UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-6275

| T. Rowe Price Balanced Fund, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2011

Item 1. Report to Shareholders

| Balanced Fund | December 31, 2011 |

The views and opinions in this report were current as of December 31, 2011. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

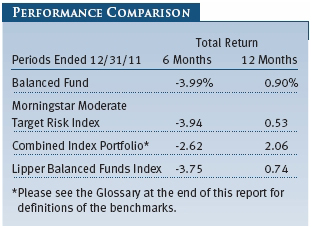

U.S. stocks rallied in the first four months of 2011 but retraced most of their gains by year-end as concerns about Europe’s sovereign debt crisis overshadowed signs of improvement in the U.S. economy. Worries about European policymakers’ inability to contain the eurozone’s financial crisis spurred investors to retreat from stocks in favor of more conservative assets like U.S. Treasuries, pushing down much of the Treasury yield curve to historic lows. Outside the U.S., European markets fell sharply amid slowing growth, the implementation of fiscal austerity measures, and dwindling confidence in policymakers’ ability to fix the region’s debt problems.

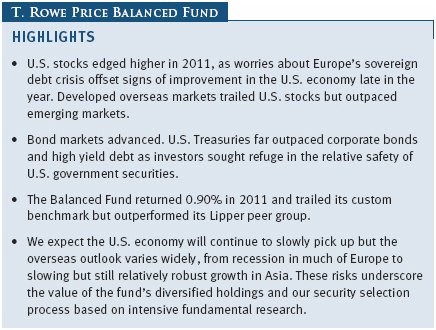

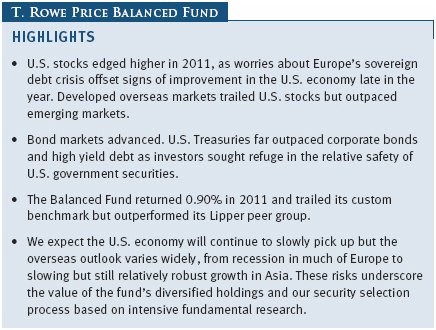

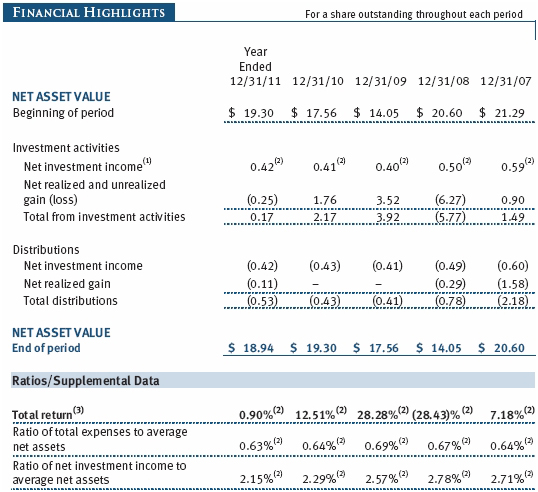

PERFORMANCE REVIEW

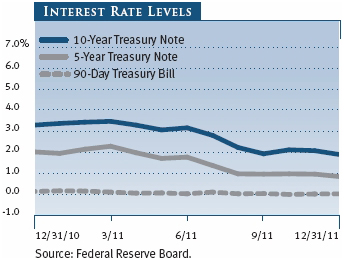

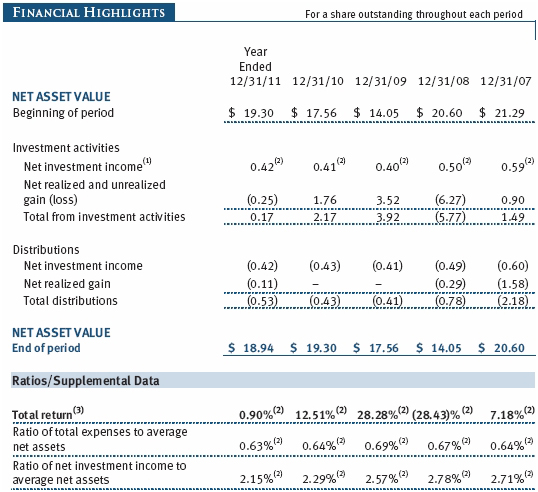

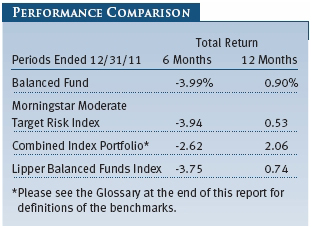

The Balanced Fund returned 0.90% for the 12 months ended December 31, 2011. As shown in the Performance Comparison table, the fund underperformed its combined index portfolio but exceeded its Lipper peer group. The combined index portfolio is composed of multiple indexes representing the broad asset classes in which the Balanced Fund invests.

Although U.S. stocks rose overall in 2011, the portfolio’s equity holdings trailed the index due to unfavorable stock selection and an underweight to more defensive sectors such as consumer staples and utilities. Strong relative performance in non-U.S. stocks was a positive contributor to performance. Our fixed income holdings lifted absolute returns, but an underweight to Treasury bonds and an emphasis on corporate bonds weighed on relative results. In addition to the negative contribution from overweighting high yield bonds, the portfolio’s holdings in real assets such as commodities and real estate detracted from relative performance.

MARKET ENVIRONMENT

U.S. stocks rallied in the first four months of 2011, as encouraging economic data overcame political unrest in the Middle East and North Africa, an ensuing spike in oil prices, and a devastating earthquake and tsunami in Japan. However, a string of mixed reports starting in the spring raised doubts about the strength of the U.S. recovery, while weakening growth in overseas markets raised talk about another global downturn after the 2008 crisis. Rising anxiety over Europe’s inability to stem its debt crisis led investors to seek refuge in the relative safety of U.S. government debt, causing the price of Treasuries to soar across the board. Partisan U.S. politics also drained investor confidence, as a divided Congress and President Barack Obama wrangled over the ballooning deficit and fiscal policy. Lawmakers engaged in a divisive debate over raising the federal debt ceiling that took the U.S. to the brink of default, which resulted in Standard & Poor’s stripping the U.S. of its AAA credit rating in August. Despite the political turmoil, a string of better-than-expected economic data in the fourth quarter showed that the U.S. recovery was picking up. The jobless rate declined to 8.5% in December, its lowest level in nearly three years, after hovering at roughly 9% for most of 2011. Still, high unemployment, the depressed housing market, and Europe’s long-running debt crisis threaten to undermine the recovery.

Overseas developed stock markets trailed U.S. stocks, partly because the dollar strengthened against other currencies. European stock markets tumbled amid contracting growth across the eurozone and fallout from the debt crisis, while developed Asian markets including Japan also fell. Emerging markets stocks fared even worse than developed markets as key countries like Brazil, India, and China tightened monetary policy to curb inflation, although some countries began to loosen policy to shore up growth in the year’s second half.

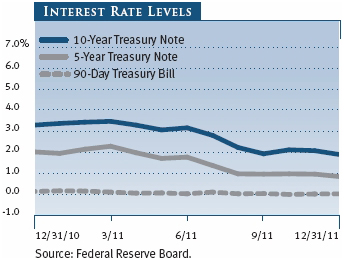

U.S. bonds produced strong returns over the last year—largely due to Treasuries—as weakening global growth and the European debt crisis spurred demand for less risky investments. In September, the Federal Reserve announced it would move $400 billion of its short-term Treasury holdings into longer-term issues in an effort to drive down long-term interest rates, a move that further supported the Treasury market. High yield bonds trailed investment-grade issues as risk aversion rose and credit spreads widened in the year’s second half. Outside the U.S., European bond markets were restrained by sharply rising yields in several peripheral countries as leaders struggled to contain the debt crisis.

ASSET ALLOCATION STRATEGY

The Balanced Fund seeks to provide capital growth and current income by investing in a combination of U.S. and international stocks and fixed income securities. We believe that stocks are reasonably valued, whereas the current low-yield environment is less favorable for bond returns. We remain neutral between U.S. and non-U.S. stocks, as we think that a relatively stronger growth outlook for the U.S. and a slowing growth profile in Europe are reflected in current valuations.

In the fixed income segment, we continue to favor high yield over investment-grade bonds. Yields offered by high yield bonds relative to Treasuries are at attractive levels, having risen as the economic outlook began to weaken in the summer. We believe that high yield bonds can do well even in a low-growth environment, as many high yield issuers have taken advantage of low interest rates to refinance debt and extend maturities.

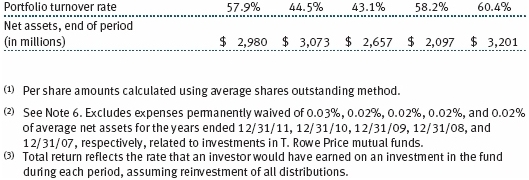

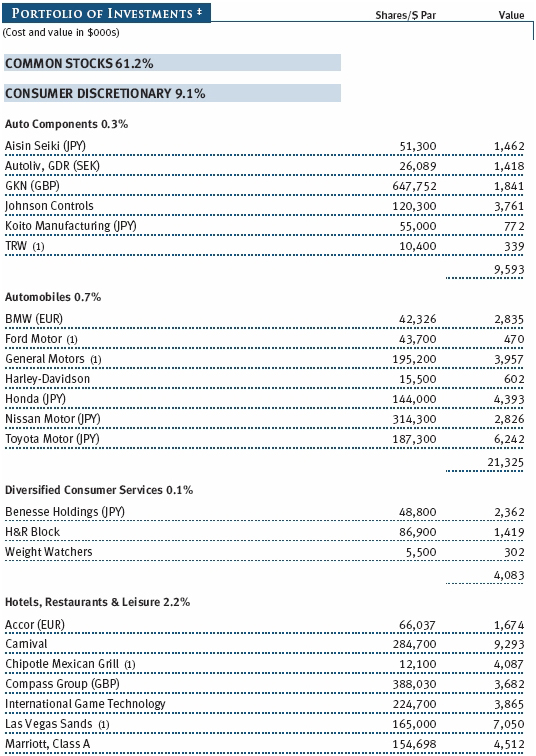

PORTFOLIO REVIEW

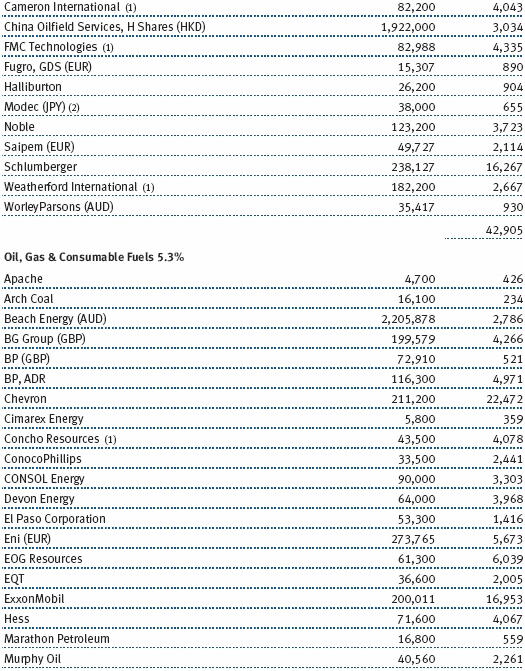

Domestic Stocks

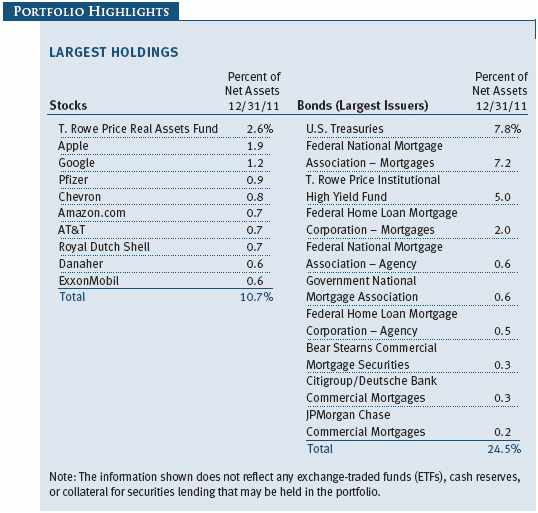

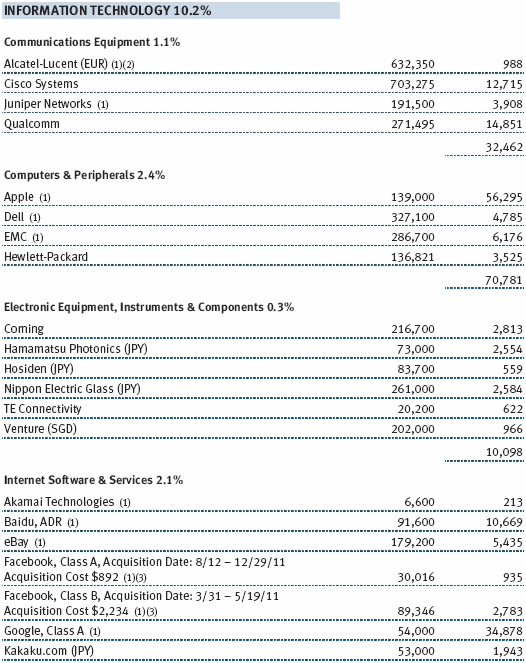

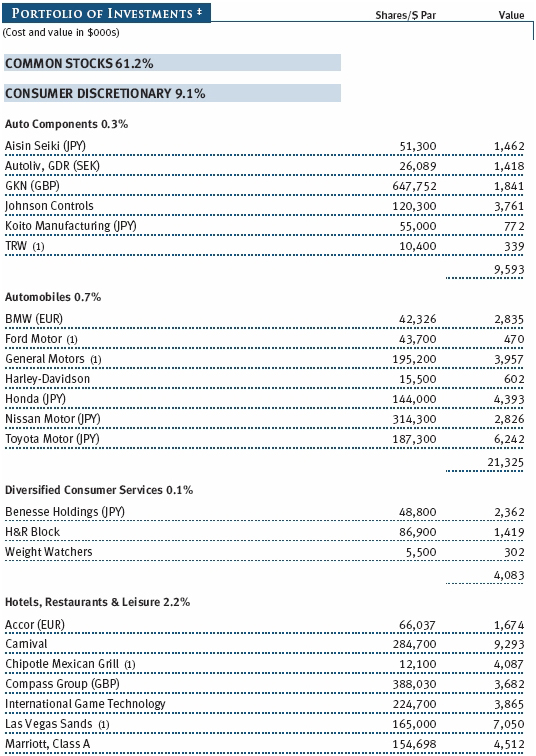

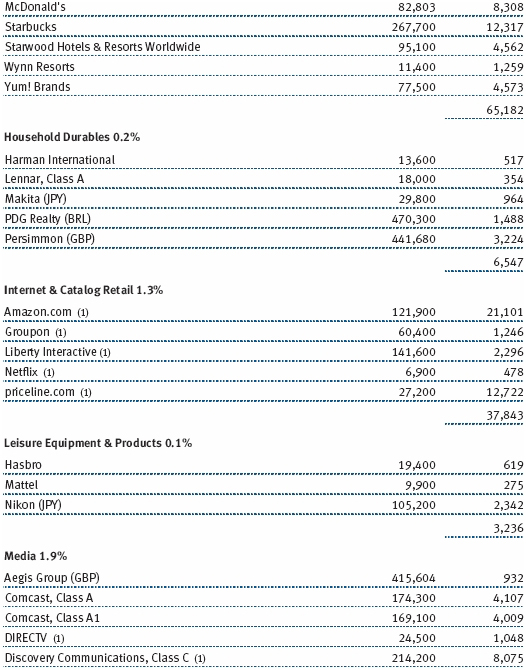

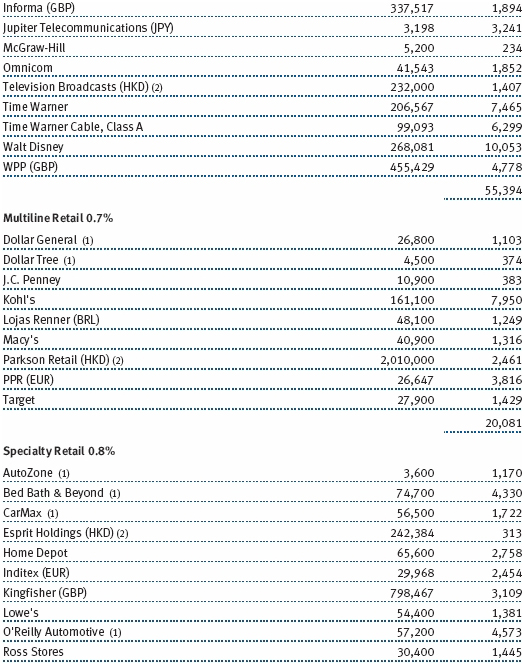

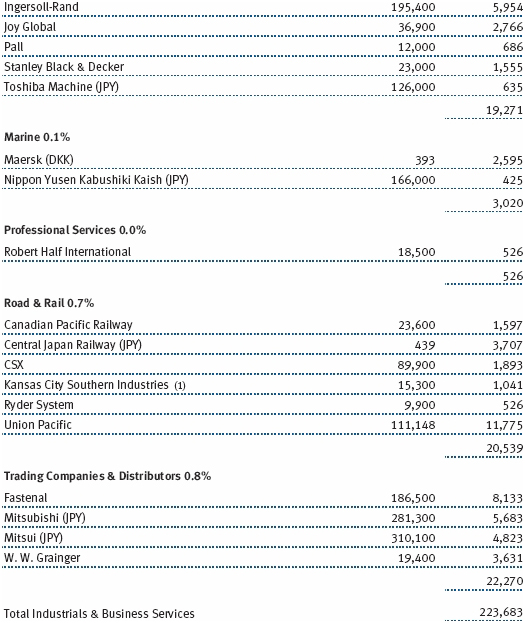

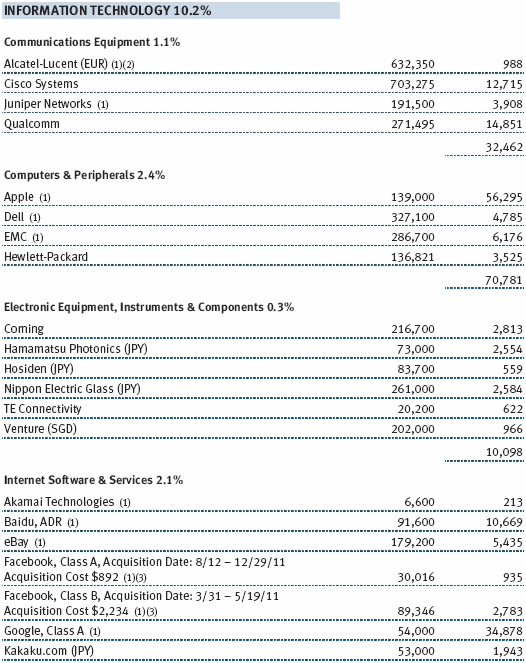

Information technology stocks dominated the fund’s biggest absolute contributors in 2011. Apple topped contributors, as the company continued to innovate new products and benefited from soaring sales of laptops, mobile phones, and tablets. Payment processing companies MasterCard and Visa also performed well amid rising volume growth as consumers worldwide increasingly use credit and debit cards instead of cash. Google was another top performer as the company continued to generate strong revenue growth due to its dominant position in online search and advertising. (Please refer to the fund’s portfolio of investments for a complete list of our holdings and the amount each represents in the portfolio.)

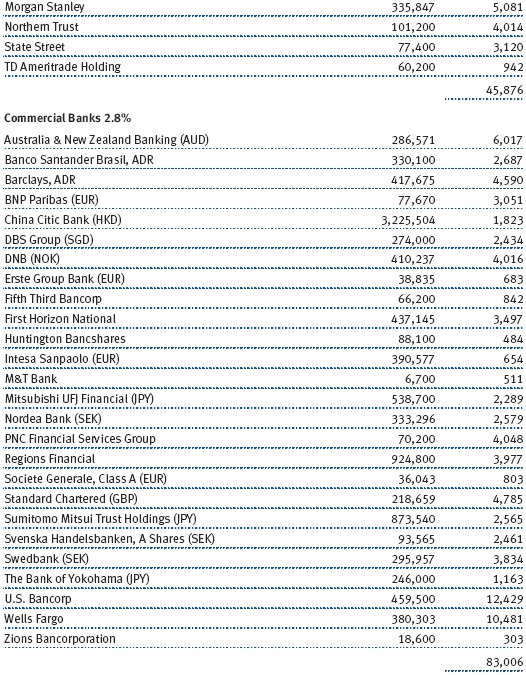

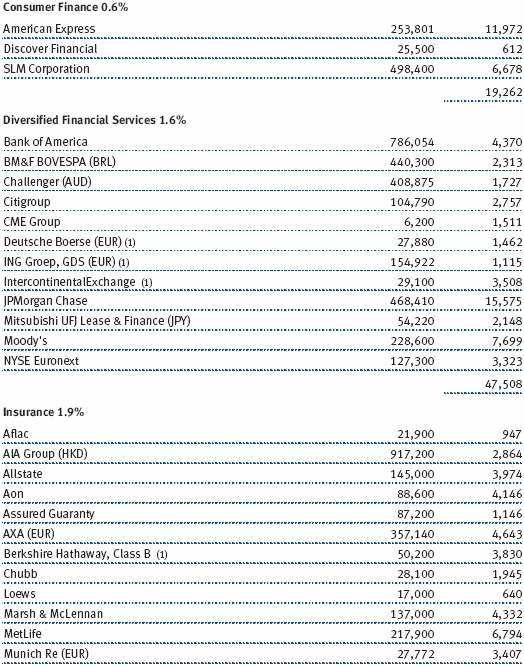

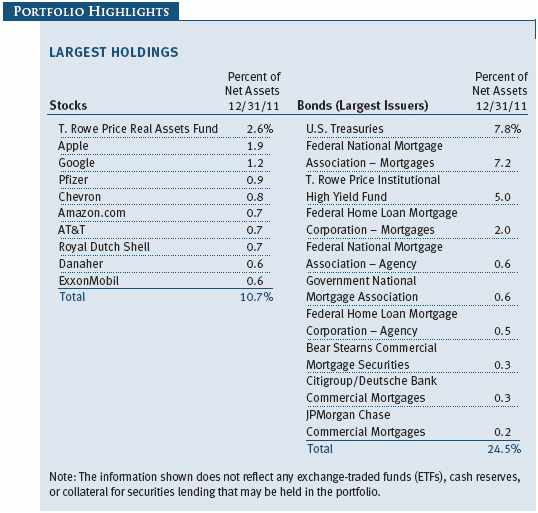

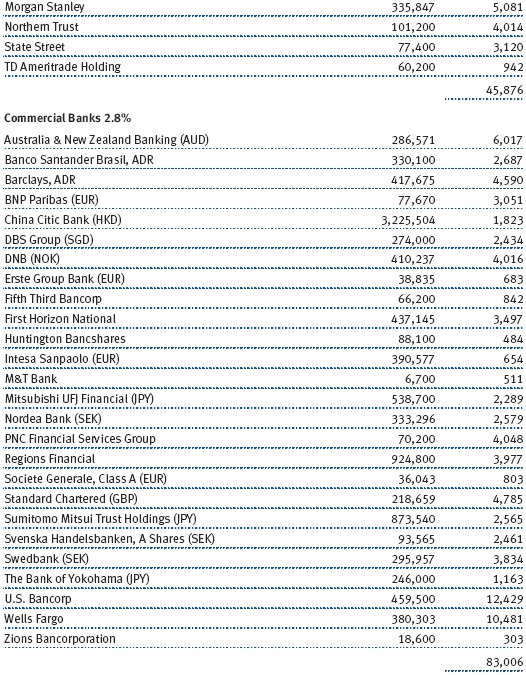

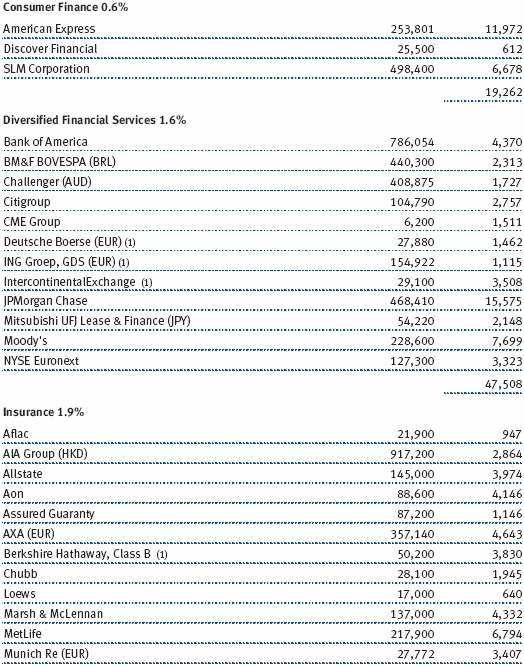

Financials was the worst-performing sector in the S&P 500 in 2011, giving up 17% for the year. Concerns about slowing global growth, the depressed housing market, volatile global markets, and Europe’s debt troubles infecting the U.S. banking system contributed to weakness in financials, on top of existing worries about regulatory changes facing the industry. Bank of America, JPMorgan Chase, Goldman Sachs and Morgan Stanley ranked among the fund’s biggest absolute detractors. The T. Rowe Price Real Assets Fund was another detractor from absolute and relative returns. This fund—which invests mostly in assets with physical properties such as commodities, real estate, energy, and natural resources—fell sharply in 2011 as its underlying holdings in industrial and precious metals, natural resources, and other assets performed poorly as global growth prospects weakened over the year.

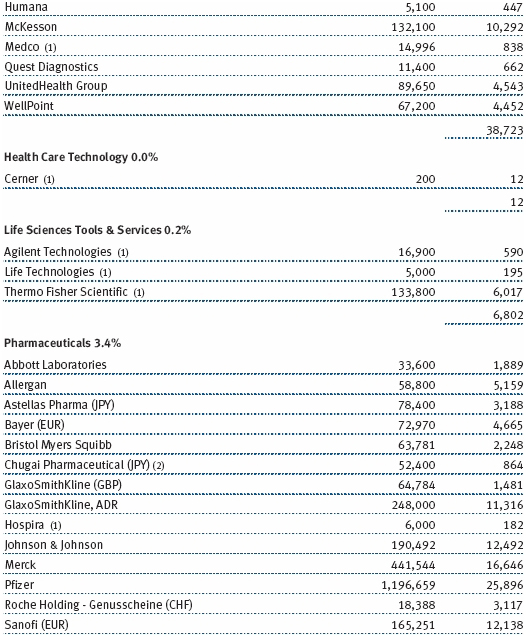

International Stocks

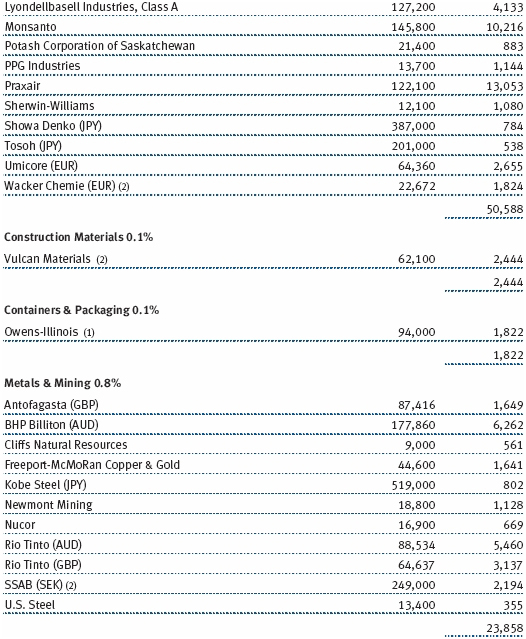

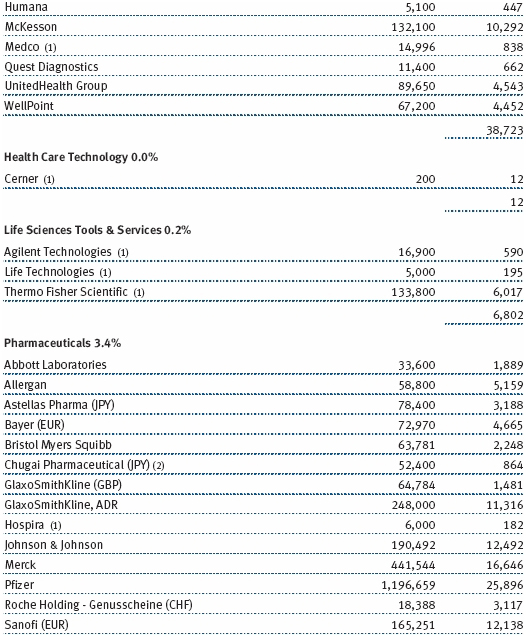

Many of the fund’s better-performing international stocks belonged to defensive sectors like energy and health care, which generally outperformed more cyclical areas as investors sought refuge in names that are less sensitive to economic prospects. Anglo-Dutch company Royal Dutch Shell, Europe’s biggest oil producer, benefited from elevated crude oil prices and asset sales completed in 2011. GlaxoSmithKline was another significant contributor, as the UK drug maker increased its share buyback program and raised its quarterly dividend throughout the year. Baidu, China’s dominant Internet search engine, rose as online search and advertising continued to surge in the world’s fastest-growing Internet market. Conversely, overseas financials stocks fared poorly along with their U.S. counterparts amid worries about the deteriorating global outlook and the spreading eurozone debt crisis. Barclays, BNP Paribas, and Credit Suisse ranked among the fund’s top absolute detractors. Materials stocks also fell sharply due to signs of slowing growth in China, a large consumer of metals and other raw materials. UK mining groups Rio Tinto and BHP Billiton were sizable detractors for the year.

As we noted in our semiannual letter, we plan to continue increasing the fund’s international equity exposure in the coming months, moving from roughly 20% earlier in 2011 to approximately 30% of its total equity allocation. We are increasing the international equity exposure in a gradual manner given market volatility. International developed and emerging market stocks are rising as a percentage of the global equity market and now represent over half of the world market capitalization. These areas often include countries that enjoy higher gross domestic product growth rates than the U.S. and companies with higher long-term earnings growth potential or more favorable valuations, offering attractive investment opportunities that complement U.S. investments. The fund’s domestic equity exposure will be reduced, and the portfolio will maintain its current overall allocation to stocks and bonds.

We continued to gradually increase our holdings in companies that derive a substantial portion of their profits or revenues from real assets. Real assets include any investments that have physical properties such as energy and natural resources, real estate, basic materials, equipment, utilities and infrastructure, and commodities. Exposure to companies operating in these areas should expand the fund’s broad diversification and position it to perform well in a variety of market conditions, including periods of rising inflation.

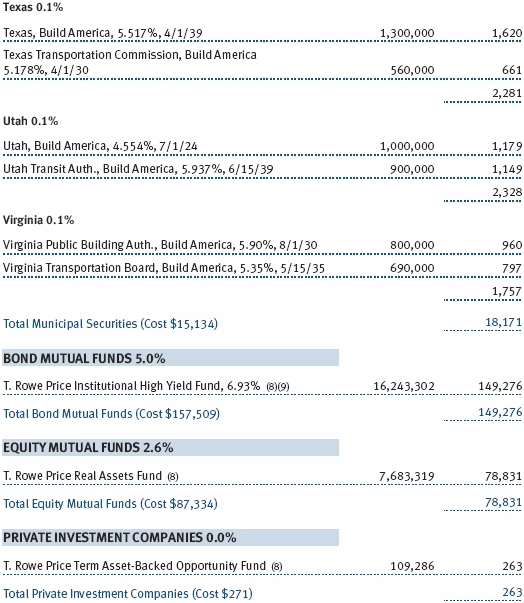

Domestic Bonds

The fund’s holdings in high yield bonds were a negative contributor to performance as higher-quality bonds, particularly U.S. Treasuries, generally outperformed. As shown in the Largest Holdings table on page 10, the T. Rowe Price Institutional High Yield Fund accounted for one of the fund’s biggest fixed income allocations. We continue to favor high yield over investment-grade bonds. Yields offered by high yield bonds relative to Treasuries are at attractive levels, having risen as the economic outlook began to weaken in the summer. We believe that high yield bonds can do well even in a low-growth environment, as many high yield issuers have taken advantage of low interest rates to refinance debt and extend maturities.

OUTLOOK

Global financial markets face numerous near-term risks that have intensified since the summer. These headwinds include the European debt crisis, uneven global growth prospects, and a loss of faith in policymakers to fix deep-rooted economic problems. Recent events have made it clear that the direction of global financial markets largely rests with government actions in the U.S. and Europe, making outcomes hard to predict and risk management challenging. Until policymakers can decisively resolve Europe’s debt problems, we believe that risk aversion will remain high and financial markets volatile. We expect U.S. interest rates to rise over the long term as the economy continues its recovery. In the near term, we believe Treasury yields and credit spreads will be range-bound and volatility will remain high.

Unfortunately, much of the current risk aversion stems from issues that have no quick or easy solution. For more than two years, fiscal policymakers in the U.S. and Europe have been struggling without success to address the twin challenges of reducing debt and increasing growth. This uncertain environment heightens risk awareness and underscores the value of the fund’s diversified holdings. We believe that a balanced portfolio strategy combined with prudent security selection can help mitigate risks while still being able to benefit from long-term growth opportunities.

Respectfully submitted,

Charles M. Shriver

Chairman of the portfolio’s Investment Advisory Committee

January 24, 2012

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the portfolio’s investment program.

RISKS OF INVESTING IN STOCKS

As with all stock mutual funds, the fund’s share price can fall because of weakness in the stock market, a particular industry, or specific holdings. Stock markets can decline for many reasons, including adverse political or economic developments, changes in investor psychology, or heavy institutional selling. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the investment manager’s assessment of companies held in a fund may prove incorrect, resulting in losses or poor performance even in rising markets.

RISKS OF INTERNATIONAL INVESTING

Funds that invest overseas generally carry more risk than funds that invest strictly in U.S. assets. Risks can result from varying stages of economic and political development; differing regulatory environments, trading days, and accounting standards; currency fluctuations; and higher transaction costs of non-U.S. markets. Investments outside the U.S. could be subject to governmental actions such as capital or currency controls, nationalization of a company or industry, expropriation of assets, or imposition of high taxes.

RISKS OF INVESTING IN BONDS

Funds that invest in bonds are subject to interest rate risk, the decline in bond prices that usually accompanies a rise in interest rates. Longer-maturity bonds typically decline more than those with shorter maturities. Funds that invest in bonds are also subject to credit risk, the chance that any fund holding could have its credit rating downgraded or that a bond issuer will default (fail to make timely payments of interest or principal), potentially reducing the fund’s income level and share price.

GLOSSARY

Barclays Capital U.S. Aggregate Index: An unmanaged index that tracks domestic investment-grade bonds, including corporate, government, and mortgage-backed securities.

Combined index portfolio: An unmanaged portfolio of 52% domestic stocks (S&P 500 Index), 35% bonds (Barclays Capital U.S. Aggregate Index), and 13% international stocks (MSCI EAFE Index).

Lipper indexes: Fund benchmarks that consist of a small number (10 to 30) of the largest mutual funds in a particular category as tracked by Lipper Inc.

Merrill Lynch-Wilshire Capital Market Index: A market capitalization-weighted index including the Wilshire 5000, Merrill Lynch High Yield II, and Domestic Master indexes. This index was discontinued on June 30, 2009.

Morningstar Moderate Target Risk Index: Represents a portfolio of global equities (fixed at 60%), bonds, and other asset classes.

MSCI EAFE Index: An index that measures equity market performance of developed countries in the Europe, Australasia, and Far East regions.

S&P 500 Index: An unmanaged index that tracks the stocks of 500 primarily large-cap U.S. companies.

Weighted average maturity: A measure of a fund’s interest rate sensitivity. In general, the longer the average maturity, the greater the fund’s sensitivity to interest rate changes. The weighted average maturity may take into account the interest rate readjustment dates for certain securities. Money funds must maintain a weighted average maturity of less than 60 days.

Weighted average effective duration (years): A measure of a portfolio’s price sensitivity to changes in interest rates. Portfolios with longer weighted-average effective durations are more sensitive to changes in interest rates than those with shorter durations.

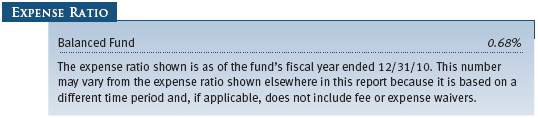

Performance and Expenses

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

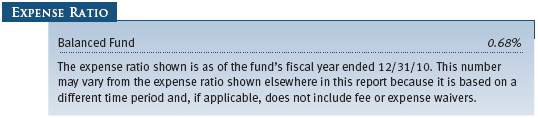

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual account service fee of $20, generally for accounts with less than $10,000 ($1,000 for UGMA/UTMA). The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $50,000 or more; accounts employing automatic investing; accounts electing to receive electronic delivery of account statements, transaction confirmations, prospectuses, and shareholder reports; accounts of an investor who is a T. Rowe Price Preferred Services, Personal Services, or Enhanced Personal Services client (enrollment in these programs generally requires T. Rowe Price assets of at least $100,000); and IRAs and other retirement plan accounts that utilize a prototype plan sponsored by T. Rowe Price (although a separate custodial or administrative fee may apply to such accounts). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

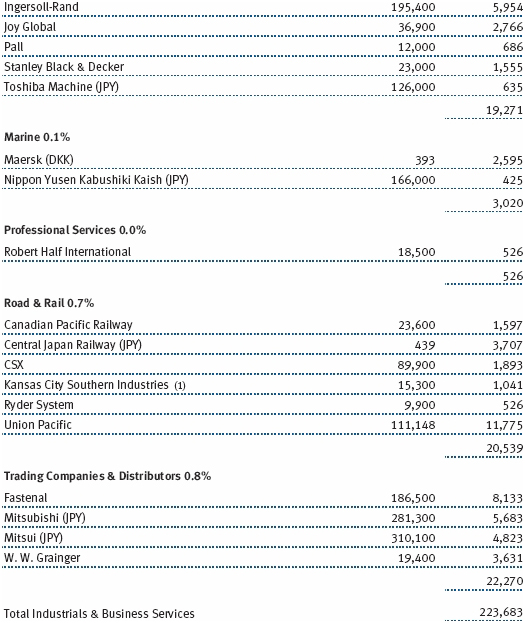

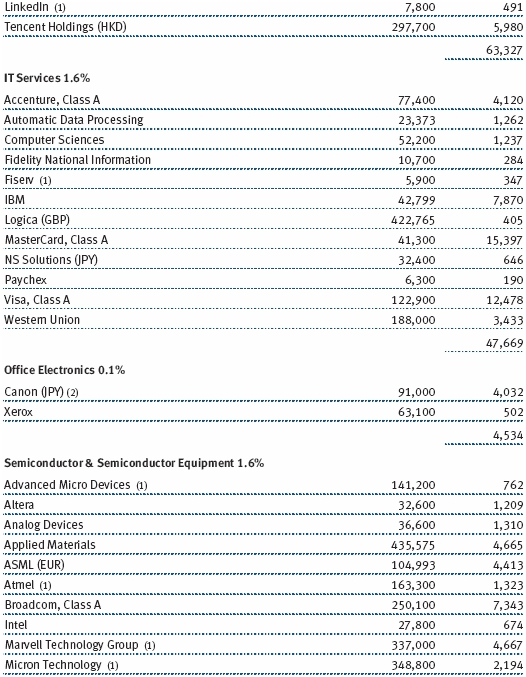

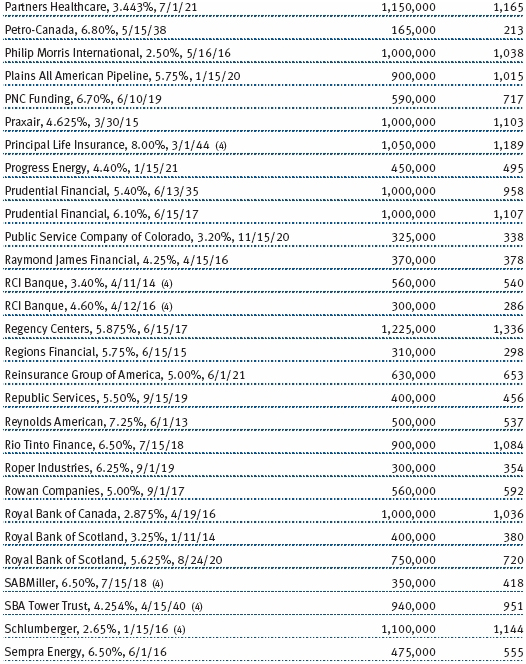

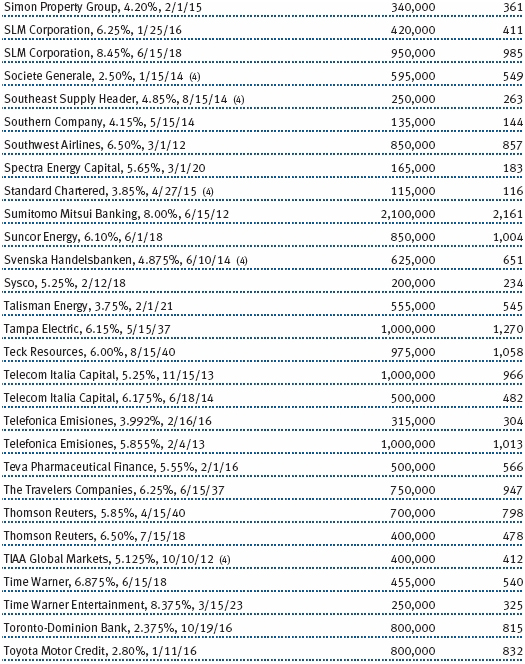

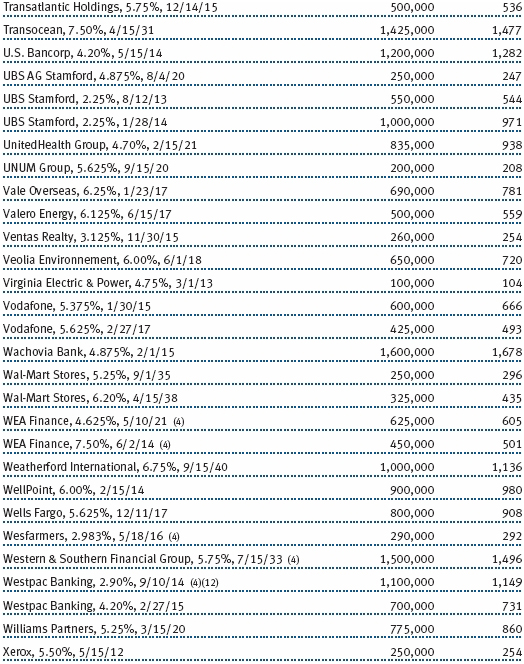

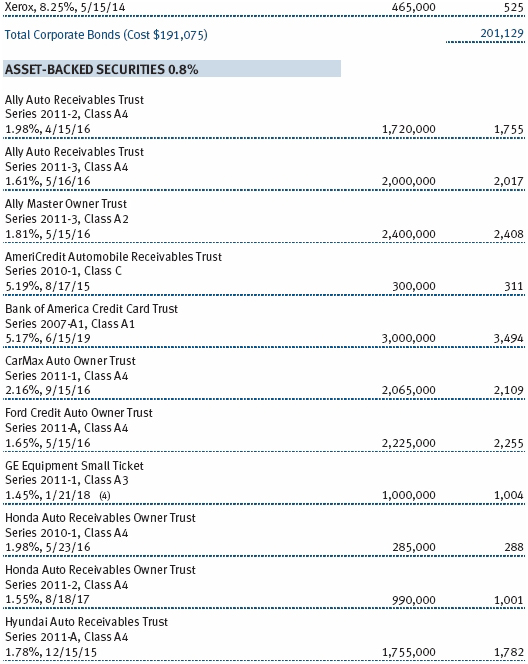

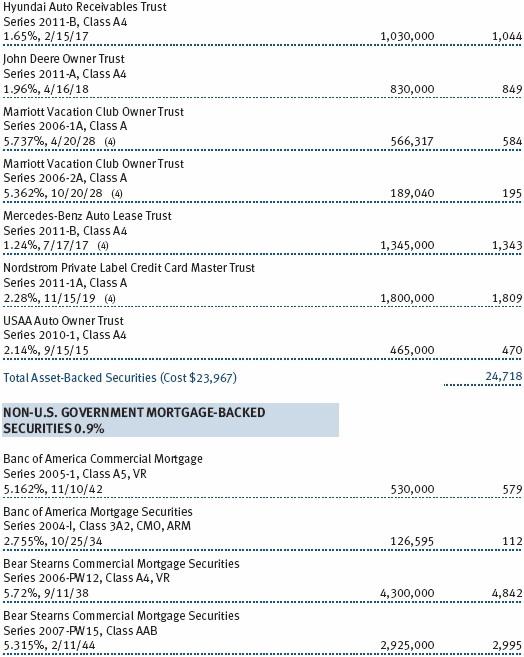

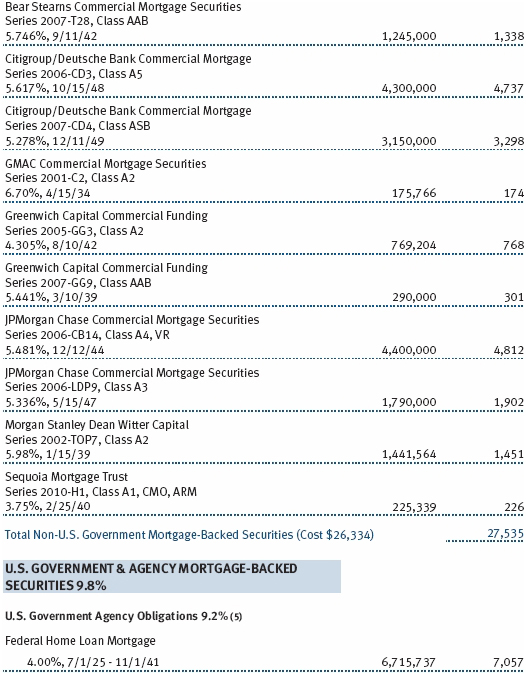

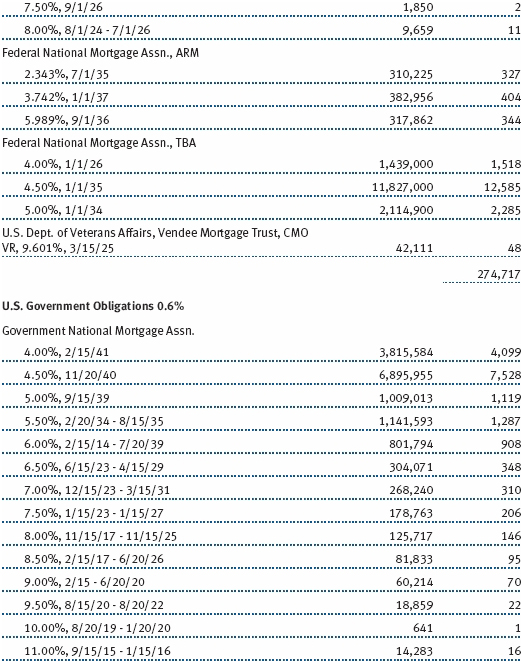

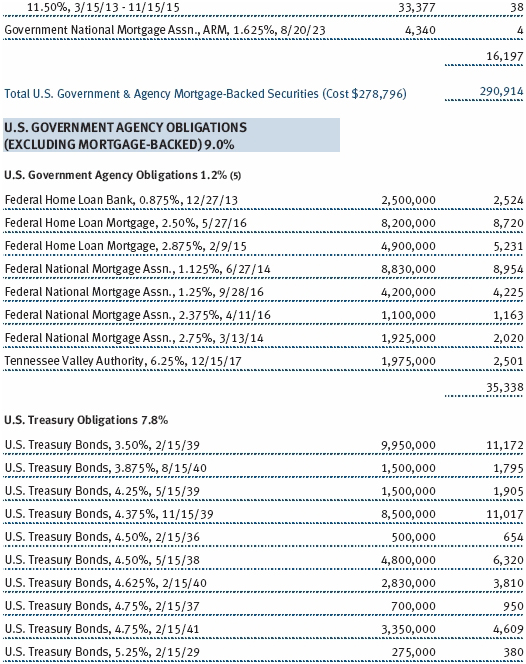

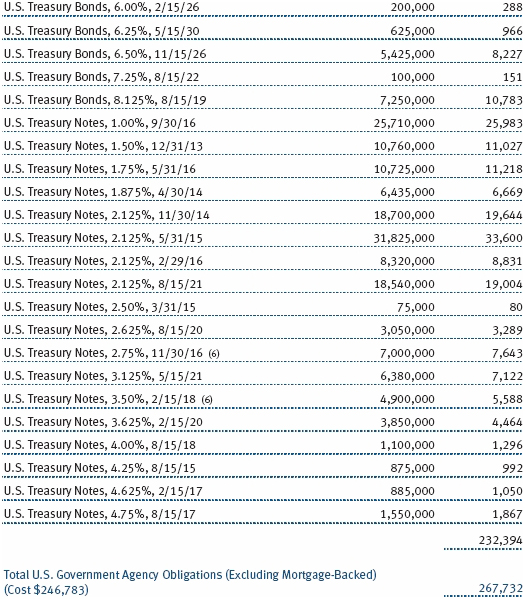

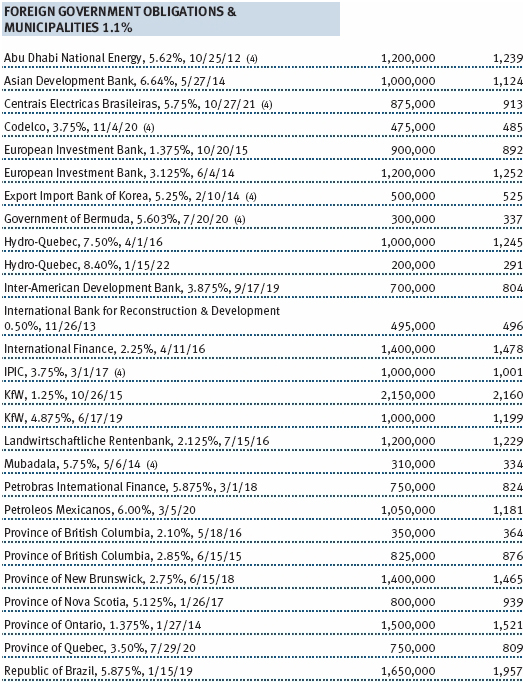

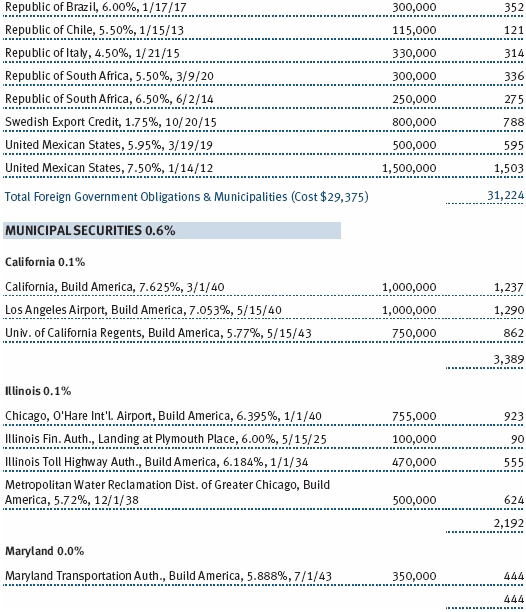

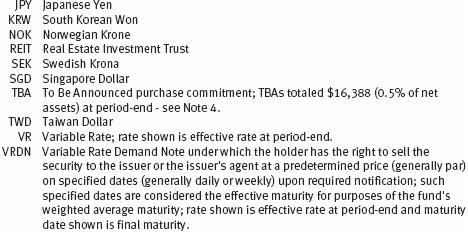

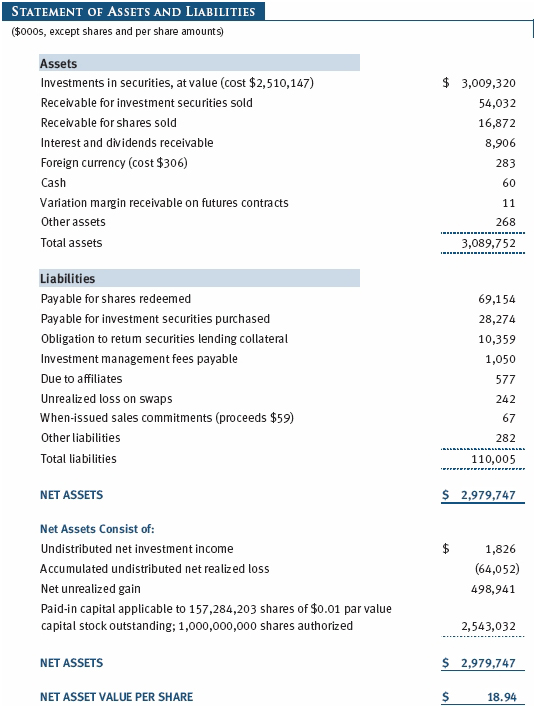

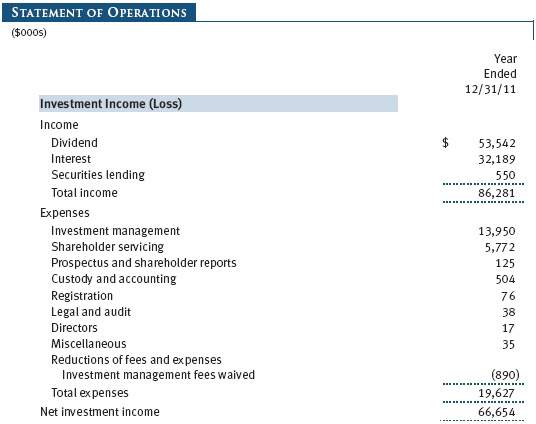

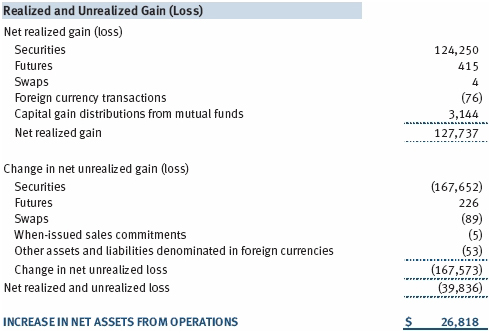

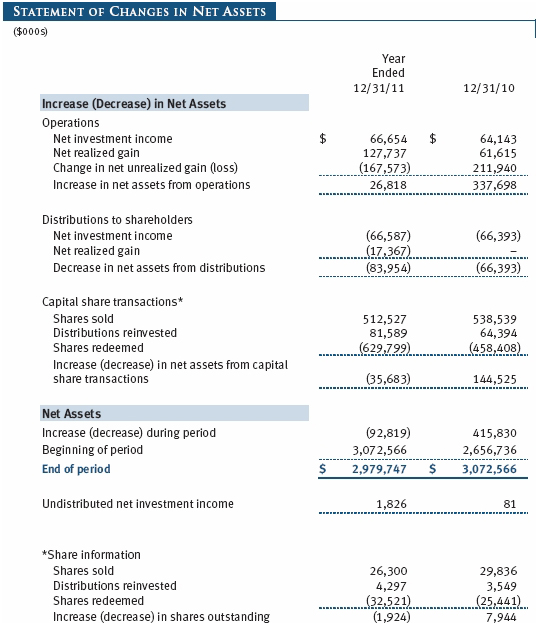

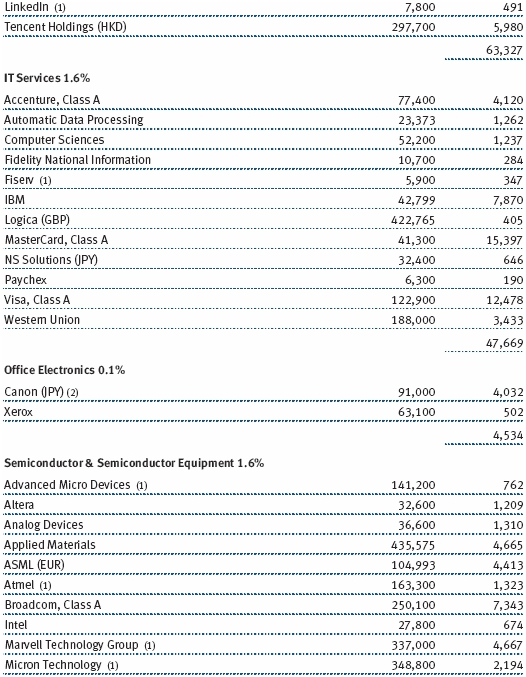

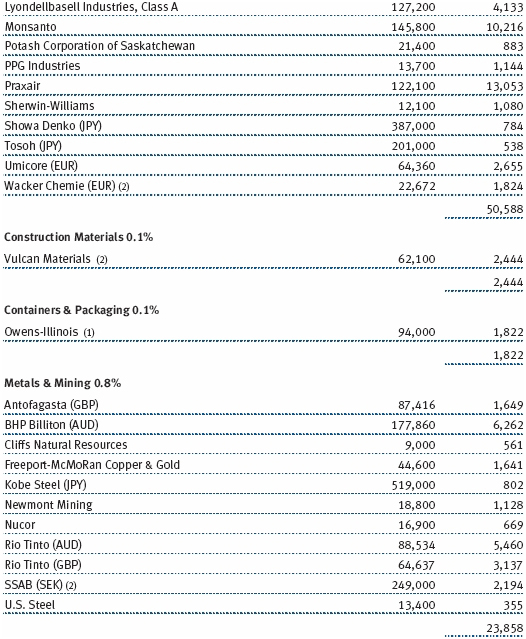

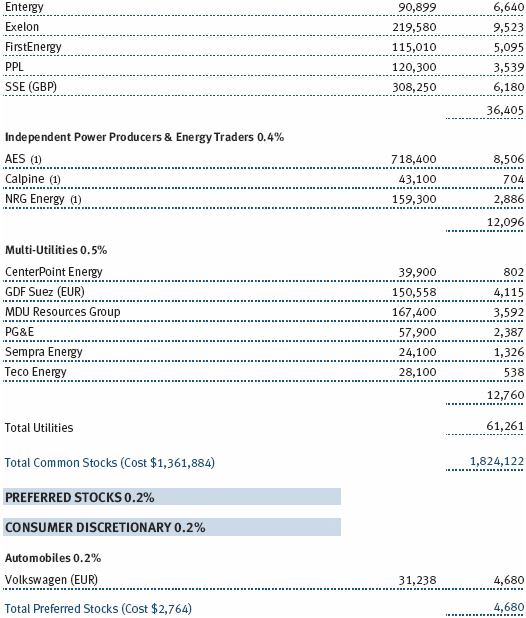

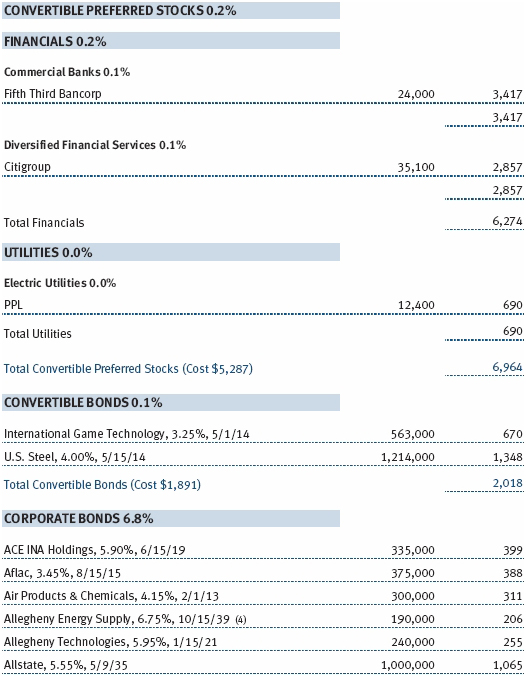

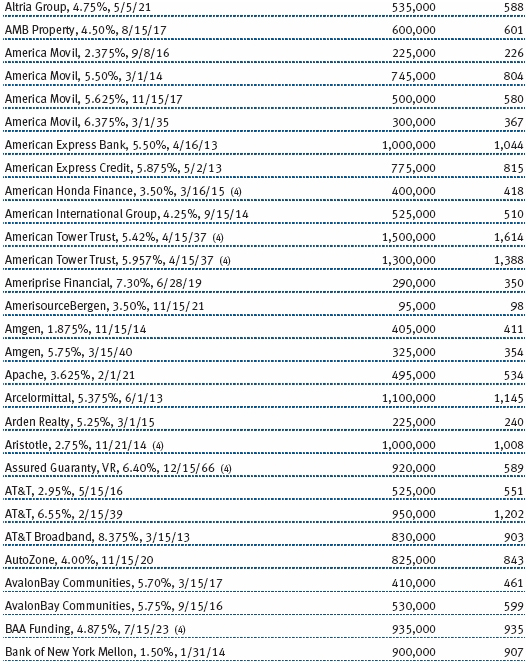

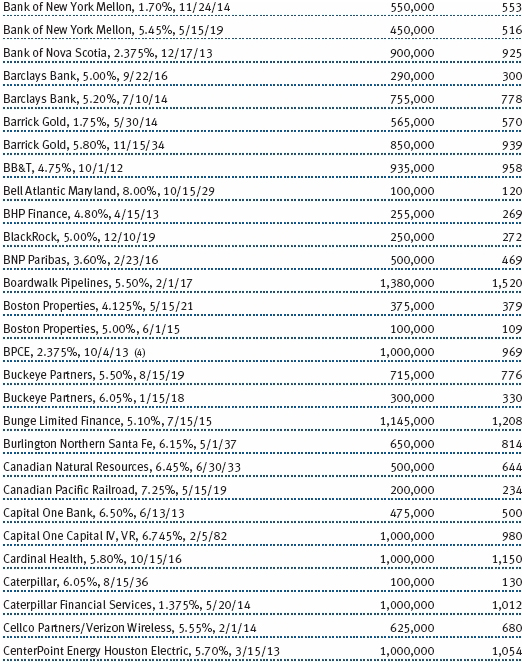

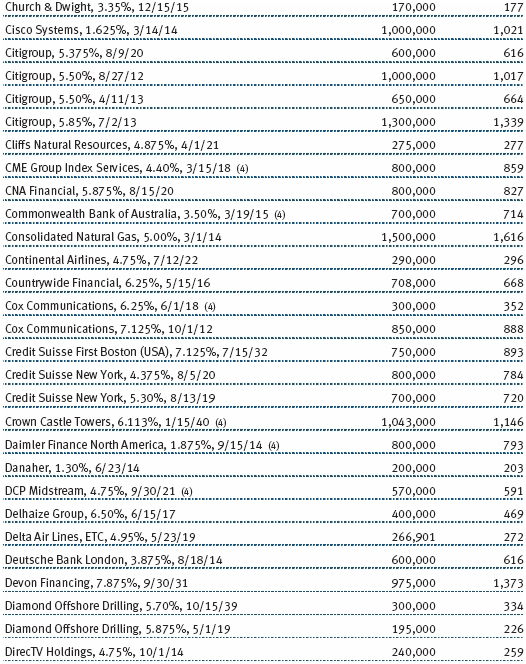

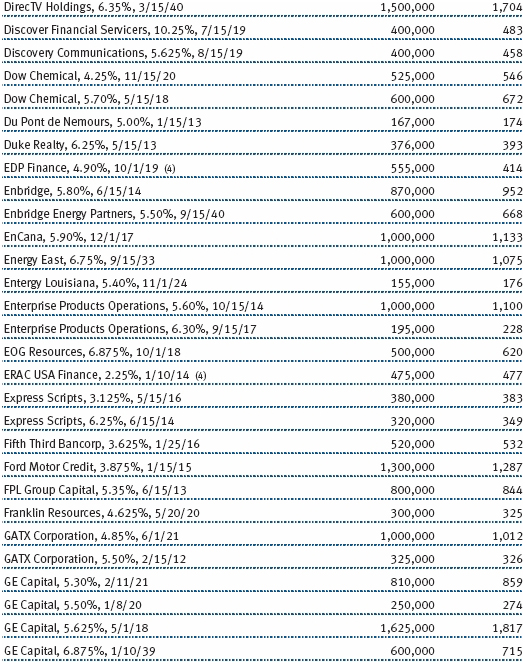

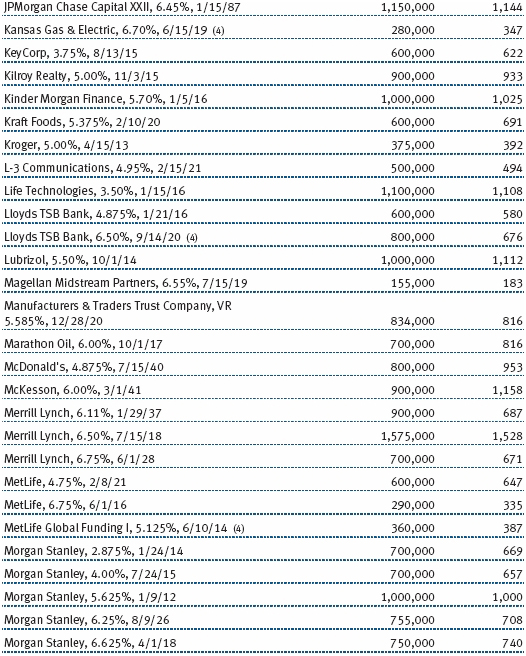

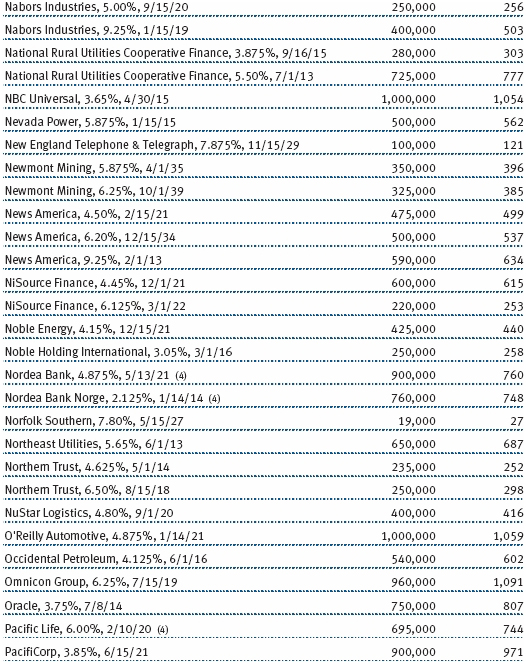

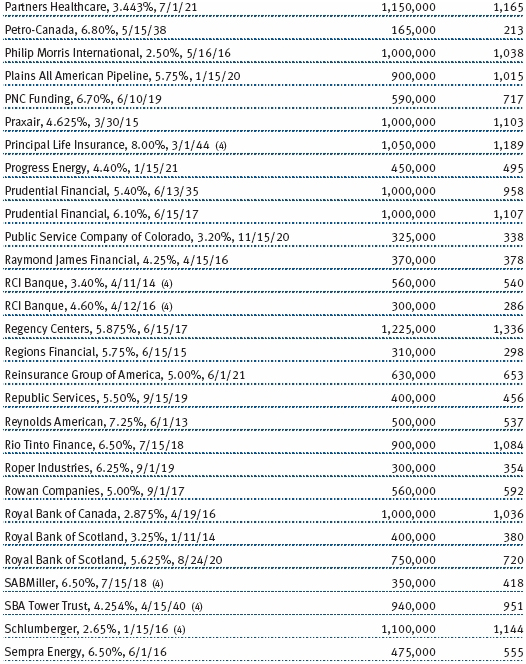

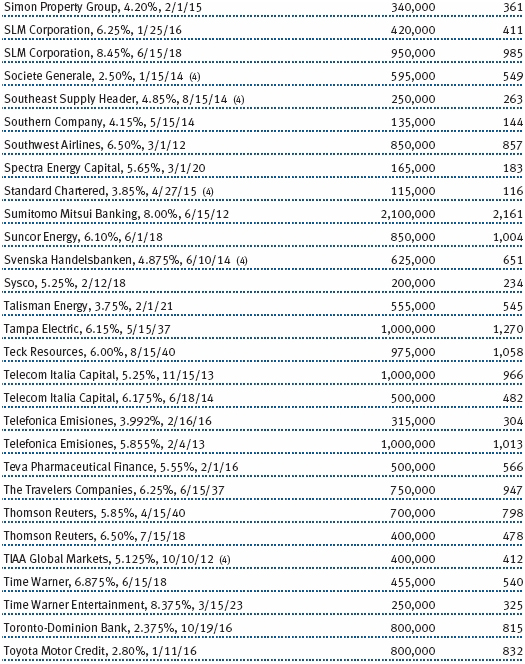

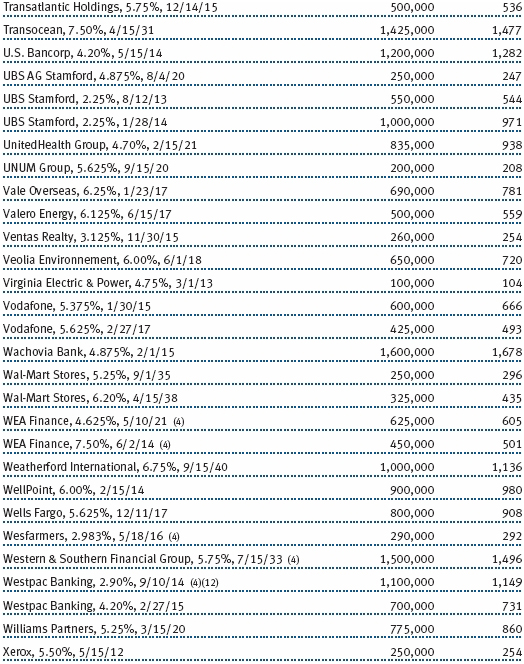

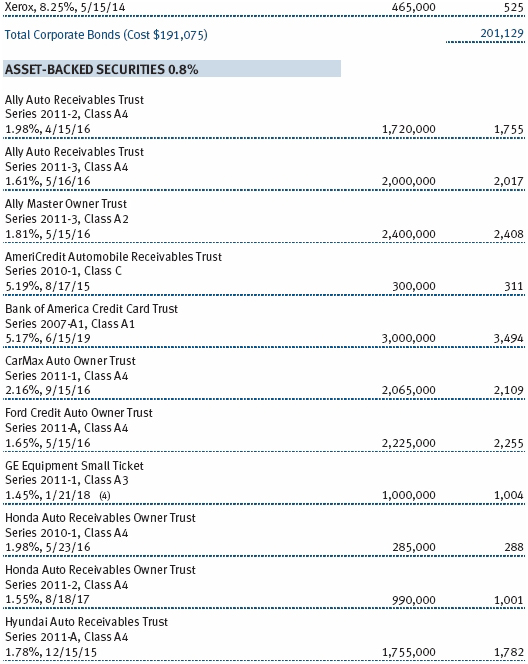

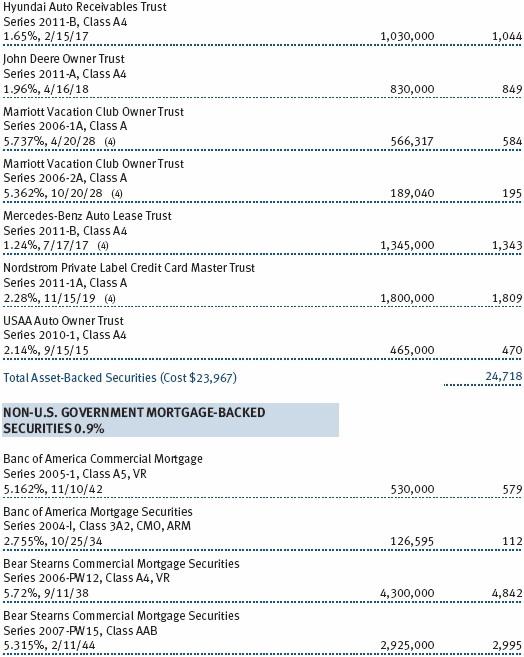

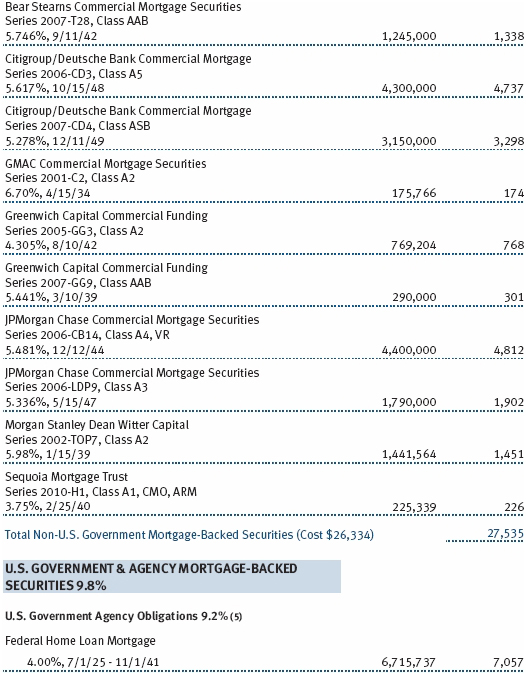

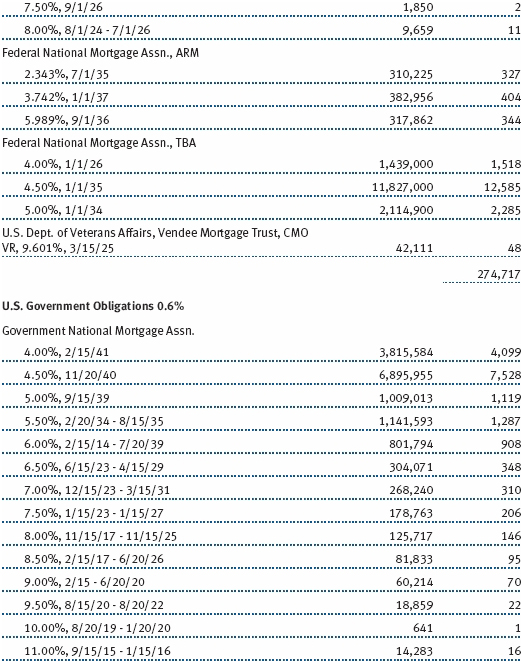

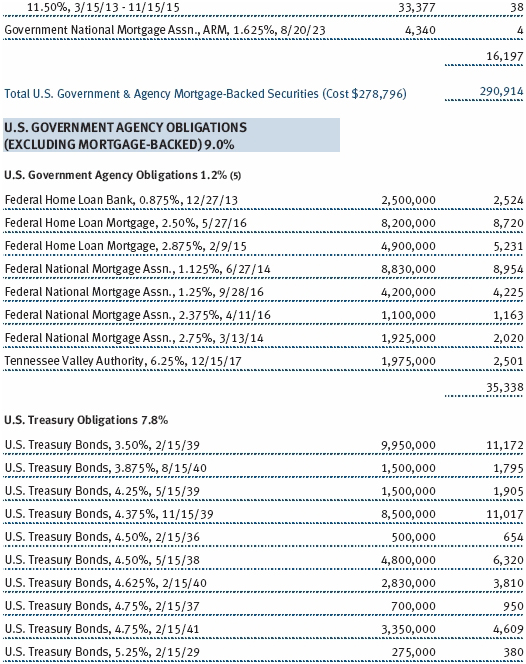

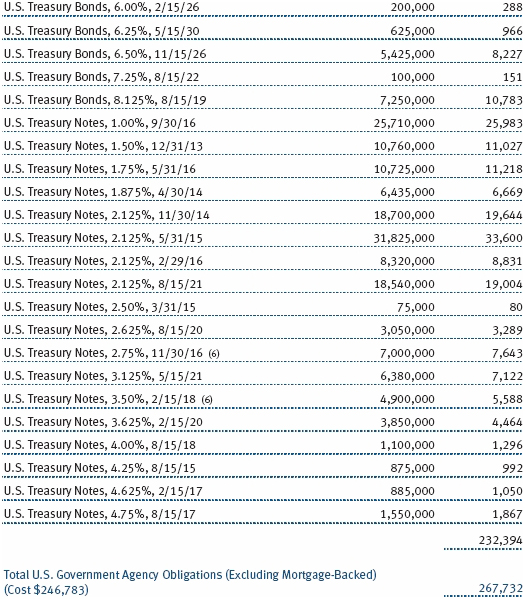

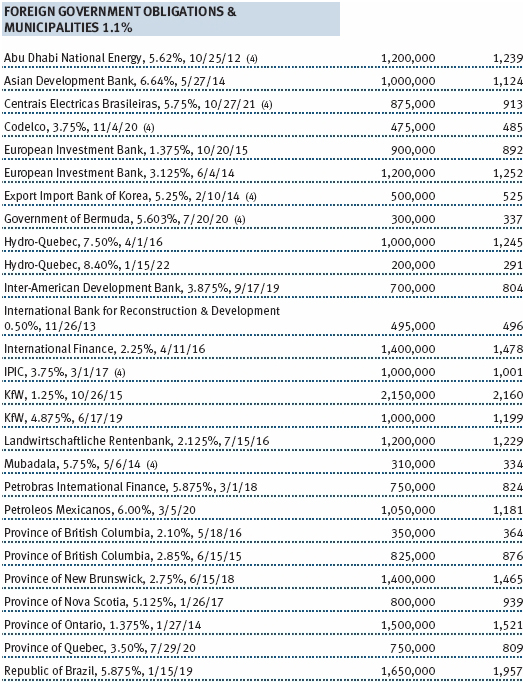

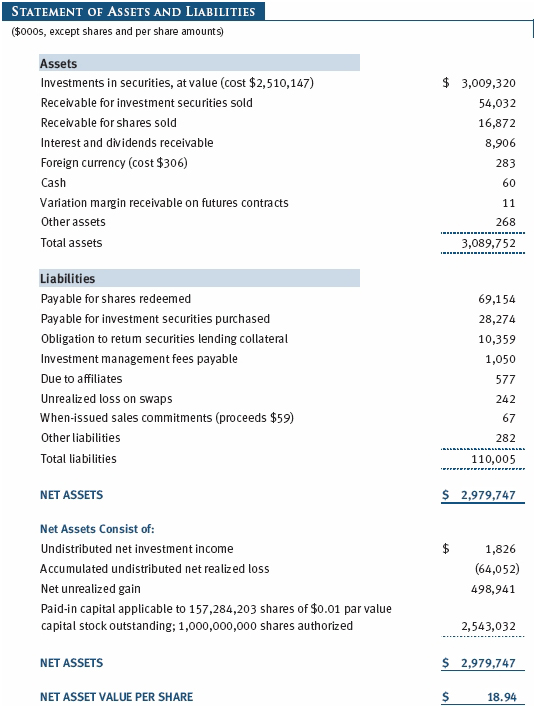

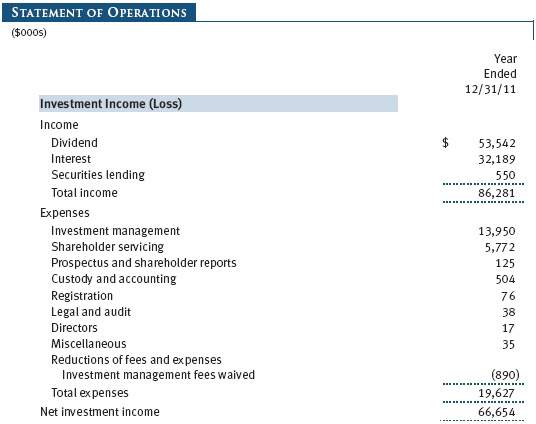

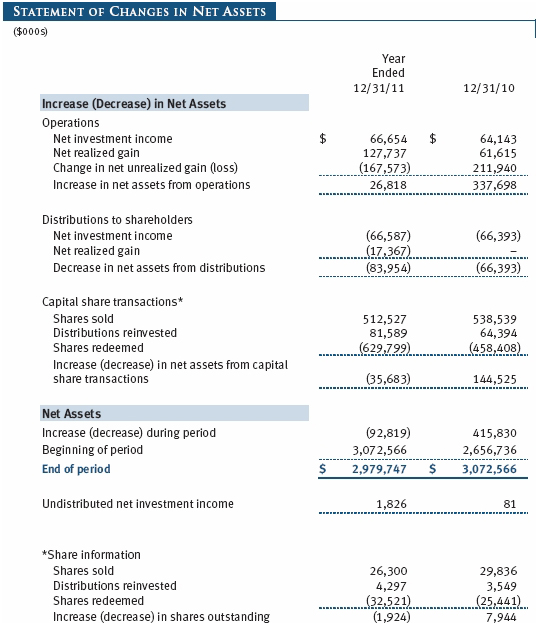

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

| Notes to Financial Statements |

T. Rowe Price Balanced Fund, Inc. (the fund), is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund commenced operations on December 31, 1939. The fund seeks to provide capital growth, current income, and preservation of capital through a portfolio of stocks and fixed-income securities.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), which require the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Paydown gains and losses are recorded as an adjustment to interest income. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Earnings on investments recognized as partnerships for federal income tax purposes reflect the tax character of such earnings. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared and paid quarterly. Capital gain distributions, if any, are generally declared and paid by the fund annually.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as quoted by a major bank. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is reflected as a component of security gains and losses.

Rebates and Credits Subject to best execution, the fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the fund in cash. Commission rebates are reflected as realized gain on securities in the accompanying financial statements and totaled $32,000 for the year ended December 31, 2011. Additionally, the fund earns credits on temporarily uninvested cash balances held at the custodian, which reduce the fund’s custody charges. Custody expense in the accompanying financial statements is presented before reduction for credits.

New Accounting Pronouncements In December 2011, the Financial Accounting Standards Board issued amended guidance to enhance disclosure for offsetting assets and liabilities. The guidance is effective for fiscal years and interim periods beginning on or after January 1, 2013; adoption will have no effect on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

The fund’s financial instruments are reported at fair value as defined by GAAP. The fund determines the values of its assets and liabilities and computes its net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business. Values in the accompanying Portfolio of Investments are as of December 30, 2011, the last business day in the fund’s fiscal year ended December 31, 2011. Some foreign markets were open between December 30 and the close of the fund’s reporting period on December 31, but any differences in values and foreign exchange rates subsequent to December 30 through December 31 were immaterial to the fund’s financial statements.

Valuation Methods Equity securities listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made, except for OTC Bulletin Board securities, which are valued at the mean of the latest bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the latest bid and asked prices for domestic securities and the last quoted sale price for international securities.

Debt securities are generally traded in the OTC market. Securities with remaining maturities of one year or more at the time of acquisition are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service, which considers the yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Securities with remaining maturities of less than one year at the time of acquisition generally use amortized cost in local currency to approximate fair value. However, if amortized cost is deemed not to reflect fair value or the fund holds a significant amount of such securities with remaining maturities of more than 60 days, the securities are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service.

Investments in mutual funds are valued at the mutual fund’s closing net asset value per share on the day of valuation. Investments in private investment companies are valued at the entity’s net asset value (or equivalent) as of the valuation date. Financial futures contracts are valued at closing settlement prices. Swaps are valued at prices furnished by independent swap dealers or by an independent pricing service.

Other investments, including restricted securities and private placements, and those financial instruments for which the above valuation procedures are inappropriate or are deemed not to reflect fair value, are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors (the Board). Subject to oversight by the Board, the Valuation Committee develops pricing-related policies and procedures and approves all fair-value determinations. The Valuation Committee regularly makes good faith judgments, using a wide variety of sources and information, to establish and adjust valuations of certain securities as events occur and circumstances warrant. For instance, in determining the fair value of private-equity instruments, the Valuation Committee considers a variety of factors, including the company’s business prospects, its financial performance, strategic events impacting the company, relevant valuations of similar companies, new rounds of financing, and any negotiated transactions of significant size between other investors in the company. Because any fair-value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions.

For valuation purposes, the last quoted prices of non-U.S. equity securities may be adjusted under the circumstances described below. If the fund determines that developments between the close of a foreign market and the close of the NYSE will, in its judgment, materially affect the value of some or all of its portfolio securities, the fund will adjust the previous closing prices to reflect what it believes to be the fair value of the securities as of the close of the NYSE. In deciding whether it is necessary to adjust closing prices to reflect fair value, the fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. A fund may also fair value securities in other situations, such as when a particular foreign market is closed but the fund is open. The fund uses outside pricing services to provide it with closing prices and information to evaluate and/or adjust those prices. The fund cannot predict how often it will use closing prices and how often it will determine it necessary to adjust those prices to reflect fair value. As a means of evaluating its security valuation process, the fund routinely compares closing prices, the next day’s opening prices in the same markets, and adjusted prices. Additionally, trading in the underlying securities of the fund may take place in various foreign markets on certain days when the fund is not open for business and does not calculate a net asset value. As a result, net asset values may be significantly affected on days when shareholders cannot make transactions.

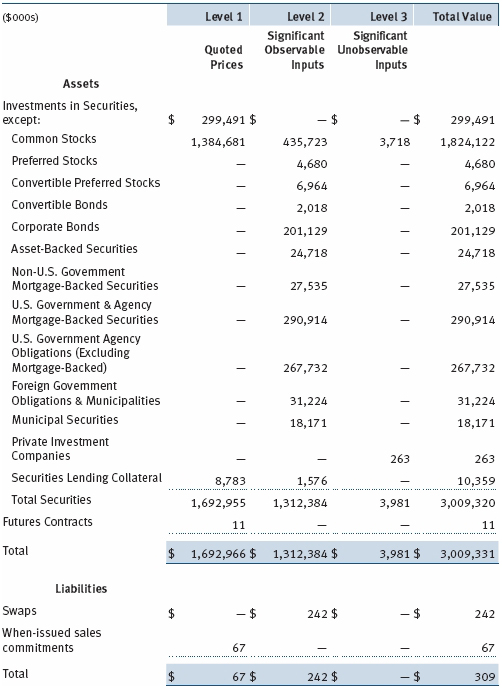

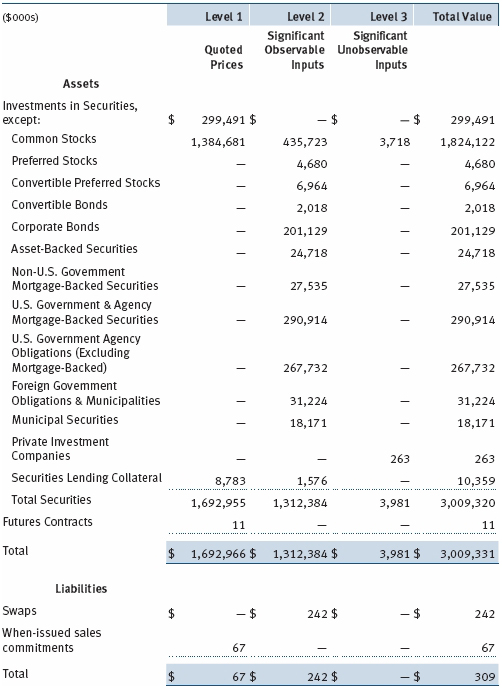

Valuation Inputs Various inputs are used to determine the value of the fund’s financial instruments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical financial instruments

Level 2 – observable inputs other than Level 1 quoted prices (including, but not limited to, quoted prices for similar financial instruments, interest rates, prepayment speeds, and credit risk)

Level 3 – unobservable inputs

Observable inputs are those based on market data obtained from sources independent of the fund, and unobservable inputs reflect the fund’s own assumptions based on the best information available. The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level. For example, non-U.S. equity securities actively traded in foreign markets generally are reflected in Level 2 despite the availability of closing prices because the fund evaluates and determines whether those closing prices reflect fair value at the close of the NYSE or require adjustment, as described above. The following table summarizes the fund’s financial instruments, based on the inputs used to determine their values on December 31, 2011:

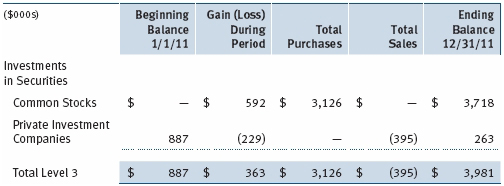

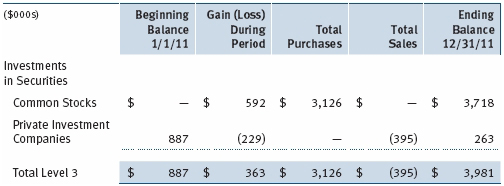

Following is a reconciliation of the fund’s Level 3 holdings for the year ended December 31, 2011. Gain (loss) reflects both realized and change in unrealized gain (loss) on Level 3 holdings during the period, if any, and is included on the accompanying Statement of Operations. The change in unrealized gain (loss) on Level 3 instruments held at December 31, 2011, totaled $363,000 for the year ended December 31, 2011.

NOTE 3 - DERIVATIVE INSTRUMENTS

During the year ended December 31, 2011, the fund invested in derivative instruments. As defined by GAAP, a derivative is a financial instrument whose value is derived from an underlying security price, foreign exchange rate, interest rate, index of prices or rates, or other variable; it requires little or no initial investment and permits or requires net settlement. The fund invests in derivatives only if the expected risks and rewards are consistent with its investment objectives, policies, and overall risk profile, as described in its prospectus and Statement of Additional Information. The fund may use derivatives for a variety of purposes, such as seeking to hedge against declines in principal value, increase yield, invest in an asset with greater efficiency and at a lower cost than is possible through direct investment, or to adjust credit exposure. The risks associated with the use of derivatives are different from, and potentially much greater than, the risks associated with investing directly in the instruments on which the derivatives are based. Investments in derivatives can magnify returns positively or negatively; however, the fund at all times maintains sufficient cash reserves, liquid assets, or other SEC-permitted asset types to cover the settlement obligations under its open derivative contracts.

The fund values its derivatives at fair value, as described below and in Note 2, and recognizes changes in fair value currently in its results of operations. Accordingly, the fund does not follow hedge accounting, even for derivatives employed as economic hedges. The fund does not offset the fair value of derivative instruments against the right to reclaim or obligation to return collateral.

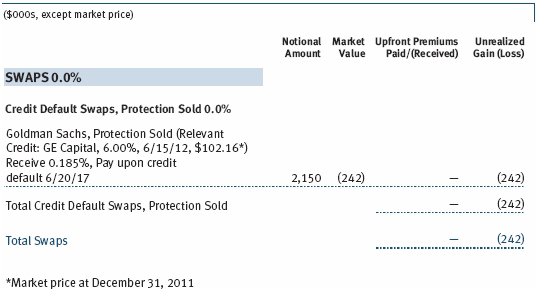

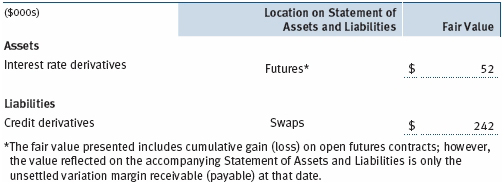

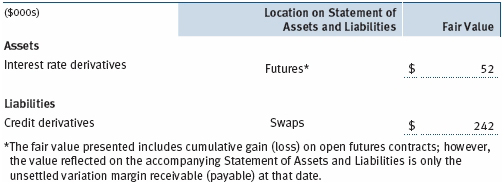

The following table summarizes the fair value of the fund’s derivative instruments held as of December 31, 2011, and the related location on the accompanying Statement of Assets and Liabilities, presented by primary underlying risk exposure:

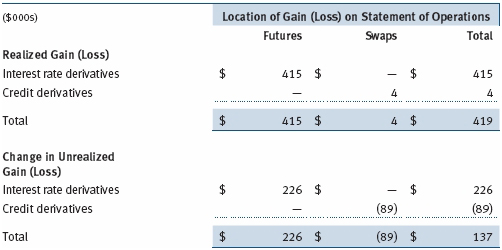

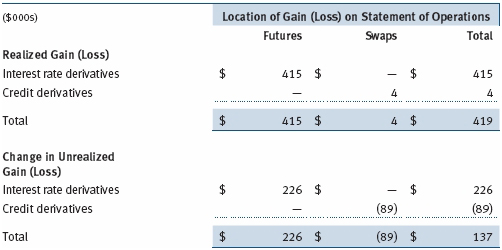

Additionally, the amount of gains and losses on derivative instruments recognized in fund earnings during the year ended December 31, 2011, and the related location on the accompanying Statement of Operations is summarized in the following table by primary underlying risk exposure:

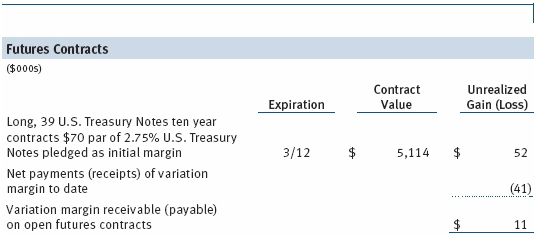

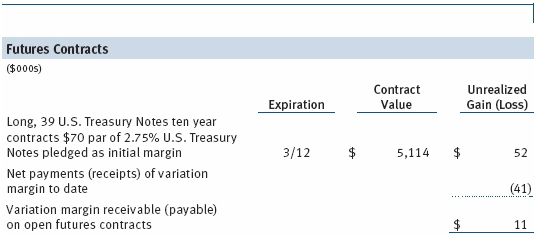

Futures Contracts The fund is subject to interest rate risk in the normal course of pursuing its investment objectives and uses futures contracts to help manage such risk. The fund may enter into futures contracts to manage exposure to interest rates, security prices, foreign currencies, and credit quality; as an efficient means of adjusting exposure to all or part of a target market; to enhance income; as a cash management tool; and/or to adjust credit exposure. A futures contract provides for the future sale by one party and purchase by another of a specified amount of a particular underlying financial instrument at an agreed-upon price, date, time, and place. The fund currently invests only in exchange-traded futures, which generally are standardized as to maturity date, underlying financial instrument, and other contract terms. Upon entering into a futures contract, the fund is required to deposit with the broker cash or securities in an amount equal to a certain percentage of the contract value (initial margin deposit); the margin deposit must then be maintained at the established level over the life of the contract. Subsequent payments are made or received by the fund each day to settle daily fluctuations in the value of the contract (variation margin), which reflect changes in the value of the underlying financial instrument. Variation margin is recorded as unrealized gain or loss until the contract is closed. The value of a futures contract included in net assets is the amount of unsettled variation margin; net variation margin receivable is reflected as an asset, and net variation margin payable is reflected as a liability on the accompanying Statement of Assets and Liabilities. Risks related to the use of futures contracts include possible illiquidity of the futures markets, contract prices that can be highly volatile and imperfectly correlated to movements in hedged security values and/or interest rates, and potential losses in excess of the fund’s initial investment. During the year ended December 31, 2011, the fund’s exposure to futures, based on underlying notional amounts, was generally less than 1% of net assets.

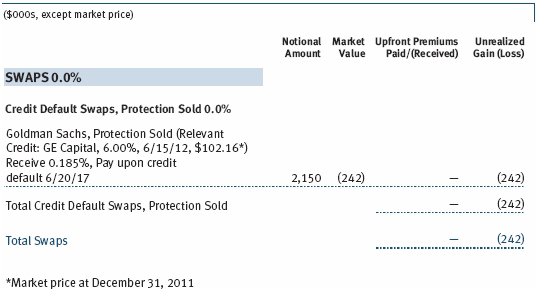

Credit Default Swaps The fund is subject to credit risk in the normal course of pursuing its investment objectives and uses swap contracts to help manage such risk. The fund may use swaps in an effort to manage exposure to changes in interest rates, inflation rates, and credit quality; to adjust overall exposure to certain markets; to enhance total return or protect the value of portfolio securities; to serve as a cash management tool; and/or to adjust portfolio duration or credit exposure. Credit default swaps are agreements where one party (the protection buyer) agrees to make periodic payments to another party (the protection seller) in exchange for protection against specified credit events, such as certain defaults and bankruptcies related to an underlying credit instrument, or issuer or index of such instruments. Upon occurrence of a specified credit event, the protection seller is required to pay the buyer the difference between the notional amount of the swap and the value of the underlying credit, either in the form of a net cash settlement or by paying the gross notional amount and accepting delivery of the relevant underlying credit. For credit default swaps where the underlying credit is an index, a specified credit event may affect all or individual underlying securities included in the index and will be settled based upon the relative weighting of the affected underlying security(s) within the index. Generally, the payment risk for the seller of protection is inversely related to the current market price of the underlying credit; or, in the case of an index swap, the market value of the contract relative to the notional amount. Therefore, the payment risk increases as the price of the relevant underlying credit, or market value of the index swap, declines due to market valuations of credit quality. As of December 31, 2011, the notional amount of protection sold by the fund totaled $2,150,000 (0.1% of net assets), which reflects the maximum potential amount the fund could be required to pay under such contracts. The value of a swap included in net assets is the unrealized gain or loss on the contract plus or minus any unamortized premiums paid or received, respectively. Appreciated swaps and premiums paid are reflected as assets, and depreciated swaps and premiums received are reflected as liabilities on the accompanying Statement of Assets and Liabilities. Net periodic receipts or payments required by swaps are accrued daily and are recorded as realized gain or loss for financial reporting purposes when settled; fluctuations in the fair value of swaps are reflected in the change in net unrealized gain or loss and are reclassified to realized gain or loss upon termination prior to maturity or cash settlement. Risks related to the use of credit default swaps include the possible inability of the fund to accurately assess the current and future creditworthiness of underlying issuers, the possible failure of a counterparty to perform in accordance with the terms of the swap agreements, potential government regulation that could adversely affect the fund’s swap investments, and potential losses in excess of the fund’s initial investment. During the year ended December 31, 2011, the fund’s exposure to swaps, based on underlying notional amounts, was generally less than 1% of net assets.

NOTE 4 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Restricted Securities The fund may invest in securities that are subject to legal or contractual restrictions on resale. Prompt sale of such securities at an acceptable price may be difficult and may involve substantial delays and additional costs.

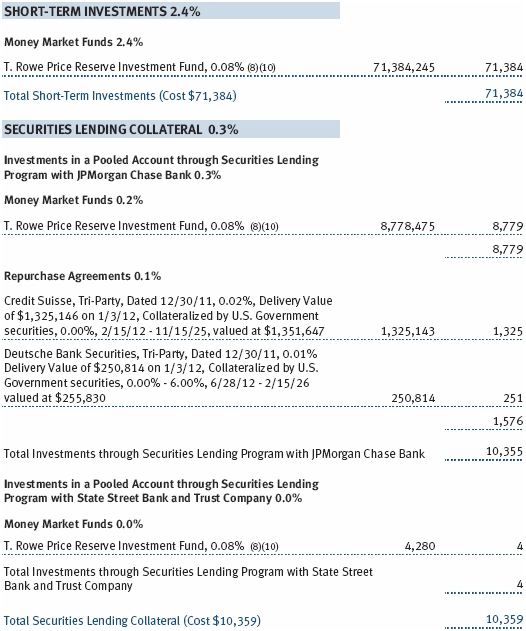

Repurchase Agreements All repurchase agreements are fully collateralized by U.S. government securities. Collateral is in the possession of the fund’s custodian or, for tri-party agreements, the custodian designated by the agreement. Although risk is mitigated by the collateral, the fund could experience a delay in recovering its value and a possible loss of income or value if the counterparty fails to perform in accordance with the terms of the agreement.

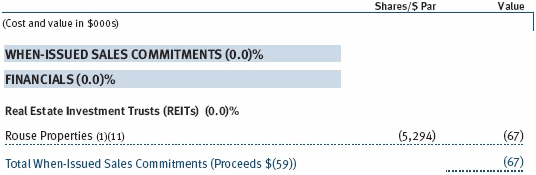

TBA Purchase and Sale Commitments During the year ended December 31, 2011, the fund entered into to be announced (TBA) purchase and/or sale commitments, pursuant to which it agrees to purchase or sell, respectively, mortgage-backed securities for a fixed unit price, with payment and delivery at a scheduled future date beyond the customary settlement period for such mortgage-backed securities. With TBA transactions, the particular securities to be delivered are not identified at the trade date; however, delivered securities must meet specified terms, including issuer, rate, and mortgage term, and be within industry-accepted “good delivery” standards. The fund generally enters into TBA purchase transactions with the intention of taking possession of the underlying mortgage securities; however, for either purchase or sale transactions, the fund also may extend the settlement by “rolling” the transaction. Until settlement, the fund maintains cash reserves and liquid assets sufficient to settle its TBA commitments.

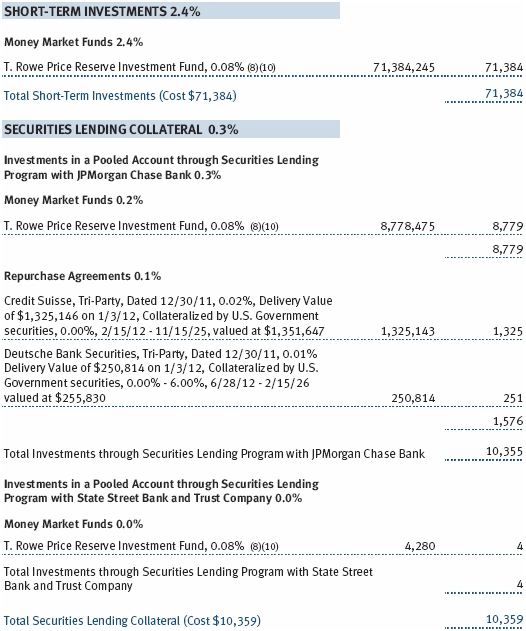

Securities Lending The fund lends its securities to approved brokers to earn additional income. It receives as collateral cash and U.S. government securities valued at 102% to 105% of the value of the securities on loan. Cash collateral is invested by the fund’s lending agent(s) in accordance with investment guidelines approved by management. Although risk is mitigated by the collateral, the fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities or if collateral investments decline in value. Securities lending revenue recognized by the fund consists of earnings on invested collateral and borrowing fees, net of any rebates to the borrower and compensation to the lending agent. In accordance with GAAP, investments made with cash collateral are reflected in the accompanying financial statements, but collateral received in the form of securities are not. On December 31, 2011, the value of cash collateral investments was $10,359,000 and the value of loaned securities was $9,962,000.

T. Rowe Price Term Asset-Backed Opportunity Fund, L.L.C. During the year ended December 31, 2011, the fund was invested in the T. Rowe Price Term Asset-Backed Opportunity Fund, L.L.C. (private fund), a private investment company managed by T. Rowe Price Associates, Inc., that participates in the Term Asset-Backed Securities Loan Facility (TALF) program created and administered by the Federal Reserve Bank of New York (FRBNY). The TALF program provided eligible borrowers with term loans secured by eligible asset-backed securities and/or commercial mortgage-backed securities, which were either owned by the borrower or purchased by the borrower and subsequently pledged as collateral for a TALF loan. TALF loans generally are nonrecourse in nature. The private fund is treated as a partnership for federal income tax purposes. It has a limited life extending five years from the date on which the TALF program closed for any new loans, which was June 30, 2010. The private fund can have two possible extensions (one year each) with the consent of a majority of its investors. Invested capital generally will be returned to investors as underlying securities are liquidated and the TALF loans are repaid or mature, with the balance paid at maturity of the private fund. Ownership interests in the private fund may not be redeemed, sold, or assigned. As of December 31, 2011, outstanding capital commitments may no longer be called by the private fund.

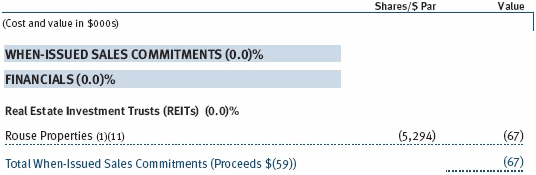

When-Issued Securities The fund may enter into when-issued purchases and/or sales commitments, pursuant to which it agrees to purchase or sell, respectively, the underlying security for a fixed unit price, with payment and delivery at a scheduled future date generally beyond the customary settlement period for such securities. When-issued refers to securities that have not yet been issued but will be issued in the future and may include new securities or securities obtained through a corporate action on a current holding. The fund normally purchases when-issued securities with the intention of taking possession but may enter into a separate agreement to sell the securities before the settlement date. Until settlement, the fund maintains cash reserves and liquid assets sufficient to settle its when-issued commitments. Amounts realized on when-issued transactions are included with realized gain/loss on securities in the accompanying financial statements.

Counterparty Risk and Collateral The fund has entered into collateral agreements with certain counterparties to mitigate counterparty risk associated with certain over-the-counter (OTC) financial instruments, including swaps, forward currency exchange contracts, TBA purchase commitments, and OTC options (collectively, covered OTC instruments). Subject to certain minimum exposure requirements (which typically range from $100,000 to $500,000), collateral requirements generally are determined and transfers made based on the net aggregate unrealized gain or loss on all OTC instruments covered by a particular collateral agreement with a specified counterparty. Collateral, both pledged by the fund to a counterparty and pledged by a counterparty to the fund, is held in a segregated account by a third-party agent and can be in the form of cash or debt securities issued by the U.S. government or related agencies. Securities posted as collateral by the fund to a counterparty are so noted in the accompanying Portfolio of Investments and remain in the fund’s net assets. As of December 31, 2011, securities valued at $262,000 had been posted by the fund to counterparties. In accordance with GAAP, cash pledged by counterparties to the fund is included in the fund’s net assets; however, securities pledged by counterparties to the fund are not recorded by the fund. As of December 31, 2011, no collateral was pledged by counterparties to the fund.

At any point in time, the fund’s risk of loss from counterparty credit risk on covered OTC instruments is the aggregate unrealized gain on appreciated covered OTC instruments in excess of collateral, if any, pledged by the counterparty to the fund. Counterparty risk related to exchange-traded futures and options contracts is minimal because the exchange’s clearinghouse provides protection against counterparty defaults. Generally, for exchange-traded derivatives such as futures and options, each broker, in its sole discretion, may change margin requirements applicable to the fund. In accordance with the terms of the relevant derivatives agreements, counterparties to OTC derivatives may be able to terminate derivative contracts prior to maturity after the occurrence of certain stated events, such as a decline in net assets above a certain percentage or a failure by the fund to perform its obligations under the contract. Upon termination, all transactions would typically be liquidated and a net amount would be owed by or payable to the fund.

Other Purchases and sales of portfolio securities other than short-term and U.S. government securities aggregated $1,066,434,000 and $1,074,372,000, respectively, for the year ended December 31, 2011. Purchases and sales of U.S. government securities aggregated $710,892,000 and $722,000,000, respectively, for the year ended December 31, 2011.

NOTE 5 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The fund files U.S. federal, state, and local tax returns as required. The fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return but which can be extended to six years in certain circumstances. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

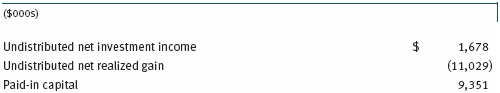

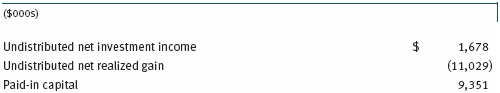

Reclassifications to paid-in capital relate primarily to a tax practice that treats a portion of the proceeds from each redemption of capital shares as a distribution of taxable net investment income and/or realized capital gain. Reclassifications between income and gain relate primarily to the character of paydown gains and losses on asset-backed securities. For the year ended December 31, 2011, the following reclassifications were recorded to reflect tax character (there was no impact on results of operations or net assets):

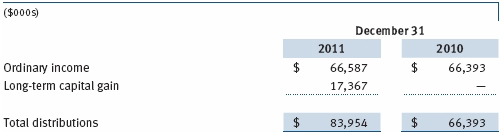

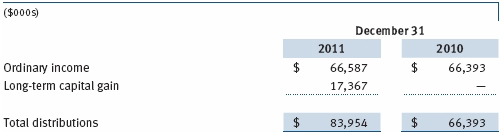

Distributions during the years ended December 31, 2011 and December 31, 2010, were characterized for tax purposes as follows:

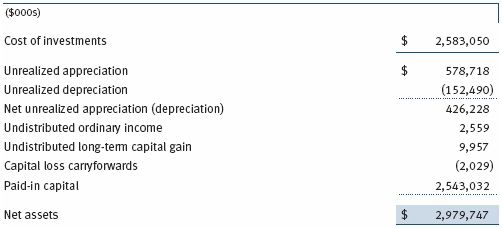

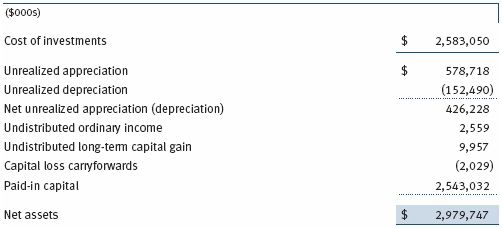

At December 31, 2011, the tax-basis cost of investments and components of net assets were as follows:

The difference between book-basis and tax-basis net unrealized appreciation (depreciation) is attributable to the deferral of losses from wash sales for tax purposes. Net realized capital losses may be carried forward indefinitely to offset future realized capital gains. All or a portion of the capital loss carryforwards may be from losses realized between November 1 and the fund’s fiscal year-end, which are deferred for tax purposes until the subsequent year but recognized for financial reporting purposes in the year realized.The fund intends to retain realized gains to the extent of available capital loss carryforwards. During the year ended December 31, 2011, the fund utilized $77,761,000 of capital loss carryforwards. The fund’s available capital loss carryforwards as of December 31, 2011, have no expiration.

NOTE 6 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The investment management agreement between the fund and Price Associates provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.15% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.28% for assets in excess of $300 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At December 31, 2011, the effective annual group fee rate was 0.30%.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates (collectively, Price). Price Associates computes the daily share price and provides certain other administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend disbursing agent. T. Rowe Price Retirement Plan Services, Inc., provides subaccounting and recordkeeping services for certain retirement accounts invested in the fund. For the year ended December 31, 2011, expenses incurred pursuant to these service agreements were $197,000 for Price Associates; $808,000 for T. Rowe Price Services, Inc.; and $3,347,000 for T. Rowe Price Retirement Plan Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

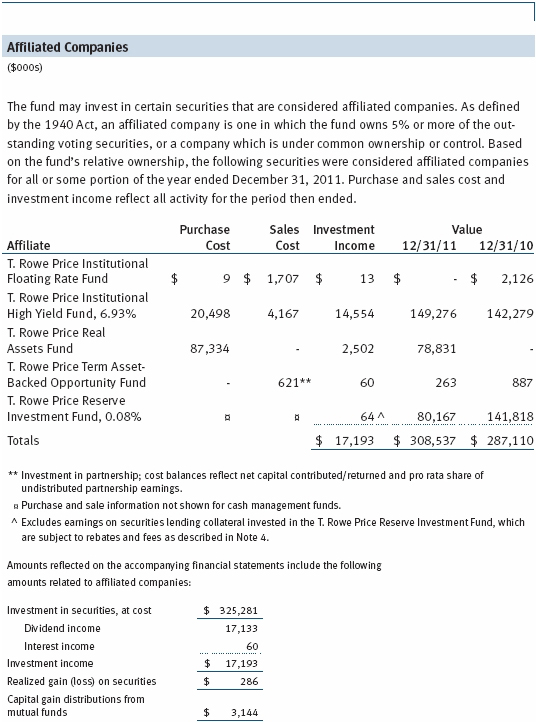

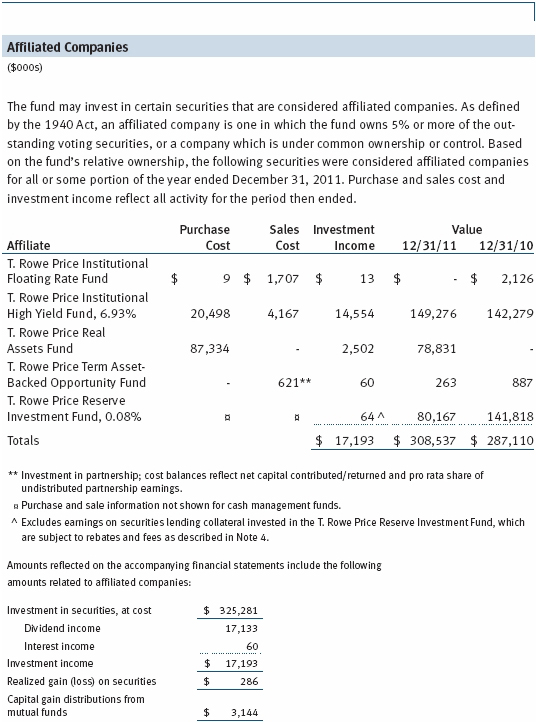

The fund may invest in the T. Rowe Price Reserve Investment Fund and the T. Rowe Price Government Reserve Investment Fund (collectively, the T. Rowe Price Reserve Investment Funds), open-end management investment companies managed by Price Associates and considered affiliates of the fund. The T. Rowe Price Reserve Investment Funds are offered as cash management options to mutual funds, trusts, and other accounts managed by Price Associates and/or its affiliates and are not available for direct purchase by members of the public. The T. Rowe Price Reserve Investment Funds pay no investment management fees.

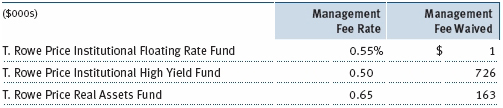

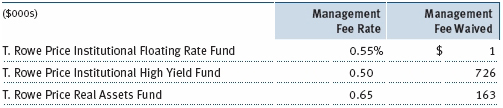

The fund may also invest in certain T. Rowe Price institutional funds and/or the T. Rowe Price Real Assets Fund (collectively, the underlying institutional funds) as a means of gaining efficient and cost-effective exposure to certain markets. The underlying institutional funds are open-end management investment companies managed by Price Associates and are considered affiliates of the fund. Each institutional fund pays an all-inclusive management and administrative fee to Price Associates; Real Assets Fund pays a management fee to Price Associates as well as operating expenses. To ensure that the fund does not incur duplicate management fees, Price Associates has agreed to permanently waive a portion of its management fee charged to the fund in an amount sufficient to fully offset the management fees paid by the underlying institutional funds related to fund assets invested therein. Accordingly, the accompanying Statement of Operations includes management fees permanently waived pursuant to this agreement. Annual fee rates and amounts waived within the accompanying Statement of Operations related to shares of the underlying institutional funds for the year ended December 31, 2011, are as follows:

| Report of Independent Registered Public Accounting Firm |

To the Board of Directors and Shareholders of

T. Rowe Price Balanced Fund, Inc.

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of T. Rowe Price Balanced Fund, Inc. (the “Fund”) at December 31, 2011, and the results of its operations, the changes in its net assets and the financial highlights for each of the periods indicated therein, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2011 by correspondence with the custodian and brokers, and confirmation of the underlying funds by correspondence with the transfer agent, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

February 17, 2012

| Tax Information (Unaudited) for the Tax Year Ended 12/31/11 |

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

The fund’s distributions to shareholders included:

$297,000 from short-term capital gains,

$26,422,000 from long-term capital gains, subject to the 15% rate gains category.

For taxable non-corporate shareholders, $36,293,000 of the fund’s income represents qualified dividend income subject to the 15% rate category.

For corporate shareholders, $23,294,000 of the fund’s income qualifies for the dividends-received deduction.

| Information on Proxy Voting Policies, Procedures, and Records |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov. The description of our proxy voting policies and procedures is also available on our website, troweprice.com. To access it, click on the words “Our Company” at the top of our corporate homepage. Then, when the next page appears, click on the words “Proxy Voting Policies” on the left side of the page.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through our website, follow the directions above, then click on the words “Proxy Voting Records” on the right side of the Proxy Voting Policies page.

| How to Obtain Quarterly Portfolio Holdings |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s website (sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| About the Fund’s Directors and Officers |

Your fund is overseen by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and other business affairs. The Board elects the fund’s officers, who are listed in the final table. At least 75% of the Board’s members are independent of T. Rowe Price Associates, Inc. (T. Rowe Price), and its affiliates; “inside” or “interested” directors are employees or officers of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the fund directors and is available without charge by calling a T. Rowe Price representative at 1-800-638-5660.

| Independent Directors | | |

| |

| Name | | |

| (Year of Birth) | | Principal Occupation(s) and Directorships of Public Companies and |

| Year Elected* | | Other Investment Companies During the Past Five Years |

| |

| William R. Brody, M.D., Ph.D. | | President and Trustee, Salk Institute for Biological Studies (2009 |

| (1944) | | to present); Director, Novartis, Inc. (2009 to present); Director, IBM |

| 2009 | | (2007 to present); President and Trustee, Johns Hopkins University |

| | (1996 to 2009); Chairman of Executive Committee and Trustee, |

| | Johns Hopkins Health System (1996 to 2009) |

| | |

| Jeremiah E. Casey | | Retired |

| (1940) | | |

| 2005 | | |

| | |

| Anthony W. Deering | | Chairman, Exeter Capital, LLC, a private investment firm (2004 |

| (1945) | | to present); Director, Under Armour (2008 to present); Director, |

| 2001 | | Vornado Real Estate Investment Trust (2004 to present); Director, |

| | Mercantile Bankshares (2002 to 2007); Director and Member of the |

| | Advisory Board, Deutsche Bank North America (2004 to present) |

| | |

| Donald W. Dick, Jr. | | Principal, EuroCapital Partners, LLC, an acquisition and management |

| (1943) | | advisory firm (1995 to present) |

| 1991 | | |

| | |

| Karen N. Horn | | Senior Managing Director, Brock Capital Group, an advisory and |

| (1943) | | investment banking firm (2004 to present); Director, Eli Lilly and |

| 2003 | | Company (1987 to present); Director, Simon Property Group (2004 |

| | to present); Director, Norfolk Southern (2008 to present); Director, |

| | Fannie Mae (2006 to 2008) |

| | |

| Theo C. Rodgers | | President, A&R Development Corporation (1977 to present) |

| (1941) | | |

| 2005 | | |

| John G. Schreiber | | Owner/President, Centaur Capital Partners, Inc., a real estate |

| (1946) | | investment company (1991 to present); Cofounder and Partner, |

| 2001 | | Blackstone Real Estate Advisors, L.P. (1992 to present); Director, |

| | General Growth Properties, Inc. (2010 to present) |

| | |

| Mark R. Tercek | | President and Chief Executive Officer, The Nature Conservancy (2008 |

| (1957) | | to present); Managing Director, The Goldman Sachs Group, Inc. |

| 2009 | | (1984 to 2008) |

| |

| *Each independent director oversees 130 T. Rowe Price portfolios and serves until retirement, resignation, or election of a successor. |

| |

| Inside Directors | | |

| |

| Name | | |

| (Year of Birth) | | |

| Year Elected* | | |

| [Number of T. Rowe Price | | Principal Occupation(s) and Directorships of Public Companies and |

| Portfolios Overseen] | | Other Investment Companies During the Past Five Years |

| | |

| Edward C. Bernard | | Director and Vice President, T. Rowe Price; Vice Chairman of the |

| (1956) | | Board, Director, and Vice President, T. Rowe Price Group, Inc.; |

| 2006 | | Chairman of the Board, Director, and President, T. Rowe Price |

| [130] | | Investment Services, Inc.; Chairman of the Board and Director, |

| | T. Rowe Price Retirement Plan Services, Inc., T. Rowe Price Savings |

| | Bank, and T. Rowe Price Services, Inc.; Chairman of the Board, Chief |

| | Executive Officer, and Director, T. Rowe Price International; Chief |

| | Executive Officer, Chairman of the Board, Director, and President, |

| | T. Rowe Price Trust Company; Chairman of the Board, all funds |

| | |

| Brian C. Rogers, CFA, CIC | | Chief Investment Officer, Director, and Vice President, T. Rowe Price; |

| (1955) | | Chairman of the Board, Chief Investment Officer, Director, and Vice |

| 2006 | | President, T. Rowe Price Group, Inc.; Vice President, T. Rowe Price |

| [74] | | Trust Company |

| |

| *Each inside director serves until retirement, resignation, or election of a successor. |

| Officers | | |

| |

| Name (Year of Birth) | | |

| Position Held With Balanced Fund | | Principal Occupation(s) |

| | |

| E. Frederick Bair, CFA, CPA (1969) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | |

| Kimberly E. DeDominicis (1976) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Trust Company |

| | |

| Wendy R. Diffenbaugh (1954) | | Vice President, T. Rowe Price |

| Vice President | | |

| | |

| Anna M. Dopkin, CFA (1967) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., T. Rowe Price International, and |

| | T. Rowe Price Trust Company |

| | |

| Roger L. Fiery III, CPA (1959) | | Vice President, Price Hong Kong, Price |

| Vice President | | Singapore, T. Rowe Price, T. Rowe Price Group, |

| | Inc., T. Rowe Price International, and T. Rowe |

| | Price Trust Company |

| | |

| Mark S. Finn CFA, CPA (1963) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| John R. Gilner (1961) | | Chief Compliance Officer and Vice President, |

| Chief Compliance Officer | | T. Rowe Price; Vice President, T. Rowe Price |

| | Group, Inc., and T. Rowe Price Investment |

| | Services, Inc. |

| | |

| Gregory S. Golczewski (1966) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Trust Company |

| | |

| Gregory K. Hinkle, CPA (1958) | | Vice President, T. Rowe Price, T. Rowe Price |

| Treasurer | | Group, Inc., and T. Rowe Price Trust Company; |

| | formerly Partner, PricewaterhouseCoopers LLP |

| | (to 2007) |

| | |

| Paul A. Karpers, CFA (1967) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | |

| Robert M. Larkins, CFA (1973) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | |

| Patricia B. Lippert (1953) | | Assistant Vice President, T. Rowe Price and |

| Secretary | | T. Rowe Price Investment Services, Inc. |

| | |

| Raymond A. Mills, Ph.D., CFA (1960) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., T. Rowe Price International, and |

| | T. Rowe Price Trust Company |

| David Oestreicher (1967) | | Director and Vice President, T. Rowe Price |

| Vice President | | Investment Services, Inc., T. Rowe Price |

| | Retirement Plan Services, Inc., T. Rowe |

| | Price Services, Inc., and T. Rowe Price Trust |

| | Company; Vice President, Price Hong Kong, |

| | Price Singapore, T. Rowe Price, T. Rowe Price |

| | Group, Inc., and T. Rowe Price International |

| | |

| Larry J. Puglia, CFA, CPA (1960) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| Deborah D. Seidel (1962) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Investment |

| | Services, Inc.; Assistant Treasurer and Vice |

| | President, T. Rowe Price Services, Inc. |

| | |

| Charles M. Shriver, CFA (1967) | | Vice President, T. Rowe Price, T. Rowe Price |

| President | | Group, Inc., T. Rowe Price International, and |

| | T. Rowe Price Trust Company |

| | |

| Guido F. Stubenrauch (1970) | | Vice President, T. Rowe Price |

| Vice President | | |

| | |

| Julie L. Waples (1970) | | Vice President, T. Rowe Price |

| Vice President | | |

| | |

| Richard T. Whitney, CFA (1958) | | Vice President, T. Rowe Price, T. Rowe Price |

| Executive Vice President | | Group, Inc., T. Rowe Price International, and |

| | T. Rowe Price Trust Company |

| |

| Unless otherwise noted, officers have been employees of T. Rowe Price or T. Rowe Price International for at least 5 years. |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors/Trustees has determined that Mr. Anthony W. Deering qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Deering is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

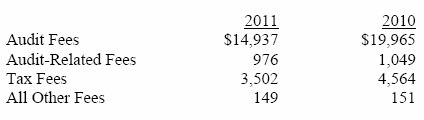

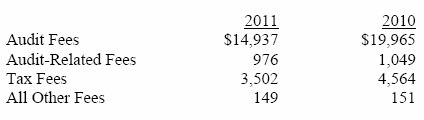

(a) – (d) Aggregate fees billed to the registrant for the last two fiscal years for professional services rendered by the registrant’s principal accountant were as follows:

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,764,000 and $1,417,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is attached.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price Balanced Fund, Inc.

| | By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date February 17, 2012 | | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date February 17, 2012 | | |

| |

| |

| By | /s/ Gregory K. Hinkle |

| | Gregory K. Hinkle |

| | Principal Financial Officer |

| |

| Date February 17, 2012 | | |