UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: Parnassus Funds (811-04044) and Parnassus Income Funds (811-06673)

Parnassus Funds

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marc C. Mahon

Parnassus Funds

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

Item 1: Report to Shareholders

Parnassus Funds Annual Report

December 31, 2021

Parnassus Core Equity FundSM

Investor Shares: PRBLX | Institutional Shares: PRILX

Parnassus Mid Cap FundSM

Investor Shares: PARMX | Institutional Shares: PFPMX

Parnassus Endeavor FundSM

Investor Shares: PARWX | Institutional Shares: PFPWX

Parnassus Mid Cap Growth FundSM

Investor Shares: PARNX | Institutional Shares: PFPRX

Parnassus Fixed Income FundSM

Investor Shares: PRFIX | Institutional Shares: PFPLX

Table of Contents

3

| | | | |

| | |

| | | | Annual Report • 2021 |

February 4, 2022

Dear Shareholder,

2021 was a fantastic year for equity investing, as the major stock indexes made significant gains. The S&P 500 Index, which represents a blend of value and growth stocks, posted a total return of 28.71% for the year, fueled by continued strength in mega-sized technology companies and a rebound in sectors that performed poorly in 2020, such as financials, energy and real estate.

Our flagship offering, the Parnassus Core Equity Fund – Investor Shares, which is benchmarked against the S&P 500, gained 27.55% for the year. Our other large cap stock fund, the Parnassus Endeavor Fund – Investor Shares, focuses on value stocks and was easily our best performer in 2021. With a return of 31.12%, the fund beat by a wide margin the 25.16% gain for the Russell 1000 Value Index, which is its primary benchmark, and the S&P 500’s return of 28.71%.

The year wasn’t as good for mid cap stock investing, and both of our funds in this category underperformed their benchmarks. The Parnassus Mid Cap Fund – Investor Shares posted a gain of 16.39% for 2021. This is normally a fantastic result, but in a year when the Russell Midcap Index returned 22.58%, it is disappointing. A silver lining is that the fund did exceptionally well in the final quarter of the year, as it gained 8.82% versus 6.44% for the benchmark. The Parnassus Mid Cap Growth Fund – Investor Shares similarly trailed its benchmark for 2021 (9.37% versus 12.73%) and finished the year with a quarter of solid outperformance (4.18% versus 2.85%).

With interest rates rising during the year, bonds posted modest losses for 2021. Our lone bond offering, the Parnassus Fixed Income Fund - Investor Shares, lost 2.09% for the year, which was slightly worse than the Bloomberg U.S. Aggregate Bond Index negative 1.54% return.

In the reports that follow, you can read in detail about what drove our funds’ performance in 2021. More importantly, you can learn what the portfolio managers think is in store for 2022, and how they have positioned their funds to achieve strong investment results. I hope you find the reports interesting and informative.

A New Portfolio Manager

As of January 3, 2022, Andrew Choi is a portfolio manager for the Parnassus Core Equity Fund. He joins me and Lead Manager Todd Ahlsten in this assignment. Andrew started working with us as a Senior Research Analyst in 2018, having been a Parnassus intern during the summer of 2017. He is hard working and understands complex ideas with relative ease. Just as important as his work ethic and intelligence is Andrew’s ability and willingness to rethink his positions-to challenge even his strongest convictions. He has an optimistic attitude, an even-keeled temperament and a healthy amount of humility. These attributes should serve Andrew well as he continues to grow as an investor.

Todd and I recently signed decade-long commitments to work at Parnassus. We love investing together and enjoy serving our shareholders. We look forward to working with Andrew for many years to come as fellow portfolio managers on our flagship fund.

4

| | | | |

| | |

| Annual Report • 2021 | | | |  |

New Hire

We added one person to the Parnassus team in the fourth quarter. Octavio Avila joined the Marketing Strategy team in December as a Marketing Associate. He recently graduated from California State University, Sacramento, with a BS in business administration, with a double concentration in marketing and finance. In his free time, Octavio enjoys traveling, making music, outdoor sports and cooking.

Thank you for investing with the Parnassus Funds.

Sincerely,

Benjamin E. Allen

President and CEO

5

| | | | |

| | |

| | | | Annual Report • 2021 |

Parnassus Core Equity Fund

Ticker: Investor Shares - PRBLX

Ticker: Institutional Shares - PRILX

As of December 31, 2021, the net asset value (“NAV”) of the Parnassus Core Equity Fund – Investor Shares was $63.41. After taking dividends into account, the total return for the year was a gain of 27.55%. This compares to a total return of 28.71% for the S&P 500 Index (“S&P 500”) and a gain of 25.00% for the Lipper Equity Income Funds Average, which represents the average return of the equity income funds followed by Lipper (“Lipper Average”).

Below is a table that summarizes the performances of the Parnassus Core Equity Fund, the S&P 500 and the Lipper Average. The returns are for the one-, three-, five- and ten-year periods.

Parnassus Core Equity Fund

| | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2021 | |

| | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | |

| | | | | |

| Parnassus Core Equity Fund – Investor Shares | | | 27.55 | | | | 26.41 | | | | 18.64 | | | | 16.41 | | | | 0.84 | |

| | | | | |

| Parnassus Core Equity Fund – Institutional Shares | | | 27.81 | | | | 26.69 | | | | 18.90 | | | | 16.64 | | | | 0.62 | |

| | | | | |

| S&P 500 Index | | | 28.71 | | | | 26.07 | | | | 18.47 | | | | 16.55 | | | | NA | |

| | | | | |

| Lipper Equity Income Funds Average | | | 25.00 | | | | 17.74 | | | | 11.85 | | | | 11.90 | | | | NA | |

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemtion of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take and expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

Year in Review

In 2021, the S&P 500 returned almost 28.71%, marking the third year in a row of strong double-digit returns. Meanwhile, the world continued to grapple with the COVID-19 pandemic, as vaccine rollouts were met with new variants. As of this writing, there have been over 290 million reported cases and over 5 million deaths worldwide. The untold impact on the vulnerable populations, including the children who have had to spend their formative years in less-than-ideal circumstances, will unfortunately be felt for many years to come. We want to acknowledge the profound suffering and loss from a pandemic that is now entering its third calendar year.

The financial markets, however, are relatively independent from the real economy. In particular, the S&P 500 reflects the performance of a select group of companies. The five largest constituents by market capitalization represented almost 22% of the index and contributed more than a quarter of the index’s total return. The outperformance of these companies, along with a healthy appetite for equities, can mask the state of the broader economy.

Despite being marred by many fits and starts, substantial progress in the economic recovery has been made since the first quarter of 2020. Fiscal and monetary intervention helped gross domestic product (GDP) growth rebound, and the unemployment rate is poised to exit the year close to 4%, down from the April 2020 peak of almost 15%. We’re also seeing the fastest wage growth in almost two decades. While the year ended in a crescendo of handwringing about inflation and COVID-19 variants, there are reasons to be optimistic about the future.

6

| | | | |

| | |

| Annual Report • 2021 | | | |  |

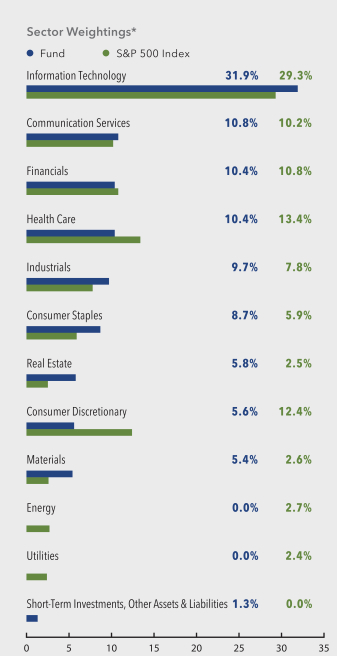

The Parnassus Core Equity Fund – Investor Shares had a gain of 27.55% for 2021, which trailed the 28.71% return for the S&P 500. Our stock selection was positive this year, but it was overwhelmed by poor sector allocation. The Fund’s strongest stock selection was in the information technology sector, led by Microsoft, Applied Materials and NVIDIA. Stock selection in the financials sector was also notably positive, driven by our positions in Charles Schwab and S&P Global. From a sector-allocation perspective, our underweight positioning in the financials and energy sectors was the biggest detractor.

Verisk Analytics, a leading provider of insurance data, was the Fund’s worst performer this year. Verisk cut the Fund’s return by 47 basis points, as the stock returned negative 17.1%.* (One basis point is 1/100th of one percent.) Although the company’s core insurance business continued to perform well during the year, its smaller energy and financials segments struggled. Despite admiring the core insurance business, we decided to sell our position.

Branded apparel company VF Corp reduced the Fund’s return by 35 basis points, as the stock’s return was negative 12.0%. The company delivered mixed financial results as it faced headwinds from COVID-19, exposure to China and some brand positioning issues. We believe the shares are attractively priced to benefit from a recovery in VF Corp’s brands, so we’re holding onto our position.

Wireless carrier Verizon reduced the Fund’s return by 27 basis points, with a loss of 8.0% for the year. Investors grappled with increasing competitive intensity in the form of more promotional activity from peers and new entrants in the form of cable companies. The near-term capital requirements of building a 5G network also weighed on the stock. Despite this, we continue to see a role for Verizon’s defensive business and attractive valuation in the portfolio.

The Fund’s three largest winners were led by Microsoft, which contributed 297 basis points to the Fund, with a total return of 52.5%. The company executed flawlessly and beat elevated investor expectations throughout the year as demand for Azure grew unabated. Microsoft is seeing strength across all its segments, as its products and services are at the center of some of

the most powerful investable trends. Despite the outperformance, the stock trades at a similar multiple as it did at the start of the year, and we continue to see upside in the shares.

Applied Materials, a semiconductor capital equipment manufacturer, added 268 basis points to the Fund, as it returned 83.6% for the year. Semiconductor shortages across the globe led to increased demand for Applied Materials’ equipment, which was additive to the long-term trend of increasing capital intensity in semiconductors.

NVIDIA, a leading provider of artificial intelligence technologies, added 245 basis points to the Fund as the stock returned 125.5%. The company significantly exceeded investor expectations throughout the year, as demand for its best-in-class datacenter and gaming products accelerated. Since we initiated the position in 2018, the moat of the company has dramatically widened, and we’re pleased that it is being rewarded by the market.

* For this report, we quote total return to the portfolio, which includes price change and dividends.

7

| | | | |

| | |

| | | | Annual Report • 2021 |

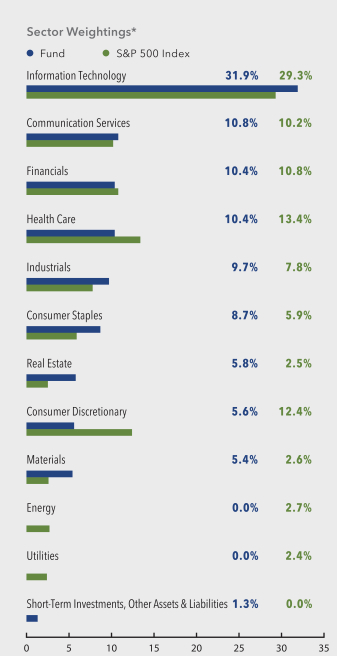

Parnassus Core Equity Fund

As of December 31, 2021

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Microsoft Corp. | | | 6.8% | |

| |

| Alphabet Inc., Class A | | | 5.7% | |

| |

| Fiserv Inc. | | | 4.1% | |

| |

| CME Group Inc., Class A | | | 4.0% | |

| |

| Danaher Corp. | | | 3.9% | |

| |

| Mastercard Inc., Class A | | | 3.6% | |

| |

| Comcast Corp., Class A | | | 3.3% | |

| |

| S&P Global Inc. | | | 3.3% | |

| |

| Linde plc | | | 3.3% | |

| |

| The Charles Schwab Corp. | | | 3.3% | |

Portfolio characteristics and holdings are subject to change periodically.

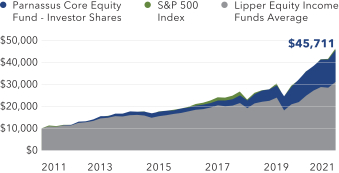

Value on December 31, 2021

of $10,000 invested on December 31, 2011

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Outlook and Strategy

As we enter 2022, the investment set up is a precarious one, potentially ushering in more volatility and lower returns. After growing over 5% in 2021, real GDP is expected to grow 4% in 2022, while inflation is running stubbornly above 6%. If the Federal Reserve tightens monetary policy to combat inflation as the impact of fiscal support wanes, we could see slower-than-expected economic growth.

A Federal Reserve that is fighting inflation puts upward pressure on interest rates, reduces liquidity and encourages deleveraging, all of which may negatively impact the stock market. Since 2008, investors have become accustomed to supportive monetary policy and to the extra jolts of liquidity whenever the markets

8

| | | | |

| | |

| Annual Report • 2021 | | | |  |

fell. This implicit “Fed put” may no longer exist due to the high inflation rate.

Ultimately, we believe that inflation will be transitory, as the COVID-19-related supply chain issues that have led to sharp price increases will eventually be alleviated. However, wage gains are sticky, and supply chain issues in certain industries could take longer to resolve, which could extend the duration of high inflation. We believe the range of outcomes for the market is wide as we enter 2022.

In this environment, we’re focused on our goal of all-weather outperformance. We continue to lean into our bias for quality compounders at fair prices, and we have substantial exposure to secular winners such as Microsoft, Google and S&P Global. We also see opportunity in stocks that rely more on earnings growth than valuation expansion to deliver returns. Companies like Fiserv, Comcast and John Deere are attractively priced, with achievable earnings growth targets.

During the fourth quarter, we bought CoStar Group and sold Xylem. CoStar is a leading provider of real-estate data and transaction marketplaces. The stock’s relative underperformance has been driven by temporary headwinds in its Apartments.com rental website and increased investment in its home-listing platforms. We believe the market is overlooking its dominant CoStar Suite commercial leasing product, and over-reacting to a short-term slowdown in Apartments.com. CoStar’s competitive advantage continues to widen, and we’re confident that its founder-led management team will reap the rewards from its investment in its home-listing assets. While we admire Xylem and the increasing importance of its water technologies to our society, the stock’s valuation was no longer compelling, as its multiple expanded to an all-time high.

We continued to add to our positions in Fiserv and Mastercard. We believe the quality and fundamentals of these payment companies are underappreciated by the market. As the market becomes less enamored

with newly hyped financial technology companies and investors refocus on strong earnings growth, we believe these two stocks are poised to benefit.

After these changes, the Fund exited the year most overweight the information technology, materials and consumer staples sectors. Our holdings in these sectors offer an attractive combination of resilient business models with attractively priced earnings.

We’re underweight the consumer discretionary sector due to elevated expectations. We’re also underweight utilities due to high valuations and interest rate exposure. We don’t own any energy stocks, consistent with our policy to avoid fossil-fuel companies. We remain underweight health care, with a preference for tool and equipment providers. We’re also slightly underweight financials, and we continue to avoid companies with credit risk.

We’re pleased that the Fund had a solid return in 2021, and we’re optimistic entering the new year. As always, we’re honored to have your trust as we continue to deliver Principles and Performance®.

Sincerely,

Todd C. Ahlsten

Lead Portfolio Manager

Benjamin E. Allen

Portfolio Manager

Andrew S. Choi

Portfolio Manager

9

| | | | |

| | |

| | | | Annual Report • 2021 |

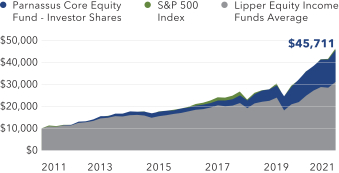

Parnassus Mid Cap Fund

Ticker: Investor Shares - PARMX

Ticker: Institutional Shares - PFPMX

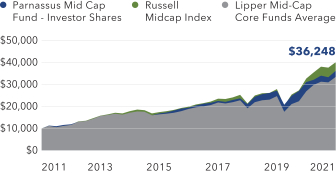

As of December 31, 2021, the net asset value (“NAV”) of the Parnassus Mid Cap Fund – Investor Shares was $45.20, so after taking dividends into account, the Fund’s total return for 2021 was 16.39%. This compares to 22.58% for the Russell Midcap Index (“Russell”) and 24.59% for the Lipper Mid-Cap Core Funds Average, which represents the average return of the mid-cap core funds followed by Lipper (“Lipper Average”). For the quarter, the Fund was up 8.82%, ahead of the Russells 6.44% gain and the Lipper Averages 8.02% rise.

Below is a table comparing the Parnassus Mid Cap Fund with the Russell and the Lipper Average for the one-, three-, five- and ten-year periods.

Parnassus Mid Cap Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2021 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Mid Cap Fund – Investor Shares | | | 16.39 | | | | 19.85 | | | | 13.23 | | | | 13.74 | | | | 0.98 | | | | 0.98 | |

| | | | | | |

| Parnassus Mid Cap Fund – Institutional Shares | | | 16.63 | | | | 20.12 | | | | 13.49 | | | | 13.91 | | | | 0.76 | | | | 0.75 | |

| | | | | | |

| Russell Midcap Index | | | 22.58 | | | | 23.29 | | | | 15.10 | | | | 14.91 | | | | NA | | | | NA | |

| | | | | | |

| Lipper Mid-Cap Core Funds Average | | | 24.59 | | | | 20.48 | | | | 12.22 | | | | 12.72 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Mid Cap Fund – Institutional Shares from commencement (April 30, 2015) was 12.24%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Mid Cap Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses.

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Midcap Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Mid-cap companies can be more sensitive to changing economic conditions and have fewer financial resources than large-cap companies.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

Net expense ratio reflects contractual agreement through May 1, 2022.

Year in Review

The Russell’s 22.58% 2021 return is among the benchmark’s highest annual returns in a decade, and its trailing three-year return impressively exceeded 70%. The economy has steadily improved since the COVID-19-induced trough of 2020, and last year’s GDP growth was the best since 1984. With this tremendous growth as a backdrop, investors focused on strong corporate earnings growth, robust consumer demand and healthy housing and labor markets to drive the market significantly higher. All the while, they shrugged off bearish headwinds, including COVID-19 waves, high inflation, indications of Fed rate tightening, supply chain bottlenecks and labor shortages.

On the surface, the Fund’s 16.39% annual return seems attractive, but it fell short of the surging Russell. It was challenging for our high-quality, lower-volatility portfolio to keep up with the raging market. The Fund’s return also trailed its Lipper peers’ 24.59% gain. As investors embraced a more defensive posture in the fourth quarter, the Fund performed well, handily besting both of its benchmarks.

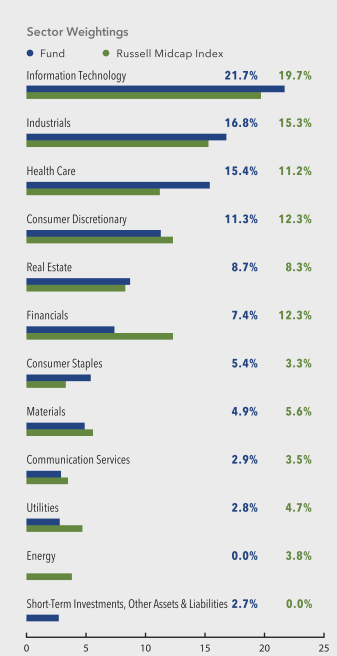

From a sector-allocation perspective, our underweight position relative to the Russell in the communication services sector, the worst-performing sector in the benchmark, helped the Fund the most, adding 37 basis points to the Fund’s return. (One basis point is 1/100th of one percent.) The Fund’s underweight position in the outperforming financials sector and overweight position in the underperforming information technology sector hurt the Fund the most, taking 42 and 32 basis points, respectively, from the Fund’s return.

10

| | | | |

| | |

| Annual Report • 2021 | | | |  |

The Fund’s weakest performer was SelectQuote, a direct-to-consumer insurance distribution platform. The stock reduced the Fund’s performance by 152 basis points, as the stock delivered a negative return of 65.4%* from our average cost. The company is experiencing higher churn in its Medicare plan customer base, which decreases both revenue and profitability. SelectQuote also struggled to hire new agents as the labor market tightened. The company’s competitive advantage is vulnerable and unit economics will be pressured going forward, so we decided to exit the position.

Grocery Outlet, a grocery chain with a small-store format and deeply discounted, branded products subtracted 104 basis points from the Fund’s annual return, as the stock dropped 27.9%. The stock fell because same-store sales growth repeatedly missed investors’ expectations against tough comparisons. The discount grocer’s relevancy was temporarily out of favor, as consumers consolidated their store visits and shifted purchases to larger stores, resulting in traffic-share losses. The company also experienced higher supply chain, freight and fuel costs, which pinched profits. We believe these headwinds are largely transitory, and the stock is attractively valued.

Teleflex, a global provider of medical devices for operative urology, anesthesia, vascular and general surgery-related procedures, subtracted 56 basis points from the Fund’s return, as the total return of its stock was a negative 19.9% for the year. The stock fell mid-year due to concerns about a proposed 2022 Medicare fee schedule that would reduce physician payments for its UroLift product. The ongoing COVID-19 pandemic, which has curtailed demand for elective medical procedures, created client staffing shortages and increased freight cost pressures also weighed on the shares.

Shifting to our winners, our strongest performer was Republic Services, the second-largest solid-waste and recycling company in the United States. The stock contributed 170 basis points to the Fund’s return as the total return, of its shares was 47.0%. Republic benefitted from the consumer-led economic recovery as waste volumes trended better than initially expected. The other key tailwinds for Republic were stronger pricing and a record level of accretive tuck-in

acquisitions. We see further upside potential as the company benefits from multi-year contracts, which include cost escalators, and its digital investments, which should boost efficiency gains.

KLA Corporation, a provider of mission-critical inspection tools used for quality control and defect detection by semiconductor manufacturers, added 161 basis points to the Fund’s return, as its total return was 68.0%. KLA had a great start in 2021, as semiconductor customers such as Intel accelerated demand for its process-control-technology. The stock moved higher throughout the year, as the company saw sustained industry growth and share gains. We believe the company’s earnings prospects are bright, driven by multi-year secular growth tailwinds, including greater usage of semiconductor chips, a robust backlog and a multi-year pipeline of innovative products.

Shares of O’Reilly Automotive generated a total return of 56.1% and contributed 125 basis points to the Fund’s performance. The stock went up steadily throughout the year, as the company consistently beat earnings expectations and gained share from both big-box retailers and smaller competitors. O’Reilly is poised to benefit from a favorable industry backdrop, with more older cars on the road, share gains due to its best-in-class distribution and service and additional margin expansion as it leverages fixed costs and in-house label products gain adoption.

* For this report, we quote total return to the portfolio, which includes price change and dividends.

11

| | | | |

| | |

| | | | Annual Report • 2021 |

Parnassus Mid Cap Fund

As of December 31, 2021

(percentage of net assets)

Portfolio characteristics and holdings are subject to change periodically.

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Republic Services Inc. | | | 3.9% | |

| |

| Hologic Inc. | | | 3.8% | |

| |

| SBA Communications Corp., Class A | | | 3.1% | |

| |

| Cerner Corp. | | | 3.1% | |

| |

| O’Reilly Automotive Inc. | | | 3.1% | |

| |

| Jack Henry & Associates Inc. | | | 2.9% | |

| |

| Avantor Inc. | | | 2.9% | |

| |

| Verisk Analytics Inc. | | | 2.7% | |

| |

| Burlington Stores Inc. | | | 2.6% | |

| |

| Guidewire Software Inc. | | | 2.6% | |

Portfolio characteristics and holdings are subject to change periodically.

Value on December 31, 2021

of $10,000 invested on December 31, 2011

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Outlook and Strategy

The U.S. economy is expected to grow nicely this year, the unemployment rate is low, the Fed’s incrementally hawkish actions aren’t yet spooking investors, the Russell Mid Cap’s earnings are expected to grow at a healthy clip and investors appear to have excess capital to deploy into risk assets like the equity markets. However, investors would be remiss to exclusively focus on these positives, as the economy and markets face significant headwinds as the pandemic enters its third year. Inflation is at a 40-year high, Fed rate action could exceed expectations, stimulus spending seems on course to wane, input and labor costs are up materially and surging Omicron cases are shutting down businesses. Another consideration that weighs on outright optimism is that the Russell is currently

1 Stock Price Per Share/2022 Estimated Earnings Per Share

2 Enterprise Value/2022 Estimated Earnings Before Interest, Taxes, Depreciation and Amortization

12

| | | | |

| | |

| Annual Report • 2021 | | | |  |

trading well above its 20-year averages in terms of forward price-to-earnings1 and EV/EBITDA2 multiples.

Considering the puts and takes mentioned above, the last observation on valuation deserves more attention. We believe this will be a fulcrum determining market performance in 2022. In short, investors’ willingness to pay premium multiples will be a driving factor in the return equation and could moderate returns in 2022, especially considering the potential for more hawkish Fed action in light of inflation. Given the wide range of outcomes, we continue to focus on owning a collection of high-quality businesses that can compound earnings in multiple economic scenarios and provide longer-term asymmetric risk-reward opportunities and full-market cycle outperformance.

Moving to our sector weightings, we are underweight relative to the Russell in the financials, materials and consumer discretionary sectors, which are likely to perform poorly in challenging markets. We also have no direct exposure to energy stocks, another economically sensitive area, consistent with our policy to avoid investments in fossil-fuel companies. We are overweight relative to the Russell in the information technology, industrials and health care sectors, owning a selection of businesses that we expect will do well regardless of the market environment. Still, across sectors, as bottom-up stock pickers, we are considering any high-quality companies that offer asymmetric risk-reward opportunities over the next three years. Finally, of note is the fact that our sector over- and under-weightings relative to the Russell, especially in the consumer discretionary and industrials sectors, are less severe than in past years.

We bought two new stocks in the fourth quarter. We initiated a position in CoStar Group, a leading provider of real estate data and transaction marketplaces including LoopNet, Homes.com and Apartments.com. The company has carved out a wide competitive moat, supported by its intangible assets, which include its highly valuable commercial real estate data sets, high switching costs and network effects. These factors should enable the company to exert pricing power and capture additional market share in its fast-growing and durable markets. The stock’s recent underperformance due to a series of temporary headwinds, including slower growth in its Apartments.com business due to historically low vacancy rates and additional investments in the residential real estate market,

provided a compelling entry point to buy the high-quality compounder. We see a long runway for growth, supported by additional margin expansion, an attractive business model with a high degree of recurring revenue, a conservative balance sheet and a disciplined capital allocation strategy.

We also initiated a position in Avalara, which is a leading sales tax and compliance cloud software platform. The company is increasingly automating the complex and onerous task of sales tax and other compliance processes for e-commerce businesses of all sizes. This is a multibillion-dollar market opportunity in the United States alone, supported by retail merchants increasingly embracing e-commerce, omni-channel and global online sales. With its specialized tax-specific data sets developed over the past decade, low customer churn rate and economies of scale, Avalara has built out a sustainable competitive moat that should support its ability to compound growth for a multi-year period.

To make room for the new holdings, we exited Nuance, as the company agreed to be acquired by Microsoft, and the deal closure is expected in the near term. We also sold our position in SelectQuote due to our concern about its deteriorating business fundamentals resulting from higher customer churn and increasing competition.

The portfolio owns a collection of well-managed, increasingly relevant businesses with sustainable competitive advantages that should grow earnings and cash flows over the long-term. We are confident that this strategy will help the Fund outperform the market over the full market cycle.

Thank you for your investment in the Parnassus Mid Cap Fund.

Yours truly,

Matthew D. Gershuny

Lead Portfolio Manager

Lori A. Keith

Portfolio Manager

13

| | | | |

| | |

| | | | Annual Report • 2021 |

Parnassus Endeavor Fund

Ticker: Investor Shares - PARWX

Ticker: Institutional Shares - PFPWX

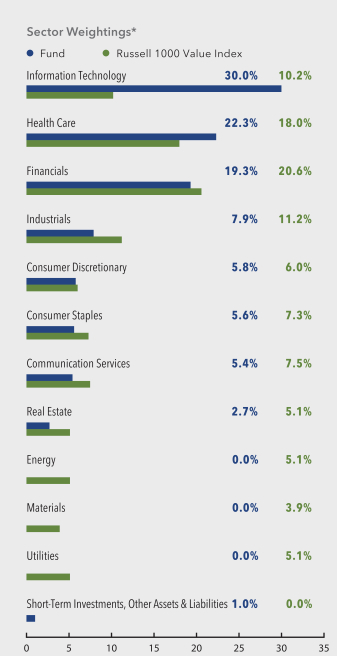

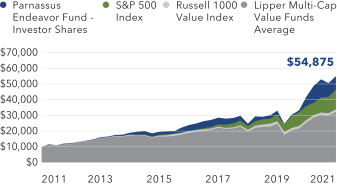

As of December 31, 2021, the net asset value (“NAV”) of the Parnassus Endeavor Fund – Investor Shares was $54.03, so after taking dividends into account, the Fund’s total return for the year was 31.12%. This compares to a gain of 25.16% for the Russell 1000 Value Index (“Russell 1000 Value”), a gain of 28.71% for the S&P 500 Index (“S&P 500”), and a gain of 26.22% for the Lipper Multi-Cap Value Funds Average, which represents the average return of the multi cap value funds followed by Lipper (“Lipper Average”). It was a terrific year for the Parnassus Endeavor Fund, driven by our holdings in financials and information technology stocks. We surpassed each of our closest benchmarks, the Russell 1000 Value and the Lipper Average, by over 490 basis points, while exceeding the S&P 500’s return by over 241 basis points. (One basis point is 1/100th of one percent.)

Below is a table that summarizes the performance of the Parnassus Endeavor Fund, Russell 1000 Value, S&P 500 and Lipper Average over multiple time periods. I am delighted to report that we beat or met all the indices for all time periods shown, often by a substantial margin. The Fund’s returns are especially strong over the three-year period

during which I have served as your portfolio manager. We invest money for the long-term, so we’re most proud of our five- and ten-year track records. Over those periods, the Parnassus Endeavor Fund – Investor Shares has produced an annual total return of over 18%, earning us the ranks of #3 out of 538 funds (five-year) and #1 out of 393 funds (ten-year) in Lipper’s Multi-Cap Value Funds Category.*** I am thrilled to provide such impressive results to our most loyal shareholders.

Year in Review

Each of our three largest detractors reduced the Fund’s return by 25 basis points or more. These stocks hail from different sectors, so the problems pressuring their share prices are idiosyncratic. Happily, our winners dominated our losers in both number and magnitude. Each of our three biggest contributors added 167 basis points or more to the Fund’s return. Financial and information technology firms were well represented in the winners list, reflecting the economy’s strong growth in 2021.

Our biggest loser was wireless carrier Verizon. It reduced the Fund’s return by 33 basis points, as its stock slipped from our average cost of $56.94 to $51.96, for a total return of negative 5.8%.* The company executed relatively well in a tough environment, but the stock failed to keep up with the broader market. Investors grappled with intensifying competition in the form of more promotional activity from peers and new entrants in the form of cable companies. The near-term capital requirements of building out a 5G network with less-certain long-term monetization potential also weighed on the stock.

Parnassus Endeavor Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2021 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio** | |

| | | | | | |

| Parnassus Endeavor Fund – Investor Shares | | | 31.12 | | | | 30.59 | | | | 18.21 | | | | 18.56 | | | | 0.94 | | | | 0.88 | |

| | | | | | |

| Parnassus Endeavor Fund – Institutional Shares | | | 31.37 | | | | 30.86 | | | | 18.47 | | | | 18.74 | | | | 0.73 | | | | 0.65 | |

| | | | | | |

| Russell 1000 Value Index | | | 25.16 | | | | 17.64 | | | | 11.16 | | | | 12.97 | | | | NA | | | | NA | |

| | | | | | |

| S&P 500 Index | | | 28.71 | | | | 26.07 | | | | 18.47 | | | | 16.55 | | | | NA | | | | NA | |

| | | | | | |

| Lipper Multi-Cap Value Funds Average | | | 26.22 | | | | 17.88 | | | | 11.30 | | | | 12.25 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Endeavor Fund – Institutional Shares from commencement (April 30, 2015) was 16.90%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Endeavor Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses.

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell 1000 Value and S&P 500 are unmanaged indexes of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Effective September 30, 2021, the Fund changed its index from the S&P 500 Index to the Russell 1000 Value Index because the Russell 1000 Value Index better reflects the underlying holdings of the Fund pursuant to its current principal investment strategies.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

* For this report, we quote total return to the portfolio, which includes price change and dividends.

** Reflects the lowered expense limitation, effective as of January 1, 2022.

Net expense ratio reflects contractual agreement through May 1, 2023.

*** The Parnassus Endeavor Fund – Investor Shares ranked #89 out of 637 funds (one-year) and #3 out of 614 funds (three-year). Lipper Rankings represent a fund’s total return rank relative to all funds that have the same Lipper category. The highest rank is 1 and the lowest is based on the total number of funds ranked in the category. It is based on Lipper total return, which includes both income and capital gains or losses and is not adjusted for sales charges or redemption fees. Past performance does not guarantee future results.

14

| | | | |

| | |

| Annual Report • 2021 | | | |  |

Biopharmaceutical company Biogen subtracted 26 basis points from the Fund’s return, as its stock sank from our average cost of $272.24 to $239.92, for a total return of negative 10.3%. Biogen develops drugs that treat neurological and neurogenerative disease, including multiple sclerosis and spinal muscular atrophy. The stock soared after the FDA approved Biogen’s experimental Alzheimer’s treatment but subsequently crashed as the approval decision was beset with controversy. At under 13x next year’s profits, Biogen’s stock price is on the floor. We see upside potential, as this wide-moat business continues to produce both life-saving therapies and abundant cash flow.

Specialty retailer VF Corp. cut the Fund’s return by 25 basis points, as its stock fell from $85.41 to $73.22, for a total return of negative 12.0%. The company reported lackluster results as their margins and growth outlook fell short of investor expectations. Disruptions throughout the supply chain, including temporary lockdowns, capacity constraints and logistics delays continued to negatively impact sales and margins. Management also noted limited operational leverage in the near-term, as the company outlined incremental expenses to support demand creation and digital transformation investments. These investments should allow the company to better capitalize on long-term trends around increased outdoor activities, active lifestyles, and more casual wear.

Semiconductor equipment manufacturer Applied Materials was our biggest winner. It contributed 433 basis points to the Fund’s return, as its stock soared from $86.30 to $157.36, for a total return of 83.6%.

Applied continues to benefit from multi-year trends for increasing chip demand and complexity. Industry-wide equipment spend and the company’s backlog are also at record highs. The company did miss expectations this quarter due to supply chain shortages, but we are confident that this is an issue with supply, not demand, and should be remedied within a few quarters.

Charles Schwab, the online brokerage firm and bank, returned 60.2% and contributed 268 basis points to the Fund’s performance, as its stock surged from $53.04 to $84.10. Schwab earns interest revenue on its clients’ cash balances, and the stock rallied as traders anticipated that the Federal Reserve would increase its benchmark Fed Funds rate. Over the course of the year, market expectations increased from zero Fed Funds rate hikes over the next twelve months to three hikes. If the market is correct, Schwab’s interest revenue should increase meaningfully in 2022.

Capital One added 167 basis points to the Fund’s return, as its stock jumped from $98.85 to $145.09, for a total return of 49.3%. Capital One is best known for its credit card business, but it offers a wide range of financial products and services to consumers, small businesses and commercial customers. The stock marched higher following a string of record profits, driven by the exceptionally strong credit profile of its customer base. A combination of government stimulus, loan forbearance and fewer opportunities to spend doubled savings rates for the average consumer, benefitting Capital One by nearly eliminating bad debt.

15

| | | | |

| | |

| | | | Annual Report • 2021 |

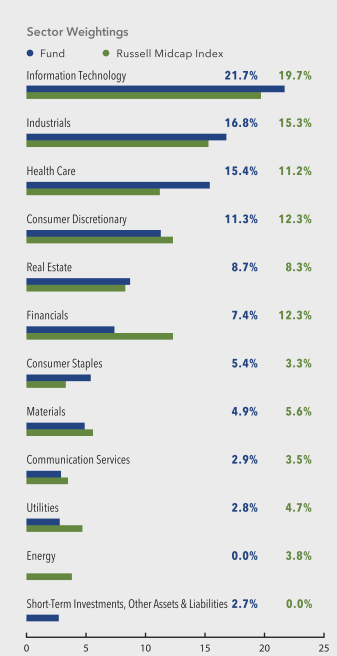

Parnassus Endeavor Fund

As of December 31, 2021

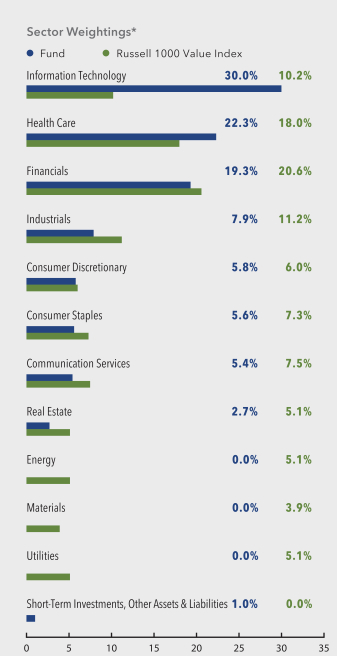

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| The Charles Schwab Corp. | | | 3.7% | |

| |

| Cisco Systems Inc. | | | 3.5% | |

| |

| Verizon Communications Inc. | | | 3.4% | |

| |

| Merck & Co., Inc. | | | 3.3% | |

| |

| Intel Corp. | | | 3.1% | |

| |

| Agilent Technologies Inc. | | | 2.9% | |

| |

| PepsiCo Inc. | | | 2.9% | |

| |

| Simon Property Group Inc. | | | 2.7% | |

| |

| Sysco Corp. | | | 2.7% | |

| |

| Global Payments Inc. | | | 2.6% | |

Portfolio characteristics and holdings are subject to change periodically.

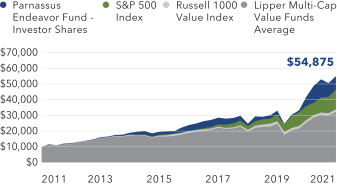

Value on December 31, 2021

of $10,000 invested on December 31, 2011

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Outlook and Strategy

U.S. stock markets posted another strong year of double-digit gains following the onset of the pandemic in early 2020. Despite worrisome outbreaks of the Delta and Omicron coronavirus variants, the S&P 500 marched steadily higher on the back of robust corporate earnings growth and fiscal stimulus. Market valuations also remained lofty, leading the index to hit 70 all-time highs over the course of President Biden’s first year in office.

2021 was a transition year, not just for the U.S. presidency, but for the Parnassus Endeavor Fund as well. As the new lead portfolio manager, I implemented a series of risk-management measures that diversified our holdings and steadied our returns.

16

| | | | |

| | |

| Annual Report • 2021 | | | |  |

ESG has been further integrated into our investment process, with our emphasis on good workplaces extended to all Parnassus funds. In October, the Russell 1000 Value Index replaced the S&P 500 as the Parnassus Endeavor Fund’s primary benchmark. This substitution was made to acknowledge the role the Parnassus Endeavor Fund can play as the foundational large cap value fund in client portfolios.

What hasn’t changed is the Parnassus Endeavor Fund’s long-standing investment philosophy of buying good and socially responsible companies at bargain prices. This means we develop our shopping list of quality stocks we’d like to buy and wait for a sufficiently discounted price. We call this approach relative value, or clean value, investing. It was designed to combine the best of traditional value investing with the quality bias of an active ESG manager.

Why does a commitment to value investing make sense now? Inflation and valuation offer two compelling reasons. High housing costs and rising wages are

fueling broad-based inflation that could spur higher interest rates this year. Such a scenario could benefit value stocks that generate cash flow now, at the expense of growth stocks that promise cash far into the future. Secondly, growth stocks are priced at levels rivaling those seen during the late 1990’s tech bubble. As it did then, a sudden change in market sentiment could spark a dramatic rebalancing of investor dollars from growth to value. Most of the companies in the Parnassus Endeavor Fund are poised to take advantage of such a market rotation.

Thank you for your investment in the Parnassus Endeavor Fund.

Yours truly,

Billy Hwan

Portfolio Manager

17

| | | | |

| | |

| | | | Annual Report • 2021 |

Parnassus Mid Cap Growth Fund

Ticker: Investor Shares - PARNX

Ticker: Institutional Shares - PFPRX

As of December 31, 2021, the net asset value (“NAV”) of the Parnassus Mid Cap Growth Fund – Investor Shares was $64.36, resulting in a gain of 9.37% for 2021. This compares to an increase of 12.73% for the Russell Midcap Growth Index (“Russell Midcap Growth”) and a gain of 15.27% for the Lipper Multi-Cap Growth Funds Average, which represents the average return of the multi-cap core funds funds followed by Lipper (“Lipper Average”).

Below is a table that summarizes the performance of the Parnassus Mid Cap Growth Fund, Russell Midcap Growth and Lipper Average. The returns are for the one-, three-, five- and ten-year periods ended December 31, 2021.

Parnassus Mid Cap Growth Fund

| | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2021 | |

| | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | |

| | | | | |

| Parnassus Mid Cap Growth Fund – Investor Shares | | | 9.37 | | | | 22.23 | | | | 13.86 | | | | 15.49 | | | | 0.83 | |

| | | | | |

| Parnassus Mid Cap Growth Fund – Institutional Shares | | | 9.50 | | | | 22.39 | | | | 14.02 | | | | 15.60 | | | | 0.68 | |

| | | | | |

| Russell Midcap Growth Index | | | 12.73 | | | | 27.46 | | | | 19.83 | | | | 16.63 | | | | NA | |

| | | | | |

| Lipper Multi-Cap Growth Funds Average | | | 15.27 | | | | 29.34 | | | | 21.88 | | | | 16.99 | | | | NA | |

The average annual total return for the Parnassus Mid Cap Growth Fund – Institutional Shares from commencement (April 30, 2015) was 12.06%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Mid Cap Growth Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses.

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Mid Cap Growth is an index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

Year in Review

The Fund gained 9.37% for the year, trailing the Russell Midcap Growth by 336 basis points. (One basis point is 1/100th of one percent.) We finished the year strong, as the Fund gained 4.18% during the fourth quarter, which was ahead of the 2.85% gain for the Russell Midcap Growth. However, it wasn’t enough to make up for our underperformance in the second and third quarters.

In 2021, sector allocations had a negative impact on our relative performance. The most meaningful detractor was our zero-weighting of the real estate sector, the index’s best-performing sector in 2021. Following the COVID-19 lockdowns of 2020, real estate benefited in 2021 as the economy re-opened. Many of the companies that drove the sector’s rebound are slow growers that lack competitive moats, so we expect them to underperform our wide-moat, secular winners over the long-term. Poor stock selection this year hurt our performance as well, most notably in the information technology sector, which overwhelmed strong stock selection in the consumer discretionary sector.

Our worst performer in 2021 was StoneCo, a technology-focused merchant payments processor in Brazil. Its stock dropped 48.4%* to our average selling price, slicing 145 basis points off the Fund’s return. The Brazilian central bank is rapidly hiking interest rates to combat rampant inflation in the country, which is reducing the profitability of StoneCo’s prepayment offering. Meanwhile, an intense competitive environment is also squeezing StoneCo’s profit margins. We decided to sell our shares in the fourth quarter, as we don’t think the company will return to its historical profitability anytime soon.

* For this report, we quote total return to the portfolio, which includes price change and dividends.

18

| | | | |

| | |

| Annual Report • 2021 | | | |  |

Cell biology tool manufacturer Berkeley Lights reduced the Fund’s return by 131 basis points, as the stock declined 64.3% to our average selling price. The stock fell after the company’s revenue missed expectations, and it dropped again after a short report questioned the effectiveness of its core Beacon product. We sold our position because we’re concerned that Beacon’s adoption will be slower than expected.

Angi, the leading online platform for home service projects, subtracted 68 basis points from the Fund’s performance, as its stock dropped 30.2%. Angi is investing heavily to increase brand awareness and expand its new, fixed-price offering. The stock fell as the transition has yet to bear fruit. We’re holding onto our shares, because we’re still in the early days of the transition and the addressable market is so big that our upside has the potential to be massive if it’s successful.

Our three biggest winners in 2021 were companies that are each best-in-class in their respective industries. These are wide-moat businesses with seasoned management teams that consistently gain market share by providing an exceptional customer experience with impeccable operational execution.

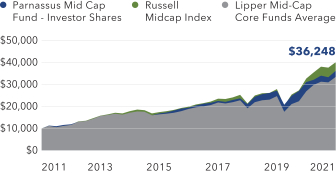

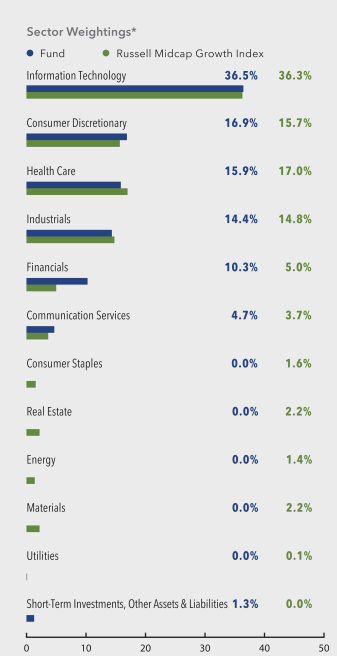

Parnassus Mid Cap Growth Fund

As of December 31, 2021

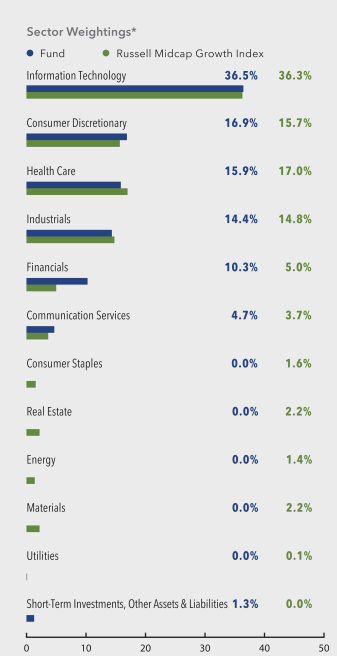

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

19

| | | | |

| | |

| | | | Annual Report • 2021 |

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Cadence Design Systems Inc. | | | 5.0% | |

| |

| Old Dominion Freight Lines Inc. | | | 4.7% | |

| |

| Pool Corp. | | | 4.5% | |

| |

| O’Reilly Automotive Inc. | | | 4.1% | |

| |

| Synopsys Inc. | | | 4.1% | |

| |

| IDEXX Laboratories, Inc. | | | 3.7% | |

| |

| Agilent Technologies Inc. | | | 3.5% | |

| |

| Burlington Stores Inc. | | | 3.3% | |

| |

| Signature Bank | | | 3.0% | |

| |

| MarketAxess Holdings Inc. | | | 2.9% | |

Portfolio characteristics and holdings are subject to change periodically.

While many companies are struggling with cost inflation and supply chain disruptions, these three have pricing power and delivered record operating margins and earnings.

Our biggest winner in 2021 was Old Dominion Freight Lines, which added 212 basis points to the Fund’s return, as its stock increased 84.2%. Old Dominion focuses on less-than-truckload shipments, and the company made the most of the red-hot freight market with impressive revenue and earnings growth. Old Dominion is beloved by its clients for its reliability, customer service and transparent pricing, which became even more desirable as shippers grappled with COVID-19-induced logistics issues.

Pool supplies distributor Pool Corp. contributed 161 basis points to the Fund’s return, as the stock gained 53.0%. The company’s financial results soared above expectations as it capitalized on strong demand for residential pools from consumers investing in their homes. Pool Corp. dominates its niche market, serving as the network connecting the industry’s diverse supply chain with its fragmented retail base. Its extensive catalog and stellar customer service should position the company well for years to come.

Auto parts retailer O’Reilly boosted the Fund’s return by 153 basis points as its stock motored 56.1% higher. O’Reilly’s same-store sales and earnings growth throughout the year were well above expectations, as the company benefitted from a rebound in miles driven, higher used car prices and favorable weather. O’Reilly’s sales growth was much higher than its peers,

which speaks to the company’s parts availability and advantaged distribution network.

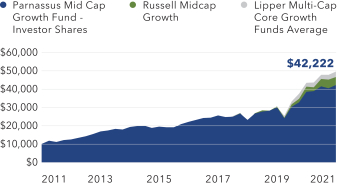

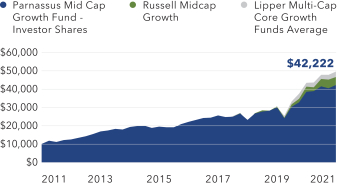

Value on December 31, 2021

of $10,000 invested on December 31, 2011

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Outlook and Strategy

The Russell Midcap Growth Index rose 12.73%, the index’s third consecutive year of double-digit gains. Despite the strong return, 2021 was marked by higher volatility and meaningful dispersion among the index constituents. The Russell Midcap Growth suffered two declines greater than 10% in 2021, the first time in a decade that the index has endured two corrections in a year. The index ended the year 6.5% off the all-time high it set in November, but 40% of the index’s constituents were more than 20% below their 2021 peaks.

The market’s range of outcomes is widening due to the removal of fiscal and monetary stimulus. The economy— and market—will need to stand on their own with less support from governments and central bankers. It’s possible the tight employment market will lead to wage gains that benefit consumers, who could then spend that money and spur the economy forward, since the consumer has historically accounted for approximately 70% of our economy. However, the hangover from the government’s debt-funded stimulus could slow growth, as this debt will eventually need to be repaid by raising taxes or by diverting funds that could have been used for more productive purposes. Additionally, central bankers may need to raise interest rates and shrink their bond holdings to temper inflation, which would likely slow economic growth by reducing consumer and corporate borrowing. Since 2009, investors have been accustomed to supportive monetary policy and expect an extra jolt of liquidity

20

| | | | |

| | |

| Annual Report • 2021 | | | |  |

whenever the markets fall. This implicit “Fed put” may no longer exist due to the high inflation rate.

We feel that our focus on investing in companies with competitive advantages, increasing relevancy, positive ESG characteristics, clean balance sheets and skilled executives is ideally suited for this environment with a wide range of outcomes. Last quarter, we wrote that we upgraded our portfolio to sharpen our focus on long-term compounders and to take advantage of some of the attractive valuations caused by the index’s dispersion. We’re pleased that our Fund outperformed in the fourth quarter, and that we found additional opportunities to upgrade our portfolio.

We swapped our investment in StoneCo for MercadoLibre, the leading online marketplace and payments platform in Latin America. The internet has created winner-take-all markets, and we believe that MercadoLibre has won Latin American e-commerce. While StoneCo has a compelling payments platform in Brazil, MercadoLibre benefits from the same secular tailwinds that PayPal, Block and Amazon have enjoyed in the U.S., and the growth story is even earlier for MercadoLibre in Latin America. We’ve followed the company for a long time, and we were excited to invest after its stock sold off.

We also swapped our investment in computer memory manufacturer Western Digital for Teradyne, a semiconductor-testing equipment manufacturer. While Western Digital and Teradyne both benefit from the secular trends behind semiconductors, Teradyne is a faster-growing, higher-margin business. Teradyne’s testing equipment has a wide competitive moat and generates attractive returns on capital. Teradyne has wisely used this capital to build an exciting industrial automation business that is the leader in co-bots, or robots that collaborate with humans. We believe this business can grow rapidly for many years to come as co-bots are adopted more broadly.

We also invested in two fast-growing cloud-based software companies this quarter, Coupa and Five9. Coupa operates a global technology platform for business-spending management. Coupa’s data analytics and artificial intelligence allow its customers to save money, reduce lead times and improve reliability. Given the supply chain dislocation caused by COVID-19, we believe that Coupa’s solutions are more valuable than ever. Five9 is a leading provider of contact center software, empowering agents with

digital tools to better serve their customers while working from anywhere. Five9’s innovative and intuitive solution is rapidly gaining market share. We believe that COVID-19 has accelerated Five9’s growth, as remote work is demanded by more employees and favored by employers since it reduces overhead costs.

To make room for Coupa and Five9, we sold Cable One, Sunrun and Teleflex. Cable One trades at a steep premium to its cable peers, and we aren’t convinced it will be immune from the slowdown in broadband subscriber growth that’s recently impacted its peers. We moved on from Sunrun because it’s being negatively impacted by higher product costs and labor inflation, and we’re concerned margins will be squeezed further if interest rates increase. Finally, Teleflex’s key product, UroLift has grown slower than expected as COVID-19 has curtailed demand for non-emergency medical procedures. We’re concerned that lower reimbursement rates for the product going forward will hurt its profitability and growth.

Shifting to our sector positioning, information technology remains our largest weighting at 37%, slightly more than the benchmark’s 36%. Within this sector, we own many innovative and fast-growing companies. We’re also overweight financials, communication services and consumer discretionary, and are slightly underweight health care and industrials. We have no exposure to the five smallest sectors in our index-real estate, materials, consumer staples, energy and utilities-because we’ve found that many of the businesses in these sectors lack competitive moats and secular growth drivers.

We’re excited about the terrific collection of businesses we own, and we’re optimistic about the Fund’s performance in 2022. Thank you for your investment in the Parnassus Mid Cap Growth Fund.

Yours truly,

Ian E. Sexsmith

Lead Portfolio Manager

Robert J. Klaber

Portfolio Manager

21

| | | | |

| | |

| | | | Annual Report • 2021 |

Parnassus Fixed Income Fund

Ticker: Investor Shares - PRFIX

Ticker: Institutional Shares - PFPLX

As of December 31, 2021, the net asset value (“NAV”) of the Parnassus Fixed Income Fund – Investor Shares was $17.22, producing a loss for the year of 2.09% (including dividends). This compares to a loss of 1.54% for the Bloomberg U.S. Aggregate Bond Index (“Bloomberg Aggregate Index”) and a loss of 1.26% for the Lipper Core Bond Funds Average, which represents the average return of the funds followed by Lipper that invest at least 85% of assets in domestic investment-grade bonds (“Lipper Average”).

Below is a table comparing the performance of the Parnassus Fixed Income Fund with that of the Bloomberg Aggregate Index and the Lipper Average. Average annual total returns are for the one-, three-, five- and ten-year periods. For December 31, the 30-day subsidized SEC yield was 1.47%, and the unsubsidized SEC yield was 1.35%.

Parnassus Fixed Income Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2021 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Fixed Income Fund – Investor Shares | | | -2.09 | | | | 5.03 | | | | 3.39 | | | | 2.37 | | | | 0.74 | | | | 0.68 | |

| | | | | | |

| Parnassus Fixed Income Fund – Institutional Shares | | | -1.90 | | | | 5.25 | | | | 3.62 | | | | 2.50 | | | | 0.55 | | | | 0.45 | |

| | | | | | |

| Bloomberg U.S. Aggregate Bond Index | | | -1.54 | | | | 4.79 | | | | 3.57 | | | | 2.90 | | | | NA | | | | NA | |

| | | | | | |

| Lipper Core Bond Funds Average | | | -1.26 | | | | 5.16 | | | | 3.65 | | | | 3.09 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Fixed Income Fund – Institutional Shares from commencement (April 30, 2015) was 3.03%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Fixed Income Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses.

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived.

Returns shown in the table do not reflect the deduction of taxes a shareholder would pay in fund distributions or redemption of shares. The Bloomberg U.S. Aggregate Bond Index (formerly known as the Barclays U.S. Aggregate Bond Index) is an unmanaged index of bonds, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

Net expense ratio reflects contractual agreement through May 1, 2022.

Year in Review

The second year of the COVID-19 pandemic brought considerable changes to the economy and to global markets. While scientists made great medical progress against the virus, the continued emergence of new variants and the compounding impact of the virus on business activity whipsawed interest rates. The 10-year Treasury nearly doubled in the first quarter from 0.91% to 1.74%, driven by concerns about rapidly rising inflation in the face of a very dovish Federal Reserve.

While yields finished the year at a more modest 1.51%, investors weighed rapidly changing expectations for inflation and the trajectory of COVID-19. Inflation is running even higher than anticipated and, in response, the Federal Reserve has become unflinchingly hawkish. As of December, the Federal Reserve is threatening to hike rates as many as three times in 2022. In the face of this environment, the Bloomberg Aggregate Index, the bond market’s most important benchmark, lost 1.54% and the Parnassus Fixed Income Fund – Investor Shares underperformed the Index for the year with a loss of 2.09%.

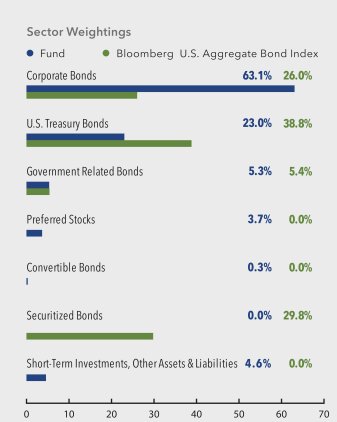

Most asset classes within the Index finished the year with similar performance. So, while corporate bonds drove our underperformance this year, that’s a result of our significant overweight in this asset class. We averaged about 64% of assets in corporate securities over the course of the year, as compared with 26% in the Index. Our corporate bond portfolio detracted 64 basis points from the total return, as compared to 29 basis points for the Index. (One basis point is 1/100th of one percent.) The worst-performing securities this year were also generally the highest rated, as these bonds had ultra-low spreads that did not compensate investors for rising rates or volatility.

22

| | | | |

| | |

| Annual Report • 2021 | | | |  |

We systematically sold many of our AA- and A-rated corporate bonds throughout the year, as it became clear that these bonds were unattractive investments.

The duration of our corporate portfolio continued to be well short of the comparable duration in the Index, at 7.51 years versus 8.51 years. Duration on corporate securities is at multi-decade longs, so a somewhat short duration position seems prudent because it tempers the impact – and volatility – associated with our overweight position.

Our best-performing securities were generally high-yield bonds and preferred stock due to their higher yields. In fact, our high-yield bonds contributed an enormous 30 basis points to the total return. These bonds are issued by companies that we know well and are usually also held in our equity funds. As of the end of the year, we held approximately 15% of assets in high-yield corporate bonds, which is near our top allocation.

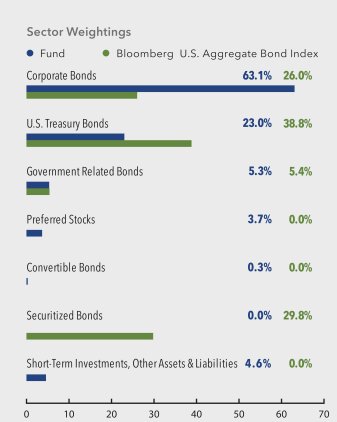

Parnassus Fixed Income Fund

As of December 31, 2021

(percentage of net assets)

Portfolio characteristics and holdings are subject to change periodically.

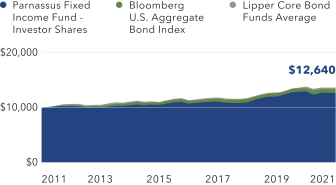

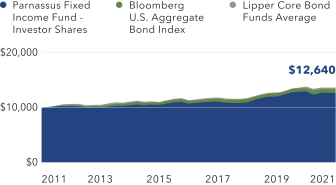

Value on December 31, 2021

of $10,000 invested on December 31, 2011

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

The Fund was also boosted by its Treasury portfolio, which detracted 61 basis points from the total return versus 86 basis points for the Index. Our Treasury bonds lost 1.54% during the year, far better than the Index’s loss of 2.32%. Early in the year, when faced with the prospect of higher inflation, we reallocated the Treasury portfolio into a barbell. This means that we hold disproportionately more bonds maturing in the next two years and in 30 years, but fewer bonds maturing in around 10 years. This restructuring served us well this year, as it helped insulate the Treasury portfolio against volatile rates.

Outlook and Strategy

Expectations are for continued, strong economic growth in 2022, with GDP growth topping 4%, despite what we see as a fundamentally different backdrop. Instead of enormous support coming from the Federal government by way of stimulus checks, government transfers to citizens will materially decline next year. Consumers, flush with cash through 2021, are returning to typical pre-COVID-19 savings rates while inflation serves as a headwind to consumer spending.

Some factors driving inflation, like wage growth, are likely persistent. We anticipated higher wages several years ago as labor’s share of GDP dropped to generational lows. It’s logical to anticipate another generational swing in favor of labor, just as we’ve seen in centuries past. However, supply chain constraints and manufacturing disruptions are likely to fade in 2022. Companies have been actively working to reconfigure supply chains around blockages, shipping costs are finally falling and consumers’ purhasing

23

| | | | |

| | |

| | | | Annual Report • 2021 |

habits will be substantially different in early 2022 as the holidays pass. That means ports, truckers and factories will have an opportunity to catch up, thereby relieving the recent frenetic pace of goods inflation.

The Federal Reserve has already taken a very hawkish turn, and we would not be surprised to see inflation decline just as the Federal Reserve ends its asset purchase program this spring. The market currently anticipates several interest rate hikes in 2022, but for the reasons above, we think the range of outcomes for yields next year is wide. It’s just as likely that yields fall from 2021 levels as rise, and so we’ve structured the Fund to meet a variety of market conditions.

Should yields rise, high-yield bonds are expected to do well. These issuers are leveraged to economic conditions, so a hotter economy buoys these bonds. High-yield bonds are also not priced using the Treasury market, so values can move independently of rising yields. With about 15% allocated to high-yield bonds versus none for the Index, the Fund should benefit from both higher yields as well as better performance in an inflationary environment.

On the other hand, if rates remain stable or even fall, our outsized position in corporate bonds should benefit. Corporate spreads are widely anticipated to remain stable next year, or even tighten slightly, and since these bonds provide a higher yield than either treasuries or securitized bonds, the carry provided by these bonds would benefit investors. We enter 2022

with 67.79% allocated to corporate securities, including high-yield bonds and preferred stock.

The Fund’s duration is a bit shorter than the Index, at 6.65 years versus the Index at 6.77 years. The duration of each asset class, including corporate bonds and Treasuries, is also below the respective duration of that asset class within the Index. However, despite this slightly short duration, the Fund enters 2022 with an option-adjusted spread (OAS) of 85 basis points versus the Index at 37 basis points. In general, the OAS measures the additional income earned on our investments as compared to a risk-free rate of return. We believe this substantially higher OAS will help drive returns for the upcoming year.

Thank you for your investment in the Parnassus Fixed Income Fund.

Samantha Palm

Lead Portfolio Manager

Minh Bui

Portfolio Manager

24

| | | | |

| | |

| Annual Report • 2021 | | | |  |

Responsible Investing Notes

One of Parnassus’s defining traits is that we’re always learning – we don’t rest on our laurels. As the ESG industry has become more competitive and complex over the years, Parnassus has consistently innovated and adapted to address the evolving landscape. As the new director of ESG research, I expect this to continue, if not accelerate. We’ve already made a number of important enhancements to our ESG processes and capabilities during the fourth quarter, and we’re excited about what we have in store for 2022.

Now more than ever, ESG issues can represent outsized risks or opportunities to a company’s bottom line and stock performance. To ensure that we’re thoughtfully analyzing the real-time stories that can have a financially material or reputational impact on our companies, we recently launched “ESG in the News.” On a monthly basis during our investment team meetings, we discuss the newsworthy ESG events across our portfolios. This not only serves as the impetus to address material ESG issues that can impact the stock’s performance, but it also deepens our knowledge on these important topics.

In December, we discussed John Deere’s United Auto Workers strike, which impacted approximately 10,000 employees and lasted one month, and Nike’s supply chain labor practices, as the company has been accused of using forced labor in China. For both situations, we diagnosed the issues and addressed whether they would have a material impact financially and/or a negative reputational impact. Equally important, we discussed the steps the companies are taking to prevent these situations from arising in the future.

We also recently established a formal Restricted List, which contains a list of companies that we’ve eliminated from the investable universe for all of our Funds. The Restricted List is reviewed quarterly, and companies may be added or removed during these meetings. The companies on the list break one of our exclusionary screens or, the spirit of these screens or are involved in controversial business activities, like for-profit education or deforestation, which we believe pose material and reputational risks to our Funds. We view the Restricted List as an important tool to further align our investments

with our values. An additional benefit is that we can now track the performance of the excluded companies and the impact avoiding them has on our Funds.

Next, just as our portfolio managers frequently refer to a dashboard that contains important portfolio statistics and risk metrics relevant to their Funds, we’re in the process of creating an ESG dashboard for each Fund that will include material environmental, social, and governance metrics. Portfolio managers will be able to compare their Fund’s ESG performance relative to its benchmark and see how these metrics change as portfolio holdings change. Over time, we see an exciting opportunity to incorporate some of this data into our client communications, so that you’ll be more informed about the impact your investment in our Funds is having.

Finally, we’re enhancing our ESG stewardship activities by filing shareholder resolutions (also called “shareholder proposals”). When we engage a company with the goal of improving an ESG issue, such as committing to science-based climate targets, our hope is that the company will adequately address the issue. But if the company is unresponsive, we may now decide to escalate the issue by presenting it for a shareholder vote through the company’s proxy statement. If enough shareholders agree with us, that will send a strong signal to management to take the recommended actions. We worked on our first two shareholder resolutions toward the end of 2021 and expect to ramp up this effort in 2022.

The integration of material ESG factors into our investment process has never been stronger. With that as a foundation, I’m excited about the enhancements to our ESG processes and capabilities, and I believe they will be additive to our ability to deliver Principles and Performance ®.

Thank you for your investment in the Parnassus Funds.

Sincerely,

Robert J. Klaber

Director of ESG Research and Portfolio Manager

25

| | | | |

| | |

| | | | Annual Report • 2021 |

Fund Expenses (unaudited)