UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06520

MANAGERS TRUST I

(Exact name of registrant as specified in charter)

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Address of principal executive offices) (Zip code)

Managers Investment Group LLC

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

| | |

Date of fiscal year end: | | OCTOBER 31 |

| |

Date of reporting period: | | NOVEMBER 1, 2005 – OCTOBER 31, 2006 |

| | (Annual Shareholder Report) |

| Item 1. | Reports to Shareholders |

ANNUAL REPORT

Managers AMG

October 31, 2006

FQ Tax-Managed U.S. Equity Fund

FQ U.S. Equity Fund

FQ Global Alternatives Fund

Managers AMG FQ Funds

FQ Tax-Managed U.S. Equity, FQ U.S. Equity, FQ Global Alternatives

Annual Report—October 31, 2006

TABLE OF CONTENTS

| | |

| | | Page |

LETTER TO SHAREHOLDERS | | 1 |

| |

ABOUT YOUR FUND’S EXPENSES | | 2 |

| |

INVESTMENT MANAGER’S COMMENTS, FUND SNAPSHOTS, AND SCHEDULES OF PORTFOLIO INVESTMENTS | | |

| |

FQ Tax-Managed U.S. Equity Fund | | 3 |

| |

FQ U.S. Equity Fund | | 8 |

| |

FQ Global Alternatives Fund | | 13 |

| |

FINANCIAL STATEMENTS: | | |

| |

Statements of Assets and Liabilities | | 15 |

| |

FQ Tax-Managed U.S. Equity and FQ U.S. Equity | | |

| |

Funds’ balance sheet, net asset value (NAV) per share computation and cumulative undistributed amount | | |

| |

Statement of Net Assets | | 16 |

| |

FQ Global Alternatives | | |

| |

Portfolio of Investments, Fund balance sheet, net asset value (NAV) per share computation and cumulative undistributed amount | | |

| |

Statements of Operations | | 17 |

| |

Detail of sources of income, Fund expenses, and realized and unrealized gains (losses) during the fiscal year | | |

| |

Statements of Changes in Net Assets | | 18 |

| |

Detail of changes in Fund assets for the past two fiscal periods | | |

| |

FINANCIAL HIGHLIGHTS | | 19 |

| |

Historical net asset values per share, distributions, total returns, expense ratios, turnover ratios and net assets | | |

| |

NOTES TO FINANCIAL STATEMENTS | | 22 |

| |

Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | 29 |

| |

TRUSTEES AND OFFICERS | | 30 |

| |

ANNUAL RENEWAL OF INVESTMENT ADVISORY AGREEMENTS | | 31 |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of The Managers Funds or Managers AMG Funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Letter to Shareholders

Dear Fellow Shareholder:

The year 2006 has been volatile but rewarding for investors. Markets confronted new Federal Reserve leadership and accompanying communication style, commodity price increases, the end (at least for now) of interest rate hikes, and then a sharp decline in oil prices and a dramatic slowdown in the real estate market. Times like these challenge investors to remove emotion from decisions and remain disciplined with their long-term investment plans.

Regardless of market conditions, we at Managers maintain our focus on providing excellent, trusted, and rigorously monitored investment solutions across all major market segments and styles. We encourage our portfolio managers to take a long-term view and to invest accordingly. We strive to stay on track even when market volatility causes some investors concern.

Regardless of market conditions, we at Managers maintain our focus on providing excellent, trusted, and rigorously monitored investment solutions across all major market segments and styles.

Our overriding goal is to hire fund managers that can effectively manage assets in all types of market conditions. Toward this goal we maintain a team of skilled investment professionals focused solely on understanding the global capital markets and overseeing the managers in our Funds. We hire fund portfolio managers who excel over time, have a strong investment discipline, and stick to that discipline.

Our investment team oversees the Funds’ managers and portfolios every day so you don’t have to. Once you have selected Managers Funds as part of your asset allocation, you can be assured that we are monitoring that investment every day to help ensure it is delivering on its investment mandate.

As 2006 comes to a close, we begin to think about next year and beyond. The two things we believe will impact investment returns the most are the condition of the economy and the change to the political landscape this fall’s election brings. Obviously, these are only the headlines and there are many subtleties relating to each.

First, with regard to the health of the economy, the risk appears to be the leverage consumers have assumed through their exposure to the residential real estate market. The “house as cash machine” combined with the speculative investment in real estate has increased the economy’s exposure to any weakness in prices or excess supply of real estate. Both these factors seem to be in play. Aside from this risk, consumers and businesses seem to be in good financial shape with relatively healthy balance sheets.

Second, with regard to the changes in Washington D.C., much has and will be written regarding mid-term power shifts, the third year of a President’s term, tax policy and its relationship to growth, and the war in Iraq. Suffice it to say that there are many interesting challenges facing the financial markets, and managing an investment portfolio requires diligence, attention, and resources.

Each of us at Managers appreciates the trust you express in us by allowing us the privilege of investing some of your capital. We will do everything we can to continue to deserve your trust in the months and years ahead.

| | | | |

| Respectfully, | | | | |

| | |

| | | |  |

| Peter M. Lebovitz | | | | Thomas G. Hoffman, CFA |

| President | | | | Executive Vice President |

| Managers Funds | | | | Chief Investment Officer |

| | | | Managers Investment Group LLC |

1

About Your Fund’s Expenses

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The first line of the table below provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | |

Six Months Ended October 31, 2006 | | Beginning

Account Value

5/1/2006 | | Ending

Account Value

10/31/2006 | | Expenses

Paid During

the Period* |

FQ Tax-Managed U.S. Equity Fund | | | | | | | | | |

Class A Shares 1 | | | | | | | | | |

Projected | | $ | 1,000 | | $ | 1,052 | | $ | 6.41 |

Hypothetical (5% return before expenses) | | $ | 1,000 | | $ | 1,019 | | $ | 6.31 |

Class C Shares 1 | | | | | | | | | |

Projected | | $ | 1,000 | | $ | 1,049 | | $ | 10.28 |

Hypothetical (5% return before expenses) | | $ | 1,000 | | $ | 1,015 | | $ | 10.11 |

Institutional Class Shares | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,054 | | $ | 5.12 |

Hypothetical (5% return before expenses) | | $ | 1,000 | | $ | 1,020 | | $ | 5.04 |

FQ U.S. Equity Fund | | | | | | | | | |

Class A Shares 1 | | | | | | | | | |

Projected | | $ | 1,000 | | $ | 1,071 | | $ | 5.43 |

Hypothetical (5% return before expenses) | | $ | 1,000 | | $ | 1,020 | | $ | 5.30 |

Class C Shares 1 | | | | | | | | | |

Projected | | $ | 1,000 | | $ | 1,069 | | $ | 9.34 |

Hypothetical (5% return before expenses) | | $ | 1,000 | | $ | 1,016 | | $ | 9.10 |

Institutional Class Shares | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,071 | | $ | 4.12 |

Hypothetical (5% return before expenses) | | $ | 1,000 | | $ | 1,021 | | $ | 4.02 |

FQ Global Alternatives Fund 2 | | | | | | | | | |

Class A Shares 2 | | | | | | | | | |

Projected | | $ | 1,000 | | $ | 970 | | $ | 12.41 |

Hypothetical (5% return before expenses) | | $ | 1,000 | | $ | 1,013 | | $ | 12.68 |

Class C Shares 2 | | | | | | | | | |

Projected | | $ | 1,000 | | $ | 967 | | $ | 16.11 |

Hypothetical (5% return before expenses) | | $ | 1,000 | | $ | 1,009 | | $ | 16.46 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

| 1 | Class A and Class C shares commenced operations on March 1, 2006. The amounts listed are based on the operating history of the Institutional Class shares during the past six months plus, Class A and Class C shares Rule 12b-1 fees of 0.25% and 1.00%, respectively. |

| 2 | Class A and Class C shares commenced operations on March 30, 2006. The amounts listed are based on the projected expenses for six months plus, Class A and Class C shares Rule 12b-1 fees of 0.25% and 1.00%, respectively. |

2

FQ Tax-Managed U.S. Equity Fund

Portfolio Manager’s Comments

The fiscal year ending October 31, 2006 was a very solid year. The Institutional Class Shares of the Fund returned 17.37% on a pre-tax basis, while the benchmark Russell 3000 Index returned 16.37%. Please refer to the table on page 4 for returns for various classes of shares and for after-tax returns. It was a very good fiscal year for the market, with most of the gain occurring in the early part of the fiscal year (November through January) and in the last several months of the fiscal year.

It was a market environment characterized by strong corporate profit growth, solid corporate productivity with corporate efficiency that remained at record highs. The market during the past year had valuations trading very close to historic norms – interestingly as corporate profit growth has expanded, multiples have actually stayed constant. Stock prices have more or less been keeping pace with profit growth. Investors are not paying more for that growth.

We have modestly outperformed the market over this time period, following an excellent year last year where we outperformed the market by 10%. The modest outperformance was driven primarily by stock selection. The portfolio positioning did not work quite as well this past fiscal year, as we were slow to move from a smaller-cap orientation to a larger-cap orientation, although we have reduced considerably our smaller-cap tilt as interest rates have increased and economic growth has slowed. The biggest contributors based on stock selection have generally been Financial Services firms - Goldman Sachs (up 51% over the fiscal year), Bear Stearns (44%), Fannie Mae (27%), WR Berkeley (28%). Other very strong contributors have been JC Penney (up 48%) and above all Phelps Dodge (up 84%) on the explosion in commodity prices.

Stock selection did not work out as well in the Energy sector, which we were overweight last year and has struggled in the latter part of this year. The good news is we moved to an underweight stance mid-2006. Dell Computer and United Health Group have also struggled, the former on earnings issues, the latter on options backdating issues. We have taken our profits in United Health, and have reduced our position in Dell to benchmark weight.

On the tax management side we continue to operate with a tax loss carryforward, and will not be delivering a capital gain distribution to our fellow shareholders. In fact we have never delivered a capital gain distribution over the entire history of the Fund, while significantly outperforming the market.

We remain cautiously optimistic looking forward to the next year. Corporate earnings growth continues to impress. Although economic growth is slowing, short-term interest rates have increased, and the housing market mania has cooled, we continue to believe we will see a soft landing for the economy, and continue to believe that U.S. equities offer a compelling risk premium.

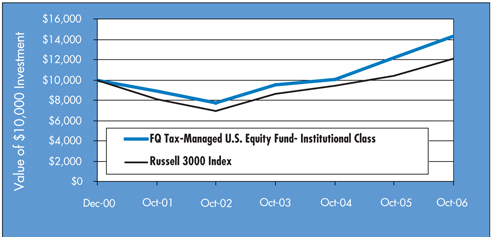

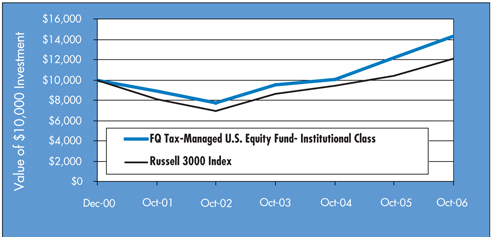

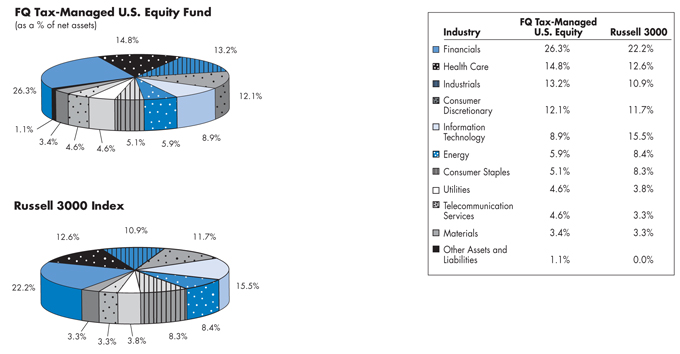

Cumulative Total Return Performance

Managers AMG FQ Tax-Managed U.S. Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. The Russell 3000 Index is composed of the 3000 largest U.S. companies as measured by market capitalization, and represents about 98% of the U.S. stock market. Unlike the Fund, the Russell 3000 Index is unmanaged, is not available for investment, and does not incur expenses. The chart illustrates the performance of a hypothetical

(continued on next page)

3

FQ Tax-Managed U.S. Equity Fund

Portfolio Manager’s Comments (continued)

$10,000 investment made in the Institutional Class Shares of the Fund on December 18, 2000 (commencement of operations) to a $10,000 investment made in the Russell 3000 Index for the same time periods. Performance for periods longer than one year is annualized. Figures include reinvestment of capital gains and dividends. The listed returns for the Fund are net of expenses and the returns for the indices exclude expenses. Total returns for the Fund would have been lower had certain expenses not been reduced.

The table below shows the average annualized total returns for the Managers AMG FQ Tax-Managed U.S. Equity Fund and the Russell 3000 Index since inception through October 31, 2006.

| | | | | | | | | | | |

Average Annual Total Returns | | One Year | | | Five Years | | | Since

Inception | | | Inception

Date |

Managers AMG FQ Tax- Managed U.S. Equity Fund | | | | | | | | | | | |

No Load Before Tax: | | | | | | | | | | | |

Institutional Class | | 17.37 | % | | 9.88 | % | | 6.25 | % | | 12/18/00 |

Class A* | | | | | | | | 6.92 | % | | 3/1/06 |

Class C* | | | | | | | | 6.30 | % | | 3/1/06 |

Russell 3000 Index | | 16.37 | % | | 8.35 | % | | | | | |

No Load After Tax on Distributions | | | | | | | | | | | |

Institutional Class | | 17.30 | % | | 9.69 | % | | 6.09 | % | | 12/18/00 |

Class A* | | | | | | | | 6.92 | % | | 3/1/06 |

Class C* | | | | | | | | 6.30 | % | | 3/1/06 |

No Load After Tax on Distributions & sale of shares | | | | | | | | | | | |

Institutional Class | | 11.29 | % | | 8.48 | % | | 5.31 | % | | 12/18/00 |

Class A* | | | | | | | | 4.50 | % | | 3/1/06 |

Class C* | | | | | | | | 4.10 | % | | 3/1/06 |

With Load Before Tax: | | | | | | | | | | | |

Class A* | | | | | | | | 0.80 | % | | 3/1/06 |

Class C* | | | | | | | | 5.30 | % | | 3/1/06 |

With Load After Tax on Distributions | | | | | | | | | | | |

Class A* | | | | | | | | 0.80 | % | | 3/1/06 |

Class C* | | | | | | | | 5.30 | % | | 3/1/06 |

With Load After Tax on Distributions & sale of shares | | | | | | | | | | | |

Class A* | | | | | | | | 0.52 | % | | 3/1/06 |

Class C* | | | | | | | | 3.45 | % | | 3/1/06 |

| * | Class A and Class C shares commenced operations on March 1, 2006. |

4

FQ Tax-Managed U.S. Equity Fund

Fund Snapshots

October 31, 2006

Portfolio Breakdown

Top Ten Holdings

| | | |

Security Name | | Percentage

of Net Assets | |

Goldman Sachs Group, Inc.* | | 3.9 | % |

Amgen, Inc.* | | 3.5 | |

FedEx Corp. | | 3.5 | |

J.C. Penney Co., Inc.* | | 3.4 | |

Fannie Mae Co.* | | 3.4 | |

Target Corp. | | 3.3 | |

Phelps Dodge Corp. | | 3.1 | |

Bear, Stearns Co. Inc.* | | 3.1 | |

Kroger Co. | | 3.0 | |

Aetna, Inc.* | | 2.9 | |

| | | |

Top Ten as a Group | | 33.1 | % |

| | | |

| * | Top Ten Holding at April 30, 2006 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security.

5

FQ Tax-Managed U.S. Equity Fund

Schedule of Portfolio Investments

October 31, 2006

| | | | | | |

| | | Shares | | | Value |

Common Stocks - 98.9% | | | | | | |

Consumer Discretionary - 12.1% | | | | | | |

J.C. Penney Co., Inc. | | 38,600 | | | $ | 2,903,878 |

Pantry, Inc., The* | | 11,000 | 2 | | | 600,380 |

Service Corp. International | | 38,000 | | | | 346,560 |

Shaw Communications, Inc. | | 61,300 | | | | 2,010,027 |

Starbucks Corp.* | | 12,000 | 2 | | | 453,000 |

Target Corp. | | 47,200 | | | | 2,793,296 |

Walt Disney Co., The | | 35,000 | | | | 1,101,100 |

Total Consumer Discretionary | | | | | | 10,208,241 |

Consumer Staples - 5.1% | | | | | | |

Energizer Holdings, Inc.* | | 12,600 | | | | 984,690 |

Kroger Co. | | 112,800 | | | | 2,536,872 |

Smithfield Foods, Inc.* | | 29,000 | 2 | | | 779,520 |

Total Consumer Staples | | | | | | 4,301,082 |

Energy - 5.9% | | | | | | |

ConocoPhillips Co. | | 39,600 | | | | 2,385,504 |

Occidental Petroleum Corp. | | 3,200 | 2 | | | 150,208 |

Tesoro Corp. | | 33,300 | 2 | | | 2,129,202 |

Valero Energy Corp. | | 6,200 | | | | 324,446 |

Total Energy | | | | | | 4,989,360 |

Financials - 26.3% | | | | | | |

Bank of America Corp. | | 5,000 | | | | 269,350 |

Bear, Stearns & Co., Inc. | | 17,000 | | | | 2,572,950 |

Capital One Financial Corp. | | 14,400 | | | | 1,142,352 |

Centennial Bank Holdings, Inc.* | | 10,400 | | | | 99,840 |

Chubb Corp. | | 1,600 | | | | 85,040 |

CIT Group, Inc. | | 7,200 | | | | 374,760 |

Fannie Mae Co. | | 48,200 | | | | 2,856,332 |

Fidelity National Title Group. Inc. | | 82,800 | 2 | | | 1,822,428 |

Goldman Sachs Group, Inc. | | 17,400 | | | | 3,302,346 |

Hartford Financial Services Group, Inc. | | 2,400 | | | | 209,208 |

Lehman Brothers Holdings, Inc. | | 25,600 | | | | 1,992,704 |

Loews Corp. | | 4,000 | | | | 155,680 |

MGIC Investment Corp. | | 8,800 | | | | 517,088 |

National City Corp. | | 14,074 | 2 | | | 524,257 |

PMI Group, Inc. | | 6,400 | 2 | | | 272,960 |

Popular, Inc. | | 35,800 | 2 | | | 651,202 |

R&G Financial Corp., Class B | | 18,200 | | | | 140,140 |

Radian Group, Inc. | | 34,200 | | | | 1,822,860 |

Safeco Corp. | | 18,000 | | | | 1,047,420 |

Sovereign Bancorp, Inc. | | 80,430 | | | | 1,919,060 |

Wachovia Corp. | | 7,894 | | | | 438,117 |

Total Financials | | | | | | 22,216,094 |

Health Care - 14.8% | | | | | | |

Aetna, Inc. | | 59,800 | | | | 2,464,956 |

Amgen, Inc.* | | 39,000 | | | | 2,960,490 |

Biogen Idec, Inc.* | | 26,000 | 2 | | | 1,237,600 |

Charles River Laboratories | | | | | | |

International, Inc.* | | 13,000 | 2 | | | 557,960 |

CIGNA Corp. | | 2,800 | | | | 327,544 |

Forest Laboratories, Inc.* | | 9,200 | 2 | | | 450,248 |

King Pharmaceuticals, Inc.* | | 19,600 | 2 | | | 327,908 |

Magellan Health Services, Inc.* | | 2,600 | 2 | | | 113,464 |

Mylan Laboratories, Inc. | | 103,000 | | | | 2,111,500 |

Pfizer, Inc. | | 8,800 | | | | 234,520 |

SurModics, Inc.* | | 1,800 | | | | 62,820 |

WellPoint, Inc.* | | 21,200 | | | | 1,617,984 |

Total Health Care | | | | | | 12,466,994 |

Industrials - 13.2% | | | | | | |

Cummins, Inc. | | 4,600 | | | | 584,108 |

Eaton Corp. | | 7,000 | | | | 507,010 |

FedEx Corp. | | 25,500 | | | | 2,920,770 |

Northrop Grumman Corp. | | 27,400 | | | | 1,819,086 |

Parker Hannifin Corp. | | 18,000 | | | | 1,505,340 |

Raytheon Co. | | 28,000 | | | | 1,398,600 |

Reliance Steel & Aluminum Co. | | 40,800 | 2 | | | 1,401,480 |

Waste Connections, Inc.* | | 24,800 | | | | 1,009,112 |

Total Industrials | | | | | | 11,145,506 |

Information Technology - 8.9% | | | | | | |

Arrow Electronics, Inc.* | | 17,800 | | | | 531,330 |

Dell, Inc.* | | 22,000 | | | | 535,260 |

Google, Inc.* | | 4,800 | 2 | | | 2,286,672 |

International Business Machines Corp. | | 10,200 | | | | 941,766 |

Microsoft Corp. | | 43,400 | | | | 1,246,014 |

Motorola, Inc. | | 37,400 | | | | 862,444 |

NCR Corp.* | | 23,600 | | | | 979,872 |

Oracle Corp.* | | 8,200 | | | | 151,454 |

Total Information Technology | | | | | | 7,534,812 |

Materials - 3.4% | | | | | | |

Abitibi-Consolidated, Inc. | | 100,000 | 2 | | | 249,000 |

Phelps Dodge Corp. | | 25,800 | | | | 2,589,804 |

Total Materials | | | | | | 2,838,804 |

Telecommunication Services - 4.6% | | | | | | |

Centurytel, Inc. | | 47,400 | 2 | | | 1,907,376 |

Qwest Communications International, Inc.* | | 232,200 | 2 | | | 2,003,886 |

Total Telecommunication Services | | | | | | 3,911,262 |

The accompanying notes are an integral part of these financial statements.

6

FQ Tax-Managed U.S. Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

| | | Shares | | Value | |

Utilities - 4.6% | | | | | | |

Energen Corp. | | 35,600 | | $ | 1,524,392 | |

Mirant Corp.* | | 81,200 | | | 2,401,084 | |

Total Utilities | | | | | 3,925,476 | |

Total Common Stocks

(cost $ 70,315,114) | | | | | 83,537,631 | |

Other Investment Companies - 17.1%1 | | | | | | |

Bank of New York Institutional Cash Reserves Fund, 5.39%3 | | 13,470,989 | | | 13,470,989 | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 5.18% | | 996,144 | | | 996,144 | |

Total Other Investment Companies

(cost $ 14,467,133) | | | | | 14,467,133 | |

Total Investments - 116.0%

(cost $ 84,782,247) | | | | | 98,004,764 | |

Other Assets, less Liabilities - (16.0)% | | | | | (13,514,686 | ) |

Net Assets - 100.0% | | | | $ | 84,490,078 | |

Note: Based on the cost of investments of $84,790,146 for Federal income tax purposes at October 31, 2006, the aggregate gross unrealized appreciation and depreciation were $13,518,301 and $303,684, respectively, resulting in net unrealized appreciation of investments of $13,214,617.

| * | Non-income-producing securities. |

| 1 | Yield shown for an investment company represents the October 31, 2006, seven-day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

| 2 | Some or all of these shares, amounting to a market value of $13,064,770, or 15.5% of net assets, were out on loan to various brokers. |

| 3 | Collateral received from brokers for securities lending was invested in this short-term investment. |

The accompanying notes are an integral part of these financial statements.

7

FQ U.S. Equity Fund

Portfolio Manager’s Comments

The fiscal year ending October 31, 2006 was a very good year. The Institutional Class shares of the Fund returned 21.44% while the benchmark Russell 3000 Index returned 16.37%. Please refer to the table on page 9 for returns for various classes of shares. It was a very good twelve months for the market, with most of the gain occurring in the early part of the fiscal year (November through January) and in the last several months of the fiscal year. It was our second full fiscal year that we have been managing the Fund, and we are gratified to deliver such a strong performance, more than 5% over the market, after the Fund outperformed by 2% last fiscal year.

It was a market environment characterized by strong corporate profit growth, solid corporate productivity with corporate efficiency that remained at record highs. The market during the past year had valuations trading very close to historic norms – interestingly as corporate profit growth has expanded, multiples have actually stayed constant. Stock prices have more or less been keeping pace with profit growth. Investors are not paying more for that growth.

The primary contributor to the outperformance was stock selection again. Our style tilts were generally neutral - stronger value orientation worked, but the smaller size orientation did not in general. Currently we have moved to neutral on size, and have reduced our value orientation as well, in response to slowing economic growth and rising inflation and interest rates. Several industry overweights worked very well - brokerage houses had an outstanding year, with Goldman Sachs up 51%, Bear Stearns up 44%, and Lehman Brothers up 31%. Telephone stocks did very well, an overweight we introduced early in 2005. Qwest Communications was up 98%, and Verizon and CenturyTel up 24%. Our focus on natural resource stocks was perhaps the single largest contributor after brokerage houses, with Phelps Dodge up 84% and with Nucor (a steel company) more than doubling in price. The final strong performer was JC Penney, in a sector we have generally avoided due to the slowing economy and housing market and rising interest rates. JC Penney dominated its peer group, at least from a stock market perspective, by gaining 48% for the fiscal year.

We remain cautiously optimistic looking forward to the next year. Corporate earnings growth continues to impress. Although economic growth is slowing, short-term interest rates have increased, and the housing market mania has cooled, we continue to believe we will see a soft landing for the economy, and continue to believe that U.S. equities offer a compelling risk premium.

(continued on next page)

8

FQ U.S. Equity Fund

Portfolio Manager’s Comments (continued)

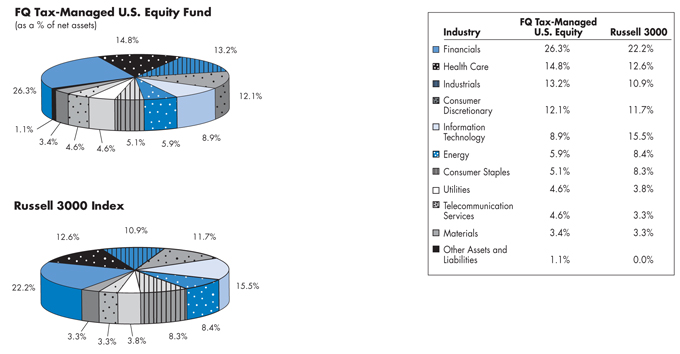

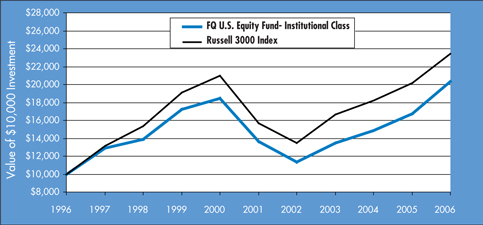

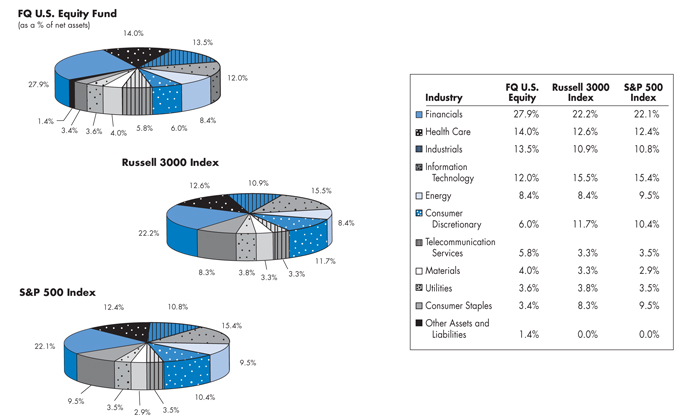

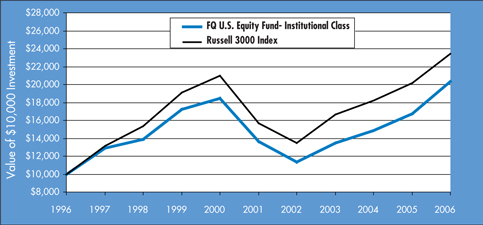

Cumulative Total Return Performance

Managers AMG FQ U.S. Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. The Russell 3000 Index is composed of the 3,000 largest U.S. companies as measured by market capitalization, and represent about 98% of the U.S. stock market. Unlike the Fund, the Russell 3000 Index is unmanaged, is not available for investment, and does not incur expenses. The chart illustrates the performance of a hypothetical $10,000 investment made in the Institutional Class shares of the Fund on October 31, 1996 to a $10,000 investment made in the Russell 3000 Index for the same time period. Performance for periods longer than one year is annualized. Figures include reinvestment of capital gains and dividends. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. Total returns for the Fund would have been lower had certain expenses not been reduced.

The table below shows the average annualized total returns for the Managers AMG FQ U.S. Equity Fund and the Russell 3000 Index since inception through October 31, 2006.

| | | | | | | | | | | | | | |

Average Annual Total Returns | | One Year | | | Five Years | | | Ten Years | | | Since

Inception | | | Inception

Date |

Managers AMG FQ U.S. Equity Fund | | | | | | | | | | | | | | |

No Load: | | | | | | | | | | | | | | |

Institutional Class | | 21.44 | % | | 8.32 | % | | 7.37 | % | | 9.70 | % | | 8/14/92 |

Class A* | | | | | | | | | | | 9.98 | % | | 3/1/06 |

Class C* | | | | | | | | | | | 9.76 | % | | 3/1/06 |

Russell 3000 Index | | 16.37 | % | | 8.35 | % | | 8.89 | % | | | | | |

With Load: | | | | | | | | | | | | | | |

Class A* | | | | | | | | | | | 3.62 | % | | 3/1/06 |

Class C* | | | | | | | | | | | 8.76 | % | | 3/1/06 |

| * | Class A and Class C shares commenced operations on March 1, 2006. |

9

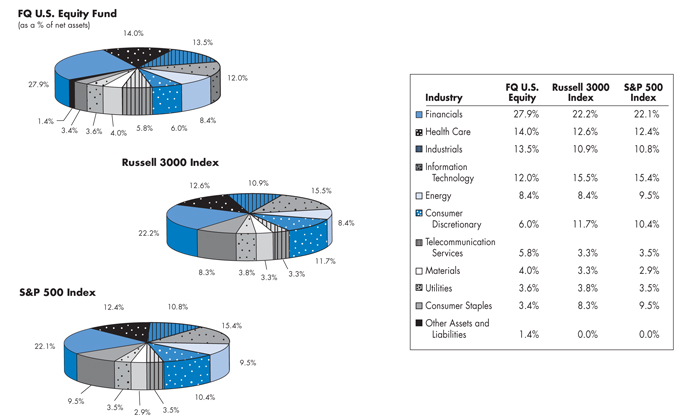

FQ U.S. Equity Fund

Fund Snapshots

October 31, 2006

Portfolio Breakdown

Top Ten Holdings

| | | |

Security Name | | Percentage

of Net Assets | |

Bank of America Corp.* | | 4.6 | % |

Citigroup, Inc.* | | 4.5 | |

Goldman Sachs Group, Inc.* | | 4.1 | |

Amgen, Inc.* | | 3.7 | |

Verizon Communications, Inc.* | | 3.4 | |

Kroger Co. | | 3.0 | |

Applied Materials, Inc. | | 2.9 | |

J.C. Penney Co., Inc.* | | 2.9 | |

Raytheon Co.* | | 2.7 | |

Masco Corp.* | | 2.6 | |

| | | |

Top Ten as a Group | | 34.4 | % |

| | | |

| * | Top Ten Holding at April 30, 2006 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security.

10

FQ U.S. Equity Fund

Schedule of Portfolio Investments

October 31, 2006

| | | | | |

| | | Shares | | Value |

Common Stocks - 98.7% | | | | | |

Consumer Discretionary - 6.0% | | | | | |

American Eagle Outfitters, Inc. | | 19,800 | | $ | 906,840 |

J.C. Penney Co., Inc. | | 29,800 | | | 2,241,854 |

Lowe’s Co., Inc. | | 5,4002 | | | 162,756 |

Marriott International, Inc. | | 9,8002 | | | 409,346 |

NTL, Inc. | | 2,6002 | | | 70,278 |

Pantry, Inc., The* | | 7,8002 | | | 425,724 |

Starbucks Corp.* | | 3,6002 | | | 135,900 |

Target Corp. | | 5,800 | | | 343,244 |

Total Consumer Discretionary | | | | | 4,695,942 |

Consumer Staples - 3.4% | | | | | |

Del Monte Foods Co. | | 11,6002 | | | 125,164 |

Kroger Co. | | 103,400 | | | 2,325,466 |

Parlux Fragrances, Inc.* | | 17,000 | | | 117,810 |

Pilgrim’s Pride Corp., Class B | | 5,2002 | | | 129,896 |

Total Consumer Staples | | | | | 2,698,336 |

Energy - 8.4% | | | | | |

Anadarko Petroleum Corp. | | 3,800 | | | 176,396 |

ChevronTexaco Corp. | | 20,400 | | | 1,370,880 |

ConocoPhillips Co. | | 27,000 | | | 1,626,480 |

Dynegy, Inc., Class A* | | 85,600 | | | 520,448 |

Devon Energy Corp. | | 6,400 | | | 427,776 |

Helmerich & Payne, Inc. | | 11,400 | | | 273,030 |

Hess Corp. | | 2,2002 | | | 93,280 |

Marathon Oil Corp. | | 800 | | | 69,120 |

Patterson-UTI Energy, Inc. | | 3,4002 | | | 78,880 |

Pride International, Inc.* | | 5,8002 | | | 160,138 |

Tesoro Corp. | | 22,4002 | | | 1,432,256 |

Valero Energy Corp. | | 7,400 | | | 387,242 |

Total Energy | | | | | 6,615,926 |

Financials - 27.9% | | | | | |

American Home Mortgage Investment Corp. | | 15,2002 | | | 519,384 |

Bank of America Corp. | | 67,600 | | | 3,641,612 |

Bear, Stearns & Co., Inc. | | 8,8002 | | | 1,331,880 |

Capital One Financial Corp. | | 2,800 | | | 222,124 |

Central Pacific Financial Corp. | | 2,600 | | | 95,654 |

Chubb Corp. | | 15,000 | | | 797,250 |

Citigroup, Inc. | | 70,800 | | | 3,551,328 |

Corus Bankshares, Inc. | | 17,8002 | | | 365,434 |

Fannie Mae Co. | | 10,600 | | | 628,156 |

Goldman Sachs Group, Inc. | | 17,000 | | | 3,226,430 |

Hartford Financial Services Group, Inc. | | 6,200 | | | 540,454 |

JPMorgan Chase & Co. | | 27,800 | | | 1,318,832 |

Lehman Brothers Holdings, Inc. | | 10,400 | | | 809,536 |

MGIC Investment Corp. | | 1,400 | | | 82,264 |

National City Corp. | | 13,000 | | | 484,250 |

PMI Group, Inc. | | 20,8002 | | | 887,120 |

Radian Group, Inc. | | 16,000 | | | 852,800 |

Safeco Corp. | | 17,800 | | | 1,035,782 |

Sovereign Bancorp, Inc. | | 25,410 | | | 606,282 |

Thornburg Mortgage, Inc. | | 6,200 | | | 159,216 |

W Holding Co., Inc. | | 7,800 | | | 44,382 |

Washington Mutual, Inc. | | 17,400 | | | 736,020 |

Total Financials | | | | | 21,936,190 |

Health Care - 14.0% | | | | | |

Aetna, Inc. | | 18,400 | | | 758,448 |

Amgen, Inc.* | | 38,4002 | | | 2,914,944 |

Applera Corp. - Applied Biosystems Group | | 2,800 | | | 104,440 |

Biogen Idec, Inc.* | | 8,2002 | | | 390,320 |

CIGNA Corp. | | 1,600 | | | 187,168 |

Forest Laboratories, Inc.* | | 12,600 | | | 616,644 |

IMS Health, Inc. | | 7,400 | | | 206,090 |

Isis Pharmaceuticals, Inc.* | | 17,400 | | | 149,292 |

Kinetic Concepts, Inc.* | | 8,400 | | | 291,984 |

King Pharmaceuticals, Inc.* | | 32,400 | | | 542,052 |

Magellan Health Services, Inc.* | | 11,4002 | | | 497,496 |

Merck & Co., Inc. | | 24,400 | | | 1,108,248 |

Mylan Laboratories, Inc. | | 50,8002 | | | 1,041,400 |

Pfizer, Inc. | | 55,000 | | | 1,465,750 |

Sierra Health Services, Inc.* | | 16,2002 | | | 554,688 |

Tenet Healthcare Corp.* | | 25,8002 | | | 182,148 |

Total Health Care | | | | | 11,011,112 |

Industrials - 13.5% | | | | | |

Cummins, Inc. | | 6,600 | | | 838,068 |

Eaton Corp. | | 12,200 | | | 883,646 |

Lennox International, Inc. | | 22,400 | | | 603,904 |

Masco Corp. | | 72,6002 | | | 2,007,390 |

Northrop Grumman Corp. | | 29,600 | | | 1,965,144 |

PACCAR, Inc. | | 6,900 | | | 408,549 |

Parker Hannifin Corp. | | 16,200 | | | 1,354,806 |

Pitney Bowes, Inc. | | 3,400 | | | 158,814 |

Raytheon Co. | | 42,000 | | | 2,097,900 |

Reliance Steel & Aluminum Co. | | 7,600 | | | 261,060 |

Ryder System, Inc. | | 1,100 | | | 57,915 |

Total Industrials | | | | | 10,637,196 |

The accompanying notes are an integral part of these financial statements.

11

FQ U.S. Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

| | | Shares | | Value | |

Information Technology - 12.0% | | | | | | |

Applied Materials, Inc. | | 131,800 | | $ | 2,292,002 | |

Arrow Electronics, Inc.* | | 24,000 | | | 716,400 | |

Avaya, Inc.* | | 11,6002 | | | 148,596 | |

Cisco Systems, Inc.* | | 18,200 | | | 439,166 | |

Credence Systems Corp* | | 16,000 | | | 51,520 | |

Exar Corp.* | | 6,600 | | | 85,602 | |

Global Payments, Inc. | | 4,6002 | | | 201,066 | |

Google, Inc.* | | 3,4002 | | | 1,619,726 | |

IKON Office Solutions, Inc. | | 8,000 | | | 119,280 | |

Imation Corp. | | 2,400 | | | 109,848 | |

Ingram Micro, Inc., Class A* | | 20,200 | | | 416,322 | |

Intergraph Corp.* | | 11,600 | | | 506,804 | |

International Business Machines Corp. | | 11,000 | | | 1,015,630 | |

Motorola, Inc. | | 16,500 | | | 380,490 | |

NCR Corp. | | 5,4002 | | | 224,208 | |

Oracle Corp.* | | 24,600 | | | 454,362 | |

Paychex, Inc. | | 8,200 | | | 323,736 | |

Sabre Holdings Corp. | | 11,600 | | | 294,872 | |

Total Information Technology | | | | | 9,399,630 | |

Materials - 4.0% | | | | | | |

Eastman Chemical Co. | | 8002 | | | 48,736 | |

Louisana-Pacific Corp. | | 10,400 | | | 205,712 | |

Lyondell Chemical Co. | | 20,6002 | | | 528,802 | |

Mirant Corp.* | | 23,500 | | | 694,895 | |

Nucor Corp. | | 5,6002 | | | 327,096 | |

Phelps Dodge Corp. | | 13,200 | | | 1,325,016 | |

Total Materials | | | | | 3,130,257 | |

Telecommunication Services - 5.8% | | | | | | |

Centurytel, Inc. | | 30,4002 | | | 1,223,296 | |

Qwest Communications International, Inc.* | | 78,0002 | | | 673,140 | |

Verizon Communications, Inc. | | 71,100 | | | 2,630,700 | |

Total Telecommunication Services | | | | | 4,527,136 | |

Utilities - 3.6% | | | | | | |

Alliant Energy Corp. | | 14,200 | | | 544,570 | |

American Electric Power Co., Inc. | | 19,000 | | | 787,170 | |

Energen Corp. | | 22,200 | | | 950,604 | |

FirstEnergy Corp. | | 6,800 | | | 400,180 | |

National Fuel Gas Co. | | 4,000 | | | 149,600 | |

Total Utilities | | | | | 2,832,124 | |

Total Common Stocks

(cost $68,037,482) | | | | | 77,483,849 | |

Other Investment Companies - 22.5%1 | | | | | | |

Bank of New York Institutional Cash Reserves Fund, 5.39%3 | | 16,874,491 | | | 16,874,491 | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 5.18% | | 779,718 | | | 779,718 | |

Total Other Investment Companies

(cost $ 17,654,209) | | | | | 17,654,209 | |

Total Investments - 121.1%

(cost $ 85,691,691) | | | | | 95,138,058 | |

Other Assets, less Liabilities - (21.1)% | | | | | (16,601,343 | ) |

Net Assets - 100.0% | | | | $ | 78,536,715 | |

Note: Based on the cost of investments of $85,691,692 for Federal income tax purposes at October 31, 2006, the aggregate gross unrealized appreciation and depreciation were $10,429,586 and $954,609, respectively, resulting in net unrealized appreciation of investments of $9,474,977.

| * | Non-income-producing securities. |

| 1 | Yield shown for an investment company represents the October 31, 2006, seven-day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

| 2 | Some or all of these shares, amounting to a market value of $16,346,092, or 20.8% of net assets, were out on loan to various brokers. |

| 3 | Collateral received from brokers for securities lending was invested in this short-term investment. |

The accompanying notes are an integral part of these financial statements.

12

FQ Global Alternatives Fund

Portfolio Manager’s Comments

The underperformance of the Global Alternatives Fund since inception is due to shortfalls in two of its four components. While gains in other dimensions have partially offset the losses, those gains have simply been too modest to overcome the losses from currency selection and country selection in 2006.

Currency selection experienced a material shortfall over the five months from April through August. The “expected equity flow” factor (investment capital fl owing between equity markets applies pressure on currencies) was the main culprit, although the failure of relative valuation to work effectively was also a significant cause of underperformance. Capital flows have behaved as we expected, but the impact on currencies that would be expected from such flows has not materialized. We have developed and examined several hypotheses as to why this may have occurred, but none of these hypotheses has led to solutions that would have worked over longer periods of time. For example, we hypothesized that large swings in the price of crude oil or commodities in general might have led to an offsetting currency impact. In fact, over the five months of underperformance, commodity importing markets such as the U.S. and Japan did experience currency declines, while commodity exporting markets in general, and Canada in particular, experienced currency appreciations. Examining this relationship more closely, we find that while it holds from time to time on a coincident basis, we find no reliable predictive power in this relationship.

With respect to the relative valuation factor, the yen has been the worst performer as the currency has grown very cheap. It is important to note that when relative valuation fails, it usually bounces back – we can just never be sure when that will happen.

Overall, the shortfall experienced in currency has not been extreme. Similar sized shortfalls (and larger) have been experienced several times in the past and the models have typically recovered fully and relatively quickly from these shortfalls. What is unique this time is that it has taken place without material offsetting gains from the other strategies.

Equity market selection has underperformed during this period, with a significant portion of this underperformance occurring in the fourth quarter. A short position on Spanish equities (driven by a large and growing current account deficit as well as modest currency risk) underperformed, as did a long position on Japanese equities (driven by good relative valuation, low currency risk, and an improving current account situation).

Overall, the relative value factor has been a positive contributor, while no premium has been paid to either currency risk or priced volatility risk. It has been the macro economic factors that have struggled this year, particularly in the fourth quarter. Specifically, the current account indicator (we dislike markets where the current account as a percentage of GDP is worsening) has led us towards the wrong countries year-to-date.

Our asset class selection decisions have been excellent this year, but only modest risk has been taken in this dimension due to the opportunity measured being low. Our bullishness on equities, and the corresponding relative bearishness on bonds, peaked at the end of June 2005 and continued to grow less and less aggressive as 2005 progressed. This meant that we began 2006 with a modest bullish posture on equities that shrank until becoming neutral in mid-April of this year. Rising bond yields along with climbing equity prices were principally responsible for the evolution in this position. We profited modestly from our bullish position on equities relative to bonds as equities outperformed bonds over this period. Subsequent to turning bearish on stocks relative to bonds in mid-April, stocks underperformed bonds as equities fell and bond prices rose. The reversal in interest rates (bond yields ceasing to rise and beginning to fall again) led our posture to revert back towards neutral until we passed through neutral again at the beginning of September. We have since moved further into a modest bullish position on global equities relative to bonds.

Bond country selection has delivered moderately strong alpha year to date. After underperforming slightly in the first quarter, it rebounded strongly in the 2nd and 3rd quarters and has begun the 4th quarter with small, but positive, performance. This positive performance has derived mostly from the overweight in Japanese bonds and the underweight in U.K. and Australian bonds. These gains were partially offset by smaller losses from the overweight in U.S. bonds in the first half of the year as well as small losses from the growing underweight in Canadian bonds in the second half of the year. Much of this success has derived from favoring markets with steep and steepening yield curves (relative to own country norms).

(continued on next page)

13

FQ Global Alternatives Fund

Portfolio Manager’s Comments (continued)

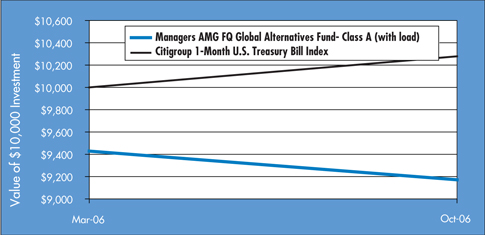

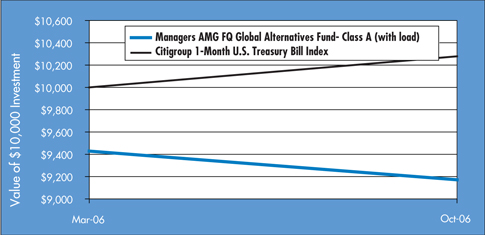

Cumulative Total Return Performance

Managers AMG FQ Global Alternatives Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. The Citigroup 1-Month U.S. Treasury Bill Index (“1-Month Treasury Index”) measures returns of 1-month treasury bills. Unlike the Fund, the 1-Month Treasury Index is unmanaged, is not available for investment, and does not incur expenses. The chart illustrates the performance of a hypothetical $10,000 investment made in the Class A shares (with load) of the Fund on March 30, 2006 (commencement of operations), to a $10,000 investment made in the 1-Month Treasury Index for the same time period. Figures include reinvestment of capital gains and dividends. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. Total returns for the Fund would have been lower had certain expenses not been reduced.

The table below shows the average total returns for the Managers AMG FQ Global Alternatives Fund and the Citigroup 1-Month U.S. Treasury Bill Index since inception through October 31, 2006.

| | | | | |

Average Total Returns | | Since

Inception | | | Inception

Date |

Managers AMG FQ Global Alternatives Equity Fund* | | | | | |

No Load: | | | | | |

Class A | | -2.70 | % | | 3/30/06 |

Class C | | -3.10 | % | | 3/30/06 |

Citigroup 1-Month U.S. Treasury Bill Index 1 | | 2.79 | % | | 3/31/06 |

With Load: | | | | | |

Class A | | -8.29 | % | | 3/30/06 |

Class C | | -4.07 | % | | 3/30/06 |

| * | Commencement of operations was March 30, 2006. |

| 1 | Performance for the Citigroup 1-Month U.S. Treasury Bill Index reflects an inception date of March 31, 2006. |

14

Managers AMG FQ Funds

Statements of Assets and Liabilities

October 31, 2006

| | | | | | | |

| | | FQ Tax- Managed

U.S. Equity | | | FQ U.S.

Equity |

Assets: | | | | | | | |

Investments at value (including securities on loan valued at $13,064,770 and $16,346,092, respectively)* | | $ | 98,004,764 | | | $ | 95,138,058 |

Cash | | | — | | | | 49,784 |

Receivable for investments sold | | | — | | | | 176,000 |

Receivable for Fund shares sold | | | 35,112 | | | | 200 |

Dividends and other receivables | | | 75,526 | | | | 111,449 |

Prepaid expenses | | | 27,498 | | | | 22,936 |

| | | | | | | |

Total assets | | | 98,142,900 | | | | 95,498,427 |

| | | | | | | |

Liabilities: | | | | | | | |

Payable upon return of securities loaned | | | 13,470,989 | | | | 16,874,491 |

Payable to Custodian | | | 31,391 | | | | — |

Payable for Fund shares repurchased | | | 44,374 | | | | — |

Accrued expenses: | | | | | | | |

Investment advisory and management fees | | | 45,265 | | | | 15,812 |

Administration fee | | | — | | | | 16,624 |

Distribution fees | | | 871 | | | | 111 |

Professional fees | | | 26,107 | | | | 27,927 |

Other | | | 33,825 | | | | 26,747 |

| | | | | | | |

Total liabilities | | | 13,652,822 | | | | 16,961,712 |

| | | | | | | |

Net Assets | | $ | 84,490,078 | | | $ | 78,536,715 |

| | | | | | | |

Net Assets Represent: | | | | | | | |

Paid-in capital | | $ | 123,058,756 | | | $ | 60,445,150 |

Undistributed net investment income | | | 61,925 | | | | 687,920 |

Accumulated net realized gain (loss) from investments and futures contracts | | | (51,853,120 | ) | | | 7,928,668 |

Net unrealized appreciation of investments and futures contracts | | | 13,222,517 | | | | 9,474,977 |

| | | | | | | |

Net Assets | | $ | 84,490,078 | | | $ | 78,536,715 |

| | | | | | | |

Class A Shares - Net Assets | | $ | 573,991 | | | $ | 371,029 |

Shares outstanding | | | 41,278 | | | | 24,931 |

| | | | | | | |

Net asset value, offering and redemption price per share | | $ | 13.91 | | | $ | 14.88 |

| | | | | | | |

Public offering price per share based on a maximum sales charge of 5.75% | | $ | 14.76 | | | $ | 15.79 |

Class C Shares - Net Assets | | $ | 941,435 | | | $ | 97,422 |

Shares outstanding | | | 68,090 | | | | 6,562 |

| | | | | | | |

Net asset value, offering and redemption price per share | | $ | 13.83 | | | $ | 14.85 |

| | | | | | | |

Institutional Class Shares - Net Assets | | $ | 82,974,652 | | | $ | 78,068,264 |

Shares outstanding | | | 5,958,394 | | | | 5,238,563 |

| | | | | | | |

Net asset value, offering and redemption price per share | | $ | 13.93 | | | $ | 14.90 |

| | | | | | | |

* Investments at cost | | $ | 84,782,247 | | | $ | 85,691,691 |

The accompanying notes are an integral part of these financial statements.

15

Managers AMG FQ Global Alternatives Fund

Statement of Net Assets

October 31, 2006

| | | | | | | |

| | | Principal

Amount | | Value | |

Assets: | | | | | | | |

Investments in Securities - 101.1% | | | | | | | |

U.S. Government Obligations - 9.3% | | | | | | | |

U.S. Treasury Bond, 4.87%, 12/14/06 1 | | $ | 2,000,000 | | $ | 1,988,330 | |

| | |

| | | Shares | | | |

Short-Term Investments - 91.8% | | | | | | | |

S&P 500 Depositary Receipts | | | 30,000 | | | 4,133,700 | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 5.18% 2 | | | 15,476,059 | | | 15,476,059 | |

| | | | | | | |

Total Investments in securities

(cost $21,366,426) | | | | | | 21,598,089 | |

| | | | | | | |

Cash | | | | | | 76,547 | |

Foreign currency (cost $13,931) | | | | | | 13,931 | |

Receivable for Fund shares sold | | | | | | 18,190 | |

Interest and other receivables | | | | | | 63,640 | |

Receivable for variation margin on futures | | | | | | 65,459 | |

Unrealized gains on forward foreign currency contracts | | | | | | 485,337 | |

Prepaid expenses | | | | | | 30,684 | |

| | | | | | | |

Total assets | | | | | | 22,351,877 | |

| | | | | | | |

Liabilities: | | | | | | | |

Payable for Fund shares repurchased | | | | | | 2,094 | |

Unrealized losses on forward foreign currency contracts | | | | | | 694,915 | |

Payable for variation margin | | | | | | 177,326 | |

Accrued expenses: | | | | | | | |

Investment advisory and management fees | | | | | | 27,974 | |

Administrative fees | | | | | | 4,502 | |

Distribution fees | | | | | | 4,818 | |

Professional fees | | | | | | 39,604 | |

Other | | | | | | 44,835 | |

| | | | | | | |

Total liabilities | | | | | | 996,068 | |

| | | | | | | |

Net Assets | | | | | $ | 21,355,809 | |

| | | | | | | |

Net Assets Represent: | | | | | | | |

Paid-in capital | | | | | $ | 21,899,620 | |

Undistributed net investment income | | | | | | 348,385 | |

Accumulated net realized loss from investments and futures contracts | | | | | | (594,047 | ) |

Accumulated net realized gain from currency contracts | | | | | | 20,984 | |

Net unrealized depreciation of investments, futures and foreign currency contracts | | | | | | (319,133 | ) |

| | | | | | | |

Net Assets | | | | | $ | 21,355,809 | |

| | | | | | | |

Class A Shares - Net Assets | | | | | $ | 20,660,935 | |

Shares outstanding | | | | | | 2,124,039 | |

| | | | | | | |

Net asset value, offering and redemption price per share | | | | | $ | 9.73 | |

| | | | | | | |

Public offering price per share based on a maximum sales charge of 5.75% | | | | | $ | 10.32 | |

Class C Shares - Net Assets | | | | | $ | 694,874 | |

Shares outstanding | | | | | | 71,710 | |

| | | | | | | |

Net asset value, offering and redemption price per share | | | | | $ | 9.69 | |

| | | | | | | |

| 1 | Security pledged to cover margin requirements for open futures positions at October 31, 2006. |

| 2 | Yield shown for an investment company represents the October 31, 2006, seven-day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

The accompanying notes are an integral part of these financial statements.

16

Managers AMG FQ Funds

Statements of Operations

For the fiscal year ended October 31, 2006

| | | | | | | | | | | | |

| | | FQ Tax- Managed U.S. Equity | | | FQ U.S. Equity | | | FQ Global

Alternatives* | |

Investment Income: | | | | | | | | | | | | |

Dividend income | | $ | 838,148 | | | $ | 1,504,971 | | | $ | 31,267 | |

Interest income | | | — | | | | — | | | | 407,613 | |

Securities lending fees | | | 35,021 | | | | 17,728 | | | | — | |

Foreign withholding tax | | | (2,116 | ) | | | (45 | ) | | | — | |

| | | | | | | | | | | | |

Total investment income | | | 871,053 | | | | 1,522,654 | | | | 438,880 | |

| | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | |

Investment advisory and management fees | | | 603,851 | | | | 265,060 | | | | 192,254 | |

Administrative fees | | | — | | | | 189,329 | | | | 28,273 | |

Distribution fees Class A | | | 437 | | | | 136 | | | | 28,090 | |

Distribution fees Class C | | | 2,616 | | | | 55 | | | | 732 | |

Transfer agent | | | 54,986 | | | | 56,150 | | | | 16,043 | |

Registration fees | | | 33,006 | | | | 28,327 | | | | 7,221 | |

Professional fees | | | 32,388 | | | | 34,955 | | | | 40,634 | |

Custodian | | | 30,493 | | | | 31,694 | | | | 24,958 | |

Reports to shareholders | | | 17,919 | | | | 7,115 | | | | 16,641 | |

Trustee fees and expenses | | | 5,944 | | | | 4,944 | | | | 1,324 | |

Miscellaneous | | | 4,556 | | | | 4,176 | | | | 6,172 | |

| | | | | | | | | | | | |

Total expenses before expense reimbursement | | | 786,196 | | | | 621,941 | | | | 362,342 | |

| | | | | | | | | | | | |

Less: Expense reimbursement | | | (79,376 | ) | | | (26,965 | ) | | | (79,067 | ) |

Expense reductions | | | — | | | | (400 | ) | | | — | |

| | | | | | | | | | | | |

Net expenses | | | 706,820 | | | | 594,576 | | | | 283,275 | |

| | | | | | | | | | | | |

Net investment income | | | 164,233 | | | | 928,078 | | | | 155,605 | |

| | | | | | | | | | | | |

Net Realized and Unrealized Gain (Loss): | | | | | | | | | | | | |

Net realized gain on investment transactions | | | 6,163,511 | | | | 7,916,539 | | | | 757 | |

Net realized gain (loss) on futures contracts | | | — | | | | 11,960 | | | | (423,008 | ) |

Net realized gain on foreign currency contracts | | | — | | | | — | | | | 20,984 | |

Net unrealized appreciation of investments | | | 4,777,717 | | | | 5,786,237 | | | | 231,663 | |

Net unrealized appreciation (depreciation) of futures contracts | | | — | | | | 35,735 | | | | (341,218 | ) |

Net unrealized depreciation of foreign currency contracts | | | — | | | | — | | | | (209,578 | ) |

| | | | | | | | | | | | |

Net realized and unrealized gain (loss) | | | 10,941,228 | | | | 13,750,471 | | | | (720,400 | ) |

| | | | | | | | | | | | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 11,105,461 | | | $ | 14,678,549 | | | | ($564,795) | |

| | | | | | | | | | | | |

| * | Commencement of operations was March 30, 2006. |

The accompanying notes are an integral part of these financial statements.

17

Managers AMG FQ Funds

Statements of Changes in Net Assets

For the fiscal years ended October 31,

| | | | | | | | | | | | | | | | | | | | |

| | | FQ Tax- Managed U.S. Equity | | | FQ U.S. Equity | | | FQ Global

Alternatives* | |

| | | 2006 | | | 2005 | | | 2006 | | | 2005 | | | 2006 | |

Increase (Decrease) in Net Assets | | | | | | | | | | | | | | | | | | | | |

From Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | $ | 164,233 | | | $ | 21,634 | | | $ | 928,078 | | | $ | 1,109,164 | | | $ | 155,605 | |

Net realized gain (loss) on investments, futures and foreign currency transactions | | | 6,163,511 | | | | 6,293,568 | | | | 7,928,499 | | | | 11,924,709 | | | | (401,267 | ) |

Net unrealized appreciation (depreciation) of investments, futures and foreign currency translations | | | 4,777,717 | | | | 2,666,656 | | | | 5,821,972 | | | | (4,129,513 | ) | | | (319,133 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 11,105,461 | | | | 8,981,858 | | | | 14,678,549 | | | | 8,904,360 | | | | (564,795 | ) |

| | | | | | | | | | | | | | | | | | | | |

Distributions to Shareholders (Institutional Class): | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (111,569 | ) | | | (448,811 | ) | | | (1,014,832 | ) | | | (931,900 | ) | | | — | |

From net realized gain on investments | | | — | | | | — | | | | (2,823,880 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (111,569 | ) | | | (448,811 | ) | | | (3,838,712 | ) | | | (931,900 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

From Capital Share Transactions: | | | | | | | | | | | | | | | | | | | | |

Proceeds from the sale of shares | | | 30,799,963 | | | | 11,829,718 | | | | 4,809,087 | | | | 3,021,007 | | | | 23,584,230 | |

Net asset value of shares issued in connection with reinvestment of dividends and distributions | | | 103,866 | | | | 429,263 | | | | 3,770,801 | | | | 913,866 | | | | — | |

Cost of shares repurchased | | | (12,784,257 | ) | | | (10,736,051 | ) | | | (13,353,393 | ) | | | (12,315,041 | ) | | | (1,663,626 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net increase (decrease) from capital share transactions | | | 18,119,572 | | | | 1,522,930 | | | | (4,773,505 | ) | | | (8,380,168 | ) | | | 21,920,604 | |

| | | | | | | | | | | | | | | | | | | | |

Total increase (decrease) in net assets | | | 29,113,464 | | | | 10,055,977 | | | | 6,066,332 | | | | (407,708 | ) | | | 21,355,809 | |

| | | | | | | | | | | | | | | | | | | | |

Net Assets: | | | | | | | | | | | | | | | | | | | | |

Beginning of period | | | 55,376,614 | | | | 45,320,637 | | | | 72,470,383 | | | | 72,878,091 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

End of period | | $ | 84,490,078 | | | $ | 55,376,614 | | | $ | 78,536,715 | | | $ | 72,470,383 | | | $ | 21,355,809 | |

| | | | | | | | | | | | | | | | | | | | |

End of period undistributed net investment income | | $ | 61,925 | | | $ | 21,336 | | | $ | 687,920 | | | $ | 774,674 | | | $ | 348,385 | |

Share Transactions: | | | | | | | | | | | | | | | | | | | | |

Sale of shares | | | 2,389,184 | | | | 1,025,346 | | | | 350,267 | | | | 329,310 | | | | 2,363,264 | |

Shares issued in connection with reinvestment of dividends and distributions | | | 8,296 | | | | 39,747 | | | | 291,839 | | | | 74,622 | | | | — | |

Shares repurchased | | | (986,692 | ) | | | (969,422 | ) | | | (976,209 | ) | | | (1,071,398 | ) | | | (167,515 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net increase (decrease) in shares | | | 1,410,788 | | | | 95,671 | | | | (334,103 | ) | | | (667,466 | ) | | | 2,195,749 | |

| | | | | | | | | | | | | | | | | | | | |

| * | Commencement of operations was March 30, 2006. |

The accompanying notes are an integral part of these financial statements.

18

Managers AMG FQ Tax-Managed U.S. Equity Fund

Financial Highlights

For a share outstanding throughout each fiscal period

| | | | | | | | | | | | | | | | | | | | |

| | | For the fiscal year ended October 31, | |

Institutional Class Shares | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

Net Asset Value, Beginning of Year | | $ | 11.89 | | | $ | 9.94 | | | $ | 9.39 | | | $ | 7.74 | | | $ | 8.91 | |

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.03 | | | | 0.01 | | | | 0.11 | | | | 0.06 | | | | 0.06 | |

Net realized and unrealized gain (loss) on investments | | | 2.03 | | | | 2.04 | | | | 0.44 | | | | 1.69 | | | | (1.23 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.06 | | | | 2.05 | | | | 0.55 | | | | 1.75 | | | | (1.17 | ) |

| | | | | | | | | | | | | | | | | | | | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.02 | ) | | | (0.10 | ) | | | — | | | | (0.10 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Year | | $ | 13.93 | | | $ | 11.89 | | | $ | 9.94 | | | $ | 9.39 | | | $ | 7.74 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return 1 | | | 17.37 | % | | | 20.75 | % | | | 5.86 | % | | | 22.90 | % | | | (13.13 | )% |

| | | | | | | | | | | | | | | | | | | | |

Ratio of net expenses to average net assets1 | | | 0.99 | % | | | 0.99 | % | | | 0.99 | % | | | 0.99 | % | | | 1.00 | % |

Ratio of net investment income to average net assets1 | | | 0.23 | % | | | 0.04 | % | | | 0.99 | % | | | 0.68 | % | | | 0.91 | % |

Portfolio turnover | | | 98 | % | | | 105 | % | | | 131 | % | | | 143 | % | | | 101 | % |

Net assets at end of year (000’s omitted) | | $ | 82,975 | | | $ | 55,377 | | | $ | 45,321 | | | $ | 53,538 | | | $ | 8,539 | |

| | | | | | | | | | | | | | | | | | | | |

Expense Offsets:4 | | | | | | | | | | | | | | | | | | | | |

Ratio of total expenses to average net assets | | | 1.11 | % | | | 1.21 | % | | | 1.20 | % | | | 1.62 | % | | | 2.55 | % |

Ratio of net investment income (loss) to average net assets | | | 0.12 | % | | | (0.17 | )% | | | 0.79 | % | | | 0.06 | % | | | (0.63 | )% |

| | | | | | | | | | | | | | | | | | | | |

| | | | |

Class A Shares | | For the fiscal

period ended

October 31, 2006* | |

Net Asset Value, Beginning of Period | | $ | 13.01 | |

Income from Investment Operations: | | | | |

Net investment income | | | 0.005 | |

Net realized and unrealized gain on investments | | | 0.90 | |

| | | | |

Total from investment operations | | | 0.90 | |

| | | | |

Net Asset Value, End of Period | | $ | 13.91 | |

| | | | |

Total Return1 | | | 6.92 | %2 |

| | | | |

Ratio of net expenses to average net assets1 | | | 1.24 | %3 |

Ratio of net investment loss to average net assets1 | | | (0.11 | )%3 |

Portfolio turnover | | | 98 | %2 |

Net assets at end of period (000’s omitted) | | $ | 574 | |

| | | | |

Expense Offsets:4 | | | | |

Ratio of total expenses to average net assets | | | 1.40 | %3 |

Ratio of net investment loss to average net assets | | | (0.27 | )%3 |

| | | | |

| |

Class C Shares | | For the fiscal

period ended

October 31, 2006* | |

Net Asset Value, Beginning of Period | | $ | 13.01 | |

Income from Investment Operations: | | | | |

Net investment loss | | | (0.03 | ) |

Net realized and unrealized gain on investments | | | 0.85 | |

| | | | |

Total from investment operations | | | 0.88 | |

| | | | |

Net Asset Value, End of Period | | $ | 13.89 | |

| | | | |

Total Return1 | | | 6.30 | %2 |

| | | | |

Ratio of net expenses to average net assets1 | | | 1.99 | %3 |

Ratio of net investment loss to average net assets1 | | | (0.91 | )%3 |

Portfolio turnover | | | 98 | %2 |

Net assets at end of period (000’s omitted) | | $ | 941 | |

| | | | |

Expense Offsets:4 | | | | |

Ratio of total expenses to average net assets | | | 2.15 | %3 |

Ratio of net investment loss to average net assets | | | (1.06 | )%3 |

| * | Class A and Class C shares commenced operations on March 1, 2006. (See Notes to Financial Statements.) |

| 1 | Total returns and net investment income would have been lower had certain expenses not been reduced. (See Note 1(c) of Notes to Financial Statements.) |

| 4 | Excludes the impact of expense reimbursements and expense offsets such as brokerage credits, but includes non-reimbursable expenses such as interest and taxes. (See Note 1(c) of Notes to Financial Statements.) |

| 5 | Rounds to less than $0.01. |

19

Managers AMG FQ U.S. Equity Fund

Financial Highlights

For a share outstanding throughout each fiscal period

| | | | | | | | | | | | | | | | | | | | |

| | | For the fiscal year ended October 31, | |

Institutional Class Shares | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

Net Asset Value, Beginning of Year | | $ | 12.93 | | | $ | 11.62 | | | $ | 10.59 | | | $ | 9.03 | | | $ | 10.90 | |

| | | | | | | | | | | | | | | | | | | | |

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.17 | | | | 0.20 | | | | 0.11 | | | | 0.08 | | | | 0.07 | |

Net realized and unrealized gain (loss) on investments | | | 2.49 | | | | 1.26 | | | | 1.00 | | | | 1.56 | | | | (1.87 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.66 | | | | 1.46 | | | | 1.11 | | | | 1.64 | | | | (1.80 | ) |

| | | | | | | | | | | | | | | | | | | | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.18 | ) | | | (0.15 | ) | | | (0.08 | ) | | | (0.08 | ) | | | (0.07 | ) |

Net realized gain on investments | | | (0.51 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.69 | ) | | | (0.15 | ) | | | (0.08 | ) | | | (0.08 | ) | | | (0.07 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Year | | $ | 14.90 | | | $ | 12.93 | | | $ | 11.62 | | | $ | 10.59 | | | $ | 9.03 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return1 | | | 21.44 | % | | | 12.64 | % | | | 10.52 | % | | | 18.37 | % | | | (16.65 | )% |

| | | | | | | | | | | | | | | | | | | | |

Ratio of net expenses to average net assets1 | | | 0.79 | % | | | 0.85 | % | | | 0.79 | % | | | 0.91 | % | | | 1.01 | % |

Ratio of net investment income to average net assets1 | | | 1.23 | % | | | 1.49 | % | | | 0.97 | % | | | 0.82 | % | | | 0.61 | % |

Portfolio turnover | | | 89 | % | | | 105 | % | | | 106 | % | | | 169 | % | | | 74 | % |

Net assets at end of year (000’s omitted) | | $ | 78,068 | | | $ | 72,470 | | | $ | 72,878 | | | $ | 71,265 | | | $ | 63,676 | |

| | | | | | | | | | | | | | | | | | | | |

Expense Offsets:4 | | | | | | | | | | | | | | | | | | | | |

Ratio of total expenses to average net assets | | | 0.82 | % | | | — | | | | — | | | | — | | | | — | |

Ratio of net investment income to average net assets | | | 1.19 | % | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| | | | |

Class A Shares | | For the fiscal

period ended

October 31, 2006* | |

Net Asset Value, Beginning of Period | | $ | 13.53 | |

Income from Investment Operations: | | | | |

Net investment income | | | 0.01 | |

Net realized and unrealized gain on investments | | | 1.34 | |

| | | | |

Total from investment operations | | | 1.35 | |

| | | | |

Net Asset Value, End of Period | | $ | 14.88 | |

| | | | |

Total Return1 | | | 9.98 | %2 |

| | | | |

Ratio of net expenses to average net assets1 | | | 1.04 | %3 |

Ratio of net investment income to average net assets1 | | | 0.63 | %3 |

Portfolio turnover | | | 89 | %2 |

Net assets at end of period (000’s omitted) | | $ | 371 | |

| | | | |

Expense Offsets:4 | | | | |

Ratio of total expenses to average net assets | | | 1.13 | %3 |

Ratio of net investment income to average net assets | | | 0.54 | %3 |

| | | | |

| |

Class C Shares | | For the fiscal

period ended

October 31, 2006* | |

Net Asset Value, Beginning of Period | | $ | 13.53 | |

Income from Investment Operations: | | | | |

Net investment income | | | 0.005 | |

Net realized and unrealized gain on investments | | | 1.32 | |

| | | | |

Total from investment operations | | | 1.32 | |

| | | | |

Net Asset Value, End of Period | | $ | 14.85 | |

| | | | |

Total Return1 | | | 9.76 | %2 |

| | | | |

Ratio of net expenses to average net assets1 | | | 1.79 | %3 |

Ratio of net investment income to average net assets1 | | | 0.16 | %3 |

Portfolio turnover | | | 89 | %2 |

Net assets at end of period (000’s omitted) | | $ | 97 | |

| | | | |

Expense Offsets:4 | | | | |

Ratio of total expenses to average net assets | | | 1.88 | %3 |

Ratio of net investment loss to average net assets | | | (0.07 | )%3 |

| | | | |

| * | Class A and Class C shares commenced operations on March 1, 2006. (See Notes to Financial Statements.) |

| 1 | Total returns and net investment income would have been lower had certain expenses not been reduced. (See Note 1(c) of Notes to Financial Statements.) |

| 4 | Excludes the impact of expense reimbursements and expense offsets such as brokerage credits, but includes non-reimbursable expenses such as interest and taxes. (See Note 1(c) of Notes to Financial Statements.) |

| 5 | Rounds to less than $0.01. |

20

Managers AMG FQ Global Alternatives Fund

Financial Highlights

For a share outstanding throughout the fiscal period

| | | | |

Class A Shares | | For the fiscal

period ended

October 31, 2006* | |

Net Asset Value, Beginning of Period | | $ | 10.00 | |

Income from Investment Operations: | | | | |

Net investment income | | | 0.16 | |

Net realized and unrealized loss on investments | | | (0.43 | ) |

| | | | |

Total from investment operations | | | (0.27 | ) |

| | | | |

Net Asset Value, End of Period | | $ | 9.73 | |

| | | | |

Total Return1 | | | (2.70 | )%2 |

| | | | |

Ratio of net expenses to average net assets1 | | | 2.50 | %3 |

Ratio of net investment income to average net assets1 | | | 1.38 | %3 |

Portfolio turnover | | | 48 | %2 |

Net assets at end of period (000’s omitted) | | $ | 20,661 | |

| | | | |

Expense Offsets:4 | | | | |

Ratio of total expenses to average net assets | | | 3.20 | %3 |

Ratio of net investment income to average net assets | | | 0.68 | %3 |

| | | | |

| |

Class C Shares | | For the fiscal

period ended

October 31, 2006* | |

Net Asset Value, Beginning of Period | | $ | 10.00 | |

Income from Investment Operations: | | | | |

Net investment income | | | 0.02 | |

Net realized and unrealized loss on investments | | | (0.33 | ) |

| | | | |

Total from investment operations | | | (0.31 | ) |

| | | | |

Net Asset Value, End of Period | | $ | 9.69 | |

| | | | |

Total Return1 | | | (3.10 | )%2 |

| | | | |

Ratio of net expenses to average net assets1 | | | 3.25 | %3 |

Ratio of net investment income to average net assets1 | | | 1.03 | %3 |

Portfolio turnover | | | 48 | %2 |

Net assets at end of period (000’s omitted) | | $ | 695 | |

| | | | |

Expense Offsets:4 | | | | |

Ratio of total expenses to average net assets | | | 3.52 | %3 |

Ratio of net investment income to average net assets | | | 0.76 | %3 |

| | | | |

| * | Class A and Class C shares commenced operations at the close of business on March 30, 2006. (See Notes to Financial Statements.) |

| 1 | Total returns and net investment income would have been lower had certain expenses not been reduced. (See Note 1(c) of Notes to Financial Statements.) |

| 4 | Excludes the impact of expense reimbursements and expense offsets such as brokerage credits, but includes non-reimbursable expenses such as interest and taxes. (See Note 1(c) of Notes to Financial Statements.) |

21

Managers AMG FQ Funds

Notes to Financial Statements

October 31, 2006

| 1. | Summary of Significant Accounting Policies |

Managers Trust I Funds (the “Trust”) is an open-end management investment company, organized as a Massachusetts business trust, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). Currently, the Trust is comprised of a number of different funds, each having distinct investment management objectives, strategies, risks, and policies. Included in this report are: Managers AMG FQ Tax-Managed U.S. Equity Fund, formerly First Quadrant Tax-Managed Equity Fund (“Tax-Managed”), Managers AMG FQ U.S. Equity Fund, formerly Managers Structured Core (“U.S. Equity”), and Managers AMG FQ Global Alternatives Fund (“Global Alternatives”), collectively the “Funds.”

On March 1, 2006, two new classes were added to Tax-Managed and U.S. Equity, Class A and Class C, in addition to the existing Institutional Class. Initial investments of $1,500 were made in each new class by Managers Investment Group LLC. Global Alternatives commenced operations on March 30, 2006 with an initial investment of $100 into Class A and $1,500 into Class C by Managers Investment Group LLC. Each class represents an interest in the same assets of the Fund and the classes are identical except for class specific expenses related to shareholder activity. Investment income, realized and unrealized capital gains and losses, the common expenses of the Fund, and certain Fund level expense reductions, if any, are allocated on a pro rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. All classes have equal voting privileges except that each class has exclusive voting rights with respect to its services and/or distribution plan. Sales of Class A shares may be subject to a front-end sales charge of up to 5.75%. Redemptions of Class C shares may be subject to a contingent-deferred sales charge (as a percentage of the original offering price or the net asset value at the time of sale, whichever is less). Tax-Managed and U.S. Equity Institutional Class shares are available, with no sales charge, to certain institutional investors and qualifying individual investors. Please refer to a current prospectus for additional information on each share class.

The Funds’ financial statements are prepared in accordance with accounting principles generally accepted in the United States of America, which require management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Funds in the preparation of their financial statements:

| a. | Valuation of Investments |