UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06520

AMG Funds I

(Exact name of registrant as specified in charter)

600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830

(Address of principal executive offices) (Zip code)

AMG Funds LLC

600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: OCTOBER 31

Date of reporting period: NOVEMBER 1, 2017 – OCTOBER 31, 2018

(Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

AMG Funds

October 31, 2018

AMG FQ Tax-Managed U.S. Equity Fund

Class N: MFQAX | Class I: MFQTX

AMG FQ Long-Short Equity Fund

Class N: FQUAX | Class I: MEQFX

AMG FQ Global Risk-Balanced Fund

Class N: MMAVX | Class I: MMASX | Class Z: MMAFX

| | | | | | | | |

amgfunds.com | | | 103118 | | | | AR014 | |

AMG Funds

Annual Report — October 31, 2018

| | | | |

TABLE OF CONTENTS | | PAGE | |

LETTER TO SHAREHOLDERS | | | 2 | |

| |

ABOUT YOUR FUND’S EXPENSES | | | 3 | |

| |

PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS AND SCHEDULES OF PORTFOLIO INVESTMENTS | | | | |

| |

AMG FQ Tax-Managed U.S. Equity Fund | | | 4 | |

| |

AMG FQ Long-Short Equity Fund | | | 11 | |

| |

AMG FQ Global Risk-Balanced Fund | | | 24 | |

| |

FINANCIAL STATEMENTS | | | | |

| |

Statement of Assets and Liabilities | | | 33 | |

Balance sheets, net asset value (NAV) per share computations and cumulative undistributed amounts | | | | |

| |

Statement of Operations | | | 35 | |

Detail of sources of income, expenses, and realized and unrealized gains (losses) during the fiscal year | | | | |

| |

Statements of Changes in Net Assets | | | 36 | |

Detail of changes in assets for the past two fiscal years | | | | |

| |

Financial Highlights | | | 37 | |

Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets | | | | |

| |

Notes to Financial Statements | | | 44 | |

Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 54 | |

| |

OTHER INFORMATION | | | 55 | |

| |

TRUSTEES AND OFFICERS | | | 56 | |

| |

ANNUAL RENEWAL OF INVESTMENT MANAGEMENT AND SUBADVISORY AGREEMENTS | | | 59 | |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds family of mutual funds. Such offering is made only by prospectus, which includes details as to offering price and other material information.

| | |

| | Letter to Shareholders |

Dear Shareholder:

The fiscal year ended October 31, 2018, was a period of mixed results for global financial markets. The global economic expansion supported strong investor sentiment early in the year before giving way to higher volatility amid a backdrop of tightening monetary policy and uncertainty around global trade policy. U.S. equities were resilient despite the volatility as the S&P 500® Index, a broad gauge of U.S. equity performance, returned 7.35% over the full fiscal year. The U.S. bull market continued into its 10th year having gained 390% since the market bottom on March 9, 2009.

Economic conditions outside the U.S. have been mixed. At the European Central Bank’s (ECB) most recent monetary policy meeting, the governing council confirmed that the European economy showed signs of continued, though slightly slower, growth and inflation progressing toward its target level. After nine months of strength, global economic growth began to show signs of deceleration in the third quarter of 2018. Although the Purchasing Managers Index, a leading economic indicator, remained slightly above the all-important level of 50 for the five largest global economies, only the United States increased from one year prior. Global interest rate policies remain accommodative, but the ECB has continued on its path to conclude its bond buying program at the end of 2018 and the Bank of England increased its target rate.

Nine of eleven economic sectors of the S&P 500® Index were positive during the 12-month reporting period, but there was significant dispersion in performance across sectors. Information technology, consumer discretionary, and healthcare all ended the period with positive double-digit returns of 16.70%, 15.69%, and 11.32%, respectively. Financials, industrials, and materials significantly lagged the broader benchmark with returns of 0.66%, (1.09)%, and (9.53)%, respectively. Overall, corporate earnings in the third quarter were better than expected with 78% of the companies in the S&P 500® Index beating the consensus earnings per share estimate.1 Growth stocks continued to outperform value with returns of 10.71% and 3.03% for the Russell 1000® Growth and Russell 1000® Value Indexes, respectively. International equities and emerging markets demonstrated significantly weaker returns, with the MSCI All Country World Index ex-USA and MSCI Emerging Markets Index returning (8.24)% and (12.52)%, respectively, in the 12 months ending October 31, 2018. Two rounds of new U.S. tariffs for Chinese imports and signs of a slowing economy acted as a drag on the largest economy within the MSCI Emerging Markets Index. Concurrently, the U.S. Dollar strengthened against most major global currencies, particularly in emerging markets, where those with large current account deficits faced significant pressure adding to the drag on performance for emerging markets.

Tightening U.S. Federal Reserve policy and higher interest rates eroded the performance of bonds. The Bloomberg Barclays U.S. Aggregate Bond Index, a broad measure of U.S. bond market performance, turned negative with (2.05)% return for the 12 months ending October 31, 2018. The yield on the 10-year U.S. Treasury note crossed above 3% at the end of September despite market speculation that the December rate hike may not materialize. During the past year, the short end of the yield curve has risen faster than the longer end, resulting in the 2–10 year Treasury spread falling (0.5)%. Bond investors willing to accept more credit risk were rewarded with higher returns as high yield bonds performed strongly and credit spreads tightened over most of the fiscal year. The Bloomberg Barclays U.S. Corporate High Yield Bond Index ended the period with a 0.97% return.

| 1 | Source: FactSet, Based on the 74% of S&P 500® companies which had reported third quarter earnings as of November 2, 2018. |

AMG Funds appreciates the privilege of providing investment tools to you and your clients. Our foremost goal is to provide investment solutions that help our shareholders successfully reach their long-term investment goals. AMG Funds provides access to a distinctive array of actively managed return-oriented investment strategies. We thank you for your continued confidence and investment in AMG Funds. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

Respectfully,

Keitha Kinne

President

AMG Funds

| | | | | | | | | | | | | | |

Average Annual Total Returns | | Periods ended

October 31, 2018* | |

Stocks: | | | | 1 Year | | | 3 Years | | | 5 Years | |

Large Caps | | (S&P 500® Index) | | | 7.35 | % | | | 11.52 | % | | | 11.34 | % |

Small Caps | | (Russell 2000® Index) | | | 1.85 | % | | | 10.68 | % | | | 8.01 | % |

International | | (MSCI All Country World Index ex USA) | | | (8.24 | )% | | | 4.37 | % | | | 1.63 | % |

| | | | |

Bonds: | | | | | | | | | | | | | | |

Investment Grade | | (Bloomberg Barclays U.S. Aggregate Bond Index) | | | (2.05 | )% | | | 1.04 | % | | | 1.83 | % |

High Yield | | (Bloomberg Barclays U.S. Corporate High Yield Bond Index) | | | 0.97 | % | | | 6.60 | % | | | 4.68 | % |

Tax-exempt | | (Bloomberg Barclays Municipal Bond Index) | | | (0.51 | )% | | | 1.90 | % | | | 3.25 | % |

Treasury Bills | | (BofA Merrill Lynch 6-Month U.S. Treasury Bill) | | | 1.68 | % | | | 1.05 | % | | | 0.70 | % |

| * | Source: FactSet. Past performance is no guarantee of future results. |

2

About Your Fund’s Expenses

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below.

ACTUAL EXPENSES

The first line of the following table provides information about the actual account values and

actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s

actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | |

Six Months Ended

October 31, 2018 | | Expense

Ratio for

the Period | | | Beginning

Account

Value

05/01/18 | | | Ending

Account

Value

10/31/18 | | | Expenses

Paid

During

the Period* | |

AMG FQ Tax-Managed U.S. Equity Fund | | | | | |

Based on Actual Fund Return | | | | | | | | | |

Class N | | | 1.14 | % | | $ | 1,000 | | | $ | 1,031 | | | $ | 5.84 | |

Class I | | | 0.89 | % | | $ | 1,000 | | | $ | 1,033 | | | $ | 4.56 | |

Based on Hypothetical 5% Annual Return | | | | | |

Class N | | | 1.14 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 5.80 | |

Class I | | | 0.89 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.53 | |

AMG FQ Long-Short Equity Fund** | | | | | |

Based on Actual Fund Return | | | | | |

Class N | | | 1.04 | % | | $ | 1,000 | | | $ | 1,048 | | | $ | 5.37 | |

Class I | | | 0.73 | % | | $ | 1,000 | | | $ | 1,049 | | | $ | 3.77 | |

Based on Hypothetical 5% Annual Return | | | | | |

Class N | | | 1.04 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.30 | |

Class I | | | 0.73 | % | | $ | 1,000 | | | $ | 1,022 | | | $ | 3.72 | |

| | | | | | | | | | | | | | | | |

Six Months Ended

October 31, 2018 | | Expense

Ratio

for the

Period | | | Beginning

Account

Value

05/01/18 | | | Ending

Account

Value

10/31/18 | | | Expenses

Paid

During

the Period* | |

AMG FQ Global Risk-Balanced Fund | | | | | |

Based on Actual Fund Return | | | | | |

Class N | | | 1.29 | % | | $ | 1,000 | | | $ | 941 | | | $ | 6.31 | |

Class I | | | 1.04 | % | | $ | 1,000 | | | $ | 942 | | | $ | 5.09 | |

Class Z | | | 0.89 | % | | $ | 1,000 | | | $ | 942 | | | $ | 4.36 | |

Based on Hypothetical 5% Annual Return | | | | | |

Class N | | | 1.29 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 6.56 | |

Class I | | | 1.04 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.30 | |

Class Z | | | 0.89 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.53 | |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

| ** | Excludes interest expense and dividends on short positions. If included, your annualized expense ratios would be 2.94% and 2.63% for Class N and Class I, respectively, and your actual and hypothetical expenses paid during the period would be $15.17 and $13.58, and $14.90 and $ 13.34 for Class N and Class I, respectively. |

3

AMG FQ Tax-Managed U.S. Equity Fund

Portfolio Manager’s Comments (unaudited)

For the fiscal year ended October 31, 2018, the AMG FQ Tax-Managed U.S. Equity Fund (the “Fund”) Class I returned 7.13%, compared to 6.60% for its benchmark, the Russell 3000® Index.

MARKET OVERVIEW

The U.S. equity market advanced throughout much of the reporting period. A comprehensive overhaul to the U.S. tax code in December 2017 created a tailwind for the domestic economy. The fiscal stimulus provided strong support for consumer and corporate spending, and contributed to a general trend of strong earnings reports. Moreover, strong domestic macro data (low unemployment, a pickup in wage growth) provided a favorable economic backdrop for foreign equity investors—particularly in contrast with other markets, which started to show signs of slowing growth.

Nevertheless, the U.S. equity market did experience a few significant downturns in February 2018, March 2018, and October 2018. During these episodes, investors worried about the prospects of a rising interest rate environment (though we believe current rate levels continue to be supportive) as well as threats to domestic and global growth.

PERFORMANCE REVIEW

In the first half of 2018, risky and low-quality stocks were generally rewarded, with investors spurred by a strengthening domestic economy and positive corporate earnings. This trend started to reverse in the third quarter of 2018, as threats to global growth started to surface (the ongoing trade war, Brexit uncertainty, emerging-market weakness). In the period’s final month, increased concern about the

Federal Reserve’s commitment to consistent rate hikes, in conjunction with a cooling domestic housing market and a dimming outlook for global growth, sparked a U.S. equity market selloff. As risk appetite deteriorated, value stocks, which had been underperforming growth stocks, received a lift from defensive trading.

An attribution of performance using risk model common factors showed that the Fund’s outperformance was largely due to a positive contribution from industry positions. The stock-specific component was also positive. The Fund’s exposure to common risk factors, however, detracted.

The Fund profited from an overweight to stocks with positive price momentum, which performed well over the fiscal year, as investors became increasingly confident in the health of the domestic economy. On the other hand, it lost ground from its overweight of small market-capitalization stocks. For much of the reporting period, “small-cap” stocks outperformed, as these companies were more insulated from concerns about global demand (stemming from the trade war). However, this trend reversed in the final months of the reporting period, and small-cap stocks experienced significant losses. Since these companies tend to maintain higher levels of debt, investors were particularly worried about how they would perform as interest rates increased.

On the other hand, the Fund benefited from its industry positioning. The strongest gains came through overweight positions in the retail food and drugs and other insurance industries during the last

several months of the period. Low unemployment and a pickup in wages, alongside the one-time tax cuts, lifted domestic consumption and supported the retail sector. Meanwhile, the Fund’s most significant industry losses came from an underweight position in medical supplies and an overweight position in forest products. Medical supplies companies benefited from an expanding healthcare industry, supported by an aging population. U.S. tariffs on Canadian lumber have increased supply costs for forest products, serving as a drag on profitability.

OUTLOOK

The signal from our quantitative model continues to have higher-than-average exposure to growth stocks, due to trends in prices and earnings, improved fundamental quality, and reduced price volatility. The signal has increased the Fund’s exposure to large-cap defensive stocks, as positive economic information has become increasingly priced into the equity market. There has been a notable increase in exposure to household products, driven by improved fundamentals, price momentum, and growth prospective. The Fund’s exposure to tobacco has declined, driven by deterioration in fundamentals, valuation, and price momentum, as well as an increase in earnings and price volatility.

This commentary reflects the viewpoints of the portfolio manager, First Quadrant, L.P., as of October 31, 2018 and is not intended as a forecast or guarantee of future results, and is subject to change without notice.

4

AMG FQ Tax-Managed U.S. Equity Fund

Portfolio Manager’s Comments (continued)

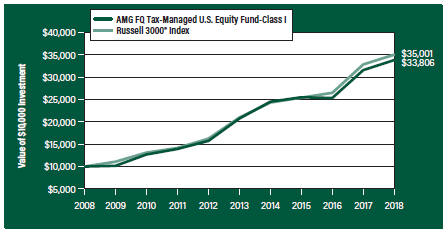

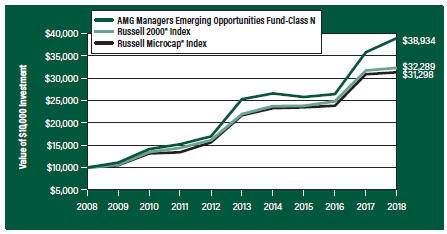

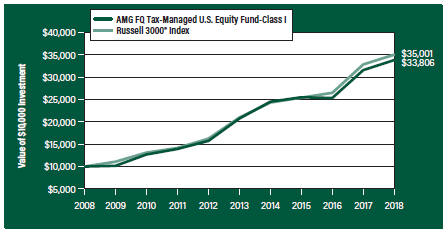

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG FQ Tax-Managed U.S. Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the AMG FQ Tax-Managed U.S. Equity Fund’s Class I shares on October 31, 2008 to a $10,000 investment made in the Russell 3000® Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG FQ Tax-Managed U.S. Equity Fund and the Russell 3000® Index for the same time periods ended October 31, 2018.

| | | | | | | | | | | | |

| Average Annual Total Returns1 | | One Year | | | Five Years | | | Ten Years | |

AMG FQ Tax-Managed U.S. Equity Fund2, 3, 4, 5 | | | | | | | | | | | | |

Class N | | | 6.84 | % | | | 10.00 | % | | | 12.68 | % |

Class I | | | 7.13 | % | | | 10.27 | % | | | 12.96 | % |

Russell 3000® Index6 | | | 6.60 | % | | | 10.81 | % | | | 13.35 | % |

Return After Taxes on Distributions7 | | | | | | | | | | | | |

Class N | | | 6.81 | % | | | 9.91 | % | | | 12.60 | % |

Class I | | | 7.01 | % | | | 10.12 | % | | | 12.81 | % |

Returns After Taxes on Distributions & Sale of Fund Shares7 | | | | | | | | | | | | |

Class N | | | 4.07 | % | | | 7.93 | % | | | 10.63 | % |

Class I | | | 4.30 | % | | | 8.14 | % | | | 10.86 | % |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.835.3879 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2018. All returns are in U.S. dollars ($). |

| 2 | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | The Fund invests in large-capitalization companies that may underperform other stock funds (such as funds that focus on small- and medium-capitalization companies) when stocks of large-capitalization companies are out of favor. |

| 4 | Although the Fund is managed to minimize taxable distributions, it may not be able to avoid taxable distributions. |

| 5 | The Fund may invest in derivatives such as options and futures; the complexity and rapidly changing structure of derivatives markets may increase the possibility of market losses. |

| 6 | The Russell 3000® Index is composed of the 3,000 largest U.S. companies as measured by market capitalization, and represents about 98% of the U.S. stock market. Unlike the Fund, the Russell 3000® Index is unmanaged, is not available for investment and does not incur expenses. |

| 7 | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

The Russell 3000® Index is a trademark of the London Stock Exchange Group companies.

Not FDIC insured, nor bank guaranteed. May lose value.

5

AMG FQ Tax-Managed U.S. Equity Fund

Fund Snapshots (unaudited)

October 31, 2018

PORTFOLIO BREAKDOWN

| | | | |

Sector | | % of

Net Assets | |

Information Technology | | | 23.1 | |

Health Care | | | 14.9 | |

Financials | | | 14.3 | |

Consumer Discretionary | | | 12.9 | |

Industrials | | | 9.4 | |

Consumer Staples | | | 7.0 | |

Energy | | | 5.2 | |

Communication Services | | | 4.5 | |

Real Estate | | | 3.4 | |

Materials | | | 2.8 | |

Utilities | | | 1.6 | |

Short-Term Investments1 | | | 1.7 | |

Other Assets Less Liabilities2 | | | (0.8 | ) |

| 1 | Includes reinvestment of cash collateral into joint repurchase agreements on security lending transactions. |

| 2 | Includes repayment of cash collateral on security lending transactions. |

TOP TEN HOLDINGS

| | | | |

Security Name | | % of

Net Assets | |

Microsoft Corp. | | | 4.0 | |

Apple, Inc. | | | 3.9 | |

Visa, Inc., Class A | | | 3.2 | |

UnitedHealth Group, Inc. | | | 2.9 | |

Berkshire Hathaway, Inc., Class B | | | 2.9 | |

Mastercard, Inc., Class A | | | 2.9 | |

Amazon.com, Inc. | | | 2.4 | |

Medifast, Inc. | | | 2.1 | |

Crocs, Inc. | | | 2.1 | |

Brown & Brown, Inc. | | | 2.0 | |

| | | | |

Top Ten as a Group | | | 28.4 | |

| | | | |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

6

AMG FQ Tax-Managed U.S. Equity Fund

Fund Snapshots (unaudited)

October 31, 2018

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks—99.1% | | | | | | | | |

Communication Services—4.5% | | | | | | | | |

Alphabet, Inc., Class A* | | | 801 | | | $ | 873,555 | |

Alphabet, Inc., Class C* | | | 814 | | | | 876,491 | |

AT&T, Inc. | | | 10,870 | | | | 333,492 | |

Boingo Wireless, Inc.* | | | 12,095 | | | | 378,936 | |

Netflix, Inc.* | | | 1,041 | | | | 314,153 | |

Verizon Communications, Inc. | | | 2,873 | | | | 164,019 | |

Vonage Holdings Corp.* | | | 25,982 | | | | 344,521 | |

Total Communication Services | | | | | | | 3,285,167 | |

Consumer Discretionary—12.9% | | | | | | | | |

Amazon.com, Inc.* | | | 1,086 | | | | 1,735,439 | |

Asbury Automotive Group, Inc.*,1 | | | 5,377 | | | | 350,043 | |

Best Buy Co., Inc. | | | 2,515 | | | | 176,452 | |

Cambium Learning Group, Inc.* | | | 15,810 | | | | 227,348 | |

Comcast Corp., Class A | | | 3,542 | | | | 135,092 | |

Crocs, Inc.*,1 | | | 75,023 | | | | 1,540,972 | |

Extended Stay America, Inc., (Units) | | | 13,285 | | | | 216,280 | |

Gentex Corp. | | | 22,692 | | | | 477,667 | |

Graham Holdings Co., Class B | | | 662 | | | | 384,655 | |

Grand Canyon Education, Inc.* | | | 4,094 | | | | 510,522 | |

The Home Depot, Inc. | | | 2,030 | | | | 357,036 | |

International Speedway Corp., Class A | | | 5,124 | | | | 192,201 | |

Johnson Outdoors, Inc., Class A | | | 3,467 | | | | 261,100 | |

Liberty Media Corp-Liberty SiriusXM* | | | 19,050 | | | | 785,622 | |

Lowe’s Cos., Inc. | | | 6,998 | | | | 666,349 | |

MCBC Holdings, Inc.* | | | 13,820 | | | | 410,178 | |

Penn National Gaming, Inc.* | | | 10,642 | | | | 258,388 | |

Ross Stores, Inc. | | | 3,534 | | | | 349,866 | |

Standard Motor Products, Inc. | | | 3,900 | | | | 211,029 | |

Stoneridge, Inc.* | | | 6,312 | | | | 160,388 | |

The Walt Disney Co. | | | 376 | | | | 43,176 | |

Total Consumer Discretionary | | | | | | | 9,449,803 | |

Consumer Staples—7.0% | | | | | | | | |

Central Garden & Pet Co.*,1 | | | 8,781 | | | | 285,207 | |

Central Garden & Pet Co., Class A* | | | 11,889 | | | | 352,509 | |

The Coca-Cola Co. | | | 1,355 | | | | 64,878 | |

Medifast, Inc. | | | 7,456 | | | | 1,578,286 | |

National Beverage Corp.*,1 | | | 6,098 | | | | 563,760 | |

The Procter & Gamble Co. | | | 1,627 | | | | 144,282 | |

Tyson Foods, Inc., Class A | | | 16,596 | | | | 994,432 | |

US Foods Holding Corp.* | | | 23,659 | | | | 690,133 | |

| | | | | | | | |

| | | Shares | | | Value | |

USANA Health Sciences, Inc.* | | | 4,059 | | | $ | 474,984 | |

Total Consumer Staples | | | | | | | 5,148,471 | |

Energy—5.2% | | | | | | | | |

Abraxas Petroleum Corp.* | | | 62,095 | | | | 114,255 | |

Chevron Corp. | | | 1,910 | | | | 213,252 | |

Exxon Mobil Corp. | | | 14,541 | | | | 1,158,627 | |

Marathon Petroleum Corp. | | | 9,400 | | | | 662,230 | |

Matrix Service Co.* | | | 1,221 | | | | 24,823 | |

Phillips 66 | | | 4,600 | | | | 472,972 | |

Renewable Energy Group, Inc.* | | | 4,518 | | | | 140,419 | |

Valero Energy Corp. | | | 5,800 | | | | 528,322 | |

W&T Offshore, Inc.*,1 | | | 67,152 | | | | 452,604 | |

Total Energy | | | | | | | 3,767,504 | |

Financials—14.3% | | | | | | | | |

Arch Capital Group, Ltd. (Bermuda)* | | | 35,100 | | | | 995,787 | |

Bank of America Corp. | | | 12,444 | | | | 342,210 | |

The Bank of NT Butterfield & Son, Ltd. (Bermuda) | | | 9,244 | | | | 372,441 | |

Berkshire Hathaway, Inc., Class B* | | | 10,287 | | | | 2,111,715 | |

Brown & Brown, Inc. | | | 50,972 | | | | 1,436,391 | |

Canadian Imperial Bank of Commerce (Canada) | | | 1,823 | | | | 157,361 | |

Citigroup, Inc. | | | 4,100 | | | | 268,386 | |

Discover Financial Services | | | 6,597 | | | | 459,613 | |

Employers Holdings, Inc. | | | 11,883 | | | | 546,143 | |

Enterprise Financial Services Corp. | | | 2,000 | | | | 86,900 | |

Erie Indemnity Co., Class A | | | 2,000 | | | | 259,380 | |

Everest Re Group, Ltd. (Bermuda) | | | 2,200 | | | | 479,292 | |

First Defiance Financial Corp. | | | 2,962 | | | | 80,626 | |

First Financial Corp. | | | 525 | | | | 24,076 | |

First Interstate BancSystem, Inc., Class A | | | 4,099 | | | | 169,945 | |

Houlihan Lokey, Inc. | | | 763 | | | | 31,420 | |

Investment Technology Group, Inc. | | | 22,783 | | | | 626,077 | |

JPMorgan Chase & Co. | | | 6,852 | | | | 747,005 | |

MGIC Investment Corp.* | | | 32,783 | | | | 400,280 | |

The Progressive Corp. | | | 5,338 | | | | 372,059 | |

Pzena Investment Management, Inc., Class A | | | 4,972 | | | | 50,018 | |

SunTrust Banks, Inc. | | | 3,197 | | | | 200,324 | |

Wells Fargo & Co. | | | 4,181 | | | | 222,555 | |

Total Financials | | | | | | | 10,440,004 | |

Health Care—14.9% | | | | | | | | |

Agilent Technologies, Inc. | | | 1,239 | | | | 80,275 | |

Amgen, Inc. | | | 6,296 | | | | 1,213,806 | |

AngioDynamics, Inc.* | | | 5,317 | | | | 108,626 | |

Anika Therapeutics, Inc.*,1 | | | 9,000 | | | | 321,840 | |

The accompanying notes are an integral part of these financial statements.

7

AMG FQ Tax-Managed U.S. Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Health Care—14.9% (continued) | | | | | | | | |

Atrion Corp. | | | 251 | | | $ | 171,227 | |

Biogen, Inc.* | | | 1,735 | | | | 527,908 | |

Cantel Medical Corp. | | | 2,899 | | | | 229,456 | |

Cardiovascular Systems, Inc.* | | | 3,960 | | | | 111,078 | |

Catalent, Inc.* | | | 7,139 | | | | 287,987 | |

Centene Corp.* | | | 10,956 | | | | 1,427,786 | |

Charles River Laboratories International, Inc.* | | | 5,950 | | | | 724,829 | |

Genomic Health, Inc.* | | | 7,518 | | | | 539,116 | |

Haemonetics Corp.* | | | 2,051 | | | | 214,268 | |

HealthStream, Inc. | | | 5,434 | | | | 142,968 | |

IDEXX Laboratories, Inc.* | | | 353 | | | | 74,878 | |

Johnson & Johnson | | | 4,713 | | | | 659,773 | |

Ligand Pharmaceuticals, Inc.*,1 | | | 844 | | | | 139,100 | |

McKesson Corp. | | | 1,199 | | | | 149,587 | |

Medidata Solutions, Inc.* | | | 1,451 | | | | 102,005 | |

Medpace Holdings, Inc.* | | | 1,170 | | | | 60,957 | |

Merck & Co., Inc. | | | 684 | | | | 50,349 | |

OraSure Technologies, Inc.* | | | 9,021 | | | | 125,392 | |

Pfizer, Inc. | | | 5,778 | | | | 248,801 | |

The Providence Service Corp.* | | | 4,454 | | | | 294,365 | |

Simulations Plus, Inc. | | | 1,181 | | | | 23,868 | |

UnitedHealth Group, Inc. | | | 8,196 | | | | 2,142,025 | |

Vanda Pharmaceuticals, Inc.* | | | 7,412 | | | | 140,606 | |

WellCare Health Plans, Inc.* | | | 2,003 | | | | 552,808 | |

Total Health Care | | | | | | | 10,865,684 | |

Industrials—9.4% | | | | | | | | |

Alaska Air Group, Inc. | | | 17,680 | | | | 1,085,906 | |

Allison Transmission Holdings, Inc. | | | 22,735 | | | | 1,002,159 | |

Atkore International Group, Inc.* | | | 3,481 | | | | 67,044 | |

The Boeing Co. | | | 335 | | | | 118,878 | |

Brady Corp., Class A | | | 478 | | | | 19,259 | |

BWX Technologies, Inc. | | | 23,997 | | | | 1,402,865 | |

Continental Building Products, Inc.* | | | 23,030 | | | | 640,464 | |

Delta Air Lines, Inc. | | | 2,728 | | | | 149,303 | |

HEICO Corp., Class A | | | 387 | | | | 25,797 | |

Huntington Ingalls Industries, Inc. | | | 5,799 | | | | 1,266,966 | |

ICF International, Inc. | | | 1,569 | | | | 115,541 | |

Rush Enterprises, Inc., Class B | | | 5,151 | | | | 185,745 | |

Southwest Airlines Co. | | | 4,500 | | | | 220,950 | |

TPI Composites, Inc.*,1 | | | 1,903 | | | | 48,070 | |

TrueBlue, Inc.* | | | 3,374 | | | | 78,715 | |

| | | | | | | | |

| | | Shares | | | Value | |

UniFirst Corp. | | | 3,000 | | | $ | 447,900 | |

Total Industrials | | | | | | | 6,875,562 | |

Information Technology—23.1% | | | | | |

Appfolio, Inc., Class A* | | | 2,427 | | | | 138,582 | |

Apple, Inc. | | | 13,046 | | | | 2,855,248 | |

Aspen Technology, Inc.* | | | 3,817 | | | | 324,025 | |

CACI International, Inc., Class A* | | | 4,423 | | | | 789,329 | |

Care.com, Inc.* | | | 3,364 | | | | 59,206 | |

CDW Corp. | | | 8,540 | | | | 768,685 | |

Ciena Corp.*,1 | | | 4,568 | | | | 142,796 | |

Cisco Systems, Inc. | | | 2,779 | | | | 127,139 | |

Diodes, Inc.* | | | 1,286 | | | | 38,824 | |

Facebook, Inc., Class A* | | | 6,229 | | | | 945,500 | |

Intel Corp. | | | 3,793 | | | | 177,816 | |

KLA-Tencor Corp. | | | 2,029 | | | | 185,735 | |

Mastercard, Inc., Class A | | | 10,621 | | | | 2,099,453 | |

MAXIMUS, Inc. | | | 3,055 | | | | 198,483 | |

Micron Technology, Inc.* | | | 13,006 | | | | 490,586 | |

Microsoft Corp. | | | 27,500 | | | | 2,937,275 | |

NVIDIA Corp. | | | 211 | | | | 44,485 | |

Oracle Corp. | | | 583 | | | | 28,474 | |

PC Connection, Inc. | | | 1,741 | | | | 57,697 | |

Progress Software Corp. | | | 26,502 | | | | 851,774 | |

QAD, Inc., Class A | | | 9,851 | | | | 417,978 | |

Rudolph Technologies, Inc.* | | | 13,064 | | | | 271,601 | |

salesforce.com, Inc.* | | | 1,696 | | | | 232,759 | |

ServiceNow, Inc.* | | | 326 | | | | 59,019 | |

TechTarget, Inc.*,1 | | | 4,156 | | | | 84,450 | |

Twitter, Inc. * | | | 994 | | | | 34,541 | |

Virtusa Corp.* | | | 1,224 | | | | 60,698 | |

Visa, Inc., Class A | | | 16,768 | | | | 2,311,469 | |

XO Group, Inc.* | | | 2,200 | | | | 76,142 | |

Zynga, Inc., Class A* | | | 25,605 | | | | 93,202 | |

Total Information Technology | | | | | | | 16,902,971 | |

Materials—2.8% | | | | | | | | |

AdvanSix, Inc.* | | | 4,109 | | | | 113,984 | |

Boise Cascade Co.1 | | | 2,922 | | | | 89,968 | |

Cabot Corp. | | | 2,197 | | | | 106,950 | |

Graphic Packaging Holding Co.1 | | | 25,299 | | | | 278,542 | |

Louisiana-Pacific Corp. | | | 25,891 | | | | 563,647 | |

LyondellBasell Industries NV, Class A | | | 7,700 | | | | 687,379 | |

Verso Corp., Class A* | | | 6,451 | | | | 181,338 | |

Total Materials | | | | | | | 2,021,808 | |

The accompanying notes are an integral part of these financial statements.

8

AMG FQ Tax-Managed U.S. Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Real Estate—3.4% | | | | | | | | |

American Homes 4 Rent, Class A, REIT | | | 11,900 | | | $ | 250,733 | |

American Tower Corp., REIT | | | 481 | | | | 74,945 | |

Equity Commonwealth, REIT | | | 1,867 | | | | 55,599 | |

Marcus & Millichap, Inc.* | | | 21,691 | | | | 753,111 | |

Park Hotels & Resorts, Inc., REIT | | | 20,815 | | | | 605,092 | |

The RMR Group, Inc., Class A | | | 9,585 | | | | 727,310 | |

Total Real Estate | | | | | | | 2,466,790 | |

Utilities—1.6% | | | | | | | | |

American Water Works Co., Inc. | | | 4,551 | | | | 402,900 | |

Hawaiian Electric Industries, Inc. | | | 10,503 | | | | 391,762 | |

NorthWestern Corp. | | | 328 | | | | 19,273 | |

Portland General Electric Co. | | | 1,009 | | | | 45,486 | |

UGI Corp. | | | 367 | | | | 19,473 | |

Vectren Corp. | | | 4,069 | | | | 291,056 | |

Total Utilities | | | | | | | 1,169,950 | |

Total Common Stocks

(Cost $45,804,598) | | | | | | | 72,393,714 | |

| |

| Principal

Amount |

| | | | |

Short-Term Investments—1.7% | | | | | |

Joint Repurchase Agreements—0.7%2 | | | | | |

Credit Suisse AG, dated 10/31/18, due 11/01/18, 2.190% total to be received $505,815 (collateralized by various U.S. Treasuries, 0.000% - 9.000%, 11/15/18 - 09/09/49, totaling $515,900) | | $ | 505,784 | | | | 505,784 | |

| * | Non-income producing security. |

| 1 | Some or all of these securities, amounting to $2,371,923 or 3.2% of net assets, were out on loan to various brokers and are collateralized by cash and various U.S. Treasury Obligations. See Note 4 of Notes to Financial Statements. |

| 2 | Cash collateral received from brokers for securities lending was invested in these joint repurchase agreements. |

| | | | | | | | |

| | | Shares | | | Value | |

Other Investment Companies—1.0% | | | | | | | | |

Dreyfus Government Cash Management Fund, Institutional Class Shares, 2.05%3 | | | 251,050 | | | $ | 251,050 | |

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Class Shares, 2.12%3 | | | 251,050 | | | | 251,050 | |

JPMorgan U.S. Government Money Market Fund, IM Shares, 2.09%3 | | | 258,658 | | | | 258,658 | |

Total Other Investment Companies | | | | | | | 760,758 | |

Total Short-Term Investments

(Cost $1,266,542) | | | | | | | 1,266,542 | |

Total Investments—100.8% | | | | | | | | |

(Cost $47,071,140) | | | | | | | 73,660,256 | |

Other Assets, less Liabilities—(0.8)% | | | | (598,448 | ) |

Net Assets—100.0% | | | | | | $ | 73,061,808 | |

| 3 | Yield shown represents the October 31, 2018, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

REIT Real Estate Investment Trust.

The accompanying notes are an integral part of these financial statements.

9

AMG FQ Tax-Managed U.S. Equity Fund

Schedule of Portfolio Investments (continued)

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of October 31, 2018:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments in Securities | | | | | | | | | | | | | | | | |

Common Stocks† | | $ | 72,393,714 | | | | — | | | | — | | | $ | 72,393,714 | |

Short-Term Investments | | | | | | | | | | | | | | | | |

Joint Repurchase Agreements | | | — | | | $ | 505,784 | | | | — | | | | 505,784 | |

Other Investment Companies | | | 760,758 | | | | — | | | | — | | | | 760,758 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | 73,154,472 | | | $ | 505,784 | | | | — | | | $ | 73,660,256 | |

| | | | | | | | | | | | | | | | |

| † | All common stocks held in the Fund are Level 1 securities. For a detailed breakout of common stocks by major industry classification, please refer to the Fund’s Schedule of Portfolio Investments. |

As of October 31, 2018, the Fund had no transfers between levels from the beginning of the reporting period.

The accompanying notes are an integral part of these financial statements.

10

AMG FQ Long-Short Equity Fund

Portfolio Manager’s Comments (unaudited)

OVERVIEW

For the fiscal year ended October 31, 2018, the AMG FQ Long-Short Equity Fund (the “Fund”) Class I returned 12.82%, significantly outperforming both the 6.60% for its primary benchmark, the Russell 3000® Index, and the 4.34% return of its secondary benchmark, an equally weighted average of the Russell 3000 Index and the ICE BofAML 0-3 Month U.S. Treasury Bill.

MARKET REVIEW

The U.S. equity market advanced throughout much of the reporting period. A comprehensive overhaul to the U.S. tax code in December 2017 created a tailwind for the domestic economy. The fiscal stimulus provided strong support for consumer and corporate spending and contributed to a general trend of strong earnings reports. Moreover, strong domestic macro data (low unemployment, a pickup in wage growth) provided a favorable economic backdrop for equity investors—particularly in contrast with other markets, which started to show signs of slowing growth.

Nevertheless, the U.S. equity market did experience a few significant downturns: February 2018, March 2018, and October 2018. During these episodes, investors worried about the prospects of a rising interest rate environment (though current rate levels continue to be supportive), as well as threats to domestic and global growth. Notably, the Fund outperformed the benchmark index in all three months, largely due to success in the dynamic, top-down part of its process.

FUND PERFORMANCE

The stock selection component of the Fund detracted modestly early in the period. The Fund’s net-long exposure to companies with recent positive performance (prompted by the Fund’s proprietary Market Sentiment signal) detracted modestly, since cash equity investors favored quality over momentum. This investor preference was perhaps due to considerable uncertainty surrounding domestic fiscal and monetary policy (coming through the debate around tax legislation, and speculation about how the U.S. Federal Reserve (the “Fed”) would set policy under new Chairman Powell).

However, this part of the process began to experience a turnaround in January 2018. The Fund’s net long exposure to the savings and loan industry benefited from heightened attention to the Fed’s plans to raise rates. Additionally, investors’ high tolerance for risk, spurred by several weeks of strong

equity performance, led to dampened preference for stability. The Fund maintained net short exposure to stocks that were undervalued relative to their dividend yield. This conviction paid off in January, as dividend yield as a risk factor underperformed.

This same net short exposure to dividend yield, however, was the primary driver behind negative performance for stock selection in April. Though some encouraging earnings reports offered motivation for risk-bearing behavior, investors also weighted rising tensions in the Middle East, as well as considerable uncertainty about global trading relationships. As a result, they still expressed some preference for fundamentals related to stability.

Over the summer, the Fund generally saw success in its stock selection. The Market Sentiment signal contributed to net long exposure to companies that were inexpensive relative to positive momentum. This positioning resulted in modest underperformance in June, as investors worried about the escalating trade war, but profited in August and September. Strong corporate earnings reinforced investor appetite for U.S. equity risk, particularly amid indications of a strong domestic economy. Furthermore, as described earlier in the discussion of dividend yield, the Fund’s stock selection maintained less of a tilt toward value than usual. As another expression of this view, it held net short exposure to stocks that were undervalued relative to their book/price metrics. Book/price significantly underperformed most other risk factors for much of 2018, so this exposure translated to gains for the Fund.

DYNAMIC TOP-DOWN VIEWS

The beta overlay experienced a few distinct episodes of performance. After a fairly quiet start to the period, the dynamic, top-down view on investor appetite for risk began to play more of a role. In January, the U.S. equity market had been experiencing a strong rally, fueled in part by a weakening U.S. dollar and speculation about the positive impact of fiscal stimulus. A top-down view, however, inferred that the equity price levels had overshot their appropriate levels (relative to fundamentals), and the Fund began to short the market. The short beta tilt initially detracted: The U.S. market continued to advance throughout January, with investor exuberance reinforced by comments from the Trump administration that appeared to favor an inexpensive currency.

As investor tolerance for risk began to decline again, however, the market stumbled and the relative underweight to equities profited. The market downturn culminated in a liquidity crisis in early February, at which point the beta management process neutralized its view. The liquidity crisis sparked broad concern that the correction could turn into a bear market, and prices continued to trend downward as risk appetite deteriorated further. Interestingly, the dynamic process now perceived an overshoot in the opposite direction, and increased the Fund’s exposure to equity beta mid-March. And as predicted, the U.S. equity market started to recover in April, with investor tolerance for risk supported by strong corporate earnings, optimism about trade relationships, recovering energy prices, and several indicators of a healthy U.S. economy.

Finally, toward the end of the period, U.S. equities came under pressure again. The Fed’s increasingly firm commitment to monetary tightening, in conjunction with mounting concern about the outlook for global growth, led to risk-off behavior. As a result, U.S. equities plunged alongside other risk assets for several weeks. The Fund saw opportunity in a long beta tilt, perceiving the market to be oversold. The positioning generated small gains when the market rebounded in the final days of the reporting period, but the overall outcome of the positioning remains to be seen.

OVERALL TRENDS

With respect to common risk factors, the Fund steadily increased its net short exposure to stocks that were undervalued relative to their book/price metrics. This risk factor performed extremely poorly over the reporting period, resulting in gains for the Fund. The Fund saw less success in its net short exposure to stocks that were undervalued relative to their dividend yield. As risk appetite deteriorated in October, investors began to pay more attention to stability, resulting in outperformance for companies that offered advantageous dividend payouts.

With respect to industries, the Fund strongly benefited from net long exposure to computer software, which received a lift from strong consumer demand for services such as cloud data storage. Additionally, for much of the period, equity investors displayed a preference for growth stocks. On the other hand, it was negatively impacted by its net long exposure to forest products. U.S. tariffs on Canadian lumber increased supply costs for this industry, serving as a drag on profitability.

11

AMG FQ Long-Short Equity Fund

Portfolio Manager’s Comments (continued)

OUTLOOK AND POSITIONING

The Fund’s quantitative signal continues to have higher-than-average exposure to growth stocks, driven by both price and earnings movements, improved fundamental quality, and reduced price volatility in growth stocks. The Fund increased its exposure to large-cap defensive stocks, as we believe positive economic information has become increasingly priced into the equity market. There has been a notable increase in exposure to household products driven by improved fundamentals, price

momentum, and prospects for growth. Exposure to tobacco has been reduced, driven by deterioration in fundamentals, valuation, and price momentum, accompanied by an increase in earnings and price volatility.

As a general rule, derivatives are an important instrument used to implement the Fund’s strategy. Specifically, equity index futures are used to gain economic exposure. The Fund also utilized total return swaps to gain exposure to the equity market, although the exposure was very small. Overall, the

liquidity and low transaction cost of this instrument offers the investment team the ability to be more nimble and to implement our investment strategy at a lower cost.

This commentary reflects the viewpoints of the portfolio manager, First Quadrant, L.P., as of October 31, 2018 and is not intended as a forecast or guarantee of future results, and is subject to change without notice.

12

AMG FQ Long-Short Equity Fund

Portfolio Manager’s Comments (continued)

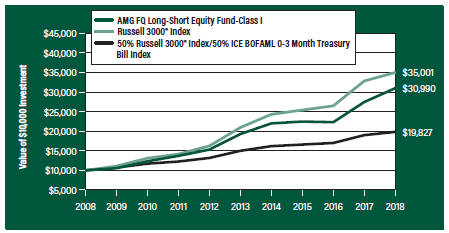

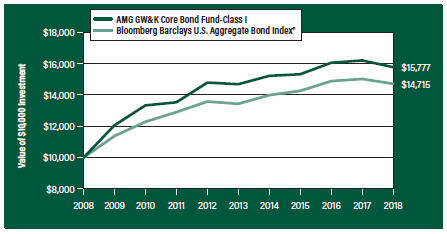

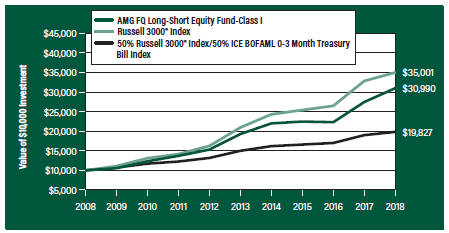

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG FQ Long-Short Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the AMG FQ Long-Short Equity Fund’s Class I shares on October 31, 2008 to a $10,000 investment made in the Russell 3000® Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG FQ Long-Short Equity Fund and the Russell 3000® Index for the same time periods ended October 31, 2018.

| | | | | | | | | | | | |

| Average Annual Total Returns1 | | One Year | | | Five

Years | | | Ten Years | |

AMG FQ Long-Short Equity Fund2, 3, 4, 5, 6, 7, 8, 9, 10, 11 | | | | | | | | | | | | |

Class N | | | 12.54 | % | | | 9.64 | % | | | 11.66 | % |

Class I | | | 12.82 | % | | | 9.94 | % | | | 11.97 | % |

Russell 3000® Index12 | | | 6.60 | % | | | 10.81 | % | | | 13.35 | % |

50% Russell 3000® Index/50% ICE BofAML 0-3 Month U.S. Treasury Bill Index13 | | | 4.34 | % | | | 5.75 | % | | | 7.09 | % |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.835.3879 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2018. All returns are in U.S. dollars ($). |

| 2 | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | The Fund invests in large-capitalization companies that may underperform other stock funds (such as funds that focus on small- and medium-capitalization companies) when stocks of large-capitalization companies are out of favor. |

| 4 | The Fund may suffer significant losses on assets that it sells short. Unlike the possible loss on a security that is purchased, there is no limit on the amount of loss on an appreciating security that is sold short. |

| 5 | In managing the Fund, the Fund’s subadviser may rely heavily on one or more quantitative models (“Model”) and information and data supplied by third parties (“Data”). When a Model or Data used in managing the Fund contains an error, or is incorrect or incomplete, any investment decision made in reliance on the Model or Data may not produce the desired results and the Fund may realize losses. In addition, any hedging based on a faulty Model or Data may prove to be unsuccessful. |

| 6 | The use of leverage in a Fund’s strategy, such as futures, swaps and forward commitment transactions, can magnify relatively small market movements into relatively larger losses for the Fund. |

| 7 | The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history and a reliance on one or a limited number of products. |

| 8 | The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. Growth stocks may under preform value stocks during given periods. |

| 9 | Active and frequent trading of a fund may result in higher transaction costs and increased tax liability. |

| 10 | The Fund is subject to special risk considerations similar to those associated with the direct ownership of real estate. Real estate valuations may be subject to factors such as changing general and local economic, financial, competitive, and environmental conditions. |

| 11 | The Fund may invest in derivatives such as options, futures and swaps; the complexity and rapidly changing structure of derivatives markets may increase the possibility of market losses. |

| 12 | The Russell 3000® Index is composed of the 3,000 largest U.S. companies as measured by market capitalization, and represents about 98% of the U.S. stock market. Unlike the Fund, the Russell 3000® |

13

[AMG FQ Long-Short Equity Fund]

[Portfolio Manager’s Comments] (continued)

| | Index is unmanaged, is not available for investment, and does not incur expenses. |

| 13 | ICE BofAML 0-3 Month U.S. Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. At the end of the month that issue is sold and rolled into a newly selected issue. The issue selected at |

| | each month-end rebalancing is the outstanding Treasury Bill that matures closest to, but not beyond, three months from the rebalancing date. Unlike the Fund, the index is unmanaged, is not available for investment and does not incur expenses. |

| | The Russell 3000® Index is a trademark of the London Stock Exchange Group companies. |

Not FDIC insured, nor bank guaranteed. May lose value.

14

AMG FQ Long-Short Equity Fund

Fund Snapshots (unaudited)

October 31, 2018

| | | | | | | | | | | | |

Sector | | Long

Exposure1 | | | Short

Exposure1 | | | Net

Exposure1 | |

Financials | | | 8.5 | | | | (9.7 | ) | | | (1.2 | ) |

Real Estate | | | 8.0 | | | | (7.4 | ) | | | 0.6 | |

Information Technology | | | 7.7 | | | | (6.2 | ) | | | 1.5 | |

Consumer Discretionary | | | 7.0 | | | | (6.3 | ) | | | 0.7 | |

Industrials | | | 6.2 | | | | (7.0 | ) | | | (0.8 | ) |

Health Care | | | 3.5 | | | | (2.2 | ) | | | 1.3 | |

Utilities | | | 2.2 | | | | (1.9 | ) | | | 0.3 | |

Materials | | | 2.1 | | | | (2.7 | ) | | | (0.6 | ) |

Energy | | | 1.7 | | | | (1.4 | ) | | | 0.3 | |

Consumer Staples | | | 1.2 | | | | (1.7 | ) | | | (0.5 | ) |

Communication Services | | | 0.4 | | | | (0.5 | ) | | | (0.1 | ) |

Short Term Investments2 | | | 11.2 | | | | — | | | | 11.2 | |

Other Assets3,4 | | | 87.3 | | | | — | | | | 87.3 | |

| 1 | As a perecentage of net assets. |

| 2 | Includes reinvestment of cash collateral into joint repurchase agreements on security lending transactions. |

| 3 | Includes repayment of cash collateral on security lending transactions. |

| 4 | Incudes collateral for short sale and swaps. |

TOP TEN HOLDINGS

| | | | |

Security Name | | %of

Net Assets | |

PS Business Parks, Inc. | | | 1.1 | |

The Progressive Corp. | | | 1.0 | |

Ciena Corp. | | | 1.0 | |

UGI Corp. | | | 1.0 | |

Progress Software Corp. | | | 1.0 | |

Houlihan Lokey, Inc. | | | 1.0 | |

Rayonier, Inc. | | | 0.9 | |

MGIC Investment Corp. | | | 0.9 | |

Bluerock Residential Growth REIT, Inc.1 | | | 0.9 | |

Helen of Troy, Ltd. | | | 0.9 | |

| | | | |

Top Ten as a Group | | | 9.7 | |

| | | | |

| 1 | Represents security sold short. |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

15

AMG FQ Long-Short Equity Fund

Schedule of Portfolio Investments

October 31, 2018

| | | | | | | | |

| | | Shares | | | Value | |

Long Positions - 59.7% | | | | | | | | |

Common Stocks - 48.5% | | | | | | | | |

Communication Services - 0.4% | | | | | |

Vonage Holdings Corp.*,1 | | | 27,720 | | | $ | 367,567 | |

Consumer Discretionary - 7.0% | | | | | |

Aaron’s, Inc. | | | 1,675 | | | | 78,943 | |

Asbury Automotive Group, Inc.*,2 | | | 4,027 | | | | 262,158 | |

Career Education Corp.*,1 | | | 2,234 | | | | 32,125 | |

Comcast Corp., Class A | | | 1,146 | | | | 43,708 | |

Core-Mark Holding Co., Inc. | | | 770 | | | | 29,576 | |

Deckers Outdoor Corp.*,1 | | | 2,819 | | | | 358,492 | |

Entravision Communications Corp., Class A | | | 37,383 | | | | 184,672 | |

Gentex Corp.1 | | | 29,321 | | | | 617,207 | |

Helen of Troy, Ltd.*,1 | | | 6,019 | | | | 747,078 | |

International Speedway Corp., Class A1 | | | 3,885 | | | | 145,726 | |

J. Jill, Inc.*,2 | | | 10,913 | | | | 55,111 | |

K12, Inc.* | | | 5,396 | | | | 115,528 | |

Liberty Expedia Holdings, Inc., Class A* | | | 5,225 | | | | 226,870 | |

Lowe’s Cos., Inc. | | | 2,527 | | | | 240,621 | |

MCBC Holdings, Inc.* | | | 8,031 | | | | 238,360 | |

MSG Networks, Inc., Class A*,2 | | | 9,296 | | | | 237,513 | |

NIKE, Inc., Class B1 | | | 6,431 | | | | 482,582 | |

Red Rock Resorts,Inc.,ClassA2 | | | 6,623 | | | | 153,256 | |

Ross Stores, Inc.1 | | | 5,823 | | | | 576,477 | |

Signet Jewelers, Ltd. | | | 670 | | | | 37,554 | |

Speedway Motorsports, Inc. | | | 13,970 | | | | 216,954 | |

Taylor Morrison Home Corp., Class A* | | | 12,374 | | | | 204,666 | |

Tilly’s, Inc., Class A | | | 361 | | | | 6,404 | |

The TJX Cos., Inc. | | | 1,539 | | | | 169,105 | |

Tower International, Inc. | | | 3,628 | | | | 107,715 | |

The Walt Disney Co. | | | 71 | | | | 8,153 | |

Total Consumer Discretionary | | | | | | | 5,576,554 | |

Consumer Staples - 1.2% | | | | | | | | |

Performance Food Group Co.*,1 | | | 13,337 | | | | 391,041 | |

The Kroger Co. | | | 709 | | | | 21,100 | |

United Natural Foods, Inc.*,1,2 | | | 8,649 | | | | 187,943 | |

US Foods Holding Corp.* | | | 5,853 | | | | 170,732 | |

USANA Health Sciences, Inc.*,1 | | | 1,555 | | | | 181,966 | |

Total Consumer Staples | | | | | | | 952,782 | |

Energy - 1.7% | | | | | | | | |

Adams Resources & Energy, Inc.1 | | | 770 | | | | 31,224 | |

CONSOL Energy, Inc.* | | | 287 | | | | 11,434 | |

Denbury Resources, Inc.*,2 | | | 2,240 | | | | 7,728 | |

| | | | | | | | |

| | | Shares | | | Value | |

Evolution Petroleum Corp.1 | | | 15,731 | | | $ | 162,029 | |

Helix Energy Solutions Group, Inc.*,2 | | | 10,229 | | | | 87,151 | |

Laredo Petroleum, Inc.*,2 | | | 19,939 | | | | 104,480 | |

Matrix Service Co.* | | | 6,992 | | | | 142,147 | |

NACCO Industries, Inc., Class A | | | 516 | | | | 17,823 | |

Peabody Energy Corp. | | | 8,599 | | | | 304,835 | |

Renewable Energy Group, Inc.*,1 | | | 13,214 | | | | 410,691 | |

W&T Offshore, Inc.*,2 | | | 11,743 | | | | 79,148 | |

Total Energy | | | | | | | 1,358,690 | |

Financials - 8.5% | | | | | | | | |

American Equity Investment Life Holding Co.1 | | | 12,561 | | | | 392,154 | |

Arthur J Gallagher & Co.1 | | | 8,367 | | | | 619,242 | |

Artisan Partners Asset Management, Inc., Class A | | | 930 | | | | 25,491 | |

The Bank of NT Butterfield & Son, Ltd. (Bermuda)1 | | | 15,350 | | | | 618,452 | |

Banner Corp.1 | | | 6,901 | | | | 399,016 | |

Cathay General Bancorp | | | 2,420 | | | | 91,161 | |

Cherry Hill Mortgage Investment Corp., REIT | | | 5,618 | | | | 100,618 | |

Discover Financial Services | | | 1,642 | | | | 114,398 | |

Employers Holdings, Inc.1 | | | 8,984 | | | | 412,905 | |

Enova International, Inc.* | | | 5,167 | | | | 122,200 | |

Essent Group, Ltd.* | | | 8,096 | | | | 319,144 | |

Evercore, Inc., Class A | | | 1,940 | | | | 158,479 | |

Federated Investors, Inc., Class B | | | 11,339 | | | | 279,733 | |

Fidelity National Financial, Inc. | | | 122 | | | | 4,081 | |

Financial Institutions, Inc. | | | 728 | | | | 20,784 | |

First American Financial Corp. | | | 212 | | | | 9,398 | |

Green Dot Corp., Class A* | | | 1,628 | | | | 123,305 | |

Houlihan Lokey, Inc.1 | | | 18,600 | | | | 765,948 | |

International Bancshares Corp. | | | 3,541 | | | | 137,037 | |

Kemper Corp. | | | 573 | | | | 43,084 | |

MGIC Investment Corp.*,1 | | | 61,824 | | | | 754,871 | |

National General Holdings Corp. | | | 571 | | | | 15,908 | |

The Progressive Corp.1 | | | 11,647 | | | | 811,796 | |

Pzena Investment Management, Inc., Class A | | | 20,291 | | | | 204,127 | |

SEI Investments Co. | | | 1,942 | | | | 103,800 | |

Silvercrest Asset Management Group, Inc., Class A2 | | | 3,722 | | | | 53,522 | |

Universal Insurance Holdings, Inc. | | | 2,831 | | | | 118,845 | |

Total Financials | | | | | | | 6,819,499 | |

Health Care - 3.5% | | | | | | | | |

Acorda Therapeutics, Inc.*,2 | | | 3,527 | | | | 67,401 | |

Amedisys, Inc.*,1 | | | 4,788 | | | | 526,680 | |

Biogen, Inc.* | | | 198 | | | | 60,245 | |

The accompanying notes are an integral part of these financial statements.

16

AMG FQ Long-Short Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Health Care - 3.5% (continued) | | | | | | | | |

Cardiovascular Systems, Inc.* | | | 3,822 | | | $ | 107,207 | |

Evolent Health, Inc., Class A*,2 | | | 370 | | | | 8,214 | |

Genomic Health, Inc.*,1 | | | 4,735 | | | | 339,547 | |

Haemonetics Corp.* | | | 491 | | | | 51,295 | |

Halozyme Therapeutics, Inc.* | | | 6,494 | | | | 100,852 | |

HealthEquity, Inc.* | | | 3,644 | | | | 334,519 | |

Horizon Pharma PLC* | | | 1,280 | | | | 23,309 | |

Ligand Pharmaceuticals, Inc.*,2 | | | 2,292 | | | | 377,745 | |

Loxo Oncology, Inc.*,2 | | | 311 | | | | 47,477 | |

Mallinckrodt PLC* | | | 6,003 | | | | 150,435 | |

Medpace Holdings, Inc.* | | | 3,752 | | | | 195,479 | |

UnitedHealth Group, Inc. | | | 629 | | | | 164,389 | |

Vanda Pharmaceuticals, Inc.* | | | 5,591 | | | | 106,061 | |

Vertex Pharmaceuticals, Inc.*,1 | | | 791 | | | | 134,043 | |

Zoetis, Inc. | | | 504 | | | | 45,436 | |

Total Health Care | | | | | | | 2,840,334 | |

Industrials - 6.2% | | | | | | | | |

Albany International Corp., Class A | | | 58 | | | | 4,059 | |

Allison Transmission Holdings, Inc.1 | | | 16,419 | | | | 723,750 | |

ArcBest Corp.2 | | | 3,090 | | | | 114,701 | |

Armstrong World Industries, Inc.* | | | 737 | | | | 45,510 | |

Atkore International Group, Inc.* | | | 13,713 | | | | 264,112 | |

Avis Budget Group, Inc.*,1 | | | 9,492 | | | | 266,915 | |

Brady Corp., Class A1 | | | 2,122 | | | | 85,495 | |

Comfort Systems USA, Inc. | | | 534 | | | | 28,558 | |

Continental Building Products, Inc.*,1 | | | 25,478 | | | | 708,543 | |

EMCOR Group, Inc.1 | | | 8,190 | | | | 581,326 | |

FTI Consulting, Inc.* | | | 2,077 | | | | 143,541 | |

Generac Holdings, Inc.* | | | 3,231 | | | | 163,909 | |

HD Supply Holdings, Inc.*,1 | | | 4,150 | | | | 155,916 | |

Interface, Inc. | | | 4,226 | | | | 68,842 | |

JetBlue Airways Corp.* | | | 15,663 | | | | 262,042 | |

Kimball International, Inc., Class B | | | 1,199 | | | | 19,736 | |

Masonite International Corp.* | | | 1,678 | | | | 92,944 | |

Moog, Inc., Class A | | | 2,142 | | | | 153,260 | |

Pentair PLC (United Kingdom) | | | 108 | | | | 4,336 | |

PGT Innovations, Inc.* | | | 3,390 | | | | 68,681 | |

Southwest Airlines Co. | | | 3,928 | | | | 192,865 | |

The Toro Co.1 | | | 7,487 | | | | 421,743 | |

TriNet Group, Inc.* | | | 205 | | | | 9,633 | |

TrueBlue, Inc.*,1 | | | 13,352 | | | | 311,502 | |

United Continental Holdings, Inc.* | | | 588 | | | | 50,280 | |

| | | | | | | | |

| | | Shares | | | Value | |

YRC Worldwide, Inc.*,1,2 | | | 4,288 | | | $ | 35,419 | |

Total Industrials | | | | | | | 4,977,618 | |

Information Technology - 7.7% | | | | | | | | |

Amkor Technology, Inc.* | | | 5,898 | | | | 42,171 | |

Aspen Technology, Inc.*,1 | | | 4,125 | | | | 350,171 | |

Blucora, Inc.* | | | 2,925 | | | | 84,591 | |

CDW Corp. 1 | | | 4,779 | | | | 430,158 | |

Ciena Corp.*,1,2 | | | 25,699 | | | | 803,351 | |

Endurance International Group Holdings, Inc.* | | | 28,769 | | | | 283,950 | |

Entegris, Inc. | | | 10,579 | | | | 280,767 | |

ePlus, Inc.* | | | 2,048 | | | | 173,834 | |

EVERTEC, Inc. (Puerto Rico)1 | | | 25,480 | | | | 664,518 | |

Intuit, Inc. | | | 204 | | | | 43,044 | |

Lumentum Holdings, Inc.*,2 | | | 1,281 | | | | 70,007 | |

MAXIMUS, Inc.1 | | | 7,230 | | | | 469,733 | |

Micron Technology, Inc.*,1 | | | 18,963 | | | | 715,284 | |

Nanometrics, Inc.* | | | 3,702 | | | | 118,686 | |

Presidio, Inc. | | | 529 | | | | 7,089 | |

Progress Software Corp.1 | | | 24,306 | | | | 781,195 | |

Sabre Corp.1 | | | 17,252 | | | | 425,262 | |

SailPoint Technologies Holding, Inc.* | | | 664 | | | | 17,290 | |

Semtech Corp.* | | | 2,896 | | | | 130,146 | |

SMART Global Holdings, Inc.*,2 | | | 665 | | | | 18,627 | |

Stamps.com, Inc.*,2 | | | 732 | | | | 147,988 | |

TTM Technologies, Inc.*,2 | | | 2,623 | | | | 30,689 | |

Yelp, Inc.* | | | 1,728 | | | | 73,993 | |

Total Information Technology | | | | | | | 6,162,544 | |

Materials - 2.1% | | | | | | | | |

Freeport-McMoRan, Inc. | | | 1,347 | | | | 15,693 | |

FutureFuel Corp. | | | 7,530 | | | | 123,492 | |

Louisiana-Pacific Corp.1 | | | 27,910 | | | | 607,601 | |

LyondellBasell Industries NV, Class A | | | 2,546 | | | | 227,281 | |

Reliance Steel & Aluminum Co.1 | | | 2,605 | | | | 205,587 | |

Trinseo, S.A.1 | | | 6,118 | | | | 329,638 | |

Verso Corp., Class A* | | | 5,923 | | | | 166,495 | |

Total Materials | | | | | | | 1,675,787 | |

Real Estate - 8.0% | | | | | | | | |

Chesapeake Lodging Trust, REIT | | | 7,097 | | | | 208,581 | |

Equity LifeStyle Properties, Inc., REIT | | | 2,810 | | | | 266,079 | |

First Industrial Realty Trust, Inc., REIT 1 | | | 23,214 | | | | 712,670 | |

Marcus & Millichap, Inc.*,1 | | | 17,234 | | | | 598,364 | |

Park Hotels & Resorts, Inc., REIT 1 | | | 15,211 | | | | 442,184 | |

Pebblebrook Hotel Trust, REIT 2 | | | 5,218 | | | | 175,899 | |

The accompanying notes are an integral part of these financial statements.

17

AMG FQ Long-Short Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Real Estate - 8.0% (continued) | | | | | | | | |

PS Business Parks, Inc.,

REIT 1 | | | 6,472 | | | $ | 845,243 | |

Rayonier, Inc., REIT 1 | | | 25,283 | | | | 763,546 | |

The RMR Group, Inc., Class A1 | | | 6,844 | | | | 519,323 | |

Ryman Hospitality Properties, Inc., REIT 1 | | | 7,646 | | | | 593,253 | |

Sunstone Hotel Investors, Inc., REIT 1 | | | 41,561 | | | | 601,388 | |

Terreno Realty Corp., REIT | | | 6,559 | | | | 245,503 | |

Xenia Hotels & Resorts, Inc., REIT 1 | | | 21,283 | | | | 437,366 | |

Total Real Estate | | | | | | | 6,409,399 | |

Utilities - 2.2% | | | | | | | | |

NorthWestern Corp.1 | | | 6,798 | | | | 399,450 | |

Portland General Electric Co.1 | | | 12,960 | | | | 584,237 | |

UGI Corp.1 | | | 14,733 | | | | 781,733 | |

Total Utilities | | | | | | | 1,765,420 | |

Total Common Stocks | | | | | | | | |

(Cost $41,647,299) | | | | | | | 38,906,194 | |

| | |

| | | Principal

Amount | | | | |

Short-Term Investments - 11.2% | | | | | |

Joint Repurchase Agreements - 0.2%3 | | | | | |

Citibank N.A., dated 10/31/18, due 11/01/18, 2.200% total to be received $160,214 (collateralized by various U.S. Treasuries, 0.000% - 8.750%, 03/07/19 - 09/09/49, totaling $163,408) | | $ | 160,204 | | | | 160,204 | |

| | |

| | | Shares | | | | |

Other Investment Companies - 11.0% | |

Dreyfus Government Cash Management Fund, Institutional Class Shares, 2.05%4 | | | 2,913,927 | | | | 2,913,927 | |

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Class Shares,

2.12%4 | | | 2,913,927 | | | | 2,913,927 | |

JPMorgan U.S. Government Money Market Fund, IM Shares, 2.09%4 | | | 3,002,228 | | | | 3,002,228 | |

Total Other Investment Companies | | | | | | | 8,830,082 | |

Total Short-Term Investments | | | | | | | | |

(Cost $8,990,286) | | | | | | | 8,990,286 | |

Total Investments - 59.7% | | | | | | | | |

(Cost $50,637,585) | | | | | | | 47,896,480 | |

Short Sales - (47.0%)5 | | | | | | | | |

Common Stocks - (47.0%) | | | | | |

Communication Services - (0.5%) | | | | | |

ORBCOMM, Inc. * | | | (40,281 | ) | | | (383,878 | ) |

Consumer Discretionary - (6.3%) | | | | | |

Caesars Entertainment Corp. * | | | (45,760 | ) | | | (393,078 | ) |

Carvana Co. * | | | (4,158 | ) | | | (161,123 | ) |

| | | | | | | | |

| | | Shares | | | Value | |

Century Casinos, Inc. * | | | (6,789 | ) | | $ | (42,363 | ) |

Cooper Tire & Rubber Co. | | | (10,379 | ) | | | (320,607 | ) |

Dine Brands Global, Inc. | | | (2,482 | ) | | | (201,141 | ) |

Entercom Communications Corp., Class A | | | (80,878 | ) | | | (524,898 | ) |

Gaia, Inc. * | | | (45,722 | ) | | | (667,999 | ) |

Hamilton Beach Brands Holding Co., Class A | | | (9,062 | ) | | | (210,420 | ) |

Liquidity Services, Inc. * | | | (802 | ) | | | (4,764 | ) |

Mattel, Inc. * | | | (44,803 | ) | | | (608,425 | ) |

Meredith Corp. | | | (11,374 | ) | | | (586,444 | ) |

Motorcar Parts of America, Inc. * | | | (17,952 | ) | | | (380,223 | ) |

The New Home Co, Inc. * | | | (53,205 | ) | | | (379,352 | ) |

Noodles & Co. * | | | (10,294 | ) | | | (97,073 | ) |

Shake Shack, Inc., Class A * | | | (1,516 | ) | | | (80,181 | ) |

Superior Industries International, Inc. | | | (10,980 | ) | | | (107,933 | ) |

Tempur Sealy International, Inc. * | | | (2,437 | ) | | | (112,614 | ) |

Tesla, Inc. * | | | (476 | ) | | | (160,564 | ) |

Wayfair, Inc., Class A * | | | (284 | ) | | | (31,322 | ) |

Total Consumer Discretionary | | | | | | | (5,070,524 | ) |

Consumer Staples - (1.7%) | | | | | | | | |

Bunge, Ltd. | | | (6,609 | ) | | | (408,436 | ) |

Campbell Soup Co. | | | (2,815 | ) | | | (105,309 | ) |

Coty, Inc., Class A | | | (57,234 | ) | | | (603,819 | ) |

Farmer Brothers Co. * | | | (9,944 | ) | | | (239,750 | ) |

Total Consumer Staples | | | | | | | (1,357,314 | ) |

Energy - (1.4%) | | | | | | | | |

Alta Mesa Resources, Inc., Class A * | | | (8,216 | ) | | | (25,880 | ) |

Diamond Offshore Drilling, Inc. * | | | (2,323 | ) | | | (32,940 | ) |

Green Plains, Inc. | | | (4,787 | ) | | | (81,571 | ) |

International Seaways, Inc. * | | | (32,471 | ) | | | (698,451 | ) |

Nabors Industries, Ltd. | | | (22,856 | ) | | | (113,594 | ) |

SEACOR Marine Holdings, Inc. * | | | (1,919 | ) | | | (35,079 | ) |

SemGroup Corp., Class A | | | (2,765 | ) | | | (51,125 | ) |

Targa Resources Corp. | | | (1,747 | ) | | | (90,268 | ) |

Total Energy | | | | | | | (1,128,908 | ) |

Financials - (9.7%) | | | | | | | | |

AGNC Investment Corp., REIT | | | (12,528 | ) | | | (223,500 | ) |

American International Group, Inc. | | | (13,102 | ) | | | (540,982 | ) |

Arlington Asset Investment Corp., Class A | | | (18,721 | ) | | | (157,444 | ) |

ARMOUR Residential REIT, Inc. | | | (10,518 | ) | | | (229,082 | ) |

Associated Capital Group, Inc., Class A | | | (13,613 | ) | | | (527,640 | ) |

Banc of California, Inc. | | | (23,132 | ) | | | (368,955 | ) |

Brighthouse Financial, Inc. * | | | (8,214 | ) | | | (325,521 | ) |

Byline Bancorp, Inc. * | | | (1,739 | ) | | | (38,258 | ) |

The accompanying notes are an integral part of these financial statements.

18

AMG FQ Long-Short Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Financials - (9.7%) (continued) | | | | | | | | |

Cowen, Inc. * | | | (5,605 | ) | | $ | (82,954 | ) |

eHealth, Inc. * | | | (7,243 | ) | | | (248,869 | ) |

First Bank/Hamilton NJ | | | (4,457 | ) | | | (52,949 | ) |

GAIN Capital Holdings, Inc. | | | (13,552 | ) | | | (103,537 | ) |

Greenhill & Co., Inc. | | | (844 | ) | | | (18,610 | ) |

Greenlight Capital Re, Ltd., Class A (Cayman Islands)* | | | (58,831 | ) | | | (681,851 | ) |

Hallmark Financial Services, Inc. * | | | (8,317 | ) | | | (92,651 | ) |

Hannon Armstrong Sustainable Infrastructure Capital, Inc., REIT | | | (22,282 | ) | | | (462,351 | ) |

HCI Group, Inc. | | | (6,835 | ) | | | (298,484 | ) |

Heritage Insurance Holdings, Inc. | | | (15,099 | ) | | | (210,782 | ) |

Howard Bancorp, Inc. * | | | (28,637 | ) | | | (455,615 | ) |

LendingClub Corp. * | | | (75,531 | ) | | | (243,965 | ) |

MBIA, Inc. * | | | (69,643 | ) | | | (689,466 | ) |

New York Community Bancorp, Inc. | | | (13,135 | ) | | | (125,833 | ) |

Ocwen Financial Corp. * | | | (26,933 | ) | | | (94,266 | ) |

PDL Community Bancorp * | | | (6,109 | ) | | | (83,754 | ) |

Republic First Bancorp, Inc. * | | | (13,685 | ) | | | (92,374 | ) |

Safeguard Scientifics, Inc. * | | | (77,991 | ) | | | (666,823 | ) |

Virtus Investment Partners, Inc. | | | (552 | ) | | | (54,836 | ) |

Westamerica Bancorporation | | | (1,574 | ) | | | (91,623 | ) |

WisdomTree Investments, Inc. | | | (60,776 | ) | | | (472,230 | ) |

Total Financials | | | | | | | (7,735,205 | ) |

Health Care - (2.2%) | | | | | | | | |

AAC Holdings, Inc. * | | | (7,677 | ) | | | (42,300 | ) |

Aclaris Therapeutics, Inc. * | | | (13,219 | ) | | | (157,174 | ) |

Adamas Pharmaceuticals, Inc. * | | | (11,231 | ) | | | (185,873 | ) |

Aerie Pharmaceuticals, Inc. * | | | (526 | ) | | | (27,973 | ) |

Agenus, Inc. * | | | (24,794 | ) | | | (39,422 | ) |

Bluebird Bio, Inc. * | | | (646 | ) | | | (74,096 | ) |

Community Health Systems, Inc. * | | | (44,524 | ) | | | (140,696 | ) |

The Cooper Cos, Inc. | | | (739 | ) | | | (190,891 | ) |

Dermira, Inc. * | | | (7,314 | ) | | | (91,791 | ) |

Evelo Biosciences, Inc. * | | | (6,489 | ) | | | (59,115 | ) |

Flexion Therapeutics, Inc. * | �� | | (5,575 | ) | | | (75,485 | ) |

Henry Schein, Inc. * | | | (2,304 | ) | | | (191,232 | ) |

Insmed, Inc. * | | | (483 | ) | | | (7,052 | ) |

Insulet Corp. * | | | (1,506 | ) | | | (132,844 | ) |

La Jolla Pharmaceutical Co. * | | | (3,273 | ) | | | (53,350 | ) |

The Medicines Co. * | | | (158 | ) | | | (3,675 | ) |

Melinta Therapeutics, Inc. * | | | (23,792 | ) | | | (62,573 | ) |

| | | | | | | | |

| | | Shares | | | Value | |

Molecular Templates, Inc. * | | | (3,484 | ) | | $ | (14,912 | ) |

Nuvectra Corp. * | | | (849 | ) | | | (16,988 | ) |

Paratek Pharmaceuticals, Inc. * | | | (4,369 | ) | | | (32,549 | ) |

Portola Pharmaceuticals, Inc. * | | | (1,075 | ) | | | (21,167 | ) |

Quorum Health Corp. * | | | (14,051 | ) | | | (55,923 | ) |

Radius Health, Inc. * | | | (4,966 | ) | | | (78,612 | ) |

TG Therapeutics, Inc. * | | | (4,119 | ) | | | (18,741 | ) |

Total Health Care | | | | | | | (1,774,434 | ) |

Industrials - (7.0%) | | | | | | | | |

Babcock & Wilcox Enterprises, Inc. * | | | (115,805 | ) | | | (113,211 | ) |

CECO Environmental Corp. * | | | (5,170 | ) | | | (38,465 | ) |

Charah Solutions, Inc. * | | | (17,722 | ) | | | (133,092 | ) |

CIRCOR International, Inc. | | | (15,168 | ) | | | (493,112 | ) |

Deere & Co. | | | (3,680 | ) | | | (498,419 | ) |

FreightCar America, Inc. * | | | (7,182 | ) | | | (102,703 | ) |

General Electric Co. | | | (57,644 | ) | | | (582,204 | ) |