UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-06526 |

|

The Boston Trust & Walden Funds |

(Exact name of registrant as specified in charter) |

|

One Beacon Street, Boston MA | | 02108 |

(Address of principal executive offices) | | (Zip code) |

|

4400 Easton Commons, Columbus, OH 43219 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-800-282-8782 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2018 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

This page intentionally left blank.

Annual Report

December 31, 2018

Table of Contents

Boston Trust and Walden Funds Economic and Market Summary | 3 |

| |

Boston Trust Asset Management Fund | |

Manager Commentary | 4 |

Investment Performance | 5 |

Schedule of Portfolio Investments | 12 |

Financial Statements | 14 |

Financial Highlights | 16 |

| |

Boston Trust Equity Fund | |

Manager Commentary | 4 |

Investment Performance | 5 |

Schedule of Portfolio Investments | 17 |

Financial Statements | 18 |

Financial Highlights | 20 |

| |

Boston Trust Midcap Fund | |

Manager Commentary | 6 |

Investment Performance | 7 |

Schedule of Portfolio Investments | 21 |

Financial Statements | 22 |

Financial Highlights | 24 |

| |

Boston Trust SMID Cap Fund | |

Manager Commentary | 8 |

Investment Performance | 9 |

Schedule of Portfolio Investments | 25 |

Financial Statements | 26 |

Financial Highlights | 28 |

| |

Boston Trust Small Cap Fund | |

Manager Commentary | 10 |

Investment Performance | 11 |

Schedule of Portfolio Investments | 29 |

Financial Statements | 30 |

Financial Highlights | 32 |

| |

Annual ESG Impact Report | 34 |

| |

Walden Asset Management Fund | |

Manager Commentary | 36 |

Investment Performance | 37 |

Schedule of Portfolio Investments | 46 |

Financial Statements | 48 |

Financial Highlights | 50 |

| |

Walden Equity Fund | |

Manager Commentary | 36 |

Investment Performance | 37 |

Schedule of Portfolio Investments | 51 |

Financial Statements | 52 |

Financial Highlights | 54 |

| |

Walden Midcap Fund | |

Manager Commentary | 38 |

Investment Performance | 39 |

Schedule of Portfolio Investments | 55 |

Financial Statements | 56 |

Financial Highlights | 58 |

| |

Walden SMID Cap Fund | |

Manager Commentary | 40 |

Investment Performance | 41 |

Schedule of Portfolio Investments | 59 |

Financial Statements | 60 |

Financial Highlights | 62 |

| |

Walden Small Cap Fund | |

Manager Commentary | 42 |

Investment Performance | 43 |

Schedule of Portfolio Investments | 63 |

Financial Statements | 64 |

Financial Highlights | 66 |

| |

Walden International Equity Fund | |

Manager Commentary | 44 |

Investment Performance | 45 |

Schedule of Portfolio Investments | 67 |

Financial Statements | 69 |

Financial Highlights | 71 |

| |

Notes to Financial Statements | 72 |

Report of Registered Independent Public Accounting Firm | 80 |

Supplementary Information | 81 |

Investment Adviser Contract Approval | 86 |

Information About Trustees and Officers | 88 |

Boston Trust Investment Management, Inc. (BTIM), a subsidiary of Boston Trust & Investment Management Company, serves as investment adviser (the “Adviser”) to The Boston Trust & Walden Funds and receives a fee for its services. Boston Trust & Investment Management Company provides certain administrative, operational, and investment support functions for the Adviser and is paid a fee for these services by the Adviser.

Shares of the Funds are not deposits of, obligations of, or guaranteed by BTIM or its affiliates, nor are they federally insured by the FDIC. Investments in the Funds involve investment risks, including the possible loss of principal. Funds are distributed by Foreside Financial Services, LLC.

The foregoing information and opinions are for general information only. The Boston Trust & Walden Funds and BTIM do not assume liability for any loss, which may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only, and are not intended as an offer or solicitation with respect to the purchase or sale of any security or offering individual or personalized investment advice. Portfolio composition is as of December 31, 2018 and is subject to change without notice.

The Boston Trust & Walden Funds may invest in foreign securities, which may involve risk not typically associated with U.S. investments.

To reduce expenses, we may only mail one copy of the Funds’ shareholder updates, such as their prospectus, annual report, semi-annual report, to those addresses shared by two or more accounts. If you are a direct shareholder and wish to receive individual copies of these documents, please call us at 800-282-8782 x7050. If you are not a direct shareholder, please contact your financial institution to opt out of householding. We will begin sending you individual copies thirty days after receiving your request.

Important Notice: The Securities and Exchange Commission will permit funds to deliver shareholder reports electronically beginning January 1, 2021. At that time, The Boston Trust & Walden Funds will send a notice, either by mail or email, each time your fund’s updated report is available on our website (www.btim.com). Investors enrolled in electronic delivery will receive the notice by email, with links to the updated report. Investors who are not enrolled in electronic delivery by January 1, 2021 will receive the notice in the mail. All investors who prefer to receive shareholder reports in paper may, at any time, choose that option free of charge by calling 1.800.282-8782 x7050.

Photography credits:

· Cover: Bruce Field

· Pages 7, 39, 43 and 45: Jim Gallagher

· Pages 5, 9, and 41: Rebecca Monette

· Pages 11 and 37: Janet C. Dygert

1

This page intentionally left blank.

2

| The Boston Trust & Walden Funds A Registered Investment Company |

|

Boston Trust and Walden Funds | Domenic Colasacco, CFA |

Economic and Market Summary | Portfolio Manager |

(Unaudited) | Boston Trust Investment Management, Inc. |

Greater investor concern about the global economic outlook led to a sharp drop in stock prices at the end of 2018. As measured by the S&P 500 Index(1), stock values fell by 13.52% in the fourth quarter; the decline completely offset the rise recorded during the third quarter, and resulted in a drop, including dividends, of 4.38% for all of 2018. Returns of other popular domestic equity indices such as the Russell 2000® Index(1), which measures the performance of smaller company stocks, and the NASDAQ Composite Index(1), where many faster growing, large and small companies are the primary components, performed even worse. And there was not much cheer in global markets either, which in the aggregate posted double-digit decreases for the 2018 calendar year.

The Boston Trust & Walden Funds experienced similar, though more muted, price patterns compared to their respective market indices. Without near perfect foresight that would have allowed well-timed stock trading, however, increasing asset value last year in any diversified securities portfolio was difficult. Not only did all of the primary equity indices decline for the full year, but many bond investments also fell due to the increase in interest rates.

To achieve an attractive longer-term investment return, we have usually ignored the many short-term price movements of the market generally and individual stocks in particular. The reason reflects the fact that not all stock market declines correctly signal that an economic recession is about to occur. Indeed, during the past 20 years, the S&P 500 has fallen more than 10% from prior peak levels on 10 different occasions. Each decline led to angst and concern similar to what we are all feeling through the current downturn. Yet only two of these last ten stock market declines preceded an actual economic recession. The first recession occurred amid the dot-com bust and 9/11 terrorist attack, and lasted from 2000 through 2002. The other even more severe economic and stock market decline was during the 2007-2009 financial crisis. The remaining eight market declines were false alarms, usually lasting just three- to six-months. Today, we agree with many economic pundits that the business outlook for the year ahead is far from certain, particularly in many international regions. Nonetheless, a slower rate of global gross domestic product (GDP)(1) growth appears more likely to us in 2019 than another financial crisis or outright economic contraction.

With respect to the overall economy, conditions here in the United States have been improving since 2010, and for the past two years many metrics have exceeded expectations of even the more optimistic forecasters. Among the positives: real GDP growth reached 3% in 2018, unemployment (due to excellent job creation) dropped below 4%, and the rate of inflation remained near a historically low level of 2%, even though wages finally began to accelerate. Moreover, aggregate net operating profits for the companies within the S&P 500 increased by more than 30% over the past two years, albeit aided by last year’s corporate tax rate cut.

The current broad stock market decline and the high day-to-day price volatility, however, clearly imply that many investors fear the positive economic metrics noted above will deteriorate in the months ahead. Several recent economic reports stoked investor concerns. For example, we have seen moderation in the key domestic housing and automotive sectors. There have also been numerous reports of economic weakness within the euro zone, with fear of further deterioration no doubt exacerbated by continuing global trade tension, the unresolved Brexit negotiations, economically induced street riots in France, and changing political leadership in Germany and Italy. Even China, which has been the fastest growing major global economy for nearly 20 years, signaled some softness in economic activity through the second-half of 2018, though it did so amid forecasts that GDP growth above 6% is expected in 2019. When we balance the still positive core economic trends with nascent reports of weakness, our opinion is similar to the Federal Reserve Board’s latest position that a slower rate of global GDP growth is more likely than an actual recession in 2019. History suggests stock values will stabilize and begin to improve in the months ahead if this view proves correct.

(1) The Gross Domestic Product (GDP) is the value of goods and services produced in a given country in a given year. The Standard & Poor’s 500 Index (S&P 500), which is widely regarded as a gauge of the U.S. equities market, includes 500 of the largest publicly traded U.S. companies. The Russell 2000® Index tracks the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index, and represents approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. The NASDAQ Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities.

3

Boston Trust Asset Management Fund

Boston Trust Equity Fund

December 31, 2018

Domenic Colasacco, CFA

Portfolio Manager

Boston Trust Investment Management, Inc.

Asset Management Fund Objective

The Fund seeks long-term capital growth and income through an actively managed portfolio of stocks, bonds, and money market instruments.

Equity Fund Objective

The Fund seeks long-term capital growth through an actively managed portfolio of stocks.

Investment Concerns

Equity securities (stocks) are more volatile and carry more risk and return potential than other forms of investments, including investments in high-grade fixed income securities.

Foreign investing involves risks not typically associated with U.S. investments, including adverse political, social and economic developments and differing auditing and legal standards. These risks are magnified in emerging markets.

Small- to mid-capitalization companies typically have a higher risk of failure and historically have experienced a greater degree of volatility.

Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss. Intermediate-term, higher quality bonds generally offer less risk than longer-term bonds and a lower rate of return.

Cash equivalents offer low risk and low return potential.

Manager Commentary (Unaudited)

Management Discussion of Fund Performance

Stocks, as measured by the S&P 500, fell by 4.38% for the 12-month period ended December 31, 2018. Bond indices were also in negative territory, with the Bloomberg Barclays U.S. Government/Credit Bond Index declining 0.42% for the year. The Boston Trust Asset Management Fund and the Boston Trust Equity Fund fell by 1.61% and 2.55%, respectively.

Amid the disappointing year for absolute returns, we are pleased that the Asset Management Fund’s overall value held up comparatively well, despite our decision to keep equity allocation near the upper-end of the 40% to 80% long-term policy range. Primary credit for that, as well as the Equity Fund’s better than S&P 500 performance, belongs to the higher quality, lower risk equity style we employ in selecting individual stocks.*

In prior reports we have mentioned that it would not be unusual for stock prices to retrace part of the strong returns posted in recent years. Frankly, though, the severity of the recent price decline and the sudden change in investor confidence about the economic outlook surprised us. From the peak level reached on September 20 to the lowest point close on December 24, the S&P 500 fell by nearly 20%, with most of the drop occurring during the few weeks just before Christmas. Even though about one-third of the decline was recouped during the last few trading days of the year, it is understandable that we continue to receive more than the usual number of client questions about the prospects for stock values. The questions asked most frequently involve the duration and extent of any further stock price declines. The simple, honest answer is that neither we nor anyone else knows for certain. Much will depend on the actual direction of economic activity in the months ahead.

Investment Strategy

Selecting a successful investment strategy for a long-term oriented securities portfolio always involves accepting prudent investment risk in an ever evolving and frequently uncertain world. For the Boston Trust Asset Management Fund, since 2010 our view has been that an equity allocation near the upper-end of the Fund’s 40% to 80% equity policy range best incorporated the prevailing risk and return tradeoffs among stocks, bonds, and money market instruments. Our preference for equities has been based on a combination of improving economic conditions, rising corporate profits, historically low interest rates, and generally reasonable stock price valuations. Cumulatively, our decision to emphasize stocks rather than bonds or money market instruments has added substantial value. From the end of 2009 through year-end 2018, the S&P 500 increased at a compound annual rate of 11.73%. Investment-grade bond indices, as represented by Bloomberg Barclays Government/Credit Bond Index, returned only about 3% per annum during this nine-year period, and money market instruments, as represented by 90-day U.S. Treasury bills, averaged less than 1%.*

A salient question as we begin 2019 is whether the long bull market is now behind us, and if it is best to invest most of the Fund’s assets in fixed income securities until the economic environment is less volatile and better defined. After considering the risks and opportunities, we believe it is best to retain the current, still high allocation to equities.*

Our asset allocation decision mostly reflects our view that an economic recession is unlikely in 2019. Further, the silver lining after a year of lower stock prices and good business conditions is that most equity valuation metrics are more attractive today than they were a year ago. For example, the average price-to-earnings ratio(1) for stocks in the S&P 500 is now close to the historical average of 15x, down from nearly 20x for most of the past five years. At current valuation levels, stocks do not need an ideal economic environment to perform well. Even a modest change in investor confidence about the 2019 economic outlook should suffice, particularly given that interest rates remain historically low and pose minimal competition for investment assets that have a longer-term time horizon.*

Among the individual stocks in both Funds, we continue to emphasize companies with below average financial leverage and lower business model risk. As was the case during the fourth quarter of 2018—and most other adverse market periods—we believe this equity style is likely to protect the Funds’ value comparatively well in the event our market assessment is wrong and stock values continue to fall. Also worth noting is that the market decline has made stocks of many above average companies available at more attractive prices, which provides us with an opportunity to strengthen the Funds’ portfolios.*

* Portfolio composition is subject to change.

(1) The price-to-earnings ratio (P/E Ratio) is a valuation ratio of a company’s current share price to its per-share earnings.

4

Investment Performance (Unaudited) | Boston Trust Asset Management Fund |

| Boston Trust Equity Fund |

| December 31, 2018 |

| | For the periods ended 12/31/18 | |

| | Average Annual Total Returns | |

| | | | | | | | | | | | | | Since | | Since | |

| | | | | | | | | | | | | | Inception | | Inception | |

| | 1 Year | | 3 Years | | 5 Years | | 10 Years | | 15 Years | | 20 Years | | (12/1/95) | | (10/1/03) | |

Boston Trust Asset Management Fund(1) | | -1.61 | % | 7.81 | % | 6.48 | % | 9.13 | % | 6.85 | % | 5.93 | % | 7.71 | % | — | |

Boston Trust Equity Fund(1) | | -2.55 | % | 9.62 | % | 7.29 | % | 11.51 | % | 7.42 | % | — | | — | | 7.88 | % |

S&P 500 Index | | -4.38 | % | 9.26 | % | 8.49 | % | 13.12 | % | 7.77 | % | 5.62 | % | 8.37 | % | 8.29 | % |

Bloomberg Barclays U.S. Government/ Credit Bond Index | | -0.42 | % | 2.19 | % | 2.53 | % | 3.46 | % | 3.85 | % | 4.54 | % | 4.94 | % | — | |

FTSE 3 Month US T-Bill Index | | 1.86 | % | 0.99 | % | 0.60 | % | 0.35 | % | 1.26 | % | 1.81 | % | 2.26 | % | — | |

Hypothetical Growth of a $100,000 Investment

The above charts represent a 10-year hypothetical $100,000 investment in the Boston Trust Asset Management Fund and the Boston Trust Equity Fund, and includes the reinvestment of dividends and capital gains in the Funds. The returns shown on the table and the graphs do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Boston Trust Asset Management Fund is measured against a combination of equity and fixed income indices. The Boston Trust Equity Fund is measured against the Standard & Poor’s 500 Index (“S&P 500”), which is widely regarded as a gauge of the U.S. equities market, includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large-cap segment of the market, with approximately 75% coverage of U.S. equities, it is also widely viewed as a proxy for the total market. The Bloomberg Barclays U.S. Government/Credit Index includes Treasuries (i.e., public obligations of the U.S. Treasury that have remaining maturities of more than one year), government-related issues (e.g., agency, sovereign, supranational, and local authority debt), and USD Corporates. The Bloomberg Barclays U.S. Government/Credit Bond Index is a component of the Bloomberg Barclays U.S. Aggregate Bond Index. The FTSE 3 Month US T-Bill Index reflects monthly return equivalents of yield averages that are not marked to the market. The index is an average of the last three-month treasury bill issues. The three-month treasury bills are the short-term debt obligations of the U.S. Government. The indexes are unmanaged and their performance does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Funds’ performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

Boston Trust Asset Management Fund

Fund Net Asset Value: | | $ | 44.27 | |

Gross Expense Ratio(1): | | 0.92 | % |

Boston Trust Equity Fund

Fund Net Asset Value: | | $ | 22.64 | |

Gross Expense Ratio(1): | | 0.93 | % |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

(1) The Gross Expense Ratio is from each Fund’s most recent prospectus, dated May 1, 2018. Additional information pertaining to each Fund’s expense ratio as of December 31, 2018 can be found in the financial highlights included in this report.

5

Boston Trust Midcap Fund

December 31, 2018

Stephen J. Amyouny, CFA

Lead Portfolio Manager

Belinda Cavazos, CFA

Portfolio Manager

Richard Q. Williams, CFA

Portfolio Manager

Boston Trust Investment Management, Inc.

Fund Objective

The Fund seeks long-term capital growth through an actively managed portfolio of stocks of middle capitalization (“mid cap”) companies.

Investment Concerns

Equity securities (stocks) are more volatile and carry more risk and return potential than other forms of investments, including investments in high-grade fixed income securities.

Mid cap funds typically carry additional risks since smaller companies generally have a higher risk of failure.

Manager Commentary (Unaudited)

Management Discussion of Fund Performance

Portfolio Review

For the 12-month period ended December 31, 2018, the Boston Trust Midcap Fund returned -3.36%, outperforming the -9.06% return of the Russell Midcap® Index. The Fund is also ahead of the index for the trailing 3- and 5-year time periods and since inception, with lower volatility than the index.

Our preference for higher-quality stocks was the primary driver of relative performance for the year. At a sector level, consumer discretionary and consumer staples stocks contributed most to relative performance. Within discretionary, our positioning among retailers was additive, while our avoidance of the most cyclical, economically sensitive industries (e.g. autos) also proved beneficial. Performance in consumer staples benefitted from the market favoring higher quality stocks. On the negative side the strategy’s modest underweight to utilities, the only sector posting a positive return for the year, detracted from results.*

Church & Dwight was the top individual stock contributor for the year. A leading manufacturer of household and personal care products, Church & Dwight produced strong sales and earnings results thanks to market share gains in laundry, positive price increases, and the successful integration of recent bolt-on acquisitions. On the negative side, IPG Photonics, the dominant provider of industrial fiber lasers, declined on disappointing revenue due to slowing orders from customers in Europe and China.*

Outlook

It is difficult to know how long the market correction will last. The underlying fundamentals of the U.S. economy, including growth in employment, retail sales, capital investments, and corporate earnings, remain solid. However, there are signs of increasing macroeconomic uncertainty as well. Several indicators point to a deceleration of gross domestic product(1) growth from the very healthy levels experienced in 2018. Some areas of concern include a growth slowdown among key trading partners like Germany, Japan, and China, increasing concerns the U.S. Federal Reserve will be too aggressive in raising interest rates, and the potential for protectionist trade policies to weaken U.S. economic growth. While some market participants fear a recession, our base case outlook remains that fundamentals for the US equity market remain solid. Valuations have become more reasonable, and some areas of speculative activity are less evident now than they were a year ago.

We remain focused on constructing a well-diversified portfolio of higher quality, reasonably valued companies that we believe can generate stronger economic returns across a full market cycle. Compared to the Russell Midcap® Index, the Boston Trust Midcap Fund is invested in companies with higher and more stable returns on invested capital, stronger revenue and earnings growth, and less reliance on capital markets to fund investments. Despite this higher quality financial profile, valuation for the Fund on a GAAP price-to-earnings(2) basis is in line with the index at 22x. The combination of superior fundamentals, more resilient balance sheets, and reasonable valuation relative to the benchmark gives us confidence the Fund is well-positioned for the future.*

* Portfolio composition is subject to change.

(1) The gross domestic product (GDP) is the measure of the market value of the goods and services produced by labor and property in the United States

(2) The price-to-earnings Ratio (P/E Ratio) is a valuation ratio of a company’s current share price to its per-share earnings.

6

Investment Performance (Unaudited) | Boston Trust Midcap Fund |

| December 31, 2018 |

| | For the periods ended 12/31/18 | |

| | Average Annual Total Returns | |

| | | | | | | | | | Since | |

| | | | | | | | | | Inception | |

| | 1 Year | | 3 Years | | 5 Years | | 10 Years | | (9/24/07) | |

Boston Trust Midcap Fund(1) | | -3.36 | % | 9.15 | % | 7.68 | % | 13.79 | % | 8.29 | % |

Russell Midcap® Index | | -9.06 | % | 7.04 | % | 6.26 | % | 14.03 | % | 6.89 | % |

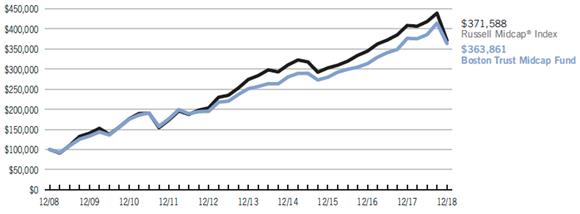

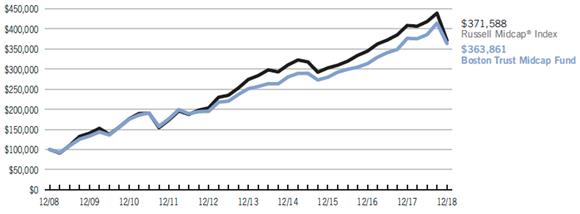

Hypothetical Growth of a $100,000 Investment

The above chart represents a 10-year hypothetical $100,000 investment in the Boston Trust Midcap Fund, and includes the reinvestment of dividends and capital gains in the Fund. The returns shown on the table and the graph do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Boston Trust Midcap Fund is measured against the Russell Midcap® Index, which is an unmanaged index that tracks the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap® Index is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market capitalization and current index membership. The Russell Midcap® Index represents approximately 31% of the total market capitalization of the Russell 1000 companies. The performance of an index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

Fund Net Asset Value: | | $ | 15.78 | |

Gross Expense Ratio(1): | | 1.00 | % |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

(1) The Gross Expense Ratio is from the Fund’s most recent prospectus, dated May 1, 2018. Additional information pertaining to the Fund’s expense ratio as of December 31, 2018 can be found in the financial highlights included in this report.

7

Boston Trust SMID Cap Fund

December 31, 2018

Kenneth P. Scott, CFA

Lead Portfolio Manager

Belinda Cavazos, CFA

Portfolio Manager

Richard Q. Williams, CFA

Portfolio Manager

Boston Trust Investment Management, Inc.

Fund Objective

The Fund seeks long-term capital growth through an actively managed portfolio of stocks of small to middle capitalization (“smid cap”) companies.

Investment Concerns

Equity securities (stocks) are more volatile and carry more risk and return potential than other forms of investments, including investments in high-grade fixed income securities.

Smid cap companies typically have a higher risk of failure and historically have experienced a greater degree of volatility.

Manager Commentary (Unaudited)

Management Discussion of Fund Performance

For the 12-month period ended December 31, 2018, the Boston Trust SMID Cap Fund declined 5.62%, outperforming the -10.00% return of the Russell 2500™ Index. The Fund is also ahead of the index for the three- and five-year periods, with less volatility than the benchmark.

Our analysis suggests that stocks of higher-quality firms outperformed the Russell 2500™ Index in 2018. On a relative basis, Fund holdings in consumer discretionary and materials contributed most positively to performance, while returns in information technology and financials detracted most from results this year. Relative underperformance in information technology was partly driven by our underweight to the internet software and services industry, which is overwhelmingly comprised of stocks we view as less reasonably valued. One of the top individual stock contributors for the year was Church & Dwight, a leading manufacturer of household and personal care products, that benefitted from strong sales and earnings results due to market share gains in laundry, positive price increases, and the successful integration of recent bolt-on acquisitions. Among detractors, Big Lots, a discount retailer, declined due to earnings that came in below expectations driven by higher labor and transportation costs.*

Outlook

It is difficult to know how long the market correction will last. The underlying fundamentals of the U.S. economy, including growth in employment, retail sales, capital investments, and corporate earnings, remain solid. However, there are signs of increasing macroeconomic uncertainty as well. Several indicators point to a deceleration of gross domestic product(1) growth from the very healthy levels experienced in 2018. Some areas of concern include a growth slowdown among key trading partners like Germany, Japan, and China, concerns that the U.S. Federal Reserve will be too aggressive in raising interest rates, and the potential for protectionist trade policies to weaken U.S. economic growth. While some market participants fear a recession, our base case outlook is that fundamentals for the U.S. smaller cap market remain solid. Valuations have become more reasonable, and some areas of speculative activity are less evident now than they were a year ago.

We remain focused on constructing a well-diversified Fund of higher quality, reasonably valued companies that we believe can generate stronger economic returns across a full market cycle. Compared to the benchmark, the Fund is invested in companies with higher and more stable returns on invested capital, stronger revenue and earnings growth, and less reliance on capital markets to fund investments. Despite this higher quality financial profile, valuation for the Fund currently stands at an average operating price-to-earnings (P/E) ratio(2) of 23x, lower than the Russell 2500™ operating P/E of 24x. On a GAAP basis, the Fund trades at a 25x P/E, a discount to the benchmark’s 29x GAAP P/E. The combination of superior fundamentals, more resilient balance sheets, and more reasonable valuation relative to the benchmark gives us confidence the Fund is well-positioned for the future.*

* Portfolio composition is subject to change.

(1) The gross domestic product (GDP) is the measure of the market value of the goods and services produced by labor and property in the United States

(2) The price-to-earnings Ratio (P/E Ratio) is a valuation ratio of a company’s current share price to its per-share earnings.

8

Investment Performance (Unaudited) | Boston Trust SMID Cap Fund |

| December 31, 2018 |

| | For the periods ended 12/31/18 | |

| | Average Annual Total Returns | |

| | | | | | | | Since | |

| | | | | | | | Inception | |

| | 1 Year | | 3 Years | | 5 Years | | (11/30/11) | |

Boston Trust SMID Cap Fund(1) | | -5.62 | % | 10.32 | % | 6.40 | % | 10.08 | % |

Russell 2500™ Index | | -10.00 | % | 7.32 | % | 5.15 | % | 10.87 | % |

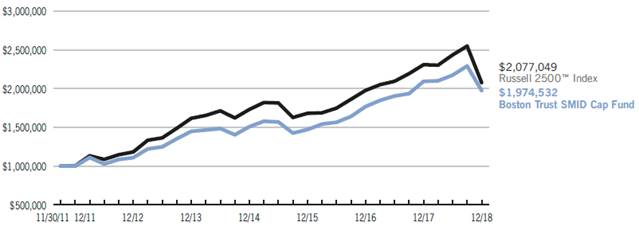

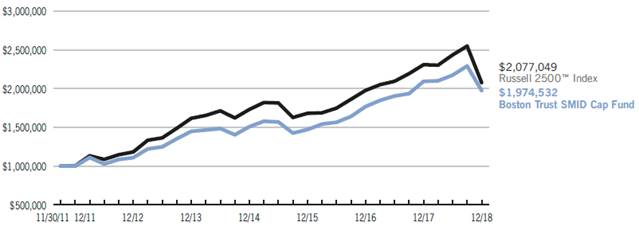

Hypothetical Growth of a $1,000,000 Investment

The above chart represents a hypothetical $1,000,000 investment in the Boston Trust SMID Cap Fund from November 30, 2011 to December 31, 2018, and includes the reinvestment of dividends and capital gains in the Fund. The returns shown on the table and the graph do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Boston Trust SMID Cap Fund is measured against the Russell 2500™ Index, which is an unmanaged index that tracks the performance of the small- to mid-cap segment of the U.S. equity universe, commonly referred to as “smid” cap. The Russell 2500 is a subset of the Russell 3000® Index. It includes approximately 2500 of the smallest securities based on a combination of their market cap and current index membership. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. The performance of an index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

Fund Net Asset Value: | | $ | 14.63 | |

Gross Expense Ratio(1): | | 1.04 | % |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. Returns less than one year are not annualized. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

(1) The Gross Expense Ratio is from the Fund’s most recent prospectus, dated May 1, 2018. The contractual fee limit under the Fund’s expense limitation agreement is 0.75% of the Fund’s average annual net assets, subject to certain limitations as described in the Fund’s prospectus. Please see the Fund’s most recent prospectus for details. Additional information pertaining to the Fund’s expense ratio as of December 31, 2018 can be found in the financial highlights included in this report. The investment performance may reflect fee reductions. If such fee reductions had not occurred, the quoted performance would have been lower. The contractual fee waiver continues through May 1, 2019 and may be renewed thereafter.

9

Boston Trust Small Cap Fund

December 31, 2018

Kenneth P. Scott, CFA

Lead Portfolio Manager

Belinda Cavazos, CFA

Portfolio Manager

Richard Q. Williams, CFA

Portfolio Manager

Boston Trust Investment Management, Inc.

Fund Objective

The Fund seeks long-term capital growth through an actively managed portfolio of stocks of small capitalization (“small cap”) companies.

Investment Concerns

Equity securities (stocks) are more volatile and carry more risk and return potential than other forms of investments, including investments in high-grade fixed income securities.

Small cap funds typically carry additional risks since smaller companies generally have a higher risk of failure, and historically, their stocks have experienced a greater degree of market volatility than stocks on average.

Manager Commentary (Unaudited)

Management Discussion of Fund Performance

For the 12-month period ended December 31, 2018, the Boston Trust Small Cap Fund declined 6.00%, outperforming the -11.01% return of the Russell 2000® Index. The Fund is also ahead of the index for the three-, five-, and twenty-year periods, with less volatility than the benchmark.

Our analysis suggests that stocks of higher-quality firms outperformed the Russell 2000® Index in 2018. On a relative basis, Fund holdings in health care and consumer discretionary contributed most positively to performance, while returns in information technology and financials detracted most from results this year. Relative underperformance in information technology was driven by our underweight to the internet software and services industry, which is overwhelmingly comprised of stocks we view as less reasonably valued. The top individual stock contributor for the year was Haemonetics, a global leader in blood management solutions, in part a reflection of their successful launch of a next generation system. The top detractor was Coherent, a leader in industrial lasers, which was impacted by a cyclical slowdown in orders for its OLED mobile phone display technology, as well as weakening demand in China.*

Outlook

It is difficult to know how long the market correction will last. The underlying fundamentals of the U.S. economy, including growth in employment, retail sales, capital investments, and corporate earnings, remain solid. However, there are signs of increasing macroeconomic uncertainty as well. Several indicators point to a deceleration of gross domestic product(1) growth from the very healthy levels experienced in 2018. Some areas of concern include a growth slowdown among key trading partners like Germany, Japan, and China, concerns that the US Federal Reserve will be too aggressive in raising interest rates, and the potential for protectionist trade policies to weaken U.S. economic growth. While some market participants fear a recession, our base case outlook is that fundamentals for the U.S. small-cap market remain solid. Valuations have become more reasonable, and some areas of speculative activity are less evident now than they were a year ago.

We remain focused on constructing a well-diversified Fund of higher quality, reasonably valued companies that we believe can generate stronger economic returns across a full market cycle. Compared to the benchmark, the Fund is invested in companies with higher and more stable returns on invested capital, stronger revenue and earnings growth, and less reliance on capital markets to fund investments. Despite this higher quality financial profile, valuation for the Fund currently stands at an average operating price-to-earnings (P/E) ratio(2) of 26x, lower than the Russell 2000® operating P/E of 30x. The combination of superior fundamentals, more resilient balance sheets, and more reasonable valuation relative to the benchmark, gives us confidence the Fund is well-positioned for the future.*

* Portfolio composition is subject to change.

(1) The gross domestic product (GDP) is the measure of the market value of the goods and services produced by labor and property in the United States

(2) The price-to-earnings ratio (P/E Ratio) is a valuation ratio of a company’s current share price to its per-share earnings.

10

Investment Performance (Unaudited) | Boston Trust Small Cap Fund |

| December 31, 2018 |

| | For the periods ended 12/31/18 | |

| | Average Annual Total Returns | |

| | | | | | | | | | | | | | Since | |

| | | | | | | | | | | | | | Inception | |

| | 1 Year | | 3 Years | | 5 Years | | 10 Years | | 15 Years | | 20 Years | | (12/31/94) | |

Boston Trust Small Cap Fund(1) | | -6.00 | % | 9.17 | % | 4.46 | % | 11.56 | % | 8.54 | % | 9.29 | % | 10.28 | % |

Russell 2000® Index | | -11.01 | % | 7.36 | % | 4.41 | % | 11.97 | % | 7.50 | % | 7.40 | % | 8.73 | % |

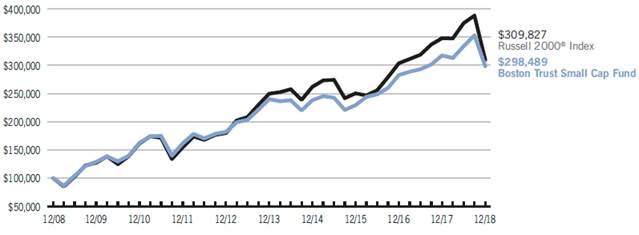

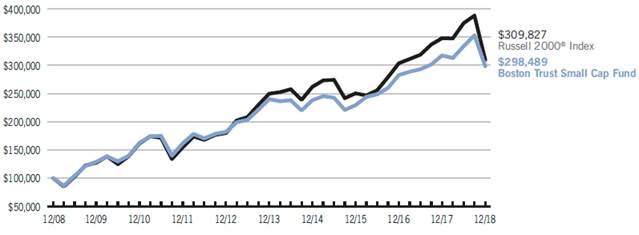

Hypothetical Growth of a $100,000 Investment

The above chart represents a 10-year hypothetical $100,000 investment in the Boston Trust Small Cap Fund and includes the reinvestment of dividends and capital gains in the Fund. The returns shown on the table and the graph do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Boston Trust Small Cap Fund is measured against the Russell 2000® Index, which is an unmanaged index that tracks the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. The performance of an index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

Fund Net Asset Value: | | $ | 12.00 | |

Gross Expense Ratio(1): | | 1.02 | % |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

(1) The Gross Expense Ratio is from the Fund’s most recent prospectus, dated May 1, 2018. The contractual fee limit under the Fund’s expense limitation agreement is 1.00% of the Fund’s average annual net assets, subject to certain limitations as described in the Fund’s prospectus. Please see the Fund’s most recent prospectus for details. Additional information pertaining to the Fund’s expense ratio as of December 31, 2018 can be found in the financial highlights included in this report. The investment performance may reflect fee reductions. If such fee reductions had not occurred, the quoted performance would have been lower. The contractual fee waiver continues through May 1, 2019 and may be renewed thereafter.

11

Schedule of Portfolio Investments | Boston Trust Asset Management Fund |

| December 31, 2018 |

Security Description | | Shares | | Fair Value ($) | |

COMMON STOCKS (76.0%) | | | | | |

Communication Services (6.4%) | | | | | |

Alphabet, Inc., Class A (a) | | 2,000 | | 2,089,920 | |

Alphabet, Inc., Class C (a) | | 15,000 | | 15,534,150 | |

Comcast Corp., Class A | | 275,000 | | 9,363,750 | |

Omnicom Group, Inc. | | 35,000 | | 2,563,400 | |

| | | | 29,551,220 | |

Consumer Discretionary (4.4%) | | | | | |

Autoliv, Inc. | | 20,000 | | 1,404,600 | |

Garrett Motion, Inc. (a) | | 3,250 | | 40,105 | |

NIKE, Inc., Class B | | 115,000 | | 8,526,100 | |

Ross Stores, Inc. | | 30,000 | | 2,496,000 | |

Starbucks Corp. | | 110,000 | | 7,084,000 | |

Veoneer, Inc. (a) | | 25,000 | | 589,250 | |

| | | | 20,140,055 | |

Consumer Staples (6.6%) | | | | | |

Church & Dwight Co., Inc. | | 75,000 | | 4,932,000 | |

Costco Wholesale Corp. | | 45,000 | | 9,166,950 | |

Diageo PLC, Sponsored ADR | | 25,000 | | 3,545,000 | |

McCormick & Co., Inc. | | 25,000 | | 3,481,000 | |

PepsiCo, Inc. | | 30,000 | | 3,314,400 | |

Procter & Gamble Co. | | 30,000 | | 2,757,600 | |

Sysco Corp. | | 35,000 | | 2,193,100 | |

The Hershey Co. | | 10,000 | | 1,071,800 | |

| | | | 30,461,850 | |

Energy (2.6%) | | | | | |

Chevron Corp. | | 27,500 | | 2,991,725 | |

ConocoPhillips | | 50,000 | | 3,117,500 | |

Exxon Mobil Corp. | | 75,000 | | 5,114,250 | |

Schlumberger Ltd. | | 20,000 | | 721,600 | |

| | | | 11,945,075 | |

Financials (14.6%) | | | | | |

American Express Co. | | 55,000 | | 5,242,600 | |

BB&T Corp. | | 100,000 | | 4,332,000 | |

Berkshire Hathaway, Inc., Class B (a) | | 60,000 | | 12,250,800 | |

Chubb Ltd. | | 35,000 | | 4,521,300 | |

Cincinnati Financial Corp. | | 60,000 | | 4,645,200 | |

Comerica, Inc. | | 30,000 | | 2,060,700 | |

Commerce Bancshares, Inc. | | 33,501 | | 1,888,451 | |

JPMorgan Chase & Co. | | 100,000 | | 9,762,000 | |

M&T Bank Corp. | | 10,000 | | 1,431,300 | |

Northern Trust Corp. | | 50,000 | | 4,179,500 | |

PNC Financial Services Group, Inc. | | 45,000 | | 5,260,950 | |

State Street Corp. | | 40,000 | | 2,522,800 | |

T. Rowe Price Group, Inc. | | 40,000 | | 3,692,800 | |

U.S. Bancorp | | 125,000 | | 5,712,500 | |

| | | | 67,502,901 | |

Health Care (12.3%) | | | | | |

Becton, Dickinson & Co. | | 60,000 | | 13,519,200 | |

Dentsply Sirona, Inc. | | 50,000 | | 1,860,500 | |

Edwards Lifesciences Corp. (a) | | 45,000 | | 6,892,650 | |

Henry Schein, Inc. (a) | | 50,000 | | 3,926,000 | |

Johnson & Johnson, Inc. | | 55,000 | | 7,097,750 | |

Medtronic PLC | | 20,000 | | 1,819,200 | |

Merck & Co., Inc. | | 40,000 | | 3,056,400 | |

Mettler-Toledo International, Inc. (a) | | 7,500 | | 4,241,850 | |

Stryker Corp. | | 25,000 | | 3,918,750 | |

UnitedHealth Group, Inc. | | 32,500 | | 8,096,400 | |

Varian Medical Systems, Inc. (a) | | 20,000 | | 2,266,200 | |

| | | | 56,694,900 | |

| | Shares or | | | |

| | Principal | | | |

| | Amount($) | | | |

Industrials (8.7%) | | | | | |

3M Co. | | 40,000 | | 7,621,600 | |

Donaldson Co., Inc. | | 50,000 | | 2,169,500 | |

Emerson Electric Co. | | 25,000 | | 1,493,750 | |

Honeywell International, Inc. | | 20,000 | | 2,642,400 | |

Hubbell, Inc. | | 40,000 | | 3,973,600 | |

Illinois Tool Works, Inc. | | 50,000 | | 6,334,500 | |

Union Pacific Corp. | | 50,000 | | 6,911,500 | |

United Parcel Service, Inc., Class B | | 50,000 | | 4,876,500 | |

W.W. Grainger, Inc. | | 15,000 | | 4,235,400 | |

| | | | 40,258,750 | |

Information Technology (16.3%) | | | | | |

Accenture PLC, Class A | | 70,000 | | 9,870,700 | |

Apple, Inc. | | 100,000 | | 15,774,000 | |

Automatic Data Processing, Inc. | | 70,000 | | 9,178,400 | |

Cisco Systems, Inc. | | 175,000 | | 7,582,750 | |

Microsoft Corp. | | 155,000 | | 15,743,350 | |

Oracle Corp. | | 150,000 | | 6,772,500 | |

Visa, Inc., Class A | | 75,000 | | 9,895,500 | |

| | | | 74,817,200 | |

Materials (2.2%) | | | | | |

Air Products & Chemicals, Inc. | | 20,000 | | 3,201,000 | |

AptarGroup, Inc. | | 30,000 | | 2,822,100 | |

PPG Industries, Inc. | | 40,000 | | 4,089,200 | |

| | | | 10,112,300 | |

Utilities (1.9%) | | | | | |

Consolidated Edison, Inc. | | 50,000 | | 3,823,000 | |

Eversource Energy | | 75,000 | | 4,878,000 | |

| | | | 8,701,000 | |

| | | | | |

TOTAL COMMON STOCKS (Cost $178,668,745) | | | | 350,185,251 | |

| | | | | |

CORPORATE BONDS (2.6%) | | | | | |

| | | | | |

Financials (1.4%) | | | | | |

American Express Co., 2.65%, 12/2/22 | | 1,926,000 | | 1,864,927 | |

Berkshire Hathaway, Inc., 3.13%, 3/15/26, | | | | | |

Callable 12/15/25 @ 100 | | 2,000,000 | | 1,940,336 | |

JPMorgan Chase & Co., 3.90%, 7/15/25, | | | | | |

Callable 4/15/25 @ 100 | | 1,000,000 | | 991,774 | |

Wells Fargo & Co., 3.55%, 9/29/25, MTN | | 2,000,000 | | 1,939,474 | |

| | | | 6,736,511 | |

Health Care (0.2%) | | | | | |

Becton, Dickinson & Co., 3.13%, 11/8/21 | | 1,000,000 | | 986,922 | |

| | | | | |

Information Technology (1.0%) | | | | | |

Apple, Inc., 3.25%, 2/23/26, Callable 11/23/25 @ 100 | | 2,500,000 | | 2,442,626 | |

Visa, Inc., 3.15%, 12/14/25, Callable 9/14/25 @ 100 | | 2,000,000 | | 1,967,204 | |

| | | | 4,409,830 | |

TOTAL CORPORATE BONDS (Cost $12,516,417) | | | | 12,133,263 | |

See Notes to Financial Statements

12

| | Principal | | | |

Security Description | | Amount($) | | Fair Value ($) | |

MUNICIPAL BONDS (0.8%) | | | | | |

Massachusetts (0.7%): | | | | | |

Massachusetts State, Series E, GO, 4.00%, 9/1/37, Callable 9/1/25 @ 100 | | 1,000,000 | | 1,031,840 | |

Massachusetts State, Series E, GO, 5.00%, 7/1/38, Callable 7/1/26 @ 100 | | 260,000 | | 295,417 | |

Massachusetts State Development Finance Agency Revenue, Series R-2, 5.00%, 7/1/28, Callable 7/1/20 @ 100 | | 460,000 | | 480,498 | |

Massachusetts State Health & Educational Facilities Authority Revenue, Series A, 5.00%, 12/15/26, Prerefunded 12/15/19 @ 100 | | 1,500,000 | | 1,545,855 | |

| | | | 3,353,610 | |

Washington (0.1%): | | | | | |

Washington State, Series C, GO, 5.00%, 2/1/26, Prerefunded 2/1/19 @ 100 | | 250,000 | | 250,655 | |

| | | | | |

TOTAL MUNICIPAL BONDS (Cost $3,789,094) | | | | 3,604,265 | |

| | | | | |

U.S. GOVERNMENT & U.S. GOVERNMENT AGENCY OBLIGATIONS (18.5%) | | | | | |

| | | | | |

Federal Farm Credit Bank (4.6%) | | | | | |

2.63%, 8/12/19 | | 10,000,000 | | 10,003,880 | |

2.85%, 3/2/28 | | 2,000,000 | | 1,971,388 | |

2.95%, 1/27/25 | | 2,000,000 | | 2,008,212 | |

3.14%, 12/5/29 | | 2,500,000 | | 2,504,310 | |

3.39%, 2/1/28 | | 2,000,000 | | 2,057,496 | |

3.85%, 12/26/25 | | 2,770,000 | | 2,932,347 | |

| | | | 21,477,633 | |

Federal Home Loan Bank (2.9%) | | | | | |

2.38%, 3/13/26 | | 6,000,000 | | 5,759,820 | |

2.50%, 12/10/27 | | 1,500,000 | | 1,418,852 | |

2.63%, 6/11/27 | | 1,500,000 | | 1,445,976 | |

2.88%, 9/13/24 | | 2,500,000 | | 2,515,275 | |

3.50%, 9/24/29 | | 2,000,000 | | 2,041,266 | |

| | | | 13,181,189 | |

U.S. Treasury Bill (3.3%) | | | | | |

2.40%, 7/18/19 | | 8,000,000 | | 7,891,924 | |

2.50%, 8/15/19 | | 7,500,000 | | 7,382,285 | |

| | | | 15,274,209 | |

U.S. Treasury Note (7.7%) | | | | | |

2.75%, 2/15/24 | | 35,000,000 | | 35,385,546 | |

| | | | | |

TOTAL U.S. GOVERNMENT & U.S. GOVERNMENT AGENCY OBLIGATIONS (Cost $85,979,385) | | | | 85,318,577 | |

| | Shares | | | |

INVESTMENT COMPANIES (1.9%) | | | | | |

JPMorgan U.S. Government Money Market Fund, Capital Shares, 2.28%(b) | | 8,899,795 | | 8,899,795 | |

TOTAL INVESTMENT COMPANIES (Cost $8,899,795) | | | | 8,899,795 | |

| | | | | |

Total Investments (Cost $289,853,436) — 99.8%(c) | | | | 460,141,151 | |

Other assets in excess of liabilities — 0.2% | | | | 984,823 | |

NET ASSETS — 100.0% | | | | $ | 461,125,974 | |

| | | | | | |

(a) Non-income producing security.

(b) Rate disclosed is the seven day yield as of December 31, 2018.

(c) See Federal Tax Information listed in the Notes to the Financial Statements.

ADR American Depositary Receipt

GO General Obligation

MTN Medium Term Note

PLC Public Limited Company

See Notes to Financial Statements

13

Financial Statements | Boston Trust Asset Management Fund |

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2018

Assets: | | | |

Investments, at fair value (cost $289,853,436) | | $ | 460,141,151 | |

Interest and dividends receivable | | 1,280,494 | |

Receivable for capital shares issued | | 119,304 | |

Prepaid expenses | | 23,042 | |

Total Assets | | 461,563,991 | |

Liabilities: | | | |

Payable for capital shares redeemed | | 33,604 | |

Accrued expenses and other liabilities: | | | |

Investment adviser | | 298,383 | |

Administration and accounting | | 20,798 | |

Custodian | | 6,217 | |

Shareholder servicing fees | | 11,684 | |

Transfer agent | | 3,312 | |

Trustee | | 625 | |

Other | | 63,394 | |

Total Liabilities | | 438,017 | |

Net Assets | �� | $ | 461,125,974 | |

Composition of Net Assets: | | | |

Paid in capital | | $ | 290,524,182 | |

Total distributable earnings/(loss) | | 170,601,792 | |

Net Assets | | $ | 461,125,974 | |

Shares outstanding (par value $0.01, unlimited number of shares authorized) | | 10,416,435 | |

Net Asset Value, Offering Price and Redemption price per share | | $ | 44.27 | |

STATEMENT OF OPERATIONS

For the year ended December 31, 2018

Investment Income: | | | |

Interest | | $ | 2,595,160 | |

Dividends | | 7,151,156 | |

Total Investment Income | | 9,746,316 | |

Expenses: | | | |

Investment adviser | | 3,677,409 | |

Administration and accounting | | 408,442 | |

Chief compliance officer | | 44,561 | |

Custodian | | 68,618 | |

Shareholder servicing | | 146,166 | |

Transfer agency | | 39,216 | |

Trustee | | 28,536 | |

Other | | 172,058 | |

Total expenses | | 4,585,006 | |

Net Expenses | | 4,585,006 | |

Net Investment Income | | 5,161,310 | |

Net Realized/Unrealized Gains (Losses) from Investments: | | | |

Net realized gains from investment transactions | | 7,439,455 | |

Change in unrealized appreciation/depreciation from investments | | (19,626,925 | ) |

Net realized/unrealized gains (losses) from investments | | (12,187,470 | ) |

Change in Net Assets Resulting from Operations | | $ | (7,026,160 | ) |

See Notes to Financial Statements

14

STATEMENTS OF CHANGES IN NET ASSETS

| | For the year | | For the year | |

| | ended | | ended | |

| | December 31, | | December 31, | |

| | 2018 | | 2017 | |

| | | | | |

Investment Activities: | | | | | |

Operations: | | | | | |

Net investment income | | $ | 5,161,310 | | $ | 5,033,185 | |

Net realized gains from investment transactions | | 7,439,455 | | 12,348,048 | |

Change in unrealized appreciation/depreciation from investments | | (19,626,925 | ) | 50,152,480 | |

Change in Net Assets Resulting from Operations | | (7,026,160 | ) | 67,533,713 | |

Distributions to shareholders: | | | | | |

Total Distributions | | (19,206,469 | ) | (11,899,110 | ) |

Change in Net Assets Resulting from distributions to shareholders | | (19,206,469 | ) | (11,899,110 | ) |

Capital Share Transactions: | | | | | |

Proceeds from shares issued | | 34,500,765 | | 59,469,516 | |

Dividends reinvested | | 16,531,889 | | 10,543,397 | |

Cost of shares redeemed | | (60,384,310 | ) | (32,905,814 | ) |

Change in Net Assets Resulting from Capital Share Transactions | | (9,351,656 | ) | 37,107,099 | |

Change in Net Assets | | (35,584,285 | ) | 92,741,702 | |

Net Assets: | | | | | |

Beginning of period | | 496,710,259 | | 403,968,557 | |

End of period | | $ | 461,125,974 | | $ | 496,710,259 | |

Share Transactions: | | | | | |

Issued | | 733,719 | | 1,338,314 | |

Reinvested | | 359,858 | | 224,998 | |

Redeemed | | (1,272,289 | ) | (741,639 | ) |

Change in shares | | (178,712 | ) | 821,673 | |

See Notes to Financial Statements

15

FINANCIAL HIGHLIGHTS

Selected data for a share outstanding throughout the periods indicated.

| | | | | | For the nine | | | | | | | |

| | For the year | | For the year | | months | | For the year | | For the year | | For the year | |

| | ended | | ended | | ended | | ended | | ended | | ended | |

| | December 31, | | December 31, | | December 31, | | March 31, | | March 31, | | March 31, | |

| | 2018 | | 2017 | | 2016 | | 2016 | | 2015 | | 2014 | |

| | | | | | | | | | | | | |

Net Asset Value, Beginning of Period | | $ | 46.88 | | $ | 41.33 | | $ | 40.92 | | $ | 41.80 | | $ | 40.03 | | $ | 36.08 | |

| | | | | | | | | | | | | |

Investment Activities: | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | |

Net investment income | | 0.52 | | 0.49 | | 0.35 | | 0.55 | | 0.50 | | 0.44 | |

Net realized/unrealized gains (losses) from investments | | (1.20 | ) | 6.22 | | 2.18 | | 0.92 | | 2.77 | | 4.28 | |

Total from investment activities | | (0.68 | ) | 6.71 | | 2.53 | | 1.47 | | 3.27 | | 4.72 | |

Dividends: | | | | | | | | | | | | | |

Net investment income | | (0.52 | ) | (0.49 | ) | (0.46 | ) | (0.57 | ) | (0.47 | ) | (0.44 | ) |

Net realized gains from investment transactions | | (1.41 | ) | (0.67 | ) | (1.66 | ) | (1.78 | ) | (1.03 | ) | (0.33 | ) |

Total dividends | | (1.93 | ) | (1.16 | ) | (2.12 | ) | (2.35 | ) | (1.50 | ) | (0.77 | ) |

| | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 44.27 | | $ | 46.88 | | $ | 41.33 | | $ | 40.92 | | $ | 41.80 | | $ | 40.03 | |

| | | | | | | | | | | | | |

Total Return | | (1.61 | )% | 16.23 | % | 6.19 | %(a) | 3.65 | % | 8.21 | % | 13.13 | % |

| | | | | | | | | | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | |

Net assets at end of period (000’s) | | $ | 461,126 | | $ | 496,710 | | $ | 403,969 | | $ | 354,405 | | $ | 353,851 | | $ | 340,963 | |

Ratio of net expenses to average net assets | | 0.93 | % | 0.92 | % | 0.95 | %(b) | 0.94 | % | 0.92 | % | 0.92 | % |

Ratio of net investment income to average net assets | | 1.05 | % | 1.13 | % | 1.15 | %(b) | 1.32 | % | 1.19 | % | 1.17 | % |

Ratio of expenses (before fee reductions or recoupment of fees previously reimbursed by the investment adviser) to average net assets | | 0.93 | % | 0.92 | % | 0.95 | %(b) | 0.94 | % | 0.93 | % | 0.93 | % |

Portfolio turnover rate | | 2.53 | % | 6.96 | % | 8.42 | %(a) | 11.64 | % | 17.74 | % | 8.94 | % |

(a) Not annualized for periods less than one year.

(b) Annualized for periods less than one year.

See Notes to Financial Statements

16

Schedule of Portfolio Investments | Boston Trust Equity Fund |

| December 31, 2018 |

Security Description | | Shares | | Fair Value ($) | |

COMMON STOCKS (99.5%) | | | | | |

Communication Services (8.5%) | | | | | |

Alphabet, Inc., Class A (a) | | 750 | | 783,720 | |

Alphabet, Inc., Class C (a) | | 5,500 | | 5,695,855 | |

Comcast Corp., Class A | | 90,000 | | 3,064,500 | |

Omnicom Group, Inc. | | 15,000 | | 1,098,600 | |

| | | | 10,642,675 | |

Consumer Discretionary (5.2%) | | | | | |

Autoliv, Inc. | | 10,000 | | 702,300 | |

Garrett Motion, Inc. (a) | | 1,400 | | 17,276 | |

NIKE, Inc., Class B | | 30,000 | | 2,224,200 | |

Ross Stores, Inc. | | 10,000 | | 832,000 | |

Starbucks Corp. | | 40,000 | | 2,576,000 | |

Veoneer, Inc. (a) | | 10,000 | | 235,700 | |

| | | | 6,587,476 | |

Consumer Staples (9.1%) | | | | | |

Church & Dwight Co., Inc. | | 25,000 | | 1,644,000 | |

Colgate-Palmolive Co. | | 2,500 | | 148,800 | |

Costco Wholesale Corp. | | 17,000 | | 3,463,070 | |

Diageo PLC, Sponsored ADR | | 7,500 | | 1,063,500 | |

McCormick & Co., Inc. | | 7,000 | | 974,680 | |

PepsiCo, Inc. | | 10,000 | | 1,104,800 | |

Procter & Gamble Co. | | 10,000 | | 919,200 | |

Sysco Corp. | | 25,000 | | 1,566,500 | |

The Hershey Co. | | 5,000 | | 535,900 | |

| | | | 11,420,450 | |

Energy (3.3%) | | | | | |

Chevron Corp. | | 15,000 | | 1,631,850 | |

ConocoPhillips | | 15,000 | | 935,250 | |

Exxon Mobil Corp. | | 22,500 | | 1,534,275 | |

Schlumberger Ltd. | | 2,500 | | 90,200 | |

| | | | 4,191,575 | |

Financials (19.5%) | | | | | |

American Express Co. | | 25,000 | | 2,383,000 | |

BB&T Corp. | | 30,000 | | 1,299,600 | |

Berkshire Hathaway, Inc., Class B (a) | | 20,000 | | 4,083,600 | |

Chubb Ltd. | | 15,000 | | 1,937,700 | |

Cincinnati Financial Corp. | | 25,000 | | 1,935,500 | |

Commerce Bancshares, Inc. | | 10,048 | | 566,406 | |

JPMorgan Chase & Co. | | 37,500 | | 3,660,750 | |

M&T Bank Corp. | | 5,000 | | 715,650 | |

Northern Trust Corp. | | 15,000 | | 1,253,850 | |

PNC Financial Services Group, Inc. | | 20,000 | | 2,338,200 | |

State Street Corp. | | 15,000 | | 946,050 | |

T. Rowe Price Group, Inc. | | 15,000 | | 1,384,800 | |

U.S. Bancorp | | 45,000 | | 2,056,500 | |

| | | | 24,561,606 | |

Health Care (15.0%) | | | | | |

Becton, Dickinson & Co. | | 16,000 | | 3,605,120 | |

Dentsply Sirona, Inc. | | 25,000 | | 930,250 | |

Edwards Lifesciences Corp. (a) | | 7,500 | | 1,148,775 | |

Henry Schein, Inc. (a) | | 15,000 | | 1,177,800 | |

Johnson & Johnson, Inc. | | 22,500 | | 2,903,625 | |

Medtronic PLC | | 10,000 | | 909,600 | |

Merck & Co., Inc. | | 15,000 | | 1,146,150 | |

Mettler-Toledo International, Inc. (a) | | 1,500 | | 848,370 | |

Stryker Corp. | | 12,000 | | 1,881,000 | |

UnitedHealth Group, Inc. | | 14,000 | | 3,487,680 | |

Varian Medical Systems, Inc. (a) | | 7,500 | | 849,825 | |

| | | | 18,888,195 | |

Industrials (12.6%) | | | | | |

3M Co. | | 16,000 | | 3,048,640 | |

Deere & Co. | | 7,500 | | 1,118,775 | |

Donaldson Co., Inc. | | 10,000 | | 433,900 | |

Honeywell International, Inc. | | 10,000 | | 1,321,200 | |

Hubbell, Inc. | | 15,000 | | 1,490,100 | |

Illinois Tool Works, Inc. | | 15,000 | | 1,900,350 | |

Union Pacific Corp. | | 22,500 | | 3,110,175 | |

United Parcel Service, Inc., Class B | | 15,000 | | 1,462,950 | |

W.W. Grainger, Inc. | | 7,000 | | 1,976,520 | |

| | | | 15,862,610 | |

Information Technology (20.8%) | | | | | |

Accenture PLC, Class A | | 25,000 | | 3,525,250 | |

Apple, Inc. | | 35,000 | | 5,520,900 | |

Automatic Data Processing, Inc. | | 20,000 | | 2,622,400 | |

Cisco Systems, Inc. | | 50,000 | | 2,166,500 | |

Microsoft Corp. | | 55,000 | | 5,586,350 | |

Oracle Corp. | | 55,000 | | 2,483,250 | |

Visa, Inc., Class A | | 32,500 | | 4,288,050 | |

| | | | 26,192,700 | |

Materials (3.3%) | | | | | |

Air Products & Chemicals, Inc. | | 7,000 | | 1,120,350 | |

AptarGroup, Inc. | | 10,000 | | 940,700 | |

PPG Industries, Inc. | | 20,000 | | 2,044,600 | |

| | | | 4,105,650 | |

Utilities (2.2%) | | | | | |

Consolidated Edison, Inc. | | 15,000 | | 1,146,900 | |

Eversource Energy | | 25,000 | | 1,626,000 | |

| | | | 2,772,900 | |

| | | | | |

TOTAL COMMON STOCKS (Cost $63,561,573) | | | | 125,225,837 | |

| | | | | |

INVESTMENT COMPANIES (0.4%) | | | | | |

| | | | | |

JPMorgan U.S. Government Money Market Fund, Capital Shares, 2.28%(b) | | 548,868 | | 548,868 | |

TOTAL INVESTMENT COMPANIES (Cost $548,868) | | | | 548,868 | |

| | | | | |

Total Investments (Cost $64,110,441) — 99.9%(c) | | | | 125,774,705 | |

Other assets in excess of liabilities — 0.1% | | | | 69,524 | |

NET ASSETS — 100.0% | | | | $ | 125,844,229 | |

| | | | | | |

(a) Non-income producing security.

(b) Rate disclosed is the seven day yield as of December 31, 2018.

(c) See Federal Tax Information listed in the Notes to the Financial Statements.

ADR American Depositary Receipt

PLC Public Limited Company

See Notes to Financial Statements

17

Financial Statements | Boston Trust Equity Fund |

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2018

Assets: | | | |

Investments, at fair value (cost $64,110,441) | | $ | 125,774,705 | |

Dividends receivable | | 173,792 | |

Receivable for capital shares issued | | 1,031 | |

Prepaid expenses | | 5,558 | |

Total Assets | | 125,955,086 | |

Liabilities: | | | |

Accrued expenses and other liabilities: | | | |

Investment adviser | | 82,616 | |

Administration and accounting | | 5,629 | |

Custodian | | 1,711 | |

Shareholder servicing fees | | 341 | |

Transfer agent | | 2,992 | |

Trustee | | 173 | |

Other | | 17,395 | |

Total Liabilities | | 110,857 | |

Net Assets | | $ | 125,844,229 | |

Composition of Net Assets: | | | |

Paid in capital | | $ | 64,552,326 | |

Total distributable earnings/(loss) | | 61,291,903 | |

Net Assets | | $ | 125,844,229 | |

Shares outstanding (par value $0.01, unlimited number of shares authorized) | | 5,559,530 | |

Net Asset Value, Offering Price and Redemption price per share | | $ | 22.64 | |

STATEMENT OF OPERATIONS

For the year ended December 31, 2018

Investment Income: | | | |

Dividends | | $ | 2,494,852 | |

Total Investment Income | | 2,494,852 | |

Expenses: | | | |

Investment adviser | | 1,018,964 | |

Administration and accounting | | 111,974 | |

Chief compliance officer | | 12,232 | |

Custodian | | 18,906 | |

Shareholder servicing | | 3,455 | |

Transfer agency | | 34,648 | |

Trustee | | 7,826 | |

Other | | 48,470 | |

Total expenses | | 1,256,475 | |

Net Expenses | | 1,256,475 | |

Net Investment Income | | 1,238,377 | |

Net Realized/Unrealized Gains (Losses) from Investments: | | | |

Net realized gains from investment transactions | | 177,204 | |

Change in unrealized appreciation/depreciation from investments | | (4,627,270 | ) |

Net realized/unrealized gains (losses) from investments | | (4,450,066 | ) |

Change in Net Assets Resulting from Operations | | $ | (3,211,689 | ) |

See Notes to Financial Statements

18

STATEMENTS OF CHANGES IN NET ASSETS

| | For the year ended | | For the year ended | |

| | December 31, 2018 | | December 31, 2017 | |

| | | | | |

Investment Activities: | | | | | |

Operations: | | | | | |

Net investment income | | $ | 1,238,377 | | $ | 1,294,849 | |

Net realized gains from investment transactions | | 177,204 | | 6,837,726 | |

Change in unrealized appreciation/depreciation from investments | | (4,627,270 | ) | 15,897,512 | |

Change in Net Assets Resulting from Operations | | (3,211,689 | ) | 24,030,087 | |

Distributions to shareholders: | | | | | |

Total Distributions | | (2,243,322 | ) | (3,410,164 | ) |

Change in Net Assets Resulting from distributions to shareholders | | (2,243,322 | ) | (3,410,164 | ) |

Capital Share Transactions: | | | | | |

Proceeds from shares issued | | 1,327,119 | | 3,018,404 | |

Dividends reinvested | | 1,559,628 | | 2,546,279 | |

Cost of shares redeemed | | (5,593,745 | ) | (5,651,405 | ) |

Cost of in-kind shares redeemed (a) | | — | | (5,350,555 | ) |

Change in Net Assets Resulting from Capital Share Transactions | | (2,706,998 | ) | (5,437,277 | ) |

Change in Net Assets | | (8,162,009 | ) | 15,182,646 | |

Net Assets: | | | | | |

Beginning of period | | 134,006,238 | | 118,823,592 | |

End of period | | $ | 125,844,229 | | $ | 134,006,238 | |

Share Transactions: | | | | | |

Issued | | 53,942 | | 139,831 | |

Reinvested | | 65,586 | | 107,802 | |

Redeemed | | (231,373 | ) | (260,095 | ) |

Redeemed in-kind (a) | | — | | (231,726 | ) |

Change in shares | | (111,845 | ) | (244,188 | ) |

Amounts designated as “—” are $0 or have been rounded to $0.

(a) See Note 3 in Notes to Financial Statements.

See Notes to Financial Statements

19

FINANCIAL HIGHLIGHTS

Selected data for a share outstanding throughout the periods indicated.

| | | | | | For the nine | | | | | | | |

| | For the year | | For the year | | months | | For the year | | For the year | | For the year | |

| | ended | | ended | | ended | | ended | | ended | | ended | |

| | December 31, | | December 31, | | December 31, | | March 31, | | March 31, | | March 31, | |

| | 2018 | | 2017 | | 2016 | | 2016 | | 2015 | | 2014 | |

| | | | | | | | | | | | | |

Net Asset Value, Beginning of Period | | $ | 23.63 | | $ | 20.09 | | $ | 19.70 | | $ | 20.66 | | $ | 19.67 | | $ | 16.85 | |

| | | | | | | | | | | | | |

Investment Activities: | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | |

Net investment income | | 0.22 | | 0.23 | | 0.16 | | 0.23 | | 0.19 | | 0.19 | |

Net realized/unrealized gains (losses) from investments | | (0.80 | ) | 3.92 | | 1.58 | | 0.27 | | 1.38 | | 2.81 | |

Total from investment activities | | (0.58 | ) | 4.15 | | 1.74 | | 0.50 | | 1.57 | | 3.00 | |

Dividends: | | | | | | | | | | | | | |

Net investment income | | (0.23 | ) | (0.23 | ) | (0.20 | ) | (0.24 | ) | (0.19 | ) | (0.18 | ) |

Net realized gains from investment transactions | | (0.18 | ) | (0.38 | ) | (1.15 | ) | (1.22 | ) | (0.39 | ) | — | |

Total dividends | | (0.41 | ) | (0.61 | ) | (1.35 | ) | (1.46 | ) | (0.58 | ) | (0.18 | ) |

| | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 22.64 | | $ | 23.63 | | $ | 20.09 | | $ | 19.70 | | $ | 20.66 | | $ | 19.67 | |

| | | | | | | | | | | | | |

Total Return | | (2.55 | )% | 20.67 | % | 8.82 | %(a) | 2.59 | % | 8.01 | % | 17.84 | % |

| | | | | | | | | | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | |

Net assets at end of period (000’s) | | $ | 125,844 | | $ | 134,006 | | $ | 118,824 | | $ | 110,831 | | $ | 110,664 | | $ | 98,408 | |

Ratio of net expenses to average net assets | | 0.92 | % | 0.93 | % | 0.96 | %(b) | 0.95 | % | 0.94 | % | 0.94 | % |

Ratio of net investment income to average net assets | | 0.91 | % | 1.02 | % | 1.01 | %(b) | 1.14 | % | 0.96 | % | 1.05 | % |

Ratio of expenses (before fee reductions or recoupment of fees previously reimbursed by the investment adviser) to average net assets (c) | | 0.92 | % | 0.93 | % | 0.96 | %(b) | 0.96 | % | 0.95 | % | 0.96 | % |

Portfolio turnover rate | | 1.67 | % | 9.00 | % | 6.65 | %(a) | 18.04 | % | 19.49 | % | 6.29 | % |

Amounts designated as “—” are $0 or have been rounded to $0.

(a) Not annualized for periods less than one year.

(b) Annualized for periods less than one year.

(c) During the periods ending March 31, 2014 through December 31, 2016, certain fees were reduced. If such fee reduction had not occurred, the ratio would have been as indicated.

See Notes to Financial Statements

20

Schedule of Portfolio Investments | Boston Trust Midcap Fund |

December 31, 2018

Security Description | | Shares | | Fair Value ($) | |

COMMON STOCKS (97.4%) | | | | | |

Communication Services (1.4%) | | | | | |

Omnicom Group, Inc. | | 14,000 | | 1,025,360 | |

| | | | 1,025,360 | |

Consumer Discretionary (12.0%) | | | | | |

Dollar General Corp. | | 11,200 | | 1,210,496 | |

Dunkin’ Brands Group, Inc. | | 12,275 | | 787,073 | |

Expedia, Inc. | | 6,700 | | 754,755 | |

Hasbro, Inc. | | 8,125 | | 660,156 | |

Hyatt Hotels Corp., Class A | | 18,600 | | 1,257,360 | |

O’Reilly Automotive, Inc. (a) | | 3,075 | | 1,058,815 | |

Polaris Industries, Inc. | | 7,400 | | 567,432 | |

Ross Stores, Inc. | | 16,200 | | 1,347,840 | |

Service Corp. International | | 17,125 | | 689,453 | |

Williams Sonoma, Inc. | | 12,700 | | 640,715 | |

| | | | 8,974,095 | |

Consumer Staples (6.6%) | | | | | |

Brown-Forman Corp., Class B | | 15,862 | | 754,714 | |

Church & Dwight Co., Inc. | | 20,450 | | 1,344,791 | |

McCormick & Co., Inc. | | 5,175 | | 720,567 | |

The Clorox Co. | | 8,325 | | 1,283,216 | |

The Hershey Co. | | 7,800 | | 836,004 | |

| | | | 4,939,292 | |

Energy (2.4%) | | | | | |

Apache Corp. | | 29,950 | | 786,188 | |

Dril-Quip, Inc. (a) | | 14,100 | | 423,423 | |

Helmerich & Payne, Inc. | | 12,500 | | 599,250 | |

| | | | 1,808,861 | |

Financials (15.9%) | | | | | |

Brown & Brown, Inc. | | 27,250 | | 751,010 | |

Commerce Bancshares, Inc. | | 18,681 | | 1,053,047 | |

Discover Financial Services | | 14,925 | | 880,277 | |

East West Bancorp, Inc. | | 11,850 | | 515,831 | |

Eaton Vance Corp. | | 13,925 | | 489,882 | |

FactSet Research Systems, Inc. | | 6,925 | | 1,385,899 | |

M&T Bank Corp. | | 7,025 | | 1,005,488 | |

Northern Trust Corp. | | 14,700 | | 1,228,773 | |

SEI Investments Co. | | 18,150 | | 838,530 | |

Signature Bank | | 7,050 | | 724,811 | |

State Street Corp. | | 12,350 | | 778,915 | |

SunTrust Banks, Inc. | | 17,050 | | 860,002 | |

T. Rowe Price Group, Inc. | | 8,125 | | 750,100 | |

W. R. Berkley Corp. | | 9,895 | | 731,339 | |

| | | | 11,993,904 | |

Health Care (11.5%) | | | | | |

Agilent Technologies, Inc. | | 12,225 | | 824,699 | |

Cerner Corp. (a) | | 13,975 | | 732,849 | |

Henry Schein, Inc. (a) | | 10,225 | | 802,867 | |

Laboratory Corp. of America Holdings (a) | | 4,650 | | 587,574 | |

Mettler-Toledo International, Inc. (a) | | 1,400 | | 791,812 | |

PerkinElmer, Inc. | | 9,475 | | 744,261 | |

STERIS PLC | | 7,825 | | 836,101 | |

The Cooper Companies, Inc. | | 3,775 | | 960,738 | |

Varian Medical Systems, Inc. (a) | | 5,125 | | 580,714 | |

Waters Corp. (a) | | 5,175 | | 976,263 | |

Zimmer Biomet Holdings, Inc. | | 7,100 | | 736,412 | |

| | | | 8,574,290 | |

Industrials (13.3%) | | | | | |

AMETEK, Inc. | | 15,700 | | 1,062,890 | |

Donaldson Co., Inc. | | 25,000 | | 1,084,749 | |

Expeditors International of Washington, Inc. | | 7,925 | | 539,613 | |

Hubbell, Inc. | | 11,225 | | 1,115,092 | |

IDEX Corp. | | 5,175 | | 653,396 | |

Kansas City Southern | | 7,950 | | 758,828 | |

Lincoln Electric Holdings, Inc. | | 9,450 | | 745,133 | |

Nordson Corp. | | 8,000 | | 954,799 | |

Roper Technologies, Inc. | | 3,750 | | 999,450 | |

Sensata Technologies Holding PLC (a) | | 13,400 | | 600,856 | |

The Middleby Corp. (a) | | 6,150 | | 631,790 | |

Verisk Analytics, Inc. (a) | | 7,125 | | 776,910 | |

| | | | 9,923,506 | |

Information Technology (15.6%) | | | | | |

Akamai Technologies, Inc. (a) | | 10,925 | | 667,299 | |

Amdocs Ltd. | | 13,875 | | 812,798 | |

Amphenol Corp., Class A | | 11,500 | | 931,730 | |

ANSYS, Inc. (a) | | 5,000 | | 714,700 | |

Aspen Technology, Inc. (a) | | 8,075 | | 663,604 | |

Check Point Software Technologies Ltd. (a) | | 7,275 | | 746,779 | |

Citrix Systems, Inc. | | 7,850 | | 804,310 | |

F5 Networks, Inc. (a) | | 7,975 | | 1,292,190 | |

Fiserv, Inc. (a) | | 11,575 | | 850,647 | |

IPG Photonics Corp. (a) | | 6,600 | | 747,714 | |

Juniper Networks, Inc. | | 34,275 | | 922,340 | |

Paychex, Inc. | | 25,000 | | 1,628,749 | |

TE Connectivity Ltd. | | 12,375 | | 935,921 | |

| | | | 11,718,781 | |

Materials (7.7%) | | | | | |

AptarGroup, Inc. | | 13,025 | | 1,225,262 | |

Avery Dennison Corp. | | 13,200 | | 1,185,756 | |

Ball Corp. | | 16,250 | | 747,175 | |

International Flavors & Fragrances, Inc. | | 10,300 | | 1,382,981 | |

RPM International, Inc. | | 20,550 | | 1,207,929 | |

| | | | 5,749,103 | |

Real Estate (5.9%) | | | | | |

Alexandria Real Estate Equities, Inc. | | 5,000 | | 576,200 | |

Digital Realty Trust, Inc. | | 6,575 | | 700,566 | |

Host Hotels & Resorts, Inc. | | 37,100 | | 618,457 | |

Jones Lang LaSalle, Inc. | | 5,900 | | 746,940 | |

Lamar Advertising Co., Class A | | 9,275 | | 641,645 | |

Realty Income Corp. | | 17,975 | | 1,133,144 | |

| | | | 4,416,952 | |

Utilities (5.1%) | | | | | |

American Water Works Co., Inc. | | 7,175 | | 651,275 | |

Consolidated Edison, Inc. | | 9,150 | | 699,609 | |

Eversource Energy | | 26,100 | | 1,697,544 | |

ONE Gas, Inc. | | 10,000 | | 796,000 | |

| | | | 3,844,428 | |

| | | | | |

TOTAL COMMON STOCKS (Cost $56,789,856) | | | | 72,968,572 | |

| | | | | |

INVESTMENT COMPANIES (4.1%) | | | | | |

| | | | | |

JPMorgan U.S. Government Money Market Fund, Capital Shares, 2.28%(b) | | 3,034,757 | | 3,034,757 | |

TOTAL INVESTMENT COMPANIES (Cost $3,034,757) | | | | 3,034,757 | |

| | | | | |

Total Investments (Cost $59,824,613) — 101.5%(c) | | | | 76,003,329 | |

Liabilities in excess of other assets — (1.5)% | | | | (1,140,493 | ) |

NET ASSETS — 100.0% | | | | $ | 74,862,836 | |

| | | | | | |

(a) Non-income producing security.

(b) Rate disclosed is the seven day yield as of December 31, 2018.