UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06431

MANAGERS TRUST II

(Exact name of registrant as specified in charter)

| | |

| 800 Connecticut Avenue, Norwalk, Connecticut | | 06854 |

| | |

| (Address of principal executive offices) | | (Zip code) |

Managers Investment Group LLC

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: MARCH 31

Date of reporting period: APRIL 1, 2005 – MARCH 31, 2006 (Annual Shareholder Report)

Item 1. Reports to Shareholders

ANNUAL REPORT

Managers Funds

March 31, 2006

| • | | Short Duration Government Fund |

| • | | Intermediate Duration Government Fund |

Managers Short Duration Government Fund

Managers Intermediate Duration Government Fund

Annual Report – March 31, 2006

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of The Managers Funds or any fund presented within this report. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Letter to Shareholders

Dear Fellow Shareholder:

Stock and bond markets have proved surprisingly resilient in the last 12 months, despite a series of natural disasters throughout the world, rising energy prices and continuing political unrest in many nations.

Money managers make investment decisions based on facts, models, research and history. Yet recent events have made it all too clear that even the most careful analysis and calculations can be disrupted by the events of a day or two—even an hour or two.

If this year has proved the old adage that nothing is certain but change, it’s also proven that successful investing requires both diversification and patience.

Diversification means that you should have investments in both stocks and bonds, domestic and international, large capitalization and small, short maturities and long ones. But to us at Managers, it also means that the people picking those securities should be a diverse group, subscribing to different investment philosophies.

Why? Because no single approach will succeed in every kind of market environment.

Managers have different views of the world. You wouldn’t invest most of your portfolio in a single market sector. For the same reasons, it’s unwise to have most of your portfolio managed according to a single investing philosophy.

Successful investing requires both diversification and Patience

At Managers, we hire subadvisors (outside investment managers). That allows you to choose among a range of holdings and investment management philosophies—often within the same asset class. Should unforeseen events trump every analysis and forecast, you’ll have a variety of investments, a variety of investment managers, and a variety of investment philosophies to cushion you.

Patience is just as important as diversity. Historically, long-term investors do better than people who try to time the market. Determine your investing strategy. Select a variety of investments and managers that will provide diversification. Then, invest regularly and remain true to your investing plan—no matter what you read in the headlines.

We know this hasn’t been the easiest 12 months in which to follow that advice. So we invite you to visit our Web site at www.managersinvest.com and read a short article entitled “Investing for the Long Term” that explains the value of a patient investing strategy.

In addition to this article, you’ll find detailed profiles on our subadvisors and their individual investing styles, as well as information about each of our Funds, with an annual commentary. If you have any questions, we invite you to call us at 800.835.3879. Thank you for investing with Managers Funds.

Sincerely,

| | |

| |  |

| |

Peter M. Lebovitz President Managers Funds | | Thomas G. Hoffman, CFA Executive Vice President Chief Investment Officer Managers Investment Group LLC |

1

About Your Fund’s Expenses

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, redemption fees; and exchange fees; and (2) ongoing costs, including management fees and other Fund expenses. These Funds incur only ongoing costs. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | |

Six Months Ended March 31, 2006 | | Beginning

Account Value

10/1/2005 | | Ending

Account Value

3/31/2006 | | Expenses Paid

During the

Period* |

Short Duration Government Fund | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,018 | | $ | 4.38 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,021 | | $ | 4.39 |

Intermediate Duration Government Fund | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,002 | | $ | 4.39 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,021 | | $ | 4.44 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (182), then divided by 365. |

2

Managers Short Duration Government Fund

Portfolio Manager’s Comments

The Managers Short Duration Government Bond Fund (“the Fund”) seeks to provide investors with a high level of current income, consistent with a low volatility of net asset value.

The Fund seeks to achieve its objective by matching the duration, or interest-rate risk, of a portfolio that invests exclusively in six-month U.S. Treasury securities on a constant maturity basis. Under normal circumstances, the Fund will invest at least 80% of its assets in debt securities issued by the U.S. Government or its agencies and instrumentalities and synthetic instruments or derivatives having economic characteristics similar to such debt securities.

The Fund typically employs hedging techniques using instruments such as interest rate futures, options, floors, caps and swaps, designed to reduce the interest-rate risk of their fixed-income securities. The Fund’s benchmark is the Six-Month T-Bill.

The Portfolio Manager

Smith Breeden Associates, Inc. (“Smith Breeden”) is the subadvisor for the Fund. Smith Breeden, located at 100 Europa Drive, Suite 200, Chapel Hill, NC., was founded in 1982. Smith Breeden is a money management and consulting firm involved in money management for separate accounts such as pensions and endowments, financial institution consulting and investment advice, and equity investments. The firm specializes in high credit quality fixed-income investments, interest rate risk management, and the application of option pricing to banking and investments. As of December 31, 2005, Smith Breeden advised or managed assets of approximately $27.5 billion.

Smith Breeden believes that innovative research provides critical insights into the fixed-income market. The firm’s experienced investment professionals apply these research insights to the management of investment portfolios designed to achieve their clients’ objectives. The key tenets of this market-tested investment philosophy are:

| | • | | Over a market cycle, a portfolio of fixed-income securities with wide risk-adjusted spreads produces an attractive total return in comparison to the market return. |

| | • | | The incremental return available from security selection and sector allocation, based on careful relative-value analysis, quantitative research, and experienced market judgment, is more consistent than the incremental return from predicting the direction of interest rates. |

| | • | | Within the investment grade fixed-income market, the spread sectors i.e., corporate bonds, mortgage-backed securities (MBS), commercial MBS (CMBS), and asset-backed securities (ABS) will tend to outperform Treasury securities over a market cycle. The mortgage, corporate, CMBS, and ABS sectors also offer the greatest active management opportunity for adding value through security selection. |

The portfolio management team at Smith Breeden specializes in analyzing and investing in mortgage securities. Through careful analysis and comparison of the characteristics of these securities, such as type of issuer, coupon, maturity, geographic structure,

3

Managers Short Duration Government Fund

Portfolio Manager’s Comments (continued)

and prepayment rates, the portfolio manager seeks to structure a portfolio with similar risk characteristics to six-month U.S. Treasury securities and slightly higher returns. Because there is less certainty about the timing of principal payments to individual mortgage securities than for U.S. Treasury securities, they tend to carry a slightly higher yield. A properly structured portfolio of mortgage securities, however, can have a highly predictable cash flow while maintaining a yield advantage over Treasuries. Although the portfolio management team often purchases securities with maturities longer than six months, it does not attempt to increase returns by actively positioning the interest rate sensitivity of the portfolio. Instead the team typically manages the weighted average duration of the portfolio so that it remains close to six months.

The ideal investment exhibits many of the following traits:

| | • | | Yield advantage over Treasuries |

| | • | | Very high quality (AAA or Government) |

| | • | | Attractive value relative to other MBS opportunities |

The portfolio:

| | • | | Seeks to optimize return per unit of risk |

| | • | | Minimal exposure to credit risk and interest rate risk |

| | • | | Consists of high quality MBS, CMBS, and ABS securities |

| | • | | Will tend to have an interest-rate sensitivity similar to a Six-Month T-Bill |

The investment team will make a sell decision when:

| | • | | They no longer view the bonds as attractive |

| | • | | They deem it necessary to reallocate the portfolio |

| | • | | To maintain the portfolio’s target duration |

The Year in Review

During the 12 months ended March 31, 2006, the Fund returned +3.00% compared to +3.54% for its benchmark, the Six-Month T-Bill.

U.S. interest rates rose during the 12 months ended March 31, 2006. However, in response to eight policy rate hikes by the Federal Open Market Committee (FOMC), shorter-term rates increased much more dramatically than longer-term rates. Thus, the U.S. yield curve flattened significantly during the period. Indeed, portions of the yield curve inverted, such that shorter-term rates had higher yields than longer-term rates. The FOMC actions did provide better yields from very short-term instruments, such as Treasury bills. The 12-month return on the Six-Month T-Bill, for instance, was its best showing since the summer of 2002. However, even the moderate rise in longer-term rates hurt the performance of longer-term bonds (where rates and prices tend to move in opposite directions.) Thus, the 12-month return from the Lehman Brothers U.S. Treasury Index was less than 2% through March 31, 2006.

4

Managers Short Duration Government Fund

Portfolio Manager’s Comments (continued)

The investment team at Smith Breeden has focused almost exclusively on the securitized portions of the bond market in subadvising this Fund. This has included the mortgage-backed securities (MBS), asset-backed securities (ABS), and commercial mortgage-backed securities (CMBS) sectors. As noted in their investment philosophy, they believe these instruments should offer a yield advantage over Treasuries given their added risks. While many of these sectors did offer competitive returns when compared to like-duration Treasuries, their absolute returns generally lagged the total return of the Six-Month T-Bill during this 12-month period. For instance, the Lehman Brothers MBS and ABS Indexes both returned 2.7% during the period, while the Lehman Brothers CMBS Index returned just 2.1%. Therefore, there were few opportunities for the team at Smith Breeden to add value within these sectors.

On a periodic basis, the Fund’s quarterly performance lagged the benchmark slightly during each quarter, except for the first quarter of 2006 (where its return was in line with the benchmark.) Again, this trend reflected the consistency of the upward trend in short-term rates as well as the very conservative portfolio management of Smith Breeden. As we noted in last year’s Annual Report, Smith Breeden’s overall management of the Fund has been defensive. They have been focused on trying to find pockets of investment opportunities within the securitized market. While few opportunities presented themselves, the investment team at Smith Breeden was also successful in minimizing the risks in the portfolio. Thus, the Fund’s overall underperformance of 0.54% (54 basis points) could be considered reasonable given the attribution within the securitized sectors.

Looking Forward

Heading into the second quarter of 2006, the Fund continues to have a conservative aggregate MBS exposure. The Fund’s spread duration, which measures its overall sensitivity to the MBS market, remains close to zero. Specifically, the Fund remains underweight GNMA securities as the investment team at Smith Breeden views them as offering very little fundamental value at current spread levels to their conventional counterparts. Finally, portfolio manager Dan Dektar continues to hold positions in IOs as he expects that a deceleration in the U.S. housing market could result in strong performance of discount interest only strips which are securities based solely on the interest payments from a pool of mortgages or other bonds.

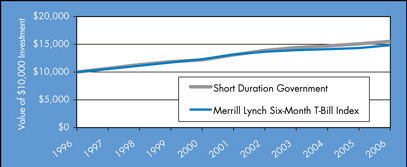

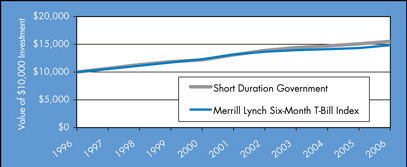

Cumulative Total Return Performance

Managers Short Duration Government Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. The Merrill Lynch Six-Month T-Bill Index is an unmanaged index that measures returns of six-month treasury bills. Unlike the Fund, the Merrill Lynch Six-Month T-Bill Index is unmanaged, is not available for investment, and does not incur expenses. The chart illustrates the performance of a hypothetical $10,000 investment made in the Fund on March 31, 1996 to a $10,000 investment made in the Merrill Lynch Six-Month T-Bill Index for the same time periods. Figures include reinvestment of capital gains and dividends. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns for the Fund would have been lower had certain expenses not been reduced.

5

Managers Short Duration Government Fund

Portfolio Manager’s Comments (continued)

The table below shows the average annualized total returns for the Managers Short Duration Government Fund and the Merrill Lynch Six-Month T-Bill Index for the 1, 5 and 10 years ended March 31, 2006.

| | | | | | | | | |

Average Annual Total Returns: | | 1 Year | | | 5 Years | | | 10 Years | |

Short Duration Government | | 3.00 | % | | 3.48 | % | | 4.50 | % |

Merrill Lynch Six-Month T-Bill Index | | 3.54 | % | | 2.43 | % | | 4.02 | % |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end please call (800) 835-3879 or visit our Web site at www.managersinvest.com.

Changing interest rates may adversely affect the value of an investment. An increase in interest rates typically causes the value of bonds and other fixed-income securities to fall.

The Fund may use derivative instruments for hedging purposes or as part of its investment strategy. There is also a risk that a derivative intended as a hedge may not perform as expected. The main risks with derivatives is that some types can amplify a gain or loss, potentially earning or losing substantially more money than the actual cost of the derivative; or that the counterparty may fail to honor its contract terms, causing a loss for the Fund. Use of these instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk, and the risk that a fund could not close out a position when it would be most advantageous to do so.

Not FDIC insured, nor bank guaranteed. May lose value.

6

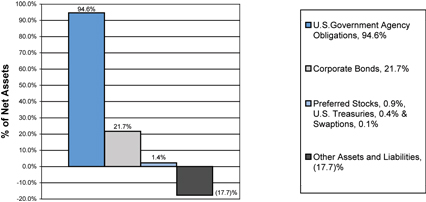

Managers Short Duration Government Fund

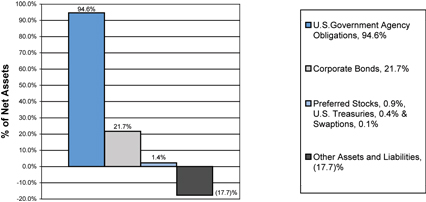

Fund Snapshots

March 31, 2006

Portfolio Breakdown

Managers Short Duration Government Fund

Top Ten Holdings

| | | |

Top Ten Holdings (out 107 of securities) | | % of

Net Assets | |

FNMA, 5.000%, TBA* | | 12.1 | % |

GNMA, 4.500%, 08/20/32 to 10/20/34 | | 8.3 | |

FNMA, 5.218%, 03/25/35 to 07/25/44* | | 8.2 | |

FHLMC, 4.999%, 06/15/35* | | 6.2 | |

GNMA, 3.500%, 07/20/35 to 09/20/35* | | 5.0 | |

FNMA Whole loan, 5.018%, 05/25/35* | | 4.2 | |

GMAC, 7.724%, 03/15/33* | | 3.8 | |

FHLMC, 5.000%, 06/01/09 to 05/01/18 | | 2.6 | |

FNMA, 7.500%, 10/01/15 to 12/25/42 | | 2.6 | |

FHLMC Gold Pool, 4.000%, 09/01/20 | | 2.5 | |

| | | |

Top Ten as a Group | | 55.5 | % |

| | | |

| * | Top Ten Holding at September 30, 2005. |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security.

7

Managers Short Duration Government Fund

Schedule of Portfolio Investments

March 31, 2006

| | | | | | |

| | | Principal

Amount | | Value |

U.S. Government and Agency Obligations – 94.6%1 | | | | | | |

Federal Home Association/Veteran’s Association – 0.7% | | | | | | |

FHA/VA, 4.750%, 10/01/062 | | $ | 172,803 | | $ | 173,625 |

FHA/VA, 5.125%, 01/01/072 | | | 1,226,421 | | | 1,231,209 |

Total Federal Home Association/Veteran’s Association | | | | | | 1,404,834 |

| | |

Federal Home Loan Mortgage Corporation – 19.9% | | | | | | |

FHLMC, 1.876%, 03/15/08 | | | 175,192 | | | 174,099 |

FHLMC, 2.815%, 06/01/072,9 | | | 2,132,579 | | | 2,087,748 |

FHLMC, 3.062%, 06/01/072,9 | | | 1,150,466 | | | 1,129,286 |

FHLMC, 4.999%, 05/15/062,9 | | | 12,708,301 | | | 12,711,810 |

FHLMC, 5.000%, 06/01/09 to 05/01/18 | | | 5,499,256 | | | 5,368,986 |

FHLMC, 5.500%, 08/01/19 to 12/01/17 | | | 3,092,248 | | | 3,073,296 |

FHLMC, 5.500%, TBA | | | 1,150,000 | | | 1,142,094 |

FHLMC, 5.580%, 10/01/102 | | | 1,831,402 | | | 1,827,598 |

FHLMC, 6.000%, 09/01/17 to 05/01/35 | | | 2,008,176 | | | 2,012,850 |

FHLMC, 7.500%, 04/01/15 | | | 879,770 | | | 916,155 |

FHLMC Gold Pool, 4.000%, 09/01/209 | | | 5,617,411 | | | 5,239,926 |

FHLMC Gold Pool, 5.000%, 04/01/19 to 08/01/19 | | | 1,103,166 | | | 1,076,154 |

FHLMC Gold Pool, 6.000%, 09/01/17 to 01/01/36 | | | 2,175,765 | | | 2,190,941 |

FHLMC Gold Pool, 7.500%, 04/01/15 to 04/01/29 | | | 447,150 | | | 467,121 |

FHLMC Gold Pool, 8.500%, 12/01/25 | | | 96,654 | | | 103,962 |

FHLMC Structured Pass Through Securities, | | | | | | |

4.391%, 11/25/38 | | | 900,000 | | | 885,091 |

FHLMC Structured Pass Through Securities, | | | | | | |

7.500%, 02/25/42 | | | 244,462 | | | 253,210 |

FHLMC Structured Pass Through Securities, | | | | | | |

7.500%, 08/25/422 | | | 424,166 | | | 434,093 |

Total Federal Home Loan Mortgage Corporation | | | | | | 41,094,420 |

| | |

Federal National Mortgage Association – 51.7% | | | | | | |

FNMA, 3.180%, 07/25/44 | | | 474,227 | | | 468,691 |

FNMA, 3.559%, 09/01/062 | | | 1,641,244 | | | 1,635,029 |

FNMA, 4.280%, 03/25/33 | | | 2,521,415 | | | 2,491,888 |

FNMA, 4.918%, 05/25/062 | | | 90,036 | | | 90,040 |

FNMA, 4.928%, 05/25/062 | | | 54,999 | | | 55,013 |

FNMA, 4.958%, 05/25/062 | | | 1,789,914 | | | 1,792,929 |

FNMA, 4.978%, 05/25/062,9 | | | 4,598,071 | | | 4,605,468 |

FNMA, 5.000%, 07/01/18 to 09/01/199 | | | 5,269,465 | | | 5,144,042 |

FNMA, 5.000%, TBA | | | 25,600,000 | | | 24,952,013 |

FNMA, 5.218%, 05/25/062,9 | | | 16,879,623 | | | 16,929,289 |

The accompanying notes are an integral part of these financial statements.

8

Managers Short Duration Government Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

| | | Principal

Amount | | Value |

Federal National Mortgage Association (continued) | | | | | | |

FNMA, 5.250%, 04/15/07 | | $ | 60,000 | | $ | 60,066 |

FNMA, 5.500%, 11/01/18 to 12/01/18 | | | 3,643,950 | | | 3,622,833 |

FNMA, 5.500%, TBA | | | 2,000,000 | | | 1,987,500 |

FNMA, 5.534%, 01/01/112 | | | 1,657,637 | | | 1,660,321 |

FNMA, 5.700%, 07/01/09 | | | 937,205 | | | 936,914 |

FNMA, 5.730%, 11/01/08 | | | 271,524 | | | 272,265 |

FNMA, 6.000%, 03/01/17 to 08/01/17 | | | 1,298,165 | | | 1,316,260 |

FNMA, 6.010%, 12/01/089 | | | 4,427,565 | | | 4,461,602 |

FNMA, 6.040%, 10/01/08 | | | 1,173,714 | | | 1,183,493 |

FNMA, 6.220%, 07/01/08 | | | 207,556 | | | 209,673 |

FNMA, 6.230%, 09/01/089 | | | 2,534,786 | | | 2,561,571 |

FNMA, 6.265%, 06/01/08 | | | 89,904 | | | 90,835 |

FNMA, 6.305%, 02/01/08 | | | 10,539 | | | 10,598 |

FNMA, 6.473%, 10/25/31 | | | 384,036 | | | 382,624 |

FNMA, 6.500%, 04/01/17 | | | 1,376,313 | | | 1,409,295 |

FNMA, 6.510%, 01/01/08 | | | 148,280 | | | 149,850 |

FNMA, 6.590%, 12/01/07 | | | 333,595 | | | 337,161 |

FNMA, 6.620%, 11/01/07 to 01/01/089 | | | 1,857,949 | | | 1,877,022 |

FNMA, 6.740%, 06/01/09 | | | 923,197 | | | 923,153 |

FNMA, 6.750%, 08/01/079 | | | 1,787,945 | | | 1,802,993 |

FNMA, 6.825%, 09/01/079 | | | 2,310,939 | | | 2,334,551 |

FNMA, 7.500%, 10/01/15 to 12/25/429 | | | 5,184,714 | | | 5,368,952 |

FNMA, 7.516%, 08/25/31 | | | 399,746 | | | 398,308 |

FNMA Grantor Trust, 4.938%, 05/25/062 | | | 877,247 | | | 877,494 |

FNMA Grantor Trust, 4.958%, 05/25/062 | | | 394,826 | | | 394,900 |

FNMA Grantor Trust, 4.968%, 05/25/062,9 | | | 3,632,451 | | | 3,635,976 |

FNMA Whole Loan, 5.018%, 05/25/062,9 | | | 8,591,762 | | | 8,622,877 |

FNMA Whole Loan, 5.268%, 05/25/062 | | | 1,773,960 | | | 1,783,027 |

Total Federal National Mortgage Association | | | | | | 106,836,516 |

| | |

Government National Mortgage Association – 20.0% | | | | | | |

GNMA, 3.500%, 10/01/062,9 | | | 10,507,839 | | | 10,252,765 |

GNMA, 3.750%, 04/01/072 | | | 657,889 | | | 654,910 |

GNMA, 4.000%, 07/01/06 to 04/01/072,9 | | | 4,887,508 | | | 4,859,042 |

GNMA, 4.250%, 04/01/072 | | | 221,160 | | | 222,360 |

GNMA, 4.375%, 07/01/06 to 04/01/072 | | | 4,314,916 | | | 4,325,436 |

GNMA, 4.500%, 10/01/06 to 04/01/072,9 | | | 17,262,929 | | | 17,237,234 |

GNMA, 4.750%, 10/01/062 | | | 560,784 | | | 563,721 |

GNMA, 5.000%, 01/01/072 | | | 1,431,038 | | | 1,433,696 |

GNMA, 5.125%, 01/01/072 | | | 1,400,139 | | | 1,408,344 |

The accompanying notes are an integral part of these financial statements.

9

Managers Short Duration Government Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

| | | Principal

Amount | | Value |

Government National Mortgage Association (continued) | | | | | | |

GNMA, 6.000%, 07/20/28 | | $ | 352,849 | | $ | 352,675 |

GNMA, 9.500%, 07/15/09 to 12/15/17 | | | 41,713 | | | 45,087 |

Total Government National Mortgage Association | | | | | | 41,355,270 |

| | |

Interest Only Strips – 1.7% | | | | | | |

FHLMC IO Strip, 2.351%, 05/15/062 | | | 499,727 | | | 22,560 |

FHLMC IO Strip, 4.500%, 08/15/35 to 09/15/35 | | | 1,071,027 | | | 270,548 |

FHLMC IO Strip, 5.000%, 07/15/20 to 08/01/35 | | | 6,848,721 | | | 1,556,667 |

FHLMC IO Strip, 7.500%, 10/01/27 | | | 94,622 | | | 21,822 |

FHLMC IO Strip, 8.000%, 06/01/31 | | | 23,839 | | | 5,437 |

FNMA IO Strip, 2.406%, 05/25/062 | | | 172,749 | | | 9,020 |

FNMA IO Strip, 5.000%, 02/01/35 to 12/01/35 | | | 5,852,612 | | | 1,485,344 |

FNMA IO Strip, 7.500%, 11/18/14 | | | 264,092 | | | 37,063 |

FNMA IO Strip, 8.000%, 08/25/22 to 05/01/30 | | | 366,344 | | | 87,199 |

FNMA IO Strip, 9.000%, 12/15/16 | | | 93,386 | | | 25,637 |

Total interest Only Strips | | | | | | 3,521,297 |

| | |

U.S. Treasury Notes – 0.6% | | | | | | |

USTN, 2.625%, 05/15/087 | | | 1,260,000 | | | 1,204,678 |

| | |

Total U.S. Government and Agency Obligations

(cost $197,226,205) | | | | | | 195,417,015 |

| | |

Corporate Bonds – 21.7% | | | | | | |

Asset-Backed Securities – 21.4% | | | | | | |

Asset Securitization Corp., 7.040%, 11/13/29 | | | 2,560,235 | | | 2,589,772 |

Countrywide Home Loans, 5.318%, 05/25/062 | | | 4,575,732 | | | 4,599,230 |

DLJ Commercial Mortgage Corp., 6.410%, 06/10/31 | | | 1,402,396 | | | 1,426,814 |

Fannie Mae Grantor Trust Pass Through, Series 2004-T1, Class 1A2, 6.500%, 01/25/44 | | | 1,455,904 | | | 1,481,996 |

First Franklin Mortgage Loan Asset Backed Certificates, Series 2005-FF10, Class A4, 5.138%, 05/25/062 | | | 1,800,000 | | | 1,802,250 |

GE Capital Commercial Mortgage Corporation, 6.496%, 01/15/33 | | | 525,000 | | | 546,232 |

GMAC, 6.957%, 09/15/35 | | | 1,570,000 | | | 1,661,957 |

GMAC, 7.724%, 03/15/337 | | | 7,341,000 | | | 7,884,136 |

GMAC, Series 2000-C2, Class A2, 7.455%, 08/16/33 | | | 1,130,000 | | | 1,208,045 |

Greenwich Capital Commercial Funding Corp., Class A2, Series 2005-GG3, 4.305%, 08/10/42 | | | 1,754,000 | | | 1,692,755 |

Harborview Mortgage Loan Trust, 5.186%, 05/19/062 | | | 5,160,143 | | | 5,172,735 |

LB Commercial Conduit Mortgage Trust, 5.870%, 10/15/35 | | | 19,019 | | | 18,979 |

Merrill Lynch Mortgage Investors, Inc., 7.560%, 11/15/31 | | | 2,650,202 | | | 2,784,893 |

Morgan Stanley Capital, Inc. 6.760%, 03/15/32 | | | 531,697 | | | 534,583 |

The accompanying notes are an integral part of these financial statements.

10

Managers Short Duration Government Fund

Schedule of Portfolio Investments (continued)

| | | | | | | |

| | | Principal

Amount | | Value | |

Asset-Backed Securities (continued) | | | | | | | |

PNC Mortgage Acceptance, 7.300%, 10/12/33 | | $ | 2,351,000 | | $ | 2,503,359 | |

Salomon Brothers Mortgage, 7.455%, 07/18/33 | | | 326,732 | | | 345,647 | |

Structured Asset Investment Loan Trust, 5.358%, 05/25/062 | | | 5,000,000 | | | 5,032,840 | |

Washington Mutual, Class 2A3, Series 2005-AR2, 5.168%, 05/25/062 | | | 2,945,650 | | | 2,953,330 | |

Total Asset-Backed Securities | | | | | | 44,239,553 | |

| | |

Asset-Backed Interest Only Strips – 0.3% | | | | | | | |

Bank of America-First Union IO Strip, Series 2001-3, Class XC, 0.678%, 04/11/372,3 | | | 5,297,205 | | | 225,994 | |

CS First Boston Mortgage Sec. Corp., IO Strip, Series 1998-C1, Class AX, 0.974%, 05/17/402 | | | 3,440,627 | | | 109,573 | |

CS First Boston Mortgage IO Strip, 0.595%, 12/15/352,3 | | | 1,730,895 | | | 73,624 | |

GMAC, Series 1999-C1 IO Strip, Class X, 0.589%, 05/15/332 | | | 10,215,132 | | | 179,548 | |

Total Asset-Backed Interest Only Strips | | | | | | 588,739 | |

Total Corporate Bonds

(cost $46,544,130) | | | | | | 44,828,292 | |

| | |

| | | Shares | | | |

Preferred Stock – 0.9%3 | | | | | | | |

Home Ownership Funding Corp., 13.331% (cost $2,166,841) | | | 7,300 | | | 1,750,403 | |

| | |

| | | Notional

Amount | | | |

Swaptions – 0.1% | | | | | | | |

3-Month LIBOR, 30 Year Swap (Call), 5.085%, 06/28/06 | | $ | 3,900,000 | | $ | 2,243 | |

3-Month LIBOR, 30 Year Swap (Put), 5.085%, 06/28/06 | | | 3,900,000 | | | 230,226 | |

Total Swaptions

(cost $272,025) | | | | | | 232,469 | |

| | |

| | | Shares | | | |

Short-Term Investments – 6.9% | | | | | | | |

Other Investment Companies – 6.5%4 | | | | | | | |

Bank of New York Institutional Cash Reserves Fund, 4.77%8 | | | 6,130,428 | | | 6,130,428 | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 4.53% | | | 7,199,568 | | | 7,199,568 | |

Total Other Investment Companies | | | | | | 13,329,996 | |

| | |

| | | Principal

Amount | | | |

U.S. Government Agency Discount Notes – 0.4%5,6 | | | | | | | |

FHLMC Discount Notes, 0.000%, 05/30/06 - 09/29/06 | | $ | 775,000 | | | 759,969 | |

FNMA Discount Notes, 0.000%, 07/17/06 | | | 100,000 | | | 98,594 | |

Total U.S. Government Agency Discount Notes | | | | | | 858,563 | |

| | |

Total Short-Term Investments

(cost $14,190,134) | | | | | | 14,188,559 | |

| | |

Total Investments - 124.2%

(cost $260,399,335) | | | | | | 256,416,738 | |

| | |

Other Assets, less Liabilities - (24.2)% | | | | | | (49,893,340 | ) |

| | |

Net Assets - 100.0% | | | | | $ | 206,523,398 | |

The accompanying notes are an integral part of these financial statements.

11

Managers Intermediate Duration Government Fund

Portfolio Manager’s Comments

The Managers Intermediate Duration Government Fund’s objective is to achieve total return in excess of the total return of the major market indices for mortgage-backed securities.

The Managers Intermediate Duration Government Fund seeks to achieve its objective by matching the duration, or interest-rate risk, of a portfolio that invests exclusively in mortgage-backed securities, as weighted in the major market indices for mortgage-backed securities. These indices currently include the Citigroup Mortgage Index and the Lehman Brothers Mortgage Index, each of which includes all outstanding government sponsored fixed-rate mortgage-backed securities, weighted in proportion to their current market capitalization. The duration of these indices is generally similar to that of intermediate-term U.S. Treasury Notes, and typically will range between three and five years.

Under normal circumstances, the Fund will invest at least 80% of its assets in debt securities issued by the U.S. Government, its agencies and instrumentalities, and synthetic instruments or derivatives, or securities having economic characteristics similar to such debt securities. The Fund’s benchmark is the Citigroup Mortgage Index.

The Portfolio Manager

Smith Breeden Associates, Inc. (“Smith Breeden”) is the subadvisor for the Managers Short Duration Government Bond Fund. Smith Breeden, located at 100 Europa Drive, Suite 200, Chapel Hill, NC., was founded in 1982. Smith Breeden is a money management and consulting firm involved in money management for separate accounts such as pensions and endowments, financial institution consulting and investment advice, and equity investments. The firm specializes in high credit quality fixed-income investments, interest rate risk management, and the application of option pricing to banking and investments. As of December 31, 2005, Smith Breeden advised or managed assets of approximately $27.5 billion.

Smith Breeden believes that innovative research provides critical insights into the fixed income market. The firm’s experienced investment professionals apply these research insights to the management of investment portfolios designed to achieve our clients’ objectives. The key tenets of this market-tested investment philosophy are:

| | • | | Over a market cycle, a portfolio of fixed-income securities with wide risk-adjusted spreads produces an attractive total return in comparison to the market return. |

| | • | | The incremental return available from security selection and sector allocation, based on careful relative-value analysis, quantitative research, and experienced market judgment, is more consistent than the incremental return from predicting the direction of interest rates. |

| | • | | Within the investment grade fixed income market, the spread sectors i.e., corporate bonds, mortgage-backed securities (MBS), commercial MBS (CMBS), and asset-backed securities (ABS) will tend to outperform Treasury securities over a market cycle. The mortgage, corporate, CMBS, and ABS sectors also offer the greatest active management opportunity for adding value through security selection. |

12

Managers Intermediate Duration Government Fund

Portfolio Manager’s Comments (continued)

The portfolio management team at Smith Breeden Associates specializes in analyzing and investing in mortgage-backed securities. Through careful analysis and comparison of the characteristics of these securities, such as type of issuer, coupon, maturity, geographic structure, and historic and prospective prepayment rates, the team seeks to structure a portfolio that will outperform the Citigroup Mortgage Index. While the portfolio managers will purchase securities of any maturity or duration, they do not attempt to add value by actively positioning the interest rate sensitivity of the portfolio. Instead, they typically manage the weighted average duration of the portfolio so that it is similar to that of the duration of the Citigroup Mortgage Index.

The ideal investment exhibits many of the following traits:

| | • | | Very high quality (AAA or Government) |

| | • | | Attractive value relative to other MBS opportunities |

Limits purchases to securities from the following asset classes:

| | • | | Securities issued directly or guaranteed by the U.S. Government or its agencies or instrumentalities |

| | • | | Mortgage-backed securities rated AAA Standard & Poor’s Corporation (“S&P”) or Aaa by Moody’s Investors Service, Inc. (“Moody’s”) |

| | • | | Securities fully collateralized by assets in either of the above classes |

| | • | | Assets which would qualify as liquidity items under federal regulations (which may change from time to time) if held by a commercial bank or savings institution; and hedge instruments |

| | • | | Stripped mortgage-backed securities, which may only be used for risk management purposes |

The investment team will make a sell decision when:

| | • | | They no longer view the bonds as attractive |

| | • | | To maintain the portfolio’s target duration |

| | • | | For portfolio allocation purposes |

The Year in review

During the 12 months ended March 31, 2006, the Fund returned +2.02% compared to +2.78% for its benchmark, the Citigroup Mortgage Index (“Citi Mortgage”).

U.S. interest rates rose during the 12 months ended March 31, 2006. However, in response to 8 policy rate hikes by the Federal Open Market Committee (FOMC), shorter-term rates increased much more dramatically than longer-term rates. Thus, the U.S. yield curve flattened significantly during the period. Indeed, portions of the yield curve inverted, such that shorter-term rates had higher yields than longer-term rates. The securitized portions of the bond market, including the mortgage-backed securities (MBS), asset-backed securities (ABS), and commercial mortgage-backed

13

Managers Intermediate Duration Government Fund

Portfolio Manager’s Comments (continued)

securities (CMBS) sectors, generally outperformed like-duration Treasuries during the quarter. Within the MBS sector, GNMA bonds slightly outperformed Treasuries while FHLMC—issued bonds slightly underperformed. Meanwhile, the ABS sector offered about 0.50% (50 basis points) of excess returns over like-duration Treasuries, thanks in part to the continued strength of the U.S. economy.

The Fund’s performance lagged the benchmark slightly during the 12 months ended March 31, 2006. It should be noted that mortgage benchmarks are difficult for mutual funds to outperform on a consistent basis. In particular, many of the securities included in MBS benchmarks are “seasoned” bonds that have very little liquidity, and are thus difficult for portfolio managers to obtain with any consistency. Because they are so thinly traded, they may offer yields that are higher than typically available in the marketplace. Put another way, the liquidity required by the daily flows into and out of open end mutual funds often results in slight underperformance relative to the benchmarks on a fairly regular basis. During the 12 months, the Fund’s performance, gross of expenses, was generally in line with the MBS market. On the positive side, the Fund’s interest-only bonds (IOs) posted strong gains slowing prepayment and expectations of a higher and steeper yield curve. On the other hand, the Fund was generally underweight GNMA bonds and overweight FNMAs, which helped during the first quarter of 2006 but was generally costly for the whole twelve months.

Looking Forward

Heading into the next fiscal year, the Fund continues to have a conservative aggregate MBS exposure, despite what portfolio manager Dan Adler views as “fair” mortgage option-adjusted spread (OAS) levels. Adler believes the risk-reward calculus for owning MBS is currently “slightly skewed” due to extension concerns, as the market tests the highs in rates of the last several years. The Fund remains underweight GNMA securities, as the investment team at Smith Breeden thinks that, at current spread levels, they offer little fundamental value when compared to their conventional counterparts. Finally, Dan continues to hold positions in IOs as a deceleration in the U.S. housing market could result in strong performance of discount interest only strips which are securities based solely on the interest payments from a pool of mortgages or other bonds.

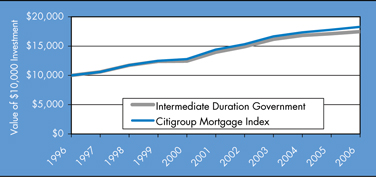

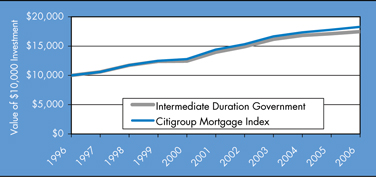

Cumulative Total Return Performance

Managers Intermediate Duration Government Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. Unlike the Fund, the Citigroup Mortgage Index is unmanaged, is not available for investment, and does not incur expenses. The chart illustrates the performance of a hypothetical $10,000 investment made in the Fund on March 31, 1996 to a $10,000 investment made in the Citigroup Mortgage Index for the same time periods. Figures include reinvestment of capital gains and dividends. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns for the Fund would have been lower had certain expenses not been reduced.

14

Managers Intermediate Duration Government Fund

Portfolio Manager’s Comments (continued)

The table below shows the average annualized total returns for the Managers Intermediate Duration Government Fund and the Citigroup Mortgage Index for the 1, 5 and 10 years ended March 31, 2006.

| | | | | | | | | |

Average Annual Total Returns: | | 1 Year | | | 5 Years | | | 10 Years | |

Intermediate Duration Government | | 2.02 | % | | 4.60 | % | | 5.74 | % |

Citigroup Mortgage Index | | 2.78 | % | | 4.89 | % | | 6.22 | % |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end please call (800) 835-3879 or visit our Web site at www.managersinvest.com.

Changing interest rates may adversely affect the value of an investment. An increase in interest rates typically causes the value of bonds and other fixed-income securities to fall.

The Fund may use derivative instruments for hedging purposes or as part of its investment strategy. There is also a risk that a derivative intended as a hedge may not perform as expected. The main risks with derivatives is that some types can amplify a gain or loss, potentially earning or losing substantially more money than the actual cost of the derivative; or that the counterparty may fail to honor its contract terms, causing a loss for the Fund. Use of these instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk, and the risk that a fund could not close out a position when it would be most advantageous to do so.

Not FDIC insured, nor bank guaranteed. May lose value.

15

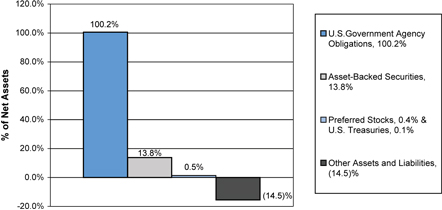

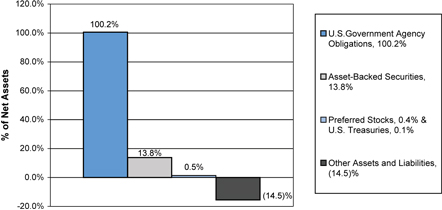

Managers Intermediate Duration Government Fund

Fund Snapshots

March 31, 2006

Portfolio Breakdown

Managers Intermediate Duration Government Fund

Top Ten Holdings

| | | |

Top Ten Holdings (out of 70 securities) | | % of

Net Assets | |

FHLMC Gold Pool, 5.500%, 01/01/35 to 06/01/35* | | 21.9 | % |

FNMA, 5.000%, TBA* | | 19.6 | |

FHLMC Gold Pool, 4.500%, 05/01/34 to 01/01/36 | | 10.1 | |

FHLMC, 6.000%, 09/01/17 to 06/01/35* | | 7.9 | |

FHLMC, 5.639%, 01/01/36 | | 6.2 | |

FNMA, 5.500%, TBA* | | 5.8 | |

FHLMC Gold Pool, 6.000%, 05/01/35 to 01/01/36 | | 5.5 | |

FHLMC, 5.500%, 01/01/18 to 07/01/35* | | 4.0 | |

FNMA, 4.500%, 12/01/18 to 09/01/35 | | 3.6 | |

FNMA, 5.500%, 03/01/17 to 03/01/19 | | 2.4 | |

| | | |

Top Ten as a Group | | 87.0 | % |

| | | |

| * | Top Ten Holding at September 30, 2005. |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security.

16

Managers Intermediate Duration Government Fund

Schedule of Portfolio Investments

March 31, 2006

| | | | | | |

| | | Principal

Amount | | Value |

U.S. Government and Agency Obligations – 100.2%1 | | | | | | |

Federal Home Mortgage Corporation – 57.9% | | | | | | |

FHLMC, 4.500%, 04/01/35 | | $ | 860,520 | | $ | 795,771 |

FHLMC, 5.000%, 05/01/18 | | | 618,489 | | | 603,933 |

FHLMC, 5.500%, 01/01/18 to 07/01/35 | | | 7,974,297 | | | 7,842,976 |

FHLMC, 5.500%, TBA | | | 500,000 | | | 488,125 |

FHLMC, 5.639%, 01/01/132,9 | | | 12,098,000 | | | 12,026,441 |

FHLMC, 6.000%, 09/01/17 to 06/01/359 | | | 15,254,789 | | | 15,275,173 |

FHLMC, 7.500%, 01/01/31 | | | 97,345 | | | 101,832 |

FHLMC Gold Pool, 4.000%, 09/01/20 | | | 1,184,258 | | | 1,104,678 |

FHLMC Gold Pool, 4.500%, 05/01/34 to 01/01/369 | | | 21,383,059 | | | 19,732,535 |

FHLMC Gold Pool, 5.000%, 04/01/19 to 08/01/19 | | | 505,713 | | | 493,330 |

FHLMC Gold Pool, 5.500%, 01/01/35 to 06/01/359 | | | 43,573,654 | | | 42,603,634 |

FHLMC Gold Pool, 6.000%, 05/01/35 to 01/01/369 | | | 10,727,138 | | | 10,734,608 |

FHLMC, Series 2186, Class PG, 6.000%, 07/15/28 | | | 131,651 | | | 132,467 |

FHLMC Structured Pass Through Securities, 7.500%, 08/25/422 | | | 593,833 | | | 607,730 |

Total Federal Home Loan Mortgage Corporation | | | | | | 112,543,233 |

| | |

Federal National Mortgage Association – 38.1% | | | | | | |

FNMA, 4.500%, 12/01/18 to 09/01/359 | | | 7,569,414 | | | 7,001,285 |

FNMA, 5.000%, 06/01/18 to 07/01/18 | | | 1,690,220 | | | 1,651,184 |

FNMA, 5.000%, TBA | | | 39,600,000 | | | 38,059,197 |

FNMA, 5.218%, 05/25/062,9 | | | 3,667,637 | | | 3,666,881 |

FNMA, 5.500%, 03/01/17 to 03/01/19 | | | 4,676,809 | | | 4,651,062 |

FNMA, 5.500%, TBA | | | 11,500,000 | | | 11,223,288 |

FNMA, 5.632%, 01/01/112 | | | 593,498 | | | 595,475 |

FNMA, 6.000%, 08/01/17 | | | 723,990 | | | 734,060 |

FNMA, 6.000%, TBA | | | 2,000,000 | | | 1,999,376 |

FNMA, 6.500%, TBA | | | 300,000 | | | 306,000 |

FNMA, 6.500%, 11/01/28 to 07/01/32 | | | 1,036,172 | | | 1,059,135 |

FNMA, 7.000%, 03/25/24 | | | 2,750,000 | | | 2,849,999 |

FNMA, 7.500%, 10/25/42 | | | 343,666 | | | 355,809 |

Total Federal National Mortgage Association | | | | | | 74,152,751 |

| | |

Government National Mortgage Association – 0.6% | | | | | | |

GNMA, 4.375%, 07/01/06 to 04/01/072 | | | 243,215 | | | 243,896 |

GNMA, 4.750%, 10/01/062 | | | 178,944 | | | 179,860 |

GNMA, 5.125%, 01/01/072 | | | 564,632 | | | 567,933 |

GNMA, 7.500%, 09/15/28 to 11/15/31 | | | 169,047 | | | 177,496 |

Total Government National Mortgage Association | | | | | | 1,169,185 |

The accompanying notes are an integral part of these financial statements.

17

Managers Intermediate Duration Government Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

| | | Principal

Amount | | Value |

Interest/Principal Only Strips – 3.6% | | | | | | |

FHLMC IO Strip, 1.951%, 05/15/062 | | $ | 1,115,004 | | $ | 45,949 |

FHLMC IO Strip, 2.351%, 05/15/062 | | | 405,882 | | | 18,323 |

FHLMC IO Strip, 2.901%, 05/15/062 | | | 973,318 | | | 50,909 |

FHLMC IO Strip, 3.151%, 05/15/062 | | | 142,316 | | | 11,667 |

FHLMC IO Strip, 4.500%, 04/15/22 to 09/15/35 | | | 2,140,524 | | | 480,024 |

FHLMC IO Strip, 5.000%, 05/15/17 to 08/01/35 | | | 11,862,948 | | | 2,809,160 |

FHLMC IO Strip, 6.000%, 05/01/31 | | | 18,200 | | | 4,199 |

FNMA IO Strip, 4.000%, 09/01/33 to 09/01/34 | | | 2,140,018 | | | 303,840 |

FNMA IO Strip, 4.500%, 07/25/19 to 12/01/35 | | | 972,774 | | | 146,946 |

FNMA IO Strip, 5.000%, 11/01/33 to 12/01/35 | | | 10,497,966 | | | 2,550,956 |

FNMA IO Strip, 7.000%, 04/01/23 to 06/01/23 | | | 626,937 | | | 137,088 |

FNMA PO Strip, 4.898%, 07/01 /335,10 | | | 619,883 | | | 441,957 |

Total Interest/Principal Only Strips | | | | | | 7,001,018 |

| | |

Total U.S. Government and Agency Obligations

(cost $198,307,916) | | | | | | 194,866,187 |

| | |

Asset-Backed Securities – 13.8% | | | | | | |

American Home Loan Investment Trust, 5.294%, 03/25/102 | | | 2,929,587 | | | 2,902,573 |

American Home Mortgage Investment Trust, 3.280%, 02/25/092 | | | 523,700 | | | 506,749 |

American Home Mortgage Investment Trust, 4.390%, 11/25/092 | | | 2,171,711 | | | 2,115,053 |

American Home Mortgage Investment Trust, 5.001%, 03/25/082 | | | 576,746 | | | 570,410 |

Bank of America Funding Corp., 3.989%, 12/20/342 | | | 1,115,150 | | | 1,106,436 |

Bear Stearns Alt-A Trust, 4.971%, 04/25/352 | | | 859,212 | | | 847,498 |

Countrywide Alternative Loan Trust, 5.118%, 05/25/062 | | | 1,277,546 | | | 1,271,511 |

Countrywide Alternative Loan Trust, 6.000%, 06/25/34 | | | 936,323 | | | 922,296 |

Countrywide Home Loans, Inc., 4.512%, 05/20/352 | | | 529,967 | | | 522,232 |

Countrywide Home Loans, Inc., Series 2004-R2, Class 1AF1, 5.238%, 05/25/062,3 | | | 805,415 | | | 801,466 |

Countrywide Home Loans, Inc., Series 2005-HYB8, Class 1A1, 5.118%, 12/20/352 | | | 434,715 | | | 432,084 |

DLJ Commercial Mortgage Corp., 6.410%, 06/10/31 | | | 217,763 | | | 221,555 |

GSMPS Mortgage Loan Trust, 5.168%, 05/25/062 | | | 630,714 | | | 633,336 |

GSR Mortgage Loan Trust, 3.685%, 02/25/072 | | | 795,933 | | | 783,380 |

Harborview Mortgage Loan Trust, 3.764%, 11/19/342 | | | 889,011 | | | 872,722 |

Master Alternative Loans Trust, 6.000%, 01/25/35 | | | 2,337,693 | | | 2,327,036 |

The accompanying notes are an integral part of these financial statements.

18

Managers Intermediate Duration Government Fund

Schedule of Portfolio Investments (continued)

| | | | | | | |

| | | Principal

Amount | | Value | |

Asset-Backed Securities (continued) | | | | | | | |

Merrill Lynch Mortgage Investors, Inc., 7.560%, 11/15/31 | | $ | 1,939,640 | | $ | 2,038,219 | |

Morgan Stanley Mortgage Loan Trust, 6.198%, 08/25/352 | | | 2,320,139 | | | 2,318,689 | |

New Century Home Equity Loan Trust, 5.068%, 05/25/062 | | | 93,020 | | | 93,040 | |

Residential Asset Mortgage Products, Inc., Series-RS1, Class AII-1, 4.928%, 05/25/062 | | | 1,029,174 | | | 1,029,379 | |

Residential Asset Securities Corp., Series 2004-KS11, Class AI-1, 4.958%, 05/25/062 | | | 42,896 | | | 42,888 | |

Structured Asset Securities Corp., Series 2005-RFI, Class A, 5.168%, 05/25/062 | | | 767,865 | | | 766,526 | |

Washington Mutual Mortgage Pass-Through Certificates, 6.000%, 10/25/35 | | | 3,660,281 | | | 3,637,810 | |

Total Asset-Backed Securities

(cost $27,232,884) | | | | | | 26,762,888 | |

| | |

| | | Shares | | | |

Preferred Stocks - 0.4%3 | | | | | | | |

Home Ownership Funding Corp., 13.331% | | | 1,500 | | | 359,672 | |

Home Ownership Funding Corp. 2, 13.338% | | | 1,500 | | | 359,766 | |

Total Preferred Stocks

(cost $694,698) | | | | | | 719,438 | |

| | |

Short-Term Investments – 13.6% | | | | | | | |

Other Investment Companies – 13.5%4 | | | | | | | |

AIM Liquid Assets Portfolio, Institutional Class Shares, 4.66%9 | | | 9,113,253 | | | 9,113,253 | |

Calvert Cash Reserves Institutional Prime Fund, Institutional Class Shares, 4.49% | | | 12,624,549 | | | 12,624,549 | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 4.53% | | | 4,571,831 | | | 4,571,831 | |

Total Other Investment Companies | | | | | | 26,309,633 | |

| | |

| | | Principal

Amount | | | |

U.S. Government Agency Discount Notes – 0.1%5,6 | | | | | | | |

FHLMC Discount Notes, 0.000%, 08/22/06 | | $ | 250,000 | | $ | 245,232 | |

| | |

Total Short-Term Investments

(cost $26,309,633) | | | | | | 26,554,865 | |

| | |

Total Investments - 128.0%

(cost $252,545,131) | | | | | | 248,903,378 | |

| | |

Other Assets, less Liabilities - (28.0)% | | | | | | (54,358,011 | ) |

| | |

Net Assets - 100.0% | | | | | $ | 194,545,367 | |

The accompanying notes are an integral part of these financial statements.

19

The Managers Funds

Notes to Schedules of Portfolio Investments

The following footnotes and abbreviations are to be read in conjunction with the Schedules of Portfolio Investments previously presented in this report.

At March 31, 2006, the cost of securities for Federal income tax purposes and the gross aggregate unrealized appreciation and/or depreciation based on tax cost were approximately as follows:

| | | | | | | | | | | | | | |

Fund | | Cost | | Appreciation | | Depreciation | | | Net | |

Short Duration | | $ | 260,399,335 | | $ | 686,978 | | $ | (4,669,575 | ) | | $ | (3,982,597 | ) |

Intermediate Duration | | | 252,545,131 | | | 563,266 | | | (4,205,019 | ) | | | (3,641,753 | ) |

| 1 | Mortgage-backed obligations and other assets are subject to principal paydowns as a result of prepayments or refinancing of the underlying mortgage instruments. As a result, the average life may be substantially less than the original maturity. The interest rate shown is the rate in effect at March 31, 2006. |

| 2 | Adjustable-rate mortgages with coupon rates that adjust periodically. The interest rate shown is the rate in effect at March 31, 2006. |

| 3 | Security is exempt from registration under Rule 144A of the Securities Act of 1 933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified buyers. At March 31, 2006, the value of these securities amounted to the following: |

| | | | | | |

Fund | | Market Value | | % of Net Assets | |

Short Duration | | $ | 2,050,021 | | 1.0 | % |

Intermediate Duration | | | 1,520,904 | | 0.8 | % |

| 4 | Yield shown for an investment company represents the March 31, 2006, seven-day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

| 6 | Security pledged to cover margin requirements for open futures positions at March 31, 2006. |

| 7 | Some or all of these securities were out on loan to various brokers as of March 31, 2006, amounting to $5,943,811 representing 3.0% of net assets for Short Duration. |

| 8 | Collateral received from brokers for securities lending was invested in these short-term investments. |

| 9 | All or part of security has been segregated for delayed delivery transactions and reverse repurchase agreements. |

| 10 | Indicates yield to maturity at March 31, 2006. |

| | |

Investments Abbreviations: | | |

| DLJ: Donaldson, Lufkin & Jenrette Securities Corp. | | GSR: Goldman Sachs REMIC |

| |

| FHA/VA: Federal Home Association/Veteran’s Association | | IO: Interest Only |

| |

| FHLMC: Federal Home Loan Mortgage Corp. | | LIBOR: London Interbank Offering Rate |

| |

| FNMA: Federal National Mortgage Association | | PO: Principal Only |

| |

| GMAC: General Motors Acceptance Corp. | | TBA: To Be Announced |

| |

| GNMA: Government National Mortgage Association | | USTN: United States Treasury Note |

| |

| GSMPS: Goldman Sachs Mortgage Participating Security | | |

Security Ratings (unaudited):

The composition of debt holdings as a percentage of portfolio assets is as follows:

| | | | | | | | | | | | | | | | | | |

S&P/Moody’s Ratings | | Gov’t/AAA | | | AA | | | A | | | BBB | | | BB | | | Not Rated | |

Short Duration | | 97.4 | % | | 0.7 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % | | 1.9 | % |

Intermediate Duration | | 99.8 | % | | 0.2 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % |

20

The Managers Funds

Statements of Assets and Liabilities

March 31, 2006

| | | | | | | | |

| | | Managers Short Duration

Government Fund | | | Managers Intermediate Duration

Government Fund | |

Assets: | | | | | | | | |

| | |

Investments at value (including securities on loan valued at $5,943,811 and $0, respectively) | | $ | 256,416,738 | | | $ | 248,903,378 | |

Cash | | | 186,307 | | | | — | |

Receivable for investments sold | | | 37,351 | | | | 28,125,625 | |

Receivable for TBA sale commitment | | | — | | | | 5,702,094 | |

Receivable for Fund shares sold | | | 1,131,572 | | | | 200,272 | |

Dividends, interest and other receivables | | | 880,712 | | | | 1,108,541 | |

Receivable for variation margin on futures | | | 10,365 | | | | 9,305 | |

Prepaid expenses | | | 13,033 | | | | 14,015 | |

| | | | | | | | |

Total assets | | | 258,676,078 | | | | 284,063,230 | |

| | | | | | | | |

Liabilities: | | | | | | | | |

| | |

Payable to Custodian | | | — | | | | 1,833,448 | |

Payable upon return of securities loaned | | | 6,130,428 | | | | — | |

Payable for investments purchased | | | — | | | | 72,311,425 | |

Payable for investments purchased on a when-issued basis | | | 28,265,321 | | | | 8,532,828 | |

Payable for Fund shares repurchased | | | 1,608,241 | | | | 876,201 | |

Payable for TBA sale commitment (at value $5,702,094) | | | — | | | | 5,680,250 | |

Reverse repurchase agreements (proceeds $15,898,000) | | | 15,918,977 | | | | — | |

Payable for variation margin on futures | | | 24,332 | | | | 1,106 | |

Investment advisory and management fee payable | | | 123,500 | | | | 119,310 | |

Other accrued expenses | | | 81,881 | | | | 163,295 | |

| | | | | | | | |

Total liabilities | | | 52,152,680 | | | | 89,517,863 | |

| | | | | | | | |

Net Assets | | $ | 206,523,398 | | | $ | 194,545,367 | |

| | | | | | | | |

Shares outstanding | | | 21,491,781 | | | | 18,759,834 | |

Net asset value, offering and redemption price per share | | $ | 9.61 | | | $ | 10.37 | |

| | |

Net Assets Represent: | | | | | | | | |

Paid-in capital | | $ | 213,018,852 | | | $ | 199,319,198 | |

Undistributed net investment income | | | 727,076 | | | | 54,798 | |

Accumulated net realized loss from investments, options, futures contracts and TBA sale commitment. | | | (4,603,284 | ) | | | (1,072,802 | ) |

Net unrealized depreciation of investments, options, futures contracts and TBA sale commitment. | | | (2,619,246 | ) | | | (3,755,827 | ) |

| | | | | | | | |

Net Assets | | $ | 206,523,398 | | | $ | 194,545,367 | |

| | | | | | | | |

____________ * Investments at cost | | $ | 260,399,335 | | | $ | 252,545,131 | |

The accompanying notes are an integral part of these financial statements.

21

The Managers Funds

Statements of Operation

For the fiscal year ended March 31, 2006

| | | | | | | | |

| | | Managers

Short Duration

Government

Fund | | | Managers

Intermediate

Duration

Government Fund | |

Investment Income: | | | | | | | | |

Interest income | | $ | 10,489,260 | | | $ | 6,292,000 | |

Dividend income | | | 348,222 | | | | 2,558,396 | |

Securities lending fees | | | 5,519 | | | | 168 | |

| | | | | | | | |

Total investment income | | | 10,843,001 | | | | 8,850,564 | |

| | | | | | | | |

Expenses: | | | | | | | | |

Investment advisory and management fees | | | 1,696,648 | | | | 1,392,807 | |

Custodian | | | 104,745 | | | | 76,816 | |

Interest expense | | | 569,342 | | | | — | |

Transfer agent | | | 84,769 | | | | 70,495 | |

Professional fees | | | 55,594 | | | | 44,148 | |

Registration fees | | | 43,623 | | | | 46,947 | |

Trustees fees and expenses | | | 13,028 | | | | 12,436 | |

Shareholder reports | | | 23,856 | | | | 26,151 | |

Miscellaneous | | | 16,718 | | | | 12,577 | |

| | | | | | | | |

Total expenses before offsets | | | 2,608,323 | | | | 1,682,377 | |

| | | | | | | | |

Expense (reimbursement) recoupment | | | (24,445 | ) | | | 69,577 | |

Expense reductions | | | (1,084 | ) | | | (177 | ) |

| | | | | | | | |

Net expenses | | | 2,582,794 | | | | 1,751,777 | |

| | | | | | | | |

Net investment income | | | 8,260,207 | | | | 7,098,787 | |

| | | | | | | | |

Net Realized and Unrealized Gain (Loss): | | | | | | | | |

Net realized loss on investments | | | (396,438 | ) | | | (700,151 | ) |

Net realized gain (loss) on options and futures contracts | | | 833,466 | | | | (30,469 | ) |

Net unrealized depreciation of investments | | | (1,645,868 | ) | | | (2,438,188 | ) |

Net unrealized appreciation (depreciation) of options and futures contracts | | | 18,056 | | | | (110,781 | ) |

| | | | | | | | |

Net realized and unrealized loss | | | (1,190,784 | ) | | | (3,279,589 | ) |

| | | | | | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 7,069,423 | | | $ | 3,819,198 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

22

Managers Short Duration Government Fund

Statement of Changes in Net Assets

For the fiscal year ended March 31,

| | | | | | | | |

| | | 2006 | | | 2005 | |

Increase (Decrease) in Net Assets From Operations: | | | | | | | | |

Net investment income | | $ | 8,260,207 | | | $ | 6,420,081 | |

Net realized gain (loss) on investments, options and futures | | | 437,028 | | | | (258,797 | ) |

Net unrealized depreciation of investments, options and futures | | | (1,627,812 | ) | | | (389,907 | ) |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 7,069,423 | | | | 5,771,377 | |

| | | | | | | | |

Distributions to Shareholders: | | | | | | | | |

From net investment income | | | (8,321,069 | ) | | | (6,454,110 | ) |

| | | | | | | | |

Total distributions to shareholders | | | (8,321,069 | ) | | | (6,454,110 | ) |

| | | | | | | | |

From Capital Share Transactions: | | | | | | | | |

Proceeds from sale of shares | | | 160,082,951 | | | | 196,835,900 | |

Net asset value of shares issued in connection with reinvestment of dividends | | | 7,882,937 | | | | 6,063,410 | |

Cost of shares repurchased | | | (198,090,359 | ) | | | (163,042,611 | ) |

| | | | | | | | |

Net increase (decrease) from capital share transactions | | | (30,124,471 | ) | | | 39,856,699 | |

| | | | | | | | |

Total increase (decrease) in net assets | | | (31,376,117 | ) | | | 39,173,966 | |

| | |

Net Assets: | | | | | | | | |

Beginning of year | | | 237,899,515 | | | | 198,725,549 | |

| | | | | | | | |

End of year | | $ | 206,523,398 | | | $ | 237,899,515 | |

| | | | | | | | |

End of year undistributed net investment income | | $ | 727,076 | | | $ | 785,029 | |

| | |

Share Transactions: | | | | | | | | |

Sale of shares | | | 16,712,702 | | | | 20,363,614 | |

Shares issued in connection with reinvestment of dividends | | | 820,082 | | | | 628,230 | |

Shares repurchased | | | (20,675,431 | ) | | | (16,869,219 | ) |

| | | | | | | | |

Net increase (decrease) in shares | | | (3,142,647 | ) | | | 4,122,625 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

23

Managers Intermediate Duration Government Fund

Statement of Changes in Net Assets

For the fiscal year ended March 31,

| | | | | | | | |

| | | 2006 | | | 2005 | |

Increase (Decrease) in Net Assets From Operations: | | | | | | | | |

Net investment income | | $ | 7,098,787 | | | $ | 3,660,891 | |

Net realized gain (loss) on investments, options and futures | | | (730,620 | ) | | | 50,366 | |

Net unrealized depreciation of investments, options and futures | | | (2,548,969 | ) | | | (1,369,208 | ) |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 3,819,198 | | | | 2,342,049 | |

| | | | | | | | |

Distributions to Shareholders: | | | | | | | | |

From net investment income | | | (7,085,544 | ) | | | (3,593,598 | ) |

From realized gains on investments | | | — | | | | (2,188,496 | ) |

| | | | | | | | |

Total distributions to shareholders | | | (7,085,544 | ) | | | (5,782,094 | ) |

| | | | | | | | |

From Capital Share Transactions: | | | | | | | | |

Proceeds from sale of shares | | | 101,429,509 | | | | 137,550,031 | |

Net asset value of shares issued in connection with reinvestment of dividends and distributions | | | 6,437,795 | | | | 4,320,112 | |

Cost of shares repurchased | | | (96,081,215 | ) | | | (76,230,581 | ) |

| | | | | | | | |

Net increase from capital share transactions | | | 11,786,089 | | | | 65,639,562 | |

| | | | | | | | |

Total increase in net assets | | | 8,519,743 | | | | 62,199,517 | |

| | |

Net Assets: | | | | | | | | |

Beginning of year | | | 186,025,624 | | | | 123,826,107 | |

| | | | | | | | |

End of year | | $ | 194,545,367 | | | $ | 186,025,624 | |

| | | | | | | | |

End of year undistributed net investment income | | $ | 54,798 | | | $ | 41,555 | |

| | |

Share Transactions: | | | | | | | | |

Sale of shares | | | 9,591,937 | | | | 12,908,547 | |

Shares issued in connection with reinvestment of dividends and distributions | | | 611,895 | | | | 406,833 | |

Shares repurchased | | | (9,109,886 | ) | | | (7,176,795 | ) |

| | | | | | | | |

Net increase in shares | | | 1,093,946 | | | | 6,138,585 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

24

Managers Short Duration Government Fund

Financial Highlights

For a share outstanding throughout each fiscal year ended March 31

| | | | | | | | | | | | | | | | | | | | |

| | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

Net Asset Value, Beginning of Year | | $ | 9.66 | | | $ | 9.69 | | | $ | 9.74 | | | $ | 9.72 | | | $ | 9.71 | |

| | | | | | | | | | | | | | | | | | | | |

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.34 | | | | 0.27 | | | | 0.25 | | | | 0.30 | | | | 0.54 | |

Net realized and unrealized gain (loss) on investments | | | (0.05 | ) | | | (0.02 | ) | | | (0.06 | ) | | | 0.06 | | | | 0.01 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.29 | | | | 0.25 | | | | 0.19 | | | | 0.36 | | | | 0.55 | |

| | | | | | | | | | | | | | | | | | | | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.34 | ) | | | (0.28 | ) | | | (0.24 | ) | | | (0.32 | ) | | | (0.54 | ) |

Return of capital | | | — | | | | — | | | | — | | | | (0.02 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.34 | ) | | | (0.28 | ) | | | (0.24 | ) | | | (0.34 | ) | | | (0.54 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Year | | $ | 9.61 | | | $ | 9.66 | | | $ | 9.69 | | | $ | 9.74 | | | $ | 9.72 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return 1 | | | 3.00 | % | | | 2.62 | % | | | 2.00 | % | | | 3.76 | % | | | 6.06 | % |

| | | | | | | | | | | | | | | | | | | | |

Ratio of net operating expenses to average net assets 1,2 | | | 0.83 | % | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % |

Ratio of total expenses to average net assets 3 | | | 1.08 | % | | | 1.00 | % | | | 0.95 | % | | | 0.93 | % | | | 1.67 | % |

Ratio of net investment income to average net assets 1,2 | | | 3.41 | % | | | 2.90 | % | | | 2.59 | % | | | 2.74 | % | | | 5.71 | % |

Portfolio turnover | | | 315 | % | | | 341 | % | | | 349 | % | | | 418 | % | | | 683 | % |

Net assets at end of year (000’s omitted) | | $ | 206,523 | | | $ | 237,900 | | | $ | 198,726 | | | $ | 160,710 | | | $ | 30,470 | |

| | | | | | | | | | | | | | | | | | | | |

| 1 | Total returns and net investment income would have been lower had certain expenses not been reduced. |

| 2 | After expense offsets excluding interest expense. (See Note 1(c) of “Notes to Financial Statements.”) |

| 3 | Includes interest expense for the fiscal years ended March 31, 2006, 2005, 2004, 2003, and 2002 of 0.23%, 0.16%, 0.03%, 0.01%, and 0.28%, respectively. (See Note 1(c) of “Notes to Financial Statements.”) |

25

Managers Intermediate Duration Government Fund

Financial Highlights

For a share outstanding throughout each fiscal year ended March 31,

| | | | | | | | | | | | | | | | | | | | |

| | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

Net Asset Value, Beginning of Year | | $ | 10.53 | | | $ | 10.74 | | | $ | 10.61 | | | $ | 10.16 | | | $ | 9.94 | |

| | | | | | | | | | | | | | | | | | | | |

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.37 | | | | 0.26 | | | | 0.23 | | | | 0.40 | | | | 0.41 | |

Net realized and unrealized gain (loss) on investments | | | (0.16 | ) | | | (0.06 | ) | | | 0.20 | | | | 0.45 | | | | 0.26 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.21 | | | | 0.20 | | | | 0.43 | | | | 0.85 | | | | 0.67 | |

| | | | | | | | | | | | | | | | | | | | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.37 | ) | | | (0.26 | ) | | | (0.23 | ) | | | (0.40 | ) | | | (0.45 | ) |

Net realized gain on investments | | | — | | | | (0.15 | ) | | | (0.07 | ) | | | 0.00 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.37 | ) | | | (0.41 | ) | | | (0.30 | ) | | | (0.40 | ) | | | (0.45 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Year | | $ | 10.37 | | | $ | 10.53 | | | $ | 10.74 | | | $ | 10.61 | | | $ | 10.16 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return 1 | | | 2.02 | % | | | 1.78 | % | | | 4.07 | % | | | 8.48 | % | | | 6.78 | % |

| | | | | | | | | | | | | | | | | | | | |

Ratio of net operating expenses to average net assets 1,2 | | | 0.88 | % | | | 0.88 | % | | | 0.88 | % | | | 0.88 | % | | | 0.88 | % |

Ratio of total expenses to average net assets 3 | | | 0.88 | % | | | 0.89 | % | | | 0.93 | % | | | 1.06 | % | | | 1.09 | % |

Ratio of net investment income to average net assets 1,3 | | | 3.53 | % | | | 2.45 | % | | | 2.09 | % | | | 3.75 | % | | | 3.76 | % |

Portfolio turnover | | | 672 | % | | | 851 | % | | | 667 | % | | | 578 | % | | | 1,106 | % |

Net assets at end of year (000’s omitted) | | $ | 194,545 | | | $ | 186,026 | | | $ | 123,826 | | | $ | 71,342 | | | $ | 26,892 | |

| | | | | | | | | | | | | | | | | | | | |

| 1 | Total returns and net investment income would have been lower had certain expenses not been reduced. |

| 2 | After expense offsets excluding interest expense. (See Note 1 (c) of “Notes to Financial Statements.”) |

| 3 | Includes interest expense for the fiscal years ended March 31, 2005, 2004 and 2003 of 0.01%, 0.00%, 0.03%, respectively. (See Note 1(c) of “Notes to Financial Statements.”) |

26

The Managers Funds

Notes to Financial Statements

March 31, 2006

| 1. | Summary of Significant Accounting Policies |

Managers Trust II (“Trust II”) is an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). Included in this report are two series of Trust II: Managers Short Duration Government Fund (“Short Duration”) and Managers Intermediate Duration Government Fund (“Intermediate Duration”). The financial statements of Short Duration and Intermediate Duration (each a “Fund” and collectively, the “Funds”) are prepared in accordance with accounting principles generally accepted in the United States of America which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting periods. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Funds in the preparation of their financial statements.

| a. | Valuation of Investments |

Equity securities traded on a domestic or international securities exchange are valued at the last quoted sale price, or, lacking any sales, at the last quoted bid price. Over-the-counter securities are valued at the NASDAQ Official Closing Price, if one is available. Lacking any sales, over-the counter securities are valued at the last quoted bid price. Under certain circumstances, the value of each Fund’s investment may be based on an evaluation of its fair value, pursuant to procedures established by and under the general supervision of the Board of Trustees of the Trust. The Fund may use the fair value of a portfolio security to calculate its NAV when, for example, (1) market quotations are not readily available because a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and has not resumed prior to the time as of which the Fund calculates its NAV, (3) where a significant event affecting the value of a portfolio security is determined to have occurred between the time of the market quotation provided for a portfolio security and the time as of which the Fund calculates its NAV, (4) a security’s price has remained unchanged over an extended period of time (often referred to as a “stale price”), or (5) the Investment Manager determines that a market quotation is inaccurate. The Investment Manager monitors intervening events that may affect the value of securities held in the Fund’s portfolio and, in accordance with procedures adopted by the Fund’s Trustees, will adjust the prices of securities traded in foreign markets, as appropriate, to reflect the impact of events occurring subsequent to the close of such markets but prior to the time each Fund’s NAV is calculated. Fixed income securities are valued based on valuations furnished by independent pricing services that utilize matrix systems, which reflect such factors as security prices, yields, maturities, and ratings, and are supplemented by dealer and exchange quotations. Futures contracts for which market quotations are readily available are valued at the settlement price as of the close of the futures exchange. Short-term investments having a remaining maturity of 60 days or less are valued at amortized cost, which approximates market. Investments in other regulated investment companies are valued at their end of day net asset value per share. Investments in certain mortgage-backed, stripped mortgage-backed, preferred stocks, convertible securities, derivatives and other debt securities not traded on an organized securities market are valued on the

27

The Managers Funds

Notes to Financial Statements (continued)

basis of valuations provided by dealers or by a pricing service which uses information with respect to transactions in such securities, various relationships between securities and yield to maturity in determining value. Securities (including derivatives) for which market quotations are not readily available are valued at fair value, as determined in good faith, and pursuant to procedures adopted by the Board of Trustees of the Trust. The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized, since such amounts depend on future developments inherent in long-term investments. Further, because of the inherent uncertainty of valuation, those estimated values may differ significantly from the values that would have been used had a ready market for the investments existed, and the differences could be material.

Security transactions are accounted for as of trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

| c. | Investment Income and Expenses |

Dividend income is recorded on the ex-dividend date. Interest income, which includes amortization of premium and accretion of discount on debt securities, as required, is accrued as earned. Non-cash dividends included in dividend income, if any, are reported at the fair market value of the securities received. Other income and expenses are recorded on an accrual basis. Expenses that cannot be directly attributed to a fund are apportioned among the Funds in the Trust and in some cases other affiliated funds based upon their relative average net assets or number of shareholders.

The Funds have a “balance credit” arrangement with the Bank of New York (“BNY”), the Funds’ custodian whereby each Fund is credited with an interest factor equal to 1% below the effective 90-day T-Bill rate for account balances left uninvested overnight. These credits serve to reduce custody expenses that would otherwise be charged to each Fund. For the fiscal year ended March 31, 2006, the custodian expense was reduced under the BNY arrangement as follows: Short Duration - $1,084 and Intermediate Duration - $177.