UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811- 06431

MANAGERS TRUST II

(Exact name of registrant as specified in charter)

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Address of principal executive offices) (Zip code)

Managers Investment Group LLC

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: DECEMBER 31

Date of reporting period: JANUARY 1, 2006 – DECEMBER 31, 2006 (Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

ANNUAL REPORT

Managers Trust II Funds

December 31, 2006

| • | | Managers High Yield Fund |

| • | | Managers Fixed Income Fund |

The Managers Funds

Annual Report — December 31, 2006

TABLE OF CONTENTS

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of The Managers Funds or Managers AMG Funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Letter to Shareholders

Dear Shareholders and Clients,

We would like to thank you for the opportunity to manage your assets in 2006, and for taking time with us to take a quick glance back at last year’s investment climate.

If all we did was focus on the strong, above-average returns generated by most of the asset classes worldwide during 2006—U.S. stocks up 15.8 % , non-U.S. stocks up 26.3% , real estate up 36.1% , global bonds up 6.6% (high quality U.S. bonds offered moderately below average returns of 4.3%)—we would be missing one of the most important lessons that 2006 teaches us about investing; for 2006 was a year in which investors needed to endure a period of negative returns in order to reap the benefits the full year had to offer.

Investors with classically diversified portfolios who stuck to their long-term investment plan during the past year should have been pleased with their results. Other investors who were enticed into making asset allocation and investment changes in response to short-term market movements, however, may have experienced below average portfolio results, and certainly took undue risk.

It can be tempting for investors without a solid plan to alter their asset allocations and investment approach. Coming off of three previous years of positive stock market returns, we entered 2006 with the widely reported expectation that the economy was running out of steam. Given the news media’s penchant for pessimism, we were repeatedly told to watch out for: slower economic growth, softer corporate profits, significantly higher oil prices, prospects for higher inflation, expectations for further Federal Reserve interest rate hikes, a collapse in the housing market, the negative impact of a decline in the dollar’s value and of course, a long list of geopolitical concerns. As if that wasn’t enough, the yield curve was borderline inverted, very often a signal of economic weakness.

Investors tried to shrug off this pessimism and through the early part of May the equity markets actually produced positive results. However, the headline risks finally became too much for investors to withstand and the market ran out of steam. From May 5 through June 13, the U.S. equity market declined by 4.5% , while from May 9 through June 13, non-U.S. equities fell by 12.7% , with emerging markets leading the slide down 20.5%. Meanwhile, U.S. bonds had been steadily declining with the Lehman Brothers Aggregate Index down 0.7% through the end of June. Near mid-year, it seemed that the bears were developing a stranglehold on the market. More than a few commentators were wondering what then-new Fed Chairman Dr. Bernanke was trying to accomplish. Cash seemed to be king, commodities were headed higher, and hedge funds were constantly in the news—all very enticing options for investors.

But the whole story was yet to be told. Despite the mixed macro economic news, corporate results were coming through better than many analysts had expected and companies were actually producing positive earnings surprises. In fact, 68 % and 76% of S&P 500 companies produced positive earnings surprises in the first and second quarters of 2006, respectively. As the year developed,

1

Letter to Shareholders (continued)

even though economic factors did not dramatically improve, they did not worsen either. The Fed stopped raising rates, oil prices stopped going up (and ultimately finished the year below where they started), inflation concerns tempered, the housing market did not experience the hard landing many had feared, and the mighty consumer did not waver. In retrospect, perhaps it was going to be the soft landing that many had sought.

As more and more positive earnings results came through during the year, even against the backdrop of mixed economic news, the markets staged a broad rally. From the June 13 bottom, the S&P 500 advanced by 17.1% , while the MSCI EAFE increased 20.8 %. Meanwhile, the Lehman Aggregate Bond Index advanced 5.1% during the second half of the year.

So what was the lesson to be learned from 2006? Investors who started the year with a reasonably diversified portfolio and simply maintained their long-term perspective had an above-average year and made real progress towards their financial goals. Going into 2006, and for the first part of the year, economic conditions and expectations could easily have compelled an investor to over-think and do something other than stay on plan. The market would have whipsawed these investors, resulting in poor relative returns. Having a well founded long-term plan and sticking with it can improve investors’ odds of reaching their investment goals, and it certainly helped in terms of getting the most out of 2006.

One of our foremost goals at Managers Investment Group ( “Managers” ) is to structure and manage mutual funds that will help our shareholders and clients become more successful at reaching their investment goals and objectives. Each of our Funds is geared to provide you with exposure to a specific asset class or portion of the market. Investors tend to use our Funds as part of their overall asset allocation in order to structure a well-diversified portfolio intended to meet individual needs. Most of our Funds, therefore, are designed to be building blocks.

Managers International Equity Fund is a great example of how we structure and manage funds for our clients’ benefit. We designed the overall Fund to provide broad exposure to the world’s non-U.S. equity markets, predominately in developed markets. Considering the broad mandate, we believe the best method of accomplishing that goal is by employing a number of investment managers, each with a different focus and approach to investing in the international equity market. As a result, we have built a virtual team of three complimentary institutional investment managers. Each of these three organizations has an experienced team of accomplished professionals and deep resources. Each of them has demonstrated great success in generating attractive investment returns. Yet each has a significantly different outlook and approach to investing. Specifically, the Fund is subadvised by AllianceBernstein, Lazard Asset Management, and Wellington Management Company, whose investment approaches are “bottom-up” value-based, “top-down” thematic, and growth-oriented, respectively. By blending managers with different styles, the portfolio is not held hostage to growth, for example, being out-of-favor. The result is a Fund with expected risk that should be lower than average and that exhibits more stable performance on a relative basis. Though this Fund won’t typically attract performance chasers, it will help investors reach their financial goals without having to zigzag their way through investment styles or fads and give them peace of mind that they have an elegantly diversified portfolio.

At Managers we appreciate the privilege of being part of your investment plan. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit. Thank you again for the opportunity to be of service.

| | | | |

| Respectfully, | | | | |

| | |

| | | |  |

| John Streur | | | | Thomas G. Hoffman, CFA |

| Senior Managing Partner | | | | Executive Vice President |

| Managers Investment Group LLC | | | | Chief Investment Officer |

| | | | Managers Investment Group LLC |

Note: Source for all data referenced in the letter is FactSet and Russell.

2

About Your Fund’s Expenses

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; reinvested dividends or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Fund Return

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | |

Six Months Ended December 31, 2006 | | Beginning

Account Value

7/1/2006 | | Ending

Account Value

12/31/2006 | | Expenses

Paid During

Period* |

Managers Mid-Cap Fund Class A | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,053 | | $ | 6.47 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,019 | | $ | 6.36 |

Managers Mid-Cap Fund Class B | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,049 | | $ | 10.33 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,015 | | $ | 10.16 |

Managers Mid-Cap Fund Class C | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,049 | | $ | 10.33 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,015 | | $ | 10.16 |

Managers Mid-Cap Fund Institutional Class | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,054 | | $ | 5.18 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,020 | | $ | 5.09 |

Managers Balanced Fund Class A | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,107 | | $ | 6.64 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,019 | | $ | 6.36 |

Managers Balanced Fund Class B | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,102 | | $ | 10.60 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,015 | | $ | 10.16 |

Managers Balanced Fund Class C | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,103 | | $ | 10.60 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,015 | | $ | 10.16 |

Managers Balanced Fund Institutional Class | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,109 | | $ | 5.32 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,020 | | $ | 5.09 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

3

About Your Fund’s Expenses (continued)

| | | | | | | | | |

Six Months Ended December 31, 2006 | | Beginning

Account Value

7/1/2006 | | Ending

Account Value

12/31/2006 | | Expenses

Paid During

Period* |

Managers High Yield Fund Class A | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,078 | | $ | 6.02 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,019 | | $ | 5.85 |

Managers High Yield Fund Class B | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,073 | | $ | 9.93 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,016 | | $ | 9.65 |

Managers High Yield Fund Class C | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,073 | | $ | 9.93 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,016 | | $ | 9.65 |

Managers High Yield Fund Institutional Class | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,080 | | $ | 4.72 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,021 | | $ | 4.58 |

Managers Fixed Income Fund Class A | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,078 | | $ | 3.88 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,021 | | $ | 3.77 |

Managers Fixed Income Fund Class B | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,075 | | $ | 7.79 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,018 | | $ | 7.58 |

Managers Fixed Income Fund Class C | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,074 | | $ | 7.79 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,018 | | $ | 7.58 |

Managers Fixed Income Fund Institutional Class | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,079 | | $ | 2.57 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,023 | | $ | 2.50 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

4

Managers Mid-Cap Fund

Portfolio Manager’s Comments

Managers Mid-Cap Fund (“Mid-Cap” ) is a stock fund seeking long-term capital appreciation through a diversified portfolio of medium-capitalization U.S. companies. Managers currently utilizes a single independent sub-advisor, a team led by James Miller of Chicago Equity Partners, LLC ( “CEP” ), to manage the Portfolio. CEP has managed the Portfolio since December 2000.

THE PORTFOLIO MANAGERS

James Miller and the investment team at Chicago Equity Partners believe fundamentals drive stock prices. That is, companies with favorable valuations and earnings expectations will outperform their peers. They utilize a systematic ranking system to identify attractive stocks and construct their portfolios through a disciplined process that minimizes portfolio risks like sector, capitalization, and style exposures.

Every day they use their proprietary model to evaluate the expectations, valuation, and quality attributes of 3,000 stocks. Over time they’ve refined this model, adding and deleting factors as well as changing their weightings, to consistently forecast solid stocks by sector and industry.

CEP’s team of analysts reviews and confirms the model’s daily rankings, paying special attention to any changes in rank. Each analyst follows a specific sector focusing on the timing and nature of earnings releases, legal and regulatory exposures of companies and any other factors the model may not capture. The analysts use an objective, systematic approach to choose the best risk-adjusted stocks within their sector.

Once the analysts have identified stocks with the highest potential to outperform their peers, they construct portfolios that neutralize risk elements that are not consistently rewarded, such as style tilts, industry weightings, and market capitalization.

CEP’s analysts review the portfolios daily, meeting at least once per month on a formal basis, to evaluate portfolio holdings, monitor risk, and rebalance as necessary. Once any necessary trades are identified, they implement them using a mix of trading strategies designed to minimize commissions and market impact.

The result of CEP’s disciplined process is a portfolio of 125 to 250 securities that they believe will generate solid excess returns over the S&P Mid Cap 400 at a moderate risk level.

THE YEAR IN REVIEW

For the year 2006, the Managers Mid-Cap Fund gained 8.96% (Institutional Class) compared with a gain of 10.32% for the S&P Mid Cap 400 Index (“the Index” ). Please note that this Fund has multiple classes. Performance for all classes can be found in the table on page 6 and at www.managersinvest.com.

The abundance of liquidity in the market, activity by private equity players, pause by the Fed, and continued growth in the U.S. economy seemed to buoy investor optimism. There was a positive rally across all capitalizations of U.S. stock markets in the second half of 2006.

Smaller-capitalization companies, especially the lowest decile capitalization companies, continued to perform well, challenging predictions by many market analysts. However, the S&P 600 was unable to outperform the S&P 500 Index this year for the first time since 1999. The small-cap index was still up a respectable 15.1% versus the 15.8% for the larger-cap index. In contrast, this was also the first year since 2003 that the S&P 600 outperformed the S&P 400 with annual returns of 15.1% and 10.3%, respectively.

Even within the mid-capitalization range, there were substantial differences between the two most well recognized indexes, the S&P Mid Cap 400 and the Russell Midcap® Index. In reference to the Russell Midcap Index, the S&P Mid Cap 400 Index underperformed by 5.0% (15.3% versus 10.3%, respectively). The difference between the two Indexes is attributable to the larger size companies or capitalizations in the Russell Midcap Index relative to the S&P Mid Cap 400. The Russell Midcap Index has an average weighted market capitalization of $8.6 billion versus $3.8 billion for the S&P Mid Cap 400. Specifically, the top 89 stocks by capitalization contributed the majority of the return for the Russell Midcap Index. These 89 stocks had market caps that are above the largest capitalization holdings in the S&P Mid Cap 400. During the second half of the year, the larger capitalization names outperformed as the market rotated to these companies as concerns mounted over a slower economy.

From a style perspective, value continued to dominate growth across all capitalizations. Value stocks once again beat growth stocks for the 7th straight year with the Russell 3000® Value Index up 22.3% versus the 9.5% return for the Russell 3000 Growth Index. This divergence is also evidence of risk aversion as the economy shows signs of decelerating growth.

Risk aversion did not completely abate as investors sought out large-capitalization, higher quality companies, as exhibited by the record closing of the Dow Industrial Index. Within CEP’s proprietary model, value and quality factors dominated while momentum factors detracted broadly across the capitalization spectrum. During 2006, the market did not reward momentum factors (companies with favorable earnings outlooks) as investors were concerned with companies’ earnings trends in an environment of slowing growth. Portfolio management considers this a short-term situation because fundamentals drive stock prices and earnings do matter in long term.

As the Fund matches sectors with the S&P Mid Cap 400 Index, the return patterns were tied very closely with those of the overall market. Stock selection in the consumer discretionary, industrials, and financials sectors were the largest contributors to the Fund. Specialty retailer American Eagle Outfitters (+106%) had a strong year, as did several producer manufacturing firms Terex Corp (+117%) and Cummins, Inc. (+33%). On the negative end of the spectrum, technology stocks in the Portfolio failed to keep pace with those of the Index and the energy sector was challenged by several double-digit decliners including Patterson-UTI Energy, Inc. (-29%) and Helmerich & Payne.

LOOKING FORWARD

Looking forward, the portfolio manager continues to add value through security selection and seeks to immunize the Portfolio against sector swings by matching sectors to the benchmark.

CEP’s comments as we progress into 2007:

Our forecast for 2007 is generally optimistic. Overall expectations are that the weakness in housing and manufacturing should moderate, the strength in the service sector will continue, and inflation will decline, all leading to moderate real growth for the economy. With the forward P/E of the S&P 500 below average historical

5

Managers Mid-Cap Fund

Portfolio Manager’s Comments (continued)

levels, valuations should continue to show positive returns as multiples expand due to lower inflation expectations and anticipation of future economic growth. Given the expected slow down in earnings and GDP, we believe investors will focus on high quality balance sheets and less on price momentum.

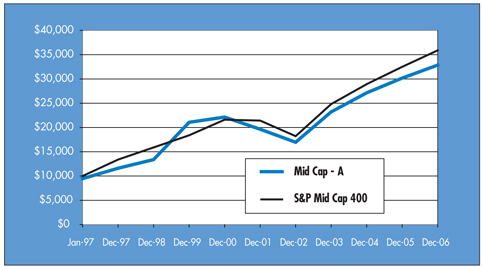

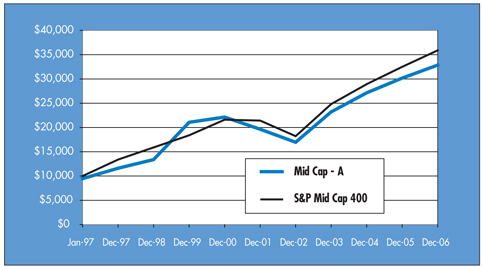

CUMULATIVE TOTAL RETURN PERFORMANCE

Mid-Cap’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The S&P Mid Cap 400 Index is an unmanaged capitalization weighted index of 400 commonly traded stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of those stocks. Unlike the Fund, the S&P Mid Cap 400 Index is unmanaged, is not available for investment, and does not incur expenses. The chart illustrates the performance of a hypothetical $10,000 investment made in the Fund’s Class A Shares on January 2, 1997 to a $10,000 investment made in the S&P Mid Cap 400 Index for the same time periods. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. Performance for periods longer than one year is annualized. Figures include reinvestment capital gains and dividends. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns for the Fund would have been lower had certain expenses not been reduced.

The table below shows the average annualized total returns for the Mid-Cap Fund and the S&P Mid Cap 400 Index since inception through December 31, 2006.

| | | | | | | | | | | | | | | |

Average Annual Total Returns | | | | | | 1 Year | | | 5 Years | | | Since Inception | | | Inception Date |

Mid-Cap | | -Class A | | No Load | | 8.69 | % | | 10.77 | % | | 13.30 | % | | 01/02/97 |

| | -Class A | | With Load | | 2.45 | % | | 9.45 | % | | 12.63 | % | | 01/02/97 |

| | -Class B | | No Load | | 7.88 | % | | 10.12 | % | | 11.76 | % | | 01/28/98 |

| | -Class B | | With Load | | 2.88 | % | | 9.85 | % | | 11.76 | % | | 01/28/98 |

| | -Class C | | No Load | | 7.87 | % | | 10.11 | % | | 10.95 | % | | 02/19/98 |

| | -Class C | | With Load | | 6.87 | % | | 9.88 | % | | 10.82 | % | | 02/19/98 |

| | -Institutional Class | | No Load | | 8.96 | % | | 11.22 | % | | 13.84 | % | | 01/02/97 |

S&P Mid Cap 400 Index | | | | | | 10.32 | % | | 10.89 | % | | 13.64 | %* | | |

| * | Performance for the S&P Mid Cap 400 Index reflects an inception date of January 2, 1997. |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end please call ( 800) 835-3879 or visit our Web site at www.managersinvest.com.

6

Managers Mid-Cap Fund

Fund Snapshots

December 31, 2006

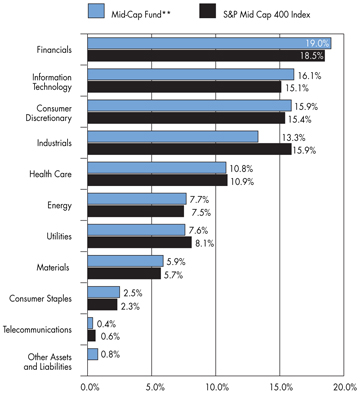

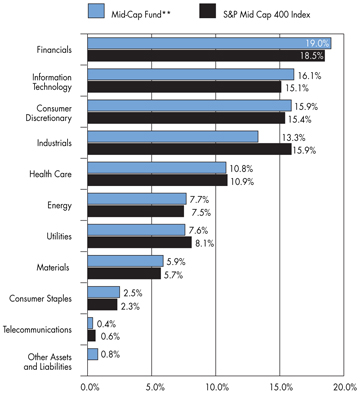

Portfolio Breakdown

| ** | As a percentage of net assets |

| | | | | | |

Industry | | Mid-Cap Fund** | | | S&P Mid Cap 400 Index | |

Financials | | 19.0 | % | | 18.5 | % |

Information Technology | | 16.1 | % | | 15.1 | % |

Consumer Discretionary | | 15.9 | % | | 15.4 | % |

Industrials | | 13.3 | % | | 15.9 | % |

Health Care | | 10.8 | % | | 10.9 | % |

Energy | | 7.7 | % | | 7.5 | % |

Utilities | | 7.6 | % | | 8.1 | % |

Materials | | 5.9 | % | | 5.7 | % |

Consumer Staples | | 2.5 | % | | 2.3 | % |

Telecommunications | | 0.4 | % | | 0.6 | % |

Other Assets and Liabilities | | 0.8 | % | | 0.0 | % |

Top Ten Holdings

| | | |

Top Ten Holdings (out of 135 securities) | | % of

Net Assets | |

American Financial Group, Inc.* | | 2.3 | % |

Cummins, Inc.* | | 2.1 | |

Terex Corp. | | 2.1 | |

Tesoro Corp.* | | 2.0 | |

Allegheny Energy, Inc.* | | 1.9 | |

Ashland, Inc. | | 1.8 | |

Applera Corp. - Applied Biosystems Group | | 1.7 | |

Sherwin-Williams Co., The | | 1.7 | |

OGE Energy Corp. | | 1.7 | |

Radian Group, Inc.* | | 1.7 | |

| | | |

Top Ten as a Group | | 19.0 | % |

| | | |

| * | Top Ten Holding at June 30, 2006 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security.

7

Managers Mid-Cap Fund

Schedule of Portfolio Investments

December 31, 2006

| | | | | | |

| | | Shares | | | Value |

Common Stocks - 99.2% | | | | | | |

Consumer Discretionary - 15.9% | | | | | | |

Abercrombie & Fitch Co. | | 13,600 | 2 | | $ | 946,968 |

American Eagle Outfitters, Inc. | | 39,450 | 2 | | | 1,231,235 |

AnnTaylor Stores Corp.* | | 25,200 | | | | 827,568 |

ArvinMeritor, Inc. | | 31,800 | 2 | | | 579,714 |

Autoliv, Inc. | | 11,500 | | | | 693,450 |

Brinker International, Inc. | | 20,400 | | | | 615,264 |

Darden Restaurants, Inc. | | 23,300 | 2 | | | 935,961 |

Dillard’s, Inc., Class A | | 37,300 | | | | 1,304,380 |

Dollar Tree Stores, Inc.* | | 20,200 | | | | 608,020 |

Furniture Brands International, Inc. | | 10,000 | | | | 162,300 |

Hasbro, Inc. | | 16,300 | | | | 444,175 |

Marvel Entertainment, Inc.* | | 6,400 | 2 | | | 172,224 |

NVR, Inc.* | | 500 | 2 | | | 322,500 |

Payless ShoeSource, Inc.* | | 39,600 | 2 | | | 1,299,672 |

Polo Ralph Lauren Corp. | | 6,100 | | | | 473,726 |

Rent-A-Center, Inc.* | | 22,000 | 2 | | | 649,220 |

Ryland Group, Inc., The | | 17,900 | | | | 977,698 |

Scholastic Corp.* | | 8,200 | 2 | | | 293,888 |

Sherwin-Williams Co., The | | 23,800 | 2 | | | 1,513,204 |

Total Consumer Discretionary | | | | | | 14,051,167 |

Consumer Staples - 2.5% | | | | | | |

Alberto-Culver Co.* | | 2,600 | | | | 55,770 |

Energizer Holdings, Inc.* | | 6,800 | 2 | | | 482,732 |

Estee Lauder Co., Class A | | 11,100 | 2 | | | 453,102 |

Hansen Natural Corp.* | | 13,200 | 2 | | | 444,576 |

Hormel Foods Corp. | | 8,900 | | | | 332,326 |

McCormick & Co. | | 12,200 | | | | 470,432 |

Total Consumer Staples | | | | | | 2,238,938 |

Energy - 7.7% | | | | | | |

Cimarex Energy Co. | | 9,900 | | | | 361,350 |

ENSCO International, Inc. | | 11,300 | 2 | | | 565,678 |

Frontier Oil Corp. | | 21,100 | | | | 606,414 |

Overseas Shipholding Group, Inc. | | 15,700 | | | | 883,910 |

Patterson-UTI Energy, Inc. | | 55,600 | 2 | | | 1,291,588 |

Tesoro Corp. | | 27,000 | 2 | | | 1,775,790 |

Tidewater, Inc. | | 18,400 | 2 | | | 889,824 |

Unit Corp.* | | 7,800 | | | | 377,910 |

Total Energy | | | | | | 6,752,464 |

Financials - 19.0% | | | | | | |

A.G. Edwards, Inc. | | 10,700 | 2 | | | 677,203 |

American Financial Group, Inc. | | 55,800 | 2 | | | 2,003,778 |

AmeriCredit Corp.* | | 35,300 | 2 | | | 888,501 |

Assurant, Inc. | | 11,600 | | | | 640,900 |

Camden Property Trust | | 9,900 | | | | 731,115 |

CB Richard Ellis Group, Inc.* | | 37,800 | | | | 1,254,960 |

CBL & Associates Properties, Inc. | | 27,000 | | | | 1,170,450 |

City National Corp. | | 4,600 | | | | 327,520 |

Colonial Properties Trust | | 6,700 | | | | 314,096 |

Compass Bancshares, Inc. | | 11,400 | 2 | | | 680,010 |

First Marblehead Corp., The | | 4,450 | 2 | | | 243,193 |

FirstMerit Corp. | | 12,300 | 2 | | | 296,922 |

Highwoods Properties, Inc. | | 28,400 | | | | 1,157,584 |

Investors Financial Services Corp. | | 4,100 | 2 | | | 174,947 |

Leucadia National Corp. | | 13,300 | 2 | | | 375,060 |

Mercantile Bankshares Corp. | | 22,350 | | | | 1,045,757 |

Nationwide Financial Services, Inc. | | 13,500 | | | | 731,700 |

New Century Financial Corp. | | 7,100 | | | | 224,289 |

New Plan Excel Realty Trust, Inc. | | 25,900 | | | | 711,732 |

PMI Group, Inc. | | 25,600 | | | | 1,207,552 |

Radian Group, Inc. | | 27,500 | | | | 1,482,525 |

Regions Financial Corp. | | 1 | | | | 37 |

Wilmington Trust Corp. | | 9,200 | 2 | | | 387,964 |

Total Financials | | | | | | 16,727,795 |

Health Care - 10.8% | | | | | | |

Applera Corp. - Applied Biosystems Group | | 41,600 | 2 | | | 1,526,304 |

C.R. Bard, Inc. | | 6,800 | | | | 564,196 |

Charles River Laboratories International, Inc.* | | 12,400 | 2 | | | 536,300 |

Coventry Health Care, Inc.* | | 18,925 | 2 | | | 947,196 |

Endo Pharmaceuticals Holdings, Inc.* | | 8,300 | 2 | | | 228,914 |

Health Net, Inc.* | | 19,400 | 2 | | | 944,004 |

Hillenbrand Industries, Inc. | | 8,900 | 2 | | | 506,677 |

ImClone Systems, Inc.* | | 14,000 | 2 | | | 374,640 |

Kinetic Concepts, Inc.* | | 11,200 | 2 | | | 442,960 |

King Pharmaceuticals, Inc.* | | 15,000 | 2 | | | 238,800 |

Manor Care, Inc. | | 7,700 | 2 | | | 361,284 |

Millennium Pharmaceuticals, Inc.* | | 43,500 | 2 | | | 474,150 |

Pediatrix Medical Group, Inc.* | | 5,500 | 2 | | | 268,950 |

Sierra Health Services, Inc.* | | 14,400 | 2 | | | 518,976 |

STERIS Corp. | | 9,400 | | | | 236,598 |

Techne Corp.* | | 23,800 | 2 | | | 1,319,710 |

Total Health Care | | | | | | 9,489,659 |

The accompanying notes are an integral part of these financial statements.

8

Managers Mid-Cap Fund

Schedule of Portfolio Investments (continued)

| | | | | | | |

| | | Shares | | | Value | |

Industrials - 13.3% | | | | | | | |

Banta Corp | | 9,800 | | | $ | 356,720 | |

Continental Airlines, Inc.* | | 12,300 | 2 | | | 507,375 | |

Cummins, Inc. | | 15,900 | 2 | | | 1,879,062 | |

Deluxe Corp. | | 7,300 | 2 | | | 183,960 | |

Dun & Bradstreet Corp.* | | 2,200 | | | | 182,138 | |

ITT Educational Services, Inc.* | | 11,300 | 2 | | | 749,981 | |

Joy Global, Inc. | | 21,100 | 2 | | | 1,019,974 | |

Manpower, Inc. | | 9,200 | | | | 689,356 | |

Miller Herman, Inc. | | 7,700 | | | | 279,972 | |

Precision Castparts Corp. | | 11,800 | | | | 923,704 | |

R.R. Donnelley & Sons Co. | | 6,000 | | | | 213,240 | |

Republic Services, Inc. | | 22,000 | | | | 894,740 | |

Ryder System, Inc. | | 13,800 | | | | 704,628 | |

SPX Corp. | | 5,000 | 2 | | | 305,800 | |

Terex Corp.* | | 28,300 | | | | 1,827,614 | |

UAL Corp.* | | 12,600 | 2 | | | 554,400 | |

U.S. Airways Group, Inc. * | | 8,500 | 2 | | | 457,725 | |

Total Industrials | | | | | | 11,730,389 | |

Information Technology - 16.1% | | | | | | | |

Avnet, Inc.* | | 22,000 | 2 | | | 561,660 | |

Avocent Corp.* | | 8,400 | | | | 284,340 | |

AVX Corp. | | 10,900 | 2 | | | 161,211 | |

BMC Software, Inc.* | | 29,000 | | | | 933,800 | |

Brocade Communications Systems, Inc.* | | 38,500 | | | | 316,085 | |

Cadence Design Systems Inc.* | | 33,700 | 2 | | | 603,567 | |

CommScope, Inc.* | | 9,000 | 2 | | | 274,320 | |

CSG Systems International, Inc.* | | 13,200 | | | | 352,836 | |

Factset Research Systems, Inc. | | 20,750 | | | | 1,171,960 | |

Global Payments, Inc. | | 19,600 | | | | 907,480 | |

Ingram Micro, Inc., Class A* | | 28,100 | | | | 573,521 | |

Integrated Device Technology, Inc.* | | 7,900 | | | | 122,292 | |

Intersil Corp., Class A | | 41,100 | | | | 983,112 | |

Lam Research Corp.* | | 2,800 | 2 | | | 141,736 | |

LSI Logic Corp.* | | 78,600 | 2 | | | 707,400 | |

MEMC Electronic Materials, Inc.* | | 7,700 | | | | 301,378 | |

Microchip Technology, Inc. | | 3,700 | 2 | | | 120,990 | |

MoneyGram International, Inc. | | 14,200 | | | | 445,312 | |

Novellus Systems, Inc.* | | 10,100 | 2 | | | 347,642 | |

Omnivision Technologies, Inc.* | | 25,900 | | | | 353,535 | |

Polycom, Inc.* | | 28,800 | 2 | | | 890,208 | |

Sybase, Inc.* | | 30,900 | 2 | | | 763,230 | |

Tech Data Corp.* | | 12,200 | | | | 462,014 | |

Tellabs, Inc.* | | 52,600 | | | | 539,676 | |

Triquint Semiconductor* | | 36,400 | | | | 163,800 | |

Vishay Intertechnology, Inc.* | | 27,100 | | | | 366,934 | |

Websense, Inc.* | | 24,600 | | | | 561,618 | |

Western Digital Corp.* | | 36,600 | | | | 748,836 | |

Total Information Technology | | | | | | 14,160,493 | |

Materials - 5.9% | | | | | | | |

Ashland, Inc. | | 22,700 | | | | 1,570,386 | |

FMC Corp. | | 16,700 | | | | 1,278,385 | |

Louisana-Pacific Corp. | | 9,400 | | | | 202,382 | |

Olin Corp. | | 16,300 | 2 | | | 269,276 | |

Rayonier, Inc. | | 7,800 | | | | 320,190 | |

Sealed Air Corp. | | 3,900 | 2 | | | 253,188 | |

Steel Dynamics, Inc. | | 41,200 | | | | 1,336,940 | |

Total Materials | | | | | | 5,230,747 | |

Telecommunication Services - 0.4% | | | | | | | |

Centurytel, Inc. | | 7,700 | 2 | | | 336,182 | |

Utilities - 7.6% | | | | | | | |

Allegheny Energy, Inc.* | | 36,300 | | | | 1,666,533 | |

Energy East Corp.* | | 13,300 | | | | 329,840 | |

MDU Resources Group, Inc. | | 42,950 | | | | 1,101,238 | |

Nicor, Inc. | | 11,100 | | | | 519,480 | |

OGE Energy Corp. | | 37,200 | | | | 1,488,000 | |

Oneok, Inc. | | 4,100 | | | | 176,792 | |

UGI Corp. | | 24,800 | | | | 676,544 | |

Wisconsin Energy Corp. | | 16,500 | | | | 783,090 | |

Total Utilities | | | | | | 6,741,517 | |

Total Common Stocks | | | | | | | |

(cost $75,405,421) | | | | | | 87,459,351 | |

Other Investment Companies - 29.6%1 | | | | | | | |

Bank of New York Institutional Cash Reserves Fund, 5.32%3 | | 25,310,467 | | | | 25,310,467 | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 5.18% | | 753,079 | | | | 753,079 | |

Total Investment Companies | | | | | | | |

(cost $26,063,546) | | | | | | 26,063,546 | |

Total Investments - 128.8% | | | | | | | |

(cost $101,468,967) | | | | | | 113,522,897 | |

Other Assets, less Liabilities - (28.8)% | | | | | | (25,391,609 | ) |

Net Assets - 100.0% | | | | | $ | 88,131,288 | |

The accompanying notes are an integral part of these financial statements.

9

Managers Balanced Fund

Portfolio Manager’s Comments

The Managers Balanced Fund’s (the “Fund” ) investment objective is to achieve a high total investment return, consistent with the preservation of capital and prudent investment risk. The Fund’s benchmark is a 60%/40% blend of the S&P 500 Index and the Lehman Brothers Aggregate Bond Index, respectively.

THE PORTFOLIO MANAGER

For most of the year 2006, the Fund employed two different portfolio managers for the equity and fixed income portions of the Portfolio. In December, the Fund’s Board of Trustees approved the transition of the fixed income portion of the Fund to Chicago Equity Partners, LLC ( “CEP” ). Hence, while Loomis Sayles & Company managed the bond portion of the portfolio through most of the year, going forward, CEP will be managing both the equity and fixed income portions of the Fund.

Chicago Equity Partners, LLC

Equity Portfolio

The investment team at Chicago Equity Partners, LLC ( “CEP” ) believes that fundamentals drive stock prices—that companies with favorable valuations and earnings expectations will outperform their peers. CEP employs a disciplined investment strategy utilizing a proprietary multi-factor model, which includes momentum, value, and quality factors, to select securities. The process focuses on security selection while remaining neutral to industry, sector, style, and capitalization benchmarks. CEP seeks to consistently apply an objective, quantitative, fundamental investment approach that identifies undervalued and overvalued securities within industry sectors.

CEP utilizes a systematic ranking system to identify attractive stocks and construct its portfolios through a disciplined process that minimizes portfolio risks like sector, capitalization, and style exposures. Every day the investment team at CEP uses its proprietary model to evaluate the expectations, valuation, and quality attributes of 3,000 stocks.

The ideal investment exhibits the following traits :

| | • | | Favorable valuation ratios relative to peers |

| | • | | Corporate profits growth is expected to be above average compared to peers |

Portfolio management :

| | • | | Utilizes a systematic ranking system to identify attractive stocks |

| | • | | Follows a disciplined portfolio construction process that minimizes portfolio risks like sector, capitalization, and style exposures |

| | • | | Constructs portfolios that neutralize risk elements that are not consistently rewarded, such as style tilts, industry weightings, and market capitalization |

| | • | | Reviews and confirms the model’s daily rankings, paying special attention to any changes in rank |

| | • | | Each analyst follows a specific sector focusing on: |

| | • | | The timing and nature of earnings releases |

| | • | | Legal and regulatory exposures of companies |

| | • | | Any other factors the model may not capture |

| | • | | The analysts use an objective, systematic approach to choose the best risk-adjusted stocks within their sector |

The Portfolio:

| | • | | Typically holds 100 to 200 securities that the investment team believes will generate solid excess returns over the S&P 500 Index at a moderate risk |

Sell Discipline

CEP has a structured sell discipline: a stock is sold if it is lowly ranked and if there is a viable alternative within its industry, based upon risk/return. This is applied consistently across the universe and over time. The team format assures decisions are being made that are consistent with the Fund’s objectives.

Fixed Income Portfolio

In its fixed income portfolios Chicago Equity Partners employs a risk controlled, low volatility process that is designed to increase the likelihood of producing excess return while controlling the level of risk versus the benchmark. CEP’s investment process involves both performance enhancement strategies and risk management techniques. Excess return is achieved in two primary ways: sector allocation and security selection. CEP’s proprietary quantitative analysis provides an efficient framework for identifying and evaluating opportunities in the bond market. In this process, they screen for bonds with the characteristics they have found to be the drivers of bond returns over time. This approach allows the team to evaluate a significant amount of bond market data in a systematic way. The qualitative overlay incorporates the opinions of their fundamental analysts and provides a check to the quantitative process.

Ideal Investment

The ideal investment typically exhibits some of the following traits:

| | • | | Falls within core competencies |

| | • | | High research ranking based on sound fundamentals |

| | • | | Offers yield advantage versus peer group |

| | • | | Attractive yield curve position |

| | • | | Provides good liquidity |

| | • | | Stable or improving fundamentals (for corporate bonds) |

Portfolio Construction

In constructing the Portfolio, the investment team follows this approach:

| | • | | Sector weightings are determined by the relative attractiveness of corporates, mortgages, agencies, and Treasuries using fundamental and quantitative analysis |

| | • | | The security selection decision is determined by analyzing bonds within their peer group and choosing the most favorable issuers from a risk/return standpoint based on proprietary research |

| | • | | Durations are maintained within a range of plus or minus 10% of the benchmark |

| | • | | Yield curve positioning is determined after a thorough review of the interest rate environment |

| | • | | Over time, value is added while reducing volatility at the sector and security level through timely responses to changing, sometimes irrational, market conditions |

Sell Discipline

The investment team may make a sell decision when a security:

| | • | | Deteriorates in research ranking due to change in fundamentals or business strategy |

| | • | | Is reevaluated because facts surrounding original purchase come into question |

10

Managers Balanced Fund

Portfolio Manager’s Comments (continued)

| | • | | Meets price target or another security offers higher total return opportunity |

| | • | | Experiences an unexplained drop in bond or stock price |

| | • | | Is downgraded by rating agency |

THE YEAR IN REVIEW

Managers Balanced Fund (Institutional Class) returned 13.98% during 2006, compared to a return of 11.20% for the hypothetical benchmark consisting of 60% S&P 500 and 40% Lehman Brothers Aggregate Bond Index (“the Index”). Please note that this Fund has multiple classes. Performance for all classes can be found on page 12 and at www.managersinvest.com.

U.S. markets turned in a strong year overcoming a fairly significant correction in early May. Within the broad market, small-cap stocks (as measured by the Russell 2000®) regained the upper hand over large-cap stocks (as measured by the Russell 1000® Index) returning 18.4% and 15.5%, respectively. Similarly, value continued its recent dominance over growth as the Russell 3000® Value gained 22.3% compared to 9.5% for its growth counterpart. The broad market exhibited across the board gains with only technology and health care failing to post double-digit returns. Despite averaging just over a 3% weight in the Index, telecommunication services was the runaway winner posting a 37% return. Also of note during the year was a lack of reward for companies with higher projected EPS growth. The lower the 5-year projected EPS growth rate, the higher the return.

The U.S. bond market in 2006 was defined by two distinct halves—the first, which was marked by escalating inflationary fears, tighter global central bank policy, and higher interest rates; and the second, which was marked by a Federal Reserve pause, poor economic data, and sharply falling rates. During the year, the Fed hiked the Fed Funds rate 4 times, from 4.25% to 5.25%, as higher energy prices and a resilient U.S. economy led to concerns over higher inflation. In August, however, for the first time in over two years, the Fed decided to keep rates on hold, signaling that the tightening cycle may have come to an end. Following the Fed pause in August, economic data releases began to signal a weakening economy, led by poor data in the housing and auto sectors. The economic slowdown sparked a sharp bond rally, as the 10-year Treasury yield fell to 4.60%, well off the year’s high of 5.24% reached in June. As longer term bonds rallied and rates fell, short-term bonds were anchored by the Fed Funds rate, which led to an inversion in the yield curve. It’s worth noting, if only for comparison sake, yield curve inversions historically have been associated with future economic recessions. U.S. corporate high yield and emerging markets debt were the top-performing sectors returning 840 basis points (8.40%) and 700 basis points (7.00%), respectively, over like-duration Treasuries. Furthermore, the interest rate environment became more favorable for mortgage backed securities toward the latter half of the year, allowing such issues to outperform like-duration Treasuries by over 120 basis points (1.2%).

The Fund’s equity-centric allocation was beneficial to performance as stocks outperformed bonds. We had noted in last year’s Annual Report that the investment outlook favored equities over bonds. Thus, we generally maintained an allocation of 70% equities versus 30% bonds throughout the year (compared to a neutral allocation of 60% equities and 40% bonds).

Within this broad allocation, the Fund’s managers performed reasonably well during 2006. The manager of the equity portion, Chicago Equity Partners, produced returns that were moderately ahead of the S&P 500 Index. As the manager’s investment philosophy is intended to immunize the Fund’s sector exposure, this outperformance came from good security selection within sectors. For instance, the Fund’s telecom holdings surged 80%, on average, compared to a 37% increase for the utilities securities within the S&P 500. Similarly the Fund’s consumer staples holdings rose almost 22% on average compared to just over a 13% increase for the industrial stocks within the S&P 500.

Meanwhile the Fund’s fixed income portion, managed by Loomis Sayles, significantly outperformed the Lehman Brothers Aggregate Bond Index. Portfolio management aggressively extended the duration of the Portfolio through the selling of shorter-term Treasuries. The shift to a market overweight in duration was in anticipation of the Fed’s decision to pause in its campaign to raise interest rates. As yields fell and prices rose, the Fund was correctly positioned to capture value. In terms of quality, the Fund’s exposure to Government/ Agency issues was down to 2% by year-end compared to nearly 40% at the end of 2005. High yield holdings grew to 45% throughout the year and proved to be one of the stronger segments of the market. With almost the entire Portfolio allocated to U.S. Dollars, the Portfolio was largely unaffected by foreign currency exposure.

LOOKING FORWARD

The Asset Allocation Committee of Managers Investment Group continues to view stocks as having generally better current risk/ reward prospects than bonds. Thus, the Fund’s overall allocation remains weighted towards stocks versus bonds. Sector allocations within the equity portion of the Fund will generally remain steady going into 2007. However, CEP is expected to move the fixed income portion of the Portfolio into higher credit quality securities. CEP’s comments as we progress into 2007:

Our forecast for 2007 is generally optimistic. Overall expectations are that the weakness in housing and manufacturing should moderate, the strength in the service sector will continue, and inflation will decline, all leading to moderate real growth for the economy. With the forward P/E of the S&P 500 below average historical levels, valuations should continue to show positive returns as multiples expand due to lower inflation expectations and anticipation of future economic growth. Given the expected slow down in earnings and GDP, we believe investors will focus on high quality balance sheets and less on price momentum. On the fixed income side, the yield curve inversion has historically been a sign of slower future growth and lower rates. The intermediate maturities historically have performed the best when the Fed stops tightening. With investors not currently being compensated for risks in lower quality bonds, the market should focus on high quality bonds emphasizing stable cash flows.

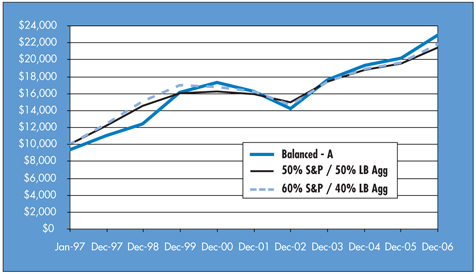

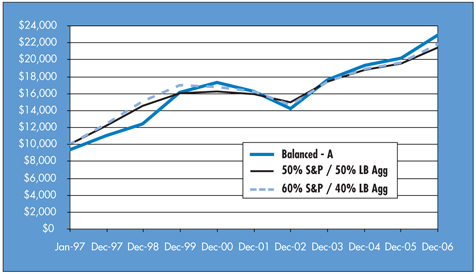

CUMULATIVE TOTAL RETURN PERFORMANCE

Managers Balanced Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The benchmark is a combination of the S&P 500 Index and the Lehman Brothers U.S. Aggregate Index. The S&P 500 Index is an unmanaged capitalization weighted index of 500 commonly traded stocks designed to measure performance of the broad domestic economy through

11

Managers Balanced Fund

Portfolio Manager’s Comments (continued)

changes in the aggregate market value of those stocks. The Lehman Brothers U.S. Aggregate Index represents securities that are SEC-registered, taxable, and U.S. dollar denominated. The Index covers the U.S. investment grade fixed-rate bond market, with 6,434 government and corporate securities, mortgage pass-through securities, and asset-backed securities. Unlike the Fund, the S&P 500 Index and the Lehman Brothers U.S. Aggregate Index are unmanaged, are not available for investment, and do not incur expenses. The chart illustrates the performance of a hypothetical $10,000 investment made in the Fund’s Class A Shares on January 2, 1997, to a $10,000 investment made in the benchmark for the same time periods. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. Performance for periods longer than one year is annualized. The listed returns for the Fund are net of expenses and the returns for the indices exclude expenses. Total returns for the Fund would have been lower had certain expenses not been reduced.

The table below shows the average annualized total returns for the Balanced Fund, 60% S&P 500 / 40% Lehman Brothers U.S. Aggregate Index and 50% S&P 500 / 50% Lehman Brothers U.S. Aggregate Index since inception through December 31, 2006.

| | | | | | | | | | | | | | | |

Average Annual Total Returns | | | | | | 1 Year | | | 5 Years | | | Since

Inception | | | Inception

Date |

Balanced | | -Class A | | No Load | | 13.73 | % | | 7.06 | % | | 9.21 | % | | 01/02/97 |

| | -Class A | | With Load | | 7.23 | % | | 5.80 | % | | 8.56 | % | | 01/02/97 |

| | -Class B | | No Load | | 12.83 | % | | 6.46 | % | | 7.31 | % | | 02/10/98 |

| | -Class B | | With Load | | 7.83 | % | | 6.15 | % | | 7.31 | % | | 02/10/98 |

| | -Class C | | No Load | | 12.88 | % | | 6.44 | % | | 7.24 | % | | 02/13/98 |

| | -Class C | | With Load | | 11.88 | % | | 6.23 | % | | 7.12 | % | | 02/13/98 |

| | -Institutional Class | | No Load | | 13.98 | % | | 7.51 | % | | 9.71 | % | | 01/02/97 |

60% S&P 500 Index & 40% Lehman Brothers

Aggregate Bond Index | | | | | | 11.20 | % | | 6.12 | % | | 8.06 | %* | | |

50% S&P 500 Index & 50% Lehman Brothers

Aggregate Bond Index | | | | | | 10.21 | % | | 6.05 | % | | 7.88 | %* | | |

| * | Performance for the 60% S&P 500 Index & 40% Lehman Brothers Aggregate Bond Index reflects an inception date of January 2, 1997. The previous benchmark for the Fund was 50% S&P 500 Index & 50% Lehman Brothers Aggregate Bond Index. The components of the underlying indices were rebalanced to coincide with the asset allocation of the Fund. Performance for the 50% S&P 500 Index & 50% Lehman Brothers Aggregate Bond Index reflects an inception date of January 2, 1997. |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end please call (800) 835-3879 or visit our Web site at www.managersinvest.com.

12

Managers Balanced Fund

Fund Snapshots

December 31, 2006

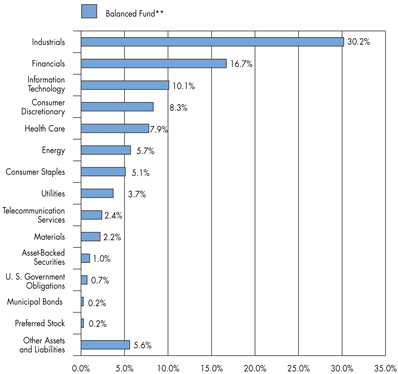

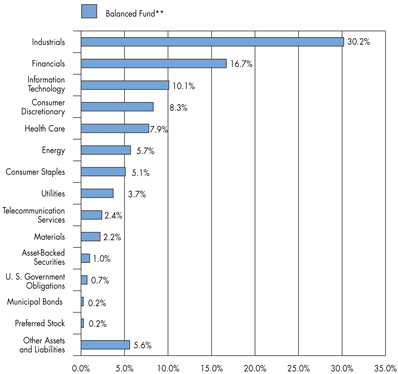

Portfolio Breakdown

| ** | As a percentage of net assets |

| | | |

Industry | | Balanced

Fund** | |

Industrials | | 30.2 | % |

Financials | | 16.7 | % |

Information Technology | | 10.1 | % |

Consumer Discretionary | | 8.3 | % |

Health Care | | 7.9 | % |

Energy | | 5.7 | % |

Consumer Staples | | 5.1 | % |

Utilities | | 3.7 | % |

Telecommunication Services | | 2.4 | % |

Materials | | 2.2 | % |

Asset-Backed Securities | | 1.0 | % |

U. S. Government Obligations | | 0.7 | % |

Municipal Bonds | | 0.2 | % |

Preferred Stock | | 0.2 | % |

Other Assets and Liabilities | | 5.6 | % |

Top Ten Holdings

| | | |

Top Ten Holdings (out of 219 securities) | | % of

Net Assets | |

Bank of America Corp.* | | 2.8 | % |

BellSouth Corp.* | | 2.4 | |

Johnson & Johnson* | | 2.2 | |

JPMorgan Chase & Co.* | | 2.1 | |

Hewlett-Packard Co. | | 1.8 | |

Goldman Sachs Group, Inc. | | 1.8 | |

Microsoft Corp. | | 1.7 | |

McDonald’s Corp. | | 1.4 | |

PG&E Corp.* | | 1.4 | |

Cisco Systems, Inc. | | 1.4 | |

| | | |

Top Ten as a Group | | 19.0 | % |

| | | |

| * | Top Ten Holding at June 30, 2006 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security.

13

Managers Balanced Fund

Schedule of Portfolio Investments

December 31, 2006

| | | | | | |

Security Description | | Shares | | | Value |

Common Stocks - 64.7% | | | | | | |

Consumer Discretionary - 8.3% | | | | | | |

American Eagle Outfitters, Inc. | | 2,400 | 2 | | $ | 74,904 |

AnnTaylor Stores Corp.* | | 1,600 | | | | 52,544 |

CBS Corp., Class B | | 3,300 | | | | 102,894 |

Dillard’s, Inc., Class A | | 2,200 | | | | 76,934 |

General Motors Corp. | | 4,000 | 2 | | | 122,880 |

IAC/InterActive Corp.* | | 3,800 | 2 | | | 141,208 |

J.C. Penney Co., Inc. | | 3,200 | | | | 247,552 |

McDonald’s Corp. | | 7,300 | 2 | | | 323,609 |

McGraw-Hill Companies, Inc., The | | 1,600 | 2 | | | 108,832 |

Office Depot, Inc.* | | 3,300 | 2 | | | 125,961 |

Omnicom Group, Inc. | | 2,300 | 2 | | | 240,442 |

Sherwin-Williams Co., The | | 2,700 | | | | 171,666 |

Walt Disney Co., The | | 2,300 | | | | 78,821 |

Total Consumer Discretionary | | | | | | 1,868,247 |

Consumer Staples - 5.1% | | | | | | |

Altria Group, Inc. | | 2,220 | | | | 190,520 |

Archer-Daniels-Midland Co. | | 600 | | | | 19,176 |

Avon Products, Inc. | | 3,400 | | | | 112,336 |

Kraft Foods, Inc. | | 4,500 | 2 | | | 160,650 |

Kroger Co. | | 6,100 | 2 | | | 140,727 |

PepsiCo, Inc. | | 4,400 | | | | 275,220 |

Procter & Gamble Co. | | 3,812 | 2 | | | 244,997 |

Total Consumer Staples | | | | | | 1,143,626 |

Energy - 5.7% | | | | | | |

ConocoPhillips Co. | | 3,200 | | | | 230,240 |

Devon Energy Corp. | | 1,500 | 2 | | | 100,620 |

Exxon Mobil Corp. | | 3,820 | 2 | | | 292,727 |

Marathon Oil Corp. | | 3,300 | | | | 305,250 |

Sunoco, Inc. | | 2,800 | 2 | | | 174,608 |

Tidewater, Inc. | | 3,800 | 2 | | | 183,768 |

Total Energy | | | | | | 1,287,213 |

Financials - 13.9% | | | | | | |

Assurant, Inc. | | 2,100 | 2 | | | 116,025 |

AvalonBay Communities, Inc. | | 600 | | | | 78,030 |

Bank of America Corp. | | 11,800 | | | | 630,002 |

Bear, Stearns & Co., Inc. | | 500 | | | | 81,390 |

CBL & Associates Properties, Inc. | | 4,100 | | | | 177,735 |

Chubb Corp. | | 3,800 | 2 | | | 201,058 |

Citigroup, Inc. | | 2,500 | | | | 139,250 |

Conseco, Inc.* | | 5,900 | 2 | | | 117,882 |

Countrywide Financial Corp. | | 800 | 2 | | | 33,960 |

The accompanying notes are an integral part of these financial statements.

14

Managers Balanced Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

Security Description | | Shares | | | Value |

Financials - 13.9% (continued) | | | | | | |

First Marblehead Corp., The | | 1,650 | 2 | | $ | 90,173 |

Goldman Sachs Group, Inc. | | 2,000 | | | | 398,700 |

JPMorgan Chase & Co. | | 9,748 | | | | 470,828 |

Lehman Brothers Holdings, Inc. | | 400 | | | | 31,248 |

Merrill Lynch & Co., Inc. | | 900 | | | | 83,790 |

New Century Financial Corp. | | 2,500 | | | | 78,975 |

PMI Group, Inc. | | 800 | | | | 37,736 |

Principal Financial Group | | 2,500 | | | | 146,750 |

Radian Group, Inc. | | 1,000 | | | | 53,910 |

SunTrust Banks, Inc. | | 2,100 | 2 | | | 177,345 |

Total Financials | | | | | | 3,144,787 |

Health Care - 7.9% | | | | | | |

Aetna, Inc. | | 3,000 | | | | 129,540 |

AmerisourceBergen Corp. | | 2,400 | 2 | | | 107,904 |

Amgen, Inc.* | | 500 | | | | 34,155 |

Applera Corp. - Applied Biosystems Group | | 2,900 | 2 | | | 106,401 |

Becton, Dickinson & Co. | | 300 | 2 | | | 21,045 |

Biogen Idec, Inc.* | | 2,700 | 2 | | | 132,813 |

CIGNA Corp. | | 1,900 | | | | 249,983 |

Endo Pharmaceuticals Holdings, Inc.* | | 1,500 | | | | 41,370 |

Johnson & Johnson | | 7,380 | | | | 487,228 |

King Pharmaceuticals, Inc.* | | 3,200 | 2 | | | 50,944 |

Merck & Co., Inc. | | 4,800 | | | | 209,280 |

Pfizer, Inc. | | 8,140 | | | | 210,826 |

Total Health Care | | | | | | 1,781,489 |

Industrials - 6.6% | | | | | | |

Continental Airlines, Inc.* | | 4,500 | 2 | | | 185,625 |

CSX Corp. | | 1,400 | | | | 48,202 |

Cummins, Inc. | | 1,500 | 2 | | | 177,270 |

Dun & Bradstreet Corp.* | | 1,200 | | | | 99,348 |

Emerson Electric Co. | | 4,600 | | | | 202,814 |

General Electric Co. | | 5,800 | | | | 215,818 |

Manpower, Inc. | | 600 | 2 | | | 44,958 |

Northrop Grumman Corp. | | 4,500 | | | | 304,650 |

Raytheon Co. | | 1,000 | | | | 52,800 |

Ryder System, Inc. | | 400 | | | | 20,424 |

Textron, Inc. | | 1,400 | | | | 131,278 |

Total Industrials | | | | | | 1,483,187 |

Information Technology - 9.8% | | | | | | |

Advanced Micro Devices, Inc.* | | 5,500 | 2 | | | 111,925 |

Altera Corp.* | | 3,000 | 2 | | | 59,040 |

BEA Systems, Inc.* | | 7,800 | | | | 98,124 |

Cisco Systems, Inc.* | | 11,540 | 2 | | | 315,388 |

The accompanying notes are an integral part of these financial statements.

15

Managers Balanced Fund

Schedule of Portfolio Investments (continued)

| | | | | | | |

Security Description | | Shares | | | Value |

Information Technology - 9.8% (continued) | | | | | | | |

Computer Sciences Corp.* | | | 2,200 | | | $ | 117,414 |

Electronic Data Systems Corp | | | 2,200 | 2 | | | 60,610 |

Fidelity National Information Services, Inc. | | | 430 | | | | 17,236 |

Google, Inc.* | | | 100 | | | | 46,048 |

Hewlett-Packard Co. | | | 9,700 | | | | 399,543 |

International Business Machines Corp. | | | 2,200 | | | | 213,730 |

LSI Logic Corp.* | | | 5,200 | 2 | | | 46,800 |

Mastercard, Inc. | | | 1,100 | | | | 108,339 |

Microsoft Corp. | | | 12,700 | | | | 379,222 |

Motorola, Inc. | | | 4,600 | | | | 94,576 |

Nvidia Corp.* | | | 3,600 | 2 | | | 133,236 |

Vishay Intertechnology, Inc.* | | | 1,800 | | | | 24,372 |

Total Information Technology | | | | | | | 2,225,603 |

Materials - 2.2% | | | | | | | |

Celanese Corp. | | | 7,600 | | | | 196,688 |

Nucor Corp. | | | 2,200 | | | | 120,252 |

Pactiv Corp.* | | | 2,700 | 2 | | | 96,363 |

United States Steel Corp. | | | 1,100 | | | | 80,454 |

Total Materials | | | | | | | 493,757 |

Telecommunication Services - 2.4% | | | | | | | |

BellSouth Corp. | | | 11,600 | | | | 546,476 |

Utilities - 2.8% | | | | | | | |

Edison International | | | 5,200 | | | | 236,496 |

PG&E Corp. | | | 6,700 | 2 | | | 317,111 |

Sempra Energy | | | 1,200 | | | | 67,248 |

Total Utilities | | | | | | | 620,855 |

Total Common Stocks (cost $ 12,171,382) | | | | | | | 14,595,240 |

| | |

| | | Principal

Amount | | | |

Corporate Bonds - 28.6% | | | | | | | |

Asset-Backed Securities - 1.0% | | | | | | | |

First Union National Bank Commercial Mortgage, Series 1999-C4, Class A1, 7.184%, 12/15/31 | | $ | 22,145 | | | | 22,225 |

Greenwich Capital Commercial Funding Corp., Series 2005-GG5, Class A2, 5.117%, 04/10/37 | | | 90,000 | | | | 89,736 |

GS Mortgage Securities Corp. II Series 2005-GG4, 4.751%, 07/10/39 | | | 50,000 | | | | 48,195 |

Morgan Stanley Capital I, Series 2005-T19, 4.890%, 06/12/47 | | | 75,000 | | | | 72,887 |

Total Asset-Backed Securities | | | | | | | 233,043 |

Finance - 2.8% | | | | | | | |

Berkshire Hathaway Finance Corp., 4.850%, 01/15/15 | | | 150,000 | | | | 145,578 |

EOP Operating LP, 4.750%, 03/15/14 | | | 75,000 | | | | 74,409 |

General Motors Acceptance Corp., 8.000%, 11/01/31 | | | 105,000 | | | | 120,897 |

Host Hotels & Resorts LP, 6.875%, 11/01/14 (a) | | | 50,000 | | | | 50,875 |

The accompanying notes are an integral part of these financial statements.

16

Managers Balanced Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

Security Description | | Principal Amount | | Value |

Finance - 2.8% (continued) | | | | | | |

Kinder Morgan Finance Co., | | | | | | |

5.150%, 03/01/15 | | $ | 10,000 | | $ | 8,988 |

5.700%, 01/05/16 | | | 45,000 | | | 41,359 |

6.400%, 01/05/36 | | | 35,000 | | | 31,301 |

Toll Brothers Finance Corp., 5.150%, 05/15/15 | | | 20,000 | | | 18,356 |

Wells Fargo Co., 5.121%, 05/01/33, (02/01/07)5 | | | 105,000 | | | 105,864 |

Western Union Co., 5.930%, 10/01/16 (a) | | | 30,000 | | | 29,767 |

Total Finance | | | | | | 627,394 |

Industrials - 23.6% | | | | | | |

Albertson’s, Inc. | | | | | | |

6.625%, 06/01/28 | | | 20,000 | | | 18,257 |

7.450%, 08/01/29 | | | 85,000 | | | 83,470 |

7.750%, 06/15/26 | | | 125,000 | | | 125,305 |

8.000%, 05/01/31 | | | 5,000 | | | 5,097 |

America Movil SA de CV, 6.375%, 03/01/35 | | | 55,000 | | | 53,935 |

American Stores Co., 8.000%, 06/01/26 | | | 5,000 | | | 5,281 |

Arrow Electronics, Inc., 6.875%, 06/01/18 | | | 75,000 | | | 77,632 |

AT&T Wireless Services, Inc., 8.750%, 03/01/31 | | | 105,000 | | | 136,850 |

AT&T, Inc., 6.150%, 09/15/34 | | | 245,000 | | | 241,765 |

Atitibi-Consolidated, Inc., 7.400%, 04/01/18 | | | 45,000 | | | 35,775 |

Avnet, Inc. | | | | | | |

6.000%, 09/01/15 | | | 25,000 | | | 24,691 |

6.625%, 09/15/16 | | | 25,000 | | | 25,753 |

Bombardier, Inc., 7.450%, 05/01/34 (a) | | | 115,000 | | | 105,800 |

Borden, Inc. | | | | | | |

7.785%, 02/15/23 | | | 10,000 | | | 8,050 |

8.375%, 04/15/16 | | | 5,000 | | | 4,375 |

9.200%, 03/15/21 | | | 15,000 | | | 13,350 |

BSKYB Finance UK PLC., 6.500%, 10/15/35 (a) | | | 60,000 | | | 59,529 |

Case Corp., 7.250%, 01/15/16 | | | 55,000 | | | 55,963 |

Centex Corp., 5.250%, 06/15/15 | | | 40,000 | | | 37,843 |

Chesapeake Energy Corp. | | | | | | |

6.375%, 06/15/15 | | | 15,000 | | | 14,925 |

6.500%, 08/15/17 | | | 115,000 | | | 112,988 |

Colorado Interstate Gas Co., 6.800%, 11/15/15 | | | 40,000 | | | 41,791 |

Comcast Corp. | | | | | | |

5.650%, 06/15/35 | | | 175,000 | | | 159,388 |

6.450%, 03/15/37 | | | 20,000 | | | 20,077 |

6.500%, 11/15/35 | | | 10,000 | | | 10,103 |

Corning Inc. | | | | | | |

6.200%, 03/15/16 | | | 60,000 | | | 61,193 |

6.850%, 03/01/29 | | | 45,000 | | | 46,966 |

7.250%, 08/15/36 | | | 50,000 | | | 53,753 |

The accompanying notes are an integral part of these financial statements.

17

Managers Balanced Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

Security Description | | Principal Amount | | Value |

Industrials - 23.6% (continued) | | | | | | |

CSC Holdings, Inc., 7.875%, 02/15/18 | | $ | 100,000 | | $ | 100,250 |

CVS Corp., 6.125%, 08/15/16 | | | 40,000 | | | 41,347 |

D.R. Horton, Inc. | | | | | | |

5.250%, 02/15/15 | | | 40,000 | | | 37,397 |

5.625%, 01/15/16 | | | 15,000 | | | 14,295 |

5.625%, 09/15/24 | | | 10,000 | | | 9,674 |

Desarrolladora Homex S.A. de C.V., 7.500%, 09/28/15 | | | 20,000 | | | 20,500 |

Dillards, Inc., 7.000%, 12/01/28 | | | 80,000 | | | 76,800 |

Dow Chemical Co., 7.375%, 11/01/29 | | | 75,000 | | | 86,945 |

Duke Energy Field Services LLC, 6.450%, 11/03/36 (a) | | | 30,000 | | | 30,928 |

Elan Finance PLC, 7.750%, 11/15/11 | | | 60,000 | | | 58,875 |

Embraer Overseas, Ltd., 6.375%, 01/24/17 (a) | | | 100,000 | | | 100,250 |

Energy Transfer Partners LP | | | | | | |

6.125%, 02/15/17 | | | 10,000 | | | 10,158 |

6.625%, 10/15/36 | | | 5,000 | | | 5,165 |

Ford Motor Co., 7.450%, 07/16/31 | | | 250,000 | | | 197,500 |

Georgia-Pacific Corp. | | | | | | |

7.700%, 06/15/15 | | | 125,000 | | | 127,969 |

8.000%, 01/15/24 | | | 10,000 | | | 10,200 |

8.875%, 05/15/31 | | | 15,000 | | | 15,938 |

HCA, Inc. | | | | | | |

6.500%, 02/15/16 | | | 30,000 | | | 25,425 |

7.050%, 12/01/27 | | | 5,000 | | | 3,788 |

7.500%, 12/15/23 | | | 10,000 | | | 8,187 |

7.580%, 09/15/25 | | | 10,000 | | | 8,187 |

7.690%, 06/15/25 | | | 30,000 | | | 24,981 |

7.750%, 07/15/36 | | | 5,000 | | | 4,035 |

Hercules, Inc., 6.500%, 06/30/29 | | | 35,000 | | | 30,100 |

Intelsat Corp., 6.875%, 01/15/28 | | | 40,000 | | | 36,800 |

Jefferson Smurfit Corp., 7.500%, 06/01/13 | | | 45,000 | | | 42,525 |

Joy Global, Inc., 6.625%, 11/15/36 (a) | | | 5,000 | | | 4,986 |

K. Hovnanian Enterprises, Inc. | | | | | | |

6.250%, 01/15/16 | | | 30,000 | | | 28,500 |

6.375%, 12/15/14 | | | 5,000 | | | 4,825 |

6.500%, 01/15/14 | | | 5,000 | | | 4,875 |

7.500%, 05/15/16 | | | 50,000 | | | 50,500 |

KB Home, 5.875%, 01/15/15 | | | 130,000 | | | 119,851 |

Lennar Corp., 5.600%, 05/31/15 | | | 15,000 | | | 14,366 |

Level 3 Communications, Inc. | | | | | | |

6.000%, 03/15/10 | | | 20,000 | | | 18,550 |

11.500%, 03/01/10 | | | 75,000 | | | 79,875 |

Lucent Technologies, Inc., 6.450%, 03/15/29 | | | 160,000 | | | 148,400 |

The accompanying notes are an integral part of these financial statements.

18

Managers Balanced Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

Security Description | | Principal Amount | | Value |

Industrials - 23.6% (continued) | | | | | | |

Nektar Therapeutics, 3.250%, 09/28/12 | | $ | 15,000 | | $ | 15,056 |

New England Telephone & Telegraph Co., 7.875%, 11/15/29 | | | 15,000 | | | 16,411 |

News America, Inc., 7.280%, 06/30/28 | | | 75,000 | | | 80,941 |

Nextel Communications, Inc., 5.950%, 03/15/14 | | | 10,000 | | | 9,752 |

NGC Corp. Capital Trust, 8.316%, 06/01/27 | | | 85,000 | | | 80,750 |

Nortel Networks Corp. | | | | | | |

6.875%, 09/01/23 | | | 45,000 | | | 38,025 |

10.125%, 07/15/13 (a) | | | 100,000 | | | 108,500 |

ONEOK Partners LP | | | | | | |

6.150%, 10/01/16 | | | 25,000 | | | 25,413 |

6.650%, 10/01/36 | | | 35,000 | | | 35,916 |

Owens & Minor, Inc., 6.350%, 04/15/16 | | | 75,000 | | | 75,434 |

Pioneer Natural Resources USA, Inc., 5.875%, 07/15/16 | | | 65,000 | | | 60,266 |

Pulte Homes, Inc. | | | | | | |

5.200%, 02/15/15 | | | 30,000 | | | 28,629 |

6.000%, 02/15/35 | | | 70,000 | | | 64,237 |

6.375%, 05/15/33 | | | 35,000 | | | 32,778 |

Qwest Corp. | | | | | | |

6.875%, 09/15/33 | | | 85,000 | | | 81,600 |

7.500%, 10/01/14 | | | 55,000 | | | 58,575 |

7.500%, 06/15/23 | | | 25,000 | | | 25,313 |

Rogers Cable, Inc., 5.500%, 03/15/14 | | | 80,000 | | | 76,895 |

Sara Lee Corp., 6.125%, 11/01/32 | | | 15,000 | | | 13,614 |

Southern Natural Gas Co., 8.875%, 03/15/10 | | | 30,000 | | | 31,623 |

Sprint Capital Corp., 6.875%, 11/15/28 | | | 75,000 | | | 75,287 |

Tennessee Gas Pipeline Co., 7.000%, 10/15/28 | | | 50,000 | | | 53,044 |

Time Warner, Inc. | | | | | | |

6.500%, 11/15/36 | | | 5,000 | | | 4,993 |

6.625%, 05/15/29 | | | 75,000 | | | 76,178 |

6.950%, 01/15/28 | | | 35,000 | | | 36,832 |

Transcontinental Gas Pipeline Corp., 6.400%, 04/15/16 | | | 55,000 | | | 55,825 |

True Move Co., Ltd., 10.750%, 12/16/13 (a) | | | 100,000 | | | 98,000 |

US West Communications, Inc., 7.250%, 09/15/25 | | | 75,000 | | | 77,438 |

USG Corp., 6.300%, 11/15/16 (a) | | | 50,000 | | | 49,652 |

Vale Overseas Ltd., 6.875%, 11/01/36 | | | 25,000 | | | 25,766 |

Verizon Global Funding Corp., 5.850%, 09/15/35 | | | 80,000 | | | 76,879 |

Verizon New York, Inc., 7.375%, 04/01/32 | | | 35,000 | | | 36,243 |

Viacom, Inc., 6.875%, 04/30/36 | | | 30,000 | | | 29,753 |

Weatherford International, Inc., 6.500%, 08/01/36 | | | 55,000 | | | 55,394 |

WellPoint Inc. | | | | | | |

5.000%, 12/15/14 | | | 25,000 | | | 24,243 |

5.850%, 01/15/36 | | | 115,000 | | | 112,099 |

Xerox Corp., 6.400%, 03/15/16 | | | 162,000 | | | 166,253 |

The accompanying notes are an integral part of these financial statements.

19

Managers Balanced Fund

Schedule of Portfolio Investments (continued)

| | | | | | | |

Security Description | | Principal Amount | | Value | |

Industrials - 23.6% (continued) | | | | | | | |

XTO Energy Inc., 5.300%, 06/30/15 | | $ | 80,000 | | $ | 77,530 | |

Total Industrials | | | | | | 5,333,989 | |

Information Technology - 0.3% | | | | | | | |

Hanaro Telecom, Inc., 7.000%, 02/01/12 (a) | | | 75,000 | | | 75,283 | |

Utilities - 0.9% | | | | | | | |

Dynergy Holdings, Inc. | | | | | | | |

7.125%, 05/15/18 | | | 40,000 | | | 39,200 | |

7.625%, 10/15/26 | | | 10,000 | | | 9,750 | |

Exelon Generation Co. LLC, 5.350%, 01/15/14 | | | 75,000 | | | 73,568 | |

Methanex Corp., 6.000%, 08/15/15 | | | 45,000 | | | 42,754 | |

Toledo Edison Co., 6.150%, 05/15/37 | | | 25,000 | | | 24,693 | |

Total Utilities | | | | | | 189,965 | |

Total Corporate Bonds (cost $6,276,126) | | | 5,938,718 | | | 6,459,674 | |

Municipal Bonds - 0.2% | | | | | | | |

MI Tobacco Settlement, 7.309%, 06/01/34 (cost $34,998) | | | 35,000 | | | 36,539 | |

U.S. Government Obligations - 0.7% | | | | | | | |

USTB, 4.500%, 02/15/36 (cost $162,394) | | | 175,000 | | | 166,469 | |

| | |

| | | Shares | | | |

Preferred Stock - 0.2% | | | | | | | |

Newell Financial Trust I, 5.250% (cost $39,878) | | | 925 | | | 44,284 | |

Other Investment Companies - 28.3%1 | | | | | | | |

Bank of New York Institutional Cash Reserves Fund, 5.32% 3 | | | 5,217,992 | | | 5,217,992 | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 5.18% | | | 1,178,867 | | | 1,178,867 | |

Total Other Investment Companies (cost $6,396,859) | | | | | | 6,396,859 | |

Total Investments - 122.7% (cost $25,081,637) | | | | | | 27,699,065 | |

Other Assets, less Liabilities - (22.7)% | | | | | | (5,125,657 | ) |

Net Assets - 100.0% | | | | | $ | 22,573,408 | |

The accompanying notes are an integral part of these financial statements.

20

Managers High Yield Fund

Portfolio Manager’s Comments

The Managers High Yield Fund seeks a high level of current income, with a secondary objective of capital appreciation.

The Fund currently employs a single subadvisor, J.P. Morgan Investment Management Inc. (“JPMorgan”), to manage the assets of the Fund. The investment philosophy at JPMorgan is based on the belief that security selection produces superior risk-adjusted returns. Thus, they place an emphasis on relative value, using a bottom-up research approach to look for opportunities where the market price of a security does not accurately reflect its intrinsic value.

The investment team at JPMorgan believes that the best investment ideas are generated collaboratively from their research analysts, traders, and portfolio managers. Research analysts perform “grass roots” fundamental research on all companies that they consider for investment.

The ideal investment exhibits the following traits:

| | • | | Strong corporate fundamentals and understandable business plan |

| | • | | Healthy capital structure to ensure priority of debt obligations |

| | • | | Attractive bond yield relative to opportunity set |

Portfolio management:

| | • | | Selects securities using a bottom-up process drawing from investment opportunities identified by asset class teams |

| | • | | Seeks value in the context of long-term horizon |

| | • | | Balances deep value to provide capital appreciation with relative value to provide income and stability |

| | • | | Diversifies broadly, limiting issues and industry concentrations |

The investment team will make a sell decision when:

| | • | | Security no longer possesses attractive risk/return dynamic |

| | • | | Attractive swap candidate emerges |

| | • | | Analyst uncovers deteriorating fundamentals not reflected in security price |

| | • | | Portfolio rebalancing is required |

THE YEAR IN REVIEW

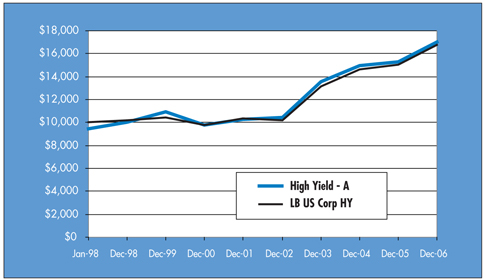

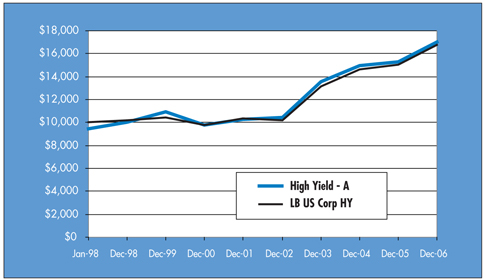

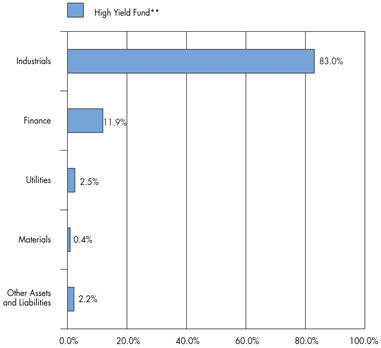

Managers High Yield Fund (Institutional Class) rose 11.38% in 2006, compared to a gain of 11.85% for the Lehman Brothers U.S. Corporate High Yield Index. Please note that this Fund has multiple classes. Performance for all classes can be found on page 22 and at www.managersinvest.com.

In 2006, the bond markets very successfully transitioned from a long period of rather predictable Federal Reserve tightening to a decidedly neutral Fed policy where there is now uncertainty regarding the timing and direction of the next FOMC (Federal Open Market Committee) action. Despite starting the year at historically low yield spreads, the credit sectors, particularly high yield bonds, produced surprisingly strong returns. The main reason for this, of course, is that the economy continued to grow, corporate profitability continued to strengthen in almost all business sectors and corporate default rates remained extremely low. Hence, aside from a brief panic attack beginning in mid-May, there was nothing to scare investors away from risky assets, and there was plenty of liquidity searching for yields.

During the first half of the year, the FOMC hiked the Fed Funds rate four times, from 4.25% to 5.25%, as higher energy prices and a resilient U.S. economy led to concerns over higher inflation. In August, for the first time in over two years, the Fed kept rates on hold, signaling that the tightening cycle may have come to an end. Following the Fed pause in August, economic data releases began to signal a moderating economy, led by poor data in the housing and auto sectors. The economic slowdown sparked a sharp bond rally, as the 10-year Treasury yield fell to 4.60%, well off the year’s high of 5.24% reached in June. U.S. corporate high yield was the top-performing sector returning 840 basis points (8.40%) over like-duration Treasuries for the year.

One of the key drivers of high yield index returns in recent years has been the bonds of the large auto manufacturers, Ford and General Motors. When these companies’ debt ratings dropped below investment grade in 2005, their bonds became a significant weighting in most high yield indexes. Because of diversification disciplines as well as the risk that these companies would eventually default, most high yield portfolio managers would not hold a market-weighted position in these bonds. However, since the companies have been able to avoid default, and the perception of their prospects has improved, the bonds have performed quite well, and most active high yield managers have found it difficult to keep up with the indexes. Hence, while the Fund slightly under-performed its benchmark during the year, it took less concentration risk than the benchmark and outperformed a significant majority of its competitors.

Although the managers completely avoided the automakers bonds during the year, they did choose to hold some of the bonds of the auto financing companies, which provided solid gains. In addition, the Fund’s Dictaphone warrants surged during the first quarter after the company announced it was being acquired by Nuance. These securities had been out of the money for some time, and thus made a significant contribution to the Fund’s performance when the deal was announced.

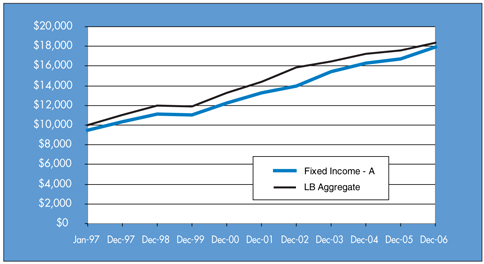

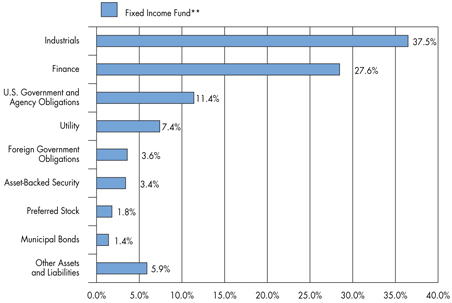

LOOKING FORWARD