UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-06526 |

|

The Boston Trust & Walden Funds |

(Exact name of registrant as specified in charter) |

|

One Beacon Street, Boston MA | | 02108 |

(Address of principal executive offices) | | (Zip code) |

|

4400 Easton Commons, Columbus, OH 43219 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-800-282-8782 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2016 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

This page intentionally left blank.

Annual Report December 31, 2016 |

|

Table of Contents

Economic and Market Summary | 3 |

| |

Boston Trust Asset Management Fund | |

Manager Commentary | 4 |

Investment Performance | 5 |

Schedule of Portfolio Investments | 12 |

Financial Statements | 14 |

Financial Highlights | 16 |

| |

Boston Trust Equity Fund | |

Manager Commentary | 4 |

Investment Performance | 5 |

Schedule of Portfolio Investments | 17 |

Financial Statements | 18 |

Financial Highlights | 20 |

| |

Boston Trust Midcap Fund | |

Manager Commentary | 6 |

Investment Performance | 7 |

Schedule of Portfolio Investments | 21 |

Financial Statements | 22 |

Financial Highlights | 24 |

| |

Boston Trust SMID Cap Fund | |

Manager Commentary | 8 |

Investment Performance | 9 |

Schedule of Portfolio Investments | 25 |

Financial Statements | 26 |

Financial Highlights | 28 |

| |

Boston Trust Small Cap Fund | |

Manager Commentary | 10 |

Investment Performance | 11 |

Schedule of Portfolio Investments | 29 |

Financial Statements | 30 |

Financial Highlights | 32 |

| |

Environmental, Social and Governance Research and Engagement Update | 34 |

| |

Walden Asset Management Fund | |

Manager Commentary | 38 |

Investment Performance | 39 |

Schedule of Portfolio Investments | 48 |

Financial Statements | 50 |

Financial Highlights | 52 |

| |

Walden Equity Fund | |

Manager Commentary | 38 |

Investment Performance | 39 |

Schedule of Portfolio Investments | 53 |

Financial Statements | 55 |

Financial Highlights | 56 |

| |

Walden Midcap Fund | |

Manager Commentary | 40 |

Investment Performance | 41 |

Schedule of Portfolio Investments | 57 |

Financial Statements | 58 |

Financial Highlights | 60 |

| |

Walden SMID Cap Fund | |

Manager Commentary | 42 |

Investment Performance | 43 |

Schedule of Portfolio Investments | 61 |

Financial Statements | 62 |

Financial Highlights | 64 |

| |

Walden Small Cap Fund | |

Manager Commentary | 44 |

Investment Performance | 45 |

Schedule of Portfolio Investments | 65 |

Financial Statements | 66 |

Financial Highlights | 68 |

| |

Walden International Equity Fund | |

Manager Commentary | 46 |

Investment Performance | 47 |

Schedule of Portfolio Investments | 69 |

Financial Statements | 71 |

Financial Highlights | 73 |

| |

Notes to Financial Statements | 74 |

Report of Independent Public Accounting Firm | 82 |

Supplementary Information | 83 |

Investment Adviser Contract Approval | 88 |

Information About Trustees and Officers | 90 |

Boston Trust Investment Management, Inc. (BTIM), a subsidiary of Boston Trust & Investment Management Company, serves as investment adviser (the Adviser) to the Boston Trust & Walden Funds and receives a fee for its services. Walden Asset Management (Walden), a division of Boston Trust & Investment Management Company, performs shareholder advocacy, proxy voting, screening services, and other environmental, social and governance initiatives for the Adviser and is paid a fee for these services by the Adviser.

Shares of the Funds are not deposits of, obligations of, or guaranteed by BTIM or its affiliates, nor are they federally insured by the FDIC. Investments in the Funds involve investment risks, including the possible loss of principal. Funds are distributed by BHIL Distributors, LLC. Member FINRA/SIPC.

The foregoing information and opinions are for general information only. Boston Trust & Walden Funds and BTIM do not assume liability for any loss, which may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only, and are not intended as an offer or solicitation with respect to the purchase or sale of any security or offering individual or personalized investment advice. Portfolio composition is as of December 31, 2016 and is subject to change without notice.

The Boston Trust & Walden Funds may invest in foreign securities, which may involve risk not typically associated with U.S. investments.

To reduce expenses, we may only mail one copy of the Fund’s shareholder updates, such as prospectus, annual report, semi-annual report, to those addresses shared by two or more accounts. If you are a direct shareholder and wish to receive individual copies of these documents, please call us at 800-282-8782; 7050. If you are not a direct shareholder, please contact your financial institution to opt out of householding. We will begin sending you individual copies thirty days after receiving your request.

Photography credits:

· Cover: Bruce Field · Pages 1, 7, 41, 45 and 47: Jim Gallagher · Pages 5, 9, and 43: Rebecca Monette · Pages 11 and 39: Janet C. Dygert

1

This page intentionally left blank.

2

| The Boston Trust & Walden Funds A Registered Investment Company |

|

Boston Trust and Walden Funds | | Domenic Colasacco, CFA |

Economic and Market Summary | | Portfolio Manager and President |

(Unaudited) | | Boston Trust Investment Management, Inc. |

For the nine month fiscal period ended December 31, 2016, the S&P 500 Index posted a total return of 10.47%; the calendar 2016 return for the Index was 11.96%. The vast majority of other domestic indices were also in positive territory for both periods, while bond and international returns (in dollar terms) were mixed, but generally lower.

When we look back at calendar 2016 stock and bond market performance a few years from now, it may be difficult to recall that the year was far more volatile than suggested by the comparatively benign final returns. Even now, it is hard to recall that the positive performance came after a volatile first quarter of calendar 2016 in which aggregate stock values fell by about 10% during the first six weeks of the year. The concern at the time was that lower commodity values would devastate many emerging economy countries dependent on raw material exports, and hurt certain financial companies that had extended too much credit to the energy sector here in the United States. Stock prices fully recovered by the end of the first quarter, though, helped by a partial rebound in oil prices. For the most part, there were few economic surprises through the balance of the year. Global gross domestic product (GDP)(1) growth advanced at an annual rate of roughly 2%, with minimal inflation in economically developed countries. Interest rates also remained at historically low levels for most of the year.

While the overall economy progressed roughly as anticipated during the last three quarters of 2016, two surprising political events each rattled investors for brief periods. The first was the so-called “Brexit” vote in Great Britain in June, which led to renewed fear about the long-term sustainability of the euro zone. Donald Trump’s victory in November was of course the other. We suspect the initial adverse stock market reaction to Trump’s win, which occurred primarily in the wee hours of November 9th as the election outcome became evident, may have been driven more by emotional political disappointment than economic analysis. That view is supported by the fact that, within days, even the most loyal, left-leaning economists conceded that Trump’s proposed core economic policies of lower personal and corporate tax rates and higher government spending are likely to benefit economic growth, at least for the next few years. Similarly, investors concluded that the policy initiatives also improved the outlook for corporate profits and thereby stock values.

We share much of this view that Keynesian economic policy will promote further gains in the economy. As investment managers, though, our key role in the year ahead will be to gain a clear understanding of the specific legislative proposals of the new Administration, and to assess whether the current investor optimism is justified or could eventually prove to be unwarranted for any number of potential reasons. The former is likely to support still higher stock values, while disappointment could easily lead to a complete retracement of recent stock price gains. At this time, we lean toward being hopeful that both GDP and corporate profit growth are likely to accelerate modestly from recent trends, without a substantial rise in inflation or interest rates. That combination should support a further rise in stock values.

In balancing risk and return considerations, we have not revised our now years-long conclusion that a diversified stock portfolio of well-situated companies with prudent business models and reasonable growth prospects remains the most attractive option among a series of lackluster investment choices.

(1) The Gross Domestic Product (“GDP”) is the value of goods and services produced in a given country in a given year.

3

Boston Trust Asset Management Fund

Boston Trust Equity Fund

December 31, 2016

Domenic Colasacco, CFA

Portfolio Manager and President

Boston Trust Investment Management, Inc.

Asset Management Fund Objective

The Fund seeks long-term capital growth and income through an actively managed portfolio of stocks, bonds and money market instruments.

Equity Fund Objective

The Fund seeks long-term capital growth through an actively managed portfolio of stocks.

Investment Concerns

Equity securities (stocks) are more volatile and carry more risk and return potential than other forms of investments, including investments in high-grade fixed income securities.

Foreign investing involves risks not typically associated with U.S. investments, including adverse political, social and economic developments and differing auditing and legal standards. These risks are magnified in emerging markets.

Small- to mid-capitalization companies typically have a higher risk of failure and historically have experienced a greater degree of volatility.

Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss. Intermediate-term, higher quality bonds generally offer less risk than longer-term bonds and a lower rate of return.

Cash equivalents offer low risk and low return potential.

Manager Commentary (Unaudited)

Management Discussion of Fund Performance

Stocks, as measured by the S&P 500 Index, added another 10.47% of total return during the nine month period ended December 31, 2016, extending a rally that has lasted almost eight years and amassed gains of over 250% on a total return basis. While domestic stock indices registered double-digit gains over the fiscal period, U.S. bonds, as measured by the Bloomberg Barclays U.S. Government/Credit Index, were in slightly negative territory.

In diversified investment portfolios, lower bond prices offset part of the recent gains contributed by equity holdings. Moreover, those investors holding large amounts of global stocks did even worse than domestic portfolios given the lower U.S. Dollar based returns recorded by the primary euro zone and Japanese equity indices. For example, a portfolio holding an asset allocation blend of 40% in the S&P 500 Index, 20% EAFE Index(1) and 40% in Bloomberg Barclays Gov’t/Credit bonds only generated a gain of 4.91% during the three quarter fiscal period. We are pleased to report that Boston Trust Asset Management Fund’s results exceeded those achieved by such a typical, broadly diversified investment portfolio, returning 6.19% on a net basis for the period, a return that was supported primarily by our decision to keep the equity allocation near the upper-end of the usual 40% to 80% policy range. The Boston Trust Equity Fund posted a total, after-fee return of 8.82% for the nine month period, trailing the S&P 500’s return of 10.47%. For calendar year 2016, the Equity Fund’s 12.01% total net return was slightly higher than the S&P 500’s 11.96% return.

There were few economic surprises during the final three quarters of 2016. GDP growth, both globally and here in the United States, remained in a modest growth trend, with low inflation and interest rates. The key domestic economic reports included an unemployment rate that remained below 5%, continued job gains at an annual rate of close to two million, and further evidence that wages have begun to rise, particularly at lower income levels. The latter, along with continued comparatively low energy prices, supported gains in overall consumer spending and a modest increase in the savings rate, both of which bode well for further economic progress. With the notable exception of companies hurt by low energy prices, aggregate corporate profits have also remained in a positive, albeit modest, growth trend.

While economic reports were short of extraordinary, two political events rattled investors for discrete periods this year—the June UK referendum vote to leave the euro zone, and of course, the election of Donald Trump. Both events precipitated initially significant negative market reactions, followed by recoveries as investors digested the surprise and implications. Indeed, much of the wide disparity in stock and bond returns occurred since the US election in November. In recent weeks, there has also been unusually wide divergence in the performance of different equity sectors and individual stocks. Market values of companies in more stable parts of the economy such as utilities and consumer staples are generally flat to down. The best gains have been registered by stocks of companies most likely to benefit from a combination of faster economic growth and higher interest rates. These include most industrial companies and banks. Stocks of mostly domestic companies, many of which are comparatively small, have also performed exceptionally well, perhaps due to the expectation that such companies will be helped most if Trump’s proposal to lower corporate tax rates is enacted. Larger global companies already shield a greater proportion of their profits from taxes and stand to benefit less if tax rates are reduced. By policy, we keep both Funds’ equity holdings broadly diversified, but we had significant exposure to more economically sensitive companies which contributed positively to U.S. equity segment performance in the final weeks and months of the year.

Our core investment strategy views have not changed much for a few years. At year-end, 10-year US Treasury notes and 30-year maturity Treasury bonds had yields of roughly 2.5% and 3%, respectively. Both are higher than the levels of three and six months ago, but still quite low and not particularly attractive by historical standards. Aggregate stock values are also higher, but, in our opinion, still remain a better investment option than either bonds or near-zero yielding money market instruments over the next several years. Our view incorporates the fact that current stock price-to-earnings ratios(2) are above their historical average. Provided the economic environment does not deteriorate, however, we believe stock valuations will hold and perhaps expand in the years just ahead within an economic environment of gradual GDP growth. Flat to rising valuations would allow even modest growth in corporate profits to translate into mid-to-high single digit equity returns over the next three to five years, or much higher than available returns in bonds. Accordingly, unless there is a change in the generally favorable economic environment or stock/bond valuation relationship, we are likely to keep the Asset Management Fund’s equity allocation near the upper-end of the 40% to 80% policy range.*

* Portfolio composition is subject to change.

(1) The MSCI EAFE Index is an equity index which captures large and mid cap representation across Developed Markets countries* around the world, excluding the US and Canada. With 930 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

(2) The Price-to-Earnings Ratio (“P/E Ratio”) is a valuation ratio of a company’s current share price to its per-share earnings.

4

Investment Performance (Unaudited)

Boston Trust Asset Management Fund

Boston Trust Equity Fund

December 31, 2016

| | For the period ended 12/31/16 | |

| | Aggregate | | Annualized | |

| | | | | | | | | | Since | | Since | |

| | | | | | | | | | Inception | | Inception | |

| | 9 Months | | 1 Year | | 5 Years | | 10 Years | | (12/1/95) | | (10/1/03) | |

Boston Trust Asset Management Fund(1) | | 6.19 | % | 9.59 | % | 9.67 | % | 6.86 | % | 7.79 | % | — | |

Boston Trust Equity Fund(1) | | 8.82 | % | 12.01 | % | 11.71 | % | 7.08 | % | — | | 7.79 | % |

S&P 500 Index | | 10.47 | % | 11.96 | % | 14.66 | % | 6.95 | % | 8.41 | % | 8.35 | % |

Bloomberg Barclays U.S. Government/Credit Index | | -0.41 | % | 3.05 | % | 2.29 | % | 4.40 | % | 5.25 | % | — | |

Citigroup 90-Day U.S. Treasury Bill Index | | 0.22 | % | 0.27 | % | 0.09 | % | 0.73 | % | 2.35 | % | — | |

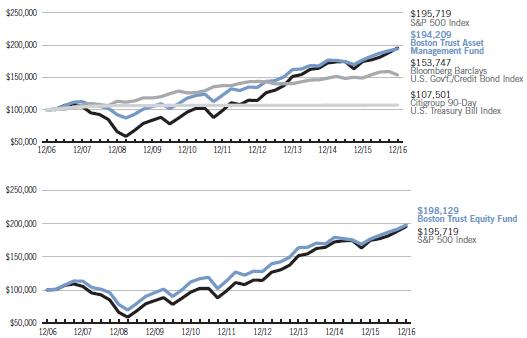

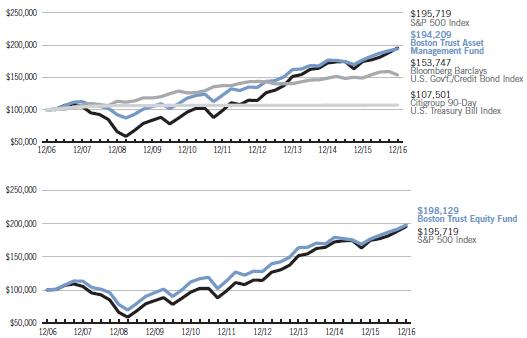

Hypothetical Growth of a $100,000 Investment

The charts represent a 10-year hypothetical $100,000 investment in the Boston Trust Asset Management Fund and the Boston Trust Equity Fund, and represent the reinvestment of dividends and capital gains in the Funds. The returns shown on the table and graphs do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Boston Trust Asset Management Fund is measured against a combination of equity and fixed income indices. The Boston Trust Equity Fund is measured against the Standard & Poor’s 500 Index (“S&P 500”), which is widely regarded as a gauge of the U.S. equities market, includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also widely viewed as a proxy for the total market. The Bloomberg Barclays U.S. Government/Credit Index includes Treasuries (i.e., public obligations of the U.S. Treasury that have remaining maturities of more than one year), government-related issues (e.g., agency, sovereign, supranational, and local authority debt), and USD Corporates. The Bloomberg Barclays U.S. Government/Credit Index is a component of the Bloomberg Barclays U.S. Aggregate Index. The Citigroup 90-Day U.S. Treasury Bill Index reflects monthly return equivalents of yield averages that are not marked to the market. The index is an average of the last three-month treasury bill issues. The three-month treasury bills are the short-term debt obligations of the U.S. Government. The indices are unmanaged and their performance does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

Boston Trust Asset Management Fund

Fund Net Asset Value: | | $ | 41.33 | |

Gross Expense Ratio(1): | | 0.94 | % |

Boston Trust Equity Fund

Fund Net Asset Value: | | $ | 20.09 | |

Gross Expense Ratio(1): | | 0.96 | % |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

(1) The Gross Expense Ratio is from the Fund’s most recent prospectus, dated August 1, 2016. The contractual fee limit under each Fund’s expense limitation agreement is 1.00% of each Fund’s average annual net assets, subject to certain limitations as described in each Fund’s prospectus. Please see each Fund’s most recent prospectus for details. Additional information pertaining to each Fund’s expense ratio as of December 31, 2016 can be found in the financial highlights included in this report.

5

Boston Trust Midcap Fund

December 31, 2016

Stephen J. Amyouny, CFA

Portfolio Manager

Boston Trust Investment Management, Inc.

Fund Objective

The Fund seeks long-term capital growth through an actively managed portfolio of stocks of middle capitalization (“midcap”) companies.

Investment Concerns

Equity securities (stocks) are more volatile and carry more risk and return potential than other forms of investments, including investments in high-grade fixed income securities.

Mid capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

Manager Commentary (Unaudited)

Management Discussion of Fund Performance

Portfolio Review

The Boston Trust Midcap Fund posted a return of 7.29% for the nine month period ended December 31, 2016, trailing the benchmark Russell Midcap® Index return of 11.30%. For calendar year 2016, the Fund returned 12.13%, compared to its benchmark’s return of 13.80% for the same period. After experiencing a sharp decline in the early weeks of 2016, equities trended higher throughout most of the year, albeit in an uneven and at times volatile pattern. In particular, equities rallied sharply following the Presidential election as investors reacted favorably to the pro-growth initiatives proposed by the Trump administration; investors anticipate that these proposals, which include increased infrastructure spending, lower taxes, and less regulation, will positively impact corporate profits if enacted.

Performance varied widely among sectors and specific industries as investors attempted to position their portfolios to benefit from expected policy changes. For example, banks, which have suffered from sluggish economic growth and low interest rates, rose sharply on expectations for stronger growth, less regulation, and rising interest rates. The portfolio also benefitted from the strong performance of certain diversified financials companies, including capital markets participants. Industrial manufacturers, especially domestically-oriented companies that export goods to international markets, and energy companies also rallied following the election. Conversely, health care stocks generally declined due to heightened concerns over drug pricing as well as the potential repeal of the Affordable Care Act (aka Obamacare). Additionally, stocks of stable companies that have above-average dividend yields came under selling pressure; rising interest rates may reduce the appeal of these income-oriented investments for which valuations have been bid up during the recent low interest rate environment. These stocks include certain companies within the utilities, consumer staples, real estate, and telecom sectors.

During this nine month period, our analysis indicates that the stocks of higher quality, more reasonably-valued companies that we favor trailed the performance of the broader market. Detracting from performance of the Fund was our underrepresentation in energy and materials companies leveraged to oil and other commodity prices. These companies, many of which have histories of volatile earnings and cash flows as well as elevated financial leverage, performed exceptionally well as oil prices nearly doubled from the trough levels reached in mid-February. Semiconductor stocks, another volatile group of companies that we have historically avoided in the past, also performed very well throughout this period. On the positive side, Fund positions within the healthcare sector performed quite well as we avoided many of the worst performing segments of health care; e.g. biotechnology, specialty pharmaceuticals, and hospitals.

Outlook

As we enter 2017, despite the powerful stock market rally in 2016, there is considerable uncertainty about the priorities of the incoming presidential administration, the path of future Federal Reserve interest rate increases, and the health of the global economy outside the U.S. Policies related to corporate taxes and global trade have the potential to most significantly impact corporate profits. Accordingly, we will be closely monitoring any developments on these issues.

The Fund remains broadly diversified among higher quality companies that we believe have sustainable business models, attractive future prospects, and reasonable valuations. Over the last year, the valuation of mid-cap stocks has expanded by 16% based on operating earnings per share, and the index price-to-earnings(1) multiple on this metric is now 25x. We believe that the valuations of many stocks reflect overly optimistic expectations for future growth and/or the projected benefits from new tax and trade policies. The Fund by contrast is trading at less than 21x operating earnings, while portfolio valuations are consistent with what they were a year ago and at a substantial discount to the market. As a result, we believe such a portfolio could produce attractive risk-adjusted performance compared to the index benchmark over full market cycles.*

* Portfolio composition is subject to change.

(1) The Price-to-Earnings Ratio (“P/E Ratio”) is a valuation ratio of a company’s current share price to its per-share earnings.

6

Investment Performance (Unaudited)

Boston Trust Midcap Fund

December 31, 2016

| | For the period ended 12/31/16 | |

| | Aggregate | | Annualized | |

| | | | | | | | Since | |

| | | | | | | | Inception | |

| | 9 Months | | 1 Year | | 5 Years | | 9/24/07 | |

Boston Trust Midcap Fund(1) | | 7.29 | % | 12.13 | % | 12.19 | % | 8.42 | % |

Russell Midcap® Index | | 11.30 | % | 13.80 | % | 14.72 | % | 7.57 | % |

Hypothetical Growth of a $100,000 Investment

The chart represents the historical performance of a hypothetical $100,000 investment in the Boston Trust Midcap Fund from September 24, 2007 to December 31, 2016, and represents the reinvestment of dividends and capital gains in the Fund. The returns shown on the table and graph do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Boston Trust Midcap Fund is measured against the Russell Midcap® Index, which is an unmanaged index that measures the performance of the mid cap segment of the U.S. equity universe. The Russell Midcap® Index is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market capitalization and current index membership. The Russell Midcap® Index represents approximately 31% of the total market capitalization of the Russell 1000 companies. The performance of an index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

Fund Net Asset Value: | | $ | 15.34 | |

Gross Expense Ratio(1): | | 1.03 | % |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

(1) The Gross Expense Ratio is from the Fund’s most recent prospectus, dated August 1, 2016. The Gross Expense Ratio excludes the impact of any contractual fee waivers, which limit the Fund’s total expenses to 1.00%, subject to certain limitations as described in the Fund’s prospectus. Please see the Fund’s most recent prospectus for details. Additional information pertaining to the Fund’s expense ratio as of December 31, 2016 can be found in the financial highlights included in this report. The investment performance may reflect fee reductions. If such fee reductions had not occurred, the quoted performance would have been lower. The expense limitation agreement shall automatically renew effective August 1 of every year until the Adviser provides written notice of non-renewal to the Trust.

7

Boston Trust SMID Cap Fund

December 31, 2016

Kenneth P. Scott, CFA

Portfolio Manager

Boston Trust Investment Management, Inc.

Fund Objective

The Fund seeks long-term capital growth through an actively managed portfolio of stocks of small to middle (“smid”) capitalization companies.

Investment Concerns

Equity securities (stocks) are more volatile and carry more risk and return potential than other forms of investments, including investments in high-grade fixed income securities.

Small- to mid-capitalization companies typically have a higher risk of failure and historically have experienced a greater degree of volatility.

Manager Commentary (Unaudited)

Management Discussion of Fund Performance

For the nine months ended December 31, 2016, the Boston Trust SMID Cap Fund returned 14.67%, trailing the 17.13% return of the Russell 2500™ Index. For calendar year 2016, the Fund returned 20.16%, outpacing the Russell 2500™ Index return of 17.59%. For longer-term periods, the Fund has provided competitive returns with less volatility than the index.

Following the volatile first quarter of calendar 2016, during which the Fund outperformed its benchmark by a wide margin, markets rebounded sharply and somewhat indiscriminately. Our analysis suggests that higher quality stocks modestly underperformed the strong market advance, which was a headwind to our style.

As evidence of the broad rally, most economic sectors appreciated more than 6% during the nine months. Performance of the real estate and health care sectors contributed most to relative performance comparisons. Materials and consumer discretionary were the biggest detractors from relative performance. Within materials the best performance came from lower quality, more commodity exposed names in the metals & mining and construction materials industries where the Fund has no exposure.

No individual stock had an outsized impact on performance during the period. Among contributors, SVB Financial, East West Bancorp, and UMB Financial are banks, which rallied broadly on investor optimism that rising interest rates and potentially less regulation would bolster profitability. Detractors included three consumer discretionary stocks, Fossil, Nordstrom, and Sally Beauty. All three are grappling with changes in consumer preferences.

Fundamental trends for the U.S. smaller cap market remain healthy. Revenue per share and earnings per share growth among Russell 2500™ companies in the third quarter of 2016 were 5% and 11%, respectively, on a year over year basis. Looking forward, we believe that continued employment gains in the U.S., coupled with modest productivity improvements, and still low interest rates, can sustain a modest pace of U.S. economic expansion, which in turn can support gains among smaller cap stocks. That said, the recent pace of smaller cap market appreciation may be difficult to sustain and any substantial improvement in the U.S. economic environment may take time to materialize. Furthermore, there is significant uncertainty around the potential ramifications of the new administration’s policies, and this may be exacerbated by higher than average index valuations.

We remain focused on constructing well-diversified portfolios of higher quality companies that can generate superior economic returns across macro-economic environments. As always, we believe valuation discipline is paramount to avoid overpaying for expectations that may prove overly optimistic. The Fund currently trades at an average operating price-to-earnings ratio(1) of 21x. This is one-third less than the Russell 2500™ operating price-to-earnings ratio of 34x and gives us confidence that the Fund has far less valuation risk than the market, especially considering the Fund’s superior quality profile.*

* Portfolio composition is subject to change.

(1) The Price-to-Earnings Ratio (“P/E Ratio”) is a valuation ratio of a company’s current share price to its per-share earnings.

8

Investment Performance (Unaudited) | Boston Trust SMID Cap Fund December 31, 2016 |

| | For the period ended 12/31/16 | |

| | Aggregate | | Annualized | |

| | | | | | | | Since | |

| | | | | | | | Inception | |

| | 9 Months | | 1 Year | | 5 Years | | 11/30/11 | |

Boston Trust SMID Cap Fund(1) | | 14.67 | % | 20.16 | % | 12.10 | % | 11.85 | % |

Russell 2500™ Index | | 17.13 | % | 17.59 | % | 14.54 | % | 14.33 | % |

Hypothetical Growth of a $100,000 Investment

The chart represents the historical performance of a hypothetical $100,000 investment in the Boston Trust SMID Cap Fund from November 30, 2011 to December 31, 2016, and represents the reinvestment of dividends and capital gains in the Fund. The returns shown on the table and graph do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Boston Trust SMID Cap Fund is measured against the Russell 2500™ Index, which is an unmanaged index that measures the performance of the small- to mid-cap segment of the U.S. equity universe, commonly referred to as “smid” cap. The Russell 2500 is a subset of the Russell 3000® Index. It includes approximately 2500 of the smallest securities based on a combination of their market cap and current index membership. The performance of an index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

Fund Net Asset Value: | | $ | 13.48 | |

Gross Expense Ratio(1): | | 1.73 | % |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. Returns less than one year are not annualized. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

(1) The Gross Expense Ratio is from the Fund’s most recent prospectus, dated August 1, 2016. The Gross Expense Ratio excludes the impact of any contractual fee waivers, which limit the Fund’s total expenses to 0.75%, subject to certain limitations as described in the Fund’s prospectus. Please see the Fund’s most recent prospectus for details. Additional information pertaining to the Fund’s expense ratio as of December 31, 2016 can be found in the financial highlights included in this report. The investment performance may reflect fee reductions. If such fee reductions had not occurred, the quoted performance would have been lower. The contractual fee waiver continues through August 1, 2017 and may be terminated thereafter.

9

Boston Trust Small Cap Fund

December 31, 2016

Kenneth P. Scott, CFA

Portfolio Manager

Boston Trust Investment Management, Inc.

Fund Objective

The Fund seeks long-term capital growth through an actively managed portfolio of stocks of small capitalization companies.

Investment Concerns

Equity securities (stocks) are more volatile and carry more risk and return potential than other forms of investments, including investments in high-grade fixed income securities.

Small capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure, and historically, their stocks have experienced a greater degree of market volatility than stocks on average.

Manager Commentary (Unaudited)

Management Discussion of Fund Performance

For the nine month period ended December 31, 2016, the Boston Trust Small Cap Fund returned 15.94%, trailing the 23.18% return of the Russell 2000® Index. For calendar year 2016, the Fund returned 23.29%, outpacing the Russell 2000® Index return of 21.31% For longer-term periods, those that cover at least one complete market cycle, the Fund provided competitive returns with less volatility than the index.

Following the volatile first quarter of calendar 2016, during which the Fund outperformed its benchmark by a wide margin, markets rebounded sharply and somewhat indiscriminately. Our analysis suggests that higher quality, more reasonably valued stocks lagged modestly the strong market advance, a headwind to our style that favors such stocks. Additionally, despite rising interest rates during the second half of 2016, we observed that stocks of more levered companies outperformed less levered peers.

As evidence of the broad rally, every economic sector appreciated more than 10% during the nine months, except for real estate. Industrials and real estate were the only two sectors that contributed favorably to relative performance for the period. Fund positioning in other sectors detracted from relative results, most acutely within health care and consumer discretionary. In both sectors, higher quality stocks trailed the overall sector.

No individual stock had an outsized impact on performance during the period. Among contributors, Bank of Hawaii and UMB Financial benefitted from the rally in banks as investors anticipated that future interest rate increases and potentially less regulation would bolster their profitability. Another contributor was CLARCOR, a relatively large position in the Fund that agreed to be acquired for an 18% premium toward the end of 2016. Detractors from performance included several names from the consumer discretionary sector; Fossil and Sally Beauty were among the bottom five.

Fundamental trends for the U.S. small-cap market remain healthy. Revenue per share and earnings per share growth among Russell 2000® companies in the third quarter of 2016 were 5% and 12%, respectively, on a year-over-year basis. Looking forward, we believe that continued employment gains in the U.S., coupled with modest productivity improvements, and still low interest rates, can sustain a modest pace of U.S. economic expansion, which in turn can support gains among small cap stocks. That said, the recent pace of small cap market appreciation may be difficult to sustain and any substantial improvement in the U.S. economic environment may take time to materialize. Furthermore, there is significant uncertainty around the potential ramifications of the new administration’s policies, and this may be exacerbated by higher than average index valuations.

We remain focused on constructing well-diversified portfolios of higher quality companies that can generate superior economic returns across macro-economic environments. As always, we believe valuation discipline is paramount to avoid overpaying for expectations that may prove overly optimistic. The portfolio currently trades at an average operating price-to-earnings ratio(1) of 23x. This is almost half the Russell 2000® operating price-to-earnings ratio of 45x and gives us confidence that the portfolio has far less valuation risk than the market, especially considering the portfolio’s superior quality profile.*

* Portfolio composition is subject to change.

(1) The Price-to-Earnings Ratio (“P/E Ratio”) is a valuation ratio of a company’s current share price to its per-share earnings.

10

Investment Performance (Unaudited) | Boston Trust Small Cap Fund December 31, 2016 |

| | For the period ended 12/31/16 | |

| | Aggregate | | Annualized | |

| | | | | | | | | | Since | |

| | | | | | | | | | Inception | |

| | 9 Months | | 1 Year | | 5 Years | | 10 Years | | (12/31/94) | |

Boston Trust Small Cap Fund(1) | | 15.94 | % | 23.29 | % | 11.85 | % | 8.55 | % | 11.00 | % |

Russell 2000® Index | | 23.18 | % | 21.31 | % | 14.46 | % | 7.07 | % | 9.46 | % |

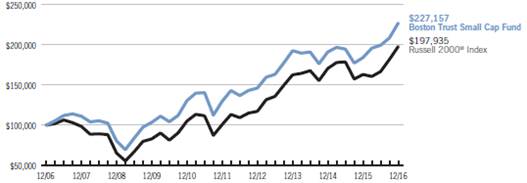

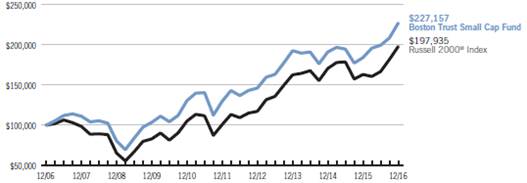

Hypothetical Growth of a $100,000 Investment

The chart represents a 10-year hypothetical $100,000 investment in the Boston Trust Small Cap Fund and represents the reinvestment of dividends and capital gains in the Fund. The returns shown on the table and graph do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Boston Trust Small Cap Fund is measured against the Russell 2000® Index, which is an unmanaged index that measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The performance of an index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

Fund Net Asset Value: | | $ | 14.33 | |

Gross Expense Ratio(1): | | 1.08 | % |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

(1) The Gross Expense Ratio is from the Fund’s most recent prospectus, dated August 1, 2016. The Gross Expense Ratio excludes the impact of any contractual fee waivers, which limit the Fund’s total expenses to 1.00%, subject to certain limitations as described in the Fund’s prospectus. Please see the Fund’s most recent prospectus for details. Additional information pertaining to the Fund’s expense ratio as of December 31, 2016 can be found in the financial highlights included in this report. The investment performance may reflect fee reductions. If such fee reductions had not occurred, the quoted performance would have been lower. The contractual fee waiver continues through August 1, 2017 and may be terminated thereafter.

11

Schedule of Portfolio Investments | | Boston Trust Asset Management Fund |

| | December 31, 2016 |

Security Description | | Shares | | Fair Value ($) | |

| | | | | |

COMMON STOCKS (75.7%) | | | | | |

Consumer Discretionary (8.9%) | | | | | |

Adient PLC (a) | | 2,089 | | 122,415 | |

Advance Auto Parts, Inc. | | 10,000 | | 1,691,200 | |

Autoliv, Inc. | | 25,000 | | 2,828,750 | |

Comcast Corp., Class A | | 140,000 | | 9,667,000 | |

NIKE, Inc., Class B | | 135,000 | | 6,862,050 | |

Nordstrom, Inc. | | 10,000 | | 479,300 | |

Omnicom Group, Inc. | | 75,000 | | 6,383,250 | |

Ross Stores, Inc. | | 60,000 | | 3,936,000 | |

Starbucks Corp. | | 75,000 | | 4,164,000 | |

| | | | 36,133,965 | |

Consumer Staples (8.2%) | | | | | |

Church & Dwight Co., Inc. | | 75,000 | | 3,314,250 | |

Colgate-Palmolive Co. | | 20,000 | | 1,308,800 | |

Costco Wholesale Corp. | | 37,500 | | 6,004,125 | |

CVS Health Corp. | | 15,000 | | 1,183,650 | |

Diageo PLC, Sponsored ADR | | 30,000 | | 3,118,200 | |

McCormick & Co., Inc. | | 25,000 | | 2,333,250 | |

PepsiCo, Inc. | | 40,000 | | 4,185,200 | |

Procter & Gamble Co. | | 35,000 | | 2,942,800 | |

Reckitt Benckiser Group PLC, Sponsored ADR | | 150,000 | | 2,520,000 | |

Sysco Corp. | | 35,000 | | 1,937,950 | |

The Hershey Co. | | 40,000 | | 4,137,200 | |

| | | | 32,985,425 | |

Energy (3.5%) | | | | | |

Chevron Corp. | | 17,500 | | 2,059,750 | |

ConocoPhillips | | 40,000 | | 2,005,600 | |

Exxon Mobil Corp. | | 82,500 | | 7,446,450 | |

Schlumberger Ltd. | | 30,000 | | 2,518,500 | |

| | | | 14,030,300 | |

Financials (14.9%) | | | | | |

American Express Co. | | 50,000 | | 3,704,000 | |

BB&T Corp. | | 35,000 | | 1,645,700 | |

Berkshire Hathaway, Inc., Class B (a) | | 40,000 | | 6,519,200 | |

Chubb Ltd. | | 45,000 | | 5,945,400 | |

Cincinnati Financial Corp. | | 90,000 | | 6,817,500 | |

Comerica, Inc. | | 30,000 | | 2,043,300 | |

Commerce Bancshares, Inc. | | 30,387 | | 1,756,672 | |

JPMorgan Chase & Co. | | 100,000 | | 8,629,000 | |

M&T Bank Corp. | | 10,000 | | 1,564,300 | |

Northern Trust Corp. | | 30,000 | | 2,671,500 | |

PNC Financial Services Group, Inc. | | 45,000 | | 5,263,200 | |

State Street Corp. | | 40,000 | | 3,108,800 | |

T. Rowe Price Group, Inc. | | 70,000 | | 5,268,200 | |

U.S. Bancorp | | 100,000 | | 5,137,000 | |

| | | | 60,073,772 | |

Health Care (11.1%) | | | | | |

Becton, Dickinson & Co. | | 50,000 | | 8,277,500 | |

C.R. Bard, Inc. | | 30,000 | | 6,739,800 | |

DENTSPLY SIRONA, Inc. | | 50,000 | | 2,886,500 | |

Edwards Lifesciences Corp. (a) | | 50,000 | | 4,685,000 | |

Johnson & Johnson, Inc. | | 55,000 | | 6,336,550 | |

Medtronic PLC | | 25,000 | | 1,780,750 | |

Merck & Co., Inc. | | 35,000 | | 2,060,450 | |

Mettler-Toledo International, Inc. (a) | | 7,500 | | 3,139,200 | |

Stryker Corp. | | 25,000 | | 2,995,250 | |

UnitedHealth Group, Inc. | | 25,000 | | 4,001,000 | |

Varian Medical Systems, Inc. (a) | | 20,000 | | 1,795,600 | |

| | | | 44,697,600 | |

Industrials (10.4%) | | | | | |

3M Co. | | 35,000 | | 6,249,950 | |

Donaldson Co., Inc. | | 40,000 | | 1,683,200 | |

Emerson Electric Co. | | 25,000 | | 1,393,750 | |

Hubbell, Inc. | | 40,000 | | 4,668,000 | |

Illinois Tool Works, Inc. | | 50,000 | | 6,123,000 | |

Rockwell Collins, Inc. | | 55,000 | | 5,101,800 | |

Union Pacific Corp. | | 50,000 | | 5,184,000 | |

United Parcel Service, Inc., Class B | | 50,000 | | 5,732,000 | |

W.W. Grainger, Inc. | | 25,000 | | 5,806,250 | |

| | | | 41,941,950 | |

Information Technology (14.3%) | | | | | |

Accenture PLC, Class A | | 70,000 | | 8,199,100 | |

Alphabet, Inc., Class A (a) | | 2,000 | | 1,584,900 | |

Alphabet, Inc., Class C (a) | | 11,000 | | 8,490,020 | |

Apple, Inc. | | 75,000 | | 8,686,500 | |

Automatic Data Processing, Inc. | | 70,000 | | 7,194,600 | |

Cisco Systems, Inc. | | 100,000 | | 3,022,000 | |

Dell Technologies, Inc., Class V (a) | | 4,458 | | 245,056 | |

Microsoft Corp. | | 150,000 | | 9,321,000 | |

Oracle Corp. | | 130,000 | | 4,998,500 | |

Versum Materials, Inc. (a) | | 10,000 | | 280,700 | |

Visa, Inc., Class A | | 75,000 | | 5,851,500 | |

| | | | 57,873,876 | |

Materials (2.4%) | | | | | |

Air Products & Chemicals, Inc. | | 20,000 | | 2,876,400 | |

AptarGroup, Inc. | | 30,000 | | 2,203,500 | |

PPG Industries, Inc. | | 50,000 | | 4,738,000 | |

| | | | 9,817,900 | |

Telecommunication Services (0.5%) | | | | | |

Verizon Communications, Inc. | | 35,000 | | 1,868,300 | |

| | | | 1,868,300 | |

Utilities (1.5%) | | | | | |

Consolidated Edison, Inc. | | 35,000 | | 2,578,800 | |

Eversource Energy | | 60,000 | | 3,313,800 | |

| | | | 5,892,600 | |

| | | | | |

TOTAL COMMON STOCKS (Cost $166,013,656) | | | | 305,315,688 | |

| | | | | |

| | Shares or | | | |

| | Principal | | | |

| | Amount($) | | | |

| | | | | |

CORPORATE BONDS (4.1%) | | | | | |

| | | | | |

Financials (2.5%) | | | | | |

American Express Bank FSB, 6.00%, 9/13/17, MTN | | 200,000 | | 206,204 | |

American Express Co., 2.65%, 12/2/22 | | 1,926,000 | | 1,898,943 | |

American Express Co., 7.00%, 3/19/18 | | 1,500,000 | | 1,594,505 | |

Berkshire Hathaway, Inc., 3.13%, 3/15/26, Callable 12/15/25 @ 100 | | 2,000,000 | | 1,989,376 | |

John Deere Capital Corp., 5.35%, 4/3/18, MTN | | 1,000,000 | | 1,047,826 | |

JPMorgan Chase & Co., 3.90%, 7/15/25, Callable 4/15/25 @ 100 | | 1,000,000 | | 1,029,367 | |

National Rural Utilities Cooperative Finance Corp., 10.38%, 11/1/18 | | 500,000 | | 576,761 | |

Wells Fargo & Co., 3.55%, 9/29/25, MTN | | 2,000,000 | | 1,998,918 | |

| | | | 10,341,900 | |

Health Care (0.3%) | | | | | |

Becton, Dickinson & Co., 3.13%, 11/8/21 | | 1,000,000 | | 1,026,378 | |

| | | | | |

Information Technology (1.3%) | | | | | |

Apple, Inc., 3.25%, 2/23/26, Callable | | | | | |

11/23/25 @ 100 | | 2,500,000 | | 2,504,275 | |

See Notes to Financial Statements

12

| | Shares or | | | |

| | Principal | | | |

Security Description | | Amount($) | | Fair Value ($) | |

| | | | | |

CORPORATE BONDS, CONTINUED | | | | | |

Information Technology, continued | | | | | |

Oracle Corp., 5.75%, 4/15/18 | | 750,000 | | 792,490 | |

Visa, Inc., 3.15%, 12/14/25, Callable 9/14/25 @ 100 | | 2,000,000 | | 2,011,050 | |

| | | | 5,307,815 | |

| | | | | |

TOTAL CORPORATE BONDS (Cost $16,478,126) | | | | 16,676,093 | |

| | | | | |

MUNICIPAL BONDS (1.2%) | | | | | |

| | | | | |

Illinois (0.1%): | | | | | |

Illinois State, GO, 5.00%, 4/1/24, Callable 4/1/17 @ 100 | | 500,000 | | 502,110 | |

| | | | | |

Massachusetts (0.7%): | | | | | |

Massachusetts State, Series E, 4.00%, 9/1/37, Callable 9/1/25 @ 100 | | 1,000,000 | | 1,025,740 | |

Massachusetts State Development Finance Agency Revenue, Series R-2, 5.00%, 7/1/28, Callable 7/1/20 @ 100 | | 460,000 | | 510,053 | |

Massachusetts State Health & Educational Facilities Authority Revenue, Series A, 5.00%, 12/15/26, Prerefunded 12/15/19 @ 100 | | 1,500,000 | | 1,650,659 | |

| | | | 3,186,452 | |

Washington (0.1%): | | | | | |

Washington State, Series C, GO, 5.00%, 2/1/26, Prerefunded 2/1/19 @ 100 | | 250,000 | | 268,583 | |

| | | | | |

Wisconsin (0.3%): | | | | | |

Wisconsin State, Series C, GO, 5.00%, 5/1/25, Prerefunded 5/1/18 @ 100 | | 200,000 | | 210,044 | |

Wisconsin State, Series D, GO, 5.50%, 5/1/26, Prerefunded 5/1/18 @ 100 | | 750,000 | | 792,578 | |

| | | | 1,002,622 | |

| | | | | |

TOTAL MUNICIPAL BONDS (Cost $5,024,445) | | | | 4,959,767 | |

| | | | | |

U.S. GOVERNMENT & U.S. GOVERNMENT AGENCY OBLIGATIONS (14.5%) | | | | | |

| | | | | |

Federal Farm Credit Bank | | | | | |

2.63%, 8/12/19 | | 10,000,000 | | 10,255,000 | |

2.85%, 3/2/28 | | 2,000,000 | | 1,986,682 | |

2.95%, 1/27/25 | | 2,000,000 | | 2,034,182 | |

3.14%, 12/5/29 | | 2,500,000 | | 2,534,515 | |

3.39%, 2/1/28 | | 2,000,000 | | 2,102,182 | |

3.85%, 12/26/25 | | 2,770,000 | | 2,996,439 | |

| | | | 21,909,000 | |

Federal Home Loan Bank | | | | | |

2.38%, 3/13/26 | | 6,000,000 | | 5,791,572 | |

2.50%, 12/10/27 | | 1,500,000 | | 1,425,117 | |

2.63%, 6/11/27 | | 1,500,000 | | 1,453,262 | |

2.88%, 9/13/24 | | 2,500,000 | | 2,579,010 | |

3.50%, 9/24/29 | | 2,000,000 | | 2,137,380 | |

| | | | 13,386,341 | |

U.S. Treasury Note | | | | | |

2.75%, 2/15/24 | | 22,500,000 | | 23,242,680 | |

| | | | | |

TOTAL U.S. GOVERNMENT & U.S. GOVERNMENT AGENCY OBLIGATIONS (Cost $58,211,182) | | | | 58,538,021 | |

| | | | | |

| | Shares | | | |

INVESTMENT COMPANIES (5.6%) | | | | | |

JPMorgan U.S. Government Money Market Fund, Capital Shares, 0.24%(b) | | 22,746,126 | | 22,746,126 | |

TOTAL INVESTMENT COMPANIES (Cost $22,746,126) | | | | 22,746,126 | |

| | | | | |

Total Investments (Cost $268,473,535) — 101.1%(c) | | | | 408,235,695 | |

Liabilities in excess of other assets — (1.1)% | | | | (4,267,138 | ) |

NET ASSETS — 100.0% | | | | $ | 403,968,557 | |

| | | | | | |

(a) | Non-income producing security. |

(b) | Rate disclosed is the seven day yield as of December 31, 2016. |

(c) | See Federal Tax Information listed in the Notes to the Financial Statements. |

| |

ADR | American Depositary Receipt |

FSB | Federal Savings Bank |

GO | General Obligation |

MTN | Medium Term Note |

See Notes to Financial Statements

13

Financial Statements | | Boston Trust Asset Management Fund |

STATEMENT OF ASSETS AND LIABILITIES | | | |

December 31, 2016 | | | |

| | | |

Assets: | | | |

Investments, at fair value (cost $268,473,535) | | $ | 408,235,695 | |

Interest and dividends receivable | | 1,126,381 | |

Receivable for capital shares issued | | 263,327 | |

Prepaid expenses and other assets | | 31,874 | |

Total Assets | | 409,657,277 | |

Liabilities: | | | |

Payable for investments purchased | | 5,252,272 | |

Payable for capital shares redeemed | | 55,462 | |

Accrued expenses and other liabilities: | | | |

Investment adviser | | 253,736 | |

Administration and accounting | | 37,746 | |

Chief compliance officer | | 1,483 | |

Custodian | | 4,975 | |

Shareholder servicing fees | | 251 | |

Transfer agent | | 6,490 | |

Trustee | | 107 | |

Other | | 76,198 | |

Total Liabilities | | 5,688,720 | |

Net Assets | | $ | 403,968,557 | |

Composition of Net Assets: | | | |

Capital | | $ | 262,768,738 | |

Accumulated undistributed net investment /(loss) | | 1 | |

Accumulated net realized gains from investment transactions | | 1,437,658 | |

Net unrealized appreciation from investments | | 139,762,160 | |

Net Assets | | $ | 403,968,557 | |

Shares outstanding (par value $0.01, unlimited number of shares authorized) | | 9,773,474 | |

Net Asset Value, Offering Price and Redemption price per share | | $ | 41.33 | |

STATEMENTS OF OPERATIONS | | | |

For the nine months ended December 31, 2016 | | | |

| | | |

Investment Income: | | | |

Interest | | $ | 1,776,047 | |

Dividends | | 4,258,956 | |

Less: Foreign tax withholding | | (46,555 | ) |

Total Investment Income | | 5,988,448 | |

Expenses: | | | |

Investment adviser | | 2,140,804 | |

Administration and accounting | | 296,417 | |

Chief compliance officer | | 12,105 | |

Custodian | | 39,630 | |

Shareholder servicing | | 3,538 | |

Transfer agency | | 28,168 | |

Trustee | | 23,809 | |

Other | | 161,851 | |

Total expenses | | 2,706,322 | |

Net Expenses | | 2,706,322 | |

Net Investment Income | | 3,282,126 | |

Net Realized/Unrealized Gains (Losses) from Investments: | | | |

Net realized gains from investment transactions | | 3,089,611 | |

Change in unrealized appreciation/depreciation from investments | | 16,305,132 | |

Net realized/unrealized gains (losses) from investments | | 19,394,743 | |

Change in Net Assets Resulting from Operations | | $ | 22,676,869 | |

For the year ended March 31, 2016 | | | |

| | | |

Investment Income: | | | |

Interest | | $ | 2,218,652 | |

Dividends | | 5,737,480 | |

Less: Foreign tax withholding | | (17,892 | ) |

Total Investment Income | | 7,938,240 | |

Expenses: | | | |

Investment adviser | | 2,636,952 | |

Administration and accounting | | 376,004 | |

Chief compliance officer | | 16,062 | |

Custodian | | 58,318 | |

Shareholder servicing | | 5,938 | |

Transfer agency | | 35,806 | |

Trustee | | 24,312 | |

Other | | 156,254 | |

Total expenses before fee reductions | | 3,309,646 | |

Fees voluntarily reduced by the transfer agent | | (12,034 | ) |

Net Expenses | | 3,297,612 | |

Net Investment Income | | 4,640,628 | |

Net Realized/Unrealized Gains (Losses) from Investments: | | | |

Net realized gains from investment transactions | | 16,469,857 | |

Change in unrealized appreciation/depreciation from investments | | (8,873,994 | ) |

Net realized/unrealized gains (losses) from investments | | 7,595,863 | |

Change in Net Assets Resulting from Operations | | $ | 12,236,491 | |

See Notes to Financial Statements

14

STATEMENTS OF CHANGES IN NET ASSETS

| | For the | | | | | |

| | nine months ended | | For the year ended | | For the year ended | |

| | December 31, 2016 | | March 31, 2016 | | March 31, 2015 | |

| | | | | | | |

Investment Activities: | | | | | | | |

Operations: | | | | | | | |

Net investment income | | $ | 3,282,126 | | $ | 4,640,628 | | $ | 4,117,970 | |

Net realized gains from investment transactions | | 3,089,611 | | 16,469,857 | | 19,703,977 | |

Change in unrealized appreciation/depreciation from investments | | 16,305,132 | | (8,873,994 | ) | 3,446,932 | |

Change in Net Assets Resulting from Operations | | 22,676,869 | | 12,236,491 | | 27,268,879 | |

Dividends: | | | | | | | |

Net investment income | | (4,258,937 | ) | (4,817,610 | ) | (3,866,046 | ) |

Net realized gains from investment transactions | | (15,310,863 | ) | (14,994,468 | ) | (8,430,347 | ) |

Change in Net Assets Resulting from Shareholder Dividends | | (19,569,800 | ) | (19,812,078 | ) | (12,296,393 | ) |

Capital Share Transactions: | | | | | | | |

Proceeds from shares issued | | 46,031,672 | | 24,649,358 | | 30,246,451 | |

Dividends reinvested | | 17,913,751 | | 18,479,514 | | 11,609,430 | |

Cost of shares redeemed | | (17,489,284 | ) | (34,998,804 | ) | (43,940,255 | ) |

Change in Net Assets Resulting from Capital Share Transactions | | 46,456,139 | | 8,130,068 | | (2,084,374 | ) |

Change in Net Assets | | 49,563,208 | | 554,481 | | 12,888,112 | |

Net Assets: | | | | | | | |

Beginning of period | | 354,405,349 | | 353,850,868 | | 340,962,756 | |

End of period | | $ | 403,968,557 | | $ | 354,405,349 | | $ | 353,850,868 | |

Share Transactions: | | | | | | | |

Issued | | 1,094,293 | | 599,690 | | 729,305 | |

Reinvested | | 433,013 | | 463,610 | | 280,083 | |

Redeemed | | (415,414 | ) | (866,940 | ) | (1,062,899 | ) |

Change in shares | | 1,111,892 | | 196,360 | | (53,511 | ) |

Accumulated undistributed net investment income/(distributions in excess of net investment income) | | $ | 1 | | $ | 955,245 | | $ | 1,169,040 | |

See Notes to Financial Statements

15

FINANCIAL HIGHLIGHTS

Selected data for a share outstanding throughout the periods indicated.

| | For the nine | | | | | | | | | | | |

| | months | | For the year | | For the year | | For the year | | For the year | | For the year | |

| | ended | | ended | | ended | | ended | | ended | | ended | |

| | December 31, | | March 31, | | March 31, | | March 31, | | March 31, | | March 31, | |

| | 2016 | | 2016 | | 2015 | | 2014 | | 2013 | | 2012 | |

| | | | | | | | | | | | | |

Net Asset Value, Beginning of Period | | $ | 40.92 | | $ | 41.80 | | $ | 40.03 | | $ | 36.08 | | $ | 33.71 | | $ | 31.56 | |

| | | | | | | | | | | | | |

Investment Activities: | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | |

Net investment income | | 0.35 | | 0.55 | | 0.50 | | 0.44 | | 0.51 | | 0.43 | |

Net realized and unrealized gains from investment transactions | | 2.18 | | 0.92 | | 2.77 | | 4.28 | | 2.41 | | 2.17 | |

Total from investment activities | | 2.53 | | 1.47 | | 3.27 | | 4.72 | | 2.92 | | 2.60 | |

Dividends: | | | | | | | | | | | | | |

Net investment income | | (0.46 | ) | (0.57 | ) | (0.47 | ) | (0.44 | ) | (0.51 | ) | (0.45 | ) |

Net realized gains from investments | | (1.66 | ) | (1.78 | ) | (1.03 | ) | (0.33 | ) | (0.04 | ) | — | |

Total dividends | | (2.12 | ) | (2.35 | ) | (1.50 | ) | (0.77 | ) | (0.55 | ) | (0.45 | ) |

| | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 41.33 | | $ | 40.92 | | $ | 41.80 | | $ | 40.03 | | $ | 36.08 | | $ | 33.71 | |

| | | | | | | | | | | | | |

Total Return | | 6.19 | %(a) | 3.65 | % | 8.21 | % | 13.13 | % | 8.77 | % | 8.36 | % |

| | | | | | | | | | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | |

Net assets at end of period (000’s) | | $ | 403,969 | | $ | 354,405 | | $ | 353,851 | | $ | 340,963 | | $ | 288,673 | | $ | 257,031 | |

Ratio of net expenses to average net assets | | 0.95 | %(b) | 0.94 | % | 0.92 | % | 0.92 | % | 0.96 | % | 1.00 | % |

Ratio of net investment income to average net assets | | 1.15 | %(b) | 1.32 | % | 1.19 | % | 1.17 | % | 1.51 | % | 1.40 | % |

Ratio of expenses (before fee reductions or recoupment of fees previously reimbursed by the investment advisor) to average net assets | | 0.95 | %(b) | 0.94 | % | 0.93 | % | 0.93 | % | 0.96 | % | 1.07 | % |

Portfolio turnover rate | | 8.42 | %(a) | 11.64 | % | 17.74 | % | 8.94 | % | 7.43 | % | 18.70 | % |

Amounts designated as “—“ are $0 or have been rounded to $0.

(a) Not annualized for periods less than one year.

(b) Annualized for periods less than one year.

See Notes to Financial Statements

16

Schedule of Portfolio Investments | | Boston Trust Equity Fund |

| | December 31, 2016 |

Security Description | | Shares | | Fair Value ($) | |

| | | | | |

COMMON STOCKS (98.3%) | | | | | |

Consumer Discretionary (10.4%) | | | | | |

Advance Auto Parts, Inc. | | 7,500 | | 1,268,400 | |

Autoliv, Inc. | | 10,000 | | 1,131,500 | |

Comcast Corp., Class A | | 50,000 | | 3,452,500 | |

NIKE, Inc., Class B | | 32,500 | | 1,651,975 | |

Omnicom Group, Inc. | | 30,000 | | 2,553,300 | |

Ross Stores, Inc. | | 10,000 | | 656,000 | |

Starbucks Corp. | | 30,000 | | 1,665,600 | |

| | | | 12,379,275 | |

Consumer Staples (11.5%) | | | | | |

Church & Dwight Co., Inc. | | 30,000 | | 1,325,700 | |

Colgate-Palmolive Co. | | 10,000 | | 654,400 | |

Costco Wholesale Corp. | | 15,000 | | 2,401,650 | |

CVS Health Corp. | | 5,000 | | 394,550 | |

Diageo PLC, Sponsored ADR | | 5,000 | | 519,700 | |

McCormick & Co., Inc. | | 7,000 | | 653,310 | |

PepsiCo, Inc. | | 12,500 | | 1,307,875 | |

Procter & Gamble Co. | | 12,500 | | 1,051,000 | |

Reckitt Benckiser Group PLC, Sponsored ADR | | 75,000 | | 1,260,000 | |

Sysco Corp. | | 25,000 | | 1,384,250 | |

The Hershey Co. | | 15,000 | | 1,551,450 | |

Wal-Mart Stores, Inc. | | 17,500 | | 1,209,600 | |

| | | | 13,713,485 | |

Energy (4.5%) | | | | | |

Chevron Corp. | | 7,500 | | 882,750 | |

ConocoPhillips | | 15,000 | | 752,100 | |

Exxon Mobil Corp. | | 30,000 | | 2,707,800 | |

Schlumberger Ltd. | | 12,500 | | 1,049,375 | |

| | | | 5,392,025 | |

Financials (19.8%) | | | | | |

American Express Co. | | 25,000 | | 1,852,000 | |

BB&T Corp. | | 32,500 | | 1,528,150 | |

Berkshire Hathaway, Inc., Class B (a) | | 17,500 | | 2,852,150 | |

Chubb Ltd. | | 16,000 | | 2,113,920 | |

Cincinnati Financial Corp. | | 30,000 | | 2,272,500 | |

Commerce Bancshares, Inc. | | 9,115 | | 526,938 | |

JPMorgan Chase & Co. | | 35,000 | | 3,020,150 | |

M&T Bank Corp. | | 5,000 | | 782,150 | |

Northern Trust Corp. | | 12,500 | | 1,113,125 | |

PNC Financial Services Group, Inc. | | 20,000 | | 2,339,200 | |

State Street Corp. | | 20,000 | | 1,554,400 | |

T. Rowe Price Group, Inc. | | 20,000 | | 1,505,200 | |

U.S. Bancorp | | 40,000 | | 2,054,800 | |

| | | | 23,514,683 | |

Health Care (14.5%) | | | | | |

Becton, Dickinson & Co. | | 16,000 | | 2,648,800 | |

C.R. Bard, Inc. | | 12,500 | | 2,808,250 | |

DENTSPLY SIRONA, Inc. | | 25,000 | | 1,443,250 | |

Edwards Lifesciences Corp. (a) | | 7,500 | | 702,750 | |

Johnson & Johnson, Inc. | | 25,000 | | 2,880,250 | |

Medtronic PLC | | 7,500 | | 534,225 | |

Merck & Co., Inc. | | 25,000 | | 1,471,750 | |

Mettler-Toledo International, Inc. (a) | | 1,500 | | 627,840 | |

Stryker Corp. | | 12,000 | | 1,437,720 | |

UnitedHealth Group, Inc. | | 12,500 | | 2,000,500 | |

Varian Medical Systems, Inc. (a) | | 7,500 | | 673,350 | |

| | | | 17,228,685 | |

Industrials (12.6%) | | | | | |

3M Co. | | 10,000 | | 1,785,700 | |

Deere & Co. | | 5,000 | | 515,200 | |

Donaldson Co., Inc. | | 10,000 | | 420,800 | |

Hubbell, Inc. | | 12,500 | | 1,458,750 | |

Illinois Tool Works, Inc. | | 15,000 | | 1,836,900 | |

Rockwell Collins, Inc. | | 15,000 | | 1,391,400 | |

Union Pacific Corp. | | 25,000 | | 2,592,000 | |

United Parcel Service, Inc., Class B | | 20,000 | | 2,292,800 | |

W.W. Grainger, Inc. | | 11,500 | | 2,670,875 | |

| | | | 14,964,425 | |

Information Technology (18.7%) | | | | | |

Accenture PLC, Class A | | 25,000 | | 2,928,249 | |

Alphabet, Inc., Class A (a) | | 750 | | 594,338 | |

Alphabet, Inc., Class C (a) | | 4,000 | | 3,087,280 | |

Apple, Inc. | | 32,500 | | 3,764,150 | |

Automatic Data Processing, Inc. | | 20,000 | | 2,055,600 | |

Cisco Systems, Inc. | | 50,000 | | 1,511,000 | |

Dell Technologies, Inc., Class V (a) | | 1,114 | | 61,237 | |

Microsoft Corp. | | 55,000 | | 3,417,700 | |

Oracle Corp. | | 50,000 | | 1,922,500 | |

Versum Materials, Inc. (a) | | 3,500 | | 98,245 | |

Visa, Inc., Class A | | 35,000 | | 2,730,700 | |

| | | | 22,170,999 | |

Materials (3.3%) | | | | | |

Air Products & Chemicals, Inc. | | 7,000 | | 1,006,740 | |

AptarGroup, Inc. | | 10,000 | | 734,500 | |

PPG Industries, Inc. | | 22,500 | | 2,132,100 | |

| | | | 3,873,340 | |

Telecommunication Services (0.9%) | | | | | |

Verizon Communications, Inc. | | 20,000 | | 1,067,600 | |

| | | | 1,067,600 | |

Utilities (2.1%) | | | | | |

Consolidated Edison, Inc. | | 15,000 | | 1,105,200 | |

Eversource Energy | | 25,000 | | 1,380,750 | |

| | | | 2,485,950 | |

| | | | | |

TOTAL COMMON STOCKS (Cost $66,396,445) | | | | 116,790,467 | |

| | | | | |

INVESTMENT COMPANIES (1.8%) | | | | | |

| | | | | |

JPMorgan U.S. Government Money Market | | | | | |

Fund, Capital Shares, 0.24%(b) | | 2,099,046 | | 2,099,046 | |

TOTAL INVESTMENT COMPANIES (Cost $2,099,046) | | | | 2,099,046 | |

| | | | | |

Total Investments (Cost $68,495,491) — 100.1%(c) | | | | 118,889,513 | |

Liabilities in excess of other assets — (0.1)% | | | | (65,921 | ) |

NET ASSETS — 100.0% | | | | $ | 118,823,592 | |

| | | | | | |

(a) Non-income producing security.

(b) Rate disclosed is the seven day yield as of December 31, 2016.

(c) See Federal Tax Information listed in the Notes to the Financial Statements.

ADR American Depositary Receipt

See Notes to Financial Statements

17

Financial Statements | | Boston Trust Equity Fund |

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2016

Assets: | | | |

Investments, at fair value (cost $68,495,491) | | $ | 118,889,513 | |

Dividends receivable | | 166,196 | |

Receivable for capital shares issued | | 31 | |

Prepaid expenses and other assets | | 5,751 | |

Total Assets | | 119,061,491 | |

Liabilities: | | | |

Payable for capital shares redeemed | | 120,540 | |

Accrued expenses and other liabilities: | | | |

Investment adviser | | 75,717 | |

Administration and accounting | | 10,469 | |

Chief compliance officer | | 439 | |

Custodian | | 1,470 | |

Shareholder servicing fees | | 697 | |

Transfer agent | | 5,807 | |

Trustee | | 30 | |

Other | | 22,730 | |

Total Liabilities | | 237,899 | |

Net Assets | | $ | 118,823,592 | |

Composition of Net Assets: | | | |

Capital | | $ | 68,699,873 | |

Accumulated undistributed net investment income/(distributions in excess of net investment income) | | — | |

Accumulated net realized losses from investment transactions | | (270,303 | ) |

Net unrealized appreciation from investments | | 50,394,022 | |

Net Assets | | $ | 118,823,592 | |

Shares outstanding (par value $0.01, unlimited number of shares authorized) | | 5,915,563 | |

Net Asset Value, Offering Price and Redemption price per share | | $ | 20.09 | |

STATEMENTS OF OPERATIONS

For the nine months ended December 31, 2016

Investment Income: | | | |

Dividends | | $ | 1,706,710 | |

Total Investment Income | | 1,706,710 | |

Expenses: | | | |

Investment adviser | | 647,553 | |

Administration and accounting | | 88,274 | |

Chief compliance officer | | 3,641 | |

Custodian | | 11,799 | |

Shareholder servicing | | 4,100 | |

Transfer agency | | 25,705 | |

Trustee | | 7,163 | |

Other | | 45,745 | |

Total expenses | | 833,980 | |

Net Expenses | | 833,980 | |

Net Investment Income | | 872,730 | |

Net Realized/Unrealized Gains (Losses) from Investments: | | | |

Net realized gains from investment transactions | | 1,255,690 | |

Change in unrealized appreciation/depreciation from investments | | 7,626,579 | |

Net realized/unrealized gains (losses) from investments | | 8,882,269 | |

Change in Net Assets Resulting from Operations | | $ | 9,754,999 | |

For the year ended March 31, 2016

Investment Income: | | | |

Dividends | | $ | 2,270,042 | |

Less: Foreign tax withholding | | (1,508 | ) |

Total Investment Income | | 2,268,534 | |

Expenses: | | | |

Investment adviser | | 815,501 | |

Administration and accounting | | 115,618 | |

Chief compliance officer | | 4,916 | |

Custodian | | 18,607 | |

Shareholder servicing | | 1,753 | |

Transfer agency | | 34,079 | |

Trustee | | 7,436 | |

Other | | 48,401 | |

Total expenses before fee reductions | | 1,046,311 | |

Fees voluntarily reduced by the transfer agent | | (12,034 | ) |

Net Expenses | | 1,034,277 | |

Net Investment Income | | 1,234,257 | |

Net Realized/Unrealized Gains (Losses) from Investments: | | | |

Net realized gains from investment transactions | | 6,530,280 | |

Change in unrealized appreciation/depreciation from investments | | (4,850,098 | ) |

Net realized/unrealized gains (losses) from investments | | 1,680,182 | |

Change in Net Assets Resulting from Operations | | $ | 2,914,439 | |

See Notes to Financial Statements

18

STATEMENTS OF CHANGES IN NET ASSETS

| | For the | | | | | |

| | nine month ended | | For the year ended | | For the year ended | |

| | December 31, 2016 | | March 31, 2016 | | March 31, 2015 | |

| | | | | | | |

Investment Activities: | | | | | | | |

Operations: | | | | | | | |

Net investment income | | $ | 872,730 | | $ | 1,234,257 | | $ | 1,013,873 | |

Net realized gains from investment transactions | | 1,255,690 | | 6,530,280 | | 7,743,467 | |

Change in unrealized appreciation/depreciation from investments | | 7,626,579 | | (4,850,098 | ) | (754,251 | ) |

Change in Net Assets Resulting from Operations | | 9,754,999 | | 2,914,439 | | 8,003,089 | |

Dividends: | | | | | | | |

Net investment income | | (1,112,873 | ) | (1,284,508 | ) | (966,299 | ) |

Net realized gains from investment transactions | | (6,430,101 | ) | (6,393,088 | ) | (2,029,175 | ) |

Change in Net Assets Resulting from Shareholder Dividends | | (7,542,974 | ) | (7,677,596 | ) | (2,995,474 | ) |

Capital Share Transactions: | | | | | | | |

Proceeds from shares issued | | 3,297,528 | | 4,569,753 | | 7,156,034 | |

Dividends reinvested | | 6,210,652 | | 7,044,804 | | 2,743,713 | |

Cost of shares redeemed | | (3,727,538 | ) | (6,684,699 | ) | (2,651,012 | ) |

Change in Net Assets Resulting from Capital Share Transactions | | 5,780,642 | | 4,929,858 | | 7,248,735 | |

Change in Net Assets | | 7,992,667 | | 166,701 | | 12,256,350 | |

Net Assets: | | | | | | | |

Beginning of period | | 110,830,925 | | 110,664,224 | | 98,407,874 | |

End of period | | $ | 118,823,592 | | $ | 110,830,925 | | $ | 110,664,224 | |

Share Transactions: | | | | | | | |

Issued | | 162,084 | | 234,638 | | 350,684 | |

Reinvested | | 308,988 | | 365,964 | | 133,125 | |

Redeemed | | (182,322 | ) | (330,644 | ) | (129,194 | ) |

Change in shares | | 288,750 | | 269,958 | | 354,615 | |

Accumulated undistributed net investment income/(distributions in excess of net investment income) | | $ | — | | $ | 236,174 | | $ | 304,834 | |

Amounts designated as “—” are $0 or have been rounded to $0.

See Notes to Financial Statements

19

FINANCIAL HIGHLIGHTS

Selected data for a share outstanding throughout the periods indicated.

| | For the nine | | | | | | | | | | | |

| | months | | For the year | | For the year | | For the year | | For the year | | For the year | |

| | ended | | ended | | ended | | ended | | ended | | ended | |

| | December 31, | | March 31, | | March 31, | | March 31, | | March 31, | | March 31, | |

| | 2016 | | 2016 | | 2015 | | 2014 | | 2013 | | 2012 | |

| | | | | | | | | | | | | |

Net Asset Value, Beginning of Period | | $ | 19.70 | | $ | 20.66 | | $ | 19.67 | | $ | 16.85 | | $ | 15.54 | | $ | 14.46 | |

| | | | | | | | | | | | | |

Investment Activities: | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | |

Net investment income | | 0.16 | | 0.23 | | 0.19 | | 0.19 | | 0.20 | | 0.13 | |

Net realized and unrealized gains from investment transactions | | 1.58 | | 0.27 | | 1.38 | | 2.81 | | 1.30 | | 1.08 | |

Total from investment activities | | 1.74 | | 0.50 | | 1.57 | | 3.00 | | 1.50 | | 1.21 | |

Dividends: | | | | | | | | | | | | | |

Net investment income | | (0.20 | ) | (0.24 | ) | (0.19 | ) | (0.18 | ) | (0.19 | ) | (0.13 | ) |

Net realized gains from investments | | (1.15 | ) | (1.22 | ) | (0.39 | ) | — | | — | | — | |

Total dividends | | (1.35 | ) | (1.46 | ) | (0.58 | ) | (0.18 | ) | (0.19 | ) | (0.13 | ) |

| | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 20.09 | | $ | 19.70 | | $ | 20.66 | | $ | 19.67 | | $ | 16.85 | | $ | 15.54 | |

| | | | | | | | | | | | | |

Total Return | | 8.82 | %(a) | 2.59 | % | 8.01 | % | 17.84 | % | 9.76 | % | 8.50 | % |

| | | | | | | | | | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | |

Net assets at end of period (000’s) | | $ | 118,824 | | $ | 110,831 | | $ | 110,664 | | $ | 98,408 | | $ | 81,154 | | $ | 69,574 | |

Ratio of net expenses to average net assets | | 0.96 | %(b) | 0.95 | % | 0.94 | % | 0.94 | % | 1.00 | % | 1.00 | % |

Ratio of net investment income to average net assets | | 1.01 | %(b) | 1.14 | % | 0.96 | % | 1.05 | % | 1.28 | % | 0.96 | % |

Ratio of expenses (before fee reductions or recoupment of fees previously reimbursed by the investment advisor) to average net assets(c) | | 0.96 | %(b) | 0.96 | % | 0.95 | % | 0.96 | % | 1.01 | % | 1.07 | % |

Portfolio turnover rate | | 6.65 | %(a) | 18.04 | % | 19.49 | % | 6.29 | % | 5.69 | % | 10.80 | % |

Amounts designated as “—” are $0 or have been rounded to $0.

(a) Not annualized for periods less than one year.

(b) Annualized for periods less than one year.

(c) During the periods ending March 31, 2012 through March 31, 2016 and December 31, 2016, certain fees were reduced. If such fee reduction had not occurred, the ratio would have been as indicated.

See Notes to Financial Statements

20

Schedule of Portfolio Investments | | Boston Trust Midcap Fund |

| | December 31, 2016 |

Security Description | | Shares | | Fair Value ($) | |

| | | | | |

Common STOCKS (99.3%) | | | | | |

Consumer Discretionary (14.7%) | | | | | |

Advance Auto Parts, Inc. | | 4,250 | | 718,759 | |

Autoliv, Inc. | | 4,250 | | 480,888 | |

Dollar General Corp. | | 8,225 | | 609,226 | |

Hasbro, Inc. | | 6,175 | | 480,353 | |

LKQ Corp. (a) | | 14,000 | | 429,100 | |

Nordstrom, Inc. | | 9,000 | | 431,370 | |

Omnicom Group, Inc. | | 11,500 | | 978,765 | |

O’Reilly Automotive, Inc. (a) | | 1,775 | | 494,178 | |

Polaris Industries, Inc. | | 3,900 | | 321,321 | |

Ross Stores, Inc. | | 13,000 | | 852,799 | |

Sally Beauty Holdings, Inc. (a) | | 22,500 | | 594,450 | |

Service Corp. International | | 17,125 | | 486,350 | |

Williams Sonoma, Inc. | | 11,750 | | 568,583 | |

| | | | 7,446,142 | |

Consumer Staples (6.3%) | | | | | |

Brown-Forman Corp., Class B | | 13,400 | | 601,928 | |

Church & Dwight Co., Inc. | | 18,950 | | 837,401 | |

McCormick & Co., Inc. | | 3,675 | | 342,988 | |

Mead Johnson Nutrition Co. | | 6,925 | | 490,013 | |

The Hershey Co. | | 5,050 | | 522,321 | |

Whole Foods Market, Inc. | | 12,000 | | 369,120 | |

| | | | 3,163,771 | |

Energy (3.9%) | | | | | |

Cabot Oil & Gas Corp. | | 19,200 | | 448,512 | |