UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: Parnassus Funds (811-04044) and Parnassus Income Funds (811-06673)

Parnassus Funds

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marc C. Mahon

Parnassus Funds

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: June 30, 2021

Item 1: Report to Shareholders

Parnassus Funds Semiannual Report

June 30, 2021

Parnassus Core Equity FundSM

Investor Shares: PRBLX | Institutional Shares: PRILX

Parnassus Mid Cap FundSM

Investor Shares: PARMX | Institutional Shares: PFPMX

Parnassus Endeavor FundSM

Investor Shares: PARWX | Institutional Shares: PFPWX

Parnassus Mid Cap Growth FundSM

Investor Shares: PARNX | Institutional Shares: PFPRX

Parnassus Fixed Income FundSM

Investor Shares: PRFIX | Institutional Shares: PFPLX

Table of Contents

3

| | | | |

| | |

| | | | Semiannual Report • 2021 |

August 6, 2021

Dear Shareholder,

The second quarter saw stocks continue their upward trend, with all major indexes posting strong returns. For the first six months of the year, the S&P 500, the Russell Midcap and the Russell Midcap Growth Indexes gained 15.25%, 16.25% and 10.44%, respectively. These are fantastic results for just six months. The main catalyst for the stock market’s strength has been optimism about the economy’s continued recovery from the damaging effects of the pandemic. An accommodative Federal Reserve and historically high deficit spending have also stoked investors’ appetite for risk.

Our equity funds have been a mixed bag so far this year, based on performance relative to their benchmarks. On the positive side, our large cap funds have either kept up with the S&P 500 or handily outpaced it. Specifically, our flagship offering, the Parnassus Core Equity Fund – Investor Shares, is up 15.04% year-to-date, and our large cap value fund, the Parnassus Endeavor Fund – Investor Shares, is up a whopping 26.21%. While our two mid-cap funds have had great year-to-date returns in absolute terms, they both lag their respective indexes. I’m confident that the portfolio managers of these funds will turn things around soon based on their long-term track records. The Parnassus Fixed Income Fund – Investor Shares, our lone bond offering, finished the first half within striking distance of its benchmark, after returning a solid 2.52% for the quarter, which was 0.69% better than the Barclays Aggregate Index. Please see the following pages for more detailed information regarding each Fund’s performance and the risks associated with investing in the Funds.

Long-Term Succession Solution

On July 6, Parnassus Investments and Affiliated Managers Group (AMG) announced a definitive agreement to form a new partnership. Upon the closing of the transaction, our founder, Jerome Dodson, and his family will no longer retain any ownership in Parnassus. Certain employees of the firm, including all portfolio managers, will receive long-term incentives in the form of equity ownership. These incentives are meant to encourage our key investment personnel to serve Parnassus Funds shareholders for many years to come.

I’m delighted that we found a long-term succession solution that not only addressed the Dodson family’s desire to transition out of the company, but also included economic incentives to help retain our key investment team leaders. Also important is that AMG will not impose any changes to how Parnassus operates, so you will see no differences in the investment approach or shareholder servicing as a result of this partnership.

This partnership with AMG is a great outcome for Parnassus Fund shareholders and the firm’s employees. We are all excited to close the transaction, but we can’t do it without your help. My fellow Parnassus Funds Trustees and I voted unanimously to approve the new partnership with AMG. The next step is for you to vote on the transaction. Please keep an eye out for your ballot. When you receive it, please vote right away, so we can begin the next chapter in the Parnassus story.

4

| | | | |

| | |

| Semiannual Report • 2021 | | | |  |

New Hires

We added three employees to our team during the second quarter. Hayden Turner is an associate on the Institutional Relations team, where he is responsible for managing relationships with banks, broker dealers, asset owners and consultants. Before joining Parnassus, Mr. Turner was a member of the institutional business development team at PIMCO, where he supported account management teams in both the U.S. and abroad. Mr. Turner earned a bachelor’s degree in business administration with an emphasis in finance from Chapman University. In his free time, Hayden enjoys traveling, skiing and going to the beach.

Nicole Kucewicz joined Parnassus as a consultant in March and was hired as a full-time investment writer in May. Nicole’s background in financial services spans various marketing-related positions at Allianz Global Investors and Fisher Investments. Nicole earned a double bachelor’s degree in political science and liberal arts from Colorado State University. Outside of work, Nicole enjoys CrossFit, various outdoor activities and cooking.

Michael Beck joined the investment team as a Senior Research Analyst. Prior to interning with Parnassus last summer, he worked for Opes Advisors and BNY Mellon. Michael holds the Chartered Financial Analyst (CFA) designation, and he earned an MBA from the UC Berkeley, Haas School of Business, and a bachelor’s degree in mechanical engineering from the University of California, Los Angeles. Michael grew up in Southern California and enjoys basketball, skiing and visiting the beach.

Interns

We have seven interns helping on the investment team this summer. Anu Gupta is an MBA candidate at the Wharton School at the University of Pennsylvania. Previously, Anu worked as a research analyst at Mellon, a Boston-based investment manager, where she covered consumer staples and tech hardware stocks. She graduated with a bachelor of science in economics from The Wharton School at the University of Pennsylvania. Anu grew up in Hong Kong and Boston and enjoys food documentaries, murder mystery novels and rooting for the New England Patriots.

Ben Whitesell is studying business at Michigan State University, where he is the head of education for both the Finance Association and the Alternative Investment Group. Previously, Ben interned at Prudential Financial in the fixed income strategy group and MERS, the Municipal Employees’ Retirement System of Michigan, as an investment analyst. In his free time, Ben enjoys playing hockey, fishing and skiing.

Craig Larkin is pursuing an economics degree from the University of California, Los Angeles. Craig has served as the Vice President of Education for Bruin Value Investing during the past two years, and recently interned at Almitas Capital, a hedge fund in Santa Monica. In his free time, he enjoys skiing, rock climbing and mountain biking.

Joey Fitzgerald is pursuing a dual degree in finance and environmental studies at Tulane University through the Altman Program in International Studies and Business. He previously

5

| | | | |

| | |

| | | | Semiannual Report • 2021 |

worked as an ESG Equity Analyst Intern at CIBC Private Wealth. He enjoys exploring the outdoors, playing sports and watching movies in his free time.

John Bogle is an MBA candidate at The Wharton School at the University of Pennsylvania. Previously, John worked as a Quantitative Equity Research Associate at MFS Investment Management in Boston. John graduated with a degree in economics and certificates (minors) in computer science and finance from Princeton University. John grew up in the Boston area and is an avid fan of basketball and crossword puzzles. He is also a CFA charter holder.

Sydnie Kong is a senior in the World Bachelor in Business program, pursuing three business degrees from the University of Southern California, the Hong Kong University of Science and Technology, and Bocconi University. She previously interned at Alaya Consulting, an ESG advisory firm in Hong Kong. Outside of work, Sydnie enjoys hiking, figure skating and playing the piano.

Christopher Sznip is our ESG research analyst for the summer. While he grew up in Colorado, Christopher attended the Groton School on the East Coast before pursuing an economics degree at Colorado College. For the coming year, he will be participating in the General Course at the London School of Economics. Previously, Christopher worked for Braddock Financials’ fixed income fund in Denver as well as G2M Insights, a boutique consulting firm. In his free time, he enjoys the outdoors, Formula 1, fantasy football and watching movies.

Thank you all for investing with the Parnassus Funds.

Sincerely,

Benjamin E. Allen

President and CEO

Shareholder Meeting Information

This letter is not a solicitation of a proxy from any shareholder of the Parnassus Core Equity Fund, the Parnassus Mid Cap Fund, the Parnassus Endeavor Fund, the Parnassus Mid Cap Growth Fund or the Parnassus Fixed Income Fund. The Funds have filed a definitive proxy statement on Schedule 14A with the Securities and Exchange Commission (SEC) in connection with the special meetings of shareholders to approve new investment advisory agreements and elect seven trustees. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of the Funds’ shareholders to approve the new investment advisory agreements and elect trustees, including, without limitation, the Funds and Parnassus Investments, and a description of the participants’ direct or indirect interests, by security holdings or otherwise, is set forth in the definitive proxy statement. Shareholders may obtain a free copy of the definitive proxy statement and proxy cards and other documents filed by the

6

| | | | |

| | |

| Semiannual Report • 2021 | | | |  |

participants with the SEC at the SEC’s web site at www.sec.gov. The definitive proxy statement and other related SEC documents filed by the participants with the SEC may also be obtained free of charge from the Funds by calling (888) 541-9895. Shareholders are urged to read the definitive proxy statement and proxy cards when they become available, because they will contain important information about the Funds, the participants, the new investment advisory agreements, the nominees, and related matters.

7

| | | | |

| | |

| | | | Semiannual Report • 2021 |

Parnassus Core Equity Fund

Ticker: Investor Shares - PRBLX

Ticker: Institutional Shares - PRILX

As of June 30, 2021, the net asset value (“NAV”) of the Parnassus Core Equity Fund – Investor Shares was $61.61. After taking dividends into account, the total return for the second quarter was a gain of 7.39%. This compares to a total return of 8.55% for the S&P 500 Index (“S&P 500”) and a gain of 5.76% for the Lipper Equity Income Funds Average, which represents the average return of the equity income funds followed by Lipper (“Lipper average”). Year to date, the Parnassus Core Equity Fund – Investor Shares posted a gain of 15.04% versus a return of 15.25% for the S&P 500 and a gain of 15.53% for the Lipper average.

Below is a table that summarizes the performance of the Parnassus Core Equity Fund, the S&P 500 and the Lipper average. The returns are for the one-, three-, five- and ten-year periods. We are pleased to report that the Fund outperformed the S&P 500 and the Lipper average for all time periods.

Parnassus Core Equity Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended June 30, 2021 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

Parnassus Core Equity Fund —

Investor Shares | | | 42.35 | | | | 21.11 | | | | 17.77 | | | | 15.07 | | | | 0.84 | | | | 0.84 | |

| | | | | | |

Parnassus Core

Equity Fund —Institutional Shares | | | 42.64 | | | | 21.38 | | | | 18.02 | | | | 15.30 | | | | 0.62 | | | | 0.62 | |

| | | | | | |

| S&P 500 Index | | | 40.79 | | | | 18.67 | | | | 17.65 | | | | 14.84 | | | | NA | | | | NA | |

| | | | | | |

| Lipper Equity Income Funds Average | | | 38.61 | | | | 12.15 | | | | 11.60 | | | | 10.66 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Core Equity Fund – Institutional Shares from commencement (April 28, 2006) was 12.28%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Core Equity Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2021, Parnassus Investments has contractually agreed to limit total operating expenses to 0.84% of net assets for the Parnassus Core Equity Fund – Investor Shares and to 0.62% of net assets for the Parnassus Core Equity Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2022, and may be continued indefinitely by the Adviser on a year-to-year basis.

Second Quarter Review

The Parnassus Core Equity Fund – Investor Shares earned a return of 15.04% during the first half of 2021, slightly less than the 15.25% return for the S&P 500. The first half of the year was highlighted by soaring economic growth and the stock market hitting all-time highs. During the second quarter, the Fund returned 7.39% versus the S&P 500’s gain of 8.55%. Stock selection, as opposed to sector allocations, subtracted 88 basis points during the second quarter, accounting for most of the underperformance. (One basis point is 1/100th of one percent.)

The Fund’s top three detractors were led by Fiserv, the payments and financial technology provider. The stock trimmed the Fund’s return by 27 basis points, as it returned -10.2%.* Investors were hoping for clearer signs of Fiserv’s business accelerating as the global economy reopens. We believe the company is executing well and showing strong sales momentum and operating discipline, while making the appropriate investments in innovation. The shares continue to trade at an attractive price that should reward patient shareholders.

Farm equipment provider John Deere was our second largest detractor. While Deere delivered yet another strong earnings quarter with many positive long-term drivers, the stock trimmed the Fund’s return by 21 basis points, as it returned -5.5%. Despite the company’s impressive execution, the stock fell along with agricultural commodity prices. While commodity prices may have taken a breather after a big run, we believe the long-term future for Deere remains bright due to its market-leading position and continuous innovation, which drive significant pricing power.

*For this report, we quote total return to the portfolio, which includes price change and dividends.

8

| | | | |

| | |

| Semiannual Report • 2021 | | | |  |

Semiconductor manufacturer Intel returned -11.8% and subtracted 13 basis points from the Fund’s return. The company delivered better-than-expected results overall, but showed weakness in its datacenter segment, a key area of investor scrutiny. Intel is a turnaround story, and there may be bumps along the road. We believe the assets the company has amassed over decades of innovation present significant optionality that should eventually benefit the stock at these levels.

The Fund’s top three winners were headlined by NVIDIA, a leading provider of advanced computer chips, which added 99 basis points to the Fund’s return, with a 49.9% gain. The company’s pace of innovation is accelerating at a time when its solutions are becoming increasingly important to the digital economy. NVIDIA’s strong results and forward guidance are supported by favorable trends in gaming, datacenter servers and, most recently, cryptocurrency mining. Lastly, the company is making progress on closing its acquisition of Arm, a strategic asset in the semiconductor ecosystem.

Microsoft returned 15.2%, contributing 84 basis points to the Fund’s return. The company continues to execute well across its business segments, especially Azure, which is gaining share and delivering against high expectations. Microsoft also agreed to acquire Nuance Communications, a provider of heath care software that is built on Azure, adding yet another driver of future growth.

Danaher, a large-cap life sciences tools company, returned 19.3% and contributed 70 basis points to the Fund’s performance. Danaher shares moved higher throughout the quarter as its core biopharma and industrial end-markets rebounded faster than expected. The company also announced an exciting deal, using the cash generated from COVID-19 testing and vaccine production to double-down on the business’s widest moat and fastest-growing end-market: bioprocessing. The announcement of the Aldevron acquisition on June 17 caused the stock to rally, as this partnership further accelerates Danaher’s organic growth and puts the company in a prime position to supply the advanced tools necessary to manufacture the upcoming wave of next-generation therapies.

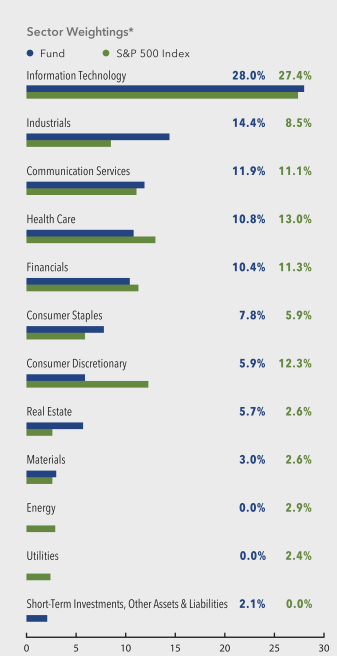

Parnassus Core Equity Fund

As of June 30, 2021 (percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

9

| | | | |

| | |

| | | | Semiannual Report • 2021 |

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Microsoft Corp. | | | 6.2% | |

| |

| Alphabet Inc., Class A | | | 4.8% | |

| |

| Danaher Corp. | | | 4.1% | |

| |

| Comcast Corp., Class A | | | 4.0% | |

| |

| CME Group Inc., Class A | | | 4.0% | |

| |

| Deere & Co. | | | 3.2% | |

| |

| S&P Global Inc. | | | 3.2% | |

| |

| The Charles Schwab Corp. | | | 3.2% | |

| |

| FedEx Corp. | | | 3.1% | |

| |

| Becton Dickinson and Co. | | | 3.0% | |

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

U.S. GDP is expected to grow more than 10% during the second quarter, making it one of the strongest quarterly growth rates since 1978. However, most forecasts call for the pace of economic growth to slow in the third quarter and to decelerate over the next several quarters as the tailwinds from monetary and fiscal stimulus begin to wane.

The Federal Reserve will likely outline a rough timeline for reducing its $120 billion in monthly purchases of Treasuries and mortgage-backed securities. Meanwhile, the economic benefit of the roughly $5 trillion in government support provided since the onset of the pandemic is also peaking. As a result, we feel that many of the current inflationary pressures may prove to be transitory, as unsustainable economic drivers begin to fade and some of the current supply-chain issues causing shortages correct themselves.

As economic growth begins to slow, investors may need to recalibrate their elevated earnings expectations for many companies. These types of transitions can often result in increased volatility and a heightened chance of a stock market correction.

We believe the Fund is well positioned, as our focus on high-quality companies with secular growth drivers and lower cyclicality will likely outperform as overall economic growth slows. However, unprecedented economic and social disruption has been met with an unprecedented amount of government intervention, so

the range of economic outcomes remains wide. As such, we continue to prefer companies like Microsoft, Danaher and Comcast that add both offensive and defensive characteristics to the Fund.

Moving to the portfolio, this quarter we sold our position in Amazon. During the pandemic, Amazon’s stock did very well, as the company shipped essential goods and groceries to consumers. The challenges of operating during the pandemic, however, fell on Amazon’s workers. Amazon did compensate them with increased wages and bonuses and invested billions of dollars in personal protective equipment (PPE), testing, and sanitation, but workplace and working conditions have nevertheless persisted as major concerns. We decided to sell Amazon, as the labor concerns, especially after the Bessemer union vote, created higher risk for the company. We feel that our capital can be better deployed elsewhere in companies with similar drivers that we already own, like Microsoft and Alphabet (the parent company of Google), and our newest position, Nike.

Nike is a unique retail company, with growing businesses in a number of attractive product categories. They also boast an incredibly valuable set of brands and robust global distribution assets and supply chains. We believe that Nike has a long runway for growth, both internationally and through its higher-margin online and direct-to-consumer business. Earlier this quarter, we had the opportunity to buy Nike at a discount, due primarily to an ongoing boycott in China that we expect to be resolved.

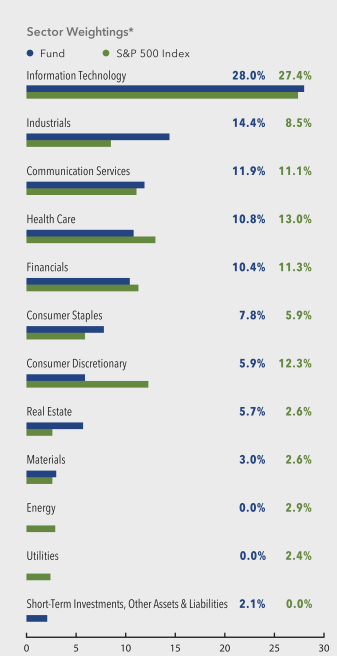

Moving next to our sector positioning, the Fund’s largest sector exposure remains information technology, which we are slightly overweight relative to the benchmark. We have a long-term view that companies such as Microsoft, NVIDIA, Mastercard, Applied Materials, Texas Instruments and Adobe represent increasingly essential and valuable building blocks in the global economy. That said, there are widespread reports about shortages in the chip sector. While that news validates the importance of these companies to the global economy, it could also indicate that we’re nearing a cyclical peak. As a result, we continued to trim our exposure to semiconductors, and technology overall, to more modestly overweight positions.

10

| | | | |

| | |

| Semiannual Report • 2021 | | | |  |

The Fund remains overweight the industrials sector, headlined by John Deere, FedEx and water infrastructure companies Pentair and Xylem. This sector offers the portfolio participation in the economic building blocks of agriculture, logistics and water infrastructure.

The Fund remains overweight high-quality consumer staples companies such as Procter & Gamble and snack-food manufacturer Mondelez. We are attracted to the defensive characteristics of these businesses, as well as their exposure to faster-growing emerging markets. We remain overweight the real estate sector, headlined by American Tower, the largest global owner of cell phone towers. We’re excited about its secular growth prospects, which are driven by the rollout of 5G and the growing usage of mobile data.

We’re slightly overweight the materials sector, which consists solely of our investment in industrial gas manufacturer Linde. We also moved to an overweight position in communication services by adding to our Alphabet holdings.

The Fund is slightly underweight the financials sector, with a focus on businesses with high returns on capital that have secular growth drivers and minimal credit risk. The Fund owns CME Group, the leading global derivatives exchange; S&P Global, the premier financials database company; and Charles Schwab, the well-known brokerage and wealth management firm.

We remain underweight, in health care due to our limited exposure to the pharmaceutical sector. Within

health care, our focus is on life sciences and medical devices, and we own wide-moat companies such as Danaher and Becton Dickinson. The Fund also remains underweight the consumer discretionary sector, after selling Amazon and initiating a modest position in Nike.

The Fund continues to maintain zero exposure to the energy sector due to our fossil fuel-free mandate. We also have no utility investments due to our concerns about climate change, increased regulations and the risk of asset impairment.

We are pleased that the Fund delivered a solid return for the first half of 2021. As always, we are honored to have your trust as we strive to continue delivering Principles and Performance®.

Sincerely,

Todd C. Ahlsten

Lead Portfolio Manager

Benjamin E. Allen

Portfolio Manager

11

| | | | |

| | |

| | | | Semiannual Report • 2021 |

Parnassus Mid Cap Fund

Ticker: Investor Shares - PARMX

Ticker: Institutional Shares - PFPMX

As of June 30, 2021, the net asset value (“NAV”) of the Parnassus Mid Cap Fund – Investor Shares was $44.54, so the total return for the quarter was a gain of 5.87%. This compares to a gain of 7.50% for the Russell Midcap Index (“Russell”) and a gain of 5.25% for the Lipper Mid-Cap Core Funds Average, which represents the average return of the mid-cap core funds followed by Lipper (“Lipper average”). For the first half of 2020, the Parnassus Mid Cap Fund - Investor Shares is up 9.22% compared to a gain of 16.25% for the Russell and a gain of 16.83% for the Lipper average.

Below is a table comparing the Parnassus Mid Cap Fund with the Russell and the Lipper average for the one-, three-, five- and ten-year periods.

Parnassus Mid Cap Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended June 30, 2021 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

Parnassus Mid Cap Fund —

Investor Shares | | | 36.92 | | | | 14.10 | | | | 13.32 | | | | 12.23 | | | | 0.98 | | | | 0.98 | |

| | | | | | |

Parnassus Mid Cap Fund —

Institutional Shares | | | 37.20 | | | | 14.36 | | | | 13.57 | | | | 12.39 | | | | 0.76 | | | | 0.75 | |

| | | | | | |

| Russell Midcap Index | | | 49.80 | | | | 16.45 | | | | 15.62 | | | | 13.24 | | | | NA | | | | NA | |

| | | | | | |

| Lipper Mid-Cap Core Funds Average | | | 48.94 | | | | 12.57 | | | | 12.67 | | | | 10.60 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Mid Cap Fund – Institutional Shares from commencement (April 30, 2015) was 12.12%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Mid Cap Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Midcap Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Mid-cap companies can be more sensitive to changing economic conditions and have fewer financial resources than large-cap companies.

The estimated impact of individual stocks on the Fund’s performance is provided by Fact Set.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2021, Parnassus Investments has contractually agreed to limit total operating expenses to 0.98% of net assets for the Parnassus Mid Cap Fund – Investor Shares and to 0.75% of net assets for the Parnassus Mid Cap Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2022, and may be continued indefinitely by the Adviser on a year-to-year basis.

Second Quarter Review

The Russell posted its fifth straight quarterly gain in the second quarter, capping a tremendous rally that has generated a 115% return since the pandemic-induced trough in March of 2020. The Russell’s year-to-date return is remarkable, as it’s one of the strongest in the past 20 years. Investor confidence in the “reopening trade” was supported by the central bank’s continued accommodative policy, robust fiscal stimulus and continued COVID-19 vaccine deployment and efficacy against emerging virus variants.

During the quarter, it was challenging for our higher-quality, lower-beta portfolio to keep up with the Russell. The Parnassus Mid Cap Fund – Investor Shares returned 5.87% during the second quarter, which captured 78% of the Russell’s 7.50% return. We’re pleased with the Fund’s absolute quarterly return but are disappointed that we fell behind the rocketing Russell. On a more positive note, the Fund beat its Lipper peers by 62 basis points during the quarter. (One basis point is 1/100th of one percent.)

The Fund’s performance during the quarter was almost exclusively the result of stock selection rather than sector allocation. The worst performer was SelectQuote, a direct-to-consumer insurance distribution platform that takes little-to-no capital risk. The stock subtracted 71 basis points from the Fund’s return, as its total return was negative 34.7%.* The shares slid after the company lowered its annual earnings guidance and disclosed that the retention rate of its 2019 Medicare Advantage cohort was lower than it expected. Despite the recent weakness, we believe SelectQuote is poised to benefit from the growth in Medicare enrollment and the shift toward virtual insurance sales. We added to our position on the weakness.

* For this report, we quote total return to the portfolio, which includes price change and dividends.

12

| | | | |

| | |

| Semiannual Report • 2021 | | | |  |

Hologic, a leading medical device manufacturer of mammography, surgical and diagnostics equipment, subtracted 32 basis points from the Fund’s performance, with a total return of negative 10.3%. While Hologic’s core diagnostics business met expectations, COVID-19 testing continued its decline, hurting both revenue growth and margins. We are optimistic that Hologic will allocate a portion of its COVID-19 testing profits into accretive higher-growth acquisitions and share repurchases which will result in excess returns. We also believe recent, robust placements of the company’s Panther automated assay system will fuel Hologic’s diagnostic segment testing revenue even without the COVID-19 catalyst. We took advantage of the recent weakness to add shares at a discounted valuation.

Grocery Outlet, the “off-price grocer,” delivered a total return of negative 6.0%, subtracting 16 basis points from the Fund’s performance. The stock fell after management disclosed a slight shortfall in the upcoming quarter’s same-store sales growth rate. The company experienced tough comparisons from a year ago, when same-store sales grew 17% through the first half of 2020 and customers consolidated shopping trips, favoring larger box retailers. We believe these headwinds are transitory and expect sentiment to improve. We’re also excited about the opportunity for Grocery Outlet to grow its store base at a double-digit clip and gain grocery share.

On the positive side, the largest contributor was Nuance Communications, a leading cloud-based voice and analytics software applications provider used by health care professionals and call centers. The stock added 75 basis points to the Fund’s return, as its total return was 24.8%. The shares jumped after the company announced an agreement to be acquired by Microsoft in an all-cash transaction valued at $19.7 billion, implying a 23% premium to the prior day’s closing price. The deal is expected to close by year-end.

Avantor, a life sciences tools company, returned 22.7% and contributed 46 basis points to the Fund’s performance. Avantor’s shares rose as its core biopharma and applied end-markets rebounded faster than expected. With excess profits from its COVID-19- related businesses, the company also announced two wide-moat acquisitions in the bioprocessing arena. Investor sentiment moved even higher after the FDA

approved Biogen’s controversial Alzheimer’s therapy. This news is not only exciting for six million potential patients, but also for the bioprocessing industry, as Avantor supplies critical ingredients required to develop this new complex therapy.

Our third big winner was Republic Services, which added 41 basis points to the Fund’s performance, as the stock’s total return was 11.2%. The company reported better-than-expected earnings driven by increased volumes and strong margins from cost control initiatives. Management also raised its annual earnings outlook, as the company is expected to benefit from improved pricing across its business segments and higher volumes. We believe the company will further benefit from a high degree of revenue visibility resulting from its multi-year contracts, a robust pipeline of tuck-in deals and additional margin expansion.

13

| | | | |

| | |

| | | | Semiannual Report • 2021 |

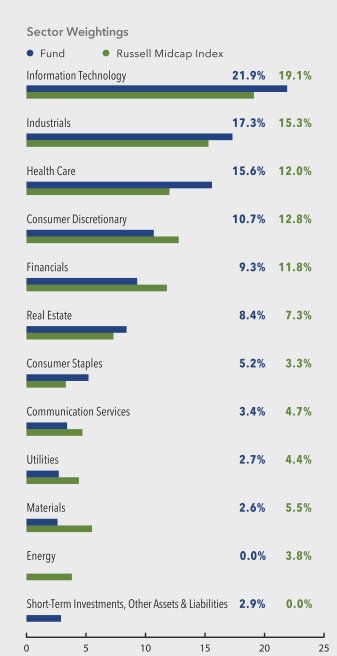

Parnassus Mid Cap Fund

As of June 30, 2021

(percentage of net assets)

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Republic Services Inc. | | | 4.2% | |

| |

| Hologic Inc. | | | 3.4% | |

| |

| Trimble Inc. | | | 3.1% | |

| |

| Jack Henry & Associates Inc. | | | 3.0% | |

| |

| Cerner Corp. | | | 2.9% | |

| |

| Burlington Stores Inc. | | | 2.8% | |

| |

| Roper Technologies Inc. | | | 2.8% | |

| |

| O’Reilly Automotive Inc. | | | 2.8% | |

| |

| Teleflex Inc. | | | 2.8% | |

| |

| Pentair plc | | | 2.8% | |

Portfolio characteristics and holdings are subject to change periodically.

Strategy and Outlook

Five quarters past the market’s COVID-19-induced low, investor optimism continues full steam ahead, buoyed by the reopening of the domestic and world economies, corporate out performance and generous fiscal and monetary policy support. There’s a lot to be excited about, but we remain ever aware of a wide range of outcomes in our market outlook.

The Fund strives to participate robustly when times are good, like now, but one of our primary goals is to position the Fund to do well when times are tough. In the current environment, our attention is very much on the potential for Fed tapering, the inflation outlook, especially in the energy sector, margin headwinds from high input costs, China economic and foreign policy and virus vaccination and variant trends. We are also spending quite a bit of time considering the level of peak corporate performance and valuation. Regarding the latter, it’s noteworthy that the Russell is now trading just below its peak 20-year forward price-to-earnings multiple.

While our core style has recently been a bit out of favor as managers and retail investors have seesawed between growth and value, and meme stocks and quality and reopening trades, we are confident the Fund will hold its own over the long term. With this backdrop, our high-conviction, concentrated, high-quality, low-beta strategy seems especially relevant given the potential volatility ahead. We continue to manage the strategy for full market cycles and believe the best way to do this is to own companies with

14

| | | | |

| | |

| Semiannual Report • 2021 | | | |  |

increasing relevancy, significant competitive advantages, astute managers and solid ESG principles.

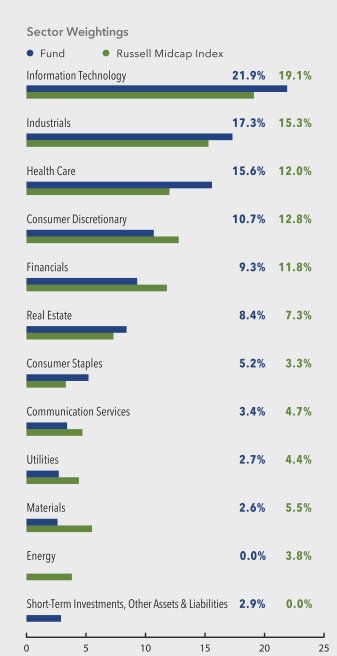

As a reflection of our bottom-up research process, the Fund is underweight in the more cyclical consumer discretionary, financials and materials sectors relative to the Russell, and has no exposure to the energy sector, per our fossil-fuel-free prospectus mandate. In contrast, we are slightly overweight in the information technology sector, health care, consumer staples, real estate and industrials sectors, owning to a combination of defensive and offensive high-quality companies that meet our rigorous process and, in our opinion, are positioned to offer good downside protection in the event of a market decline.

Following an active buying period in the first quarter, we bought only one new stock this quarter. We initiated a position in Broadridge Financial, a leading provider of investor communication services and third-party trade processing services. As the dominate player in proxy and interim investor communications for broker/dealers for more than 20 years, the company has significant cost advantages due to its significant scale and high switching costs with high client retention rates. We’re excited about the company’s long-term growth prospects as it benefits from a broader participation by retail investors, outsourcing of trade processing technology and margin expansion opportunities.

We exited five stocks in the second quarter, primarily due to excessive market cap and merger activity. We sold Kansas City Southern after the company announced that it would be acquired. We’re sorry to lose such a high-quality name, but believe the arbitration-related upside isn’t enough to maintain our position. We also sold our remaining shares of Maxim Integration due to its pending merger with Analog Device Integrated. We exited Autodesk, a leading

provider of design software. We bought the stock after the steep market decline of early 2020, and its subsequent 91% gain from our average cost, along with its market capitalization rise to over $66 billion, provoked our sell. Similar to Autodesk, we sold FedEx, as the company’s market capitalization sky-rocketed to over $80 billion, and it no longer fits with our mid cap mandate. Finally, we sold MDU Resources, a conglomerate of construction materials, construction services, utility and pipeline businesses. While the company has benefited recently from robust demand in its construction businesses, we believe the stock is fully valued and will likely remain at a discount to its peers due to its conglomerate structure and the slow adoption of renewables by its utility business.

Despite our underperformance this past quarter, we’re confident that our investment process will lead to strong risk-adjusted returns over the full market cycle. Our portfolio holdings have strong business prospects and attractive risk-reward profiles based on our long-term investment horizon.

Thank you for your investment in the Parnassus Mid Cap Fund.

Yours truly,

Matthew D. Gershuny

Lead Portfolio Manager

Lori A. Keith

Portfolio Manager

15

| | | | |

| | |

| | | | Semiannual Report • 2021 |

Parnassus Endeavor Fund

Ticker: Investor Shares - PARWX

Ticker: Institutional Shares - PFPWX

As of June 30, 2021, the net asset value (“NAV”) of the Parnassus Endeavor Fund – Investor Shares was $60.97, so the total return for the quarter was 8.01%. This compares to a gain of 8.55% for the S&P 500 Index (“S&P 500”) and 5.61% for the Lipper Multi-Cap Value Funds Average, which represents the average return of the multi-cap value funds followed by Lipper (“Lipper average”). The Fund lagged the S&P 500, but beat our Lipper peers by over 200 basis points. (One basis point is 1/100th of one percent.) Longer-term, the Parnassus Endeavor Fund is well ahead of both benchmarks for all time periods (one-, three-, five- and ten-year periods). See the table below for the details.

Parnassus Endeavor Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended June 30, 2021 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Endeavor Fund – Investor Shares | | | 74.28 | | | | 23.22 | | | | 21.48 | | | | 17.53 | | | | 0.94 | | | | 0.94 | |

| | | | | | |

| Parnassus Endeavor Fund – Institutional Shares | | | 74.59 | | | | 23.51 | | | | 21.74 | | | | 17.69 | | | | 0.73 | | | | 0.71 | |

| | | | | | |

| S&P 500 Index | | | 40.79 | | | | 18.67 | | | | 17.65 | | | | 14.84 | | | | NA | | | | NA | |

| | | | | | |

| Lipper Multi-Cap Value Funds Average | | | 47.78 | | | | 11.74 | | | | 12.34 | | | | 10.73 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Endeavor Fund – Institutional Shares from commencement (April 30, 2015) was 17.65%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Endeavor Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2021, Parnassus Investments has contractually agreed to limit total operating expenses to 0.94% of net assets for the Parnassus Endeavor Fund – Investor Shares and to 0.71% of net assets for the Parnassus Endeavor Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2022, and may be continued indefinitely by the Adviser on a year-to-year basis.

Second Quarter Review

Three companies each reduced the Fund’s return by more than 10 basis points, while three companies each increased the Fund’s return by 60 basis points or more.

Semiconductor manufacturer Intel was the Fund’s biggest detractor this quarter. It cut 53 basis points from the Fund’s return, as its stock sank from $64.00 to $56.14, for a total return of negative 11.8%.* The company delivered better-than-expected results overall, but showed weakness in their datacenter segment, which is a key area of scrutiny. Intel is a turnaround story that will take multiple quarters. We believe the new CEO and the assets the company has amassed over decades of innovation present significant options that should eventually benefit the stock at these levels.

Memory-chip maker Micron subtracted 29 basis points from the Fund, as its stock fell from $88.21 to $84.98, for a total return of negative 3.7%. Pricing and demand for memory remained strong across all key markets, but Micron’s stock underperformed due to expectations for slowing volume growth and higher costs from more advanced and expensive chips. We continue to believe in the long-term technology trends across all sectors such as enterprise, mobile, data centers, and auto that drive demand for Micron’s memory chips.

Apparel manufacturer Hanesbrands subtracted 13 basis points from the Fund’s return, as its stock slipped from $19.67 to $18.67, for a total return of negative 4.4%. Despite strong innerwear and activewear sales during the first quarter, management tempered its earnings expectations for the remainder of the year, reflecting higher incremental brand

* For this report, we quote total return to the portfolio, which includes price change and dividends.

16

| | | | |

| | |

| Semiannual Report • 2021 | | | |  |

investments and the exit of its European innerwear business. Management also provided more details on its new strategy, which is directed towards a more streamlined and performance-driven company. This includes reducing product assortment, exiting underperforming businesses, and embracing a more consumer-centric approach.

Our biggest winner was Capital One Financial. It contributed 67 basis points to the Fund’s return, as the stock jumped from $127.23 to $154.69, for a total return of 21.9%. Capital One is best known for its credit card business, but it offers a wide range of financial products and services to consumers, small businesses, and commercial customers. The stock soared after the company posted its third consecutive quarter of record profits, driven by the exceptionally strong credit profile of its customer base. A combination of government stimulus, loan forbearance, and fewer opportunities to spend doubled savings rates for the average consumer, benefitting Capital One by nearly eliminating bad debt.

Biopharmaceutical company Biogen added 61 basis points to the Fund’s return, as its stock surged from $279.75 to $346.27, for a total return of 23.8%. Biogen develops drugs that treat neurological and neurogenerative disease, including multiple sclerosis and spinal muscular atrophy. The stock soared 40% after the FDA approved Biogen’s experimental Alzheimer’s treatment. More than one hundred other Alzheimer’s drugs have failed in clinical trials over the past 20 years, so the decision is as historic as it is controversial. Investors cheered the breakthrough, which offered new hope to patients and opened a large new frontier for the company.

Credit card issuer Discover Financial increased the Fund’s return by 60 basis points, as its stock leapt from $94.99 to $118.29, for a total return of 25.0%. Discover is a digital bank and payment services company. It offers a variety of consumer banking products and operates one of the largest payment networks. Like Capital One, Discover benefitted from an extremely favorable consumer credit environment. The company’s charge-off rates were significantly below pre-pandemic levels and remained low month after month. Lower credit losses, combined with higher efficiency and cost controls at the company, resulted in explosive profits for investors.

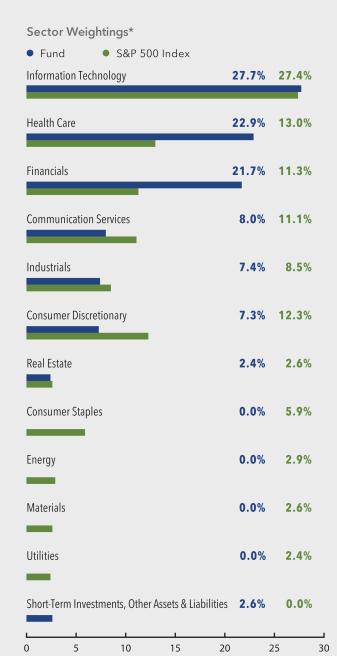

Parnassus Endeavor Fund

As of June 30, 2021

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

17

| | | | |

| | |

| | | | Semiannual Report • 2021 |

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| The Charles Schwab Corp. | | | 4.4% | |

| |

| Verizon Communications Inc. | | | 3.9% | |

| |

| Intel Corp. | | | 3.4% | |

| |

| Cisco Systems Inc. | | | 3.2% | |

| |

| Biogen Inc. | | | 3.2% | |

| |

| FedEx Corp. | | | 3.1% | |

| |

| Western Digital Corp. | | | 3.0% | |

| |

| Agilent Technologies Inc. | | | 3.0% | |

| |

| Hanesbrands Inc. | | | 2.8% | |

| |

| Gilead Sciences Inc. | | | 2.7% | |

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

In the second quarter, the stock market posted gains that exceeded those achieved in the first quarter of the year. This acceleration of returns shows just how powerful the U.S. economic recovery has been coming out of the COVID-19 pandemic. The rise in stock prices has also been remarkably steady. Only reports of higher-than-expected inflation and fears of an early hike in interest rates perturbed markets. By the end of June, investors had all but forgotten these worries, and stocks continued their march to all-time highs.

There is a flip side, however, to ever-increasing stock prices. One concern today is that both stocks and bonds appear overvalued based on historical norms. Smoothly ascending markets also invite investor complacency. Vivid imaginations are required to grasp the potential of some of the market’s highest-flying darlings.

How should one pick stocks in this environment? One very common approach is to go with the flow, or basically buy expensive stocks with captivating stories in the hope that one can sell those stock with an even

better story at a higher price. Conversely, one can go against the tide, doing the difficult work of buying undervalued stocks and generating returns by selling them at a fair price. The Parnassus Endeavor Fund unquestionably embraces this latter philosophy. Our job is to construct a portfolio of high-quality and socially responsible companies trading at discounted prices. The Fund’s exceptional performance over multiple market cycles has been the investor’s reward.

The Fund made new investments in the period. Simon Property Group operates premium malls and outlets that are poised to benefit from renewed tourism and the retail relief boom. Becton Dickinson is a medical technology company that provides equipment and supplies critical to the increase in elective health care procedures. Vertex Pharmaceuticals is the market leader in cystic fibrosis therapies. These companies stand out not only on the merits of their business fundamentals, but also for their undervaluation relative to the broader stock market.

We are bottom-up fundamental stock pickers, but equally, I monitor and manage risk at the portfolio level. I am happy to report that tracking error for the Fund has been cut in half compared to the end of 2020. This means the Fund should provide substantially more consistency versus the benchmark going forward, with the goal of improving risk-adjusted returns.

Thank you for your investment in the Parnassus Endeavor Fund.

Yours truly,

Billy Hwan

Portfolio Manager

18

| | | | |

| | |

| Semiannual Report • 2021 | | | |  |

Parnassus Mid Cap Growth Fund

Ticker: Investor Shares - PARNX

Ticker: Institutional Shares - PFPRX

As of June 30, 2021, the net asset value (“NAV”) of the Parnassus Mid Cap Growth Fund – Investor Shares was $66.12, resulting in a gain of 6.66% for the second quarter. This compares to an increase of 11.07% for the Russell Midcap Growth Index (“Russell Midcap Growth”) and a 9.50% increase for the Lipper Multi-Cap Growth Funds Average, which represents the average multi-cap growth funds followed by Lipper (“Lipper average”).

Below is a table that summarizes the performance of the Parnassus Mid Cap Growth Fund, Russell Midcap Growth, S&P 500 and Lipper average. We completed the transition to a mid cap growth strategy on May 15, 2020, so we’re keeping the S&P 500, our old index, in the table for historical context. The returns are for the one-, three-, five- and ten-year periods ended June 30, 2021.

Parnassus Mid Cap Growth Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended June 30, 2021 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

Parnassus Mid Cap Growth Fund –

Investor Shares | | | 36.99 | | | | 18.46 | | | | 16.78 | | | | 14.67 | | | | 0.83 | | | | 0.83 | |

| | | | | | |

Parnassus Mid Cap Growth Fund –

Institutional Shares | | | 37.22 | | | | 18.64 | | | | 16.95 | | | | 14.77 | | | | 0.68 | | | | 0.68 | |

| | | | | | |

Russell Midcap

Growth Index | | | 43.77 | | | | 22.39 | | | | 20.53 | | | | 15.13 | | | | NA | | | | NA | |

| | | | | | |

| S&P 500 Index | | | 40.79 | | | | 18.67 | | | | 17.65 | | | | 14.84 | | | | NA | | | | NA | |

| | | | | | |

| Lipper Multi-Cap Growth Funds Average | | | 43.32 | | | | 23.32 | | | | 22.16 | | | | 15.72 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Mid Cap Growth Fund – Institutional Shares from commencement (April 30, 2015) was 12.80%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Mid Cap Growth Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Mid Cap Growth and S&P 500 are unmanaged indexes of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2021, Parnassus Investments has contractually agreed to limit total operating expenses to 0.83% of net assets for the Parnassus Mid Cap Growth Fund – Investor Shares and to 0.68% of net assets for the Parnassus Mid Cap Growth Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2022, and may be continued indefinitely by the Adviser on a year-to-year basis. Prior to May 1, 2021, the benchmark for the Parnassus Mid Cap Growth Fund (formerly known as the Parnassus Fund) was the S&P 500 Index.

Second Quarter Review

The Parnassus Mid Cap Growth Fund - Investor Shares rose 6.66% in the second quarter, trailing the 11.07% rise of the Russell Midcap Growth. After a brief intra-quarter swoon, the index rebounded to hit an all-time high. Our Fund trailed as companies that are growing quickly, but are unprofitable and expensive, led the way higher this quarter. While sector allocation was a minor drag on our performance this quarter, stock selection accounted for most of the underperformance. This was a disappointing quarter for our Fund, following a strong first quarter. While the Fund is now trailing the Russell Midcap Growth for the year, we believe that our diversified portfolio of economically resilient businesses with expanding moats, increasing relevancy and positive environmental, social and governance characteristics should outperform the index over the long-term.

Our worst performer was insurance broker SelectQuote, as its shares fell 34.7%* and cut the Fund’s performance by 68 basis points. (One basis point is 1/100th of one percent.) SelectQuote’s shares stumbled after the company lowered its annual earnings guidance and stated that the retention rate of its 2019 Medicare Advantage cohort was lower than it had previously expected. We’re disappointed in the guidance cut, but we believe that management has now tweaked its strategy to improve retention. With the secular tailwind of an aging population of tech-savvy consumers behind it, we believe SelectQuote’s independent, full-service and remote brokerage offerings should generate strong growth for years to come. We added to our position on the weakness.

Silvergate Capital was our biggest winner last quarter, and it gave back some of those gains this

* For this report, we quote total return to the portfolio, which includes price change and dividends.

19

| | | | |

| | |

| | | | Semiannual Report • 2021 |

quarter. The shares dropped by 20.3%, lowering the Fund’s return by 38 basis points. The stock fell along with the prices of digital assets like bitcoin, as investors worried that Silvergate’s customer deposits and transfer activity on its real-time payments network could fall, too. Nonetheless, during the quarter, Silvergate announced that it will be the exclusive issuer of Diem, the stablecoin project backed by Facebook, Shopify and many others. We believe that Diem has the potential to be transformational to Silvergate’s earnings, and we expect many more partnerships and new product offerings as the digital asset ecosystem evolves.

nCino, a bank software provider, reduced the Fund’s return by 38 basis points as the stock declined 25.4% to our average selling price during the quarter. The stock fell as investors worried that its revenue growth could decelerate this year. We sold nCino and redeployed the proceeds into Guidewire, a software provider for insurers, which we believe offers a better risk-reward profile.

Moving on to happier subjects, our best-performing stock during the quarter was IDEXX Laboratories, the leading pet diagnostics company. IDEXX contributed 94 basis points to the Fund’s return, as the stock rose 29.1%. IDEXX reported quarterly earnings that were well above expectations and increased its guidance for the full year. IDEXX is a COVID-19 beneficiary and a market leader that expects to maintain its business at the new, higher level going forward. Over the past year, many of us welcomed new pets or spent more time with our current pets, which has led to a greater focus on pet well-being. Vet diagnostics usage continues to increase, and as the innovation leader in the pet diagnostics market, IDEXX is very well positioned.

Pool distributor Pool Corp. added 92 basis points to the Fund’s return, as its stock jumped 33.1%. Pool Corp. reported an outstanding quarter, highlighted by 51% organic sales growth and a 30% increase to its annual earnings guidance. Similar to IDEXX, Pool Corp. is a COVID-19 beneficiary, as we all spent more time at home over the past year and many people invested in new pools or upgraded their existing ones. The company is showing no signs of slowing down, as demand remains high and management is executing with precision on its opportunity to gain market share and build on its leadership position in a fragmented industry.

Illumina, the largest provider of gene sequencing instruments and related consumables, boosted the Fund’s return by 76 basis points, as its shares climbed 23.2%. After a challenging 2020 due to COVID-19 lockdowns, both clinical and research customers now exceed pre-COVID-19 levels, as Illumina’s business has rebounded with tremendous momentum. The company has also established a durable and growing COVID-19 surveillance business, which should help countries around the world fight future COVID-19 outbreaks.

20

| | | | |

| | |

| Semiannual Report • 2021 | | | |  |

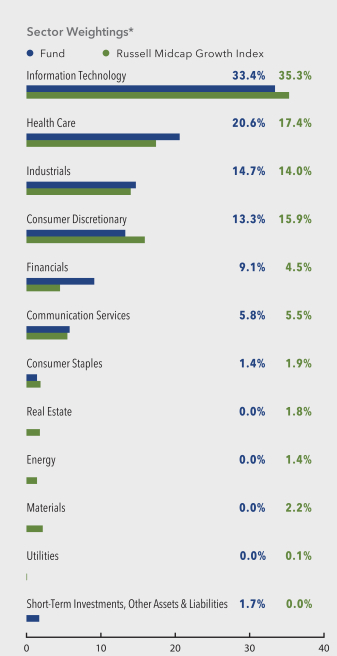

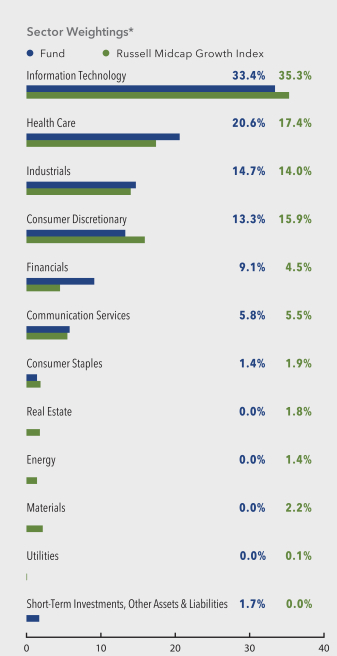

Parnassus Mid Cap Growth Fund

As of June 30, 2021

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Agilent Technologies Inc. | | | 4.1% | |

| |

| IDEXX Laboratories Inc. | | | 3.9% | |

| |

| Synopsys Inc. | | | 3.7% | |

| |

| Illumina Inc. | | | 3.6% | |

| |

| Burlington Stores Inc. | | | 3.6% | |

| |

| Cadence Design Systems Inc. | | | 3.6% | |

| |

| Pool Corp. | | | 3.6% | |

| |

| O’Reilly Automotive Inc. | | | 3.2% | |

| |

| Old Dominion Freight Lines Inc. | | | 3.2% | |

| |

| Western Digital Corp. | | | 3.1% | |

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

The Russell Midcap Growth Index roared back from a greater than 9% intra-quarter drop from late April to early May to generate an impressive 11.07% gain and end the quarter pushing new all-time highs. That was the second time this year that the index fell by more than 9%, but both times the index came back with a vengeance. The recent large swings in growth stocks reflects the cross currents presently in the market.

On the one hand, as the country has re-opened from COVID-19 lockdowns, economic growth has been robust. After being stuck at home for a year, and with millions of Americans receiving stimulus checks, the American consumer is mentally ready and monetarily able to spend. According to estimates from Moody’s, U.S. households have stockpiled more than $2 trillion in additional savings since the pandemic began. With consumer spending accounting for roughly two-thirds of U.S. GDP, the economy could remain strong for longer than analysts currently expect. In this scenario, the premium associated with growth stocks would likely fall as investors rotate into more economically sensitive companies.

On the other hand, U.S. GDP growth is expected to peak in the second quarter, and then decelerate as government stimulus programs end. We’re also seeing inflation run higher-than-expected; at its June meeting, the Federal Reserve raised its inflation expectation for 2021 to 3.4%, a full percentage point higher than its last projection in March. While the Federal Reserve believes that inflation will be transitory, should it persist

21

| | | | |

| | |

| | | | Semiannual Report • 2021 |

longer than expected, it may need to raise interest rates faster than anticipated, which could ultimately result in slower economic growth. In an environment where growth is scarce, growth stocks would likely be in favor.

So, the range of outcomes is clearly very wide, and we’ve seen growth stocks both fall out of favor and return back into favor in just the first half of this year alone. Our approach is to remain extremely focused on investing in innovative companies that are gaining market share and can compound value at a fast clip. Our portfolio consists of economically resilient companies with expanding moats, which we believe should provide protection during volatile market environments. We have high conviction that the durable growth and quality characteristics of our portfolio position it well for whatever macroeconomic scenario unfolds.

This quarter, we welcomed a prior holding, Guidewire, back to the Fund. Guidewire is a software provider for the property and casualty insurance market. After working through a management and business model transition, we believe that growth is set to accelerate as insurers recognize the benefits of Guidewire’s cloud-based offering. We’ve always liked Guidewire’s competitive position in the large and attractive market it operates in, and with an accelerating growth profile and a large margin expansion opportunity in front of it, we think the stock should provide the Fund with an attractive return. As we mentioned earlier, we sold nCino to make room for Guidewire.

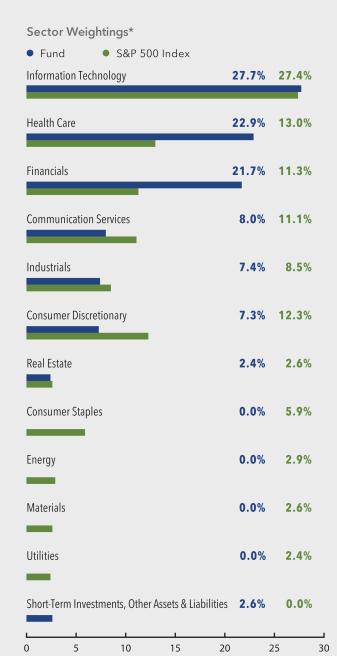

At the end of the quarter, the Russell Midcap Growth Index underwent its annual reconstitution. While we made only modest changes to our portfolio during the quarter, the reconstitution resulted in three big weighting changes to the index, which impacted our relative positioning. First, the weighting of the consumer discretionary sector increased by nearly 500

basis points. We had been overweight prior to the reconstitution, but we’re now underweight. We own a handful of category killers within this sector, such as Pool Corp, which is larger than its next 30 competitors combined, and off-price retailer Burlington, which has done a great job of providing consumers with phenomenal value and driving consistent market share gains. Second, the weighting of the health care sector dropped by almost 500 basis points. We had been slightly underweight the sector, but we’re now overweight. Within this sector, we own best-in-class tools companies such as IDEXX, as well as fast-growing genomics companies like Illumina, 10x Genomics, and Berkeley Lights. Finally, the weighting of the information technology sector declined by approximately 250 basis points. Our information technology positioning is now roughly in-line with the index following the reconstitution, and it remains our largest sector on an absolute basis. Most of our information technology holdings are within the software sub-sector, where innovative companies like Trade Desk, Synopsys and Cadence are winning in large and expanding addressable markets.

Thank you for your investment in the Parnassus Mid Cap Growth Fund.

Yours truly,

Robert J. Klaber

Portfolio Manager

Ian E. Sexsmith

Portfolio Manager

22

| | | | |

| | |

| Semiannual Report • 2021 | | | |  |

Parnassus Fixed Income Fund

Ticker: Investor Shares - PRFIX

Ticker: Institutional Shares - PFPLX

As of June 30, 2021, the net asset value (“NAV”) of the Parnassus Fixed Income Fund – Investor Shares was $17.53, producing a gain for the quarter of 2.52% (including dividends). This compares to a gain of 1.83% for the Bloomberg Barclays U.S. Aggregate Bond Index (“Barclays Aggregate Index”) and a gain of 1.89% for the Lipper Core Bond Funds Average, which represents the average return of the funds followed by Lipper that invest at least 85% of assets in domestic investment-grade bonds (“Lipper average”). For the first half of 2021, the Fund posted a loss of 1.91%, compared to a loss of 1.60% for the Barclays Aggregate Index and a loss of 1.10% for the Lipper average.

Below is a table comparing the performance of the Parnassus Fixed Income Fund with that of the Barclays Aggregate Index and the Lipper average. Average annual total returns are for the one-, three-, five- and ten-year periods. For June 30, the 30-day subsidized SEC yield was 1.21%, and the unsubsidized SEC yield was 0.98%.

Parnassus Fixed Income Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended June 30, 2021 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

Parnassus Fixed

Income Fund –

Investor Shares | | | -0.75 | | | | 5.42 | | | | 3.04 | | | | 2.87 | | | | 0.74 | | | | 0.68 | |

| | | | | | |

Parnassus Fixed

Income Fund –

Institutional Shares | | | -0.51 | | | | 5.69 | | | | 3.28 | | | | 3.01 | | | | 0.55 | | | | 0.45 | |

| | | | | | |

| Bloomberg Barclays U.S. Aggregate Bond Index | | | -0.33 | | | | 5.34 | | | | 3.02 | | | | 3.39 | | | | NA | | | | NA | |

| | | | | | |

| Lipper Core Bond Funds Average | | | 1.61 | | | | 5.57 | | | | 3.32 | | | | 3.49 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Fixed Income Fund – Institutional Shares from commencement (April 30, 2015) was 3.30%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Fixed Income Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns shown in the table do not reflect the deduction of taxes a shareholder would pay in fund distributions or redemption of shares. The Bloomberg Barclays U.S. Aggregate Bond Index (formerly known as the Barclays U.S. Aggregate Bond Index) is an unmanaged index of bonds, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2021, Parnassus Investments has contractually agreed to limit total operating expenses to 0.68% of net assets for the Parnassus Fixed Income Fund – Investor Shares and to 0.45% of net assets for the Parnassus Fixed Income Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2022, and may be continued indefinitely by the Adviser on a year-to-year basis.

Second Quarter Review

The Parnassus Fixed Income Fund - Investor Shares meaningfully outperformed its Index in the quarter, gaining 69 basis points relative to the Index. (One basis point is 1/100th of one percent.) This outperformance substantially improved the performance of the Fund thus far in 2021, leaving the Fund trailing the Index by only 31 basis points at midyear. After a blistering sell-off in the first quarter led to the worst start for corporate bonds in decades, a calmer market and improving corporate bond spreads improved performance.

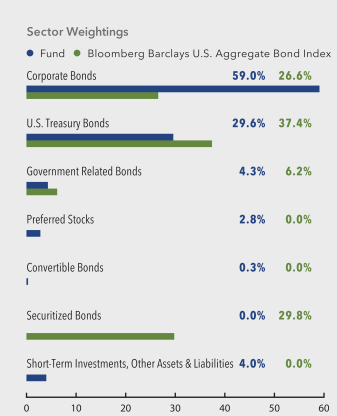

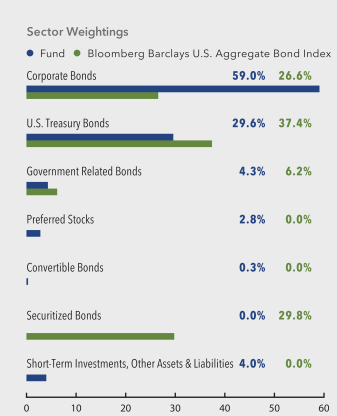

In the quarter, the Fund gained 94 basis points from its positive allocation across fixed income asset classes, as a very substantial overweight position corporate bonds drove returns. Our corporate bond holdings gained 3.52%, in line with the Index’s corporate portfolio gains of 3.54%. However, our corporate bond portfolio contributed 212 basis points to the total return in the quarter, well ahead of the 93 basis points contributed by the equivalent portfolio in the Index, due to the overweight allocation. Corporate bonds were the best-performing asset class, with commanding gains relative to securitized at 0.41% and Treasuries at 1.75%. Over the course of the quarter, the Fund held an average of 60.43% of assets in corporate bonds versus the Index at 26.63%.

Treasury bonds contributed 59 basis points to the total return, slightly behind the 65 basis points of contribution from Treasuries in the Index. Our somewhat underweight allocation at 31.69% versus 37.43% and our slightly short duration drove the difference. The Parnassus Fixed Income Fund also benefited from not owning Securitized bonds, a sector that comprises nearly a third of the Index but only gained 0.41% in the quarter.

23

| | | | |

| | |

| | | | Semiannual Report • 2021 |

Selection, or the individual bonds we chose, removed just 7 basis points from the total return, principally due to our slightly short duration position in corporate bonds. Thus far in 2021, the Fund’s performance is fairly neutral in both selection and allocation.

While several bonds had slightly negative returns in the quarter, none was substantial enough to reduce the total return by even a basis point. The gains across corporate debt and Treasuries were broad-based.

Our best-performing bonds in the quarter were issued by Aptiv, the automotive safety and technology company. We’ve been long-time holders of Aptiv bonds and added to our position with these long-dated bonds with a maturity in 2049 during the quarter. These securities gained 12.20%* and added 8 basis points to the total return. Aptiv’s bonds benefitted from interest rates rallying, particularly in the 30-year space, but also from company-specific factors. Aptiv is the leading producer of components for electric vehicles, which are rapidly gaining in popularity. The company is also the leader in producing components and software systems for autonomous vehicles, so we expect excellent growth from the company in the years ahead.

Long-dated bonds maturing in 2041 issued by BNSF rallied 7.11% and added 5 basis points to the total return. These bonds benefitted from both economic reopening and from their long-duration, similar to Aptiv’s 2049 issue. As the economy reopened from COVID-19 lockdowns and restrictions, BNSF’s logistics and transportation capabilities were in high demand, providing a boost to the company. With the rally in 30-year Treasuries, these bonds excelled.

Bonds issued by Pentair, the maker of pool equipment and water filters, with a 2029 maturity gained 3.73% and also added 5 basis points to the total return. Pentair’s sales have been excellent over the last year, as a focus on the home has buoyed demand for new pools or upgrades to existing pools. We appreciate the company’s careful management of the balance sheet after a tumultuous decade.

Several Treasury bonds were among the top-performing bonds in the quarter. All of the top-performing Treasury bonds were 30-year bonds. After

the June Federal Reserve press release showed that several voting members anticipated earlier rate hikes, the long end of the interest rate saw a huge rally. In short, if the Federal Reserve is going to be more attuned to inflation, then there’s less risk of long-term runaway inflation. Our transition to a barbell position in Treasuries, where we own a disproportionate amount of very short-dated and very-long dated Treasuries instead of intermediate duration bonds, helped us benefit from this move in the markets.

Parnassus Fixed Income Fund

As of June 30, 2021

(percentage of net assets)

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

Economic growth in the first half of 2021 may prove to be the fastest in a generation, spurred forward by reopening and enormous government transfers to consumers. The economy is also lapping some of the worst data in generations, far worse than the financial crisis of 2008, which makes the data difficult to interpret. For example, headline inflation has been a hot media topic as it spiked to levels last seen in the

* For this report, we quote total return to the portfolio, which includes price change and dividends.

24

| | | | |

| | |

| Semiannual Report • 2021 | | | |  |

1990s. However, most of that jump was caused by prices on cars and hotels and is directly tied to the reopening. It’s difficult to see how prices on these goods and services could continue to increase at the same pace into 2022.