UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-06279 |

|

Harris Associates Investment Trust |

(Exact name of registrant as specified in charter) |

|

Two North La Salle Street, Suite 500 Chicago, Illinois | | 60602-3790 |

(Address of principal executive offices) | | (Zip code) |

|

John R. Raitt Harris Associates L.P. Two North La Salle Street, #500 Chicago, Illinois 60602 | | Cameron S. Avery Bell, Boyd & Lloyd LLP Three First National Plaza, #3100 Chicago, Illinois 60602 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (312) 621-0600 | |

|

Date of fiscal year end: | 09/30/07 | |

|

Date of reporting period: | 09/30/07 | |

| | | | | | | | | | |

Item 1. Reports to Shareholders.

ANNUAL REPORT

SEPTEMBER 30, 2007

Advised by Harris Associates L.P.

THE OAKMARK FUNDS

2007 Annual Report

| President's Letter | | | 1 | | |

|

| Summary Information | | | 2 | | |

|

| Fund Expenses | | | 4 | | |

|

| Commentary on The Oakmark and Oakmark Select Funds | | | 6 | | |

|

| The Oakmark Fund | |

|

| Letter from the Portfolio Managers | | | 8 | | |

|

| Schedule of Investments | | | 9 | | |

|

| The Oakmark Select Fund | |

|

| Letter from the Portfolio Managers | | | 13 | | |

|

| Schedule of Investments | | | 14 | | |

|

| The Oakmark Equity and Income Fund | |

|

| Letter from the Portfolio Managers | | | 16 | | |

|

| Schedule of Investments | | | 18 | | |

|

| The Oakmark Global Fund | |

|

| Letter from the Portfolio Managers | | | 23 | | |

|

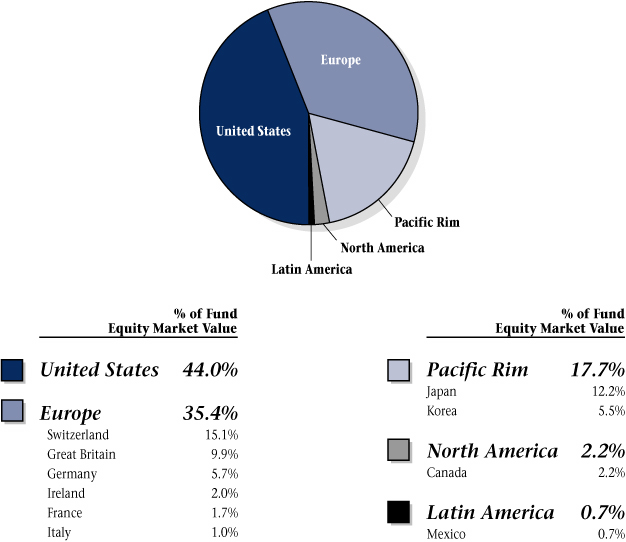

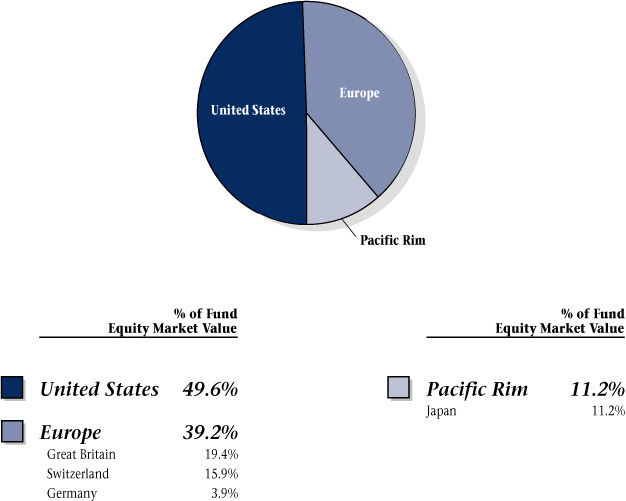

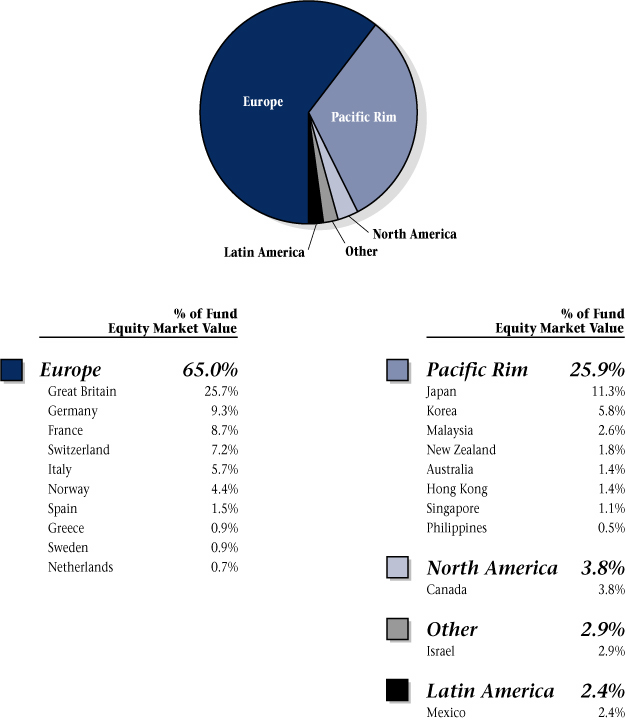

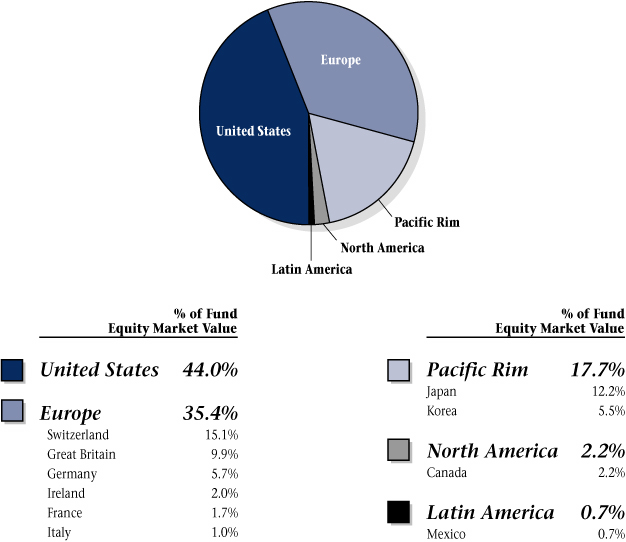

| Global Diversification Chart | | | 25 | | |

|

| Schedule of Investments | | | 26 | | |

|

| The Oakmark Global Select Fund | |

|

| Letter from Portfolio Managers | | | 31 | | |

|

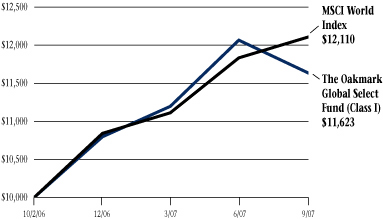

| Global Diversification Chart | | | 33 | | |

|

| Schedule of Investments | | | 34 | | |

|

| Commentary on The International and International Small Cap Funds | | | 37 | | |

|

| The Oakmark International Fund | |

|

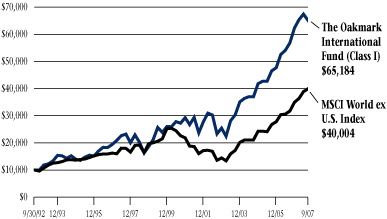

| Letter from the Portfolio Manager | | | 38 | | |

|

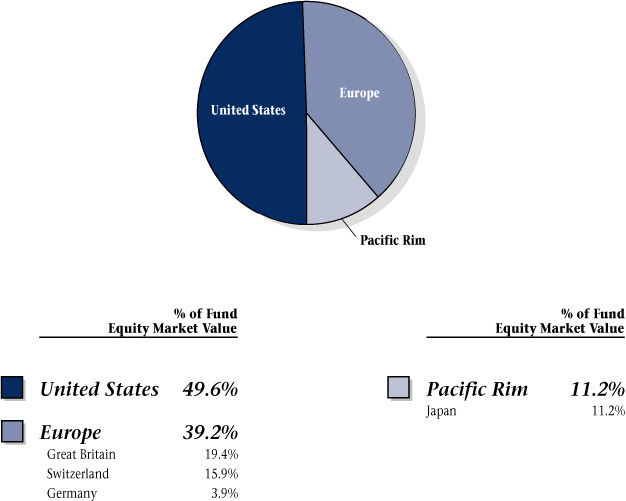

| International Diversification Chart | | | 40 | | |

|

| Schedule of Investments | | | 41 | | |

|

| The Oakmark International Small Cap Fund | |

|

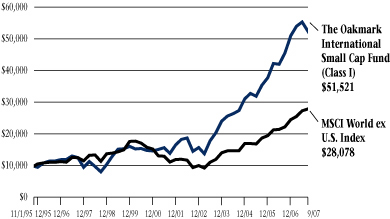

| Letter from the Portfolio Managers | | | 46 | | |

|

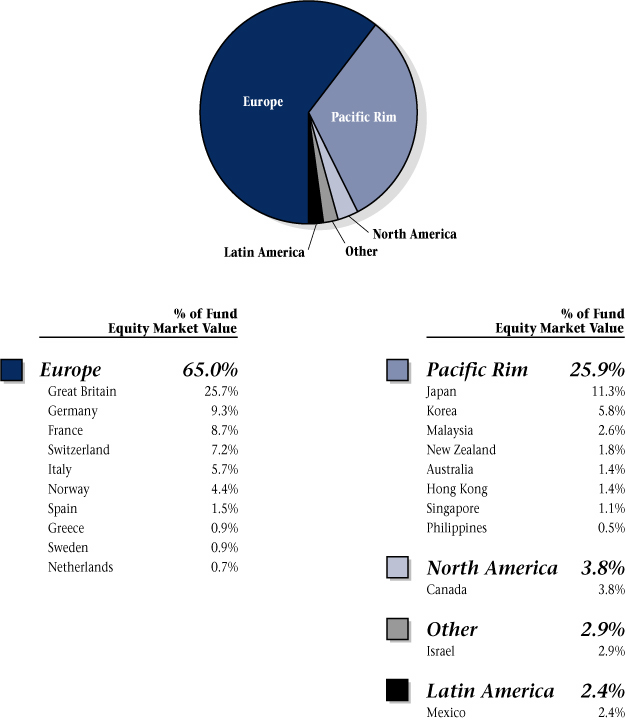

| International Diversification Chart | | | 48 | | |

|

| Schedule of Investments | | | 49 | | |

|

| Financial Statements | |

|

| Statements of Assets and Liabilities | | | 56 | | |

|

| Statements of Operations | | | 58 | | |

|

| Statements of Changes in Net Assets | | | 60 | | |

|

| Notes to Financial Statements | | | 67 | | |

|

| Trustees and Officers | | | 88 | | |

|

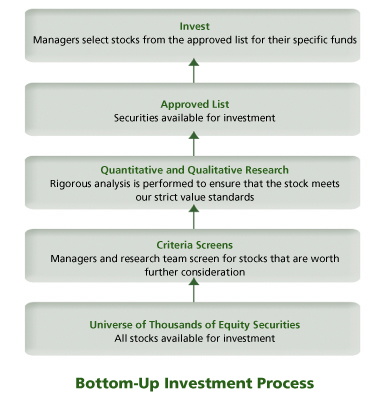

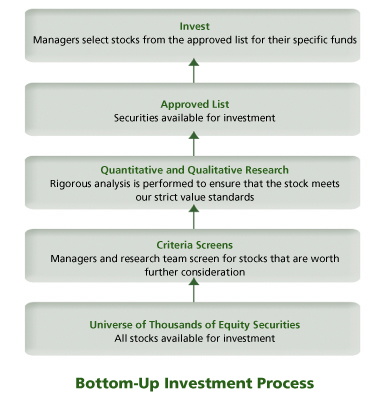

| Oakmark Philosophy and Process | | | 91 | | |

|

| The Oakmark Glossary | | | 92 | | |

|

FORWARD-LOOKING STATEMENT DISCLOSURE

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements". Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate", "may", "will", "expect", "believe", "plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

President's Letter

Dear Fellow Shareholders,

Domestic and international stock markets rose in the third quarter, with most of the broader indexes extending their gains of the past several quarters. While world stock markets finished the quarter up slightly, the endpoint belies the volatility of the period. Rapid deterioration of the U.S. mortgage market in the early summer and a related liquidity squeeze converged to threaten financial market stability. U.S. stocks fell over 6% in the quarter before the Fed stepped in to cut the discount rate and reassure investors.

With this quarter's gains, most of the broader U.S. indexes have produced mid-teens increases over year-ago levels, and international equity indexes have risen over 20%. Low interest rates and worldwide economic growth (albeit somewhat slower growth) continue to contribute to this performance. Looking through the rear-view mirror at 15-25%+ returns in the domestic and international markets for the last several years, the market looks great. However, interest rates, history and economics suggest that returns are likely to revert to long-term norms—with prospective returns averaging in the high single digits.

Though almost all of our Funds produced solid double-digit returns for the fiscal year just ended and our clients' wealth has grown, only two of our Funds kept pace with the rapidly rising market indexes. As we have counseled our investors in the past, this is often the case with our disciplined value investment approach.

Credit Cycles and Investment Risk (Chapter II)

In our June quarterly report, we discussed the widespread underpricing of risk in the world's capital markets. Several of our portfolio managers also made similar observations related to international and domestic debt and equity markets. In particular, I suggested that the abundance of capital available for risky investments had led to excesses that made a credit market correction likely.

The ink was hardly dry on last quarter's letters when the correction hit with a vengeance. Difficulties in the subprime mortgage market accelerated. Rising default rates prompted nervous lenders to pull credit lines to mortgage brokers. At several banks with large mortgage lending operations, depositors lined up to withdraw their money. Market bids for riskier mortgage securities all but disappeared. The mortgage market suddenly faced a full-fledged liquidity panic.

Several hedge funds that had invested in mortgage securities were quickly liquidated. These difficulties spread to the high-yield bond market as debt investors demanded higher yields and several pending leveraged buyouts ("LBOs") were cancelled. For other LBOs for which banks had committed to underwrite loans at fixed rates, the increase in market rates led to hundreds of millions of dollars of write-offs. Further deterioration was headed off only when the Federal Reserve stepped up in mid-August to lower short-term interest rates and provide assurances of liquidity to the market. A strong stock market rally ensued, and broader market indexes have surprisingly reached new highs.

While the white knuckle days of mid-August are behind us, two important observations are worth making about the unwinding of this credit cycle. First, fundamentals suggest that the credit correction has not completely run its course. As we pointed out last quarter, the excesses of the underpricing of risk occurred in a broad range of markets—not just for mortgages and LBOs. The unwinding of these excesses is likely to include other market adjustments, including rising corporate debt default rates, higher yield premiums for risky loans, and a broader differentiation of business quality in equity market valuations. Oakmark's investment approach, with our focus on valuation and risk-and-reward tradeoffs, has limited our exposure to investments in areas vulnerable to these forces.

Second, although we see potential for further distress in the debt and equity markets, we will not be tempted to time the market. Instead, we view weakness in market prices as an opportunity to add to existing holdings or buy new stocks at steeply discounted valuations—as we did in the recent quarter. While the market delivered a few bumps and bruises to our holdings this summer, we continue to believe that our disciplined investment process—involving thorough analysis, a valuation driven focus, and patience will continue to reward our shareholders.

Thank you for entrusting your long term assets to The Oakmark Funds. We welcome your comments and questions. You can reach us via e-mail at ContactOakmark@oakmark.com.

John R. Raitt

President of The Oakmark Funds

President and CEO of Harris Associates L.P.

September 30, 2007

1

THE OAKMARK FUNDS

Summary Information

Performance for Periods

Ended September 30, 20071

(Unaudited) | | The Oakmark

Fund—Class I

(OAKMX) | | The Oakmark

Select Fund—Class I

(OAKLX) | | The Oakmark

Equity and Income

Fund—Class I

(OAKBX) | | The Oakmark

Global Fund—Class I

(OAKGX) | |

| 3 Months* | | | -2.94 | % | | | -6.48 | % | | | 3.17 | % | | | 0.25 | % | |

| 1 Year | | | 11.51 | % | | | 7.00 | % | | | 15.77 | % | | | 21.29 | % | |

Average Annual Total

Return for: | |

| 3 Year | | | 9.23 | % | | | 8.18 | % | | | 11.91 | % | | | 20.85 | % | |

| 5 Year | | | 12.58 | % | | | 12.86 | % | | | 13.98 | % | | | 25.32 | % | |

| 10 Year | | | 6.29 | % | | | 12.78 | % | | | 11.87 | % | | | N/A | | |

| Since inception | | | 15.01%

(8/5/91) | | | | 16.79%

(11/1/96) | | | | 13.56%

(11/1/95) | | | | 17.23%

(8/4/99) | | |

Top Five Equity

Holdings as of

September 30, 20072

Company and % of Total

Net Assets | | | McDonald's

Corporation 3.4%

Yum! Brands, Inc. 2.9%

Washington

Mutual, Inc. 2.8%

Schering-Plough

Corporation 2.5%

Raytheon

Company 2.4% | | | | Washington

Mutual, Inc. 13.1%

Yum! Brands, Inc. 8.1%

McDonald's

Corporation 6.8%

H&R Block, Inc. 6.2%

Discovery Holding

Company,

Class A 5.6% | | | | XTO Energy, Inc. 4.9%

Nestle SA 3.3%

General Dynamics

Corporation 3.0%

CVS Caremark

Corporation 3.0%

EnCana Corp 2.9%

GlaxoSmithKline plc 3.5% | | | |

Oracle Corporation 3.4%

XTO Energy, Inc. 3.3%

DaimlerChrysler AG 3.2%

Rohm Company

Limited 3.2% | | |

Sector

Allocation as of

September 30, 2007

Sector and %

of Market Value | | | Consumer

Discretionary 35.4%

Financials 14.9%

Information

Technology 13.5%

Consumer Staples 13.3%

Health Care 11.5%

Industrials 7.7%

Telecommunication

Services 2.1%

Energy 1.6% | | | | Consumer

Discretionary 51.5%

Financials 17.6%

Information

Technology 15.6%

Health Care 8.9%

Telecommunication

Services 3.7%

Industrials 2.7% | | | | U.S. Government

Securities 36.2%

Consumer

Discretionary 14.5%

Consumer Staples 14.5%

Energy 12.9%

Industrials 9.1%

Health Care 6.1%

Financials 3.4%

Foreign Government

Securities 2.4%

Information

Technology 0.8%

Materials 0.1% | | | | Consumer

Discretionary 25.9%

Health Care 18.2%

Information

Technology 18.1%

Financials 14.8%

Consumer Staples 8.5%

Industrials 5.7%

Energy 5.5%

Telecommunication

Services 2.8%

Materials 0.5% | | |

The performance data quoted represents past performance. The above performance information for the Funds does not reflect the imposition of a 2% redemption fee on shares held for 90 days or less to deter market timers. If reflected, the fee would reduce the performance quoted. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Average annual total return measures annualized change, while total return measures aggregate change. To obtain current month end performance data, visit oakmark.com.

* Not annualized

THE OAKMARK FUNDS

2

Performance for Periods

Ended September 30, 20071

(Unaudited) | | The Oakmark

Global Select

Fund—Class I

(OAKWX) | | The Oakmark

International

Fund—Class I

(OAKIX) | | The Oakmark

International

Small Cap Fund—Class I

(OAKEX) | |

| 3 Months* | | | -3.65 | % | | | -3.48 | % | | | -6.60 | % | |

| 1 Year | | | N/A | | | | 14.53 | % | | | 13.35 | % | |

Average Annual Total

Return for: | |

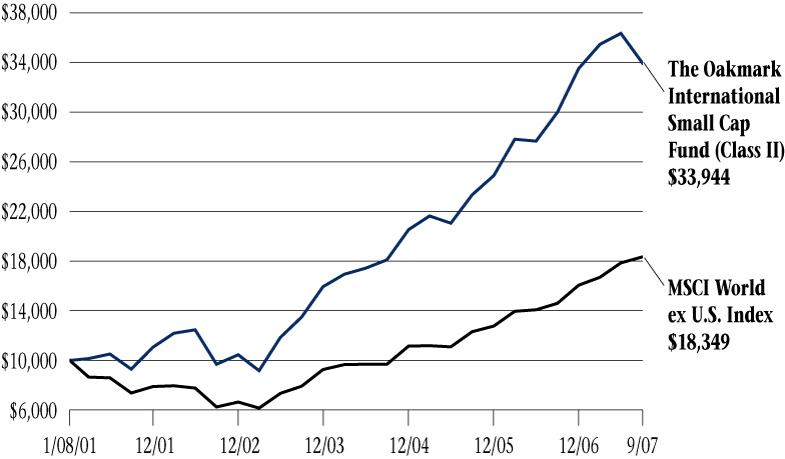

| 3 Year | | | N/A | | | | 20.75 | % | | | 23.41 | % | |

| 5 Year | | | N/A | | | | 22.78 | % | | | 28.61 | % | |

| 10 Year | | | N/A | | | | 10.84 | % | | | 15.06 | % | |

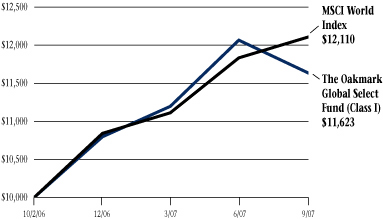

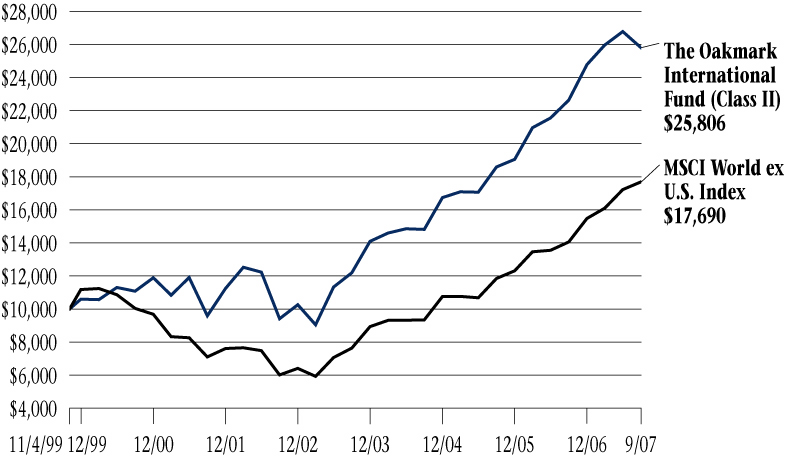

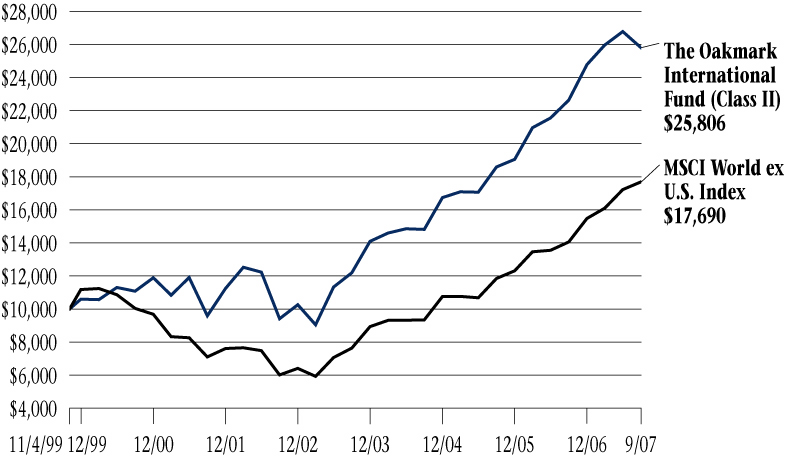

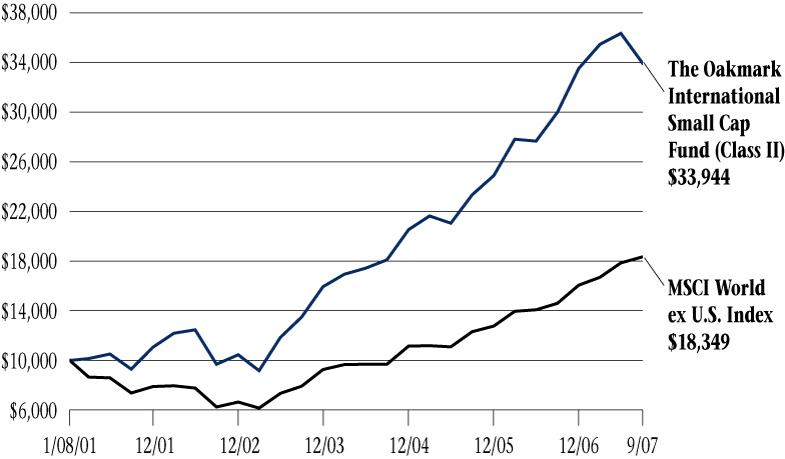

| Since inception | | 16.23%

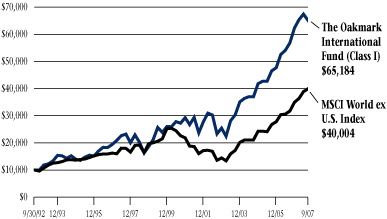

(10/2/06) | | 13.31%

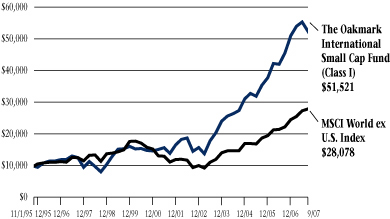

(9/30/92) | | | 14.75%

(11/1/95) | | |

Top Five Equity

Holdings as of

September 30, 20072

Company and % of Total

Net Assets | | | Intel Corporation 5.3%

GlaxoSmithKline plc 5.3%

Daiwa Securities

Group Inc. 5.3%

McDonald's

Corporation 5.2%

Rohm Company

Limited 5.2% | | | | GlaxoSmithKline plc 4.1%

Daiwa Securities

Group Inc. 4.0%

UBS AG 4.0%

Credit Suisse

Group 3.5%

Novartis AG 3.5% | | | | Benfield Group Plc 3.7%

Carpetright plc 3.6%

MDS Inc. 3.6%

Julius Baer

Holding Ltd. 3.6%

Enodis plc 3.3% | | |

Sector

Allocation as of

September 30, 2007

Sector and %

of Market Value | | | Consumer

Discretionary 27.5%

Financials 24.6%

Information

Technology 16.2%

Health Care 15.9%

Consumer Staples 5.5%

Industrials 5.2%

Telecommunication

Services 5.1% | | | | Financials 35.4%

Consumer

Discretionary 27.4%

Information

Technology 10.7%

Consumer Staples 9.0%

Health Care 8.6%

Industrials 4.9%

Telecommunication

Services 3.3%

Materials 0.7% | | | | Consumer

Discretionary 34.8%

Industrials 19.6%

Financials 16.7%

Information

Technology 13.7%

Health Care 7.6%

Consumer Staples 6.7%

Materials 0.9% | | |

As of 9/30/07, the expense ratio was 1.01% for The Oakmark Fund, 0.97% for The Oakmark Select Fund, 0.83% for The Oakmark Equity and Income Fund, 1.13% for The Oakmark Global Fund, 1.31% for The Oakmark Global Select Fund, 1.05% for The Oakmark International Fund and 1.34% for The Oakmark International Small Cap Fund.

THE OAKMARK FUNDS

3

FUND EXPENSES

A shareholder of each Fund incurs two types of costs: (1) transaction costs, such as redemption fees, and (2) ongoing costs, including investment advisory fees, transfer agent fees, and other fund expenses. The examples below are intended to help shareholders understand the ongoing cost (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other funds.

Actual Expenses

The following table provides information about actual account values and actual fund expenses for Class I of each Fund. The table shows the expenses a Class I shareholder would have paid on a $1,000 investment in each Fund from April 1, 2007, to September 30, 2007, as well as how much a $1,000 investment would be worth at the close of the period, assuming actual fund returns and expenses. A Class I shareholder can estimate expenses incurred for the period by dividing the account value at September 30, 2007, by $1,000 and multiplying the result by the number in the Expenses Paid During Period row as shown below.

Certain accounts invested for 90 days or less may be charged a 2% redemption fee. Please consult the Funds' prospectus at oakmark.com for more information.

| | | The Oakmark Fund | | The Oakmark Select Fund | | The Oakmark Equity and Income Fund | | The Oakmark Global Fund | | The Oakmark Global Select Fund | | The Oakmark International Fund | | The Oakmark International Small Cap Fund | |

Beginning

Account

Value | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending

Account

Value | | $ | 1,032.30 | | | $ | 1,008.50 | | | $ | 1,073.40 | | | $ | 1,058.00 | | | $ | 1,038.50 | | | $ | 995.90 | | | $ | 957.50 | | |

Expenses

Paid

During

Paid* | | $ | 5.15 | | | $ | 4.88 | | | $ | 4.31 | | | $ | 5.83 | | | $ | 6.44 | | | $ | 5.30 | | | $ | 6.58 | | |

Annualized

Expense

Ratio | | | 1.01 | % | | | 0.97 | % | | | 0.83 | % | | | 1.13 | % | | | 1.26 | % | | | 1.06 | % | | | 1.34 | % | |

* Expenses are equal to each Fund's annualized expense ratio for Class I, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by 365 (to reflect the one-half year period).

THE OAKMARK FUNDS

4

Hypothetical Example for Comparison Purposes

The following table provides information about hypothetical account values and hypothetical expenses for Class I of each Fund based on actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds' actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses shareholders paid for the period. Shareholders may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as redemption fees. Therefore, the third line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, the total costs would have been higher.

| | | The Oakmark Fund | | The Oakmark Select Fund | | The Oakmark Equity and Income Fund | | The Oakmark Global Fund | | The Oakmark Global Select Fund | | The Oakmark International Fund | | The Oakmark International Small Cap Fund | |

Beginning

Account

Value | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending

Account

Value | | $ | 1,020.00 | | | $ | 1,020.21 | | | $ | 1,020.91 | | | $ | 1,019.40 | | | $ | 1,018.75 | | | $ | 1,019.75 | | | $ | 1,018.35 | | |

Expenses

Paid

During

Paid* | | $ | 5.11 | | | $ | 4.91 | | | $ | 4.20 | | | $ | 5.72 | | | $ | 6.38 | | | $ | 5.37 | | | $ | 6.78 | | |

Annualized

Expense

Ratio | | | 1.01 | % | | | 0.97 | % | | | 0.83 | % | | | 1.13 | % | | | 1.26 | % | | | 1.06 | % | | | 1.34 | % | |

* Expenses are equal to each Fund's annualized expense ratio for Class I, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by 365 (to reflect the one-half year period).

THE OAKMARK FUNDS

5

THE OAKMARK AND OAKMARK SELECT FUNDS

At Oakmark, we are long-term investors. We attempt to identify growing businesses that are managed to benefit their shareholders. We will purchase stock in those businesses only when priced substantially below our estimate of intrinsic value. After purchase, we patiently wait for the gap between stock price and intrinsic value to close.

"In a crisis, don't hide behind anything or anybody. They're going to find you anyway." Bear Bryant

"In a crisis, don't hide behind anything or anybody. They're going to find you anyway." Bear Bryant

In August we posted a special letter on our website to Oakmark Select shareholders highlighting the negative performance that the Fund had experienced following the end of the second quarter. Though many shareholders expressed their appreciation for the additional update, several expressed surprise that a fund family as long-term oriented as Oakmark would be responsive to a short-term performance shortfall. To explain our thinking, here is our approach to shareholder communication: We believe that well-informed shareholders are more likely to have positive experiences owning our Funds, and satisfying customers makes good business sense. Of course we know that none of you are investing in our Funds just to get these quarterly letters! Like us, you expect the Funds to achieve good returns. But i f there is a way to consistently produce good returns each and every quarter, we unfortunately haven't found it. And that means that even good long-term results will inevitably include some disappointing short-terms. As a group, mutual fund investors have, regrettably, shown an uncanny ability to take self-destructive actions following poor performance periods—buying near tops and selling near bottoms. We believe that investors who understand how their managers think about investing will be more likely to avoid that mistake.

A mutual fund company isn't required to say much to its shareholders: only two reports per year, mailed up to 60 days after quarter-end, including a summary of top holdings, fund financial statements, and a brief discussion and analysis of results (which some funds limit to a list of their best and worst performing holdings). In addition, complete portfolio holdings need to be filed quarterly with the SEC. When funds only deliver the minimum communication, it is no wonder that investors make decisions primarily based on recent performance.

When we invest in a business, we want timely, candid communication from management. We believe our Fund shareholders deserve the same. We don't think reporting semi-annually is frequent enough. Our companies report to their shareholders quarterly, and even though we are very long-term owners, we appreciate getting performance updates at that frequency. To us, quarterly reporting for mutual funds seems appropriate, too. Some of our Fund shareholders ask why we don't give updates more often than once a quarter, with some even requesting daily updates of our activity. We believe there is little to be said in more frequent updates, and importantly, such updates could disclose our intentions, which would invite front-running and increase our transactions costs. Sixty days after quarter-end doesn't seem timely to us. We expect to hear from our companies closer to the end of the quarter they are reporting on, so we strive to do the same. Our goal i s to have our quarterly commentary and portfolio weightings available on our website within two weeks of quarter-end.

We also want a company to explain what went wrong. Most businesses love to trumpet their successes. It's not unusual to see a company issue a press release to draw attention to each tidbit of good news. Few companies give equal treatment to bad news. It raises a red flag for us when a company promotes the good news, but makes us dig through their 10-Qs to find the bad news. When we have good news to share with you, we'll wait for our normal reporting cycle, and chances are you'll find out about it before that. But when we have bad news, we want to make sure you hear it from us. Throughout Oakmark's history, we've only contacted shareholders between quarterly reports to explain bad news. We believe that communicating bad news in a candid, timely fashion builds trust.

We want our quarterly reports to be informative and tell our story. When we start researching a potential new holding, we will often read old annual reports. If a corporate annual report is well written it will not only highlight the ups and downs of the prior year, but it will also give a strategic plan. Managers will state their views of their company's competitive strengths and will explain how they intend to capitalize on them. After reading a series of these reports we can develop an informed opinion about a management's business philosophy and its rationale. We want our reports to leave a similar trail. An investor who reads a series of Oakmark reports should without a doubt understand that we are stock-pickers, that we are value investors, that we use a very long time horizon, and that we aren't concerned about short-term deviation from benchmarks. They should know that our goal is to maximize long-term, after-tax returns. They can se e why we positioned the portfolios as we did, and what we got right and what we got wrong. They will get a much more complete view of how we approach investing than an investor who just looks at the performance figures.

THE OAKMARK AND OAKMARK SELECT FUNDS

6

We believe communication should be two-way. Most good companies want to answer questions from their investors. In some smaller companies, top management will communicate one-on-one with investors or potential investors, but to protect their managers' time, most larger companies have an investor relations officer whose job is handling investor inquiries. We use e-mail to facilitate one-on-one communication with investors. We not only want to answer your questions, but seeing the questions from our investors helps us to better target future commentary. From the day we first published e-mail addresses in our quarterlies we've been asked "Aren't you afraid too many shareholders will contact you?" We've always said we hope that time comes, and if it does, we'll get help to answer all the questions. For me, that time has finally arrived, and I've asked Mike Neary, our head of client servicing, and his team to begin helping me handle e-mail respons es.

In summary, what we really want to see from a company's communication is that a management team's goal is to maximize the long-term value of the company's stock, that it has a reasonable strategy to achieve that goal, and that like us, it has an important personal investment in the stock. In our President's letter, once a year we update you on the total ownership our employees and Fund trustees have in The Oakmark Funds. Those numbers show that our investment is significant, and also, by comparing prior years, they show that we are adding new capital to our investment each year. By going far beyond the required level of communication we aim to have the most informed mutual fund shareholders. You can know with certainty our goals, our methods for achieving those goals, and our economic alignment with you. There are many unknowns in investing, but how your Fund is managed doesn't need to be one of them.

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com

oaklx@oakmark.com

September 30, 2007

THE OAKMARK AND OAKMARK SELECT FUNDS

7

THE OAKMARK FUND

Report from Bill Nygren and Kevin Grant, Portfolio Managers

THE VALUE OF A $10,000 INVESTMENT IN THE OAKMARK FUND FROM ITS INCEPTION (8/5/91) TO PRESENT (9/30/07) AS COMPARED TO THE STANDARD & POOR'S 500 INDEX3 (UNAUDITED)

| | | | | Average Annual Total Returns | |

| | | | | (as of 9/30/07) | |

| (Unaudited) | | Total Return

Last 3 Months* | | 1-year | | 5-year | | 10-year | | Since

Inception

(8/5/91) | |

| Oakmark Fund (Class I) | | | -2.94 | % | | | 11.51 | % | | | 12.58 | % | | | 6.29 | % | | | 15.01 | % | |

| S&P 5004 | | | 2.03 | % | | | 16.44 | % | | | 15.45 | % | | | 6.57 | % | | | 11.08 | % | |

| Dow Jones Average4 | | | 1.83 | % | | | 18.92 | % | | | 14.90 | % | | | 7.62 | % | | | 12.31 | % | |

Lipper Large Cap

Value Index5 | | | 0.21 | % | | | 15.05 | % | | | 16.04 | % | | | 6.76 | % | | | 10.93 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Expense Ratio as of 9/30/07 was 1.01%.

The performance data quoted represents past performance. The above performance information for the Fund does not reflect the imposition of a 2% redemption fee on shares held for 90 days or less to deter market timers. If reflected, the fee would reduce the performance quoted. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Average annual total return measures annualized change, while total return measures aggregate change. To obtain most recent month-end performance data, visit oakmark.com.

* Not annualized

Our fiscal year ended with a down quarter, but our return for the year was still a respectable 12%. Over the twelve-month period, we had positions in sixty-one different stocks. Forty-three of those stocks went up in price while we held them, and only eighteen declined. Looking at the large magnitude changes, only three stocks declined by over 20% (Pulte Homes, Harley Davidson and MGIC) while twenty-one increased by more than 20%. The two most important positive contributors were McDonalds, our largest holding up 43%, and InBev, a lesser position but up 66%. Both achieved significantly stronger than expected earnings growth. Our portfolio followed its typical pattern for good years: more winners than losers, and more big winners than big losers. Despite the good absolute return, our satisfaction is tempered by the fact that other investors had even higher returns. The S&P 500 gained 16% for the year, assisted by very large increases in e nergy and materials stocks, businesses in which we have negligible investment.

Last quarter was our weakest quarter of the year, losing 3% while the S&P 500 gained 2%. During the quarter we sold the remainder of our Gap position and used that money to add to our other retailers that we believe are better positioned yet no more expensive. The two new names in the portfolio, Covidien and Tyco Electronics, were not new purchases, but rather were spin-offs from our position in Tyco Industries. The shortfall in quarterly performance was the result of both declines in stocks we held, as well as gains in those we didn't. Energy was the best performing market sector again last quarter, and we have little exposure. We continue to believe that financial speculators have driven current oil and gas prices well beyond the level justified by long-term supply and demand. Retailers were one of the worst performing industries, and we suffered double-digit declines in Kohl's, Limited Brands (Victoria's Secret), Home Depot and Libert y Interactive (QVC). In addition, continued weakness in housing led to losses in Pulte Homes, Washington Mutual, and MGIC (mortgage insurance). We believe that retailers and consumer finance companies are priced as if we are likely to be entering a recession, while the rest of the market is priced as if growth will continue. To us, the risk-reward tradeoff in our portfolio holdings looks quite attractive.

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com | | Kevin G. Grant, CFA

Portfolio Manager

oakmx@oakmark.com | |

|

September 30, 2007

THE OAKMARK FUND

8

THE OAKMARK FUND

Schedule of Investments—September 30, 2007

| Name | | Shares Held | | Market Value | |

| Common Stocks—95.3% | |

| Apparel Retail—1.9% | |

| Limited Brands | | | 4,628,047 | | | $ | 105,935,996 | | |

| Broadcasting & Cable TV—3.7% | |

| Liberty Media Holding Corporation - Capital, Class A (a) | | | 999,670 | | | $ | 124,788,806 | | |

| Discovery Holding Company, Class A (a) | | | 1,540,140 | | | | 44,433,039 | | |

| The DIRECTV Group, Inc. (a) | | | 1,650,000 | | | | 40,062,000 | | |

| | | | 209,283,845 | | |

| Catalog Retail—1.3% | |

| Liberty Media Holding Corporation - Interactive, Class A (a) | | | 3,699,850 | | | $ | 71,074,118 | | |

| Computer & Electronics Retail—2.0% | |

| Best Buy Co., Inc. | | | 2,419,400 | | | $ | 111,340,788 | | |

| Department Stores—1.8% | |

| Kohl's Corporation (a) | | | 1,750,000 | | | $ | 100,327,500 | | |

| Home Improvement Retail—1.8% | |

| The Home Depot, Inc. | | | 3,181,500 | | | $ | 103,207,860 | | |

| Homebuilding—0.8% | |

| Pulte Homes, Inc. | | | 3,492,200 | | | $ | 47,528,842 | | |

| Household Appliances—2.0% | |

| The Black & Decker Corporation | | | 1,350,000 | | | $ | 112,455,000 | | |

| Housewares & Specialties—1.9% | |

| Fortune Brands, Inc. | | | 1,350,000 | | | $ | 110,011,500 | | |

| Motorcycle Manufacturers—1.6% | |

| Harley-Davidson, Inc. | | | 2,000,000 | | | $ | 92,420,000 | | |

| Movies & Entertainment—6.6% | |

| Time Warner, Inc. | | | 7,447,700 | | | $ | 136,739,772 | | |

| Viacom, Inc., Class B (a) | | | 3,239,745 | | | | 126,252,863 | | |

| The Walt Disney Company | | | 3,300,000 | | | | 113,487,000 | | |

| | | | 376,479,635 | | |

| Restaurants—6.3% | |

| McDonald's Corporation | | | 3,550,000 | | | $ | 193,368,500 | | |

| Yum! Brands, Inc. | | | 4,948,000 | | | | 167,390,840 | | |

| | | | 360,759,340 | | |

| Specialized Consumer Services—2.0% | |

| H&R Block, Inc. | | | 5,358,600 | | | $ | 113,495,148 | | |

THE OAKMARK FUND

9

THE OAKMARK FUND

Schedule of Investments—September 30, 2007 cont.

| Name | | Shares Held | | Market Value | |

| Common Stocks—95.3% (cont.) | |

| Brewers—4.3% | |

| InBev NV (b) | | | 1,450,000 | | | $ | 131,418,404 | | |

| Anheuser-Busch Companies, Inc. | | | 2,250,000 | | | | 112,477,500 | | |

| | | | 243,895,904 | | |

| Distillers & Vintners—2.0% | |

| Diageo plc (c) | | | 1,271,000 | | | $ | 111,504,830 | | |

| Hypermarkets & Super Centers—1.5% | |

| Wal-Mart Stores, Inc. | | | 2,000,000 | | | $ | 87,300,000 | | |

| Packaged Foods & Meats—3.5% | |

| General Mills, Inc. | | | 1,756,000 | | | $ | 101,865,560 | | |

| H.J. Heinz Company | | | 2,150,000 | | | | 99,330,000 | | |

| | | | 201,195,560 | | |

| Soft Drinks—1.3% | |

| The Coca-Cola Company | | | 1,298,700 | | | $ | 74,636,289 | | |

| Integrated Oil & Gas—1.5% | |

| ConocoPhillips | | | 1,000,373 | | | $ | 87,802,738 | | |

| Asset Management & Custody Banks—1.4% | |

| Bank of New York Mellon Corporation | | | 1,839,630 | | | $ | 81,201,268 | | |

| Consumer Finance—1.2% | |

| Capital One Financial Corporation | | | 1,028,000 | | | $ | 68,290,040 | | |

| Diversified Banks—2.0% | |

| U.S. Bancorp | | | 3,450,000 | | | $ | 112,228,500 | | |

| Life & Health Insurance—1.6% | |

| AFLAC Incorporated | | | 1,567,000 | | | $ | 89,381,680 | | |

| Other Diversified Financial Services—4.1% | |

| JPMorgan Chase & Co. | | | 2,700,000 | | | $ | 123,714,000 | | |

| Citigroup, Inc. | | | 2,400,000 | | | | 112,008,000 | | |

| | | | 235,722,000 | | |

| Thrifts & Mortgage Finance—3.9% | |

| Washington Mutual, Inc. | | | 4,537,300 | | | $ | 160,212,063 | | |

| MGIC Investment Corporation | | | 1,828,800 | | | | 59,088,528 | | |

| | | | 219,300,591 | | |

| Health Care Equipment—4.3% | |

| Baxter International, Inc. | | | 2,000,000 | | | $ | 112,560,000 | | |

| Medtronic, Inc. | | | 1,850,000 | | | | 104,358,500 | | |

| Covidien Limited | | | 639,500 | | | | 26,539,250 | | |

| | | | 243,457,750 | | |

THE OAKMARK FUND

10

THE OAKMARK FUND

Schedule of Investments—September 30, 2007 cont.

| Name | | Shares Held | | Market Value | |

| Common Stocks—95.3% (cont.) | |

| Pharmaceuticals—6.7% | |

| Schering-Plough Corporation | | | 4,460,200 | | | $ | 141,076,126 | | |

| Bristol-Myers Squibb Company | | | 4,400,000 | | | | 126,808,000 | | |

| Abbott Laboratories | | | 2,137,300 | | | | 114,602,026 | | |

| | | | 382,486,152 | | |

| Aerospace & Defense—4.1% | |

| Raytheon Company | | | 2,150,000 | | | $ | 137,213,000 | | |

| Honeywell International, Inc. | | | 1,600,000 | | | | 95,152,000 | | |

| | | | 232,365,000 | | |

| Air Freight & Logistics—1.4% | |

| FedEx Corp. | | | 750,000 | | | $ | 78,562,500 | | |

| Building Products—1.4% | |

| Masco Corporation | | | 3,433,600 | | | $ | 79,556,512 | | |

| Industrial Conglomerates—0.5% | |

| Tyco International, Ltd. | | | 639,500 | | | $ | 28,355,430 | | |

| Computer Hardware—5.2% | |

| Hewlett-Packard Company | | | 2,225,000 | | | $ | 110,782,750 | | |

| Dell Inc. (a) | | | 3,900,000 | | | | 107,640,000 | | |

| Sun Microsystems, Inc. (a) | | | 13,770,000 | | | | 77,249,700 | | |

| | | | 295,672,450 | | |

| Data Processing & Outsourced Services—1.0% | |

| Western Union Company | | | 2,575,000 | | | $ | 53,997,750 | | |

| Electronic Manufacturing Services—0.4% | |

| Tyco Electronics, Ltd. | | | 639,500 | | | $ | 22,657,485 | | |

| Office Electronics—1.6% | |

| Xerox Corporation (a) | | | 5,272,400 | | | $ | 91,423,416 | | |

| Semiconductors—4.7% | |

| Texas Instruments Incorporated | | | 3,700,000 | | | $ | 135,383,000 | | |

| Intel Corporation | | | 5,200,000 | | | | 134,472,000 | | |

| | | | 269,855,000 | | |

| Wireless Telecommunication Services—2.0% | |

| Sprint Nextel Corporation | | | 5,903,000 | | | $ | 112,157,000 | | |

| Total Common Stocks (Cost: $3,751,680,900) | | | | | | | 5,417,325,417 | | |

THE OAKMARK FUND

11

THE OAKMARK FUND

Schedule of Investments—September 30, 2007 cont.

| Name | | Par Value | | Market Value | |

| Short Term Investments—5.2% | |

| U.S. Government Agencies—1.6% | |

Federal Home Loan Bank, 4.68% - 4.70%

due 10/5/2007 - 10/15/2007 | | $ | 90,000,000 | | | $ | 89,901,089 | | |

| Total U.S. Government Agencies (Cost: $89,901,089) | | | | | 89,901,089 | | |

| Repurchase Agreement—3.6% | |

State Street Bank and Trust Co. Repurchase

Agreement, 5.00% dated 9/28/2007 due 10/1/2007,

repurchase price $204,447,188, collateralized by

Federal Home Loan Mortgage Corp. Bonds, with

rates of 6.103%, with maturities from

1/15/2036 - 5/15/2036, and with an aggregate

market value plus accrued interest of $114,100,205,

and by Federal National Mortgage Association Bonds,

with rates of 5.431% - 5.511%, with maturities from

1/25/2036 - 5/25/2036, and with an aggregate

market value plus accrued interest of $100,483,413 | | $ | 204,362,037 | | | $ | 204,362,037 | | |

| Total Repurchase Agreement (Cost: $204,362,037) | | | | | 204,362,037 | | |

| Total Short Term Investments (Cost: $294,263,126) | | | | | 294,263,126 | | |

| Total Investments (Cost $4,045,944,026)—100.5% | | | | $ | 5,711,588,543 | | |

| Other Liabilities In Excess Of Other Assets—(0.5)% | | | | | (25,597,014 | ) | |

| Total Net Assets—100% | | | | $ | 5,685,991,529 | | |

(a) Non-income producing security.

(b) Represents a foreign domiciled corporation.

(c) Represents an American Depository Receipt.

See accompanying Notes to Financial Statements.

THE OAKMARK FUND

12

THE OAKMARK SELECT FUND

Report from Bill Nygren and Henry Berghoef, Portfolio Managers

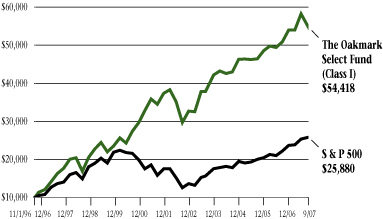

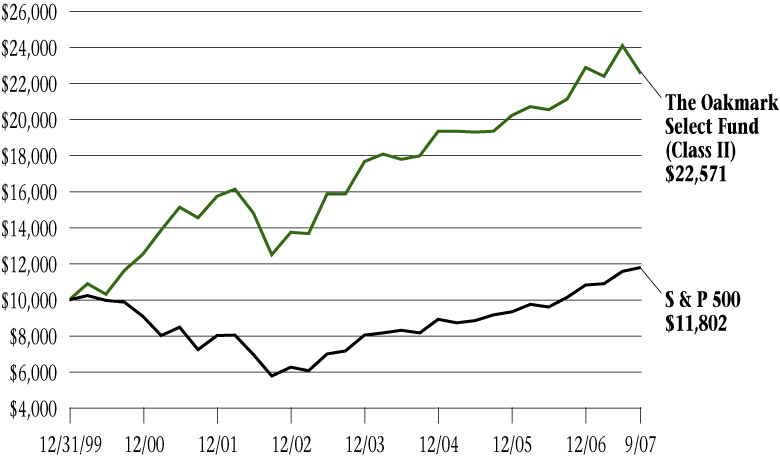

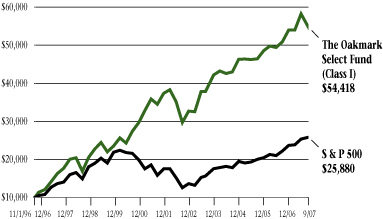

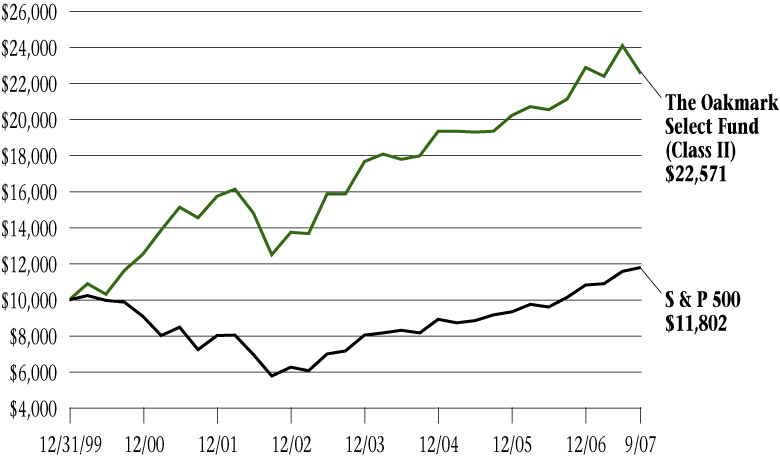

THE VALUE OF A $10,000 INVESTMENT IN THE OAKMARK SELECT FUND FROM ITS INCEPTION (11/1/96) TO PRESENT (9/30/07) AS COMPARED TO THE STANDARD & POOR'S 500 INDEX3 (UNAUDITED)

| | | | | Average Annual Total Returns | |

| | | | | (as of 9/30/07) | |

| (Unaudited) | | Total Return

Last 3 Months* | | 1-year | | 5-year | | 10-year | | Since

Inception

(11/1/96) | |

Oakmark Select Fund

(Class I) | | | -6.48 | % | | | 7.00 | % | | | 12.86 | % | | | 12.78 | % | | | 16.79 | % | |

| S&P 500 | | | 2.03 | % | | | 16.44 | % | | | 15.45 | % | | | 6.57 | % | | | 9.10 | % | |

Lipper Multi-Cap

Value Index6 | | | -1.93 | % | | | 12.72 | % | | | 16.62 | % | | | 7.49 | % | | | 9.81 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Expense Ratio as of 9/30/07 was 0.97%.

The performance data quoted represents past performance. The above performance information for the Fund does not reflect the imposition of a 2% redemption fee on shares held for 90 days or less to deter market timers. If reflected, the fee would reduce the performance quoted. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Average annual total return measures annualized change, while total return measures aggregate change. To obtain most recent month-end performance data, visit oakmark.com.

* Not annualized

The Oakmark Select Fund had a difficult end to its fiscal year, with fourth quarter losses reducing our one-year return to only 7%. The Fund's best performer for the year, Discovery Holdings, doubled. Good programming, large increases in viewers, and closure of a money-losing division combined to dramatically boost reported earnings. Our fast-food companies, YUM Brands and McDonalds, also posted good earnings gains and very good stock price performance. On the flip side, our stocks with housing or retail exposure—Pulte Homes (new home construction), Home Depot (building supply retailing), Washington Mutual (home mortgages), and Limited Brands (Victoria's Secret)—each experienced losses of over 10% which detracted from performance.

As we said in our mid-quarter letter, last quarter had very disappointing performance. The Fund lost 6% of its value, and that happened despite the S&P 500's slight increase. We believe three general themes explain that weakness. First, industrial and commodity-based businesses performed well, and we don't own any of them. Second, the weak dollar substantially increased the value of non-U.S. earnings. By most estimates, about 40% of the business of S&P 500 companies is generated outside the U.S. However, most of our holdings—with the exception of strong international operators like McDonald's, YUM and IMS— derive the overwhelming majority of their profit domestically. Finally, performance was weak in consumer companies, including retail financials, and we are heavily invested in those areas. One of the reasons investing is so challenging is that there is a strong temptation to sell what has hurt you and to buy what you shou ld have owned. More often than not, that is a mistake. As we look forward, we believe that U.S. consumer financials and retail stocks are among the few sectors that appear to be priced as if a recession is probable. We don't have an opinion as to whether or not a recession is imminent, but if it is, we can't believe it will be confined to consumer businesses. We also believe that abundant financial speculation is present across commodity markets including energy, and we believe that has pushed prices well beyond long-term market clearing levels. Finally, we think the decline in the dollar has created a purchasing power gap that makes further declines less likely—just ask anyone who has recently traveled to Europe what prices there are like!

Last quarter was an extremely frustrating one for us because we believe the stocks we own performed much worse than did the businesses they represent. We believe our portfolio has become more attractive and is properly positioned to capitalize on today's undervalued opportunities. We appreciate your patience as we wait for our stocks to reflect that value.

William C. Nygren, CFA

Portfolio Manager

oaklx@oakmark.com | | Henry R. Berghoef, CFA

Portfolio Manager

oaklx@oakmark.com | |

|

September 30, 2007

THE OAKMARK SELECT FUND

13

THE OAKMARK SELECT FUND

Schedule of Investments—September 30, 2007

| Name | | Shares Held | |

Market Value | |

| Common Stocks—95.6% | |

| Apparel Retail—3.9% | |

| Limited Brands | | | 9,280,981 | | | $ | 212,441,655 | | |

| Broadcasting & Cable TV—5.6% | |

| Discovery Holding Company, Class A (a) | | | 10,609,500 | | | $ | 306,084,075 | | |

| Catalog Retail—4.2% | |

| Liberty Media Holding Corporation - Interactive, Class A (a) | | | 11,750,000 | | | $ | 225,717,500 | | |

| Home Improvement Retail—2.7% | |

| The Home Depot, Inc. | | | 4,600,000 | | | $ | 149,224,000 | | |

| Homebuilding—2.9% | |

| Pulte Homes, Inc. | | | 11,562,600 | | | $ | 157,366,986 | | |

| Movies & Entertainment—8.8% | |

| Time Warner, Inc. | | | 13,767,000 | | | $ | 252,762,120 | | |

| Viacom, Inc., Class B (a) | | | 5,775,000 | | | | 225,051,750 | | |

| | | | 477,813,870 | | |

| Restaurants—14.9% | |

| Yum! Brands, Inc. | | | 13,031,000 | | | $ | 440,838,730 | | |

| McDonald's Corporation | | | 6,800,000 | | | | 370,396,000 | | |

| | | | 811,234,730 | | |

| Specialized Consumer Services—6.2% | |

| H&R Block, Inc. | | | 15,919,600 | | | $ | 337,177,128 | | |

| Other Diversified Financial Services—3.8% | |

| JPMorgan Chase & Co. | | | 4,444,000 | | | $ | 203,624,080 | | |

| Thrifts & Mortgage Finance—13.1% | |

| Washington Mutual, Inc. | | | 20,167,400 | | | $ | 712,110,894 | | |

| Health Care Technology—4.5% | |

| IMS Health Incorporated | | | 7,903,441 | | | $ | 242,161,433 | | |

| Pharmaceuticals—4.0% | |

| Bristol-Myers Squibb Company | | | 7,610,200 | | | $ | 219,325,964 | | |

| Diversified Commercial & Professional Services—2.6% | |

| The Dun & Bradstreet Corporation (b) | | | 1,434,900 | | | $ | 141,495,489 | | |

| Computer Hardware—3.5% | |

| Dell Inc. (a) | | | 6,913,000 | | | $ | 190,798,800 | | |

| Data Processing & Outsourced Services—3.3% | |

| Western Union Company | | | 8,515,400 | | | $ | 178,567,938 | | |

THE OAKMARK SELECT FUND

14

THE OAKMARK SELECT FUND

Schedule of Investments—September 30, 2007 cont.

| Name | | Shares Held/

Par Value | |

Market Value | |

| Common Stocks—95.6% (cont.) | |

| Office Electronics—3.9% | |

| Xerox Corporation (a) | | | 12,346,400 | | | $ | 214,086,576 | | |

| Semiconductors—4.2% | |

| Intel Corporation | | | 8,797,000 | | | $ | 227,490,419 | | |

| Wireless Telecommunication Services—3.5% | |

| Sprint Nextel Corporation | | | 10,000,000 | | | $ | 190,000,000 | | |

| Total Common Stocks (Cost: $3,682,109,502) | | | | | | | 5,196,721,537 | | |

| Short Term Investments—4.4% | |

| U.S. Government Agencies—1.1% | |

| Federal Home Loan Bank, 4.70% due 10/5/2007 | | $ | 50,000,000 | | | $ | 49,973,889 | | |

| Federal Farm Credit Bank, 4.72% due 10/16/2007 | | | 11,000,000 | | | | 10,978,366 | | |

| Total U.S. Government Agencies (Cost: $60,952,255) | | | | | | | 60,952,255 | | |

| Repurchase Agreement—3.3% | |

State Street Bank and Trust Co. Repurchase Agreement,

5.00% dated 9/28/2007 due 10/1/2007, repurchase

price $177,682,178, collateralized by Federal Home

Loan Mortgage Corp. Bonds, with rates of

5.528% - 6.103%, with maturities from

6/1/2036 - 7/15/2036, and with an aggregate

market value plus accrued interest of $38,301,307,

and by Federal National Mortgage Association.

Bonds, with a rates of 5.431% - 5.441%, with a

maturity of 5/25/2036, and with an aggregate

market value plus accrued interest of $148,187,995 | | $ | 177,608,175 | | | $ | 177,608,175 | | |

| Total Repurchase Agreement (Cost: $177,608,175) | | | | | | | 177,608,175 | | |

| Total Short Term Investments (Cost: $238,560,430) | | | | | | | 238,560,430 | | |

| Total Investments (Cost $3,920,669,932)—100.0% | | | | | | $ | 5,435,281,967 | | |

| Other Liabilities In Excess Of Other Assets—(0.0)% | | | | | | | (1,666,534 | ) | |

| Total Net Assets—100% | | | | | | $ | 5,433,615,433 | | |

(a) Non-income producing security.

(b) See footnote number five in the Notes to the Financial Statements regarding investments in affiliated issuers.

See accompanying Notes to Financial Statements.

THE OAKMARK SELECT FUND

15

THE OAKMARK EQUITY AND INCOME FUND

Report from Clyde S. McGregor and Edward A. Studzinski, Portfolio Managers

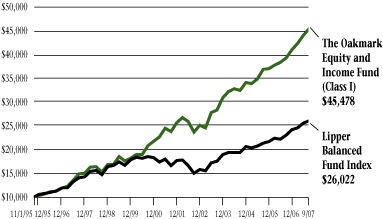

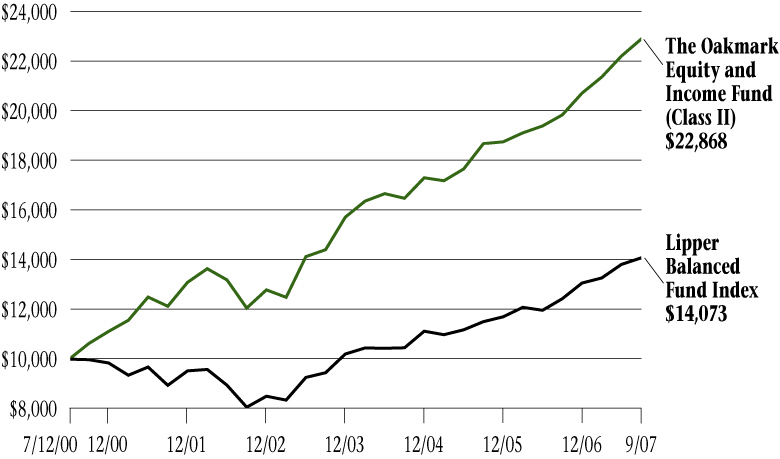

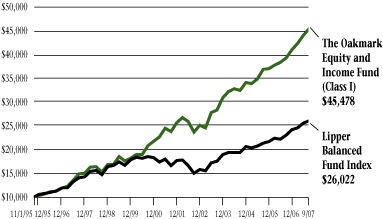

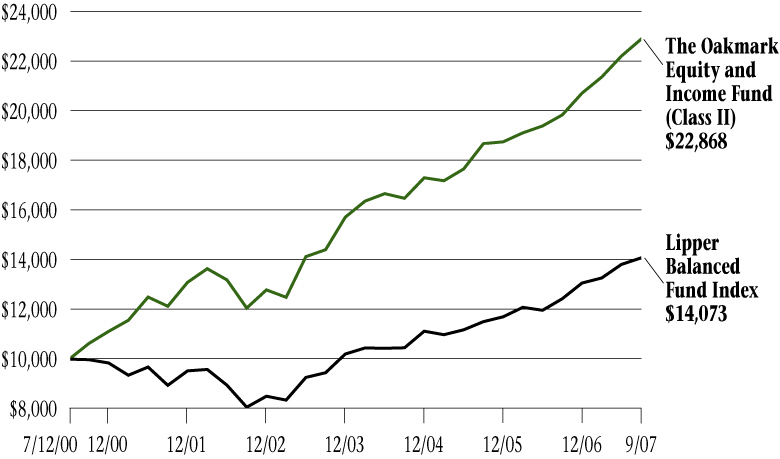

THE VALUE OF A $10,000 INVESTMENT IN THE OAKMARK EQUITY AND INCOME FUND FROM ITS INCEPTION (11/1/95) TO PRESENT (9/30/07) AS COMPARED TO THE LIPPER BALANCED FUND INDEX7 (UNAUDITED)

| | | | | Average Annual Total Returns | |

| | | | | (as of 9/30/07) | |

| (Unaudited) | | Total Return

Last 3 Months* | | 1-year | | 5-year | | 10-year | | Since

Inception

(11/1/95) | |

Oakmark Equity &

Income Fund (Class I) | | | 3.17 | % | | | 15.77 | % | | | 13.98 | % | | | 11.87 | % | | | 13.56 | % | |

Lipper Balanced

Fund Index | | | 1.90 | % | | | 13.22 | % | | | 11.76 | % | | | 6.42 | % | | | 8.36 | % | |

| S&P 5003 | | | 2.03 | % | | | 16.44 | % | | | 15.45 | % | | | 6.57 | % | | | 10.23 | % | |

Lehman Govt./

Corp. Bond8 | | | 3.01 | % | | | 5.08 | % | | | 4.16 | % | | | 6.03 | % | | | 6.08 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Expense Ratio as of 9/30/07 was 0.83%.

The performance data quoted represents past performance. The above performance information for the Fund does not reflect the imposition of a 2% redemption fee on shares held for 90 days or less to deter market timers. If reflected, the fee would reduce the performance quoted. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Average annual total return measures annualized change, while total return measures aggregate change. To obtain most recent month-end performance data, visit oakmark.com.

* Not annualized

"Our current system of levered finance and its related structures may be critically flawed. Nothing within it allows for the hedging of liquidity risk, and that is the problem of the moment."

William Gross, CIO of PIMCO

Quarter and Fiscal-Year Review

Anyone who slept through the summer quarter may glance at the Equity and Income Fund's return of 3% and the Lipper Balanced Fund Index 2% result and think that the quarter was pleasant and probably dull. All others will know that pleasant and dull were not the operative descriptors. For what seemed like forever, market forecasters had argued that securities markets were mis-pricing risk and that low volatility could not continue. But as the late MIT Professor Rudi Dornbusch once observed, in financial markets, things always take longer to happen than you expect, but once they happen, events unfold much more quickly than you expect. During the summer the cumulative effect of overly aggressive private equity transactions combined with many quarters of poor mortgage underwriting to precipitate a financial markets crisis. Several hedge funds required liquidation, and in both the U.S. and the UK, depositors made panicked withdrawals from wounded institutions. The monetary authorities in the U.S. and Europe stepped in to provide liquidity. The Federal Reserve cut-short term interest rates and the Bank of England pretty much had to rescue that country's fifth largest mortgage lender. At the nadir of the crisis, the CFO of a major investment bank stated that "We are seeing things that are 25 standard deviation events...." Your Fund's managers note that such events happen less than once in 100,000 years, somewhat beyond the scope of even our long-term investment horizon.

The Equity and Income Fund was conservatively oriented going into the summer swoon, and this positioning enabled us to be opportunistic as market dislocations occurred. We were active in equities, reducing the number of holdings while taking advantage of volatility to build up undervalued positions. We re-worked our financial industry exposures. We eliminated two successful holdings (Ceridian and CDW) that were the subjects of buyout offers, both with private equity components. Perhaps most importantly, we worked carefully with our firm's fixed income team to ensure that the Fund's cash reserves were defensively positioned during this challenging time. Our biggest disappointment during the quarter derived from the failure of issues in the high yield corporate debt market to fall to prices that would offer compellingly attractive total returns to Fund investors. Newer Equity and Income Fund shareholders have yet to see a meaningful high yield debt allocation, yet historically this has been an important source of the Fund's returns and income.

THE OAKMARK EQUITY AND INCOME FUND

16

September 30 also ends the Fund's fiscal year. We are pleased to report a return of nearly 16% for that time period, which compares to 13% for the Lipper Balanced Fund Index. As always, we report the Lipper figure only because our industry demands a benchmark. In truth, our goal for returns is to produce positive outcomes in every measuring period. While this goal is not realistic on a quarterly basis, we are pleased that only one fiscal year has produced a negative outcome which was a mere -0.47%. The compound rate of return since inception exceeds 13% per year.

Investing Environment Outlook

One of our all-time favorite comic strips came many years ago from the writer of the Wizard of Id. In the strip the king sits before his fortune teller and asks, "What are your predictions for the coming year?" She replies, "Plague, famine, and pestilence." The king, unperturbed, states, "You say that every year." To which the fortune teller replies, "Maybe this year I'll get lucky."

Given the recent financial crisis, which may not be over yet, it would be easy to write a fearsome forecast at this point. Real estate, currency values, and domestic inflation all look to remain difficult issues. Nevertheless, history teaches that financial crises that do not lead to meaningful recessions tend to create favorable investing conditions. Whether the U.S. can avoid a recession in spite of the various retarding effects remains a pivotal question.

We do not make economic forecasts but we do have to make investing decisions based on an understanding of the prevailing investing environment. While we can easily see an outcome where U.S. growth is sluggish because of the problems mentioned above, a recession forecast seems extreme. Economic growth remains robust in much of the world, particularly in developing economies, and the low value of the U.S. dollar will help export-oriented companies. Corporate balance sheets are healthy, and profit margins are wide. While many economists have predicted a downturn in consumer spending, we believe evidence to date does not support this idea.

Given the data currently available, a recession forecast appears aggressive. While the Wizard of Id fortune teller may some day get lucky, we believe that the resiliency and diversification of the U.S. economy, combined with worldwide economic momentum, will limit the impact of the past summer's events.

Is Growth the New Value?

We recently received a copy of an abstract from the consulting firm Frank Russell. The abstract's writers recommend that investors now shift toward growth equities. Quoting from their conclusion, "The last seven years have represented a perfect scenario for the Value investor. They began with historically dispersed valuations inside the market due to rampant speculation and euphoric expectations. In the period following, we witnessed unprecedented corporate scandals, a terrorist attack on U.S. soil, a major corporate profits recession, a dramatic decline in credit spreads, soaring commodity prices, major tax law changes that disproportionately helped income-oriented stocks, an extended war, an abnormal period of double-digit corporate profit growth, and a global flight to income. With these gale-force tailwinds, the market has responded with the strongest leadership shift in the history of Russell indexes in favor of more conservative, lower valuation investments."9

Your managers are card-carrying value investors, but the Russell analysis does not discourage us. Our goal has always been to understand and to interpret value as the market presents it to us at any moment of time. The Russell piece implies that value investors always favor equities with low price/earnings or price/book value ratios. While this describes part of our stock selection process, our approach is far more wide-ranging. As we have often written, we first look for companies selling at a significant discount to what an informed investor would pay to purchase the entire company. We next attempt to determine whether the company has been persistently increasing its intrinsic value per share. A company's ability to grow is itself an important component of its value. We also study management actions and investment position in the company to assess whether they have been shareholder friendly (watch what they do, not what they say). Sometime s our analysis leads us to noticeable industry concentrations. At other times we may find value leading us to favor either larger or smaller companies. And, if we are having difficulty populating the equity side of the portfolio with dominant investing ideas, we will enlarge the fixed income portion.

What does the current equity portfolio state about the Fund's managers perception of the investing environment? In general, the Fund remains quite diversified and eclectic in its composition. With 40 individual holdings, the portfolio is somewhat more concentrated than usual, and this reflects a greater degree of confidence in individual holdings. The Fund continues to have a significant exposure to oil and natural gas exploration companies. Foreign-domiciled concerns comprise almost one-fifth of the equity portfolio. The average market capitalization of the Fund's holdings has risen, but the range remains wide from low to high ($600 million up to $172 billion). Over the last few years we have added several traditional growth names to the portfolio such as Medtronic, McDonalds, and Express Scripts, but it would be hard to say that such names constitute an important theme.

In conclusion, your managers continue their search for value wherever it may be found, both in terms of equities and fixed income investments. Our job is fascinating to us in part because the investing environment is always evolving and recasting value. We thank you for being our shareholders and welcome your suggestions and comments.

Clyde S. McGregor, CFA

Portfolio Manager

oakbx@oakmark.com | | Edward A. Studzinski, CFA

Portfolio Manager

oakbx@oakmark.com | |

|

September 30, 2007

THE OAKMARK EQUITY AND INCOME FUND

17

THE OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—September 30, 2007

Name | |

Shares Held | | Market Value | |

| Equity and Equivalents—59.0% | |

| Common Stocks—59.0% | |

| Apparel Retail—1.4% | |

| Foot Locker, Inc. | | | 7,000,000 | | | $ | 107,310,000 | | |

| The TJX Companies, Inc. | | | 2,900,000 | | | | 84,303,000 | | |

| | | | 191,613,000 | | |

| Apparel, Accessories & Luxury Goods—0.4% | |

| Carter's, Inc. (a) | | | 2,750,000 | | | $ | 54,862,500 | | |

| Broadcasting & Cable TV—5.1% | |

| EchoStar Communications Corporation, Class A (a) | | | 8,250,000 | | | $ | 386,182,500 | | |

| The E.W. Scripps Company, Class A | | | 6,400,000 | | | | 268,800,000 | | |

| CBS Corporation, Class A | | | 910,000 | | | | 28,674,100 | | |

| | | | 683,656,600 | | |

| Home Furnishings—0.5% | |

| Mohawk Industries, Inc. (a) | | | 850,200 | | | $ | 69,121,260 | | |

| Movies & Entertainment—1.9% | |

| News Corporation, Class B | | | 11,000,000 | | | $ | 257,290,000 | | |

| Publishing—3.2% | |

| The Washington Post Company, Class B | | | 325,000 | | | $ | 260,910,000 | | |

| Idearc, Inc. | | | 5,250,000 | | | | 165,217,500 | | |

| Primedia, Inc. | | | 583,333 | | | | 8,189,995 | | |

| | | | 434,317,495 | | |

| Restaurants—1.2% | |

| McDonald's Corporation | | | 3,000,000 | | | $ | 163,410,000 | | |

| Specialty Stores—0.2% | |

| Zale Corporation (a) | | | 940,000 | | | $ | 21,751,600 | | |

| Brewers—1.6% | |

| InBev NV (b) | | | 2,350,000 | | | $ | 212,988,448 | | |

| Distillers & Vintners—2.7% | |

| Diageo plc (c) | | | 4,100,000 | | | $ | 359,693,000 | | |

| Drug Retail—2.9% | |

| CVS Caremark Corporation | | | 10,000,000 | | | $ | 396,300,000 | | |

| Hypermarkets & Super Centers—1.0% | |

| Costco Wholesale Corporation | | | 2,100,000 | | | $ | 128,877,000 | | |

| Packaged Foods & Meats—3.3% | |

| Nestle SA (c)(d) | | | 3,900,000 | | | $ | 437,985,600 | | |

THE OAKMARK EQUITY AND INCOME FUND

18

THE OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—September 30, 2007 cont.

Name | |

Shares Held | | Market Value | |

| Equity and Equivalents—59.0% (cont.) | |

| Personal Products—1.6% | |

| Avon Products, Inc. | | | 5,720,100 | | | $ | 214,675,353 | | |

| Tobacco—0.9% | |

| UST, Inc. | | | 2,332,300 | | | $ | 115,682,080 | | |

| Oil & Gas Exploration & Production—12.4% | |

| XTO Energy, Inc. | | | 10,561,338 | | | $ | 653,113,142 | | |

| EnCana Corp. (b) | | | 6,303,902 | | | | 389,896,339 | | |

| Apache Corporation | | | 3,850,000 | | | | 346,731,000 | | |

| Newfield Exploration Co. (a) | | | 5,600,000 | | | | 269,696,000 | | |

| | | | 1,659,436,481 | | |

| Property & Casualty Insurance—2.0% | |

| SAFECO Corporation | | | 4,000,000 | | | $ | 244,880,000 | | |

| First American Corporation | | | 600,000 | | | | 21,972,000 | | |

| | | | 266,852,000 | | |

| Reinsurance—0.7% | |

| PartnerRe, Ltd. (b) | | | 1,150,000 | | | $ | 90,838,500 | | |

| Thrifts & Mortgage Finance—0.6% | |

| MGIC Investment Corporation | | | 2,528,995 | | | $ | 81,711,828 | | |

| Health Care Equipment—4.0% | |

| Medtronic, Inc. | | | 5,900,000 | | | $ | 332,819,000 | | |

| Hospira, Inc. (a) | | | 5,000,000 | | | | 207,250,000 | | |

| | | | 540,069,000 | | |

| Health Care Services—1.1% | |

| Express Scripts, Inc. (a) | | | 2,600,000 | | | $ | 145,132,000 | | |

| Life Sciences Tools & Services—0.8% | |

| Varian, Inc. (a)(e) | | | 1,649,400 | | | $ | 104,918,334 | | |

| Aerospace & Defense—5.7% | |

| General Dynamics Corporation | | | 4,700,000 | | | $ | 397,009,000 | | |

| Raytheon Company | | | 3,599,700 | | | | 229,732,854 | | |

| Alliant Techsystems, Inc. (a) | | | 1,325,000 | | | | 144,822,500 | | |

| | | | 771,564,354 | | |

| Industrial Conglomerates—0.5% | |

| Walter Industries, Inc. | | | 2,500,700 | | | $ | 67,268,830 | | |

| Industrial Machinery—2.5% | |

| Ingersoll-Rand Co., Class A | | | 4,805,000 | | | $ | 261,728,350 | | |

| Mueller Water Products, Inc., Class B (e) | | | 6,719,153 | | | | 73,910,683 | | |

| | | | 335,639,033 | | |

THE OAKMARK EQUITY AND INCOME FUND

19

THE OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—September 30, 2007 cont.

Name | | Shares Held/

Par Value | | Market Value | |

| Equity and Equivalents—59.0% (cont.) | |

| Application Software—0.4% | |

| Mentor Graphics Corporation (a) | | | 3,288,318 | | | $ | 49,653,602 | | |

| Semiconductors—0.4% | |

| International Rectifier Corporation (a) | | | 1,599,700 | | | $ | 52,774,103 | | |

| Total Common Stocks (Cost: $5,571,500,047) | | | | | | | 7,908,082,001 | | |

| Total Equity And Equivalents (Cost: $5,571,500,047) | | | | | | | 7,908,082,001 | | |

| Fixed Income—37.2% | |

| Corporate Bonds—0.1% | |

| Paper Packaging—0.1% | |

| Sealed Air Corporation, 144A, 5.625% due 7/15/2013 (f) | | $ | 20,000,000 | | | $ | 19,249,180 | | |

| Total Corporate Bonds (Cost: $20,151,030) | | | | | | | 19,249,180 | | |

| Government and Agency Securities—37.1% | |

| Canadian Government Bonds—1.9% | |

| Canada Government, 3.75% due 6/1/2008 | | CAD | 250,000,000 | | | $ | 250,512,743 | | |

| France Government Bonds—0.4% | |

France Government, 3.00% due 7/25/2012,

Inflation Indexed | | EUR | 39,209,450 | | | $ | 58,502,177 | | |

| U.S. Government Notes—32.5% | |

| United States Treasury Notes, 4.875% due 5/15/2009 | | $ | 750,000,000 | | | $ | 760,722,750 | | |

| United States Treasury Notes, 5.125% due 5/15/2016 | | | 500,000,000 | | | | 520,976,500 | | |

| United States Treasury Notes, 5.125% due 6/30/2011 | | | 500,000,000 | | | | 517,383,000 | | |

| United States Treasury Notes, 4.875% due 2/15/2012 | | | 500,000,000 | | | | 514,922,000 | | |

United States Treasury Notes, 3.625% due 1/15/2008,

Inflation Indexed | | | 386,811,000 | | | | 386,327,486 | | |

| United States Treasury Notes, 5.00% due 8/15/2011 | | | 250,000,000 | | | | 258,300,750 | | |

| United States Treasury Notes, 4.75% due 3/31/2011 | | | 250,000,000 | | | | 255,468,750 | | |

United States Treasury Notes, 2.00% due 4/15/2012,

Inflation Indexed | | | 256,632,500 | | | | 254,767,808 | | |

| United States Treasury Notes, 4.875% due 8/15/2009 | | | 250,000,000 | | | | 254,023,500 | | |

| United States Treasury Notes, 4.875% due 1/31/2009 | | | 250,000,000 | | | | 252,871,000 | | |

| United States Treasury Notes, 4.00% due 4/15/2010 | | | 250,000,000 | | | | 250,019,500 | | |

United States Treasury Notes, 0.875% due 4/15/2010,

Inflation Indexed | | | 137,443,750 | | | | 132,880,205 | | |

| | | | 4,358,663,249 | | |

THE OAKMARK EQUITY AND INCOME FUND

20

THE OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—September 30, 2007 cont.

Name | | Par Value | | Market Value | |

| Fixed Income—37.2% (cont.) | |

| U.S. Government Agencies—2.3% | |

| Federal Home Loan Bank, 5.25% due 1/16/2009 | | $ | 50,000,000 | | | $ | 50,423,700 | | |

| Federal Home Loan Bank, 5.00% due 2/4/2009 | | | 34,840,000 | | | | 35,067,854 | | |

| Federal Farm Credit Bank, 3.75% due 1/15/2009 | | | 25,887,000 | | | | 25,644,594 | | |

| Federal Home Loan Bank, 4.50% due 6/9/2010 | | | 25,000,000 | | | | 25,037,500 | | |

| Federal Farm Credit Bank, 4.92% due 1/11/2010 | | | 20,000,000 | | | | 20,216,100 | | |

| Federal Farm Credit Bank, 5.00% due 3/2/2009 | | | 15,500,000 | | | | 15,611,383 | | |

| Federal Home Loan Bank, 4.50% due 5/12/2010 | | | 15,000,000 | | | | 15,023,235 | | |

| Federal Farm Credit Bank, 5.15% due 7/20/2009 | | | 10,531,000 | | | | 10,663,417 | | |

| Federal Farm Credit Bank, 5.25% due 7/16/2010 | | | 10,000,000 | | | | 10,209,280 | | |

| Federal Home Loan Bank, 4.54% due 7/6/2010 | | | 10,000,000 | | | | 10,024,910 | | |

| Tennessee Valley Authority, 6.79% due 5/23/2012 | | | 9,000,000 | | | | 9,776,331 | | |

| Tennessee Valley Authority, 5.625% due 1/18/2011 | | | 8,991,000 | | | | 9,274,945 | | |

| Federal Home Loan Bank, 6.795% due 6/30/2009 | | | 7,005,000 | | | | 7,281,228 | | |

| Federal Farm Credit Bank, 4.85% due 12/16/2009 | | | 6,500,000 | | | | 6,548,607 | | |

| Federal Farm Credit Bank, 5.125% due 6/6/2011 | | | 5,605,000 | | | | 5,720,082 | | |

| Federal Farm Credit Bank, 4.125% due 4/15/2009 | | | 5,147,000 | | | | 5,122,721 | | |

| Federal Farm Credit Bank, 5.10% due 8/9/2011 | | | 5,000,000 | | | | 5,095,975 | | |

| Federal Farm Credit Bank, 4.90% due 9/2/2009 | | | 5,000,000 | | | | 5,045,505 | | |

| Federal Farm Credit Bank, 4.75% due 5/7/2010 | | | 5,000,000 | | | | 5,038,160 | | |

| Federal Home Loan Bank, 4.75% due 12/11/2009 | | | 5,000,000 | | | | 5,034,225 | | |

| Federal Farm Credit Bank, 5.01% due 1/22/2009 | | | 5,000,000 | | | | 5,031,920 | | |

| Federal Farm Credit Bank, 4.125% due 7/17/2009 | | | 5,000,000 | | | | 4,975,075 | | |

| Federal Farm Credit Bank, 4.85% due 3/9/2011 | | | 4,457,000 | | | | 4,510,627 | | |

| Federal Home Loan Bank, 4.75% due 3/13/2009 | | | 4,100,000 | | | | 4,116,347 | | |

| Federal Farm Credit Bank, 5.05% due 5/25/2011 | | | 4,000,000 | | | | 4,072,508 | | |

| Federal Farm Credit Bank, 4.50% due 8/8/2011 | | | 3,000,000 | | | | 2,968,446 | | |

| | | | 307,534,675 | | |

| Total Government and Agency Securities (Cost: $4,869,342,387) | | | | | | | 4,975,212,844 | | |

| Total Fixed Income (Cost: $4,889,493,417) | | | | | | | 4,994,462,024 | | |

| Short Term Investments—3.8% | |

| U.S. Government Agencies—2.3% | |

Federal Home Loan Bank, 4.70% - 4.89%

due 10/5/2007 - 1/4/2008 | | $ | 300,000,000 | | | $ | 298,713,876 | | |

| Federal Agricultural Mortgage Corp., 4.90% due 11/21/2007 | | | 6,300,000 | | | | 6,256,267 | | |

| Total U.S. Government Agencies (Cost: $304,970,143) | | | | | | | 304,970,143 | | |

THE OAKMARK EQUITY AND INCOME FUND

21

THE OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—September 30, 2007 cont.

Name | | Par Value | | Market Value | |

| Short Term Investments—3.8% (cont.) | |

| Repurchase Agreement—1.5% | |

State Street Bank and Trust Co. Repurchase

Agreement, 5.00% dated 9/28/2007 due 10/1/2007,

repurchase price $199,517,116, collateralized by

Federal Home Loan Mortgage Corp. Bonds, with

rates of 5.765% - 6.103%, with maturities from

8/15/2036 - 10/1/2036, and with an aggregate

market value plus accrued interest of $160,490,290,

and by Federal National Mortgage Association

Bonds, with rates of 5.431% - 5.531%, with a

maturities from 8/25/2036 - 10/25/2036, and

with an aggregate market value plus accrued

interest of $48,917,665 | | $ | 199,434,018 | | | $ | 199,434,018 | | |

| Total Repurchase Agreement (Cost: $199,434,018) | | | | | 199,434,018 | | |

| Total Short Term Investments (Cost: $504,404,161) | | | | | 504,404,161 | | |

| Total Investments (Cost $10,965,397,625)—100.0% | | | | $ | 13,406,948,186 | | |

| Other Liabilities In Excess Of Other Assets—(0.0)% | | | | | (2,276,615 | ) | |

| Total Net Assets—100% | | | | $ | 13,404,671,571 | | |

(a) Non-income producing security.

(b) Represents a foreign domiciled corporation.

(c) Represents an American Depository Receipt.

(d) Market value is determined in accordance with procedures established in good faith by the Board of Trustees.

(e) See footnote number five in the Notes to the Financial Statements regarding investments in affiliated issuers.

(f) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

Key to abbreviations:

CAD: Canadian Dollar

EUR: Euro

See accompanying Notes to Financial Statements.

THE OAKMARK EQUITY AND INCOME FUND

22

THE OAKMARK GLOBAL FUND

Report from Clyde S. McGregor and Robert A. Taylor, Portfolio Managers

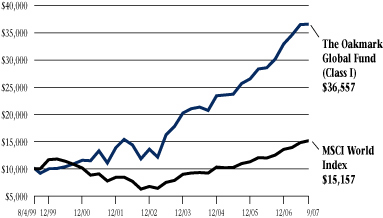

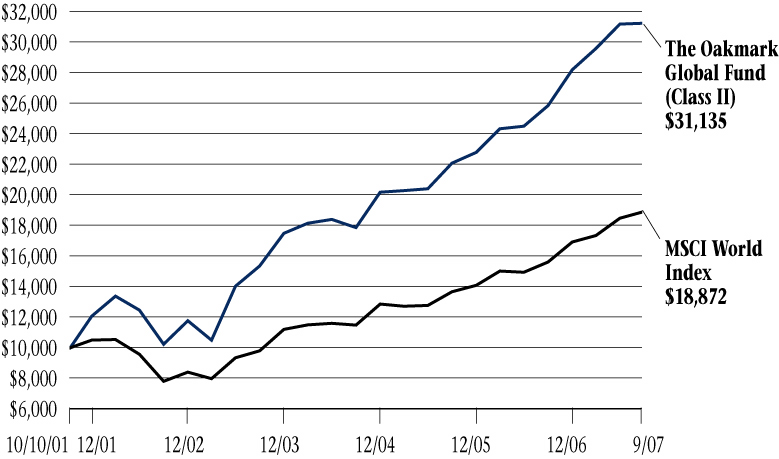

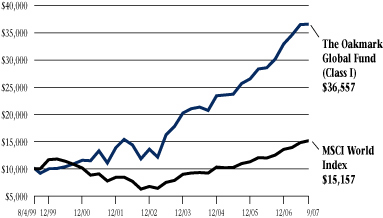

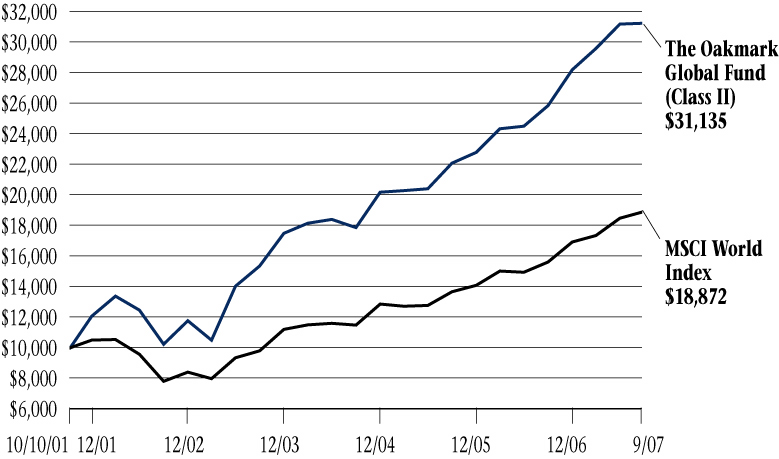

THE VALUE OF A $10,000 INVESTMENT IN THE OAKMARK GLOBAL FUND FROM ITS INCEPTION (8/4/99) TO PRESENT (9/30/07) AS COMPARED TO THE MSCI WORLD INDEX10 (UNAUDITED)

| | | | | Average Annual Total Returns

(as of 9/30/07) | |

| (Unaudited) | | Total Return

Last 3 Months* | | 1-year | | 5-year | | Since

Inception

(8/4/99) | |

| Oakmark Global Fund (Class I) | | | 0.25 | % | | | 21.29 | % | | | 25.32 | % | | | 17.23 | % | |

| MSCI World | | | 2.36 | % | | | 21.10 | % | | | 19.28 | % | | | 5.23 | % | |

| Lipper Global Fund Index11 | | | 1.80 | % | | | 21.00 | % | | | 18.98 | % | | | 7.00 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Expense Ratio as of 9/30/07 was 1.13%.

The performance data quoted represents past performance. The above performance information for the Fund does not reflect the imposition of a 2% redemption fee on shares held for 90 days or less to deter market timers. If reflected, the fee would reduce the performance quoted. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Average annual total return measures annualized change, while total return measures aggregate change. To obtain most recent month-end performance data, visit oakmark.com.

* Not annualized

Quarter and Fiscal Year Review

While the Oakmark Global Fund extended its streak of profitable quarters to twelve in the quarter ended September 30, the Fund's recent relative returns were uninspiring. For the quarter the Fund returned a fraction of a percent, which lagged the 2% returns of both the Lipper Global Fund Index and the MSCI World Index. It was a particularly poor quarter for Europe as the pan-European Dow Jones Stoxx 600 Index12 fell 4%. Oakmark Global's large Europe weighting, as well as its lack of exposure to resource-based economies and to the BRIC's (Brazil, Russia, India, and China), all dampened Fund results. See David Herro's International and International Small Cap Letter for more commentary on commodities and emerging markets. Countries where the Fund enjoyed strong relative performance included Japan, France, and Germany, while Switzerland, the United Kingdom, and Canada brought up the rear. Currency translations played a meaningful part in the quarter's returns as the U.S. dollar's value eroded. We maintained partial hedges against the British pound and initiated a hedge versus the Euro.

We are pleased to report that the Fund's return for the fiscal year exceeded 21% which matches the 21% for the Lipper Global Fund Index and the MSCI World Index. As always, we most enjoy reporting that the compound annualized rate of return since the Fund's inception is 17%.

For more than a year, the balance between U.S. and foreign-domiciled companies has been close to 40/60. Since investors often express interest in how we determine this balance, we will take the liberty of repeating ourselves. We build the portfolio from the bottom up. Each individual name fights for space within the portfolio. The resulting split between U.S. and international is simply an artifact of this endless battle for portfolio position. The same could be said for our Japanese holdings versus our European, emerging market versus developed, etc. We take the portfolio wherever we find dominant value opportunities. Currently that means a lot of U.S., United Kingdom, continental Europe, and Japanese equities.

Oceans of Difference on Competition

Last quarter we wrote about the effect of private equity transactions on equity markets and suggested that the environment was trending less favorably for private equity deals. For once we made a timely and correct forecast! The summer quarter saw several important transactions fall apart, and others experienced duress as bankers struggled to offload some of the debt that makes these deals possible. While we probably should

THE OAKMARK GLOBAL FUND

23

retire from making forecasts at this point, we will push our luck and argue that the ruling in the Luxembourg-based Court of First Instance against Microsoft in its nine-year antitrust battle will prove in the long-term to be the most important financial markets event of the quarter.

Quoting from the Financial Times, "the judgment was delivered in Luxembourg, drafted by an Irishman and read out by a judge from Denmark. The original (European) Commission ruling was prepared by a Spaniard and handed down by Mario Monti, the Italian EU competition commissioner. He has since been replaced by a Dutch official, Neelie Kroes."13 While we are not antitrust law experts, we understand the core of the difference between U.S. and European authorities revolves around market domination and its collateral impacts. Oakmark Global owns shares of Intel, the U.S.-based microprocessor company, and the European Commission issued antitrust ch arges against that company early in the summer, again alleging abuse of a dominant market position. We will not make a specific forecast as to how the divergent application of antitrust law will affect investing opportunities, but we do expect this issue to remain an important factor when analyzing large international companies.

Portfolio Activity

Once again we ended the quarter with 51 equity holdings in the portfolio. We actually eliminated two positions and added only one. With Tyco International splitting into three separate companies and the buyout of eFunds effected in September, however, the portfolio number remained flat at 51.