UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: Parnassus Funds (811-04044) and Parnassus Income Funds (811-06673)

Parnassus Funds

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marc C. Mahon

Parnassus Funds

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code:(415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2018

Item 1: Report to Shareholders

Parnassus Funds Annual Report

December 31, 2018

Parnassus FundSM

Investor Shares: PARNX | Institutional Shares: PFPRX

Parnassus Core Equity FundSM

Investor Shares: PRBLX | Institutional Shares: PRILX

Parnassus Endeavor FundSM

Investor Shares: PARWX | Institutional Shares: PFPWX

Parnassus Mid Cap FundSM

Investor Shares: PARMX | Institutional Shares: PFPMX

Parnassus Fixed Income FundSM

Investor Shares: PRFIX | Institutional Shares: PFPLX

Beginning on January 1, 2021, as permitted by regulations adopted by the SEC, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website (www.parnassus.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 800-999-3505 or by sending an email request to shareholder@parnassus.com.

You may elect to receive all future reports in paper copies free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call 800-999-3505 or send an email request to shareholder@parnassus.com to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive paper copies of reports will apply to all funds held in your account if you invest through your financial intermediary.

Table of Contents

3

| | | | |

| | |

| | | | Annual Report • 2018 |

February 8, 2019

Dear Shareholder,

After nine consecutive annual gains, the S&P 500 finally stumbled in 2018. Thankfully, it was a modest loss of just 4.38%. The Russell Midcap did worse, as it returned a loss of 9.06% for the year. Our equity funds were a mixed bag this year, as two of them outperformed their benchmarks and two fell short. Our most popular offering, the Parnassus Core Equity Fund, was easily our best-performing fund in 2018, beating the S&P 500 Index and its Lipper peer group average by over 4% and 7%, respectively. Lead portfolio manager Todd Ahlsten, with his nearly two decades of tenure on the Fund, deserves the lion’s share of credit for the terrific performance in 2018. The Parnassus Mid Cap Fund, managed by Matthew Gershuny and Lori Keith, also outperformed its Index and Lipper peer group average for the year. These two funds share a similar style, in that they are managed with an emphasis on minimizing downside risk. This approach paid off during the volatile fourth quarter.

The two equity funds that trailed their benchmarks, the Parnassus Endeavor Fund and the Parnassus Fund, still boast attractive long-term track records. Despite a challenging 2018, I’m confident that these funds will return to form in 2019 by posting attractive investment results.

Please see the following pages for more detailed information regarding each fund’s performance and the risks associated with investing in the Funds. Also included are the investment outlooks of our portfolio managers for the coming year. I hope you enjoy the reports and find them informative.

New Employee

During the fourth quarter, Leah Weaver joined Parnassus’s marketing team full time. She had previously interned with us while completing her undergraduate studies at the University of California, Berkeley. Leah earned a double major in legal studies and rhetoric, with honors in rhetoric and distinction in general scholarship. She worked throughout her college career, including positions ranging from museum assistant to venture capital intern. Leah is a classically trained singer and enjoys hiking, reading and writing.

Thank you for investing with the Parnassus Funds.

Yours truly,

Benjamin E. Allen

President and CEO

4

| | | | |

| | |

| Annual Report • 2018 | | | |  |

Parnassus Fund

Ticker: Investor Shares - PARNX

Ticker: Institutional Shares - PFPRX

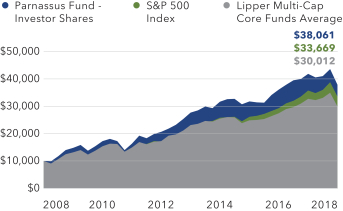

As of December 31, 2018, the net asset value (“NAV”) of the Parnassus Fund – Investor Shares was $40.54, resulting in a loss of 9.73% for 2018. This compares to a loss of 4.38% for the S&P 500 Index (“S&P 500”) and a loss of 7.88% for the LipperMulti-Cap Core Funds Average, which represents the average return of themulti-cap core funds followed by Lipper (“Lipper average”). For the fourth quarter, the Parnassus Fund – Investor Shares fell 13.04%, which compares to a loss of 13.52% for the S&P 500 and a loss of 14.41% for the Lipper average.

Below is a table that summarizes the performance of the Parnassus Fund, the S&P 500 and the Lipper average. The returns are for theone-, three-, five- and ten-year periods ended December 31, 2018.

Parnassus Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2018 | |

| | | | | | |

| | | One

Year

| | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

Parnassus Fund –

Investor Shares | | | -9.73 | | | | 5.94 | | | | 6.45 | | | | 14.26 | | | | 0.84 | | | | 0.84 | |

| | | | | | |

Parnassus Fund –

Institutional Shares | | | -9.57 | | | | 6.09 | | | | 6.56 | | | | 14.32 | | | | 0.69 | | | | 0.69 | |

| | | | | | |

| S&P 500 Index | | | -4.38 | | | | 9.26 | | | | 8.49 | | | | 13.12 | | | | NA | | | | NA | |

| | | | | | |

LipperMulti-Cap Core

Funds Average | | | -7.88 | | | | 6.58 | | | | 5.52 | | | | 11.61 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Fund – Institutional Shares from commencement (April 30, 2015) was 4.27%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recentmonth-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800)999-3505.

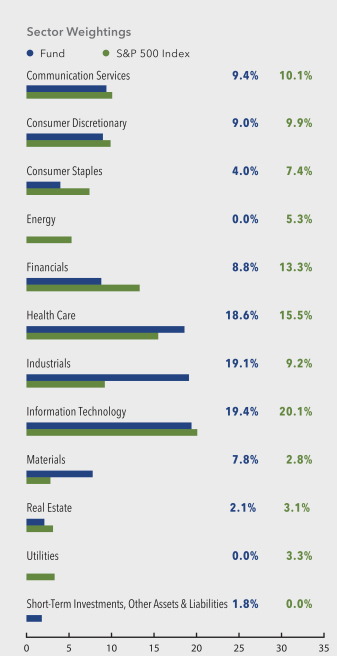

Year in Review

The Parnassus Fund declined 9.73% on the year and trailed the S&P 500 by 5.35%. Sector allocations had a positive impact on our relative performance, with the most meaningful contributor being our lack of exposure to energy, as falling oil prices caused the sector to underperform the market. We expect the energy sector to underperform over the long term, as

our society becomes more energy-efficient and better utilizes alternative energy sources. Poor stock selection, however, overwhelmed the benefits of our sector allocations.

Our worst performer was Alliance Data Systems, the leading private-label credit card issuer. It subtracted 242 basis points (One basis point is 1/100th of one percent.) from the Fund’s return, as the stock’s total return was a loss of 40.2%. (For this report, we will quote total return to the portfolio, which includes price change and dividends.) The shares fell as the company’s credit delinquency rates remained above management’s expectations, while its loan growth decelerated. We were disappointed with Alliance Data’s performance, but we’re holding onto our position because the management team is taking action to right the ship. The loan portfolio is being repositioned by discontinuing partnerships with struggling mall-based apparel retailers and focusing on growing verticals like hospitality, home furnishings ande-commerce. Alliance Data has also commenced a sale process for its marketing segment, Epsilon, which should sell at a higher valuation than the stock’s current multiple. As the loan portfolio repositioning bears fruit and the company repurchases stock with proceeds from the Epsilon sale, we expect 2019 will be a much better year for shareholders.

Patterson Companies, a distributor of dental and animal health products, cut 93 basis points from the Fund’s return, as the stock’s total return for the Fund was negative 34.1%. The company experienced a sharp decline in demand for its dental consumables and equipment due to the loss of exclusivity with its largest manufacturing partner, Dentsply Sirona. Additionally, Patterson experienced disruption from

5

| | | | |

| | |

| | | | Annual Report • 2018 |

internal sales-force changes and greater competition from online players such as Amazon. We sold the stock during the year after we lost confidence in management’s turnaround plan.

First Horizon National, aTennessee-based regional bank, reduced the Fund’s return by 91 basis points, as its stock yielded a negative total return of 32.3%. The shares fell after loan growth came in below expectations when it took longer than expected to integrate its acquisition of Capital Bank. With the integration now complete, loan growth should accelerate in 2019. We believe that First Horizon’s dominant position in Tennessee, its diversified,low-risk loan book, and its new growth markets in the Carolinas and South Florida from the Capital Bank acquisition position the bank to outperform going forward.

Moving on to happier subjects, luxury hotelier Belmond was the Fund’s biggest winner, contributing 172 basis points to the Fund’s return, as its stock generated an amazing total return of 104.3%. The shares soared when the company announced it was selling itself for $25 per share to Paris-based luxury goods conglomerate LVMH. We’ve owned Belmond since 2013, and we remained confident that the stock price would eventually rise to reflect the value of the company’s iconic hotels. We’re happy that our patience was rewarded.

Motorola Solutions, the largest provider of mission-critical communications solutions, added 105 basis points to the Fund’s return as its total return was 29.6%. The stock moved higher as the company raised its full-year earnings guidance three times during the year due to broad-based demand for its land mobile radio systems and surveillance solutions from Avigilon, a recent acquisition. Motorola is winning market share and expanding its addressable markets by providing the most innovative and complete communications solutions to its public safety and corporate clients.

Thomson Reuters provides information and data for professionals in the legal, tax, accounting and financial sectors. The stock generated a total return of 14.3% and contributed 79 basis points to the Fund’s performance. The shares declined at the beginning of the year, as investors were initially disappointed by the company’s decision to sell a 55% interest in its financial segment to Blackstone. We added to our position on the weakness, because the sale allows Thomson

Reuters to focus on its higher-growth and higher-margin segments. Investors eventually came around to our perspective and the stock rebounded, then continued to move higher as revenue growth in its legal segment accelerated.

Parnassus Fund

As of December 31, 2018

(Percentage of net assets)

6

| | | | |

| | |

| Annual Report • 2018 | | | |  |

| | | | |

| |

| Top 10 Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Thomson Reuters Corp. | | | 4.6% | |

| |

| Alliance Data Systems Corp. | | | 4.5% | |

| |

| Mondelez International Inc., Class A | | | 4.0% | |

| |

| Hologic Inc. | | | 4.0% | |

| |

| Motorola Solutions Inc. | | | 3.9% | |

| |

| CVS Health Corp. | | | 3.9% | |

| |

| Signature Bank | | | 3.8% | |

| |

| Alphabet Inc., Class A | | | 3.7% | |

| |

| Starbucks Corp. | | | 3.7% | |

| |

| Novartis AG (ADR) | | | 3.3% | |

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

After posting positive returns for nine consecutive years, the S&P 500’s return was negative in 2018. It was a rollercoaster ride from start to finish. The market dropped at the beginning of the year and then rallied during the second and third quarters to reachall-time highs toward the end of September. The S&P 500 then finished the year with a vicious 20% drop. There are several explanations for the market’s abrupt drop: trade tensions have escalated between the U.S. and China; global economic growth is beginning to slow, particularly in Europe and China; and there is concern that the U.S. Federal Reserve’s fourth interest rate hike of 2018 could hamper growth in the U.S.

As we turn the page to 2019, a slowdown in U.S. growth seems likely. However, given still strong economic data, a recession does not seem to be right around the corner. The unemployment rate remains below 4%, interest rates are still low by historical standards and the consumer remains confident. In fact, Mastercard recently reported that consumers drove the best holiday sales season in six years. These data points are not typical of impending recessions.

Our credit-sensitive stocks fared poorly in 2018, as their valuations fell to levels last seen during the Great Financial Crisis of 2008–2009. Alliance Data and First Horizon were two of our worst performers, while air lessor Air Lease and New York–based Signature Bank didn’t fare much better. We have confidence in the credit quality and the capitalization of these companies, so we added to our positions in all four stocks. The valuation of transportation provider FedEx

Value on December 31, 2018

of $10,000 invested on December 31, 2008

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

also fell to recession levels, due in part to the cyclicality of its air freight segment, so we added to FedEx as well. If we’re right and the economy slows but doesn’t decline, all five stocks should move meaningfully higher. And if the economy does decline, since these stocks are already trading at recession-level valuations, we think they can still outperform.

Warren Buffet likes to say that you should be greedy when others are fearful. We took advantage of the fear in the market during the fourth quarter and went bargain hunting, finding five new companies to invest in. All five are secular winners with attractive growth opportunities and pristine balance sheets. We initiated a position in Old Dominion Freight Lines, the country’s fourth largest less-than-truckload (LTL) carrier. Old Dominion consistently gains market share due to itsbest-in-class service, which provides the company with access to more profitable freight. Old Dominion reinvests the profits in newer trucks, better technology and higher compensation, which improves the quality of the company’s service...and the virtuous cycle continues.

Emerging technologies like artificial intelligence and autonomous driving are becoming increasingly relevant, so we were excited to have the opportunity to invest in two companies empowering this future after their stocks fell for short-term reasons. NVIDIA is the leading provider of graphics processing units (GPUs). GPUs were traditionally used in gaming and professional visualization applications, but have also become critical for delivering accelerated computing

7

| | | | |

| | |

| | | | Annual Report • 2018 |

power in data centers, autonomous driving and machine learning. We believe the company is uniquely positioned to take advantage of these large and rapidly growing markets. We also initiated a position in Cadence Systems, which sells design hardware and software to semiconductor companies. Cadence is benefitting from an expanding customer base, increasing chip complexity and emerging technologies, all of which are creating exponential growth in data processing and storage needs. We think that earnings growth could meaningfully accelerate over the next few years, so we’re excited to own Cadence in the Fund.

In addition, we added Cerner, the largest publicly traded health care information technology company. Cerner has a history of innovation, providing a wide range of software, hardware and services that are used across hospitals, pharmacies and physician practices. The company recently signed aten-year, $10 billion contract with the United States Department of Veterans Affairs, the largest health system in the world. Going forward, we believe Cerner has several exciting growth opportunities and the ability to expand margins.

Our last new holding is Adobe, inventor of the PDF file format and a leadingsoftware-as-a-service provider of creative and digital marketing solutions. Adobe’s products are mission critical in creating digital content, which is becoming increasingly relevant in today’s digital economy.

To make room for these positions, we sold three stocks during the fourth quarter. We exited eBay due to our concern that online niche marketplaces have disrupted its broad marketplace, which will result in slower growth. We sold Intel after generating a solid profit because we believe it’s losing market share in its important data center business. Finally, we exited long-term holding Redwood Trust for valuation reasons, as the stock was trading at book value.

Atyear-end, we believe that our portfolio is well positioned to deal with lower, but still positive, economic growth in 2019. We took advantage of the market’s swoon in the fourth quarter to add to our favorite cyclical names and pick up five new secular winners, so we’re excited about the Fund’s prospects.

Thank you for your investment in the Parnassus Fund.

Yours truly,

|

|

|

Robert J. Klaber Portfolio Manager |

|

|

Ian E. Sexsmith Portfolio Manager |

8

| | | | |

| | |

| Annual Report • 2018 | | | |  |

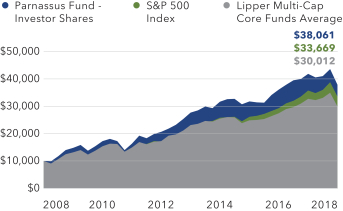

Parnassus Core Equity Fund

Ticker: Investor Shares - PRBLX

Ticker: Institutional Shares - PRILX

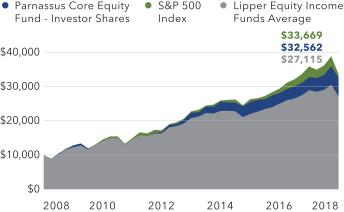

As of December 31, 2018, the net asset value (NAV) of the Parnassus Core Equity Fund – Investor Shares was $38.99. After taking dividends into account, the total return for the fourth quarter was a loss of 9.61%. This compares to a loss of 13.52% for the S&P 500 Index (“S&P 500”) and loss of 11.32% for the Lipper Equity Income Funds Average, which represents the average return of the equity income funds followed by Lipper (“Lipper average”). For the year, the Fund posted a loss of 0.18% versus a loss of 4.38% for the S&P 500 and loss of 7.25% for the Lipper average.

Below is a table that summarizes the performances of the Parnassus Core Equity Fund, the S&P 500 and the Lipper average. The returns are for theone-, three-, five- andten-year periods. We are pleased to report that the Fund outperformed the Lipper average for all periods.

Parnassus Core Equity Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2018 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Core Equity Fund – Investor Shares | | | -0.18 | | | | 8.71 | | | | 7.90 | | | | 12.58 | | | | 0.87 | | | | 0.87 | |

| | | | | | |

| Parnassus Core Equity Fund – Institutional Shares | | | 0.05 | | | | 8.94 | | | | 8.13 | | | | 12.80 | | | | 0.64 | | | | 0.64 | |

| | | | | | |

| S&P 500 Index | | | -4.38 | | | | 9.26 | | | | 8.49 | | | | 13.12 | | | | NA | | | | NA | |

| | | | | | |

| Lipper Equity Income Funds Average | | | -7.25 | | | | 6.89 | | | | 5.44 | | | | 10.61 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Core Equity Fund – Institutional Shares from commencement (April 28, 2006) was 9.52%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Core Equity Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800)999-3505.

Year in Review

The Parnassus Core Equity Fund – Investor Shares provided significant downside protection during 2018,

reporting a loss of only 0.18%, which beat the S&P 500 by 420 basis points. (One basis point is 1/100th of one percent.) Asbottom-up stock investors, we are very pleased that stock selection, as opposed to sector allocations, was the source of all of the Fund’s outperformance in 2018.

The Fund’s holdings in two sectors significantly outperformed the benchmark. Our consumer staples and industrials holdings each contributed more than 100 basis points of positive stock-selection effect. For instance, the Fund’s investments in consumer staples rose more than 11%, while the average stock in that sector fell 8%. The only sector with significantly negative stock-selection effect was health care, which accounted for a 174 basis point headwind to our relative performance.

Only three stocks reduced the Fund’s return by more than 40 basis points. National Oilwell Varco, a global supplier of equipment and technology for energy companies, shaved 56 basis points from the Fund’s return, as its stock posted a total return loss of 28.3%. (For this report, we will quote total return to the portfolio, which includes price change and dividends.) Oil prices were down 24% for the year, having surged more than 20% through the first nine months before dropping 40% in the fourth quarter. Despite OPEC’s announcement in December that they would support oil prices by curtailing production, investors’ concerns shifted from excess oil supply to lower oil demand amid worries about a potential global growth slowdown. We continue to hold the stock as we think that the company remains the industry’s dominant equipment manufacturer.

9

| | | | |

| | |

| | | | Annual Report • 2018 |

Charles Schwab, the San Francisco–based bank and brokerage firm, returned a negative 18.4%, trimming our return by 45 basis points. While Schwab’s earnings grew impressively during 2018, the stock fell significantly during the fourth quarter. The prospect of slower economic growth lowered the outlook for future interest rate hikes, which would limit the company’s ability to increase the yield on its deposits. In addition, the fourth quarter stock market drop trimmed client assets, which will be a headwind to 2019 earnings growth. While 2018 was a tough year for the stock, we’re holding our Schwab position because the company continues to gain market share due to its intuitive online platform and terrific client service.

UPS, the package delivery company, returned a negative 15.5%, reducing the Fund’s return by 44 basis points. The company increased capital spending during the year and said that it will maintain an elevated level of spending over the next three years. In theshort-to-medium-term, these investments in new sorting facilities, equipment, automation and technology will depress earnings and cash flows. Investors also remained cautious amid reporting that Amazon may introduce a competing delivery service. The risk of disruption from Amazon delivery seems relatively low for now because it is more likely aimed at supplementing rather than supplanting existing delivery networks. We think that UPS is undervalued, and that margin headwinds should fade with better pricing and continued network productivity.

Despite a negative year for the S&P 500, we are pleased that the Fund held three stocks that boosted the Fund’s return by at least 50 basis points. Mastercard, the leading payments company, had another terrific year, adding 70 basis points to the Fund’s return as the stock gained 25.3%. The company continues to grow revenues and earnings at a strong clip due to payment volume growth and new partnerships.

Motorola Solutions, the largest provider of mission-critical communications solutions, added 58 basis points to the Fund’s return with a 29.6% return for the stock. Motorola’s stock moved higher as the company raised its 2018 earnings guidance three times over the year due to broad-based demand for land mobile radio systems and surveillance solutions from Avigilon, a recently acquired subsidiary. Motorola is gaining market share and expanding its addressable markets by providing the most innovative and complete communications solutions to its public safety and corporate clients.

WD-40, the global multi-purpose maintenance product company, increased the Fund’s return by 52 basis points as the stock gained 57.7%. The company’s sales and earnings reached record highs during the year, as management continued its strategy to distribute its products into new markets. The company also plans to increase its capital investment to support new product innovation that will lower manufacturing costs and improve gross margins over the long term.

Parnassus Core Equity Fund

As of December 31, 2018

(Percentage of net assets)

10

| | | | |

| | |

| Annual Report • 2018 | | | |  |

| | | | |

| |

| Top 10 Holdings | | | | |

| (percentage of net assets) | | | | |

| The Walt Disney Co. | | | 4.9% | |

| Linde plc | | | 4.7% | |

| CVS Health Corp. | | | 4.6% | |

| 3M Company | | | 4.0% | |

| The Clorox Company | | | 3.8% | |

| Starbucks Corp. | | | 3.6% | |

| Mastercard Inc., Class A | | | 3.6% | |

| Cadence Design Systems Inc. | | | 3.4% | |

| American Express Co. | | | 3.3% | |

| Synopsys Inc. | | | 3.2% | |

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

The headline for 2018 was a return of volatility and the first annual decline for the S&P 500 since 2008. After a strong first nine months supported by robust economic activity and earnings growth, the stock market plunged from ayear-to-date gain of almost 11% as of October 1st to a loss of 10% by December 24th. Stocks went down as investors started worrying that earnings growth was unsustainably high due to factors such as the major tax cut, elevated government spending and stock buybacks. At the same time, interest rate hikes and wider credit spreads increased balance sheet risk for highly leveraged companies. In addition, we saw elevated political tensions during the fourth quarter, especially regarding trade wars and the government shutdown.

The key question we’re focused on as we enter 2019 is which companies we should own when GDP growth is slowing and volatility is elevated. We think the answer is high-quality companies trading at reasonable valuations. Such companies have high recurring demand for their products and services, long-term secular growth drivers, sustainable competitive advantages and healthy balance sheets. This is the same approach that has historically led to strong relative performance for the Fund in times of decelerating growth and heightened volatility, for example in 2000–2002, 2008 and 2018.

During the fourth quarter, the Fund exited two holdings. We sold a leading semiconductor company, Intel, at $48 per share after a successful investment. Despite an expanding datacenter market, the company faces increasing competitive threats to its dominant

Value on December 31, 2018

of $10,000 invested on December 31, 2008

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

position in server central processing units (CPUs). In addition, we are concerned that Intel’s CEO search is a distraction that could impact results. We also exited Novartis, a large Swiss pharmaceutical and health care company. The stock reached our fair-value estimate after it rose 18.9% from $74 inmid-June to $88 in November, so we exited the position.

The fourth quarter decline for many stocks presented three new opportunities for the Fund, all of which should benefit from the ongoing digitization of the economy. The first of these is Digital Realty, a real estate company that owns scarce land and datacenters in strategic locations. The stock saw some weakness as the company announced they were raising equity for development, and investors grew concerned about a slowdown in capital spending from their large “hyperscale” customers. We believe the company is uniquely positioned with a portfolio of irreplaceable internet gateways and unrivaled capacity for large-scale deployments. As cloud computing and artificial-intelligence adoption continue to grow, the company should benefit well into the future.

The second new holding is NVIDIA. This chip company is the leading provider of graphics processing units (GPUs), which have traditionally been used in gaming and professional visualization applications. Today, GPUs have also become critical for delivering accelerated computing power in applications such as machine learning and autonomous driving. We have long admired the company, and we bought shares after the stock fell almost 50% within eight weeks after

11

| | | | |

| | |

| | | | Annual Report • 2018 |

a disappointing earnings report. The stock’s plunge, largely related to temporary cryptocurrency-related channel issues, provided an attractive entry opportunity.

The last stock we added is Microsoft, the leading provider of business productivity software and the number two provider of cloud computing services. Microsoft has unrivaled enterprise relationships and a comprehensive portfolio of offerings across information technology, from infrastructure to software. The enterprise transition to the cloud is still nascent and, as it matures, Microsoft should become even more engrained in the digitized economy.

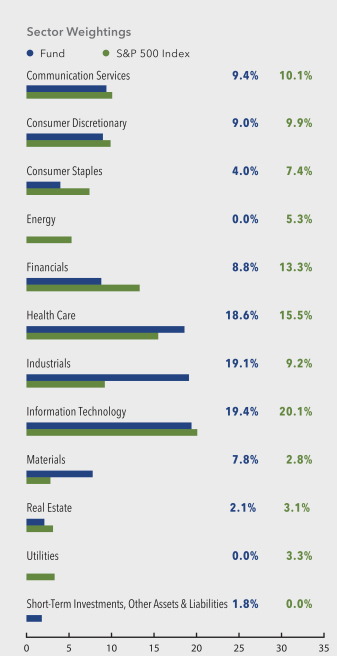

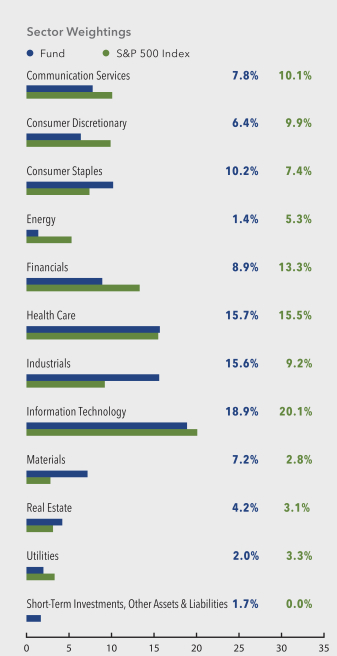

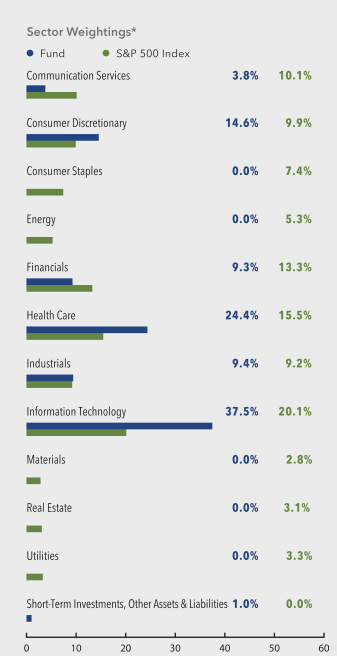

With the additions of NVIDIA and Microsoft, we reduced our underweight allocation to the information technology sector. The Fund’s largest underweight atyear-end relative to the S&P 500 was the financials sector. This is due to the heightened probability that the yield curve will invert, which would be a headwind for bank earnings. We are still significantly underweight in energy stocks, as oil prices suffer from excess supply and weak demand. Our third significant underweight allocation is to the consumer discretionary sector, where valuations for many companies, especially Amazon, remain elevated relative to our appraisal of their fundamentals.

The Fund’s largest overweight sectors are industrials and materials, where we own a basket of companies that feature high recurring revenues and increasingly relevant products for the global economy. We remain overweight in the consumer staples sector, where we own solid franchises with defensive characteristics. Given these sector weightings and other portfolio characteristics, we think the Fund should perform well relative to the S&P 500, especially if volatility remains elevated throughout 2019.

Thank you for your confidence and investment in the Parnassus Core Equity Fund.

Sincerely,

|

|

Todd C. Ahlsten Lead Portfolio Manager |

|

|

Benjamin E. Allen Portfolio Manager |

12

| | | | |

| | |

| Annual Report • 2018 | | | |  |

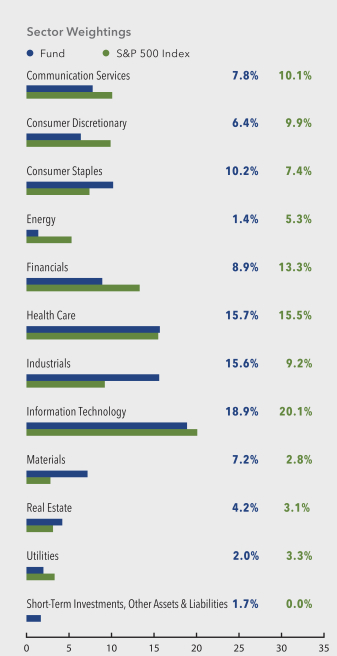

Parnassus Endeavor Fund

Ticker: Investor Shares - PARWX

Ticker: Institutional Shares - PFPWX

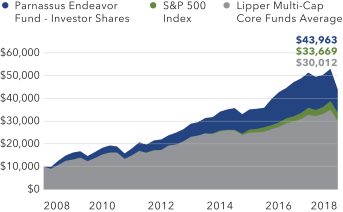

As of December 31, 2018, the net asset value (“NAV”) of the Parnassus Endeavor Fund – Investor Shares was $28.87, so after taking dividends into account, the total return for the year was a loss of 13.49%. This compares to a loss of 4.38% for the S&P 500 Index (“S&P 500”) and a loss of 7.88% for the LipperMulti-Cap Core Funds Average, which represents the average return of themulti-cap core funds followed by Lipper (“Lipper average”). Clearly, it was a tough year for the Parnassus Endeavor Fund. After averaging over 18% per year for the previous five years, the Fund experienced its biggest drop since the 2008 financial crisis. Both of our benchmarks (Lipper average and the S&P 500) also posted losses, but much less than the Fund.

Below is a table comparing the Parnassus Endeavor Fund with the S&P 500 and the Lipper average over the pastone-, three-, five- andten-year periods. You’ll notice that while we’re way behind our benchmarks for theone-year period, the Fund is ahead of the Lipper average for the three-year period, and a little over one percent behind the S&P 500. We’re ahead of all the indices for the five- andten-year periods.

We’re very disappointed with our performance this year; it’s the first time in the13-year history of the Fund that we’ve underperformed the market by such a large margin. Our goal is to do much better in 2019, and we’ll work hard to give you the kind of returns we’ve had through most of our history.

Parnassus Endeavor Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2018 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Endeavor Fund – Investor Shares | | | -13.49 | | | | 7.97 | | | | 9.02 | | | | 16.08 | | | | 0.92 | | | | 0.92 | |

| | | | | | |

| Parnassus Endeavor Fund – Institutional Shares | | | -13.25 | | | | 8.21 | | | | 9.18 | | | | 16.17 | | | | 0.72 | | | | 0.72 | |

| | | | | | |

| S&P 500 Index | | | -4.38 | | | | 9.26 | | | | 8.49 | | | | 13.12 | | | | NA | | | | NA | |

| | | | | | |

| Lipper Multi-Cap Core Funds Average | | | -7.88 | | | | 6.58 | | | | 5.52 | | | | 11.61 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Endeavor Fund – Institutional Shares from commencement (April 30, 2015) was 6.60%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Endeavor Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800)999-3505.

Year in Review

There were five stocks that each sliced more than 100 basis points from the Fund’s return. (A basis point is 1/100th of one percent.) There was no stock that added 100 basis points to the NAV. (There was, however, one issue that contributed 98 basis points.)

Our worst performer was toy manufacturer Mattel, which sliced 199 basis points from the Fund’s performance, as its stock dropped a total return of 35.0% from $15.38 to $9.99 during the year. (For this report, we will quote total return to the portfolio, which includes price change and dividends.) As the saying goes, bad luck comes in threes, and this unfortunately held true for Mattel in 2018. Toys“R”Us, the largest U.S.toy-store chain, announced the liquidation of its domestic stores in March, which reduced toy revenues across the industry. In July, the company revealed it had overestimated demand in China, and in December, the company lost part of the DC Comics toy contract to competitor Spin Master. 2018 was a difficult year for Mattel, but we remain optimistic about the company’s future. Key brands like Barbie and Hot Wheels are growing, and the company is repositioning itself to drive overall revenue growth through its new film and franchising divisions. Mattel’s 2018 corporate restructuring plan has significantly reduced its operating costs, and we expect the combination of growing revenue and falling expenses to boost the stock.

13

| | | | |

| | |

| | | | Annual Report • 2018 |

Hanesbrands, a leading manufacturer of undergarments and athletic apparel, reduced the Fund’s return by 170 basis points, as its stock went from our average cost of $20.67 to $12.53 for a loss of 39.1%. Retail store bankruptcies and inventory reductions by key customers, such as Walmart and Target, led to lower sales for its basics and innerwear products in the U.S. Target also announced that it will discontinue the C9 Champion apparel brand when the exclusive contract ends in January 2020. Despite the lost future revenue, management remained confident in the long-term potential of the Champion brand, with continued double-digit growth in all regions. Within the challenging intimates category, management commented on market share beginning to stabilize after multiple quarters of decline, as the company introduced new product designs and innovation.

Alliance Data Systems, the leading private label credit card issuer, cut 162 basis points from the Fund’s return as the stock fell from $253.48 to $150.08, for a loss of 40.2%. The shares fell as the company’s credit delinquency rates remained above management’s expectations, while its loan growth decelerated. We were disappointed with Alliance Data’s performance, but we’re holding onto our position because the management team is taking action to right the ship. The loan portfolio is being repositioned by discontinuing partnerships with struggling mall-based apparel retailers and focusing on growing industries like hospitality, home furnishings ande-commerce. Alliance Data has also commenced a sale process for its marketing segment, Epsilon, which should sell at a higher valuation than the stock’s current multiple. As the loan portfolio repositioning bears fruit and the company repurchases stock with proceeds from the Epsilon sale, we expect 2019 will be a better year for shareholders.

Perrigo, the leading producer of store-brand generic drugs, subtracted 138 basis points from the Fund’s return, as its stock declined from $87.16 to $38.75, for a loss of 55.1%. The company’s board surprised investors by appointing a new CEO to replace the person it had selected only ten months earlier. New management subsequently lowered the company’s financial forecast due to price erosion in its prescription topicals business, which has been marked for sale. The stock took another blow after the Irish government assessed a€1.6 billion tax bill on one of Perrigo’s subsidiaries. We expect the stock to rebound,

as management focuses on stabilizing the consumer health business, divesting underperforming assets and appealing the tax ruling.

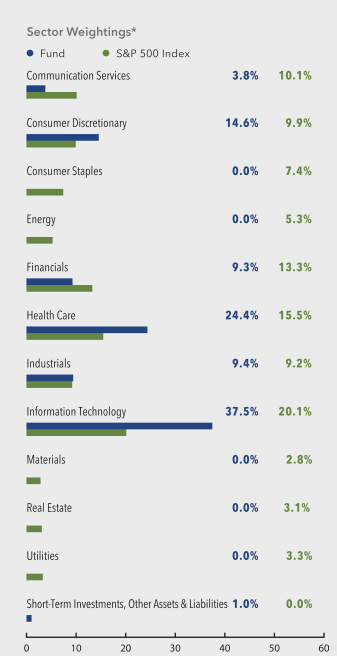

Parnassus Endeavor Fund

As of December 31, 2018

(Percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

14

| | | | |

| | |

| Annual Report • 2018 | | | |  |

| | | | |

| |

| Top 10 Holdings | | | | |

| (percentage of net assets) | | | | |

| Applied Materials Inc. | | | 5.9% | |

| Lam Research Corp. | | | 5.5% | |

| Micron Technology Inc. | | | 5.5% | |

| Cummins Inc. | | | 5.4% | |

| Mattel Inc. | | | 5.3% | |

| Starbucks Corp. | | | 5.2% | |

| Gilead Sciences Inc. | | | 5.1% | |

| Celgene Corp. | | | 4.9% | |

| American Express Co. | | | 4.6% | |

| Hanesbrands Inc. | | | 4.1% | |

Portfolio characteristics and holdings are subject to change periodically.

Micron Technology sliced 129 basis points from the Fund’s performance, as its stock sank from $41.12 to $31.73 for a loss of 22.8% for the year. Prices for Micron’s dynamic random-access memory chips (DRAMs) declined this year, after rising steadily for two years. This stoked investor fears that the cycle had peaked, and this fear was magnified when management lowered their profit forecast, citing weaker personal computer demand, higher inventory with customers and the potential impact of the U.S.-China trade dispute. We think Micron’s shares have sold off too much, however, as strong demand from datacenters and the Internet of Things (IoT) should increase sales of memory chips for years to come.

The big winner for the year was Autodesk, the leading software provider for architects, engineers and designers. Its stock soared from $104.83 to $128.61, yielding a total return of 22.7% for the year and increasing the Fund’s return by 98 basis points. Surging demand for its cloud-based products increased revenue and earnings, while the number of subscribers moved higher. The company also gained share in the construction lifecycle-management market with the acquisitions of three fast-growing companies. We believe profits will continue to grow as customers adopt Autodesk’s software tools in the design process.

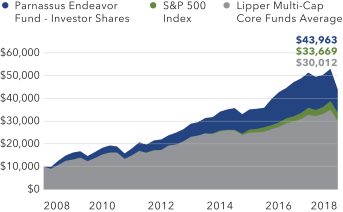

Value on December 31, 2018

of $10,000 invested on December 31, 2008

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Outlook and Strategy

2018 was a challenging year for stock markets around the world and for the Parnassus Endeavor Fund. The S&P 500 broke its nine-year streak of annual gains with its first money-losing year since the end of the global financial crisis. Investor sentiment, which rode high for the first three quarters of the year, abruptly soured in the fourth quarter. What changed? For one thing, the U.S. trade war with China accelerated a slowdown already underway in one of the world’s largest economies. The U.S. economy also cooled due to rising interest rates and the fading effect of last year’s tax cuts. These factors reached a breaking point in early October with asell-off in high-flying technology stocks.

While we can’t predict every threat to stocks, we do spend a lot of time thinking about downside risk. There are three main ways we try to protect ourselves. First, we look for stocks that are trading at a significant discount to their intrinsic value and only buy stocks that are cheap compared to the company’s own history or its industry. We also check for strong balance sheets that can help a company weather a variety of storms. Lastly, we want companies that generate excess profits and use them to reward shareholders and employees

15

| | | | |

| | |

| | | | Annual Report • 2018 |

alike. These measures are by no means foolproof. In the short term, the stock market can ignore our assessments of quality and value, as it did this year, and cause the Fund to underperform. We’re confident our holdings are worth more than what we paid for them, and at some point, our stocks should move higher. In the meantime, our short-term performance can vary widely from the overall market.

We’re not changing our approach because we know that it works. The Parnassus Endeavor Fund’s long-term track record is excellent and includes periods of temporary underperformance such as this one. When we’re in it, the rough patches are extremely painful, to be sure, but they’re also opportunities to stock up on companies that will roar back when investor worries abate. Unfortunately, there’s no way of knowing how

long that will take. Experience gives us the confidence that buying high-quality companies at bargain prices will eventually reward the patient investor.

Thank you for investing in the Parnassus Endeavor Fund.

|

|

Jerome L. Dodson |

Lead Portfolio Manager |

|

|

Billy J. Hwan |

Portfolio Manager |

16

| | | | |

| | |

| Annual Report • 2018 | | | |  |

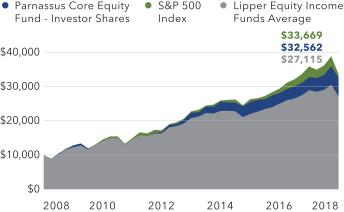

Parnassus Mid Cap Fund

Ticker: Investor Shares - PARMX

Ticker: Institutional Shares - PFPMX

As of December 31, 2018, the net asset value (“NAV”) of the Parnassus Mid Cap Fund – Investor Shares was $28.86, and after taking dividends into account, the total return for 2018 was a loss of 6.64%. This compares to a loss of 9.06% for the Russell Midcap Index (“Russell”) and a loss of 7.88% for the LipperMulti-Cap Core Funds Average, which represents the average return of themulti-cap core funds followed by Lipper (“Lipper average”). For the quarter, the Fund was down 11.18%, less than the Russell’s 15.37% loss and the Lipper average’s 14.41% loss.

Below is a table comparing the Parnassus Mid Cap Fund with the Russell and the Lipper average for theone-, three-, five- andten-year periods. The Fund’s long-term track record remains very good, and we’re pleased to report that the Fund outperformed both of its benchmarks in nearly all the listed periods.

Parnassus Mid Cap Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2018 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Mid Cap Fund – Investor Shares | | | -6.64 | | | | 7.86 | | | | 6.71 | | | | 13.40 | | | | 1.01 | | | | 0.99 | |

| | | | | | |

| Parnassus Mid Cap Fund – Institutional Shares | | | -6.39 | | | | 8.10 | | | | 6.89 | | | | 13.50 | | | | 0.75 | | | | 0.75 | |

| | | | | | |

| Russell Midcap Index | | | -9.06 | | | | 7.04 | | | | 6.26 | | | | 14.03 | | | | NA | | | | NA | |

| | | | | | |

| Lipper Multi-Cap Core Funds Average | | | -7.88 | | | | 6.58 | | | | 5.52 | | | | 11.61 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Mid Cap Fund – Institutional Shares from commencement (April 30, 2015) was 6.20%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Mid Cap Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Midcap Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.Mid-cap companies can be more sensitive to changing economic conditions and have fewer financial resources thanlarge-cap companies.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800)999-3505. As described in the Fund’s current prospectus dated May 1, 2018, Parnassus Investments has contractually agreed to limit total operating expenses to 0.99% of net assets for the Parnassus Mid Cap Fund – Investor Shares and to 0.85% of net assets for the Parnassus Mid Cap Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2019, and may be continued indefinitely by the Adviser on ayear-to-year basis.

Year in Review

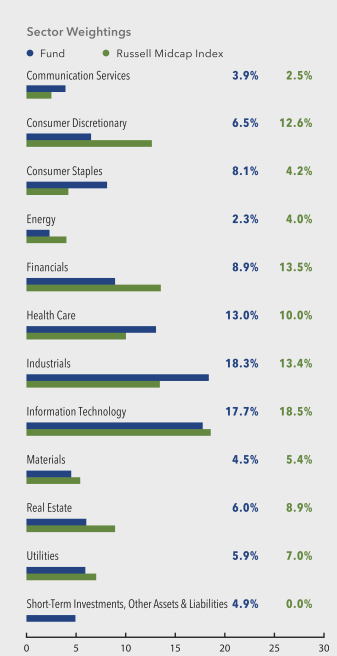

The Russell Midcap Index dropped more than 9% in 2018, but this result doesn’t tell the whole story.Mid-cap stocks rose almost 8% through the middle of September, as investors focused on positive news such as the strong domestic economy and robust earnings growth boosted by the corporate tax cut. Sentiment turned sour shortly afterward, when investors became fixated on threats from rising interest rates, domestic political pageantry and the trade war with China. Thesell-off was steep and fast, withmid-cap stocks falling an astonishing 21% from peak to trough. While we are never happy to report a loss, the silver lining is that for the year, the Fund outperformed the Russell by 242 basis points and the Lipper average by 124 basis points. (One basis point is 1/100th of one percent.)

From a sector-allocation perspective, the Fund benefitted from being underweight relative to the Russell Index in the energy and financial sectors, two of the worst-performing sectors in the benchmark. These allocations increased the Fund’s return relative to the Russell by 36 and 33 basis points, respectively. Our underweight position relative to the Russell in the information technology sector hurt the Fund the most, subtracting 44 basis points from the Fund’s return. Our overweight position relative to the Russell in the materials sector also hurt, cutting 32 basis points from the Fund’s return.

As usual, the primary driver of the Fund’s performance was stock selection rather than sector allocation. The Fund’s health care and financial stock selection hurt performance relative to the Russell by 157 and 100 basis points, respectively. Conversely, strong stock selection in industrials and the information technology

17

| | | | |

| | |

| | | | Annual Report • 2018 |

sectors helped the Fund’s performance relative to the Russell by 295 and 200 basis points, respectively.

The Fund’s weakest performer was First Horizon National, aTennessee-based regional bank. The stock subtracted 134 basis points from the Fund’s return, as its shares yielded a total negative return of 32.3%. (For this report, we will quote total return to the portfolio, which includes price change and dividends.) The shares fell after loan growth came in below expectations, as the integration of its recently completed acquisition of Capital Bank took longer than expected. First Horizon shares were also under pressure throughout the year, along with other bank stocks, as investors worried that the flattening yield curve would reduce net interest revenues and could portend a recession, which would increase credit losses. With the integration of Capital Bank now complete, we expect loan growth to accelerate in 2019. We continue to like First Horizon’s dominant position in Tennessee, its diversified,low-risk loan book, its exposure to growth markets in the Carolinas and South Florida and its cheap valuation.

Dentsply Sirona, one of the largest manufacturers of dental equipment and consumables, subtracted 123 basis points from the Fund’s return, as the total return of its stock was negative 43.0% for the year. The stock fell throughout the year because revenue growth repeatedly missed investors’ expectations. The company’s equipment business was hurt by material destocking headwinds, especially in the second half of 2018. Management unveiled a restructuring plan in late 2018, aiming to simplify the business, reduce duplicate facility costs and boost operating margins. We believe the stock is now attractively valued relative to expectations, and we see upside ahead, if management can successfully execute its restructuring plan and deliver higher revenue growth through product innovation and improved sales effectiveness.

Hanesbrands, a leading manufacturer of undergarments and athletic apparel, reduced the Fund’s return by 114 basis points, as its stock posted a 38.0% loss. Retail store bankruptcies and inventory reductions by key customers such as Walmart and Target led to sluggish demand for its basics and innerwear products in the U.S. Target also announced that it is discontinuing Hanes’s C9 Champion apparel brand when the exclusive contract ends in January 2020. Despite the lost future revenue, management

remains confident in the long-term potential of the global Champion brand, which continues to grow revenue by double-digit percentages in all regions. Within the challenging intimates category, management is introducing new product designs and innovations, which is helping to stabilize this business after multiple quarters of decline.

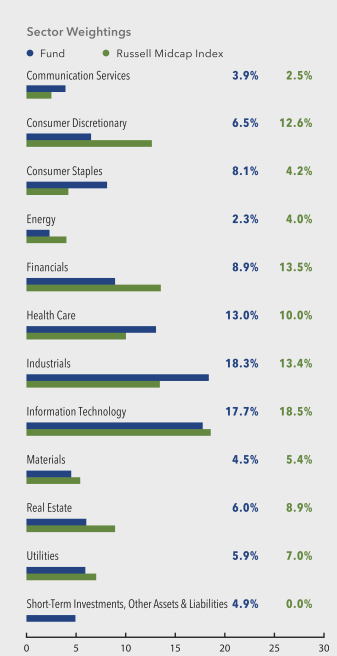

Parnassus Mid Cap Fund

As of December 31, 2018

(Percentage of net assets)

18

| | | | |

| | |

| Annual Report • 2018 | | | |  |

| | | | |

| |

| Top 10 Holdings | | | | |

| (percentage of net assets) | | | | |

| Teleflex Inc. | | | 4.5% | |

| Hologic Inc. | | | 4.4% | |

| Motorola Solutions Inc. | | | 4.3% | |

| Fiserv Inc. | | | 3.8% | |

| First Horizon National Corp. | | | 3.7% | |

| Xylem Inc. | | | 3.7% | |

| Verisk Analytics Inc. | | | 3.4% | |

| The Clorox Company | | | 3.2% | |

| Trimble Inc. | | | 3.1% | |

| Sempra Energy | | | 3.0% | |

Portfolio characteristics and holdings are subject to change periodically.

Our biggest winner was Motorola Solutions, the largest provider of mission-critical communications solutions. The stock added 99 basis points to the Fund’s return as its total return was 29.6%. The stock moved higher as the company raised its 2018 earnings guidance three times over the year due to broad-based demand for land mobile radio systems and surveillance solutions from Avigilon, a recent acquisition. Motorola is winning market share and expanding its addressable markets by providing the most innovative and complete communications solutions to its public safety and corporate clients.

McCormick, the herb and spice seasonings company, contributed 79 basis points to the Fund’s return, as the total return of its shares was 39.0%. The stock moved higher as the company benefited from healthy demand following distribution gains and increased brand marketing. The acquisition a year ago of Frank’s RedHot sauces and French’s condiments also contributed to the strong performance, as these brands saw accelerated growth. Management also noted that this strong momentum should continue through strengthening distribution, product innovation, improved category management and brand marketing investments.

Integrated Device Technology, Inc., a leading provider of high-performance analog mixed-signal solutions, contributed 54 basis points to the Fund’s return, as the total return of its shares was 58.4%. The stock rose in the summer after the company delivered better than expected earnings. The shares jumped again after the company announced an agreement with Renesas

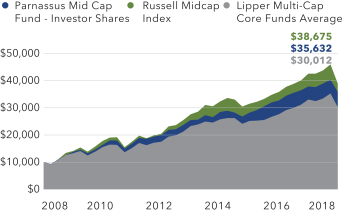

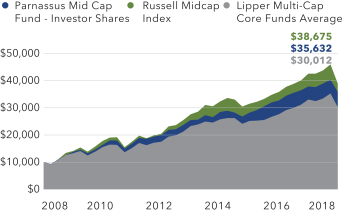

Value on December 31, 2018

of $10,000 invested on December 31, 2008

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Electronic Corporation to be acquired for $49 per share in anall-cash transaction.

Outlook and Strategy

After a nearlyten-year bull market, the Russell tumbled sharply in late 2018. The economy is still healthy by most measures and inflation remains in check, but the same issues that plagued the market starting at the end of the third quarter of 2018 persist as we enter 2019. The overall theme is fear of a slowing global economy, but specific concerns include uncertainty related to international and domestic political and economic conflicts, economic weakness in China and emerging markets, rising consumer and corporate leverage, the high federal budget deficit, rising interest rates and slowing corporate earnings growth. It’s difficult to predict whether these concerns will abate or deepen, but it’s fair to say that there are more moving parts than there have been for a while.

At year end, following the recent market rout, the Russell traded at about 14 times forward earnings estimates, a materially lower multiple than the 18 times we saw at this time last year and below the20-year average of 16 times. Stocks are cheaper than they have been in a while, which is creating select buying opportunities. At the same time, for many stocks the range of outcomes has widened and expected earnings growth is less certain given the risks mentioned above. As a result, we are sticking to our knitting, focusing on maintaining a portfolio of individual businesses that we believe offer longer-term asymmetric risk-reward opportunities.

19

| | | | |

| | |

| | | | Annual Report • 2018 |

We took advantage of the recent market weakness to add to many of our high-quality positions as well as buy some new stocks. We initiated a position in Digital Realty, a real estate company that owns scarce datacenter properties in attractive markets. The stock pulled back when the company announced an equity sale to fund development and growth. Investors also worried about a spending slowdown by their largest customers. We believe these are short-term concerns, and that Digital’s assets are becoming increasingly relevant as enterprises move applications to the cloud and connectivity demands increase due to the emergence of the Internet of Things and artificial intelligence. Finally, the company has a strong competitive moat supported by global scale and high switching costs for its tenants.

We also initiated a position in Cerner, the largest publicly traded health care information technology company. Cerner has a dominant market position providing a wide range of software, hardware and services, which are used across hospitals, pharmacies and physician practices. Cerner’s core product, electronic medical records, operates in a duopoly, and nearlytwo-thirds of the company’s revenue is recurring. The company recently signed aten-year, $10 billion contract with the United States Department of Veterans Affairs, the largest health system in the world. Going forward, we believe the company has several exciting growth opportunities and the ability to expand margins.

Reflecting ourbottom-up process, the Fund currently has a 27% weighting in the less-cyclical consumer staples, health care and utilities sectors, as compared to 21% for the Russell. Our exposure to the more cyclical financials, consumer discretionary and energy sectors is 18%, which is well below the Russell’s 30%

weighting. We continue to own slightly more industrial stocks than the benchmark. Within this sector, we own innovative companies in growing markets such as Xylem and Fortive, along with several business service companies with significant recurring revenue such as Verisk Analytics. This positioning, which isn’t too different from past years, should enable the Fund to do well in many different market environments, but especially in the event of further weakness.

We’re pleased that our strategy is providing good long-term results to shareholders. We’re especially pleased that in the down-market years over the last decade – 2008, 2011, 2015 and 2018 – the Fund handily beat its benchmarks. We will continue to focus on owning responsible, well-managed, increasingly relevant businesses with sustainable competitive advantages. We are confident that this strategy will help the Fund outperform the market over the long term, by participating inup-markets, providing down-market outperformance and avoiding permanent capital losses.

Thank you for your investment in the Parnassus Mid Cap Fund.

Yours truly,

|

|

Matthew D. Gershuny |

Lead Portfolio Manager |

|

|

Lori A. Keith |

Portfolio Manager |

20

| | | | |

| | |

| Annual Report • 2018 | | | |  |

Parnassus Fixed Income Fund

Ticker: Investor Shares - PRFIX

Ticker: Institutional Shares - PFPLX

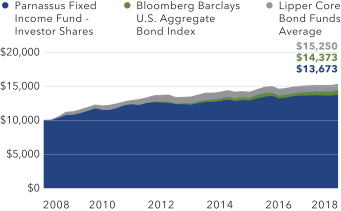

As of December 31, 2018, the net asset value (“NAV”) of the Parnassus Fixed Income Fund – Investor Shares was $15.92, producing a loss for the year of 1.12% (including dividends). This compares to a gain of 0.01% for the Bloomberg Barclays U.S. Aggregate Bond Index (“Barclays Aggregate Index”) and a loss of 0.69% for the Lipper Core Bond Funds Average, which represents the average return of the funds followed by Lipper that invest at least 85% of assets in domestic investment-grade bonds (“Lipper average”).

Below is a table comparing the performance of the Fund with that of the Barclays Aggregate Index and the Lipper average. Average annual total returns are for theone-, three-, five- andten-year periods. For December 31, the30-day subsidized SEC yield was 3.45%, and the unsubsidized SEC yield was 3.16%.

Parnassus Fixed Income Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2018 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Fixed Income Fund – Investor Shares | | | -1.12 | | | | 1.45 | | | | 1.90 | | | | 2.97 | | | | 0.82 | | | | 0.68 | |

| | | | | | |

| Parnassus Fixed Income Fund – Institutional Shares | | | -0.89 | | | | 1.66 | | | | 2.05 | | | | 3.05 | | | | 0.49 | | | | 0.47 | |

| | | | | | |

| Bloomberg Barclays U.S. Aggregate Bond Index | | | 0.01 | | | | 2.05 | | | | 2.52 | | | | 3.48 | | | | NA | | | | NA | |

| | | | | | |

| Lipper Core Bond Funds Average | | | -0.69 | | | | 1.99 | | | | 2.20 | | | | 4.18 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Fixed Income Fund – Institutional Shares from commencement (April 30, 2015) was 1.26%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Fixed Income Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns shown in the table do not reflect the deduction of taxes a shareholder would pay in fund distributions or redemption of shares. The Bloomberg Barclays U.S. Aggregate Bond Index (formerly known as the Barclays U.S. Aggregate Bond Index) is an unmanaged index of bonds, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800)999-3505. As described in the Fund’s current prospectus dated May 1, 2018, Parnassus Investments has contractually agreed to limit total operating expenses to 0.68% of net assets for the Parnassus Fixed Income Fund – Investor Shares and to 0.58% of net assets for the Parnassus Fixed Income Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2019, and may be continued indefinitely by the Adviser on ayear-to-year basis.

Year in Review

After two quiet years, the bond market delivered fireworks in 2018. Concerns about economic growth at the beginning of the year gave way to exuberance by summer and fall as growth shot higher and unemployment fell. Four interest rate hikes by the Federal Reserve pushed the yield on the10-year Treasury up from 2.41% at the beginning of the year to as high as 3.24% in November. While it ultimately settled at 2.69% byyear-end, the fourth quarter was especially tumultuous. A realization that the expectations were perhaps too frothy, a slowdown of other important global economies and concerns about rising debt costs pushed interest rates lower and cooled expectations for 2019.

The Parnassus Fixed Income Fund trailed the Barclays Aggregate Index for the year, with a loss of 1.12% versus a gain of 0.01%. The Fund also trailed its Lipper category, Core Bonds, as the peer set lost an average of 0.69%. The underperformance was driven by the Fund’s substantial overweight allocation to corporate bonds. As ofyear-end, the Fund held 70% of assets in corporate securities versus 25% for the Index. Concerns about rising interest rates, slowing profit growth and the impact of tariffs pushed the value of corporate bonds lower, especially in the fourth quarter. While our selection of corporate bonds was good – our portfolio of bonds lost 1.28% versus the Barclays Aggregate Index at a loss of 2.54% – the overweight position meant that corporate bonds removed 82 basis points from the total return. (One basis point is 1/100th of one percent.)

Corporate bonds issued by Pentair, Masco Corporation and Xylem outperformed the Index and contributed

21

| | | | |

| | |

| | | | Annual Report • 2018 |

positively to the total return. Pentair, a company that provides water solutions for pools, municipalities and industrial operations,saw its bonds perform well as the company spun off its electrical business and substantially reduce debt. This means that the company is in much better financial condition and the bonds rallied to reflect this rosier picture. Pentair bonds held by the Fund gained 2.82% and added 5 basis points to the total return.

Bonds issued by Masco Corporation have been a solid performer all year and ultimately added 4 basis points to the total return. Masco owns home improvement brands including Behr Paint, Delta Faucets and Milgard Windows. It has benefitted from strong sales, as well as management’s efforts to restructure and improve its windows and cabinets businesses. While we like the company’s longer-term prospects and believe the company is much better positioned for an eventual recession than in prior years, we believe the bonds are close to fair value at this point in the economic cycle. For that reason, we trimmed the position in the fourth quarter.

Finally, bonds issued by Xylem added 4 basis points to the total return in the year. Xylem is the Fund’s other water-focused company, providing highly engineered solutions to a wide range of industries, including agriculture, food and beverage, commercial buildings and waste treatment centers. The company’s technologies facilitate the full cycle of water use, culminating with a return to the environment. The bonds benefitted from the company’s strong performance in the year. As sales rose, margins improved and leverage declined.

Several corporate securities meaningfully detracted from the total return, including those issued by Public Storage, Verisk Analytics and Zayo Group. The Fund’s position in preferred stock issued by Public Storage declined 10.22% and removed 14 basis points from the total return. While the company is facing more competition from new storage facilities being built across the country, this was not the main driver behind the security’s performance. Instead, the preferred stock was impacted by rising interest rates and declining appetite for corporate credit. Public Storage’s preferred stock has the equivalent of anA-rating from Moody’s and a high coupon, so we believe it will prove to be a good long-term investment.

Bonds issued by Verisk Analytics declined by 8.32% and removed 13 basis points from the total return. The company’s performance has been excellent, with operating income increasing steadily the last few years. However, we own the company’s long-dated bonds that mature in 2045. These bonds also have a long duration, which means they are especially sensitive to changes in both Treasury rates and credit spreads, or the premium corporations pay over Treasury bonds. Since interest rates rose and credit spreads widened in the year, these bonds were negatively impacted. We believe the company’s balance sheet will continue to improve and that the services it provides are increasingly relevant, so we maintained our position atyear-end.

Parnassus Fixed Income Fund

As of December 31, 2018

(Percentage of net assets)

Finally, bonds issued by Zayo Group, a leading provider of bandwidth infrastructure in North America and Europe, fell 6.24% and removed 11 basis points from the total return. The company missed bookings numbers significantly in the fourth quarter and announced a surprise decision to split the company into two independent entities. Management hopes the separation of the infrastructure unit from the managed

22

| | | | |

| | |

| Annual Report • 2018 | | | |  |

services business will help improve execution, but we see this as a credit negative. We were disappointed by the news, especially since it was a new holding as of the third quarter, and sold the bonds.

Outlook and Strategy

While we don’t make specific economic forecasts, we did take several steps in the second half of the year to position the Fund more conservatively. The intersection of exuberant expectations and the lapping ofone-time events, like the corporate tax cut and a simulative federal budget, made us concerned about future growth expectations.

We reduced exposure to severalBBB-rated companies, which sit at the low end of investment grade, as well as to some high-yield companies. Bonds issued by these companies are more volatile during times of economic uncertainty and carry more risk of a downgrade. Specifically, the Fund reduced its position in Sealed Air, a company with a high yield rating from S&P and Masco Corporation, as discussed above. Our position size increased in Microsoft, which is seeing solid growth in cloud computing and is one of the few companies with an AAA rating. We also added a position in Procter & Gamble. We believe P&G is making strides to improve the relevancy of their products as consumer preferences evolve, and we appreciate that its sales are relatively less sensitive to economic swings.

The Fund’s position in supranational bonds also increased in the year, from 2% to about 4%. Though the numbers are small, our supranational bonds did exceptionally well this year and contributed 12 basis points to the total return. Our bonds in this category have been issued by the World Bank and the International Finance Corporation, a member of the World Bank Group. These are both green bonds, which means the proceeds directly support climate-change-mitigating projects in developing countries. We are proud to have participated in the World Bank’s special10-year anniversary issue of the first-ever green bond, and even more pleased by these bonds’ performance. Both carry excellent credit ratings and are fairly divorced from the political machines that influence Treasury bonds, so they make great investments.

Finally, the duration of the Fund increased in 2018, reflecting the more balanced nature of the interest rate

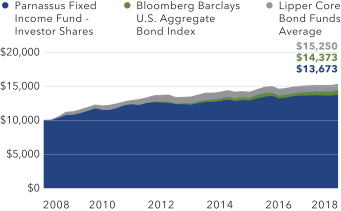

Value on December 31, 2018

of $10,000 invested on December 31, 2008

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

market. As a reminder, duration is a measure of interest rate sensitivity. The longer the duration, the more the value of the Fund moves as interest rates move. The Fund had a shorter duration than the Index while rates were low, because rates were more likely to rise than fall, and the short duration helped protect the value of the Fund. Now that rates have risen considerably and economic data is mixed, there is less likelihood that interest rates will continue their upward trajectory.

As ofyear-end, the Fund’s duration is 6.48 years versus 6.09 years for the Barclays Aggregate Index. The bulk of the Fund’s long duration comes from its positions in Treasuries and corporates. The duration of our Treasury portfolio is 6.45 years versus 6.04 years for the Index, though this is partially offset by our underweight allocation. By being long duration in Treasuries, the Fund benefits if rates stay the same or go down. While our corporate bond holdings have a duration of 6.60 years versus the Barclays Aggregate Index at 7.08 years, 6.60 years is considerably longer than the duration of the Index overall. Therefore, our overweight in corporate bonds pulls up the duration as well.

Thank you for your investment in the Parnassus Fixed Income Fund.

Samantha D. Palm

Portfolio Manager

23

| | | | |

| | |

| | | | Annual Report • 2018 |

Responsible Investing Notes

2018 was a fascinating year for the Parnassus Funds. Three dominant ESG themes occurred this year, each a significant matter in its own right: climate change, data privacy and workplace misconduct in Silicon Valley. I’ve written at length about data privacy in the Q2 Responsible Investing Notes, so I won’t touch upon it in this note.