Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-06324 |

| | |

| Exact name of registrant as specified in charter: | Delaware Group® Global & International Funds |

| | |

| Address of principal executive offices: | 610 Market Street Philadelphia, PA 19106 |

| | |

| Name and address of agent for service: | David F. Connor, Esq. 610 Market Street Philadelphia, PA 19106 |

| | |

| Registrant’s telephone number, including area code: | (800) 523-1918 |

| | |

| Date of fiscal year end: | November 30 |

| | |

| Date of reporting period: | November 30, 2022 |

| | |

Table of Contents

Item 1. Reports to Stockholders

Annual report

Global / international equity mutual funds

Delaware Emerging Markets Fund

Delaware International Small Cap Fund

Delaware International Value Equity Fund

November 30, 2022

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Funds’ prospectus and their summary prospectuses, which may be obtained by visiting delawarefunds.com/literature or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit delawarefunds.com/edelivery.

Table of Contents

Experience Delaware Funds by Macquarie®

Macquarie Asset Management (MAM) is a global asset manager that aims to deliver positive impact for everyone. MAM Public Investments traces its roots to 1929 and partners with institutional and individual clients to deliver specialist active investment capabilities across global equities, fixed income, and multi-asset solutions using a conviction-based, long-term approach to investing. In the US, retail investors recognize our Delaware Funds by Macquarie family of funds as one of the oldest mutual fund families.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Funds or obtain a prospectus for Delaware Emerging Markets Fund, Delaware International Small Cap Fund, and Delaware International Value Equity Fund at delawarefunds.com/literature.

Manage your account online

| ● | Check your account balance and transactions |

| ● | View statements and tax forms |

| ● | Make purchases and redemptions |

Visit delawarefunds.com/account-access.

Macquarie Asset Management (MAM) is the asset management division of Macquarie Group. MAM is a full-service asset manager offering a diverse range of products across public and private markets including fixed income, equities, multi-asset solutions, private credit, infrastructure, renewables, natural assets, real estate, and asset finance. The Public Investments business is a part of MAM and includes the following investment advisers: Macquarie Investment Management Business Trust (MIMBT), Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, and Macquarie Investment Management Europe S.A.

The Funds are distributed by Delaware Distributors, L.P. (DDLP), an affiliate of MIMBT and Macquarie Group Limited.

Other than Macquarie Bank Limited ABN 46 008 583 542 (“Macquarie Bank”), any Macquarie Group entity noted in this document is not an authorized deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these other Macquarie Group entities do not represent deposits or other liabilities of Macquarie Bank. Macquarie Bank does not guarantee or otherwise provide assurance in respect of the obligations of these other Macquarie Group entities. In addition, if this document relates to an investment, (a) the investor is subject to investment risk including possible delays in repayment and loss of income and principal invested and (b) none of Macquarie Bank or any other Macquarie Group entity guarantees any particular rate of return on or the performance of the investment, nor do they guarantee repayment of capital in respect of the investment.

The Funds are governed by US laws and regulations.

This annual report is for the information of Delaware Emerging Markets Fund, Delaware International Small Cap Fund, and Delaware International Value Equity Fund shareholders, but it may be used with prospective investors when preceded or accompanied by the Delaware Fund fact sheet for the most recently completed calendar quarter. These documents are available at delawarefunds.com/literature.

Unless otherwise noted, views expressed herein are current as of November 30, 2022, and subject to change for events occurring after such date.

The Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor.

All third-party marks cited are the property of their respective owners.

© 2023 Macquarie Management Holdings, Inc.

Table of Contents

| Portfolio management review | |

| Delaware Emerging Markets Fund | November 30, 2022 (Unaudited) |

| | |

| Performance preview (for the year ended November 30, 2022) | | | | | |

| Delaware Emerging Markets Fund (Institutional Class shares) | | 1-year return | | | -23.76% |

| Delaware Emerging Markets Fund (Class A shares) | | 1-year return | | | -23.97% |

| MSCI Emerging Markets Index (net) | | 1-year return | | | -17.43% |

| MSCI Emerging Markets Index (gross) | | 1-year return | | | -17.07% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Emerging Markets Fund, please see the table on page 10. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. The performance of both Institutional Class shares and Class A shares reflects the reinvestment of all distributions.

Please see page 12 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investment objective

The Fund seeks long-term capital appreciation.

Market review

The MSCI Emerging Markets Index lagged developed markets and declined 17.4% during the fiscal year ended November 30, 2022. Several factors influenced performance. First, geopolitical tension between Russia and Ukraine escalated to full-scale military conflict. As events unfolded, the US and the European Union imposed sanctions on certain Russian entities, corporations, and individuals, while MSCI eliminated all Russian stocks from the benchmark at a de minimis price. Second, China maintained its stringent zero-COVID policy, imposing lockdowns in major metropolitan areas that further dampened the economic outlook. Third, to combat inflationary pressure, the US Federal Reserve quickened the pace of monetary tightening, which contributed to rising US bond yields and a strengthening US dollar.

Returns across countries and sectors diverged significantly amid volatile market conditions. Latin America outperformed the most among geographic regions. Equities in Brazil and Peru, buoyed by rising commodities prices and currency appreciation, posted returns exceeding 20% in US dollar terms. Mexico also outperformed with notable strength in the financials and industrials sectors. Excluding the impact of Russia’s removal from the MSCI Emerging Markets Index, markets in the Europe, Middle East, and Africa (EMEA) region also outperformed. Rising energy prices supported equities in the Middle East, while in South Africa, the energy, industrials, and financials sectors bolstered performance. Equities rallied amid high inflation in Turkey.

In contrast, Asia relatively lagged, particularly the North Asian markets. Concern about slowing economic growth weighed on consumer-related stocks in China. Moreover, lingering uncertainty in the regulatory environment, both in China and the US, contributed to underperformance in the technology, communication services, and healthcare sectors. In Taiwan and South Korea, technology stocks underperformed as demand weakness appeared to spread beyond consumer-related applications to other end markets. Equities in South and Southeast Asia outperformed as domestic demand

1

Table of Contents

Portfolio management review

Delaware Emerging Markets Fund

helped insulate these economies from slowing global growth. Indonesia, Thailand, and India outperformed the most among Asian markets.

On a sector basis, utilities, financials, and industrials relatively outperformed. In contrast, communication services and healthcare underperformed the most.

Within the Fund

For the fiscal year ended November 30, 2022, Delaware Emerging Markets Fund underperformed it benchmark, the MSCI Emerging Markets Index. The Fund’s Institutional Class shares declined 23.76%. The Fund’s Class A shares declined 23.97% at net asset value and 28.34% at maximum offer price. These figures reflect all distributions reinvested. During the same period, the Fund’s benchmark, the MSCI Emerging Markets Index (net) declined 17.43%. For complete, annualized performance of Delaware Emerging Markets Fund, please see the table on page 10.

Among countries, Russia detracted the most from relative performance. The Fund’s investment process centers on identifying individual companies that we believe possess sustainable franchises and favorable long-term growth prospects, and trade at what we believe are significant discounts to their intrinsic value. Historically, we have found selective Russian companies attractive from a fundamental perspective. For example, in the energy sector, we believe that the oil resources of Rosneft Oil Co. PJSC have some of the lowest extraction costs globally, and that the company’s long-term growth opportunities and valuation compare favorably to peers. However, we have also recognized heightened risks associated with these investments and have sought to manage such risks through enhanced valuation discounts and limits to position sizes. On balance, the Fund has maintained a measured overweight position in Russia relative to its country weighting in the benchmark. While we closely monitored tensions between Russia and Ukraine as they ratcheted up in late 2021 and early 2022, the likelihood of a full-scale invasion appeared low in our assessment at that time.

After Russia’s incursion into Ukraine and the swift application of sanctions against certain Russian entities, trading on Moscow’s stock exchange was halted on February 28, 2022. Several Russian stocks listed offshore continued to trade but plunged in value before being suspended for trading on or around March 2, 2022. As of November 30, 2022, trading in Russian stocks remained suspended for foreign investors. Considering these trading suspensions and ongoing geopolitical uncertainty, the value of the Fund’s Russian holdings has been written down based on fair valuation protocols.

Outside of Russia, the Fund’s stock selection in South Korea and Taiwan was unfavorable. The Strategy holds large overweight positions in semiconductor stocks including MediaTek Inc., SK Hynix Inc., Taiwan Semiconductor Manufacturing Co. Ltd., and Samsung Electronics Co. Ltd. These stocks underperformed as deterioration in the demand outlook heightened investors’ concerns about rising inventories, price declines for semiconductor chips, and downward earnings estimate revisions.

On the positive side, the Fund’s position in Reliance Industries Ltd. in India outperformed as domestic consumption recovered. In Chile, shares of Sociedad Quimica y Minera de Chile SA outperformed as lithium prices rallied.

The prevailing sources of uncertainty – including inflation, rising interest rates, energy

2

Table of Contents

markets, and a potential slowdown of global growth – are unlikely to abate in the near term, in our view. Although we expect market conditions to remain volatile, we do not believe these uncertainties have derailed long-term growth opportunities that are underpinned by secular trends such as digitalization and consumption premiumization (consumers’ preference for high-quality, healthy, and premium products). Moreover, we believe that equity valuations across several pockets of the emerging markets universe appear attractive.

Among countries, we currently hold overweight positions in South Korea, Brazil, and Mexico. Conversely, we are currently underweight relative to the benchmark the Middle East, Southeast Asia, South Africa, and China. Sectors we currently favor include technology, consumer staples, and energy (largely due to the Fund’s holding in Reliance Industries). The Strategy is most underweight in financials and industrials

The Fund used foreign currency exchange contracts to facilitate the purchase and sale of equities traded on international exchanges. The effect of these contracts on performance was not material.

3

Table of Contents

| Portfolio management review | |

| Delaware International Small Cap Fund | November 30, 2022 (Unaudited) |

| | | | | | |

| Performance preview (for the year ended November 30, 2022) | | | | | |

| Delaware International Small Cap Fund (Institutional Class shares) | | 1-year return | | | -23.59% |

| Delaware International Small Cap Fund (Class A shares) | | 1-year return | | | -23.72% |

| MSCI ACWI (All Country World Index) ex USA Small Cap Index (net) | | 1-year return | | | -16.73% |

| MSCI ACWI (All Country World Index) ex USA Small Cap Index (gross) | | 1-year return | | | -16.30% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware International Small Cap Fund, please see the table on page 14.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. The performance of both Institutional Class shares and Class A shares reflects the reinvestment of all distributions.

Please see page 16 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investment objective

The Fund seeks long-term capital appreciation.

Market review

The fiscal year ended November 30, 2022, was turbulent and challenging as a combination of macroeconomic and geopolitical events roiled financial markets. Historically high and persistent inflation was exacerbated by the impact of the Russia-Ukraine war on energy and commodity prices. In response, the US Federal Reserve and other major global central banks aggressively tightened monetary policy – significantly raising interest rates – to squeeze inflationary pressures out of the economy.

Other major global events and factors that weighed on financial markets included China’s zero-COVID lockdowns, which contributed to supply-chain disruptions and rising commodity prices; surging fixed income yields; and the sustained strength of the US dollar relative to other major currencies. Late in the period, political and economic volatility in the UK spiked when the newly formed government led by Prime Minister Liz Truss proposed a budget that was deeply unpopular. Within days the British pound plunged, and Prime Minister Truss resigned.

International value stocks significantly outperformed during the 12-month period while their growth counterparts sold off sharply on an indiscriminate basis.

Fund performance

For the fiscal year ended November 30, 2022, Delaware International Small Cap Fund underperformed its benchmark, the MSCI ACWI ex USA Small Cap Index (net). The Fund’s Institutional Class shares declined 23.59%. The Fund’s Class A shares declined 23.72% at net asset value and 28.10% at maximum offer price. These figures reflect all distributions reinvested. During the same period, the Fund’s benchmark (net) declined 16.73%. For complete, annualized performance of Delaware International Small Cap Fund, please see the table on page 14.

In an environment in which global macroeconomic forces rather than stock-specific fundamentals were the determining factor of stock performance, the Fund was at a

4

Table of Contents

distinct disadvantage. Nonetheless, we remained true to our process of bottom-up selection of individual companies undergoing positive, fundamental change that we believe have the potential to drive earnings growth beyond market expectations.

With that in mind, sectors that detracted the most from the Fund’s relative performance during the fiscal year were industrials and real estate. This and other aspects of performance attribution resulted from individual stock selection based on the Fund’s methodology.

Countries that detracted the most from the Fund’s relative performance were the UK, Japan, and Australia. The three largest individual detractors from performance were MIPS AB in Sweden, Future PLC in the UK, and InMode Ltd., based in Israel.

MIPS, a provider of helmet safety technology, underperformed despite the company’s solid financial results. Supply-chain issues, mainly attributable to lockdowns in China, were successfully mitigated. Although MIPS continued to see strong demand, it was hurt as investors rotated from growth to value stocks. We exited our position.

Future is a media publisher with a strong presence in specialty online and print magazine publishing. While Future reported continued trading momentum with digital advertising growth during the period, the shares suffered as growth companies fell out of favor. Although we reduced our weighting in Future, we still hold the stock since we believe the thesis remains intact. However, we continue to monitor the stock closely.

InMode has developed technologies that fill the treatment gap between non-invasive and invasive procedures within the large and growing aesthetics market. Despite reporting strong first-quarter financial results, the stock underperformed during the period. We did add to our position over the summer when the company continued to deliver strong financial results.

Sectors that added the most to the Fund’s performance relative to its benchmark included energy and consumer staples. Energy benefited from global supply shortages that led to both higher prices and profits. Canada, India, and Mexico were the countries that contributed the most to the Fund’s relative performance.

Among individual stocks, the three largest contributors to performance were Varun Beverages Ltd. in India, and Vermilion Energy Inc. and K+S AG, both in Canada.

Varun Beverages is one of the largest global franchisees of PepsiCo Inc. The company manufactures and distributes PepsiCo’s beverages in India as well as selected international markets. Varun outperformed as it benefited from strong in-home demand across its markets along with a rise in out-of-home demand. The company continued to expand its geographic presence, enhancing its distribution network.

Vermilion Energy is a Canada-based independent oil and gas exploration and production company, with operations in North America, Europe, and Australia. Vermilion’s diverse international exposure positioned it to benefit from higher commodity prices, improved cash flow, and merger and acquisition opportunities.

K+S is a leading global producer of potash fertilizer, and a leading distributor of agricultural chemicals. The company benefited from strong commodity prices, supported by global supply constraints. Potash prices remained elevated and K+S has remained positive about its near-term outlook. Recent constraints on Russian and Ukrainian

5

Table of Contents

Portfolio management review

Delaware International Small Cap Fund

agricultural exports have also pushed prices higher for soft commodities.

At the end of the Fund’s fiscal year, there is some optimism that China’s economy will reopen and that the Fed and other central banks will ease monetary constraints once inflation peaks. It would also be a boost to financial markets if we could achieve a so-called economic soft landing and avoid a recession. At the same time, there are plenty of ongoing concerns, including the Russia-Ukraine war, the potential for inflation to remain a concern longer than currently anticipated, uncertainty regarding a possible recession, and the impact of an economic slowdown on corporate earnings.

As previously noted, the Fund’s country and sector weights are driven primarily by bottom-up stock selection. As a result, relative to the Fund’s benchmark at the end of the fiscal year, the Fund was overweight Japan and Canada. From a sector perspective, the Fund’s largest overweight allocations were in industrials and energy. Conversely, Australia and Taiwan were the largest underweight country positions while materials and real estate were the Fund’s largest sector underweights at period end.

The Fund may use derivatives or structured products in limited situations. However, it did not use derivatives during the fiscal period.

6

Table of Contents

| Portfolio management review | |

| Delaware International Value Equity Fund | November 30, 2022 (Unaudited) |

| | |

| Performance preview (for the year ended November 30, 2022) | | | | | |

| Delaware International Value Equity Fund (Institutional Class shares) | | 1-year return | | | -13.23% |

| Delaware International Value Equity Fund (Class A shares) | | 1-year return | | | -13.46% |

| MSCI EAFE (Europe, Australasia, Far East) Index (net) | | 1-year return | | | -10.14% |

| MSCI EAFE (Europe, Australasia, Far East) Index (gross) | | 1-year return | | | -9.70% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware International Value Equity Fund, please see the table on page 18.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. The performance of both Institutional Class shares and Class A shares reflects the reinvestment of all distributions.

Please see page 20 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investment objective

The Fund seeks long-term growth without undue risk to principal.

Market review

During the last months of 2021, investors focused their concern on supply-chain disruptions, rising energy prices, and inflation. At the time, it was unclear whether rising inflation would prove to be transitory, as the US Federal Reserve initially maintained, or tenacious. In its last meeting of the year, the Fed turned hawkish as inflation persisted, reaching the highest level seen in decades.

Market returns declined in the first quarter of 2022 as the Russian invasion of Ukraine, inflation, rising energy prices, and central bank interest rate increases worldwide resulted in a risk-off environment. Negative market returns persisted in the second quarter 2022 as China’s zero-COVID policy, mandating continued economic lockdowns, exacerbated disruptions to the already-fragile global supply chain.

In July we saw a strong rally triggered by expectations that the Fed would make a U-turn and reduce interest rates in 2023. The rally faltered, however, as an uncertain outlook for the global economy underpinned central banks’ commitment to reducing inflation by raising rates. Markets continued to decline in the third quarter of 2022, with all sectors in the red. Nonetheless, it appeared that the Fed’s policies were beginning to dampen inflation. In turn, investors worldwide looked to the US as a so-called safe haven, pushing a strong US dollar even higher against other major currencies, including the British pound sterling, euro, and Japanese yen.

Within the Fund

For the fiscal year ended November 30, 2022, Delaware International Value Equity Fund showed a loss and underperformed its benchmark, the MSCI EAFE Index (net). The Fund’s Institutional Class shares lost 13.23%. The Fund’s Class A shares declined 13.46% at net asset value (NAV) and declined 18.42% at maximum offer price. These figures reflect reinvestment of all distributions. During the same period, the Fund’s benchmark (net) lost 10.14%. For complete, annualized performance of Delaware International Value Equity Fund, please see the table on page 18.

7

Table of Contents

Portfolio management review

Delaware International Value Equity Fund

We invest with the mindset of long-term business owners. We seek to identify undervalued quality companies that have the potential to provide solid relative capital protection in challenging times. Therefore, the Fund’s portfolio is built bottom up (stock-by-stock) by selecting company stocks based on quantitative insights and qualitative assessments.

Within the benchmark, energy and financials provided the strongest sector returns during the fiscal year ended November 30, 2022, at 38.6% and -2.1%, respectively. The weakest performance came from information technology, real estate, and consumer discretionary with returns of -26.0%, -19.9%, and -17.6%, respectively.

Active sector allocation as well as stock selection had a negative effect on the Fund’s relative performance. The Fund had no investments in financials and energy, the two strongest sectors in the benchmark, and thus underperformed. Weak stock selection in healthcare and industrials also detracted from relative performance.

Contributions to relative performance came from stock selection in communication services and information technology as well as a lack of investment in real estate, which underperformed in the benchmark.

We had no investments in four out of 11 MSCI sectors: financials, energy, real estate, and utilities. In these sectors, we were unable to identify companies that possessed a business model consistent with our investment philosophy.

In terms of individual holdings, three of the largest contributors to performance were French facilities management company Sodexo SA, Danish multinational pharmaceutical company Novo Nordisk A/S, and French advertising company Publicis Groupe SA.

Sodexo’s third-quarter sales improved 18%, driven by strong volume recovery and upward price revisions in contracts. At period end, Sodexo’s business activity was at 97% of pre-COVID levels compared to 94% in the previous quarter. The recovery in activity was broad-based, across all lines of business and geographies. The Sport & Leisure segment not surprisingly posted the strongest rebound.

The successful Danish insulin producing company Novo Nordisk beat high expectations, growing both sales and earnings by double digits during the fiscal year. The company’s key franchises, diabetes and obesity care, demonstrated strong growth rates, benefiting from an attractive combination of large and expanding addressable markets with low current penetration. Novo Nordisk is a leader in both markets. The company upgraded its guidance, driven in part by a helpful tailwind from the strong US dollar.

The share-price movements of advertising agency conglomerates, like Publicis Groupe, often indicate what investors anticipate for the global economy and market performance. During the past twelve months, Publicis beat stock market estimates on several occasions and upgraded its guidance for organic growth, operating margin, and free cash flow, even though the company voiced concern that the macroeconomic environment might deteriorate. While consumers and marketers alike are feeling the pinch of inflation, rising interest rates, and slower economic growth, businesses are still spending on advertising, says Publicis CEO Arthur Sadoun, who notes that advertising is “essential” to growing a business.

8

Table of Contents

Three significant detractors from the Fund’s performance during the fiscal year were German sportswear manufacturer adidas AG, German global dialysis provider Fresenius Medical Care AG & Co. KGaA, and Spanish IT provider Amadeus IT Group SA.

A challenging trading environment in Greater China, caused by COVID-19 restrictions and industry-wide supply-chain disruptions, has hurt adidas’ shares. The company lowered its outlook for the year citing lower growth rates and margins than initially expected, largely due to China, which is both a very profitable market for adidas and an important source of materials. Its guidance indicates that its profit margin will be far below what the company earned in the past and what we believe it could earn in a more-normal operating environment. We believe the underlying margin potential to be substantially higher for adidas driven by operating leverage, more direct-to-consumer content, and cost-reductions following the sale of Reebok. Before higher margins can be achieved, however, adidas needs to clear some inventory at mark-down prices. That said, adidas is not alone in the industry; we think its peers face similar challenges.

The world’s leading kidney dialysis company, Fresenius Medical Care, was caught in a perfect storm together with its competitors. COVID-19 reduced the patient population, slowed clinic traffic, and increased the cost of serving patients. The industry works on a contract-basis and prices for dialysis services have yet to be adjusted higher to reflect inflation. In essence, Fresenius Medical Care must take the higher costs on its shoulders until prices are renegotiated. Management has withdrawn its 2025 targets. Despite all the headwinds, we think Fresenius Medical Care will remain a profitable business.

Amadeus IT Group is the global leader in ticketing software for the airline industry, with a market share above 40%. The company’s profits are driven by the number of tickets sold, not the ticket price, which provides Amadeus with more stability than its customers. Global air travel is now recovering from the pandemic. Second-quarter earnings confirmed that the travel industry worldwide is continuing to recover and is presently at 75% of pre-pandemic levels. The US market is somewhat stronger while the Asia-Pacific and European markets lag somewhat. Amadeus incurs little additional cost as ticket volumes increase. That is central to our case, which sees earnings improving rapidly as travel volumes recover. Pre-COVID Amadeus had earnings before interest, taxes, depreciation, and amortization (EBITDA) margins just above 40%. In the second quarter 2022 Amadeus again showed EBITDA margins of about 40% and cash flow of 182 million euros generated on revenues that were 17% below pre-COVID levels. Air traffic growth has historically proven resilient during recessions.

The Fund used foreign currency exchange contracts to facilitate the purchase and sale of equities traded on international exchanges. The effect of these contracts on performance was not material.

9

Table of Contents

| Performance summaries | |

| Delaware Emerging Markets Fund | November 30, 2022 (Unaudited) |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| Fund and benchmark performance1,2 | Average annual total returns through November 30, 2022 |

| | | 1 year | | 5 year | | 10 year | | Lifetime |

| Class A (Est. June 10, 1996) | | | | | | | | |

| Excluding sales charge | | -23.97% | | -1.20% | | +3.96% | | — |

| Including sales charge | | -28.34% | | -2.36% | | +3.35% | | — |

| Class C (Est. June 10, 1996) | | | | | | | | |

| Excluding sales charge | | -24.56% | | -1.93% | | +3.18% | | — |

| Including sales charge | | -25.29% | | -1.93% | | +3.18% | | — |

| Class R (Est. August 31, 2009) | | | | | | | | |

| Excluding sales charge | | -24.15% | | -1.44% | | +3.70% | | — |

| Including sales charge | | -24.15% | | -1.44% | | +3.70% | | — |

| Institutional Class (Est. June 10, 1996) | | | | | | | | |

| Excluding sales charge | | -23.76% | | -0.95% | | +4.22% | | — |

| Including sales charge | | -23.76% | | -0.95% | | +4.22% | | — |

| Class R6 (Est. May 2, 2016) | | | | | | | | |

| Excluding sales charge | | -23.67% | | -0.83% | | — | | +5.81% |

| Including sales charge | | -23.67% | | -0.83% | | — | | +5.81% |

| MSCI Emerging Markets Index (net) | | -17.43% | | -0.42% | | +2.07% | | — |

| MSCI Emerging Markets Index (gross) | | -17.07% | | -0.04% | | +2.44% | | — |

| 1 | Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares. |

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed in the “Fund expense ratios” table on page 11. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service (12b-1) fee.

Class A shares are sold with a maximum front-end sales charge of 5.75%, and have an annual 12b-1 fee of 0.25% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge (CDSC) of 1.00% if

10

Table of Contents

redeemed during the first 12 months. They are also subject to an annual 12b-1 fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that CDSCs did not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual 12b-1 fee of 0.50% of average daily net assets.

Class R6 shares are available only to certain investors. In addition, Class R6 shares do not pay any service fees, sub-accounting fees, and/or sub-transfer agency fees to any brokers, dealers, or other financial intermediaries. Class R6 shares pay no 12b-1 fee.

International investments entail risks including fluctuation in currency values, differences in accounting principles, or economic or political instability. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility, lower trading volume, and higher risk of market closures. In many emerging markets, there is substantially less publicly available information and the available information may be incomplete or misleading. Legal claims are generally more difficult to pursue.

Investments in small and/or medium-sized companies typically exhibit greater risk and higher volatility than larger, more established companies.

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Fund from executing advantageous investment decisions in a timely manner and could negatively impact the Fund’s ability to achieve its investment objective and the value of the Fund’s investments.

| 2 | The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. The expense ratios below may differ from the expense ratios in the “Financial highlights” since they are based on different time periods and the expense ratios in the prospectus include acquired fund fees and expenses, if any. See Note 2 in “Notes to financial statements” for additional details. Please see the “Financial highlights” section in this report for the most recent expense ratios. |

| Fund expense ratios | | Class A | | Class C | | Class R | | Institutional

Class | | Class R6 |

Total annual operating expenses

(without fee waivers) | | 1.59% | | 2.34% | | 1.84% | | 1.34% | | 1.23% |

Net expenses (including fee

waivers, if any) | | 1.48% | | 2.23% | | 1.73% | | 1.23% | | 1.14% |

| Type of waiver | | Contractual | | Contractual | | Contractual | | Contractual | | Contractual |

11

Table of Contents

Performance summaries

Delaware Emerging Markets Fund

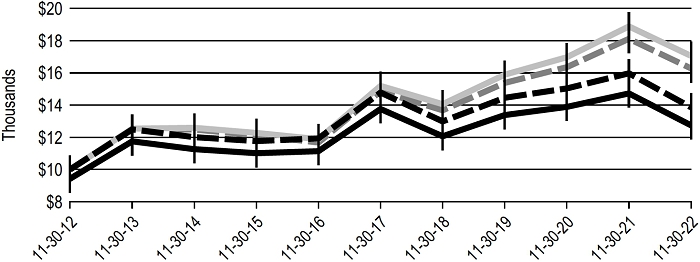

Performance of a $10,000 investment1

For the period November 30, 2012 through November 30, 2022

| | | | Starting value | | Ending value |

| Delaware Emerging Markets Fund — Institutional Class

shares | | | $10,000 | | | | $15,123 | |

| Delaware Emerging Markets Fund — Class A shares | | | $9,425 | | | | $13,898 | |

| MSCI Emerging Markets Index (gross) | | | $10,000 | | | | $12,723 | |

| MSCI Emerging Markets Index (net) | | | $10,000 | | | | $12,269 | |

| 1 | The “Performance of a $10,000 investment” graph assumes $10,000 invested in Institutional Class and Class A shares of the Fund on November 30, 2012, and includes the effect of a 5.75% front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 11. Please note additional details on pages 10 through 13. |

The graph also assumes $10,000 invested in the MSCI Emerging Markets Index as of November 30, 2012. The MSCI Emerging Markets Index represents large- and mid-cap stocks across emerging market countries worldwide. The index covers approximately 85% of the free float-adjusted market capitalization in each country. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate. Index “gross” return approximates the maximum possible dividend reinvestment.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Performance of other Fund classes will vary due to different charges and expenses.

12

Table of Contents

| | | Nasdaq symbols | | CUSIPs |

| Class A | | | DEMAX | | | 245914841 |

| Class C | | | DEMCX | | | 245914825 |

| Class R | | | DEMRX | | | 245914569 |

| Institutional Class | | | DEMIX | | | 245914817 |

| Class R6 | | | DEMZX | | | 245914510 |

13

Table of Contents

| Performance summaries | |

| Delaware International Small Cap Fund | November 30, 2022 (Unaudited) |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| Fund and benchmark performance1,2 | | Average annual total returns through November 30, 2022 |

| | | 1 year | | 5 year | | 10 year | | Lifetime |

| Class A (Est. December 29, 2008) | | | | | | | | |

| Excluding sales charge | | -23.72% | | -1.05% | | +5.31% | | — |

| Including sales charge | | -28.10% | | -2.22% | | +4.69% | | — |

| Class C (Est. December 29, 2010) | | | | | | | | |

| Excluding sales charge | | -24.39% | | -1.81% | | +4.51% | | — |

| Including sales charge | | -25.09% | | -1.81% | | +4.51% | | — |

| Class R (Est. December 29, 2010) | | | | | | | | |

| Excluding sales charge | | -23.91% | | -1.32% | | +5.04% | | — |

| Including sales charge | | -23.91% | | -1.32% | | +5.04% | | — |

| Institutional Class (Est. December 29, 2008) | | | | | | | | |

| Excluding sales charge | | -23.59% | | -0.81% | | +5.57% | | — |

| Including sales charge | | -23.59% | | -0.81% | | +5.57% | | — |

| Class R6 (Est. June 30, 2017) | | | | | | | | |

| Excluding sales charge | | -23.41% | | -0.72% | | — | | +2.44% |

| Including sales charge | | -23.41% | | -0.72% | | — | | +2.44% |

| MSCI ACWI ex USA Small Cap Index (net) | | -16.73% | | +1.25% | | +5.64% | | — |

MSCI ACWI ex USA Small Cap Index

(gross) | | -16.30% | | +1.66% | | +6.05% | | — |

| 1 | Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares. |

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed in the “Fund expense ratios” table on page 15. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service (12b-1) fee.

Class A shares are sold with a maximum front-end sales charge of 5.75%, and have an annual 12b-1 fee of 0.25% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

14

Table of Contents

Class C shares are sold with a contingent deferred sales charge (CDSC) of 1.00% if redeemed during the first 12 months. They are also subject to an annual 12b-1 fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that CDSCs did not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual 12b-1 fee of 0.50% of average daily net assets.

Class R6 shares are available only to certain investors. In addition, Class R6 shares do not pay any service fees, sub-accounting fees, and/or sub-transfer agency fees to any brokers, dealers, or other financial intermediaries. Class R6 shares pay no 12b-1 fee.

International investments entail risks including fluctuation in currency values, differences in accounting principles, or economic or political instability. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility, lower trading volume, and higher risk of market closures. In many emerging markets, there is substantially less publicly available information and the available information may be incomplete or misleading. Legal claims are generally more difficult to pursue.

Investments in small and/or medium-sized companies typically exhibit greater risk and higher volatility than larger, more established companies.

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Fund from executing advantageous investment decisions in a timely manner and could negatively impact the Fund’s ability to achieve its investment objective and the value of the Fund’s investments.

| 2 | The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. The expense ratios below may differ from the expense ratios in the “Financial highlights” since they are based on different time periods and the expense ratios in the prospectus include acquired fund fees and expenses, if any. See Note 2 in “Notes to financial statements” for additional details. Please see the “Financial highlights” section in this report for the most recent expense ratios. |

| Fund expense ratios | | Class A | | Class C | | Class R | | Institutional

Class | | Class R6 |

Total annual operating expenses

(without fee waivers) | | 1.48% | | 2.23% | | 1.73% | | 1.23% | | 1.13% |

Net expenses (including fee

waivers, if any) | | 1.37% | | 2.12% | | 1.62% | | 1.12% | | 1.00% |

| Type of waiver | | Contractual | | Contractual | | Contractual | | Contractual | | Contractual |

15

Table of Contents

Performance summaries

Delaware International Small Cap Fund

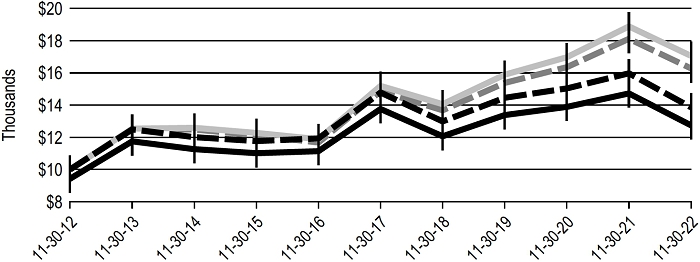

Performance of a $10,000 investment1

For the period November 30, 2012 through November 30, 2022

| | | | Starting value | | Ending value |

| MSCI ACWI ex USA Small Cap Index (gross) | | | $10,000 | | | | $17,986 | |

| MSCI ACWI ex USA Small Cap Index (net) | | | $10,000 | | | | $17,315 | |

| Delaware International Small Cap Fund — Institutional

Class shares | | | $10,000 | | | | $17,195 | |

| Delaware International Small Cap Fund — Class A shares | | | $9,425 | | | | $15,808 | |

| 1 | The “Performance of a $10,000 investment” graph assumes $10,000 invested in Institutional Class and Class A shares of the Fund on November 30, 2012, and includes the effect of a 5.75% front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 15. Please note additional details on pages 14 through 17. |

The graph also assumes $10,000 invested in the MSCI ACWI ex USA Small Cap Index as of November 30, 2012. The MSCI ACWI (All Country World Index) ex USA Small Cap Index represents small-cap stocks across 22 of 23 developed market countries (excluding the United States) and 24 emerging market countries. The index covers approximately 14% of the global equity opportunity set outside the US. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate. Index “gross” return approximates the maximum possible dividend reinvestment.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Performance of other Fund classes will vary

16

Table of Contents

due to different charges and expenses.

| | | Nasdaq symbols | | CUSIPs |

| Class A | | | DGGAX | | | 246118541 |

| Class C | | | DGGCX | | | 246118533 |

| Class R | | | DGGRX | | | 246118525 |

| Institutional Class | | | DGGIX | | | 246118517 |

| Class R6 | | | DGRRX | | | 245914486 |

17

Table of Contents

| Performance summaries | |

| Delaware International Value Equity Fund | November 30, 2022 (Unaudited) |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| Fund and benchmark performance1,2 | Average annual total returns through November 30, 2022 |

| | | 1 year | | 5 year | | 10 year | | Lifetime |

| Class A (Est. October 31, 1991) | | | | | | | | |

| Excluding sales charge | | -13.46% | | -1.52% | | +3.06% | | — |

| Including sales charge | | -18.42% | | -2.68% | | +2.45% | | — |

| Class C (Est. November 29, 1995) | | | | | | | | |

| Excluding sales charge | | -14.07% | | -2.25% | | +2.29% | | — |

| Including sales charge | | -14.87% | | -2.25% | | +2.29% | | — |

| Class R (Est. June 2, 2003) | | | | | | | | |

| Excluding sales charge | | -13.68% | | -1.77% | | +2.80% | | — |

| Including sales charge | | -13.68% | | -1.77% | | +2.80% | | — |

| Institutional Class (Est. November 9, 1992) | | | | | | | | |

| Excluding sales charge | | -13.23% | | -1.27% | | +3.32% | | — |

| Including sales charge | | -13.23% | | -1.27% | | +3.32% | | — |

| Class R6 (Est. March 29, 2018) | | | | | | | | |

| Excluding sales charge | | -13.17% | | — | | — | | -1.14% |

| Including sales charge | | -13.17% | | — | | — | | -1.14% |

| MSCI EAFE Index (net) | | -10.14% | | +1.85% | | +4.99% | | — |

| MSCI EAFE Index (gross) | | -9.70% | | +2.34% | | +5.48% | | — |

| 1 | Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares. |

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed in the “Fund expense ratios” table on page 19. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service (12b-1) fee.

Class A shares are sold with a maximum front-end sales charge of 5.75%, and have an annual 12b-1 fee of 0.25% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge (CDSC) of 1.00% if

18

Table of Contents

redeemed during the first 12 months. They are also subject to an annual 12b-1 fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that CDSCs did not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual 12b-1 fee of 0.50% of average daily net assets.

Class R6 shares are available only to certain investors. In addition, Class R6 shares do not pay any service fees, sub-accounting fees, and/or sub-transfer agency fees to any brokers, dealers, or other financial intermediaries. Class R6 shares pay no 12b-1 fee.

International investments entail risks including fluctuation in currency values, differences in accounting principles, or economic or political instability. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility, lower trading volume, and higher risk of market closures. In many emerging markets, there is substantially less publicly available information and the available information may be incomplete or misleading. Legal claims are generally more difficult to pursue.

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Fund from executing advantageous investment decisions in a timely manner and could negatively impact the Fund’s ability to achieve its investment objective and the value of the Fund’s investments.

| 2 | The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. The expense ratios below may differ from the expense ratios in the “Financial highlights” since they are based on different time periods and the expense ratios in the prospectus include acquired fund fees and expenses, if any. See Note 2 in “Notes to financial statements” for additional details. Please see the “Financial highlights” section in this report for the most recent expense ratios. |

| Fund expense ratios | | Class A | | Class C | | Class R | | Institutional

Class | | Class R6 |

Total annual operating expenses

(without fee waivers) | | 1.32% | | 2.07% | | 1.57% | | 1.07% | | 1.00% |

Net expenses (including fee

waivers, if any) | | 1.13% | | 1.88% | | 1.38% | | 0.88% | | 0.81% |

| Type of waiver | | Contractual | | Contractual | | Contractual | | Contractual | | Contractual |

19

Table of Contents

Performance summaries

Delaware International Value Equity Fund

Performance of a $10,000 investment1

For the period November 30, 2012 through November 30, 2022

| | | | Starting value | | Ending value |

| MSCI EAFE Index (gross) | | | $10,000 | | | | $17,056 | |

| MSCI EAFE Index (net) | | | $10,000 | | | | $16,279 | |

| Delaware International Value Equity Fund — Institutional

Class shares | | | $10,000 | | | | $13,860 | |

| Delaware International Value Equity Fund — Class A

shares | | | $9,425 | | | | $12,741 | |

| 1 | The “Performance of a $10,000 investment” graph assumes $10,000 invested in Institutional Class and Class A shares of the Fund on November 30, 2012, and includes the effect of a 5.75% front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 19. Please note additional details on pages 18 through 21. |

The graph also assumes $10,000 invested in the MSCI EAFE Index as of November 30, 2012. The MSCI EAFE (Europe, Australasia, Far East) Index represents large- and mid-cap stocks across 21 developed markets, excluding the United States and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate. Index “gross” return approximates the maximum possible dividend reinvestment.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Performance of other Fund classes will vary

20

Table of Contents

due to different charges and expenses.

| | | Nasdaq symbols | | CUSIPs |

| Class A | | | DEGIX | | | 245914106 |

| Class C | | | DEGCX | | | 245914858 |

| Class R | | | DIVRX | | | 245914577 |

| Institutional Class | | | DEQIX | | | 245914403 |

| Class R6 | | | DEQRX | | | 245914478 |

21

Table of Contents

Disclosure of Fund expenses

For the six-month period from June 1, 2022 to November 30, 2022 (Unaudited)

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from June 1, 2022 to November 30, 2022.

Actual expenses

The first section of the tables shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the tables shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Funds’ expenses shown in the tables reflect fee waivers in effect and assume reinvestment of all dividends and distributions.

22

Table of Contents

Delaware Emerging Markets Fund

Expense analysis of an investment of $1,000

| | | Beginning

Account Value

6/1/22 | | Ending

Account Value

11/30/22 | | Annualized

Expense Ratio | | Expenses

Paid During Period

6/1/22 to 11/30/22* |

| Actual Fund return† | | | | | | | | | | | | |

| Class A | | | $1,000.00 | | | | $892.10 | | | | 1.48 | % | | | $7.02 | |

| Class C | | | 1,000.00 | | | | 888.90 | | | | 2.23 | % | | | 10.56 | |

| Class R | | | 1,000.00 | | | | 891.30 | | | | 1.73 | % | | | 8.20 | |

| Institutional Class | | | 1,000.00 | | | | 893.40 | | | | 1.23 | % | | | 5.84 | |

| Class R6 | | | 1,000.00 | | | | 894.00 | | | | 1.14 | % | | | 5.41 | |

| Hypothetical 5% return (5% return before expenses) |

| Class A | | | $1,000.00 | | | | $1,017.65 | | | | 1.48 | % | | | $7.49 | |

| Class C | | | 1,000.00 | | | | 1,013.89 | | | | 2.23 | % | | | 11.26 | |

| Class R | | | 1,000.00 | | | | 1,016.39 | | | | 1.73 | % | | | 8.74 | |

| Institutional Class | | | 1,000.00 | | | | 1,018.90 | | | | 1.23 | % | | | 6.23 | |

| Class R6 | | | 1,000.00 | | | | 1,019.35 | | | | 1.14 | % | | | 5.77 | |

Delaware International Small Cap Fund

Expense analysis of an investment of $1,000

| | | Beginning

Account Value

6/1/22 | | Ending

Account Value

11/30/22 | | Annualized

Expense Ratio | | Expenses

Paid During Period

6/1/22 to 11/30/22* |

| Actual Fund return† | | | | | | | | | | | | | | | | |

| Class A | | | $1,000.00 | | | | $920.80 | | | | 1.35 | % | | | $6.50 | |

| Class C | | | 1,000.00 | | | | 917.10 | | | | 2.10 | % | | | 10.09 | |

| Class R | | | 1,000.00 | | | | 918.30 | | | | 1.60 | % | | | 7.69 | |

| Institutional Class | | | 1,000.00 | | | | 921.40 | | | | 1.10 | % | | | 5.30 | |

| Class R6 | | | 1,000.00 | | | | 921.80 | | | | 1.00 | % | | | 4.82 | |

| Hypothetical 5% return (5% return before expenses) |

| Class A | | | $1,000.00 | | | | $1,018.30 | | | | 1.35 | % | | | $6.83 | |

| Class C | | | 1,000.00 | | | | 1,014.54 | | | | 2.10 | % | | | 10.61 | |

| Class R | | | 1,000.00 | | | | 1,017.05 | | | | 1.60 | % | | | 8.09 | |

| Institutional Class | | | 1,000.00 | | | | 1,019.55 | | | | 1.10 | % | | | 5.57 | |

| Class R6 | | | 1,000.00 | | | | 1,020.05 | | | | 1.00 | % | | | 5.06 | |

23

Table of Contents

Disclosure of Fund expenses

For the six-month period from June 1, 2022 to November 30, 2022 (Unaudited)

Delaware International Value Equity Fund

Expense analysis of an investment of $1,000

| | | Beginning

Account Value

6/1/22 | | Ending

Account Value

11/30/22 | | Annualized

Expense Ratio | | Expenses

Paid During Period

6/1/22 to 11/30/22* |

| Actual Fund return† | | | | | | | | | | | | |

| Class A | | | $1,000.00 | | | | $939.50 | | | | 1.13 | % | | | $5.49 | |

| Class C | | | 1,000.00 | | | | 936.60 | | | | 1.88 | % | | | 9.13 | |

| Class R | | | 1,000.00 | | | | 938.50 | | | | 1.38 | % | | | 6.71 | |

| Institutional Class | | | 1,000.00 | | | | 941.30 | | | | 0.88 | % | | | 4.28 | |

| Class R6 | | | 1,000.00 | | | | 941.30 | | | | 0.81 | % | | | 3.94 | |

| Hypothetical 5% return (5% return before expenses) |

| Class A | | | $1,000.00 | | | | $1,019.40 | | | | 1.13 | % | | | $5.72 | |

| Class C | | | 1,000.00 | | | | 1,015.64 | | | | 1.88 | % | | | 9.50 | |

| Class R | | | 1,000.00 | | | | 1,018.15 | | | | 1.38 | % | | | 6.98 | |

| Institutional Class | | | 1,000.00 | | | | 1,020.66 | | | | 0.88 | % | | | 4.46 | |

| Class R6 | | | 1,000.00 | | | | 1,021.01 | | | | 0.81 | % | | | 4.10 | |

| * | “Expenses Paid During Period” are equal to the relevant Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

| † | Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns. |

In addition to the Fund’s expenses reflected above, each Fund also indirectly bears its portion of the fees and expenses of any investment companies (Underlying Funds) in which it invests, including exchange-traded funds. The tables above do not reflect the expenses of any Underlying Funds.

24

Table of Contents

| Security type / country and sector allocations |

| Delaware Emerging Markets Fund | As of November 30, 2022 (Unaudited) |

Sector designations may be different from the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different than another fund’s sector designations.

| Security type / country | | Percentage of net assets |

| Common Stocks by Country | | | 98.51 | % |

| Argentina | | | 0.45 | % |

| Australia | | | 1.73 | % |

| Bahrain | | | 0.06 | % |

| Brazil | | | 5.90 | % |

| Chile | | | 1.78 | % |

| China | | | 27.29 | % |

| Hong Kong | | | 0.24 | % |

| India | | | 15.88 | % |

| Indonesia | | | 1.57 | % |

| Malaysia | | | 0.02 | % |

| Mexico | | | 4.96 | % |

| Peru | | | 0.55 | % |

| Republic of Korea | | | 18.95 | % |

| Russia | | | 0.01 | % |

| South Africa | | | 0.29 | % |

| Taiwan | | | 15.79 | % |

| Turkey | | | 1.26 | % |

| United Kingdom | | | 0.06 | % |

| United States | | | 1.72 | % |

| Preferred Stocks | | | 1.88 | % |

| Rights | | | 0.02 | % |

| Warrants | | | 0.01 | % |

| Exchange-Traded Fund | | | 0.21 | % |

| Participation Notes | | | 0.00 | % |

| Short-Term Investments | | | 0.09 | % |

| Total Value of Securities | | | 100.72 | % |

| Liabilities Net of Receivables and Other Assets | | | (0.72 | %) |

| Total Net Assets | | | 100.00 | % |

25

Table of Contents

Security type / country and sector allocations

Delaware Emerging Markets Fund

Common stock, participation notes, and

preferred stock by sector t | | Percentage of net assets |

| Communication Services | | | 11.99 | % |

| Consumer Discretionary | | | 11.79 | % |

| Consumer Staples | | | 12.96 | % |

| Energy | | | 11.80 | % |

| Financials | | | 5.62 | % |

| Healthcare | | | 1.33 | % |

| Industrials | | | 1.17 | % |

| Information Technology* | | | 35.92 | % |

| Materials | | | 7.07 | % |

| Real Estate | | | 0.15 | % |

| Utilities | | | 0.59 | % |

| Total | | | 100.39 | % |

| t | Narrow industries are utilized for compliance purposes for concentration whereas broad sectors are used for financial reporting. |

| * | To monitor compliance with the Fund’s concentration guidelines as described in the Fund’s Prospectus and Statement of Additional Information, the Information Technology sector (as disclosed herein for financial reporting purposes) is subdivided into a variety of “industries” (in accordance with the requirements of the Investment Company Act of 1940, as amended). The Information Technology sector consisted of Commercial Services, Computers, Electronics, Electronic Components-Semiconductors, Internet, Investment Companies, Retail, Semiconductor Components-Integrated Circuits, and Software. As of November 30, 2022, such amounts, as a percentage of total net assets were 0.09%, 1.97%, 0.17%, 18.04%, 0.69%, 3.65%, 0.01%, 10.48%, and 0.82%, respectively. The percentage in any such single industry will comply with the Fund’s concentration policy even if the percentage in the Information Technology sector for financial reporting purposes may exceed 25%. |

26

Table of Contents

| Security type / country and sector allocations |

| Delaware International Small Cap Fund | As of November 30, 2022 (Unaudited) |

Sector designations may be different from the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different than another fund’s sector designations.

| Security type / country | | Percentage of net assets |

| Common Stocks by Country | | | 97.28 | % |

| Argentina | | | 0.85 | % |

| Australia | | | 3.39 | % |

| Austria | | | 0.51 | % |

| Brazil | | | 4.63 | % |

| Canada | | | 11.54 | % |

| China | | | 1.09 | % |

| Denmark | | | 1.84 | % |

| Finland | | | 0.76 | % |

| France | | | 2.81 | % |

| Germany | | | 2.41 | % |

| India | | | 5.60 | % |

| Indonesia | | | 0.67 | % |

| Ireland | | | 0.88 | % |

| Israel | | | 1.16 | % |

| Italy | | | 3.33 | % |

| Japan | | | 26.29 | % |

| Malaysia | | | 0.37 | % |

| Mexico | | | 3.74 | % |

| Norway | | | 3.75 | % |

| Republic of Korea | | | 2.27 | % |

| Russia | | | 0.01 | % |

| South Africa | | | 2.64 | % |

| Spain | | | 2.03 | % |

| Sweden | | | 1.74 | % |

| Taiwan | | | 1.96 | % |

| Thailand | | | 0.69 | % |

| United Kingdom | | | 9.19 | % |

| United States | | | 1.13 | % |

| Short-Term Investments | | | 2.62 | % |

| Total Value of Securities | | | 99.90 | % |

| Receivables and Other Assets Net of Liabilities | | | 0.10 | % |

| Total Net Assets | | | 100.00 | % |

27

Table of Contents

Security type / country and sector allocations

Delaware International Small Cap Fund

| Common stocks by sector | | Percentage of net assets |

| Communication Services | | | 2.22 | % |

| Consumer Discretionary | | | 11.68 | % |

| Consumer Staples | | | 7.89 | % |

| Energy | | | 7.99 | % |

| Financials | | | 15.00 | % |

| Healthcare | | | 6.50 | % |

| Industrials | | | 24.36 | % |

| Information Technology | | | 9.29 | % |

| Materials | | | 4.96 | % |

| Real Estate | | | 5.38 | % |

| Utilities | | | 2.01 | % |

| Total | | | 97.28 | % |

28

Table of Contents

| Security type / country and sector allocations |

| Delaware International Value Equity Fund | As of November 30, 2022 (Unaudited) |

Sector designations may be different from the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different than another fund’s sector designations.

| Security type / country | | Percentage of net assets |

| Common Stocks by Country | | | 98.79 | % |

| Denmark | | | 4.64 | % |

| France | | | 17.64 | % |

| Germany | | | 12.66 | % |

| Japan | | | 9.96 | % |

| Netherlands | | | 6.11 | % |

| Spain | | | 5.62 | % |

| Sweden | | | 10.13 | % |

| Switzerland | | | 13.67 | % |

| United Kingdom | | | 18.36 | % |

| Exchange-Traded Funds | | | 0.44 | % |

| Securities Lending Collateral | | | 0.07 | % |

| Total Value of Securities | | | 99.30 | % |

| Obligation to Return Securities Lending Collateral | | | (0.07 | %) |

| Receivables and Other Assets Net of Liabilities | | | 0.77 | % |

| Total Net Assets | | | 100.00 | % |

| Common stocks by sector t | | Percentage of net assets |

| Communication Services | | | 5.30 | % |

| Consumer Discretionary | | | 14.15 | % |

| Consumer Staples* | | | 35.84 | % |

| Healthcare | | | 15.61 | % |

| Industrials | | | 12.02 | % |

| Information Technology | | | 10.41 | % |

| Materials | | | 5.46 | % |

| Total | | | 98.79 | % |

| t | Narrow industries are utilized for compliance purposes for concentration whereas broad sectors are used for financial reporting. |

29

Table of Contents

Security type / country and sector allocations

Delaware International Value Equity Fund

| * | To monitor compliance with the Fund’s concentration guidelines as described in the Fund’s Prospectus and Statement of Additional Information, the Consumer Staples sector (as disclosed herein for financial reporting purposes) is subdivided into a variety of “industries” (in accordance with the requirements of the Investment Company Act of 1940, as amended). The Consumer Staples sector consisted of Beverages, Cosmetics/Personal Care, and Food. As of November 30, 2022, such amounts, as a percentage of total net assets were 7.11%, 11.63%, and 17.10%, respectively. The percentage in any such single industry will comply with the Fund’s concentration policy even if the percentage in the Consumer Staples sector for financial reporting purposes may exceed 25%. |

30

Table of Contents

| Schedules of investments | |

| Delaware Emerging Markets Fund | November 30, 2022 |

| | | Number of

shares | | | Value (US $) |

| Common Stocks – 98.51%∆ | | | | | | | |

| Argentina – 0.45% | | | | | | | |

| Arcos Dorados Holdings Class A | | | 573,518 | | | $ | 4,295,650 |

| Cablevision Holding GDR | | | 443,972 | | | | 1,064,999 |

| Cresud ADR † | | | 1,624,384 | | | | 9,730,060 |

| Grupo Clarin GDR Class B 144A #, † | | | 131,213 | | | | 135,586 |

| IRSA Inversiones y Representaciones ADR | | | 1,474,962 | | | | 6,312,837 |

| | | | | | | | 21,539,132 |

| Australia – 1.73% | | | | | | | |

| BHP Group ADR | | | 380,000 | | | | 23,864,000 |

| Rio Tinto ADR | | | 800,000 | | | | 54,912,000 |

| Woodside Energy Group ADR | | | 137,332 | | | | 3,463,513 |

| | | | | | | | 82,239,513 |

| Bahrain – 0.06% | | | | | | | |

| Aluminium Bahrain GDR 144A # | | | 221,400 | | | | 2,977,454 |

| | | | | | | | 2,977,454 |

| Brazil – 5.90% | | | | | | | |

| Americanas | | | 10,770,362 | | | | 21,584,932 |

| Atacadao | | | 500,000 | | | | 1,540,655 |

| Banco Bradesco ADR | | | 16,000,000 | | | | 47,520,000 |

| Banco Santander Brasil ADR | | | 3,051,128 | | | | 16,262,512 |

| BRF ADR † | | | 6,850,000 | | | | 12,467,000 |

| Centrais Eletricas Brasileiras ADR | | | 989,541 | | | | 8,866,287 |

| Embraer ADR † | | | 420,704 | | | | 4,467,877 |

Getnet Adquirencia e Servicos para Meios de

Pagamento ADR | | | 381,391 | | | | 652,179 |

| Itau Unibanco Holding ADR | | | 7,170,000 | | | | 35,706,600 |

| Rumo | | | 1,905,351 | | | | 7,111,998 |

| Telefonica Brasil ADR | | | 2,050,000 | | | | 14,985,500 |

| TIM ADR | | | 1,244,820 | | | | 15,510,457 |

| Vale ADR | | | 5,430,000 | | | | 89,595,000 |

| XP Class A † | | | 211,715 | | | | 3,707,130 |

| | | | | | | | 279,978,127 |

| Chile – 1.78% | | | | | | | |

| Cia Cervecerias Unidas ADR | | | 410,528 | | | | 5,000,231 |

| Sociedad Quimica y Minera de Chile ADR | | | 800,000 | | | | 79,328,000 |

| | | | | | | | 84,328,231 |

| China – 27.29% | | | | | | | |

| Alibaba Group Holding † | | | 2,300,000 | | | | 25,031,274 |

| Alibaba Group Holding ADR † | | | 1,940,000 | | | | 169,866,400 |

| ANTA Sports Products | | | 2,317,600 | | | | 27,545,249 |

31

Table of Contents

Schedules of investments

Delaware Emerging Markets Fund

| | | Number of

shares | | | Value (US $) |

| Common Stocks∆ (continued) | | | | | | | |

| China (continued) | | | | | | | |

| Baidu ADR † | | | 420,000 | | | $ | 45,612,000 |

| BeiGene † | | | 1,615,700 | | | | 24,021,996 |

| China Petroleum & Chemical Class H | | | 30,000,000 | | | | 14,162,829 |

| DiDi Global ADR † | | | 1,278,300 | | | | 3,419,453 |

| Full Truck Alliance ADR † | | | 1,800,000 | | | | 15,354,000 |

| Guangshen Railway Class H † | | | 11,000,000 | | | | 1,726,635 |

| Hengan International Group | | | 2,000,000 | | | | 9,218,895 |

| iQIYI ADR † | | | 700,000 | | | | 2,079,000 |

| JD.com Class A | | | 226,190 | | | | 6,457,220 |

| JD.com ADR | | | 3,080,000 | | | | 176,114,400 |

| Joinn Laboratories China Class H 144A # | | | 85,848 | | | | 402,055 |

| Kangji Medical Holdings | | | 3,000 | | | | 3,030 |

| Kunlun Energy | | | 21,000,000 | | | | 16,292,754 |

| Kweichow Moutai Class A | | | 700,000 | | | | 157,750,699 |

| New Oriental Education & Technology Group ADR † | | | 700,000 | | | | 20,118,000 |

| PetroChina Class H | | | 18,000,000 | | | | 8,190,580 |

| Ping An Insurance Group Co. of China Class H | | | 4,000,000 | | | | 24,696,033 |

| Sohu.com ADR † | | | 2,219,642 | | | | 32,806,309 |

| Sun Art Retail Group | | | 15,079,500 | | | | 3,937,508 |

| TAL Education Group ADR † | | | 1,030,000 | | | | 6,149,100 |

| Tencent Holdings | | | 5,000,000 | | | | 189,081,579 |

| Tencent Music Entertainment Group ADR † | | | 950,000 | | | | 6,659,500 |

| Tianjin Development Holdings | | | 15,885,550 | | | | 3,027,346 |

| Tingyi Cayman Islands Holding | | | 13,000,000 | | | | 21,262,106 |

| Trip.com Group ADR † | | | 582,400 | | | | 18,607,680 |

| Tsingtao Brewery Class H | | | 7,000,000 | | | | 66,265,789 |

| Uni-President China Holdings | | | 31,186,000 | | | | 27,373,790 |

| Weibo ADR † | | | 960,481 | | | | 15,310,067 |

| Wuliangye Yibin Class A | | | 7,000,000 | | | | 155,740,016 |

| ZhongAn Online P&C Insurance Class H 144A #, † | | | 739,600 | | | | 1,937,344 |

| | | | | | | | 1,296,220,636 |

| Hong Kong – 0.24% | | | | | | | |

| Vinda International Holdings | | | 4,300,000 | | | | 11,194,391 |

| | | | | | | | 11,194,391 |

| India – 15.88% | | | | | | | |

| Aurobindo Pharma | | | 1,500,000 | | | | 8,666,021 |

| Glenmark Pharmaceuticals | | | 1,167,988 | | | | 6,188,228 |

| HCL Technologies | | | 2,800,000 | | | | 38,865,620 |

| Indiabulls Real Estate GDR † | | | 102,021 | | | | 104,356 |

| Infosys | | | 2,640,000 | | | | 53,660,408 |

32

Table of Contents

| | | Number of

shares | | | Value (US $) |

| Common Stocks∆ (continued) | | | | | | | |

| India (continued) | | | | | | | |

| Lupin | | | 2,500,000 | | | $ | 23,576,515 |

| Reliance Industries | | | 10,500,000 | | | | 353,194,000 |

| Reliance Industries GDR 144A # | | | 2,340,879 | | | | 155,779,650 |

| Tata Chemicals | | | 1,866,909 | | | | 23,847,954 |

| Tata Consultancy Services | | | 950,000 | | | | 39,895,722 |

| Tata Consumer Products | | | 2,128,276 | | | | 21,438,716 |

| United Breweries | | | 1,000,000 | | | | 20,737,297 |

| Zee Entertainment Enterprises | | | 2,530,000 | | | | 8,242,458 |

| | | | | | | | 754,196,945 |

| Indonesia – 1.57% | | | | | | | |

| Astra Agro Lestari | | | 9,132,500 | | | | 4,838,074 |

| Astra International | | | 180,000,000 | | | | 69,641,812 |

| | | | | | | | 74,479,886 |

| Malaysia – 0.02% | | | | | | | |

| UEM Sunrise † | | | 17,000,000 | | | | 1,077,630 |

| | | | | | | | 1,077,630 |

| Mexico – 4.96% | | | | | | | |

| America Movil ADR Class L | | | 1,369,199 | | | | 26,644,613 |

| Banco Santander Mexico ADR | | | 8,042,900 | | | | 48,337,829 |