UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06520

MANAGERS TRUST I

(Exact name of registrant as specified in charter)

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Address of principal executive offices) (Zip code)

Managers Investment Group LLC

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: OCTOBER 31

Date of reporting period: NOVEMBER 1, 2005 – OCTOBER 31, 2006 (Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

ANNUAL REPORT

Managers Funds

October 31, 2006

| • | | Managers Fremont Global Fund |

| • | | Managers Small Cap Fund |

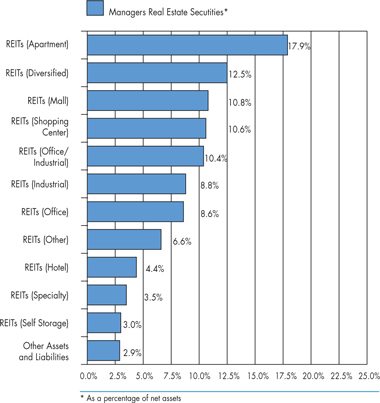

| • | | Managers Real Estate Securities Fund |

| • | | Managers California Intermediate Tax-Free Fund |

| • | | Fremont Money Market Fund |

AR010d

The Managers Funds

Annual Report — October 31, 2006

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of The Managers Funds or Managers AMG Funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Letter to Shareholders

Dear Fellow Shareholder:

The year 2006 has been volatile but rewarding for investors. Markets confronted new Federal Reserve leadership and accompanying communication style, commodity price increases, the end (at least for now) of interest rate hikes, and then a sharp decline in oil prices and a dramatic slowdown in the real estate market. Times like these challenge investors to remove emotion from decisions and remain disciplined with their long-term investment plans.

Regardless of market conditions, we at Managers maintain our focus on providing excellent, trusted, and rigorously monitored investment solutions across all major market segments and styles. We encourage our portfolio managers to take a long-term view and to invest accordingly. We strive to stay on track even when market volatility causes some investors concern.

Our overriding goal is to hire fund managers that can effectively manage assets in all types of market conditions. Toward this goal, we maintain a team of skilled investment professionals focused solely on understanding the global capital markets and overseeing the managers in our Funds. We hire fund portfolio managers who excel over time, have a strong investment discipline, and stick to that discipline.

Regardless of market conditions, we at Managers maintain our focus on providing excellent, trusted, and rigorously monitored investment solutions across all major market segments and styles.

Our investment team oversees the Funds’ managers and portfolios every day so you don’t have to. Once you have selected Managers Funds as part of your asset allocation, you can be assured that we are monitoring that investment every day to help ensure it is delivering on its investment mandate.

As 2006 comes to a close, we begin to think about next year and beyond. The two things we believe will impact investment returns the most are the condition of the economy and the change to the political landscape this fall’s election brings. Obviously, these are only the headlines and there are many subtleties relating to each.

First, with regard to the health of the economy, the risk appears to be the leverage consumers have assumed through their exposure to the residential real estate market. The “house as cash machine” combined with the speculative investment in real estate has increased the economy’s exposure to any weakness in prices or excess supply of real estate. Both these factors seem to be in play. Aside from this risk, consumers and businesses seem to be in good financial shape with relatively healthy balance sheets.

Second, with regard to the changes in Washington D.C., much has and will be written regarding mid-term power shifts, the third year of a President’s term, tax policy and its relationship to growth, and the war in Iraq. Suffice it to say that there are many interesting challenges facing the financial markets, and managing an investment portfolio requires diligence, attention, and resources.

Each of us at Managers appreciates the trust you express in us by allowing us the privilege of investing some of your capital. We will do everything we can to continue to deserve your trust in the months and years ahead.

Respectfully,

| | |

| |  |

Peter M. Lebovitz President Managers Funds | | Thomas G. Hoffman, CFA Executive Vice President Chief Investment Officer Managers Investment Group LLC |

1

About Your Fund’s Expenses

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The first line of the table below provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your on going costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | |

Six Months Ended October 31, 2006 | | Beginning Account Value

5/1/2006 | | Ending Account Value

10/31/2006 | | Expenses Paid

During the

Period* |

Managers Fremont Global Fund | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,022 | | $ | 5.61 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,020 | | $ | 5.60 |

Managers Small Cap Fund | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 983 | | $ | 6.80 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,018 | | $ | 6.92 |

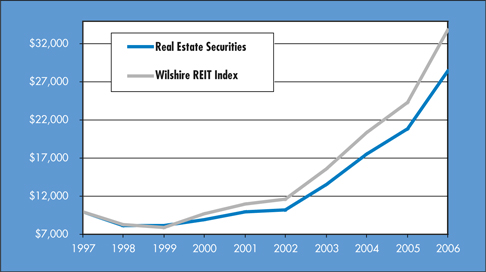

Managers Real Estate Securities Fund | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,180 | | $ | 7.86 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,018 | | $ | 7.27 |

Managers California Intermediate Tax Free Fund | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,050 | | $ | 2.84 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,022 | | $ | 2.80 |

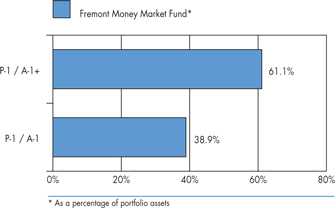

Fremont Money Market Fund | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,023 | | $ | 3.32 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,022 | | $ | 3.31 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

2

Fremont Global Fund

Portfolio Manager’s Comments

Managers Fremont Global Fund seeks to maximize total return while reducing risk by investing in U.S. and international stocks, bonds, and short-term securities (cash).

Northstar Capital Management

Northstar Capital Management’s investment team believes that investing in high quality, high earnings growth companies will generate superior investment returns over full market cycles. To find these companies, the portfolio management team performs fundamental, bottom-up research using a combination of quantitative and qualitative criteria.

The investment process begins with the universe of stocks with market capitalizations exceeding $5 billion. Stocks must also exhibit low volatility and high liquidity. The team then runs a screen to identify stocks that exhibit: (1) higher than market trailing EPS growth; (2) higher than market 5-year projected EPS growth; (3) higher earnings stability; (4) P/E to growth ratio lower than the market; and (5) return on equity higher than the market. This quantitative screen narrows the universe to approximately 100 stocks.

Fundamental, bottom-up analysis is then performed on each company, narrowing the candidate universe down to those with strong qualitative characteristics. Management looks for companies that have excellent businesses with unique characteristics deriving from superior products, niche markets, first-rate customer service, innovative approaches, creative skills, superior management, and high employee involvement. These companies are typically acknowledged leaders in their fields. This qualitative analysis then leads to a portfolio of approximately 25 - 30 names representing the best ideas of the portfolio management team. Stocks in the portfolio are generally equally weighted, and holdings are monitored to assure competitive advantage and growth characteristics.

Armstrong Shaw Associates, Inc.

Jeff Shaw and the investment management team at Armstrong Shaw take a disciplined absolute value approach to investing in the equity market. The team’s goal is to purchase companies that are selling at a substantial discount to intrinsic value. Armstrong Shaw defines intrinsic value as an estimate of what a company would be worth if it were sold as a continuing operation to a knowledgeable buyer. This approach permits price appreciation if the stock grows into its intrinsic value while limiting the risk of significant price depreciation.

The team begins by screening the universe of domestic stocks for those with market caps more than $2.5 billion, P/E ratios below the market average, EPS growth better than 10%, and return on equity better than 15%. The team might also search for certain events or special situations such as restructurings, industry events, or legislative changes. After narrowing the universe to about 200 mid- and large-cap names, the investment team analyzes the companies by speaking with management, suppliers and customers and examining financial statements. Qualitatively, Armstrong Shaw prefers companies with discernable business franchises and a management team with a successful track record. Unlike a deep value manager where price is the main concern, Armstrong Shaw is willing to pay a bit more for a company with a strong business plan as long as the price is still below what the team estimates as the intrinsic value. Quantitatively, the team compares the stock prices to cash flows, EPS, sales, etc. The team will estimate the stock’s intrinsic value and purchase stocks only when they are selling for less than 70% of the estimated intrinsic value.

This results in a portfolio of 30-40 of the team’s best ideas. Another 100 stocks or so remain on a watch list for future consideration. Then the team sets target prices on there stocks that reflect its expectation of 30-50% price appreciation over the next 2-3 years. Thus, turnover tends to be low. The portfolio’s performance is driven by each stock’s appreciation toward its intrinsic value along with rising intrinsic value in response to improved business or industry outlooks. Armstrong Shaw will sell a position when a price target is reached, the company’s fundamentals deteriorate, or if it reports below-expectation financial results. Additionally, a drop in price of 25% from average cost triggers an automatic review process for potential sale.

First Quadrant, L.P.

First Quadrant believes that there are significant and recurring market inefficiencies and that history can help identify which inefficiencies are profitable. Inefficiencies may be identified through ongoing fundamental research conducted by First Quadrant’s research team. Incorporating this fundamental research into a quantitative model leads to a consistent, disciplined investment process.

Led by Chris Luck and Max Darnell, First Quadrant’s investment team uses a proprietary multi-factor quantitative model to construct portfolios that combine a top-down analysis of market and economic conditions with a bottom-up stock selection process. The top-down analysis consists of a review of market and economic data to identify those industries and sectors of the market that are likely to benefit from present and future economic conditions. The top-down analysis helps fund management determine how to tilt the portfolio relative to the benchmark in terms of style, market cap, and industry weightings. Individual stock selection, however, is driven by bottom-up models that focus primarily on market sentiment, valuation, and accounting fundamentals.

Kern Capital Management LLC

Kern Capital Management believes the U.S. micro-cap stock universe provides the opportunity to invest in innovative companies with exceptional growth prospects. With minimal research coverage by brokerage firms and low institutional ownership, Kern Capital Management believes micro-cap stocks represent the least efficient sector of the market.

Bob Kern is one of the pioneers of small-cap and micro-cap investing. While focusing his attention on small companies, Bob Kern and his team direct their efforts toward finding companies that are succeeding through innovation of new products or services. Thus, the portfolio tends to be concentrated in the technology, health care, consumer goods and service sectors. The team seeks to earn returns from the appreciation of stocks as the companies’ products develop and penetrate new markets.

In most cases, the analysis of the product and judgments regarding its potential are the most important aspects of the decision to own a stock. In all cases, however, the operational and financial health of the company must be verified. Bob and the investment team at Kern Capital like to find companies in which margins will increase with revenue growth and that can finance much of their growth from operating cash flow. Although valuation is clearly important, the team is often willing to pay relatively high multiples when it sees compelling growth potential.

3

Fremont Global Fund

Portfolio Manager’s Comments (continued)

Wellington Management Company, LLP

Wellington Management’s portfolio is managed by its International Growth Team (“IGT”), comprised of portfolio managers Jean-Marc Berteaux and Andrew S. Offit. Jean-Marc and Andy are supported by Wellington Management’s global industry analysts and regional analysts as well as specialized fundamental, quantitative, and technical analysts, and traders. The IGT’s investment philosophy is built on the beliefs that industry is the dominant competitive factor for companies, that companies can dominate industries on a global basis, and that expectations about companies, specifically earnings, drive stock prices. Wellington’s focus is to identify industry leaders with earnings forecasts ahead of market expectations, and to identify the key drivers for the earnings.

The initial investable universe is comprised of companies in the MSCI EAFE Index with market capitalizations greater than U.S. $1 billion. These companies are researched by Wellington Management’s specialist group of industry analysts who perform intensive ongoing fundamental analysis. Analysts provide assessments, financial models, and fundamental research to the IGT. The focus of this research is to update an ongoing assessment of management, current business challenges, and aggregate industry trends. Thorough analysis is done in preparation for and following company contacts to ensure that “the numbers support the story” – that the strategy and challenges outlined by management are coming through in financial results. The companies ultimately purchased for the portfolio will exhibit the following characteristics: industry leadership, identified earnings drivers, and above consensus earnings growth expectations. Companies in the portfolio are continually monitored to ensure their fundamental attractiveness based on the identified earnings drivers. Market expectations catching up to their earnings forecast and/or deterioration in earnings drivers will factor into the sell decision. The portfolio will generally hold 50 to 80 securities. Portfolio turnover is expected to be high, exceeding 150% on average per annum. While the portfolio’s holdings-based turnover is expected to be in the 100% range, the IGT will actively trade these positions as a result of significant near-term price movements and other factors.

Bernstein Investment Research and Management

Bernstein’s approach to investing is value-based and research driven. Bernstein’s thesis is that human nature leads investors to buy and sell financial assets based on an overreaction to near-term events as they confuse temporary or cyclical characteristics with structural change. Thus, short-term problems, which cause profits and stocks to decline, can create buying opportunities, as investors underestimate the potential for corrective strategies to restore long-term earnings power. The investment team, led by Kevin Simms, attempts to exploit this by using research to separate fact from emotion. Bernstein’s International Strategic Value discipline is designed to create a focused portfolio of companies with strong fundamentals and sound business prospects not yet reflected in their share price.

The investment process begins with a broad universe of several thousand companies. The investment team screens this universe with a proprietary return model to identify the companies with the most attractive valuations relative to their earnings power. The model derives an expected return for each company by assessing it both from a global industry-based perspective and from a country-based standpoint, including such factors as price to cash earnings, price to book, return on equity, and price momentum. A deep team of analysts perform extensive research, focusing on the most attractively valued stocks. These analysts dissect corporate financial statements and visit company management and also meet frequently with customers, suppliers, or other industry experts. They build spreadsheets of historical and projected balance-sheet and income-statement information in order to estimate normalized earnings power, cash flow and asset values for each company for the next five years, performing simulations to see the potential impact of changes in various components. Analysts then present their estimates and ratings for each security to the Research Review Committee of the Investment Policy Group (IPG). The Committee challenges the analyst’s assumptions and conclusions to ensure they are sound. The IPG uses this research to build a portfolio of approximately 40-60 of the best ideas, building on the combined convictions of Bernstein industry analysts and regional portfolio management teams. A stock is sold when it has achieved forecasted fair value target, or if a change in the earnings forecast reduces the price target to current levels.

333 Global Advisers

Sandie Kinchen of 333 Global Advisers manages the fixed income portion of the portfolio. The manager’s goal is to provide diversification within the global bond environment. The investment process begins with macro analysis of fundamentals that affect bond yields and monetary policies in the G7 countries. The majority of holdings in the portfolio are government bonds, although business cycle and credit research will identify value added opportunities in the investment-grade corporate bond market. This portfolio also holds global inflation-linked bonds to reduce the inflation risk of a typical bond portfolio. The manager applies a macro forecast and interest rate sensitivity analysis to adjust portfolio duration between 4 to 6.5 years. Foreign currency exposures are typically hedged when management is neutral on its currency view. From time to time, the portfolio will have foreign currency exposure based on fundamental analysis of long-term currency trends.

The Year in Review

The financial markets were quite strong during the fiscal year ending October 31, 2006, such that the Fund was able to deliver a satisfying return of 13.67% for the twelve-month period. Most of these gains were paced by stock appreciation. With interest rates remaining modest and corporate profitability at all time highs, stock markets across the globe appreciated meaningfully. Foreign stock markets were especially strong as foreign economies generally seem to be in an earlier stage of economic growth, while the U.S. economy has begun to moderate. In addition, foreign stocks got a boost in U.S. dollar terms as foreign currencies generally appreciated versus the dollar during the period. For example, the MSCI EAFE Index returned 27.5% in U.S. dollars during the period, while the S&P 500 returned 16.3%.

Meanwhile, bonds provided modest yet steady gains throughout the period. In the U.S., even while short-term rates moved sharply higher through most of the period until the Fed finally stopped raising rates, long-term yields moved lower such that bond prices moved higher. Overseas, although rates moved modestly higher, they remain relatively low from an historical standpoint. Foreign currency gains benefited U.S. holders of foreign bonds. The JP Morgan Global Bond Index returned 5.07% for the twelve months ended October 31st.

4

Fremont Global Fund

Portfolio Manager’s Comments (continued)

While nominally satisfying, the return for the Fund was less than its primary benchmark during the period. The Fund returned 13.67% for the twelve months ending October 31, 2006 compared to a return of 16.34% for the S&P 500. The secondary bench-mark, a combination of 65% MSCI World Index (equities) and 35% JPMorgan Global Bond Index –hedged, returned 15.22% during the period. In large part the underperformance was due to the fact that the portfolio had less exposure to foreign stocks and a corresponding overweight in U.S. equities. Although we can be pleased that our decision to increase the Fund’s foreign stock exposure was directionally correct, we could have been even more aggressive. Our decision to increase the Fund’s exposure to foreign currencies within the fixed income portfolio was generally constructive, and our tactical overweight to equities throughout the year was also additive. From a style perspective, we entered fiscal 2006 with a slight bias toward the growth strategies, particularly within the domestic equity managers. While this was sub-optimal during most of the year, we remain convinced that it is prudent and are beginning to see the tide turn.

Looking Forward

Heading into the next fiscal year, the Fund’s long-term neutral allocation is 45% domestic equity, 20% foreign equity, 33% global bonds (both nominal and inflation linked), and 2% cash. On a tactical basis, the Fund’s asset allocation committee is guardedly optimistic, believing that strong corporate profitability and modest economic growth will continue to favor stocks over bonds, particularly in foreign markets. Hence, we will continue to modestly overweight stocks with an increasing proportion of foreign holdings.

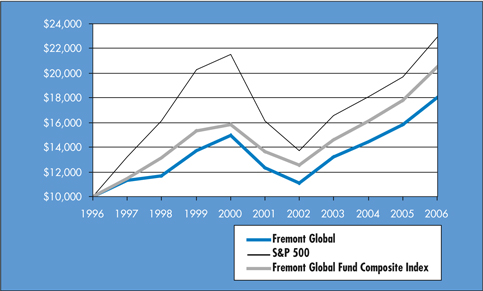

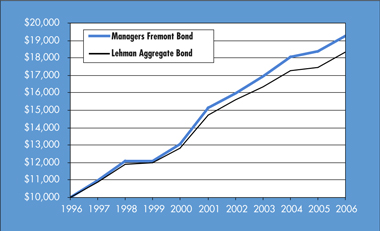

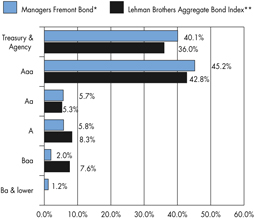

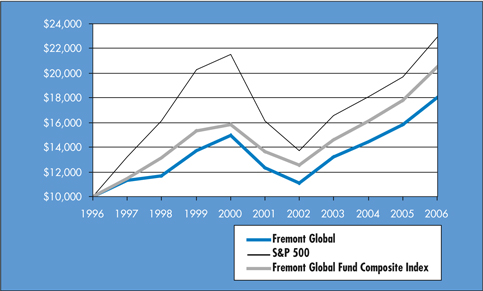

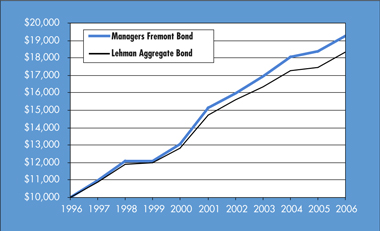

Cumulative Total Return Performance

The Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in aggregate market value of 500 stocks representing all major industries. The Managers Fremont Global Fund Composite Index is a hypothetical representation of the performance of the Fund’s stock and bond asset classes according to their respective weightings in the Fund’s neutral mix (65% global equities and 35% global bonds). The MSCI World Index is Morgan Stanley Capital International’s market capitalization weighted index composed of companies representative of the market structure of 22 developed market countries in North America, Europe, and the Asia/Pacific Region. The index is calculated without dividends, with net or with gross dividends reinvested, in both US dollars and local currencies. Countries include Australia, Hong Kong, Singapore, Austria, Ireland, South Africa, Belgium, Italy, Spain, Canada, Japan, Sweden, Denmark, Malaysia, Switzerland, Finland, Netherlands, United Kingdom, France, New Zealand, United States, Germany and Norway. The JP Morgan Global Government Bond Index (Hedged) consists of issues from 13 international bond markets including Australia, Belgium, Canada, Denmark, France, Germany, Italy, Japan, Netherlands, Spain, Sweden, the United Kingdom, and the United States. The

(continued on next page)

5

Fremont Global Fund

Portfolio Manager’s Comments (continued)

index consist of regularly traded, fixed-rate, domestic government bonds of countries that offer opportunity to international investors. Unlike the Fund, the above stated indices are unmanaged, are not available to investment, and do not incur expenses. The chart illustrates the performance of a hypothetical $10,000 investment made in the Managers Fremont Global Fund on October 31, 1996, to a $10,000 investment made in the above stated indices for the same period. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the indices exclude expenses. Total returns for the Fund would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the Managers Fremont Global Fund, S&P 500 index, and the Managers Fremont Global Fund Composite Index (before taxes) since October 31, 1996 through October 31, 2006.

| | | | | | | | | |

Average Annual Total Returns | | One Year | | | Five Years | | | Ten Years | |

Managers Fremont Global | | 13.67 | % | | 7.89 | % | | 6.05 | % |

S&P 500 Index | | 16.34 | % | | 7.26 | % | | 8.64 | % |

Fremont Global Composite Index | | 15.22 | % | | 8.45 | % | | 7.44 | % |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end please call (800) 835-3879 or visit our Web site at www.managersinvest.com.

Investment in foreign securities are subject to additional risks such as erratic market conditions, economic and political instability, and currency exchange rate fluctuations.

Changing interest rates may adversely affect the value of an investment. An increase in interest rates typically causes the value of bonds and other fixed-income securities to fall.

6

Managers Fremont Global Fund

Fund Snapshots

October 31, 2006

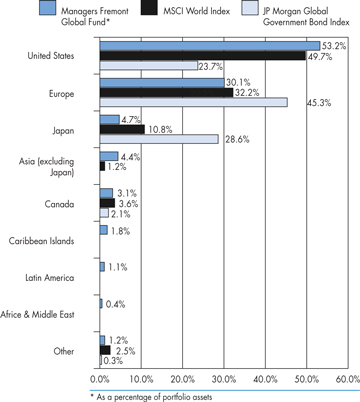

Portfolio Breakdown

| | | | | | | | | |

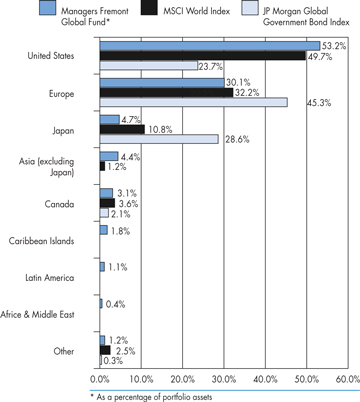

Geographic Diversification | | Managers Fremont Global Fund* | | | JP Morgan Global Government Bond Index | | | MSCI World Index | |

United States | | 53.2 | % | | 23.7 | % | | 49.7 | % |

Europe | | 30.1 | % | | 45.3 | % | | 32.2 | % |

Japan | | 4.7 | % | | 28.6 | % | | 10.8 | % |

Asia (excluding Japan) | | 4.4 | % | | 0.0 | % | | 1.2 | % |

Canada | | 3.1 | % | | 2.1 | % | | 3.6 | % |

Caribbean Islands | | 1.8 | % | | 0.0 | % | | 0.0 | % |

Latin America | | 1.1 | % | | 0.0 | % | | 0.0 | % |

Africe & Middle East | | 0.4 | % | | 0.0 | % | | 0.0 | % |

Other | | 1.2 | % | | 0.3 | % | | 2.5 | % |

Top Ten Holdings

| | | |

Security Name | | Percentage of Net Assets | |

Norwegian Government, 5.000%, 05/15/15* | | 1.4 | % |

Bank of America Corp.* | | 1.2 | |

France Telecom SA, 7.000%, 12/23/09* | | 1.1 | |

Pemex Project Funding Master Trust, 6.625%, 04/04/10* | | 1.1 | |

U.S. Treasury Bonds, 4.875%, 08/15/06 | | 1.1 | |

U.K. Gilts, 4.750%, 03/04/20* | | 1.1 | |

Citigroup, Inc.* | | 1.1 | |

France, Government of, 3.400%, 07/25/29* | | 1.1 | |

France, Government of, 8.500%, 10/25/19* | | 1.0 | |

U.K. Gilts, 4.000%, 03/07/09 | | 1.0 | |

| | | |

Top Ten as a Group | | 11.2 | % |

| | | |

| * | Top Ten Holding at April 30, 2006 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security.

7

Managers Fremont Global Fund

Schedule of Portfolio Investments

October 31, 2006

| | | | | |

| | | Shares | | Value |

Common Stocks - 66.7% | | | | | |

Consumer Discretionary - 8.7% | | | | | |

American Eagle Outfitters, Inc. | | 7,000 | | $ | 320,600 |

Aristocrat Leisure, Ltd. (Australia) | | 9,8883 | | | 106,591 |

A.T. Cross Co.* | | 1,800 | | | 12,384 |

Carphone Warehouse Group, The (United Kingdom) | | 95,652 | | | 516,042 |

Century Casinos, Inc.* | | 10,000 | | | 103,300 |

Coach, Inc. | | 25,000 | | | 991,000 |

Comcast Corp., Special Class A | | 24,6803 | | | 999,046 |

Continental AG (Germany) | | 5,600 | | | 627,364 |

Debenhams PLC (United Kingdom) | | 56,781 | | | 203,371 |

dELiA*s Corp.* | | 3,529 | | | 32,043 |

EMI Group PLC (United Kingdom) | | 92,251 | | | 474,324 |

Garmin, Ltd. (Cayman Islands) | | 7,5003 | | | 400,575 |

Harley-Davidson, Inc. | | 14,0003 | | | 960,820 |

Harris Interactive, Inc.* | | 14,100 | | | 94,188 |

Hyundai Motor Co. - Sponsored GDR (South Korea) (a) | | 1,2003 | | | 48,000 |

IMAX Corp. (Canada) | | 13,5003 | | | 66,015 |

J.C. Penney Co., Inc.* | | 9,760 | | | 734,245 |

KarstadtQuelle AG (Germany)* | | 2,6133 | | | 61,545 |

Kesa Electricals PLC (United Kingdom) | | 46,349 | | | 308,948 |

Koninklijke (Royal) Phillips Electronics N.V. (Netherlands) | | 14,453 | | | 503,439 |

Lakes Gaming, Inc.* | | 5,900 | | | 67,024 |

Leopalace21 Corp. (Japan) | | 3,200 | | | 120,168 |

Lowe’s Co., Inc. | | 47,7403 | | | 1,438,884 |

Marriott International, Inc. | | 3,4003 | | | 142,018 |

Nevada Gold & Casinos, Inc.* | | 9,000 | | | 48,960 |

News Corp., Inc., Class A* | | 43,000 | | | 896,550 |

NTL, Inc. | | 1,2003 | | | 32,436 |

Pantry, Inc., The* | | 2,6003 | | | 141,908 |

Persimmon PLC (United Kingdom) | | 4,200 | | | 106,912 |

Pinault-Printemps-Redoute SA (France) | | 2,778 | | | 414,270 |

Rakuten, Inc. (Japan)* | | 2313 | | | 102,507 |

Reed Elsevier PLC (United Kingdom) | | 24,570 | | | 279,320 |

Renault SA (France) | | 5,700 | | | 665,979 |

Scopus Video Neworks, Ltd. (Israel)* | | 9,4003 | | | 35,720 |

Sharp Corp. (Japan) | | 23,000 | | | 409,403 |

Starbucks Corp. | | 22,6003 | | | 853,150 |

SUZUKI MOTOR Corp. (Japan) | | 11,000 | | | 311,649 |

Swatch Group AG, The (Switzerland) | | 5,963 | | | 238,169 |

Target Corp. | | 2,600 | | | 153,868 |

Time Warner, Inc.* | | 48,0003 | | | 960,480 |

Toyota Motor Corp. (Japan) | | 11,300 | | | 667,214 |

Wyndham Worldwide Corp. | | 7,176 | | | 211,692 |

Total Consumer Discretionary | | | | | 15,862,121 |

| | |

Consumer Staples - 3.8% | | | | | |

Admiral Group PLC (United Kingdom)* | | 3,528 | | | 62,437 |

Boots Group PLC (United Kingdom) | | 25,012 | | | 386,369 |

British American Tobacco PLC (United Kingdom) | | 7,200 | | | 196,091 |

ConAgra Foods, Inc. | | 600 | | | 15,690 |

CVS Corp. | | 16,420 | | | 515,260 |

Del Monte Foods Co.* | | 4,2003 | | | 45,318 |

Deutche Luftansa AG (Germany) | | 12,600 | | | 291,344 |

Fomento Economico Mexicano SA de CV (Mexico) | | 1,600 | | | 154,704 |

Groupe Danone (France)* | | 3,888 | | | 569,228 |

J Sainsbury PLC (United Kingdom) | | 61,500 | | | 459,451 |

Japan Tobacco, Inc. (Japan) | | 250 | | | 1,088,114 |

Kroger Co.* | | 34,000 | | | 764,660 |

Nestle SA, Registered (Switzerland) | | 675 | | | 230,658 |

Parlux Fragrances, Inc. | | 6,200 | | | 42,966 |

Pilgrim’s Pride Corp., Class B | | 1,4003 | | | 34,972 |

Reckitt Benckiser PLC (United Kingdom) | | 8,103 | | | 352,265 |

Swedish Match AB (Sweden) | | 18,400 | | | 293,966 |

Tesco PLC (United Kingdom) | | 82,211 | | | 616,768 |

Walgreen Co. | | 17,000 | | | 742,560 |

Total Consumer Staples | | | | | 6,862,821 |

| | |

Energy - 4.4% | | | | | |

Anadarko Petroleum Corp. | | 1,200 | | | 55,704 |

Apache Corp.* | | 400 | | | 26,128 |

BP PLC (United Kingdom) | | 12,800 | | | 143,094 |

ChevronTexaco Corp. | | 20,100 | | | 1,350,720 |

China Petroleum and Chemical Corp., Class H (Hong Kong) | | 368,000 | | | 255,218 |

ConocoPhillips Co. | | 19,310 | | | 1,163,234 |

Devon Energy Corp. | | 15,800 | | | 1,056,072 |

Dynegy, Inc., Class A | | 26,600 | | | 161,728 |

Eni S.p.A. (Italy) | | 14,900 | | | 450,722 |

Helmerich & Payne, Inc. | | 3,000 | | | 71,850 |

Hess Corp. | | 6003 | | | 25,440 |

Linde AG (Germany) | | 1,057 | | | 104,894 |

Marathon Oil Corp. | | 200 | | | 17,280 |

The accompanying notes are an integral part of these financial statements.

8

Managers Fremont Global Fund

Schedule of Portfolio Investments (continued)

| | | | | |

| | | Shares | | Value |

Energy (continued) | | | | | |

Mirant Corp.* | | 6,400 | | $ | 189,248 |

MOL Magyar Olaj- es Gazipari Rt. (Hungary)* | | 1,970 | | | 195,922 |

Patterson-UTI Energy, Inc. | | 1,4003 | | | 32,480 |

PetroChina Co., Ltd. (China)* | | 100,000 | | | 110,356 |

Petroleo Brasileiro S.A. (Brazil) | | 5,300 | | | 429,088 |

Pride International, Inc.* | | 1,0003 | | | 27,610 |

Repsol YPF, S.A. (Spain) | | 11,200 | | | 372,334 |

Smith International, Inc.* | | 22,1003 | | | 872,508 |

SulphCo, Inc.* | | 12,9003 | | | 70,563 |

Tesoro Corp. | | 7,6003 | | | 485,944 |

Total SA (France) | | 4,8003 | | | 324,700 |

Valero Energy Corp.* | | 2,200 | | | 115,126 |

Total Energy | | | | | 8,107,963 |

| | |

Financials - 17.9% | | | | | |

Allianz AG (Germany) | | 1,802 | | | 334,852 |

Allstate Corp., The | | 6,780 | | | 416,021 |

American Express Co. | | 16,900 | | | 976,989 |

American Home Mortgage Investment Corp. | | 5,4003 | | | 184,518 |

American International Group, Inc. | | 15,740 | | | 1,057,256 |

Aviva PLC (United Kingdom) | | 30,100 | | | 444,616 |

Banco Bilbao Vizcaya Argentaria SA (Spain) | | 10,036 | | | 242,228 |

Bank of America Corp. | | 40,789 | | | 2,197,302 |

Barclays PLC (United Kingdom) | | 36,700 | | | 494,484 |

Bear, Stearns & Co., Inc.* | | 3,0003 | | | 454,050 |

Blackrock, Inc. | | 2,2003 | | | 331,848 |

BNP Paribas SA (France) | | 7,825 | | | 859,399 |

BOC Hong Kong Holdings, Ltd. (Hong Kong)* | | 128,500 | | | 287,134 |

British Land Co., PLC (United Kingdom) | | 12,105 | | | 345,184 |

Capital One Financial Corp. | | 4,240 | | | 336,359 |

Cash Systems, Inc.* | | 19,100 | | | 113,645 |

CB Richard Ellis Group, Inc. | | 29,700 | | | 891,891 |

Central Pacific Financial Corp. | | 1,400 | | | 51,506 |

Chicago Mercantile Exchange Holdings, Inc.* | | 2,0003 | | | 1,002,000 |

Chubb Corp. | | 11,890 | | | 631,954 |

Citigroup, Inc. | | 39,200 | | | 1,966,271 |

Corus Bankshares, Inc. | | 6,4003 | | | 131,392 |

Credit Agricole SA (France) | | 8,400 | | | 356,872 |

Credit Suisse Group (Switzerland) | | 8,200 | | | 494,304 |

Deutsche Boerse AG (Germany) | | 2,342 | | | 378,327 |

Erste Bank der oesterreichischen Sparkassen AG (Austria)* | | 4,360 | | | 296,603 |

Euronext NV (Netherlands) | | 1,011 | | | 100,953 |

Fannie Mae Co. | | 3,600 | | | 213,336 |

Fondiaria-Sai SpA (Italy) | | 4,200 | | | 186,847 |

Fondiaria-Sai SpA - RNC (Italy)* | | 600 | | | 19,927 |

Fortis (Belgium)* | | 6,100 | | | 255,790 |

Franklin Resources, Inc. | | 9,300 | | | 1,059,828 |

Friends Provident PLC (United Kingdom) | | 38,000 | | | 150,025 |

Goldman Sachs Group, Inc. | | 5,600 | | | 1,062,824 |

Hartford Financial Services Group, Inc.* | | 2,200 | | | 191,774 |

HBOS PLC (United Kingdom) | | 26,370 | | | 546,306 |

ING Groep NV (Netherlands) | | 19,700 | | | 872,478 |

JPMorgan Chase & Co. | | 10,400 | | | 493,376 |

KBC Bank & Insurance Group, Inc. (Belgium) | | 938 | | | 102,426 |

Kookmin Bank, Sponsored ADR (South Korea) | | 2,900 | | | 230,144 |

Lehman Brothers Holdings, Inc. | | 15,400 | | | 1,198,735 |

Man Group PLC (United Kingdom) | | 35,466 | | | 329,548 |

Merrill Lynch & Co., Inc. | | 6,100 | | | 533,262 |

MGIC Investment Corp.* | | 400 | | | 23,504 |

Moody’s Corp. | | 15,400 | | | 1,021,020 |

Morgan Stanley Co. | | 14,400 | | | 1,100,592 |

Muenchener Rueckversicherungs AG (Germany) | | 3,400 | | | 551,202 |

National City Corp. | | 3,800 | | | 141,550 |

North Fork Bancorporation, Inc. | | 14,740 | | | 421,269 |

ORIX Corp. (Japan) | | 2,990 | | | 840,890 |

PMI Group, Inc. | | 7,4003 | | | 315,610 |

Radian Group, Inc.* | | 5,6003 | | | 298,480 |

Royal Bank of Scotland Group PLC (United Kingdom) | | 15,900 | | | 566,011 |

Safeco Corp. | | 6,200 | | | 360,778 |

Shinsei Bank, Ltd. (Japan) | | 13,000 | | | 74,958 |

Shun TAK Holdings, Ltd. (Hong Kong) | | 190,000 | | | 250,681 |

Sino Land Co., Ltd. (Hong Kong)* | | 67,4013 | | | 117,174 |

Societe Generale (France) | | 2,730 | | | 453,220 |

Sovereign Bancorp, Inc. | | 8,610 | | | 205,435 |

Standard Bank Group, Ltd. (South Africa)* | | 17,500 | | | 205,634 |

Standard Chartered, PLC (United Kingdom)* | | 11,685 | | | 328,721 |

Sumitomo Mitsui Financial Group, Inc. (Japan) | | 48 | | | 524,558 |

The accompanying notes are an integral part of these financial statements.

9

Managers Fremont Global Fund

Schedule of Portfolio Investments (continued)

| | | | | |

| | | Shares | | Value |

Financials (continued) | | | | | |

Sumitomo Realty & Development Co., Ltd. (Japan)* | | 11,000 | | $ | 364,440 |

Thornburg Mortgage, Inc. | | 2,800 | | | 71,904 |

UBS AG (Switzerland) | | 7,000 | | | 417,987 |

Unibail (France) | | 6673 | | | 145,150 |

Washington Mutual, Inc. | | 24,900 | | | 1,053,270 |

Total Financials | | | | | 32,678,622 |

| | |

Health Care - 7.0% | | | | | |

Abbott Laboratories Co. | | 14,500 | | | 688,895 |

Aetna, Inc.* | | 6,200 | | | 255,564 |

Amgen, Inc.* | | 23,400 | | | 1,776,293 |

AngioDynamics, Inc.* | | 4,400 | | | 95,260 |

Applera Corp. - Applied Biosystems Group* | | 1,200 | | | 44,760 |

AstraZeneca PLC (United Kingdom) | | 5,195 | | | 306,154 |

AstraZeneca PLC - Sponsored ADR (United Kingdom) | | 9,400 | | | 551,780 |

Biogen Idec, Inc. | | 3,0003 | | | 142,800 |

Boston Scientific Corp. | | 33,760 | | | 537,122 |

Cardica, Inc.* | | 5,700 | | | 24,624 |

Cepheid, Inc.* | | 8,600 | | | 70,606 |

CIGNA Corp.* | | 600 | | | 70,188 |

Conceptus, Inc.* | | 10,900 | | | 216,038 |

Cyberonics, Inc. | | 2,700 | | | 48,681 |

Daiichi Sankyo Co., Ltd. (Japan)* | | 9,600 | | | 285,268 |

Eclipsys Corp.* | | 8,400 | | | 177,996 |

Eisai Co., Ltd. (Japan) | | 6,600 | | | 337,596 |

Elan Corp., PLC - Sponsored ADR (Ireland)* | | 14,6003 | | | 211,408 |

Essilor International SA (France) | | 2,225 | | | 233,206 |

Forest Laboratories, Inc. | | 4,200 | | | 205,548 |

Gilead Sciences, Inc. | | 14,4003 | | | 992,160 |

GlaxoSmithKline PLC (United Kingdom) | | 3,500 | | | 93,277 |

Harvard Bioscience, Inc.* | | 11,200 | | | 57,232 |

HCA, Inc.* | | 8,4403 | | | 426,389 |

ICON PLC (Ireland)* | | 2,600 | | | 93,288 |

Isis Pharmaceuticals, Inc. | | 7,600 | | | 65,208 |

Kinetic Concepts, Inc. | | 2,8003 | | | 97,328 |

King Pharmaceuticals, Inc. | | 11,600 | | | 194,068 |

Magellan Health Services, Inc.* | | 4,2003 | | | 183,288 |

Medtronic, Inc. | | 16,400 | | | 798,352 |

Merck & Co., Inc.* | | 8,600 | | | 390,612 |

Mylan Laboratories, Inc.* | | 17,0003 | | | 348,500 |

NeoPharm, Inc.* | | 23,262 | | | 168,417 |

Nobel Biocare Holding AG (Switzerland) | | 630 | | | 172,369 |

NxStage Medical, Inc.* | | 4,300 | | | 31,519 |

Omnicell, Inc.* | | 10,300 | | | 192,919 |

Pfizer, Inc. | | 34,000 | | | 906,100 |

Regeneration Technologies, Inc.* | | 27,600 | | | 175,812 |

Roche Holding AG (Switzerland) | | 1,026 | | | 179,641 |

Sanofi -Synthelabo SA (France)* | | 5,172 | | | 440,404 |

Sierra Health Services, Inc. | | 5,8003 | | | 198,592 |

Tenet Healthcare Corp.* | | 8,8003 | | | 62,128 |

UCB SA (Belgium) | | 1,5473 | | | 95,681 |

Vital Images, Inc. | | 2,200 | | | 68,288 |

Total Health Care | | | | | 12,711,359 |

| | |

Industrials - 7.9% | | | | | |

Air France - KLM (France) | | 4,600 | | | 163,841 |

BAE Systems PLC (United Kingdom) | | 36,800 | | | 294,234 |

British Airways PLC (United Kingdom)* | | 25,243 | | | 220,797 |

Buzzi Unicem S.p.A (Italy) | | 9,100 | | | 239,747 |

Caterpillar, Inc. | | 12,000 | | | 728,520 |

Coinstar, Inc.* | | 1,200 | | | 36,456 |

Cummins, Inc. | | 2,000 | | | 253,960 |

Eaton Corp. | | 3,800 | | | 275,234 |

Emerson Electric Co. | | 8,150 | | | 687,860 |

European Aeronautic Defense and Space Co. (Netherlands) | | 8,4003 | | | 227,503 |

Flow International Corp.* | | 9,700 | | | 114,266 |

Fuel Tech, Inc.* | | 1,800 | | | 35,370 |

General Electric Co. | | 46,200 | | | 1,622,081 |

Global Traffic Network, Inc.* | | 14,300 | | | 71,071 |

Honeywell International, Inc. | | 11,100 | | | 467,532 |

InnerWorkings, Inc.* | | 3,600 | | | 53,820 |

Insituform Technologies, Inc.* | | 800 | | | 18,696 |

KVH Industries, Inc.* | | 4,600 | | | 50,232 |

Lennox International, Inc. | | 8,000 | | | 215,680 |

Lockheed Martin Corp. | | 9,900 | | | 860,607 |

Masco Corp. | | 23,2003 | | | 641,480 |

Mitsui O.S.K. Lines, Ltd. (Japan) | | 25,000 | | | 208,185 |

Northrop Grumman Corp. | | 10,800 | | | 717,012 |

PACCAR, Inc.* | | 2,700 | | | 159,867 |

Parker Hannifin Corp. | | 5,200 | | | 434,876 |

PDG Environmental, Inc.* | | 44,500 | | | 44,500 |

Pitney Bowes, Inc. | | 17,600 | | | 822,096 |

Potash Corp. of Saskatchewan, Inc. (Canada) | | 900 | | | 112,410 |

The accompanying notes are an integral part of these financial statements.

10

Managers Fremont Global Fund

Schedule of Portfolio Investments (continued)

| | | | | |

| | | Shares | | Value |

Industrials (continued) | | | | | |

Powell Industries, Inc.* | | 4,700 | | $ | 112,659 |

Raytheon Co. | | 14,600 | | | 729,270 |

Reliance Steel & Aluminum Co. | | 2,400 | | | 82,440 |

Ryanair Holdings PLC (Ireland)* | | 4,5003 | | | 300,690 |

Ryder System, Inc.* | | 400 | | | 21,060 |

SNC-Lavalin Group, Inc. (Canada) | | 7,900 | | | 215,694 |

Stanley, Inc.* | | 2,900 | | | 50,518 |

Sumitomo Heavy Industries, Ltd. (Japan) | | 31,000 | | | 265,089 |

TVI Corp.* | | 58,200 | | | 171,690 |

Tyco International, Ltd. | | 23,400 | | | 688,662 |

United Technologies Corp. | | 22,000 | | | 1,445,840 |

Wright Express Corp. (France) | | 2,139 | | | 531,692 |

Total Industrials | | | | | 14,393,237 |

| | |

Information Technology - 10.3% | | | | | |

Acacia Research Corp.* | | 3,800 | | | 48,564 |

Access Integrated Technologies, Inc.* | | 4,600 | | | 48,944 |

Airspan Networks, Inc. | | 32,000 | | | 94,400 |

Aladdin Knowledge Systems, Ltd. (Israel)* | | 3,300 | | | 58,938 |

Alcatel SA (France) | | 8,026 | | | 101,887 |

Anaren Microwave, Inc.* | | 6,000 | | | 120,660 |

Apple Computer, Inc. | | 13,6003 | | | 1,102,688 |

Applied Materials, Inc. | | 32,800 | | | 570,392 |

ARM Holdings PLC (United Kingdom)* | | 129,180 | | | 289,671 |

Arrow Electronics, Inc.* | | 5,200 | | | 155,220 |

ASML Holding N.V. (Netherlands)* | | 9,976 | | | 227,637 |

Astro-Med, Inc. | | 5,425 | | | 55,118 |

ATMI, Inc.* | | 11,900 | | | 377,111 |

AudioCodes, Ltd. (Israel)* | | 25,200 | | | 279,216 |

Avaya, Inc. | | 4,2003 | | | 53,802 |

Bottomline Technologies, Inc.* | | 4,100 | | | 39,688 |

CalAmp Corp.* | | 17,600 | | | 117,040 |

Canon, Inc. (Japan) | | 3,700 | | | 197,603 |

Ceragon Networks, Ltd. (Israel)* | | 18,900 | | | 101,871 |

Cisco Systems, Inc.* | | 45,100 | | | 1,088,262 |

Cognizant Technology Solutions Corp.* | | 13,800 | | | 1,038,864 |

CommVault Systems, Inc.* | | 2,900 | | | 51,823 |

Eagle Test Systems, Inc.* | | 3,200 | | | 56,320 |

eCollege.com* | | 8,600 | | | 148,780 |

EDGAR Online, Inc.* | | 11,7003 | | | 42,354 |

Elpida Memory, Inc. (Japan) | | 5,700 | | | 265,762 |

EMCORE Corp.* | | 12,000 | | | 69,000 |

Equinix, Inc.* | | 6,7003 | | | 458,280 |

Exar Corp.* | | 1,600 | | | 20,752 |

Exfo Electro-Optical Engineering, Inc. (Canada) | | 33,200 | | | 163,676 |

FEI Co.* | | 11,800 | | | 269,748 |

First Data Corp. | | 11,3503 | | | 275,238 |

Flextronics International, Ltd. (Singapore)* | | 14,100 | | | 163,560 |

Global Payments, Inc.* | | 1,600 | | | 69,936 |

Google, Inc.* | | 3,100 | | | 1,476,808 |

High Tech Computer Corp. (Taiwan) | | 1,000 | | | 99,218 |

HON HAI Precision Industry Co., Ltd. (Taiwan) | | 30,234 | | | 391,787 |

Identity Solutions, Inc.* | | 5,492 | | | 78,591 |

IKON Office Solutions, Inc. | | 3,400 | | | 50,694 |

Imation Corp. | | 6003 | | | 27,462 |

Ingram Micro, Inc., Class A* | | 7,200 | | | 148,392 |

Intel Corp.* | | 25,974 | | | 554,285 |

Intergraph Corp.* | | 4,200 | | | 183,498 |

Internap Network Services Corp.* | | 7,520 | | | 123,930 |

International Business Machines Corp. | | 9,150 | | | 844,820 |

Lightbrigde, Inc.* | | 5,000 | | | 57,800 |

Logitech International S.A. (Switzerland)* | | 19,696 | | | 517,574 |

Motorola, Inc.* | | 4,600 | | | 106,076 |

NCI, Inc., Class A * | | 4,500 | | | 52,245 |

NCR Corp. | | 600 | | | 24,912 |

Nintendo Co., Ltd. (Japan) | | 2,300 | | | 470,051 |

Omniture, Inc.* | | 3,600 | | | 32,688 |

Online Resources Corp.* | | 9,500 | | | 99,370 |

Openwave Systems, Inc.* | | 6,500 | | | 56,095 |

OPNET Technologies, Inc.* | | 6,000 | | | 87,720 |

Optibase Ltd. (Israel)* | | 29,000 | | | 85,840 |

Optical Communication Products, Inc.* | | 38,100 | | | 81,915 |

Oracle Corp.* | | 33,300 | | | 615,051 |

Pericom Semiconductor Corp.* | | 3,900 | | | 37,479 |

Photon Dynamics, Inc.* | | 8,600 | | | 102,082 |

Power Integrations, Inc.* | | 9,300 | | | 204,042 |

Quanta Computer, Inc. (Taiwan) | | 24,400 | | | 180,838 |

Rae Systems, Inc.* | | 11,700 | | | 45,162 |

Research In Motion, Ltd. (Canada)* | | 5,2003 | | | 610,896 |

RightNow Technologies, Inc.* | | 600 | | | 9,912 |

Rudolph Technologies, Inc.* | | 3,500 | | | 61,810 |

Sabre Holdings Corp.* | | 4,200 | | | 106,764 |

Samsung Electronics Co., Ltd., GDR (South Korea) (a) | | 2,013 | | | 652,697 |

The accompanying notes are an integral part of these financial statements.

11

Managers Fremont Global Fund

Schedule of Portfolio Investments (continued)

| | | | | |

| | | Shares | | Value |

Information Technology (continued) | | | | | |

Silicon Motion Technology Corp., ADR (Taiwan)* | | 2,900 | | $ | 44,573 |

Simpletech, Inc.* | | 11,100 | | | 96,126 |

SRS Labs, Inc.* | | 16,800 | | | 106,008 |

Standard Microsystems Corp. | | 2,000 | | | 61,660 |

Stratasys, Inc.* | | 2,700 | | | 75,276 |

Symantec Corp. | | 35,7003 | | | 708,288 |

Taiwan Semiconductor Manufacturing Co., Ltd., Sponsored ADR (Taiwan) | | 27,5683 | | | 267,410 |

Techwell, Inc.* | | 9,600 | | | 145,056 |

Terayon Communication Systems, Inc. | | 72,700 | | | 111,958 |

The Knot, Inc.* | | 2,800 | | | 67,116 |

Tokyo Electron, Ltd. (Japan) | | 600 | | | 44,753 |

Xerox Corp. | | 37,0703 | | | 630,190 |

Total Information Technology | | | | | 18,859,723 |

| | |

Materials - 2.3% | | | | | |

BASF AG (Germany) | | 2,500 | | | 220,748 |

Calgon Carbon Corp.* | | 14,200 | | | 65,604 |

Cameco Corp. (Canada)* | | 6,300 | | | 221,319 |

Cemex SA de CV (Mexico) | | 14,960 | | | 459,870 |

Compania Vale do Rio Doce - ADR (Brazil)* | | 3,200 | | | 81,408 |

JFE Holdings, Inc. (Japan)* | | 14,300 | | | 574,230 |

Louisana-Pacific Corp. | | 4,0003 | | | 79,120 |

Lyondell Chemical Co.* | | 6,8003 | | | 174,556 |

Mitsui Chemicals, Inc. (Japan) | | 27,000 | | | 185,024 |

Mittal Steel Co. NV (Netherlands) | | 7,379 | | | 316,084 |

Northern Technologies International Corp.* | | 6,950 | | | 66,025 |

Nucor Corp.* | | 1,8003 | | | 105,138 |

Phelps Dodge Corp. | | 4,400 | | | 441,672 |

POSCO, Sponsored ADR (South Korea) | | 5,3003 | | | 373,756 |

Salzgitter AG (Germany) | | 2,135 | | | 229,142 |

Symyx Technologies, Inc.* | | 4,200 | | | 103,110 |

Xstrata PLC (United Kingdom)* | | 10,401 | | | 442,875 |

Total Materials | | | | | 4,139,681 |

| | |

Telecommunication Services - 2.7% | | | | | |

America Movil , S.A. de C.V. (Mexico) | | 22,000 | | | 943,140 |

Centurytel, Inc. | | 10,6003 | | | 426,544 |

China Mobile Ltd. (Hong Kong) | | 14,500 | | | 117,798 |

China Netcom Group Corp., (HK) Ltd. (Hong Kong)* | | 116,0003 | | | 205,859 |

Cogent Comminications Group, Inc.* | | 10,100 | | | 143,016 |

Iliad SA (France)* | | 1,559 | | | 132,707 |

Nippon Telegraph & Telephone Corp. (Japan) | | 43 | | | 216,007 |

Qwest Communications International, Inc. | | 24,6003 | | | 212,298 |

Rogers Communications, Inc. (Canada)* | | 5,000 | | | 299,167 |

Sprint Nextel* | | 39,7033 | | | 742,049 |

TeleCommunication Systems, Inc. | | 24,9003 | | | 80,925 |

Verizon Communications, Inc. | | 23,530 | | | 870,610 |

Vodaphone Group PLC (United Kingdom) | | 210,088 | | | 541,344 |

Total Telecommunication Services | | | | | 4,931,464 |

| | |

Utilities - 1.7% | | | | | |

Alliant Energy Corp. | | 4,600 | | | 176,410 |

American Electric Power Co., Inc.* | | 7,200 | | | 298,296 |

E.ON AG (Germany) | | 3,400 | | | 409,403 |

Endesa, S.A. (Spain) | | 1,700 | | | 74,585 |

Energen Corp.* | | 7,800 | | | 333,996 |

Exelon Corp. | | 11,300 | | | 700,374 |

FirstEnergy Corp. | | 2,600 | | | 153,010 |

National Fuel Gas Co. | | 1,600 | | | 59,840 |

RWE AG (Germany) | | 3,370 | | | 333,777 |

Veolia Environnement (France) | | 8,699 | | | 532,344 |

Total Utilities | | | | | 3,072,035 |

Total Common Stocks (cost $100,461,408) | | | | $ | 121,619,026 |

The accompanying notes are an integral part of these fi nancial statements.

12

Managers Fremont Global Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

Security Description | | Principal Amount | | Value |

Corporate Bonds - 10.5% | | | | | | |

Banque De Tunisie, 3.300%, 08/02/10 | | JPY | 100,000,000 | | $ | 904,477 |

BAT International Finance PLC, 5.125%, 07/09/13 | | EUR | 1,000,000 | | | 1,328,792 |

Deutsche Bahn Finance BV, 5.000%, 06/10/08 | | EUR | 2,000,000 | | | 1,328,094 |

Fidelity International Ltd., 6.250%, 03/21/12 | | EUR | 1,000,000 | | | 1,394,642 |

Ford Credit of Canada Ltd., 7.250%, 12/07/07 | | GBP | 500,000 | | | 952,357 |

France Telecom SA, 7.000%, 12/23/09 | | EUR | 1,500,000 | | | 2,076,840 |

General Electric Capital Australia Funding Property Ltd., 7.000%, 09/15/09 | | AUD | 2,000,000 | | | 1,566,322 |

General Electric Capital Corp., 5.250%, 04/15/13 5 | | USD | 1,000,000 | | | 974,862 |

General Electric Capital Corp., Series A, 5.430%, 01/03/08, (01/03/07) 1 | | USD | 1,000,000 | | | 1,001,640 |

General Motors Acceptance Corp., 7.500%, 12/01/06 | | NZD | 1,000,000 | | | 668,344 |

Glencore Funding LLC, 6.000%, 04/15/04 (a) | | USD | 500,000 | | | 486,401 |

HSBC Finance Corp., 1.790%, 09/18/15 | | USD | 100,000,000 | | | 837,300 |

Kazkommerts International BV, 7.875%, 04/07/14 (a) | | USD | 1,750,000 | | | 1,809,063 |

Pacific Life Funding LLC, 6.500%, 04/15/08 | | AUD | 1,000,000 | | | 772,130 |

Pemex Project Funding Master Trust, 6.625%, 04/04/10 | | EUR | 1,500,000 | | | 2,050,771 |

Shinhan Bank, 5.663%, 03/02/35 5 | | EUR | 1,000,000 | | | 942,075 |

Total Corporate Bonds (cost $18,253,333) | | | | | | 19,094,110 |

Foreign Government - 14.6% | | | | | | |

Bonos Y Obligaciones Del Estado (Spain), 5.500%, 07/30/17 | | EUR | 1,000,000 | | | 1,465,782 |

Canadian Government Real Return Bonds, 4.500%, 06/01/15 | | CAD | 1,700,000 | | | 1,568,308 |

Canadian Government Real Return Bonds, 5.250%, 06/01/13 | | CAD | 1,600,000 | | | 1,530,426 |

Deutschland Republic, 3.250%, 07/04/15 | | EUR | 1,000,000 | | | 1,233,702 |

Development Bank of Japan, 1.700%, 09/20/22 | | JPY | 100,000,000 | | | 795,126 |

Eurofima, 6.000%, 01/28/14 | | AUD | 2,000,000 | | | 1,533,993 |

Finnish Government, 5.750%, 02/23/11 | | EUR | 1,000,000 | | | 1,380,016 |

France, Government of, 3.000%, 07/25/12 | | EUR | 1,101,880 | | | 1,512,894 |

France, Government of, 3.150%, 07/25/32 | | EUR | 626,626 | | | 1,049,249 |

France, Government of, 3.400%, 07/25/29 | | EUR | 1,164,096 | | | 1,955,567 |

France, Government of, 8.500%, 10/25/19 | | EUR | 1,000,470 | | | 1,884,720 |

International Finance Corp., 6.750%, 07/15/09 | | NZD | 1,000,000 | | | 659,250 |

Norwegian Government, 5.000%, 05/15/15 | | NOK | 15,500,000 | | | 2,505,831 |

Norwegian Government, 5.500%, 05/15/09 | | NOK | 6,000,000 | | | 950,660 |

Norwegian Government, 6.000%, 05/16/11 | | NOK | 5,000,000 | | | 823,646 |

Singapore, Government of, 3.500%, 07/01/12 | | SGD | 1,600,000 | | | 1,048,750 |

Singapore, Government of, 3.625%, 07/01/14 | | SGD | 1,500,000 | | | 994,506 |

U.K. Gilts, 4.000%, 03/07/09 | | GBP | 1,000,000 | | | 1,868,533 |

U.K. Gilts, 4.750%, 03/04/20 | | GBP | 1,000,000 | | | 1,971,672 |

Total Foreign Government (cost $24,113,731) | | | | | | 26,732,631 |

U.S. Government and Agency Obligations - 3.7% | | | | | | |

Federal National Mortgage Association - 0.9% | | | | | | |

FNMA, 6.000%, 10/01/24 | | USD | 658,821 | | | 668,018 |

The accompanying notes are an integral part of these financial statements.

13

Managers Fremont Global Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

Security Description | | Principal Amount | | | Value | |

Federal National Mortgage Association (continued) | | | | | | | | |

FNMA Gold Pool, 5.500%, 12/01/15 | | USD | 906,850 | | | $ | 910,471 | |

Total Federal National Mortgage Association | | | | | | | 1,578,489 | |

United States Treasury Bonds - 2.8% | | | | | | | | |

U.S. Treasury Bonds, 2.000%, 01/15/14 to 01/15/06 | | USD | 2,130,700 | 3 | | | 2,074,099 | |

U.S. Treasury Bonds, 4.875%, 08/15/06 | | USD | 2,000,000 | 3 | | | 2,042,188 | |

U.S. Treasury Inflation Indexed Bonds, 0.875%, 04/15/10 | | USD | 1,076,230 | | | | 1,014,516 | |

Total United States Treasury Bonds | | | | | | | 5,130,803 | |

Total U.S. Government and Agency Obligations (cost $6,836,807) | | | | | | | 6,709,292 | |

| | |

| | | Shares | | | | |

Warrants - 0.2% | | | | | | | | |

AU Optronics Corp. (Luxembourg) | | | 146,400 | | | | 197,640 | |

United Microelectronics Corp. (Taiwan) | | | 337,828 | | | | 188,508 | |

Total Warrants (cost $437,255) | | | | | | | 386,148 | |

Other Investment Companies - 16.8%4 | | | | | | | | |

Bank of New York Institutional Cash Reserves Fund, 5.32%2 | | | 23,917,531 | | | | 23,917,531 | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 5.18% | | | 6,769,386 | | | | 6,769,386 | |

Total Other Investment Companies (cost $30,686,917) | | | | | | | 30,686,917 | |

Total Investments - 112.5% (cost $180,789,451) | | | | | | | 205,228,124 | |

Other Assets, less Liabilities - (12.5)% | | | | | | | (22,840,875 | ) |

Net Assets - 100.0% | | | | | | $ | 182,387,249 | |

The accompanying notes are an integral part of these financial statements.

14

Managers Small Cap Fund

Portfolio Manager’s Comments

Managers Small Cap Fund seeks to achieve long-term capital appreciation by investing primarily in the stocks of small-capitalization companies.

TimesSquare Capital Management, LLC

TimesSquare Capital Management LLC (“TimesSquare”) utilizes a bottom-up fundamental approach to small-cap investing. Led by co-managers Yvette Bockstein, Grant Babyak, and Ken Duca, the investment team at TimesSquare believes its proprietary fundamental research skills, which place a particular emphasis on the assessment of management quality and an in-depth understanding of superior business models, enable the team to build a diversified portfolio of small-cap growth stocks designed to generate good risk-adjusted returns. When selecting small-cap growth stocks, Fund management utilizes a fundamental, bottom-up process to identify companies that demonstrate consistent and sustainable revenue and earnings growth, offer distinct and sustainable competitive advantages, have strong, experienced management teams, have stocks selling at reasonable valuations, and that Fund management believes have the potential to appreciate in price by 25-50% within the next 12-18 months.

The Year in Review

Good things come in small packages. Much to the surprise of many investment strategists, small-cap stocks are not easily ceding their lead to the larger-cap stocks. Good earnings growth paved the way as small-cap stocks moved in a steady upward trajectory for most of the last twelve months. Worries of rising oil prices and tensions in the Middle East briefly weighed more heavily on the small-caps than on the large-caps in the Spring and early Summer, but when the armed conflict in Lebanon calmed down, when oil prices took a tumble, and when the Fed stopped tightening, the market responded favorably and resumed its upward trek with small caps reasserting their lead, posting solid double-digit returns for the twelve months ended October 31st, ahead of the large caps. The Russell 2000 Index rose 20.0% for the period vs. 16.0% for the Russell 1000 Index. Because the sell-off was crueler to the growth stocks, small-cap value stocks came out on top for the twelve months; the Russell 2000 Value Index was up 22.9% vs. 17.1% for the Russell 2000 Growth Index.

Within the market, double digit returns were to be found across the board in all economic sectors. The Energy sector responded to rising oil and gas prices early in the period but then rolled over as the commodity prices faded. Technology stocks took a beating during the correction but rebounded nicely, though not enough to make it one of the stronger sectors. Financial services did well in anticipation of the end of the Fed’s tightening. Health care stocks provided decent returns though they were among the less robust sectors of the benchmark.

Given that our process is strictly a bottom-up one that focuses on identifying quality managements with superior business models, that demonstrate sustainable competitive advantage and good sales and earnings growth, it is not surprising that stock selection was entirely responsible for the Fund’s solid outperformance over the last twelve months. Strong relative stock selection was evident across almost every sector. Favorable results came from the Fund’s financial services, health care, technology, and consumer discretionary holdings. Disappointments came from a couple of holdings in the energy sector and a couple of Technology companies.

Though banks stocks were not the place to be over the past twelve months, the rest of the Financial Services sector did well enough to make it one of the better performing sectors. Our holdings strongly outperformed the sector. The portfolio’s top contributor for the period was Alliance Data Systems, up almost 71%. The provider of transaction services, credit services, and marketing services, reported stronger than expected earnings. Fundamentals remain strong as the company is experiencing solid business momentum in all segments. Credit trends also remain better than expected for its private label credit card business. The Fund also benefited from a strong contribution from Trammell Crow, which provides commercial real estate services, up approximately 92%. As the period was coming to a close CB Richard Ellis signed an agreement to acquire it for $49.51 per share in cash. Cohen & Steers, an investment manager of equity portfolios specializing in real estate investment trusts, has been experiencing good asset flows into its products and the stock soared 92%. Options securities broker OptionsXpress reported good quarterly earnings; resulting in a 66% increase in the stock price.

The wave of mergers and acquisitions and management buyouts was evident throughout the year within our portfolio and contributed to the outperformance of our holdings in the consumer discretionary sector. In particular, education services provider Education Management announced it is going private, in a private equity deal with Goldman Sachs and Providence Equity Partners. The stock rose 39% over the period and was the second largest contributor to results. West Corporation, a leading provider of outsourced communication solutions, announced that it would go private in a transaction sponsored by an investor group; it rose approximately 23%, making a good contribution. Both positions are now gone from the portfolio as the deals have been consummated. Pool Corporation, the largest wholesale distributor of swimming pool products and one of the larger positions in the portfolio has been constrained of late because of its perceived ties to residential construction. Though we don’t agree that the slowdown in housing significantly impacts the company, the current perception is otherwise. Nevertheless the stock returned a respectable 15% for the full year. We eliminated our position in Radio One as the deteriorating industry fundamentals proved to be too big of a headwind for the company; the stock returned -40% for the period, one of the bottom contributors.

Our results in health care added good relative value and though the benchmark sector fell a little short of the Russell 2000 Growth Index return, our holdings outperformed even the overall benchmark. Our focus on the services businesses continued to add value. Within our services holdings, we have been adding to our position in Magellan Health Services. The provider of mental health services completed its acquisition of National Imaging Associates, a privately held radiology benefits management firm. This new direction should create substantial growth opportunities; the position returned almost 47%. The company just recently signed a major contract for this business and fundamentals look attractive. We have been gradually scaling out of a position in kidney dialysis services provider DaVita due to its larger capitalization. It added another 13% to last year’s excellent return. On the negative side, we sold Allion Healthcare, a national provider of specialty pharmacy and disease management services focused on HIV/AIDS patients; we were disappointed with management’s execution of its business strategy. The small position was the portfolio’s worst

15

Managers Small Cap Fund

Portfolio Manager’s Comments (continued)

contributor, down 74%. Biotech and pharmaceuticals were laggards in the benchmark. Though underweighted, our biotech and pharmaceutical holdings generally provided excellent returns to the portfolio. Results were bolstered by a good contribution from Biomarin Pharmaceuticals, a position we had added to over the period. It is one of the few biotechnology companies focused on enzyme replacement therapies for rare genetic diseases, a niche market with low clinical and regulatory risks and high barriers to entry. It was up approximately 90% for the period with successful launches of a couple of products and with news that the FDA approved its orally administered version of prednisolone for acute asthma in children. The company has a solid pipeline of products which we believe gives it one of the best growth profiles in biotech.

Our holdings within the industrials sector added excellent value to results both on an absolute and relative basis. We recently increased our position in Orbital Sciences, which develops and manufactures small rockets and space systems for commercial, military, and civil government customers in the United States. The company won several contracts, increasing the visibility into its favorable outlook for 2007. The stock made a solid contribution with its 56% return. In addition, an excellent contribution came from Manitowoc, up 46%. The manufacturer of construction cranes reported strong earnings benefiting from the strong commercial construction cycle. We sold the position when it reached our price target and were out by the end of July. Documents management software company American Reprographics, which provides document management services to the architectural, engineering, and construction industries was among the top contributors, up 110%, a beneficiary of the strength of the commercial construction cycle.

Technology holdings outperformed the benchmark sector and made a modest total contribution to overall results. A poor contribution was made by Wind River System, down 38%. We sold the supplier of software solutions and development tools for embedded systems as we got concerned about the competitive landscape and a change in management. Atheros Communications, a market share leader in the design and development of wireless semiconductor products, reported much better than expected fourth quarter earnings and experienced strong near-term business conditions. We sold the position at our price target in anticipation of challenges for some of their new products; the position returned 73%. Microsemi, which makes specialized semiconductors that manage and control or regulate power, reported better than expected results at the end of July with its chips gaining market share in notebooks, but then sold off sharply in September as the company pre-announced a small disappointment citing overall weakness in its markets; our position returned -17% for the period and was among the poorer contributors.

It was an incredibly volatile twelve months for the energy sector with the stocks down late in 2005, soaring in the first half of calendar 2006, before reversing much of the gains in the latter part of the period. Stock prices followed the volatile oil and gas prices. The benchmark sector managed to pull out double digit returns; our holdings did not and produced some of the portfolio’s poorer contributors. TODCO, which provides oil and gas drilling services, primarily in the Gulf of Mexico is dependent on the supply of drilling rigs and the day rates for these services. Day rates have seen some softening and the stock was a detractor for the period, down 23%. Our holdings that were more levered to natural gas prices suffered. In particular, Brigham Exploration, which reported some mixed quarters depreciated by 35%. Offsetting some of the detractors was a stellar contribution from Universal Compression, which provides compression services to the domestic and international natural gas industry. The company actually raised its revenue and earnings guidance over the course of the year. In a move to unlock values, the company restructured to offload debt through the initial public offering of its natural-gas-compression-services business, as a master limited partnership; the stock was up 69% over the period.

Looking Forward

Small caps are not inexpensive relative to the large caps and strategists have been saying for a while that the large caps are the place to be. However our research has shown that more often than not, long-term performance is on the side of the small caps. The pace of small-cap mergers and acquisitions in 2006 is on track to surpass the 2005 level and has traditionally been associated with a good small cap market. Leveraged buyouts in the small cap space continue to rise to levels not seen since the late 1980s.

Though value stocks have stood their ground and proven difficult to overtake, valuation parameters continue to support a move into the growth stocks. This has been the case for a while yet valuation by itself is not an impetus for leadership change. The Fed is in a wait and see mode as the economy has some signs of slowing, but core inflation remains above its comfort zone of 1.5% to 2%. If the weakening economy succeeds in bringing down core inflation, the Fed may shift into reverse, cutting rates. When that happens, we believe the catalyst to get growth stocks going will be in place. In the meantime, we continue to find good opportunities within this universe from quality growth companies with sound business models and great management teams with the potential to generate strong, consistent growth in their businesses.

(continued on next page)

16

Managers Small Cap Fund

Portfolio Manager’s Comments (continued)

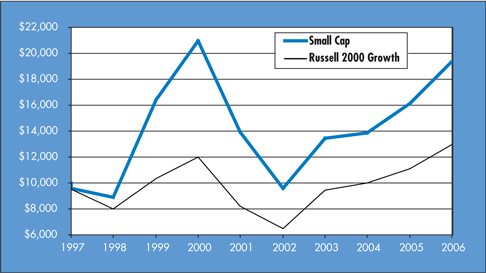

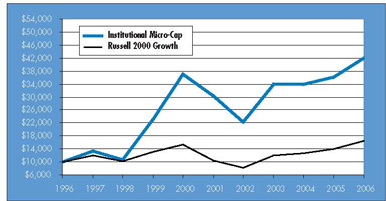

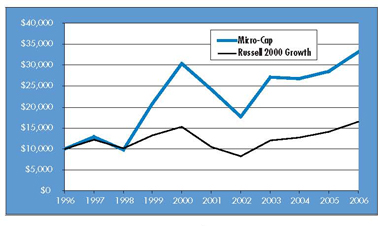

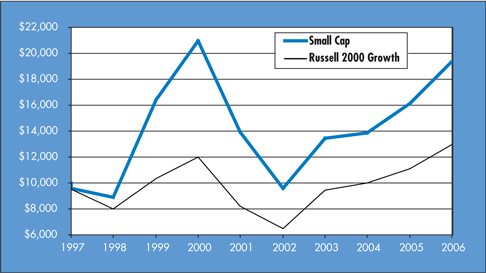

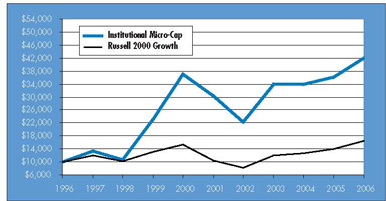

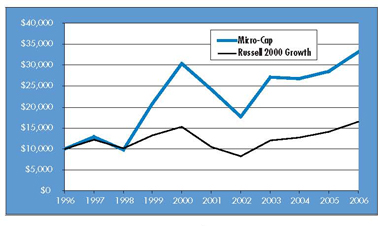

Cumulative Total Return Performance

The Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. The Russell 2000 Growth Index measures the performance of the Russell 2000 companies with higher price to-book ratios and higher forecasted growth values. Unlike the Fund, the Russell 2000 Growth Index is unmanaged, is not available to investment, and does not incur expenses. The chart illustrates the performance of a hypothetical $10,000 investment made in the Managers Small Cap Fund on September 24, 1997, to a $10,000 investment made in the Russell 2000 Growth Index for the same period. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns for the Fund would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the Managers Small Cap Fund and the Russell 2000 Growth Index since inception through October 31, 2006.

| | | | | | | | | |

Average Annual Total Returns | | One Year | | | Five Years | | | Since Inception* | |

Small Cap | | 20.02 | % | | 6.84 | % | | 7.53 | % |

Russell 2000 Growth Index | | 17.07 | % | | 9.51 | % | | 2.90 | % |

| * | Commencement of operations was September 24, 1997. |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end please call (800) 835-3879 or visit our Web site at www.managersinvest.com.

The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history, and a reliance on one or a limited number of products.

17

Managers Small Cap Fund

Fund Snapshots

October 31, 2006

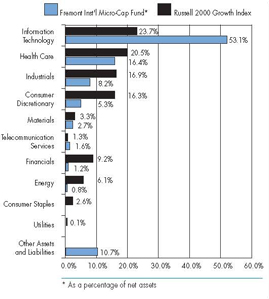

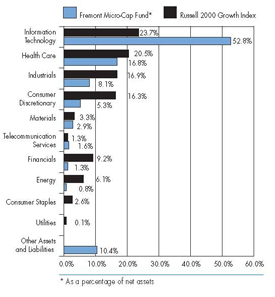

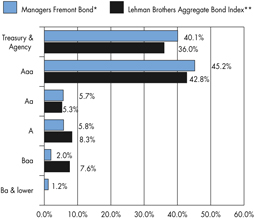

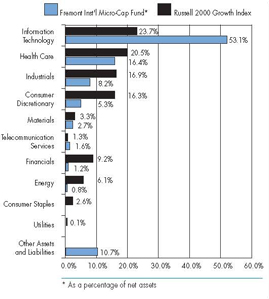

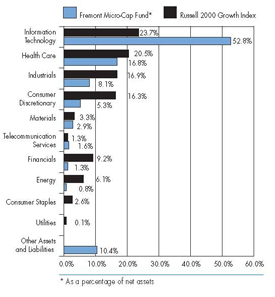

Portfolio Breakdown

| | | | | | |

Industry | | Small Cap* | | | Russell 2000 Growth Index | |

Industrials | | 21.3 | % | | 16.9 | % |

Health Care | | 20.8 | % | | 20.5 | % |

Information Technology | | 20.6 | % | | 23.7 | % |

Financials | | 13.1 | % | | 9.2 | % |

Consumer Discretionary | | 8.7 | % | | 16.3 | % |

Energy | | 6.0 | % | | 6.1 | % |

Consumer Staples | | 3.9 | % | | 2.6 | % |

Telecommunication Services | | 0.3 | % | | 1.3 | % |

Utilities | | 0.0 | % | | 0.1 | % |

Materials | | 0.0 | % | | 3.3 | % |

Other Assets and Liabilities | | 5.3 | % | | 0.0 | % |

Top Ten Holdings

| | | |

Security Name | | Percentage of Net Assets | |

Alliance Data Systems Corp.* | | 3.4 | % |

SCP Pool Corp.* | | 2.5 | |

Universal Compression Holdings, Inc.* | | 1.8 | |

Magellan Health Services, Inc. | | 1.6 | |

Mobile Mini, Inc.* | | 1.6 | |

Corporate Executive Board Co.* | | 1.6 | |

Global Payments, Inc. | | 1.6 | |

Trammell Crow Co. | | 1.5 | |

DaVita, Inc.* | | 1.5 | |

Resources Connection, Inc. | | 1.4 | |

| | | |

Top Ten as a Group | | 18.5 | % |

| | | |

| * | Top Ten Holding at April 30, 2006 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security.

18

Managers Small Cap Fund

Schedule of Portfolio Investments

October 31, 2006

| | | | | | |

| | | Shares | | | Value |

Common Stocks - 94.7% | | | | | | |

| | |

Consumer Discretionary - 8.7% | | | | | | |

Aaron Rents, Inc. | | 16,900 | 3 | | $ | 420,472 |

Gaylord Entertainment Co., Class A* | | 19,000 | 3 | | | 884,260 |

Hibbett Sporting Goods, Inc. | | 13,500 | | | | 394,740 |

Marvel Entertainment, Inc.* | | 18,600 | 3 | | | 471,510 |

Monro Muffler Brake, Inc. | | 16,200 | | | | 614,466 |

Orient-Express Hotels, Ltd. | | 20,900 | | | | 824,505 |

Outdoor Channel Holdings, Inc.* | | 31,600 | | | | 441,768 |

Playtex Products, Inc. | | 46,600 | 3 | | | 649,604 |

Pool Corp. | | 55,250 | 3 | | | 2,264,145 |

Williams Scotsman International, Inc.* | | 31,900 | | | | 750,607 |

Total Consumer Discretionary | | | | | | 7,716,077 |

| | |

Consumer Staples - 3.9% | | | | | | |

Central Garden & Pet Co.* | | 22,800 | | | | 1,139,316 |

Herbalife Ltd. | | 30,400 | | | | 1,112,640 |

Inter Parfums, Inc. | | 24,300 | | | | 477,009 |

United Natural Foods, Inc.* | | 21,600 | 3 | | | 753,840 |

Total Consumer Staples | | | | | | 3,482,805 |

| | |

Energy - 6.0% | | | | | | |

Brigham Exploration Co.* | | 64,100 | | | | 499,339 |

Denbury Resources, Inc.* | | 34,300 | 3 | | | 985,782 |

Hydril Co. | | 8,200 | 3 | | | 492,410 |

Pioneer Drilling Co.* | | 27,100 | | | | 355,823 |

Quicksilver Resources, Inc.* | | 18,850 | 3 | | | 646,178 |

TODCO, Class A* | | 23,100 | 3 | | | 788,403 |

Universal Compression Holdings, Inc.* | | 26,700 | | | | 1,608,942 |

Total Energy | | | | | | 5,376,877 |

| | |

Financials - 13.1% | | | | | | |

Argonaut Group, Inc.* | | 26,500 | | | | 901,265 |

Assured Guaranty, Ltd. | | 26,800 | | | | 674,556 |

Bancshares of Florida, Inc.* | | 16,400 | | | | 342,596 |

Clayton Holdings, Inc.* | | 48,000 | | | | 675,360 |

Cohen & Steers, Inc. | | 17,900 | 3 | | | 624,352 |

CVB Financial Corp. | | 37,041 | 3 | | | 538,206 |

Evercore Partners, Inc., Class A* | | 4,500 | | | | 165,060 |

Investors Financial Services Corp. | | 29,100 | | | | 1,144,212 |

Jefferies Group, Inc. | | 29,800 | | | | 856,154 |

Markel Corp.* | | 2,900 | | | | 1,158,550 |

Midwest Banc Holdings, Inc. | | 19,700 | | | | 463,738 |

optionsXpress, Inc. | | 25,400 | | | | 789,432 |

Primus Guaranty, Ltd. | | 56,900 | | | | 650,367 |

PrivateBancorp, Inc. | | 9,700 | | | | 398,379 |

Resource Capital Corp. | | 23,800 | | | | 391,986 |

Texas Capital Bancshares, Inc. | | 11,200 | | | | 224,448 |

Trammell Crow Co.* | | 27,800 | 3 | | | 1,355,250 |

UCBH Holdings, Inc. | | 20,300 | 3 | | | 347,942 |

Total Financials | | | | | | 11,701,853 |

| | |

Health Care - 20.8% | | | | | | |

Adeza Biomedical Corp.* | | 27,700 | | | | 386,138 |

Advisory Board Co., The* | | 17,400 | | | | 960,828 |

American Dental Partners, Inc.* | | 32,000 | | | | 624,000 |