Scott C. Goebel, Secretary

82 Devonshire St.

Item 1. Reports to Stockholders

The turnaround in global capital markets that marked most of 2009 slowed in early 2010, as investors considered the risks to a sustained recovery, including increased political uncertainty, high unemployment, weak consumer spending and potential inflation on the horizon. Financial markets are always unpredictable, of course, but there also are several time-tested investment principles that can help put the odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There can be tax advantages and cost benefits to consider as well. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best-performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or by phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Abigail P. Johnson

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2009 to February 28, 2010).

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Municipal Securities - 100.1% |

| Principal Amount (000s) | | Value (000s) |

Alabama - 0.7% |

Daphne-Villa Mercy Spl. Care Facilities Fing. Auth. Rev. (Mercy Med. Hosp. Proj.) 0.18%, LOC Wachovia Bank NA, VRDN (a) | $ 12,400 | | $ 12,400 |

Mobile Spl. Care Facilities Fing. Auth. Rev. (Infirmary Health Sys., Inc.) Series 2010 B, 0.16%, LOC Deutsche Bank Ag New York Bnch, VRDN (a) | 3,000 | | 3,000 |

| | 15,400 |

Alaska - 1.2% |

Valdez Marine Term. Rev. (ConocoPhillips Proj.): | | | |

Series 1994 A, 0.2%, VRDN (a) | 21,000 | | 21,000 |

Series 1994 B, 0.18% (ConocoPhillips Guaranteed), VRDN (a) | 4,100 | | 4,100 |

| | 25,100 |

Arizona - 2.3% |

Arizona Health Facilities Auth. Rev.: | | | |

(Banner Health Sys. Proj.): | | | |

Series 2008 B, 0.18%, LOC Bank of Nova Scotia New York Branch, VRDN (a) | 4,800 | | 4,800 |

Series 2008 C, 0.17%, LOC Bank of Nova Scotia New York Branch, VRDN (a) | 2,810 | | 2,810 |

Series 2008 E, 0.23%, LOC Landesbank Baden-Wuert, VRDN (a) | 8,100 | | 8,100 |

(Catholic Healthcare West Proj.) Series 2005 B, 0.17%, LOC JPMorgan Chase Bank, VRDN (a) | 3,780 | | 3,780 |

Arizona Health Facilities Auth. Sr. Living Rev. (Royal Oaks Life Care Cmnty. Proj.) Series 2008, 0.18%, LOC Bank of America NA, VRDN (a) | 4,150 | | 4,150 |

Chandler Gen. Oblig. Participating VRDN Series GS 07 49TP, 0.23% (Liquidity Facility Wells Fargo & Co.) (a)(d) | 10,695 | | 10,695 |

Glendale Indl. Dev. Auth. (Midwestern Univ. Proj.) Series 2008, 0.2%, LOC Bank of America NA, VRDN (a) | 1,200 | | 1,200 |

Phoenix Indl. Dev. Auth. Multi-family Hsg. Rev. (Del Mar Terrance Apts. Proj.) Series 1999 A, 0.22%, LOC Freddie Mac, VRDN (a) | 6,100 | | 6,100 |

Pima County Ctfs. of Prtn. Bonds Series 2009, 3% 6/1/10 | 1,000 | | 1,004 |

Salt River Proj. Agricultural Impt. & Pwr. District Elec. Sys. Rev. Participating VRDN: | | | |

Series Putters 3467, 0.2% (Liquidity Facility JPMorgan Chase Bank) (a)(d) | 2,115 | | 2,115 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Arizona - continued |

Salt River Proj. Agricultural Impt. & Pwr. District Elec. Sys. Rev. Participating VRDN: - continued | | | |

Series ROC II R 11712, 0.2% (Liquidity Facility Citibank NA) (a)(d) | $ 1,000 | | $ 1,000 |

Tempe Indl. Dev. Auth. Rev. (ASUF Brickyard Proj.) Series 2004 A, 0.2%, LOC Bank of America NA, VRDN (a) | 3,500 | | 3,500 |

| | 49,254 |

California - 4.5% |

Bay Area Toll Auth. San Francisco Bay Toll Bridge Rev. Participating VRDN Series EGL 07 0053, 0.2% (Liquidity Facility Citibank NA) (a)(d) | 3,465 | | 3,465 |

California Gen. Oblig.: | | | |

Series 2003 A1, 0.14%, LOC JPMorgan Chase Bank, VRDN (a) | 1,000 | | 1,000 |

Series 2004 A4, 0.14%, LOC Citibank NA, LOC California Teachers Retirement Sys., VRDN (a) | 3,000 | | 3,000 |

Series 2004 A5, 0.1%, LOC Citibank NA, LOC California Teachers Retirement Sys., VRDN (a) | 1,500 | | 1,500 |

0.32% 3/2/10, LOC Dexia Cr. Local de France, LOC Royal Bank of Canada, CP | 3,800 | | 3,800 |

California Infrastructure & Econ. Dev. Bank Rev. (Pacific Gas and Elec. Co. Proj.) Series 2009 A, 0.1%, LOC Wells Fargo Bank NA, San Francisco, VRDN (a) | 1,000 | | 1,000 |

East Bay Muni. Util. District Wtr. Sys. Rev.: | | | |

Participating VRDN Series ROC II R 10397, 0.2% (Liquidity Facility Citibank NA) (a)(d) | 3,980 | | 3,980 |

Series 2008 B3, 0.21% (Liquidity Facility Landesbank Baden-Wuert), VRDN (a) | 3,600 | | 3,600 |

Los Angeles County Gen. Oblig. TRAN 2.5% 6/30/10 | 31,100 | | 31,274 |

Los Angeles Gen. Oblig. TRAN Series 2009, 2.5% 4/28/10 | 13,600 | | 13,644 |

Los Angeles Unified School District TRAN Series A, 2% 8/12/10 | 6,100 | | 6,138 |

Menlo Park Cmnty. Dev. Agcy. Tax (Las Pulgas Cmnty. Dev. Proj.) Series 2006, 0.13%, LOC State Street Bank & Trust Co., Boston, VRDN (a) | 4,000 | | 4,000 |

Metropolitan Wtr. District of Southern California Wtrwks. Rev. Participating VRDN Series EGL 07 0044, 0.2% (Liquidity Facility Citibank NA) (a)(d) | 9,430 | | 9,430 |

Orange County Apt. Dev. Rev. (Larkspur Canyon Apts. Proj.) Series 1997 A, 0.18%, LOC Fannie Mae, VRDN (a) | 200 | | 200 |

Orange County Sanitation District Ctfs. of Prtn. Participating VRDN Series ROC II R 11304, 0.21% (Liquidity Facility Citibank NA) (a)(d) | 6,990 | | 6,990 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

California - continued |

San Francisco Bay Area Rapid Transit Fing. Auth. Participating VRDN Series ROC II R 11251, 0.2% (Liquidity Facility Citibank NA) (a)(d) | $ 2,880 | | $ 2,880 |

San Francisco City and County Fin. Corp. Lease Rev. (Moscone Ctr. Expansion Proj.) Series 2008 2, 0.17%, LOC State Street Bank & Trust Co., Boston, VRDN (a) | 1,250 | | 1,250 |

| | 97,151 |

Colorado - 2.0% |

Adams County Rev. (Adams Mental Health Foundation Prog.) Series 1997, 0.51%, LOC JPMorgan Chase Bank, VRDN (a) | 1,045 | | 1,045 |

Colorado Health Facilities Auth. Retirement Hsg. Rev. Participating VRDN Series Putters 1390, 0.2% (Liquidity Facility JPMorgan Chase Bank) (a)(d) | 1,685 | | 1,685 |

Colorado Health Facilities Auth. Rev.: | | | |

Participating VRDN Series Putters 2999, 0.25% (Liquidity Facility JPMorgan Chase Bank) (a)(d) | 6,245 | | 6,245 |

(Catholic Health Initiatives Proj.) Series 2004 B: | | | |

0.18% (Liquidity Facility Landesbank Hessen-Thuringen), VRDN (a) | 2,600 | | 2,600 |

0.22% (Liquidity Facility Landesbank Hessen-Thuringen), VRDN (a) | 3,600 | | 3,600 |

Colorado Reg'l. Trans. District Sales Tax Rev.: | | | |

Participating VRDN Series EGL 07 0040, 0.21% (Liquidity Facility Citibank NA) (a)(d) | 3,700 | | 3,700 |

0.22% 3/31/10, LOC Wells Fargo Bank NA, CP | 6,665 | | 6,665 |

Colorado Springs Utils. Rev. Series 2000 A, 0.19%, VRDN (a) | 7,225 | | 7,225 |

Mesa County Econ. Dev. Rev. (Leitner-Poma of America, Inc. Proj.) Series 2009, 0.28%, LOC Wells Fargo Bank NA, VRDN (a) | 8,000 | | 8,000 |

Univ. of Colorado Hosp. Auth. Rev. Series 2008 B, 0.18%, LOC Wachovia Bank NA, VRDN (a) | 2,500 | | 2,500 |

| | 43,265 |

Connecticut - 2.1% |

Connecticut Dev. Auth. Poll. Cont. Rev. Bonds (New England Pwr. Co. Proj.) Series 1999, 0.85% tender 3/11/10, CP mode | 5,000 | | 5,000 |

Connecticut Gen. Oblig.: | | | |

BAN Series 2009 A, 2% 4/28/10 | 6,100 | | 6,115 |

Series 2004 A, 0.21% (Liquidity Facility Landesbank Hessen-Thuringen), VRDN (a) | 4,000 | | 4,000 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Connecticut - continued |

Connecticut Health & Edl. Facilities Auth. Rev.: | | | |

Participating VRDN Series EGL 7 05 3031, 0.2% (Liquidity Facility Citibank NA) (a)(d) | $ 4,300 | | $ 4,300 |

(Trinity College Proj.) Series L, 0.17%, LOC JPMorgan Chase Bank, VRDN (a) | 1,900 | | 1,900 |

(Wesleyan Univ. Proj.) Series D, 0.21% (Liquidity Facility Bank of America NA), VRDN (a) | 1,000 | | 1,000 |

(Yale Univ. Proj.) Series X2, 0.15%, VRDN (a) | 5,500 | | 5,500 |

Connecticut Hsg. Fin. Auth. (Hsg. Mtg. Fin. Prog.): | | | |

Series 2005 D4, 0.21% (Liquidity Facility Fed. Home Ln. Bank of Boston), VRDN (a) | 3,915 | | 3,915 |

Series 2005 D6, 0.21% (Liquidity Facility Fed. Home Ln. Bank of Boston), VRDN (a) | 1,380 | | 1,380 |

Series 2005 E4, 0.21% (Liquidity Facility Fed. Home Ln. Bank of Boston), VRDN (a) | 4,180 | | 4,180 |

Danbury Gen. Oblig. BAN Series 2009, 2% 7/29/10 | 7,300 | | 7,347 |

| | 44,637 |

Delaware - 0.5% |

Delaware Health Facilities Auth. Rev. (Bayhealth Med. Ctr. Proj.): | | | |

Series 2009 B, 0.17%, LOC PNC Bank NA, Pittsburgh, VRDN (a) | 2,515 | | 2,515 |

Series 2009 C, 0.13%, LOC Wachovia Bank NA, VRDN (a) | 2,900 | | 2,900 |

Wilmington Adjustable Rate Demand Rev. (Delaware Art Museum, Inc. Proj.) 0.21%, LOC Wachovia Bank NA, VRDN (a) | 5,000 | | 5,000 |

| | 10,415 |

District Of Columbia - 2.1% |

District of Columbia Gen. Oblig. Series 2001 C, 0.18%, LOC JPMorgan Chase Bank, VRDN (a) | 1,600 | | 1,600 |

District of Columbia Rev.: | | | |

(Ctr. For Strategic & Int'l. Studies Proj.) Series 2008, 0.17%, LOC PNC Bank NA, Pittsburgh, VRDN (a) | 6,730 | | 6,730 |

(The AARP Foundation Proj.) Series 2004, 0.2%, LOC Bank of America NA, VRDN (a) | 1,600 | | 1,600 |

(The Pew Charitable Trust Proj.) Series 2008 A, 0.17%, LOC PNC Bank NA, Pittsburgh, VRDN (a) | 15,000 | | 15,000 |

(The Phillips Collection Issue Proj.) Series 2003, 0.2%, LOC Bank of America NA, VRDN (a) | 4,035 | | 4,035 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

District Of Columbia - continued |

District of Columbia Rev.: - continued | | | |

(The Washington Ctr. for Internships and Academic Seminars Proj.) Series 2009, 0.19%, LOC Branch Banking & Trust Co., VRDN (a) | $ 4,900 | | $ 4,900 |

District of Columbia Univ. Rev. (American Univ. Proj.) Series 2003, 0.2%, LOC Bank of America NA, VRDN (a) | 11,400 | | 11,400 |

| | 45,265 |

Florida - 7.8% |

Alachua County Health Facilities Auth. Health Facilities Rev. Bonds (Shands Teaching Hospitals & Clinics, Inc. Proj.) Series 2008 B, 0.2% tender 3/3/10, LOC Bank of America NA, CP mode | 6,200 | | 6,200 |

Florida Board of Ed. Lottery Rev. Bonds Series 2007 A, 5% 7/1/10 | 2,735 | | 2,776 |

Florida Gen. Oblig. Participating VRDN Series PZ 130, 0.21% (Liquidity Facility Wells Fargo & Co.) (a)(d) | 3,310 | | 3,310 |

Florida Hsg. Fin. Corp. Multi-family Mtg. Rev. (Victoria Park Apts. Proj.) Series 2002 J, 0.19%, LOC Fannie Mae, VRDN (a) | 1,100 | | 1,100 |

Florida Hurricane Catastrophe Fund Fin. Corp. Rev. Bonds Series 2006 A, 5% 7/1/10 | 5,000 | | 5,074 |

Jacksonville Econ. Dev. Commission Rev. (YMCA of Florida's First Coast Proj.) 0.2%, LOC Bank of America NA, VRDN (a) | 9,335 | | 9,335 |

Jacksonville Elec. Auth. Elec. Sys. Rev. Bonds Series F, 0.29% tender 3/3/10 (Liquidity Facility Landesbank Hessen-Thuringen), CP mode | 15,000 | | 15,000 |

Jacksonville Hsg. Fin. Auth. Multi-family Hsg. Rev. (Augustine Apts. Proj.) 0.2%, LOC Fannie Mae, VRDN (a) | 2,650 | | 2,650 |

JEA Saint Johns River Pwr. Park Sys. Rev. Bonds Series 17 Issue 2, 5.25% 10/1/10 | 6,050 | | 6,215 |

JEA Wtr. & Swr. Sys. Rev. Bonds Series 2009 B, 3% 10/1/10 | 4,130 | | 4,190 |

Manatee County Poll. Cont. Rev. (Florida Pwr. & Lt. Co. Proj.) Series 1994, 0.19%, VRDN (a) | 2,000 | | 2,000 |

Nassau County Poll. Cont. Rev. (Rayonier Proj.) 0.22%, LOC Bank of America NA, VRDN (a) | 4,400 | | 4,400 |

Orange County Health Facilities Auth. Rev. (Presbyterian Retirement Cmnty., Inc. Proj.) Series 2006 B, 0.18%, LOC Branch Banking & Trust Co., VRDN (a) | 6,905 | | 6,905 |

Palm Beach County Rev.: | | | |

(Benjamin Private School Proj.) 0.2%, LOC Bank of America NA, VRDN (a) | 16,300 | | 16,300 |

(Hanley Ctr. Proj.) Series 2006, 0.2%, LOC Bank of America NA, VRDN (a) | 7,455 | | 7,455 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Florida - continued |

Palm Beach County Rev.: - continued | | | |

(King's Academy, Inc. Proj.) Series 2006, 0.18%, LOC Wachovia Bank NA, VRDN (a) | $ 1,600 | | $ 1,600 |

(Morse Oblig. Group Proj.) Series 2003, 0.18%, LOC TD Banknorth, NA, VRDN (a) | 6,345 | | 6,345 |

(Saint Andrew's School of Boca Raton, Inc. Proj.) Series 2007, 0.2%, LOC Bank of America NA, VRDN (a) | 2,200 | | 2,200 |

Palm Beach County School District RAN Series 2009, 0.85% 3/10/10 | 9,200 | | 9,200 |

Pasco County School Board Ctfs. of Prtn.: | | | |

Series 2008 A, 0.18%, LOC Wachovia Bank NA, VRDN (a) | 5,100 | | 5,100 |

Series 2008 C, 0.2%, LOC Bank of America NA, VRDN (a) | 5,100 | | 5,100 |

Pinellas County Health Facilities Auth. Rev.: | | | |

(BayCare Health Sys. Proj.) Series 2009 A3, 0.18%, LOC Wachovia Bank NA, VRDN (a) | 1,000 | | 1,000 |

(Suncoast Hospice Proj.) Series 2004, 0.18%, LOC Wachovia Bank NA, VRDN (a) | 1,000 | | 1,000 |

Pinellas County School District TAN Series 2009, 1.5% 6/30/10 | 4,300 | | 4,316 |

Putnam County Dev. Auth. Poll. Cont. Rev. (Florida Pwr. & Lt. Co. Proj.) Series 1994, 0.19%, VRDN (a) | 1,600 | | 1,600 |

Saint Petersburg Health Facilities Auth. Rev.: | | | |

(All Children's Hosp. Proj.) Series 2005 A1, 0.18%, LOC Wachovia Bank NA, VRDN (a) | 8,000 | | 8,000 |

(Presbyterian Retirement Cmntys. Proj.) Series 2009, 0.18%, LOC Branch Banking & Trust Co., VRDN (a) | 3,400 | | 3,400 |

Santa Rosa County Health Facilities Rev. (Baptists Hosp., Inc. Proj.) 0.2%, LOC Bank of America NA, VRDN (a) | 10,580 | | 10,580 |

Sunshine State Govt. Fing. Commission Rev. Series L, 0.23% 3/2/10, LOC Dexia Cr. Local de France, CP | 10,300 | | 10,300 |

Tampa Bay Wtr. Reg'l. Wtr. Supply Auth. Util. Sys. Rev. Participating VRDN Series Putters 3324, 0.2% (Liquidity Facility JPMorgan Chase Bank) (a)(d) | 1,000 | | 1,000 |

Volusia County Hsg. Fin. Auth. Multi-family Hsg. Rev. (Fisherman's Landing Apts. Proj.) 0.2%, LOC Fannie Mae, VRDN (a) | 1,050 | | 1,050 |

Winter Haven Util. Sys. Impt. & Rfdg. Rev. Participating VRDN Series Solar 06 54, 0.2% (Liquidity Facility U.S. Bank NA, Minnesota) (a)(d) | 4,670 | | 4,670 |

| | 169,371 |

Georgia - 1.3% |

Atlanta Tax Allocation (Westside Proj.) Series 2008, 0.18%, LOC Wachovia Bank NA, VRDN (a) | 4,700 | | 4,700 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Georgia - continued |

Bartow County Dev. Auth. Poll. Cont. Rev. (Georgia Pwr. Co. Plant Bowen Proj.) First Series 2009, 0.13%, VRDN (a) | $ 2,700 | | $ 2,700 |

DeKalb County Hsg. Auth. Multi-family Hsg. Rev. (Timber Trace Apts. Proj.) Series 2003, 0.2%, LOC Freddie Mac, VRDN (a) | 5,225 | | 5,225 |

Fulton County Dev. Auth. (Pace Academy, Inc. Proj.) Series 2008, 0.2%, LOC Bank of America NA, VRDN (a) | 4,300 | | 4,300 |

Georgia Road & Thruway Auth. Rev. Bonds Series 2009 A, 2.5% 6/1/10 | 2,000 | | 2,010 |

Muni. Elec. Auth. of Georgia: | | | |

BAN (Plant Vogtle Additional Units Non-PPA Proj.) Series 2009 A, 1.25% 5/7/10 | 3,400 | | 3,402 |

Series 1985 B, 0.2%, LOC Landesbank Hessen-Thuringen, VRDN (a) | 3,800 | | 3,800 |

Smyrna Hsg. Fin. Auth. Multi-family Hsg. Rev. (The Hills of Post Village Proj.) Series 1995, 0.19%, LOC Fannie Mae, VRDN (a) | 2,100 | | 2,100 |

| | 28,237 |

Hawaii - 0.2% |

Honolulu City & County Gen. Oblig. Participating VRDN Series Putters 3391, 0.2% (Liquidity Facility JPMorgan Chase Bank) (a)(d) | 5,000 | | 5,000 |

Illinois - 4.3% |

Chicago Board of Ed. Series 2009 A1, 0.19%, LOC Harris NA, VRDN (a) | 5,000 | | 5,000 |

Chicago Metropolitan Wtr. Reclamation District Greater Chicago Participating VRDN Series Putters 3448, 0.2% (Liquidity Facility JPMorgan Chase Bank) (a)(d) | 2,805 | | 2,805 |

Chicago O'Hare Int'l. Arpt. Rev. Series 2005 C, 0.24%, LOC Landesbank Baden-Wuert, VRDN (a) | 2,200 | | 2,200 |

DuPage County Rev. (Morton Arboretum Proj.) 0.2%, LOC Bank of America NA, VRDN (a) | 10,500 | | 10,500 |

Illinois Fin. Auth. Rev.: | | | |

(Chicago Historical Society Proj.) Series 2006, 0.2%, LOC JPMorgan Chase Bank, VRDN (a) | 18,900 | | 18,900 |

(Children's Memorial Hosp. Proj.) Series 2008 C, 0.2%, LOC JPMorgan Chase Bank, VRDN (a) | 19,200 | | 19,200 |

(Clare Oaks Proj.) Series C, 0.18%, LOC Banco Santander SA, VRDN (a) | 11,300 | | 11,300 |

(Edward Hosp. Obligated Group Proj.) Series 2008 B2, 0.19%, LOC JPMorgan Chase Bank, VRDN (a) | 1,000 | | 1,000 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Illinois - continued |

Illinois Fin. Auth. Rev.: - continued | | | |

(Northwest Cmnty. Hosp. Proj.) Series 2008 B, 0.2%, LOC Wells Fargo Bank NA, VRDN (a) | $ 1,100 | | $ 1,100 |

(OSF Healthcare Sys. Proj.) Series 2009 D, 0.19%, LOC JPMorgan Chase Bank, VRDN (a) | 5,000 | | 5,000 |

(Saint Xavier Univ. Proj.) Series 2008, 0.2%, LOC Bank of America NA, VRDN (a) | 3,900 | | 3,900 |

Illinois Reg'l. Trans. Auth. Participating VRDN Series GS 06 40TP, 0.23% (Liquidity Facility Wells Fargo & Co.) (a)(d) | 6,000 | | 6,000 |

Lisle Village Multi-family Hsg. Rev. (Four Lakes Phase V-Lisle) Series 1996, 0.22%, LOC Bank of America NA, VRDN (a) | 7,180 | | 7,180 |

| | 94,085 |

Indiana - 3.5% |

Indiana Dev. Fin. Auth. Rev. (Indianapolis Museum of Art, Inc. Proj.) Series 2001, 0.21%, LOC JPMorgan Chase Bank, VRDN (a) | 5,200 | | 5,200 |

Indiana Fin. Auth. Health Sys. Rev. (Sisters of Saint Francis Health Svcs., Inc. Obligated Group Proj.): | | | |

Series 2008 A, 0.19%, LOC JPMorgan Chase Bank, VRDN (a) | 10,000 | | 10,000 |

Series 2008 F, 0.18%, LOC Bank of New York, New York, VRDN (a) | 7,140 | | 7,140 |

Series 2008 G, 0.18%, LOC Bank of New York, New York, VRDN (a) | 6,250 | | 6,250 |

Series 2008 J, 0.18%, LOC Wells Fargo Bank NA, VRDN (a) | 1,425 | | 1,425 |

Indiana Fin. Auth. Hosp. Rev.: | | | |

(Cmnty. Foundation of Northwest Indiana Proj.) Series 2008, 0.18%, LOC Harris NA, VRDN (a) | 6,800 | | 6,800 |

(Cmnty. Health Network Proj.) Series 2009 B, 0.17%, LOC Nat'l. City Bank Cleveland, VRDN (a) | 9,000 | | 9,000 |

Indiana Fin. Auth. Rev. (DePauw Univ. Proj.) Series 2008 B, 0.2%, LOC Harris NA, VRDN (a) | 16,600 | | 16,600 |

Lawrenceburg Poll. Cont. Rev. (Indiana Michigan Pwr. Co. Proj.) Series 2008 H, 0.21%, LOC Royal Bank of Scotland PLC, VRDN (a) | 8,400 | | 8,400 |

Marion Econ. Dev. Rev. (Indiana Wesleyan Univ. Proj.) Series 2001, 0.2%, LOC Bank of America NA, VRDN (a) | 5,540 | | 5,540 |

| | 76,355 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Iowa - 1.0% |

Iowa Fin. Auth. Poll. Cont. Facility Rev. (MidAmerican Energy Proj.) Series 2008 B, 0.29%, VRDN (a) | $ 15,000 | | $ 15,000 |

Iowa Fin. Auth. Rev. (Trinity Health Sys. Proj.) Series 2000 D, 0.18%, VRDN (a) | 6,915 | | 6,915 |

| | 21,915 |

Kansas - 0.1% |

Kansas Dept. of Trans. Hwy. Rev. Series 2002 D, 0.18% (Liquidity Facility Dexia Cr. Local de France), VRDN (a) | 305 | | 305 |

Wyandotte County/Kansas City Unified Govt. Gen. Oblig. BAN Series 2010 I, 0.625% 3/1/11 | 2,900 | | 2,904 |

| | 3,209 |

Louisiana - 1.3% |

Louisiana Gas & Fuel Tax Rev. Participating VRDN Series Solar 06 150, 0.19% (Liquidity Facility U.S. Bank NA, Minnesota) (a)(d) | 20,670 | | 20,670 |

Louisiana Pub. Facilities Auth. Rev. (CommCare Corp. Proj.) Series 2008 A, 0.19%, LOC JPMorgan Chase Bank, VRDN (a) | 7,940 | | 7,940 |

| | 28,610 |

Maine - 0.7% |

Maine Health & Higher Ed. Facilities Auth. Rev.: | | | |

Series 2008 A, 0.21%, LOC KBC Bank NV, VRDN (a) | 5,760 | | 5,760 |

Series 2008 B, 0.21%, LOC KBC Bank NV, VRDN (a) | 2,000 | | 2,000 |

Maine Health Student Finl. Auth. Participating VRDN Series Solar 06 122, 0.19% (Liquidity Facility U.S. Bank NA, Minnesota) (a)(d) | 7,020 | | 7,020 |

| | 14,780 |

Maryland - 3.2% |

Baltimore County Econ. Dev. Rev.: | | | |

(Blue Circle, Inc. Proj.) Series 1992, 0.21%, LOC BNP Paribas SA, VRDN (a) | 6,100 | | 6,100 |

(The Bais Yaakov School for Girls Proj.) Series 2003, 0.2%, LOC Bank of America NA, VRDN (a) | 1,000 | | 1,000 |

Carroll County Rev. (Fairhaven and Copper Ridge Proj.) Series 2004 A, 0.18%, LOC Branch Banking & Trust Co., VRDN (a) | 8,435 | | 8,435 |

Maryland Cmnty. Dev. Administration Multi-family Dev. Rev. (Avalon Lea Apt. Proj.) Series 1997, 0.23%, LOC Fannie Mae, VRDN (a) | 1,200 | | 1,200 |

Maryland Econ. Dev. Corp. Rev. (Constellation Energy Group, Inc. Proj.) Series 2006 A, 0.19%, LOC Wachovia Bank NA, VRDN (a) | 1,500 | | 1,500 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Maryland - continued |

Maryland Health & Higher Edl. Facilities Auth. Rev.: | | | |

(Adventist Healthcare Proj.) Series 2005 A, 0.18%, LOC Bank of America NA, VRDN (a) | $ 13,900 | | $ 13,900 |

(Howard County Gen. Hosp. Proj.) Series 2008, 0.17%, LOC PNC Bank NA, Pittsburgh, VRDN (a) | 9,250 | | 9,250 |

(Mercy Med. Ctr. Proj.): | | | |

Series 2007 B, 0.2%, LOC Bank of America NA, VRDN (a) | 3,500 | | 3,500 |

Series 2007 D, 0.18%, LOC Wachovia Bank NA, VRDN (a) | 3,100 | | 3,100 |

(Univ. of Maryland Med. Sys. Proj.) Series 2008 B, 0.18%, LOC Bank of America NA, VRDN (a) | 18,250 | | 18,250 |

Montgomery County Econ. Dev. Rev. (Georgetown Preparatory School, Inc. Proj.) Series 2005, 0.2%, LOC Bank of America NA, VRDN (a) | 2,330 | | 2,330 |

Washington Suburban San. District Bonds (Sewage Disp. Proj.) Series 2005, 5% 6/1/10 | 2,000 | | 2,023 |

| | 70,588 |

Massachusetts - 3.1% |

Massachusetts Bay Trans. Auth. Sales Tax Rev.: | | | |

Series 2008 A1, 0.22% (Liquidity Facility JPMorgan Chase Bank), VRDN (a) | 10,000 | | 10,000 |

Series 2008 A2, 0.2% (Liquidity Facility JPMorgan Chase Bank), VRDN (a) | 3,700 | | 3,700 |

Massachusetts Dev. Fin. Agcy. Rev. (Childrens Museum Proj.) Series 2006, 0.16%, LOC RBS Citizens NA, VRDN (a) | 1,000 | | 1,000 |

Massachusetts Gen. Oblig.: | | | |

Participating VRDN: | | | |

Series DCL 08 42, 0.3% (Liquidity Facility Dexia Cr. Local de France) (a)(d) | 3,000 | | 3,000 |

Series SG 126, 0.17% (Liquidity Facility Societe Generale) (a)(d) | 2,000 | | 2,000 |

Series 2001 B, 0.19% (Liquidity Facility Landesbank Hessen-Thuringen), VRDN (a) | 4,200 | | 4,200 |

Series 2001 C, 0.19% (Liquidity Facility State Street Bank & Trust Co., Boston), VRDN (a) | 4,115 | | 4,115 |

Series 2005 A, 0.19% (Liquidity Facility Citibank NA), VRDN (a) | 18,635 | | 18,635 |

Series 2006 A, 0.17% (Liquidity Facility Dexia Cr. Local de France), VRDN (a) | 3,200 | | 3,200 |

Massachusetts Health & Edl. Facilities Auth. Rev. (Stonehill College Proj.) Series 2008 K, 0.14%, LOC Bank of America NA, VRDN (a) | 1,100 | | 1,100 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Massachusetts - continued |

Massachusetts Indl. Fin. Agcy. Poll. Cont. Rev. Bonds (New England Pwr. Co. Proj.) Series 1993 A, 0.8% tender 3/1/10, CP mode | $ 3,100 | | $ 3,100 |

Massachusetts School Bldg. Auth. Dedicated Sales Tax Rev. Participating VRDN: | | | |

Series BA 08 1082, 0.21% (Liquidity Facility Bank of America NA) (a)(d) | 6,680 | | 6,680 |

Series EGL 07 0031, 0.2% (Liquidity Facility Citibank NA) (a)(d) | 1,000 | | 1,000 |

Series Putters 2479Z, 0.2% (Liquidity Facility JPMorgan Chase Bank) (a)(d) | 3,100 | | 3,100 |

Massachusetts Wtr. Resources Auth. Wtr. & Swr. Rev. Series 2008 C, 0.28% (Liquidity Facility Bayerische Landesbank), VRDN (a) | 1,700 | | 1,700 |

| | 66,530 |

Michigan - 1.3% |

Kent Hosp. Fin. Auth. Hosp. Facilities Rev. (Spectrum Health Sys. Proj.) Series 2008 B1, 0.38%, LOC RBS Citizens NA, VRDN (a) | 9,700 | | 9,700 |

Michigan Bldg. Auth. Rev.: | | | |

Series 2007 I, 0.18%, LOC JPMorgan Chase Bank, VRDN (a) | 2,000 | | 2,000 |

Series 5, 0.25% 3/25/10, LOC Bank of New York, New York, LOC State Street Bank & Trust Co., Boston, CP | 3,670 | | 3,670 |

Michigan Hosp. Fin. Auth. Rev. Bonds (Ascension Health Cr. Group Proj.) Series 1999 B2, 0.24%, tender 4/27/10 (a) | 3,700 | | 3,700 |

Michigan State Univ. Revs. 0.15% (Liquidity Facility Landesbank Hessen-Thuringen), VRDN (a) | 1,500 | | 1,500 |

Michigan Strategic Fund Ltd. Oblig. Rev.: | | | |

(Grand Rapids Art Museum Proj.) Series 2006 A, 0.2%, LOC Bank of America NA, VRDN (a) | 1,900 | | 1,900 |

(Van Andel Research Institute Proj.) Series 2008, 0.18%, LOC Bank of America NA, VRDN (a) | 1,100 | | 1,100 |

Waterford Econ. Dev. Corp. Ltd. Oblig. Rev. (Canterbury Health Care, Inc. Proj.) Series 2009, 0.23%, LOC Fed. Home Ln. Bank of Boston, VRDN (a) | 4,300 | | 4,300 |

| | 27,870 |

Minnesota - 0.5% |

Oak Park Heights Multi-Fam Rev. 0.26%, LOC Freddie Mac, VRDN (a) | 3,265 | | 3,265 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Minnesota - continued |

St. Paul City Port Auth. District Heating Rev. Series 2009 7Q, 0.2%, LOC Deutsche Bank AG, VRDN (a) | $ 1,300 | | $ 1,300 |

Univ. of Minnesota Series 2001 C, 0.23% (Liquidity Facility JPMorgan Chase Bank), VRDN (a) | 6,250 | | 6,250 |

| | 10,815 |

Mississippi - 0.2% |

Mississippi Bus. Fin. Corp. Rev. (Jackson Med. Mall Foundation Prog.) Series 2008 A, 0.21%, LOC JPMorgan Chase Bank, VRDN (a) | 4,800 | | 4,800 |

Missouri - 1.3% |

Cape Girardeau County Indl. Dev. Auth. (St. Francis Med. Ctr. Proj.) Series 2009 B, 0.2%, LOC Wells Fargo Bank NA, VRDN (a) | 4,200 | | 4,200 |

Kansas City Indl. Dev. Auth. Student Hsg. Facilities Rev. (Oak Street West Proj.) Series 2006, 0.17%, LOC Bank of America NA, VRDN (a) | 13,205 | | 13,205 |

Missouri Health & Edl. Facilities Auth. Edl. Facilities Rev. (Saint Louis Univ. Proj.) Series 2008 A2, 0.12%, LOC Wells Fargo Bank NA, VRDN (a) | 6,660 | | 6,660 |

Missouri Health & Edl. Facilities Auth. Health Facilities Rev. (Cox Health Sys. Proj.) Series 2008 C, 0.2%, LOC Bank of America NA, VRDN (a) | 5,000 | | 5,000 |

| | 29,065 |

Nebraska - 0.3% |

Central Plains Energy Proj. Rev. (Nebraska Gas Proj.) Series 2009, 0.19% (Liquidity Facility Royal Bank of Canada), VRDN (a) | 5,600 | | 5,600 |

Nevada - 1.1% |

Clark County Arpt. Rev.: | | | |

Series 2008 D1, 0.24%, LOC Landesbank Baden-Wuert, VRDN (a) | 11,420 | | 11,420 |

Series 2008 D2, 0.24%, LOC Landesbank Baden-Wuert, VRDN (a) | 2,800 | | 2,800 |

Clark County Fuel Tax: | | | |

Participating VRDN Series ROC II R 11507, 0.2% (Liquidity Facility Citibank NA) (a)(d) | 2,800 | | 2,800 |

Series 2008 A: | | | |

0.27% 5/6/10, LOC California Teachers Retirement Sys., LOC State Street Bank & Trust Co., Boston, CP | 3,700 | | 3,700 |

0.45% 3/10/10, LOC BNP Paribas SA, CP | 4,000 | | 4,000 |

| | 24,720 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

New Hampshire - 0.2% |

New Hampshire Health & Ed. Facilities Auth. Rev. (Univ. Sys. of New Hampshire Proj.) Series 2005 A2, 0.14%, VRDN (a) | $ 4,000 | | $ 4,000 |

New Jersey - 1.1% |

New Jersey Econ. Dev. Auth. School Facilities Construction Rev. Series 2008 V5, 0.17%, LOC Wachovia Bank NA, VRDN (a) | 2,100 | | 2,100 |

New Jersey Gen. Oblig. TRAN Series 2010 B, 2.5% 6/24/10 | 20,600 | | 20,727 |

| | 22,827 |

New Mexico - 0.4% |

New Mexico Fin. Auth. Trans. Rev. Series 2008 B1, 0.18%, LOC State Street Bank & Trust Co., Boston, VRDN (a) | 3,400 | | 3,400 |

New Mexico Muni. Energy Acquisition Auth. Gas Supply Rev. Series 2009, 0.19% (Liquidity Facility Royal Bank of Canada), VRDN (a) | 4,500 | | 4,500 |

| | 7,900 |

New York - 1.7% |

New York City Gen. Oblig. Series 2004 H3, 0.17%, LOC Bank of New York, New York, VRDN (a) | 3,480 | | 3,480 |

New York City Muni. Wtr. Fin. Auth. Wtr. & Swr. Sys. Rev.: | | | |

Series 2008 B2, 0.14% (Liquidity Facility Lloyds TSB Bank PLC), VRDN (a) | 1,990 | | 1,990 |

Series 7, 0.3% 5/3/10, CP | 3,300 | | 3,300 |

Series 8, 0.3% 5/13/10, CP | 3,900 | | 3,900 |

New York City Trust Cultural Resources Rev. (Lincoln Ctr. for the Performing Arts, Inc. Proj.) Series 2008 B1, 0.17%, LOC U.S. Bank NA, Minnesota, VRDN (a) | 1,000 | | 1,000 |

New York Dorm. Auth. Revs. Participating VRDN: | | | |

Series EGL 06 47 Class A, 0.2% (Liquidity Facility Citibank NA) (a)(d) | 4,500 | | 4,500 |

Series EGL 07 0003, 0.2% (Liquidity Facility Citibank NA) (a)(d) | 15,000 | | 15,000 |

New York Hsg. Fin. Agcy. Rev. (505 West 37th Street Proj.) Series 2009 B, 0.23%, LOC Landesbank Hessen-Thuringen, VRDN (a) | 1,600 | | 1,600 |

New York Metropolitan Trans. Auth. Rev. Series C, 0.35% 5/4/10, LOC ABN-AMRO Bank NV, CP | 1,600 | | 1,600 |

| | 36,370 |

North Carolina - 2.7% |

Charlotte Wtr. & Swr. Sys. Rev. Series 2006 B, 0.18% (Liquidity Facility Wachovia Bank NA), VRDN (a) | 7,000 | | 7,000 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

North Carolina - continued |

Greensboro Combined Enterprise Sys. Rev.: | | | |

Bonds Series 2009 C, 2% 6/1/10 | $ 1,465 | | $ 1,470 |

Series 2005 B, 0.2% (Liquidity Facility Bank of America NA), VRDN (a) | 2,550 | | 2,550 |

Guilford County Gen. Oblig. Series 2007 B, 0.18% (Liquidity Facility Branch Banking & Trust Co.), VRDN (a) | 6,180 | | 6,180 |

New Hanover County Hosp. Rev. (New Hanover Reg'l. Med. Ctr. Proj.) Series 2008 B, 0.19%, LOC RBC Centura Bank, Rocky Mount, VRDN (a) | 1,000 | | 1,000 |

North Carolina Cap. Facilities Fin. Agcy. Rev. (Elon Univ. Proj.) Series 2006, 0.22%, LOC Bank of America NA, VRDN (a) | 3,800 | | 3,800 |

North Carolina Med. Care Commission Health Care Facilities Rev.: | | | |

(Cape Fear Valley Health Sys. Proj.) Series 2008 A2, 0.18%, LOC Branch Banking & Trust Co., VRDN (a) | 3,000 | | 3,000 |

(Deerfield Episcopal Retirement Cmnty. Proj.) Series 2008 B, 0.19%, LOC Branch Banking & Trust Co., VRDN (a) | 5,000 | | 5,000 |

(Friends Homes, Inc. Proj.) Series 2003, 0.22%, LOC Bank of America NA, VRDN (a) | 6,275 | | 6,275 |

Orange Wtr. & Swr. Auth. Series 2004 B, 0.2% (Liquidity Facility Bank of America NA), VRDN (a) | 3,100 | | 3,100 |

Raleigh Combined Enterprise Sys. Rev. Participating VRDN Series EGL 07 0010, 0.2% (Liquidity Facility Citibank NA) (a)(d) | 9,900 | | 9,900 |

Wake County Gen. Oblig.: | | | |

Series 2003 B, 0.18% (Liquidity Facility Lloyds TSB Bank PLC), VRDN (a) | 2,100 | | 2,100 |

Series 2003 C, 0.19% (Liquidity Facility Lloyds TSB Bank PLC), VRDN (a) | 1,685 | | 1,685 |

Series 2007 B, 0.19%, VRDN (a) | 5,400 | | 5,400 |

| | 58,460 |

Ohio - 3.6% |

Cleveland Wtrwks. Rev. Series 2008 Q, 0.18%, LOC Bank of America NA, VRDN (a) | 5,300 | | 5,300 |

Columbus Gen. Oblig. Participating VRDN Series Putters 2365, 0.2% (Liquidity Facility JPMorgan Chase Bank) (a)(d) | 4,360 | | 4,360 |

Delaware Gen. Oblig. BAN 1.5% 4/28/10 | 3,685 | | 3,689 |

Franklin County Health Care Facilities Rev. (Friendship Village of Dublin, Ohio, Inc. Proj.) Series 2004 B, 0.18%, LOC Nat'l. City Bank Cleveland, VRDN (a) | 1,995 | | 1,995 |

Fulton County Gen. Oblig. Rev. (Fulton County Health Ctr. Proj.) Series 2005, 0.18%, LOC JPMorgan Chase Bank, VRDN (a) | 7,000 | | 7,000 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Ohio - continued |

Hamilton County Hosp. Facilities Rev.: | | | |

(Childrens Hosp. Med. Ctr. Proj.) Series 2000, 0.2%, LOC JPMorgan Chase Bank, VRDN (a) | $ 1,410 | | $ 1,410 |

(Elizabeth Gamble Deaconess Home Assoc. Proj.) Series 2002 A, 0.21%, LOC JPMorgan Chase Bank, VRDN (a) | 3,000 | | 3,000 |

Lake County Hosp. Facilities Rev. (Lake Hosp. Sys., Inc. Proj.) Series 2008 B, 0.18%, LOC JPMorgan Chase Bank, VRDN (a) | 28,750 | | 28,750 |

Ohio Air Quality Dev. Auth. Rev.: | | | |

(Cincinnati Gas & Elec. Co. Proj.) Series A, 0.3%, VRDN (a) | 2,000 | | 2,000 |

(FirstEnergy Corp. Proj.) Series 2006 B, 0.18%, LOC Wachovia Bank NA, VRDN (a) | 3,000 | | 3,000 |

Ohio Higher Edl. Facility Commission Rev. Bonds (Cleveland Clinic Proj.) Series 2008 B6, 0.26% tender 5/6/10, CP mode | 9,200 | | 9,200 |

Ohio Hosp. Facilities Rev. Participating VRDN Series Putters 3591, 0.14% (Liquidity Facility JPMorgan Chase Bank) (a)(d) | 1,495 | | 1,495 |

Ohio Hsg. Fin. Agcy. Residential Mtg. Rev. Participating VRDN Series BC 09 35W, 0.16% (Liquidity Facility Barclays Bank PLC) (a)(d) | 8,000 | | 8,000 |

| | 79,199 |

Oklahoma - 0.0% |

Oklahoma City Ind. & Cultural Facilities (Oklahoma City Univ. Proj.) Series 2005 B, 0.2%, LOC Bank of America NA, VRDN (a) | 1,000 | | 1,000 |

Oregon - 1.2% |

Clackamas County Hosp. Facility Auth. Bonds (Providence Health Sys. Proj.): | | | |

Class F, 0.38% tender 6/8/10, CP mode | 5,000 | | 5,000 |

Series 2003 D, 0.35% tender 8/6/10, CP mode | 4,000 | | 4,000 |

Series F, 0.35% tender 7/14/10, CP mode | 10,000 | | 10,000 |

Oregon Facilities Auth. Rev. (PeaceHealth Proj.) Series 2008 B, 0.16%, LOC U.S. Bank NA, Minnesota, VRDN (a) | 1,000 | | 1,000 |

Salem Hosp. Facility Auth. Rev. (Salem Hosp. Proj.) Series 2008 B, 0.18%, LOC U.S. Bank NA, Minnesota, VRDN (a) | 5,000 | | 5,000 |

| | 25,000 |

Pennsylvania - 7.6% |

Berks County Muni. Auth. Rev. (Phoebe-Devitt Homes Obligated Group Proj.) Series 2008 A, 0.18%, LOC Banco Santander SA, VRDN (a) | 2,600 | | 2,600 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Pennsylvania - continued |

Butler County Indl. Dev. Auth. Rev. (Concordia Lutheran Health & Human Care Proj.) Series 2008 A, 0.18%, LOC Bank of America NA, VRDN (a) | $ 7,300 | | $ 7,300 |

Cambria County Indl. Dev. Auth. Rev. (American Nat'l. Red Cross Proj.) Series 2008, 0.17%, LOC JPMorgan Chase Bank, VRDN (a) | 6,500 | | 6,500 |

Chester County Indl. Dev. Auth. Student Hsg. Rev. Series 2008 A, 0.17%, LOC Fed. Home Ln. Bank Pittsburgh, VRDN (a) | 10,000 | | 10,000 |

Crawford County Indl. Dev. Auth. College Rev. (Allegheny College Proj.) Series 2009 B, 0.19%, LOC PNC Bank NA, Pittsburgh, VRDN (a) | 2,000 | | 2,000 |

Delaware County Auth. Rev.: | | | |

(Riddle Village Proj.) Series 2006, 0.18%, LOC Banco Santander SA, VRDN (a) | 3,300 | | 3,300 |

(White Horse Village Proj.) Series 2006 B, 0.23%, LOC Citizens Bank of Pennsylvania, VRDN (a) | 1,800 | | 1,800 |

Delaware County Indl. Dev. Auth. Rev. (Academy of Notre Dame de Namur Proj.) Series 2007, 0.38%, LOC Citizens Bank of Pennsylvania, VRDN (a) | 200 | | 200 |

Doylestown Hosp. Auth. Hosp. Rev. Series 2008 B, 0.17%, LOC PNC Bank NA, Pittsburgh, VRDN (a) | 3,700 | | 3,700 |

Lancaster Indl. Dev. Auth. Rev. (United Zion Retirement Cmnty. Proj.) 0.39%, LOC Citizens Bank of Pennsylvania, VRDN (a) | 4,795 | | 4,795 |

Lower Merion School District Series 2009 B, 0.18%, LOC U.S. Bank NA, Minnesota, VRDN (a) | 4,300 | | 4,300 |

Luzerne County Indl. Dev. Auth. Rev. (United Methodist Homes Proj.) Series 2003, 0.2%, LOC Banco Santander SA, VRDN (a) | 4,125 | | 4,125 |

Montgomery County Higher Ed. & Health Auth. Rev. (William Penn Charter School Proj.) Series 2001, 0.19%, LOC PNC Bank NA, Pittsburgh, VRDN (a) | 2,585 | | 2,585 |

Montgomery County Indl. Dev. Auth. Rev. (Archdiocese of Philadelphia Proj.) Series 2008 A, 0.17%, LOC PNC Bank NA, Pittsburgh, VRDN (a) | 5,000 | | 5,000 |

Montgomery County Redev. Auth. Multi-family Hsg. Rev. (Forge Gate Apts. Proj.) Series 2001 A, 0.2%, LOC Fannie Mae, VRDN (a) | 4,990 | | 4,990 |

Northeastern Pennsylvania Hosp. and Ed. Auth. Rev. (The Commonwealth Med. College Proj.) Series 2009, 0.17%, LOC PNC Bank NA, Pittsburgh, VRDN (a) | 5,700 | | 5,700 |

Pennsylvania Econ. Dev. Fing. Auth. Indl. Dev. Rev. Series 2004 E1, 0.19%, LOC PNC Bank NA, Pittsburgh, VRDN (a) | 2,835 | | 2,835 |

Pennsylvania Gen. Oblig. TAN 1.5% 6/30/10 | 24,000 | | 24,096 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Pennsylvania - continued |

Pennsylvania Higher Edl. Facilities Auth. Rev.: | | | |

(California Univ. of Pennsylvania Student Hsg. Proj.) Series 2006 A, 0.17%, LOC Fed. Home Ln. Bank Pittsburgh, VRDN (a) | $ 6,640 | | $ 6,640 |

(Indiana Univ. of Pennsylvania Student Hsg. Proj.) Series 2008, 0.17%, LOC Fed. Home Ln. Bank Pittsburgh, VRDN (a) | 6,300 | | 6,300 |

(Mercyhurst College Proj.) Series 12, 0.19%, LOC PNC Bank NA, Pittsburgh, VRDN (a) | 2,170 | | 2,170 |

Pennsylvania Tpk. Commission Tpk. Rev.: | | | |

Series 2008 B1, 0.18%, LOC Bank of America NA, VRDN (a) | 5,500 | | 5,500 |

Series 2008 B5, 0.2%, LOC Bank of America NA, VRDN (a) | 6,900 | | 6,900 |

Philadelphia Gas Works Rev. (1998 Gen. Ordinance Proj.) Eighth Series B, 0.16%, LOC Wachovia Bank NA, VRDN (a) | 3,700 | | 3,700 |

Philadelphia School District Series 2008 B3, 0.18%, LOC Wachovia Bank NA, VRDN (a) | 4,600 | | 4,600 |

Scranton-Lackawanna Health & Welfare Auth. Rev. Series 2002, 0.19%, LOC PNC Bank NA, Pittsburgh, VRDN (a) | 3,815 | | 3,815 |

Somerset County Gen. Oblig. Series 2009 A, 0.19%, LOC PNC Bank NA, Pittsburgh, VRDN (a) | 3,450 | | 3,450 |

South Fork Muni. Auth. Hosp. Rev. (Conemaugh Health Ctr. Proj.) Series 2005 C, 0.19%, LOC Nat'l. City Bank Cleveland, VRDN (a) | 12,465 | | 12,465 |

Southeastern Pennsylvania Trans. Auth. Rev. Series 2007, 0.17%, LOC PNC Bank NA, Pittsburgh, VRDN (a) | 14,200 | | 14,200 |

| | 165,566 |

South Carolina - 5.9% |

Charleston Wtrwks. & Swr. Rev.: | | | |

Series 2006 B, 0.18% (Liquidity Facility Wachovia Bank NA), VRDN (a) | 7,700 | | 7,700 |

Series A, 0.19% (Liquidity Facility Bank of America NA), VRDN (a) | 4,000 | | 4,000 |

Greenville County School District Bonds Series D, 2% 6/1/10 | 17,000 | | 17,066 |

Greenville Hosp. Sys. Facilities Rev. Series 2008 E, 0.18%, LOC Wachovia Bank NA, VRDN (a) | 9,000 | | 9,000 |

South Carolina Assoc. of Governmental Organizations Ctfs. of Prtn. Bonds Series 2009 A, 1.5% 4/15/10 | 10,900 | | 10,914 |

South Carolina Edl. Facilities Auth. for Private Nonprofit Institutions of Higher Learning Edl. Facilities Rev. (Claflin Univ. Proj.) 0.2%, LOC Bank of America NA, VRDN (a) | 7,731 | | 7,731 |

South Carolina Jobs-Econ. Dev. Auth. (Palmetto Health Proj.) Series 2008 A, 0.2%, LOC Bank of America NA, VRDN (a) | 4,805 | | 4,805 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

South Carolina - continued |

South Carolina Jobs-Econ. Dev. Auth. Econ. Dev. Rev.: | | | |

(Carolina Piedmont Foundation Proj.) 0.25%, LOC Bank of America NA, VRDN (a) | $ 3,600 | | $ 3,600 |

(Institute for Bus. and Home Safety Proj.) Series 2009, 0.19%, LOC Branch Banking & Trust Co., VRDN (a) | 4,500 | | 4,500 |

South Carolina Pub. Svc. Auth. Rev.: | | | |

Participating VRDN: | | | |

Series ROC II R 11426, 0.21% (Liquidity Facility Citibank NA) (a)(d) | 3,900 | | 3,900 |

Series Solar 07 70, 0.19% (Liquidity Facility U.S. Bank NA, Minnesota) (a)(d) | 20,505 | | 20,505 |

0.19% 3/10/10, CP | 4,148 | | 4,148 |

0.27% 3/4/10, CP | 2,642 | | 2,642 |

0.28% 4/7/10, CP | 6,924 | | 6,924 |

South Carolina Trans. Infrastructure Bank Rev. Series 2003 B1, 0.19%, LOC Bank of America NA, VRDN (a) | 2,000 | | 2,000 |

Spartanburg County School District #1 Bonds Series Solar 06 152, 0.19%, tender 3/5/10 (Liquidity Facility U.S. Bank NA, Minnesota) (a)(d) | 10,560 | | 10,560 |

Sumter County Gen. Oblig. BAN Series 2009, 1.5% 6/2/10 | 5,200 | | 5,212 |

York County Poll. Cont. Rev. Bonds (Duke Energy Corp. Proj.) 0.9% tender 3/1/10, CP mode | 3,750 | | 3,750 |

| | 128,957 |

Tennessee - 1.2% |

Blount County Pub. Bldg. Auth. (Local Govt. Pub. Impt. Proj.) Series 2008 E1A, 0.19%, LOC Branch Banking & Trust Co., VRDN (a) | 5,600 | | 5,600 |

Clarksville Pub. Bldg. Auth. Rev. (Tennessee Muni. Bond Fund Proj.) Series 1994, 0.24%, LOC Bank of America NA, VRDN (a) | 7,100 | | 7,100 |

Knox County Health Edl. & Hsg. Facilities Board Hosp. Facilities Rev. (Catholic Healthcare Partners Proj.) Series 2008 A, 0.22%, LOC Landesbank Baden-Wuert, VRDN (a) | 4,300 | | 4,300 |

Montgomery County Pub. Bldg. Auth. Pooled Fing. Rev. (Tennessee County Ln. Pool Prog.) Series 1999, 0.24%, LOC Bank of America NA, VRDN (a) | 8,920 | | 8,920 |

| | 25,920 |

Texas - 12.4% |

Austin Independent School District Participating VRDN Series Putters 3554, 0.2% (Liquidity Facility JPMorgan Chase Bank) (a)(d) | 7,045 | | 7,045 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Texas - continued |

Comal Independent School District Participating VRDN Series Solar 06 36, 0.19% (Liquidity Facility U.S. Bank NA, Minnesota) (a)(d) | $ 13,170 | | $ 13,170 |

Fort Bend Independent School District Participating VRDN Series PZ 124, 0.21% (Liquidity Facility Wells Fargo & Co.) (a)(d) | 10,140 | | 10,140 |

Galena Park Independent School District Participating VRDN Series SG 154, 0.23% (Liquidity Facility Societe Generale) (a)(d) | 9,900 | | 9,900 |

Grand Prairie Independent School District Participating VRDN Series ROC II R 11161, 0.2% (Liquidity Facility Citibank NA) (a)(d) | 7,955 | | 7,955 |

Harris County Cultural Ed. Facilities Fin. Corp. Spl. Facilities Rev. (Texas Med. Ctr. Proj.) Series 2008 B2, 0.21%, LOC Compass Bank, VRDN (a) | 9,370 | | 9,370 |

Harris County Health Facilities Dev. Corp. Hosp. Rev. (Baylor College of Medicine Proj.) Series 2008 A, 0.38%, LOC Compass Bank, VRDN (a) | 3,600 | | 3,600 |

Houston Gen. Oblig. TRAN Series 2009, 2% 6/30/10 | 4,000 | | 4,020 |

Houston Higher Ed. Fin. Corp. Higher Ed. Rev. (Rice Univ. Proj.) Series 2006 A, 0.18% (Liquidity Facility JPMorgan Chase Bank), VRDN (a) | 7,150 | | 7,150 |

Houston Util. Sys. Rev.: | | | |

Participating VRDN Series Solar 06 70, 0.17% (Liquidity Facility U.S. Bank NA, Minnesota) (a)(d) | 4,000 | | 4,000 |

Series 2004 B3, 0.19%, LOC Dexia Cr. Local de France, LOC Bank of America NA, VRDN (a) | 2,165 | | 2,165 |

Series 2008 A1, 0.19%, LOC Bank of America NA, VRDN (a) | 22,100 | | 22,100 |

Series B1, 0.23% 3/9/10, LOC JPMorgan Chase Bank, CP | 4,000 | | 4,000 |

Judson Independent School District Participating VRDN Series MS 06 1859, 0.19% (Liquidity Facility Wells Fargo & Co.) (a)(d) | 3,940 | | 3,940 |

Lovejoy Independent School District Participating VRDN Series DB 514, 0.23% (Liquidity Facility Deutsche Bank AG) (a)(d) | 6,095 | | 6,095 |

Lower Neches Valley Auth. Indl. Dev. Corp. Exempt Facilities Rev. (ExxonMobil Proj.) Series 2001 A, 0.11% (Exxon Mobil Corp. Guaranteed), VRDN (a) | 1,100 | | 1,100 |

Mansfield Independent School District Participating VRDN Series PT 4627, 0.2% (Liquidity Facility Deutsche Postbank AG) (a)(d) | 10,825 | | 10,825 |

North East Texas Independent School District Participating VRDN Series Putters 2355, 0.2% (Liquidity Facility JPMorgan Chase Bank) (a)(d) | 4,460 | | 4,460 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Texas - continued |

Plano Gen. Oblig. Participating VRDN Series MS 06 1862, 0.19% (Liquidity Facility Wells Fargo & Co.) (a)(d) | $ 2,920 | | $ 2,920 |

Princeton Independent School District Participating VRDN Series SGB 02 41A, 0.18% (Liquidity Facility Societe Generale) (a)(d) | 3,500 | | 3,500 |

San Antonio Elec. & Gas Sys. Rev.: | | | |

Participating VRDN Series Putters 3344, 0.2% (Liquidity Facility JPMorgan Chase Bank) (a)(d) | 3,215 | | 3,215 |

Series 2003, 0.23% (Liquidity Facility Bank of America NA), VRDN (a) | 8,500 | | 8,500 |

Series A: | | | |

0.27% 3/4/10, CP | 12,660 | | 12,660 |

0.28% 4/6/10, CP | 5,300 | | 5,300 |

0.29% 3/4/10, CP | 4,200 | | 4,200 |

San Antonio Gen. Oblig. Series A, 0.23% 4/8/10, LOC Bank of America NA, CP | 4,830 | | 4,830 |

San Antonio Wtr. Sys. Rev. Series 2001 A, 0.28% 4/6/10, CP | 1,418 | | 1,418 |

Spring Branch Independent School District Participating VRDN Series Putters 3377, 0.2% (Liquidity Facility JPMorgan Chase Bank) (a)(d) | 2,245 | | 2,245 |

Tarrant County Cultural Ed. Facilities Fin. Corp. Hosp. Rev. (Scott and White Memorial Hosp. and Scott, Sherwood and Brindley Foundation Proj.) Series 2008 3, 0.24%, LOC Compass Bank, VRDN (a) | 9,225 | | 9,225 |

Tarrant County Cultural Ed. Facilities Fin. Corp. Rev. (Texas Health Resources Proj.) Series 2008 A, 0.18%, VRDN (a) | 5,430 | | 5,430 |

Texas Gen. Oblig. TRAN Series 2009, 2.5% 8/31/10 | 40,000 | | 40,405 |

Texas Wtr. Dev. Board Rev. Participating VRDN Series SGA 00 104, 0.21% (Liquidity Facility Societe Generale) (a)(d) | 10,470 | | 10,470 |

Travis County Health Facilities Dev. (Longhorn Village Proj.) Series 2008 B, 0.16%, LOC Bank of Scotland PLC, VRDN (a) | 19,730 | | 19,730 |

Univ. of Texas Permanent Univ. Fund Rev. Participating VRDN Series ROC II R 11266, 0.2% (Liquidity Facility Citibank NA) (a)(d) | 3,680 | | 3,680 |

| | 268,763 |

Utah - 0.4% |

Emery County Poll. Cont. Rev. (PacifiCorp Proj.) Series 1994, 0.18%, LOC Wells Fargo Bank NA, VRDN (a) | 1,000 | | 1,000 |

Intermountain Pwr. Agcy. Pwr. Supply Rev.: | | | |

Bonds Series 2009 A, 3% 7/1/10 | 1,200 | | 1,211 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Utah - continued |

Intermountain Pwr. Agcy. Pwr. Supply Rev.: - continued | | | |

Series 1997 B1, 0.3% 4/9/10 (Liquidity Facility Bank of Nova Scotia), CP | $ 4,400 | | $ 4,400 |

Series 1997 B2, 0.32% 6/7/10 (Liquidity Facility Bank of Nova Scotia), CP | 2,800 | | 2,800 |

| | 9,411 |

Virginia - 2.9% |

Albemarle County Indl. Dev. Auth. Health Srv 0.18%, LOC Wachovia Bank NA, VRDN (a) | 3,815 | | 3,815 |

Fairfax County Econ. Dev. Auth. Rev. (Smithsonian Institution Proj.) Series A, 0.2% (Liquidity Facility Bank of America NA), VRDN (a) | 1,535 | | 1,535 |

Fairfax County Indl. Dev. Auth. Bonds (Inova Health Sys. Proj.) Series 2009 B1, 0.55%, tender 3/8/10 (a) | 11,500 | | 11,500 |

Norfolk Econ. Dev. Auth. Hosp. Facilities Rev. (Sentara Healthcare Proj.) Series 2009 C, 0.16%, VRDN (a) | 2,000 | | 2,000 |

Norfolk Econ. Dev. Auth. Rev. (Bon Secours Health Sys. Proj.) Series 2008 D1, 0.24%, LOC Landesbank Baden-Wuert, VRDN (a) | 5,900 | | 5,900 |

Richmond Pub. Util. Rev. Participating VRDN: | | | |

Series ROC II R 10410, 0.21% (Liquidity Facility Citibank NA) (a)(d) | 3,930 | | 3,930 |

Series ROC II R 11262, 0.21% (Liquidity Facility Citibank NA) (a)(d) | 4,880 | | 4,880 |

Univ. of Virginia Gen. Rev. Participating VRDN Series EGL 06 17 Class A, 0.2% (Liquidity Facility Citibank NA) (a)(d) | 17,200 | | 17,200 |

Virginia College Bldg. Auth. Edl. Facilities Rev. Participating VRDN Series PZ 161, 0.21% (Liquidity Facility Wells Fargo & Co.) (a)(d) | 3,860 | | 3,860 |

Virginia Resources Auth. Clean Wtr. Rev. Participating VRDN Series MS 06 1860, 0.19% (Liquidity Facility Wells Fargo & Co.) (a)(d) | 4,720 | | 4,720 |

Virginia Small Bus. Fing. Auth. Health Care Facilities Rev. Participating VRDN Series Putters 3651, 0.2% (Liquidity Facility JPMorgan Chase Bank) (a)(d) | 4,225 | | 4,225 |

| | 63,565 |

Washington - 2.1% |

Cascade Wtr. Alliance Wtr. Sys. Rev. Participating VRDN Series Solar 06 73 0.17% (Liquidity Facility U.S. Bank NA, Minnesota) (a)(d) | 8,615 | | 8,615 |

Central Puget Sound Reg'l. Trans. Auth. Sales & Use Tax Rev. Participating VRDN Series Putters 2866, 0.2% (Liquidity Facility JPMorgan Chase Bank) (a)(d) | 1,000 | | 1,000 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Washington - continued |

Energy Northwest Elec. Rev. Bonds Series 2008 D, 5% 7/1/10 | $ 4,610 | | $ 4,680 |

King County Swr. Rev.: | | | |

Participating VRDN Series ROC II R 11717, 0.2% (Liquidity Facility Citibank NA) (a)(d) | 5,645 | | 5,645 |

Series A, 0.35% 3/4/10 (Liquidity Facility Bayerische Landesbank Girozentrale), CP | 3,000 | | 3,000 |

Pierce County Econ. Dev. Corp. Spl. Rev. (Weyerhaeuser Real Estate Proj.) Series 1997 A, 0.22%, LOC Bank of America NA, VRDN (a) | 1,100 | | 1,100 |

Seattle Muni. Lt. & Pwr. Rev. Bonds Series 2008, 5% 4/1/10 | 2,160 | | 2,168 |

Seattle Wtr. Sys. Rev. Participating VRDN Series MS 06 2170, 0.19% (Liquidity Facility Wells Fargo & Co.) (a)(d) | 2,510 | | 2,510 |

Snohomish County Pub. Util. District #1 Elec. Rev. RAN Series 2009 B, 2% 8/5/10 | 11,595 | | 11,671 |

Washington Health Care Facilities Auth. Rev. (Childrens Hosp. Reg'l. Med. Ctr. Proj.) Series 2008 B, 0.19%, LOC Bank of America NA, VRDN (a) | 3,150 | | 3,150 |

Washington Hsg. Fin. Commission Nonprofit Rev. (United Way King County Proj.) 0.5%, LOC Bank of America NA, VRDN (a) | 1,560 | | 1,560 |

Washington Pub. Pwr. Supply Sys. Nuclear Proj. #1 Rev. Series 1993 1 A2, 0.17%, LOC Bank of America NA, VRDN (a) | 1,200 | | 1,200 |

| | 46,299 |

West Virginia - 0.5% |

West Virginia Hosp. Fin. Auth. Hosp. Rev. (West Virginia United Health Sys. Proj.) Series 2008 D, 0.22%, LOC Bank of America NA, VRDN (a) | 10,810 | | 10,810 |

Wisconsin - 2.1% |

Univ. of Wisconsin Hosp. & Clinics Auth. Series 2009 A, 0.16%, LOC U.S. Bank NA, Minnesota, VRDN (a) | 4,870 | | 4,870 |

Wisconsin Ctr. District Tax Rev. Series 2001 A, 0.21%, LOC U.S. Bank NA, Minnesota, VRDN (a) | 7,300 | | 7,300 |

Wisconsin Gen. Oblig.: | | | |

Bonds Series 1992, 6.25% 5/1/10 | 3,765 | | 3,801 |

Series 2005 A, 0.25% 4/6/10 (Liquidity Facility State Street Bank & Trust Co., Boston) (Liquidity Facility California Teachers Retirement Sys.), CP | 4,700 | | 4,700 |

Wisconsin Health & Edl. Facilities Auth. Rev. Bonds (Alexian Brothers Health Sys. Proj.) 0.27% tender 3/1/10, LOC JPMorgan Chase Bank, CP mode | 3,200 | | 3,200 |

Municipal Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Wisconsin - continued |

Wisconsin Trans. Rev.: | | | |

Series 1997, 0.25% 4/7/10 (Liquidity Facility State Street Bank & Trust Co., Boston) (Liquidity Facility California Teachers Retirement Sys.), CP | $ 10,884 | | $ 10,884 |

Series 2006 A: | | | |

0.28% 4/6/10 (Liquidity Facility State Street Bank & Trust Co., Boston) (Liquidity Facility California Teachers Retirement Sys.), CP | 7,500 | | 7,500 |

0.32% 3/1/10 (Liquidity Facility State Street Bank & Trust Co., Boston) (Liquidity Facility California Teachers Retirement Sys.), CP | 3,000 | | 3,000 |

| | 45,255 |

| Shares | | |

Other - 7.5% |

Fidelity Tax-Free Cash Central Fund, 0.16% (b)(c) | 162,860,900 | | 162,861 |

TOTAL INVESTMENT PORTFOLIO - 100.1% (Cost $2,174,200) | | 2,174,200 |

NET OTHER ASSETS - (0.1)% | | (1,529) |

NET ASSETS - 100% | $ 2,172,671 |

Fidelity AMT Tax-Free Money Fund (the Fund) is a fund of Fidelity Union Street Trust II (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware statutory trust.

The Fund may invest in Fidelity Central Funds, which are open-end investment companies available only to other investment companies and accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of FMR.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) web site at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC web site or upon request.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the fund's own assumptions based on the best information available)

As permitted by compliance with certain conditions under Rule 2a-7 of the 1940 Act, securities are valued at amortized cost, which approximates value and are categorized as Level 2 in the hierarchy.

The Fund participated in the U.S. Treasury Department's Temporary Guarantee Program for Money Market Funds (the "Program") through September 18, 2009. The Fund paid the U.S. Treasury Department fees equal to 0.04% based on the number of shares outstanding as of September 19, 2008 to participate in the Program through September 18, 2009. The expense was borne by the Fund without regard to any expense limitation in effect for the Fund.

Dividends are declared daily and paid monthly from net investment income. Distributions from realized gains, if any, are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. In addition, the Fund claimed a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to deferred trustees compensation.

The Fund purchases municipal securities whose interest, in the opinion of the issuer, is free from federal income tax. There is no assurance that the IRS will agree with this opinion. In the event the IRS determines that the issuer does not comply with relevant tax requirements, interest payments from a security could become federally taxable, possibly retroactively to the date the security was issued.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

FMR voluntarily agreed to reimburse the Fund to the extent annual operating expenses exceeded .33% of average net assets. Some expenses, for example interest expense and the fee for participating in the U.S. Treasury Department's Temporary Guarantee Program, are excluded from this reimbursement. During the period this reimbursement reduced the Fund's expenses by $1,193.

FMR or its affiliates voluntarily agreed to waive certain fees during the period. The amount of the waiver is $478.

In addition, through arrangements with the Fund's custodian, credits realized as a result of uninvested cash balances were used to reduce the Fund's management fee. During the period, these credits reduced the Fund's expenses by One Hundred and Sixty Five dollars.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Each year, the Board of Trustees, including the Independent Trustees (together, the Board), votes on the renewal of the management contract and sub-advisory agreements (together, the Advisory Contracts) for the fund. The Board, assisted by the advice of fund counsel and Independent Trustees' counsel, requests and considers a broad range of information throughout the year.

The Board meets regularly and considers at each of its meetings factors that are relevant to its annual consideration of the renewal of the fund's Advisory Contracts, including the services and support provided to the fund and its shareholders. The Board has established three standing committees, each composed of Independent Trustees with varying backgrounds, to which the Board has assigned specific subject matter responsibilities in order to enhance effective decision-making by the Board. The Operations Committee meets regularly throughout the year and, among other matters, considers matters specifically related to the annual consideration of the renewal of the fund's Advisory Contracts. The Board, acting directly and through its Committees, requests and receives information concerning the annual consideration of the renewal of the fund's Advisory Contracts. The Board also meets as needed to consider matters specifically related to the Board's annual consideration of the renewal of Advisory Contracts.

At its September 2009 meeting, the Board of Trustees, including the Independent Trustees, unanimously determined to renew the fund's Advisory Contracts. In reaching its determination, the Board considered all factors it believed relevant, including (i) the nature, extent, and quality of the services to be provided to the fund and its shareholders (including the investment performance of the fund); (ii) the competitiveness of the fund's management fee and total expenses; (iii) the total costs of the services to be provided by and the profits to be realized by Fidelity from its relationship with the fund; (iv) the extent to which economies of scale would be realized as the fund grows; and (v) whether fee levels reflect these economies of scale, if any, for the benefit of fund shareholders.

In considering whether to renew the Advisory Contracts for the fund, the Board ultimately reached a determination, with the assistance of fund counsel and Independent Trustees' counsel and through the exercise of its business judgment, that the renewal of the Advisory Contracts and the compensation to be received by Fidelity under the management contract is consistent with Fidelity's fiduciary duty under applicable law. The Board's decision to renew the Advisory Contracts was not based on any single factor noted above, but rather was based on a comprehensive consideration of all the information provided to the Board at its meetings throughout the year. The Board, in reaching its determination to renew the Advisory Contracts, is aware that shareholders in the fund have a broad range of investment choices available to them, including a wide choice among mutual funds offered by competitors to Fidelity, and that the fund's shareholders, with the opportunity to review and weigh the disclosure provided by the fund in its prospectus and other public disclosures, have chosen to invest in this fund, managed by Fidelity.

The Board noted that the growth of fund assets over time across the complex allows Fidelity to reinvest in the development of services designed to enhance the value or convenience of the Fidelity funds as investment vehicles. These services include 24-hour access to account information and market information through phone representatives and over the Internet, and investor education materials and asset allocation tools.

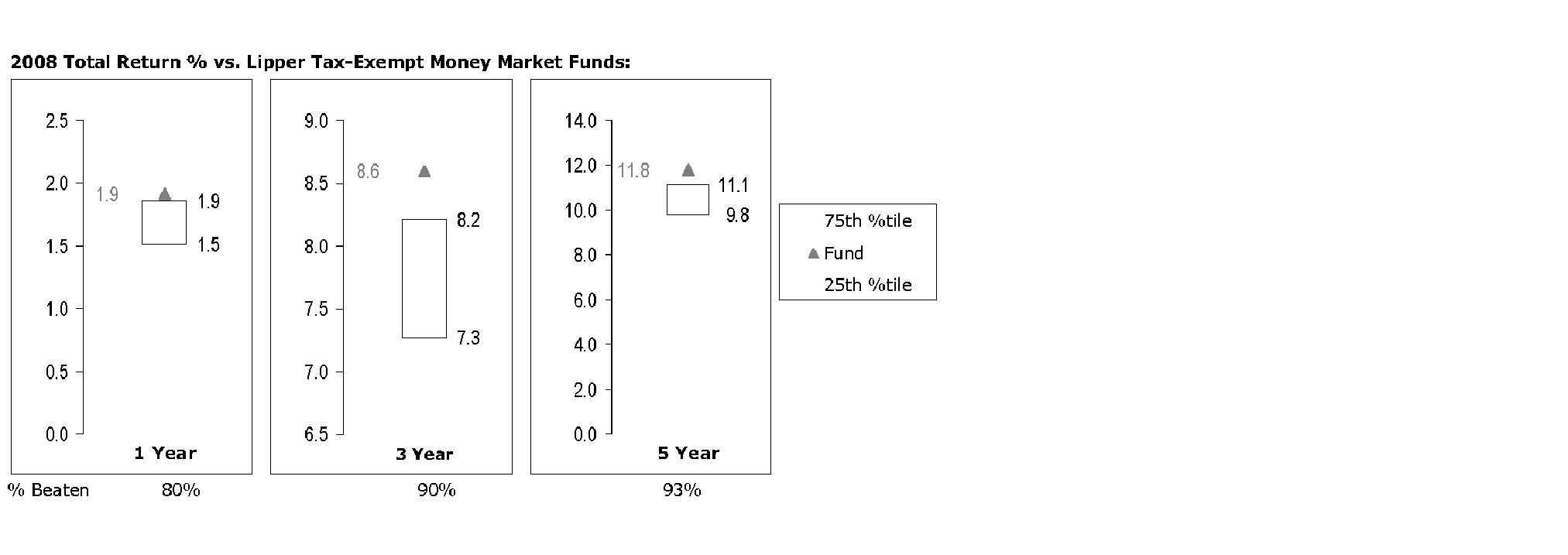

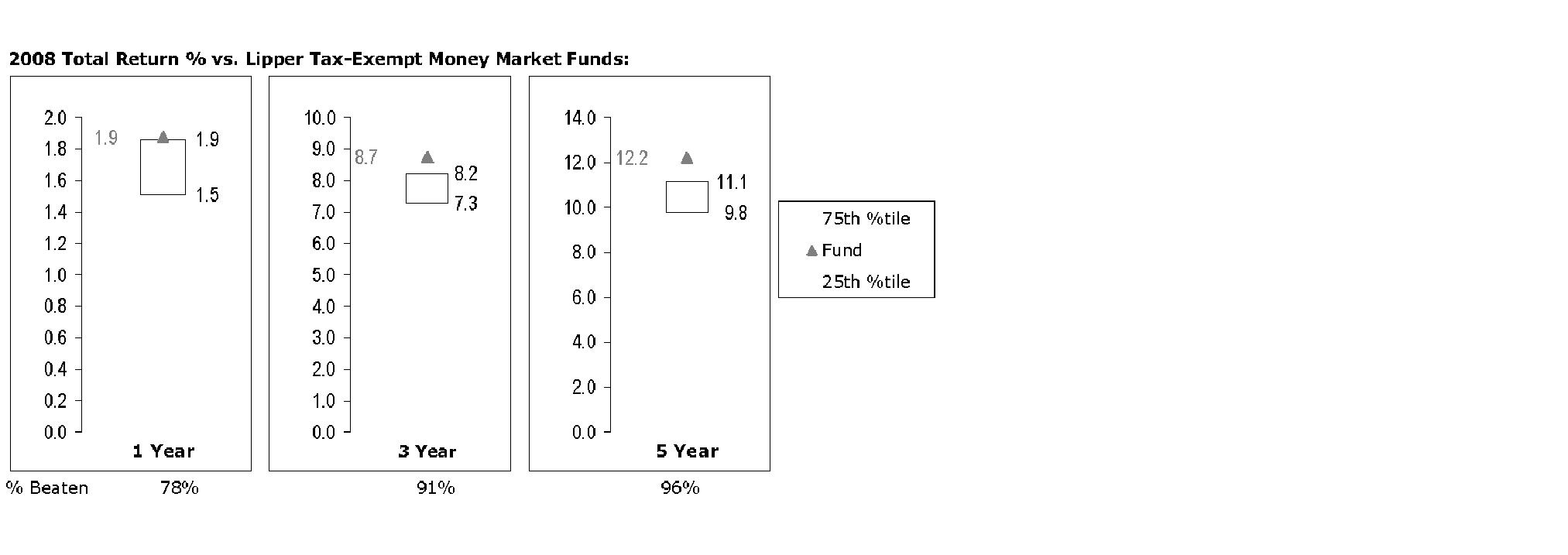

The Board reviewed the fund's relative investment performance against its peer group and stated that the performance of the fund was in the first quartile for all the periods shown. The Board also reviewed the fund's performance during 2009.

Based on its review, and giving particular weight to the nature and quality of the resources dedicated by the Investment Advisers to maintain and improve relative performance and factoring in the unprecedented recent market events, the Board concluded that the nature, extent, and quality of the services provided to the fund will benefit the fund's shareholders, particularly in light of the Board's view that the fund's shareholders benefit from investing in a fund that is part of a large family of funds offering a variety of investment disciplines and services.

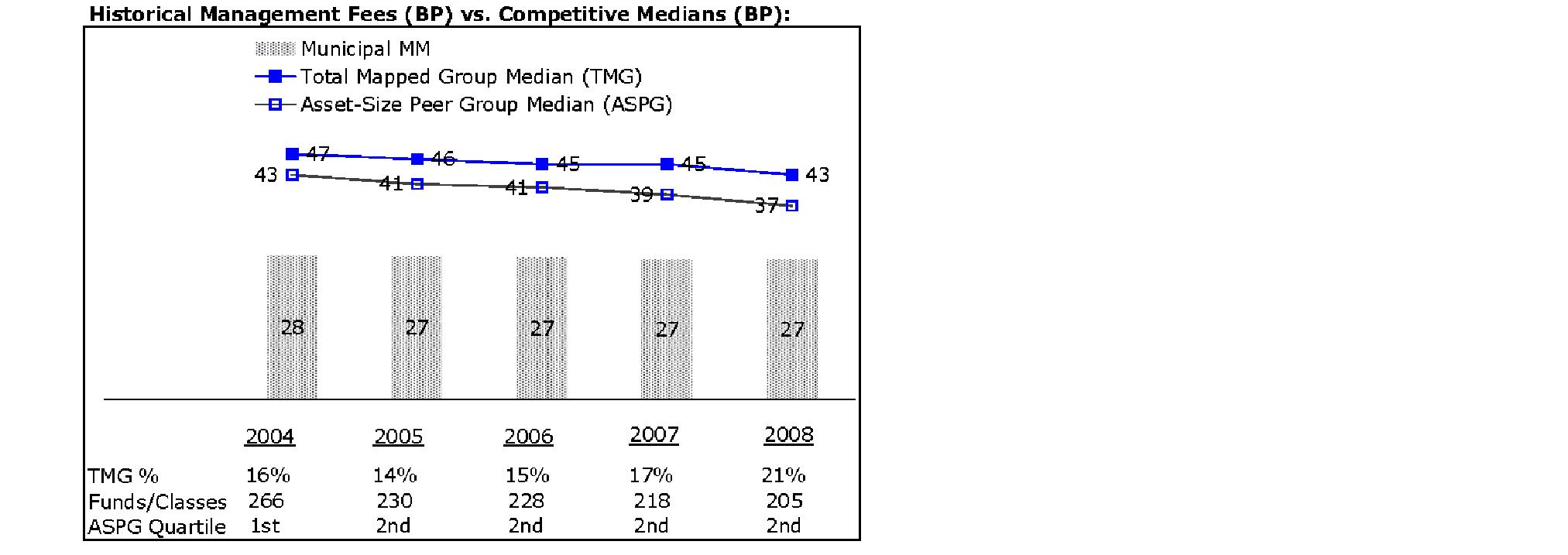

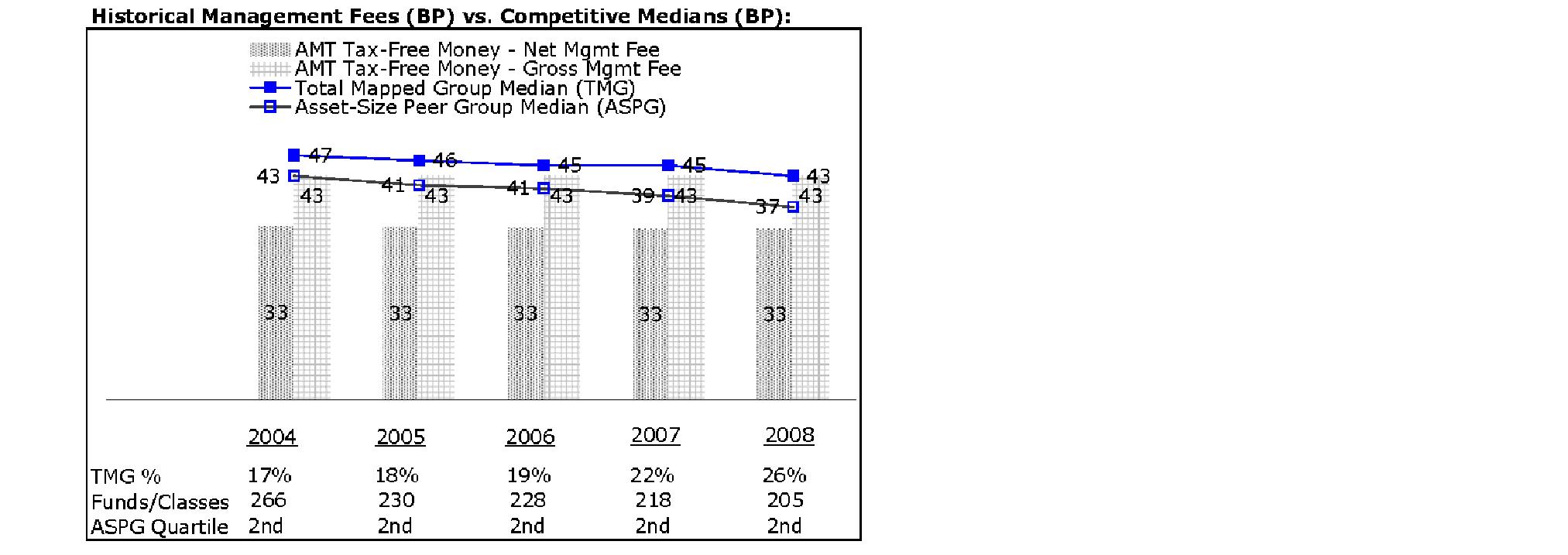

The Board considered two proprietary management fee comparisons for the 12-month periods shown in the chart below. The group of Lipper funds used by the Board for management fee comparisons is referred to below as the "Total Mapped Group" and, for the reasons explained above, is broader than the Lipper peer group used by the Board for performance comparisons. The Total Mapped Group comparison focuses on a fund's standing relative to the total universe of comparable funds available to investors, in terms of gross management fees before expense reimbursements or caps. "TMG %" represents the percentage of funds in the Total Mapped Group that had management fees that were lower than the fund's. For example, a TMG % of 26% means that 74% of the funds in the Total Mapped Group had higher management fees than the fund. The "Asset-Size Peer Group" (ASPG) comparison focuses on a fund's standing relative to non-Fidelity funds similar in size to the fund within the Total Mapped Group. The ASPG represents at least 15% of the funds in the Total Mapped Group with comparable asset size and management fee characteristics, subject to a minimum of 50 funds (or all funds in the Total Mapped Group if fewer than 50). Additional information, such as the ASPG quartile in which the fund's management fee ranked, is also included in the chart and considered by the Board. For a more meaningful comparison of management fees, the fund is compared on the basis of a hypothetical "net management fee," which is derived by subtracting payments made by FMR for non-management expenses (including transfer agent fees, pricing and bookkeeping fees, and custody fees) from the fund's all-inclusive fee. In this regard, the Board realizes that net management fees can vary from year to year because of differences in non-management expenses.

The Board noted that the fund's hypothetical net management fee ranked below the median of its Total Mapped Group and below the median of its ASPG for 2008.

Based on its review, the Board concluded that the fund's management fee was fair and reasonable in light of the services that the fund receives and the other factors considered.

In its review of the fund's total expenses, the Board considered the fund's hypothetical net management fee as well as the fund's all-inclusive fee. The Board also considered other expenses, such as transfer agent fees, pricing and bookkeeping fees, and custodial, legal, and audit fees, paid by FMR under the all-inclusive arrangement. The Board also noted the effects of any waivers and reimbursements on fees and expenses. As part of its review, the Board also considered current and historical total expenses of the fund compared to competitive fund median expenses. The fund is compared to those funds and classes in the Total Mapped Group (used by the Board for management fee comparisons) that have a similar sales load structure.

The Board noted that the fund's total expenses ranked below its competitive median for 2008.

In its review, the Board also considered Fidelity fee structures and other information on clients that FMR and its affiliates service in other competitive markets, such as other mutual funds advised or subadvised by FMR or its affiliates, pension plan clients, and other institutional clients.

Based on its review, the Board concluded that the fund's total expenses were reasonable in light of the services that the fund and its shareholders receive and the other factors considered.

On an annual basis, FMR presents to the Board Fidelity's profitability for the fund. Fidelity calculates the profitability for each fund, as well as aggregate profitability for groups of Fidelity funds and all Fidelity funds, using a series of detailed revenue and cost allocation methodologies which originate with the audited books and records of Fidelity. The Audit Committee of the Board reviews any significant changes from the prior year's methodologies.

PricewaterhouseCoopers LLP (PwC), independent registered public accounting firm and auditor to Fidelity and certain Fidelity funds, has been engaged annually by the Board as part of the Board's assessment of Fidelity's profitability analysis. PwC's engagement includes the review and assessment of Fidelity's methodologies used in determining the revenues and expenses attributable to Fidelity's mutual fund business, and completion of agreed-upon procedures surrounding the mathematical accuracy of fund profitability and its conformity to allocation methodologies. After considering PwC's reports issued under the engagement and information provided by Fidelity, the Board believes that while other allocation methods may also be reasonable, Fidelity's profitability methodologies are reasonable in all material respects.

The Board has also reviewed Fidelity's non-fund businesses and any fall-out benefits related to the mutual fund business as well as cases where Fidelity's affiliates may benefit from or be related to the fund's business.

The Board considered the costs of the services provided by and the profits realized by Fidelity in connection with the operation of the fund and determined that the amount of profit is a fair entrepreneurial profit for the management of the fund.

In February 2009, the Board created an Ad Hoc Committee (the "Committee") to analyze economies of scale. The Committee was formed to consider whether FMR attains economies of scale in respect of the management and servicing of the Fidelity funds, whether the Fidelity funds have appropriately benefited from such economies of scale, and whether there is potential for realization of any further economies of scale.

The Board concluded, considering the findings of the Committee, that any potential economies of scale are being shared between fund shareholders and Fidelity in an appropriate manner.

Based on its evaluation of all of the conclusions noted above, and after considering all material factors, the Board ultimately concluded that the advisory fee structures are fair and reasonable, and that the fund's Advisory Contracts should be renewed.

Fidelity offers several ways to conveniently manage your personal investments via your telephone or PC. You can access your account information, conduct trades and research your investments 24 hours a day.

Fidelity Automated Service Telephone provides a single toll-free number to access account balances, positions, quotes and trading. It's easy to navigate the service, and on your first call, the system will help you create a personal identification number (PIN) for security.

Fidelity's web site on the Internet provides a wide range of information, including daily financial news, fund performance, interactive planning tools and news about Fidelity products and services.

Citibank, N.A.

New York, NY

Fidelity Investments Institutional Operations Company, Inc.

Fidelity Service Company, Inc.

Citibank, N.A.

The turnaround in global capital markets that marked most of 2009 slowed in early 2010, as investors considered the risks to a sustained recovery, including increased political uncertainty, high unemployment, weak consumer spending and potential inflation on the horizon. Financial markets are always unpredictable, of course, but there also are several time-tested investment principles that can help put the odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There can be tax advantages and cost benefits to consider as well. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best-performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or by phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Abigail P. Johnson

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2009 to February 28, 2010).

The first line of the accompanying table for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.