UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number | | 811-01136 |

SECURITY EQUITY FUND

|

| (Exact name of registrant as specified in charter) |

| | |

| ONE SECURITY BENEFIT PLACE, TOPEKA, KANSAS | | 66636-0001 |

| (Address of principal executive offices) | | (Zip code) |

MICHAEL G. ODLUM, PRESIDENT

SECURITY EQUITY FUND

ONE SECURITY BENEFIT PLACE

TOPEKA, KANSAS 66636-0001

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (785) 438-3000

Date of fiscal year end: September 30

Date of reporting period: March 31, 2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

| Item 1. | Reports to Stockholders. |

Security Equity Fund

Security Large Cap Value Fund

Security Mid Cap Growth Fund

March 31, 2007

Semi-Annual Report

(unaudited)

Table of Contents

1

Chairman’s Letter

May 16, 2007

Mike Odlum

Chairman of the Board

To Our Shareholders:

The performance of selected major indexes in each quarter and for the six-month period is shown in the table below.

| | | | | | |

| | | Return % |

Index | | 4th Qtr

2006 | | 1st Qtr

2007 | | Six Months

9/30/06-

3/31/07 |

S&P 500 | | 6.70 | | .64 | | 7.38 |

Russell 1000 | | 6.95 | | 1.21 | | 8.24 |

Russell 2500 | | 8.70 | | 3.55 | | 12.56 |

Russell 2000 | | 8.90 | | 1.95 | | 11.02 |

MSCI EAFE ($US) | | 10.35 | | 4.08 | | 14.85 |

Lehman Aggregate Bond | | 1.24 | | 1.50 | | 2.75 |

Lehman High Yield | | 4.20 | | 2.64 | | 6.95 |

While the markets provided positive returns on average in each quarter, most of that was concentrated in the 4th quarter of 2006. This was a period when investors were generally positive about the state of the economy, and corporate earnings along with consumer spending were showing continued strength. In addition, merger and acquisition activity was generating headlines, which helped to keep investors thinking positively about the markets. In the 1st quarter of 2007 events were quite different as the market weathered news about the housing market as well as increased volatility triggered by events in the Asian markets. The fact that the stock market rebounded to end the quarter with positive returns is remarkable and an indication that fundamentals such as corporate earnings growth and benign inflation continued to be strong drivers.

Overall during the period, the highest returns came from international equities. On the domestic side, mid and small cap stocks outperformed their large cap brethren representing a mini resurgence of a trend that had persisted for much of the first half of this decade.

Interest rates on U.S. Treasury securities with both short-term and long-term maturities during the period are summarized below.

| | | | | | |

| | | % Rates |

U.S. Treasury Maturity | | 9/30/06 | | 12/31/05 | | 3/31/07 |

3 Month | | 4.89 | | 5.02 | | 5.04 |

5 Year | | 4.59 | | 4.70 | | 4.54 |

10 Year | | 4.64 | | 4.71 | | 4.65 |

20 Year | | 4.84 | | 4.91 | | 4.92 |

Interest rates overall were fairly steady in both the 4th quarter of 2006 and the 1st quarter of 2007. The Federal Reserve was in a watch and wait mode with the key factors being the growth in the economy and inflationary trends. As economic growth moderates over the next few quarters, and absent any spike in inflation, the market would expect the next Federal Reserve move to be one of easing, or lowering short term rates. Short term rates more traditionally tend to be lower than long term rates; so the current flat yield curve is not the norm. Over the past several quarters, with low inflation and an economy growing faster than the level of short term rates, this has not been an issue. However, if economic growth begins to dip below the short term rates, the rate level becomes more of a burden, and the Fed may be more likely to lower them later in 2007.

Regardless of what the future may bring, investors always need to be cognizant of the need to maintain a diversified portfolio strategy that is designed to meet their objectives over the long run. One of the key purposes of the Security Funds is to provide professionally managed investment portfolios that give shareholders the benefits of diversification as well as to seek investment returns that help meet their goals over the long run. We appreciate your continued investment in the Funds and as always welcome any comments or questions you may have.

With this my first written shareholder communication for the Security Funds since recently assuming the role of Chairman, I would like to acknowledge the enormous contribution made by the outgoing Chairman, John Cleland. John has played a pivotal role in close to 40 years of service to the Security and SBL Funds in various roles including Portfolio Manager, long-time Director and in recent years the Chairman of the Board of the Security Funds. The entire Board I think put it best,

“…we have been privileged in our friendship and association with John Cleland and have benefited from his guidance, experience, sense of history and investing savvy, all of which have favorably affected the Security Funds… the Directors of the Security Funds, and his many friends throughout Security Management, wish him the best in the years ahead.”

Sincerely,

Michael G. Odlum

Chairman, The Security Funds

2

Security Equity Fund

Alpha Opportunity Series

Adviser,

Security Management Company, LLC

and

Subadviser,

Mainstream Investment Advisers

3

| | |

| | Security Equity Fund |

| Performance Summary | | Alpha Opportunity Series |

| March 31, 2007 | | (unaudited) |

PERFORMANCE

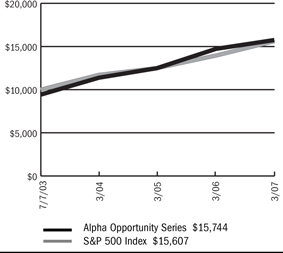

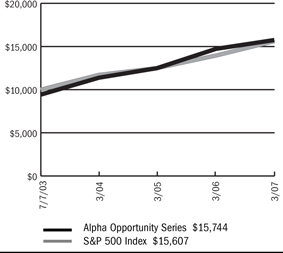

Security Alpha Opportunity Series vs. S&P 500 Index

$10,000 Since Inception

This chart assumes a $10,000 investment in Class A shares of Alpha Opportunity Series on July 7, 2003 (date of inception), reflects deduction of the 5.75% sales load and assumes all dividends reinvested. The chart does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. The S&P 500 Index is a capitalization weighted index composed of 500 selected common stocks that represent the broad domestic economy and is a widely recognized unmanaged index of market performance.

Average Annual Returns

| | | | | |

Periods Ended 3-31-07 | | 1 Year | | | Since Inception |

A Shares | | 6.90 | % | | 14.73% (7-07-03) |

A Shares with sales charge | | 0.74 | % | | 12.92% (7-07-03) |

B Shares | | 6.07 | % | | 13.87% (7-07-03) |

B Shares with CDSC | | 1.30 | % | | 13.30% (7-07-03) |

C Shares | | 6.07 | % | | 13.87% (7-07-03) |

C Shares with CDSC | | 5.12 | % | | 13.87% (7-07-03) |

The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Series will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The figures above do not reflect deduction of the maximum front-end sales charge of 5.75% for Class A shares or the contingent deferred sales charge of 5% for Class B shares and 1% for Class C shares, as applicable, except where noted. The figures do not reflect the deduction of taxes that a shareholder would pay on distributions or redemption of shares. Such figures would be lower if the maximum sales charge and any applicable taxes were deducted. Fee waivers and/or reimbursements reduced expenses of the Series and in the absence of such waiver, the performance quoted would be reduced.

Portfolio Composition by Sector as of 3-31-07*

| | | |

Consumer Discretionary | | (0.57 | )% |

Consumer Staples | | 0.39 | |

Energy | | 2.22 | |

Financials | | 0.14 | |

Health Care | | (0.24 | ) |

Industrials | | 14.04 | |

Information Technology | | 2.18 | |

Materials | | 15.89 | |

Telecommunication Services | | 0.90 | |

Exchange Traded Funds | | 4.31 | |

U.S. Government Sponsored Agencies | | 40.25 | |

Cash & other assets, less liabilities | | 20.49 | |

Total net assets | | 100.00 | % |

| | | |

| * | Securities sold short are netted with long positions in common stocks in the appropriate sectors. |

The accompanying notes are an integral part of the financial statements.

| | |

| | Security Equity Fund |

| Performance Summary | | Alpha Opportunity Series |

| March 31, 2007 | | (unaudited) |

PERFORMANCE

Information About Your Series Expenses

Calculating your ongoing Series expenses

Example

As a shareholder of the Series, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; contingent deferred sales charges on redemptions; and redemption fees, if any; and (2) ongoing costs, including management fees; distribution and/or service fees (12b-1); and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, October 1, 2006 – March 31, 2007.

Actual Expenses

The first line for each class of shares in the table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each class of shares in the table provides information about hypothetical account values and hypothetical expenses based on the Series actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions, and redemption fees, if any. Therefore, the second line for each class of shares is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Series Expenses

| | | | | | | | | |

| | | Beginning

Account Value

10-01-06 | | Ending

Account Value

03-31-071 | | Expenses

During

Period2 |

Alpha Opportunity | | | | | | | | | |

Series - Class A | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,115.30 | | $ | 13.55 |

Hypothetical | | | 1,000.00 | | | 1,012.12 | | | 12.89 |

| | | |

Alpha Opportunity | | | | | | | | | |

Series - Class B | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,111.60 | | | 17.48 |

Hypothetical | | | 1,000.00 | | | 1,008.38 | | | 16.62 |

| | | |

Alpha Opportunity | | | | | | | | | |

Series - Class C | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,111.60 | | | 17.48 |

Hypothetical | | | 1,000.00 | | | 1,008.38 | | | 16.62 |

1 | The actual ending account value is based on the actual total return of the Series for the period from October 1, 2006 to March 31, 2007, after actual expenses and will differ from the hypothetical ending account value, which is based on the Series expense ratio and a hypothetical annual return of 5% before expenses. The actual cumulative return at net asset value for the period from October 1, 2006 to March 31, 2007 was 11.53%, 11.16% and 11.16%, for Class A, B and C shares, respectively. |

2 | Expenses are equal to the Series annualized expense ratio (2.57%, 3.32% and 3.32% for Class A, B and C shares, respectively), net of any applicable fee waivers or custodian earnings credits, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

5

| | |

| | |

| Schedule of Investments | | Security Equity Fund - Alpha Opportunity Series |

| March 31, 2007 (Unaudited) | | |

| | | | | |

| | | Shares | | Value |

COMMON STOCK—41.4% | | | | | |

Aerospace & Defense—0.4% | | | | | |

Hexcel Corporation * | | 6,800 | | $ | 134,980 |

| | | | | |

Agricultural Products—0.0% | | | | | |

Cresud S.A. ADR | | 600 | | | 12,318 |

| | | | | |

Airlines—0.1% | | | | | |

Alaska Air Group, Inc. * | | 900 | | | 34,290 |

| | | | | |

Alternative Carriers—0.9% | | | | | |

Level 3 Communications, Inc. * | | 49,800 | | | 303,780 |

| | | | | |

Aluminum—1.4% | | | | | |

Alcoa, Inc. | | 1,600 | | | 54,240 |

Aluminum Corporation of China, Ltd. ADR | | 8,500 | | | 220,915 |

Century Aluminum Company * | | 3,900 | | | 182,832 |

| | | | | |

| | | | | 457,987 |

| | | | | |

Commodity Chemicals—1.2% | | | | | |

Lyondell Chemical Company (1) | | 13,200 | | | 395,604 |

| | | | | |

Construction & Engineering—4.5% | | | | | |

Chicago Bridge & Iron Company N.V. | | 11,400 | | | 350,550 |

EMCOR Group, Inc. * | | 3,800 | | | 224,124 |

Fluor Corporation | | 1,100 | | | 98,692 |

Foster Wheeler, Ltd. * | | 6,200 | | | 362,018 |

Granite Construction, Inc. | | 2,400 | | | 132,624 |

KBR, Inc. * | | 8,700 | | | 177,045 |

Perini Corporation * | | 3,100 | | | 114,266 |

Quanta Services, Inc. * | | 2,700 | | | 68,094 |

| | | | | |

| | | | | 1,527,413 |

| | | | | |

Construction & Farm Machinery & Heavy Trucks—2.7% | | | | | |

AGCO Corporation * | | 4,600 | | | 170,062 |

ASV, Inc. * | | 1,000 | | | 15,260 |

Bucyrus International, Inc. (1) | | 9,200 | | | 473,800 |

CNH Global N.V. | | 2,200 | | | 82,038 |

Lindsay Corporation | | 3,500 | | | 111,265 |

Wabash National Corporation | | 3,300 | | | 50,886 |

| | | | | |

| | | | | 903,311 |

| | | | | |

Data Processing & Outsourced Services—1.2% | | | | | |

Electronic Data Systems Corporation (1) | | 14,300 | | | 395,824 |

| | | | | |

Diversified Commercial & Professional Services—0.8% | | | | | |

Pike Electric Corporation * | | 5,200 | | | 94,016 |

Ritchie Bros Auctioneers, Inc. | | 3,100 | | | 181,412 |

| | | | | |

| | | | | 275,428 |

| | | | | |

Diversified Metals & Mining—1.4% | | | | | |

AMCOL International Corporation | | 2,200 | | | 65,230 |

Anglo American plc ADR | | 1,900 | | | 50,198 |

Mechel ADR | | 3,600 | | | 119,700 |

Peru Copper, Inc. * | | 15,300 | | | 63,036 |

Titanium Metals Corporation * | | 5,000 | | | 179,400 |

| | | | | |

| | | | | 477,564 |

| | | | | |

Electrical Components & Equipment—0.9% | | | | | |

American Superconductor Corporation * | | 600 | | | 8,082 |

General Cable Corporation * | | 2,700 | | | 144,261 |

GrafTech International, Ltd. * | | 200 | | | 1,816 |

Lamson & Sessions Company * | | 5,300 | | | 147,287 |

| | | | | |

| | | | | 301,446 |

| | | | | |

Electronic Equipment Manufacturers—0.1% | | | | | |

OYO Geospace Corporation * | | 300 | | | 21,276 |

| | | | | |

Exchange Traded Funds—4.3% | | | | | |

CurrencyShares Japanese Yen Trust * | | 1,600 | | | 135,776 |

iShares Lehman 20+ Year Treasury Bond Fund | | 2,100 | | | 185,535 |

iShares Silver Trust * | | 2,600 | | | 347,100 |

Streettracks Gold Trust * (1) | | 11,900 | | | 782,544 |

| | | | | |

| | | | | 1,450,955 |

| | | | | |

Fertilizers & Agricultural Chemicals—4.4% | | | | | |

Agrium, Inc. | | 2,200 | | | 84,326 |

CF Industries Holdings, Inc. | | 1,600 | | | 61,680 |

Monsanto Company | | 3,000 | | | 164,880 |

Mosaic Company * | | 2,200 | | | 58,652 |

Potash Corporation of Saskatchewan, Inc. (1) | | 5,800 | | | 927,594 |

Sociedad Quimica y Minera de Chile S.A. ADR | | 1,300 | | | 189,800 |

| | | | | |

| | | | | 1,486,932 |

| | | | | |

Gold—0.4% | | | | | |

Randgold Resources, Ltd. ADR | | 6,100 | | | 145,851 |

| | | | | |

Industrial Conglomerates—0.5% | | | | | |

McDermott International, Inc. * | | 3,500 | | | 171,430 |

| | | | | |

Industrial Machinery—3.1% | | | | | |

SPX Corporation (1) | | 7,100 | | | 498,420 |

Valmont Industries, Inc. (1) | | 9,500 | | | 549,385 |

| | | | | |

| | | | | 1,047,805 |

| | | | | |

Oil & Gas Equipment & Services—0.5% | | | | | |

Input/Output, Inc. * | | 2,100 | | | 28,938 |

Lone Star Technologies, Inc. * | | 500 | | | 33,015 |

Willbros Group, Inc. * | | 5,300 | | | 119,462 |

| | | | | |

| | | | | 181,415 |

| | | | | |

Oil & Gas Exploration & Production—1.7% | | | | | |

Apache Corporation | | 3,900 | | | 275,730 |

The accompanying notes are an integral part of the financial statements.

6

| | |

| | |

| Schedule of Investments | | Security Equity Fund - Alpha Opportunity Series |

| March 31, 2007 (Unaudited) - continued | | |

| | | | | |

| | | Shares | | Value |

COMMON STOCK (continued) | | | | | |

Oil & Gas Exploration & Production (continued) | | | | | |

Norsk Hydro ASA ADR | | 6,400 | | $ | 210,048 |

Quicksilver Resources, Inc. * | | 2,000 | | | 79,540 |

| | | | | |

| | | | | 565,318 |

| | | | | |

Packaged Foods & Meats—0.4% | | | | | |

Perdigao S.A. ADR | | 1,100 | | | 29,205 |

Pilgrim’s Pride Corporation | | 1,100 | | | 36,509 |

Smithfield Foods, Inc. * | | 1,100 | | | 32,945 |

Tyson Foods, Inc. | | 1,100 | | | 21,351 |

| | | | | |

| | | | | 120,010 |

| | | | | |

Paper Products—0.9% | | | | | |

Abitibi-Consolidated, Inc. | | 33,300 | | | 93,906 |

Bowater, Inc. | | 8,000 | | | 190,560 |

| | | | | |

| | | | | 284,466 |

| | | | | |

Personal Products—0.2% | | | | | |

Estee Lauder Companies, Inc. | | 1,100 | | | 53,735 |

| | | | | |

Real Estate Management & Development—1.1% | | | | | |

Brookfield Asset Management, Inc. (1) | | 7,100 | | | 371,046 |

| | | | | |

Semiconductor Equipment—0.4% | | | | | |

Asyst Technologies, Inc. * | | 2,500 | | | 17,575 |

Formfactor, Inc. * | | 2,500 | | | 111,875 |

| | | | | |

| | | | | 129,450 |

| | | | | |

Semiconductors—0.6% | | | | | |

Analog Devices, Inc. | | 1,500 | | | 51,735 |

Intersil Corporation | | 4,400 | | | 116,556 |

ON Semiconductor Corporation * | | 2,000 | | | 17,840 |

| | | | | |

| | | | | 186,131 |

| | | | | |

Steel—6.3% | | | | | |

AK Steel Holding Corporation * | | 10,600 | | | 247,934 |

Allegheny Technologies, Inc. | | 1,400 | | | 149,366 |

Cia Vale do Rio Doce ADR | | 9,600 | | | 355,104 |

Friedman Industries, Inc. | | 1,000 | | | 9,240 |

Gibraltar Industries, Inc. | | 7,300 | | | 165,126 |

Olympic Steel, Inc. | | 5,800 | | | 179,742 |

Quanex Corporation | | 3,800 | | | 160,930 |

Schnitzer Steel Industries, Inc. | | 7,600 | | | 305,292 |

Steel Technologies, Inc. | | 7,900 | | | 233,682 |

Worthington Industries, Inc. | | 15,800 | | | 325,164 |

| | | | | |

| | | | | 2,131,580 |

| | | | | |

Trading Companies & Distributors—0.8% | | | | | |

UAP Holding Corporation | | 9,500 | | | 245,575 |

United Rentals, Inc. * | | 1,300 | | | 35,750 |

| | | | | |

| | | | | 281,325 |

| | | | | |

Trucking—0.2% | | | | | |

J.B. Hunt Transport Services, Inc. | | 3,100 | | | 81,344 |

| | | | | |

TOTAL COMMON STOCK (Cost $13,781,707) | | | | $ | 13,930,014 |

| | | | | |

| | | | | | |

| | | Principal

Amount | | Value |

U.S. GOVERNMENT SPONSORED AGENCY BONDS & NOTES—40.3% | | | | | | |

Federal Farm Credit Discount Note | | | | | | |

5.03% - 2007 (1) | | $ | 600,000 | | $ | 592,211 |

5.103% - 2007 (1) | | | 1,175,000 | | | 1,170,312 |

| | |

Federal Home Loan Bank | | | | | | |

5.107% - 2007 (1) | | | 700,000 | | | 692,150 |

5.12% - 2007 (1) | | | 425,000 | | | 422,764 |

5.135% - 2007 (1) | | | 450,000 | | | 447,112 |

5.15% - 2007 (1) | | | 450,000 | | | 446,736 |

5.17% - 2007 (1) | | | 250,000 | | | 249,180 |

5.17% - 2007 (1) | | | 1,100,000 | | | 1,097,492 |

| | |

Federal Home Loan Mortgage Corporation | | | | | | |

5.11% - 2007 (1) | | | 383,000 | | | 379,738 |

5.124% - 2007 (1) | | | 1,150,000 | | | 1,147,706 |

5.12% - 2007 (1) | | | 275,000 | | | 272,770 |

5.135% - 2007 (2) | | | 750,000 | | | 750,000 |

5.135% - 2007 (1) | | | 725,000 | | | 724,277 |

| | |

Federal National Mortgage Association | | | | | | |

5.09% - 2007 (1) | | | 200,000 | | | 196,782 |

5.13% - 2007 (1) | | | 1,500,000 | | | 1,498,077 |

5.125% - 2007 (2) | | | 1,050,000 | | | 1,045,520 |

5.135% - 2007 (2) | | | 750,000 | | | 749,786 |

5.137% - 2007 (1) | | | 300,000 | | | 299,017 |

5.14% - 2007 (2) | | | 1,100,000 | | | 1,093,116 |

5.135% - 2007 (1) | | | 270,000 | | | 267,509 |

| | | | | | |

TOTAL U.S. GOVERNMENT SPONSORED AGENCY BONDS & NOTES | | | | | $ | 13,542,255 |

(Cost $13,540,394) | | | | | | |

| | | | | | |

Total Investments (Security Equity Fund—Alpha Opportunity Series) | | | | | $ | 27,472,269 |

(Cost $27,322,101)—81.7% | | | | | | |

Other Assets in Excess of Liabilities—18.3% | | | | | | 6,171,191 |

| | | | | | |

TOTAL NET ASSETS—100.0% | | | | | $ | 33,643,460 |

| | | | | | |

Schedule of Securities Sold Short

March 31, 2007

Security Equity Fund - Alpha Opportunity Series

| | | | | | | |

| | | Shares | | | Value | |

COMMON STOCK—(2.1)% | | | | | | | |

| | |

Apparel Retail—(0.1)% | | | | | | | |

HOT Topic, Inc. * | | (3,900 | ) | | $ | (43,290 | ) |

| | | | | | | |

Biotechnology—(0.2)% | | | | | | | |

Genentech, Inc. * | | (1,000 | ) | | | (82,120 | ) |

| | | | | | | |

Diversified Chemicals—(0.1)% | | | | | | | |

Ashland, Inc. | | (500 | ) | | | (32,800 | ) |

| | | | | | | |

General Merchandise Stores—(0.2)% | | | | | | | |

Family Dollar Stores, Inc. | | (2,900 | ) | | | (85,898 | ) |

| | | | | | | |

The accompanying notes are an integral part of the financial statements.

7

| | |

| | |

| Schedule of Investments | | Security Equity Fund - Alpha Opportunity Series |

| March 31, 2007 (Unaudited) - continued | | |

| | | | | | | |

| | | Shares | | | Value | |

COMMON STOCK (continued) | | | | | | | |

| | |

Human Resource & Employment Services—(0.1)% | | | | | | | |

Administaff, Inc. | | (1,000 | ) | | $ | (35,200 | ) |

| | | | | | | |

Hypermarkets & Super Centers—(0.1)% | | | | | | | |

Wal-Mart Stores, Inc. | | (500 | ) | | | (23,475 | ) |

| | | | | | | |

Other Diversified Financial Services—(0.6)% | | | | | | | |

Bank of America Corporation | | (3,900 | ) | | | (198,978 | ) |

| | | | | | | |

Regional Banks—(0.3)% | | | | | | | |

BB&T Corporation | | (500 | ) | | | (20,510 | ) |

PNC Financial Services Group, Inc. | | (1,000 | ) | | | (71,970 | ) |

| | | | | | | |

| | | | | | (92,480 | ) |

| | | | | | | |

Reinsurance—(0.1)% | | | | | | | |

Montpelier Re Holdings, Ltd. | | (1,900 | ) | | | (32,946 | ) |

| | | | | | | |

Restaurants—(0.2)% | | | | | | | |

Brinker International, Inc. | | (1,900 | ) | | | (62,130 | ) |

| | | | | | | |

Tobacco—(0.1)% | | | | | | | |

Reynolds American, Inc. | | (500 | ) | | | (31,205 | ) |

| | | | | | | |

TOTAL COMMON STOCK | | | | | $ | (720,522 | ) |

(Proceeds $719,069) | | | | | | | |

| | | | | | | |

Total Securities Sold Short (Security Equity Fund—Alpha Opportunity Series) (Proceeds $719,069) | | | | | $ | (720,522 | ) |

| | | | | | | |

Footnotes

Percentages are stated as a percent of net assets. For federal income tax purposes the identified cost of investments owned at 3/31/2007 was $27,487,503.

| * | - Non-income producing security |

| 1 | - Security is segregated as collateral for open futures contracts. |

| 2 | - Security is segregated as collateral for snort positions. |

Glossary:

| ADR | - American Depositary Receipt |

| plc | - Public Limited Company |

See notes to financial statements.

The accompanying notes are an integral part of the financial statements.

8

| | |

| | Security Equity Fund |

| | Alpha Opportunity Series |

| | (unaudited) |

Statement of Assets and Liabilities

March 31, 2007

| | | | |

Assets: | | | | |

Investments, at value1 | | $ | 27,472,269 | |

Cash | | | 5,282,703 | |

Receivables: | | | | |

Fund shares sold | | | 57,986 | |

Securities sold | | | 3,646,384 | |

Dividends | | | 10,304 | |

Prepaid expenses | | | 29,073 | |

| | | | |

Total assets | | | 36,498,719 | |

| | | | |

Liabilities: | | | | |

Common stock sold short, at value2 | | | 720,522 | |

Payable for: | | | | |

Securities purchased | | | 2,035,741 | |

Fund shares redeemed | | | 4,043 | |

Variation margin | | | 2,925 | |

Dividends on short sales | | | 143 | |

Management fees | | | 55,274 | |

Custodian fees | | | 2,289 | |

Transfer agent/maintenance fees | | | 2,083 | |

Administration fees | | | 5,196 | |

Professional fees | | | 9,580 | |

12b-1 distribution plan fees | | | 13,957 | |

Directors’ fees | | | 48 | |

Other | | | 3,458 | |

| | | | |

Total liabilities | | | 2,855,259 | |

| | | | |

Net Assets | | $ | 33,643,460 | |

| | | | |

Net assets consist of: | | | | |

Paid in capital | | $ | 31,650,046 | |

Accumulated net investment loss | | | (14,477 | ) |

Undistributed net realized gain on sale of investments, securities sold short and futures | | | 1,547,853 | |

Net unrealized appreciation in value of investments, securities sold short and futures | | | 460,038 | |

| | | | |

Net assets | | $ | 33,643,460 | |

| | | | |

Class A: | | | | |

Capital shares outstanding (unlimited number of shares authorized) | | | 1,801,276 | |

Net assets | | $ | 22,204,940 | |

Net asset value and redemption price per share | | $ | 12.33 | |

| | | | |

Maximum offering price per share (net asset value divided by 94.25%) | | $ | 13.08 | |

| | | | |

Class B: | | | | |

Capital shares outstanding (unlimited number of shares authorized) | | | 469,929 | |

Net assets | | $ | 5,601,674 | |

Net asset value, offering and redemption price per share (excluding any applicable contingent deferred sales charge) | | $ | 11.92 | |

| | | | |

Class C: | | | | |

Capital shares outstanding (unlimited number of shares authorized) | | | 489,612 | |

Net assets | | $ | 5,836,846 | |

Net asset value, offering and redemption price per share (excluding any applicable contingent deferred sales charge) | | $ | 11.92 | |

| | | | |

1 Investments, at cost | | $ | 27,322,101 | |

2 Common stock sold short, at proceeds | | | 719,069 | |

Statement of Operations

For the Six Months Ended March 31, 2007

| | | | |

Investment Income: | | | | |

Dividends (net of foreign witholding tax $ 166) | | $ | 72,526 | |

Interest | | | 375,550 | |

| | | | |

Total investment income | | | 448,076 | |

| | | | |

Expenses: | | | | |

Management fees | | | 303,916 | |

Custodian fees | | | 31,631 | |

Transfer agent/maintenance fees | | | 16,386 | |

Administration fees | | | 26,749 | |

Directors’ fees | | | 693 | |

Professional fees | | | 3,688 | |

Reports to shareholders | | | 2,317 | |

Registration fees | | | 15,337 | |

Other expenses | | | 1,474 | |

Dividends on short sales | | | 8,052 | |

12b-1 distribution plan fees—Class A | | | 27,016 | |

12b-1 distribution plan fees—Class B | | | 26,060 | |

12b-1 distribution plan fees—Class C | | | 29,534 | |

| | | | |

Total expenses | | | 492,853 | |

Less: Earnings credits | | | (30,403 | ) |

| | | | |

Net expenses | | | 462,450 | |

| | | | |

Net investment loss | | | (14,374 | ) |

| | | | |

Net Realized and Unrealized Gain (Loss): | | | | |

Net realized gain (loss) during the period on: | | | | |

Investments | | | 2,739,868 | |

Securities sold short | | | (388,635 | ) |

Futures | | | 485,608 | |

| | | | |

Net realized gain | | | 2,836,841 | |

| | | | |

Net unrealized appreciation during the period on: | | | | |

Investments | | | 486,380 | |

Securities sold short | | | 92,556 | |

Futures | | | 127,718 | |

| | | | |

Net unrealized appreciation | | | 706,654 | |

| | | | |

Net realized and unrealized gain | | | 3,543,495 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 3,529,121 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

| | |

| | Security Equity Fund |

Statement of Changes in Net Assets | | Alpha Opportunity Series |

| | | | | | | | |

| | | Six Months Ended

March 31, 2007

(unaudited) | | | Year Ended

September 30, 2006 | |

Increase (decrease) in net assets from operations: | | | | | | | | |

Net investment loss | | $ | (14,374 | ) | | $ | (212,445 | ) |

Net realized gain during the period on investments, securities sold short and futures | | | 2,836,841 | | | | 2,290,275 | |

Net unrealized appreciation during the period on investments, securities sold short and futures | | | 706,654 | | | | (514,291 | ) |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 3,529,121 | | | | 1,563,539 | |

| | | | | | | | |

Distributions to shareholders from: | | | | | | | | |

Net realized gain | | | | | | | | |

Class A | | | (2,136,563 | ) | | | (1,193,077 | ) |

Class B | | | (523,992 | ) | | | (346,675 | ) |

Class C | | | (617,311 | ) | | | (438,798 | ) |

| | | | | | | | |

Total distributions to shareholders | | | (3,277,866 | ) | | | (1,978,550 | ) |

| | | | | | | | |

Capital share transactions: | | | | | | | | |

Proceeds from sale of shares | | | | | | | | |

Class A | | | 3,811,977 | | | | 7,974,133 | |

Class B | | | 813,745 | | | | 988,390 | |

Class C | | | 485,780 | | | | 1,340,669 | |

Distributions reinvested | | | | | | | | |

Class A | | | 2,077,296 | | | | 1,170,685 | |

Class B | | | 522,694 | | | | 343,297 | |

Class C | | | 556,963 | | | | 380,745 | |

Cost of shares redeemed | | | | | | | | |

Class A | | | (4,506,403 | ) | | | (2,922,942 | ) |

Class B | | | (605,371 | ) | | | (512,280 | ) |

Class C | | | (781,290 | ) | | | (3,871,410 | ) |

| | | | | | | | |

Net increase from capital share transactions | | | 2,375,391 | | | | 4,891,287 | |

| | | | | | | | |

Net increase in net assets | | | 2,626,646 | | | | 4,476,276 | |

| | | | | | | | |

Net assets: | | | | | | | | |

Beginning of period | | | 31,016,814 | | | | 26,540,538 | |

| | | | | | | | |

End of period | | $ | 33,643,460 | | | $ | 31,016,814 | |

| | | | | | | | |

Accumulated net investment loss at end of period | | $ | (14,477 | ) | | $ | (103 | ) |

| | | | | | | | |

Capital Share Activity: | | | | | | | | |

Shares sold | | | | | | | | |

Class A | | | 311,700 | | | | 641,932 | |

Class B | | | 68,346 | | | | 81,728 | |

Class C | | | 40,000 | | | | 110,434 | |

Shares reinvested | | | | | | | | |

Class A | | | 174,124 | | | | 99,888 | |

Class B | | | 45,216 | | | | 29,904 | |

Class C | | | 48,180 | | | | 33,166 | |

Shares redeemed | | | | | | | | |

Class A | | | (369,173 | ) | | | (239,609 | ) |

Class B | | | (50,851 | ) | | | (42,378 | ) |

Class C | | | (67,049 | ) | | | (318,091 | ) |

The accompanying notes are an integral part of the financial statements.

| | |

| Financial Highlights | | Security Equity Fund |

| Selected data for each share of capital stock outstanding throughout each period | | Alpha Opportunity Series |

| | | | | | | | | | | | | | | | | | | | |

Class A | | Six Months Ended

March 31, 2007g | | | 2006 | | | 2005 | | | 2004 | | | Year Ended,

September 30, 2003e | |

Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 12.23 | | | $ | 12.37 | | | $ | 11.79 | | | $ | 10.21 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)c | | | 0.01 | | | | (0.06 | ) | | | (0.10 | ) | | | (0.16 | ) | | | (0.03 | ) |

Net gain on securities (realized and unrealized) | | | 1.36 | | | | 0.93 | | | | 1.50 | | | | 2.33 | | | | 0.24 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.37 | | | | 0.87 | | | | 1.40 | | | | 2.17 | | | | 0.21 | |

| | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

Distributions from realized gains | | | (1.27 | ) | | | (1.01 | ) | | | (0.82 | ) | | | (0.59 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (1.27 | ) | | | (1.01 | ) | | | (0.82 | ) | | | (0.59 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 12.33 | | | $ | 12.23 | | | $ | 12.37 | | | $ | 11.79 | | | $ | 10.21 | |

| | | | | | | | | | | | | | | | | | | | |

Total Returna | | | 11.53 | % | | | 7.39 | % | | | 12.26 | % | | | 21.68 | % | | | 2.10 | % |

| | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of period (in thousands) | | $ | 22,205 | | | $ | 20,595 | | | $ | 14,622 | | | $ | 6,556 | | | $ | 2,935 | |

| | | | | | | | | | | | | | | | | | | | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.17 | % | | | (0.50 | )% | | | (0.83 | )% | | | (1.48 | )% | | | (1.35 | )% |

Total expensesb | | | 2.76 | % | | | 3.20 | % | | | 2.94 | % | | | 3.57 | % | | | 3.25 | % |

Net expensesd | | | 2.57 | % | | | 3.01 | % | | | 2.86 | % | | | 2.78 | % | | | 2.75 | % |

Expenses prior to custodian earnings credits and net of expense waivers | | | 2.76 | % | | | 3.10 | % | | | 2.86 | % | | | 2.79 | % | | | 2.75 | % |

Net expenses prior to performance fee adjustmentf | | | 2.71 | % | | | 2.82 | % | | | 2.78 | % | | | 2.78 | % | | | 2.75 | % |

| | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 1,599 | % | | | 1,302 | % | | | 1,502 | % | | | 1,175 | % | | | 867 | % |

| | | | | | | | | | | | | | | | | | | | |

Class B | | Six Months Ended

March 31, 2007g | | | 2006 | | | 2005 | | | 2004 | | | Year Ended, September 30, 2003e | |

Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 11.90 | | | $ | 12.15 | | | $ | 11.68 | | | $ | 10.20 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment lossc | | | (0.03 | ) | | | (0.15 | ) | | | (0.18 | ) | | | (0.25 | ) | | | (0.05 | ) |

Net gain on securities (realized and unrealized) | | | 1.32 | | | | 0.91 | | | | 1.47 | | | | 2.32 | | | | 0.25 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.29 | | | | 0.76 | | | | 1.29 | | | | 2.07 | | | | 0.20 | |

| | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

Distributions from realized gains | | | (1.27 | ) | | | (1.01 | ) | | | (0.82 | ) | | | (0.59 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (1.27 | ) | | | (1.01 | ) | | | (0.82 | ) | | | (0.59 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 11.92 | | | $ | 11.90 | | | $ | 12.15 | | | $ | 11.68 | | | $ | 10.20 | |

| | | | | | | | | | | | | | | | | | | | |

Total Returna | | | 11.16 | % | | | 6.56 | % | | | 11.39 | % | | | 20.68 | % | | | 2.00 | % |

| | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of period (in thousands) | | $ | 5,602 | | | $ | 4,846 | | | $ | 4,106 | | | $ | 2,324 | | | $ | 1,731 | |

| | | | | | | | | | | | | | | | | | | | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.58 | )% | | | (1.24 | )% | | | (1.60 | )% | | | (2.25 | )% | | | (2.11 | )% |

Total expensesb | | | 3.50 | % | | | 3.95 | % | | | 3.69 | % | | | 4.29 | % | | | 4.01 | % |

Net expensesd | | | 3.32 | % | | | 3.76 | % | | | 3.61 | % | | | 3.53 | % | | | 3.50 | % |

Expenses prior to custodian earnings credits and net of expense waivers | | | 3.50 | % | | | 3.85 | % | | | 3.61 | % | | | 3.53 | % | | | 3.50 | % |

Net expenses prior to performance fee adjustmentf | | | 3.46 | % | | | 3.57 | % | | | 3.53 | % | | | 3.53 | % | | | 3.50 | % |

| | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 1,599 | % | | | 1,302 | % | | | 1,502 | % | | | 1,175 | % | | | 867 | % |

The accompanying notes are an integral part of the financial statements.

| | |

| Financial Highlights | | Security Equity Fund |

Selected data for each share of capital stock outstanding throughout each period | | Alpha Opportunity Series |

| | | | | | | | | | | | | | | | | | | | |

Class C | | Six Months Ended

March 31, 2007g | | | 2006 | | | 2005 | | | 2004 | | | Year Ended,

September 30, 2003e | |

Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 11.90 | | | $ | 12.15 | | | $ | 11.68 | | | $ | 10.20 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment lossc | | | (0.03 | ) | | | (0.15 | ) | | | (0.18 | ) | | | (0.25 | ) | | | (0.05 | ) |

Net gain on securities (realized and unrealized) | | | 1.32 | | | | 0.91 | | | | 1.47 | | | | 2.32 | | | | 0.25 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.29 | | | | 0.76 | | | | 1.29 | | | | 2.07 | | | | 0.20 | |

| | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

Distributions from realized gains | | | (1.27 | ) | | | (1.01 | ) | | | (0.82 | ) | | | (0.59 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (1.27 | ) | | | (1.01 | ) | | | (0.82 | ) | | | (0.59 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 11.92 | | | $ | 11.90 | | | $ | 12.15 | | | $ | 11.68 | | | $ | 10.20 | |

| | | | | | | | | | | | | | | | | | | | |

Total Returna | | | 11.16 | % | | | 6.56 | % | | | 11.39 | % | | | 20.68 | % | | | 2.00 | % |

| | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 5,837 | | | $ | 5,576 | | | $ | 7,813 | | | $ | 3,143 | | | $ | 1,723 | |

| | | | | | | | | | | | | | | | | | | | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.58 | )% | | | (1.18 | )% | | | (1.58 | %) | | | (2.24 | )% | | | (2.11 | )% |

Total expensesb | | | 3.51 | % | | | 3.95 | % | | | 3.68 | % | | | 4.30 | % | | | 4.01 | % |

Net expensesd | | | 3.32 | % | | | 3.75 | % | | | 3.61 | % | | | 3.53 | % | | | 3.50 | % |

Expenses prior to custodian earnings credits and net of expense waivers | | | 3.51 | % | | | 3.83 | % | | | 3.61 | % | | | 3.53 | % | | | 3.50 | % |

Net expenses prior to performance fee adjustmentf | | | 3.46 | % | | | 3.57 | % | | | 3.53 | % | | | 3.53 | % | | | 3.50 | % |

| | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 1,599 | % | | | 1,302 | % | | | 1,502 | % | | | 1,175 | % | | | 867 | % |

a | Total return information does not reflect deduction of any sales charges imposed at the time of purchase for Class A shares or upon redemption for Class B and C shares. |

b | Total expense information reflects expense ratios absent fund expense reductions by the Investment Manager and custodian earnings credits, as applicable. |

c | Net investment income (loss) was computed using average shares outstanding throughout the period. |

d | Net expense information reflects the expense ratios after voluntary expense waivers, reimbursements and custodian earnings credits, as applicable. |

e | Security Alpha Opportunity Series was initially capitalized on July 7, 2003 with a net asset value of $10 per share. Percentage amounts for the period, except total return, have been annualized. |

f | Net expenses prior to performance fee adjustment reflect ratios after voluntary expense waivers, reimbursements, custodian earnings credits, and before performance fee adjustments, as applicable. |

g | Unaudited figures for the six months ended March 31, 2007. Percentage amounts, except total return, have been annualized. |

The accompanying notes are an integral part of the financial statements.

Security Equity Fund

Equity Series

Adviser,

Security Management Company, LLC

13

| | |

| | Security Equity Fund |

| Performance Summary | | Equity Series |

| March 31, 2007 | | (unaudited) |

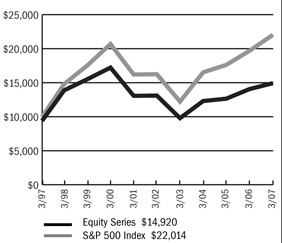

PERFORMANCE

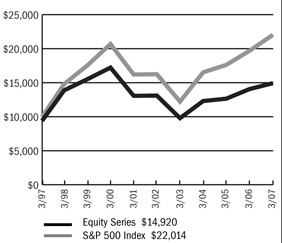

$10,000 Over Ten Years

This chart assumes a $10,000 investment in Class A shares of Equity Series on March 31, 1997, reflects deduction of the 5.75% sales load and assumes all dividends reinvested. The chart does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. The S&P 500 Index is a capitalization weighted index composed of 500 selected common stocks that represent the broad domestic economy and is a widely recognized unmanaged index of market performance.

Average Annual Returns

| | | | | | | | | |

Periods Ended 3-31-07 | | 1 Year | | | 5 Years | | | 10 Years or

Since Inception | |

A Shares | | 6.11 | % | | 2.63 | % | | 4.70 | % |

A Shares with sales charge | | 0.07 | % | | 1.42 | % | | 4.08 | % |

B Shares | | 5.40 | % | | 1.85 | % | | 3.90 | % |

B Shares with CDSC | | 0.70 | % | | 1.52 | % | | 3.90 | % |

C Shares | | 5.41 | % | | 1.84 | % | | (1.42 | )% |

| | | | | | | | (1-29-99 | ) |

C Shares with CDSC | | 4.47 | % | | 1.84 | % | | (1.42 | )% |

| | | | | | | | (1-29-99 | ) |

The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Series will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The figures above do not reflect deduction of the maximum front-end sales charge of 5.75% for Class A shares or the contingent deferred sales charge of 5% for Class B shares and 1% for Class C shares, as applicable, except where noted. The figures do not reflect the deduction of taxes that a shareholder would pay on distributions or redemption of shares. Such figures would be lower if the maximum sales charge and any applicable taxes were deducted.

Portfolio Composition by Sector as of 3-31-07

| | | |

Consumer Discretionary | | 9.69 | % |

Consumer Staples | | 8.56 | |

Energy | | 11.65 | |

Financials | | 21.71 | |

Health Care | | 15.58 | |

Industrials | | 16.28 | |

Information Technology | | 11.76 | |

Materials | | 1.27 | |

Telecommunication Services | | 2.31 | |

Asset Backed Commerical Paper | | 0.94 | |

Commercial Paper | | 0.25 | |

Repurchase Agreement | | 0.07 | |

Liabilities in excess of other assets | | (0.07 | ) |

Total net assets | | 100.00 | % |

| | | |

The accompanying notes are an integral part of the financial statements.

| | |

| | Security Equity Fund |

| Performance Summary | | Equity Series |

| March 31, 2007 | | (unaudited) |

PERFORMANCE

Information About Your Series Expenses

Calculating your ongoing Series expenses

Example

As a shareholder of the Series, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; contingent deferred sales charges on redemptions; and redemption fees, if any; and (2) ongoing costs, including management fees; distribution and/or service fees (12b-1); and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, October 1, 2006 – March 31, 2007.

Actual Expenses

The first line for each class of shares in the table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each class of shares in the table provides information about hypothetical account values and hypothetical expenses based on the Series actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions, and redemption fees, if any. Therefore, the second line for each class of shares is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Series Expenses

| | | | | | | | | |

| | | Beginning

Account Value

10-01-06 | | Ending

Account Value

03-31-071 | | Expenses Paid

During

Period2 |

Equity Series—Class A | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,053.30 | | $ | 6.81 |

Hypothetical | | | 1,000.00 | | | 1,018.30 | | | 6.69 |

Equity Series—Class B | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,048.80 | | | 10.62 |

Hypothetical | | | 1,000.00 | | | 1,014.56 | | | 10.45 |

Equity Series—Class C | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,049.20 | | | 10.63 |

Hypothetical | | | 1,000.00 | | | 1,014.56 | | | 10.45 |

1 | The actual ending account value is based on the actual total return of the Series for the period from October 1, 2006 to March 31, 2007, after actual expenses and will differ from the hypothetical ending account value, which is based on the Series expense ratio and a hypothetical annual return of 5% before expenses. The actual cumulative return at net asset value for the period from October 1, 2006 to March 31, 2007 was 5.33%, 4.88% and 4.92%, for Class A, B and C shares, respectively. |

2 | Expenses are equal to the Series annualized expense ratio (1.33%, 2.08% and 2.08% for Class A, B and C shares, respectively) multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

15

| | |

| Schedule of Investments | | Security Equity Fund - Equity Series |

| March 31, 2007 (Unaudited) | | |

| | | | | |

| | | Shares | | Value |

COMMON STOCK—98.8% | | | | | |

Aerospace & Defense—4.3% | | | | | |

General Dynamics Corporation | | 173,800 | | $ | 13,278,320 |

L-3 Communications Holdings, Inc. | | 42,000 | | | 3,673,740 |

| | | | | |

| | | | | 16,952,060 |

| | | | | |

Air Freight & Logistics—2.9% | | | | | |

FedEx Corporation | | 107,700 | | | 11,570,211 |

| | | | | |

Biotechnology—1.8% | | | | | |

Amgen, Inc. * | | 127,700 | | | 7,135,876 |

| | | | | |

Broadcasting & Cable TV—1.2% | | | | | |

CBS Corporation (CI.B) | | 158,100 | | | 4,836,279 |

| | | | | |

Coal & Consumable Fuels—1.6% | | | | | |

Evergreen Energy, Inc. * | | 979,800 | | | 6,437,286 |

| | | | | |

Communications Equipment—1.9% | | | | | |

ADC Telecommunications, Inc. * | | 447,757 | | | 7,495,452 |

| | | | | |

Construction & Engineering—1.5% | | | | | |

Shaw Group, Inc. * | | 184,800 | | | 5,778,696 |

| | | | | |

Consumer Finance—8.1% | | | | | |

American Express Company | | 193,850 | | | 10,933,140 |

Capital One Financial Corporation | | 112,500 | | | 8,489,250 |

First Marblehead Corporation | | 278,850 | | | 12,517,576 |

| | | | | |

| | | | | 31,939,966 |

| | | | | |

Data Processing & Outsourced Services—4.0% | | | | | |

First Data Corporation | | 208,100 | | | 5,597,890 |

Western Union Company | | 456,400 | | | 10,017,980 |

| | | | | |

| | | | | 15,615,870 |

| | | | | |

Drug Retail—2.3% | | | | | |

CVS Corporation | | 264,200 | | | 9,019,788 |

| | | | | |

Health Care Equipment—1.8% | | | | | |

Hospira, Inc. * | | 175,700 | | | 7,186,130 |

| | | | | |

Health Care Services—3.7% | | | | | |

Medco Health Solutions, Inc. * | | 198,550 | | | 14,400,832 |

| | | | | |

Home Improvement Retail—3.9% | | | | | |

Home Depot, Inc. | | 421,700 | | | 15,493,258 |

| | | | | |

Hotels, Resorts & Cruise Lines—1.9% | | | | | |

Carnival Corporation | | 158,800 | | | 7,441,368 |

| | | | | |

Hypermarkets & Super Centers—6.3% | | | | | |

Costco Wholesale Corporation | | 226,300 | | | 12,183,992 |

Wal-Mart Stores, Inc. | | 267,000 | | | 12,535,650 |

| | | | | |

| | | | | 24,719,642 |

| | | | | |

Industrial Conglomerates—7.6% | | | | | |

General Electric Company | | 491,400 | | | 17,375,904 |

Tyco International, Ltd. | | 394,300 | | | 12,440,165 |

| | | | | |

| | | | | 29,816,069 |

| | | | | |

Industrial Gases—1.3% | | | | | |

Praxair, Inc. | | 79,500 | | | 5,005,320 |

| | | | | |

Integrated Oil & Gas—7.1% | | | | | |

Chevron Corporation | | 128,500 | | | 9,503,860 |

ConocoPhillips | | 8,500 | | | 580,975 |

Exxon Mobil Corporation | | 229,700 | | | 17,330,865 |

Sasol, Ltd. ADR | | 15,600 | | | 515,580 |

| | | | | |

| | | | | 27,931,280 |

| | | | | |

IT Consulting & Other Services—2.3% | | | | | |

Unisys Corporation * | | 1,088,000 | | | 9,171,840 |

| | | | | |

Managed Health Care—5.4% | | | | | |

UnitedHealth Group, Inc. | | 162,000 | | | 8,581,140 |

WellPoint, Inc. * | | 156,700 | | | 12,708,370 |

| | | | | |

| | | | | 21,289,510 |

| | | | | |

Movies & Entertainment—2.6% | | | | | |

Time Warner, Inc. | | 528,000 | | | 10,412,160 |

| | | | | |

Multi-Line Insurance—4.8% | | | | | |

American International Group, Inc. | | 282,500 | | | 18,989,650 |

| | | | | |

Oil & Gas Drilling—0.7% | | | | | |

Transocean, Inc. * | | 36,200 | | | 2,957,540 |

| | | | | |

Oil & Gas Equipment & Services—2.2% | | | | | |

Baker Hughes, Inc. | | 61,000 | | | 4,033,930 |

BJ Services Company | | 53,900 | | | 1,503,810 |

Halliburton Company | | 95,600 | | | 3,034,344 |

| | | | | |

| | | | | 8,572,084 |

| | | | | |

Other Diversified Financial Services—5.0% | | | | | |

Citigroup, Inc. | | 244,600 | | | 12,557,764 |

JPMorgan Chase & Company | | 150,600 | | | 7,286,028 |

| | | | | |

| | | | | 19,843,792 |

| | | | | |

Pharmaceuticals—2.9% | | | | | |

Johnson & Johnson | | 189,000 | | | 11,389,140 |

| | | | | |

Properly & Casualty Insurance—3.8% | | | | | |

Berkshire Hathaway, Inc. * | | 136 | | | 14,822,640 |

| | | | | |

Systems Software—3.6% | | | | | |

Microsoft Corporation | | 505,300 | | | 14,082,711 |

| | | | | |

Wireless Telecommunication Services —2.3% | | | | | |

Sprint Nextel Corporation | | 480,600 | | | 9,112,176 |

| | | | | |

TOTAL COMMON STOCK (Cost $313,723 ,587) | | | | $ | 389,418,626 |

| | | | | |

| | | | |

| | | Principal

Amount | | Value |

ASSET BACKED COMMERCIAL PAPER— 0.9% | | | | |

Financial Companies—Trade Receivables—0.9% | | | | |

Old Line Funding LLC | | | | |

5.28%, 4/2/2007 | | 1,000,000 | | 999,853 |

The accompanying notes are an integral part of the financial statements.

16

| | |

| Schedule of Investments | | Security Equity Fund - Equity Series |

| March 31, 2007 (Unaudited) - continued | | |

| | | | | | | |

| | | Principal Amount | | Value | |

ASSET BACKED COMMERCIAL PAPER (continued) | | | | | | | |

Financial Companies—Trade Receivables (continued) | | | | | | | |

Sheffield Receivables Corporation | | | | | | | |

5.35%, 4/2/2007 | | | 1,300,000 | | $ | 1,299,807 | |

5.29%, 4/4/2007 | | | 1,400,000 | | | 1,399,383 | |

| | | | | | | |

| | | | | | 3,699,043 | |

| | | | | | | |

TOTAL ASSET BACKED COMMERCIAL PAPER (Cost $3,699,043) | | | | | $ | 3,699,043 | |

| | | | | | | |

COMMERCIAL PAPER—0.3% | | | | | | | |

Financial—Other—0.3% | | | | | | | |

Countrywide Financial Corporation | | | | | | | |

5.37%, 4/5/2007 | | | 1,000,000 | | | 999,403 | |

| | | | | | | |

TOTAL COMMERCIAL PAPER (Cost $999,403) | | | | | $ | 999,403 | |

| | | | | | | |

REPURCHASE AGREEMENT—0.1% | | | | | | | |

United Missouri Bank, 4.89%, dated 3/30/07, matures 4/02/07; repurchase amount of $266,108 (Collateralized by GNMA, 3.50%, 5/20/26 with a value of $271,320) | | $ | 266,000 | | $ | 266,000 | |

| | | | | | | |

TOTAL REPURCHASE AGREEMENT (Cost $266,000) | | | | | $ | 266,000 | |

| | | | | | | |

Total Investments (Security Equity Fund—Equity Series) | | | | | $ | 394,383,072 | |

(Cost $318,688,033)—100.1% | | | | | | | |

Liabilities in Excess of Other Assets—(0.1)% | | | | | | (257,916 | ) |

| | | | | | | |

TOTAL NET ASSETS—100.0% | | | | | $ | 394,125,156 | |

| | | | | | | |

Footnotes

Percentages are stated as a percent of net assets.

For federal income tax purposes the identified cost of investments owned at 3/31/2007 was $318,688,033.

| * | -Non-income producing security |

Glossary:

| ADR | -American Depositary Receipt |

See notes to financial statements.

The accompanying notes are an integral part of the financial statements.

17

| | |

| | Security Equity Fund |

| | Equity Series (unaudited) |

Statement of Assets and Liabilities

March 31, 2007

| | | | |

Assets: | | | | |

Investments, at value1 | | $ | 394,383,072 | |

Cash | | | 452 | |

Receivables: | | | | |

Fund shares sold | | | 45,663 | |

Dividends | | | 289,275 | |

Prepaid expenses | | | 41,741 | |

| | | | |

Total assets | | | 394,760,203 | |

| | | | |

| |

Liabilities: | | | | |

Payable for: | | | | |

Fund shares redeemed | | | 143,410 | |

Management fees | | | 251,267 | |

Custodian fees | | | 2,250 | |

Transfer agent/maintenance fees | | | 38,024 | |

Administration fees | | | 31,977 | |

Professional fees | | | 30,841 | |

12b-l distribution plan fees | | | 102,494 | |

Directors’ fees | | | 258 | |

Other | | | 34,526 | |

| | | | |

Total liabilities | | | 635,047 | |

| | | | |

Net Assets | | $ | 394,125,156 | |

| | | | |

| |

Net assets consist of: | | | | |

Paid in capital | | $ | 306,030,527 | |

Accumulated net investment loss | | | (187,517 | ) |

Undistributed net realized gain on sale of investments and options written | | | 12,587,107 | |

Net unrealized appreciation in value of investments and options written | | | 75,695,039 | |

| | | | |

Net assets | | $ | 394,125,156 | |

| | | | |

| |

Class A: | | | | |

Capital shares outstanding (unlimited number of shares authorized) | | | 55,864,867 | |

Net assets | | $ | 365,070,791 | |

Net asset value and redemption price per share | | $ | 6.53 | |

| | | | |

Maximum offering price per share (net asset value divided by 94.25%) | | $ | 6.93 | |

| | | | |

| |

Class B: | | | | |

Capital shares outstanding (unlimited number of shares authorized) | | | 4,135,046 | |

Net assets | | $ | 23,377,962 | |

Net asset value, offering and redemption price per share (excluding any applicable contingent deferred sales charge) | | $ | 5.65 | |

| | | | |

| |

Class C: | | | | |

Capital shares outstanding (unlimited number of shares authorized) | | | 942,620 | |

Net assets | | $ | 5,676,403 | |

Net asset value, offering and redemption price per share (excluding any applicable contingent deferred sales charge) | | $ | 6.02 | |

| | | | |

1 Investments, at cost | | $ | 318,688,033 | |

Statement of Operations

For the Six Months Ended March 31, 2007

| | | | |

Investment Income: | | | | |

Dividends | | $ | 2,369,661 | |

Interest | | | 283,296 | |

| | | | |

Total investment income | | | 2,652,957 | |

| | | | |

| |

Expenses: | | | | |

Management fees | | | 1,534,900 | |

Custodian fees | | | 21,879 | |

Transfer agent/maintenance fees | | | 379,085 | |

Administration fees | | | 194,776 | |

Directors’ fees | | | 7,312 | |

Professional fees | | | 14,776 | |

Reports to shareholders | | | 20,935 | |

Registration fees | | | 21,003 | |

Other expenses | | | 14,146 | |

12b-l distribution plan fees—Class A | | | 471,622 | |

12b-l distribution plan fees—Class B | | | 130,470 | |

12b-l distribution plan fees—Class C | | | 29,575 | |

| | | | |

Total expenses | | | 2,840,479 | |

Less: Earnings credits | | | (5 | ) |

| | | | |

Net expenses | | | 2,840,474 | |

| | | | |

Net investment loss | | | (187,517 | ) |

| | | | |

| |

Net Realized and Unrealized Gain: | | | | |

Net realized gain during the period on: | | | | |

Investments | | | 19,184,552 | |

Options written | | | 693,377 | |

| | | | |

Net realized gain | | | 19,877,929 | |

| | | | |

| |

Net unrealized appreciation during the period on: | | | | |

Investments | | | 1,900,027 | |

Options written | | | 164,800 | |

| | | | |

Net unrealized appreciation | | | 2,064,827 | |

| | | | |

Net realized and unrealized gain | | | 21,942,756 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 21,755,239 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

| | |

| | Security Equity Fund |

| Statement of Changes in Net Assets | | Equity Series |

| | | | | | | | |

| | | Six Months Ended

March 31, 2007

(unaudited) | | | Year Ended

September 30, 2006 | |

Increase (decrease) in net assets from operations: | | | | | | | | |

Net investment loss | | $ | (187,517 | ) | | $ | (625,371 | ) |

Net realized gain during the period on investments and options written | | | 19,877,929 | | | | 41,580,103 | |

Net unrealized appreciation (depreciation) during the period on investments and options written | | | 2,064,827 | | | | (9,213,626 | ) |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 21,755,239 | | | | 31,741,106 | |

| | | | | | | | |

Distributions to shareholders from: | | | | | | | | |

Net investment income | | | | | | | | |

Class A | | | — | | | | (2,147,421 | ) |

Net realized gain | | | | | | | | |

Class A | | | (36,813,622 | ) | | | (11,068,277 | ) |

Class B | | | (2,833,129 | ) | | | (1,320,160 | ) |

Class C | | | (617,995 | ) | | | (182,232 | ) |

| | | | | | | | |

Total distributions to shareholders | | | (40,264,746 | ) | | | (14,718,090 | ) |

| | | | | | | | |

Capital share transactions: | | | | | | | | |

Proceeds from sale of shares | | | | | | | | |

Class A | | | 13,181,817 | | | | 52,710,115 | |

Class B | | | 2,187,220 | | | | 7,159,305 | |

Class C | | | 376,674 | | | | 1,001,095 | |

Distributions reinvested | | | | | | | | |

Class A | | | 33,789,434 | | | | 12,004,929 | |

Class B | | | 2,766,531 | | | | 1,296,700 | |

Class C | | | 607,148 | | | | 180,424 | |

Cost of shares redeemed | | | | | | | | |

Class A | | | (36,172,453 | ) | | | (84,851,352 | ) |

Class B | | | (7,964,537 | ) | | | (21,542,434 | ) |

Class C | | | (779,023 | ) | | | (1,287,944 | ) |

| | | | | | | | |

Net increase (decrease) from capital share transactions | | | 7,992,811 | | | | (33,329,162 | ) |

| | | | | | | | |

Net decrease in net assets | | | (10,516,696 | ) | | | (16,306,146 | ) |

| | | | | | | | |

Net assets: | | | | | | | | |

Beginning of period | | | 404,641,852 | | | | 420,947,998 | |

| | | | | | | | |

End of period | | $ | 394,125,156 | | | $ | 404,641,852 | |

| | | | | | | | |

Accumulated net investment loss at end of period | | $ | (187,517 | ) | | $ | — | |

| | | | | | | | |

Capital Share Activity: | | | | | | | | |

Shares sold | | | | | | | | |

Class A | | | 1,926,515 | | | | 8,042,578 | |

Class B | | | 365,674 | | | | 1,205,513 | |

Class C | | | 59,641 | | | | 160,281 | |

Shares reinvested | | | | | | | | |

Class A | | | 5,073,489 | | | | 1,816,177 | |

Class B | | | 479,468 | | | | 221,280 | |

Class C | | | 98,723 | | | | 29,101 | |

Shares redeemed | | | | | | | | |

Class A | | | (5,271,307 | ) | | | (12,720,895 | ) |

Class B | | | (1,320,807 | ) | | | (3,666,875 | ) |

Class C | | | (122,674 | ) | | | (208,581 | ) |

The accompanying notes are an integral part of the financial statements.

| | |

| Financial Highlights | | Security Equity Fund |

| Selected data for each share of capital stock outstanding throughout each period | | Equity Series |

| | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | Six Months Ended

March 31, 2007i | | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | Year Ended,

September 30,

2002c,e | |

Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 6.85 | | | $ | 6.58 | | | $ | 6.50 | | | $ | 5.98 | | | $ | 5.09 | | | $ | 6.36 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)b | | | — | h | | | (0.01 | ) | | | 0.04 | | | | 0.01 | | | | 0.01 | | | | 0.01 | |

Net gain (loss) on securities (realized and unrealized) | | | 0.38 | | | | 0.52 | | | | 0.49 | | | | 0.52 | | | | 0.88 | | | | (1.28 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.38 | | | | 0.51 | | | | 0.53 | | | | 0.53 | | | | 0.89 | | | | (1.27 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | (0.04 | ) | | | — | | | | (0.01 | ) | | | — | | | | — | |

Distributions from realized gains | | | (0.70 | ) | | | (0.20 | ) | | | (0.45 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.70 | ) | | | (0.24 | ) | | | (0.45 | ) | | | (0.01 | ) | | | ��� | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 6.53 | | | $ | 6.85 | | | $ | 6.58 | | | $ | 6.50 | | | $ | 5.98 | | | $ | 5.09 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Returna | | | 5.33 | % | | | 7.88 | % | | | 8.20 | % | | | 8.87 | % | | | 17.49 | % | | | (19.97 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 365,071 | | | $ | 371,006 | | | $ | 375,280 | | | $ | 391,384 | | | $ | 430,161 | | | $ | 412,791 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.03 | )% | | | (0.08 | )% | | | 0.57 | % | | | 0.08 | % | | | 0.23 | % | | | 0.13 | % |

Total expensesf | | | 1.33 | % | | | 1.34 | % | | | 1.30 | % | | | 1.28 | % | | | 1.25 | % | | | 1.11 | % |

Net expensesg | | | 1.33 | % | | | 1.34 | % | | | 1.30 | % | | | 1.28 | % | | | 1.25 | % | | | 1.11 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 26 | % | | | 34 | % | | | 32 | % | | | 28 | % | | | 54 | % | | | 30 | % |

Class B | | Six Months Ended

March 31, 2007i | | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | Year Ended,

September 30,

2002c,e | |

Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 6.04 | | | $ | 5.83 | | | $ | 5.85 | | | $ | 5.41 | | | $ | 4.64 | | | $ | 5.86 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment lossb | | | (0.02 | ) | | | (0.05 | ) | | | (0.01 | ) | | | (0.04 | ) | | | (0.03 | ) | | | (0.05 | ) |

Net gain (loss) on securities (realized and unrealized) | | | 0.33 | | | | 0.46 | | | | 0.44 | | | | 0.48 | | | | 0.80 | | | | (1.17 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.31 | | | | 0.41 | | | | 0.43 | | | | 0.44 | | | | 0.77 | | | | (1.22 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions from realized gains | | | (0.70 | ) | | | (0.20 | ) | | | (0.45 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.70 | ) | | | (0.20 | ) | | | (0.45 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 5.65 | | | $ | 6.04 | | | $ | 5.83 | | | $ | 5.85 | | | $ | 5.41 | | | $ | 4.64 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Returna | | | 4.88 | % | | | 7.16 | % | | | 7.35 | % | | | 8.13 | % | | | 16.59 | % | | | (20.82 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 23,378 | | | $ | 27,842 | | | $ | 39,962 | | | $ | 49,600 | | | $ | 61,733 | | | $ | 66,267 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.78 | )% | | | (0.83 | )% | | | (0.16 | )% | | | (0.67 | )% | | | (0.52 | )% | | | (0.78 | )% |

Total expensesf | | | 2.08 | % | | | 2.09 | % | | | 2.05 | % | | | 2.03 | % | | | 2.00 | % | | | 2.02 | % |

Net expensesg | | | 2.08 | % | | | 2.09 | % | | | 2.05 | % | | | 2.03 | % | | | 2.00 | % | | | 2.02 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 26 | % | | | 34 | % | | | 32 | % | | | 28 | % | | | 54 | % | | | 30 | % |

The accompanying notes are an integral part of the financial statements.

| | |

| Financial Highlights | | Security Equity Fund |

Selected data for each share of capital stock outstanding throughout each period | | Equity Series |

| | | | | | | | | | | | | | | | | | | | | | | | |

Class C | | Six Months Ended

March 31, 2007i | | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | Year Ended,

September 30,

2002c,d,e | |

Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 6.39 | | | $ | 6.16 | | | $ | 6.16 | | | $ | 5.69 | | | $ | 4.88 | | | $ | 6.16 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment lossb | | | (0.02 | ) | | | (0.05 | ) | | | (0.01 | ) | | | (0.04 | ) | | | (0.03 | ) | | | (0.05 | ) |

Net gain (loss) on securities (realized and unrealized) | | | 0.35 | | | | 0.48 | | | | 0.46 | | | | 0.51 | | | | 0.84 | | | | (1.23 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.33 | | | | 0.43 | | | | 0.45 | | | | 0.47 | | | | 0.81 | | | | (1.28 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions from realized gains | | | (0.70 | ) | | | (0.20 | ) | | | (0.45 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.70 | ) | | | (0.20 | ) | | | (0.45 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 6.02 | | | $ | 6.39 | | | $ | 6.16 | | | $ | 6.16 | | | $ | 5.69 | | | $ | 4.88 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Returna | | | 4.92 | % | | | 7.10 | % | | | 7.32 | % | | | 8.26 | % | | | 16.60 | % | | | (20.78 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 5,676 | | | $ | 5,794 | | | $ | 5,706 | | | $ | 6,329 | | | $ | 6,651 | | | $ | 4,979 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.78 | )% | | | (0.83 | )% | | | (0.18 | )% | | | (0.67 | )% | | | (0.52 | )% | | | (0.76 | )% |

Total expensesf | | | 2.08 | % | | | 2.09 | % | | | 2.05 | % | | | 2.03 | % | | | 2.00 | % | | | 2.02 | % |

Net expensesg | | | 2.08 | % | | | 2.09 | % | | | 2.05 | % | | | 2.03 | % | | | 2.00 | % | | | 2.02 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 26 | % | | | 34 | % | | | 32 | % | | | 28 | % | | | 54 | % | | | 30 | % |

a | Total return information does not reflect deduction of any sales charges imposed at the time of purchase for Class A shares or upon redemption for Class B and C shares. |

b | Net investment income (loss) was computed using average shares outstanding throughout the period. |

c | The financial highlights for the Equity Series exclude the historical financial highlights of the Total Return Series Class A, B and C shares. The assets of the Total Return Series were acquired by the Equity Series on August 27, 2002. |

d | The financial highlights for Class C shares exclude the historical financial highlights of Class S shares. Class S shares were exchanged for Class C shares on June 3, 2002. |

e | Effective May 1, 2002 the fee structure for Equity Series changed. Per share information reflects this change. |

f | Total expense information reflects expense ratios absent fund expense reductions by the Investment Manager and custodian earnings credits, as applicable. |

g | Net expense information reflects the expense ratios after voluntary expense waivers, reimbursements and custodian earnings credits, as applicable. |

h | Net investment income is less than $0.01 per share. |

i | Unaudited figures for the six months ended March 31, 2007. Percentage amounts, except total return, have been annualized. |

The accompanying notes are an integral part of the financial statements.

This page left blank intentionally.

22

Security Equity Fund

Global Series

Subadviser,

OppenheimerFunds, Inc.

23

| | |

| | Security Equity Fund |

| Performance Summary | | Global Series |

| March 31, 2007 | | (unaudited) |

PERFORMANCE

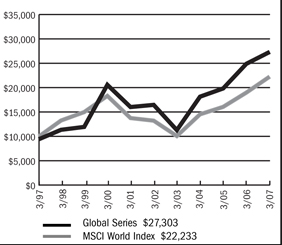

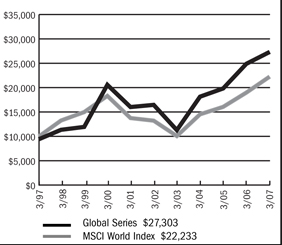

Security Global Series vs. Morgan Stanley Capital International World Index

$10,000 Over Ten Years

This chart assumes a $10,000 investment in Class A shares of Global Series on March 31, 1997, reflects deduction of the 5.75% sales load and assumes all dividends reinvested. The chart does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. The MSCI World Index is an unmanaged capitalization-weighted index that is designed to measure global developed market equity performance.

Portfolio Composition by Sector as of 3-31-07

| | | |

Consumer Discretionary | | 18.91 | % |

Consumer Staples | | 8.34 | |

Energy | | 5.68 | |

Financials | | 14.50 | |

Health Care | | 9.53 | |

Industrials | | 14.31 | |

Information Technology | | 21.30 | |

Materials | | 0.24 | |

Telecommunication Services | | 3.90 | |

Utilities | | 0.62 | |

Repurchase Agreement | | 2.31 | |

Cash & other assets, less liabilities | | 0.36 | |

Total net assets | | 100.00 | % |

| | | |

Average Annual Returns

| | | | | | | | | |

Periods Ended 3-31-07 | | 1 Year | | | 5 Years | | | 10 Years or

Since Inception | |

A Shares | | 9.72 | % | | 10.65 | % | | 11.23 | % |

A Shares with sales charge | | 3.42 | % | | 9.35 | % | | 10.57 | % |

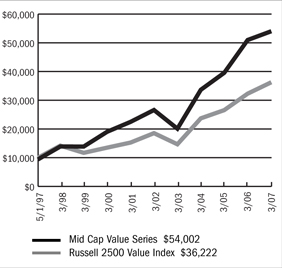

B Shares | | 10.04 | % | | 10.45 | % | | 10.68 | % |