UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06241

Loomis Sayles Funds II

(Exact name of Registrant as specified in charter)

888 Boylston Street, Suite 800 Boston, Massachusetts 02199-8197

(Address of principal executive offices) (Zip code)

Susan McWhan Tobin, Esq.

Natixis Distribution, LLC

888 Boylston Street, Suite 800

Boston, Massachusetts 02199-8197

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2139

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Item 1. Reports to Stockholders.

(a) The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Annual Report

December 31, 2023

Loomis Sayles International Growth Fund |

|

Natixis Oakmark International Fund |

Natixis U.S. Equity Opportunities Fund |

Vaughan Nelson Mid Cap Fund |

Vaughan Nelson Small Cap Value Fund |

IMPORTANT NOTICE TO SHAREHOLDERS

The Securities and Exchange Commission (SEC) has adopted new regulations that will result in changes to the design and delivery of annual and semiannual shareholder reports. Beginning in July 2024, Funds will be required by the SEC to send shareholders a paper copy of a new tailored shareholder report in place of the full shareholder report that is currently being provided. If you would like to receive shareholder reports and other communications from the Funds electronically, instead of by mail, you may make that request at www.icsdelivery.com/natixisfunds. If you have already elected to receive shareholder reports electronically, you will not be affected by this change, and you need not take any action.

Loomis Sayles International Growth Fund

|

Aziz V. Hamzaogullari, CFA® |

Loomis, Sayles & Company, L.P.

|

Investment GoalThe Fund's investment goal is long-term growth of capital.

Market Conditions

International equities delivered strong, double-digit total returns in 2023, with much of the gain occurring in November and December. The asset class generally performed well in the first half of the year, with stocks trending higher in choppy trade amid expectations that central banks’ interest-rate increases were largely nearing their conclusion. Sentiment shifted in the third quarter, however, as worries mounted that central banks would need to keep interest rates “higher for longer.” The international equity markets experienced a protracted decline in the August-October time frame as a result, bringing the major international indexes back near the levels where they began the year. The outlook changed yet again in November, when a series of weaker-than-expected inflation reports and comments from U.S. Federal Reserve officials indicated that not only were interest-rate increases largely concluded, but also that rate cuts were likely to begin as soon as the first half of 2024. Stocks rose in response, helping the key indexes finish December near their highs for the year.

The European markets were a key driver of performance for the broader asset class. Economic growth in the region exceeded the depressed expectations that existed coming into 2023, when concerns about the effects of the war in Ukraine remained at the forefront. Italy and Spain were top performers in Europe, as were the larger markets of Germany and France. The Asian markets, while posting gains, lagged somewhat due to the more proximate impact of China’s sub-par growth.

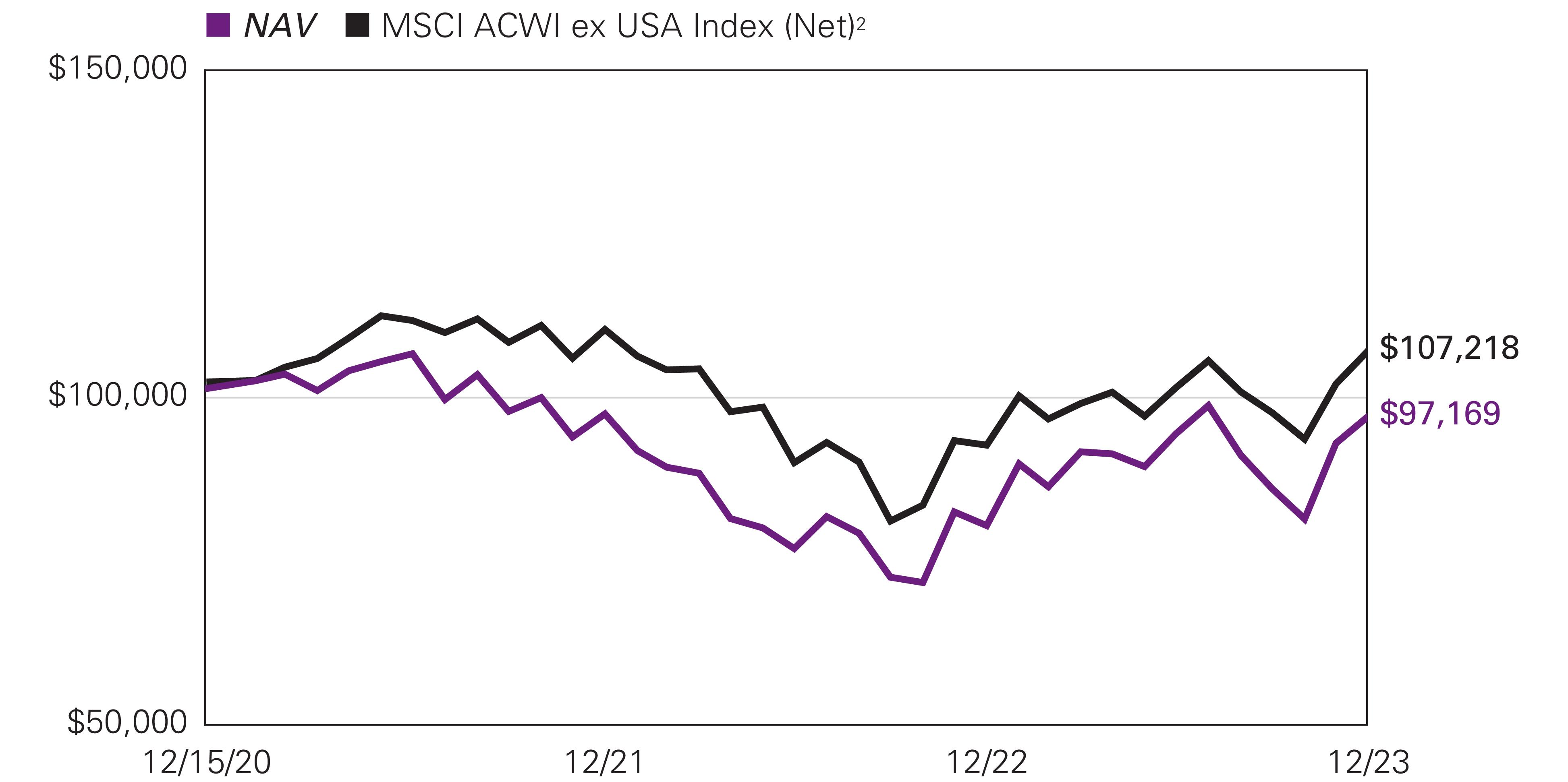

Performance Results

For the 12 months ended December 31, 2023, Class Y shares of the Loomis Sayles International Growth Fund returned 20.81% at net asset value. The Fund outperformed its benchmark, the MSCI All Country World Index ex USA Index (Net), which returned 15.62%.

Explanation of Fund Performance

We are an active manager with a long-term, private equity approach to investing. Through our proprietary bottom-up research framework, we look to invest in those few high-quality businesses with sustainable competitive advantages and profitable growth when they trade at a significant discount to intrinsic value. Given the rare confluence of quality, growth, and valuation, we may study dozens of companies but may only invest in a select few businesses each year. We believe identifying those few businesses with such characteristics is an art, not a science. As a result of this rigorous approach, ours is a selective, high-conviction portfolio of typically 30–45 names.

The Fund’s positions in MercadoLibre, Novo Nordisk, and WiseTech Global contributed the most to performance. Stock selection in the consumer discretionary, information technology, and healthcare sectors, along with our allocations in the information technology sector, contributed positively to relative performance.

MercadoLibre is the largest online commerce platform in Latin America. The company offers its users an ecosystem of six integrated e-commerce services that include its marketplace, payment and fintech solutions, shipping and logistics, advertising, classified listings, and merchant web services. The company operates in 18 countries representing the vast majority of Latin American GDP, and its 148 million active users in 2022 represented approximately 30% of the region’s estimated 480 million internet users. We believe MercadoLibre benefits from strong and sustainable competitive advantages that include its network and ecosystem, brand, and understanding of local markets that collectively contribute to its leadership position in each market it serves. A Fund holding since inception, the company delivered strong revenue growth that was consistently above consensus expectations, driven by growth in gross merchandise volume and payments, and continued market share gains in both e-commerce and payments. MercadoLibre remains in an elevated investment cycle to build out a more powerful ecosystem focused on greater product selection, easier payment options, wider credit availability, and lower cost and faster speed of delivery. The company also expects to increase its investments in several areas, including first-party sales, an improved loyalty program, and advertising technology. While these investments impact near-term profitability, operating margins still expanded substantially and exceeded expectations throughout the period, and we believe the investments have contributed to market share gains in e-commerce and payments and a stronger competitive position. We believe management remains focused on balancing the investments needed to further improve user experience and extend the company’s

Loomis Sayles International Growth Fund

leadership in e-commerce and payments, while maintaining a sustainable and profitable financial model. With continued growth in internet access, increasing availability of credit, and the company’s continuing investments to improve the ease and convenience of transacting online, we believe MercadoLibre remains well positioned for sustained growth over the next decade, driven by the secular growth of e-commerce across Latin America. Over our forecast period, we believe the penetration of e-commerce can more than double, which would bring the penetration rate into the mid-20% level. We believe the current market price embeds expectations for key revenue and cash flow growth drivers that are well below our long-term assumptions. As a result, we believe the shares trade at a significant discount to our estimate of intrinsic value and offer a compelling long-term reward-to-risk opportunity.

Headquartered in Denmark, Novo Nordisk is a global healthcare company with 100 years of innovation and leadership in diabetes care. Over this time, Novo has amassed unparalleled experience in the biology of diabetes, expertise in protein science, and developed significant competitive advantages as a result. Its diabetes products have captured approximately one-third of the global branded diabetes care market, which along with its first-mover position in related obesity therapies account for over 90% of the company’s annual revenues. We believe Novo’s strong and sustainable advantages include its deep experience in diabetes care and therapeutic proteins, strong infrastructure that took decades to build, efficient manufacturing techniques, robust pipeline, and economies of scale. A Fund holding since inception, shares have been up strongly since early August when the company released results from a five-year cardiovascular outcomes trial for Wegovy, the company’s newest GLP-1 treatment for obesity. Among non-type 2 diabetes obese patients with established cardiovascular (CV) disease, the therapy resulted in a 20% decrease in CV events such as CV death, heart attack, and stroke, versus the placebo. The 17,500-person trial represents the first study evaluating the longer-term benefits that GLP-1 therapies can provide to an obese population. The company’s financial results also reflected strong execution as year-to-date sales rose 33% year over year, driven by strong uptake in GLP-1 therapies across both its diabetes and obesity-care franchises, and operating profit grew 37%. The GLP-1 class of therapies are a quickly growing class of medications that while first documented in 1987, were first approved for type-2 diabetes in 2005 and later for obesity in 2014. The therapies are currently being tested in a range of comorbidities including heart failure, sleep apnea, NASH (nonalcoholic steatohepatitis), and kidney disease. In the diabetes indication, GLP-1 sales grew 49% year over year, contributing to the company’s nearly 55% total GLP-1 market share. In addition to targeting diabetes with its GLP-1s, in 2021, Novo received approval for semaglutide (the same molecule behind its leading diabetes therapies, Ozempic and Rybelsus) in the obesity setting under the brand name Wegovy. While operational challenges limited the initial production of Wegovy, the company is seeing robust early demand which contributed to 174% year-to-date sales growth in its nascent obesity care franchise. Diabetes is a global epidemic with an estimated population of 530 million. The market has been growing annually in the low double digits over the last ten years, driven by aging of the global population and increasing obesity. Further, there are estimated to be almost 500 million non-diabetic obese people globally who may benefit from Novo’s therapies. We believe Novo’s deep experience in diabetes care and leadership in the nascent obesity market, differentiated product suite, and leading innovation should enable the company to grow revenues and free cash flow in the low double digits over our long-term investment horizon. We believe the company’s shares continue to sell at a meaningful discount to our estimate of intrinsic value and offer an attractive reward-to-risk opportunity.

Wisetech Global is the leading software solutions provider to the global logistics industry. Founded in 1994 to provide freight-forwarding and customs software to the Australian logistics industry, Wisetech solutions are used in whole or in part by over 85% of the world’s 50 largest third-party logistics providers (3PLs) and almost all of the 25 largest freight forwarders, led by the company’s primary SAAS (software-as-a-service) platform, CargoWise One. From a single unified platform, the company offers function-specific and enterprise-wide modules that support the complex international movement of goods and create substantial efficiencies for its logistics clients. The company’s vision is to become the world’s operating system for global logistics. A holding since Fund inception, Wisetech reported financial results for its 2023 fiscal year ended June 2023 that reflected continued strong penetration of its end markets and organic revenue growth in excess of 20%. After having substantially slowed its pace of acquisition activity in recent quarters, the company announced two sizeable acquisitions in landside logistics earlier in the year, which continued to expand the company’s capabilities outside of forwarding to execute on its strategy of building a universal operating system for global logistics. However, shares pulled back midyear after the company disclosed that it expects the acquisitions to depress its operating margins for the next few years. We do not believe the decline in margins is structural, and in our view, the company continues to execute well on its long-term strategic vision. Outside of its acquisition activity, the company showed continued growth among its existing client base, with every calendar-year cohort of new clients going back to 2006 showing growth over the prior year, continuing a multi-year trend. We believe Wisetech benefits from strong and sustainable competitive advantages that include an installed client base with high switching costs, its freight-forwarding industry expertise, significant investments in research and development, its brand, and network. We believe Wisetech will benefit from secular growth in logistics software and services as companies increasingly move towards outsourcing and away from less effective in-house solutions. With virtually no comparable off-the-shelf competition to its unified global platform, Wisetech is the dominant market share leader in its legacy freight-forwarding market. We estimate the company now captures over 20% share of its addressable freight forwarding market, up from the mid-single digits five years ago, with gains coming at the expense of proprietary solutions or competitor offerings that addressed only limited industry functions or geographies. Through underlying industry growth, continued market share gains in its legacy freight-forwarding market, and ongoing penetration of other

Loomis Sayles International Growth Fund

parts of the logistics industry performed by 3PLs, including warehouse management, land transportation, and cargo handling, we believe the company can generate compounded annual revenue growth of approximately 20% over our long-term investment horizon, with faster growth in operating profits and free cash flow as the company benefits from scale and operating leverage. Prior to the share price drop that followed the company’s lowered margin guidance, we meaningfully trimmed our position in the company, which had been our largest position at the time. We continue to believe the expectations embedded in Wisetech’s share price underestimate the company’s superior positioning and the sustainability of its growth. As a result, we believe the shares trade at a discount to our estimate of intrinsic value and represent an attractive reward-to-risk opportunity.

The Fund’s positions in Yum China, Budweiser Brewing APAC, and Doximity detracted the most from performance. Stock selection in the consumer staples, industrials, and communication services sectors, as well as our allocations in the consumer staples, healthcare, industrials, consumer discretionary, financials, and communication services sectors, detracted from relative performance.

Yum China is the largest restaurant company in China, operating over 14,000 restaurants primarily under the KFC and Pizza Hut brands. A Fund holding since inception, Yum China reported financial and operating results throughout the period that we believe reflected the company’s success in navigating a challenging China consumer spending environment that was still impacted by Covid-19 and related restrictions in the early part of the year. Shares responded negatively to the company’s most recent quarterly financial results that were below consensus expectations, despite including record revenues, operating profits, and net new store openings. The company observed a noticeable slowdown in consumer traffic in September 2023 that continued into the fourth quarter as macroeconomic weakness persists and more local competitors have returned to the market as China continues to normalize post Covid. This near-term economic weakness does not affect our structural investment thesis for the company, which continues to expand into lower-tier cities while consistently innovating to sustain consumer purchases – especially among its over 460 million loyalty members. We also believe the company has the products and scale to offer increasingly value-conscious consumers attractive food options at all price points. We believe Yum China’s strong and sustainable competitive advantages include its exclusive license to operate and franchise two of the most prominent restaurant brands in China, the scale of its distribution and supply chain infrastructure, a first-mover advantage in real estate procurement, which allows the company to identify the best locations with respect to traffic flow and thereby offer the most convenient service, and decades of experience in restaurant operations. The Chinese economy is transitioning to a consumption-driven economy, following a path similar to that of other developing economies. We believe this will fuel future consumption spending, including expenditures in restaurants, as food options such as Pizza Hut and KFC become increasingly affordable to an emerging middle class with rising levels of disposable income. With its iconic brands, large and complex supply chain infrastructure, and real estate procurement expertise, we believe Yum China remains well positioned to benefit from the secular growth of consumer spending on restaurants in China. We believe the current market price embeds expectations for free cash flow growth that are well below our long-term estimates. As a result, we believe the company is selling at a significant discount to our estimate of intrinsic value, and offers a compelling reward-to-risk opportunity.

Budweiser Brewing Company APAC Ltd (Bud APAC) is the Asia-Pacific division of Anheuser-Busch InBev (AB InBev), the world’s largest beer brewer and distributor. The company became a publicly traded entity following its September 2019 initial public offering (IPO) and remains 87% owned by AB InBev. Bud APAC is the market share leader in its two largest markets, China and South Korea, which account for over 90% of revenues. The company sells over 50 brands across all segments of the beer market, but is focused on the premium segments where it is the regional leader. We believe Bud APAC’s strong and sustainable competitive advantages include its portfolio of leading local and global beer brands, difficult-to-replicate global and local scale in manufacturing, and strong distribution capabilities, which contribute to leading regional market share. On a standalone basis, Bud APAC is one of the largest brewers in the world and over our long-term investment horizon, we believe it is among the best-positioned companies in the entire value chain. A Fund holding since inception, over the past year, Bud APAC demonstrated continued recovery from the impact of the pandemic on alcohol consumption in on-premise consumption channels – particularly in its largest country, China. However, the market reacted negatively to the company’s performance in South Korea, its second largest country, which accounts for approximately 20% of its EBITDA (earnings before interest, taxes, depreciation and amortization), and where it is the leader in a duopoly structure. The South Korea beer industry is facing material near-term headwinds as consumer spending has softened. This has resulted in industry growth slowing to what we believe is below the long-term structural growth rate. Coupled with high cost inflation, which the company is slowly recovering through both pricing and premiumization, Bud APAC has also experienced a decrease in profit margins. Over the long-term, we believe the beer industry will benefit from structural drivers that include growth in per capita consumption and premiumization. Today, premium beer represents only 25% of total volume in South Korea. We believe premium beer can approach 40% as in other developed markets and that margins will improve as the company continues to recoup inflation costs through price increases. We believe the secular growth opportunity for Bud APAC is long-term growth in Asia-Pacific emerging market spending on beer, in particular, China and India. Today, the Asia-Pacific beer markets in which Bud APAC is primarily focused, namely China, South Korea and India, represent an estimated $120 billion in annual retail spending, which has grown at a mid-single-digit percentage over the past decade. As a function of its numerous competitive advantages, over our long-term investment horizon, we believe the company can generate mid-single-digit growth in revenue, driven by mid-to-high single-digit

Loomis Sayles International Growth Fund

growth in China and India, and low single-digit growth in South Korea. With respect to profitability, we believe Bud APAC will benefit in all of its markets from premiumization, which improves the gross margin, greater efficiency within its sales and marketing expenditures, which are high when compared with AB InBev’s other regions, and operating leverage. Combining these drivers, we believe operating margins will expand and operating profits will thereby grow faster than revenue. In addition, as revenue growth outpaces stable capital expenditures and working capital efficiency further improves, we expect free cash flow will grow faster than revenues and profits. Over our investment time horizon, we believe free cash flow will grow at a mid-to-high single-digit compounded annual rate. We believe the share price embeds expectations that underestimate the long-term secular growth drivers and the company’s superior competitive position. As a result, we believe the shares are selling at a significant discount to our estimate of intrinsic value, representing a compelling reward-to-risk opportunity.

Doximity is a leading cloud-based platform specifically built for US medical professionals (“MPs”). The company was founded in 2010 and has grown to over 2 million members, including approximately 800,000 physicians representing every medical specialty. Doximity provides a single place for MPs to access productivity tools that enable collaboration with colleagues, secure coordination of patient care, virtual patient visits, customized medical news and research, and career management. Doximity is free to healthcare providers and monetizes its platform primarily by providing targeted marketing access to customers that are largely pharmaceutical manufacturers and healthcare systems, which accounted for over 90% of revenue in its most recent fiscal year. A portfolio holding since the first quarter of 2022, shares responded negatively to the company’s fiscal first quarter financial report in August. The company reported quarterly financial results that were fundamentally solid and in line with consensus expectations. However, management significantly lowered its full-year revenue guidance, implying 10% year-over-year growth versus a previous estimate of 20%. Doximity typically enters its fiscal year with approximately 60%-65% of subscription-based revenue already under contract, with a further 30%-35% generated through renewing and upselling existing customers – typically in the summer months. In 2023, the company experienced substantially lower upsell rates, which it attributed to slowing industry spending and the company’s “white-glove” approach to client sales that is more time-intensive than the programmatic banner advertising that captured share during the summer. We believe Doximity’s strong and sustainable competitive advantages include the power of its network, its “physicians first” focus, and its trusted reputation and brand. The company has firmly established itself as the de facto digital network for healthcare professionals, including over 80% of US physicians (up from 25% in 2013) and over 90% of graduating US medical students. Members average over 50 connections with Doximity colleagues, which drives utility through referrals, care coordination, knowledge exchange, and career management. A powerful network effect occurs as the number and engagement of members has increased; Doximity has more data to create engaging and useful products that are specifically tailored to physician workflows, which in turn drives higher membership and greater stickiness among users. Shares partially rebounded following the most recent earnings release in November 2023, which exceeded management’s guidance for revenue and operating profit, leading the company to modestly raise its full-year outlook. The company also reported that active workflow users reached record levels, as did the number of quarterly, monthly, weekly, and daily active users – suggesting continued strong levels of engagement among its physician user base. Notably, daily users grew the most, underscoring the integral role Doximity now plays in day-to-day patient care. Further, net revenue retention among the company’s 20 largest customers was 119%, versus 114% overall – indicating that its most sophisticated and engaged clients continue to be the company’s fastest growing customer cohort. We believe Doximity’s primary growth driver is the secular shift from traditional marketing channels to digital channels, specifically in healthcare, where digital spending has lagged due in part to a historic reliance on pharmaceutical sales representatives. Today, market intelligence firm IDC estimates less than 30% of healthcare advertising spending is via digital channels, versus 46% on an industry-wide basis and greater than 80% in industries such as computing, appliances, and media and entertainment. Given the superior return on investment (ROI) for digital advertising as opposed to traditional advertising, coupled with growing restrictions on the ability to gain access to key healthcare decision makers through traditional, in-person methods, we estimate that digital marketing expenditures will grow substantially over our long-term investment horizon to approach 50% of total healthcare advertising spending. As a physicians-first company, Doximity has historically allocated approximately 90% of its R&D (research and development) spending towards physician-facing products. The company intends to allocate a higher level of R&D spending to build client-facing technologies that enable advertising clients to more-seamlessly direct incremental advertising dollars akin to other successful ad platforms and which likely benefited less-advantaged banner advertising during the quarter. The company is currently beta testing a new self-service client portal that it expects to be ready in advance of the 2024 upsell season. With its commanding penetration among healthcare decision makers and superior ROIs for advertisers, we believe Doximity can grow its capture of the digital opportunity from approximately 5% today to exceed 25%. Over our long-term investment horizon, we believe the company can generate approximately 20% compounded annual growth in overall revenues. As the company further penetrates its existing market and gains scale, we believe it will benefit from operating leverage, and that operating profits and free cash flow will grow faster than revenue. We believe Doximity’s share price embeds expectations for key revenue and cash flow growth drivers that are well below our long-term assumptions. As a result, we believe the company is selling at a significant discount to our estimate of its intrinsic value and offers a compelling reward-to-risk opportunity. We added to our holdings in the company during the year.

All aspects of our quality-growth-valuation investment thesis must be present simultaneously for us to make an investment. Often our research is completed well in advance of the opportunity to invest. We are patient investors and maintain coverage of high-quality

Loomis Sayles International Growth Fund

businesses in order to take advantage of meaningful price dislocations if and when they occur. During the period we initiated a new position in Arm Holdings plc. We added to our existing holdings in Adyen, Block, and Doximity. We trimmed our existing positions in Novartis and WiseTech Global.

Outlook

Our investment process is characterized by bottom-up fundamental research and a long-term investment time horizon. The nature of the process leads to a lower-turnover portfolio in which sector positioning is the result of stock selection. The Fund ended the year with overweight positions in the consumer discretionary, consumer staples, healthcare, information technology, and communication services sectors and was underweight in the financials and industrials sectors. We had no exposure to stocks in the materials, energy, utilities, or real estate sectors. From a geographic standpoint we were overweight in emerging markets and Europe and underweight in developed Asia and North America.

Top Ten Holdings as of December 31, 2023 |

| |

1 Novo Nordisk AS, Class B | |

| |

| |

| |

| |

| |

| |

| |

| |

10 Shopify, Inc., Class A | |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments, are presented on an individual security basis and do not represent holdings of the issuer. |

Hypothetical Growth of $100,000 Investment in Class Y Shares1 |

December 15, 2020 (inception) through December 31, 2023 |

Loomis Sayles International Growth Fund

Average Annual Total Returns —December 31, 20231 |

| | | |

| | |

Class Y (Inception 12/15/20) | | | | |

| | | | |

Class A (Inception 12/15/20) | | | | |

| | | | |

With 5.75% Maximum Sales Charge | | | | |

Class C (Inception 12/15/20) | | | | |

| | | | |

| | | | |

Class N (Inception 12/15/20) | | | | |

| | | | |

| | | | |

MSCI ACWI ex USA Index (Net)2 | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com/performance. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| The MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 Developed Markets (DM) countries (excluding the US) and 24 Emerging Markets (EM) countries. With 2,311 constituents, the index covers approximately 85% of the global equity opportunity set outside the US. |

| Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 4/30/24. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 5 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

| Performance for Class C shares assumes a 1.00% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

Investment GoalThe Fund seeks long-term capital appreciation.

Market Conditions

U.S. equity markets showed strength in 2023 following a challenging 2022, aided by better-than-expected economic data. The calendar year included heightened volatility, highlighted by turmoil in the banking sector in March and pressure in October when Hamas, an Islamist political and military organization, orchestrated an attack against Israel, shaking the geopolitical landscape and markets. The U.S. 10-Year yield rose as high as 5% before declining and ending the period around 3.86% as investors continued to digest economic data and expectations on interest rates. In the fourth quarter, the U.S. reported its strongest gross domestic product growth in nearly two years at 4.3% annualized.

Markets were shaken in March as worry about the health of the banking system spread, ignited by the collapse of Silicon Valley Bank and Signature Bank and furthered by UBS’s purchase of Credit Suisse at a discounted valuation. Major banking institutions and government agencies around the globe stepped in to help assure depositors their money was safe, which helped avoid contagion across the system. Central banks throughout the world continued to tighten monetary policy to combat elevated inflation. The U.S. Federal Reserve increased its benchmark interest rate by a total of 100 basis points to reach 5.50%. Inflation in the U.S. decelerated throughout the year, and the Federal Reserve paused its interest rate increases toward the end of the year while assessing economic data.

Performance Results

For the 12 months ended December 31, 2023, Class Y shares of the Natixis Oakmark Fund returned 31.28% at net asset value. The Fund outperformed its benchmark, the S&P 500® Index, which returned 26.29%.

Explanation of Fund Performance

On an absolute-return basis, the financials sector contributed the most to the return of the Fund, while consumer staples was the largest detractor to total performance.

Meta was a top contributor for the year. The underlying health of the U.S. social media company’s platforms remained strong, in our view, as daily active users reached new all-time highs. CEO Mark Zuckerberg said since the launch of Reels, time spent on Instagram has increased 24% and monetization is improving rapidly. Furthermore, the company’s technical enhancements around targeting seem to be gaining steam with advertisers, and management remains bullish on the continued growth of messaging across their platforms. We appreciate Meta’s keen focus on operating efficiency and believe its major investments in AI infrastructure over the past couple years have positioned it well.

KKR was also a top contributor for the year. In August, the New York-headquartered investment company reported second-quarter results that were modestly ahead of consensus estimates, largely due to increased transactional activity as capital markets activity accelerated. Management has highlighted that more than 30 strategies will come to market in the next 12 to 18 months and noted this number is likely to increase during the third quarter. Separately, KKR launched its retail-oriented private equity and infrastructure funds mid-year. Management said initial fundraising performance was ahead of expectations and it remains bullish on the 5- to 10-year opportunity in this largely untapped market, citing KKR’s brand, track record, and significantly expanded marketing and distribution teams. Finally, in November, KKR announced its acquisition of the remaining 37% of Global Atlantic (GA) for $2.7 billion. GA has a strong retail distribution network for its annuity business, which KKR can leverage as it continues to establish its own retail funds.

APA Corp. was a top detractor for the year. Despite reporting solid business fundamentals, the oil and natural gas explorer traded lower alongside increased volatility in commodity markets. We continue to believe APA has a long runway of underappreciated inventory in the form of untapped energy assets in the ground, which results in less capital required to replace assets and grow the

business over time. We also appreciate that at our estimate of normalized oil prices, APA generates a double-digit free cash flow yield, and management is returning cash to shareholders via sustainable buybacks and dividends.

Liberty Broadband was also a top detractor for the year despite reporting solid results. The U.S. communication services company owns GCI, the primary cable provider in Alaska, and has a notable stake in Charter Communications. We believe Liberty Broadband is trading at a material discount to its net asset value and that our ownership provides access to Charter Communications at a discount. Liberty Broadband’s management team is taking advantage of this discount by repurchasing shares. We would not be surprised to see the price-value gap reduced or eliminated through a transaction with Charter Communications.

Outlook

We believe our intensive research process and focus on the long term help us find opportunities despite the pervasive themes of the time. When the market does not separate the macro from the micro, this creates an exploitable opportunity for long-term investors. We use times of uncertainty and volatility to strategically position our portfolios for long-term success and believe this approach best positions us for achieving the protection and appreciation of our investors’ capital over the long term.

Top Ten Holdings as of December 31, 2023 |

| |

1 Alphabet, Inc., Class A | |

2 Capital One Financial Corp. | |

3 Intercontinental Exchange, Inc. | |

| |

| |

| |

| |

| |

9 American International Group, Inc. | |

| |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments, are presented on an individual security basis and do not represent holdings of the issuer. |

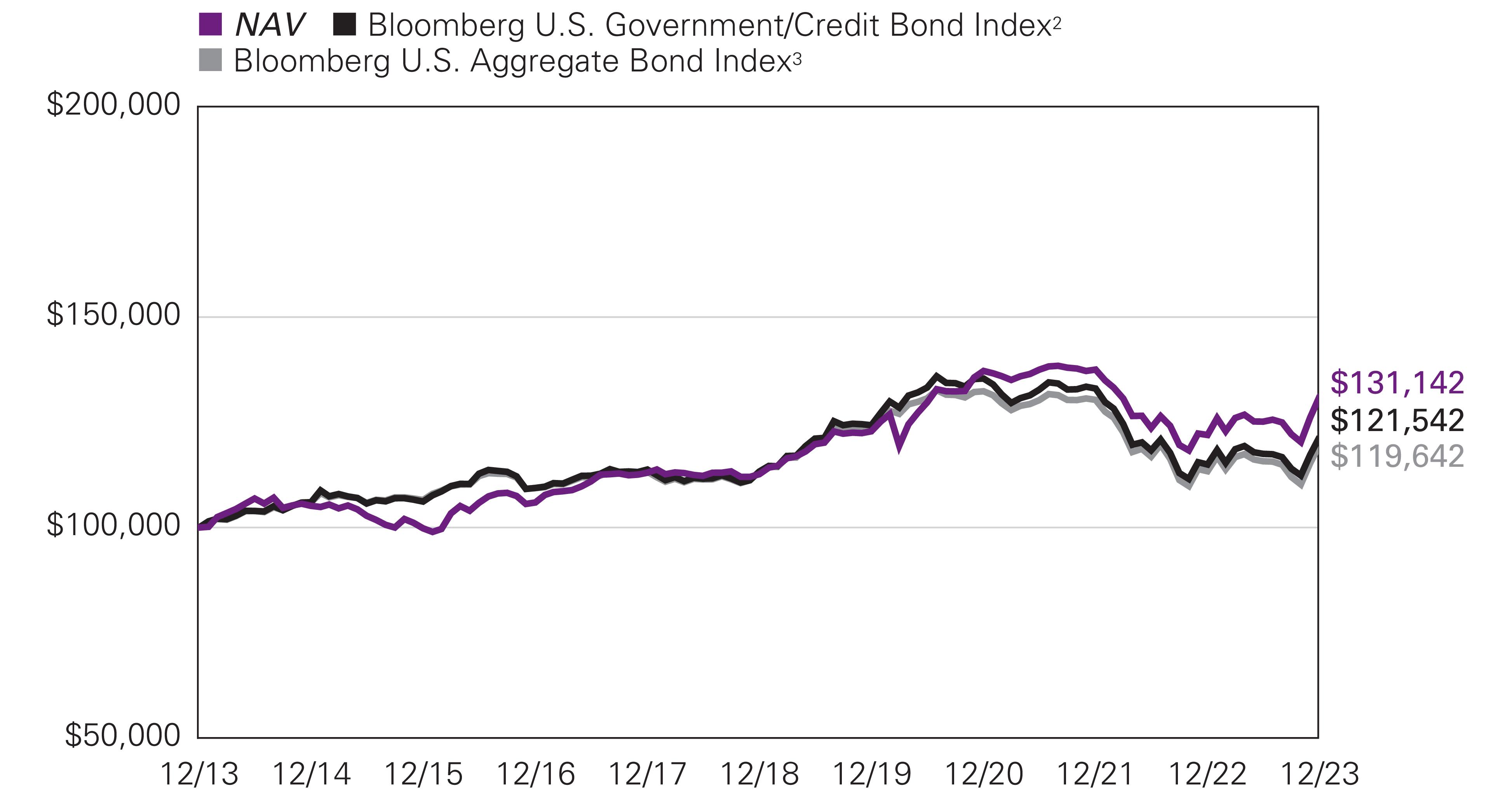

Hypothetical Growth of $100,000 Investment in Class Y Shares1 |

December 31, 2013 through December 31, 2023 |

Average Annual Total Returns —December 31, 20231 |

| | | | | |

| | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

With 5.75% Maximum Sales Charge | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Class N (Inception 5/1/17) | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com/performance. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| S&P 500® Index is a widely recognized measure of U.S. stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. It also measures the performance of the large cap segment of the U.S. equities market. |

| Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 4/30/24. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 5 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

| Performance for Class C shares assumes a 1.00% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase, and includes automatic conversion to Class A shares after eight years. |

Natixis Oakmark International Fund

| Effective August 31, 2023, Eric Liu serves as portfolio manager of the Fund. |

Investment GoalThe Fund seeks long-term capital appreciation.

Market Conditions

Major global markets generally showed strength in 2023 following a challenging 2022. The calendar year included heightened volatility, highlighted by turmoil in the banking sector in March and pressure in October when Hamas, an Islamist political and military organization, orchestrated an attack against Israel, shaking the geopolitical landscape and markets. While the U.S. and European equity markets showed strength on the back of better-than-expected economic data, Asian markets were mixed with Chinese equities experiencing pressure and Japanese equities reaching 30-year highs during the period. The U.S.10-Year yield rose as high as 5% before declining and ending the period around 4% as investors continued to digest economic data and expectations on interest rates.

Central banks throughout the world continued to tighten monetary policy to combat elevated inflation. The U.S. Federal Reserve increased its benchmark interest rate by a total of 100 basis points to reach 5.50%, the European Central Bank opted for 200 basis points to reach 4.50%, and the Bank of England chose 175 basis points to reach 5.25%. Inflation in the U.S. and eurozone decelerated throughout the year, with most central banks pausing their interest rate increases toward the end of the year while assessing economic data. The Bank of Japan continued its accommodative monetary policy stance although it took a step toward reversing the policy when it announced that the 1% cap on its 10-year government bonds would be considered a reference rate going forward. In the fourth quarter, the yen reversed its trend and gained value, ending the period at approximately 141 USD/JPY.

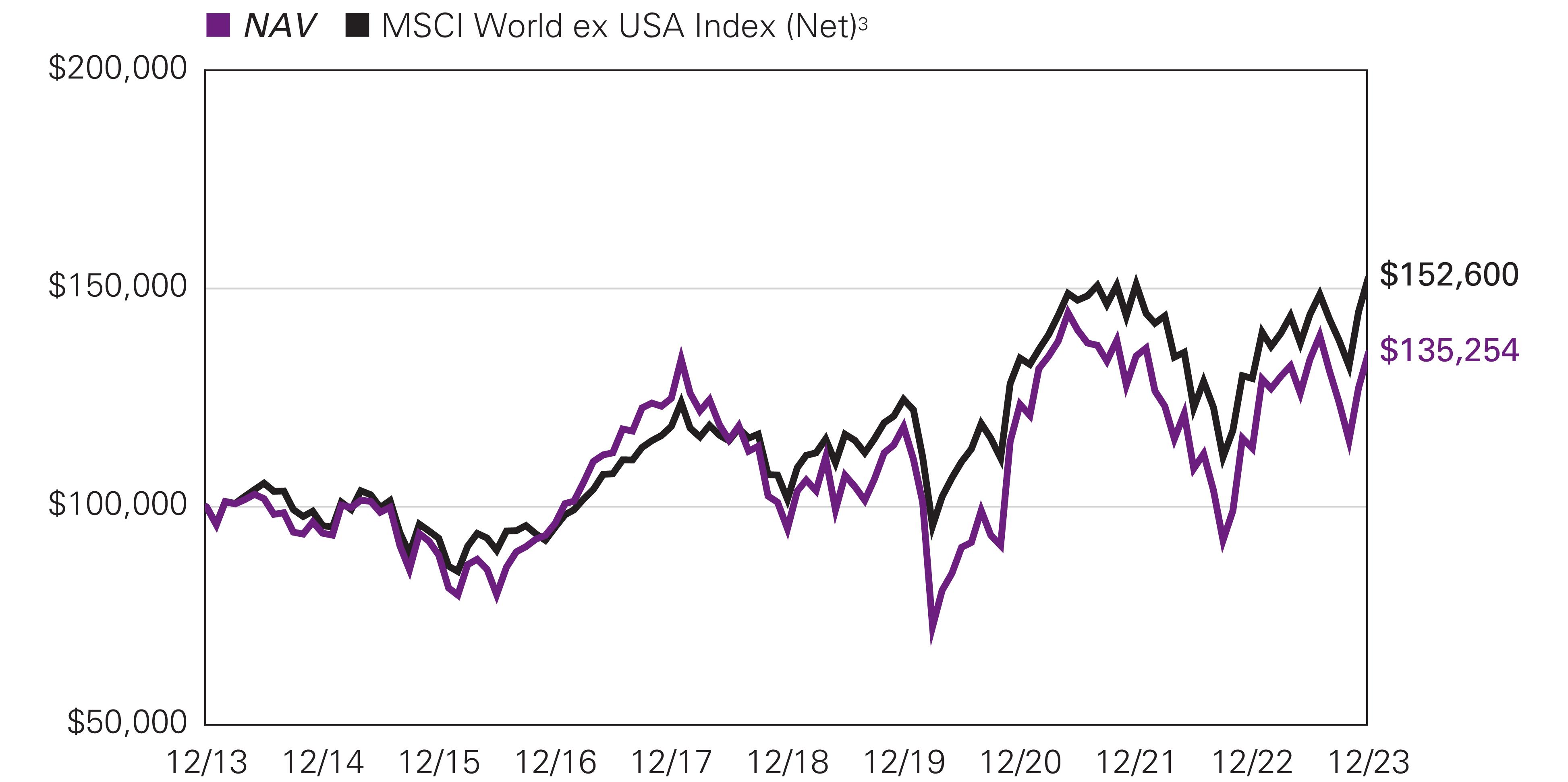

Performance Results

For the 12 months ended December 31, 2023, Class Y shares of the Natixis Oakmark International Fund returned 19.26% at net asset value. The Fund outperformed its benchmark, the MSCI World ex USA Index (Net), which returned 17.94%.

Explanation of Fund Performance

The industrials sector contributed most to the Fund’s return and no sectors impacted Fund performance negatively.

Ryanair was a top contributor for the year. The Irish airline benefitted from strong travel demand within Europe as well as a pickup in foreign visitors to the region. During our mid-year conversations with management, CEO Michael O’Leary was optimistic about Ryanair’s future due to increased bookings industry-wide, expectations for higher oil prices and elevated cost structures of peers driving higher pricing. We appreciate that Ryanair continues to reduce unit costs and widen the gap between itself and more capacity-constrained European competitors. In the fourth quarter, Ryanair reported additional revenue growth and strong free cash flow levels, which allowed the company to reinstate a EUR 400 million dividend and announce an incremental EUR 1.5 billion return to shareholders starting in 2025.

Intesa Sanpaolo, the largest bank in Italy, was a top contributor for the year. Intesa has generated substantial net profit increases in recent periods thanks to a significant rise in net interest income. This was consistent with our view that Intesa would dramatically benefit from rising rates. In addition, Intesa’s non-performing loan formation has continued to decline, reflecting its low-risk business model and strong underwriting practices. Management has also been able to keep operating costs well-controlled thanks to efficiency measures that have largely offset inflationary impacts. With one of the highest dividend payout ratios in Europe, Intesa has been returning capital to shareholders via buybacks while maintaining a robust balance sheet.

Worldline was a top detractor for the year. In October, the French multinational payment and transactional services company delivered a weaker than expected set of results and the stock fell significantly on the news. Management reduced growth estimates citing two factors: (1) a negative mix shift in Germany as German consumers shifted from discretionary to non-discretionary purchases and (2) merchant terminations, driven by Worldline voluntarily and proactively cutting ties with certain online merchants at risk of

Natixis Oakmark International Fund

violating new regulatory standards. We spoke with management after the results and confirmed both factors are transitory. We continue to believe the payments industry is a structurally attractive GDP+ growth market, and Worldline, as the European payments leader, has a very long growth runway given lower European cashless penetration and higher levels of bank payment in-sourcing versus the U.S.

Bayer was also a top detractor for the year. In November, shares of the German health care company fell after it announced negative news on two known unknowns: (1) Bayer stopped its phase III OCEANIC-AF trial for anti-clotting drug asundexian early due to lack of efficacy and (2) the company received an adverse RoundUp verdict for $1.5 billion over three plaintiffs. We spoke with CEO Bill Anderson after the announcement and he articulated a very strategic, thoughtful framework for managing the situation. Although we reduced our estimate of intrinsic value, we continue to view Bayer’s position across the crop sciences ecosystem as unrivaled and believe the company can take portfolio actions to unlock value.

Outlook

We believe our intensive research process and focus on the long term help us find opportunities despite the pervasive themes of the time. When the market does not separate the macro from the micro, this creates an exploitable opportunity for long-term investors. We use times of uncertainty and volatility to strategically position our portfolios for long-term success and believe this approach best positions us for achieving the protection and appreciation of our investors’ capital over the long term.

Top Ten Holdings as of December 31, 2023 |

| |

| |

2 Lloyds Banking Group PLC | |

| |

| |

| |

| |

| |

| |

9 Fresenius Medical Care AG | |

| |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments, are presented on an individual security basis and do not represent holdings of the issuer. |

Natixis Oakmark International Fund

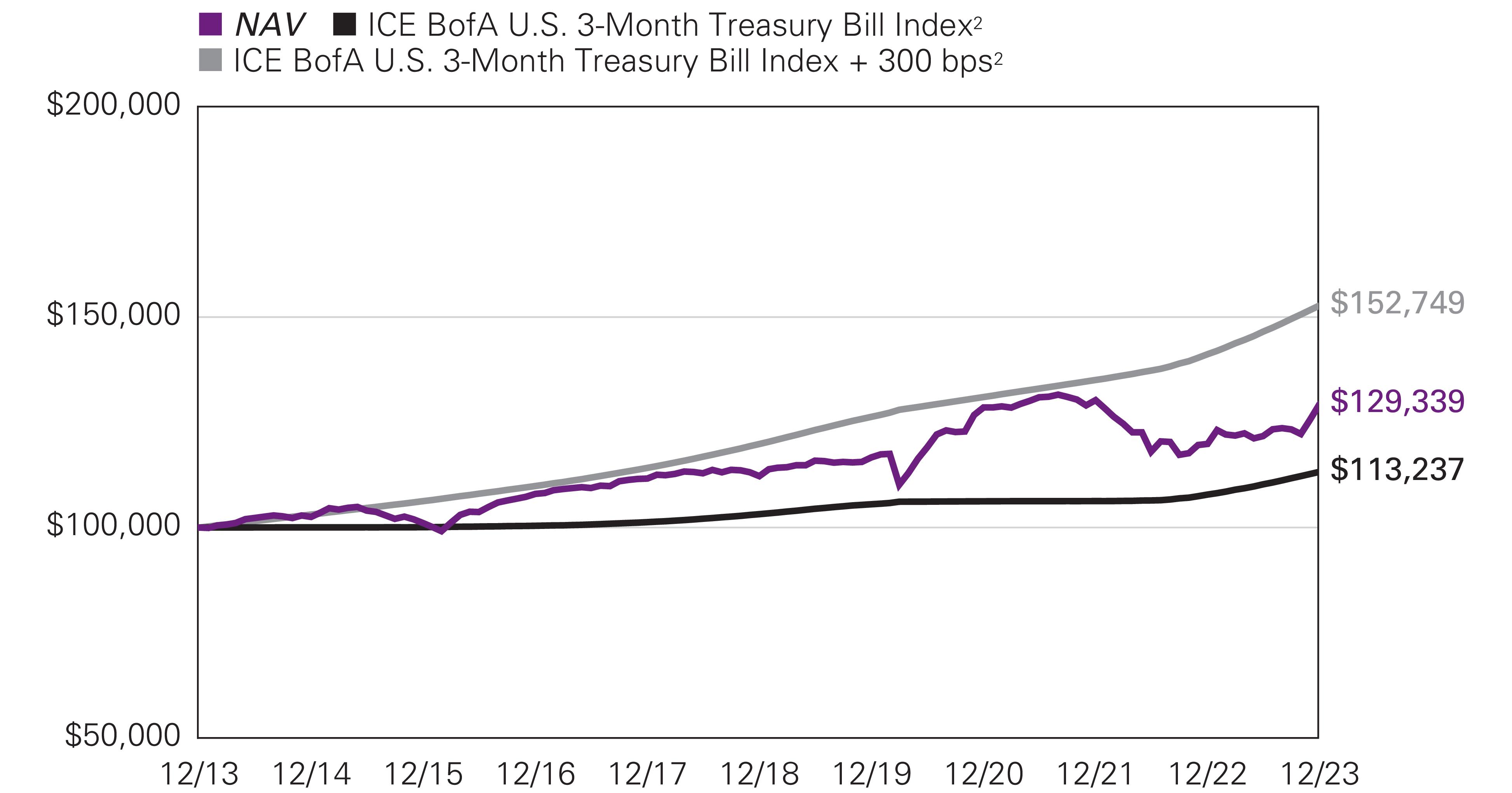

Hypothetical Growth of $100,000 Investment in Class Y Shares1, 2 |

December 31, 2013 through December 31, 2023 |

Natixis Oakmark International Fund

Average Annual Total Returns —December 31, 20231 |

| | | | | |

| | |

Class Y (Inception 5/1/17) | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

With 5.75% Maximum Sales Charge | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Class N (Inception 5/1/17) | | | | | | |

| | | | | | |

| | | | | | |

MSCI World ex USA Index (Net)3 | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com/performance. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| Prior to the inception of Class Y shares (5/1/2017), performance is that of Class A shares and reflects the higher net expenses of that share class. |

| MSCI World ex USA Index (Net) is an unmanaged index that is designed to measure the equity market performance of developed markets, excluding the United States. |

| Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 4/30/24. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 5 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

| Performance for Class C shares assumes a 1.00% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase, and includes automatic conversion to Class A shares after eight years. |

Natixis U.S. Equity Opportunities Fund

|

|

Michael J. Mangan, CFA®, CPA |

|

|

|

Aziz V. Hamzaogullari, CFA® |

Loomis, Sayles & Company, L.P.

|

Investment GoalThe Fund seeks long-term growth of capital.

Market Conditions

The Natixis U.S. Equity Opportunities Fund is composed of two separate segments, combining the value expertise of Harris Associates with the growth expertise of Loomis Sayles. The two segments have common investment philosophies and a rigorous long-term, bottom-up research process focused on high-quality businesses trading at a significant discount to intrinsic value.

Despite the economic pessimism that prevailed at the beginning of 2023, the economy continued to turn in strong results while the S&P 500® posted a 26.4% return including dividends. This came in the wake of 2022, when the U.S. Federal Reserve (Fed) began an aggressive campaign to raise interest rates, the S&P 500® posted a 19.44% loss, and many economists predicted a recession. By the end of 2023, after seven Fed rate increases, inflation as measured by the Consumer Price Index fell by more than half from 6.4% in January to 3.1%. Late in the year, the Fed announced an end to its series of rate increases and is expected to cut rates three times in 2024 as inflation continues to moderate.

Despite declining inflation during 2023, mortgage rates remained high by recent standards, hitting a 20-year high of 8% in October. When the Fed reported that the rate hiking cycle had ended, mortgage rates began to fall, settling below 7% in December. Despite this fact, mortgage rates are still twice as high as they were in January 2021. Housing prices continued to increase, with median home prices rising above $400,000 in the third quarter as inventory fell to new lows, making it difficult for new buyers to enter the market. With many employees on hybrid schedules, commercial real estate took a beating that is expected to continue into 2024. This sector lost $590 billion in value in 2023 and is expected to hemorrhage a further $480 billion in 2024.

Contributing to the Fed’s anticipated rate cuts in 2024 were moderating job gains. While unemployment rates stayed low—below 4%—for all of 2023, job growth cooled. Wages rose robustly at 0.8% annually through November for all wages and 1.1% for non-supervisory and production workers, who make up 80% of the workforce. Consumers continued to prop up the economy in 2023, spending more than expected, even as savings from the Covid-19 pandemic dwindled.

On the technology front, generative artificial intelligence (AI) took the economy and markets by storm. Worldwide generative AI spending neared $20 billion in 2023, as organizations sought to monetize this productivity-enhancing technology. The seven largest technology stocks by market capitalization led the market in 2023, contributing nearly half the overall stock market gain. Overall, technology stocks turned in their best performance since 2009, rallying by 59.1%. The tech-heavy Nasdaq rose by 43%. Small-cap stocks, as captured by the Russell 2000® Index, notched a 15.1% gain, as the Dow Jones Industrial Average rose by 13%.

The bond market bounced back in 2023 following its worst year on record in 2022. The 10-Year Treasury Bond yield ended 2023 at 3.84%, while the 2-Year Treasury Bill yield was 4.26%. The effective Federal Funds rate was 5.33%. The Morningstar U.S. Core Bond index rose by 5.32%, buoyed by a strong fourth quarter. Savers benefitted from higher rates, as rates on CDs, high-yield savings and newly issued bonds increased. With Fed rate cuts on the horizon in 2024, these rates are expected to decline, although they are likely to remain higher than in the recent past.

Natixis U.S. Equity Opportunities Fund

While the economy continued to hum along, turbulence continued on the geopolitical front as war broke out between Israel and Hamas and the conflict between Russia and Ukraine dragged into the second year. Despite these conflicts, gas prices fell during 2023, contributing to the overall decline in inflation. Global stock markets overall tracked U.S. markets, with the MSCI Global Index notching a 22% gain in 2023.

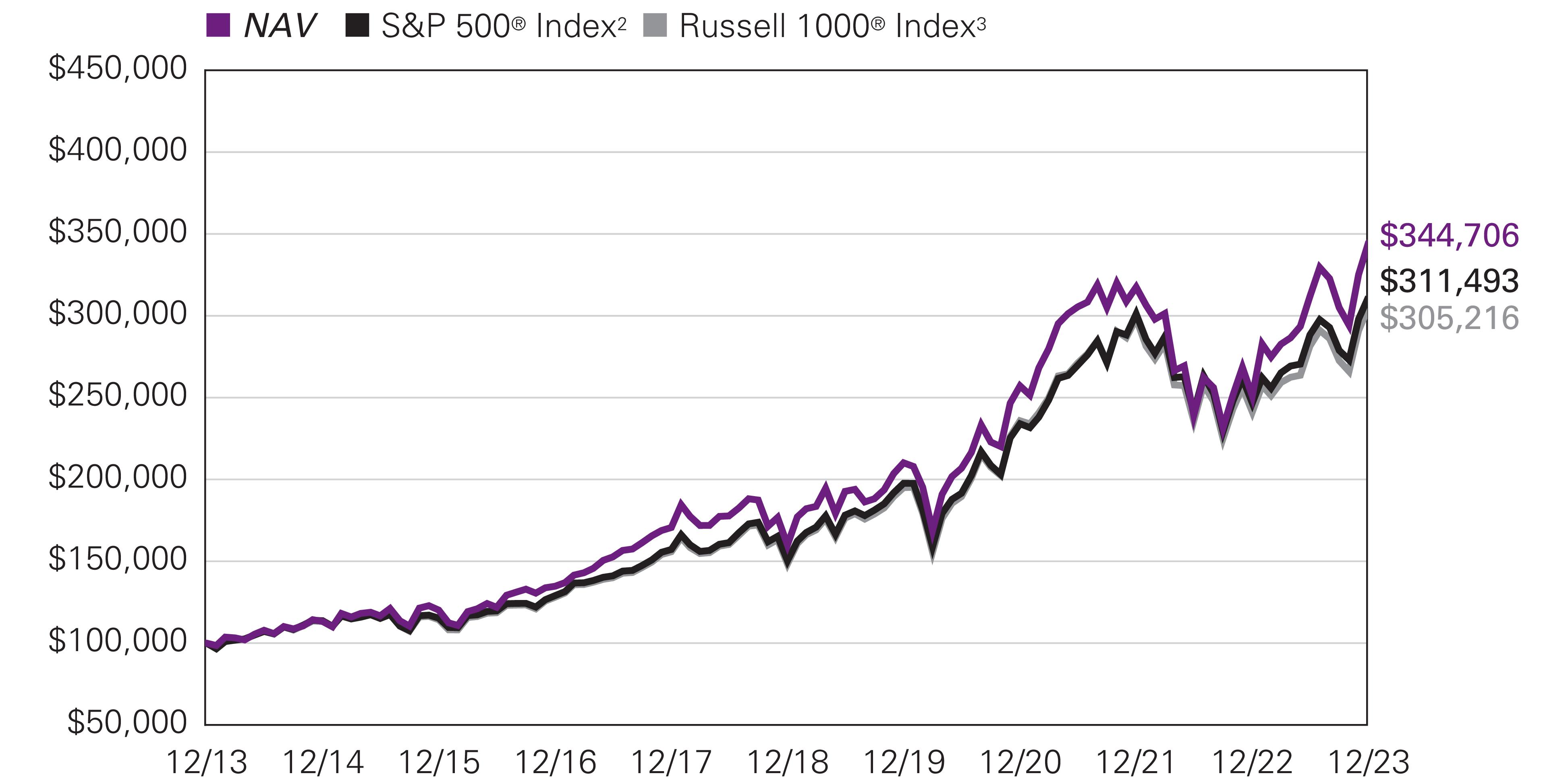

Performance Results

For the 12 months ended December 31, 2023, Class Y shares of the Natixis U.S. Equity Opportunities Fund returned 37.35% at net asset value. The Fund outperformed its primary benchmark, the S&P 500® Index, which returned 26.29%, and also outperformed its secondary benchmark, the Russell 1000® Index, which returned 26.53%.

Explanation of Fund Performance

Each of the portfolio’s segments uses a distinct investment style, providing shareholders with exposure to a variety of different stocks:

• The Harris Associates Large Cap Value segment invests primarily in the common stocks of larger-capitalization companies that Harris Associates L.P. (“Harris Associates”) believes are trading at a substantial discount to the company’s “true business value.”

• The Loomis Sayles All Cap Growth segment invests primarily in equity securities and may invest in companies of any size. The segment employs a growth style of equity management that emphasizes companies with sustainable competitive advantages versus others, long-term structural growth drivers that will lead to above-average future cash flow growth, attractive cash flow returns on invested capital, and management teams focused on creating long-term value for shareholders. The segment aims to invest in companies when they trade at a significant discount to the estimate of intrinsic value.

Both segments contributed positively to the Fund’s performance.

Harris Associates Large Cap Value Segment

On an absolute-return basis, the financials sector contributed the most to the return of the segment, while the consumer staples sector was the only sector with a negative contribution to the total return.

Meta was a top contributor for the year. The underlying health of the U.S. social media company’s platforms remained strong, in our view, as daily active users reached new all-time highs. CEO Mark Zuckerberg said since the launch of Reels, time spent on Instagram has increased 24% and monetization is improving rapidly. Furthermore, the company’s technical enhancements around targeting seem to be gaining steam with advertisers, and management remains bullish on the continued growth of messaging across their platforms. We appreciate Meta’s keen focus on operating efficiency and believe its major investments in AI infrastructure over the past couple years have positioned it well.

KKR was also a top contributor for the year. In August, the New York-headquartered investment company reported second-quarter results that were modestly ahead of consensus estimates, largely due to increased transactional activity as capital markets activity accelerated. Management has highlighted that more than 30 strategies will come to market in the next 12 to 18 months and noted this number is likely to increase during the third quarter. Separately, KKR launched its retail-oriented private equity and infrastructure funds mid-year. Management said initial fundraising performance was ahead of expectations and it remains bullish on the 5- to 10-year opportunity in this largely untapped market, citing KKR’s brand, track record, and significantly expanded marketing and distribution teams. Finally, in November, KKR announced its acquisition of the remaining 37% of Global Atlantic (GA) for $2.7 billion. GA has a strong retail distribution network for its annuity business, which KKR can leverage as it continues to establish its own retail funds.

APA Corp. was a top detractor for the year. Despite reporting solid business fundamentals, the oil and natural gas explorer traded lower alongside increased volatility in commodity markets. We continue to believe APA has a long runway of underappreciated inventory in the form of untapped energy assets in the ground, which results in less capital required to replace assets and grow the business over time. We also appreciate that at our estimate of normalized oil prices, APA generates a double-digit free cash flow yield, and management is returning cash to shareholders via sustainable buybacks and dividends.

General Motors (GM) was also a top detractor for the year. In April, the U.S. auto company reported a drop in profits and the discontinuation of its top-selling electric vehicle, the Chevrolet Volt. In August, shares fell again on news that production of GM’s electric vehicle lineup was being slowed by issues in assembling updated battery modules. Finally, members of the United Auto Workers union (UAW) went on strike following the expiration of its labor contract in September. The strike targeted the GM

Natixis U.S. Equity Opportunities Fund

Wentzville assembly plant, which accounts for around 7% of the company’s North American production. UAW was able to reach a deal with GM in mid-November, ending the six-week labor disruption.

Loomis Sayles All Cap Growth Segment

We are an active manager with a long-term, private equity approach to investing. Through our proprietary bottom-up research framework, we look to invest in those few high-quality businesses with sustainable competitive advantages and profitable growth when they trade at a significant discount to intrinsic value. For the period, the All Cap Growth segment posted a positive absolute return. Our holdings in each of the information technology, communication services, consumer discretionary, industrials, financials, consumer staples, and healthcare sectors contributed positively to the segment’s performance.

Nvidia and Meta Platforms were the largest contributors to performance during the period. Nvidia is the world leader in artificial intelligence (AI) computing, which enables computers to mimic human-like intelligence for problem solving and decision-making capabilities. We believe the company’s competitive advantages include its intellectual property, brands, and a large and growing ecosystem of developers and applications utilizing its GPU (graphic processing unit) technology. A portfolio holding since January 2019, after shares were under pressure throughout most of 2022 given a weak market backdrop, shares rebounded substantially over the past 12 months, with gains accelerating following the company’s first quarter earnings report in May. Nvidia reported record financial results that were well above consensus expectations, as AI applications, including generative AI, are driving strong demand for GPUs by companies looking to leverage these capabilities and drive competitive differentiation. The company also provided revenue guidance that was substantially higher than consensus expectations, resulting in a material increase in expectations for revenue, profits, and free cash flow for its full fiscal year. Revenue in the company’s gaming segment had been depressed, which we believe reflected global demand for PCs returning to pre-pandemic levels after a period of excess and the impact of Covid restrictions on China consumer spending. However, we believe the company has worked expeditiously in clearing existing inventory in its retail channels, which contributed to the gaming business returning to growth in the past two quarters. In the company’s data center business, we believe the company’s decades of focused investment, cumulative know-how, and robust software platform and architecture that has attracted millions of developers, position the company to benefit from several secular long-term growth drivers, including continued growth in use cases for artificial intelligence. To further drive adoption by enterprises, Nvidia is also partnering with cloud service providers including Oracle, Microsoft, and Google to offer AI services via the cloud. We believe Nvidia remains strongly positioned to benefit from secular growth in PC gaming and is still in the early stages of growth in its data center business, which has the potential to be much larger. We believe Nvidia’s strong growth prospects are not currently reflected in its share price. As a result, we believe the company’s shares are trading at a significant discount to our estimate of intrinsic value, offering a compelling reward-to-risk opportunity. We trimmed our position on multiple occasions during the year as the company reached our maximum allowable position size of eight percent due to market appreciation.

Meta Platforms operates online social networking platforms that allow people to connect, share, and interact with friends and communities. With 3.9 billion monthly users, 200 million businesses, and 10 million advertisers worldwide using its family of apps – Facebook, Messenger, WhatsApp, and Instagram – we believe the scale and reach of Meta’s network is unrivaled. A strategy holding since its initial public offering in 2012, Meta’s shares rebounded substantially in 2023 after being under pressure throughout most of 2022 due to a perceived lack of discipline in the company’s capital expenditures – especially with respect to the metaverse – that coincided with what we believed was temporary fundamental weakness arising from the company’s transition to a new advertising format and maneuvering around privacy changes imposed by Apple in 2021. Our analysis suggested that Meta was being priced as if a high-quality, high-returning, growth company – whose returns on capital were many times larger than its cost of capital – would become a low-quality business that both ceased to grow and would also see its margins and returns on invested capital deteriorate. We took advantage of price weakness in 2022 to add to our holdings on multiple occasions during that year, most recently in November 2022. Despite ongoing macroeconomic pressure on advertising spending, Meta has since posted four consecutive quarters of better-than-expected financial results, including accelerating revenue growth in the last three quarters as it made further progress in navigating Apple’s privacy changes and saw improved monetization of its newest Reels video format. Following this period of temporary weakness and elevated investment spending, Meta announced a set of efficiency measures that have already led to significant improvements in margins and lower capital expenditure plans, and shares responded positively to the company’s increased focus on productivity and cost management. We believe founder and CEO Mark Zuckerberg has always managed the company with a long-term focus and strong strategic vision. Over the past ten years, Meta has spent over $125 billion on research and development and $110 billion on capital expenditures – a level of investment that few firms can match, and which creates high barriers to entry for competitors that are further buttressed by the growth of cumulative knowledge over time. The successful development of a metaverse is not an explicit part of our investment thesis for Meta. However, given the potential size of the opportunity, which we estimate could impact over $1 trillion of spending over the long term, and Meta’s positioning with billions of users and hundreds of millions of businesses, we believe Meta’s current balanced approach to its forward-looking investments make sense. We expect that corporations will continue to allocate an increasing proportion of their advertising spending online, and Meta remains one of very few platforms where advertisers can reach consumers at such scale in such a targeted and effective fashion. We believe Meta’s brands, network, and

Natixis U.S. Equity Opportunities Fund

targeting advantage position the company to take increasing share of the industry’s profit pool and grow its market share from approximately 6% currently to approximately 10% of the total global advertising market over our investment time horizon. On the basis of its core business alone, we believe the company is substantially undervalued and trades at a significant discount to our estimate of intrinsic value. We trimmed our position on multiple occasions during the year because it reached our maximum allowable position size of eight percent due to market appreciation.

Alnylam Pharmaceuticals and Illumina were the largest detractors during the period. Alnylam Pharmaceuticals is a leader in gene therapies based on its pioneering small-interfering RNA (siRNA) approach to disease treatment. Founded in 2002, Alnylam was one of the first companies to develop and commercialize therapies based on RNA interference (RNAi), a breakthrough discovery in understanding how genes are naturally regulated within cells that was recognized with the 2006 Nobel Prize in Medicine. RNAi therapies exploit a naturally occurring biological pathway within cells that regulates the expression of specific genes. In particular, siRNA has proven to be one of the most effective approaches to RNAi therapy, and Alnylam remains the first and only company to successfully commercialize siRNA-based therapies. We believe Alnylam’s strong and sustainable competitive advantages include its deep, cumulative and compounding knowledge in the science of RNAi therapeutics, in particular its creation and advancement of unique siRNA-based therapies, and the multiple partnerships it has entered on the basis of its technology which provide both external funding and established commercialization avenues. Currently, the company’s technology is the basis for five approved therapies, ten therapies currently in clinical trials, and a robust pipeline of potential treatments that we expect to enter the clinic in the coming years, with a focus on genetic diseases, cardiometabolic diseases, infectious diseases, and central nervous system and ocular diseases. A strategy holding since the second quarter of 2021, shares responded negatively to the dimming prospects for patisiran, Alnylam’s approved therapy for hATTR amyloidosis, to receive regulatory approval in the larger, related indication of ATTR with cardiomyopathy (ATTR-CM). In October, the company decided to discontinue its bid to attain approval in favor of its more robust and longer trial for vutrisiran. Vutrisiran is also approved for hATTR amyloidosis, but the therapy is delivered via subcutaneous injection every three months, while patisiran requires intravenous administration every three weeks. While the outcomes for patisiran were positive and statistically significant, the FDA was likely to require further study, and the easier administration of vutrisiran, which was developed after patisiran, makes the therapy more commercially attractive. Vutrisiran is currently in Phase III clinical trials for ATTR-CM, with results expected in the first half of 2024. We believe the uniqueness of Alnylam’s pioneering scientific expertise and technology is evident from both its existing products, which provide meaningful value to previously underserved patient populations, as well as the numerous partnerships in which world-class global pharmaceutical companies and specialty competitors alike have sought to access its proprietary technology. With its approved therapies and substantial pipeline of significant late-stage clinical programs, we believe the company has now reached the point at which its existing therapies will continue to contribute positively and its subsequent innovations will shift its financial profile from that of an early-stage biotech company to a profitable business with normalized margins that is able to internally fund its ongoing growth needs. Over our long-term investment horizon, we believe the company can generate substantial revenue growth, while turning profitable and generating substantial cumulative free cash flow. We believe Alnylam’s market price continues to substantially undervalue the potential contribution from the company’s clinical-stage assets – which we believe is unsupported by the company’s established track record for producing genetically validated therapeutics. Further, while embedded expectations reflect some success for its currently marketed products, we believe the market is focused on short-term profitability while ignoring the platform the company has built, that we believe will serve as the basis for ongoing innovation over our long-term investment horizon and beyond. As a result, we believe the company is selling at a substantial discount to our estimate of its intrinsic value and offers a compelling reward to risk opportunity.

Founded in 1998, Illumina is the industry leader in the fast-growing field of sequencing for genetic and genomic analysis, supporting research, clinical, and consumer genetics applications. A strategy holding since March 2020, Illumina’s shares have been under pressure due to lower-than-expected results in its core business, uncertainty regarding its acquisition of GRAIL, and near-term management uncertainty following an activist investor campaign that succeeded in ousting the Chairman of the Board in May and later prompted the resignation of CEO Francis deSouza in June. While orders for its newest sequencing platform, NovaSeq X, had been solid, they slowed in the company’s most recently reported quarter as the company observed a lengthening sales cycle among customers facing macroeconomic pressure – which has similarly impacted peers as well. Still, the company’s recent results and guidance are below our long-term expectations as we believe the GRAIL acquisition has detracted from near-term focus and returns. Illumina acquired GRAIL in August 2021, but closed the transaction prior to receiving approval from the EU, which has since ordered that the business be divested. In December 2023, Illumina announced it will divest GRAIL and aims to have the terms finalized by the end of second quarter 2024. GRAIL is an early leader in asymptomatic cancer screening through liquid biopsies that use Illumina’s sequencing technology to detect tumor DNA in the bloodstream before it could otherwise be sampled via a traditional biopsy. While we believed that there was potential upside in GRAIL, our structural investment thesis for Illumina was not premised on a successful completion of the acquisition, and GRAIL will remain an important customer for the company. We believe the core Illumina business remains highly attractive on a reward-to-risk basis and remains substantially discounted relative to intrinsic value. Illumina is in the early stages of a major platform launch while simultaneously facing more competition than in recent years. Over the last two years, Illumina’s share of industry revenue has dropped from an estimated 80% to 77%. These share losses have been most pronounced in China and in the

Natixis U.S. Equity Opportunities Fund

lower-value, mid- and low- throughput portions of the sequencing market. We anticipate Illumina will retain its dominant share in the high-value, high-throughput ends of the market on the strength of its product ecosystem and continue to capture approximately 75% of the sequencing market. In September, the company named Jacob Thaysen, Ph.D. as its new CEO. Thaysen previously served as President of the Life Sciences and Applied Markets Group at Agilent, and brings a background in research and development (R&D) as well as experience operating in genetics and clinical end markets. We met with Thaysen and our interactions have been positive as we believe he has the requisite skills and vision to reinvigorate the core Illumina franchise. We are encouraged that new management seems committed to redoubling its focus on the significant opportunity in Illumina’s core markets and reinvigorating operational execution – which appeared to have diminished over the last several quarters under deSouza. In addition to the activist-sponsored candidate, Illumina also added two new board members with significant experience at innovative, market-expanding healthcare businesses that we believe should contribute positively to Illumina’s return to growth. Despite the near-term uncertainty, we believe Illumina remains advantageously positioned in a high-quality industry benefiting from long-term, secular growth. We believe Illumina is at the forefront of a multi-decade transformation that will see genetic analysis incorporated into multiple facets of our lives. While demand today is still predominantly from large life sciences research facilities, over the next decade we believe democratization of gene sequencing technology and greater practical application will result in the equipment becoming ubiquitous in clinical settings as well, with oncology offering the largest market opportunity. We believe Illumina is a dominant competitor whose sequencing technology represents the critical enabling technology that ideally positions it to capitalize on an approximately $100 billion market opportunity. We believe Illumina’s shares embed expectations for key revenue and cash flow growth drivers that are well below our long-term assumptions. As a result, we believe the company is selling at a significant discount to our estimate of its intrinsic value and offers a compelling reward-to-risk opportunity. We added to our position on multiple occasions this year, most recently in late September.

Top Ten Holdings as of December 31, 2023 |

| |

1 Alphabet, Inc., Class A | |

| |

3 Meta Platforms, Inc., Class A | |

| |

5 Capital One Financial Corp. | |

| |

| |

| |

| |

| |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments, are presented on an individual security basis and do not represent holdings of the issuer. |

Natixis U.S. Equity Opportunities Fund

Hypothetical Growth of $100,000 Investment in Class Y Shares1 |

December 31, 2013 through December 31, 2023 |

See notes to chart on page 21.

Natixis U.S. Equity Opportunities Fund

Average Annual Total Returns —December 31, 20231 |

| | | | | |

| | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

With 5.75% Maximum Sales Charge | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Class N (Inception 5/1/17) | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com/performance. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| S&P 500® Index is a widely recognized measure of U.S. stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. It also measures the performance of the large cap segment of the U.S. equities market. |

| Russell 1000® Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000® Index represents approximately 92% of the U.S. market and is constructed to provide a comprehensive and unbiased barometer for the large-cap segment and is completely reconstituted annually to ensure new and growing equities are reflected. |

| Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 4/30/25. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 5 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

| Performance for Class C shares assumes a 1.00% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase, and includes automatic conversion to Class A shares after eight years. |

Vaughan Nelson Mid Cap Fund

|

|

|

|

Vaughan Nelson Investment Management, L.P.

|

Investment GoalThe Fund seeks long-term capital appreciation.

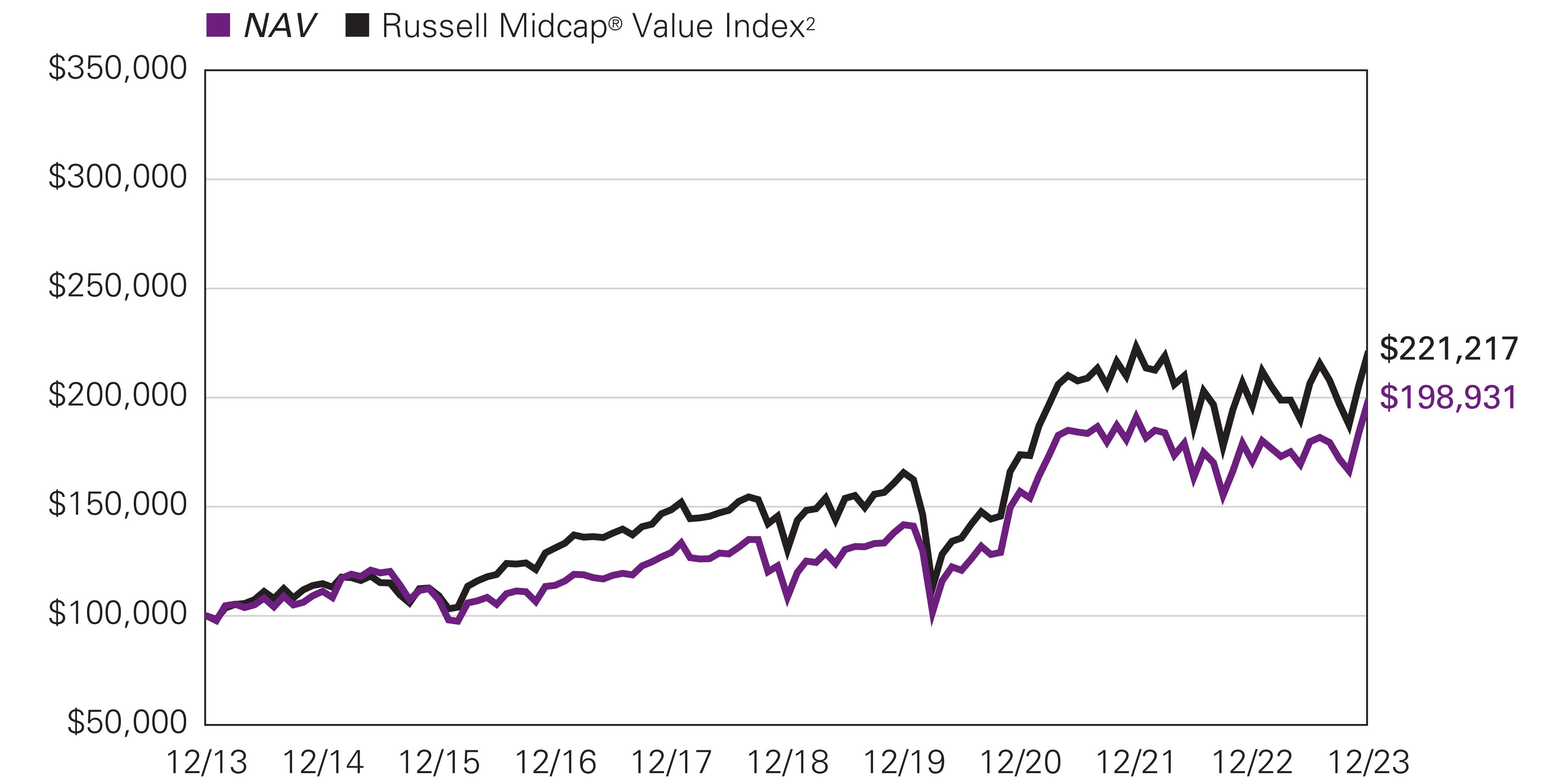

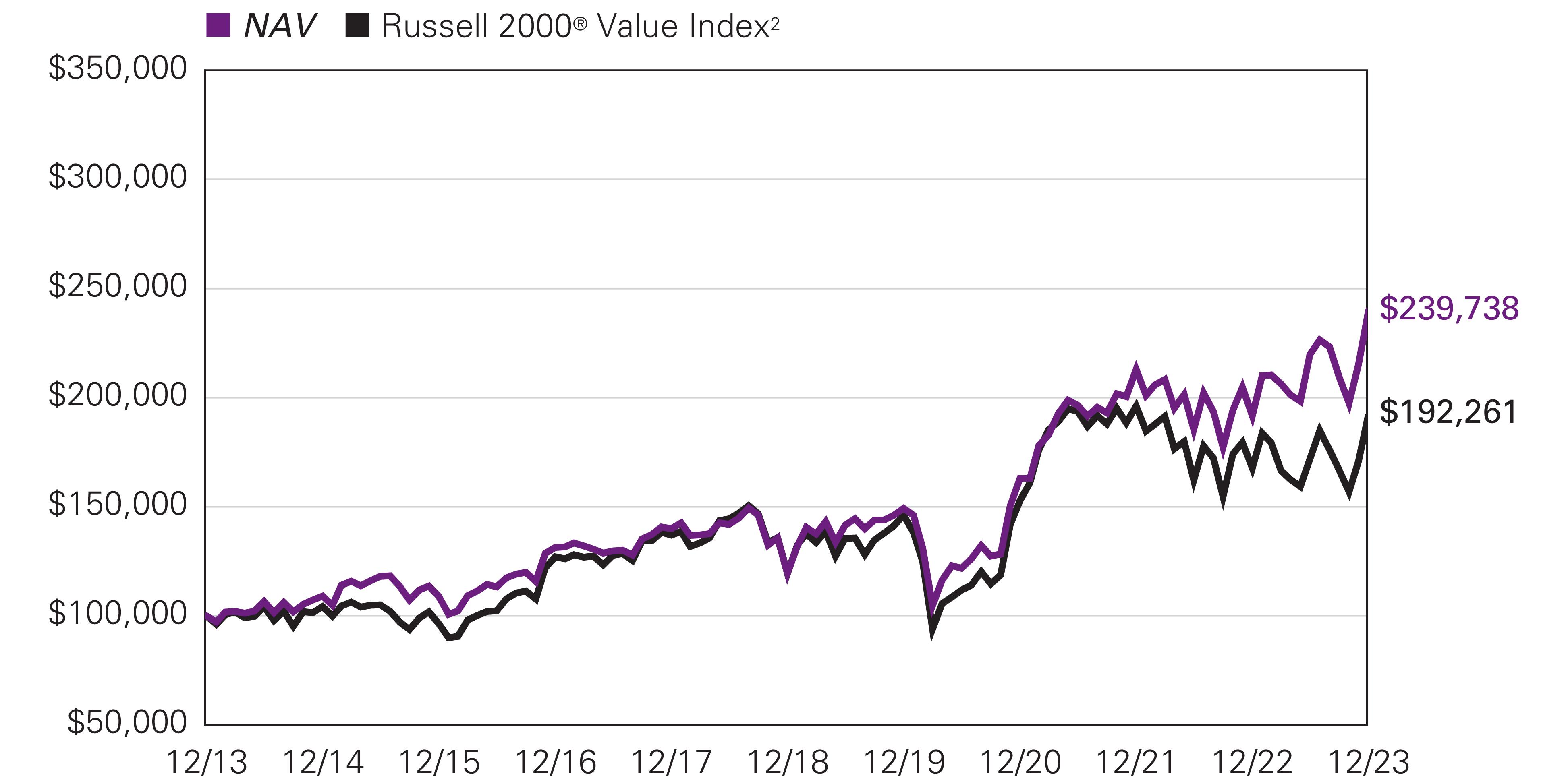

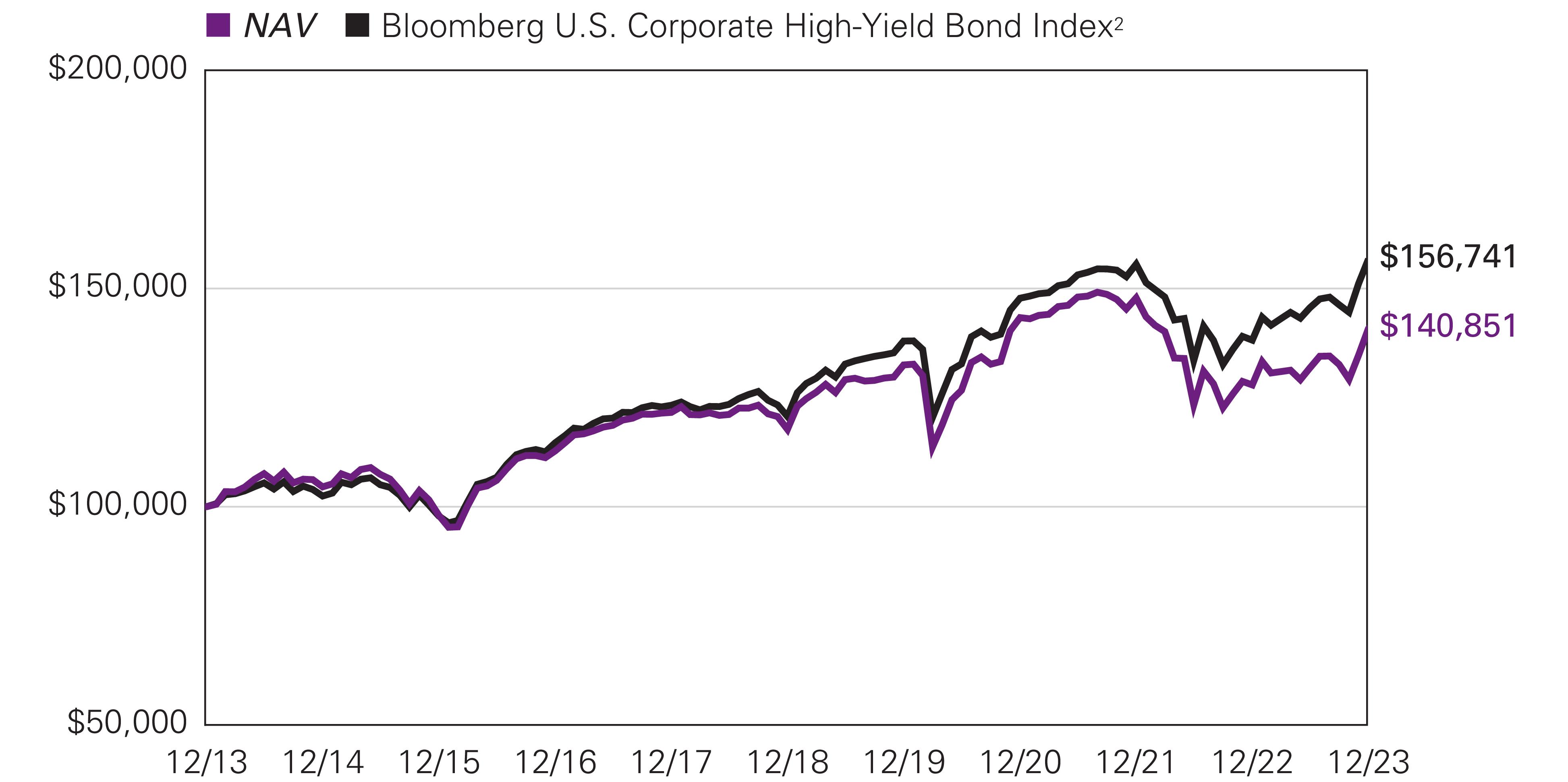

Market Conditions