| UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 |

| FORM N-CSR |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES |

| Investment Company Act file number | 811- 6490 |

| Dreyfus Premier Investment Funds, Inc. (Exact name of Registrant as specified in charter) |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 (Address of principal executive offices) (Zip code) |

| Michael A. Rosenberg, Esq. 200 Park Avenue New York, New York 10166 (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (212) 922-6000 |

| Date of fiscal year end: | 10/31 | |

| Date of reporting period: | 10/31/09 |

The following N-CSR relates only to the Registrant s series listed below and does not affect the other series of the Registrant, which has a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR Form will be filed for this series, as appropriate.

| DREYFUS PREMIER INVESTMENT FUNDS, INC. - Dreyfus Diversified Global Fund - Dreyfus Diversified International Fund - Dreyfus Diversified Large Cap Fund - Dreyfus Emerging Asia Fund - Dreyfus Greater China Fund - Dreyfus Satellite Alpha Fund |

| FORM N-CSR |

| Item 1. | Reports to Stockholders. |

| Dreyfus |

| Diversified Global Fund |

| ANNUAL REPORT October 31, 2009 |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

| Contents | |

| THE FUND | |

| 2 | A Letter from the Chairman and CEO |

| 3 | Discussion of Fund Performance |

| 6 | Understanding Your Fund’s Expenses |

| 6 | Comparing Your Fund’s Expenses With Those of Other Funds |

| 7 | Statement of Investments |

| 8 | Statement of Assets and Liabilities |

| 9 | Statement of Operations |

| 10 | Statement of Changes in Net Assets |

| 11 | Financial Highlights |

| 12 | Notes to Financial Statements |

| 20 | Report of Independent Registered Public Accounting Firm |

| 21 | Information About the Review and Approval of the Fund’s Management Agreement |

| 24 | Board Members Information |

| 26 | Officers of the Fund |

| FOR MORE INFORMATION | |

| Back Cover | |

| Dreyfus Diversified Global Fund |

| The Fund |

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Diversified Global Fund, covering the period since the fund’s inception on July 15, 2009, through October 31, 2009.

Recent reports of positive economic growth in the United States’, European and Asian markets may have signaled the end of the deep global recession that technically began here in the U.S. in late 2007. Signs that the world economies finally have turned a corner include inventory rebuilding among manufacturers, improvements in domestic housing, and more robust consumer spending.These developments helped fuel a sustained worldwide stock rally since the early spring, with the most beaten-down securities in less developed nations generally leading the rebound. Higher-quality stocks within more developed markets have participated in the rally, but have so far lagged on a relative performance basis.

In our judgment, the global financial markets currently appear poised to enter into a new phase in which underlying fundamentals, such as sound capital and financial structures—and not bargain hunting—are likely to drive investment returns. Of course, the best strategy for your portfolio depends not only on your view of the global economy’s direction, but on your current financial needs, future goals and attitudes toward risk. Your financial advisor can help you decide which investments have the potential to benefit from a recovery while guarding against the risk that may accompany unexpected market developments.

For information about how the fund performed during the reporting period, as well as market perspectives, we have provided a Discussion of Fund Performance.

Thank you for your continued confidence and support.

| Jonathan R. Baum Chairman and Chief Executive Officer The Dreyfus Corporation November 16, 2009 |

| 2 |

DISCUSSION OF FUND PERFORMANCE

For the period of July 15, 2009, through October 31, 2009, as provided by Phillip N. Maisano, Richard B. Hoey,William J. Reilly, CFA, Christopher E. Sheldon, CFA, and Keith L. Stransky, CFA, Portfolio Managers

Fund and Market Performance Overview

For the period between the fund’s inception on July 15, 2009, and the end of its fiscal year on October 31, 2009, Dreyfus Diversified Global Fund’s Class A shares produced a total return of 13.84%, Class C shares returned 13.12% and Class I shares returned 13.52%.1 In comparison, the fund’s benchmark, the Morgan Stanley Capital International World (MSCI World) Index (the “Index”), produced a total return of 14.45% for the same period.2

The fund began operations in the midst of a sustained rally in global equity markets as economic and market conditions stabilized in the wake of a severe recession and financial crisis.The fund produced returns lower than its benchmark, primarily due to its relatively defensive investment posture at a time when lower-quality stocks led the market rebound.

The Fund’s Investment Approach

The fund seeks long-term capital appreciation.To pursue its goal, the fund normally allocates its assets among other mutual funds advised by The Dreyfus Corporation (Dreyfus), or its affiliates, that invest primarily in stocks issued by global companies.The underlying funds are selected based on their investment objectives and management policies, portfolio holdings, risk/reward profiles, historical performance and other factors. Dreyfus seeks to diversify the fund’s investments by investment objectives and management policies, portfolio holdings, risk/reward profiles, historical performance and other factors, including the correlation and covariance among the underlying funds. The Dreyfus Investment Committee will rebalance the fund’s investments in the underlying funds at least annually, but may do so more often in response to market conditions.

The Fund 3

| DISCUSSION OF FUND PERFORMANCE (continued) |

Global Equity Markets Rebounded Sharply

When the fund began operations,the world was recovering from a global financial crisis that nearly led to the collapse of the worldwide banking system.Meanwhile,rising unemployment,declining housing markets and plunging consumer confidence in many markets had produced the most severe global recession since the 1930s.

Although these influences fueled a bear market that drove stocks to multi-year lows in the first quarter of 2009, most of the world’s stock markets already had recovered a significant amount of previously lost ground by the start of the reporting period. Market sentiment had improved when it became clearer that aggressive remedial actions by the world’s government and monetary authorities—including historically low short-term interest rates, rescues of troubled corporations, massive economic stimulus programs and unprecedented injections of liquidity into the global banking system—had helped repair the credit markets. During the reporting period, additional evidence of global economic stabilization and a return to growth continued to propel stocks higher. The emerging markets generally produced more robust gains during the rally than developed markets.

Cautious Posture Dampened Relative Performance

In the midst of heightened market volatility and following several months of rising stock prices, we positioned the fund relatively defensively upon its inception.The fund began operations with underweighted positions in the United States and Japan, overweighted exposure to France and a mild degree of exposure to the emerging markets, especially Brazil.These tilts generally enhanced the fund’s performance compared to the benchmark. From a market sector perspective, an emphasis on traditionally defensive consumer staples companies also aided performance. However, relatively light exposure to the financials sector, which continued to bounce back strongly from its earlier troubles, detracted from the fund’s relative results for the reporting period.

Soon after the fund began operations, we eliminated its position in Global Alpha Fund due to the underlying fund’s exposure to global

4

fixed-income markets. In our judgment, the fund’s assets would be more effectively allocated to underlying funds that are substantially invested in equities.As part of our risk management approach, we also reduced the fund’s allocation to Dreyfus Global Real Estate Securities Fund in order to move the fund’s investment mix to proportions that more closely resemble the MSCI World Index. We reallocated those assets to Dreyfus Worldwide Growth Fund, Global Stock Fund and Dreyfus Global Equity Income Fund, all of which focus primarily on higher-quality companies and markets. In September, we made another allocation adjustment designed to increase the fund’s market sensitivity (exposure) when we transferred some assets from Dreyfus Global Equity Income Fund to Dreyfus Global Sustainability Fund.

Finding Opportunities in Recovering Markets

As of the reporting period’s end, we have seen evidence that investor sentiment may be shifting to higher-quality companies with sound business fundamentals. In our judgment, the fund’s current positioning may be particularly well suited for an investment environment that favors well established, fundamentally sound stocks.Accordingly, the fund ended the reporting period with approximately 15% of its assets allocated to Dreyfus Global Equity Income Fund, 30% to Dreyfus Worldwide Growth Fund, 30% to Global Stock Fund, 20% to Dreyfus Global Sustainability Fund and 5% to Dreyfus Global Real Estate Securities Fund.

November 16, 2009

| 1 | Total return includes reinvestment of dividends and any capital gains paid, and does not take into | |

| consideration the maximum initial sales charge in the case of Class A shares, or the applicable | ||

| contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these | ||

| charges been reflected, returns would have been lower. Past performance is no guarantee of future | ||

| results. Share price and investment return fluctuate such that upon redemption, fund shares may be | ||

| worth more or less than their original cost. Return figures provided reflect the absorption of certain | ||

| fund expenses by The Dreyfus Corporation pursuant to an agreement in effect until March 1, | ||

| 2011. Had these expenses not been absorbed, the fund’s returns would have been lower. | ||

| 2 | SOURCE: Morgan Stanley Capital International – Reflects reinvestment of net dividends and, | |

| where applicable, capital gain distributions.The Morgan Stanley Capital International (MSCI) | ||

| World Index is an unmanaged index of global stock market performance, including the United | ||

| States, Canada, Europe, Australia, New Zealand and the Far East. |

The Fund 5

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Diversified Global Fund from July 15, 2009 (commencement of operations) to October 31, 2009. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Expenses and Value of a $1,000 Investment assuming actual returns for the six months ended October 31, 2009 |

| Class A | Class C | Class I | ||||

| Expenses paid per $1,000† | $ 2.36 | $ 4.74 | $ 1.56 | |||

| Ending value (after expenses) | $1,138.40 | $1,131.20 | $1,135.20 |

| COMPARING YOUR FUND’S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited) |

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| Expenses and Value of a $1,000 Investment assuming a hypothetical 5% annualized return for the six months ended October 31, 2009 |

| Class A | Class C | Class I | ||||

| Expenses paid per $1,000††† | $ 3.77 | $ 7.58 | $ 2.50 | |||

| Ending value (after expenses) | $1,021.48 | $1,017.69 | $1,022.74 |

| † | Expenses are equal to the fund’s annualized expense ratio of .74% for Class A, 1.49% for Class C and .49% for Class I, | |

| multiplied by the average account value over the period, multiplied by 109/365 (to reflect the actual days in the period). | ||

| †† | Please note that while Class A, Class C and Class I shares commenced operations on July 15, 2009, the Hypothetical | |

| expenses paid during the period reflect projected activity for the full six month period for purposes of comparability.This | ||

| projection assumes that annualized expense ratios were in effect during the period May 1, 2009 to October 31, 2009. | ||

| ††† Expenses are equal to the fund’s annualized expense ratio of .74% for Class A, 1.49% for Class C and .49% for Class I, | ||

| multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). | ||

6

| STATEMENT OF INVESTMENTS October 31, 2009 |

| Other Investment—100.2% | Shares | Value ($) | ||

| Registered Investment Company; | ||||

| Dreyfus Global Equity Income Fund, Cl. I | 6,903 a | 60,950 | ||

| Dreyfus Global Real Estate | ||||

| Securities Fund, Cl. I | 3,241 a | 20,872 | ||

| Dreyfus Global Sustainability Fund, Cl. I | 5,410 a | 80,442 | ||

| Dreyfus Worldwide Growth Fund, Cl. I | 3,315 a | 122,512 | ||

| Global Stock Fund, Cl. I | 10,037 a | 119,745 | ||

| Total Investments (cost $383,794) | 100.2% | 404,521 | ||

| Liabilities, Less Cash and Receivables | (.2%) | (625) | ||

| Net Assets | 100.0% | 403,896 | ||

| a Investment in affiliated mutual fund. | ||||

| Portfolio Summary (Unaudited)† | ||

| Value (%) | ||

| Affiliated mutual funds | 100.2 |

| † Based on net assets. See notes to financial statements. |

The Fund 7

| STATEMENT OF ASSETS AND LIABILITIES October 31, 2009 |

| Cost | Value | |||

| Assets ($): | ||||

| Investments in affiliated issuers—See Statement of Investments | 383,794 | 404,521 | ||

| Prepaid expenses | 38,491 | |||

| Deferred assets | 30,000 | |||

| Due from The Dreyfus Corporation and affiliates—Note 2(c) | 3,354 | |||

| 476,366 | ||||

| Liabilities ($): | ||||

| Cash overdraft due to Custodian | 4,611 | |||

| Payable for registration fees | 37,772 | |||

| Accrued expenses | 30,087 | |||

| 72,470 | ||||

| Net Assets ($) | 403,896 | |||

| Composition of Net Assets ($): | ||||

| Paid-in capital | 380,066 | |||

| Accumulated net realized gain (loss) on investments | 3,103 | |||

| Accumulated gross unrealized appreciation | ||||

| on investments in affiliated issuers | 20,727 | |||

| Net Assets ($) | 403,896 |

| Net Asset Value Per Share | ||||||

| Class A | Class C | Class I | ||||

| Net Assets ($) | 290,579 | 56,574 | 56,743 | |||

| Shares Outstanding | 20,419 | 4,000 | 4,000 | |||

| Net Asset Value Per Share ($) | 14.23 | 14.14 | 14.19 | |||

| See notes to financial statements. | ||||||

8

| STATEMENT OF OPERATIONS From July 15, 2009 (commencement of operations) to October 31, 2009 |

| Investment Income ($): | ||

| Income: | ||

| Cash dividends from affiliated issuers | 224 | |

| Expenses: | ||

| Auditing fees | 25,000 | |

| Legal fees | 19,920 | |

| Registration fees | 15,021 | |

| Prospectus and shareholders’ reports | 3,703 | |

| Shareholder servicing costs—Note 2(c) | 362 | |

| Directors’ fees and expenses—Note 2(d) | 138 | |

| Distribution fees—Note 2(b) | 124 | |

| Custodian fees—Note 2(c) | 80 | |

| Miscellaneous | 3,081 | |

| Total Expenses | 67,429 | |

| Less—expense reimbursement from The Dreyfus Corporation | ||

| due to undertaking—Note 2(a) | (66,798) | |

| Less—reduction in fees due to earnings credits—Note 1(b) | (6) | |

| Net Expenses | 625 | |

| Investment (Loss)—Net | (401) | |

| Realized and Unrealized Gain (Loss) on Investments—Note 3 ($): | ||

| Net realized gain (loss) on investments in affiliated issuers | 3,336 | |

| Net unrealized appreciation (depreciation) on investments in affiliated issuers | 20,727 | |

| Net Realized and Unrealized Gain (Loss) on Investments | 24,063 | |

| Net Increase in Net Assets Resulting from Operations | 23,662 | |

| See notes to financial statements. | ||

The Fund 9

| STATEMENT OF CHANGES IN NET ASSETS From July 15, 2009 (commencement of operations) to October 31, 2009 |

| Operations ($): | ||

| Investment (loss)—net | (401) | |

| Net realized gain (loss) on investments in affiliated issuers | 3,336 | |

| Net unrealized appreciation (depreciation) | ||

| on investments in affiliated issuers | 20,727 | |

| Net Increase (Decrease) in Net Assets | ||

| Resulting from Operations | 23,662 | |

| Capital Stock Transactions ($): | ||

| Net proceeds from shares sold: | ||

| Class A Shares | 280,234 | |

| Class C Shares | 50,000 | |

| Class I Shares | 50,000 | |

| Increase (Decrease) in Net Assets | ||

| from Capital Stock Transactions | 380,234 | |

| Total Increase (Decrease) in Net Assets | 403,896 | |

| Net Assets ($): | ||

| Beginning of Period | — | |

| End of Period | 403,896 | |

| Capital Share Transactions (Shares): | ||

| Class A | ||

| Shares sold | 20,419 | |

| Class C | ||

| Shares sold | 4,000 | |

| Class I | ||

| Shares sold | 4,000 | |

| See notes to financial statements. | ||

10

FINANCIAL HIGHLIGHTS

The following table describes the performance for each share class for the period from July 15, 2009 (commencement of operations) to October 31, 2009. All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distrib-utions.These figures have been derived from the fund’s financial statements.

| Class A | Class C | Class I | ||||

| Shares | Shares | Shares | ||||

| Per Share Data ($): | ||||||

| Net asset value, beginning of period | 12.50 | 12.50 | 12.50 | |||

| Investment Operations: | ||||||

| Investment (loss)—neta | (.02) | (.05) | (.01) | |||

| Net realized and unrealized | ||||||

| gain (loss) on investments | 1.75 | 1.69 | 1.70 | |||

| Total from Investment Operations | 1.73 | 1.64 | 1.69 | |||

| Net asset value, end of period | 14.23 | 14.14 | 14.19 | |||

| Total Return (%)b | 13.84c | 13.12c | 13.52 | |||

| Ratios/Supplemental Data (%): | ||||||

| Ratio of total expenses to average net assetsd,e | 89.42 | 95.60 | 94.61 | |||

| Ratio of net expenses to average net assetsd,e | .74 | 1.49 | .49 | |||

| Ratio of net investment (loss) | ||||||

| to average net assetsd,e | (.45) | (1.17) | (.17) | |||

| Portfolio Turnover Rateb | 28.98 | 28.98 | 28.98 | |||

| Net Assets, end of period ($ x 1,000) | 291 | 57 | 57 |

| a | Based on average shares outstanding at each month end. | |

| b | Not annualized. | |

| c | Exclusive of sales charge. | |

| d | Annualized. | |

| e | Amounts do not include the activity of the underlying funds. |

| See notes to financial statements. |

The Fund 11

NOTES TO FINANCIAL STATEMENTS

NOTE 1-Significant Accounting Policies:

Dreyfus Diversified Global Fund (the “fund”) is a separate diversified series of Dreyfus Premier Investment Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering ten series, including the fund, which commenced operations on July 15, 2009. The fund’s investment objective seeks long-term capital appreciation. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Mellon Capital Management Corporation (“Mellon Capital”), a subsidiary of BNY Mellon, serves as the fund’s sub-investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares. The fund is authorized to issue 50 million shares of $.001 par value Common Stock in each of the following classes of shares: Class A, Class C, and Class I. Class A shares are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class C shares redeemed within one year of purchase. Class I shares are sold at net asset value per share only to institutional investors. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each cl ass of shares based on its relative net assets.

As of October 31, 2009, MBC Investments Corp., an indirect subsidiary of BNY Mellon, held 8,000 Class A, 4,000 Class C and 4,000 Class I shares of the fund.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

12

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) has become the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The ASC has superseded all existing non-SEC accounting and reporting standards. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: Investments are valued at the net asset value of each underlying fund determined as of the close of the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date.

The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e. the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value.This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

The Fund 13

| NOTES TO FINANCIAL STATEMENTS (continued) |

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements.These inputs are summarized in the three broad levels listed below:

| Level 1—unadjusted quoted prices in active markets for identical investments. Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.). Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments). |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of October 31, 2009 in valuing the fund’s investments:

| Level 2—Other | Level 3— | |||||||

| Level 1— | Significant | Significant | ||||||

| Unadjusted | Observable | Unobservable | ||||||

| Quoted Prices | Inputs | Inputs | Total | |||||

| Assets ($) | ||||||||

| Investments in Securities: | ||||||||

| Mutual Funds | 404,521 | — | — | 404,521 | ||||

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

The fund has arrangements with the custodian and cash management bank whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset custody and cash management fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

14

(c) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” in the Act.

(d) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(e) Federal income taxes: It is the policy of the fund to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended October 31, 2009, the fund did not have any liabilities for any uncertain tax positions.The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period, the fund did not incur any interest or penalties.

The tax year for the period ended October 31, 2009 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At October 31, 2009, the components of accumulated earnings on tax basis were as follows: undistributed ordinary income $3,103 and unrealized appreciation $20,727.

During the period ended October 31, 2009, as a result of permanent book to tax differences, primarily due to fund start-up costs and net

The Fund 15

| NOTES TO FINANCIAL STATEMENTS (continued) |

operating losses, the fund increased accumulated undistributed investment income-net by $401, decreased accumulated net realized gain (loss) on investments by $233 and decreased paid-in capital by $168. Net assets and net asset value per share were not affected by this reclassification.

NOTE 2—Management Fee and Other Transactions With Affiliates:

(a) Pursuant to a management agreement (“Agreement”) with the Manager, there is no management fee paid to the Manager.The fund invests in other mutual funds advised by the Manager. All fees and expenses of the underlying funds are reflected in the underlying funds’ net asset value.

The Manager has contractually agreed to waive receipt of its fees and/or assume the expenses of the fund, until March 1, 2011, so that the total annual fund and underlying funds operating expenses of none of the classes (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest, brokerage commissions and extraordinary expenses) exceed 1.50% of the value of the fund’s average daily net assets. The expense reimbursement, pursuant to the undertaking, amounted to $66,798 during the period ended October 31, 2009.

(b) Under the Distribution Plan (the “Plan”) adopted pursuant to Rule 12b-1 under the Act, Class C shares pay the Distributor for distributing their shares at an annual rate of .75% of the value of their average daily net assets. During the period ended October 31, 2009, Class C shares were charged $124 pursuant to the Plan.

(c) Under the Shareholder Services Plan, Class A and Class C shares pay the Distributor at an annual rate of .25% of the value of their average daily net assets for the provision of certain services. The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding Class A and Class C shares and providing reports and other information, and services related to the maintenance of shareholder accounts.The Distributor may make payments to Service Agents (a securities dealer, financial institution or other industry professional) in respect of these services.The Distributor

16

determines the amounts to be paid to Service Agents. During the period ended October 31, 2009, Class A and Class C shares were charged $101 and $41, respectively, pursuant to the Shareholder Services Plan.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of the Manager, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the fund. During the period ended October 31, 2009, the fund was charged $109 pursuant to the transfer agency agreement, which is included in Shareholder servicing costs in the Statement of Operations.

The fund compensates The Bank of NewYork Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, under a cash management agreement for performing cash management services related to fund subscriptions and redemptions. During the period ended October 31, 2009, the fund was charged $6 pursuant to the cash management agreement, which is included in Shareholder servicing costs in the Statement of Operations. These fees were offset by earnings credits pursuant to the cash management agreement.

The fund also compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. During the period ended October 31, 2009, the fund was charged $80 pursuant to the custody agreement.

During the period ended October 31, 2009, the fund was charged $2,227 for services performed by the Chief Compliance Officer.

The components of “Due from The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: Rule 12b-1 distribution plan fees $37, shareholder services plan fees $54, custodian fees $60, chief compliance officer fees $2,227 and transfer agency per account fees $62, which are offset against an expense reimbursement currently in effect in the amount of $5,794.

(d) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

The Fund 17

| NOTES TO FINANCIAL STATEMENTS (continued) |

NOTE 3—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities (all of which were affiliated issuers), during the period ended October 31, 2009, amounted to $454,433 and $73,975, respectively.

The fund may invest in shares of certain affiliated investment companies also advised or managed by the adviser. Investments in affiliated investment companies for the period ended October 31, 2009 were as follows:

| Affiliated Investment | Value | Sales | ||||||

| Company | 10/31/2008 ($) | Purchases ($) Proceeds ($) Dividends ($) | ||||||

| Global Alpha Fund, Cl. I | — | 40,000 | 40,821 | — | ||||

| Dreyfus Global Equity | ||||||||

| Income Fund, Cl. I | — | 77,621 | 22,892 | 224 | ||||

| Dreyfus Global Real | ||||||||

| Estate Securities | ||||||||

| Fund, Cl. I | — | 29,011 | 10,262 | — | ||||

| Dreyfus Worldwide | ||||||||

| Growth Fund, Cl. I | — | 114,481 | — | — | ||||

| Dreyfus Global | ||||||||

| Sustainability | ||||||||

| Fund, Cl. I | — | 78,839 | — | — | ||||

| Global Stock Fund, Cl. I | — | 114,481 | — | — | ||||

| Total | — | 454,433 | 73,975 | 224 | ||||

| Change in Net | ||||||||

| Unrealized | ||||||||

| Affiliated Investment | Net Realized | Appreciation | Value | % of Net | ||||

| Company | Gain/(Loss) ($) (Depreciation) ($) | 10/31/2009 ($) | Assets | |||||

| Global Alpha Fund, Cl. I | 821 | — | — | — | ||||

| Dreyfus Global Equity | ||||||||

| Income Fund, Cl. I | 2,288 | 3,933 | 60,950 | 15.1 | ||||

| Dreyfus Global Real | ||||||||

| Estate Securities | ||||||||

| Fund, Cl. I | 227 | 1,895 | 20,872 | 5.2 | ||||

| Dreyfus Worldwide | ||||||||

| Growth Fund, Cl. I | — | 8,031 | 122,512 | 30.3 | ||||

| Dreyfus Global | ||||||||

| Sustainability | ||||||||

| Fund, Cl. I | — | 1,603 | 80,442 | 19.9 | ||||

| Global Stock Fund, Cl. I | — | 5,265 | 119,745 | 29.7 | ||||

| Total | 3,336 | 20,727 | 404,521 | 100.2 | ||||

18

The fund adopted the provisions of ASC Topic 815 “Derivatives and Hedging” which requires qualitative disclosures about objectives and strategies for using derivatives, quantitative disclosures about fair value amounts of gains and losses on derivative instruments and disclosures about credit-risk-related contingent features in derivative agreements. The fund held no derivatives during the period ended October 31, 2009.These disclosures did not impact the notes to the financial statements.

At October 31, 2009, the cost of investments for federal income tax purposes was $383,794;accordingly,accumulated net unrealized appreciation on investments was $20,727, consisting of gross unrealized appreciation.

NOTE 4—Subsequent Events Evaluation:

Dreyfus has evaluated the need for disclosures and/or adjustments resulting from subsequent events through December 29, 2009, the date the financial statements were issued. This evaluation did not result in any subsequent events that necessitated disclosures and/or adjustments.

The Fund 19

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

| Shareholders and Board of Directors Dreyfus Diversified Global Fund |

We have audited the accompanying statement of assets and liabilities, including the statement of investments, of Dreyfus Diversified Global Fund (one of the series comprising Dreyfus Premier Investment Funds, Inc.) as of October 31, 2009, and the related statements of operations and changes in net assets and financial highlights for the period from July 15, 2009 (commencement of operations) to October 31, 2009.These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement.We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significa nt estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2009 by correspondence with the custodian and others.We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Diversified Global Fund at October 31, 2009, and the results of its operations, the changes in its net assets and the financial highlights for the period from July 15, 2009 to October 31, 2009, in conformity with U.S. generally accepted accounting principles.

| New York, New York December 29, 2009 |

20

| INFORMATION ABOUT THE REVIEW AND APPROVAL OF THE FUND’S MANAGEMENT AGREEMENT (UNAUDITED) |

At a meeting of the fund’s Board held on July 9, 2009, the Board unanimously approved the fund’s Management Agreement, pursuant to which Dreyfus will provide the fund with investment management ser-vices.The Board members, none of whom are “interested persons” (as defined in the Investment Company Act of 1940, as amended) of the fund, were assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of Dreyfus. In approving the Management Agreement, the Board members considered all factors that they believed to be relevant, including, among other things, the factors discussed below.

Analysis of Nature, Extent and Quality of Services Provided to the Fund. The Board members considered information previously provided to them in a presentation from representatives of Dreyfus regarding services provided to other funds in the Dreyfus fund complex, and representatives of Dreyfus confirmed that there had been no material changes in this information. The Board also discussed the nature, extent and quality of the services to be provided to the fund pursuant to the Management Agreement. The Board members also referenced information provided and discussions at previous meetings regarding the relationships Dreyfus has with various intermediaries and the different needs of each, the diversity of distribution among the funds in the Dreyfus fund complex, and Dreyfus’ corresponding need for broad, deep, and diverse resources to be able to provide ongoing shareholde r services to the different distribution channels.

The Board members also considered Dreyfus’ research and portfolio management capabilities and Dreyfus’ oversight of day-to-day fund operations, including fund accounting and administration and assistance in meeting legal and regulatory requirements.The Board members also considered Dreyfus’ extensive administrative, accounting and compliance infrastructure.

The Fund 21

| INFORMATION ABOUT THE REVIEW AND APPROVAL OF THE FUND’S MANAGEMENT AGREEMENT (Unaudited) (continued) |

Comparative Analysis of the Fund’s Performance and Management Fee and Expense Ratio. As the fund had not yet commenced operations, the Board members were not able to review the fund’s performance. The Board discussed with representatives of Dreyfus the investment strategies to be employed in the management of the fund’s assets. The Board members noted the reputation and experience of Dreyfus and Dreyfus’ investment committee responsible for managing the fund’s assets.

The Board members noted that the fund will not pay Dreyfus a management fee, but that the fund will bear its proportionate share of the fees and expenses of the funds in which the fund will invest (the “Underlying Funds”). Representatives of Dreyfus informed the Board that Dreyfus will contractually agree, until at least March 1, 2011, to assume the expenses of the fund so that the direct expenses of the fund’s share classes (including indirect fees and expenses of the Underlying Funds, but excluding fund Rule 12b-1 fees, shareholder services fees, taxes, interest, brokerage commissions, commitment fees on borrowings and extraordinary expenses) do not exceed 1.50%.

Representatives of Dreyfus stated that there were no other funds or other accounts managed by Dreyfus with similar investment objectives, policies and strategies as the fund.

Analysis of Profitability and Economies of Scale. Dreyfus would not have direct profits from the fund’s management fee, since the fund would pay no direct management fee. Similarly, potential economies of scale were not relevant.The Board members considered potential benefits to Dreyfus from acting as investment adviser.

22

At the conclusion of these discussions, the Board agreed that it had been furnished with sufficient information to make an informed business decision with respect to approving the fund’s Management Agreement. Based on the discussions and considerations as described above, the Board made the following conclusions and determinations.

- The Board concluded that the nature, extent and quality of the ser- vices to be provided by Dreyfus are adequate and appropriate.

- The Board concluded that, since the fund had not yet commenced operations, its performance could not be measured and was not a fac- tor.The Board considered the reputation and experience of Dreyfus and Dreyfus’ investment committee responsible for managing the fund’s assets.

- Since the fund would not pay a direct management fee, profitability and potential economies of scale were not relevant.

The Board members considered these conclusions and determinations, and, without any one factor being dispositive, the Board determined that approval of the fund’s Management Agreement was in the best interests of the fund and its shareholders.

The Fund 23

BOARD MEMBERS INFORMATION (Unaudited)

| Joseph S. DiMartino (66) |

| Chairman of the Board (1995) |

| Principal Occupation During Past 5Years: |

| • Corporate Director and Trustee |

| Other Board Memberships and Affiliations: |

| • The Muscular Dystrophy Association, Director |

| • CBIZ (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small |

| and medium size companies, Director |

| • The Newark Group, a provider of a national market of paper recovery facilities, paperboard |

| mills and paperboard converting plants, Director |

| • Sunair Services Corporation, a provider of certain outdoor-related services to homes and |

| businesses, Director |

| No. of Portfolios for which Board Member Serves: 173 |

| ——————— |

| Gordon J. Davis (68) |

| Board Member (1993) |

| Principal Occupation During Past 5Years: |

| • Partner in the law firm of Dewey & LeBoeuf LLP |

| • President, Lincoln Center for the Performing Arts, Inc. (2001) |

| Other Board Memberships and Affiliations: |

| • Consolidated Edison, Inc., a utility company, Director |

| • Phoenix Companies Inc., a life insurance company, Director |

| • Board Member/Trustee for several not-for-profit groups |

| No. of Portfolios for which Board Member Serves: 43 |

| ——————— |

| David P. Feldman (69) |

| Board Member (1991) |

| Principal Occupation During Past 5Years: |

| • Corporate Director and Trustee |

| Other Board Memberships and Affiliations: |

| • BBH Mutual Funds Group (11 funds), Director |

| • The Jeffrey Company, a private investment company, Director |

| No. of Portfolios for which Board Member Serves: 47 |

24

| Lynn Martin (69) |

| Board Member (1993) |

| Principal Occupation During Past 5Years: |

| • Advisor to the international accounting firm of Deloitte &Touche, LLP and Chair to its Council |

| for the Advancement of Women from March 1993-September 2005 |

| Other Board Memberships and Affiliations: |

| • AT&T Inc., a telecommunications company, Director |

| • Ryder System, Inc., a supply chain and transportation management company, Director |

| • The Proctor & Gamble Co., a consumer products company, Director |

| • Constellation Energy Group, Director |

| • Chicago Council on Global Affairs |

| • Coca-Cola International Advisory Council |

| • Deutsche Bank Advisory Council |

| No. of Portfolios for which Board Member Serves: 15 |

| ——————— |

| Philip L. Toia (76) |

| Board Member (1997) |

| Principal Occupation During Past 5Years: |

| • Private Investor |

| No. of Portfolios for which Board Member Serves: 26 |

| ——————— |

| Once elected all Board Members serve for an indefinite term, but achieve Emeritus status upon reaching age 80.The |

| address of the Board Members and Officers is in c/o The Dreyfus Corporation, 200 Park Avenue, NewYork, NewYork |

| 10166. Additional information about the Board Members is available in the fund’s Statement of Additional Information |

| which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-554-4611. |

| Sander Vanocur, Emeritus Board Member |

| Daniel Rose, Emeritus Board Member |

The Fund 25

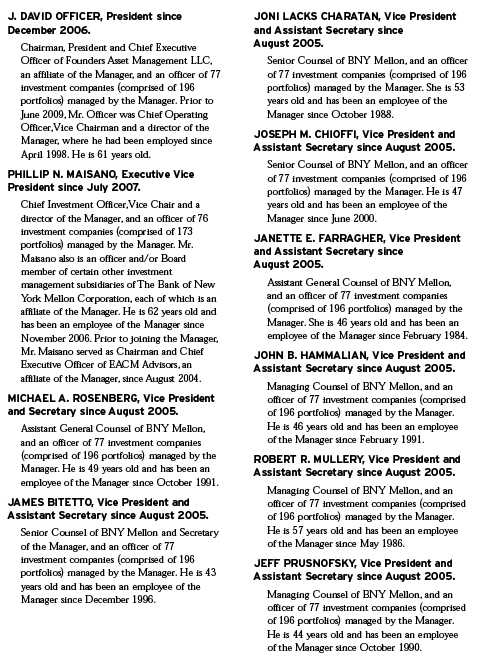

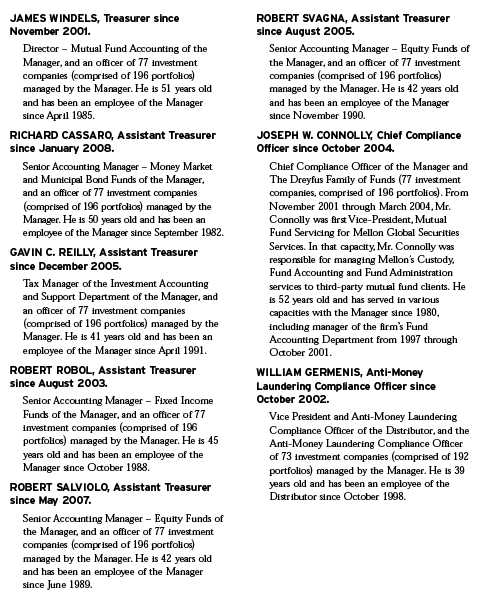

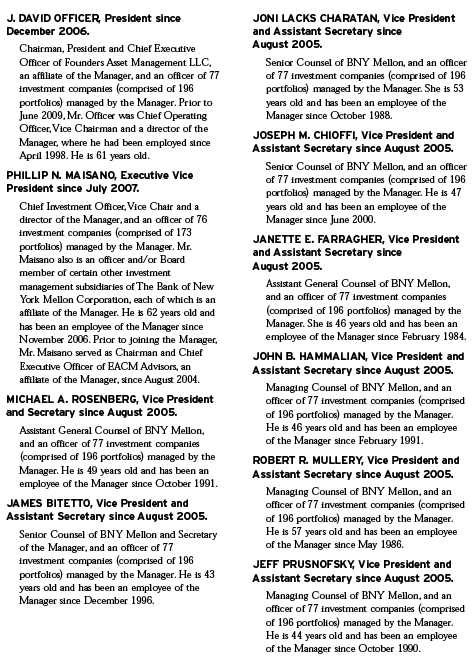

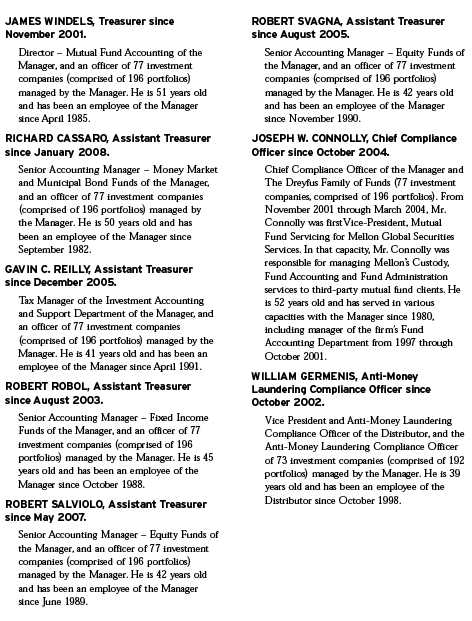

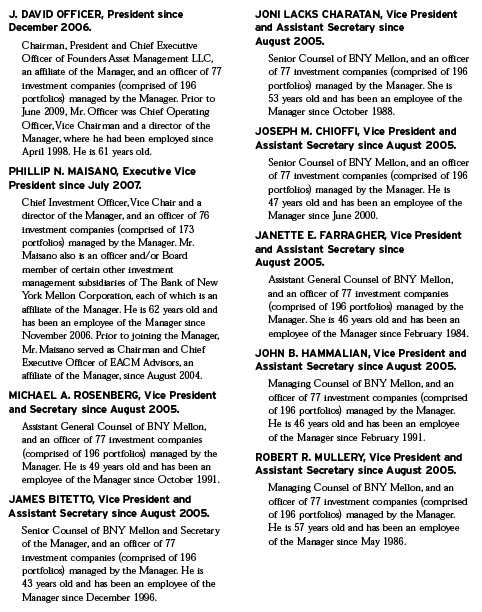

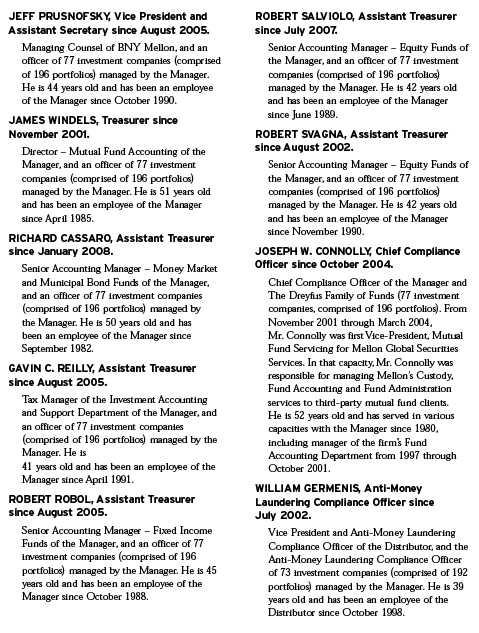

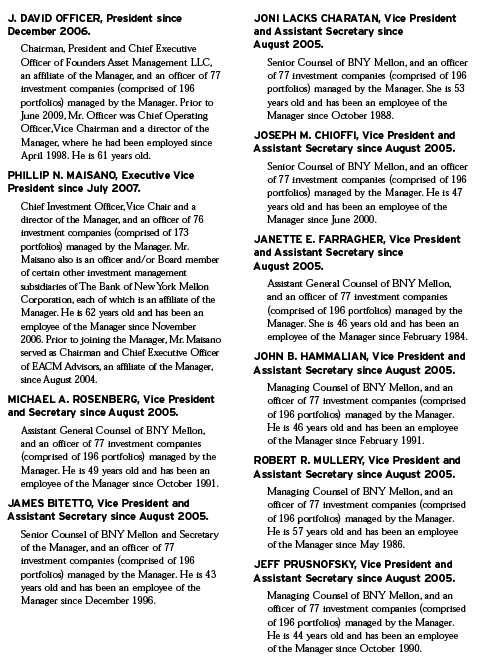

OFFICERS OF THE FUND (Unaudited)

26

The Fund 27

NOTES

| Dreyfus |

| Diversified |

| International Fund |

| ANNUAL REPORT October 31, 2009 |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

| Contents | |

| THE FUND | |

| 2 | A Letter from the Chairman and CEO |

| 3 | Discussion of Fund Performance |

| 6 | Fund Performance |

| 8 | Understanding Your Fund’s Expenses |

| 8 | Comparing Your Fund’s Expenses With Those of Other Funds |

| 9 | Statement of Investments |

| 10 | Statement of Assets and Liabilities |

| 11 | Statement of Operations |

| 12 | Statement of Changes in Net Assets |

| 14 | Financial Highlights |

| 17 | Notes to Financial Statements |

| 26 | Report of Independent Registered Public Accounting Firm |

| 27 | Important Tax Information |

| 28 | Information About the Review and Approval of the Fund’s Management Agreement |

| 32 | Board Members Information |

| 34 | Officers of the Fund |

| FOR MORE INFORMATION | |

| Back Cover | |

| Dreyfus |

| Diversified |

| International Fund |

| The Fund |

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Diversified International Fund, covering the 12-month period from November 1, 2008, through October 31, 2009.

Recent reports of positive economic growth in the United States’, European and Asian markets may have signaled the end of the deep global recession that technically began here in the U.S. in late 2007. Signs that the world economies finally have turned a corner include inventory rebuilding among manufacturers, improvements in domestic housing, and more robust consumer spending. These developments helped fuel a sustained worldwide stock rally since the early spring, with the most beaten-down securities in less developed nations generally leading the rebound. Higher-quality stocks within more developed markets have participated in the rally, but have so far lagged on a relative performance basis.

In our judgment, the global financial markets currently appear poised to enter into a new phase in which underlying fundamentals, such as sound capital and financial structures—and not bargain hunting—are likely to drive investment returns. Of course, the best strategy for your portfolio depends not only on your view of the global economy’s direction, but on your current financial needs, future goals and attitudes toward risk. Your financial advisor can help you decide which investments have the potential to benefit from a recovery while guarding against the risk that may accompany unexpected market developments.

For information about how the fund performed during the reporting period, as well as market perspectives, we have provided a Discussion of Fund Performance.

Thank you for your continued confidence and support.

| Jonathan R. Baum Chairman and Chief Executive Officer The Dreyfus Corporation November 16, 2009 |

2

DISCUSSION OF FUND PERFORMANCE

For the period of November 1, 2008, through October 31, 2009, as provided by Phillip N. Maisano, Richard B. Hoey,William J. Reilly, CFA, Christopher E. Sheldon, CFA, and Keith L. Stransky, CFA, Portfolio Managers

Fund and Market Performance Overview

For the 12-month period ended October 31, 2009, Dreyfus Diversified International Fund’s Class A shares produced a total return of 28.80%, Class C shares returned 27.73% and Class I shares returned 28.89%.1 In comparison, the fund’s benchmark, the Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE) Index (the “Index”), produced a total return of 27.71% for the same period.2

Steep declines in global stock markets early in the reporting period were followed by sustained rallies as economic and market conditions stabilized.The fund produced modestly higher returns than its benchmark, primarily due to its relatively defensive investment posture during the downturn.Although the fund’s cautious positioning limited its participation in the 2009 rally, it was not enough to fully offset earlier relative strength for the reporting period overall.

The Fund’s Investment Approach

The fund seeks long-term capital appreciation. To pursue its goal, the fund normally allocates its assets among other mutual funds advised by The Dreyfus Corporation (Dreyfus), or its affiliates, that invest primarily in stocks issued by foreign companies.The underlying funds are selected based on their investment objectives and management policies, portfolio holdings, risk/reward profiles, historical performance and other factors. Dreyfus seeks to diversify the fund’s investments by market capitalization, investment style and geographic region. The Dreyfus Investment Committee will rebalance the fund’s investments in the underlying funds at least annually, but may do so more often in response to market conditions.

Equity Markets Plunged, Then Rebounded Sharply

In the weeks before the start of the reporting period, the failures of several major financial institutions sparked a global financial crisis that

The Fund 3

| DISCUSSION OF FUND PERFORMANCE (continued) |

nearly led to the collapse of the worldwide banking system. In addition, rising unemployment, declining housing markets and plunging consumer confidence in many markets produced the most severe global recession since the 1930s.These influences fueled a bear market that drove stocks to multi-year lows in the first quarter of 2009.

Market sentiment began to improve in March, when it became clearer that aggressive remedial actions by the world’s government and monetary authorities—including historically low short-term interest rates, rescues of troubled corporations, massive economic stimulus programs and unprecedented injections of liquidity into the global banking system—had helped repair the credit markets. Subsequently, evidence of global economic stabilization and a return to growth propelled stocks higher through the reporting period’s end. The emerging markets generally produced more robust gains during the rally than developed markets.

Cautious Posture Enhanced Relative Performance

By the start of the reporting period, we had positioned the fund more defensively by eliminating its exposure to Emerging Markets Opportunity Fund and redeploying those assets to investments that focus primarily on developed markets, including the International Stock Fund and Dreyfus International Value Fund. In November 2008, we moved some assets from Dreyfus/Newton International Equity Fund to Dreyfus InternationalValue Fund.These shifts proved helpful, as the mutual funds receiving higher allocations also adopted more defensive postures during the financial crisis and recession, including underweighted positions in the troubled financials sector and relatively light holdings of companies carrying heavy debt loads. As a result, the fund held up better than its benchmark during the downturn, supporting its relative performance for the reporting period overall.

However, the fund’s generally defensive stance limited its participation in the 2009 rally, which in its early stages was especially robust among lower-quality stocks. Because of their focus on higher-quality companies with sound business fundamentals, International Stock Fund and Dreyfus/Newton International Equity Fund detracted from the fund’s relative performance over the reporting period’s second half. In March, when it became apparent that global investor sentiment was improving,

4

we shifted some assets from the conservatively managed International Stock Fund to Dreyfus InternationalValue Fund, which helped bolster the fund’s returns. In July, we reestablished a position in Emerging Markets Opportunity Fund, thereby increasing the fund’s exposure to the stronger-performing emerging markets over the remainder of the reporting period.

In September, one of the fund’s underlying investments, Dreyfus International Small Cap Fund, ceased operations. We added two new alternatives,Dreyfus Emerging Markets Fund and Dreyfus Emerging Asia Fund, both of which provide exposure to emerging market large- and small-cap companies. We had allocated no assets to either of the new underlying funds by the reporting period’s end.

Finding Opportunities in Recovering Markets

We recently have seen evidence that investor sentiment may be shifting to higher-quality companies with sound business fundamentals. In our judgment, the fund’s current positioning may be particularly well suited for an investment environment that favors well established, fundamentally sound stocks. The fund ended the reporting period with approximately 26% of its assets allocated to Dreyfus International Value Fund, 24% to Dreyfus/Newton International Equity Fund, 20% to Dreyfus International Equity Fund, 20% to International Stock Fund and 10% to Emerging Markets Opportunity Fund.

November 16, 2009

| 1 | Total return includes reinvestment of dividends and any capital gains paid, and does not take into | |

| consideration the maximum initial sales charge in the case of Class A shares, or the applicable | ||

| contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these | ||

| charges been reflected, returns would have been lower. Past performance is no guarantee of future | ||

| results. Share price and investment return fluctuate such that upon redemption, fund shares may be | ||

| worth more or less than their original cost. Return figures provided reflect the absorption of certain | ||

| fund expenses by The Dreyfus Corporation through March 1, 2010, at which time it may be | ||

| extended, terminated or modified. Had these expenses not been absorbed, the fund’s returns would | ||

| have been lower. | ||

| 2 | SOURCE: BLOOMBERG L.P. — Reflects reinvestment of net dividends and, where | |

| applicable, capital gain distributions.The Morgan Stanley Capital International Europe, | ||

| Australasia, Far East (MSCI EAFE) Index is an unmanaged index composed of a sample of | ||

| companies representative of the market structure of European and Pacific Basin countries. |

The Fund 5

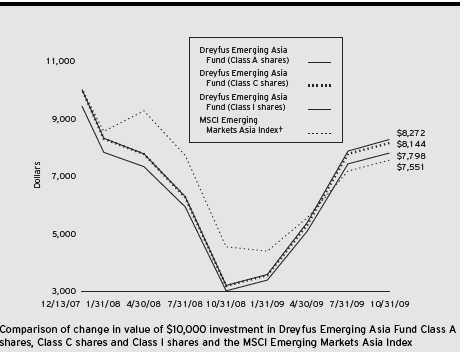

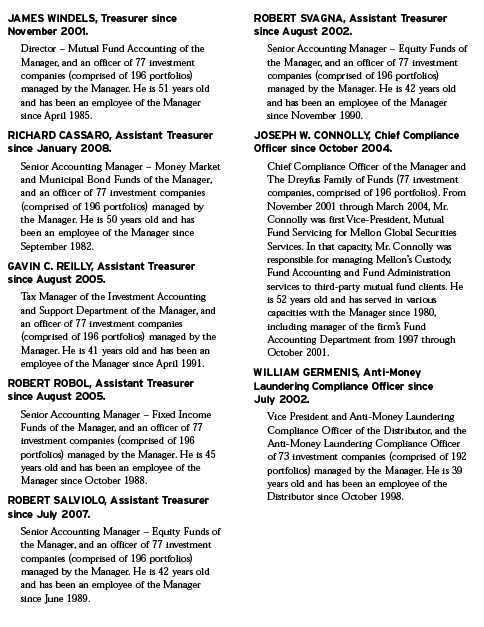

FUND PERFORMANCE

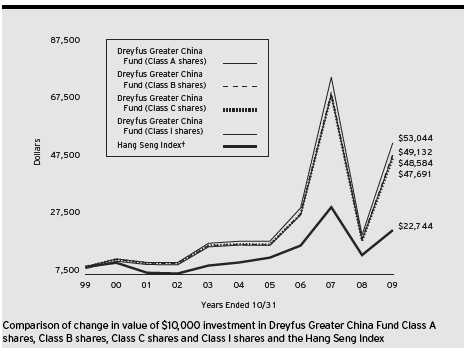

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a $10,000 investment made in Class A, Class C and Class I shares of Dreyfus Diversified International Fund on 12/18/07 (inception date) to a $10,000 investment made in the Morgan Stanley Capital International Europe,Australasia, Far East Index (the “Index”) on that date.All dividends and capital gain distributions are reinvested. For comparative purposes, the value of the Index on 12/31/07 is used as the beginning value on 12/18/07.

The fund’s performance shown in the line graph takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes.The Index is an unmanaged index composed of a sample of companies representative of the market structure of European and Pacific Basin countries. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| Average Annual Total Returns as of 10/31/09 | ||||||

| Inception | From | |||||

| Date | 1 Year | Inception | ||||

| Class A shares | ||||||

| with maximum sales charge (5.75%) | 12/18/07 | 21.44% | –15.04% | |||

| without sales charge | 12/18/07 | 28.80% | –12.32% | |||

| Class C shares | ||||||

| with applicable redemption charge † | 12/18/07 | 26.73% | –13.01% | |||

| without redemption | 12/18/07 | 27.73% | –13.01% | |||

| Class I shares | 12/18/07 | 28.89% | –12.16% | |||

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| † The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the |

| date of purchase. |

The Fund 7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Diversified International Fund from May 1, 2009 to October 31, 2009. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Expenses and Value of a $1,000 Investment assuming actual returns for the six months ended October 31, 2009 |

| Class A | Class C | Class I | ||||

| Expenses paid per $1,000† | $ 2.40 | $ 6.85 | $ 0.52 | |||

| Ending value (after expenses) | $1,270.20 | $1,264.20 | $1,271.10 |

| COMPARING YOUR FUND’S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited) |

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| Expenses and Value of a $1,000 Investment assuming a hypothetical 5% annualized return for the six months ended October 31, 2009 |

| Class A | Class C | Class I | ||||

| Expenses paid per $1,000† | $ 2.14 | $ 6.11 | $ 0.46 | |||

| Ending value (after expenses) | $1,023.09 | $1,019.16 | $1,024.75 |

| † Expenses are equal to the fund’s annualized expense ratio of .42% for Class A, 1.20% for Class C and .09% for Class |

| I, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

8

| STATEMENT OF INVESTMENTS October 31, 2009 |

| Other Investment—98.0% | Shares | Value ($) | ||

| Registered Investment Company; | ||||

| Emerging Markets | ||||

| Opportunity Fund, Cl. I | 1,722,408 a | 16,793,477 | ||

| International Stock Fund, Cl. I | 2,812,083 a | 32,760,767 | ||

| Dreyfus/Newton International | ||||

| Equity Fund, Cl. I | 2,503,360 a | 39,853,498 | ||

| Dreyfus International | ||||

| Equity Fund, Cl. I | 1,277,206 a | 33,169,041 | ||

| Dreyfus International | ||||

| Value Fund, Cl. I | 3,785,952 a | 42,402,666 | ||

| Total Investments (cost $143,593,279) | 98.0% | 164,979,449 | ||

| Cash and Receivables (Net) | 2.0% | 3,293,006 | ||

| Net Assets | 100.0% | 168,272,455 | ||

| a Investment in affiliated mutual fund. | ||||

| Portfolio Summary (Unaudited)† | ||

| Value (%) | ||

| Affiliated mutual funds | 98.0 | |

| † Based on net assets. | ||

| See notes to financial statements. |

The Fund 9

| STATEMENT OF ASSETS AND LIABILITIES October 31, 2009 |

| Cost | Value | |||

| Assets ($): | ||||

| Investments in affiliated issuers—See Statement of Investments | 143,593,279 | 164,979,449 | ||

| Cash | 3,389,235 | |||

| Prepaid expenses | 18,763 | |||

| 168,387,447 | ||||

| Liabilities ($): | ||||

| Due to The Dreyfus Corporation and affiliates—Note 3(c) | 4,034 | |||

| Payable for shares of Capital Stock redeemed | 13,496 | |||

| Accrued expenses | 97,462 | |||

| 114,992 | ||||

| Net Assets ($) | 168,272,455 | |||

| Composition of Net Assets ($): | ||||

| Paid-in capital | 144,552,996 | |||

| Accumulated undistributed investment income—net | 92,809 | |||

| Accumulated net realized gain (loss) on investments | 2,240,480 | |||

| Accumulated gross unrealized appreciation on investments | 21,386,170 | |||

| Net Assets ($) | 168,272,455 |

| Net Asset Value Per Share | ||||||

| Class A | Class C | Class I | ||||

| Net Assets ($) | 4,578,097 | 83,819 | 163,610,539 | |||

| Shares Outstanding | 484,569 | 8,936 | 17,274,336 | |||

| Net Asset Value Per Share ($) | 9.45 | 9.38 | 9.47 | |||

| See notes to financial statements. | ||||||

10

| STATEMENT OF OPERATIONS Year Ended October 31, 2009 |

| Investment Income ($): | ||

| Income: | ||

| Cash dividends from affiliated issuers | 217,374 | |

| Expenses: | ||

| Registration fees | 85,778 | |

| Prospectus and shareholders’ reports | 46,035 | |

| Auditing fees | 34,750 | |

| Shareholder servicing costs—Note 3(c) | 12,195 | |

| Interest expense—Note 2 | 3,717 | |

| Custodian fees—Note 3(c) | 3,535 | |

| Directors’ fees and expenses—Note 3(d) | 2,692 | |

| Legal fees | 1,238 | |

| Distribution fees—Note 3(b) | 501 | |

| Loan commitment fees—Note 2 | 139 | |

| Miscellaneous | 12,789 | |

| Total Expenses | 203,369 | |

| Less—expense reimbursement from The Dreyfus | ||

| Corporation due to undertaking—Note 3(a) | (139,825) | |

| Less—reduction in fees due to earnings credits—Note 1(b) | (218) | |

| Net Expenses | 63,326 | |

| Investment Income—Net | 154,048 | |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | ||

| Net realized gain (loss) on investments in affiliated issuers | 2,345,636 | |

| Capital gain distributions from affiliated issuers | 12,508 | |

| Net Realized Gain (Loss) | 2,358,144 | |

| Net unrealized appreciation (depreciation) on investments in affiliated issuers | 22,231,206 | |

| Net Realized and Unrealized Gain (Loss) on Investments | 24,589,350 | |

| Net Increase in Net Assets Resulting from Operations | 24,743,398 | |

| See notes to financial statements. | ||

The Fund 11

STATEMENT OF CHANGES IN NET ASSETS

| Year Ended October 31, | ||||

| 2009a | 2008b | |||

| Operations ($): | ||||

| Investment income (loss)—net | 154,048 | (1,475) | ||

| Net realized gain (loss) on investments | 2,358,144 | (112,579) | ||

| Net unrealized appreciation | ||||

| (depreciation) on investments | 22,231,206 | (845,036) | ||

| Net Increase (Decrease) in Net Assets | ||||

| Resulting from Operations | 24,743,398 | (959,090) | ||

| Dividends to Shareholders from ($): | ||||

| Investment income—net: | ||||

| Class A Shares | (61,678) | — | ||

| Class C Shares | (1,416) | — | ||

| Class I Shares | (1,060) | — | ||

| Class T Shares | (846) | — | ||

| Total Dividends | (65,000) | — | ||

| Capital Stock Transactions ($): | ||||

| Net proceeds from shares sold: | ||||

| Class A Shares | 2,874,267 | 2,676,174 | ||

| Class C Shares | 27,700 | 64,497 | ||

| Class I Shares | 145,448,054 | 50,000 | ||

| Class T Shares | — | 50,000 | ||

| Dividends reinvested: | ||||

| Class A Shares | 60,263 | — | ||

| Class C Shares | 624 | — | ||

| Cost of shares redeemed: | ||||

| Class A Shares | (761,609) | (134,395) | ||

| Class C Shares | (41) | (1,215) | ||

| Class I Shares | (5,773,572) | — | ||

| Class T Shares | (27,600) | — | ||

| Increase (Decrease) in Net Assets | ||||

| from Capital Stock Transactions | 141,848,086 | 2,705,061 | ||

| Total Increase (Decrease) in Net Assets | 166,526,484 | 1,745,971 | ||

| Net Assets ($): | ||||

| Beginning of Period | 1,745,971 | — | ||

| End of Period | 168,272,455 | 1,745,971 | ||

| Undistributed investment income—net | 92,809 | 1,296 | ||

12

| Year Ended October 31, | ||||

| 2009a | 2008b | |||

| Capital Share Transactions: | ||||

| Class Ac | ||||

| Shares sold | 355,715 | 230,150 | ||

| Shares issued for dividends reinvested | 8,144 | — | ||

| Shares redeemed | (96,143) | (13,297) | ||

| Net Increase (Decrease) in Shares Outstanding | 267,716 | 216,853 | ||

| Class C | ||||

| Shares sold | 3,702 | 5,312 | ||

| Shares issued for dividends reinvested | 85 | — | ||

| Shares redeemed | (3) | (160) | ||

| Net Increase (Decrease) in Shares Outstanding | 3,784 | 5,152 | ||

| Class I | ||||

| Shares sold | 17,954,860 | 4,000 | ||

| Shares redeemed | (684,524) | — | ||

| Net Increase (Decrease) in Shares Outstanding | 17,270,336 | 4,000 | ||

| Class Tc | ||||

| Shares sold | — | 4,000 | ||

| Shares redeemed | (4,000) | — | ||

| Net Increase (Decrease) in Shares Outstanding | (4,000) | 4,000 | ||

| a Effective as of the close of business on February 4, 2009, the fund no longer offers Class T shares. |

| b From December 18, 2007 (commencement of operations) to October 31, 2008. |

| c On the close of business on February 4, 2009, 4,000 Class T shares representing $27,600 were converted to 4,012 |

| Class A shares. |

| See notes to financial statements. |

The Fund 13

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| Year Ended October 31, | ||||

| Class A Shares | 2009 | 2008a | ||

| Per Share Data ($): | ||||

| Net asset value, beginning of period | 7.59 | 12.50 | ||

| Investment Operations: | ||||

| Investment income (loss)—netb | .16 | (.01) | ||

| Net realized and unrealized | ||||

| gain (loss) on investments | 1.96 | (4.90) | ||

| Total from Investment Operations | 2.12 | (4.91) | ||

| Distributions: | ||||

| Dividends from investment income—net | (.26) | — | ||

| Net asset value, end of period | 9.45 | 7.59 | ||

| Total Return (%)c | 28.80 | (39.28)d | ||

| Ratios/Supplemental Data (%): | ||||

| Ratio of total expenses to average net assetse | 1.89 | 14.57f | ||

| Ratio of net expenses to average net assetse | .37 | .31f | ||

| Ratio of net investment income (loss) | ||||

| to average net assetse | 2.01 | (.13)f | ||

| Portfolio Turnover Rate | 36.68 | 25.65d | ||

| Net Assets, end of period ($ x 1,000) | 4,578 | 1,646 | ||

| a | From December 18, 2007 (commencement of operations) to October 31, 2008. | |

| b | Based on average shares outstanding at each month end. | |

| c | Exclusive of sales charge. | |

| d | Not annualized. | |

| e | Amounts do not include the activity of the underlying funds. | |

| f | Annualized. |

| See notes to financial statements. |

14

| Year Ended October 31, | ||||

| Class C Shares | 2009 | 2008a | ||

| Per Share Data ($): | ||||

| Net asset value, beginning of period | 7.54 | 12.50 | ||

| Investment Operations: | ||||

| Investment income (loss)—netb | .14 | (.05) | ||

| Net realized and unrealized | ||||

| gain (loss) on investments | 1.90 | (4.91) | ||

| Total from Investment Operations | 2.04 | (4.96) | ||

| Distributions: | ||||

| Dividends from investment income—net | (.20) | — | ||

| Net asset value, end of period | 9.38 | 7.54 | ||

| Total Return (%)c | 27.73 | (39.68)d | ||

| Ratios/Supplemental Data (%): | ||||

| Ratio of total expenses to average net assetse | 3.33 | 15.79f | ||

| Ratio of net expenses to average net assetse | 1.12 | 1.06f | ||

| Ratio of net investment income (loss) | ||||

| to average net assetse | 1.76 | (.51)f | ||

| Portfolio Turnover Rate | 36.68 | 25.65d | ||

| Net Assets, end of period ($ x 1,000) | 84 | 39 | ||

| a | From December 18, 2007 (commencement of operations) to October 31, 2008. | |

| b | Based on average shares outstanding at each month end. | |

| c | Exclusive of sales charge. | |

| d | Not annualized. | |

| e | Amounts do not include the activity of the underlying funds. | |

| f | Annualized. |

| See notes to financial statements. |

The Fund 15

| FINANCIAL HIGHLIGHTS (continued) |

| Year Ended October 31, | ||||

| Class I Shares | 2009 | 2008a | ||

| Per Share Data ($): | ||||

| Net asset value, beginning of period | 7.61 | 12.50 | ||

| Investment Operations: | ||||

| Investment income—netb | .01 | .05 | ||

| Net realized and unrealized | ||||

| gain (loss) on investments | 2.12 | (4.94) | ||

| Total from Investment Operations | 2.13 | (4.89) | ||

| Distributions: | ||||

| Dividends from investment income—net | (.27) | — | ||

| Net asset value, end of period | 9.47 | 7.61 | ||

| Total Return (%) | 28.89 | (39.12)c | ||

| Ratios/Supplemental Data (%): | ||||

| Ratio of total expenses to average net assetsd | .24 | 14.86e | ||

| Ratio of net expenses to average net assetsd | .08 | .06e | ||

| Ratio of net investment income | ||||

| to average net assetsd | .16 | .54e | ||

| Portfolio Turnover Rate | 36.68 | 25.65c | ||

| Net Assets, end of period ($ x 1,000) | 163,611 | 30 | ||

| a | From December 18, 2007 (commencement of operations) to October 31, 2008. | |

| b | Based on average shares outstanding at each month end. | |

| c | Not annualized. | |

| d | Amounts do not include the activity of the underlying funds. | |

| e | Annualized. |

| See notes to financial statements. |

16

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Diversified International Fund (the “fund”) is a separate diversified series of Dreyfus Premier Investment Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering ten series, including the fund.The fund’s investment objective is long-term capital appreciation.The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares. The fund is authorized to issue 100 million shares of $.001 par value Common Stock in each of the following classes of shares: Class A, Class C and Class I. Class A shares are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class C shares redeemed within one year of purchase. Class I shares are sold at net asset value per share only to institutional investors. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each cl ass of shares based on its relative net assets.

Effective December 3, 2008, investments for new accounts were no longer permitted in Class T shares of the fund, except that participants in certain group retirement plans were able to open a new account in Class T shares of the fund, provided that the fund was established as an investment option under the plans before December 3, 2008. On February 4, 2009, the fund issued to each holder of its Class T shares, in exchange for said shares, Class A shares of the fund having an aggregate net asset value equal to the aggregate net asset value of the share-

The Fund 17

| NOTES TO FINANCIAL STATEMENTS (continued) |

holder’s Class T shares. Subsequent investments in the fund’s Class A shares made by prior holders of the fund’s Class T shares who received Class A shares of the fund in exchange for their Class T shares are subject to the front-end sales load schedule that was in effect for Class T shares at the time of the exchange. Otherwise, all other Class A share attributes will be in effect. Effective as of the close of business on February 4, 2009, the fund no longer offers Class T shares.

As of October 31, 2009, MBSC Investments Corp., an indirect subsidiary of BNY Mellon, held 4,000 Class C shares of the fund.