UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06318

CONSULTING GROUP CAPITAL MARKETS FUNDS

(Exact name of registrant as specified in charter)

2000 Westchester Avenue

Purchase, NY 10577

(Address of principal executive offices)(Zip code)

CT Corp

155 Federal Street Suite 700

Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: (888) 454-3965

Date of fiscal year end: August 31

Date of reporting period: August 31, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking rules.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS

Consulting Group

Capital Markets Funds

Annual Report

| • | | Small-Mid Cap Equity Fund |

| • | | International Equity Fund |

| • | | Emerging Markets Equity Fund |

| • | | International Fixed Income Fund |

| • | | Inflation-Linked Fixed Income Fund |

| • | | Ultra-Short Term Fixed Income Fund |

| • | | Alternative Strategies Fund |

INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

Table of Contents

Consulting Group

Capital Markets Funds

DEAR SHAREHOLDER,

Global equity market returns were mixed over the twelve-month period ending August 31, 2018. U.S. markets led the way with the S&P 500® Index i gaining 19.7% while developed international markets represented by the MSCI EAFE® Index (Net) vi gained 4.4%. However, emerging markets did not fare as well with the MSCI Emerging Markets Index (Net) v losing 0.7%. The strength in the U.S. markets can be attributed to multiple factors including a strong economy, higher wages and tax cuts which drove revenues and earnings growth. After performing well in 2017, overseas markets including emerging markets have underperformed the U.S. markets due to a variety of factors including tighter financial conditions, issues on trade and geopolitical events.

During the trailing 12 months ending August 31, 2018, growth stocks continued to outperform value stocks in both the U.S. and abroad. The large-cap Russell 1000® Growth Index vii increased 27.2% and the Russell 1000® Value Index viii increased 12.5%. The small-cap Russell 2000® Growth Index ix increased 30.7% and the Russell 2000® Value Index x increased 20.1%. In developed international markets, the MSCI EAFE® Growth Index xii increased 8.1% and the MSCI EAFE® Value Index xi increased 0.6%. In emerging markets, the differential was not as great but still in favor of growth over value.

Within the United States, all 11 sectors of the S&P 500® posted positive results over the twelve-month period ending August 31, 2018. The returns are as follows: Information Technology (+32.8%), Consumer Discretionary (+32.3%), Energy (+22.1%), Financials (+16.9%), Health Care (+16.1%), Industrials (+13.1%), Materials (+10.0%), Real Estate (+6.3%), Telecom Services (+3.7%), Consumer Staples (+1.0%) and Utilities (+0.7%).

Fixed income markets struggled during this same 12-month period as interest rates increased across the yield curve. The yield on the U.S. 2-year Treasury-Note rose from 1.33% to 2.62% and the yield on the 10-year Treasury-Note rose from 2.13% to 2.85%. Broad investment grade indices such as the Bloomberg Barclays U.S. Aggregate BondTM Index xiii returned a negative 1.1% and the Bloomberg Barclays Global Aggregate Bond Index xiv returned a negative 1.4%. U.S. high yield markets bucked the trend given the strong economy with the Bloomberg Barclays U.S. Corporate High Yield Bond Index xv returning a positive 3.4%.

Morgan Stanley & Co. economists expect U.S. real GDP growth to be approximately 2.7% in 2018 and 2.2% in 2019. The forecast for global real GDP growth will be approximately 3.9% in 2018 and 3.8% in 2019.

Consulting Group Capital Markets (CGCM) Funds

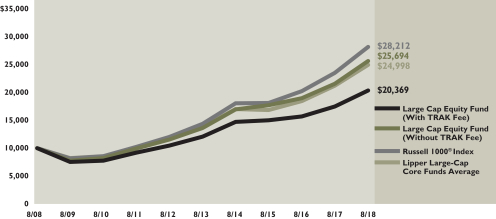

The Large Cap Equity Fund returned +18.9% in the fiscal year ending August 31, 2018 compared to the Russell 1000® Index ii which returned +19.8%. The return of the Lipper Large-Cap Core Funds Average xvi investment category was +17.6%. The Fund’s allocation effect had a positive impact on performance, but stock selection within Financials, Health Care and Information Technology contributed to the underperformance. Top contributors to performance included Amazon, Apple, Microsoft, Cisco and Alphabet (Class A), while the top detractors included Molson Coors Brewing Company, Philip Morris International, Celgene, General Electric and AT&T.

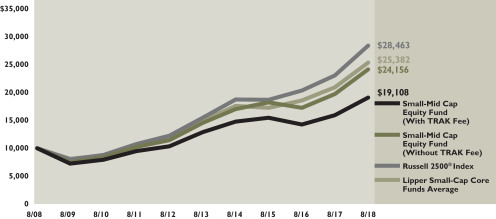

The Small-Mid Cap Equity Fund returned +22.2% during the fiscal year ending August 31, 2018 compared to the Russell 2500® Index iii which returned +23.3%. The return of the Lipper Small-Cap Core Funds Average xvii investment category was +21.2%. The Fund’s allocation effect had a positive impact on performance, but stock selection within Health Care and Information Technology were the largest detractors. Top contributors to performance included Ross Stores, Greenhill & Co., Nektar Therapeutics, Keysight Technologies and the iShares Russell 2000® Value ETF, while the top detractors included Prothena, Incyte, Manitowoc and MACOM Technology Solutions Holdings.

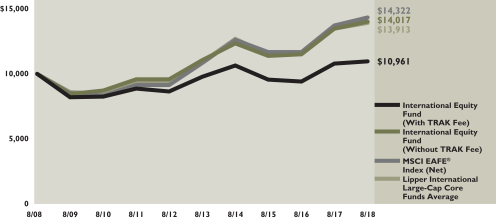

I

The International Equity Fund returned +4.2% during the fiscal year ending August 31, 2018 compared to the MSCI EAFE® Index (Net) vi which returned +4.4%. The return of the Lipper International Large-Cap Core Funds Average xviii investment category was +3.2%. Sectors contributing most to performance included Information Technology, Energy and Financials while Consumer Discretionary and Telecommunication Services were the larger detractors. Countries contributing most to performance were Germany, Sweden and Spain while the larger detractors included Japan and France. Top contributors to performance included Volkswagen AG, BP PLC, AstraZeneca PLC, CSL Limited and Temenos AG, while the top detractors included British American Tobacco PLC, UniCredit SPA, BNP Paribas SA, Takeda Pharmaceutical Ltd. and Bayer AG.

The Emerging Markets Equity Fund returned -5.6% during the fiscal year ending August 31, 2018 compared to the MSCI Emerging Markets Index (Net) v which returned -0.7%. The return of the Lipper Emerging Markets Funds Average xix investment category returned -3.0%. Sectors detracting most from performance included Financials, Energy and Health Care. Countries detracting the most included Turkey, Brazil and Taiwan. Top contributors included LUKOIL, Ping An Insurance (Group) Company, Taiwan Semiconductor Manufacturing, Samsung Electronics Co and SK hynic Inc. while the larger detractors included Tofas Turk Otomobil Fabrikasi A.S., Akbank TAS, CCR S.A., Cielo, Turk Telekomunikasyon A.S.

The Core Fixed Income Fund returned -1.4% during the fiscal year ending August 31, 2018 compared to the Bloomberg Barclays U.S. Aggregate BondTM Index xiii which returned -1.1%. The return of the Lipper Core Bond Funds Average xx was also -1.1%.

The High Yield Fund returned +3.5% during the fiscal year ending August 31, 2018 compared to Bloomberg Barclays U.S. Corporate High Yield Bond Index xv which returned +3.4%. The return of the Lipper High Yield Funds Average xxi was +2.6%.

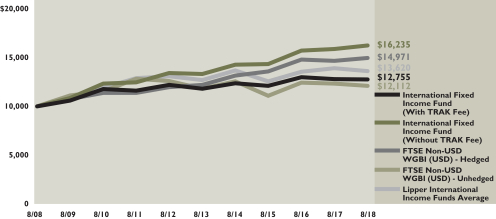

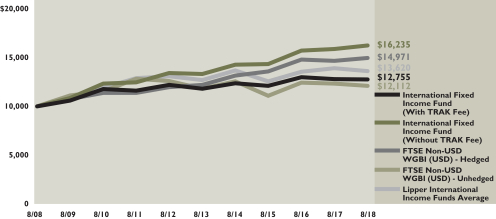

The International Fixed Income Fund returned +2.3% during the fiscal year ending August 31, 2018 compared to the FTSE Non-USD World Government Bond Index (USD) Hedged xxii which returned +2.0%. The return of the Lipper International Income Funds Average xxiii was -2.2%.

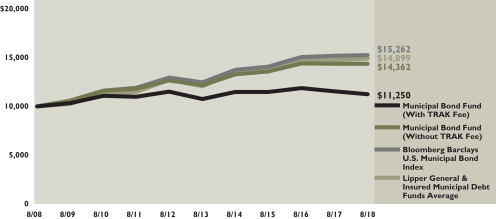

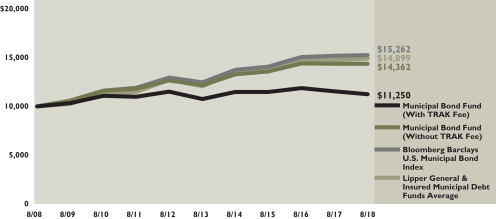

The Municipal Bond Fund returned -0.2% during the fiscal year ending August 31, 2018 compared to the Bloomberg Barclays U.S. Municipal Bond Index xxiv which returned +0.5%. The return of the Lipper General & Insured Municipal Debt Funds Average xxv was +0.8%.

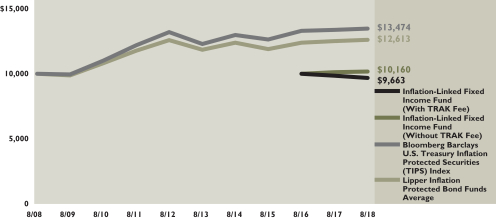

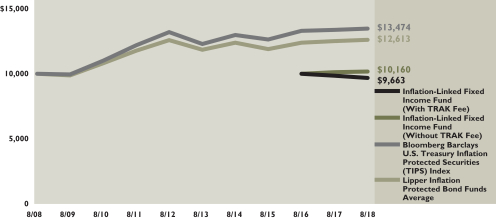

The Inflation-Linked Fixed Income Fund returned +0.6% during the fiscal year ending August 31, 2018 compared to the Bloomberg Barclays U.S. Treasury Inflation Protected Securities (TIPS) Index xxvi which returned +0.8%. The return of the Lipper Inflation Protected Bond Funds Average xxviii was also +0.8%.

The Ultra-Short Term Fixed Income Fund returned +2.1% during the fiscal year ending August 31, 2018 compared to the FTSE 3-Month U.S. Treasury Bill Index xxvii which returned +1.5%. The return of the Lipper Ultra-Short Obligations Funds Average xxix was +1.6%.

The Alternative Strategies Fund returned -1.2% since inception on February 15, 2018 through August 31, 2018 compared to the HFRX Global Hedge Fund Indexxxx that returned -1.5% in the same period.

Additional information regarding the investment managers of the CGCM Funds and commentary specific to each individual Sub-adviser is available in the Annual Report following this Shareholder Letter.

We thank you for your continued confidence in Morgan Stanley Wealth Management and support as shareholders of the CGCM Funds.

Sincerely,

Paul Ricciardelli

Chief Executive Officer

II

Although the statements of fact and data contained herein have been obtained from, and are based upon, sources the firm believes reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed. All opinions included in this report constitute the firm’s judgment as of the date herein, and are subject to change without notice. This material is for informational purposes only, and is not intended as an offer or solicitation with respect to the purchase or sale of any security. This report may contain forward-looking statements, and there can be no guarantee that they will come to pass. The index returns shown are preliminary and subject to change. Past performance is not a guarantee of future results.

Risk Considerations

Equity securities may fluctuate in response to news on companies, industries, market conditions, and general economic environment.

Investing in foreign markets entails risks not typically associated with domestic markets, such as currency fluctuations and controls, restrictions on foreign investments, less governmental supervision and regulation, and the potential for political instability. These risks may be magnified in countries with emerging markets and frontier markets, since these countries may have relatively unstable governments and less established markets and economies.

Investing in small- to medium-sized companies entails special risks, such as limited product lines, markets, and financial resources, and greater volatility than securities of larger, more established companies.

The value of fixed income securities will fluctuate and, upon a sale, may be worth more or less than their original cost or maturity value. Bonds are subject to interest rate risk, call risk, reinvestment risk, liquidity risk, and credit risk of the issuer.

High yield bonds (bonds rated below investment grade) may have speculative characteristics and present significant risks beyond those of other securities, including greater credit risk, price volatility, and limited liquidity in the secondary market. High yield bonds should comprise only a limited portion of a balanced portfolio.

Yields are subject to change with economic conditions. Yield is only one factor that should be considered when making an investment decision.

Asset allocation and diversification do not assure a profit or protect against loss in declining financial markets.

The indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment.

Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies.

Growth investing does not guarantee a profit or eliminate risk. The stocks of these companies can have relatively high valuations. Because of these high valuations, an investment in a growth stock can be more risky than an investment in a company with more modest growth expectations.

Value investing does not guarantee a profit or eliminate risk. Not all companies whose stocks are considered to be value stocks are able to turn their business around or successfully employ corrective strategies which would result in stock prices that do not rise as initially expected.

III

| | | | |

Performance of the Consulting Group Capital Markets Funds For the Year Ended August 31, 2018†* | |

| |

| Large Cap Equity Fund | | | 18.89 | % |

Russell 1000® Index (ii) | | | 19.82 | |

| |

| Small-Mid Cap Equity Fund | | | 22.17 | |

Russell 2500® Index (iii) | | | 23.33 | |

| |

| International Equity Fund | | | 4.15 | |

MSCI EAFE® Index (Net) (vi) | | | 4.39 | |

| |

| Emerging Markets Equity Fund | | | -5.61 | |

MSCI Emerging Markets Index (Net) (v) | | | -0.68 | |

| |

| Core Fixed Income Fund | | | -1.35 | |

Bloomberg Barclays U.S. Aggregate BondTM Index (xiii) | | | -1.05 | |

| |

| High Yield Fund | | | 3.47 | |

Bloomberg Barclays U.S. Corporate High Yield Bond Index (xv) | | | 3.40 | |

| |

| International Fixed Income Fund | | | 2.25 | |

FTSE Non-USD World Government Bond Index (USD) Hedged (xxii) | | | 1.95 | |

| |

| Municipal Bond Fund | | | -0.21 | |

Bloomberg Barclays U.S. Municipal Bond Index (xxiv) | | | 0.49 | |

| |

| Inflation-Linked Fixed Income Fund | | | 0.55 | |

Bloomberg Barclays U.S. Treasury Inflation Protected Securities (TIPS) Index (xxvi) | | | 0.83 | |

| |

| Ultra-Short Term Fixed Income Fund | | | 2.09 | |

FTSE 3-Month U.S. Treasury Bill Index (xxvii) | | | 1.49 | |

| |

| Alternative Strategies Fund | | | -1.20 | |

HFRX Global Hedge Fund Index (xxx) | | | -1.47 | |

See pages 26 through 29 for all footnotes.

IV

Large Cap Equity Fund

|

| ABOUTTHE SUB-ADVISERS |

• ClearBridge Investments, LLC (“ClearBridge”) ClearBridge is a wholly-owned subsidiary of Legg Mason, Inc., a financial services holding company. The Portfolio Managers for the ClearBridge Large Cap Growth strategy utilize a fundamental, bottom-up research approach that emphasizes company analysis, management and stock selection. ClearBridge invests in large capitalization companies that it believes are dominant in their industries due to product, distribution or service strength. ClearBridge emphasizes individual security selection while diversifying the Fund’s investments across industries, which may help to reduce risk. ClearBridge attempts to identify established large capitalization companies with the highest growth potential, then analyze each company in detail, ranking its management, strategy and competitive market position. The Portfolio Managers pursue a collaborative approach in which both they and the research analysts propose companies with attractive business models and good long-term growth prospects for further review. The team is particularly valuation conscious, gravitating toward “controversy”, or companies that are temporarily inefficiently priced. |

|

• Columbia Management Investment Advisers, LLC (“Columbia”) |

Columbia uses a combination of fundamental and quantitative analysis with risk management, including cross-correlation analysis, in identifying investment opportunities and constructing it’s portion of the Fund’s portfolio. In selecting investments, Columbia considers, among other factors: |

|

| · overall economic and market conditions; and |

| · the financial condition and management of a company, including its competitive position, the quality of its balance sheet and earnings, its future prospects, and the potential for growth and stock price appreciation. |

|

| Columbia may sell a security when the security’s price reaches a target set by Columbia; if Columbia believes that there is deterioration in the issuer’s financial circumstances or fundamental prospects; if other investments are more attractive; or for other reasons. |

|

• BlackRock Financial Management, Inc. (“BlackRock”) |

| BlackRock employs a “passive” management approach, attempting to invest in a portfolio of assets whose performance is expected to match approximately the performance of the Russell 1000® Index. The Fund will be substantially invested in securities in the Russell 1000® Index, and will invest, under normal circumstances, at least 80% of its assets in securities or other financial instruments that are components of or have economic characteristics similar to the securities included in the Russell 1000® Index. |

As of August 31, 2018, the Sub-advisers for CGCM Large Cap Equity Fund (“Fund”) were BlackRock Financial Management, Inc. (“BlackRock”), Columbia Management Investment Advisers, LLC (“Columbia”), Lazard Asset Management, LLC (“Lazard”), Delaware Investments Fund Advisers (“Delaware”), Lyrical Asset Management LP (“Lyrical”) and ClearBridge Investments, LLC (“ClearBridge”). Note ClearBridge was hired on November 20, 2017 and replaced Wedgewood Partners, Inc. (“Wedgewood”) as a Sub-adviser.

For the fiscal year ending August 31, 2018, the Fund returned 18.9% compared to the Russell 1000® Indexii return of 19.8%. The Fund’s overweight to Information Technology and underweight to Real Estate and Utilities contributed to performance. Stock selection was strongest within the Energy sector, but weakest in the Information Technology sector. The top positions contributing to performance included Amazon, Apple, Microsoft, Cisco Systems and Alphabet Inc. Class A, while the top detractors included Molson Coors Brewing Company, Philip Morris International, Celgene Corp., General Electric Company and AT&T Inc.

The Fund’s holdings offered a dividend yield of 1.7%, in-line with the benchmark which was also 1.7%. On a valuation basis, the Fund’s forward P/E was 17.7, slightly cheaper than the benchmark at 18.3. The estimated earnings per share growth over the next 3-5 years of 14.2% for the Fund was slightly higher than the benchmark’s 13.9% growth rate. The top 10 individual positions by weight were the iShares Core S&P U.S. Value ETF, Amazon, Apple, Microsoft, Cisco Systems, Coca-Cola Company, Alphabet Inc. Class A, Johnson & Johnson, Facebook, Inc. Class A and Medtronic PLC.

For the fiscal year ending August 31, 2018, BlackRock performed in-line with the Russell 1000® Indexii, gross of fees, which matched its passive mandate to track the index.

The portion of the Fund managed by Lazard trailed the benchmark gross of fees for the period which can be contributed to their value bias and individual stock selection. Large cap value stocks underperformed large cap growth stocks by nearly 15% during the fiscal year. Contributing to performance was relative positioning to the Information Technology, Industrials and Health Care sectors. Detracting from performance was relative positioning to Consumer Staples, Consumer Discretionary and the Material sectors. Stock selection was strongest within the Energy sector and weakest in the Consumer Staples sector. The top five contributors were Medtronic, Cisco Systems, Motorola Solutions, Alphabet Inc. Class A and DXC Technology while the top five detractors included Molson Coors Brewing Company, Skyworks Solutions, Vulcan Materials, Crown Holdings and AT&T Inc. As of August 31, 2018, the top five holdings represented approximately 46% of Lazard’s portfolio and consisted of Coca-Cola Company, Analog Devices, Medtronic, Cisco Systems and Alphabet Inc. Class A.

The portion of the Fund managed by Delaware trailed the benchmark gross of fees for the period due mainly to their value strategy along with their relative sector positioning within the Information Technology and Consumer Discretionary sectors. Stock selection was strongest within Energy and Consumer Staples and weakest within Health Care. The top five contributors were Lowe’s Companies, Marathon

1

|

|

• Lazard Asset Management, LLC (“Lazard”) |

| Lazard, an indirect, wholly-owned subsidiary of Lazard Ltd., is known for its global perspective on investing and years of experience with global, regional and domestic portfolios. With more than 300 investment personnel worldwide, Lazard offers investors of all types an array of equity, fixed income, and alternative investment solutions from its network of local offices in ten different countries. Its team-based approach to portfolio management helps Lazard to deliver robust and consistent performance over time, and strong client relationships allow them to understand how to employ their capabilities to its clients’ advantage. |

| Lazard manages an all cap, concentrated strategy designed to leverage the best collection of ideas from the U.S. Equity team. It is benchmark-agnostic, seeking to outperform any broad-based market index (i.e., S&P 500® Index, Russell 1000® Index, Russell 3000® Index) by investing in companies that compound earnings and capital and by taking advantage of valuation anomalies. |

|

• Delaware Investments Fund Advisers, a member of Macquarie Investment Management Business Trust (“MIM”) |

| MIM will invest under normal circumstances, at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in securities of large-capitalization companies. MIM invests primarily in securities of large-capitalization companies that the Manager believes have long-term capital appreciation potential. MIM currently defines large-capitalization stocks as those with market capitalizations of $5 billion or greater at the time of purchase. Typically, the Manager seeks to select securities that it believes are undervalued in relation to their intrinsic value, as indicated by multiple factors, including the earnings and cash flow potential or the asset value of the respective issuers. The Manager also considers a company’s plans for future operations on a selective basis. The Manager may sell a security if it no longer believes the security will contribute to meeting the investment objective of the Fund. |

• Wedgewood Partners, Inc. (“Wedgewood”) |

| Wedgewood seeks long-term capital appreciation by investing in equity securities of large capitalization companies that Wedgewood believes have above-average growth prospects. The Fund invests primarily in common stocks. The Fund considers companies with market capitalizations in excess of $5 billion to be large capitalization companies. The Fund is non-diversified and invests in a limited number of companies, generally holding securities of approximately 20 companies. The Fund invests primarily in the securities of U.S. companies, but it may also invest outside of the U.S. Wedgewood seeks investments in market leaders with dominant products or services that are irreplaceable or lack substitutes in today’s economy. Wedgewood invests for the long-term, and expects to hold securities, in many cases, for more than 5 years. |

Oil, ConocoPhillips, Cisco Systems and Intel while the top five detractors were American International Group, Cardinal Health, Oracle, AT&T and Edison International. As of August 31, 2018, the top five holdings represented approximately 16% of Delaware’s portfolio and consisted of Cisco Systems, CVS Health Corporation, Express Scripts Holding Company, Lowe’s Companies and Pfizer.

The portion of the Fund managed by Lyrical trailed the benchmark gross of fees for the period which can be contributed to their deep value strategy and individual stock selection. Stock selection within Energy and Health care contributed to performance while stock selection within Information Technology, Consumer Discretionary and Financials were the biggest detractors. The top five contributors were National Oilwell Varco, EOG Resources, HCA Healthcare, Anthem and TE Connectivity while the top five detractors were Adient, Whirlpool, Goodyear Tire & Rubber, Affiliated Managers Group and Western Digital. The top five holdings as of August 31, 2018 represented approximately 29% of Lyrical’s portfolio and consisted of HCA Healthcare, Anthem, Corning, EOG Resources and Aflac.

The portion of the Fund managed by ClearBridge, which as mentioned above was incepted in November 2017 as a replacement for Wedgewood, outperformed the benchmark gross of fees for the period due their growth strategy, relative sector positioning and stock selection. Sector positioning was mostly positive with the largest contribution coming from the Information Technology, Real Estate, Consumer Discretionary and Financials. Stock selection was strongest in the Information Technology, Consumer Discretionary and Industrials sectors and weakest within Health Care. The top five contributors were Amazon, W.W. Grainger, Microsoft, Adobe Systems and Visa Inc. Class A while the top five detractors were Tractor Supply Co., Anheuser-Busch InBev, Dentsply Sirona, Inc., Celgene and CVS Health Corp. The top five holdings as of August 31, 2018 represented approximately 21% of ClearBridge’s portfolio and consisted of Amazon, Microsoft, Visa Inc. Class A, Alphabet Inc. Class C and Apple.

The portion of the Fund managed by Columbia outperformed the benchmark gross of fees for the period due to their aggressive growth strategy and relative sector positioning. Sector positioning was positive across the majority of sectors with Information Technology and Consumer Discretionary being the larger contributors. Stock selection detracted from performance with most of the negative contribution coming from the Heath Care and Industrial sectors. The top five contributors were Amazon, Illumina, Nvidia, Splunk and Salesforce.com while the top five detractors included Celegene, Intercept Pharmaceuticals, DexCom, Alexion Pharmaceuticals and Applied Materials. The top five holdings as of August 31, 2018 represented approximately 21% of the Columbia portfolio and consisted of Amazon, Nvidia, PayPal, Salesforce.com and Facebook, Inc. Class A.

2

|

• Lyrical Asset Management LP (“Lyrical”) |

| Lyrical employs a deep value style with a high quality focus. Lyrical employs a value investing philosophy and believes that a portfolio of companies with low valuations relative to their long-term normalized earnings power will outperform the overall market over time and unlike some traditional value investors who are willing to own any business at the right price, Lyrical’s philosophy is to invest only in businesses that it believes are of good quality. Lyrical invests only in the common stock of companies within its investable universe, which is the top 1,000 U.S. listed stocks by market capitalization. |

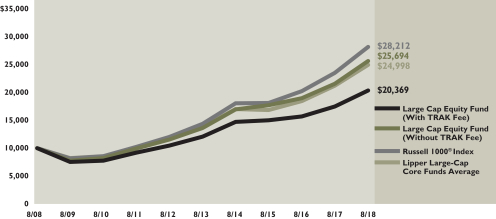

The following graph depicts the performance of Russell 1000® Indexii vs. the Lipper Large-Cap Core Funds Averagexvi

|

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2018 LARGE CAP EQUITY FUND Comparison of $10,000 Investment in the Fund with the Russell 1000® Index

and the Lipper Large-Cap Core Funds Average |

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/ or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.morganstanley.com/cgcm.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | | | | | | | |

| | | LARGE CAP EQUITY FUND Average Annual Total Returns for the Period Ended August 31, 2018† |

| | | | | Without

Annual

Advisory

Program

Fee | | With

Annual

Advisory

Program

Fee* | | Russell

1000®

Index** | | Lipper

Large-Cap

Core Funds

Average** |

| | Since inception 11/18/1991 | | | | 8.64 | % | | | | 5.97 | % | | | | 10.11 | % | | | | 9.51 | % |

| | 10 years | | | | 9.90 | | | | | 7.20 | | | | | 10.93 | | | | | 9.74 | |

| | 5 years | | | | 13.48 | | | | | 10.69 | | | | | 14.36 | | | | | 12.79 | |

| | 3 years | | | | 13.17 | | | | | 10.41 | | | | | 15.84 | | | | | 14.10 | |

| | | 1 year | | | | 18.89 | | | | | 16.03 | | | | | 19.82 | | | | | 17.55 | |

See pages 26 through 29 for all footnotes.

3

Small-Mid Cap Equity Fund

|

| ABOUTTHE SUB-ADVISERS |

• Neuberger Berman Investment Advisers LLC (“Neuberger”) |

| Neuberger employs in-depth research to identify out-of-favor small cap companies selling at a significant discount to intrinsic value, where there is a dynamic plan or event that is expected to both enhance value and narrow the price/value gap. Neuberger’s analysts seek to invest when there is a true disconnect between reality and market perception – something that occurs regularly in particular types of companies. For example, we believe the market tends to demonstrate inefficiency in pricing companies with complex corporate structures since many investors will not take the time to understand them. Neuberger’s valuation approach resembles the due diligence effort that Neuberger’s a private equity firm might employ to evaluate the purchase of an entire company. Neuberger’s analysts also focus on investing in businesses where management has a significant ownership stake as, in our view, such companies tend to be more aligned with shareholders’ interests. |

|

• Frontier Capital Management Co., LLC (“Frontier”) |

| Frontier is a research-driven firm specializing in the management of growth-oriented U.S. equity portfolios. Frontier believes that growth must be purchased at a reasonable price and that fundamental, bottom-up research is the cornerstone to adding value. The firm’s philosophy since its founding in 1980 is that stock prices ultimately follow earnings growth. Frontier believes that there are three key drivers of long-term, consistent performance and look for companies that possess, improving business models; unrecognized earnings power; and attractive valuations. |

|

• Hahn Capital Management LLC (“Hahn”) |

| Hahn employs a bottom-up investment process to construct a portfolio of U.S. mid-cap companies that Hahn’s mid-cap value investment team believes possess a combination of high quality balance sheets, sustainable & durable business models, superior management and an attractive valuation relative to Hahn’s estimate of underlying intrinsic value. Protection of capital is the strategy’s primary goal with the ability to compound earnings an important secondary goal. |

As of August 31, 2018, the Sub-advisers for the CGCM Small-Mid Cap Equity Fund (“Fund”) were BlackRock Financial Management, Inc. (“BlackRock”), Frontier Capital Management Co., LLC (“Frontier”), Hahn Capital Management LLC (“Hahn”), Neuberger Berman Investment Advisers LLC (“Neuberger”), Rutabaga Capital Management LLC (“Rutabaga”) and Westfield Capital Management Company, L.P. (“Westfield”).

As of August 31, 2018, the Fund returned 22.2% compared to the Russell 2500® Indexiii return of 23.3%. The Fund’s relative sector positioning was a contributor to performance while individual stock selection was a detractor. The Fund’s overweight to Information Technology and underweight to Real Estate and Utilities contributed to performance. Stock selection was strongest within Consumer Discretionary and weakest in the Information Technology and Health Care sectors. The top positions contributing to performance included Ross Stores, Greenhill & Co., Nektar Therapeutics, Keysight Technologies and the iShares Russell 2000® Value ETF while the top detractors included Mohawk Industries, Prothena Corp, Incyte Corp., Manitowoc Company and MACOM Technology Solutions Holdings.

The Fund’s holdings offered a dividend yield of 0.9% compared to the benchmark’s yield of 1.4%. On a valuation basis, the Fund’s forward P/E was 19.3, higher than the benchmark of 18.6. The higher premium can be attributed to the estimated 3-5 years earnings per share growth rate of 15.2% for the Fund compared to the benchmark of 14.2%. The top 10 individual positions by weight were the iShares Russell 2000® Value ETF, Keysight Technologies, Ross Stores, Becton, Dickinson and Company, Hexcel Corp., Jacobs Engineering Group, Euronet Worldwide, CBRE Group, Inc. Class A, IDEX Corp and Mid-America Apartment Communities.

For the fiscal year ending August 31, 2018, BlackRock performed in-line with the Russell 2500® Indexiii, which matched its passive mandate to track the index.

The portion of the Fund managed by Frontier trailed the benchmark gross of fees during the period mainly due to individual stock selection. Contributing to performance was relative positioning to the Real Estate, Information Technology and Health Care sectors. Detractors included Materials and Energy. Stock selection was strongest within the Energy and Financials, but weakest within Health Care and Information Technology. The top five contributors were O’Reilly Automotive, Aligh Technology, Zoetis, Inc. Class A, Cintas Corp, SS&C Technologies Holdings while the top five detractors were Expedia Group, Incyte Corp., Equifax, MACOM Technology Solutions Holdings and Euronet Worldwide. As of August 31, 2018, the top five holdings represented approximately 12% of Frontier’s portfolio and consisted of Global Payments, Cintas Corp., Cooper Companies, Worldpay, Inc. Class A and O’Reily Automotive.

The portion of the Fund managed by Hahn trailed the benchmark gross of fees due to their value strategy, relative sector positioning and stock selection. Contributing to performance was their relative positioning in Consumer Discretionary while detractors included Information Technology, Health Care and Real Estate. Stock selection was strongest within the Industrials and Real Estate sectors, but weakest within Health Care, Consumer Discretionary and Information Technology. The top five contributors were Ross Stores, Becton, Dickinson and Company, Jacobs

4

|

• Rutabaga Capital Management LLC (“Rutabaga”) |

| Rutabaga focuses exclusively on micro- and small capitalization stocks and looks to unearth uncommon or currently out-of-favor stocks. The firm’s analysts employ extensive bottom-up fundamental research to identify high quality companies with catalysts to increase margins and intrinsic value but are neglected or misperceived by the market. |

|

• Westfield Capital Management Company, L.P. (“Westfield”) |

| Westfield favors investing in earnings growth stocks given a conviction that stock prices follow earnings progress and that they offer the best opportunity for superior real rates of return. Reasonably priced stocks of companies with high foreseen earnings potential are best identified through in-depth, fundamental research. It is Westfield’s belief that the small capitalization portion of the market is under-researched, and therefore less efficient, than the large capitalization sector. |

|

• BlackRock Financial Management, Inc. (“BlackRock”) |

| BlackRock Financial Management, Inc. employs a “passive” management approach, attempting to invest in a portfolio of assets whose performance is expected to match approximately the performance of the Russell 2500® Index. The Fund will be substantially invested in securities in the Russell 2500® Index, and will invest, under normal circumstances, at least 80% of its assets in securities or other financial instruments that are components of or have economic characteristics similar to the securities included in the Russell 2500® Index. |

Engineering Group, Keysight Technologies and CBRE Group, Inc. Class A while the top detractors were Mohawk Industries, Hanesbrands, Envision Healthcare, JELD-WEN Holdings, Inc. and Albermarle Corp. As of August 31, 2018, the top five holdings represented approximately 22% of Hahn’s portfolio and included Keysight Technologies, Becton, Dickinson and Company, Ross Stores, CBRE Group, Inc. Class A and Jacobs Engineering Group.

The portion of the Fund managed by Neuberger underperformed the benchmark gross of fees due to their value strategy and individual stock selection. Relative positioning to the Information Technology (overweight), Real Estate (underweight) and Financial (underweight) sectors contributed to performance while their underweight to Consumer Discretionary detracted somewhat. Stock selection was strongest within Consumer Discretionary, Health Care and Financials and weakest within Information Technology and Industrials. The top five contributors were SeaWorld Entertainment, Molina Healthcare, Ciena, Acxiom and Mellanox Technologies, Ltd., while the top detractors were Babcock & Wilcox Enterprises, MACOM Technology Solutions Holdings, Diebold Nixdorf Inc., TiVo Corp. and Crown Holdings. As of August 31, 2018, the top five holdings represented approximately 15% of Neuberger’s portfolio and consisted of Ciena, ARRIS International Plc, Verint Systems, Charles River Laboratories International and Mellanox Technologies, Ltd.

The portion of the Fund managed by Rutabaga outperformed the benchmark gross of fees due to their relative sector positioning and individual stock selection. Relative positioning to Real Estate (underweight) and Materials (underweight) added to performance while their underweight to Health Care and overweight to Industrials detracted from performance. Stock selection was strongest within Financials, Consumer Discretionary and Consumer Staples, but weakest within Energy. The top five contributors were Lindblad Expeditions Holdings, Greenhill & Co., Thermon Group Holdings, SPX Flow, and Calgon Carbon, while the top five detractors were Key Energy Services, Tivity Health, Manitowoc Company, Granite Construction and Textainer Group Holdings Limited. As of August 31, 2018, the top five holdings represented approximately 28% of Rutabaga’s portfolio and consisted of Andersons, Lindblad Expeditions Holdings, Cooper Tire & Rubber Company, Varex Imaging and Mistras Group.

The portion of the Fund managed by Westfield outperformed the benchmark gross of fees due to their growth strategy, relative sector positioning and individual stock selection. Relative positioning to most sectors except Energy (underweight) and Materials (overweight) added to performance. Stock selection was strongest within Information Technology, Consumer Discretionary and Financials, but weakest within Health Care, Industrials and Materials. The top five contributors were Eldorado Resorts, The Bank of N.T. Butterfield & Son Limited, Nektar Therapeutics, Zendesk and Integrated Device Technology while the top five detractors were Prothena Corp. Plc, Clovis Oncology, DexCom, Aclaris Therapeutics and Berry Global Group. As of August 31, 2018, the top five holdings represented approximately 10% of Westfield’s portfolio and consisted of Masimo, ICON Plc., Bio-Rad Laboratories, Inc. Class A, Eldorado Resorts and Ultimate Software Group.

5

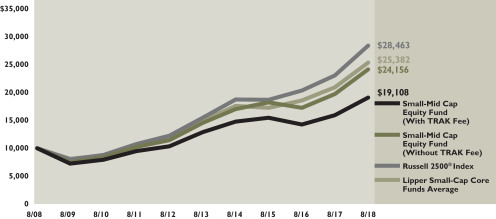

The following graph depicts the performance of Russell 2500® Indexiii vs. the Lipper Small-Cap Core Funds Averagexvii

|

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2018 SMALL-MID CAP EQUITY FUND Comparison of $10,000 Investment in the Fund with the Russell 2500® Index

and the Lipper Small-Cap Core Funds Average |

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/ or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.morganstanley.com/cgcm.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | | | | | | | |

| | | SMALL-MID CAP EQUITY FUND Average Annual Total Returns for the Period Ended August 31, 2018† |

| | | | | Without

Annual

Advisory

Program

Fee | | With

Annual

Advisory

Program

Fee* | | Russell

2500®

Index** | | Lipper

Small-Cap

Core Funds

Average** |

| | Since inception 11/18/1991 | | | | 9.50 | % | | | | 5.97 | % | | | | 11.30 | % | | | | 10.91 | % |

| | 10 years | | | | 9.22 | | | | | 6.52 | | | | | 11.03 | | | | | 10.01 | |

| | 5 years | | | | 10.65 | | | | | 7.90 | | | | | 12.96 | | | | | 11.60 | |

| | 3 years | | | | 9.74 | | | | | 7.03 | | | | | 14.96 | | | | | 13.87 | |

| | | 1 year | | | | 22.17 | | | | | 19.20 | | | | | 23.33 | | | | | 21.17 | |

See pages 26 through 29 for all footnotes.

6

International Equity Fund

|

| ABOUTTHE SUB-ADVISERS |

• Victory Capital Management, Inc. (“Victory Capital”) |

| Victory Capital’s investment franchise, Trivalent Investments, employs a bottom-up investment approach that emphasizes individual stock selection. The investment process uses a combination of quantitative and traditional qualitative, fundamental analysis to identify stocks with low relative price multiples and positive trends in earnings forecasts. The stock selection process is designed to produce a diversified portfolio that, relative to the S&P Developed ex-U.S. Small Cap Index, tends to have a below-average price-to-earnings ratio and an above-average earnings growth trend. |

|

• Wellington Management Company, LLP (“Wellington”) |

| Tracing our history to 1928, Wellington is one of the world’s largest independent investment management firms. With over US$1 trillion in assets under management as of 30 June 2018, we serve as a trusted investment adviser to more than 2,200 institutional clients and mutual fund sponsors in over 60 countries. Our comprehensive investment capabilities are built on the strength of rigorous, proprietary research and span nearly all segments of the global capital markets, including equity, fixed income, multi-asset, and alternative strategies. As a private partnership whose sole business is investment management, our long-term views and interests are aligned with those of our clients. Our commitment to investment excellence is evidenced by our significant presence and long-term track records in nearly all sectors of the global securities markets. |

|

• Causeway Capital Management LLC (“Causeway”) |

Causeway’s international developed market investment philosophy is based on a long-term value strategy and the investment team applies an active, bottom-up, research-intensive approach towards stock selection. Causeway’s investment approach seeks to identify under-priced stocks of high quality companies believed to be exhibiting superior financial strength as compared to peers. In addition to fundamental analysis, quantitative research is considered an integral part of the process and is used for screenings of investment candidates as well as risk management. Portfolio managers work as a team to make investment decisions and are supported by the firm’s dedicated fundamental and quantitative research analysts. Analysts and portfolio managers are assigned global industry-specific research responsibilities. Fundamental |

As of August 31, 2018, the Sub-advisers for the CGCM International Equity Fund (“Fund”) were BlackRock Financial Management Inc. (“BlackRock”), Causeway Capital Management, LLC (“Causeway”), OppenheimerFunds, Inc. (“OFI”), Schroders Investment Management North America, Inc. (“Schroders”), Victory Capital Management Inc. (“Victory Capital”) and Wellington Management Company, LLP (“Wellington”). Please note Victory Capital was added as a Sub-adviser on November 27, 2017 and Wellington was added as a Sub-adviser on December 4, 2017.

For the fiscal year ending August 31, 2018, the Fund returned 4.2% compared to the MSCI EAFE® Index (Net)vi return of 4.4%. The Fund’s relative country selection contributed to performance while individual stock selection within those countries detracted. The Fund’s overweight to emerging markets added to performance but their underweight to Japan detracted. Individual stock selection was strongest in Europe and weakest in emerging markets and Japan. The top five positions contributing to performance included Volkswagen AG Pref, BP PLC, AstraZeneca PLC, CSL Limited and Temenos AG while the top five detractors were British American Tobacco PLC., UniCredit SPA, BNP Paribas SA Class A., Takeda Pharmaceutical Co. Ltd, and Bayer AG.

The Fund’s holdings offered a dividend yield of 2.9% compared to the benchmark of 3.2%. On a valuation basis, the Fund’s forward P/E was 14.1, in-line with the benchmark which was also 14.1. The estimated 3-5 years earnings per share growth for the Fund is 10.3%, compared to the benchmark of 9.8%. The top 10 individual positions by weight were BP PLC, AstraZeneca PLC, Novartis AG, Total SA, SAP SE, Prudential PLC, Royal Dutch Shell PLC Class B, Nestle SA, China Mobile Limited and Roche Holding Ltd Genusssch.

For the fiscal year ending August 31, 2018, BlackRock performed in-line with the MSCI EAFE® Index (Net)vi gross of fees, which matched its passive mandate to track the index.

The portion of the Fund managed by Causeway was in-line with the Fund’s benchmark gross of fees despite being a value manager in a market where international value stocks underperformed international growth stocks during the fiscal year ending August 31, 2018. Relative country allocation added to performance, but was offset by the individual security selection within those countries. When combining both the country allocation and security selection effect together, the top contributors to performance included Germany, Canada, Spain, Sweden and Australia while the top detractors included Japan, France, Italy, Switzerland and China. From a sector standpoint, contributors to performance included Energy, Materials and Industrials while detractors included Consumer Staples, Information Technology and Health Care. At fiscal year-end, the top five holdings represented approximately 17% of Causeway’s portfolio and consisted of Volkswagen AG Pref, Linde AG TEMP, China Mobile Limited, ABB Ltd. and BP PLC.

The portion of the Fund managed by OFI underperformed the Fund’s benchmark gross of fees during the fiscal year ending August 31, 2018. Relative country allocation added to performance, but was offset by the individual security selection

7

|

research is further organized into six research clusters: financials/materials, consumer, industrial/ manufacturing, energy, technology and health care. Causeway’s unconstrained, international established market value equity approach invests in a variety of market capitalization ranges, but primarily in large- and midcapitalization non-U.S. developed market companies. Causeway can also invest in small-cap issues and less developed emerging markets. Value-driven security characteristics may include low price/earnings ratio, low price/ book ratio, low price/cash flow ratio and high dividend yield, but may also include out-of-favor companies that may have high rates of growth of earnings. Sector and regional weights are byproducts of the investment process. • BlackRock Financial Management, Inc. (“BlackRock”) BlackRock Financial Management, Inc. employs a “passive” management approach, attempting to invest in a portfolio of assets whose performance is expected to match approximately the performance of the MSCI EAFE® Index (Net). The Fund will be substantially invested in securities in the MSCI EAFE® Index (Net), and will invest, under normal circumstances, at least 80% of its assets in securities or other financial instruments that are components of or have economic characteristics similar to the securities included in the MSCI EAFE® Index (Net). |

|

• OppenheimerFunds, Inc. (“OFI”) |

| OFI’s Global Equity team seeks to generate alpha through high conviction decisions driven by fundamental bottom-up analysis. Several secular growth themes are used as a way to focus attention on segments of the global marketplace that may grow faster than world GDP. The team’s investment process is driven by a number of very powerful, long-term economic, demographic and technological forces summarized as MANTRA®—Mass Affluence, New Technologies, Restructuring and Aging. The portfolio managers utilize a bottom-up, fundamental investment approach, and seek to invest initially in high-quality companies that are temporarily out of favor; trading at attractive valuations; and which demonstrate sustainable, above-average growth potential over a three- to five-year time horizon. The process is indexagnostic, searching for companies with high growth rates and high quality balance sheets with minimal focus with respect to region or country, sector or security. |

|

• Schroders Investment Management North America, Inc. (“Schroders”) |

| Schroders uses a bottom-up growth oriented approach towards stock selection and employs a fundamental, research driven process to identify quality growth companies with attractive medium-term growth and valuation, quality management and financial position, and a sustainable competitive advantage. Schroders’ “best ideas” portfolio blends both core and opportunistic holdings. |

within those countries. When combining both the country allocation and security selection effect together, the top contributors to performance included Switzerland, Spain, Sweden, Belgium and Australia while top detractors included Japan, United Kingdom, Finland, China and India. From a sector standpoint, contributors to performance included Financials, Information Technology, Health Care, Consumer Staples and Industrials while detractors included Consumer Discretionary, Energy and Telecommunication Services. At fiscal year-end, the top five holdings represented approximately 11% of OFI’s portfolio and consisted of Temenos AG, Infineon Technologies AG, SAP SE, CSL Limited and ICICI Bank Limited Sponsored ADR.

The portion of the Fund managed by Schroders outperformed the Fund’s benchmark gross of fees during the fiscal year ending August 31, 2018. The strategy’s growth bias along with their relative country allocation and individual security selection within those countries added to performance. When combining both the country allocation and security selection effect together, the top contributors included Belgium, Sweden, Netherlands, Australia and Japan while the top detractors included Spain, Germany, Finland and Brazil. From a sector standpoint, contributors included Information Technology, Financials, Materials and Consumer Staples while detractors included Consumer Discretionary, Industrials, Telecommunication Services and Energy. At fiscal year-end, the top five holdings represented approximately 11% of Schroder’s portfolio and consisted of Nestle SA, Total SA, Novartis AG, Toyota Motor Corp. and AIA Group Limited.

The portion of the Fund managed by Wellington underperformed the Fund’s benchmark gross of fees since Wellington’s inception on December 4, 2017 through fiscal year-end on August 31, 2018. The strategy’s value bias acted as a headwind along with their security selection, however their country allocation added to performance. When combining both the country allocation and security selection effect together, top contributors included the United Kingdom, Sweden, Italy, Spain and Germany while top detractors included France, Netherlands, Switzerland, India and Korea. From a sector standpoint, Energy and Consumer Staples added value, but Financials, Consumer Discretionary, Materials and Health Care were the larger detractors. At fiscal year-end, the top five holdings represented approximately 13% of Wellington’s portfolio and consisted of Total SA, BP PLC, Eni SPA, AstraZeneca PLC and Honda Motor Co, LTD.

The portion of the Fund managed by Victory Capital outperformed the Fund’s benchmark gross of fees since Victory Capital’s inception on November 27, 2017 through fiscal year-end on August 31, 2018. Relative country allocation slightly detracted from performance with the main driver of returns coming from their security selection within those countries. When combining both country allocation and security selection effect, key contributors included France, Germany, Italy and Hong Kong while detractors included the United Kingdom, Netherlands, Norway and Korea. From a sector standpoint, Energy, Health Care, Information Technology and Real Estate added to performance while Financials, Materials and Telecommunication Services detracted somewhat. At fiscal year-end, the top five holdings represented approximately 6% of Victory Capital’s portfolio and consisted of Wirecard AG, Teleperformance SE, IpsenSA, Logitech International SA and Amplifon SPA.

8

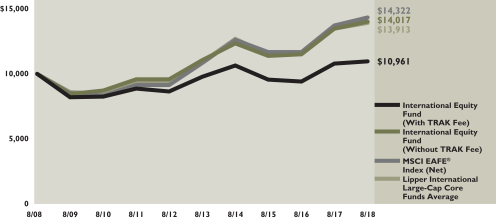

The following graph depicts the performance of MSCI EAFE® Index (Net)vi vs. the Lipper International Large-Cap Core Funds Averagexviii

|

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2018 INTERNATIONAL EQUITY FUND Comparison of $10,000 Investment in the Fund with the Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE®) Index (Net) and the Lipper International Large-Cap Core Funds Average |

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/ or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.morganstanley.com/cgcm.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | | | | | | | |

| | | INTERNATIONAL EQUITY FUND Average Annual Total Returns for the Period Ended August 31, 2018† |

| | | | | Without

Annual

Advisory

Program

Fee | | With

Annual

Advisory

Program

Fee* | | MSCI

EAFE®

Index

(Net)** | | Lipper

International

Large-Cap

Core Funds

Average** |

| | Since inception 11/18/1991 | | | | 5.41 | % | | | | 2.81 | % | | | | 5.18 | % | | | | 6.45 | % |

| | 10 years | | | | 3.43 | | | | | 0.90 | | | | | 3.66 | | | | | 3.65 | |

| | 5 years | | | | 4.85 | | | | | 2.28 | | | | | 5.73 | | | | | 4.95 | |

| | 3 years | | | | 7.19 | | | | | 4.59 | | | | | 7.04 | | | | | 5.96 | |

| | | 1 year | | | | 4.15 | | | | | 1.64 | | | | | 4.39 | | | | | 3.21 | |

See pages 26 through 29 for all footnotes.

9

Emerging Markets Equity Fund

|

| ABOUTTHE SUB-ADVISERS |

• Van Eck Associates Corporation (“VanEck”) |

| VanEck is privately held global asset management firm founded in 1955. VanEck’s mission is to develop and offer investors forward-looking, intelligently designed investment strategies that strengthen a long-term portfolio. VanEck’s Emerging Markets Equity Strategy (“Strategy”) seeks long-term competitive risk-adjusted returns through investments that demonstrate structural growth at a reasonable price. The Strategy seeks to uncover structural growth opportunities wherever they exist within emerging markets, and employs a fundamentally driven stock selection and research process with the flexibility to invest across the market capitalization spectrum. |

• BlackRock Financial Management, Inc. (“BlackRock”) |

| BlackRock Financial Management, Inc. employs a “passive” management approach, attempting to invest in a portfolio of assets whose performance is expected to match approximately the performance of the MSCI Emerging Market Index (Net). The Fund will be substantially invested in securities in the MSCI Emerging Market Index (Net), and will invest, under normal circumstances, at least 80% of its assets in securities or other financial instruments that are components of or have economic characteristics similar to the securities included in the MSCI Emerging Market Index (Net). |

• Lazard Asset Management, LLC (“Lazard”) |

Lazard, an indirect, wholly-owned subsidiary of Lazard Ltd., is known for its global perspective on investing and years of experience with global, regional and domestic portfolios. With more than 300 investment personnel worldwide, Lazard offers investors of all types an array of equity, fixed income, and alternative investment solutions from its network of local offices in ten different countries. Its team-based approach to portfolio management helps Lazard to deliver robust and consistent performance over time, and strong client relationships allow them to understand how to employ their capabilities to its clients’ advantage. Lazard manages a relative value strategy (“Value Strategy”) and invests primarily in equity securities, principally common stocks, |

As of August 31, 2018, the Sub-advisers for the CGCM Emerging Markets Equity Fund (“Fund”) were BlackRock Financial Management, Inc. (“BlackRock”), Van Eck Associates Corporation (“VanEck”) and Lazard Asset Management, LLC (“Lazard”).

For the fiscal year ending August 31, 2018, the Fund returned -5.6% compared to the MSCI Emerging Markets Index (Net)v return of -0.7%. The underperformance can be contributed to a combination of country allocation and stock selection within those countries with some of the key detractors including exposures to Turkey, Russia and Taiwan.

The Fund’s holdings offered a dividend yield of 2.5%, in-line with the MSCI Emerging Market’s Index (Net)v yield of 2.5%. On a valuation basis, the Fund’s forward P/E was 12.1 compared to the benchmark which was 12.0. The estimated 3-5 years earnings per share growth for the Fund is 13.5%, compared to the benchmark of 14.5%. The top 10 individual positions by weight were Tencent Holdings Ltd., Alibaba Group Holdings Ltd., Samsung Electronics Co, Ltd., Taiwan Semiconductor Manufacturing Co., Ltd., China Construction Bank Corporation Class H., Samsung Electronics Co Ltd PFD Non-Voting, Pin An Insurance (Group) Company of China, Ltd. Class H, Naspers Limited Class N, SK Hynix Inc. and China Mobile Limited Sponsored ADR.

For the fiscal year ending August 31, 2018, BlackRock performed in-line with the MSCI Emerging Markets Index (Net)v, which matched its passive mandate to track the index.

The portion of the Fund managed by VanEck underperformed the Fund’s market index benchmark gross of fees, the MSCI Emerging Markets Index (Net)v, for the fiscal year ending August 31, 2018. Unfavorable stock selection in China, India and Taiwan detracted from performance while stock selection in Korea and South Africa added to performance. From a sector perspective, stock selection within Consumer Discretionary, Staples and Real Estate added value, while stock selection in Financials, Health Care, Industrials and Utilities detracted value. Top contributors included CIE Automotive S.A., Huazhu Group Ltd., Pin An Insurance (Group) Company, while top detractors included Tofas Turk Otomobil Fabrikasi A.S., MLP Saglik Hizmetleri AS Class B and Beijing Capital International Airport Co. Ltd Class H. At fiscal year-end, the top five holdings represented approximately 27% of VanEck’s portfolio and consisted of Alibaba, Tencent Holdings, Samsung Electronics, Ping An Insurance (Group) Company and Naspers Limited Class N.

The portion of the Fund managed by Lazard underperformed the Fund’s market index benchmark gross of fees, the MSCI Emerging Markets Index (Net)v, for the fiscal year ending August 31, 2018. Unfavorable exposures to Russia, Turkey and Brazil detracted from performance while favorable stock selection within China, Taiwan and Pakistan added to performance. From a sector perspective, the portfolio’s exposures to Consumer Discretionary and Utilities added value, while some key detractors included exposures to Financials, Information Technology, Telecommunication Services and Consumer Staples. Top contributors included Lukoil, Taiwan Semiconductor Manufacturing and SK Hynix Inc., while top detractors included Akbank, Banco do Brasil. At fiscal year-end, the top five

10

|

| of non-U.S. companies whose principal activities are located in emerging or developing market countries. In the Value Strategy, assets are invested in companies that are believed to be undervalued based on their earnings, cash flow or asset values. Lazard’s approach consists of an analytical framework, accounting validation, fundamental analysis and portfolio construction parameters and its selection process focuses on growth and considers the sustainability of growth and the tradeoff between valuation and growth. |

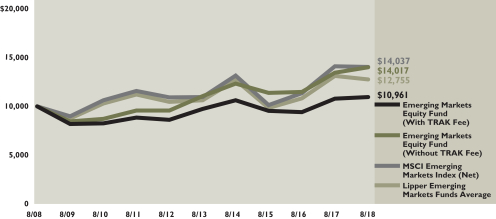

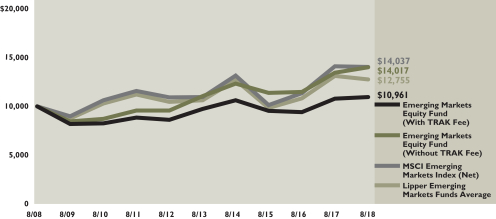

The following graph depicts the performance of MSCI Emerging Markets Index (Net)v vs. the Lipper Emerging Markets Funds Averagexix

holdings represented approximately 22% of Lazard’s portfolio and consisted of China Construction Bank Corp., Samsung Electronics, Taiwan Semiconductor Manufacturing, China Mobile Limited and SK Hynix.

|

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2018 EMERGING MARKETS EQUITY FUND Comparison of $10,000 Investment in the Fund with the MSCI Emerging Markets Index (Net)

and the Lipper Emerging Markets Funds Average |

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/ or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.morganstanley.com/cgcm.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | | | | | | | |

| | | EMERGING MARKETS EQUITY FUND Average Annual Total Returns for the Period Ended August 31, 2018† |

| | | | | Without

Annual

Advisory

Program

Fee | | With

Annual

Advisory

Program

Fee* | | MSCI

Emerging

Markets

Index

(Net)** | | Lipper

Emerging

Markets

Funds

Average** |

| | Since inception 4/20/1994 | | | | 4.70 | % | | | | 2.14 | % | | | | N/A | | | | | 5.87 | % |

| | 10 years | | | | 2.17 | | | | | (0.34 | ) | | | | 3.45 | | | | | 3.15 | |

| | 5 years | | | | 4.46 | | | | | 1.92 | | | | | 5.04 | | | | | 4.10 | |

| | 3 years | | | | 10.95 | | | | | 8.28 | | | | | 11.42 | | | | | 9.17 | |

| | | 1 year | | | | (5.61 | ) | | | | (7.90 | ) | | | | (0.68 | ) | | | | (2.99 | ) |

See pages 26 through 29 for all footnotes.

11

Core Fixed Income Fund

|

| ABOUTTHE SUB-ADVISERS |

• Metropolitan West Asset Management LLC (“MetWest”) |

| MetWest seeks to achieve consistent outperformance through the measured and diversified application of five fixed income management strategies, including: (i) duration management; (ii) yield curve positioning; (iii) sector allocation; (iv) security selection; and (v) opportunistic execution. Predicated on a long-term economic outlook, MetWest employs a value-oriented approach to managing fixed income that recognizes the periodic inefficient nature of over-the-counter markets and the mean-reverting characteristics of the investable universe. |

|

• Western Asset Management Company (“WAMco”) |

| WAMco combines traditional analysis with innovative technology applied to all sectors of the market. Western believes inefficiencies exist in the fixed-income market and attempts to add incremental value by exploiting these inefficiencies across all eligible market sectors. The key areas of focus are: (i) sector and sub-sector allocation; (ii) issue selection; (iii) duration; and (iv) term structure. |

|

• BlackRock Financial Management, Inc. (“BlackRock”) |

| BlackRock’s Customized Core strategy employs a fundamental, diversified, relative-value approach that seeks alpha by strategically allocating among three alpha sources - macro strategies, sector allocation and security selection - based on best and highest information ratio ideas, and aims to provide superior long-term performance relative to the benchmark index by creating a diversified portfolio of investment grade securities. A disciplined and risk-budgeted risk management framework which consists of determining interest rate risk, yield curve risk, cash flow risk, credit risk and liquidity risk of all securities. |

As of August 31, 2018, the Sub-advisers for the CGCM Core Fixed Income Fund (“Fund”) were Metropolitan West Asset Management, LLC (“MetWest”), Western Asset Management Company (“WAMco”) and BlackRock Financial Management, Inc. (“BlackRock”).

For the fiscal year ending August 31, 2018, the Fund returned -1.4% compared its benchmark, the Bloomberg Barclays U.S. Aggregate BondTM Indexxiii which returned -1.1%.

The portion of the Fund managed by MetWest outperformed the Bloomberg Barclays U.S. Aggregate BondTM Index (“benchmark”), gross of fees during the fiscal year ending August 31, 2018. Outperformance was driven by a defensive duration profile of the portfolio, which was extended on the backup in rates to a slightly longer than Index position near the latter part of this period. Relative sector positioning further contributed, particularly the off-Index allocation to high yield corporates, while the emphasis on higher quality issues in the investment grade corporate space was a drag as lower quality generally outpaced higher quality bonds over the past year. The overweight to securitized products further benefited relative returns, led by subprime non-agency MBS, government guaranteed student loan ABS, and CMBS, as these sectors enjoyed favorable supply/demand technicals and were relatively insulated from the aforementioned macro volatility. However, issue selection within fixed rate, lower coupon agency MBS detracted given higher rates and the diminishing role of the Fed as the largest sponsor of agency MBS.

The portion of the Fund managed by BlackRock outperformed the Fund’s market index benchmark during the fiscal year ending August 31, 2018, gross of fees. Over the period, U.S. rates moved notably higher and the yield curve flattened dramatically as the Federal Reserve continued on its hiking cycle and the market grappled with tax reform and geopolitical risks. U.S. tax cuts and plans for more government spending were tailwinds for growth, however, the rise of U.S. protectionism in trade policy has created uncertainty. The primary drivers of alpha generation (excess returns versus the benchmark) were individual security selection within spread sectors, as well as yield curve and duration management of the portfolio. The portfolio’s positioning and security selection within investment grade credit was the primary contributor to performance, notably within financials and industrials. As credit spreads began to widen earlier in the year, first at the front end of the curve and then further out, the team moved to an overweight position as entry points became attractive across the curve. In terms of duration positioning, the portfolio moved to an overweight position earlier in the year as rates moved higher and have tactically traded that position since. Positioning within CMBS also contributed positively to performance. Over the year, there were no notable detractors from performance.

The portion of the Fund managed by Western underperformed the Fund’s market index benchmark during the fiscal year ending August 31, 2018, gross of fees. A tactical duration overweight position weighed on performance over the one-year period as U.S. Treasury rates ended meaningfully higher, with the 2-year U.S. Treasury yield up 127 bps to 2.62%, the 10-Year U.S Treasury yield up 70 bps to 2.86%, and the 30-year U.S. Treasury yield up 25 bps to 3.02%. The Fund’s yield curve positioning helped provide an offset to the negative duration contribution as

12

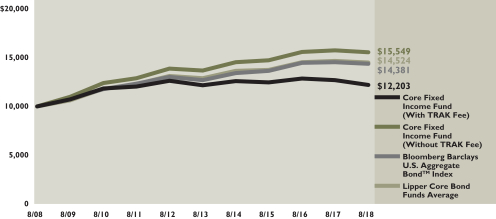

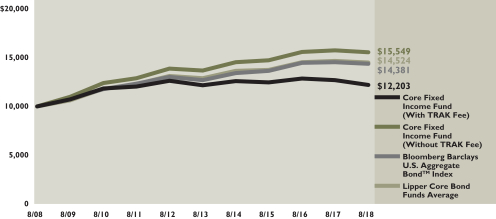

The following graph depicts the performance of Bloomberg Barclays U.S. Aggregate BondTM Indexxiii vs. the Lipper Core Bond Funds Averagexx

the yield curve flattened over the period. Emerging market exposure was also a large detractor, contributing as much to the negative performance as did the duration overweight. The deterioration of multiple EM currencies against the U.S. dollar, which was precipitated by a number of geopolitical events, played a large part in the negative performance of Emerging Market Debt. Over the 12-month period ended August 31, 2018, the Argentine peso (ARS) declined over 53% against the USD, the Brazilian real (BRL) declined 22.5%, and the Mexican peso (MXN) declined 6.7%. The poor performance in Emerging Market Debt was partially offset by positive performance from developed non-USD positions, namely the Fund’s euro short, as the currency declined 2.2% over the period. During the period, the Fund’s overweight to High-Yield contributed positively, aided by strong corporate earnings and relatively low defaults. Structured products positions, especially in non-agency RMBS and CMBS benefited, as fundamentals for the overall real estate sector were strong. Finally, the Fund’s TIPS exposure, which serves as a diversifier and as a hedge to our base inflation view contributed positively to performance as breakeven rates rose with increasing inflation expectations.

|

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2018 CORE FIXED INCOME FUND Comparison of $10,000 Investment in the Fund with the Bloomberg Barclays U.S. Aggregate Bond™ Index and the Lipper

Core Bond Funds Average |

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/ or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.morganstanley.com/cgcm.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | | | | | | | |

| | | CORE FIXED INCOME FUND Average Annual Total Returns for the Period Ended August 31, 2018† |

| | | | | Without

Annual

Advisory

Program

Fee | | With

Annual

Advisory

Program

Fee* | | Bloomberg

Barclays

U.S.

Aggregate

Bond™

Index** | | Lipper

Core Bond

Funds

Average** |

| | Since inception 11/18/1991 | | | | 5.20 | % | | | | 2.61 | % | | | | 5.49 | % | | | | 5.38 | % |

| | 10 years | | | | 4.51 | | | | | 1.94 | | | | | 3.70 | | | | | 3.83 | |

| | 5 years | | | | 2.56 | | | | | 0.03 | | | | | 2.49 | | | | | 2.34 | |

| | 3 years | | | | 1.81 | | | | | (0.71 | ) | | | | 1.76 | | | | | 1.76 | |

| | | 1 year | | | | (1.35 | ) | | | | (3.80 | ) | | | | (1.05 | ) | | | | (1.10 | ) |

See pages 26 through 29 for all footnotes.

13

High Yield Fund

|

| ABOUTTHE SUB-ADVISERS |

• Eaton Vance Management (“Eaton Vance”) |

| Eaton Vance monitors the credit quality of securities held by the Fund and other securities available to the Fund. Although Eaton Vance considers security ratings when making investment decisions, it performs its own credit and investment analysis utilizing various methodologies including “bottom up/top down” analysis and consideration of macroeconomic and technical factors, and does not rely primarily on the ratings assigned by the rating services. Eaton Vance attempts to improve yield and preserve and enhance principal value through timely trading. Eaton Vance also considers the relative value of securities in the marketplace in making investment decisions. |

|

• Western Asset Management Company (“Western”) |

| Western combines traditional analysis with innovative technology applied to all sectors of the market. Western believes inefficiencies exist in the fixed-income market and attempts to add incremental value by exploiting these inefficiencies across all eligible market sectors. The key areas of focus are: (i) sector and sub-sector allocation; (ii) issue selection; (iii) duration; and (iv) term structure. |

As of August 31, 2018, the Sub-advisers for the CGCM High Yield Bond Fund (“Fund”) were Western Asset Management Company (“Western”) and Eaton Vance Management (“Eaton Vance”).

For the fiscal year ending August 31, 2018, the Fund returned 3.5% compared to its benchmark, the Bloomberg Barclays U.S. Corporate High Yield Bond Indexxv which returned 3.4%.

The portion of the Fund managed by Eaton Vance modestly underperformed the Fund’s market benchmark gross of fees during the fiscal year ending August 31, 2018. While security selection was positive over this period, sector selection was modestly negative. Credit selection in the services sector led performance relative to the Index; however, this was offset by adverse credit selection in the energy sector. Meanwhile an underweight in the underperforming banking sector aided relative performance, but an underweight in telecommunications proved a headwind to relative performance. At the end of the period, Eaton Vance was overweight the Utility and Healthcare sectors and underweight the Cable-Media and Telecommunications sectors. Eaton Vance believes that while the U.S. economic backdrop is healthy and the corporate fundamentals of high yield issuers have continued to modestly improve and remain healthy, valuations are relatively full and potential headwinds remain. Although the backdrop for high yield bonds remains supportive, rising input costs, the continued tightening of financial conditions and ongoing uncertainty regarding the future of U.S. trade policy with key trading partners could lead to elevated volatility. At the same time, a lack of new issuance has outweighed soft demand for U.S. high yield and we expect limited net-new issuance to persist moving forward, potentially helping to dampen volatility when it arises. Although valuations are relatively full at the end of the period, on a risk-adjusted basis, Eaton Vance believes the carry in high yield remains attractive relative to many alternatives.

The portion of the Fund managed by Western outperformed the Fund’s market benchmark gross of fees during the fiscal year ending August 31, 2018. Issue selection was a key contributor to performance. Quality positioning had a marginally positive impact on relative performance as the benefit of an overweight to top performing CCC’s and underweight to bottom performing BB’s more than offset the detraction for an allocation to investment grade credit, which in general underperformed high yield. Sub-sector allocation aided relative performance due in large part to an overweight to Exploration & Production (9.49%), and underweight to Technology (2.60%) and Wirelines (1.98%). Opportunistic allocation to bank loans aided relative performance as loans outperformed high yield bonds. The portfolio maintained a long duration position throughout the period which detracted from performance as rates rose.

14

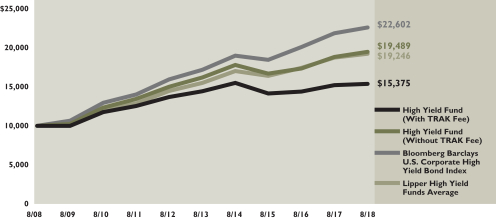

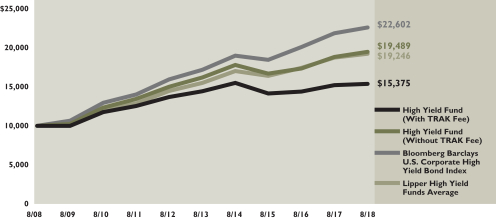

The following graph depicts the performance of Bloomberg Barclays U.S. Corporate High Yield Bond Indexxv vs. the Lipper High Yield Funds Averagexxi

|

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2018 HIGH YIELD FUND Comparison of $10,000 Investment in the Fund with the Bloomberg Barclays U.S. Corporate High Yield Bond Index

and the Lipper High Yield Funds Average |