UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-06279 |

|

Harris Associates Investment Trust |

(Exact name of registrant as specified in charter) |

|

Two North La Salle Street, Suite 500 Chicago, Illinois | | 60602-3790 |

(Address of principal executive offices) | | (Zip code) |

|

John R. Raitt | | Cameron S. Avery |

Harris Associates L.P. | | Bell, Boyd & Lloyd LLP |

Two North La Salle Street, #500 | | Three First National Plaza, #3100 |

Chicago, Illinois 60602 | | Chicago, Illinois 60602 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (312) 621-0600 | |

|

Date of fiscal year end: | 09/30/08 | |

|

Date of reporting period: | 09/30/08 | |

| | | | | | | | | | |

Item 1. Reports to Shareholders.

ANNUAL REPORT

SEPTEMBER 30, 2008

Advised by Harris Associates L.P.

THE OAKMARK FUNDS

2008 Annual Report

| President's Letter | | | 1 | | |

|

| Summary Information | | | 2 | | |

|

| Fund Expenses | | | 4 | | |

|

| Commentary on Oakmark and Oakmark Select Funds | | | 6 | | |

|

| Oakmark Fund | |

|

| Letter from the Portfolio Managers | | | 8 | | |

|

| Schedule of Investments | | | 9 | | |

|

| Oakmark Select Fund | |

|

| Letter from the Portfolio Managers | | | 13 | | |

|

| Schedule of Investments | | | 14 | | |

|

| Oakmark Equity and Income Fund | |

|

| Letter from the Portfolio Managers | | | 16 | | |

|

| Schedule of Investments | | | 18 | | |

|

| Oakmark Global Fund | |

|

| Letter from the Portfolio Managers | | | 23 | | |

|

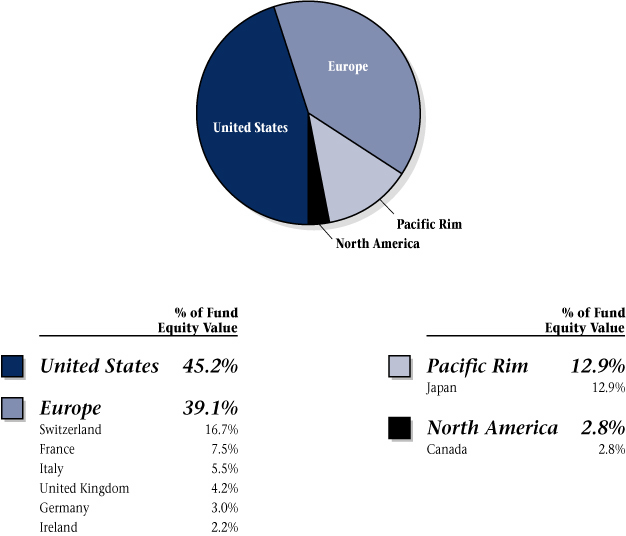

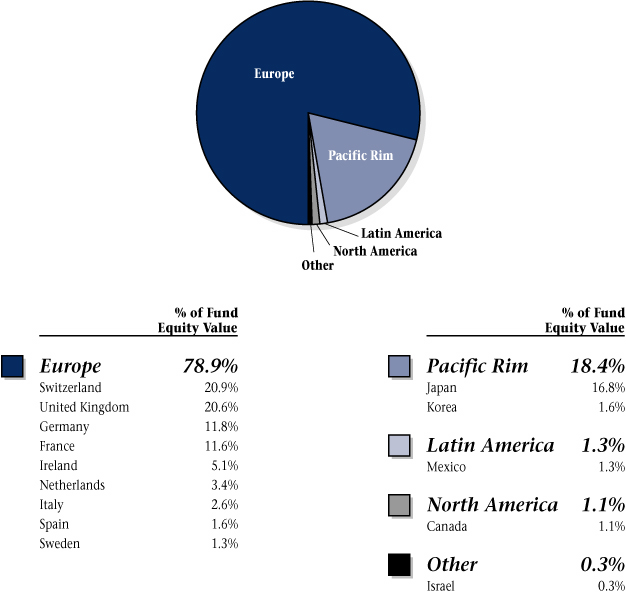

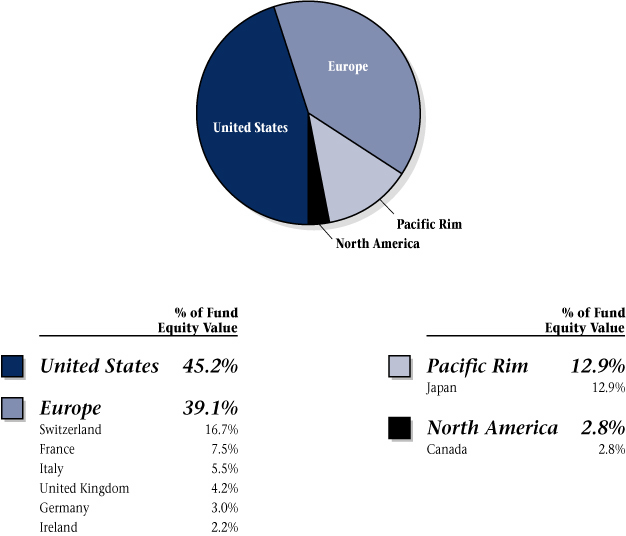

| Global Diversification Chart | | | 25 | | |

|

| Schedule of Investments | | | 26 | | |

|

| Oakmark Global Select Fund | |

|

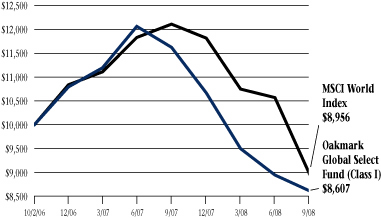

| Letter from the Portfolio Managers | | | 30 | | |

|

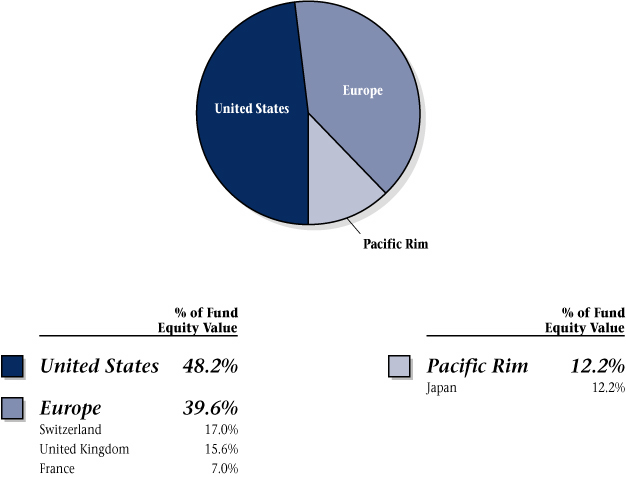

| Global Diversification Chart | | | 32 | | |

|

| Schedule of Investments | | | 33 | | |

|

| Commentary on International and International Small Cap Funds | | | 35 | | |

|

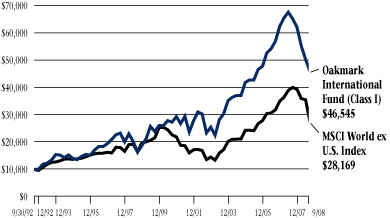

| Oakmark International Fund | |

|

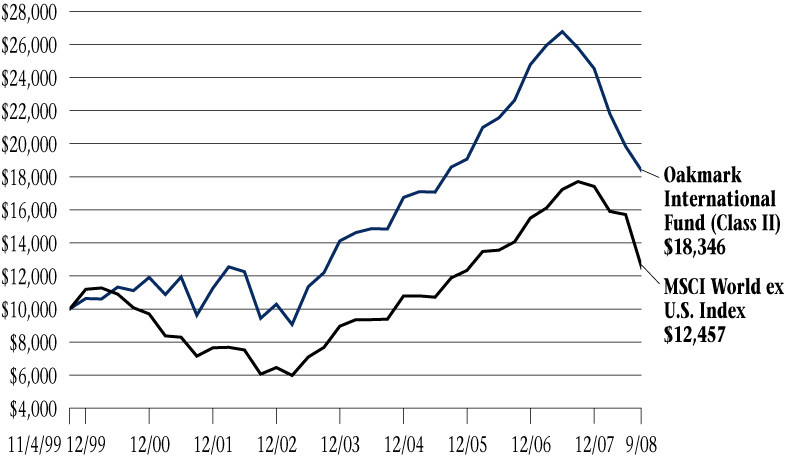

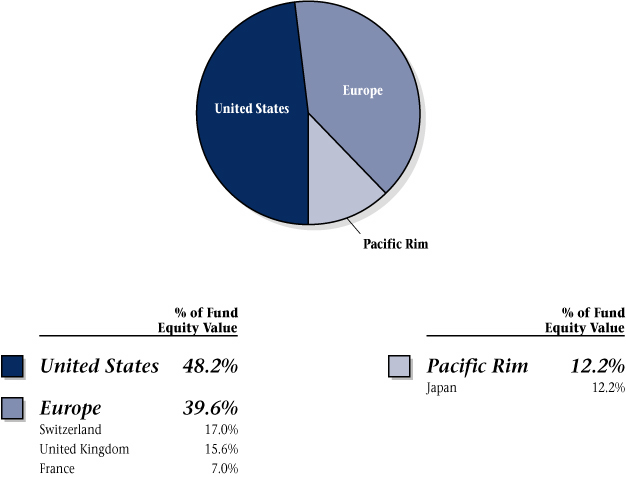

| Letter from the Portfolio Manager | | | 36 | | |

|

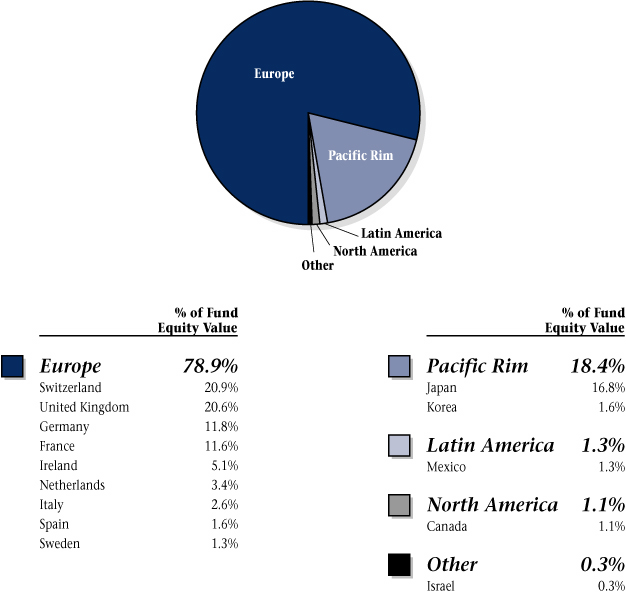

| Global Diversification Chart | | | 38 | | |

|

| Schedule of Investments | | | 39 | | |

|

| Oakmark International Small Cap Fund | |

|

| Letter from the Portfolio Managers | | | 44 | | |

|

| Global Diversification Chart | | | 46 | | |

|

| Schedule of Investments | | | 47 | | |

|

| Financial Statements | |

|

| Statements of Assets and Liabilities | | | 52 | | |

|

| Statements of Operations | | | 54 | | |

|

| Statements of Changes in Net Assets | | | 56 | | |

|

| Notes to Financial Statements | | | 63 | | |

|

| Trustees and Officers | | | 84 | | |

|

| Oakmark Glossary | | | 87 | | |

|

FORWARD-LOOKING STATEMENT DISCLOSURE

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements". Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate", "may", "will", "expect", "believe", "plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

President's Letter

Dear Fellow Shareholders,

The third quarter was extremely difficult for investors around the world as the deepening problems in the banking system continued to depress global markets. Through the end of the third quarter, the broad U.S. and global market indexes fell over 25% from their peak last fall. The weakness has continued into the early days of October. While our Funds all performed better than the market averages in the third quarter, we are disappointed that recent returns fell short of our long-term goal of positive absolute returns.

The Economy and Stock Valuation

The world banking system is facing its most difficult challenge in decades. Debt markets are in disarray, and with the decline of equity markets that has continued into early October, the market's decline is now one of the deepest in many years. Although economic data indicate that the economy is very weak, if not in recession, it is important to note that recent market weakness does not seem to be a product of lower business values, but instead a crisis of market liquidity and confidence. The credit crunch is creating forced selling across broad sectors of the capital markets. Limited liquidity and a surplus of sellers have pushed prices down quickly. Other investors, spooked by market declines, have also run for the exits, adding fuel to the fire.

Last fall, before the current market decline set in, we believed that average equity valuations were reasonable. Although our outlook for corporate earnings is lower today, we do not believe that the change justifies the 40%+ declines of the broader market indexes. In fact, for our list of approved securities that our Funds can purchase, the average stock now sells at less than 40% of our estimate of intrinsic value—an historic extreme.

As we step back and examine the market from an unemotional perspective, we are sobered by the challenges facing the world's financial system, but we are won over by low valuations and investors' deeply negative sentiments. This is consistent with our belief that the best time to buy stocks is when it is emotionally hardest to do.

Cash Management and Securities Lending

Investment managers and money market funds recently made headlines when two activities believed to be relatively low risk—cash management and securities lending—produced surprise losses for investors. In good economic times, it is easy for investors to reach for extra returns by accepting what they think is a small amount of additional risk. We have often spoken about the importance of capital preservation and our desire to take risk only when we believe that we are generously rewarded for doing so. We take this approach because we understand that the unexpected often occurs and that in turbulent times, outcomes can be extreme. Last month, for example, investors learned this lesson anew as Lehman's bankruptcy filing triggered a long chain of losses for investors and money market funds that held Lehman Brothers commercial paper or participated in securities lending programs exposed to the credit of Lehman and/or other low quality collateral.

We have received many inquiries from shareholders asking about our cash management and securities lending practices. You should know that the Funds' approach to these matters is entirely consistent with the principles stated above. The Funds' cash management strategy stresses capital preservation. We generally invest only in: 1) short–term U.S. Treasury securities, 2) U.S. agencies and 3) overnight repurchase agreements secured by U.S. Treasury or agency securities.

Securities lending is a means by which funds earn a fee by making a temporary loan of a security from their portfolio to a broker/dealer to support that firm's trading activities. The lending fund then receives collateral from the borrower that it may retain if the borrower is unable to return the securities when required.

Each of our Funds, except Oakmark Fund, is permitted to engage in securities lending. Historically, however, we have only done so infrequently and selectively. Generally, we limit our securities lending to special circumstances when the market is willing to pay fees that we believe are well above average. When we lend securities, we take the conservative approach of only accepting U.S. Treasury securities as collateral for the loaned securities. These requirements typically reduce the fees that we earn, but they also provide us with greater security and limit our exposure to losses on collateral and collateral pools. For more information about these practices, please read our Statement of Additional Information at Oakmark.com.

Capital Gains Distributions

In line with our desire to minimize the taxes that our shareholders pay, our portfolio managers pay close attention to taxable gains and losses and try to minimize required tax distributions. While volatile markets can make this more challenging, we are pleased to announce that estimated capital gains distributions for all of our Funds will be substantially smaller this year, and will equal zero for some Funds.

We would like to thank you for your continued patience and support. We welcome your comments and questions. You can reach us via e-mail at ContactOakmark@oakmark.com.

John R. Raitt

President and CEO of The Oakmark Funds

President and CEO of Harris Associates L.P.

October 9, 2008

1

THE OAKMARK FUNDS

Summary Information

Performance for Periods

Ended September 30, 20081 | | Oakmark

Fund—Class I

(OAKMX) | | Oakmark

Select Fund—Class I

(OAKLX) | | Oakmark

Equity and Income

Fund—Class I

(OAKBX) | | Oakmark

Global Fund—Class I

(OAKGX) | |

| 3 Months* | | | -1.42 | % | | | -7.08 | % | | | -7.09 | % | | | -8.95 | % | |

| 1 Year | | | -18.14 | % | | | -30.43 | % | | | -3.85 | % | | | -22.10 | % | |

Average Annual Total

Return for: | |

| 3 Year | | | 0.28 | % | | | -6.56 | % | | | 5.84 | % | | | 3.53 | % | |

| 5 Year | | | 4.12 | % | | | 0.02 | % | | | 9.09 | % | | | 9.89 | % | |

| 10 Year | | | 4.62 | % | | | 8.38 | % | | | 11.15 | % | | | N/A | | |

| Since inception | | | 12.75%

(8/5/91) | | | | 11.82%

(11/1/96) | | | | 12.10%

(11/1/95) | | | | 12.11%

(8/4/99) | | |

Top Five Equity

Holdings as of

September 30, 20082

Company and % of Total

Net Assets | | | Yum! Brands, Inc. 3.2%

Anheuser-Busch

Companies, Inc. 3.1%

Capital One

Financial Corp. 2.9%

JPMorgan Chase &

Co. 2.8%

Schering-Plough

Corp. 2.8% | | | | H&R Block, Inc. 9.7%

Yum! Brands, Inc. 7.8%

Capital One

Financial Corp. 5.8%

JPMorgan Chase &

Co. 5.3%

Bristol-Myers

Squibb Co. 4.9% | | | | XTO Energy, Inc. 4.7%

CVS Caremark

Corp. 2.9%

Nestle SA 2.9%

General Dynamics

Corp. 2.8%

Apache Corp. 2.7% | | | | Credit Suisse Group 5.4%

Snap-on Inc. 4.6%

Daiwa Securities

Group Inc. 4.4%

Neopost SA 4.0%

Oracle Corp. 3.9% | | |

Sector

Allocation as of

September 30, 2008

Sector and % of

Market Value | | | Consumer

Discretionary 39.3%

Consumer Staples 16.1%

Information

Technology 15.0%

Financials 14.9%

Health Care 10.2%

Industrials 4.5% | | | | Consumer

Discretionary 57.9%

Information

Technology 17.3%

Financials 15.3%

Health Care 9.5% | | | | U.S. Government

Securities 38.3%

Consumer Staples 15.5%

Energy 13.7%

Industrials 11.1%

Consumer

Discretionary 9.8%

Health Care 7.4%

Information

Technology 2.2%

Financials 1.4%

Foreign Government

Securities 0.4%

Materials 0.2% | | | | Consumer

Discretionary 27.8%

Information

Technology 18.8%

Financials 18.2%

Health Care 17.2%

Industrials 10.8%

Energy 5.9%

Consumer Staples 1.3% | | |

The performance data quoted represents past performance. The above performance information for the Funds does not reflect the imposition of a 2% redemption fee on shares of all Funds, other than Oakmark Equity and Income Fund, redeemed within 90 days, in order to deter market timers. If reflected, the fee would reduce the performance quoted. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Average annual total return measures annualized change, while total return measures aggregate change. To obtain current month end performance data, visit oakmark.com.

* Not annualized

THE OAKMARK FUNDS

2

Performance for Periods

Ended September 30, 20081 | | Oakmark

Global Select

Fund—Class I

(OAKWX) | | Oakmark

International

Fund—Class I

(OAKIX) | | Oakmark

International

Small Cap Fund—Class I

(OAKEX) | |

| 3 Months* | | | -3.74 | % | | | -7.42 | % | | | -13.41 | % | |

| 1 Year | | | -25.95 | % | | | -28.59 | % | | | -32.47 | % | |

Average Annual Total

Return for: | |

| 3 Year | | | N/A | | | | -0.04 | % | | | -0.55 | % | |

| 5 Year | | | N/A | | | | 8.92 | % | | | 11.20 | % | |

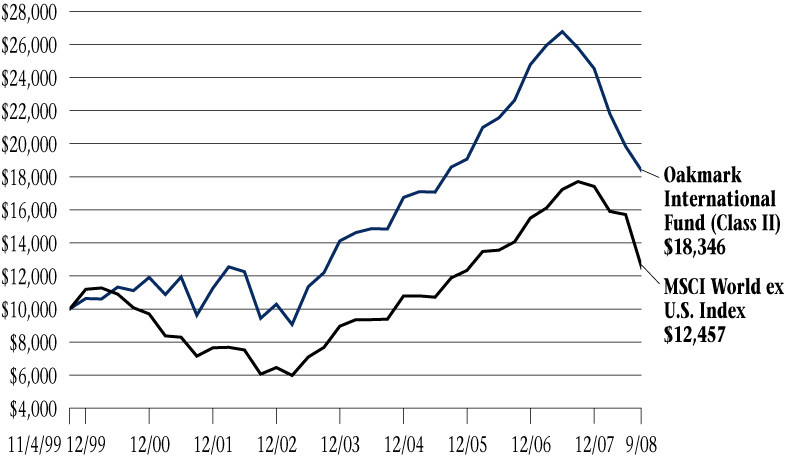

| 10 Year | | | N/A | | | | 11.05 | % | | | 15.53 | % | |

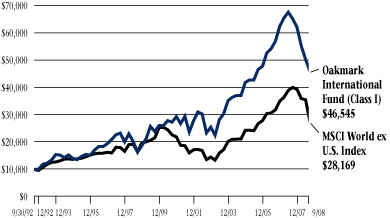

| Since inception | | | -7.25%

(10/2/06) | | | | 10.09%

(9/30/92) | | | | 10.14%

(11/1/95) | | |

Top Five Equity

Holdings as of

September 30, 20082

Company and % of Total

Net Assets | | | Adecco SA 6.9%

Societe Television

Francaise 1 6.5%

Daiwa Securities

Group Inc. 6.0%

Credit Suisse Group 5.8%

GlaxoSmithKline PLC 5.4% | | | | Publicis Groupe 4.1%

Credit Suisse Group 4.1%

Adecco SA 4.0%

Daiwa Securities

Group Inc. 3.5%

Signet Jewelers Ltd. 3.2% | | | | Ichiyoshi Securities

Co., Ltd. 3.5%

M6 Metropole

Television 3.4%

Pasona Group Inc. 3.2%

Neopost SA 3.1%

Tomkins PLC 3.0% | | |

Sector

Allocation as of

September 30, 2008

Sector and % of

Market Value | | | Consumer

Discretionary 35.8%

Financials 23.0%

Health Care 19.4%

Information

Technology 14.4%

Industrials 7.4% | | | | Consumer

Discretionary 35.2%

Financials 28.3%

Industrials 13.5%

Information

Technology 13.1%

Health Care 5.0%

Materials 2.7%

Consumer Staples 2.2% | | | | Industrials 31.4%

Consumer

Discretionary 28.8%

Financials 14.5%

Information

Technology 14.4%

Consumer Staples 5.0%

Materials 4.3%

Health Care 1.6% | | |

As of 9/30/08, the expense ratio for Class I shares was 1.10% for Oakmark Fund, 1.08% for Oakmark Select Fund, 0.81% for Oakmark Equity and Income Fund, 1.16% for Oakmark Global Fund, 1.35% for Oakmark Global Select Fund, 1.10% for Oakmark International Fund and 1.41% for Oakmark International Small Cap Fund.

THE OAKMARK FUNDS

3

FUND EXPENSES

A shareholder of each Fund incurs two types of costs: (1) transaction costs, such as redemption fees, and (2) ongoing costs, including investment advisory fees, transfer agent fees, and other fund expenses. The examples below are intended to help shareholders understand the ongoing cost (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other funds.

Actual Expenses

The following table provides information about actual account values and actual fund expenses for Class I of each Fund. The table shows the expenses a Class I shareholder would have paid on a $1,000 investment in each Fund from April 1, 2008 to September 30, 2008, as well as how much a $1,000 investment would be worth at the close of the period, assuming actual fund returns and expenses. A Class I shareholder can estimate expenses incurred for the period by dividing the account value at September 30, 2008, by $1,000 and multiplying the result by the number in the Expenses Paid During Period row as shown below.

Shares of all Funds, other than Oakmark Equity and Income Fund, invested for 90 days or less may be charged a 2% redemption fee. Please consult the Funds' prospectus at oakmark.com for more information.

| | | Oakmark Fund | | Oakmark Select Fund | | Oakmark Equity and Income Fund | | Oakmark Global Fund | | Oakmark Global Select Fund | | Oakmark International Fund | | Oakmark International Small Cap Fund | |

Beginning

Account

Value | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending

Account

Value | | $ | 944.10 | | | $ | 864.80 | | | $ | 942.20 | | | $ | 880.40 | | | $ | 906.40 | | | $ | 842.90 | | | $ | 812.00 | | |

Expenses

Paid

During

Period* | | $ | 5.39 | | | $ | 4.99 | | | $ | 3.88 | | | $ | 5.31 | | | $ | 6.39 | | | $ | 4.98 | | | $ | 6.16 | | |

Annualized

Expense

Ratio | | | 1.11 | % | | | 1.07 | % | | | 0.80 | % | | | 1.13 | % | | | 1.34 | % | | | 1.08 | % | | | 1.36 | % | |

* Expenses are equal to each Fund's annualized expense ratio for Class I, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by 366 (to reflect the one-half year period).

THE OAKMARK FUNDS

4

Hypothetical Example for Comparison Purposes

The following table provides information about hypothetical account values and hypothetical expenses for Class I of each Fund based on actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds' actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses shareholders paid for the period. Shareholders may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as redemption fees. Therefore, the third line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, the total costs would have been higher.

| | | Oakmark Fund | | Oakmark Select Fund | | Oakmark Equity and Income Fund | | Oakmark Global Fund | | Oakmark Global Select Fund | | Oakmark International Fund | | Oakmark International Small Cap Fund | |

Beginning

Account

Value | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending

Account

Value | | $ | 1,019.45 | | | $ | 1,019.65 | | | $ | 1,021.00 | | | $ | 1,019.35 | | | $ | 1,018.30 | | | $ | 1,019.60 | | | $ | 1,018.20 | | |

Expenses

Paid

During

Period* | | $ | 5.60 | | | $ | 5.40 | | | $ | 4.04 | | | $ | 5.70 | | | $ | 6.76 | | | $ | 5.45 | | | $ | 6.86 | | |

Annualized

Expense

Ratio | | | 1.11 | % | | | 1.07 | % | | | 0.80 | % | | | 1.13 | % | | | 1.34 | % | | | 1.08 | % | | | 1.36 | % | |

* Expenses are equal to each Fund's annualized expense ratio for Class I, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by 366 (to reflect the one-half year period).

THE OAKMARK FUNDS

5

OAKMARK AND OAKMARK SELECT FUNDS

At Oakmark, we are long-term investors. We attempt to identify growing businesses that are managed to benefit their shareholders. We will purchase stock in those businesses only when priced substantially below our estimate of intrinsic value. After purchase, we patiently wait for the gap between stock price and intrinsic value to close.

I'm writing this letter on the last day of the quarter. The stock market fell more points yesterday than it ever has before, the S&P 5003 is down 19% for the year, and the House has voted down the Treasury's plan to stabilize the credit markets. During the quarter we witnessed the demise of Fannie Mae, Freddie Mac, Lehman Brothers, AIG, Washington Mutual and Wachovia Bank. Just one year ago those companies had a combined market value of over $400 billion. In such unsettled times I thought it might be useful to answer some basic questions that our shareholders have been frequently asking.

I'm writing this letter on the last day of the quarter. The stock market fell more points yesterday than it ever has before, the S&P 5003 is down 19% for the year, and the House has voted down the Treasury's plan to stabilize the credit markets. During the quarter we witnessed the demise of Fannie Mae, Freddie Mac, Lehman Brothers, AIG, Washington Mutual and Wachovia Bank. Just one year ago those companies had a combined market value of over $400 billion. In such unsettled times I thought it might be useful to answer some basic questions that our shareholders have been frequently asking.

Should I sell stocks now?

It's unfortunate that this question is always asked after large declines rather than before. Everyone's risk tolerance is different, but if you can't sleep at night because you are so worried about stocks falling more, then yes, you should sell enough so you can sleep. It's never worth risking your health. You should also sell if you have invested money in the stock market that you know you will need to spend soon. We always encourage limiting stock market investments to capital that you aren't likely to need within the next five years.

If you are sleeping well and won't be a forced seller anytime soon, then we strongly believe you should not sell. In fact, we believe the decline in the market has created a very attractive environment for investing new capital. For most people, the right question to ask after a big decline is: "Should I be investing more?" We believe this is a very good time to be a cautiously optimistic buyer. I say "cautiously" because volatility has been so extreme that it seems prudent to keep some capital in reserve so that if prices fall further you can take advantage of them. Finally, remember that our Funds, like most equity mutual funds, are usually close to fully invested, so if you want to own more stocks, you need to invest additional capital.

Why do you say stocks are attractive?

Our view on whether a stock is attractive or not is based on the difference between our estimate of long-term value and the current stock price. When the stock price is well below our business value estimate, we say that stock is attractive. We started 2008 believing that many stocks were attractive—priced well below business value and likely to produce long-term returns that would significantly exceed returns on fixed income investments. Most of the businesses we own, with the exception of financial services companies, have grown business value this year more slowly than we expected, but they did grow. With stock prices down and business value up slightly, the discount to estimated fair value has increased. We therefore believe that stocks have become even more attractive investments.

You thought stocks were cheap last year, what went wrong?

Bear markets typically follow periods of excessive valuation, meaning stocks were selling at very high multiples of earnings. When price-to-earnings ratios become elevated, other investment opportunities, such as fixed income, become attractive substitutes. Investors sell stocks, driving down prices and increasing their prospective returns, and they buy bonds, reducing their yields. Eventually stocks look more attractive than bonds and the whole cycle repeats. This time, however, stock P/E4 ratios were not historically high, and competing bond yields did not look compelling in comparison. This market has been less about correcting overly generous valuations, and more about the fear that the losses in the banking system will spread to the rest of the economy. It wasn't the typical valuation correction, and we didn't anticipate the financial services collapse.

Why do you own any financial services companies?

Financial services companies are the exception to my comment that most of our stocks have slightly higher business value estimates today than they did a year ago. Mortgage losses for financials far exceeded our expectations and resulted in significant decreases to our value estimates. However, for most of these companies, stock prices have declined far more than estimated value. Therefore, their discount to value has grown. And for the survivors, the current turmoil has provided opportunities to make acquisitions that appear to have been real bargains. JPMorgan purchased Bear Stearns and Washington Mutual for almost nothing. Citigroup has announced the same with Wachovia. These companies sell at low price-to-earnings and price-to-book ratios, have value additive acquisition opportunities, and face less competition than they previously did. We believe the winners will emerge as very strong companies.

OAKMARK AND OAKMARK SELECT FUNDS

6

What did you miss on Washington Mutual?

Washington Mutual was held in all three Funds I co-manage. We sold our position during the quarter when it appeared that regulators were increasingly looking at mark-to-market implied losses, which eliminated the chance that Washington Mutual could, over time, earn back its mortgage losses. Selling was the right decision but by the time we sold, the damage had been done. Owning Washington Mutual was a big mistake for which I fully accept responsibility. Though we believed home prices had been rising at an unsustainable pace, we took comfort that previous home price bubbles had corrected with home prices plateauing for several years rather than sharply falling. Expecting that to continue, I took too much comfort in the fact that the overwhelming majority of mortgages Washington Mutual owned had balances of less than 80% of appraised value. Believing that the collateral was so valuable, I wasn't as concerned as I should have been with softening underwriting standards. After all, if the borrower defaulted, the house could still be sold for more than the mortgage debt. After nationwide prices fell 20%—and further in hot markets—the collateral was no longer worth more than the loan, and serious losses resulted. A mortgage market previously viewed as secure became viewed as very risky. Sellers flooded the market, and prices fell sharply. Because of its leverage, Washington Mutual's assets, marked-to-market, were no longer greater than its liabilities. Ironically, the asset we've always believed was under appreciated, its strong retail deposit base, is now owned by another of our holdings, JP Morgan. Though there are many lessons to be learned from this error, perhaps the most important is that in today's economic climate, we need to consider a broader array of outcomes than we previously considered, especially for companies that employ financial leverage.

Do you think the Paulson plan can work?

Yes. Every banking executive we talk to says their models show that mortgages are worth much more than they are selling for in the market. It makes sense to us that mortgages have become undervalued because so many financial firms have been forced to sell their positions. Market prices of mortgages fell which created losses and reduced the equity of the firms that held them. With typical leverage ratios of 15:1, each $1 loss forced the sale of $14 of assets, primarily mortgages. That further depressed prices, increasing losses, decreasing equity, and forcing more sales. The downward spiral fed on itself. In most markets, value buyers step in to take advantage of low prices and reverse that vicious cycle. But because the mortgage market is so large, that process will take a long time unless a very large investor intervenes. The government, borrowing for thirty years at less than a 5% interest rate, has more attractive access to capital than any private investor. That makes it especially well-suited to step in and eliminate the supply-demand imbalance. As Warren Buffett said, "People who are buying these instruments in the market are expecting to make 15 to 20 percent...If they (the government) do it right...I think they'll make a lot of money." I agree. Many say the proposal forces Main Street to bail out Wall Street. I see it as Main Street taking advantage of Wall Street's mistakes. Investing $700 billion in cheap mortgages should yield annual profits of double-digit billions, and have the nice side-effect of reversing the downward spiral in prices. If the process is not politicized, and the money is simply invested in attractively priced debt securities, we could be arguing several years from now about whether the profits should be spent on increased services or returned through lower taxes.

The market decline has been unpleasant and the landscape is changing rapidly, so it is hard to anticipate what will happen tomorrow or next week. But as long-term investors we think about five years from now, and it is easy to be excited about the opportunities we see today.

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com

oaklx@oakmark.com

September 30, 2008

OAKMARK AND OAKMARK SELECT FUNDS

7

OAKMARK FUND

Report from Bill Nygren and Kevin Grant, Portfolio Managers

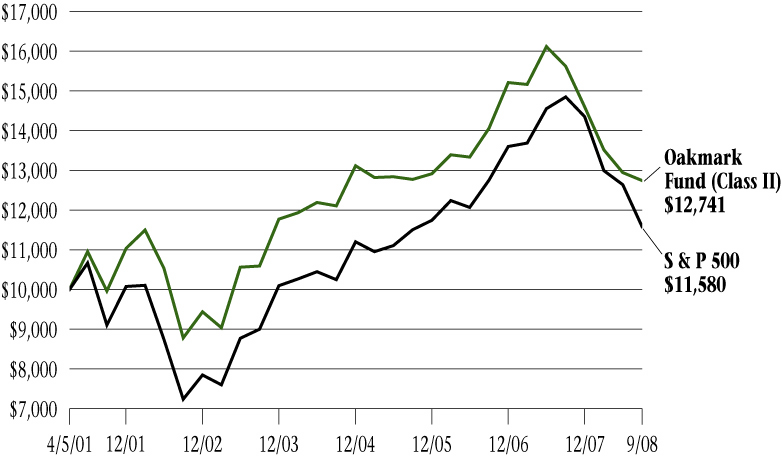

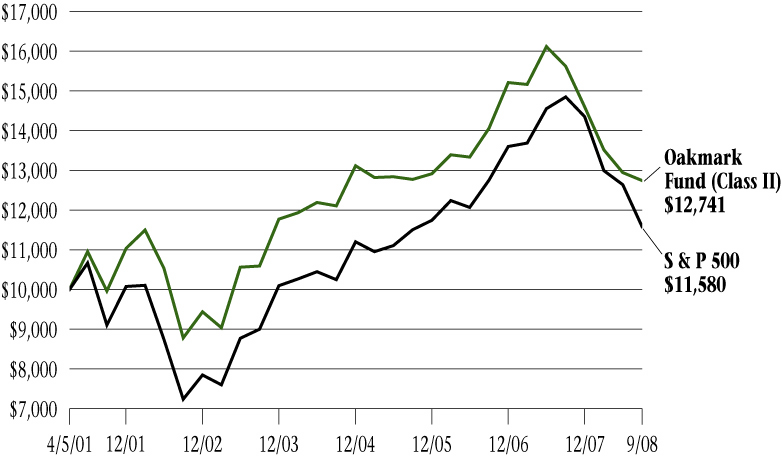

THE VALUE OF A $10,000 INVESTMENT IN OAKMARK FUND FROM ITS INCEPTION (8/5/91) TO PRESENT (9/30/08) AS COMPARED TO THE STANDARD & POOR'S 500 INDEX3 (UNAUDITED)

| | | | | Average Annual Total Returns

(as of 9/30/08) | |

| (Unaudited) | | Total Return

Last 3 Months* | | 1-year | | 5-year | | 10-year | | Since

Inception

(8/5/91) | |

| Oakmark Fund (Class I) | | | -1.42 | % | | | -18.14 | % | | | 4.12 | % | | | 4.62 | % | | | 12.75 | % | |

| S&P 500 | | | -8.37 | % | | | -21.98 | % | | | 5.17 | % | | | 3.06 | % | | | 8.82 | % | |

| Dow Jones Average5 | | | -3.72 | % | | | -19.86 | % | | | 5.60 | % | | | 5.46 | % | | | 10.27 | % | |

Lipper Large Cap

Value Index6 | | | -8.64 | % | | | -23.89 | % | | | 5.48 | % | | | 3.73 | % | | | 8.52 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The expense ratio for Class I shares as of 9/30/08 was 1.10%.

The performance data quoted represents past performance. The above performance information for the Fund does not reflect the imposition of a 2% redemption fee on shares redeemed within 90 days, in order to deter market timers. If reflected, the fee would reduce the performance quoted. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Average annual total return measures annualized change, while total return measures aggregate change. To obtain most recent month-end performance data, visit oakmark.com.

* Not annualized

Oakmark Fund lost 1% of its value last quarter. That loss was relatively minor compared to the 8% drop in the S&P 500. We have two goals for our Fund. Number one is to grow your capital. Number two is to outperform our competitors. Losing a little money when competitors lose a lot doesn't thrill us. However, limiting losses in tough times is perhaps the single most important requirement for achieving long-term capital growth. As Warren Buffett said, "Over the years, a number of very smart people have learned the hard way that a long stream of impressive numbers multiplied by a single zero always equals zero."

In a quarter when many financial services stocks were obliterated, our three best performers, oddly, were financials: Bank of America, Capital One and JP Morgan. We believe all three have significantly improved their competitive position during this crisis. As the saying goes, what doesn't kill you makes you stronger. At the other extreme, stocks that hurt the Fund the most were Viacom, Texas Instruments and Merrill Lynch. A slowing economy reduced sales forecasts for both Viacom and Texas Instruments. We don't believe that the value of either company meaningfully declined. We sold Merrill Lynch after its agreement to merge with Bank of America. We also sold US Bancorp because it neared our sell target as other financials traded at increasing discounts. We sold Washington Mutual and Sprint because we were disappointed with their fundamental performance. New stocks in the portfolio include Ascent Media (spun-off from Discovery), American Express and Boeing. The American Express purchase is explained on our web site.

Boeing (BA – $57)

The Boeing Company is a leading defense contractor and commercial jet manufacturer. Last year Boeing stock reached $108 because investors were excited about prospects for commercial aviation. As oil prices rose, concerns mounted about the health of the airline industry, especially airlines based in the United States. Though we share those concerns, we note the strength of non-U.S. airlines and also the compelling economics, driven by better fuel efficiency, for modernizing the fleet. More importantly, we focus on the value of Boeing's defense division, which attracts far less attention than commercial aviation does. We believe that if one values its defense business as other publicly traded defense contractors are valued, it is nearly worth Boeing's current stock price, which means the price for commercial aviation is trivial. We believe Boeing is an exceptional value selling at only 8 times expected 2009 earnings.

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com | | Kevin G. Grant, CFA

Portfolio Manager

oakmx@oakmark.com | |

|

September 30, 2008

OAKMARK FUND

8

OAKMARK FUND

Schedule of Investments—September 30, 2008

| Name | | Shares Held | | Value | |

| Common Stocks—95.1% | |

| Apparel Retail—1.8% | |

| Limited Brands | | | 3,814,647 | | | $ | 66,069,686 | | |

| Broadcasting—0.6% | |

| Discovery Communications, Inc. Class A (a) | | | 770,070 | | | $ | 10,973,498 | | |

| Discovery Communications, Inc. Class C (a) | | | 770,070 | | | | 10,904,191 | | |

| | | | 21,877,689 | | |

| Cable & Satellite—4.5% | |

| Liberty Media Corp. - Entertainment (a) | | | 3,398,680 | | | $ | 84,865,040 | | |

| Comcast Corp., Class A | | | 4,000,000 | | | | 78,880,000 | | |

| | | | 163,745,040 | | |

| Catalog Retail—1.3% | |

| Liberty Media Holding Corp. - Interactive, Class A (a) | | | 3,699,850 | | | $ | 47,765,063 | | |

| Computer & Electronics Retail—2.5% | |

| Best Buy Co., Inc. | | | 2,419,400 | | | $ | 90,727,500 | | |

| Department Stores—2.5% | |

| Kohl's Corp. (a) | | | 1,976,900 | | | $ | 91,095,552 | | |

| Home Improvement Retail—2.1% | |

| The Home Depot, Inc. | | | 2,881,500 | | | $ | 74,602,035 | | |

| Household Appliances—2.3% | |

| The Black & Decker Corp. | | | 1,350,000 | | | $ | 82,012,500 | | |

| Housewares & Specialties—2.2% | |

| Fortune Brands, Inc. | | | 1,350,000 | | | $ | 77,436,000 | | |

| Motorcycle Manufacturers—1.8% | |

| Harley-Davidson, Inc. | | | 1,762,000 | | | $ | 65,722,600 | | |

| Movies & Entertainment—7.3% | |

| The Walt Disney Co. | | | 3,000,000 | | | $ | 92,070,000 | | |

| Time Warner, Inc. | | | 6,947,700 | | | | 91,084,347 | | |

| Viacom, Inc., Class B (a) | | | 2,739,745 | | | | 68,055,266 | | |

| Liberty Media Holding Corp. - Capital, Class A (a) | | | 949,670 | | | | 12,706,584 | | |

| Ascent Media Corp. Class A (a) | | | 77,007 | | | | 1,879,741 | | |

| | | | 265,795,938 | | |

| Restaurants—5.7% | |

| Yum! Brands, Inc. | | | 3,564,000 | | | $ | 116,222,040 | | |

| McDonald's Corp. | | | 1,444,000 | | | | 89,094,800 | | |

| | | | 205,316,840 | | |

OAKMARK FUND

9

OAKMARK FUND

Schedule of Investments—September 30, 2008 cont.

| Name | | Shares Held | | Value | |

| Common Stocks—95.1% (cont.) | |

| Specialized Consumer Services—2.8% | |

| H&R Block, Inc. | | | 4,458,600 | | | $ | 101,433,150 | | |

| Brewers—4.8% | |

| Anheuser-Busch Cos., Inc. | | | 1,750,000 | | | $ | 113,540,000 | | |

| InBev NV (b) (c) | | | 1,000,000 | | | | 59,494,704 | | |

| | | | 173,034,704 | | |

| Distillers & Vintners—1.9% | |

| Diageo PLC (d) | | | 1,021,000 | | | $ | 70,306,060 | | |

| Drug Retail—1.4% | |

| Walgreen Co. | | | 1,600,000 | | | $ | 49,536,000 | | |

| Hypermarkets & Super Centers—2.6% | |

| Wal-Mart Stores, Inc. | | | 1,600,000 | | | $ | 95,824,000 | | |

| Packaged Foods & Meats—4.6% | |

| General Mills, Inc. | | | 1,256,000 | | | $ | 86,312,320 | | |

| H.J. Heinz Co. | | | 1,600,000 | | | | 79,952,000 | | |

| | | | 166,264,320 | | |

| Asset Management & Custody Banks—1.7% | |

| Bank of New York Mellon Corp. | | | 1,839,630 | | | $ | 59,935,145 | | |

| Consumer Finance—3.9% | |

| Capital One Financial Corp. | | | 2,064,800 | | | $ | 105,304,800 | | |

| American Express Co. | | | 1,000,000 | | | | 35,430,000 | | |

| | | | 140,734,800 | | |

| Investment Banking & Brokerage—1.2% | |

| Morgan Stanley | | | 1,900,000 | | | $ | 43,700,000 | | |

| Other Diversified Financial Services—7.4% | |

| JPMorgan Chase & Co. | | | 2,200,000 | | | $ | 102,740,000 | | |

| Bank of America Corp. | | | 2,700,000 | | | | 94,500,000 | | |

| Citigroup, Inc. | | | 3,500,000 | | | | 71,785,000 | | |

| | | | 269,025,000 | | |

| Health Care Equipment—2.4% | |

| Medtronic, Inc. | | | 1,750,000 | | | $ | 87,675,000 | | |

| Pharmaceuticals—7.3% | |

| Schering-Plough Corp. | | | 5,501,135 | | | $ | 101,605,964 | | |

| GlaxoSmithKline PLC (d) | | | 2,000,000 | | | | 86,920,000 | | |

| Bristol-Myers Squibb Co. | | | 3,600,000 | | | | 75,060,000 | | |

| | | | 263,585,964 | | |

OAKMARK FUND

10

OAKMARK FUND

Schedule of Investments—September 30, 2008 cont.

| Name | | Shares Held | | Value | |

| Common Stocks—95.1% (cont.) | |

| Aerospace & Defense—1.1% | |

| The Boeing Co. | | | 700,000 | | | $ | 40,145,000 | | |

| Air Freight & Logistics—2.1% | |

| FedEx Corp. | | | 950,000 | | | $ | 75,088,000 | | |

| Industrial Conglomerates—1.1% | |

| Tyco International, Ltd. | | | 1,139,500 | | | $ | 39,905,290 | | |

| Communications Equipment—1.5% | |

| Cisco Systems, Inc. (a) | | | 2,500,000 | | | $ | 56,400,000 | | |

| Computer Hardware—4.0% | |

| Hewlett-Packard Co. | | | 1,725,000 | | | $ | 79,764,000 | | |

| Dell Inc. (a) | | | 3,900,000 | | | | 64,272,000 | | |

| | | | 144,036,000 | | |

| Data Processing & Outsourced Services—1.7% | |

| Western Union Co. | | | 2,575,000 | | | $ | 63,525,250 | | |

| Electronic Manufacturing Services—1.1% | |

| Tyco Electronics, Ltd. | | | 1,439,500 | | | $ | 39,816,570 | | |

| Office Electronics—1.7% | |

| Xerox Corp. | | | 5,272,400 | | | $ | 60,790,772 | | |

| Semiconductors—4.2% | |

| Intel Corp. | | | 4,400,000 | | | $ | 82,412,000 | | |

| Texas Instruments Inc. | | | 3,200,000 | | | | 68,800,000 | | |

| | | | 151,212,000 | | |

| Total Common Stocks (Cost: $2,894,160,960) | | | | | | | 3,444,139,468 | | |

OAKMARK FUND

11

OAKMARK FUND

Schedule of Investments—September 30, 2008 cont.

| Name | | Par Value | | Value | |

| Short Term Investment—4.7% | |

| Repurchase Agreement—4.7% | |

Fixed Income Clearing Corp. Repurchase Agreement,

1.70% dated 9/30/2008 due 10/1/2008, repurchase price

$172,706,159, collateralized by Federal National Mortgage

Association Bonds, with rates from 5.225% - 6.110%,

with maturities from 1/27/2023 - 8/24/2027, and with an

aggregate market value plus accrued interest of

$176,154,703 | | $ | 172,698,004 | | | $ | 172,698,004 | | |

| Total Repurchase Agreement (Cost: $172,698,004) | | | | | 172,698,004 | | |

| Total Short Term Investment (Cost: $172,698,004) | | | | | 172,698,004 | | |

| Total Investments (Cost: $3,066,858,964)—99.8% | | | | $ | 3,616,837,472 | | |

| Other Assets In Excess of Liabilities—0.2% | | | | | 5,660,284 | | |

| Total Net Assets—100% | | | | $ | 3,622,497,756 | | |

(a) Non income-producing security.

(b) Represents a foreign domiciled corporation.

(c) Market value is determined in accordance with procedures established in good faith by the Board of Trustees.

(d) Represents an American Depositary Receipt.

See accompanying Notes to Financial Statements.

OAKMARK FUND

12

OAKMARK SELECT FUND

Report from Bill Nygren and Henry Berghoef, Portfolio Managers

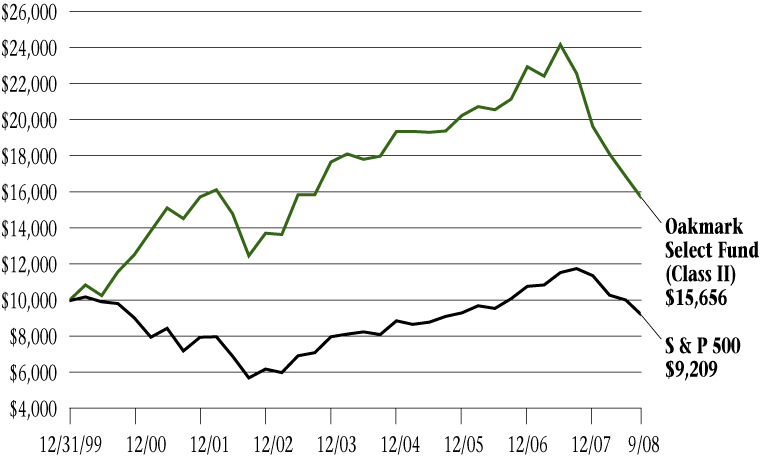

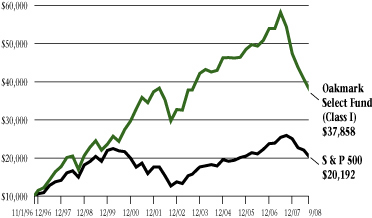

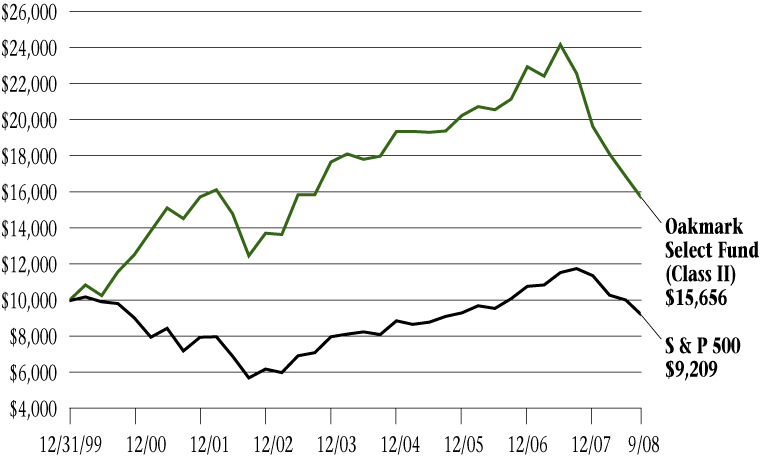

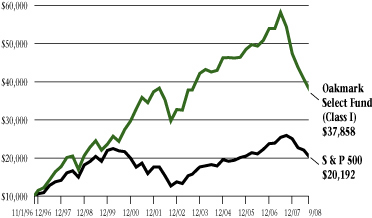

THE VALUE OF A $10,000 INVESTMENT IN OAKMARK SELECT FUND FROM ITS INCEPTION (11/1/96) TO PRESENT (9/30/08) AS COMPARED TO THE STANDARD & POOR'S 500 INDEX3 (UNAUDITED)

| | | | | Average Annual Total Returns

(as of 9/30/08) | |

| (Unaudited) | | Total Return

Last 3 Months* | | 1-year | | 5-year | | 10-year | | Since

Inception

(11/1/96) | |

Oakmark Select Fund

(Class I) | | | -7.08 | % | | | -30.43 | % | | | 0.02 | % | | | 8.38 | % | | | 11.82 | % | |

| S&P 500 | | | -8.37 | % | | | -21.98 | % | | | 5.17 | % | | | 3.06 | % | | | 6.08 | % | |

Lipper Multi-Cap

Value Index7 | | | -9.24 | % | | | -25.26 | % | | | 4.88 | % | | | 5.19 | % | | | 6.32 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The expense ratio for Class I shares as of 9/30/08 was 1.08%.

The performance data quoted represents past performance. The above performance information for the Fund does not reflect the imposition of a 2% redemption fee on shares redeemed within 90 days, in order to deter market timers. If reflected, the fee would reduce the performance quoted. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Average annual total return measures annualized change, while total return measures aggregate change. To obtain most recent month-end performance data, visit oakmark.com.

* Not annualized

Oakmark Select Fund lost 7% last quarter, slightly less than the 8% loss for the S&P 500. Despite the larger losses many of our competitors suffered, we are always disappointed when we nearly match a market decline. Our best performer in the quarter was JP Morgan, which increased in value by more than a third. Last quarter we highlighted its bargain purchase of Bear Stearns. This quarter it added another bargain, Washington Mutual, which was one of our most negative performers. JP Morgan appears to have dodged the bullets from this financial crisis. It is now reaping the rewards of being capital rich, while its competition is capital starved.

Last quarter we stated that our three largest positions—Yum! Brands, H&R Block and Discovery Holdings—would likely be the most important factors for our future performance. H&R Block continued to be positively recognized for its new-found focus on its tax business, making it one of our best performers. Yum! Brands gave back some of its gains due to concern about a slowing Chinese economy. The performance of those two stocks basically offset each other. The other large holding, Discovery, had the most negative effect on Fund performance. Declining expectations for advertising in a weakening economy hurt many media companies, including Discovery. We believe Discovery's business value is not only intact, but growing, so we view the decline as a significant over-reaction. Discovery completed its restructuring last quarter, spinning off Ascent Media and eliminating its holding company structure. We view those changes as important positives, and we believe other investors will, too, after the financial industry settles down and investors focus more on fundamentals and less on price momentum.

If portfolio managers add value through their stock selection, then over the long run, their favorite stocks perform better than those they have less conviction about. Investing only in their favorite stocks, rather than fully diversifying, amplifies the effect, plus or minus, that stock selection has on their results. Concentrated investing has served us well over the life of the Fund. Although we are chastised by this year's performance, we remain confident that our stock selection will add value and that our focused approach will improve long-term results. Thank you for your continued confidence.

William C. Nygren, CFA

Portfolio Manager

oaklx@oakmark.com | | Henry R. Berghoef, CFA

Portfolio Manager

oaklx@oakmark.com | |

|

September 30, 2008

OAKMARK SELECT FUND

13

OAKMARK SELECT FUND

Schedule of Investments—September 30, 2008

| Name | | Shares Held | | Value | |

| Common Stocks—94.8% | |

| Apparel Retail—4.5% | |

| Limited Brands | | | 6,680,981 | | | $ | 115,714,591 | | |

| Broadcasting—5.5% | |

| Discovery Communications, Inc. Class A (a) | | | 5,425,150 | | | $ | 77,308,387 | | |

| Discovery Communications, Inc. Class C (a) | | | 4,484,350 | | | | 63,498,396 | | |

| | | | 140,806,783 | | |

| Cable & Satellite—4.4% | |

| Comcast Corp., Class A | | | 5,750,000 | | | $ | 113,390,000 | | |

| Catalog Retail—4.7% | |

| Liberty Media Holding Corp. - Interactive, Class A (a) | | | 9,400,000 | | | $ | 121,354,000 | | |

| Computer & Electronics Retail—4.1% | |

| Best Buy Co., Inc. | | | 2,800,000 | | | $ | 105,000,000 | | |

| Movies & Entertainment—9.3% | |

| Viacom, Inc., Class B (a) | | | 4,675,000 | | | $ | 116,127,000 | | |

| Time Warner, Inc. | | | 8,617,000 | | | | 112,968,870 | | |

| Ascent Media Corp. Class A (a) | | | 472,197 | | | | 11,526,329 | | |

| | | | 240,622,199 | | |

| Restaurants—12.7% | |

| Yum! Brands, Inc. | | | 6,165,000 | | | $ | 201,040,650 | | |

| McDonald's Corp. | | | 2,028,000 | | | | 125,127,600 | | |

| | | | 326,168,250 | | |

| Specialized Consumer Services—9.7% | |

| H&R Block, Inc. | | | 11,019,600 | | | $ | 250,695,900 | | |

| Consumer Finance—5.8% | |

| Capital One Financial Corp. | | | 2,910,600 | | | $ | 148,440,600 | | |

| Investment Banking & Brokerage—3.4% | |

| Morgan Stanley | | | 3,850,000 | | | $ | 88,550,000 | | |

| Other Diversified Financial Services—5.3% | |

| JPMorgan Chase & Co. | | | 2,894,000 | | | $ | 135,149,800 | | |

| Pharmaceuticals—9.0% | |

| Bristol-Myers Squibb Co. | | | 6,010,200 | | | $ | 125,312,670 | | |

| Schering-Plough Corp. | | | 5,782,954 | | | | 106,811,161 | | |

| | | | 232,123,831 | | |

| Computer Hardware—3.3% | |

| Dell Inc. (a) | | | 5,113,000 | | | $ | 84,262,240 | | |

OAKMARK SELECT FUND

14

OAKMARK SELECT FUND

Schedule of Investments—September 30, 2008 cont.

| Name | | Shares Held/

Par Value | | Value | |

| Common Stocks—94.8% (cont.) | |

| Data Processing & Outsourced Services—4.8% | |

| Western Union Co. | | | 5,065,400 | | | $ | 124,963,418 | | |

| Office Electronics—3.8% | |

| Xerox Corp. | | | 8,546,400 | | | $ | 98,539,992 | | |

| Semiconductors—4.5% | |

| Intel Corp. | | | 6,147,000 | | | $ | 115,133,309 | | |

| Total Common Stocks (Cost: $2,091,039,340) | | | | | | | 2,440,914,913 | | |

| Short Term Investment—5.2% | |

| Repurchase Agreement—5.2% | |

Fixed Income Clearing Corp. Repurchase Agreement,

1.70% dated 9/30/2008 due 10/1/2008, repurchase price

$133,273,667, collaterized by a Federal National

Mortgage Association Bond, with a rate of 5.225%,

with a maturity of 1/27/2023, and with an aggregate

market value plus accrued interest of $135,935,694 | | $ | 133,267,374 | | | $ | 133,267,374 | | |

| Total Repurchase Agreement (Cost: $133,267,374) | | | | | | | 133,267,374 | | |

| Total Short Term Investment (Cost: $133,267,374) | | | | | | | 133,267,374 | | |

| Total Investments (Cost: $2,224,306,714)—100.0% | | | | | | $ | 2,574,182,287 | | |

| Liabilities In Excess of Other Assets—0.0% | | | | | | | (145,955 | ) | |

| Total Net Assets—100% | | | | | | $ | 2,574,036,332 | | |

(a) Non income-producing security.

See accompanying Notes to Financial Statements.

OAKMARK SELECT FUND

15

OAKMARK EQUITY AND INCOME FUND

Report from Clyde S. McGregor and Edward A. Studzinski, Portfolio Managers

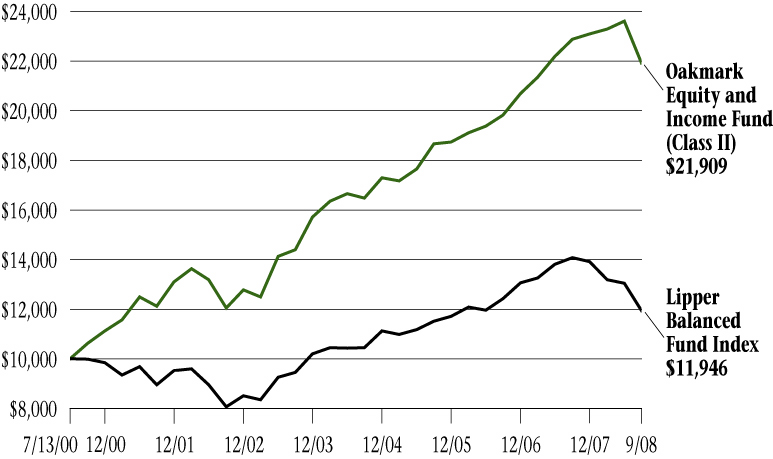

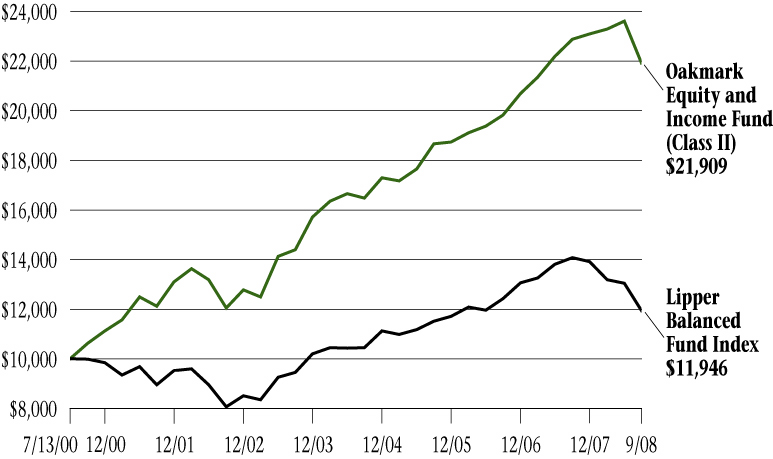

THE VALUE OF A $10,000 INVESTMENT IN OAKMARK EQUITY AND INCOME FUND FROM ITS INCEPTION (11/1/95) TO PRESENT (9/30/08) AS COMPARED TO THE LIPPER BALANCED FUND INDEX8 (UNAUDITED)

| | | | | Average Annual Total Returns

(as of 9/30/08) | |

| (Unaudited) | | Total Return

Last 3 Months* | | 1-year | | 5-year | | 10-year | | Since

Inception

(11/1/95) | |

Oakmark Equity &

Income Fund (Class I) | | | -7.09 | % | | | -3.85 | % | | | 9.09 | % | | | 11.15 | % | | | 12.10 | % | |

Lipper Balanced

Fund Index | | | -8.39 | % | | | -15.11 | % | | | 4.78 | % | | | 4.20 | % | | | 6.33 | % | |

| S&P 5003 | | | -8.37 | % | | | -21.98 | % | | | 5.17 | % | | | 3.06 | % | | | 7.32 | % | |

Lehman Govt./

Corp. Bond9 | | | -1.64 | % | | | 2.41 | % | | | 3.34 | % | | | 5.00 | % | | | 5.79 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The expense ratio for Class I shares as of 9/30/08 was 0.81%.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Average annual total return measures annualized change, while total return measures aggregate change. To obtain most recent month-end performance data, visit oakmark.com.

* Not annualized

Quarter and Fiscal Year Review

Earlier this year one of our firm's equity traders quipped that "flat is the new up." At the time, we found this amusing, but sadly it now appears to be prophetic. Oakmark Equity and Income Fund declined in value by 7% for the quarter ended September 30, which contrasts to an 8% loss for the Lipper Balanced Fund Index, the Equity and Income Fund's primary standard for comparison. For the September 30 fiscal year, the numbers are -4% for the Fund and -15% for the Lipper Balanced Fund Index. Long-time readers of these reports have endured regular pronouncements concerning your managers' unstinting focus on generating positive rates of return regardless of the environment, and we ask your indulgence as we reiterate that part of our philosophy.

Anyone reading this report is probably well aware of the math of investing, especially the discouraging power of negative returns. The simplest example is the one where a fund loses 50% in the first year requiring it to gain 100% in the second year just to return to breakeven. Negative return outcomes rapidly degrade even very long-term compounded growth rates. For the Equity and Income Fund, the past fiscal year's loss has been sufficient to reduce the annualized rate of return since inception (13 years) by more than one full percentage point. Of course, the Fund's returns have compared well to many others, and some of you have generously commented on that when you write to us. But in all honesty, your managers would be happier if the Fund were up 10% for the year. We are not in the business of besting competitors. Rather, we are in the business of stewarding our client-partners hard-earned assets so that they may maintain or even improve their lifestyles. Negative returns do not achieve that end no matter the comparative realities.

Both of the Fund's managers have had the privilege and daunting responsibility of serving on investment committees for eleemosynary endowment funds. One of us also serves as the chair of an organization's budget and finance committee. We experience first hand how negative returns harm endowments. The spending drain on the endowment continues during negative market periods, amplifying the shrinkage, a pattern that some of you have experienced personally. Eleemosynary institutions have the possibility of fund-raising their way back to breakeven (although that is easier said than done in the present environment), but for retired individuals who use the Equity and Income Fund as their entire investment program, fund-raising is not an option. Given the above, your managers must express how honored we are to have client-partners who have placed so much trust in Harris Associates generally and us specifically. We always strive to treat your assets with the respect that they deserve.

OAKMARK EQUITY AND INCOME FUND

16

Activity

We are well aware that turnover of investments in the Fund is expensive for our shareholders, and we aim to hold turnover of equities to less than 40%. Extraordinary times produce higher turnover levels, however, and the September quarter was certainly an extraordinary time. We eliminated nine equity holdings, all U.S. Treasury inflation-indexed securities, and all Fannie Mae and Freddie Mac issued long-term debt. We initiated three new equity positions, received shares of Scripps Networks Interactive from a spinoff distribution, and meaningfully increased the Fund's U.S. Treasury holdings, while maintaining the Fund's duration in the fixed income portfolio at 2.5 years. The net effect of this activity left the Fund at its historical low for the percentage allocated to equities and, concomitantly, its highest short-term investment position.

The quarter saw the culmination of the Fund's second investing experience with UST, the smokeless tobacco and wine company. Altria Group has agreed to purchase the company for $68.50 per share, which made UST the biggest positive contributor to the Fund's return in the quarter. For many years UST's prodigious cash flow enabled the company to maintain a high dividend payout. While we were happy simply to enjoy the benefits of ownership of this business, we have long believed that it made sense for one of the cigarette companies to acquire UST. Altria's limited success in attacking the smokeless market with a Marlboro-branded product may have driven their management to the same conclusion.

Other strong contributors in the quarter (yes, there were a few) included Avon Products (solid earnings abroad), Foot Locker (fundamental results exceeded expectations that had become overly pessimistic), and the stocks of several mid-capitalization companies that bounced from extreme valuation levels. The bottom of the contributor/detractor list for the quarter featured previous winners, all energy-related. During the quarter, the price of natural gas declined to levels that make gas exceptionally cheap on a BTU-equivalent basis to crude oil. Some believe that the U.S. is entering a period of natural gas surpluses (remember the gas bubble earlier this decade?) that will hold down prices. Given this possibility, it is important that investments in this industry be with companies that are low-cost producers, and we believe that our holdings satisfy this criterion.

As mentioned above, we eliminated the Fund's substantial holdings of U.S. Treasury inflation-indexed securities. These notes had become too richly priced, in our judgment. As well, we perceived the risk of an inflationary surge to be less than the probability of no inflation or even deflation. Finally, we sold all long-term holdings of Fannie Mae and Freddie Mac during the quarter. In hindsight, this proved to be a mistake as the government chose to protect the interests of debt-holders. While we foresaw this as a likely outcome, we sold the securities because the upside from the actual outcome was small and the downside could have been severe. We always prefer to assume risk in the equity portion of the portfolio, where upside is unlimited, rather than in the fixed income portion of the portfolio, where upside potential is always capped.

Mistake Buckets

In a recent interview, a consultant probed for our investing weaknesses and noted that he had categorized our missteps into various "mistake buckets." As you may well imagine, we spend a lot of time considering our mistakes, including the one mentioned in the preceding paragraph, but we had not spent time categorizing them. Since we focus our equity analysis on valuation, business fundamentals, and management, most of our equity mistakes derive from errors in those areas. In this discussion with the consultant, we found another type of error we make—one we might call "getting it half right," or not extending an insightful judgment far enough.

Oakmark Equity and Income is intended to be the least volatile Fund in the Oakmark Family. To that end, your managers seek to craft a balanced portfolio of stocks and bonds and pay considerable attention to the downside risk of each security. Several years ago our assessment of risk in the financial sector led us to limit the Fund's financial industry exposures to well-capitalized insurance companies. We failed to draw the conclusion, however, that our risk assessment on financials, if correct, would also portend difficult times for all leveraged companies. This failure resulted in our holding of IDEARC, the yellow pages business spun off from Verizon, which became the largest loser in dollar terms in the Fund's history.

We make plenty of mistakes, of course. In fact, we make so many that we think playing baseball is excellent experience for investors. Even the best hitters make outs in the majority of their at bats. But just like baseball batters as they anticipate the next pitch, we intend to be successful with every investment that we make for our clients. And similar to the batter who has trouble hitting curve balls, we must learn from our mistakes and develop the disciplines that make them less likely in the future.

As always, we thank you for being our shareholders and invite your comments and questions.

Clyde S. McGregor, CFA

Portfolio Manager

oakbx@oakmark.com | | Edward A. Studzinski, CFA

Portfolio Manager

oakbx@oakmark.com | |

|

September 30, 2008

OAKMARK EQUITY AND INCOME FUND

17

OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—September 30, 2008

| Name | | Shares Held | | Value | |

| Equity and Equivalents—51.6% | |

| Common Stocks—51.6% | |

| Apparel Retail—1.4% | |

| Foot Locker, Inc. | | | 7,050,000 | | | $ | 113,928,000 | | |

| The TJX Cos., Inc. | | | 2,813,000 | | | | 85,852,760 | | |

| | | | 199,780,760 | | |

| Automobile Manufacturers—0.3% | |

| Thor Industries, Inc. | | | 1,710,600 | | | $ | 42,457,092 | | |

| Cable & Satellite—2.8% | |

| Scripps Networks Interactive, Inc., Class A | | | 6,208,000 | | | $ | 225,412,480 | | |

| DISH Network Corp. (a) | | | 8,002,500 | | | | 168,052,500 | | |

| | | | 393,464,980 | | |

| Home Furnishings—1.8% | |

| Mohawk Industries, Inc. (a) | | | 3,320,000 | | | $ | 223,734,800 | | |

| Leggett & Platt, Inc. | | | 1,279,056 | | | | 27,870,630 | | |

| | | | 251,605,430 | | |

| Hotels, Resorts & Cruise Lines—0.7% | |

| Carnival Corp. | | | 3,000,000 | | | $ | 106,050,000 | | |

| Publishing—1.3% | |

| The Washington Post Co., Class B | | | 315,200 | | | $ | 175,490,752 | | |

| The E.W. Scripps Co., Class A | | | 2,069,333 | | | | 14,630,185 | | |

| | | | 190,120,937 | | |

| Distillers & Vintners—2.3% | |

| Diageo PLC (c) | | | 4,782,314 | | | $ | 329,310,142 | | |

| Drug Retail—2.9% | |

| CVS Caremark Corp. | | | 12,170,000 | | | $ | 409,642,200 | | |

| Packaged Foods & Meats—4.6% | |

| Nestle SA (c) (d) | | | 9,457,500 | | | $ | 408,734,235 | | |

| ConAgra Foods, Inc. | | | 12,500,000 | | | | 243,250,000 | | |

| | | | 651,984,235 | | |

| Personal Products—1.6% | |

| Avon Products, Inc. | | | 5,548,500 | | | $ | 230,651,145 | | |

| Tobacco—1.7% | |

| UST, Inc. | | | 3,742,096 | | | $ | 248,999,068 | | |

| Coal & Consumable Fuels—0.8% | |

| Walter Industries, Inc. | | | 2,425,700 | | | $ | 115,099,465 | | |

OAKMARK EQUITY AND INCOME FUND

18

OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—September 30, 2008 cont.

| Name | | Shares Held | | Value | |

| Equity and Equivalents—51.6% (cont.) | |

| Oil & Gas Exploration & Production—10.8% | |

| XTO Energy, Inc. | | | 14,305,572 | | | $ | 665,495,209 | | |

| Apache Corp. | | | 3,734,500 | | | | 389,433,660 | | |

| EnCana Corp. (b) | | | 5,508,500 | | | | 362,073,705 | | |

| Newfield Exploration Co. (a) (e) | | | 3,831,100 | | | | 122,556,889 | | |

| | | | 1,539,559,463 | | |

| Reinsurance—1.0% | |

| PartnerRe, Ltd. (b) | | | 2,100,000 | | | $ | 142,989,000 | | |

| Health Care Equipment—4.3% | |

| Medtronic, Inc. | | | 7,000,000 | | | $ | 350,700,000 | | |

| Hospira, Inc. (a) | | | 6,500,000 | | | | 248,300,000 | | |

| Advanced Medical Optics, Inc. (a) | | | 850,000 | | | | 15,113,000 | | |

| | | | 614,113,000 | | |

| Health Care Services—1.6% | |

| Laboratory Corp. of America Holdings (a) | | | 3,236,539 | | | $ | 224,939,461 | | |

| Life Sciences Tools & Services—0.4% | |

| Varian, Inc. (a) (e) | | | 1,409,400 | | | $ | 60,463,260 | | |

| Aerospace & Defense—5.6% | |

| General Dynamics Corp. | | | 5,500,000 | | | $ | 404,910,000 | | |

| Rockwell Collins, Inc. | | | 5,782,601 | | | | 278,085,282 | | |

| Alliant Techsystems, Inc. (a) | | | 1,285,200 | | | | 120,731,688 | | |

| | | | 803,726,970 | | |

| Industrial Machinery—3.4% | |

| ITT Corp. | | | 5,670,500 | | | $ | 315,336,505 | | |

| Pentair, Inc. | | | 3,707,437 | | | | 128,166,097 | | |

| Mueller Water Products, Inc., Class B (e) | | | 6,000,000 | | | | 39,000,000 | | |

| | | | 482,502,602 | | |

| Marine—0.4% | |

| Kirby Corp. (a) | | | 1,704,150 | | | $ | 64,655,451 | | |

| Application Software—0.3% | |

| Mentor Graphics Corp. (a) | | | 3,189,718 | | | $ | 36,203,299 | | |

| Communications Equipment—0.7% | |

| EchoStar Corp. (a) | | | 4,000,000 | | | $ | 96,400,000 | | |

| Computer Hardware—0.2% | |

| Teradata Corp. (a) | | | 1,757,600 | | | $ | 34,273,200 | | |

OAKMARK EQUITY AND INCOME FUND

19

OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—September 30, 2008 cont.

| Name | | Shares Held/

Par Value | | Value | |

| Equity and Equivalents—51.6% (cont.) | |

| Electronic Manufacturing Services—0.7% | |

| Tyco Electronics, Ltd. | | | 3,636,600 | | | $ | 100,588,356 | | |

| Total Common Stocks (Cost: $6,443,478,014) | | | | | | | 7,369,579,516 | | |

| Total Equity and Equivalents (Cost: $6,443,478,014) | | | | | | | 7,369,579,516 | | |

| Fixed Income—33.3% | |

| Corporate Bonds—0.4% | |

| Paper Packaging—0.2% | |

| Sealed Air Corp., 144A, 5.625%, due 7/15/2013 (f) | | $ | 19,400,000 | | | $ | 19,052,080 | | |

| Other Diversified Financial Services—0.1% | |

Private Export Funding Corp. Secured Note, Series 1,

7.20%, due 1/15/2010 | | $ | 15,000,000 | | | $ | 15,738,645 | | |

| Consumer Finance—0.1% | |

| Toyota Motor Credit Corp., 4.00%, due 6/25/2010 | | $ | 15,000,000 | | | $ | 14,949,915 | | |

| Total Corporate Bonds (Cost: $50,267,521) | | | | | | | 49,740,640 | | |

| Government and Agency Securities—32.9% | |

| France Government Bonds—0.3% | |

France Government, 3.00%, due 7/25/2012 ,

Inflation Indexed | | EUR | 33,570,432 | | | $ | 49,319,604 | | |

| U.S. Government Agencies—3.9% | |

| Federal Farm Credit Bank, 3.50%, due 10/3/2011 | | $ | 100,000,000 | | | $ | 99,625,400 | | |

| Federal Farm Credit Bank, 3.078%, due 2/22/2012 (g) | | | 97,000,000 | | | | 96,431,677 | | |

| Tennessee Valley Authority, 6.79%, due 5/23/2012 | | | 58,730,000 | | | | 64,461,813 | | |

| Federal Farm Credit Bank, 2.75%, due 5/4/2010 | | | 50,000,000 | | | | 49,578,200 | | |

| Federal Farm Credit Bank, 2.25%, due 7/1/2010 | | | 50,000,000 | | | | 49,104,900 | | |

| Federal Farm Credit Bank, 3.15%, due 5/19/2011 | | | 35,000,000 | | | | 34,676,670 | | |

| Federal Farm Credit Bank, 4.25%, due 4/15/2013 | | | 25,000,000 | | | | 24,888,700 | | |

| Federal Farm Credit Bank, 4.92%, due 1/11/2010 | | | 19,400,000 | | | | 19,806,546 | | |

| Federal Farm Credit Bank, 2.75%, due 11/20/2009 | | | 15,000,000 | | | | 14,926,785 | | |

| Federal Farm Credit Bank, 5.15%, due 7/20/2009 | | | 10,216,000 | | | | 10,374,297 | | |

| Federal Farm Credit Bank, 5.25%, due 7/16/2010 | | | 9,700,000 | | | | 10,023,689 | | |

| Tennessee Valley Authority, 4.375%, due 6/15/2015 | | | 10,000,000 | | | | 9,987,400 | | |

| Tennessee Valley Authority, 5.625%, due 1/18/2011 | | | 8,721,000 | | | | 9,163,765 | | |

| Federal Farm Credit Bank, 5.28%, due 8/16/2013 | | | 7,500,000 | | | | 7,858,718 | | |

| Federal Farm Credit Bank, 4.85%, due 12/16/2009 | | | 6,305,000 | | | | 6,420,375 | | |

| Federal Farm Credit Bank, 5.125%, due 6/6/2011 | | | 5,435,000 | | | | 5,654,009 | | |

OAKMARK EQUITY AND INCOME FUND

20

OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—September 30, 2008 cont.

| Name | | Par Value | | Value | |

| Fixed Income��33.3% (cont.) | |

| U.S. Government Agencies—3.9% (cont.) | |

| Federal Farm Credit Bank, 5.10%, due 8/9/2011 | | $ | 4,850,000 | | | $ | 5,047,308 | | |

| Federal Farm Credit Bank, 4.75%, due 5/7/2010 | | | 4,850,000 | | | | 4,958,737 | | |

| Federal Farm Credit Bank, 4.90%, due 9/2/2009 | | | 4,850,000 | | | | 4,925,791 | | |

| Federal Farm Credit Bank, 4.125%, due 7/17/2009 | | | 4,850,000 | | | | 4,885,686 | | |

| Federal Farm Credit Bank, 3.539%, due 7/29/2009 (g) | | | 4,850,000 | | | | 4,841,842 | | |

| Federal Farm Credit Bank, 4.85%, due 3/9/2011 | | | 4,322,000 | | | | 4,461,156 | | |

| Federal Farm Credit Bank, 5.05%, due 5/25/2011 | | | 3,880,000 | | | | 4,028,352 | | |

| Federal Farm Credit Bank, 4.50%, due 8/8/2011 | | | 2,910,000 | | | | 2,961,853 | | |

| Federal Farm Credit Bank, 4.82%, due 10/12/2012 | | | 2,425,000 | | | | 2,503,827 | | |

| | | | 551,597,496 | | |

| U.S. Government Notes—28.7% | |

| United States Treasury Notes, 5.125%, due 6/30/2011 | | $ | 485,000,000 | | | $ | 523,307,240 | | |

| United States Treasury Notes, 4.875%, due 2/15/2012 | | | 485,000,000 | | | | 521,223,680 | | |

| United States Treasury Notes, 2.125%, due 4/30/2010 | | | 500,000,000 | | | | 502,383,000 | | |

| United States Treasury Notes, 2.875%, due 1/31/2013 | | | 500,000,000 | | | | 501,289,000 | | |

| Unites States Treasury Notes, 4.25%, due 1/15/2011 | | | 250,000,000 | | | | 263,047,000 | | |

| United States Treasury Notes, 5.00%, due 8/15/2011 | | | 242,500,000 | | | | 261,786,267 | | |

| United States Treasury Notes, 4.75%, due 3/31/2011 | | | 242,500,000 | | | | 258,451,893 | | |

| United States Treasury Notes, 2.875%, due 6/30/2010 | | | 250,000,000 | | | | 254,121,000 | | |

| United States Treasury Notes, 2.75%, due 7/31/2010 | | | 250,000,000 | | | | 253,886,750 | | |

| United States Treasury Notes, 2.375%, due 8/31/2010 | | | 250,000,000 | | | | 251,914,000 | | |

| United States Treasury Notes, 4.00%, due 4/15/2010 | | | 242,500,000 | | | | 250,419,080 | | |

| United States Treasury Notes, 2.75%, due 2/28/2013 | | | 250,000,000 | | | | 248,711,000 | | |

| | | | 4,090,539,910 | | |

| Total Government and Agency Securities (Cost: $4,543,020,657) | | | | | | | 4,691,457,010 | | |

| Total Fixed Income (Cost: $4,593,288,178) | | | | | | | 4,741,197,650 | | |

| Short Term Investments—16.0% | |

| Canadian Treasury Bills—1.6% | |

Canadian Treasury Bills, 2.42% - 2.81%,

due 11/13/2008 - 8/6/2009 | | CAD | 250,000,000 | | | $ | 232,940,569 | | |

| Total Canadian Treasury Bills (Cost: $244,717,372) | | | | | | | 232,940,569 | | |

| U.S. Government Agencies—1.5% | |

Federal National Mortgage Association, 2.38%,

due 10/6/2008 | | | 50,000,000 | | | $ | 49,996,550 | | |

OAKMARK EQUITY AND INCOME FUND

21

OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—September 30, 2008 cont.

| Name | | Par Value | | Value | |

| Short Term Investments—16.0% (cont.) | |

| U.S. Government Agencies—1.5% (cont.) | |

Federal Home Loan Mortgage Corp., 2.42%,

due 10/30/2008 | | $ | 50,000,000 | | | $ | 49,979,850 | | |

Federal Farm Credit Bank, 1.93% - 2.74%,

due 10/8/2008 - 6/5/2009 | | | 83,000,000 | | | | 82,853,571 | | |

| Federal Home Loan Bank, 2.56%, due 11/24/2008 | | | 30,000,000 | | | | 29,912,250 | | |

| Total U.S. Government Agencies (Cost: $212,760,380) | | | 212,742,221 | | |

| U.S. Government Bills—7.7% | |

United States Treasury Bills, 1.57% - 2.20%,

due 10/23/2008 - 8/27/2009 | | $ | 1,100,000,000 | | | $ | 1,092,621,547 | | |

| Total U.S. Government Bills (Cost: $1,090,066,292) | | | | | | | 1,092,621,547 | | |

| Repurchase Agreement—5.2% | |

Fixed Income Clearing Corp. Repurchase Agreement,

1.70% dated 9/30/2008 due 10/1/2008, repurchase price

$746,460,886, collateralized by Federal National

Mortgage Association Bonds, with rates from

5.210% - 5.500%, with maturities from

12/14/2022 - 1/27/2023 and with an aggregate

market value plus accrued interest of $761,359,764 | | $ | 746,425,638 | | | $ | 746,425,638 | | |

| Total Repurchase Agreement (Cost: $746,425,638) | | | | | | | 746,425,638 | | |

| Total Short Term Investments (Cost: $2,293,969,682) | | | | | | | 2,284,729,975 | | |

| Total Investments (Cost: $13,330,735,874)—100.9% | | | | | | $ | 14,395,507,141 | | |

| Liabilities In Excess of Other Assets—(0.9)% | | | | | | | (122,492,770 | ) | |

| Total Net Assets—100% | | | | | | $ | 14,273,014,371 | | |

(a) Non income-producing security.

(b) Represents a foreign domiciled corporation.

(c) Represents an American Depositary Receipt.

(d) Market value is determined in accordance with procedures established in good faith by the Board of Trustees.

(e) See footnote number five in the Notes to the Financial Statements regarding investments in affiliated issuers.

(f) Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

(g) Floating Rate Note. Rate shown is as of September 30, 2008.

Key to abbreviations:

CAD: Canadian Dollar

EUR: Euro Dollar

See accompanying Notes to Financial Statements.

OAKMARK EQUITY AND INCOME FUND

22

OAKMARK GLOBAL FUND

Report from Clyde S. McGregor and Robert A. Taylor, Portfolio Managers

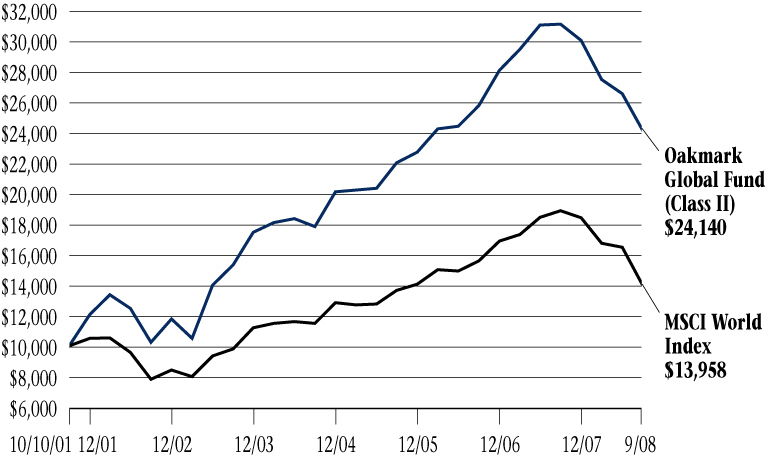

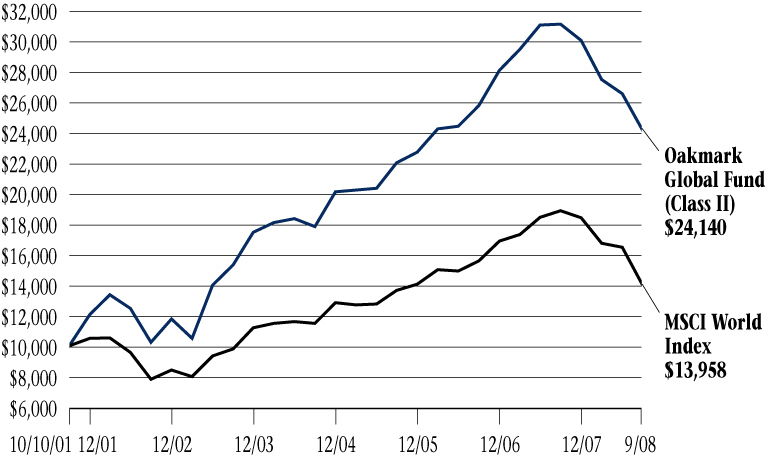

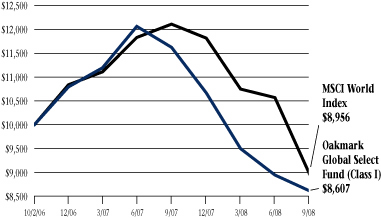

THE VALUE OF A $10,000 INVESTMENT IN OAKMARK GLOBAL FUND FROM ITS INCEPTION (8/4/99) TO PRESENT (9/30/08) AS COMPARED TO THE MSCI WORLD INDEX10 (UNAUDITED)

| | | | | Average Annual Total Returns

(as of 9/30/08) | |

| (Unaudited) | | Total Return

Last 3 Months* | | 1-year | | 5-year | | Since

Inception

(8/4/99) | |

| Oakmark Global Fund (Class I) | | | -8.95 | % | | | -22.10 | % | | | 9.89 | % | | | 12.11 | % | |

| MSCI World | | | -15.24 | % | | | -26.04 | % | | | 7.33 | % | | | 1.26 | % | |

| Lipper Global Fund Index11 | | | -13.61 | % | | | -24.80 | % | | | 7.90 | % | | | 2.95 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The expense ratio for Class I shares as of 9/30/08 was 1.16%.

The performance data quoted represents past performance. The above performance information for the Fund does not reflect the imposition of a 2% redemption fee on shares redeemed within 90 days, in order to deter market timers. If reflected, the fee would reduce the performance quoted. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Average annual total return measures annualized change, while total return measures aggregate change. To obtain most recent month-end performance data, visit oakmark.com.

* Not annualized

"Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria. The time of maximum pessimism is the best time to buy, and time of maximum optimism is the best time to sell."

Sir John Templeton

We write this letter at what, to use John Templeton's phrase, feels like a time of maximum pessimism. The great Sir John, an early advocate of global value investing, passed away early in the summer, so we will not be able to learn his opinion about whether we have reached the height of the current pessimism. Sir John is also credited with having said that the five most dangerous words in investing are "This time things are different." While we agree with his aphorism, we do believe that the current investing landscape differs greatly from others, especially given the increasing degree of economic globalization. The recent loss of faith in financial structures has come at a time of unprecedented leverage, which has produced a worldwide bear market of significant proportions.

In any event, we can filibuster no longer. For the quarter ended September 30, Oakmark Global Fund recorded a loss of 9%, compared to the 15% drop of the MSCI World Index, the industry's benchmark for global funds. The Lipper Global Fund Index registered a 14% decline. Countries where holdings contributed positively to relative performance were France, the U.K., and Italy, while the Fund's Irish, U.S., and Japanese positions had the largest negative impact on relative performance. Concerning individual holdings, it is often the case that a poor performer in one quarter may reverse and be a leader in the next, and the opposite occasionally occurs. During this quarter both phenomena occurred. XTO Energy, historically a strong contributor to Fund returns, was a detractor to the Fund's return, while Live Nation, the concert promotion and venue concern, rebounded strongly from its June 30 price to rise to the top of the contributors. For the Fund's fiscal year, which ended September 30, the returns are -22% for the Global Fund, -26% for the MSCI World Index, and -25% for the Lipper Global Fund Index.

We hate these returns as much as we imagine our shareholders do. Readers who are primarily familiar with U.S. investing returns may find it surprising to learn that the U.S. stock market has outperformed almost all other national stock markets for 2008 to date, at least in U.S. dollar terms. The stupefying volatility that U.S. investors witnessed in late September was foreshadowed elsewhere. For example, the Russian stock market declined roughly 40% in the first half of September before government intervention catalyzed a vigorous, if short-lived, rally. Less than two years ago we wrote about stock market volatility and

OAKMARK GLOBAL FUND

23

the fact that moderate single-digit rates of return are rare. Sometimes we are sorry to be correct!

We remain pleased to be able to report that the annualized rate of return from the Fund's inception is 12%. Testing a fund's long-term record at a time of great stress in the markets is probably the fairest measuring stick for investors. We sincerely hope that we never have the opportunity to test our long term record against a bear market more vicious than the current period.

Activity Review

Given that the breakdown between the U.S. and international investments remained nearly flat for the quarter, one could assume that we were rather inactive in trading. This was true in terms of new purchases—we made none. The Fund did receive shares of Ascent Media as a spinoff distribution from Discovery Holdings. Discovery itself transformed from a tracking stock to an operating company, changing its name to Discovery Communications.

We were more active on the sell side, eliminating holdings of Samsung (Korea), Cadbury (U.K.), Dr. Pepper Snapple Group (U.S.), Teradata (U.S.), and Viacom (U.S.). We attempt to be tax-sensitive as we manage the Fund, and most of these sales contributed to this tax-management effort.

Our hedges performed well during the quarter, adding approximately 2.6% to performance. As the dollar has strengthened versus the Pound and the Euro, we have reduced our hedges from approximately 65% to 40% and 60% to 50%, respectively. Our Swiss Franc hedge was maintained at approximately 75%, because the franc remains expensive versus the dollar and because of our heavy Swiss exposure.

Core Principles