UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: Parnassus Funds (811-04044) and Parnassus Income Funds (811-06673)

Parnassus Funds

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marc C. Mahon

Parnassus Funds

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2015

Item 1: Report to Shareholders

PARNASSUS FUNDS®

ANNUAL REPORT ¡ DECEMBER 31, 2015

PARNASSUS FUNDS

| | |

| |

| Parnassus FundSM | | |

Investor Shares | | PARNX |

Institutional Shares | | PFPRX |

| |

| Parnassus Core Equity FundSM | | |

Investor Shares | | PRBLX |

Institutional Shares | | PRILX |

| |

| Parnassus Endeavor FundSM | | |

Investor Shares | | PARWX |

Institutional Shares | | PFPWX |

| |

| Parnassus Mid Cap FundSM | | |

Investor Shares | | PARMX |

Institutional Shares | | PFPMX |

| |

| Parnassus Asia FundSM | | |

Investor Shares | | PAFSX |

Institutional Shares | | PFPSX |

| |

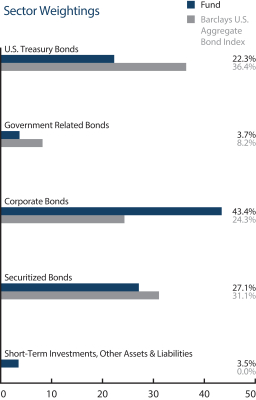

| Parnassus Fixed Income FundSM | | |

Investor Shares | | PRFIX |

Institutional Shares | | PFPLX |

Table of Contents

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2015 |

February 7, 2016

Dear Shareholder:

Enclosed are all the investment reports for the Parnassus Funds. It was pretty much a flat year with the S&P 500 up just 1.39%. The Parnassus Endeavor Fund – Investor Shares was our best-performer, gaining 3.25% or almost two percentage points above the S&P 500, and more than five percentage points ahead of the Lipper Multi-Cap Core Funds Average, which lost 2.14%.

Looking longer-term, both the Parnassus Endeavor Fund – Investor Shares and the Parnassus Core Equity Fund – Investor Shares are #1 in their respective Lipper categories over the last ten years. For the past ten years, the Parnassus Endeavor Fund – Investor Shares has earned an average of 11.61% each year compared to 6.19% for the average multi-cap core funds, making it #1 of the 372 funds in its Lipper category.* The Parnassus Core Equity Fund – Investor Shares has earned an average of 9.89% per year for the last ten years compared to 6.29% for the average equity income funds, making it #1 of 189 funds in its Lipper category.*

New Staff Member

Constance Scott joined us in October as Senior Marketing Associate and Financial Writer. Constance has been in the investment industry for over 20 years at Dodge & Cox, AssetMark and AXA Rosenberg. In these roles, she was responsible for investment communication with advisors and institutional clients across various mediums. She has a B.A. in Technical Writing and Economics from San Francisco State University. At Parnassus, Constance will apply her talents to helping us communicate our investment strategies. We’re glad to have someone of her experience at our firm.

Shareholder Meeting

Donald Potter, who had been our lead trustee and was a trustee of the Funds for over 13 years, retired effective December 31 because he reached the Funds’ mandatory retirement age of 70 during 2015. I want to thank Don for his diligent service to the Funds and for always putting the shareholders’ best interests first. Jeanie Joe, who has been a trustee of the Funds for 12 years, was elected lead trustee at the December 2015 board meeting. As a result of Don’s retirement, we’ll need to have a shareholder meeting, since it is a regulatory requirement that a majority of the trustees be elected by shareholders. We have scheduled a shareholder meeting for March 22nd at 6:30 pm at The Palace Hotel in San Francisco for the purpose of electing the Board of Trustees. You will be sent proxy materials separately, and I encourage you to review the materials and vote your shares. There will be a reception at 6:00 pm, and there will be a question and answer session with Portfolio Managers immediately following the shareholder meeting. If you would like to attend, please RSVP to Marie Lee at marie.lee@parnassus.com or by calling (415) 778-2607.

Yours truly,

Jerome L. Dodson

President

* The Parnassus Endeavor Fund – Investor Shares placed #35 of 737 funds, #26 of 656 funds and #10 of 576 funds for the one-, three- and five-year periods, respectively. The Parnassus Core Equity Fund – Investor Shares placed #93 of 509 funds, #3 of 397 funds and #9 of 298 funds for the one-, three- and five-year periods, respectively.

4

| | | | |

| | |

| Annual Report • 2015 | | | | PARNASSUS FUNDS |

PARNASSUS FUND

Ticker: Investor Shares - PARNX

Ticker: Institutional Shares - PFPRX

As of December 31, 2015, the net asset value per share (“NAV”) of the Parnassus Fund – Investor Shares was $40.46, so after taking dividends into account, the total return for the year was 0.26%. This compares to a gain of 1.39% for the S&P 500 Index (“S&P 500”) and a loss of 2.14% for the Lipper Multi-Cap Core Average, which represents the average return of the multi-cap core funds followed by Lipper (“Lipper average”). For the year, we trailed the S&P 500, but we beat the Lipper average.

Below is a table comparing the Parnassus Fund with the S&P 500 and the Lipper average over the past one-, three-, five- and ten-year periods. Although the Fund is behind the S&P 500 for the one-year period, we’re ahead of the Lipper average for that time span. Longer-term, the Fund is ahead of both its benchmarks for all time periods. Most striking is the ten-year number, where we have gained an average of 9.74% per year, which is more than two percentage points per year ahead of the S&P 500 and more than three percentage points per year ahead of the Lipper average.

| | | | | | | | | | | | | | | | | | | | | | | | |

| Parnassus Fund | |

Average Annual

Total Returns (%) | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

for periods ended

December 31, 2015 | | | | | | |

| | | | | | | |

| Parnassus Fund Investor Shares | | | 0.26 | | | | 15.56 | | | | 13.06 | | | | 9.74 | | | | 0.84 | | | | 0.84 | |

| | | | | | | |

| Parnassus Fund Institutional Shares | | | 0.37 | | | | 15.60 | | | | 13.09 | | | | 9.75 | | | | 0.77 | | | | 0.77 | |

| | | | | | | |

| S&P 500 Index | | | 1.39 | | | | 15.12 | | | | 12.55 | | | | 7.30 | | | | NA | | | | NA | |

| | | | | | | |

| Lipper Multi-Cap Core Average | | | -2.14 | | | | 12.86 | | | | 10.14 | | | | 6.19 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Fund-Institutional Shares from commencement (April 30, 2015) was -2.37%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Fund-Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2015, Parnassus Investments has contractually agreed to limit total operating expenses to 0.77% of net assets for the Parnassus Fund-Institutional Shares. This agreement will not be terminated prior to May 1, 2016, and may be continued indefinitely by the Adviser on a year-to-year basis.

Company Analysis

Five companies each had a negative impact of 25¢ or more on the value of each Parnassus Fund share. The stock that hurt us the most was Whole Foods, the world’s largest retailer of organic and natural foods, as its stock sank 33.6% during the year from $50.42 to $33.50 for a loss of 68¢ for each fund share. The stock fell throughout the year, because revenue growth repeatedly missed expectations. The company also announced it will launch a new chain of lower-priced stores called 365, which investors believe will compete directly with existing Whole Foods outlets, thus cannibalizing sales. There is no doubt that 365 will take some sales from the Whole Foods brand, but our view is that 365 will appeal to enough new customers, so that taken together, the two brands will accelerate growth for the company as a whole. The stock is now on the bargain table, and we think it will climb higher in 2016.

Potash Corporation plummeted 51.5% from $35.32 to $17.12, slicing 62¢ off the NAV. Low crop prices caused farmers to apply less fertilizer, which pushed the price of potash in the key growing region of the U.S. Midwest down more than 20%. Investors also worried that new mines scheduled to open over the next few years will push prices down further, but we disagree. Demand for potash has to increase, because the world needs to feed more people each day, and an emerging middle class in Asia that desires a more nutritious diet. Fertilizer is the best way to improve crop yields and meet this burgeoning demand. We believe Potash’s low costs will enable it to ride out the cyclical downturn, and the company’s spare capacity will allow it to benefit, when demand increases and prices recover. After the sharp decline in its share price, Potash’s dividend yield is now 8.9%, so we’re being paid handsomely as we wait.

5

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2015 |

Qualcomm, a major designer and producer of smartphone chips, sliced 40¢ off the value of each fund share, as its stock sank 32.8%, dropping from $74.33 to $49.99. The company’s licensing division had difficulty collecting royalties in China, while regulators in South Korea and Taiwan announced they were investigating Qualcomm’s licensing practices. Meanwhile, the company’s chipset division lost market share to lower-cost competitors and is being investigated by the European Union. Not everything is bleak, though. There has been positive feedback on the latest product, the Snapdragon 820, and the signing of a number of new licensing agreements in China. The company has also taken steps to improve margins and is repurchasing $10 billion of its shares. At only $49.99, we think the stock is a bargain.

Shares of Mill Valley, California-based Redwood Trust fell 33.0% from $19.70 to $13.20, subtracting 28¢ from the value of each fund share. Redwood acquires jumbo home mortgages from banks, packages them into securitizations, and sells them to fixed-income investors. The stock declined this year, because Redwood completed only a handful of securitizations, as persistently low interest rates enticed banks to retain most of their 30-year fixed-rate jumbo mortgages by funding them with short-term deposits. Now that the Federal Reserve has raised interest rates for the first time in a decade, we expect banks to sell more of their jumbo mortgages to avoid the earnings compression that rising deposit costs would cause. With jumbo securitizations at only one-tenth of their volumes since the last time the Fed raised interest rates, we believe Redwood’s earnings could soar.

Cummins, the diesel engine manufacturer, cut 26¢ off the value of each fund share, as the stock dropped 13.8% from our average cost of $102.06 to $88.01. A prolonged downturn in commodity prices and weakness in Brazil and China reduced demand for the company’s engines in 2015, and its guidance for a revenue decline of up to 4% in 2016 disappointed investors. We were disappointed by the weak guidance as well, but we’re holding onto the stock, because we believe the company’s best-in-class technology for emissions control and fuel efficiency will allow it to grow quickly when its end markets recover.

Looking on the bright side, we had five stocks that each added 25¢ or more to the NAV. Our biggest winner was Altera, a manufacturer of field programmable gate arrays, a type of semiconductor that customers configure on their own for use in a wide variety of applications. Altera contributed 88¢ to each Parnassus Fund share, as its stock soared 46.2% from $36.94 to $54.00, where it was acquired by Intel, the giant semiconductor company. Interestingly, in July the stock was trading well below the $54 in cash that Intel had agreed to pay sometime over the next nine months, so we added to our position at an average cost of

| | |

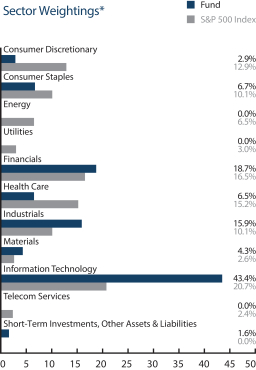

Parnassus Fund as of December 31, 2015 (percentage of net assets) | | |

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

$41.20 per share. While we don’t normally invest more than 5% of the portfolio in any one company, we increased our holding in Altera to 8%, because we felt the risk of the deal falling through was low. Intel had the cash and needed an acquisition like Altera to get the company growing again; we also expected regulators to approve the transaction, since the companies are not direct competitors. We were proven correct when the deal closed on December 28.

The shares of Alphabet (formerly Google) gained 46.6% from $530.66 to $778.01 during the year, adding 64¢ to the NAV. Nearly all the gain occurred in the second half of the year, after management announced a major restructuring. Going forward, Alphabet’s non-core business lines will have more freedom to operate, which should lead to better growth and strategic clarity. Under the previous structure, these divisions had to compete for capital and attention with Google, YouTube and Android (the mobile operating system), which are the company’s most strategic assets. Terrific financial results also helped Alphabet’s shares in 2015, with revenue growth expected to have accelerated to nearly 15% for the full year, as compared to 10% for 2014.

Altera wasn’t the only takeover stock in our portfolio this year. SanDisk makes NAND flash memory chips, a fast-growing type of semiconductor used in consumer electronics and data-storage equipment. The stock started the year trading around $98 a

6

| | | | |

| | |

| Annual Report • 2015 | | | | PARNASSUS FUNDS |

Top 10 Holdings

(percentage of net assets)

| | | | |

| |

| Intel Corp. | | | 5.0% | |

| |

| Whole Foods Market Inc. | | | 4.7% | |

| |

| Ciena Corp. | | | 4.7% | |

| |

| SanDisk Corp. | | | 4.5% | |

| |

| Applied Materials Inc. | | | 4.5% | |

| |

| International Business Machines Corp. | | | 4.3% | |

| |

| American Express Co. | | | 4.1% | |

| |

| Air Lease Corp. | | | 4.0% | |

| |

| Cummins Inc. | | | 3.8% | |

| |

| Micron Technology Inc. | | | 3.8% | |

Portfolio characteristics and holdings are subject to change periodically.

| | |

|

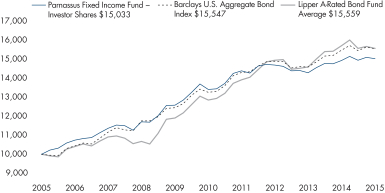

| Value on December 31, 2015 of $10,000 invested on December 31, 2005 |

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

share, then fell sharply to our average cost of $65.16 because of quality issues around some of its products, and reduced expectations for revenue and earnings. The stock started to climb higher on takeover speculation, then on October 21, disk-drive manufacturer, Western Digital, offered to acquire SanDisk for $86.50 a share. As of December 31, SanDisk was trading at $75.99 a share, so we have a nice profit in the stock, but as with Altera, there may be more upside if the $86.50 acquisition price is realized. We think the deal will go through, so we’re holding on. Based on our cost of $65.16 and the year-end price of $75.99, we have a gain of 16.6% in the stock, which translates into a gain of 30¢ for each fund share.

Ciena Corporation, the optical networking company, rose 6.6% from $19.41 to $20.69, contributing 30¢ to the NAV. Our return on Ciena was higher than the 6.6% annual gain would suggest, because we sold 600,000 shares at an average price of $24.49 during the second quarter, after the company reported earnings that exceeded expectations.

Intel helped our fund twice this year, as we profited from its acquisition of Altera, and we also enjoyed a nice gain on our investment in the company’s shares. Intel added 29¢ to the NAV, even though the stock decreased 5.07% during the year from $36.29 to $34.45. Just like SanDisk, there was no magic involved in our ability to profit from a declining stock; we just waited for a lower price. Then the stock slumped to our average cost of $30.97 after the company lowered its revenue outlook due to weaker demand for PCs and difficult macroeconomic conditions in Europe. The stock rebounded in the fourth quarter, as its PC business appears to be stabilizing, and its data-center business is growing at a double-digit rate.

Outlook and Strategy

(Note: This section applies to both the Parnassus Fund and the Parnassus Endeavor Fund.)

Right now, the stock market looks fully-valued, but not overvalued. The market has been weak in early January, and some analysts are predicting a bear market. However, being fully-valued or overvalued does not mean a bear market is on the way. There are lots of examples of the market moving much higher for months or even years from a fully-valued or overvalued position. Most of the time, there has to be some sort of catalyst to start a bear market. In 1990, it was Saddam Hussein’s invasion of Kuwait. In 2000, it was the bursting of the tech bubble. In 2008, it was the melt-down in the mortgage-securities market. Each time, the catalyst was different, and most people did not foresee what would happen.

For now, my best guess is that we’re not going into a bear market. The American economy looks very strong, with over 200,000 new jobs being created each month, no signs of inflation, persistently low interest rates and no signs of excess like we saw in 2000 and 2008. Unemployment is now down to 5%, which looks pretty good, compared to 10% in the aftermath of the 2008 crisis.

There are, however, signs that point in the opposite direction. Warren Buffett once said that if he were stranded on a desert island and could look at only one economic indicator, he would choose railroad traffic. By this measure, things don’t look

7

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2015 |

very good. Rail volumes fell at an annual rate of 6% in the fourth quarter and dropped to a 9% decline in the month of December. While we agree with Warren Buffett most of the time, in this case, I don’t think reduced rail traffic points to a recession or bear market ahead. What reduced rail traffic means is that people are moving less stuff around – mostly things like oil, metals and other commodities. Commodity prices, especially oil, are much lower now and this shows less demand. The consumer economy, though, remains quite strong. Manufacturing activity has slowed down, but demand for services has picked up, and most of our economy is based on services – not mining, manufacturing or drilling for oil. From a consumer’s perspective, low oil prices are a good thing. Low oil prices also reduce the cost of manufacturing, which helps the overall economy. Of course, lower prices mean fewer jobs in the oil patch, less drilling and less economic activity indirectly related to oil and that is substantial. That appears to be the reason for lower rail traffic and less manufacturing activity. Overall though, lower oil prices should be good for America. As the labor market picks up, salaries and wages should increase, and people will be able to buy more goods and services, moving the economy higher. It looks like there’s a tug-of-war going on with the commodities and manufacturing sectors pulling one way, while the consumer and services sectors pull the other way.

As stock-pickers, though, we can’t control the economy, and we can’t invest based on economic forecasts. All we can do is find what we believe to be undervalued stocks with good prospects and invest in them. Any weakness in the economy should make some stocks go down, and this should present us with some nice opportunities.

Yours truly,

| | |

| |  |

| Jerome L. Dodson | | Ian Sexsmith |

| Lead Portfolio Manager | | Portfolio Manager |

8

| | | | |

| | |

| Annual Report • 2015 | | | | PARNASSUS FUNDS |

PARNASSUS CORE EQUITY FUND

Ticker: Investor Shares - PRBLX

Ticker: Institutional Shares - PRILX

As of December 31, 2015, the net asset value (NAV) of the Parnassus Core Equity Fund - Investor Shares was $36.97. After taking dividends into account, the total return for the fourth quarter was 4.79%. This compares to increases of 7.04% for the S&P 500 Index (“S&P 500”) and 4.57% for the Lipper Equity Income Fund Average, which represents the average equity income funds followed by Lipper (“Lipper average”). For the year, the Fund generated a loss of 0.55%, which compares favorably to the 3.66% loss for the Lipper average, but falls short of the 1.39% gain for the S&P 500.

Below is a table that summarizes the performances of the Fund, the S&P 500 and the Lipper average. The returns are for the one-, three-, five- and ten-year periods.

| | | | | | | | | | | | | | | | | | | | | | | | |

| Parnassus Core Equity Fund | |

Average Annual Total

Returns (%) | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

for periods ended

December 31, 2015 | | | | | | |

| | | | | | | |

| Parnassus Core Equity Fund Investor Shares | | | -0.55 | | | | 15.12 | | | | 12.68 | | | | 9.89 | | | | 0.87 | | | | 0.87 | |

| | | | | | | |

| Parnassus Core Equity Fund Institutional Shares | | | -0.34 | | | | 15.32 | | | | 12.89 | | | | 10.10 | | | | 0.67 | | | | 0.67 | |

| | | | | | | |

| S&P 500 Index | | | 1.39 | | | | 15.12 | | | | 12.55 | | | | 7.30 | | | | NA | | | | NA | |

| | | | | | | |

Lipper Equity Income Fund

Average | | | -3.66 | | | | 10.55 | | | | 9.25 | | | | 6.29 | | | | NA | | | | NA | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

The average annual total return for the Parnassus Core Equity Fund-Institutional Shares from commencement (April 28, 2006) was 9.70%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Core Equity Fund- Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505.

Year in Review

The Fund generated a modest loss of 0.55% for the year, and trailed the S&P 500 by 1.94%. During an especially volatile second half, the Fund performed relatively well. It experienced only 61% of the index’s third quarter loss, and captured almost 70% of the fourth quarter rebound. This resulted in a return 50 basis points (a basis point is 1/100th of one percent) better than the S&P 500. Unfortunately, this wasn’t enough to overcome our disappointing first half.

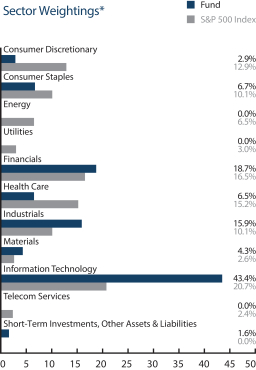

For the year, sector allocations were a net positive for the Fund’s relative performance. The largest beneficial impact came from our underweight position, relative to the index, in energy stocks, which were weak in 2015 due to the collapse in oil and natural gas prices. The only two significant negative allocation effects came from our underweight in consumer discretionary stocks (which did well last year) and our overweight in industrials (which performed poorly).

Stock selection is normally a strength for the Fund, but that wasn’t the case last year. Our relative performance suffered from large gains in two Internet stocks, Amazon.com and Facebook, which were in the index but not our portfolio. On a combined basis, our avoidance of these high-fliers represented a headwind of over 100 basis points for the Fund. Since both stocks trade at over 100x estimated 2015 earnings, they simply didn’t meet our valuation standards.

As for stocks that we did own, our biggest loser was National Oilwell Varco (NOV), a global supplier of equipment and technology that help companies drill wells safely and efficiently. The stock slumped 48.9% from $65.53 to $33.49, cutting 68¢ from each Fund share. For the first time since 1988, oil prices declined for a second consecutive year in 2015, dropping 30% from $53

9

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2015 |

to $37 per barrel. As a result, oil producers cut their capital investment, which reduced the demand for NOV’s oil and gas drilling solutions. During this downturn, management is focused on managing costs and improving efficiencies, while continuing to develop new technologies. We think this strategy will strengthen NOV’s position in the marketplace as a trusted, efficient, low-risk supplier to its customers. When energy prices and oil services demand eventually recover, we expect NOV to be a major beneficiary.

Our second biggest loser was Pentair, a diversified industrial company with leading positions in pumps, filters, valves and thermal solutions. The company subtracted 36¢ from each Fund share, as its stock dropped 25.4% from $66.42 to $49.53. The combination of a prolonged downturn in commodity prices and weak global industrial activity hurt Pentair’s earnings during 2015. For the year, both sales and earnings are expected to be down more than 10%. Despite this challenging outlook, we are holding on to the shares, because we still like Pentair’s long-term fundamentals.

Shaw Communications, a cable company in Western Canada, cut 35¢ off the value of each Fund share, as its stock dropped 36.3% from $26.99 to $17.19. The stock fell as the company lost TV subscribers to its rival, Telus, and lower oil prices caused layoffs and less investment in Western Canada. In December, the stock dropped further after Shaw announced the acquisition of cell phone operator Wind Mobile, because the deal ended long-running speculation that another cable company might someday acquire Shaw.

Our biggest winner was Alphabet (formerly Google), which gained 44.2% from $526.40 to $758.88, adding 45¢ to the Fund’s NAV. Nearly all of the gain occurred in the second half of the year, after management announced a major restructuring. Going forward, Alphabet’s non-core business lines will have more freedom to operate, which should lead to better growth and strategic clarity. Under the previous structure, these divisions had to compete for capital and attention with Google, YouTube and Android (the mobile operating system), which are the company’s most strategic assets. Terrific financial results also helped Alphabet’s shares in 2015, with revenue expected to have accelerated to nearly 15% for the full year, as compared to 10% for 2014.

Mondelez, a leading snacks company with iconic brands such as Oreo, Cadbury and Trident, added 31¢ to each Fund share, as its stock rose 23.4% from $36.33 to $44.84. The stock climbed throughout the year, as the company consistently reported better than expected sales and earnings. Mondelez has generated solid revenue growth thanks to its strong brands and exposure to fast-growing food categories and geographies. The company also has done an excellent job reducing expenses by eliminating excess manufacturing facilities, cutting overhead and discontinuing unprofitable products. While operating margins have increased from 12% to 14% over the past two years, we believe there is still upside for the company’s profitability.

Allergan, an innovative pharmaceutical company best known for developing Botox, climbed 21.4% from $257.41 to $312.50, for a gain of 29¢ for each Fund share. The stock rose early in the year after the company announced robust earnings and provided an encouraging outlook related to its R&D pipeline. Allergan spiked later in the year, when management announced that it was selling the company’s generic drug unit to Teva for more than $40 billion. This deal made Allergan an even more attractive company, as it’s now focused exclusively on high margin and fast-growing branded drugs. Within just a few months of the Teva deal, Pfizer approached Allergan and agreed to acquire the

| | |

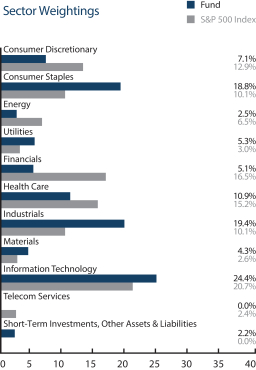

Parnassus Core Equity Fund as of December 31, 2015 (percentage of net assets) |

Top 10 Holdings

(percentage of net assets)

| | | | |

| |

| Danaher Corp. | | | 4.8% | |

| |

| Motorola Solutions Inc. | | | 4.3% | |

| |

| Mondelez International Inc., Class A | | | 4.0% | |

| |

| Procter & Gamble Co. | | | 3.6% | |

| |

| Intel Corp. | | | 3.6% | |

| |

| United Parcel Service Inc., Class B | | | 3.1% | |

| |

| Alphabet Inc., Class C | | | 3.1% | |

| |

| Xylem Inc. | | | 3.0% | |

| |

| VF Corp. | | | 3.0% | |

| |

| Gilead Sciences Inc. | | | 3.0% | |

Portfolio characteristics and holdings are subject to change periodically.

10

| | | | |

| | |

| Annual Report • 2015 | | | | PARNASSUS FUNDS |

company for $160 billion. If approved by regulators, this would be the world’s largest-ever healthcare deal. We are eager to see how this latest chapter in Allergan’s story unfolds in 2016.

Outlook and Strategy

Stocks were basically flat last year on average, because many companies in the index had trouble growing earnings. This weakness was especially acute for energy companies, but it spilled over to other commodity producers, as well as industrial companies that support resource extraction. Businesses relying on exports to fuel growth also faced headwinds in 2015, as the strong dollar negatively impacted their competitive positions in overseas markets. The silver lining as we look forward to 2016 is that valuations are relatively attractive for companies that suffered last year from these cyclical issues. We certainly believe this to be the case for the aforementioned National Oilwell Varco and Pentair.

| | |

|

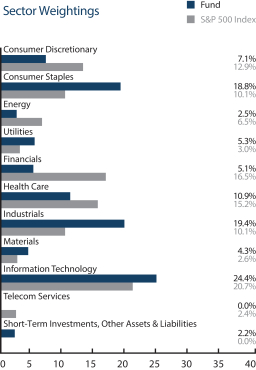

| Value on December 31, 2015 of $10,000 invested on December 31, 2005 |

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Despite the slump in commodity and export markets, certain pockets of the economy are thriving. Internet companies are reshaping how people interact with each other and with businesses that want them as customers. And unlike their late 1990s predecessors, today’s Internet leaders are taking in staggering amounts of revenue, and some are even turning attractive profits. Healthcare and consumer discretionary companies also posted strong results in 2015, as they were the two fastest growing sectors in the S&P 500, as measured by earnings per share. Our hope, as we look forward to 2016, is that these strong parts of the economy give a boost to the weak ones.

In the fourth quarter, we initiated a position in VF Corp., an apparel and footwear company better known by its top brands: The North Face, Timberland, Vans and Wrangler. We have long admired this company for its growth potential, commitment to corporate responsibility and excellent management team. We finally got a chance to buy the stock in December, after a disappointing earnings announcement caused a 14% drop in the shares from the pre-report price of $73 to our average cost of $63. We hope to own VF Corp. for many years, as we expect its brands to continue to gain market share domestically and abroad.

VF Corp. was the fifth new stock added to the Fund in 2015, joining Danaher, Deere, Intel and PayPal. We chose to divest six stocks: Accenture, Energen, Expeditors International, Teleflex, Spectra Energy and Qualcomm. We also trimmed (but didn’t exit) a number of positions, most notably our drug-related stocks, and added to certain long-term holdings due to improved valuations.

These changes to the portfolio had a meaningful impact on our sector weights. Unlike a year ago, the Fund is now underweight the healthcare sector. We have a less pronounced underweight position in consumer discretionary stocks, due to the addition of VF Corp. We still have very little exposure to financials, as the stocks in that sector don’t appear to offer attractive enough risk-reward profiles to justify our investment. Our largest overweights are in the industrials and consumer staples sectors, where we own stocks with excellent long-term prospects and attractive valuations.

If 2015 proves to be just a pause in the bull market that began in 2009, our goal is to modestly outpace the index going forward. If last year’s second half volatility was a precursor to a 2016 market correction, we’d expect our portfolio to hold up relatively well, given its quality bias. Minimizing losses in downturns and keeping pace with the index during bull markets is our recipe for attractive long-term investment results.

Thank you for your trust and investment with us,

| | |

| |  |

| Todd C. Ahlsten | | Benjamin E. Allen |

| Lead Portfolio Manager | | Portfolio Manager |

11

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2015 |

PARNASSUS ENDEAVOR FUND

Ticker: Investor Shares - PARWX

Ticker: Institutional Shares - PFPWX

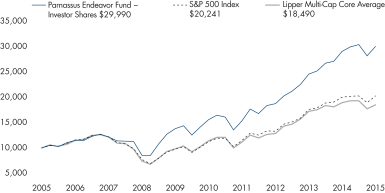

As of December 31, 2015, the NAV of the Parnassus Endeavor Fund – Investor Shares was $28.07, so after taking dividends into account, the total return for the year was 3.25%. This compares to a return of 1.39% for the S&P 500 Index (“S&P 500”) and a loss of 2.14% for the Lipper Multi-Cap Core Average, which represents the average return of the multi-cap core funds followed by Lipper (“Lipper average”). In a difficult year for the stock market, the Parnassus Endeavor Fund performed very well, beating the S&P 500 by almost two percentage points and beating the Lipper average by well over five percentage points.

Below is a table comparing the Parnassus Endeavor Fund with the S&P 500 and the Lipper average over the past one-, three-, five- and ten-year periods. You can see that the Fund has outperformed both benchmarks for all time periods. Most striking is the fact that the Parnassus Endeavor Fund – Investor Shares has beaten the S&P 500 by more than four percentage points per year over the past ten years, averaging 11.61% per year compared to 7.30% for the S&P 500. This performance has made the

| | | | | | | | | | | | | | | | | | | | | | | | |

| Parnassus Endeavor Fund | |

Average Annual Total

Returns (%) | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

for periods ended

December 31, 2015 | | | | | | |

| | | | | | | |

| Parnassus Endeavor Fund Investor Shares | | | 3.25 | | | | 17.08 | | | | 14.01 | | | | 11.61 | | | | 1.02 | | | | 0.95 | |

| | | | | | | |

| Parnassus Endeavor Fund Institutional Shares | | | 3.38 | | | | 17.12 | | | | 14.04 | | | | 11.62 | | | | 0.87 | | | | 0.83 | |

| | | | | | | |

| S&P 500 Index | | | 1.39 | | | | 15.12 | | | | 12.55 | | | | 7.30 | | | | NA | | | | NA | |

| | | | | | | |

| Lipper Multi-Cap Core Average | | | -2.14 | | | | 12.86 | | | | 10.14 | | | | 6.19 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Endeavor Fund-Institutional Shares from commencement (April 30, 2015) was -0.22%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Endeavor Fund-Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2015, Parnassus Investments has contractually agreed to limit total operating expenses to 0.95% of net assets for the Parnassus Endeavor Fund-Investor Shares and to 0.83% of net assets for the Parnassus Endeavor Fund-Institutional Shares. This agreement will not be terminated prior to May 1, 2016, and may be continued indefinitely by the Adviser on a year-to-year basis.

Parnassus Endeavor Fund – Investor Shares the best-performing of all 372 multi-cap core funds followed by Lipper over the past ten years.*

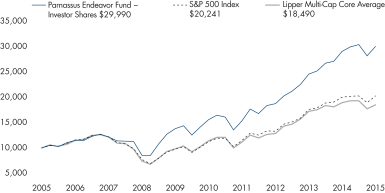

On page 14, you will also find a graph that shows the growth of a hypothetical $10,000 investment in the Fund made ten years ago, compared to the growth of a $10,000 investment in the S&P 500 or the Lipper average. As you can see, you would have almost 50% more money at the end of the ten years with the Parnassus Endeavor Fund than with the S&P 500 or the Lipper average.

Company Analysis

Four companies each contributed 20¢ or more to the NAV, and there were also four companies that each cut 20¢ or more off the value of each share of the Parnassus Endeavor Fund. Fortunately, the winners added more than the losers subtracted from the NAV.

The stock that hurt us the most was Whole Foods, the world’s largest retailer of organic and natural foods, as its stock sank 33.6% during the year from $50.42 to $33.50 for a loss of 47¢ for each fund share. The stock fell throughout the year, because revenue growth repeatedly missed expectations. The company also announced it will launch a new chain of lower-priced stores called 365, which investors believe will compete directly with existing Whole Foods outlets, thus cannibalizing sales. There is no doubt that 365 will take some sales from the Whole Foods brand, but our view is that 365 will appeal to enough

* For the one-, three- and five-year periods, the Fund was #35 of 737 funds, #26 of 656 funds and #10 of 576 funds, respectively.

12

| | | | |

| | |

| Annual Report • 2015 | | | | PARNASSUS FUNDS |

new customers, so that taken together, the two brands will accelerate growth for the company as a whole. The stock is now on the bargain table, and we think it will climb higher in 2016.

Qualcomm, a major designer and producer of smartphone chips, sliced 44¢ off the value of each fund share, as its stock crashed 32.8%, dropping from $74.33 to $49.99. The company’s licensing division had difficulty collecting royalties in China, while regulators in South Korea and Taiwan announced they were investigating Qualcomm’s licensing practices. Meanwhile, the company’s chipset division lost market share to lower-cost competitors and is being investigated by the European Union. Not everything is bleak, though. There has been positive feedback on the latest product, the Snapdragon 820, and the signing of a number of new licensing agreements in China. The company has also taken steps to improve margins and is repurchasing $10 billion of its shares. At only $49.99, we think the stock is a bargain.

Cummins, the diesel-engine manufacturer, cut 35¢ off the NAV, as its stock sank 18.9% from our average cost of $108.51, when we bought it during the fourth quarter to $88.01, by year-end. Weakness in the company’s major overseas markets of Brazil and China hurt the stock, and Cummins reported that it is going through a cyclical downturn, warning that revenue could fall as much as 4% in 2016. At just over $100 a share, we thought the stock had hit bottom, but it fell even further. We’re still holding on, because the company’s low debt level and strong cash flow should help it through this difficult period, until demand for the company’s products increases.

International Business Machines (IBM) saw its stock fall 14.2% from $160.44 to $137.62, cutting 20¢ off the value of each fund share. The stock rose in early 2015, after the company announced better-than-expected earnings, driven primarily by stronger margins in the systems and technology segment. Over the summer, though, the stock started falling, as IBM missed sales forecasts due to sluggish demand for its legacy software and computers. Sales were also affected in overseas markets by the strong dollar, and investor sentiment turned negative as revenue growth failed to pick up. We’ve been disappointed in IBM, but we believe the company’s investments in high-growth technology products and services will eventually boost sales. In the meantime, the stock is paying a 4.0% dividend and is trading at a bargain price, so we’re holding on.

Although these four losers really hurt our performance for the year, their negative effect was outweighed by some star performers. Most notable was Altera, which contributed an extraordinary 73¢ to the NAV, as its stock soared 46.2% from $36.94 at the beginning of the year to $54, when the company was sold to Intel on December 28. Altera makes a type of semiconductor known as a field-programmable gate-array (FPGA), and Intel bought the company to fill in its semiconductor product line and improve its growth prospects. What was interesting about this investment was that the stock was trading well below the $54 cash price that Intel agreed to pay, even after the public announcement of the transaction. We added more shares at an average cost of around $50, bringing our position in Altera to over 10% of the portfolio.

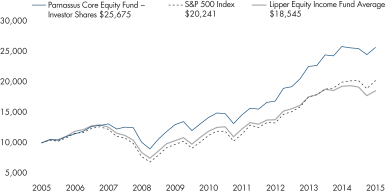

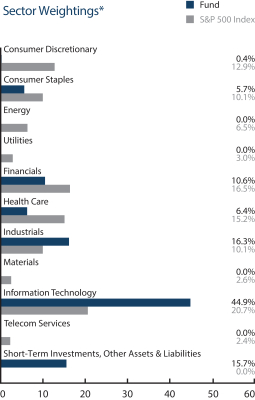

| | |

Parnassus Endeavor Fund as of December 31, 2015 (percentage of net assets) | | |

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Top 10 Holdings

(percentage of net assets)

| | | | |

| |

| Applied Materials Inc. | | | 5.6% | |

| |

| SanDisk Corp. | | | 5.5% | |

| |

| Whole Foods Market Inc. | | | 5.1% | |

| |

| Ciena Corp. | | | 4.8% | |

| |

| American Express Co. | | | 4.8% | |

| |

| International Business Machines Corp. | | | 4.8% | |

| |

| Intel Corp. | | | 4.7% | |

| |

| Deere & Co. | | | 4.4% | |

| |

| Cummins Inc. | | | 4.3% | |

| |

| Autodesk Inc. | | | 4.1% | |

Portfolio characteristics and holdings are subject to change periodically.

13

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2015 |

Normally, we never have more than 5% of our assets in any one issuer, but this seemed a special case and the risk was very low. Intel had the cash, and they were motivated to complete the transaction to get the company growing again. It was also likely that anti-trust regulators would approve the deal even though both companies made semiconductors, because Intel did not compete directly in the FPGA market. It was a rare opportunity, and we decided to take a calculated risk. I don’t think we’ve ever had more than 10% of the Fund’s assets in any one company before, so this was a rare exception. There was some risk, but the risk was relatively minor, and there was an inexplicable gap between the market price and the purchase price. We saw an opportunity, we took our chances and shareholders are richer for it.

Altera wasn’t the only takeover stock in our portfolio this year. SanDisk makes NAND flash

| | |

| |

| Value on December 31, 2015 of $10,000 invested on December 31, 2005 | | |

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

memory chips, a fast-growing type of semiconductor used in consumer electronics and data-storage equipment. The stock started the year trading around $98 a share, then fell sharply because of quality issues around some of its products, and reduced expectations for revenue and earnings. When the stock dropped into the 50’s, we acquired a position of around a million shares at an average cost of $57.93, which at the time amounted to about 4% of our portfolio. The stock started to climb higher on takeover speculation, then on October 21, disk-drive manufacturer, Western Digital, offered to acquire SanDisk for $86.50 a share. As of December 31, SanDisk was trading at $75.99 a share, so we have a nice profit in the stock, but as with Altera, there may be more upside if the $86.50 acquisition price is realized. We think the deal will go through, so we’re holding on. Based on our cost of $57.93 and the year-end price of $75.99, we have a gain of 31.2% in the stock, which translates into a gain of 49¢ for each fund share.

All of you probably know what Google is, but most of you have probably never heard of Alphabet, which is now the parent holding company of Google, so now our shares of Google have been converted into shares of Alphabet. During the year, shares of Alphabet gained 46.6% from $530.66 to $778.01 by year-end, thereby adding 41¢ to the NAV. Nearly all of the gain occurred in the last half of the year, after management announced a major restructuring. Alphabet’s non-core business lines will now have more freedom to operate, which should lead to more growth and strategic clarity. Under the previous structure, these divisions had to compete for capital and management attention with the core businesses of Google, YouTube and Android (the mobile-phone operating system), which are the company’s strategic assets. Terrific financial results also helped the stock in 2015, with revenue growing at a rate of about 15%, compared with 10% in 2014.

Autodesk, the leading software-provider for architects, engineers and designers, added 28¢ to the value of each fund share, even though the stock only increased 1.4% during the year, going from $60.06 to $60.93. There was no magic involved. We initiated our position in the middle of the year, when investor sentiment turned negative, causing shares to slump, because revenue growth decelerated due to weak demand in emerging markets and foreign-exchange headwinds. However, the stock rose sharply after activist-investor Sachem Head and Eminence Capital announced big positions in Autodesk. By this time, though, we had already accumulated a position in Autodesk at $49.60 a share. After that, the company delivered better-than-expected third quarter sales and earnings results. The combination of the two events pushed up the price of the stock to $60.93 by the end of the year, and that’s how the Parnassus Endeavor Fund added 28¢ to the NAV. We expect the stock to move even higher with increased sales of its subscription/cloud-based offerings used by manufacturing and construction firms.

Yours truly,

Jerome L. Dodson

Portfolio Manager

14

| | | | |

| | |

| Annual Report • 2015 | | | | PARNASSUS FUNDS |

PARNASSUS MID CAP FUND

Ticker: Investor Shares - PARMX

Ticker: Institutional Shares - PFPMX

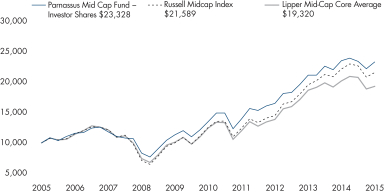

As of December 31, 2015, the NAV of the Parnassus Mid Cap Fund – Investor Shares was $25.56, so after taking dividends into account, the total return for 2015 was a loss of 0.87%. This compares to a loss of 2.44% for the Russell Midcap Index (“Russell”) and a loss of 4.35% for the Lipper Mid-Cap Core Average, which represents the average mid-cap core funds followed by Lipper (“Lipper average”). For the quarter, the Fund was up 5.04%, ahead of the Russell’s 3.62% return and the Lipper average’s 2.40% gain.

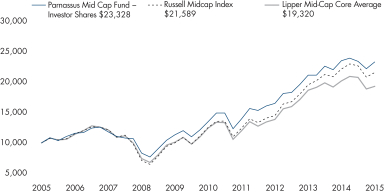

Below is a table comparing the Parnassus Mid Cap Fund with the Russell and the Lipper average for the one-, three-, five- and ten-year periods. On page 17 is a graph showing the growth of a hypothetical $10,000 investment in the Fund made ten years ago, compared to the growth of a $10,000 investment in the Russell or the Lipper average.

| | | | | | | | | | | | | | | | | | | | | | | | |

| Parnassus Mid Cap Fund | |

Average Annual

Total Returns (%) | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

for periods ended

December 31, 2015 | | | | | | |

| | | | | | | |

| Parnassus Mid Cap Fund Investor Shares | | | -0.87 | | | | 12.25 | | | | 11.63 | | | | 8.84 | | | | 1.09 | | | | 0.99 | |

| | | | | | | |

| Parnassus Mid Cap Fund Institutional Shares | | | -0.65 | | | | 12.33 | | | | 11.68 | | | | 8.87 | | | | 0.94 | | | | 0.85 | |

| | | | | | | |

| Russell Midcap Index | | | -2.44 | | | | 14.18 | | | | 11.44 | | | | 8.00 | | | | NA | | | | NA | |

| | | | | | | |

| Lipper Mid-Cap Core Average | | | -4.35 | | | | 11.55 | | | | 9.01 | | | | 6.58 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Mid Cap Fund-Institutional Shares from commencement (April 30, 2015) was -1.30%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Mid Cap Fund-Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Midcap Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Mid-cap companies can be more sensitive to changing economic conditions and have fewer financial resources than large-cap companies.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2015, Parnassus Investments has contractually agreed to limit total operating expenses to 0.99% of net assets for the Parnassus Mid Cap Fund-Investor Shares and to 0.85% of net assets for the Parnassus Mid Cap Fund-Institutional Shares. This agreement will not be terminated prior to May 1, 2017, and may be continued indefinitely by the Adviser on a year-to-year basis.

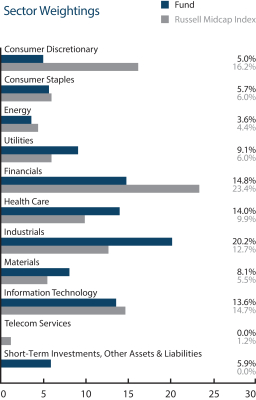

Year in Review

The Fund performed relatively well this year, as its 0.87% loss was far less than the Russell’s 2.44% decline and the Lipper average’s 4.35% drop. It’s never fun to lose money, but we’re pleased that our strategy outperformed its benchmarks by such wide margins.

As usual, our stock selection was the main driver of the Fund’s performance relative to the index. That said, the Fund also benefitted from having minimal exposure to the worst-performing sector in the benchmark: energy. Our overweight position in the industrials sector hurt performance the most, because this sector dropped over twice as much as the Russell during the year.

The Fund had three stocks that reduced the NAV by 20¢ or more during 2015. Our worst performer was Pentair, a diversified industrial company that manufactures and sells pumps, filters, valves and thermal solutions. The stock subtracted 25¢ from each fund share, as it dropped 25.4% from $66.42 to $49.53. The shares initially fell after the company reduced its earnings outlook, due to weakness in its global industrial and energy end-markets. The shares got a boost during the second quarter, after activist investor, Trian Partners, bought a 7.2% stake in the company. The market’s enthusiasm was short-lived, though, as the stock declined after the company lowered earnings expectations once again in the third quarter. We’re hanging onto our shares, because this quality business is now on sale, and earnings should rebound once the industrial and energy end-markets recover and restructuring initiatives take effect.

Iron Mountain, the leader in document storage services, fell 30.1% from $38.66 to $27.01, cutting

15

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2015 |

24¢ from the NAV. The stock had a rocky start to the year, after the company reduced its earnings guidance, due to negative effects from foreign exchange. The weakness continued in the second quarter, after management agreed to buy rival storage company Recall Holdings, which raised Iron Mountain’s debt level and jeopardized its generous dividend payout. Despite investor concerns, we remain confident in the company’s competitive position, which should support stable cash flow and dividends ahead.

Shaw Communications, a Western Canadian cable company, plummeted 36.3% from $26.99 to $17.19, cutting 20¢ from the Fund’s NAV. The stock fell early in the year, as the company lost TV subscribers to its rival, Telus. The shares reached a new low in December, after Shaw announced the acquisition of cell phone operator Wind Mobile, because the deal ended long-running speculation that Shaw would be acquired by another cable company. We’re holding onto our relatively small position for now, because the company has good assets, a high dividend yield and an attractive valuation.

Three stocks in the Fund’s portfolio added more than 17¢ to the NAV. The Fund’s biggest winner was SEI Investments, the financial technology solutions provider and asset manager. The stock jumped 30.9% during the year from $40.04 to $52.40, adding 23¢ to the NAV. The shares moved higher throughout the year as management delivered strong results across each of its business segments. Investors mostly focused on the company’s Private Banking and Trust unit, where sales and margins are finally improving, after years of heavy technology investment. We still like the company’s prospects, because we think there is a long runway for sales growth and margin improvement.

Insperity, a provider of human resource services to small- and mid-sized businesses, surged 42.1% from $33.89 to $48.15, for a gain of 21¢ per fund share. In early 2015, the stock rose after activist investor Starboard Value took a large stake in the company and pressured management to reduce operating costs, repurchase stock and explore the sale of the company. Following a mid-year lull due to lackluster operating results, the stock jumped in December after the company announced a $125 million Dutch auction to repurchase common stock. With Starboards’ help, we believe management’s focus on reducing costs and increasing share repurchases should drive earnings higher, so we’re holding onto the stock.

Cameron International, a leading supplier of drilling and safety equipment used by energy firms, surged 26.5% from $49.95 to $63.20 for a gain of 18¢ per fund share. The stock rose early in the year after the company reported better than expected earnings results, driven by stronger margins in its Subsea segment and lower expenses. The big event for the stock occurred in August after the company agreed to a cash and stock offer valued at more than $66 per share from Schlumberger, the world’s largest oil services firm. We began selling our position after the deal was announced, since we did not expect a higher offer to emerge.

Outlook and Strategy

This year’s 2% drop in the Russell was not a major correction, and many stocks are still expensive. After taking dividends into account, the Russell is up over 300% since the trough of 2009, which represents an annualized return of 23%. At year-end, the Russell traded at 18.6 times forward earnings estimates, above the ten year average of 17.7 times.

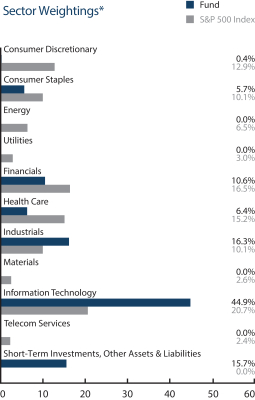

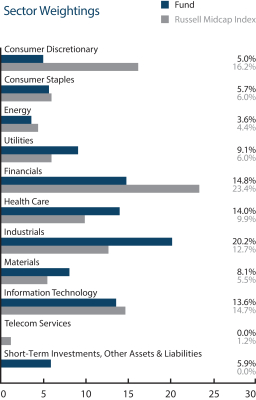

| | |

Parnassus Mid Cap Fund as of December 31, 2015 (percentage of net assets) |

Top 10 Holdings

(percentage of net assets)

| | | | |

| |

| First Horizon National Corp. | | | 3.8% | |

| |

| Cardinal Health Inc. | | | 3.5% | |

| |

| Xylem Inc. | | | 3.4% | |

| |

| Applied Materials Inc. | | | 3.4% | |

| |

| SEI Investments Co. | | | 3.4% | |

| |

| Patterson Companies Inc. | | | 3.2% | |

| |

| DENTSPLY International Inc. | | | 3.2% | |

| |

| Pentair plc | | | 3.2% | |

| |

| Sysco Corp. | | | 3.1% | |

| |

| Fiserv Inc. | | | 3.1% | |

Portfolio characteristics and holdings are subject to change periodically.

16

| | | | |

| | |

| Annual Report • 2015 | | | | PARNASSUS FUNDS |

In 2015, certain sectors went down much more than the Russell. For example, the energy, industrial and consumer discretionary sectors went down 34%, 6% and 4%, respectively. Given these price drops, we spent extra time looking for quality bargains in these areas.

In the energy sector, we initiated a modest position in National Oilwell Varco, a leading provider of equipment and components to the energy industry. The stock dropped almost 50% in 2015 when their customers slashed spending on its equipment and services as the price of oil fell to a ten-year low. We expect that the oil and gas market will remain relevant over our investment horizon, and National Oilwell has the best collection of products and services to help companies drill wells safely and efficiently. Also, given its financial position, the company is in an enviable position not only to survive the current energy downturn, but also to emerge as an even

| | |

|

| Value on December 31, 2015 of $10,000 invested on December 31, 2005 |

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

stronger player. If energy prices move up over the next few years, we should do very well in this investment. If they don’t, we’ll be happy to collect the company’s nearly 5% dividend yield.

In the industrial sector, we initiated a core position in Deere & Co. Best known for its bright green and yellow tractors, Deere is one of the world’s leading farm equipment manufacturers. Deere’s business suffered over the past few years, as crop prices fell and farmers delayed purchases of new equipment. Our research process convinced us that Deere is a high-quality, resilient business, and is poised to benefit as global demand for food – and as a result farm equipment – rises.

We also found compelling opportunities in the consumer sector. The first is VF Corporation, a leading apparel and footwear company. The stock dropped almost 20% in 2015, given sluggish consumer spending and currency headwinds, which allowed us to buy this high-quality business at an attractive price. We’re aware that we could be nearing the end of the recent economic expansion cycle, but we‘re impressed with the company’s fantastic collection of brands, like The North Face, Vans, Timberland and Wrangler, which command pricing power and contribute to consistently high returns on invested capital. We also like VF Corp’s scale advantages, resulting from its product breadth and well-managed global supply chain and manufacturing capabilities.

Another new consumer-oriented investment is eBay. Best known for its online auction marketplace, the company spun off its payments segment, PayPal, over the summer. We bought the stock back in October, when the shares dropped due to a series of short-term issues including a cyberattack and search-engine optimization problem. We especially like the company’s exposure to the fast growing e-commerce marketplace, its sustainable competitive advantages due to eBay’s network effect, highly profitable business model and cheap valuation.

As always, we remain committed to investing in responsible, well-priced businesses with increasing relevance, sustainable competitive advantages and properly incentivized managers.

Thank you for your investment.

Yours truly,

| | |

| |  |

| Matthew D. Gershuny | | Lori A. Keith |

| Lead Portfolio Manager | | Portfolio Manager |

17

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2015 |

PARNASSUS ASIA FUND

Ticker: Investor Shares - PAFSX

Ticker: Institutional Shares - PFPSX

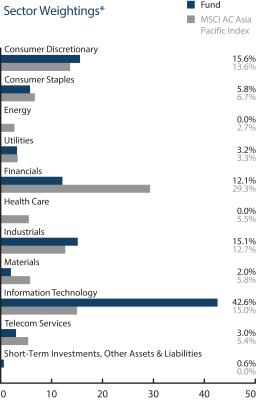

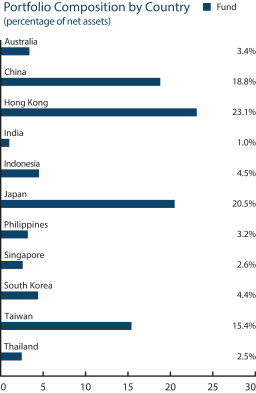

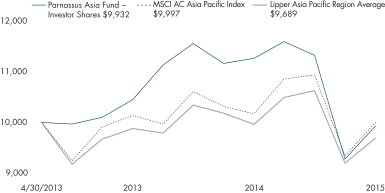

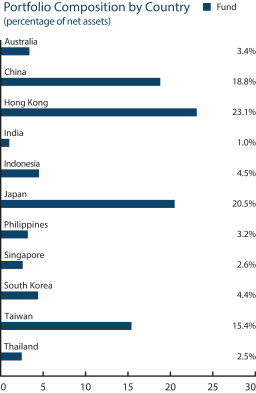

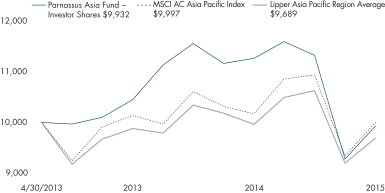

As of December 31, 2015, the NAV of the Parnassus Asia Fund – Investor Shares was $14.74, so the total return for the year was a loss of 11.84%. This compares to a loss of 1.68% for the MSCI AC Asia Pacific Index (“MSCI Index”) and a loss of 3.12% for the Lipper Asia Pacific Region Average, which represents the average return of the Asia Pacific Region funds followed by Lipper (“Lipper average”). The primary reasons for our underperformance were our underweighting in Japan and weakness in our emerging market investments.

| | | | | | | | | | | | | | | | |

| Parnassus Asia Fund | |

Average Annual

Total Returns (%) | | One

Year | | | Since

Inception on

4/30/13 | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

for periods ended

December 31, 2015 | | | | |

| | | | | |

Parnassus Asia Fund

Investor Shares | | | -11.84 | | | | -0.26 | | | | 3.53 | | | | 1.25 | |

| | | | | |

| Parnassus Asia Fund Institutional Shares | | | -11.60 | | | | NA | | | | 3.48 | | | | 1.22 | |

| | | | | |

| MSCI AC Asia Pacific Index | | | -1.68 | | | | -0.03 | | | | NA | | | | NA | |

| | | | | |

| Lipper Asia Pacific Region Average | | | -3.12 | | | | -1.50 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Asia Fund-Institutional Shares from commencement (April 30, 2015) was -17.48%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Asia Fund-Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The MSCI AC Asia Pacific Index is an unmanaged index of Asian stock markets, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The Fund invests primarily in non-U.S. securities. Foreign markets can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market or economic developments and can perform differently from the U.S. market.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2015, Parnassus Investments has contractually agreed to limit the total operating expenses to 1.25% of net assets for the Parnassus Asia Fund-Investor Shares and to 1.22% of net assets for the Parnassus Asia Fund-Institutional Shares. This agreement will not be terminated prior to May 1, 2016, and may be continued indefinitely by the Adviser on a year-to-year basis.

2015 was a terrible year for the Parnassus Asia Fund. We lagged behind both of our benchmarks by a wide margin, trailing the MSCI Index by over ten percentage points and the Lipper average by almost nine percentage points. We are making a comeback, though. In the fourth quarter, the Fund turned around and grew 7.04%, beating both of its benchmarks for that period. We now stand slightly behind the MSCI Index for the period since inception, and remain ahead of the Lipper average since the Fund’s launch on April 30, 2013.

Company Analysis

The Asia Fund’s weak performance was attributable to our investments in emerging market stocks, which declined dramatically as China’s economy slowed. Five companies each knocked 14¢ or more from the NAV, due to related macroeconomic pressures as well as company-specific factors.

The Fund’s worst performer this year was OSIM International, a Singapore-based retailer of healthy lifestyle products. OSIM sliced 30¢ off the NAV, as its stock plummeted 49% from $1.49 to $0.76. The company makes and markets a range of consumer and household products including massage chairs, fitness and diagnostic equipment, nutrition products and supplements, and luxury tea products. Weak demand in China and fluctuating exchange rates across Asia weighed on consumer sentiment, cutting into company sales and margins. In response, OSIM announced it would restructure itself in 2016, closing unprofitable stores in Australia and reallocating resources to the company’s core markets in Singapore, Malaysia, Taiwan and China. Despite the sell-off, we held on to our position given the company’s strong cash generation, nearly 6% dividend yield, owner-operator management and inexpensive valuation.

Hermes Microvision, a Taiwan-based maker of semiconductor-manufacturing equipment, reduced the value of each fund share by 17¢, as its stock

18

| | | | |

| | |

| Annual Report • 2015 | | | | PARNASSUS FUNDS |

price dropped 28% from $49.89 to $35.83. The company develops and markets electron beam (E-beam) inspection tools for semiconductor-manufacturers for use in testing for defects in silicon wafers. Hermes’s stock price collapsed after management sharply lowered its sales guidance for the year. The company saw customers delaying orders for equipment due to weak demand for personal computers and Android smartphones – and the chips used to build them. Hermes’s E-beam technology remains the best in the industry and continues to gain market share from older optical inspection methods. We previously trimmed our position, but reversed course and added to our stake following the share price correction, which we believe was overdone.

Novatek Microelectronics cut the value of each fund share by 16¢, as its stock plunged 40% from $5.57 to $3.34. Based in Hsinchu, Taiwan’s version of Silicon Valley, Novatek is the world’s largest supplier of display-driver integrated circuits and Taiwan’s second-largest fabless semiconductor company. The company supplies chips that power such devices as television displays, notebook monitors, smartphones and set-top boxes. The company disclosed that sales would decline and margins would fall due to poor demand and a key customer’s inventory adjustment. Evidence that new competitors were entering the market and investor concerns that Samsung, the world’s largest manufacturer of TVs, would adopt in-house chips also sent the stock into a tailspin. With Novatek’s competitive position called into question, we sold our stake at a loss.

Qualcomm, a major designer and producer of smartphone chips, sliced 16¢ off the value of each fund share, as its stock crashed 32.7%, dropping from $74.33 to $49.99. The company’s licensing division had difficulty collecting royalties in China, while regulators in South Korea and Taiwan announced they were investigating Qualcomm’s licensing practices. Meanwhile, the company’s chipset division lost market share to lower-cost competitors and is being investigated by the European Union. Not everything is bleak, though. There has been positive feedback on the latest product, the Snapdragon 820, and the signing of a number of new licensing agreements in China. The company has also taken steps to improve margins and is repurchasing $10 billion of its shares. At only $49.99, we think the stock is a bargain.

Bank Danamon fell 33% from 36¢ to 24¢, reducing the value of each fund share by 15¢. Danamon is Indonesia’s sixth largest bank by assets and one of the country’s largest credit card issuers. Negative loan growth in the mass-market segment translated into shrinking net interest margins, while persistently high non-performing loans increased credit costs. The bank, especially its heavy equipment financing, was also affected by the commodity down-cycle. Although Indonesia remains an attractive long-term market, we do not foresee an immediate recovery in commodity prices, so we exited our position in Danamon.

| | |

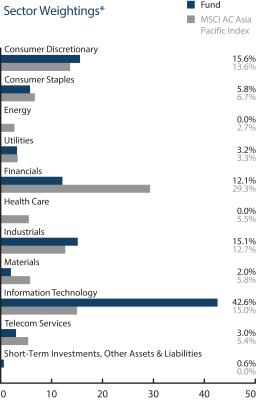

Parnassus Asia Fund as of December 31, 2015 (percentage of net assets) | | |

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

While all of the Fund’s losers besides Qualcomm were emerging market stocks, the Fund’s two biggest winners were from Japan. Overall, three companies each added 7¢ or more to the Fund’s NAV.

KDDI Corporation, the second largest telecommunications company in Japan, saw its stock price rise 24% from $20.94 to $25.97, boosting the value of each fund share by 14¢. Over the year, the company began selling a greater diversity of handsets to customers and rolled out new pricing plans to suit both younger subscribers and senior citizens. These innovations, along with prior investments in its high-speed LTE network, won over customers who are willing to pay hefty monthly fees for large volumes of data. For iPhone users in particular, KDDI boasts faster download speeds than its competitors, a key reason the company continues to gain share.

Japanese Internet company Kakaku.com, one of the Fund’s new positions in 2015, climbed 22% from $16.14 to $19.67, adding 9¢ to the Fund’s NAV. Kakaku is the country’s largest online repository of consumer product information and prices, allowing users to comparison-shop a wide range of goods and services before they buy. Kakaku also owns a site called

19

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2015 |

Tabelog, which aggregates diner reviews and restaurant recommendations. The company saw double digit increases in traffic last year, as consumer purchases continue to shift online. It also revised its cost-per-click upwards in February, boosting the company’s profits in the face of higher demand for its services.

PT Asuransi, an Indonesian insurance company, contributed 7¢ to the NAV, as the stock soared 46% from 235 Indonesian rupiah ($0.019) to 380 rupiah ($0.028). The company sells policies that insure cars, property, cargo, health and human life against sudden misfortunes such as accidents, fire, damage, disability and death. Although operating results were weak, the stock climbed higher when the company said it would merge with Panin Insurance, the general insurance arm of its parent

company. The merger makes it easier for both entities to maintain profitability through economic cycles, and investors cheered the combination.

Outlook and Strategy

2015 was a turbulent year for the Asian financial markets and a disappointing one for the Parnassus Asia Fund. The MSCI Asia Pacific Index fluctuated wildly, going from a bull to a bear market within the first nine months of the year. In October, Asian markets collectively rallied 13%, then sank 7% again before ending the year down 1.68%. Against this backdrop of severe volatility, the Parnassus Asia Fund did not fare well. We rose less when the market climbed higher, and fell harder when the market crashed in the summer, ending the year with losses of over 11%. A myriad of factors contributed to this poor performance.

The most important factor was the Fund’s large underweighting in Japan. At the end of the year, Japan had grown to 43% of the MSCI Asia Pacific Index, but only 17% of the Parnassus Asia Fund. That worked against us all year. Indeed, Japan was the best-performing of all Asian markets by a wide margin in 2015, rising 9.9% in dollar terms, and was the only market in Asia with positive returns. That’s right. Every single one of the 12 stock markets in Asia other than Japan’s ended the year in negative territory. An underweight in Japan meant an overweight in other countries that lost value.

What’s happening in Japan and why are we underweight there? Japan’s economy is fragile but supported by a massive stimulus program dubbed Abenomics and a weak yen, which benefits the country’s exporters. Wages, retail sales and business investment are stagnant, while the threats of deflation and an aging, shrinking population loom large. Meanwhile, Japan’s high debt level is likely to constrain policy options, despite the government’s commitment to maintain stimulus until inflation hits 2%, an unrealistic goal. Though we continually look for investment opportunities in Japan – we added three Japanese stocks this year including price comparison site Kakaku.com – we do not necessarily believe Japan should comprise half of a portfolio focused on Asian stocks.

Compared to Japan, Chinese companies are generally poised to offer higher returns in the future, despite violent fluctuations in the short-term. China’s overall GDP growth is slowing, but its service sector, which makes up almost half of the economy, is growing at double-digit rates. Chinese consumers have high savings rates and strong balance sheets and are seeing their wages and salaries rise rapidly. This translates to a higher propensity to consume electronics, entertainment, food, beverages, snacks, and online goods and services – all areas where

| | |

Parnassus Asia Fund as of December 31, 2015 (percentage of net assets) | | |

Parnassus considers companies that do a substantial amount of business in Asia to be Asian Companies.

Top 10 Holdings

(percentage of net assets)

| | | | |

| |

| Alibaba Group Holding Ltd. (ADR) | | | 4.7% | |

| |

| Samsung Electronics Co., Ltd. | | | 4.4% | |

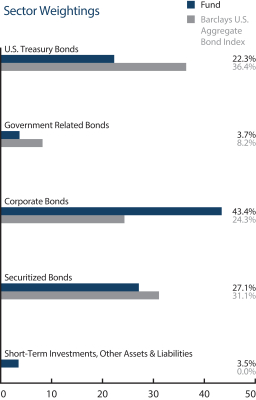

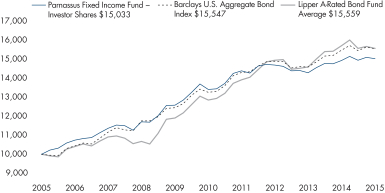

| |