UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: Parnassus Funds (811-04044) and Parnassus Income Funds (811-06673)

Parnassus Funds

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marc C. Mahon

Parnassus Funds

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code:(415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2019

Item 1: Report to Shareholders

Parnassus Funds Annual Report

December 31, 2019

Parnassus FundSM

Investor Shares: PARNX | Institutional Shares: PFPRX

Parnassus Core Equity FundSM

Investor Shares: PRBLX | Institutional Shares: PRILX

Parnassus Endeavor FundSM

Investor Shares: PARWX | Institutional Shares: PFPWX

Parnassus Mid Cap FundSM

Investor Shares: PARMX | Institutional Shares: PFPMX

Parnassus Fixed Income FundSM

Investor Shares: PRFIX | Institutional Shares: PFPLX

Beginning on January 1, 2021, as permitted by regulations adopted by the SEC, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website (www.parnassus.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 800-999-3505 or by sending an email request to shareholder@parnassus.com.

You may elect to receive all future reports in paper copies free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call 800-999-3505 or send an email request to shareholder@parnassus.com to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive paper copies of reports will apply to all funds held in your account if you invest through your financial intermediary.

This report must be preceded or accompanied by a current fund prospectus.

Table of Contents

3

| | | | |

| | |

| | | | Annual Report • 2019 |

February 7, 2020

Dear Shareholder,

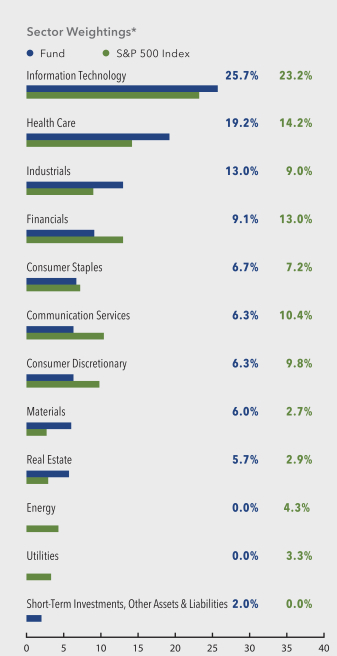

2019 was a terrific year for stocks, with the S&P 500 Index and the Russell Midcap Index both gaining more than 30%. The year capped off an incredible decade for equities, which saw the S&P 500 return better than 250%, a rally that would have grown an initial investment of $10,000 to just over $35,000. Technology stocks have been the biggest winners, as seen by the performance of the Nasdaq Composite Index. This tech-heavy benchmark has blown away the more diversified S&P 500 of late, with cumulative returns of 340% and 37% for the past ten years and 2019, respectively.

Our best performing fund for 2019, the Parnassus Endeavor Fund, was also our strongest performer for the 2010s. For both periods, the Fund’s return exceeded that of its primary benchmark, the S&P 500. Lead portfolio manager, Jerry Dodson, has been at the helm of the Parnassus Endeavor Fund since its inception in 2005, and he’s been assisted byco-portfolio manager, Billy Hwan, since 2018. Please see the following pages for more detailed information regarding each fund’s performance and the risks associated with investing in the Funds.

In addition to leading the Parnassus Endeavor Fund portfolio management team, Jerry Dodson is also the Chairman and Founder of Parnassus Investments. The firm just recently turned 35, and in honor of this birthday, I’d like to share some insight from Jerry’s first shareholder letter, written in April of 1985. In it, he discusses an “error of judgment” that led him to purchase shares of discount airline People’s Express based on its exceptional workplace characteristics. The mistake Jerry admits to was “invest(ing) in a company because of its social aspects without fully considering business operations or financial implications.” Jerry goes on to state that this “illustrates a mistake commonly made by ‘pure’ social investment funds,” and that this “is the main reason why equity social investment funds have not done well over the years.”

Three and a half decades have passed since Jerry launched the Parnassus Funds on the idea that there doesn’t have to be a compromise between following one’s principles and enjoying strong financial results. As for doing well over the years, Parnassus’ total assets under management when Jerry mistakenly invested in People’s Express were just under $500,000. As of this writing, this number has grown to over $30 billion. This success demonstrates that mistakes are fuel for growth, so long as one has the humility and temperament to learn from them.

Thank you for investing with the Parnassus Funds.

Yours truly,

Benjamin E. Allen

President and CEO

4

| | | | |

| | |

| Annual Report • 2019 | | | |  |

Parnassus Fund

Ticker: Investor Shares - PARNX

Ticker: Institutional Shares - PFPRX

As of December 31, 2019, the net asset value (“NAV”) of the Parnassus Fund – Investor Shares was $50.47. After taking dividends into account, the total return for the year was a gain of 29.82%. This compares to an increase of 31.49% for the S&P 500 Index (“S&P 500”) and a gain of 28.32% for the LipperMulti-Cap Core Funds Average, which represents the average return of themulti-cap core funds followed by Lipper (“Lipper average”).

Below is a table that summarizes the performance of the Parnassus Fund, the S&P 500 and the Lipper average. The returns are for theone-, three-, five- andten-year periods ended December 31, 2019.

Parnassus Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2019 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Fund – Investor Shares | | | 29.82 | | | | 10.80 | | | | 9.12 | | | | 12.78 | | | | 0.85 | | | | 0.85 | |

| | | | | | |

| Parnassus Fund – Institutional Shares | | | 29.98 | | | | 10.97 | | | | 9.27 | | | | 12.85 | | | | 0.69 | | | | 0.69 | |

| | | | | | |

| S&P 500 Index | | | 31.49 | | | | 15.27 | | | | 11.70 | | | | 13.56 | | | | NA | | | | NA | |

| | | | | | |

| Lipper Multi-Cap Core Funds Average | | | 28.32 | | | | 12.42 | | | | 8.91 | | | | 11.38 | | | | NA | | | | NA | |

* For this report, we will quote total return to the portfolio, which includes price change and dividends.

The average annual total return for the Parnassus Fund – Institutional Shares from commencement (April 30, 2015) was 9.31%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505.

Year in Review

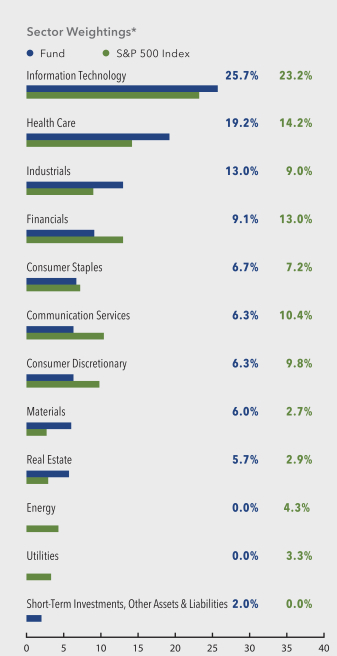

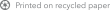

The Parnassus Fund gained 29.82% on the year, trailing the S&P 500 by 167 basis points. (One basis point is 1/100th of one percent.) Sector allocations had a positive impact on our relative performance, with the most

meaningful contributors being ourzero-weighting of the energy sector, the worst performing sector in 2019, and our overweight in the information technology sector, which was the best performing sector. However, our sector allocation was partially offset by the drag from our cash position. Even though our cash position averaged only 2.5% during the year, the market’s relentless rise caused it to subtract 106 basis points from our relative performance. Poor stock selection this year detracted from our performance as well.

Our worst performer was private-label credit card issuer Alliance Data Systems, which cut 76 basis points from the Fund’s return, as the stock’s total return was negative 23.8%.* Alliance Data sold its Epsilon marketing segment and received $3.5 billion of net proceeds, well below the $5 billion investors were expecting. Then, the company reduced its 2019 earnings guidance by 25% due to the Epsilon sale, mark-downs on the sale ofnon-core loan portfolios and slower-than-expected core loan growth. Due to this tumult, shareholders then endured two CEO changes. Now that Alliance Data has shed itslow-growth marketing segment and pruned its credit card portfolio to focus on faster-growing merchants, we expect earnings to bounce higher in 2020. Incoming CEO Ralph Andretta hails from Citigroup, the world’s largest credit card issuer, and his fresh perspective will be welcomed. With the stock trading at a historically low valuation of 5x expected 2020 earnings, we believe theset-up is very favorable.

Auto insurer Progressive subtracted 30 basis points from the Fund’s return, as its total return was negative 9.5% from our purchase price. The stock fell as the company’s underwriting loss rate increased due to rising medical and legal accident costs. Insurance is a cyclical industry, and Progressive’s peers are experiencing the same

5

| | | | |

| | |

| | | | Annual Report • 2019 |

trends. We expect industry-wide pricing to increase to recoup the higher costs, increasing Progressive’s earnings. The second order impact is that many consumers will shop for a new policy upon receiving a higher bill, which plays into Progressive’s strength as their data-based pricing algorithms and telematics allow them to identify the safest drivers and offer them the lowest rates. We expect Progressive’s new policy growth will accelerate in a rising price environment, which would provide further upside to earnings.

Industrial conglomerate 3M reduced the Fund’s performance by 12 basis points, as the total return to our average selling price was negative 9.7%. We sold the stock during the second quarter, after the company reported weak quarterly earnings and significantly reduced its financial guidance for the full year, due to a slowdown in China and its automotive and electronics businesses. As were-evaluated our investment, we became concerned that more aggressive restructuring may be required to improve the company’s performance. We were also worried that 3M’s environmental liabilities for its historical production ofper- and poly-fluorinated substances (PFAS) could be significant, so we exited our position.

Our biggest winner in 2019 was Thomson Reuters. Thomson Reuters provides information and data for legal, tax and accounting professionals. The stock generated a total return of 51.6% and contributed 223 basis points to the Fund’s return. Revenue growth accelerated thanks to the company’s new Westlaw Edge legal research software, which combinesstate-of-the-art artificial intelligence with the industry’s most comprehensive collection of legal information. The company also announced the sale of Refinitiv, its financial-segment partnership with Blackstone, to the London Stock Exchange for $27 billion.

Cadence Design Systems, which provides tools for designing semiconductors, boosted the Fund’s return by 199 basis points as the stock’s total return was 59.5%. The company had an outstanding year, expanding its customer base and innovating to create new applications for its products in emerging technologies.

Motorola Solutions, the largest provider of mission-critical communications solutions, added 180 basis points to the Fund’s return, as its total return was 42.2%. The stock jumped to begin the year after the company provided an EPS target of $10 in 2021, which was 12% higher than investors’ expectations. The shares continued to move higher as the company’s

quarterly financial results consistently beat expectations. Motorola’s dominant land mobile radio business is a ballast for its product portfolio, while its software, services and video offerings are growing rapidly as customers are attracted to Motorola’s integrated, cost-effective and innovative products.

Parnassus Fund

As of December 31, 2019

(Percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

6

| | | | |

| | |

| Annual Report • 2019 | | | |  |

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Microsoft Corp. | | | 5.4% | |

| |

| Thomson Reuters Corp. | | | 4.0% | |

| |

| Mondelez International Inc., Class A | | | 3.9% | |

| |

| Alphabet Inc., Class A | | | 3.6% | |

| |

| Cerner Corp. | | | 3.2% | |

| |

| Dentsply Sirona Inc. | | | 3.2% | |

| |

| Alliance Data Systems Corp. | | | 3.2% | |

| |

| NVIDIA Corp. | | | 3.1% | |

| |

| CVS Health Corp. | | | 3.1% | |

| |

| Linde plc | | | 3.1% | |

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

What a difference 12 months makes! After posting a negative return in 2018 and ending the year with a vicious 20% drop, the S&P 500 generated a 31.49% return in 2019–its best year since 2013. This marks the sixth time in the past eight years that the market has generated a double-digit return. Three main factors contributed to the market’s banner year. Accommodative monetary policy bolstered stocks, as the Federal Reserve cut interest rates three times. Economic data also came in better than initially feared, as the unemployment rate remained solidly below 4%, consumer spending was robust and 2019 GDP is expected to grow 2.3%. Finally, despite back-and-forth negotiations throughout the year, the market rallied by 9.07% in the fourth quarter as the U.S. and China came together and announced that they will sign a Phase 1 trade deal in January.

According to Evercore ISI, the S&P 500 has now increased by 29% or more in seven years since 1950. After the prior six occasions, the S&P 500 rose again the following year. So, history suggests the market could rise again in 2020. While that sounds promising and the U.S. economy appears to be on stable footing, we’re concerned that expectations heading into the year are considerably higher than they’ve been in the past. In fact, at 18x forward earnings estimates, the market’s valuation is near its highest level in the past 15 years. Earnings growth was roughly flat in 2019, so it was higher valuations that lifted the market. We expect that earnings growth, rather than multiple expansion, will be the key driver for the market’s move in 2020. As a result, we’ve been focused on investing in high-quality businesses that should grow earnings at a strong clip.

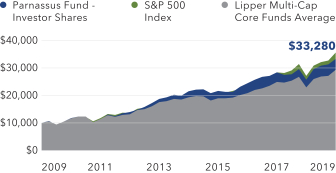

Value on December 31, 2019

of $10,000 invested on December 31, 2009

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

We were able to identify two such companies during the fourth quarter. We invested in V.F. Corporation, the maker of dominant brands such as The North Face, Vans and Timberland, after the stock sank following an earnings miss. The company spun off its lower-growth jeans business earlier in the year. We like the fact that management is focused on accelerating growth at their key brands by selling directly to consumers, rather than through wholesalers, and by expanding overseas. V.F. Corporation has a long runway to expand margins, so we’re excited we had an opportunity to add it to our portfolio.

We also added Morningstar, a dominant provider of financial research. The business is becoming increasingly relevant in the asset management industry due to their independent research and deep data sets. Morningstar has grown its sales organically at an impressive high single-digit clip since its IPO in 2005, and we think this can continue for the foreseeable future. The stock has also historically outperformed during market downturns due to its recurring, license-based revenue. We like the fact that this investment should offer strong growth while providing potential protection if there’s a drop in the market.

We sold two stocks during the fourth quarter to make room for these new positions. We exited Monolithic Power Systems due to our concern that their inventory levels were elevated and because we felt that other holdings in the portfolio offered similar exposure with less risk. We also sold New York–based Signature Bank because we believe their expansion into new markets will cause expenses to grow faster than revenue, thereby reducing profitability.

7

| | | | |

| | |

| | | | Annual Report • 2019 |

Given the strong move in the market in 2019, our portfolio atyear-end has a somewhat defensive posture. We’re underweight highly cyclical sectors such as consumer discretionary and financials, while we’re overweight health care and real estate, which have historically been more defensive. Nevertheless, our portfolio consists of innovative industry leaders which, we feel should enable us to perform well if the market continues to increase.

Our focus for 2020 remains the same as it’s always been: invest in competitively advantaged, socially responsible businesses that are increasingly relevant and that trade at attractive prices. It’s been a profitable strategy for us in the past, and we expect it will remain so in the future.

Thank you for your investment in the Parnassus Fund.

Yours truly,

Robert J. Klaber

Portfolio Manager

Ian E. Sexsmith

Portfolio Manager

8

| | | | |

| | |

| Annual Report • 2019 | | | |  |

Parnassus Core Equity Fund

Ticker: Investor Shares - PRBLX

Ticker: Institutional Shares - PRILX

As of December 31, 2019, the net asset value (“NAV”) of the Parnassus Core Equity Fund – Investor Shares was $47.03. After taking dividends into account, the total return for the year was a gain of 30.69%. This compares to a return of 31.49% for the S&P 500 Index (“S&P 500”) and a gain of 24.40% for the Lipper Equity Income Funds Average, which represents the average return of the equity income funds followed by Lipper (“Lipper average”).

Below is a table that summarizes the performances of the Parnassus Core Equity Fund, the S&P 500 and the Lipper average. The returns are for theone-, three-, five- andten-year periods. We are pleased to report that the Fund outperformed the Lipper average for all periods.

Parnassus Core Equity Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2019 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Core Equity Fund – Investor Shares | | | 30.69 | | | | 15.00 | | | | 10.80 | | | | 12.75 | | | | 0.87 | | | | 0.87 | |

| | | | | | |

| Parnassus Core Equity Fund – Institutional Shares | | | 30.96 | | | | 15.24 | | | | 11.03 | | | | 12.97 | | | | 0.63 | | | | 0.63 | |

| | | | | | |

| S&P 500 Index | | | 31.49 | | | | 15.27 | | | | 11.70 | | | | 13.56 | | | | NA | | | | NA | |

| | | | | | |

| Lipper Equity Income Funds Average | | | 24.40 | | | | 10.13 | | | | 8.05 | | | | 10.70 | | | | NA | | | | NA | |

* For this report, we will quote total return to the portfolio, which includes price change and dividends.

The average annual total return for the Parnassus Core Equity Fund – Institutional Shares from commencement (April 28, 2006) was 10.96%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Core Equity Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800)999-3505.

Year in Review

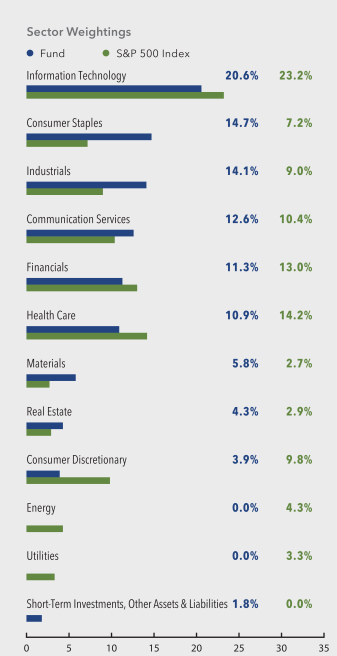

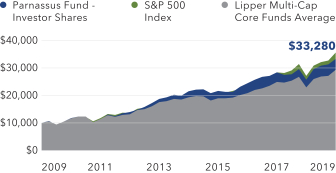

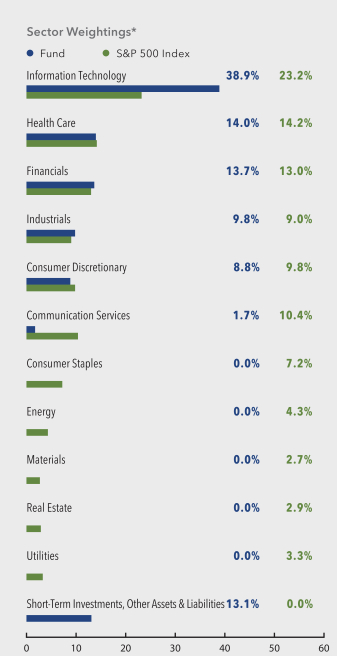

We are pleased that the Parnassus Core Equity Fund – Investor Shares had a total return of 30.69% in 2019, which represents 97% of the 31.49% gain for the S&P 500. Overall, sector allocation had a slightly negative effect. Our overweight positions in two underperforming sectors, consumer staples and materials, were the biggest headwinds.

As for individual stocks, there were two significant losers in 2019. Transportation provider FedEx reduced the Fund’s performance by 84 basis points (One basis point is 1/100th of one percent), as its total return from our average cost was negative 17.4%.* The stock fell because the expectation for the company’s current fiscal-year earnings dropped by a shocking 30%. FedEx’s earnings suffered as the company ended its relationship with Amazon, underestimated the cost to rolloutseven-day shipping, and lost market share in Europe. At the same time, falling global air freight volumes, caused by theU.S.-China trade dispute, reduced the company’s highest incremental margin business. Despite these challenges, we’re holding on to our shares. We believe the upside for the stock will be significant, as management resolves its company-specific issues and global air freight volumes improve from their worst year since 2009.

Industrial conglomerate 3M reduced the Fund’s 2019 performance by 21 basis points, as the total return to our average selling price was negative 12.13%. We sold the stock during the second quarter, after the company reported weak earnings and significantly reduced its guidance for the full-year earnings. As we

9

| | | | |

| | |

| | | | Annual Report • 2019 |

re-evaluated our investment, we became concerned that more aggressive restructuring may be required to improve the company’s performance. We were also concerned that 3M’s environmental liabilities related to its historical production ofper- and poly-fluorinated substances (PFAS) could be significant.

The Fund had four stocks that rose at least 50% in 2019, each adding more than 190 basis points to the annual return. Microsoft, the leading business productivity software and cloud computing provider, was the biggest winner, with a gain of 57.6% and a 228 basis point boost to the Fund’s return. Microsoft’s stock moved higher as the company beat earnings expectations for the past three quarters by more than 10%. Even with high expectations and positive investor sentiment, the company continued to outperform by executing well across some of the largest, fastest-growing markets in enterprise software. Microsoft’s Commercial Cloud business, which includes Office 365 and Azure, exhibited strong growth. Microsoft Azure is gaining market share and technical validation, and the company remains in the early innings of capturing the cloud computing opportunity.

Our investments in leading electric design automation (“EDA”) companies Cadence Design Systems and Synopsys together contributed 395 basis points to the Fund’s return. Cadence added 200 basis points to the Fund’s return with a 59.5% gain, while Synopsys climbed 65.2% and contributed 195 basis points. These companies provide tools for designing semiconductors. Several broad-based factors are supporting EDA industry growth, including increased demand from traditional semiconductor companies and diversification into new markets. Demand for EDA companies’ software and hardware solutions is accelerating as their customers continue to design increasingly complex chips and devices.

Mastercard, the global payments network company, added 191 basis points to the Fund’s return with a 59.2% gain for the stock. Mastercard’s stock increased as the company beat earnings expectations in every quarter of 2019. Management also made strategic acquisitions and positioned the company to capture new payment flows. The stock should continue to do well over time as the company benefits from the transition from cash to cashless payments.

Parnassus Core Equity Fund

As of December 31, 2019

(Percentage of net assets)

10

| | | | |

| | |

| Annual Report • 2019 | | | |  |

| | | | |

|

| Top 10 Equity Holdings | |

| (percentage of net assets) | |

| |

| Microsoft Corp. | | | 6.3% | |

| |

| The Walt Disney Co. | | | 4.9% | |

| |

| Danaher Corp. | | | 3.6% | |

| |

| Verizon Communications Inc. | | | 3.5% | |

| |

| American Express Co. | | | 3.3% | |

| |

| CME Group Inc. | | | 3.3% | |

| |

| Costco Wholesale Corp. | | | 3.2% | |

| |

| Linde plc | | | 3.2% | |

| |

| The Clorox Company | | | 3.2% | |

| |

| Bank of America Corp. | | | 3.2% | |

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

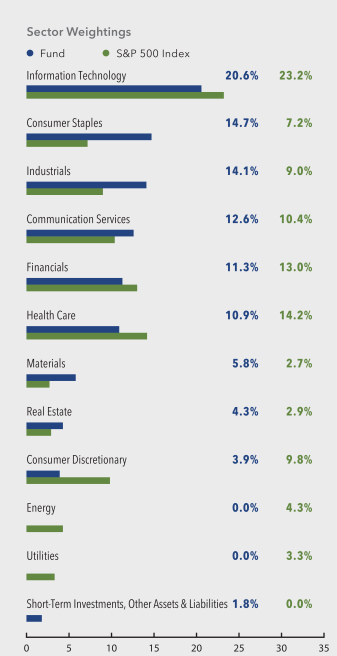

The S&P 500 bull market will celebrate its 11th anniversary in 2020, making it the longest bull market since 1900. Low interest rates from the Federal Reserve and the emergence of a trade truce will likely keep investors upbeat about the market in the near-term. However, the recent rebound in global growth looks more cyclical than secular to us. We think high valuations combined with expected moderate revenue and earnings growth have caused elevated downside risk for stocks in 2020.

Nearly 80% of 2019’s equity performance was driven by multiple expansion, as profit growth was generally subdued. In fact, earnings growth remained elusive for the past three quarters, and this trend was even worse for small-andmid-cap companies. One of the key downside risks to earnings comes from margin pressures, with potential headwinds from renewed trade tariffs, rising input costs and bipartisan support for new regulations on U.S. tech companies, where profit margins are particularly high.

As a result, the Fund is more defensively positioned heading into 2020 than it was a year ago. While the Fund has significant exposure to the technology sector (approximately 20% of the portfolio), we are underweight relative to the S&P 500. Within the technology sector, the Fund has low exposure to hardware and semiconductors because they seem fully valued after significant gains in 2019. In contrast, the Fund is overweight software companies like Microsoft, Cadence and Synopsys, which have benefited from growth in cloud computing, analytics and chip design complexity.

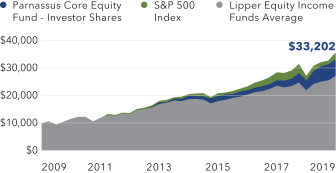

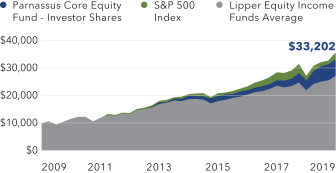

Value on December 31, 2019

of $10,000 invested on December 31, 2009

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

The Fund is underweight the consumer discretionary and financials sectors. We don’t own Amazon.com, by far the index’s largest weighted stock in the consumer discretionary sector, due to its high valuation. In financial services, the Fund’s exposure is mostly in disruptive and growth-oriented companies such as American Express, Charles Schwab and CME Group. We also have a significant investment in Bank of America, because of its relatively conservative lending approach and attractive valuation.

Moving to health care, the Fund is underweight mainly due to having no exposure in the pharmaceutical sector. We are concerned that drug pricing will remain under scrutiny, and at the same time we believe the overall return on investment for drug development will continue to decline. Our largest position in the sector is Danaher, a diversified holding company with attractive diagnostics and analytics franchises.

Rounding out our underweight sectors, the Fund does not own any energy companies due to our fossil-fuel free mandate. We are pleased that the Fund’s carbon emissions are 49% less than that of the S&P 500, as measured by the portfolio on July 31, 2019. This is important given the potential long-term cost of externalities related to climate change. Additionally, we have no exposure to the utilities sector due to high valuations.

The Fund’s largest overweight sector is consumer staples. Our largest investment in the sector is retail titan Costco, which has abest-in-class cost structure and a valuable membership base. We also have significant exposure to food company Mondelez and high-quality household products companies Clorox

11

| | | | |

| | |

| | | | Annual Report • 2019 |

and P&G. We believe these holdings offer an attractive combination of growth through innovation and stability due to dividends.

We are overweight the industrials and materials sectors with two major themes. First, we have significant investments in competitively advantaged, recurring revenue businesses like Waste Management, Verisk Analytics and Linde. Second, the Fund has positions in cyclical businesses like Federal Express and John Deere, which have low expectations and valuations entering 2020, but still maintain solid long-term business prospects.

Finally, the Fund is now overweight the communications services sector. Disney, which was a strong performer in 2019, is our largest investment in the sector. During the fourth quarter, we added Verizon and Comcast to the portfolio.

Verizon is the country’s largest wireless carrier, and has a leading brand due to its superior network. The company’s massive network represents a high barrier to entry, while its long-term relevancy appears solid due to growing mobile data consumption. Verizon’s valuation is attractive at 12x next year’s earnings. It also currently offers a compelling 4% dividend yield, which is supported by strong cash flows and a solid balance sheet.

Comcast is abest-in-class cable company that also owns media assets such as NBC, Sky and Universal

Studios. We think that investors are overly focused on the threats to Comcast’s media segments. Specifically, the company’s broadcast assets are experiencing weakness due to cord cutting. At the same time, Comcast plans to spend at least $2 billion over the next two years on Peacock, itsdirect-to-consumer (“DTC”) streaming business. On the positive side, Comcast’s crown-jewel cable business generates almost 53% of the overall company’s revenues and over 71% of earnings before interest, taxes, depreciation and amortization (“EBITDA”). We think the cable business is a very attractive and valuable franchise, and since it represents such a large proportion of the company’s overall value, we’re willing to accept the risks associated with the media assets.

Thank you for your confidence and investment in the Parnassus Core Equity Fund.

Sincerely,

Todd C. Ahlsten

Lead Portfolio Manager

Benjamin E. Allen

Portfolio Manager

12

| | | | |

| | |

| Annual Report • 2019 | | | |  |

Parnassus Endeavor Fund

Ticker: Investor Shares - PARWX

Ticker: Institutional Shares - PFPWX

As of December 31, 2019, the net asset value (“NAV”) of the Parnassus Endeavor Fund – Investor Shares was $38.18, and after taking dividends into account, the total return for the year was 33.29%. This compares to a gain of 31.49% for the S&P 500 Index (“S&P 500”) and 28.32% for the LipperMulti-Cap Core Funds Average, which represents the average return of themulti-cap core funds followed by Lipper (“Lipper average”). The Fund had a great year, beating the S&P 500 by almost two percentage points and walloping the Lipper average by almost five percentage points.

This year marked a great comeback for the Parnassus Endeavor Fund. In last year’s annual report at the end of 2018, we wrote, “We’re very disappointed with our performance this year; it’s the first time in the13-year history of the Fund that we’ve underperformed by such a large margin. Our goal is to do much better in 2019, and we’ll work hard to give you the kind of returns we’ve had throughout most of our history.”

Parnassus Endeavor Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2019 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Endeavor Fund – Investor Shares | | | 33.29 | | | | 11.38 | | | | 11.61 | | | | 13.82 | | | | 0.95 | | | | 0.95 | |

| | | | | | |

| Parnassus Endeavor Fund – Institutional Shares | | | 33.57 | | | | 11.62 | | | | 11.84 | | | | 13.94 | | | | 0.72 | | | | 0.72 | |

| | | | | | |

| S&P 500 Index | | | 31.49 | | | | 15.27 | | | | 11.70 | | | | 13.56 | | | | NA | | | | NA | |

| | | | | | |

| LipperMulti-Cap Core Funds Average | | | 28.32 | | | | 12.42 | | | | 8.91 | | | | 11.38 | | | | NA | | | | NA | |

* For this report, we will quote total return to the portfolio, which includes price change and dividends.

The average annual total return for the Parnassus Endeavor Fund – Institutional Shares from commencement (April 30, 2015) was 11.88%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Endeavor Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800)999-3505.

We expected that we’d have a good year in 2019 when we wrote that, but we never dreamed that we would be up more than 30%. At the beginning of the year, the prevailing opinion was very negative about the market after the difficult year in 2018. No one that we know of was predicting gains of 30% for 2019. This year’s performance underlines the futility of market timing. It’s just too difficult to see into the future. At the Parnassus Endeavor Fund, we make no claims about knowing what the market will do in the year ahead.

The only skill we have is being able to make a reasonable estimate of the intrinsic value of a stock. Once we’ve done that, we wait until a stock is sellingone-third below its intrinsic value, then we buy. Waiting for a stock to sink that low, we believe, gives us a margin of safety. We hold onto that stock until the price reaches intrinsic value, then we sell. That sums up the strategy of the Parnassus Endeavor Fund.

Below is a table comparing the Parnassus Endeavor Fund with the S&P 500 and the Lipper average for the pastone-, three-, five- andten-year periods.

Company Analysis

As you might expect, there were a lot of stocks that did well last year. 11 of them contributed 100 basis points or more to the Fund’s return. (One basis point is 1/100th of one percent.) There were no stocks that sliced more than 100 basis points off the Fund’s return.

The one that hurt us the most cut 99 basis points off the Fund’s return. This stock was Regeneron Pharmaceuticals, which is a very interesting case. The stock actually went

13

| | | | |

| | |

| | | | Annual Report • 2019 |

up during the year from our cost of $335 to $375 by the end of the year. What caused the loss was a sale of a lot of our shares at an average price of $315. The stock hit a low of $277 in September, and we became very discouraged about the prospects for the company. By the time it traded up to $315, we started selling, happy that it had gained quite bit from the low point of $277. As it turned out, we should have held on longer. Most of the time we have more patience with our stocks, and that’s why our long-term performance has been excellent. We’re taking the case of Regeneron as a cautionary tale and as a reminder not to act too quickly.

Regeneron is a biotechnology company that focuses on treatments for the eye, heart diseases, cancer and inflammation. Its blockbuster drug, Eyelea, faces pressure from a competing drug by Novartis, as well as a loss of patent exclusivity in 2023. The stock raced higher in the fourth quarter after a strong commercial launch and expanded indications for Dupixent, Regeneron’s drug for adolescent eczema.

Now let’s turn to the winners. The four best-performing stocks in the portfolio were all related to semiconductors. There’s a lot of irony in this situation, since sales declined and earnings dropped for the industry. Why would stocks with declining sales and earnings do so well? The answer is that the stock market is a discounting mechanism, so the present value of a stock is based on future expectations. In some ways, it’s like a chess game, where you have to be five moves ahead of your opponent. If I (Jerry) ever played Magnus Carlsen in a game of chess, he would undoubtedly have me check-mated in five moves. However, I think I could beat him in a stock-picking contest, because I know the industry and know how the stocks move related to their fundamentals.

Getting back to semiconductors, we believe the outlook for 2020 is pretty good – especially in the second half — according to industry participants. That drove the stocks higher in 2019. However, when we bought most of these stocks in late 2018, the outlook was not good. Firms had just had a good year, but expectations were for difficult times ahead. The stocks were selling at cyclical lows when we invested.

Our biggest winner was Applied Materials, a leading maker of equipment used to manufacture semiconductors. The stock contributed 524 basis points to the Fund’s return, as the stock rose from

$32.74 to $61.04 for a total return of 89.9%.* Companies making semiconductors ordered more equipment as demand picked up.

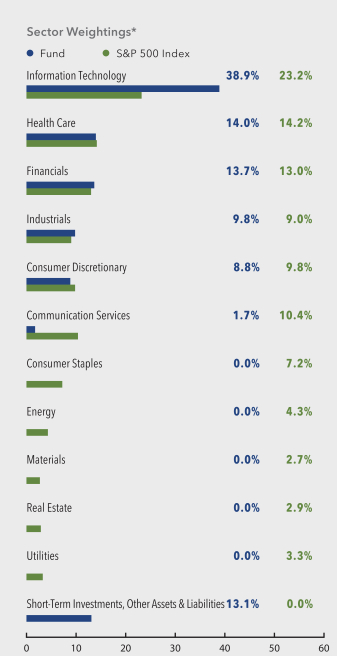

Parnassus Endeavor Fund

As of December 31, 2019

(Percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

14

| | | | |

| | |

| Annual Report • 2019 | | | |  |

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Micron Technology Inc. | | | 9.0% | |

| |

| Applied Materials Inc. | | | 8.4% | |

| |

| Lam Research Corp. | | | 6.8% | |

| |

| Charles Schwab Corp. | | | 6.1% | |

| |

| Cisco Systems Inc. | | | 5.2% | |

| |

| The Gap Inc. | | | 4.7% | |

| |

| Gilead Sciences Inc. | | | 4.4% | |

| |

| Hanesbrands Inc. | | | 4.1% | |

| |

| Perrigo Co. plc | | | 4.0% | |

| |

| Cummins Inc. | | | 3.7% | |

Portfolio characteristics and holdings are subject to change periodically.

Next was Lam Research, a competitor to Applied, which added 518 basis points to the Fund’s return, as the stock rose from $136 to $292 for a 119.3% total return. Despite the weak market for memory chips, Lam grew its installed base of machines, suggesting that demand for equipment had bounced off the bottom. Strong demand for semiconductor equipment in China, and an expected upswing in the memory chips market helped Lam.

Micron Technology added 421 basis points to the Fund’s return, as its stock climbed from $31.73 to $53.78 for a total return of 69.5%. The company makes memory semiconductors used in PCs, smartphones and data servers. Despite more supply than demand for chips last year, the stock did well due to the recovering server market, stabilizing pricing for memory chips and the industry’s efforts to limit capacity. Management has indicated that 2020 should be an inflection point with high teens growth in sales, led by demand for enterprise uses and the cloud, as well as long-term data-center demand and IOT (Internet of Things) trends.

NVIDIA Corporation added 291 basis points to the Fund’s performance, as its stock rose from $134 to $235 for a total return of 77.0%. The company started the year down over 50% from its recent highs, after the cryptocurrency bubble burst and management was forced to lower their financial targets. As the year progressed, NVIDIA exceeded earnings expectations and the company introduced new products. We believe in NVIDIA’s widening moat as demand for artificial intelligence chips continues to accelerate.

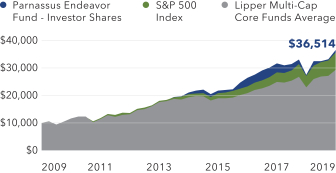

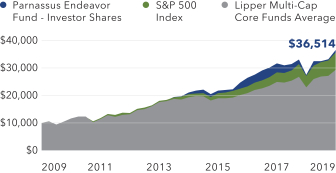

Value on December 31, 2019

of $10,000 invested on December 31, 2009

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Biopharmaceutical company Celgene boosted the Fund’s return by 257 basis points, as its stock jumped from $64.09 to our sale price of $92.45, for a total return of 50.6%. The company develops therapies that treat blood cancer and inflammatory diseases. Celgene’s stock price spiked when pharma giant Bristol Meyers announced plans to acquire Celgene for $74 billion, or about $102 per share, in cash and stock. The move helps Celgene diversify its existing drug pipeline and pools the combined company’s R&D resources. Though some of Bristol’s shareholders initially opposed the deal, Celgene’s stock got another boost when major proxy advisory firms effectively sealed the deal by coming out in favor of the combination.

Cummins, a leading maker of diesel engines, added 179 basis points to the Fund’s return. Its stock rose from $134 to $179, for a total return of 38.1%. Although total orders for Class 8 trucks fell during the year, the company’s profits grew due to an increase inoff-highway sales and lower warranty charges. We believe Cummins has the financial strength to invest through the cycle by continuing to launch new products and services that help improve fuel economy and lower diesel engine emissions.

Toy-manufacturer Mattel added 144 basis points to the Fund’s return, as its stock rose from $9.99 to our average selling price of $12.00 for a total return of 8.5%. The stock rallied to a high of $17.07 to start the year, as Mattel’s sales at the end of 2018 during theall-important holiday season were better than expected and profits increased significantly as a result. The stock gave back some of these gains after the company’s

15

| | | | |

| | |

| | | | Annual Report • 2019 |

2019 financial guidance failed to meet investors’ expectations, a reminder that Mattel’s turnaround remains a work in process. We sold our position in May, following the news that more than 30 sleeping infant fatalities had been linked to its Fisher Price Rock ‘n Play Sleepers. After engaging with the company, including the CEO, we found their explanation of Mattel’s product safety oversight to be inadequate to justify our continued investment.

Qualcomm, the leading manufacturer of mobile phone chips, contributed 141 basis points to the Fund’s return, as the stock soared from $56.91 to $88.23 for a total return of 60.7%. The stock saw its biggestone-day jump in nearly 20 years after Qualcomm reached an agreement with Apple to settle all litigation between the two companies worldwide. The years-long dispute centered around what royalties Apple should pay for the chip that powers the Apple iPhone. Ultimately, Apple paid Qualcomm for the chips it received, and further agreed to long-term license and supply contracts. Though Qualcomm’s victory was later tempered by antitrust rulings in the U.S. and EU, we applaud management’s commitment to R&D, and believe the stock has more upside in the years ahead.

Hanesbrands, a leading manufacturer of undergarments and athletic apparel, contributed 131 basis points to the Fund’s return, as its stock rose from $12.53 to $14.85 for a 23.0% total return. Stronger-than-expected performances in the company’s Champion brand and international businesses led management to raise its revenue guidance for fiscal year 2019. The company also used its cash flows to pay down debt to improve its capital structure.

Credit card—issuer American Express boosted the Fund’s return by 110 basis points, as the stock rose from $95.32 to $124.49 for a total return of 32.5%. The shares moved higher throughout the year, as the company delivered industry-leading revenue growth of 8%, while maintaining its strong balance sheet.

Charles Schwab contributed 104 basis points to the Fund’s return, as its stock rose from $41.53 to $47.56 for a total return of 16.4%. The return on our average cost, however, was significantly higher at 52.4%. How is this possible, you may ask? In October, Schwab shocked the market by eliminating trading fees, causing its stock to fall sharply to a low of $35.10 as investors fretted over the lost profits. We added to our

position after the drop, because we believed that eliminating trading fees would improve Schwab’s competitive position and highlight its diversified earnings model. Sure enough, Schwab took advantage of its enhanced competitive position faster than even we expected, when it announced in November that it would acquire competitor TD Ameritrade for $26 billion. The stock rallied to end the year, as investors celebrated the anticipated 15% to 20% earnings accretion from the acquisition.

Outlook and Strategy

The Parnassus Endeavor Fund had a great year in 2019, so now we’re thinking about 2020. After last year’srun-up in stocks, the market as a whole, as represented by the S&P 500, is fully valued, and maybe even overvalued. The long-term average for the price/earnings (P/E) ratio* of the S&P 500 is in the range of17-18, and as of early January, that ratio is 22.0. This does not mean there will necessarily be a big move down in the stock market. Earnings could go much higher, while the market stabilizes, and this would bring down the P/E ratio. It does mean, though, that we may be unlikely to have another big year in the stock market.

Although the market is richly valued, the stocks in the Parnassus Endeavor Fund are not. The P/E ratio of our stocks is only 16.8 compared to 23.0 for the S&P. This doesn’t mean that our stocks won’t go down in a market correction, but we believe it gives us a margin of safety.

Right now, the U.S. economy is strong, and the unemployment rate is very low — in the range of 3.4% to 3.5%. Consumer purchases are very strong, while business investments have dropped off. This probably means that companies are concerned that the economy may slow down.

However, if unemployment stays low, and consumer spending keeps growing, business investment should pick up. Right now, there’s a lot of confidence in the economy.

Of course, the wild card in all of this is Donald Trump and what he will do in relation to China and Iran. As this report is being written, Trump has just ordered a missile attack that killed one of the most important Iranian generals. It’s highly likely that Iran will order some kind of retaliation against American interests. It

16

| | | | |

| | |

| Annual Report • 2019 | | | |  |

could be aone-time incident or it could escalate into something worse. If it’s the former, it wouldn’t have too much effect on the stock market. However, if it’s the latter, then there would definitely be an impact, and all bets are off.

Right now, it looks like there has been a truce in the trade war with China. There are still many unresolved issues between the two countries, but it appears that there will be negotiations to settle our differences.

Both of these international issues could have an effect on the economy, and of course, they could also have a big impact on the stock market and our investments in the Parnassus Endeavor Fund. The actual effect, though, is impossible to predict.

Because of this, all we can do is focus on individual companies and invest in good stocks when they are out

of favor. Right now, we’re happy with the stocks we have picked for the portfolio.

We would like to thank all of you for investing with us in the Parnassus Endeavor Fund.

Yours truly,

Jerome L. Dodson

Lead Portfolio Manager

Billy J. Hwan

Portfolio Manager

* Price/Earnings ratio is a ratio of a stock’s current price to its per-share earnings over the past 12 months.

17

| | | | |

| | |

| | | | Annual Report • 2019 |

Parnassus Mid Cap Fund

Ticker: Investor Shares - PARMX

Ticker: Institutional Shares - PFPMX

As of December 31, 2019, the net asset value (“NAV”) of the Parnassus Mid Cap Fund – Investor Shares was $35.63, and after taking dividends into account, the total return for 2019 was a gain of 28.75%. This compares to 30.54% for the Russell Midcap Index (“Russell”) and 28.32% for the LipperMulti-Cap Core Funds Average, which represents the average return of themulti-cap core fund followed by Lipper (“Lipper average”).

Below is a table comparing the Parnassus Mid Cap Fund with the Russell and the Lipper average for theone-, three-, five- andten-year periods.

Parnassus Mid Cap Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2019 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Mid Cap Fund – Investor Shares | | | 28.75 | | | | 11.65 | | | | 9.88 | | | | 12.76 | | | | 1.02 | | | | 0.99 | |

| | | | | | |

| Parnassus Mid Cap Fund – Institutional Shares | | | 29.02 | | | | 11.91 | | | | 10.12 | | | | 12.89 | | | | 0.75 | | | | 0.75 | |

| | | | | | |

| Russell Midcap Index | | | 30.54 | | | | 12.06 | | | | 9.33 | | | | 13.19 | | | | NA | | | | NA | |

| | | | | | |

| LipperMulti-Cap Core Funds Average | | | 28.32 | | | | 12.42 | | | | 8.91 | | | | 11.38 | | | | NA | | | | NA | |

* For this report, we will quote total return to the portfolio, which includes price change and dividends.

The average annual total return for the Parnassus Mid Cap Fund – Institutional Shares from commencement (April 30, 2015) was 10.72%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Mid Cap Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Midcap Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.Mid-cap companies can be more sensitive to changing economic conditions and have fewer financial resources thanlarge-cap companies.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800)999-3505. As described in the Fund’s current prospectus dated May 1, 2019, Parnassus Investments has contractually agreed to limit total operating expenses to 0.99% of net assets for the Parnassus Mid Cap Fund – Investor Shares and to 0.77% of net assets for the Parnassus Mid Cap Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2020, and may be continued indefinitely by the Adviser on ayear-to-year basis.

Year in Review

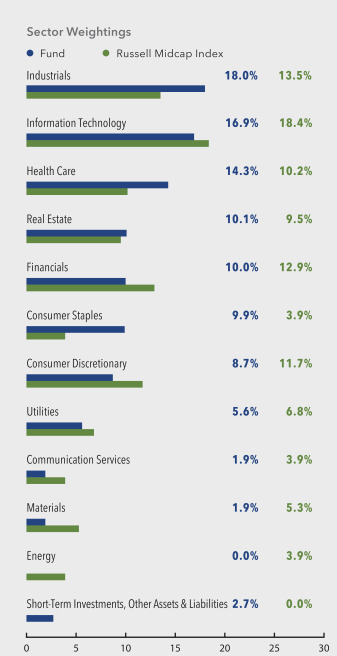

The Russell Midcap Index posted four consecutive quarterly gains in 2019 for a total return above 30%. Despite generally anemic earnings growth and trade-war noise, investors focused on the Federal Reserve’s easing cycle and generally positive economic news to drive stocks to a record high. This return was the largest since 2013 and caps a record-long bull market for U.S. equities.

The Parnassus Mid Cap Fund – Investor Shares had a 28.75% return, which captured more than 94% of the Russell’s gain. The Fund’s return beat our Lipper peers’ 28.32% gain. The Fund’syear-to-date performance was ahead of the Russell heading into the fourth quarter, but fell behind when the information technology sector, an area where we are defensively positioned, rallied more than 11%. We’re never excited to underperform the market, but considering the Fund’s focus on downside risk, we are tolerant of this high level of upside capture.

From a sector allocation perspective, the Fund benefitted from being underweight relative to the Russell in the energy sector, the worst-performing sector in the benchmark, and being overweight relative to the Russell in the industrials sector, the second-best performing sector in the benchmark. These allocations increased the Fund’s return relative to the Russell by 63 and 23 basis points (One basis point is 1/100th of one percent.), respectively. Our overweight position relative to the Russell in the consumer staples sector hurt the Fund the most, subtracting 34 basis points from the Fund’s return.

The Fund’s weakest performer was National Oilwell Varco, a global supplier of oilfield equipment and technology. The stock subtracted 28 basis points from the Fund’s return, as its total return from our average

18

| | | | |

| | |

| Annual Report • 2019 | | | |  |

cost was negative 35.9%.* We sold our position in the third quarter after the company reported steep order declines for its oilfield equipment and significantly lower earnings guidance. As were-evaluated our thesis on the stock, we became concerned about declining relevancy of the company’s products as the global economy continues to decarbonize and shift toward renewable fuel sources and electric transportation. Following our exit of the stock, Parnassus adopted a firmwide fossil fuel free policy, which means that our funds will avoid investing in companies that derive significant revenues from the extraction, exploration, production or refining of fossil fuels.

Americold Realty Trust, one of the largest cold storage providers, subtracted 17 basis points from the Fund’s return as its total return was negative 6.5%. The company missed earnings estimates in the most recent quarter due to higher-than-expected employee health care costs and new developmentstart-up costs. We view the pullback as temporary and believe the company is uniquely positioned with its mission-critical cold storage assets and multi-year contracts. The company is also positioned as an industry consolidator and has a healthy acquisition pipeline. Coupled with management’s focus on operating efficiency, we believe this should drive durable revenue growth and margin expansion over the long term.

IDACORP, Inc., the largest electric utility in Idaho, subtracted four basis points from the Fund’s return, as its total return was negative 0.9%. Although the company reported stronger-than-expected earnings results, raised its full-year earnings guidance and upped its dividend payout ratio in the fourth quarter of 2019, investors soured on the utility sector, causing IDA’s earnings multiple to contract. Despite the sentiment change, we believe the company has attractive earnings prospects, as it benefits from a favorable regulatory environment, robust pipeline of renewable energy projects and positive demographic trends in Idaho.

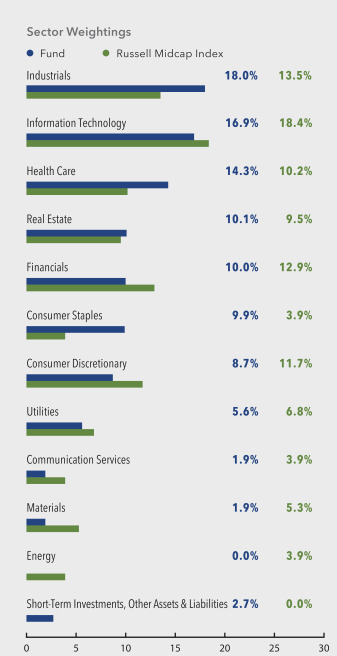

Parnassus Mid Cap Fund

As of December 31, 2019

(Percentage of net assets)

19

| | | | |

| | |

| | | | Annual Report • 2019 |

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| US Foods Holding Corp. | | | 4.4% | |

| |

| Hologic Inc. | | | 4.1% | |

| |

| Teleflex Inc. | | | 3.8% | |

| |

| Motorola Solutions Inc. | | | 3.6% | |

| |

| Cerner Corp. | | | 3.4% | |

| |

| Republic Services Inc. | | | 3.3% | |

| |

| Pentair plc | | | 3.2% | |

| |

| Jack Henry & Associates Inc. | | | 3.2% | |

| |

| Trimble Inc. | | | 3.1% | |

| |

| Burlington Stores Inc. | | | 3.1% | |

Portfolio characteristics and holdings are subject to change periodically.

Shifting to our winners, our strongest performer was Motorola Solutions, the largest provider of mission-critical communications solutions. The stock added 185 basis points to the Fund’s return, as its total return was 42.2%. The stock jumped in early 2019 after the company provided an EPS target of $10 in 2021, which was 12% higher than investors’ expectations. The shares continued to move higher as the company’s quarterly financial results consistently beat expectations. Motorola’s dominant land mobile radio business is a ballast for its product portfolio, while its software, services and video offerings are growing rapidly as customers are attracted by Motorola’s integrated, cost-effective and innovative product offerings.

Leading medical device manufacturer Teleflex added 174 basis points to the Fund’s return, as its total return was 46.3%. The stock rose early in 2019, as the company saw stronger-than-expected demand for its leading,non-invasive UroLift solution for benign prostatic hyperplasia and its portfolio of minimally invasive products for coronary and peripheral vascular diseases. Sales momentum continued throughout the year, driven by the strength of recent acquisitions in the vascular and urology segments and robust international demand. Investors became more bullish on the stock after the company raised its revenue outlook in the third quarter to7.5-8.0% from its annual guidance of 6.0-7.0% at the beginning of the year. We remain excited about the company’s long-term prospects, as it benefits from increasing adoption of its urology and vascular products, additional margin expansion and strong free cash flow generation.

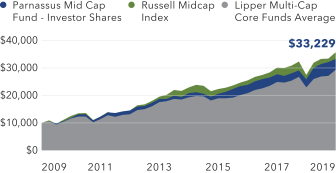

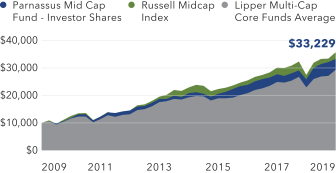

Value on December 31, 2019

of $10,000 invested on December 31, 2009

The chart shows the growth in value of a hypothetical $10,000 investment over the last ten years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Our third big winner was Fiserv, a leading provider of financial services technology and core processing software used by banks. The stock added 131 basis points to the Fund’s return, as the total return from our average cost of its shares was 84.2%. The stock rose early in the year after management provided a positive earnings outlook, driven by strong demand for its core systems, digital offerings andpeer-to-peer payment solutions. Investors became even more bullishmid-year after the company completed its merger with First Data Corporation. After enjoying gains resulting from the transaction, we exited the stock in the third quarter as Fiserv’s market capitalization rose above $70 billion following the deal closure.

Outlook and Strategy

The Russell’s bull run is just a few months away from celebrating its 11th anniversary. This is the longest bull market in many decades. On the positive side, the domestic economy is still healthy by most measures, inflation remains in check, the global economy is showing signs of life, a trade truce could be on the horizon and the Fed’s accommodative policy is giving investor’s comfort. However, uncertainty related to international and domestic political and economic conflicts, economic concerns in China, rising consumer and corporate debt in the U.S., a growing federal budget deficit and slowing corporate earnings growth temper our optimism.

One of our larger concerns is stock valuation. At year end, the Russell traded at more than 18 times forward earnings estimates, a materially higher multiple than the20-year average of 16 times. Further, much of the

20

| | | | |

| | |

| Annual Report • 2019 | | | |  |

rise in stock prices during the past year was driven by multiple expansion rather than earnings growth. It’s difficult to predict whether this issue, as well as the concerns mentioned above, will result in a significant market correction, but we believe the market’s downside risk has increased. As a result, we remain focused on our strategy of owning a collection of high-quality businesses that we believe offer longer-term asymmetric risk-reward opportunities.

The Fund is defensively positioned heading into 2020. We are underweight relative to the Russell in the consumer discretionary, financials, materials and information technology sectors, which we feel are likely to underperform in a market correction.

We are overweight relative to the Russell in the consumer staples, health care and real estate sectors, which should prove to be resilient in a marketsell-off. We are overweight relative to the Russell in the generally cyclical industrials sector, but as discussed in the past, many of our positions in this area are less-cyclical business service-style companies. Positions such as Republic Services and Verisk Analytics serve as a portfolio ballast, because these companies provide mission-critical services that are supported by significant recurring revenue and long-term contracts. Our traditional industrial exposure is through Fortive, Xylem and Pentair, which have strong secular tailwinds, such as a decade-long replacement cycle for water technology and infrastructure. We believe this overall sector positioning may serve us well in any market condition, but especially in the event of a downturn.

We added only one new stock in the recent quarter. We initiated a position in Americold Realty Trust, one of the largest cold storage providers for food producers, distributors and retailers. The company is well-positioned to capture potential outsized market share gains with its mission-critical temperature-controlled storage facilities, as they are increasingly integrated into its customers’ supply chains. We were

also attracted by Americold’s defensive business model, which is supported by multi-year contracts and highly sticky customer relationships. We believe the company has a long runway for earnings growth, as the company benefits from industry consolidation, operational efficiency gains and strong secular tailwinds.

During the quarter, we exited our position in document storage provider Iron Mountain, primarily due to our concerns about long-term secular pressures on its document storage business and increasing competition in its wholesale data center business.

We’re pleased that our strategy has provided excellent long-term, risk-adjusted results to shareholders. Our upside capture percentage is healthy, especially relative to the Fund’s risk profile. We’re especially pleased that in the down-market years during our portfolio management tenure-2008, 2011, 2015 and 2018 – the Fund handily beat its benchmarks. We will continue to focus on owning responsible, well-managed, increasingly relevant businesses with sustainable competitive advantages. We are confident that this strategy will help the Fund outperform the market over the long term.

Thank you for your investment in the Parnassus Mid Cap Fund.

Yours truly,

Matthew D. Gershuny

Lead Portfolio Manager

Lori A. Keith

Portfolio Manager

21

| | | | |

| | |

| | | | Annual Report • 2019 |

Parnassus Fixed Income Fund

Ticker: Investor Shares - PRFIX

Ticker: Institutional Shares - PFPLX

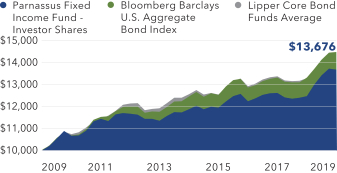

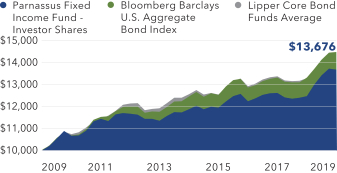

As of December 31, 2019, the net asset value (“NAV”) of the Parnassus Fixed Income Fund – Investor Shares was $17.05, producing a gain for the year of 9.63% (including dividends). This compares to a gain of 8.72% for the Bloomberg Barclays U.S. Aggregate Bond Index (“Barclays Aggregate Index”) and a gain of 8.70% for the Lipper Core Bond Funds Average, which represents the average return of the funds followed by Lipper that invest at least 85% of assets in domestic investment-grade bonds (“Lipper average”).

Below is a table comparing the performance of the Fund with that of the Barclays Aggregate Index and the Lipper average. Average annual total returns are for theone-, three-, five- andten-year periods. For December 31, the30-day subsidized SEC yield was 1.47%, and the unsubsidized SEC yield was 1.14%.

Parnassus Fixed Income Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2019 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Fixed Income Fund – Investor Shares | | | 9.63 | | | | 3.78 | | | | 2.88 | | | | 3.18 | | | | 0.86 | | | | 0.68 | |

| | | | | | |

| Parnassus Fixed Income Fund – Institutional Shares | | | 9.82 | | | | 4.01 | | | | 3.07 | | | | 3.28 | | | | 0.50 | | | | 0.45 | |

| | | | | | |

| Bloomberg Barclays U.S. Aggregate Bond Index | | | 8.72 | | | | 4.03 | | | | 3.05 | | | | 3.74 | | | | NA | | | | NA | |

| | | | | | |

| Lipper Core Bond Funds Average | | | 8.70 | | | | 3.80 | | | | 2.86 | | | | 3.78 | | | | NA | | | | NA | |

* For this report, we will quote total return to the portfolio, which includes price change and dividends.

The average annual total return for the Parnassus Fixed Income Fund – Institutional Shares from commencement (April 30, 2015) was 3.04%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Fixed Income Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns shown in the table do not reflect the deduction of taxes a shareholder would pay in fund distributions or redemption of shares. The Bloomberg Barclays U.S. Aggregate Bond Index (formerly known as the Barclays U.S. Aggregate Bond Index) is an unmanaged index of bonds, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999 3505. As described in the Fund’s current prospectus dated May 1, 2019, Parnassus Investments has contractually agreed to limit total operating expenses to 0.68% of net assets for the Parnassus Fixed Income Fund – Investor Shares and to 0.48% of net assets for the Parnassus Fixed Income Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2020, and may be continued indefinitely by the Adviser on ayear-to-year basis

Year in Review

Despite pessimistic views and economic headwinds at the beginning of the year, 2019 was the year when everything worked. The Barclays Aggregate Index, the bond market’s most important benchmark, gained 8.72%. Corporate bonds gained 14.48%, long-dated Treasury bonds returned 15.11% and the S&P 500 jumped 31.49%. These are impressive returns for any year, but especially for an economy in its 10th year of expansion. Interestingly, these big gains were almost entirely driven by better sentiment, as corporate profits were unchanged from 2018.

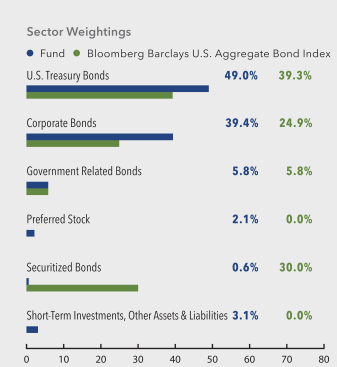

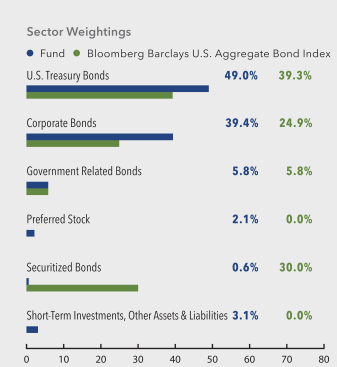

The Parnassus Fixed Income Fund – Investor Shares nicely outperformed the Barclays Aggregate Index for the year, with a gain of 9.63% versus a gain of 8.72% for the index. The Fund also outperformed its Lipper category, Core Bonds, as the peer set gained an average of 8.70%. The Fund’s positive performance was primarily driven by its allocation to winning sectors. Our position in corporate bonds, the best-performing asset category this year, was double that of the Index at 50% versus 25%. While our corporate bond portfolio returns somewhat trailed the performance of the corporates in the Index with a gain of 12.60% versus 14.48%, the substantial overweight allocation overwhelmed this shortfall. As a result, our corporate securities contributed 6.76% to the total return of the Fund versus 3.50% for the Index.

We made the decision at the beginning of 2019 to divest from securitized bonds and use Treasuries as a replacement, given our team’s expertise in corporate research and our focus on ESG. That decision benefitted the Fund during the year, as securitized bonds had the lowest return of the major asset

22

| | | | |

| | |

| Annual Report • 2019 | | | |  |

categories. Securitized bonds in the Index returned 6.44%, far below corporate bonds at 14.48% and even with Treasuries at 6.83%.

The best-performing corporate securities for the year were also the highest-yielding. Our position in Sempra Energy’s mandatory convertible preferred shares gained a whopping 36.55% and added 46 basis points to the total return.* (One basis point is 1/100th of one percent.) These shares, which pay a 6% coupon and are convertible before January 2021, benefitted from the overall fall in interest rates. As a reminder, preferred shares and mandatory convertible preferred issues are fixed-income instruments because of the fixed dividend payments. The shares also benefitted from company-specific factors, including good financial performance and more clarity about the financial risks from future California wildfires. However, we exited the position in September as our firm moved to a fossil fuel free stance.

Preferred shares issued by Public Storage returned 23.72% over the year and added 28 basis points to the total return. Like the shares issued by Sempra Energy, Public Storage’s 5.15% preferred stock issue benefitted from falling rates overall, making the high coupons offered by preferred stock more attractive.

Bonds issued by Aptiv were our top-performing traditional bond in the year. The company’s 4.25% issue maturing January 15, 2026 gained 15.14% and boosted the total return by 24 basis points. Aptiv supplies high-technology components to auto manufacturers, including infotainment systems, cameras and safety features like lane departure assistance. The company’s content per vehicle is increasing dramatically as consumers demand more technology inside vehicles as well as life-saving safety features. Aptiv is also at the forefront of autonomous driving and will continue to be a major beneficiary as the technology develops and is eventually adopted. Even though global auto production declined over the year, Aptiv saw strong sales growth from its highly relevant products. We are excited about the company’s future growth potential and ability to expand margins as sales grow.

Several Treasury bonds also ranked at the top of our attribution list, with healthy gains from falling yields. As a whole, our Treasury portfolio gained 7.90% versus the Index at 6.83%. Additionally, the Fund had a long-

duration position in Treasuries, which means that we owned more bonds maturing20-30 years into the future than the Index. This made our portfolio more sensitive to interest rate movements, so our bonds gained more than the Index as rates fell, resulting in a 3.03% return to the Fund from Treasuries versus 2.71% for the Index.

The worst-performing securities in the Fund over the year were all Treasury bonds. While Treasury bonds rallied overall, there was a big dip in rates over the summer, so timing issues impacted the performance of these securities. Two Treasury bonds purchased in August, a 10-year and a 30-year, each removed 3 basis points from the total return as rates rose through the fall. Similarly, a 30-year bond purchased in September lost as rates rose and also detracted 3 basis points from the total return.

Parnassus Fixed Income Fund

As of December 31, 2019

(Percentage of net assets)

Portfolio characteristics and holdings are subject to change periodically.

23

| | | | |

| | |

| | | | Annual Report • 2019 |

Outlook and Strategy