UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: Parnassus Funds (811-04044) and Parnassus Income Funds (811-06673)

Parnassus Funds

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marc C. Mahon

Parnassus Funds

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Item 1: Report to Shareholders

Parnassus Funds Annual Report

December 31, 2023

Parnassus Core Equity FundSM

Investor Shares: PRBLX | Institutional Shares: PRILX

Parnassus Growth Equity FundSM

Investor Shares: PFGEX | Institutional Shares: PFPGX

Parnassus Value Equity FundSM

Investor Shares: PARWX | Institutional Shares: PFPWX

Parnassus Mid Cap FundSM

Investor Shares: PARMX | Institutional Shares: PFPMX

Parnassus Mid Cap Growth FundSM

Investor Shares: PARNX | Institutional Shares: PFPRX

Parnassus Fixed Income FundSM

Investor Shares: PRFIX | Institutional Shares: PFPLX

Table of Contents

3

| | | | |

| | |

| | | | Annual Report • 2023 |

February 2, 2024

Dear Shareholder,

It was a great year to be invested in stocks and bonds. All of our stock Funds posted double-digit returns for 2023, and our growth-oriented offerings were the best of the lot. The Parnassus Mid Cap Growth Fund gained 36% for the year, while the Parnassus Growth Equity Fund finished with an eye-popping 45% return. Rounding out the top three performers with a 25% gain is our flagship Parnassus Core Equity Fund, which is a large cap strategy that includes growth and value stocks. Our other two stock Funds, the Parnassus Value Equity Fund and the Parnassus Mid Cap Fund, posted healthy gains of 14% and 13%, respectively. Finally, the Parnassus Fixed Income Fund returned 7% for the year, which is a notable outcome for a fixed income fund.

In the reports that follow, you will find detailed commentary on all six of our Funds. This includes retrospectives on last year’s performance, as well as outlooks for the coming year. After the Fund reports, you can find our Responsible Investing Notes, which reflect on our team’s 2023 active ownership activities and our stewardship priorities for 2024.

New Portfolio Manager Assignment

On January 1, 2024, Parnassus veteran Ian Sexsmith became the third portfolio manager (“PM”) for the Parnassus Mid Cap Fund, joining veteran PMs Matt Gershuny and Lori Keith, who have managed the Fund since 2008. Mr. Sexsmith started at Parnassus as a senior analyst in 2011 and has been a portfolio manager for the Parnassus Mid Cap Growth Fund since 2013. While the investment strategy will remain consistent with its core mid cap objectives, we believe Ian’s growth-oriented style of investing will provide a nice complement to the more conservative approach of Mr. Gershuny and Ms. Keith.

New Team Members

We welcomed two new employees to Parnassus in the fourth quarter. Jean Lu joined us as Managing Director, Research Team Strategy. In this newly created leadership role, Ms. Lu is responsible for overseeing the firm’s investment research team. Jean reports directly to me and will work in close partnership with Chief Investment Officer Todd Ahlsten.

Ms. Lu brings over 15 years of investment experience with her. Prior to joining Parnassus, Jean was a Managing Director and Chief Investment Officer for Cambridge Associates’ outsourced investment office (“OCIO”) business. Prior to Cambridge Associates, Jean worked at J.P. Morgan, managing U.S. equity portfolios. She received an MBA with honors from the University of California at Berkeley and holds undergraduate degrees in math and management science from the Massachusetts Institute of Technology. Outside of work, Jean loves to spend time with her two boys and to explore food cultures during her travels.

Madeline Graw is our new Human Resources Generalist, responsible for a variety of HR responsibilities. Prior to joining Parnassus, Ms. Graw was on Bain & Company’s HR and people operations team for eight years. She is passionate about providing top-tier support to all employees and fostering a people-first company culture. In her free time, Madeline enjoys quality time with her family, as well as cooking and staying active with Pilates and yoga.

4

| | | | |

| | |

| Annual Report • 2023 | | | |  |

Thank you for investing in the Parnassus Funds. We wish you a peaceful, healthy and prosperous 2024.

Sincerely,

Benjamin E. Allen

CEO and Portfolio Manager

5

| | | | |

| | |

| | | | Annual Report • 2023 |

Parnassus Core Equity Fund

Ticker: Investor Shares - PRBLX

Ticker: Institutional Shares - PRILX

As of December 31, 2023, the net asset value (“NAV”) of the Parnassus Core Equity Fund – Investor Shares (“the Fund”) was $55.11. After taking dividends into account, the total return for the year was a gain of 24.93%. This compares to a gain of 26.29% for the S&P 500 Index (“S&P 500”).

Below is a table that summarizes the performances of the Parnassus Core Equity Fund and the S&P 500. The returns are for the one-, three-, five- and ten-year periods.

Parnassus Core Equity Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2023 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Core Equity Fund – Investor Shares | | | 24.93 | | | | 9.05 | | | | 15.48 | | | | 11.63 | | | | 0.85 | | | | 0.82 | |

| | | | | | |

| Parnassus Core Equity Fund – Institutional Shares | | | 25.21 | | | | 9.28 | | | | 15.73 | | | | 11.86 | | | | 0.62 | | | | 0.61 | |

| | | | | | |

| S&P 500 Index | | | 26.29 | | | | 10.00 | | | | 15.69 | | | | 12.03 | | | | NA | | | | NA | |

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

As described in the Fund’s current prospectus dated May 1, 2023, Parnassus Investments, LLC has contractually agreed to reduce its investment advisory fee to the extent necessary to limit total annual fund operating expenses to 0.82% of net assets for the Parnassus Core Equity Fund – Investor Shares and to 0.61% of net assets for the Parnassus Core Equity Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2024, and may be continued indefinitely by the investment adviser on a year-to-year basis.

Year in Review

The last three years have been volatile. The year 2021 saw a market rally against a backdrop of fiscal stimulus and a near-zero Federal Funds Rate. Then, the market corrected in 2022 as inflation soared and monetary policy tightened significantly, driving the 10-year U.S. Treasury yield from 1.6% to almost 3.9% by year end. In 2023, the stock market grappled with the trajectory of inflation and the resilience of the economy. Despite turbulence, the market finished the year up significantly as inflation decelerated and the economy proved more resilient than expected. These favorable economic data points set the stage for a “soft landing”—an outcome in which inflation slows and economic growth remains robust.

The market rally was characterized not only by favorable macroeconomic data, but also by a significant concentration of returns in what became known as the “Magnificent Seven”1—the top seven largest technology market constituents. These stocks accounted for over 60% of the market’s total return, due to exceptional earnings growth and positive investor sentiment surrounding their prospects in artificial intelligence (AI). With this tailwind, the S&P 500’s forward price-to-earnings (PE) multiple expanded from 17 times to almost 20 times, while forward earnings expectations landed 6% higher since the beginning of the year. Entering 2024, the S&P 500 is expected to grow earnings by over 11%, slightly above the median long-term growth rate of the market.

We remained disciplined and true to our investment process throughout the year by positioning ourselves for upside while being focused on the full range of possible market outcomes. While underweighting the “Magnificent Seven” hurt performance, our relative

1 Apple, Microsoft, Alphabet, Amazon, Meta Platforms (formerly Facebook), Tesla and NVIDIA.

6

| | | | |

| | |

| Annual Report • 2023 | | | |  |

preference for enterprise software and semiconductor stocks mitigated the impact.

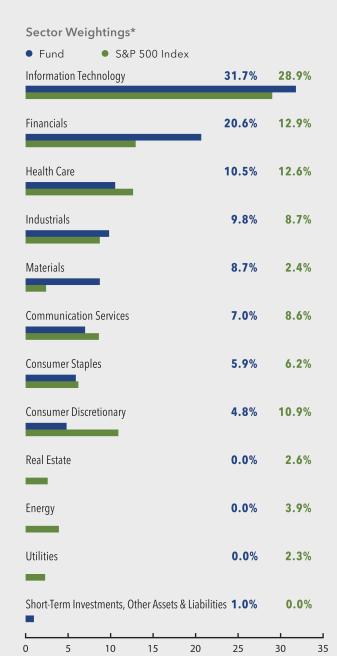

Turning to Fund performance, the Parnassus Core Equity Fund – Investor Shares experienced a gain of 24.93% for 2023, trailing the 26.29% return for the S&P 500. Our stock selection was positive, although it was offset by negative sector allocation. The Fund’s strongest stock selection was in the Information Technology sector, headlined by Salesforce and Adobe. The Financials and Consumer Staples sectors were also notable contributors. From a sector allocation perspective, our underweight positioning in Consumer Discretionary was the leading detractor, largely due to our lack of exposure to Amazon and Tesla. Our overweight positions in Materials and Financials were also notable detractors.

Our top three relative contributors in 2023 were Salesforce, Adobe and Intel. Salesforce, the leading customer relationship management (CRM) software provider, rose 98.5% and added 1.7%* to the Fund’s relative return in 2023. The company consistently delivered better-than-expected sales and margin throughout the year. The management team is committed to spending more efficiently, and the cost discipline is having a positive effect on profit margins. The incumbent position and access to proprietary data also position the company well to take advantage of the AI opportunity in the CRM market.

Adobe, the leading provider of design software, returned 77.3% and added 1.0% to the Fund’s relative return. Adobe’s execution benefitted the company significantly from a sentiment shift surrounding the monetization prospect of generative AI features across its product suite. Its forward PE multiple expanded more than 60% from trough to peak in 2023.

Lastly, Intel returned 84.7% and contributed 0.8% to the Fund’s relative return. The stock continued to appreciate throughout the year, as investor concerns with both the cyclical and secular components of the company lessened.

Our top three relative detractors in 2023 were John Deere, Charles Schwab and Apple. John Deere returned -5.5% and impacted the Fund’s relative return

by -1.2%. The stock struggled as investors worried about the turning of the agriculture equipment cycle. The company’s valuation multiple and forward earnings expectations both declined, and the company guided next year’s results below consensus expectations in the fourth quarter. However, we believe that the stock is poised to outperform as the company continues to gain share and demonstrate their improved through-cycle margin structure.

Charles Schwab, a financial brokerage, returned -41.1% and contributed -1.2% to the Fund’s relative return. Entering the year, investors worried about the impact of “cash sorting”—the movement of customer deposits into money markets and other higher-yielding assets. The concern impacted the company’s profits, as part of its business model is to earn a spread on low-cost deposits. We exited our position in the second quarter in favor of more attractive opportunities.

Lastly, Apple returned 49.0% but added -0.8% to the Fund’s relative return due to our relative underweight. Most of the stock’s return during the year was explained by valuation multiple expansion. Despite a tougher consumer environment, sentiment around the company’s prospects improved. Additionally, earnings per share remained resilient, largely due to the company’s capital returns.

* For this report, we quote total return to the portfolio, which includes price change and dividends.

7

| | | | |

| | |

| | | | Annual Report • 2023 |

Parnassus Core Equity Fund

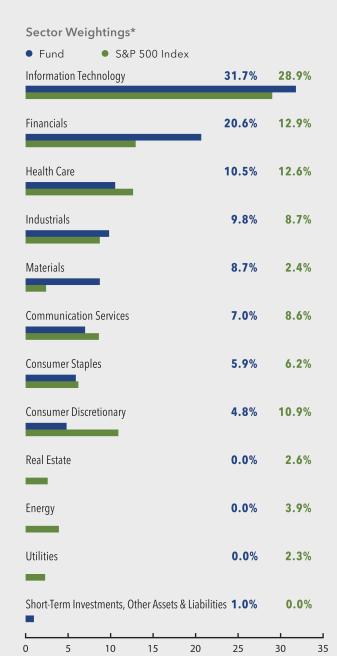

As of December 31, 2023

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Microsoft Corp. | | | 6.5% | |

| |

| Alphabet Inc., Class A | | | 5.2% | |

| |

| Apple Inc. | | | 4.5% | |

| |

| Salesforce Inc. | | | 4.5% | |

| |

| Deere & Co. | | | 4.0% | |

| |

| Oracle Corp. | | | 4.0% | |

| |

| Bank of America Corp. | | | 3.4% | |

| |

| Mastercard Inc., Class A | | | 3.4% | |

| |

| CME Group Inc., Class A | | | 3.2% | |

| |

| Intercontinental Exchange Inc. | | | 3.1% | |

Portfolio characteristics and holdings are subject to change periodically.

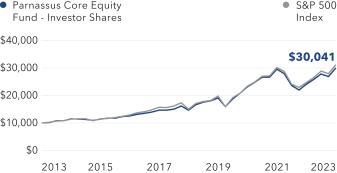

Value on December 31, 2023

of $10,000 invested on December 31, 2013

The chart shows the growth in value of a hypothetical $10,000 investment over the last 10 years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Outlook and Strategy

With the S&P 500 up over 26.29% in 2023, the market exited the year within 1% of its all-time high at the beginning of 2022. This is impressive considering the historic inflation witnessed since then. The pursuant aggressive campaign by the Federal Reserve to raise benchmark interest rates by more than 500 basis points marked the fastest interest rate increase in more than 40 years. (One basis point is 1/100th of one percent.) On top of this, we witnessed the start of two major military conflicts that could destabilize markets. However, asset prices held strong thanks largely to easing inflation and robust economic growth, buoyed by strong employment and wage growth.

Looking at the year ahead, several crosscurrents could drive the markets into a wide range of potential outcomes. The economy is likely to cyclically soften,

8

| | | | |

| | |

| Annual Report • 2023 | | | |  |

with an elevated chance of a U.S. recession by the second quarter. This would help ease inflation, especially in areas such as housing rent, which represents about a third of CPI2 and which is already showing price softness. Thus, it is likely that we are leaving a regime of higher rates and tight financial conditions and entering one with lower rates and loose financial conditions. However, rates are unlikely to fall to the extremely low levels we witnessed in the previous decade due to factors such as higher structural deficits, relative deglobalization and resource scarcity.

Regardless of the macroeconomic backdrop, we continue to focus on long-term outperformance through the ownership of high-quality businesses that are available at attractive prices due to near-term uncertainty. During the fourth quarter, we added one stock and sold another while making some notable sector allocation changes. We bought shares of Equifax, a consumer credit reporting agency. We expect the company to benefit from a rebound in mortgage volumes. Further, we believe that the long-term potential of Equifax’s Work Number (a digital employment and income verification service) and proprietary data platform is underappreciated. We sold shares of Becton Dickinson in favor of more attractive opportunities in Health Care.

From a sector allocation perspective, the two most notable changes were shifting from an overweight to a slightly underweight positioning in Consumer Staples and increasing our underweight in Health Care. We reduced our Consumer Staples exposure across the board, while our exit of Becton Dickinson contributed to the reduction in Health Care exposure. Next, we increased our overweight in Financials by adding to our position in Intercontinental Exchange and Bank of America.

With these changes, the Fund ended the year most overweight in Financials followed by Materials. Our holdings in the Financials sector represent a diverse collection of businesses that offer unique exposure to credit, consumption and the capital markets at attractive valuations. Our Materials exposure features high-quality businesses like Sherwin-Williams and Linde, along with companies poised for a cyclical

rebound such as Ball and Nutrien. We continue to lean into our bias for quality compounders at fair prices through our overweight positioning in Information Technology. We have substantial exposure to secular winners such as Microsoft, Salesforce and Applied Materials. We are also overweight Industrials through the addition of Equifax and the increased position in John Deere. We believe that both companies have attractive long-term earnings potential.

We remain underweight the Consumer Discretionary sector, preferring to selectively own defensive exposure such as AutoZone and attractively priced secular share-gainers such as Marriott and D.R. Horton. We are also underweight Health Care and Communication Services, mostly due to business quality concerns. We do not own any Energy, Real Estate or Utilities stocks, as we are seeing more attractive opportunities in other sectors.

Even though the first half of 2024 may see relative economic weakness, we believe that the market is reasonably priced for the most likely outcome—one with continued easing of inflation, economic resilience and loosening financial conditions. Further, it is important to remember that the benchmark index contains many of the best companies in the world. The earnings and intrinsic value of these companies will grow on the back of remarkable innovation and extraordinary businesses that can compound value in any environment. Given the makeup of today’s market index, the aggregate profile of the market (in terms of returns on equity and free cash flow margins) is markedly higher quality than in the past, though it does not trade at a commensurately higher valuation.

With this market backdrop, we enter 2024 disciplined and focused on executing a process that has served us well in divergent market conditions. As always, we are honored to have your trust as we continue to deliver Principles and Performance®.

2 Consumer Price Index, U.S. Bureau of Labor Statistics.

9

| | | | |

| | |

| | | | Annual Report • 2023 |

We thank you for your investment in the Parnassus Core Equity Fund.

Sincerely,

Todd C. Ahlsten

Lead Portfolio Manager

Benjamin E. Allen

Portfolio Manager

Andrew S. Choi

Portfolio Manager

10

| | | | |

| | |

| Annual Report • 2023 | | | |  |

Parnassus Growth Equity Fund

Ticker: Investor Shares - PFGEX

Ticker: Institutional Shares - PFPGX

As of December 31, 2023, the net asset value (“NAV”) of the Parnassus Growth Equity Fund – Investor Shares (“the Fund”) was $21.30. After taking dividends into account, the total return for the year was a gain of 44.82%. This compares to a gain of 42.68% for the Russell 1000 Growth Index (“Russell 1000 Growth”).

Below is a table that summarizes the performances of the Parnassus Growth Equity Fund and the Russell 1000 Growth. The returns are for the one-year period.

Parnassus Growth Equity Fund

| | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31,

2023 | |

| | | | |

| | | One

Year | | | Since

Inception* | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | |

| Parnassus Growth Equity Fund – Investor Shares | | | 44.82 | | | | 43.91 | | | | 2.71 | | | | 0.84 | |

| | | | |

| Parnassus Growth Equity Fund – Institutional Shares | | | 45.09 | | | | 44.17 | | | | 2.30 | | | | 0.63 | |

| | | | |

| Russell 1000 Growth Index | | | 42.68 | | | | 45.01 | | | | NA | | | | NA | |

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell 1000 Growth is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

* Since Inception, December 28, 2022 (commencement of operations) through December 31, 2023.

As described in the Fund’s current prospectus dated May 1, 2023, Parnassus Investments, LLC has contractually agreed to reduce its investment advisory fee to the extent necessary to limit total annual fund operating expenses to 0.84% of net assets for the Parnassus Growth Equity Fund – Investor Shares and to 0.63% of net assets for the Parnassus Growth Equity Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2024, and may be continued indefinitely by the investment adviser on a year-to-year basis.

Year in Review

The last three years have been volatile. The year 2021 saw a market rally against a backdrop of fiscal stimulus and a near-zero Federal Funds Rate. Then, the market corrected in 2022 as inflation soared and monetary policy tightened significantly, driving the 10-year U.S. Treasury yield from 1.6% to almost 3.9% by year end. In 2023, the stock market grappled with the trajectory of inflation and the resilience of the economy. Despite turbulence, the market finished the year up significantly as inflation decelerated and the economy proved more resilient than expected. These favorable economic data points set the stage for a “soft landing”—an outcome in which inflation slows and economic growth remains robust.

The market rally was characterized not only by favorable macroeconomic data, but also by a significant concentration of returns in what became known as the “Magnificent Seven”1—the top seven largest technology market constituents. These stocks accounted for over 60% of the market’s total return, due to exceptional earnings growth and positive investor sentiment surrounding their prospects in artificial intelligence (AI). With this tailwind, the S&P 500’s forward price-to-earnings (PE) multiple expanded from 17 times to almost 20 times, while forward earnings expectations landed 6% higher since the beginning of the year. Entering 2024, the S&P 500 is expected to grow earnings by over 11%, slightly above the median long-term growth rate of the market.

We remained disciplined and true to our investment process throughout the year by positioning ourselves for upside while being focused on the full range of possible market outcomes. While underweighting the “Magnificent Seven” hurt performance, our relative

1 Apple, Microsoft, Alphabet, Amazon, Meta Platforms (formerly Facebook), Tesla and NVIDIA.

11

| | | | |

| | |

| | | | Annual Report • 2023 |

preference for enterprise software and semiconductor stocks mitigated the impact.

Turning to performance, the Parnassus Growth Equity Fund – Investor Shares returned 44.82% for 2023, which beat the Russell 1000 Growth’s return of 42.68%, driven primarily by our stock selection. From a sector allocation perspective, our largest detractors were cash, our overweight positioning in Health Care and underweight positioning in Information Technology. From a stock selection perspective, Information Technology and Financials were our two largest contributors.

Our top three relative contributors for the year were Adobe, Adyen and Salesforce. Adobe, the leading provider of design software, was the Fund’s best performer, with the stock returning 72.6% and contributing 2.0%* to the Fund’s relative return this year. When we initiated our position in Adobe, the company was trading at historically low valuation due to regulatory concerns around the acquisition of design competitor, Figma, and AI disruption. These overhangs have now been removed with the termination of the Figma deal and greater market appreciation for Firefly and Adobe’s AI opportunity.

Adyen, a payment company, returned 79.0% and added 1.7% to the Fund’s relative return. Like Adobe, we were able to buy Adyen after a significant share price and valuation decline due to concerns with competitive pressures and pricing. We remain confident in the underlying business quality, profitability and premium positioning of the company.

Finally, Salesforce gained 98.5%, adding 1.1% to the Fund’s relative return. Salesforce, the leading provider of customer relationship management software (CRM), executed well on its strategy of increased productivity and profitability. We continue to believe the company has underappreciated opportunities to grow profitably and reward shareholders.

Our biggest three relative detractors for the year were Thermo Fisher Scientific, Planet Fitness and SBA Communications. Thermo Fisher, a life science tools provider, returned -3.4% and contributed -1.3% to the Fund’s relative return. Life science tools companies had a difficult year, as their pharma and biotech customers

worked through stockpiled inventory from the pandemic and rationalized Research and Development (R&D) spending given higher interest rates; Chinese customer demand also declined given the macroeconomic environment. We believe these headwinds are temporary and secular tailwinds around increasing drug discovery, technology and innovation in the life science sector should support Thermo Fisher’s long-term growth.

Planet Fitness, a nationwide gym franchise, returned -15.0% and impacted the Fund’s relative return by -1.3%. Planet Fitness trailed because of slowing new gym construction and worsening HVAC (heating, ventilation and air conditioning) supply chains. We sold Planet Fitness due to concerns that higher interest rates will continue to pressure the rate of new store openings, a key metric for growth.

Lastly, SBA Communications, a wireless communications infrastructure operator, returned -18.6% and detracted -1.0% from the Fund’s relative return. The company issued a cautious guide for the year as wireless carriers cut back network investments due to the current macro environment. Rising interest rates have also pressured sector valuations. We sold SBA Communications due to the pressure the macroeconomic cycle and potential lead cable lawsuits would have on wireless carriers’ capex budgets.

* For this report, we quote total return to the portfolio, which includes price change and dividends.

12

| | | | |

| | |

| Annual Report • 2023 | | | |  |

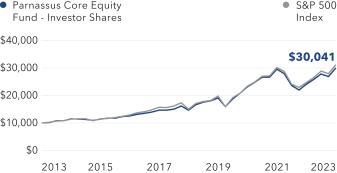

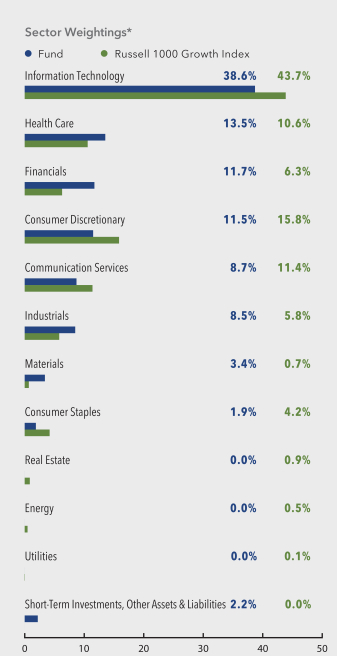

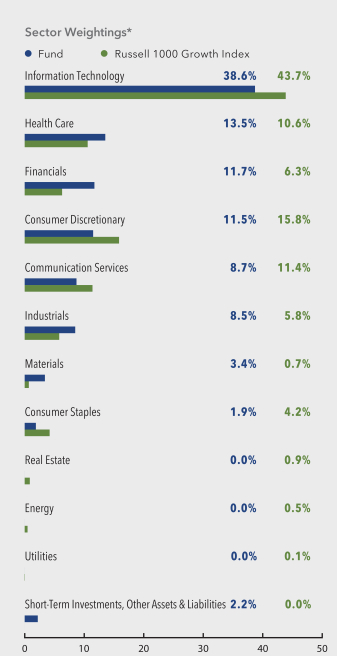

Parnassus Growth Equity Fund

As of December 31, 2023

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Microsoft Corp. | | | 10.4% | |

| |

| Alphabet Inc., Class A | | | 5.9% | |

| |

| Amazon.com Inc. | | | 5.8% | |

| |

| Visa Inc., Class A | | | 4.5% | |

| |

| Apple Inc. | | | 4.2% | |

| |

| NVIDIA Corp. | | | 4.1% | |

| |

| Salesforce Inc. | | | 4.0% | |

| |

| Intuit Inc. | | | 3.7% | |

| |

| Adyen N.V. ADR | | | 2.9% | |

| |

| Eli Lilly & Co. | | | 2.7% | |

Portfolio characteristics and holdings are subject to change periodically.

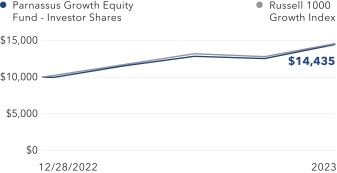

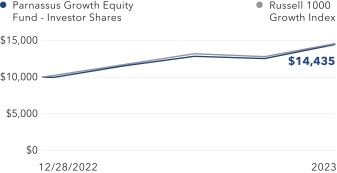

Value on December 31, 2023

of $10,000 invested on December 28, 2022

The chart shows the growth in value of a hypothetical $10,000 investment since inception (December 28, 2022) and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Outlook and Strategy

With the Russell 1000 Growth up over 42.68% in 2023, the market ended the year within 2% of its all-time high, which previously occurred at the end of 2021. This is impressive considering the historic inflation witnessed since then. The pursuant aggressive campaign by the Federal Reserve to raise benchmark interest rates by more than 500 basis points marked the fastest interest rate increase in more than 40 years. (One basis point is 1/100th of one percent.) On top of this, we witnessed the start of two major military conflicts that could destabilize markets. However, asset prices held strong thanks largely to easing inflation and robust economic growth, buoyed by strong employment and wage growth.

Looking at the year ahead, several crosscurrents could drive the markets into a wide range of potential

13

| | | | |

| | |

| | | | Annual Report • 2023 |

outcomes. The economy is likely to cyclically soften, with an elevated chance of a U.S. recession by the second quarter. This would help ease inflation, especially in areas such as housing rent, which represents about a third of CPI2 and which is already showing price softness. Thus, it is likely that we are leaving a regime of higher rates and tight financial conditions and entering one with lower rates and loose financial conditions. However, rates are unlikely to fall to the extremely low levels in the previous decade due to factors such as higher structural deficits, relative deglobalization and resource scarcity.

Regardless of the macroeconomic backdrop, we continue to focus on long-term outperformance through the ownership of high-quality businesses that are available at attractive prices due to near-term uncertainty. During the fourth quarter, we added one stock and sold two stocks while making some notable sector allocation changes. We bought shares of Equifax, a consumer credit reporting agency. We expect the company to benefit from a rebound in mortgage volumes. Further, we believe that the long-term potential of the Equifax’s Work Number (a digital employment and income verification service) and proprietary data platform is underappreciated. We sold Ulta, a beauty specialty retailer, due to the increased promotional environment and competitive threats, especially from new entrant TikTok Shop. We also sold Hershey, a confectionary manufacturer, and reallocated the capital to more attractive defensive exposure.

From a sector allocation perspective, our most notable change was shifting from an underweight to an overweight position in Industrials through the addition of Equifax and the increased position in John Deere. Our sales of Ulta and Hershey increased our underweight positioning in Consumer Staples and Consumer Discretionary.

With these changes, the Fund exited the year most overweight in Financials, followed by Health Care and Materials. Our holdings in the Financials sector represent a diverse collection of businesses that offer unique exposure to credit, consumption and the capital markets at attractive valuations. Within Health Care, we own high-quality franchises across pharma,

biotech, life sciences tools and insurance. We prefer the more defensive exposure in Health Care to Consumer Staples where we are underweight. Our Materials exposure features high-quality businesses like Sherwin-Williams and Linde.

We remain underweight the Information Technology and Communication Services sectors largely due to our underweight positions in Apple and Alphabet. We are seeing attractive opportunities across the broader technology and internet ecosystem. We do not own any Energy, Real Estate or Utilities stocks.

Even though the first half of 2024 may see relative economic weakness, we believe that the market is reasonably priced for the most likely outcome—one with continued easing of inflation, economic resilience, and loosening financial conditions. Further, it is important to remember that the benchmark index contains many of the best companies in the world. The earnings and intrinsic value of these companies will grow on the back of remarkable innovation and extraordinary businesses that can compound value in any environment. Given the makeup of today’s market index, the aggregate profile of the market (in terms of returns on equity and free cash flow margins) is markedly higher quality than in the past, though it does not trade at a commensurately higher valuation.

With this market backdrop, we enter 2024 disciplined and focused on executing a process that has served us well in divergent market conditions.

We thank you for your investment in the Parnassus Growth Equity Fund.

Sincerely,

Andrew S. Choi

Lead Portfolio Manager

Shivani R. Vohra

Portfolio Manager

2 Consumer Price Index, U.S. Bureau of Labor Statistics.

14

| | | | |

| | |

| Annual Report • 2023 | | | |  |

Parnassus Value Equity Fund

Ticker: Investor Shares - PARWX

Ticker: Institutional Shares - PFPWX

As of December 31, 2023, the net asset value (“NAV”) of the Parnassus Value Equity Fund – Investor Shares (“the Fund”) was $50.54. After taking dividends into account, the Fund’s total return for the year was a gain of 13.70%. This compares to a gain of 11.46% for the Russell 1000 Value Index (“Russell 1000 Value”). For the fourth quarter of 2023, the Parnassus Value Equity Fund – Investor Share posted a gain of 12.92%. This compares to a gain of 9.50% for the Russell 1000 Value.

Below is a table that summarizes the performances of the Parnassus Value Equity Fund and the Russell 1000 Value over multiple time periods. The Fund’s performance is in line with our benchmark over the three-year period and remains highly competitive over all other periods.

Parnassus Value Equity Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2023 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Value Equity Fund – Investor Shares | | | 13.70 | | | | 8.72 | | | | 16.89 | | | | 12.89 | | | | 0.92 | | | | 0.88 | |

| | | | | | |

| Parnassus Value Equity Fund – Institutional Shares | | | 13.94 | | | | 8.95 | | | | 17.14 | | | | 13.10 | | | | 0.72 | | | | 0.65 | |

| | | | | | |

| Russell 1000 Value Index | | | 11.46 | | | | 8.86 | | | | 10.91 | | | | 8.40 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Value Equity Fund – Institutional Shares from commencement (April 30, 2015) was 12.56%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Value Equity Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses.

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell 1000 Value is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

As described in the Fund’s current prospectus dated May 1, 2023, Parnassus Investments, LLC has contractually agreed to reduce its investment advisory fee to the extent necessary to limit total annual fund operating expenses to 0.88% of net assets for the Parnassus Vaule Equity Fund – Investor Shares and to 0.65% of net assets for the Parnassus Value Equity Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2024, and may be continued indefinitely by the investment adviser on a year-to-year basis.

Year in Review

After three quarters of lackluster performance, the Russell 1000 Value posted most of its annual gains in the fourth quarter. On an equal-weighted basis, the Communication Services and Information Technology sectors outperformed the most, at 41% and 36%, respectively. However, the biggest contributor to the benchmark’s return came from the Financials sector, which appreciated 15%. This is because Financials represent 20% of the index, more than twice the 9% weight of Information Technology, and more than three times the 6% weight of Communication Services. The Energy sector underperformed as crude oil prices declined. The Utilities and Health Care sectors were the worst performers.

The Parnassus Value Equity Fund - Investor Shares returned 13.70%, beating the Russell 1000 Value’s 11.46%. Sector allocation accounted for most of the outperformance, with stock selection largely neutral. Within sector allocation, our overweight in Information Technology and underweights in Energy and Utilities were the biggest contributors, while our overweight to Health Care was the biggest detractor. Within stock selection, our biggest contributor was Information Technology, followed by Consumer Discretionary.

D.R. Horton, America’s largest homebuilder, was our biggest winner in 2023. Its stock soared 72.1%, adding 1.4%* to the Fund’s relative return. Shares outperformed as the company’s newly finished homes sold faster than expected. While higher mortgage rates made homes less affordable, builder confidence and new home demand ultimately proved resilient due to the limited supply of existing homes for sale. The company delivered strong financial results and skillfully

* For this report, we quote total return to the portfolio, which includes price change and dividends.

15

| | | | |

| | |

| | | | Annual Report • 2023 |

offset macroeconomic headwinds to new orders through sales incentives, price reductions and smaller floorplans. Less expensive input costs and scale advantages also supported the company’s profitability.

Micron’s shares rose 71.9% during the year, contributing 1.0% to the Fund’s relative return. The memory semiconductor market has begun to recover after more than a year of declining prices and excess inventory. Industry-wide supply cuts and new demand from artificial intelligence (AI) applications are rapidly restoring the balance of supply and demand, with a positive impact on per unit pricing. Additionally, existing end markets such as PCs and smartphones have bottomed after one of the worst corrections in over a decade. We are maintaining our position, as we believe we are still in the early stages of this inflection in industry fundamentals.

Microsoft appreciated 58.2% in price, boosting the Fund’s relative return by 0.9%. Positive sentiment around generative AI’s capacity to drive future growth outweighed slower enterprise IT spend, while Microsoft’s cloud computing business, Azure, stabilized in the year’s second half. Microsoft remains the dominant global enterprise software platform—providing our portfolio both offense and defense. This technological leadership and the breadth of its productivity suite enables Microsoft to not only win in secular growth areas like cloud, but also benefit from vendor consolidation as IT budgets contracted.

Signature Bank, our only regional bank stock, was the Fund’s worst relative performer. It sliced 1.5% from the Fund’s relative return after regulators seized the company, effectively rendering it worthless. Higher interest rates set by the Fed to tackle high inflation culminated in a regional bank crisis in March. In the crisis, Silicon Valley Bank, a regional bank focused on start-up companies, failed suddenly after massive losses on its bond portfolio caused a run on the bank. While Signature did not have the same investment losses or industry concentration as Silicon Valley Bank, contagion from the panic spread to Signature and other banks as their customers’ feared losing money in a similar bank run.

Moderna’s stock returned -45.3% over the year, impacting the Fund’s relative return by -1.1%. Although the company boasts a robust pipeline with significant potential, the extended timeline for material revenue contribution from these assets created an air pocket of uncertain cash burn. Uncomfortable with this risk and lack of meaningful catalysts, we opted to sell our shares and reallocate capital to opportunities with higher conviction.

Finally, Charles Schwab shares returned -16.0%, contributing -0.9% to the Fund’s relative return. Schwab’s profits fell as clients moved cash from lucrative deposit accounts to better-yielding vehicles. The company also recorded losses on its investment portfolio, which is primarily composed of bonds. These problems became more acute during the regional bank crisis in March, forcing investors to consider whether Schwab’s earnings would be impaired for several years. We reduced our position early, believing that the market was too optimistic about the company’s future earnings, but the company’s strong wealth management franchise remains intact. We believe Schwab can return to healthy earnings growth in the next few years as the immediate impact of rising rates passes.

16

| | | | |

| | |

| Annual Report • 2023 | | | |  |

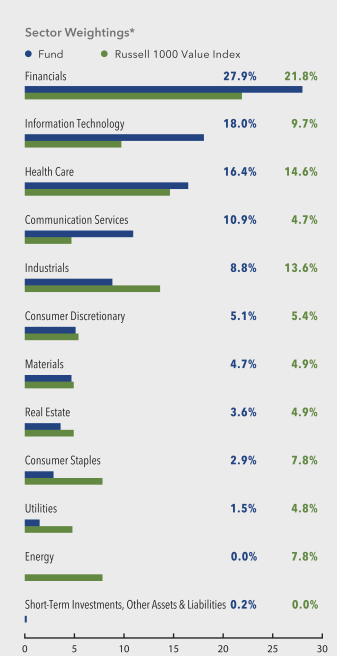

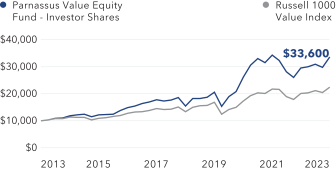

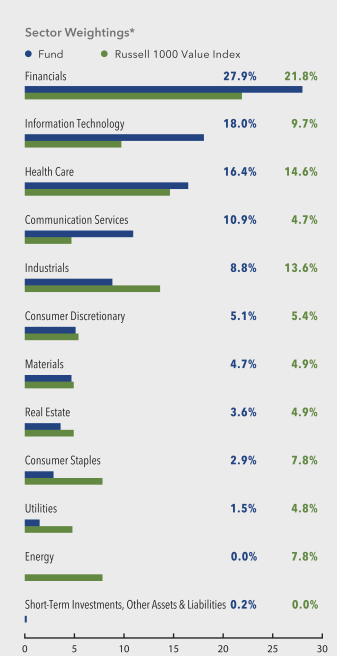

Parnassus Value Equity Fund

As of December 31, 2023

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Verizon Communications Inc. | | | 4.0% | |

| |

| Intel Corp. | | | 3.8% | |

| |

| Bank of America Corp. | | | 3.3% | |

| |

| The Progressive Corp. | | | 3.2% | |

| |

| Micron Technology Inc. | | | 3.1% | |

| |

| Oracle Corp. | | | 3.1% | |

| |

| S&P Global Inc. | | | 3.0% | |

| |

| Sysco Corp. | | | 2.9% | |

| |

| Ball Corp. | | | 2.9% | |

| |

| Global Payments Inc. | | | 2.9% | |

Portfolio characteristics and holdings are subject to change periodically.

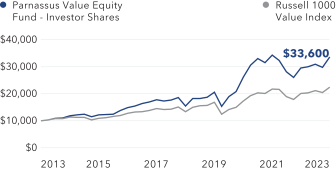

Value on December 31, 2023

of $10,000 invested on December 31, 2013

The chart shows the growth in value of a hypothetical $10,000 investment over the last 10 years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Outlook and Strategy

Despite its challenges, the Parnassus Value Equity Fund ended 2023 on a strong note. We surpassed our benchmark, the Russell 1000 Value index, by 224 basis points in one of the most turbulent stock markets in recent memory. (One basis point is 1/100th of one percent.) Investors grappled with a host of dilemmas: Will inflation recede or become entrenched? Can Fed officials execute a never-before-seen economic soft landing? When will consumers exhaust their excess pandemic savings? How will AI transform entire industries? What will be the spillover effects of the Russia-Ukraine and Israel-Hamas conflicts? Investor sentiment vacillated from ebullience over AI in January, despair about the regional bank crisis in March, optimism for a soft landing in July and panic over spiking U.S. Treasury yields in October.

17

| | | | |

| | |

| | | | Annual Report • 2023 |

Although as managers we did not resolve every dilemma perfectly, we stood by our process to navigate the market’s inevitable uncertainties.

Notably, we strongly outperformed our benchmark in the final months of the year. In the fourth quarter of 2023, the Value Equity Fund – Investor Shares appreciated nearly 12.92%, or 3.4% more than the Russell 1000 Value Index’s gains of 9.50%. Several factors turned in our favor and drove this acceleration. First, oil prices fell due to an unexpected surge in petroleum supplies. This contributed to our relative performance as we avoid investing in fossil fuels. Our carefully selected investments in cyclical stocks ranging from semiconductors and homebuilders to Financials and Consumer Discretionary companies also outperformed, as falling inflation moved the economy onto a more solid footing. Finally, stocks surged as bond yields fell from their mid-October highs. As has long been the case, the Parnassus Value Equity Fund is constructed to capture greater upside when stocks rise, which historically occurs in most years.

Indeed, the 10-year Treasury yields steadily climbed all year, only to fall after breaching 5% in October. The rate, which serves as the cost of capital, has profound implications for the valuation of financial assets and is influenced by the actions and words of Fed officials. Since early 2022, the Fed has focused intently on tackling record-high inflation through the fastest series of rate hikes in recent history. Between October and November, though, the cumulative data in inflation began to look more benign, suggesting the Fed’s long rate-hike cycle was nearing an end. Investors, who were bearishly positioned and fearful of a policy error, suddenly changed their minds and jumped into the market, spurring a furious rally.

Given the Fed’s dominance over financial markets, it is worth pondering what its next move could be. Currently, Fed officials are forecasting three rate cuts in 2024 with markets predicting even more. However, recall the Fed has a dual mandate of price stability and full employment. Once inflation is no longer the economy’s biggest risk, it is logical that the Fed should shift its focus to the labor market. The labor market is healthy, with unemployment ending the year at 3.7%, the lowest reading since 1969. The economy added 2.7 million jobs in 2023, the highest number since 2015. A strong job market is beneficial—except when it contributes to inflation. But, if the Fed can apply the

same vigilance to maintaining full employment as it has to tackling inflation, the outlook for the economy should be favorable.

We saw buying opportunities in the market’s volatility at year end and added three new positions to the portfolio. Canada-based Nutrien is one of the largest producers of agricultural fertilizers in the world. Low potash prices have pressured the stock, but demand for this essential input should recover next year as supply discipline re-enters the market. We also added TSMC (Taiwan Semiconductor Manufacturing Co.), the world’s leading semiconductor foundry. The stock is down due to geopolitical friction between the U.S. and China, as well as a post-pandemic slump in global smartphone shipments. However, the company’s high-performance chip segment should grow strongly from developments in AI, while the smartphone cycle is poised for a cyclical rebound. Finally, we have long admired commercial real estate broker (CBRE) and initiated a position when the spike in Treasury yields brought the entire sector to historically low valuations. Unlike most real estate companies, CBRE has an asset-light business model, attractive recurring revenue streams and a strong balance sheet that is not dependent on debt financing.

Even with this report’s discussion of macroeconomic factors, we are now and always bottom-up stock pickers. We believe that evaluating the relevancy of a company’s products and services, the durability of its competitive advantages and the quality of its management provides a more secure foundation for assessing the suitability of any investment. Moreover, we believe that buying good companies at discounted or reasonable prices increases the likelihood of outperformance over economic cycles. Like 2023, 2024 will no doubt have its share of twists and turns. Year after year, we remain committed to our time-tested process designed to build wealth responsibly for long-term shareholders.

18

| | | | |

| | |

| Annual Report • 2023 | | | |  |

Thank you for your investment in the Parnassus Value Equity Fund.

Billy J. Hwan

Lead Portfolio Manager

Krishna S. Chintalapalli

Portfolio Manager

19

| | | | |

| | |

| | | | Annual Report • 2023 |

Parnassus Mid Cap Fund

Ticker: Investor Shares - PARMX

Ticker: Institutional Shares - PFPMX

As of December 31, 2023, the net asset value (“NAV”) of the Parnassus Mid Cap Fund – Investor Shares was $37.25, so after taking dividends into account, the total return for 2023 was a gain of 12.67%. This compares to a gain of 17.23% for the Russell Midcap Index (“Russell Midcap”). For the fourth quarter, the Parnassus Mid Cap fund – Investor Shares was up 13.61%, ahead of the Russell Midcap’s 12.82% gain.

Below is a table comparing the Parnassus Mid Cap Fund with the Russell Midcap for the one-, three-, five- and ten-year periods.

Parnassus Mid Cap Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2023 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Mid Cap Fund – Investor Shares | | | 12.67 | | | | 0.95 | | | | 8.76 | | | | 7.73 | | | | 0.97 | | | | 0.96 | |

| | | | | | |

| Parnassus Mid Cap Fund – Institutional Shares | | | 12.92 | | | | 1.15 | | | | 8.99 | | | | 7.94 | | | | 0.76 | | | | 0.75 | |

| | | | | | |

| Russell Midcap Index | | | 17.23 | | | | 5.92 | | | | 12.68 | | | | 9.42 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Mid Cap Fund – Institutional Shares from commencement (April 30, 2015) was 7.80%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Mid Cap Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses.

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Midcap Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Mid cap companies can be more sensitive to changing economic conditions and have fewer financial resources than large cap companies.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

As described in the Fund’s current prospectus dated May 1, 2023, Parnassus Investments, LLC has contractually agreed to reduce its investment advisory fee to the extent necessary to limit total annual fund operating expenses to 0.96% of net assets for the Parnassus Mid Cap Fund – Investor Shares and to 0.75% of net assets for the Parnassus Mid Cap Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2024, and may be continued indefinitely by the investment adviser on a year-to-year basis.

Year in Review

The Russell Midcap returned an impressive 17.23% for 2023, its second-highest annual return since 2013. Despite this high return, the benchmark’s performance was volatile. Regional bank failures, artificial intelligence speculation and Federal Reserve interest rate hikes swung stocks around during the first three quarters of the year, leaving the Russell Midcap with an anemic 3.91% return by September 30. The index then surged nearly 15% in the fourth quarter, as the Federal Reserve signaled a more accommodative interest rate policy in the wake of lower inflation readings. Another driver of this year’s performance was real-GDP (Growth Domestic Product) growth above 2%, much higher than the 0.4% expected at the onset of 2023. Investors clearly discounted concerns about an economic hard landing and escalating geo-political tensions to push stocks markedly higher.

The Parnassus Mid Cap Fund - Investor Shares’ 2023 gain of 12.67% fell short of the Russell Midcap’s 17.23% surge. The main cause of underperformance can be traced back to the Fund’s challenging March quarter, stemming from our investments in two regional banks that eventually shut down. Performance improved in the second half, driven by positive stock selection, which added to the Fund’s return by 162 basis points. (One basis point is 1/100th of one percent.)

From a sector allocation perspective, our overweight position to the Industrials sector, the second-best performing sector in the Russell Midcap, added 99 basis points to the Fund’s return. The Fund’s underweight position to Utilities stocks, the Russell Midcap’s worst-performing worst performing sector, added 66 basis points to the Fund’s return. The Fund’s overweight position to the underperforming Health

20

| | | | |

| | |

| Annual Report • 2023 | | | |  |

Care sector hurt the Fund by 70 basis points, and our overweight position to the Consumer Staples sector hurt the Fund by 30 basis points.

The Fund had positive stock selection in the Information Technology, Consumer Discretionary and Materials sectors but stock selection detracted from performance in the Industrials, Financials and Real Estate sectors. First Republic Bank was the Fund’s weakest performer, with the stock falling a shocking 73.3% from its average price, subtracting 1.6%* from the Fund’s relative return. The California-based regional bank plunged during the March banking crisis, after Silicon Valley Bank’s sudden failure caused contagion. First Republic experienced a bank run, as its concentrated client base of successful businesses and high net-worth individuals in coastal markets took their deposits to bigger and more diversified banks. The loss to the Fund was heavy, but we fortunately sold our shares in First Republic before it failed.

Another of the largest detractors was CNH Industrial NV, a leader in agricultural technology and equipment. The stock fell 22.0%, shaving the Fund’s relative return by 1.3%. The company saw sluggish demand for its agricultural products, especially in South America, where farmers curtailed their spending due to lower commodity prices. Investors lost confidence as management lowered its sales growth forecast from 8%–11% to 3%–6% for 2023. We remain optimistic about CNH’s prospects because cost reduction and efficiency measures should help the company mitigate current challenges and boost profitability.

Hologic Inc., a leading provider of diagnostics and mammography devices, declined 4.5% in 2023, reducing the Fund’s relative return by 1.0%. The company saw solid underlying growth in non-pandemic diagnostics every quarter and offered a favorable outlook for organic revenue growth in 2024. However, investors soured on the stock given tougher comparisons in 2024, slowing growth in China, high chip costs in its breast health products and expected changes in expert guidelines for cervical screening and other tests. Despite these near-term concerns, we remain upbeat about Hologic’s long-term growth prospects given its innovative diagnostics, surgical and breast health devices, international

expansion opportunities, strong free cash flow and healthy balance sheet.

Shifting to our winners, Workday, a leading platform for human capital management and financial applications, soared 65.0%, adding 1.1% to the Fund’s relative return. Workday exceeded investor expectations on key metrics in every quarter, thanks to the solid demand for its cloud-based software for human capital management and financial processes. We believe the company has a long runway for growth, driven by additional market share gains, further international penetration and cross-selling opportunities.

Cboe Global Markets, a leading market exchange and trading platform, rose by 44.4% and added 0.9% to the Fund’s relative return. Robust demand for its data and access solutions, healthy index option volumes and improved margins drove better-than-expected earnings throughout 2023. Cboe also invested heavily over the past several years in new product launches, innovative technologies and operational initiatives, which should allow it to gain market share and deliver higher earnings in the coming years.

D.R. Horton, the largest homebuilder in the United States with an extensive geographic footprint, climbed 72.1%, contributing 0.9% to the Fund’s relative return. The company beat investor expectations with strong earnings throughout 2023, thanks to healthy demand for its affordable homes, market share gains and reduced expenses. We believe D.R. Horton has a competitive edge in the U.S. housing market, which faces a shortage of supply and a growing need for entry-level housing. We also like D.R. Horton’s solid financial position and potential for margin expansion.

* For this report, we quote total return to the portfolio, which includes price change and dividends.

21

| | | | |

| | |

| | | | Annual Report • 2023 |

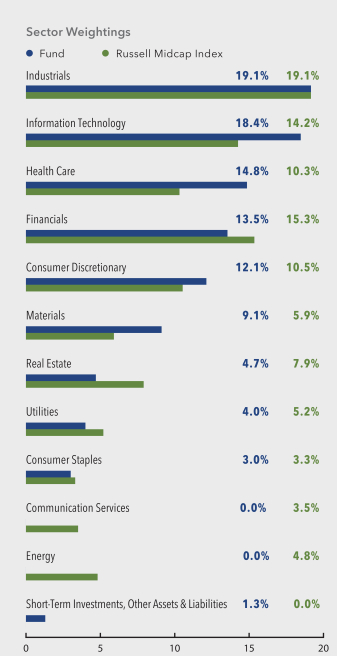

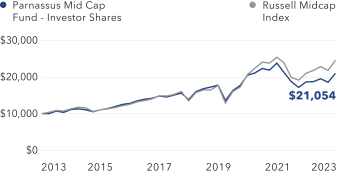

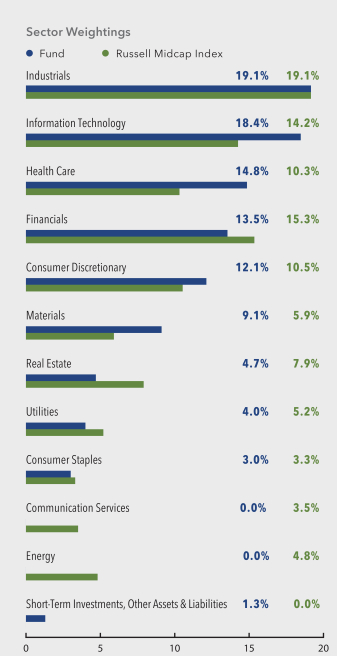

Parnassus Mid Cap Fund

As of December 31, 2023

(percentage of net assets)

Portfolio characteristics and holdings are subject to change periodically.

| | | | |

| |

Top 10 Equity Holdings | | | | |

(percentage of net assets) | | | | |

| |

The Sherwin-Williams Co. | | | 3.9% | |

| |

Hologic Inc. | | | 3.8% | |

| |

Cboe Global Markets Inc. | | | 3.5% | |

| |

Roper Technologies Inc. | | | 3.3% | |

| |

IQVIA Holdings Inc. | | | 3.2% | |

| |

TransUnion | | | 3.1% | |

| |

Ball Corp. | | | 3.1% | |

| |

Ross Stores Inc. | | | 3.1% | |

| |

Fidelity National Information Services | | | 3.0% | |

| |

Sysco Corp. | | | 3.0% | |

Portfolio characteristics and holdings are subject to change periodically.

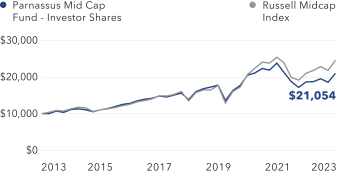

Value on December 31, 2023

of $10,000 invested on December 31, 2013

The chart shows the growth in value of a hypothetical $10,000 investment over the last 10 years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Outlook and Strategy

We believe the Federal Reserve’s actions will continue to be a core driver of investor sentiment and market direction in 2024. The market is anticipating significant rate cuts in 2024 after consumer inflation, which peaked at around 9.1% in mid-2022, declined to 3.1% in November. The coming interest rate changes relative to expectations will dictate investor behavior to a substantial extent.

The economic outlook for 2024 is modest, with the consensus projection for a real GDP growth rate of 1.2% in the U.S. and a 50% chance of recession within the next six months. Underlying economic strength, combined with these muted expectations, make us cautiously optimistic. However, notable wildcards include the upcoming elections and escalating geo-political tensions, which could cause volatility.

22

| | | | |

| | |

| Annual Report • 2023 | | | |  |

Additionally, we are increasingly mindful of our portfolio’s factor exposures, given the increased volatility from fast-shifting investor sentiment and the influence of algorithmic trading.

Mid cap stocks overall are fairly valued relative to historical measures, with the Russell Midcap entering 2024 at a forward price-to-earnings (PE) multiple of 17.1 times. This is slightly higher than the 20-year average of 16.4x and well above the 20-year low of 9.0x. Still, we believe that good deals still are available as we construct and position our concentrated portfolio to beat the 800+ company Russell.

The Fund is underweight relative to the Russell Midcap in Communication Services, Real Estate and Financials. These sectors tend to be vulnerable to negative economic surprises. The Fund is overweight relative to the benchmark in Information Technology, Health Care and Materials. Our holdings in these sectors have the potential to perform relatively well in any market environment and have durable business models, competitive advantages and attractive valuations.

Two areas of the market where we currently see significant opportunities are in select established software stocks and life sciences tools and services companies. Our software investments enjoy highly sustainable revenue growth and wide competitive advantages, while our life sciences investments include quality companies poised to rebound following two years of post-COVID challenges.

During the quarter, we initiated five new positions while exiting three stocks. We invested in two leading technology companies with strong competitive advantages. Fortinet is a leader in network security software and stands to benefit from growing demand for endpoint security and cloud security solutions as cyber threats rise. The stock price fell recently due to weak demand for firewall appliances, but we believe this is a temporary setback and expect the company to gain market share, improve margins and deliver multi-year growth. We also initiated an offensive position in Block, a leading payments company for small and medium-sized businesses. The company’s CashApp is one of the most widely used mobile payments apps that lets users send money, buy stocks and more. We are optimistic about the company’s growth prospects and renewed focus to boost profitability in coming years.

We also bought shares in Brookfield Renewable Corp., CBRE Group and Truist Financial. All three companies have suffered from high interest rates in the past few years, but they could benefit from lower rates and other factors. Brookfield, one of the world’s largest owners and operators of renewables, is poised to benefit from multi-year demand for renewable power from utility and commercial customers. The stock has underperformed lately because of high interest rates, but we think it offers an attractive risk-reward trade-off. We also added CBRE, one of the largest asset-light real estate brokers. We are particularly impressed by the company’s record of gaining market share in the commercial real estate sector and its disciplined capital allocation strategy. Lastly, we bought Truist, one of the largest regional banks in the Southeast. Truist and its industry peers were challenged by balance sheet constraints and unrealized losses on its securities in 2023, but we believe investors will increasingly focus on net interest margins and earnings. In that scenario, Truist should shine with its attractive mix of assets, including a respected capital markets business and the seventh largest insurer in the U.S.

To make room for these new holdings, we sold our positions in Verisk and Jack Henry & Associates. Both are solid companies, but we believed that their stocks were overpriced. We prefer Fidelity National Information Services, which offers exposure that is similar to Jack Henry, but at a better value. We also sold third-party logistics company C.H. Robinson, due to concerns about its slowing growth prospects, recent leadership turnover and a long turnaround.

Our portfolio is constructed with both high-quality defensive and offensive holdings. This approach should help us protect against potential market downturns and take advantage of growth opportunities. Our quality criteria remain the same—investing in businesses with more upside than downside over three years, increasing relevancy, durable competitive advantages, disciplined and driven managers and sustainable business practices. We are confident that this strategy will enable the Fund to outperform the market over the full market cycle.

23

| | | | |

| | |

| | | | Annual Report • 2023 |

Thank you for your investment in the Parnassus Mid Cap Fund.

Yours truly,

Matthew D. Gershuny

Lead Portfolio Manager

Lori A. Keith

Portfolio Manager

24

| | | | |

| | |

| Annual Report • 2023 | | | |  |

Parnassus Mid Cap Growth Fund

Ticker: Investor Shares - PARNX

Ticker: Institutional Shares - PFPRX

As of December 31, 2023, the net asset value (“NAV”) of the Parnassus Mid Cap Growth Fund – Investor Shares was $55.57, resulting in a gain of 35.60% for 2023. This compares to a gain of 25.87% for the Russell Midcap Growth Index (“Russell Midcap Growth”).

Below is a table that summarizes the performance of the Parnassus Mid Cap Growth Fund and the Russell Midcap Growth Index. The returns are for the one-, three-, five- and ten-year periods ended December 31, 2023.

Parnassus Mid Cap Growth Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2023 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Mid Cap Growth Fund – Investor Shares | | | 35.60 | | | | -0.47 | | | | 10.48 | | | | 8.45 | | | | 0.80 | | | | 0.80 | |

| | | | | | |

| Parnassus Mid Cap Growth Fund – Institutional Shares | | | 35.77 | | | | -0.35 | | | | 10.62 | | | | 8.58 | | | | 0.70 | | | | 0.68 | |

| | | | | | |

| Russell Midcap Growth Index | | | 25.87 | | | | 1.31 | | | | 13.81 | | | | 10.57 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Mid Cap Growth Fund – Institutional Shares from commencement (April 30, 2015) was 7.88%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Mid Cap Growth Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses.

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Mid Cap Growth is an index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

Contributions to returns quoted for individual stocks are their returns relative to the Fund’s index.

As described in the Fund’s current prospectus dated May 1, 2023, Parnassus Investments, LLC has contractually agreed to reduce its investment advisory fee to the extent necessary to limit total annual fund operating expenses to 0.80% of net assets for the Parnassus Mid Cap Growth Fund – Investor Shares and to 0.68% of net assets for the Parnassus Mid Cap Growth Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2024, and may be continued indefinitely by the investment adviser on a year-to-year basis.

Year in Review

The Parnassus Mid Cap Growth Fund – Investor Shares gained 35.60% in 2023, outpacing the Russell Midcap Growth by 973 basis points. (One basis point is 1/100th of one percent.) The seeds of our strong performance in 2023 were sown in 2022, when investors were concerned with rising inflation, a rapid series of interest rate hikes by the Federal Reserve targeted to slow the economy and a land war in Europe that caused commodity prices to spike. Against this backdrop in 2022, innovative, secularly growing and competitively advantaged stocks were punished disproportionately due to their higher valuations. We took advantage of a steep price decline in leading software providers, semiconductor companies and other innovative, best-in-class businesses by adding to our positions, as we thought the market’s focus on near-term valuations was overlooking their long-term earnings potential. Over the course of 2023, the economy grew faster than expected as consumer spending was resilient due to a robust employment market and excess savings from the COVID pandemic years. Inflation decelerated as supply chains normalized and commodity prices fell. Against this backdrop, investors refocused on long-term earnings potential and business quality, and our Fund reaped the rewards.

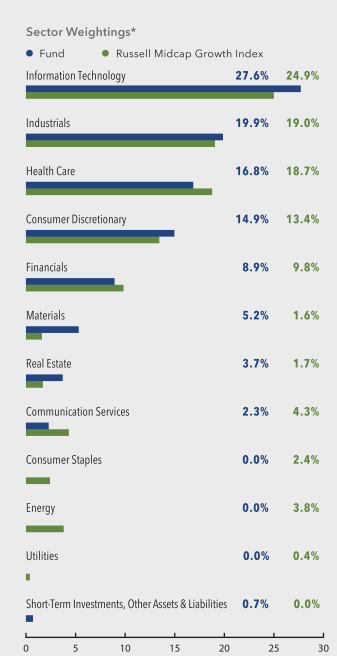

The vast majority of our outperformance in 2023 came from strong stock selection. Sector allocation also added to our performance, with our overweight of the Information Technology sector being the largest contributor. For the year, Information Technology, Health Care and Consumer Discretionary drove our returns, as each contributed more than 250 basis points to performance. The Financials sector was our most significant detractor.

Our worst performer this year was First Republic Bank. First Republic fell a shocking 73.0% from its average

25

| | | | |

| | |

| | | | Annual Report • 2023 |

price, subtracting 2.2%* from the Fund’s relative return. First Republic plunged during the regional bank crisis in early March, after Silicon Valley Bank’s sudden failure caused contagion. First Republic’s concentrated client base of successful businesses and high net-worth individuals in a select few coastal markets fled in a bank run to larger, more-diversified banks. We exited First Republic before it ultimately failed.

Fertilizer manufacturer Nutrien reduced the Fund’s relative return by 1.1% as its stock returned a -20.2%. Nutrien’s stock price fell along with their earnings as fertilizer prices declined. Lower crop prices reduced fertilizer usage, and supply was less constrained than anticipated as Russian and Belarussian potash exports continued despite economic sanctions. Nutrien is the world’s largest producer of potash, a commodity whose supply is controlled by only a handful of key global producers. We’re holding onto our position because we believe Nutrien will be a major beneficiary when the commodity cycle inevitably recovers.

Call center software provider Five9, Inc. reduced the Fund’s relative return by 0.9% as the stock dropped 24.1% from its average price. The stock declined as investors became concerned that Five9 could be negatively impacted by new artificial intelligence (AI) technology, as Five9 lacks a proprietary AI solution, and the number of call center agents could decline over time if AI-enabled chat bots are widely adopted. We were unable to disprove these concerns, so we exited our position.

Our best performer in 2023 was enterprise software provider Splunk. Splunk’s shares soared 70.6%, adding 2.9% to the Fund’s relative return. Splunk’s shares outperformed as it gained traction from cross-selling its suite of data monitoring software to its loyal base of customers and its management team dramatically improved the company’s profitability. Splunk’s impressive financial performance also caught the eye of technology giant Cisco, which announced it would acquire Splunk for $157 per share.

Insurance software provider Guidewire boosted the Fund’s relative return by 1.9% as its stock rose 74.3%. Guidewire delivered better-than-expected revenue and operating margins and provided an upbeat

outlook for its next two fiscal years. Guidewire ended the year in our largest position, due to its predictable and durable revenue growth as well as its margin expansion opportunity.

MercadoLibre, the leading online consumer marketplace and payments platform in Latin America, contributed 1.8% to our relative return as it gained 85.7%. MercadoLibre’s earnings estimates for 2023 rose by over 50% during the year as the company exceeded sales and profitability expectations. MercadoLibre’s e-commerce business continues to gain market share, driven by its strong value proposition centered around a broad assortment of products, compelling price points and fast delivery speeds. The company’s payments business is becoming a one-stop shop for financial services, as it now offers a full suite of products, ranging from payments to credit, insurance and savings.

* For this report, we quote total return to the portfolio, which includes price change and dividends.

26

| | | | |

| | |

| Annual Report • 2023 | | | |  |

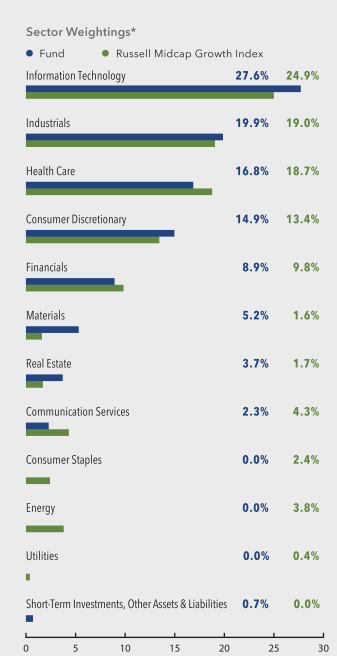

Parnassus Mid Cap Growth Fund

As of December 31, 2023

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Guidewire Software Inc. | | | 4.9% | |

| |

| CoStar Group Inc. | | | 3.7% | |

| |

| Agilent Technologies Inc. | | | 3.6% | |

| |

| Equifax Inc. | | | 3.6% | |

| |

| IDEXX Laboratories Inc. | | | 3.3% | |

| |

| Morningstar Inc. | | | 3.3% | |

| |

| Cintas Corp. | | | 3.1% | |

| |

| Ross Stores Inc. | | | 3.0% | |

| |

| Old Dominion Freight Line Inc. | | | 3.0% | |

| |

| Verisk Analytics Inc. | | | 2.8% | |

Portfolio characteristics and holdings are subject to change periodically.

Value on December 31, 2023

of $10,000 invested on December 31, 2013

The chart shows the growth in value of a hypothetical $10,000 investment over the last 10 years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Outlook and Strategy

2023 was a good year for equity markets, and a great year for our Fund. We’re pleased with our performance in 2023, and our goal is to deliver consistent outperformance relative to the Russell Midcap Growth over a business cycle.

Our strategy is to invest in high-quality growth compounders. To us, these are innovative companies that are market-share gainers in secularly growing markets with competitive advantages and seasoned management teams. Our sweet spot is to build positions in shares of these high-quality businesses when they fall due to transitory issues, but the long-term opportunity remains intact. Transitory issues could include a business model transition, like shifting from selling software on-premise by a license to a cloud-

27

| | | | |

| | |

| | | | Annual Report • 2023 |