UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06241

Loomis Sayles Funds II

(Exact name of Registrant as specified in charter)

399 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Coleen Downs Dinneen, Esq.

Natixis Distributors, L.P.

399 Boylston Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2810

Date of fiscal year end: September 30

Date of reporting period: September 30, 2009

| Item 1. | Reports to Stockholders. |

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

INCOME FUNDS

ANNUAL REPORT

September 30, 2009

Loomis Sayles Core Plus Bond Fund

Loomis Sayles High Income Fund

Loomis Sayles International Bond Fund

Loomis Sayles Limited Term Government and Agency Fund

Loomis Sayles Strategic Income Fund

TABLE OF CONTENTS

Management Discussion and Performancepage 1

Portfolio of Investmentspage 18

Financial Statementspage 55

LOOMIS SAYLES CORE PLUS BOND FUND

PORTFOLIO PROFILE

Objective:

Seeks a high level of current income consistent with what the fund considers reasonable risk

Strategy:

Invests primarily in U.S. corporate and U.S. government bonds

Fund Inception:

November 7, 1973

Managers:

Peter W. Palfrey, CFA

Richard G. Raczkowski

Loomis, Sayles & Company, L.P.

Symbols:

| | |

| Class A | | NEFRX |

| Class B | | NERBX |

| Class C | | NECRX |

| Class Y | | NERYX |

What You Should Know:

Fixed-income securities are subject to credit risk and interest rate risk; their value generally rises when prevailing interest rates fall and falls when rates rise.

The fund can invest a significant percentage of assets in debt securities that are rated below investment grade and the value of fund shares can be adversely affected by changes in economic conditions or other circumstances. Lower rated debt securities have speculative characteristics and may be subject to greater price volatility than higher rated investments. In addition, the secondary market for these securities may lack liquidity. The fund can also invest a significant percentage of assets in foreign securities and the value of the fund shares can be adversely affected by changes in currency exchange rates, political, and economic developments. In emerging markets, these risks can be significant. Fund shares should be viewed as a long-term investment.

Management Discussion

In the extremely difficult market environment that characterized the end of 2008 and early 2009, widespread concern about the world’s financial markets triggered a massive flight to safety. This hurt risk markets and drove yields on U.S. Treasury securities to record lows. As the risk markets neared a bottom, Loomis Sayles Core Plus Bond Fund moved aggressively back into credit and securitized markets as well as into Treasury Inflation Protected Securities (TIPS) at attractive valuations. These moves worked well for the fund.

For the fiscal year ended September 30, 2009, the total return on Class A shares of the fund was 20.07% based on the net asset value and $0.66 in reinvested dividends. By comparison, the fund’s benchmark, Barclays Capital U.S. Aggregate Bond Index, returned 10.56% for the fiscal period, while Morningstar’s Intermediate-Term Bond peer group returned 11.81%.

WHICH OF THE TACTICS YOU USED WAS MOST HELPFUL TO THE FUND?

Our move from a very defensive positioning in the fall of 2008 to a much more aggressive positioning late in 2008 and in 2009 as risk markets recovered was key to protecting capital through the worst of the financial crisis and participating in the upturn. Our increased allocation to higher-yielding securities was also strongly positive. Corporate bonds performed well, particularly industrials, which were the largest contributor. Strong security selection and our overweight positions in investment-grade financial and utility companies were also positive.

The recovery in the high-yield market began late in December of 2008 and continued through September of 2009. We doubled the fund’s exposure to high-yield securities during the year and began harvesting gains in earnest in the second quarter of 2009 as evidence mounted that economic conditions were stabilizing. An increasing number of companies issued new debt and some of our holdings in previously distressed companies — including Ford and GMAC — came back into favor.

DID THE DECLINE IN THE U.S. DOLLAR IMPACT THE FUND?

The fund’s significant allocation to the Japanese yen was an effective defensive measure during the closing quarter of 2008, and we sold most of the fund’s yen-denominated holdings late in 2008 at substantial gains. We opportunistically added positions in Australian and Canadian dollars to capture the anticipated rebound in commodity currencies as risk markets began to stabilize. During the summer of 2009, we shifted the fund’s remaining non-U.S.-dollar position back into Treasuries due to concerns mounting that the depreciating U.S. dollar might be overdue for a correction.

WHAT ABOUT OTHER POSITIONS? HOW DID THEY IMPACT PERFORMANCE?

Commercial mortgage-backed securities (CMBS) detracted from performance in the final quarter of 2008 and early in 2009, but this sector was very positive throughout the remainder of the fiscal year. This reflected improving investor confidence in higher-rated CMBS and support from government stimulus programs. Following a significant rally, we trimmed holdings in CMBS at a profit in the third quarter or 2009.

WHAT’S YOUR OUTLOOK?

The significant rebound from such distressed price levels and the sharp contraction in yield spreads has helped normalize most markets, but we believe there is still good value to be found should the U.S. and global economies continue to recover as expected. Going forward, the timing of the government’s exit strategy from its current levels of monetary and fiscal support, as well as investor risk preferences, will likely drive the markets over the next 12 months. Portfolio yield in the shorter maturity sectors should become increasingly important as Treasury yields start to normalize and inflation fears become more prevalent. We plan to maintain a high degree of liquidity in the fund in anticipation of what we expect to be a bumpy recovery and to take advantage of volatility we see ahead for the markets in the coming year.

1

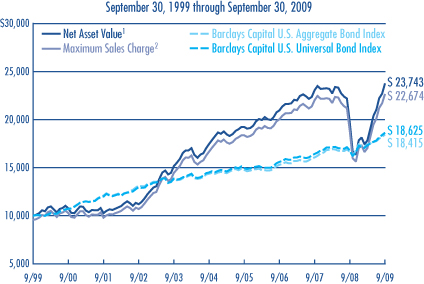

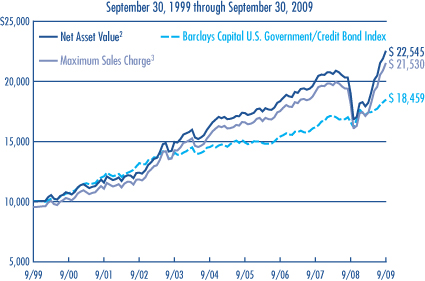

LOOMIS SAYLES CORE PLUS BOND FUND

Investment Results through September 30, 2009

PERFORMANCE IN PERSPECTIVE

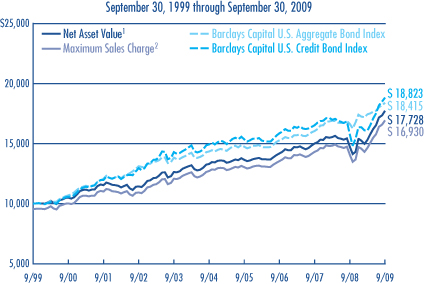

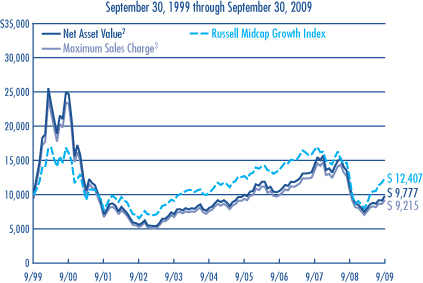

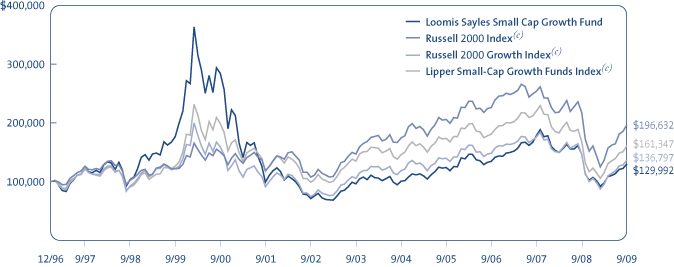

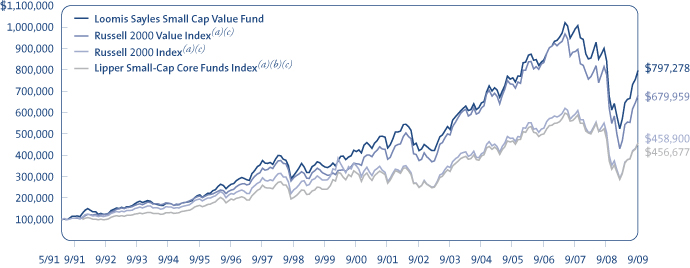

The charts comparing the fund’s performance to two indexes provide you with a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

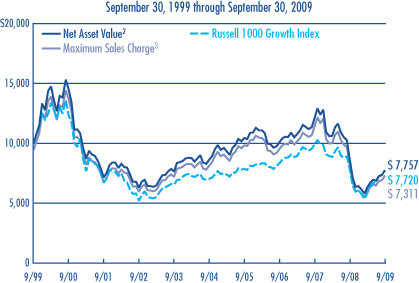

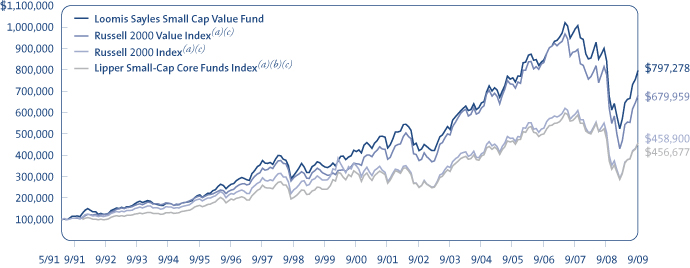

Growth of a $10,000 Investment in Class A Shares4

Average Annual Total Returns — September 30, 20094

| | | | | | | | | |

| | | | |

| | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

CLASS A (Inception 11/7/73) | | | | | | | | | |

Net Asset Value1 | | 20.07 | % | | 5.88 | % | | 5.89 | % |

With Maximum Sales Charge2 | | 14.63 | | | 4.91 | | | 5.41 | |

| | | | |

CLASS B (Inception 9/13/93) | | | | | | | | | |

Net Asset Value1 | | 19.19 | | | 5.10 | | | 5.12 | |

With CDSC3 | | 14.19 | | | 4.77 | | | 5.12 | |

| | | | |

CLASS C (Inception 12/30/94) | | | | | | | | | |

Net Asset Value1 | | 19.20 | | | 5.08 | | | 5.11 | |

With CDSC3 | | 18.20 | | | 5.08 | | | 5.11 | |

| | | | |

CLASS Y (Inception 12/30/94) | | | | | | | | | |

Net Asset Value1 | | 20.37 | | | 6.16 | | | 6.26 | |

| | | | |

| COMPARATIVE PERFORMANCE | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

Barclays Capital U.S. Aggregate Bond Index | | 10.56 | % | | 5.13 | % | | 6.30 | % |

Barclays Capital U.S. Credit Bond Index | | 19.49 | | | 4.72 | | | 6.53 | |

Morningstar Int.-Term Bond Fund Avg. | | 11.81 | | | 3.82 | | | 5.38 | |

See page 11 for a description of the indices.

All returns represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary and you may have a gain or loss when you sell your shares. All results include reinvestment of any dividends and capital gains. Current returns may be higher or lower than those shown. For performance current to the most recent month-end, visit www.funds.natixis.com. Class Y shares are available to certain investors, as described in the prospectus.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | | | |

| |

| | | % of Net Assets as of |

| CREDIT QUALITY | | 9/30/09 | | 9/30/08 |

Aaa | | 51.5 | | 59.1 |

Aa | | 4.7 | | 5.6 |

A | | 9.0 | | 4.8 |

Baa | | 19.6 | | 14.6 |

Ba | | 5.9 | | 4.8 |

B | | 3.3 | | 5.7 |

Caa | | 1.3 | | 0.5 |

Ca | | 1.0 | | 0.3 |

Not Rated* | | 1.9 | | 3.8 |

Short-term and other | | 1.8 | | 0.8 |

Credit quality is based on ratings from Moody’s Investors Service.

* Securities that are not rated by Moody’s may be rated by another rating agency or by Loomis Sayles.

| | | | | | |

| |

| | | % of Net Assets as of | |

| EFFECTIVE DURATION | | 9/30/09 | | | 9/30/08 | |

1 year or less | | 6.7 | | | 8.8 | |

1-5 years | | 36.6 | | | 39.7 | |

5-10 years | | 43.9 | | | 40.0 | |

10+ years | | 12.8 | | | 11.5 | |

Average Effective Duration | | 5.9 | years | | 5.7 | years |

Portfolio characteristics will vary.

EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | | | |

| Share Class | | Gross Expense Ratio5 | | | Net Expense Ratio6 | |

A | | 1.04 | % | | 0.90 | % |

B | | 1.80 | | | 1.65 | |

C | | 1.79 | | | 1.65 | |

Y | | 0.75 | | | 0.65 | |

NOTES TO CHARTS

| 1 | Does not include a sales charge. |

| 2 | Includes maximum sales charge of 4.50%. |

| 3 | Performance for Class B shares assumes a maximum 5% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C shares performance assumes a 1% CDSC applied when you sell shares within one year of purchase. |

| 4 | Fund performance has been increased by expense reductions and reimbursements, if any, without which performance would have been lower. |

| 5 | Before reductions and reimbursements. |

| 6 | After reductions and reimbursements. Expense reductions are contractual and are set to expire on 1/31/10. |

2

LOOMIS SAYLES HIGH INCOME FUND

PORTFOLIO PROFILE

Objective:

Seeks high current income plus the opportunity for capital appreciation to produce a high total return

Strategy:

Invests primarily in lower-quality fixed-income securities

Fund Inception:

February 22, 1984

Managers:

Matthew J. Eagan, CFA

Kathleen C. Gaffney, CFA

Elaine M. Stokes

Loomis, Sayles & Company, L.P.

Symbols:

| | |

| Class A | | NEFHX |

| Class B | | NEHBX |

| Class C | | NEHCX |

| Class Y | | NEHYX |

What You Should Know:

Fixed-income securities are subject to credit risk and interest rate risk; their value generally rises when prevailing interest rates fall and falls when rates rise.

The fund can invest a significant percentage of assets in debt securities that are rated below investment grade and the value of fund shares can be adversely affected by changes in economic conditions or other circumstances. Lower rated debt securities have speculative characteristics and may be subject to greater price volatility than higher rated investments. In addition, the secondary market for these securities may lack liquidity. The fund can also invest a significant percentage of assets in foreign securities and the value of the fund shares can be adversely affected by changes in currency exchange rates, political, and economic developments. In emerging markets, these risks can be significant. Fund shares should be viewed as a long-term investment.

Management Discussion

As the credit crisis eased last spring, investors turned away from low-yielding, government-backed issues in search of better returns in other sectors. High-yield bonds in particular benefited from this renewed risk appetite. Increased demand and stronger market liquidity pushed prices of lower-rated issues sharply higher and their yields plunged. By the end of the period, spreads – the yield advantage high-yield issues have over Treasury issues of similar maturity – had narrowed dramatically from the exceptionally wide levels that had prevailed at the height of the financial crisis.

For the fiscal year ended September 30, 2009, Class A shares of Loomis Sayles High Income Fund provided a total return at net asset value of 15.97%, including $0.33 in dividends reinvested during the period. The fund underperformed its benchmark, Barclays Capital U.S. Corporate High-Yield Bond Index, which returned 22.34% for the period. However, its performance was above the 13.16% average of the funds in Morningstar’s High Yield Bond category.

WHAT WERE THE BEST PERFORMING MARKET AREAS?

As capital returned to the credit markets in the latter part of fiscal 2009, lower-rated industrial bonds made the strongest contribution to results. The ability of lower-rated companies to refinance pending maturities brought default assumptions down significantly and enticed investors to reach for higher returns in the lower-rated portions of the market.

Improving conditions in the world financial system also spurred merger talks, notably in the consolidating pharmaceutical industry. This trend, combined with the broader debate over universal healthcare, spurred demand in the healthcare sector. As a result, consumer non-cyclicals led sector performance for the period. In terms of quality, the fund’s strongest returns came from securities rated B by Moody’s Investors Service.

WHAT CAUSED THE FUND TO LAG ITS BENCHMARK DURING THE YEAR?

In general, the fund underperformed its benchmark because its portfolio included more higher-quality issues during a period when the lower-quality sector provided the best results. Specifically, the fund was underweight in high-yield financials, where government guarantees of certain issues increased investor confidence. Subsequent infusions of capital as part of the government’s stimulus programs also enhanced performance in this area, but the fund’s participation was limited. The fund’s underweight in bonds rated CCC by Moody’s also hindered performance, as this sector recorded some of the period’s better gains. Moreover, our commitment to bank loans and Treasury securities – which are not part of the benchmark – also handicapped results, as higher-rated holdings lost favor in the second half of the year.

WHAT’S YOUR OUTLOOK?

Looking ahead, we continue to believe there is select value in corporate bonds. Despite their recent tightening, spreads remain wide relative to long-term averages. A vast majority of the spread tightening that has taken place this year is due to the re-emergence of liquidity in the markets. Over the long term, further spread tightening from these levels will most likely be generated by an improvement in global and U.S. economic fundamentals. Our view is that maintaining specific risk in the portfolio will present the best opportunity for long-term performance.

Global risk appetite has weakened the U.S. dollar, and we expect this may continue. Currencies from developed and emerging markets may offer more long-term upside potential, particularly the European peripheral currencies and Asian currencies tied to China and its global-growth story.

3

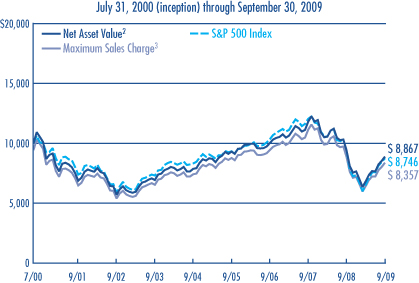

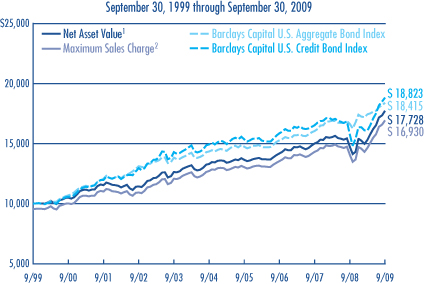

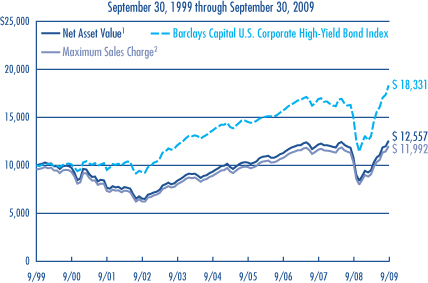

LOOMIS SAYLES HIGH INCOME FUND

Investment Results through September 30, 2009

PERFORMANCE IN PERSPECTIVE

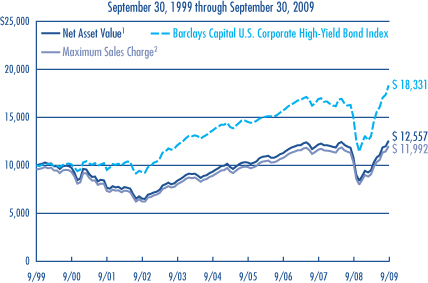

The charts comparing the fund’s performance to an index provide you with a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

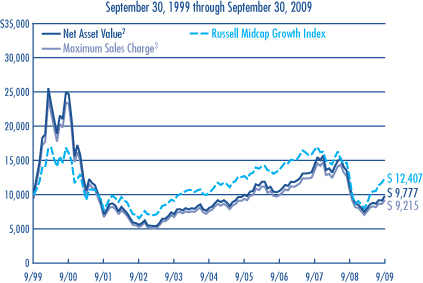

Growth of a $10,000 Investment in Class A Shares4

Average Annual Total Returns — September 30, 20094

| | | | | | | | | | | | |

| | | | | |

| | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | | | SINCE

INCEPTION | |

CLASS A (Inception 2/22/84) | | | | | | | | | | | | |

Net Asset Value1 | | 15.97 | % | | 6.14 | % | | 2.31 | % | | — | |

With Maximum Sales Charge2 | | 10.75 | | | 5.15 | | | 1.84 | | | — | |

| | | | | |

CLASS B (Inception 9/20/93) | | | | | | | | | | | | |

Net Asset Value1 | | 15.06 | | | 5.32 | | | 1.55 | | | — | |

With CDSC3 | | 10.06 | | | 5.02 | | | 1.55 | | | — | |

| | | | | |

CLASS C (Inception 3/2/98) | | | | | | | | | | | | |

Net Asset Value1 | | 15.37 | | | 5.34 | | | 1.56 | | | — | |

With CDSC3 | | 14.37 | | | 5.34 | | | 1.56 | | | — | |

| | | | | |

CLASS Y (Inception 2/29/08) | | | | | | | | | | | | |

Net Asset Value1 | | 16.29 | | | — | | | — | | | 3.56 | % |

| | | | | |

| COMPARATIVE PERFORMANCE | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | | | SINCE

CLASS Y

INCEPTION7 | |

Barclays Capital U.S. Corporate High-Yield Bond Index | | 22.34 | % | | 6.13 | % | | 6.25 | % | | 8.05 | % |

Morningstar High Yield Bond Fund Avg. | | 13.16 | | | 4.11 | | | 4.47 | | | 3.47 | |

See page 11 for a description of the indices.

All returns represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary and you may have a gain or loss when you sell your shares. All results include reinvestment of dividends and capital gains. Current returns may be higher or lower than those shown. For performance current to the most recent month-end, visit www.funds.natixis.com. Performance history includes periods from a predecessor fund. Class Y shares are available to certain investors, as described in the prospectus.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | | | |

| |

| | | % of Net Assets as of |

| CREDIT QUALITY | | 9/30/09 | | 9/30/08 |

Aaa | | 10.0 | | 17.3 |

Aa | | 0.5 | | 2.0 |

A | | 0.2 | | 1.0 |

Baa | | 5.3 | | 7.6 |

Ba | | 28.5 | | 14.9 |

B | | 28.2 | | 28.9 |

Caa | | 12.9 | | 16.4 |

Ca | | 1.9 | | 0.5 |

C | | — | | 0.0 |

Not Rated* | | 5.6 | | 10.1 |

Short-term and other | | 6.9 | | 1.3 |

Credit quality is based on ratings from Moody’s Investors Service.

* Securities that are not rated by Moody’s may be rated by another rating agency or by Loomis Sayles.

| | | | | | |

| |

| | | % of Net Assets as of | |

| EFFECTIVE MATURITY | | 9/30/09 | | | 9/30/08 | |

1 year or less | | 6.8 | | | 16.0 | |

1-5 years | | 32.1 | | | 25.7 | |

5-10 years | | 34.2 | | | 28.5 | |

10+ years | | 26.9 | | | 29.8 | |

Average Effective Maturity | | 8.6 | years | | 8.8 | years |

Portfolio characteristics will vary.

EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | | | |

| Share Class | | Gross Expense Ratio5 | | | Net Expense Ratio6 | |

A | | 1.40 | % | | 1.15 | % |

B | | 2.15 | | | 1.90 | |

C | | 2.15 | | | 1.90 | |

Y | | 1.15 | | | 0.90 | |

NOTES TO CHARTS

| 1 | Does not include a sales charge. |

| 2 | Includes maximum sales charge of 4.50%. |

| 3 | Performance for Class B shares assumes a maximum 5% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C shares performance assumes a 1% CDSC applied when you sell shares within one year of purchase. |

| 4 | Fund performance has been increased by expense reductions and reimbursements, if any, without which performance would have been lower. |

| 5 | Before reductions and reimbursements. |

| 6 | After reductions and reimbursements. Expense reductions are contractual and are set to expire on 1/31/10. |

| 7 | The since-inception comparative performance figures shown for Class Y shares are calculated from 3/1/08. |

4

LOOMIS SAYLES INTERNATIONAL BOND FUND

PORTFOLIO PROFILE

Objective:

Seeks high total return through a combination of high current income and capital appreciation

Strategy:

Invests primarily in fixed-income securities located outside the U.S.

Fund Inception:

February 1, 2008

Managers:

Lynda L. Schweitzer, CFA

Kenneth M. Buntrock, CFA, CIC

David W. Rolley, CFA

Loomis, Sayles & Company, L.P.

Symbols:

| | |

| Class A | | LSIAX |

| Class C | | LSICX |

| Class Y | | LSIYX |

What You Should Know:

Fixed-income securities are subject to credit risk and interest rate risk; their value generally rises when prevailing interest rates fall and falls when rates rise. The fund may also invest in public or private debt obligations issued or guaranteed by U.S. or non-U.S. issuers. The fund can invest a significant percentage of assets in foreign securities and the value of the fund shares can be adversely affected by changes in currency exchange rates, political, and economic developments. In emerging markets these risks can be significant. The fund can invest a significant percentage of assets in debt securities that are rated below investment grade. Lower-rated debt securities have speculative characteristics and may be subject to greater price volatility than higher-rated investments. In addition, the secondary market for these securities may lack liquidity. Fund shares should be viewed as a long-term investment.

Management Discussion

Trends in global fixed-income markets reversed course in the spring of 2009, as rising optimism about an economic recovery replaced fears of a protracted worldwide recession. The changing market sentiment helped investment-grade corporate bonds, high-yield debt and emerging market securities stage strong comebacks over the second half of the 12-month period ended September 30, 2009. The robust rally offset many of the losses incurred during the previous six months.

The fund’s positioning for a global economic recovery helped drive Loomis Sayles International Bond Fund’s strong relative performance for the fiscal year ended September 30, 2009. Based on the net asset value of Class A Shares, the fund produced a total return of 20.41%, including $0.20 in dividends reinvested during the period. The fund outpaced the 15.41% return on its benchmark, Barclays Capital Global Aggregate ex-USD Bond Index and the 14.82% average return of the funds in Morningstar’s World Bond category.

WHAT FACTORS CONTRIBUTED TO THE FUND’S STRONG PERFORMANCE?

The fund’s emphasis on the U.S., U.K. and European corporate bond markets, as well as strong security selection, was primarily responsible for its outperformance. Our focus on corporate bonds had held back results during the first half of the fiscal year, but the fund was positioned well when credit markets began a recovery about halfway through the period. As investors became less risk-averse and more interested in the yield advantage that corporate bonds have over government debt, money poured into the higher-yield sectors of the fixed-income markets.

In addition to investment-grade corporate debt, holdings in high-yield corporate bonds and emerging-market securities helped propel the fund’s solid return. The fund’s overall currency strategy also helped, as our overweight position in the Norwegian krone and tactical positioning in the South Korean won also contributed to strongly positive returns.

WHICH STRATEGIES DETRACTED FROM THE FUND’S RESULTS?

While our exposure to U.S. corporate securities supported performance, the financial institutions represented in the portfolio generally detracted in the closing quarter of 2008 and early 2009 as a result of the rapid deterioration in the international financial markets.

Despite the overall success of our Scandinavian currency strategy, the fund’s performance was negatively impacted by its underweight relative to its benchmark in the Icelandic krona. The fund was also underweight in the Japanese yen, which was a drag on performance when the yen strengthened against the U.S. dollar during the latter part of the year.

WHAT’S YOUR OUTLOOK?

Despite strong performance this past quarter, we still see attractive opportunities in corporate bonds, the high-yield sectors of the securitized market and selected currencies. Yield spreads – the difference in yield between corporate bonds and Treasury securities – are still wide relative to their long-term averages and may tighten further as the economy recovers.

Market trends and conditions vary from country to country, but we believe the overall global economy is moving toward a gradual recovery. In the United States, however, we think the recovery is likely to be weak, hampered by high unemployment and sluggish consumer and investment spending. Accordingly, we limited the fund’s exposure to U.S. high-yield corporate debt. We also added to the fund’s holdings in non-U.S. dollar currencies. We also plan to reduce the duration of our U.S. dollar-based investments in anticipation of higher yields in 2010.

5

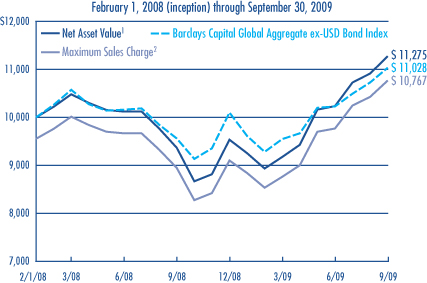

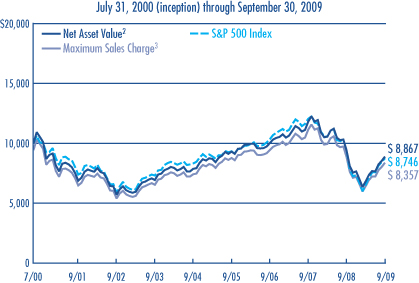

LOOMIS SAYLES INTERNATIONAL BOND FUND

Investment Results through September 30, 2009

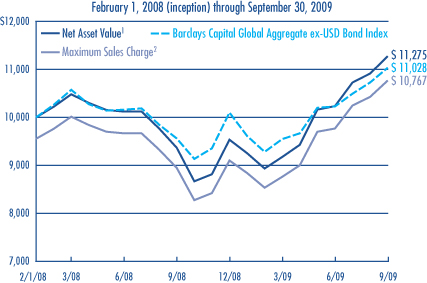

PERFORMANCE IN PERSPECTIVE

The charts comparing the fund’s performance to an index provide you with general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, an index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Growth of $10,000 Investment in Class A Shares4

Average Annual Total Returns — September 30, 20094

| | | | | | |

| | | |

| | | 1 YEAR | | | SINCE

INCEPTION | |

CLASS A (Inception 2/1/08) | | | | | | |

Net Asset Value1 | | 20.41 | % | | 7.48 | % |

With Maximum Sales Charge2 | | 15.03 | | | 4.55 | |

| | | |

CLASS C (Inception 2/1/08) | | | | | | |

Net Asset Value1 | | 19.58 | | | 6.63 | |

With CDSC3 | | 18.58 | | | 6.63 | |

| | | |

CLASS Y (Inception 2/1/08) | | | | | | |

Net Asset Value1 | | 20.73 | | | 7.63 | |

| | | |

| COMPARATIVE PERFORMANCE | | 1 YEAR | | | SINCE

INCEPTION | |

Barclays Capital Global Aggregate ex-USD Bond Index | | 15.41 | % | | 6.05 | % |

Morningstar World Bond Fund Avg. | | 14.82 | | | 4.92 | |

See page 11 for a description of the indices.

All returns represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary and you may have a gain or loss when you sell your shares. All results include reinvestment of dividends and capital gains. Current returns may be higher or lower than those shown. For performance current to the most recent month-end, visit www.funds.natixis.com. Class Y shares are available to certain investors, as described in the prospectus.

The table does not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | | | |

| |

| | | % of Net Assets as of |

| CREDIT QUALITY | | 9/30/09 | | 9/30/08 |

Aaa | | 52.5 | | 54.2 |

Aa | | 19.1 | | 18.7 |

A | | 7.0 | | 8.3 |

Baa | | 10.7 | | 10.5 |

Ba | | 2.7 | | 3.1 |

B | | 1.2 | | 0.5 |

Caa | | 0.4 | | 0.7 |

Not Rated* | | 3.3 | | 2.3 |

Short-term and other | | 3.1 | | 1.7 |

Credit quality is based on ratings from Moody’s Investors Service.

* Securities that are not rated by Moody’s may be rated by another rating agency or by Loomis Sayles.

| | | | | | |

| |

| | | % of Net Assets as of | |

| EFFECTIVE MATURITY | | 9/30/09 | | | 9/30/08 | |

1 year or less | | 17.3 | | | 12.5 | |

1-5 years | | 35.9 | | | 18.4 | |

5-10 years | | 29.2 | | | 55.2 | |

10+ years | | 17.6 | | | 13.9 | |

Average Effective Maturity | | 6.7 | years | | 8.1 | years |

Portfolio characteristics will vary.

EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | | | |

| Share Class | | Gross Expense Ratio5 | | | Net Expense Ratio6 | |

A | | 2.20 | % | | 1.10 | % |

C | | 2.93 | | | 1.85 | |

Y | | 1.83 | | | 0.85 | |

NOTES TO CHARTS

| 1 | Does not include a sales charge. |

| 2 | Includes maximum sales charge of 4.50%. |

| 3 | Class C shares performance assumes a 1% CDSC applied when you sell shares within one year of purchase. |

| 4 | Fund performance has been increased by expense reductions and reimbursements, if any, without which performance would have been lower. |

| 5 | Before reductions and reimbursements. |

| 6 | After reductions and reimbursements. Expense reductions are contractual and are set to expire on 1/31/10. |

6

LOOMIS SAYLES LIMITED TERM GOVERNMENTAND AGENCY FUND

PORTFOLIO PROFILE

Objective:

Seeks a high current return consistent with preservation of capital

Strategy:

Invests primarily in securities issued or guaranteed by the U.S. government, its agencies or instrumentalities

Fund Inception:

January 3, 1989

Managers:

John Hyll

Clifton V. Rowe, CFA

Loomis, Sayles & Company, L.P.

Symbols:

| | |

| Class A | | NEFLX |

| Class B | | NELBX |

| Class C | | NECLX |

| Class Y | | NELYX |

What You Should Know:

Fixed-income securities are subject to credit risk and interest rate risk; their value generally rises when prevailing interest rates fall and falls when rates rise. Securities issued by the U.S. government are guaranteed by the U.S. government if held to maturity; mutual funds that invest in these securities are not guaranteed. Securities issued by U.S. government agencies may not be government guaranteed.

Management Discussion

After a difficult start to the fiscal year last fall, Loomis Sayles Limited Term Government and Agency Fund experienced strong performance during the balance of the year, outperforming both its benchmark and the average return of its Morningstar peer group. The massive flight to quality, which was triggered by the financial meltdown during the closing quarter of 2008, gave way to an increasing willingness on the part of investors to accept greater risk. Price recovery in the fund’s position in mortgage-related securities was primarily responsible for the fund’s outperformance.

For the fiscal year ended September 30, 2009, the fund’s total return based on the net asset value of Class A shares was 9.05% including $0.36 in reinvested dividends. For the same period, Barclays Capital U.S. 1-5 Year Government Bond Index returned 5.43%, while Morningstar’s Short Government category returned 5.48%.

WHICH SECTORS HAD THE MOST POSITIVE IMPACT ON FUND PERFORMANCE?

Although mortgage-related and asset-backed securities offer a yield advantage over U.S. Treasury securities, they had become significantly undervalued in the latter part of 2008, as concerns surrounding the real estate and mortgage markets mounted. However, beginning in the second quarter of 2009 and continuing into the third quarter, confidence began to return to the markets and investors recognized the compelling values offered by higher-quality mortgage securities. As a result, investors’ appetite for risk led to a shift away from safety and toward securities with a combination of better income and capital appreciation potential.

Treasury inflation protected securities (TIPS) also performed well, reflecting the modest improvement in the economic outlook during the second and third quarter of 2009. Concerns about deflation eased, resulting in strengthened TIPS valuations.

WHICH SECTORS HAD A NEGATIVE IMPACT DURING THE YEAR?

The same sectors that had provided the most support for the fund in the turbulent period at the end of 2008 and early 2009 were relative underperformers during the market recovery in the second and third quarters of 2009. Investors turned their attention from Treasuries and securities issued by government sponsored entities (GSEs) toward higher-yielding, lower-quality sectors. Performance in the top-quality arena fell behind. As interest rates declined, securities with shorter maturities also lagged relative to longer-term securities with higher yields, so the fund’s relatively short maturity detracted from overall performance.

WHICH OF THE TACTICS YOU USED WAS MOST HELPFUL DURING THE PERIOD?

This fund’s mandate is to seek a high current return consistent with preservation of capital, primarily by investing in short-term government securities. However, within that framework, we strive to provide shareholders with attractive returns with as little risk as possible in any given market environment. Early in the fund’s fiscal year, we increased its holdings in TIPS because they appeared to be attractively valued. This move gave the fund yields similar to non-inflation-protected securities at a lower cost. As the year progressed, we turned our attention to securities offering even higher income potential, primarily in the mortgage-related market.

WHAT IS YOUR OUTLOOK?

For the intermediate term, we look for a gradual rise in interest rates and we believe our mortgage positions will benefit from the relatively stable interest-rate environment we see ahead. We believe the Federal Reserve Board will hold off on raising interest rates longer than the majority of investors expect, and we do not anticipate any significant shifts in the yield curve.

Despite the market’s positive performance in the latter part of 2009, we still see attractive opportunities for conservative bond investors, but we think the “rising tide lifts all boats” phenomenon may be nearing an end. Good results are likely to become harder to find.

7

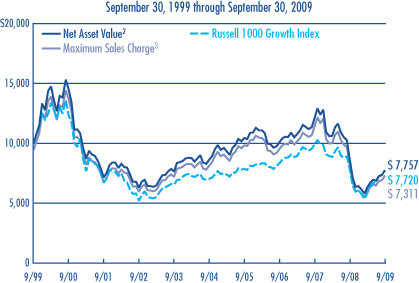

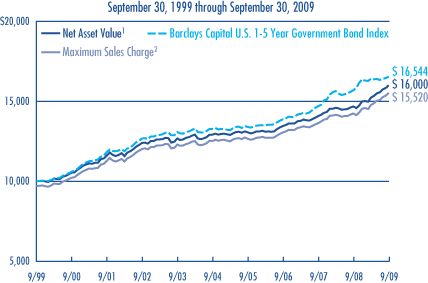

LOOMIS SAYLES LIMITED TERM GOVERNMENTAND AGENCY FUND

Investment Results through September 30, 2009

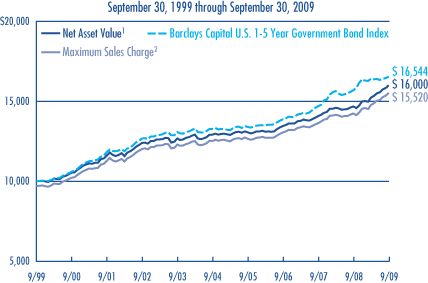

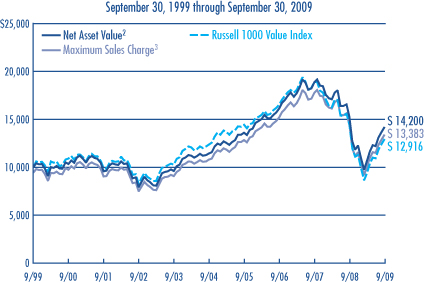

PERFORMANCE IN PERSPECTIVE

The charts comparing the fund’s performance to an index provide you with a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

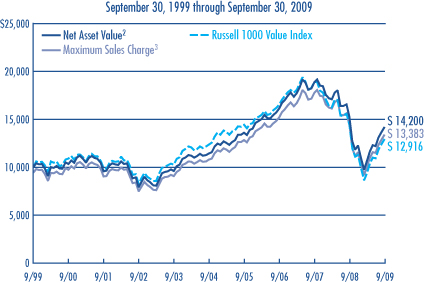

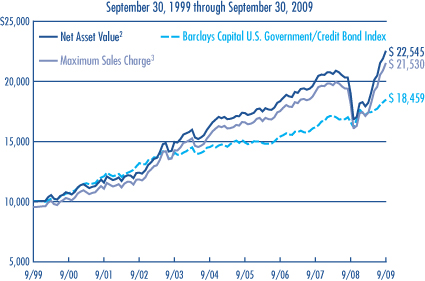

Growth of a $10,000 Investment in Class A Shares4

Average Annual Total Returns — September 30, 20094

| | | | | | | | | |

| | | | |

| | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

CLASS A (Inception 1/3/89) | | | | | | | | | |

Net Asset Value1 | | 9.05 | % | | 4.38 | % | | 4.81 | % |

With Maximum Sales Charge2 | | 5.77 | | | 3.74 | | | 4.49 | |

| | | | |

CLASS B (Inception 9/27/93) | | | | | | | | | |

Net Asset Value1 | | 8.24 | | | 3.59 | | | 4.08 | |

With CDSC3 | | 3.24 | | | 3.24 | | | 4.08 | |

| | | | |

CLASS C (Inception 12/30/94) | | | | | | | | | |

Net Asset Value1 | | 8.24 | | | 3.60 | | | 4.08 | |

With CDSC3 | | 7.24 | | | 3.60 | | | 4.08 | |

| | | | |

CLASS Y (Inception 3/31/94) | | | | | | | | | |

Net Asset Value1 | | 9.40 | | | 4.65 | | | 5.15 | |

| | | | |

| COMPARATIVE PERFORMANCE | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

Barclays Capital U.S. 1-5 Year Government Bond Index | | 5.43 | % | | 4.51 | % | | 5.16 | % |

Morningstar Short Gov’t Fund Avg. | | 5.48 | | | 3.79 | | | 4.38 | |

See page 11 for a description of the indices.

All returns represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary and you may have a gain or loss when you sell your shares. All results include reinvestment of dividends and capital gains. Current returns may be higher or lower than those shown. For performance current to the most recent month-end, visit www.funds.natixis.com. Performance history includes periods from a predecessor fund. Class Y shares are available to certain investors, as described in the prospectus.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | | | |

| |

| | | % of Net Assets as of |

| FUND COMPOSITION* | | 9/30/09 | | 9/30/08 |

Mortgage Related | | 42.4 | | 70.6 |

Treasuries | | 14.6 | | 4.6 |

Commercial Mortgage-Backed Securities | | 10.9 | | — |

Government Owned - No Guarantee | | 10.0 | | — |

Government Sponsored | | 8.3 | | — |

Government Guaranteed | | 3.5 | | — |

ABS Credit Card | | 3.4 | | 2.7 |

ABS Car Loan | | 2.1 | | — |

Automotive | | — | | 1.8 |

Hybrid ARMs | | 2.0 | | 1.6 |

ABS Home Equity | | 1.2 | | — |

Collateralized Mortgage Obligations | | 0.4 | | 0.1 |

ABS Other | | 0.3 | | — |

Asset-Backed Securities | | — | | 3.5 |

Mortgage Backed Securities | | — | | 2.0 |

Short-Term Investments & Other | | 0.9 | | 13.1 |

| | | | |

* Security classification changes made by Barclays Capital during the year ended 9/30/09 are not reflected in Fund Composition as of 9/30/08. | | | | |

| | | | | | |

| |

| | | % of Net Assets as of | |

| EFFECTIVE MATURITY | | 9/30/09 | | | 9/30/08 | |

1 year or less | | 1.9 | | | 19.0 | |

1-5 years | | 83.5 | | | 74.5 | |

5-10 years | | 14.6 | | | 6.5 | |

10+ years | | n/a | | | n/a | |

Average Effective Maturity | | 3.5 | years | | 3.0 | years |

Portfolio characteristics will vary.

EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | | | |

| Share Class | | Gross Expense Ratio5 | | | Net Expense Ratio6 | |

A | | 1.07 | % | | 0.90 | % |

B | | 1.82 | | | 1.65 | |

C | | 1.83 | | | 1.65 | |

Y | | 0.72 | | | 0.65 | |

NOTES TO CHARTS

| 1 | Does not include a sales charge. |

| 2 | Includes maximum sales charge of 3.00%. |

| 3 | Performance for Class B shares assumes a maximum 5% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C shares performance assumes a 1% CDSC applied when you sell shares within one year of purchase. |

| 4 | Fund performance has been increased by expense reductions and reimbursements, if any, without which performance would have been lower. |

| 5 | Before reductions and reimbursements. |

| 6 | After reductions and reimbursements. Expense reductions are contractual and are set to expire on 1/31/10. |

8

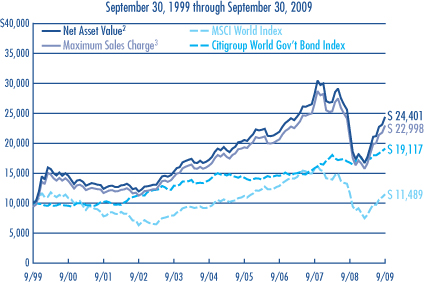

LOOMIS SAYLES STRATEGIC INCOME FUND

PORTFOLIO PROFILE

Objective:

Seeks high current income, with a secondary objective of capital growth

Strategy:

Invests primarily in income-producing securities in the U.S. and around the world

Fund Inception:

May 1, 1995

Managers:

Daniel J. Fuss, CFA, CIC

Kathleen C. Gaffney, CFA

Associate Managers:

Matthew J. Eagan, CFA

Elaine M. Stokes

Loomis, Sayles & Company, L.P.

Symbols:

| | |

| Class A | | NEFZX |

| Class B | | NEZBX |

| Class C | | NECZX |

| Class Y | | NEZYX |

What You Should Know:

Fixed-income securities are subject to credit risk and interest rate risk; their value generally rises when prevailing interest rates fall and falls when rates rise.

The fund can invest a significant percentage of assets in debt securities that are rated below investment grade and the value of fund shares can be adversely affected by changes in economic conditions or other circumstances. Lower rated debt securities have speculative characteristics and may be subject to greater price volatility than higher rated investments. In addition, the secondary market for these securities may lack liquidity. The fund can also invest a significant percentage of assets in foreign securities and the value of the fund shares can be adversely affected by changes in currency exchange rates, political, and economic developments. In emerging markets, these risks can be significant. Fund shares should be viewed as a long-term investment.

Management Discussion

Beginning in March of 2009, signs that the recession was easing and the global economy was righting itself drew investors away from top-quality issues to seek higher returns. As a result of rigorous rallies following last winter’s severely depressed market, bond prices rose in a variety of corporate sectors and ratings categories. Resulting higher prices narrowed the extraordinarily wide spreads, or yield advantage, that had prevailed between Treasury and corporate issues during the economic crisis.

For the fiscal year ended September 30, 2009, Class A shares of Loomis Sayles Strategic Income Fund provided a total return at net asset value of 20.56%, including $0.86 in dividends and $0.08 in capital gains reinvested during the year. The fund outperformed its benchmark, Barclays Capital U.S. Aggregate Bond Index, which returned 10.56% over the period. It also outdistanced Morningstar’s Multisector Bond category, which had an average return of 13.15%.

WHAT WAS RESPONSIBLE FOR THE FUND’S STRONG PERFORMANCE?

Investment-grade corporate issues were among the best performers, with industrial bonds rated BBB by Moody’s Investor Services leading results. In addition, our emphasis on investment-grade industrials aided returns relative to the benchmark. Notable strength came from cable, wireline communications and oil field services companies. Consumer-related sectors, including healthcare and tobacco, also delivered strong performance, as did retail issues and others expected to benefit from an anticipated economic upturn. Financials were another source of positive performance, as surviving banks and other financial firms recovered from a period of exceptional stress. Real estate investment trusts and select utility companies also contributed. The high-yield sector as a whole gained the greatest impetus from investors’ renewed risk appetite, with financial securities rated CC by Moody’s Investors Service leading the way. Among high-yield industrial issues, automotive, pharmaceutical, and residential construction, as well as wireless telecommunications all boosted portfolio returns.

As currencies of commodity-rich countries rallied amid improving global growth prospects, the fund gained positive momentum from holdings denominated in the Brazilian real, the Norwegian krone, the New Zealand dollar and Indonesia’s rupiah. Although Canada’s dollar also strengthened, weak local market conditions diluted the contributions of the fund’s Canadian holdings. In contrast, strong regional markets amplified the positive impact of the fund’s euro-denominated investments.

Among convertibles, security-specific gains in the technology, wireline telecommunications and automotive industries added to results. Asset-backed obligations, especially credit-card issues, also moved higher. In addition, the fund’s relatively small positions in U.S. Treasury and government agency securities, as well as its underweight in mortgage-backed securities, proved helpful as improving risk tolerance caused investors to turn toward riskier assets in search of higher returns.

WHAT WERE THE PERIOD’S DISAPPOINTMENTS?

The fund experienced few areas of underperformance amid the widespread bullish sentiment in the past several months. High-yield electric utilities were a relative underperformer. In terms of quality categories, industrial bonds rated CCC by Moody’s detracted from the fund’s relative performance.

WHAT’S YOUR OUTLOOK?

Looking ahead, we continue to believe there is select value in corporate bonds. Despite their recent tightening, spreads remain wide relative to long-term averages. A vast majority of the spread tightening that has taken place this year is due to the re-emergence of liquidity in the markets. Over the long term, further spread tightening from these levels will most likely be generated by an improvement in global and U.S. economic fundamentals. Our view is that maintaining specific risk in the portfolio will present the best opportunity for long-term performance.

Global risk appetite has weakened the U.S. dollar, and we expect this may continue. Currencies from developed and emerging markets may offer more long-term upside potential, particularly the European peripheral currencies and Asian currencies tied to China and its global-growth story.

9

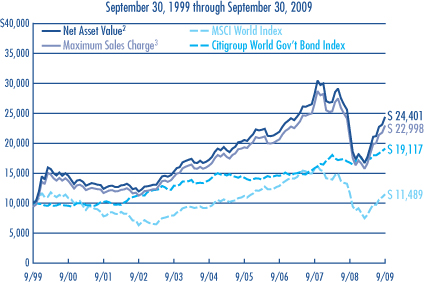

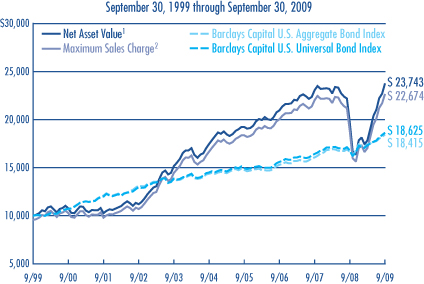

LOOMIS SAYLES STRATEGIC INCOME FUND

Investment Results through September 30, 2009

PERFORMANCE IN PERSPECTIVE

The charts comparing the fund’s performance to two indexes provide you with a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

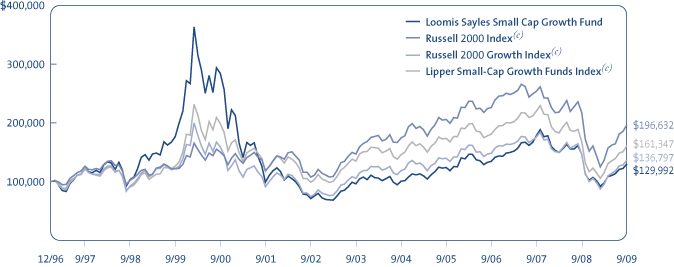

Growth of a $10,000 Investment in Class A Shares4

Average Annual Total Returns — September 30, 20094

| | | | | | | | | | | | |

| | | | | |

| | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | | | SINCE

INCEPTION | |

CLASS A (Inception 5/1/95) | | | | | | | | | | | | |

Net Asset Value1 | | 20.56 | % | | 6.35 | % | | 9.03 | % | | — | |

With Maximum Sales Charge2 | | 15.14 | | | 5.38 | | | 8.53 | | | — | |

| | | | | |

CLASS B (Inception 5/1/95) | | | | | | | | | | | | |

Net Asset Value1 | | 19.62 | | | 5.56 | | | 8.21 | | | — | |

With CDSC3 | | 14.62 | | | 5.24 | | | 8.21 | | | — | |

| | | | | |

CLASS C (Inception 5/1/95) | | | | | | | | | | | | |

Net Asset Value1 | | 19.66 | | | 5.55 | | | 8.21 | | | — | |

With CDSC3 | | 18.66 | | | 5.55 | | | 8.21 | | | — | |

| | | | | |

CLASS Y (Inception 12/1/99) | | | | | | | | | | | | |

Net Asset Value1 | | 20.91 | | | 6.63 | | | — | | | 9.22 | % |

| COMPARATIVE PERFORMANCE | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | | | SINCE

CLASS Y

INCEPTION | |

Barclays Capital U.S. Aggregate Bond Index | | 10.56 | % | | 5.13 | % | | 6.30 | % | | 6.37 | % |

Barclays Capital U.S. Universal Bond Index | | 10.91 | | | 5.15 | | | 6.42 | | | 6.47 | |

Morningstar Multisector Bond Fund Avg. | | 13.15 | | | 4.99 | | | 6.21 | | | 6.16 | |

See page 11 for a description of the indices.

All returns represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary and you may have a gain or loss when you sell your shares. All results include reinvestment of dividends and capital gains. Current returns may be higher or lower than those shown. Performance history includes periods from a predecessor fund. For performance current to the most recent month-end, visit www.funds.natixis.com. Class Y shares are available to certain investors, as described in the prospectus.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | | | |

| |

| | | % of Net Assets as of |

| CREDIT QUALITY | | 9/30/09 | | 9/30/08 |

Aaa | | 15.6 | | 18.3 |

Aa | | 6.1 | | 4.1 |

A | | 7.4 | | 8.1 |

Baa | | 30.8 | | 32.0 |

Ba | | 10.5 | | 10.0 |

B | | 6.9 | | 10.3 |

Caa | | 8.1 | | 7.4 |

Ca | | 3.9 | | 0.8 |

C | | 0.0 | | 0.0 |

Not Rated* | | 6.7 | | 8.8 |

Short-term and other | | 4.0 | | 0.2 |

Credit quality is based on ratings from Moody’s Investors Service.

* Securities that are not rated by Moody’s may be rated by another rating agency or by Loomis Sayles.

| | | | | | |

| |

| | | % of Net Assets as of | |

| EFFECTIVE MATURITY | | 9/30/09 | | | 9/30/08 | |

1 year or less | | 5.7 | | | 8.6 | |

1-5 years | | 25.8 | | | 20.6 | |

5-10 years | | 33.1 | | | 28.2 | |

10+ years | | 35.4 | | | 42.6 | |

Average Effective Maturity | | 12.3 | years | | 13.8 | years |

Portfolio characteristics will vary.

EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | | | |

| Share Class | | Gross Expense Ratio5 | | | Net Expense Ratio6 | |

A | | 0.98 | % | | 0.98 | % |

B | | 1.73 | | | 1.73 | |

C | | 1.73 | | | 1.73 | |

Y | | 0.73 | | | 0.73 | |

NOTES TO CHARTS

| 1 | Does not include a sales charge. |

| 2 | Includes maximum sales charge of 4.50%. |

| 3 | Performance for Class B shares assumes a maximum 5% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C share performance assumes a 1.00% CDSC applied when you sell shares within one year of purchase. |

| 4 | Fund performance has been increased by expense reductions and reimbursements, if any, without which performance would have been lower. |

| 5 | Before reductions and reimbursements. |

| 6 | After reductions and reimbursements. Expense reductions are contractual and are set to expire on 1/31/10. |

10

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the funds are actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

For more complete information on any Natixis Fund, contact your financial professional, visit the funds website at www.funds.natixis.com or call Natixis Funds at 800-225-5478 and ask for a free prospectus, which contains more complete information including charges and other ongoing expenses. Investors should consider a fund’s objective, risks and expenses carefully before investing. This and other fund information can be found in the prospectus. Please read the prospectus carefully before investing.

INDEX/AVERAGE DESCRIPTIONS

Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of investment-grade bonds with one- to ten-year maturities issued by the U.S. government, its agencies and U.S. corporations.

Barclays Capital Global Aggregate ex-USD Bond Index is an unmanaged index which provides a broad-based measure of the international investment-grade bond market.

Barclays Capital U.S. Corporate High-Yield Bond Index is a market-weighted, unmanaged index of fixed-rate, non-investment grade debt.

Barclays Capital U.S. 1-5 Year Government Bond Index is an unmanaged, market-weighted index of bonds issued by the U.S. government and its agencies, with maturities between one and five years.

Barclays Capital U.S. Credit Bond Index is an unmanaged index that includes all publicly issued, fixed-rate, nonconvertible, dollar-denominated, SEC-registered, U.S. investment-grade corporate debt, and foreign debt that meets specific maturity, liquidity and quality requirements.

Barclays Capital U.S. Universal Bond Index is an unmanaged index representing a blend of the Lehman Aggregate Bond Index, the High Yield Index, and the Emerging Market Index, among other indexes.

Morningstar Fund Averages are the average performance without sales charge of funds with similar investment objectives, as calculated by Morningstar, Inc.

PROXY VOTING INFORMATION

A description of the funds’ proxy voting policies and procedures is available without charge, upon request, by calling Natixis Funds at 800-225-5478; on the funds’ website at www.funds.natixis.com; and on the Securities and Exchange Commission’s (SEC’s) website at www.sec.gov. Information regarding how the funds voted proxies relating to portfolio securities during the 12-month period ended June 30, 2009 is available from the funds’ website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

The funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The funds’ Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling

1-800-SEC-0330.

| | | | |

| NOT FDIC INSURED | | MAY LOSE VALUE | | NO BANK GUARANTEE |

11

UNDERSTANDING FUND EXPENSES

As a mutual fund shareholder, you incur different costs: transaction costs, including sales charges (loads) on purchases, redemption fees and contingent deferred sales charges on redemptions; certain exchange fees; and ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. In addition, each fund may assess a minimum balance fee of $20 on an annual basis for accounts that fall below the required minimum to establish an account. Certain exemptions may apply. These costs are described in more detail in the funds’ prospectuses. The examples below are intended to help you understand the ongoing costs of investing in the funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table of each Class of fund shares shows the actual account values and actual fund expenses you would have paid on a $1,000 investment in the fund from April 1, 2009 through September 30, 2009. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 = 8.60) and multiply the result by the number in the Expenses Paid During Period column as shown below for your Class.

The second line in the table of each Class of fund shares provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs such as sales charges, redemption fees, or exchange fees. Therefore, the second line in the table of each fund is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

| | | | | | |

| LOOMIS SAYLES CORE PLUS BOND FUND | | BEGINNING ACCOUNT VALUE

4/1/2009 | | ENDING ACCOUNT VALUE

9/30/2009 | | EXPENSES PAID DURING PERIOD*

4/1/2009 – 9/30/2009 |

CLASS A | | | | | | |

Actual | | $1,000.00 | | $1,156.70 | | $4.87 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,020.56 | | $4.56 |

CLASS B | | | | | | |

Actual | | $1,000.00 | | $1,152.70 | | $8.90 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,016.80 | | $8.34 |

CLASS C | | | | | | |

Actual | | $1,000.00 | | $1,152.30 | | $8.90 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,016.80 | | $8.34 |

CLASS Y | | | | | | |

Actual | | $1,000.00 | | $1,158.40 | | $3.52 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,021.81 | | $3.29 |

| * | Expenses are equal to the Fund’s annualized expense ratio (after fee reduction/reimbursement): 0.90%, 1.65%, 1.65% and 0.65% for Class A, B, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 365 (to reflect the half-year period). |

12

UNDERSTANDING FUND EXPENSES

| | | | | | |

| LOOMIS SAYLES HIGH INCOME FUND | | BEGINNING ACCOUNT VALUE

4/1/2009 | | ENDING ACCOUNT VALUE

9/30/2009 | | EXPENSES PAID DURING PERIOD*

4/1/2009 – 9/30/2009 |

CLASS A | | | | | | |

Actual | | $1,000.00 | | $1,321.70 | | $6.69 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,019.30 | | $5.82 |

CLASS B | | | | | | |

Actual | | $1,000.00 | | $1,319.60 | | $11.05 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,015.54 | | $9.60 |

CLASS C | | | | | | |

Actual | | $1,000.00 | | $1,319.80 | | $11.05 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,015.54 | | $9.60 |

CLASS Y | | | | | | |

Actual | | $1,000.00 | | $1,323.60 | | $5.24 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,020.56 | | $4.56 |

| * | Expenses are equal to the Fund’s annualized expense ratio (after fee reduction/reimbursement): 1.15%, 1.90%, 1.90% and 0.90% for Class A, B, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 365 (to reflect the half-year period). |

| | | | | | |

| LOOMIS SAYLES INTERNATIONAL BOND FUND | | BEGINNING ACCOUNT VALUE

4/1/2009 | | ENDING ACCOUNT VALUE

9/30/2009 | | EXPENSES PAID DURING PERIOD*

4/1/2009 – 9/30/2009 |

CLASS A | | | | | | |

Actual | | $1,000.00 | | $1,229.20 | | $6.15 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,019.55 | | $5.57 |

CLASS C | | | | | | |

Actual | | $1,000.00 | | $1,225.30 | | $10.32 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,015.79 | | $9.35 |

CLASS Y | | | | | | |

Actual | | $1,000.00 | | $1,229.70 | | $4.75 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,020.81 | | $4.31 |

| * | Expenses are equal to the Fund’s annualized expense ratio (after fee reduction/reimbursement): 1.10%, 1.85% and 0.85%, for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 365 (to reflect the half-year period). |

13

UNDERSTANDING FUND EXPENSES

| | | | | | |

LOOMIS SAYLES LIMITED TERM GOVERNMENT AND

AGENCY FUND | | BEGINNING ACCOUNT VALUE

4/1/2009 | | ENDING ACCOUNT VALUE

9/30/2009 | | EXPENSES PAID DURING PERIOD*

4/1/2009 – 9/30/2009 |

CLASS A | | | | | | |

Actual | | $1,000.00 | | $1,050.60 | | $4.63 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,020.56 | | $4.56 |

CLASS B | | | | | | |

Actual | | $1,000.00 | | $1,047.70 | | $8.47 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,016.80 | | $8.34 |

CLASS C | | | | | | |

Actual | | $1,000.00 | | $1,047.70 | | $8.47 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,016.80 | | $8.34 |

CLASS Y | | | | | | |

Actual | | $1,000.00 | | $1,052.80 | | $3.34 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,021.81 | | $3.29 |

| * | Expenses are equal to the Fund’s annualized expense ratio (after fee reduction/reimbursement): 0.90%, 1.65%, 1.65% and 0.65%, for Class A, B, C and Y, respectively, multiplied by the average account value over the period multiplied by the number of days in the most recent fiscal half-year, divided by 365 (to reflect the half-year period). |

| | | | | | |

| LOOMIS SAYLES STRATEGIC INCOME FUND | | BEGINNING ACCOUNT VALUE

4/1/2009 | | ENDING ACCOUNT VALUE

9/30/2009 | | EXPENSES PAID DURING PERIOD*

4/1/2009 – 9/30/2009 |

CLASS A | | | | | | |

Actual | | $1,000.00 | | $1,331.70 | | $5.73 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,020.16 | | $4.96 |

CLASS B | | | | | | |

Actual | | $1,000.00 | | $1,327.00 | | $10.09 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,016.39 | | $8.74 |

CLASS C | | | | | | |

Actual | | $1,000.00 | | $1,326.20 | | $10.09 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,016.39 | | $8.74 |

CLASS Y | | | | | | |

Actual | | $1,000.00 | | $1,333.90 | | $4.15 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,021.51 | | $3.60 |

| * | Expenses are equal to the Fund’s annualized expense ratio: 0.98%, 1.73%, 1.73% and 0.71% for Class A, B, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 365 (to reflect the half-year period). |

14

BOARD APPROVALOFTHE EXISTING ADVISORYAND SUB-ADVISORY AGREEMENTS

The Board of Trustees, including the Independent Trustees, considers matters bearing on each Fund’s advisory agreement and, with respect to the Loomis Sayles Core Plus Bond Fund, its Advisory Administration Agreement (collectively, the “Agreements”) at most of its meetings throughout the year. Each year, usually in the spring, the Contract Review and Governance Committee of the Board meets to review the Agreements to determine whether to recommend that the full Board approve the continuation of the Agreements, typically for an additional one-year period. After the Committee has made its recommendation, the full Board, including the Independent Trustees, determines whether to approve the continuation of the Agreements.

In connection with these meetings, the Trustees receive materials that the Funds’ investment adviser ( the “Adviser”) believes to be reasonably necessary for the Trustees to evaluate the Agreements. These materials generally include, among other items, (i) information on the investment performance of the Funds and the performance of peer groups of funds and the Funds’ performance benchmarks, (ii) information on the Funds’ advisory fees and other expenses, including information comparing the Funds’ expenses to those of peer groups of funds and information about any applicable expense caps and fee “breakpoints,” (iii) sales and redemption data in respect of the Funds, (iv) information about the profitability of the Agreements to the Funds’ Adviser and (v) information obtained through the completion of a questionnaire by the Adviser (the Trustees are consulted as to the information requested through that questionnaire). The Board of Trustees, including the Independent Trustees, also consider other matters such as (i) the Adviser’s financial results and financial condition, (ii) each Fund’s investment objective and strategies and the size, education and experience of the Adviser’s investment staff and its use of technology, external research and trading cost measurement tools, (iii) arrangements in respect of the distribution of the Funds’ shares and the related costs, (iv) the procedures employed to determine the value of the Funds’ assets, (v) the allocation of the Funds’ brokerage, if any, including, if applicable, allocations to brokers affiliated with the Adviser and the use of “soft” commission dollars to pay Fund expenses and to pay for research and other similar services, (vi) the resources devoted to, and the record of compliance with, the Funds’ investment policies and restrictions, policies on personal securities transactions and other compliance policies, (vii) information about amounts invested by the Funds’ portfolio managers in the Funds or in similar accounts that they manage and (viii) the general economic outlook with particular emphasis on the mutual fund industry. Throughout the process, the Trustees are afforded the opportunity to ask questions of and request additional materials from the Adviser.

In addition to the materials requested by the Trustees in connection with their annual consideration of the continuation of the Agreements, the Trustees receive materials in advance of each regular quarterly meeting of the Board of Trustees that provide detailed information about the Funds’ investment performance and the fees charged to the Funds for advisory and other services. This information generally includes, among other things, an internal performance rating for each Fund based on agreed-upon criteria, graphs showing each Fund’s performance and fee differentials against each Fund’s peer group of funds, performance ratings provided by a third-party, total return information for various periods, and third-party performance rankings for various periods comparing a Fund against its peer group. The portfolio management team for each Fund or other representatives of the Adviser make periodic presentations to the Contract Review and Governance Committee and/or the full Board of Trustees, and Funds identified as presenting possible performance concerns may be subject to more frequent board presentations and reviews. In addition, each quarter the Trustees are provided with detailed statistical information about each Fund’s portfolio.

The Board of Trustees most recently approved the continuation of the Agreements at their meeting held in June 2009. The Agreements were continued for a one-year period for the Funds. In considering whether to approve the continuation of the Agreements, the Board of Trustees, including the Independent Trustees, did not identify any single factor as determinative. Individual Trustees may have evaluated the information presented differently from one another, giving different weights to various factors. Matters considered by the Trustees, including the Independent Trustees, in connection with their approval of the Agreements included the factors listed below.

The nature, extent and quality of the services provided to the Funds under the Agreements. The Trustees considered the nature, extent and quality of the services provided by the Adviser and its affiliates to the Funds and the resources dedicated to the Funds by the Adviser and its affiliates, including recent or planned investments by the Adviser in additional personnel or other resources. They considered the need for the Adviser to offer competitive compensation in order to attract and retain capable personnel and the need for the Adviser to expend additional resources as the Funds grew in size.

For each Fund, the Trustees also considered the benefits to shareholders of investing in a mutual fund that is part of a family of funds that offers shareholders the right to exchange shares of one type of fund for shares of another type of fund, and provides a variety of fund and shareholder services.

15

BOARD APPROVALOFTHE EXISTING ADVISORYAND SUB-ADVISORY AGREEMENTS

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the nature, extent and quality of services provided supported the renewal of the Agreements.

Investment performance of the Funds and the Adviser. As noted above, the Trustees received information about the performance of the Funds over various time periods, including information which compared the performance of the Funds to the performance of peer groups of funds and the Funds’ respective performance benchmarks. In addition, the Trustees also reviewed data prepared by an independent third party which analyzed the performance of the Funds using a variety of performance metrics, including metrics which also measured the performance of the Funds on a risk adjusted basis.

With respect to each Fund, the Board concluded that the Fund’s performance or other relevant factors supported the renewal of the Agreement relating to that Fund. In the case of each Fund that had performance that lagged that of a relevant peer group for certain (although not necessarily all) periods, the Board concluded that other factors relevant to performance supported renewal of the Funds’ Agreements. These factors varied from Fund to Fund, but included one or more of the following: (1) that the Fund had a limited operating history, (2) that the underperformance was attributable, to a significant extent, to investment decisions (such as security selection or sector allocation) by the Fund’s Adviser that were reasonable and consistent with the Fund’s investment objective and policies (3) that the Fund’s performance, although lagging in certain recent periods, was stronger over the longer term (4) that the Fund’s more recent performance was competitive when compared to relevant performance benchmarks or peer groups, and (5) reductions in the Fund’s expense levels resulting from decreased expenses were not yet fully reflected in the Fund’s performance results.

The Trustees also considered the Adviser’s performance and reputation generally, the Funds’ performance as a fund family generally (as noted by certain financial publications), and the historical responsiveness of the Adviser to Trustee concerns about performance and the willingness of the Adviser to take steps intended to improve performance.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the performance of the Funds and the Adviser and/or other relevant factors supported the renewal of the Agreements.

The costs of the services to be provided and profits to be realized by the Adviser and its affiliates from their respective relationships with the Funds. The Trustees considered the fees charged to the Funds for advisory services as well as the total expense levels of the Funds. This information included comparisons (provided both by management and also by an independent third party) of the Funds’ advisory fees and total expense levels to those of their peer groups and information about the advisory fees charged by the Adviser to comparable accounts. In considering the fees charged to comparable accounts, the Trustees considered, among other things, management’s representations about the differences between managing mutual funds as compared to other types of accounts, including the additional resources required to effectively manage and the greater regulatory costs associated with the management of mutual fund assets. In evaluating each Fund’s advisory fee, the Trustees also took into account the demands, complexity and quality of the investment management of such Fund. The Trustees considered that over the past several years, management had made recommendations regarding reductions in advisory fee rates, implementation of advisory fee breakpoints and the institution of advisory fee waivers and expense caps for various Funds in the Fund family. They noted that, as of December 31, 2008, all of the Natixis Funds in this report have expense caps in place, and the Trustees considered the amounts waived or reimbursed by the Adviser under these caps. The Trustees noted that the Loomis Sayles Strategic Income Fund had an advisory fee rate that was above the median of a peer group of funds. The Trustees considered the circumstances that accounted for such relatively higher expenses. The Trustees noted that for the Loomis Sayles Strategic Income Fund, the Fund’s total expense ratio was below the median even though the advisory fee was above the median and they noted that they had recently implemented an additional breakpoint in the Fund’s advisory fee schedule. The Trustees also noted that while the Loomis Sayles Limited Term Government and Agency Fund’s advisory fee was above the median for its peer group of funds, after the application of the Fund’s expense cap, it was below the median.

The Trustees also considered the compensation directly or indirectly received or to be received by the Adviser and its affiliates from their relationships with the Funds. The Trustees reviewed information provided by management as to the profitability of the Adviser’s and its affiliates’ relationships with the Funds, and information about the allocation of expenses used to calculate profitability. They also reviewed information provided by management about the effect of distribution costs and changes in asset levels on Adviser profitability, including information regarding resources spent on distribution activities. When reviewing profitability, the Trustees also considered information about court cases in which adviser profitability was an issue, the performance of the relevant Funds, the expense levels of the Funds, and whether the Adviser had implemented breakpoints and/or expense caps with respect to such Funds.

16

BOARD APPROVALOFTHE EXISTING ADVISORYAND SUB-ADVISORY AGREEMENTS

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the advisory fee charged to each of the Funds was fair and reasonable, and that the costs of these services generally and the related profitability of the Adviser and its affiliates in respect of their relationships with the Funds supported the renewal of the Agreements.

Economies of Scale. The Trustees considered the existence of any economies of scale in the provision of services by the Adviser and whether those economies are shared with the Funds through breakpoints in their investment advisory fees or other means, such as expense waivers or caps. The Trustees noted that each of the Funds was subject to an expense cap or waiver. For Loomis Sayles Strategic Income Fund, the Trustees noted that they had recently implemented an additional breakpoint in response to the growth of assets in the Fund. The Trustees further considered the effect of recent market volatility on all of the Fund’s assets and possible effect on the Fund’s future profitability. In considering these issues, the Trustees also took note of the costs of the services provided (both on an absolute and a relative basis) and the profitability to the Adviser and its affiliates of their relationships with the Funds, as discussed above.

After reviewing these and related factors, the Trustees considered, within the context of their overall conclusions regarding each of the Agreements, that the extent to which economies of scale were shared with the Funds supported the renewal of the Agreements.

The Trustees also considered other factors, which included but were not limited to the following:

| · | | the effect of recent market and economic turmoil on the performance, asset levels and expense ratios of each Fund. |

| · | | whether each Fund has operated in accordance with its investment objective and the Fund’s record of compliance with its investment restrictions, and the compliance programs of the Funds and the Adviser. They also considered the compliance-related resources the Adviser and its affiliates were providing to the Funds. |

| · | | the nature, quality, cost and extent of administrative and shareholder services performed by the Adviser and its affiliates, both under the Agreements and under separate agreements covering administrative services. |

| · | | so-called “fallout benefits” to the Adviser, such as the engagement of affiliates of the Adviser to provide distribution, administrative and brokerage services to the Funds, and the benefits of research made available to the Adviser by reason of brokerage commissions generated by the Funds’ securities transactions. The Trustees considered the possible conflicts of interest associated with these fallout and other benefits, and the reporting, disclosure and other processes in place to disclose and monitor such possible conflicts of interest. |

| · | | the Trustees’ review and discussion of the Funds’ advisory arrangements in prior years, and management’s record of responding to Trustee concerns raised during the year and in prior years. |

Based on their evaluation of all factors that they deemed to be material, including those factors described above, and assisted by the advice of independent counsel, the Trustees, including the Independent Trustees, concluded that each of the existing Agreements should be continued through June 30, 2010.

17

LOOMIS SAYLES CORE PLUS BOND FUND — PORTFOLIOOF INVESTMENTS

Investments as of September 30, 2009

| | | | | | |

Principal