UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: Parnassus Funds (811-04044) and Parnassus Income Funds (811-06673)

Parnassus Funds

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marc C. Mahon

Parnassus Funds

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2017

Item 1: Report to Shareholders

PARNASSUS FUNDS®

ANNUAL REPORT ◾ DECEMBER 31, 2017

PARNASSUS FUNDS

| | |

| |

| Parnassus FundSM | | |

Investor Shares | | PARNX |

Institutional Shares | | PFPRX |

| |

| Parnassus Core Equity FundSM | | |

Investor Shares | | PRBLX |

Institutional Shares | | PRILX |

| |

| Parnassus Endeavor FundSM | | |

Investor Shares | | PARWX |

Institutional Shares | | PFPWX |

| |

| Parnassus Mid Cap FundSM | | |

Investor Shares | | PARMX |

Institutional Shares | | PFPMX |

| |

| Parnassus Asia FundSM | | |

Investor Shares | | PAFSX |

Institutional Shares | | PFPSX |

| |

| Parnassus Fixed Income FundSM | | |

Investor Shares | | PRFIX |

Institutional Shares | | PFPLX |

Table of Contents

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2017 |

February 9, 2018

President’s Letter

2017 was a terrific year to be invested in stocks. With a 21.83% gain, the S&P 500 Index joined other major indexes across the globe in posting an exceptionally high return. An acceleration of economic growth was a key factor in boosting investor sentiment. The consensus expectation for growth in 2017 was 2.3% for the U.S., which is well ahead of last year’s 1.5%. Even more important, economists expect growth to accelerate to 2.5% for 2018. The unemployment rate has been on a similar trajectory, dropping from 4.7% at the end of 2016 to an expected 4.1% for the end of 2017.

In 2017, investors betting on change and disruption were the big winners. The stocks of companies with missions to disrupt long-stable industries led the market higher last year. Amazon, Netflix and Facebook posted great returns, as they were all up over 50% in 2017. A less well-known technology company that did even better was semiconductor company Nvidia, which posted an 82% gain. One use of Nvidia’s chips is for mining cryptocurrencies, like Bitcoin. Amazingly, this new currency soared from $1,000 at the beginning of 2017 to more than $12,000 in just 12 months, and in doing so emphatically underscored the “change and disruption wins” theme.

The corollary of this dominant theme is that companies in the crosshairs of the innovators remained out of favor in 2017. That many of these traditional companies entered the year with attractive valuations did nothing to improve their stocks’ performance. In fact, the subset of the S&P 500 labeled “Value” by the index provider returned a relatively pedestrian 15.4% in 2017. This is more than six percentage points less than the broad index, and a full 12 percentage points worse than the S&P 500 Growth Index.

Our fund managers incorporate rigorous valuation work into their investment decisions. This means that we buy stocks only when they have modest or better valuations, and we avoid stocks with sky-high valuations. We do this because we believe that investing in securities with attractive valuations is one of the most reliable ways to generate attractive risk-adjusted returns over the long-term. Unfortunately, when growth stocks are clearly in favor, a value-oriented approach represents a stiff headwind to performance. This was one reason why our funds didn’t keep up with the soaring indexes in 2017. A consolation is that the Parnassus Core Equity Fund and the Parnassus Endeavor Fund beat their respective Lipper averages, and the Parnassus Mid Cap Fund finished in a virtual tie with its peer average.

In the reports that follow, our portfolio managers discuss their funds’ performance for 2017. They also discuss their outlooks and strategies to get back to outperforming their indexes in the coming year. I hope you enjoy the reports.

Thank you all for investing with the Parnassus Funds.

Yours truly,

Benjamin E. Allen

President

4

| | | | |

| | |

| Annual Report • 2017 | | | | PARNASSUS FUNDS |

PARNASSUS FUND

Ticker: Investor Shares - PARNX

Ticker: Institutional Shares - PFPRX

As of December 31, 2017, the net asset value per share (“NAV”) of the Parnassus Fund – Investor Shares was $48.27, so after taking dividends into account, the total return for the year was 16.08%. This compares to a gain of 21.83% for the S&P 500 Index (“S&P 500”) and a gain of 19.50% for the Lipper Multi-Cap Core Average, which represents the average return of the multi-cap core funds followed by Lipper (“Lipper average”). Normally, we’d be pleased with an annual return of more than 16%, but this year, it doesn’t look too good in comparison with our benchmarks. The market’s advance was led by technology stocks that we didn’t own due to their expensive valuations. Investors paid exorbitant prices for growth and left behind many of our socially responsible, competitively advantaged businesses with long track records of success. Eventually, we believe the market will come to its senses and realize that these technology stocks are overvalued, or that our industry leaders are undervalued, or both.

Below is a table comparing the Parnassus Fund with the S&P 500 and the Lipper average over the past one-, three-, five- and ten-year periods. Our underperformance in 2017 pulled the Fund’s return below the S&P 500 for the one-, three- and

| | | | | | | | | | | | | | | | | | | | | | | | |

| Parnassus Fund | |

Average Annual

Total Returns (%) | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

for period ended

December 31, 2017 | | | | | | |

| | | | | | | |

| Parnassus Fund Investor Shares | | | 16.08 | | | | 9.71 | | | | 15.24 | | | | 10.72 | | | | 0.86 | | | | 0.86 | |

| | | | | | | |

| Parnassus Fund Institutional Shares | | | 16.25 | | | | 9.84 | | | | 15.31 | | | | 10.76 | | | | 0.71 | | | | 0.71 | |

| | | | | | | |

| S&P 500 Index | | | 21.83 | | | | 11.41 | | | | 15.79 | | | | 8.50 | | | | NA | | | | NA | |

| | | | | | | |

| Lipper Multi-Cap Core Average | | | 19.50 | | | | 8.90 | | | | 13.74 | | | | 7.14 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Fund-Institutional Shares from commencement (April 30, 2015) was 9.99%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Fund-Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505.

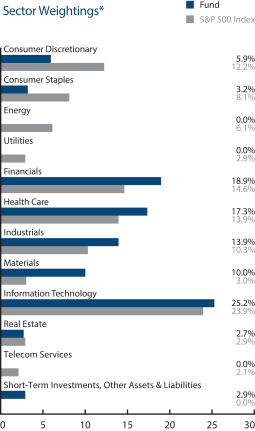

five-year periods, but we remain well ahead on the ten-year period. The Fund is trailing the Lipper average for the one-year period, but is ahead on the three-, five- and ten-year periods. We’re proud of the ten-year period, where the Parnassus Fund – Investor Shares has returned 10.72% per year, compared to 8.50% for the S&P 500 and 7.14% for the Lipper average. This is 2.22% per year more than the S&P 500 and 3.58% per year more than the Lipper average.

Company Analysis

Eight companies each contributed 80 basis points (a basis point is 1/100th of one percent) or more to the Parnassus Fund’s return this year, while only three subtracted more than 30 basis points from the return. The stock that hurt us the most was toy-manufacturer Mattel, best known for its iconic brands Barbie, Hot Wheels and Fisher-Price. Mattel’s stock cut 65 basis points from the Fund’s return as it dropped 10.3% from our average purchase price of $17.15 to $15.38. The shares slumped as Mattel reported declining sales and earnings, which forced the company to suspend its dividend. The weak performance was caused by a combination of tired brands, poor production planning and the bankruptcy of Toys R Us, the largest toy-store chain in the country. Mattel now has a new management team in place, and we believe their plan to reinvigorate the company will create significant upside for shareholders, so we added to our position as the stock sunk to its low of $13.04 in November. The stock quickly jumped off its low after press speculation that toy-rival Hasbro may acquire Mattel. We believe the current stock price does not reflect the company’s valuable brands, and we expect our upside will be significant, as management either improves operations, or sells the company at a premium.

5

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2017 |

Allergan, a pharmaceutical company best known for developing Botox, fell 22.1% from $210.01 to $163.58, reducing the Fund’s return by 35 basis points. The stock fell after a federal judge invalidated patents covering the company’s $1.5 billion dry eye drug, Restasis, thereby enabling a generic version to come to the market. Shares declined again after Revance Therapeutics, a clinical-stage biotech company, presented data showing that its competing Botox product lasts longer than Allergan’s Botox. We added to our position as the stock moved lower, because we think Allergan’s aesthetics franchise remains solid despite increasing competition. The stock is also cheap, trading at just ten times expected 2018 earnings.

Patterson Companies, a leading animal health and dental distributor, sank 11.9% from $41.03 to $36.13, lowering the Fund’s return by 34 basis points. The company reported weak earnings due to sluggish dental sales caused by personnel issues and the loss of exclusivity with its largest dental manufacturing partner. The stock is now on the bargain table, and we’re hopeful the newly appointed CEO, Mark Walchirk, will improve Patterson’s sales execution and operating margins.

Auto insurer Progressive was the Parnassus Fund’s best performer, adding 192 basis points to the Fund’s return as its shares soared 58.6% from $35.50 to $56.32. Progressive’s earnings growth shifted into high gear due to the impressive combination of accelerating revenue growth and lower policy loss rates. The company is the industry leader in predictive analytics, which allows it to identify safe drivers and reward them with lower prices, while avoiding unsafe drivers who are unprofitable. A new home insurance product drove Progressive’s revenue growth, as customers bundled their home and auto policies together to save money and time.

Industrial gas supplier Praxair contributed 122 basis points to the Fund’s return, as the stock rose 32.0% from $117.19 to $154.68. Praxair announced a merger with Linde, a German competitor. The merger will create the world’s largest industrial gas supplier, combining Praxair’s leading position in the Americas with Linde’s strong presence in Europe and Asia. The combination of Praxair’s operational excellence and Linde’s engineering and technology leadership should accelerate earnings growth.

Semiconductor manufacturer Micron Technology added 94 basis points to the Parnassus Fund’s return, as the stock jumped 21.3% from $21.92 to our average selling price of $26.59. Micron makes two kinds of memory chips, DRAMs (dynamic random access memory) and NAND flash memory chips. Memory chips are commodities, which are sensitive to supply-demand relationships. Memory chip prices continued their upward momentum from 2016 due to surging demand from data-center servers, smartphones and Internet-connected devices, while producers were careful not to oversupply the market.

KLA-Tencor, a leading semiconductor equipment manufacturer, boosted the Fund’s return by 90 basis points, as its stock rose 33.5% from $78.68 to $105.07. The stock climbed higher as healthy demand for the company’s wafer inspection tools drove better than expected earnings results.

|

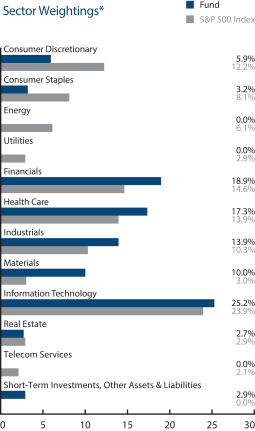

Parnassus Fund as of December 31, 2017 (percentage of net assets) |

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Top 10 Holdings

(percentage of net assets)

| | | | |

| |

| Alliance Data Systems Corp. | | | 4.4% | |

| |

| Progressive Corp. | | | 4.4% | |

| |

| Gilead Sciences Inc. | | | 4.3% | |

| |

| Motorola Solutions Inc. | | | 4.2% | |

| |

| Praxair Inc. | | | 4.1% | |

| |

| International Business Machines Corp. | | | 3.3% | |

| |

| Mattel Inc. | | | 3.3% | |

| |

| Mondelez International Inc., Class A | | | 3.2% | |

| |

| Intel Corp. | | | 3.2% | |

| |

| Pentair plc | | | 3.0% | |

Portfolio characteristics and holdings are subject to change periodically.

6

| | | | |

| | |

| Annual Report • 2017 | | | | PARNASSUS FUNDS |

Alphabet, the parent of Google, added 86 basis points to the Fund’s return, as its stock increased 32.9% from $792.45 to $1,053.40. The stock marched higher throughout the year, as revenue growth exceeded 20%. Mobile search, YouTube and digital advertising were the main growth drivers.

Pentair manufactures pumps, filters, valves and thermal solutions for the water and electrical markets. The company contributed 84 basis points to the Fund’s return, as its stock jumped 26.0% from $56.07 to $70.62. Early in the year, investors cheered the company’s plan to separate its water and electrical segments into two standalone companies. Pentair also noted signs of improvement in its markets throughout the year, supporting sales momentum into 2018.

Transportation provider FedEx added 83 basis points to the Fund’s return, as the stock climbed

|

|

| Value on December 31, 2017 of $10,000 invested on December 31, 2007 |

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

34.0% from $186.20 to $249.54. The company delivered solid earnings and benefited from growing demand for international air freight and e-commerce shipments, as consumers globally are purchasing more imported goods online.

Semiconductor giant Intel added 80 basis point to the Fund’s return, as its stock rose 27.3% from $36.27 to $46.16. The company raised its financial forecast for the year due to surging demand for semiconductors in its data center business, especially from its cloud computing customers. Intel also closed the acquisition of Mobileye, a leader in computer vision for autonomous driving, which will boost sales and earnings in the future.

Outlook and Strategy

The S&P 500 was up 21.83% in 2017, the ninth consecutive year of positive returns. It was a remarkably smooth ride, as 2017 was the first year in history that the market rose in every month. Stocks moved higher due to strong corporate earnings growth, synchronized global economic expansion and tax reform, which should boost corporate earnings in 2018 and provide consumers with more cash in their pockets.

The S&P 500 Growth Index returned 27.4% in 2017, far exceeding the 15.4% return of the S&P 500 Value Index. This 12.0% difference is the largest outperformance of Growth over Value since 1999, the peak of the dot-com bubble. This large gap hurt us in 2017, as the Fund skews more toward Value than Growth. While it’s fun to own the stocks that everyone is talking about, we’re confident that our time-tested discipline to avoid the high-flyers and search for under-the-radar bargains will pay off over the long-term.

As we turn the page to 2018, the economy looks strong. The U.S. has added jobs for 86 consecutive months, the longest period on record, and the unemployment rate now stands at just 4.1%, the lowest level since 2000. A strong job market and the excitement around tax reform have propelled consumer confidence close to its highest level in 17 years. Mortgage rates remain low by historical standards, helping to support a robust housing market.

However, we’re also monitoring several cautious data points. Wage growth and inflation have remained stubbornly low, which have held longer-term Treasury yields down while shorter-term yields have risen. This phenomenon, known as a flattening yield curve, has been a leading indicator of economic downturns. Additionally, we think the biggest risk to the stock market in 2018 is its high valuation. At year-end, the S&P 500 traded at 18.2 times forward earnings estimates, its highest level since 2002. This level of optimism among investors makes us nervous, but we gain some comfort knowing that the stocks in our portfolio trade at just 16.8 times forward earnings estimates. While we won’t be immune to a market correction, we expect the Fund to fall less than the market if we experience a sell-off.

7

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2017 |

Overall, we think the market is fully-valued, if not over-valued. So, we were pleased to identify an attractive investment opportunity toward the end of the year. We purchased shares of Nielsen, the leading information and data company that measures what consumers buy and watch. The company’s “Buy” business, which provides consumer packaged-goods data to manufacturers and retailers, has suffered as manufacturers have reduced their marketing spend. We believe this is more than reflected in the stock’s cheap valuation, and that management has the expertise needed to improve this segment’s performance. Meanwhile, Nielsen’s “Watch” business, which measures media viewership, continues to do well.

Over the course of 2017, we reduced our exposure to the technology sector given its significant outperformance and high valuation. We increased our exposure to the health care and consumer discretionary sectors, where we have found a number of undervalued businesses with competitive advantages. The Fund remains overweight the financial sector, which we expect will benefit from a strong economy and rising rates.

We’re not market forecasters, so although the market is expensive, we don’t know if its next move will be up or down. Our focus is on investing in increasingly relevant, high-quality businesses that trade at bargain prices. That’s what’s worked for us in the past, and we believe it will continue to pay dividends in the future.

Yours truly,

| | | | |

| |

| |

|

Jerome L. Dodson Lead Portfolio Manager | | Robert J. Klaber Portfolio Manager | | Ian E. Sexsmith Portfolio Manager |

8

| | | | |

| | |

| Annual Report • 2017 | | | | PARNASSUS FUNDS |

PARNASSUS CORE EQUITY FUND

Ticker: Investor Shares - PRBLX

Ticker: Institutional Shares - PRILX

As of December 31, 2017, the net asset value (NAV) of the Parnassus Core Equity Fund – Investor Shares was $42.67. After taking dividends into account, the total return for the fourth quarter was 5.52%. This compares to increases of 6.64% for the S&P 500 Index (“S&P 500”) and 5.46% for the Lipper Equity Income Fund Average, which represents the average equity income funds followed by Lipper (“Lipper average”). For the year, the Parnassus Core Equity Fund – Investor Shares gained 16.58%, which was better than the 15.48% return for the Lipper average, but falls short of the 21.83% gain for the S&P 500.

Below is a table that summarizes the performances of the Parnassus Core Equity Fund, the S&P 500 and the Lipper average. The returns are for the one-, three-, five- and ten-year periods.

| | | | | | | | | | | | | | | | | | | | | | | | |

| Parnassus Core Equity Fund | |

Average Annual Total

Returns (%) | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

for period ended

December 31, 2017 | | | | | | |

| | | | | | | |

| Parnassus Core Equity Fund Investor Shares | | | 16.58 | | | | 8.58 | | | | 14.45 | | | | 9.70 | | | | 0.87 | | | | 0.87 | |

| | | | | | | |

| Parnassus Core Equity Fund Institutional Shares | | | 16.81 | | | | 8.79 | | | | 14.65 | | | | 9.92 | | | | 0.66 | | | | 0.66 | |

| | | | | | | |

| S&P 500 Index | | | 21.83 | | | | 11.41 | | | | 15.79 | | | | 8.50 | | | | NA | | | | NA | |

| | | | | | | |

| Lipper Equity Income Fund Average | | | 15.48 | | | | 8.24 | | | | 12.32 | | | | 7.00 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Core Equity Fund-Institutional Shares from commencement (April 28, 2006) was 10.37%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Core Equity Fund-Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505.

Year in Review

The Fund returned 16.58% for the year and trailed the S&P 500 by 5.25%. Sector allocations had a slightly negative effect on our relative performance. Our overweight position in consumer staples stocks cost us the most, as this group gained 13.3% on average during the year, far less than the index. The most significant positive allocation effect came from our underweight in the energy sector, which posted a slight loss for the year.

Moving on to individual stocks, our biggest loser for the year was CVS Health. The stock reduced the Fund’s return by 21 basis points (a basis point is 1/100th of one percent) as it dropped 8.1% from $78.91 to $72.50. Customer losses, weakness in its retail business and concern that Amazon may enter the pharmaceutical supply chain weighed on CVS Health throughout the year. Partly to offset these headwinds, the company announced in December that it will invest $77 billion to acquire Aetna, one of the country’s largest health care insurers. This deal will transform CVS Health into a vertically integrated health care company, which should enable more coordinated care and greater savings for patients and the health care system.

Compass Minerals, a leading provider of salt for road safety and minerals for plant nutrition, dropped 17.2% from $78.35 to our average selling price of $64.89, subtracting 19 basis points from the Fund’s return. The stock fell at the beginning of the year after management issued a disappointing earnings outlook for 2017, as a warm winter reduced demand for the company’s de-icing salt. Shares declined again in September when the company cut its earnings guidance due to weaker than expected plant nutrition volumes

9

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2017 |

and a production outage at one of its salt mines. We decided to sell our shares, because we were disappointed with the company’s capital allocation decisions, high leverage and significant management turnover.

Sempra Energy, a San Diego, California-based utility, reduced the Fund’s return by 13 basis points in 2017, as the stock fell 7.1% from our average buy price of $115.11 to $106.92. The stock declined during December, as Northern California-based

utility PG&E announced the suspension of its dividend due to a large potential liability associated with the wildfires in Napa and Sonoma Counties. While none of Sempra’s operations were impacted by the Northern California wildfires, the stock fell in sympathy with PG&E. During 2017, we met extensively with Sempra’s management team, and have been very impressed with its fire management strategy, which includes state-of-the-art weather monitoring, electric shut-off protocols, advanced camera systems, vegetation management, a high percentage of steel pole infrastructure and contracted fire crews. In addition, a large percentage of Sempra’s electric infrastructure is underground, which greatly reduces fire risk. Another positive about Sempra is that it generates 43% of its electricity from renewable sources, well ahead of California’s regulations. We are excited about Sempra’s prospects in 2018 as they plan to close their acquisition of Texas utility Oncor during first quarter of 2018.

Tech giant Apple had a fantastic year, as the stock surged 46.1% from $115.82 to $169.23, increasing the Fund’s return by 165 basis points. The stock rose early in the year after the company reported better than expected earnings, driven by robust demand for its iPhone 7, Mac computers and service offerings across nearly all its major sales regions. The stock moved higher over the summer as investors turned their attention to the launch of the widely-anticipated tenth anniversary iPhone X. After positive reviews of the newly released iPhone X and its captivating features, such as Face ID, investors gained even greater conviction that Apple could sustain its sales momentum. We remain excited about Apple’s long-term growth prospects, as it benefits from a strong product upgrade cycle, growing services business and tremendous free cash flow.

PayPal, the leading digital payments company, rose an amazing 86.5% from $39.47 to $73.62, adding 146 basis points to the Fund’s return. The stock climbed steadily throughout 2017, as the company consistently delivered better than expected sales and earnings. The company saw meaningful improvement during the year in customer engagement, transaction volumes and pricing. Investors also gained confidence in the long-term relevancy of PayPal’s platform after it announced strategic partnerships with numerous players in the payments ecosystem, including Visa, Mastercard and Facebook.

Praxair added 142 basis points to the Fund’s return, as the stock rose 32.0% from $117.19 to $154.68. The company announced during the year a merger of equals with Linde, a leading German industrial gas company. The merger will create the world’s largest industrial gas company with a combined market value of over $70 billion and revenue of approximately $30 billion. The new company will have more diverse and balanced end-markets and will combine Praxair’s leading position in the Americas with Linde’s strong presence in Europe and Asia. Additionally, each company brings complementary strengths, with Praxair’s operational excellence and Linde’s engineering and technology leadership. The deal is expected to close in the second half of 2018.

| | |

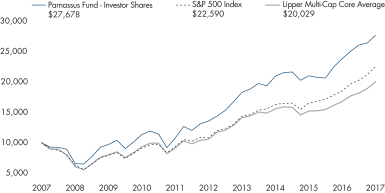

Parnassus Core Equity Fund

as of December 31, 2017

(percentage of net assets) | | |

Top 10 Holdings

(percentage of net assets)

| | | | |

| |

| Intel Corp. | | | 5.4% | |

| |

| Danaher Corp. | | | 5.3% | |

| |

| Praxair Inc. | | | 4.9% | |

| |

| Gilead Sciences Inc. | | | 4.7% | |

| |

| The Walt Disney Co. | | | 4.3% | |

| |

| VF Corp. | | | 4.0% | |

| |

| Wells Fargo & Co. | | | 4.0% | |

| |

| Novartis AG (ADR) | | | 3.4% | |

| |

| The Clorox Company | | | 3.2% | |

| |

| United Parcel Service Inc., Class B | | | 3.1% | |

Portfolio characteristics and holdings are subject to change periodically.

10

| | | | |

| | |

| Annual Report • 2017 | | | | PARNASSUS FUNDS |

Outlook and Strategy

Entering 2018, we feel that, while the economic cycle appears to be in the late innings, a recession doesn’t seem imminent. In fact, economic growth accelerated during the second half of 2017, and signs point to continued acceleration in 2018. Geopolitics are a concern, as always, but we think these risks are best mitigated by owning companies with durable franchises. A risk more difficult to manage is the overall valuation of the stock market, a result of an unusually long bull market that began in early 2009. According to FactSet, the S&P 500 currently trades at a P/E ratio of 27 times expected 2017 earnings, while the tech-heavy NASDAQ is even more expensive at 27 times earnings. These multiples are significantly above historic averages.

While many technology companies have great long-term prospects due to potential growth in cloud computing, data analytics and connectivity,

|

|

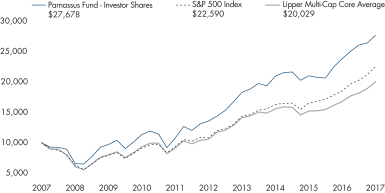

| Value on December 31, 2017 of $10,000 invested on December 31, 2007 |

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

valuations for most technology companies seem excessive. As a result, the Fund is underweight the technology sector. This sector allocation decision could reduce downside risk, if richly valued technology companies come back to earth in 2018.

We remain underweight the energy sector. We expect oil prices to remain low for the long-term, due to increased shale oil supply and weaker hydrocarbon demand as renewable energy gains share. Our other major underweight is in the financial sector.

A major theme of our portfolio is to own companies that use technology to transform their operations, but which trade at reasonable valuations. Portfolio companies Disney, Starbucks and UPS use technology to drive efficiency, improve customer experiences and develop new growth opportunities. Another good example of this theme is Clorox, the Oakland, California-based household products company, an innovative version of its much larger competitor, Procter & Gamble.

Health care remains a significant overweight position in the Fund. The Fund’s highest conviction health care investments include leaders in innovation, including Danaher, Gilead Sciences, Novartis and Hologic. The Fund is also overweight consumer staples companies that offer durable earnings growth potential. While we are closely monitoring Amazon’s ability to change the competitive landscape, we think our consumer staples investments, led by Clorox and global snack company Mondelez, can grow due to strong brands and innovation. Finally, the Fund is overweight the industrials and materials sectors. Our holdings in these areas offer long-term upside due to increasing demand for infrastructure, manufacturing and logistics.

We wake up every morning expecting good things to happen to our portfolio companies, while also keeping a close eye on risks. While some of the worst risks are nearly impossible to predict and mitigate, we think a consistent stock selection process can help minimize losses in the event of an overall stock market correction. Our stock selection process has served us well over the course of multiple market cycles, and we expect the Fund to offer an attractive balance of upside participation and downside risk mitigation in the future.

As always, we thank you for your confidence and investment in the Parnassus Core Equity Fund.

| | |

| |

|

Todd C. Ahlsten Lead Portfolio Manager | | Benjamin E. Allen Portfolio Manager |

11

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2017 |

PARNASSUS ENDEAVOR FUND

Ticker: Investor Shares - PARWX

Ticker: Institutional Shares - PFPWX

As of December 31, 2017, the NAV of the Parnassus Endeavor Fund – Investor Shares was $37.18, so after taking dividends into account, the total return for the year was 19.81%. This compares to a return of 21.83% for the S&P 500 Index (“S&P 500”) and 19.50% for the Lipper Multi-Cap Core Average, which represents the average return of the multi-cap core funds followed by Lipper (“Lipper average”). It was another great year for the Parnassus Endeavor Fund, as we’ve gained about 20% for two years in a row. I’m happy that we were able to give our shareholders such an attractive return.

Even though we earned almost 20% this year, our return was two percentage points below the S&P 500. The main reason for this was that technology now accounts for about 24% of the S&P 500 (up from 19.7% three years ago), and technology stocks

| | | | | | | | | | | | | | | | | | | | | | | | |

| Parnassus Endeavor Fund | |

Average Annual Total

Returns (%) | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

for period ended

December 31, 2017 | | | | | | |

| | | | | | | |

| Parnassus Endeavor Fund Investor Shares | | | 19.81 | | | | 14.52 | | | | 18.48 | | | | 13.65 | | | | 0.97 | | | | 0.95 | |

| | | | | | | |

| Parnassus Endeavor Fund Institutional Shares | | | 20.03 | | | | 14.72 | | | | 18.59 | | | | 13.71 | | | | 0.74 | | | | 0.74 | |

| | | | | | | |

| S&P 500 Index | | | 21.83 | | | | 11.41 | | | | 15.79 | | | | 8.50 | | | | NA | | | | NA | |

| | | | | | | |

| Lipper Multi-Cap Core Average | | | 19.50 | | | | 8.90 | | | | 13.74 | | | | 7.14 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Endeavor Fund-Institutional Shares from commencement (April 30, 2015) was 15.17%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Endeavor Fund-Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2017, Parnassus Investments has contractually agreed to limit total operating expenses to 0.95% of net assets for the Parnassus Endeavor Fund-Investor Shares and to 0.83% of net assets for the Parnassus Endeavor Fund-Institutional Shares. This agreement will not be terminated prior to May 1, 2018, and may be continued indefinitely by the Adviser on a year-to-year basis.

had a great year, driving the S&P 500 much higher. Although the Parnassus Endeavor Fund has traditionally had a large representation of technology stocks – usually about 35% of the portfolio – we reduced our holdings during the year in some of those stocks that appeared to be fully-valued and even overvalued. For example, we owned 400,000 shares of Apple at the beginning of the year, when it traded around $116 a share, but by the end of the year, we only owned 25,000 shares when it traded at $169 a share. Similarly, we owned 2,200,000 shares of Applied Materials at the start of the year trading at $32 a share, but we only owned 100,000 shares at the end of the year, when it traded at $51.

During the year, we made some very nice gains in technology stocks, so we decided to take some profits by selling when I thought they were fully-valued. As it turned out, those stocks kept going higher, so that we didn’t quite keep up with the S&P 500 for the year.

To the left is a table comparing the Parnassus Endeavor Fund – Investor Shares with the S&P 500 and the Lipper average over the past one-, three-, five- and ten-year periods. You’ll notice that we’re ahead of the S&P 500 for all time periods except for the one-year period, and we’re ahead of the Lipper average for all time periods. This performance has made the Parnassus Endeavor Fund – Investor Shares the best-performing of all 391 multi-cap core funds followed by Lipper over the past ten years.*

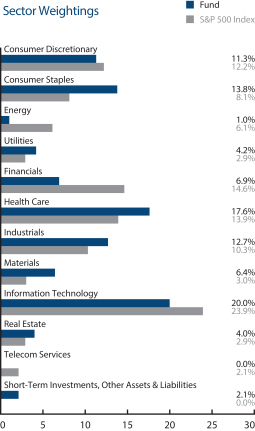

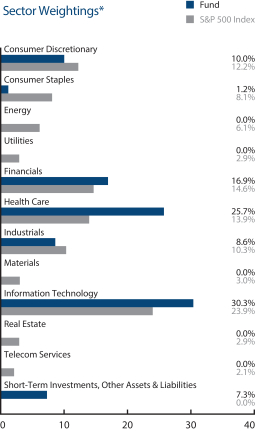

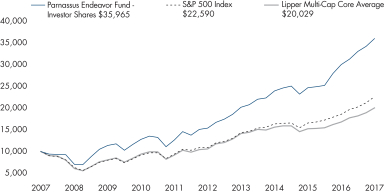

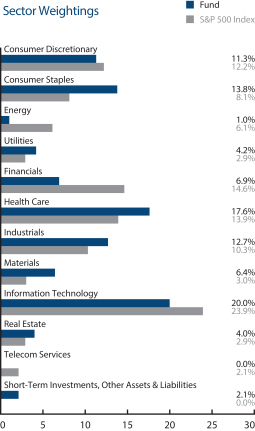

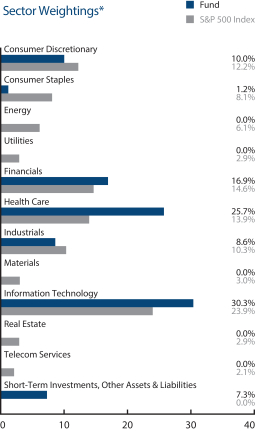

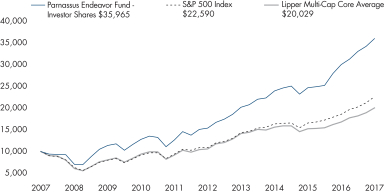

To put the Fund’s performance in dollar terms, look at the graph on page 14. It shows the growth of a hypothetical $10,000 investment in the Fund made ten years ago, compared to the growth of a $10,000 investment in the S&P 500 and a $10,000 investment in the Lipper average. Had

* For the one-, three- and five-year periods, the Fund was #426 of 779 funds, #1 of 650 funds and #4 of 564 funds, respectively.

12

| | | | |

| | |

| Annual Report • 2017 | | | | PARNASSUS FUNDS |

you been able to invest $10,000 in the S&P 500 on December 31, 2007, you would have had $22,590 on December 31 of 2017, and if you would have invested $10,000 in the multi-cap core funds covered by the Lipper average, you would have

had $20,029. By comparison, you would have had $35,965, if you had invested in the Parnassus Endeavor Fund. In other words, you would have made $12,590 with the S&P 500 and $10,029 with the Lipper average, but $25,965 with the Parnassus Endeavor Fund or more than double over the ten-year period.

Company Analysis

There were seven companies that each contributed 110 basis points (a basis point is 1/100th of one percent) or more to the Fund’s return, and there were no stocks that subtracted that much from the NAV. The only one that did substantial damage to our return was toy-manufacturer Mattel, which cut 81 basis points from the Fund’s return, as its stock sank 11.8% from our cost of $17.43, where we bought it during the year to $15.38 by the end of the year. The shares slumped after Mattel reported disappointing sales and lower gross margins in the middle of the year, then fell further in September after Toys R Us, the largest U.S. toy-store chain, filed for bankruptcy, casting a pall over the outlook for future sales of Mattel’s toys. Besides the bankruptcy, tired brands and poor production planning hurt the stock. While we recognize the near-term challenges facing Mattel, we think new CEO Margaret Georgiadis’ plan to reinvigorate Mattel’s brands by creating online media content, shortening the product development cycle and fostering innovation, should improve performance in the future. Right now, it looks like the stock has hit bottom, and I expect the next big move to be higher. The company has some great brands in Barbie, Hot Wheels and Fisher-Price, and if it’s able to introduce some hot-selling new brands, Mattel’s stock could have some substantial gains.

The big winner for the year was Micron Technology, which soared 87.6% from $21.92 to $41.12 for an astonishing gain of 330 basis points to the Fund’s return. Surging demand from data-centers, smartphone manufacturers and Internet-connected devices moved prices much higher for the memory chips produced by Micron, causing company earnings to hit an all-time high.

VF Corporation, the global apparel company with important brands such as The North Face, Vans and Timberland, increased the Fund’s return by 196 basis points, as its stock surged 38.7% from $53.35 to $74.00. The company had strong sales and earnings paced by Vans and The North Face, as well as higher e-commerce sales and good growth in international sales.

American Express boosted the Fund’s return by 148 basis points, as its stock rose 34.1% from $74.08 to $99.31. After losing the Costco credit card account to Citigroup in 2016, management responded with new marketing initiatives and membership rewards that improved cardholder engagement and accelerated earnings growth. American Express is capitalizing on its premium brand and great customer service.

Whole Foods, a leading retailer of organic and natural foods, added 123 basis points to the Fund’s return, as its stock jumped 36.5% from $30.76 to $42.00 on a takeover by Amazon. The takeover occurred after the stock slumped in 2016, and activist investors pressed management to sell the company.

| | |

Parnassus Endeavor Fund as of December 31, 2017 (percentage of net assets) |

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Top 10 Holdings

(percentage of net assets)

| | | | |

| |

| QUALCOMM Inc. | | | 10.2% | |

| |

| Gilead Sciences Inc. | | | 9.7% | |

| |

| VF Corp. | | | 5.1% | |

| |

| Mattel Inc. | | | 4.8% | |

| |

| United Parcel Service Inc., Class B | | | 4.3% | |

| |

| International Business Machines Corp. | | | 4.3% | |

| |

| American Express Co. | | | 4.2% | |

| |

| Wells Fargo & Co. | | | 4.0% | |

| |

| Intel Corp. | | | 3.9% | |

| |

| Signature Bank | | | 3.7% | |

Portfolio characteristics and holdings are subject to change periodically.

13

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2017 |

Autodesk, the leading software provider for architects, engineers and designers rose 41.6% from $74.01 to $104.83, adding 120 basis points to the Fund’s return. The stock moved higher in early 2017 with better earnings and new subscriber growth, then moved higher later in the year, when investors gained confidence in Autodesk’s ability to execute its transition to a software-as-a-service model.

The last two stocks we’ll talk about are very interesting, because each of them added 110 basis points to the Fund’s return for the year. While one stock was almost flat during the period, and the other one actually finished the year at a price that was lower than where it started the year, I swear I did not do this with black magic. This feat, though, does deserve an explanation.

Gilead Sciences is a biotechnology firm that makes therapies for HIV and hepatitis C. The stock

| | |

|

| Value on December 31, 2017 of $10,000 invested on December 31, 2007 |

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

started the year at $71.61 and ended the year at $71.64, so the gain was only 0.04% or almost flat. However, the stock contributed 110 basis points to our return with almost no gain for the year. We owned 1.8 million shares at the beginning of the year when the price was $71.61, but the price dropped into the 60’s in February, and we continued to buy during the year, adding millions of shares at prices as low as $65.50 in February, then adding more in May at prices as low as $64, then buying more throughout the year, thus bringing our cost down to $69.32. The stock moved into the 80’s in September and October based on the news that Gilead would acquire Kite Pharma, a leader in cellular therapy for cancer. We began selling much of our stake in Gilead at this time for prices as high as $85 a share, thus locking in a profit. When the stock fell back into the low 70’s, we started adding to our position again. That’s how we were able to gain 110 basis points to the Fund’s return on our position in Gilead.

We started the year with two million shares of Qualcomm, the leading manufacturer of mobile phone chips, when the price was $65.20 per share. The price of the shares dropped into the 50’s and at one point even went down to $48.92 based on a dispute with Apple over the price that Apple should pay for the chip that powers the Apple iPhone. Apple stopped paying for the chips it was buying from Qualcomm, and I figured that at some point, they would settle the dispute and Apple would have to pay for the chips that it received. We added to our position in the stock, bringing our cost down to $56.27 per share. In early November, Broadcom made an offer of $70 a share to buy Qualcomm, which would amount to a price tag of about $105 billion.

Qualcomm’s shares moved into the 60’s and ended the year at $64.02. This added 110 basis points to the Fund’s return, so we made a nice profit on the stock, even though it dropped from $65.20 to $64.02 over the year.

Outlook and Strategy

The S&P 500 is now trading at 23 times its last 12 months’ earnings. Over the last ten years, the multiple has averaged 17 times, and the average has been in the 15 to 16 range if you go back a few years. By any historical measure, the market is way overvalued and due for a correction. Does this mean that there will be a big move down for the stock market in 2018?

One would think so, but there are some unusual circumstances that may prevent a big sell-off. First, interest rates are extremely low, so investors have few alternatives to the stock market, so this might keep the market moving higher, or at least prevent a big move lower.

Second, the economy is very strong right now, and unemployment is only around 4.1%. That should keep corporate earnings moving higher, and if this happens, the price/earnings (P/E) ratio should move lower, since the “E” would be higher. A lower P/E ratio would move it into the normal range.

14

| | | | |

| | |

| Annual Report • 2017 | | | | PARNASSUS FUNDS |

Third, the tax cut will help corporate earnings, since more revenue will drop to the bottom line. This will definitely make the “E” go higher and reduce the P/E ratio.

Given this situation, it’s quite possible that the market will continue to move higher. At some point though, there should be a correction, but there needs to be a catalyst for this correction to take place. One never knows what this catalyst might be, but in the past, the thing that triggers a move down comes as a surprise. Possibilities include an increase in interest rates or lower corporate earnings.

If the economy keeps getting stronger, interest rates will probably rise. If they increase enough, some people will take money out of the stock market and put it in the bank or invest in bonds. This would put pressure on the stock market and might start a move lower.

If technology products saturate the market, and consumers stop increasing their spending on iPhones and other high-tech products, then earnings will stagnate and stocks will go down. This would ripple through the whole economy and bring equities down to more reasonable levels.

A trade war is another factor that would move the market lower. President Trump has taken an adversarial position against many of our trading partners, and if this results in a trade war, that might drive the economy into a recession and force the stock market into a free fall.

Even with all these factors pointing to a possible big move down for the market, stocks could still keep moving higher. After the election of Donald Trump as President, I thought there might be a major correction in 2017, given the high valuations and the unpredictability of Trump’s policies. Fortunately, we stayed fully-invested, and both the S&P 500 and the Parnassus Endeavor Fund moved up about 20% last year.

Those are my thoughts for the outlook, now what’s my strategy? Even with my concerns about the valuation of the stock market right now, I plan to keep the portfolio close to fully-invested, which for me means at least 90% of the assets in equities. However, there are two defensive measures I’ve taken with the portfolio. First, I’m investing in companies where the P/E ratio is lower than the historical ratios for those companies. This should give us a cushion if there is a downdraft. Our stocks will go down if there is a big drop, but hopefully, they won’t go down as much as the market as a whole. As I indicated earlier, the P/E ratio of the S&P 500 is around 23, while the ratio for the Parnassus Endeavor Fund is 17.2, so that should help cushion any big move lower.

Second, I’ve reduced our exposure to technology stocks compared to our traditional practice of having around 35% or more in the portfolio. There is a risk in doing this. If technology stocks keep moving higher, the Parnassus Endeavor Fund will underperform compared to the S&P 500.

This is a risk, though, that I’m willing to take. Here’s why. Right now, about 24% of the S&P 500 is invested in technology stocks like Apple, Facebook, Google, Netflix, Amazon and Microsoft. A year ago, it was 20.8%. Three years ago, tech stocks had a 19.7% weighting. This means that index funds have a higher portion of tech stocks in their portfolios than in the past. If technology stocks move lower, that will have a much bigger impact on the S&P 500. Given my views, it’s best to have a lower percentage of technology stocks in the portfolio right now.

Thank you for investing with us in the Parnassus Endeavor Fund.

Yours truly,

Jerome L. Dodson

Portfolio Manager

15

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2017 |

PARNASSUS MID CAP FUND

Ticker: Investor Shares - PARMX

Ticker: Institutional Shares - PFPMX

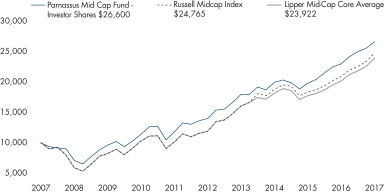

As of December 31, 2017, the NAV of the Parnassus Mid Cap Fund – Investor Shares was $32.07, so after taking dividends into account, the total return for 2017 was a gain of 15.79%. This compares to a gain of 18.52% for the Russell Midcap Index (“Russell”) and a gain of 15.83% for the Lipper Mid-Cap Core Fund Average, which represents the average mid-cap core funds followed by Lipper (“Lipper average”). For the quarter, the Parnassus Mid Cap Fund – Investor Shares was up 4.07%, behind the Russell’s 6.07% return and the Lipper average’s 5.54% gain.

Below is a table comparing the Parnassus Mid Cap Fund with the Russell and the Lipper average for the one-, three-, five- and ten-year periods. The Fund’s long-term track record remains very good, as it outperformed its benchmarks in most of the listed periods.

| | | | | | | | | | | | | | | | | | | | | | | | |

| Parnassus Mid Cap Fund | |

Average Annual Total

Returns (%) | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

for period ended

December 31, 2017 | | | | | | |

| | | | | | | |

| Parnassus Mid Cap Fund Investor Shares | | | 15.79 | | | | 10.04 | | | | 13.71 | | | | 10.28 | | | | 1.01 | | | | 0.99 | |

| | | | | | | |

| Parnassus Mid Cap Fund Institutional Shares | | | 16.04 | | | | 10.26 | | | | 13.84 | | | | 10.35 | | | | 0.80 | | | | 0.80 | |

| | | | | | | |

| Russell Midcap Index | | | 18.52 | | | | 9.58 | | | | 14.96 | | | | 9.11 | | | | NA | | | | NA | |

| | | | | | | |

| Lipper Mid-Cap Core Fund Average | | | 15.83 | | | | 8.37 | | | | 13.24 | | | | 7.79 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Mid Cap Fund-Institutional Shares from commencement (April 30, 2015) was 11.34%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Mid Cap Fund-Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Midcap Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Mid-cap companies can be more sensitive to changing economic conditions and have fewer financial resources than large-cap companies.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2017, Parnassus Investments has contractually agreed to limit total operating expenses to 0.99% of net assets for the Parnassus Mid Cap Fund-Investor Shares and to 0.85% of net assets for the Parnassus Mid Cap Fund-Institutional Shares. This agreement will not be terminated prior to May 1, 2018, and may be continued indefinitely by the Adviser on a year-to-year basis.

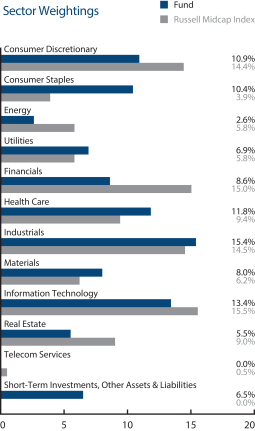

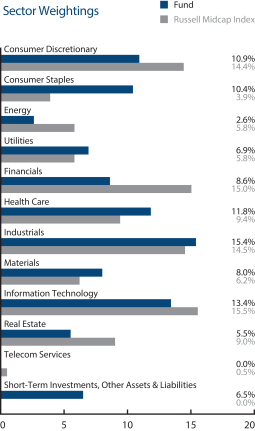

Year in Review

The Parnassus Mid Cap Fund – Investor Shares returned 15.79% in 2017. Normally, we would be thrilled with this return. However, the Fund’s gain wasn’t enough to keep up with the surging Russell. The Fund trailed the Russell by 273 basis points (a basis point is 1/100th of one percent) and the Lipper average by 4 basis points.

The Fund had positive attribution from its sector allocations. The Fund benefitted from having an underweight position in energy and real estate stocks, two of the worst performing sectors in the benchmark. These allocations increased the Fund’s return relative to the benchmark by 90 and 45 basis points, respectively. Our overweight position in the consumer staples sector hurt us the most, detracting 45 basis points from the Fund’s return.

The Fund’s health care and information technology stocks hurt performance relative to the Russell by 216 and 98 basis points, respectively. Our health care stocks, which were up 8.7% in aggregate, significantly trailed the benchmark’s health care return of 26.0%. Similarly, our information technology stocks, which rose 26.6% in aggregate during the year, also performed poorly relative to the overall sector, which increased 34.8%. Conversely, our strong stock selection in the consumer staples sector, which rose 21.0% in aggregate versus the Russell’s consumer staples group’s 7.8% return, helped the Fund’s performance by 133 basis points.

The Fund’s weakest performer was drug distributor Cardinal Health, as its stock plummeted 16.5% from $71.97 to $60.06, where we sold it, slicing 56 basis points from the Fund’s return. The stock fell in early 2017, after the company reported disappointing sales due to pricing pressure in its pharmaceutical business and the loss of a contract with Safeway. The stock

16

| | | | |

| | |

| Annual Report • 2017 | | | | PARNASSUS FUNDS |

took another leg down in the fall after management provided a disappointing outlook for 2018, and investors became concerned about the potential entry of Amazon into the drug distribution segment. To compound these issues, the stock was also hurt by its exposure to the nation’s opioid crises. While Cardinal Health does not manufacture or prescribe opioids, the company has become the subject of a growing number of lawsuits due to its distribution practices within affected communities. Based on our re-evaluation of the ESG investment case and concerns the company no longer met our ESG standards, we exited our position. Please see the Responsible Investing Notes on page 26 for further details related to the ESG investment case for divestment from the drug distributors due to the opioid crisis.

Mattel, the toy manufacturer famous for its Barbie and Fisher-Price brands, cut 32 basis points from the Fund’s return as it dropped 24.7% from our initial purchase price of $20.43 to $15.38. The shares slumped, as Mattel reported declining sales and falling gross margins, which slashed earnings and forced the company to suspend its dividend. The weak performance was caused by a combination of tired brands, poor production planning and the bankruptcy of Toys R Us, the largest toy-store chain in the country. Mattel has a new management team in place, and we feel their plan to reinvigorate the company will create significant upside for shareholders over time. We also believe the current stock price does not reflect the company’s valuable brands, and we see significant upside ahead as management either improves operations or sells the company at a premium.

Patterson Companies, the dental and animal health products distributor, slumped 11.9% from $41.03 to $36.13, taking 29 basis points from the Fund’s return. The stock had a good start in 2017, as strong demand for its core dental equipment boosted earnings. However, the stock started falling over the summer after the company reported weak earnings due to sluggish dental sales and the loss of exclusivity with its largest dental manufacturing partner. Investor sentiment soured after management lowered earnings guidance in the Fall. The stock is now on the bargain table, and we’re hopeful that the newly appointed CEO, Mark Walchirk, will take steps to improve sales execution and operating margins.

Our best performer during the year was health care product distributor Teleflex. The shares surged 54.4% from $161.15 to $248.82, increasing the Fund’s return by 159 basis points. The stock steadily climbed throughout the year as the company consistently delivered better than expected sales and earnings. The company saw sales momentum accelerate, after it released new anesthesia and catheter products. Investors became more bullish on the stock after the company acquired Vascular Solutions, a minimally invasive provider of coronary and vascular products, and NeoTract, a leading urology provider of minimally invasive treatment for benign prostatic hyperplasia. We’re excited about the company’s long-term growth prospects, as it benefits from synergies from its recent acquisitions, new products and margin expansion.

Xylem, an industrial manufacturer focused on water infrastructure, rose 37.7% from $49.52 to $68.20, increasing the Fund’s return by 114 basis points. The stock moved higher in the spring after the company reported better than expected sales, driven by healthy demand in its public utility segment in North America and increased order growth in the emerging markets. Investors gained even greater conviction in the Fall after management raised the 2017 earnings guidance due to strong order trends, driven by its multiple applications for smarter watershed management, water quality and advanced analytics.

| | |

Parnassus Mid Cap Fund as of December 31, 2017 (percentage of net assets) |

Top 10 Holdings

(percentage of net assets)

| | | | |

| |

| First Horizon National Corp. | | | 4.1% | |

| |

| Motorola Solutions Inc. | | | 4.1% | |

| |

| Fiserv Inc. | | | 4.0% | |

| |

| Verisk Analytics Inc. | | | 3.9% | |

| |

| Sysco Corp. | | | 3.8% | |

| |

| The Clorox Company | | | 3.7% | |

| |

| Shaw Communications Inc., Class B | | | 3.7% | |

| |

| Dentsply Sirona Inc. | | | 3.6% | |

| |

| Iron Mountain Inc. | | | 3.6% | |

| |

| Praxair Inc. | | | 3.5% | |

Portfolio characteristics and holdings are subject to change periodically.

17

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2017 |

VF Corporation, the apparel manufacturer famous for brands such as The North Face, Vans and Wrangler, contributed 109 basis points to the Fund’s return, as its stock soared 38.7% during the year from $53.35 to $74.00. As the year progressed, the company raised its annual sales and earnings forecast. Strength in Vans and The North Face businesses, rising e-commerce sales and higher growth from international markets all contributed to a better outlook. During the year, VF Corporation also made two acquisitions that complement its existing brand portfolio and offer new growth opportunities. The company acquired Williamson-Dickie, a workwear company known for its namesake Dickies brand and Icebreaker Holdings, an outdoor apparel brand specializing in merino wool and natural fibers.

Outlook and Strategy

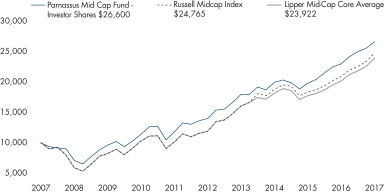

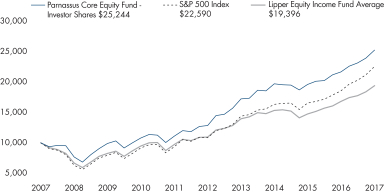

We are in the ninth year of a bull market. This is the second longest cycle on record without a

| | |

|

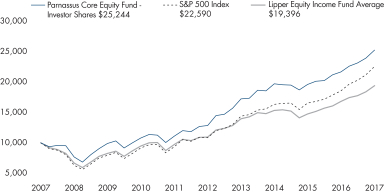

| Value on December 31, 2017 of $10,000 invested on December 31, 2007 |

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares

major correction. After this year’s 19% surge in the Russell and after taking dividends into account, the Russell is up over 362% since the trough of 2009. This represents an annualized return of nearly 21%. At year-end, the Russell traded at over 18 times forward earnings estimates, close to the ten-year high and well above the ten-year average of 16 times. In short, stocks are expensive.

In our view, stock valuations are already pricing in good news from the solid economy, low unemployment, robust corporate earnings growth and expectations for lower taxes. Additionally, investors are quick to shrug off risks from the tumultuous geo-political environment, rising interest rates and record-high corporate debt levels. As a result, we remain focused on identifying stocks with attractive risk-reward opportunities.

In 2017, certain sectors went up much more or substantially less than the Russell, creating opportunities for us to adjust our individual portfolio holdings. For example, the information technology sector rose 35%. We reduced our exposure in this area, because the range of outcomes for some stocks became less favorable. Over the past year, we decreased our information technology holdings by almost 500 basis points. Our most significant reductions were in the semiconductor space. We exited our positions in Applied Materials and Micron after their tremendous outperformance and reduced our position in KLA-Tencor. These stocks are also highly volatile, so when momentum changes, they can suffer steep declines very quickly. We also exited our position in software-maker Autodesk after the stock reached our price target.

Conversely, the consumer staples sector underperformed the Russell in 2017, rising 8%. We increased the Fund’s consumer staples weighting by almost 350 basis points. We initiated a position in Clorox and added to our holding in Sysco. We like the stability of these businesses and believe they are uniquely positioned with their leading products and services to deliver strong earnings and cash flow growth.

The Fund seeks to own high-quality businesses at reasonable prices that can grow intrinsic value faster than our benchmarks over the long-term. We are confident that this strategy will help the Fund outperform the market over the long-term, by participating in up-markets, providing down-market performance and avoiding permanent capital losses.

Thank you for your investment in the Parnassus Mid Cap Fund.

Yours truly,

| | |

| |  |

| Matthew D. Gershuny | | Lori A. Keith |

| Lead Portfolio Manager | | Portfolio Manager |

18

| | | | |

| | |

| Annual Report • 2017 | | | | PARNASSUS FUNDS |

PARNASSUS ASIA FUND

Ticker: Investor Shares - PAFSX

Ticker: Institutional Shares - PFPSX

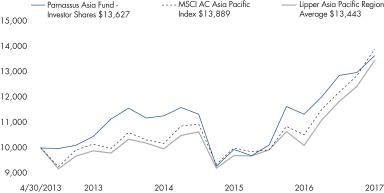

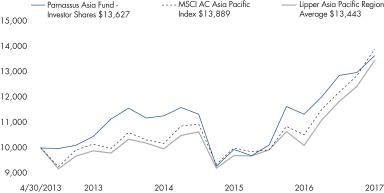

As of December 31, 2017, the net asset value (“NAV”) of the Parnassus Asia Fund – Investor Shares was $19.02, so the total return for the year was 20.39%. This compares to a gain of 32.04% for the MSCI AC Asia Pacific Index (“MSCI Index”) and a gain of 33.60% for the Lipper Asia Pacific Region Average, which represents the average return of the Asia Pacific Region funds followed by Lipper (“Lipper average”). The Parnassus Asia Fund generated its best annual return on record last year, yet fell significantly behind its benchmarks. We underperformed by being too cautious, as our conservative investment approach kept us away from hot emerging market stocks that rose spectacularly as the Chinese government revved its economy. Given the Fund’s runaway performance in 2016, we are disappointed to have backtracked in 2017. Still, we remain optimistic about the prospects for the companies in the Fund, which are carefully selected for their future upside potential.

| | | | | | | | | | | | | | | | | | | | |

| Parnassus Asia Fund | |

Average Annual Total

Returns (%) | | One

Year | | | Three

Years | | | Since

Inception on

4/30/13 | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

for period ended

December 31, 2017 | | | | | |

| | | | | | |

| Parnassus Asia Fund Investor Shares | | | 20.39 | | | | 6.55 | | | | 6.86 | | | | 3.13 | | | | 1.25 | |

| | | | | | |

Parnassus Asia Fund

Institutional Shares | | | 20.60 | | | | 6.78 | | | | NA | | | | 1.10 | | | | 0.96 | |

| | | | | | |

| MSCI AC Asia Pacific Index | | | 32.04 | | | | 10.94 | | | | 7.27 | | | | NA | | | | NA | |

| | | | | | |

| Lipper Asia Pacific Region Average | | | 33.60 | | | | 10.60 | | | | 6.79 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Asia Fund-Institutional Shares from commencement (April 30, 2015) was 4.92%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Asia Fund-Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The MSCI AC Asia Pacific Index is an unmanaged index of Asian stock markets, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The Fund invests primarily in non-U.S. securities. Foreign markets can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market or economic developments and can perform differently from the U.S. market.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2017, Parnassus Investments has contractually agreed to limit the total operating expenses to 1.25% of net assets for the Parnassus Asia Fund-Investor Shares and to 1.22% of net assets for the Parnassus Asia Fund-Institutional Shares. This agreement will not be terminated prior to May 1, 2018, and may be continued indefinitely by the Adviser on a year-to-year basis.

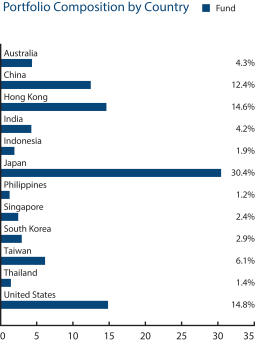

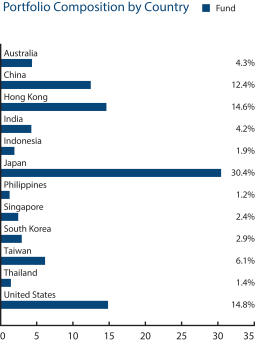

To the left is a table comparing the Parnassus Asia Fund with the MSCI Index and the Lipper average over the past one- and three-year periods, and since inception. Last year’s relative underperformance has put us behind both benchmarks on a one- and three-year basis. Since inception, the Parnassus Asia Fund - Investor Shares has returned 6.86% per year, which slightly trails the 7.27% returned by the MSCI Index and slightly leads the 6.79% returned by the Lipper average.

Year in Review

The Parnassus Asia Fund – Investor Shares generated a gain of 20.39% for the year, but couldn’t match the MSCI Index, which gained 32.04%. Sector allocation had an overall negative impact on our relative performance. In a year when every sector in the benchmark was up over double digits, our underweight allocations in financials and consumer staples hurt the Fund’s performance.

Individually, four companies reduced the Fund’s return by more than 13 basis points (a basis point is 1/100th of one percent). ASICS’s stock price sank 20.3% from $19.93 to $15.89 and reduced the Fund’s return by 64 basis points. Based in Japan, ASICS is a global sportswear company that sells athletic and casual apparel, and is best known for its ASICS running shoes, a trusted and preferred brand among serious runners. Amid a generally weak sporting goods market, the company suffered from inventory markdowns and heightened competition, especially from a resurgent Adidas. Softer sales in the U.S. and Europe dominated the outlook in 2017, but should be offset by brisk growth in key markets such as China and Southeast Asia in 2018. We held our shares, as the stock looks excessively undervalued and could surge once promotions and inventories normalize.

19

| | | | |

| | |

| PARNASSUS FUNDS | | | | Annual Report • 2017 |

The stock of toy-manufacturer Mattel, best known for its iconic brands Barbie, Hot Wheels and Fisher-Price, cut 59 basis points from the Fund’s return as it dropped 10.6% from our average purchase price of $17.78 to $15.89. The shares slumped as Mattel reported declining sales and falling gross margins, which slashed earnings and forced the company to suspend its

dividend. The weak performance was caused by a combination of tired brands, poor production planning, and the bankruptcy of Toys R Us, the largest toy-store chain in the country. Mattel now has a new management team in place, and we believe their plan to improve operations or sell the company at a premium will create significant upside for shareholders.

The stock price of Rakuten declined 6.7% from $9.80 to $9.14, subtracting 15 basis points from the Fund’s return. Based in Japan, Rakuten is an international online shopping mall with tens of thousands of merchants; it is also a major player in online financial services, including securities brokerage and credit cards. Domestic gross merchandise sales again grew at a fast clip, and ecommerce profits rose for the first time in over a year. However, the company incurred higher costs in its card business, launched a new data-driven advertising operation, and announced it would enter the mobile telecommunications business. While these investments could increase Rakuten’s ecosystem value and offer earnings upside in the future, the upfront outlay worried investors, who took profits.

Brambles decreased the Fund’s return by 13 basis points, as its stock price shrank 12.1% from $8.92 to $7.84. The Australia-based company is the largest global operator of pallet and reusable plastic crate pooling services, with operations in over 50 countries around the world. Brambles significantly reduced its profit growth forecast early in the year, citing margin pressures from competition and de-stocking issues. It also withdrew its long-term return targets, leading analysts to downgrade the stock. We still like Brambles’s global scale and economic moat driven by its extensive distribution network. Despite the challenging environment, Brambles is still scoring new accounts, a good foundation for a turnaround in 2018.

Our best performing stock was Alibaba Group, which added 251 basis points to the Fund’s return, as its stock price surged 96.4% from $87.81 to $172.43. Based in China, Alibaba is the world’s largest online and mobile commerce company by sales volume. Its major marketplaces – Taobao, Tmall and Juhuasuan – together generated gross merchandise volume of over half a trillion dollars last year, more than Amazon and

|

Parnassus Asia Fund

as of December 31, 2017

(percentage of net assets) |

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

eBay combined. The company demonstrated continued sales momentum, driven by personalization efforts within core commerce and a healthy macro environment. Fast growth in Alibaba’s dominant cloud business indicated brisk progress towards profitability, setting a positive precedent for the company’s other investments in offline retail, digital media, mobile and advertising platforms.

SITC International Holdings increased the Fund’s return by 241 basis points, as its stock soared 62.3% from $0.61 to $0.99. The Hong Kong-based integrated shipping-and-logistics company has operations that span Mainland China, Japan, Southeast Asia and the rest of the world, making it the tenth-largest container shipping operator in Asia. Both SITC’s container shipping and freight forwarding volumes accelerated, driven by a synchronized recovery in external demand across the region. The company also continued expanding its profit margins, despite higher bunker costs, by improving load factors and controlling costs.

Samsung Electronics contributed 202 basis points to the Fund’s return, as its stock climbed 60.1%, from $1,489.45 to $2,384.11. The South Korean consumer electronics giant ranks number-one in sales of mobile phones and displays worldwide, and this year took number-one in semiconductors, a spot occupied by Intel for 25 years. Samsung’s share price

20

| | | | |

| | |

| Annual Report • 2017 | | | | PARNASSUS FUNDS |

rallied on positive reviews and strong pre-orders for the company’s Galaxy S8 smartphone, which includes new services powered by artificial intelligence. Semiconductor profits also blew through analyst expectations due to rising prices for memory chips. The windfall overshadowed negative court rulings against company leadership and sent the stock another leg higher.

The stock price of OMRON leapt 55.6% from $38.21 to $59.47, enhancing the Fund’s return by 167 basis points. OMRON is a Japanese specialty manufacturer of sensing and control equipment. Their main products include factory automation devices, electronic and automotive components, and blood pressure monitors. OMRON’s operating profits overshot consensus forecasts by a wide margin, driven by strong growth in its industrial and automotive business to core clients. In August, the company also acquired Microscan Systems, a leading supplier of industrial code readers and smart cameras, to bolster its product line-up in machine vision. Investors applauded OMRON’s positive momentum and the acquisition, since profit targets look to rise.

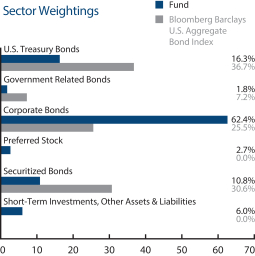

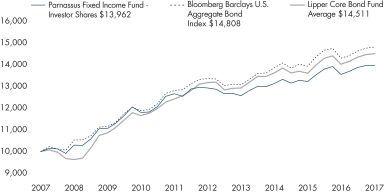

Outlook and Strategy