Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: Parnassus Funds (811-04044) and Parnassus Income Funds (811-06673)

Parnassus Funds

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marc C. Mahon

Parnassus Funds

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: June 30, 2022

Table of Contents

Item 1: Report to Shareholders

Table of Contents

Parnassus Funds Semiannual Report

June 30, 2022

Parnassus Core Equity FundSM

Investor Shares: PRBLX | Institutional Shares: PRILX

Parnassus Mid Cap FundSM

Investor Shares: PARMX | Institutional Shares: PFPMX

Parnassus Endeavor FundSM

Investor Shares: PARWX | Institutional Shares: PFPWX

Parnassus Mid Cap Growth FundSM

Investor Shares: PARNX | Institutional Shares: PFPRX

Parnassus Fixed Income FundSM

Investor Shares: PRFIX | Institutional Shares: PFPLX

Table of Contents

Table of Contents

| Letter from Parnassus Investments | 4 | |

| Fund Performance and Commentary | ||

| Parnassus Core Equity Fund | 8 | |

| Parnassus Mid Cap Fund | 12 | |

| Parnassus Endeavor Fund | 16 | |

| Parnassus Mid Cap Growth Fund | 19 | |

| Parnassus Fixed Income Fund | 23 | |

| Responsible Investing Notes | 26 | |

| Fund Expenses | 27 | |

| Portfolios of Investments | ||

| Parnassus Core Equity Fund | 28 | |

| Parnassus Mid Cap Fund | 30 | |

| Parnassus Endeavor Fund | 32 | |

| Parnassus Mid Cap Growth Fund | 34 | |

| Parnassus Fixed Income Fund | 36 | |

| Financial Statements | 42 | |

| Notes to Financial Statements | 48 | |

| Financial Highlights | 58 | |

| Additional Information | 62 | |

3

Table of Contents

| Semiannual Report • 2022 | |||

August 5, 2022

The first half of the year mercifully has come to an end, with stocks and bonds posting major losses. The S&P 500 closed the half with a loss of -20.0%, while the Russell MidCap returned -21.6%. Even bonds were down double digits, with the Bloomberg U.S. Aggregate Bond Index dropping -10.4%. The corrosive impact of high inflation and the rapid increase in interest rates, spurred on by the Federal Reserve in an effort to combat inflation, are the main culprits for this market correction.

There was a major divergence between value and growth in the first half of 2022, as seen by the difference in returns for the Russell 1000 Value Index down -12.9% and the Russell Midcap Growth Index down -31.0%. After many years of outperforming value stocks, growth had a dismal six months to start 2022.

The major contributor to value’s dominance this year has been the strength of oil and gas stocks. As we know, the prices of fossil fuels have spiked this year, primarily due to the Russian invasion of Ukraine. Parnassus believes that investing in oil and gas is not a good long-term, sustainable investment, so we avoid the sector entirely. This policy helped us in prior years, when oil and gas stocks didn’t do well, but it has hurt us in recent quarters. As long-term, responsible investors, we still believe that avoiding oil and gas investments is the right course of action for our funds.

It is natural for investment conviction to wane when a bear market rears its ugly head. Besides the brief, but severe, downturn at the start of the pandemic, we haven’t had a bear market since the Great Financial Crisis of 2008-2009. The years in between saw fantastic gains for stocks and bonds, and those who held on during the unsettling times benefited greatly for their perseverance. It’s impossible to know if we’ve reached the bottom of this market cycle. What I can say with full confidence is that eventually the market will start making gains again. If you are in a position to hold on to your investments during this troubling bear market, I encourage you to do so.

New Head of ESG Stewardship

As I’ve written in recent shareholder reports, Parnassus is increasing its commitment to investment stewardship. In particular, this means we are putting more resources into engaging with our portfolio companies in an effort to improve their performance on environmental and social matters. By guiding our companies to improve in these areas, we are acting in accord with our values. In addition, the areas of engagement that we select have a clear connection to long-term shareholder value creation. This intersection of shareholder value creation and adherence to our values is what Parnassus Investments is all about.

Coming into the year, our ESG stewardship team consisted of three talented professionals: Rachel Nishimoto, Marissa LaFave and Simar Kaur. In April, the team grew to four with the addition of its new leader, Marian Macindoe. As our head of ESG stewardship, Marian is responsible for oversight of Parnassus’ proxy voting, ESG engagements and stockholder proposal strategy. Prior to joining us, Ms. Macindoe was the head of ESG strategy and

4

Table of Contents

| Semiannual Report • 2022 |  | |||

engagement at Uber Technologies. Prior to that, she acted as the director of investment stewardship at Charles Schwab. Marian received her master’s in regional and urban planning from the London School of Economics and her bachelor’s degree in international and comparative policy studies (economics) from Reed College. Marian sits on the board of an Oakland-based nonprofit that serves youth transitioning out of foster care, First Place for Youth.

New Hires

In addition to Marian, we added a whopping six new employees in the quarter. Some of these replaced employees who moved on from Parnassus, and a few are filling new positions. Cameron Hall joined the client relationship team as an advisor relations associate. In this role, he is responsible for managing relationships with financial advisors and other similar clients. Prior to joining Parnassus, Cameron was a senior analyst with Nasdaq’s Capital Markets Advisory practice. He received his bachelor’s degrees in finance and French, as well as a minor in leadership studies from Chapman University. In his free time, Cameron enjoys skiing, travel, and reading nonfiction.

Colin Rennich also joined our advisor relations group as a manager of advisor relations. Before joining Parnassus, Colin worked at Appleseed Capital, Principal Financial Group and Ameriprise Financial. Colin earned a bachelor’s degree in business management from Purdue University. In his free time, Colin enjoys coaching youth sports, playing golf and traveling. Colin is working fully remote from Chicago, where he can better serve our clients in the Midwest.

Randall Dobkin joined our communications team as an investment reporting specialist. He graduated from the University of California, Davis, with a double major in economics and political science and a minor in global international studies. Prior to joining Parnassus, Randall worked as a consultant with the business development team at the International Research and Exchanges Board (IREX) and as a policy analyst for the Environmental Policy Innovation Center (EPIC) and California State Senate. In his free time, he enjoys camping, traveling, and rooting for the Detroit Lions.

Dan Lee joined the marketing strategy team as a senior digital strategist. He previously led digital marketing efforts at AIG First Principles, Mellon Investments and State Street Global Advisors. Dan earned a bachelor’s degree in sociology from the University of California, Santa Cruz. In his free time, Dan enjoys sailing, snowboarding, traveling, cooking, and wine tasting.

Bashir Nakhuda joined Parnassus as a senior financial analyst, where he will be working on corporate financial planning and analysis functions. Prior to joining Parnassus, Bashir spent the last 11 years working at Duff and Phelps within their Valuation Services Group. Bashir has a BA in political economy from the University of California, Berkeley, and is a Chartered Financial Analyst (CFA). In his spare time, Bashir enjoys traveling and rooting for Bay Area sports teams.

Kayla Ware is an investment operations associate. In this role, she is responsible for supporting operations and administration of Parnassus mutual funds and separate accounts. She recently graduated from California State University, East Bay, with a BS in business administration. In her free time, Kayla enjoys cooking, traveling, and going to the beach.

5

Table of Contents

| Semiannual Report • 2022 | |||

Interns

It wouldn’t be summertime at Parnassus if we didn’t have a full complement of interns. We have five interns on the research team helping our analysts and portfolio managers make investment decisions. Tracy Wang is an MBA candidate at Harvard Business School. Previously, Tracy worked as an industry specialist at Capital Group, where she covered Chinese consumer discretionary sectors. She graduated magna cum laude with a BA in geography from Dartmouth College. Tracy grew up in Shanghai, China, sings in an a cappella group, and enjoys Chinese calligraphy and traveling.

Alex Morse is an MBA candidate at the Haas School of Business at the University of California, Berkeley. He previously worked at Bernstein Research as a senior research associate and at climate-technology startup Minimum. He is a CFA charter holder and graduated with a BA in english literature from the University of Oxford. Alex grew up in London and enjoys skiing, reading, and supporting the Chelsea Football Club.

Joon Kang is pursuing an economics degree from Cornell University. He previously interned in the equity research team at NH-Amundi Asset Management in Seoul, South Korea, and is a member of Johnson Private Equity & Credit at his school. Born in South Korea and raised in Queretaro, Mexico, Joon enjoys playing golf and hanging out with friends and family.

Christine Zhang is a Master of environmental studies candidate at the University of Pennsylvania. Previously, Christine interned as a sustainability consultant at KPMG and ESG analyst at Workiva. She graduated with a BA in economics and environmental studies (Honors) from the University of Pennsylvania. Christine grew up in New Zealand, and enjoys practicing yoga, traveling and eating at new restaurants.

Katelyn Moulton is a rising fourth year at the University of Virginia (UVA) studying economics and statistics. She is the director of an ESG career-development seminar through the McIntire School of Commerce at UVA and works with the sustainability office to pilot composting throughout campus. She completed a fellowship last summer with a non-profit based in Appalachia as a data science analyst. In her free time, Katelyn enjoys hiking in the Shenandoah Mountains and trying out new restaurants.

We have two interns working with the ESG Stewardship team. Coco Xu is pursuing a double degree in environmental economics & policy and psychology at the University of California, Berkeley. She previously worked as a think tank research intern at Industrial Securities in Shanghai. In her free time, Coco enjoys hiking, scuba diving, and playing volleyball.

Coming from a rural province in the Philippines, Emman Uy attended the Hong Kong University of Science and Technology and graduated with a BBA in economics and finance. After this, he pursued further studies as a Master’s in development engineering student at the University of California, Berkeley, focusing on energy, water and environmental engineering research in the Philippines. Emman loves his home and enjoys spending time with the people there swimming, hiking, and going on trips.

6

Table of Contents

| Semiannual Report • 2022 |  | |||

We have two local high school students serving as interns this summer. Lucas Hom is a rising junior at Acalanes High School in the East Bay town of Lafayette. Lucas has been coding since age eight and started an online coding school during the pandemic, teaching kids how to get a start in programming using Scratch. This summer, Lucas is working at Parnassus as a software engineer intern while also teaching coding summer camps for The Coder School. In his free time, Lucas collects vinyl records, hangs out with friends, and is learning how to play ukulele.

Brayden Lee is a rising senior at Lowell High School, the prestigious San Francisco public school. Born and raised in the Bay Area, he is a sports enthusiast and a fan of the Warriors, 49ers, and Giants. Brayden participates in Lowell’s Intelligent Investors and UNICEF clubs while being committed to the varsity basketball team. In his free time, he loves outdoor activities like hiking and skiing, eating out with friends, and traveling especially to Hawaii.

Thank you all for investing with the Parnassus Funds.

Sincerely,

Benjamin E. Allen

President and CEO

7

Table of Contents

| Semiannual Report • 2022 | |||

Ticker: Investor Shares - PRBLX

Ticker: Institutional Shares - PRILX

As of June 30, 2022, the net asset value (“NAV”) of the Parnassus Core Equity Fund – Investor Shares (“the Fund”) was $50.53. After taking dividends into account, the total return for the second quarter was a loss of -15.34%. This compares to a loss of -16.10% for the S&P 500 Index (“S&P 500”). Year to date, the Parnassus Core Equity Fund – Investor Shares posted a loss of -20.20%. This compares to a loss of -19.96% for the S&P 500.

Below is a table that summarizes the performances of the Parnassus Core Equity Fund and the S&P 500. The returns are for the one-, three-, five- and ten-year periods.

Parnassus Core Equity Fund

| Average Annual Total Returns (%) | ||||||||||||||||||||

| for period ended June 30, 2022 | ||||||||||||||||||||

| One Year | Three Years | Five Years | Ten Years | Gross Expense Ratio | ||||||||||||||||

| Parnassus Core Equity Fund – Investor Shares | -11.51 | 10.28 | 11.90 | 13.09 | 0.82 | |||||||||||||||

| Parnassus Core Equity Fund –Institutional Shares | -11.33 | 10.52 | 12.14 | 13.31 | 0.61 | |||||||||||||||

| S&P 500 Index | -10.62 | 10.60 | 11.31 | 12.96 | NA | |||||||||||||||

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take and expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

Second Quarter Review

The S&P 500 is off to its worst start since 1970, finishing down -19.96% in the first half. Volatility persisted and the stock market fell just over 16% in the second quarter alone. Even the utilities and energy sectors, the only positive returners in the first quarter, had negative returns as the market selloff intensified. The story of virus variants, supply-chain disruptions, a geopolitical conflict, elevated inflation, and tightening financial conditions continued. The market had to reorient to the higher-than-expected inflation as measured by CPI,1,2 which accelerated year-over-year in May. Stocks fell as the Federal Reserve responded to the higher CPI by raising interest rates to curb demand and thereby stymie inflation. Volatility continued as market concerns fluctuated between inflation and the risk of recession.

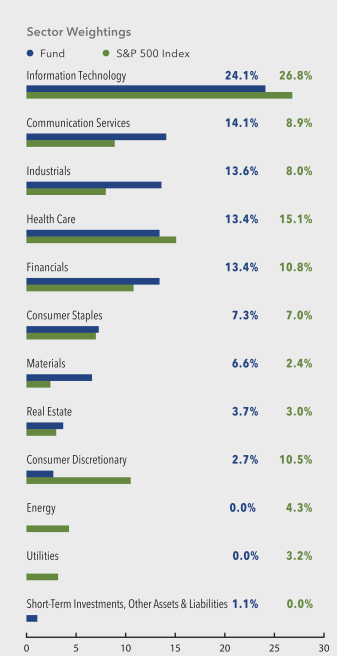

Against this economic backdrop, the Parnassus Core Equity Fund – Investor Shares returned -15.34% compared to the S&P 500’s -16.10%. While sector allocation was slightly positive, most of our outperformance was explained by stock selection, particularly in the communication services and consumer discretionary sectors. Within sector allocation, our underweight positioning in energy, driven by our avoidance of fossil fuels, continued to be our largest detractor. This was followed closely by our underweight in utilities. Despite this, we had a notably positive contribution from our underweight in consumer discretionary, which helped drive a positive contribution from sector allocation overall.

1 Consumer Price Index, U.S. Bureau of Labor.

2 Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a fixed basket of consumer goods and services (such as food, transportation, shelter, utilities, and medical care), and is widely used as a cost-of-living benchmark.

8

Table of Contents

| Semiannual Report • 2022 |  | |||

T-Mobile, the US wireless carrier, was the Fund’s best performer in the quarter, with the stock returning 4.8%, contributing positive 0.1%* to the Fund’s return. The company reported a strong quarter, beating expectations on key metrics and raising full-year earnings guidance. T-Mobile continues to gain market share while ramping up their home broadband business. We like the share-gain story and find the improving financials and attractive cash flow generation promising.

Our next-best performer was Becton Dickinson, a global medical technology company, if only in a relative sense, with the stock returning -4.6%, contributing -0.2% to the Fund’s return. The company beat earnings expectations in the quarter, while completing the spin-off of Embecta and announcing the acquisition of Parata Systems, a provider of pharmacy automation solutions. We believe that the company’s shares are attractively priced as revenue could grow and profit margins expand more than expected.

American Tower, owner of wireless telecommunications infrastructure, was also a relative top performer. The company’s stock returned 2.9% in the quarter, contributing positive 0.1% to the Fund’s return. The company reported solid results that were slightly ahead of expectations while modestly raising their guidance. Despite a challenging interest rate environment, we continue to find the secular growth potential at American Tower attractive.

The three largest detractors in the quarter were Deere, Alphabet and Charles Schwab. Deere’s stock returned -27.7% in the quarter, which detracted -1.2% from the Fund’s return. After a period of outperformance, Deere reported mixed results in the quarter, as sales and margins missed expectations. The company is dealing with temporary supply-chain issues and volatile commodity prices despite a robust equipment-demand backdrop. Deere’s products are becoming increasingly relevant to the future of farming, and we continue to believe the longer-term upside from precision agriculture is underappreciated.

Alphabet, owner of Google and YouTube, returned -21.7% for the Fund, detracting -1.3% from the Fund’s return. Despite strong performance from Google Search, results from YouTube missed investor

expectations due to the emerging short-form video format, which is not currently generating revenue. Further, Alphabet’s exposure to digital advertising and overall economic activity weighed on shares, as economic growth expectations came down during the quarter. Despite this, we find Alphabet shares to be attractively priced even in a volatile macroeconomic environment.

Lastly, Charles Schwab, a dominant investment brokerage, returned -24.8% during the quarter as the company reported weak results along with the building of cash on its balance sheet to fund a potential deposit run-off. This lowers the amount of money Schwab can earn on customer cash deposits as customers opt to hold less cash in favor of higher-yielding alternatives. The company also has some exposure to “payment for order flow,” where Schwab makes money by routing trades to certain market makers. This practice is under scrutiny by regulators and the company’s exposure weighed on shares. The stock detracted -0.6% from the Fund’s return.

* For this report, we quote total return to the portfolio, which includes price change and dividends.

9

Table of Contents

| Semiannual Report • 2022 | |||

Parnassus Core Equity Fund

As of June 30, 2022

(percentage of net assets)

Portfolio characteristics and holdings are subject to change periodically.

| Top 10 Equity Holdings | ||||

| (percentage of net assets) | ||||

| Microsoft Corp. | 6.8% | |||

| Alphabet Inc., Class A | 5.8% | |||

| Fiserv Inc. | 4.5% | |||

| CME Group Inc., Class A | 4.1% | |||

| Becton, Dickinson and Co. | 4.1% | |||

| Danaher Corp. | 3.8% | |||

| Mastercard Inc., Class A | 3.4% | |||

| S&P Global Inc. | 3.4% | |||

| Comcast Corp., Class A | 3.3% | |||

| Deere & Co. | 3.3% | |||

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

We are still seeing inflation of 8.6%,3 which is the highest in over four decades. What’s changed since the first quarter is that the stock market is now off to the worst start in over five decades. Entering 2022, investors underappreciated the persistence and magnitude of elevated inflation. The second quarter saw the market sell off with more interest rate increases, prompted again by stubbornly high inflation. While it’s difficult to know exactly how rate sensitive the real economy is today, conditions have clearly deteriorated. Real GDP growth expectations for this year, which had already been coming down at the time of our last quarterly commentary, have dropped from 3.5% to 2.4% in a matter of months. The Federal Reserve now expects unemployment, which had been trending down to 3.6%, to tick up to 3.9% in 2023. We seem to be rapidly approaching the apex of uncertainty surrounding the path of inflation and the impact on overall demand from both higher prices and tightening financial conditions.

This uncertainty is a headwind for investors. However, there are reasons to be optimistic regarding a more certain path toward taming inflation and stable interest rates. An increasingly aggressive Federal Reserve may shorten this economic cycle, creating opportunity. We are seeing early signs of slowing industrial production, weakening freight and shipping pricing, commodity price corrections, inventory builds and other signs of economic slowdown. The obvious concern, which we

share, is greater-than-expected demand destruction, which could lead to a painful recession. The silver lining is that stock valuations are also now more attractive. The valuation of the S&P 500 in terms of a forward price-to-earnings ratio is down -30% while forward earnings estimates are up 13%.

3 Consumer Price Index – May 2022, U.S. Bureau of Labor.

10

Table of Contents

| Semiannual Report • 2022 |  | |||

Clearly, not all companies will meet short-term earnings expectations and not all stocks are bargains. It is precisely during these times of near-term uncertainty that our focus on longer-term performance and high-quality ESG fundamentals becomes key. Consistent with our investment process, we are looking out over the next few years, where fundamentals may be mispriced and where we may be in an entirely different macroeconomic regime. Many positive secular trends related to technology adoption and innovation across sectors like software, media, life sciences and agriculture continue unabated. We are working to ensure that the Fund has the appropriate balance of resilient companies that can weather a slowing economy and attractively priced secular growers with achievable earnings expectations. In deteriorating economic conditions, we are cognizant that some companies may reasonably need to reduce staff or cut costs. It is important to Parnassus that companies undertake these activities with compassion and empathy toward affected stakeholders. As part of our ongoing ESG risk reviews, we will look for disclosures around these activities to ensure alignment with our principles. With this framework in mind, we made some notable changes to existing Fund holdings during the quarter, while adding one new stock and selling out of two. Overall, we continued to take advantage of the market volatility to upgrade the return profile of the portfolio, while tilting the Fund toward more resilient long-term business fundamentals.

Our largest overweight is still industrials. We continue to see attractive opportunities in this sector, which offer unique exposure to different parts of the economy. We reduced our overweight slightly by exiting Pentair, a water treatment company. We sold Pentair to reduce the Fund’s cyclicality and due to concerns around demand destruction and elevated earnings expectations. Our next largest overweight sector is communications services. We added to our exposure to this sector by adding to our positions in T-Mobile, Verizon and Comcast. We continue to see the resilient cash-flow generation in this sector as attractively priced in this economic environment. We remain overweight materials through our positions in high-quality businesses like Sherwin-Williams, Ball and Linde.

Our biggest change in sector allocation for the quarter was a further reduction to our exposure to information technology stocks. We trimmed our semiconductor holdings Texas Instruments, NVIDIA, Micron and Applied Materials. While we acknowledge the long-term growth and innovation in semiconductor companies, we are concerned about short-term

demand. Despite these trims, we are also seeing opportunity in this sector, as we increased our stake in Adobe, the design software company that is at the center of digital content creation. Our next-biggest change in sector allocation was an increase to our overweight positioning in financials. We did this without taking additional credit risk by initiating a position in Marsh & McLennan, the world’s leading insurance broker and risk advisor. The company has demonstrated consistent, stable growth through multiple economic cycles given the mission-critical nature of its insurance and risk management products.

Our largest underweight sector continues to be consumer discretionary, as we view valuations to be unattractive given the elevated risk to certain consumer segments. We reduced our exposure to the sector by selling Booking Holdings, the online travel agent. We are concerned that demand will be negatively impacted in Booking’s core markets.

We continue to be slightly overweight real estate and consumer staples while being underweight health care. Our portfolio also continues to be underweight utilities due to high valuations and unattractive return profiles. We have no direct energy exposure due to our avoidance of fossil fuel companies.

While we share the market’s near-term concerns relative to historic inflation and a slowing economy, we believe the portfolio is positioned well to deliver strong long-term returns. As always, we’re honored to have your trust as we continue pursuing Principles and Performance® for you.

Sincerely,

Todd C. Ahlsten

Lead Portfolio Manager

Benjamin E. Allen

Portfolio Manager

Andrew S. Choi

Portfolio Manager

11

Table of Contents

| Semiannual Report • 2022 | |||

Ticker: Investor Shares - PARMX

Ticker: Institutional Shares - PFPMX

As of June 30, 2022, the net asset value (“NAV”) of the Parnassus Mid Cap Fund – Investor Shares was $35.55, so the total return for the quarter was -11.76%. This compares to a return of -16.85% for the Russell Midcap Index (“Russell”). For the first half of 2022, the Parnassus Mid Cap Fund – Investor Shares is down -21.35% compared to a loss of -21.57% for the Russell.

Below is a table comparing the Parnassus Mid Cap Fund with the Russell for the one-, three-, five- and ten-year periods.

Parnassus Mid Cap Fund

| Average Annual Total Returns (%) | ||||||||||||||||||||

| for period ended June 30, 2022 | ||||||||||||||||||||

One Year | Three Years | Five Years | Ten Years | Gross Expense Ratio | ||||||||||||||||

| Parnassus Mid Cap Fund – Investor Shares | -16.18 | 3.59 | 6.13 | 9.95 | 0.96 | |||||||||||||||

| Parnassus Mid Cap Fund – Institutional Shares | -16.02 | 3.83 | 6.37 | 10.13 | 0.75 | |||||||||||||||

| Russell Midcap Index | -17.30 | 6.59 | 7.96 | 11.29 | NA | |||||||||||||||

The average annual total return for the Parnassus Mid Cap Fund – Institutional Shares from commencement (April 30, 2015) was 7.69%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Mid Cap Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses.

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Midcap Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Mid-cap companies can be more sensitive to changing economic conditions and have fewer financial resources than large-cap companies.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

Second Quarter Review

Runaway inflation, rising interest rates, fear of recession and geo-political uncertainty battered worldwide financial markets in the second quarter, and domestic mid-cap stocks were not immune to the downdraft. The Russell had one of its worst quarterly performances in memory and is now down almost -21.57% for the year-to-date. This negative return is a sharp contrast to the similar period just a year ago, when the Russell posted one of its strongest six-month returns in decades.

There weren’t many bright spots for the market in the first half of 2022. Among them was the astronomic rise in commodities prices, mostly oil, gas and certain materials. The main catalyst for this was the Russia-Ukraine war, which disrupted supplies of oil and wheat along with other staples. We are also experiencing a flood of demand following a prolonged period of COVID-19-induced restraint and generous fiscal stimulus. The result has been rising inflation across the board, an aggressive Federal Reserve response in the form of interest rate hikes and the sale of risk assets by investors.

Good stock picking and the portfolio’s quality bias were at the heart of the Fund’s quarterly outperformance. The Parnassus Mid Cap Fund – Investor Shares were down -11.76% during the second quarter, which captured just under 70% of the Russell’s -16.85% loss. We’re pleased with the Fund’s relative quarterly return, but are disappointed to have a negative absolute quarterly return. On an incrementally positive note, despite a challenging first quarter, the Parnassus Mid Cap Fund – Investor Shares is now slightly ahead of the Russell for the first half of 2022, posting a loss of -21.35% versus a loss of -21.57% for the benchmark.

12

Table of Contents

| Semiannual Report • 2022 |  | |||

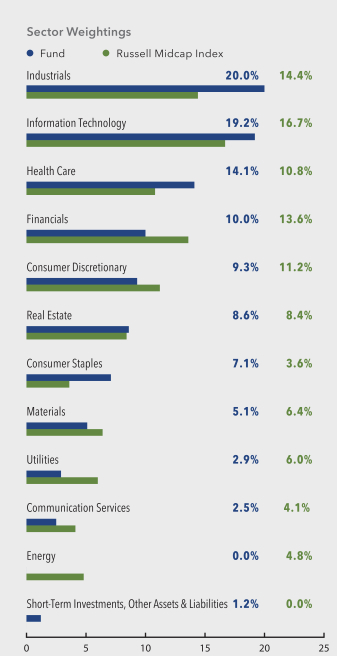

The Fund’s second-quarter relative performance rebound occurred despite a zero allocation to energy stocks, which cost the fund 54 basis points from an attribution perspective. (One basis point is 1/100th of

one percent.) Other than energy, our underweight position in utilities stocks relative to the Russell, a sector that we mostly avoid due to its many constituents’ poor ESG performance and exposure to nuclear power, cost the Fund 33 basis points from an attribution perspective.

While the Fund’s year-to-date performance is only slightly better than the Russell, it looks materially better when focusing on our investable universe. For the year to date, our underweight allocations in the energy and utilities sectors hurt the Fund by 189 basis points and 43 basis points, respectively.

The Fund’s performance during the quarter was heavily driven by stock selection rather than sector allocation. The worst performer was Signature Bank, a regional bank operating primarily in the greater New York City area and on the West Coast. The stock dropped -38.8%,* reducing the fund’s return by -1.21%, after the company announced that total deposit balances grew slower than expected. Furthermore, investors became concerned about the bank’s partial reliance on its digital currency platform to drive future asset balances. While investor concerns are somewhat valid, the company’s core non-crypto business is still performing well, and the cryptocurrency-related business accounts for less than 25% of total deposits and none of its loan growth. We believe Signature is especially attractive at the current valuation given its long runway for earnings growth, solid credit metrics and asset sensitive portfolio that will benefit as interest rates rise.

Alexandria Real Estate, the leader in life sciences real estate, fell by -27.4%, reducing the fund’s return by -0.26%. Concerns about life science tenant credit, as well as uncertain real estate demand given current capital markets conditions, hurt Alexandria’s stock. Rising interest rates were also a headwind, as Alexandria carries material debt due to its REIT structure. We believe the company’s decades of expertise, attractive tenant base, top tier properties and strong reputation are positive differentiators that will help Alexandria succeed in what remains an attractive industry over the long-term.

Avalara, a leading online tax software player, declined by -29.1%, reducing the fund’s return by -0.26%. Although the company delivered better-than-expected revenue growth and solid new customer additions, the stock experienced multiple compression consistent with the broader software sector. We are encouraged by management’s recent analyst day targets to deliver mid-20s organic revenue growth with improving free cash flow margins over the next three years, and believe Avalara is a direct beneficiary of the highly complex multi-jurisdictional tax system in the United States.

On the positive side, the largest contributor was Grocery Outlet, the “off-price grocer,” which rose by 30.0%, adding 1.07% to the Fund’s total return. The company reported better-than-expected same-store sales growth of 5.2%, driven by greater store traffic and improved customer basket size. We see further upside ahead, as the company benefits from new store unit growth and market share gains as customers seek greater value in this rising price environment.

Sysco, the leading, domestic food distributor, climbed 4.3%, adding 0.7% to the Fund’s total return. Despite higher fuel prices, the company reported robust earnings, driven by market share gains, strong expense management and accelerating domestic demand. The company continues to make progress with its “Recipe for Growth” strategic plan, as it deployed its new AI-powered pricing tool to drive better pricing, a new customer loyalty program and enhancements to its employee training programs, which should boost margins and earnings ahead.

Cboe Global Markets, one of the largest exchange holding companies, went down just -0.7%, contributing 0.6% to the Fund’s total return. The company’s quarterly earnings beat consensus expectations and management raised its annual revenue outlook. Investor sentiment rose after recent investments in new products, such as European Derivatives, showed strong customer traction. The company also resumed share buybacks after a two-quarter pause. With expanding opportunities in new geographies and products, a strong balance sheet and robust free cash-flow generation, we believe the stock’s risk-reward remains attractive.

13

* For this report, we quote total return to the portfolio, which includes price change and dividends.

Table of Contents

| Semiannual Report • 2022 | |||

Parnassus Mid Cap Fund

As of June 30, 2022

(percentage of net assets)

Portfolio characteristics and holdings are subject to change periodically.

| Top 10 Equity Holdings | ||||

| (percentage of net assets) | ||||

| Cboe Global Markets Inc. | 4.2% | |||

| Sysco Corp. | 4.0% | |||

| Hologic Inc. | 3.9% | |||

| C.H. Robinson Worldwide Inc. | 3.6% | |||

| Avantor Inc. | 3.5% | |||

| Jack Henry & Associates Inc. | 3.5% | |||

| SBA Communications Corp., Class A | 3.4% | |||

| Verisk Analytics Inc. | 3.2% | |||

| Republic Services Inc. | 3.1% | |||

| Grocery Outlet Holding Corp. | 3.1% | |||

Portfolio characteristics and holdings are subject to change periodically.

Strategy and Outlook

While large losses were experienced by most equity investors in the first half of 2022, it’s important to remember that domestic equity indices boomed from 2019 to 2021. During this period, the Russell Midcap Index cumulatively returned well over 70%, a return much greater than its typical performance. This doesn’t soften the blow from recent losses, but does remind us that keeping a long-term perspective and investing for a full-market cycle is often prudent. Going through this contraction also reminds us of the importance of investing in reasonably valued, quality businesses that should perform well over full market cycles. The silver lining is that the year-to-date market correction is creating attractive investment opportunities.

Many pundits believe a recession is around the corner, and investors are responding by selling stocks to reduce portfolio risk. Looking forward, it’s difficult to predict exactly what will happen with the economy and stock market over the near- and medium-terms, but we expect volatility to continue. We believe our strategy of owning a concentrated collection of high-quality businesses with increasing relevancy, competitive advantages, disciplined management, strong ESG practices, solid balance sheets and favorable upside-downside potential will do relatively well in this environment. We are optimistic that our portfolio construction will dampen any pending volatility and deliver solid returns relative to the benchmark over the full-market cycle.

14

Table of Contents

| Semiannual Report • 2022 |  | |||

As a reflection of our bottom-up research process, the Fund is currently slightly underweight relative to the Russell in the more volatile and cyclical consumer discretionary, financial and materials sectors and has no exposure to the energy sector. In contrast, we are overweight in the predominantly stable sub-sections of the information technology sector, health care, consumer staples, real estate and industrials sectors, owning a combination of defensive and offensive high-quality companies. That said, we own quite a few companies that should do well if we see investor appetite for risk assets increase.

Following an active buying period in the first quarter, we bought only one new stock during the second quarter. We initiated a position in Otis Worldwide, the world’s largest provider of new equipment and services in the elevator and escalator industry. Over half of the company’s revenue is derived from its services segment, which provides a significant source of recurring revenue and free cash flow. The company has significant cost advantages due to its scale and large installed base of equipment. We’re excited about the company’s long-term growth prospects, as it benefits from recent investments in products, sales and digital field capabilities and margin expansion opportunities.

We exited three stocks during the second quarter. A theme for these sales, as well as sales we made in the first quarter, is excessive valuation. We sold Hilton Worldwide, a leading hospitality company that owns, leases, manages and franchises hotels and resorts. We

had initially purchased the stock in 2020 after the COVID-19 pandemic caused demand for business and leisure travel to temporarily collapse. The company has since benefited from a rebound in demand as leisure and corporate travel increased, but we believe the stock is no longer undervalued. We also sold ANGI Inc., a leading online home services provider. While we believe the company has a significant opportunity to penetrate the online home services category, we became concerned with the company’s increasing investments required to rebrand the business, slow turnaround progress and high valuation. Finally, we exited AES corporation, a power operator and utility operator, due to concerns about slowing earnings growth and its continued reliance on high carbon-emission generation sources.

Thank you greatly for your trust and investment in the Parnassus Mid Cap Fund.

Yours truly,

Matthew D. Gershuny

Lead Portfolio Manager

Lori A. Keith

Portfolio Manager

15

Table of Contents

| Semiannual Report • 2022 | |||

Ticker: Investor Shares - PARWX

Ticker: Institutional Shares - PFPWX

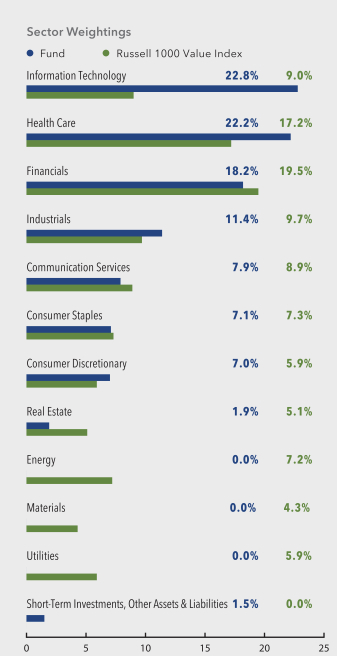

As of June 30, 2022, the net asset value (“NAV”) of the Parnassus Endeavor Fund – Investor Shares was $44.30, so the total return for the second quarter was a loss of -13.07%. This compares to a decline of -12.21% for the Russell 1000 Value Index (“Russell 1000 Value”). For the year-to-date period, the Parnassus Endeavor Fund – Investor Shares has posted a loss of -18.01% compared to the Russell 1000 Value’s loss of -12.86%. It has been a challenging year for stocks, but especially for the Fund. Technology stocks, where the Fund is overweight, led the decliners. Energy, in which we do not invest, is the only sector with a positive real return so far this year.

Below is a table that summarizes the performances of the Parnassus Endeavor Fund, the Russell 1000 Value and the S&P 500 Index^. The returns are for the one-, three-, five- and ten-year periods.

Parnassus Endeavor Fund

| Average Annual Total Returns (%) | ||||||||||||||||||||||||

| for period ended June 30, 2022 | ||||||||||||||||||||||||

| One Year | Three Years | Five Years | Ten Years | Gross Expense Ratio | Net Expense Ratio | |||||||||||||||||||

| Parnassus Endeavor Fund – Investor Shares | -14.82 | 15.56 | 11.46 | 15.21 | 0.90 | 0.88 | ||||||||||||||||||

| Parnassus Endeavor Fund – Institutional Shares | -14.64 | 15.81 | 11.71 | 15.39 | 0.71 | 0.65 | ||||||||||||||||||

| Russell 1000 Value Index | -6.82 | 6.87 | 7.17 | 10.50 | NA | NA | ||||||||||||||||||

| S&P 500 Index^ | -10.62 | 10.60 | 11.31 | 12.96 | NA | NA | ||||||||||||||||||

The average annual total return for the Parnassus Endeavor Fund – Institutional Shares from commencement (April 30, 2015) was 12.50%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Endeavor Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses.

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell 1000 Value and S&P 500 are unmanaged indexes of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

Net expense ratio reflects contractual agreement through May 1, 2023.

Second Quarter Review

For the quarter, the Parnassus Endeavor Fund lagged our benchmark by 0.86%. While stock selection was neutral to positive, sector allocation was negative and explained all our underperformance. Our overweight positioning in technology was the biggest detractor, followed by our underweight positioning in the energy sector. Within stock selection, health care was our biggest contributor.

Shares of Charles Schwab fell by -24.8% in the quarter, which cut -0.4%* from the Fund’s return. The stock slid in April after the company forecast faster cash withdrawals than investors anticipated, lowering future earnings. The brokerage firm earns interest income on cash held within client portfolios, so it is one of the few beneficiaries of an aggressive Federal Reserve. However, higher interest rates also lead some customers to invest in lower-margin products within Schwab’s ecosystem rather than hold cash. We maintained our position since we believe the company can still grow earnings substantially as the Fed raises rates through the rest of the year.

Gap’s stock returned -40.8% in the quarter, which detracted -0.4% from the Fund’s return. Gap is the parent company of Old Navy, the largest individual apparel brand by retail sales in the United States. Poor merchandising decisions, elevated freight costs and supply-chain disruptions related to COVID-19 shutdowns in China negatively impacted same-store sales and profitability. Meanwhile, persistently high oil prices also crowded out consumer demand for apparel. Finally, the stock took another leg down when Old Navy CEO Nancy Green abruptly departed. We believe these problems are known, temporary, and fixable, so we continued to hold our shares.

* For this report, we quote total return to the portfolio, which includes price change and dividends.

^ Effective September 30, 2021, the Fund’s benchmark changed from the S&P 500 to the Russell 1000 Value Index.

16

Table of Contents

| Semiannual Report • 2022 |  | |||

Hanesbrands, a global manufacturer of inner and activewear, slid -30.1% in the quarter, reducing the Fund’s return by -0.4%. The company is facing an incrementally more-challenging global macro environment, with higher input and freight costs expected for the rest of the year. As such, management no longer expects a second half margin expansion, and now forecasts earnings to be at the low end of its prior annual guidance. Investors are also concerned that excess inventory across some of the company’s wholesale partners, like Walmart and Target, may lead to slower ordering, potential canceled orders and additional markdowns to balance inventory.

Turning to our winners, global pharmaceutical giant Merck was the Fund’s best performer in the quarter. The stock returned 12.0%, contributing a positive 0.6% to the Fund’s return. Merck’s sales grew faster than investors expected, driven by extensions in cancer drug Keytruda, greater adoption of HPV vaccine Gardasil and the launch of COVID-19 pill Lagevrio. In late June, Merck also entered talks to acquire biotech Seagen for $40 billion to bolster its oncology franchise. Investors praised Merck’s progress in diversifying its sources of revenue by bidding up the company’s shares.

Sysco, the world’s leading foodservice distributor, was also a positive contributor in the quarter with the stock returning 4.4%, adding 0.5% to the Fund’s return. Sysco is the largest-scaled player in its industry, and the lowest-cost supplier, so it uniquely benefits from the current inflationary environment. The company is gaining independent-restaurant market share faster than expected, thanks to solid execution of the company’s new pricing tool, loyalty program, and staffing levels. Sysco is also skillfully taking out structural costs while passing through elevated inflation, raising the prospect for enhanced profitability coming out of the pandemic.

Finally, Vertex Pharmaceuticals had another strong quarter, as its stock returned 8.0%, adding 0.3% to the Fund’s return. With AbbVie’s disappointing readout in cystic fibrosis, Vertex solidified its effective monopoly in the space. Vertex continues to grow its cystic fibrosis franchise internationally and invest in addressing the remaining patient population through its partnership with Moderna. Vertex has also had several pipeline wins, notably in later stage trials for APOL1-mediated kidney disease and its CRISPR partnership for sickle cell

disease and beta thalassemia. We believe Vertex’s cystic fibrosis franchise is now fairly valued, but continue to be excited about the pipeline opportunities with five clinical programs with proof of concept.

Parnassus Endeavor Fund

As of June 30, 2022

(percentage of net assets)

Portfolio characteristics and holdings are subject to change periodically.

17

Table of Contents

| Semiannual Report • 2022 | |||

| Top 10 Equity Holdings | ||||

| (percentage of net assets) | ||||

| Merck & Co., Inc. | 4.7% | |||

| Verizon Communications Inc. | 4.0% | |||

| Sysco Corp. | 3.7% | |||

| PepsiCo Inc. | 3.4% | |||

| The Charles Schwab Corp. | 3.3% | |||

| The Progressive Corp. | 2.8% | |||

| Cisco Systems Inc. | 2.8% | |||

| Global Payments Inc. | 2.8% | |||

| Gilead Sciences Inc. | 2.7% | |||

| Agilent Technologies Inc. | 2.6% | |||

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

The U.S. stock market, as measured by the S&P 500 Index, deflated 20% in the first half of 2022. Investors today confront a drumbeat of negative news–new virus variants, the war in Ukraine, lockdowns in China, and global supply chain disruptions. For stocks, the focus is on the Federal Reserve’s plan to combat inflation through restrictive monetary policy. The effects have been dramatic. Asset values have collapsed, consumer demand has evaporated, and economic growth has slowed. If we are not already in a recession, we can surmise one is near. At the same time, this is not a typical downturn since consumer balance sheets are strong and jobs remain plentiful.

How are we investing in this unprecedented environment? First, our investment philosophy of buying good companies at discounted prices remains the same. Characteristics we look for in a good company include a long history of consistently high profitability, a conservatively financed balance sheet and a socially responsible enterprise. To buy at a discounted price means the stock is selling at an inexpensive valuation relative to our assessment of the company’s future potential. Certainly, compared to the end of 2021, stocks are selling at discounted prices. It is our job, then, to determine and assemble a portfolio of good, if not the best, companies out there.

To that end, we had an active second quarter, selling three positions and buying three others. We profitably

sold cloud software company VMware and electronic health records provider Cerner when larger technology firms acquired them. Conversely, we exited PayPal due to worsening fundamentals in ecommerce retail, opting instead to harvest tax losses.

We initiated positions in Amdocs, Deere and Ross Stores. Amdocs is a leading IT consultancy that services the telecommunications industry worldwide. It is poised to benefit from the increasing competitive intensity of wireless and cable players as they undergo digital transformation, cloud migration and 5G adoption. We purchased farming equipment company Deere when its stock price sank due to supply-chain concerns. Deere is a pioneer in precision agriculture, a promising field that aims to boost crop output while using less resources such as land, fertilizer and water. Finally, we bought shares of off-price retailer Ross Stores. The company is in a prime position to benefit from snarled supply-chains because it helps vendors and manufacturers sell excess inventory instead of throwing it away.

Finally, a note about our benchmark, the Russell 1000 Value. A recent reconstitution of this index by its owner resulted in surprising changes. This is due to the dramatic fluctuations in stock values this year, which got codified in June. Meta, formerly Facebook, now appears in our benchmark, as does Netflix, Zoom and Pinterest. Even crypto wallet Coinbase, meme stock GameStop and electric vehicle startup Lucid Group have moved in. It is not clear what to make of these new neighbors or how long they will stay. Rest assured that we are committed to search the entire universe of stocks available in an effort to generate attractive, long-term risk-adjusted returns for our shareholders.

Thank you for your investment in the Parnassus Endeavor Fund.

Sincerely,

Billy Hwan

Portfolio Manager

18

Table of Contents

| Semiannual Report • 2022 |  | |||

Ticker: Investor Shares - PARNX

Ticker: Institutional Shares - PFPRX

As of June 30, 2022, the net asset value (“NAV”) of the Parnassus Mid Cap Growth Fund – Investor Shares was $42.38, resulting in a loss of -21.94% for the second quarter. This compares to a loss of -21.07% for the Russell Midcap Growth Index (“Russell Midcap Growth”). For the first half of 2022, the Parnassus Mid Cap Growth Fund – Investor Shares is down -34.15% compared to a loss of -31.00% for the Russell Midcap Growth.

Below is a table that summarizes the performance of the Parnassus Mid Cap Growth Fund and the Russell Midcap Growth. The returns are for the one-, three-, five- and ten-year periods ended June 30, 2022.

Parnassus Mid Cap Growth Fund

| Average Annual Total Returns (%) | ||||||||||||||||||||

| for period ended June 30, 2022 | ||||||||||||||||||||

| One Year | Three Years | Five Years | Ten Years | Gross Expense Ratio | ||||||||||||||||

| Parnassus Mid Cap Growth Fund — Investor Shares | -33.08 | 0.04 | 2.85 | 9.54 | 0.80 | |||||||||||||||

| Parnassus Mid Cap Growth Fund — Institutional Shares | -33.01 | 0.18 | 3.00 | 9.65 | 0.68 | |||||||||||||||

| Russell Midcap Growth Index | -29.57 | 4.25 | 8.88 | 11.51 | NA | |||||||||||||||

The average annual total return for the Parnassus Mid Cap Growth Fund – Institutional Shares from commencement (April 30, 2015) was 4.89%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Mid Cap Growth Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses.

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Mid Cap Growth is an index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

Second Quarter Review

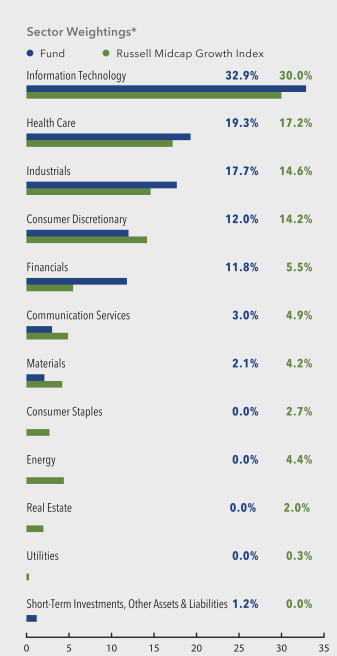

Our Parnassus Mid Cap Growth Fund – Investor Shares dropped -21.94% in the second quarter, trailing the -21.07% loss for the Russell Midcap Growth. With interest rates increasing since the start of the year, growth stocks have fallen out of favor. We’ve seen this before–where investors shun a part of the market and overreact, only to return to it shortly thereafter. While we’re disappointed that we underperformed this quarter, we’re sticking to our knitting and believe our portfolio of high-quality growth compounders will win the day.

Sector allocation accounted for most of our underperformance, led by the energy sector, which cost us 0.5%. As a fossil fuel-free** fund, we don’t invest in oil and gas stocks. While energy prices will be volatile in the short term, we believe that our portfolio will benefit over the long term as the economy transitions toward renewable energy sources. Stock selection was a more modest performance headwind, with the largest drag coming from the financials sector.

Our worst performer was financial technology company Block, formerly known as Square, as its shares fell -54.7% and cut -1.6%* from the Fund’s performance. During the quarter, the company hosted an upbeat analyst day that highlighted its large addressable market. Nevertheless, investors were concerned that growth at Block’s popular Cash App will slow due to its exposure to low-end consumers. Additionally, Block acquired “buy now, pay later” company Afterpay earlier in the year, and investors worried that some loans may not get repaid in a worsening economic environment. We view Block as one of the most disruptive companies in our portfolio, and believe the company’s prospects remain bright.

Illumina, the largest provider of gene sequencing instruments and related consumables, subtracted -1.4% from the Fund’s performance, as its shares returned

* For this report, we quote total return to the portfolio, which includes price change and dividends.

** The Fund is fossil-fuel free, meaning it does not invest in companies that derive significant revenues from the extraction, exploration, production or refining of fossil fuels; the Fund may invest in companies that use fossil fuel-based energy to power their operations or for other purposes. The Funds define “significant revenues” as being 10% or greater.

19

Table of Contents

| Semiannual Report • 2022 | |||

-47.2%. Illumina’s stock fell due to concerns that new competitors will offer cheaper sequencing tools. The stock took another leg down after the company’s CFO announced he was leaving to work at a different health care company. While we’re closely monitoring the competitive environment, we believe Illumina’s moat and new, innovative products, which will launch later this year, will enable the company to remain the leader in the growing sequencing market.

Silvergate Capital, a leading provider of financial infrastructure for the digital asset industry, dropped -64.4% and reduced the Fund’s performance by -1.3%. The stock fell as valuations across the digital asset industry declined meaningfully. As a result, investors were concerned about volumes on Silvergate’s real-time payments network and deposit growth. We are bullish on the digital asset industry over the long-term and believe Silvergate is a unique asset.

Moving to our outperformers, leading U.S. auto insurer Progressive increased the Fund’s return by 0.1%, as the stock climbed 2.1%. Investors appreciate the company’s rising profitability, as the company led the industry in raising prices to offset the jump in used-vehicle prices and repair costs over the past year. Additionally, Progressive is benefiting from higher yields, as they result in higher net investment income on the company’s fixed income portfolios. Overall, we’re pleased with Progressive’s execution and believe the company’s long-term track record of market share gains will continue for the foreseeable future.

Veeva Systems is a leading provider of cloud-based software for the life sciences industry. Our overweight positioning benefited our performance, as the stock dropped less than the Russell Midcap Growth. Veeva returned -6.8% during the quarter and had a neutral impact on the Fund’s return. The company reported stronger-than-expected quarterly results and provided upbeat guidance, as it’s not feeling the impact from a slowing macro economy. The highlight of the quarter was Veeva signing one of its largest deals ever. With a long runway for growth and best-in-class margins, we remain enthusiastic about Veeva’s prospects.

Our large position in Thomson Reuters, which provides information and data for legal, tax and accounting professionals, was also beneficial to our performance, as the stock declined much less than the benchmark. The stock returned -3.8% during the quarter and had a neutral impact on the Fund’s return. The company reported a strong first quarter and increased

its revenue growth outlook for the year. In addition to broad-based growth, Thomson Reuters is making solid progress with its cost savings program. We believe the company is well positioned in a volatile macro environment given its resilient end markets, recurring revenue model and strong balance sheet.

Parnassus Mid Cap Growth Fund

As of June 30, 2022

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

20

Table of Contents

| Semiannual Report • 2022 |  | |||

| Top 10 Equity Holdings | ||||

| (percentage of net assets) | ||||

| Veeva Systems Inc., Class A | 5.1% | |||

| Pool Corp. | 4.5% | |||

| Fortinet Inc. | 4.4% | |||

| Verisk Analytics Inc. | 4.3% | |||

| Agilent Technologies Inc. | 4.2% | |||

| Ansys Inc. | 3.9% | |||

| MarketAxess Holdings Inc. | 3.7% | |||

| Splunk Inc. | 3.4% | |||

| CoStar Group Inc. | 3.3% | |||

| Thomson Reuters Corp. | 3.2% | |||

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

During the quarter, the Russell Midcap Growth sank -21.1%, bringing the year-to-date loss to -31.0%. The Index is off -35.8% from the all-time high it set in November 2021.

Growth stocks have been on sale because inflation jumped to its highest level in decades. Inflation accelerated to a 40-year high in May, with clogged supply chains keeping prices high for many goods and Russia’s invasion of Ukraine causing elevated commodity prices. The Federal Reserve has pivoted from viewing inflation as transitory, and as a result, it has had to act aggressively. In June, the Federal Reserve increased interest rates by 75 basis points, the largest increase since 1994, and signaled an additional 50 or 75 basis point hike in July. (One basis point is 1/100th of one percent.) Since stocks with high long-term growth rates derive a higher portion of their intrinsic value from cash flows expected further out in the future, an increase in the discount rate reduces the value of higher-growth equities more than lower-growth equities.

The Federal Reserve is walking a tight rope-trying to raise interest rates enough to slow inflation, but not so much that it causes a recession. While time will tell whether the economy falls into recession, we’re starting to see the consequences of the Federal Reserve’s actions. During the quarter, the 10-year Treasury yield jumped, making everything from car loans to mortgages more expensive. Consumers are beginning to feel the pinch in their wallets, and consumer confidence has declined since the beginning of the

year. Real GDP expectations have also fallen, with this year’s growth now expected to be just 2.6%, down from 4% at the start of the year.

While there’s a lot of grim news out there, the silver lining is that the Russell Midcap Growth ended the quarter at just 20x forward earnings estimates, below its 5-year and 10-year averages of 27x and 23x, respectively. So while there are real headwinds facing the economy and growth stocks, a lot of that has already been priced in.

In the second quarter, we took advantage of the market’s downturn and invested in three new companies, which we believe further enhance the quality of our fund. We bought Splunk, a software company focused on data analytics and security. We’ve followed the company for a long time and are particularly excited about the company’s rapidly growing cybersecurity business. We believe that the company can grow sales at a 20% clip during our investment horizon and that margins will inflect meaningfully higher. Trading at just 5x forward sales estimates, Splunk, in our view, offers asymmetric upside.

We also invested in C.H. Robinson, the largest domestic truck broker. The company is firing on all cylinders, led by its truck brokerage business, which is growing nicely and showing operating leverage. C.H. Robinson’s business is resilient, and we believe it should generate more than $2 billion in free cash flow over the next two years. Management has a track record of successfully allocating capital, which gives us confidence it will again deploy excess cash in an accretive manner.

Finally, we bought Align Technology, the leader in the clear aligner market. The stock has fallen sharply this year, as growth has been slower than expected due to COVID-19-related lockdowns in China and waning consumer confidence in Europe and North America. Despite these near-term headwinds, we believe the clear aligner category will continue to take market share from metal braces and that Align will be leading that charge. The company’s moat, history of innovation, pristine balance sheet and strong profitability point to better days ahead for Align.

To make room for these new positions, we sold Coupa Software and 10x Genomics. We believe Coupa’s growth will be hurt as we enter a more challenging macro environment, as customers may delay their

21

Table of Contents

| Semiannual Report • 2022 | |||

purchases or choose to consolidate back-office spend into platform companies like Oracle or Workday. We moved on from 10X Genomics given its uncertain path to profitability and because of our concern that ongoing COVID-19 lockdowns in China will adversely impact the company.

At the end of the quarter, the Russell Midcap Growth underwent its annual reconstitution. The reconstitution resulted in three big weighting changes to the index, which impacted our relative positioning. First, the weighting of the information technology sector declined by nearly 300 basis points. We had been modestly overweight prior to the reconstitution, but at quarter-end we’re overweight by approximately 300 basis points, and it remains our largest sector on an absolute basis. Most of our information technology holdings are within the software sub-sector, where we own market leaders like Fortinet and Trade Desk. Second, the weighting of the communication services sector increased by more than 200 basis points. Our position size had been equal to the benchmark’s, but we’re now underweight. Within this sector we own Match Group, the global leader in online dating, and Angi, the dominant online platform for home service projects. Finally, the weighting of the materials sector rose by approximately 175 basis points. Our position size was in line with the benchmark’s, but we’re now

underweight. The sole materials company we own is Nutrien, the world’s largest crop nutrient company, which is uniquely positioned to benefit from fertilizer supply curtailments in China, Europe, Russia and Belarus.

As we enter the second half of the year, we’re excited about our companies’ prospects. Our portfolio consists of innovative companies with durable growth, expanding moats and clean balance sheets. We have conviction that these characteristics position us well for whatever the rest of the year has in store.

Thank you for your investment in the Parnassus Mid Cap Growth Fund.

Yours truly,

Ian E. Sexsmith

Lead Portfolio Manager

Robert J. Klaber

Portfolio Manager

22

Table of Contents

| Semiannual Report • 2022 |  | |||

Ticker: Investor Shares - PRFIX

Ticker: Institutional Shares: PFPLX

As of June 30, 2022, the net asset value (“NAV”) of the Parnassus Fixed Income Fund – Investor Shares was $14.91, producing a loss for the quarter of -6.21% (including dividends). This compares to a loss of -4.69% for the Bloomberg U.S. Aggregate Bond Index (“Bloomberg Aggregate Index”). For the first half of 2022, the Parnassus Fixed Income Fund – Investor Shares posted a loss of -12.47%, as compared to a loss of -10.35% for the Bloomberg Aggregate Index.

Below is a table comparing the performance of the Parnassus Fixed Income Fund with that of the Bloomberg Aggregate. Average annual total returns are for the one-, three-, five- and ten-year periods. For June 30, the 30-day subsidized SEC yield was 3.20%, and the unsubsidized SEC yield was 3.08%.

Parnassus Fixed Income Fund

| Average Annual Total Returns (%) | ||||||||||||||||||||||||

| for period ended June 30, 2022 | ||||||||||||||||||||||||

| One Year | Three Years | Five Years | Ten Years | Gross Expense | Net Expense Ratio | |||||||||||||||||||

| Parnassus Fixed Income Fund – Investor Shares | -12.62 | -1.95 | 0.20 | 0.84 | 0.76 | 0.68 | ||||||||||||||||||

| Parnassus Fixed Income Fund – Institutional Shares | -12.40 | -1.70 | 0.44 | 0.98 | 0.56 | 0.45 | ||||||||||||||||||

| Bloomberg U.S. Aggregate Bond Index | -10.29 | -0.93 | 0.88 | 1.54 | NA | NA | ||||||||||||||||||

The average annual total return for the Parnassus Fixed Income Fund – Institutional Shares from commencement (April 30, 2015) was 0.95%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Fixed Income Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses.

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived.

Returns shown in the table do not reflect the deduction of taxes a shareholder would pay in fund distributions or redemption of shares. The Bloomberg U.S. Aggregate Bond Index (formerly known as the Barclays U.S. Aggregate Bond Index) is an unmanaged index of bonds, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

Net expense ratio reflects contractual agreement through May 1, 2023.

Second Quarter Review

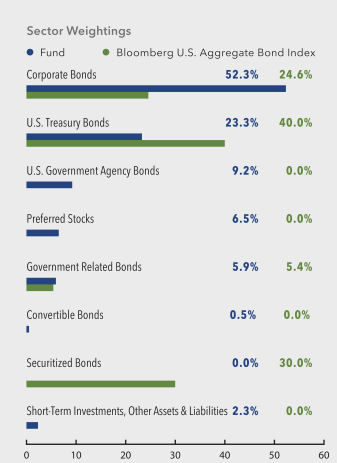

The second quarter continued to be difficult for bond investors, as a combination of rising interest rates and widening corporate bond spreads impacted returns. The Fund’s underperformance was driven by our overweight position in corporate bonds, which fell significantly more than other major fixed income asset classes. Corporate bonds within the Index lost -7.27% versus losses of -4.01% and -3.77% for securitized bonds and Treasuries, respectively.

Overall, allocation reduced the Fund’s value by -1.43%, principally due to our overweight allocation to corporate bonds. While our weight in corporate bonds was reduced from a peak of about 70% to 63.53% over the course of the quarter, it remained significantly higher than the Index at 24.60%. As a result, allocation to corporate bonds reduced the total return by -1.07%. Similarly, the absence of securitized bonds in the Fund reduced our total return by -0.21%.

Security selection continued to be a bright spot this quarter, with a positive 0.19% impact on total return. This was principally from our corporate bond portfolio, which recorded 0.21% of positive security selection. Our corporate bonds lost -6.86% in the quarter, as compared to a loss of -7.27% for the Index. Investing in companies that have more durable cash flows helped our corporate portfolio weather the volatility.

The worst-performing assets in the portfolio during the quarter were preferred stock issued by banks. We have 6.79% of assets allocated to banks, versus 5.55% for the Index, but a much longer duration due to our preferred stock positions. Preferred stock accounts for 6.5% of the portfolio, while the Index has none. This asset tends to be more volatile than investment-grade

23

Table of Contents

| Semiannual Report • 2022 | |||

bonds, but offers significantly higher yields as well. All our preferred stock positions have yields above 5.50%, with many issues boasting yields above 6.00%. The shares we hold were issued by excellent companies, including Morgan Stanley, Charles Schwab and Public Storage. As a result, we’re confident in the long-term advantages of our preferred stock positions.

Government-related securities owned by the fund performed well, adding 0.14% to the total return with 0.13% of positive attribution from selection. This category of bonds is broad, but for the Parnassus Fixed Income Fund, there are two main groups: supranational bonds and government-sponsored entities. About 6% of the Fund’s assets are in green bonds issued by supranational organizations like the World Bank. We were pleased by the outperformance of the green bonds, which added 0.10% to the total return.

We also began investing in bonds issued by government-sponsored entities (GSEs) in the quarter, like Fannie Mae and Freddie Mac. These bonds were trading at bargain prices compared to Treasury bonds, providing us with an attractive buying opportunity. It’s important to note that these are not securitized bonds, which means there are no mortgages supporting repayment. They are the equivalent of corporate bonds issued by organizations like Fannie Mae and the Federal Home Loan Bank. We finished the quarter with 9.16% of assets in GSEs. These bonds provide a yield over 3% with a short duration, which we think is an excellent alternative to certain short-term Treasury bonds.

Parnassus Fixed Income Fund

As of June 30, 2022

(percentage of net assets)

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

The second half of the year is sure to be a very interesting period for investors. Economic conditions have been opaque and continue to be so, as nearly all the data we receive is backward-looking. Headline numbers are also noisy, deeply impacted by inflation.

We believe that headline growth will continue to slow relative to last year’s breakneck pace of 5.7%. The current forecast is for growth of 2.5% overall in 2022, down from an expectation of 4.0% at the beginning of the year. However, one of the biggest factors driving the revisions downward has been the impact of inflation. The growth numbers that are discussed in the media and tracked by investors are real growth rates, which means that the impact of inflation is removed. In a time like today, when consumer inflation exceeds 8%, that means the nominal growth rate is quite strong indeed, and is likely above 9%.

24

Table of Contents

| Semiannual Report • 2022 |  | |||

The Federal Reserve has committed to fighting inflation and demonstrated its commitment during the June meeting, when it raised rates by 0.75%. This was the largest hike since 1994 and indicative of the scope of the problem. Inflation has been partially driven by some supply problems, specific to oil and the invasion of Ukraine, but it’s mostly been driven by excess demand. The Federal Reserve hopes that raising rates and cooling off the economy, destroys some of that demand so that inflation returns to its target range.

While a headline growth rate of 2.5% for 2022 may appear to be a cooler economy, it’s a very different 2.5% growth than we saw in 2015 and 2017. In those years, inflation averaged around 2%, so nominal growth was about 4.5%. Today, nominal growth is nearly 10%, which is driving inflation, and so it’s likely that the Federal Reserve will hike interest rates through the remainder of the year.

As of the end of the quarter, the duration of the Fund declined to 6.08 years, and is now 0.40 years short of the Index. A slightly shorter duration protects the Fund against rising interest rates. Our duration position is short across all asset classes, with the most significant deviation in Treasury bonds. We also trimmed positions in high-yield bonds, as the asset class’s outperformance in the first five months of the year became stretched. High-yield companies have demonstrated excellent balance sheet discipline over the last year and, relative to the past, are very healthy