UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811- 6395 |

| |

| DREYFUS NEW YORK MUNICIPAL CASH MANAGEMENT | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| John Pak, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6000 |

| |

Date of fiscal year end: | 1/31 | |

Date of reporting period: | 1/31/14 | |

| | | | | | | |

FORM N-CSR

Item 1. Reports to Stockholders.

| | |

| Contents | |

| |

| The Funds | |

| Letter to Shareholders (Taxable) | 3 |

| Letter to Shareholders (Tax-Exempt) | 5 |

| Understanding Your Fund’s Expenses | 7 |

| Comparing Your Fund’s Expenses | |

| With Those of Other Funds | 9 |

| Statements of Investments | 11 |

| Statements of Assets and Liabilities | 54 |

| Statements of Operations | 57 |

| Statements of Changes in Net Assets | 59 |

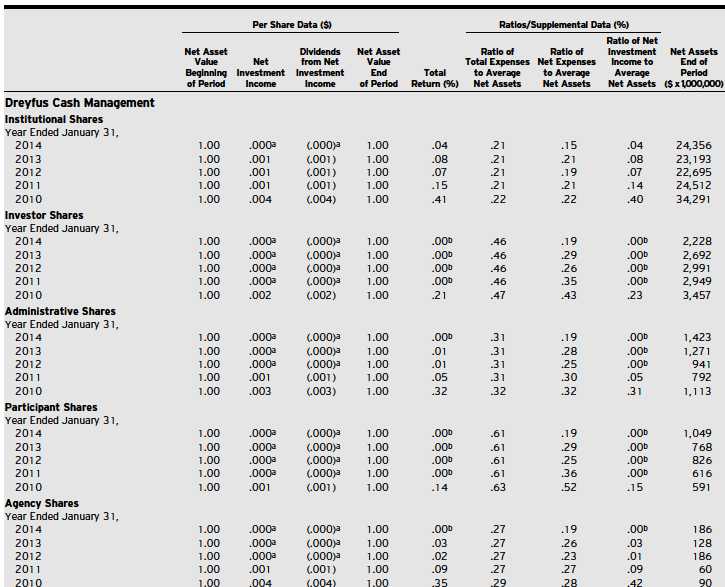

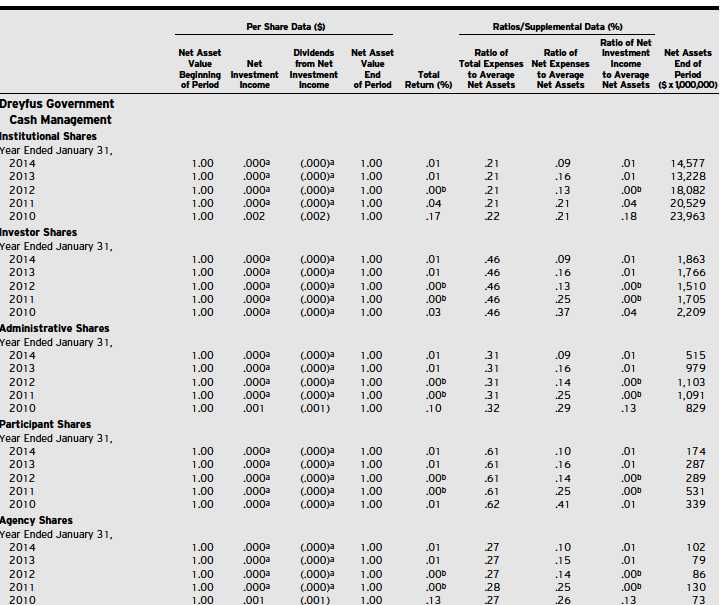

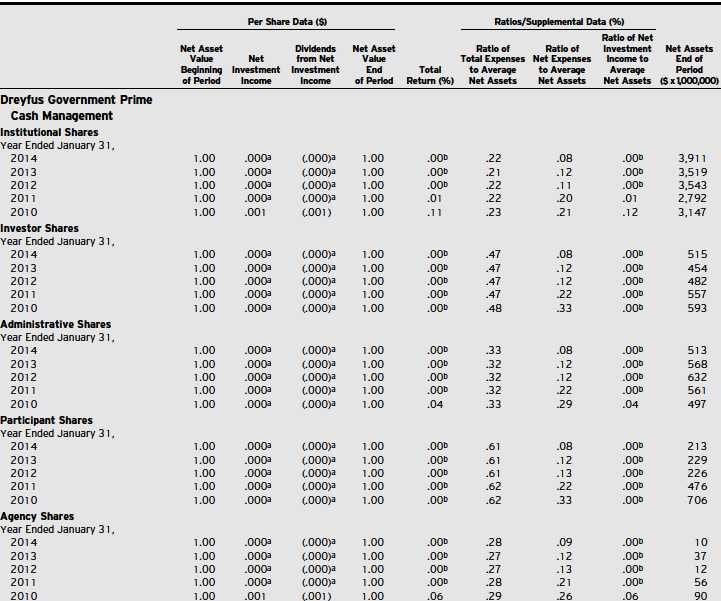

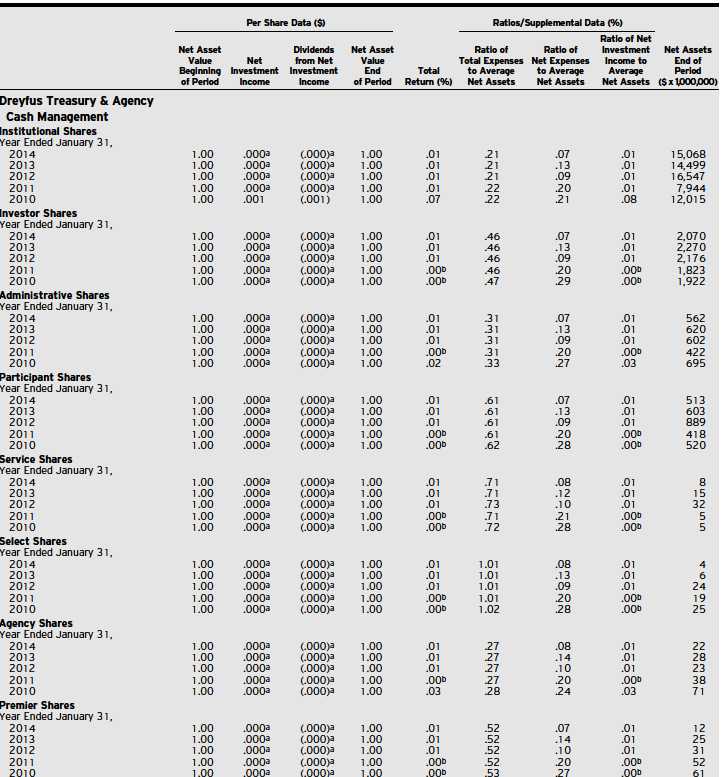

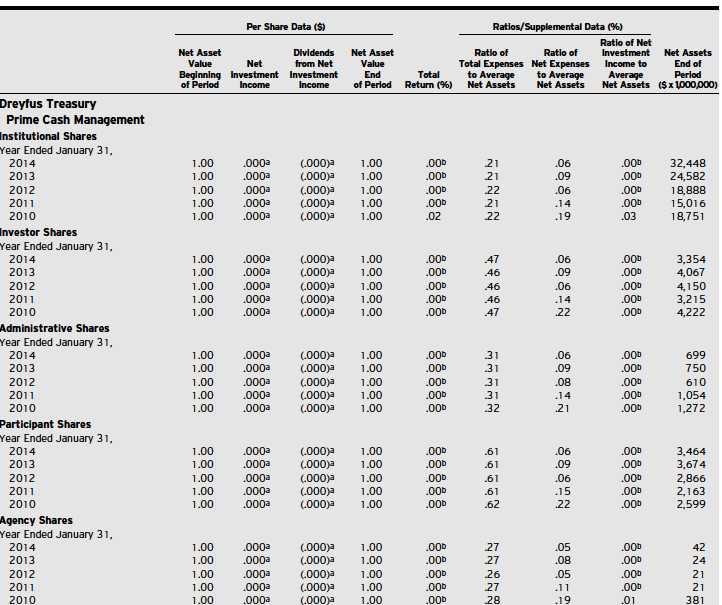

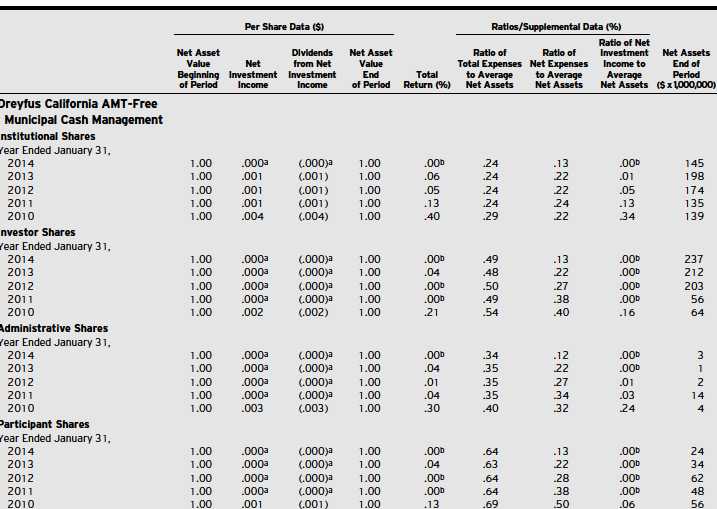

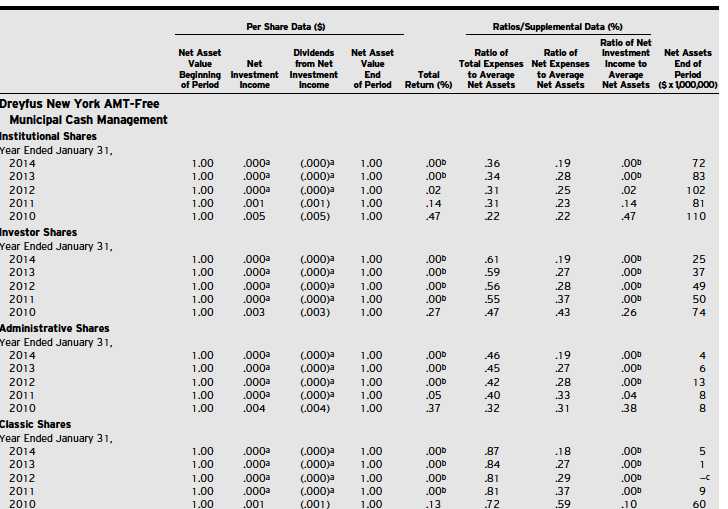

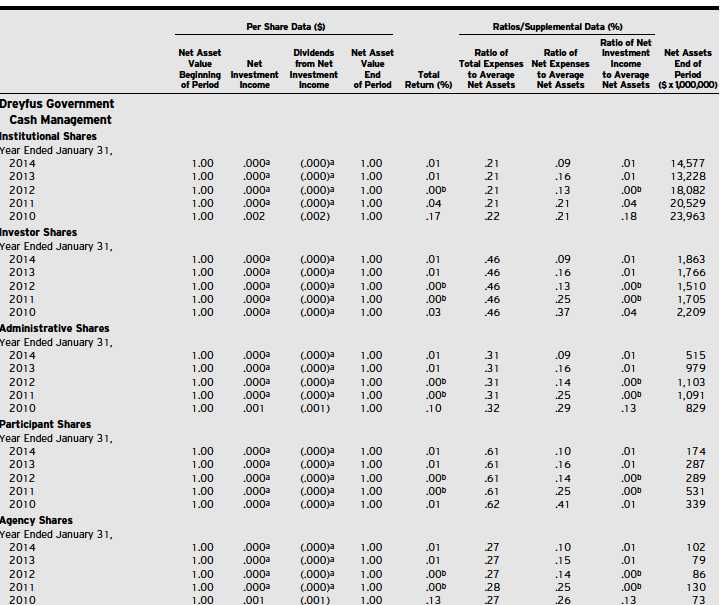

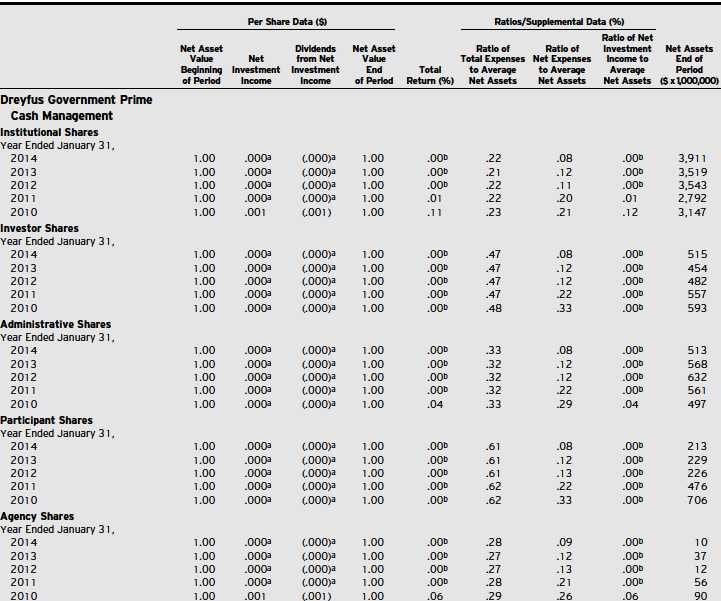

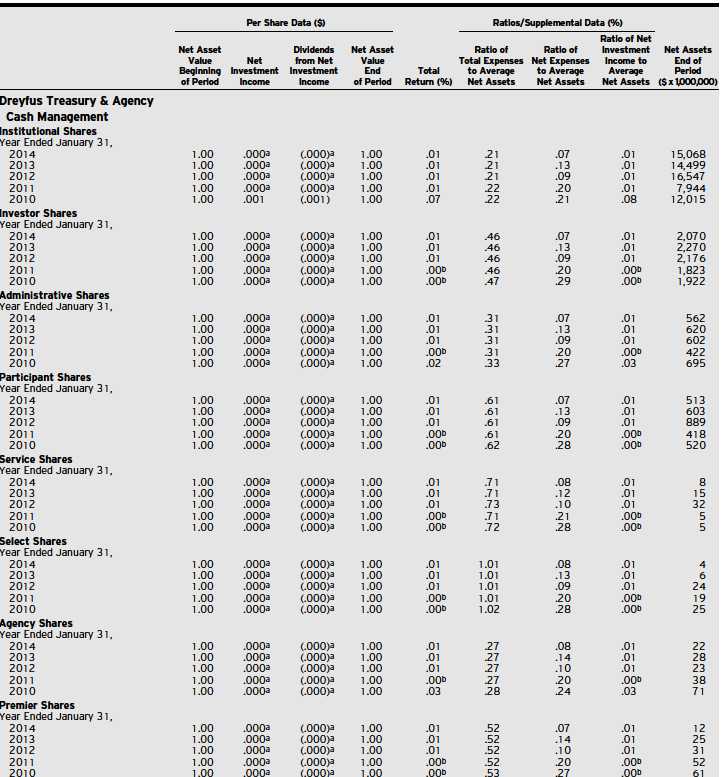

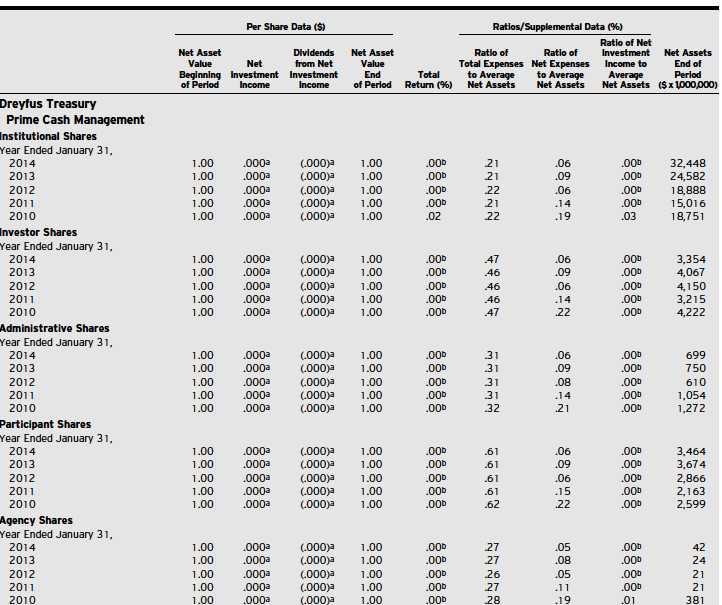

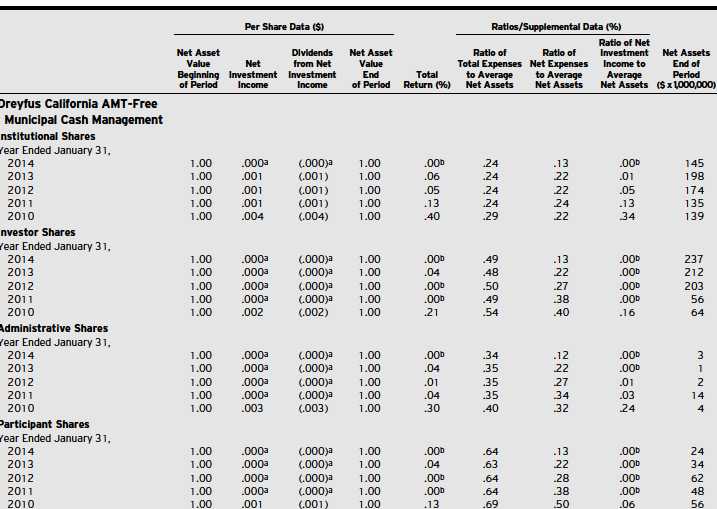

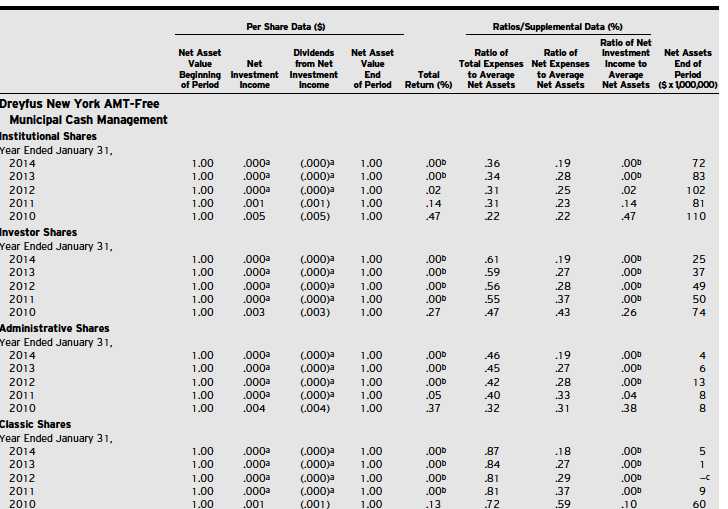

| Financial Highlights | 64 |

| Notes to Financial Statements | 74 |

| Report of Independent Registered | |

| Public Accounting Firm | 83 |

| Important Tax Information | 84 |

| Proxy Results | 85 |

| Board Members Information | 89 |

| Officers of the Funds | 91 |

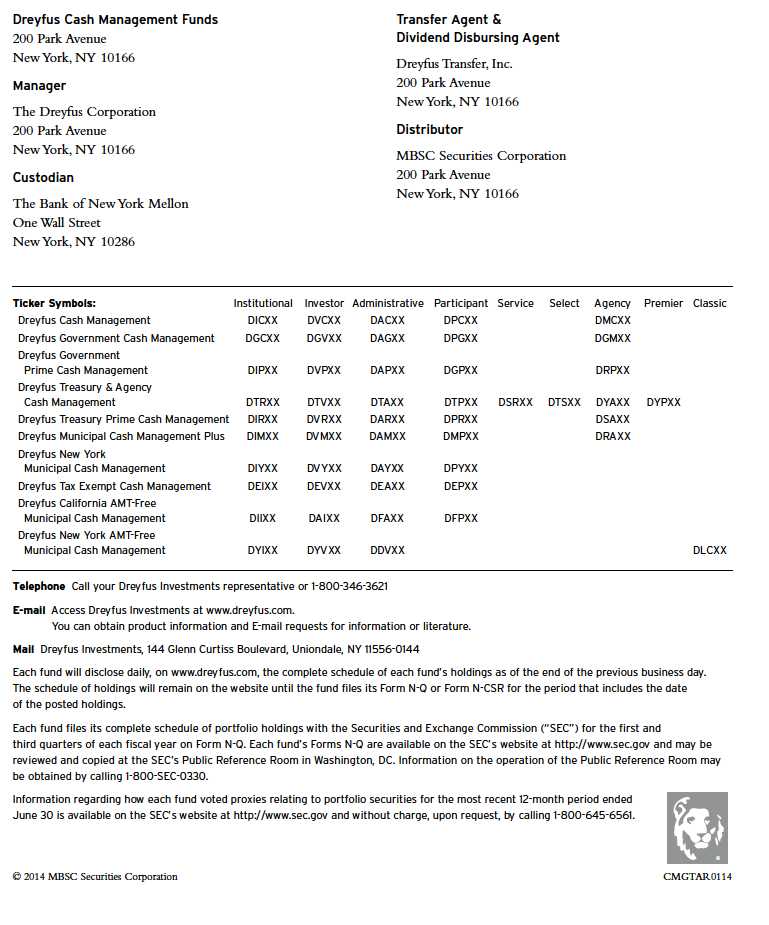

| For More Information | |

| Back cover | |

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

| |

| • Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Dreyfus Cash Management Funds

The Funds

LETTER TO

SHAREHOLDERS

Dear Shareholders:

This annual report for the several Dreyfus Cash Management Funds (Taxable) covers the 12-month period ended January 31, 2014. Over the reporting period, these funds achieved the following yields and, taking into account the effects of compounding, the following effective yields:1,2

| | | |

| | | Effective |

| | Yield (%) | Yield (%) |

| Dreyfus Cash Management | | |

| Institutional Shares | 0.04 | 0.04 |

| Investor Shares | 0.00 | 0.00 |

| Administrative Shares | 0.00 | 0.00 |

| Participant Shares | 0.00 | 0.00 |

| Agency Shares | 0.00 | 0.00 |

| Dreyfus Government | | |

| Cash Management | | |

| Institutional Shares | 0.01 | 0.01 |

| Investor Shares | 0.01 | 0.01 |

| Administrative Shares | 0.01 | 0.01 |

| Participant Shares | 0.01 | 0.01 |

| Agency Shares | 0.01 | 0.01 |

| Dreyfus Government | | |

| Prime Cash Management | | |

| Institutional Shares | 0.00 | 0.00 |

| Investor Shares | 0.00 | 0.00 |

| Administrative Shares | 0.00 | 0.00 |

| Participant Shares | 0.00 | 0.00 |

| Agency Shares | 0.00 | 0.00 |

| Dreyfus Treasury & Agency | | |

| Cash Management | | |

| Institutional Shares | 0.01 | 0.01 |

| Investor Shares | 0.01 | 0.01�� |

| Administrative Shares | 0.01 | 0.01 |

| Participant Shares | 0.01 | 0.01 |

| Service Shares | 0.01 | 0.01 |

| Select Shares | 0.01 | 0.01 |

| Agency Shares | 0.01 | 0.01 |

| Premier Shares | 0.01 | 0.01 |

| Dreyfus Treasury | | |

| Prime Cash Management | | |

| Institutional Shares | 0.00 | 0.00 |

| Investor Shares | 0.00 | 0.00 |

| Administrative Shares | 0.00 | 0.00 |

| Participant Shares | 0.00 | 0.00 |

| Agency Shares | 0.00 | 0.00 |

Although long-term interest rates climbed amid a recovering U.S. economy over the reporting period, short-term rates and money market yields remained anchored by an unchanged federal funds rate between 0% and 0.25%.

U.S. Economic Recovery Gained Traction

A mild U.S. economic recovery appeared to gain momentum in February 2013, when the unemployment rate declined from 7.9% to 7.7% and 236,000 new jobs were created.The unemployment rate continued to edge lower in March to 7.6%, but just 88,000 new jobs were added during the month.The economy grew at a lackluster 1.1% annualized rate during the first quarter of 2013.

The gradual recovery continued in April when the unemployment rate ticked down to 7.5%. In May, the Federal Reserve Board (the “Fed”) signaled that it would begin to curtail its quantitative easing program sooner than expected despite subsequent releases of data showing reduced manufacturing activity and an increase in the unemployment rate to 7.6%. Investors responded to the Fed’s hawkish remarks by driving long-term interest rates higher in June amid robust increases in home and automobile sales, the creation of 195,000 jobs, and an unchanged unemployment rate. For the second quarter, the U.S. economy grew at a more respectable 2.5% annualized rate.

July brought welcome evidence of market stabilization when investors realized that imminent increases in short-term rates were unlikely, even as the unemployment rate slid to 7.4%. In August, the manufacturing sector expanded at its fastest pace since June 2011, and the unemployment rate dipped to 7.3%. Financial markets rallied in September when the Fed unexpectedly refrained from tapering its quantitative easing program, manufacturing activity expanded, and the service sector continued to grow. Yet, only 146,000 jobs were added in September even as the unemployment rate fell to 7.2%. It later was

LETTER TO SHAREHOLDERS (continued)

announced that U.S. economic activity accelerated to a robust 4.1% annualized growth rate during the third quarter.

October saw 204,000 new jobs, but furloughs of government workers during a U.S. government shutdown drove the unemployment rate to 7.3%, and the Fed again refrained from reducing its bond purchases. However, economic data for November showed a more robust recovery, including 274,000 new jobs and an unemployment rate of 7.0%.

Manufacturing activity accelerated in December, as new orders reached their highest level in four years.The Fed responded to more robust economic data by modestly reducing its monthly bond purchases, marking the first of what is expected to be a series of cuts. However, only 75,000 new jobs were created in December, the lowest monthly gain in three years. The unemployment rate slid to 6.7% as workers left the labor force. The U.S. economy grew at an estimated 3.2% annualized GDP growth rate during the fourth quarter.

In January 2014, investors worried that ongoing downturns in the emerging markets could dampen the U.S. economic recovery. However, corporate earnings growth generally remained strong, and the unemployment rate declined to 6.6% with the addition of 113,000 jobs. As expected, the Fed announced an additional reduction in quantitative easing after its January meeting.

No Change Expected for Short-Term Rates

Despite higher long-term interest rates in an accelerating recovery, money market yields remained near zero percent, and yield differences along the market’s maturity spectrum stayed relatively narrow. In addition, monetary policymakers appear unlikely to raise short-term interest rates this year, and we expect regulators to issue changes to the rules governing some money market funds over the coming months.

Therefore, as we have for some time, we have maintained the fund’s weighted average maturity in a market-neutral position, and we remained focused on well-established issuers with good liquidity characteristics.

| | |

| | An investment in the funds is not insured or guaranteed by the FDIC or |

| | any other government agency.Although the funds seek to preserve the value |

| | of your investment at $1.00 per share, it is possible to lose money by |

| | investing in the funds. |

| | Short-term corporate, asset-backed securities holdings and municipal |

| | securities holdings (as applicable), while rated in the highest rating category |

| | by one or more NRSRO (or unrated, if deemed of comparable quality by |

| | Dreyfus), involve credit and liquidity risks and risk of principal loss. |

| 1 | Effective yield is based upon dividends declared daily and reinvested |

| | monthly. Past performance is no guarantee of future results.Yields fluctuate. |

| 2 | Yields provided reflect the absorption of certain fund expenses by The |

| | Dreyfus Corporation pursuant to an undertaking, which is voluntary and |

| | temporary, not contractual, and can be terminated at any time without |

| | notice. Had these expenses not been absorbed, fund yields would have been |

| | lower, and in some cases, 7-day yields during the reporting period would |

| | have been negative absent the expense absorption. |

4

LETTER TO

SHAREHOLDERS

Dear Shareholder:

We are pleased to present the annual report for the several Dreyfus Cash Management Funds (Tax Exempt). For the 12-month period ended January 31, 2014, these tax-exempt money market funds achieved the following yields and effective yields:1,2

| | | |

| | | Effective |

| | Yield (%) | Yield (%) |

| Dreyfus Municipal | | |

| Cash Management Plus | | |

| Institutional Shares | 0.00 | 0.00 |

| Investor Shares | 0.00 | 0.00 |

| Administrative Shares | 0.00 | 0.00 |

| Participant Shares | 0.00 | 0.00 |

| Agency Shares | 0.00 | 0.00 |

| Dreyfus New York | | |

| Municipal Cash Management | | |

| Institutional Shares | 0.00 | 0.00 |

| Investor Shares | 0.00 | 0.00 |

| Administrative Shares | 0.00 | 0.00 |

| Participant Shares | 0.00 | 0.00 |

| Dreyfus Tax Exempt | | |

| Cash Management | | |

| Institutional Shares | 0.00 | 0.00 |

| Investor Shares | 0.00 | 0.00 |

| Administrative Shares | 0.00 | 0.00 |

| Participant Shares | 0.00 | 0.00 |

| Dreyfus California AMT-Free | | |

| Municipal Cash Management | | |

| Institutional Shares | 0.00 | 0.00 |

| Investor Shares | 0.00 | 0.00 |

| Administrative Shares | 0.00 | 0.00 |

| Participant Shares | 0.00 | 0.00 |

| Dreyfus New York AMT-Free | | |

| Municipal Cash Management | | |

| Institutional Shares | 0.00 | 0.00 |

| Investor Shares | 0.00 | 0.00 |

| Administrative Shares | 0.00 | 0.00 |

| Classic Shares | 0.00 | 0.00 |

Long-Term Rates Climbed in Economic Recovery

Economic conditions continued to improve over the reporting period as U.S. GDP accelerated from 2.5% during the second quarter of the year to a more robust 4.1% for the third quarter and 3.2% in the fourth quarter amid falling unemployment, rebounding housing markets, increased manufacturing activity, and a massive quantitative easing program from the Federal Reserve Board (the “Fed”). Longer term interest rates climbed as the recovery progressed, but the Fed left short-term interest rates unchanged near historical lows.

Investors were surprised in May 2013, when the Fed appeared ready to back away from its longstanding, aggressively accommodative monetary policy stance. Relatively hawkish remarks by Fed Chairman Ben Bernanke were interpreted as a signal that U.S. monetary policymakers would begin to curtail their quantitative easing program sooner than most analysts had expected. This development sent long-term rates sharply higher, and yield differences widened along the bond market’s maturity spectrum. Although long-term rates declined somewhat when the Fed unexpectedly refrained from tapering its bonds purchases in the fall, subsequent releases of robust economic data sent rates higher over the reporting period’s final months.

The municipal money markets also were influenced by supply-and-demand factors. Demand remained strong for a limited supply of tax-exempt securities, including from nontraditional buyers, such as intermediate bond funds and taxable money market funds seeking attractive tax-exempt yields compared to similar maturity taxable securities. However, individual investors

LETTER TO SHAREHOLDERS (continued)

remained focused on longer term municipal bonds with higher yields. In this environment, yields of high-quality, one-year municipal notes remained low, and rates on variable rate demand notes (“VRDNs”) stayed steady amid steady demand from taxable money market funds seeking to comply with more stringent liquidity requirements.

Despite a bankruptcy filing by the city of Detroit over the summer and media reports detailing Puerto Rico’s economic and fiscal woes in September, municipal credit quality generally continued to improve as tax revenues increased for most states and municipalities. California’s finances continued to benefit from stronger tax revenues in the wake of tax increases on higher income residents. The State of New York also fared relatively well, supported by balanced budgets enacted on time, improved finances, better spending controls, and well-funded pension liabilities.

Credit Selection Remained Paramount

Most municipal money market funds have maintained short weighted average maturities compared to historical averages due to narrow yield differences along the money market’s maturity range and ongoing regulatory uncertainty.The funds were no exception, as we generally maintained their weighted average maturities in a position that was consistent with industry averages.

Well-researched credit selection remained paramount during the reporting period. We continued to favor state general obligation bonds; essential service revenue bonds backed by water, sewer, and electric facilities; certain local credits with strong financial positions and stable tax bases; and health care and education issuers with stable credit characteristics.

Low Rates Likely to Persist

The Fed made modest cuts in its monthly bond purchases in December and January, marking the start of what is expected to be a series of measured reductions in its quantitative easing program. However, the Fed also has made clear that short-term interest rates are likely to remain low for some time to come. Consequently, in our judgment, the prudent course continues to be an emphasis on preservation of capital and liquidity.

| | |

| | An investment in the funds is not insured or guaranteed by the FDIC or |

| | any other government agency.Although the funds seek to preserve the |

| | value of your investment at $1.00 per share, it is possible to lose money |

| | by investing in the funds. |

| | Short-term corporate, asset-backed securities holdings and municipal |

| | securities holdings (as applicable), while rated in the highest rating category |

| | by one or more NRSRO (or unrated, if deemed of comparable quality by |

| | Dreyfus), involve credit and liquidity risks and risk of principal loss. |

| 1 | Effective yield is based upon dividends declared daily and reinvested |

| | monthly. Past performance is no guarantee of future results.Yields fluctuate. |

| | For the national funds, income may be subject to state and local taxes. For |

| | the NewYork and California funds, income may be subject to state and |

| | local taxes for out-of-state residents. For each non-AMT-Free fund, some |

| | income may be subject to the federal alternative minimum tax (AMT). |

| 2 | Yields provided reflect the absorption of certain fund expenses by The |

| | Dreyfus Corporation pursuant to an undertaking, which is voluntary and |

| | temporary, not contractual, and can be terminated at any time without |

| | notice. Had these expenses not been absorbed, the funds’ yields would |

| | have been lower, and in some cases, 7-day yields during the reporting |

| | period would have been negative absent the expense absorption. |

6

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in each class of each fund from August 1, 2013 to January 31, 2014. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | | | | | | | | | | | | | |

| Expenses and Value of a $1,000 Investment | | | | | | | | | | | | | |

| assuming actual returns for the six months ended January 31, 2014 | | | | | | | | | | | |

| |

| | | Institutional | | Investor | | Administrative | | Participant | | Service | | Select | | Agency | | Premier |

| Dreyfus Cash | | | | | | | | | | | | | | | | | | |

| Management | | | | | | | | | | | | | | | | | | |

| Expenses paid | | | | | | | | | | | | | | | | | | |

| per $1,000† | | $ | .66 | $ | .86 | | $ | .86 | $ | .86 | | — | | — | $ | .86 | | — |

| Ending value | | | | | | | | | | | | | | | | | | |

| (after expenses) | | $ | 1,000.20 | $ | 1,000.00 | | $ | 1,000.00 | $ | 1,000.00 | | — | | — | $ | 1,000.00 | | — |

| Annualized | | | | | | | | | | | | | | | | | | |

| expense ratio (%) | | | .13 | | .17 | | | .17 | | .17 | | — | | — | | .17 | | — |

| Dreyfus | | | | | | | | | | | | | | | | | | |

| Government Cash | | | | | | | | | | | | | | | | | | |

| Management | | | | | | | | | | | | | | | | | | |

| Expenses paid | | | | | | | | | | | | | | | | | | |

| per $1,000† | | $ | .35 | $ | .35 | | $ | .35 | $ | .35 | | — | | — | $ | .35 | | — |

| Ending value | | | | | | | | | | | | | | | | | | |

| (after expenses) | | $ | 1,000.10 | $ | 1,000.10 | | $ | 1,000.10 | $ | 1,000.10 | | — | | — | $ | 1,000.10 | | — |

| | | | | | | | | | | | | | | | | |

| Annualized | | | | | | | | | | | | | | | | | | |

| expense ratio (%) | | | .07 | | .07 | | | .07 | | .07 | | — | | — | | .07 | | — |

| Dreyfus | | | | | | | | | | | | | | | | | | |

| Government Prime | | | | | | | | | | | | | | | | | | |

| Cash Management | | | | | | | | | | | | | | | | | | |

| Expenses paid | | | | | | | | | | | | | | | | | | |

| per $1,000† | | $ | .35 | $ | .35 | | $ | .35 | $ | .35 | | — | | — | $ | .35 | | — |

| Ending value | | | | | | | | | | | | | | | | | | |

| (after expenses) | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | | — | | — | $ | 1,000.00 | | — |

| Annualized | | | | | | | | | | | | | | | | | | |

| expense ratio (%) | | | .07 | | .07 | | | .07 | | .07 | | — | | — | | .07 | | — |

| Dreyfus Treasury & | | | | | | | | | | | | | | | | | | |

| Agency Cash | | | | | | | | | | | | | | | | | | |

| Management | | | | | | | | | | | | | | | | | | |

| Expenses paid | | | | | | | | | | | | | | | | | | |

| per $1,000† | | $ | .30 | $ | .30 | | $ | .30 | $ | .30 | $ | .25 | $ | .30 | $ | .30 | $ | .25 |

| Ending value | | | | | | | | | | | | | | | | | | |

| (after expenses) | | $ | 1,000.10 | $ | 1,000.10 | | $ | 1,000.10 | $ | 1,000.10 | $ | 1,000.10 | $ | 1,000.10 | $ | 1,000.10 | $ | 1,000.10 |

| | | | | | | | | | | | | | | | | |

| Annualized | | | | | | | | | | | | | | | | | | |

| expense ratio (%) | | | .06 | | .06 | | | .06 | | .06 | | .05 | | .06 | | .06 | | .05 |

| Dreyfus | | | | | | | | | | | | | | | | | | |

| Treasury Prime | | | | | | | | | | | | | | | | | | |

| Cash Management | | | | | | | | | | | | | | | | | | |

| Expenses paid | | | | | | | | | | | | | | | | | | |

| per $1,000† | | $ | .25 | $ | .20 | | $ | .20 | $ | .20 | | — | | — | $ | .20 | | — |

| Ending value | | | | | | | | | | | | | | | | | | |

| (after expenses) | | $ | 1,000.00 | $ | 1,000.00 | | $ | 1,000.00 | $ | 1,000.00 | | — | | — | $ | 1,000.00 | | — |

| Annualized | | | | | | | | | | | | | | | | | | |

| expense ratio (%) | | | .05 | | .04 | | | .04 | | .04 | | — | | — | | .04 | | — |

| |

| UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited) (continued) |

| |

| † Expenses are equal to each fund’s annualized expense ratios as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half |

| year period). |

| | | | | | | | | | | | | | |

| Expenses and Value of a $1,000 Investment (continued) | | | | | | | | |

| assuming actual returns for the six months ended January 31, 2014 | | | | | | | | |

| |

| | | Institutional | | Investor | | Administrative | | Participant | | Agency | | Classic |

| Dreyfus | | | | | | | | | | | | | |

| Municipal Cash | | | �� | | | | | | | | | | |

| Management Plus | | | | | | | | | | | | | |

| Expenses paid | | | | | | | | | | | | | |

| per $1,000† | | $ | .81 | $ | .81 | $ | .81 | $ | .81 | $ | .86 | | — |

| Ending value | | | | | | | | | | | | | |

| (after expenses) | | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | | — |

| Annualized | | | | | | | | | | | | | |

| expense ratio (%) | | | .16 | | .16 | | .16 | | .16 | | .17 | | — |

| Dreyfus | | | | | | | | | | | | | |

| New York | | | | | | | | | | | | | |

| Municipal Cash | | | | | | | | | | | | | |

| Management | | | | | | | | | | | | | |

| Expenses paid | | | | | | | | | | | | | |

| per $1,000† | | $ | .81 | $ | .76 | $ | .81 | $ | .81 | | — | | — |

| Ending value | | | | | | | | | | | | | |

| (after expenses) | | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | | — | | — |

| Annualized | | | | | | | | | | | | | |

| expense ratio (%) | | | .16 | | .15 | | .16 | | .16 | | — | | — |

| Dreyfus | | | | | | | | | | | | | |

| Tax Exempt Cash | | | | | | | | | | | | | |

| Management | | | | | | | | | | | | | |

| Expenses paid | | | | | | | | | | | | | |

| per $1,000† | | $ | .55 | $ | .55 | $ | .55 | $ | .55 | | — | | |

| Ending value | | | | | | | | | | | | | |

| (after expenses) | | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | | — | | — |

| Annualized | | | | | | | | | | | | | |

| expense ratio (%) | | | .11 | | .11 | | .11 | | .11 | | — | | — |

| Dreyfus California | | | | | | | | | | | | | |

| AMT-Free | | | | | | | | | | | | | |

| Municipal Cash | | | | | | | | | | | | | |

| Management | | | | | | | | | | | | | |

| Expenses paid | | | | | | | | | | | | | |

| per $1,000† | | $ | .50 | $ | .50 | $ | .55 | $ | .50 | | — | | — |

| Ending value | | | | | | | | | | | | | |

| (after expenses) | | $ | 1,000.00 | | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | | — | | — |

| Annualized | | | | | | | | | | | | | |

| expense ratio (%) | | | .10 | | .10 | | .11 | | .10 | | — | | — |

| Dreyfus New York | | | | | | | | | | | | | |

| AMT-Free | | | | | | | | | | | | | |

| Municipal Cash | | | | | | | | | | | | | |

| Management | | | | | | | | | | | | | |

| Expenses paid | | | | | | | | | | | | | |

| per $1,000† | | $ | .81 | $ | .81 | $ | .81 | | — | | — | $ | .81 |

| Ending value | | | | | | | | | | | | | |

| (after expenses) | | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | | — | | — | $ | 1,000.00 |

| Annualized | | | | | | | | | | | | | |

| expense ratio (%) | | | .16 | | .16 | | .16 | | — | | — | | .16 |

8

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return.You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | | | | | | | | | | | | | | | | |

| Expenses and Value of a $1,000 Investment | | | | | | | | | | | | | | | |

| assuming a hypothetical 5% annualized return for the six months ended January 31, 2014 | | | | | | | | |

| |

| | | Institutional | | | Investor | | Administrative | | | Participant | | Service | | Select | | Agency | | Premier |

| Dreyfus Cash | | | | | | | | | | | | | | | | | | | | | |

| Management | | | | | | | | | | | | | | | | | | | | | |

| Expenses paid | | | | | | | | | | | | | | | | | | | | | |

| per $1,000† | | $ | .66 | | $ | .87 | | $ | .87 | | | $ | .87 | | — | | — | $ | .87 | | — |

| Ending value | | | | | | | | | | | | | | | | | | | | | |

| (after expenses) | | $ | 1,024.55 | | $ | 1,024.35 | | $ | 1,024.35 | | | $ | 1,024.35 | | — | | — | $ | 1,024.35 | | — |

| Annualized | | | | | | | | | | | | | | | | | | | | | |

| expense ratio (%) | | | .13 | | | .17 | | | .17 | | | | .17 | | — | | — | | .17 | | — |

| Dreyfus | | | | | | | | | | | | | | | | | | | | | |

| Government Cash | | | | | | | | | | | | | | | | | | | | | |

| Management | | | | | | | | | | | | | | | | | | | | | |

| Expenses paid | | | | | | | | | | | | | | | | | | | | | |

| per $1,000† | | $ | .36 | | $ | .36 | | $ | .36 | | | $ | .36 | | — | | — | $ | .36 | | — |

| Ending value | | | | | | | | | | | | | | | | | | | | | |

| (after expenses) | | $ | 1,024.85 | | $ | 1,024.85 | | $ | 1,024.85 | | | $ | 1,024.85 | | — | | — | $ | 1,024.85 | | — |

| Annualized | | | | | | | | | | | | | | | | | | | | | |

| expense ratio (%) | | | .07 | | | .07 | | | .07 | | | | .07 | | — | | — | | .07 | | — |

| Dreyfus | | | | | | | | | | | | | | | | | | | | | |

| Government Prime | | | | | | | | | | | | | | | | | | | | | |

| Cash Management | | | | | | | | | | | | | | | | | | | | | |

| Expenses paid | | | | | | | | | | | | | | | | | | | | | |

| per $1,000† | | $ | .36 | | $ | .36 | | $ | .36 | | | $ | .36 | | — | | — | $ | .36 | | — |

| Ending value | | | | | | | | | | | | | | | | | | | | | |

| (after expenses) | | $ | ,024.85 | | $ | 1,024.85 | | $ | 1,024.85 | | | $ | 1,024.85 | | — | | — | $ | 1,024.85 | | — |

| Annualized | | | | | | | | | | | | | | | | | | | | | |

| expense ratio (%) | | | .07 | | | .07 | | | .07 | | | | .07 | | — | | — | | .07 | | — |

| Dreyfus Treasury & | | | | | | | | | | | | | | | | | | | | | |

| Agency Cash | | | | | | | | | | | | | | | | | | | | | |

| Management | | | | | | | | | | | | | | | | | | | | | |

| Expenses paid | | | | | | | | | | | | | | | | | | | | | |

| per $1,000† | | $ | .31 | | $ | .31 | | $ | .31 | | | $ | .31 | $ | .26 | $ | .31 | $ | .31 | $ | .26 |

| Ending value | | | | | | | | | | | | | | | | | | | | | |

| (after expenses) | | $ | 1,024.90 | | $ | 1,024.90 | | $ | 1,024.90 | | | $ | 1,024.90 | $ | 1,024.95 | $ | 1,024.90 | $ | 1,024.90 | $ | 1,024.95 |

| | | | | | | | | | | | | | | | | | |

| Annualized | | | | | | | | | | | | | | | | | | | | | |

| expense ratio (%) | | | .06 | | | .06 | | | .06 | | | | .06 | | .05 | | .06 | | .06 | | .05 |

| Dreyfus | | | | | | | | | | | | | | | | | | | | | |

| Treasury Prime | | | | | | | | | | | | | | | | | | | | | |

| Cash Management | | | | | | | | | | | | | | | | | | | | | |

| Expenses paid | | | | | | | | | | | | | | | | | | | | | |

| per $1,000† | | $ | .26 | | $ | 0.20 | | $ | 0.20 | | | $ | 0.20 | | — | | — | $ | .20 | | — |

| Ending value | | | | | | | | | | | | | | | | | | | | | |

| (after expenses) | | $ | ,024.95 | | $ | 1,025.00 | | $ | 1,025.00 | | | $ | 1,025.00 | | — | | — | $ | 1,025.00 | | — |

| Annualized | | | | | | | | | | | | | | | | | | | | | |

| expense ratio (%) | | | .05 | | | .04 | | | .04 | | | | .04 | | — | | — | | .04 | | — |

COMPARING YOUR FUND’S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited) (continued)

| | | | | | | | | | | | | | | |

| Expenses and Value of a $1,000 Investment (continued) | | | | | | | | | |

| assuming a hypothetical 5% annualized return for the six months ended January 31, 2014 | | | | | | |

| |

| | | Institutional | | Investor | | Administrative | | Participant | | Agency | | Classic |

| Dreyfus | | | | | | | | | | | | | | |

| Municipal Cash | | | | | | | | | | | | | | |

| Management Plus | | | | | | | | | | | | | | |

| Expenses paid | | | | | | | | | | | | | | |

| per $1,000† | | $ | .82 | $ | .82 | | $ | .82 | $ | .82 | $ | .87 | | — |

| Ending value | | | | | | | | | | | | | | |

| (after expenses) | | $ | 1,024.40 | $ | 1,024.40 | | $ | 1,024.40 | $ | 1,024.40 | $ | 1,024.35 | | — |

| Annualized | | | | | | | | | | | | | | |

| expense ratio (%) | | | .16 | | .16 | | | .16 | | .16 | | .17 | | — |

| Dreyfus | | | | | | | | | | | | | | |

| New York | | | | | | | | | | | | | | |

| Municipal Cash | | | | | | | | | | | | | | |

| Management | | | | | | | | | | | | | | |

| Expenses paid | | | | | | | | | | | | | | |

| per $1,000† | | $ | .82 | $ | .77 | | $ | .82 | $ | .82 | | — | | — |

| Ending value | | | | | | | | | | | | | | |

| (after expenses) | | $ | 1,024.40 | $ | 1,024.45 | | $ | 1,024.40 | $ | 1,024.40 | | — | | — |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Annualized | | | | | | | | | | | | | | |

| expense ratio (%) | | | .16 | | .15 | | | .16 | | .16 | | — | | — |

| Dreyfus | | | | | | | | | | | | | | |

| Tax Exempt Cash | | | | | | | | | | | | | | |

| Management | | | | | | | | | | | | | | |

| Expenses paid | | | | | | | | | | | | | | |

| per $1,000† | | $ | .56 | $ | .56 | | $ | .56 | $ | .56 | | — | | — |

| Ending value | | | | | | | | | | | | | | |

| (after expenses) | | $ | 1,024.65 | $ | 1,024.65 | | $ | 1,024.65 | $ | 1,024.65 | | — | | — |

| Annualized | | | | | | | | | | | | | | |

| expense ratio (%) | | | .11 | | .11 | | | .11 | | .11 | | — | | — |

| Dreyfus California | | | | | | | | | | | | | | |

| AMT-Free | | | | | | | | | | | | | | |

| Municipal Cash | | | | | | | | | | | | | | |

| Management | | | | | | | | | | | | | | |

| Expenses paid | | | | | | | | | | | | | | |

| per $1,000† | | $ | .51 | $ | .51 | | $ | .56 | $ | .51 | | — | | — |

| Ending value | | | | | | | | | | | | | | |

| (after expenses) | | $ | 1,024.70 | $ | 1,024.70 | | $ | 1,024.65 | $ | 1,024.70 | | — | | — |

| Annualized | | | | | | | | | | | | | | |

| expense ratio (%) | | | .10 | | .10 | | | .11 | | .10 | | — | | — |

| Dreyfus New York | | | | | | | | | | | | | | |

| AMT-Free | | | | | | | | | | | | | | |

| Municipal Cash | | | | | | | | | | | | | | |

| Management | | | | | | | | | | | | | | |

| Expenses paid | | | | | | | | | | | | | | |

| per $1,000† | | $ | .82 | $ | .82 | | $ | .82 | | — | | — | $ | .82 |

| Ending value | | | | | | | | | | | | | | |

| (after expenses) | | $ | 1,024.40 | $ | 1,024.40 | | $ | 1,024.40 | | — | | — | $ | 1,024.40 |

| Annualized | | | | | | | | | | | | | | |

| expense ratio (%) | | | .16 | | .16 | | | .16 | | — | | — | | .16 |

| |

| † Expenses are equal to each fund’s annualized expense ratios as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half |

| year period). |

10

STATEMENT OF INVESTMENTS

January 31, 2014

| | | | |

| | Principal | | |

| Dreyfus Cash Management | Amount ($) | | Value ($) |

| |

| Negotiable Bank Certificates of Deposit—38.7% | | | |

| Bank of Montreal (Yankee) | | | |

| 0.15%—0.18%, 3/12/14—3/17/14 | 850,000,000 | | 850,000,000 |

| Bank of Nova Scotia (Yankee) | | | |

| 0.23%—0.25%, 2/3/14 | 950,000,000 | a | 949,985,480 |

| Bank of Tokyo-Mitsubishi Ltd. (Yankee) | | | |

| 0.20%—0.25%, 2/3/14—4/28/14 | 1,100,000,000 | | 1,100,000,000 |

| Credit Industriel et Commercial (Yankee) | | | |

| 0.16%, 3/3/14 | 300,000,000 | | 300,000,000 |

| Credit Suisse New York (Yankee) | | | |

| 0.19%—0.20%, 2/3/14—3/10/14 | 900,000,000 | | 900,000,000 |

| Deutsche Bank AG (Yankee) | | | |

| 0.20%, 3/31/14 | 200,000,000 | | 200,000,000 |

| JPMorgan Chase Bank, N.A. | | | |

| 0.25%, 4/21/14—4/25/14 | 430,000,000 | | 430,000,000 |

| Mitsubishi UFJ Trust and Banking Corp. (Yankee) | | | |

| 0.20%, 4/30/14 | 100,000,000 | | 100,000,000 |

| Mizuho Bank (Yankee) | | | |

| 0.21%, 3/14/14—4/30/14 | 1,250,000,000 | | 1,250,000,000 |

| Nordea Bank Finland (Yankee) | | | |

| 0.20%—0.24%, 2/26/14—7/16/14 | 850,000,000 | | 849,997,399 |

| Norinchukin Bank (Yankee) | | | |

| 0.21%—0.22%, 2/12/14—4/8/14 | 772,000,000 | | 771,998,168 |

| Rabobank Nederland (Yankee) | | | |

| 0.22%, 6/2/14 | 250,000,000 | | 250,000,000 |

| Royal Bank of Canada (Yankee) | | | |

| 0.29%, 2/3/14 | 50,000,000 | a | 50,000,000 |

| Sumitomo Mitsui Banking Corp. (Yankee) | | | |

| 0.21%—0.25%, 2/13/14—6/2/14 | 1,200,000,000 | b | 1,200,000,000 |

| Sumitomo Mitsui Trust Bank (Yankee) | | | |

| 0.21%, 2/27/14—3/12/14 | 500,000,000 | b | 500,000,000 |

| Svenska Handelsbanken (Yankee) | | | |

| 0.20%—0.21%, 7/21/14 | 350,000,000 | b | 350,008,255 |

| Toronto Dominion Bank NY (Yankee) | | | |

| 0.22%—0.24%, 2/18/14—10/22/14 | 700,000,000 | | 700,000,000 |

| UBS AG (Yankee) | | | |

| 0.17%, 3/14/14 | 150,000,000 | | 150,000,000 |

| Wells Fargo Bank, NA | | | |

| 0.20%—0.24%, 2/3/14—6/9/14 | 455,000,000 | a | 455,000,000 |

| Total Negotiable Bank Certificates of Deposit | | | |

| (cost $11,356,989,302) | | | 11,356,989,302 |

| |

| Commercial Paper—20.8% | | | |

| ANZ International Ltd. | | | |

| 0.21%—0.28%, 2/10/14—7/31/14 | 200,000,000 | a,b | 199,895,000 |

| Australia and New Zealand Banking Group Ltd. | | | |

| 0.24%, 2/28/14 | 100,000,000 | a,b | 100,000,000 |

| Bank of Nova Scotia | | | |

| 0.19%, 2/3/14 | 250,000,000 | | 249,997,361 |

STATEMENT OF INVESTMENTS (continued)

| | | | | |

| | | Principal | | |

| | Dreyfus Cash Management (continued) | Amount ($) | | Value ($) |

| |

| | Commercial Paper (continued) | | | |

| | Commonwealth Bank of Australia | | | |

| | 0.21%—0.26%, 2/4/14—5/6/14 | 730,000,000 | a,b | 729,929,826 |

| | Erste Abwicklungsanstalt | | | |

| | 0.15%—0.17%, 2/19/14—5/20/14 | 575,000,000 | | 574,852,208 |

| | General Electric Capital Corp. | | | |

| | 0.23%, 2/5/14 | 100,000,000 | | 99,997,444 |

| | HSBC Bank PLC | | | |

| | 0.23%—0.25%, 2/3/14—2/19/14 | 400,000,000 | a,b | 400,000,000 |

| | JPMorgan Securities LLC | | | |

| | 0.36%, 2/10/14 | 75,000,000 | a,b | 75,000,000 |

| | National Australia Funding (DE) Inc. | | | |

| | 0.20%, 7/14/14—8/1/14 | 581,000,000 | b | 580,448,872 |

| | Nordea Bank AB | | | |

| | 0.22%, 4/17/14 | 149,450,000 | b | 149,381,502 |

| | NRW Bank | | | |

| | 0.11%—0.12%, 2/14/14 | 650,000,000 | b | 649,973,729 |

| | Rabobank USA Financial Corp. | | | |

| | 0.22%, 4/30/14—7/10/14 | 690,000,000 | | 689,411,989 |

| | Toyota Motor Credit Corp. | | | |

| | 0.21%—0.23%, 2/3/14—3/24/14 | 545,000,000 | a | 544,922,946 |

| | Westpac Banking Corp. | | | |

| | 0.22%—0.28%, 2/3/14—2/17/14 | 1,025,000,000 | a,b | 1,025,000,000 |

| | Total Commercial Paper | | | |

| | (cost $6,068,810,877) | | | 6,068,810,877 |

| |

| | Asset-Backed Commercial Paper—3.2% | | | |

| | Bedford Row Funding | | | |

| | 0.30%, 4/30/14 | 91,300,000 | b | 91,233,047 |

| | CAFCO | | | |

| | 0.17%, 3/12/14 | 50,000,000 | b | 49,990,792 |

| | CIESCO LLC | | | |

| | 0.17%, 3/10/14 | 50,000,000 | b | 49,991,264 |

| | Collateralized Commercial Paper II Co., LLC | | | |

| | 0.28%, 3/11/14 | 333,390,000 | b | 333,291,465 |

| | Collateralized Commercial Paper Program Co., LLC | | | |

| | 0.28%, 4/1/14—7/8/14 | 400,000,000 | | 399,664,000 |

| | Total Asset-Backed Commercial Paper | | | |

| | (cost $924,170,568) | | | 924,170,568 |

| |

| | Time Deposits—20.4% | | | |

| | Canadian Imperial Bank of Commerce (Grand Cayman) | | | |

| | 0.04%, 2/3/14 | 150,000,000 | | 150,000,000 |

| | Credit Agricole (Grand Cayman) | | | |

| | 0.09%, 2/3/14 | 1,000,000,000 | | 1,000,000,000 |

| | DnB Bank (Grand Cayman) | | | |

| | 0.03%—0.04%, 2/3/14 | 900,000,000 | | 900,000,000 |

12

| | | | |

| | | Principal | |

| | Dreyfus Cash Management (continued) | Amount ($) | Value ($) |

| |

| | Time Deposits (continued) | | |

| | Landesbank Hessen-Thuringen Girozentrale (Grand Cayman) | | |

| | 0.04%, 2/3/14 | 150,000,000 | 150,000,000 |

| | Lloyds Bank (London) | | |

| | 0.06%, 2/3/14 | 1,000,000,000 | 1,000,000,000 |

| | Natixis New York (Grand Cayman) | | |

| | 0.10%, 2/3/14 | 587,000,000 | 587,000,000 |

| | Skandinaviska Enskilda Banken (Grand Cayman) | | |

| | 0.04%, 2/3/14 | 993,000,000 | 993,000,000 |

| | Swedbank (Grand Cayman) | | |

| | 0.05%, 2/3/14 | 578,000,000 | 578,000,000 |

| | U.S. Bank NA (Grand Cayman) | | |

| | 0.10%, 2/3/14 | 600,000,000 | 600,000,000 |

| | Total Time Deposits | | |

| | (cost $5,958,000,000) | | 5,958,000,000 |

| |

| | U.S. Government Agencies—.6% | | |

| | Federal Farm Credit Bank | | |

| | 0.01%, 2/3/14 | 35,000,000 | 34,999,981 |

| | Federal Home Loan Bank | | |

| | 0.06%, 2/20/14 | 131,700,000 | 131,696,177 |

| | Total U.S. Government Agencies | | |

| | (cost $166,696,158) | | 166,696,158 |

| |

| | U.S. Treasury Bills—.5% | | |

| | 0.06%, 2/6/14 | | |

| | (cost $149,998,750) | 150,000,000 | 149,998,750 |

| |

| | U.S. Treasury Notes—4.9% | | |

| | 0.06%—0.22%, 2/15/14—6/30/14 | | |

| | (cost $1,423,370,203) | 1,419,000,000 | 1,423,370,203 |

| |

| | Repurchase Agreements—10.9% | | |

| | ABN AMRO Bank N.V. | | |

| | 0.02%, dated 1/31/14, due 2/3/14 in the amount of $780,001,300 (fully collateralized by | | |

| | $146,681,866 U.S. Treasury Bills, due 7/10/14, value $146,649,010 and $653,649,151 | | |

| | U.S. Treasury Notes, 0.25%-1.75%, due 6/30/14-10/31/20, value $648,951,013) | 780,000,000 | 780,000,000 |

| | Barclays Capital, Inc. | | |

| | 0.02%, dated 1/31/14, due 2/3/14 in the amount of $663,001,105 (fully collateralized by | | |

| | $376,000,852 U.S. Treasury Inflation Protected Securities, 0.13%, due 4/15/16-1/15/23, | | |

| | value $390,701,951, $26,619,900 U.S. Treasury Notes, 2.13%, due 1/31/21, value $26,520,075 | | |

| | and $417,418,627 U.S. Treasury Strips, due 2/15/17-11/15/43, value $259,038,065) | 663,000,000 | 663,000,000 |

| | BNP Paribas | | |

| | 0.02%, dated 1/31/14, due 2/3/14 in the amount of $10,000,017 (fully | | |

| | collateralized by $9,805,900 U.S. Treasury Inflation Protected Securities, | | |

| | 0.13%, due 4/15/18, value $10,200,053) | 10,000,000 | 10,000,000 |

STATEMENT OF INVESTMENTS (continued)

| | | | |

| | Principal | | |

| Dreyfus Cash Management (continued) | Amount ($) | | Value ($) |

| |

| Repurchase Agreements (continued) | | | |

| Credit Agricole CIB | | | |

| 0.02%-0.03%, dated 1/31/14, due 2/3/14 in the amount of $1,240,002,400 (fully | | | |

| collateralized by $259,801,895 Federal Home Loan Mortgage Corp., 1.88%-7.50%, | | | |

| due 3/1/27-11/1/43, value $52,283,074, $888,683,047 Federal National Mortgage | | | |

| Association, 0%-6.50%, due 9/1/15-3/1/50, value $292,507,553, $237,755,186 | | | |

| Government National Mortgage Association, 0.96%-7%, due 7/20/30-12/20/63, | | | |

| value $63,019,377, $526,533,217 U.S. Treasury Inflation Protected Securities, | | | |

| 0.13%-2%, due 7/15/14-4/15/17, value $620,695,210 and $227,951,539 | | | |

| U.S. Treasury Notes, 0.88%-3.38%, due 3/31/14-11/15/19, value $236,294,790) | 1,240,000,000 | | 1,240,000,000 |

| Deutsche Bank Securities Inc. | | | |

| 0.03%, dated 1/31/14, due 2/3/14 in the amount of $200,000,500 (fully | | | |

| collateralized by $205,877,800 U.S. Treasury Notes, 0.25%-1.13%, | | | |

| due 12/31/15-5/31/19, value $204,000,043) | 200,000,000 | | 200,000,000 |

| TD Securities (USA) LLC | | | |

| 0.02%, dated 1/31/14, due 2/3/14 in the amount of $300,000,500 (fully | | | |

| collateralized by cash, value $56,671,808, $78,292,412 U.S. Treasury Bills, | | | |

| due 2/27/14-7/17/14, value $78,289,886, $6,432,300 U.S. Treasury Bonds, | | | |

| 2.75%-7.63%, due 11/15/22-11/15/42, value $7,191,220, $2,255,300 | | | |

| U.S. Treasury Inflation Protected Securities, 0.75%-2.13%, due 2/15/40-2/15/42, | | | |

| value $2,089,128, $146,936,100 U.S. Treasury Notes, 0.25%-4.50%, | | | |

| due 2/28/14-11/15/23, value $150,797,699 and $27,700,000 | | | |

| U.S. Treasury Strips, due 11/15/39-11/15/43, value $9,826,823) | 300,000,000 | | 300,000,000 |

| Total Repurchase Agreements | | | |

| (cost $3,193,000,000) | | | 3,193,000,000 |

| |

| Total Investments (cost $29,241,035,858) | 100.0 | % | 29,241,035,858 |

| |

| Cash and Receivables (Net) | .0 | % | 1,507,432 |

| |

| Net Assets | 100.0 | % | 29,242,543,290 |

| |

| a Variable rate security—interest rate subject to periodic change. |

| b Securities exempt from registration pursuant to Rule 144A under the Securities Act of 1933.These securities may be resold in transactions exempt from registration, normally to qualified |

| institutional buyers.At January 31, 2014, these securities amounted to $6,484,143,752 or 22.2% of net assets. |

| | | | |

| Portfolio Summary (Unaudited)† | | | |

| |

| | Value (%) | | Value (%) |

| Banking | 77.7 | Finance | 2.2 |

| Repurchase Agreements | 10.9 | Asset-Backed/Multi-Seller Programs | .4 |

| U.S. Government/Agencies | 6.0 | | |

| Asset-Backed/Banking | 2.8 | | 100.0 |

| |

| † Based on net assets. | | | |

| See notes to financial statements. | | | |

14

STATEMENT OF INVESTMENTS

January 31, 2014

| | | | | |

| | Annualized | | | |

| | Yield on | | | |

| | Date of | Principal | | |

| Dreyfus Government Cash Management | Purchase (%) | Amount ($) | | Value ($) |

| |

| U.S. Government Agencies—64.9% | | | | |

| Federal Farm Credit Bank: | | | | |

| 2/7/14 | 0.04 | 50,000,000 | | 49,999,667 |

| 2/18/14 | 0.05 | 150,000,000 | | 149,996,458 |

| 4/1/14 | 0.03 | 50,000,000 | | 49,997,542 |

| 4/17/14 | 0.09 | 10,000,000 | | 9,998,125 |

| 6/6/14 | 0.11 | 65,000,000 | | 64,975,174 |

| Federal Home Loan Bank: | | | | |

| 2/3/14 | 0.12 | 500,000,000 | a | 500,000,000 |

| 2/6/14 | 0.06 | 300,000,000 | | 299,997,500 |

| 2/7/14 | 0.06 | 250,000,000 | | 249,997,500 |

| 2/10/14 | 0.06 | 250,000,000 | | 249,996,250 |

| 2/10/14 | 0.13 | 100,000,000 | | 99,999,686 |

| 2/11/14 | 0.06 | 150,000,000 | | 149,997,500 |

| 2/12/14 | 0.10 | 300,000,000 | | 299,990,833 |

| 2/14/14 | 0.10 | 100,000,000 | | 99,996,389 |

| 2/26/14 | 0.05 | 270,000,000 | | 269,990,625 |

| 3/4/14 | 0.05 | 250,000,000 | | 249,989,236 |

| 3/6/14 | 0.06 | 250,000,000 | | 249,986,250 |

| 3/7/14 | 0.08 | 486,200,000 | | 486,162,744 |

| 3/12/14 | 0.06 | 150,000,000 | | 149,990,250 |

| 3/13/14 | 0.04 | 500,000,000 | | 499,977,778 |

| 3/14/14 | 0.04 | 49,000,000 | | 48,997,768 |

| 3/19/14 | 0.04 | 505,900,000 | | 505,874,143 |

| 3/21/14 | 0.05 | 135,000,000 | | 134,991,900 |

| 3/21/14 | 0.12 | 100,000,000 | | 100,006,457 |

| 3/25/14 | 0.04 | 100,000,000 | | 99,994,222 |

| 4/1/14 | 0.05 | 200,000,000 | | 199,984,167 |

| 4/11/14 | 0.05 | 355,200,000 | | 355,164,251 |

| 4/14/14 | 0.05 | 200,000,000 | | 199,980,555 |

| 4/16/14 | 0.14 | 40,000,000 | | 39,999,021 |

| 4/25/14 | 0.07 | 541,300,000 | | 541,218,204 |

| 5/2/14 | 0.07 | 200,000,000 | | 199,965,000 |

| 5/16/14 | 0.11 | 205,000,000 | | 204,934,855 |

| 5/27/14 | 0.12 | 48,000,000 | | 48,000,000 |

| 5/28/14 | 0.06 | 69,000,000 | | 68,986,660 |

| 7/1/14 | 0.09 | 250,000,000 | | 249,906,250 |

| 7/16/14 | 0.09 | 250,000,000 | | 249,902,604 |

| 7/22/14 | 0.11 | 250,000,000 | | 249,981,606 |

| 7/22/14 | 0.11 | 200,000,000 | | 199,994,728 |

| 8/5/14 | 0.10 | 50,000,000 | | 49,974,305 |

| 1/16/15 | 0.17 | 56,800,000 | | 56,797,277 |

| 1/27/15 | 0.17 | 150,000,000 | | 149,992,603 |

STATEMENT OF INVESTMENTS (continued)

| | | | | | |

| | | Annualized | | | |

| | | Yield on | | | |

| | | Date of | Principal | | |

| | Dreyfus Government Cash Management (continued) | Purchase (%) | Amount ($) | | Value ($) |

| |

| | U.S. Government Agencies (continued) | | | | |

| | Federal Home Loan Mortgage Corp.: | | | | |

| | 2/25/14 | 0.15 | 500,000,000 | a,b | 500,000,000 |

| | 2/26/14 | 0.12 | 250,000,000 | b | 249,979,167 |

| | 2/27/14 | 0.12 | 250,000,000 | b | 249,978,333 |

| | 3/13/14 | 0.12 | 100,000,000 | b | 99,986,667 |

| | 3/26/14 | 0.04 | 121,025,000 | b | 121,017,873 |

| | 5/12/14 | 0.11 | 65,000,000 | b | 64,981,042 |

| | 6/18/14 | 0.12 | 550,000,000 | b | 549,748,833 |

| | Federal National Mortgage Association: | | | | |

| | 4/21/14 | 0.10 | 500,000,000 | b | 499,890,278 |

| | 4/23/14 | 0.09 | 200,000,000 | b | 199,959,500 |

| | 8/18/14 | 0.13 | 500,000,000 | b | 499,642,500 |

| | Total U.S. Government Agencies | | | | |

| | (cost $11,170,870,276) | | | | 11,170,870,276 |

| |

| |

| | U.S. Treasury Bills—1.7% | | | | |

| | 2/6/14 | | | | |

| | (cost $299,996,875) | 0.08 | 300,000,000 | | 299,996,875 |

| |

| |

| | U.S. Treasury Notes—7.3% | | | | |

| | 3/15/14 | 0.09 | 250,000,000 | | 250,345,145 |

| | 3/31/14 | 0.10 | 150,000,000 | | 150,035,824 |

| | 3/31/14 | 0.10 | 400,000,000 | | 401,050,444 |

| | 7/31/14 | 0.14 | 200,000,000 | | 199,988,463 |

| | 9/30/14 | 0.17 | 250,000,000 | | 253,647,990 |

| | Total U.S. Treasury Notes | | | | |

| | (cost $1,255,067,866) | | | | 1,255,067,866 |

| |

| |

| | Repurchase Agreements—28.4% | | �� | | |

| | Bank of Nova Scotia | | | | |

| | dated 1/31/14, due 2/3/14 in the amount of $500,000,833 (fully | | | | |

| | collateralized by $282,719,880 Federal Home Loan Bank, 1%-5.40%, | | | | |

| | due 3/10/14-12/7/27, value $268,417,849, $27,108,434 Federal | | | | |

| | Home Loan Mortgage Corp., 1%, due 8/20/14, value $27,357,078, | | | | |

| | $163,556,024 Federal National Mortgage Association, 0.55%-6.25%, | | | | |

| | due 9/28/16-5/15/29, value $163,882,374 and $50,360,482 U.S. Treasury | | | | |

| | Notes, 0.25%-0.38%, due 1/31/16-5/15/16, value $50,342,757) | 0.02 | 500,000,000 | | 500,000,000 |

16

| | | | |

| | Annualized | | |

| | Yield on | | |

| | Date of | Principal | |

| Dreyfus Government Cash Management (continued) | Purchase (%) | Amount ($) | Value ($) |

| |

| Repurchase Agreements (continued) | | | |

| Barclays Capital, Inc. | | | |

| dated 1/31/14, due 2/3/14 in the amount of $85,000,142 | | | |

| (fully collateralized by $50,212,830 U.S. Treasury Inflation | | | |

| Protected Securities, 0.13%, due 4/15/16-1/15/23, | | | |

| value $52,134,483 and $55,699,503 U.S. Treasury Strips, | | | |

| due 2/15/17-11/15/43, value $34,565,519) | 0.02 | 85,000,000 | 85,000,000 |

| Citigroup Global Markets Holdings Inc. | | | |

| dated 1/31/14, due 2/3/14 in the amount of $135,000,225 | | | |

| (fully collateralized by $815,000 Federal Farm Credit Bank, 1.89%, | | | |

| due 4/29/21, value $773,614, $75,896,100 Federal Home Loan Bank, | | | |

| 0%-2.53%, due 7/30/14-4/10/28, value $60,631,034, $40,819,000 | | | |

| Federal National Mortgage Association, 2%-3%, due 3/13/14-9/6/23, | | | |

| value $40,048,290 and $27,455,600 U.S. Treasury Inflation Protected | | | |

| Securities, 2.38%-2.50%, due 1/15/17-1/15/29, value $36,247,120) | 0.02 | 135,000,000 | 135,000,000 |

| Deutsche Bank Securities Inc. | | | |

| dated 1/31/14, due 2/3/14 in the amount of $55,000,092 (fully | | | |

| collateralized by $2,366,000 Federal Agricultural Mortgage Corp., | | | |

| 5.13%, due 4/19/17, value $2,688,985, $15,512,909 Federal Home | | | |

| Loan Bank, 0%-5.38%, due 2/7/14-7/25/33, value $16,396,790, | | | |

| $11,100,000 Federal Home Loan Mortgage Corp., 3.54%, due 7/19/28, | | | |

| value $10,836,708 and $35,453,000 Federal National Mortgage | | | |

| Association, 0%-3.03%, due 2/5/14-5/15/30, value $26,177,683) | 0.02 | 55,000,000 | 55,000,000 |

| Federal Reserve Bank of New York, | | | |

| dated 1/31/14, due 2/3/14 in the amount of $2,000,005,000 (fully | | | |

| collateralized by $2,158,941,500 U.S. Treasury Bonds, 3.13%, | | | |

| due 2/15/42, value $2,000,005,026) | 0.03 | 2,000,000,000 | 2,000,000,000 |

| JPMorgan Chase & Co. | | | |

| dated 1/31/14, due 2/3/14 in the amount of $150,000,500 | | | |

| (fully collateralized by $1,312,810,889 Federal National | | | |

| Mortgage Association, 5.61%-6.89%, due 6/25/29-12/25/43, | | | |

| value $153,000,640) | 0.04 | 150,000,000 | 150,000,000 |

| RBC Capital Markets | | | |

| dated 1/31/14, due 2/3/14 in the amount of $550,000,458 (fully | | | |

| collateralized by $7,659,000 Federal Farm Credit Bank, 0.50%-7.32%, | | | |

| due 2/5/14-12/17/36, value $7,598,730, $243,638,000 Federal Home | | | |

| Loan Bank, 0%-7%, due 3/21/14-2/15/30, value $235,493,758, | | | |

| $101,872,000 Federal Home Loan Mortgage Corp., 0%-6.25%, | | | |

| due 2/25/14-7/15/32, value $101,491,024 and $224,190,000 | | | |

| Federal National Mortgage Association, 0.38%-8.20%, | | | |

| due 2/5/14-4/29/33, value $216,417,337) | 0.01 | 550,000,000 | 550,000,000 |

STATEMENT OF INVESTMENTS (continued)

| | | | | | |

| | Annualized | | | | |

| | Yield on | | | | |

| | Date of | Principal | | | |

| Dreyfus Government Cash Management (continued) | Purchase (%) | Amount ($) | | Value ($) | |

| |

| Repurchase Agreements (continued) | | | | | |

| Societe Generale | | | | | |

| dated 1/31/14, due 2/3/14 in the amount of $1,425,003,563 (fully | | | | | |

| collateralized by $90,507,000 Federal Farm Credit Bank, 0.59%-1.50%, | | | | | |

| due 11/16/15-6/27/16, value $92,727,039, $312,405,000 Federal Home | | | | | |

| Loan Bank, 0.50%-1.38%, due 5/28/14-11/20/17, value $313,032,330, | | | | | |

| $206,001,000 Federal National Mortgage Association, 0.50%-2.13%, | | | | | |

| due 10/21/15-7/10/18, value $206,242,912, $80,000,000 U.S. Treasury | | | | | |

| Bills, due 7/3/14- 9/18/14, value $79,977,300, $289,118,700 | | | | | |

| U.S. Treasury Bonds, 7.13%-7.50%, due 2/15/23—11/15/24, | | | | | |

| value $416,746,025 and $349,844,400 U.S. Treasury Notes, | | | | | |

| 0.25%-2.13%, due 2/15/15-8/31/20, value $344,776,775) | 0.03 | 1,425,000,000 | | 1,425,000,000 | |

| Total Repurchase Agreements | | | | | |

| (cost $4,900,000,000) | | | | 4,900,000,000 | |

| |

| Total Investments (cost $17,625,935,017) | | 102.3 | % | 17,625,935,017 | |

| |

| Liabilities, Less Cash and Receivables | | (2.3 | %) | (394,292,512 | ) |

| |

| Net Assets | | 100.0 | % | 17,231,642,505 | |

| |

| a Variable rate security—interest rate subject to periodic change. |

| b The Federal Housing Finance Agency (“FHFA”) placed the Federal Home Loan Mortgage Corporation and Federal National Mortgage Association into conservatorship with FHFA as |

| the conservator.As such, the FHFA oversees the continuing affairs of these companies. |

| | | | |

| Portfolio Summary (Unaudited)† | | | |

| |

| | Value (%) | | Value (%) |

| Federal Home Loan Bank | 45.3 | Federal National Mortgage Association | 7.0 |

| Repurchase Agreements | 28.4 | Federal Farm Credit Bank | 1.9 |

| Federal Home Loan Mortgage Corp. | 10.7 | U.S. Treasury Bills | 1.7 |

| U.S. Treasury Notes | 7.3 | | 102.3 |

| |

| † Based on net assets. | | | |

| See notes to financial statements. | | | |

18

STATEMENT OF INVESTMENTS

January 31, 2014

| | | | | |

| | Annualized | | | |

| | Yield on | | | |

| | Date of | Principal | | |

| Dreyfus Government Prime Cash Management | Purchase (%) | Amount ($) | | Value ($) |

| |

| U.S. Government Agencies—77.3% | | | | |

| Federal Farm Credit Bank: | | | | |

| 2/3/14 | 0.01 | 100,000,000 | | 99,999,917 |

| 2/5/14 | 0.02 | 25,000,000 | | 24,999,944 |

| 2/10/14 | 0.03 | 25,000,000 | | 24,999,812 |

| 2/12/14 | 0.01 | 15,000,000 | | 14,999,954 |

| 2/12/14 | 0.10 | 50,000,000 | a | 50,008,075 |

| 2/14/14 | 0.09 | 90,000,000 | | 89,997,075 |

| 2/19/14 | 0.16 | 100,000,000 | a | 99,999,507 |

| 2/20/14 | 0.02 | 30,000,000 | | 29,999,683 |

| 2/27/14 | 0.02 | 15,000,000 | | 14,999,783 |

| 3/12/14 | 0.07 | 80,000,000 | | 79,993,933 |

| 3/19/14 | 0.03 | 50,000,000 | | 49,998,083 |

| 3/21/14 | 0.03 | 40,000,000 | | 39,998,400 |

| 3/25/14 | 0.05 | 22,200,000 | | 22,198,237 |

| 3/31/14 | 0.05 | 100,000,000 | | 99,991,944 |

| 4/10/14 | 0.07 | 5,000,000 | | 4,999,339 |

| 4/11/14 | 0.05 | 75,000,000 | | 74,992,812 |

| 4/17/14 | 0.09 | 40,000,000 | | 40,209,796 |

| 4/24/14 | 0.09 | 25,000,000 | | 24,994,875 |

| 4/28/14 | 0.08 | 5,000,000 | | 4,999,044 |

| 5/19/14 | 0.04 | 15,000,000 | | 14,998,217 |

| 5/30/14 | 0.05 | 50,000,000 | | 49,991,806 |

| 6/3/14 | 0.08 | 50,000,000 | | 49,986,444 |

| 6/4/14 | 0.06 | 75,000,000 | | 74,984,625 |

| 6/6/14 | 0.06 | 25,000,000 | | 24,994,792 |

| 6/19/14 | 0.12 | 50,000,000 | | 49,977,000 |

| 6/27/14 | 0.08 | 45,000,000 | | 44,984,792 |

| 7/18/14 | 0.08 | 19,499,000 | | 19,491,764 |

| 8/11/14 | 0.08 | 20,000,000 | | 19,991,511 |

| 8/15/14 | 0.08 | 15,000,000 | | 14,993,500 |

| Federal Home Loan Bank: | | | | |

| 2/3/14 | 0.01 | 100,000,000 | | 99,999,944 |

| 2/3/14 | 0.12 | 50,000,000 | a | 50,000,000 |

| 2/6/14 | 0.11 | 100,000,000 | a | 99,998,661 |

| 2/12/14 | 0.02 | 383,702,000 | | 383,699,981 |

| 2/14/14 | 0.02 | 150,000,000 | | 149,998,917 |

| 2/19/14 | 0.02 | 5,000,000 | | 4,999,950 |

| 2/21/14 | 0.04 | 187,000,000 | | 186,995,589 |

| 2/26/14 | 0.07 | 297,650,000 | | 297,635,531 |

STATEMENT OF INVESTMENTS (continued)

| | | | |

| | Annualized | | |

| | Yield on | | |

| | Date of | Principal | |

| Dreyfus Government Prime Cash Management (continued) | Purchase (%) | Amount ($) | Value ($) |

| |

| U.S. Government Agencies (continued) | | | |

| Federal Home Loan Bank (continued): | | | |

| 2/28/14 | 0.06 | 97,863,000 | 97,858,312 |

| 3/6/14 | 0.06 | 100,000,000 | 99,994,500 |

| 3/7/14 | 0.07 | 25,000,000 | 24,998,347 |

| 3/13/14 | 0.04 | 100,000,000 | 99,995,556 |

| 4/7/14 | 0.09 | 15,000,000 | 14,997,563 |

| 4/25/14 | 0.11 | 50,000,000 | 49,987,896 |

| 5/1/14 | 0.05 | 10,000,000 | 9,998,888 |

| 5/28/14 | 0.12 | 99,196,000 | 99,157,644 |

| 6/2/14 | 0.13 | 153,200,000 | 153,183,614 |

| 6/4/14 | 0.13 | 48,800,000 | 48,779,158 |

| 6/6/14 | 0.13 | 25,000,000 | 24,988,715 |

| 6/13/14 | 0.13 | 24,992,000 | 24,980,270 |

| 6/18/14 | 0.13 | 9,000,000 | 8,995,616 |

| 6/25/14 | 0.13 | 47,404,000 | 47,379,654 |

| 6/27/14 | 0.13 | 75,000,000 | 74,961,067 |

| Tennessee Valley Authority: | | | |

| 2/13/14 | 0.02 | 225,000,000 | 224,998,633 |

| 2/20/14 | 0.02 | 235,539,000 | 235,536,514 |

| 2/27/14 | 0.01 | 117,648,000 | 117,647,087 |

| Total U.S. Government Agencies | | | |

| (cost $3,988,542,271) | | | 3,988,542,271 |

| |

| |

| U.S. Treasury Bills—7.9% | | | |

| 2/6/14 | 0.01 | 80,000,000 | 79,999,944 |

| 4/24/14 | 0.03 | 80,000,000 | 79,995,444 |

| 5/1/14 | 0.01 | 250,000,000 | 249,993,819 |

| Total U.S. Treasury Bills | | | |

| (cost $409,989,207) | | | 409,989,207 |

| |

| |

| U.S. Treasury Notes—14.8% | | | |

| 2/15/14 | 0.14 | 100,000,000 | 100,050,328 |

| 3/15/14 | 0.04 | 50,000,000 | 50,072,624 |

| 3/31/14 | 0.09 | 165,000,000 | 165,043,112 |

| 4/30/14 | 0.07 | 120,000,000 | 120,052,141 |

20

| | | | | |

| | Annualized | | | |

| | Yield on | | | |

| | Date of | Principal | | |

| Dreyfus Government Prime Cash Management (continued) | Purchase (%) | Amount ($) | | Value ($) |

| |

| U.S. Treasury Notes (continued) | | | | |

| 5/15/14 | 0.08 | 50,000,000 | | 50,664,047 |

| 5/31/14 | 0.14 | 50,000,000 | | 50,349,365 |

| 6/15/14 | 0.06 | 125,000,000 | | 125,312,603 |

| 6/30/14 | 0.11 | 100,000,000 | | 100,057,172 |

| Total U.S. Treasury Notes | | | | |

| (cost $761,601,392) | | | | 761,601,392 |

| |

| Total Investments (cost $5,160,132,870) | | 100.0 | % | 5,160,132,870 |

| Cash and Receivables (Net) | | .0 | % | 1,994,785 |

| Net Assets | | 100.0 | % | 5,162,127,655 |

| | |

| a | Variable rate security—interest rate subject to periodic change. |

| | | | |

| Portfolio Summary (Unaudited)† | | | |

| |

| | Value (%) | | Value (%) |

| Federal Home Loan Bank | 41.7 | Tennessee Valley Authority | 11.2 |

| Federal Farm Credit Bank | 24.4 | U.S. Treasury Bills | 7.9 |

| U.S. Treasury Notes | 14.8 | | 100.0 |

| |

| † Based on net assets. | | | |

| See notes to financial statements. | | | |

STATEMENT OF INVESTMENTS

January 31, 2014

| | | | |

| | Annualized | | |

| | Yield on | | |

| | Date of | Principal | |

| Dreyfus Treasury & Agency Cash Management | Purchase (%) | Amount ($) | Value ($) |

| |

| U.S. Treasury Bills—13.8% | | | |

| 2/6/14 | 0.00 | 164,000,000 | 164,000,000 |

| 4/10/14 | 0.04 | 1,726,510,000 | 1,726,376,750 |

| 4/17/14 | 0.09 | 125,000,000 | 124,977,865 |

| 5/29/14 | 0.10 | 500,000,000 | 499,835,469 |

| Total U.S. Treasury Bills | | | |

| (cost $2,515,190,084) | | | 2,515,190,084 |

| U.S. Treasury Notes—36.2% | | | |

| 2/15/14 | 0.08 | 275,000,000 | 275,145,125 |

| 2/28/14 | 0.13 | 200,000,000 | 200,018,081 |

| 2/28/14 | 0.14 | 640,000,000 | 640,838,708 |

| 3/15/14 | 0.10 | 905,000,000 | 906,246,903 |

| 3/31/14 | 0.05 | 100,000,000 | 100,270,369 |

| 3/31/14 | 0.09 | 300,000,000 | 300,075,968 |

| 4/15/14 | 0.06 | 600,000,000 | 601,430,184 |

| 4/30/14 | 0.09 | 444,420,000 | 444,593,087 |

| 4/30/14 | 0.09 | 302,165,000 | 303,475,187 |

| 5/15/14 | 0.11 | 276,000,000 | 279,641,315 |

| 5/31/14 | 0.10 | 700,000,000 | 700,343,447 |

| 5/31/14 | 0.14 | 465,000,000 | 468,254,788 |

| 6/15/14 | 0.08 | 250,000,000 | 250,614,800 |

| 7/31/14 | 0.14 | 200,000,000 | 199,988,463 |

| 8/15/14 | 0.14 | 280,000,000 | 280,512,787 |

| 9/30/14 | 0.17 | 250,000,000 | 253,647,990 |

| 11/15/14 | 0.20 | 287,000,000 | 296,251,191 |

| 11/30/14 | 0.11 | 100,000,000 | 101,638,322 |

| Total U.S. Treasury Notes | | | |

| (cost $6,602,986,715) | | | 6,602,986,715 |

| Repurchase Agreements—49.9% | | | |

| ABN AMRO Bank N.V. | | | |

| dated 1/31/14, due 2/3/14 in the amount of $700,001,167 | | | |

| (fully collateralized by $231,542,175 Government National | | | |

| Mortgage Association, 4%-4.50%, due 9/20/41-6/15/42, | | | |

| value $162,578,358, $37,610,735 U.S. Treasury Bills, | | | |

| due 7/10/14, value $37,602,310, $5,037,900 U.S. Treasury | | | |

| Bonds, 4.63%, due 2/15/40, value $6,080,064, $7,594,200 | | | |

| U.S. Treasury Inflation Protected Securities, 2.38%, due 1/15/17, | | | |

| value $9,708,184 and $471,449,046 U.S. Treasury Notes, | | | |

| 0.25%-4.63%, due 6/30/14-11/15/23, value $498,031,142) | 0.02 | 700,000,000 | 700,000,000 |

22

| | | | |

| | Annualized | | |

| | Yield on | | |

| | Date of | Principal | |

| Dreyfus Treasury & Agency Cash Management (continued) | Purchase (%) | Amount ($) | Value ($) |

| |

| Repurchase Agreements (continued) | | | |

| Bank of Nova Scotia | | | |

| dated 1/31/14, due 2/3/14 in the amount of $200,000,333 | | | |

| (fully collateralized by $167,460 U.S. Treasury Bills, due 5/15/14, | | | |

| value $167,440, $33,115,440 U.S. Treasury Bonds, 2.75%-7.88%, | | | |

| due 2/15/21-8/15/42, value $37,811,873, $26,916,300 | | | |

| U.S. Treasury Inflation Protected Securities, 1.13%-2.50%, | | | |

| due 1/15/16-1/15/29, value $33,344,044 and $130,961,411 | | | |

| U.S. Treasury Notes, 0.25%-4.50%, due 2/15/14-5/15/22, | | | |

| value $132,676,648) | 0.02 | 200,000,000 | 200,000,000 |

| Barclays Capital, Inc. | | | |

| dated 1/31/14, due 2/3/14 in the amount of $374,000,623 | | | |

| (fully collateralized by $220,936,450 U.S. Treasury Inflation | | | |

| Protected Securities, 0.13%, due 4/15/16-1/15/23, value | | | |

| $229,391,726 and $245,077,812 U.S. Treasury Strips, | | | |

| due 2/15/17-11/15/43, value $152,088,283) | 0.02 | 374,000,000 | 374,000,000 |

| Citigroup Global Markets Holdings Inc. | | | |

| dated 1/31/14, due 2/3/14 in the amount of $140,000,117 | | | |

| (fully collateralized by $13,509,900 U.S. Treasury Inflation | | | |

| Protected Securities, 0.38%, due 7/15/23, value $13,448,641 | | | |

| and $130,828,300 U.S. Treasury Notes, 1%-1.38%, | | | |

| due 3/31/17-1/31/20, value $129,351,457) | 0.01 | 140,000,000 | 140,000,000 |

| Credit Agricole CIB | | | |

| dated 1/31/14, due 2/3/14 in the amount of $2,115,003,525 | | | |

| (fully collateralized by $1,325,735,422 U.S. Treasury Inflation | | | |

| Protected Securities, 0.13%-2%, due 7/15/14-4/15/17, | | | |

| value $1,562,821,868 and $573,487,383 U.S. Treasury Notes, | | | |

| 0.88%-3.38%, due 3/31/14-11/15/19, value $594,478,143) | 0.02 | 2,115,000,000 | 2,115,000,000 |

| Credit Suisse Securities LLC | | | |

| dated 1/31/14, due 2/3/14 in the amount of $250,000,417 (fully | | | |

| collateralized by $269,825,136 Government National Mortgage | | | |

| Association, 2.18%-6.50%, due 7/20/27-3/15/55, value $255,001,983) | 0.02 | 250,000,000 | 250,000,000 |

| Deutsche Bank Securities Inc. | | | |

| dated 1/31/14, due 2/3/14 in the amount of $125,000,208 | | | |

| (fully collateralized by $445,066,376 Government National Mortgage | | | |

| Association, 2.28%-8%, due 3/15/25-8/15/55, value $127,500,000) | 0.02 | 125,000,000 | 125,000,000 |

| Federal Reserve Bank of New York, | | | |

| dated 1/31/14, due 2/3/14 in the amount of $2,850,007,125 | | | |

| (fully collateralized by $2,681,296,600 U.S. Treasury Notes, | | | |

| 2.63%, due 4/30/18, value $2,850,007,189) | 0.03 | 2,850,000,000 | 2,850,000,000 |

| Merrill Lynch & Co. Inc. | | | |

| dated 1/31/14, due 2/3/14 in the amount of $120,000,200 | | | |

| (fully collateralized by $1,896,294,988 Government National Mortgage | | | |

| Association, 1.63%-13%, due 6/15/14-3/15/55, value $122,400,000) | 0.02 | 120,000,000 | 120,000,000 |

STATEMENT OF INVESTMENTS (continued)

| | | | | |

| | Annualized | | | |

| | Yield on | | | |

| | Date of | Principal | | |

| Dreyfus Treasury & Agency Cash Management (continued) | Purchase (%) | Amount ($) | | Value ($) |

| |

| Repurchase Agreements (continued) | | | | |

| RBC Capital Markets | | | | |

| dated 1/31/14, due 2/3/14 in the amount of $400,000,033 (fully | | | | |

| collateralized by $66,236,600 U.S. Treasury Bills, due 7/17/14-7/31/14, | | | | |

| value $66,218,075, $16,676,000 U.S. Treasury Bonds, 4.50%-8.75%, | | | | |

| due 2/15/20-8/15/39, value $19,777,487, $9,425,100 U.S. Treasury | | | | |

| Inflation Protected Securities, 1.13%-2.63%, due 1/15/17-1/15/21, | | | | |

| value $11,279,093 and $311,475,400 U.S. Treasury Notes, 0.75%-4.13%, | | | | |

| due 2/15/15-11/15/21, value $310,725,418) | 0.001 | 400,000,000 | | 400,000,000 |

| Societe Generale | | | | |

| dated 1/31/14, due 2/3/14 in the amount of $1,425,003,563 (fully | | | | |

| collateralized by $42,373,000 U.S. Treasury Bills, due 3/27/14-5/29/14, | | | | |

| value $42,369,683, $268,131,900 U.S. Treasury Bonds, 2.75%-11.25%, | | | | |

| due 2/15/15-11/15/42, value $262,465,716, $1,054,965,541 | | | | |

| U.S. Treasury Notes, 0.25%-4.25%, due 8/15/14-9/30/20, | | | | |

| value $1,070,244,972 and $171,434,489 U.S. Treasury Strips, | | | | |

| due 11/15/18-8/15/43, value $78,419,640) | 0.03 | 1,425,000,000 | | 1,425,000,000 |

| TD Securities (USA) LLC | | | | |

| dated 1/31/14, due 2/3/14 in the amount of $425,000,708 (fully | | | | |

| collateralized by $13,685,400 U.S. Treasury Bonds, 4.50%-11.25%, | | | | |

| due 2/15/15-8/15/39, value $17,509,354, $313,369,700 U.S. Treasury | | | | |

| Inflation Protected Securities, 0.13%-3.88%, due 4/15/14-2/15/42, | | | | |

| value $367,120,210, $45,836,900 U.S. Treasury Notes, 0.25%-4.50%, | | | | |

| due 4/15/14-6/30/20, value $46,903,134 and $5,400,000 U.S. Treasury | | | | |

| Strips, due 11/15/39-2/15/42, value $1,967,336) | 0.02 | 425,000,000 | | 425,000,000 |

| Total Repurchase Agreements | | | | |

| (cost $9,124,000,000) | | | | 9,124,000,000 |

| |

| Total Investments (cost $18,242,176,799) | | 99.9 | % | 18,242,176,799 |

| |

| Cash and Receivables (Net) | | .1 | % | 16,388,268 |

| |

| Net Assets | | 100.0 | % | 18,258,565,067 |

| | | | |

| Portfolio Summary (Unaudited)† | | | |

| | Value (%) | | Value (%) |

| Repurchase Agreements | 49.9 | U.S. Treasury Bills | 13.8 |

| U.S. Treasury Notes | 36.2 | | 99.9 |

| † Based on net assets. | | | |

| See notes to financial statements. | | | |

24

STATEMENT OF INVESTMENTS

January 31, 2014

| | | | |

| | Annualized | | |

| | Yield on | | |

| | Date of | Principal | |

| Dreyfus Treasury Prime Cash Management | Purchase (%) | Amount ($) | Value ($) |

| |

| U.S. Treasury Bills—89.0% | | | |

| 2/6/14 | 0.01 | 7,378,000,000 | 7,377,985,489 |

| 2/13/14 | 0.01 | 5,325,000,000 | 5,324,979,271 |

| 2/20/14 | 0.03 | 1,369,000,000 | 1,368,978,399 |

| 2/27/14 | 0.05 | 450,000,000 | 449,983,028 |

| 4/3/14 | 0.03 | 4,977,000,000 | 4,976,749,748 |

| 4/10/14 | 0.03 | 5,184,000,000 | 5,183,667,508 |

| 4/17/14 | 0.03 | 2,735,000,000 | 2,734,831,813 |

| 4/24/14 | 0.03 | 2,120,000,000 | 2,119,837,014 |

| 5/1/14 | 0.08 | 326,000,000 | 325,938,565 |

| 5/8/14 | 0.08 | 425,000,000 | 424,912,167 |

| 5/15/14 | 0.07 | 713,000,000 | 712,849,062 |

| 5/22/14 | 0.08 | 301,000,000 | 300,923,069 |

| 6/5/14 | 0.10 | 500,000,000 | 499,827,778 |

| 6/12/14 | 0.09 | 2,600,000,000 | 2,599,157,597 |

| 7/3/14 | 0.09 | 466,000,000 | 465,828,084 |

| 7/24/14 | 0.07 | 750,000,000 | 749,765,729 |

| Total U.S. Treasury Bills | | | |

| (cost $35,616,214,321) | | | 35,616,214,321 |

| |

| U.S. Treasury Notes—11.0% | | | |

| 2/15/14 | 0.00 | 1,136,600,000 | 1,138,368,622 |

| 2/15/14 | 0.09 | 435,000,000 | 435,228,568 |

| 2/28/14 | 0.06 | 67,000,000 | 67,009,267 |

| 2/28/14 | 0.21 | 50,000,000 | 50,063,017 |

| 3/15/14 | 0.08 | 100,000,000 | 100,141,026 |

| 3/31/14 | 0.10 | 230,000,000 | 230,603,372 |

| 4/15/14 | 0.06 | 402,000,000 | 402,962,161 |

| 4/30/14 | 0.09 | 450,000,000 | 450,177,447 |

| 4/30/14 | 0.10 | 425,000,000 | 426,829,894 |

| 5/31/14 | 0.13 | 234,000,000 | 235,643,123 |

STATEMENT OF INVESTMENTS (continued)

| | | | | |

| | Annualized | | | |

| | Yield on | | | |

| | Date of | Principal | | |

| Dreyfus Treasury Prime Cash Management (continued) | Purchase (%) | Amount ($) | | Value ($) |

| |

| U.S. Treasury Notes (continued) | | | | |

| 6/15/14 | 0.10 | 600,000,000 | | 601,431,539 |

| 6/30/14 | 0.12 | 250,000,000 | | 250,137,852 |

| Total U.S. Treasury Notes | | | | |

| (cost $4,388,595,888) | | | | 4,388,595,888 |

| Total Investments (cost $40,004,810,209) | | 100.0 | % | 40,004,810,209 |

| Cash and Receivables (Net) | | .0 | % | 1,467,116 |

| Net Assets | | 100.0 | % | 40,006,277,325 |

| | | | |

| Portfolio Summary (Unaudited)† | | | |

| | Value (%) | | Value (%) |

| U.S. Treasury Bills | 89.0 | U.S. Treasury Notes | 11.0 |

| | | | 100.0 |

| † Based on net assets. | | | |

| See notes to financial statements. | | | |

26

STATEMENT OF INVESTMENTS

January 31, 2014

| | | | | | |

| | Coupon | Maturity | Principal | | |

| Dreyfus Municipal Cash Management Plus | Rate (%) | Date | Amount ($) | | Value ($) |

| |

| Short-Term Investments—100.9% | | | | | |

| Alabama—.6% | | | | | |

| Mobile County Industrial Development Authority, Gulf Opportunity | | | | | |

| Zone Revenue (SSAB Alabama Inc.) (LOC; Swedbank) | 0.07 | 2/7/14 | 2,000,000 | a | 2,000,000 |

| Arizona—2.2% | | | | | |

| Maricopa County Industrial Development Authority, MFHR | | | | | |

| (San Clemente Apartments Project) (Liquidity Facility; | | | | | |

| FNMA and LOC; FNMA) | 0.08 | 2/7/14 | 1,010,000 | a | 1,010,000 |

| Mesa Unified School District Number 4 of Maricopa County, | | | | | |

| GO Notes (School Improvement Bonds) | 4.25 | 7/1/14 | 2,000,000 | | 2,033,448 |

| Phoenix Civic Improvement Corporation, Water System | | | | | |

| Revenue, CP (LOC; Royal Bank of Canada) | 0.12 | 3/10/14 | 4,000,000 | | 4,000,000 |

| Arkansas—1.6% | | | | | |

| Arkansas Development Finance Authority, | | | | | |

| MFHR (Capri Apartments Project) (LOC; FHLB) | 0.09 | 2/7/14 | 5,200,000 | a | 5,200,000 |

| California—6.0% | | | | | |

| Alameda County Industrial Development Authority, Revenue | | | | | |

| (Oakland Pallet Company, Inc. Project) (LOC; Comerica Bank) | 0.09 | 2/7/14 | 1,850,000 | a | 1,850,000 |

| Alameda County Industrial Development Authority, Revenue | | | | | |

| (Tool Family Partnership Project) (LOC; Wells Fargo Bank) | 0.06 | 2/7/14 | 1,512,000 | a | 1,512,000 |

| California Pollution Control Financing Authority, SWDR | | | | | |

| (Bay Counties Waste Services, Inc. Project) (LOC; Comerica Bank) | 0.10 | 2/7/14 | 2,300,000 | a | 2,300,000 |

| California Pollution Control Financing Authority, SWDR | | | | | |

| (Rainbow Disposal Company Inc. Project) (LOC; Comerica Bank) | 0.10 | 2/7/14 | 13,815,000 | a | 13,815,000 |

| Colorado—2.8% | | | | | |

| City and County of Denver, GO Notes | | | | | |

| (Justice System Facilities and Zoo Bonds) | 5.00 | 8/1/14 | 450,000 | | 460,704 |

| Colorado Housing and Finance Authority, EDR | | | | | |

| (Wanco, Inc. Project) (LOC; U.S. Bank NA) | 0.19 | 2/7/14 | 1,835,000 | a | 1,835,000 |

| Deutsche Bank Spears/Lifers Trust (Series DBE-1129 X) | | | | | |

| (City and County of Denver, Airport System Revenue) | | | | | |

| (Liquidity Facility; Deutsche Bank AG and LOC; Deutsche Bank AG) | 0.11 | 2/7/14 | 7,000,000 a,b,c | | 7,000,000 |

| Florida—9.9% | | | | | |

| Branch Banking and Trust Co. Municipal Trust (Series 2042) | | | | | |

| (Collier County School Board, COP, Refunding (Master | | | | | |

| Lease-Purchase Agreement)) (Liquidity Facility; Branch | | | | | |

| Banking and Trust Co. and LOC; Branch Banking and Trust Co.) | 0.08 | 2/7/14 | 4,975,000 a,b,c | | 4,975,000 |

| Branch Banking and Trust Co. Municipal Trust (Series 2057) | | | | | |

| (Miami-Dade County, Aviation Revenue (Miami International | | | | | |

| Airport)) (Liquidity Facility; Branch Banking and Trust Co. | | | | | |

| and LOC; Branch Banking and Trust Co.) | 0.07 | 2/7/14 | 10,060,000 a,b,c | | 10,060,000 |

| Kissimmee Utility Authority, CP | | | | | |

| (Liquidity Facility; JPMorgan Chase Bank) | 0.14 | 2/10/14 | 5,750,000 | | 5,750,000 |

| Miami-Dade County, Aviation Revenue (Miami-Dade International | | | | | |

| Airport) (Eagle 2013-0016) (Liquidity Facility; Citibank NA) | 0.07 | 2/7/14 | 5,000,000 a,b,c | | 5,000,000 |

STATEMENT OF INVESTMENTS (continued)

| | | | | | |

| Dreyfus Municipal | Coupon | Maturity | Principal | | |

| Cash Management Plus (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| |

| Short-Term Investments (continued) | | | | | |

| Florida (continued) | | | | | |

| Saint Lucie County School District, TAN | 2.00 | 3/1/14 | 2,000,000 | | 2,002,924 |

| Sunshine State Governmental Financing Commission, | | | | | |

| Revenue, CP (Liquidity Facility; JPMorgan Chase Bank) | 0.15 | 3/14/14 | 3,000,000 | | 3,000,000 |

| Sunshine State Governmental Financing Commission, | | | | | |

| Revenue, CP (Liquidity Facility; JPMorgan Chase Bank) | 0.13 | 4/9/14 | 1,625,000 | | 1,625,000 |

| Georgia—1.2% | | | | | |

| Fayette County Hospital Authority, RAC | | | | | |

| (Fayette Community Hospital Project) (LOC; FHLB) | 0.03 | 2/7/14 | 4,000,000 | a | 4,000,000 |

| Idaho—.5% | | | | | |

| Deutsche Bank Spears/Lifers Trust (Series DBE-1102) | | | | | |

| (Idaho Health Facilities Authority, Revenue (Saint Luke's | | | | | |

| Health System Project)) (Liquidity Facility; | | | | | |

| Deutsche Bank AG and LOC; Deutsche Bank AG) | 0.09 | 2/7/14 | 1,500,000 a,b,c | | 1,500,000 |

| Indiana—2.6% | | | | | |

| Indiana Finance Authority, EDR (JRL Leasing, Inc. and | | | | | |

| LaSarre Co., LLC Project) (LOC; PNC Bank NA) | 0.11 | 2/7/14 | 2,585,000 | a | 2,585,000 |

| Lawrence, Fort Harrison Reuse Authority, Tax Increment Revenue | | | | | |

| (Fort Harrison Military Base Reuse District) (LOC; PNC Bank NA) | 0.06 | 2/7/14 | 5,960,000 | a | 5,960,000 |

| Iowa—1.4% | | | | | |

| Iowa Finance Authority, Revenue (YMCA and Rehabilitation | | | | | |

| Center Project) (LOC; Bank of America) | 0.07 | 2/7/14 | 4,685,000 | a | 4,685,000 |

| Kansas—2.5% | | | | | |

| Kansas Development Finance Authority, MFHR | | | | | |

| (Tree House Apartments) (LOC; U.S. Bank NA) | 0.06 | 2/7/14 | 8,105,000 | a | 8,105,000 |

| Louisiana—1.5% | | | | | |

| Ascension Parish, Revenue, CP (BASF SE) | 0.27 | 4/24/14 | 5,000,000 | | 5,000,000 |

| Maryland—1.6% | | | | | |

| Anne Arundel County, EDR (Atlas Container | | | | | |

| Corporation Project) (LOC; M&T Trust) | 0.16 | 2/7/14 | 5,275,000 | a | 5,275,000 |

| Massachusetts—4.0% | | | | | |

| Massachusetts Health and Educational Facilities Authority, Revenue | | | | | |

| (Museum of Fine Arts Issue) (Liquidity Facility; Bank of America) | 0.06 | 2/3/14 | 10,700,000 | a | 10,700,000 |

| Springfield, GO Notes, BAN | 1.00 | 2/14/14 | 2,500,000 | | 2,500,544 |

| Michigan—.9% | | | | | |

| Pittsfield Township Economic Development Corporation, | | | | | |

| LOR, Refunding (Arbor Project) (LOC; Comerica Bank) | 0.09 | 2/7/14 | 2,995,000 | a | 2,995,000 |

| Minnesota—2.9% | | | | | |

| Minnesota Rural Water Finance Authority, | | | | | |

| Public Projects Construction Notes | 1.00 | 2/1/14 | 4,600,000 | | 4,600,174 |

| RBC Municipal Products Inc. Trust (Series E-19) (Minneapolis, | | | | | |

| Health Care System Revenue (Fairview Health Services)) (Liquidity | | | | | |

| Facility; Royal Bank of Canada and LOC; Royal Bank of Canada) | 0.04 | 2/7/14 | 5,000,000 a,b,c | | 5,000,000 |

28