UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: Parnassus Funds (811-04044) and Parnassus Income Funds (811-06673)

Parnassus Funds

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marc C. Mahon

Parnassus Funds

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: June 30, 2023

Item 1: Report to Shareholders

Parnassus Funds Semiannual Report

June 30, 2023

Parnassus Core Equity FundSM

Investor Shares: PRBLX | Institutional Shares: PRILX

Parnassus Growth Equity FundSM

Investor Shares: PFGEX | Institutional Shares: PFPGX

Parnassus Value Equity FundSM

Investor Shares: PARWX | Institutional Shares: PFPWX

Parnassus Mid Cap FundSM

Investor Shares: PARMX | Institutional Shares: PFPMX

Parnassus Mid Cap Growth FundSM

Investor Shares: PARNX | Institutional Shares: PFPRX

Parnassus Fixed Income FundSM

Investor Shares: PRFIX | Institutional Shares: PFPLX

Table of Contents

3

| | | | |

| | |

| | | | Semiannual Report • 2023 |

August 4, 2023

Dear Shareholder,

The first half of the year saw stocks surge, with growth-oriented companies leading the charge. This was a major reversal from last year, when value stocks outpaced the broader stock market. Our newest offering, the Parnassus Growth Equity Fund – Investor Shares, had a tremendous start to the year with a massive gain of 28.65% for the first half. The Fund benefited from fortuitous timing, as we launched just as growth stocks returned to favor after a challenging 2022. The early success is also attributable to our hardworking investment team, especially portfolio managers Andrew Choi and Shivani Vohra.

Our other growth-oriented fund, the Parnassus Mid Cap Growth Fund – Investor Shares, had a strong first half of the year, with a return of 18.66%. Our flagship offering, the Parnassus Core Equity Fund – Investor Shares, also turned in compelling performance, with a return of 15.58%. Our other three Funds finished the first half in positive territory, but with more modest gains measured in the single digits.

Please read on for our portfolio managers’ detailed reports. You’ll find commentary on recent performance and outlooks for the remainder of 2023.

New Team Members

We welcomed four employees to Parnassus in the second quarter. Taylor Le joined us as a Sales and Marketing Coordinator. She attended San Francisco State University and received her bachelor’s degree in business with a concentration in Marketing. Prior to joining us, Taylor worked at First Republic on the Advisor Onboarding Team. Taylor’s hobbies include attending concerts and music festivals, traveling and grabbing boba tea or coffee with friends.

Olivia Barbee joined us as Senior Product Marketing Manager. Olivia began her marketing career in 2008, when she joined Wells Fargo Bank as a content marketer. During her 13-year tenure with the bank, she worked in various capacities to create thought leadership marketing content. Olivia earned her bachelor’s degree from Stanford University. In her free time, Olivia enjoys reading, watching ballet and listening to podcasts.

Pai-Szu Chan also joined the firm as Senior Product Marketing Manager. Prior to joining Parnassus, Pai-Szu held various investment marketing and communications roles at Artisan Partners, Franklin Templeton and BNY Mellon. She received a bachelor’s degree in English from Fu Jen University in Taiwan and a master’s degree in Humanities from the University of Chicago. In her spare time, Pai-Szu enjoys yoga, nature walks and playing piano.

Alex Zhang joined the team as Staff Accountant. Prior to joining Parnassus, Alex was with Tigergraph, where he worked as an Accounts Receivable and Billing Specialist. Previously, he held similar roles at ExamSoft Worldwide and MacPherson’s. Alex received his bachelor’s degree from California State University, Sacramento. In his spare time, Alex enjoys spending time with friends and working out, and considers himself to be a retired foodie.

4

| | | | |

| | |

| Semiannual Report • 2023 | | | |  |

Interns

We are pleased to have four interns join us this summer. Emily Cheng is a Software Engineer intern and is currently a student at the University of California at Davis, where she studies statistics with a minor in computer science and managerial economics. In her spare time, Emily enjoys arts and crafts, exploring coffee shops and spending time with friends and family.

Jennifer Cuahutencos is an environmental, social and governance (ESG) Integration Analyst intern and is currently pursuing her bachelor’s degree at Claremont McKenna College. She is majoring in Environment, Economics and Politics, and is involved in nonprofit consulting at school. In her spare time, Jennifer enjoys running, reading, painting and crocheting.

Shane Kim joins us as a Research Analyst intern and is currently an MBA Candidate at the Tuck School of Business at Dartmouth. Prior to Tuck, Shane was a Manager at Altman Solon-a boutique strategy consulting firm focused on the technology, media and telecommunications sectors. He graduated from Yale in 2017 with a degree in Economics and a certificate in Education Studies. Shane is a former collegiate rugby player with experience playing internationally in both Argentina and Chile, and currently plays squash and hockey at Tuck.

Baoer Li joins us as a Software Engineer Intern. Baoer is pursuing his bachelor’s degree at the University of California, Berkeley. He is active within his school community doing research in the Berkeley Operations and Behavioral Analytics Lab. He also works as a computer science mentor for the Department of Electrical Engineering and Computer Sciences. In his spare time, Baoer enjoys playing tennis, Texas Hold’em poker and hockey.

Thank you for investing with the Parnassus Funds.

Sincerely,

Benjamin E. Allen

Chief Executive Officer

5

| | | | |

| | |

| | | | Semiannual Report • 2023 |

Parnassus Core Equity Fund

Ticker: Investor Shares - PRBLX

Ticker: Institutional Shares - PRILX

As of June 30, 2023, the net asset value (“NAV”) of the Parnassus Core Equity Fund – Investor Shares (“the Fund”) was $54.09. After taking dividends into account, the total return for the second quarter was a gain of 7.47%. This compares to a gain of 8.74% for the S&P 500 Index (“S&P 500”). Year to date, the Fund posted a gain of 15.58%. This compares to a gain of 16.89% for the S&P 500.

Below is a table that summarizes the performance of the Parnassus Core Equity Fund and the S&P 500. The returns are for the one-, three-, five- and ten-year periods.

Parnassus Core Equity Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended June 30, 2023 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Core Equity Fund – Investor Shares | | | 17.88 | | | | 14.08 | | | | 13.13 | | | | 12.54 | | | | 0.85 | | | | 0.82 | |

| | | | | | |

| Parnassus Core Equity Fund – Institutional Shares | | | 18.12 | | | | 14.32 | | | | 13.37 | | | | 12.77 | | | | 0.62 | | | | 0.61 | |

| | | | | | |

| S&P 500 Index | | | 19.59 | | | | 14.60 | | | | 12.31 | | | | 12.86 | | | | NA | | | | NA | |

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

As described in the Fund’s current prospectus dated May 1, 2023, Parnassus Investments, LLC has contractually agreed to reduce its investment advisory fee to the extent necessary to limit total annual fund operating expenses to 0.82% of net assets for the Parnassus Core Equity Fund – Investor Shares and to 0.61% of net assets for the Parnassus Core Equity Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2024 and may be continued indefinitely by the investment adviser on a year-to-year basis.

Second Quarter Review

This time last year, the S&P 500 was off to its worst start in more than five decades. In 2023, the market finds itself in a very different place, with the S&P 500 rising nearly 16.89% in the first half of the year and nearly 8.74% in the second quarter alone. The rally was driven by the Information Technology sector, which accounted for more than half of the market’s return. Notably, this return was concentrated in the largest market constituents, with the top five and ten companies accounting for 55% and 75%, respectively, of the S&P 500’s return.

In the second quarter, the Parnassus Core Equity Fund – Investor Shares returned 7.47%, slightly less than the S&P 500’s 8.74%. Sector allocation and stock selection presented headwinds. Within sector allocation, our underweight in Consumer Discretionary and overweight in Consumer Staples were the biggest detractors. Our overweight in the Materials sector was also a notable detractor. Within stock selection, our most notable detractor was Health Care.

The Fund’s best relative performer in the quarter was Oracle, the dominant provider of relational-database software, which returned 28.7%, contributing 1.0%* to the Fund’s return. Oracle reported strong financial results and guidance for the year. The company’s cloud business is growing exceptionally well and is proving to be a durable growth driver. Investors are starting to appreciate Oracle’s strong position in the cloud infrastructure market, which is reflected in the stock price’s recent appreciation.

The next-best performer was design-software company Adobe. Adobe’s stock returned 26.9% and added 0.7% to the Fund’s return during the quarter. Adobe reported better-than-expected earnings and

* For this report, we quote total return to the portfolio, which includes price change and dividends.

6

| | | | |

| | |

| Semiannual Report • 2023 | | | |  |

raised its guidance for net-new recurring revenue for the full fiscal year. Investor sentiment improved further after the company released new information about its generative artificial intelligence product, Firefly. In light of Adobe’s scale and distribution advantages, we believe the company is well positioned to capitalize on artificial intelligence opportunities within digital creation and create meaningful value for shareholders.

Insurance data provider Verisk Analytics was also a top contributor. The company’s stock returned 18.0% and contributed 0.4% to the Fund’s return in the quarter. Verisk reported strong earnings and provided guidance that exceeded investor expectations. The company’s organic growth rate accelerated beyond its long-term growth target, fueling positive investor sentiment.

The three largest relative detractors in the quarter were Target, Gilead and John Deere. Target’s stock returned negative 19.8% in the quarter, detracting 0.5% from the Fund’s return. Despite reporting modestly better-than-expected first-quarter results, Target encountered challenges in the second quarter, encountering a backlash over some of its Pride Month merchandise. This ultimately affected foot traffic in the short term, which weighed on investors. Despite this setback, we believe that the stock is trading at an attractive valuation relative to the recovery potential in sales and profit margin.

Gilead’s stock returned negative 6.2% in the quarter, detracting 0.2% from the Fund’s return. Gilead reported higher than expected costs driven by increased investments in its late-stage clinical programs as well as its commercial infrastructure. We believe Gilead’s HIV business remains well-positioned and will see accelerating growth as Biktarvy continues take share and their longer lasting lenacapavir drug launches in the prophylaxis market. In the meantime, Gilead continues to not get the full credit for their best-in-class cell therapy franchise that continues to gain scale. The next largest detractor was agriculture-equipment provider John Deere. The company’s stock returned a negative 1.6%, detracting 0.1% from the Fund’s return. Although the company reported strong earnings results, investor sentiment was weighed down by growing channel inventories, weaker pricing and concerns around the equipment cycle turning negative. This was partially offset by drought concerns, which boosted crop prices exiting the quarter. We expect the company to manage through the cycle well.

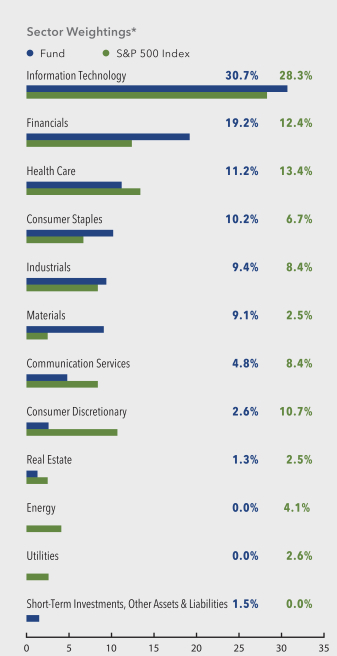

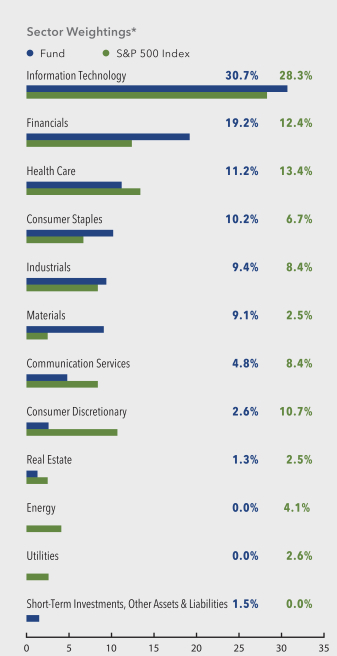

Parnassus Core Equity Fund

As of June 30, 2023

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

7

| | | | |

| | |

| | | | Semiannual Report • 2023 |

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Microsoft Corp. | | | 6.7% | |

| |

| Apple Inc. | | | 4.9% | |

| |

| Alphabet Inc., Class A | | | 4.8% | |

| |

| Oracle Corp. | | | 4.1% | |

| |

| Salesforce Inc. | | | 3.8% | |

| |

| Deere & Co. | | | 3.6% | |

| |

| Mastercard Inc., Class A | | | 3.3% | |

| |

| Linde plc | | | 3.3% | |

| |

| CME Group Inc., Class A | | | 3.0% | |

| |

| Bank of America Corp. | | | 2.9% | |

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

Investors remain concerned about tightening monetary policy and a potential recession. However, we exited the second quarter with CPI1 continuing to moderate, employment remaining robust and economic growth surprising to the upside. On top of this, the emergence of generative artificial intelligence (AI) applications fueled optimism about a potential wave of technological innovation and productivity gains. These factors, in part, contributed to a market rally led by large incumbent technology companies. As of the end of the quarter, the S&P 500 is now up nearly 25% from its most recent October low and nearly 17% year to date, mostly due to increased valuation measures, such as price-to-earnings multiples. Since the end of last year, estimates for this year’s real economic growth, inflation and employment have all moved higher, while the U.S. 10-Year Treasury yield has remained relatively flat. There has been a rise in optimism that we will experience a “soft landing,” in which inflation will continue to fall and the economy will not enter a major recession. This optimism, coupled with the expectation of eventual lower interest rates, has created a constructive environment for stocks.

Over the past few years, investors have likely overestimated the sensitivity of the economy to interest rates and underappreciated the impact of falling personal savings rates. This has led to more durable household spending and better-than-expected growth.

Despite the robust economy, financial markets continue to expect the Federal Reserve to cut interest rates next year. The setup for stocks here is precarious, with continued appreciation likely contingent on financial easing, fiscal stimulus and company earnings, which still need to deliver double-digit growth next year to meet investor expectations.

We entered this year with the view that a soft landing was increasingly probable, and that the market could produce double-digit gains. We’ve already seen that much return just halfway through the year. It’s likely that we pulled forward some returns and that the second half of the year could be more challenging. Last quarter, we believed that it was prudent to exercise incremental caution. We continue to hold that belief. Expectations for financial conditions, growth and corporate earnings are higher, while inflation, monetary policy and recession risks remain. Despite this uncertainty, it’s important to remember that markets are forward looking, and a weaker economy is typically met with fiscal and monetary stimulus. As such, we continue to focus on finding underappreciated long-term, secular winners, staying disciplined on valuation, and focusing on our longer-term investment horizon. Many positive secular trends continue unabated, namely those related to technology adoption and innovation across sectors like software, media, life sciences and agriculture. We are working to ensure that the Fund has exposure across these markets through attractively priced businesses. With this framework in mind, we made some notable changes to existing Fund holdings during the quarter, adding one new stock and selling out of two. Overall, we continued to take advantage of opportunities to upgrade the return profile of the portfolio, while maintaining a modestly defensive position.

Turning to portfolio positioning, our largest overweight is still Financials through high-quality companies like Mastercard, S&P Global and Fiserv. We also own derivative exchanges CME Group and Intercontinental Exchange, both of which should benefit from market and interest-rate volatility. We slightly reduced our overweight position by selling financial brokerage Charles Schwab, which continues to experience headwinds from customer-cash management. Our next largest overweight is Materials, where we own Ball,

1 Consumer Price Index, U.S. Bureau of Labor Statistics.

8

| | | | |

| | |

| Semiannual Report • 2023 | | | |  |

Linde, Sherwin-Williams and Nutrien. We believe that this collection of high-quality businesses offers a compelling balance of defensive and offensive characteristics. We slightly increased our overweight positioning by adding to Nutrien, where we believe that longer-term opportunity is attractive. We remain overweight Consumer Staples through excellent brands and retailers such as Costco, Procter & Gamble and Target.

Our largest underweight position continues to be Consumer Discretionary, where we prefer more resilient companies like AutoZone to those with more exposure to discretionary spending in areas such as travel and entertainment. We also remain underweight in Energy and, to a lesser extent, Communication Services, where our position became more underweight after we sold wireless carrier T-Mobile. Given the deterioration of its industry structure and fundamentals, we no longer felt the stock was attractively priced. We also continue to be underweight in Health Care, Utilities and Real Estate, as we believe we are finding better opportunities to own rate-sensitive or defensive stocks in Financials and Consumer Staples.

In terms of other notable sector allocation changes, the biggest change was our move to an overweight position in Information Technology. We added to our holdings in Adobe and Apple and initiated a new position in semiconductor company Intel. Despite Intel’s technology and execution challenges, we believe that the stock presents an attractive opportunity. The company is positioned for a cyclical recovery in personal computer and server chips in the coming quarters. Longer term, we anticipate that Intel will likely continue to play a crucial role in deploying

computing and AI infrastructure. We sized up Adobe, as we think the company’s ability to create value through AI is underappreciated, and we also increased our exposure to Apple. Finally, we decreased our overweight position in Industrials by trimming Verisk and Canadian Pacific to take advantage of opportunities in Information Technology and Materials.

After a strong start to the year, investor expectations are elevated. This may present challenges as we enter the second half of the year. Regardless of these potential challenges, we believe that the portfolio is positioned well to deliver strong long-term returns in a wide range of market outcomes. As always, we’re honored to have your trust as we continue pursuing Principles and Performance®.

Sincerely,

Todd C. Ahlsten

Lead Portfolio Manager

Benjamin E. Allen

Portfolio Manager

Andrew S. Choi

Portfolio Manager

9

| | | | |

| | |

| | | | Semiannual Report • 2023 |

Parnassus Growth Equity Fund

Ticker: Investor Shares - PFGEX

Ticker: Institutional Shares - PFPGX

As of June 30, 2023, the net asset value (“NAV”) of the Parnassus Growth Equity Fund – Investor Shares (“the Fund”) was $19.22. The Fund’s total return for the second quarter was a gain of 11.36%. This compares to a gain of 12.81% for the Russell 1000 Growth Index (“Russell 1000 Growth”). Year to date, the Parnassus Growth Equity Fund – Investor Shares posted a gain of 28.65%. This compares to a gain of 29.02% for the Russell 1000 Growth.

Below is a table that summarizes the performance of the Parnassus Growth Equity Fund and the Russell 1000 Growth.

Parnassus Growth Equity Fund

| | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended June 30, 2023 | |

| | | |

| | | Since

Inception,

December 28,

2022 | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | |

| Parnassus Growth Equity Fund – Investor Shares | | | 28.13 | | | | 2.71 | | | | 0.84 | |

| | | |

| Parnassus Growth Equity Fund – Institutional Shares | | | 28.27 | | | | 2.30 | | | | 0.63 | |

| | | |

| Russell 1000 Growth Index | | | 31.52 | | | | NA | | | | NA | |

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell 1000 Growth is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

As described in the Fund’s current prospectus dated May 1, 2023, Parnassus Investments, LLC has contractually agreed to waive 0.10% of its management fee for each class, and to reimburse the Fund for expenses to the extent necessary to limit total annual fund operating expenses to 0.84% of net assets for the Parnassus Growth Equity Fund – Investor Shares and to 0.63% of net assets for the Parnassus Growth Equity Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2024 and may be continued indefinitely by the investment adviser on a year-to-year basis.

Second Quarter Review

In the second quarter, the Parnassus Growth Equity Fund – Investor Shares returned 11.36%, slightly less than the Russell 1000 Growth’s 12.81% return. It was a mixed quarter for the Fund, with negative sector allocation and stock selection. Our underweight in Information Technology and overweight in Health Care were the largest detractors in allocation. Within selection, Consumer Discretionary was the largest detractor.

The best relative performer was design-software company Adobe. Adobe’s stock returned 41.5% and added 1.5%* to the Fund’s return during the quarter. Adobe reported better-than-expected earnings and raised its guidance for net-new recurring revenue for the full fiscal year. Investor sentiment improved further after the company released new information about its generative artificial intelligence product, Firefly. In light of Adobe’s scale and distribution advantages, we believe the company is well positioned to capitalize on artificial intelligence opportunities within digital creation and create meaningful value for shareholders.

Eli Lilly, a pharmaceutical company, was the next-best performer, gaining 36.9% and adding 0.9% to the Fund’s return. Eli Lilly had a positive Phase III readout for its Alzheimer’s drug donanemab, which is now expected to launch as part of a new multi-billion therapeutic category by the end of this year or early next year. Eli Lilly continues to have a record-breaking uptake of its diabetes drug Mounjaro, with FDA approval for weight loss expected by the end of this year.

Finally, Applied Materials, a dominant semiconductor capital equipment company, returned 18.0% and added 0.5% to the Fund’s returns. The company reported strong

* For this report, we quote total return to the portfolio, which includes price change and dividends.

10

| | | | |

| | |

| Semiannual Report • 2023 | | | |  |

financial results and forward guidance. This, coupled with optimism for a rebound in semiconductor demand driven by artificial intelligence, drove the stock’s strong performance in the quarter.

Our biggest relative detractor in this quarter was Thermo Fisher Scientific, a life science tools provider. Thermo Fisher’s stock declined 9.4%, detracting 0.3% from the Fund’s return. This year is a reset for the life science tools companies as their pharmaceutical and biotechnology customers work through stockpiled inventory from the pandemic and rationalized research and development “R&D” spending. We are still confident in the long-term trends supporting increased drug discovery, technology and innovation in the life science sector, which should support Thermo Fisher’s long-term growth.

Planet Fitness, a nationwide gym franchise, returned negative 13.2%, subtracting 0.3% from the Fund’s return. Planet Fitness trailed this quarter after management guided to the bottom of their new store expectations for the year. We underestimated the near-term headwinds around new gym construction due to tighter financing conditions and a worsening HVAC supply chain. We believe Planet Fitness is now attractively priced despite these headwinds, and we believe its growth will continue to be supported by a strong brand awareness, consumer focus on wellness, and favorable demographics and unit expansion.

Finally, NVIDIA, a semiconductor chip manufacturer, gained 52.3% this quarter and added 1.2% to the Fund’s return on an absolute basis. NVIDIA was a relative detractor in this quarter due to our Fund’s underweight position. While we appreciate the company’s dominant competitive position and increasing relevancy, we believe its stock’s valuation reflects significant optimism.

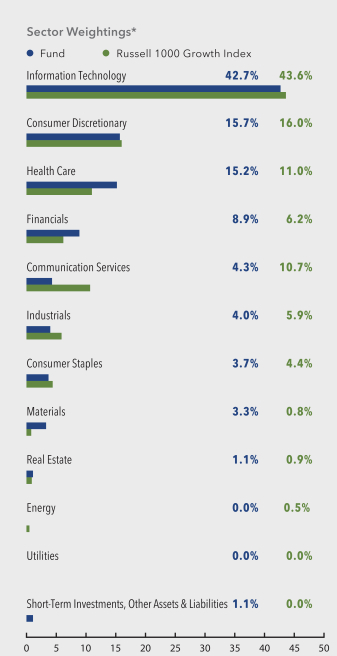

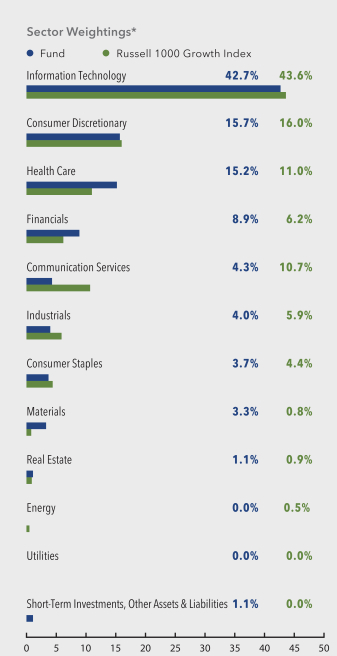

Parnassus Growth Equity Fund

As of June 30, 2023

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

11

| | | | |

| | |

| | | | Semiannual Report • 2023 |

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Microsoft Corp. | | | 10.7% | |

| |

| Apple Inc. | | | 6.9% | |

| |

| Amazon.com Inc. | | | 6.6% | |

| |

| Adobe Inc. | | | 4.6% | |

| |

| Visa Inc. | | | 4.5% | |

| |

| Alphabet Inc., Class A | | | 4.3% | |

| |

| Intuit Inc. | | | 3.2% | |

| |

| NVIDIA Corp. | | | 3.1% | |

| |

| UnitedHealth Group Inc. | | | 2.7% | |

| |

| Eli Lilly & Co. | | | 2.6% | |

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

Investors remain concerned about tightening monetary policy and a potential recession. However, we exited the second quarter with CPI1 continuing to moderate, employment remaining robust and economic growth surprising to the upside. On top of this, the emergence of generative artificial intelligence (AI) applications fueled optimism about a potential wave of technological innovation and productivity gains. These factors, in part, contributed to a market rally led by large incumbent technology companies. As of the end of the quarter, the Russell 1000 Growth is now up nearly 33% from its most recent October low and 29% year to date, mostly due to increased valuation measures, such as price-to-earnings multiples. Since the end of last year, estimates for this year’s real economic growth, inflation and employment have all moved higher, while the U.S. 10-Year Treasury yield has remained relatively flat. There has been a rise in optimism that we will experience a “soft landing,” in which inflation will continue to fall and the economy will not enter a major recession. This optimism, coupled with the expectation of eventual lower interest rates, has created a constructive environment for stocks.

Over the past few years, investors have likely overestimated the sensitivity of the economy to interest rates and underappreciated the impact of falling personal savings rates. This has led to more durable household spending and better-than-expected growth. Despite the robust economy, financial markets continue to expect the Federal Reserve to cut interest

rates next year. The setup for stocks here is precarious, with continued appreciation likely contingent on financial easing, fiscal stimulus and company earnings, which still need to deliver double-digit growth next year to meet investor expectations.

We entered this year with the view that a soft landing was increasingly probable, and that the market could produce double-digit gains. We’ve already seen that much return just halfway through the year. It’s likely that we pulled forward some returns and that the second half of the year could be more challenging. Last quarter, we believed that it was prudent to exercise incremental caution. We continue to hold that belief. Expectations for financial conditions, growth and corporate earnings are higher, while inflation, monetary policy and recession risks remain. Despite this uncertainty, it’s important to remember that markets are forward looking, and a weaker economy is typically met with fiscal and monetary stimulus. As such, we continue to focus on finding underappreciated long-term, secular winners, staying disciplined on valuation, and focusing on our longer-term investment horizon. Many positive secular trends continue unabated, namely those related to technology adoption and innovation across sectors like software, media, life sciences and agriculture. We are working to ensure that the Fund has exposure across these markets through attractively priced businesses.

With this framework in mind, we had an active quarter, buying six new stocks while selling six as well. For our six new positions, we took advantage of market volatility to buy high-quality, secular winners at compelling valuations. First, within Information Technology, we initiated three new positions in Intuit, Adobe and Twilio and sold our positions in ServiceNow, ASML and PTC. Intuit is a provider of accounting and tax software. We felt the near-term macroeconomic concerns small- and medium-sized businesses overshadowed the underlying business quality, stickiness of the product and potential for revenue acceleration. Intuit has a wealth of financial data that positions it well for AI adoption. We also initiated positions in Adobe and Twilio. Both companies should be generative AI beneficiaries, as Adobe commercializes generative design software and Twilio benefits from increasing chatbot volumes and features. We sold our positions in ServiceNow, PTC and ASML as we repositioned the Fund to benefit from underappreciated AI beneficiaries. Information Technology continues to be

1 Consumer Price Index, U.S. Bureau of Labor Statistics.

12

| | | | |

| | |

| Semiannual Report • 2023 | | | |  |

our largest underweight, driven by our underweight in Apple.

Next, we also repositioned within the Consumer Discretionary and Consumer Staples sectors to take advantage of more compelling opportunities. We bought Yum! Brands, owner of Taco Bell, KFC and Pizza Hut brands, and Ulta Beauty, a beauty specialty retailer. We believe both companies have defensive growth characteristics and can benefit from trade down if U.S. consumer spending weakens. To fund these purchases, we sold Nike and Colgate. While we still admire the brand, expectations for Nike were high coming into their fiscal year 2024 with increasing uncertainty around U.S. and Chinese consumer demand, inventory levels and the company’s expanding relationship with wholesale partners. We sold Colgate, because we felt we had more attractive defensive consumer exposure with our collective positions in Yum! Brands, Costco and Hershey Company.

Lastly, we initiated a position in Danaher, a life science tools provider, given the volatility in the subsector. We believe this is a unique opportunity to buy the dominant bioprocessing company at a discount ahead of a wave of biopharma innovation. Within Industrials, we sold Verisk Analytics, a provider of insurance data analytics and services. While the stock has done well year to date and continues to have strong fundamentals, its valuation is approaching a five-year high, and we felt the capital could be better deployed in other high-quality compounders like Danaher. Health Care continues to be our largest sector overweight relative to the Russell 1000 Growth. We

continue to believe it’s an attractive sector to find less economically sensitive companies at reasonable valuations.

In addition to Information Technology, our biggest underweights continue to be Communication Services and Industrials. After Health Care, our biggest overweight remains Financials, where we own what we believe to be secularly advantaged, resilient businesses with minimal balance sheet risk.

After a strong start to the year, investor expectations are elevated. This may present challenges as we enter the second half of the year. Regardless of these potential challenges, we believe that the portfolio is positioned well to deliver strong long-term returns in a wide range of market outcomes. As always, we are honored to have your trust as we continue pursuing Principles and Performance®.

Sincerely,

Andrew S. Choi

Lead Portfolio Manager

Shivani R. Vohra

Portfolio Manager

13

| | | | |

| | |

| | | | Semiannual Report • 2023 |

Parnassus Value Equity Fund

Ticker: Investor Shares - PARWX

Ticker: Institutional Shares - PFPWX

As of June 30, 2023, the net asset value (“NAV”) of the Parnassus Value Equity Fund – Investor Shares was $47.38. The Fund’s total return for the second quarter was a gain of 3.18%. This compares to a gain of 4.07% for the Russell 1000 Value Index (“Russell 1000 Value”). We lagged the benchmark by a little less than one percent this quarter, mainly because our defensive positions failed to keep up in a rising market. For the year to date period, the Parnassus Value Equity Fund – Investor Shares posted a gain of 4.66%, compared to the Russell 1000 Value’s gain of 5.12%.

Below is a table that summarizes the performance of the Parnassus Value Equity Fund and the Russell 1000 Value over multiple time periods. The Fund trailed our benchmark over the one-year period but remains substantially ahead over longer time horizons.

Parnassus Value Equity Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended June 30, 2023 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Value Equity Fund –Investor Shares | | | 10.02 | | | | 17.76 | | | | 11.89 | | | | 13.59 | | | | 0.92 | | | | 0.88 | |

| | | | | | |

| Parnassus Value Equity Fund – Institutional Shares | | | 10.28 | | | | 18.02 | | | | 12.14 | | | | 13.79 | | | | 0.72 | | | | 0.65 | |

| | | | | | |

| Russell 1000 Value Index | | | 11.54 | | | | 14.30 | | | | 8.11 | | | | 9.22 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Value Equity Fund – Institutional Shares from commencement (April 30, 2015) was 12.22%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Value Equity Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses.

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell 1000 Value is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

As described in the Fund’s current prospectus dated May 1, 2023, Parnassus Investments, LLC has contractually agreed to waive 0.10% of its management fee for each class, and to reimburse the Fund for expenses to the extent necessary to limit total annual fund operating expenses to 0.88% of net assets for the Parnassus Vaule Equity Fund – Investor Shares and to 0.65% of net assets for the Parnassus Value Equity Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2024 and may be continued indefinitely by the investment adviser on a year-to-year basis.

Second Quarter Review

Three of our stocks each detracted 0.3% or more from the Fund’s total return this period. Two hail from different corners of the Health Care sector, while the third posted losses due to a turbulent retail environment. Each of our top three performers contributed 0.4% or more to the Fund’s total return, with software companies accounting for two of these winners. Overall, while our technology investments boosted returns, these gains were offset by our defensive positioning within Health Care, Consumer Staples and insurance.

Our worst performer this quarter was Target. Its stock dropped 19.8% and clipped 0.5%* from the Fund’s total return due to fears that weakening consumer demand and a highly politicized retail environment will hurt sales. In May, conservative criticism of Target’s Pride-themed merchandise exploded into a backlash that included threats of violence, ransacking of stores and a popular song calling for a boycott. Liberal groups then took issue with management’s decision to pull certain Pride items and to relocate displays to the back of the store to protect the safety and well-being of store employees. Of even more concern, Target called out a $500 million loss from shrink, which involves theft of merchandise perpetrated by organized retail crime groups. Although these problems are scary, we believe the stock reaction is overdone. Long term, the company has continued to gain share based on its inviting store network, multi-category portfolio, top-rated owned-brands and data-driven investments in customer engagement.

Moderna fell 20.9%, cutting 0.5% from the Fund’s total return. While the company released positive first

* For this report, we quote total return to the portfolio, which includes price change and dividends.

14

| | | | |

| | |

| Semiannual Report • 2023 | | | |  |

quarter financials, negative sentiment continues to grow as the company guided to a COVID-19-delivery low in the second quarter. Uncertainty around Moderna’s COVID-19 revenues, as well as what the company’s expense profile will look like going into next year, has depressed the stock. We believe there are enough potential offsets to the declining COVID-19 business going into 2024, such as future RSV and flu vaccines. Moderna is also showing promising data in other parts of its large pipeline, such as its combination respiratory vaccines, personalized cancer vaccine and other therapeutic protein indications.

Agilent Technologies’ stock dipped 12.8%, reducing the Fund’s return by 0.3%, after management cut its revenue guidance slightly. The company is not alone in seeing a slowdown in pharma spending, driven by a normalization of analytical instrument demand and a constrained biotech funding environment impacting smaller customers. Nonetheless, we believe Agilent remains a quality compounder now trading at an attractive price, as the company continues to gain market share in an industry with very high switching costs. The Agilent story still has several idiosyncratic drivers that could drive upside to earnings expectations, such as PFAS and lithium-ion battery testing, as well as RNAi oligonucleotide manufacturing. We also believe the company continues to have a long runway of consistent margin expansion as it increases the attach rate of high-margin consumables and services within its large installed base of instruments.

The largest contributor to performance this period was enterprise software company Oracle. Oracle appreciated 28.7% in price, adding 0.8% to the Fund’s total return. The market’s narrative around Oracle has shifted from a safe harbor amid weaker enterprise IT spending to a longer-term growth story. The company has successfully begun to reaccelerate top-line growth by transitioning customers from on-premise to cloud-based services. This growth renaissance should prove more durable than the market believes-driven largely by Oracle’s Cloud Infrastructure business that can keep growing rapidly and take share in the global public cloud market.

D.R. Horton’s stock surged 24.9%, adding 0.7% to the Fund’s total return as the second-largest contributor. The largest home builder in the United States delivered better-than-expected earnings, driven by solid demand and strong pricing for new homes. The company saw

an encouraging start to the spring selling season and limited home inventory nationwide, benefiting new home sales relative to existing ones. We remain excited about the company’s long-term growth prospects, as it benefits from its significant scale, additional share gains, a strong balance sheet and a long runway to consolidate smaller builders.

Finally, the share price of Microsoft increased 18.4%, boosting the Fund’s return by 0.4%. Positive sentiment around generative AI’s capacity to drive future growth continued to outweigh near-term concerns over decelerating Azure growth. Microsoft remains the dominant global enterprise software platform-providing both an offensive and defensive role for the portfolio. The company’s technological leadership and breadth of its productivity suite enable it to not only win in secular growth areas like cloud, but also benefit from vendor consolidation in this environment of weaker IT spending.

15

| | | | |

| | |

| | | | Semiannual Report • 2023 |

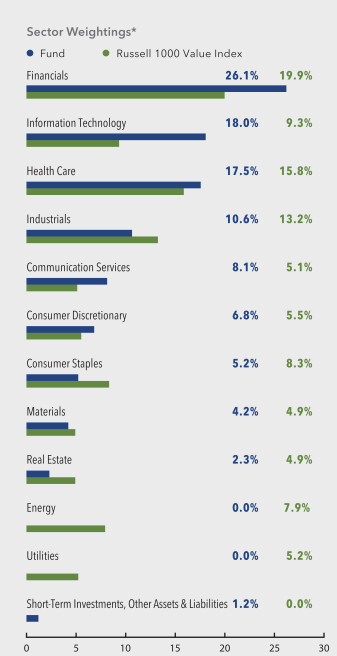

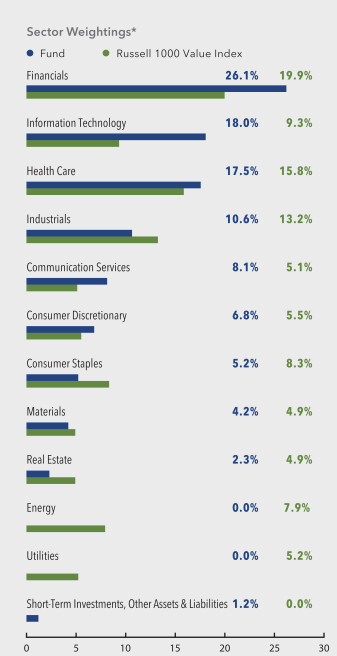

Parnassus Value Equity Fund

As of June 30, 2023

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Merck & Co., Inc. | | | 3.3% | |

| |

| Oracle Corp. | | | 3.2% | |

| |

| Sysco Corp. | | | 3.1% | |

| |

| Gilead Sciences Inc. | | | 2.9% | |

| |

| Ball Corp. | | | 2.9% | |

| |

| S&P Global Inc. | | | 2.8% | |

| |

| Comcast Corp., Class A | | | 2.8% | |

| |

| Verizon Communications Inc. | | | 2.8% | |

| |

| D.R. Horton Inc. | | | 2.7% | |

| |

| The Progressive Corp. | | | 2.6% | |

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

As measured by the S&P 500, U.S. stocks have fully recovered their losses after the Fed began raising interest rates over a year ago. The much-anticipated recession from higher borrowing costs hasn’t arrived yet. Consumer spending remains resilient as unemployment is at multi-decade lows and wage growth is robust. Advances in generative AI are fueling investor optimism about a new era of worker productivity and corporate opportunity. The current macroeconomic backdrop is in stark contrast to earlier expectations for a severe downturn from potential impacts of higher interest rates, supply chain disruptions and high energy prices. While inflation is gradually moderating and economic growth is indeed slowing, it is far from certain whether the so-called hard-landing or soft-landing scenario is the more likely outcome over the coming months.

This divergence in macroeconomic outcomes from prior expectations is a reminder of two important decisions investors face-timing and time horizon. As stewards of your capital, we remain vigilant about macroeconomic risks, but our fundamental bottom-up driven investment process avoids undue reliance on timing macroeconomic changes. We invest with a long-term time horizon that helps us tide over short-term changes in the economy, and resist waiting for the perfect time to buy and sell stocks, as that is often only obvious in hindsight. We buy stocks when we find bargains and sell when the risk-reward is no longer attractive.

16

| | | | |

| | |

| Semiannual Report • 2023 | | | |  |

As active managers, we’re focused on assessing whether portfolio companies are prudently planning for a range of economic scenarios, not just a specific one. At the portfolio level, we’ve applied a similar measure of risk management in our positioning. We are overweight select Financials and technology stocks, which should do well if the economy avoids a hard landing, while our overweight positioning in Health Care and telecommunications stocks should hedge capital in the event of a major economic downturn.

In the second quarter, we initiated new positions in Fidelity National Information Services (FIS) and Adobe. FIS is a financial transaction technology provider. The company’s stock took a hit due to concerns about exposure to regional banks and weak performance in its payments processing business. However, the company’s revenue from regional banks is highly recurring and should continue to grow as regional banks invest more in technology to defend market share. FIS is also divesting its payments processing business, which should help strengthen its balance sheet.

Adobe is the world’s largest maker of design software. Concerns about the impact of generative AI on its business provided us the opportunity to buy this quality franchise trading off-price. We believe Adobe should be a leading beneficiary of generative AI adoption due to its strong incumbent position and early investments in AI that should be even more evident in upcoming product releases.

We also reinitiated a position in the semiconductor company Intel. The company slashed its dividend to reduce cash burn as it invests to regain competitiveness, and new management’s turnaround

plans are showing early signs of success. Intel should also benefit from a recovery in demand for PC and Server CPUs next year, which slumped coming out of the pandemic.

To fund these purchases, we sold Apple at a substantial gain, and booked profits in Paychex and Accenture. These companies now trade at elevated valuations, which reflect high investor expectations relative to fundamentals.

Finally, our benchmark, the Russell 1000 Value, is reconstituted every year in June. Meta (formerly Facebook), Alphabet, Home Depot and Starbucks are well-known companies that exited the benchmark. Union Pacific, Nike and Estee Lauder are notable new additions. Changes in the benchmark, however, do not affect our time-tested investment process. We look for bargains across the entire universe of investable stocks to generate attractive, long-term, risk-adjusted returns for our shareholders.

Thank you for your investment in the Parnassus Value Equity Fund.

Billy J. Hwan

Lead Portfolio Manager

Krishna S. Chintalapalli

Portfolio Manager

17

| | | | |

| | |

| | | | Semiannual Report • 2023 |

Parnassus Mid Cap Fund

Ticker: Investor Shares - PARMX

Ticker: Institutional Shares - PFPMX

As of June 30, 2023, the net asset value (“NAV”) of the Parnassus Mid Cap Fund – Investor Shares was $35.40. The Fund’s total return for the quarter was 4.00%. This compares to a return of 4.76% for the Russell Midcap Index (“Russell”). For the first half of 2023, the Parnassus Mid Cap Fund – Investor Shares is up 4.49% compared to a gain of 9.01% for the Russell.

Below is a table comparing the Parnassus Mid Cap Fund with the Russell for the one-, three-, five- and ten-year periods.

Parnassus Mid Cap Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended June 30, 2023 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Mid Cap Fund –Investor Shares | | | 4.20 | | | | 6.15 | | | | 5.35 | | | | 8.48 | | | | 0.97 | | | | 0.96 | |

| | | | | | |

| Parnassus Mid Cap Fund –Institutional Shares | | | 4.44 | | | | 6.37 | | | | 5.58 | | | | 8.68 | | | | 0.76 | | | | 0.75 | |

| | | | | | |

| Russell Midcap Index | | | 14.92 | | | | 12.50 | | | | 8.46 | | | | 10.32 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Mid Cap Fund – Institutional Shares from commencement (April 30, 2015) was 7.29%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Mid Cap Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses.

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Midcap Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Mid cap companies can be more sensitive to changing economic conditions and have fewer financial resources than large cap companies.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

As described in the Fund’s current prospectus dated May 1, 2023, Parnassus Investments, LLC has contractually agreed to reduce its investment advisory fee to the extent necessary to limit total annual fund operating expenses to 0.96% of net assets for the Parnassus Mid Cap Fund – Investor Shares and to 0.75% of net assets for the Parnassus Mid Cap Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2024 and may be continued indefinitely by the investment adviser on a year-to-year basis.

Second Quarter Review

The risk appetite of investors surged in the second quarter, buoyed by continued economic strength, easing inflation, the Federal Reserve’s decision to pause rate hikes in June and encouraging signs of stabilization in the banking system. The bullish sentiment drove large cap growth equities, the best-performing domestic market segment, to a near 13% quarterly gain for the Russell 1000 Growth. Mid cap stocks generated a healthy albeit lower return of 4.76% for the Russell. For the first half of 2023, the top-performing large cap growth segment gained more than 29.02% for the Russell 1000 Growth, and the Russell returned 9.01%. Any way you slice it, this year’s boost in investor optimism is a welcome change from last year’s market decline, which was triggered by soaring inflation, rising interest rates and recession fears.

The Parnassus Mid Cap Fund – Investor Shares were up 4.00% during the second quarter, capturing 84% of Russell’s 4.76% gain. Year to date, the Parnassus Mid Cap Fund - Investor Shares returned 4.49% compared to the Russell’s 9.01% return. Challenging stock selection in the Financials sector, primarily in the regional banks, accounted for much of the Fund’s underperformance in the year-to-date period. We are disappointed and humbled by the first half shortfall, but remain confident in the portfolio’s ability to perform well over the long term.

From an allocation perspective, the Fund’s large overweight in Industrial stocks relative to the Russell added 60 basis points to the Fund’s total return in the quarter, while its large overweight in Health Care stocks hurt the return by 21 basis points. (One basis point is 1/100th of one percent.) Consistent with our strategy, stock selection was the primary driver of

18

| | | | |

| | |

| Semiannual Report • 2023 | | | |  |

performance in the past quarter, with good stock picking in the Consumer Discretionary and Materials sectors adding 36 and 30 basis points, respectively, to the Fund’s return. Relatively poor stock picking in the Industrials, Real Estate and Health Care sectors hurt second-quarter performance by 81, 66 and 49 basis points, respectively.

The worst performer this quarter was SBA Communications, which fell 10.9%, detracting 0.4%* from the Fund’s return. The stock dropped after management provided disappointing financial guidance, signaling a slowdown in domestic gross revenue growth for 2023. While leasing of its wireless infrastructure should sustain healthy levels, SBA faces a tough year-over-year comparison due to the early 5G deployment activity that bolstered sales in 2022. Additionally, higher interest rates and anticipated churn from Sprint and international customers present medium-term headwinds. Despite these challenges and considering the stock’s multi-year low valuation, we remain optimistic about SBA’s potential.

Agilent Technologies, a leading life sciences tools and technology provider, dropped 12.8%, reducing the Fund’s return by 0.4%, after management reduced its fiscal 2023 revenue outlook. The company faces weaker-than-expected demand for its analytical instruments, driven by a slowdown in spending among its pharmaceutical customers and a constrained funding environment affecting smaller customers. Despite the recent weakness, we believe Agilent is poised to benefit from additional market share gains, the adoption of its testing products for PFAS and lithium-ion batteries and additional margin expansion through its cost control initiatives.

Nutrien, one of the world’s largest producers of fertilizers, dropped 19.3% in the quarter, reducing the Fund’s total return by 0.3%. The company reported weak first-quarter earnings and issued a disappointing outlook for the remainder of the year. Potash prices continued to fall during the quarter, as supply from Russia and Belarus recovered and as a major potash contract with China was settled at lower price than expected. Sluggish global demand has also been a drag, as farmers deplete existing inventories and cut

back on fertilizer applications to manage costs. We are holding on to the shares, as global crop fundamentals remain robust and the bad news is largely discounted into the stock.

Shifting to our winners, Sherwin-Williams, the largest architectural paint provider in the United States, was the largest contributor to the Fund’s return, rising 18.4% and adding 0.5% to the Fund’s total return.

The company’s earnings exceeded expectations, benefiting from moderating raw material costs and

improving demand, particularly from professional customers. Sherwin is poised to benefit from investments in its supply chain, new stores, workforce and digital initiatives, which should support enhanced gross-margin and operating efficiency.

Verisk, a leading data and analytics provider for the insurance industry, rose by 18.0%, adding 0.5% to the Fund’s total return. The company surpassed growth expectations this quarter, driven by broad-based demand across its core underwriting, property estimating anti-fraud analytics and extreme event modeling solutions. With a renewed focus on its wide-moat insurance business following recent divestitures, we anticipate continued robust growth. However, we trimmed our position in response to the stock’s elevated valuation.

D.R. Horton, the largest home builder in the United States, climbed 24.9%, adding 0.5% to the Fund’s total return. The company delivered earnings that exceeded consensus expectations, driven by solid demand and favorable pricing for new homes in a supply constrained market. We trimmed our position after the recent outperformance but are holding on to a core position. Horton is positioned to benefit from its significant scale, market share gains, deflating input costs, strong balance sheet and opportunities to consolidate smaller builders.

* For this report, we quote total return to the portfolio, which includes price change and dividends.

19

| | | | |

| | |

| | | | Semiannual Report • 2023 |

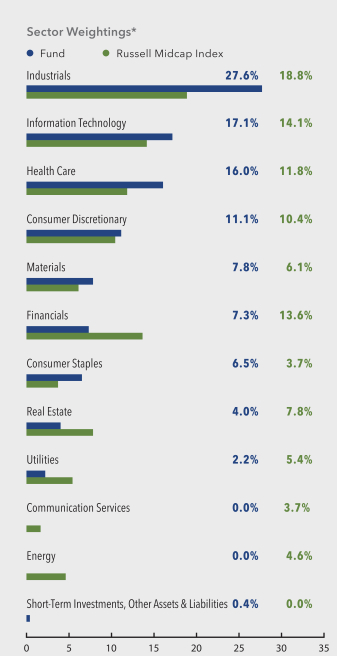

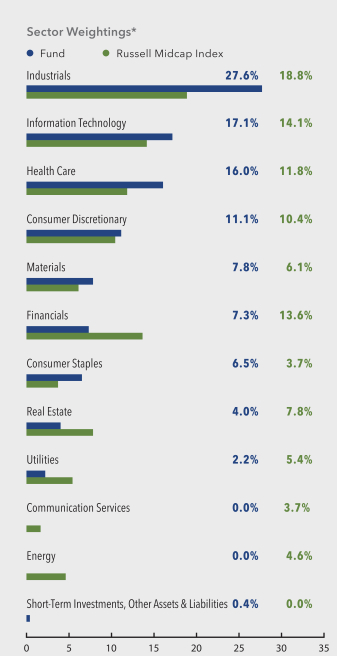

Parnassus Mid Cap Fund

As of June 30, 2023

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Hologic Inc. | | | 5.3% | |

| |

| Sysco Corp. | | | 4.2% | |

| |

| Republic Services Inc. | | | 3.6% | |

| |

| Otis Worldwide Corp. | | | 3.5% | |

| |

| C.H. Robinson Worldwide Inc. | | | 3.2% | |

| |

| The Sherwin-Williams Co. | | | 3.2% | |

| |

| Cboe Global Markets Inc. | | | 3.2% | |

| |

| Ball Corp. | | | 3.2% | |

| |

| Avantor Inc. | | | 3.1% | |

| |

| SBA Communications Corp., Class A | | | 3.1% | |

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

The market has come a long way since the significant declines of 2022, although the Russell remains about 13% below its November 2021 peak. Investor focus has shifted to sustained economic growth, labor market strength, investments in artificial intelligence, “controlled inflation” and the resolution of the debt ceiling and banking sector crises. However, inflation and the direction of interest rates continue to be key areas of investor debate.

Considering the potential impact of higher interest rates on consumer spending and corporate earnings growth, we are cautious about a possible economic downturn and prioritize resilient businesses with a favorable risk-to-reward profile. Moreover, historically low borrowing rates enjoyed by Americans during the past two decades are unlikely to be sustained and real rates may settle slightly higher. This could put a damper on the extreme valuations witnessed in certain sectors, particularly within Information Technology, over the past decade. While growth stocks have performed well this year regardless of valuation, our strategy emphasizes growth supported by reasonable valuations and quality attributes such as strong moats, relevancy and effective management. We also find some market-leading, low-PE cyclical issues attractive due to recent valuation contractions and muted expectations.

Mid cap stocks are now trading at their most appealing valuation relative to the S&P 500 in more than 20 years. They are also trading at close to the average forward earnings multiple of the past 20 years. This

20

| | | | |

| | |

| Semiannual Report • 2023 | | | |  |

environment favors active management, and we are optimistic about the prospects of our 40-stock portfolio’s focus on owning quality businesses at attractive prices.

During the second quarter, we bought five new stocks and exited three positions. In the consumer sector, we initiated a position in Hilton, a leading hotel and resort owner with a loyalty base of 158 million members. Hilton is poised to gain share as it expands into new markets, capitalizes on customer loyalty and launches new lifestyle brands including Spark and Home2. We also purchased shares in Ross Stores, the second-largest off-price retailer in the United States, which we believe will benefit from a favorable buying environment and increased consumer focus on its bargain-priced apparel and home products. With a pristine balance sheet, a long runway of store-count expansion and an attractive value proposition, we believe Ross is positioned to deliver solid earnings in the coming years.

Conversely, we exited Burlington Stores, the third-largest off-price retailer, due to concerns about its high valuation compared to its peers and elevated debt leverage. We also sold apparel company VF Corporation, due to concerns about its slow turnaround progress and elevated debt leverage, which could constrain its ability to invest behind its brands.

Within the Materials sector, we initiated a position in Nutrien, a Canadian-based company and one of the world’s largest providers of crop inputs. Despite recent pressure from weak commodity pricing, Nutrien is well positioned to benefit from the next upcycle, with significant earnings leverage and spare capacity to meet long-term, growing market demand.

In the Industrials sector, we added credit agency TransUnion and transportation service provider Old Dominion Freight Line. TransUnion’s valuation is close to historical lows due to a gloomy lending outlook and concerns about recent, large acquisitions. We believe these concerns will be short lived and present an idiosyncratic opportunity given the valuation. As stable, wide-moat businesses, credit bureaus have demonstrated resilience throughout economic cycles, and we have confidence management will succeed with maximizing the recent purchases of Neustar and Argus.

Old Dominion Freight Line stands out among Industrials with one of the highest returns on invested capital. This is attributed to its exceptional trucking network, cost-management initiatives and competitive position as the second-largest less-than-truckload player in the U.S. The company has consistently invested in expanding its network capacity over the past decade, leading to superior network services and market share gains.

We exited our position in Western Digital Corp., a provider of memory and NAND storage technology, due to our concerns about softening demand, bloated inventories and high debt leverage.

As a reflection of our bottom-up research process, the Fund remains overweight in Industrials, Health Care and Information Technology, as we expect most of our positions in these sectors to do well regardless of the economic environment. The portfolio is underweight relative to the Russell in Financials, Real Estate, Communications Services and Utilities, where we perceive these sectors to have higher potential for significant pitfalls. Our strategy focuses on owning a concentrated collection of high-quality businesses with increasing relevancy, competitive advantages, disciplined management, strong ESG practices, solid balance sheets and favorable upside-downside potential. We are optimistic that our portfolio construction will mitigate potential downturns and deliver solid returns relative to the benchmark over the long term.

Thank you for your trust and investment in the Parnassus Mid Cap Fund.

Yours truly,

Matthew D. Gershuny

Lead Portfolio Manager

Lori A. Keith

Portfolio Manager

21

| | | | |

| | |

| | | | Semiannual Report • 2023 |

Parnassus Mid Cap Growth Fund

Ticker: Investor Shares - PARNX

Ticker: Institutional Shares - PFPRX

As of June 30, 2023, the net asset value (“NAV”) of the Parnassus Mid Cap Growth Fund – Investor Shares was $50.17, resulting in a gain of 4.35% for the second quarter. This compares to a gain of 6.23% for the Russell Midcap Growth Index (“Russell Midcap Growth”). For the first half of 2023, the Parnassus Mid Cap Growth Fund – Investor Shares posted a gain of 18.66%, compared to a gain of 15.94% for the Russell Midcap Growth.

Below is a table that summarizes the performance of the Parnassus Mid Cap Growth Fund and the Russell Midcap Growth. The returns are for the one-, three-, five- and ten-year periods ended June 30, 2023.

Parnassus Mid Cap Growth Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended June 30, 2023 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Mid Cap Growth Fund – Investor Shares | | | 19.80 | | | | 3.17 | | | | 5.91 | | | | 8.89 | | | | 0.80 | | | | 0.80 | |

| | | | | | |

| Parnassus Mid Cap Growth Fund – Institutional Shares | | | 19.93 | | | | 3.30 | | | | 6.05 | | | | 9.01 | | | | 0.70 | | | | 0.68 | |

| | | | | | |

| Russell Midcap Growth Index | | | 23.13 | | | | 7.63 | | | | 9.72 | | | | 11.53 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Mid Cap Growth Fund – Institutional Shares from commencement (April 30, 2015) was 6.63%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Mid Cap Growth Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses.

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Mid Cap Growth is an index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

As described in the Fund’s current prospectus dated May 1, 2023, Parnassus Investments, LLC has contractually agreed to reduce its investment advisory fee to the extent necessary to limit total annual fund operating expenses to 0.80% of net assets for the Parnassus Mid Cap Growth Fund – Investor Shares and to 0.68% of net assets for the Parnassus Mid Cap Growth Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2024 and may be continued indefinitely by the investment adviser on a year-to-year basis.

Second Quarter Review

The market gained 6.23% during the second quarter, as the Russell Midcap Growth added to its first quarter performance. Our Parnassus Mid Cap Growth Fund – Investor Shares gained 4.35% during the second quarter, trailing the index by 188 basis points. (One basis point is 1/100th of one percent.) For the year-to-date (YTD) period, the Fund returned 18.66%, outperforming the benchmark’s 15.94% return by 272 basis points.

During the second quarter, sector allocation had a positive impact on our relative performance. The Energy sector was the benchmark’s worst-performing sector, so our avoidance of the sector as a fossil fuel-free fund added to our relative return. Additionally, the Information Technology sector outperformed the index and we benefitted from our overweight position. Stock selection detracted from our positive sector allocation, as some of the Information Technology companies in our portfolio did not keep up with the sector’s strong performance.

Illumina, the largest provider of gene sequencing instruments and related consumables, subtracted 0.7%* from the Fund’s return as its shares fell 19.4%. The focus during the quarter was on the company’s high-profile proxy fight with Carl Icahn, and the stock dropped when investors learned that only one of Icahn’s three nominees was elected to Illumina’s board. While Illumina’s CEO survived the proxy contest, he resigned later in the quarter and investors worried that the company might need to reduce its annual guidance. We’re holding onto our shares because we believe Illumina will be able to attract a world-class CEO, and that its moat and innovative products will enable the company to remain the leader in the growing sequencing market.

* For this report, we quote total return to the portfolio, which includes price change and dividends.

22

| | | | |

| | |

| Semiannual Report • 2023 | | | |  |

Call center software provider Five9 reduced the Fund’s return by 0.7%, as the stock dropped 28.8% to our average selling price. The stock dropped as investors became concerned that Five9 could be negatively impacted by new artificial intelligence (AI) technology, as Five9 lacks a proprietary AI solution and the number of call center agents could decline over time if AI-enabled chat bots are widely adopted. We were unable to disprove these concerns, so we exited our position.

MercadoLibre, the leading online consumer marketplace and payments platform in Latin America, reduced the Fund’s return by 0.5%, as the stock fell 10.1%. The company reported a strong quarter, beating on both the top and bottom lines. Nevertheless, after a big first-quarter rally that sent the stock up more than 50%, investors digested MercadoLibre’s results and considered whether the company’s share gains and increasing profitability can continue. We believe both can, and we think the company will profitably grow the business for a long time.

CoStar, a leading operator of online real estate marketplaces and data services, was our Fund’s best performer and added 0.9% to the return, as the stock jumped 29.3%. CoStar’s stock rallied as the company reported accelerating revenue growth and raised its annual earnings guidance. Investors were also excited that traffic to CoStar’s nascent Homes.com platform continues to rise.

The Trade Desk, a leading programmatic advertising platform, boosted the Fund’s return by 0.7%, as the stock rose 26.8% after the company reported quarterly results that were well above investors’ expectations. Later in the quarter, The Trade Desk launched its new platform, Kokai, which features advanced AI to refine ad selection and improve measurement capabilities. We expect Kokai will further entrench The Trade Desk as the advertising platform of the open internet.

KLA Corporation is the leader in process control equipment for semiconductor manufacturing. Its shares contributed 0.5% to the Fund’s return, as the stock returned 21.9%. KLA rallied as investors anticipated that the second quarter will mark the bottom of the business cycle for the semiconductor capital equipment industry, spurred in part by the advent of

widespread AI, which is driving demand for the semiconductor chips powering the technology.

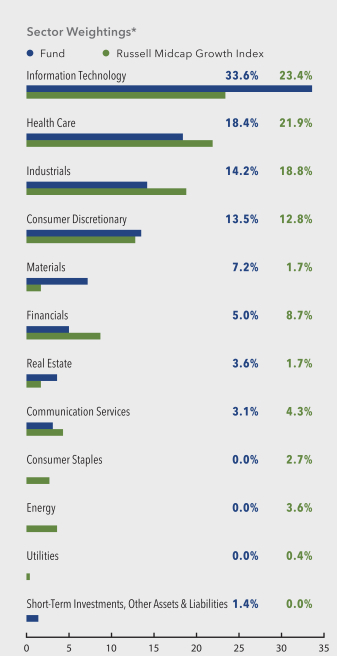

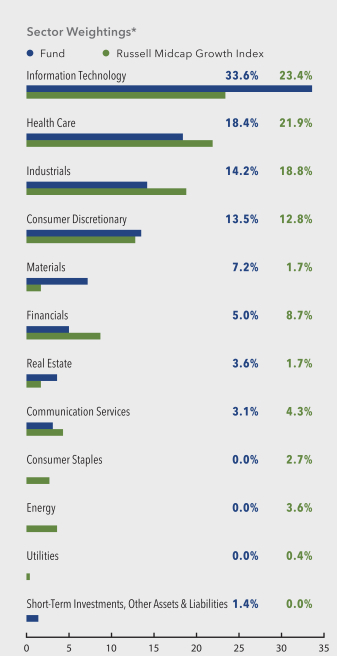

Parnassus Mid Cap Growth Fund

As of June 30, 2023

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

23

| | | | |

| | |

| | | | Semiannual Report • 2023 |

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Splunk Inc. | | | 5.3% | |

| |

| Guidewire Software Inc. | | | 4.3% | |

| |

| Fortinet Inc. | | | 3.8% | |

| |

| CoStar Group Inc. | | | 3.6% | |

| |

| Ansys Inc. | | | 3.5% | |

| |

| Workday Inc., Class A | | | 3.5% | |

| |

| Old Dominion Freight Line Inc. | | | 3.4% | |

| |

| Verisk Analytics Inc. | | | 3.3% | |

| |

| IDEXX Laboratories Inc. | | | 3.3% | |

| |

| MercadoLibre Inc. | | | 3.3% | |

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

Russell Midcap Growth continued its momentum into the second quarter, as the index returned 6.23%. Investors cheered decelerating inflation and healthy economic data. The U.S. consumer is still in good shape financially, with a buoyant jobs market and bank account balances that exceed pre-COVID-19 levels due to prior government stimulus. Resilient consumers have helped the U.S. economy power through higher borrowing costs from the Federal Reserve’s interest-rate-hiking campaign and a reduction in credit availability from regional banks due to rising deposit costs.

However, just because the Federal Reserve’s aggressive rate hikes or banks’ reduced ability to lend haven’t impacted the economy yet, that doesn’t mean they won’t. The economy’s resilience is emboldening the Federal Reserve to continue on its path, and its governors are now estimating two additional rate hikes this year, which could exacerbate the eventual economic impact when it occurs. Meanwhile, the global economy has fared worse, as the anticipated demand boost from China’s economic re-opening after years of COVID-19 lockdowns has failed to materialize, while Russia’s war in Ukraine continues.

Given what we feel is a tenuous economic environment, we are maintaining our focus on high-quality growth compounders-innovative companies that are market share gainers with expanding competitive advantages and clean balance sheets. If the economy remains strong, we expect our best-in-class companies to take full advantage of it. If

economic growth slows, then the resiliency of our holdings’ revenue streams, supported by their competitive moats, should allow them to outperform. We’re invested in a number of software companies that we believe should exemplify this.

The potential of artificial intelligence, or AI, captivated investors this quarter and boosted the valuations of many software and semiconductor companies. We believe that AI could lower the unit cost and increase the productivity of software development, which would make software more affordable and accessible. This could dramatically expand the addressable market for certain software companies, while also enhancing their operating margins. Our research team has identified specialization, limited alternatives and a wide distribution platform as the criteria for success in software with AI, and our software holdings have been curated to meet that criteria. Semiconductors are the building blocks of all technology, including AI, so an increase in AI spending should benefit semiconductors. Our portfolio has long been overweight semiconductors due to their foundational position in the technology ecosystem.