UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: Parnassus Funds (811-04044) and Parnassus Income Funds (811-06673)

Parnassus Funds

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marc C. Mahon

Parnassus Funds

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

Item 1: Report to Shareholders

Parnassus Funds Annual Report

December 31, 2020

Parnassus Core Equity FundSM

Investor Shares: PRBLX | Institutional Shares: PRILX

Parnassus Mid Cap FundSM

Investor Shares: PARMX | Institutional Shares: PFPMX

Parnassus Endeavor FundSM

Investor Shares: PARWX | Institutional Shares: PFPWX

Parnassus Mid Cap Growth FundSM

Investor Shares: PARNX | Institutional Shares: PFPRX

Parnassus Fixed Income FundSM

Investor Shares: PRFIX | Institutional Shares: PFPLX

Table of Contents

3

| | | | |

| | |

| | | | Annual Report • 2020 |

February 5, 2021

Dear Shareholder,

This past year was one of profound loss. The lives cut short by the pandemic amount to nearly two million worldwide and 400,000 in our country alone. Our hearts go out to the families and friends impacted by these deaths, and our gratitude goes out to the medical workers without whom these numbers would be even bigger. We feel for those suffering financial insecurity due to job loss, for business owners whose dreams were shattered and for the widespread mental toll caused by anxiety and isolation. It was a very difficult year for so many people; I hope this experience increases our compassion as a nation and world.

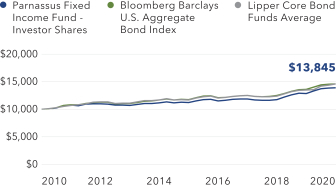

Despite the heartbreaking losses, 2020 was also a year of gains and growth. Most notable and relevant for this report are the fantastic gains made in financial markets. After crashing in the early weeks of the pandemic, stocks surged to record highs by the end of the year. The S&P 500 Index returned 18.40% in 2020, just outpacing the 17.10% gain for the Russell Midcap Index. Even more impressive was the 35.59% return posted by the Russell Midcap Growth Index. As one would expect given its category, the Parnassus Mid Cap Growth Fund had our highest return for the year. The Parnassus Fixed Income Fund – Investor Shares didn’t gain as much as our stock funds, but its 7.91% return was enough to beat its benchmark, the Bloomberg Barclays Aggregate Bond Index. 2020 was a good year to be invested, a rare bright spot for an otherwise challenging chapter in our lives.

Parnassus Endeavor Fund

On the basis of returns relative to benchmarks, our best offering by far for 2020 was the Parnassus Endeavor Fund – Investor Shares – its 27.42% total return beat the S&P 500 by a convincing 9.02%. Jerry Dodson was the lead portfolio manager of the Parnassus Endeavor Fund from its inception in 2005 through the end of 2020. Jerry founded Parnassus Investments in 1984, and will continue to serve as our Chairperson.

I’m so happy for Jerry that his final year as a portfolio manager was so successful. I was raised in Boston with stories of local sports legends, so naturally I told Jerry that his swan song was reminiscent of the great Celtic, Bill Russell, who won his 11th championship in his 13th and final season, and Red Sox star, Ted Williams, who belted a home run in his last at-bat. Jerry has never dunked a basketball or hit a baseball 400 feet, but in the arena of investments, there are few who have done what Jerry Dodson has in his remarkable 35-year career.

As important as Jerry has been to the success of the Parnassus Endeavor Fund, he did not do it alone. Since 2017, portfolio manager Billy Hwan has been by Jerry’s side, co-managing the fund and learning as much as he could. Billy joined Parnassus in 2012 with an already-stellar resume, highlighted by an undergraduate degree from Stanford, two master’s degrees and work experience at Dodge & Cox, an elite value investment firm in San Francisco. Billy will stay on as portfolio manager of the Parnassus Endeavor Fund, providing continuity for shareholders, and he’ll continue to receive the support of our deep and talented investment team. I’m confident that the Parnassus Endeavor Fund is in good hands.

4

| | | | |

| | |

| Annual Report • 2020 | | | |  |

New Hire

We made one new hire during the fourth quarter. Claire Kurmel is our new Head of Marketing Strategy. Prior to joining Parnassus, Claire worked in marketing at Matthews Asia, and before that she worked at State Street Global Advisors, BlackRock and Barclays Global Investors. Claire earned a bachelor’s degree in visual communications from California State University, Chico, and a master’s degree in business administration from the University of California, Davis. Outside of work, Claire enjoys hiking, cooking and connecting with her family and friends.

Thank you for investing with the Parnassus Funds.

Sincerely,

Benjamin E. Allen

President and CEO

5

| | | | |

| | |

| | | | Annual Report • 2020 |

Parnassus Core Equity Fund

Ticker: Investor Shares - PRBLX

Ticker: Institutional Shares - PRILX

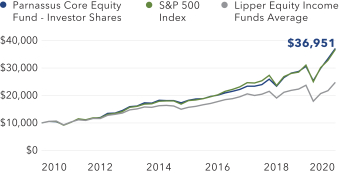

As of December 31, 2020, the net asset value (“NAV”) of the Parnassus Core Equity Fund – Investor Shares was $53.65. After taking dividends into account, the total return for the year was a gain of 21.19%. This compares to a total return of 18.40% for the S&P 500 Index (“S&P 500”) and a gain of 4.43% for the Lipper Equity Income Funds Average, which represents the average return of the equity income funds followed by Lipper (“Lipper average”).

Below is a table that summarizes the performances of the Parnassus Core Equity Fund, the S&P 500 and the Lipper average. The returns are for the one-, three-, five- and ten-year periods. We are pleased to report that the Fund outperformed the S&P 500 and the Lipper average for all time periods.

Parnassus Core Equity Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2020 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Core Equity Fund – Investor Shares | | | 21.19 | | | | 16.49 | | | | 15.27 | | | | 13.96 | | | | 0.86 | | | | 0.86 | |

| | | | | | |

| Parnassus Core Equity Fund – Institutional Shares | | | 21.47 | | | | 16.76 | | | | 15.51 | | | | 14.19 | | | | 0.63 | | | | 0.63 | |

| | | | | | |

| S&P 500 Index | | | 18.40 | | | | 14.18 | | | | 15.22 | | | | 13.88 | | | | NA | | | | NA | |

| | | | | | |

| Lipper Equity Income Funds Average | | | 4.43 | | | | 6.46 | | | | 9.88 | | | | 9.79 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Core Equity Fund – Institutional Shares from commencement (April 28, 2006) was 11.65%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Core Equity Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2020, Parnassus Investments has contractually agreed to limit total operating expenses to 0.86% of net assets for the Parnassus Core Equity Fund – Investor Shares and to 0.63% of net assets for the Parnassus Core Equity Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2021, and may be continued indefinitely by the Adviser on a year-to-year basis.

Year in Review

2020 was a year that exemplified how it’s often only when we lose essential and sacred things, such as family, friends, economic security or personal freedoms, that we truly appreciate them. It could take many years to repair the social and economic damage that has occurred. We hope that in the wake of 2020, there is a movement to build a more resilient, inclusive and sustainable society.

We’re humbly pleased to report that the Parnassus Core Equity Fund – Investor Shares had a strong gain of 21.19% for 2020 and significantly outperformed the 18.40% return for the S&P 500. Overall, stock selection and sector allocation were both positive contributors during the year, adding 152 and 163 basis points, respectively. (One basis point is 1/100th of one percent.) The Fund’s strongest stock selection was in the industrials sector, led by FedEx and John Deere. Stock selection in the technology sector was also positive, driven by the software and semiconductor subgroups. Positive sector allocation, especially our zero-weight in energy and utilities, also helped our performance.

While the Fund had a strong year, it still had three stocks that trimmed the NAV by at least 170 basis points. Food service distributor Sysco reduced the Fund’s performance by 230 basis points, with a loss of 58.8%* to our average selling price. The COVID-19 pandemic created a challenging environment for Sysco’s customers. Many of the company’s higher-margin independent restaurants are likely to close permanently due to shelter-in-place restrictions, and many of its hotel and educational customers are closed

* For this report, we quote total return to the portfolio, which includes price change and dividends.

6

| | | | |

| | |

| Annual Report • 2020 | | | |  |

indefinitely. We decided to sell the stock, as the company faces a long road to recovery.

Media conglomerate Disney reduced the Fund’s performance by 189 basis points, as the stock returned negative 20.1% to our average selling price. The company faced existential challenges this year as the pandemic decimated their parks and resorts business. Meanwhile, Disney’s streaming content business is consuming capital without a promise of near-term returns. We decided to exit our investment.

Bank of America reduced the Fund’s return by 170 basis points, as the stock’s total return to our average selling price was negative 35.2%. The shares fell as investors worried that the regional lockdowns and job losses caused by COVID-19 would increase credit losses, while the Federal Reserve’s interest rate cuts and quantitative easing in response to the crisis would decrease net interest revenue. We decided to exit our position because we fear these impacts will linger.

The Fund’s three largest winners were led by Amazon, which contributed 360 basis points to the Fund, with a total return of 82.5% from our average purchase price. Amazon’s e-commerce business benefited significantly from the pandemic, as consumers shifted purchases to Amazon that were previously made in-store at other retailers. The company’s higher margin cloud computing and advertising businesses also executed well, and remain compelling growth opportunities.

While there is still room to improve, we’ve been pleased with Amazon’s continued focus and engagement on ESG topics, evidenced by their steps to protect workers during COVID-19, investing in supplies and education in local communities, and increased sustainability in products and packaging. We’re excited to see Amazon’s continued ESG progress, innovation and growth in 2021.

Microsoft added 315 basis points to the Fund’s return with a 42.5% gain in 2020. The mission-critical nature of the company’s products was rewarded by strong, resilient financial results throughout the year. The strategic relevance of Microsoft is increasing as cloud and digital capabilities become table stakes for the global economy.

NVIDIA, a leading provider of computing solutions, added 297 basis points to the Fund’s return with a 122.3% gain. The company’s outperformance was driven by incredible feats of innovation, coupled with the accelerating demand for computing across the economy. NVIDIA’s latest products pushed the frontier of computing performance, and strong market adoption has led to record sales. The company is uniquely positioned to increase its share of one of the economy’s most valuable markets.

7

| | | | |

| | |

| | | | Annual Report • 2020 |

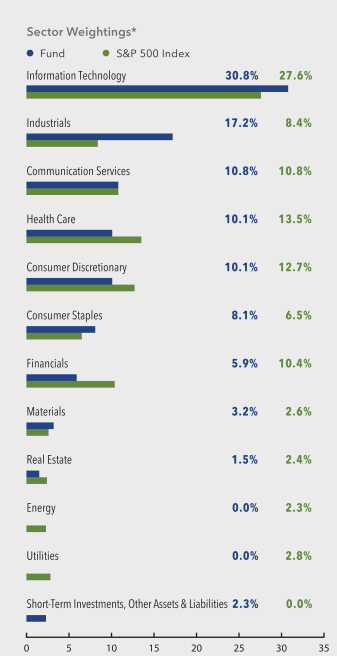

Parnassus Core Equity Fund

As of December 31, 2020

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Microsoft Corp. | | | 5.7% | |

| |

| Amazon.com Inc. | | | 5.1% | |

| |

| Comcast Corp., Class A | | | 4.3% | |

| |

| Danaher Corp. | | | 4.0% | |

| |

| Applied Materials Inc. | | | 3.9% | |

| |

| Deere & Co. | | | 3.8% | |

| |

| Verizon Communications Inc. | | | 3.6% | |

| |

| Mastercard Inc., Class A | | | 3.3% | |

| |

| CME Group Inc. | | | 3.2% | |

| |

| Linde plc | | | 3.2% | |

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

A once-in-a-century pandemic shook the world in 2020, causing the global economy to experience the deepest and fastest recession since World War II. The tragic suffering and loss of life caused by this pandemic, combined with the collapse in economic activity, has inflicted a deep financial and emotional wound upon society.

Despite this, the S&P 500 recovered to all-time highs by the end of the year. The stock market seemed unfazed in the closing weeks of 2020, even as coronavirus trends worsened and restrictions on activity were reestablished across many geographies. The market narrative has been dominated by a view that continued monetary and fiscal stimulus will cushion stock market losses while we wait for a vaccine-led economic recovery. It seems to us that the pendulum of investor sentiment has swung far from the fear of losses in March to the fear of missing out. This makes the stock market’s historic 2020 rally prone to corrections in 2021 if the reality doesn’t meet investors’ elevated expectations.

Nevertheless, we think that the highest probability for the economy in 2021 is solid growth. U.S. GDP could grow in the ballpark of 5% as stimulus programs continue, vaccinations roll out and economic activity begins to normalize. Given the apparent willingness of both political parties to run record government deficits, the magnitude and runway of potential future stimulus feels far greater and longer than ever before.

8

| | | | |

| | |

| Annual Report • 2020 | | | |  |

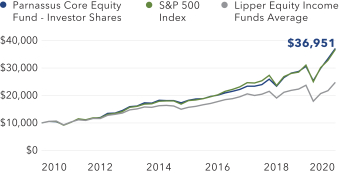

Value on December 31, 2020

of $10,000 invested on December 31, 2010

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

It could take years for many small businesses to recover. More than ten million Americans are unemployed, and millions of Americans owe back rents on housing and small businesses. This dynamic implies that inflation and interest rates could remain low, which would be supportive of stock prices. However, we are cognizant of the increasing risk of inflation rising with each additional stimulus policy.

As we discussed last quarter, our portfolio construction is based on owning the best companies across three categories: temporarily impaired businesses with significant upside potential, defensive businesses that offer significant volatility mitigation and “hybrid” businesses that offer elements of both. Our weightings across these categories reflect our conviction in the path forward while including a significant margin of safety given the wide range of potential outcomes. As always, our preference is for high-quality companies that will emerge from the pandemic with increasingly essential products and stronger competitive advantages.

During 2020, our 37% portfolio turnover was within our historical range. We bought one new stock during the fourth quarter. Texas Instruments is the largest analog semiconductor manufacturer and serves a diverse and growing group of customers. High barriers to entry and significant switching costs make this business incredibly attractive, with market-leading margins and returns on invested capital. Texas Instruments’ combination of impressive cash flow and durable growth drivers is a welcome addition to the portfolio. To make room, we sold our position in networking

company Cisco Systems, as we believe its enterprise campus sales have been significantly impacted by the work-from-home trend.

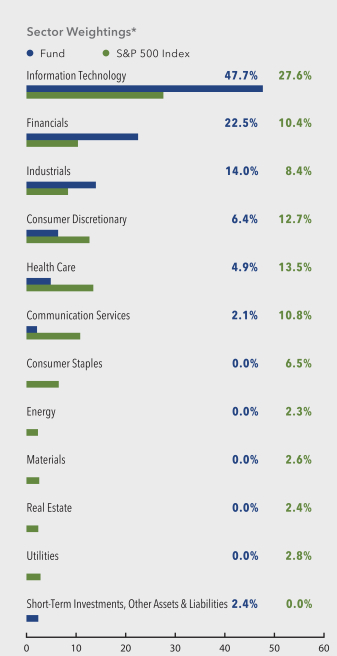

Moving to our sector weightings, the Fund’s largest exposure is an overweight position in information technology, particularly in software and semiconductors. We feel that companies like Microsoft, Adobe, Applied Materials, NVIDIA and Cadence Design Systems are increasingly essential building blocks in the global economy.

The Fund’s largest sector overweight, at about twice the benchmark weight, is industrials. Our exposure is anchored by agricultural titan John Deere and logistics provider FedEx. The Fund is also overweight the materials sector, headlined by our investment in industrial gas giant, Linde. These companies should help the Fund maintain upside participation if the economy rebounds faster-than-expected and stocks keep going up.

Our final sector overweight is consumer staples, exemplified by Costco. Our focus in this sector is to own market-share gainers that have resilient businesses with defensive characteristics. The Fund is approximately equal weight the communication services sector. Our two largest positions in this sector are Comcast and Verizon. The former offers offensive characteristics with leverage to an economic reopening, while the latter contributes to the Fund’s defensiveness.

The Fund’s largest underweight position remains financials. We worry that loan losses from the pandemic’s economic crater, combined with interest rates that we believe will likely remain historically low, have reduced long-term bank earnings power. Our largest financials’ positions are CME, the largest derivatives exchange, and Charles Schwab, the leading retail brokerage platform. These high-quality businesses should provide upside capture if interest rates and inflation exceed our expectations, and financial stocks rally.

We’re significantly underweight the health care sector. Most of our health care exposure resides in life sciences, medical devices and health care information technology. The Fund is also underweight the consumer discretionary sector, with Amazon being our largest position. We’re underweight real estate, due to

9

| | | | |

| | |

| | | | Annual Report • 2020 |

our concern that the pandemic’s lasting effects could negatively impact many property types, which could be devastating for a sector with high debt levels.

Finally, the Fund has zero exposure to the energy sector due to our fossil fuel free mandate. We also have no investments in utilities because of our view that this sector is marked by high valuations, low growth prospects, inadequate returns on capital and asset impairment risk due to climate change.

As always, we are honored to have your trust as we seek Principles and Performance®.

Sincerely,

Todd C. Ahlsten

Lead Portfolio Manager

Benjamin E. Allen

Portfolio Manager

10

| | | | |

| | |

| Annual Report • 2020 | | | |  |

Parnassus Mid Cap Fund

Ticker: Investor Shares - PARMX

Ticker: Institutional Shares - PFPMX

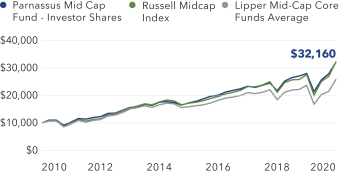

As of December 31, 2020, the net asset value (“NAV”) of the Parnassus Mid Cap Fund – Investor Shares was $40.78, so after taking dividends into account, the total return for 2020 was 14.88%. This compares to 17.10% for the Russell Midcap Index (“Russell”) and 9.18% for the Lipper Mid-Cap Core Funds Average, which represents the average return of the mid-cap core funds followed by Lipper (“Lipper average”). For the quarter, the Fund was up 15.43%, below the Russell’s 19.91% gain and the Lipper average’s 20.44% rise.

Below is a table comparing the Parnassus Mid Cap Fund with the Russell and the Lipper average for the one-, three-, five- and ten-year periods.

Parnassus Mid Cap Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2020 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Mid Cap Fund – Investor Shares | | | 14.88 | | | | 11.36 | | | | 13.17 | | | | 12.39 | | | | 1.01 | | | | 0.99 | |

| | | | | | |

| Parnassus Mid Cap Fund – Institutional Shares | | | 15.16 | | | | 11.62 | | | | 13.42 | | | | 12.54 | | | | 0.75 | | | | 0.75 | |

| | | | | | |

| Russell Midcap Index | | | 17.10 | | | | 11.61 | | | | 13.40 | | | | 12.41 | | | | NA | | | | NA | |

| | | | | | |

| Lipper Mid-Cap Core Funds Average | | | 9.18 | | | | 7.00 | | | | 9.81 | | | | 9.56 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Mid Cap Fund – Institutional Shares from commencement (April 30, 2015) was 11.49%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Mid Cap Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Midcap Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Mid-cap companies can be more sensitive to changing economic conditions and have fewer financial resources than large-cap companies.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2020, Parnassus Investments has contractually agreed to limit total operating expenses to 0.99% of net assets for the Parnassus Mid Cap Fund – Investor Shares and to 0.75% of net assets for the Parnassus Mid Cap Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2021, and may be continued indefinitely by the Adviser on a year-to-year basis.

Year in Review

It was a volatile year for mid cap stocks. After a disastrous first quarter due to the debilitating economic and social effects of COVID-19, the Russell clawed its way back to a slight loss by the end of the third quarter. Riding a wave of optimism following the presidential election, fiscal spending and monetary stimulus, and approval of multiple COVID-19 vaccines, the index surged nearly 20% in the fourth quarter to finish the year with a greater-than-17% return. Despite a significant year-over-year earnings contraction, investors took the over bet on the positives mentioned above to drive stocks to a record high. This late-year surge capped another big year for mid cap stocks, building on 2019’s greater-than-30% gain.

The Parnassus Mid Cap Fund – Investor Shares 2020 return was 14.88%, which captured 87% of the Russell’s gain. The Fund’s return handily beat our Lipper peers’ 9.18% gain. The Fund’s year-to-date performance was ahead of the Russell heading into the fourth quarter, but fell behind when the Russell surged late in the year. The jump was fueled by greater-than-20% gains in the communication services, financials, information technology and materials sectors, which together make up over 40% of the benchmark.

From a sector allocation perspective, our overweight position relative to the Russell in the surging information technology sector helped the Fund the most, adding 120 basis points to the Fund’s return. (One basis point is 1/100th of one percent.) The Fund’s underweight position in the consumer discretionary sector was the largest detractor, taking 42 basis points from the Fund’s return, because this sector also outperformed the Index.

The Fund’s weakest performer was US Foods, a leading food service distributor. US Foods reduced the Fund’s

11

| | | | |

| | |

| | | | Annual Report • 2020 |

performance by 457 basis points, as the total return to our average selling price was negative 60.6%*. Food distribution has historically been a stable business, but US Foods’ restaurant, hotel, travel and educational customers were disproportionally impacted by the COVID-19 pandemic, creating an unprecedented demand shock. The company also made a poorly timed acquisition one month before the lockdowns went into place, adding liquidity risks. With the company’s range of outcomes moving higher, we decided to exit the position.

Real estate developer and operator Howard Hughes reduced the Fund’s performance by 201 basis points as the stock delivered a negative return of 61.4% from our average cost. Despite our belief in the underlying quality of the company’s assets, the COVID-19 pandemic brought unprecedented challenges that significantly weighed on the company’s stock. Ultimately, we decided to exit the stock.

Zions Bancorporation reduced the Fund’s return by 140 basis points, as the stock achieved a negative return of 39.2% from our average selling price. The shares fell as investors worried that the regional lockdowns and job losses caused by COVID-19 would increase credit losses, especially in Zions’ large commercial real estate portfolio. Furthermore, the Federal Reserve’s interest rate cuts in response to the pandemic have decreased net interest revenue, which will hurt bank profitability. We decided to exit our position because we fear these pandemic impacts will linger.

Shifting to our winners, our strongest performer was Nuance Communications. Nuance added 325 basis points to the Fund’s return, with a 144.5% gain for the stock. The company posted strong, resilient results, demonstrating the mission criticality and the value of Nuance’s solutions. Within health care, the company launched their flagship Dragon Ambient experience product and signed major hospital systems as initial customers. This product uses artificial intelligence to fundamentally improve the quality of both the doctor and patient experience.

Cadence Systems, which provides leading software and hardware tools for designing semiconductor chips, contributed 255 basis points to the Fund’s return, as its stock generated a 96.7% total return. The stock rose early in the year, as the company reported better-than-expected earnings and management raised its annual earnings outlook in respone to increased customer design activity. With the EDA industry consolidated to largely three players, we believe Cadence is positioned to deliver robust growth, as increasing chip design complexity drives greater demand for its mission-critical design software.

Shares of transportation provider FedEx generated a total return of 70.3% and contributed 236 basis points to the Fund’s performance. Earnings in the company’s ground shipping segment jumped as a surge in e-commerce led to a sharp acceleration in parcel shipments. FedEx’s air cargo profits were also boosted by the pandemic, as the reduction in passenger air travel sharply reduced overall cargo capacity across the airline industry and profits surged as FedEx’s planes filled. We believe these pandemic-induced effects are durable, as consumers increasingly shift purchases online and global air cargo capacity remains tight.

* For this report, we quote total return to the portfolio, which includes price change and dividends.

12

| | | | |

| | |

| Annual Report • 2020 | | | |  |

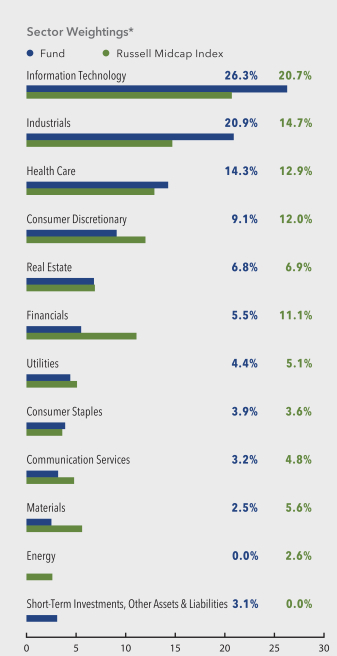

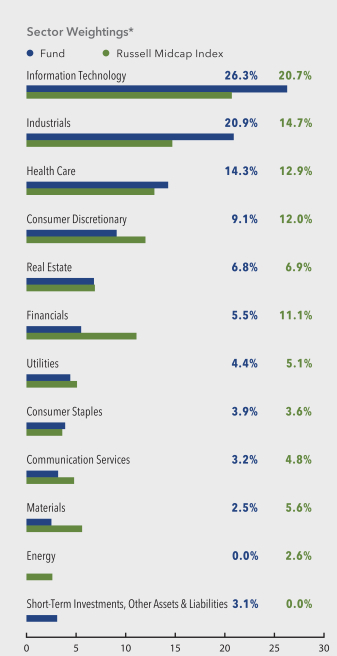

Parnassus Mid Cap Fund

As of December 31, 2020

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Nuance Communications Inc. | | | 4.0% | |

| |

| Republic Services Inc. | | | 4.0% | |

| |

| Cerner Corp. | | | 3.1% | |

| |

| Xylem Inc. | | | 3.0% | |

| |

| Teleflex Inc. | | | 3.0% | |

| |

| Hologic Inc. | | | 3.0% | |

| |

| Burlington Stores Inc. | | | 2.9% | |

| |

| Trimble Inc. | | | 2.9% | |

| |

| KLA Corp. | | | 2.9% | |

| |

| Verisk Analytics Inc. | | | 2.8% | |

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

After the Russell’s tremendous fourth quarter rally, mid-cap stocks are now up over 12%, annualized, over the past ten years. In short, it’s been a great decade to be a stock investor. As we head into 2021, the bullish mindset continues to prevail as investors focus on an economic recovery from the COVID-19 induced lows, mild inflation, additional fiscal stimulus and an accommodative federal monetary policy. The recent release of multiple COVID-19 vaccines is fueling further optimism for a fast economic recovery.

While we also believe an economic recovery is probable, our view is that it will be uneven, with plenty of starts, stalls and stops due to the long timeframe for achieving widespread immunization. Furthermore, the significant uncertainty related to international and domestic political and economic conflicts, including domestic political party tensions, the trade war with China and near-perpetual cyber warfare with Russia, as well as rising consumer and corporate debt in the U.S. temper our optimism.

Another consideration that weighs on outright optimism is that the Russell reached an all-time high at year-end and now trades at nearly 23 times forward earnings estimates, a materially higher multiple than the 20-year average of 16 times. Further, much of the rise in stock prices during the past year was driven by multiple expansion rather than earnings growth. In fact, earnings per share shrunk almost 29% in 2020, while the average earnings multiple increased by 25%.

13

| | | | |

| | |

| | | | Annual Report • 2020 |

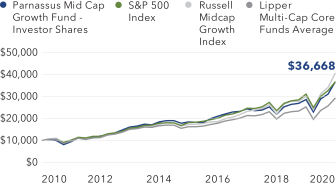

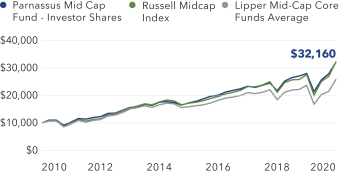

Value on December 31, 2020

of $10,000 invested on December 31, 2010

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

It’s difficult to predict whether this factor, as well as the concerns mentioned above, will result in a significant market correction, but we believe that investor expectations are elevated, creating a greater risk of a correction if the expected pace of recovery falls short. Given the wide range of outcomes, we’re focused on owning a collection of high-quality businesses that can compound earnings in multiple economic scenarios and provide longer-term asymmetric risk-reward opportunities.

Moving to our sector weightings, we are underweight relative to the Russell in the financials, consumer discretionary and materials sectors, which are likely to perform poorly in a market correction. Given our fossil fuel free mandate, we also have no direct exposure to energy stocks.

We are selectively overweight relative to the Russell in the information technology, industrials and health care sectors, which should allow us to participate in market upside and provide resilience in a market sell-off. Our technology companies, such as Autodesk and Nuance Communications, are prime examples, offering a blend of offensive and defensive characteristics. Both companies have asset-light, defensive business models that are supported by a significant degree of recurring revenue as well as offensive exposure to fast-growing markets in construction and health care as customers accelerate spending on digital software solutions. Our largest industrial holding, Republic Services, provides essential waste services supported by recession-resilient multi-year contracts, but should also enjoy a rebound in growth as commercial waste volumes

recover. Our health care holdings, such as Cerner and Agilent, are well-positioned with their highly differentiated solutions in the areas of electronic medical records and diagnostic testing.

We added four new stocks in the recent quarter. We initiated a position in ANGI Homeservices Inc., an operator of a leading online home services marketplace with a portfolio of brands that include HomeAdvisor, Angie’s List and Handy. The company, which connects consumers and professional home service providers across over 500 different categories, such as plumbing and landscaping, recently reported slower-than-expected sales due to supply constraints impacting its service providers, causing the stock to fall sharply in August. We felt that investors overreacted, and we believe that ANGI, as the largest online player in the home services sector with significant scale, is positioned to capture additional market share gains.

We bought BioMarin Pharmaceutical, a biotechnology company that focuses on orphan and ultra-orphan drugs for serious and life-threatening rare diseases. The stock fell in August due to a delay in FDA approval for its Roctavian market launch, creating a compelling opportunity to buy a high-quality biotech company. While the news will hurt the company’s sales growth in the near term, we believe BioMarin has a unique collection of patented and commercial drugs and a deep pipeline of potential drugs.

We also established a position in Grocery Outlet, a leading off-price food retailer that operates 337 stores in the United States. Like its apparel off-price peers, such as Burlington Stores, Grocery Outlet has a unique business model that enables it to offer name-brand groceries at deep discounts relative to conventional food retailers. We’re excited about the company’s ability to deliver long-term compound earnings growth, driven by further share gains in the food retailing space, new store expansion and margin leverage.

Finally, we added Cboe Global Markets, which operates as one of the largest global exchange holdings companies, with a diverse revenue exposure across U.S. equities, options, futures, European equities and foreign exchange. Cboe has a wide moat, attractive margins and counter-cyclical qualities as a financial company with no credit, interest rate or balance sheet risks.

14

| | | | |

| | |

| Annual Report • 2020 | | | |  |

To make room for the new holdings, we exited three of our positions. We sold our remaining shares in Motorola Solutions, primarily due to our concerns about weakening public spending on its radio equipment. We also exited our position in Shaw Communications due to concerns about its eroding moat in the wireless segment. Finally, we exited our position in First American Financial due to our concerns related to a significant data security breach, as well as the hyper-cyclical nature of the business.

We’re pleased that our strategy has provided excellent long-term, risk-adjusted results to shareholders. Our goal is to always outperform the market, but given the tremendous gains for the Russell these past two years, our upside participation is bearable in the context of the Fund’s risk profile. We will continue to focus on owning responsible, well-managed, increasingly relevant businesses with sustainable competitive

advantages. We are confident that this strategy will help the Fund outperform the market over the full market cycle.

Thank you for your investment in the Parnassus Mid Cap Fund.

Yours truly,

Matthew D. Gershuny

Lead Portfolio Manager

Lori A. Keith

Portfolio Manager

15

| | | | |

| | |

| | | | Annual Report • 2020 |

Parnassus Endeavor Fund

Ticker: Investor Shares - PARWX

Ticker: Institutional Shares - PFPWX

As of December 31, 2020, the net asset value (“NAV”) of the Parnassus Endeavor Fund – Investor Shares was $48.31, so after taking dividends into account, the total return for the quarter was 25.93%. This compares to a gain of 12.15% for the S&P 500 Index (“S&P 500”) and 14.22% for the Lipper Multi-Cap Core Funds Average, which represents the average return of the multi-cap core funds followed by Lipper (“Lipper average”). For the quarter, then, our return was more than double that of the S&P 500.

Interestingly enough, the Lipper average did better than the S&P 500, which is unusual. Since the S&P 500 is heavily weighted toward very large companies, it shows that smaller stocks did better than the giant companies for the quarter.

Parnassus Endeavor Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2020 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Endeavor Fund – Investor Shares | | | 27.42 | | | | 13.69 | | | | 16.41 | | | | 15.20 | | | | 0.97 | | | | 0.95 | |

| | | | | | |

| Parnassus Endeavor Fund – Institutional Shares | | | 27.72 | | | | 13.96 | | | | 16.67 | | | | 15.35 | | | | 0.71 | | | | 0.71 | |

| | | | | | |

| S&P 500 Index | | | 18.40 | | | | 14.18 | | | | 15.22 | | | | 13.88 | | | | NA | | | | NA | |

| | | | | | |

| Lipper Multi-Cap Core Funds Average | | | 16.56 | | | | 11.41 | | | | 12.83 | | | | 11.85 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Endeavor Fund – Institutional Shares from commencement (April 30, 2015) was 14.52%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Endeavor Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2020, Parnassus Investments has contractually agreed to limit total operating expenses to 0.95% of net assets for the Parnassus Endeavor Fund – Investor Shares and to 0.71% of net assets for the Parnassus Endeavor Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2021, and may be continued indefinitely by the Adviser on a year-to-year basis.

For the year, the Parnassus Endeavor Fund – Investor Shares gained 27.42% compared to 18.40% for the S&P 500 and 16.56% for the Lipper average, so we beat the S&P 500 by over nine percentage points and the Lipper average by almost 11 percentage points. It was a great year for the Parnassus Endeavor Fund!

To the left is a table showing the returns for the Parnassus Endeavor Fund for the one-, three-, five- and ten-year periods. You will notice that we beat all the indices for all time periods, except for the S&P 500 for the three-year period when we were slightly behind. We did, however, beat the Lipper average for the three years by over two percentage points.

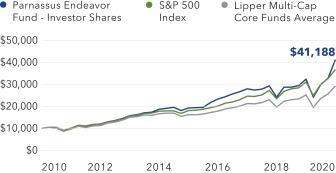

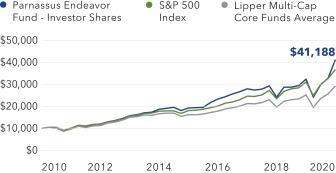

For the ten-year period, the chart on page 18 shows that an investor who put $10,000 in the Fund would have $41,188 compared to $36,664 for the S&P 500 and $29,301 for the Lipper average. That means an extra $4,524 over the S&P 500 and an extra $11,887 over the Lipper average.

Year in Review

Two companies reduced the Fund’s return by more than 300 basis points each. (One basis point is 1/100th of one percent.) These companies’ business models were directly impaired by the pandemic, so we sold our investments in both. Thankfully, our gains more than made up for our losses. Seven stocks each boosted the Fund’s return by 190 basis points or more, which added up to a fantastic year for the Fund.

Private-label credit card issuer Alliance Data cut 389 basis points from the Fund’s return, as the stock dropped 61.7%* from $112.20 to our average sales price of $42.99. Alliance Data’s retail partners were hit hard by the sharp drop in foot traffic caused by social

* For this report, we will quote total return to the portfolio, which includes price change and dividends.

16

| | | | |

| | |

| Annual Report • 2020 | | | |  |

distancing, so the company’s revenue for operating retailers’ credit card programs fell below the company’s prior estimates. Meanwhile, investors dumped the stock, fearing that the jump in unemployment claims could lead to rising credit losses. Although we believed the company had the capital to withstand the year’s economic turbulence, we sold our position to take advantage of more attractive long-term investments elsewhere.

Alaska Air Group reduced the Fund’s returns by 333 basis points, as the stock dove 42.8% from $67.75 to our average sales price of $38.70. Alaska is the fifth-largest airline in the country with routes primarily on the West Coast. The company stood out to us because of its fortress balance sheet, cost efficient fleet, and shareholder-oriented management. Nonetheless, Alaska’s stock hit the skids as the coronavirus outbreak engulfed the U.S., resulting in collapsing demand for air travel and a $50 billion bailout of the airline industry. Management took decisive action in response to the crisis, including cutting flights, suspending stock buybacks and the dividend to conserve cash, but it was not enough. We exited our position, since a rebound in passenger demand would be elusive for some time.

Parnassus Endeavor Fund

As of December 31, 2020

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

17

| | | | |

| | |

| | | | Annual Report • 2020 |

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Micron Technology Inc. | | | 11.5% | |

| |

| Applied Materials Inc. | | | 9.3% | |

| |

| Charles Schwab Corp. | | | 6.5% | |

| |

| FedEx Corp. | | | 5.2% | |

| |

| Intel Corporation | | | 4.6% | |

| |

| Lam Research Corp. | | | 4.3% | |

| |

| W.W. Grainger Inc. | | | 4.1% | |

| |

| Cisco Systems Inc. | | | 4.1% | |

| |

| Capital One Financial Corp. | | | 3.9% | |

| |

| The Gap Inc. | | | 3.8% | |

Portfolio characteristics and holdings are subject to change periodically.

Value on December 31, 2020

of $10,000 invested on December 31, 2010

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Turning to our winners, Micron Technology increased the Fund’s performance by 513 basis points, as its stock jumped from $53.78 to $75.18, for a total return of 39.8%. Micron manufactures memory chips used in a variety of devices, including servers, phones and computers. Despite near-term headwinds from the loss of Huawei as a large customer, Micron executed well and had a strong year. We expect an even better 2021, with recovery in segments impacted by the pandemic such as mobile, industrial and automotive, as well as improved pricing, particularly in DRAM. Increased volume and pricing coupled with decreasing costs, should result in another strong year for Micron.

Applied Materials makes semiconductor equipment. It added 445 basis points to the Fund’s performance, as

its stock climbed from $61.04 to $86.30, for a total return of 43.3%. Executing well despite the trade tensions with China, the company had a very strong year fueled by increased equipment demand due to new and more complex applications for semiconductor chips. We expect this growth to continue into 2021, with double digit-growth in industry equipment spend and its ongoing share gain in the DRAM memory market.

Shares of transportation provider FedEx contributed 396 basis points to the Fund’s performance, as its stock soared from our cost of $148.83 to $259.62, for a total return of 70.0%. Earnings in FedEx’s ground shipping segment jumped as the pandemic-induced surge in e-commerce led to a sharp acceleration in parcel shipments. FedEx’s air cargo profits were also boosted by the pandemic, as the reduction in passenger air travel sharply reduced overall cargo capacity, and profits surged as FedEx’s planes were filled, and pricing rose. We believe these pandemic-induced effects will last, as we expect more consumers to shift purchases online while global air cargo capacity should remain constrained for several years by reduced international travel.

Apple added 348 basis points to the Fund’s return, as its stock rose from $73.41 to $132.69, for a total return of 82.3%. Work-from-home trends significantly benefited the world’s most valuable consumer electronics company. Results across Apple’s products were strong and resilient throughout the year, as people increasingly relied on them to work and play from home. Investor optimism around the latest iPhone launch, coupled with the 5G upgrade cycle, also drove shares higher.

Lam Research Corporation had a strong year, as its stock surged from $292.40 to $472.27 for a total return of 64.0%, contributing 292 basis points to the Fund’s performance. As a large player in the semiconductor equipment market, Lam Research Corporation benefited from increased investment. We believe elevated equipment spend is a multi-year tailwind due to growing semiconductor chip complexity from emerging technologies such as 5G, cloud and artificial intelligence. In 2021, we believe Lam Research Corporation will continue to benefit from more investment, particularly in memory and NAND.

18

| | | | |

| | |

| Annual Report • 2020 | | | |  |

Agilent, a leading life science tools company, contributed 193 basis points to the Fund’s return as its stock increased from $85.31 to $118.49 for a total return of 39.8%. This year, the company executed exceptionally well despite the COVID-19 pandemic affecting its more industrial end-markets. Agilent’s best-in-class innovation, along with its top workplace and talent, led to even faster share gains than investors expected. While competitors had to furlough staff and cut pay, Agilent’s workforce was focused on winning in the marketplace – which can be seen in the different growth rates reported. As the core business continues to take share, Agilent invested aggressively in the business to accelerate growth, as highlighted by the exciting oligonucleotide manufacturing business’s capacity expansion. Agilent is doing a good job shifting toward higher growth and less cyclical consumables and services that should yield sustainable growth for years to come, with a significant margin expansion opportunity as well.

Discover Financial, the third-largest credit card issuer in the country, contributed 191 basis points to the Fund’s return, as its stock soared from our average purchase price of $49.40 to $90.53, for a total return of 84.3%. We first bought shares in June, following the pandemic-induced sell-off, as investors feared that surging unemployment numbers would lead to a wave of credit losses at the bank. In actuality, credit performance was nowhere near as bad as anticipated, due to the powerful triple effects of government stimulus, conservative household balance sheets and the rapid economic recovery. Discover’s record of disciplined underwriting also paid off, as monthly net charge-offs were consistently better-than-expected and even ended the year at rates lower than before the pandemic began.

Outlook and Strategy

2020 was a disruptive year for the stock markets, the country and the world. A deadly pandemic upended the lives of every person on earth. The casualty count is staggering: COVID-19 has infected 21 million people in the U.S. and killed 400,000 Americans so far. Over ten million people have lost their jobs due to government-mandated lockdowns. Fortunately, the year ended on a hopeful note. In one of the greatest scientific achievements in U.S. history, drug companies developed two vaccines in record time and have begun programs to inoculate millions of people against the virus.

The world shifted in other ways, too. President Trump became the third U.S. president in history to be impeached, and was ultimately acquitted. Americans grew more politically divided than ever, and in a fiercely contested election, chose Joseph Biden as the 46th president of the United States. A global movement for racial justice emerged out of the tragic and infuriating murders of George Floyd and others at the hands of police. Alarm bells rang around climate change as California and Australia faced devastating wildfires. As the pandemic grew, U.S. stock markets briefly collapsed 35%, then seemed to disconnect from reality by surging 70% to end 2020 with strong gains.

In a year that turned the world upside down, the Parnassus Endeavor Fund ended up on top. How did we do it? It was not by anticipating the pandemic, the recession or the outcome of the presidential election. Our singular advantage is that we have a repeatable process and the right people in place to execute on our investment philosophy. Our philosophy seeks to invest in good and socially responsible companies that are trading at discounted prices to our estimate of intrinsic value. This is easier said than done, because it often requires going against conventional wisdom. Having the right people with the right temperament matters most in those moments. In stock after stock, Jerry and I honed our ability to identify opportunities and act on them. I’m delighted that our years of hard work have paid off handsomely with eye-popping returns for our shareholders.

As previously announced, I will be the Parnassus Endeavor Fund’s sole manager starting in 2021. My priority in managing the Fund will be maintaining continuity. The same investment philosophy and process described above that has guided the Fund since inception will remain fully intact. Moreover, I will be supported by the collective talents of the 17-person Parnassus investment team I have grown with over my last eight years at the firm. I am also a firm believer in continuous improvement. The Fund has had a long history of outperformance, but its volatility has been a challenge. I plan to lower the Fund’s overall risk through strategic diversification for example, by trimming outsized positions. The goal is to increase the Fund’s risk-adjusted returns for long-term shareholders.

I am optimistic about the economy in the year ahead. After years of gridlock, we have a unified

19

| | | | |

| | |

| | | | Annual Report • 2020 |

government committed to economic recovery through accommodative fiscal and monetary policy. The housing market, which typically leads the economy into and out of recessions, remained resilient last year. This suggests that despite the twin health and economic crises the country is weathering, there was not also a structural credit crisis. Uncertainty over domestic and trade policy, which ballooned under the previous administration, should revert to a more predictable pace under a Biden administration. Global economies therefore may experience a simultaneous, vaccine-led relief rally, helping consumer confidence worldwide.

The fly in the ointment is that stocks are expensive. The S&P 500 trades at 23x expected earnings, its highest in 20 years, compared to the post-financial crisis average of 16x. Companies of all stripes rushed to sell their shares on stock market exchanges, another sign of overvalued public markets. I would expect a period of consolidation and occasional corrections as exuberance gives way to sober reality. I believe the Parnassus Endeavor Fund is precisely designed to accommodate such market moves. With a valuation average of 17x expected earnings, our collection of stocks is already on sale if markets fall, and should have more room to rise if markets continue to march higher.

Thank you for your investment in the Parnassus Endeavor Fund.

Yours truly,

Jerome L. Dodson

Lead Portfolio Manager

Billy Hwan

Portfolio Manager

Letter from Jerome L. Dodson

As of the first of the year, I am no longer the portfolio manager of the Parnassus Endeavor Fund. I’m retiring from active fund management, although I will continue as Chairperson of Parnassus Investments. Also, a lot of my personal money will remain in the Fund, as an expression of my confidence in Billy Hwan. Although Billy is the new lead portfolio manager, he is not new to the Fund. He has been at Parnassus for eight years and has been a portfolio manager with the Parnassus Endeavor Fund for almost three years. He is a very capable manager, and I know he will take good care of your money.

At the age of 77, I’ve decided that managing investments for 36 years is long enough. As Chairperson and a shareholder, I will still keep an eye on things, but I plan to do a lot of traveling, reading and getting to know my grandchildren better.

It’s been a wonderful career for me. I’m able to do well financially, while also contributing to social responsibility. At the beginning of 1985, socially responsible investing was not well known at all. Parnassus was one of the few funds that took social and environmental factors into account. Today, there are literally thousands of funds that consider social issues in making investment decisions. It’s become mainstream, and I think it has influenced a lot of companies to consider social and environmental issues in the way they operate their businesses. When I first started Parnassus, I would go to company meetings and ask about how a company treated their employees or how a company made sure its operations did not have a negative impact on the environment. Many company managers expressed surprise that I would ask those kinds of questions. That would no longer happen now, as social and environmental responsibility is considered important by most corporations today.

When Parnassus Investments started operating in 1985, people were skeptical that a social responsibility fund could have good returns. I wasn’t even sure myself that we would be able to beat the market or even outperform conventional mutual funds. As it turned out, the Parnassus Endeavor Fund has been the best-performing mutual fund in its category since its

20

| | | | |

| | |

| Annual Report • 2020 | | | |  |

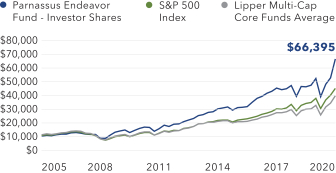

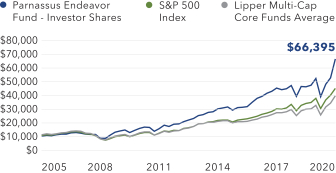

inception on April 29 of 2005. According to the Lipper Multi-Cap Core Funds Average, which represents the average return of the multi-cap core funds followed by Lipper (“Lipper average”), the Parnassus Endeavor Fund – Investor Shares has been the best-performing multi-cap core fund since the inception date: #1 out of 228 funds,* earning an average of 12.84% per year compared to 10.05% for the S&P 500 and 8.99% for the average multi-cap core funds in the Lipper average. This record has been achieved through many ups and downs, including the crash of 2008. Had you put $10,000 in the Parnassus Endeavor Fund – Investor Shares at inception, you would have $66,395 today. By comparison, you would have $44,917 had you been able to invest in the S&P 500 and you would have had $39,761 had you been able to invest in the average multi-cap core funds followed by the Lipper average. I’m delighted that we’ve been able to give our shareholders such a good return.

(*The Fund is #45 of 660 funds for one year, #193 of 593 for three years, #17 of 514 for five years and #5 of 356 for 10 years.)

Value on December 31, 2020

of $10,000 invested on April 29, 2005

The chart shows the growth in value of a hypothetical $10,000 investment since inception on 4/29/2005 and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Why has the Parnassus Endeavor Fund done so well over the years? There are two reasons. First, I think that

our social responsibility philosophy has helped. A company that treats its employees well has an advantage, because its staff will work harder and more efficiently for a company that cares for its workers. That means that the company will be more productive. A good place to work will not need to hire as many workers, so it will be more profitable. A firm with a strong environmental policy will be less likely to be prosecuted or fined. That kind of company will also be more efficient in its use of resources. The other reason is our policy of investing in companies that are temporarily out of favor. This means that the market price will be low relative to its earning capacity. If you invest in a good company that’s trading at a bargain price, you should have an excellent return, when that company bounces back from whatever caused the stock to drop in the first place.

How do you know that a company that’s had a hard time will make a comeback and see its price rise more than the market? There’s no easy answer to this question. Most of the time when I invest in a company whose stock has fallen on hard times, I’m very nervous. More often than not, they do come back, but there’s no guarantee, and I’ve had many disappointments in my investing career. Fortunately, most of them do make a strong comeback and earn a good return. Things I look for are quality products, a strong management team, a good marketing strategy, low costs and other advantages. As the Fund’s performance shows, most of our investments have been successful.

Best wishes to all of you in your investing career.

Yours truly,

Jerome L. Dodson

Chairperson, Parnassus Investments

21

| | | | |

| | |

| | | | Annual Report • 2020 |

Parnassus Mid Cap Growth Fund

Ticker: Investor Shares - PARNX

Ticker: Institutional Shares - PFPRX

As of December 31, 2020, the net asset value (“NAV”) of the Parnassus Mid Cap Growth Fund – Investor Shares was $61.44, resulting in a gain of 28.61% after taking dividends into account for 2020. On May 15, we completed the Fund’s transition from a multi-cap strategy to a mid cap growth strategy. To reflect the new strategy, our benchmark changed from the S&P 500 Index (“S&P 500”) to the Russell Midcap Growth Index (“Russell Midcap Growth”). The Fund’s 28.61% return for the year was between the S&P 500’s return of 18.40% and the Russell Midcap Growth’s return of 35.59%. The Fund was substantially ahead of the 16.56% increase for the Lipper Multi-Cap Core Funds Average, which represents the average return of the multi-cap core funds followed by Lipper (“Lipper average”). We anticipate that Lipper will eventually change the Fund’s peer group to reflect the new strategy.

Parnassus Mid Cap Growth Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2020 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Mid Cap Growth Fund – Investor Shares | | | 28.61 | | | | 14.65 | | | | 14.70 | | | | 13.88 | | | | 0.84 | | | | 0.84 | |

| | | | | | |

| Parnassus Mid Cap Growth Fund – Institutional Shares | | | 28.81 | | | | 14.83 | | | | 14.86 | | | | 13.97 | | | | 0.68 | | | | 0.68 | |

| | | | | | |

| Russell Midcap Growth Index | | | 35.59 | | | | 20.50 | | | | 18.66 | | | | 15.05 | | | | NA | | | | NA | |

| | | | | | |

| S&P 500 Index | | | 18.40 | | | | 14.18 | | | | 15.22 | | | | 13.88 | | | | NA | | | | NA | |

| | | | | | |

| Lipper Multi-Cap Core Funds Average | | | 16.56 | | | | 11.41 | | | | 12.83 | | | | 11.85 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Mid Cap Growth Fund – Institutional Shares from commencement (April 30, 2015) was 12.53%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Mid Cap Growth Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Midcap Growth and S&P 500 are unmanaged indexes of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2020, Parnassus Investments has contractually agreed to limit total operating expenses to 0.84% of net assets for the Parnassus Mid Cap Growth Fund – Investor Shares and to 0.68% of net assets for the Parnassus Mid Cap Growth Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2021, and may be continued indefinitely by the Adviser on a year-to-year basis. Prior to May 1, 2020, the benchmark for the Parnassus Mid Cap Growth Fund (formerly known as the Parnassus Fund) was the S&P 500 Index.

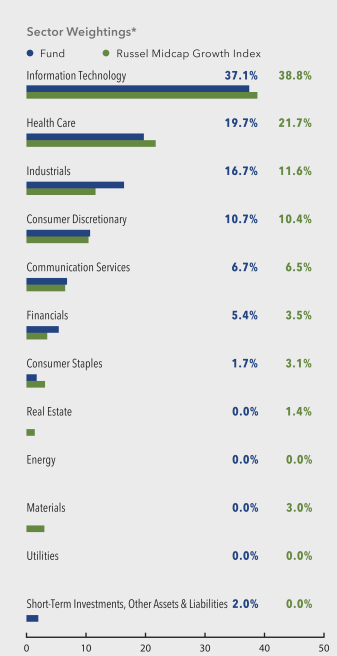

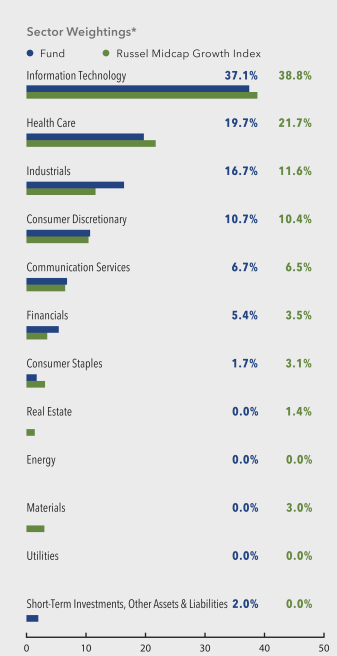

To the left is a table that summarizes the performance of the Parnassus Mid Cap Growth Fund, Russell Midcap Growth, S&P 500 and Lipper average. The returns are for the one-, three-, five- and ten-year periods ended December 31, 2020.

Year in Review

We’re pleased that the Parnassus Mid Cap Growth Fund – Investor Shares had a total return of 28.61% in 2020. The year was literally a tale of two halves for our fund, as we transitioned from a multi-cap core strategy to a mid cap growth strategy. From the start of the year until the transition was completed on May 15, our fund fell 10.09%, which outperformed the 10.69% drop of our old benchmark, the S&P 500. From May 15 through the end of the year, our Fund soared 43.03%, which slightly trailed the incredible 44.14% rally in our new benchmark, the Russell Midcap Growth.

Given the market’s huge rally from its bottom in March, our three worst performers for the year were all stocks we exited prior to the Fund’s transition. None of these companies were growing fast enough to fit our new mid cap growth strategy. Our worst performer was food distributor Sysco, which cut 285 basis points (One basis point is 1/100th of one percent) from the Fund’s return, as the total return to our average selling price was negative 58.8%*. The company was at the epicenter of COVID-19’s impact on the U.S. economy, as many of Sysco’s restaurant, hotel, travel and educational customers were forced to close or operate at reduced capacity.

* For this report, we quote total return to the portfolio, which includes price change and dividends.

22

| | | | |

| | |

| Annual Report • 2020 | | | |  |

Global apparel company VF Corporation dropped 50.6% to our average selling price, trimming 218 basis points from the Fund’s return, as investors worried about the financial impact of store closures forced by COVID-19. We sold the stock to make room for faster-growing retailers that are better positioned for the new post-pandemic world, like Lululemon and Grocery Outlet.

Hologic, a medical technology company focused on improving women’s health, subtracted 204 basis points from the Fund’s performance, as the total return to our average selling price was negative 39.7%. The stock fell as consumers deferred elective procedures and hospitals delayed expensive machine purchases. We sold our position and redeployed the capital into more innovative medical technology companies, such as pet health care specialist IDEXX Laboratories and conversational artificial intelligence provider Nuance Communications.

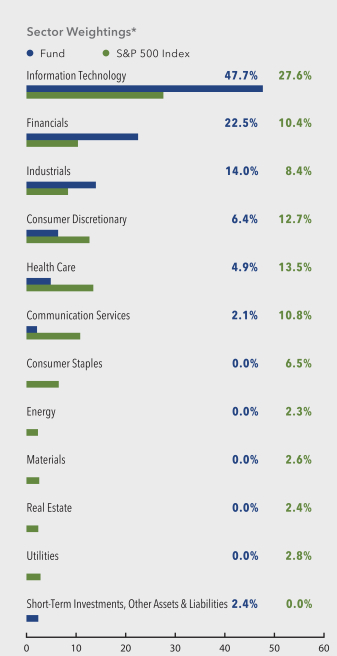

Parnassus Mid Cap Growth Fund

As of December 31, 2020

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

23

| | | | |

| | |

| | | | Annual Report • 2020 |

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Square Inc., Class A | | | 3.9% | |

| |

| Cadence Design Systems Inc. | | | 3.8% | |

| |

| Synopsys Inc. | | | 3.7% | |

| |

| Agilent Technologies Inc. | | | 3.5% | |

| |

| Autodesk Inc. | | | 3.4% | |

| |

| CoStar Group Inc. | | | 3.3% | |

| |

| IDEXX Laboratories, Inc. | | | 3.3% | |

| |

| Burlington Stores Inc. | | | 3.1% | |

| |

| Illumina Inc. | | | 3.0% | |

| |

| Xylem Inc. | | | 3.0% | |

Portfolio characteristics and holdings are subject to change periodically.

Our biggest winner in 2020 was Square, which added an incredible 552 basis points to the Fund’s return, as its stock soared 185.8% from our average purchase price. Investors cheered the tremendous growth of Cash App, Square’s peer-to-peer mobile payment network and digital bank. COVID-19 and the U.S. government’s associated stimulus payments caused Cash App’s adoption to inflect higher, as consumers valued the convenience of Cash App’s mobile direct deposit and money transfer features. Cash App’s monthly gross profit growth peaked above 200% during the year, and its monthly active users now exceed 30 million.

The Trade Desk is the leading programmatic advertising platform. Its shares contributed 313 basis points to the Fund’s return, as the stock surged 187.2% from our average purchase price. The company’s financial results soared above all expectations as the shift toward digital advertising accelerated and advertisers gravitated toward The Trade Desk’s open, independent and transparent ad buying platform.

IDEXX Laboratories, the leading pet diagnostics company, added 298 basis points to the Fund’s return, as the stock’s total return from our average purchase price was an impressive 131.6%. While COVID-19 restrictions forced many veterinary visits to be cancelled from March through May, visits rebounded rapidly once the restrictions were lifted and IDEXX returned to its targeted double-digit revenue growth rate. IDEXX is the industry’s innovation leader, and the company should continue to benefit from growing diagnostics utilization and expansion overseas.

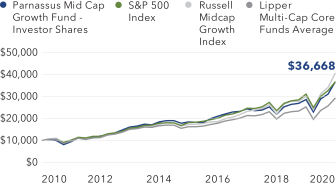

Value on December 31, 2020

of $10,000 invested on December 31, 2010

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Outlook and Strategy

What a year! Despite the sharpest economic contraction on record in the second quarter and elevated unemployment throughout the year, the stock market made an amazing recovery. The market entered a bear market in March, but ended with a solid double-digit gain for the year. The market proved to be far more resilient than most expected for a few reasons. First, when the pandemic started, the Federal Reserve immediately communicated that it would do whatever it takes to support the economy. Policymakers pledged to keep interest rates near 0% through at least 2023, and purchased trillions of dollars of bonds, which provided liquidity to the debt markets and supported equities in the process. Additionally, the U.S. government passed massive fiscal stimulus programs to support consumers and industries battered by the pandemic. Finally, since the market is forward-looking, investors believed COVID-19’s negative impact on the economy peaked in the first half of 2020, and that GDP would rebound in 2021 as COVID-19 vaccines become available, businesses re-open and affluent consumers spend money saved during the pandemic.

We continue to witness a “K” shaped recovery, meaning that some companies are benefiting from the economic shifts that COVID-19 is accelerating, while others are losing their relevance. The pandemic has resulted in a winner-take-all market where the strong continue to get stronger. As a growth fund, we embrace the opportunity to invest behind the businesses that we believe are the winners of tomorrow. We are, however, balancing investing in fast-growing companies with the exuberance we’re

24

| | | | |

| | |

| Annual Report • 2020 | | | |  |

seeing as investors have piled into advantaged businesses, particularly those that are unprofitable but have seemingly massive total addressable markets (TAMs). As an example, tremendous enthusiasm for the initial public offering (IPO) of Airbnb, the online vacation rental marketplace, caused its stock to soar, and it ended the year valued at more than $100 billion. This makes Airbnb worth more than Hilton, Marriott and Hyatt combined! We aren’t able to justify valuations like these.

More broadly, the valuation for the Russell Midcap Growth Index ended the year at nearly 40x forward earnings estimates. This is roughly double its 20-year average of 20x, and the highest level since 2000, the peak of the tech bubble. Against this backdrop, we’re pleased that we were able to invest in a handful of innovative market leaders during the fourth quarter. Relative to our average cost, each company was purchased when it was off 20% or more from its 52-week high, except for 10x Genomics, which was 10% below its 52-week high.

We invested in ANGI Homeservices, the owner of HomeAdvisor, Angie’s List, and Handy, and the leader in the $500 billion U.S. home services industry. Less than 20% of home service projects are currently fulfilled online, so the company will benefit as the migration from offline to online continues. ANGI is also investing in a fixed-price service offering where pricing is transparent, thereby resulting in higher satisfaction for both service professionals and homeowners.

We bought two biotech companies during the quarter. Seagen is the leader in developing antibody drug conjugates (ADC), which attack cancer cells. The stock sold off after weaker-than-expected third quarter sales, but the long-term outlook for the company remains terrific, as product sales are expected to grow more than 30% for the next few years. Alnylam Pharmaceuticals uses its Nobel Prize-winning technology based on RNA interference (RNAi) to silence genes. The company’s expertise in RNAi has enabled them to achieve a higher probability of success in bringing drugs to market compared to the industry overall. Sales growth should be strong during the coming years due to recently approved drugs and a robust pipeline of novel therapies. Additionally, we purchased 10x Genomics, a tools company that is the leader in single-cell analysis. Analysis at the single-cell level is still in its very early days, and we believe that

the company has a tremendous long-term opportunity within the academic and spatial markets, and eventually the clinical market. This is a unique asset with solid double-digit growth, nearly 80% gross margins and a net cash position.

nCino provides software to financial institutions. The company utilizes artificial intelligence and machine learning to assist financial institutions in better managing the entire loan life cycle, thereby reducing time and costs in the process. nCino already serves four of the top ten U.S. commercial banks, and should see robust growth for many years.

Finally, Insperity provides full-service HR solutions to small- and medium-sized businesses. Insperity has been temporarily impacted by higher-than-expected health care costs, but as these costs normalize, earnings should accelerate. The company is a market share gainer in a large and growing market, and should benefit from long-term trends such as increased HR complexity and legislative changes.

We sold four stocks during the fourth quarter to make room for these new positions: SBA Communications, an owner of wireless communication towers; Americold Realty Trust, an owner of temperature-controlled food warehouses; Guidewire, a software provider for the property and casualty insurance market; and spice maker McCormick. We exited these stocks because they have elevated valuations and growth that generally falls below that of the Fund.

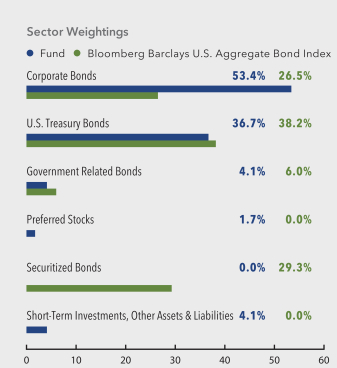

At year-end, the Fund’s largest overweight sector is industrials. Within this diverse sector, nearly half of our exposure is to best-in-class data providers such as CoStar Group, Verisk Analytics and Thomson Reuters. We don’t have any exposure to the real estate and materials sectors, and only own one consumer staples company, because these sectors generally lack the innovative, fast-growing companies we’re looking to invest behind. The Fund has the most exposure to the information technology sector on an absolute basis. More than half of our technology exposure is to the software sub-sector, where we own a number of innovative companies with large and expanding addressable markets, including Cadence Design Systems, Synopsys and Autodesk.