UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

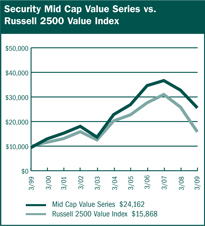

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-01136

SECURITY EQUITY FUND

(Exact name of registrant as specified in charter)

ONE SECURITY BENEFIT PLACE, TOPEKA, KANSAS 66636-0001

(Address of principal executive offices) (Zip code)

RICHARD M. GOLDMAN, PRESIDENT

SECURITY EQUITY FUND

ONE SECURITY BENEFIT PLACE

TOPEKA, KANSAS 66636-0001

(Name and address of agent for service)

Registrant’s telephone number, including area code: (785) 438-3000

Date of fiscal year end: September 30

Date of reporting period: March 31, 2009

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

| Item 1. | Reports to Stockholders. |

Security Equity Fund

Security Large Cap Value Fund

Security Mid Cap Growth Fund

March 31, 2009

Semi-Annual Report

(unaudited)

Table of Contents

Chairman’s Letter

May 16, 2009

| | |

| | To Our Shareholders: I am pleased to announce our new brand name, Rydex | SGI Funds, which reflects the array of quantitative alternative mutual funds offered through Rydex Investments and the traditional investment offerings which you have known as the Security Funds. With the integration of Rydex Investments and the Security Funds, we look forward to providing you with an expanded choice of funds managed by investment professionals committed to your best interests and future. |

The six-month period ended March 31, 2009 began with one of the most precipitous and unnerving market drops in the past 20 years. Only during the final month of the period did the markets and economy begin to show signs of stability, preventing further collapse.

The end of the six-month period marked the one-year anniversary of the Federal Reserve Bank’s supported buyout of Bear Stearns by JPMorgan, the first major event in the current crisis. Historically, the average financial crisis has resulted in a 55% decline in stock prices, almost exactly the peak to trough drop for the S&P 500 during this crisis, only with more intensity. To add perspective, the 50% decline in stock prices in the wake of the dotcom bubble occurred over a three-year period. The wealth destruction in the recent market environment took a mere 11 months.

While uncertainty lessened in the first quarter, there were still many unknowns regarding the effects of the enormous budget proposal by the Obama administration and Treasury Secretary Geithner’s plan for troubled banks and toxic assets. Since the market lows of early March, the Federal Reserve and the Treasury Department unveiled and articulated plans to inject massive liquidity into the financial markets and remove toxic assets from bank balance sheets. However, investors continue to worry about these actions on individual businesses and consumers.

The outlook for economic growth throughout 2009 remains dismal and may continue into 2010 as unemployment continues to rise, but there is hope that the worst of the economic and market turmoil is behind us. Toward the end of the period, the rate of deceleration in the U.S. economy began to slow and there were indications of stabilization returning to the

housing market and interest rates, which remained at historic lows. While the housing market, and mortgage foreclosures, remains a key to the economy, a deceleration in the rate of decline does not foretell a recovery, but may indicate the beginning-of-the-end to the recession.

In March, markets bounced off lows due to a viewpoint that securities may have been oversold. Consumers continued to pay down debt and save at levels not seen in 15 years. As with all major downturns, it appears that a deep analysis of necessary business rationalization is in the early stages, fundamentally changing how organizations will operate, which should eventually support economic recovery.

It is in times as these when our core philosophy and the disciplined process of our investment strategies become paramount. Our managers continue to use a rigorous fundamental process to identify strong companies, focus on risk management, and remain opportunistic in our approach.

The economic and market conditions of the past six months reinforces how vital it is for investors to develop a strategy to meet their individual circumstances and to maintain a diversified portfolio. One of the key objectives of the Security Funds is to provide professional risk-managed investment portfolios that give shareholders the benefits of diversification and performance returns to help meet their goals over the long-term.

Thank you for your continued investments in the Rydex | SGI Funds.

Sincerely,

Richard M. Goldman

President and Chairman, Rydex | SGI Funds

The funds are distributed by Security Distributors, Inc. (SDI) and/or Rydex Distributors, Inc. (RDI). Security Global InvestorsSM is the investment advisory arm of Security Benefit Corporation (Security Benefit). Security Global Investors consists of Security Global Investors, LLC, Security Investors, LLC and Rydex Investments. Rydex Investments is the primary business name for PADCO Advisors, Inc. and PADCO Advisors II, Inc. SGI, SDI, Rydex Investments and RDI are affiliates and are all subsidiaries of Security Benefit.

This page left blank intentionally.

| | |

Performance Summary March 31, 2009 | | Security Equity Fund All Cap Value Series (unaudited) |

| |

| |

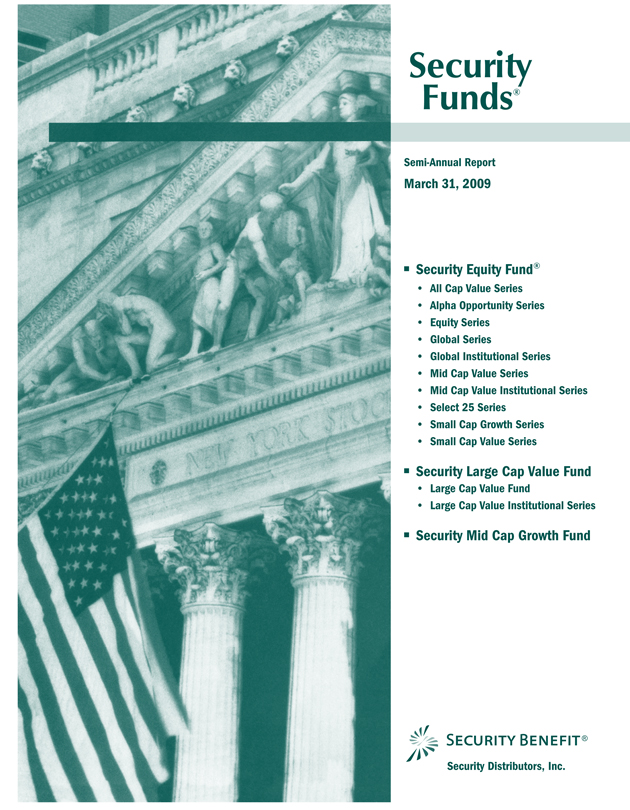

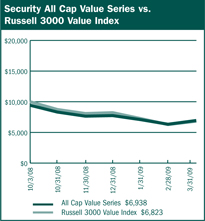

$10,000 Since Inception

This chart assumes a $10,000 investment in Class A shares of All Cap Value Series on October 3, 2008 (date of inception), reflects deduction of the 5.75% sales load and assumes all dividends reinvested. The chart does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. The Russell 3000 Value Index is an unmanaged index that measures the performance of the broad value segment of the U.S. equity universe. It includes those Russell 3000 companies with lower price-to-book ratios and lower forecasted growth values.

| | |

| Average Annual Returns |

Period Ended 3-31-09 | | Since

Inception

(10-03-08) |

A Shares | | (26.60%) |

A Shares with sales charge | | (30.82%) |

C Shares | | (26.80%) |

C Shares with CDSC | | (27.53%) |

Institutional Class | | (26.50%) |

| | |

Period Ended 3-31-09 | | Since

Inception

(10-03-08) |

The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Series will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The figures above do not reflect deduction of the maximum front-end sales charge of 5.75% for Class A shares or the contingent deferred sales charge of 1% for Class C shares, as applicable, except where noted. The figures do not reflect the deduction of taxes that a shareholder would pay on distributions or redemption of shares. Such figures would be lower if the maximum sales charge and any applicable taxes were deducted. Fee waivers and/or reimbursements reduced expenses of the Series and in the absence of such waiver, the performance quoted would be reduced. |

| | | | | | | | |

| | | Portfolio Composition by Sector as of 3-31-09 | | |

| | | Consumer Discretionary | | 10.00% | | | | |

| | | Consumer Staples | | 8.92 | | | | |

| | | Energy | | 11.69 | | | | |

| | | Financials | | 9.96 | | | | |

| | | Health Care | | 8.30 | | | | |

| | | Industrials | | 18.49 | | | | |

| | | Information Technology | | 9.60 | | | | |

| | | Materials | | 4.64 | | | | |

| | | Telecommunication Services | | 0.93 | | | | |

| | | Utilities | | 6.03 | | | | |

| | | Exchange Traded Funds | | 2.85 | | | | |

| | | Cash & Other Assets, Less Liabilities | | 8.59 | | | | |

| | | Total Net Assets | | 100.00% | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | |

| | | 4 | | The accompanying notes are an integral part of the financial statements |

| | |

Performance Summary March 31, 2009 | | Security Equity Fund All Cap Value Series (unaudited) |

| |

| |

Information About Your Series Expenses

Calculating your ongoing Series expenses

Example

As a shareholder of the Series, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; contingent deferred sales charges on redemptions; and redemption fees, if any; and (2) ongoing costs, including management fees; distribution and/or service fees (12b-1); and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period October 3, 2008 (commencement of operations) through March 31, 2009.

Actual Expenses

The first line for each class of shares in the table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each class of shares in the table provides information about hypothetical account values and hypothetical expenses based on the Series actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions, and redemption fees, if any. Therefore, the second line for each class of shares is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | |

| Series Expenses |

| | | Beginning

Account

Value

10/3/2008* | | Ending

Account

Value

3/31/2009 1 | | Expenses

Paid

During

Period 2 |

All Cap Value | | | | | | |

Series - Class A | | | | | | |

Actual | | $1,000.00 | | $734.00 | | $5.77 |

Hypothetical | | 1,000.00 | | 1,018.00 | | 6.72 |

All Cap Value | | | | | | |

Series - Class C | | | | | | |

Actual | | 1,000.00 | | 732.00 | | 8.97 |

Hypothetical | �� | 1,000.00 | | 1,014.62 | | 10.43 |

All Cap Value | | | | | | |

Series- Institutional Class | | | | | | |

Actual | | 1,000.00 | | 735.00 | | 4.71 |

Hypothetical | | 1,000.00 | | 1,019.66 | | 5.48 |

* Commencement of operations

1 The actual ending account value is based on the actual total return of the Series for the period October 3, 2008 (commencement of operations) to March 31, 2009 after actual expenses and will differ from the hypothetical ending account value which is based on the Series expense ratio and a hypothetical annual return of 5% before expenses. The actual cumulative return at net asset value for the period October 3, 2008 to March 31, 2009 was (26.60%), (26.80%) and (26.50%) for Class A, C and Institutional shares, respectively.

2 Expenses are equal to the Series annualized expense ratio (1.42%, 2.17% and 1.17% for Class A, C, and Institutional shares, respectively), net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 176/365 (to reflect the period since commencement of operations).

| | |

Schedule of Investments March 31, 2009 (unaudited) | | Security Equity Fund All Cap Value Series |

| |

| | | | | |

| | | Shares | | Value |

COMMON STOCKS - 91.4% | | | | | |

Aerospace & Defense - 1.9% | | | | | |

United Technologies Corporation | | 302 | | $ | 12,980 |

| | | | | |

| | |

Air Freight & Logistics - 2.3% | | | | | |

FedEx Corporation | | 349 | | | 15,527 |

| | | | | |

| | |

Apparel Retail - 0.6% | | | | | |

Brown Shoe Company, Inc. | | 401 | | | 1,504 |

Chico's FAS, Inc. * | | 160 | | | 859 |

Talbots, Inc. | | 460 | | | 1,615 |

| | | | | |

| | | | | 3,978 |

| | | | | |

Apparel, Accessories & Luxury | | | | | |

Goods - 0.6% | | | | | |

Fossil, Inc. * | | 100 | | | 1,570 |

Maidenform Brands, Inc. * | | 183 | | | 1,676 |

Oxford Industries, Inc. | | 115 | | | 710 |

| | | | | |

| | | | | 3,956 |

| | | | | |

| | |

Biotechnology - 0.0% | | | | | |

Combinatorx, Inc. * | | 440 | | | 273 |

| | | | | |

| | |

Building Products - 1.0% | | | | | |

Trex Company, Inc. * | | 200 | | | 1,526 |

USG Corporation * | | 650 | | | 4,947 |

| | | | | |

| | | | | 6,473 |

| | | | | |

| | |

Cable & Satellite - 0.5% | | | | | |

Time Warner Cable, Inc. | | 127 | | | 3,156 |

| | | | | |

| | |

Coal & Consumable Fuels - 0.9% | | | | | |

Evergreen Energy, Inc. * | | 1,500 | | | 2,088 |

USEC, Inc. * | | 874 | | | 4,195 |

| | | | | |

| | | | | 6,283 |

| | | | | |

Communications Equipment - 0.6% | | | | | |

Symmetricom, Inc. 1,* | | 1,220 | | | 4,270 |

| | | | | |

| | |

Computer Hardware - 1.7% | | | | | |

Hewlett-Packard Company | | 364 | | | 11,670 |

| | | | | |

| | |

Computer Storage & | | | | | |

Peripherals - 0.5% | | | | | |

STEC, Inc. * | | 441 | | | 3,250 |

| | | | | |

| | |

Construction & Engineering - 1.4% | | | | | |

Insituform Technologies, Inc. * | | 304 | | | 4,755 |

URS Corporation * | | 126 | | | 5,091 |

| | | | | |

| | | | | 9,846 |

| | | | | |

Construction Materials - 1.3% | | | | | |

Eagle Materials, Inc. | | 400 | | | 9,700 |

| | | | | |

Consumer Finance - 0.6% | | | | | |

First Marblehead Corporation * | | 3,021 | | | 3,897 |

| | | | | |

Data Processing & Outsourced | | | | | |

Services - 4.3% | | | | | |

Affiliated Computer Services, Inc. * | | 77 | | | 3,688 |

Computer Sciences Corporation * | | 218 | | | 8,031 |

Western Union Company | | 1,370 | | | 17,221 |

| | | | | |

| | | | | 28,940 |

| | | | | |

| | |

Department Stores-3.2% | | | | | |

JC Penney Company, Inc. | | 1,101 | | | 22,097 |

| | | | | |

| | | Shares | | Value |

COMMON STOCKS - 91.4% (continued) | | | | | |

Diversified Banks - 1.0% | | | | | |

Wells Fargo & Company | | 486 | | $ | 6,921 |

| | | | | |

| | |

Diversified Chemicals - 0.5% | | | | | |

Dow Chemical Company | | 382 | | | 3,220 |

| | | | | |

| | |

Drug Retail - 1.4% | | | | | |

CVS Caremark Corporation | | 336 | | | 9,237 |

| | | | | |

| | |

Electric Utilities - 4.2% | | | | | |

Allete, Inc. | | 80 | | | 2,135 |

Edison International | | 612 | | | 17,633 |

Empire District Electric Company | | 60 | | | 866 |

Great Plains Energy, Inc. | | 242 | | | 3,260 |

Northeast Utilities | | 116 | | | 2,504 |

Westar Energy, Inc. | | 131 | | | 2,296 |

| | | | | |

| | | | | 28,694 |

| | | | | |

| | |

Electrical Components & | | | | | |

Equipment - 0.3% | | | | | |

Power-One, Inc. 1,* | | 2,307 | | | 2,030 |

| | | | | |

| | |

Electronic Manufacturing | | | | | |

Services - 1.5% | | | | | |

Maxwell Technologies, Inc. 1,* | | 646 | | | 4,490 |

Tyco Electronics, Ltd. | | 510 | | | 5,630 |

| | | | | |

| | | | | 10,120 |

| | | | | |

| | |

Exchange Traded Funds - 2.8% | | | | | |

iShares Russell 1000 Value Index Fund | | 239 | | | 9,701 |

iShares S&P 500 Value Index Fund | | 260 | | | 9,672 |

| | | | | |

| | | | | 19,373 |

| | | | | |

| | |

Forest Products - 0.2% | | | | | |

Louisiana-Pacific Corporation | | 693 | | | 1,545 |

| | | | | |

| | |

Gas Utilities - 0.5% | | | | | |

Atmos Energy Corporation | | 151 | | | 3,491 |

| | | | | |

| | |

Health Care Equipment - 3.2% | | | | | |

Aspect Medical Systems, Inc. * | | 263 | | | 1,102 |

Covidien, Ltd. | | 230 | | | 7,645 |

Hospira, Inc. * | | 423 | | | 13,054 |

| | | | | |

| | | | | 21,801 |

| | | | | |

| | |

Health Care Facilities - 0.3% | | | | | |

Community Health Systems, Inc. * | | 125 | | | 1,918 |

| | | | | |

| | |

Health Care Services - 1.7% | | | | | |

Medco Health Solutions, Inc. * | | 173 | | | 7,152 |

Mednax, Inc. * | | 100 | | | 2,947 |

Providence Service Corporation * | | 100 | | | 688 |

RehabCare Group, Inc. * | | 48 | | | 837 |

| | | | | |

| | | | | 11,624 |

| | | | | |

| | |

Highways & Railtracks - 0.1% | | | | | |

Quixote Corporation 1 | | 142 | | | 493 |

| | | | | |

| | |

Home Furnishings - 0.8% | | | | | |

Leggett & Platt, Inc. | | 398 | | | 5,170 |

| | | | | |

| | |

Home Improvement Retail - 2.9% | | | | | |

Lowe's Companies, Inc. | | 1,092 | | | 19,929 |

| | | | | |

| | | | |

| | | 6 | | The accompanying notes are an integral part of the financial statements |

| | |

Schedule of Investments March 31, 2009 | | Security Equity Fund All Cap Value Series |

| |

| | | | | |

| | | Shares | | Value |

COMMON STOCKS - 91.4% (continued) | | | | | |

Human Resources & Employment | | | | | |

Services - 0.4% | | | | | |

Administaff, Inc. | | 125 | | $ | 2,641 |

| | | | | |

| | |

Hypermarkets & Super | | | | | |

Centers - 2.5% | | | | | |

Wal-Mart Stores, Inc. | | 324 | | | 16,880 |

| | | | | |

| | |

Independent Power Producers & | | | | | |

Energy Traders - 0.8% | | | | | |

NRG Energy, Inc. * | | 300 | | | 5,280 |

| | | | | |

| | |

Industrial Conglomerates - 3.0% | | | | | |

General Electric Company | | 806 | | | 8,149 |

McDermott International, Inc. * | | 915 | | | 12,252 |

| | | | | |

| | | | | 20,401 |

| | | | | |

| | |

Industrial Machinery - 1.7% | | | | | |

Dover Corporation | | 106 | | | 2,796 |

Harsco Corporation | | 100 | | | 2,217 |

Parker Hannifin Corporation | | 200 | | | 6,796 |

| | | | | |

| | | | | 11,809 |

| | | | | |

| | |

Insurance Brokers - 0.2% | | | | | |

Arthur J Gallagher & Company | | 75 | | | 1,275 |

| | | | | |

| | |

Integrated Oil & Gas - 5.6% | | | | | |

Chevron Corporation | | 214 | | | 14,390 |

ConocoPhillips | | 238 | | | 9,320 |

Exxon Mobil Corporation | | 206 | | | 14,029 |

| | | | | |

| | | | | 37,739 |

| | | | | |

| | |

Integrated Telecommunication | | | | | |

Services - 0.9% | | | | | |

Windstream Corporation | | 787 | | | 6,343 |

| | | | | |

| | |

Managed Health Care - 1.1% | | | | | |

Aetna, Inc. | | 300 | | | 7,299 |

| | | | | |

| | |

Movies & Entertainment - 1.4% | | | | | |

Time Warner, Inc. | | 507 | | | 9,787 |

| | | | | |

| | |

Multi-Line Insurance - 0.7% | | | | | |

American Financial Group, Inc. | | 292 | | | 4,687 |

| | | | | |

| | |

Multi-Utilities - 0.5% | | | | | |

SCANA Corporation | | 117 | | | 3,614 |

| | | | | |

| | |

Oil & Gas Drilling - 0.4% | | | | | |

Helmerich & Payne, Inc. | | 116 | | | 2,641 |

| | | | | |

| | |

Oil & Gas Equipment & | | | | | |

Services - 1.7% | | | | | |

Global Industries, Ltd. * | | 1,304 | | | 5,007 |

Halliburton Company | | 438 | | | 6,776 |

| | | | | |

| | | | | 11,783 |

| | | | | |

| | |

Oil & Gas Exploration & | | | | | |

Production - 2.0% | | | | | |

Chesapeake Energy Corporation | | 400 | | | 6,824 |

Goodrich Petroleum Corporation * | | 100 | | | 1,936 |

Gulfport Energy Corporation * | | 162 | | | 376 |

Newfield Exploration Company * | | 19 | | | 431 |

PetroHawk Energy Corporation * | | 200 | | | 3,846 |

| | | | | |

| | | | | 13,413 |

| | | | | |

| | | | | |

| | | Shares | | Value |

COMMON STOCKS - 91.4% (continued) | | | | | |

Oil & Gas Storage & | | | | | |

Transportation - 1.1% | | | | | |

Southern Union Company | | 191 | | $ | 2,907 |

Williams Companies, Inc. | | 424 | | | 4,825 |

| | | | | |

| | | | | 7,732 |

| | | | | |

| | |

Other Diversified Financial | | | | | |

Services - 1.1% | | | | | |

JPMorgan Chase & Company | | 276 | | | 7,336 |

| | | | | |

| | |

Packaged Foods & Meats - 3.1% | | | | | |

Hormel Foods Corporation | | 261 | | | 8,277 |

JM Smucker Company | | 124 | | | 4,621 |

Smithfield Foods, Inc. * | | 281 | | | 2,658 |

TreeHouse Foods, Inc. * | | 203 | | | 5,845 |

| | | | | |

| | | | | 21,401 |

| | | | | |

| | |

Paper Packaging - 1.2% | | | | | |

Bemis Company, Inc. | | 234 | | | 4,907 |

Sonoco Products Company | | 155 | | | 3,252 |

| | | | | |

| | | | | 8,159 |

| | | | | |

| | |

Paper Products - 0.5% | | | | | |

Schweitzer-Mauduit International, Inc. | | 166 | | | 3,064 |

| | | | | |

| | |

Pharmaceuticals - 2.0% | | | | | |

Schering-Plough Corporation | | 577 | | | 13,588 |

| | | | | |

| | |

Property & Casualty | | | | | |

Insurance - 6.0% | | | | | |

Alleghany Corporation * | | 18 | | | 4,972 |

Assured Guaranty, Ltd. | | 100 | | | 677 |

Berkshire Hathaway, Inc. (Cl.B) * | | 8 | | | 22,560 |

Employers Holdings, Inc. | | 169 | | | 1,612 |

Hanover Insurance Group, Inc. | | 142 | | | 4,092 |

United America Indemnity, Ltd. * | | 71 | | | 285 |

W.R. Berkley Corporation | | 290 | | | 6,540 |

| | | | | |

| | | | | 40,738 |

| | | | | |

| | |

Railroads - 2.4% | | | | | |

Kansas City Southern * | | 127 | | | 1,614 |

Union Pacific Corporation | | 354 | | | 14,553 |

| | | | | |

| | | | | 16,167 |

| | | | | |

| | |

Regional Banks - 0.4% | | | | | |

Wilmington Trust Corporation | | 300 | | | 2,907 |

| | | | | |

| | |

Research & Consulting | | | | | |

Services - 3.1% | | | | | |

Equifax, Inc. | | 637 | | | 15,574 |

ICF International, Inc. * | | 100 | | | 2,297 |

Navigant Consulting, Inc. * | | 245 | | | 3,202 |

| | | | | |

| | | | | 21,073 |

| | | | | |

| | |

Security & Alarm Services - 0.6% | | | | | |

GeoEye, Inc. * | | 200 | | | 3,950 |

| | | | | |

| | |

Semiconductors - 1.0% | | | | | |

IXYS Corporation 1 | | 884 | | | 7,125 |

| | | | | |

| | |

Specialty Chemicals-0.9% | | | | | |

Rohm & Haas Company | | 62 | | | 4,888 |

Zoltek Companies, Inc. * | | 150 | | | 1,022 |

| | | | | |

| | | | | 5,910 |

| | | | | |

| | | | |

| | | 7 | | The accompanying notes are an integral part of the financial statements |

| | |

Schedule of Investments March 31, 2009 (unaudited) | | Security Equity Fund All Cap Value Series |

| |

| | | | |

| | | Shares | | Value |

COMMON STOCKS - 91.4% (continued) |

Tobacco - 1.9% | | | | |

Philip Morris International, Inc. | | 371 | | $13,200 |

| | | | |

Trucking - 0.4% | | | | |

Saia, Inc. * | | 210 | | 2,510 |

| | | | |

| | | | |

TOTAL COMMON STOCKS | | | | |

(cost $822,758) | | | | $622,314 |

Total Investments - 91.4% | | | | |

(cost $822,758) | | | | $622,314 |

Cash & Other Assets, Less Liabilities - 8.6% | | | | 58,492 |

| | | | |

Total Net Assets - 100.0% | | | | $680,806 |

| | | | |

For federal income tax purposes the identified cost of investments owned at March 31, 2009 was $822,758.

* Non-income producing security

1 Security is deemed illiquid. The total market value of illiquid securities is $18,408 (cost $24,790), or 2.7% of total net assets.

| | | | |

| | | 8 | | The accompanying notes are an integral part of the financial statements |

Security Equity Fund

All Cap Value Series

(unaudited)

| | |

Statement of Assets and Liabilities March 31, 2009 |

| | | |

Assets: | | | |

Investments, at value* | | $ | 622,314 |

Cash | | | 35,480 |

Receivables: | | | |

Securities sold | | | 152 |

Dividends | | | 1,480 |

Security Investors | | | 4,654 |

Prepaid expenses | | | 25,906 |

| | | |

Total assets | | | 689,986 |

| | | |

Liabilities: | | | |

Payable for: | | | |

Management fees | | | 372 |

Custodian fees | | | 499 |

Transfer agent/maintenance fees | | | 18 |

Administration fees | | | 275 |

Professional fees | | | 5,133 |

12b-1 distribution plan fees | | | 222 |

Directors’ fees | | | 277 |

Other | | | 2,384 |

| | | |

Total liabilities | | | 9,180 |

| | | |

Net assets | | $ | 680,806 |

| | | |

Net assets consist of: | | | |

Paid in capital | | $ | 903,002 |

Undistributed net investment income | | | 2,460 |

Accumulated net realized loss on sale of investments | | | (24,212) |

Net unrealized depreciation in value of investments | | | (200,444) |

| | | |

Net assets | | $ | 680,806 |

| | | |

Class A: | | | |

Capital shares outstanding (unlimited number of shares authorized) | | | 34,393 |

Net assets | | $ | 252,541 |

Net asset value and redemption price per share . | | $ | 7.34 |

| | | |

Maximum offering price per share (net asset value divided by 94.25%) | | $ | 7.79 |

| | | |

Class C: | | | |

Capital shares outstanding (unlimited number of shares authorized) | | | 29,932 |

Net assets | | $ | 219,003 |

Net asset value, offering and redemption price per share (excluding any applicable contingent deferred sales charge) | | $ | 7.32 |

| | | |

Institutional Class: | | | |

Capital shares outstanding (unlimited number of shares authorized) | | | 28,464 |

Net assets | | $ | 209,262 |

Net asset value, offering and redemption price per share (excluding any applicable contingent deferred sales charge) | | $ | 7.35 |

| | | |

*Investments, at cost | | $ | 822,758 |

| | |

Statement of Operations For the Period Ended March 31, 2009* |

| | | |

Investment Income: | | | |

Dividends | | $ | 7,482 |

Interest | | | 114 |

| | | |

Total investment income | | | 7,596 |

| | | |

| |

Expenses: | | | |

Management fees | | | 2,162 |

Transfer agent/maintenance fees | | | 54 |

Administration fees | | | 692 |

Custodian fees | | | 2,203 |

Directors’ fees | | | 294 |

Professional fees | | | 6,076 |

Reports to shareholders | | | 2,384 |

Registration fees | | | 17,378 |

Other expenses | | | 1,741 |

12b-1 distribution fees - Class A | | | 272 |

12b-1 distribution fees - Class C | | | 1,079 |

| | | |

Total expenses | | | 34,335 |

Less: | | | |

Reimbursement of expenses - Class A | | | (9,838) |

Reimbursement of expenses - Class C | | | (9,760) |

Reimbursement of expenses - Institutional Class | | | (9,601) |

| | | |

Net expenses | | | 5,136 |

| | | |

Net investment income | | | 2,460 |

| | | |

| |

Net Realized and Unrealized Gain (Loss): | | | |

Net realized gain (loss) during the period on: | | | |

Investments | | | (24,212) |

| | | |

Net realized loss | | | (24,212) |

| | | |

| |

Net unrealized appreciation (depreciation) during the period on: | | | |

Investments | | | (200,444) |

| | | |

Net unrealized depreciation | | | (200,444) |

| | | |

Net loss | | | (224,656) |

| | | |

Net decrease in net assets resulting from operations | | $ | (222,196) |

| | | |

*For the period from October 3, 2008 (commencement of operations) to March 31, 2009.

| | | | |

| | | 9 | | The accompanying notes are an integral part of the financial statements |

| | |

| Statement of Changes in Net Assets | | Security Equity Fund All Cap Value Series |

| |

| | | | |

| | | Period Ended

March 31, 2009* | |

| | | | |

| |

Increase (decrease) in net assets from operations: | | | | |

Net investment income | | $ | 2,460 | |

Net realized loss during the period on investments | | | (24,212 | ) |

Net unrealized depreciation during the period on investments | | | (200,444 | ) |

| | | | |

Net decrease in net assets resulting from operations | | | (222,196 | ) |

| | | | |

| |

Capital share transactions: | | | | |

Proceeds from sale of shares | | | | |

Class A | | | 322,321 | |

Class C | | | 296,051 | |

Institutional Class | | | 284,637 | |

Cost of shares redeemed | | | | |

Class A | | | (7 | ) |

| | | | |

Net increase from capital share transactions | | | 903,002 | |

| | | | |

Net increase in net assets | | | 680,806 | |

| | | | |

| |

Net assets: | | | | |

Beginning of period | | | – | |

| | | | |

End of period | | $ | 680,806 | |

| | | | |

| |

Undistributed net investment income at end of period | | $ | 2,460 | |

| | | | |

| |

Capital share activity: | | | | |

Shares sold | | | | |

Class A | | | 34,394 | |

Class C | | | 29,932 | |

Institutional Class | | | 28,464 | |

Shares redeemed | | | | |

Class A | | | (1 | ) |

* For the period October 3, 2008 (commencement of operations) to March 31, 2009.

| | | | |

| | | 10 | | The accompanying notes are an integral part of the financial statements |

| | |

Financial Highlights Selected data for each share of capital stock outstanding throughout each period | | Security Equity Fund All Cap Value Series |

| | |

| Class A | | Period Ended

March 31, 2009a |

Per Share Data | | |

Net asset value, beginning of period | | $10.00 |

Income (loss) from investment operations: | | |

Net investment incomeb | | 0.03 |

Net loss on securities (realized and unrealized) | | (2.69) |

| | |

Total from investment operations | | (2.66) |

Net asset value, end of period | | $7.34 |

| | |

| | |

Total Return c | | (26.60%) |

Ratios/Supplemental Data | | |

Net assets, end of period (in thousands) | | $253 |

Ratios to average net assets: | | |

Net investment income | | 0.92% |

Total expensesd | | 10.10% |

Net expensese | | 1.42% |

Net expenses prior to custodian earning credits and net of expense waivers | | 1.42% |

Portfolio turnover rate | | 30% |

| |

| Class C | | Period Ended

March 31, 2009a |

Per Share Data | | |

Net asset value, beginning of period | | $10.00 |

Income (loss) from investment operations: | | |

Net investment incomeb | | 0.01 |

Net loss on securities (realized and unrealized) | | (2.69) |

| | |

Total from investment operations | | (2.68) |

Net asset value, end of period | | $7.32 |

| | |

| | |

Total Return c | | (26.80%) |

Ratios/Supplemental Data | | |

Net assets, end of period (in thousands) | | $219 |

Ratios to average net assets: | | |

Net investment income | | 0.18% |

Total expensesd | | 10.83% |

Net expensese | | 2.17% |

Net expenses prior to custodian earning credits and net of expense waivers | | 2.17% |

Portfolio turnover rate | | 30% |

| | | | |

| | 11 | | The accompanying notes are an integral part of the financial statements |

| | |

Financial Highlights Selected data for each share of capital stock outstanding throughout each period | | Security Equity Fund

All Cap Value Series |

| |

| | |

| Institutional Class | | Period Ended

March 31,

2009a |

Per Share Data | | |

Net asset value, beginning of period | | $10.00 |

Income (loss) from investment operations: | | |

Net investment incomeb | | 0.04 |

Net loss on securities (realized and unrealized) | | (2.69) |

| | |

Total from investment operations | | (2.65) |

Net asset value, end of period | | $7.35 |

| | |

| | |

Total Return | | (26.50%) |

Ratios/Supplemental Data | | |

Net assets, end of period (in thousands) | | $209 |

Ratios to average net assets: | | |

Net investment income | | 1.14% |

Total expensesd | | 9.87% |

Net expensese | | 1.17% |

Net expenses prior to custodian earning credits and net of expense waivers | | 1.17% |

Portfolio turnover rate | | 30% |

a Security All Cap Value Series was initially capitalized on October 3, 2008 with a net asset value of $10 per share. Percentage amounts for the period, except total return, have been annualized.

b Net investment income (loss) was computed using average shares outstanding throughout the period.

c Total return information does not reflect deduction of any sales charges imposed at the time of purchase for Class A shares or upon redemption for Class C shares.

d Total expense information reflects expense ratios absent expense reductions by the Investment Manager and custodian earnings credits, as applicable.

e Net expense information reflects the expense ratios after voluntary expense waivers, reimbursements and custodian earnings credits, as applicable.

| | | | |

| | | 12 | | The accompanying notes are an integral part of the financial statements |

This page left blank intentionally.

| | |

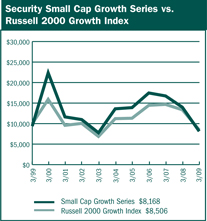

Performance Summary March 31, 2009 | | Security Equity Fund Alpha Opportunity Series (unaudited) |

| |

| |

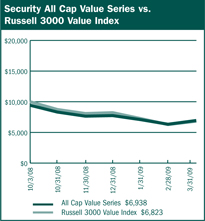

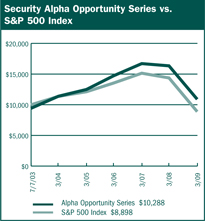

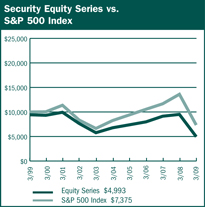

$10,000 Since Inception

This chart assumes a $10,000 investment in Class A shares of Alpha Opportunity Series on July 7, 2003 (date of inception), reflects deduction of the 5.75% sales load and assumes all dividends reinvested. The chart does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. The S&P 500 Index is a capitalization weighted index composed of 500 selected common stocks that represent the broad domestic economy and is a widely recognized unmanaged index of market performance.

| | | | | | |

Average Annual Returns |

Periods Ended 3-31-09 | | 1 Year | | 5 Years | | Since

Inception |

A Shares | | (37.05%) | | (2.00%) | | 1.54% (7-07-03) |

A Shares with sales charge | | (40.65%) | | (3.15%) | | 0.50% (7-07-03) |

B Shares | | (37.55%) | | (2.75%) | | 0.77% (7-07-03) |

B Shares with CDSC | | (40.67%) | | (2.99%) | | 0.77% (7-07-03) |

C Shares | | (37.72%) | | (2.78%) | | 0.75% (7-07-03) |

C Shares with CDSC | | (38.34%) | | (2.78%) | | 0.75% (7-07-03) |

Institutional Class | | – | | – | | (11.80%) (11-07-08) |

The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Series will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The figures above do not reflect deduction of the maximum front-end sales charge of 5.75% for Class A shares or the contingent deferred sales charge of 5% for Class B shares and 1% for Class C shares, as applicable, except where noted. The figures do not reflect the deduction of taxes that a shareholder would pay on distributions or redemption of shares. Such figures would be lower if the maximum sales charge and any applicable taxes were deducted. Fee waivers and/or reimbursements reduced expenses of the Series and in the absence of such waiver, the performance quoted would be reduced. |

| | | | | | | | |

| | | Portfolio Composition by Sector as of 3-31-09* | | |

| | | Consumer Discretionary | | 5.98% | | | | |

| | | Consumer Staples | | 8.40 | | | | |

| | | Energy | | 0.63 | | | | |

| | | Financials | | (1.21) | | | | |

| | | Health Care | | 0.55 | | | | |

| | | Industrials | | 5.09 | | | | |

| | | Information Technology | | 8.43 | | | | |

| | | Materials | | 0.02 | | | | |

| | | Telecommunication Services | | 0.82 | | | | |

| | | Utilities | | (0.91) | | | | |

| | | Exchange Traded Funds | | 1.24 | | | | |

| | | U.S. Government Sponsored Agencies | | 14.63 | | | | |

| | | Repurchase Agreement | | 9.70 | | | | |

| | | Short Term Investments | | 21.44 | | | | |

| | | Cash & Other Assets, Less Liabilities | | 25.19 | | | | |

| | | Total Net Assets | | 100.00% | | | | |

| | | | | | | | | |

| | | | | | | | | |

*Securities sold short are netted with long positions in common stocks in the appropriate sectors.

| | | | |

| | | 14 | | The accompanying notes are an integral part of the financial statements |

| | |

Performance Summary March 31, 2009 | | Security Equity Fund Alpha Opportunity Series (unaudited) |

| |

| |

Information About Your Series Expenses

Calculating your ongoing Series expenses

Example

As a shareholder of the Series, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; contingent deferred sales charges on redemptions; and redemption fees, if any; and (2) ongoing costs, including management fees; distribution and/or service fees (12b-1); and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period October 1, 2008 or November 7, 2008 (commencement of operations) through March 31, 2009.

Actual Expenses

The first line for each class of shares in the table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each class of shares in the table provides information about hypothetical account values and hypothetical expenses based on the Series actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions, and redemption fees, if any. Therefore, the second line for each class of shares is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher

| | | | | | |

Series Expenses | | | | |

| | | Beginning

Account

Value

10/1/2008 | | Ending

Account

Value

3/31/2009 1 | | Expenses

Paid

During

Period 2 |

Alpha Opportunity | | | | |

Series - Class A | | | | | | |

Actual | | $1,000.00 | | $688.03 | | $8.25 |

Hypothetical | | 1,000.00 | | 1,015.16 | | 9.85 |

Alpha Opportunity | | | | | | |

Series - Class B | | | | | | |

Actual | | 1,000.00 | | 685.88 | | 11.43 |

Hypothetical | | 1,000.00 | | 1,011.37 | | 13.64 |

Alpha Opportunity | | | | |

Series - Class C | | | | | | |

Actual | | 1,000.00 | | 683.97 | | 11.38 |

Hypothetical | | 1,000.00 | | 1,011.42 | | 13.59 |

Alpha Opportunity | | | | |

Series - Institutional Class * | | | | | | |

Actual | | 1,000.00 | | 882.00 | | 5.12 |

Hypothetical | | 1,000.00 | | 1,018.05 | | 6.94 |

* November 7, 2008 (commencement of operations)

1 The actual ending account value is based on the actual total return of the Series for the period October 1, 2008 or November 7, 2008 (commencement of operations), as applicable, to March 31, 2009 after actual expenses and will differ from the hypothetical ending account value which is based on the Series expense ratio and a hypothetical annual return of 5% before expenses. The actual cumulative return at net asset value for the period October 1, 2008 or November 7, 2008 (commencement of operations), as applicable, to March 31, 2009 was (31.20%), (31.41%), (31.60%) and (11.80%) for Class A, B, C and Institutional Class shares, respectively.

2 Expenses are equal to the Series annualized expense ratio (1.99%, 2.80%, 2.80% and 1.80% for Class A, B, C and Institutional Class shares, respectively), net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 180/365 (to reflect the one-half year period) for Class A, B and C shares, and multiplied by 141/365 (to reflect the period since commencement of operations) for Institutional Class shares.

| | |

| Schedule of Investments | | Security Equity Fund |

| | Alpha Opportunity Series |

March 31, 2009 | | (unaudited) |

| | | | |

| | | Shares | | Value |

COMMON STOCKS - 70.5% | | | | |

Aerospace & Defense - 2.0% | | | | |

Lockheed Martin Corporation 1,2 | | 3,753 | | $259,070 |

Northrop Grumman

Corporation 1,2 | | 1,100 | | 48,004 |

| | | | |

| | | | 307,074 |

| | | | |

| | |

Agricultural Products - 2.1% | | | | |

Archer-Daniels-Midland

Company 3 | | 11,897 | | 330,499 |

| | | | |

| | |

Airlines - 0.5% | | | | |

Airtran Holdings, Inc. * | | 18,224 | | 82,919 |

| | | | |

| | |

Apparel Retail - 3.9% | | | | |

Aeropostale, Inc. * | | 4,439 | | 117,900 |

Chico’s FAS, Inc. * | | 24,298 | | 130,479 |

Gap, Inc. 1,2 | | 6,000 | | 77,940 |

Gymboree Corporation 1,2,* | | 3,000 | | 64,050 |

Jos A. Bank Clothiers, Inc. * | | 934 | | 25,975 |

Ltd. Brands, Inc. 1,2 | | 5,100 | | 44,370 |

Ross Stores, Inc. 1,2 | | 2,100 | | 75,348 |

TJX Companies, Inc. 1,2 | | 3,600 | | 92,304 |

| | | | |

| | | | 628,366 |

| | | | |

|

Apparel, Accessories & Luxury |

Goods - 1.6% | | | | |

Carter’s, Inc. * | | 11,999 | | 225,701 |

Phillips-Van Heusen

Corporation 1,2 | | 800 | | 18,144 |

| | | | |

| | | | 243,845 |

| | | | |

|

Automobile Manufacturers - 0.1% |

Honda Motor Company,

Ltd. ADR | | 835 | | 19,790 |

| | | | |

|

Automotive Retail - 0.8% |

Carmax, Inc. * | | 2,804 | | 34,882 |

O'Reilly Automotive, Inc. * | | 2,618 | | 91,656 |

| | | | |

| | | | 126,538 |

| | | | |

|

Biotechnology - 1.0% |

Amgen, Inc. 1,2,* | | 1,800 | | 89,136 |

Cephalon, Inc. * | | 890 | | 60,609 |

| | | | |

| | | | 149,745 |

| | | | |

|

Casinos & Gaming - 0.1% |

Ameristar Casinos, Inc. | | 1,401 | | 17,625 |

| | | | |

|

Communications Equipment - 0.5% |

Harmonic, Inc. 1,2,* | | 11,000 | | 71,500 |

| | | | |

|

Computer & Electronics |

Retail - 0.3% | | | | |

RadioShack Corporation 1,2 | | 5,100 | | 43,707 |

| | | | |

|

Computer Storage & |

Peripherals - 0.2% | | | | |

China Digital TV Holding Company, |

Ltd. ADR | | 434 | | 2,921 |

STEC, Inc. * | | 2,804 | | 20,665 |

| | | | |

| | | | 23,586 |

| | | | |

|

Construction & Engineering - 3.6% |

Aecom Technology Corporation * | | 3,739 | | 97,513 |

Foster Wheeler AG * | | 2,137 | | 37,333 |

Granite Construction, Inc. | | 3,972 | | 148,872 |

| | | | |

| | | Shares | | Value |

COMMON STOCKS - 70.5% (continued) |

Construction & Engineering - 3.6% |

(continued) | | | | |

MasTec, Inc. * | | 3,037 | | $36,717 |

MYR Group, Inc. * | | 4,921 | | 75,045 |

Quanta Services, Inc. * | | 5,140 | | 110,253 |

URS Corporation * | | 1,168 | | 47,199 |

| | | | |

| | | | 552,932 |

| | | | |

|

Construction & Farm Machinery & |

Heavy Trucks - 1.8% | | | | |

Joy Global, Inc. 1,2 | | 9,080 | | 193,404 |

Trinity Industries, Inc. 1,2 | | 10,200 | | 93,228 |

| | | | |

| | | | 286,632 |

| | | | |

|

Diversified Banks - 0.6% |

Wells Fargo & Company | | 7,009 | | 99,808 |

| | | | |

|

Electrical Components & |

Equipment - 0.4% | | | | |

AO Smith Corporation 1,2 | | 2,800 | | 70,504 |

| | | | |

|

Electronic Components - 0.1% |

AU Optronics Corporation ADR | | 1,669 | | 14,003 |

| | | | |

|

Environmental & Facilities |

Services - 0.8% | | | | |

Tetra Tech, Inc. * | | 6,542 | | 133,326 |

| | | | |

|

Exchange Traded Funds - 2.4% |

Claymore | | 6,022 | | 56,245 |

iShares Silver Trust * | | 5,140 | | 65,792 |

SPDR Gold Trust * | | 2,804 | | 253,146 |

| | | | |

| | | | 375,183 |

| | | | |

| | |

Food Retail - 0.5% | | | | |

Safeway, Inc. 1,2 | | 3,900 | | 78,741 |

| | | | |

|

General Merchandise |

Stores - 0.8% | | | | |

Family Dollar Stores, Inc. 1,2 | | 3,700 | | 123,469 |

| | | | |

| | |

Gold - 0.4% | | | | |

Harmony Gold Mining Company, |

Ltd. ADR * | | 2,804 | | 30,676 |

Iamgold Corporation | | 2,504 | | 21,409 |

Yamana Gold, Inc. | | 835 | | 7,724 |

| | | | |

| | | | 59,809 |

| | | | |

|

Health Care Distributors - 0.6% |

Owens & Minor, Inc. 1,2 | | 2,700 | | 89,451 |

| | | | |

|

Health Care Equipment - 0.6% |

Baxter International, Inc. 1,2 | | 1,800 | | 92,196 |

China Medical Technologies, Inc. |

ADR | | 280 | | 3,856 |

| | | | |

| | | | 96,052 |

| | | | |

|

Health Care Facilities - 0.4% |

Kindred Healthcare, Inc. 1,2,* | | 3,900 | | 58,305 |

| | | | |

|

Health Care Services - 0.5% |

Lincare Holdings, Inc. 1,2,* | | 3,800 | | 82,840 |

| | | | |

| | | | |

| | | 16 | | The accompanying notes are an integral part of the financial statements |

| | |

Schedule of Investments March 31, 2009 | | Security Equity Fund Alpha Opportunity Series (unaudited) |

| |

| |

| | | | |

| | | Shares | | Value |

COMMON STOCKS - 70.5% (continued) |

| Home Entertainment Software - 3.7% | | | | |

Shanda Interactive Entertainment, Ltd. ADR 1,2,* | | 15,100 | | $596,902 |

| | | | |

| | |

| Homebuilding - 0.6% | | | | |

DR Horton, Inc. | | 1,402 | | 13,599 |

Pulte Homes, Inc. | | 7,242 | | 79,155 |

| | | | |

| | | | 92,754 |

| | | | |

| | |

Homefurnishing Retail - 0.3% | | | | |

Rent-A-Center, Inc. * | | 2,103 | | 40,735 |

| | | | |

| | |

| Hotels, Resorts & Cruise Lines - 1.7% | | | | |

Choice Hotels International, Inc. 3 | | 10,247 | | 264,578 |

| | | | |

| | |

| Human Resources & Employment Services - 0.9% | | | | |

Watson Wyatt Worldwide, Inc. 1,2 | | 2,901 | | 143,222 |

| | | | |

| | |

| Hypermarkets & Super Centers - 0.7% | | | | |

Wal-Mart Stores, Inc. 1,2 | | 2,200 | | 114,620 |

| | | | |

| | |

| Independent Power Producers & Energy Traders - 0.7% | | | | |

Constellation Energy Group, Inc. 1,2 | | 5,100 | | 105,366 |

| | | | |

| | |

| Industrial Conglomerates - 0.3% | | | | |

General Electric Company 1,2 | | 4,200 | | 42,462 |

| | | | |

| | |

| Industrial Machinery - 0.3% | | | | |

Watts Water Technologies, Inc. 1,2 | | 2,800 | | 54,768 |

| | | | |

| | |

| Integrated Oil & Gas - 0.5% | | | | |

ConocoPhillips 1,2 | | 1,500 | | 58,740 |

StatoilHydro ASA ADR | | 835 | | 14,562 |

| | | | |

| | | | 73,302 |

| | | | |

| | |

| Integrated Telecommunication Services - 1.7% | | | | |

AT&T, Inc. 1,2 | | 10,600 | | 267,120 |

| | | | |

| | |

| Internet Retail - 2.1% | | | | |

Amazon.com, Inc. 3,* | | 4,439 | | 326,000 |

| | | | |

| | |

| Internet Software & Services - 0.3% | | | | |

Akamai Technologies, Inc. * | | 2,569 | | 49,839 |

| | | | |

| | |

| Investment Banking & Brokerage - 2.0% | | | | |

Greenhill & Company, Inc. | | 2,987 | | 220,590 |

Knight Capital Group, Inc. * | | 2,570 | | 37,882 |

MF Global, Ltd. * | | 5,607 | | 23,718 |

Morgan Stanley | | 934 | | 21,267 |

| | | | |

| | | | 303,457 |

| | | | |

| | |

| IT Consulting & Other Services - 0.5% | | | | |

Accenture, Ltd. | | 2,153 | | 59,186 |

| | | | |

| | | Shares | | Value |

COMMON STOCKS - 70.5% (continued) |

| IT Consulting & Other Services - 0.5% (continued) | | | | |

MAXIMUS, Inc. | | 531 | | $21,166 |

| | | | |

| | | | 80,352 |

| | | | |

| | |

| Life Sciences Tools & Services - 2.9% | | | | |

Charles River Laboratories International, Inc. 1,2,* | | 2,000 | | 54,420 |

Illumina, Inc. * | | 6,075 | | 226,232 |

Life Technologies Corporation 1,2,* | | 2,800 | | 90,944 |

Millipore Corporation 1,2,* | | 1,800 | | 103,338 |

| | | | |

| | | | 474,934 |

| | | | |

| | |

| Managed Health Care - 0.2% | | | | |

WellCare Health Plans, Inc. 1,2,* | | 2,300 | | 25,875 |

| | | | |

| | |

| Mortgage REIT’s - 0.2% | | | | |

Annaly Capital Management, Inc. | | 1,968 | | 27,296 |

| | | | |

| | |

| Movies & Entertainment - 0.9% | | | | |

Marvel Entertainment, Inc. 1,2,* | | 5,400 | | 143,370 |

| | | | |

| | |

| Multi-Line Insurance - 0.7% | | | | |

Genworth Financial, Inc. 1,2 | | 4,000 | | 7,600 |

HCC Insurance Holdings, Inc. | | 4,306 | | 108,468 |

| | | | |

| | | | 116,068 |

| | | | |

| | |

| Oil & Gas Exploration & Production -1.3% | | | | |

Anadarko Petroleum | | | | |

Corporation 1,2 | | 2,755 | | 107,142 |

Concho Resources, Inc. * | | 467 | | 11,951 |

EnCana Corporation | | 334 | | 13,564 |

Southwestern Energy Company * | | 2,431 | | 72,176 |

| | | | |

| | | | 204,833 |

| | | | |

| | |

| Oil & Gas Refining & Marketing - 1.0% | | | | |

NuStar Energy, LP | | 1,169 | | 53,903 |

Sunoco, Inc. | | 934 | | 24,732 |

Western Refining, Inc. | | 7,009 | | 83,687 |

| | | | |

| | | | 162,322 |

| | | | |

| | |

| Packaged Foods & Meats - 0.5% | | | | |

Cosan, Ltd. * | | 2,449 | | 6,000 |

Dean Foods Company * | | 4,382 | | 79,227 |

| | | | |

| | | | 85,227 |

| | | | |

| | |

| Personal Products - 0.2% | | | | |

Herbalife, Ltd. 1,2 | | 2,500 | | 37,450 |

| | | | |

| | |

| Pharmaceuticals - 2.9% | | | | |

Biovail Corporation | | 1,135 | | 12,428 |

Forest Laboratories, Inc. 1,2,* | | 3,400 | | 74,664 |

Johnson & Johnson 1,2 | | 5,000 | | 263,001 |

Teva Pharmaceutical Industries, Ltd. ADR | | 1,069 | | 48,158 |

Viropharma, Inc. 1,2,* | | 9,900 | | 51,975 |

| | | | |

| | | | 450,226 |

| | | | |

| | |

| Property & Casualty Insurance - 0.6% | | | | |

ACE, Ltd. | | 961 | | 38,824 |

| | | | |

| | | 17 | | The accompanying notes are an integral part of the financial statements |

| | |

Schedule of Investments March 31, 2009 | | Security Equity Fund Alpha Opportunity Series (unaudited) |

| |

| | | | |

| | | Shares | | Value |

COMMON STOCKS - 70.5% (continued) |

Property & Casualty Insurance - 0.6% (continued) | | | | |

Amtrust Financial Services, Inc. 1,2 | | 6,000 | | $57,300 |

| | | | |

| | | | 96,124 |

| | | | |

Regional Banks - 1.2% | | | | |

Commerce Bancshares, Inc. | | 0 | | 2 |

First Horizon National Corporation | | 17,897 | | 192,214 |

| | | | |

| | | | 192,216 |

| | | | |

Reinsurance - 1.3% | | | | |

Endurance Specialty Holdings, Ltd. 1,2 | | 3,000 | | 74,820 |

RenaissanceRe Holdings, Ltd. | | 934 | | 46,177 |

Validus Holdings, Ltd. | | 3,423 | | 81,057 |

| | | | |

| | | | 202,054 |

| | | | |

Restaurants - 1.4% | | | | |

BJ’s Restaurants, Inc. * | | 802 | | 11,156 |

Jack in the Box, Inc. 1,2,* | | 5,869 | | 136,689 |

Papa John’s International, Inc. * | | 3,271 | | 74,808 |

| | | | |

| | | | 222,653 |

| | | | |

Semiconductor Equipment - 0.2% | | | | |

Amkor Technology, Inc. 1,2,* | | 9,200 | | 24,656 |

| | | | |

Semiconductors - 3.4% | | | | |

Atmel Corporation * | | 65,543 | | 237,922 |

Broadcom Corporation * | | 1,402 | | 28,012 |

Cree, Inc. * | | 4,138 | | 97,367 |

Cypress Semiconductor Corporation * | | 16,622 | | 112,531 |

Nvidia Corporation * | | 1,168 | | 11,516 |

PMC - Sierra, Inc. * | | 7,944 | | 50,683 |

Taiwan Semiconductor Manufacturing Company, Ltd. ADR | | 835 | | 7,473 |

| | | | |

| | | | 545,504 |

| | | | |

Soft Drinks - 0.4% | | | | |

Hansen Natural Corporation * | | 1,636 | | 58,896 |

| | | | |

Systems Software - 3.4% | | | | |

CA, Inc. 1,2 | | 19,362 | | 340,964 |

Check Point Software Technologies * | | 3,196 | | 70,984 |

McAfee, Inc. * | | 934 | | 31,289 |

Symantec Corporation 1,2,* | | 5,900 | | 88,146 |

| | | | |

| | | | 531,383 |

| | | | |

Technology Distributors - 0.7% | | | | |

Arrow Electronics, Inc. 1,2,* | | 2,600 | | 49,556 |

Avnet, Inc. 1,2,* | | 3,100 | | 54,281 |

| | | | |

| | | | 103,837 |

| | | | |

Tobacco - 4.0% | | | | |

Altria Group, Inc. 1,2 | | 16,700 | | 267,534 |

Philip Morris International, Inc. 1,2 | | 9,800 | | 348,683 |

| | | | |

| | | | 616,217 |

| | | | |

| | | | |

| | | Shares | | Value |

COMMON STOCKS - 70.5% (continued) |

Trucking - 0.2% | | | | |

Con-way, Inc. 1,2 | | 1,700 | | $30,481 |

| | | | |

| | | | |

TOTAL COMMON STOCKS (cost $14,283,791) | | $11,073,348 |

| | | Shares | | Value |

FOREIGN STOCKS - 7.3% |

Canada - 2.3% | | | | |

Agnico-Eagle Mines, Ltd. | | 6,195 | | $356,057 |

| | | | |

France - 0.3% | | | | |

UBISOFT Entertainment * | | 2,446 | | 44,712 |

| | | | |

Germany - 2.5% | | | | |

Volkswagen AG 3 | | 1,300 | | 399,455 |

| | | | |

Japan - 0.6% | | | | |

JGC Corporation | | 4,288 | | 48,347 |

NTT DoCoMo, Inc. | | 39 | | 52,680 |

| | | | |

| | | | 101,027 |

| | | | |

Portugal - 0.7% | | | | |

BRISA | | 15,796 | | 109,119 |

| | | | |

South Africa - 0.2% | | | | |

Aveng, Ltd. | | 9,842 | | 27,061 |

| | | | |

United Kingdom - 0.7% | | | | |

Cadbury plc | | 5,903 | | 44,636 |

Imperial Tobacco Group plc | | 2,724 | | 61,284 |

| | | | |

| | | | 105,920 |

TOTAL FOREIGN STOCKS (cost $1,219,858) | | $1,143,351 |

| | | Principal

Amount | | Value |

U.S. GOVERNMENT SPONSORED AGENCY BONDS & NOTES - 14.6% |

Federal Home Loan Mortgage Corporation | | | | |

0.36%, 4/27/20091 | | $1,000,000 | | $999,964 |

0.30%, 5/4/20093 | | 800,000 | | 799,875 |

Federal National Mortgage Association | | | | |

0.70%, 4/20/20093 | | 500,000 | | 499,987 |

TOTAL U.S. GOVERNMENT SPONSORED AGENCY BONDS & NOTES (cost $2,299,422) | | $2,299,826 |

| | | Principal

Amount | | Value |

SHORT TERM INVESTMENTS - 21.4% |

State Street General Account U.S. Government Fund | | $3,370,252 | | $3,370,252 |

TOTAL SHORT TERM INVESTMENTS (cost $3,370,252) | | | | $3,370,252 |

| | | | |

| | | 18 | | The accompanying notes are an integral part of the financial statements |

| | |

Schedule of Investments March 31, 2009 (unaudited) | | Security Equity Fund Alpha Opportunity Series |

| |

| | | | | |

| | | Principal

Amount | | Value | |

REPURCHASE AGREEMENT - 9.7% | | | |

State Street, 0.01%, dated 3/31/09, matures 4/01/09; repurchase amount $1,525,478 (Collateralized by U.S. Treasury Note, 07/02/09 with a value of $1,559,220) | | $1,525,478 | | $1,525,478 | |

TOTAL REPURCHASE AGREEMENT | | | | | |

(cost $1,525,478) | | | | $1,525,478 | |

Total Investments - 123.5% | | | |

(cost $22,698,801) | | | | $19,412,255 | |

Liabilities, Less Cash & Other Assets - (23.5)% | | | | (3,689,398 | ) |

| | | | | |

Total Net Assets - 100.0% | | $15,722,857 | |

| | | | | |

Schedule of Securities Sold Short

| | | | | | |

| | | Shares | | | Value | |

COMMON STOCKS - (25.5)% | | | | | | |

Advertising - (0.4)% | | | | | | |

Focus Media Holding, Ltd. ADR 4 ,* | | (2,130 | ) | | $(63,900 | ) |

| | | | | | |

Air Freight & Logistics - (0.1)% | | | | | | |

United Parcel Service, Inc. (Cl.B) | | (387 | ) | | (19,048 | ) |

| | | | | | |

Alternative Carriers - (0.2)% | | | | | | |

Global Crossing, Ltd. 4,* | | (1,800 | ) | | (28,746 | ) |

| | | | | | |

Application Software - (0.1)% | | | | | | |

Autodesk, Inc. * | | (773 | ) | | (12,994 | ) |

| | | | | | |

Biotechnology - (3.3)% | | | | | | |

Acorda Therapeutics, Inc. 4,* | | (2,800 | ) | | (74,900 | ) |

Alnylam Pharmaceuticals, Inc. 4,* | | (2,900 | ) | | (85,289 | ) |

Cepheid, Inc. 4,* | | (5,300 | ) | | (81,620 | ) |

Regeneron Pharmaceuticals,

Inc. 4,* | | (3,180 | ) | | (69,038 | ) |

Rigel Pharmaceuticals, Inc. 4,* | | (3,050 | ) | | (78,324 | ) |

Savient Pharmaceuticals, Inc. 4,* | | (2,420 | ) | | (48,013 | ) |

Vertex Pharmaceuticals, Inc. 4,* | | (2,600 | ) | | (71,942 | ) |

| | | | | | |

| | | | | (509,126 | ) |

| | | | | | |

Building Products - (0.9)% | | | | | | |

USG Corporation 4,* | | (4,940 | ) | | (141,877 | ) |

| | | | | | |

Communications | | | | | | |

Equipment - (0.3)% | | | | | | |

Riverbed Technology, Inc. 4,* | | (3,280 | ) | | (43,624 | ) |

| | | | | | |

Computer Hardware - (0.1)% | | | | | | |

Hewlett-Packard Company | | (580 | ) | | (18,595 | ) |

| | | | | | |

Computer Storage & | | | | | | |

Peripherals - (0.3)% | | | | | | |

Intermec, Inc. 4,* | | (2,740 | ) | | (54,307 | ) |

| | | | | | |

Diversified Banks - (3.4)% | | | | | | |

Wells Fargo & Company 4 | | (12,384 | ) | | (539,689 | ) |

| | | | | | |

| | | | | | |

| | | Shares | | | Value | |

COMMON STOCKS - (25.5)% (continued) | |

Diversified Metals & | | | | | | |

Mining - (0.2)% | | | | | | |

Ivanhoe Mines, Ltd. 4,* | | (4,440 | ) | | $(37,030 | ) |

| | | | | | |

Electric Utilities - (1.6)% | | | | | | |

Korea Electric Power Corporation

ADR 4 | | (18,310 | ) | | (247,734 | ) |

| | | | | | |

Exchange Traded Funds - (1.1)% | | | | | | |

Currency Shares Euro Trust | | (387 | ) | | (51,421 | ) |

iShares Barclays 20+ Year | | | | | | |

Treasury Bond Fund | | (966 | ) | | (102,115 | ) |

iShares MSCI Germany Index | | | | | | |

Fund | | (552 | ) | | (8,258 | ) |

iShares MSCI South Korea Index | | | | | | |

Fund | | (359 | ) | | (10,221 | ) |

SPDR KBW Regional Banking ETF | | (387 | ) | | (7,438 | ) |

| | | | | | |

| | | | | (179,453 | ) |

| | | | | | |

Food Retail - (0.1)% | | | | | | |

Whole Foods Market, Inc. | | (607 | ) | | (10,198 | ) |

| | | | | | |

Health Care Equipment - (0.4)% | | | | | | |

Intuitive Surgical, Inc. 4,* | | (200 | ) | | (56,100 | ) |

| | | | | | |

Health Care Supplies - (0.5)% | | | | | | |

Align Technology, Inc. 4,* | | (6,100 | ) | | (74,420 | ) |

| | | | | | |

Health Care Technology - (0.6)% | | | | | | |

athenahealth, Inc. 4,* | | (2,500 | ) | | (89,625 | ) |

| | | | | | |

Home Entertainment | | | | | | |

Software - (0.2)% | | | | | | |

Electronic Arts, Inc. 4,* | | (900 | ) | | (36,720 | ) |

| | | | | | |

Internet Software & | | | | | | |

Services - (1.7)% | | | | | | |

Baidu, Inc. ADR 4,* | | (200 | ) | | (53,726 | ) |

Equinix, Inc. 4,* | | (1,000 | ) | | (79,940 | ) |

SAVVIS, Inc. 4,* | | (5,700 | ) | | (84,017 | ) |

VeriSign, Inc. 4,* | | (1,200 | ) | | (30,756 | ) |

| | | | | | |

| | | | | (248,439 | ) |

| | | | | | |

Leisure Products - (1.8)% | | | | | | |

Pool Corporation 4 | | (11,639 | ) | | (288,065 | ) |

| | | | | | |

Life Sciences Tools & | | | | | | |

Services - (1.6)% | | | | | | |

AMAG Pharmaceuticals, Inc. 4,* | | (1,900 | ) | | (82,954 | ) |

Exelixis, Inc. 4,* | | (4,500 | ) | | (28,845 | ) |

Luminex Corporation 4,* | | (2,500 | ) | | (63,725 | ) |

Sequenom, Inc. 4,* | | (3,810 | ) | | (78,524 | ) |

| | | | | | |

| | | | | (254,048 | ) |

| | | | | | |

Oil & Gas Exploration & | | | | | | |

Production - (0.7)% | | | | | | |

BPZ Resources, Inc. 4,* | | (5,700 | ) | | (107,160 | ) |

| | | | | | |

Pharmaceuticals - (0.9)% | | | | | | |

Auxilium Pharmaceuticals, Inc. 4,* | | (1,540 | ) | | (56,703 | ) |

Sepracor, Inc. 4,* | | (1,400 | ) | | (24,500 | ) |

XenoPort, Inc. 4,* | | (1,376 | ) | | (63,062 | ) |

| | | | | | |

| | | | | (144,265 | ) |

| | | | | | |

| | | | |

| | | 19 | | The accompanying notes are an integral part of the financial statements |

| | |

Schedule of Investments March 31, 2009 (unaudited) | | Security Equity Fund Alpha Opportunity Series |

| |

| | | | |

| | | Shares | | Value |

COMMON STOCKS - (25.5)% (continued) |

Regional Banks - (0.7)% |

PrivateBancorp, Inc. 4 | | (2,390) | | $(102,770) |

| | | | |

Semiconductor Equipment - (0.2)% |

Varian Semiconductor Equipment Associates, Inc. 4,* | | (1,260) | | (33,037) |

| | | | |

Semiconductors - (1.1)% |

Cree, Inc. 4,* | | (4,000) | | (109,840) |

Rambus, Inc. 4,* | | (3,600) | | (55,224) |

| | | | |

| | | | (165,064) |

| | | | |

Soft Drinks - (0.6)% |

Hansen Natural Corporation 4,* | | (3,250) | | (96,232) |

| | | | |

Specialized Finance - (0.4)% |

CME Group, Inc. | | (276) | | (68,004) |

| | | | |

Specialty Chemicals - (0.3)% |

Zoltek Companies, Inc. 4,* | | (2,700) | | (49,221) |

| | | | |

Systems Software - (0.7)% |

Red Hat, Inc. 4,* | | (2,610) | | (46,589) |

VMware, Inc. 4,* | | (2,400) | | (68,592) |

| | | | |

| | | | (115,181) |

| | | | |

| Wireless Telecommunication Services - (1.0)% | | | | |

Clearwire Corporation 4,* | | (2,530) | | (28,665) |

Leap Wireless International, Inc. 4,* | | (1,500) | | (65,100) |

SBA Communications Corporation 4,* | | (2,400) | | (69,096) |

| | | | |

| | | | | (162,861) |

TOTAL COMMON STOCKS SOLD SHORT |

(proceeds $3,973,206) | | | | $(3,997,533) |

| | | Shares | | Value |

FOREIGN STOCKS - (23.2)% |

Australia - (1.4)% | | | | |

Aquila Resources, Ltd. 4,* | | (2,500) | | $(21,907) |

Arrow Energy, Ltd. 4,* | | (8,900) | | (22,965) |

Ausenco, Ltd. 4 | | (2,100) | | (22,658) |

Queensland Gas Company, Ltd. 4,* | | (12,800) | | (49,787) |

Riversdale Mining, Ltd. 4,* | | (6,700) | | (50,985) |

Sino Gold Mining, Ltd. 4,5,* | | (8,600) | | (35,368) |

Western Areas NL 4,* | | (6,200) | | (44,457) |

| | | | |

| | | | (248,127) |

| | | | |

Austria - (2.8)% | | | | |

bwin Interactive Entertainment AG 4,* | | (1,600) | | (45,582) |

Erste Group Bank AG 4 | | (5,200) | | (319,536) |

Intercell AG 4,* | | (1,900) | | (74,840) |

| | | | |

| | | | (439,958) |

| | | | |

Bermuda - (0.1)% | | | | |

C C Land Holdings, Ltd. 4 | | (50,000) | | (13,945) |

| | | | |

Canada - (1.5)% | | | | |

Agnico-Eagle Mines, Ltd. 4 | | (1,800) | | (119,002) |

Silver Wheaton Corporation 4,* | | (6,100) | | (64,046) |

Trican Well Service, Ltd. 4 | | (2,000) | | (34,043) |

| | | | |

| | | | (217,091) |

| | | | |

| | | | |

| | | Shares | | Value |

FOREIGN STOCKS - (23.2)% (continued) |

China - (1.7)% | | | | |

Anhui Conch Cement Company, Ltd. 4 | | (4,500) | | $(20,259) |

Beijing Capital International Airport Company, Ltd. 4 | | (218,000) | | (188,550) |

China Communications Construction Company, Ltd. 4 | | (15,000) | | (15,536) |

China National Building Material Company, Ltd. 4 | | (14,700) | | (19,910) |

China National Materials Company, Ltd. 4,* | | (34,400) | | (17,537) |

| | | | |

| | | | (261,792) |

| | | | |

Germany - (3.8)% | | | | |

Premiere AG 4,* | | (4,000) | | (65,668) |

Volkswagen AG 4 | | (1,300) | | (539,375) |

| | | | |

| | | | (605,043) |

| | | | |

Gibraltar - (0.3)% | | | | |

PartyGaming plc 4 | | (15,200) | | (57,210) |

| | | | |

Hong Kong - (0.4)% | | | | |

China Merchants Holdings International Company, Ltd. 4 | | (3,100) | | (11,047) |

Franshion Properties China, Ltd. 4 | | (79,400) | | (22,104) |

Fushan International Energy Group, Ltd. 4,* | | (66,000) | | (23,727) |

| | | | |

| | | | (56,878) |

| | | | |

Ireland - (0.2)% | | | | |

Ryanair Holdings plc 4,* | | (9,600) | | (35,971) |

| | | | |

Isle Of Man - (0.3)% |

Genting International plc 4,* | | (124,900) | | (41,123) |

| | | | |

Japan - (3.3)% | | | | |

Access Company, Ltd. 4,* | | (17) | | (32,755) |

Aeon Mall Company, Ltd. 4 | | (1,700) | | (52,093) |

Aozora Bank, Ltd. 4 | | (16,300) | | (26,250) |

Japan Steel Works, Ltd. 4 | | (1,500) | | (20,809) |

Marui Group Company, Ltd. 4 | | (29,100) | | (219,527) |

Mizuho Financial Group, Inc. 4 | | (11,000) | | (45,461) |

Mizuho Trust & Banking Company, Ltd. 4 | | (17,700) | | (24,682) |

Modec, Inc. 4 | | (900) | | (23,195) |

Monex Group, Inc. 4 | | (78) | | (27,384) |

Tokyo Broadcasting System, Inc. 4 | | (1,300) | | (21,836) |

Toyo Tanso Company, Ltd. 4 | | (500) | | (27,007) |

| | | | |

| | | | (520,999) |

| | | | |

Norway - (0.2)% | | | | |

Sevan Marine ASA 4,* | | (5,900) | | (30,951) |

| | | | |

Portugal - (3.0)% | | | | |

BRISA 4 | | (44,400) | | (461,804) |

| | | | |

Spain - (0.3)% | | | | |

Zeltia S.A. 4 | | (8,000) | | (54,559) |

| | | | |

Sweden - (2.5)% | | | | |

Electrolux AB 4 | | (30,100) | | (395,762) |

| | | | |

Switzerland - (0.9)% | | | | |

Basilea Pharmaceutica 4,* | | (500) | | (83,364) |

Meyer Burger Technology AG 4,* | | (200) | | (49,878) |

| | | | |

| | | | (133,242) |

| | | | |

| | | | |

| | | 20 | | The accompanying notes are an integral part of the financial statements |

| | |

Schedule of Investments March 31, 2009 (unadited) | | Security Equity Fund Alpha Opportunity Series |

| |

| | | | |

| | | Shares | | Value |

FOREIGN STOCKS - (23.2)% (continued) | | | | |

United Kingdom - (0.5)% | | | | |

Imperial Energy Corporation plc 4,* | | (3,900) | | $(77,681) |

| | | | |

| | | | |

TOTAL FOREIGN STOCKS SOLD SHORT | | | | |

(proceeds $3,495,580) | | | | $(3,652,136) |

TOTAL SECURITIES SOLD SHORT - (48.7%) | | | | |

(proceeds $7,468,786) | | | | $(7,649,669) |

| | | | |

For federal income tax purposes the identified cost of investments owned at March 31, 2009 was $23,017,253.

| ADR | American Depositary Receipt |

| plc | Public Limited Company |

* Non-income producing security

1 Security is segregated as collateral for open short positions.

2 Security is deemed illiquid. The total market value of illiquid securities is $5,581,800 (cost $8,577,438), or 35.5% of total net assets. The securities were liquid at time of purchase. This security is deemed illiquid due to the Series exposure to Lehman Brothers International Europe ("LBIE") prime brokerage services.

3 Security is segregated as collateral for open futures contracts.

4 Security is fair valued by the Valuation Committee at March 31, 2009. The total market value of fair valued securities amounts to $(7,341,377) (cost $(7,166,694)), or (46.7%) of total net assets.

5 Security is a PFIC (Passive Foreign Investment Company).

| | | | |

| | 21 | | The accompanying notes are an integral part of the financial statements |

| | |

| | Security Equity Fund Alpha Opportunity Series (unaudited) |

| |

| |

| | |

Statement of Assets and Liabilities March 31, 2009 |

Assets: | | |

Investments, at value* | | $19,412,255 |

Cash | | 93,863 |

Cash denominated in a foreign currency, at value*** | | 544,332 |

Restricted cash | | 708,516 |

Restricted cash denominated in a foreign currency, at value**** | | 2,668,108 |

Receivables: | | |

Fund shares sold | | 6 |

Securities sold | | 822,985 |

Interest | | 549 |

Dividends | | 24,458 |

Variation margin | | 31,500 |

Security Investors | | 6,665 |

Prepaid expenses | | 34,757 |

| | |

Total assets | | 24,347,994 |

| | |

Liabilities: | | |

Securities sold short, at value** | | 7,649,669 |

Payable for: | | |

Securities purchased | | 705,752 |

Fund shares redeemed | | 195,085 |

Dividends on short sales | | 7,126 |

Management fees | | 16,433 |

Transfer agent/maintenance fees | | 3,531 |

Administration fees | | 5,572 |

Professional fees | | 35,710 |

12b-1 distribution plan fees | | 4,973 |

Directors’ fees | | 1,286 |

| | |

Total liabilities | | 8,625,137 |

| | |

Net assets | | $15,722,857 |

| | |

Net assets consist of: | | |

Paid in capital | | $35,266,071 |

Accumulated net investment loss | | (93,055) |

Accumulated net realized loss on sale of investments and foreign currency transactions | | (16,026,684) |

Net unrealized depreciation in value of investments and translation of assets and liabilities in foreign currencies | | (3,423,475) |

| | |

Net assets | | $15,722,857 |

| | |

Class A: | | |

Capital shares outstanding (unlimited number of shares authorized) | | 1,564,269 |

Net assets | | $10,072,699 |

Net asset value and redemption price per share | | $6.44 |

| | |

Maximum offering price per share (net asset value divided by 94.25%) | | $6.83 |

| | |

Class B: | | |

Capital shares outstanding (unlimited number of shares authorized) | | 246,301 |

Net assets | | $1,495,198 |

Net asset value, offering and redemption price per share (excluding any applicable contingent deferred sales charge) | | $6.07 |

| | |

Class C: | | |

Capital shares outstanding (unlimited number of shares authorized) | | 334,772 |

Net assets | | $2,027,733 |

Net asset value, offering and redemption price per share (excluding any applicable contingent deferred sales charge) | | $6.06 |

| | |

Class Institutional: | | |

Capital shares outstanding (unlimited number of shares authorized) | | 241,294 |

Net assets | | $2,127,227 |

Net asset value, offering and redemption price per share (excluding any applicable contingent deferred sales charge) | | $8.82 |

| | |

| |

*Investments, at cost | | $22,698,801 |

**Securities sold short, proceeds | | 7,468,786 |

***Cash denominated in a foreign currency, at cost | | 571,928 |

****Restricted cash denominated in a foreign currency, at cost | | 2,803,373 |

| | |

Statement of Operations For the Six Months Ended March 31, 2009 |

Investment Income: | | |

Dividends (net of foreign withholding tax of $1,176) | | $151,844 |

Interest | | 33,077 |

| | |

Total investment income | | 184,921 |

| | |

| |

Expenses: | | |

Management fees | | 140,140 |

Transfer agent/maintenance fees | | 78,577 |

Administration fees | | 25,889 |

Custodian fees | | 16,009 |

Directors' fees | | 1,097 |

Professional fees | | 94,951 |

Reports to shareholders | | 6,342 |

Registration fees | | 19,806 |

Other expenses | | 2,913 |

Dividends on short sales | | 6,897 |

12b-1 distribution fees - Class A | | 18,552 |

12b-1 distribution fees - Class B | | 12,263 |

12b-1 distribution fees - Class C | | 14,354 |

| | |

Total expenses | | 437,790 |

Less: | | |

Reimbursement of expenses - Class A | | (120,157) |

Reimbursement of expenses - Class B | | (19,401) |

Reimbursement of expenses - Class C | | (25,233) |

Reimbursement of expenses - Institutional Class | | (24,871) |

Earnings credits applied | | (5,723) |

| | |

Net expenses | | 242,405 |

| | |

Net investment loss | | (57,484) |

| | |

Net Realized and Unrealized Gain (Loss): |

Net realized gain (loss) during the period on: | | |

Investments | | (8,880,819) |

Securities sold short | | 205,505 |

Foreign currency transactions | | (146,295) |

Futures | | (3,881,478) |

| | |

Net realized loss | | (12,703,087) |

| | |

Net unrealized appreciation (depreciation) during the period on: | | |

Investments | | 344,825 |

Securities sold short | | (255,763) |

Futures | | 1,114,290 |

Translation of assets and liabilities in foreign currencies | | (75,027) |

| | |