.02 | ) |

| | | | |

| | | | | |

Total distributions | | | (0.65 | ) | | | (2.52 | ) | | | (1.64 | ) | | | (0.78 | ) | | | (0.30 | ) |

| | | | |

| | | | | |

Net asset value, end of year | | | $21.40 | | | | $17.96 | | | | $25.08 | | | | $19.93 | | | | $20.90 | |

| | | | |

| | | | | |

Total return | | | 22.86% | | | | (18.48)% | | | | 34.18% | | | | (0.85)% | | | | 1.88% | |

| | | | | |

| Ratios to average net assets | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses before waiver and payments by affiliates | | | 1.02% | | | | 1.01% | | | | 0.99% | | | | 0.99% | | | | 0.98% | |

| | | | | |

Expenses net of waiver and payments by affiliates | | | 1.02%c | | | | 1.00%d | | | | 0.98%d | | | | 0.98%d | | | | 0.98%c,d | |

| | | | | |

Net investment income | | | 1.48% | | | | 1.54% | | | | 1.28% | | | | 1.44% | | | | 1.28% | |

| | | | | |

| Supplemental data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s) | | | $782,971 | | | | $739,576 | | | | $1,040,180 | | | | $931,879 | | | | $1,260,407 | |

| | | | | |

Portfolio turnover rate | | | 39.48% | | | | 34.10% | | | | 25.97% | | | | 21.36% | | | | 29.11% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cBenefit of waiver and payments by affiliates rounds to less than 0.01%.

dBenefit of expense reduction rounds to less than 0.01%.

| | | | |

| | | |

| 24 | | Annual Report | The accompanying notes are an integral part of these financial statements. | | ftinstitutional.com |

TEMPLETON INSTITUTIONAL FUNDS

Statement of Investments, December 31, 2019

Foreign Smaller Companies Series

| | | | | | | | | | | | |

| | | Industry | | | Shares/

Warrants | | | Value | |

| | | |

Common Stocks and Other Equity Interests 94.9% | | | | | | | | | | | | |

| | | |

Argentina 0.9% | | | | | | | | | | | | |

| | | |

aLivent Corp. | | | Chemicals | | | | 799,000 | | | $ | 6,831,450 | |

| | | | | | | | | | | | |

| | | |

Bahamas 2.4% | | | | | | | | | | | | |

| | | |

aOneSpaWorld Holdings Ltd. | | | Diversified Consumer Services | | | | 1,063,020 | | | | 17,901,257 | |

| | | |

aOneSpaWorld Holdings Ltd., wts., 3/19/24 | | | Diversified Consumer Services | | | | 210,345 | | | | 1,228,415 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 19,129,672 | |

| | | | | | | | | | | | |

| | | |

Belgium 3.0% | | | | | | | | | | | | |

| | | |

Barco NV | |

| Electronic Equipment, Instruments

& Components |

| | | 62,168 | | | | 15,268,308 | |

| | | |

Ontex Group NV | | | Personal Products | | | | 379,020 | | | | 7,969,725 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 23,238,033 | |

| | | | | | | | | | | | |

| | | |

Bermuda 0.7% | | | | | | | | | | | | |

| | | |

Axis Capital Holdings Ltd. | | | Insurance | | | | 91,830 | | | | 5,458,375 | |

| | | | | | | | | | | | |

| | | |

Brazil 3.1% | | | | | | | | | | | | |

| | | |

Camil Alimentos SA | | | Food Products | | | | 4,459,500 | | | | 9,996,292 | |

| | | |

Grendene SA | |

| Textiles, Apparel & Luxury

Goods |

| | | 2,315,500 | | | | 7,074,099 | |

| | | |

M. Dias Branco SA | | | Food Products | | | | 791,300 | | | | 7,510,410 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 24,580,801 | |

| | | | | | | | | | | | |

| | | |

Canada 4.7% | | | | | | | | | | | | |

| | | |

Canaccord Genuity Group Inc. | | | Capital Markets | | | | 1,422,338 | | | | 5,301,183 | |

| | | |

a,bCanada Goose Holdings Inc. | | | Textiles, Apparel & Luxury Goods | | | | 102,500 | | | | 3,710,554 | |

| | | |

Canadian Western Bank | | | Banks | | | | 416,415 | | | | 10,225,993 | |

| | | |

Computer Modelling Group Ltd. | | | Energy Equipment & Services | | | | 1,561,904 | | | | 9,886,686 | |

| | | |

The North West Co. Inc. | | | Food & Staples Retailing | | | | 299,400 | | | | 6,301,095 | |

| | | |

Russel Metals Inc. | | | Trading Companies & Distributors | | | | 90,700 | | | | 1,548,451 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 36,973,962 | |

| | | | | | | | | | | | |

| | | |

China 3.8% | | | | | | | | | | | | |

| | | |

China ZhengTong Auto Services Holdings Ltd. | | | Specialty Retail | | | | 8,364,000 | | | | 2,983,961 | |

| | | |

aGoodbaby International Holdings Ltd. | | | Household Durables | | | | 15,014,600 | | | | 3,333,452 | |

| | | |

Greatview Aseptic Packaging Co. Ltd. | | | Containers & Packaging | | | | 6,739,200 | | | | 3,087,528 | |

| | | |

Hollysys Automation Technologies Ltd. | |

| Electronic Equipment, Instruments

& Components |

| | | 416,700 | | | | 6,838,047 | |

| | | |

Shanghai Haohai Biological Technology Co. Ltd., H | | | Biotechnology | | | | 639,500 | | | | 3,857,205 | |

| | | |

Xtep International Holdings Ltd. | | | Textiles, Apparel & Luxury Goods | | | | 18,246,715 | | | | 9,694,365 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 29,794,558 | |

| | | | | | | | | | | | |

| | | |

Denmark 0.4% | | | | | | | | | | | | |

| | | |

Matas AS | | | Specialty Retail | | | | 396,909 | | | | 3,282,160 | |

| | | | | | | | | | | | |

| | | |

Finland 2.3% | | | | | | | | | | | | |

| | | |

Huhtamaki OYJ | | | Containers & Packaging | | | | 320,140 | | | | 14,856,289 | |

| | | |

aOutotec OYJ | | | Machinery | | | | 511,999 | | | | 3,306,136 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 18,162,425 | |

| | | | | | | | | | | | |

| | | | | | |

| | | |

| ftinstitutional.com | | Annual Report | | | 25 | |

TEMPLETON INSTITUTIONAL FUNDS

STATEMENT OF INVESTMENTS

Foreign Smaller Companies Series(continued)

| | | | | | | | | | | | |

| | | Industry | | | Shares/

Warrants | | | Value | |

Common Stocks and Other Equity Interests(continued) | | | | | | | | | |

France 1.8% | | | | | | | | | | | | |

Beneteau SA | | | Leisure Products | | | | 398,336 | | | $ | 4,837,912 | |

Maisons du Monde SA | | | Specialty Retail | | | | 181,372 | | | | 2,638,093 | |

Nexans SA | | | Electrical Equipment | | | | 127,836 | | | | 6,234,799 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 13,710,804 | |

| | | | | | | | | | | | |

Germany 7.4% | | | | | | | | | | | | |

Gerresheimer AG | | | Life Sciences Tools & Services | | | | 158,042 | | | | 12,229,298 | |

Grand City Properties SA | | | Real Estate Management & Development | | | | 336,361 | | | | 8,064,794 | |

Jenoptik AG | |

| Electronic Equipment, Instruments &

Components |

| | | 270,261 | | | | 7,722,586 | |

Rational AG | | | Machinery | | | | 18,176 | | | | 14,614,952 | |

Stabilus SA | | | Machinery | | | | 197,604 | | | | 13,440,222 | |

azooplus AG | | | Internet & Direct Marketing Retail | | | | 16,495 | | | | 1,579,756 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 57,651,608 | |

| | | | | | | | | | | | |

Hong Kong 4.0% | | | | | | | | | | | | |

Johnson Electric Holdings Ltd. | | | Electrical Equipment | | | | 1,647,241 | | | | 3,745,891 | |

Techtronic Industries Co. Ltd. | | | Machinery | | | | 1,846,000 | | | | 15,055,029 | |

Value Partners Group Ltd. | | | Capital Markets | | | | 8,652,000 | | | | 5,329,569 | |

VTech Holdings Ltd. | | | Communications Equipment | | | | 727,100 | | | | 7,184,875 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 31,315,364 | |

| | | | | | | | | | | | |

India 0.9% | | | | | | | | | | | | |

DCB Bank Ltd. | | | Banks | | | | 1,551,914 | | | | 3,738,687 | |

Welspun India Ltd. | | | Textiles, Apparel & Luxury Goods | | | | 5,185,935 | | | | 3,488,542 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 7,227,229 | |

| | | | | | | | | | | | |

Indonesia 0.7% | | | | | | | | | | | | |

aPT XL Axiata Tbk | | | Wireless Telecommunication Services | | | | 23,013,700 | | | | 5,221,909 | |

| | | | | | | | | | | | |

Italy 4.6% | | | | | | | | | | | | |

Interpump Group SpA | | | Machinery | | | | 387,449 | | | | 12,270,412 | |

aSanlorenzo SpA/Ameglia | | | N/A | | | | 446,150 | | | | 7,992,350 | |

Technogym SpA | | | Leisure Products | | | | 1,223,719 | | | | 15,905,417 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 36,168,179 | |

| | | | | | | | | | | | |

Japan 23.7% | | | | | | | | | | | | |

Anicom Holdings Inc. | | | Insurance | | | | 276,500 | | | | 9,375,684 | |

Asahi Co. Ltd. | | | Specialty Retail | | | | 280,700 | | | | 3,649,681 | |

Asics Corp. | | | Textiles, Apparel & Luxury Goods | | | | 707,700 | | | | 11,825,932 | |

Bunka Shutter Co. Ltd. | | | Building Products | | | | 524,700 | | | | 4,654,344 | |

Daibiru Corp. | | | Real Estate Management & Development | | | | 653,400 | | | | 7,894,311 | |

Dowa Holdings Co. Ltd. | | | Metals & Mining | | | | 204,400 | | | | 7,664,412 | |

en-japan Inc. | | | Professional Services | | | | 184,900 | | | | 8,124,201 | |

Fuji Oil Holdings Inc. | | | Food Products | | | | 432,800 | | | | 11,692,669 | |

Hoshino Resorts REIT Inc. | | | Equity Real Estate Investment Trusts (REITs) | | | | 1,064 | | | | 5,492,560 | |

Idec Corp. | | | Electrical Equipment | | | | 358,300 | | | | 7,457,783 | |

IDOM Inc. | | | Specialty Retail | | | | 1,226,600 | | | | 7,088,151 | |

Kobayashi Pharmaceutical Co. Ltd. | | | Personal Products | | | | 78,200 | | | | 6,670,476 | |

MEITEC Corp. | | | Professional Services | | | | 242,900 | | | | 13,745,894 | |

| | | | |

| | | |

| 26 | | Annual Report | | ftinstitutional.com |

TEMPLETON INSTITUTIONAL FUNDS

STATEMENT OF INVESTMENTS

Foreign Smaller Companies Series(continued)

| | | | | | | | | | | | |

| | | Industry | | | Shares/

Warrants | | | Value | |

Common Stocks and Other Equity Interests(continued) | | | | | | | | | |

Japan (continued) | | | | | | | | | | | | |

Morita Holdings Corp. | | | Machinery | | | | 235,200 | | | $ | 3,947,594 | |

Nichiha Corp. | | | Building Products | | | | 401,100 | | | | 9,906,164 | |

Nihon Parkerizing Co. Ltd. | | | Chemicals | | | | 354,300 | | | | 3,833,971 | |

Nissei Asb Machine Co., Ltd. | | | Machinery | | | | 184,700 | | | | 8,098,417 | |

Qol Co. Ltd. | | | Food & Staples Retailing | | | | 498,500 | | | | 7,018,220 | |

Square Enix Holdings Co. Ltd. | | | Entertainment | | | | 142,000 | | | | 7,095,100 | |