UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06520

MANAGERS TRUST I

(Exact name of registrant as specified in charter)

| | |

| 800 Connecticut Avenue, Norwalk, Connecticut | | 06854 |

| (Address of principal executive offices) | | (Zip code) |

Managers Investment Group LLC

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

| | |

| Date of fiscal year end: | | OCTOBER 31 |

| |

| Date of reporting period: | | NOVEMBER 1, 2004 - OCTOBER 31, 2005 |

| | | (Annual Shareholder Report) |

| Item 1. | Reports to Shareholders |

ANNUAL REPORT

Managers Funds

October 31, 2005

| • | | Managers Fremont Micro-Cap Fund |

MANAGERS FREMONT MICRO-CAP FUND

(formerly Fremont U.S. Micro-Cap Fund)

Annual Report

October 31, 2005

TABLE OF CONTENTS

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of The Managers Funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Letter to Shareholders

Dear Fellow Shareholder:

Over the past 12 months the markets have been beset with a number of difficult and unpredictable challenges, including a massive tsunami in Southeast Asia; continuing strife in the Middle East; numerous terrorist incidents; multiple hurricanes in the Gulf of Mexico; and a significant rise in energy prices. We are fortunate that the stock and bond markets have continued to perform so well under these circumstances.

These events serve to remind us that no one can predict the events that are going to shape the markets in coming months. This reinforces our belief that to invest successfully in an uncertain world you have to diversify your investments and be patient.

Most people think of diversification as holding different types of stocks and bonds, but we believe that there is another type of diversification that receives too little notice, and that is diversification by investment manager and holdings. Simply put, no single approach is going to succeed in every kind of market—some growth stock managers will be successful in a rising market, and some will be more successful in a stagnant market. This can be an issue with some investment firms that adhere to only one method of looking at the markets.

That is a major benefit that we bring you at Managers Funds —since we hire subadvisors (outside investment managers) to run our portfolios, we offer you a wide selection of very different investment styles to choose from, sometimes within the same asset class. Invest in multiple Managers Funds, and you can get managers with very different approaches and holdings, helping you reduce the risks created by changing economic conditions and natural and man-made events, such as those of the past 12 months.

We also believe that once you have made your manager selection, you must be patient. On the home page of our Web site at www.managersinvest.com, you will find a short article entitled “Stay Invested for the Long Term” that highlights how important it is to consistently stay in the market rather than trying to time the market. We think the implication is clear: to be successful in the market over the long term, select a wide variety of investments giving you good diversification, invest regularly and stick with your investment plan no matter what events dominate the news.

We invite you to visit our Web site on an ongoing basis to stay in tune with your Managers Funds holdings. The Web site provides detailed profiles of our subadvisors and their investment styles, as well as quarterly commentary on each Fund. If you have any questions, please do call us at 800.835.3879. Thank you for investing with Managers Funds.

| | | | |

Sincerely, | | | | |

| | |

| | | |  |

| | |

| Peter M. Lebovitz | | | | Thomas G. Hoffman, CFA |

| President | | | | Chief Investment Officer |

| Managers Funds | | | | Managers Investment Group LLC |

1

About Your Fund’s Expenses

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Fund incurs only ongoing costs. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The first line of the table below provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | |

Six Months Ended October 31, 2005

| | Beginning

Amount

Value

4/30/2005

| | Ending

Amount

Value

10/31/2005

| | Expenses

Paid

During

the Period*

|

Managers Fermont Micro-Cap Fund | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,087 | | $ | 8.15 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,017 | | $ | 7.88 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

2

Managers Fremont Micro-Cap Fund

Portfolio Manager Comments

The Managers Fremont Micro-Cap Fund primarily invests in the stocks of U.S. micro-capitalization companies. These companies have market capitalizations that, at the time of initial purchase, place them among the smallest 5% of companies listed on U.S. stock markets. Normally, the Fund will invest at least 80% of its assets in U.S. micro-cap stocks. The Russell 2000 Growth Index is the benchmark for the Fund.

The Portfolio Manager

Kern Capital Management LLC

Kern Capital Management LLC (“KCM”) is the subadvisor for the Managers Fremont Micro-Cap Fund, was founded in 1997 by Robert (Bob) E. Kern, Jr. and David G. Kern. KCM is an employee owned investment advisory firm dedicated to researching and investing in innovative micro-cap and small-cap growth companies and its investment process is designed to capitalize on this inefficiency.

KCM believes the U.S. smaller company stock universe provides the opportunity to invest in innovative companies with exceptional growth prospects. With minimal research coverage by brokerage firms and low institutional ownership, KCM believes small and micro-cap stocks represent the least efficient sector of the market.

KCM’s fundamental research is dedicated to uncovering innovative small companies early in their growth cycle while they are still relatively undiscovered. With a huge universe of investment opportunity, KCM’s investment process focuses on the most innovative sectors in the U.S. economy (technology, healthcare, services and consumer sectors). Research specialization by economic sector provides the depth of knowledge necessary to make high quality investment decisions and minimize fundamental investment mistakes.

KCM builds portfolios one company at a time with investment research focused on the most innovative sectors of the economy (technology, health care, services and consumer). The team’s hands-on approach to fundamental investment research and financial analysis seeks to answer three basic questions to determine an investment’s attractiveness.

| | • | | How attractive is the business? Companies that are pioneering new markets or revolutionizing existing ones can often sustain rapid growth as they establish leading positions in their targeted markets. |

| | • | | How strong is the management? Successful companies require management capable of capitalizing on attractive growth opportunities. Management’s vision and ability to execute the business plan represent key elements in determining how successful a company will be. |

| | • | | How much is the company worth? The team’s process is valuation sensitive. Depending on the economic sector, different criteria are used to determine a company’s enterprise value, which determines if KCM would buy the entire company at the current market value of its equity. |

Given that KCM is focused on investing in innovative growth companies, the first two questions are answered before determining if the valuation is attractive. In fact, the answers to the first two questions will help determine the appropriate valuation for the company.

The ideal company exhibits many of the following traits:

| | • | | Leading market position in a rapidly growing market with high barriers to entry |

3

Managers Fremont Micro-Cap Fund

Portfolio Manager Comments (continued)

| | • | | Entrepreneurial management team with experience managing a growth business |

| | • | | Focused business plan with tight internal controls |

Portfolio management:

| | • | | Invests in between 70 and 90 companies which have market capitalizations that, at the time of initial purchase, place them among the smallest 5% of companies listed in the U.S. stock markets |

| | • | | Builds portfolios from the bottom up and seeks to identify companies early in their growth cycle |

| | • | | Utilizes a team approach to cover approximately 600 stocks through an extensive network of contact and other information sources: |

| | • | | Brokerage firm and industry analysts |

| | • | | Corporate management contacts |

| | • | | Trade shows and trade journals |

| | • | | Focuses on business sectors where KCM believes the level of innovation is greatest, such as technology, health care, services and consumer |

| | • | | Uses fundamental analysis to identify small, relatively unknown companies that exhibit the potential to become much larger and more successful |

| | • | | Meets with corporate management to discuss business plans and strategies |

The investment team will make a sell decision when:

| | • | | An investment’s growth prospects deteriorate |

| | • | | Investments achieve excessive valuation relative to the growth opportunities and/or addressable markets. |

| | • | | There is a negative change in fundamental confidence and/or investment time horizon |

The Year in Review

The fiscal year ended October 31, 2005 was up and down. Fiscal year 2005 started just as the prior year ended with positive double digit performance across all Russell 2000 Growth sectors. Sentiment changed as 2005 began and for the next four months every Russell 2000 Growth index sector declined except for energy. A summer rally beginning in May lasted to the end of July and produced strong results across all sectors with especially strong performance from the energy sector. The month of August was down a little and September was flat, which was somewhat surprising given the devastation and far reaching impact of Hurricane Katrina. October, on the other hand, proved very challenging as the concern over an already fragile energy infrastructure in the Gulf Coast region became threatened again by Hurricane Rita. In total, fiscal year 2005 produced 6 months of positive performance and 6 months of negative performance.

For the year as a whole, the Managers Fremont Micro-Cap Fund returned 6.42% while the Russell 2000 Growth Index returned 10.91%. An attribution analysis of the fiscal year reveals positive performance from every sector within the Russell 2000 Growth Index. With an emphasis on innovation, the Fund focuses on the information technology (IT), healthcare and consumer discretionary sectors. In each of these sectors, the Fund beat its benchmark.

4

Managers Fremont Micro-Cap Fund

Portfolio Manager Comments (continued)

However, two primary factors lead to the Fund’s underperformance relative to the Russell 2000 Growth Index: the strong performance of the energy sector and the Fund’s overweight position in the information technology sector.

First, and representing almost the entire performance differential between the Fund and the Benchmark, was the very strong performance of the energy sector. There is a lack of innovation in the energy field and the 68% average return for the energy stocks within the Russell 2000 Growth Index was driven by soaring commodity (oil and natural gas) prices. Second, the IT sector of the Russell 2000 Growth Index produced a return of just over 1% for the last twelve months, which was significantly less than the overall benchmark return and last among all benchmark sectors. Investment in key innovative areas like advanced televisions (Trident Microsystems) and internet filtering/security management software (Websense) helped the Fund outperform the benchmark IT sector performance but the overweight position the Fund had in this sector detracted from overall performance. Among individual holdings, delays in government funding for key biometric initiatives pressured the stock of Identix while disappointing quarterly results and a reorganization of management led to the poor performance of Greenfield Online.

Investments in key innovators within the healthcare sector performed strongly during the last year. Most notably, Intuitive Surgical’s robotic surgery platform has gained significant market share in radical prostatectomy surgeries and has the potential to become an important tool to improve many other surgeries. Additionally, 3D Visualization software, like that developed by Vital Images, is becoming a standard tool for radiologists for viewing CT and MRI images.

The traditional retailers, while not always known for high levels of innovation, can produce significant winners as was the case with Gymboree this past year. As one of the Fund’s largest investments, Gymboree has recovered from its merchandising problems of a year ago and is now beating analyst expectations through higher revenue growth and margin expansion and other investors have noticed.

Looking Forward

The performance of the energy sector has been off the charts - not just in 2005 but for the last three years. Additionally, small-cap value stocks have performed significantly better than small-cap growth stocks over the last five years. During times that are more challenging for the Fund’s investment focus on innovation, it is important to focus on the highest confidence investments and position the Fund for when investor confidence returns. The lagging performance and negative psychology of the technology sector has hampered Fund returns but, importantly, has also provided attractive purchase opportunities in companies well positioned to capitalize on future growth opportunities. The investment team at KCM strongly believes that innovation is a critical element for long-term success and the beginning of improved performance of small-cap growth stocks vs. value stocks may have already begun.

Any sectors, industries or securities discussed should not be perceived as investment recommendations. The views expressed represent the opinions of Managers Investment Group and are not intended as a forecast or guarantee of future results. Any securities discussed may no longer be held in an account’s portfolio. It should not be assumed that any of the securities transactions discussed were or will prove to be profitable, or that the investment recommendations we make in the future will be profitable.

5

Managers Fremont Micro-Cap Fund

Portfolio Manager Comments (continued)

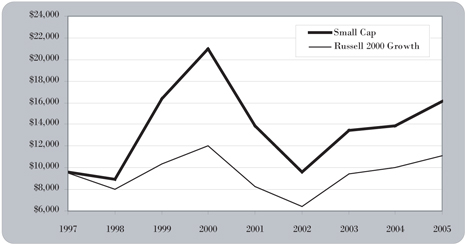

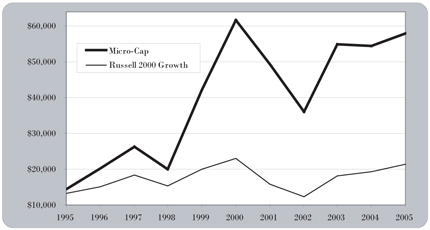

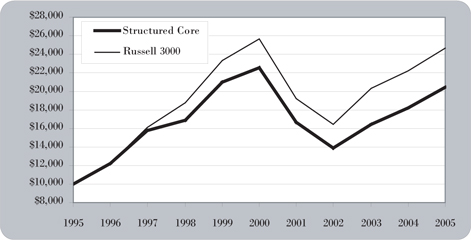

Cumulative Total Return Performance

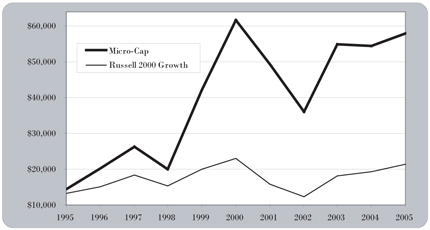

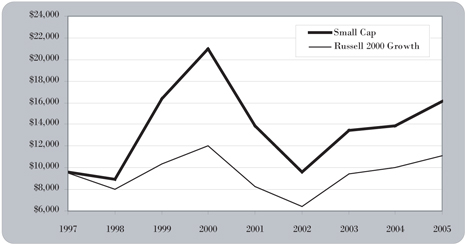

Managers Fremont Micro-Cap Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. The Russell 2000 Growth Index measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. Unlike the Fund, the Russell 2000 Growth Index is unmanaged, is not available for investment, and does not incur expenses. This chart compares a hypothetical $10,000 investment made in the Managers Fremont Micro-Cap Fund on 10/31/95 to a $10,000 investment made in the Russell 2000 Growth Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. Past performance is not indicative of future results. Performance for periods longer than one year is annualized. Figures include reinvestment of capital gains and dividends. The listed returns for the Fund are net of expenses and the returns for the indices exclude expenses. Total returns for the Fund would have been lower had certain expenses not been reduced.

The table below shows the average annualized total returns for the Managers Fremont Micro-Cap Fund and the Russell 2000 Growth Index since inception through October 31, 2005.

| | | | | | | | | | | | |

Average Annual Total Returns:

| | 1 Year

| | | 5 Years

| | | 10 Years

| | | Since Inception*

| |

Managers Fremont Micro-Cap | | 6.42 | % | | (1.24 | )% | | 14.96 | % | | 16.76 | % |

Russell 2000 Growth Index | | 10.91 | % | | (1.62 | )% | | 4.81 | % | | 6.90 | % |

| * | Commencement of operations was June 30, 1994. |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end please call (800) 835-3879 or visit our Web site at www.managersinvest.com.

6

Managers Fremont Micro-Cap Fund

Portfolio Manager Comments (continued)

The returns shown were achieved during a period of generally rising market values, especially in the technology sector. In addition, a portion of the Fund’s performance can be attributed to investments in Initial Public Offerings (IPOs). Investors should not expect that such favorable returns can be consistently achieved.

The Fund is subject to the special risks associated with investments in micro-cap companies such as relatively short earnings history, conditions, less publicly available corporate information, and a reliance on a limited number of products.

7

Managers Fremont Micro-Cap Fund

Fund Snapshots

October 31, 2005

Portfolio Breakdown

| | | | | | |

Major Sectors

| | Percentage of

Net Assets

| | | Percentage of

Russell 2000

Growth Index

| |

Information Technology | | 48.5 | % | | 24.8 | % |

Health Care | | 17.5 | | | 20.6 | |

Consumer Discretionary | | 11.0 | | | 15.5 | |

Industrials | | 10.3 | | | 14.6 | |

Financials | | 1.8 | | | 10.1 | |

Materials | | 1.5 | | | 3.3 | |

Energy | | 0.0 | | | 7.9 | |

Consumer Staples | | 0.0 | | | 2.1 | |

Telecommunication Services | | 0.0 | | | 1.0 | |

Utilities | | 0.0 | | | 0.1 | |

Other Assets and Liabilities | | 9.4 | | | 0.0 | |

| | |

|

| |

|

|

| | | 100.0 | % | | 100.0 | % |

| | |

|

| |

|

|

Any sectors, industries or securities discussed should not be perceived as investment recommendations.

Top Ten Holdings

| | | |

Security Name

| | Percentage of

Net Assets

| |

ATMI, Inc. * | | 4.9 | % |

Gymboree Corp. * | | 3.7 | |

Regeneration Technologies, Inc. * | | 3.4 | |

Integral Systems, Inc. * | | 3.3 | |

Anaren Microwave, Inc. * | | 2.8 | |

NeoPharm, Inc. * | | 2.8 | |

Identix, Inc. | | 2.6 | |

Terayon Communication Systems, Inc. * | | 2.4 | |

AudioCodes, Ltd. | | 2.2 | |

Equinix, Inc. | | 2.1 | |

| | |

|

|

Top Ten as a Group | | 30.2 | % |

| | |

|

|

| * | Top Ten Holding at April 30, 2005 |

Mention of a specific security should not be considered a recommendation to buy or solicitation to sell the security.

8

Managers Fremont Micro-Cap Fund

Schedule of Portfolio Investments

October 31, 2005

| | | | | | |

| | | Shares

| | | Value

|

Common Stocks - 90.6% | | | | | | |

Consumer Discretionary - 11.0% | | | | | | |

Alloy, Inc. * | | 1,507,200 | 1 | | $ | 6,933,120 |

Celebrate Express, Inc.* | | 264,500 | | | | 3,602,490 |

Century Casinos, Inc.* | | 442,900 | | | | 3,330,608 |

Gymboree Corp.* | | 841,900 | 1 | | | 14,901,630 |

Harris Interactive, Inc.* | | 752,700 | | | | 3,138,759 |

IMAX Corp.* | | 475,600 | 1 | | | 4,313,692 |

IMPCO Technologies, Inc.* | | 157,300 | 1 | | | 816,386 |

Lakes Gaming, Inc.* | | 98,600 | | | | 924,129 |

Nevada Gold & Casinos, Inc.* | | 165,300 | 1 | | | 1,727,385 |

Parker Vision, Inc. * | | 153,800 | 1 | | | 1,121,202 |

Rocky Shoes & Boots, Inc.* | | 123,800 | | | | 3,060,336 |

Total Consumer Discretionary | | | | | | 43,869,737 |

Financials - 1.8% | | | | | | |

Cash Systems, Inc. * 4 | | 1,212,600 | 1 | | | 7,045,206 |

Health Care - 17.5% | | | | | | |

AngioDynamics, Inc.* | | 249,400 | | | | 5,449,390 |

Atherogenics, Inc.* | | 133,800 | 1 | | | 2,007,000 |

Cepheid, Inc.* | | 289,600 | 1 | | | 1,836,064 |

Conceptus, Inc.* | | 618,500 | 1 | | | 6,351,995 |

DexCom, Inc.* | | 239,900 | 1 | | | 3,121,099 |

Eclipsys Corp.* | | 141,200 | 1 | | | 2,259,200 |

Harvard Bioscience, Inc. * | | 525,400 | | | | 1,686,534 |

ICON PLC.* | | 114,700 | | | | 4,614,381 |

Intuitive Surgical, Inc.* | | 49,200 | 1 | | | 4,365,516 |

NeoPharm, Inc.* | | 1,171,520 | 1 | | | 11,258,307 |

NxStage Medical, Inc.* | | 144,000 | | | | 1,634,400 |

OraSure Technologies, Inc.* | | 443,100 | | | | 4,878,531 |

Regeneration Technologies, Inc.* 4 | | 1,861,400 | 1 | | | 13,457,922 |

Sonosite, Inc. * | | 40,300 | | | | 1,184,417 |

Vital Images, Inc.* | | 230,700 | 1 | | | 5,363,775 |

Total Health Care | | | | | | 69,468,531 |

Industrials - 10.3% | | | | | | |

Aaon, Inc.* | | 180,600 | | | | 3,106,320 |

Allied Defense Group, Inc., The* | | 127,500 | | | | 2,843,250 |

Color Kinetics, Inc.* | | 365,200 | 1 | | | 5,565,648 |

CoStar Group, Inc.* | | 137,100 | 1 | | | 6,573,945 |

Gevity HR, Inc. | | 98,900 | 1 | | | 2,545,686 |

Insituform Technologies, Inc.* | | 379,400 | 1 | | | 6,814,024 |

KVH Industries, Inc.* 4 | | 769,300 | 1 | | | 7,108,332 |

Nuco2, Inc.* | | 44,800 | 1 | | | 1,025,920 |

TVI Corp.* | | 1,441,300 | | | | 5,361,636 |

Total Industrials | | | | | | 40,944,761 |

The accompanying notes are an integral part of these financial statements.

9

Managers Fremont Micro-Cap Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

| | | Shares

| | | Value

|

Information Technology - 48.5% | | | | | | |

Actel Corp.* | | 424,700 | 1 | | $ | 5,924,565 |

Airspan Networks, Inc.* | | 349,700 | 1 | | | 1,741,506 |

Aladdin Knowledge Systems, Ltd.* | | 297,100 | 1 | | | 5,225,989 |

Anaren Microwave, Inc.* | | 800,400 | | | | 11,325,660 |

ASM International NV* | | 221,700 | 1 | | | 2,944,176 |

ATMI, Inc.* | | 717,900 | 1 | | | 19,605,849 |

AudioCodes, Ltd.* | | 787,800 | 1 | | | 8,878,506 |

Cascade Microtech, Inc.* | | 163,500 | | | | 1,896,600 |

Centra Software, Inc.* | | 547,700 | | | | 985,860 |

Ceragon Networks, Ltd. * 4 | | 1,952,600 | | | | 7,556,562 |

Comtech Group, Inc.* | | 513,400 | | | | 3,203,616 |

CyberOptics Corp.* | | 263,400 | | | | 3,487,416 |

Equinix, Inc.* | | 227,800 | 1 | | | 8,403,542 |

Exfo Electro-Optical Engineering, Inc.* 4 | | 1,574,500 | 1 | | | 6,880,565 |

Greenfield Online, Inc.* | | 336,200 | 1 | | | 1,687,724 |

Identix, Inc. * | | 2,330,268 | 1 | | | 10,323,089 |

Integral Systems, Inc. 4 | | 586,800 | | | | 12,933,072 |

Intevac, Inc.* | | 311,700 | 1 | | | 2,848,938 |

Kanbay International, Inc. * | | 185,900 | 1 | | | 2,710,422 |

MRO Software, Inc.* | | 372,400 | 1 | | | 6,099,912 |

NCI, Inc., Class A* | | 182,800 | | | | 2,211,880 |

Netscout Systems, Inc.* | | 458,900 | | | | 2,588,196 |

OPNET Technologies, Inc.* | | 648,500 | | | | 5,402,005 |

Optibase Ltd.* 4 | | 767,100 | | | | 3,789,474 |

Pervasive Software, Inc.* | | 556,500 | | | | 2,337,300 |

PLX Technology, Inc.* | | 259,900 | 1 | | | 1,946,651 |

Rae Systems, Inc.* | | 659,000 | 1 | | | 2,319,680 |

RightNow Technologies, Inc. * | | 300,400 | 1 | | | 4,572,088 |

RIT Technologies Ltd.* 4 | | 960,800 | 1 | | | 2,690,240 |

Silicon Motion Technology Corp., ADR* | | 254,300 | | | | 3,656,834 |

Sirenza Microdevices, Inc.* | | 1,239,600 | | | | 3,966,720 |

Stratasys, Inc.* | | 172,100 | 1 | | | 4,082,212 |

TechTeam Global, Inc. * 4 | | 510,900 | | | | 4,761,588 |

Terayon Communication Systems, Inc.* | | 3,612,500 | | | | 9,717,625 |

Terremark Worldwide, Inc. * | | 855,390 | 1 | | | 2,386,538 |

Trident Microsystems, Inc. * | | 92,700 | 1 | | | 2,805,102 |

Witness Systems, Inc.* | | 282,000 | 1 | | | 5,527,200 |

Woodhead Industries, Inc. | | 274,700 | | | | 3,458,473 |

Total Information Technology | | | | | | 192,883,375 |

Materials - 1.5% | | | | | | |

Calgon Carbon Corp. | | 806,900 | 1 | | | 4,397,605 |

Northern Technologies International Corp. 4 | | 330,450 | | | | 1,777,821 |

Total Materials | | | | | | 6,175,426 |

Total Common Stocks (cost $367,507,507) | | | | | | 360,387,036 |

The accompanying notes are an integral part of these financial statements.

10

Managers Fremont Micro-Cap Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

| | | Shares

| | Value

| |

Other Investment Companies - 33.3%2 | | | | | | |

Bank of New York Institutional Cash Reserves Fund, 3.97%3 | | 91,686,105 | | $ | 91,686,105 | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 3.73% | | 25,526,414 | | | 25,526,414 | |

Vanguard Prime Money Market Fund, Institutional Class Shares, 3.79% | | 15,234,479 | | | 15,234,479 | |

Total Other Investment Companies (cost $132,446,998) | | | | | 132,446,998 | |

Total Investments - 123.9% (cost $499,954,505) | | | | | 492,834,034 | |

Other Assets, less Liabilities - (23.9)% | | | | | (95,205,267 | ) |

Net Assets - 100.0% | | | | $ | 397,628,767 | |

| Note: | Based on the cost of investments of $503,890,654 for Federal income tax purposes at October 31, 2005, the aggregate gross unrealized appreciation and depreciation were $37,436,926 and $48,493,546, respectively, resulting in net unrealized depreciation of investments of $11,056,620. |

| * | Non-income-producing securities. |

| 1 | Some or all of these shares, amounting to a market value of $90,477,773, or 22.8% of net assets, were out on loan to various brokers. |

| 2 | Yield shown for an investment company represents the October 31, 2005, seven-day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

| 3 | Collateral received from brokers for securities lending was invested in this short-term investment. |

| 4 | Affiliated Company- See Note 7 in the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

11

Managers Fremont Micro-Cap Fund

Statement of Assets and Liabilities

October 31, 2005

| | | | |

Assets: | | | | |

Investments at value (including securities on loan valued at $90,477,773) | | $ | 492,834,034 | |

Receivable for investments sold | | | 1,829,977 | |

Receivable for Fund shares sold | | | 102,168 | |

Dividends and other receivables | | | 176,417 | |

Prepaid expenses | | | 7,850 | |

| | |

|

|

|

Total assets | | | 494,950,446 | |

| | |

|

|

|

Liabilities: | | | | |

Payable for Fund shares repurchased | | | 884,912 | |

Payable upon return of securities loaned | | | 91,686,105 | |

Payable for investments purchased | | | 3,935,035 | |

Accrued expenses: | | | | |

Investment advisory and management fees | | | 346,459 | |

Administrative fees | | | 86,615 | |

Other | | | 382,553 | |

| | |

|

|

|

Total liabilities | | | 97,321,679 | |

| | |

|

|

|

Net Assets | | | $397,628,767 | |

| | |

|

|

|

Shares Outstanding | | | 13,412,010 | |

| | |

|

|

|

Net asset value, offering and redemption price per share | | $ | 29.65 | |

| | |

|

|

|

Net Assets Represent: | | | | |

Paid-in capital | | $ | 443,217,865 | |

Undistributed net investment income | | | — | |

Accumulated net realized loss from investments | | | (38,468,627 | ) |

Net unrealized depreciation of investments | | | (7,120,471 | ) |

| | |

|

|

|

Net Assets | | | $397,628,767 | |

| | |

|

|

|

Investments at cost | | $ | 499,954,505 | |

The accompanying notes are an integral part of these financial statements.

12

Managers Fremont Micro-Cap Fund

Statement of Operations

For the fiscal year ended October 31, 2005

| | | | |

Investment Income: | | | | |

Dividend income | | $ | 1,528,211 | |

Interest income | | | 213,165 | |

Securities lending fees | | | 341,377 | |

| | |

|

|

|

Total investment income | | | 2,082,753 | |

| | |

|

|

|

Expenses: | | | | |

Investment management fees | | | 5,284,466 | |

Administrative fees | | | 886,904 | |

Transfer agent | | | 681,889 | |

Custodian | | | 109,039 | |

Reports to shareholders | | | 103,854 | |

Professional fees | | | 95,938 | |

Trustees fees and expenses | | | 25,511 | |

Miscellaneous | | | 30,744 | |

| | |

|

|

|

Total expenses before offsets | | | 7,218,345 | |

| | |

|

|

|

Expense reductions | | | (199 | ) |

| | |

|

|

|

Net expenses | | | 7,218,146 | |

| | |

|

|

|

Net investment loss | | | (5,135,393 | ) |

| | |

|

|

|

Net Realized and Unrealized Gain (Loss): | | | | |

Net realized gain on investment transactions | | | 65,151,923 | |

Net unrealized depreciation of investments | | | (25,791,471 | ) |

| | |

|

|

|

Net realized and unrealized gain | | | 39,360,452 | |

| | |

|

|

|

Net Increase in Net Assets Resulting from Operations | | $ | 34,225,059 | |

| | |

|

|

|

The accompanying notes are an integral part of these financial statements.

13

Managers Fremont Micro-Cap Fund

Statement of Changes in Net Assets

For the fiscal year ended October 31,

| | | | | | | | |

| | | 2005

| | | 2004

| |

Increase (Decrease) in Net Assets | | | | | | | | |

From Operations: | | | | | | | | |

Net investment loss | | $ | (5,135,393 | ) | | $ | (7,827,000 | ) |

Net realized gain on investments | | | 65,151,923 | | | | 98,930,000 | |

Net unrealized depreciation of investments | | | (25,791,471 | ) | | | (96,203,000 | ) |

| | |

|

|

| |

|

|

|

Net increase (decrease) in net assets resulting from operations | | | 34,225,059 | | | | (5,100,000 | ) |

| | |

|

|

| |

|

|

|

From Capital Share Transactions: | | | | | | | | |

Proceeds from sale of shares | | | 42,000,900 | | | | 87,508,000 | |

Cost of shares repurchased | | | (169,124,192 | ) | | | (165,558,000 | ) |

| | |

|

|

| |

|

|

|

Net decrease from capital share transactions | | | (127,123,292 | ) | | | (78,050,000 | ) |

| | |

|

|

| |

|

|

|

Total decrease in net assets | | | (92,898,233 | ) | | | (83,150,000 | ) |

| | |

|

|

| |

|

|

|

Net Assets: | | | | | | | | |

Beginning of year | | | 490,527,000 | | | | 573,677,000 | |

| | |

|

|

| |

|

|

|

End of year | | $ | 397,628,767 | | | $ | 490,527,000 | |

| | |

|

|

| |

|

|

|

End of year undistributed net investment income | | $ | — | | | $ | — | |

| | |

|

|

| |

|

|

|

Share Transactions: | | | | | | | | |

Sale of shares | | | 1,633,719 | | | | 3,010,000 | |

Shares repurchased | | | (5,826,551 | ) | | | (5,790,000 | ) |

| | |

|

|

| |

|

|

|

Net decrease in shares | | | (4,192,832 | ) | | | (2,780,000 | ) |

| | |

|

|

| |

|

|

|

The accompanying notes are an integral part of these financial statements.

14

Managers Fremont Micro-Cap Fund

Financial Highlights

For a share outstanding throughout each fiscal year

| | | | | | | | | | | | | | | | | | | | |

| | | Fiscal year ended October 31,

| |

| | | 2005

| | | 2004

| | | 2003

| | | 2002

| | | 2001

| |

Net Asset Value, Beginning of Year | | $ | 27.86 | | | $ | 28.14 | | | $ | 18.43 | | | $ | 25.22 | | | $ | 34.99 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.38 | ) | | | (0.44 | ) | | | (0.33 | ) | | | (0.35 | ) | | | (0.13 | ) |

Net realized and unrealized gain (loss) on investments | | | 2.17 | | | | 0.16 | | | | 10.04 | | | | (6.44 | ) | | | (6.69 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from investment operations | | | 1.79 | | | | (0.28 | ) | | | 9.71 | | | | (6.79 | ) | | | (6.82 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | | — | | | | — | | | | — | | | | .— | |

Net realized gain on investments | | | — | | | | — | | | | — | | | | — | | | | (2.95 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total distributions to shareholders | | | — | | | | — | | | | — | | | | — | | | | (2.95 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Asset Value, End of Year | | $ | 29.65 | | | $ | 27.86 | | | $ | 28.14 | | | $ | 18.43 | | | $ | 25.22 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Return (a) | | | 6.42 | % | | | (1.00 | )% | | | 52.69 | % | | | (26.92 | )% | | | (20.05 | )% |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Ratio of net operating expenses to average net assets | | | 1.56 | % (b) | | | 1.62 | % | | | 1.64 | % | | | 1.61 | % | | | 1.60 | % |

Ratio of net investment loss to average net assets (a) | | | (1.11 | )% | | | (1.41 | )% | | | (1.47 | )% | | | (1.33 | )% | | | (0.47 | )% |

Portfolio turnover | | | 68 | % | | | 83 | % | | | 105 | % | | | 68 | % | | | 90 | % |

Net assets at end of year (000’s omitted) | | $ | 397,629 | | | $ | 490,527 | | | $ | 573,677 | | | $ | 401,068 | | | $ | 600,259 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| (a) | Total returns and net investment income would have been lower had certain expenses not been reduced. |

| (b) | After expense offsets. (See Note 1(c) of “Notes to Financial Statements.”) |

15

Managers Fremont Micro-Cap Fund

Notes to Financial Statements

October 31, 2005

| (1) | Summary of Significant Accounting Policies |

Managers Trust I (the “Trust”) is an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). Currently, the Trust is comprised of a number of investment series. Included in this report is the Managers Fremont Micro-Cap Fund (the “Fund”), formerly Fremont U.S. Micro-Cap Fund (the “Predecessor Fund”).

At the close of business on January 14, 2005, the Predecessor Fund was re-organized from a series of Fremont Mutual Funds, Inc. into Managers Fremont Micro-Cap Fund, a series of Managers Trust I.

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America, which require management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting periods. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements:

| (a) | Valuation of Investments |

Equity securities traded on a domestic securities exchange are valued at the last quoted sale price, or, lacking any sales, at the last quoted bid price. Over-the-counter securities are valued at the Nasdaq Official Closing Price, if one is available. Lacking any sales, over-the-counter securities are valued at the last quoted bid price. Under certain circumstances, the value of the Fund investment may be based on an evaluation of its fair value, pursuant to procedures established by and under the general supervision of the Board of Trustees of the Trust. The Fund may use the fair value of a portfolio security to calculate its NAV when, for example, (1) market quotations are not readily available because a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and has not resumed prior to the time as of which the Fund calculates its NAV, (3) where a significant event affecting the value of a portfolio security is determined to have occurred between the time of the market quotation provided for a portfolio security and the time as of which the Fund calculates its NAV, (4) a security’s price has remained unchanged over an extended period of time (often referred to as a “stale price”), or (5) the Investment Manager determines that a market quotation is inaccurate. The Investment Manager monitors intervening events that may affect the value of securities held in the Fund’s portfolio and, in accordance with procedures adopted by the Fund’s Trustees, will adjust the prices of securities traded in foreign markets, as appropriate, to reflect the impact of events occurring subsequent to the close of such markets but prior to the time each Fund’s NAV is calculated. Fixed-income securities are valued based on valuations furnished by independent pricing services that utilize matrix systems, which reflect such factors as security prices, yields, maturities and ratings, and are supplemented by dealer and exchange quotations. Short-term investments having a remaining maturity of 60 days or less are valued at amortized cost, which approximates market value. Investments in other regulated investment companies are valued at their end of

16

Managers Fremont Micro-Cap Fund

Notes to Financial Statements (continued)

day net asset value per share except iShares or other ETF’s which are valued the same as equity securities. Securities (including derivatives) for which market quotations are not readily available are valued at fair value, as determined in good faith, and pursuant to procedures adopted by the Board of Trustees of the Trust. The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized, since such amounts depend on future developments inherent in long-term investments. Further, because of the inherent uncertainty of valuation, those estimated values may differ significantly from the values that would have been used had a ready market of the investments existed, and the differences could be material.

Security transactions are accounted for as of the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

| (c) | Investment Income and Expenses |

Dividend income is recorded on the ex-dividend date except certain dividends from foreign securities where the ex-dividend date may have passed. These dividends are recorded as soon as the Trust is informed of the ex-dividend date. Dividend income on foreign securities is recorded net of any withholding tax. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Non-cash dividends included in dividend income, if any, are reported at the fair market value of the securities received. Other income and expenses are recorded on an accrual basis. Expenses that cannot be directly attributed to a fund are apportioned among the Funds in the Trust and in some cases other affiliated funds based upon their relative average net assets or number of shareholders.

The Fund may participate in a directed brokerage program whereby certain portfolio trades are directed to various brokers who pay a portion of the Fund’s expenses. For the fiscal year ended October 31, 2005 no trades were directed under this program.

In addition, the Fund has a “balance credit” arrangement with The Bank of New York (“BNY”), the Fund’s custodian, whereby the Fund is credited with an interest factor equal to 1% below the effective 90-day T-Bill rate for account balances left uninvested overnight. These credits serve to reduce custody expenses that would otherwise be charged the Fund. For the fiscal year ended October 31, 2005, the custodian expense was reduced by $199. (Prior to January 15, 2005, the Predecessor Fund participated in a similar program offered by State Street Bank, the Predecessor Fund’s custodian).

Managers Investment Group LLC (the “Investment Manager”), a subsidiary of Affiliated Managers Group, Inc. (“AMG”) and the Investment Manager for the Fund, has contractually agreed, through at least March 1, 2006, to waive fees and pay or reimburse expenses to the extent that the total annual operating expenses (exclusive of brokerage, interest, taxes and extraordinary expenses) of the Fund exceed 1.98% of the Fund’s average daily net assets. For the fiscal year ended October 31, 2005, no reimbursement payments were required.

Effective January 15, 2005, the Fund may be obligated to repay the Investment Manager such amounts waived, paid or reimbursed in future years provided that the repayment

17

Managers Fremont Micro-Cap Fund

Notes to Financial Statements (continued)

occurs within three (3) years after the waiver or reimbursement and that such repayment would not cause the Fund’s expenses in any such year to exceed the previously stated percentages of that Fund’s average daily net assets. Prior to January 15, 2005, the Fund had a similar expense reimbursement agreement with the former Investment Advisor, Fremont Investment Advisors, Inc. (“FIA”).

| (d) | Dividends and Distributions |

Dividends resulting from net investment income, if any, normally will be declared and paid annually. Distributions of capital gains, if any, will be made on an annual basis and when required for Federal excise tax purposes. Income and capital gain distributions are determined in accordance with Federal income tax regulations, which may differ from generally accepted accounting principles. These differences are primarily due to differing treatments for losses deferred due to wash sales, equalization accounting for tax purposes, foreign currency and market discount transactions. Permanent book and tax basis differences, if any, relating to shareholder distributions will result in reclassifications to paid-in capital. The Fund paid no distributions during 2005 or 2004.

The Fund intends to comply with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended, to distribute substantially all of its taxable income and gains to its shareholders and to meet certain diversification and income requirements with respect to investment companies. Therefore, no provision for Federal income or excise tax is included in the accompanying financial statements.

Additionally, based on the Fund’s understanding of the tax rules and rates related to income, gains and transactions for the foreign jurisdictions in which it invests, the Fund will provide for foreign taxes, and where appropriate, deferred foreign taxes.

| (f) | Capital Loss Carryovers |

As of October 31, 2005, the Fund had an accumulated net realized capital loss carryover of $34,532,478. This amount may be used to offset realized capital gains, if any, through October 31, 2010.

The Trust’s Declaration of Trust authorizes for each series the issuance of an unlimited number of shares of beneficial interest, without par value. The Fund records sales and repurchases of its capital stock on the trade date. Dividends and distributions to shareholders are recorded on the ex-dividend date.

At October 31, 2005, certain unaffiliated shareholders, specifically omnibus accounts, individually held greater than 10% of the outstanding shares of the Fund as follows: three own collectively 64%.

The Fund may enter into repurchase agreements provided that the value of the underlying collateral, including accrued interest, will be equal to or exceed the value of the repurchase agreement during the term of the agreement. The underlying collateral for all repurchase agreements is held in safekeeping by the Fund’s custodian or at the Federal Reserve Bank.

18

Managers Fremont Micro-Cap Fund

Notes to Financial Statements (continued)

If the seller defaults and the value of the collateral declines, or if bankruptcy proceedings commence with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

| (2) | Agreements and Transactions with Affiliates |

The Trust has entered into an Investment Management Agreement dated January 15, 2005 under which the Investment Manager provides or oversees investment management services to the Fund. (Prior to January 15, 2005, the Predecessor Fund had a Unitary Fee Agreement with FIA under which the Predecessor Fund paid FIA 2.50% of the first $30 million, 2.00% of the next $70 million, and 1.50% of the balance over $100 million of average net assets per annum. FIA, in turn, was obliged to pay all of the expenses of the Predecessor Fund). The Investment Manager selects subadvisors for the Fund (subject to Trustee approval) and monitors the subadvisor’s investment programs and results. The Fund’s investment portfolio is managed by a portfolio manager who serves pursuant to a Subadvisory Agreement with the Investment Manager.

Investment management fees are paid directly by the Fund to the Investment Manager based on average daily net assets. The annual investment management fee rate, as a percentage of average daily net assets for the period from January 15, 2005 to October 31, 2005, was 1.00%.

The Trust has entered into an Administration and Shareholder Servicing Agreement under which Managers Investment Group LLC serves as the Fund’s administrator (the “Administrator”) and is responsible for all aspects of managing the Fund’s operations, including administration and shareholder services to each Fund, its shareholders, and certain institutions, such as bank trust departments, broker-dealers and registered investment advisers, that advise or act as an intermediary with the Fund’s shareholders. During the period January 15, 2005 through October 31, 2005, the Fund paid a fee to the Administrator at the rate of 0.25% per annum of the Fund’s average daily net assets.

Prior to July 1, 2005, the aggregate annual retainer paid to each Independent Trustee for all Trusts in the Fund family was $52,000, plus $2,000 for each meeting attended. Effective July 1, 2005, the aggregate annual retainer paid to each Independent Trustee is $55,000, plus $4,000 for each meeting attended. The Trustees’ fees and expenses are allocated amongst all of the Funds for which Managers Investment Group LLC serves as the Investment Manager (the “Managers Funds”) based on the relative net assets of such Funds. The Trust has an additional Independent Trustee who is paid an annual retainer of $30,000, plus $4,000 for each meeting attended. The fee is allocated amongst the Funds in the Trust based on the relative net assets of each Fund. The Independent Chairman of the Trusts receives an additional payment of $10,000 per year. (Prior to July 1, 2005, the Independent Chairman was paid an additional $5,000 per year). Effective July 1, 2005, the Chairman of the Audit Committee receives an additional $2,000 per year. The “Trustee fees and expenses” shown in the financial statements amounting to $25,511 represent the Fund’s allocated portion of the total fees and expenses paid by the Fund and other affiliated funds in the Trust and in the complex for the period January 15, 2005 through October 31, 2005.

19

Managers Fremont Micro-Cap Fund

Notes to Financial Statements (continued)

The Fund is distributed by Managers Distributors, Inc. (“MDI”), a wholly-owned subsidiary of Managers Investment Group LLC. Certain Trustees and Officers of the Fund are Officers and/or Directors of the Investment Manager, AMG and/or MDI. MDI serves as the principal underwriter for the Fund. MDI is a registered broker-dealer and member of the National Association of Securities Dealers, Inc. Shares of the Fund will be continuously offered and will be sold by brokers, dealers or other financial intermediaries who have executed selling agreements with MDI. MDI bears all the expenses of providing services pursuant to an Underwriting Agreement, including the payment of the expenses relating to the distribution of Prospectuses for sales purposes and any advertising or sales literature. (Prior to January 15, 2005, the Predecessor Fund had a similar distribution agreement with Quasar Distributors, LLC).

| (3) | Purchases and Sales of Securities |

Purchases and sales of securities, excluding short-term securities, for the fiscal year ended October 31, 2005, were $281,729,919 and $380,267,074, respectively. There were no purchases or sales of U.S. Government securities.

| (4) | Portfolio Securities Loaned |

The Fund may participate in a securities lending program offered by BNY providing for the lending of equities, corporate bonds and government securities to qualified brokers. Collateral on all securities loaned is accepted in cash and/or government securities. Collateral is maintained at a minimum level of 102% of the market value, plus interest, if applicable, of investments on loan. Collateral received in the form of cash is invested temporarily in institutional money market funds or other short-term investments by BNY. Securities lending fees include earnings of such temporary cash investments, plus or minus any rebate to a borrower. These earnings (after rebate) are then divided between BNY, as a fee for its services under the program, and the Fund according to agreed-upon rates.

| (5) | Commitments and Contingencies |

In the normal course of business, the Fund may enter into contracts and agreements that contain a variety of representations and warranties, which provide general indemnifications. The maximum exposure to the Fund under these arrangements is unknown, as this would involve future claims that may be against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

Prior to January 15, 2005 the Predecessor Fund had a Line of Credit Arrangement (“LOC”) with State Street Bank and Trust Company (“SSB”). Under the terms of the LOC, the Predecessor Fund’s borrowings could not exceed 20% of the Fund’s net assets and the combined borrowings of all the former Fremont Funds could not exceed the $40 million cap on the total line of credit. The interest rate paid on the LOC equaled SSB’s overnight federal funds rate as determined on each day at 11:00 a.m. Boston time plus 0.50% per annum. The former Fremont Funds paid a commitment fee of 0.09% per annum of the unused balance of the LOC. The Predecessor Fund’s portion of this fee for the period November 1, 2004 through January 14, 2005, equaled $1,330. The LOC was terminated at the close of business on January 14, 2005.

20

Managers Fremont Micro-Cap Fund

Notes to Financial Statements (continued)

| (7) | Transactions with Affiliated Companies |

An affiliated company is a company that is directly or indirectly controlled by a related party or a company in which a fund has ownership of at least 5% of the voting securities. Transactions during the fiscal year ended October 31, 2005, with companies which are or were affiliates are as follows:

Summary of Transactions with Affiliated Companies:

| | | | | | | | | | | | |

Affiliate

| | Purchase

Cost

| | Sales

Cost

| | Dividend

Income

| | Market

Value

|

Cash Systems, Inc. | | $ | 8,337,021 | | | — | | | — | | $ | 7,045,206 |

Ceragon Networks, Ltd. | | | — | | $ | 1,639,337 | | | — | | | 7,556,562 |

Exfo Electro-Optical Engineering Inc. | | | 71,466 | | | — | | | — | | | 6,880,565 |

Integral Systems, Inc. | | | 9,960,224 | | | — | | $ | 59,656 | | | 12,933,072 |

KVH Industries, Inc. | | | 1,235,728 | | | 854,307 | | | — | | | 7,108,332 |

Northern Technologies International Corp. | | | — | | | — | | | 23,132 | | | 1,777,821 |

Optibase Ltd. | | | 4,337,571 | | | — | | | — | | | 3,789,474 |

Regeneration Technologies, Inc. | | | 4,402,196 | | | 625,225 | | | — | | | 13,457,922 |

RIT Technologies Ltd. | | | 848,474 | | | 2,899,381 | | | — | | | 2,690,240 |

TechTeam Global, Inc. | | | 6,832,622 | | | — | | | — | | | 4,761,588 |

| | |

|

| |

|

| |

|

| |

|

|

Totals | | $ | 36,025,302 | | $ | 6,018,250 | | $ | 82,788 | | $ | 68,000,782 |

| | |

|

| |

|

| |

|

| |

|

|

Tax Information (unaudited)

The Fund hereby designates the maximum amount allowable of its net taxable income as qualified dividends as provided in the Jobs and Growth Tax Relief Reconciliation Act of 2003. The 2005 Form 1099-DIV you receive for the Fund, will show the tax status of all distributions paid to you during the year.

Pursuant to section 852 of the Internal Revenue Code, there were no long-term capital gains for the Fund for the taxable year ended October 31, 2005.

21

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Managers Trust I and the Shareholders of Managers Fremont Micro-Cap Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of portfolio investments and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Managers Fremont Micro-Cap Fund (formerly Fremont U.S. Micro-Cap Fund) (the “Fund”) at October 31, 2005, the results of its operations, the changes in its net assets and the financial highlights for the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2005 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

December 19, 2005

22

Trustees and Officers

The Trustees and Officers of the Trust, their business addresses, principal occupations for the past five years and dates of birth are listed below. The Trustees provide broad supervision over the affairs of the Trust and the Fund. The Trustees are experienced executives who meet periodically throughout the year to oversee the Fund’s activities, review contractual arrangements with companies that provide services to the Fund, and review the Fund’s performance. Unless otherwise noted, the address of each Trustee or Officer is the address of the Trust: 800 Connecticut Avenue, Norwalk, Connecticut 06854.

There is no stated term of office for Trustees. Trustees serve until their resignation, retirement or removal in accordance with the Trust’s organizational documents and policies adopted by the Board from time to time. The President, Treasurer and Secretary hold office until a successor has been duly elected and qualified. Other officers serve at the pleasure of the Trustees.

Independent Trustees

The following Trustees are not “interested persons” of the Trust within the meaning of the 1940 Act:

| | |

Name, Date of Birth, Number of Funds

Overseen in Fund Complex*

| | Principal Occupation(s) During Past 5 Years and Other Directorships Held by Trustee

|

Jack W.Aber, 9/9/37 • Trustee since 2000 • Oversees 36 Funds in Fund Complex | | Professor of Finance, Boston University School of Management (1972-Present); Trustee of Appleton Growth Fund (1 portfolio); Trustee of Third Avenue Trust (4 portfolios); Trustee of Third Avenue Variable Trust (1 portfolio) |

| |

William E. Chapman, II, 9/23/41 • Independent Chairman • Trustee since 2000 • Oversees 36 Funds in Fund Complex | | President and Owner, Longboat Retirement Planning Solutions (1998-Present); Hewitt Associates, LLC (part time) (provider of Retirement and Investment Education Seminars); Interim Executive Vice President, QuadraMed Corporation (2001); President, Retirement Plans Group, Kemper Funds (1990-1998); Trustee of Bowdoin College (2002-Present); Trustee of Third Avenue Trust (4 portfolios); Trustee of Third Avenue Variable Trust (1 portfolio) |

| |

Edward J. Kaier, 9/23/45 • Trustee since 2000 • Oversees 36 Funds in Fund Complex | | Attorney at Law and Partner, Hepburn Willcox Hamilton & Putnam, LLP (1977-Present); Trustee of Third Avenue Trust (4 portfolios); Trustee of Third Avenue Variable Trust (1 portfolio) |

23

Trustees and Officers (continued)

| | |

Richard E. Holmes, 5/14/43 • Trustee since 2005 • Oversees 11 Funds in Fund Complex | | Vice President and Director, BelMar Advisors, Inc. (1998-Present); Executive Director-Investment Management, Pacific Telesis Group (1983-1987); Managers Trust and Thrift Investments, Bechtel Power Corp. (1980-1983); Independent Director, Fremont Mutual Funds, Inc. (1988-2005) |

| |

Steven J. Paggioli, 4/3/50 • Trustee since 2000 • Oversees 36 Funds in Fund Complex | | Consultant (2001-Present); Formerly Executive Vice President and Director, The Wadsworth Group (1986-2001); Executive Vice President, Secretary and Director, Investment Company Administration, LLC (1990-2001); Vice President, Secretary and Director, First Fund Distributors, Inc. (1991-2001); Trustee, Professionally Managed Portfolios (21 portfolios); Advisory Board Member, Sustainable Growth Advisors, LP; Director, Guardian Mutual Funds (28 portfolios) |

| |

Eric Rakowski, 6/5/58 • Trustee since 2000 • Oversees 36 Funds in Fund Complex | | Professor, University of California at Berkeley School of Law (1990-Present); Visiting Professor, Harvard Law School (1998-1999); Trustee of Third Avenue Trust (4 portfolios); Trustee of Third Avenue Variable Trust (1 portfolio) |

| |

Thomas R. Schneeweis, 5/10/47 • Trustee since 2000 • Oversees 36 Funds in Fund Complex | | Professor of Finance, University of Massachusetts (1985-Present); Director, CISDM at the University of Massachusetts, (1996-Present); President, Alternative Investment Analytics, LLC, (formerly Schneeweis Partners, LLC) (2001- Present); Director of Research, Lyra/Starview Capital LLC, (2004-Present); Partner, Northampton Capital, LLC; Partner, Schneeweis Advisors and Massachusetts Finance Institute (both wholly owned subsidiaries of Alternative Investment Analytics). No other directorships held by Trustee. |

| * | The Fund Complex consists of Managers AMG Funds, The Managers Funds, Managers Trust I and Managers Trust II. |

24

Trustees and Officers (continued)

Interested Trustees

The following Trustees are “interested persons” of the Trust within the meaning of the 1940 Act. Mr. Lebovitz is an interested person of the Trust within the meaning of the 1940 Act by virtue of his positions with Managers Investment Group LLC and Managers Distributors, Inc. Mr. Nutt is an interested person of the Trust within the meaning of the 1940 Act by virtue of his positions with, and interest in securities of, Affiliated Managers Group, Inc.

| | |

Name, Date of Birth, Number of Funds

Overseen in Fund Complex*

| | Principal Occupation(s) During Past 5 Years and Other Directorships Held by Trustee

|

Peter M. Lebovitz, 1/18/55 • Trustee since 2002 • President since 2000 • Oversees 36 Funds in Fund Complex | | Managing Partner, Managers Investment Group LLC (2005-Present); President and Chief Executive Officer, The Managers Funds LLC (1999-2004); President, Managers Distributors, Inc. (2000-Present); President, The Managers Funds (1999-Present); President, Managers AMG Funds (1999-Present); President, Managers Trust II (2000-Present); Director of Marketing, The Managers Funds, LP (1994-1999); Director of Marketing, Hyperion Capital Management, Inc. (1993-1994); Senior Vice President, Greenwich Asset Management, Inc. (1989-1993); No other directorships held by trustee. |

| |

William J. Nutt, 3/30/45 • Trustee since 2005 • Oversees 36 Funds in Fund Complex | | Chairman and Founder of Affiliated Managers Group, Inc., (1993-Present); Chief Executive Officer of Affiliated Managers Group, Inc. (1993-2004); Director, Affiliated Managers Group, Inc. (1993-Present); President of Affiliated Managers Group, Inc. (1993-1999); President and Chief Operating Officer, The Boston Company (1989-1993); Senior Executive Vice President, The Boston Company (1982-1989) |

| * | The Fund Complex consists of Managers AMG Funds, The Managers Funds, Managers Trust I and Managers Trust II. |

25

Trustees and Officers (continued)

Officers

| | |

Name, Date of Birth, Position(s) Held with

Fund and Length of Time Served

| | Principal Occupation(s) During Past 5 Years

|

Bruce M. Aronow, 5/31/65 • Chief Financial Officer since 2005 | | Managing Partner, Managers Investment Group LLC (2005-Present); Executive Vice President and Chief Financial Officer and Principal, Rorer Asset Management (1999-2004); Chief Operating Officer, Rorer Asset Management (2001-2004); Staff Accountant, Manager and Partner, PricewaterhouseCoopers LLP (1987-1998) |

| |

Christine C. Carsman, 4/2/52 • Secretary since 2004 | | Vice President and Chief Regulatory Counsel, Affiliated Managers Group, Inc. (2004-Present); Secretary, The Managers Funds, Managers AMG Funds and Managers Trust II (2004-Present); Senior Counsel, Vice President and Director of Operational Risk Management and Compliance, Wellington Management Company, LLP (1995-2004); Deputy General Counsel, The Boston Company, Inc. (1993-1995); Associate General Counsel, The Boston Company Advisors, Inc. (1991-1993); Associate, Sullivan & Worcester LLP (1987-1991) |

| |

Donald S. Rumery, 5/29/58 • Treasurer since 2000 | | Senior Vice-President, Managers Investment Group LLC (2005-Present); Director, Finance and Planning, The Managers Funds LLC, (1994-2004); Treasurer and Chief Financial Officer, Managers Distributors, Inc. (2000-Present); Treasurer, The Managers Funds (1995-Present); Treasurer, Managers AMG Funds (1999-Present); Treasurer, Managers Trust II (2000-Present); Secretary, Managers Trust I and Managers Trust II (2000-2004) and Secretary, The Managers Funds (1997-2004) |

26

THIS PAGE INTENTIONALLY LEFT BLANK

Investment Manager and Administrator

Managers Investment Group LLC

800 Connecticut Avenue

Norwalk, Connecticut 06854

(203) 299-3500 or (800) 835-3879

Distributor

Managers Distributors, Inc.

800 Connecticut Avenue

Norwalk, Connecticut 06854

(203) 299-3500 or (800) 835-3879

Subadvisor

Kern Capital Management LLC

114 West 47th Street, 19th Floor

New York, New York 10036

Custodian

The Bank of New York

2 Hanson Place, 7th Floor

Brooklyn, New York 11217

Legal Counsel

Ropes & Gray LLP

One International Place

Boston, Massachusetts 02110-2624

Transfer Agent

PFPC, Inc.

Attn: Managers

P.O. Box 9769

Providence, Rhode Island 02940

(800) 358-7668

MANAGERS AND MANAGERS AMG EQUITY FUNDS

CAPITAL APPRECIATION

Bramwell Capital Management, Inc.

Essex Investment Management Co., LLC

EMERGING MARKETS EQUITY

Rexiter Capital Management Limited

ESSEX AGGRESSIVE GROWTH

ESSEX LARGE CAP GROWTH

ESSEX SMALL/MICRO CAP GROWTH

Essex Investment Management Co., LLC

FIRST QUADRANT TAX-MANAGED EQUITY

First Quadrant, L.P.

INSTITUTIONAL MICRO-CAP

Kern Capital Management LLC

INTERNATIONAL EQUITY

Bernstein Investment Research and Management

Lazard Asset Management, LLC

Wellington Management Company, LLP

INTERNATIONAL GROWTH

Wellington Management Company, LLP

MICRO-CAP

Kern Capital Management LLC

MID-CAP

Chicago Equity Partners, LLC

REAL ESTATE SECURITIES

Urdang Securities Management, Inc.

RENAISSANCE LARGE-CAP EQUITY

Renaissance Investment Management

RORER MID-CAP RORER LARGE-CAP

Rorer Asset Management, LLC

SMALL CAP

TimesSquare Capital Management, LLC

SMALL COMPANY

Kalmar Investment Advisers, Inc.

SPECIAL EQUITY

Donald Smith & Co., Inc.

Kern Capital Management LLC

Skyline Asset Management, L.P.

Veredus Asset Management LLC

Westport Asset Management, Inc.

STRUCTURED CORE

First Quadrant, L.P.

SYSTEMATIC VALUE

Systematic Financial Management, L.P.

TIMESSQUARE MID CAP GROWTH

TIMESSQUARE SMALL CAP GROWTH

TimesSquare Capital Management, LLC

VALUE

Armstrong Shaw Associates Inc.

Osprey Partners Investment Mgmt., LLC

20

Oak Associates, Ltd.

MANAGERS BALANCED FUNDS

BALANCED

Chicago Equity Partners, LLC

Loomis, Sayles & Company L.P.

GLOBAL

333 Global Advisers*

Armstrong Shaw Associates Inc.

Bernstein Investment Research and Management

First Quadrant, L.P.

Kern Capital Management LLC

Northstar Capital Management, Inc.

Wellington Management Company, LLP

MANAGERS FIXED INCOME FUNDS

BOND (MANAGERS)

Loomis, Sayles & Company L.P.

BOND (MANAGERS FREMONT)

Pacific Investment Management Co. LLC

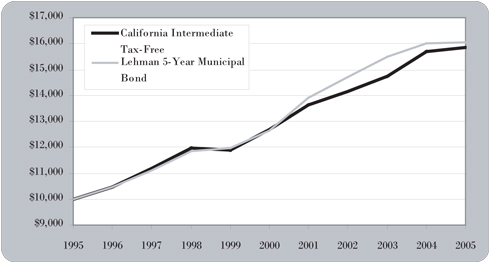

CALIFORNIA INTERMEDIATE TAX-FREE

Evergreen Investment Management Company, LLC

FIXED INCOME

Loomis, Sayles & Company L.P.

GLOBAL BOND

Loomis, Sayles & Company L.P.

HIGH YIELD

J.P. Morgan Investment Management Inc.

INTERMEDIATE DURATION GOVERNMENT

Smith Breeden Associates, Inc.

MONEY MARKET (MANAGERS)

JPMorgan Investment Advisors Inc.

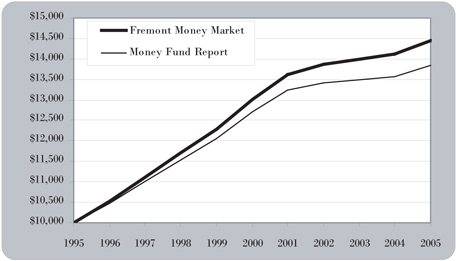

MONEY MARKET (FREMONT)

333 Global Advisers*

SHORT DURATION GOVERNMENT

Smith Breeden Associates, Inc.

| * | A division of Managers Investment Group LLC |

This report is prepared for the Fund’s shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by an effective prospectus. To receive a free copy of the prospectus or Statement of Additional Information, which includes additional information about Fund Trustees, please contact us by calling 1-800.835.3879. Distributed by Managers Distributors, Inc., member NASD.

A description of the policies and procedures each Fund uses to vote its proxies is available: (i) without charge, upon request, by calling 1-800.835.3879, or (ii) on the Securities and Exchange Commission’s (SEC) Web site at www.sec.gov. For information regarding each Fund’s proxy voting record for the 12-month period ended June 30, call 1-800.835.3879 or visit the SEC Web site at www.sec.gov.

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at www.sec.gov. A Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. To review a complete list of the Fund’s portfolio holdings, or to view the most recent quarterly holdings report, semiannual report, or annual report, please visit www.managersinvest.com.

AR010a-1005

| | |

| www.managersinvest.com | |  |

ANNUAL REPORT

Managers Funds

October 31, 2005

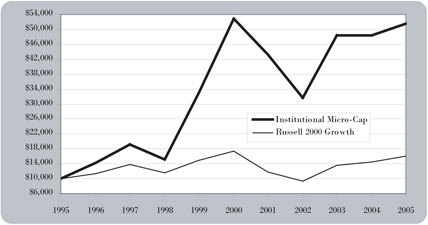

| • | | Managers Fremont Institutional Micro-Cap Fund |

MANAGERS FREMONT INSTITUTIONAL

MICRO-CAP FUND

(formerly Fremont Institutional U.S. Micro-Cap Fund)

Annual Report

October 31, 2005

TABLE OF CONTENTS

| | |

| | | Page

|

Letter to Shareholders | | 1 |

| |

About Your Fund’s Expenses | | 2 |

| |

Portfolio Manager Comments | | 3 |

| |

Fund Snapshots | | 8 |

| |

Top ten holdings and portfolio breakdown at October 31, 2005 | | |

| |

Schedule of Portfolio Investments | | 9 |

Detailed portfolio listings by security type and industry sector, as valued at October 31, 2005 | | |

| |

Financial Statements: | | |

| |

Statement of Assets and Liabilities | | 12 |

Fund balance sheet, net asset value (NAV) per share computation and cumulative undistributed amounts | | |

| |

Statement of Operations | | 13 |

Detail of sources of income, Fund expenses, and realized and unrealized gains (losses) during the fiscal year | | |

| |

Statement of Changes in Net Assets | | 14 |

Detail of changes in Fund assets for the past two fiscal years | | |

| |

Financial Highlights | | 15 |

| |

Historical net asset values per share, distributions, total returns, expense ratios, turnover ratios and total net assets | | |

| |

Notes to Financial Statements | | 16 |

| |

Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | |

| |

Report of Independent Registered Public Accounting Firm | | 22 |

| |

Trustees and Officers | | 23 |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of The Managers Funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Letter to Shareholders

Dear Fellow Shareholder:

Over the past 12 months the markets have been beset with a number of difficult and unpredictable challenges, including a massive tsunami in Southeast Asia; continuing strife in the Middle East; numerous terrorist incidents; multiple hurricanes in the Gulf of Mexico; and a significant rise in energy prices. We are fortunate that the stock and bond markets have continued to perform so well under these circumstances.

These events serve to remind us that no one can predict the events that are going to shape the markets in coming months. This reinforces our belief that to invest successfully in an uncertain world you have to diversify your investments and be patient.

Most people think of diversification as holding different types of stocks and bonds, but we believe that there is another type of diversification that receives too little notice, and that is diversification by investment manager and holdings. Simply put, no single approach is going to succeed in every kind of market—some growth stock managers will be successful in a rising market, and some will be more successful in a stagnant market. This can be an issue with some investment firms that adhere to only one method of looking at the markets.

That is a major benefit that we bring you at Managers Funds —since we hire subadvisors (affiliates and non-affiliates) to run our portfolios, we offer you a wide selection of very different investment styles to choose from, sometimes within the same asset class. Invest in multiple Managers Funds, and you can get managers with very different approaches and holdings, helping you reduce the risks created by changing economic conditions and natural and man-made events, such as those of the past 12 months.

We also believe that once you have made your manager selection, you must be patient. On the home page of our Web site at www.managersinvest.com, you will find a short article entitled “Stay Invested for the Long Term” that highlights how important it is to consistently stay in the market rather than trying to time the market. We think the implication is clear: to be successful in the market over the long term, select a wide variety of investments giving you good diversification, invest regularly and stick with your investment plan no matter what events dominate the news.

We invite you to visit our Web site on an ongoing basis to stay in tune with your Managers Funds holdings. The Web site provides detailed profiles of our subadvisors and their investment styles, as well as quarterly commentary on each Fund. If you have any questions, please do call us at 800.835.3879. Thank you for investing with Managers Funds.

| | | | |

Sincerely, | | | | |

| | |

| | | |  |

| | |

| Peter M. Lebovitz | | | | Thomas G. Hoffman, CFA |

| President | | | | Chief Investment Officer |

| Managers Funds | | | | Managers Investment Group LLC |

1

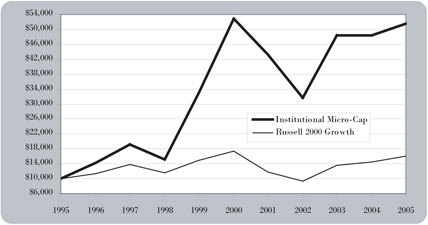

About Your Fund’s Expenses