UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: Parnassus Funds (811-04044) and Parnassus Income Funds (811-06673)

Parnassus Funds

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marc C. Mahon

Parnassus Funds

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2012

Item 1: Report to Shareholders

PARNASSUS FUNDS®

ANNUAL REPORT ¡ DECEMBER 31, 2012

PARNASSUS FUNDS

| | |

| |

| Parnassus FundSM | | PARNX |

| |

| Parnassus Equity Income FundSM – Investor Shares | | PRBLX |

| |

| Parnassus Equity Income Fund – Institutional Shares | | PRILX |

| |

| Parnassus Mid-Cap FundSM | | PARMX |

| |

| Parnassus Small-Cap FundSM | | PARSX |

| |

| Parnassus Workplace Fund® | | PARWX |

| |

| Parnassus Fixed-Income FundSM | | PRFIX |

Table of Contents

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2012 |

February 11, 2013

Dear Shareholder:

2012 was a great year for the Parnassus Funds. The Parnassus Fund, the Workplace Fund, the Small-Cap Fund and the Mid-Cap Fund all beat their respective benchmarks by a substantial margin. The Equity Income Fund beat its Lipper peer group, and it was just slightly below the S&P 500 Index. The Equity Income Fund has a relatively conservative investment strategy, so it’s designed to provide downside protection in difficult years and capture most of the upside in good years. Portfolio managers Todd Ahlsten and Ben Allen did a remarkable job this year in capturing almost all of the upside.

Enclosed you will find reports on each of our funds, telling how we achieved this year’s returns. I think you’ll find that it makes for interesting reading.

New Staff Members

Charles Darlington has joined us as a fund accountant. Charles is a graduate of Case Western Reserve University, where he majored in accounting and was a member of the Beta Alpha Psi accounting fraternity. He previously interned with a forensic accounting firm in Ohio and volunteered with the tax assistance programs LadderUp and Refund Ohio. He enjoys playing golf and softball.

Rachel Tan has come aboard as a permanent employee conducting ESG (environmental, social and governance) research. She graduated from the University of California, Los Angeles and was part of the campus Research Team for Responsible Investment. She is conversant in Mandarin and was a competitive gymnast.

Scott Chun recently received his bachelor’s degree in financial economics from Emory University in Atlanta and was a member of the varsity tennis team, earning All-UAA honors. Scott will be assisting the Institutional Sales & Marketing team over the next few months, focusing on investment proposals for institutions.

Amy Phan has joined us as a sales and marketing intern. She is working on her undergraduate degree at the University of California, Berkeley, majoring in environment economics and media studies. She enjoys digital photography and videography.

Yours truly,

Jerome L. Dodson

President

4

| | | | |

| | |

| Annual Report • 2012 | | | | PARNASSUS FUNDS |

THIS PAGE LEFT INTENTIONALLY BLANK

5

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2012 |

PARNASSUS FUND

Ticker: PARNX

As of December 31, 2012, the net asset value per share (“NAV”) of the Parnassus Fund was $40.62, so after taking dividends into account, the total return for the quarter was 3.77%. This compares to a loss of 0.38% for the S&P 500 Index (“S&P 500”) and a gain of 1.50% for the Lipper Multi-Cap Core Average, which represents the average multi-cap core fund followed by Lipper (“Lipper average”). For the quarter, we beat both benchmarks by a substantial percentage.

For the year, the Fund was up 26.04%, compared to a gain of 16.00% for the S&P 500 and 15.09% for the Lipper average. Most of the stocks in our portfolio had strong returns, but the standouts were homebuilders and a building materials company. Big improvements in the housing market and increases in construction moved these stocks much higher. There were a number of other companies that also made big contributions, and we’ll discuss these in the Company Analysis section.

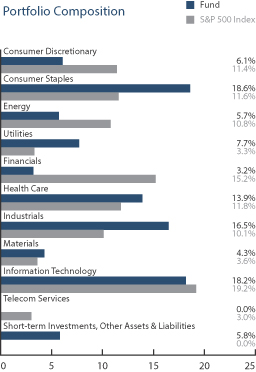

We beat the S&P 500 by more than ten percentage points, and this more than made up for our underperformance in 2011. Below is a table, comparing the Parnassus Fund with the S&P 500 and the Lipper average over the past one-, three-, five- and ten-year periods. As you can see, we’re ahead of both our benchmarks for all periods, except for the ten-year period, where we’re tied with the Lipper average, but ahead of the S&P 500. On page 8 is a graph showing the growth of a hypothetical $10,000 investment in the Fund over the last ten years.

| | | | | | | | | | | | | | | | | | | | | | | | |

| Parnassus Fund | |

Average Annual

Total Returns (%) | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

for periods ended December 31, 2012 | | | | | | |

| | | | | | | |

| Parnassus Fund | | | 26.04 | | | | 11.80 | | | | 6.37 | | | | 7.41 | | | | 0.94 | | | | 0.94 | |

| | | | | | | |

| S&P 500 Index | | | 16.00 | | | | 10.86 | | | | 1.66 | | | | 7.09 | | | | NA | | | | NA | |

| | | | | | | |

Lipper Multi-Cap Core Average | | | 15.09 | | | | 9.24 | | | | 0.98 | | | | 7.41 | | | | NA | | | | NA | |

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 Composite Stock Index (also known as the S&P 500) is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Prior to May 1, 2004, the Parnassus Fund charged a sales load (maximum of 3.5%), which is not reflected in the total return calculations. Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website, or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2012, Parnassus Investments has contractually agreed to limit the total operating expenses to 0.99% of net assets, exclusive of acquired fund fees, until May 1, 2013. This limitation may be continued indefinitely by the Adviser on a year-to-year basis.

Company Analysis

Our strong performance in 2012 was paced by seven stocks, each of them adding 46¢ or more to the NAV. No stock accounted for a loss of 46¢ or more per fund share, but the worst performer was W&T Offshore, which dropped 24.4% from $21.21 to $16.03, for a loss of 28¢ per fund share. Oil- and gas-producer W&T performed well for the Parnassus Fund in 2010 and 2011, but in 2012, concerns about weak oil demand, particularly in Europe, caused oil prices to fall 10.6% from $101.34 to $90.62 per barrel in 2012, so earnings slumped. Investor sentiment sank in late 2012, after W&T reported higher than expected operating costs and production delays due to third-party pipeline outages for its onshore wells. If the economy strengthens and energy prices move upward, earnings should move much higher.

The most important driver for our outstanding results in 2012 was the housing recovery. Many years ago, I spent six years as president of a small savings and loan in San Francisco. This experience was invaluable, since it gave me a keen insight into banking, monetary policy and the housing market. One thing my fellow executives and I often complained about was the fact that when the economy got going with the housing industry leading the way, the Federal Reserve would increase interest rates, and this would depress housing construction and sharply slow down the sale of homes. Since a savings and loan is a bank that specializes in housing, this would hurt our business and reduce our earnings. After one of

6

| | | | |

| | |

| Annual Report • 2012 | | | | PARNASSUS FUNDS |

these complaint sessions, an elder statesman of the savings and loan industry said to us, “You have to realize that the Fed uses the housing industry to control the economy. They don’t have anything against us personally, it’s just that controlling interest rates and the housing market is the best way for them to carry out monetary policy that will have an effect on the economy. Booms and busts come with the territory, so if you’re going to stay in this industry, you have to get used to it.”

It’s almost always housing that drives the economy into a recession and pulls the economy out of a recession. As we have seen, housing created the boom that ended in late 2007; the subprime mortgage crisis of 2008 ended that boom. The crash of

‘08 was different from most other housing recessions, because of its severity and because it was not caused by the Fed’s raising interest rates, but rather, by speculation in the housing market. After housing crashed in 2008, the Fed lowered interest rates, but the housing market did not come back right away. High unemployment and too many houses on the market delayed the recovery.

We had a few shares of homebuilders at the end of 2007, but we didn’t start serious investing in the sector until 2008 and 2009. I had expected the homebuilders to snap back by 2010, but it didn’t happen until 2012. All I can say is “better late than never.” New home construction increased 22% this year and prices are moving higher.

The housing recovery of 2012 produced the Fund’s biggest winner. The PulteGroup soared an astonishing 188% during the year from $6.31 to $18.16 for a gain of $1.61 for each Parnassus Fund share. Pulte was a prime beneficiary of the housing recovery. After losses in 2011, Pulte started earning money in 2012 because of the increase in demand for housing.

Another homebuilder, DR Horton, added 70¢ to the NAV, as its shares rocketed up 56.9% from $12.61 to $19.78. Horton weathered the housing market collapse better than many of its peers because of its broad geographic base and strong balance sheet. For 2012, its order backlog increased by 61% and operating profit surged an amazing 333%.

Toll Brothers saw its stock climb 58.3%, shooting up from $20.42 to $32.33 for an increase of 69¢ for each fund share. Toll and Horton moved up substantially, but not as much as Pulte, because the two former had already returned to profitability in 2011, while Pulte just turned profitable in 2012. Pulte’s stock price dropped more in 2011 than those of Toll and Horton, so much of Pulte’s gain was a bounce-back from very depressed levels.

Gilead Sciences, specializing in medicine to treat HIV and liver diseases, soared 79.5% from $40.93 to $73.45, while adding 72¢ to the NAV. The company has had positive clinical trials for its new drug, Sofosbuvir, an innovative treatment for hepatitis C (HCV), a chronic virus that leads to liver failure. Gilead has also had success in its core HIV franchise, receiving FDA approval for Stribild, a four-in-one pill that combines two new Gilead-patented molecules with two existing therapies that offers patients higher HIV viral suppression with fewer side effects.

Ciena makes optical equipment for telecommunications, and it contributed 57¢ to each Parnassus Fund share, as its stock shot up 29.8% from $12.10 to $15.70. The company had a challenging 2011, when its customers delayed capital expenditures because of the weak economic environment. However, enormous increases in the use of wireless devices is finally forcing telecommunications carriers to

| | |

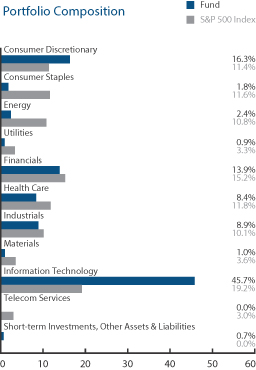

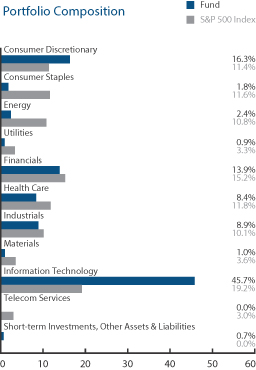

Parnassus Fund as of December 31, 2012 (percentage of net assets) | | |

Top 10 Holdings

(percentage of net assets)

| | | | |

| |

| Ciena Corp. | | | 5.4 | % |

| |

| Applied Materials Inc. | | | 4.7 | % |

| |

| Finisar Corp. | | | 4.6 | % |

| |

| Intel Corp. | | | 3.7 | % |

| |

| Charles Schwab Corp. | | | 3.6 | % |

| |

| Microsoft Corp. | | | 3.6 | % |

| |

| Gilead Sciences Inc. | | | 3.5 | % |

| |

| PulteGroup Inc. | | | 3.3 | % |

| |

| Wells Fargo & Co. | | | 3.3 | % |

| |

| Cisco Systems Inc. | | | 3.2 | % |

Portfolio characteristics and holdings are subject to change periodically.

7

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2012 |

purchase more equipment. AT&T recently announced that it is increasing capital expenditures by 15% each year for the next three years, while Sprint-Nextel received an $8 billion investment from Softbank to upgrade the network.

Lowe’s, the second largest home-improvement retailer, benefited from some of the same trends as the homebuilders, as its stock rose 40% from $25.38 to $35.52 for a contribution of 49¢ to the NAV. Rising home prices improved consumer sentiment and increased demand for home-improvement products. Lowe’s also did a good job of controlling costs by reducing head count and eliminating items that did not sell very well. Also boosting the stock price was an increase in the dividend by 14% and the company’s repurchasing 10% of the shares outstanding.

| | |

| |

| Value on December 31, 2012 of $10,000 invested on December 31, 2002 | | |

The chart shows the growth in value of a hypothetical $10,000 investment over the last 10 years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Shares of San Francisco-based Wells Fargo rose 24% from $27.56 to $34.18 during the year, increasing the value of each fund share by 46¢. The bank is reaping the rewards of prudent lending decisions made during the boom years and is using its healthy balance sheet to take market share from weakened competitors saddled with bad loans. In 2012, Wells Fargo originated more than 30% of all mortgages made in America and benefited enormously from the recovery in the housing market. The bank reported four consecutive quarters of record earnings, with each quarter higher than the one before it.

Outlook and Strategy

Note: This section represents my thoughts and applies to the three funds that I manage: the Parnassus Fund, the Parnassus Small-Cap Fund and the Parnassus Workplace Fund. The other portfolio managers discuss their thoughts in their respective reports.

The Parnassus Fund had a great year! We were up 26% and we beat the S&P 500 by ten percentage points. The market also had a good year, with the S&P 500 gaining 16%. This is remarkable, given the fact that there was so much pessimism at the start of the year. Investors and analysts were all forecasting a terrible year with stocks falling off a cliff. Even I was somewhat pessimistic, despite the fact that I tend to be an optimist by nature.

In the last quarterly report, I described how the stock market seems to climb a wall of worry. When most people are pessimistic, stocks become depressed and sell at bargain prices. There are, however, a few investors who can divorce themselves from their emotions, and they start buying because stocks are so cheap. This starts an upward trend, and soon more people jump on the bandwagon and start buying stocks. Before you know it, there’s a full-scale rally. That seems to be what happened in 2012.

Stocks are still trading at pretty reasonable prices, but they’re not the bargains they were at the end of 2011. I still think the general trend will be higher for 2013.

What gives me confidence is the state of the housing market. As I have indicated, the housing market almost always drives the economy into a recession and almost always pulls the economy out of a recession. When housing starts pick up, that means more work for bricklayers, carpenters, plumbers, electricians and laborers. With new homes, people buy furniture, home appliances, pots and pans, dishes, drapes and rugs. Designers, architects, engineers, lawyers and real estate agents also have more income. Money gets spread around, more people have jobs and soon the economy is firing on all cylinders.

As most of you know, the housing recovery has been a long time coming. We had so many empty houses that construction virtually came to a halt. That changed in 2012. I live in San Francisco, and here there is a shortage of houses on the market, which is pushing prices much higher. This phenomenon is taking place all over the country in desirable areas and places where the economy is strong. I expect this phenomenon of a stronger housing market to spread all over the country in 2013. This will mean more jobs and more money in the hands of consumers.

There are, of course, risks to this recovery. One of them, fortunately, has been addressed---at least temporarily. Congress passed a bill that addressed the fiscal cliff, and that means there will be no tax increase for most Americans and that government programs won’t be sharply cut back. People will have more money in their pocket and that should keep the economy growing.

8

| | | | |

| | |

| Annual Report • 2012 | | | | PARNASSUS FUNDS |

We still face the economic problems in Europe, but I’m hopeful things will improve there. In any case, I don’t think this poses a major threat to the American economy.

What concerns me most is unemployment. Usually when we come out of a deep recession, job growth is very strong---on the order of 300,000 to 400,000 new jobs a month. We’ve had growth in jobs this year, but only at the rate of 100,000 to 200,000 a month. Since we lost over six million jobs during the recession, we need a lot more to pull down the rate of unemployment. We’re now at an unemployment rate of 7.8%. Federal Reserve Chairman Bernanke says he will keep interest rates very low until unemployment drops to 6.5%, but I would like the rate to drop to around 5%. Current job growth is encouraging, but we need to step up the pace.

That’s my outlook, so what’s my strategy? I’m keeping all three of my funds positioned for continuing economic recovery. Housing stocks have made an enormous contribution to both the Parnassus Fund and the Small-Cap Fund. We’ll keep these stocks a bit longer, since I expect them to go higher into 2013. At some point, though, I suspect we’ll start to sell them. The housing recovery will continue, and the homebuilders will continue to see their earnings increase, but these stocks should reach their intrinsic value sometime this year. However, they should still make a nice contribution to the funds’ performance in the first half of the year.

The place where I see the biggest potential contribution to performance in 2013 is in technology and telecommunications. As our veteran shareholders will remember, it took a long time for my bet on homebuilders to pay off, but once they did, the return was very attractive. I believe the same thing applies to telecommunications stocks.

They haven’t yet had the returns that I was anticipating, but I expect that to change in 2013. They could make the same kind of contributions to our funds that the homebuilders made in 2012. If you look at the portfolios listed in this annual report, you will see that we have big positions in telecommunications equipment providers like Ciena, Finisar, Qualcomm and Cisco. If the phone companies start investing in equipment like I think they will, this could be a very big year for all three of my funds. Just as the move in the homebuilding stocks was delayed for a long time, I think the telecomm equipment stocks have had the same kind of delay. That delay could be over in 2013, and if it is, the effect on the funds could be even greater than the effect the homebuilders had in 2012.

Some of our technology stocks could do well in 2013 such as Microsoft, Intel and Applied Materials. The latter is a very interesting company, because the stock is trading at such a depressed valuation. Applied makes equipment used to manufacture semiconductors, and semiconductors have a big role in telecommunications and all the electronic devices people use every day. Another interesting aspect of Applied is that they make equipment used to manufacture panels for solar energy. I think demand will increase for this kind of equipment and that the stock could do quite well. This stock is also consistent with our philosophy of investing in companies that help the environment.

Financial stocks, such as Schwab, Wells Fargo and First Horizon should also do well. Of course, there is no guarantee of future returns, but I’m optimistic for 2013.

Thank you very much for investing in the Parnassus Funds.

Yours truly,

Jerome L. Dodson

Portfolio Manager

9

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2012 |

PARNASSUS EQUITY INCOME FUND

Ticker: Investor Shares - PRBLX

Ticker: Institutional Shares - PRILX

As of December 31, 2012, the NAV of the Parnassus Equity Income Fund-Investor Shares was $29.20. After taking dividends into account, the total return for the fourth quarter was a gain of 1.20%. This return compares favorably to a loss of 0.38% for the S&P 500 Index (“S&P” 500) and a gain of 0.29% for the Lipper Equity Income Fund Average, which represents the average equity income fund followed by Lipper (“Lipper average”). For the year, the Fund rose 15.43%, which handily beat the Lipper average of 12.44%, but fell short of the S&P 500’s 16.00% gain.

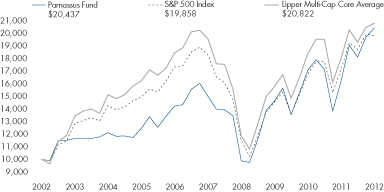

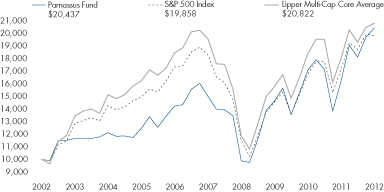

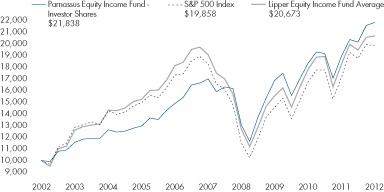

The accompanying table compares the performance of the Fund with that of the S&P 500 and the Lipper average. Average annual total returns are for the one-, three-, five- and ten-year periods. On page 12 is a graph showing the growth of a hypothetical $10,000 investment in the Fund over the last ten years.

| | | | | | | | | | | | | | | | | | | | | | | | |

| Parnassus Equity Income Fund | |

Average Annual Total Returns (%) | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

for periods ended December 31, 2012 | | | | | | |

| | | | | | | |

| Parnassus Equity Income Fund Investor Shares | | | 15.43 | | | | 9.03 | | | | 5.15 | | | | 8.12 | | | | 0.94 | | | | 0.94 | |

| | | | | | | |

| Parnassus Equity Income Fund Institutional Shares | | | 15.64 | | | | 9.26 | | | | 5.38 | | | | 8.27 | | | | 0.70 | | | | 0.70 | |

| | | | | | | |

| S&P 500 Index | | | 16.00 | | | | 10.86 | | | | 1.66 | | | | 7.09 | | | | NA | | | | NA | |

| | | | | | | |

Lipper Equity Income Fund Average | | | 12.44 | | | | 10.13 | | | | 1.80 | | | | 7.45 | | | | NA | | | | NA | |

The total return for the Parnassus Equity Income Fund-Institutional Shares from commencement (April 28, 2006) was 7.27%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Equity Income Fund-Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. On March 31, 1998, the Fund changed its investment objective from a balanced portfolio to an equity income portfolio. Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505. As described in the Fund’s current prospectus dated, May 1, 2012, Parnassus Investments has contractually agreed to limit the total operating expenses to 0.99% and 0.78% of net assets, exclusive of acquired fund fees, through May 1, 2013 for the Investor Shares and Institutional Shares, respectively. These limitations may be continued indefinitely by the Adviser on a year-to-year basis.

2012 Review

2012 was a terrific year for stocks, as the S&P 500 gained 16.0%. The year started off well, with the index soaring 12.6% in the first quarter, but fears of a worsening European debt crisis pushed stocks down violently in May. The decline was so severe that it brought the year-to-date gain of the index to just 2.6% by June 1st. These worries eventually abated, and stocks recovered, after European Central Bank chief Mario Draghi promised to do “whatever it takes to preserve the euro,” and then added “and believe me, it will be enough.” This tough talk boosted the confidence of market participants on both sides of the Atlantic for the remainder of the year.

Fed Chairman Ben Bernanke also helped send stocks higher in 2012 by introducing a series of unorthodox monetary policies intended to keep rates low and boost asset prices. These included buying mortgage bonds and promising to maintain a strongly accommodative stance until unemployment reaches 6.5%, or inflation tops 2.5%. The scope of the Federal Reserve’s recent policies is staggering, as its balance sheet finished the year just shy of $3 trillion. This is a whopping 230% larger than the Fed’s balance sheet in August of 2007, when our country was in the very early stages of the credit crisis that triggered our most recent recession. While this expansion has been beneficial for stocks over the last few years, we’re concerned about the long-term risks, including inflation, of such a dramatic increase in the money supply.

In addition to supportive central banking actions, improving economic data helped boost the market last year. The highlight clearly was homebuilding, which finally recovered from its multi-year slump. In its latest release, the Commerce Department reported that the annual rate for housing starts jumped to 861,000 in

10

| | | | |

| | |

| Annual Report • 2012 | | | | PARNASSUS FUNDS |

November, 22% greater than a year ago. The overall labor picture also improved, with the unemployment rate dropping from 8.3% to 7.8% over the course of the year. Joblessness is still too high, and we’re clearly not growing at our full potential, but we’re encouraged that the economy showed signs of improvement in 2012.

The Fund performed well for the year, gaining 15.43%, just 57 basis points short of the S&P 500’s gain (a basis point is 1/100th of 1%). We’re happy with this result, since we captured 96% of the upside for the index, while employing a lower-risk investment strategy. During the year, we had a major underweight in the financials sector, which is very economically

sensitive, and a significant overweight in the defensive utilities sector. These allocation decisions, combined with our 6% average cash balance for the year, reduced our return relative to the S&P 500 by almost three percentage points. Thankfully, our stock selection in other sectors, especially healthcare, almost entirely offset the impact of our defensive posture.

Company Analysis

Two companies – Energen and W&T Offshore – reduced the NAV by 4¢ or more this year. Both are crude oil producers and were negatively impacted by a 10.6% decline in that commodity’s price for 2012. In addition, Energen’s stock sagged in the fourth quarter after management lowered its production guidance, due to higher than expected costs and delays in its West Texas drilling operation. The combined effect of these negative factors was a 9.8% drop in Energen’s stock price for the year, from $50.00 to $45.09, and a 5¢ drag on our NAV.

W&T Offshore dropped 24.4% from $21.21 to $16.03, and shaved 4¢ off of the Fund’s NAV. The hit to the NAV was relatively modest, even though the stock dropped so much, because the company paid $1.11 per share in dividends in 2012. Like Energen, W&T suffered from production delays late in the year, which hurt the stock. Despite this setback, the company made solid progress in 2012 with its West Texas and Gulf of Mexico assets, and is well-positioned to deliver earnings growth for the long-term. Based on these positive factors and the price drop, we doubled our position.

Five stocks contributed at least 20¢ to the Fund’s NAV, including one that added an amazing 65¢, Gilead Sciences. This Bay Area-based biotech company soared 79.5% to $73.45 from $40.93, due to tremendous progress made in its two key therapeutic areas of focus: HIV/AIDS and hepatitis C. The advances regarding HIV/AIDS were in a drug called Stribild, a once-a-day pill that promises better outcomes for patients and fewer psychiatric side-effects than Gilead’s current therapy, Atripla.

Gilead’s hepatitis C drug, Sofosbuvir (previously called GS-7977), posted terrific results throughout the year in multiple clinical trials. This pill has the potential to cure hepatitis C patients, including those who can’t tolerate the existing standard of care, which includes an injection of interferon, a chemical that causes very unpleasant, flu-like side-effects. If Gilead reports positive data in its final trials planned for the first quarter of 2013, management should apply for approval to market the drug shortly thereafter. Throughout the year, we sold some of our Gilead stock, in response to its significant price increase, but we still held a sizable position at year-end.

Charles Schwab boosted the Fund by 22¢, as its stock jumped 27.5% from $11.26 to $14.36. In its most recent monthly business update,

Schwab reported $16.2 billion of new client assets and a record $1.9

|

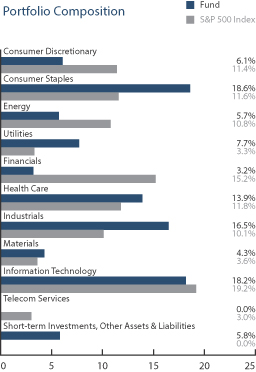

Parnassus Equity Income Fund as of December 31, 2012 (percentage of net assets) |

Top 10 Holdings

(percentage of net assets)

| | | | |

| |

| Procter & Gamble Co. | | | 4.5% | |

| |

| PepsiCo Inc. | | | 4.2% | |

| |

| Teleflex Inc. | | | 4.1% | |

| |

| Gilead Sciences Inc. | | | 4.0% | |

| |

| Applied Materials Inc. | | | 4.0% | |

| |

| Waste Management Inc. | | | 3.9% | |

| |

| Google Inc. | | | 3.5% | |

| |

| Charles Schwab Corp. | | | 3.2% | |

| |

| Questar Corp. | | | 3.1% | |

| |

| Pentair Ltd. | | | 3.1% | |

Portfolio characteristics and holdings are subject to change periodically.

11

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2012 |

trillion of total client assets. In a December meeting at the company’s San Francisco headquarters, we asked Schwab’s CFO, Joseph Martinetto, how the company is able to keep growing so fast from such an enormous base. He said that it was because the company’s tools are better than the competition and are offered at lower prices, and its employees always put clients first. We love this strategy and the fact that Charles Schwab’s balance sheet is far more understandable and offers less risk than most publicly-traded financial companies.

MasterCard rocketed 31.8% this year, from $372.82 to $491.28, increasing each fund share by 22¢. The stock was basically a market-performer until September, when management established revenue and earnings guidance for 2013-2015 that exceeded most analysts’ expectations. The

| | |

| |

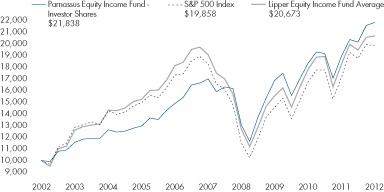

| Value on December 31, 2012 of $10,000 invested on December 31, 2002 | | |

The chart shows the growth in value of a hypothetical $10,000 investment over the last 10 years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

guidance is for annual growth of 11-14% for revenue and 20% for earnings per share. Even after the stock’s great run, we still like MasterCard, since it should benefit from a multi-year, global trend from cash to electronic payments. We also think that the company has a winning strategy for the emerging mobile payments sector.

Teleflex gained 16.4% for the year, going from $61.29 to $71.31, and contributed 20¢ to the NAV. 2012 marked a milestone for the company, as it was the first full year during which all of Teleflex’s business lines were healthcare-related. We’re happy to report that the results were very good. The company executed a well-designed plan to boost prices on certain products, while at the same time maintaining its low-cost position in the single-use, medical device market. In addition, the company completed five small acquisitions to increase its global reach and supplement its research and development programs. We think Teleflex will continue to improve its business in 2013, which is why it was our third largest holding in the Fund at year-end.

Our final significant winner was McCormick, the spice-maker, which chipped in 20¢ to the NAV, as its stock rose 26.0% from $50.42 to close at $63.53. The company performed well this year, despite volatile commodity prices and tepid consumer spending. McCormick was able to do this because of its valuable brands and customer loyalty, which allow the company to increase prices to offset cost inflation without losing business to discount competitors. We’ve owned McCormick since the summer of 2005, and have never sold a share, in large part because of management’s ability to successfully navigate challenging environments such as 2012.

Outlook and Strategy

As we’ve written in previous reports, we consider risk mitigation to be one of the most important goals of portfolio management. We normally devote the bulk of our outlook and strategy discussion to how we’ve positioned the Fund to avoid permanent losses of capital, stemming from macroeconomic or financial market risks. We’re still focused on risk, and are especially concerned about U.S. consumer spending, Europe’s recession and a potential slowdown in China. However, since we’ve written so much about these issues in recent shareholder letters, we’ve decided to spare you the details this time around. Instead, we’ve chosen to highlight two investment themes that collectively account for 21% of the Fund’s assets and ten portfolio companies, as of year-end. Because we’ve invested so much in these areas, they are critical to our investment strategy for 2013.

The first theme is logistics, which in layman’s terms means “helping customers move something from one place to another efficiently.” We’re currently invested in two logistics companies that own their transportation equipment and specialize in certain parts of the market. The larger of the two positions is Sysco, which dominates the food distribution industry, with twice the sales as its next closest competitor. The second investment is United Parcel Service (UPS), which is the leader in parcel shipping, with a focus on ground transportation. These two companies enjoy sustainable competitive advantages given their reputations for excellent service and massive investments in distribution centers, trucks and other equipment. Because of these advantages, Sysco and UPS earn high returns on capital, which enable the companies to offer handsome dividend yields of 3.5% and 3.0%, respectively.

We also own two businesses, C. H. Robinson and Expeditors International of Washington, which are leaders in logistics brokerage. These companies benefit from scale, since larger brokers have more extensive networks to match shippers and

12

| | | | |

| | |

| Annual Report • 2012 | | | | PARNASSUS FUNDS |

carriers. The other great thing about Robinson and Expeditors is that, unlike Sysco and UPS, they don’t have to keep heavy equipment on their balance sheets. Less capital expenditure means more operating cash flow that can be distributed to shareholders. We’ve long admired these asset-light logistics companies, and were excited that their stocks dropped to levels in 2012, where we could buy them at value prices.

The second key theme in the portfolio is infrastructure, and we include in this category two industrial holdings, Praxair and Pentair, and our four utilities. Praxair sells gases for industrial use, such as oxygen, hydrogen, nitrogen, argon and many others. This business is attractive, because Praxair builds plants adjacent to its customers’ factories, using pipelines to deliver the goods. This makes it very difficult for competitors to poach clients. In addition, since the company is tightly integrated into the infrastructure of its customers’ operations, management has great visibility into future sales and cash flow.

Pentair offers fluid-handling equipment to customers in a wide range of sectors such as energy, municipal water and agriculture. The company just completed a merger with the fluid control division of Tyco, so it now has a much broader suite of products and an even wider geographical reach. Water is an essential part of our global infrastructure, so we expect Pentair to sell a lot of their equipment into high-growth emerging markets and developed economies that need upgrades to their aging water infrastructure.

Our utilities holdings derive the bulk of their revenue from natural gas-related businesses, ranging from storage and pipelines to electricity-generation. The companies in this group, in order of position size in the Fund at year-end, are: Questar, MDU Resources, Northwest Natural Gas and AGL Resources. These companies have great prospects, because we expect natural gas to be an important part of our energy infrastructure for many decades to come. While it’s certainly not perfect, the fuel has many positive attributes: it has a better environmental profile than crude oil and coal, it doesn’t have the disposal issues associated with nuclear power, and it’s a great bridge fuel to the day when alternative energy gains sufficient scale to power our entire economy.

We’ve invested more than a fifth of the Fund’s assets in logistics- and infrastructure-related stocks, because we believe they should perform well in a wide range of economic outcomes. In bearish scenarios, they should go down less than the market, due to their attractive competitive positions and robust balance sheets. In bullish scenarios, they should thrive because demand for their services should increase rapidly if economic growth accelerates. So, regardless of how the overall stock market does in 2013, if we’re right about these two key investment themes, our portfolio should perform very well.

We thank you for your investment in the Fund,

| | |

| |  |

| Todd C. Ahlsten | | Benjamin E. Allen |

| Portfolio Manager | | Portfolio Manager |

13

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2012 |

PARNASSUS MID-CAP FUND

Ticker: PARMX

As of December 31, 2012, the NAV of the Parnassus Mid-Cap Fund was $20.27, so after taking dividends into account, the total return for 2012 was 18.58%. This compares favorably to 17.28% for the Russell Midcap Index (“Russell”) and 15.09% for the Lipper Multi-Cap Core Average, which represents the average multi-cap core fund followed by Lipper (“Lipper average”). For the quarter, the Fund was up 2.52%, just short of the Russell’s 2.88% return, but well ahead of the Lipper average’s 1.50% gain.

We are proud of the Fund’s strong performance in 2012 and are pleased that we beat our benchmarks for the second year in a row. The Fund’s long-term track record also remains outstanding. The Fund has outperformed both the Russell and its Lipper peers over the three- and five-year periods and for the period since inception. In addition, since we assumed management of the Fund on October 1, 2008, the Fund has generated an annualized return of 10.77%, better than the Russell’s 9.65% return and the Lipper average’s 6.75% return.

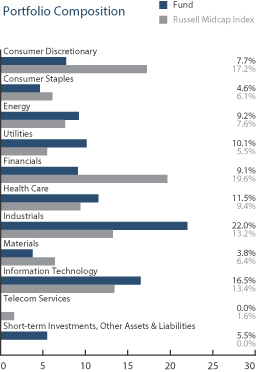

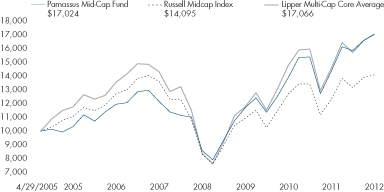

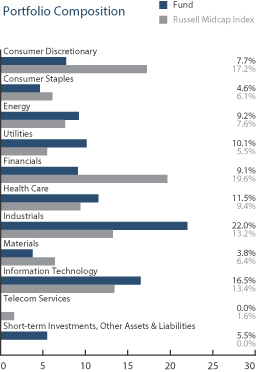

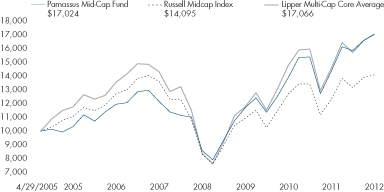

Below is a table comparing the Parnassus Mid-Cap Fund with the Russell and the Lipper average for the one-, three- and five-year periods and for the period since inception on April 29, 2005. On page 16 is a graph showing the growth of a hypothetical $10,000 investment in the Fund since inception.

| | | | | | | | | | | | | | | | | | | | | | | | |

| Parnassus Mid-Cap Fund | |

Average Annual Total Returns (%) | | One

Year | | | Three

Years | | | Five

Years | | | Since

Inception on

4/29/05 | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

for periods ended

December 31, 2012 | | | | | | |

| | | | | | | |

| Parnassus Mid-Cap Fund | | | 18.58 | | | | 13.30 | | | | 6.95 | | | | 7.19 | | | | 1.24 | �� | | | 1.20 | |

| | | | | | | |

| Russell Midcap Index | | | 17.28 | | | | 13.15 | | | | 3.57 | | | | 7.09 | | | | NA | | | | NA | |

| | | | | | | |

| Lipper Multi-Cap Core Average | | | 15.09 | | | | 9.24 | | | | 0.98 | | | | 4.74 | | | | NA | | | | NA | |

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Midcap Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Mid-cap companies can be more sensitive to changing economic conditions and have fewer financial resources than large-cap companies. Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website, or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2012, Parnassus Investments has contractually agreed to limit the total operating expenses to 1.20% of net assets, exclusive of acquired fund fees, until May 1, 2013. This limitation may be continued indefinitely by the Adviser on a year-to-year basis.

2012 Review

2012 was a good year for the Fund. We provided a strong return, outperformed both of our benchmarks, and more than doubled assets under management.

The Russell closed the year up 17.3%, just above its previous all-time high made in July of 2007, and a whopping 151.9% above its March of 2009 low. Mid-cap stocks outperformed both large- and small-cap issues during the year, with the Russell Midcap Index beating the S&P 500 and Russell 2000 small-cap index by 1.3 and 0.9 percentage points, respectively.

Despite the positive total return for the year, it was another bumpy ride for the Russell. The market went up 12.9% in the first quarter, down 4.4% in the second quarter, up 5.6% in the third quarter and up 2.9% in the fourth quarter. Investor sentiment was driven by central bank and government announcements, as well as debate about the U.S economy, the European debt crisis and the Chinese economy.

Ultimately, optimism triumphed, as investors focused on steady job growth and better housing data in the U.S., including rising prices, accelerating starts and lower inventories. The mood was buoyed in the back half of the year, after the European Central Bank head, Mario Draghi, announced that he was committed to keeping the Euro-zone intact. A few months later, more positive news came when the European Central Bank announced a sovereign debt buying program, and the U.S. Federal Reserve launched a third round of quantitative easing.

14

| | | | |

| | |

| Annual Report • 2012 | | | | PARNASSUS FUNDS |

The Fund beat the Russell for the year by 1.3 percentage points and its Lipper peer group by 3.5 percentage points. The primary reason for the Fund’s outperformance was strong stock selection. Good stock-picking in the industrial, information technology and financial sectors helped us the most this year, while poor stock selection in the energy and utility sectors hurt the Fund.

Company Analysis

The Fund only had a handful of stocks that reduced the NAV in 2012. The stock that hurt us the most was natural-gas producer Ultra Petroleum. Its share price sank 38.8%, from $29.63 to $18.13, for a decrease of 9¢ for each fund share. In early 2012, unusually warm weather and an oversupply of natural gas caused prices to tumble from $3.02 to $1.91 per million British thermal unit (Btu), so earnings slumped. The stock moved higher as natural gas prices improved, increasing to $4 per Btu in October, driven by higher usage of natural gas by electric utilities. However, investor confidence eroded toward the end of the year, when the price fell to $3.37 per Btu on lower demand. As one of the lowest-cost natural gas producers, Ultra should see higher profits once gas prices rebound.

Check Point Software, a leading provider of security software, cost the Fund 4¢ per share, as its stock fell 9.3% from $52.54 to $47.64. Strong demand for security software boosted earnings in early 2012, but slower than expected billings growth, due to weakness in Europe, and a mix shift towards lower margin security products, dragged down the stock by year-end. We believe it will rebound as the company delivers higher earnings with its market-leading products and strong share buyback program.

Oil and gas producer Concho Resources fell 5.8% from our cost of $85.52 to $80.56, for a decrease of 3¢ to each fund share. Concerns about weak oil demand, particularly from Europe, caused oil prices to fall 10.6% from $101.34 to $90.62 per barrel in 2012, so earnings slumped. Investor sentiment sank after the company missed third quarter earnings expectations due to lower oil production in the West Texas Permian Basin. With a significant inventory of high-margin oil assets, we believe Concho is well-positioned to deliver higher cash flow in 2013.

The Fund’s biggest winner was Insperity, a provider of human-resource services to small businesses. Its stock surged 28.4% during the year, from $25.35 to $32.56, adding 23¢ to the NAV. Insperity is gaining clients because job growth has been good, and the company is expanding its service offerings. Also, in November, management announced shareholder-friendly initiatives including a $50 million share buyback and a 3.9% special dividend. We still like the stock, because management is further enhancing its service-offerings and growing its sales force by 20%, actions we expect to result in profitable growth.

SEI Investments, the investment technology solutions provider and asset-manager, was the Fund’s second-largest contributor. The shares jumped 34.5% during the year, from $17.35 to $23.34, adding 19¢ to the NAV. The bulk of company revenue is from fees earned from assets under management and administration, so the stock went up with the rising equity and debt markets. Investors are also excited about the Global Wealth Platform, the company’s best-in-class technology, which should drive higher profits in the coming years.

Equifax, the large, consumer-credit bureau, added 17¢ to each fund share, as its stock soared 39.7% during the year from $38.74 to $54.12. Banks and other lending institutions rely on the company’s credit score database to make loan decisions, so the stock rose with the housing market

|

Parnassus Mid-Cap Fund as of December 31, 2012 (percentage of net assets) |

Top 10 Holdings

(percentage of net assets)

| | | | |

| |

| Teleflex Inc. | | | 4.1% | |

| |

| Waste Management Inc. | | | 3.9% | |

| |

| Questar Corp. | | | 3.9% | |

| |

| Shaw Communications Inc. | | | 3.6% | |

| |

| Iron Mountain Inc. | | | 3.2% | |

| |

| MDU Resources Group Inc. | | | 3.2% | |

| |

| First Horizon National Corp. | | | 3.2% | |

| |

| Sysco Corp. | | | 3.2% | |

| |

| Applied Materials Inc. | | | 3.1% | |

| |

| Pentair Ltd. | | | 3.0% | |

Portfolio characteristics and holdings are subject to change periodically.

15

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2012 |

improvement, including increasing home purchases and greater refinancing activity. The stock moved even higher in December, after management announced the highly accretive purchase of Computer Sciences Corporation’s credit services arm.

Outlook and Strategy

Almost all major banks are predicting that the stock market will go up in 2013. It’s hard to say whether this consensus is right, but we agree that the underlying driver is the slowly improving economy. The most positive development this past year was housing. Most predictions at the beginning of 2012 called for continued weakness, but instead we saw price stabilization and improvement, and lower inventories. We expect to see gradual housing market improvement in 2013, given the Fed’s commitment to low interest rates. Since housing market improvement creates jobs, the result should be another year of economic expansion.

| | |

| |

| Value on December 31, 2012 of $10,000 invested on April 29, 2005 | | |

The chart shows the growth in value of a hypothetical $10,000 investment since inception (April 29, 2005) and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

On the flip side, we’re concerned that the Fed’s low interest-rate policy will eventually result in inflation. While economic growth remains subdued, this inflation shouldn’t be a problem. However, when the economy picks up steam, inflation will likely set in, harming the overall economy.

Similar to the beginning of 2012, we are concerned about the European debt and economic crises. Despite the European Central Bank’s helpful actions last year, we worry about Germany’s willingness to support Spain and other highly indebted European countries. If Germany discontinues its support, the Euro-zone could implode, which would undoubtedly hurt the U.S. equity markets. As a result, we are wary of exposing the Fund to companies that earn a significant portion of their revenue and profit from Europe.

Since the beginning of last year, we have decreased our information technology exposure. We sold some technology names because of slowing revenue growth, regulatory concerns and European exposure. We also increased our exposure in the energy and utilities sectors. We believe natural gas prices will rebound over time, which favors names like Ultra Petroleum, a low-cost producer. We believe our oil holdings have strong prospects with their long-life oil reserves and solid cash flow generation. We are confident that our utility stocks will perform well going forward, because each of our holdings is a solid operator in a growing market.

Corporate profit-margins are currently at an all-time high and probably won’t go up much more. For the market to move higher, either earnings must rise or investors must pay greater multiples for stocks. If neither of these things happen, the market will probably go down, in which case our quality bias should provide downside protection. If they do occur, the Fund is well-positioned, because our process results in owning attractive companies with disciplined managers, above-market revenue growth rates and competitive advantages. This strategy has generated excellent results for investors so far, and we’re confident it will yield attractive risk-adjusted returns in the long run.

Thank you for your investment.

Yours truly,

| | |

Matthew D. Gershuny | |

Lori A. Keith |

| Portfolio Manager | | Portfolio Manager |

16

| | | | |

| | |

| Annual Report • 2012 | | | | PARNASSUS FUNDS |

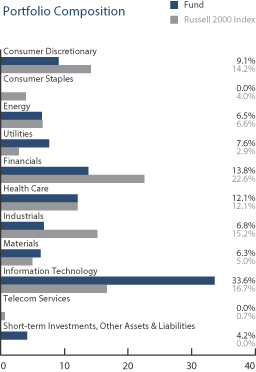

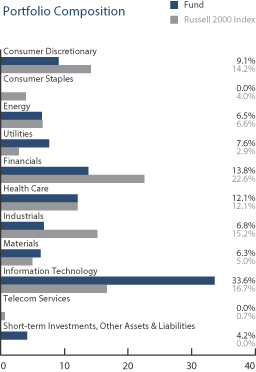

PARNASSUS SMALL-CAP FUND

Ticker: PARSX

As of December 31, 2012, the NAV of the Parnassus Small-Cap Fund was $23.77, so after taking dividends into account, the total return for the quarter was 5.01%. This compares to a return of 1.85% for the Russell 2000 Index (“Russell 2000”) of smaller companies and 2.59% for the Lipper Small-Cap Core Average, which represents the average small-cap core fund followed by Lipper (“Lipper average”), so we are well ahead of both our benchmarks.

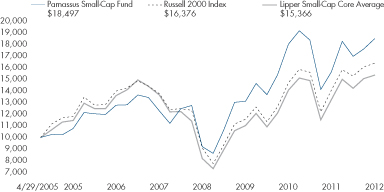

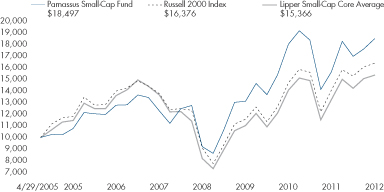

For the year, the Fund was up 18.40% compared to 16.35% for the Russell 2000 and 14.74% for the Lipper average. Below is a table, comparing the performance of the Parnassus Small-Cap Fund with that of the Russell 2000 and the Lipper average over the past one-, three- and five-year periods and the period since inception. The Fund is ahead of all indices for all time periods, except that we are slightly behind the Russell 2000 for the three-year period, although we are ahead of the Lipper average for that time period. On page 18 is a graph showing the growth of a hypothetical $10,000 investment in the Fund since inception.

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Parnassus Small-Cap Fund | |

Average Annual Total Returns (%) | | One

Year | | | Three

Years | | | Five

Years | | | Since

Inception on

4/29/05 | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

for periods ended

December 31, 2012 | | | | | | |

| | | | | | | |

| Parnassus Small-Cap Fund | | | 18.40 | | | | 12.14 | | | | 8.53 | | | | 8.35 | | | | 1.22 | | | | 1.20 | |

| | | | | | | |

| Russell 2000 Index | | | 16.35 | | | | 12.25 | | | | 3.56 | | | | 6.53 | | | | NA | | | | NA | |

| | | | | | | |

| Lipper Small-Cap Core Average | | | 14.74 | | | | 11.50 | | | | 3.28 | | | | 6.19 | | | | NA | | | | NA | |

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell 2000 Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Small-cap companies can be particularly sensitive to changing economic conditions and have fewer financial resources than large-cap companies. Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website, or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2012, Parnassus Investments has contractually agreed to limit the total operating expenses to 1.20% of net assets, exclusive of acquired fund fees, until May 1, 2013. This limitation may be continued indefinitely by the Adviser on a year-to year basis.

Company Analysis

Seven companies in the portfolio each accounted for a gain of 21¢ or more for the year, while only one accounted for a loss of 21¢ or more. The loser was Ceragon Networks, a manufacturer of microwave backhaul equipment, which connects cellular telephone towers to the main communications network. The stock sank 42.7% during the year from $7.70 to $4.41, slicing 24¢ off each fund share. Ceragon’s customers reduced their capital expenditures because of the weak economy, which resulted in less revenue and less cash on the balance sheet. This led to concerns about the company’s liquidity, so the company filed to issue $150 million in new securities. The liquidity concerns and the fear of dilution caused panic among investors and the stock hit new lows. We think the company has enough cash for normal operations, and they probably won’t issue the new securities, so we bought more shares at very low prices. Our view is that the growth of smartphones, tablets and other electronic devices will force Ceragon’s customers to increase capital expenditures, and when they do, Ceragon will get a big share of the business because of its low-cost products.

Of the seven companies making a significant contribution to the NAV, the biggest contributor was homebuilder PulteGroup, which climbed an astonishing 188% during the year from $6.31 to $18.16, while contributing 89¢ to the value of each fund share. New home construction increased 22% in 2012 and Pulte was a prime beneficiary. After losses in 2011, Pulte started earning money in 2012.

The second biggest contributor was First American Financial, a large title insurer that added 51¢ to each fund share, as its stock surged 90.1% from $12.67 to $24.09. Homeowners took advantage of unprecedented low interest rates to refinance their mortgages, and First American benefited because

17

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2012 |

refinancing requires new title insurance. Although the refinancing boom is coming to an end, we are holding the stock, believing that improving home sales will drive another wave of growth.

Clothing-manufacturer Hanesbrands shot up 63.9% from $21.86 to $35.82 for a gain of 26¢ for each fund share. In May, the company divested its low-margin, private-label business and used the proceeds to reduce its debt. The company’s profit margins have increased substantially, as prices for cotton, its primary raw material, have dropped more than 60% from record highs in 2011.

Insperity, a provider of human resource services, climbed 28.4% from $25.35 to $32.56 while contributing 24¢ to the NAV. Its customers pay the company a monthly fee per employee, so Insperity’s revenue has increased along with the rising number of jobs in the country. The company has introduced new products and is increasing its sales force by 20%, so revenue should keep growing. Insperity also announced a special 3.9% dividend to shareholders.

| | |

| |

| Value on December 31, 2012 of $10,000 invested on April 29, 2005 | | |

The chart shows the growth in value of a hypothetical $10,000 investment since inception (April 29, 2005) and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

The stock of homebuilder Toll Brothers soared 58.3% from $20.42 to $32.33 for an increase of 22¢ for each fund share. The strong housing recovery moved the stock much higher, although it did not go up as much as Pulte because Toll had already returned to profitability in 2011 while Pulte just became profitable in 2012. Pulte’s stock price dropped more in 2011 than Toll’s, so much of Pulte’s gain was a bounce-back from very depressed levels.

Arbitron, the industry-standard radio ratings-agency, added 22¢ to the NAV, as its stock gained 36% from $34.41 to $46.96 where we sold it. On December 18, Nielsen, the industry-standard television ratings-agency, made an offer for Arbitron for $48 a share in cash. We locked in our gain by selling our shares the same day, because we were concerned that the FTC might block the acquisition on antitrust grounds.

Ciena makes optical equipment for telecommunications, and it contributed 21¢ to each fund share, as its stock shot up 29.8% from $12.10 to $15.70. The company had a challenging 2011, when its customers delayed capital expenditures because of the weak economic environment. However, an enormous increase in the use of wireless devices is finally forcing telecommunications carriers to purchase more equipment. AT&T recently announced that it is increasing capital expenditures by 15% each year for the next three years, while Sprint-Nextel received an $8 billion investment from Softbank to upgrade the network.

Yours truly,

Jerome L. Dodson

Portfolio Manager

|

Parnassus Small-Cap Fund as of December 31, 2012 (percentage of net assets) |

Top 10 Holdings

(percentage of net assets)

| | | | |

| |

| Finisar Corp. | | | 4.9% | |

| |

| Ciena Corp. | | | 4.6% | |

| |

| First American Financial Corp. | | | 4.4% | |

| |

| First Horizon National Corp. | | | 4.4% | |

| |

| Insperity Inc. | | | 4.2% | |

| |

| PulteGroup Inc. | | | 4.1% | |

| |

| Harmonic Inc. | | | 3.6% | |

| |

| VCA Antech Inc. | | | 3.6% | |

| |

| Riverbed Technology Inc. | | | 3.2% | |

| |

| W&T Offshore Inc. | | | 3.1% | |

Portfolio characteristics and holdings are subject to change periodically.

18

| | | | |

| | |

| Annual Report • 2012 | | | | PARNASSUS FUNDS |

PARNASSUS WORKPLACE FUND

Ticker: PARWX

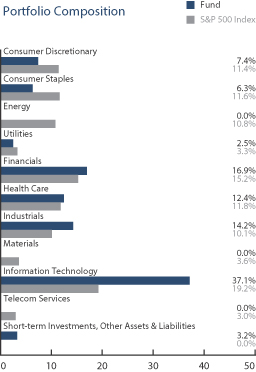

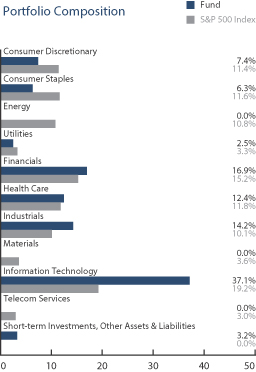

As of December 31, 2012, the NAV of the Parnassus Workplace Fund was $22.17, so after taking dividends into account, the total return for the quarter was 2.03%. This compares to a loss of 0.38% for the S&P 500 Index (“S&P” 500) and a return of 0.23% for the Lipper Large-Cap Core Average, which represents the average large-cap core fund followed by Lipper (“Lipper average”). We beat both our benchmarks by a substantial amount, posting a nice gain compared to a loss for the S&P 500 and a small fractional gain for the Lipper average.

For the year, the Workplace Fund was up 22.03%, compared to a gain of 16.00% for the S&P 500 and 14.95% for the Lipper average. We beat the S&P 500 by more than six percentage points and the Lipper average by more than seven percentage points, so it was a very good year. There was no one theme for this year’s outstanding performance. The five stocks that contributed the most to our returns were all from different industries.

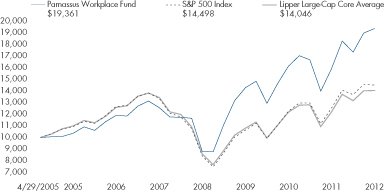

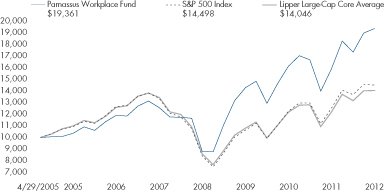

Below is a table comparing the Parnassus Workplace Fund with the S&P 500 and the Lipper average for the one-, three- and five-year periods and the period since inception. You’ll notice that the Fund is ahead of all benchmarks for all time periods, except that we’re slightly behind the S&P 500 for the three-year period, but we’re well ahead of the Lipper average for that period. The Workplace Fund has a remarkable long-term track record. Since inception on April 29, 2005, the Fund has placed fifth out of the 607 large-cap core funds followed by Lipper and for the five years ended December 31, 2012, the Fund placed third out of the 753 large-cap core funds followed by Lipper.* I think this long-term record shows that companies that are great places to work are also great investments. On the following page is a graph showing the growth of a hypothetical $10,000 investment in the Fund since inception.

| | | | | | | | | | | | | | | | | | | | | | | | |

| Parnassus Workplace Fund | |

Average Annual Total

Returns (%) | | One

Year | | | Three

Years | | | Five

Years | | | Since

Inception on

4/29/05 | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

for periods ended

December 31, 2012 | | | | | | |

| | | | | | | |

| Parnassus Workplace Fund | | | 22.03 | | | | 10.69 | | | | 9.02 | | | | 8.99 | | | | 1.16 | | | | 1.16 | |

| | | | | | | |

| S&P 500 Index | | | 16.00 | | | | 10.86 | | | | 1.66 | | | | 4.95 | | | | NA | | | | NA | |

| | | | | | | |

| Lipper Large-Cap Core Average | | | 14.95 | | | | 8.93 | | | | 0.68 | | | | 4.41 | | | | NA | | | | NA | |

* The Parnassus Workplace Fund placed 16th of 941 funds for the one-year period and 150th of 864 funds for the three-year period.

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website, or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2012, Parnassus Investments has contractually agreed to limit the total operating expenses to 1.20% of net assets, exclusive of acquired fund fees, until May 1, 2013. This limitation may be continued indefinitely by the Adviser on a year-to-year basis.

Company Analysis

Five companies, all very different from each other, each accounted for a gain of 22¢ or more to the NAV. No stock accounted for a loss of 22¢ or more or even close to that. The stock making the biggest contribution to the value of our fund shares was Gilead Sciences, a company that specializes in medicine to treat HIV and liver disease. The stock soared an amazing 79.5% during the year, zooming from $40.93 to $73.45, while contributing 41¢ to each fund share. The company has had positive clinical trials for its new drug, Sofosbuvir, an innovative treatment for hepatitis C (HCV), a chronic virus that leads to liver failure. Gilead has also had success in its core HIV franchise, receiving FDA approval for Stribild, a four-in-one pill that combines two new Gilead-patented molecules with two existing therapies that offers patients higher HIV viral suppression with fewer side effects.

Scripps Networks Interactive, best known for its Food Network, Home and Garden Television (HGTV) and the Travel Channel, contributed 24¢ to the value of each fund share, as its stock shot up 36.5% from $42.42 to $57.92. Early in the year, its shares traded at depressed levels because of weak ratings. The company’s subsequent investment in new programming improved ratings, enabling Scripps to lock in higher affiliate fees and generate stronger than expected advertising revenues.

19

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2012 |

| | |

| |

| Value on December 31, 2012 of $10,000 invested on April 29, 2005 | | |

The chart shows the growth in value of a hypothetical $10,000 investment since inception (April 29, 2005) and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Shares of San Francisco-based Wells Fargo rose 24% from $27.56 to $34.18 during the year, increasing the value of each fund share by 24¢. The bank is reaping the rewards of prudent lending decisions made during the boom years and is using its healthy balance sheet to take market share from weakened competitors who are saddled with bad loans. In 2012, Wells Fargo originated more than 30% of all mortgages made in America and benefited enormously from the recovery in the housing market. The bank reported four consecutive quarters of record earnings, with each quarter higher than the one before it.

EBay’s stock added 23¢ to the NAV, as it jumped 42.6% from $30.33 at the start of the year to $43.26, where we sold it late in the year after it hit our target price. Led by strong growth in its PayPal online payments business, the company surpassed earnings estimates in early 2012. The stock moved even higher later in the year, as the company’s auction volumes rebounded, thanks to recent investments in mobile and improved online buyer experience.

Seagate Technology, a maker of hard-disk drives, added 22¢ to each fund share, as its stock soared 65.7% from $16.40 at the beginning of the year to $27.17 where we sold it during the year. A lot of the world’s production of drives takes place in Thailand, and floods in that country disrupted operations and limited the availability of key drive components. Seagate’s broader supplier base allowed it to build and ship more drives than its competitors and do it at higher prices. The stock price climbed much higher as Seagate’s gross margins rose from 20% to 37%. We sold the stock because of the temporary nature of Seagate’s good fortune.

Yours truly,

Jerome L. Dodson

Portfolio Manager

|

Parnassus Workplace Fund as of December 31, 2012 (percentage of net assets) |

Top 10 Holdings

(percentage of net assets)

| | | | |

| |

| Applied Materials Inc. | | | 5.1% | |

| |

| Gilead Sciences Inc. | | | 4.7% | |

| |

| Corning Inc. | | | 4.5% | |

| |

| Intel Corp. | | | 4.4% | |

| |

| Microsoft Corp. | | | 4.3% | |

| |

| First Horizon National Corp. | | | 4.2% | |

| |

| Charles Schwab Corp. | | | 4.0% | |

| |

| Wells Fargo & Co. | | | 4.0% | |

| |

| Autodesk Inc. | | | 3.5% | |

| |

| C.H. Robinson Inc. | | | 3.4% | |

Portfolio characteristics and holdings are subject to change periodically.

20

| | | | |

| | |

| Annual Report • 2012 | | | | PARNASSUS FUNDS |

PARNASSUS FIXED-INCOME FUND

Ticker: PRFIX

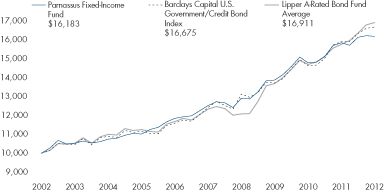

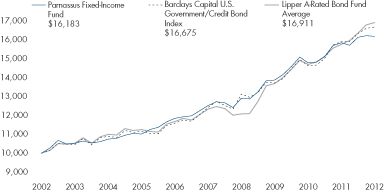

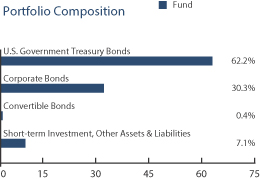

As of December 31, 2012, the NAV of the Parnassus Fixed-Income Fund was $17.56, producing a total return for the year of 2.08%, including dividends. This compares to a gain of 4.82% for the Barclays Capital U.S. Government/Credit Bond Index (“Barclays Capital Index”) and a gain of 7.09% for the Lipper A-Rated Bond Fund Average, which represents the average return of all A-rated bond funds followed by Lipper (“Lipper average”). For the fourth quarter, the Fund was down 0.25% compared to a gain of 0.37% for the Barclays Capital Index and a gain of 0.63% for the Lipper average.

Below is a table comparing the performance of the Fund with that of the Barclays Capital Index and the Lipper average. Average annual total returns are for the one-, three-, five- and ten-year periods. For December 2012, the 30-day subsidized SEC yield was 0.65% and the unsubsidized SEC yield was 0.59%. On page 22 is a graph showing the growth of a hypothetical $10,000 investment in the Fund over the last 10 years.

2012 Review

2012 was a strong year for U.S. financial markets. Shrugging off the economic growth scare of the summer, U.S. investors regained confidence after the Federal Open Market Committee (FOMC) unveiled a third round of quantitative easing to support the economic recovery. In addition, the FOMC announced a major policy shift by saying that it will maintain its bond-buying program until the labor market improves substantially.

| | | | | | | | | | | | | | | | | | | | | | | | |

| Parnassus Fixed-Income Fund | |

Average Annual Total

Returns (%) | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

for periods ended

December 31, 2012 | | | | | | |

| | | | | | | |

| Parnassus Fixed-Income Fund | | | 2.08 | | | | 5.28 | | | | 5.25 | | | | 4.93 | | | | 0.81 | | | | 0.75 | |

| | | | | | | |

| Barclays Capital U.S. Government/Credit Bond Index | | | 4.82 | | | | 6.70 | | | | 6.06 | | | | 5.24 | | | | NA | | | | NA | |

| | | | | | | |

| Lipper A-Rated Bond Fund Average | | | 7.09 | | | | 7.16 | | | | 6.30 | | | | 5.33 | | | | NA | | | | NA | |

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns shown in the table do not reflect the deduction of taxes a shareholder would pay in fund distributions or redemption of shares. The Barclays Capital U.S. Government/Credit Bond Index is an unmanaged index of bonds, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website, or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2012, Parnassus Investments has contractually agreed to reduce its investment advisory fee to the extent necessary to limit total operating expenses to 0.75% of net assets for the Parnassus Fixed-Income Fund. This limitation continues until May 1, 2013, and may be continued indefinitely by the investment adviser on a year-to-year basis.

Buoyed by the central bank’s intervention, investors moved out of the safety of Treasury bonds and into stocks, corporate bonds and other riskier investments. U.S. corporate bonds were the best performing fixed-income asset class, returning 9.82% for the year. Mortgage-backed securities gained 2.59%, while U.S. Treasury bonds were up 1.99%.

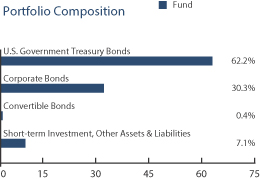

The Fund returned 2.08% for the year, with all asset classes in the portfolio contributing positively to the NAV. Our investments in corporate bonds were the biggest winners, adding 26¢ to the NAV. U.S. Treasuries increased the NAV by 22¢ and our convertible bonds added 1¢. Despite the gain for the year, our performance was very disappointing because we underperformed both the Barclays Capital Index and the Lipper average. Our poor return relative to our benchmarks was due to two reasons.

The first was my decision to have a large exposure to the Treasury market, as I expected that Treasury bonds would outperform riskier assets in response to slowing economic growth. As of the end of the fourth quarter, U.S. Treasuries, not including Treasury Inflation-Protected Securities, represented 59.2% of the Fund’s total net assets, compared to 53.4% for the Barclays Capital Index.

During the year, economic forecasters continually reduced their projections for economic growth. However, this revised growth outlook didn’t dent investors’ optimism, as they focused on the

21

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2012 |

FOMC’s commitment to provide easier financial conditions for households and businesses through its bond-buying program. As a result, U.S. Treasury bonds underperformed relative to riskier investments, such as corporate bonds.

The second reason for our poor performance was that our corporate bonds didn’t go up as much as the ones held in the Barclays Capital Index and the Lipper average. Low-rated bonds issued by financial institutions were the best performers among corporate bonds. For example, BBB-rated financial corporate bonds returned 17.95% for the year compared to only 5.91% for A-rated industrial corporate bonds.

At the end of the fourth quarter, our corporate bonds represented 30.3% of the Fund’s total net assets. Close to 70% of these bonds were rated A or better and were issued mainly by companies in the industrial, technology and healthcare sectors. Because of this higher rating bias and little exposure to the financial sector, our corporate bond holdings couldn’t keep up with the stronger returns of the benchmarks.

Outlook and Strategy

The recent U.S. budget deal removed the risk of severe spending cuts and tax increases that could have reduced GDP growth by almost 5% and caused a recession. The agreement on the fiscal cliff is good news, and financial markets have responded positively so far in January. However, I don’t think that this is an all-clear signal for the economy.

| | |

| |

| Value on December 31, 2012 of $10,000 invested on December 31, 2002 | | |

The chart shows the growth in value of a hypothetical $10,000 investment over the last 10 years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.